By Ovi

All of the Crude plus Condensate (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM which provides updated information up to September 2023.

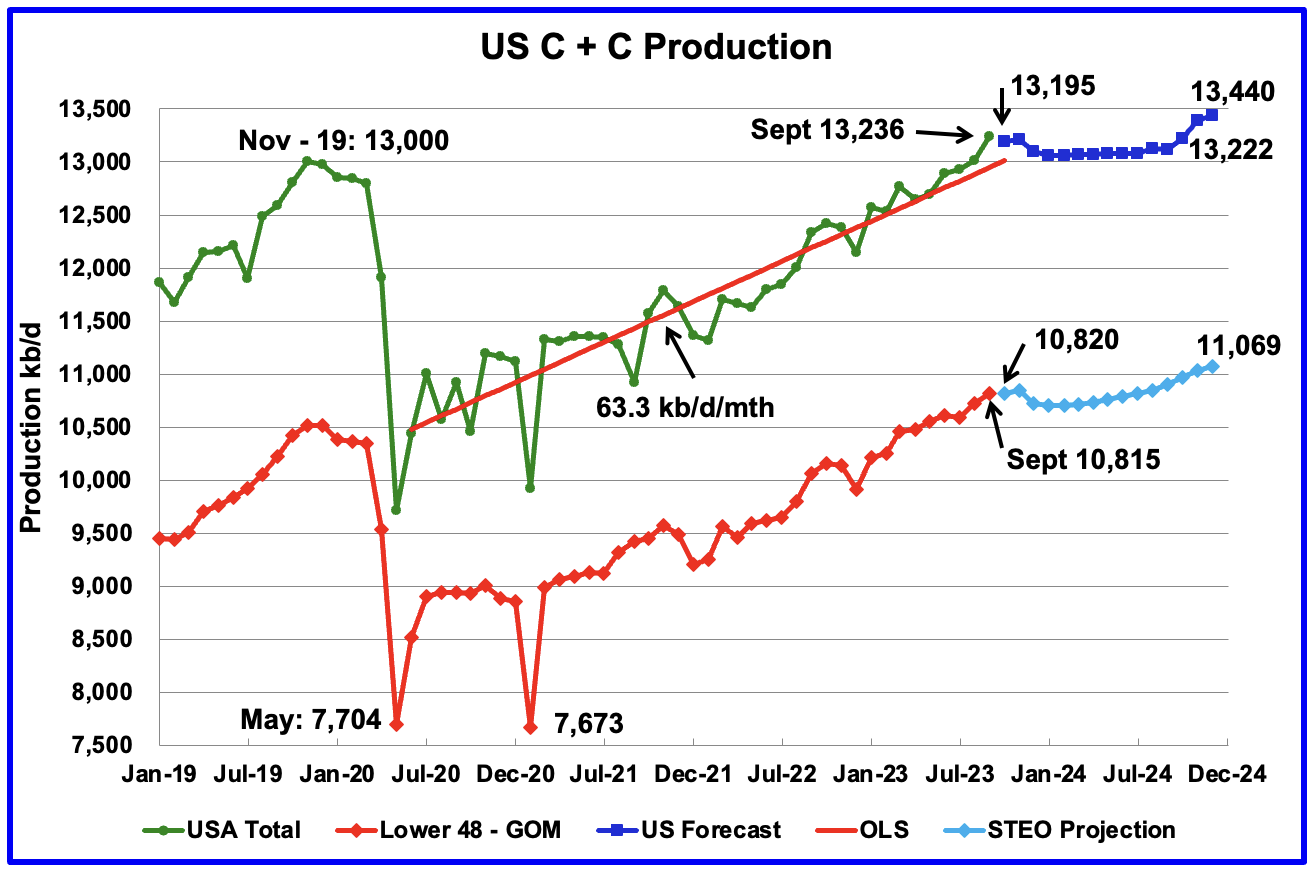

U.S. September oil production increased by 224 kb/d to 13,236kb/d, a new record high by 236 kb/d over November 2019. The increase was primarily due to increases in the GOM and North Dakota. Note that August production was revised down from 13,053 kb/d to 13,012 kb/d, which accounts for 41 kb/d of the 224 kb/d September increase.

The dark blue graph, taken from the November 2023 STEO, is the forecast for U.S. oil production from October 2023 to December 2024. Output for December 2024 is expected to reach 13,440 kb/d which is 43 kb/d higher than forecast last month. While September production came in at 13,236 kb/d, the EIA weekly production report has been reporting constant production of 13,200 kb/d from the week ending October 6 to November 24 and is consistent with the STEO’s estimate for October and November.

The red OLS line from June 2020 to September 2023 indicates a monthly production growth rate of 63.3 kb/d/mth or 760 kb/d/yr. Clearly the growth rate going forward into the rest of 2023 and 2024, shown by the dark blue graph, is lower than seen in the previous June 2020 to September 2023 time period. From October 2023 to December 2024, production is expected to grow by 245 kb/d. Production is expected to fall from December 2023 to July 2024 before beginning to rise.

While overall US oil production increased by 224 kb/d, the Onshore L48 had a production increase of 91 kb/d to 10,815 kb/d in September. Most of the 91 kb/d came from North Dakota, 79 kb/d.

The light blue graph is the STEO’s projection for output to December 2024 for the Onshore L48. From October 2023, to December 2024, production is expected to increase by 249 kb/d to 11,069 kb/d.

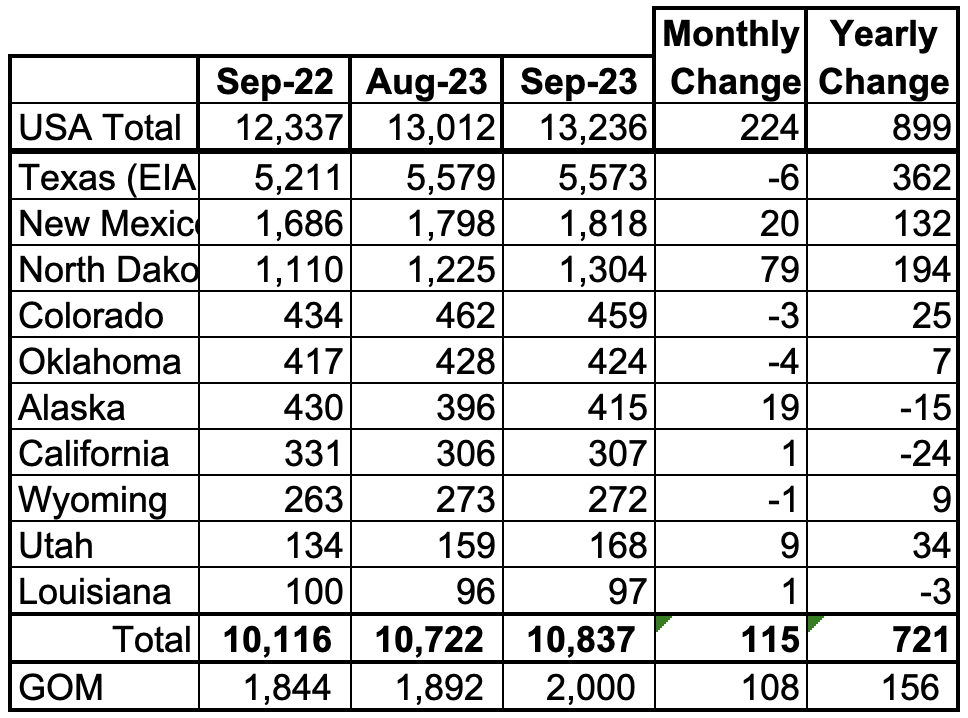

Oil Production Ranked by State

Listed above are the 10 states with the largest US oil production along with the Gulf of Mexico. These 10 states accounted for 81.9% of all U.S. oil production out of a total production of 13,236 kb/d in September 2023.

On a YoY basis, US production increased by 899 kb/d with the majority, 688 kb/d coming from Texas, New Mexico and North Dakota. GOM was up 108 kb/d MoM and up 156 kb/d YoY.

State Oil Production Charts

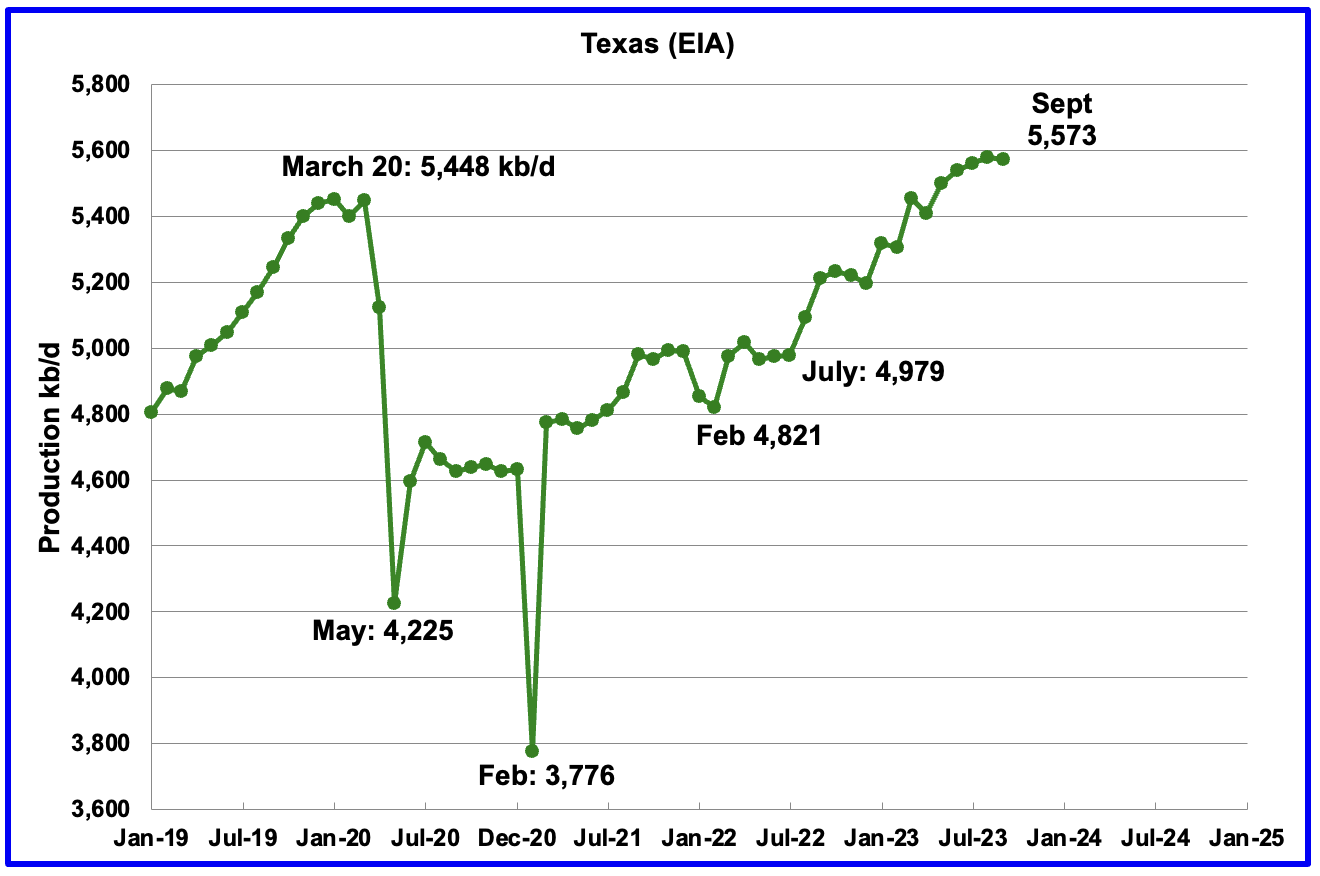

Texas production decreased by 6 kb/d in September to 5,573 kb/d. However, relative to August’s production reported last month, 5,631 kb/d, September output is down by 58 kb/d. In the EIA’s September report, August was revised down by 62 kb/d to 5,579 kb/d.

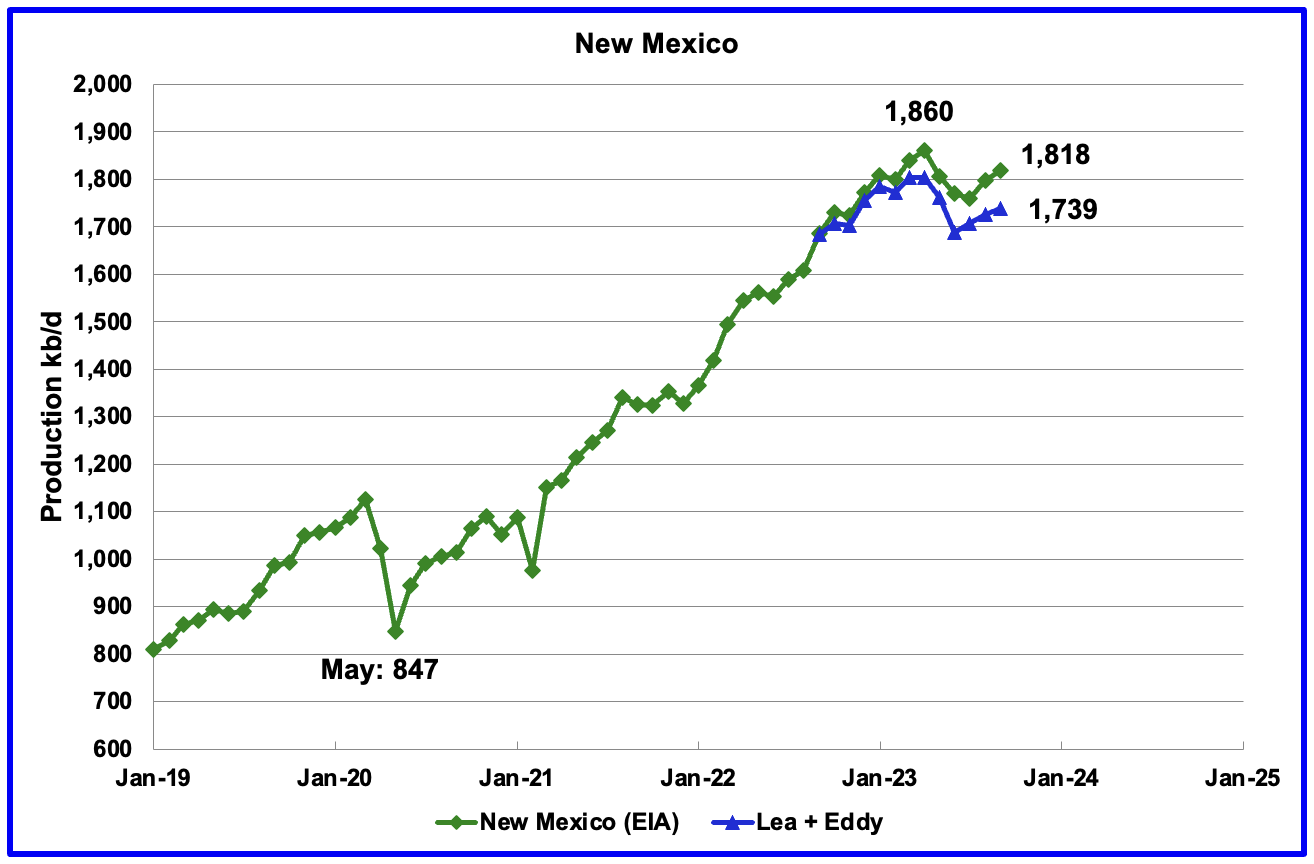

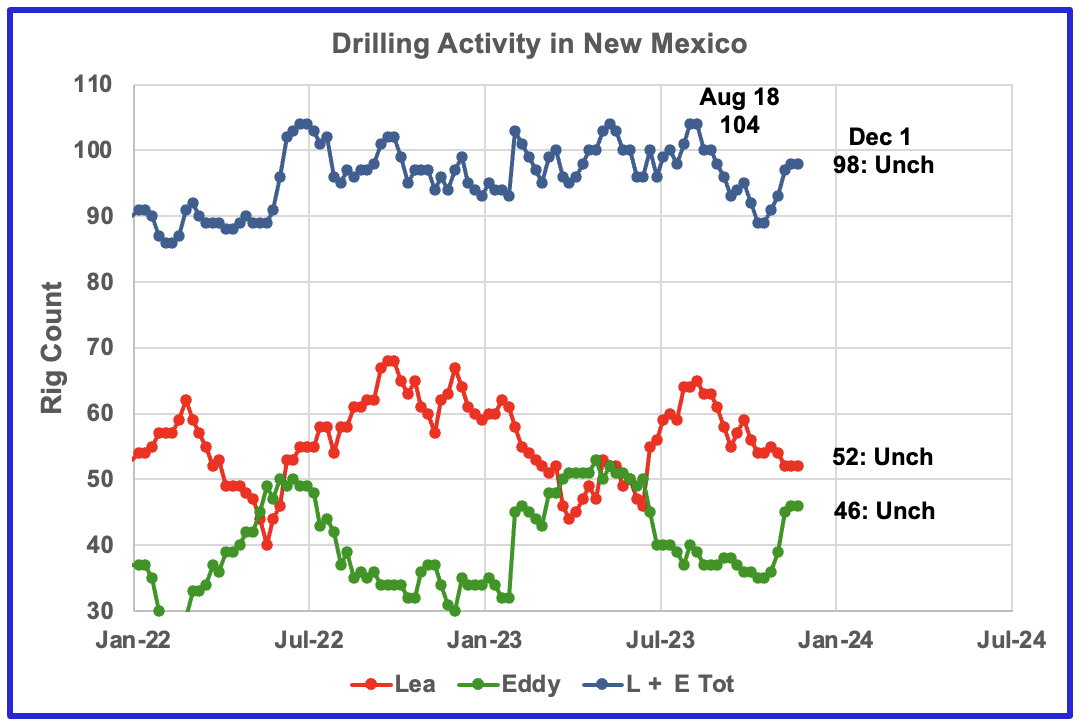

New Mexico’s September production rose by 20 kb/d to 1,818 kb/d. The combined output from Lea and Eddy counties rose by 13 kb/d. It is interesting to see that the Lea + Eddy production trend is similar to the EIA’s for the last two months. The current gap between the NM production report and the EIA’s is 79 kb/d and the majority of that gap will be closed over the next six months as the producers update their information.

Of the EIA’s 1,818 kb/d output from New Mexico, 1,739 kb/d (95.7%) came from the Lea and Eddy counties. The Lea and Eddy county production data for September is not complete and will be updated over the next three months.

More production information from these two counties is reviewed in the special Permian section further down.

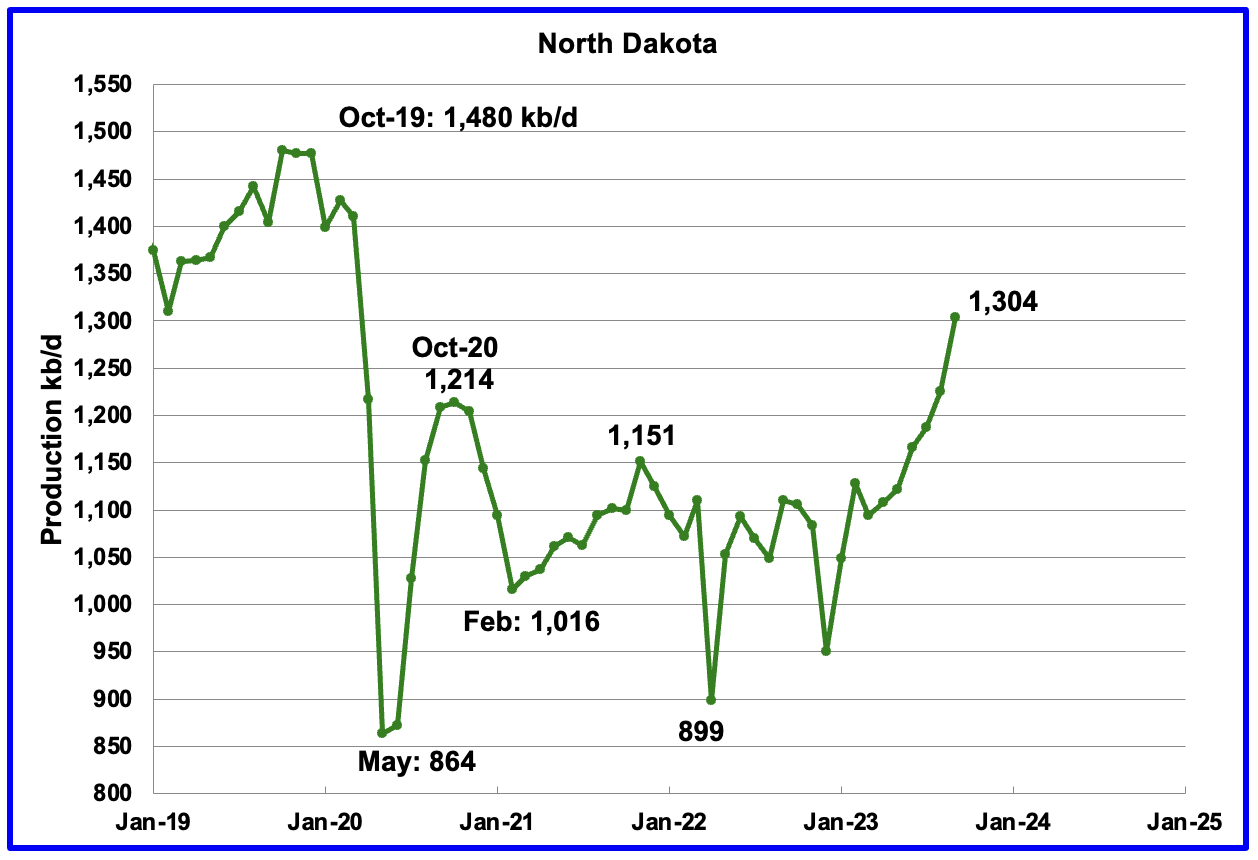

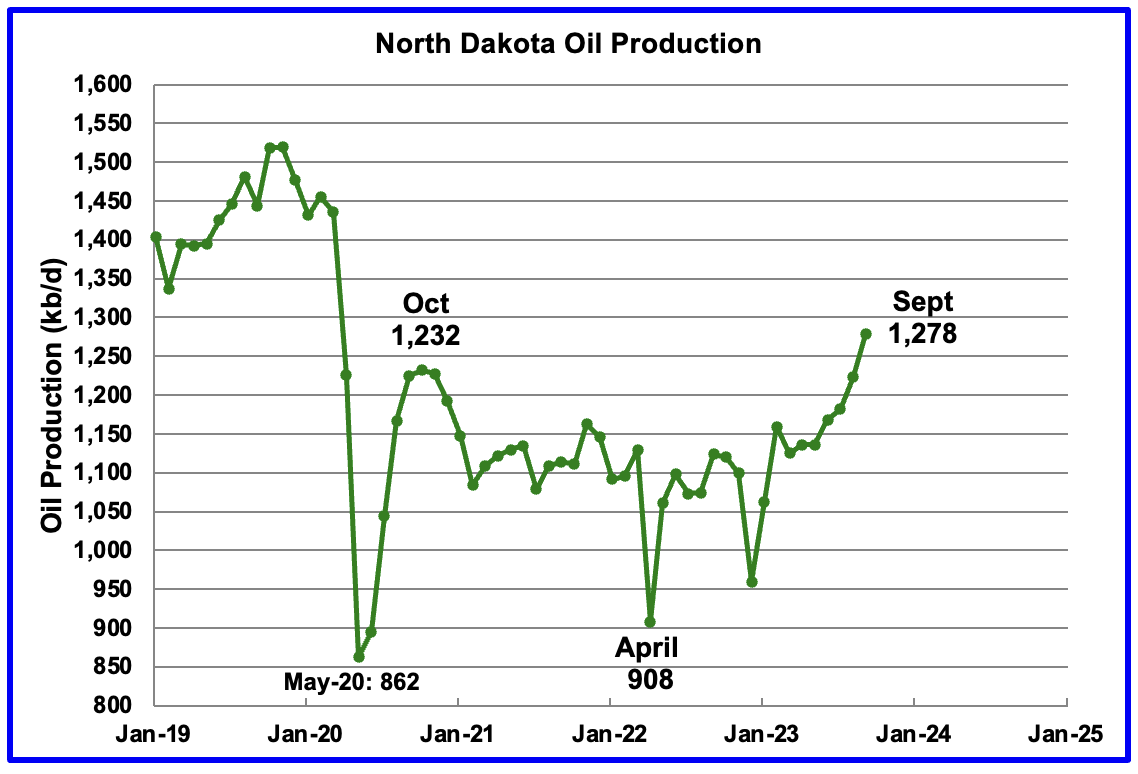

September’s output increased by 79 kb/d to 1,304 kb/d. This is the second post pandemic month in which North Dakota’s output exceeded October’s 2020 rebound production of 1,214 kb/d.

