Notice: The data I thought would be out today: EIA Crude Oil Production by State will not be out until Thursday, Feb. 27th. However I will have another post coming out later today anyway.

This is a guest post by Ovi Colavincenzo

There is considerable discussion on this site regarding when the North Dakota portion of the Bakken will peak. Having looked at the monthly Bakken data that the State publishes, it raised the question of whether it was possible to do a reverse analysis of the data and then use it to develop a model that would replicate the ND Bakken production, exactly. The objective being to provide further insight on what is happening in the ND Bakken.

In order to do this, the following conditions and information were required:

- A monotonically increasing number of new producing wells

- A typical/average decline curve for the ND Bakken field

- Not too many wells being shut/reworked each month

The last bullet is a preferred condition because if a number of low producing wells are shut and replaced by newer high producing wells, then the estimated flow rate of the new wells will be on the high side.

From 1999 to mid 2005, approximately 200 wells were in production in every month. The addition of an increasing number of new wells began to occur in mid-2005, so start date for the analysis was set at the beginning of 2008 to address the first bullet point above.

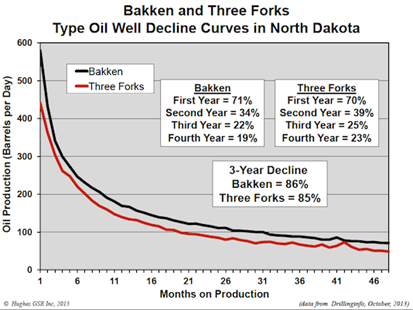

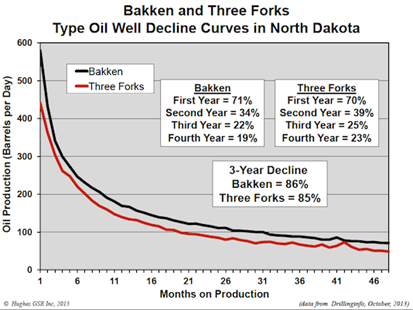

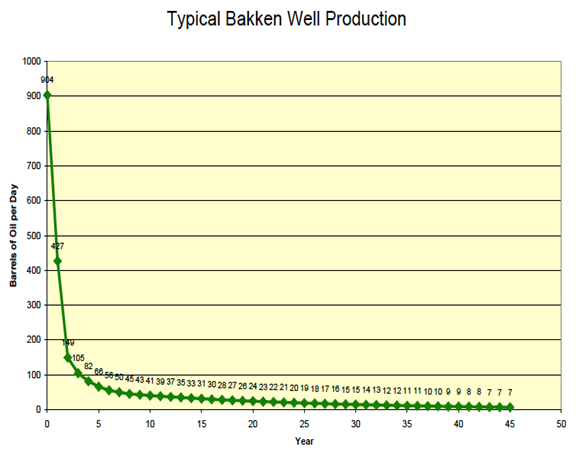

Figure 1: Source: The Shale Revolution” by J.D. Hughes

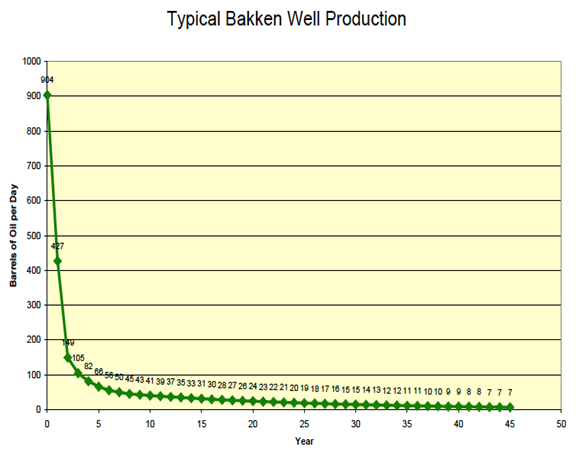

For the decline curves, two were used and are shown in Figures 1 and 2. One came from “The Shale Revolution” by J.D. Hughes, November 19, 2013 shown in Figure 1. The other came from North Dakota’s Directors cut, “Tribal Leader Summit” 09 05 12 (PDF), Figure 2.

Figure 2: Source: North Dakota Director’s Cut “Tribal Leader Summit”

Read More