It is has now been confirmed. The first measured 24 hour production from Bakken wells is a very good predictor of the future production of that well. And it has also been confirmed that new wells with higher well numbers are producing a lot less.

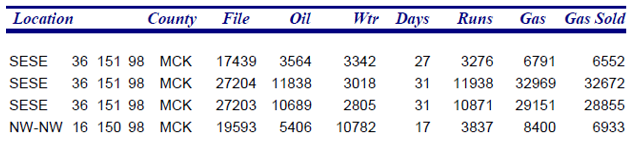

In the NDIC’s Daily Activity Reports they publish “WELLS RELEASED FROM “TIGHT HOLE” STATUS” as well as “PRODUCING WELL COMPLETED”. By searching these two lists, then eliminating the duplicates that appear on both lists, we find that perhaps 70 to 80 percent of all wells report their first 24 hours of measured production. It is listed as “BOPD” (Barrels Oil Per Day) and “BWPD” (Barrels Water Per Day). An example below, and notice the second well listed does not give any production numbers:

The “per day” in this case is the first 24 hours of measured production and not necessarily the first 24 hours of preduction. I have collected, from this source, the data from 2,565 wells dating from November 1st 2013 to the present date. Enno Peters gathered data from several thousand Bakken wells dating from the early Bakken t mid 2014. Using the well numbers, I have managed to match 1,127 wells in my database with the same well number in Enno’s data. There were a more matches than this but had no data or incomplete data. But it was mostly because only a little over half my data overlapped his.

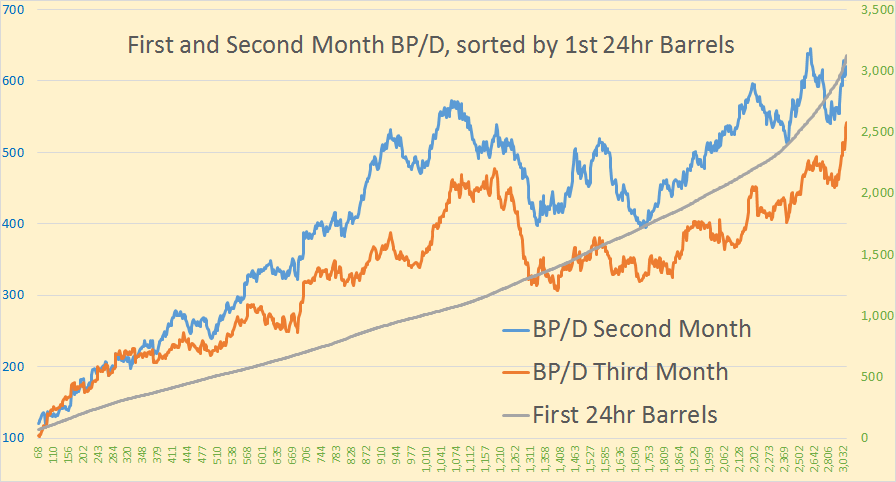

From his data I used the 2nd and 3rd months production data because the first month’s data was often for less than one full month. I converted his monthly data to barrels per data by dividing the monthly data by 30.417. There were sometimes great anomalies in the data so to smooth things out, on the first three charts below, I used a 50 well average. Here are the results. The horizontal and right axis is first 24 hour barrels. The “First 24hr Barrels” is a smooth line because that was the sort column.

When I sorted the data by production in the first 24 hours I found a strong correlation with the second months production. This was especially true with first 24 hour production up to 1,050 barrels. The “First 24hr Barrels” chart line is smooth of course because that is the sort index.

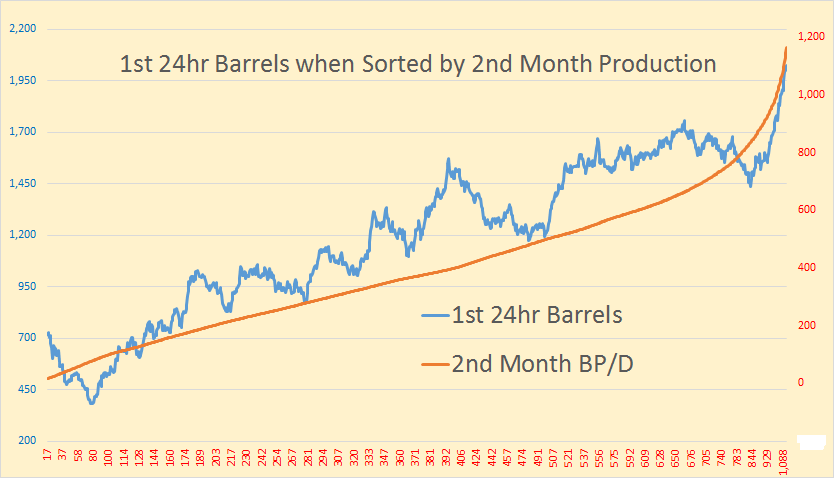

Sorting all wells by the second months production we see a very strong correlation to the first 24 hours of measured production.

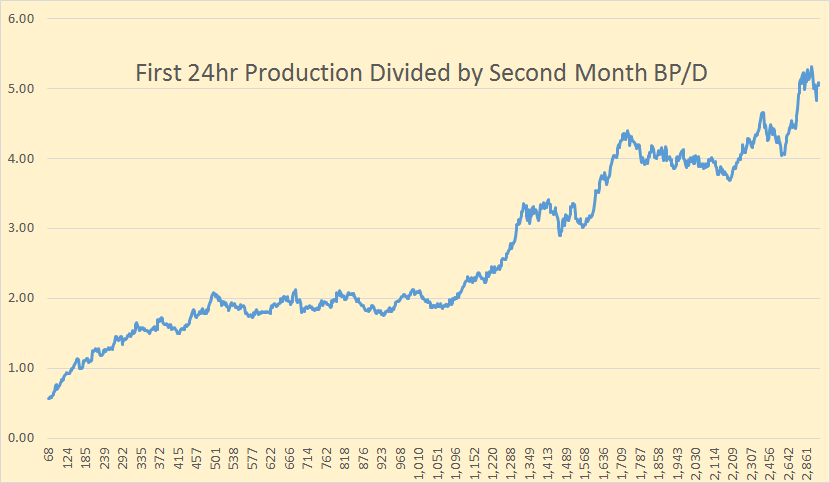

The Horizontal axis here is the first measured 24 hours of production. The vertical axis is the devisor needed to convert the first 24 hours production to second month barrels per day.

From this chart you can see that the conversion from the first 24 hour production to the second months production is non-linear. For instance if the first 24 hours production was between 50 and 1050 barrels then we could expect the second months production to be about half that. From about 1350 barrels to 1600 barrels the first 24 hours then the average second months production would be about one third that number. Or if the from 1700 to 2200 barrels the first 24 hours we could expect the second months production to be about one fourth that number.

The average second months production was 412 barrels per day while the average third months production was 328 barrels per day. This is a drop of 84 BP/D or 20 percent from the second to third months.

Enno’s data ends mid 2014. However I collected some data of my own from July and August 2014. If you go to NDIC Oil and Gas Production Report, you find data on all wells previously brought on line. Of the 1,127 wells in this sample, 87 or 7.7% had no third month production. Probably because they had not on been line long enough. Also 16 or 1.4% had a third months production but no second months production. This means the well was shut down that month. For all months with no production that cell was was left blank rather than incerting a zero. Therefore months with no production were not counted in any average. Blanks are not averaged, zeros are.

Enno’s data ends mid 2014. However I collected some data of my own from July and August 2014. If you go to NDIC Oil and Gas Production Report, you find data on all wells previously brought on line. The data is in this format:

If you divide “Oil” by “Days” you get barrels per day for what I presume is the first month. I collected data on 332 from this source that matches well numbers from my “first 24 hour” data base from July and August 2014. This was a very time consuming process since each well number had to be searched then copied and pasted into my Excel spreadsheet, one well at a time.

The right axis as well as the horizontal axis is the 24 hour barrels sort number. The left axis is barrels per day. One can clearly see that the higher the 1st measured 24 hour production the higher the daily production for the next full, or nearly full, month. We can now say, with very strong conviction, that the first 24 hours of measured production will tell us just how well that particular well is likely to perform in the future.

I think this leaves little doubt that the BOPD number that the NDIC reports in their Daily Activity Report Index is a very good guide to what kind of future production we can expect from any particular well. However I must make one important point that I should have made a month ago when I first posted on “The First 24 Hours of Production”

I can find nothing that specifically states that the figure represented as “BOPD” above actually represents the first 24 hours of production. What I do know is that it is the first 24 hours of measured production. I think it is highly likely that they waited until a lot of the frack water had been pushed out before they started to measure. At any rate, based on the data I have researched above, it is definitely a useful guide to the future production of a particular well.

