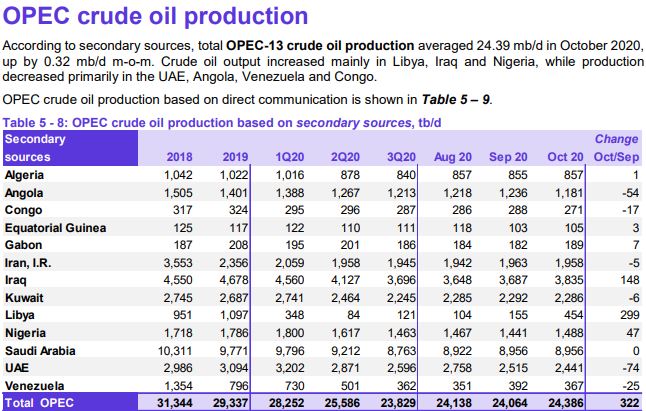

All OPEC data for this report is from the OPEC Monthly Oil Market Report. All data is through October 2020 and is in thousand barrels per day.

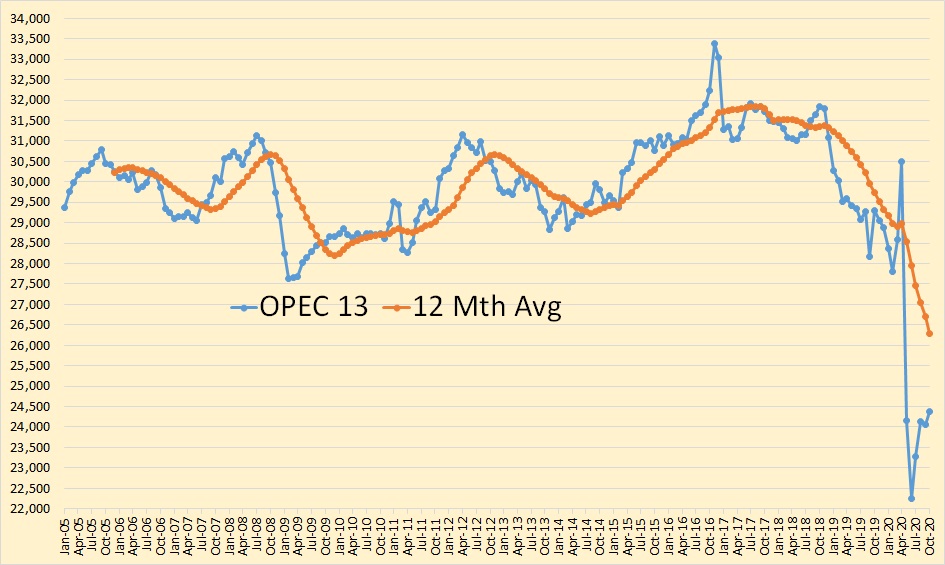

The combined production of all OPEC nations was up 322,000 barrels per day in October. However, that was after September production had been revised downward by 41,000 barrels per day.

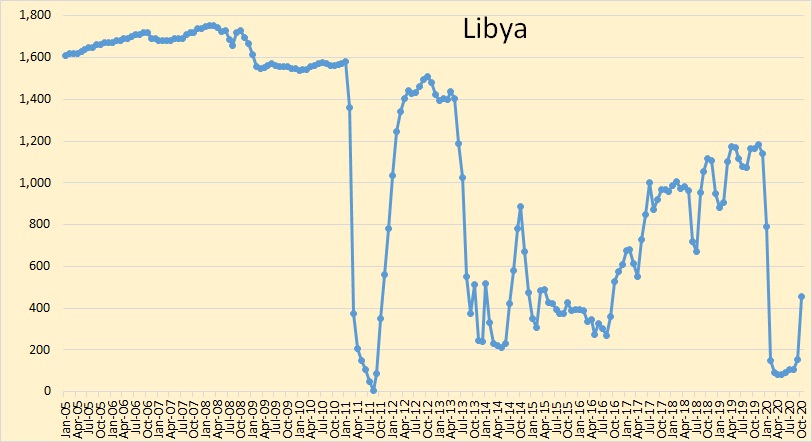

Libya had the big gain in October.

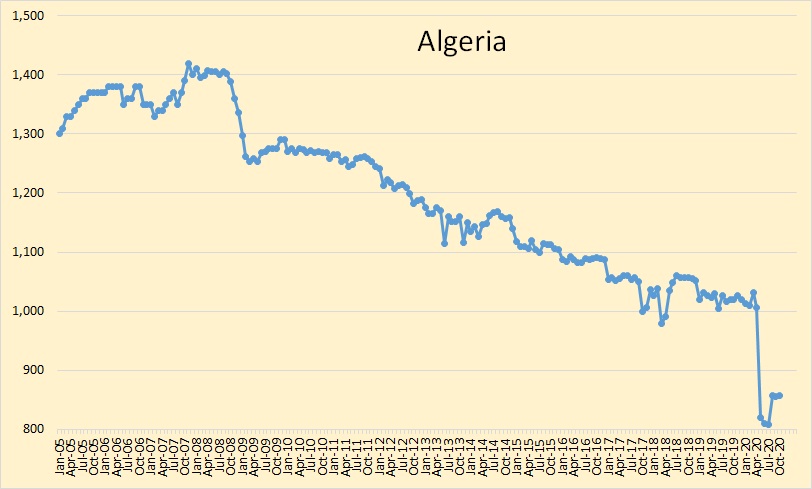

Little change in Algeria since August.

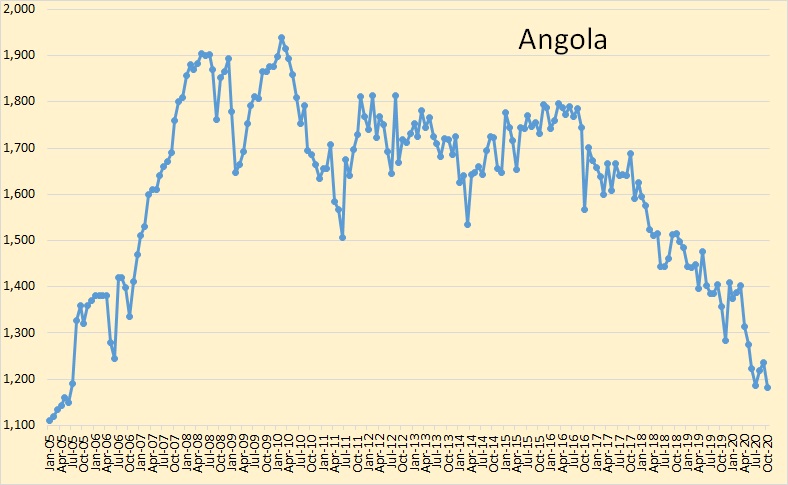

Angola was down 54,000 barrels per day in October.

The Congo was down slightly in October.

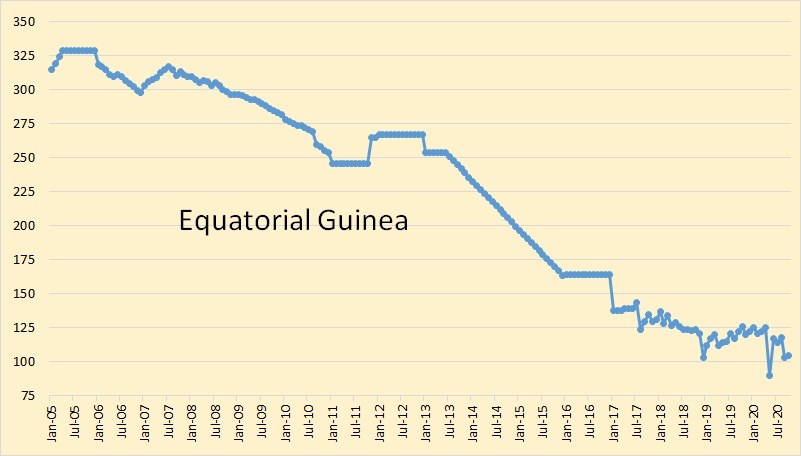

Equatorial Guinea is holding steady, such as it is.

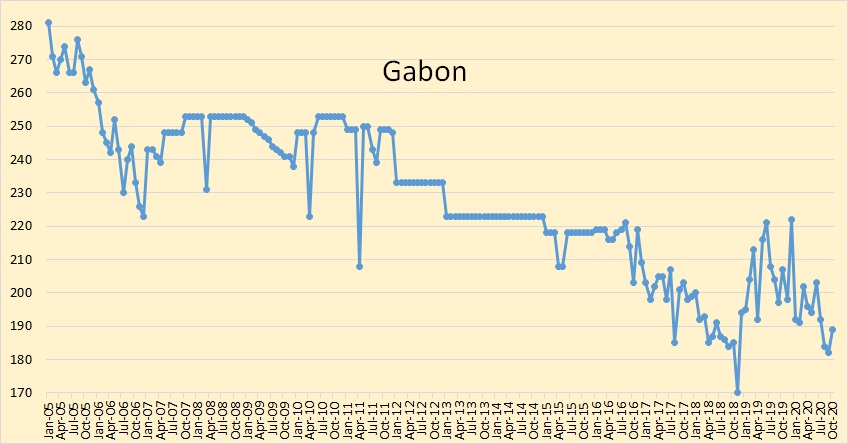

Gabon was up slightly in October.

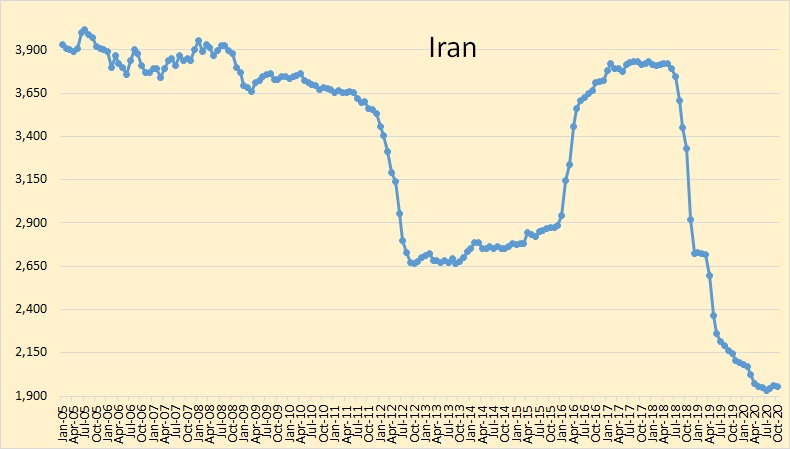

Not much change in Iranian production. The big question is what will happen after Biden is sworn in. Will Biden keep the sanctions imposed by Trump? Will Biden try to revert back to the deal they had under Obama, or is it too late for that?

