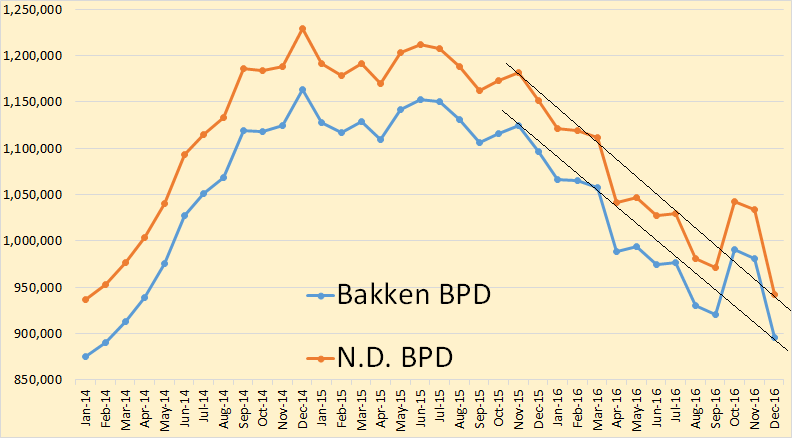

North Dakota has released December production data for the Bakken and for all North Dakota. They were a little shocking.

Bakken production down 86,150 barrels per day 895,330 bpd. North Dakota production down 92,029 bpd to 942,455 bpd. It was noted that this the largest decline ever in North Dakota production. But it should not be overlooked that the October in crease in production was also the largest ever increase in North Dakota production.

From the Director’s Cut

Oil Production

November 31,034,520 barrels = 1,034,484 barrels/day

December 29,216,093 barrels = 942,455 barrels/day (preliminary)

(all-time high was Dec 2014 at 1,227,483 barrels/day

Gas Production

November 52,785,707 MCF = 1,759,524 MCF/day

December 47,679,872 MCF = 1,538,060 MCF/day (preliminary)

(all-time high was Nov 2016 at 1,759,524 MCF/day)

Producing Wells

November 13,520

December 13,337 (preliminary)

(all-time high was Nov 2016 at 13,520)

11,449 wells or 86% are now unconventional Bakken – Three forks wells

1,888 wells or 14% produce from legacy conventional pools

Permitting

November 76 drilling and 2 seismic

December 35 drilling and 0 seismic

January 81 drilling and 1 seismic (all time high was 370 in 10/2012)

ND Sweet Crude Price

November $34.58/barrel

December $39.93/barrel

January $40.75/barrel

Today $42.50/barrel (all-time high was $136.29 7/3/2008)

Rig Count

November 37

December 40

January 38

Today’s rig count is 38 (all-time high was 218 on 5/29/2012)

Comments:

The drilling rig count increased three from November to December, then decreased two from December to January, and is currently unchanged from January to today. Operators are shifting from running the minimum number of rigs to incremental increases throughout 2017, as long as oil prices remain between $50/barrel and $60/barrel WTI.

The number of well completions decreased slightly from 84(final) in November to 81(preliminary) in December.

Oil price weakness is anticipated to last into the second quarter of 2017.

There were three significant precipitation events, fifteen days with wind speeds in excess of 35 mph (too high for completion work), and nine days with temperatures below -10F. January 2017 will be more of the same.

Over 98% of drilling now targets the Bakken and Three Forks formations.Estimated wells waiting on completion2 is 807, down 32 from the end of November to the end of December. Estimated inactive well count3 is 1,573, up 54 from the end of November to the end of December.

Crude oil take away capacity remains dependent on rail deliveries to coastal refineries to remain adequate.

Low oil price associated with lifting of sanctions on Iran, a weak world economy, and capital movement to the Permian basin continued to depress drilling rig count.