Now that the connection has been firmly established, let’s look at what that data is telling us.

This chart is all the wells listed by the NDIC with actual BOPD data from November 1st, 2013 through December 19th, 2014. There are 2,565 wells in this sample. Of course there were a few more wells than this but their first 24 hours of production was not published by the NDIC. What you see here is clearly the first 24 hours of production declining as the well numbers increase. However the decrease did not start until we were about half way through well numbers in the 25,000s.

First 24hr production was up and down until about well number 25600 then a steady decline set in. The highest 300 well numbers are averaging just under 1,000 barrels the first 24 hours. That translates to just under 300 bpd the second month if past first barrels at that level hold true in the future.

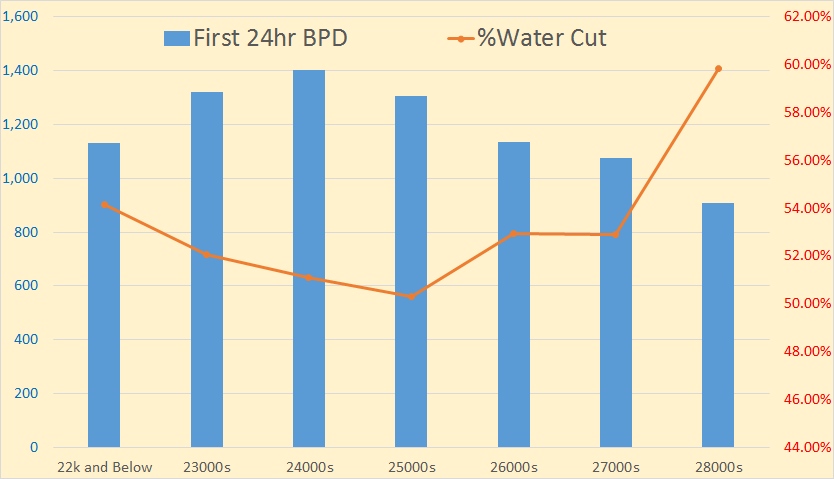

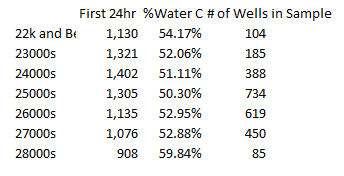

This chart shows the average first barrels per day for groups of well numbers. Below is the data for that chart along with the number of wells in each sample.

Wells in the 24000s were averaging 1,402 barrels of original production. The 28000 wells are averaging only 908 barrels the first 24 hours of measured production. That is a drop of over 35 percent. However there are only 85 wells with well numbers over 28000.

There are still some wells being drilled with low well numbers. Two wells are currently being drilled that are in the 21000s. And 27 wells are currently being drilled below the 27000s or below. But 153 of the 180 wells being drilled, (181 if you count the salt water disposal well), or 85 percent of wells being drilled are in the 28000s or above. 105 of 180 wells are in the 29000 or above. 3 are in the 30000s.

Where in the past, though some wells with numbers above 27000 were being drilled, the majority of wells were below that number. Therefore no obvious decline in monthly well production could be gleaned from the numbers. Only when the wells are sorted by well number does the decline become apparent. But that is all about to change because most of the choicest places have already been drilled.

It is important to remember that wells are not drilled in permit number sequence. There are always far more permits issued and awaiting the driller than wells being drilled.

It is unclear, to me anyway, whether the lower production per well is because of downspacing, moving further away from the sweet spots, or both. But it is clearly happening. Newer wells, or at least those with higher permit numbers, are definitely coming in with lower production numbers.

In 2015 we will see the squeeze coming in from two sides, fewer wells being drilled and lower production from those that are being drilled. It is my prediction that the Bakken will peak in 2015. In which month it will peak is hard to guess.

But there is a third squeeze, from another side. The junk bonds that many small shale drillers depend on for their financing are dropping through the floor. That means yields are going through the roof.

U.S. shale junk debt tumbles amid oil crunch

HOUSTON – Prices for the risky corporate bonds that have fueled the U.S. shale energy boom are plummeting as oil prices have fallen below $60 a barrel for the first time in more than five years.

The U.S. energy-sector’s high-yield bond prices, known as junk bonds because they carry high risk for investors, have dropped 18.9 percent since the end of June to the close of trading Friday – putting the sector on track for its worst performance in returns since the financial crisis of 2008, according to Barclays…

Prices for the entire spectrum of U.S. corporate bonds have tumbled 7.7 percent since June, and are also set to perform worse than any year since the U.S. credit crunch six years ago, according to Barclays…

The sharp selloff comes as a handful of small oil companies are approaching or have exceeded 20 percent yields, analysts with Tudor, Pickering, Holt & Co. said in an investor update Monday.

Twenty percent, imagine that! How long can any driller afford to rollover any debt at those rates? With very low oil prices, less production from their new wells and the cost of new money at unheard of rates… they are sunk!

Note: This will be my last post until sometime after Christmas. If would like to get on the notification list of new posts please email me at DarwinianOne at Gmail.com.

Ron, gonna need some clarification.

1) You seem to say months 2, 3 whatever correlate to first 24 hour IP. That seems intuitive. If the initial number is higher, and the decline rate is somewhat the same, then out months should also be higher. If IP is 500 bpd then a 50% decline leaves you 250, but if IP is 1000 bpd a 50% decline leaves you 500.

2) Then you suggest it is non linear and that is where I thought it was going to get interesting . . . I thought you were saying higher IPs steepen the decline rate. Is that what you’re saying? 500 bpd gets you 50% decline to month whatever 3, but 1000 bpd declines steeper to maybe 60%?

It’s not clear what the conclusion is being presented. Also, the laying out of well numbers, what do they correlate to? Is it purely geography?

1) You seem to say months 2, 3 whatever correlate to first 24 hour IP. That seems intuitive.

Intuitive: adjective 1. perceiving directly by intuition without rational thought, as a person or the mind.

Good Lord no. I just plotted the data. It is what it is. Nothing was left to intuition. And I don’t seem to say anything. The data says what it says.

2) Then you suggest it is non linear and that is where I thought it was going to get interesting .

No I suggest no such thing. The data shows it is non linear. That is no single multiplier, or divisor, can be used to convert first 24 hour barrels per day to barrels per month or barrels per year. It is a sliding scale. That is what the data shows.

It’s not clear what the conclusion is being presented. Also, the laying out of well numbers, what do they correlate to? Is it purely geography?

Oh. Perhaps you just overlooked it. Here is the answer, copied and pasted from above, to both questions, but in reverse order to how you asked them.

It is unclear, to me anyway, whether the lower production per well is because of downspacing, moving further away from the sweet spots, or both. But it is clearly happening. Newer wells, or at least those with higher permit numbers, are definitely coming in with lower production numbers.

Ahh, so the higher permit numbers are just lower. Nothing presumed about geography. Could be well spacing and “interference”, aka previously drained, by adjacent wells.

“From this chart you can see that the conversion from the first 24 hour production to the second months production is non-linear. For instance if the first 24 hours production was between 50 and 1050 barrels then we could expect the second months production to be about half that. From about 1350 barrels to 1600 barrels the first 24 hours then the average second months production would be about one third that number. Or if the from 1700 to 2200 barrels the first 24 hours we could expect the second months production to be about one fourth that number.”

This is the big deal. If they get big production on day one, pressure is down, or hell, total is down, and out years just won’t flow as well as out month output from a lower IP well.

What’s the total cumulative over just the 3 months. Is it the same? Or does the big IP well (I hesitate to say raw open choke) produce less in total over 3 months?

As a mineral rights owner in an area of the Bakken, it has not taken a complicated math analysis to understand that recent drilling (higher well numbers) has shifted to areas quite distant from the sweetspots of the Bakken (hereafter referred to as “remote” wells). Up until the start of the 2014 price drop, drilling in these “remote” areas was motivated by:

1. the calendar (need to drill wells to hold by production before the lease ran out). Such motivation isn’t a simple matter- – because the potential of future drilling at deeper Three Forks formations, will depend on a big experiment that has largely yet to take place – – and likely will not take place until higher prices return.

2. the fact that past high prices helped make these “remote” wells initially economically profitable in spite of their lower b/p/d production.

3. Also, the shift in drilling to “remote” locations was in part due to NDIC restrictions on flaring of natural gas. Wells in the remote locations (being newer) were given the standard holiday from flaring restrictions, whereas old wells in the sweetspots had to be ” throttled” back in some cases.

The Bakken long range potential (middle and three forks) is still too dependent upon future exploration of the Three Forks and upon expected future improvements of fraccing technology, for anyone to safely state that the Bakken production is in true permanent decline.