According to this source, production growth for October could be flat or a bit lower due to October snow storms.

“The state’s drilling rig count as of Tuesday was 35, up from an average of 33 in October. The rig count statewide is expected to gradually rise to the mid-forties over the next two years, according to the state Department of Mineral Resources.

Another rig moved out of the Fort Berthold Reservation, highlighting a trend of companies moving beyond the core area of oil production, Mineral Resources Director Lynn Helms said.

Well completion, which is the process needed to prepare a well for production, was at 96 in September, down from 129 in September.”

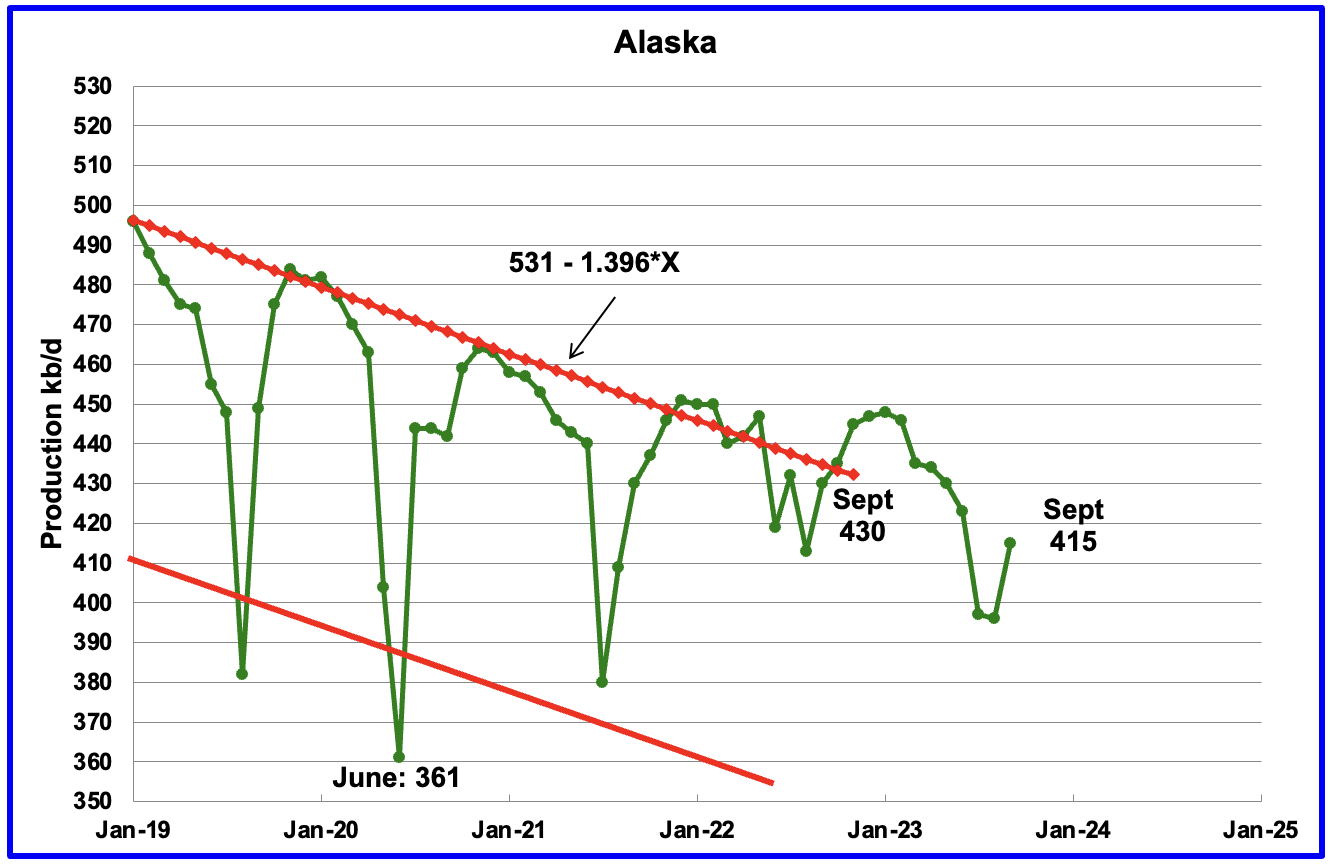

Alaskaʼs September output increased by 19 kb/d to 415 kb/d. Production YoY and two years ago is down by 15 kb/d.

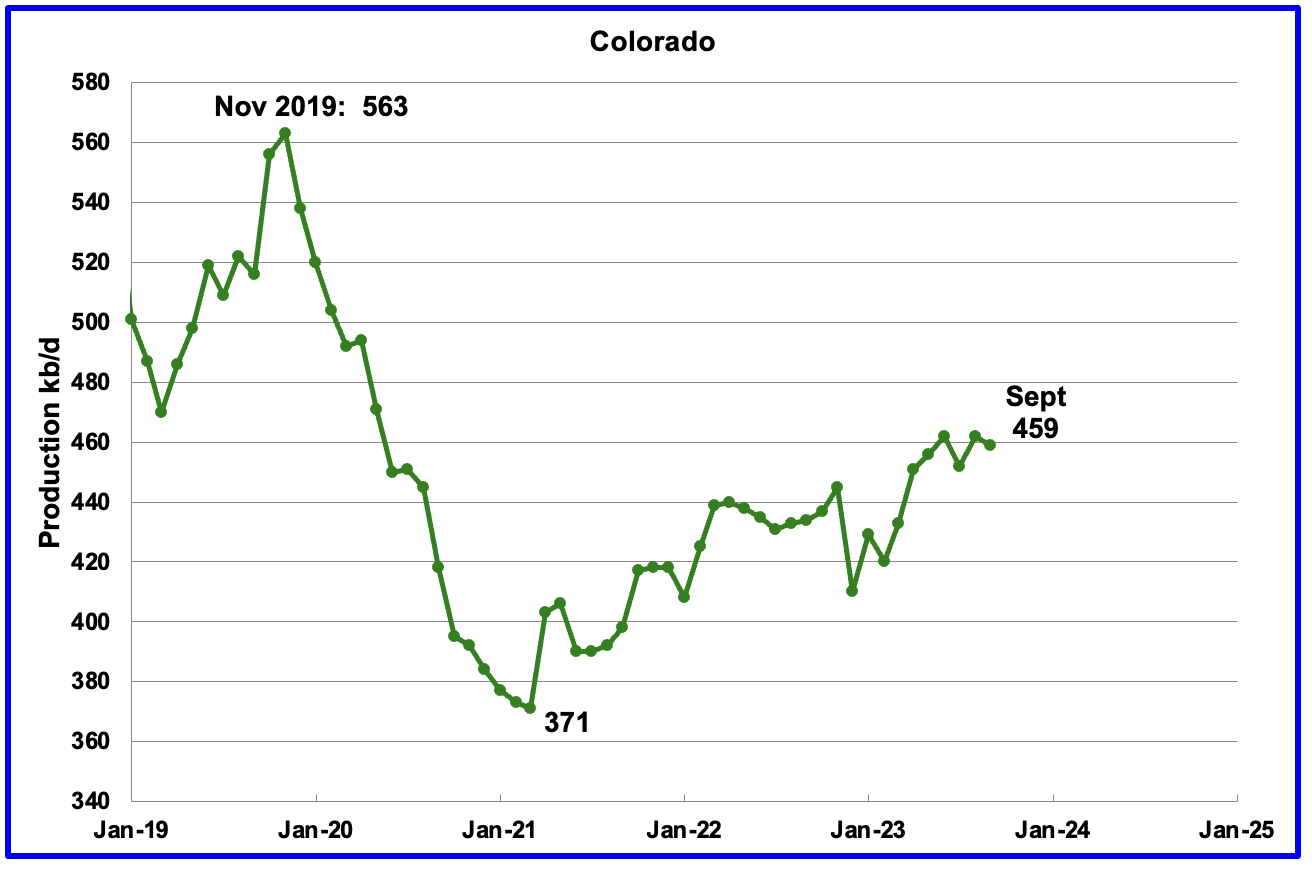

Coloradoʼs September production decreased by 3 kb/d to 459 kb/d.

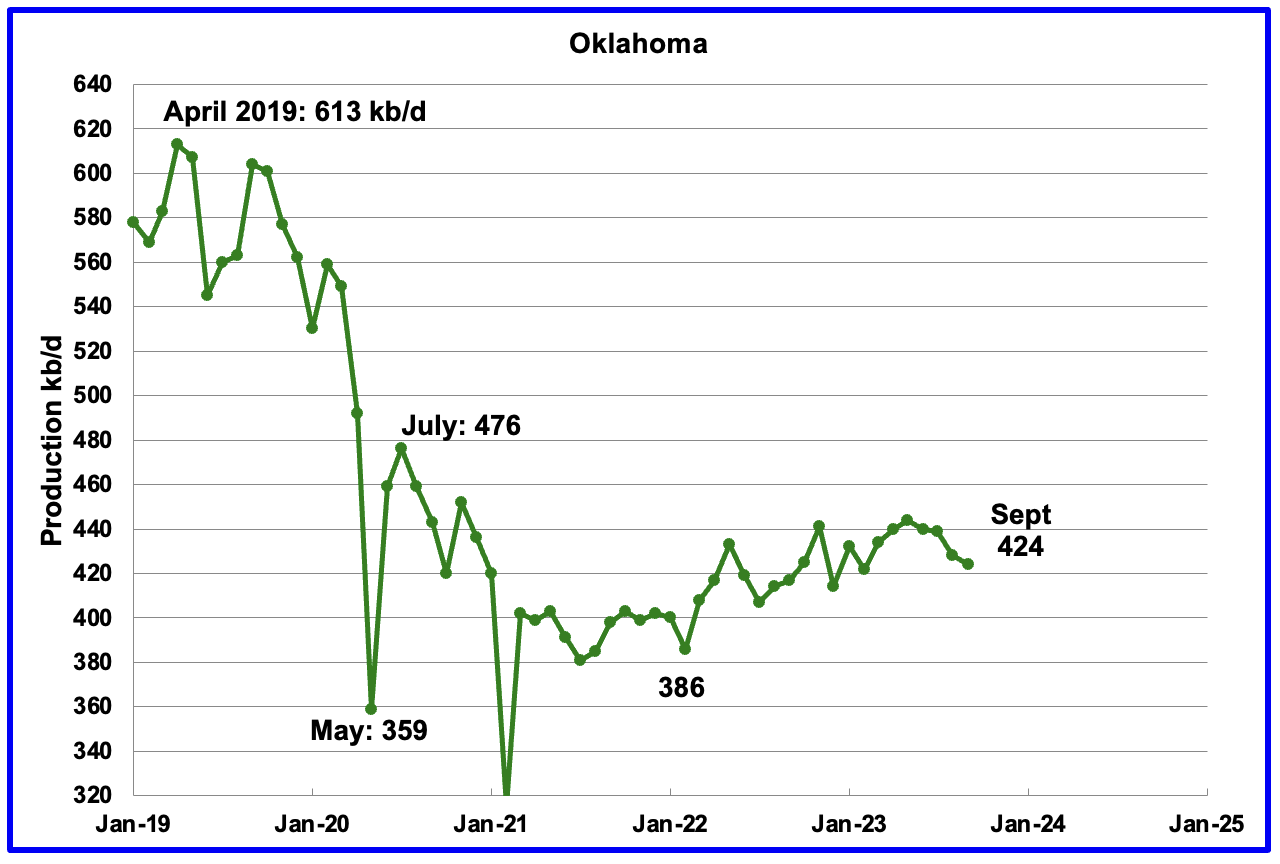

Oklahoma’s output in September decreased by 4 kb/d to 424 kb/d. Production remains 52 kb/d below the post pandemic July 2020 high of 476 kb/d. Output may be in a plateau/declining phase.

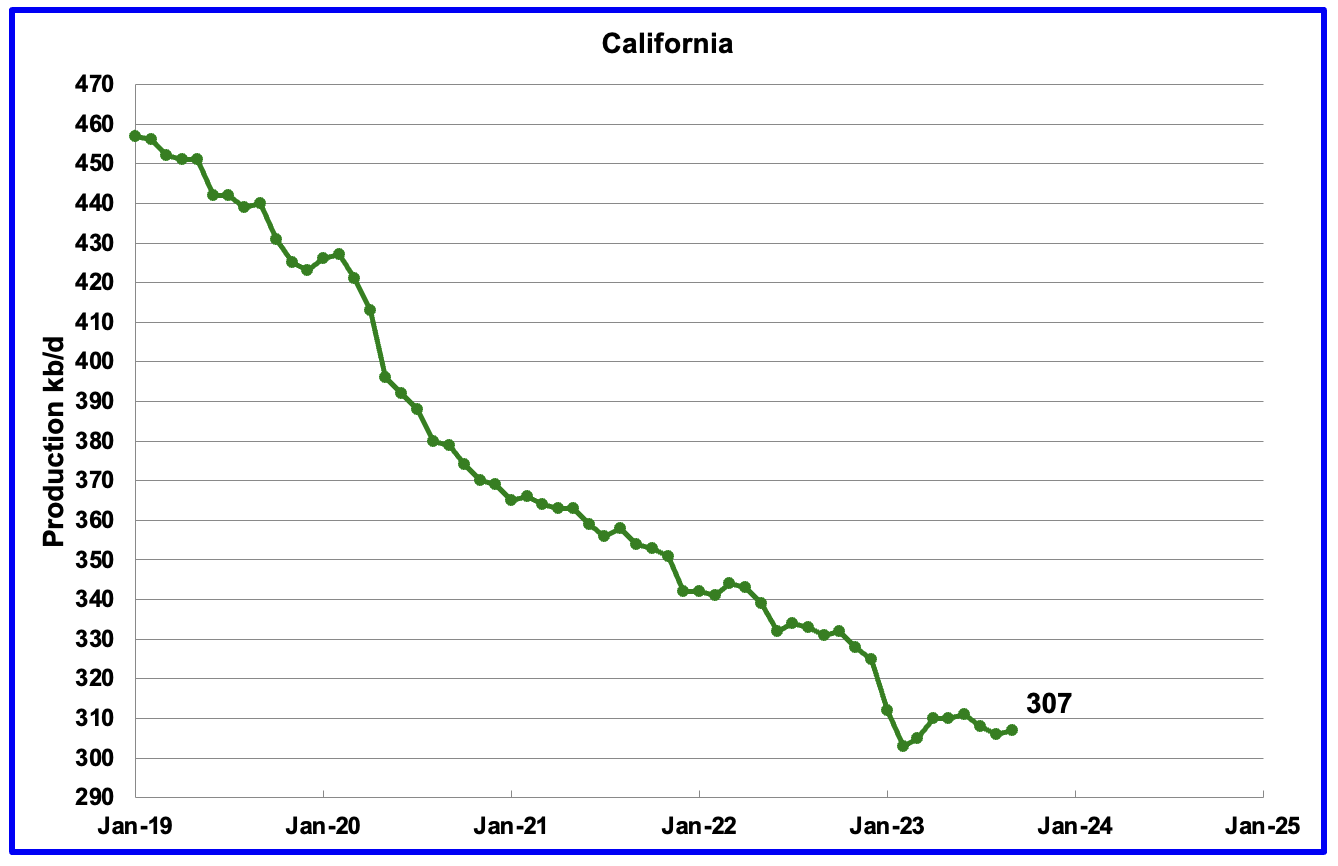

Californiaʼs September production rose by 1 kb/d to 307 kb/d.

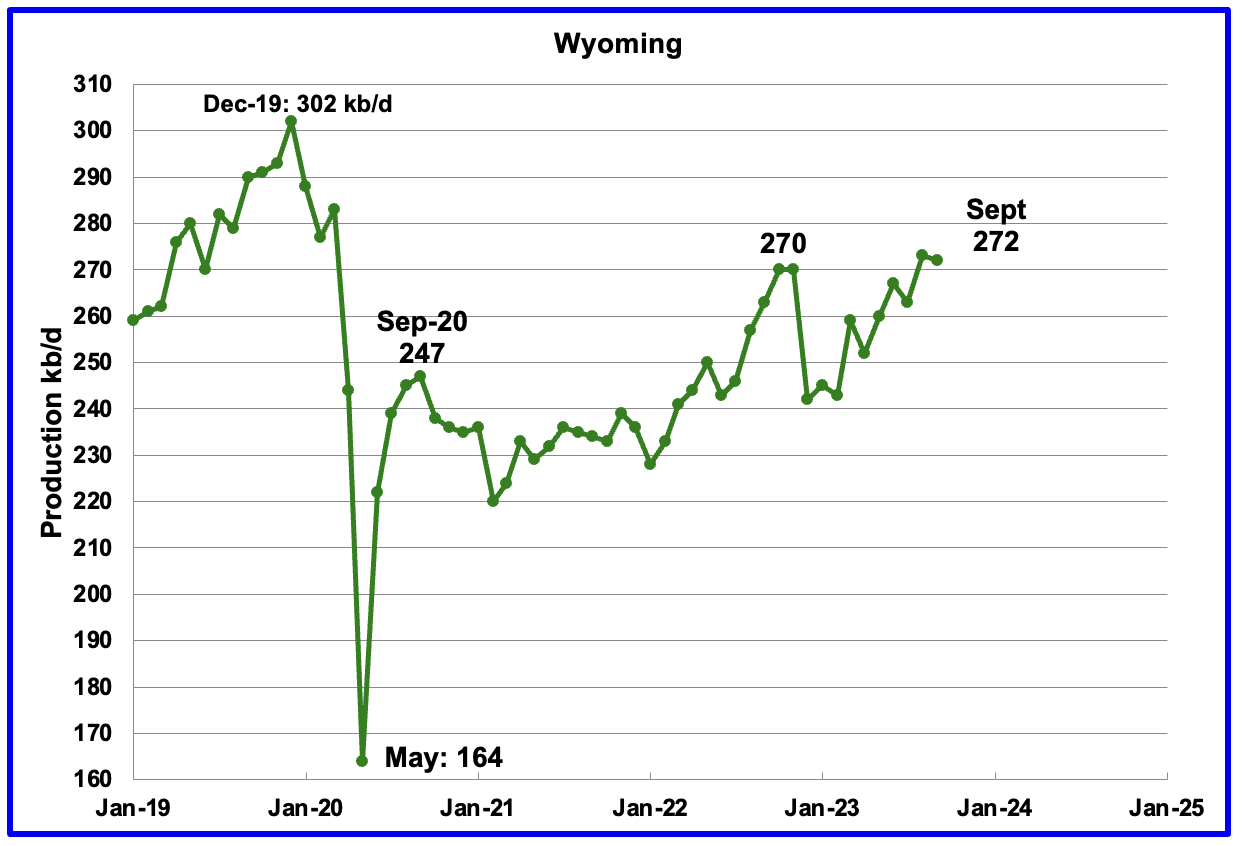

Wyoming’s oil production in October and November 2022 reached a post pandemic high of 270 kb/d and then dropped. Its production has been rebounding since February 2023 and August’s and September’s oil production rose to 273 kb/d and 272 kb/d respectively, exceeding November 2022.

