The Texas Railroad Commission has released its incomplete production data for February. The RRC also estimates final production but that data has not been posted yet.

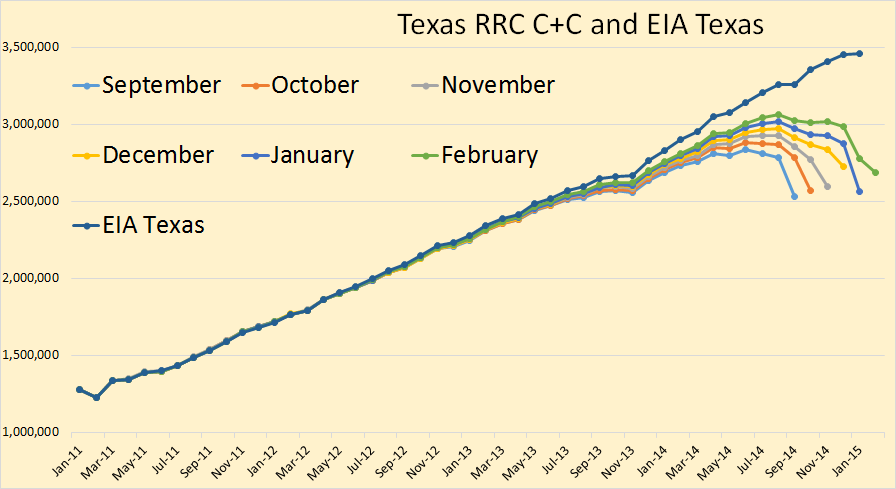

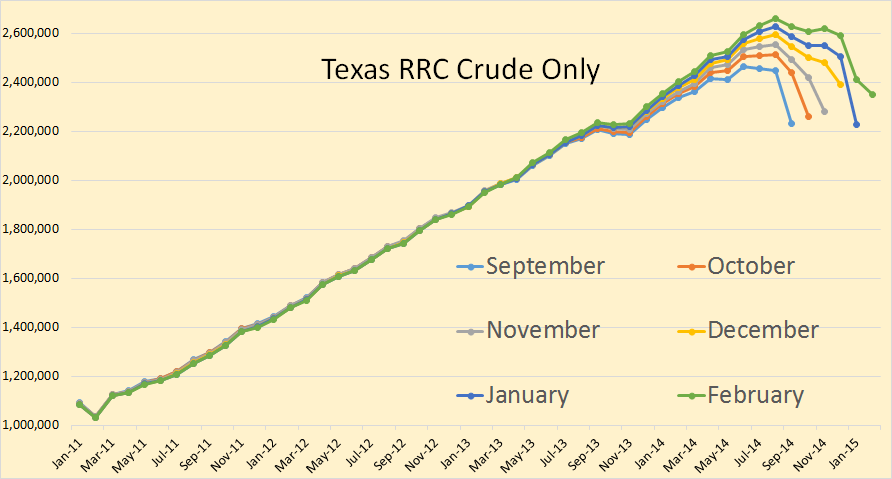

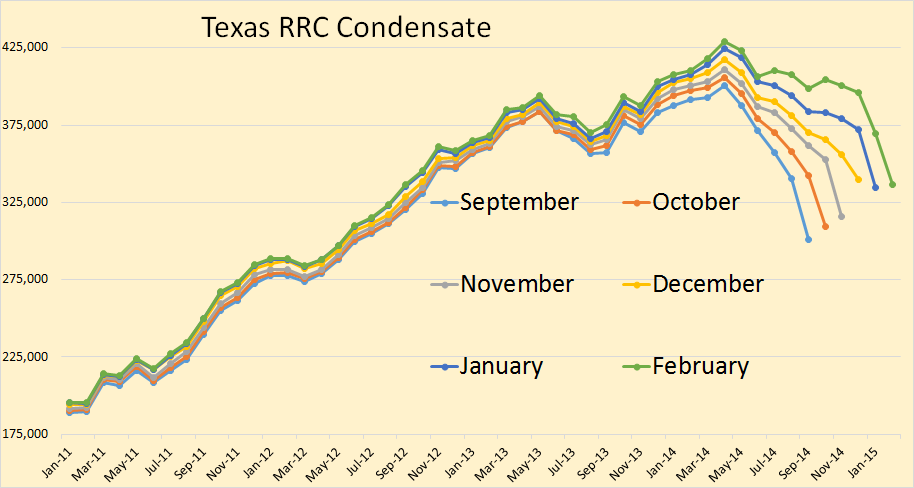

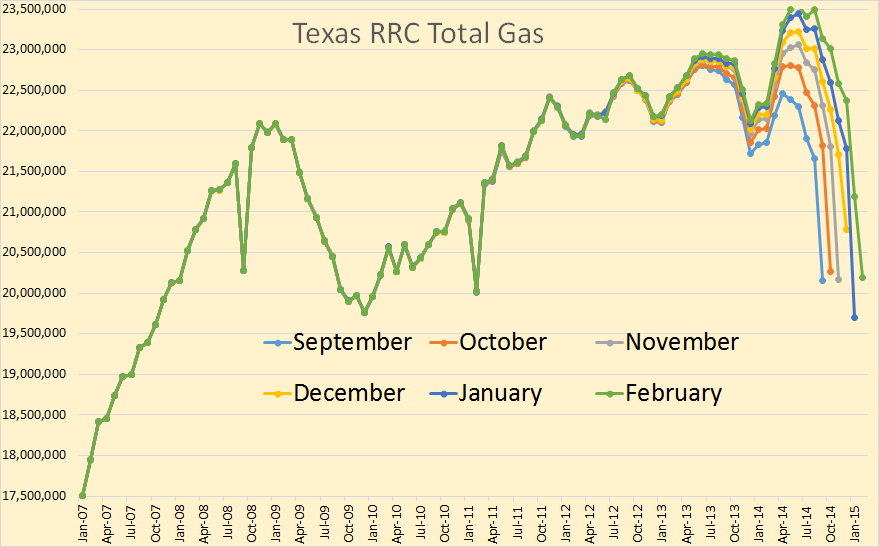

All Texas RRC data is through February. The EIA data is through January.

It looks like, after the final Texas data comes in, that February crude oil will be above January production but still below December production. It is my best guess that Texas production will be down about 80,000 barrels per day in January and up about 50,000 bpd in February or about 30,000 bpd below December production.

I always post the last six months data just so we can get some idea of the general trend. You can see the general trend is up until January when it took a huge hit and only partially recovered in February.

Texas condensate likely peaked back in April 2014 but it will be close. December condensate production could, after all the data comes in, could be a bit higher.

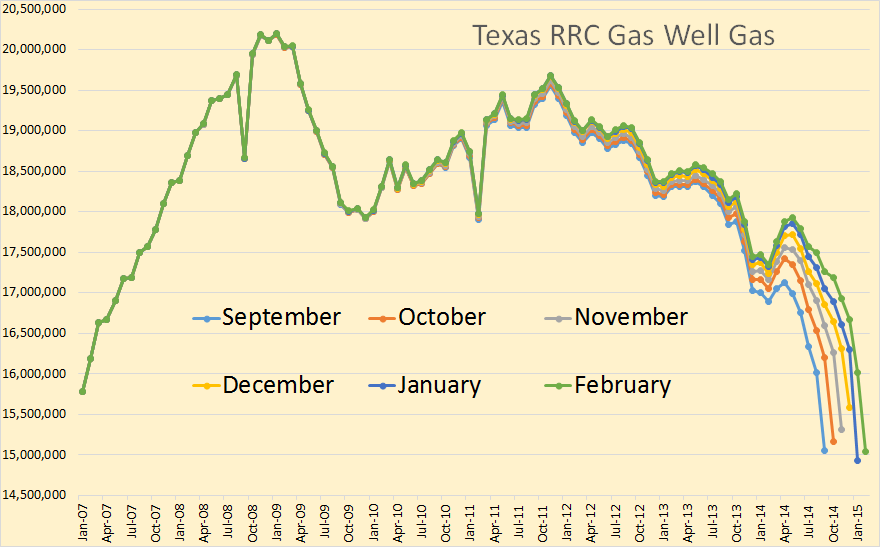

Texas gas production is in MCF. Texas total gas has been going up and down for about six years now. I have no idea how much natural gas Texas could produce if gas prices were higher. But it looks like, at current prices, Texas natural gas production peaked back in August.

Texas gas well gas inched up slightly in February after that huge decline in January. So February numbers will still be well below the December production numbers.