Nonetheless I am thankful and appreciative of the painstaking analysis that has taken place to generate this discussion.

DOB502

Thanks DOB502, we deeply appreciate the input from an actual Bakken mineral rights owner. I guess we can assume that drilling in these remote areas will now cease as they are no longer profitable.

Cease – no. Significant decline is what I expect. This Bakken shale play is too complex to safely predict black and white answers. For example, while drilling in “remote” locations would generally tend to be non-profitable (if the only change was in the price of oil), there are already predictions of significant drops in the cost of drilling Bakken wells (as fewer drilling and service companies compete for fewer wells). And that helps those remaining companies who are able to continue experimental drilling in the Bakken Three Forks, to better position themselves for the day when oil prices will rise back up again. Just exactly where all this will settle out remains to be seen. In any commodity business, one bust contains the seeds of the next boom, and vice versa. Merry Christmas to all.

I think the point here is that first day production is a good leading indicator or total production, making it a handy way to predict output.

ABU DHABI (Reuters) – Saudi Arabia said on Sunday it would not cut output to prop up oil markets even if non-OPEC nations did so, in one of the toughest signals yet that the world’s top petroleum exporter plans to ride out the market’s biggest slump in years.

As I posted before – after over 40 years of being trashed for high prices, OPEC will wait for other countries to cut production so that OPEC can say that they did not manipulate prices higher (when prices inevitably rise), they will say blame it on the US (and others) who cut production.

Well done analysis. This casts shadow on the total LTO produced from this formations. EIA is clearly overestimating the potential of shale to transform world energy future. With demand rising steadily at 700k-1m bpd per year rate, existing oversupply will soon be digested. In 2016 Russia will begin its fall in North Sea-style. Iraq and Libya can make for it, but shale will be falling until then. This suggests global ultimate peak oil in 2015/2016. I bet late 2015. Now interesting thing is how many companies will cut their exploration budgets and just how constrained will the supply be in coming years.

Ya it is interesting analysis. I’m gonna let some other posts address it because I’m curious about the non linearity things said. Later, there were some late night posts to previous thread that were good rebuttal/thoughts to bailout discussion and will bring them over, but not yet. This IP related to out months may be a big deal worth some focus.

Fantastic post, and a very interesting read. Thanks for all your hard work and distilling data/graphs with comments. Have a good hoilday. (ha, I mispelled holiday but think it kind of fits).

Ron,

This is very interesting, thanks. Could you maybe do a scatter plot of first 24 hours vs 2nd months production.

Also, if you’d like I could have a word with my brother about trying to make something to automate the data collection that you’re doing. He works in that sort of area and is qualified in computer science so could probably help save you some time. If you could give a few links to the files you’re looking at and the data you’d like extracting.

Sam, thanks for the offer but I will just have to figure out what I am going to work on next.

Of course Excel can do scatter plots but they just don’t make any sense to me. After I do them I have no idea what I am looking at. But I will do a little research and see if I can figure it out.

A scatter plot of first day production vs 2nd month might give an indication of what sort of a relationship exists between the two, if it’s a linear function, how strong the correlation is between the two and so on.

I’d also be interested to see some statistical analysis on the change in productivity with time. Without such an analysis it’s hard to say whether your conclusion about declining productivity is signal or noise. If I could have a look at your the data I’d be perfectly happy to run the numbers to try and give us a better idea of what’s going on there. I’m always conscious of trying not to torture confessions that aren’t there out of data.

Hi Sam,

I did a scatter plot of 24 hour IP vs 3 month cumulative. Although the R squared is low, a regression shows the intercept and slope are statistically significant. (P-value for intercept is 6E-207 and for slope is 1E-59, t-stat is 35 and 17.)

Denis, if 3 months cumulative output is zero, 24 hour should also be zero. I think the trend line should go through (0,0). What do you think?

What about the same graph with data from the graph below (moving average of 100 wells 24 hour IP vs 3 month cumulative output)?

Hi Chris,

I agree that makes sense and did it that way initially, but forcing a (0,0) intercept makes R squared negative (which is not intuitive), doing a least squares regression gives a statistically significant intercept and slope, this is where the data leads.

perfect. that’s why we use a stochastic model such as dispersive diffusion, to capture the variation in rates.

The well populations in that scatter plot are grouped (notice there are two distinct lobes). Both groups, when treated independently, will show zero intercepts.

The two lobes are probably associated with something fairly global, I would try grouping them by water cut (ratio of produced water to produced oil in the THIRD month). If that doesn’t work then it may be a reservoir property issue such as the thickness of high quality mixture of shale and carbonate (??).

Hi Fernando,

I try not to massage the data too much, otherwise you create something that is not there. I have very limited information about the data and how would I decide which data belongs to which group? The decision would be arbitrary, I think there have been changes over time with choking, fracking, where the wells have been drilled, and lots of things I haven’t thought of.

I made the remark because one of you noticed the x and y intercepts weren’t zero.

Plus I have to confess I spent years bossing and mentoring petroleum engineers, this means as soon as I realize there’s a lot of data I start asking for lots of plots.

Let me ask you, are you guys trying to determine if the well quality is dropping, and if so how fast?

Hi Fernando,

Yes that is what I am looking for, I will let Ron and Chris speak for themselves.

yes Fernando, we do the analysis work that you guys from the oil patch are incapable of doing — for whatever reason I am not sure.

Webby, we charge for this type of work. I’m retired, and I don’t mind helping out. This site has a lot of good information. Also, I suppose you realize when we muscle up for this type of analysis we gather a lot of privately held information, which even if I had I can’t share?

Fernando says:

Do you realize how lame you sound Fernando? What is a Petroleum Engineering degree for? Do they not teach anything worthwhile in Petroleum Engineering?

Just imagine if someone was interested in finding out how an electrical circuit worked. Is your answer that “Us electrical engineers charge a lot for this type of information, and that it is privately held information — so sorry about not being able to share it” ? Afraid not, this stuff is taught in classes and books.

Ha ha, fortunately, we can figure this out without your style of “help”. The discipline is called earth sciences, and it holds to the same kind of physical laws as any other natural phenomena.

Another type of scatter plot with 100 well moving average, well id is on horizontal axis. 24 hour IP in red and blue, 3 month cumulative in black and yellow plotted against well ID . 24 hour IP in barrels on right vertical axis.

Dennis, this tells me the first three months’ cumulative is a better, or steadier reflection of overall well quality. I keep wondering if water cut isn’t a parameter which can be used to segregate these wells?

Hi Fernando,

Water cut has tended to increase over time, so if we included water cut it would be like adding time to the mix.

What about a plot of 3 month cumulative BO vs 3 month cumulative BW?

If you do that plot, it probably should be the ratio Cum BW versus Cum BO (cumulative water to oil ratio versus well completion sequence). Based on what I’ve seen previously it will show a very clear tendency to increase as a function of well count.

However these types of curves can have unexpected inflection points (such as when they realize they ought to complete in a different fashion).

Hi Fernando,

Thanks. Before reading your comment I did 3 mo cumulative oil vs water

There seems to be about 2 barrels of water for every 3 barrels of oil on average.

ok. We know WOR increases with well sequence number. So the trick is to plot the older well cumulative oil versus this potential diagnostic parameter (3 month WOR cumulative). If they have a significant number of wells with say 3 year life then it should be possible to plot cumulative oil versus 3 month WOR. That may give you a diagnostic parameter??

Another water and oil chart with the 3 month cumulative water output to 3 month cumulative oil output ratio vs well sequence. Well 1 started producing in Jan 2012 and well 5030 started producing in August 2014, wells are in sequence by date with wells sorted by well name for wells starting production on the same date. The trend is up from about well 3000 (Sept 2013), but there have been noisy periods on several occasions.

Chart above is a 100 well average of the 3 mo. cumul water to 3 mo. cumul. oil ratio.

That shows a pretty clear trend to increased Water to Oil ratio. Let’s see….take well population from 1 to 3000, and sort for the ones with the three month water to oil ratio above 1. That ought to yield a population of wells with the parameter closer to the overall value they will be drilling (around 1.5 WOR). Because well numbers below 3000 are older you can take the average recovery for x years for the sorted population. That in turn may be a predictive parameter for the well population they WOULD have drilled if they had continued using the same practices. I think they are about to get more selective. looking at that 1.5 WOR family may be a good idea. We never know until the data is visualized.

Another Chart with wells by date, well 1 started producing in May 2013, and the most recent wells started production in August 2014 (end of data is October, so 3 month cumulative requires an August start). There are about 1750 wells with IP data collected by Ron and monthly output data collected by Enno Peters.

Thank you both for sharing your data. Note that for each month from May 2013 to August 2014, the order of wells within months was randomized.

