The OPEC 2015 World Oil Outlook came out a few days ago. They basically produce two outlooks, a medium term outlook to 2020 and a long term outlook to 2040. I found their medium term outlook pessimistic in some cases to optimistic in others. But I found their long term outlook to be wildly optimistic… in most cases.

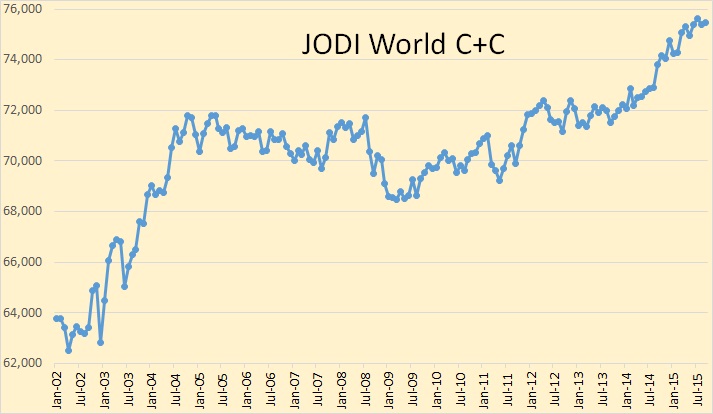

In all cases below I chart crude when it is available and “liquids” only when no other option is available. The data is in million barrels per day.

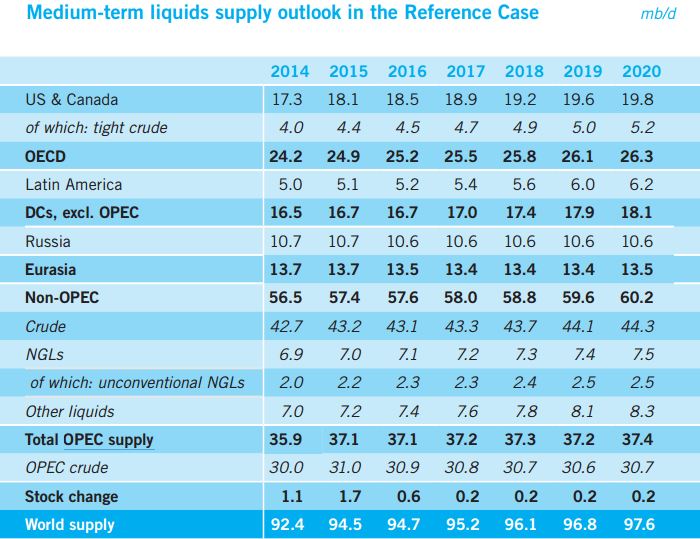

Here is their medium term outlook chart. Notice they expect both OPEC and Non-OPEC crude to decline in 2016 but Non-OPEC crude starts a slow recovery in 2017. They say OPEC crude will not start their recovery until 2019.