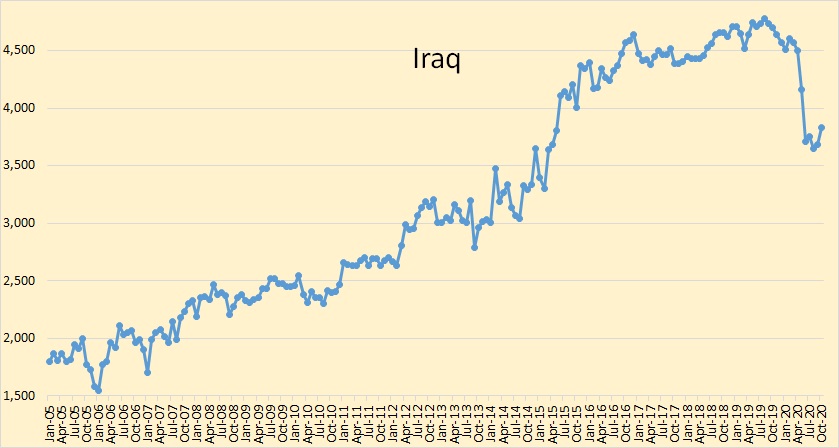

It doesn’t look like much on this chart but Iraq increased crude oil production by 148,000 barrels per day in October. They likely needed the revenue.

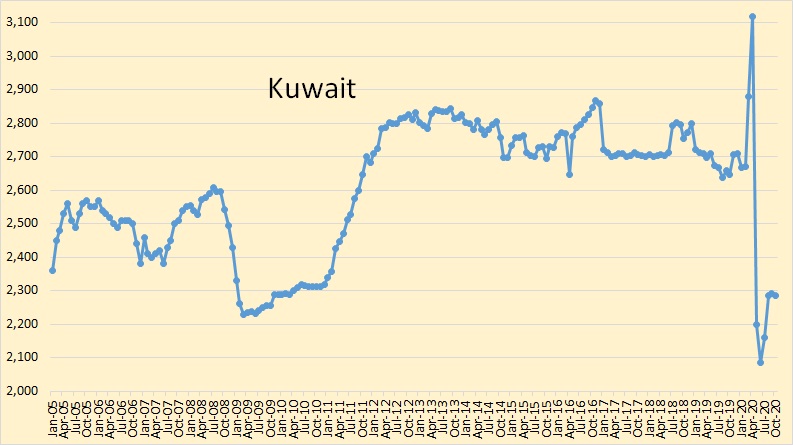

There has been little change in Kuwaiti crude production since August.

Libyan crude oil production increased almost 300,000 bpd in October to 454,000 barrels per day.

However, on October 29: Libya oil production at 680,000 barrels per day

On October 31: Libya’s oil production surges to 800,000 barrels per day

Then Today: Libya Oil Production at 1.1 Million Barrels a Day

That is an increase of over 1 million barrels per day from their lows this past summer.

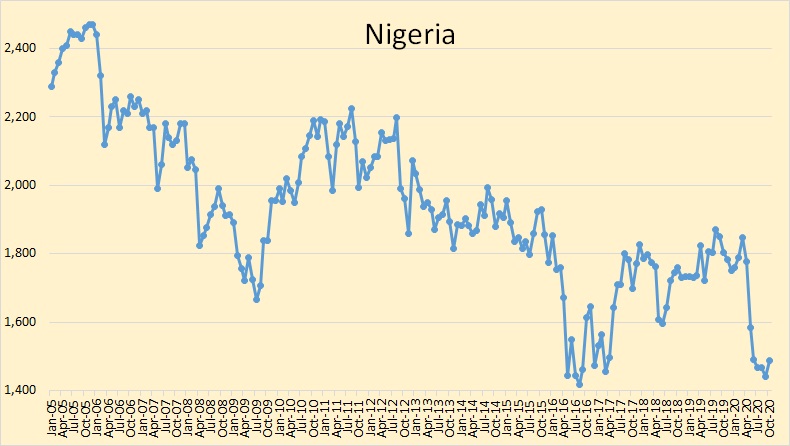

Nigerian crude oil production was up 47,000 barrels per day in October.

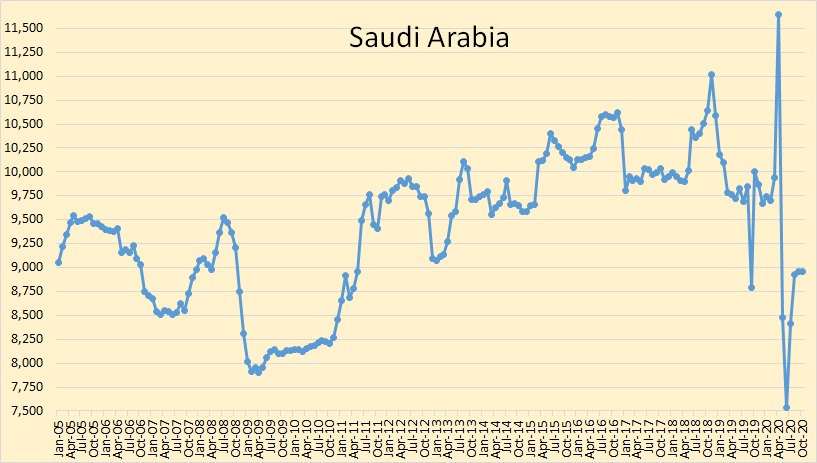

There was no change in Saudi crude production in October.

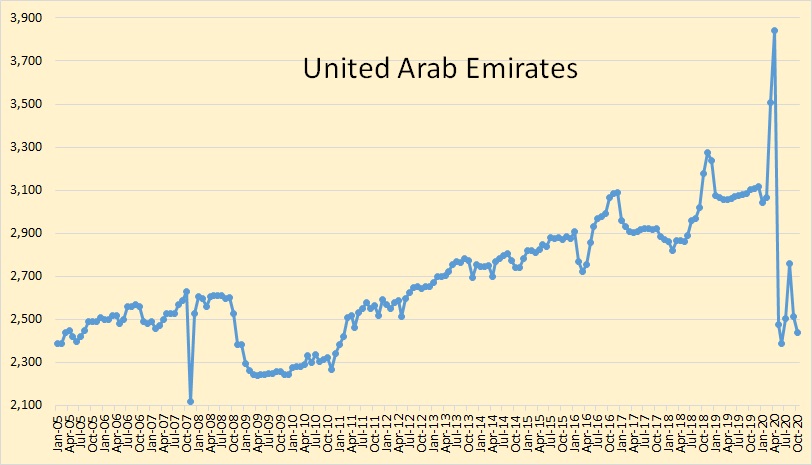

The UAE was down 47,000 barrels per day in October.

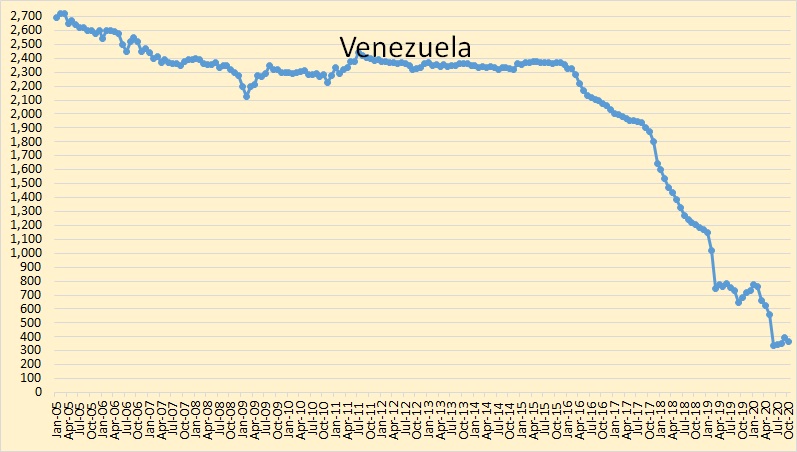

Venezuelan crude production was down 25,000 barrels per day in October.

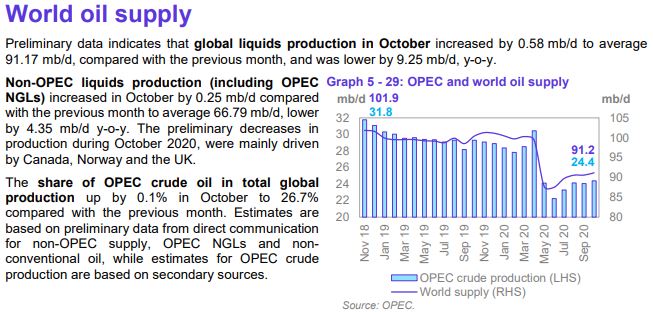

World total liquids production was 91,170,000 barrels per day in October according to OPEC. That was an increase of 58,000 barrels per day over September. That is total liquids, not C+C.

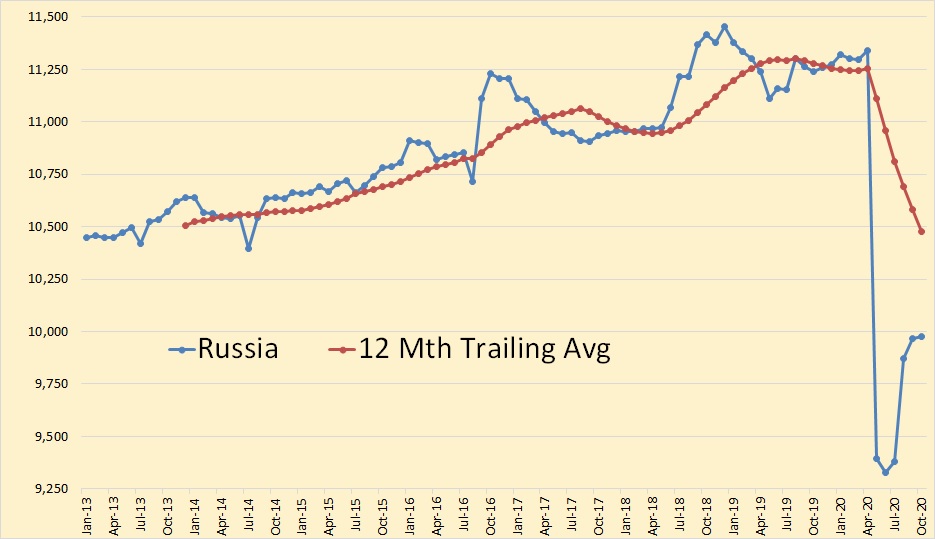

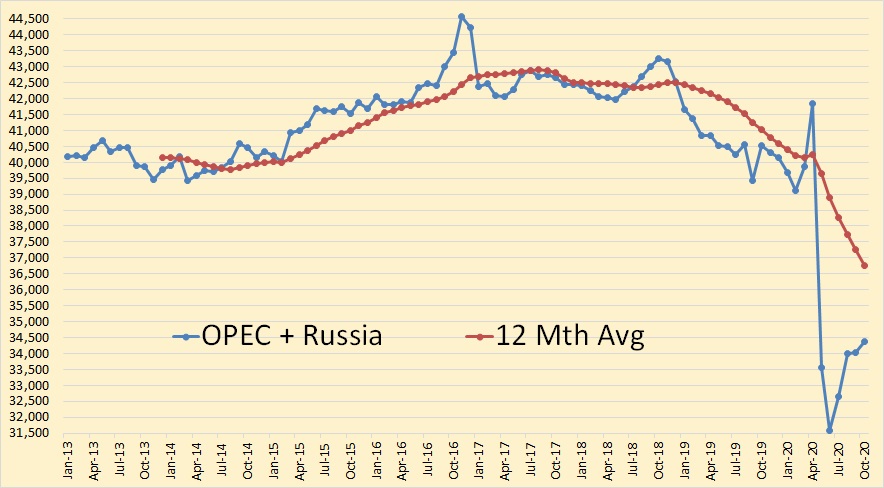

There was little change in Russian production in October, they were up 10,000 barrels per day.

