By Ovi

Below are a number of Crude plus Condensate (C + C) production charts, usually shortened to “oil”, for oil producing countries. The charts are created from data provided by the EIA’s International Energy Statistics and are updated to October 2023. This is the latest and most detailed/complete World Oil production information available. Information from other sources such as OPEC, the STEO and country specific sites such as Brazil, Norway and China is used to provide a short term outlook

World Oil Production and Projection

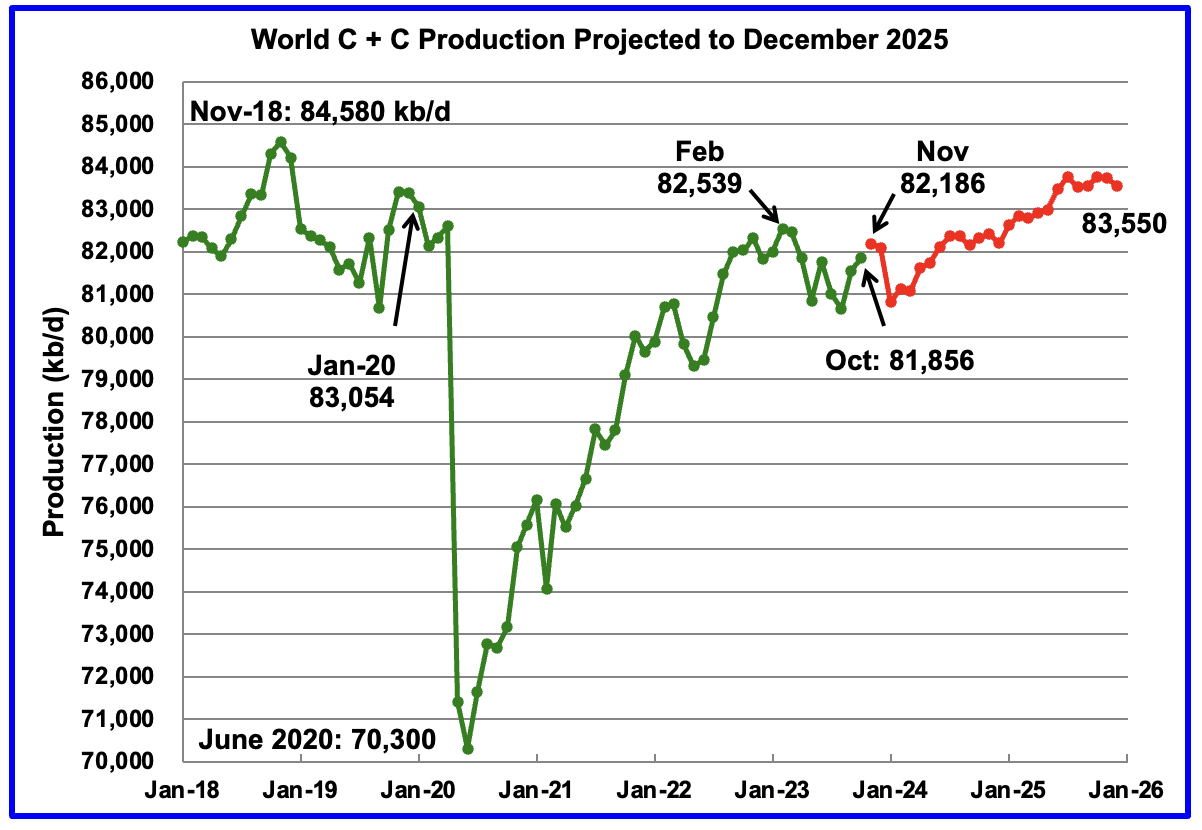

World oil production increased by 302 kb/d in October, green graph. The largest increase came from Canada and Kazakhstan with both adding 123 kb/d each.

This chart also projects World C + C production out to December 2025. It uses the February 2024 STEO report along with the International Energy Statistics to make the projection. (Red markers).

The red graph forecasts that World crude production in December 2025 will be 83,550 kb/d and is 1,030 kb/d lower than the November 2018 peak.

From November 2023 to December 2025, production is estimated to increase by 1,364 kb/d or an average of 59 kb/d/mth. Part of the big drop projected for January 2024 is associated with the expected drop in US January production due to bad weather.

Over and above the projection to 2025, keep in mind that OPEC + has close to 3,000 kb/d of cuts in reserve if required.

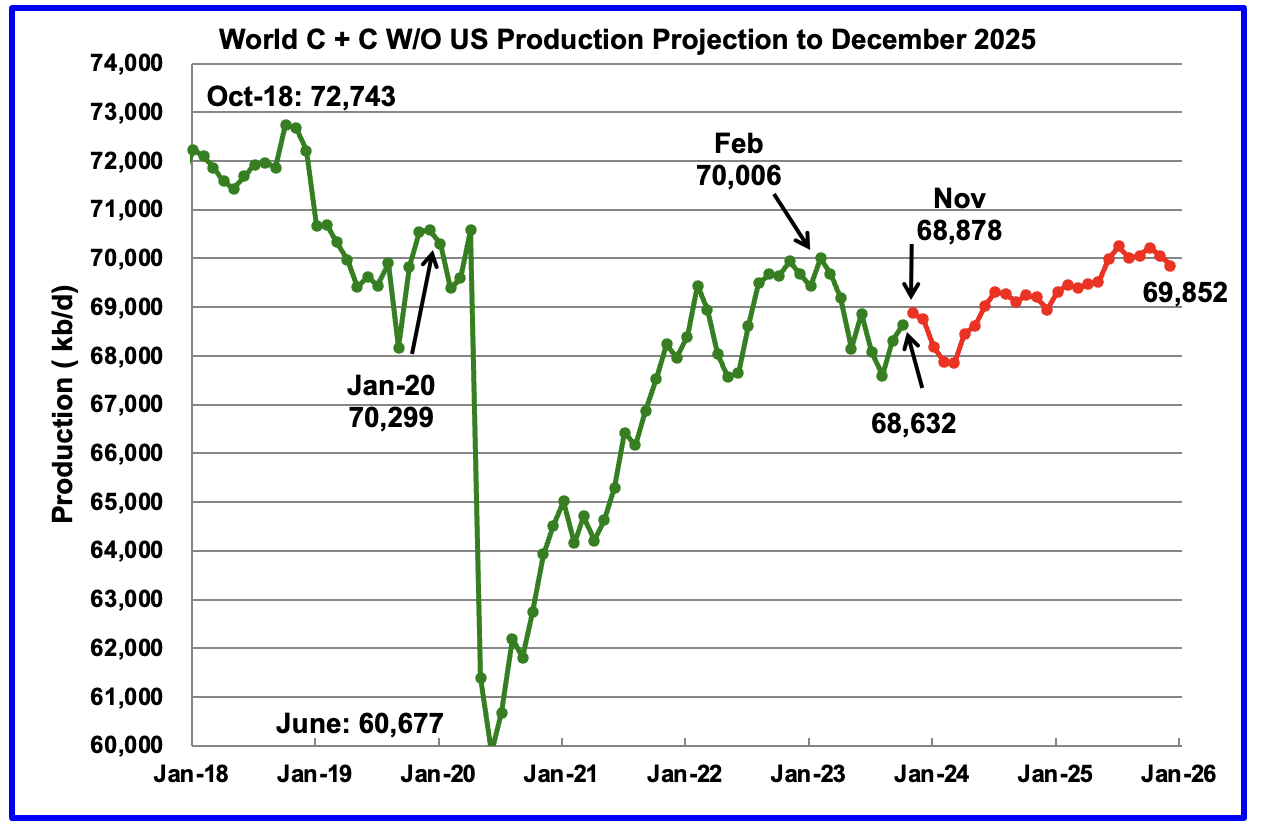

World without US October oil output increased by 304 kb/d to 68,632 kb/d. November is expected to add 246 kb/d to 68,878 kb/d.

Note that December 2025 output of 69,852 kb/d is lower than February 2023.

World oil production W/O the U.S. from November 2023 to December 2025 is forecast to increase by a total of 974 kb/d.

A Different Perspective on World Oil Production

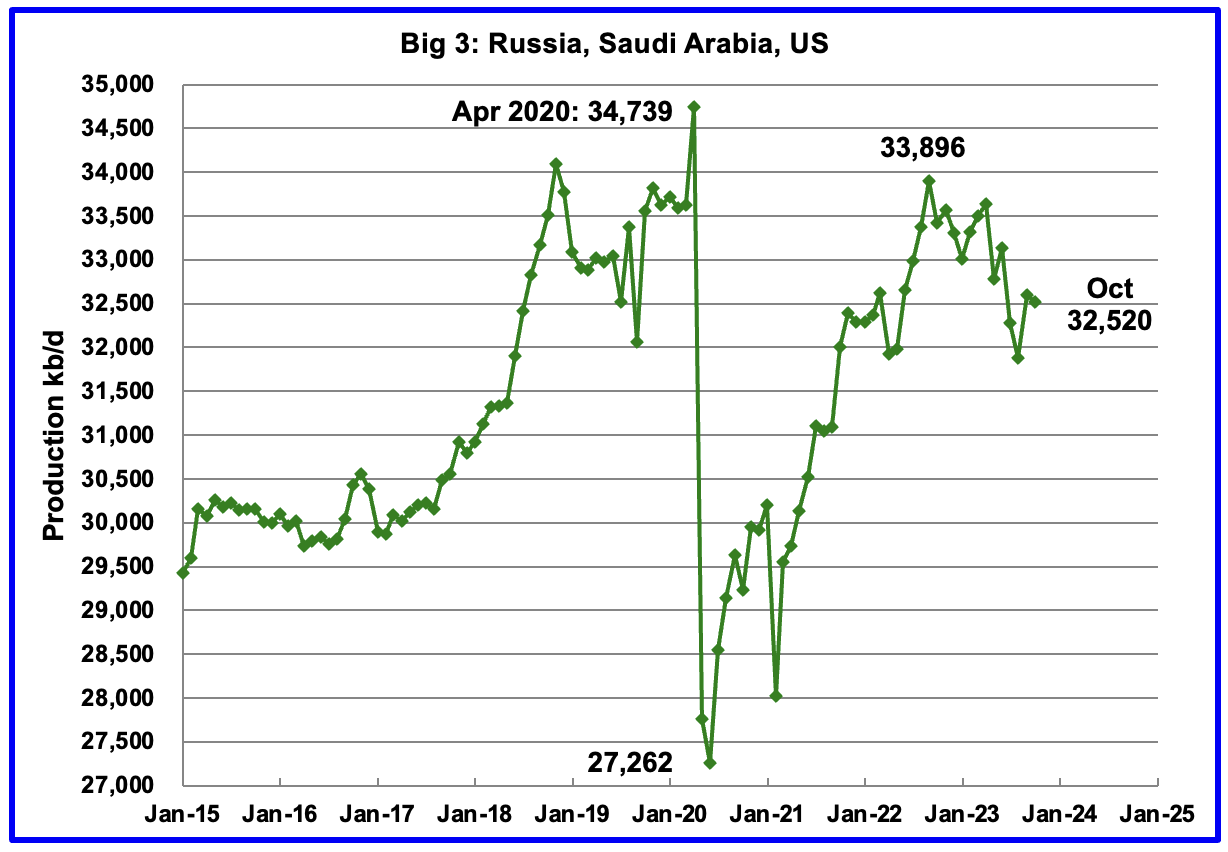

Instead of dividing the World oil producing countries into OPEC countries and Non-OPEC countries, this section divides the countries into two groups on the basis of their production capacity. The division will be The Big Three, US, Saudi Arabia and Russia, and the Rest, i.e. the World oil producers W/O the Big 3. The top producer in the Rest, currently Canada, produces close to half of the lowest producer in the Big Three.

Peak production in the Big 3 occurred in April 2020 with a rate of 34,739 kb/d. The peak was associated with a large production increase from Saudi Arabia. Post covid, production peaked at 33,896 kb/d in September 2022. The production drop since then is due to cutbacks in Russia and Saudi Arabia.

October production from the Big 3 decreased by 74 kb/d to 32,520 kb/d.

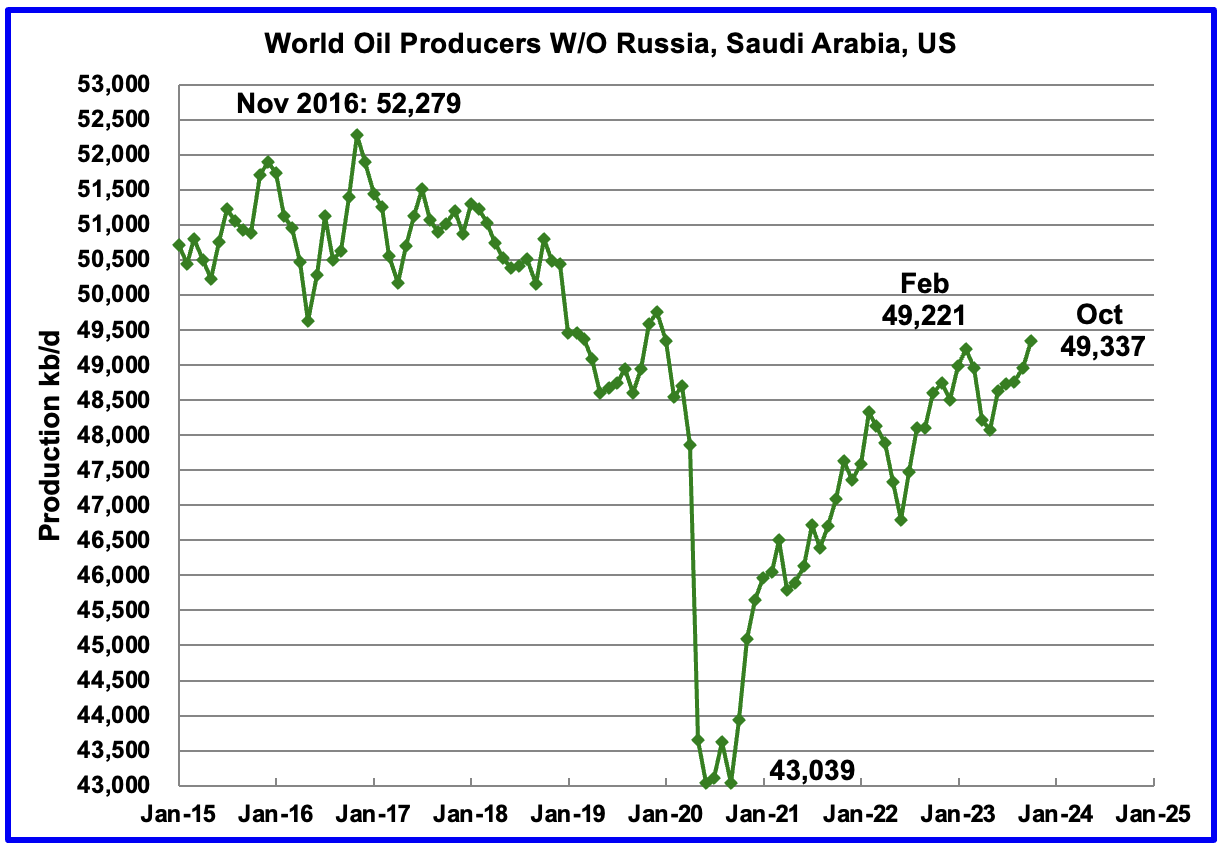

Production in the Rest has been slowly increasing since the low of September 2020 at 43,039 kb/d. In February 2023 production rose to a post covid high 49,221 kb/d. Output in October was 49,337 kb/d, an increase of 375 kb/d over September and exceeding the February 2023 high by 116 kb/d.

Production is down 2,942 kb/d from November 2016.

