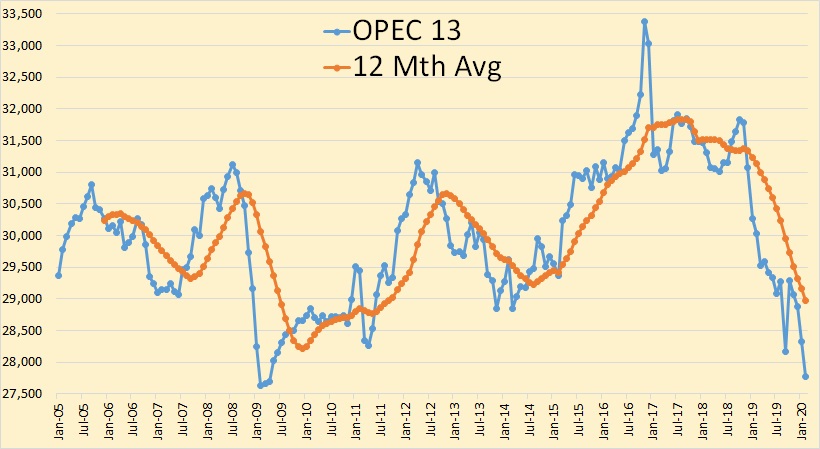

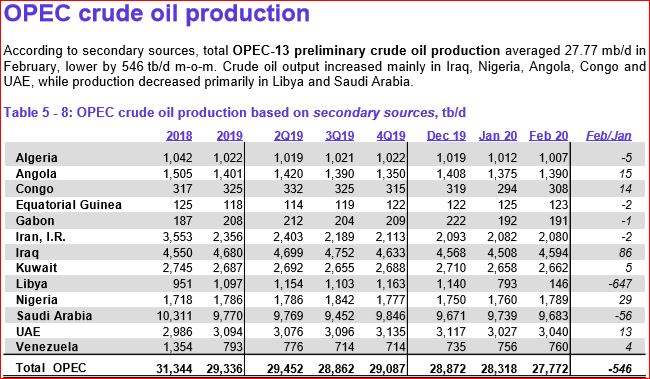

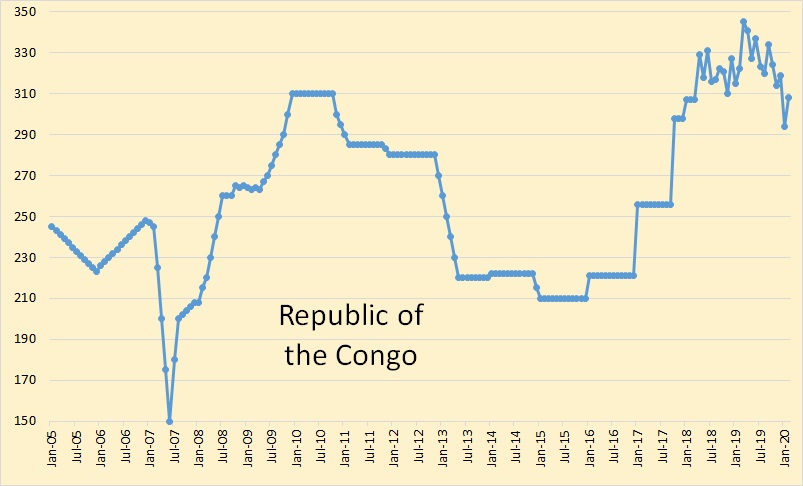

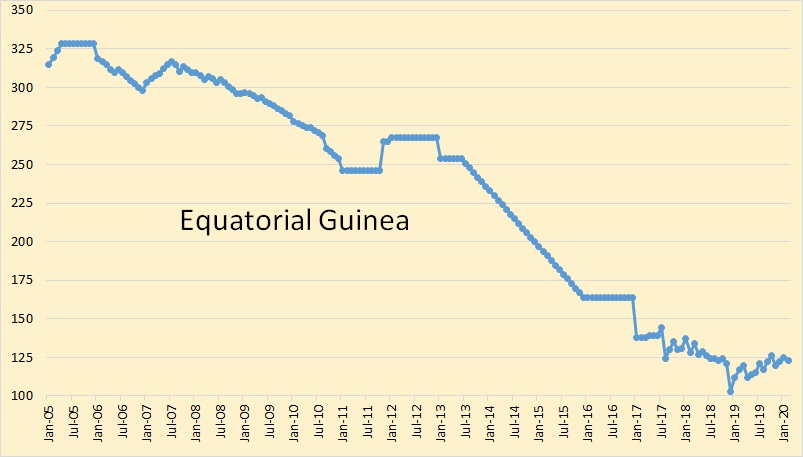

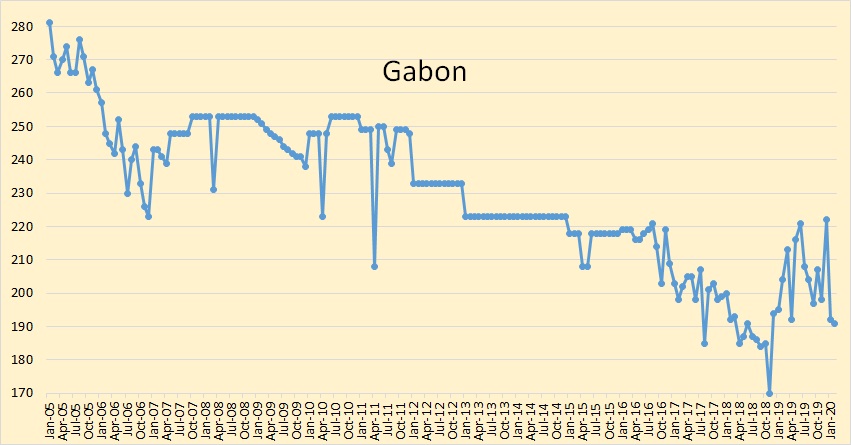

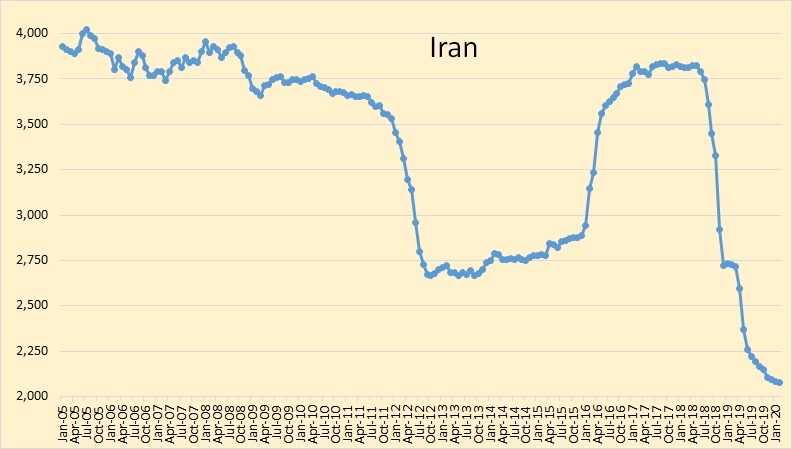

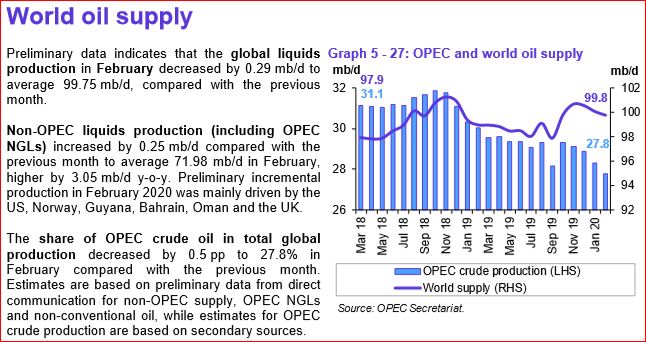

All OPEC data below is from the OPEC Monthly Oil Market Report. It is thousand barrels per day and is through February 2020.

The OPEC data no longer includes Ecuador. OPEC 13 was down 546,000 barrels per day in February.

The only major decliners were Libya and Saudi Arabia.

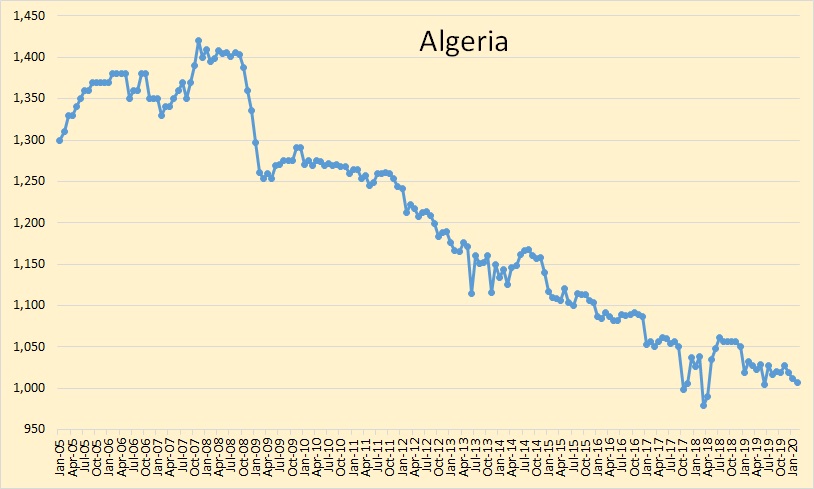

Algeria is simply in slow decline. Quotas have meant nothing to Algeria.

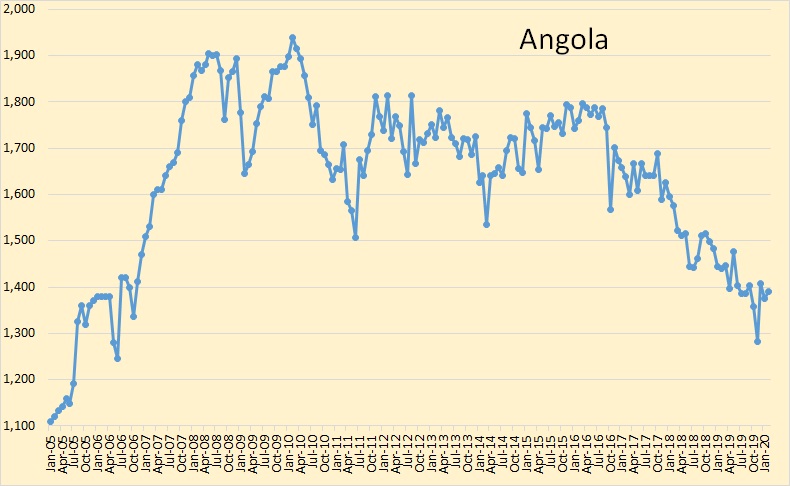

The same story goes for Angola.