OPEC crude only plus Russian C+C was up 233,000 barrels per day in October.

I think OPEC is in big trouble. With Libyan production increasing by one million barrels per day and the possibility of Iran increasing production under Biden, and the virus driving demand down even further, it just don’t look good.

Also, Russia could easily increase production by about 1.2 million barrels per day if they decided to do so. Production capacity will greatly outpace demand for the next 5 years… at least. Oil is up today. Brent at $44.44 per barrel. That price is based on optimism about the new vaccine. But nothing there will happen for months. A build in storage will soon be obvious. If I was a trader I would be selling. The price will be lower soon, and remain lower.

Well, that is just my humble opinion. But what do I know? 🙂

The election hasn’t been called yet. People that think it has are setting themselves up for some possible big disappointment. Market will chase vaccine. It’s like a big damn carrot to a rabbit. It won’t trade in a straight line up but the direction is up.

We will be back at $60-$75 WTI within 18 months. And people won’t understand it because some of the fundamentals will not have changed all that much.

It’s the narrative that is going to matter.

And don’t be surprised if the recovery narrative is US dollar positive and oil price positive at the same time.

WTI is still in a massive falling wedge from the 2008 highs. The spike down into negative price didn’t change this pattern. Price close well within the pattern on monthly chart. This is a massive Bullish pattern. And the price action within the pattern has turn Bullish.

My long term view on economy and where we are going is as bearish as anybody’s. We just aren’t there yet. That is why i am currently long oil and copper and NZD and AUD dollars. Which all goes against my long term view. I’m also long USD again but it’s against JPY and CHF. Every single one of these trades is based on the recovery narrative.

The election hasn’t been called yet. People that think it has are setting themselves up for some possible big disappointment.

Bullshit. It’s over! The election has been called. It was called by American voters. Trumpers who are hoping for a miracle have a serious problem facing reality. But Trumpers have always had a problem with reality.

We will be back at $60-$75 WTI within 18 months.

Possible but I seriously doubt it.

And people won’t understand it because some of the fundamentals will not have changed all that much.

If the fundamentals do not change then the price will not change. Demand is down because of the virus. Production capacity is one hell of a lot higher than demand. If prices start to creep up then production will creep up, keeping prices low. The fundamentals are called “supply and demand” and that is exactly what determines the price of oil. Sure, news, like the vaccine, very often causes wild swings in the price of oil. But they always swing back to where supply meets demand.

It’s the narrative that is going to matter.

What the hell are you talking about?

narrative

NOUN

a spoken or written account of connected events; a story.

Yeah right. That’s what will determine the price of oil? RITFLMAO.

Why are trumpites so smart….I mean dumb???

https://www.youtube.com/watch?v=gQpqsj3tcMU

Downside to oil price:

– Covid 19: my estimate, at least 6 more months of decreased activity.

– Prices above LOE: owners will produce flat out.

– Election uncertainty and poor transition to the next US president: lack of governance.

– Bankruptcies: falling market and more cash for extraction.

– Unemployment problems: many people without resources to buy oil.

– Changing markets due to climate change mitigation.

– Economic turmoil because our economic system is poorly adapted to economic contraction.

Upside to oil price:

– Decreased investment: -35% 2020 acording to the IEA, 2021?

– End to Covid 19.

The oil price depends on the oil economy which contracted more than 4.4%, on the order of 10% (check oil price and extraction rate). My guess is that 2021 E&P investment will be the same or below 2020. If so, a very rough estimate (Dennis would be better at this than I) would be a 6-10% drop in oil extraction capacity by end 2021 with respect to 2019. My guess is that the oil economy in 2021 will be flat to down. Because of the many uncertainties, I would not be surprised to see oil at either Ron’s estimate

nor HHH’s estimate. We will see.

– Election uncertainty and poor transition to the next US president: lack of governance.

There is NO election uncertanity except in the Georgia Senate race. There will be a smooth transition to the new President. Trump’s temper tantrum will not change that. As for governance, if the Republicans retain control of the Senate that may be a problem.

I agree with all your other points except the last one, End of covid 19. You didn’t say when. Not in 2021, that is for certain. However the deep recession brought on by the pandemic will last until well after 2025.

And there will be big improvement in governance beginning in late January with the Biden inauguration, which will provide a substantial improvement in the nations business planning environment, as well as more coherent, effective and rapid response to the pandemic.

Ron,

World Real GDP is projected to reach 2019 level by 2022 by major agencies such as IMF, they might be wrong, but they got it right in Oct 2009.

Can you give us your expectation for oil price?

My $75/bo scenario (in 2030) is at $51/bo in June 2022. That’s my guess for 2022, in 5 years (Nov 2025) Brent would be at $61/bo in my $75/bo scenario.

Also OPEC projects World growth at -4.3% in 2020 and 4.4% in 2021. This puts 2021 World real GDP at 99.9% of 2019 real World GDP, it is likely that by 2022 World real GDP will be higher than 2019, if the OPEC estimate is correct. (see page 10 of OPEC Nov 2020 MOMR)

Can you give us your expectation for oil price?

I expect oil to remain below $45 a barrel through 2021. I would expect that price to remain, adjusted for inflation, for the next few years. However, inflation may increase that $45 to well over $50 or even $60 a barrel for 2022 through 2025. But I expect it to remain below $50 a barrel in today’s dollars through 2025.

Of course all that is just a wild ass guess. The difference in your expectations and mine has to do with the rate of recovery from the covid pandemic. You seem to be expecting a much faster recovery than I do. That is our difference, Dennis. Of course, you think there is a whole lot more oil left in the ground than I. But the pandemic recovery rate is our major difference.

Ron,

Thanks. Note that C+C output will remain quite low at the oil prices you project, note that I forgot to mention that the oil prices I proposed were in constant 2019 US$. My scenario assumes major organizations (IMF, IEA, EIA, OPEC) are making reasonable projections of future economic output (all of these agencies are making very similar projections, of course that doesn’t mean they will be correct).

I agree our different projections for future World economic output results in different oil price predictions.

Interestingly, your projection is one of oversupply of C+C for the next 5 years, my expectation is roughly a balanced market from 2021 to 2027, tending toward scarcity after 2022. Also the $75/bo maximum oil price scenario (in 2019 US$) I would consider a minimum reasonable scenario at least through 2030, I expect oil prices might be much higher as demand outruns supply around 2027 to 2028 with oil prices perhaps rising to $100/bo in 2019 US$ sometime after 2030.

This is because I think the oil that can be extracted at these oil prices at a profit is indeed quite limited.

World Real GDP is projected to reach 2019 level by 2022 by major agencies such as IMF, they might be wrong, but they got it right in Oct 2009.

I should have addressed that point in my previous reply to this post, but I overlooked it. People who compare the 2008 recession and hit on the world economy are making a very serious mistake. This pandemic hit on the world economy will make the 2008 hit look miniscule. No comparison whatsoever. No, the economy will not be back to 2019 levels in 2022. We will recover if we get a vaccine, but not quick. There will be lasting effects regardless of the vacccine.

Ron,

The point was simply that previously the IMF made a pretty good forecast, in this case their forecast is very different and it may well be wrong, we won’t know for a few years what the future will bring. Note also that in 2009 their forecast was too conservative for the first few years, but the forecast 4 and 5 years out was too optimistic (only by a small amount). In this case we don’t really know what will happen, or I don’t, others claim to have foresight. 🙂

World Real GDP in trillions of 2010 US $ at market exchange rates based on IMF October database

https://www.imf.org/en/Publications/WEO/weo-database/2020/October/weo-report?a=1&c=001,&s=NGDP_RPCHMK,NGDPD,&sy=2008&ey=2025&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

The forecast (in red) recovers to previous trend by roughly 2025.

The 2025 level is as if nothing ever happened. That is, this is the level that would have been reached if the Covid 19 virus had never happened. And it will be at that level even though it did happen. So, in the long run, the covid 19 virus made no difference whatsoever. Somehow I have trouble believing that.

Also, according to the IMF database, in 2021 we will be back to 2019 levels. That even though the virus will still be raging. Right now it is raging like wildfire. Bur next year everything will be back to 2019 levels, back to the level it was when we knew nothing about the virus. Somehow I have trouble believing that also.

Ron,

I agree the IMF outlook seems optimisic, they have a different downsidevrisk scenario which may be more realistic, but the data out to 2025 is less accessible. Eventually the economy will recover especially if good government policy is adopted.

Hey Ron,

Consider the roaring 20s that followed the 1918 pandemic, the US economy grew at 6.6% per year on average from 1940 to 1970. I do not expect we will see World growth at this level and certainly not OECD economies, but we may see strong growth in India, China, and many emerging economies following the pandemic.

Dennis ,2020 is not 1920 . As to strong growth out of India ,you can kiss that goodbye . Let’s talk about collapse . I have detailed the current situation in a post below . This year it will be the worst performing economy in the world at -10.5% . It would need to grow at 10% per year for the next 3-4 years just to get back to 2019 . Never has been done by any nation excluding China . Coming to China . China is 17.8 % exports . As the world markets contract ,so will China . There are only so many ghost cities and roads to no where that can be built . It is just plain unsustainable .

Hole in head,

Yes 1920 was different from 2020, we know far more now than 100 years ago.

I have met a lot of very talented people from both South Asia and East Asia.

My guess is that the pandemic will subside, and India and China will resume rapid economic growth.