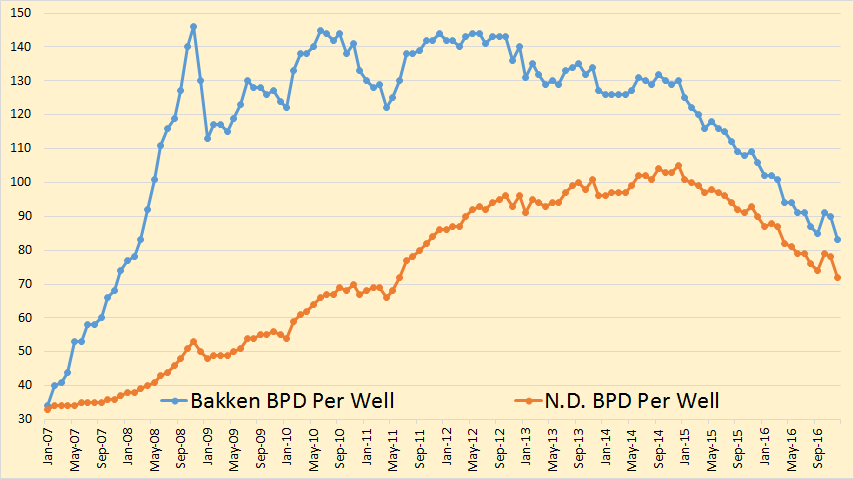

Barrels per day per well continues to drop. In December it stood an 83 in the Bakken and 72 for all North Dakota.

