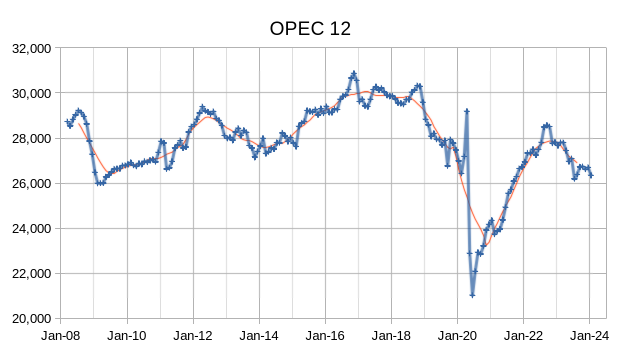

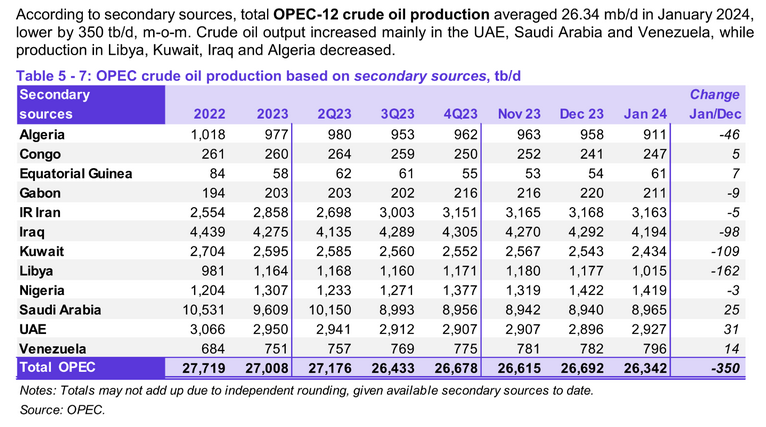

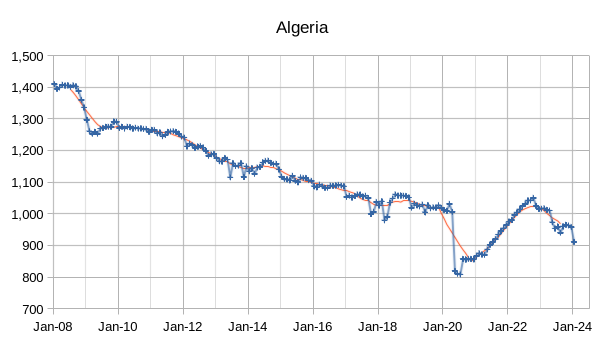

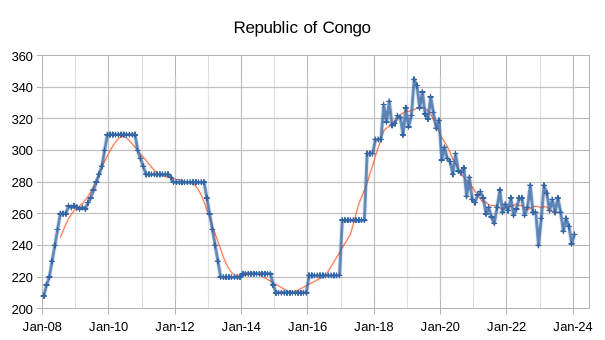

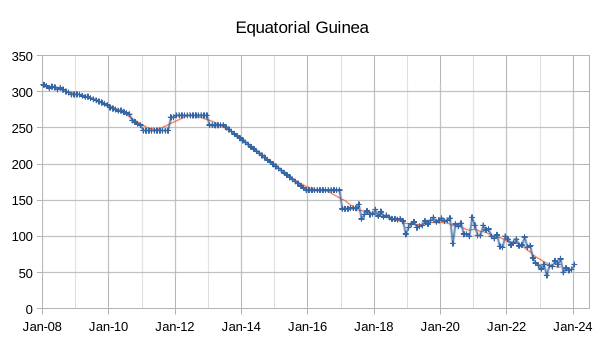

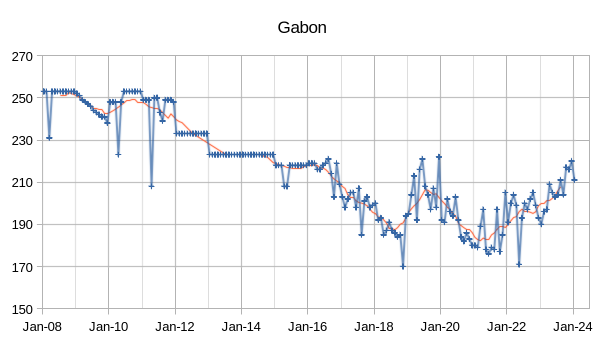

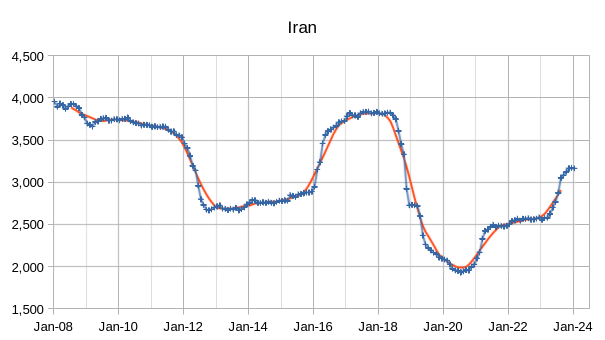

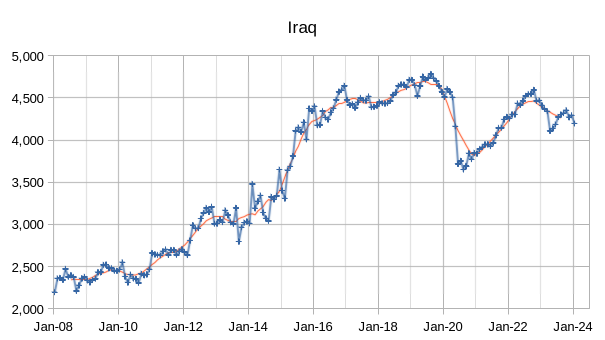

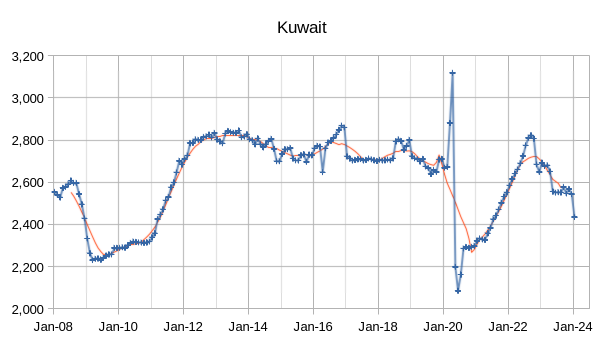

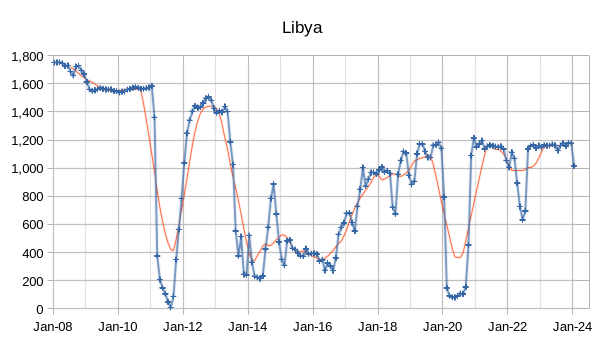

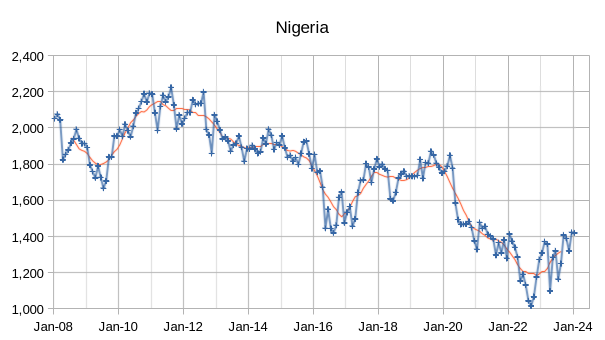

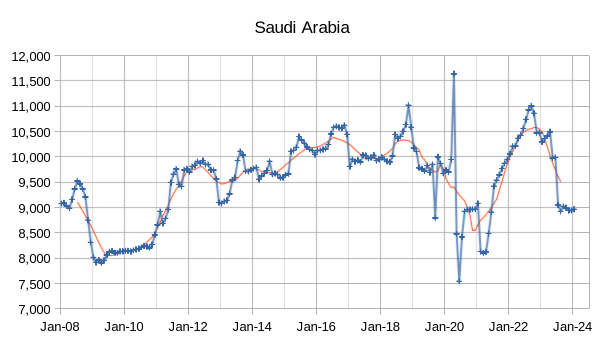

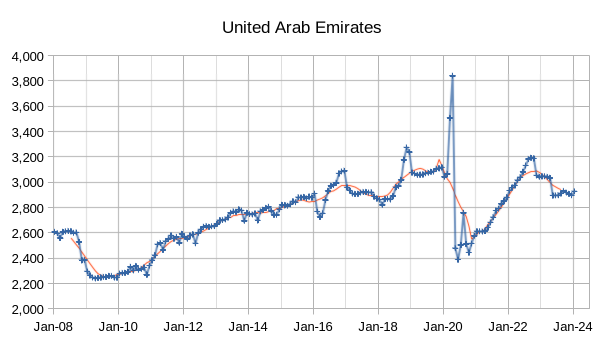

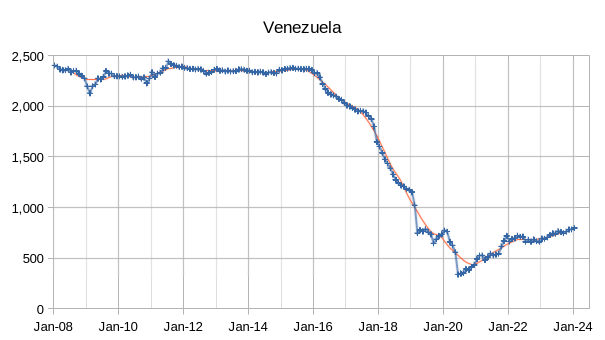

The OPEC Monthly Oil Market Report (MOMR) for February 2024 was published recently. The last month reported in most of the OPEC charts that follow is January 2024 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the OPEC charts that follow the blue line with markers is monthly output and the thin red line is the centered twelve month average (CTMA) output.