Dennis , ignorance is bliss . All Asians you know are US based . Asians are talented but they need they correct eco system which will deploy their talent . Dr Khurana , Dr Sen , Dr Banerjee all of Indian origin but won the Noble prize because they did their work in USA where the eco system existed for their talent . I can go on and on for talented Indians in USA, UK ,Germany etc where the eco system exists for the use and growth of their talent . Unfortunately their success has nothing to do with pulling the growth in India . Your exposure to Asians is limited to persons who immigrated because there were no avenues for them to apply their talent in their homeland . India has + 50 % of the total world’s illiterates , + 50 % of the women and children are malnourished , are 3rd from the bottom on the hunger index . Corruption , crime ,cults and crazies thrive . You know very little to discuss on this topic . You are making a guess and I am giving you solid data and figures . A little knowledge is a dangerous thing .

Hole in head,

Perhaps I am wrong but I imagine there are many talented Indians whobhave not emigrated.

Time will tell. Your data is anecdotal.

Dennis, yes you are wrong . Many talented still remain in India ,but they are all decaying because the eco system to harvest their talent is nonexistent . Imagine doing 3 years in B tech + 2 years to do M tech and then having to drive for Uber or delivering Pizza’s and filling up orders at Amazon . One is 25 years old with no future . Immigrating is not an option now , all countries have tightened their immigration policies because of their own local unemployment . I have earlier commented that the tsunami of the unemployed worldwide is going to cause social and political upheaval . In India 10 million students enter the workforce every year . In 2020 the job loses were 2.5 million in the organised sector .In 2021 another 10 million will be ready to join the workforce . This is a cumulative disaster . India is at the confluence of Meadows ” Limits to growth ” and Catton’s ” Overshoot ”

As to my data being anecdotal , please note data is either true or false ,never anecdotal or anything else . If you want I can post links about what I have stated since all comes from UN reports .

P.S; On a personal note I immigrated after reading ” Overshoot” . That pushed me over the cliff .

Dennis and HH, I have been following your debate very closely. HH is claiming that India is deep into overshoot and on the verge of total collapse. Dennis’s argument is basically: Nah, everything will eventually be just fine in India, and besides, your data is anecdotal.

Dennis, I have been thrashing this straw for half a century. I am familiar with every facet of the overshoot debate. And I must say, that in this case, you are not just wrong but horribly wrong. HH has put his finger squarely on the root of the problem. The problem is just too damn many people trying to find their place in a desperately overcrowded world.

But what blew my mind is the problem is just so damn blatantly obvious. I mean the causes of the problem just slap you squarely in the face. It is bad, very bad, and getting worse. And there is no answer to the problem other than letting nature take its course. And as HH points out, Nature taking its course has already started in India: 50 % of the women and children are malnourished.

Everything is just so damn obvious, how can people continue to deny something just so damn obvious. I’ll tell you how. Because of their worldview. Their worldview defines who they are. People have their whole life invested in their worldview and they cannot give it up. They cannot because they have everything invested in their worldview.

Nick believes that renewables will save the world from the coming anarchy, famine, and collapse. Dennis, rather reluctantly, seems to agree with him. It is their worldview and come hell or high water, nothing will ever change that worldview.

My world view has been telling me that overpopulated regions of the world, like India, are ripe for a collapse scenario, for many decades now.

So far, it hasn’t happened, except in a few failed-state pockets like Syria or Somalia.

Some day perhaps- Next month, or in 50 years.

In the meantime, the number of India people with a small measure of prosperity and hope has grown steadily and at a brisk pace over the last 50 years.

For a glimpse at the big picture, here is a summary-

https://www.asianstudies.org/publications/eaa/archives/the-middle-class-in-india-from-1947-to-the-present-and-beyond/

This is not to say that the whole culture is not fragile, or that the environment can sustain the rapid growth. I hope to be gone (and without a TV) when the project unravels.

[I have a son-in-law who is Bengali, and all of his family lives in India]

Here is a chart of GDP/capita in India over the last 25 years

Nick believes that renewables will save the world from the coming anarchy, famine, and collapse.

I don’t think I’ve said any part of that: I try to avoid saying things like “will”, and “save the world”. Renewables can provide clean, abundant affordable energy. They don’t guarantee competent governance. The US is now the poster child for that, with our accidental reality-show president.

I don’t think I’ve said any part of that:

Perhaps I expressed what I think is your opinion in the wrong way. No, of course, renewables will never heal the political problems of the world, and will not help with religious bigotry or racism or anything like that. What I meant, and what I think you believe, is that renewables will completely replace fossil fuel and therefore there will not be any serious world energy problems with the future world, or within the next few hundred years anyway.

Please correct me if I am mistaken.

My opinion is, of course, that I think energy will be a very serious problem and will contribute to, though not cause, the coming collapse of civilization as we know it. Renewables will definitely help but they will never completely replace fossil fuel.

Ron,

Will F humans stop burning fossil fuels in significant quantities in the reasonably near future? IMHO, I don’t think that’s guaranteed, given the power of reactionary forces like the Koch network of billionaires. But humans could stop burning FF, and be far better off.

Will there be serious energy problems? Again, IMO those are likely, though they could be prevented by good governance. As an example: the Great Depression was caused in large part by farm automation, which you can describe as an energy transition: horses running on biomass to tractors running on oil. The Depression could have been largely prevented by floating exchange rates; international free trade; federal bank deposit insurance; farm price supports; unemployment insurance; Keynesian deficits, etc., etc.

So, are problems likely? Sure. For instance, there are lots of badly managed FF subsidies around the world. Both India and China have reduced their subsidies somewhat, but they’ve had a lot of problems doing so: riots, etc. Those subsidy reductions have generally been badly handled: you have to consult with the people who get them before you take them away; you have to explain the need; and most of all you have to replace them with better low income subsidies: programs that are cheaper, more targeted and that don’t encourage energy waste and misuse, and yet actually help low income folks more than cheap fuel.

I think your remaining question about renewables was basically seasonal intermittency: what do you do in the depths of winter when there’s not much sun or wind? Is that correct?

I think your remaining question about renewables was basically seasonal intermittency: what do you do in the depths of winter when there’s not much sun or wind? Is that correct?

Oh if it were only that simple. If only that was the only concern.

Of course, that is one concern, but far from the only concern. But on that point, thinking batteries will get us through those long winter months is a childish fantasy. There are other concerns. Batteries will not power aircraft or sea-going vessels. Battery product requires massive amounts of fossil fuel. Mining requires fossil fuel that will likely not be produced by batteries. Blast furnaces require fossil fuel. Fertilizer production requires massive amounts of fossil fuel.

Nick, believing that the world as we currently know can be run on renewables is a pipe dream, a fantasy. The world will eventually be powered exclusively by renewable enerby, as it once was. But that will be a world of far less than one billion people.

Hole in head,

The IMF expects strong growth from India from 2021 to 2025, average rate of growth from 2005-2019 about 7% per year for real GDP (at market exchange rates). After the 10.3% drop in output expected in 2020, growth resumes at about 7.48% per year on average from 2021 to 2025.

Data from

https://www.imf.org/en/Publications/WEO/weo-database/2020/October

I agree the IMF forecast is likely too optimistic, but perhaps your assessment errs on the side of pessimism.

Dennis , this is the same IMF that structured a $ 50 billion bailout of Argentina just two years ago . Argentina is bankrupt again . IMF just like UN and EU is a parking place for connected bureaucrats to collect hefty salaries and pensions . The jokers would not be able to count beyond their fingers . Trust their figures and forecasts at peril .

Yeah, but who grows and who doesn’t. It’s kinda like in the US where the top 1% get the growth and the lower and middle class get the shaft. Here is what’s really happening in India, bold mine.

Malnutrition behind 69 per cent deaths among children below 5 years in India: UNICEF report

NEW DELHI: Malnutrition caused 69 per cent of deaths of children below the age of five in India, according to a UNICEF report released on Wednesday.

In its report — The State of the World’s Children 2019, UNICEF said that every second child in that age group is affected by some form of malnutrition.

This includes stunting (35 per cent), wasting (17 pc) and overweight (2 pc). Only 42 pc of children (in the age group of 6 to 23 months) are fed at adequate frequency and 21 pc get adequately diverse diet.

Timely complementary feeding is initiated for only 53 per cent of infants aged 6-8 months.

About Indian women’s health, it said every second woman is anaemic. It also said that anaemia is the most prevalent in children under the age five years. Its prevalence among adolescent girls is twice that of adolescent boys.

Indian children are being diagnosed with adult diseases such as hypertension, chronic kidney disease and pre-diabetic.

The data states that children under the age of five years are affected by micronutrient deficiencies. While every fifth child under the age five is vitamin A deficient, one in every third baby has vitamin B12 deficiency and two out of every five children are anemic.

Just imagine if every second woman in America were anaemic. Just imagine if only 42 pc of children in America (in the age group of 6 to 23 months) are fed at adequate frequency and 21 pc get adequately diverse diet.

Yes, just imagine that for one damn minute. And you think everything is just hunky-dory in India? If we had similar conditions here, you would be singing a different story.

Ron, true indeed that the number of impoverished, malnourished and at risk population in India is vast. But the percentage of such people in India is lower than in the past.

Pre-covid “During the eight-year period between 2004 and 2012, the middle class doubled in size from 300 million to 600 million.”

We will see how the recovery goes.

Looking at the big picture, don’t be surprised that by the end of this decade that India is the largest country in the world, and that its oil and coal consumption has continued to rise, that its GDP is far larger than today, that its middle class has grown much larger…. and that it also has one of the largest populations in the world who are short on water, short on food, and in a state of poverty. I believe that all of this is ‘baked in the cake’.

Hickory , I am at ground zero , so let me explain somethings you are not aware of . India defaulted on its foreign debt in 1990/91 . It pledged it’s gold reserves to IMF for a loan of $ 500 million . IMF forced the opening of the economy which was socialistic into a market economy . The rupee went from $ 1 = Rs 14 to Rs 25 . In the same year the govt made all profits from exports 100% tax free and loosened up credit markets . The result was a boom in exports . Now I will tell you something interesting . Sometime around the same period the Y2K problem appeared . The Y2K was written in an outdated computer language ( I think it was COBOL) and there were no programmers in the West who were then writing in this language . India was a laggard in the 90’s and the only country where the outdated computer language was being taught and practiced . Result ,all the Y2K business came to India . This was the stepping stone for the current big players like TCS , Wipro , Infosys etc . I did some calculation and found that if one was to deduct the inward remittances from the IT industry + remittances from overseas Indians were subtracted from the current reserves o $ 550 billion , we will land up in a negative balance of payments situation like 1991 . I immigrated in 1992 , my estimated year of collapse was 2000 . The Y2K issue came up in 1995 and the benefits obtained from it pushed the collapse to 2014 . Since 2014 their was a continuous secular decline in growth . The country was always in ” overshoot ” and had in 2014 hit ” Limits to growth ” . Covid has accelerated the process . Collapse does not mean zombies walking the street or buildings falling down , that is for Hollywood , Bollywood and Tollywood . Collapse is also lose of hope and confidence that tomorrow will be better than today . Ron, has taken the trouble to look up the facts and posted accordingly .