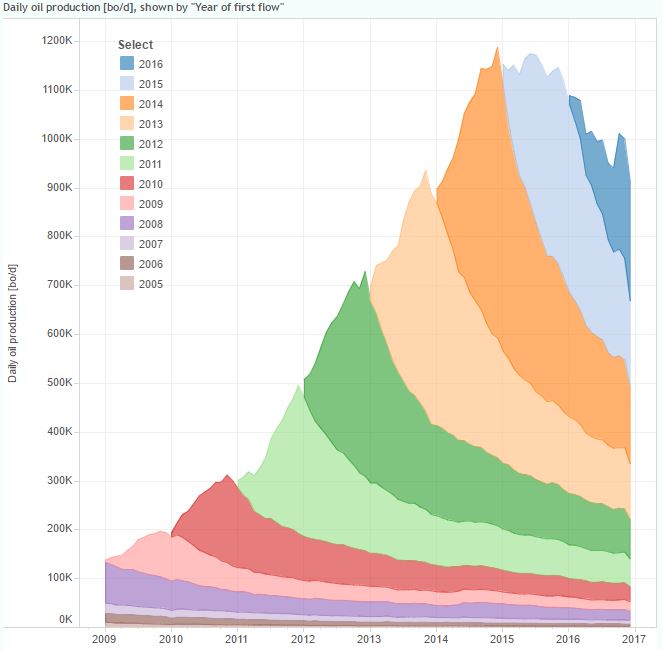

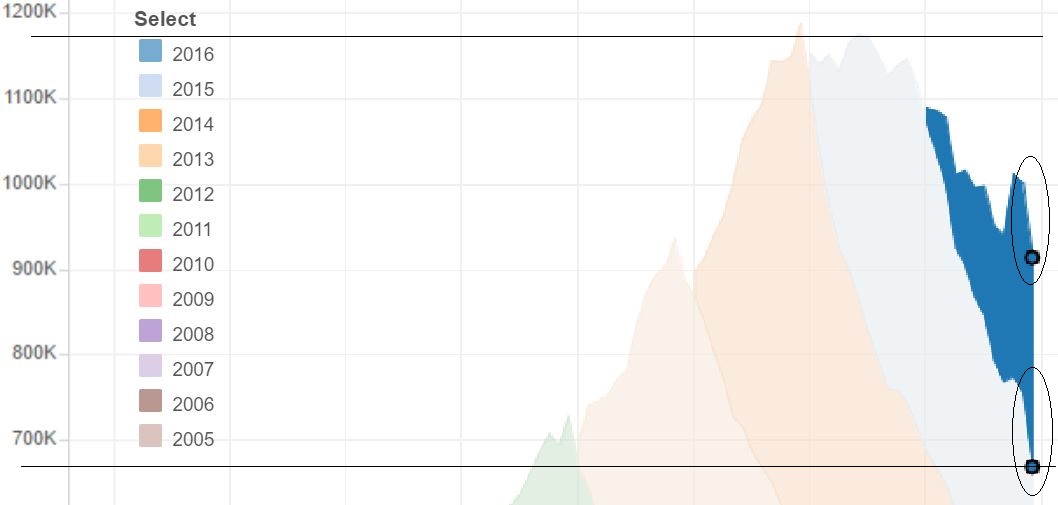

This great chart was produced by Enno Peters. It warrants a closer look. The data is in barrels per day.

The two horizontal lines represent the 2015 peak and the 2015 peak production at the end of 2016.. And the difference is almost exactly one half million barrels per day.

But more important is the points I have placed in the ovals. Notice that production from 2016 wells in December changed very little from November 2016 wells. The decline was almost entirely from legacy production. That is from wells drilled prior to 2016.

If you look at Enno’s first chart you will notice that the decline was shared by a decline in production from every year prior to 2016.

According to the Director’s Cut, producing wells dropped by 183, from 13,520 to 13,337. 81 new wells were brought on line so that means 264 wells had to be shut down. the numbers from the North Dakota web site were different. They had the well count going from 13,201 to 13,013, a decline of 188. At any rate between 260 and 270 wells had to be shut down if either number is correct and 81 new wells were brought on line.

So we could conclude that the huge drop in legacy production was due to all those wells being shut down. But why were they shut down? Your first thought would be that they were shut down because of low production. But if that were the case, that they were mostly low producers, then the barrels per day per well should have risen. It did not. Barrels per day per well dropped by 6, from 78 bpd to 72 bpd.

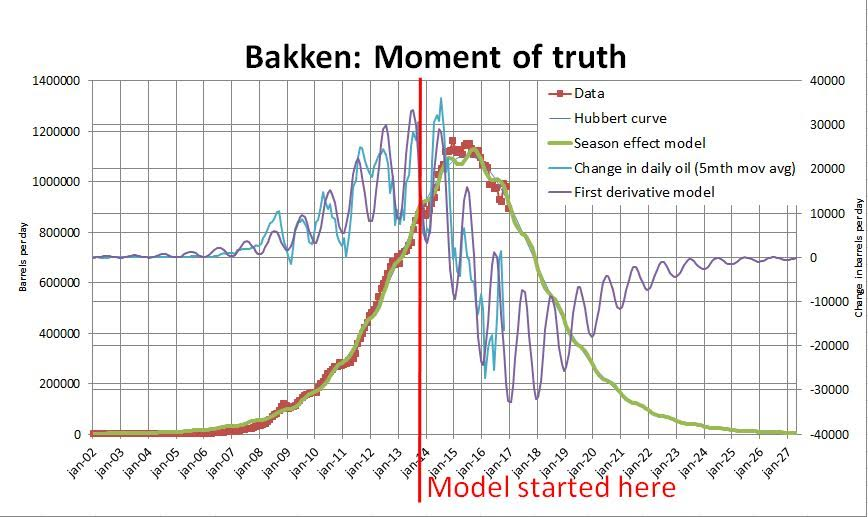

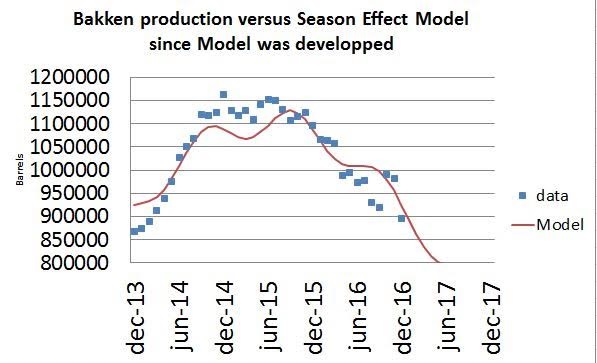

Bruno Verwimp sends us the above chart. The accuracy of his prediction is uncanny.