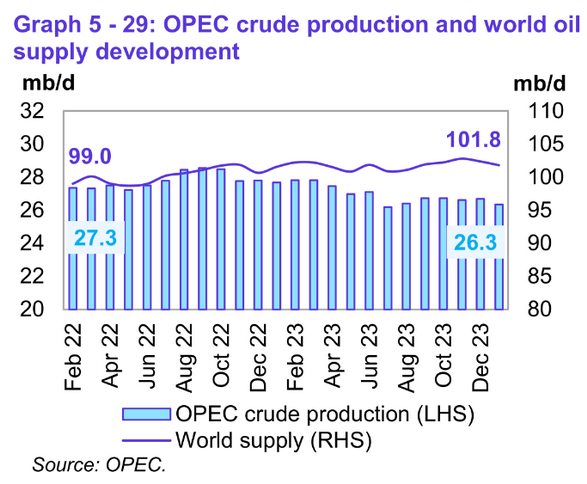

Preliminary data indicates that global liquids production in January 2024 decreased by 0.6 Mb/d compared with the previous month to average 101.8 Mb/d. The estimate for December 2023 was revised higher by 1.5 Mb/d to 102.4 Mb/d this month from last month’s preliminary estimate of 100.9 Mb/d. Liquids supply was 2.8 Mb/d higher than 23 months earlier and OPEC crude output was 1.0 Mb/d less than 23 months earlier.

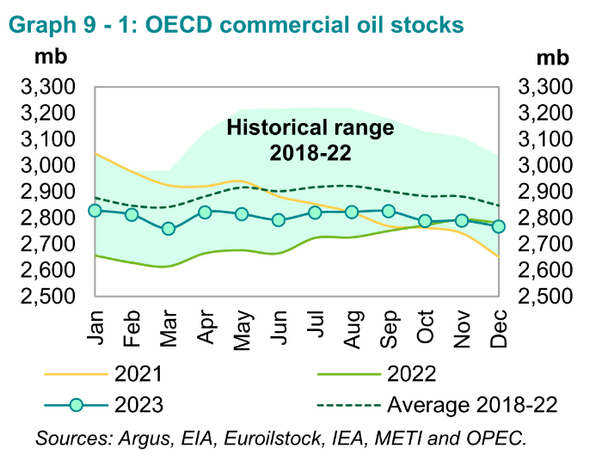

Preliminary December 2023 data shows total OECD commercial oil stocks down by 22.6 Mb from the November level. At 2767 Mb, they were 14 Mb lower than the same time one year ago, 80 Mb lower than the latest five-year average and 159 Mb below the 2015–2019 average.

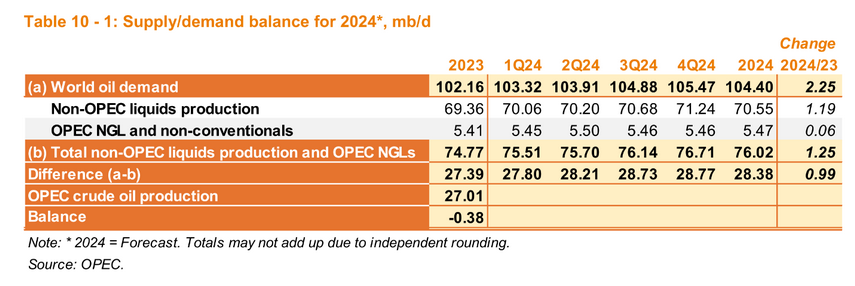

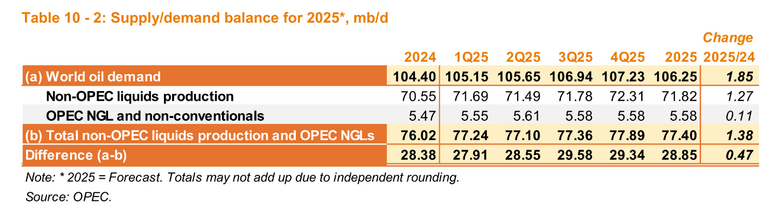

Demand for OPEC crude in 2024 and 2025 has been revised lower this month by 0.11 Mb/d compared to last month’s estimates. My estimate for OPEC sustainable output is about 28.41 Mb/d which suggests a shortage of crude in 2025, if the OPEC estimates for World Demand and non-OPEC supply are correct. Note that the EIA Short Term Energy Outlook estimate for World liquids demand in 2025 is 103.71 Mb/d, 1.54 Mb/d less than the OPEC MOMR estimate. The EIA STEO estimates that only 27.35 Mb/d of OPEC crude will be needed in 2025 to balance World liquids supply and demand, 1.5 Mb/d lower than the OPEC MOMR estimate.

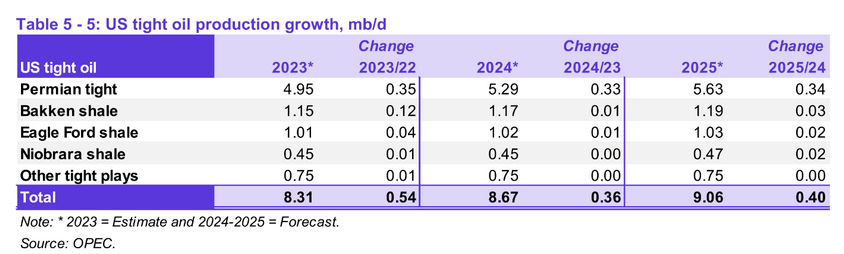

OPEC expects slower US tight oil growth in 2024 and 2025, than in 2023 and the 2024 and 2025 estimates have been revised slightly lower than last month (0.03 Mb/d in 2024 and 0.04 Mb/d in 2025).

Mr. Coyne, I appreciate the time it took for you to put this data together, write it up in coherent terms, and publish it. I rarely agree with it all, but thank you. And thank you to Ovi, who also spends a lot of time to present HIS posts. It is a thankless job and you both should be commended. You are curious and in a world full of lies, seem to be interested in getting to the truth. For that you have my respect. I try all the time at my place for about the same amouth of grief.

The internet has made arrogant, self-absorbed “experts” out of the most oil and gas ignorant of people; Reservegrowth, Coffeyguyzz, Nony and other people, for instance. They lack the courage to put their own name behind their criticisms and personal attacks on those who DO take pride in using their own names. Berman, for instance, Likvern, Maddox and many others, myself included…they rant and rave behind the protection of a keyboard. seldom publishing any of their own work, content to criticize others. Imagine thinking you know more than somebody who’s feed his family for years from oil and gas production. Phfttttttt.

These would not be people you would want to fight an oil well fire with, I assure you.

This from a previous thread… https://patzek-lifeitself.blogspot.com/2016/03/is-us-shale-oil-gas-production-peaking.html

I’ve met Tad several times, he and one of his colleagues at UT came to one of my fields once long ago to do work on dynometers in rod lift, producing fluid levels, pump off controls. He and Dr. Podio were awesome. They asked more questions than I could give answers for. They were…searchers. We ate enchiladas together. I sat their lectures.

For the likes of Coffeequzz and Nony to be arguing with Patzek, 8 years ago, about anything to do with oil and gas, is embrarassing. It goes to show you how fucked up people can get on the internet.

Who really gives a rats ass about how much hypothetical gas there is to recover in the APP Basin at $5/MMBTU when the price of it is now 60 cents/MMBTU, seldom exceeds $2 and all those un-American assholes that produce it want to do is export it to Europe anyway?

You guys need to find a job, get off the computer. Pickle ball is fun, I am told…if you are old and crippled up. Leave the oil and gas business to people who understand it and have the guts to tell the truth about it.

Thank you Mike.

I appreciate the kind words. I agree that Ovi does great work, I do my best with help from you and other oil pros that have taught me so much. Errors are all mine though.

Dennis and Ovi,

I too thank you guys very much for the hard work you put into your presentations and your daily activity on this site. I too garner a lot of information from your presentations and having drilled many wells in the Permian and East Texas, I find the trends invaluable in making investment decisions and anticipated trends. keep up the great work in presenting the facts as they roll in.

Thank you LTO Survivor,

I have also learned a lot from you, it is much appreciated by everyone who reads this blog.

Thanks Mike

We appreciate your hands on feedback. Dennis’ models are great and add invaluable insight of where oil production will be five to ten years out.

Where production might be. Everybody would be much smarter if they took the OSB Stripper Well Economics 101 course.

My “staff” (hee hee) was charged this month with reviewing 2023 K’s for set aside money. For P,A &D funds to plug and abandon thousands of wells in inventory declining like a rock. So far, not so good. So far, scary as hell.

Diversified Energy, not a shale operator, owns more oil and gas wells in the US than any single operator, 70,000 of the damn things, only half of them are capable of production in paying (profitable) quanities. Where do you think that is going?

P,A &D is a liability. Like paying back debt to drill and complete wells. What most folks don’t get about this real, mostly imaginary resource stuff to extract deep down there in the dark is… it takes lots of money. In the hands of private enterprise its got to be profitable or all that URR stuff is just pissing in a strong north wind.

Profitable means paying ALL debt, including future plugging costs. There is enough pipe in the ground in the Permian to go around the world six times…do you want to just leave it buried, out of sight out of mind?

Not much of this is going to work out like all the cheerleaders think. Remember, they got not skin in it.

Thanks Mike,

I agree, the economics has to work, as you often say hoping for higher prices is not much of a plan.