P.S ; Ask your son in law what is Tollywood and also express my grief for the death of Soumitra Chaterjee an icon of Tollywood . Side note , your daughter hit the jackpot . Bengali’s are geniuses . Out of the 5 Noble Prize winners from India 3 are Bengali’s , Dr Amartaya Sen , Dr Abhijit Banerjee , Rabindranath Tagore . Be well.

Nick you posted ,”They don’t guarantee competent governance. ” When did Ron talk about governance ? He says that the Achilles heel of renewables are storage and intermittency and until these two issues are addressed it fails to deliver . I endorse his viewpoint . Let me give you a benchmark , when a factory making solar panels and wind turbines along with installation of the panels and the turbines can be achieved without fossil fuel energy then give me a call . Till then please excuse me , I have no desire to get into an argument on this .

HIH,

Y2K was a date problem (a 2 character field was used for dates, not a 3 or 4 character field that could capture the century or millennium), not a COBOL program, and COBOL (for better or worse) was definitely still being used for programming in the US in 1990. Interesting side note: I once saw a “decade” problem, where a single character field was used for the date!

I’m curious: where did you immigrate from in 1992, and where did you go?

Regarding renewables: you can’t really start a discussion by making a strong statement, and then say you don’t want to have a discussion.

So….don’t forget the wide range of solutions, which need to be used in an integrated, optimized way. Many analyses look at simple solutions, used for everything: 100% solar, or 100% chemical batteries, or 100% enormous HVDC transmission bands, etc. These will be very, very expensive.

A big one is supply diversity: Wind is a bit stronger at night and during the winter, so a balanced mix of solar and wind will do much better in winter than you might expect.

Another big one is overbuilding: as an example, the current US grid has a capacity of 1,050GW, while average demand is 450GW. A renewable grid would do something roughly similar.

Finally, seasonal backup (that is, winter) storage is unsuited to chemical batteries, which have a relatively high cost per kWh. You want something similar to current natural gas storage: “wind-gas”, probably hydrogen in salt domes.

————————————————

Ron talked about coming anarchy: my point was that renewables are a source of energy, and they can solve problems related to energy. If we have anarchy, it won’t be primarily because of energy, though I would agree that energy transitions can cause stress that could cause fragile and incompetent governments to do badly. India, in particular, is not known for the best governance.

Hole in head,

The future is difficult to predict. Some IMF forecasts have been pretty good, as the October 2009 IMF World outlook proved fairly accurate at the World level. Note that they underpredicted actual World real GDP growth from 2010 to 2012, but were a bit optimistic for 2013 and 2014, overall they did quite well during a time of great uncertainty, probably a lucky guess.

Odds of success are zero for any prediction of the future, the statistics are very simple.

Number of possible futures is equal to infinity, number of actual futures is one odds of picking the correct future path is exactly one divided by infinity.

Any claim that past predictions have been incorrect is kind of silly, kind of like a complaint that liquid water is wet. 🙂

Dennis , your latest post is bullshit crap . I don’t like using the term . By your own words

2010-12 they underestimated ,2013-2014 they overestimated and for the rest of the times it was as you said ” probably a lucky guess ” . These guys are paid six figure salaries + benefits to hit the bullseye and not being ” a little bit off ” . Yes ,just like being a little bit pregnant . Imagine what would happen to Lionel Messi or Christan Ronaldo if they underestimated or overestimated where the goal posts were or to Le Baron if he estimated where the basket was or to Tiger Woods if he estimated where the hole was . Paying six figures and getting continuously incorrect conclusions , fire them all , better just shut it down . Heck , monkey’s throwing darts would have a better track record and they would be cheap ,only bananas .:-)

Hole in head,

Have you ever studied statistics?

The comparison between forecasts and ball sports is far from apt.

Can you point me to anyone who forecasts the future accurately?

The October 2009 forecast was quite good, nobody knows the future (except you and perhaps Ron). 🙂

Hi Ron,

Try quotes of what I have said, don’t make shit up.

What I said is that the IMF forecast is optimistic and HIH is pessimistic, in a nutshell.

Chart below has India’s Real GDP per capita from 1990 to 2019 data from World bank (link below)

https://data.worldbank.org/indicator/NY.GDP.MKTP.KD?locations=IN&view=chart

The average annual rate of growth was 4.73% per year for India from 1990 to 2019 the average rate of growth for World real GDP per capita was 1.62% (India was almost 3 times faster than the World average over the 1990-2019 period).

Dennis wrote: Try quotes of what I have said, don’t make shit up. You know who you sound like when you do that?

Huh? What in the hell are you talking about? I haven’t a clue.

Ron,

You get very annoyed when others attribute things to you that you have not said. Read what I write and don’t add ideas that you think I have said, when I have not.

I showed the IMF forecast and said it was likely too optimistic, I also said I believed Hole in head’s forecast of impending collapse seemed pessimistic.

I am curious, does Hole in Head’s forecast of WTI at $25/bo by 2025 seem plausible to you? Perhaps we have found someone more pessimistic than you. 🙂

Chart of India’s real GDP per capita from 1990 to 2019 below.

Well, I still haven’t a clue as to what the hell you are talking about. But I will try to answer your question.

I think oil will be below $50 a barrel in 2025. It could be below $35 a barrel. I think $25 is a little low. But about collapse. Collapse is inevitable. I just have no idea when. It could be within the next 5 years or it could be 50 years from now. I am talking right here about world economic collapse. World ecological collapse is already well underway.

Hole in head,

You mentioned that I have met Indians who have emigrated, that is correct (these are physicians who went to medical school in India and then did their post medical school training in the US or UK, no nobel prize winners, I have never met one). So is your claim that all talented Indians leave India? Clearly that is not the case, not that I am not claiming that all Indians are equally talented, simply that there are no doubt many talented people who live in India.

Let’s say India’s real GDP was 100 in 2019, below we have real GDP from 2019 to 2025 where we assume -11% growth in 2020, then 5% growth from 2021 to 2025.

India real GDP (2019-2025)

100.0

89.0

93.5

98.1

103.0

108.2

113.6

Note that from 2009 to 2019 the average annual growth rate for India’s real GDP was 6.64%, so my 5% growth rate assumption is quite conservative.

Ron,

Wow,

How about your expectation for World real GDP in constant dollars in 2025? I guess you are assuming World real GDP will remain below the 2019 level for the next 5 years, that is the only way that oil prices remain at $50/bo or less for the next 5 years.

That will be wrong in my opinion, I would put the odds of the average annual oil price for WTI being at $50/bo or less in 2025 at less than 1 in 10 odds.

In 2019 the average annual price for WTI was $57/bo and the only year since 2004 when the real average annual price for WTI (in 2019$) was $50/bo or less was 2016 (the WTI price was $46/bo that year in 2019$).

We will see if the current economic collapse continues for 6 years, I doubt it.

I guess you are assuming World real GDP will remain below the 2019 level for the next 5 years, that is the only way that oil prices remain at $50/bo or less for the next 5 years.

No! That is a non-sequitur. World GDP can very well be above 2019 levels while a world oil glut is still around, keeping prices low.

We will see if the current economic collapse continues for 6 years, I doubt it.

Errr… I do think we are talking about a different kind of collapse. I had no idea you thought the world was currently in an economic collapse. Let’s just call it a recession. But yes, the current recession could very well last well beyond 2025.

But when the collapse comes, you will not need an explanation as to what is happening.

Ron,

I put my comment in wrong place.

You said:

Dennis and HH, I have been following your debate very closely. HH is claiming that India is deep into overshoot and on the verge of total collapse. Dennis’s argument is basically: Nah, everything will eventually be just fine in India, …

I think you may have characterized Hole in head correctly, can you find where I say everything will be fine in India?

I said:

The IMF expects strong growth from India from 2021 to 2025, average rate of growth from 2005-2019 about 7% per year for real GDP (at market exchange rates). After the 10.3% drop in output expected in 2020, growth resumes at about 7.48% per year on average from 2021 to 2025.

…

I agree the IMF forecast is likely too optimistic, …

Okay, sorry about that Dennis. But HH was referring to the eventual collapse of India. That would just be a precursor to the collapse of the rest of the world. However, you have always doubted total collapse. That was what I was referring to.

Sorry for the misunderstanding.

Hi Ron,

So you expect there will be a continued oil glut with oil prices at $50/bo or less from now through 2025, have you become a cornucopian?

Generally an economic depression is considered an economic collapse, I would say the World economy is in a Depression at present. If economic growth remains very low for the next 5 years so that in 2025 World output is roughly equal to 2019 (in constant 2019 US dollars), then your oil price forecast might be correct, that is the only way there would be an oil glut at the oil prices you foresee. By 2023 at the latest, the annual average oil price will be above $50 (for Brent in 2019 US$). My expectation is that the average annual oil price in 2023 will be at least $53/bo for Brent (possibly as low as $47/b for WTI) in 2019 US$.

Hi Ron,

I think hole in head thinks India’s collapse has begun and it will never recover. I disagree, I think there is a severe depression currently (we agree on that point), on the future I am unsure what will happen, but I am doubtful that India’s depression will be permanent.

So you expect there will be a continued oil glut with oil prices at $50/bo or less from now through 2025, have you become a cornucopian?

No, believing that the recovery will be extremely slow does not make me a cornucopian.

Generally an economic depression is considered an economic collapse,

Wow! Imagine that, I always assumed that depression and collapse were entirely two different things…. Oh well.

I would say the World economy is in a Depression at present.

My dad, who lived through the Great Depression, would argue with you on that point. You do indeed have a strange definition for the word “depression”.

I think hole in head thinks India’s collapse has begun and it will never recover. I disagree, I think there is a severe depression currently (we agree on that point), on the future I am unsure what will happen, but I am doubtful that India’s depression will be permanent.

Dennis, nothing is permanent. But I think India will never recover from their current predicament. Their economic collapse is coming head to head with their environmental collapse.

The world collapse will begin in India or Bangladesh. This just may be it.

Hole is criticizing Dennis for his analysis.

Funny.

Just about 10 days ago Hole said something to affect of- “there will never be an effective virus”

Hickory , here is a copy paste from my post of 13/11/2020 .