Iranian production seems to have found a bottom.

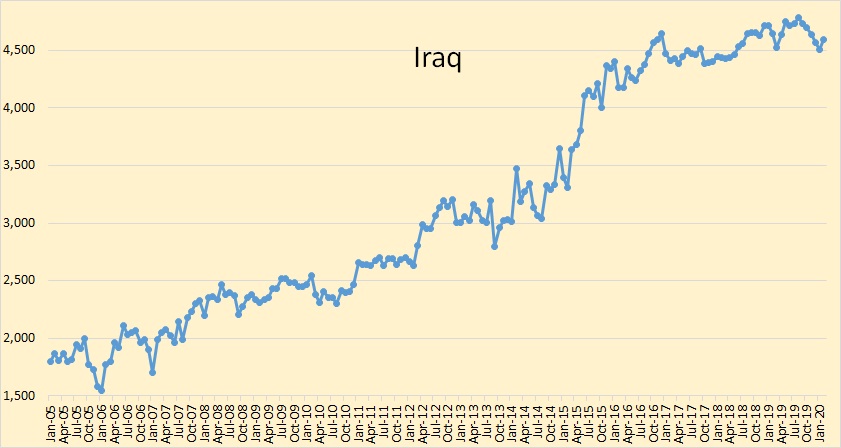

Iraqi production was up 86,000 barrels per day in February. Iraq is, and has been producing flat out.

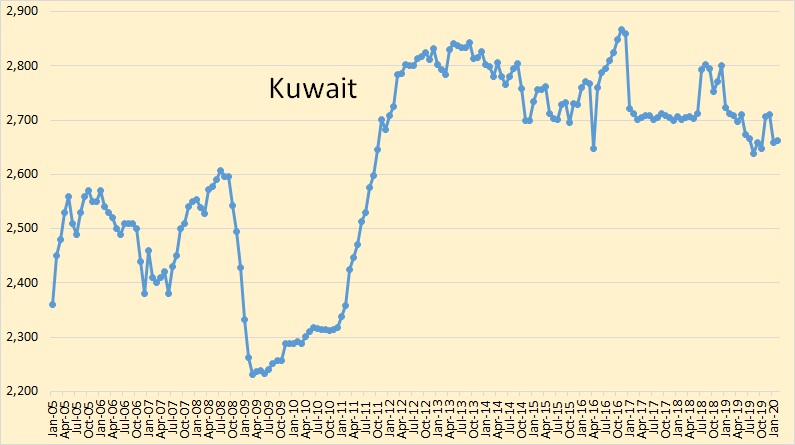

Kuwait possibly could produce more, but not very much more.

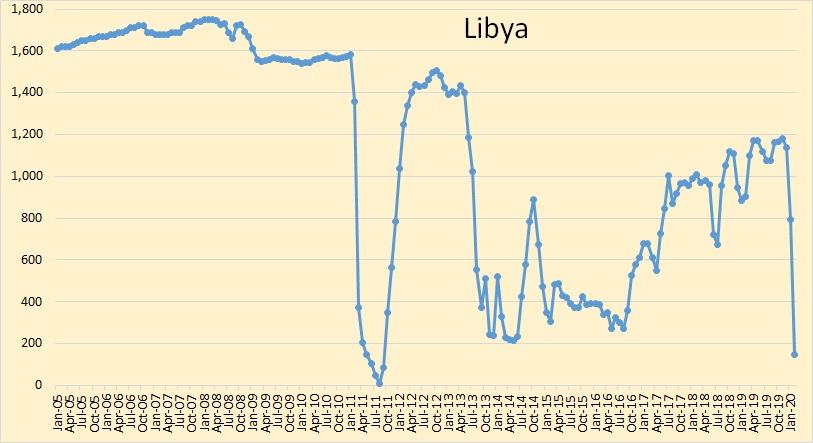

The rebels have blocked Libya’s export terminals. Their storage tanks are full so they have had to shut down most production.

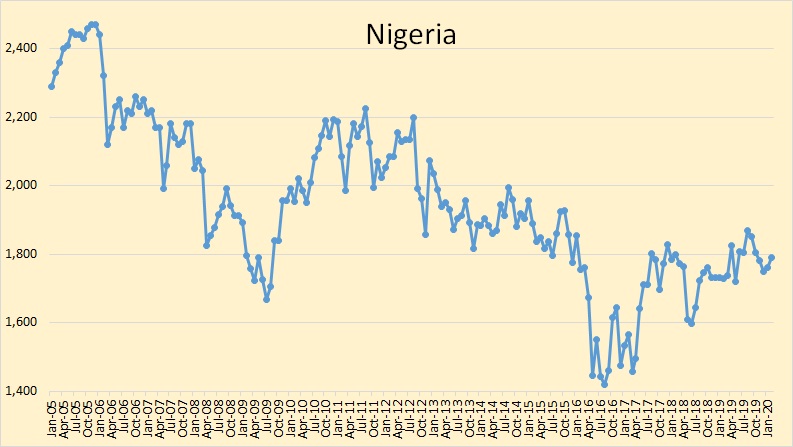

Nigeria has paid no attention to quotas.

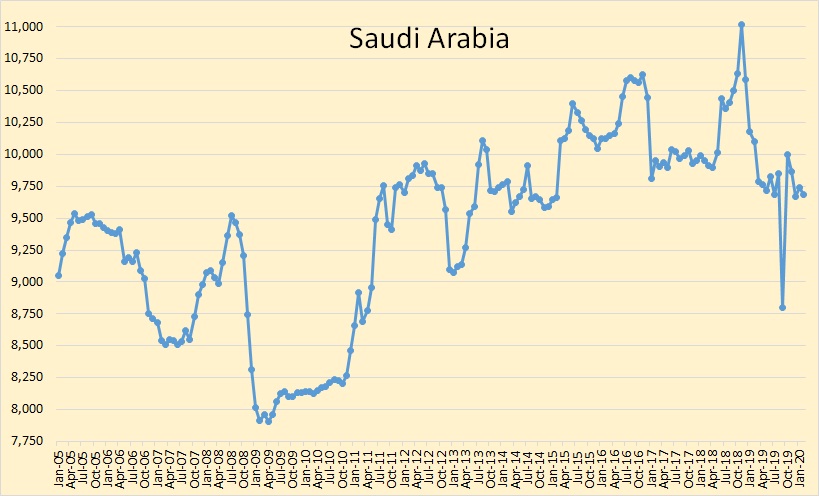

Saudi production declined by 56,000 barrels per day in February. How much could they produce if they decided to produce flat out? We are about to find out.

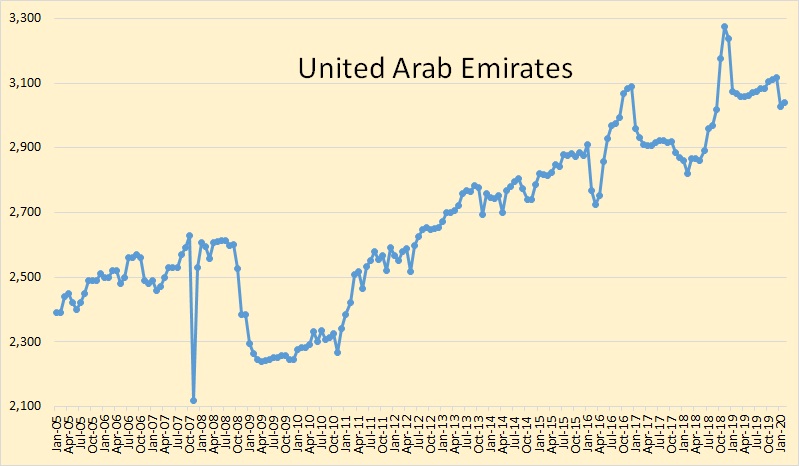

UAE may be able to produce a few more barrels per day. Again, we shall soon find out.

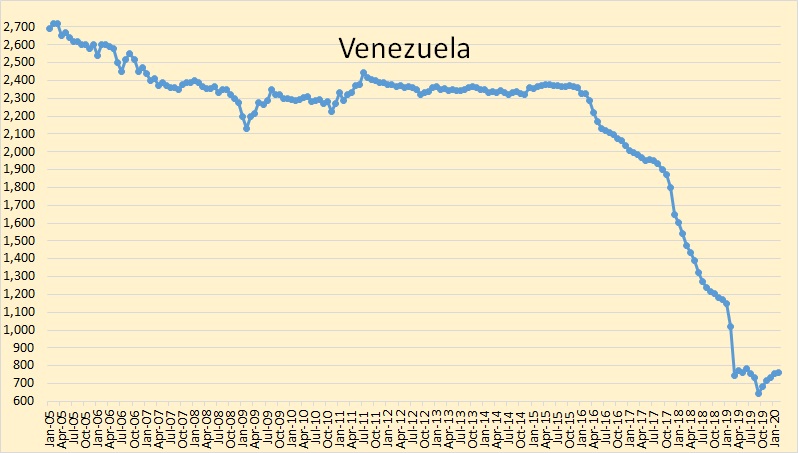

Venezuela has reached a lower plateau of what they can produce and sell. But their economy, as well as their government is on the verge of collapse. What will happen next is anyone’s guess.

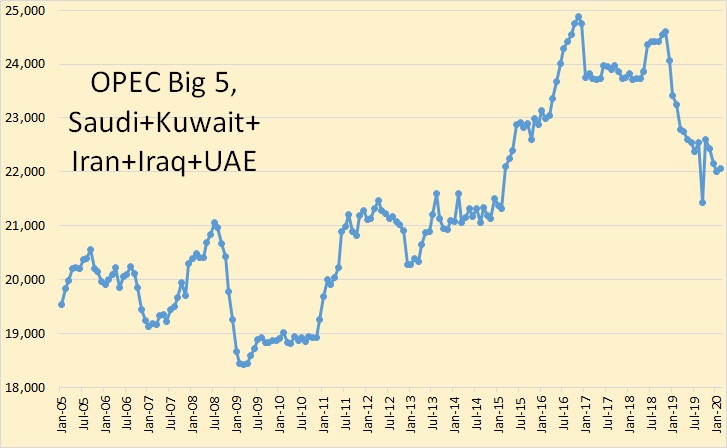

Here is 80% of OPEC production. The two peaks are November 2016 and the latest, November 2018.