Josh Young

https://twitter.com/Josh_Young_1/status/1760434106821656638

Grinning as he stands over a Bakken flare, touting all the profits to be had. Consolidation = selling deck chairs on the Titanic?

As someone who doesn’t know shit, I love this site. It keeps me informed & thinking.

I’ve got to snicker…just a little Mike. I put my name on every article I’ve published in science journals since the late 1990’s. Every “attack” I’ve ever leveled at anyone where ideas matter ( as opposed to the “working man” ethos you prefer, or are limited to) had a footnote accompanying it. And when they came after me it had nothing to do with whether or not I knew which end of a pipe wrench was the business end. You aren’t the only one who has managed and/or owned working interest. But unlike you, some of us didn’t just stop there. We’ve been evacuated from rigs that have caught fire out in the Gulf like everyone else, blown up wells when the casing split during a completion, completed a frack job when the last operating pressure gauge failed in the middle of a job which was flat out stupid but I was young and experienced with ancilliary indicators, tried to keep people from getting killed in all the usual situations that come up in the oil field. And in general appreciated that this practical experience was invaluable. As a first career. Not a lifetime of work solving the same stuck packer problems, workover on a disposal well, laying pipelines, talking landowners out of waving guns around, building compressor stations and al those normal things that I well undertand that some people might be happy, or limited to, forever being. God loves stripper well operators I’ve been told. And good for them.

But please don’t pretend that these experiences, and less cartoonish oil man activities like running a 1000 well production company across 3 states, managing science teams in litigation support on billion dollar lawsuits, are the natural career limits to all us who qualified early as pipe wrench handlers.

My nom de plume was born the day after Thanksgiving, 2005. And it lingers on the internet in certain (now near invisible) circles because that username didn’t buy the cock and bull story being sold all along the way by true believers in peak oil and their idiot bell shaped curves who didn’t know any more about the geosciences than they would which end of a pipe wrench to hold.

Thanks for mentioning that Tad with his PhD doesn’t even understand pump off controls. I was using those as a well tender before I was 23 years old. Was he awe struck when you explained how a murphy switch works? Shouted in glee at explanations of how a rabbit well works? And Art? Art “there is no significant oil in US shales”? Before…you know….the oil showed up? I wouldn’t let him on my drilling or completion location if he was wearing TWO hard hats.

Good for you, man. RGR; snicker away.

You are better than me, than the “average stripper well operator,” or the average hand that I so respect, because you rose above the fray and became someone…better. You left us behind, because you were smarter, and had more education, I assume. We were “limited,” because we were not as educated as you. We did the work, so you didn’t have to.

Your are just another pompus ass on the internet. Fuck you.

Whatever you might have done in real life that tied you to the oil business, and gives you self served, credibility, a diver turned insurance agent, a worm on a rig floor with a pipe wrench that wiggled his way up in the big Corporate tree, that was a long time ago. You lost it man. Thats all gone now.

You forgot.

My heros all have scars, and blisters, and brown faces with deep wrinkles, yes. They risked their money and lived, or died, accordingly. I think they are all better than you, whomever you are, and many others who fuck with people, anonymously, as they know more than those of is in the real life.

Who are you? What makes you so special? If you have something so important to say to others about their hydrocarbon future, use your name. Be somebody. Don’t be a chickenshit. Give us some reason, any reason to believe you.

Well there you go Mike…you got me. I was once a worm. 20 years old, dumb as a stump, listen carrefully, follow instuctions, try not to get killed. Was it much different for you?

As far as who I am now……that involves an interesting combination of timing, ever growing experience and responsibility, some natural talent and blind luck, and two oustanding mentors. Was your development much different?

Sorry but I can’t offer you anything to believe. All I did was begin working the problem, pieces here, pieces there, publishing and presenting as I went. I always just figured that the beauty of science is that it works out irrespective of your belief in it.

No, it was exactly the same. I just didn’t forget. You did.

Science, whatever that means regarding resources, is meanningless. Its all about money, dude. How much it costs, how much it makes, what it takes to get it out the ground, whether it makes money for private enterprise.

With regards to shale oil and gas, so far, not so good.

The fear of peak affordable oil production, worldwide, and whether it can meet demand, to prolong the transition to renewables, is the real deal, man. Ignore it, as you and many others do, and you hurt the industry’s ability to move forward. Your story is a bad one. You think by touting abundance you are helping…its just the opposite.

Please Mike, I haven’t forgotten. I just don’t carry it like a chip on my shoulder like you do. That experience was a springboard to something else is all. And economics is a science Mike. What a quaint idea, that science wouldn’t interact with both the geosciences and economics simultaineously.

As far as what you fear, this new and exciting concept of peak affordable production as opposed to the volume metric that people keep screwing the pooch on, it is entirely relative. And belongs squarely in the realm of economics. Which has this wonderful saying of “What is the cure for high oil prices?” …wait for it…. “High oil prices!”.

Go look up how supply and demand curves work, gleen some knowledge from that devilishly clever trifecta of factors. Then you too can figure out far more oily stuff than those limited to bell shaped curves and ultimate recoveries.

My story isn’t bad, any more than your story is bad for being a oilman. Polluting the atmosphere with enriching yourself off black polluting gold! How dare you! 🙂

And I have touted no abundance Mike. I have just disagreed with those proclaiming peak oils without even taking the time to understand some of the most basic concepts of large scale oil and gas development. And I don’t even mean reserve growth anymore, I’m talking about that devilish trifecta.

“ I put my name on every article I’ve published in science journals since the late 1990’s.”

Wow. An author of scientific papers who’s too chickenshit to use their real name. You must really believe in that science you did lmfao

Thanks for switching back to Reservegrowthrulz for this thread, “Anonymous” was getting old.

Stephen,

Reservegrowthrulz and Anonymous are differnent people. Anonymous used to use Nony as a pseudonym when the blog first started.

“use their real name”

I remember early on in the internet days when people were perhaps rightly concerned about using their real name, either trying to avoid spam or fear that their employers would use that against them. Well, that turned out to be unfounded. NO ONE CARES, or THEY ALREADY KNOW EVERYTHING YOU DO ANYWAYS. Plus, if you use your real name, it turns out that the AI large language models will pick that up and credit you for all sorts of interesting ideas that you may have presented. Ask ChatGPT4 who is Mike Shellman and you get a pretty good synopsis if his contributions. Impressive actually. But ask about Reservegrowthrulz, nothing.

Why are we doing this? Are we here posting and commenting to make a difference? If you’re anonymous, odds are less that you will have any impact.

What are you talking about? You can’t read? My name is on every article I’ve ever authored, domestic and international.

And I haven’t ever posted as “Anonymous”, but I have read what they wrote with interest, and been surprised there were some nuggets in there I was unfamiliar with. Anonymous has some cred.

Reservegrowthrulz,

One could ask the same question of you. Every comment you have ever made on blogs under the pseudonym of Reservegrowthrulz is not credited to you, it is ignored. If you attached your actual name to those comments then they would be credited to you. Only you know who you are, and me, but I will not reveal your name. Thus nobody knows whether you are credible or not. This may apply also to others who may use pseudonyms rather than their real name.

Damn those people on the Internet with pseudonyms. So 1999. Don’t they understand Facebook?

You might have to evaluate their arguments based on like sourcing and internal logic. And dry boring facts and stuff. Instead of how salty they are. Ugh…sounds like work.

Crap! Let’s dox them! Gotta protect our forum.

https://www.flamewarriorsguide.com/warriorshtm/xenophobe.htm

Anonymous,

Lots is written and posted on the internet, it is difficult to evaluate every word that is written, the point is simply that evaluating someone’s background helps to determine whether they are worth paying attention to.

Of course. If pressed for time, it is a quick way to evaluate things. Of course if you have the time (and the brains and the heart) than you can actually read what they write and see the quality. Or lack thereof.

Oh…eff it. That would be too much work. Dox the evil foreign microbes. Throw dung and stones at them! We are tribal monkeys!

Why does the author name matter? I have been using Gungagalonga since the mid 1990’s, started on those old Yahoo Finance message boards. Wild trading days! Thought Gungagalonga was funny… think Caddyshack. I am also the only person on the planet with my real name. Truly. I don’t give it out lightly. How many Mike Shellmans are there on the planet? Is that his real name? Don’t know, never seen an ID posted. But he hates shale harvesters!

Regardless, the author name is meaningless… it’s the content and goal of discussing Peak Oil that matters. As long as the content is backed up and written with respect and integrity, the author’s style of name is their choice.

Remember, Mark Twain was not Mark Twain.

The point is that it’s difficult to get a comprehensive view of a commenters argument without a real name attached. Soon enough, ChatGPT will be used by people to get snapshots of their viewpoints. This is what ChatGPT says about GUNGAGALONGA:

OTOH, what ChatGPT says about Dennis Coyne:

Keeping up with the information technology is always a good idea.

I did look for scientific papers written by anyone named Reservegrowthrulz and nothing came up. Perhaps you can assist me with where I should look for these “papers” you wrote.

But yes, you’re right, the name issue is small fry. It’s more the refusal or inability to acknowledge any nuance in the oil supply situation that is the most troubling aspect. There is a juvenile level of gloating from you (and apparently from someone else writing as Anonymous who Dennis tells me is not also you). The fact is that peak oil did and did not happen when the peakers (myself humbly included) predicted in 2008. Conventional oil supply has trended downward since that time. Tight oil has filled the gap but at insane decline rates that, one could easily argue, put us in a more precarious position than before. Peak supply was six years ago but you act like the world is reaching new heights every day. People who come to this blog do so because of the intelligence of the comments that add depth and nuance to an extremely complicated situation. Braggadocio and grandstanding are your true sins. The cowardice is merely secondary.

Paul, so what the heck does that all mean about GPT Gunga? Seriously, don’t know. My 14-year-old is a badass tech kid, so he will work the problem. maybe he can tell me.

Ok Paul, now I understand. The wisdom of a 14-year-old helped me.

I don’t do any social media, work for myself and have never been published. Frankly, I’m amazed Chat GPT has enough to make any opinion of my Gunga name. But i see your point on that perspective, so fair enough.