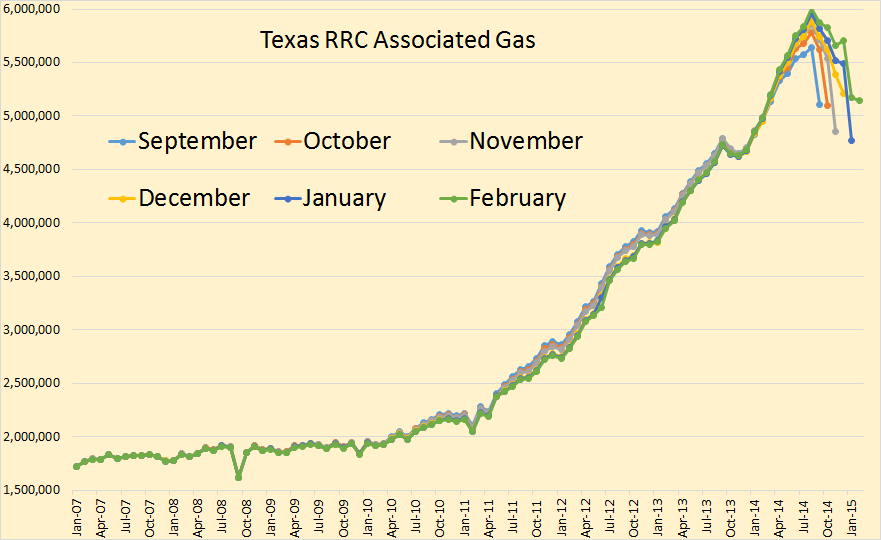

Texas associated gas production in February was well above their January production numbers. Associated gas accounts for about one fourth of total Texas gas production.

Survey shows Texans confused over Railroad Commission, favor name change

Given the choice, the majority of Texans would trust the Texas Energy Commission to ensure safe and responsible oil and gas drilling, according to a survey conducted by Dallas-based Breitling Energy.

There’s just one problem: That agency does not exist, at lease not by that name. Not yet.

It’s the Texas Railroad Commission that actually regulates oil and gas in Texas…

“The RRC has nothing to do with trains! Did you know that? If not, you aren’t alone,” Sitton wrote. “There’s a woefully inadequate level of understanding regarding what the RRC does.”

The below article has likely been discussed before in the comments section but if so I missed it.

How Long Can the U.S. Oil Boom Last?

The long-term problem for oil frackers isn’t just low prices. It’s low reserves…

The basis for these forecasts are estimates of shale oil reserves. A 2013 Energy Department report on technically recoverable shale oil—the amount that’s recoverable without regard to cost—puts U.S. potential at 58 billion barrels. That’s equivalent to a little more than eight years of U.S. consumption at the current rate of almost 19 million barrels a day.

The Energy Department’s estimate of “proved reserves” of shale oil—those that can be recovered economically today—is only about ten billion barrels. That’s about a sixth of technically recoverable reserves, and less than a year and a half’s worth of current consumption. Proved reserves include all currently known U.S. oil shale resources-North Dakota Bakken, Texas Eagle Ford, Colorado and Nebraska Niobrara, Texas Barnett, and others.

Economically recoverable shale oil reserves, at $55 a barrel, are a lot less than 10 billion barrels. In fact if all expenses are included, lease costs to taxes and interest payments, the break even point is likely a lot more than $55 a barrel.

_______________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne@gmail.com

I think the Jury is still out on whether it is an increase or decrease from February. Yes, thirty one days vs 28 days, but the condensate is way under January.

I think you meant the jury is still out on whether it is an increase or decrease from January. But I don’t think it is. No, the condensate is not way under January. You are looking at the data wrong. Look at where January condensate was reported last month when January was the last month reported. It was 334,847 barrels per day. This month February is the latest moth reported. The latest month came in at 336,221 barrels per day or 1,374 bpd above what the latest month was last month.

That’s why I post six months data. The data is incomplete but if you look at the trend of the latest month, up or down form the latest month the month before, you can get a general idea of which way things are heading. Looking at it that way February was a better month than January.

Yes, I can get an idea by joining the last point in each curve and then moving the resulting imaginary curve up until it overlaps the general curve. January production should be more or less at the level of september production. February shows a recovery. Middle point between both looks like a slight decline of about 25,000 bpd/month from december peak. It will be very interesting to follow this trend in the coming months. Thanks, Ron.

Maybe someone should email the Texas RRC how the production data should be reported? Maybe give the Noth Dakota example? Biggest oil producing state doesn’t provide accurate numbers how much it’s produced for two years – it’s a joke.

My bad. I will offer a hedged projection of oil prices for the next three months, which I originally dedicated to all the dead lemmings, as a peace offering.. The prices, I predicted back in January, however, I have added some hedging to the price structure. Ahem! The price of oil will be closer to $60 a barrel the end of April, than Citicorp’s prediction of $20 a barrel. The price of oil will be closer to $70 a barrel the end of May, than Goldman Sucks prediction of $30 a barrel. The price of oil will be, percentage wise, closer to $80 at the end of June, than Texas actual production is to EIA prediction of Texas production in May. Take it to the bank.

The basis for these forecasts are estimates of shale oil reserves. A 2013 Energy Department report on technically recoverable shale oil—the amount that’s recoverable without regard to cost—puts U.S. potential at 58 billion barrels. That’s equivalent to a little more than eight years of U.S. consumption at the current rate of almost 19 million barrels a day.

Technically recoverable, economically recoverable, there needs to be a third category.

In dire circumstances, economically recoverable doesn’t matter. You just print the money required. So ignore that category.

But technically recoverable likely does not address the issue of burning 6 barrels to fuel the drill and the fracking pump to recover 1 barrel. The geologists just care about the porosity and . . . perhaps not even permeability. If one pore holding a barrel is 1000 feet from the next pore of 1 barrel, one presumes they count that as 2 barrels of reserves, even though two separate wells will have to be prepared to get just 1 barrel each.

So there is a true reserves total somewhere between technically recoverable — which matters in desperate times — and economically recoverable — which won’t matter in desperate times.

Wait that’s badly phrased. Clearly some issue of permeability is involved or technically recoverable would be the same as OOIP. One wonders what defines technically recoverable in terms of EREOI.

In dire circumstances, economically recoverable doesn’t matter. You just print the money required. So ignore that category.

I think you are badly mistaken on that count. The government might print money to provide oil, at a loss, for the military, but not for the general public.

When oil production starts to decline prices will go up to bring supply and demand into balance. But when it really gets expensive it will start to adversely affect the the economy. If this condition last long enough, and prices keep rising, it will crash the economy. Printing money will not solve this problem!

”Printing money will not solve this problem!”

I totally agree but subsidizing oil would probably result in putting off the day of reckoning.

Getting drunk puts off the aches and pains associated with old age until you sober up.

Ya gotta sober up eventually – or die drunk.

“I totally agree but subsidizing oil would probably result in putting off the day of reckoning.”

That’s what is happening now, so you can leave out the word ‘probably’ in your sentence.

>>but not for the general public

It’s not as direct as that. The government won’t say they are printing money to buy oil. But nonetheless it can and will do so in a variety of ways. If extraordinary measures can be taken on behalf of the housing and auto industries, it isn’t hard to imagine similar steps on behalf of oil. And bailing out the financial industry affects them all.

In times of turmoil, we’ve already seen tax rebates rushed through and checks mailed out across the land. Is that to buy food or fuel? It doesn’t really matter. Ditto the ARRA and helping out state and local budgets.

But also consider the secondary effects of managing interest rates, credit ratings, backing for MBS purchases and what type are accepted. I don’t know we’ll ever see something as clear cut as, Fed now targeting securitized Bakken bonds, but the flow on effect of providing all that liquidity surely already has influenced the volume of dollars and ease with which they were available.

I agree none of this is a solution.

Printing a trillion dollars won’t solve the problem..yeah prossibly.

A trillion dollars of capital for CTL/GTL/KTL, whatever…will unquestionably help…

It may not solve the problem…but it will help!

The US government can print a trillion dollars with almost NO inflation penalty.

The LAWS OF THERMODYNAMICS prevent a free lunch. But the USA is in much better shape than most countries for a FREE LUNCH.

Woot Woot!

I do not believe Uncle can print a trillion with no inflation ” penalty”. In this sort of situation there is no good phrase to describe the general case of how things work out. Some people talk about effects being lost in the noise which is ok when the effect is small. Others say as I have often” If you don’t get it, just think how bad it would have been otherwise!”

When Uncle has printed the last few trillions there has actually been very little OBSERVED increases in prices. The reason for this is that the overall economic environment is in a DEFLATIONARY state or condition with huge swaths of the world economy suffering from the economic flu and some segments worse than the flu.

The inflation that would have resulted from printing these recent trillions under the conditions that have prevailed for most of the last fifty years or more has manifested itself in OFFSETTING DEFLATION that would otherwise be MUCH more obvious.

There should be a shorthand phrase that everybody knows to describe this general observation other than ” lost in the noise ” or ” Just think how it would have been otherwise” but I haven’t run across it.

Betcha the Germans have a word for it but it would take a month to memorize the spelling of it , lol.

If inflation is defined as an increase in the total supply of money and credit in the system then a trillion dollars is a tiny percentage of usa money supply. This would be trivial compared to a liquid fuels crisis.