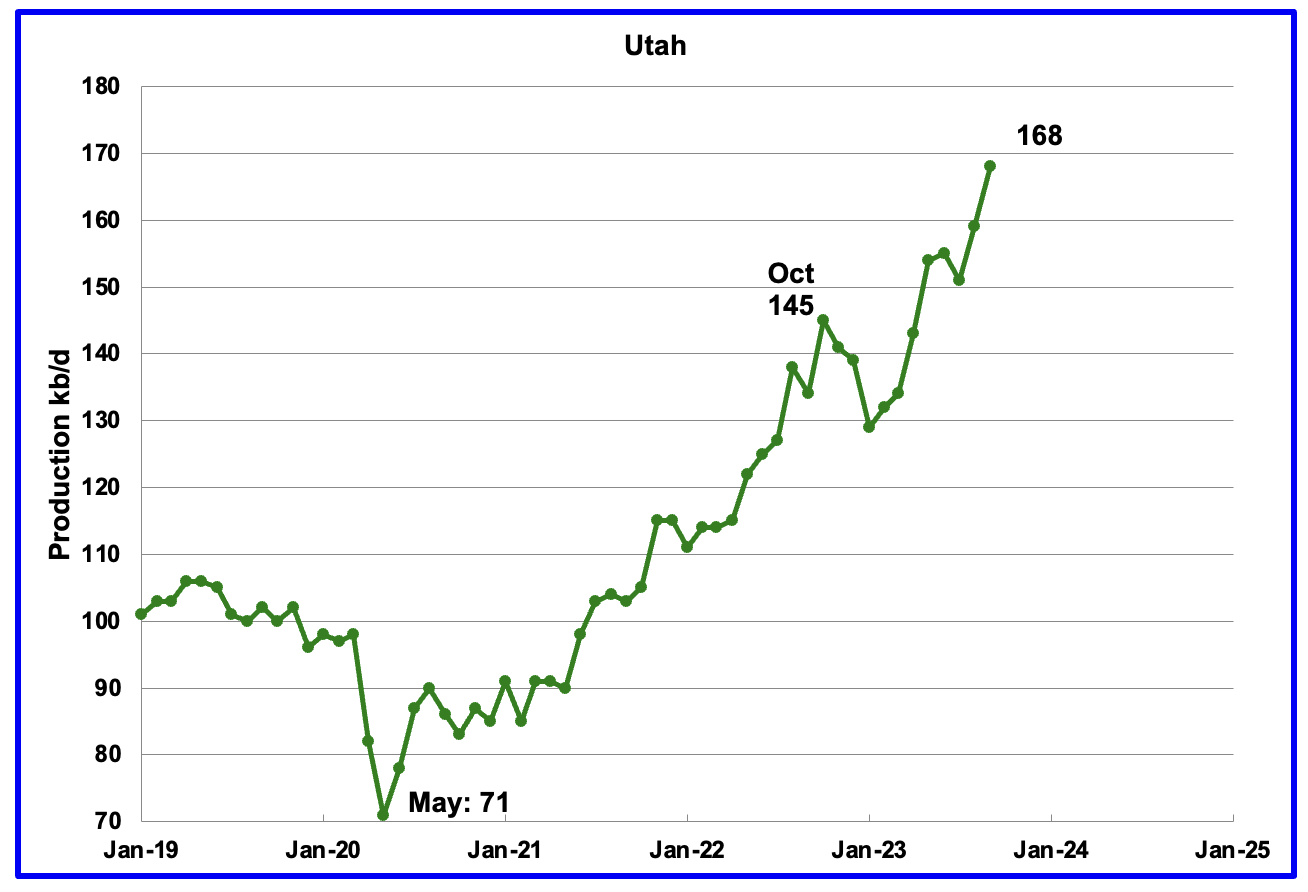

September’s production increased by 9 kb/d to 168 kb/d to another record high. For the first 4 months of 2023, Utah had 7 rigs operating. Since May the number of operational rigs has bounced between 8 and 9, which may account for the increased production.

The increased production since February has come from the Uinta basin.

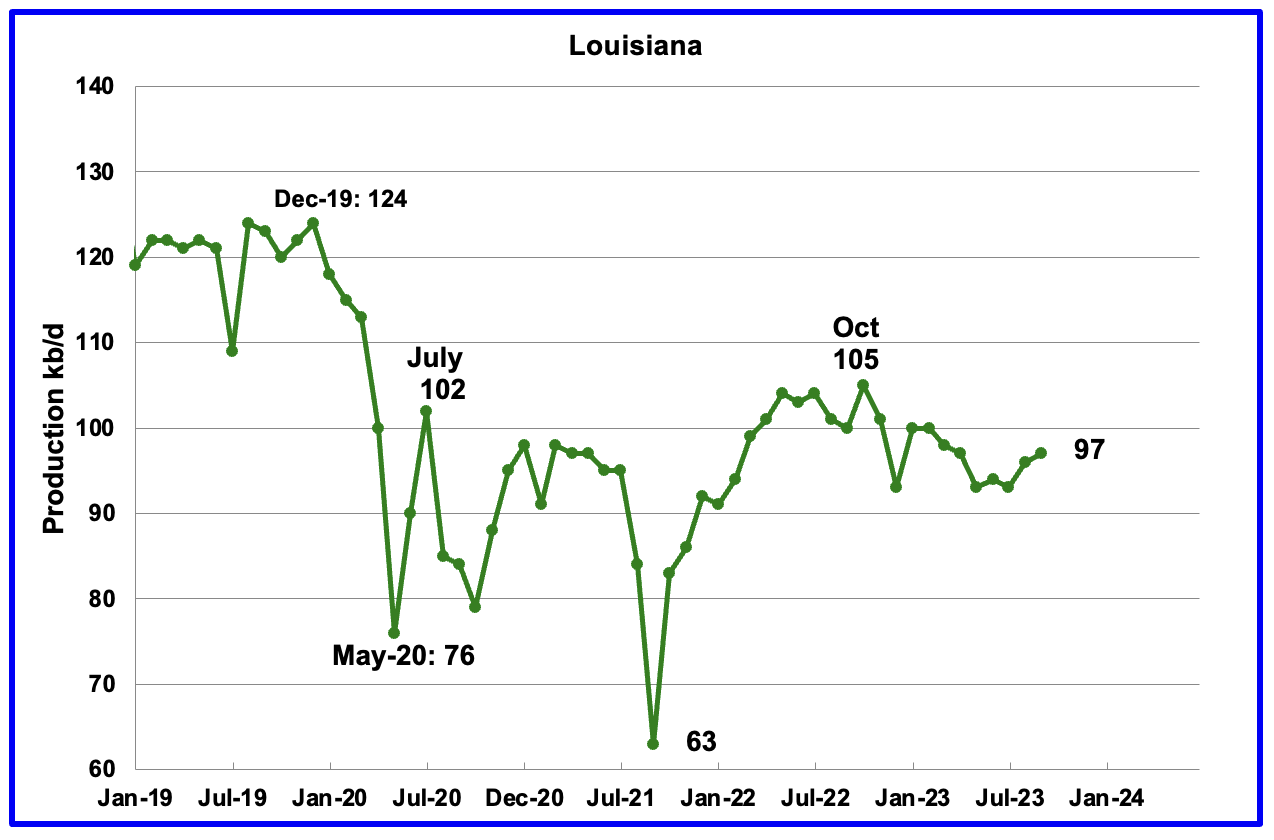

Louisiana’s output entered into a slow decline phase in October 2022. September’s production increased by 1 kb/d to 97 kb/d and is 8 kb/d lower than October 2022.

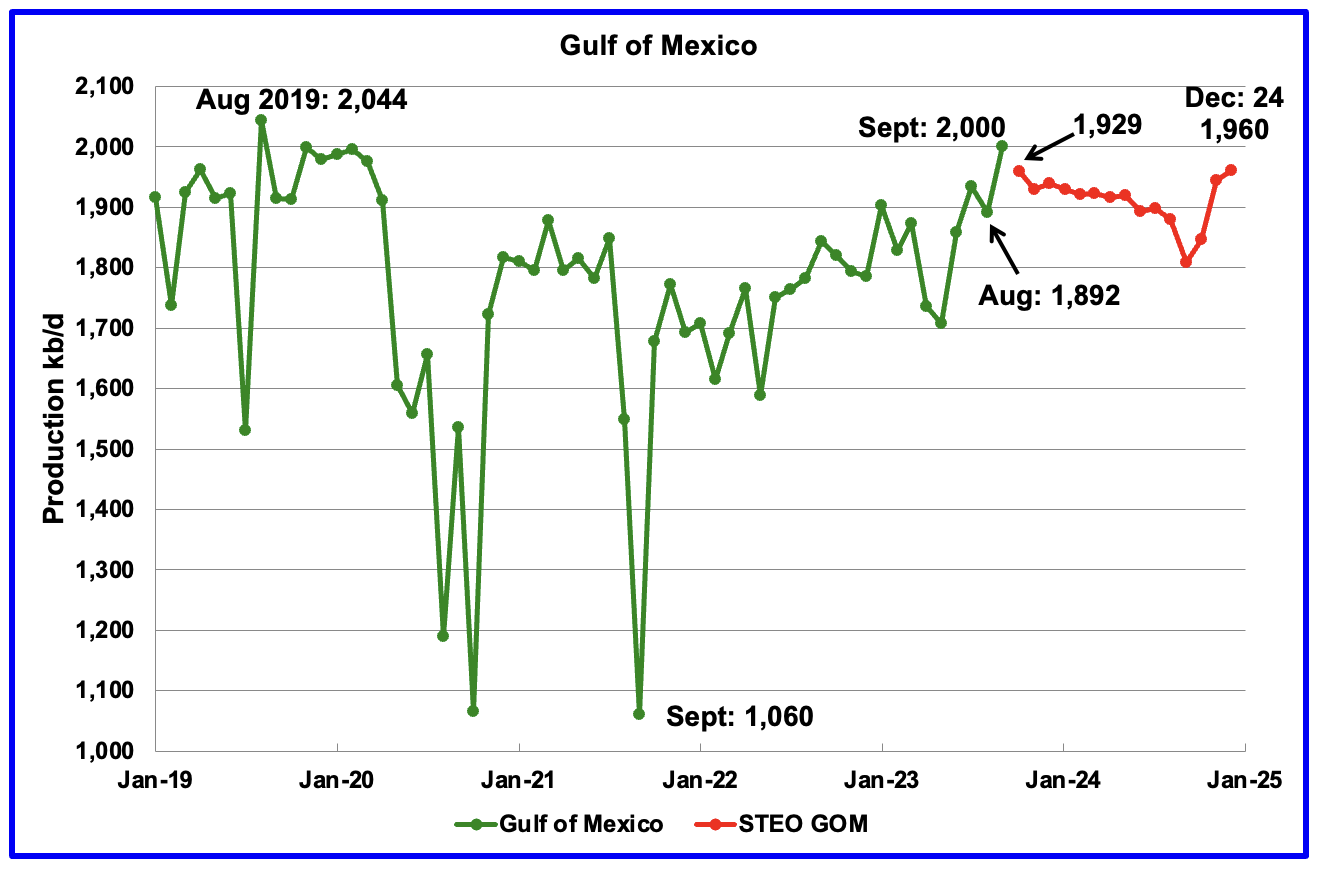

GOM production increased by 108 kb/d in September to 2,000 kb/d, a post pandemic high. From May to September, GOM output grew by 292 kb/d to 2,000 kb/d and is 44 kb/d lower than August 2019.

The November 2023 STEO projection for the GOM output has been added to this chart. It projects that over the next twelve months production will fall close to 1,800 kb/d before rebounding to 1,960 kb/d in December 2024.

It is not known if the GOM decline shown after September 2023 is related to a combination of extensive maintenance and general decline of wells. Also disappointing production from some highly touted wells could be an issue according to this source.

“PowerNap looks like an even bigger disappointment and is declining towards zero having produced less than 5% of its original reserve estimate.”

A Different Perspective on US Oil Production

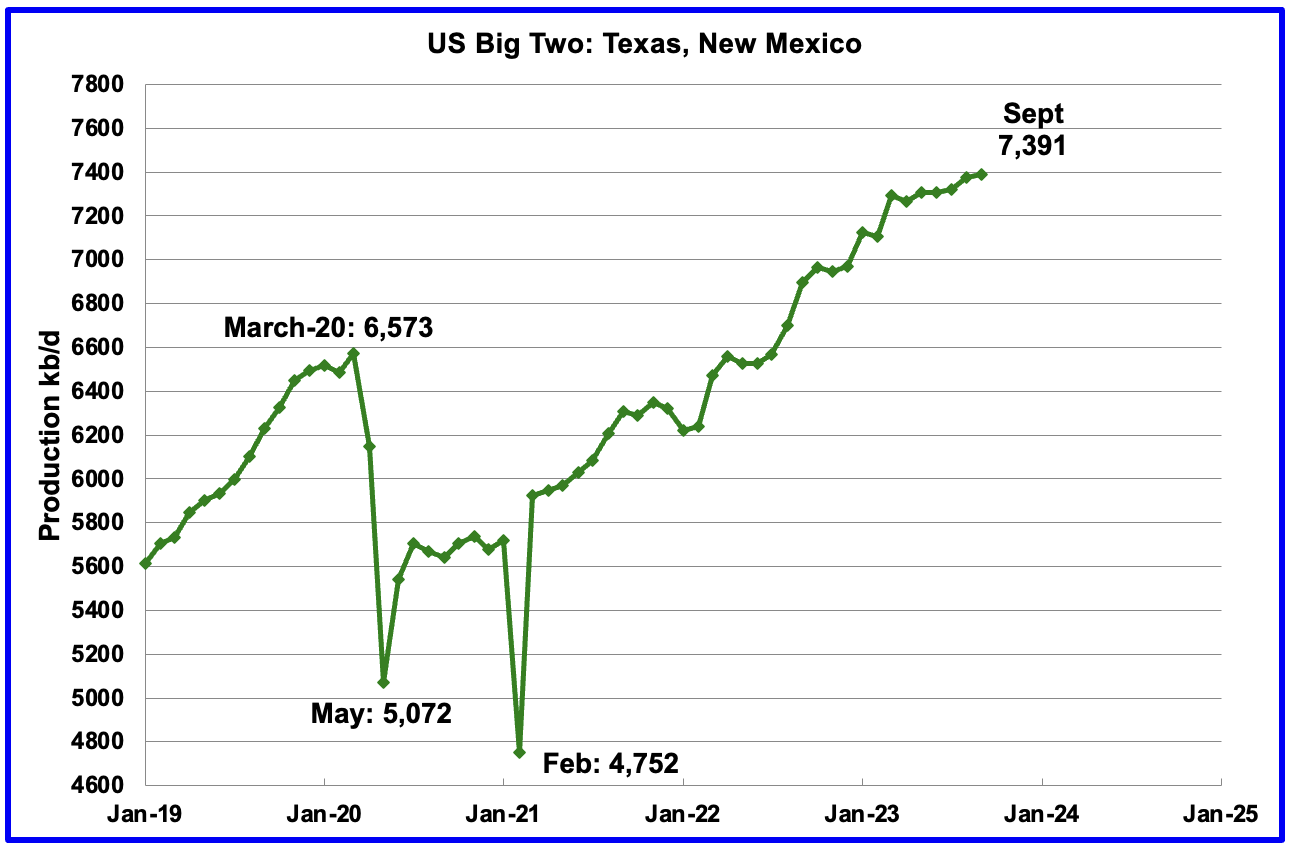

The Big Two states’ combined oil output for Texas and New Mexico.

September’s production in the Big Two states increased by a combined 14 kb/d to 7,391 kb/d with Texas dropping 6 kb/d while New Mexico added 20 kb/d. September production of 7,391 kb/d is 37 kb/d lower than reported last month for August, 7,428 kb/d.

Oil production by The Rest

September’s production in The Rest increased by 93 kb/d to 3,430 kb/d. This is a new high relative to the September 2020 high of 3,301 kb/d. The majority of the 93 kb/d increase came from North Dakota, 79 kb/d. A chart which shows On-Shore lower 48 W/O the big three shows a different trend, next chart.

The main takeaway from The Rest chart is that current production is 663 kb/d below the high of October 2019 and this appears to be a permanent loss that will never be recovered.

The On-Shore lower 48 W/O the big three shows a slow rising trend from the low of January 2022. It is still 32 kb/d lower than the post covid rebound to 2,158 in July 2020.

Permian Basin Report by Main Counties and Districts

This monthly Permian section has being added to the US report because of a range of views on whether Permian production will continue to grow or will peak over the next year or two. The issue was brought into focus recently by the Goehring and Rozencwajg Report which indicated that a few of the biggest Permian oil producing counties were close to peaking or past peak. Also comments by posters on this site have similar beliefs from hands on experience.

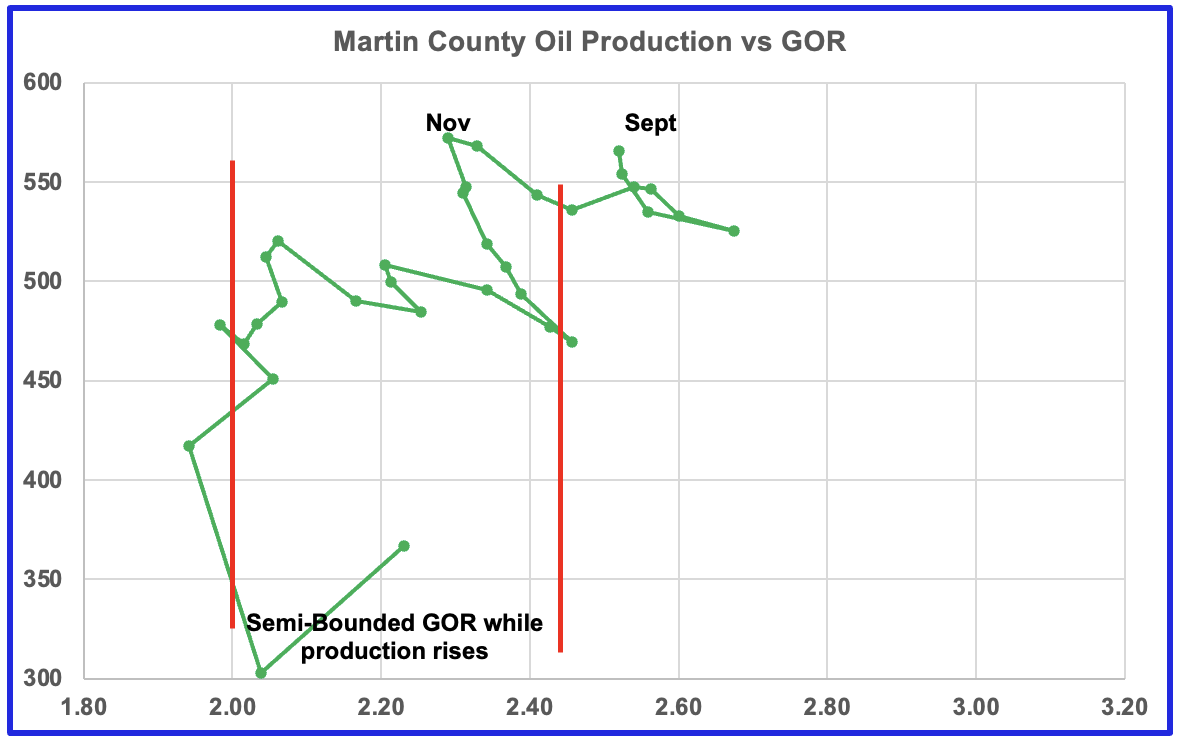

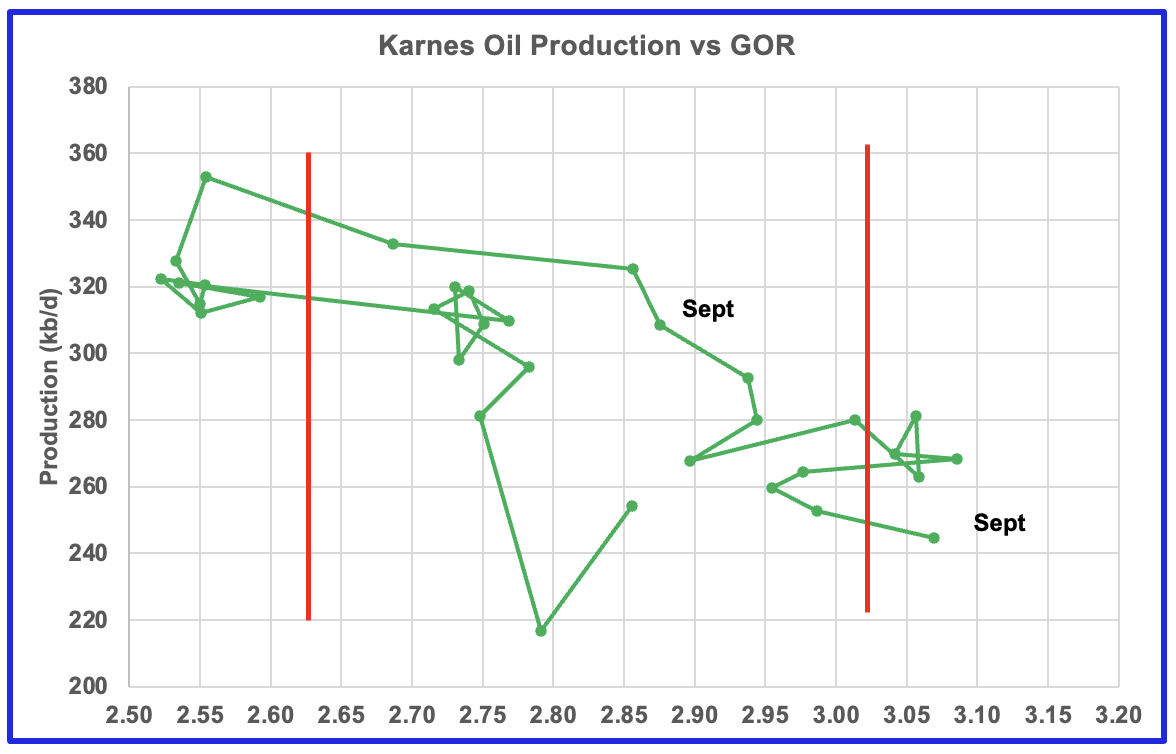

This section will focus on the four largest oil producing counties in the Permian, Lea, Eddy, Midland and Martin. It will track the oil and natural gas production and the associated Gas Oil Ratio (GOR) on a monthly basis. The data is taken from the state’s government agencies for Texas and New Mexico. Typically the data for the latest two or three months is not complete and is revised upward as companies submit their updated information. Note that the natural gas production shown in the charts that is used to calculate the GOR is the gas coming from both the gas and oil wells.

Of particular interest will be the charts which plot oil production vs GOR for a county to see if a particular characteristic develops that indicates the field is close to entering the bubble point phase. While the GOR metric is best suited for characterizing individual wells, counties with closely spaced horizontal wells may display a behaviour similar to individual wells due to pressure cross talking . For further information on the bubble point and GOR, there are a few good thoughts on the intricacies of the GOR in an earlier POB comment. Also check this EIA topic on GOR.