I will continue using Gunga, but I’m more of a lurker than writer, so it’s immaterial here. Thanks again to Ovi, Dennis and the other true contributors to this effort.

RGR:

Our family owns stripper wells. It is a very small company.

I readily admit there is much I do not know about upstream oil and gas.

We are truly investors, and rely on employees tremendously. We aren’t out in the field on a daily basis.

We are very thankful for the people that do the real work for us, 24/7/365. They are out at all hours, in all weather, with nobody holding their hands. They make decisions all day, every day. They consult with us often, gather all the information they can, and help us make informed decisions on major matters. They deal with contractors, well inspectors, land owners and many others. They bargain with companies on our behalf when buying equipment, such as tubing, rods, pumping units and the like. They record data daily.

I’m not clear on your business. I assume there are people actually doing the labor for your business, and you manage it and them?

I don’t understand why you post that the people who really do the work are “limited.”

Extremely condescending in my opinion.

You say you have worked in the field, and I don’t doubt that. But I question why you devalue it?

Without the people who actually do the work in the world’s oil fields, we would not have a damn thing to discuss on this website.

In fact, without them, there would be no website. There would be no computers, cell phones or internet. Most of us wouldn’t have been born.

“In fact, without them, there would be no website. There would be no computers, cell phones or internet. Most of us wouldn’t have been born.”

Wonder about that.

Also the Pacific Electric Railway in the Pacific

So without oil, we may have had an electric revolution.

I respectfully disagree.

Shallow sand,

It is not really possible to know how an alternative history might have played out if oil production had never occurred.

I think we can all agree that history would have been different. The path that might have been taken is impossible to know, there are an infinite number of possibilities, the probability of anyone predicting that path is exactly 1 divided by infinity which is equal to zero.

I agree with Mike. Dennis, you do more work on this topic than a legion of the old peak oiler types. You have the ability to learn, you are logical, you do not appear to have the faith based angles so common on this topic, you represent what you are doing and the results in a straight forward and forthright manner, you understand that there are scenarios of various sizes and shapes involved and have a system that tries to reasonably quantify them.

Keep up the good work. Your tolerance for explaining anything to anyone, regardless of the quality of the question, appears to be infinite.

Keep up the good work.

https://www.youtube.com/watch?v=HhnmQnhXCBY

Peter Zeihan – Nigeria and the future of oil.

(Note: Zeihan thinks USA has never ending shale, but other than that he provides high quality analysis).

Zeihan is pro-American, so he thinks there is an unending quantity of oil there.

That’s typical of his wishful thinking based analysis. It’s all doom and gloom for people he doesn’t like and the best of all possible worlds for people he does like.

Ziehan thinks America is going to give up on the global experiment.

Build microchips at home and live off shale oil.

The rest of the World will have to fend for itself.

I think he is correct, with the exception of living off shale oil. The USA will start parking its Navy off the coast of South America ( specifically Venezuela )

“It’s all doom and gloom for people he doesn’t like and the best of all possible worlds for people he does like.”

Exactly; Panglossian. PZ is a story teller. He brings up interesting data points, but his analysis is flawed.

This site is my every-possible-morning coffee place to look for information of our upcoming predicament; lots of thanks and respect for Ovi and Mr. Coyne and also for Mr Shellman. Without this site it would be rather complicated to find similar data and discussions…

Has there been any news that would explain why Algeria might have started to decline more quickly? There was a post Covid shut-in recovery which went away quickly but it seems to have come off the plateau/shallow decline path it was on before. Its oil rig count started declining in 2018 but isn’t down by that many. Oil production is about half of gas in equivalent barrels so the loss of revenue would be quite significant and its had plenty of social problems in the past.

Interesting question, i wonder too. According to this link (https://www.offshore-technology.com/data-insights/oil-gas-field-profile-hassi-messaoud-conventional-oil-field-algeria/) the field of hassi messaoud is now probably in terminal decline after a long period of plateau. I don’t know how much these values can be trusted and i don’t have any knowledge about the level of oil production by field for algeria, but i guess this could probably be a part of the answer to your question “why Algeria might have started to decline more quickly”.

Have a good day george.

Hello, just dropping in to express my gratitude for the steady and great work of everybody involved in this blog (especially of course Ovi, David and Ron). Though I did comment close to nothing in the last couple of months, I’ve been eagerly reading every publication. Once again, a big thank you!

Westexasfanclub/Others above

Thanks for your kind words. Much appreciated. I try to let the numbers speak for themselves.

Also thanks for the feedback.

Thank you everyone for the kind words, without the participation from all of you and the questions, insights, and discussion offered the blog would not be worth visiting.

So we thank you for reading and commenting.

Yea, Thanks!

Westtexasfanclub,

D is for Dennis.

Hmm,

Wondering, if one had the means to retire with a 10 year margin from a BAU perspective, should one just retire, anticipating that all will pretty much go kaput within those 10 years? Asking for a friend.

It’s gonna be a steady slow decline methinks.

Peekaboo

The first time frame is 9 months.

Saudi Aramco: 6 Million Bpd of Global Oil Production Is Being Lost Every Year

Due to the natural decline in operating fields, as many as 6 million barrels per day (bpd) of global oil production is being lost every year and needs to be replaced, Al-Murshed said at the Saudi Capital Market Forum 2024 in Riyadh.

Thanks Frugal. From your link:

Global oil supply is sufficient now, but natural declines at oilfields mean that the world would need to find a Saudi Arabia every two years to offset these production drops, Saudi Aramco’s chief financial officer Ziad Al-Murshed has said.

Saudi has been screaming for about three years now that the shit is about to hit the fan. And if anybody should know, they should know. Saudi Arabia is seeing its fields decline to near the end of their lives. They are panicking. If Saudi is panicking and you are not, then there is something you just do not understand.

A global annual natural decline of 6 million barrels/day works out out to a 7.3% natural decline rate, which is in line with what Saudi Arabia has been saying about their own fields. If this production can’t be replaced, we’re already past the World peak.

Correct me if I’m wrong but aren’t the Saudis notorious for lying about their numbers? To which side depends who you ask.

Did Saudi Arabia show signs of panic when they went public with Saudi Aramco a few years ago? I consider it the final grift from the culture that invented the grift.

Assuming that’s in the context of reserves, which he is guessing which is fine. The part that gets me is “would need to find a Saudi Arabia every two years to offset these production drops” — maybe an SA in a sad state but not a pristine SA. If that was the case, the reserves would sky-rocket.

If that was the case, the reserves would sky-rocket.

I have been turning that statement over and over in my mind. Why would that be the case? If “would need to find a Saudi Arabia every two years to offset these production drops”?????

Why would the fact that we would need two Saudi Arabia’s every two years cause reserves to skyrocket? Reserves are oil in the ground. How would discovering we need so much oil to replace current consumption cause the oil in the ground to skyrocket? Nothing happening above ground can possibly cause an increase of oil in the ground. Sorry, but that conclusion just does not make any sense at all.

Ron, The statement was in the link https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-6-Million-Bpd-of-Global-Oil-Production-Is-Being-Lost-Every-Year.html, where the Saudi Aramco CFO Al-Murshed was reported to say it at the meeting. The reporter quoted it, so I went to watch the video and verified that he indeed said it. Logically, if the world found/discovered a brand-new Saudi Arabia every two years, that would much more than compensate for any depletion. That would include a Ghawar every 2 years — imagine that. These analogies have to be thought out carefully. He probably meant something else, maybe 6 million/day loss per year means the world needs the annual production of a SA every 2 years to make up the loss. That’s completely different.

Remember that reporters just report what is being said. They don’t typically try to interpret the crazy statements made. That’s up to the reader, or some pundit in an editorial to explain, or someone in a blog comments section.

I think the logic is if we need two Saudi’s every two years then this would suggest oil prices going through the roof. If oil prices rise rapidly then a large number of reserves become economically viable hence the reserve figure rises or “skyrockets”. I don’t believe this will be the case but that is the argument I am seeing when reading between the lines.

There is a reason investment in the search for new reserves is down. Most of the oil has already been found. It is slim pickings from here on out. Reserves cannot skyrocket if there is little oil to be found. True, if oil gets very expensive, then there will be some expensive to produce oil found. But not a lot. Consumption is now outpacing discoveries by about six to one.

Reserves will never skyrocket again.

Most of the Canadian companies I invest in have corporate decline rates of 25% to 35%. That is, with no new wells drilled on their lands output would fall by that amount. Sometimes a water flood or other enhanced recovery when applied can slow these rates. Rates of decline for oilsands mining operations are very low, while rates for SAGD PROJECTS are not much different than for conventional drilling. I would say an overall decline rate of only 6% to 8 % would be very low.

Paul:

I’m probably the last person Ron wants backing him up. But this isn’t even a cornie/peaker thing. I think Ron is right…the remarks are referencing “global base decline”, which means how much production drops with no drilling. There is no context of reserves, especially Saudi ones. It’s a more immediate problem.

Note that a rate is referred to (production), not an amount (reserves). And the 7% is sort of a classic estimate of global base decline (probably low since shale came on the scene, 10% global is my estimate now).

Reserves (or discoveries) can go up/down with no immediate effect on production. Yes, there is the word “find”, but you can get (“find”) more production without (or with) exploration. E.g. by development drilling. And really often it takes a long time to move true discoveries to production.

Note that the ‘a Saudi Arabia in X years’ is a common way to describe base decline. Here is Jimmy Carter in 1977:

“…we need the production of a new Texas every year, an Alaskan North Slope every 9 months, or a new Saudi Arabia every 3 years…”

https://www.presidency.ucsb.edu/documents/address-the-nation-energy

P.s. It’s very common for producers, like the Saudis to talk about the crisis in the world getting supply (as they want to talk prices up, the are also sitting on 1 MM bopd offline to try to prop price up). You see similar chatter even in the US. PXD or CLR or EOG or the like will talk about how shale growth is challenged…not them of course…but everyone else. I still remember Hamm and Papa saying the EIA was holding prices down with unrealistic US growth projections/reports in 2017. (The EIA actually underpredicted/reported growth, in retrospect.)