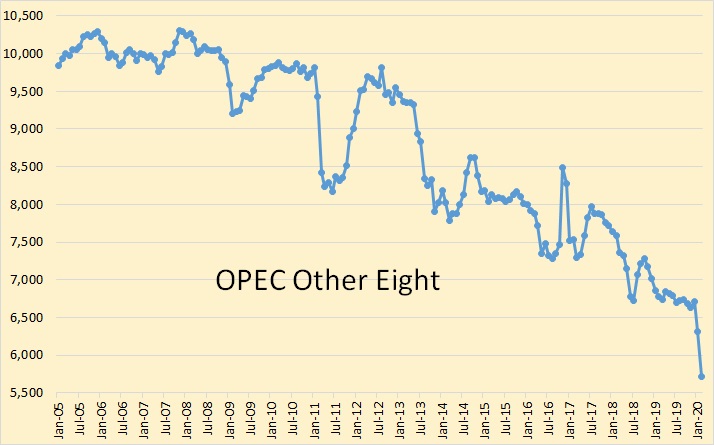

And here is the other 20%, in long term decline.

OPEC in this chart is crude only while World supply is total liquids. They still have the peak in November 2018. It is a question what March OPEC production will look like as it was on the 10th that they decided to all produce flat out. So production should be up in March. But April’s production should give us some indication of what OPEC is really capable of producing. Perhaps, but perhaps not:

Exclusive: Russia calls for new enlarged OPEC deal to tackle oil demand collapse

https://www.reuters.com/article/us-oil-opec-russia-rdif-exclusive-idUSKBN21E13T

MOSCOW (Reuters) – A new OPEC+ deal to balance oil markets might be possible if other countries join in, Kirill Dmitriev, head of Russia’s sovereign wealth fund said, adding that countries should also cooperate to cushion the economic fallout from coronavirus.

A pact between the Organization of the Petroleum Exporting Countries and other producers, including Russia (known as OPEC+), to curb oil production to support prices fell apart earlier this month, sending global oil prices into a tailspin.

“Joint actions by countries are needed to restore the(global) economy… They (joint actions) are also possible in OPEC+ deal’s framework,” Dmitriev, head of the Russian Direct Investment Fund (RDIF), told Reuters in a phone interview.

Dmitriev and the Energy Minister Alexander Novak were Russia’s top negotiators in the production cut deal with OPEC. The existing deal expires on March 31.

Ron,

It seems as if the huge decline in oil demand, and then production will start to show in March and even larger in April. However, I believe the 18 mbd decline in demand by April is likely understated. I see Global Oil Demand falling 20-25+ mbd by April-May.

THE ENERGY DISASTER KICKING INTO FULL GEAR: World Is Totally Unprepared For What’s Ahead

https://srsroccoreport.com/the-energy-disaster-kicking-into-full-gear-world-is-totally-unprepared-for-whats-ahead/

Steve

>>I believe the 18 mbd decline in demand by April is likely understated

Hello. Where does this figure, 18 mbd, come from?

Seems to me, if correct, oil prices are headed for less than $10/barrel? Which should kill off UK oil production, plus others, were it to last for more than a few weeks?

Minority Of One,

That chart comes from the IEA.

steve

Whether oil demand is falling by 15 million barrels per day or 25 is somewhat academic. Either way this is a disaster for the livelihood of many in the oil industry and for the financial stability of countries like Nigeria, Venezuela and many others.

At the moment $25 per barrel oil is only profitable for about a third of global oil production. When you look at countries like Nigeria, Saudi Arabia, Iraq etc, they require $60 – $70 to buy food, medicines and much else. For the first time there are no countries with supplies to spare.

In the UK nurses and doctors are in tears because they risk bringing the virus back to their families because of lack of masks and protective equipment.

Now farmers are saying crops will rot in the fields and grasshouses because the 60,000 EXPERIENCED migrant workers cannot come here due to travel bans.

Why are we locking down the movement of those under 40 when 99.9% of them would not even need to go to hospital?????

We are destroying the world when we could have simply isolated the elderly and vulnerable.

How many people in India will starve to death?

https://www.indiatoday.in/india/story/corona-chandigarh-lockdown-curfew-hunger-ration-police-brutality-1660032-2020-03-26

Wayne, you need to get out more (better still stay home)! The age distribution of the deceased in USA shows that Covid-19 does not spare the young. This will not end well, economically socially or politically.

Adam Ash

Please provide your data rather than stupid sarcasm

The number of people who have died who are over 60 and who did not have existing health conditions is very small.

Do you have the imagination to understand what happens to people who have no food and no money, as is the case with 400 million people in the world.

Millions of people in India did not eat yesterday, does that compute at all?

Wayne. Apologies for my tone but I am tired of folk minimizing the social heath risk of Covid-19. There are many deaths among younger people so they cannot just be thrown under the bus and left to be exposed in order to save the economy. The data shows that the risk of death from covid is similar to the risk of death from all other causes for each age group. So of course more old folk die of it compared to young.

Some countries have instituted total border shut downs and full isolation of all but essential services. Supported by vast QE to hold the economy together. Other countries are putting the economy first.

We shall see which method works.

(I’m not offering references to data – you will find it all on line very readily, and that way you will usefully self-educate, rather than shooting this humble messenger.)

Adam

I have in the past condemned governments for the grotesque amounts of money spent on warfare while cutting health services to the bone. The UK has cut 400,000 beds down to 100,000 and really experienced nurses have left in their thousands due to the stress.

If we had those beds and proportionately the 20,000 ITUs we would have been ready for this virus.

At the moment very elderly people have to go out shopping because they cannot get food any other way.

This lockdown has removed food from the most vulnerable, they have to travel further and visit more shops to get what they need.

All this is doing is reducing the daily death toll, the overall death toll will be the same.

In India people work and buy food that day, if they do not work they have no food. Hunger kills everyone, the coronavirus kills 1%

a good source for all to look at

https://ourworldindata.org/covid-mortality-risk

I can give one answer version Wayne.

You could take the path you suggest- do not restrict the movement of the majority of people in the world (those under 40).

One big ramification is that all hospitals and clinics would be quickly swamped, in most the world. If you made the provision that no one with fever or cough could come to facilities for treatment, and the hospitals would be left for the normal function they perform, then you could do that path. But you better have tankloads morphine to dole out, and security forces to guard the hospitals. And temporary morgues would need a massive build out.

Its a tragic choice either way.

I share your concern.

Hickory

Perhaps people should have demonstrated against the costly wars over the past 30 years and demanded that the money go to healing people rather than killing people.

If the United States still had those 500,000 beds it cut over the last 40 years how different things would be.

https://www.statista.com/statistics/185860/number-of-all-hospital-beds-in-the-us-since-2001/

Only 2% of healthy people under 40 need to go to hospital with covid 19, and with treatment the death rate is tiny.

What you have now is total lockdown because you all cut so many beds and a high death rate because people still need to go out for food.

It’s been noted that KSA, Russia and LTO can not throttle back production without

physical risk to ultimate recovery. Any pondering on which resource has the least flexibility in flow rate? Seems when storage reaches capacity itmay be ugly. winners/causalities ?

Longtimber,

You bring up an excellent point. I don’t believe the world will ever see 100 million barrels per day of production (2019). Once a lot of this production comes offline, it will be difficult to ramp it back up due to the destruction of the underlying financial system.

steve

Great post by Mike Shellman at link below

https://www.oilystuffblog.com/single-post/2020/03/27/Hold-My-Beer-I-Can-Fix-This

An excerpt below, but the whole piece is well worth a read, Mike’s blog is exceptional, in my humble opinion.

Approximately 38% of America’s current light tight oil production is less than a year old (shaleprofile.com). The far better way to show cooperation with the rest of the world to raise and stabilize oil prices, to save Texas jobs, bring capital back to a capital intensive industry, stop the waste of associated gas, preserve reservoir pressure and increase recovery of oil in place… is to slow the frantic pace of drilling new wells.

For context, I believe he is referring specifically to the drilling of new tight oil wells, which is clear when you read the whole piece.

Dennis, I appreciate you getting this out to anyone wishing to read it and to anyone willing to share it. It’s an easy fix to a very, very serious problem in our country at the moment. Even the staunchest of anti-oil proponents would agree that we need a healthy oil and natural gas industry to get us through a long, protracted transition to renewables. Thank you once again.

Mike,

You’re welcome.

I agree 100% with what you lay out in your post. I also agree we need a healthy oil industry to accomplish an eventual transition to non-fossil fuel energy, it is likely to take 2 to 4 decades to accomplish.

Thank you for all you have taught us here at peak oil barrel.

Though clearly I have much to learn.

Mike. I greatly appreciate the post you wrote. I was not clear in my initial comment, and I hope you now understand I was referring to the free market conservative dolt on the Texas RRC, and not you in any way.

We are not in a free market. For health reasons large parts of the economy are being shut down, on hopefully a temporary basis.

Russia and OPEC have taken this time, which is economically similar to wartime, to crush the US shale industry. Of course, the US shale industry deserves it.

But, the rest of the oil industry doesn’t deserve it. I haven’t seen offshore, Alaska, Canada, Mexico, or any other producers being creamed by this ultra low price saying or doing the stupid stuff US shale has said and done.

I also don’t think the workers in shale and non-shale deserve this. Unfortunately many in the oil industry will lose jobs.

I am again reading about EOG and their profitable at $30 premium locations. Sorry guys, even though this is just as false as it was when you said it in 2016, WTI closed at $21 and change today.

Western Canada select is $4.58, and it costs $7-9 to transport to the Gulf, so it is negative. Heavy sour crude in Wyoming is negative. A lot of oil is in single digits in the lower 48.

I suspect if the Texas RRC and the other shale basins would agree to enforce the 1,200’ spacing rules, OPEC and Russia would likely strike a deal, oil would get into the $30s and most could survive.

Since significant shale was going BK at $50 WTI, what difference does it make if they have to drill on 1,200’ spacing?

We’re good, Shallow. I knew exactly what you meant. I was covering up my article, which, by the way, had 30,000 look sees all across social media today. I am determined to go down swinging!! Thanks, y’all.

shallow,

I believe the coming destruction of U.S. oil demand will be far worse than the U.S. shale oil industry trying to survive on $30 oil.

I don’t believe analysts realize how much oil demand is being destroyed in the United States. Also, those who believe there will be a SHARP recovery when the COVID-19 peaks and declines, whenever that will be, are not considering a much slower recovery.

So, consider that within the next 2-3+ months, look for U.S. shale oil production to drop 3 mbd, regardless of the price.

steve

Steve. You may be correct. So much is unknown. Even a “deal” among major producing countries might not help.

Oil could go negative or close to negative across the entire United States and require the shut in of almost all of the close to 13 million BOPD.

Most operators simply do not have much storage. If physical storage runs out, and the tankers can’t pick up our oil we will have to shut down.

Where I am, most leases have anywhere from 100 BO to 400 BO of storage. Many leases have one tank or more hauled every month. I suspect there isn’t a lot of extra storage at leases anywhere lower 48 US because I have never heard of such a thing happening – not being able to have oil hauled from leases. Severe weather is the only time this occurs, and usually that is fairly temporarily (day to a week).