“The world will never be the same again .There will be no vaccine in 2021. My best bet is 2023 if we can be in one piece by then . Agreed the system has displayed astonishing resilience till now , but so did Joe Frazier and George Foreman till they crumbled to Ali . Yes , a lot of announcements will be made for the cure but these will be nothing but “pump and dump” affairs for Wall Street just like Pfizer .”

I did not say there will be no vaccine . I was also correct about the announcements and the “pump and dump ” . Moderna did that just yesterday .

Dennis , a little knowledge is a dangerous thing . Let me give you some data and some info that you don’t have and are on the wrong side of the equation . First data

year GDP growth Increase/ decrease

2014 7.8% — 2018 6.12% –o.92

2015 8.0% 0.2 2019 5.02% — 1.02

2016 8.26% 0.26 2020 3.8% — 1.22(Estimate by govt

2017 7.04% –1.2 Actual 2020 — 8.9% (New estimate after Covid

As you can observe the economy hit the” Limits to Growth) in 2015 and has been in a secular decline even before Covid . It was already in ” overshoot ” . So now the trouble starts . Let me enlighten you some more . India is 1.3 billion people . 50 million are USA ,400 million are Malaysia and 850 million are Chad/ Mali . The 50 million have all , their children study in Harvard , they vacation in France and wear Gucci, Prada. Their car is a Mercedese ,BMW or Audi Their budget is limitless .They are far away from real collapse . The next 350 million are the aspiring class . Their children study in India and aspire to get a job or maybe settle overseas after studying , their car is a Suzuki or if lower down the ladder a motorbike/scooter ,they can take a vacation locally or maybe to Thailand and Singapore every two/three years . They dress well and are comfortable but no luxury . They have a monthly budget and are thrifty . However if their is a health emergency they will have to cancel the vacation or a wedding to meet the expense .

Now we come to the balance . This is where the collapse is happening . For them the issue is only food and water . They know that they, their offspring and future generations will live in a hut , the children will get no education , their future is as domestic servants to the 50 million and 400 million as above or work on a daily wage basis digging canals , road repairs or other odd jobs . In an earlier post I had mentioned that the govt gives a handout of 5Kg wheat + 1 Kg chickpeas free for a family of 4 PER MONTH . Well that works out to 5100 calories per person per month or 175 calories per day . If you will total ,you will observe that the total number of the population do not match . The reason is that for 50 million is only scavenging or begging . They are beyond poverty ,they are destitute.

What Covid has done is that it has hit about 100 million(the one’s with the motorbike and scooter) of the 400 million Malaysia . They have lost their jobs and are now living day to day . The aspirational class is dead in the water . Their children realise this and that is why a spike in student suicides which I have indicated in my earlier post . This malaise and a slide into a black hole is creeping onto the next 300 million as the economy slows down and opportunities not only decline but are non existent . I know the next 100 million are feeling the heat . The other 200 million are still complacent. Like I said earlier” Just because it hasn’t happened to you ,does not mean it is not happening ”

Please don’t jab at Ron ,me or others who don’t meet your world view . Let me just confirm that neither of us is a” collapsenik” . Collapse is like war . There are no winners , only looser . In case of a collapse my son,daughter ,friends everybody looses . What pleasure can we get by saying ” I told you so ” ? I realize that we are now living in peak civilisation , heck life could not get better then why should we wish for a collapse ? I see no reason for you to brand us as ” collapseniks” . Ron ,me and others only report the news ,we don’t fabricate them . Nobody is trying to scare anybody ,the objective is to make aware . Hope you can make a better judgement with all the info I have provided you . Sorry ,it is long .

Dennis , the data is crowded in my post ,so posting it separately .

Year GDP growth Increase/decrease

2014 7.85% base

2015 8.0% 0.2%

2016 8.26% 0.26%

2017 7.04% -1.22%

2018 6.12% -0.92%

2019 5.02% – 1.10%

2020 3.8% – 1.22% (Estimate by govt)

2020 – 8.9% Actual now as per govt

See how deep the hole is .

Hole in head,

No nation continues growing at an 8% per year annual rate of real GDP growth, so one would expect the rate of growth would eventually slow down.

A better metric is growth in real GDP per capita.

If we look at historical growth rates of real GDP per capita for South Korea, from 1980 to 1999 the average annual rate of growth was 7.5% per year and from 2000 to 2019 the average annual rate of growth of real GDP per capita was 3.2%.

Generally we will see rates of growth become slower as nations become more developed, this is expected.

I agree there is currently a very severe recession in India and most nations (including the US). The slow down in 2019 in India was due to policy changes by the government that disrupted the economy, in 2020 obviously we have the pandemic.

It is a terrible time for many in India and for many in other developing nations and for the poor everywhere. I think it likely that things will improve as the World moves past the pandemic. It is likely that covid19 vaccines will not be widely distributed worldwide until late 2021 or possibly late 2022, in my opinion, my expectation is that once this occurs economic recovery may be swift in most nations.

OECD has a nice forecast tool at link below

https://data.oecd.org/gdp/real-gdp-long-term-forecast.htm#indicator-chart

chart for india at link below

https://data.oecd.org/chart/6aq2

Ron,

I agree things always change, and in my opinion not only in one direction sometimes things get worse and other times they get better, the future direction is far from clear (at least to me).

In earlier comment you suggest a recession lasting until 2025, typically a recession is considered to be a period of negative economic growth for 2 quarters or more, also a recession that lasts for 4 years or more is typically considered a depression, a fall in GDP at an annual rate of more than 10% is also typically considered a Depression (many parts of the World such as Europe and South Asia and the US had annual economic growth rates in 2020Q2 of less than negative 10%). In any case, a recession (or depression) lasting from 2020 to 2025 suggests World real GDP of less than the 2019 level in 2025 and if this were to occur there might indeed be a glut of oil and low oil prices, I just expect such a forecast is improbable (perhaps a 1 in 100 probability of being correct).

OECD long term forecast for World real GDP at link below

https://data.oecd.org/chart/6aq7

Dennis , for me stats are just stats . i can justify my position by using one metric and you can justify your position by another metric , Unimportant . I have given you the ground reality of the Indian economy . The baggage of 850 million people to be carried by the rest is just too heavy . Let me give you some more info . Only 15 million (out of 1.3 billion) file a tax return of above $ 6700 PER YEAR . The govt has raised it’s hands they have told the public they have funds only for (1) Defense(2) oil imports (3) salaries and pensions (4) food subsidy (cannot afford food riots ) . No money for education ,healthcare , infrastructure , environment , maintains etc . You are on your own from 2021 . However I like to come back to the aspirational part of the economy which is important . For the 400 million in Malaysia their breakout was (1) Pass the civil service exam and join the creme de la creme of the govt . High salaries , job security and tons of money via corruption . This avenue is closed . The govt put a lid on recruitment . They have no money for additional employees . (2) Do an MBA and get a job in a multinational . Avenue closed . There is negative employment as MNC’s downsize ,since their is negative demand growth . (3) Go overseas . Avenue closed due to Covid and foreign govt restrictive immigration policy due to local unemployment . I get requests for help weekly to help with immigration ,but I have to disappoint them . The clock has run out . Youth depression is unimaginable . I understand this because I was in Greece when the ECB cut off the funds to the Greek banks . The level of despondency was out of the books .

Hole in head,

Yes we see the statistics differently. There is no doubt that there is an economic crisis currently in India, as to the future I think that could possibly work out differently than you expect, you expected collapse in 2000 and have explained why that did not occur. Is it possible that just as something you did not expect to occur in 1992, which delayed collapse to beyond 2000, some other unexpected set of events might delay the collapse you expect yet again.

I imagine there are many possibilities for utilizing the highly skilled unemployed workforce in India to produce any number of goods, enlightened government policy to attract foreign investment or private public partnerships to foster greater output, employment, and income are no doubt possible. There are many talented economists in India and many others from India that have trained at the best Universities in the World that could advise the Indian government on the best way forward.

I have not read the report linked below, but there are ideas out there

https://www.mckinsey.com/featured-insights/india/indias-turning-point-an-economic-agenda-to-spur-growth-and-jobs#

I have now read the McKinsey report, looks good to me, but I am not an expert on India, perhaps the authors know India well.

Dennis , miracles happen but as Osho (Indian mystic) said ” Miracles are for suckers ” . As to the Mckinsey report a lot of “ifs ” and ” buts ” . Question ? Who will bell the cat ? Best to put it in file 13 ( also called the waste paper basket ) . I have admitted that there are many bright lads in India still , but the eco system is dead to harvest their talent . What good is a high quality seed if the soil is dead and no water or sunshine ? As to intelligent economists , all economic advisors appointed by the govt leave within 12 mths maximum . The govt wants only ” yes” men which is an anathema for a free thinking individual ,so goodbye to rational economic advisors .

Hole in head,

Sometimes good leaders are elected, it does not happen often.

Perhaps you know the future, I will wait to see the truth revealed, I have consistently claimed that the future is unknown, that remains my position.

Dennis , I am in ground zero . The current ruling party will win the elections slated for 2024 until there is a ” black swan ” event ,over that I have no control .So if they win in 2024 ( possibility probability 100%) as of this date nothing will change then we are entering 2029 when the next election will be held . You want to place a bet ?

P.S : In my last post I said ” Who will bell the cat ” . The cat is the politicians . Some data for you : 70 % of the members of parliament(the saw called lawmakers in USA) have educational qualifications of up to Class 8 . Yes , they did not even clear high school . Jesus 3% can go further than writing their name in the local language ,leave alone Hindi or English. 40 % have criminal cases against them . 10 % have serious criminal cases which are murder, attempt to murder, rape ,attempt to rape . These carry a death sentence or life imprisonment . 25% have land grabbing , extortion , kidnapping etc . Minimum to maximum imprisonment of 5 to 15 years . But it gets better 80% are indicted for financial fraud basically running Ponzi schemes . So, the crooks are now the lawmakers . The fox is given the charge of the hens . I said ” A little knowledge is dangerous ” . I have ” an ear to the ground ” . I am not an armchair analyst .

Hole in head,

I don’t really follow Indian politics, assuming the elections are not fraudulent, voters get the leaders they choose, just like the US.

I noticed that India no longer does 5 year plans, it seems the slow down in growth coincided with the lack of 5 year plans, the new agency created seems to be doing a bad job of it.

You would no doubt know more.

Good post by Nate Hagens on election/Covid/peak oil etc

https://www.resilience.org/stories/2020-11-05/no-matter-who-wins/

Nate is out of date – he still seems to believe that fossil fuels and oil in particular have a mysterious, special magic.

For instance, his first point about energy is that “1) renewable energy isn’t renewable, it’s rebuildable“. Well, that’s just silly. All energy production equipment and infrastructure is “rebuildable”: it all requires periodic maintenance, repair and parts replacement. But renewable hardware generally has longer lifetimes than FF, and doesn’t require depleting fuel!