“…we need the production of a new Texas every year, an Alaskan North Slope every 9 months, or a new Saudi Arabia every 3 years…”

Geez. That’s exactly what I said. Jimmy Carter phrased it correctly by saying production, not “finding”. For any reserve amount, one needs to essentially replace any yearly production level with pretty much that amount for the supply to remain constant over time. That’s almost a tautology.

A self-sufficient farmer would say the same thing. They would plant the same amount of seed to replace that they consumed the previous year, thus maintaining a constant supply. Almost too obvious when explained that way.

Cool…agreed. 🙂

It is interesting though how emotive the remark “a Saudi Arabia every X years”. Sounds like it would be freaking hard. I mean where are you going to get/find/develop that?

Meanwhile we’ve done almost 50 years of base decline replacement since Carter sounded the alarm bell. Hmmm. 😉

Note also that replacing a SA of production is hella easier than replacing a SA of reserves. But the way people say it makes it a little unclear what they are talking about–dramatizes the situation.

Well…unless you think SA reserves are about to run out. They sure didn’t run out since 1977.

And Matt Simmons sounded the SA alarm bell in 2004 and yet here we are 20 years later. Hmm. 😉 Must be those secret Saudi tank farms they have to goose production and cover up how they are going to run out. 20 years of production…that would be a massive tank farm! Maybe they hide the tank farm underground. Like, um…in the formation. 😉

Reserves are more a function of price and technology than geology. And technology here is a function of price – enabling production at a given $ price.

There are literally trillions barrels of known hydrocarbons in the ground. But they are no reserves at 70$.

The whole oil thing is not a discussion of oil, but cheap oil. And nobody really needs expensive oil. It will be replaced first by propane / natgas and later other technologies fast.

(I’ve seen all taxis in Sofia/Bulgaria driving on propane 20 years ago. It have been normal cars, the conversion can be done by a mechanic in short time). I think propane was dirt cheap there at that time, and gas hard taxed.

And how much propane can be produced as a byproduct of natgas? Enough to make a dent in oil demand for sure when oil is too expensive.

Agree with your point on oil reserves/price EulenSpiegel.

However in most countries the vehicles will be EV rather than propane/nat gas powered when oil gets relatively too expensive.

Oil will be primarily valued for its uses beyond light transport.

btw- speaking of monikers I like yours-

EulenSpiegel- ‘A German folk hero of the 14th century, Till Eulenspiegel was a peasant trickster whose jokes and pranks became the source of many folk tales. The jests and practical jokes, which generally depend on a pun, are broadly farcical, often brutal, and sometimes obscene, but they have a serious theme. In the figure of Eulenspiegel, the individual gets back at society; the stupid yet cunning peasant demonstrates his superiority to the narrow, dishonest, condescending townsman, as well as to the clergy and nobility.’

Thank you.

And it’s a little bit more, his forename is mine ;).

Thinking a little differently.

Say there is around $50,000 – $250,00 Trillion worth of crude oil remaining. In current terms, $2,500 Trillion worth of oil is harvested every year. This means oil will last between 20-100 years. Median might be $125,000 Trillion over 50 years. Discoveries and growth could drive this to the high end, while minimal growth and no discovery could see a much lower time frame (10 years).

If crude oil market value is to grow from $50k T to $250k T over the next 15-20 years, that’s roughly $10k T every year. This means annual discovery/growth of at least 100 Gb is needed. Current growth is nowhere near this level.

More likely, the market will depreciate and many of the remaining supply will stay in the ground. Next 6 months is a major turning point, by 2025 there will be significant strain on the entire economic and financial systems, likely causing failure of banks, companies, and even countries. I’m sure there are signs of this already, if you know where to look. As always, there will be opportunities for those with an appetite for risk. North America will fare much better than many parts of the world (Africa, India, and China for example).

It’s no longer a question of production growth and related economic/financial growth, the story is now dominated by decay/degrowth. Many here see it, at least those who do not have $ signs for eyeballs…

Thanks to everyone here for the insight and discussion.

Interesting way of looking at it (do you mean billions rather than trillions, or is the comma a decimal?)

George, you are right, so to make it simple we can assume European decimal system 😉

As long as it’s physically possible to extract oil I imagine we will do so, economics be damned. If the industry finds itself too deep in debt we’ll likely see bailouts or even nationalization. It’s simply too important to industrial economies.

Layman,

If other sources of energy are cheaper than fossil fuel (when looking at total social and environmental costs for harvesting and utilizing a given source of energy) those other sources will gradually replace fossil fuels as an energy source. Where fossil fuels are physically used as an input to production processes (as opposed to being burned as a source of energy input) they will continue to be extracted for those uses unless alternatives are found that are cheaper.

Dennis – Not sure what sources you are referring to. But once the intermittence issues of solar and wind are factored in, they are not remotely cheaper than gas for electricity generation. You still need expensive peaker plants step in when it’s not windy or not sunny. Don’t believe food/farming has found alternate energy sources either. More importantly, oil is the lifeblood for economic expansion and creation of wealth (GDP), that’s unlikely to change anytime soon, if ever…

Wheat and potatoes are intermittent sources of food, and require storage after harvest.

Livestock can be harvested year round.

Canning of perishable fruit and vegetables is a decent form of “expensive peaker” food.

The mixed system is what we have learned to live with.

Same with energy sources up to now,

and same going forward from here.

Layman – But does the math, math? Capitalism = Oilism, without either there is no life as we currently know it…it’s back to feudalism or tribalism, for whoever is left…

Dennis

Good report as usual.

Attached is a chart that shows oil on the water and oil on land. This gives some indication of the success of the OPEC + cutbacks, especially oil on land.

I am wondering if the recent increase of 41 M barrels of oil on water has to do with sanctions the US has placed on the dark fleet moving Russian oil which now cannot find a buyer?

that’s true, but those unsold russia barrels, primarily sokol, are only reported to stock up on water about 10m barrels. moreover, the red sea disruption makes more oil on water, those tankers needs longer voyage

Nice chart Ovi and great points you and Hanzel.

Russian oil is flowing to China/India and not to Europe. Without the war, Europe would be the natural buyer (closer, less shipping cost, in some cases pipelines even). Conversely Middle East oil (“East of Suez”) normally heads to Asia more and Europe less…but has partially adjusted to supply Europe as a replacement. Both effects mean more days on the water. Possibly partially mitigated by some American crude getting squeezed out of Asia by discounted Russian crude and heading to Europe (which is less days on the water). The Red Sea disturbances explain the last little blip.

The oil on land…yes that is OPEC+ cuts. Or more simply, it’s just the backwardated price strip, over time, that OPEC+ has created. They are sort of like the Federal Reserve. Have more power to change near term price (interest rate) than long term.

https://www.cmegroup.com/markets/energy/crude-oil/west-texas-intermediate-wti-crude-oil-calendar-swap-futures.html#venue=globex

See that DEC2024 futures are $5 less than MAR2024 futures. So there are incentives to run midstream assets and downstream assets with less crude in the system. Most of volumes are determined by operations, but there is a small amount of flexibility to run a little leaner.

Opposite thing happens when the strip is in contango (incentives to store oil, as it will be worth more later). I remember–I mean I heard of this guy, since I’m not an industry guy but an Internet commenter–getting yelled at when the head of refinery wanted to play “free money” storage game…and two of my–I mean this guy I heard about’s–crude tanks were broken and unavailable for storage. Head of refinery gets very angry when there’s free money…and my (I mean this guy’s) broken gear is stopping him from making it. 🙁

Ovi – That’s a good chart, the scales make it tricky to interpret (a total of both would be useful). OOW recently hit a peak of 1.4 Gb (a change of 0.5 Gb since 2013). Meanwhile OOL peaked in 2017 at 4.6 Gb and is now around 4.0 Gb. So added together OOL/W was ~5 Gb in 2013, 5.7 in 2017, 5.4 Gb in 2019, 5.4 Gb in 2023, and presently 5.2 Gb. OOL/W appears to be at a similar level as 2014. Presumably OOL will recover and OOW will fall back to a lower level of ~1.1 Gb or so…

Reading into it a little more, it appears to be declining at a rate of 1.6%, not sure if that is tied to the global peak in 2018, or something else…

Chesapeake is one of the oldest producers for shale gas. Last year it sold off or produced all of its remaining oil and NGL so now its only reserves are in dry gas. Overall it has had negative adjustments (grey bar), which to me means it originally overstated its reserves and basically has no probable or possible categories (i.e. the reported proven reserves in annual report is the actual total URR and may still be overstated). In recent years its discoveries and extensions (blue), which really reflect FID decisions for new wells as the shale extent is pretty well delineated now, have been low or zero, and the undeveloped reserves have been trending down and on trend would hit zero in around seven years. R/P ratio is eight years. This seems to indicate a company in late life without many options except M&A, hence the Southwestern initiative. It seems likely that most companies (oil as well as gas) might be seeing similar patterns in reserve replacement even as they are managing to keep production fairly high, although Chesapeake is ahead of most and has reached lower R/P numbers earliest.

CNX is another medium sized independent shale gas producer. It almost always announces negative adjustments (note it breaks out those related to price changes, which have sometimes been positive) so its reserves are probably still overstated. Undeveloped reserves are trending towards zero within about eight years and the “discoveries” have been dropping every year recently. R/P is still around 15 years (realistically probably closer to 12) but overall this indicates a company running out of organic options.

CNX is interesting.

1. “It almost always announces negative adjustments (note it breaks out those related to price changes, which have sometimes been positive)”

1. Can you break out how much of the yearly CNX revisions have been price versus just understanding the reservoir better? That would be fascinating. I would think both could be prone to up/down revisions.

2. Intuitively, I would think of PDP adjustments (i.e. not production, divestiture, etc.) as mostly reservoir assessment changing…e.g. type curve getting revised up/down as we get more years of knowledge.