Ron, when i look at this type of well population I also look at total fluid, gas to oil ratio and water cut. A well’s ability to produce is handicapped by water. On the other hand gas helps the column move to the surface.

Once a well goes on artificial lift the gas ratio can be a hassle (the pumps aren’t designed to compress the free gas). But if you are focusing on the first 60-90 days of production I don’t think the artificial lift issue is that meaningful (??).

If you want to diagnose if well quality is decreasing I would simply use the first 90 days’ cumulative production (check the validity of this parameter comparing the first 90 days’ cumulative versus three year cumulative for older wells).

The problem I see with trying to be so prescient is that the frac jobs may be using larger volumes, or the regulations are forcing them to cut back on gas flaring. This can get complicated.

Hi Fernando,

I used your original idea of 3 month cumulative vs 3 year cumulative for older wells and only had about 1700 data points up to Nov 2011, so I changed it slightly to 3 month cumulative vs 2 year cumulative so we have 3400 data points which extend the data to Nov 2012. Chart below.

Using the linear relationship from the chart above between 3 month cumulative and 2 year cumulative output, I used 3 month cumulative data (200 well average of wells sorted by date of first output) from Dec 2012 to August 2014 to model the 2 year cumulative and extend the 2 year output to wells starting production in August 2014.

This assumes the relationship from Jan 2010 to Nov 2012 between 3 month cumulative and 2 year cumulative continues to hold for wells drilled from Dec 2012 to Aug 2014, the assumption may well be incorrect. If it is correct the 2 year cumulative going forward would look like the chart below based on available 3 month cumulative data.

If the average well in the Bakken field produces 100,000 barrels in 3 years ( $50 million), and costs $10 million +- $4 million.

Then there is some serious money still to be made in that field.

100,000 barrels in 3 years ( $50 million)

How do you get that? Those barrels would have to be selling for $500 each.

Your are right. $5 million is the correct revenue number.

It seems like a lousy investment.

Hi Canabuck,

The average well produces 125 kb over 2 years, and 150 kb over three years. Net revenue is about $32/b, so ignoring the discount rate (for future money being worth less than present money), that amounts to 4.8 million in net revenue over three years for a well that costs at least $7 million (optimistic estimate of well cost). I agree this would be a poor investment.

At these prices a well would need to produce 218 kb to pay out in 2 years, very few Bakken/Three Forks wells produce at this level. The best results by company for the average well over the 2009-2014 period are by QEP Energy at a 220 kb 3 year cumulative which would barely pay out over 3 years.

I agree at an oil price of $65/b or less, there will be very few new wells being drilled as it is a lousy investment.

Excellent trend. The forward looking forecast looks very sound. It tells me the latest well crop was completed in decent rock and with better practices.

This approach can be used to forecast total performance, but if water cut is used somehow to separate them into populations you will get a refined look.

There’s a way to prepare hyperbolic and exponential curve fits to extrapolate for say 10 years, which requires linear programming (I prepared one many years ago using Fortran). However my experience is that if you prepare a very detailed analysis it doesn’t perform much better. You are at about the 60 % solution, and going beyond 80 % isn’t practical.

Based on what I see these producers do need a lower transportation cost, higher prices at the refinery gate, and a lower well cost.

I think this very detailed analysis gives great confidence to the idea that newer wells are producing less oil. The only thing further that could be done to confirm this would be to do an actual spatial relationship between well outputs, permit numbers and physical location.

Thanks a lot Ron for all your work and producing such an interesting and informative site.

I also really appreciate the level of commenting on this site, some very interesting points and discussions occur below the main posting.

Have a Merry Christmas.

Check the December 24 post by Dennis Coyne with the projected 2 year cumulative. It uses a different approach.

David Hughes just sent me the below chart with this comment:

Here’s a chart of average first six-month production for Bakken wells from 1/1/2013. The wells are sorted by first production date and are all wells drilled in 2013 and 2014 with at least six-months of production. The well count on the x axis is all wells from year zero that have at least six months of production.

I am having a little trouble with his “Year Drilled” axis. But it seems to confirm that production per well peaked in late 2013 and early 2014.

This is from Sept before the price smash would have asserted in more or less any way. Geology is much more compelling than dollars.

Very interesting post Ron

One thing I wonder if can be ruled out, if new techniques produce more water and less product initially, it could screw things up

Does the permit specify exactly what kind of completion will be done?

In other words are producers locked in to an old technique based on an old permit

More likely it would seem you are onto something

No, I don’t think technique has a lot to do with the percent water cut unless they count a lot of frac water. Bot that still wouldn’t cause them to produce less oil. And no, I am pretty sure the permit does not specify what technique to use. Here is what the Permit says:

#30285 – XTO ENERGY INC., STENEHJEM 31X-28D, NWNE 28-150N-97W, MCKENZIE CO., 275′ FNL and 2220′ FEL, DEVELOPMENT, SIVERSTON, ‘Tight Hole’, 2225′ Ground, API #33-053-06602

‘Tight Hole” just signifies that it will be a confidential well. I don’t think it has anything to do with sex. 😉 The N and W is the location. I have no idea what FNL or FEL stands for but I doubt it has anything to do with drilling technique.

From north line and from east line. It’s an old coordinates system. In other nations we use x and y as per the national cartographic agency, making reference to the projections, and also add lats and longs. The directional target windows have to be included. I can’t tell from the statement what they do about the horizontal leg. I assume they don’t allow wise guys to drill across lease boundaries unless they have the other leaseholders’ agreement.

Hughes explains the “Year Drilled” problem:

Oops yes that shouldn’t be year drilled. It is simply the well count in the order of first production starting 1/1/2013 – the ticks are at 500 well intervals. I plan to look into this in some of the other plays as well to dispel the myth that technology can trump geology!! Dave

Ok, here it is

What Hughes called “Years Drilled” appears to be a mis-typo for “Wells Drilled”

Ron, thank you for your painstaking but very interesting and very important work.

Chart below with NDIC data collected by Enno Peters though Oct 2014, wells with 6 months of output started producing in May 2014 (month 6 in Oct 2014). Data from Jan 2012 to Oct 2014, data from 4569 wells, 200 well trailing moving average has trended up over this period for the 6 month cumulative. Well 1 started producing in Jan 2012, the last well started producing in May 2014 for data plotted, wells for each of the 29 months are randomized (order of data points within each month is chosen at random).

For comparison the horizontal axis is the well ID#, again this is 6 month cumulative output data for wells starting production from Jan 2012 to May 2014, with a 200 well trailing moving average and a trend line on the output data.

The dip in the 200 well moving average may not be significant because there are only 60 wells in the data set between 27,000 and 27,700. For comparison there are over 400 wells with well ID’s between 26,000 and 27,000 in this data set. For well IDs between 20,000 and 26,000 there are about 4000 wells or 670 wells per 1000 well ID numbers.

Basically the data is too sparse above well ID 27,000 for 6 month cumulative data to tell us very much at this time.

Due to the uneven distribution of wells by ID#, I did a 200 well average on the 6 month cumulative data sorted by well ID #, then I plot the wells from lowest ID # (well #1) to highest well ID # (well #4568).

To me it is not clear if the dip towards the end is significant, looks more like statistical noise, the overall trend over the 2012 to 2014 is towards greater output, though this will flatten over time and then decrease. I am not sure we are there yet, I think we will know in 6 to 12 months, Ron has suggested patience, and I agree we will have to wait and see.

Forgot the chart

The following chart is similar to the previous chart, but wells are sorted by well ID# rather than by date. 200 well trailing moving average vs well #, where wells numbers start at 1 and end at well #5347, well #1 has well ID#=17308 and well # 5347 has well ID#=28859. Again, the trend is up since Jan 2012 (data set includes wells from Jan 2012 at the earliest, though wells are not sorted by date) and the dip below the trendline after well # 5200 is likely to be statistical noise.

http://www.zerohedge.com/news/2014-12-21/houston-you-have-problem-texas-headed-recession-due-oil-crash-jpm-warns

This is loaded with “shale is TBTF” evidence. e.g.,

The Perryman Group estimates that the industry as a whole generates an economic stimulus of almost $1.2 trillion in gross product each year, as well as more than 9.3 million permanent jobs across the nation.

That’s oil in total, not just shale.

API had this, but probably quoting the same people:

The API’s report said each of the direct jobs in the oil and natural gas industry translated to 2.8 jobs in other sectors of the U.S. economy. That in turn translates to a total impact on U.S. gross domestic product of $1.2 trillion, the study found.

Shale is what, about 40% of total US oil production? If that’s linear it’s 480 billion dollars at risk. 0.480/18 trillion = 2.5% GDP drag. Job wise it’s probably a bigger impact because those jobs pay much better than waitressing and medical certificate people, where the only other job gains have been seen.