“But renewable hardware generally has longer lifetimes than FF, and doesn’t require depleting fuel!”

Data set or you’re a troll

Wind turbines and “renewable hardware” are constructed without fossil fuel?

Embarrassing, as usual.

I feel that Nate is generally well intentioned, and I like some of his ideas. I agree with him that we have enough stuff, and need to pay attention to people and more important ideals.

Nevertheless, he’s still repeating fossil fuel talking points, and making up new ones, like this silly “rebuildable” idea. Worse, other people seem to see him as an authority, and repeat these ideas and confuse yet more people.

No, of course wind turbines and other renewables stuff are typically built with the tools and vehicles that currently are typically used by builders. But the idea that this is ordained by god, and that renewable power couldn’t provide the power needed to build yet more renewable power is completely unrealistic.

The first oil wells were built by horses, and the first oil barrels were moved by teams of horses (which named the Teamster’s union), and wood charcoal was used to make the iron that was used to build the first coal mines. The current infrastructure always has to build the next generation of infrastructure.

In my way of seeing things the concept of power (energy per unit of time) is more important than the concept of energy. So I see the problem with renewables is really the volume (time times area) they require to generate some amount of energy and then the need to transform this energy in order to be stored somewhere. When you start to compute the area covered by windmills and solar panels so that fossil fuels can be replaced, you realize how difficult the so called transition is. There is an article of Seeking Alpha presenting a study that puts the bill in 30+ trillion dollars untill 2050 for the world to transition 50% away from dirty electricity. The artcile doesn’t say anything about liquid fuels, but the author concludes that renewables cannot replace petroil so fast. The outcome of oil depletion plus low profitability of energy companies plus wealth concentration is nothing but a disaster to the majority of world’s peoples.

I have a small solar system on the roof.

It makes enough power to electrocute a person,

and to hurl a fullsize vehicle down the highway at 90 mph.

And its acceleration puts equivalent petrol cars in the rear view mirror.

On a larger scale, there are only two ways to find out just how viable a future is without fossil fuel.

1- do not deploy renewables, and just watch the fossil fuel depletion process progress

2- deploy renewables as quickly as a smart culture can muster, and replace fossil fuels at a pace which attempts to keep up with depletion.

The choice between 1 and 2 will have a huge impact on the prosperity of a region or country.

The area need to power the United States with solar is small compared to the area used to grow maize for methanol. Area is definitely not a problem. The question is whether solar is cheaper than fossil fuels, and the answer seems to be yes.

I agree that the energy industry is headed for much lower profits than it had in the past. Renewables are profit killers, both because they are cheaper and also because they are zero marginal cost, meaning it is impossible to compete on price with existing renewables, even if your total costs are lower. The idea that that is bad for people who don’t own fossil fuel resources seems doubtful to me. I can see Seeking Alpha being sad about lower profits though.

Alimbiquated,

There’s another factor: solar power has low barriers of entry, like much manufacturing. Sunlight is everywhere and PV can be deployed in very small projects (and projects can grow in very small increments as needed).

Oil, on the other hand, is badly distributed, which contributes to producers’ ability to gouge consumers. Remember John D Rockefeller’s Standard Oil Trust? Remember the Texas Railroad Commission? Then, of course, there’s OPEC. All of these entities drove up prices and artificially supported prices, sometimes for very long periods.

Oil industry employees tend to be paid more than people in other industries for the same work (as Shallow Sand has noted). Much of this is due to the monopoly/oligopoly tactics discussed above. Manufacturing wages are falling (due to Republican attacks on unions, and international competition), and PV economies of scale will continue to drive down costs for installed PV.

Wind and solar will continue to get cheaper and cheaper.

The sun delivers everyday

“doesn’t require depleting fuel!”

Hi Nick, I believe it’s theoretically possible to power a reasonably sized economy with renewable energy instead of fossil fuels. If everyone was on board and we had a WWII-type effort to transition and to readjust our consumerist mindset, that would maybe be possible. Unfortunately humanity appears to be fatally flawed and practically achieving this result is extremely unlikely. Nate is one of the few messengers who finds a middle ground between collapse and BAU substituting renewables. Also, he does a better job than most others (not necessarily in this article but elsewhere) in explaining where our debt comes from (depleting amounts of per capita fossil energy and other nonrenewable resources) and the fantastic amount of energy and resources we squander. I appreciate your advocacy for renewables, but for me it’s better to be realistic as to what we humans can realistically achieve and understand that, due to our collective obstinacy/inertia, a partial collapse of the global economy system is the most likely outcome. Further, it is not just energy that we are referring to, but other Limits to Growth such as plastic pollution, depleting aquifers, fish stock depletion, top soil depletion, etc…

“I believe it’s theoretically possible to power a reasonably sized economy with renewable energy instead of fossil fuels.”

Well, lets hope you are right, since there is no other option other than to make this switch as we move beyond peak oil. Hopefully the attempt will pick up steam as more people in the world become aware of the issue.

Stephen Hren,

I agree an energy transition is not likely to be easy, there will be unforeseen difficulties beyond the obvious problems, but over many decades (2020 to 2060) it might be possible and we will need to change behavior and respect the environment, most younger people recognize this and the older folks who don’t won’t be around much longer and won’t be pulling the levers of power.

I remain cautiously optimistic that things might change gradually over time.

Stephen,

I put an effort into discussing presentations like the one that started this thread because I don’t think they are realistic. The primary obstacle to a transition away from fossil fuels is the political power of the FF industry (and related industries, like cars, road building, etc). Presentations like Nate’s are a part of the problem: they support the oil/FF industry’s argument that it is essential, and that a fast transition (or, really, any organized effort at all towards a transition) would harm consumers.

There is no realistic prospect of serious electricity shortages due to a transition away from FF: wind and solar electrical generation are cheaper in most places, more abundant in most places, easier and faster to build, easier and cheaper to maintain, etc.

A planned transition towards non-oil transportation, HVAC and industrial energy would only improve things: cheaper, more reliable, etc.

So, here’s the thing: Nate is saying that renewables are an inferior replacement for FF. He agrees they are a good and necessary idea, but says that life will be be harder when we rely on them. That’s a FF & oil industry talking point.

I want to hear him say that renewables are better, and the faster we move to them the better off we’ll be!

Alpert’s YouTube channel has some interesting analysis on how fucked we are, assuming all 7 billion of us don’t get on the same page and start rowing in the same direction.

https://youtu.be/Cnyweoke5Cc

holy fuck we’re saved lol

I’m curious to see people deny a famine when we’re having one

Pay attention, over 70 million just voted for pandemic denial to a real emergency

You need to check the dates on your emergency food supply, Elon hasn’t stamped your hunt and gather ticket to eternity paradise

“Wind turbines and “renewable hardware” are constructed without fossil fuel?”

OMG. That is the best crap you have? It would not make a huge difference to use the elctricity of a windturbine for P2L, however, it does not make sense atm. If you do not understand this difference you are wrong in a serious discussion.

I’m afraid P2l and synthetic fuels are not well understood by many…

Thanks Ron for your untiring work.

In Australia, BP’s Kwinana refinery in Perth (Western Australia) will be closing down.

https://www.abc.net.au/news/2020-10-30/bp-shuts-down-kwinana-refinery-hundreds-of-job-losses-expected/12832372

I am writing an article on this, an update on this post:

12/1/2020

Australia’s oil consumption highly vulnerable to events in the Middle East

http://crudeoilpeak.info/australias-oil-consumption-highly-vulnerable-to-events-in-the-middle-east

Australia (peak oil 2000) has been importing crude from its neighboring crude producers which also peaked. Australia then imported crude from West-Africa, e.g. Nigeria. I was looking for Nigerian crude export statistics. They can be found in the Annual Statistical Bulletin of the Nigerian National Petroleum Corporation:

https://nnpcgroup.com/NNPCDocuments/Annual%20Statistics%20Bulletin%E2%80%8B/2019%20ASB.pdf

But I wonder whether these statistics are correct. Production is in table 5.01. In 2019 it was 2,014 kb/d while your above OPEC table shows something like 1,800 kb/d. Do you know where OPEC gets its Nigeria data from?

In table 10 they have exports, for 2019 it’s 2,008 kb/d How can that be?

I think reliable export data are even more important than production data. I work on the hypothesis that Asian countries, especially China, will fight for oil imports. That’s why I wrote 4 articles on peak oil in Asia

OPEC gets its Nigerian data from several sources including Platts. It does an aerage of all its secondary sources and posts that. However, the do get info by direct communication, that is they pick up the phone and call them. They publish this information (below) seperately. Iran and Libya does not give them any information and others just lie. So direct the direct communication data is published seperately and not regarded as reliable.

Huge downside potential to oil building up. Surging US and OECD Covid cases right before the winter traveling season will majorly dampen travel demand. Pfizer vaccine has major distribution issues because it needs to be kept at -70C, in addition to the general manufacturing ramp up concerns. Late Spring 2021 return to something approximating normal is the earliest possible, but economy will still be in tatters, especially as US government is likely to be split and no major stimulus likely. Producers meanwhile are adding rigs at this price, Libya is back online, Iran is likely to have more oil production in 2021 as sanctions soften, and fatigue is setting in among OPEC members such as Iraq and Kuwait.

Libyan oil production above 1.2M/day:

https://oilprice.com/Latest-Energy-News/World-News/Libyas-Oil-Production-Exceeds-12-Million-Bpd.html

Air travel is starting to contract again:

https://dfw.cbslocal.com/2020/11/12/southwest-airlines-air-travel-recovery-fading-coronavirus-cases-rise/

Oil rigs up 10 last week:

https://www.rigzone.com/news/baker_hughes_counts_show_15_more_rigs-14-nov-2020-163852-article/

Covid cases above 184K/day in US, Global record also broken:

https://www.cbsnews.com/news/covid-19-cases-united-states-184k-friday-record/

I suspect a very bad week for oil coming up.

40.9 Million Barrel shortfall this year due to GOM hurricane shutin’s. ~two days of US consumption. Anyone know what % is deepwater unconventional? I’ve been too busy dealing with Hurricane carnage to browse POB.

https://www.zerohedge.com/commodities/largest-production-decline-offshore-oil-decade-amid-record-breaking-hurricane-season

LT – 0% of GOM offshore production is unconventional – all is conventional.

GOM production in 2019 was an all-time high of 1.9 mmbopd. It was thought that 2020 would be slightly higher. For the first 3 months of 2020 it was about 1.97 mmbopd.

As a result of covid and hurricanes, I currently predict GOM production will average between 1.6 and 1.7 mmbopd.

(Through August it is averaging 1.7 mmbopd. I predict August’s severely hurricane impacted BSEE production of 1.1 mmbopd will be the lowest of the year.)