3. Intuitively, would think of PUD adjustments as more related to price. Maybe not 100% price (you could learn/confess that downspacing assumptions were too generous before, because of higher interference). But a big price component for sure. I mean if they cut rigs, it’s just less drilling planned and I think they have to have plans to drill a spot within 5 years to count it as PUD…so some spots would just move out of PUD. (Not sure if when they come back–can say “if they come back”–if that is considered a “discovery” or a PUD upward revision.

Can’t edit my posts any more. 🙁 Disregard the faulty numbering, please.

Problem with not being able to edit posts has been corrected.

Dennis, thank you.

You know just looking at the reserves totals, they’ve gone up over the years, and we’ve had a lot of production.

E.g. look at 2012 to 2023. That’s a start date after shale gas was a very prominent thing in the media. So not some massive technology leap. Also that is after their 2011 acquisition (big yellow). And then remaining acquisitions about net out with divestitures. Of course we are only seeing reserves, not “resource”.

Extracting by eye:

2012: 650 boe

2023: 1450 boe

——

change: +800 boe

So even with all the adjustment concerns, they more than doubled reserves. And, on top of that, produced a fair amount.

Of course that is an artifact of the SEC reporting that doesn’t allow you to claim “resource” (have to list it as a discovery, blue bar…unless it is PDP or very strictly defined PUD infill wells).

It definitely seems like some (not saying all) of the downward revisions are related to price, not lying/confessing. Like 2012 was a crash in gas price. 2015 and 2020 were crashes in both oil and gas. The 2021/2022 upward revisions seem like a reversal of a price-caused event. We don’t see much upswings earlier after price rebounds so perhaps it’s just lying/confessing and using the price crash as a chance to flush out the dirty laundry.

I do wonder (not asserting) if some of the blue bar volumes are recovery of lost PUD, once price/drilling plans allow. After all, most of the blue bars are not really “discoveries” in the sense of drilling Guyana. The company had the shale and eventually drilled a parent well, to allow claiming reserves. but they knew it was there, before also…just couldn’t claim it.

I read the above comments on the Dark Fleet that is moving large amounts of Russian oil. I have followed this since the term was introduced. Windward (a reliable outfit tabulating data for the insurance industry and others) now has that fleet numbering over 1,000 vessels, many of which are old, uninsured, and flagged in Gabon. As noted above, they sell mainly to China and India, but basically have no scruples, and their existence, and discounted crude, have kept Putin’s war machine going.

I’m reluctant to draw a Machiavellian diagram, but the United States administration has not been overly keen on policing the sanctions, or even the Dark Fleet–though those vessels pose a threat to conventional maritime traffic. Why not? Well, when up to ten-percent of global oil is heavily discounted, it weighs on the world price for crude.

There is no good way–even using Lloyd’s List or Windward–to know for sure how much “sanctioned” oil has made its way into China and India and many other countries, but it is presumed to be vast. This administration (as is the case with any administration: Clinton, Geo W, Obama, Trump) wants a low price for plentiful crude oil. Ignoring a growing problem with the Dark Fleet transporting discounted oil is one way to get it.

Yeah, administration backed off of some Iran/Vz sanctions enforcement also, when they sanctioned Russia, for the same reasons.

Even the construction of the sanctions (“price cap” rather than a don’t produce) shows that they just want to hurt the price Russia gets, not truly deprive the market of the several million bopd that Russia exports.

I think the whole shadow fleet thing isn’t even really about Russia getting to sell its oil at all. It’s about them getting more than the $60 or whatever amount they are supposedly capped at. They are still getting less than they would if there were no war…since there’s a lot of cost involved with longer shipping, smaller ships, transfers, discounts, bribe, etc.

In reply to Anons comment from 2/22 – 12:31 PM (posts are acting up for some reason)

Wishful thinking Anon! (see below, recycled from a comment I made 7/31/2023):

World reserves (1P and 2P) have been shrinking ~5% annually for at least past ~10 years.

>>>>>>>1P in 2016 was 381 Gb, 2023 it’s 285 Gb. Projected to 2030, 1P will be only ~190, assuming consumption of ~210 Gb and discovery/growth of 115 Gb, if not, then 2030 could see 1P below 100 Gb…

>>>>>>>2P, 2016 was 655 Gb, now it’s 505 Gb. A reduction that is nearly equivalent to production over that period.

If trend continues and production falls at 1% annually, total URR = ~2,000 Gb, see below:

image:

What a mess. At least Dennis and Ron are logical. You are a train wreck.

1. Where the heck are you getting these numbers from? Link?

2. Also, I get that you are projecting from 2023 into the future, but what the heck are you doing in between 2016 and 2023? Are these real historical data for 2017-2022? Looks way too “pretty” to be real data. Did you just go and “project the past”? Aiyiyi! 🙁

You sir are deaf!

Here’s additional data, 1P is running short:

Proven (1P)

2008 – 750 Gb

2016 – 500 Gb

2024 – 250 Gb

Future

2032 – 0 Gb 1P reserves

(This assumes essentially no discoveries or growth between now and 2032).

Let’s see the growth and discoveries come to the rescue, please

I can’t believe that perfect 750/500/250 every 8 years is actual data. I’m not sure you understand what data is.

2000 (USGS) – 959 Gb (Produced = 810 Gb)

2008 – 750 Gb (P. = 1,050 Gb)

2016 (Rystad) – 505 Gb (P. = 1,260 Gb)

2024 (2023 Rystad -30 Gb) – 250 Gb (P. = 1,500 Gb)

URR = 1,769 Gb (2000), 1,800 Gb (2008), 1,765 Gb (2016), 1,750 Gb (2024)

Probability >90%

For 2P (P50), URR might be as high as 2,000 Gb.

If you believe Dennis then there is another 1,000 plus of undiscovered plus reserve growth, I’m not so sure about that…

Sigh…what a mess. No links. Different sources mixed into a time series. And calculated values labeled as data.

Enjoy that 750/500/250. Really funny how the “historical data” was so perfect!

505 Gb and output about 30 Gb per year would be roughly 17 years of output if there is constant output and no reserve growth. If we assume output decreases by 2% per year, then 20 years of output assuming no reserve growth. Historically 2P reserves have grown so this is unlikely to be a good assumption. A better measure is to look at 2PC resources which includes the engineering best estimate of contingent resources, often these 2C contingent resources become reserves over time. The 2PC estimate is about 1200 Gb or so, which at 30 Gb per year lasts about 40 years with no new discoveries or reserve growth. If we also include the 2% output decline assumption these 2PC resources would last about 79 years or to 2102.

My guess is that output falls faster than this after 2035 due to lack of demand (less land transport demand for crude oil) so the resource would in fact last longer than proposed in this oversimplified model.

Literally just gave you actuals from 2016 to present Dennis, show me the growing 1P and 2P reserves, please

Kengeo,

1P is not relevant, 2P by itself leaves out contingent resources (2C being the engineering best guess).

Contingent resources have been discovered and evaluated, but are waiting on something (the contingency) to be able to be booked as reserves such as and FID on a deep sea platform or some other type of infrastructure.

This is why 2PC resources are a better metric than 2P reserves.

Let’s take your 2016 2P reserves of 655 Gb and the 2022 estimate of 505 Gb. The difference is 150 Gb over a 6 year period or 150/6=25 Gb/year. Over that 6 year period there was about 175 Gb of C plus C produced in the World, so if there had been no reserve growth or new discoveries we would expect World 2P reserves would be 655 minus 175 equals 480 Gb, but in fact we see that 2P reserves grew by 25 Gb so that 2P reserves at the end of 2022 were 505 Gb. The fact remains that there are about 740 Gb of contingent resources (2C estimate) which you do not account for, this will result in a large underestimate in your scenarios, if demand declines due to a fast transition away from oil for land transport we might see World C plus C URR as low as 2500 Gb, but 2700 to 2800 Gb remains my best guess. A URR of 2000 Gb for World C plus C is highly unlikely (less than a 1% probability in my view).

By nature isn’t it 50% likely? How could you possibly say that something with a P50 has a less than 1% likelihood, that math doesn’t math. There’s also a chance that P90 of 1P reserves is in reality closer to P80 or P70, will be interesting to see if the 5% rule holds…implies URR of ~2,100 Gb, decline rate of 4% or so. Demand is irrelevant, supply is already constrained and will only get more so (we are in fact approaching 6 years post peak)…

Ken Geo,

Let’s say 2018 remains the peak, cumulative output was 1357 Gb at the end of 2018, so if we are going to assert that 2018 is the final peak (this might not be the case) it would imply a URR of 2 times 1357 Gb or a bit over 2700 Gb. Or the peak may be in 2025 when cumulative output may be about 1560 Gb implying a URR of about 3100 Gb.

You continue to ignore contingent resources, which get added to 2P reserves over time as resources are developed, 2PC reserves are given by Rystad for a reason, it is because this is probably the best estimate of remaining resources (though discoveries and reserve growth may make the 2PCX estimate the best estimate for remaining resources.)

Dennis:

Thanks for trying to reason with your peak oil brother. But…some men…you just can’t reach them. 😉

https://www.youtube.com/watch?v=_WUyZXhLHMk

Beyond 1P reserves (250 Gb) only lies speculation…you’ve convinced yourself that there is somewhere around 1,000 Gb of oil that will somehow materialize in the next ~10 years (ie 2PC which will move to 2P, then to 1P). As I pointed out, both 1P and 2P are shrinking (not growing). In simplest terms, 1P was estimated at 959 Gb in 2000. Current 1P estimate is only 250 Gb. In ~23 years since 2000 there has been production of around 700 Gb or so. 2P is only ~ 200 Gb more than 1P. So the best estimate P50 is 1500 Gb produced plus another ~450 Gb. This amounts to a URR of 1,950 Gb.

It appears you think this trend either doesn’t exist, or will turnaround at some point…

Relatively high oil prices have been in play for almost 20 years, I really want to believe in fairytales, I just don’t know how to.

Together, 2022 plus 2023 discoveries were only around 10 Gb, so going forward it looks like we can replace 1 year of production every decade or so…

Dennis – Does it really matter what URR is used, seems like maybe not?

