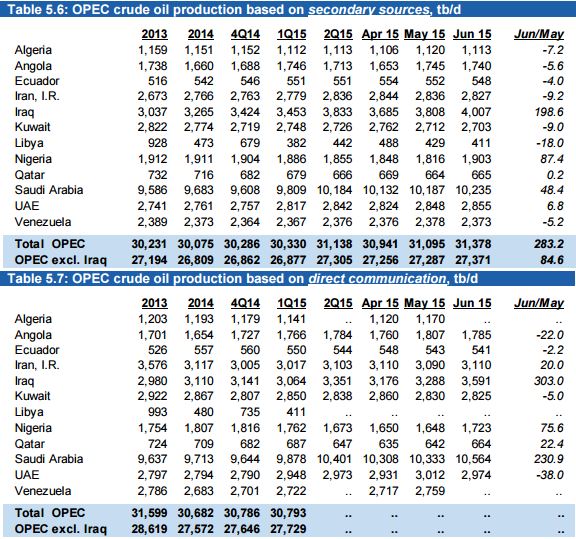

The July OPEC Monthly Oil Market Report is out with all OPEC Crude Only production data for June 2015.

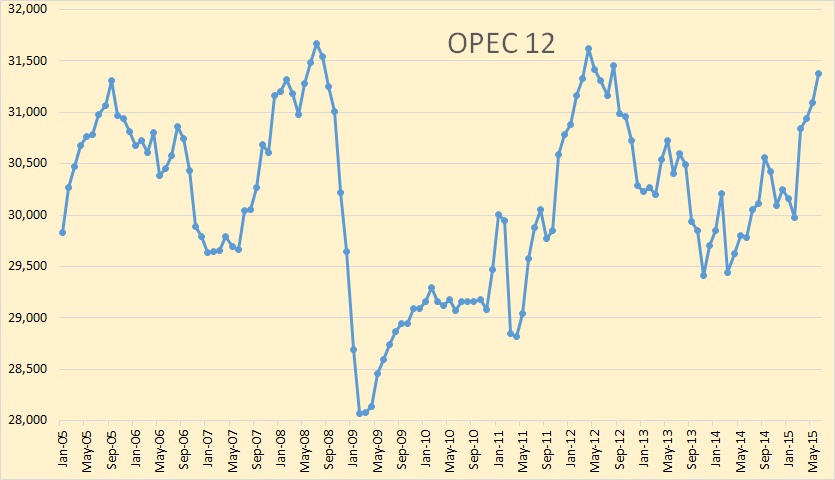

Crude Only production for the entire OPEC 12 as up 283,000 barrels per day in June to 31,378,000 bpd. But that was after May production had been revised up by 120,000 bpd. So counting May’s revisions and June’s numbers, OPEC production was up 403,000 bpd from what was originally reported last month.

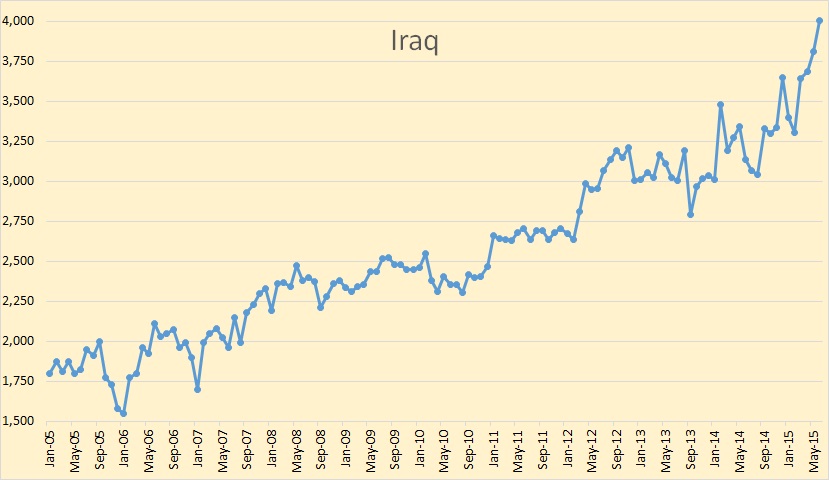

The biggest gainer, by far, was Iraq, up 198,600 barrels per day over May to 4,007,000 bpd. It is interesting to note that Iraq via “Direct Communication” say they only produced 3,591,000 bpd in June, 416,000 bpd less than what “Secondary Sources” said they produced.

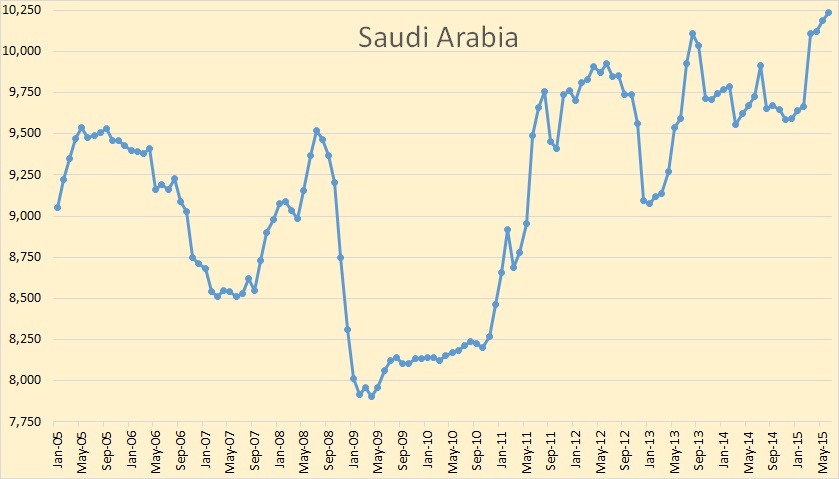

Saudi Arabia was up 48,400 bpd in June to 10,235,000 bpd. That is just over one half million barrels per day above their 2014 average.

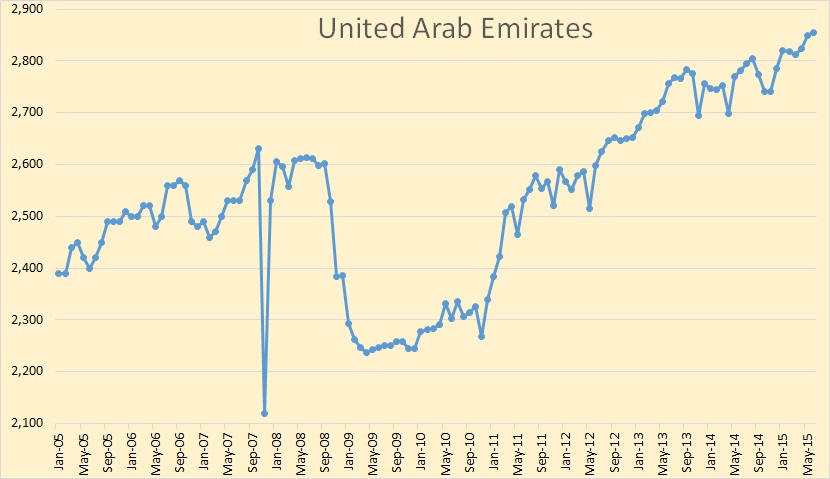

The United Arab Emirates barely increased production in June, up 6,800 bpd to 2,855,000 bpd.

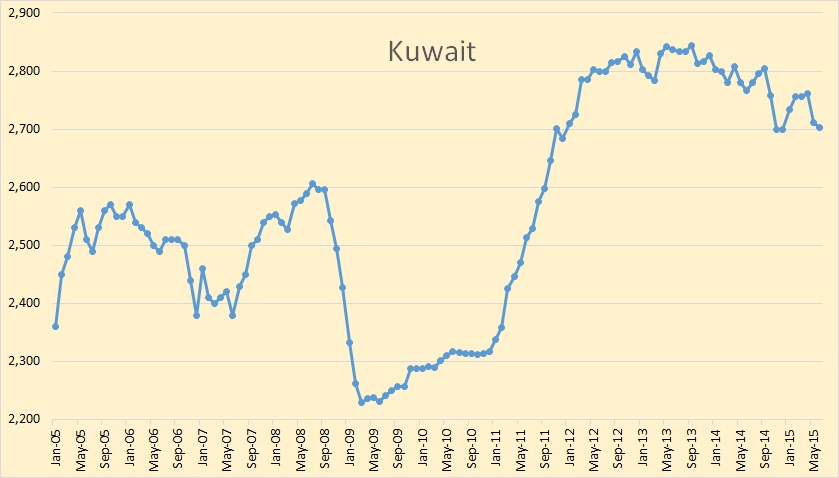

Kuwait was the only one of the big four to decline in June. They were down 9,000 bpd from May to 2,703,000 bpd and down 41,000 bpd from their peak September of 2013.