Mr. Patterson, Two charts – Fig. 2-9 from Mr. Hughes’ Drilling Deeper and slide/page 7 from ND’s September 18th ‘ND Producing Counties’ presentation should – clearly, I would think – firmly put the ‘drilling sweet spots’ meme in context.

In Mr. Hughes’ slide, the ‘greenish blob’ to the left is the Elm Coulee area with considerably lower productivity than ND’s Bakken/Three Forks formation. The relatively much larger areas in ND that contain red (bright yellow in the ND DMR’s slide) are barely drilled compared to other fields – such as the Sanish – which are heavily laced with high-output wells.

There are MANY reasons operators drill in less-than-most productive locations in the early years of a ‘new’ find, including, but not limited to the all important Held By Production clauses in the leases which have a limited – frequently 36 months – window of time in which an operator MUST produce hydrocarbons or go bye-bye.

After the land grab is over, operators may be inclined to drill delineation/appraisal wells – especially with high priced oil to compensate presumably lower output.

The underlying Three Forks – with at least three productive ‘layers/benches’ – has not even been delineated yet.

Just a few moments looking/ studying both Mr. Hughes’ slide and the even more informative ND DMR slide with Bakken-wide 60 day IPs, current as a few months ago, should unequivocally demonstrate there is a huge amount of highly productive area yet to be developed.

While I am in disagreement with many of your conclusions, I appreciate the copious amount of time and effort you put forth and wish you an agreeable respite in the coming weeks.

Just a few moments looking/ studying both Mr. Hughes’ slide and the even more informative ND DMR slide with Bakken-wide 60 day IPs, current as a few months ago, should unequivocally demonstrate there is a huge amount of highly productive area yet to be developed.

This begs the question why these “highly productive areas” haven’t been developed yet. If they’re that good, nobody would have ignored them for the three years while oil was at $100/barrel. Your above statement goes directly against human nature and I therefore call it false.

Frugal, the areas mentioned have not been ignored, each 2 sq. mile DSU (Drilling Spacing Unit) has at least one well on it – as is clearly visible in the DMR slide. The far more densely packed fields with yellow lines (wells) are the forerunners of what will come to pass in the fields that are now held by the operators with high (over 500bpd 60 day IP) producing wells on them.

A further factor is the lack of infrastructure to economically remove the hydrocarbons. A somewhat dramatic example of this currently exists in the Marcellus as there are presently about 2,000 wells – a year’s worth of effort – already drilled and fractured but not flowing due to lack of pipelines.

Exactly, it’s not highly productive but instead less productive and therefore more expensive to extract than what ‘s being produced right now. And this is also why the infrastructure doesn’t exist yet. This is a clear example why peak oil is real.

There is no such thing as “Held By Production” clauses in an oil and gas lease. There is a primary term in which the Lessee has a designated length of time to commence operations to establish profitable production, usually 2, 3, 5 years, or the lease terminates. After production is established the lease can be perpetuated for as long as profitable production exists, without lapses usually not to exceed 3-6 months. That is where the term held by production comes from. Many later oil and gas leases taken in shale plays actually contain continuous drilling provisions whereby operators have to drill it all up, or lose it.

Early in the development of the Bakken and Eagle Ford plays, sweet spots containing all the endearing traits (perms., high oil saturations, over pressured, high GOR, low waters) necessary to make good wells were delineated and those areas got pounded with wells. Economy of scale, water disposal systems, pad drilling, zipper frac’ing, gas gathering systems, stock performance, steep decline rates, and the need to book as many barrels of reserves as possible for the benefit of the finance folks all required the good stuff got drilled as fast as it could get drilled. Look at drilling permits and you’ll see unit wells as high as #15H or higher being drilled already. I do not accept that there is huge amount of “highly productive area” yet to be developed. Whatever amount of productive area is left is hardly going to be developed at 30 dollar net oil prices anyway. Going forward its debt that is going to dictate how fast what gets drilled.

I am going to keep you own your toes as much as I can, Mr. Coffee. I for one am tired of the bullshit the shale oil industry keeps delivering to the American public and a great deal of what you post comes straight off company websites and press releases. America needs the shale oil industry to survive but lets call it for what it is; very high cost, low return hydrocarbon extraction that is now suckin’ air because of 55 dollar oil prices.

Mike

Mike, your first sentence in the second paragraph is so demonstrably false, I am very surprised. When Mark Papa announced in the spring of 2010 that EOG had leased hundreds of thousands of acres in the Eagle Ford, there was not only minimal drilling prior to that, Floyd Wilson’s ‘discovery well’ two years earlier with Petrohawk barely registered in the wider oil industry. EOG’s people were very nervous about investing all that money in yet-to-be-drilled acrege.

‘Pounded with wells’? You or anyone can look at the ND DMR slide and see all those ‘white’ dashes to the right that denote the Parshall field, widely acknowledged as the sweetest of sweet spots in all the Bakken. Barely nothing there yet but EOG’s retention wells to protect their lease obligations.

Oh yeah, Mike, I just made up that HBP stuff to sound like I know what I’m talkin’ about.

There are no HBP “provisions” in a oil and gas lease; google it. Drilling a well under the primary term of a lease is different. One well can sometimes HBP a lease, or pooled unit, but not always. If you are going to be a spokesman for the shale oil industry I just want to make sure you get your terminology right. I made my point, lets not get in a chicken fight about that.

Yes, early in a source shale play there is vast amounts of acreage leased. Companies delineate their acreage plays and use well analysis and a learning curve to find sweet spots. There is a lot of scenery that gets a well drilled on it in the delineation process, when those wells are not so good that scenery is subsequently never developed. For the reasons I mentioned, and stand by, that Mr. Frugal correctly questioned, those sweet spots get the snot drilled out of them. If all shale was created equal, as you seem to imply, why focus on any sweet spot? Lack of infrastructure? Geeze.

It is not going to happen the way you want it to happen, Mr. Coffee. It wasn’t anyway and oil prices have foiled the abundance party. Sorry, don’t get mad at me.

I think if you are drumming attendance to another shale oil revival meeting you might be disappointed in this Peak Oil Barrel crowd. They are pretty savvy.

Mike

I looked at North Dakota production info for October, 2014. Parshall field has 328 wells with reported production plus 37 more on confidential list. It has had the best wells in the Bakken for the most part. I suppose the issue is how successful down spacing will be.

Also interesting to note 161 of the 328 wells wherein production was reported showed oil production in October, 2014 of less than 2000 bbl, or under 70 per day. Does that mean the field varies greatly, depletes quickly, or both?

I likewise have no doubt there are some great wells in Bakken, EFS, etc. But there are also many that are not.

If I’m not mistaken, the oil EUR in Bakken is 320,000 on average and 168,000 in EFS. Not sure about numbers for other areas. Gas sales help somewhat. Most water appears to be trucked, which isn’t cheap.

Wells cost $7-10 million in these areas based upon my reading. This makes the high IPs less impressive. I think many get caught up in those high IP. Yes a 500+ IP in the lower 48 is great for a $750,000-$1million vertical hole. But what is the difference in profitability between a $750,000 vertical hole in S Texas that has EUR of 16,800 v the “average” EFS horizontal hole?

I suppose the LOE ratio for the above example is not 10-1. On that I stand to be corrected. I’ve posted this type of comparison more than once and no one seems to be interested, let alone point out that I’m wrong.

I agree these wells have really made an impact, but IMO on the whole they need a higher oil price than present to make sense.

Oil has eroded the 50 cents in Singapore. Down about a dime now. 57.xx

Mike doesn’t need any help from me but I can assure everyone that Mike speaks truth about the Oil and Gas Leases. I am landman in Midland Texas with more than 30 years of experience as a major company employee and as an independent putting deals together.

Mike is spot on with everything he says on this blog. I would post more on the Permian Basin but I am not current on any of the well costs.

Every geoscientist that I know and every petroleum, drilling, operations, or facilities engineer with more than 10 years of experience would tell you the exact same thing that Mike has posted on this blog.

Oh, and Merry Christmas to all!

All y’all Texans swaggering because of the Cowboys.

Thank you, sir. Merry Christmas to you.

Mike

Sorry folks,

But I’m having an extremely difficult time even believing, that these PO discussions about Bakken sweet spots supposedly being tapped out are still going on….AFTER ALL THESE YEARS!!!!!

All you had to do was to look at the maps KOG was putting on their website, which show exactly where each Bakken well is drilled. Then you compare that drilling pattern to CLR’s maps, which show you where all the sweet spots are. Even Rune is now “aware” that the sweet spots are largely determined by pressure gradients, which is what CLR’s maps shows. I found out about all this, MORE THAN FOUR YEARS AGO !!! by simply writing an email to CLR and asking why they choked back their wells so much.