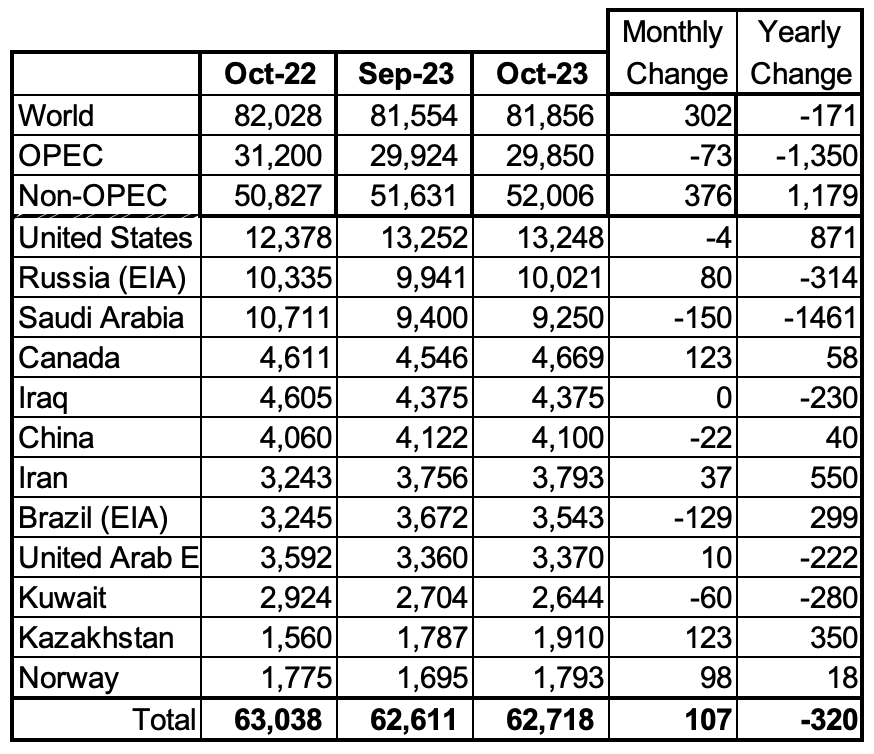

World Oil Countries Ranked by Production

Above are listed the World’s 12th largest oil producers. In October 2023, these 12 countries produced 76.6% of the world’s oil. On a MoM basis, these 12 countries increased production by 107 kb/d while on a YOY basis, production dropped by 320 kb/d. On a YoY basis, note how the size of the Saudi Arabia production drop overshadows the US increase.

Non-OPEC Oil Production Charts

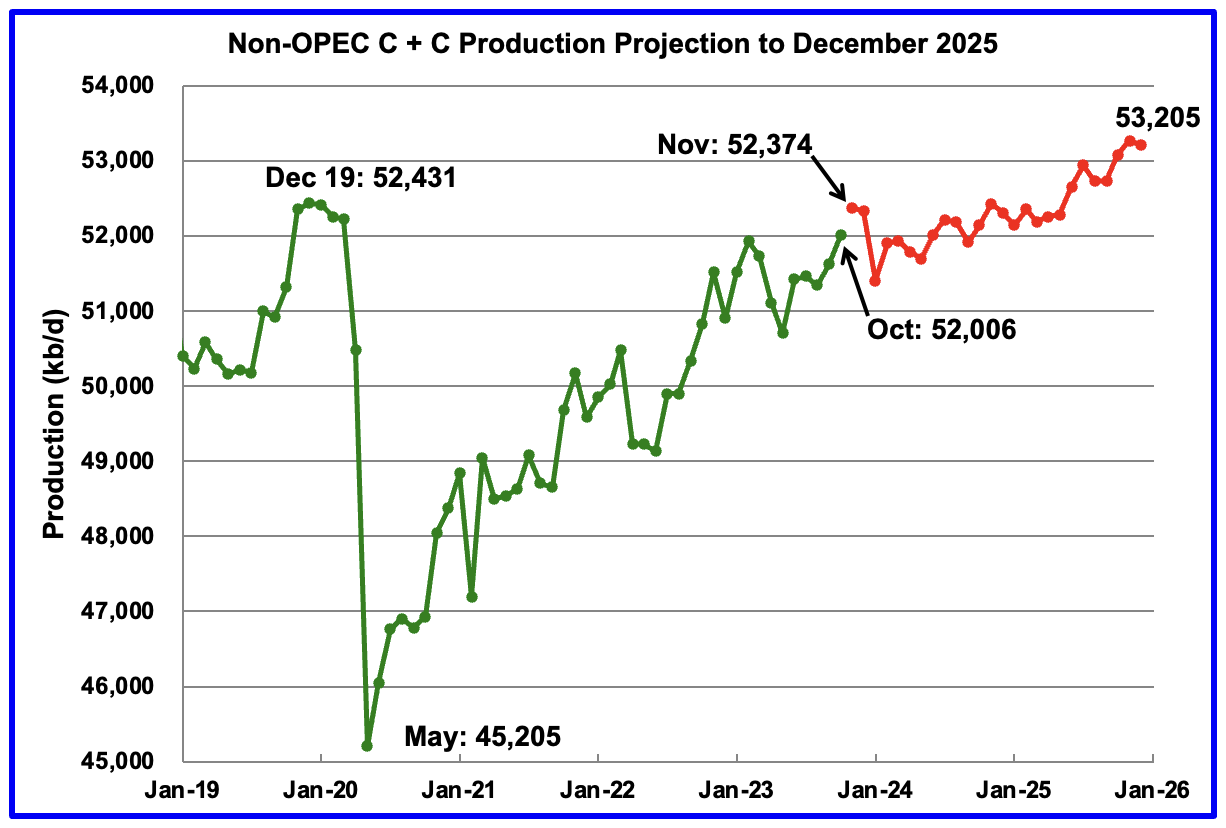

October Non-OPEC oil production rose by 376 kb/d to 52,006 kb/d. The largest increases came from Canada and Kazakhstan.

Using data from the February 2023 STEO, a projection for Non-OPEC oil output was made for the period November 2023 to December 2025. (Red graph). Output is expected to reach 53,205 kb/d in December 2025, which is 774 kb/d higher than the December 2019 peak of 52,431 kb/d. The updated December 2025 output is close to 100 kb/d higher than reported in the previous world report.

From November 2023 to December 2025, oil production in Non-OPEC countries is expected to increase by 831 kb/d. According to the STEO, the major contributors to the increase are expected to be the US and Guyana.

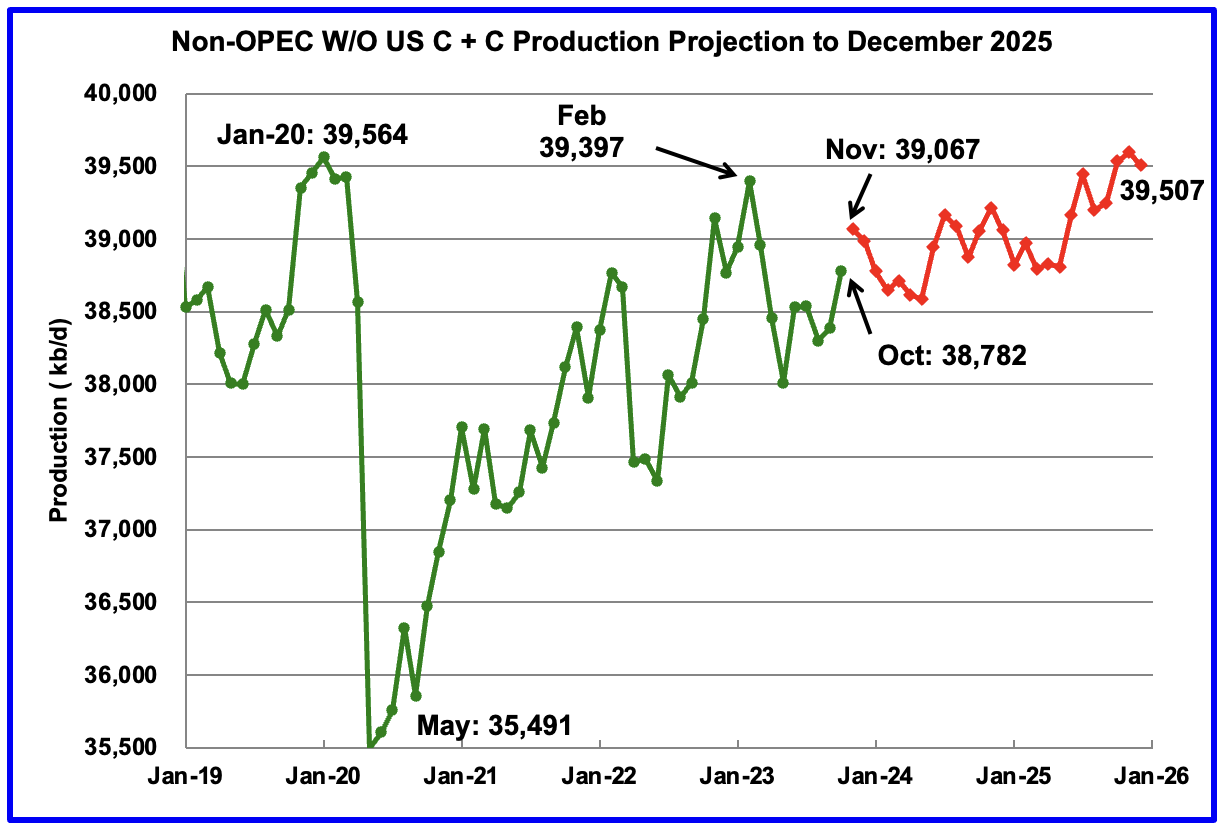

October Non-OPEC W/O US production increased by 298 kb/d to 38,782 kb/d. November production is projected to increase by 285 kb/d over October.

From November 2023 to December 2025, production in Non-OPEC countries W/O the US is expected to increase by 440 kb/d.

Note that December 2025 output is 110 kb/d higher than the February 2020 high of 39,397 kb/d. It is also 57 kb/d lower than the pre-pandemic high of January 2020, 39,564 kb/d.

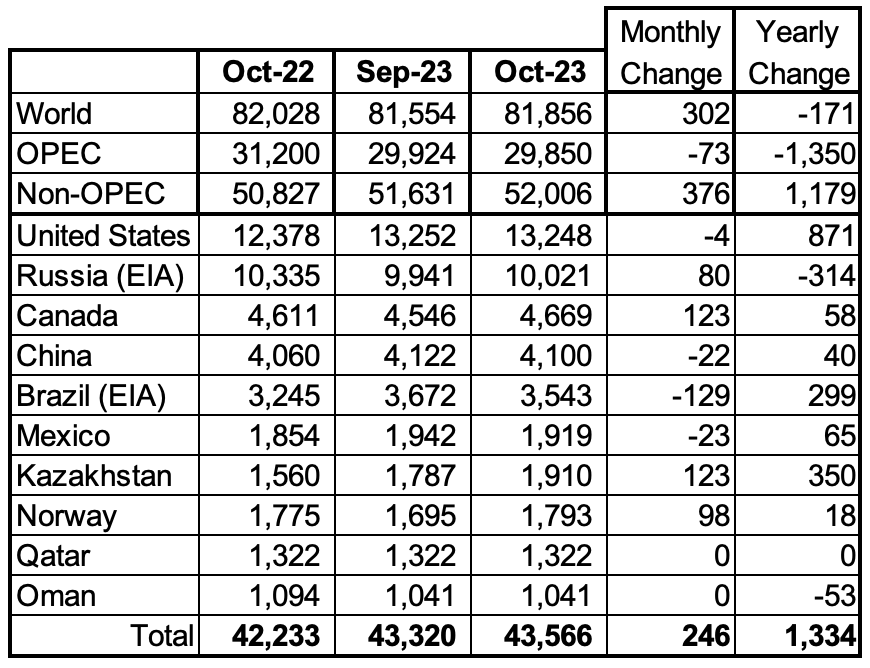

Non-OPEC Oil Countries Ranked by Production

Listed above are the World’s 10 largest Non-OPEC producers. The criteria for inclusion in the table is that all of the countries produce more than 1,000 kb/d.

October’s production increase for these ten Non-OPEC countries was 246 kb/d while as a whole the Non-OPEC countries saw a production increase of 376 kb/d.

In October 2023, these 10 countries produced 83.8% of all Non-OPEC oil production.

OPEC’s C + C production decreased by 73 kb/d MoM while YoY it decreased by 1,350 kb/d. World MoM production increased by 302 kb/d while YoY output decreased by 171 kb/d.

Non-OPEC Oil Production Charts

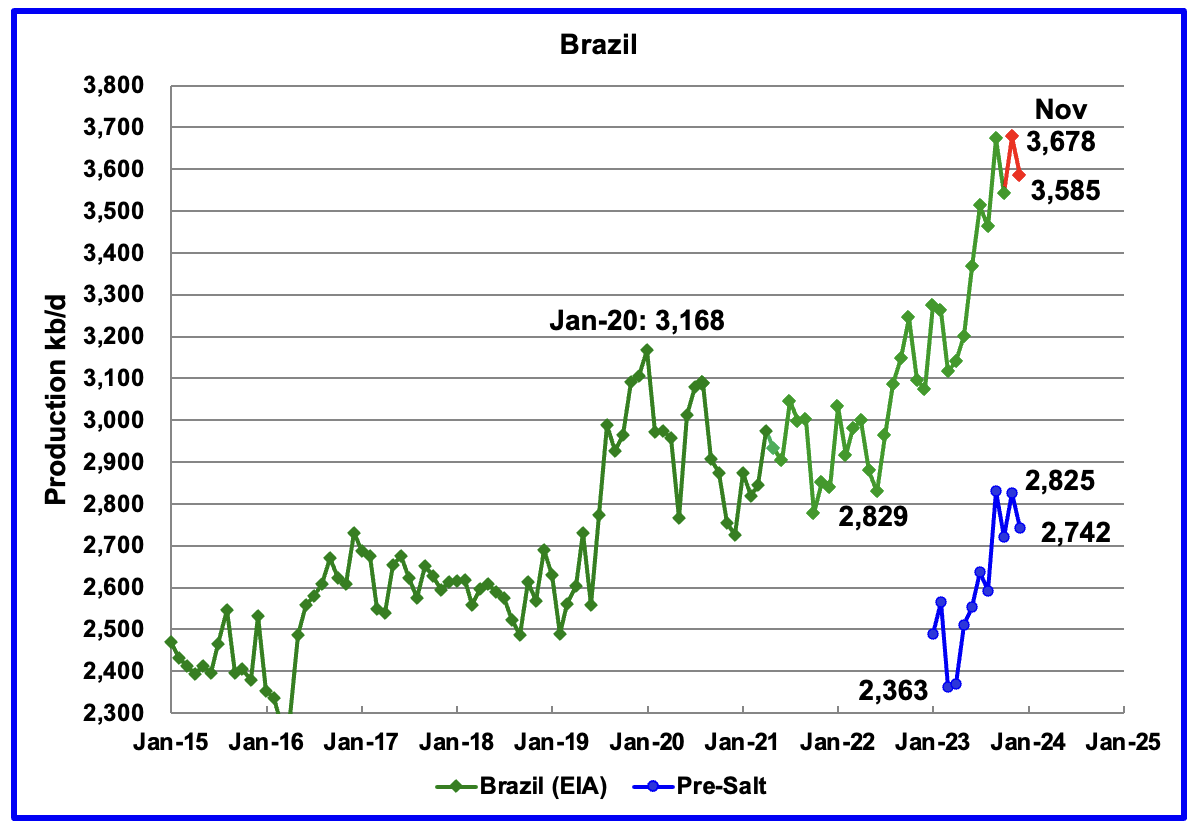

The EIA reported that Brazil’s October production decreased by 129 kb/d to 3,543 kb/d.

Brazil’s National Petroleum Association (BNPA) reported that output in November rebounded to 3,678 kb/d, a new high. December production dropped by 93 kb/d to 3,585 kb/d.

From March 2023 to November 2023, production increased by 563 kb/d. A similar rise in production is not expected in 2024. For 2024 the MOMR is expecting a smaller increase, closer to 100 kb/d while the EIA is forecasting flat output. The January MOMR also notes that : “increasing costs in the offshore market and inflation might also continue to delay projects and could temper growth in the short term.”

Production from Brazil’s off-shore “pre-salt” region has been added to this chart. November oil production increased by 103 kb/d to 2,825 kb/d while December dropped by 83 kb/d to 2,742 kb/d.