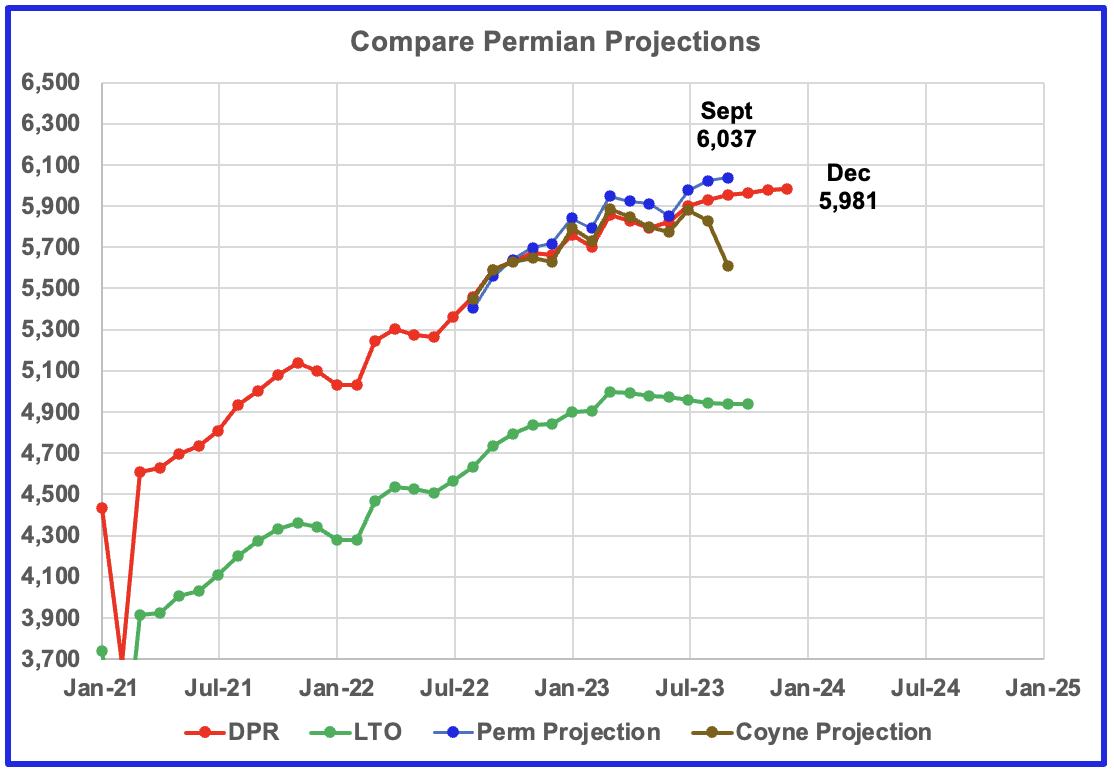

This chart shows four oil production projections for the Permian basin. The gap between the DPR and LTO projections is there because the DPR projection includes both LTO oil along with oil from conventional wells in the basins that it covers.

The red and green graphs show production as published by the EIA’s DPR and the LTO offices. Comparing the two, it appears that the LTO office believes Permian LTO production is declining while the DPR office is showing a bit more growth before plateauing. The brown and blue markers are projections by D Coyne and yours truly respectively based on different methodologies.b

The blue chart only uses two months of production data to make its first projection. A few more months of data is required to refine and modify the methodology.

New Mexico Permian

Over the past 5 weeks drilling activity in Lea has been dropping while it has increased in Eddy county. For the week ending December 1, the rig count in both counties did not change. The total NM rig count is down by 6 from a high of 104 in August.

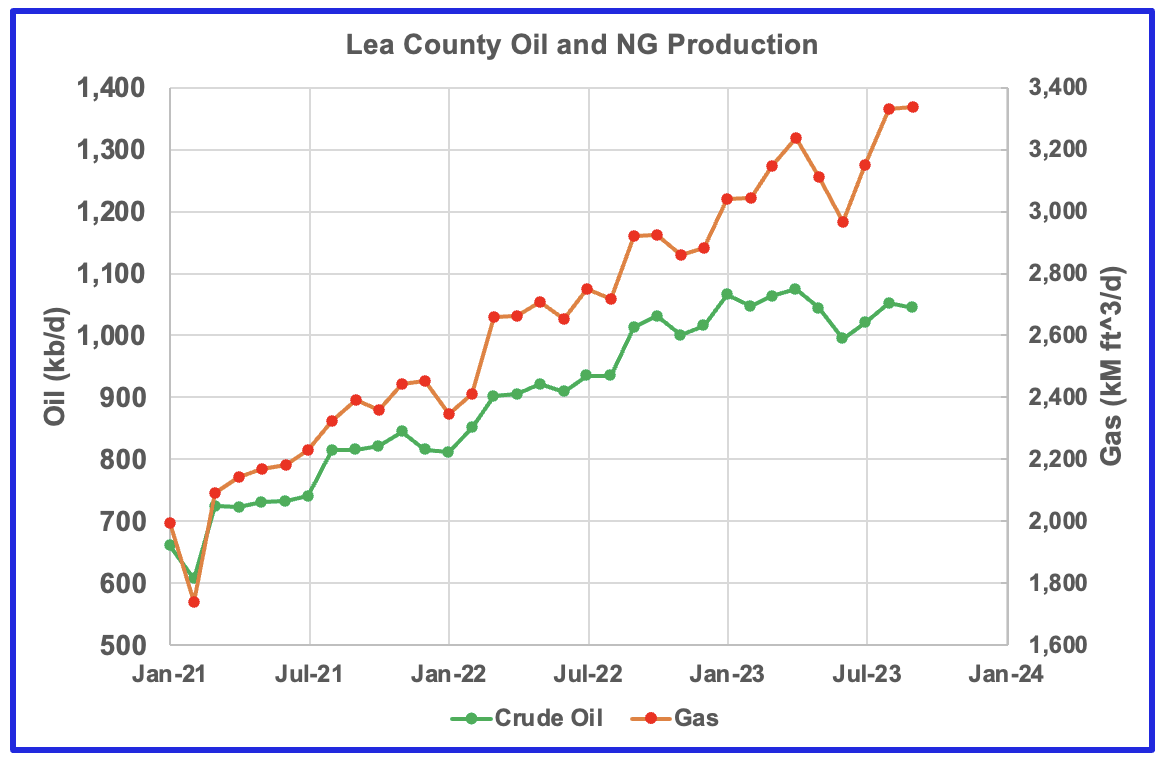

Over the last three months gas production has risen faster than oil production in Lea county. September oil production saw a decrease of 8 kb/d to 1,044 kb/d.

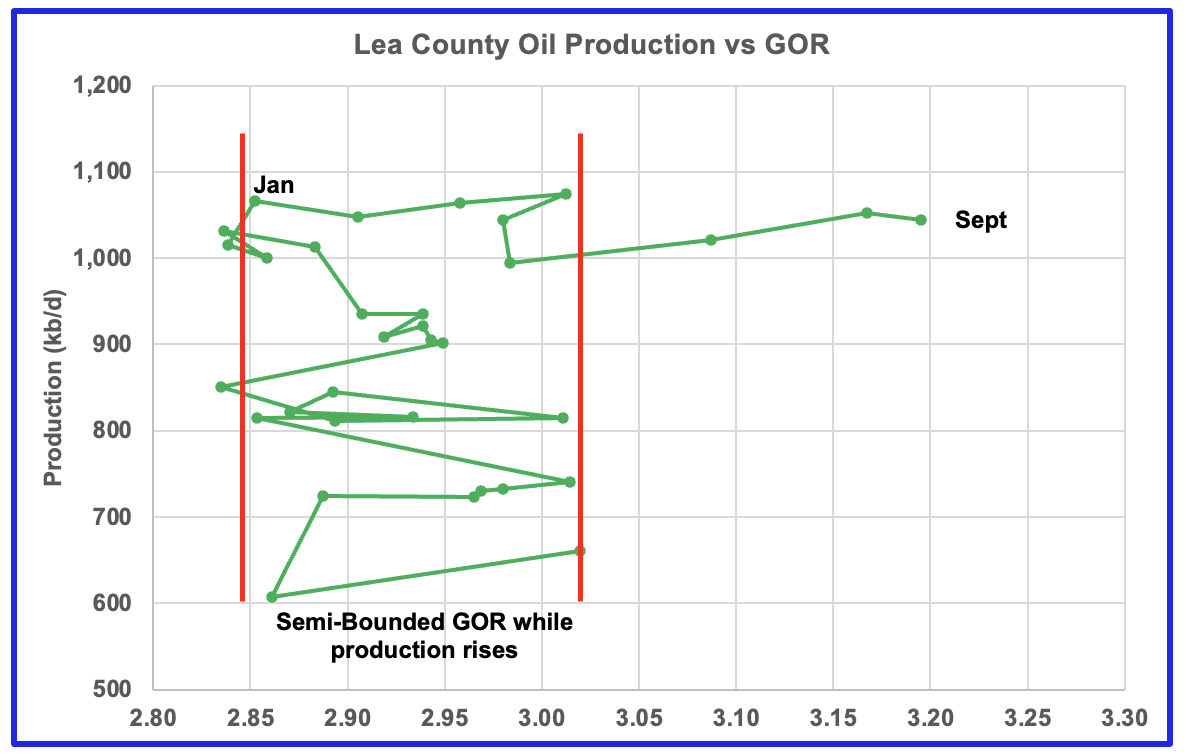

After much zigging and zagging, oil production in Lea county stabilized above 1,000 kb/d while the GOR started to increase in February and exceeded the semi-bounded GOR in July while production remained relatively flat. The data for the last three months, July to September, is incomplete.

This pattern of a zigging and zagging GOR within a semi-bounded GOR while oil production increases to some stable level and then moves out to a higher GOR to the right has shown up in a number of counties. See an additional three cases below. This is the third month in which Lea county has registered a GOR outside the semi-bounded GOR range.

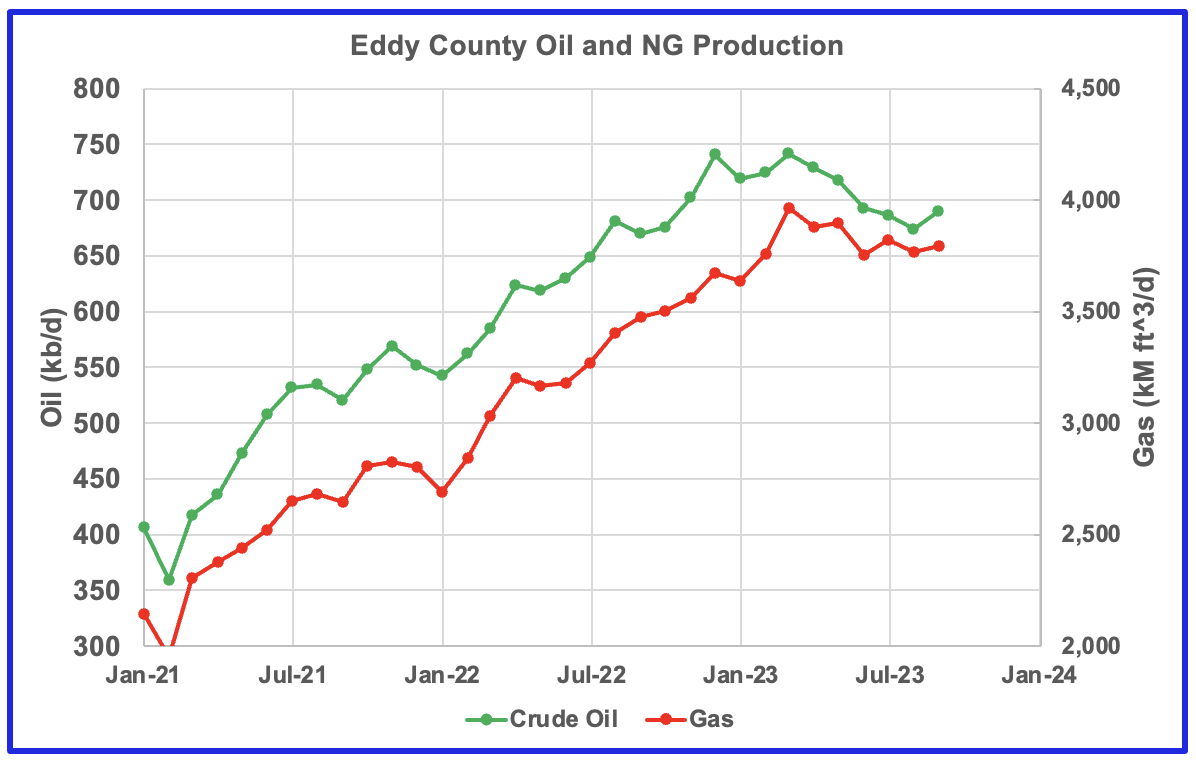

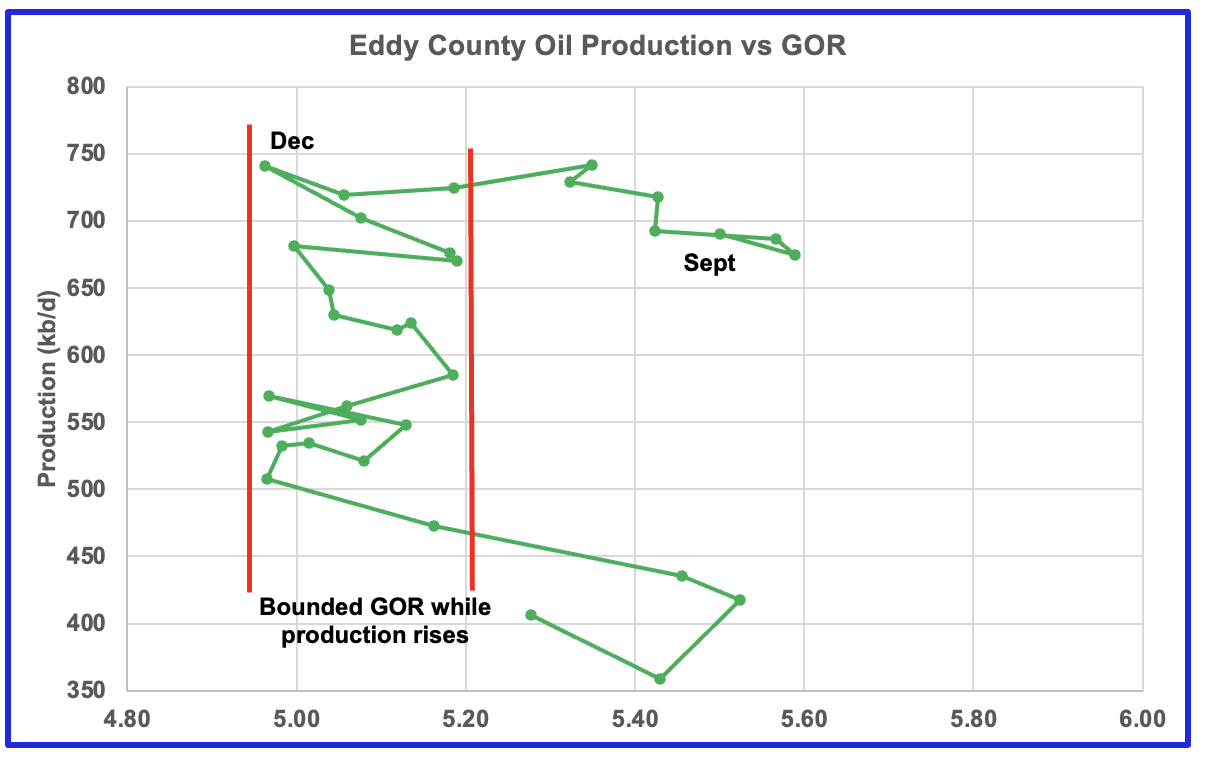

Eddy county oil production is showing early signs that is has peaked.

The Eddy county GOR pattern is similar to Lea county except that Eddy has broken out from the semi bounded range for a longer period while oil production has been dropping. Does the September reversal in the GOR indicate that most of the wells in this county are in the bubble point phase and most of the gas has been released?

Texas Permian

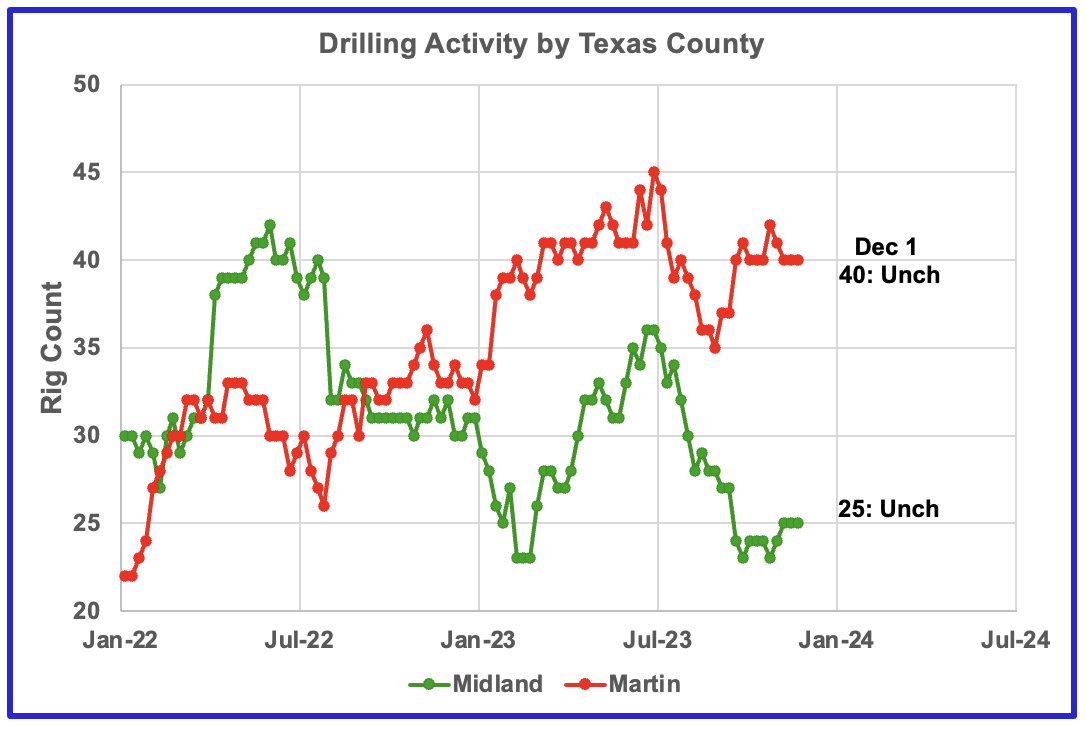

During November drilling activity increased in Midland county while it dropped in Martin county. Since these two counties are adjacent, could these rigs just be moving between counties?

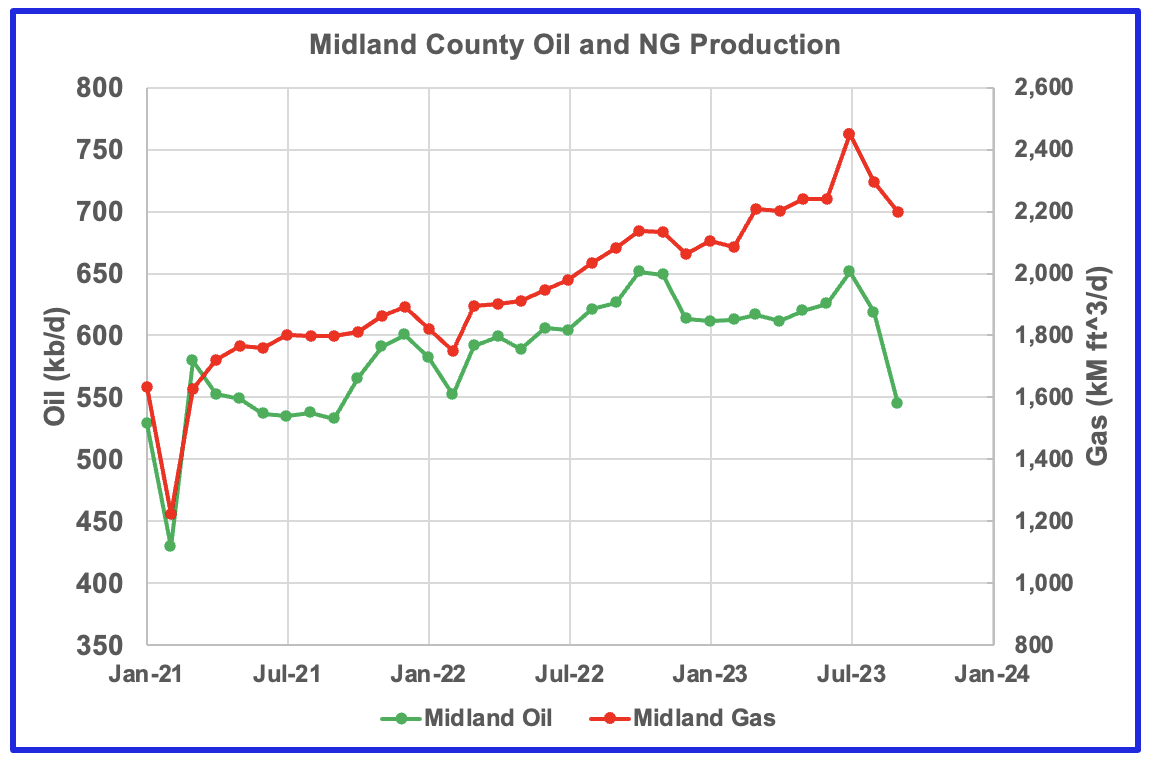

Both natural gas and oil production are dropping in Midland county. Cannot find any explanation for the July spike in oil and gas production.