I understand this is already happening in certain locations. It hasn’t happened to us yet and the crude purchasers say as of now the refiners they market crude to still want our oil.

But we realize this could change for us, as it already has for others.

Steve,

My models suggest that if the new well completion rate falls to zero by May 2020, then US tight oil output falls by about 3 Mb/d by November 2020. See chart below (well completion rate on right axis).

Dennis,

The BIG UNKNOWN will be the extent to the lockdown of the virus. If it continues to spread into May, then the U.S. storage of about 135 million barrels remaining, at 4 mbd surplus, that would take about five weeks to fill.

However, 4 mbd surplus may be too low of a figure. The U.S. consumes roughly 14 mbd of gasoline, jet fuel, and diesel. I highly doubt the loss of consumption will be 4 mbd, probably more like 5-7 mbd. Hell, it could even be 8-9 mbd for a period of time

So, at some point, there just won’t be anywhere for the oil to go. And it seems to me that towards the end of April, storage will be full.

Thus, Shale companies will be forced to shut in wells, besides totally cutting drilling-fracking.

No one realizes how quickly this will occur within the next 4-6 weeks.

steve

Steve.

There is an article in today’s Houston Chronicle that says Texas producers are already being asked to cut by first purchases because their tanks are full and the pipelines they ship on are full.

Have heard US refineries have greatly cut run rates. After all, a 200K BOPD refinery loses $600K a day with a -$3 crack spread.

Shallow,

Indeed, the situation is already horrible. This type of demand destruction has never occurred in such a short period of time.

When these shale wells get shut-in, they never come back to their previous level, without serious CAPEX investment. Furthermore, I see a total collapse of the Service Companies due to drilling-fracking heading towards ZERO.

What keeps me up at night is imagining what type of DESTRUCTION is taking place in the Financial System and Economy. We just have no idea because a lot of the supply chain and financial system are hidden to most people.

The damage being done to 401K’s, pension plans, money markets, and etc will never recover. If we have to stay locked down for another month-plus, then I don’t see how we ever restart this economy resembling anything close to what it looked like at the end of 2019. If we can go back to 50-60%, that might be all we get.

There is just WAY TOO MUCH DAMAGE taking place that is irreversible. This has to be one of the most misunderstood factors occurring, even though the Wall Street Clowns are forecasting a return to NORMALCY by the end of the year.

The V-Shaped recovery may turn out to be an L-Shaped recovery.

steve

What about Nat Gas- is there demand destruction, do wells get ‘turned off’?

Steve,

I agree consumption might fall temporarily to more than 4 Mb/d, imports of C C are about 6 Mb/d, those could be reduced to zero, the rest of US output might fall by 2.5 Mb/d so with zero imports and a fall in US output of 6.5 Mb/d we have a fall in US C C inputs to refineries of 12.5 Mb/d, recently the level of inputs to refineries is 15 Mb/d, so do you expect inputs to refineries will fall to less than 2.5 Mb/d (a drop of 83%)?

I think that would be a ridiculous assumption to make. I would say it might fall by 33%, but likely not more than that over a 6 to 12 month period.

Not many tight oil wells will get shut in except low volume wells which Mike Shellman has suggested might be shut in with liitle damage.

Negative oil price

https://www.bloomberg.com/news/articles/2020-03-27/one-corner-of-u-s-oil-market-has-already-seen-negative-prices

Impact of Corona Virus similar to some earlier peak oil scenarios

http://crudeoilpeak.info/impact-of-corona-virus-similar-to-some-earlier-peak-oil-scenarios

Interstate FIFO work under COVID-19

Western Australia, South Australia, Tasmania and the Northern Territory have effectively shut their borders, requiring anyone visiting to undertake a 14-day period of self-quarantine.

In Western Australia, workers in the energy and resources sector are exempt from these isolation periods.

This was confirmed by WA Premier Mark McGowan on Sunday and the WA Chamber of Mines and Energy added that only 2,500 “critical” interstate workers were flying into WA during this time.

“Mining, oil and gas are critical, both to keeping the lights on in WA and also to keep revenue coming in for Government,” Mr Everingham said on Sunday.

“We’ve agreed to massively reduce our footprint, but keep open critical operations on mine sites and oil and gas facilities.

“That means interstate flights and travel from FIFO workers will be massively curtailed.”

https://www.abc.net.au/news/2020-03-27/coronavirus-mining-and-resources-new-procedures/12062380

Oil Rigs down by 40 this week. Breakout by basin attached. Permian down by 23, a 5.7% drop. When does this show up in oil production drop?

Production in the Permian is probably already dropping, although we won’t know for sure for a few months.

Ovi,

Typically we see production drop 4 to 6 months after the rig count drops.

Using pivot table data (link below)

https://rigcount.bakerhughes.com/na-rig-count

I get the following for Permian horizontal oil rig count from Jan 2012 to March 27, 2020. The count was 365 in the most recent week, it was 369 in early December 2019, the count fell to 116 in April 2016. Chart below uses data from Baker-Hughes for weekly horizontal oil rig count.

tight oil EIA official estimate

https://www.eia.gov/energyexplained/oil-and-petroleum-products/data/US-tight-oil-production.xlsx

chart of recent data below in thousands of barrels per day (kb/d) below.

Typically we see production drop 4 to 6 months after the rig count drops.

Yes, this would be true if the decline was because of the rig count drop. But there will be a decline in production because of the dramatic decline in demand. Storage tanks are full and no one is buying. Therefore wells, good producing wells, will be shut in. We are going to see production drop a lot sooner than in 4 to 6 months.

Dennis, I looked the EIA shale oil data you posted. They have shale production increasing by 8,000 barrels per day in January and by another 80,000 barrels per day in February. I really don’t think so. However it will be March when we see the trend headed down. Then in April and May the shit really hits the fan. And it will not be because the rig count has fallen.

Ron,

Perhaps that will be the case, I was simply stating what the historical relationship has been. I agree the Feb tight oil estimate looks too high, likely it will be revised.

I am simply reporting the EIA tight oil data, which is often revised at a later date.

Chart below shows revisions from last month’s tight oil estimate to the most recent tight oil estimate, last month’s data was revised lower for Nov 2019 to Jan 2020, see chart below.

Additionally, folks, the correlation is not directly to the rig count but rather to the completion count and therefore the completion fleet count. This info is available behind paywalls. If anyone would like to share, I’d appreciate it.

My assumption is that rigs are kept onsite to drill multiple laterals, and then completion spreads are brought in, the correlation of production/rig count has broken down.

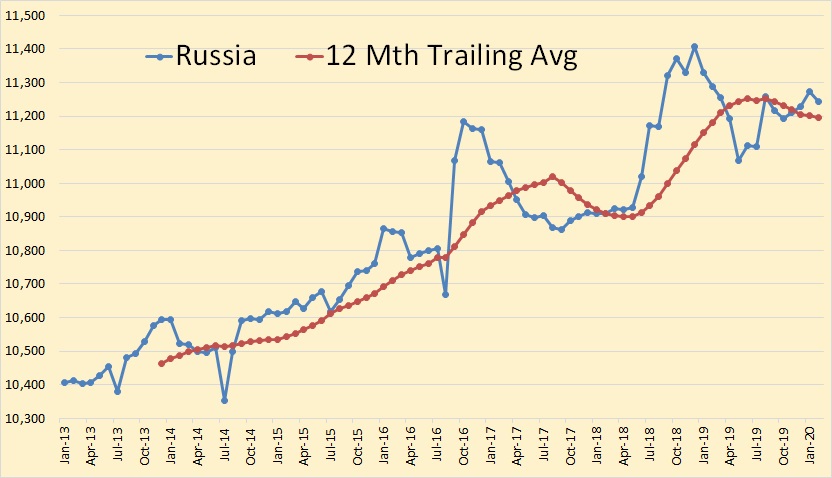

Second line of inquiry I’d be interested in in what is actually “on the ground” in Russia. FT suggested large increases in Russian production in an article yesterday. Is this supported by real, funded activity levels, with transportation infrastructure from, I assume, Siberia.

Brad,

Yes frac fleet count is probably a better metric, but I do not have access to that data, my guess is if we had access to that data the lag between active frac fleet count changes and output changes would be shorter, perhaps 2 to 4 months, though without the data, this is speculative.

On Russia I have no insight, lots of conflicting news reports, I mostly judge things by Russian Energy Ministry output data there.

https://minenergo.gov.ru/en/activity/statistic

Russia calls for new enlarged OPEC deal to tackle oil demand collapse

A new OPEC+ deal to balance oil markets might be possible if other countries join in, Kirill Dmitriev, head of Russia’s sovereign wealth fund said, adding that countries should also cooperate to cushion the economic fallout from coronavirus.

As much as Putin would like to give it to the US shale producers, he doesn’t like it when money coming into his own pocket is reduced.

My guess is that Russia’s plan, as encouraged by the head of Rosneft, was to say no. They thought that OPEC/SA, not wanting wanting to show discord with Russia, would fudge some reason to do the 1.5 Mb/d cut themselves. Note that Russia also knew SA needs $80/bbl to meet their social needs so they felt they had SA in a box. Also note that OPEC made a concession on Condensate a few months earlier to Russia. I think that made MBS realize that the Russians were sneaks. So when Russia walked away, they totally embarrassed MBS and the rest is history.

The only way to solve this so that everyone can safe face, and that is probably the most important piece of trivia for Putin and MBS, will be to create a new global pact between OPEC+Russia+ US plus others.

And this will maybe not happen, because some players now calculate they will get an advantage by waiting until the storage systems are full and weaker producers are forced to shut in by negative pricing, which is already happening in some parts of the US and Canada as I undestand.

A proper Deal would be – now:

Cut 30% production worldwide among most producers, not seeing this will agreed/happen on a voluntary base.

The highest posted price on the Plains All-American crude oil bulletin for 3/27/20 is $18.50. There are 8 grades with a posting in single digits. The majority of grades are $16 or below.

The posted price I am finding for Williston Sweet is $11.25. This is per the Williston Herald website.

I would note that I extrapolated. The website has yesterdays price at $12.25. It appears this price has been adjusting on a dollar for dollar basis to WTI. So it should be $11.25 today, 3/27/20.

Just read where there was a 5.0 scale earthquake near Mentone in Loving, County, TX. This is in the heart of the Delaware Basin. There have been a total of 6 in the past two days.

Water disposal into the basement rock?

Looking at the satellite map, I see Anadarko is right there. And a whole lot of pump jacks all over.

Greenbub.

If wells disposing of water from the upstream oil industry are responsible for these earthquakes, I suspect the wells are recently drilled deep wells, used to dispose of shale well produced water. These tend to be very deep.