The laws of thermodynamics mean that u cant print your way to long term prosperity as there is no free lunch.

The laws of mathematics show that u can’t go into debt forever without the bill eventually showing up. Someone on either side of the balance sheet eventually gets screwed.

The choice between liquid fuels and toilet paper that costs 2 percent more ain’t no choice at all.

Pay very close attention to military activity at this very moment in time if u want to observe a great leading indicator.

In any case, in regard to the National Geographic article, “How Long Can the U.S. Oil Boom Last?” following is an excerpt:

Obviously, I think that it’s a mistake to take Middle East stated reserve estimates at face value, but more importantly what counts, as I have once or twice opined, is the volume of net exportable oil.

Based on the 2005 to 2013 rate of decline in the (2005) Top 33 net exporters’ ECI Ratio (ratio of production to consumption), and rounding off to the nearest 100 billion barrels (Gb), I estimate that post-2005 Global CNE (Cumulative Net Exports*) are on the order of 500 Gb, with about 143 Gb having been consumed from 2006 to 2014 inclusive, putting estimated post-2005 Global CNE at about 30% depleted, through 2014.

*Total petroleum liquids + other liquids, EIA data, (2005) Top 33 net exporters

Hi Jeff,

Ron has posted his own estimates of these countries reserves often but I can’t remember the specifics. I am thinking his estimates are around half what they claim they have.

Whose numbers did you or do you use for reserves when you do run your net export model?

Mac, I prepared a webpage to discuss Venezuela’s reserves. It’s in my blog, look on the right side, I think it’s

underneath the blog roll.

I focus on estimates for CNE (Cumulative Net Exports). For example, for the Six Country Case History*, if you extrapolate their 1995 to 2002 rate of decline in their combined ECI Ratio (Ratio of production to consumption), they would have approached zero net exports about 20 years after 1995. Annual net exports at peak were 1.0 Gb/year (in 1995).

So, based on the 1995 t0 2002 rate of decline in their ECI Ratio, Estimated post-1995 CNE were:

1.0 GB/year X 20 years X 0.5 (area under a triangle), less 1.0 Gb (net exports at peak in 1995) = 9.0 Gb

Actual post-1995 CNE were 7.3 Gb

*Major net exporters, excluding China, that hit or approached zero net exports from 1980 to 2010

And US has 0% net exportable oil, which always seems to be missed in the media. Or, we could state it as -40%, give or take a few shale booms.

Ron has posted his own estimates of these countries reserves often but I can’t remember the specifics. I am thinking his estimates are around half what they claim they have.

No, my estimate, and also the estimate of a whole lot of other people, is that they have about one third of the reserves they claim to have.

Jean Laherrere’s estimate is best, and is roughly half of the EIA estimate in 2010. The EIA estimate excludes Venezuela’s Orinoco belt reserves of 40 Gb and is about 910 Gb of OPEC reserves. Jean Laherrere’s estimate for year end 2010 is about 480 Gb for OPEC 2P C+C less extra heavy.

If we use BP’s numbers for 2010 and deduct 220 Gb of Orinoco belt reserves from the OPEC total we get 943 Gb of C+C less extra heavy OPEC reserves, again Jean Laherrere’s estimate is roughly half the BP estimate. The 1 for every three estimate must come from using all OPEC reserves (including extra heavy oil) of roughly 1200 Gb in 2013 and then rounding current reasonable estimates of about 440 Gb down to 400 Gb and we would have the 1 barrel for every three estimate.

The difference between 400 Gb and 440 Gb (my estimate based on my understanding of Jean Laherrere’s outstanding research) in 2013 is insignificant.

Hi Jeffrey,

Jean Laherrere estimates OPEC C+C less extra heavy 2P reserves at about 480 Gb in 2010, roughly 40 Gb were produced from Jan 2011 to Dec 2014, so if there has been no discovery or reserve growth since 2010, OPEC reserves would be about 440 Gb at the end of 2014 (excluding extra heavy oil in the Orinoco belt).

See figure 33 on page 22 at link below:

http://aspofrance.viabloga.com/files/JL_2013_oilgasprodforecasts.pdf

Jean Laherrere’s estimates are the best that I have seen.

Dennis, I prepared a rough sketch of Venezuela’s oil reserves under four scenarios. I think this gives you a hint of how price and politics dependent the issue can be. I mentioned the nuclear plants because we really do consider them, but they are just symbols of the inputs required to produce and upgrade the extra heavy oil.

http://21stcenturysocialcritic.blogspot.com.es/p/venezuelas-oil-reserves.html

I wish to repeat this is highly conceptual. I used public figures but I did lean on my previous work.

Hi Fernando,

For your $160/b scenario, if oil prices gradually rose by 10% per year for 5 years, 5%/year for the next 5 years and the 2% per year until reaching $160/b, would that be enough to develop the 200 Gb of extra heavy resources? Scenario below. Nice work.

Dennis, i’m not sure. The $160 per barrel scenario has a 7+ Mmbopd plateau. That’s a huge production build, and to get there we need a pretty detailed project plan. To make the plan we need assurance the oil price will be there.

That rate requires roughly 24 upgraders, costing $360 billion. The upgraders will need hydrogen supply (6 plants). Hydrogen will require natural gas (full development of the offhore and onshore fields). The electric power can be supplied by hydro from Guri, but there’s a need to offset that, so I suppose they will need three nuclear power plants.

So if you tell me the oil price goes up slowly to reach $100 in 2014 by 2025, the BIG project can’t take off.

Please note I have a professional difference of opinion with other planners. I have reached the conclusion that a development intended to recover more than 6 % of original oil has to be designed to start injecting ASAP. This is critical because it keeps water from encroaching. Also the well designs for cold and hot flow are different.

If I have to use your curve production won’t build, and some really good reservoirs will be ruined for EOR. This is already happening. Bottom line. That 200 billion barrel scenario is extreme. I did it on purpose to see the outer limits. The no regime change case is the inner limit. You can run a full Monte Carlo inside those boundaries.

I don’t know what’s going to happen with the politics. But many outcomes drive recovery to the lower values.

Hi Fernando,

So no, that wouldn’t work. Could you specify the oil price scenario you are thinking of? An alternative below (10%/year rise in prices until $160/b). This also assumes regime change within 5 years (or sooner).

Hi Fernando,

Could the bitumen extracted, be burned in a power plant to provide the energy for producing the steam?

It might be cheaper than a nuclear power plant. I would think the solar resource would be pretty good in Venezuela, is there a good wind resource?

Those combined with hydro backup, might also be cheaper than nuclear power.

Dennis, the obvious (cheap) solution is to upgrade the crude to make (roughly) about 15 % of the inlet volume into petcoke. The remaining 85 % “swells”due to the hydrogenation of the broken molecules. The amount of “upgrader gain” is a function of the process.

The coke can be used to make steam. But the emissions are pretty bad. So the alternative is to feed the coke (or a vacuum distillation unit bottoms) into a gasifier. The gasifier yields high pressure CO2. And the CO2 can be injected for EOR in medium gravity fields located to the north.

There are dozens of schemes. But the delay in implementing a rational plan is killing the reservoir.

Dennis, they tried it but it just didn’t work out.

Orimulsion

Raw bitumen has an extremely high viscosity and specific gravity between 8 to 10 API gravity, at ambient temperatures and is unsuitable for direct use in conventional power stations. Orimulsion is made by mixing the bitumen with about 30% fresh water and a small amount of surfactant. The result behaves similarly to fuel oil.

But alas: Venezuela ceases orimulsion production

The Energy and Petroleum Ministry officially announced that Venezuela is terminating production of orimulsion currently used to fuel powerhouses in several nations worldwide.

Venezuela made such a move after a comprehensive survey on the product found that orimulsion is not a suitable use of Venezuelan extra-heavy crude oil.

Ron, Orimulsion was designed to allow transport to overseas markets (Japan, Italy, etc). The water emulsion dropped the viscosity to allow pumping it.

The extra heavy has a lot of asphalt, so it’s fairly easy to design a process to burn the heavy molecules within an upgrader complex. This only requires moving the material up to say 1 km. if the material is coke it can be transported by rail, or by barge.

I’ve worked on quite a few design options for schemes to produce up to 1.2 million BOPD new build (on top of the roughly 700,000 BOPD existing capacity). Such a development puts a huge strain on the natural gas infrastructure, and requires offshore gas field developments.

As the design oil rate increases it becomes evident the optimum solution is to burn coke. But if the design rate is really high I think they run into environmental problems.

This is the reason why I included a gasifier option in studies I have performed.

I recall reading a paper by an Exxon engineer who claimed it was simpler to gasify (I think he wanted to use 50 % of the produced stream), make synfuels and take the excess heat beyond the plant limits.

The way I remembered the story, Orimulsion was developed as a work around of OPECs quotas. The claim was Orimulsion was not oil, and therefore not subject to quota.

