This post was originally posted at my blog “Fractional Flow”.

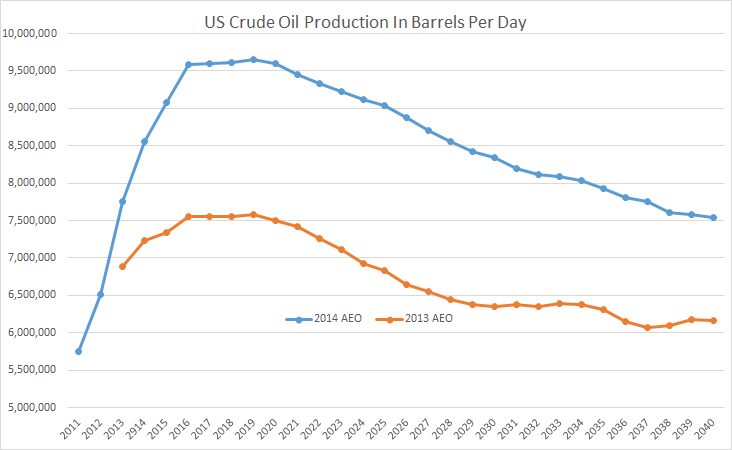

In this post I present an update to my previous posts over at The Oil Drum (The Red Queen series) on developments in tight oil production from the Bakken formation in North Dakota with some additional estimates, mainly presented in charts. The expansion is much about the differences between wells capable of producing, actual producing wells and idle wells (here defined as the difference between the number of wells capable of producing and the number of actual producing wells).

There is still noticeable growth in tight oil production from an accelerated additions of producing wells.

- For October 2013 North Dakota Industrial Commission (NDIC) reported a production of 877 kb/d from Bakken/Three Forks.

- In October 2013YTD production from Bakken/Three Forks (ND) was 775 kb/d.

(It is now expected that average daily production for all 2013 from Bakken (ND) will become around 800 kb/d. - The cash flow analysis now suggests less use of debt for manufacturing wells for 2013.

Major funding for new wells now appears to come mainly from from net cash flows.

kb; kilo barrels = 1,000 barrels