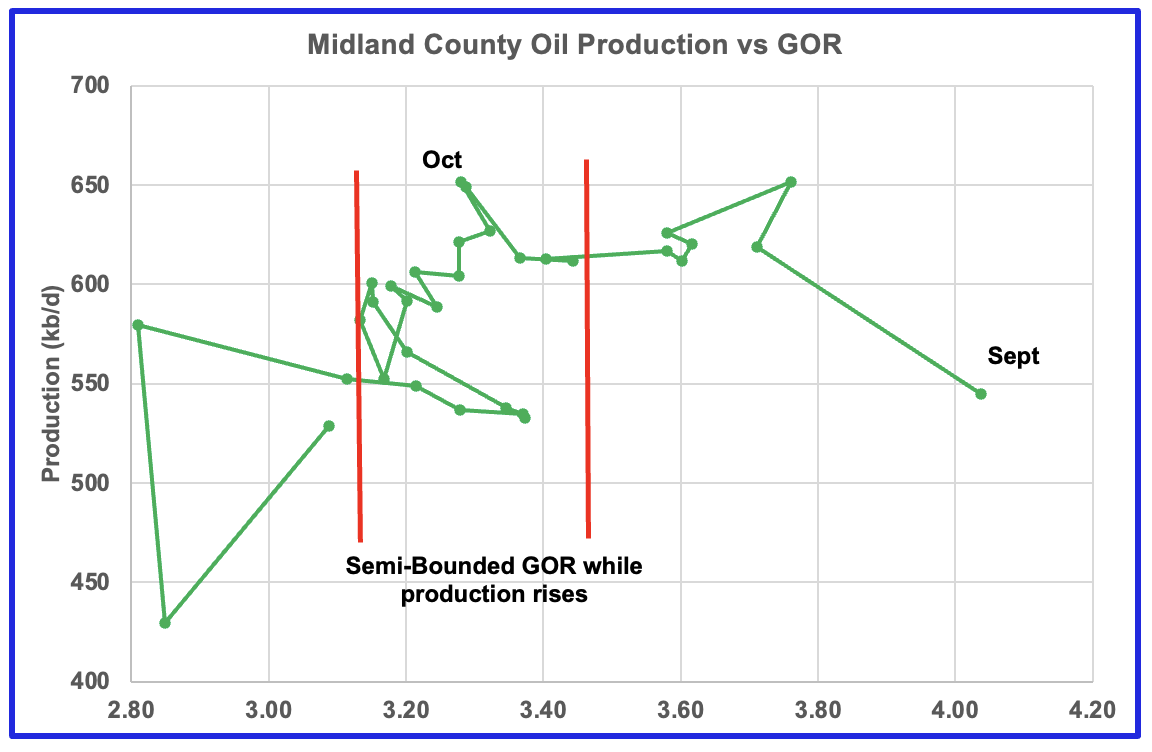

Oil production is dropping and the GOR is increasing . It appears that Midland has entered the bubble phase?

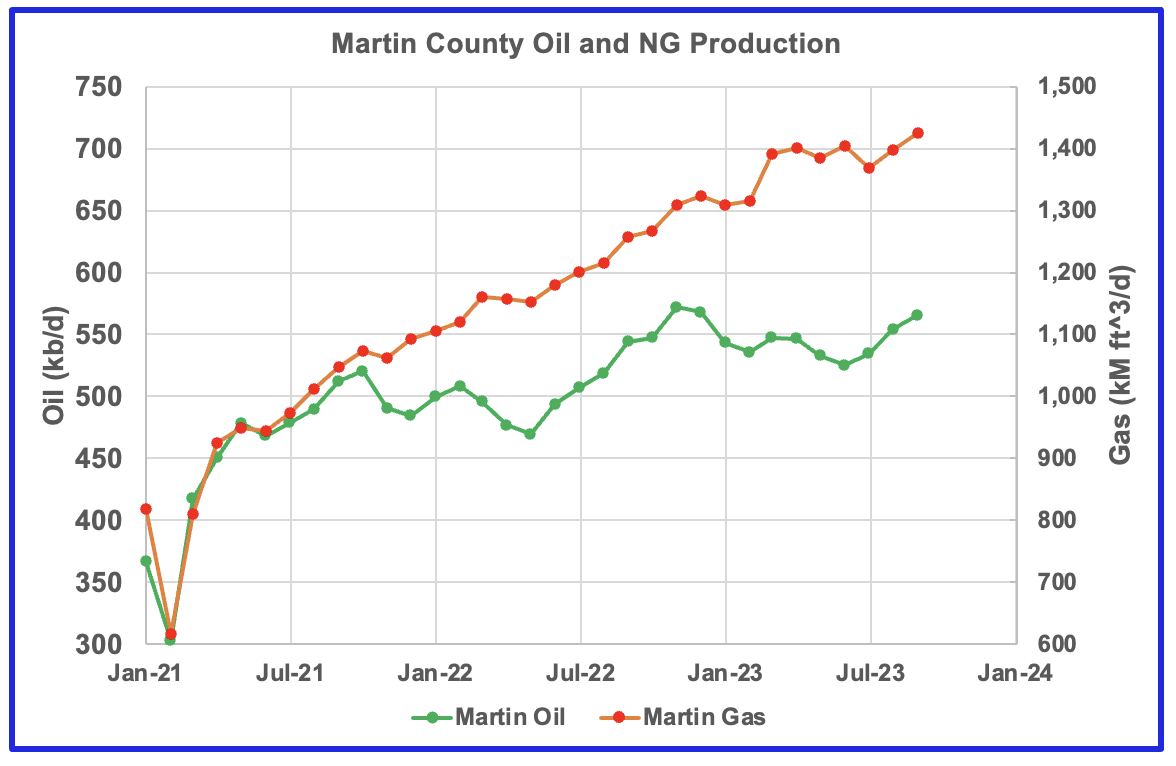

Both natural gas and oil production are increasing in Martin county.

Martin county is displaying a new trend of increasing oil production and a decreasing GOR.

Three of the four oil production vs GOR charts above are exhibiting characteristics indicating that three of the largest oil producing counties in the Permian are in the bubble point phase and are close to or past their peak? Not clear as to what is happening in Martin County.

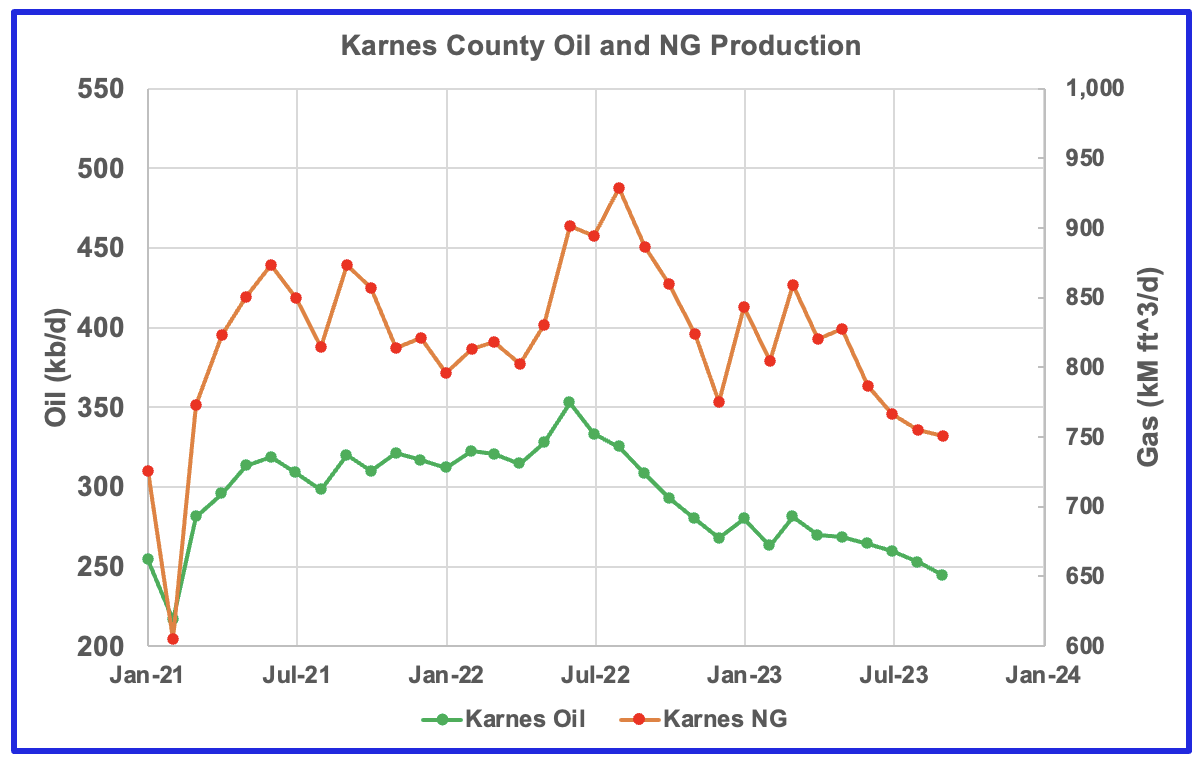

Eagle Ford’s Biggest Oil producing County

Both oil and gas production are falling in Karnes county and both are down close to 30% from the peak.

This is the GOR vs oil production for Karnes county but the GOR is still within its typical range while production is dropping. This may indicate that Karnes county wells have not entered the bubble point phase or weren’t very gassy to start with.

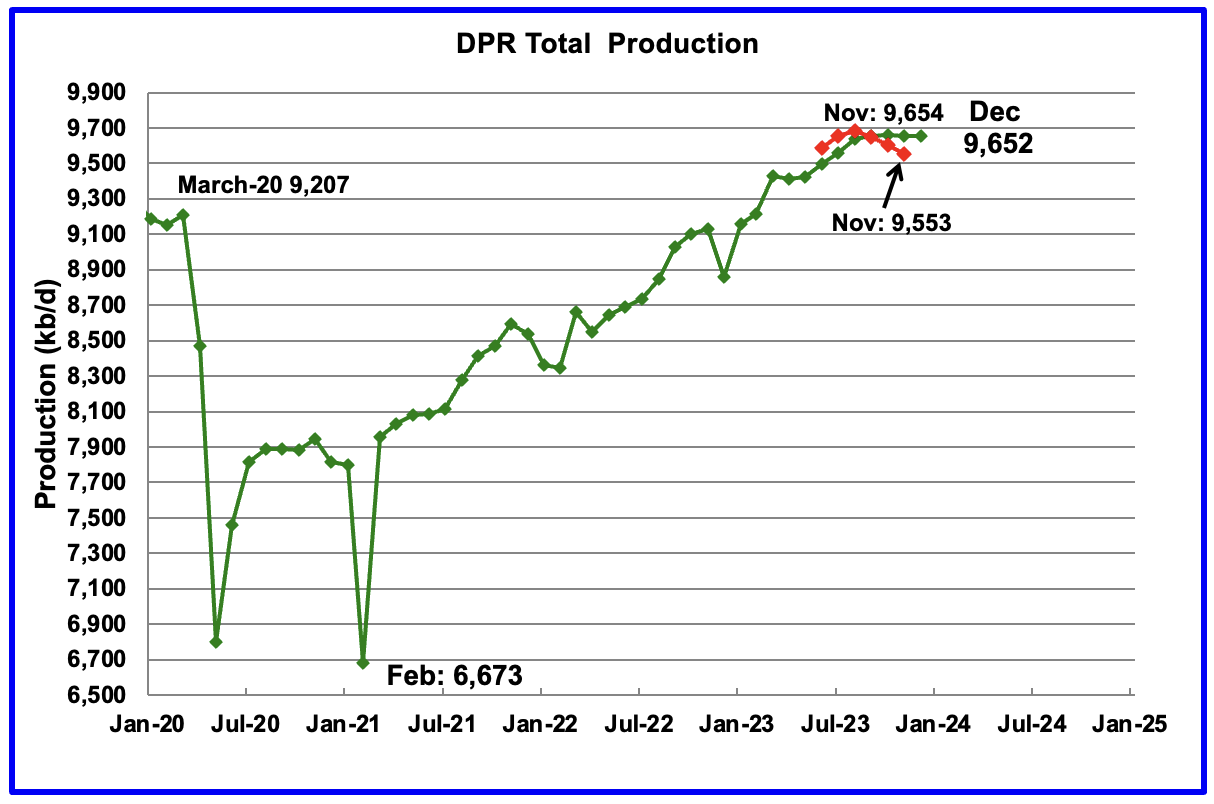

Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The November DPR report forecasts production to December 2023 and the following charts are updated to December 2023. The DUC charts and Drilled Wells charts are updated to October 2023.

Above is the total oil production projected to December 2023 for the 7 DPR basins that the EIA tracks. Note that DPR production includes both LTO oil and oil from conventional wells.

The DPR is projecting that oil output for December 2023 will decrease by 2 kb/d to 9,652 kb/d.

While the green graph shows DPR production being essentially flat since September, it also had a significant upward revision to its production since the last report, red graph. For November, total DPR production has been revised up by 101 kb/d, from 9,553 kb/d to 9,654 kb/d with the biggest increase occurring in the Permian basin.

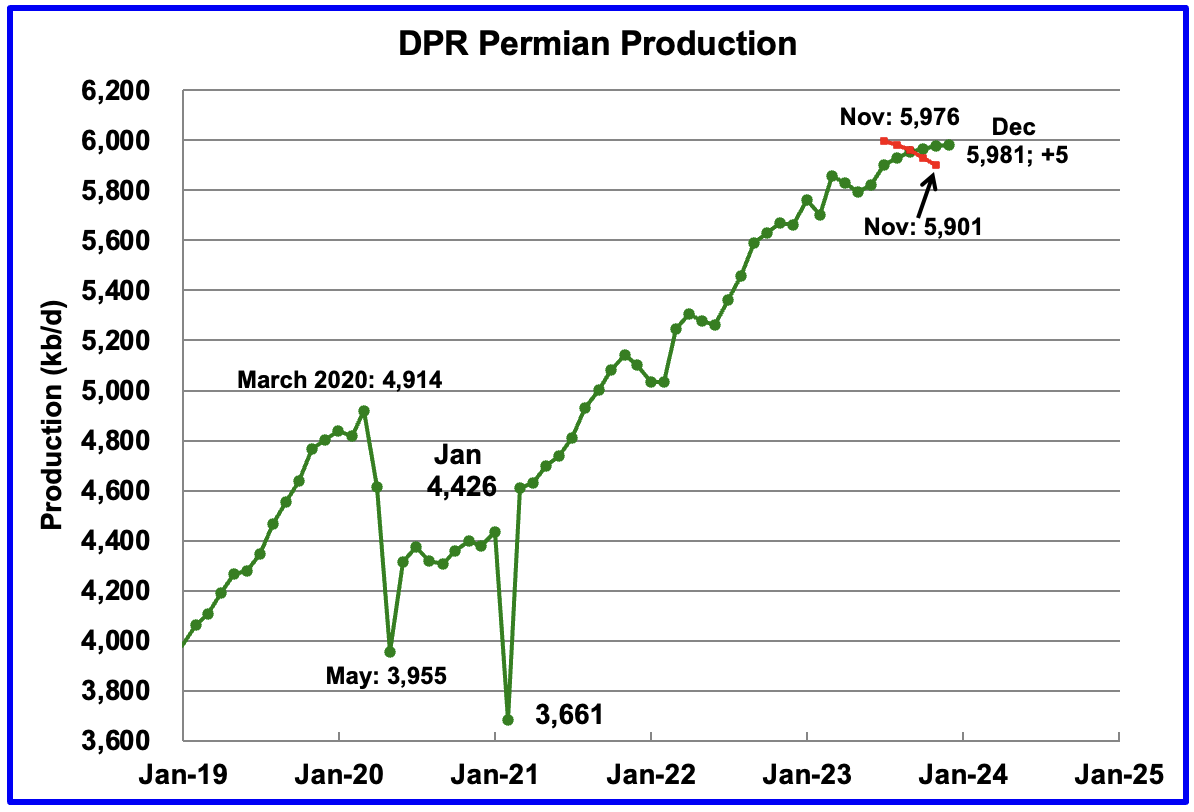

According to the EIA’s DPR report, Permian output growth continued its slow rise in December. It is expected to increase by 5 kb/d to 5,981 kb/d. The last four months of production data clearly shows a dropping trend in monthly production growth.

In addition to the small production increase in December, Permian production was revised up. November production in the previous report, red markers, has been revised up from 5,901 kb/d to 5,976 kb/d, an increase of 75 kb/d.

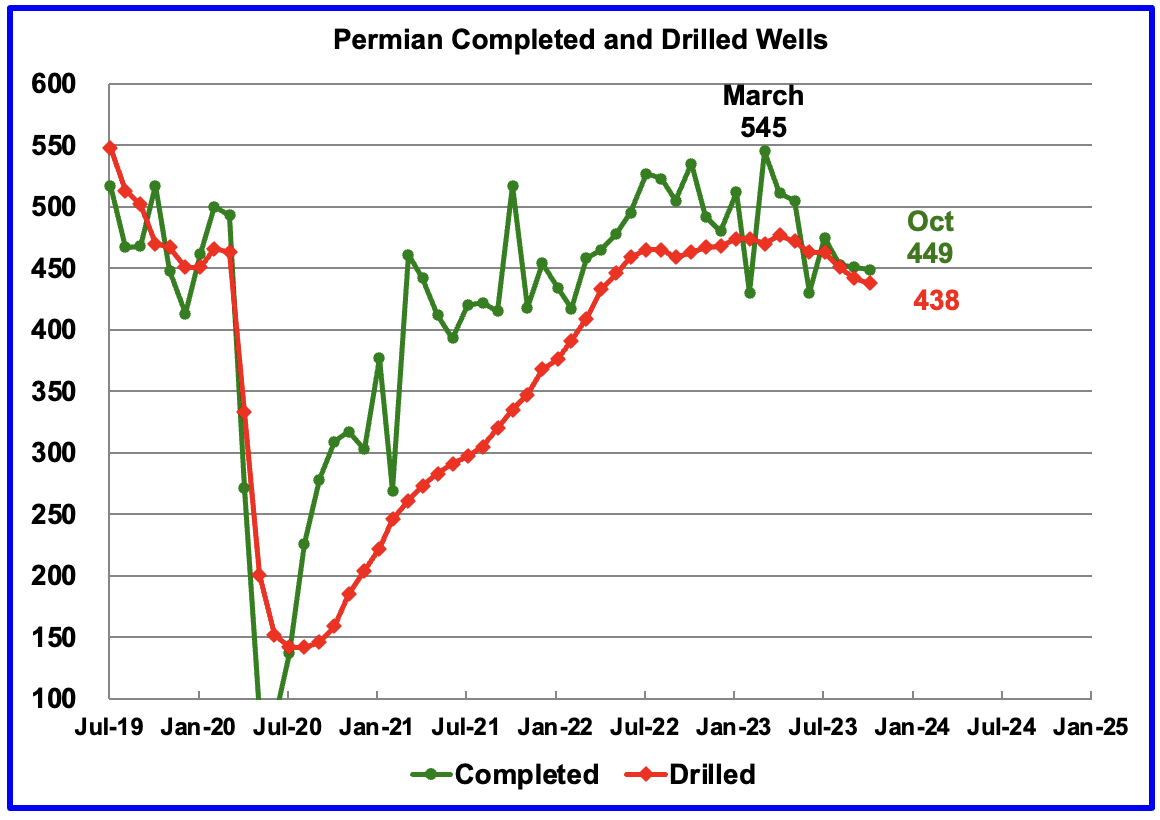

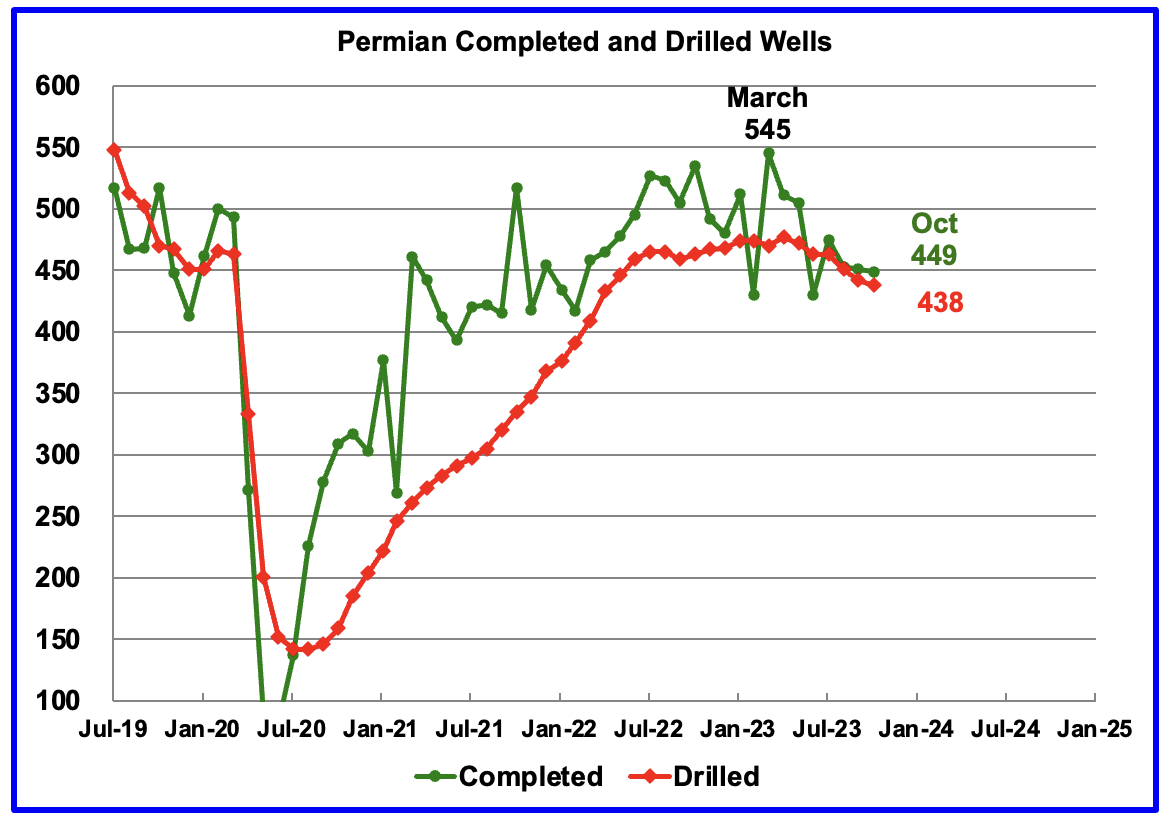

During October, 438 wells were drilled and 449 were completed in the Permian. (Note that October is the latest month for DUC information). The completed wells added 408 kb/d to October’s output for an average of 909 b/d/well. The overall decline was 395 kb/d which resulted in a net increase for Permian output in October of 13 kb/d. Of the 449 completed wells in October 434 were required to offset the decline.