And here is an amplification of his model with the actual data.

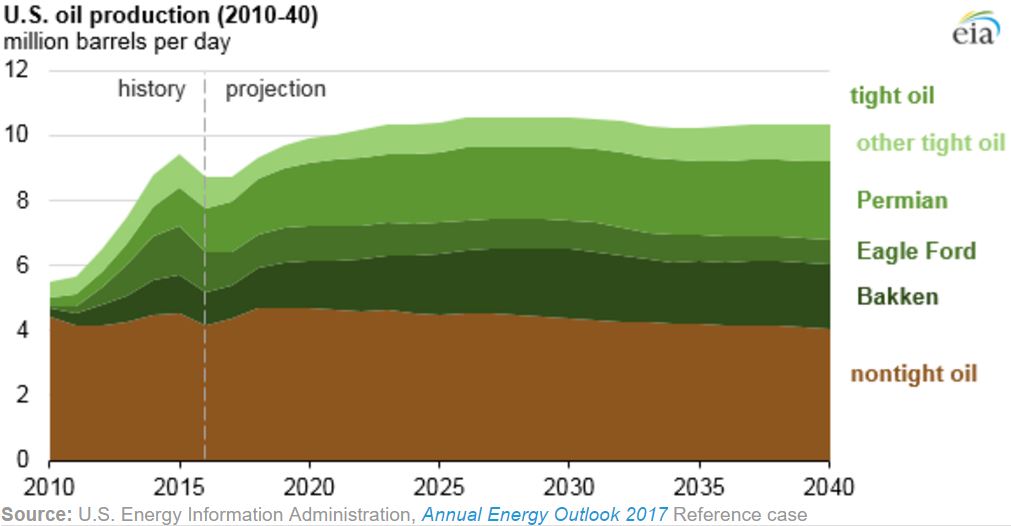

The EIA has a far more optimistic take on Bakken production. That is their reference case.

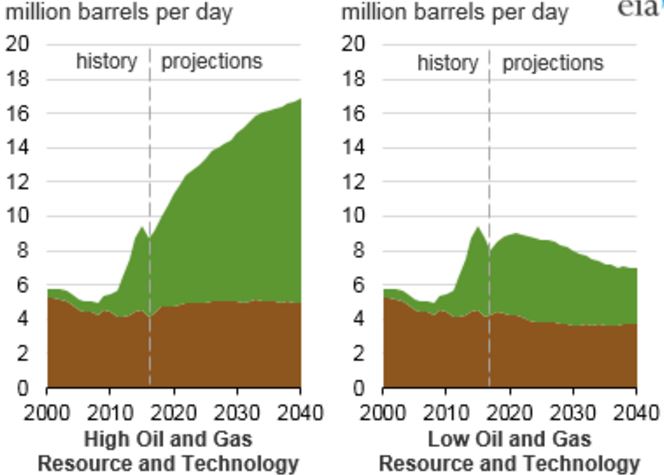

Here is their High Oil case and Low Oil case. The green is tight oil.

It is my opinion that the EIA is wildly over optimistic. More so concerning the Bakken but with other plays as well. Tight oil will be a complete bust. The Permian is performing well because it is mostly conventional production. But even the Permian will begin to decline by 2020 or shortly thereafter. All other shale plays are already in decline. But the idea that the Bakken will still be producing two million barrels per day in 2040 is ludicrous beyond belief.

Thanks for staying on top of this Ron. I wonder if the Bakken is really starting to head off a cliff now. They need to be drilling as fast as possible to steady production if that is the case. It will be interesting to see how much oil is being produced in the Bakken at the end of 2017. I’m thinking Bakken production may be under 750k per day for December 2017. What do you think?