Let’s assume the annual production would have been 2 mmbopd without covid. The 40.9 mmbo of lost production due to hurricanes (as per Long Timber’s reference above) amount to about 110 kbopd.

If you do a bit of fuzzy math, and accept my production estimates, you can determine that covid may result in 200-300 kbopd of production decline in the GOM for 2020.

(Note that 2019 hurricane production losses, as per the reference above, amounted to about 25 kbopd.)

SouthLaGeo,

What is your expectation for URR for US GOM? A simple Hubbert Linearization suggests about 39 Gb, though typically those estimates tend to be too low.

The BOEM estimated economically recoverable resources at about 60 Gb at $40/b (mean estimate from 2016).

Dennis,

Cumulative northern GOM oil production through 2019 is about 22 Gb, with shelf around 13 and deepwater around 9. Approximately 90% of current oil production is from deepwater.

In this forum, I estimated in 2016 an EUR range of 30-37-47 Gb, and then in 2018 a range of 27-31-36 Gb. I was driven to reduce my estimate after numerous productive exchanges with George Kaplan.

In the time window between 2018 and early 2020, exploration results have been lackluster, and since covid it has been even more lackluster (to almost non-existent). More and more and more, operators who are exploring in the GOM are looking toward tieback (smaller) opportunities, vs. big discoveries that could result in new facilities.

I never did create production charts that reflect my 2018 estimates. I have recently attempted to do that. The chart below reflects a new range of 31-36-41 Gb. The downside estimate of 31 Gb reflects a constant initial decreasing production rate of 50-60 kbopd/year, dropping to 40 kbopd per year starting in 2042, ending in 2050. The midcase estimate of 36 Gb reflects flat production for 2020 and 2021 of 1.65 mmbopd, a slight increase in 2022 to 1.7, then steadily decreasing production out to 2064. The upside reflects a similar trend as the midcase with a 2022 peak of 1.8, then decreasing production til 2075.

Note that my current estimates of 31-36-41 are not too different from my 2016 estimates of 30-37-47, especially the downside and midcase estimates. That is primarily because GOM production in the intervening years has been better than I estimated it would be in 2016. In 2016 my midcase prediction for average 2016-2019 production was 1.6 mmbopd and it turned out to be 1.73. Not a big difference, but it did cause me to raise my downside estimate to 31. My midcase estimate is down slightly. My upside range is down the most. This is primarily because no new exploration trends have been uncovered since 2016. While some significant discoveries have been made, they have been in existing trends, which I allowed for in 2016. Whale, Black Tip (both in the Wilcox) and Ballymore (Norphlet) are probably the biggest.

(Note that all of this assumes some return to business as usual starting around 2022 or so. If, for example, the incoming Biden administration decides to eliminate future GOM lease sales, that will most certainly negatively impact the midcase and upside estimates, but have a lesser impact on the downside estimate. If they go further and decide to refuse to grant drilling permits, while I believe quite unlikely, then all bets are off.)

Thanks SouthLaGeo,

I could not remember your estimates. What do you think of AEO 2020 reference oil price scenario? See chart below, which case would be more likely if that scenario was roughly correct?

Why is the BOEM so far off?

I am sure you have read this report (it is 6 years old so probably out of date). Their F95 TRR estimate is 65 Gb (so they believed in 2014 there was a 95% probability that TRR would be higher than 65 Gb (see pages 32 and 35 of the report) for ERR at $40/bo for oil and $2.14/MCF natural gas and F95 confidence level they estimate 54 Gb (page 37).

Your estimate is probably better, typically USGS is pretty good (in my opinion) perhaps BOEM is not.

Can’t fit this in below your reply,,

If the price scenario in the chart below plays out, then I’d be more on the bullish side,, Your 39 Gb is, in that case, not a bad estimate.

I honestly don’t consider oil price too much,, my downside estimate assumes essentially no new discoveries, and that operators are largely going to try to maximize the value of their existing investments/facilities/FIDs. This could be realized with low oil prices.

My upside assumes fairly aggressive exploration, but is dampened by my view that the GOM is a fairly mature exploration province. The price forecast you show, which I see as fairly favorable/aggressive, could result in that upside outcome.

Thanks again SouthLaGeo,

Watch for a new post by George Kaplan on Wed Nov 18.

Note that the oil price scenario is the reference case (best estimate) from the EIA’s 2020 Annual Energy Outlook (this was prepared before the pandemic was evident). I wonder if there might be older discoveries that become viable at higher oil prices as well as some newer discoveries that might be made in a high oil price environment.

It seems that often the hubbert linearization technique results is very conservative estimates, so my guess is that 39 Gb would be a minimum for economically recoverable resources (under a low oil price scenario and possibly a rapid energy transition to non-fossil fuel).

Jean Laherrere’s August 13, 2020 HL estimate for ultimate GOM oil production was 34 Gb – I’ve added an image from that paper below. HL estimation, with noisy data, is as much art as science, in my opinion.

Regarding why BOEM has such a higher estimate – I suspect they assign risked resources to all of the undrilled structures in the GOM.

Jean Laherrere does excellent analysis, generally his estimates get revised higher over time

For World URR (excluding extra heavy oil) in Gb

1998, 2000

2005, 2200

2010, 2400

2018, 2700

My HL for 39 Gb uses 2001 to 2019 GOM annual data, using a wider data set (1977 to 2019) the HL gives a slightly lower estimate (37 Gb), similar to the estimate by Laherrere on page 17 of his paper (1998-2019).

https://aspofrance.files.wordpress.com/2020/08/us-gomupdated.pdf

In any case it is very different from the BOEM resource estimate of 60 Gb, most of the difference is the deep water resources. Laherrere expects 20 to 23 Gb for deepwater GOM URR, for BOEM it is more like 45 Gb at the F95 level for ERR at $40/b (old report from 2014). Perhaps the BOEM would evaluate differently today.

SouthLageo , what would POB without you and Mr Kaplan . Blind , as far as GOM is concerned . Greatly appreciated . Kudos, from an admirer of your work .

We’re seeing a number of EUR predictions in the +/- 35-40 Gb range. BOEM’s assessment is the outlier. Interestingly, their’s is the assessment that gets stated by industry spokes-people. We’re all just chumps, Dennis.

By the way – thanks for the kind words, Hole in Head, and, looking forward to George’s post.

SouthLaGeo,

I am simply trying to reconcile different points of view, sometimes geologists and geophysicists working for government agencies do pretty good work, especially the TRR estimates. At least for tight oil the ERR estimates tend to be about 75% of the TRR estimate, but I am less familiar with the economics for offshore oil. If the mean TRR estimate is about 80 Gb and the ERR is 75% of that, we would get a 60 Gb ERR estimate, if the mean TRR estimate by the BOEM was correct and ERR is 40 Gb, that implies only 50% of the TRR is profitable to produce. As I said the economics of offshore oil production is unfamiliar to me so I haven’t a clue how to evaluate, it is also possible the folks at BOEM do not do as good a job as USGS.

Curious, when you look at USGS resource reports for oil and natural gas do they seem reasonable to you? The 2013 Bakken Assessment seemed to be pretty good, to the end of 2018 proved reserves and cumulative production was about 8.7 Gb for North Dakota Bakken/Three Forks. Mean TRR estimate was about 11 Gb in 2013. There might be some probable reserves that get added.

Dennis,

I’m not inclined to critique resource estimates for any of the resource plays.

The geologists and geophysicists working at BSEE and BOEM are top notch. Many have previous experience with oil companies.

The BOEM folks have to assess the resource potential of every lease that receives a bid in offshore lease sales in order to determine if they believe the bid amount was fair. (By the way, there is a lease sale tomorrow – November 18th). In addition to assessing blocks that receive bids, they frequently update their resource assessments on already leased blocks. This gets to one of the reasons I believe their resource assessments are higher. In their evaluations of all these leases that received bids in past years, they have assigned risked resources. The bidding company may be granted the lease, but, in many cases, the leases never get drilled, but the risked resources remain on BOEM’s books. I suspect the only time the resources are removed from BOEM’s books are if a dry hole has been drilled. If a discovery is drilled, I suspect BOEM will update their assessment with the results of the discovery well.

SouthLaGeo,

Thanks for the explanation. Based on this it would seem that if the F95 UTRR estimates are about 28 Gb and 80% of these are economically recoverable (at AEO 2020 reference case price scenario), then we would have about 22 Gb of undiscovered ERR.

Cumulative output plus 2P reserves is approximately 28 Gb (where 2P=1.4 times EIA proved reserves), that gets us to about a 50 Gb URR for GOM (as we have used an F95 estimate and we assume BOEM professionals are top notch this might be a conservative estimate in my view).

Electors are appointed by state legislatures. Very clear in the Constitution. WI, MI and PA all have strong Republican majority state legislatures. They are the court to which evidence would be presented. Retaliation not possible because only 1 Trump EV is from a state with a Dem legislature, Maine. Refusal to accept the report of how the electors voted also not possible. The Constitution specifies that the President of the Senate receives and reads the elector report — that’s the Vice Prez.

New item today. Nordstream 2 sanctions will maneuver towards insurers. Previous sanctions clearly dodged and completion imminent. Insurers is an interesting target.

Seems highly unlikely state legislators choosing electors that lost the state’s popular vote would withstand a legal challenge before the supreme court. See article below for a full discussion:

https://www.lawfareblog.com/state-legislatures-cant-ignore-popular-vote-appointing-electors

Not only is it unlikely that it would withstand a legal challenge, but it also would not withstand the public’s challenge. If a majority of the public voted one but the state legislators decided to ignore the public’s wishes, there would be hell to pay in the next election. Bottom line, they wouldn’t dare.

From your link:

What’s more, such a move would justifiably be seen by much of the public as a coup. It is a terrible idea.

“Electors are appointed by state legislatures.”- Watcher

Biden won the popular vote by over 5.3 million votes.

If lame duck trump arranged to steal the election, by any means,

you would see thermonuclear rage in this country as never seen before.

-Lame Duck president Donald Trump carried 2,497 counties across the country that together generate 29% of the American economy, while President-elect Joe Biden won 477 counties that together generate 70% of U.S. GDP.

-Biden flipped seven of the nation’s 100-highest-output counties in the 2020 election and further cemented the link between the Democratic Party and the nation’s core economic hubs.

This time Georgia and Arizona. Texas- we (the American majority)are coming for you.

Expect goodness- even from your leaders.

Projection for US tight oil through 2025 from all tight oil basins from shaleprofil.com (link follows)

https://shaleprofile.com/us-tight-oil-gas-projection/

This projection assumes no change in rig count and wells completed per rig from Nov 2020 to Dec 2025, it also assumes no change in average new well EUR over the same period.