CLR also presently claims to have more than eight years of future drilling sites available in the Bakken (at their present rate of drilling) which they say will yield more than 750,000 boe in EUR’s per well. As CLR is a good proxy for the entire Bakken, what does that tell you about the future of the entire Bakken?

I might mention that “the best” definition of a Bakken sweet spot given at this website by a true believer, “Watcher”, was that sweet spots were defined by latitude and longitude, not EUR’s. How pathetic.

If you don’t believe what the industry is saying, then you just admitted that your point of view is based upon BELIEF, not facts. Therefore, PO is a religion. If you want it to be a science, then you have to first disprove what the industry is saying. I have noticed, that no one here is actually doing that.

As for this sentence from the above “article”…… ” The first measured 24 hour production from Bakken wells is a very good predictor of the future production of that well.” The truth is exactly the opposite, for among many other reasons, the choking history is not even taken into account.

All the recent mega activity at this site just seems to be one big cover up of the fact, that all your great PO theories got shot to shit with the recent fall in oil price due to over production from US shale. The latest figures from the EIA show that 9,137,000 bpd were being produced in the US as of 12/12/14, and that is an increase. Sorry, but that is not how terminal decline plays out in the world of reality.

8 yrs. 750K barrels EUR per well. At current 175ish/month well addition rate that’s 16000ish wells added in 8 years.

Current total 11,000ish. So 27000 wells total then. X 750K =

about 2 Trillion barrels of oil. Don’t think even CLR expects more than 50 billion, and they are bizarre. But hey, at $40 barrel Bakken sweet prices, that’s a lot of money. $80 Trillion. What a bonanza.

CLR was $30 a few days ago. $80 a few months ago. Maybe they’ll go bankrupt. That will really mess up Mrs. Hamm’s lawyers.

Watcher,

I’m not going to even bother to check your math. Your numbers are way too far out for me. But, more than four years ago, CLR estimated 24 billion boe recoverable. That was recently upped to 62-96 billion boe “recoverable” (@$100) Call it less, if you like at today’s prices. But, the Bakken is still Ghawar sized, so you can eventually expect Ghawar sized production.

As to the number of eventual wells, try starting at 100,000, and go up from there. In the 4,000 square mile CLR designated sweet spot, their plan is for 16 wells per square mile (in four different zones) which means 160 acre spacing. That’s 64,000 wells right there.

How about Y-O-U defining what constitutes a PO Bakken sweet spot in EUR’s, instead. Then, we can start communicating. (maybe).

Carl Martin: Is an average EUR of 750,000 net bbl of oil per well accurate in the Bakken? It doesn’t appear that it is when one looks through the public information put out by the State of North Dakota. Further, it doesn’t appear generally that Continental has the wells capable of hitting this figure. EOG and Whiting are the primary companies to have the wells capable of 750,000 net bbl EUR, based upon public data.

I have read on this site that 320,ooo gross bbl EUR is more probable overall in the Bakken, although I am sure if people have agendas they can skew the numbers. I think at least a few of the people who post here appear to have strong enough math/science/engineering backgrounds to make some pretty reasonable calculations and are making an unbiased attempt to be as accurate as possible.

Trying to figure out what is accurate and what is not is more difficult than what you let on, IMO. It does appear that substantially lower oil prices may provide some answers.

Oops. The 750,000 number is BOE, so that does make a difference. The 320,000 figure I referenced is BO, not BOE.

BTW, CLR just cut CAPEX budget to $2.7 billion. This is the second cut they have announced in about 3 months.

There is that. 2.7 Billion at $10 million/well, from the CLR Nov investor briefing, is 270 wells. For the whole year.

Avg flow year 1 is about 450 bpd? So incremental revs in 2015 would be 270 X 450 X $30 (net of Bakken Sweet minus royalties, taxes) = $3.65 million, for the whole field for the whole year from new wells.

Maybe Warren Buffett will do what he did for BoA. They created a special preferred issue for him to buy $5 B of. Paid 8% dividend or something. Hell, he may get more of Harold’s money than the ex.

“Avg flow year 1 is about 450 bpd? So incremental revs in 2015 would be 270 X 450 X $30 (net of Bakken Sweet minus royalties, taxes) = $3.65 million, for the whole field for the whole year from new wells.”

err I think you forgot that a year has 365 days? That comes out to more than 1.3 billion dollars even at these depressed prices!

The average well flow for the first year is about 233 b/d, not 450 b/d (second month output is usually highest at about 400 b/d), the average well produces roughly 85 kb in year 1.

Using Watcher’s figure of 270 wells and call refinery gate oil prices $60/b, transport costs $12/b, OPEX plus other costs $8/b leaving $40/b, then we need to pay taxes and royalties of roughly 25% on wellhead revenue of $48/b, so we need to subtract another $12/b and we get to $36/b net. If 270 average wells are drilled we get about 23 million barrels of oil in year 1 for a net of $826 million. The wells cost about $9 million each for a total of $2.4 billion. Looking at a single well, we need 250 kb for simple payback (ignoring the time value of money), but the average Bakken well takes at least 8 years to reach 250 kb of output, typically a “good well” pays out in 18 months or less. At two years the average Bakken/Three Forks well in North Dakota produces about 130 kb which is about $4.3 million in net revenue and far short of a $9 million payout level.

SS,

No, the 750,000 boe is just a reference to CLR’s claim, that they have eight years of drilling activities, that can produce that much per well. TRANSLATION: The current low oil price environment is easily weathered by simply high grading. Any company with similar property can do the same. But, many of the newer, smaller Bakken dotcoms have no such property, so their very existence is in great danger.

It is nowhere near the average Bakken EUR.

By the way, unlike so many others here, I don’t guess anything, and have very few opinions of my own. I mostly just repeat what is generally accepted knowledge about the shale industry, because no one has so far been able to prove any of it to be wrong.

It’s just that none of my researched information supports any PO theory at all. That’s the rub.

So at what cost does oil have to be produced in the future? Where are we find this oil? And are you so negative about renewables you think they won’t be competitive with oil at $500 per barrel in today’s dollars?

I have been using just under 300,000 for the diffusional model I put together a few years ago.

What is nice about making early projections is that you can see how production plays out.

So where do we get the oil when the better shale zones are drilled and declining? Chinese shales?

Hi Carl,

Enno Peters collects data on all North Dakota wells from the NDIC, the EUR of the average Bakken well between 2011 and 2014 is about 325 kb of oil, if you add in natural gas and convert to barrels of oil equivalent(boe), it increases to 406 kboe, but note that the extra 80 kboe is very low value relative to crude.

Note that the typical well in an investor presentation is not the same as an average well. Maybe CLR only drills above average wells. 🙂

Dennis,

I don’t dispute your average EUR numbers, as I don’t have the neccesary info to do so. Besides that, they sound about right to me. But you need to be careful about getting too hung up in the word or concept of average. After all, what do you think is the average gender in the US in Dec. 2014?

Investor presentations ALWAYS show their best results, and almost never reveal all the failures, that bring their averages down. This is just business as usual. But, it is okay because they are always moving up the learning curve, so by showing their best results now, they are giving a clear indication of where they expect their average results to one day be.

Also, if you want to understand this industry, it does no good to focus on average companies, you need to look at the leaders, because they are the trend setters. Ultimately everything is based upon best practices, and EOG is presently the undisputed best at everything. They just don’t keep investors very well informed. Therefore, I still get most of my info from CLR.

This sentence of yours is not as silly as you might think. “Maybe CLR only drills above average wells.” In a sense, “they do.” That is to say, that they have no monster wells, that I know of, they choke a lot more than others, and they have used their standard 10,000 foot lateral and 30 frack stages well design over most of the Bakken, even when it didn’t make economic sense to use it. It is because they use their standard well as a measuring stick. Now they have a fixed point for reference to compare different areas of the Bakken.

That’s why they know exactly what they are talking about, and why I accept most everything they say. You obviously don’t. But, you have never given a good reason for not doing so, other than the results they are claiming don’t show up in the data bases you are using. Why don’t you just send them an email and try to clear up a major misunderstanding on your part? Then everyone at this website will be able to move forward.

Hi Carl,

Continental wells with first month of output between Jan 2009 and Oct 2014 have an average cumulative output over 70 months of 186 kb, this is slightly below the average Bakken well over the same period for all wells completed(925 wells).

There is a lot of hype in investor presentations.

The Continental wells will produce considerably less oil that the 480 kb claimed (only 80% of the 600 boe EUR is oil) in investor presentations. The EUR is more in the 250- 300 kb range for the average Continental well.

Thank you again, Dennis, for the information you provide.

AAAAAmen!

Happy holidays to all!