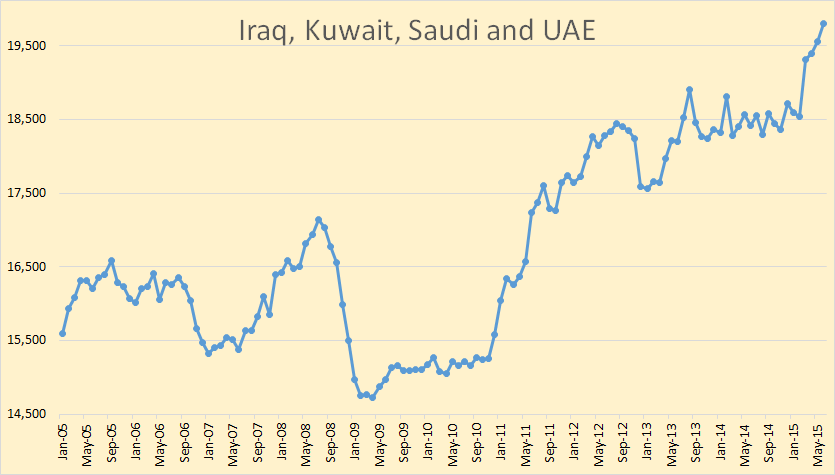

I call Iraq, Kuwait, the UAE and Saudi the big four because since the first half of 2008 they have been responsible for keeping OPEC production almost flat since 2008. The first half of 2008 these four countries averaged 16,626,000 barrels per day. For the first half of 2015 they averaged 19,201,000 bpd for an increase of 2,575,000 bpd.

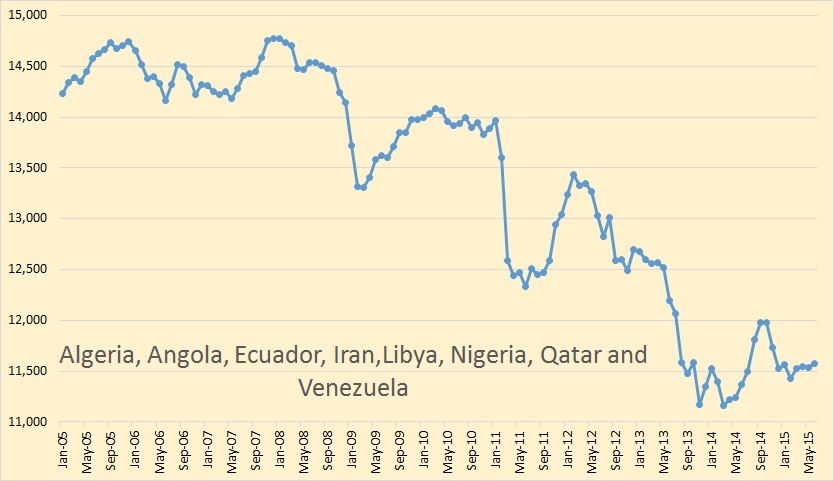

The other eight also rans have been in a steady decline since 2008. In the first half of 2008 these eight countries averaged 14,615,000 bpd. In the first half of 2015 they averaged 11,531,000 bpd for a decline of 3,083,000 bpd.

All OPEC nations, during the first half of 2008, averaged 31,240,000 during the first half of 2008. During the first half of 2015 all OPEC nations averaged 30,732,000 bpd for a decline, so far, of 508,000 bpd. But OPEC production dropped significantly after July 2008 and ended the year averaging 31,066,000 bpd. Their high, since 2000, was 2012 when they averaged 31,143,000 bpd. I think it highly unlikely they will reach that average this year.

Here are the data for OPEC as reported in their Monthly Oil Market Report.

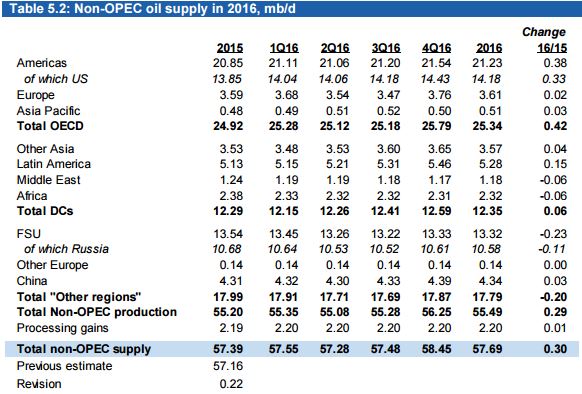

Just one other item of note. OPEC expects Non-OPEC total liquids to increase by just 300,000 bpd in 2016. They expect the US to be up 380,000 bpd.

The page OPEC Charts has been updated with the June data for all 12 OPEC nations.

The below link was sent to me by Joel Kopel and I am extremely thankful to him for the effort. It is a 1 hour 27 minute video lecture by Mr. Vladimire Milov, founder and president of Russia’s Institute of Energy Policy. The lecture lasts 40 minutes and the rest is a question and answer period. I found that part even more interesting than the lecture.

I think this is the most rewarding video I have watched in many months. It is a real eye opener about the workings of Russia’s oil and gas energy policy. Some parts were a real surprise, even a little shocking for me. And for what it’s worth, Mr. Milov says 2015 will be the year Russian oil production begins to decline.

Russia’s Energy Market: Under Sanctions and Confronting a Low Price Environment

Mr. Vladimir Milov, Founder and President, Institute of Energy Policy

The Center on Global Energy Policy and the New York Energy Forum hosted a presentation and discussion with Mr. Vladimir Milov, founder and president of the Institute of Energy Policy. Mr. Milov has served in Russia as Deputy Minister of Energy (2002), adviser to the Minister of Energy (2001-2002), and head of department at the Federal Energy Commission (1999-2001). Since leaving the Russian Government in 2002, Mr. Milov has become active in Russian politics, serving as Chairman of the Democratic Choice opposition party.

The lecture was taped in January 2015. Mr. Milov mentions that Russia hopes that the sanctions would be lifted in July of this year. They were not: Russia and “Crimea & Sevastopol” sanctions renewed and Russia slams EU sanctions renewal as pointless ‘blackmail’.

If you are at all interested in Russian oil and gas production, or even peak oil in general, you should definitely watch this video. (The podcast is just an audio of the same lecture.) I would like to get some input from some of the Russian experts here. I imagine opinions will vary. But I loved it and saw no reason to question any of Mr. Milov’s opinions.

__________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

442 responses to “OPEC Production Still Increasing”

So is increasing OPEC production a precursor to another year of low oil prices?

So to summarize: Bakken up, Texas up, OPEC ‘big four’ up. Growth-oriented producers are doubling down across the board, into the teeth of negative fundamentals and an associated poor pricing environment. The only significant demand driver is China, which is furiously trying to prop up what is universally recognized as an asset bubble. Wow.

It is almost as if producers are trying to catch that wave while it lasts. But OPEC will catch it better than LTO producers, because OPEC is closer to China than we are. I think it’s really that simple.

What kind of reckoning are we in for when China well and truly comes off? China was actually sort of the starting gun for the 2008 implosion when their flood of Olympics-driven buying came to an end. Are we ready for global financial crisis 2.0?

EDIT — On Texas, I was referring back to the yoy increase that was widely reported last week, and which Ron covered with well-considered qualifications. Not an actual increase, and so my comments above are less pertinent. I remain surprised at the resiliency of global production.

Steve in CO says: “The only significant demand driver is China”

The most significant, but not the only driver

Annual change in oil demand by region (mb/d)

Source: OPEC MOMR July 2015

AlexS —

Excellent point which adds nuance to my ‘instant reaction’. US producers can be seen to double down against US demand, while OPEC doubles down against China demand.

US scaled back economic stimulus last year, and it has achieved a modicum of steady growth domestically. But if China’s QE implodes, it looks like they will need to, in effect, hand the baton back to the US to sustain the global economy. The US presumably would prefer not to go back to the stimulus well, but the first to benefit would be LTO producers, ironically.

Steve in CO, if one looks at real GDP per capita for 65-70% of the world economy, the rate decelerated below the historical “stall speed” not coincidentally after the point that the price of oil peaked and commenced the crash to date.

China’s “alleged” ~6% real growth per capita has contributed 45-75% to incremental global growth since 2008-09, but China’s growth is decelerating (I submit that growth is no faster than 2-3% and well below 1% potential real GDP per capita), whereas US growth is not poised for “escape velocity” but rather trending at ~1% real per capita and ~0% real per capita since 2007-08.

That is to say, world real GDP per capita is at a permanent post-2007 structural trend rate of less than 1% and eventually 0% to negative for the post-Oil Age epoch hereafter.

Most of us are still missing the reality of the global situation in terms of the decelerating per-capita rate of change of growth of real GDP and oil production and consumption.

The net liquid fossil fuel energy costs of extracting energy to maintain real GDP per capita are now prohibitive.

Therefore, growth per capita is over, therefore, growth of real revenues, profits, debt to wages and GDP, purchasing power of labor, gov’t spending for social goods, and capitalism is over; we just don’t collectively know it yet, and we’re not supposed to know it.

Agreed.

But if (to paraphrase) ‘we can’t handle the truth’, why tell the truth? You will just end up like those poor saps in Greece who succumbed to Syriza because Syriza, you know, had a ‘secret way out.’ Except they admitted last week they don’t have a secret way out.

Channeling Gail Tverberg (and a few others) the end of growth really means the contraction of credit. It’s hard to lend at interest if the underlying asset has declining productivity/value.

It seems to me the US & China can pass the baton for a couple more cycles at best.

Steve in CO, rather than the US and China passing the baton, the historical precedent and the imperial imperative is more likely that trade and diplomatic relations between the US and China will further deteriorate and collapse as China’s domestic financial, economic, political, and social conditions worsen, providing the eventual rationalization for engaging the last-man-standing contest between the West and China for the world’s remaining scarce resources.