I think that would be a little low. I would put December 2017 production closer to 800k for the Bakken, a bit more for North Dakota.

But right now everything is just a wild ass guess.

Well if my prediction is wrong I will say it was a wild ass guess. If it is spot on, I shall call it ‘sheer brillance’. 😉

This is some items about Bakken and more information about crude stocks trend:

http://en.angi.ru/news/604-CRUDE%20STOCKS%20TROUBLE%3A%20SOME%20ARE%20GROWING%2C%20OTHER%20COME%20SHORT/

EIA wildly optimistic in Bakken, Gulf and Texas. Their current numbers have to be way high in relation to what is actually happening. Even Texas RRC site is not predicting an upturn until current permits and completions get a lot higher. At $53 oil, it is not happening, or going to happen.

This is the official North Dakota stance.

North American Shale Magazine – Bakken has large production dip, but major frack activity starts: “But, starting in May, the Bakken will once again be bustling with truck activity. According to Helms, operators are enthusiastic about the current oil price and have already committed and planned to frack as many wells as possible this year. The expectation, Helms said, is that industry will complete roughly 700 wells in fiscal year 2017 and 1,000 wells in fiscal 18. ‘There is going to be a lot of truck traffic in May,’ he said. ‘Companies are going to add as many frack crews as they can this summer,’ he added.”

BoomerII,

700 to 1000 wells per year are not many wells per year. In its haydays Bakken had over 2000 wells per year. Given the current shutdowns of wells (264 wells in December alone), there might be not many net wells added in 2017 and 2018.

Most of those wells will come back on line when the weather warms up (probably already are now in fact), or there may been some some shut in for completion actions in the same section, they might take longer if the weather delays things. But 1000 isn’t much above last year: by my counts there were 550 net permits (new minus cancelled), 625 spuds and 723 completions in 2016. But if the completions do lead to bigger initial flows and higher recoveries, as some of the major players are promising, there would be a proportionally larger impact on production. Combine that with a higher proportion of legacy wells and the decline rate should at least ameliorate, even if production doesn’t increase. They could likely meet the target by clearing DUCs and without adding too many rigs – I think they need about 3 to 6 months inventory of DUCs to allow the rigs and completions crews to wok independently, so say 400.

“Most of those wells will come back on line when the weather warms up (probably already are now in fact)”

George,

Wells are not shut down in Canada (very similar weather to ND) due to cold weather ever. There are technical reasons, spills, flowline need to be replaced, cost of replacement too high so you shut down well, overproduction at the well and not enough tank trucks …etc but these are odd reason. Cold weather is not issue at all.

But seasonal impacts are big in ND – that’s why Verwimp’s sine wave imposed on the logistic comes out so well. The director’s cut pretty much states that weather was an impact, and one of the shale blogs specifically stated that some gas lines had frozen. I am not saying the shutdown was planned, and they would certainly have preferred not to do so, but they have very new infrastructure, it takes a bit of time to get it working, especially with stretched budgets as all the operators have had.

” But seasonal impacts are big in ND ”

Seasonal impacts are exactly the same as in Alberta, Saskatchewan in Canada where all conventional wells are located. I am telling you George nothing shuts down in terms of production in winter. Drilling is seasonal but has always been the case. But we are talking here about wells shut down. George, these shale wells in ND don’t have long term “mojo” and the most reasonable explanation would be what Heinrich says that this is simply the cost issue if a well goes from 100 barrels to 20 barrels per day.

I guess we’ll find out in a couple of months when the February figures come out.

George, I’m sure, DUC wells aren’t the best. All the best DUC wells were put into operations last summer. That’s why we watch no changes of DUC wells number from August 2016.

AK – The number has been coming down slowly, but although it is fairly constant the wells that make up the DUCs are constantly cycled through. DUCs cannot be left for more than two years (I think it is now – it used to be one but the rule was relaxed after the price crash). After that they have to be abandoned (temporary or permanent -either way they aren’t DUCs anymore) or have to get a non-completions waiver. Most of the DUCs are 6 to 12 months old. The rigs and completions crews work independently so a company probably contracts the completions once a pad has been fully drilled and they now what they are getting. Below is from last September but the shape doesn’t change much, although the wells split by company do.