I wonder if they have run flow meters to check how much flow they get from the toe of a 10 thousand foot lateral. You seem to follow this closely, are those wells slugging?

Hi Fernando,

It is not clear who you are asking.

I do not know what slugging is.

Dennis, sometimes very long wells in three phase flow can have phase segregation in the horizontal section. This causes liquid slugs to accumulate, which tend to move up the well in slug flow. This can be avoided by placing the heel higher than the toe. But I’ve never worked with a 10 thousand foot well. And I was wondering if they had sensors to confirm the toe is producing.

I came to the same conclusion as you Dennis. The Continental wells are actually bellow average. I have attached a graph showing the production profile for Continental wells from January 2010 to October 2014. I also included the average Bakken well profile for 2010 for reference. The first 3 year cumulative oil + gas production for an average Continental well is about 170.000 boe. No one knows what the EUR will be, but EIA suggests that 50% of the oil has been produced during that time (http://www.eia.gov/forecasts/aeo/tight_oil.cfm) which gives an EUR of about 340.000 boe.

Carl, you are saying yourself that they only show the best results and don´t tell about their failures. So why should we then believe in anything they tell us? I have learned that you should never ever trust in what companies tell in their presentations. Especially not smaller companies which are dependent on cheap credits. It is actually quite disturbing that companies can make such exaggerations and get away with it.

I however agree with you Carl that there are still drillable locations left in sweetspots. But perhaps some companies start to run out of them. That would affect total Bakken output, which I am mostly interested in.

Hi FreddyW,

Along the same lines I did the chart below. Cumulative well profiles.

Thanks Dennis. It´s good that we are several people who can look at the data from different angles.

I posted a chart for average Bakken cumulative output per well by company for four large companies over the Jan 2009 to Oct 2014 period( about 1/3 of all ND bakken/Three Forks wells drilled(3462 wells).

The “avg” well is for all Bakken/Three Forks wells in North Dakota over the same period with a cumulative of 197 kb per well over the first 58 months of output.

Chart came out a little small the first time so I will try it again.

I put together data for more companies, about 75% of total wells, too many for a clear well profile so I am using a bar chart with 54 month (4.5 year) cumulative output for the average well for each company over the Jan 2009 to Oct 2014 period. The average Bakken well is shown for comparison. Companies with more than 200 wells over the chosen period are presented below.

Dennis, thanks so much for this information!

Surprised by QEP, they don’t get the hype the others do. Always assumed EOG had the most productive wells in the Balkan due to Parshall. Must have wells in other areas which bring the average way down.

I wish TX reported by well as opposed to by lease. Would be really interesting to see the same info for EFS and Permian horizontal wells.

Really seems irresponsible for these companies to claim EUR oil at 600,000+. I guess they assume the wells will produce 40-60 bbl per day for 25 years. Will be interesting to see if they do.

Bakken. Spell check got me I guess?

Dennis,

It looks like the quote from the other day, “Continental must drill all above average wells”, may need some adjustment. To “Continental must drill all below average wells”?

Hi all,

I show the North Dakota Bakken/Three Forks cumulative average well profiles by company for the Jan 2009 to Oct 2014 period, total wells for this set of companies is 6472 wells of about 8054 wells completed (drilled and fracked) for all companies operating in the North Dakota Bakken/Three Forks (80%). This is where I got the data for the bar chart. QEP energy is the high well profile and OXY is the low well profile, the middle dashed line is the average well profile for all companies (including those not presented in the chart).

https://www.dmr.nd.gov/OaGIMS/viewer.htm

zoom in, you’ll see well numbers, locations, horizontals.

Updated on 12/16/2014.

Initial Monday numbers, Sydney open, Japan pre open 8 AM, oil down 52 pennies to low $57s. Dollar a bit strong across the board.

Exactly, Mr. Walter. If one uses the ND DMR Gis map to get a micro view, then glance at ‘bigger picture’ using either Mr. Hughes’ colored dots or – more informatively – the aforementioned ND slides, it should be clear that the high productive/sweet spots (red – Hughes, yellow/white – DMR) have a lot of drilling yet to go.

dood, you have not one square inch left to go at $55.

And I think you know it.

Watcher, I’d say the dance floor is getting a little crowded, wouldn’t you?

That’s a great graphic that shows many things. The spacing on virtually every one of those wells is st least 1,200′ apart. The successful down spacing will prompt a near doubling of those wells if the 700′ spacing proves widely workable. The designs of the fracs are more and more purposefully geared to extend no farther than 300′ or so from the wellbore.

The underlying Three Forks formation has at least two or three productive layers that the USGS actually claims to be larger in recoverable hydrocarbons than even the middle Bakken.

Crowded dance floor? If Shania walked in, room would be made garonteeed.

I have a geologic theory to propose on the basis of no evidence. Doug, listen up. Mike, ditto.

So we drilled and fracked a lot of laterals. Then we are going to shut down. For a year or three. We’re going to near zero output. Loss of 3.5 mbpd, up the imports to keep people fed, etc.

People come back and say, the price is up. Let’s get going again.

But down there 10,000 feet we have four counties that have been pin cushioned and nanopores down there having been subjected to 3-5 yrs of explosion type vibrations. And there are lots and lots of empty pores now, from wells drilled and emptied.

If we give the nanopores in the undrilled places long enough, with very poor natural permeability, and lets say long enough isn’t a million years, lets say it’s just 3, might that oil flow over to the empty pores?

Then you have drilled and fracked wells that refilled, but only about 1/8th of what they had. The pressure is gone. Much more important, those areas not yet drilled are losing their oil. It’s flowing to the already drained wells.

I *think* this makes the whole field uneconomic pretty much forever? No one well will have enough in it to warrant going after it?

Heh Watcher, I’m currently “in transit” and, damn it, I left my crystal ball on the mantle. Truth is I have no idea. My gut feeling is you could come back and carry on. Perhaps the areas drilled like Swiss cheese would be degraded on some scenario like you suggest, BUT, in general, tight formations are tight and fracked “cylinders” could (should) be independent (new) structures — I imagine. But your opinion is as good as mine. And although I’ve some geological savvy I’ve zero LTO experience. I’ll think about your question on our next flight leg but main concern right now is Christmas presents getting to Norway (Bergen) in one piece. Meanwhile keep doing your stuff. Cheers.

Watcher, one quick comment before I go to work, its never good to frac a well then shut it in. I know that is true in fractured carbonates and other tight sandstones, it must be true for shale also. As you elude to, the frac “energy” is lost over time (like blowing up a balloon and the letting it squeal out the outlet). Natural micro fractures in shale are expanded and filled with proppant during the frac process; they will closed back if the well is not produced. At that depth there is over burden forces that cause proppant to embed into the shale also closing the fractures.

Mike

Well, I don’t know what the scale is on that map and neither to you. Lets assume you are right, they’ll go back in between those wells and drill more wells, when the price of oil is 119.oo dollars a barrel. But to accommodate that, spend more money and get even more in debt, they’ll re-tweak the frac-radiuses on those wells so they DON’T interfere with each other; less sand, less rates, fewer stages?

But wait, I thought they were doing just the opposite, they were using more sand, more water, bigger rates, more stages, super-hero, big-boy frac’s…no? Might they be doing that to increase frac radiuses and URR on a given unit…to keep from having to drill in between wells? I am confused.

Whooptie to doo on the stacked horizon thing. Not so good, I hear. And the USGS, well, the boat done left the dock without them out there in California, uh?

Time to give up the ghost. Time for the shale oil biz to tell it like it is. They’ll win friends and influence more people by telling the damn truth!

Mike, both you, I and anyone can get precise scaling from your graphic by clicking on the above (Mr. Walters) link which takes you to the North Dakota DMR Gis map. It contains a ton of info – including physical locations – of every well drilled in the state going back to the fifties. The one sq. mile rectangles are formed into 1,280 sq. acre/2 sq. mile Drilling Spacing Units.

The issue of mimimally effective spacing between wells is an ongoing quest with companies like Carrizo claiming success with 300 foot spacing in the Niobrara.

Gotta go. Best wishes and best of luck to you all.

Mike,

Just curious as to why you (apparently) think that oil companies don’t actually want well communication ( well interference/ pirating) between wells in the same zone?

The actual production of oil wells is highly influenced by all the natural low grade seismic activity going on in their area. Fracking is just artificial low grade seismic activity, and there is considerable evidence out there, that fracking actually improves overall oil production, if there is well communication going on within specific zones. That’s why nearby wells are temporarily shut in during fracking operations. But, so far no one wants well communication going on between two different zones, because it would be too difficult to monitor and control.

If done correctly very close down spacing can result in greater overall productivity, and at a lower cost. That is, after all, why it is done. Would you consider doing some homework on this issue?