I doubt the much shallower water flood and CO2 flood wells, many of which have been there for decades, are responsible for the earthquakes.

From my reading, in OK, shale salt water disposal wells were drilled into basement rock, which has been thought to cause OK recent spike in earthquakes.

Hi SS,

It seems like horizontal well casings would be very vulnerable to rupture from earthquakes, have you ever heard anything about that? Or vertical for that matter?

Thanks,

6 km or does injection induce deeper quakes that the injection site?

NAOM

Shallow sand,

For your field, what oil price causes most wells to be temporarily shut in?

In 2016 some wells were shut in. The lowest month price we received was $25.

The current price for operators here now ranges from $14-18. Over 1,000 of about 2,600 producing wells have been shut in thus far. I think several are running wells through the end of the month to make sure and sell what they can this month. Everyone is on a monthly average contract, and the crude purchasers have said they will honor those. The price will be $24-28 per barrel for March for producers here.

If these prices persist or go lower almost all wells here will be shut in.

Assuming the COVID -19 pandemic continues of its current course I suspect most stripper production will be shut in during April or May. It is now looking like COVID-19 will be with us for several months.

Dennis. I will add many at e trying to determine if the payroll protection SBA program is applicable to upstream oil and gas production. That program could make a big difference as to whether production is shut in.

Labor is the number one expense. Utilities number two. However, lots of questions. It’s a two month program.

shallow sand,

Thanks.

Recent IEA “pessimistic” estimate from the March 2020 Oil Market report for decrease in World oil demand is about 700 kb/d. This estimate seems too optimistic to me, I would expect a fall in average annual oil consumption of at least 2000 kb/d with a peak monthly decrease of 5000 kb/d (probably in July or August 2020, comparing July 2020 consumption with July 2019 consumption). Obviously this is speculative.

Note that if we look at World C C monthly output and the biggest YOY monthly output decrease (we use this as a proxy for consumption) over the Jan 1973 to Dec 2019 period (EIA data) we find the biggest was Oct 1980 with a 7877 kb/d decrease from Oct 1979, there was also a 6867 kb/d decrease from April 1981 to April 1982, and a 6164 kb/d decrease from April 1974 to April 1975. Note that in percentage terms these decreases were 12.8%, 12.6%, and 11.4% respectively. My 5000 kb/d guess would be only 6% of 2019 average annual C C output, so conservative relative to large decreases of 1975, 1980 and 1982.

Link to IEA report (Published March 9, 2020) summary below

https://www.iea.org/reports/oil-market-report-march-2020

Dennis Coyne,

So you think a peak monthly decrease of 5 mbd of global oil demand? Really? Where did you pull that figure out of??

The U.S. Airline traffic is down 90%. U.S. gasoline consumption is likely down 50+%. Now, let’s multiply that across the world and you believe peak global oil demand loss will be 5 mbd??

LOL… Dennis, thanks for the wonderful laugh.

steve

Steve.

I am assuming about half the decrease of the largest ever seen in 1982, if it is a similar percentage as in 1982 it would be 10 Mb/d, if it is double it would be 20 Mb/d.

A scenario below has a 26 Mb/d drop in output over a two year period (2020 and 2021), perhaps too pessimistic, though probably not for some. 🙂

Note that if all of World C C demand falls by 40 Mb/d that would be 1.2 Gb per month added to storage, so if you are correct we would quickly see storage filled to capacity and oil price would fall to zero or perhaps go negative.

I will believe this after there is statistical evidence that it has occurred.

Steve,

Re-reading your comment, I think you misunderstood what I meant (or I wrote unclearly), I expected over a 12 month period we might see World C+C output fall by roughly 5 Mb/d, so if output was 83 Mb/d in July 2019, we would see it fall to 78 Mb/d in July 2020. The 2 Mb/d estimate was for the annual average so if 2019 average output was 83 Mb/d, I was suggesting an average output of 81 Mb/d in 2020.

Recent IEA “pessimistic” estimate from the March 2020 Oil Market report for decrease in World oil demand is about 700 kb/d.

That is not either pessimistic or optimistic, it is a frigging joke. The world consumes, total liquids, almost 100 million barrels per day. And the IEA says that will decrease by 7 tenths of one percent?

Your estimate Dennis: at least 2000 kb/d with a peak monthly decrease of 5000 kb/d (probably in July or August 2020,…

Okay, that’s 2 million barrels per day soon and 5 million barrels per day by July or August. That is a 2% drop then a 5% drop in World total liquids. Really Dennis, you are almost, but not quite, as optimistic as the Donald. 😉

Ron,

The estimate of 2000 kb/d is the annual average for all of 2020, I agree even 5000 kb/d by August may be too optimistic. For the GFC output for the largest monthly decrease over a 12 month period was about 1200 kb/d for the World. If we see a 12% decrease as in the early 1980s that would be 10 Mb/d, a shock model below suggests a possible decrease of 26 Mb/d over a 2 year period from 2019 to 2021. No doubt still too optimistic from your perspective. 🙂

World C+C output trailing 12 month output data from link below

https://www.eia.gov/international/data/world/petroleum-and-other-liquids/monthly-petroleum-and-other-liquids-production?pd=5&p=00000000000000000000000000000000002&u=0&f=M&v=mapbubble&a=-&i=none&vo=value&&t=C&g=00000000000000000000000000000000000000000000000001&l=249-ruvvvvvfvtvnvv1vrvvvvfvvvvvvfvvvou20evvvvvvvvvvvvvvs&s=94694400000&e=1575158400000

Peak for average 12 month trailing output was April/May 2019 at 83054 kb/d, the centered 12 month output peak would be Oct/Nov 2018.

A shock model that assumes extraction rate from conventional proved producing reserves falls by 30% as it did in the early 1980s from 5.6% to 3.7% and then recovers to 5.4% by 2025 and remains fixed at that level. Output falls from 83 Mb/d in 2019 to 68 Mb/d in 2020 and to 57 Mb/d in 2021 and then recovers to 87 Mb/d in 2025. Note that I consider this a pessimistic scenario as far as how far World C C output falls over a short period. Tight oil output is modelled separately and falls to 4 Mb/d by 2021 and recovers to 9 Mb/d by 2025 for this scenario.

Alternative shock model scenario with slower recovery of extraction rates from 2025 to 2035. Leads to later peak in 2031 at a lower peak (84 Mb/d) compared to the previous scenario.

As always nobody knows what the future will look like, this is a guess based on what has happened historically, the guess is likely to be a incorrect as the number of possible scenarios is infinite and I have chosen 2 from an infinite set. Chances of success are zero.

Yes Dennis. It looks to me that finally, the poison from the scorpion sting (shale ‘executives’) delivered to the frog (investors, service providers, true believers) halfway across the river will deal death to both.

Michael,

Most of this is due to the economic crisis precipitated by the covid-19 pandemic, though tight oil producers have overproduced, that is not the major cause of the fall in output in my shock model, it is simply due to a lack of demand leading to low oil prices and a cut back in the supply of high cost oil (tight oil, deep water, oil sands, and other high cost oil supply).

Mike Shellman at his “oily stuff blog” has a solution to excess tight oil output in Texas (which produces about 56% of US tight oil.)

see

https://www.oilystuffblog.com/single-post/2020/03/27/Hold-My-Beer-I-Can-Fix-This

Several comments above:

1) It’s not a free market (exact quote, btw)

2) What sort of disruption in oil field production can become permanent. Phrasing was cannot cut production without physical risk to ultimate recovery.

3) Slow the frantic pace of drilling

4) Quake near Mentone Texas

We have tried here over the years to explore how one could permanently destroy an oil field that is not empty. People tend to be quiet about it, suggesting there may be ways. At no time has anyone said that suspending production would be such a way to physically prevent ultimate recovery.

Quakes of a proper geological sort tend to be 60ish km deep. The Mentone quake was 6-7 km deep. Suggests something improper and not geological. The recent 5.7 that did actual damage in Utah was only 11 Km deep but my recall is it was nowhere near any oil production or production water disposal and was in a shallow fault region with a history. Magnitude is important and focused on, but depth is a big deal. I recall the Oklahoma quakes were shallow, too.

Couple of years ago when oil price fell there was lots of discussion here about how KSA had to reduce production. Because it had always been KSA that reduced production for such reason.

So, why? Why does it always have to be someone else’s ox getting gored? Why now must it be LTO? Why can’t it be conventional US production? Because it was “their fault?” There’s no such thing. You think taking production down is going to save something? Why would it, if it’s your production taken down? How does that save you?

Ending frantic drilling clearly costs more jobs than ending flow from already existing wells, or conventional production. So why end frantic drilling? Answer obvious: because that would be someone else’s ox getting gored.

I was pretty surprised KSA and Russia did this to begin with. They should have just printed up money like the US did and run up more debt. They made a mistake thinking money had to make sense. Maybe they won’t make it again.

“I was pretty surprised KSA and Russia did this to begin with. They should have just printed up money like the US did and run up more debt. They made a mistake thinking money had to make sense. Maybe they won’t make it again.”

Watcher, that may be the only cognitively realistic (as opposed to dissonant) thing I’ve seen you drool out in a long, long, long time.

Comment missing again

Watcher,

Sorry I don’t understand why that happens.

Based off what I read here on Peak Oil Barrel plus many other sources, I can’t see the Saudi production being ramped-up to 12.3 million barrel a day or whatever their bluff says they can produce.

Ron or Dennis once posted here a big chart with 7 or 8 sources that showed most of the Saudi oil fields being at least 50% declined from their original (claimed) resource size. If the chart were true, then how could the Saudis possibly get back to 12.3 million (or whatever the brag is) million a day?

Seems like a big bluff in the price-war with Russia. The Clash of the Titan-Egos.

Plus, Saudi Arabia is probably the most “Opaque” regime (opposed to “transparent”) on the planet, ain’it?

Cheers,

B.G.

BG,

The most that Saudi Arabia has aver produced is about 11 Mb/d, I will believe they can produce 12.3 Mb/d when I see it. Perhaps output will increase from 9.75 Mb/d to 11 Mb/d, but that is about it in my opinion. Also possible they cannot get to higher than 10.5 Mb/d.

And that was with a fit and healthy workforce.

It is a lie to sell stock in Aramco (if and when they get around to it…it’s just a lie, and it doesn’t cost anything. Better to tell a lie and not need it than to need a lie and not have told it).

I can’t think of any other reason: the only people the lie will work on are people not well-versed in oil markets. It’s not fooling anyone on this site and it’s certainly not fooling the Russians.

“If the chart were true, then how could the Saudis possibly get back to 12.3 million (or whatever the brag is) million a day?”