IOW, the baton will look more like a big Anglo-American imperial stick wielded in the Pacific, Middle East, Central Asia, and Africa.

Hi BC,

There is a very real possibility that you are right about an East West confrontation on the grand scale. I personally think it is actually likely.

This brings us to a point often made by generals for as far back as we have records.

If a country is going to start a war , during a time of declining power and resources it must do so while it is still strong enough to hopefully bring the war to a successful conclusion.

No major power will directly and deliberately attack another nuclear armed major power unless things get to be very desperate indeed.

So most or maybe even all the fighting baked in will be with conventional weapons.

China is the home now to the heavy industry that enables a country to fight a large scale protracted conventional war but she lacks a blue water navy and the ability to project conventional power long distances – for now.

I fear we live in very interesting times.

“You will just end up like those poor saps in Greece who succumbed to Syriza because Syriza, you know, had a ‘secret way out.’ Except they admitted last week they don’t have a secret way out.”

Steve in CO,

And why do you think Sryzia was actually doing anything, besides talking, for a way out? If the party that you are negotiating knows that you are not doing anything, besides talking, then they put you back to “freezer”

“Germany just killed its golden goose. And boy, is that ever stupid. They could have had -again, relative, we’re in a recession- peace and prosperity, and they’re blowing it all away.

Tsipras for obvious reasons cannot talk about the threats he’s been receiving, but he did give up some hints early this morning:

• “We took the responsibility for the decision to avert the most extreme plans by conservative circles in Europe..”

• “I promise you that as hard as we fought here, we will now fight at home, to finish the oligarchy which brought us to this state.”

• “We resisted demands for the transfer of state assets abroad and averted a banking collapse which had been meticulously planned.”

• “… decision to avert the most extreme plans by most extreme circles in Europe”

The Italians and Spanish and French have noted every word of this, and more. Europe as it is, is already over. Everything from here on in is a mere death rattle. “

Is that writing something from Obama’s “hope & change” speech files 🙂

cytochrome, don’t believe bullshit rhetoric that we are fed daily. Greece is unfortunately financial corpse of current debt based monetary system that is put back into freezer for the next 3 years.

True, as long as you stay in small enough box.

However, that is not a given.

Here in Spain the majority is feeling very upbeat. The tourist season is booming, the economy is growing, and the threat posed by the extreme left seems to be subsiding. It was very good to see the way the Greek problem was handled.

What’s the unemployment rate in Spain, 24%?

What’s not to feel good about?

I guess this is what happens when things fall apart slowly, we just get treat the new position as ‘normal’ and feel upbeat about absurdly high levels of unemployment because things are improving (until the next crisis comes along).

I also find it amazing that anyone in Spain would feel positive about the idea of countries leaving (being forced out of) the Euro moving from unthinkable to official policy!

People feel upbeat because unemployment is going down, and the economy is growing. They can see it’s getting brighter.

Right now I’m listening to the parliamentary debate about the Greek rescue. I’ve heard the extremist ultra radical Podemos type spout his nonsense, inflame hatred, and skip over Tsipras’s irresponsible behavior. The UPyD leader was very critical of Tsipras, but also said it was evident the Greeks are not to be trusted, and she wants to hear from the government what’s going to be done about the Greek mess in the future, because it’s going to get worse. The overall trend expressed by deputies is support for Spain to give €10 billion to Greece, but they want guarantees that Greece will straighten out. The only ones trying to undermine the European project are the extreme left and extreme right. The key is to take them out.

An historic betrayal has consumed Greece. Having set aside the mandate of the Greek electorate, the Syriza government has willfully ignored last week’s landslide “No” vote and secretly agreed on a raft of repressive, impoverishing measures in return for a “bailout” that means sinister foreign control and a warning to the world.

Prime Minister Alexis Tsipras has pushed through parliament a proposal to cut at least 13 billion euros from the public purse – 4 billion euros more than the “austerity” figure rejected overwhelmingly by the majority of the Greek population in a referendum on July 5.

These reportedly include a 50 percent increase in the cost of health care for pensioners, almost 40 percent of whom live in poverty; deep cuts in public sector wages; the complete privatization of public facilities such as airports and ports; a rise in value-added tax to 23 percent, now applied to the Greek islands where people struggle to eke out a living.

http://www.truth-out.org/opinion/item/31842-the-problem-of-greece-is-not-only-a-tragedy-it-is-a-lie

The Greeks need to reform and abandon their left wing tendencies, or they need to leave the eurozone and learn to live as a third world workers’ paradise. But they can’t be in the eurozone and keep on gobbling up aid.

If they reform the rest of Europe will kindly consent to debt rescheduling. But reforms have to be turned into law.

Greece is a democracy, so it’s their choice. If they don’t like it they can change Tsipras and get out of the euro.

http://time.com/3957416/greek-bailout-parliament/?xid=gonewsedit&google_editors_picks=true

It is their choice. I think its better for the EU if they leave. We can tale the middle class and those who don’t like being ruled by communists. The communists can stay and rage and destroy the country. It’ll serve as a lesson, to remind people in Europe what communism is like.

The Greeks need to curb graft,fraud,waste and abuse. Sorry but these problems have no political stripes. I’d go into the horror of the Franco regime but I don’t have a few hours to spare…

You got to be living in an alternate reality to mention the Franco regime, this reminds me of Spanish communists who call me worm and try to justify Castro’s crimes by mentioning Batista.

Fern, you keep saying “they have a choice, it’s a democracy.” Well it seems pretty clear they already voted their choice, only they didn’t get it.

How ironic that the EU is printing 60 billion euros per MONTH, and could have covered the pending debt repayment with the mud off their boot, but instead chose to grind that boot into Greece’s neck.

The vote was sheer irresponsibility by the Syriza types, who failed to explain it was a little bulkshit quickie referendum by people asking for money. The ideas being put out by the left are sheer buffoonery. We don’t have to pay the Greeks a dime. If they don’t like it they can leave. Good riddance.

I am mostly just listening to the Greek debate rather than commenting since I don’t really know a whole lot about it IN DETAIL.

But so far as I can tell , the Greeks have in the words of Margaret Thatcher, paraphrased, run out of other peoples money.

The reflexive response of any liberal is to make fun of anything said by a conservative ( and vice versa ) but the undeniable fact is that they have been borrowing too much too long and they are fucking busted.

There comes a day when you just can’t ask other people to support you ”after your accustomed lifestyle ” any longer and that day is past for the Greeks. I do not know WHY , precisely , they borrowed so much, but it appears the rest of the Euro community was eager to lend it to them- up until recently at least. So the blame is perhaps not one hundred percent their own. To my way of thinking barkeepers are partly responsible for alcoholism.

Even the simplest thought experiment illustrates that the argument made by people who say it is only magically printed pixie dust in question is complete bullshit.

If governments could just create money out of thin air any time to any extent then there would be no IRS in the USA or any need for tax collections of any sort anywhere anytime.

When money is printed it flows first to SOMEBODY – whoever is first in line with his beggars cup out. (Beggars include megabanks and multinational corporations worth billions. ) That person gets full value for it. The people who get it second get less value. Eventually the money circulates widely and the value gained in the early stages of this circulation is negated by the small loss suffered by the entire citizenry as individuals.

If the Germans decide to print a few hundred billion Euros, they have a CHOICE as to where they spend them- on GERMANS OR on GREEKS.

I paid taxes all my life supporting people who refused to behave as if they have any fucking sense. One of my nearest neighbors bought a DOZEN new cars over the years and beer and cigarettes on a daily basis.LOTS of beer and cigarettes. When he had a heart attack on top of his lung cancer he went to the hospital I go to in an emergency and the hospital had to write of the entire bill. The last time I set foot inside it before getting on old age welfare they charged me eighteen hundred bucks for scan that took thirty minutes using a ten year old machine operated by a community college trained technician – and by fucking sky daddy I had to pay every DIME out of my own pocket. That million dollar machine operated by forty thousand dollar technicians has taken in from four or five thousand bucks a day on up to twenty thousand some days for the entire ten years.

So the hospital can afford to write of some beggars bills- because they overcharge people like me. Because you see, I am an ant rather than a grasshopper. I have NEVER owned a new car or truck.

There IS A REAL LIMIT to what can be paid for when it is being given away. If the rest of the Euro community wants to give away more then they have the choice as to WHO they give it to. They in their own clearly stated opinion have given the Greeks ENOUGH.

I feel some compassion for the Greeks , given hat they do not seem to understand WHY they are between the devil and the deep blue sea.

But they are going to have to live within their means because the rest of the world is not able to support them living beyond their means without setting the example for the next hard up country in line expecting charity on the same level – then the next one after that.

FER SKY DADDY’S SAKE , this is a PEAK OIL forum, and the large majority of the regulars who comment here, as well as our host, understand the VERY real limits to growth and that the ENTIRE world is bumping hard into those limits.

It will not be too much longer before the Germans themselves are having a tough time. It won’t be too much longer before the USA is in deep financial shit. We are already as a matter of fact but so far we are like WILEY COYOTE , and continue to be able to walk on air- SO LONG AS WE DON”T LOOK DOWN..

Most of our American ACTUAL government obligations are not even OFFICIALLY acknowledged. The regulars here generally understand this undeniable fact. The kindest thing I can think of to say about the ones who do not is that they somehow found their way into a discussion above their grade level and need to listen rather than talk when it comes to government finances.