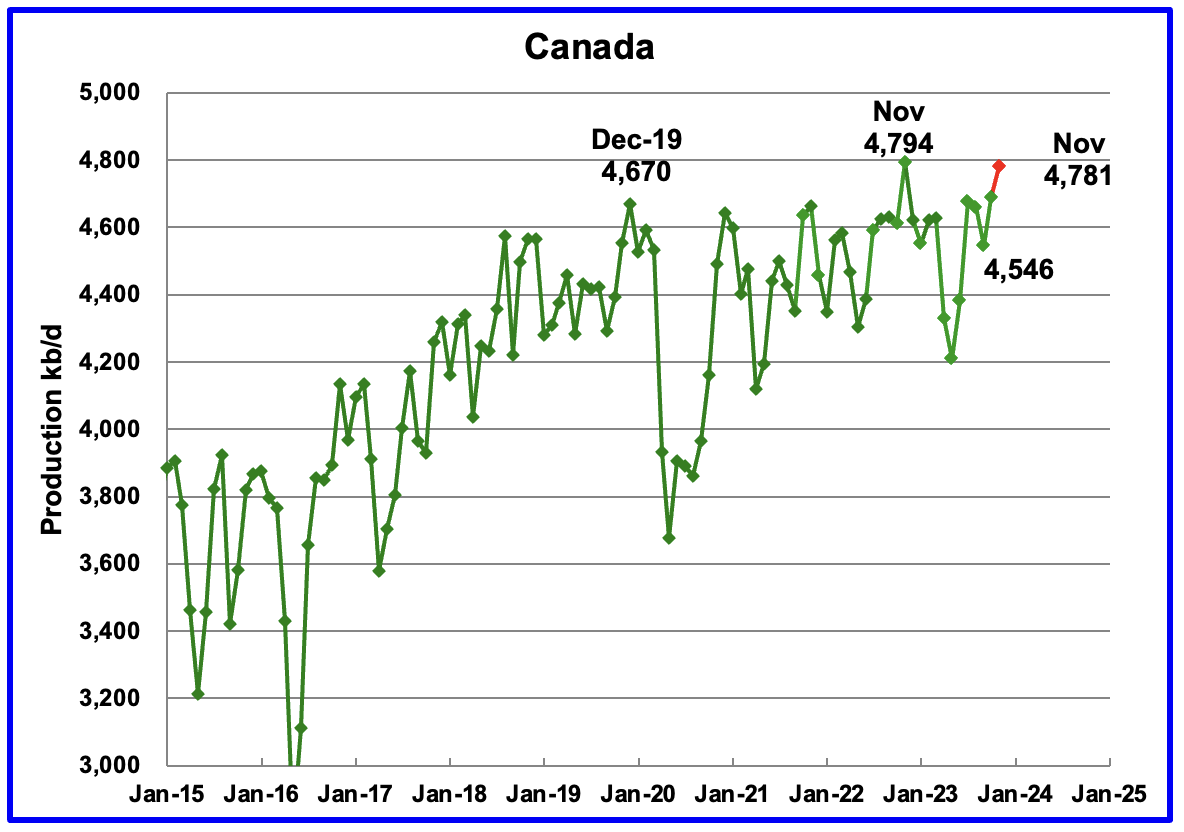

According to the EIA, Canada’s production increased by 123 kb/d in October to 4,669 kb/d.

The STEO is forecasting that Canadian production will rise by 93 kb/d in November to 4,781 and could be at a new high in December, red marker.

In January 2024, the Canada Energy Regulator approved another variance request by the Trans Mountain Pipeline (TMX). Line fill of the TMX pipeline could start in March/April.

A later Report indicated a later start date and additional problems.

“Calgary, 29 January (Argus) — Canada’s 590,000 b/d Trans Mountain Expansion (TMX) will now be completed in the second quarter at the earliest, as complications while pulling pipe through a tunnel this past week created additional delays, the company said today.

Technical issues encountered during pipeline pullback activity between 25-27 January in British Columbia “will result in additional time to determine the safest and most prudent actions for minimizing further delay,” Trans Mountain said in a statement.”

That second paragraph indicates TMX started to pull the pipe through the tunnel and it then got stuck and hence had to pull it back out. They now need time to figure out the problem and the fix. For TMX, it has been one problem after another.

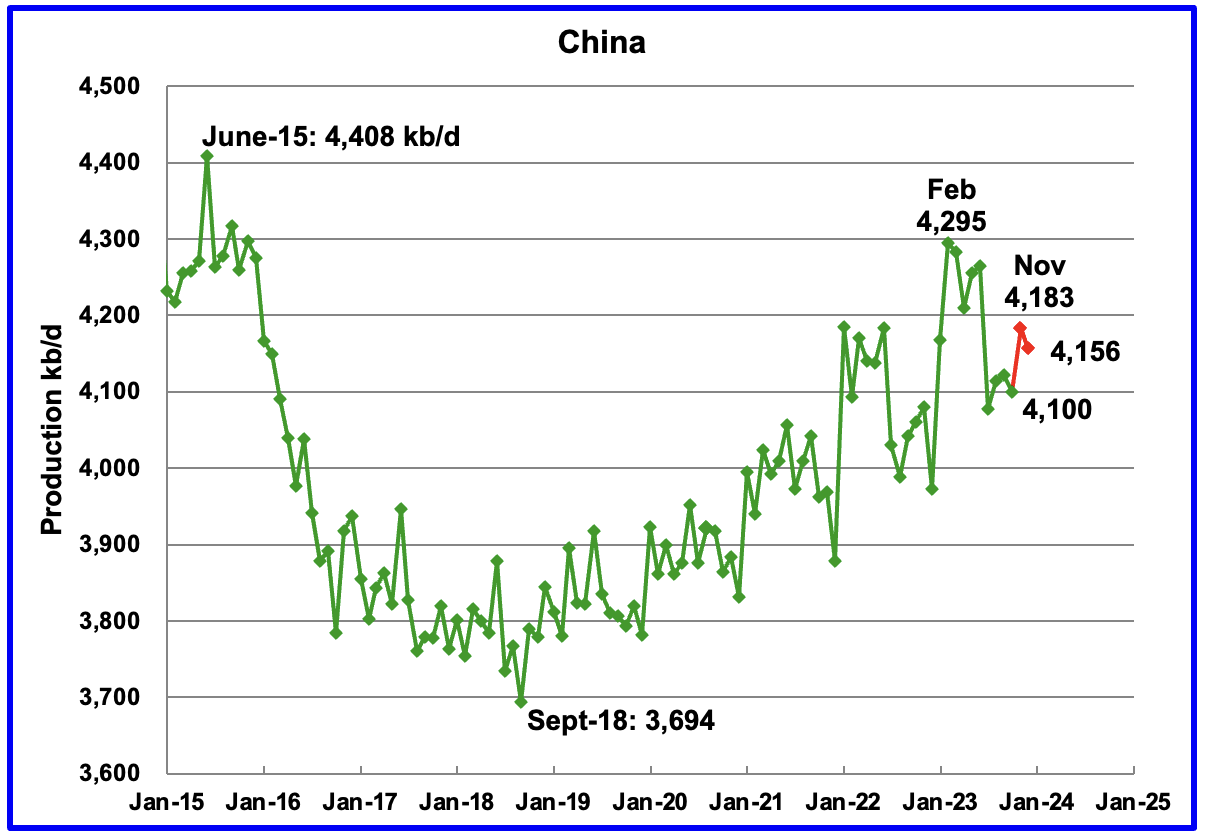

The EIA reported China’s oil output in October dropped by 22 kb/d to 4,100 kb/d.

The China National Bureau of Statistics reported that output rebounded in November by 83 kb/d to 4,183 kb/d and then dropped in December to 4,156 kb/d.

Every January for the last four years, China’s production has seen a massive increase. In 2022 production jumped by 322 kb/d from December 2021 to February 2022. However according to the January MOMR: For 2024, Chinese liquids production is expected to remain steady at the 2023 level of 4.6 m/d. The EIA generally agrees in that it is also projecting no growth for 2024.

While China’s production growth has risen steadily since 2018, it may be approaching its post pandemic high as inferred by the January MOMR and the EIA.

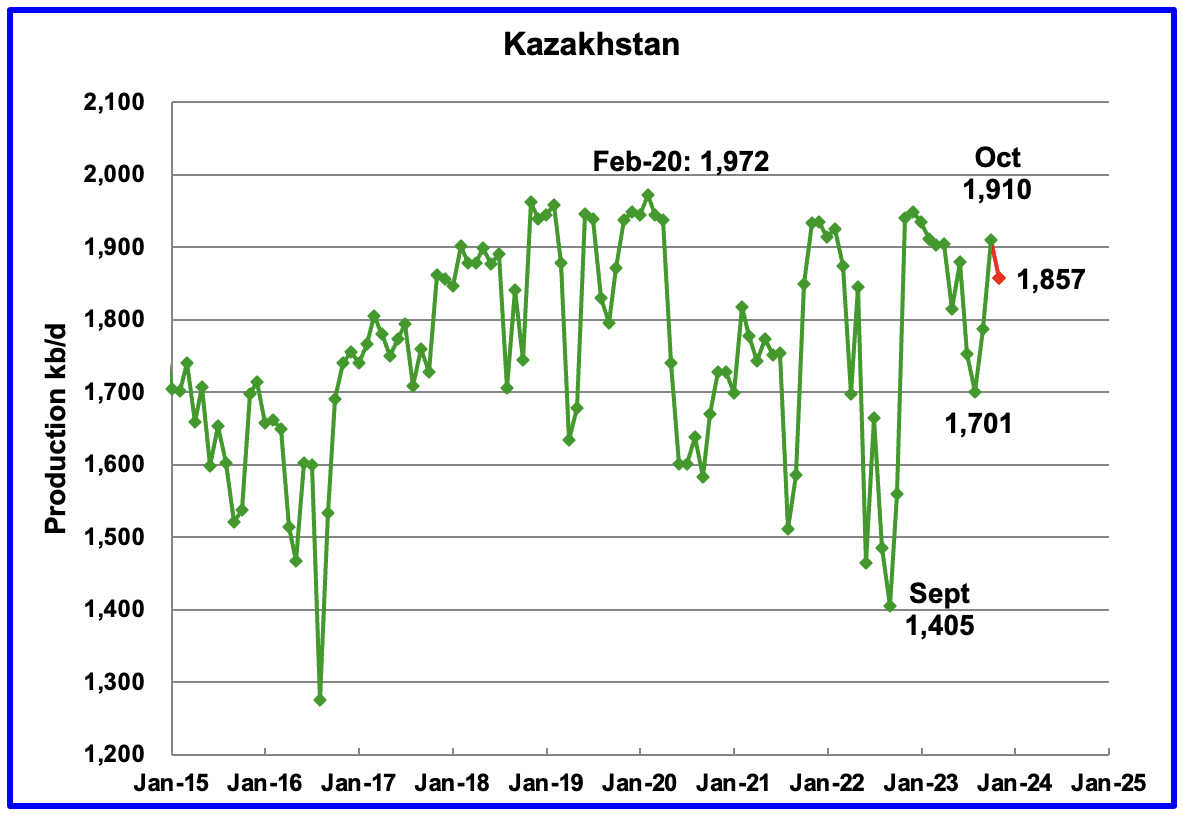

According to the EIA, Kazakhstan’s output increased by 123 kb/d in October to 1,910 kb/d but then dropped in November according to the STEO.

The January MOMR is reporting that “November Crude production dropped by 44 tb/d, m-o-m, to average 1.6 mb/d.”

According to the EIA, Mexico’s output decreased by 23 kb/d in October to 1,919 kb/d.

According to Pemex, Mexico’s oil production dropped in December to 1,910 kb/d.

Mexico has recently revised its definition of condensate. This has resulted in the EIA adding an extra 55 kb/d to 60 kb/d, on average, to the Pemex report. The red markers include an additional 60 kb/d.

According to the January 2024 MOMR: “Pemex’s total crude production decline in mature areas like Ku-Maloob-Zaap and Integral Yaxche-Xanab is forecast to outweigh production ramp-ups in Area-1 and El Golpe-Puerto Ceiba, and from a few start-ups, namely TM-01, Paki and AE-0150-Uchukil.“

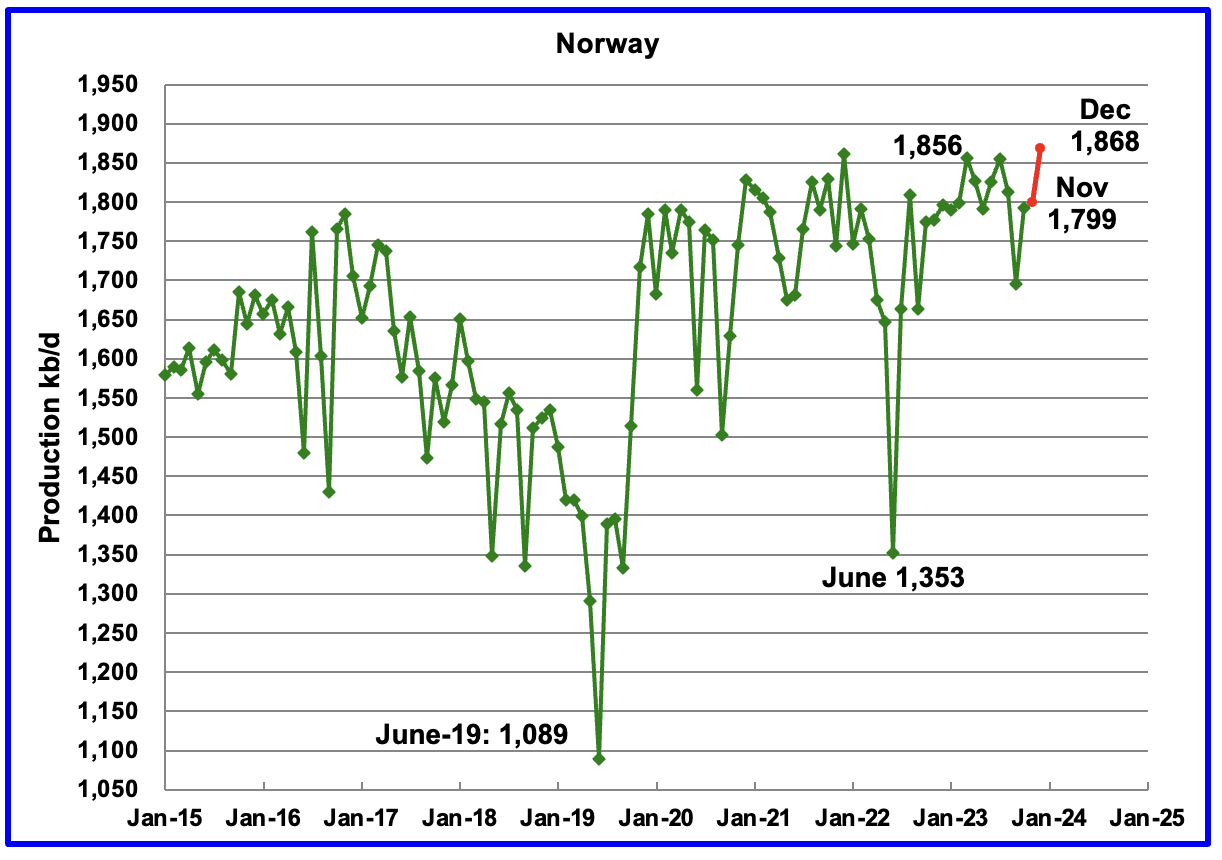

The EIA reported Norway’s October production increased to 1,793 kb/d.

Separately, the Norway Petroleum Directorate (NPD) reported that November’s production added 6 kb/d in November to 1,799 kb/d, red markers, and December made a new post pandemic high of 1,868 kb/d.

According to the NPD : “Oil production in December was 1.9 percent higher than the Norwegian Offshore Directorate’s forecast and 0.5 percent lower than the forecast this year.”