Comeuppance comes slowly, then all at once –

To loosely paraphrase Hemmingway

Ok just so i can come on here and say i told you so 3-4 years from now. 🙂 I’ll give you the long term technicals on WTI chart. Price went right to the trendline that comes of the 2009 lows and the 2016 lows. Just like i told you last April it would. Technical pattern is a falling wedge. It’s just a 12 year long falling wedge. Price hit bottom trendline 3 times. Very typical of a falling wedge. Now you have to look a the upper bound trendline of this falling wedge that come off the highs from 2008. Which is exactly where price is headed to. Once it reaches this trendline and breaks above it and holds. Price target from this pattern depending on exactly what the price is at the point where the upper bound trendline is overtaken by actual price is somewhere between $160-$170 WTI. That is the target. New all time highs.

The technicals on the WTI chart are screaming peak oil or less oil dead ahead. Well either that or someones currency devalued Bigly. Or both.

HHH,

Pretty sure when you made your $20/b prediction you did not give a date, just in the future. Do you have a date for the $165/b price, or should we put it at 3.5 years +/-0.5 years from now or roughly in 2023 or 2024. Also to be clear this is nominal US $ for WTI, I think. I think your prediction makes sense, but would expect to see that price in the 2026 to 2027 time frame. In 2020$ the price would be about $145/bo in 2026 assuming an inflation rate annual average of about 2% over a 6.5 year period, that seems pretty reasonable.

Of course there are those that believe a never ending financial crisis is about to hit any day. I think there will be a financial crisis, but it will last 1 to 3 years in my view.

You keep touting that correct call as if it means something.

Please link to the post in which you predicted $20 oil in response to a global pandemic and a price war. If you can’t, all that happened is you got lucky.

The “technicals” you have repeatedly touted did not lead to the price plunge. You correctly predicted neither the coronavirus nor the disagreement between Russia and the Saudis. The only thing convincing you that you have done something meaningful is confirmation bias.

If I’m wrong, please, please link to the post in which you correctly predicted the REASONS for the price collapse.

A correct guess means nothing if it’s for the wrong reasons.

“A correct guess means nothing if it’s for the wrong reasons.”

For those who stake their fortune and reputation on technical analysis,

they live for the correct guess (regardless of the reason).

That is all they have, other than tepid odds.

Some people can take tepid odds and milk them for an occasional win. And loss.

Dennis can pull up every comment i’ve ever made. Again it doesn’t matter how price got to where it’s at today. All that matters is it did. and again price is going to $160-$170 like it or not. Price doesn’t give two shits as to matter of why.

The why will only be known after the fact.

I’m totally aware that the majority of people don’t understand exactly what technical analysis is.

yeah yeah yeah i know Ron thinks it’s horseshit But i was dead on within a dollar or two of where the low would be in price. A year before it actually happened. And I get paid to do this for a living. What the hell do you do for a living Hickory? It’s not a guess it’s just reading the chart the way it was intended to read.

The price doesn’t care, but your audience here on POB cares.

Jeanne Dixon was a self-described psychic. She made zillions of predictions, and got little attention until she happened to predict something that could be interpreted as Kennedy’s assassination. She milked that coincidence for decades…

Weren’t you calling for 3.5% 10 year T’s for Q4 last year?

Sorry, that’s not a question.

I actually know quite a bit about technical analysis, from Bollinger Bands to RSI to OBV. Brokerage firms typically carry a couple or 3 such analysts on staff.

Their task is not to be right. Their task is to entertain clients whose commissions fund the firm. I once was visiting a brokerage firm waiting to talk to somebody and heard one of their chartists explicitly told this.

His reply was to return to his office and collect his paycheck.

HHH,

your observation is that the oil price is going down since 2008. You found that using technical analysis. A thermodynamical analysis of the oil extraction process gives the result, that the oil proce must go down.

https://limitstogrowth.de/wp-content/uploads/2020/01/Mar_2020_Thermo_EN_09.pdf

read and understand

On Page 8 you show heat flow in the wrong direction, heat flows from hot to cold so from below the Earth’s surface to the surface.

The ETP model has been debunked many times.

If we see oil prices crash when supply is less than demand for oil, then your thermodynamic model might be validated.

Do you have any data that supports the premise that the internal temperature of the Earth has changed in any significant way, besides expected changes based on geophysics?

Seems this remains just a hypothesis. Also keep in mind that there are many cases where there are heat flows that have nothing to do with Work or exergy. In addition there are lots of non-petroleum inputs to the petroleum production process (electricity used to run pumps for example that is produced by nuclear, coal, or renewable energy. The bottom line is that if oil is profitable to produce, the net energy used in the petroleum production process is of little consequence. The aim of oil production is not to produce oil, it is to produce money.

I’m totally aware that the majority of people don’t understand exactly what technical analysis is.

yeah yeah yeah i know Ron thinks it’s horseshit…

No, no, no. I never said it was horseshit, I said it was bullshit. There is a subtle difference you know. 😉

Always kinda liked the smell of horseshit. Even the faint whiff of bullshit sets me off though. 🙂

Llamas shit in one place.

Great fertilizer.

I think TA has some merits. But not as much as you seem to think. TA shows the aggregate “market psychology” (support, resistance levels etc.). It works until it doesn´t.

You did not call the recent price collapse for the right reason and not the right timing either. You have also made a lot of statements on price moves that turned out to be wrong and your attitude is far from humble. These are probably some of the reasons why a lot of people don´t listen.

HHH says:

07/07/2019 at 7:13 am

”

[Dennis ask HHH to estimate the average oil price in spring 2020]

“That $45 is trendline support on the WTI chart by the way. So Brent would likely be $6 higher at about $51. That is just where support is currently and will be for a couple of months. 6 months from now support will be a little higher than $45.

Oh, and since you don’t seem to like Mr. Steve too much his long gold trade is likely to blow up in his face when treasury yields start steeping. Last weeks highs were actual the perfect time to sell gold.”

I doubt the average Brent oil price 1H 2020 will be $51.

And no, gold has moved higher since your comment.

HHH says:

07/07/2019 at 1:35 pm

“Something very rare is likely to happen before FED steps back in and buys. Both stocks and bonds get sold at the same time.

The demographic pension fund crisis that has no answer will trigger this. Stocks and Bonds are both at or near all time highs and retirement funds are still woefully underfunded. There will be a run on those funds. Those that get their money out early will get their money. Those that don’t won’t be able to get their money out. Only question is timing.”

No, FED started QE by another name in the autumn and unlimited QE is a response to the corona crises.

“What the hell do you do for a living Hickory? It’s not a guess it’s just reading the chart the way it was intended to read.”

You are very correct on that.

I work in a sector categorized as a vital service (by all).

“But i was dead on within a dollar or two of where the low would be in price.”

According to Dennis (and I trust him for this) you never gave a date on your $20 prediction. And I know you were never even close to getting the right reasons. And as pointed out elsewhere in this thread (using evidence, unlike yourself) you’ve been wrong more than you’ve been right.

Your predictions are about as valuable as freshly used toilet paper.

Hello. Long time lurker finally contributing… Is there a chance, for discussion, that Trump would mandate purchasing domestic crude first and imports second? The point is, our domestic storage tightening problem could be minimized if the majority of domestic production was absorbed into the market preferentially over imports. Just a thought for discussion, thanks.

No, Trump cannot mandate that oil companies do anything unless he invokes the War Powers Act. There is just no way that the act would be justified messing with oil companies in this way.

Anyway, oil companies, refineries, are always looking at the bottom line. They do what is most economical for them to do. They export grades they don’t need and import grades they do need. There is no way our idiot president would dare mess with that.

Ron,

I agree. The US refineries do not have the capacity to handle the light tight oil, to retrofit the refineries to utilize the tight oil would be very expensive so the excess tight oil is exported. At current oil prices nobody will buy those exports at a price that will lead to profits for tight oil producers. The correct response is for the rate of well completion to fall to zero and within 15 to 18 months US tight oil output will fall by about 4000 kb/d, that would be more in line with the refinery capacity that exists, in addition some low volume wells will be temporarily shut in, so US output might fall by 5000 to 6000 kb/d, perhaps more. Eventually World C+C output might fall by 25 Mb/d over the next few years, eventually the economy will recover, oil prices will rise to $60-$80 per barrel and World C+C output will recover. That’s my guess, the exact path is unlikely to follow my scenarios with any precision.

Heck, the crack spread went negative. Refineries are operating at a loss. They aren’t retrofitting anything now. Our’s is rumored to be cancelling a big turnaround that was scheduled for the fall.

We are living in a world wide pandemic disaster. CAPEX isn’t being cut by 5-10%. Think more than half, some industries almost 100%.

Shallow sand,

Am I correct in thinking that my suggestion of US output falling to 6 Mb/d is too low? I think tight oil output will fall by 4 Mb/d, I am estimating the rest of US output also falls by half. I am not figuring that low output tight oil wells get shut in, if that occurs, tight oil output falls more, my expectation is that mostly no new wells are completed.

Obviously this is a guess on my part, output could fall by more than I expect, in the past it has fallen less than I expected (2014 to 2016).

Dennis. Clearly there is too much uncertainty to know how much US supply will fall.

From what I am reading and watching, health experts are talking that the flatten the curve measures could take a year or more.

What kind of economic shock would a year of stay at home orders result in?

“ What kind of economic shock would a year of stay at home orders result in? “

Let’s wait first what the effect is of (existing) medicines, like remdesivir. Trials are running now. One bottleneck is that therapy probably has to be started before patients get critically ill.

Another option is treatment with antibodies from cured patients. Here a bottleneck is to find sufficient donors and that preferably within a few months time from now.

If almost nobody will die anymore the stay at home orders and social distancing orders will be removed

Shallow sand,

A year would be a disaster, I doubt it will be longer than a month or two. There will still be some level of economic activity as food, electricity, and other energy will still need to be produced and it will. Difficult to predict how this plays out over the next year.

Mr Tariff Man could throw down a tariff though. He likes to do that. If these countries are selling oil for less than the cost of production, then they are dumping.

Selling oil for less than the cost of production? Well hell, what do you think shale oil producers have been doing for the past four years?

Even though Saudi Arabia needs $80 a barrel to balance their budget, it only cost them $4 or $5 dollars a barrel to produce it. USA probably has the highest cost per barrel for production than anyone else in the world.

If possible, please post your chart here. I’m interested. I believe that $160/bbl on the rebound is likely.

LOL

Thank you Paul.

Even a blind man could see that every post he puts up on various sites, are guided by a single principle- self-interest above all else, certainly above truth based on facts. [very similar to the orange man].

Paul,

In this particular case, I think David Archibald is correct, note he did not say when oil prices might reach $160/b and also note that if we assume this happens in 2026, the real price in 2020$ (assuming an average annual inflation rate of 2%) would be about $145/bo. That does not seem unrealistic to me as oil supply is not likely to meet oil demand by 2026, I expect the World economy will have recovered by 2026 and Brent oil prices might reach $165/bo nominal in the 2026 to 2030 time frame.