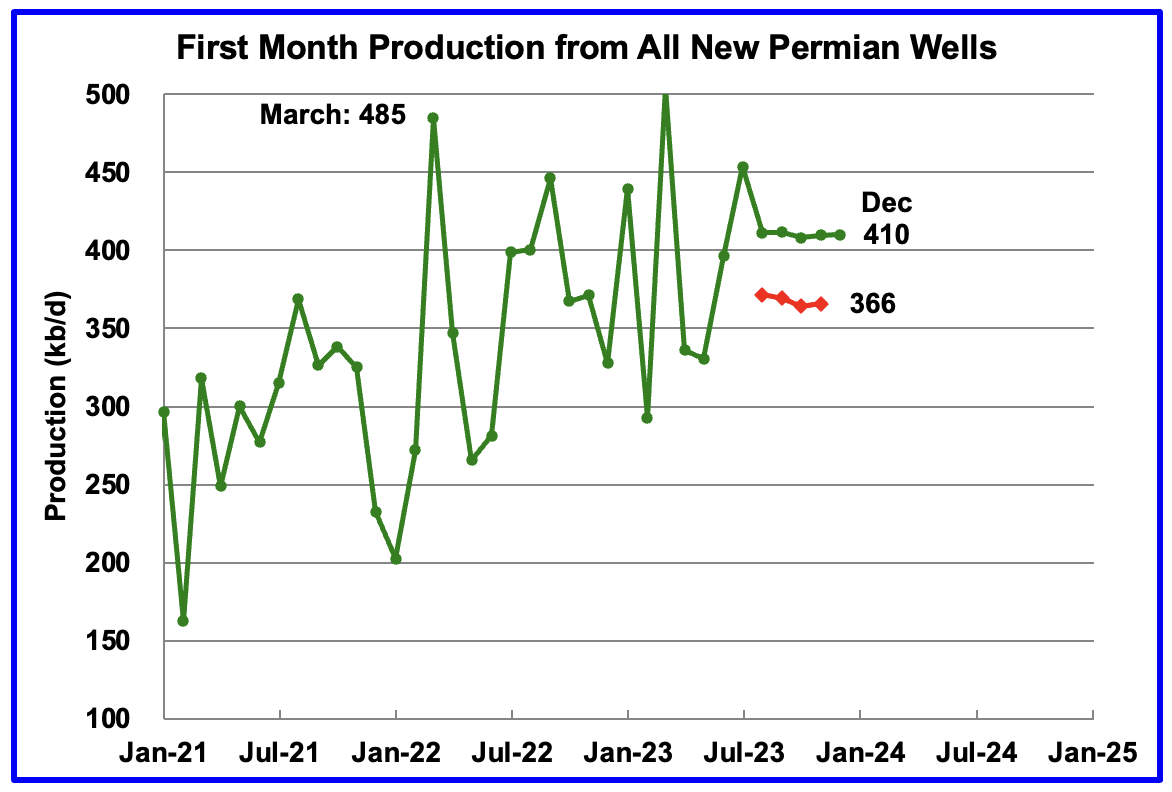

This chart shows the average first month total production from Permian wells tracked on a monthly basis. The total monthly production from the newest Permian wells in December is expected to be 410 kb/d. This is an 11% production increase over the rate reported last month, red markers.

Recall that this production of 410 kb/d is offset by a decline of 405 kb/d for a net overall output increase in the Permian basin of 5 kb/d.

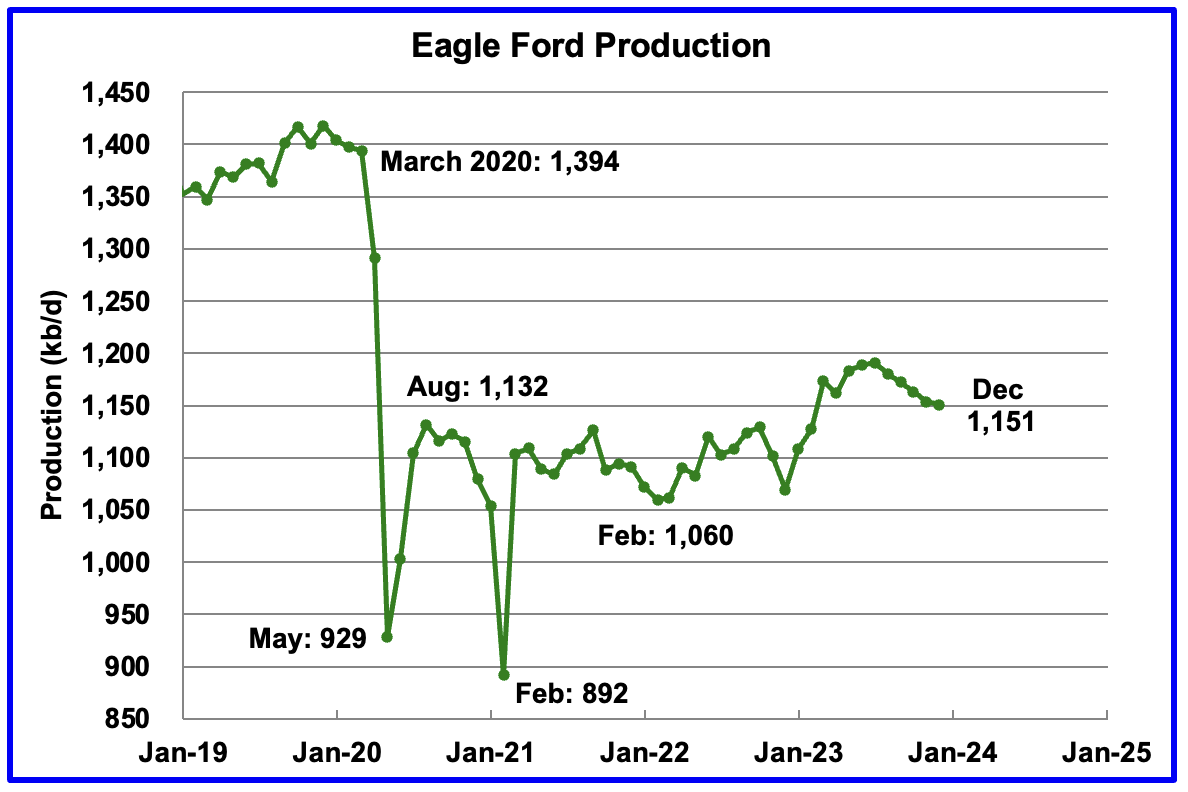

Output in the Eagle Ford basin has been in a downtrend since August. December’s forecast projects output to decrease by 3 kb/d to 1,151 kb/d. The Eagle Ford’s output for November was also revised up by 35 kb/d from the previous report.

At the beginning of the year 2023, 68 rigs were operating in the Eagle Ford basin. The rig count began to drop in mid March to 60 and slowly dropped further to 47 in November.

The DPR forecasts Bakken output in December will be 1,272 kb/d, 2 kb/d higher than November. December production is now projected to be 27 kb/d higher than the post pandemic peak of 1,245 kb/d in October 2020.

The North Dakota government reported that September production increased by 54 kb/d to 1,278 kb/d. Note that in the Bakken chart above, August production shows a similar spike in production, 46 kb/d.

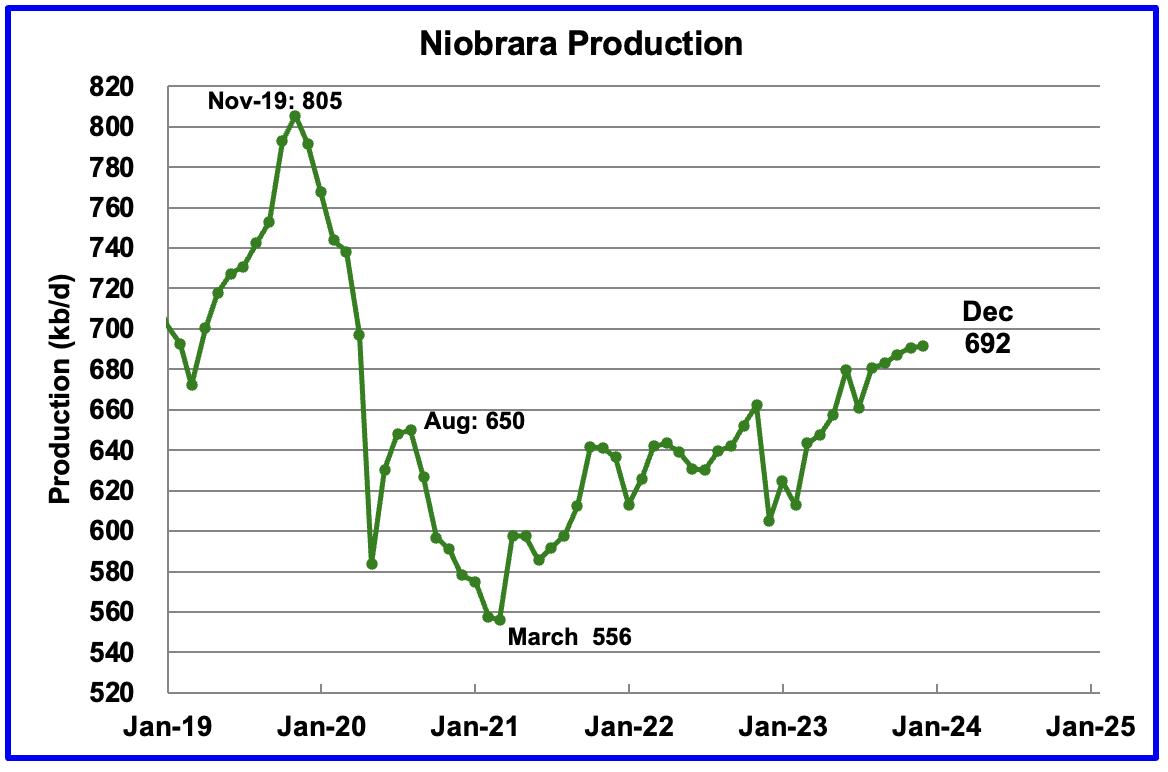

Output in the Niobrara continues to increase slowly. December’s output increased by 1 kb/d to 692 kb/d.

Production increased due to the addition of rigs into the basin but stabilized at 16 ± 1 rigs in March and April. However from August to November, the rig count has dropped to 14.

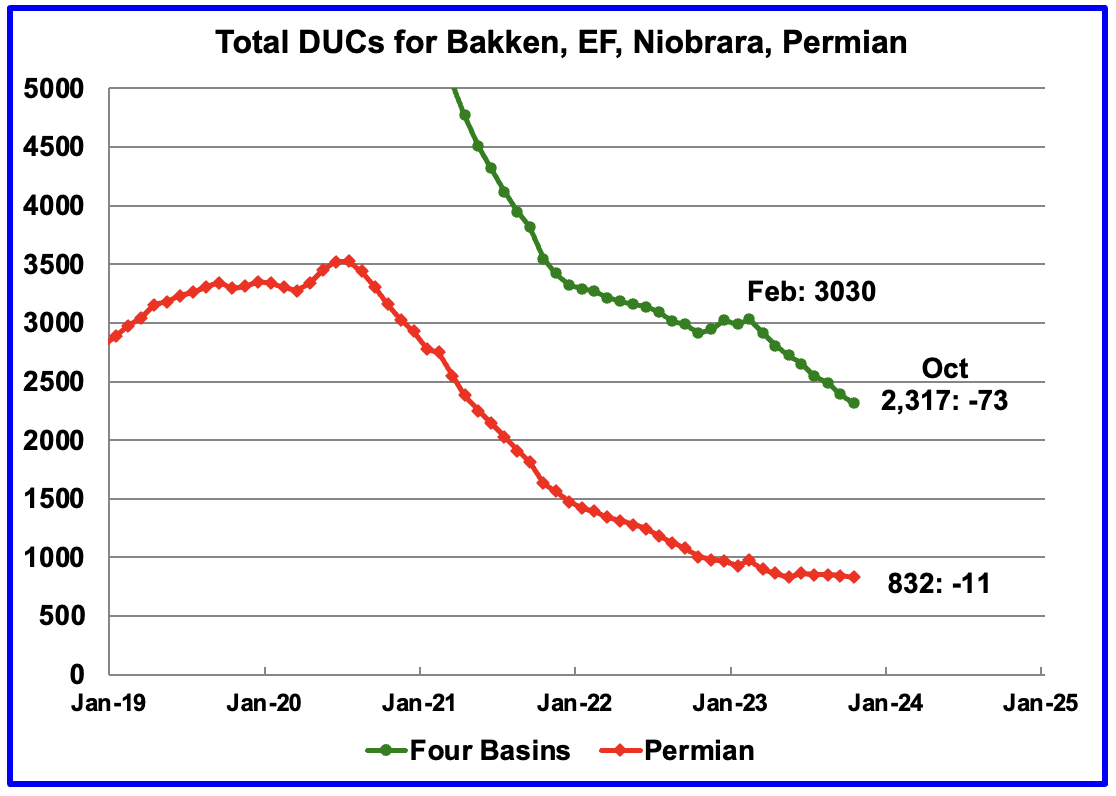

DUCs and Drilled Wells

The number of DUCs available for completion in the Permian and the four major DPR oil basins has fallen every month since July 2020. October DUCs decreased by 73 to 2,317. The average DUC decline rate since March has been 89 DUCs/mth. Of the 73 DUCs decrease, 27 came from the Niobrara followed by 18 and 17 from the Bakken and Eagle Ford respectively.

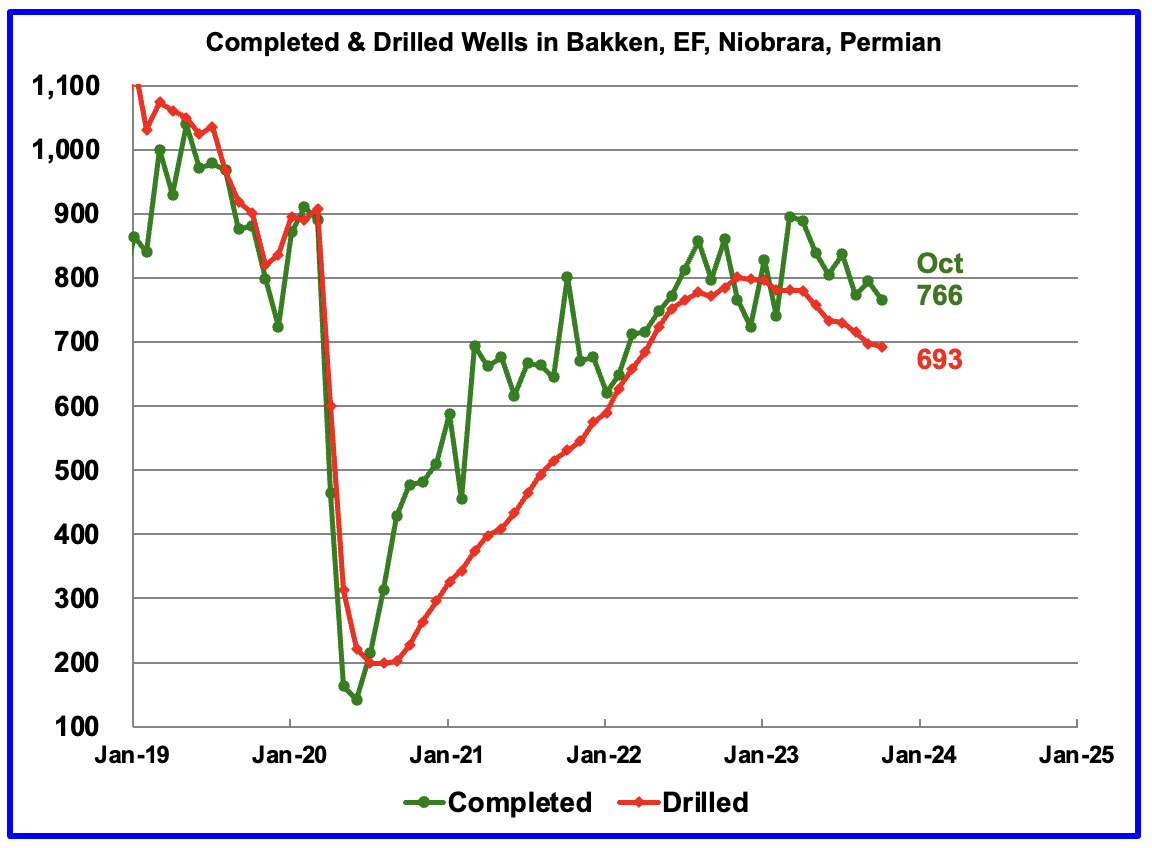

In these 4 basins, 766 wells were completed while 693 were drilled. Both drilled wells and completions are down from higher levels in early 2023.

In the Permian, the monthly completion and drilling rates have been slowing since the March 2023 high of 545.

In October 2023, 449 wells were completed while 438 new wells were drilled. The gap between completed and drilled wells in the Permian is now very small compared to late 2022 and early 2023.

The Permian, as of October, had 832 DUCs remaining and the completion rate was 449 wells/mth. This means the current cycle time between drilling and completions is 1.85 months or 56 days

Great article, thank you!

One thing about PSM is that the last four months are not directly comparable with the ones from before. EIA has had discrepancies with their balances, so they did an investigation and made changes, starting with the June PSM.

The two main findings were that: (1) some “natural gasoline” NGLs were getting blended into crude, mostly for export (Canada and others), and (2) some production was underreported. Correction (1) only affects the disposition side of the balances and not production, however, (2) affects the production numbers. They have been reporting the corrected numbers since June, but haven’t gone backwards to correct the historical reports.

The discrepancies in these prior PSMs resided in the Adjustment category, which included what has now become Correction (1) and (2) and other smaller discrepancies.

For your purpose to track C+C it may be useful to plot C+C*, where C* is total condensate, including natural gasoline that is blended for exports. Natural gasoline is in essence lighter condensate, which drops a bit further midstream from the gas feed. In other countries this fraction, which is mostly C5, is always included in the condensate statistics.

So if you decide to make this C+C* plot it should be:

For months prior to June 2023: Reported Production + Adjustment

From June 2023 onward: Reported Production + Adjustment + Correction (1). (Correction (1) is given as “natural gasoline transfers to crude oil” in the PSM)

If you do that, maybe the proper Title of the plot should be C+C*+E, where E is the error that is undetermined, apart from Correction (1) and (2). This is probably a very small error, given what EIA told us about their investigation.

The adjustment number relates to weekly production estimates. Not the 914 survey numbers.

KDIMITROV

Thanks for your information.

I have been tracking the transfers to crude supply in the weekly data since they started. However, I thought this addition was supposed to reduce the variability in the adjustment factor. It typically is still above 1 M/d. See attached for this week.

As far as I am aware, the quantities that you are referring to are not available in the PSM.

At this time my preference is to keep things simple and present the data as published by the EIA. My preference is that our information be consistent with what is widely reported in the press.

Ovi,

Sure, sure. PSM is a much better resource than WPSR and the monthly adjustments are smaller.

Regarding the WSPR it has improved greatly with production corrected and with the crude transfers, however, it is not visible because the Export/Import data is extremely noisy from week-to-week. EIA gets that data from Customs, however, private sources who track tanker movements say that if you use tanker tracking, which is more real-time than Customs, the Adjustment factor has gone to almost zero.

The other point I was making was about natural gasoline, which should be included in condensate totals for all intends and purposes, yet EIA tracks it separately. Volumes have gone substantially in recent years to 800 Kbpd

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=M_EPLLNG_FPF_NUS_MBBLD&f=M

Interestingly, there is strong seasonality to it, as you can see. My only explanation for the seasonality is that in colder weather more of it drops out earlier in the process and is counted in the Crude category, while in the summer it carries with the gas further midstream and is counted as NGL.

27 Nov 2023

Middle East oil supply situation as Gaza war brings world into unknown territory (part2)

https://crudeoilpeak.info/me-oil-supply-situation-as-gaza-war-brings-world-into-unknown-territory-part-2

Part 1 is here:

25 Oct 2023

Middle East oil supply situation as Gaza war brings world into unknown territory (part1)

http://crudeoilpeak.info/me-oil-supply-situation-as-gaza-war-brings-world-into-unknown-territory

So, the CTAs managed to bring oil under the next support.

So another -5 or -10$ the next weeks can happen. In the financial press this movements is ratiolized – they speed of production cuts are bearish, and US production will grow big next year (as everyone still “knows” they have costs of 30$ / barrel).

This seems a big battle between US money and OPEC oil production. OPEC removes real oil from the market, US money sells hundreds of millions of paper barrels. As long as tanks are full enough the paper barrel will win – until they not.

Perhaps this is even a cheap way to curb inflation (and earn on big positions here). Less inflation will induce more big stock rallys and bond selloffs.

Times stay interesting…

Economic data is shitty. The global recession that the yield curves have been screaming about for over a year nears.

Stocks tend to sell off in a recession because lenders don’t lend. Bonds will be bid because safety and liquidity will be in high demand. Oil is going to $25

China is facing something similar to the Great Depression.

Unless the FED buys from non bank entities within the economy there is no increase in the money supply. And by law the FED isn’t allowed to buy from non bank entities.

To HHH above:

So you’re saying we’re headed for a deflationary cycle that might last for a very long time, if I’m reading you correctly. At $25 oil, every rig will shut down in the U.S. shale basins. Chaos will ensue. The Central Banks would have to drop rates to near zero again. China cannot face a depression without a revolution. Thermal attenuation will still be necessary and the global grids are ill-prepared for the generation of electricity without the use of natural gas. In the scenario you are describing the use of coal–mostly of mediocre quality–would soar. I’m not about to debate the markets, because I’m pretty ignorant of them, but I am acutely aware of where we stand with regard to oil reserves, and the cost of bringing them up. In my humble opinion, these current oil prices are being driven by algorithms that are teetering on the brink of reality. The Permian kingpins have demonstrated that they can dramatically increase IP90 by longer laterals and fine-tuned “technical” features, but I have serious doubts that individual well productivity–EUR–will increase at all. Russia is not increasing production, nor is KSA or any other OPEC members to any meaningful extent. Someone mentioned Venezuela. That oil from the entire Orinoco belt is API 8, and its transport is akin to moving roofing tar. In my view we’re getting ourselves in a pickle. I always enjoy reading your slant on things, because it’s a worse pickle than even I can imagine. But I also have to believe that MbS has his own algorithm jockeys, and Putin is going along with him. To tell you the truth I’m more concerned with how much “oil on water” is out there–especially from Iran. I suspect it’s a lot. I see something very akin to the black day in 2020 coming down the pike. And then I trust the world will dust itself off and we’ll rebalance. But alas, I fear that we are throwing the babies out with the bathwater.