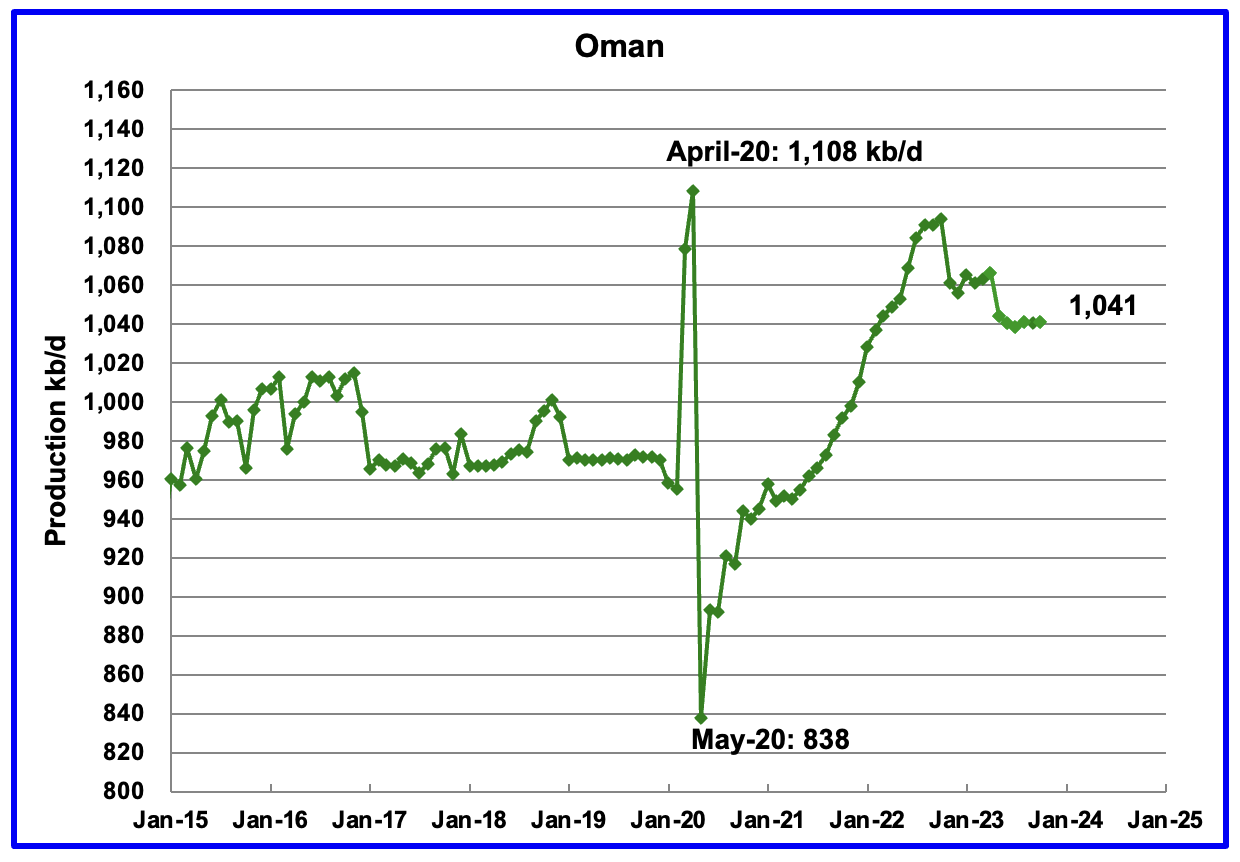

Oman’s production has risen very consistently since the low of May 2020. However production began to drop in November 2022. According to the EIA, October’s output was unchanged at 1,041 kb/d.

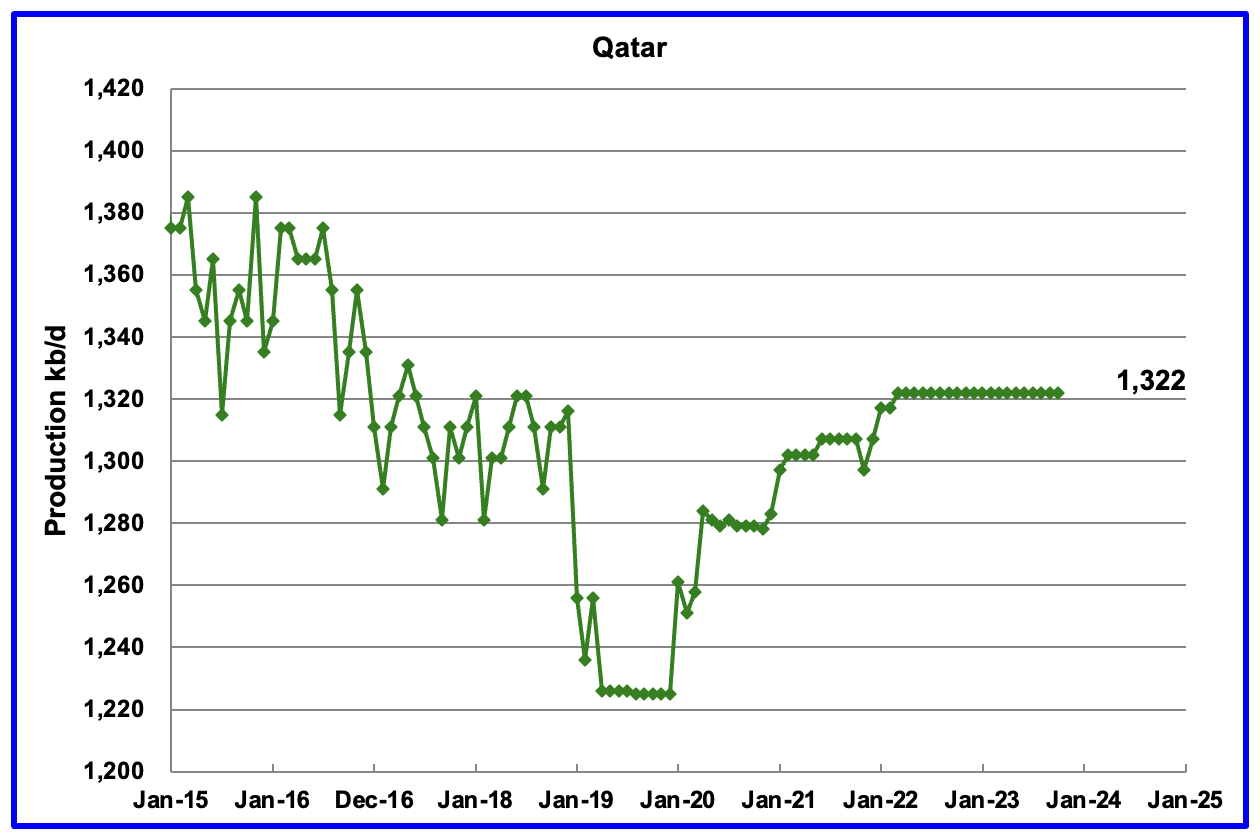

Qatar’s October’s output was unchanged at 1,322 kb/d, possibly due to lack of updated information.

The EIA reported Russia’s October C + C production rose by 80 kb/d to 10,021 kb/d. Using data from the February STEO report, Russian output is expected be slightly higher at 10,076 kb/d in January 2024, orange markers.

Using data from Argus Media reports, Russian crude production is shown from May 2023 to January 2024. For January 2024, Argus reported that Russian crude production was 9,410 kb/d, a decrease of 30 kb/d, blue markers. Adding 8% to Argus’ January crude production provides a C + C production estimate of 10,163 kb/d, which is a proxy for the Pre-War Russian Ministry estimate, red markers. S & P Platts reports that Russian January crude production was 9,420 kb/d, down 10 kb/d from December, very close to the Argus estimate.

Comparing the Argus crude data with the latest STEO projection indicates that the EIA’s estimate for Russian C + C is between the two Argus estimates for Crude and C + C. Prior to the war, the Russian Ministry estimate was alway 404 kb/d higher than the EIA estimate for C + C. The current October Russia Proxy output is 216 kb/d higher than the EIA’s Russia estimate.

If the EIA’s STEO Russian production projection is correct, this indicates that there is no sign that Western sanctions are affecting their oil production at this time. However the trend in the Argus data indicates that Russian production has been slowly declining since October 2023. Note the trend difference between the EIA and Argus production estimates after October. Is this an indication EIA’s estimate for Russian C + C is too high or Argus is too low?

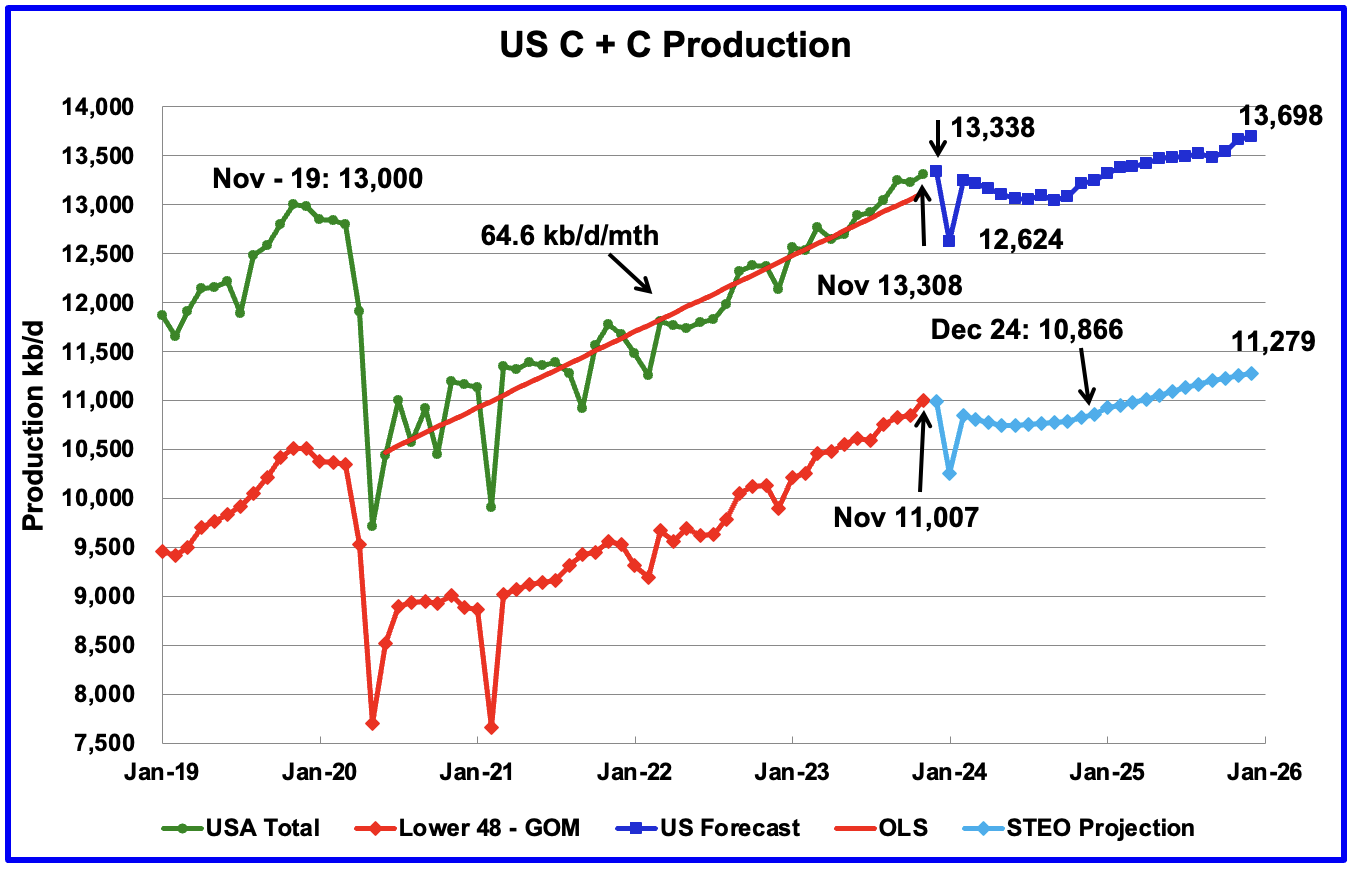

U.S. November oil production increased by 84 kb/d to 13,308 kb/d, a new record high. The increase was primarily due to increases in Texas and New Mexico offset by a decrease in the GOM.

The US projections in this chart has been updated using the February STEO.

The dark blue graph is the forecast for U.S. oil production from December 2023 to December 2025. Output for December 2025 is expected to reach 13,698 kb/d, close to 100 kb/d higher than forecast in last week’s US post.

The light blue graph is the STEO’s projection for output to December 2025 for the Onshore L48. For 2024, the STEO is forecasting dropping production in the L48 states. From December 2023 to December 2024, production is expected to drop by 127 kb/d.

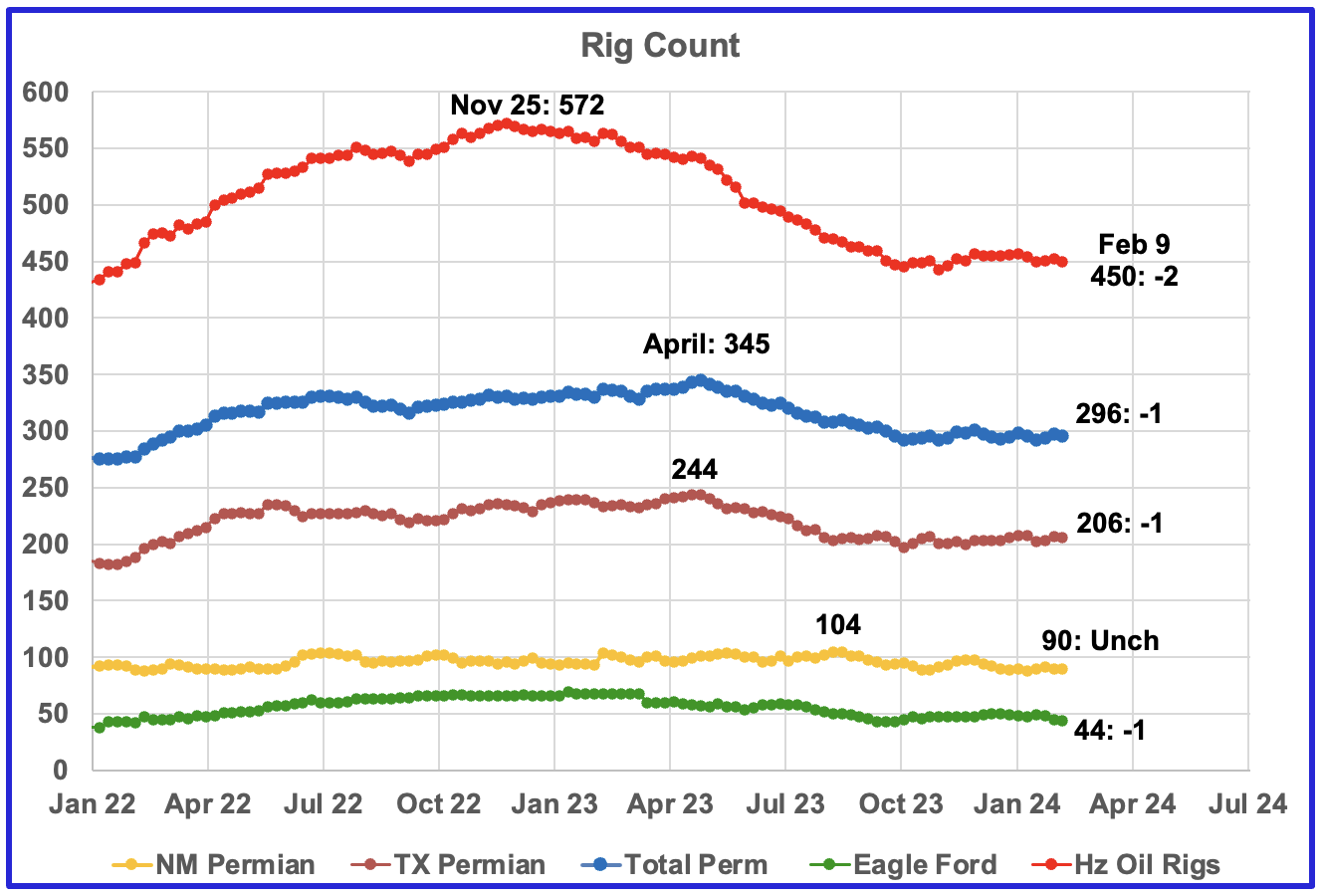

Rig Report for Week Ending February 9

– US Hz oil rigs decreased by 2 to 450. The rig count has been close to 450 since the beginning of October.

– Permian rigs were down 1 to 296. Texas Permian was down 1 at 206 while NM was unchanged at 90. In New Mexico, Lea county added 3 to 43 while Eddy dropped 3 to 47.

– Eagle Ford dropped 1 to 44 and is 1 rig above the low of September 2023.