A new post on Permian basin at https//shaleprofile.com at link below

https://shaleprofile.com/blog/permian-monthly-update/permian-update-through-december-2019/

An excerpt:

In the “well quality tab” you can easily see how well productivity has evolved over the last decade. Performance edged again higher in 2019, but the relative improvement since 2016 has been minor. In fact, after only considering oil wells and normalizing for lateral length (possible only in our our advanced analytics service), we now see the first signs of a small deterioration in well results compared with wells that began production in 2016.

This is big news. Productivity of the average Permian well per lateral foot has started to decrease, if I have interpreted Mr. Peters correctly.

Doesn’t have to be geology. We’re heard this sort of thing before. Could be choke management.

Chokes on a Permian well? I would think you would just turn the pump on or off if you wanted to control the flow?

Ron,

The initial output flows from pressure from associated gas, no pump is needed. It is later in the well’s life after natural gas pressure falls that pumps are installed.

Yes, I knew that Dennis. But I did not think the pressure flow time lasted very long on a fracked oil well. I drove through the Permian last year and there were donkey head pumps everywhere.

Ron,

I agree the pumps are definitely needed. I do not know how soon they are installed, they may be set up at the start and just turned on after 24 to 36 months. I imagine there are 50k to 100k old stripper wells in the Permian basin that are conventional or vertical fracked wells. Again Mike Shellman or Shallow Sand could set us straight here, they know this stuff, I do not.

No, pumps would not be set up at the start only to set idle for two to three years. A pump is a very expensive piece of equipment, far too expensive to set up years before you intend to use it.

That being said, I doubt very seriously that a fracked well will be pressure driven for anywhere near that long. But as you say, we need an expert opinion here.

My view as always is this is largely diffusional flow, with the fast decline and fatter tails associated with diffusional math. I have gotten beat up for this view but the mechanism can only be inferred as I don’t think there is any physical evidence or sensors that show exactly what is happening underground.

So if these wells are not actively producing for any length of time, as may happen during the coming recession, the diffusion will continue and spread out over a larger volume, and eventually lost to entropy. This would be different than a conventional oil reservoir where the oil would stay put.

Paul,

There is certainly some pressure component as the oil needs to be pumped towards the tail, there may be a combination pressure/diffusion aspect to this. You are correct that we don’t have the data needed to answer definitively, no doubt some of the larger companies may have this data and perhaps it has been shared with petroleum engineer researchers at Texas universities.

Watcher,

I will let Mike Shellman or Shallow Sand comment, but I am pretty sure that new tight oil wells are not choked very much. And no, Enno Peters has never reported this before, up till now he has said there has been little increase in productivity since 2016.

A very interesting article. Bold mine.

The big question facing the oil industry is when will demand come back

Here are the last three paragraphs of the article:

For the next few months, single-digit pricing is on the way, and a battle between higher-cost suppliers trying to stay alive, and Opec countries trying to force even more oil on reluctant refiners.

Will closed-down fields return to production when prices recover? There will be no spending on wells requiring “workovers” to remove sand or shut off unwanted water production. US “stripper” wells, which produce less than 10 barrels per day each, but collectively over 1 million bpd, are unlikely to be worth restarting, once stopped. The same applies to offshore platforms on mature fields in the North Sea, south-east Asia, shallow-water Gulf of Mexico and Brazil.

So, the course of future prices depends on how much decline turns into permanent destruction: of demand, and of supply. Likely most demand will bounce back, but with some persistent negative effects. Rocks don’t run out of money, but a much smaller and chastened shale industry will not be in a position to go back to frantic drilling. Eventually, it will be time for the flexible members of Opec to capitalise, but for now they have to make their way through the worst crash in history.

In other words, a lot of oil, once shut in, just ain’t coming back.

Ron,

That is an interesting article, i was wondering if all these shale companies was to go bankrupt, will new ones return once oil prices re-stabilize ?

If the answer is no as the article predicts, then oil prices will head much higher.

i was wondering if all these shale companies was to go bankrupt, will new ones return once oil prices re-stabilize ?

I doubt if new small companies will return. Remember that though they were losing money, they were losing other peoples money. New companies would have to find new investors to to finance their drilling and fracking. But since so many lost money in previous shale plays, new sucker money will likely be hard to come by.

New shale deals, if there are any, will have to be financed by major oil companies with deep pockets.

Iron Mike,

It is likely higher oil prices ($75/bo for WTI in 2020$) will bring back tight oil. A well run company can make money at that price.

And if they can hedge their output it will be easy to get financing.

I don’t think any of them want to sell oil futures, (hedge), at $21 a barrel, where futures are today. Of course if oil does go to $75 a barrel, then their problems are solved. But that is a real long shot, pie in the sky. This virus caused recession could last a decade. Some industry will never come back.

Waiting for higher prices will likely mean a long, long wait.

Ron,

If there is a 10 year recession, we won’t need a lot of oil. We have learned a bit of economics since 1929, so a decade long recession would require economists to forget all that has been learned.

My guess is a 3 year recession/depression, 5 years at the outside.

The short-term issue of collapsed demand is the immediate effect of the covid shutdowns, but the longer term effect will be the reduced spending power of the populations and businesses that currently consume oil. Many jobs will not come back, much tax revenue will not be paid, which will mean that those that do earn anything will have to pay more of their dollar earned to support the newly-unemployed. This reduced spending power is what will kill any resumption of ‘business as usual’ and suppress demand for oil to significantly below current levels.

So its likely that the demand, once reduced, just ain’t coming back either.

I guess what the big bettors in this game are hoping for is that the remaining spending power vs demand will result in a ‘sensible’ price for the oil that is demanded in the remaining market.

To get an idea of where demand is today, look around the www at the thousands of traffic cameras showing current volumes on main roads around the world. A busy site may be carrying 10% of its usual flow, the worst show nothing but old news papers and stray dogs. Its like scenes from Nevil Shute’s movie On The Beach. Disaster.

That is one of my favorite apocalyptic movies. Although it’s about slow moving radiation, it can translate to slow moving pandemic. The original is best, but HBO put out a two or three part version that was pretty good as well.

I need to watch it again.

There are jobs that are not coming back, but I anticipate the government requiring removal of automation in many applications to generate jobs. Fiscal budgets everywhere are going to be smashed and efficiency will be far less important than unsmashing them.

Construction and real estate will require a bailout and some of that was in the stimulus package just passed. Stop thinking about money as if it has to be logical. That will not be allowed. It’s not possible.

You’re going to be looking globally at deficit-to-gdp ratios that are through the roof. There won’t be any way to address that other than creating more money from nothing. Not only will tax revenue not be coming in, but various stimuli will be going out. You cannot have people out of work for long periods of time when you are already running a deficit of five or six percent of GDP.

The expenditures are just beyond imagining. There are school closings all across the nation, but teacher paychecks continue. Many government employees at various levels who have been deemed non-essential will continue to be paid. Their tasking is to stay at home. They will be paid for performing that task.

The president and his team have this correct. People have got to get back to work. There are many counties with very few cases and those will have to be the beginning. There’s no morality issue in this. It’s not lives balanced against the distasteful interest in dollars. If this doesn’t happen government budgets will disintegrate . At all levels. You may or may not remember that California tried to get Bernanke to buy California bonds. He could not. It’s outside the Fed charter. States will fall apart. Money will disappear. ATM machines will stop working. Credit cards won’t work. The banks will shut down. The food will not be there on the shelves . The Fed will try to back stop banks but there are conditions on that and those conditions won’t allow the banks to function.

If state budgets fall apart all of the poverty programs and food stamps themselves will shutdown. States do not have a central bank. Illinois does not have a central bank. Maryland does not have a central bank. Chicago and Baltimore will be a bloodbath if benefits shut down and they’ll have to. Their budgets will have no revenue.

This is not just the United States. Essentially all of Europe is going to face the same fiscal destruction. You will soon hear them start to talk about getting things under way again because their deficits are often worse. They may or may not be called immoral, depending on if the leader in question is a darling of or hated by the local media.

In our country, with borders shut and full lockdown for four weeks underway, only essential services operate. Supermarket shelves are stocked, banking functions are working well enough, primary industry and internal and external transport for essential supplies continue. We are allowed out to get groceries and medical assistance. Five million of us.

Social support is achieved by enough QE to do the job, and will be repaid in the future if there is one.

Yes the results will mean that we will never see business as usual again. There will be ‘fiscal destruction’ but our government believes this is preferable to social disintegration from ongoing rolling hits to the population from spread of the virus which will overwhelm our health and emergency systems. The aim is to avoid the premature death of many.

To us, that, morally, is the correct approach.

After it, the people are still there (when the virus is defeated, as in your country it should be soon with consequent lockdown), the government is still there, and the machines and farm land is still there.

Just print some money to cover the chaos, and when everyone is working again, wealth will be generated again.

When the economy is restarted, the printed money will just disappear to some Cayman Islands accounts to increase some number of zeros there when it has done it’s job.

Another shot at oil shock model with low and high case. For tight oil the low case has tight oil recovering from a low of 4 Mb/d in 2021 to a peak of 6.8 Mb/d in 2031/2032 and the high case has a similar low point in 2021 but a higher secondary peak at 9.4 Mb/d in 2030. For conventional oil (excludes tight or extra heavy oil production) the low case has the extraction rate from conventional producing reserves fall from 5.5% in 2019 to 3.8% in 2021 and then increase to 5.2% by 2025 and the high case has extraction rate fall to 5% by 2020 and increase to 5.6% by 2025 (in 2018 the extraction rate was also 5.6%). Chart below shows high and low cases and an “average case” which is simply the average of the high and low cases. My guess is that there is roughly a 33% probability that actual output will fall between the low and high cases from 2021 to 2040, with an equal chance that output might be above the high case or below the low case (roughly a 33% probability for either case).

No doubt pessimists will believe the low case is too high and optimists will believe the high case is too low, but this is always true and when so, makes me think I have it about right.

Dennis, why will banks be inclined to invest money in tight oil when they will have lots hundreds of billions of dollars the first go round, with oil prices as high as $100 barrel at times? This time around the industry will have to finance their own way, which means they will need a consistent oil price of $80+ for years running to increase production in a meaningful way. There are too many geological (degraded resource base) and geopolitical factors (OPEC+/Democrats in power/etc) interplaying for there to likely be such stability and consistency again.

Tight oil is a failure as an industry, perhaps the biggest failure of all time. Capitalists are suppose to make profits. Even heavily subsidized this industry did nothing but destroy wealth, and this doesn’t even take into account that they are failing to pay for the carbon, methane and other types of pollution they are spewing into the atmosphere and the toxic chemicals in the ground along with the earthquakes from the pumped waste water.

