A Guest Post by George Kaplan

Overview

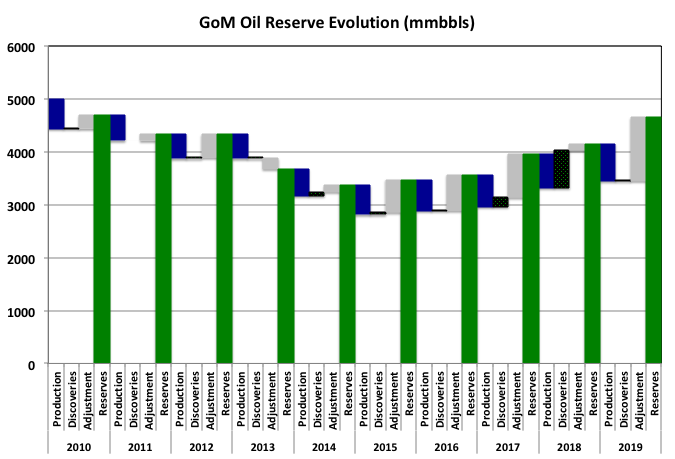

For 2019 BOEM showed a large increase in remaining reserves of 1.3Gboe, 91% of it oil, from newly discovered oil with Appomattox/Vicksburg and Vito the largest contributors at over 400mmboe each, followed by Buckskin and Kaikias, which are fairly large multi-well tie-backs, and smaller, one or two well tie-backs of Blue Wing Olive, Constellation, Claibourne, Red Zinger and Stonefly. These discoveries were made with exploration wells between 2006 and 2016 but were only counted as reserves once firm development plans were put in place. Even given this the year in which BOEM includes the reserves is rather opaque and idiosyncratic, for example some of theses fields started production before 2018, and some developments, notably Kings Quay, are more advanced than Vito but are not included.

Other additions came from revisions to Thunder Horse, Atlantis, Mars-Ursa and Jack/St. Malo, which had major brownfield developments. The fields were not all added as discoveries or adjustments for 2019, but were spread over 2016 to 2019. Some other discoveries under development, such as Anchor, Whale and Ballymore, or in pre-FID studies, such as North Platte and Fort Sumter, will likewise be added against their discovery years as their estimates are finalised. Several of these projects are among the first to use new 20ksi wellhead equipment and it will be interesting to see what teething troubles are experienced.