Once Vz oil production dropped below their quota, then the Heavy oil in Orimulsion, could attract more money by calling it oil, by upgrading, dilution etc. So Orimulsion production was slowed and contracts cancelled.

Toolpush, there was a little more to it. In 1999, when the Chávez regime took over, they named Dr. Bernard Mommer to be deputy oil minister. Dr Mommer was convinced the oil should be marketed as is, wrote a pretty good paper about it.

Mommer is a Marxist economist, so he pushed to have the oil block assigned to make Orimulsion to the Chinese.

At the same time they saw pushback due to the contamination caused by burning the stuff.

So it was a mixture of reasons. If you check Venezuela’s production history you will see it had OPEC restrictions until the 2002 oil workers’ strike. But by then the Chinese were exporting the crude in diluted form to China.

Here’s a link to an article I got from a friend. The information is bs.

http://uk.reuters.com/article/2015/04/20/venezuela-pdvsa-production-idUKL2N0XE1CE20150420

Watcher, where do you get those numbers? Like the 6 barrels?

metaphorical.

I think folks are responding to this comment in a context of something rather a lot less than dire circumstances. They are envisioning some “stresses”. Not dire circumstance. To put a definition on it, lets say when there are crowds in parking lots waiting for MREs to be handed out from trucks, and the reason for that was food didn’t get to the grocery stores, then THAT is dire circumstance. If you have universities feeding faculty, then you haven’t reached dire levels yet.

If oil gets scarce, it doesn’t do so in globally uniform way. Then those on the short end of that distribution must and morally should take violent action for their own people. The magnitude of upheaval becomes extreme (aka dire) in all sorts of ways.

When you have to have it, you print the money to get it. Again, people, have a look at how Hitler financed his military buildup. That was printed money, printed outside monitored channels. There was no other way for him to “boom his economy” to an extent that could support that military build up, and in an invisible way.

When circumstances are dire, when cities can’t get food, there won’t be much concern about money at any level at all.

Watcher says “Then those on the short end of that distribution must and morally should take violent action for their own people.” Does Watcher even read what he/she writes? Who are “their own people?” I did not know that “people” possessed people, such that someone could say that “these are my people,” and I must take violent action for them. Sounds like something that ISIS would say. And, if you can select people and claim that “these are my people” does that preclude any of those people (i.e., people that belong to you) from claiming others and saying that “these are my people.” WTF

Hi Clueless,

I am not taking sides with Watcher but he does have a point- sort of .

When the shit hits the fan people will form up into new groups for various purposes , getting oil being one of them. When this happens people in general will decide very quickly who is an ”us ” or group member or a ” them” – an outsider.

Most of these groups will be patterned after existing groups , as for instance nationalities. Or religions. Or professions. Or membership in various existing organizations.

Defining who is an insider and an outsider might not be easy to do on the basis of clear cut rules but it will happen spontaneously.

Remember the uptight folks who get upset about pornography?

They do not need or want a clear cut definition of porn.

THEY KNOW IT WHEN THEY SEE IT.

Group members will know each other, fight for each other , and gladly throw the rest of the world under the bus.

Being a southern flavor yankee myself I doubt my ingroup will suffer any serious grief from a shortage of oil anytime soon.

Now health care for instance brings into the question another set of groups. The best cared for large group of people- taken AS a group- in the USA are without a doubt in my mind is the set composed of full time federal employees.

Taken as a group they would see the rest of us in hell before they would see their medical bennies cut a little in order to pay for let us say food for starving children.

Hey folks it IS a Darwinian world.

When the shit hits the fan Uncle Sam will revert to exporting a little democracy again and the next time he will be apt to stick around and make sure the oil flows OUR way.

Of course this will not be a permanent solution but it will probably work – if necessary – longer than I expect to be around myself.

OFM

What does “it IS a Darwinian world” mean? Do not say “survival of the fittest.” Ron ridiculed me for saying that is what Darwin thought. And, pornography?? What is running through your mind today? But, spot on about federal employees. Even Roosevelt told his advisors that it would be insane to let government workers unionize. I think (but, I am not sure) that they can thank Republican Nixon for that right.

What does “it IS a Darwinian world” mean? Do not say “survival of the fittest.” Ron ridiculed me for saying that is what Darwin thought.

Clueless, sorry that you got the wrong impression from my post. Darwin did indeed say that “survival of the fittest” was even a better term than “natural selection” was to describe the process. He did use that phrase in later editions of “On The Origin of Species”. My point was he did not coin that phrase, Herbert Spencer had that honor.

But I really did get upset at your post and was you suggesting that what was happening now, concerning species extinction, has been happening for billions of years. Well I am sure you know better than that now. Or at least I hope you do.

Mammals are going extinct at least 100 times faster than in the past and other species are going extinct thousands of times faster than they were before we came on the scene.

Yes, it is we, Homo sapiens are the ones driving them into extinction. Such an extinct rate has never happened before. Even during the five other great extinctions likely happened a lot slower. The KT extinction took place over almost a million years. We are currently destroying species at a far greater rate than that.

It’s not utterly inconceivable that, at the current trends of population, ecological food print, resource depletion per capita, and the like, the “fittest” will be the top 0.001-1% (???) who succeed in collecting all the chips in order to be able to afford to create a “Manna”- and “Elysium”-like future for themselves at the expense of everyone else.

In the retrospective perspective of the self-selecting remnant ~10% of human apes who survive the impending Catton-like bottleneck in the coming decades, they might indeed perceive themselves as perfectly worthy of being the fittest survivors and reproducers.

What the prospective remnants ancestors today do to the rest of us to achieve their and their descendants’ position as fittest is what concerns me in the meantime.

Therefore, if one accepts that “natural selection” or “survival of the fittest” is the operative force at work, then would arguably be remiss in not identifying and them emulating the traits, values, objectives, expectations, and behaviors that are more likely to render one “fitter” or the “fittest”.

What are those traits? Clearly in much of the West, and certainly the English-speaking world, it is sociopathy, hyper-competitiveness, deceit, parasitism, a dearth of empathy, and a self-selected winner-take-all world view and self-identity in order to compete successfully to be a “winner”.

Therefore, one can argue that “evolution” in our overpopulated, hyper-competitive, hyper-financialized, complex, high-tech, high-entropy world is self-selecting for the sociopathic, rentier-financier “winners” on Wall St. and in The City, DC, Westminster, Frankfurt, Brussels, and the CEO corner office suites.

If so, one can infer how the “winners” will likely deal with us “losers” during the bottleneck.

http://futuristicnews.com/dr-peter-h-diamandis-intelligent-self-directed-evolution/

Intelligent Self-directed Evolution Drives Mankind’s Metamorphosis into an Immortal Planetary Meta-intelligence

We are extraordinarily fortunate to be alive on this planet during a period of unprecedented, exponentially accelerating, self-directed evolutionary change. We humans have begun to incorporate technology inside ourselves. Humans themselves are becoming an information technology. Over the last decades mankind has suddenly started changing from a loose collection of 7 billion individuals to a new kind of perpetually morphing non-physical social tissue woven from densely interconnected arrays of mobile person-nodes.

In this process we—humanity—are becoming a new organism: a meta-intelligence. As a species, as this new organism, we are becoming conscious on an unprecedented new level, in a new cosmic-scale realm.

As we are going through the metamorphosis process of becoming this new meta-intelligence organism, we are going from evolution by natural selection—Darwinism—to evolution by intelligent direction. We are starting to direct the evolution of our biology and of our minds ourselves. Before long, this will result in our minds becoming independent from their original biological substrate—the biological human brain—the evolution speed of which has become far too slow to keep up with our exponentially increasing pace of innovation and invention. As we begin to liberate our thoughts, our memes, our consciousness from the biological constraints that we presently have, this will allow us to evolve far faster and ever faster.

I suspect that the “we” Diamandis refers to is the aforementioned top 0.001-1%, not the collective “we” bottom 99% “losers” and bystanders to accelerating “self-directed, intelligent evolution” of the “fittest” top 0.001-1%.

He starts off: There is no problem on this planet that cannot be solved. Period. Bar none.

That is the biggest crock of shit I have ever come across in my entire life. Period. Bar none!

I do not want to get into a fine grained discussion of survival of the fittest and all that sort of thing – the details are important but not in this context.

The toughest meanest luckiest best situated smartest best organized groups of people are going to survive in greater numbers than other groups that are less tough less mean less lucky less smart less organized.

Now as far people ”recognizing pornography when they see it” which used to be a popular standard in uptight communities such as my own—- I might have come up with a better analogy.

Preacher sez”we know porn when we see it ”and Playboy and the SI swimsuit issue are porn by his standards and the standards of his church members.

What I meant was that in times of stress and distress people form alliances pretty quick once they start down that path. You can recognize a potential political ally or enemy in a flash in most cases. No formal rule book needed.

Various groups will recognize that they share a common interest in the coming battle with some other groups and tend to merge with those other groups into a new larger group.

You can recognize who your friends and enemies are going to be without a precise set of rules being needed to decide who is who. You will know as soon as you see them if they are friend or foe.