The actual production of oil wells is highly influenced by all the natural low grade seismic activity going on in their area.

Uh?

I am sitting on a rig right now trying to get home to see my family for Christmas, Mr. Martin. I don’t have the time, nor the inclination to engage with you, or whomever, about lofty shale oil EUR’s and years of drillable locations, nor do I seek to debate you the merits of zipper frac’ing, interlacing frac tips and the economics of infield development. Whatever you have to say about it comes straight off a shale oil website, or quarterly report, anyway. I have heard it all before. There must be a press package to download somewhere.

The point that you wish to make, I think, is that I have it all wrong, as do a lot of people that post here often, about shale oil. It is everything shale oil companies say it is, that you say it is, and much more. Got it!

Have a productive day, Mr. Martin. Feliz Navidad.

Nope.

It is geology 101 and has nothing to do with shale oil companies. All the rocks on planet earth are in constant (slow) motion. The proof of this can be seen in oil production. In any given area, or well, it is not at all steady. You can easily see how oil production jumps in all the wells in a given area, when a minor seismic event occurs nearby. Why don’t you ask a geologist in the company you work for about this phenomenom?

I’ve been here and done this before with another oil field worker. Just because you happen to work in an oil field doesn’t mean that you know much about the business. What you know, or don’t know, certainly gets revealed pretty quickly in a forum like this.

You are basically saying that you won’t prove me wrong, because you don’t have time to do so. That’s just a cover up. You won’t attempt to prove me wrong, because you simply can’t, but your hurt pride won’t allow you to admit it.

We are all witness to what coffeeguyzz has said to you, and you wern’t left with a leg to stand on. Sorry, but I’ve yet to meet a PO believer who has not revealed himself to be anything other than a hot bag of air.

If that shoe doesn’t fit you, then I’d sure be interested in anything further you have to say.

I’m convinced peak oil is a given. The debate is really about the timing, isn’t it?

Carl: “The actual production of oil wells is highly influenced by all the natural low grade seismic activity going on in their area.” What’s your point? Are you suggesting micro seismic events increase or decrease well productivity? I’ve never heard anyone suggest micro seismic activity correlated with oil flow rate increases. I’ve no doubt strong events affect rock permeability, in various ways, but would be loath to say it was working in one direction. Of course there is always background activity (as well as diurnal (tidal) rock formation flexing). If you wish to pursue this I recommend: Stress Waves in Solids by Kolsky, a readable work on wave propagation in non-elastic solids.

Doug, I can’t get too detailed about it here…in some cases we have both lab, and field, data showing vibrations and pressure pulses increase recovery. I have a theoretical outline for pressure pulse effects in heavy oil displacement I may publish one of these days. I haven’t seen data for fractured tight zones, therefore I can’t say anything about it, but I wouldn’t toss ideas in the waste basket so fast.

Mr. Leanme, the comment above implied “natural” seismic activity in the earth “highly” effects the consistency of oil production (everywhere). Oil pressure “jumps” in areas of seismic activity, that sediments are constantly moving. I don’t buy that, not to the effect they change production. I have not seen that in 50 years of doing this stuff. We were not talking about induced seismic pulsation or vibration down casing, that sort of thing. I have experienced that theory; in clastic sands and fractured carbonates it did not work.

Mr. Martin, by the way, you have the manners of a goat. My trying to get home from a well to see my family for Christmas was not a “cover up.” I wished you a Merry Christmas and you then insulted me. I am not retired (at 65), nor am I an “oilfield worker.” I am still actively engaged in exploration and production, from developing the prospect to seeing the end result into the tanks and managing the production over the ensuing years. That is how I feed my family and the families of my employees. In other words, I have to invest my money into my beliefs, my money where my mouth is, so to speak. How ’bout you? That does not make me an expert on anything, on the other hand I don’t like to be insulted by kids on computers who develop ideas based on website dribble. I think clearly your ideas about 750K EUR’s is BS. You just got embarrassed with some real data.

Indeed there are lots of straws to still get stuck in sweet spots, big deal. I believe, and several very smart people believe, that sweet spots are being depleted. Production data, declining IP’s, increasing GOR and increasing WOR all indicate that, clearly. The bottom line in all discussions of oil development, past, present and future, is based on the ECONOMIC sustainability of that development. The numbers and fluff don’t mean nada; its about the money. I am still waiting on the shale industry to sho’ me some money.

Merry Christmas, y’all.

Mike

Why would they drill wells perpendicular to each other? Have you guys discussed the well productivity versus the way the horizontal leg is pointed?

In the Eagle Ford, lateral orientation is generally dip oriented, heel to toe from NW to SE or vice versa. I think this corresponds to stress fractures in the rock. The shale guys down here like to drill two laterals parallel to each other, not perpendicular, and frac both laterals at the same time, something they call zipper frac’ing. The frac’s are designed so that the tips interlace with each other to achieve better URR; that is their “downsizing” MO. Having said that, the shale oil folks are now touting bigger frac’s; more stages, tons of sand pumped at enormous rates, to achieve greater frac radiuses to get those highly sought after IP’s, that translate into big EUR’s, that translate into booked reserves that translate into happy bankers. I don’t why they would then want to drill 9 million dollar in between wells, just to say they can, inside the partially drained radius of a nearby well but hey, if its on the internet, it must be true.

Mike, that sure makes sense for the Eagle Ford. I was referring to the Bakken well layouts. Some operators hace wells drilled perpendicular to the “normal” direction.

Reference the vibes and pulsing, I think it depends on the reservoir. Pulsing works with highly viscous oils if the reservoir is being flooded. It works much better if the producers aren’t cutting a lot of water. I saw some odd results for vibration but that may have been fake data put out by a promoter. But none of this is from natural seismicity.

Fernando, “but I wouldn’t toss ideas in the waste basket so fast”. I’m not sure how saying: “I’ve never heard anyone suggest micro seismic activity correlated with oil flow rate increases..” is tossing anything in a basket. I understood Carl’s comments as being directed at NATURAL micro seismic activity. Pulsing (something that you introduced) doesn’t seem relevant to Carl’s (or my) remarks.

My mistake.

Hi all,

A few people have mentioned higher density drilling in the Bakken and the layers of the Three Forks which might be exploited.

The Continental Hawkinson well data is available which is a poster child for higher well density (more wells per square mile).

Note that the first Hawkinson well was drilled in the three Forks and started producing in Feb 2010 and was very productive (356 kb over first 24 months), two more wells started producing in Sept 2011 (one in middle Bakken and one in Three Forks). All three of these wells look like they were refracked by Sept 2013 when 11 more wells started producing as part of the high density experiment. Early wells were averaged together by month from first output, the early wells are the first 3 wells which started producing Sept 2011 or earlier.

Later wells are the 11 wells which started producing in Sept 2013 (7 are Three Forks wells, 3 are middle Bakken, and one is not labelled). The later wells produce an average cumulative output about 40% lower than the first 3 “early” wells.

Chart with individual Hawkinson wells, the indication is that higher density drilling will reduce the average well output, despite what the investor presentations might suggest.

Another point, is that sometimes people claim that with low prices the oil companies will just drill in the “sweet spots”. As the Hawkinson wells show, even in a sweet spot, as the first three wells clearly were, further drilling does not always produce high EUR wells, you don’t really know what you will get until you drill and frack and then start producing.

Seems to me the key to this business is to batch drill and complete multiwell pads, use liners, gas lift, design surface systems for 700 Barrels of fluid per day, keep things simple, automate, keep things simp,e, widen spacing and negotiate hard to lower costs. They also need pipelines. And this wouldn’t be such a critical decision if the state used its brains and paced development to hold state production flat at say 700 thousand BOPd. It’s a shame they allowed the play to go wild, it causes a lot of human suffering.

You.

And/or some of your comments, what they seem to suggest, and how they sometimes read– like a corporate commercial shill… Maybe that G is actually a 6? …Looks a little funny over here on my screen… Maybe there’re attempts being made to assimilate/upsell me as well… Should I upgrade to the new Nissan Leaf-blower or the Toyota Priapus?

‘With the tax credit!‘.

…Examples ostensibly suggestive of those caught in the Matrix/Plato’s Cave, and upholding it while subverting their own foundations, lives, freedoms, fellow creatures. The ultimate prisoners perhaps, ones that don’t believe they are, and that resist reasonable attempts at being freed.

“In The Decline of the West, Spengler noted that the last phases of every civilization are marked by increasing technological complexity. This is strikingly true of planetary culture today…

…’Why Civilizations Fail’ outlines quite ably the reasons why civilizational failure is inevitable, why the grasping control ethos of domestication comes to its self-defeating end. The book’s first sentence also serves very well to announce the fatal illusion that prevails today: ‘Modern civilization believes it commands the historical process with technological power.’