Using 5% rule, this would imply there is less than 600 Gb remaining.

2024 – 576

2026 – 522 (72 mb/d)

2028 – 471 (65 mb/d)

2030 – 422 (60 mb/d) (URR = ~2,100 Gb)

Reality will likely be a URR somewhere between 1,900 Gb and 2,000 Gb (Call it P60).

1. So how come world R/P has kept constant or increased, event though production happened?

https://en.wikipedia.org/wiki/Reserves-to-production_ratio#/media/File:Ratio_World_Proved_Oil_Reserves_-_Production_1980-2011.png

Oh yeah…you don’t believe the R numbers, when they go bad for you. 😉

2. How come the US (a tired old petroleum province) has had increases in reserves since 2010? And that is using SEC reserves (very restrictive).

https://www.eia.gov/naturalgas/crudeoilreserves/images/figure_1.png

Oh yeah….that’s the darned shale….that peak oilers have fought tooth and nail, year by year, constantly saying it was overestimated…and repeatedly getting spanked by the growth. Oh…but nobody could see it coming. Roi…ght! 🙂

Nony,

Below is a model for the Permian I did in Jan 2019, based on the mean TRR USGS estimate and using average capital and LOE costs at that time, the average Permian EUR at that time and the AEO 2018 reference oil price scenario to estimate economically recoverable resources (ERR). This was a lucky guess, note that data after October 2018 has been filled in. The model assumed incorrectly that average new well EUR would start to decrease in 2020, this is correct on a normalized lateral length basis. The number of completed wells is too high, but adjusting for lateral length may be about right.

Way to go man.

But I’m still annoyed that your ball was in the shop in 2020…or did you forget to do your laundry before New Year’s Day? It wasn’t just the oil that you messed up. 😉

Still remember flying out in summer of 2020 to a Middle East site (not an upstream project). And it was a jumbo jet for a national airline, which had cut flights to 2/week. And there were 7 of us in a 60-person business class section. 0 in economy. (No first section.) Think about the carbon footprint. Almost as bad as DiCaprio. 😉 What a crazy year!

Not to pick at a scab…but taking another look at Saputra/Kirati/Hughes/Patzek:

1. I don’t seem to be able to find the per well EUR for each type curve (for each of the 16 cohorts). Maybe it is in there and missing it…but just not finding a nice table. There’s tables for all the mysterious Greek letter parameters but not for that.

2. Figure 10 shows how “physical scaling” affects the EURs. It makes them low, but very slightly (maybe 5%). Hard to tell exactly, judging by eye. The physical scaling is the red lines in the graphs. It does affect the core more (no limitation at all seen in the fringe). But still, pretty small. [This is not a negative point…just something I figure out, now.]

3. Table 4 shows the EUR lifetime cutoffs for the paper. They seem very conservative. 14 years in SW core. 16 years in the NE core.

There’s a section of the paper (numbered page 28, pdf page 14) where he discusses how he comes up with that EUR EOL. There’s some handwaving about parabolic models and yearly attrition. But the bottom line is we don’t know how long the wells will be around…and he had very limited attrition to date to help him make a prediction.

Also, the numbers don’t even make sense. Even at that time. Even the history! I went and pulled the Novi Labs blog post

https://novilabs.com/blog/pennsylvania-update-through-march-2023/ (well status tab)

And even at the time of his paper, his % wells already attrited (the “colored stairsteps”) is much more than what the actual data shows. Not even the parabolic extension model, but results to date, at that time! Plugged wells are a tiny percentage. Even if you throw in inactive wells (and you shouldn’t), his numbers are still much too high. I think this is just a blatant mistake.

Also, we are a few years later and can look at say 2011 wells and how they are doing. At the end of 2022 (i.e. 11-12 years of production for the generation), there are 1005 wells and only 20 are plugged. I.e. only 2% are plugged. (4% are inactive.)

If you assume Saputra end of life is valid, along with his model of yearly attrition, we should have way more than that gone by then. After all, his average EOL is something like 15 years for the play.

So by JUL2026, we need to have at least 50% of the 2011 wells dead! There is ZERO discussion of this massive amount of P&Aing happening. Gonna need to get on their skates if they are going to hit the P&A prediction.

Bullet man, why do some P get the bullets and others don’t, it’s a unique style for sure…let me try

1.here I will pontificate profusely.

2. here as well, but slightly less so.

Rant

Rave

Rant, some more

Final rave…

You are onto something!

Anonymous,

The data shows terminal decline of about 10%. Many inactive wells are producing too little to justify necessary downhole repairs and plugging the well is expensive so many operators leave the well in an inactive state as long as they are allowed. If we look at average 2020 Pennsylvannia Marcellus wells using a hyperbolic (Arps) fit with 10% exponential terminal decline, the difference between 15 year well life and 30 year well life is about a 10% increase in EUR, if we extend to 50 years compared with 15 years the difference is 12%. So for the Saputra et al analysis this would add 180 times 0.12 or about 21 TCF to the ERR estimate so roughly 201 TCF. If we exclude the non-core areas due to assumed low natural gas prices we get 140 times 1.12=157 TCF.

What real oil men in the field tell me is that low volume wells that need expensive downhole repairs are often left inactive because it does not make economic sense to do the repair. A high percentage of older wells (more than 15 years old) will eventually become inactive for this reason. As only 10% of 2010 wells are no longer active after 13 years, the 15 year end of life estimate does seem low, but the 50 year estimate by Boswell seems high, 25 to 30 years seems more reasonable. Even using a 50 year end of life, it is unlikely that Marcellus output will be more than 225 TCF, when we account for likely future decline in productivity as sweet spots run out of room for more wells. Tighter spacing could lead to higher output, but is unlikely to be economic unless natural gas prices double.

The F5 estimate by the USGS for Marcellus is about 300 TCF, this seems like a reasonable upper bound under the assumption of very high natural gas prices. Note that the AEO 2023 reference case projects falling natural gas prices from 2023 to 2028 with a gradual return to 2023 prices by 2040. If this reference scenario is accurate, it seems unlikely that the Marcellus will reach more than 200 TCF for its URR.

A. The USGS has a long (long, longitty, long-long) history of being too conservative. What makes you think they ahve learned? They sure don’t write fulsome discussions. Saputra (for all its flaws) is far superior there.

B. Sure…who wants to P&A. But somehow those “broken wells” are not so broken they have to be secured. Talk to the stripper well operators about how a well can still produce for a long time…

C. Even if you count inactive wells (and you shouldn’t…there’s a clear pattern of them “moving back into the green, producing”, not moving to inactive…and also inactive wells are a NORMAL aspect of infill drilling…DUH!), the Saputra numbers are STILL wrong. Look at his figure with the colored stairsteps and the ShaleProfile data. It’s just too high…even WITH inactive. (And why did it not surprise me you want to include those!)

D. How much chitchat with real operators, industry people do you really have? Do not overvalue the very tiny (and somewhat biased) subset of operators that comment here. There is a bigger universe out there. For that matter, having seen an AFE or supervised a rod change-out, does not make someone an expert on future production. I actually have more hope for USGS/you/EIA/Boswell/Patzek/Rystad than some random small time commenter. Doesn’t mean you can’t learn things from them…but be eclectic…don’t take their opining on larger issues as Gospel.

P.s. Thanks for the comment about the 15 year life time. Getting way too close for that to be disproven! 😉 One more negative peaker projection about to get pimp-slapped by reality. 😉 But…who could see it coming? Roi…ght.

The Saputra paper gives this description for their figure 11,

“Figure 11. Probability of survival for (A) the northeast core area and (B) the southwest core area. The colored stairstep lines represent well survival probabilities for different completionyears. For instance, in the northeast core area, only 75% of wells completed in 2009 survived after 11 yr. The newer wells survive less longer, so that the average survival probability is only 52%. Finally, from a parabolic extrapolation, we obtain the maximum time of well survival of 14 yr.”

The major difference between Marcellus and Haynesville is the lifetime. You could find from NOVI that Haynesville already have more abandoned/inactive wells than Marcellus while the total number of wells are ~12(M):8(H).

The hype that made the shale revolution bubble 20 years ago was based on the Marcellus shale gas type curve that accumulated on ~100 year old shale gas wells completed with old technology, i.e. no fracing. The type curve gives very small decline <3% over very long lifetime, i.e 50 years.

This slow decline feature is not universal for shale gas, and even so far nonexist for shale oil. But, Marcellus and Barnett have such slow decline, although not 3%, but certainly 10% or less, therefore much longer lifetime, the first Barnett shale well refraced with water in 1997 still producing till 2020, and made almost 0.6BCF.

Interesting old Enno post on Permian well quality dropping.

https://novilabs.com/blog/permian-update-through-july-2023/#comment-8409

A. I’m not sure that the drop is systemic, e.g. exhaustion of good spots, though. (Not that he asserts this. But it’s a logical concern.) For one thing the graph seems to show normalized well quality high during low price regimes (2016 and 2020) and lower during high price regimes. Looks like high/low grading since 2016. Well count (line thickness) seems to back that up also.

B. Also don’t think normalized well quality is right metric when thinking about rigs versus production over time. Because lateral length is increasing, rigs are becoming more efficient (less moves/1000 ft). Anyhow, if you are going to look at wells versus basin production, why look at normalized well quality at all…you just have to multiply out the normalization anyhow and “unnormalize” to look at basin production. Not saying it’s not an interesting metric on its own (to see how the land gets chewed up)…but he seems to mention it right after talking about rigs versus production prediction.

P.s. Proud of him for what he has done. Very cool.

One of the OFS CEO’s had a very simple and lucid comment recently: all that matters is how much sand you blast-in in a basin. # of wells, feet, etc. is all irrelevant. Production follows strictly the tons of sand blasted-in, and if you want to make any judgement on geological quality or depletion, all you need is oil produced per ton of sand.