And we Yankees are generally acknowledged as being the worlds richest and most powerful country- although a few small countries are richer per capita. I for one do not expect their riches to last anymore than I expect it to always be a bright sunny morning in America.

The whole world is head on for a hard crash into the concrete bridge abutment of resource limitations. Greece just happens to be the first casualty among modern western nations. There will be a lot more such casualties within my remaining years if my own luck holds.

Buckle your seat belts and put out your smokes and understand that we are in for a rough ride and that a LOT of people are not going to make it thru the next hundred years without suffering REAL hardships. A lot of people are not even going to survive.

I am with Fernando on this one.

Mac,

Just so you know: hospitals markup tests by 5x to 10x. Then insurance companies discount them by 80% to 90%.

People without insurance get hurt, badly, by this system. It’s a very good idea to get insurance, to protect yourself.

Now, of course, you have Medicare. You might want to consider getting a Medigap policy.

Hi Old Farmer Mac,

On Greece, I disagree with you and Fernando.

The fault lies with borrower and lender. The lender should be careful when lending, the German banks were not very careful before the financial crisis because of a false sense of security from the Euro.

The response of the European Union and the IMF was to impose policies which just made the debt situation worse, when an economy contracts due to unemployment rising to 25% due to austerity measures, the government will not be able to pay down debt. The economics is very simple, but Europeans (and conservatives) seem not to understand this.

The Euro was a very dumb idea, it only works if there is a political union first, creating a monetary union without a political union puts the cart before the horse.

The idea of transferring money from an area which is doing well to an area that is doing badly economically happens all the time in the United States.

For example, during the savings and loan crisis from 1986 to 1995 in the US about 132 billion of taxpayer money was used to bailout failed banks (about 1000 out of 3200 banks nationwide). About 40% of total bank failures occurred in Texas in 1988 the peak year of the crisis.

About 29% of the assets of failed US banks from 1980 to 1994 were from Texas banks(about 44% of all Texas Bank assets were in Banks that failed over the period).

A substantial portion of the 132 billion dollars used to bail out the 5 states with the highest asset value failed banks (75% of US total). These states were Texas, Illinois, New York, Pennsylvania, and Massachusetts with 60, 35, 32, 17, and 10 billion dollars in failed assets of a $206 billion US total.

In the US where there is both a political and monetary union the banks in these states could be bailed out without anybody questioning the character of Texans or New Yorkers.

If Greece was not a member of the Eurozone, it would have control over both its fiscal and monetary policy and could decide democratically how best to deal with an economic crisis.

On one point I do agree with Fernando, Greece should leave the Eurozone, but not because Europe would be better off, simply because it would be better for Greece. Its leaders would be smart to secretly prepare to reintroduce a Greek currency.

To Steve in CO’s point:

http://www.reuters.com/article/2015/05/20/saudi-china-oil-idUSL5N0Y918W20150520

http://rt.com/business/269146-russia-china-oil-trade/

http://tinyurl.com/pj39xbu

http://www.bloomberg.com/politics/articles/2015-04-12/china-russia-saudi-arabia-increased-defense-most-as-u-s-cut

http://www.ned.org/events/the-authoritarian-resurgence-china-russia-saudi-arabia-and-venezuela

One needs to be informed about this dynamic in order to fully understand Peak Oil-influenced geopolitical/geoeconomic events and to anticipate outcomes.

Alex

I want to thank you for your ongoing contributions to this site.

Your charts regularly ‘get’ and convey different, relevant aspects in the oil/gas world.

Muchos gracias.

¡De nada!

I second that motion. I always make sure I read AlexS posts. Filled with facts. Thanks!!

Totally agree, Alex’s contributions are always excellent.

Тhank you gentlemen. It’s a privilege for me to post in Ron’s excellent site. And I always enjoy reading your informative and thought-provoking posts.

The ned.org link includes the following:

“Russia, Venezuela, China, and Saudi Arabia are among the most influential authoritarian states that are seeking to reshape the international order. These regimes may disagree on many things, but they share the objective of obstructing the advance of democracy and weakening the influence of democratic principles in the world.

The established democracies have been slow to recognize the increasingly determined challenge from today’s authoritarians, perhaps because they hope that these regimes will be undone by their flaws.

But given the resilience that the authoritarians have displayed so far, it would be imprudent for the democracies to underestimate the seriousness of the dangers that they pose. …… Corrales, Andrew J. Nathan, Lilia Shevtsova, and Frederic Wehrey discussed the multifaceted challenges presented by these regimes.”

The close relationship between the Cuban dictatorship and the Venezuelan Chavistas seems to escape these gentlemen. Cuban agents and mentors are what enables Maduro’s survival and controls his behavior.

The established democracies have been slow to recognize the increasingly determined challenge from today’s authoritarians, perhaps because they hope that these regimes will be undone by their flaws.

I think countries do recognize various international threats. But having the tools to deal with those threats is limited.

We haven’t been able to control the world with either wars or economic sanctions.

Im not into controlling the world. Nor am I into preemptive wars like Iraq 2003. But sanctions seem to have worked on Iran. The key is to have European, Canadian, Japanese, and other key countries’ cooperation.

Here’s a recent post I put up discussing the view within the US War College about Venezuela:

http://21stcenturysocialcritic.blogspot.com.es/2015/07/opinion-about-venezuela-within-us-war.html

The key is to have European, Canadian, Japanese, and other key countries’ cooperation.

Wasn’t that the principle behind forming the United Nations? And yet you have US right wingers who are very suspicious of the UN.

Getting global cooperation on anything seems to lead to thoughts of conspiracies on the part of some folks.

I’m not a right winger. I do like the Iran deal, and I watch Fox News when I’m sick and need to throw up.

On the other hand, I think it’s better to squeeze the Castros. That one eyed psychopathic princeling they got lined up to inherit power from his father is pretty dangerous.

Interesting to me is how KSA’s projected deficit for 2015 keeps growing. If I am not mistaken, they started out estimating $39 billion. Per recent CNBC article, their estimate is now $130 billion. They just issued some bonds also. If war with Yemen drags on, this will cost KSA big $$. Commentator states by 2018 or 2019, reserves will be gone, unless they decide to continue to borrow.

Before someone blinks, there will surely be a record amount of deficit spending by oil producing nations and companies.

As a small producer, just have to keep telling yourself that the huge jump in world wide production is not coming cheaply. Can’t last forever, and low price will stoke demand to the point it can’t stay ahead.

Could be over two years though.

Shallow

The house of Saud has many enemies, some mortal and implacable.

In any type of conflict, from the macro to one-on-one, if an opponent senses a vulnerability (ie., a boxer knowing his opponent was hurt by that last punch), a huge, concerted effort may arise to press home the advantage.

Although the western media is pretty much ignoring it, the KSA seems to be faring very poorly in their conflict in Yemen. Should reports of attacks within KSA prove true – and continue to grow – the next few months may be very interesting, indeed.

coffee. I have read much of the KSA military are from Yemen.

I wonder how that works.

I readily admit I know little about KSA, but have had the feeling if anyone attacked them, without another county’s help they would be in big trouble.

Article on palace intrigue in Saudi Arabia:

http://www.usnews.com/news/articles/2015/05/04/saudi-palace-intrigue-sparks-speculation

And an excerpt from “On Saudi Arabia,” published in 2012:

Jeffrey, as you well know, the State Dept., Pentagon, and Israelis have numerous contingencies in place to rationalize invasion and occupation of the Saudi peninsula to “protect the sacred sites of Islam” in order to maintain “order and stability” in the oil-rich kingdom and her emirate neighbors.

But we all know the real motivation and which countries the West wants to prevent taking our place “protecting” the oil emirates.

BC Wrote:

” the State Dept., Pentagon, and Israelis have numerous contingencies in place to rationalize invasion and occupation of the Saudi peninsula to “protect the sacred sites of Islam” in order to maintain “order and stability””

Iran, Iraq, Yemen, Libya, Lebanon: Pillars of Stability after western occupation/regime change. 🙂

KSA is spending boatloads of cash in order to defer an Arab spring. Of course if KSA runs out of cash, they could begin to liquidate US and EU investments to support KSA state spending.

I put in a link to an article about Saudi Arabia borrowing money because they were running short at current prices. This tells me they won’t have the ability to hold prices down for years like they did in the mid80s.

I also noticed the OPEC secondary sources say Venezuela is producing at the same rate, but everything I read and hear tells me production is dropping. For example, a few days ago I read a letter from a mid level pdvsa employee who reported pdvsa isn’t paying its contractors, and that some haven’t been paid in about a year. The guy wrote he was providing the information because production was hurting, equipment was falling apart, and he didn’t want pdvsa employees to have a terrible reputation in the industry when the truth is revealed.

Finally, Milov is good, but he knows a lot he didn’t discuss. That talk was aimed at a USA audience, and some of it was material intended to please them. For example, when he discussed Crimea he failed to explain the fact that Russians think it’s Russian, they have been taught for centuries it was Russian territory, and that it has very nice beaches (as far as Russians are concerned). Maybe he should have explained that Russia won’t give it up.

Fernando,

You are right about Milov. He is now much more an opposition politician than an expert.