To make a fairly large scale example California farmers form the core of their own large group dedicated to hanging onto the water used to irrigate their farms. Other groups that will naturally take one look around and join up with the big farmers are the farm machinery dealerships, the car dealers selling pickups to the farmers, real estate agents in farming communities, all the small business people in the communities where the farming is done, the farm hands themselves , etc. If a county is primarily agricultural then the entire county government can be counted on to be on board.

This large agricultural conglomerate group will exclude city slickers on the assumption that their only reason for trying to join would be to slick the farming coalition out of the water. It will exclude organizations devoted to minority rights because such organizations are not good for rich farmers who employ lots of low paid minority labor. You know the enemy on sight. You know your friends on sight.

As far as your reference to Nixon and unionized government employees goes , I don’t get it.

What happens when stress is applied to multicultural societies? Do you see people of different ethnic backgrounds banding together for the common good, or do you think it is more natural for people to band with and look after people with a similar look / cultural background?

Very Interesting the question. I suspect the answer is not what you might expect.

Studies done with very young infants suggest native fluency in the infant’s mother tongue, trumps race when it comes to who the infant is willing to engage with. Now who would have thunk that…

The Great Debate: XENOPHOBIA – Why do we fear others?

http://goo.gl/BdKA1j

We know quite a bit about ourselves thanks to science! That knowledge is available to most of us here. What never ceases to amaze me is how few people are aware of that simple fact.

Dave wrote: “What happens when stress is applied to multicultural societies? Do you see people of different ethnic backgrounds banding together for the common good,”

Ethnic cleansing and Genocide is common in history when there is a ruleset change or economic collapse in a region. Niall Ferguson (Harvard History Professor) wrote a book about it. below is a video series based upon his book:

https://www. youtube.com/watch?v=q5AbQF1jJ_A

I put a space in the url to avoid wordpress from auto embedding the video

WW1 and WW2 have severe ethnic cleansing overtones, but its not limited to just modern times. History is full of ethic cleasing going back to the beginning. Its not just a Western issue, but also applies to the East.

We can see the ME moving toward ethnic cleansing as factions battle for control and murder outsiders. I fear Europe is primed for major ethnic cleansing. There seems to be a lot of contention in the EU with Muslim immigrants which may turn ugly when the EU economy starts to collapse. Its likely what is happing in the Middle East will spill into Europe eventually. We already see very chaotic riots in France, Spain, Greece, Italy, and even Germany (over the ECB building opening about a week ago). Most of the EU has double digit youth unemployment, and they will begin rebelling as the economy deteriorates.

In my opinion, Central bank money printing as temporarily stabilize the global economy. ZIRP (Zero Interest Rate Policy) has pretty much run its course, and now central banks are turning to NIRP (Negative Interest Rate Policy) once NIRP has run its course I don’t see how they can kick the can any further. I also don’t expect NIRP to last as long as ZIRP.

If the stress is great enough dissimilar ethnic groups will find ways to work together. After the stress is relieved they will most likely go back to their mostly separate ways.

If the kids grow up together any two groups can morph into one over a few generations. I am not sure how long this takes but I have observed it happening to a huge extent in just one generation when schools were integrated in the South where I live. This is not to say the process of integration cured racism here but it is not even a tenth what it was when I grew up. When the rest of the old farts are gone the process will be MOSTLY completed.

I don’t live very far from GREENSBORO.

I cannot even remember the last time I saw an obviously racist encounter in a store or on a job site. The only really pressing racism problem left is the cop problem. Paradoxically the cops who are supposed to protect us all are just about the worst racists left in terms of large well organized groups. Driving while black is several times as likely to get you pulled over as driving while white.

Outfits such as the KKK barely even EXIST these days.

There was a KKK rally very near my home some years ago that has been publicized to the ends of the Earth over and over, creating the impression this neighborhood is a hot bed of racism.

I never even heard of it until seeing it mentioned on the net and nobody I know locally ever heard it happened except a couple of people who remembered it being mentioned in the local paper long after the fact.

This community was selected for this rally PRECISELY because it could happen here on an isolated farm without anybody even realizing it.

You can drive around here for months on end without seeing a stars and bars flag. I have seen only one in the last year.

OFM wrote – “The best cared for large group of people- taken AS a group- in the USA are without a doubt in my mind is the set composed of full time federal employees. Taken as a group they would see the rest of us in hell before they would see their medical bennies cut a little in order to pay for let us say food for starving children. ”

Clueless then wrote – “spot on about federal employees. Even Roosevelt told his advisors that it would be insane to let government workers unionize. I think (but, I am not sure) that they can thank Republican Nixon for that right.”

OFM then wrote – “As far as your reference to Nixon and unionized government employees goes , I don’t get it.”

Now clueless writes – I do not get OFM’s “I don’t get it.”

As always, I remain clueless.

Well, for example, if they elect you, you probably swear an oath to perform your duties in a manner designed to benefit them.

That would not include letting them starve.

Oil extraction will also be hampered by higer EROEI energy sources’ availability. Walking, animal power, mechanical hand power, relocalising will have higher EROEI than oil based infrastructure in increasing areas of the world the higher the cost (and price) of oil gets.

Hi everyone. My usual presentation will have many more corrected data and plots this month: therefore take beer and pop corn and relax! 🙂 So, let’s start with the classical brief description of the basic methodology:

Using the latest RRC data up to T and the previous data up to T-1, I computed the amount of corrections that each month should undergo to be close to the real data. In doing this, I consider only the last 24 months (older months have only negligible corrections): what I did was to sum for each month the corrections which took place in the previous “h” months, where I put h=24 for computational simplicity.

For example, the correction for the last month (which is one subject to the highest degree of corrections over time) were equal to 678741 bbl/day (only oil , no condensate).

By doing this for all the past 24 months, I reconstructed the supposed “real” Texas oil production data. The result is the figure attached to this comment

here is condensate:

here is natural gas

and finally my C+C vs the latest EIA C+C

Some comments: in February, the correction factors seem to show (seasonal) much higher values. For example, the correction factor for the latest month was 678741 b/d, when the average correction factor for the latest month is around 500000 b/d. This evidence, together with the initial back-testing evidence reported below, make me say that my corrected value for February 2015 which is 3,558,351 b/d should be probably 100,000-200,000 lower. My latest corrected data are reported below:

Sep 2014 3355155

Oct 2014 3394238

Nov 2014 3478418

Dec 2014 3531689

Jan 2015 3436997

Feb 2015 3558351

Dean, this is the first departure from what might be called “smooth” in your corrected curve. Does this make sense?

I have noticed that (January and) February data tend to provide very high correction factors, which probably resulted in overestimated numbers (I suppose for some seasonality in data reporting). The best solution in this case would be to employ seasonal corrections factors: that is a set of factors for January data, another set for February data, and so on. Unfortunately, my collection of vintage data start in January 2014, so that I am not able to create seasonal correction factors right now. In May, I will write to the Texas RRC and ask them whether thy can send me all their vintage data, so that I can work and build a seasonal model. Let’s hope for the best.

For now I suggest you look at my corrected data using the average factors reported below, which is the best solution given the data currently available. In any case, February 2015 did indeed showed a rebound in oil production data close to December data.

It’s the Xmas vacation hangover factor.

That’s partly my point, and it’s hard to see how vintage seasonal data is going to be meaningful for just the few years fracking has been going on.

You would see seasonality in the conventional fields, but shale is such a new ballgame that it’s not likely 5 years or so of Januarys will mean much — especially with such a big price change from Jan 2015 vs 2014.

But conventional is not insignificant so seasonality won’t be meaningless. It just won’t teach much about shale, which will be the most sensitive to price.

There is both seasonality and a structural break in the underlying model structure due to the shale arrival. This is easily visible if we consider, for example, a simple auto-regressive model with seasonal intercepts and breaks estimated with North Dakota and Texas oil production data from January 2000 up to September 2014. Below the estimates for North Dakota:

..and here Texas

specification tests (not reported) do not highlight any particular misspecification apart from some weak heteroskedasticity

here is the fit of the previous models for the log-returns of North Dakota oil production data

…and the fit for the log returns of Texas oil production data

http://www.rrc.state.tx.us/oil-gas/research-and-statistics/production-data/texas-monthly-oil-gas-production/

This is the link of the actual Texas production, which is updated per month for each month. Because it is a big state with lots of wells, oil companies, and various fields, it takes about four months for most of the production to be posted. This entity (currently called the RRC), is not much interested in estimating stuff, they are absolutely concerned with actual, because that is what they derive their income from, They do use an estimate of monthly contained in the monthly report “RRC Production Statistics and Allowables”, which if you compare over a year’s period of time is pretty close to the actual numbers eventually posted to the site above, but only if you go back six months. Or, Texas needs to build up a research team to go after all of those companies that have under reported the oil by the massive amount that you, and the EIA are coming up with.