Kdimitrov,

I would like to know the original link for the statement above you mentioned about “all you need is oil produced per ton of sand”

you know the landmark 1997 SPE paper, setting the prelude for shale revolution has a title ““Proppant, we don’t need no Stinkin’ Proppant”. One of the leading author was SPE president.

then 1998 SPE paper, Mitchel Energy completion engineer Nick Steinsberg co-authored another paper announcing the success of slick water fracing in shale, and title is “Proppant? we still don’t need no proppant”.

here is the story I wrote several years ago,

https://www.linkedin.com/pulse/shale-revolution-arent-when-you-judge-conventional-wisdom-sheng-wu/?trackingId=KWAuMCY2Qhq5qeWkZXjXfQ%3D%3D

Sheng,

I’m sorry, I cannot recall which call this was from. may come to me sometime later…

However, the point was entirely about frac intensity, it had nothing to do with water/sand ratios or proprietary recipes. He was just saying the more we blast the more oil we get. Propant was just used as a measure of how much they frac.

On another note, I am not going to stand here and tolerate your bigoted disparagement of the fine letter K!!! We gonna have problems!!!

🙂

This is not true at all. We had a consortium of 5 large Independents conduct a fiber optic study on frac rates (barrels per minute) sand loading pounds per foot and we came up with more efficiency at 90-95 barrels per minute and 3000 pounds per per foot. More is not necessarily better. Sorry

good to hear your fiber optic results!

The finding of “more efficiency at 90-95 bpm and 3000 ppf” without mentioning fluid loading or type, is certainly not in contraversy to the revolution — where the revolution emphasize is more fluid loading with less proppant fluid ratio (ppg). For example, the completion from 2014 to 2016 change in major basins see a huge jump productivity, especially IP, while all just first emphasize the proppant size increase, but less mentioning change from expensive gel to slickwater (which means ppg dropped significantly), and proppant changed from expensive ceramic to high strength sand (now adays even wet local sand).

beside Pioneer in Midland, the other major suffered decline in IP productivity is Chevron, concentrating more in Delaware basin.

The fear is not running out of good spots, but over-drilling already destroyed optimum recovery, leaving more oil behind.

Tighter spacing leads to worse average well quality, but drives higher EUR/area. At an extreme, too tight spacing will be negative NPV. Yes, there are diminishing returns. But the too tight spacing is not leaving more oil behind. The opposite, more is extracted. Just, at an extreme, not enough to compensate for the (almost linear) cost of the marginal wells. This is both theoretically true and shown in spacing tests.

The key is to determine max NPV per square mile. Not best wells (which would imply 100% parent wells). Not max oil (which would imply as close as technically feasible). But max NPV. You look at the marginal well and how much extra revenue it provides, versus the almost linear cost (at least of child wells).

The added revenue of a marginal well is non-linear–each one gives you less added, because yes there is competition and cannibalization…but always still positive…you are cracking more rock. Once that added revenue is less than the cost, you stop downspacing. But there’s never a point where more drilling leads to less oil per square mile. You crack the rock more and you get more out. I winced at the “sand is all that matters” comment, but it is closer to truth than the idea that overdrilling leaves oil behind.

Overdrilling doesn’t give lower total extraction…it just gives uneconomic additional extraction. Of course this means that an optimal spacing pattern is a function of oil price and well costs. If the oil price goes up, or the well cost goes down (for same size drill/completion), then tighter spacing is justified. And visa versa. It’s like something out of a calculus textbook.

Anonymous, with respect, you omitted the most important collateral damage from overly tight spacing: the very thing we’re experiencing now. These LTO wells are all solution gas driven, which naturally means that there is a great amount of NG dissolved in the oil. So much, in fact, that when prices were good, it used to make up 25% of money proceeds from the well.

Since the natural decline of a shale oil well eventually leads to a fall in reservoir pressure until the bubble point is reached, these wells go through a very gassy phase. If enough of them reach bubble point at one time, the price will plummet. Closer spacing accentuates this morbid process, making many of these wells marginally profitable.

This is nothing out of a calculus textbook; this is straight from Boyles’ Law. And when much of this tight spacing was drawn out, the CEO of one of the biggest shale companies in the Permian declared that it didn’t apply. A glut of NG (along with water and venting/flaring issues) has dramatically reduced the returns on new wells. At giveaway NG prices, twelve-million-dollar wells with unimpressive EURs don’t pencil out.

It is not a simple Boyle’s law situation (fixed volume, PV=nRT). Shales are very impermeable. They are not sandstone. That is why you have to frack them in the first place. Doing more laterals, as with doing bigger fracks, exposes more reservoir. Pockets of rock that would never have produced at all. That had no path to the well.

However, there is definitely competition as well. As spacing increases the added marginal volume accessed goes up in diminishing amounts. But it is never negative.

How fast you draw down the reservoir is really a separable issue from how much you frack it (by downspacing). I’m not an expert on “bubble point death” (which sounds scary as heck…but what is it really…and it is being pushed by some guy on LinkedIn posts…not strong academic papers with lots of data, controls and clear explanations).

Getting a lower price for gas hurts marginal wells or gassier wells. But many Permian and Bakken wells are economic even with flaring the gas. The regulators just won’t allow it (much).

Also, low gas prices are not permanent. The strip for HH shows prices above $3 next winter. You can even hedge it in, if you’re worried about not getting it. Yeah, maybe we have another warm winter and natty prices suck next winter also. But you could also have a cold winter and prices outperform. $3+ is the market middle expectation.

If I spud a well now (I mean if a salty oil man does, I’m just a commenter), it won’t be put onto production until AUG or later. And lots of the wells drilled this summer won’t come on line until the winter.

Yeah…I wish there were more rigs turning. Let’s go, Brandon. 😉 But the reason there are not zero rigs is because operators understand these basic points (oil is way more important than gas…and even gas prices won’t stay below $2 forever).

Nony,

For current oil and natural gas prices the cumulative net revenue for a 2021 Permian well (note that productivity for 2022 and 2023 wells is actually lower) would be about 16.8 million over the 15 year life of the well (it starts losing money after month 179 so I assume it is shut in at that point.) The full capital cost of the well is about 13 million so a net profit of 3.8 million on 13 million invested over 15 years. The average annual rate of return is about 1.7% per year, not a very attractive investment.

I imagine you realize that strip prices are often not realized and that their are costs to hedging, so claiming that future strip prices are higher and that a company can hedge are not enough to make this work by itself. Prices may rise in the future, they might also fall, the future is not known.

Boyles law is relatively applicable, the volume increases as incompressible fluid (oil) is removed from the rock and the pressure in the rock decreases in the volume where the oil has been removed. At some point (the bubble point) pressure becomes low enough that the gas dissolved in the oil is released and we see higher volumes of gas produced with the oil and the volume of oil produced falls. In areas where wells are tightly spaced (core areas) we may see a generalized loss of pressure in that volume of rock such that any new wells drilled (so called child wells) will be less productive due to the overall lower pressure. This is the reason we see average normalized productivity falling in the core areas of the Permian Basin.

Dennis:

If the volume were fixed-Boyle’s law, PV=nRT, V fixed and n(subzero) fixed–then I could produce an entire shale formation with a single well. I wouldn’t even need to frack it. Clearly this is not true. There needs to be a path for hydrocarbons to move to the lateral. This is not a pool, not a porous sponge, not a pressure vessel, not a tank. Yes, there is an ASPECT of Boyle’s law. And this is part of why results are diminishing as you space tighter (the amount of new resource versus competition for the same resource drops). But…no…you won’t get the same ultimate TRR from a section with one lateral as you get with six. Parts of the rock will keep their secrets forever, if you go down that road.

Dennis:

Yes, there is a cost to hedging. Personally I’m against it. Like exposure to risk. Think it motivates the management team. Think the investor wants it actually.

All that said, even with a cost of hedging, you can still lock in higher prices than the prompt. Let’s say DEC2024 is $3.37 (is as I type this). And it costs you ten cents to hedge. That means you can lock in $3.27. I have no idea the cost to hedge. (Just a basement dweller who reads the Internet…not an “earl guy”.) But even if it’s a quarter or whatever…clearly you can lock in higher than the $1.67 at the prompt.

So the “nobody looks at strip–makes decisions off the prompt” is a non-starter. Either you just take the risk and use the casino odds (strip) or you lock in the prices (at a cost, sure). But there’s NO WAY that your decision should be based on the prompt.

A PROVOCATION: Let’s say the prompt was $6 and the strip showed reversion to $3 several months from now. (This is not unrealistic, in the event of a cold winter.) In that case, would you advocate for doing projects that required $6? Hmm? 😉

Dennis:

1. I’m proud of you for doing a little financial model/estimate. Seriously. Not patronizing. Good work-way to start to get your arms wrapped around things.

2. Of course 1.7% return is not adequate. That doesn’t even match Brandon-flation! 😉 We can argue about what the WACC should be. But for a simple picture, assume I need 10%. Really, I want more…but also, setting it impossibly high just leads the management to lie harder. I might know how to help them lie…oh wait, I am a basement dweller…let’s say I read about that effect. 😉

3. But…have a little humility. You don’t exactly know capital or operating costs or future production or end of life. It could even be worse! Like did you include P&A at the end? Granted it is discounted over 15 years, but still, part of the project. I’m totally in favor of you making best estimate you can…point (1), but just keep humility.

4. I also wonder a little bit about the structure of your model. Did you include gas? What prices did you use (prompt or strip)? Did you consider that the revenue actually is somewhat front loaded (because of shale decline)? There are also aspects of “option value” that play into some final decisions. E.g. HBP. [The classic MBA case study example is Hollywood blockbusters where option to do a sequel actually justifies negative NPV on first film.]

5. Have you ever made a project NPV model in a corporate setting? Not just supplied inputs or looked at what the bizdev guy was doing, but done it yourself, from start to finish? Not meant to say you can’t comment…I am just a basement dweller also, hypothetically. 😉 Just watch out for Dunning Kruger. A man needs to know his limitations.

https://www.youtube.com/watch?v=uki4lrLzRaU

6. In any case, you can see how rigs go up/down with price. They are certainly not completely irrational. Perhaps they just get a different answer than you do. But they are not government programs divorced from economics.

Nony,