I should have added – the date is when the well, now listed as NC or NCW (i.e. non complete or with a waiver), was originally spudded.

Looking at that chart might explain why CLR suddenly have to start doing a lot of completions as their block of oldest wells are getting to the two year mark.

George, thank you, it’s right. During two years any well should been completed. My point is that nobody leaves a good well for a long time. This being so, I expect some problems.

The problems can be technical: the well may not be connected to a pipeline, the separation units may not have enough capacity, there is also an important reason such as “no money”. Such well don’t stay idle long, because it is wasteful to have no payback from the millions buried in the earth. It’s worse when the reasons are geological: the well happened to penetrate a thinner layer, which has too much clay or too few fractures, so a good inflow is not guaranteed at all.

“nobody leaves a good well for a long time” – that might be right usually, but CLR definitely chose to defer completion on many of their wells last year, and this year they are clearing the backlog (131 new wells from DUCs but only 17 from new drills by their presentation). Whiting at one time planned the same and then changed their mind. If there are issues with infrastructure (e.g. access to pipelines) then you’d have to wonder why they drilled in the first place – but if their were unexpected issues, then eventually these will be cleared and the well completed.

I don’t know enough about the process to say, but is it known for sure that a well will be good or bad just from drilling, or does it need to be completed to tell?

GK, you are in the right way. I will try to explain.

Sometimes drilling and logging operations give you the exact reply, that the well will be good and such wells are completed immediately.

Sometimes drilling and logging operations give you the exact reply, that the well will be bad and such well is stored up for the abandonment.

But many times there are no exact reply after drilling and logging. Such wells became DUC. If new drilled wells are not better the operator will complete DUC wells.

My economic evaluation, done a couple of years ago, showed it could be worthwhile to delay completion for up to 3 years. I believe now is the window to go for it, because costs will be going back up by say 20 % from last year. More or less.

It would be better to complete the wells and start production when prices are higher, but companies need cash.

And I agree with you, oil services costs are already rising.

DAPL is expected to be fully operational (bout half million barrels a day) by summer.

Although figures vary, the additional netback for the operators may be in the $8/9 bbl range.

That’s a lot.

Winter weather and road restrictions may curtail near term completions, but May and June timeframe should show marked increase in production.

Hiring spree currently underway out of Williston, especially for CDL holders and frac crews.

Furthermore, several of the 1,500 +/- inactive wells may be brought back online with higher realized prices.

coffe,

Do you have any data on how much ($/bo) it will cost to ship through DAPL?

Normally pipeline transport comes with ship or pay obligations.

Rune

Good question that I don’t (and should) have the answer to.

ETP may be a source to get the transport fees, but my understanding is the various operators commit to both provide product and fixed payment, and those numbers vary by amounts contracted as well as how earlier in the process the commitments are made.

Further clouding the issue is cost of CBR by operator as well as final destination.

Export is also playing a larger role in all this.

Varying estimates that I’ve seen range from $5/$12 barrel.

Big spread.

Rune

Regarding the cost to ship via DAPL … some analyst just said it would vary between $1/$2 range per barrel.

So, depending upon how much CBR runs, netback increase could be in the $9/bbl range.

Somewhat surprisingly, some reports are now saying oil might flow through DAPL as early as March or April.

Should have significant impact on ND production numbers.

George Kaplan,

In my view there is simply a cost issue here. If a well goes from 100 barrels to 20 barrels per day, the mainenance, operating and transport costs go up fivefold per barrel, even if they are the same for the well. So, it might not pay off to send a crew there and pay for transport. Unless, the oil price does not go up, these wells and many more wells are likely to shut down for a while.