– NG Hz rigs added 4 to 109 (not shown)

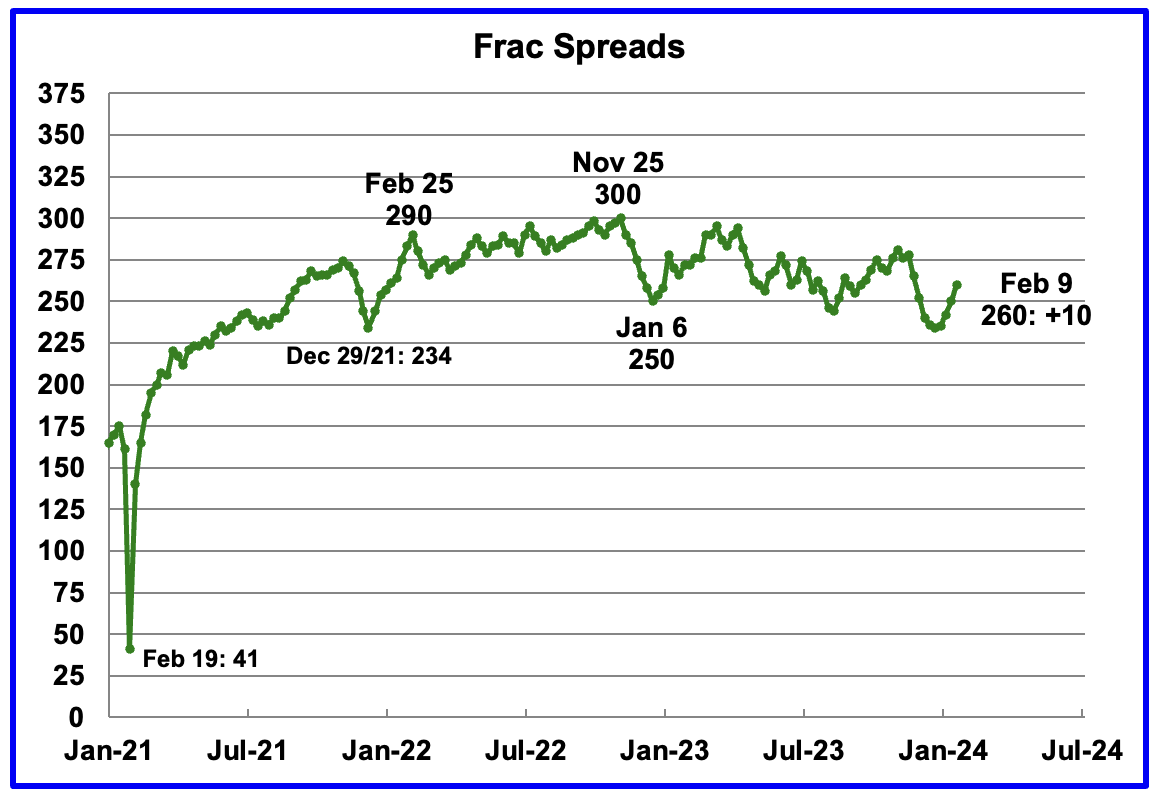

Frac Spread Count for Week Ending February 9

The frac spread count was up 10 to 260 and is down 6 from one year ago.

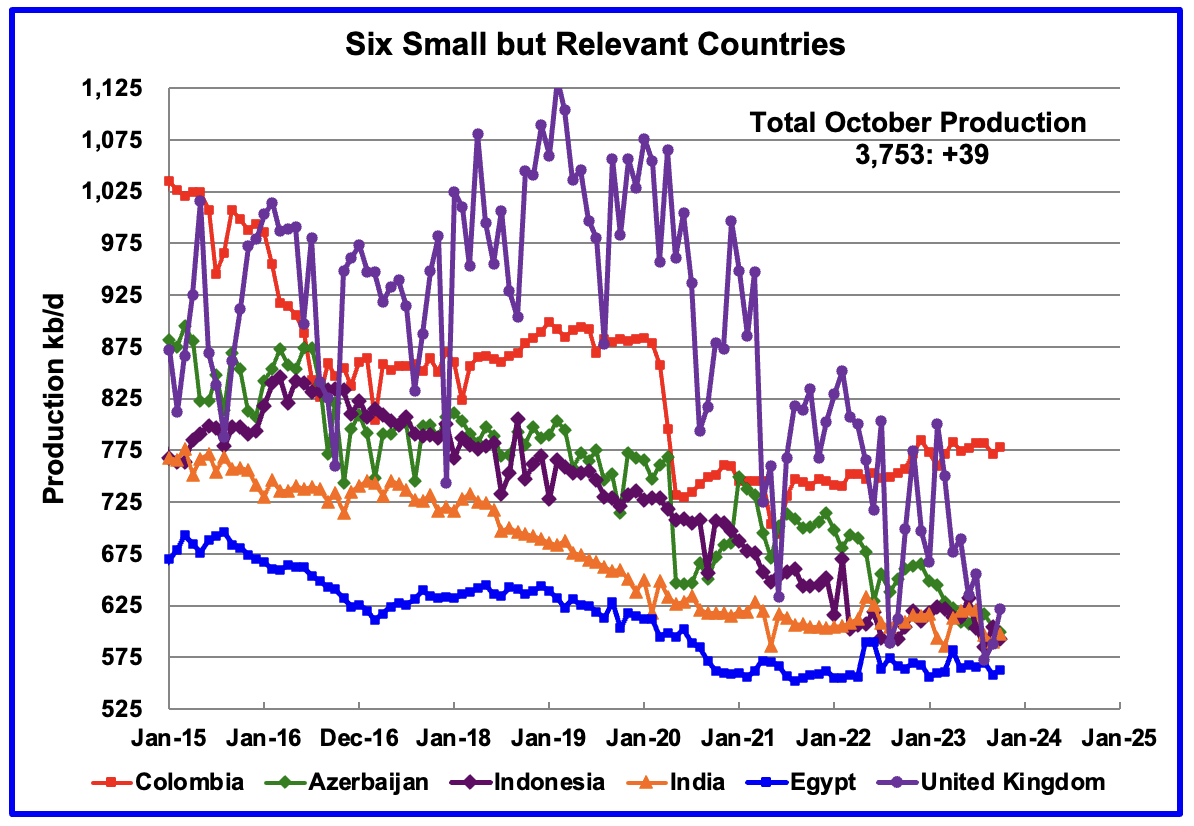

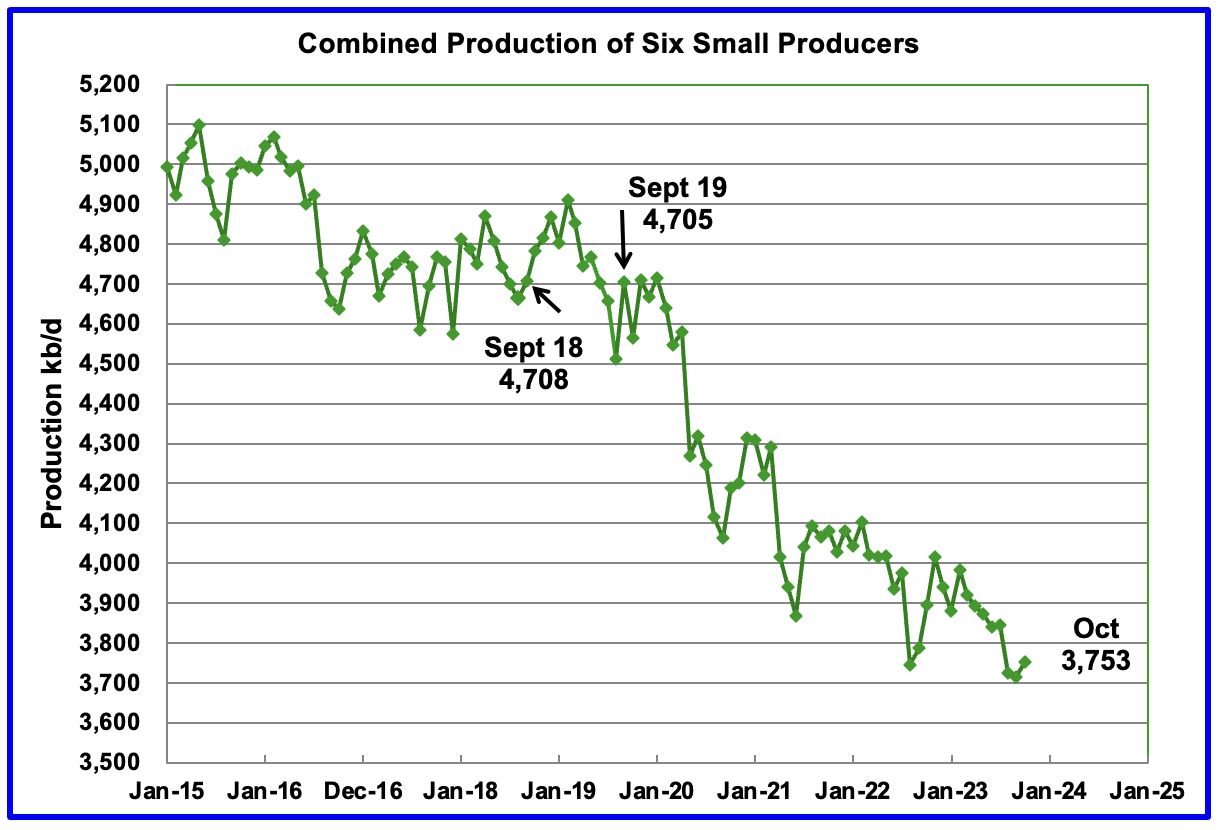

These six countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Note that the UK has been added to this list since its production has been below 1,000 kb/d since 2020 and fell to a new low of 573 kb/d in August. in October, the UK added 33 kb/d to 621 kb/d.

Their combined October production was 3,753 kb/d, up 39 kb/d from September. The main contributor to the increase was the UK.

The overall output from the above six countries has been in a slow steady decline since 2014 and appears to have accelerated after 2019.

The decline from either September 2018 or September 2019 to October 2023 is essentially 1,000 kb/d. This means that the combined average decline rate for these six countries is somewhere between 200 kb/d/yr and 250 kb/d/yr.

Thanks Ovi.

Excellent job as always.

A suggestion for future posts is to add Angola to top 10 non-OPEC producers, or do top 11 perhaps. In October 2023 EIA has Angola at 1199 kb/d.

Dennis

Thanks

I was thinking of doing it for the January report because that is when Angola is officially out. I guess it would be OK to start in the next report and note that the change is being done ahead of time.

Attached is the Non-OPEC chart updated with Angola removed. The projection is essentially the same except that the graph has been shifted up by over 1,000 kb/d.

One difference is the production change between December 2025 and December 2019. With Angola removed, December 2025 is 514 kb/d higher than December 2019. In the original chart, the gap is 774 kb/d. The difference is due to Angola’s falling production that started prior to 2019.

Ovi,

That makes sense to start in January, though EIA is now reporting OPEC 12 for OPEC output rather than OPEC 13. Just an idea for future reports in any case.

What is the highest 12 month average for your new non-OPEC projection? Prior to May 2023 the highest centered 12 month average for non-OPEC output was in November 2019 at 52728 kb/d vs the very rough eyeball estimate for 2025 annual average output of 53900 kb/d or so. OPEC output is projected to remain about 3000 kb/d below the World peak in 2018 while non-OPEC 12 month average output is projected to be about 2800 lower in 2025 than the 2018 non-OPEC average. So based on these projections, the 12 month average World C plus C output would remain below the 2018 peak through 2025 if the most recent STEO projection is correct.

Dennis

Thanks. I think everything is OK.

So the Non-OPEC chart in the post is based on Angola still being in OPEC.

The February STEO does not contain Angola as part of OPEC but in the EIA World C + C sheet, Angola is still in OPEC where the calculation is made. So the program just changed the ratio of EIA OPEC (C + C)/OPEC STEO OPEC crude from 1.076 to 1.12 to make up the loss of Angola. While not perfect, I decided it was good enough rather than start making wholesale changes to the program.

The chart in the comments section takes Angola out of OPEC in the EIA World C + C sheet and the six month ratio of EIA OPEC (C + C)/EIA STEO OPEC crude reverts back to 1,076. Note the six month and current ratio are both 1.076.

So here are the numbers for October for the new updated chart

EIA OPEC C + C: 28,652 kb/d

Non-OPEC:53,205 kb/d

Total: 81,856 kb/d

WRT to the 12 month centred average, the previous peak was 51,328 kb/d on November 2019. The current peak with Angola out has shifted up to 52,728 kb/d for November 2019.

Hi Ovi,

What is the 12 month average for your projection for Jan 2025 to December 2025 for non-OPEC and World?

Dennis

TMCA

World: 83,289 kb/d

Non-OPEC: 53,857 kb/d

The highest pre-covid TMCA I have is 83,009 kb/d in February 2019.

Ovi,

Thanks, so based on the STEO projection the World 12 month average peak would be surpassed in 2025, interesting indeed.

Ovi – I would guess that the Jan-2026 value of 54.4 mb/d is overestimated by around 5%. More likely production would be somewhere around 52 mb/d based on long term trends for many of those producers. With around 300 Gb of 2P reserves at the beginning 2023, by 2026 there would be only ~240 Gb. If peak Non-OPEC bares any similarity to peak OPEC in 2016, then 1.5% annual decline rate could be expected. That would be an annual loss of almost 1mb/d from the Non-OPEC group.

A large contingent of that group has been losing 0.5 mb/d since peaking in 2006 (world excluding N.A., CIS, and OPEC).

This rest of world group produces ~40mb/d and has 2P reserves of 60 GB (~4 years) and 2PC reserves of 260 GB (17 years). Decline rate for this 40 mb/d (50% supply) group could increase significantly over the next few years depending on when 2P reserves run out…

The biggest wildcard is clearly US production for your chart above, a drop of almost 3 mb/d by 2026 would not be surprising, so there is a chance production for your Non-OPEC group could plummet by several mb/d beginning anytime…

Indeed, thank you Ovi.

Another relevant country cluster would be non-OPEC Latin America production.

This would include significant producers like Brazil, Mexico, Colombia, Guyana and Argentina.

(Venezuela is an OPEC member).

Hickory thanks.

Thanks for the thought regarding a new cluster. Yes it would be interesting to see how South American production increases going forward now that Argentina has started to grow and Guyana will be a major addition in a few years.

These posts are getting long and they already take up a lot of my time to prepare and cross check everything.

About Russia oil production, the recent drones attack on oil refineries in Western Russia caused a fall of oil product exports by a third.

https://news.yahoo.com/sbu-set-two-more-russian-125000356.html

2 more.

“Without it, the enemy will not be able to produce diesel fuel for military needs,” the source stated.

”Not only do they work for Russia’s defense industry and provide fuel for Russian troops, but they are important for the Russian economy. Russia is a Goliath that stands on its oil legs. We are systematically cutting them off. And we will continue to do so until Goliath falls.”

IMO, militaries are the most conscious entities (not counting POB) on the planet regarding Peak Oil.

It is a natural rational progression to go from “Let’s oil embargo our enemy” to “How much available oil is on the planet”.

This is a threat to low oil prices generally overlooked in the press at the moment.

Everyone looks at Iran in the gulf, but reduced production from Russia if these attacks continue isn’t on the radar.

For Ukraine this is a logical step: Reduce Diesel supply to the army, reduce the money income used for smuggling chips and buying weapons – and last but not least Russia must pull troops from the frontline to defend this critical infrastructure against sabotage and drones.

I would argue that if there is a a reason for Russia to use tactical nukes it would be the Ukraine trying to destroy their domestic oil supply.

Russia has shown a vulnerability to drones within its borders.

It’s the tactical games from every stalemate war:

Ukrainians target now the oil infrastructure, Russians the energy infrastructure and sometimes people.

Then air defence must be relocated from the front to these facilities, lessening the pressure on the front. Or allowing tactical attacks like on air fields and amunition depots and headquarters where the air defence was withdrawn.

It’s actually been more hands off in some ways than the norm, versus civilians. The US would have taken down the Ukraine electrical grid, across the entire country, the first day of the war, and kept it down. (We did it in Iraq for instance. The Israelis did it in Gaza.)