He is a fierce critic of Putin, and is clearly biased

Clearly biased? What the hell does that mean? Isn’t Alex biased with his opinions? And Fernando is one of the most biased people I have ever read. And yes, I am politically biased, I am a liberal democrat. When politics is involved every human being on earth is biased. We all have our political opinions and when we read something that goes against our politics, we scream “Bias, bias, bias”.

But when you say a person is biased you are just giving an excuse for not giving an argument to counter that persons argument. When you cannot muster an intelligent counter argument you just scream bias and hope that sways the argument that the guy doesn’t know what he is talking about.

But since he gave his argument and you did not, I am far more swayed by the argument that was given instead of the one that was not given.

Edit: I think he was spot on about Putin. But not being an egotist like Putin or a supporter of his plans to take over the Ukraine I am clearly biased.

Milov is a neoliberal. Nothing wrong with that, it’s just that Russia has had its experience with neoliberal economics (large scale privatization, destruction of state authority, creation of the oligarch class, etc…) in the 1990s, and it was those neoliberal economics that nearly destroyed Russia. After this experience and suffering, no sane russian would want to go back to that. That’s the reason why these figures like Milov or the late Nemtsov have essentialy zero public support. It’s easy to look at Russia from thousands of miles away and declare Putin a “dictator” without the knowledge of what happened in the 1990s and the consequences. And you don’t need to read russian sources… just read this piece by Jeffrey Sachs, one of the main architects of the russian economic reforms, on how Russia was betrayed by the west:

http://jeffsachs.org/2012/03/what-i-did-in-russia/

That betrayal is now embedded in the russian collective memory, and ordinary russians will never again trust the west and they will never support someone like Milov who clearly represents western interests.

I don’t know how anyone could possibly declare a democratically elected president with an approval rating of 89% as a dictator, but they keep trying.

JR, :-D.

As the old saying goes, in a dictatorship, everyone “votes” for a dictator, and it isn’t how many “votes” a candidate receives but who counts the “votes”.

In western “democracies”, it’s not how many “votes” are cast or who counts the “votes” per se but who can afford to “buy” the “votes” or the “best gov’t that all the money of the top 0.001-1% can afford”.

The US has a plutocratic-oligarchical system in which there is “no representation without taxation (of the top 1-10% who pay 70-75% of all federal, state, and local income taxes).”

JR, among y’alls’ awl-industry peers, do you prefer Range Rovers or Bentleys?

http://money.cnn.com/2015/03/30/autos/most-expensive-suv/

http://bentayga.bentleymotors.com/en/the-new-bentley-suv.html

Putin has stolen all major media resources. That means the Russian people don’t have a clue other than what Putin’s agents tells them.

I dunno, perhaps I’m a Russian with no clue, but I don’t see Putin’s agents around me, and I can read any English media resource. Are all of them stolen by Putin?

Alexsey, If you are literate in English and spend substantial time accessing media outside of Russia then you are likely to very much have a clue. However, my understanding is that there is very little diversity of major media within Russia in the Russian language. Putin’s reported popularity is in the order of 80% because the average Russian does not have a clue about the magnitude of mismanagement within Russia or the misrepresentations about what is real with the various military efforts or the reasons why so many sanctions are being imposed on Russia. I presumed that you can have an informed discussion about any or all of these issues. But I doubt that the average Russian is well informed at all. There needs to be a richly diverse media establishment with very little fear of reprisals for stories that contradict the propaganda from the central government. That very much exists here. My understanding that it does not exist in Russia.

It would be pretty naive to presume that by mere virtue of English literacy I would agree with dominant Western narrative on Russia. If your idea about Russia comes from “richly diverse media establishment” you enjoy, then I would take the liberty to advise you to closely follow Fernando’s comments. As he says he worked in Russia for some time, and it shows, he knows a little bit beyond what you can find in major media.

Sachs’s policy’s and reforms was one of the factors Russia lost millions of people after the fall of the Soviets.

It was not very street smart of Jeffery, and quite naive, as he drunk the neoliberal Kool Aid. He let the rape and scrape looters have full reign.

It is a good character trait that he now recognizes this.

Russia never implemented neoliberal policies. I was there at the time, and I could only glimpse a small piece, but it was evident that Yeltsin didn’t understand what he was supposed to do.

I asked a close Russian friend what the hell was Yeltsin thinking when he allowed the oligarchs to steal so many companies, and he told me Yeltsin was focused on ensuring communism never returned, but he actually believed the soviet school lessons he had received, so he set out to create a new class of oligarchs who would invent Russian capitalism.

At the same time he allowed a surge in corruption and never dared privatize most properties, nor create the legal framework and independent judiciary neoliberalism requires. So the oligarchs stole everything they could, murdered anybody who opposed them, and the people got screwed.

“That betrayal is now embedded in the russian collective memory, and ordinary russians will never again trust the west and they will never support someone like Milov who clearly represents western interests.”-

You’re absolutely right.

I don’t want to discuss politics here, but I agree with all that said Strummer, JR_Ewing and clueless

Fernando, I read your link about KSA borrowing money.

I agree with you about Venezuela. I don’t see how oil production there could be flat given the how poorly the government functions.

What companies are helping PDVSA with technical matters? Can Venezuela go it alone with its oil and gas industry in the event the foreign help is not paid?

Shallow, there are several tiers of help. The most effective is delivered by outfits such as Halliburton, Schlumberger and Wood Group. But I understand they aren’t getting paid.

The second tier is delivered by smaller companies, many owned by Venezuelan boligarchs. There are also Chinese, Russian, and Cuban outfits providing some services, but those tend to be low quality and involve huge surcharges (there’s a tremendous amount of corruption).

The third tier is delivered by companies such as Repsol and Chevron Texaco, which continue to help out hoping the government will fall. Most foreign companies don’t generate real cash flow in Venezuela, they have paper profits but they can’t get the money out. This is one reason why the official rate isn’t devalued. And why the black market rate is running at 617 bolivars to the $.

Regarding the chaos, I’m going to see if I can load an exhibit shown by the interior ministry last night, they were briefing the media about efforts by security forces to retake the Cota 905, an area near downtown Caracas. They mobilized 200 national guard (they say the total manpower used was 2800). The firefight lasted several hours, and by the end of the day the government reported 17 dead. However, there was a report the gang in control of Cota 905 had moved their weapons towards El Cementerio, and last night there was a firefight there with five killed.

Thanks Fernando. I did some Internet reading on the Venezuela oil industry. A few topics include:

ExxonMobil obtained a 1.6 billion dollar judgment concerning the confiscation of their assets by the government.

HP was not getting paid, shut down their rigs. The government confiscated the rigs.

An engineer in Venezuela is now effectively making $400 per month. Most have left.

I know all of the above is old news and that you have referred to these stories or similar many times.

Hard to see how production is not falling there.

Fernando. You said that Russians were “taught” that it was part of Russia. In a like manner, Americans are “taught” that the New England states are part of America. Catherine the Great made the Crimea a part of Russia many years before the American Revolution made the New England states part of America. Khrushchev, for their valor in WWII, illegally “gave” [no vote in Russia, no vote in the United Nations] Crimea to the Ukraine [a part of the USSR] not knowing, of course, that the Ukraine would not always be Russian. So, with Crimea having the only Russian warm water port for the military, what would any competent leader do? I know what the US would do. Just read about the Civil War.

Yes clueless. I happen to agree with the Russians in this case, Crimea is Russian. But what I tried to convey was the idea that no matter what the U.S. elites think and their media propaganda says, they are going to run into a solid wall. The Russian people are taught at a very young age about Russian history, and what their borders are supposed to look like.

And I don’t think a Russian leader can allow key Russian territory to fall in the hands of people allied with France, UK, and Germany. These nations invaded Russia in the past.

Where is the link? Please post it again.

It makes good sense for the Saudis to borrow if they can get the money at near zero interest. There is really no doubt whatsoever that they will be able to repay it selling oil at substantially higher prices later on – and with money that is depreciating as well. So in effect by borrowing NOW they are getting a higher price for their oil.If oil is back to say eighty bucks in two or three years then the interest will be trivial in comparison to the extra income.

If oil only goes up ten bucks in three years the Saudis will still probably make out ok on this strategy.

And there is a real possibility that loaned money will NEVER be repaid anyway.

But I have never bought the argument that they are deliberately holding the price down MOSTLY to break the American tight oil industry.

That won’t work any longer than it takes the price of oil to go backup unless they are able to come into this country and buy up the industry physically plus maybe a year or two at the outside. Yankee oil men will be back after tight oil like a duck after a june bug once the price goes back up. If nobody will loan money to the industry then people with money will buy it up and run it with their own money.

I think the Saudis are more interested in hurting their oil exporting enemies than anything else. The blood bath in Yankee oil is more icing on the cake than the cake itself in my view.

Fascinating speech and Q&A indeed by Mr. Milov, it was very revealing.

There is a very interesting article in the Wall Street Journal today.

Oil Production Shows Signs of Flagging

Confronted with the plunge in prices, companies in these regions are delaying and canceling projects. Across the world, just six major oil projects received the green light in 2014, compared with an average of more than 20 a year from 2002 to 2013, according to Deutsche Bank.

The International Energy Agency said Friday that non-OPEC supply growth would “grind to a halt” in 2016, with output due to fall in Russia, Mexico, Europe and elsewhere.