First let’s address the central bank’s. There is zero demand by commercial banks for bank reserves. Let me repeat that. There is zero demand for bank reserves by commercial banks.

Commercial banks that create 98% of all the money in the economy don’t need bank reserves to make loans. Even when the dollar was tied to gold. You didn’t have to have gold in your vault in order to make loans. The money supply was never determined by how much gold you have on hand.

It’s doesn’t matter one iota how many bank reserves a central bank creates. They never leave the banking system or balance sheet.

Commercial banks control the money supply via lending. Even in 2008-2009 we still had 10% growth in the money supply, yoy that is.

Money supply growth is currently deeply negative. We are actually heading into a depression. It’s not clear that zero percent interest rates or negative interest rates will make banks want to extend loans.

I’m in total agreement with you on oil needing higher prices in order to keep supply flowing. I just think that we aren’t going to get those higher prices and the oil flow will be reduced by lot.

China has built enough condominiums and apartments for every Chinese citizen to have two. Hundreds of millions of units that will never be lived in. It’s going to go down as the largest bubble in history to pop. It a $65 trillion bubble. It’s doesn’t have to even fall that far to create huge hole in the balance sheets of their banks.

And a lot of the loans are dollar denominated. A lot of offshore banks are extremely exposed here. What happens in China won’t stay in China.

I checked copper and steel price – the metals that will be hit even more than oil with a chinese recession. They haven’t been hit so far, these traders do business as usual – steel is even recovering a bit.

Banks need reserves to pay out the loans they make – if they don’t have enough. There is a minimum reserve rate for making loans, another tool to regulate credit and money creation.

But QE was not about reserve creation(banks can lend them from other banks, too, if they need them), it was about bringing interest rates down to make loans cheaper and induce a boom. Did work only good on state finances so politicans could throw out heaps of money for their favorite projects (Conservatives lowering taxes, socialists dishing out social help).

China can now go from building empty houses to building things that shoot. When I interpret the war mongering about Taiwan right.

HHH,

When do you expect this Global recession to begin (maybe a 12 month window)? You have been predicting oil at $25/b for some time, eventually we may get there, my expectation is in 10 years or so maybe some time between Dec 2033 and Dec 2034.

Many people have been feeling a recession for a long time. Things can be generally bad for a good chunk of society without there being the economist definition of two quarters negative growth. I have not, for example, known of this much worrying about paying bills in my circle since 2008. And I do not work with people who are particularly badly paid, but everything is being intensified on the precarity side of things.

I noticed a fun couple of articles this week about immigrants to Canada deciding to up and leave again because of how terrible living there was with cost of living. These were people from Hong Kong and Ukraine properly disillusioned with the way the West is run.

Kleiber,

Often a recession is associated with high unemployment, in the US employment has been pretty good.

https://fred.stlouisfed.org/series/UNRATE#

Business have been holding onto workers hoping for the so-called soft landing to occur. As they’ll be needing those employees under such a scenario.

Bond markets are right though and have been calling it for over a year. The interest rate hikes aren’t necessarily the problem. More the inverted yield curve is the problem.

Interest rates are going to have to go lower much lower in order to spur the credit growth needed to pull the economy forward.

What is going to happen is the market will set interest rates back to zero via a credit crunch and central banks will respond by cutting interest rates.

When you see the Fed cutting it’s just them acknowledging we are in trouble. By that time joblessness will be up significantly and oil prices down significantly.

Oil prices and bond yields tanking are a major sign of economic weakness.

As the FED and other central banks start to cut rates. Oil prices and bond yields will accelerate lower.

HHH,

Bond yields have decreased, “crash” overstates things imho.

https://fred.stlouisfed.org/series/DAAA#

The US economy is doing fine.

See https://fred.stlouisfed.org/series/GDPC1

You’re not hearing what I’m saying. It’s the inversion that is a problem. If we were going to get a Goldilocks scenario the yield curve would steepen out with the long end going higher in yields.

We are getting the exact opposite of best case scenario. The bond and oil markets don’t agree with the best case scenario. And it’s China and Europe that will be leading us the way down.

The deflation coming out of China will hit all shores. And Europe has a wall of debt that will have to be rolled over at higher interest rates throughout 2024.

Not to mention the money supply. Actual money in real economy not the interbank tokens known as banks reserves has shrank by $2.8 trillion.

HHH,

You said :

Oil prices and bond yields tanking are a major sign of economic weakness.

What do you mean when you say “bond yields tanking”?

30 year bonds have gone from 2.99% in Dec 2021 to 5.8% in Nov 2023.

The yield curve remains inverted as it has been since Oct 2022, the spread between 10 year and 3 month treasuries has taken a dive lately, so it may be the change in the yield spread that you are referring to.

3H, your running out of time and the American economy is only getting stronger.

“The yield on two-year Treasuries climbed above that for 10-year government bonds in July 2022, causing a closely watched “two-ten inversion.” The reversal is the longest-lasting since 1980, and the spread between the two yields widened the most since 1981 in July. Investors interpret these signs as bad omens because they reflect fears that near-term economic risks exceed the dangers of holding longer-dated debt.

At first sight, they are right: Yield curve inversions have been a consistent predictor of future downturns. Every modern U.S. recession has been preceded by an inversion. The yield curve has only shown one false positive, in 1960, and only because the following slowdown wasn’t dramatic enough to constitute a recession”

https://www.reuters.com/breakingviews/new-economic-rules-shatter-us-bonds-crystal-ball-2023-09-19/#:~:text=The yield on two-year U.S. Treasury notes has been,that on longer-term bonds.

How long does it take from yield curve inversion to recession?

According to Dow Jones Market Data, inversions of the 2-year and 10-year yields—the most commonly cited pair—have preceded recessions by as little as seven months or as much as two years. In early July, the 2-year yield exceeded the 10-year yield by nearly 1.1 percentage points.

https://www.investopedia.com/articles/basics/06/invertedyieldcurve.asp#:~:text=1 Under normal circumstances, the,riskier than the long term.

Biden Economics

If your waiting for $25 oil. You will miss the next energy rally. It’s that time to start shopping and fill your cart over the next month or two with oil equities.

You snooze, you lose

Dennis, The bond market is pricing in a crash not a soft landing. Hundred basis points of inversion. We are right at the 18 months lag.

Historically it’s 18 to 24 months before recession shows up. Do you really believe somehow this time is different and we will escape recession?

The recent turn lower in bond yields and oil prices are loudly telling us growth and inflation are done.

Yield curve is going to un-invert with the Fed and the rest of the central banks being forced by the market to cut interest rates back to zero or negative.

HB, if the American economy was getting better oil prices would go up and bond yields would steepen out above the FED’s overnight rate. That’s not happening. The exact opposite is happening.

HB, you live in la la land and while I could be talking about California I’m not.

And I wouldn’t bet on QE being able to save the day. There are a lot of entities that are holding government bonds yielding 5% now that just aren’t going to sell at any price.

Which leaves mainly just the bonds on commercial banks balance sheets. When a central bank buys from a bank there is no increase in M2.

Commercial banks don’t need those bank reserves to make loans either.

Government will have to step in and deficit spend. Now how big is the hole that they are going to have to attempt to fill?

Helicopter money that puts deposits on balance sheets in real economy will cause temporary inflation. As we’ve seen.

Temporary can mean 2 years. While governments need to inflate debt away, can they really go big and risk a repeat of the price swings we’ve seen over last couple of years?

When wages don’t keep up with price increases. Prices eventually fall. That is exactly where we are currently at. Hint, home prices have never been as expensive as they are today compared to the average wage. 4.5 times the average yearly wage. We are in a bigger bubble now than 2008.

To the average American there is nothing affordable in the economy currently.

THE EMPLOYMENT SITUATION — NOVEMBER 2023

Total nonfarm payroll employment increased by 199,000 in November, and the unemployment rate edged down to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care and government. Employment also increased in manufacturing, reflecting the return of workers from a strike. Employment in retail trade declined.

This news release presents statistics from two monthly surveys. The household survey measures labor force status, including unemployment, by demographic characteristics. The establishment survey measures nonfarm employment, hours, and earnings by industry. For more information about the concepts and statistical methodology used in these two surveys, see the Technical Note.

Household Survey Data

The unemployment rate edged down to 3.7 percent in November, and the number of unemployed

persons showed little change at 6.3 million. (See table A-1.)

Household Survey Data

The unemployment rate edged down to 3.7 percent in November, and the number of unemployed persons showed little change at 6.3 million.

The number of persons employed part time for economic reasons decreased by 295,000 to 4.0 million in November. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs.

In November, average hourly earnings for all employees on private nonfarm payrolls rose by 12 cents, or 0.4 percent, to $34.10. Over the past 12 months, average hourly earnings have increased by 4.0

percent. In November, average hourly earnings of private-sector production and nonsupervisory employees rose by 12 cents, or 0.4 percent, to $29.30.

https://www.bls.gov/news.release/pdf/empsit.pdf

The consumer price index, a closely watched inflation gauge, increased 0.1% in November, and was up 3.1% from a year ago.

Excluding volatile food and energy prices, the core CPI increased 0.3% on the month and 4% from a year ago.

A 2.3% decrease in energy prices helped keep inflation in check, as gasoline fell 6% and fuel oil was off 2.7%. Food prices increased 0.2%.

https://www.cnbc.com/2023/12/12/cpi-inflation-report-november-2023.htm

EULENSPIEGEL

According to the first chart, if we believe the STEO, there will be no growth in US production next until July and when growth starts, 2024 will only add 245 kb/d to supply in the last quarter.

As for $30/b for the cost of US oil, that sounds low to me. The sense I get is that the drillers want $70/b to make a decent return. I think the experts should way in on what the drillers need before they drill.

The other issue here besides reducing inflation is the desire of the US to reduce Russian revenues from their oil. Could they be working with the CTAs, as you mention, to keep selling paper barrels?

What has happened to WTI over the last week does not make any sense if we are to believe the OPEC and IEA reports. The MOMR claims that demand exceeds supply by over 2 Mb/d in Q4-23. If true, market forces would be raising the price of oil. So something is wrong in the data. Either supply is greater than the MOMR is reporting or Demand is a lot weaker.

According to the IEA: “Chinese oil demand rose to another record high of 17.1 mb/d in September, underpinning global growth. China is set to account for 1.8 mb/d of the total 2.4 mb/d increase that lifts demand to 102 mb/d in 2023. Overall growth is expected to slow to 930 kb/d in 2024.”

The IEA says China demand is strong but this morning I see news about possible weak China demand.

To make matters worse, the US reported a 4.6 M barrel drop in their stock/inventory this morning. Typically this would cause a rally in the price of oil. In addition, production in the week ending December 1 dropped by 100 kb/d. Another two bullish factors that are out the window this morning as WTI is currently down $3/b and under $70/b.

Bottom line Nobody knows Nothing.

When we run out of oil in the tank, we’ll just pay more and oil will be provided. Geez, it’s really not that hard.

Economy’s great!

I citated stuff from the financial sites – they where bullshited with enough investor presentations to believe the 30$ stuff.

I’m long enough trading stocks – the price often makes the story. Good for CTAs when they move stuff around.

Ovi:

Thank you for the detailed and thorough update on US production!

I have a question for the oil men and energy experts here, please.

The oil men have been saying they can’t make a go of it (ie. make $$$) at $75 oil in a recent post. I know Mike Shellman and others have been pointing out this important fact and why for some time. So, given the collapsed shale DUc count, Permian completions have been declining since early 2023, Ted Cross at Novi says Permian productivity has been falling for 2 years, the fact that oil producers dropped rigs starting early August 2023 WHEN WTI WAS ~$80, Karnes County (EFs biggest producer) has been in decline for months now, Midland County oil production recently went in to decline (after a year of rig count declines) and Martin County oil production is flat, how can US shale production not fall at $69 oil?

Yes, I know that the Bakken is doing better, but overall, indicators almost all point to falling US shale oil production.

Joel & Ovi:

I am increasingly thinking that what is happening is a manifestation of commodity trading algorithms that feed on momentum until an absolute breaking point is reached.

Prices are out of synch with what is happening in world geopolitics, a diminished SPR, and an emergency meeting of Putin with MbS on Saudi turf.

The OPEC cut last month was a wet fart on the markets. If that didn’t raise havoc, not sure what. Maybe the Houthis knocking out a Saudi oil field? Who knows?

Israel and Hamas duking it out didn’t do much to the price, so either the markets know something we don’t, or they know nothing at all and also are brainless algos.

I can’t say I’m particularly optimistic about this.

Putin likely is flying to Riyadh to beg MbS not to open the taps in an attempt to drown out US shale. A 2014 replay could be at hand.

Joel,

If we use 6 month cumulative production to evaluate well productivity for the Permian we get the following from

https://novilabs.com/blog/permian-update-through-july-2023/

From 2021 to 2022 the average cumulative output at 6 months fell by about 3.66%, but note that 6 month cumulative output rose from 89.6 Kb in 2018 to 106.8 kb in 2020, and in 2022 6 month cumulative was 111.1 kb. It is too early to have complete data for 6 month cumulative for 2023 wells, but 2021 was indeed a high point at 115.3 kb for 6 month cumualtive output.

I don’t think it’s that prominent in the Permian, but in other basins, you’ve seen high/low grading having a huge effect on average well productivity. So when prices are low and production is falling, only the best wells are completed. And vice versa.

People routinely try to make inferences from trends in well quality but omit the impact of price driven high grading. If you see well quality going up, while price is going up, than you can say for sure wells are getting better. Conversely if wells are getting worse, when prices are dropping, than you really do see ‘running out of acreage”. When things are mixed (as is the norm), you can’t say for sure. Need to do more complicated multiple regressions or other analyses that disentangle the confounding effect of high grading.

I have seen $12-14 million in the cost range to drill, complete and equip a horizontal well in the Delaware Basin.

Assuming that is correct, figure what price of oil, NGL’s and natural gas it takes to pay off a well in 3-5 years. It seems there is excellent data as to what an “average” well will produce in the Delaware Basin. There should also be a lot of LOE data from public company 10k and 10q, same for G&A expense. Same for ad valorem taxes. Also, seems like most of the leases provide for a 1/4 royalty, so deduct that from the gross income.

To simplify, just take 3/4 of the products produced over 3 years times current product prices, less $20 per BO for LOE, G&A and ad valorem taxes. It’s very back of napkin, but might be helpful? I’m open to criticism from those more in the know.

So, if the product prices aren’t able to payout the well in 3-5 years, it is likely the companies will defer drilling.

Also, keep in mind the public shale companies now cater to dividend investors, not growth investors. The shale companies paid some big special dividends since 2021. So, that extra burden is a big deal. I suspect the shares of shale companies will drop like a rock without those dividends. I only own COP regarding shale, but therefore I follow it. I’m not sure why it’s still worth $110 a share if it was worth $65 a share at the same oil price in 2018? If anything, costs have went up a lot since 2018. Those that think oil will stay here/go lower should trade the shales, as they haven’t sold off like they should under that price scenario. Again, just IMO.

I haven’t done any calculations in awhile, but I suspect there is no way $30-40 WTI supports Permian Basin wells.

As for the other basins, not sure they matter a whole lot individually, but collectively they have been growing production. I would be surprised if any could withstand $30-$40 WTI.

This oil price volatility is bonkers, but it isn’t new. It’s been around pretty much since the US invaded Iraq. I’ve lived it for 20 years.

Shallow sand,

For a well with a 13 million capital cost and a well profile similar to the average 2020 Permian well (note that Delaware basin wells are on average more productive than Midland Basin wells) the well pays out in 47 months at $73/b at wellhead assuming NG at $3/MCF and NGL at 30% of the crude price per barrel ($21.90/b for NGL for this case). On average the 2022 Permian basin wells have a similar profile to the 2020 wells, it is too early to make a good estimate for 2023 wells in my opinion, I don’t have access to enough data.

Dennis. As Mike points out, we aren’t including land, seismic, interest and other costs in these calculations.

Some shale proponents also think we should leave out the cost of drilling the hole once drilled, as it has become a “sunk cost” like some of the other expenses I mentioned above.

It will be interesting to see what kind of dividends the pure shale public companies pay if wellhead oil prices stay $70 or below.

It is also my understanding that natural gas prices in the major shale basins remain depressed, below $3.

Shallow sand,

Yes some producers may pay the WAHA price which is depressed, but if you look at 10Q or 10K reports the larger producers receive higher prices for their natural gas (Pioneer reported $2.48/MCF in third quarter 2023). The 13 Million price probably would include land cost, I don’t think interest should be part of a well payback excercise. Over the 143 month life of this well at the prices assumed the net revenue from the well (ignoring interest) would be 17.2 million, so if we assume a 10 year corporate bond is issued at 6% that raises the payback over 10 years to 13 plus 7.8 million in interest paid over 10 years or 20.8 million. That would raise the wellhead price needed to payback principal plus interest over 10 years to $86 at wellhead. I would think the higher current interest rates are leading to less borrowing and more drilling being financed from cash flow. Also the 13 million estimate for all in costs may be too high, average well costs may be lower than this, not every well drilled and completed is a 15 thousand foot lateral well, on average the wells are in the 10k range on average (with some shorter and some longer). For the 9 months ending Sept 30, 2023 Pioneer reported 3.6 billion on net earning, capital spend was 1.1 billion with 95 wells completed in third quarter which suggests about 11.58 million in capital spending per well completed. Interest expense during the first 9 months of 2023 was about 114 million which is about 3 % of net income attributable to common shareholders. From link below

https://investors.pxd.com/investors/news-releases/news-details/2023/Pioneer-Natural-Resources-Reports-Third-Quarter-2023-Financial-and-Operating-Results/

I agree at todays prices things do not look good.

Joel

The first chart shows flat US production to July/August 2024. So while you say “but overall, indicators almost all point to falling US shale oil production.”, plateauing production over the near term may be a better description. If oil holds here at $70/b, that small increase seen in Q4-24, may not appear.

Joel, you can google me.

There is NO evidence whatsoever that suggests US tight oil will plateau from the Permian for the next 6-8 months in 2024, as the Energy Inaccuracy Agency implies, other that “statistical trendology.” Wells in the Permian, the only basin to care about, are getting worse (down 4% across the basin the past 2 years and in heavily drilled sweet spots like Lea County, New Mexico, the largest producing county in the Permain Basin, down 16% the past two years [Enverus, Novi, TRRC]), well economics are getting worse by the day, rig counts are falling and remaining T1/2 locations are now so scarce that in 2023, mergers and acquistions in the Permian lent themselves to paying $1MM to $3MM per location…over and above $13MM well costs. WTI Midland is now down to $63 at the WH, after deducts and severance taxes, Waha gas is a little north of a dollar.

Mr. Ovi himself can be quoted here: ” …of the 449 completed wells in October 434 were required to offset the decline.” That implies but for 15 lousy wells in Ocotober the Permian would have had NO growth.

Highgrading cores areas mean much less productive wells than 4% and DUC’s have been all but deducted from the big picture. A few less rigs, drilling fewer wells in T 3/4 areas, taking a few days longer per well, with higher inflationary costs in 2024 to drill and complete, and the Permian is going down, which I suggested 6 months ago, and we appear to be on track to see manningful decline by 2Q24. You are right to be concerned.

Thanks Mike,

If oil and natural gas prices continue to fall and completion rate decreases in the Permian basin then we will see Permian basin output fall. We generally see about 1.45 spuds per horizontal oil rig in the Permian Basin in the past 12 months. Recently the horizontal oil rig count in the Permian basin was about 301. That suggests about 436 wells could be drilled at current rig count levels in the Permian.

If we assume 436 wells per month were completed from Nov 2023 to September 2030 and then decreased by 10 wells per month to zero completions after May 2033, we would have a scenario with about 33 Gb of Permian basin tight oil output from Jan 2010 to June 2041 with 88740 total horizontal tight oil wells completed from Jan 2010 to May 2033 (currently about 45500 horizontal tight oil wells have been completed in the Permian.) Output would decline in this scenario (see chart below). The scenario assumes new well EUR decreases at an annual rate of 3.65% per year starting Jan 2023 for this scenario, the average 2020 well profile is used for Jan 2020 to Dec 2022.

The scenario is likely to be wrong as I cannot predict future well profiles or completion rates, this scenario seems pretty conservative to me as the USGS F95 TRR is about 45 Gb for the Permian basin and the mean TRR is 75 Gb.

Is the EIA production data not overstating US oil production?

Art Berman’s THEY’RE NOT MAKING OIL LIKE THEY USED TO: STEALTH PEAK OIL says no:

https://www.artberman.com/2023/01/18/theyre-not-making-oil-like-they-used-to-stealth-peak-oil/

A large portion of what EIA says is oil production are ngl’s and ethanol. So, is the market pricing WTI on EIA’s inflated oil production?

Joel,

The EIA reports C plus C out put at link below, this is crude plus condensate, no NGL, or ethanol is included.

https://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_m.htm

So no, the US C plus C output is not being overreported, we don’t pay a lot of attention to the output level for NGL and Ethanol at peak oil barrel, the focus is on crude plus condensate.

https://www.dailymail.co.uk/news/article-12830451/venezuela-invade-guyana-change-maps-esequiba-maduro.html

Venezuela preparing to invade oil rich Guyana.

The perfect excuse for the USA to invade Venezuela.

Seems like attempts at redrawing of country borders is becoming a bit of a trend.

Co-incidence that Russia and Iran are the primary sponsors of Maduro?

https://www.msn.com/en-us/news/world/us-to-conduct-guyana-flights-as-tensions-mount-over-venezuela-dispute/ar-AA1lacCx

“The United States has said it will conduct joint flight drills with Guyana amid growing border tensions between Guyana and Venezuela.”

“Venezuelan President Nicolas Maduro has issued arrest warrants for opposition politicians who are challenging a move to annex oil-rich Essequibo in a last-minute ploy to ensure his chances of maintaining the presidency against wildly falling popularity.