Right now, you can go party at the discos in Kiev and not even feel like the war is going on. Americans would have made sure everyone was huddling in the dark. “Pour encouragez les autres.” And we don’t even think that’s harsh or a war crime. It’s not firebombing civilians. It’s just first day of air war 101. (I served on a couple JFACs.)

The Russians mistakenly think that not taking down the whole country’s infrastructure will buy them some empathy with the Ukrainians, but they are fools. Ukraine has turned much more anti-Russian than it was before. Nobody likes being invaded. Russians were fools to invade. Should have just dealt with their shit sandwich, even if it meant Kiev joining NATO. Still better than the massive waste of money and lives and reputation that the invasion has been. The Chinese are smarter…they bide their time.

Did it in Serbia too.

You say that comparing Big 3 to ROW is more meaningful than OPEC versus non, but I disagree. I understand you think you want to do something different and have some better insights. However, I think the conventional comparison is more meaningful.

Why is this? Because OPEC is a cartel of net oil exporting countries that exists to raise price. It has done so periodically over all of its history. It is not all powerful. However, that is what it does and why it exists. Not to hobnob in Vienna. Not to confound ASPO or TOD (oh wait…POB). Really…you are not that important to them. The reason for making the split the conventional way is that you are comparing price-setters (who restrict supply) versus price takers…who do everything they can (economically) do. So…when OPEC cuts…price goes up…and eventually non-OPEC increases…as more production becomes economical.

Now, sure there may be parts of OPEC that can’t pump more, especially if affected by sanctions or war. I think this is much more the issue than geology. The ME is an incredibly rich oil province…way more fertile, cheap, easy to get massive new wells (with lower decline) than shale for instance. But the main story is colluders versus free competitors.

Actually, you really should add in the + in OPEC, also. Countries like Russia that are not formally part of OPEC…but do formally coordinate with it, and reduce production, have quotas, etc.

Talk to people really in the know (e.g. Fereidun Fesharaki, not the very tiny slice of the industry…and non-analysts who frequent this blog) and you will hear the same story. It’s basic micro economics. Heck even both sides of the US political spectrum (Republicans and DOE Secretary) agree with the basic economics here…that OPEC is a cartel (Jenny G has used these exact words) and that US oil production helps to fight cartel actions. They disagree on long term actions and speed of response and the like…the congressional Republicans want a long term pro oil policy to engender more drilling and JennyG thinks she can wax hot and cold and the industry should trust here. But in terms of the basic issue of OPEC, they agree.

Honestly, even if you are wedded to your different from the norm view, I think it makes sense to graph the conventional view as well as Big 3, versus non. I.e. do both.

Anonymous

I did not say “comparing Big 3 to ROW is more meaningful than OPEC versus non”. The headline says “A Different Perspective on World Oil Production”

I don’t understand your last paragraph. Did you miss the section shown in the picture below?

As I noted to Hickory above; “These posts are getting long and they already take up a lot of my time to prepare and cross check everything.”

OK.

Ovi,

I think your perspective is of interest because all of the increase in World Production has come from the 3 largest producers since 2016 (US, Saudii Arabia and Russia). In addition the only OPEC members currently subject to quotas that have any spare capacity are Saudi Arabia, UAE, Iraq, and Kuwait. Possibly looking at the top 10 producers vs the rest of the World might be useful, but I don’t think it adds much. OPEC vs non-OPEC doesn’t tells us much in my opinion, it is as arbitrary as any other grouping.

Your big 3 is simple and excellent.

If you want to break out SA, Gulf Allies, and Iraq versus world that works also. The point is to break out price makers versus price takers.

SA in particular is sort of a “strategic player”. In the 1980s, SA dropped it’s production from ~9 MM bopd to 3 MM bopd, while trying to keep price up. Eventually they threw in the towel and raised production back up. That had a massive impact on oil prices…and on oil production from the free competitors (who have higher cost of production and get pushed out of the market with low prices). To a less dramatic extent we saw similar behavior in the last twenty years.

Here is the dynamic, Dennis:

https://twitter.com/MOAR_Drilling/status/1346532124581634053/photo/1

Anonymous,

It has mostly been Saudi Arabia that has acted as the swing producer since 1973, I agree, the other Gulf producers have contributed much less to the attempt to control oil prices. Whether a nation is a price maker or price taker makes little difference, the fact is that since 2016 all of the World increase came from US, Russia, and Saudi Arabia. In the future these increases are likely to be smaller and soon these increases may no longer offset decreases in the rest of the World, perhaps as soon as 2026, if the recent STEO estimate proves accurate (often this is not the case).

Much depends on the price of oil on World Markets, if it remains around $80/b in 2023$ for Brent, then 2018 may remain the peak in World C plus C output.

Saudi Arabia Says Energy Transition Drove Decision to Halt Capacity Expansion

The decision of Saudi Arabia to abandon plans to expand its crude oil production capacity is a result of the energy transition, Saudi Energy Minister, Prince Abdulaziz bin Salman, said on Monday.

In other words, we can’t produce any more oil than we already do.

Steve Where are You?

Why is NG below $2?

Take a bow.

Ovi,

Low natural gas prices are due to reduced demand due to a warmer than normal winter.

Dennis

When you make your Permian production projections, how much does the projection change when going from $1.50 NG to $2.50 to $3.50. I have just arbitrarily used a $1 spread.

Ovi,

Not sure off the top of my head.

Ovi,

I looked at this briefly, for Oil at $75/bo at wellhead and NGL at 30% of crude price and Natural gas at $1.50, 2.50, and 3.50 per MCF, I get well payout for the average 2020 Permian well (which may be similar to the average 2022 well) at 49 months, 41 months, and 36 months respectively assuming CAPEX for the well is 12.5 million. These are rough calculations, OPEX averages about $13/BOE over the life of the well. Royalty and tax payments are assumed to be 28.5% of gross revenue.

As I understand it, Shallow sand aims for 60 month payout and Mr Shellman aims for 36 month payout for a prospective well, so 48 months would be the midrange of their rules of thumb. If we assume natural gas is 50 cents per MCF at wellhead the well would take 62 months to reach payout.

The price of natural gas, NGL, and crude oil are all important in understanding the well economics and it is no doubt far more complicated in the real world than in my oversimplified model.

I would anticipate it being minor. The Permian is not as oil rich as the Bakken, but is still a pretty good oil producer. The gas is associated. In most cases, the oil alone justifies investment. Of course, in a few cases, the gas makes a difference to a marginal oil well. But it’s different from the Eagle Ford, or especially from Ohio (where you can almost think of associated oil to gas production).

The bigger issue in the Permian is takeaway. Oil you have some flexibility with, but gas has to hit a pipeline. And if they are full, they are full. Producers would willingly flare in some cases, but are not allowed to.

Local Permian gas prices (Waha hub) can even turn negative. (So can Bakken gas prices.) Right now Waha (the main gas hub in the Permian) is about $.75 lower than Henry Hub (national gas hub).

https://www.eia.gov/naturalgas/weekly/

Note that gas prices are really a short/medium term issue. I would say it doesn’t make sense for Dennis to try to model when pipes come in (or how NG prices gyrate with weather). He is looking at longer term production. And in that case, might as well figure $3 gas (or something close to it) in an economic model. And the pipes will get straightened out over time…in the worst case, if the tree-spikers stop construction, the production would just wait for declines to allow space on the pipe, stretching out decline a bit and leading to a smaller peak, longer tail.

This is a stupid comment made by someone who never owned WI in his/her/it’s sheltered life. Its clearly becoming more obvious why this person chooses to remain anonymous. “Minor” my Texas ass.

A cursory review of nat gas prices in the US show that price stuck in the $2/MMBTU range, /-. Little upticks don’t last long and one thing America can ALWAYS count on is that when the shale industry, oil or gas, has a chance to shoot itself in the foot with oversupply, its gonna. Its porch lights are on but nobody is ever home.

Because of pressure depletion, rising GOR and declining liquids production in the Permian (AKA, depletion) gas and natural gas liquids, including all the little nuiances assocatiated with gas, now represent fully 50% of the production stream. That will only increase. When you can only muster a buck and change for half your revenue stream, you are stuck in the mud and 4WD don’t help. You have to pay the bills to understand that. RI, ORRI and make believe experts with no skin don’t, that.

At the WH in the Permian, at the moment, try 40 cents.

Whatever future strips hold for gas, that’s lame hope. Don’t buy it.

How associated gas goes in the Permian Basin is how the Permian goes. Not crude and condensate, but gas. If you want to understand the future of oil from the single biggest source of oil in the world, sort out associated gas. It’s no longer a by-product.

The things people say to be releavant, Jeezy. If you happen to be remotely associated with the American oil industry, yet don’t feel a responsibility to the public to tell the truth, I am embararassed for you.

At $2.50 gas and $75 oil, the average 2022 Permian well would have had a 12:1 ratio of revenue from oil versus gas. (170,000 bo and 441 mmcf gas, in first 12 months.)

Source, Novilabs blog: https://novilabs.com/shale-oil-and-gas-insights-blog/

Of course, operators want that gas revenue. But a 50% drop in gas price is 1/12th the problem that an oil price 50% drop is. For a good well, operator probably resent not being allowed to flare if it means waiting a year (time value of money lost is more than the value of the gas).

Also, Dennis is interested in the long term. Not current gas price complaints, which are related to weather, which varies from year to year.

“For a good well, operator probably resent not being allowed to flare if it means waiting a year (time value of money lost is more than the value of the gas).”

You don’t know that gas prices will be higher in a year. You are guessing. Weather aside, which varies from year to year, and accordingly is called weather, most of the problem with gas at the moment is oversupply. You’re hoping for $4 gas again, and are willing to make other people’s decisions based on that (that don’t include your money) but its not the same world we lived in just 2 years ago. Now tight oil wells are turning into tight gas wells and gas is oozing out of every orfice the oilfield has. Your hope is based on LNG exports.

But well said. Clever. Guys like you now run the American oil and gas industry and that is precisely why it is so fucked up. None of you have skin in the game, nor wish to put country first. You guys seem to take some sort to twisted pride in <10% recovery rates while you whine about flaring, and methane emissions. Waste is not a big deal because you so mistakenly think there is enough of it TO waste.

God bless America's long term energy security, uh?

It is strange that Novilabs and Enverus with huge database did not do a study on the spacing or density of drilling, and find out the optimal spacing after balancing EUR, ROI etc, so as to derive an optimal URR for Permian or Bakken?

Instead, they count just the drilling rigs and project the future oil production based on past results.

“did not do a study on the spacing or density of drilling”

When secondary infilling occurs on a contiguous region such as the Bakken, a good approximation is to estimate the future production as a fraction more (50%?, 25%, 10%) than the cumulative extracted so far. That’s just common sense in applying the law of diminishing returns.

Associated gas within the 3 major formations of the Permian, Bone Spring, Spraberry and Wolfcamp, are operating in two different groups. Spraberry and Bone Spring are both increasing, call it a doubling from initial production GOR within a year or two from original conditions. The Wolfcamp is doing it faster, and has a higher starting point. Of the 3, it is the main concern. Later today I’ll have the split between Delaware and Midland for that formation, just as a curiousity thing. There are other differences between the two sub-basins as well, so I’m speculating there might be a GOR growth difference as well. Built all the software a week or two ago for the basics, figured I’d do the Wolfcamp this weekend.

Oil is still the primary Permian product, gas certainly hasn’t overwhelmed oil on a volume equivalent or energy equivalent. Yet.But answering that question should be something easily calculated, as to the when. The answer as of this moment is….not yet.

Let others do the arm waving, quantify it or it doesn’t count.

the associated gas from Permian is wet and at a natural disadvantage to dry gas if you just want to directly market the gas — operators can not send the wet associated gas into the pipeline, and have to pay a big fee to process it dry before collecting the gas price.

This might explain that the big operators like vertically integrated majors could benefit because they could process/sell the NGL out of the process at a much larger return price premium or pass the savings to their downstream, while small operators can not? Otherwise, it is quite puzzling to see majors like CVX and EXXON are still planning to overdrill, even wells are getting gassy fast. For example, although Shell sold its Permian, it still control a huge global LNG trading, investing in LNG terminals and shipping etc.

You have to pay for the processing, but you do get the value of the NGLs. If there is decent capacity of gas plants and transmission lines (to include Y-grade), then the value of the NGLs more than makes up for the cost of the processing. In some cases, it doesn’t. If you want to figure, it’s a wash, that’s probably conservative, industry-wide.

At times in the Bakken, there’s capacity for gas processing, but a lack of methane gas transmission capacity (Canadian producers feel the same pain, it’s the same pipe). Plants have asked reasonably in that case to be allowed to strip the NGLs and flare methane at the processing plants…but that has been denied. It’s actually less wasteful than flaring at the wellhead…but no. Nicht erlaubt.

Unless they have a superbig field and their own infrastructure (and I doubt the majors do, in the Permian), I don’t see why they have any advantages for gas processing. That’s a midstreamer situation. You have to contract with the gas processing plants, with Targa or the like…like you contract with gas (or oil) transmission pipelines.

https://www.targaresources.com/operations/gathering-processing-segment

“Producers would willingly flare in some cases, but are not allowed to.” Well F*ck you too! For the sake of personal profit, we’re willing and happy to screw everyone else on the planet. Thanks Buddy. Flaring gas is a crime against humanity and should be prosecuted.

Tree-spikers? A right wing media hoax. For the good of humanity, people are willing to fight for their children and the future of life on the planet, to discount their humanity is to show your inhumanity.

+1

Not sure which Steve, you mean, but I still remember a 2016 “Steve” POB article with shale gas being predicted as about to have massive declines.

https://peakoilbarrel.com/collapse-of-shale-gas-production-has-begun/

[Was dramatically wrong.]

Shale Gas output since 2016 in chart below using data from EIA. For the past 15 months output has not increased a lot.

1. So up ~78% since 2016. (35/45). Pretty dramatic for a “mature industry”. And it sure ain’t the “collapse”. Collapse means fast decline. And instead it went up. Pretty impressively.

2. Just go easy on interpreting the last year or so, Dennis. There is a long, long, longitty, long-long pattern of peakers predicting peak too fast every time production turned down of shale gas (and here it’s not even turning down…just not growing fast enough for you).

3. P.s. Interesting how this is the one chart you show with a true zero axis. I’m actually in favor of it (almost always). But fascinating to me…that you go for it here and so rarely elsewhere. How does that graph look like if you make it a 40 to 90 axis? 😉

Shale gas has increased a lot since 2016, lately it has increased more slowly. My expectation is that the peak will be 85 to 90 BCF/d in 5 to 7 years perhaps followed by an undulating plateau for 5 to 7 years depending upon the price of oil and natural gas.

It’s pretty hard to export natural gas. In a lot of ways, it’s more like electricity than it is like oil. (I.e. market limited.) So, you have to think about the natty story differently than the typical geology emphasis of peak oil Internet analysts. You also have some interesting dynamics of “ass gas” (essentially a byproduct of oil) and of gas on gas competition, within the US. Very different dynamic from oil, with a world price.

Of course if the production is restricted (because of lack of extra LNG capacity), that just means a longer run rate for the existing resource. And I would seriously entertain the PGC analyses. Those are real academics and industry professionals…WAY more compiled expertise than Art Berman, David Hughes, and Laherre. I know you don’t like big numbers, Dennis…but you’ve been time over time too small with your outlook. Need to dream bigger:

https://www.youtube.com/watch?v=0juabdtMzN4

Anonymous,

I use the USGS estimates, in some cases these may turn out to be low as the entire US may not be covered completely. The USGS mean assessment for undiscovered continuous gas technically recoverable resources is 1640 TCF vs PGC estimate of 3368 TCF of undiscovered natural gas resources. The USGS F5 estimate of continuous gas URR is 2981 TCF which is close to the PGC estimate, but note that this estimate has a 95% probability of being higher than the actual TRR for shale gas and coalbed methane whereas the 1640 TCF estimate is an scientific best guess (far more useful than the F5 estimate).

Just as using the F95 estimate makes little sense (except perhaps as a likely lower bound) it also makes little sense to use the F5 estimate except to create a possible upper bound.

If we want a realistic guess, we use the USGS mean TRR estimate and then apply a bit of economics to create a best guess based on both physics and economics and create an ERR best guess. If the mean TRR estimate is revised, then redo the analysis.

I agree in 2012 my outlook was a bit too low as I was using a URR of only 2500 and 2800 Gb for World C plus C.