Oil companies need to replace between 5% and 8% of crude output each year just to offset shrinking production from old wells, analysts estimate. Currently, that amounts to at least five million barrels of daily output. Falling production in areas that have been outside the spotlight in recent months could send prices shooting up in the coming years, hurting consumers and damping economic growth, once the market works through the current overhang, investors and industry officials say.

“When you start cutting exploration budgets and you stop developing the next frontier…the seeds have been sown for the next bull market,” said Virendra Chauhan, analyst at London consulting firm Energy Aspects.

Several majors, e.g., ExxonMobil, were cutting upstream capex prior to the recent oil price decline.

In the comments section following the WSJ article, I added my usual 2¢ worth about actual crude versus C+C. Following is an interesting comment by Mike Walker:

Hi JB,

I have seen it mentioned many times that some of the biggest players were reducing capex well before the price crash. To me this is about as dead certain an indication they expected excess supply to depress the price as I can imagine. Maybe they foresaw excess production. Maybe they foresaw a weak world wide economy. Probably some of both?

I have not seen any good reporting about why the big oil companies apparently saw the over supply arriving whereas all the major banks and other big players seem to have missed it- unless just maybe some did see it coming and were busy very quietly arranging their own trading operations to take advantage of it.

Hopefully somebody will have more to say about this.

My own guess is that given their ultimate insider status the big oil companies that cut back early saw supply increasing faster than projected consumption rather than being better economic forecasters than all the big banks.

But the banks have a huge incentive to down play bad news if they think it is coming in the form of an economic slowdown. It has often been said that making a fortune in a crash is just as easy as making one in a boom.

IMO, the (pre-oil price crash) decline in upstream capex expenditures had less to do with an expectation of a future oil price decline, and more to do with poor returns on capex expenditures, due to the rate of increase in upstream capex costs (and due to the declining number of large quality conventional prospects), versus the plateau in oil prices that we saw from 2011 to early 2014–especially when we focus on actual crude oil production (45 and lower API gravity crude).

The global oil industry has spent trillions of dollars on upstream capex since 2005, with probably little, if any increase in actual crude oil production.

Steven Kopits had a great presentation on what he called capex compression.

Do you have a link to the presentation?

Your reasoning makes a great deal more sense than mine, but then I am handicapped by being a complete amateur. LOL

But in the end both arguments boil down to an expectation on the part of the big oil companies that the price would be inadequate to justify the upstream expenditure.

February, 2014 presentation by Steven Kopits:

https://www.youtube.com/watch?v=dLCsMRr7hAg

March, 2014 article on ExxonMobil’s capex cuts:

http://fortune.com/2014/03/06/exxon-performance-spending-cuts-rattle-investors-nerves/

Monthly Brent prices fell below $100 in September, 2014:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RBRTE&f=M

Hi. A bit late but anyway. All oil companies were suffering from extreme price inflation and saw their profits drop despite high oil prices. They had to cut down costs…. oilprice crash soon after only accelerated this development.

retail gasoline market going crazy in SoCal

Interesting. I wonder if Alaska wildfires could be slowing down flows to Calif. refineries?

http://www.newsminer.com/news/local_news/aggie-creek-fire-grows-nears-trans-alaska-pipeline-pump-station/article_ca5b9472-275b-11e5-9f6c-fbc52fca4781.html

I’m not sure what is going on except perhaps they miscalculated summer demand. Local news coverage is terrible as to cause except to say it’s all a conspiracy.

I have been seeing references to imports of refined gasoline coming from Asia!?!?!?

We have had problems with port traffic lately.

Thanks for the Russian video reference Ron. For me Milov’s major point concerned the substantive declines that are occurring the old Russian brown field reserves. If you add in his references concerning decreased financing, it seems clear to me that within a year or two, Russian production should show major measurable declines.

Look who is reading your site Ron:

Chris Nelder @nelderini 9m9 minutes ago

Vladimir Milov, President, Institute of Energy Policy says Russian oil production will begin to decline this year. http://bit.ly/1UVoLde

Got a link to Nelder’s comment? I found his blog but there was nothing current there.

In Russia every year talking about falling. The old Soviet school, conservative thinking. But oil production is growing every year.

In its new Drilling Productivity Report, the EIA has lowered its estimates for the Bakken oil production by 35 – 80 kb/d from January to June 2015. The new DPR numbers for April are still about 85 kb/d higher than the combined numbers for North Dakota and Montana from the NDIC and Montana Board of Oil & Gas. The numbers for March are 60 kb/d higher. Historically, the discrepancy between the DPR and state agencies’ numbers was between 40 and 50 kb/d. Note, that the DPR data is for “Bakken area”, which includes some conventional production.

According to the new DPR numbers, Bakken production has peaked at 1252 kb/d in December and is expected to decline to 1182 kb/d by August

There were no significant revisions in estimates for Eagle Ford. The DPR expects a fall in EFS oil production from the peak of 1709 kb/d in March to 1538 kb/d

Estimates for the Permian were lowered by 15-20 kb/d from November to July.

The EIA still projects a very slow growth from 2010 kb/d in March to 2046 kb/d in August

Ron you stated that Mr. Vladimir Milov’s presentation and discussion was a real eye opener about the workings of Russia’s oil and gas energy policy and some parts were a real surprise, even a little shocking for you. Could you elaborate on those statements. Other bloggers feel free to chime in as well.

I was shocked to learn that Russian big oil was depending borrowed money from Western banks to finance their operations. And that money had been shut off because of sanctions. And that even if sanctions were lifted that money was not likely to return because those Western banks would not know what stunt Putin might pull next.

That was the one thing that shocked me most. Other things was how political the whole thing was. When a small private company becomes successful, the state just takes them over.

And there were other things which I will comment on later.

“I was shocked to learn that Russian big oil was depending borrowed money from Western banks to finance their operations. And that money had been shut off because of sanctions. And that even if sanctions were lifted that money was not likely to return because those Western banks would not know what stunt Putin might pull next. ”

This is complete bullshit, Ron.

Russian companies have been indeed heavily borrowing from Western banks. But when Western capital markets were effectively closed for them because of sanctions, they were able to repay their debts from internal sources. As a result, the combined foreign debt of the Russian non-financial sector decreased by $89bn, from $451 in mid-2014 to $362bn now.

Foreign debt of the Russian non-financial sector ($bn)

Source: Central Bank of Russia ( http://www.cbr.ru/statistics/?Prtid=svs&ch=itm_47538#CheckedItem)

Even with conservative oil price assumptions, Russian oil companies and other companies in other sectors will be able to repay or refinance their debt from domestic sources. The amount of the debt maturing in 2016-17 is significantly less than in the second half 2014 and in 2015.

——————————————–

Russia faces $100bn corporate debt mountain

Moody’s says Russian companies will be able to repay or refinance their debt in domestic markets, despite difficult sanctions

18 Jun 2015

http://www.telegraph.co.uk/finance/globalbusiness/11683564/Russia-faces-100bn-corporate-debt-mountain.html

Russian companies outside the financial sector face a $100bn debt mountain that will need to be refinanced, or repayed, over the next two years, according to a leading ratings agency.

Moody’s Ratings Service has said that large Russian corporations have $40bn worth of debt maturing this year and a further $60bn of repayments due between 2016 and 2017.

But these companies should be able to meet their debt obligations, despite expectations that Russia’s real gross domestic product (GDP) will contract by around 3pc this year and remain flat in 2016, the ratings agency said.

————————————

External Debt of the Russian non-financial corporate sector by maturity ($bn)

Source: Central Bank of Russia (http://www.cbr.ru/eng/statistics/?Prtid=svs&ch=itm_11905#CheckedItem)

Isn’t the pay down of debt just due to borrowing less? With less money coming into the system there should be some future effects on oil field development and production.

“Isn’t the pay down of debt just due to borrowing less?”

No. Russian corporate sector got a huge boost from the rouble devaluation. It’s like a hidden tax&bailout, the population indirectly finances the corporations. And the anger of common man is redirected to the West and the sanctions. A win-win for the government.

So you say the ruble is worth less and that paid down the foreign debt? Or are you trying to say that the government paid it down?

The government pays it. They can also offer tax relief if they wish. They have already given up a huge chunk of the tax pie. This reduces government income.

I think the key is to understand that lower oil production is good for Russia. It helps the rest of the economy, makes them more self sufficient. This seems to be ignored by short sighted Russian elites. They are sort of stupid in this area.

Re KSA sovereign wealth fund aka reserves.

If you were lending to KSA, what interest rate would you demand? As if this means anything anymore. 1 Yr KSA paper quotes at 0.9%. 1 Yr German paper quotes at -0.257%. That’s a minus sign, sportsfans, re: As if this means anything anymore.

And so, if your SWF is getting you 5% / yr, and you’re paying 1% for money, you borrow. It doesn’t have to have anything to do with desperation or politics.

(Note shenanigans. Super Mario Draghi is QE printing 1 Trillion by Sept next year. The instrumentality for this is individual country Central Banks. He sends them money he prints and they buy their own country bonds. Germany proportionally the majority, of course, but while other countries are hitting the long end of the yield curve, the Bundesbank has been buying the short end, which lowers rates, of course, or . . . used to, and still does, until someone decides it doesn’t.)

Forgot to note sometimes the KSA deficit is quoted in Saudi currency and sometimes USD. Lots a variance when so.

Please notice that in recent weeks USA coal extraction rate is down about 17% yoy, which is equivalent of about 2mb/d of oil.