For those of you who fix sate on the monthly or amount of Texas current production peak are missing the big picture. It has become clear over the last 6 months that record world demand is no longer bumping up against limited production. The Saudis talking about market share should have caught your attention. The near term future of oil prices is now a different game.

After a decade of tight oil supply and costly gasoline, the economics of substitution and efficiency are preparing us for the future. Two hundred mile range EV’s are around the corner with cheap solar panels on rooftops to power them. Spare oil production capacity sitting in America waiting for a bump up in oil price.

The world has a lot bigger problems than limited energy supply. We have enough to cook ourselves.

ChiefEngineer,

I have a question. Obviously there is a divergent range of opinion on peakoil, but for someone like yourself who believes its not really that big a deal and can be easily solved by say “Two hundred mile range EV’s are around the corner with cheap solar panels on rooftops to power them” why do you frequent this or any other peakoil site? I mean I am fairly convinced that the earth is not flat so I feel no need to post on the flat earth society web site (http://www.theflatearthsociety.org/cms/). In fact I would have no interest in peakoil at all if I were not convinced of the magnitude of the problem. Of course this question could apply to a couple of other posters really I’m just curious.

“Early industrial societies used whale oil widely in oil lamps and to make soap and margarine. With the commercial development of substitutes such as kerosene and vegetable oils, the use of whale oils declined considerably in the 20th century. With most countries having banned whaling, the sale and use of whale oil as of 2015 has practically ceased.”

http://en.wikipedia.org/wiki/Whale_oil

ChiefEngineer

Ok you have demonstrated again that you think peakoil is a non issue. There was a substitution for whale oil so there will be a substitution for crude oil I gather is your argument, but you still haven’t answered my question. Why do you care about peakoil or try to convince anyone else as to your point of view if you don’t think its a problem? Why not take up another hobby as we all transition to a solar powered utopia? There are people who obsess about the earth being destroyed by asteroids I personally think it is a non issue hence I don’t post on their forums. Really what is your motivation? I’m simply fascinated.

Marcus, I never said “peak oil is a non issue”

I believe the following will help you understand the answer to your question.

“Splitting (also called black and white thinking or all-or-nothing thinking) is the failure in a person’s thinking to bring together both positive and negative qualities of the self and others into a cohesive, realistic whole. It is a common defence mechanism used by many people. The individual tends to think in extremes (i.e., an individual’s actions and motivations are all good or all bad with no middle ground.)

The concept of splitting was developed by Ronald Fairbairn in his formulation of object relations theory; it begins as the inability of the infant to combine the fulfilling aspects of the parents (the good object) and their unresponsive aspects (the unsatisfying object) into the same individuals, but sees the good and bad as separate. In psychoanalytic theory this functions as a defence mechanism.

Splitting creates instability in relationships because one person can be viewed as either personified virtue or personified vice at different times, depending on whether he or she gratifies the subject’s needs or frustrates them. This along with similar oscillations in the experience and appraisal of the self lead to chaotic and unstable relationship patterns, identity diffusion, and mood swings. The therapeutic process can be greatly impeded by these oscillations, because the therapist too can become seen as all good or all bad. To attempt to overcome the negative effects on treatment outcome, constant interpretations by the therapist are needed.

Splitting contributes to unstable relationships and intense emotional experiences. Splitting is not uncommon during adolescence, but is regarded as transient. Splitting has been noted especially with persons diagnosed with borderline personality disorder. Treatment strategies have been developed for individuals and groups based on dialectical behavior therapy, and for couples. There are also self-help books on related topics such as mindfulness and emotional regulation that have been helpful for individuals who struggle with the consequences of splitting.”

http://en.wikipedia.org/wiki/Splitting_(psychology)

ChiefEngineer

I’m not really sure what you are trying to highlight by linking to a symptom of a personality disorder. Sorry, but every comment I have seen you post here suggests that you do indeed think that peakoil is a non issue and can be easily solved in some fashion or the other. However perhaps I’m doing you an injustice please be so good as to direct me to a previous post of yours that suggests otherwise.

Have you sat down and extrapolated, as an engineer, what 745 watts per horsepower means?

I mean don’t get me wrong here it’s not like I don’t often encounter sceptics. On a regular basis I talk to people in banking mainly Goldman & JPM as well as hedge fund people. None of them needless to say are paid up government shills, but they are the most cornucopian people you could ever hope to meet and they would not spend five minutes posting on a peak oil web site. Why? Because they don’t care. Why don’t they care? Simply because they don’t think it is or ever will be an issue. So I was simply curious why anyone of that opinion would ever act differently.

Marcus ,

Do you believe the people at the top – I mean the folks who OWN big chunks of big banks and RUN big banks think peak oil will never be an issue?

I don’t have any trouble believing the run of the mill lower and mid level people are incapable of critical thinking.

Hi old farmer mac,

Well I’ve never meet anyone one that far up the food chain nor am I ever likely to so obviously this is pure conjecture on my part. At the top I think they are very worried, but not about oil supply they are looking at the vast quantity of debt that has been built up in the global economy, the most since the end of WWII even more they are looking at the trillions in derivatives swirling around the global casino, the oscillations in shadow banking etc. Even amongst those who are fully peakoil aware It seems many believe that the economy will be first to collapse long before shortages appear Gail Tverberg for example appears to echo those very thoughts in her latest blog post http://ourfiniteworld.com/2015/04/15/putting-the-real-story-of-energy-and-the-economy-together/. Having said that I’m pretty sure that those who hold high positions in both Government and the military in multiple countries are very concerned directly about peakoil which is precisely why we will never hear about it in the MSM.

I am no doomer, ie I don’t agree that civilisation will fall with the inevitable and proximate decline in oil supply. But I hang out here because the counterfactual is always more instructive that an echo chamber. Also because it is the best source of facts. The opinion, like this one, can easily be skipped. Change is coming, are the only options the world exactly as it is now or doom? Far far too binary. And we know it won’t remain the same; it never does. I’m win the Chief, but the details are unwritten and fascinating to mull over. This site is great for watching the inevitable end of the 20thC paradigm, which is well underway.

I wish I could have a more optimistic view like yourself. Unfortunately there’s too many problems coming our way that trouble me like:

– Climate change.

– Resource depletion.

– Ecosystem destruction.

– Top-soil loss.

– Ocean acidification.

– Increasing pollution / industrial toxins.

– Ocean fish collapse.

– Extinction of mammals.

– Deforestation.

– Growing human population.

– Increasing calls for war etc.

Perhaps I am too pessimistic? If we were actually doing anything to prevent / mitigate the above list then perhaps I could join you on the sunny-side! I just can’t see our current system ending well (or without a fight).

Dave P,

You and ChiefEngineer are in rough agreement. Here’s what he said: “The world has a lot bigger problems than limited energy supply. We have enough to cook ourselves.”

Clearly, he’s talking about Climate Change, which was top of your list.

Marcus wrote:

” but they are the most cornucopian people you could ever hope to meet and they would not spend five minutes posting on a peak oil web site. Why? Because they don’t care. Why don’t they care? Simply because they don’t think it is or ever will be an issue.”

As Upton sinclair wrote:

“It is difficult to get a man to understand something when his salary depends upon his not understanding it.”

Bankers depend on a growth economy to stay employed. For them to accept peak oil and a permanent economic decline would result in them no longer having a job, a purpose, or a suitable skill.

Most people continue to believe there is a solution is because they cannot accept that there entire life\career is based upon a house of cards. Many have children and cannot accept that their future is imperil. Its far easier to just bury your head in the sand and ignore the problem. For at the moment they can still afford $5 lattes, air travel, and all of the other modern luxuries available. Unless they are falling off a cliff, they will continue to believe everything is fine.

Ever notice that continue people pile into bubbles (Dot-com bubble, housing bubble) and never realize it until the crash is 3 months underway?

There is also the older generations that acknowledge Oil depletion is a huge problem, but the expect that the problems will begin after the die and don’t have worry about.

Marcus and TechGuy

The next to last financial adviser my employer allowed in to “help” us save for retirement quit his job 4 months after I introduced him to peak oil and asked for his advice on dealing with it. I decided not to tell his successor.

Jim

Good question, Marcus.

Dropping coal production is also caused only by pollution right?

Keep posting Chief. I read not so much as to find like minded people, but rather to see what others say, even if I conclude that it is misguided. I am motivated by money – I do not want to die broke. And, I have been most successful when I determine that most are misguided, which presents an opportunity. Obviously, I am not on the right side all of the time – just enough to stay ahead so far. If everyone in the world thinks that Secretariat will win, and he does, no one makes any money. The track takes 15% and every bettor loses.

Do you share the same workplace as Nick G?

As you know, I have started collecting vintage data from the Texas RRC since January 2014 for oil and natural gas and since April 2014 for condensate. Given that I have now 1 year (or more) of vintage data I can start using the average correcting factors over all vintage data-sets for month T up to month T-23. Moreover, I can start building 95% confidence intervals around the corrected data using the variability in my past vintage data.