Dennis:

There is a lot of structural uncertainty in these resource assessments. Different respected professionals come up with very different TRR estimates. In the Marcellus, it’s like 95 versus 560 (TCF). So talking about the within USGS method 5-50-95 percent probabilities is missing the story…when USGS might be out to lunch by 95 versus 560 TCF on the mean.

And you can’t automatically say that the other studies are crazy high and you don’t like them. Maybe. Maybe so. But maybe USGS is crazy low instead. Who knows. We have different people that are all good professionals, coming up with widely different estimate. But as a Bayesian, knowing these different estimates exist, my personal span of uncertainty need to be at least 95-560 (for the Marcellus).

USGS has a history of revising upwards. Marcellus went from 1.9 to 84 to 95. And it should be going down…since wells are drilled, moving TRR to production (and PDP reserves). For instance the 84 and 95 sound similar, but over 100 TCF between assessments had already moved to production/PDP! Bakken had a similar trajectory…195 MM BO to 4 B O to 8 BO. Now…sure, they learned more and adjusted up. But why always up. What is going on to be so conservative early? Shouldn’t they tend to be wrong in both directions? Or is there something about their method that is biased conservative, especially when knowledge is lacking? Oh…and did the new revisions fall within their old 5-50-95 boundaries? I bet not. Which goes to my point that you think you are capturing uncertainty with the 5-50-95 (or different scenarios), but really are not.

P.s. See this document for some perspective:

https://www.osti.gov/servlets/purl/1805223

In particular, look at Exhibit 1-2 (numbered page 4, or page 12 of the pdf).

Edit: look at numbered pages 20 and 21 also. Those are actual fully drilled sections. It’s a great methodology really. See also, final figure 5.1 on numbered page 32. basically, this (quite good) study agrees with the high studies for the Utica and Marcellus (done by excellent academic groups). USGS is the outlier, low.

Again…who know who is right. Maybe it is USGS. But, you don’t get to say “nobody could have known”, when you are making a conscientious choice to always pick the outlier lower estimates.

Also, of course, USGS really doesn’t do country-wide assessments (or if they do, please point me to them…I might be wrong). They do this area by area thing, sweeping in again every few years.

Anonymous,

Yes there is a lot of uncertainty and yes the USGS does not do the entire nation at one time. The PGC estimate has also grown over time, in 2006 it was 1532 TCF vs 3978 TCF in 2022, note that about 870 TCF of this estimate is speculative resource. If none of the speculative resource is recovered and the 2022 estimate is accurate, the US reaches 50% of URR in 20 years assuming constant production of 38 TCF per year (the average rate of 2020 and 2021). If all of the sopeculative resource is eventually recovered and the 2022 estimate is accurate then 50% of URR is reached in 32 years assuming contant natural gas output at 38 TCF per year. Obviously the peak is reached sooner if output grows, if we assume 1% growth in NG output per year peak is reached in 2041 with zero speculative resources and in 2050 if the speculative resources are 870 TCF with peak assumed at 50% of URR.

See link below for summary of PGC report

https://www.aga.org/wp-content/uploads/2023/09/PGC-2022-Report-Executive-Summary.pdf

Anonymous,

The 2021 USGS estimate for Bakken Three Forks has TRR at 8.7 Gb for mean estimate and 11.7 Gb for F5 estimate, in 2013 the estimate was 11 Gb for the mean and 15 Gb for the F5 estimate for Bakken/Three Forks TRR.

We also have to account for the roughly 3.6 Gb of oil produced from Jan 2013 to Dec 2021. If we add this to the 2021 TRR estimates to make it comparable to the 2013 USGS estimate, we have 12.3 Gb for the mean URR (assuming all of the mean TRR is extracted) and 15.3 Gb for the F5 estimate for URR. Thus the new mean estimate for TRR is well within the F95 to F5 limits of the 2013 USGS estimate for the Bakken/Three Forks formations of the Williston Basin.

See

https://pubs.usgs.gov/fs/2013/3013/fs2013-3013.pdf

and

https://pubs.usgs.gov/fs/2021/3058/fs20213058.pdf

Dennis:

You also need to account for the change in PDP reserves. But yes, the two last Bakken ones are the best for USGS.

Other places like Marcellus or Utica, they are way more out to lunch, looking at changes over time. Like big upratchets needed.

Anonymous,

The proved reserves are included in each of my TRR estimates as USGS evaluates undiscovered resources and proved reserves need to be added to those estimates, I have done that for both the 2013 estimate and the 2021 estimate.

Note that there are a number of different formations in the Marcellus, you have to add up several to get the full USGS estimate. For the 2019 estimates of Utica and Marcellus the USGS has UTRR at 214 TCF, when we add the proved reserves of 159 TCF the total is 373 TCF for the mean estimate, if we use the F5 estimate (which you seem to favor) the estimate is roughly 462 for UTRR (with a 95% probability that actual UTRR is less than this) adding proved reserves the TRR is 621 TCF. I think the mean estimate is likely more accurate than the F5 estimate.

OK on PDP reserves.

I’m well aware of the Utica. I’m comparing apples to apples. If you look at USGS (U and M) versus others U and M, it’s a similar story as just comparing M from one to the others.

Yeah, USGS has 214 for U and M. But if you look at EIA, PGC, Boswell (or BEG and Utica Playbook)…they are ~1000. Not just 25% higher or lower, but ~5X. So, it’s the same basic story as just looking at the M. Are you a technical expert who can show why one estimate uses a better method than the other?

FWIW, I think it’s simpler to stick to M itself as it is much better understood. (Also the two strata are over a thousand feet apart…you don’t even winerack.)

Talking about 5-50-95 within USGS is missing the bigger issue, when the mean uncertainty is so much larger. You have a choice on who to use and pick the TRR that is the lowest. That’s a choice, Dennis. Heck, maybe it is right. But you have no way of knowing that. So the true uncertainty is much higher.

I strongly urge you to read at least the few pages of the Boswell paper I called out. You don’t even need to look at the Boswell estimate itself. But look at the pages talking about how radically the USGS and other estimates differ. Heck, even Patzek notes this in his introduction (where he has a ~2X versus USGS number).

Anonymous,

The PGC does not break out the Marcellus, it lumps Appalachia together, I hadn’t looked at Boswell paper.

A couple of things with Boswell, it uses 50 year estimates, probably not the best method for shale gas, downhole problems will make repairs not viable for low output wells and they are likely to be shut in in 20 to 25 years. Also he assumes 6% terminal decline, Novilabs shows Pennsylvannia Marcellus wells have terminal decline of about 10%, this makes a difference in EUR.

Like I said, you can look at U+M or just look at M. You will have some data that are available for either way (as they do both and break them out). In other cases, you have some available for U+M only (say PGC implicitly) or M only (say BEG). Implicitly it is a similar story though. Massive 200-600% alternatives to USGS. And it’s not just the Boswell paper. Patzek, EIA, BEG, PGC.

I sort of lean towards looking at the M as I think there’s slightly more comparables. Also, there’s massively more wells drilled in the Marcellus. Utica is still very much a puzzle, something for later (wells are big but very deep and difficult). But again, it’s same problem either way. USGS is still ~5x off if you add the big U and M estimates together (Boswell, PGC Atlantic, or UT plus West Virginia). You can’t compare the 214 of USGS U plus M to the 506 of BEG for M only. Even though it would still be a massive difference.

In any case, you are not a technical expert to be able to say why one is right or preferred over the other. You’re just picking the smaller estimate. Really, your uncertainty ought to include the span of the competing estimates. Not the within method uncertainty of just one of them.

Boswell also shows examples (drilled sections) where the USGS method fails even because of existing production.

Also, somehow I doubt that tail of late production (10 versus 6%, 25 year wells versus 50) is driving a 5X difference. We both know most of the production comes early. Boswell has alternatives in his paper with lower decline or higher and they are the sort of 15-30% variations of his mean, that you are familiar with.

USGS has a lot of issues too…I think the biggest being their lack of cell-based granularity. E.g. if you look at their 2019 assessment,

https://pubs.usgs.gov/fs/2019/3050/fs20193050.pdf

They evaluate essentially all of NE PA as one area (see Table 1, top left). And figuring on 3 wells per section (120 acre spacing, 75% success factor), at 3 BCF EURs. These EURs are much lower than what we have seen for modern wells in NEPA, even just based on completed production (source NoviLabs, etc.). Spacing is also low. Now, you can say they’ve drilled the best first and the rest will not be as good. And everyone will agree (Boswell even shows a contour map of production EURs in Susquehanna County). But this is the reason everyone else (BEG, Patzek, Boswell, PGC) uses a more granular approach. And probably this is why they are getting bigger numbers. The big wells really do produce a lot. And USGS is (I speculate) missing that. It’s sort of the opposite problem of assuming a whole play will behave like the core. They are (I speculate) assuming the average salesperson will produce like the median one. (If you know the 80-20 Pareto principle, you’ll know that actually undercounts total sales…the average is higher than the median…you aren’t giving enough credit to the performance of the core.)

Also, USGS in the Marcellus (and Utica if you want) is a 5 years old publications. A lot of the data will be even older since you need say 12 (or better 24 ) months to establish a type curve. How sanguine are you that such dated UGS surveys won’t need a revision up again? At least PGC updates every two years.

But who knows. Maybe USGS is right. Neither of us is a good enough technical expert to say. I would love to moderate a work session with the different authors locked in a room though. But in any case, you really can’t tell that USGS is right. You haven’t studied it hard enough to know that. And good people (well qualified) are coming up with radically different answers.

Also keep in mind that Marcellus productivity has been decreasing since 2020 and likely longer than that if we normalize for output per acre.

Dennis, yes, good point. But how important is that? And what else has happened, before 2020, but after the dataset for the USGS study? Let’s look.

I don’t have the normalized production, but you are likely right that lateral length has been creeping up. Maybe not as much as Permian, but maybe some. The Bakken is the one basin that has had relatively fixed (2mi) lateral length for forever. Normalizing doesn’t help you there. 😉

[Parenthetically, I take away a little of my spacing criticism of the USGS. If we think about two-mile laterals, 120 acres, with 75% “success” implies 6 well spacing. And 6-8 wells is the operator pattern of development. So, I step back from that crit.]

Novilabs, based on state data from MAR2023:

https://novilabs.com/blog/pennsylvania-update-through-march-2023/

Here is some analysis, based on 12 month cums (I like longer ones, but this is so we can assess recent vintages):

year BCF

2022 3.59

2021 4.05

2020 3.98

2019 3.14

2018 2.96

2017 2.68

2016 2.00

2015 1.65

2014 1.72

2013 1.48

2012 1.11

Here is the same thing, but comparing to 2020 as a baseline:

year pct2020

2022 90%

2021 102%

2020 100%

2019 79%

2018 74%

2017 67%

2016 50%

2015 41%

2014 43%

2013 37%

2012 28%

OK. Discussion.

1. Yes, 2022 wells are worse than 2020 ones. 10% worse.

2. Total values are very high. Yes, even with 2 mile assumed laterals, the spacing is likely 6-8. So this is a fair comparison to USGS. And what we are seeing is the 12 month cum is already more than their EUR! Now we can worry about later degredation and the like…but this just goes to show why you need to grid and look at core versus non…the way everyone else, cornie or peaker does…and they are basing future EURs on old type curves….and somehow coming up with 3 BCF cums, that get obliterated in 12 months!

3. 2021 is actually slightly better than 2020. For all intensive purposes, it’s the same. And if you look at the whole grapht, they are on top of each other. So I don’t think “dropping since 2020” is fair. More like 2022 was worse than previous two.

4. It’s mostly a story of increases prior to 2020. And dramatically. 2021 is almost four times better than 2012.

5. It’s mostly monotonic increase to 2021, but not totally. Look at 2014 and 2015. It actually dipped slightly before going up. Now, I agree that the 2022 dip is bigger (12% dip, versus 5%, relative to prior year). Still something to watch out for, before assuming every year after will keep going down. What would an evaluation in 2015 have said about well quality starting to go down?

6. With respect to 5, it is interesting to look at 2023. We have very limited data here. So no firm conclusions. But if you look at the 3 month cum (only one month of wells here for 2023), you will see it was actually up versus 2020. 1.186 cum versus 1.144 cum. Again…not making too much soup out of this onion. Limited data. Early. Blabla. But just beware of assuming wells will keep going down like the 2022 generation. 2023 is looking like a recovery. (Maybe 2022 is just one data point also.)

7. I would also recommend to think about what data USGS had when they were building their type curves. Their last M assessment was released in 2019. Probably done in 2018. If we posit 12 month cums, that means 2017 was their most recent generation. 24 month cums implies 2016. And a lot of older wells mixed into the average also.

8. Pretty much everyone (including peakers like Patzek) makes the point that you can’t equate older wells and newer ones. There has been a massive change in completion methods (with much higher EURs). Point 4, here. Patzek accommodates this by splitting into old and new generations. Others just use new only. But in any case, USGS is missing a beat and likely mixing in a lot of oranges (or at least crabapples) with their apples, when developing type curves based on production history.

Shale Gas and especially Marcellus has been an exception in US shale revolution,

1. It has never seen more than 10% drop in total production over 1 year or extend period of time, while maintaining upward trend and see it more than double over the past 10 years, while average gas price has been low $2 range in the Appalachians.

2. It has never seen more than 10% drop in basin wide per well IP and EUR drop more than 12% always seen IP and EUR increase for each average well in the past 10 years,

Looking into the details, the major drop in 2022 IP or EUR come from NE PA, i.e. Cottera and Chesapeake, and probably are due to their constraint capital and testing less productive upper Marcellus with actually shorter lateral, as there as they are running out tier one in lower Marcellus.

see,

https://thecapitolforum.com/coterra-energy-pennsylvania-drilling-signals-early-shift-towards-less-promising-targets-as-legacy-marcellus-wells-underperform-peers/

Other major operators actually also have constraints and limtied dropping rigs and don’t want to rush the production even with the gas surge as a result of the war in Ukraine,but they are still seeing upward trend in IP and EUR.

Dennis:

One other general thing to watch out for is high/low grading. We have seen in the past where wells got better during low prices (because of high grading) and then worse as prices recovered. I’m not saying this happened (seems like well count is pretty stable across last three years). But just something to watch out for.

Sheng Wu:

Interesting. Donno. But one more reason we need more vintages before saying Marcellus in general is drilled out of good sites.

Anonymous,

I did a very rudimentary analysis of Marcellus, for production after 2019 I get about 182 TCF assuming only 3 best AUs get developed (Northern, Southern and Southwestern Interior Marcellus) for wells completed after Dec 31 2019. This vey rough estimate assumes that the average 2020 well reflects mostly the Northern Interior AU and that the releative EUR for Southern and Southwestern AUs is similar to the ratio in the USGS assessment (with the South and Southwestern AUs having EURs that are about 67% od the Northern Interior).

When we add 2019 proved reserves (139 TCF) and cumulative production to Dec 2019 (45 TCF) we get a URR of about 366 TCF for Marcellus. This would be my best guess based on this very abbreviated analysis. Probably 200 to 500 TCF would be a good window.

By the end of 2023 about 82 TCF has been produced from Marcellus, but at end of 2021 about 64 TCF hasd been produced, proved reserves at the end of 2021 were 145 TCF, so if peak occurs at half of my best guess URR that is cumulative output of 183 TCF. If output was equal to the average 2023 output for the next 11 years the peak would be reached in 11 years for the Marcellus if my URR guess is correct. If we assume output grows at 1% per year the peak is reached in 2034.

Dennis:

Shake your manly hand.

Dennis and Anonymous,

Boswell 2021 NETL report gives uTRR at 609~997TCF for Marcellus (PA WV OH NY, but mainly PA WV), Exhibit 4-8 table.

Patzek 2024 AAPG paper gives

“The Marcellus Shale is predicted to produce 85 trillion SCF (TSCF) of gas from 12,406 existing wells. By drilling ∼3700 and ∼7800 new wells in the core and noncore areas, the estimated ultimate recovery is poised to increase to ∼180 TSCF. In contrast to data from the Energy Information Administration, we show that drilling in the Marcellus outer area is uneconomic.”