Demand is low mostly due to natural gas and prices are low. Mines slow and shut down then until times get better.

https://www.youtube.com/watch?v=_2aE2gdvM0U

http://stanford.edu/dept/france-stanford/Conferences/Risk/Nur.pdf

http://eslectures.stanford.edu/endofoil/docs/OilWarRevistingHubbert.pdf

A last-man-standing war for oil and the remaining finite resources on a spherical planet is inevitable if history and human nature are a guide.

Don’t worry, most likely your neighbors will have killed you for your resources or just out of anger before the world Armeggedon gets going. Can you imagine how cranky people will be when their cable fails, they have to wait in line for gasoline at high prices and half their favorite brands are no longer available? People act dangerously crazy now just to get home and watch the news or get down the road to go shopping. Imagine what extra stresses will do to them.

And if you still have a job, the jobless will be breaking in while your away and taking your stores of stuff. It will unravel long before major war. All we need is another deep depression. The whole system is so spread across the globe now and so dependent upon on-time arrival; it’s unstable.

Global trade starts to collapse and we will soon be up to our necks in local troubles.

”And if you still have a job, the jobless will be breaking in while your away and taking your stores of stuff. It will unravel long before major war. All we need is another deep depression.”

It is never too early to make good friends with your neighbors. When I lived in the city one of the things that bothered me most was that hundreds of people I could never hope to meet lived within a hundred yards of my apartment. A third were the salt of the earth, a third university students, the last third questionable, to put it politely, in respect to their morals.

You will not be able to count on the police in a collapsing society unless you are very well connected. Once collapse is well under way, the last people you want to talk to may be the police.Cops are just more tailless monkeys. Expecting them to look after you in preference to looking after their own families during extended emergencies is naive.

I don’t expect collapse here in the USA – except in some cities- within my remaining personal lifetime. But if it comes before I depart, then I am prepared to do my part helping guard the immediate community..

In THIS community we mostly all know each other by reputation and by sight and our parents and grandparents and kids and wives are all buried together in the same churchyards where most of us got married.

Local lawlessness will not be our major problem. The failure of the water and sewer systems will not be our problem. We all use wells and septic systems. If the grid goes down we are going to be in a real fix, but it won’t be a tenth as bad as the fix city folks are in.

So long as we can put our hands on SOME fertilizer, diesel fuel, pesticides, spare parts and so forth we will be able to eat and ”export” a substantial amount of food – enough that such authorities as are in power will likely try to make sure we have access to these things in exchange for the excess food.

If we have to go back to the sort of farming my great grandparents did, we will most likely be able to scratch enough food out of the ground to live – but we won’t have any trouble fitting into thirty inch waist pants after a year. That sort of farming done by hand doesn’t leave much time for anything else in this part of the world but otoh not much is more important than eating.

Any body who has a house in the suburbs or out in the country should give serious consideration to installing a chimney if the house doesn’t have one already. The odds of intermittent grid failure will be rather high once things start downhill. Frozen water pipes can be quite a problem. Keeping a stock of firewood on hand is not that big a deal.

Why not build a bunker and fill it with butane bottles? It’s better than wood. And it’s one hell of a self defense weapon.

Most of us can’t afford a bunker nevertheless one filled up with butane bottles. LOL. I understand this suggestion is tongue it cheek or dry style humor.

But a chimney is not out of reach of most home owners.

Not meant to cause any more of a ruckus.

just info wrt the ongoing discussion of IPCC and carbon emissions. lots of references.

“How much carbon can we safely emit into the atmosphere without the planet suffering dangerous climate change? It would be good to know. The world’s governments have agreed that “dangerous” should mean any warming above two degrees Celsius. And in recent reports, the Intergovernmental Panel on Climate Change (IPCC) has tried to translate that into a future carbon budget.

But too many different numbers are still floating around. We could have more than 500 billion tons of carbon that we could safely emit, or the real

figure might be close to 100 billion tons — it depends on whose estimates you decide to accept.

The carbon budget looks to be one of the most critical single metrics for keeping planet Earth a safe place to live through the coming century. So it would be a good idea to get to the bottom of the discrepancies, especially since the countdown to dangerous climate change may be shorter than the lifetime of a new coal-fired power plant.

Here is an attempt to cut through the statistical fog. ”

http://e360.yale.edu/mobile/feature.msp?id=2825

one of the referenced papers..

http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3405665/

Ezry, we are well past the point of safe right now. This whole arbitrary carbon/temperature limit is a crock of shit. There are multiple interdependent forces at play. We don’t even have a hope of controlling the one we could control and we certainly cannot control all the other “feedbacks” in the system.

The gun was loaded and fired. We are just waiting for the bullet to hit now. Firing more bullets will only accelerate the problem.

Of course we could get lucky for a while, reflective cloud cover could increase, the sun could emit less radiation, the thermohaline circulation could keep burying the heat for a while longer. But any of those will only cause people to think they can get away with more carbon pollution when in reality all those modifiers I just listed are temporary and only put off the major consequences.

well, we could try and not make it worse

Hi Ezrydermike,

It all depends on how safe one wants to be. We could build a bridge that will handle 20 times more weight than it is likely to ever carry, but most people would think that is wasteful spending.

The 1000 billion metric tonnes of net carbon emissions from 1750 to 2300 including fossil fuels, cement production, natural gas flaring, and land use change should keep us under the 2 C limit (above the holocene average global temperature up to 1750) if the equilibrium climate sensitivity(ECS) is about 3C.

If we assume the ECS might be 3.75 C (if the probability distribution is normal there is about an 84% probability it will be lower than 3.75C) we would need lower carbon emissions (maybe 750 billion tons of carbon after 1750).

About 550 billion metric tonnes of carbon were emitted from 1751 to 2013 from fossil fuels, cement production, and land use change. So this leaves us 200 to 450 billion metric tonnes of carbon emissions. In 2013 we emitted about 10 billion tonnes of carbon, if we assume emissions remain the same we reach 750 billion metric tonnes by 2033, we will be lucky if we keep carbon emissions below 1000 billion metric tonnes, peak fossil fuels may help.

so I am picking up a distinction between rates of emissions vs cumulative emissions.

Does this leave open the possibility that mitigation efforts might be more helpful then previously thought?

Should we be seed bombing trees on a massive scale?

I’m for geoengineering research. For example, grinding up rocks, and tossing iron in the ocean. Or burning a bit of sulfur with jet fuel. Things like that.

I’m for geoengineering research. For example, grinding up rocks, and tossing iron in the ocean. Or burning a bit of sulfur with jet fuel.

You are familiar with Pandora’s Box from Greek mythology, right?

Because opening that box is precisely what geoengineering is like! It is the very last thing we need!

Granted we have been geoengineering the planet for the last 100,000 years or more or less the time in which modern man has existed. As I look around at the results I am ever more convinced that humanity should not be deliberately doing experiments with the planetary systems. We have neither the knowledge nor the expertise to do so safely!

And the absolute worst people of all to be allowed to do this are engineers who have zero understanding of complex ecosystem dynamics. I want them to keep their hands off the levers and dials of the ecosystem controls because they are not competent or qualified to operate them!

Certainly it’s better to stop rocking the boat, rather than try to have someone jump up on the other side of the boat to balance things out.

OTOH, let’s not put down engineers: they’re not the problem. It’s business interests who don’t want their investments threatened, that are the problem.

And, there’s a hidden assumption here that renewables are more expensive than fossil fuels. They’re not. We only gain by eliminating fossil fuels, in every way.

“We only gain by eliminating fossil fuels, in every way.”

If it were only that simple; large hydroelectric facilities (Geo-engineering) have caused significant damage across the planet. Dams have led to extinction of many fish and other aquatic species, the disappearance of birds in floodplains, huge losses of forest, wetland and farmland.

Certainly, dams have caused much harm (though I think calling them “geo-engineering” is a bit distracting, as they’re not related to what we’re talking about here).

But AFAIK existing dams are a net benefit, environmentally. And wind and solar are much better than the FFs they’d replace.

Doug L, Fred M,

Another little aspect of reservoirs that I rarely see mentioned is that they are sources of methane. Organic material carried into reservoirs settles out and provides the requisite anaerobic environment for methanogens. Some of the gas makes it into the atmosphere; I admit, though, that this is a fairly new area of study to me.

I’d expect the big reservoirs in Brazil would be important methane sources. Fred! Fred M! Check on this while you’re down there, OK? Thanks.

I’d expect the big reservoirs in Brazil would be important methane sources. Fred! Fred M! Check on this while you’re down there, OK? Thanks.

Yep, just arrived in Brazil last night… but have been aware of the methane issue at many large Brazilian hydroelectric projects for a long long time!

Whenever you flood hundreds of square Kms of tropical rain forest you have massive release of methane due to the decomposing organic matter underwater.

However that is, IMHO, a relatively minor concern compared to wholesale wiping out of ecosystems and an indigenous way of life to promote the infinite growth paradigm which is what our current consumer society is all about.

https://goo.gl/qX3xFB

The full movie

https://goo.gl/BZ8NIj

As for engineers, I’m willing to discuss geoengineering only with those of them who can show they have an understanding of ecosystem dynamics. Otherwise they are simply not qualified.

So are you going to make a coherent and logical statement about geoengineering or limit yourself to discussing Greek mythology?

If you can show that you have an understanding of ecosystem dynamics, I’ll be more than willing to eschew Greek mythology and talk straight science with you.

