A post by Ovi

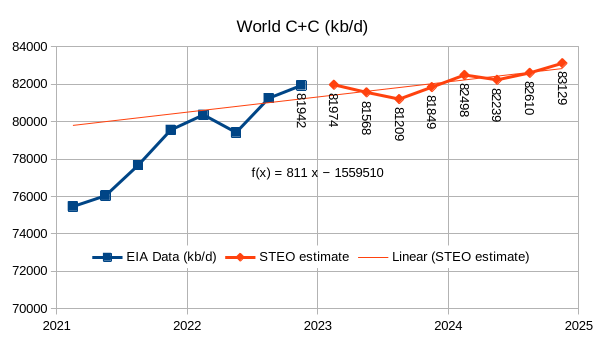

Below are a number of Crude plus Condensate (C + C) production charts, usually shortened to “oil”, for Non-OPEC countries. Normally the charts are created from data provided by the EIA’s International Energy Statistics in the first week of the month. Unfortunately the EIA was not able to update the production information for March until today. Consequently the charts below are produced from a mixture of country specific sites such as Brazil, Norway and China and the July STEO and the International report. The International report was used to update the March production data.

Where STEO data was used, the ratio of C + C to All Liquids was calculated. The average from the last six months was used to project the March production numbers and extended to May in a few cases.

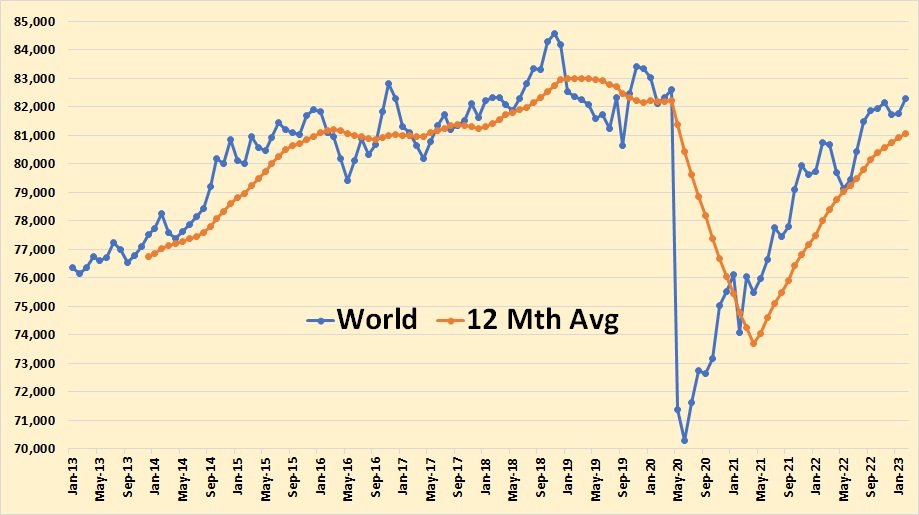

World oil production charts are found at the end of this post.

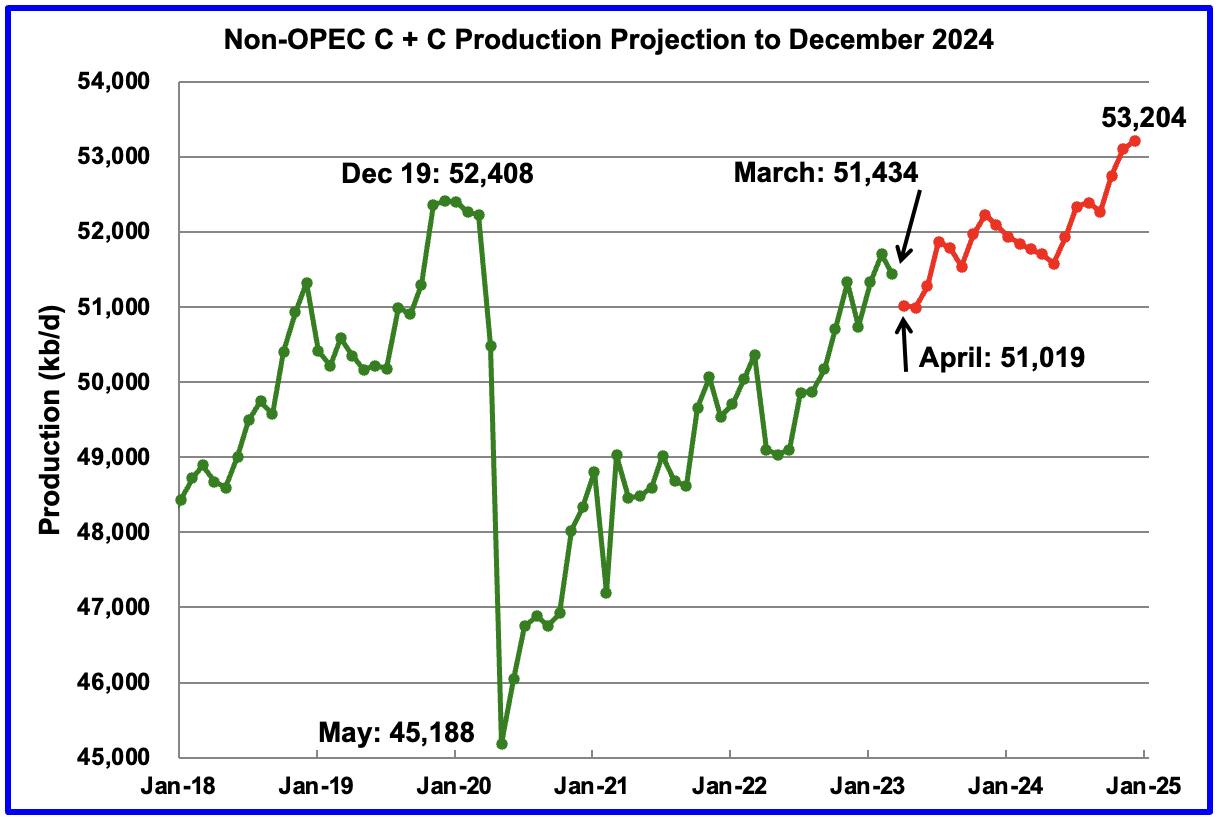

March Non-OPEC oil production dropped by 268 kb/d to 51,434 kb/d. The largest decreases came from the Russia, 300 kb/d and Brazil 146 kb/d.

Read More