I made an error in my analysis, I get a URR of about 340 TCF for this preliminary analysis, but need to do further work to get a better estimate. The EUR for a single Pennsylvannia Marcellus well is about 14 TCF for the average 2020 well. I don’t have data on wells from West Virginia or Ohio. Roughly 80% of Marcellus output comes from Pennsylvannia. The estimate does not take account of decreasing Marcellus well productivity since 2020 and for this reason is likely an overestimate, perhaps an F25 estimate (with a 75% probability the actual URR will be lower than this estimate.)

Dennis, something wrong in the math here…

” The EUR for a single Pennsylvannia Marcellus well is about 14 TCF for the average 2020 well.”

That would mean a single well was flowing at 50,000,000Cuft/d for 767 years. Perhaps you should look up these details again…perhaps it’s BCF?

Hideaway,

Thanks.

Yes I got the units wrong it is about 14 BCF for EUR of average 2020 Pennsylvannia Marcellus well.

is it possible the mid-stream gas pipeline and NGL consumers are making money?

They are also funded by the majors or the banks that finance all the gas producers.

In China, a reverse way happens, the majors also own the pipelines, and does not even allow private smaller operators’ gas to get in. They could lose money when importing Russian gas or LNG and sell at discount to end user, but the fee in the pipeline will make up all the losses and more.

You can see massive growth in USGS estimates at times, as they add new areas. I think the PGC method is more holistic and Bayesian reasonable than the USGS, one place at a time, method. PGC feels a lot more like the Hubbert “all the sedimentary basins” ideal, than the USGS, one place at a time. And any way you cut it…USGS has grown. And has long delays. And we will get more efficient and find new things over decades.

But I completely understand you liking lower numbers as a peak oiler. But you don’t get to claim nobody warned you and a meteor hit…not when PGC is there and you decided to ignore it. And PGC is real industry and academia. Not Laherre or the like.

Anonymous,

PGC estimates have more than doubled since 2006.

Yeah, you’re cherrypicking a bit though on start date. Growth has been slower more recently.

And in any case, if you look at estimates of same vintage, PGC is much higher than USGS.

Also, PGC doing whole country and updating every two years is better than the USGS process (less frequent and more hit/miss coverage).

I also suspect the PGC method is more granular (cell based). BEG, Patzek, PGC all have done estimates using much more granular approach. You would think the wide coverage approach would bias large, but it may actually be the opposite. I suspect USGS of implicitly undervalueing the core production. Pareto principle. The average is higher than the median. (Donno…but suspected.)

P.s. Have you read the Boswell paper yet? Very readable. And I even gave you specific pages if you are being a Zoomer who doesn’t like reading. 😉

P.s.s. Even Patzek, Hughes et al (hardly cornies) are double the USGS for Marcellus. I mean there is something screwed with USGS. Like they are mechanically operating an algorithm and not thinking, learning. (They don’t even comment on why their estimates changed. No mea culpa needed…just as a curious analyst what factors drove the change (EUR revision of existing? Bigger wells? Spacing? Other?) They don’t even explain…just drop off their sterile reports.

Anonymous,

You often cite peak oil estimates from 2005, so 2006 is hardly cherry picking, yes the increases have slowed may even reverse in time.

Dennis:

It’s not just about neener-neener. The point of showing that previous estimates had to be revised up is that we should not be sanguine this may not be needed again. Also that one should evaluate the reasons for changes and discuss why/how it has affected methods going forward.

PGC is not as transparent, reflective as I would like. But at least they do an every two year update, which is…something, I guess.

FWIW, if you graph the changes (plus production and deltaPDP reserves), PGC sort of looks to be converging. Doesn’t actually mean they are right. We may have much less (or more, watch out…remember the mensch!) production in the end than what they posit in TRR. But it does seem like their evaluations are becoming more stable. Or…at least their evaluation of their evaluations!

In general, with USGS (yes except maybe the last couple in the Bakken), we don’t see this sort of narrowing down, as they don’t do assessments frequent enough versus the evolution of the relevant growing production areas.

Again, the point is not just good guys versus bad guys…but about all of them being off and off low. I remember when BEG came out and said the Haynesville would continue decline unless prices rose to $5 natty. Instead the H turned around and had a whole new peak, and in a $3 environment.

I guess given all the history of people underestimating the shale, I would not be so quick to pick the smallest estimate among competing versions. Or to discuss uncertainty as small flavors of that lowest estimate (versus the uncertainty being estimate versus estimate). And if you have to bet, consider taking the “over”. (I warned you, year ago.) But even if you don’t decide to take the over (OK), embrace the idea that uncertainty is much higher. And include at least occasional spaghetti from the higher estimates (yes, like from the PGC). You could do it on 01APR, you mensch, you. 😉

Anonymous,

Consider that the USGS Bakken estimate from 2013 was very similar to their estimate from 2021, this suggests their methodology was sound in 2013. The methodology for the 2019 estimates for the Marcellus and Utica was no different than the methodology used since 2013.

We have had experts make all kinds of estimates, both high and low, industry insiders were claiming the Bakken/Three Forks URR would be at least 3 times more than the USGS estimates, I didn’t believe them then and I would not believe it now,

I am not an expert, I rely on the expertise of the USGS. Some industry professionals believe the USGS estimates are much too optimistic, you seem to think they are much too low, the fact that there are those that think my estimates are much too high and those that believe they are much too low might mean they are about right.

Time will tell. On the Marcellus, I have never analyzed this very carefully, I simply think the USGS estimates may bound the eventual URR fairly well. I will investigate a little further.

Read the part of the Boswell paper where they talk about different estimates (lit review). And read a few of the different ones. (Also look at the Patzek/Hughes 2024 Marcellus paper.)

It’s not just about me liking the big one and you liking the small one. Or Boswell being magic. (If I want to criticize it, I might ask why it is so little cited, e.g.) But you’ll learn something. Resource total is the key uncertainty. Not the faux physics “shock model” specific spaghetti. Even if you decide you hate the big ones and like the small ones, you should have some intuition why you favor one versus the other (hopefully more than just the answer looking nicer, but methods comparisons, data inputs, etc.)

I already gave you that they did better (so far) with the two most recent Bakken numbers. (But not the two before.) Like I said, lot of other place where they had to revise up. Including the Marcellus (the 2011 and 2019 look similar until you account for production and PDP increase, where you see a big upratchet). Since 2019, we’ve produced another 40TCF (and probably replaced or increased PDP reserves). Nothing about the production would seem to indicate incipient peaking. So I’d be pretty wary of buying into us having produced half the M. Odds are they will need to ratchet up again there too.

Anonymous,

The 2019 Marcellus estimate from USGS has 96.5 TCF for mean estimate of undiscovered resources, to this we add proved reserves (135 TCF) and cumulative production through the end of 2018 (37.5 TCF), this gives a total mean TRR estimate for the Marcellus of (96.5 plus 135 plus 37.5=)269 TCF. The Saputra et al, 2024 paper has an estimate of 180 TCF for the Marcellus, far less than the USGS estimate. You seem to forget that the USGS estimates undiscovered resources and we need to add in cumulative production and proved reserves to get the full TRR estimate. The USGS estimate looks pretty reasonable and perhaps too high based on the Saputra analysis.

The Saputra et al 2024 paper is excellent, see link below

https://archives.datapages.com/data/bulletns/2024/01jan/BLTN21078/images/bltn21078.pdf

Looking at the paper more carefully the mean URR estimate for the core areas is about 140 TCF, when the non-core areas are added the estimate increases to 180 TCF, it may be that the non-core areas of the Marcellus never become economic to produce, so a more realistic estimate might be 140 to 160 TCF for the Marcellus which suggests the peak may already be here as there has already been about 82 TCF produced from the Marcellus.

This paper produces a far better estimate than my quick back of napkin analysis (which was probably 2 times too high.)

Thanks for taking a look at it. I thought you would like it.

I think it is important to look at various different estimates, methods. Aristotle said “It is the mark of an educated mind to be able to entertain a thought without accepting it.”

I was blown away to look at the chart in the Boswell paper:

https://www.osti.gov/servlets/purl/1805223 (numbered page 4, pdf page 12, Figure 1-2)

1. To be honest, I need to reread each paper to see if their meanings for TRR differed. (Patzek different from USGS.)

2. Note Boswell (and others) have argued that what USGS uses as “TRR” excludes PDP reserves, but not PUD reserves. As they use undrilled locations as the basis of their TRR. (PUD are undrilled areas, essentially spots for infill wells…you didn’t even used to be able to call that a reserve.)

3. Also, for the Patzek paper, watch out that it came out in 2024, but is based on an (early I think, but have to check) 2021 dataset. Look at the methodology and the publication history. For all these papers, it is useful to see exactly when they drew the line for data timing. I remember the Montgomery paper did this well and in general USGS does it worse than academic papers (that are more detailed). But in many cases, there is some uncertainty about the exact timing of their analysis.

4. Note also that the year end reserves don’t come out until DEC FY 1. I.e. 12 months later. Or for 2022 until FEB FY 2, 14 months later! So, for example the USGS 2019 paper didn’t have the 2018 reserves number available (did not come out until DEC2019).

[None of this is to fuss at your numbers. Just FYI.]

Anonymous,

My understanding is that USGS does not include proved reserves, but there might be an issue with reserves that have been booked, but not yet developed, I do use 2018 reserves for the 2019 TRR as I realize that USGS would not have had the 2019 reserves when the paper was written, I also use cumulative output through the end of 2018. Note that only about 71 TCF of the 97 TCF of undiscovered resources is likely to be developed, so the TRR estimate would be reduced by about 26 TCF to about 243 TCF, still quite a bit higher than the Saputra et al 2024 estimate (at about 180 TCF), perhaps some of this is due to proves undeveloped reserves that should not be included in the TRR estimate, I do not have figures on that specifically for the Marcellus.

For the US L48 natural gas proved reserves in 20 about 38% of the total was proved non-producing reserves. So we could assume the proportion is the same for Marcellus shale gas. For Pennsylvannia and W Virginia the proportion of proved undeveloped reserves is about 43% for 2019, so this might be a better estimate.

If we use the 43% number on 135 TCF of reserves, that is about 58 TCF, so the TRR estimate would be reduced to about 185 TCF which matches closely with the Saputra et al 2024 estimate.

Dennis:

In 2019, USGS would (extremely likely) not have even had the 2018 reserves. They didn’t get released until 13DEC2019.

https://www.eia.gov/naturalgas/crudeoilreserves/archive/2018/

“U.S. Crude Oil and Natural Gas Proved Reserves, Year-end 2018

With Data for 2018 | Release Date: December 13, 2019”

I actually think the point is kind of philosophical though. Since what USGS does is look at undrilled locations. They never pull a reserve number at all (that’s others outside of them, doing that.)

What really matters to their estimate is the timing of their study data (like the vintage of the IHS or DI data that they bought.) I guess if they bought well data from end of year 2018, it would actually line up well to consider year end 2018 reserves as additional. (Even though USGS didn’t have that–we DO have it in retrospect.)

I do think it’s likely PDP reserves that matter. PUD reserves are probably implicitly part of the USGS TRR. As they are undrilled locations.

Another thing you mention is Saputra using smaller areas than USGS, it is not clear you are correct on that. They use 4 areas, the USGS has 6 assessment units for the Marcellus, 2 more than the Saputra et al 2024 paper. They have more cohorts, but that is because they use 4 different time periods combined with 4 areas for a 4 by 4 matrix, a nice analysis. I tend to use basin wide averages for different time periods, often annual EUR estimates. I may try to do a better analysis for the Marcellus and see what I find.

Dennis:

1. Saputra (what I have been calling the Patzek paper) says “Due to regulatory restrictions, it is impractical to drill and produce inside-city boundaries. Therefore, we exclude every grid cell that intersects urban areas, shown as the dark gray areas in Figure 3.”

As you can see, Pittsburgh is smack dab in the “red polka dot” SWPA sweet spot. I don’t think this radically changes things. I donno, 25% at the most? That is good land (and undrilled, for most parts). Everyone else includes that land. Not even arguing if you should include it or not…just that it is not apples to apples to exclude it, when nobody else does. I’d actually rather he have done two cases and showed us the with/without.

As far as the number of AUs…that has no bearing on which study has more area. I can take the same pizza and slice it less/more. And for that matter, it’s probably not about total acres, if they define the fringes differently, as there is so little relative resource there. But excluding part of the core , moves the needle (some).

2. I like their different well vintages. Everyone else has noted this. But USGS does not seem to make any allowance for it. 🙁

3. I relooked at Saputra and it is not as good as I thought in terms of gridding. (He gridded for infills remaining, but not for quality.) It’s actually a lot like the USGS approach in terms of just having those super big AUs and assuming the wells are the same and just having a haircut for the whole mass for sweet spottedness. BEG and Boswell are much more granular, which is sort of a very industry, geological way. In the past peakers have criticized too broad areal estimates. E.g. touting the Montgomery paper about the Bakken and EIA.

Probably you could drive estimates falsely in both directions. Imputing sweet spot performance to large areas (giving overestimates)–something peakers have always worried about before. Or smearing out the core into the non-core and losing the Pareto benefit of areas that more than carry their weight. I’m not clear how Patzek does their GEV and how “physical scaling” (whatever that is) works. Would have to reread those papers and they may be a little too technically worded. But there’s the potential of this latter effect (or even the former) occurring. Would rather he gridded the whole thing as someone like Montgomery would advise.

4. Relooking at USGS and even downloading one of their “input forms”, I get the impression the EURs and % success are very SWAGish. Big round numbers like 1, 3 or 6 BCF for EURs, e.g. in the NE AU input form. WTF? I really wonder how much work they did…or if it was sort of Fermi estimation (piano tuner business case). In the past, I have seen more detailed work from USGS (E.g. showing EUR development from well result type curves. At least Saputra DID show type curve development.) And more detailed reports, academic publications around the reports. But the USGS 2019 is sort of a mystery. (Let’s say we give them a pass on the 2011 one, which was even skimpier.)

5. I also wonder a bit about the “physical EURs”. If his EURs are much lower than others, is he right and others wrong? And how can we really tell, now? He cites old Barnett wells, but it’s really kind of a black box without digging through his method and basis for it. He could even be right. But it’s just not clear. We are not technical experts and end up in “trust me bro” land.

I wish he had some comparison of how his EURs perform versus others. And for granular areas, that we have lots of data and estimates on. (Not the type curves meant to show a massive AU.) Like, I liked the part of the Boswell paper where he compared 3 different EURs and sort of had his estimate and a couple that were 15-30% better/worse.

Now…this might actually be a case where his whole number is way off. (Like my comments about you using slightly different flavors of USGS…when there’s a 5:1 difference versus the BEG estimate!) I donno.

Again, if Patzek is just a bit worse than others (e.g. 25% worse), it’s not that big a deal. It doesn’t explain the 5:1 (or more) difference versus BEG or Boswell. And I’m not saying he should match them. Just…I want to understand what is driving the difference. Intuitively, it must be spacing or EURs.

Note, that BEG is not ideal here either. As their final report kind of looks like it was done to satisfy a grant requirement and there was no detailed academic publication on the Marcellus (as there had been for their much earlier work…even if wrong, you got the details). Boswell has a pretty decent explication, but I’m unclear of it’s quality.

Again, it’s not about low ones are great and big ones are crap. Or visa versa. But of what is driving the differences…and based on that, we can, maybe, evaluate which one is more likely correct. Boswell has only 3 cites, not a good sign. BEG doesn’t have a detailed paper. And Saputra is not maybe perfect either. Why did it take them 3 years to get published? (And yes, they just came out…but it’s been a preprint forever…and has 7 cites…all from Patzek and Saputra!)

The gas rig count has been pretty low for awhile, when new liquification capacity comes online they will bring on more gas, to meet market demand somewhere.

Does anyone have a data source for Quatar? 1332 daily production is stale, but I haven’t found anything better. Their largest oilfield Dukham started production in the 1920’s and was said to have been over 80 percent produced by turn of century.

Another big one is Al Shaheen which is uphole from the North gas field and wasn’t developed until the 90’s. It was developed with extended reach horizontal drilling, including a record setting well length of 40,320 feet in 2008. Production in 2000’s was 240,000 bopd.

The public natural gas weighted companies have been an awful investment over the past ten years. EQT, RRC, AR all down 40-60%.

I can attest these long term, low prices have hit conventional US gas hard. All of the majors and large independents fled the Hugoton gas field years ago. Its but a shell of its former self.