Dennis

Then of course there are the wild cards, cloud cover, water vapor, natural methane emissions, and vegetation loss.

Do those estimates include non- CO2 greenhouse gases?

Hi Marblezepplin,

Yes those estimates are based on the mainstream climate science view from around 2009. This may have changed a little since then, but the ECS range in the latest IPCC report is 1.5 to 4.5C with a best guess of 3C, so the mainstream view has not changed by much.

Note that the range of ECS includes those wild cards, the uncertainty about clouds and aerosols and their effect on climate in the future is the main reason for the large uncertainty.

As I said 1000 Gt C asumes ECS is 3C with the usual scenarios for other green house gases and land use change and feedbacks and 750 Gt of C emissions assumes an ECS of 3.75C (plus one sigma assuming a normal probability distribution).

If you are referring to earth system sensitivity(ESS), that is even more uncertain than ECS, but many mainstream climate scientists think that Hansen’s 6C estimate is too high, also those will take 500 to 1000 years to be realized. As population falls in the future and land use change is reversed some carbon will be removed from the atmosphere and we may be able to keep global temperature increases close to 2 C, I agree though that this is highly uncertain and it would be best to keep carbon emissions as low as feasible.

If ECS and ESS are on the low side, the carbon can be emitted at a later date when we understand the earth system better. This course of action is unlikely to be taken, but it would be the prudent course.

Dennis, do the turkeys who work out these carbon budgets account for plastics and asphalt? Do they have the right molecule accounts? I ask because I’ve seen so much shoddy work in the past I wonder if they documented what they do in a detailed fashion?

Heck, plastic either gets recycled or (mostly) gets sequestered in land fills.

Asphalt is 99% recycled, at least in the US.

A fraction of fossil fuel production is used for plastics. Another fraction is used as asphalt. These materials aren’t oxidized. I assume we can have a discussion about the subject without irrelevant clutter.

If the population falls slowly some carbon may eventually be removed from the atmosphere, except then the ocean will lose carbon dioxide to equilibrate. The long tail of equilibration goes on for over 5000 years if there are no other sources of CO2 such as melting permafrost, soil degradation and methane releases. Then the long tail might not occur for a million years.

Hansen and others who predict a potential 6C are taking into account the various feedbacks and the methane clathrate potential. If one chooses to ignore the past record and the present potential then the lower values around 3C rise make sense.

If population falls fairly quickly, as from war and societal collapses, vegetative losses (burning) and infrastructure losses (burning) will make a temporary particulate chill then an increased radiative input from the excess CO2 injected from the losses.

In both cases the permafrost and methane clathrate problem still exist. My own calculations on albedo changes give a much higher positive forcing than the IPCC range. The reduction of albedo forcing is dependent upon continued or increased cloud reflectance and lack of vegetative growth. I would not bet my planet on cloud cover levels remaining the same or increasing. The problem with vegetative growth in tundra areas as they warm is already being seen. Snow is shadowed and vegetation is dark, thus reducing the reflectance of snow as the plants grow larger and extend northward.

Right now we are enjoying a period of heavy cloud cover in the Arctic, yet the warming still continues. Once those clouds reduce, the Arctic and tundra areas will control the radiative forcings well beyond any gain or reduction we can effect. So it is imperative we make the carbon and nitrogen input reductions now, not wait and play a game of how much we can get away with.

http://earthobservatory.nasa.gov/Features/ArcticReflector/arctic_reflector4.php

Hi Marblezepplin,

Some of the high estimates of Earth System Sensitivity(ESS) are based on the ice age cycles, but in those cases there were significant ice sheets which led to a very large albedo change. Ice sheets are much smaller now and though I agree there will be some albedo change, I do not think it will be as large and the ESS will likely be lower than the Hansen estimate. I do not think the methane issue will be as much of a problem as some propose, I agree with David Archer on that point and also agree with his estimates of the very long tail of atmospheric carbon.

On clouds there is a lot of uncertainty, along with aerosols, this could lead to either higher or lower ECS, more research is needed, in the meantime less carbon is the safer path.

pretty good paper from The Royal Society Philosophical Transactions Series….Jan 2014 “The Future of Oil Supply”. Part of a Theme series

Like a primer of many of the subjects discussed here. Lots of references.

http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3866387/

Not bad. It has a couple of errors, but overall it’s good.

Info for OFM,

Who was interested in hydraulic hybrid systems for trucks and buses.

http://www.greencarcongress.com/2015/07/20150711-lightning.html

Thanks TP,

I am glad to see the tech is now actually being sold, but I have not yet heard of anybody buying it. Usually I run across press releases about such things. It ought to work out just fine on trucks used on a regular basis in stop and go , such as garbage trucks.

So if it’s all related to supply and demand why is everyone producing flat out ? Prices have been low for around 8 months now.

Imagine that.

Hi Wiseindian,

The market price is determined by the interaction of supply and demand. Individual firms will try to maximize their profits and take the price as given (under the assumptions of a perfectly competitive market). The low oil price tends to increase the amount of oil demanded, the producers are producing flat out to meet that demand and hoping that some of their competitors will go out of business at these prices. Eventually those bankruptcies will occur, then supply goes down and oil prices start to rise.

It takes some time for the market to adjust, we have been fooled by OPEC and before that the RRC, into thinking that the oil industry reacts quickly and easily to changing oil prices, but that was an illusion. We would need to go back to before the RRC started controlling Texas oil output in 1930 to remember how difficult this adjustment is.

See https://en.wikipedia.org/wiki/Railroad_Commission_of_Texas#Expansion_to_oil

As I have said before, OPEC has decided to no longer regulate World oil output so perhaps the RRC and NDIC need to step in and start restricting output. The RRC already has the power to do this, the NDIC could be given that power and just follow the lead of the RRC. They could simply hold output flat in Texas and North Dakota until oil prices start to rise and the industry gets back to health.

Thanks, the oil price cuts are a blessing to my country where 80% of it is imported. I would wish it stays there for a long time but I know that’s not possible.

Hi Wiseindian,

Low oil prices are only a blessing if oil supply remains adequate at those prices.

We need to find a price where long term supply and demand for oil match. My guess is that this would be about $85/b to $100/b at present if there were some institution controlling output (OPEC, RRC, and/or NDIC). Volatile oil prices help no one, that is the reason the RRC controlled oil output from 1930 to 1970 and that OPEC controlled it from 1975 to 2014. It will be interesting if OPEC continues to stand on the sidelines to see how volatile oil prices become.

If the RRC, NDIC, and OPEC refuse to step up then maybe the EIA or IEA need to attempt to regulate oil output. A couple of million barrels per day (higher or lower) can make a huge difference in oil prices.

”If the RRC, NDIC, and OPEC refuse to step up then maybe the EIA or IEA need to attempt to regulate oil output”.

Good luck with that one!

Hi Rune,

I agree, a very unlikely scenario. Only after a period of very volatile oil prices is this even remotely possible.

Dennis,

Try checking out the mission statements for EIA and IEA.

I got a better idea. We can create the “Commodity Price Fixing Administration”. It will include the “Office of Oil and Natural Gas Price Optimization”, the “Production and Reserves Information Agency”, and a “Oil production enforcement Agency”. This last one has the “Lease Product Transfer Bureau” with armed deputies.

Hi Fernando,

Well the Texans preferred the RRC regulating output over oil at 25 cents per barrel in the 1930s. Those crazy communists down in Texas. 🙂

The RRC regulations also helped increase recovery factor. Implementing a price cartel isn’t really a communist idea. Communists seem to like price and currency exchange controls, nationalizing industry and commerce, building large, extremely powerful and centralized bureaucracies and entrenching themselves in power, which they achieve via media censorship, a very well funded secret policy able to torture and murder as they please, a supine judiciary, and the elimination of any vestige of democracy.

Volatile oil prices help no one

Volatility is a cost. Just one of the many costs of oil that are badly accounted for.

If governments want to reduce those costs, the sensible solution is to push hard on the transition away from oil. For instance, much higher CAFE MPG regulations. That’s both easier and more productive than price fixing.

Hi Nick,

Note it is not price fixing, it is restricting output and letting the market determine the price. Quantity is adjusted, prices respond to demand. Carbon taxes are much better policy than the government choosing the MPG in my view. Internalize the external costs using taxes, then let the market work.

It’s price fixing, just using output controls instead of direct price controls.

Raising prices increases the transfers of income and wealth from consumers to producers. Consumers will object, and rightly so. Plus, of course, it will only affect a minority of producers. KSA has refused to make that sacrifice, and so will Texans and N. Dakotans. FInally, it increases incentives for oil production, which probably aren’t a good idea – we need to leave it in the ground.

I agree that carbon taxes are the best instrument. The problem is that the oil industry seems to have succeeded in making the idea politically toxic. MPG regulations exist, and have had great success (despite the problems caused by automakers succeeding in creating a light truck/UV loophole).

$85-$90 is affordable here, even $100 is not an issue

Hi Wiseindian,

Oil prices should be in the $85-100 window, but only regulation of oil output will allow that to happen.

Or carbon taxes, which would be much better.

For better or worse, both are very hard to implement now.

Fernando, what say you?

Story on the Washington Post web site:

Why Venezuela wants to annex two-thirds of the country next door.

For some reason I cannot copy and paste the link…it is secured by Entrust.