So, here it is my corrected data for oil using the average correcting factors:

here it is my corrected data for condensate using the average correcting factors:

here it is my corrected data for oil+condensate (C+C) using the average correcting factors:

and finally my corrected data for natural gas using the average correcting factors:

Hi Dean,

Thank you for your excellent work!

The Chart for Oil + Condensate is the most interesting chart in my view, in the future you might include the EIA estimate as a dashed line for comparison.

Thanks for the suggestion. Find below my average corrected C+C vs EIA C+C

Thanks Dean,

The EIA estimate looks pretty good until the most recent 6 months or so. Could you give me the data for the “CORRECTED” line from Sept through Feb?

Here they are:

Sep 2014 3265363

Oct 2014 3294576

Nov 2014 3351721

Dec 2014 3382036

Jan 2015 3259908

Feb 2015 3364216

Hi Dean,

Using your data from Sept 2014 to Feb 2015 (your best estimate) for Texas C+C and EIA estimates fro Jan 2011 to August 2014, along with RRC C+C data over the 2011 to 2015 period for both Eagle Ford and all Texas, I estimated Eagle Ford C+C output.

This was done by using the RRC data to find the % of Eagle Ford output relative to all Texas output.

Then it was assumed that these percentages would represent fairly well the percentage of total Texas output from the Eagle Ford when using the better EIA estimates, and your better estimates from sept through Feb. Chart below with Eagle Ford C+C estimate in kb/d.

I think it is a reasonable estimate

Given that the correcting factors are stationary (I checked it using panel unit root tests), my corrected data using average correcting factors are to be preferred. Anyway, in the future I will post both of them. Interestingly, as you see, natural gas data show much higher variability than oil data.

Finally, in a past post, there was a discussion between Ron and Dennis about the “goodness-of-fit” of the final estimates provided by Texas RRC and EIA estimates.

Similarly to what done by Ron, I will post below my estimated oil (only) production up to February 2014 [which I computed with the data published by Texas RRC in April 2014] , together with the latest Texas RRC data published yesterday up to February 2014 (I report data only up to February 2014, since major corrections to RRC data can take place only up to 1 year from the initial release, while minor corrections up to 2 years):

As you see, my corrected oil data seem to slightly overestimate the (not-far-from-being-final) RRC oil data, up to 200,000 b/d for the latest month [in this case February 2014].

I report below my estimated natural gas production up to February 2014 [which I computed with the data published by Texas RRC in April 2014] , together with the latest Texas RRC data published yesterday up to February 2014:

In case of natural gas, my estimates seem to work pretty good, except for the last month, which (usually) suffers from extremely high volatility in reporting.

As for condensate (and the possibility to compare my C+C with the EIA C+C), I will do that in 2-month time, since my first corrected condensate data was April 2014.

Finally, I want to say that this is an ongoing project, performed in real time: if this method will prove to be stable and fairly robust, it is my intention to write an academic paper about it (it is my job 🙂 ). If you are an oil&gas researcher, journalist, producer, etc, and you are potentially interested in writing a joint paper, please let me know it!

Dean. Appreciate your work and can see you spend a lot of time analyzing Texas production.

Do you have access to subscription information like IHS Energy or Drilling Info? I believe those sites have crude sales information. Do you compare those databases sales information or use it in your analysis?

I look at that information when deciding on what to offer for existing production. I find it is accurate and within a month or two of being up to date.

No, unfortunately my university does not have a subscription to those data providers. However, if I got it correctly (I am sorry if wrong) , those two providers offer exact (that is final) data only for limited plays, or a sample of them, but not for the final total Texas oil&gas production, whose data (from RRC) take 1 or 2 year to stabilize. I am interested in the development of a robust nowcasting methodology, more than the data per se (since I am an academic, not a trader 🙂 )

Dean. It may be that those providers do not have all information. However, I have looked at production for sale in the following states and was always able to find the sales information on a lease by lease basis:

OK

KS

TX

CO

WY

I was able to verify the data was correct through other sources. I have not found IHS Energy to have faulty data. We have a plan that does not incur charges until used, so some months we pay $0. There is also information for each well, that I have also found is very accurate also.

I believe IHS Energy purchases this information from the crude oil purchasers.

I do not know if IHS Energy compiles each state’s data and provides that to subscribers. I don’t think that is in the plan we have, but I will try to look. Also, it may be that there are companies which do not provide IHS Energy the data.

I am a proponent of requiring the crude purchasers to submit their monthly purchases to the EIA. I believe this would be a very efficient way to determine US production. However, there may be faults with this proposal that I have not thought of or am unaware of.

It seems strange to me that there can be a debate about the direction of US crude supply several months after the fact, given technology in 2015. As the crude purchasers have very automated data collection procedures, and because they are already required to report data to other governmental entities, it doesn’t seem like my idea is unworkable.

I don’t trade crude oil, but if I did, I would be at a disadvantage to all the big banks and hedge funds, whom I assume are able to purchase such data. That the public data reporting system is inaccurate gives me the impression that crude oil trading is rigged against small investors in favor of the big banks, hedge funds and foreign country sovereign wealth funds.

Kind of like a real life Trading Places.

I have the same impression as well

If data is “rigged” against small investors, that is the easiest way to make money. For example, let’s assume that you think that the spreads on NFL games are “rigged.” Then bet against the rigged spreads. I talked to this guy once and he said he spent a year coming up with a system to bet NFL games. Finally, he placed 10 bets and lost them all. I told him that he had found a perfect system. Just bet on the teams that his system said should lose to win.

Explain how I can use the fact that others have production data before me to my advantage?

Actually, I admit I am being sour grapes. I’ll love those big traders when they run oil up again.

A lot of people knew that the mortgage boom was going to go bust before the big banks did – and they had all of the data. They originated the loans. It is easier to be nimble and opportunistic on your own, than it is for a huge bureaucracy. There are a lot of individual floor traders who make money trading, and they really do not invest in research.

Hi Dean,

On your Oil only chart above, it is not clear if you are using the “corrected” estimate using average correction factors over the past 12 months or the current month’s correction factors, which you have stated seem to be an overestimate. A more interesting chart would be your “best guess” vs RRC data.

That may be what you presented, but this is not clear to me.

Hi Dennis,

those reported above for the back-testing up to February 2014 are the simple corrected data, built without using the average corrected factors. I reported those because using the average corrected factors with data published in April 2014 would create a problem of “looking-ahead-bias”, that is using information which was not yet available at that time. I can make a try, but statistically it is not sound. In the case I will receive the full vintage package from RRC (I will write to them in May), I will definitely compare the corrected data with the average factors available at the time of publication.

Hi Dean,

I have some of the vintage RRC data. But not every month, link to file below.

Feel free to use it if you can.

Dec 2012, March 2013, August 2013, and Nov 2013, crude and condensate data only.

https://drive.google.com/file/d/0B4nArV09d398eHhoWERZNjRIcWM/view?usp=sharing

Thanks

seems like something went seriously wrong in previous months reporting, with this months data indicating a much smoother slowdown in production than indications from last months data. Does anybody have an explanation for this?

Explanation for this is that Texas RRC reporting sucks. They should send some scouts to ND, and learn.

Kam, since you are the one doing all the mouthin’ off, I think it should be you that contacts the Railroad Commission of Texas. Here is the Chairman’s email address:

Christi.Craddick@rrc.state.tx.us

I might suggest you explain to Chairman Craddick who you are and why you think Texas is a “joke” with regards to production reporting. We are generally polite down here, especially to women, I would mind your manners and refrain from using the word, “joke,” but that is entirely up to you. It would be helpful to tell her where you are from. If you are from New Jersey, she will want to know. She will want to know if you are in the oil business and know anything whatsoever about it.

If you think the way Texas reports its oil production is a “joke,” you might explain to her why accurate, real time production data is so important to you. For instance, if its about not knowing how to trade oil futures without the inside scoop on Texas, she will want to know that. If not knowing exact Texas oil production for several months down the road is a matter of national security, she will definitely want to know that. If the ONLY reason you need to know how many barrels Texas produces, immediately, is because you participate in a peak oil blog and you need to know exactly when to plant the flag on the summit of Peak Oil, she will want to know that too.

Ms. Craddick is a busy woman; try to be brief. Texas has more oil and natural gas wells that any other state in the country X 5. Since all oil and natural gas regulatory agencies around the world modeled themselves after the Texas Railroad Commission I would leave out the references that Texas should go to North Dakota for advise. She might take offense to that, as Chairman of the Railroad Commission of Texas. But, that’s up to you. You’ll be emailing her so anything goes, uh?

If you get a response from Chairman Craddick it might go something like this, I suspect: “relax, Kam, oil prices are half of what they were, the shale business was marginally profitable before oil prices went down, now its not, production is going down in Texas and everywhere else, oil is finite resource, what difference does a couple of months make one way or another? Next question?”

Good luck.