Your models never address this consistent lack of profits or this unpaid-for environmental degradation.

Stephen,

As tight oil producers became more efficient during the 2014-2016 price crash, they were making money in 2018 when oil prices were around $75/b. At $85/bo or higher they will be making plenty of money and I expect as the economy recovers, and I believe that it will that demand will outstrip supply and drive oil prices over $100/b, note also that the “low case” does not have the completion rate returning to earlier levels and tight oil output does not return to previous level (8Mb/d) but to about 6.4 Mb/d. Chart below has tight oil scenarios.

“…they were making money in 2018 when oil prices were around $75/b”.

Ok, they were making money. However, in 2025 they will still be dealing with:

– degraded resource base;

– large amounts of scrapped equipment;

– severely reduced capacity from drillers such as Halliburton and Schlumberger;

– an aged workforce that will have retired or otherwise no longer be available;

– likely environmental restrictions;

– much less access to capital markets because of their previously failed business model. They made money in 2018. They lost money all the other years.

– EVs from major companies that get 400+ mpg meaning any rise in prices will also be accompanied by news of buyers switching to EVs;

Well said ! … it’s almost over for Shale.

Stephen,

Yes there could be problems, major oil companies have very deep pockets and will be able to finance tight oil, EVs will not really dent demand significantly until 2035 at earliest. High oil prices overcome all the problems you present. The oil price scenario used for the tight oil scenarios is shown below, the World oil shock model does not use price as an explicit input to the model.

“High oil prices overcome all the problems you present.”

Not quite. Consistent high oil prices would (3+ years of them), but I am arguing that is highly unlikely for the many reasons listed above. Oil prices have been increasing in volatility. This is common during a paradigm shift when the future gets cloudier. This volatility will make it very difficult for people making longer term bets on the longevity of future oil production such as banks, potential engineers, equipment providers, etc to reap any financial rewards, and dissuade many from participating. There will be more false starts and many more failures.

How would that volatility affect the ability to hedge production?

Nick, volatility is just high velocity price movement, up and down. Prices always vary. Sometimes they vary very fast. That is high volatility.

I don’t see high volatility as preventing hedging. A hedger should just look for the high swings and try to hedge when the price is high. But they can only hedge at the then current futures price.

It would make no sense to hedge today because the price is just way too low.

Volatility affects the price of puts.

Yeah, of course it does. I forgot about that. I was thinking that the producer would hedge just by selling the futures. If he does it by buying puts, then high volatility will cost him dearly. And the further out in time the put, the more it cost him.

So it would be a gamble. Sell the future and have only a tiny commission to pay, or buy the put for several bucks a whack.

Which do most hedgers choose?

Stephen,

Oil industry has always been high risk/high reward. When price becomes high enough, people are willing to risk their capital due to high potential reward.

The economy will recover and oil prices will rise, at $100/bo there will be adequate supply, and if not, price will be higher until supply meets demand. Perhaps the EVs might reduce demand, but I doubt uptake of EVs will be very quick with very low oil prices and low economic activity, my expectation the EVs and hybrids and plugin hybrids will not reduce demand to less than supply at market oil prices until 2037 to 2040. There are a lot of ice vehicles on the road, it will take 20 to 25 years to replace them.

Dennis, the bottom of your V, in your chart above, is in mid 2021. In my humble opinion, that is not even close. According to Dan Yergin, (see my link below) demand will drop 20 million bpd in April. By the first of May, all storage tanks will be full, so we shall see production drop dramatically in May.

And there will be no V shaped decline or recovery. The decline will be sharp and immediate. It will hit bottom way before the middle of next year. Actually it will be closer to the middle of this year. Then there will be a leveling out for months before a very slow increase in consumption.

But here is the sad part Dennis. The economy will never return to pre-pandemic levels.

Ron,

We will see what happens with the economy. Neither of us knows what will happen in the future. Note that the model is production. In 1978 to 1985 we had the conventional oil extraction rates below:

11.6%

11.7%

10.9%

9.9%

9.1%

8.7%

8.5%

8.1%

So 8.1/11.7=0.69, roughly a 31% drop over 6 years. My low case has a 31% drop over a 2 year period. Output drops by 30% (25 Mb/d) over a 2 year period. Note also these are annual averages, the path of monthly output is not considered in the shock model.

Note also that the low case does not have oil output returning to pre-pandemic levels, oil output at the secondary peak in 2027 is at 97% of the 2018 peak.

As to actual output we might see a 25 Mb/d drop in World C+C over 12 to 15 months, but I doubt it will be more than that as the total shut down of the economy will not last for more than 6 to 12 months (as far as most of the work force staying home to avoid thew spread of covid-19). Eventually the economy will recover to pre-pandemic levels, but it might take 5 to 10 years. Nobody knows, these are just different guesses from your guesses.

Dennis, the big drop will be immediately, April and May. Then, hopefully, people will start going back to work in June. So there will very likely be a very slow increase in demand, starting in June.

That’s about all we really know, and we really don’t know if the recovery will start in June or not. But we do know, almost certainly, that the demand destruction will be here in April and May. It is already here, the last days March. That much we know because it has already started. The demand destruction is already here in full force. That is not a prediction. It is a simple observation.

Ron,

We won’t know the level of oil consumption at the World level for quite a while, currently we have production data through Dec 2019, we can guess what the level of demand will be, but we do not really know.

The model I presented has yearly average output. So 2020 output is the annual average for the entire year.

What is your expectation for annual average C C output for 2020?

My low case has 71 Mb/d for average annual output in 2020 and the high case has 75 Mb/d for average annual output in 2020.

How is demand destruction “observed”, I try to use data, do you have data for March, I only have weekly data through March 20 and not a big drop so far.

We won’t know the level of oil consumption at the World level for quite a while,…

No, but we’ve got a pretty good idea.

What is your expectation for annual average C C output for 2020?

After all storage tanks are filled, I expect at least a 20% drop in production.

How is demand destruction “observed”?

It ain’t difficult at all. Just go to any school that is closed down. Gaze at all the cars that ain’t there. Go to any mall, bar, restaurant, or any kind of shop that is closed down. Again, gaze at all the cars that ain’t there. Walk out to the freeway. Observe that you see only about half the normal traffic you would normally observe. Go to any airport and observe that at least half the flights have been cancelled.

That Dennis, is how you observe demand destruction.

Ron,

Does not give us quantities, sounds rather anecdotal as I cannot observe every highway, airport, school, etc.

I am more interested in data, I don’t have data beyond March 20 for the US and Dec 2019 for World C C output, the consumption data at the World level is very spotty (as in not very good).

Your “observations” only tell us demand has dropped, it tells us very little about how much it has dropped Worldwide.

I disagree that we have a good idea about how much demand has dropped, I would say we have almost no idea.

I agree with a 20% drop in World C C output, that is 83*.2=16.6 Mb/d or 66 Mb/d. See my updated model. Note that I would consider this a low case rather than a high case.

Note that the biggest annual drop in World C C output ever was 5.9% in 1981, so I question whether a 20% estimate is reasonable for annual average output. A 10 Mb/d drop in annual average output would be about a 12% drop in output.

“…….Go to any airport and observe that at least half the flights have been cancelled.”

Ron,

For example KLM executes only 10% of flights now.

Worldwide the situation will get worse the next weeks. Above all in the U.S., in S-American countries, in Africa. Quite a few countries still have no ‘stay at home’ order.

Demand destruction of 20 mbd won’t surprise me.

“Then, hopefully, people will start going back to work in June. So there will very likely be a very slow increase in demand, starting in June.”

In June or maybe May people will start going back to work but it is risky. If in two months time about 0.o1% of the population (1000 in a city of 10 million people) can transmit the virus, then it can start all over again. To prevent this they are planning to test anyone with beginning symptoms immediately and isolate them if tested positive. Most children have almost no or no symptoms but probably are able to infect others. And it seems that infected people can even transmit the virus a day or so before symptoms show up.

For the rest of this year the best or only remedy is a (combination of) medicine(s) and/or antibody treatment

Flightradar24 is quite interesting nowadays.

You can have large parts of Europe in the browser without missing a single flight currently in the air.

Now you can spot any private single motor plane while having all of Central Europe in the browser on a measly Full HD display.

Another problem is that early in the disease the test will come back negative in people that are infected, so better to wait for disease to present with symptoms before testing. Just widespread testing (on everyone) will result in a lot of false negative tests.

Ron,

Here is an alternative Oil Shock Model, using my low tight oil scenario.

Dennis,

So the current situation we are in would delay your peak oil projections by 5 years or so right?

Iron Mike,

It depends on the speed of recovery, I would guess the peak will be delayed between 1 to 5 years, best guess is about 2 or 3 years, maybe 2027 or 2028.

If we have a long depression, then 2018 will be the peak, I think there is less than a 15% probability (subjective) that the peak for World C+C will be 2018, but we will know in 5 to 10 years.

Dennis,

In the alternative OSM, why would it take so long for oilconsumption to be back at 80+ mbd ? If in 2025 oilconsumption is at 73 mbd that could mean that worldeconomy is still in recession then.

Another scenario is that in the second half of this year and next year the economy recovers rather rapidly, but that oilproduction cannot keep pace with that.

The consequences are easy to imagine

Han,

Just a different scenario, it would be due to a slow economic recovery, Ron thought my previous scenario was too optimistic, so I created something a bit more pessimistic. In the V shaped recovery we would see a spike in oil prices and tight oil might recover quickly if oil prices rise to $80/bo or more. That might look something like scenario below.

Dennis,

did you factor in the slower, but more prolonged depletion?

And did you have in account permanent well damage caused by the shutdown?

How many barrels will get lost each year because of that?

West Texasfanclub,

If a well is damaged it can be worked over or a new well can be drilled, the oil that has not been produced remains in the ground and may be produced later. Depletion is built into the shock model, oil is discovered, then fields are developed in stages (fallow, construction and maturation stages in the shock model) then oil is extracted from proved producing reserves. The model estimates 2800 Gb for the URR of conventional resources the other 200 Gb is from combined output of tight oil and extra heavy oil resources (in Canada and Venezuela), about 100 Gb for each. Note that the USGS estimated 3000 Gb for World resources in 2000 and Jean Laherrere’s most recent estimate is about 2500 Gb for conventional resources (with a range of 2300 to 2900 Gb).

My 3000 Gb model is simply my best guess for World URR, I expect it is likely (60% probability) to fall in the 2800 to 3200 Gb range, with a 20% probability it might be below this range and a 20% probability it might be above that range. Probabilities are simply my subjective estimate.

See https://royalsocietypublishing.org/doi/full/10.1098/rsta.2013.0179

and

https://www.amazon.com/Mathematical-Geoenergy-Discovery-Depletion-Geophysical/dp/1119434297

might be available in a university library, it is at my local university.