Maduro has officially placed the disputed territory of oil-rich Essequibo under military jurisdiction, putting oil exploration and production operations of Exxon and Chevron at risk. ”

https://oilprice.com/Latest-Energy-News/World-News/Maduro-Arrests-Opposition-Figures-as-Oil-Rich-Guyana-Readies-for-Invasion.html

https://oilprice.com/Energy/Crude-Oil/Guyana-To-Become-The-11th-Country-To-Produce-Over-1-Million-Barrels-Of-Oil-Per-D.html

Guyana the hottest oil prospect in South America

Big Surprise. EIA Updated World Production

World production was 80,700 kb/d in August, down 1,838 kb/d from February. The Saudi Lollipop cut accounts for 1,000 kb/d of the 1,838 kb/d. Note that December 2024 is lower than February 2023, assuming the projection is correct and the updated EIA numbers are correct. I note that the EIA updated a lot of the earlier production data.

It’s looking increasingly as if economists like Shinzy who think peak oil will mostly be a low price phenomena have the right idea.

If peak oil does play out as a low-price phenomena, this implies generalized and long term economic stagnation with declining demand, and a generalized lack of purchasing power for oil products and all that oil products enable.

The ramifications of this growth stagnation or outright contraction scenario are of course huge.

One these ramifications is the implied growth in the disparity of economic prospects as some peoples and regions will fair much worse than others, and this is a recipe for a dramatic escalation of geopolitical instability.

A second ramifications is much lower overall oil production, with less money available to fund higher cost projects. This leaves a big chunk of low EROEI oil in the ground.

Some might say that electrification of transport and industry would have a significant causative role in a proposed low-price peak oil scenario, since less oil /unit of GDP will be needed. I’m sure that is true to an extent, but it remains an open question just to what degree this offsetting factor will be an effective force. Much of this uncertainty involves timing, and policy choices within the major economies.

“As We Exhaust Our Oil, It Will Get Cheaper But Less Affordable” is the name of this very very good article from Blair Fix (2020) and you can find it here:

https://economicsfromthetopdown.com/2020/12/03/as-we-exhaust-our-oil-it-will-get-cheaper-but-less-affordable/

Thank you for the above article. It makes sense of the title.

Thanks Required.

A point is made in this article that lower EROEI oil is less affordable (since it takes higher input cost to yield the same product).

And- “What’s interesting is that even if oil purchasing power does decline as I’ve predicted, this says nothing about prices. Oil prices could explode (as many peak-oil theorists expect). But oil prices could also collapse. It all depends on what income does.”

‘We don’t think about this alternative [“that a resource could get less affordable because your income goes down’] because it involves something that few living people have experienced: the continuous contraction of income.” (globally)

Its an interesting discussion of the balance of price and affordability.

Required

Thanks it’s a good read. Affordability is key.

Ron has talked about this in the past and he makes a lot of sense. When looking at the typical price cycle, high production tends to lower prices, hence the old saw, “the cure for high prices is high prices”. So it makes sense that the peak of production will be at a point of overproduction, a glut, which results in low prices near and just after the peak of production. Eventually production slows, prices rise and production follows the price back up. We’ll know when the peak has been reached when very high prices can’t stimulate enough production to cause another glut in supply exceeding the previous glut. Such has been the case recently, so it’s looking more and more like 2018 was indeed the peak.

Of course this price cycle phenomenon assumes that the non-oil sectors of the economy are functioning normally. A financial crisis, a pandemic or a war can affect oil production more in the short term than long-term depletion. But eventually depletion wins.

Permian scenario assuming productivity (new well EUR) decrease of 3.65% per year (this is the productivity decrease from 2021 to 2022 in Permian basin) starting in Jan 2023. New wells added match the Novi estimate up to March 2023 and uses the DPR estimate for completions in DUC spreadsheet from April to October 2023. After October 2023 I assume the completion rate remains at 449 wells per month (October 2023 rate) until September 2030 and then decreases at 13 wells per month until falling to zero completions in August 2023. URR is 34 Gb, total wells completed are 90,255 wells from Jan 2010 to August 2033.

Peak in Dec 2025 at 5564 kb/d. Note that my estimate for Permian output in Sept 2023 is 5521 kb/d (only 43 kb/d below peak output for the scenario in the chart below). If this scenario were correct and my estimate for Permian output were also correct (neither is likely to be true) we would currently be very close to peak output in the Permian basin, basically on a plateau from October 2023 (5500 kb/d) to Nov 2027 (5500 kb/d) with a 64 kb/d increase and then decrease over the period from Oct 2023 to Dec 2025 (for increase) and Dec 2025 to Nov 2027 (for decreasing period).

A new paper by Jean Laherrere: The evolution of oil production forecasts for the World and the US by different reporting agencies: a visual summary, Jean Laherrère, 3 décembre 2023

https://aspofrance.org/2023/12/04/the-evolution-of-oil-production-forecasts-for-the-world-and-the-usby-different-reporting-agencies-a-visual-summary-jean-laherrere-3-decembre-2023/

(Easier to read if you download the pdf.)

Thanks George.

Laherrere asks how accurate the EIA 914 estimate is. Over the Jan 2015 to Sept 2022 period (when we have relatively accurate state level data), the sum of the EIA 914 estimate for all months compared to the sum of the EIA Final estimate (which is revised to the level reported by individual state agencies) is about 0.998%. If we look at the mean of the absolute relative error over all of these months it is 0.47%. Chart below shows the data comparison. The 914 estimate is pretty good.

Global oil production is 4 to 5 million barrels per day higher Ovi data.

https://www.apirasol.com/illicit-oil-trade

Stolen and illegally traded oil does not figure on EIA data, you have to go looking for other sources of information.

Charles,

The output is gathered from secondary sources for production. Oil that is stolen or “illegally traded” to avoid sanctions is oil being exported or imported, it does not affect production numbers.

Can you point us to a source for “correct information” for oil output?

The source you point to talks about illicit trade. Let’s say a company produces 100 computers and 20 of them get stolen. The reported production of 100 computers has still occurred and there will still be 100 computers out in the World, with 80 purchased legally and the other 20 purchased online from dealers in stolen merchandise. It is no different for oil. The output numbers from the EIA are the oil produced, whether the oil is later stolen or otherwise traded in a way that avoids sanctions is beside the point.

Dennis

I have already posted various studies conducted by different agencies. Oil production in many less developed countries is only counted when it gets to a refinery or put on a ship. So calculating how much goes missing before then takes a great deal of analysis.

Russia is illegally transporting oil on at least 500 tankers. They are obviously not going to these lengths to hide that oil and then tell the EIA exactly how much oil they produce. They hide it.

Monitoring dark tankers provides a good idea of the quantity of oil hidden from production data. These tankers serve Iran, Venezuela, Libya and many other countries.

https://www.aspistrategist.org.au/russia-using-shadow-fleet-to-keep-oil-revenues-flowing/

OPEC has put consumption at 103.2 million barrels per day.

The percentage of ngl is only tiny bit higher than 2018.

Global gdp is over 9 trillion higher than 2018.

Everything points to production at least 2 million barrels of c and c higher than 2018

Charles,

The EIA gets its data from secondary sources. Last I checked oil tankers are pretty difficult to hide, there are companies that specifically track tankers. How do you think estimates are made of oil stolen?

x barrels go into the pipe and Y barrels come out the other end, oil stolen is x minus y. This isn’t rocket science. Oil produced is X, they know how much they send down the pipeline and they know how much gets stolen. The production is X, that is what gets counted as output. There are different estimates of consumption, the EIA estimates 101.4 Mb/d for 2023 about 1.3 Mb/d more than 2018. In the most recent 12 months the average total liquids production that was not C plus C was about 1.5 Mb/d higher than at the peak of World C plus C output in Nov 2018. The amount of C plus C consumed per trillion 2015$ of real GDP produced changes over time, it has been decreasing most years since 1972.

Dennis

You dismiss any evidence that does not suit your ingrained views. No point discussion with person with such a closed mind like yours.

The tankers go dark to hide that they exchange cargo and destination.

You really think Iran, Russia and Venezuela tell everyone what they are doing this is too painful

Oil consumption to gdp has been reducing over the years but it has never been negative in the last 30 years. Only when a third of oil was being burned in power stations in the 1970s was there a few years where this consumption was changed to coal and gas. This allowed growth with less consumption for a few years.

Charles,

Just because I don’t agree with you, does not mean I am close minded. Ad hominem shows you don’t have any answers to my critique. Production does not have to be reported. There are many firms that track shipments independently of governments and they publish their data for a price. These secondary sources are what are used by the EIA, OPEC, and the IEA to estimate World output. You can choose not to believe the numbers and make up your own, just don’t expect many will believe that theu are correct.

There are a few things that would be nice to know to have an overlook about oil production, and this gets complicated:

How is the historical chart of oil smuggling?

We have Iran/Iraq embargoes going on since long time, and chaos in Africa,too. Smuggling has a long tradition.

I think Russia is reporting half way right – they have their Opec+ Numbers not that much below the values before the war – the oil just gets produced and then magically disappears before leaving Russia. Their smuggling to China is even almost official.

In the triangle around Iraq – Iran, Turkey, Syria, there have been reports about oil smuggling the last 10 years. Everything about Iraq numbers smells fishy. Kurdish oil tends to disappearing, and the Iran/Iraq boarder has holes, too.

I could think some Iran oil doesn’t go per shadow tanker but is official Iraq production…

Can anyone explain Canada’s strange oil production chart? What happens when their production suddenly jumps or falls? The data is January 2013 through August, 2023

The spring break-up is seasonal, every year around march-april, possibly may. Then there are probably some shut-ins due to the pipeline problems and wildfires every now and then.

Ron,

Canada has different data see

https://www.cer-rec.gc.ca/en/data-analysis/energy-commodities/crude-oil-petroleum-products/statistics/estimated-production-canadian-crude-oil-equivalent.html

Data is relatively complete only through May 2023.

It seems the EIA still does not have its act together, so World oil data remains suspect, the disfunction in the US government is working down to the Federal Agencies it seems which is unfortunate. The EIA was once pretty good at least for data, not clear this is still the case.

Thank you for pointing this out, it makes the EIA’s entire World dataset suspect.

As a quick check I looked at EIA data vs Statistical Review of World Energy for Crude plus Condensate, the EIA data is messed up.

Dennis/Ron

I will send note to EIA. They have left out condensate.

Ovi,

Seems like it may be more than that for Canada, looking at the World Data it is mostly changes to the Canadian and Russian data, the Russian data is more difficult to evaluate since the Russian Ministry of Energy stopped reporting data. From Jan 1973 to Dec 2016 the EIA data is unchanged, beginning with Jan 2017 there are problems with Canadian and perhaps Russian data. Both data sets are from the EIA, with current being most recent set and previous being data from just before the most recent update.

Russian EIA data current and previous data sets.

Most of the difference between the current and previous EIA data is explained by the changes in the Russian and Canadian data. I have looked back at old data from Russian Energy Ministry up to Jan 2022 (last data I have available) and the previous EIA data is more consistent with the Russian data through Jan 2022, after that we need to rely on OPEC reports and IEA estimates which include NGL and make it more difficult to assess.

Dennis

Attached is a chart that compares the May 2020 EIA world report (green graph) with the latest EIA August report (blue graph). The blue graph has 50 kb/d added to it to separate it from the EIA May data. Also included are some of the first captures of Russia Ministry data, red graph, 404 kb/d higher than the EIA data.

I see a small discrepancy in 2017, see picture. I don’t see the big gap shown in the chart above.

I have sent you an email.

Ovi,

Yes they have corrected the Russian data, it all looks pretty good now.

I have a download saved of previous World data from just before the update, the chart below compares current data with this previous data. A portion of this comes from the Canadian data, but I will need to dig deeper to find other nations which may have suspect data.

Dennis/Ron

The EIA has left out the oil from conventional wells from Jan 21 to Dec 2022.

I have sent of an email with this picture to the EIA

Thanks Ovi,

Did they do the same in 2017?

Dennis

I have just heard back and they are looking into it. I have told then to also check 2017.

Fixed

Thanks Ovi,

They seem to respond to your requests, maybe you should ask them to look into Russian output from 2017 to 2021.

Dennis

I will look at my old data, obtained from the Russian ministry and see what I have. Recall that the Russian Ministry data used to be 404 kb/d higher than the EIA’s. Maybe they have reevaluated their position.

Ovi,

Perhaps, but it is inconsistent compared to Russian ministry data. If you look at the Russia chart I posted comparing previous EIA data (just before most recent update) and current EIA data, it will be clear there is a problem.

Note that I haven’t checked since they made the update to Canadian output, they may have already found the Russia data problem.

Now I have checked, the problem with Russian data has also been corrected. The World Data now looks pretty good.

Russia data from EIA Now, (after corrections suggested by Ovi) Previous 1 (recent revision before Ovi brought problems to EIA’s attention) and Previous 2 (before the most recent update where data only was up to May 2023 (currently the estimate goes to August 2023).

Thanks Ovi, you are awesome!

Oil price volatility

Seems to me current low oil price is primarily related to volatility (not market or fundamentals).

In US, theme is overproduction, so maybe they can refill some of the SPR. But so far, after reaching a minimum level of 346,758,000 barrels in July, it’s only gone up to ~352 million barrels (+1.5%)…so not looking too promising..

Dennis

Do you have a projection for Guyana production in the event of an invasion by Venezuela?

Lightsout

I don’t have any idea on what happens if a war were to break out. Currently I get the sense that XOM is not pleased with how the Guyanese govt is treating them and It seems to be holding production pretty flat since last July.

” XOM is not pleased with how the Guyanese govt is treating them”

What is your basis for that line of thinking, rather than the other explanation that it takes time to bring on new production (and why rush it when the prices are stagnant)?

‘I get the sense that XOM is not pleased with how the Guyanese govt is treating them’

What is the basis for your line of thought,

as opposed to the other explanation that it takes time to bring on new production facilities (and why rush it when the prices are stagnant)?

Exxon boosts Guyana oil output, undecided on future auction bid

This is not surprising. XOM could have come up dry with their drilling program and so the contract is very slanted towards XOM. The big surprise is how large the field is and how much oil it can produce. Not surprising that Guyana wants more.

“While Guyana is looking to dilute Exxon’s power over production and wants more favorable contract terms, Vice President Bharrat Jagdeo said earlier this year it may consider allowing Exxon and its partners into new acreage if they accelerated investment plans.

Guyana has been deciding whether to hold an auction for unassigned exploration areas, or to recruit a national oil company for a partnership that could produce oil from the new properties, Jagdeo said.”

https://www.reuters.com/business/energy/exclusive-exxon-boosts-guyana-oil-output-undecided-future-auction-bid-source-2022-09-20/

https://www.theguardian.com/world/2021/aug/18/guyana-to-seek-better-royalties-terms-for-future-oil-contracts-exxonmobil

Ovi,

I think output depends on capacity of existing FSPOs, basically output capacity may be limited to about 400 kb/d until more FSPOs are brought online.

Lightsout,

No, my rough guess would be less output than before such an invasion. I would also expect the US would step in so such an invasion is not likely to succeed in that case.

OPEC Oil monthly reviews

Non OPEC’s production in highest quarter of 2018 was 58.7mb/d

https://www.opec.org/opec_web/static_files_project/media/downloads/publications/MOMR%20December%202018.pdf

Non opec production in third quarter of this year is 65.6 mb/d.

https://momr.opec.org/pdf-download/res/pdf_delivery_momr.php?secToken2=accept

OPEC production is 5 million barrels per day less.

The percentage of NGL has hardly charged since 2019, how on earth can anyone think oil production is 2 million barrels per day less than 2018?

IEA and OPEC do not think so. They both say oil production at highest level ever.

EIA can’t even run a website let alone compile international oil production data

Charles,

I agree the EIA has not done very good work of late.

OPEC reports total liquids, as does the IEA. In OPEC’s Annual Statistical Bulletin (ASB) they report World Crude output.

See https://asb.opec.org/data/ASB_Data.php

In 2018 average annual World Crude output was 75297 kb/d according to OPEC and in 2022 it was 72801 kb/d.

I would venture to say that the Biden appointed leaders of the EIA are there for only one job. To promote, the World is in danger and if you just give us more control of your lives, we will save you from carbon dioxide. Providing reliable information really isn’t that important.

Thats such a dumb & gay take. Everyone knows its (((them)) that r f*ing things up.

Dennis

Thanks for that link. Jowever i am looking at this year

OPEC oil monthly report says all liquids production is 103 mb/d in October 2023

This is higher than the highest month on 2018 by 2 million barrels per day.

If they are correct, and they are normally very close than C&C is at it’s highest production ever.

Your refusal to read any of the indepth studies conducted by highly qualified organizations investigating the theft of oil which by the nature of theft is uncounted is baffling to say the least.

Their estimates put uncounted oil entering the global market is in the region of 3 to 5 million barrels per day.

Charles,

If someone has an estimate of theft, there is a count. There are x units produced and y units sold legally z=x minus y are the units stolen or lost.

We know what x is and it is likely that x gets consumed, some of it sold on black market.

I focus on 12 month averages, OPEC has very different consumption estimates than EIA, they might be wrong.

Charles from November 2023 MOMR, page 50

Preliminary data indicates that global liquids production in October increased by 0.3 mb/d to average 101.6 mb/d compared with the previous month.

From IEA

https://www.iea.org/reports/oil-market-report-november-2023

World oil output increased by 320 kb/d in October to 102 mb/d.

The EIA estimates World output in October 2023 at 102.3 Mb/d from STEO.

https://www.eia.gov/outlooks/steo/data/browser/#/?v=6&f=M&s=0&maptype=0&ctype=linechart

Average of three estimates for October 2023 is 102 Mb/d for October 2023. In Nov 2018 World liquids output was about 102.2 Mb/d. Note that total liquids minus C plus C output has increased over the intervening 5 years.

Dennis

This is truely a magical time.

We have had an increase of Global GDP of £8 trillion in the last 5 years with oil production falling by 3 million per day.

Over the next 10 years I expect global gdp to increase by another £14 trillion and oil production to be down to 50 million barrels per day😂

Charles,

Just going by the data rather than adjusting it to what I think should occur. Facts matter.

Energy use has increased, but the World is using less oil per unit of GDP. In the next 10 years I think oil output will be fairly flat, real GDP is likely to increase.

For the most recent 12 months World C plus C average output was about 1230 kb/d less than at the 12 month average peak in 2018. Also the most recent 12 month average was about 8077 kb/d above the low point for 12 month average output in November 2020 (centered 12 month average). There was a big change in the oil use by society due to more work from home that came about in response to the pandemic. This reduced World oil demand.

Interesting perspective on deepwater oil production:

https://www.youtube.com/watch?v=i0Py2vo8sVA

There’s part of it that are sort of folksy, not data intensive. Yet, I recommend hearing it out. Key aspects:

1. Increase in production over the decades.

2. Skeptics versus believers.

3. Technology advancement.

4. Oil major attitude (presenter was a VP at Shell).

5. Role of oil price and comparison of projects by type (e.g. shale versus offshore).

6. How is deepwater different/same versus onshore oil. I think it’s interesting how radical the ocean engineering is for offshore oil. Many massive developments in ocean engineering owe themselves to oil production (e.g. ROVs). But then there are also strange times when offshore is not that different than onshore.

7. Role of service companies, especially in the US.

Ovi,

Great work, as usual. Much appreciation for your time and efforts.

Although Utah’s numbers are somewhat small, the upward trend indicates improved operational processes as the Uinta Basin companies struggle for increased takeaway. (The proposed new 85 mile rail line has been stymied by court decisions.)

This dovetails with Ohio’s near 40% yoy oil production increase to 84 kbd output. (By this time next year, Ohio is likely to surpass Looeezeeana and take 10th spot on your charts.)

As an Encino executive just stated at the DUG conference, his company (biggest Ohio natgas producer) continues to improve operations which enables them to economically recover oil in the mostly-neglected northern Utica oil window. They are aggressively expanding their acreage position.

Same goes for EOG.

My point in posting this … these (Utah/Ohio) are concrete examples of what was derided as ‘Cornucopian’ fantasies by the pearl clutchers for so many years.

While many folks – including many (most?) – on this site embrace an outlook of hydrocarbon scarcity, ongoing, unfolding events actually point to a picture of hydrocarbon (over)abundance far off into the future.

My 5 cents worth, anyway.

Thanks, Coffee, I always learn from you. But in case you haven’t noticed, the world has declared war on hydrocarbons. COP28 says 2030 will mark the end.

For a very long time I have been in thrall to the waxy yellow oil of the Uinta basin. It is free of sulfur and most toxins and is of low enough API gravity that it is the ideal heavy oil to mix with LTO at the refineries. There’s also a lot of it in the interior of Utah, a friendly state in which to do business.

But therein lies the rub. In order to wind its way to the Gulf Coast it has to first wind through the mountain passes of Colorado, riding the same rails as the old “Ski Train” from Denver to Winter Park. Ain’t gonna happen. Ever.

It is called waxy for a reason. At room temperature it turns into a waxy solid. Warm it a few degrees and it turns liquid. It is so low in methane gas that even if it were to derail off the Ski Train track it wouldn’t explode, nor would it spill because it’s, well, a wax. But it’s up there, and the refineries are down there.

I sincerely believe that the world has plenty of natural gas for its forever needs–though some of it is dirty and could sure use a wash job in the LNG train. But oil? Well, we’ve got it, but a lot of it’s going nowhere fast.

Thanks Gerry. Interesting. Not clear if there is as much Natural Gas as some believe. At $2.50/MCF it will be much less, but with higher LNG exports the price may increase, that could hit demand in the US.

CoffeeGuyzz

Thanks

The Biden Administration unveiled new methane rules which take effect in two years.

It appears flaring will not be permitted except at stripper oil wells that meet certain criteria.

Not sure if and when this will affect shale oil. Would seem it may slow development?

Shallow sand,

If the rules are written well, it might slow development a bit, but would reduce the wasteful flaring of natural gas. From my perspective that would be a good thing, but I don’t know enough to evaluate the rules, you and others would give a more accurate assessment. Have you had a chance to look at them? Perhaps a post on the subject?

1,690 pages. Not easy to read. Still trying to figure it out.

Shallow sands,

Thanks, I should have known a government regulation would be difficult (or perhaps impossible) to figure out.

It will be hard for the Greenfolk in the Administration to sign onto military policies designed to help hated Exxon.

It’s a very clever maneuver by Maduro, and with CNOOC involved, they could evolve to be the arbiter of arguments.