By Ovi

All of the Crude plus Condensate (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM which provides updated information up to August 2023.

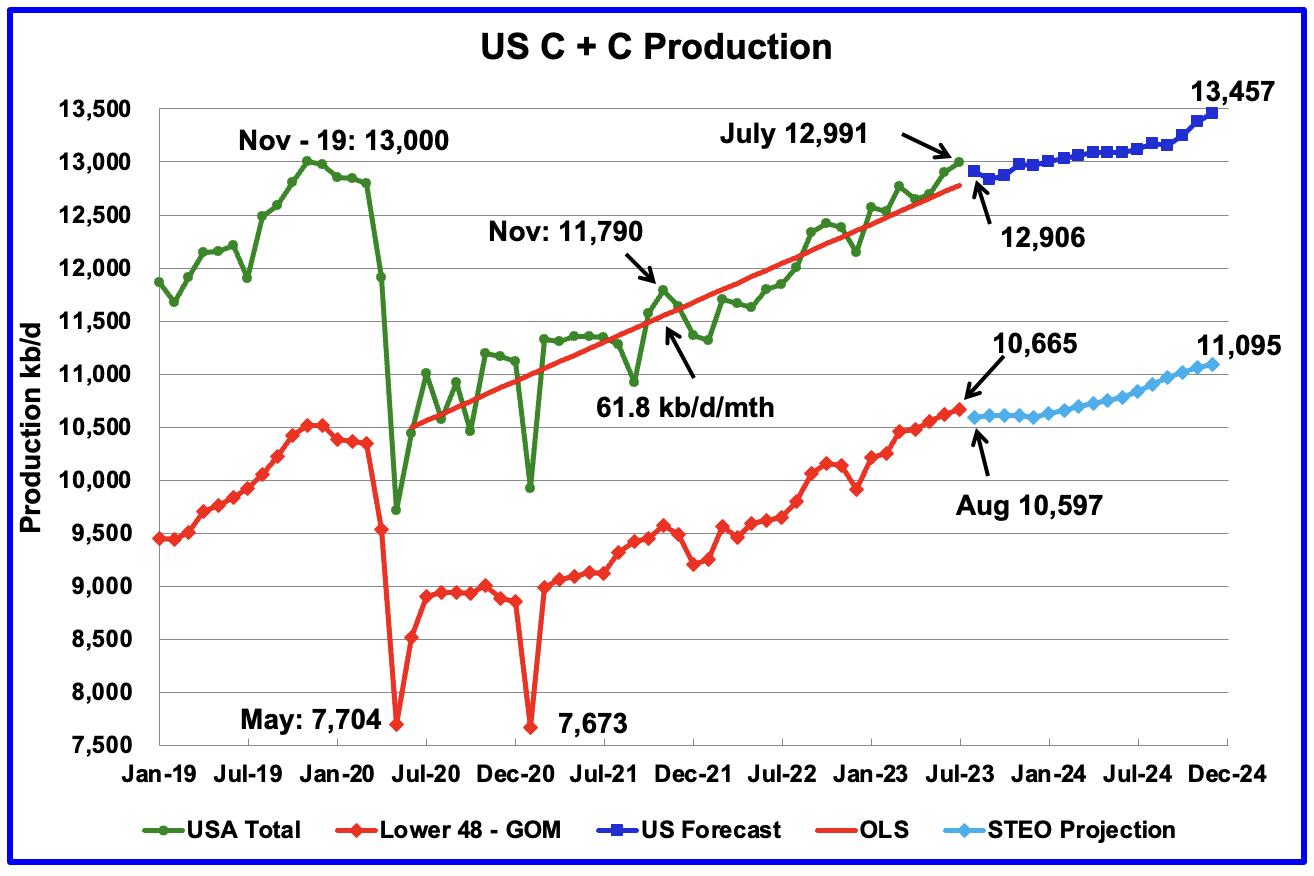

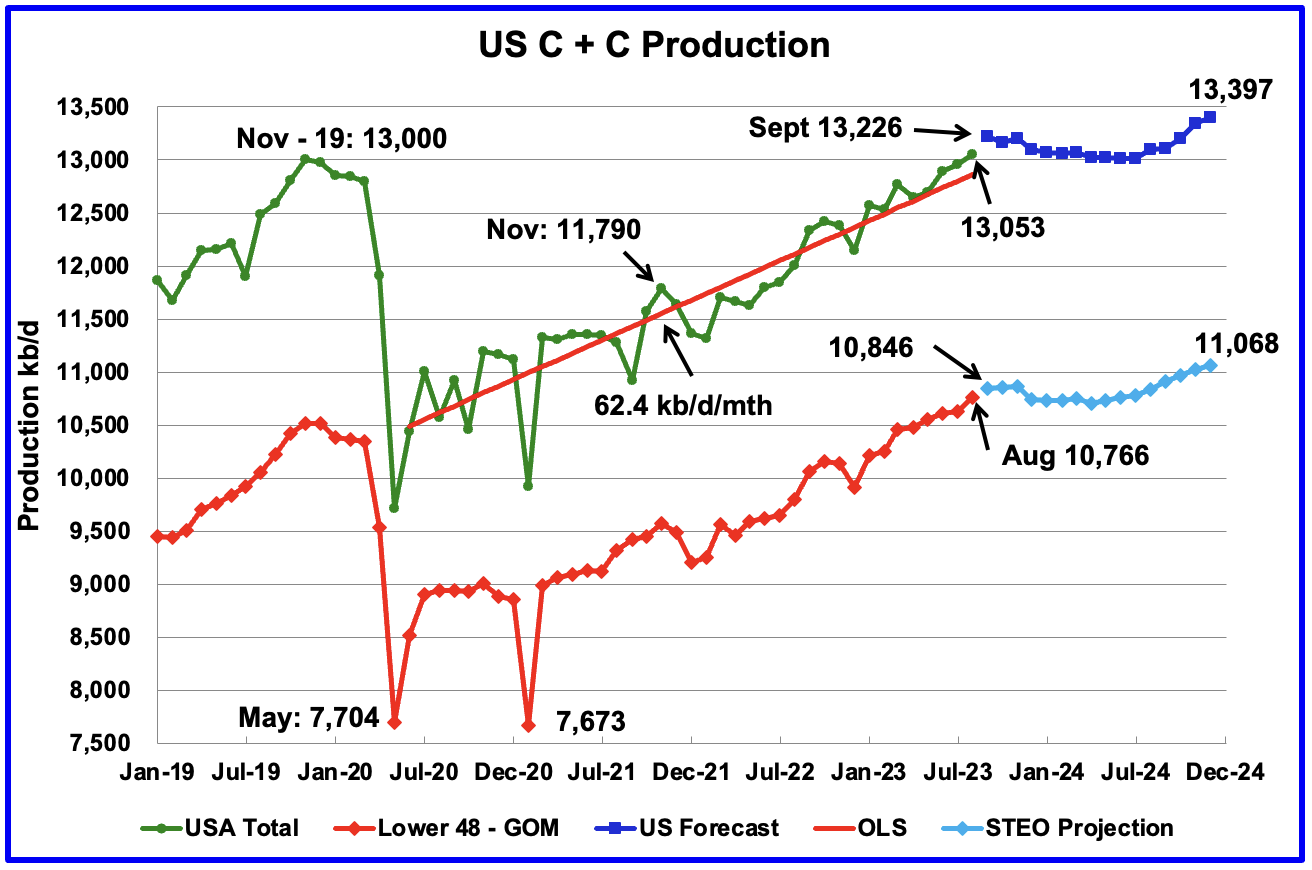

U.S. August oil production increased by 94 kb/d to 13,053kb/d, a new record high by 53 kb/d over November 2019. The increase was primarily due to increases in Texas, New Mexico and North Dakota. Note that July production was revised down from 12,991 kb/d to 12,959 kb/d, which accounts for 32 kb/d of the 94 kb/d August increase.

Read More