Mike

LOL. Actually, I did contact Christi Craddick’s email to try to define why the EIA data and Texas estimates were about 500k barrels a day different. While she did not reply directly, I did receive some responses by an appointee. Try it, they are nice people. In response to how EIA comes up with their numbers, they simply said it is their estimates, and that I must contact them. I tried sending a request to the designated individual in charge of that, and received no reply. However, I am sure that is because my internet is not connected to areas outside of Earth.

Marmico posted data from a company called Genscape which showed significant production loss in the Permian Basin in January. This may be why January has the noticeable dip. This may require EIA to revise their January data downward.

Due to cold weather in PB 1/15.

As I’ve said before, January was particularly bad in the Permian. There were power lines down all over the basin, and that directly impacts production. We lost a field for the entire month of January and the first week of February because of downed power lines. On top of that, wells are shut in for cold weather anyway. It wouldn’t surprise me if part of the reason for a decrease in production in January was weather related.

Hi MBP,

How have things been since then, do you expect big decreases or do you think output may be roughly flat in the Permian Basin, over the March to April time frame?

Dennis,

I have no idea honestly. I don’t deal much with the unconventional side of things, I’m usually trying to fight decline in waterfloods and CO2 floods. Obviously things have slowed down here, there was another round of layoffs on Friday for a few companies, so I would imagine continuing to increase production will become difficult. Midland ISD has lost something like 400 or 500 kids so far this year from parents moving, which is a lot for its size. I would imagine a lot of families are staying to let their kids finish the school year and will leave this summer if things haven’t improved.

MBP,

Sorry to hear it. I hope for you, Mike, Shallow Sands, and Toolpush (and any others I have missed) that oil prices continue to rise, but not so much that they crash the economy.

This uneconomy needs to crash, and sooner rather than later.

And people need to be empowered to do things about it beyond forking over yet more centralized controlled crony-capitalist plutarchy fiat currency for items that that same dystem greenwash-vomits out.

“David’s argument is essentially that radical, but achievable, behaviour change from dependent consumers to responsible self-reliant producers (by some relatively small minority of the global middle class) has a chance of stopping the juggernaut of consumer capitalism from driving the world over the climate change cliff. It maybe a slim chance, but a better bet than current herculean efforts to get the elites to pull the right policy levers; whether by sweet promises of green tech profits or alternatively threats from mass movements shouting for less consumption.” ~ ‘Crash on Demand: Welcome to the Brown Tech Future’, by David Holmgren

Dennis, with regard to your question under a previous article with regard to if I have a car, well no. I have not had a car since my teen years, and even then, had it for only about a year and a half and hardly drove it after its engine blew. 😀

Unlike some people, who don’t practice what they preach.

I boot, bike, blade, and bus it, baby.

“This uneconomy needs to crash, and sooner rather than later.”

I personally have to question the mental stability of someone who would wish so much pain on so many. I can understand someone wanting to fix problems in the economic system, but to wish others back towards the stone age I find disturbing.

Caelan, you come across more like a jealous loser than a concerned human.

Apparently, the longer this unethical uneconomy lasts in its current state, the more pain there will be.

Speaking of questions of mental stability, your virgin-level comment’s ad homs not only amount to trolling and fly in the face of Ron Patterson’s specific requests not to use them– not that you necessarily give a shit about that either– but, along with cowering behind your unrecognized moniker, you don’t help make your case, which really sounds little more than a pathetic/juvenile personal drive-by vendetta anyway. (Is that John B?)

So I question whether you really care as you proclaim to about others. My suspicion is you don’t.

And it is not just me who is advocating a crash of the uneconomy, which makes everyone lose. (Not that you care either about the link to David Holmgren.)

By the way, loser is spelled with one o. I can handle ad homs, though, and you may notice that, regardless, I still don’t use them.

My advice: If you want to stick around, stick to the issue/message, never mind the messenger.

(This fine message crafted on-the-fly with the Patterson Press™ Comment Editor. Got second thoughts? Press it with the Patterson!)

Nothing to be sorry about. This has happened before, and it will happen again. Thus is the oil patch.

Dennis. If we could get to $75 WTI I think most conventional producers would be good. We have surprised ourselves in being able to cut some here and there. Probably got a little loose with $90-100 WTI.

Can’t do much to fight decline at $50 WTI though. And not going to borrow to do it.

Daniel, nothing went wrong. That is just the nature of the oil business, sometimes you get a very good month and sometimes you get a bad one. There is no rule that, in a time of declining production, the decline must be smooth. There is nothing surprising about what is happening in Texas with oil production.

An example of what I propose is KS. Kansas has a very good state site, which is based on sales reports from crude purchasers.

The only problem I have with it is timeliness. It currently just has through 12/14.

I now present for your Sunday evening reading pleasure:

The $5 Billion Race to Build a Better Battery

It starts:

Professor Donald Sadoway remembers chuckling at an e-mail in August 2009 from a woman claiming to represent Bill Gates. The world’s richest man had taken Sadoway’s Introduction to Solid State Chemistry online, the message explained. Gates wondered if he could meet the guy teaching the popular MIT course the next time the billionaire was in the Boston area, Bloomberg Markets magazine will report in its May issue. “I thought it was a student prank,” says Sadoway, who’s spent more than a decade melting metals in search of a cheap, long-life battery that might wean the world off dirty energy. He’d almost forgotten the note when Gates’s assistant wrote again to plead for a response.

A month later, Gates and Sadoway were swapping ideas on curbing climate change in the chemist’s second-story office on the Massachusetts Institute of Technology campus.

and concludes:

Phil Giudice, the CEO who’s running Sadoway’s Ambri, says new batteries emerging with the help of big backers will finally enable renewables to compete with fossil fuels. “Khosla, Gates, Musk, and the Pritzkers are all excited about changing the world in a better way, and they’re swinging for the fences,” Giudice says. “We’re getting closer every day.”

I trust that Ron does not find this irrelevant to the discussions here because, I know he does not share my belief that the world may be entering a period of a race between “The Clean Disruption” of the energy and transportation businesses and oil depletion. The question in my mind is, will the clean disruption, already under-way, happen fast enough to mask the decline in world crude oil production? (already under-way?)

I bring this up because, when I first became aware of Peak Oil, back in late 2007, early 2008, the first modern series production car, powered by lithium ion batteries, the Roadster by Tesla Motors, was not yet on sale and I was worried that the planned successor to that car would never see the light of day, once Peak Oil related recession took hold. Well here we are seven plus years later and Tesla recently reported that they sold just over 10,000 units of the successor to the Roadster in the first quarter of 2015 and according to a Wikipedia entry on Electric car use by country, as of December 2014, more than 712,000 highway-capable plug-in electric passenger cars and utility vans have been sold worldwide. My island home is home to the largest wind farm in the Caribbean with ground-breaking for an expansion to that wind farm scheduled for this month. At the beginning of 2008 Just over 9GW of solar PV had been deployed world wide and now seven years later, that total is up to over 177GW with projections for that to climb to over 230 GW by the end of this year. That is remarkable growth in that almost 95% of the solar PV deployed in the world, has been installed in the last seven years!

Earlier this year I bought a little battery operated chain saw and within the next few months I hope to finally get around installing the PV system I am putting together on the old homestead. It is a damn sight easier using the chain saw than using an axe or machete to cut down trees that were killed in a bush fire during a series of fires brought on by a very dry period last year(my fire was started by a complete idiot, clearing the the verge of the roadway adjoining my property on behalf of the local government). I really didn’t think life was going to be as “normal” as this in 2015 and maybe if we can squeak by for a few more years, the Oil Age will not end because of shortages of oil but because of the clean disruption. I’m aware of the overshoot problem but the idea of mass starvation, riots and wars is just truly awful and anything that will help soften the crash is not all bad in my view.

Alan from the islands

Earlier this year I bought a little battery operated chain saw

cc to horsepower is always a tricky conversion but a division by 30 will get you in the ballpark.

Here’s a small chain saw.

http://www.homedepot.com/p/Blue-Max-2-In-1-20-in-and-14-in-45cc-Gas-Chainsaw-Combo-with-Blow-Molded-Case-8902/202555248?N=5yc1vZbxa8Z1z0zy8m#specifications

45 cc divided by 30 –> 1.5 horsepower for $150

That’s 745 watts X 1.5 = 1117.5 watts

Now this is damn near the only battery powered chainsaw HD carries:

http://www.homedepot.com/p/Greenworks-10-in-20-Volt-Cordless-Electric-Chainsaw-Battery-Not-Included-20602/202281143?N=5yc1vZbxa8Z1z0zy82 $70

No amperage quoted. But at 1117.5 watts and 20 volts, the amps have to be 59. I’ll leave you to look it up, but such batteries for chainsaws are usually 2 ampere hours. That’s 2/59 = 0.03 hours life.

If your battery lasts longer than that, then you ain’t drawing 59 amps. That means you ain’t getting 1.5 horsepower and you’re taking a longer time to cut wood.