I saw a recent story about the rise in the cost of fracking to completion for these DUC wells. Costs are said to have risen to something like $3.2 million in some of the areas where wells need completion. I believe the Director’s Cut said last month there were 86o wells awaiting completion. If the story I read was true, then it will be around $2.8 billion to frack those 860 wells. I don’t know what the cost of getting a well to the DUC stage is, but it sure seems a lot of money to have sunk in the ground for wells that will be outputting just 100 barrel a day after their first 24 months.

Is my thinking fuzzy on this?

Bruno Verwimp wrote back in 2016, September 16th, “….Hold your breath for the next winter. It might bring severe decline in oil production in ND Bakken….”

I wrote at the same time: “…FWIW my ‘money’ is on Verwimp’s observation and model for the Bakken. … I for one will be interested to see your chart next spring!”

Another 3 months will be interesting. By the look of it, it might well be down to 700,000 bpd in a year if the uncanny accuracy continues. As I understand it, his chart has nothing in it derived from price.

That is correct. Verwimp’s model has no oil price input. This is a serious problem since everybody recognizes that oil price has been determinant in the current oil situation. Therefore one can only conclude that Verwimp’s model is accurate due to chance, and therefore has no predicting capability. It will continue to be accurate until it doesn’t. It probably represents oil production decay in the absence of sufficient economical incentive.

@Ron, Thanks for including my graphs. I like the label ‘uncanny’.

@Phil, as for now your ‘money’ appeared to be safe. Indeed oil price is not a parameter in the model. I just don’t need it. I don’t believe oil price makes any difference after all. Geology makes a difference in the first place and furthermore the expectation of earning money in the future. That expectation, strengthened by high oil prices, has triggered US shale to start booming. But that’s it. Why is Permian shale peaking so much later than Bakken or Eagle Ford? Same price environment, same political economy, same technology… that leaves only other geology?

Why did so many countries experience increase, and other countries decrease in oil production between 2005-2012? They operated in the same price environment those days. Difference in geology (and in field maturity) is the main factor.

But, I know, some people stick to their beliefs, even confronted with evidence that opposes these beliefs. As far as US shale is concerned, I presume the profound belief that higher prices will bring back the good old days of growing oil production and the salvation connected with energy independence, hinders the rational observation that ND Bakken is 2 years post peak now and US shale as a whole is 700k barrels per day post peak.

Hi Verwimp,

Geology absolutely plays a role, especially when oil prices are relatively high it is clear which fields are constrained by geology. When oil prices fall by a factor of 3 or 4 fields that are not constrained by geology will decline due to economic constraints (poor profitability.) The Bakken only increased in output due to high oil prices and a high well completion rate. Eventually geology will be the reason for Bakken decline, low oil prices clearly are the reason at present.

In Jan 2018 your model predicts about 680 kb/d for ND Bakken/TF output. My 61 well model predicts about 818 kb/d in Jan 2018 and the 85 well model predicts 900 kb/d in Jan 2018, I expect ND Bakken/Three Forks output will be around 825 to 900 kb/d in Jan 2018, with a best guess of 866 kb/d (847 kb/d in Dec 2018). This corresponds to a 75 well model, chart below.

Hi Dennis,

” I expect ND Bakken/Three Forks output will be around 825 to 900 kb/d in Jan 2018, with a best guess of 866 kb/d (847 kb/d in Dec 2018)”

Is that a prediction or a scenario? 😉

As I said on several occasions: Time will tell.

As I said on several occasions: I really appreciate your scenario’s, because they make clear, for example: “Even if from now on 75 new wells were to be added each month, still a (slow) production decline will occur.”

That being said, I think you may evaluate the opportunity to tinker the parameters of the input of your convolution. You may notice the later 2015 wells and the 2016 wells that were added, gave more oil than your model shows. I presume that is because their initial flow is higher than your average well (and their decline is steeper too).

Profitability sounds like the quintessence for an operator to add wells. According to what I understand of Rune Likverns analysis, none of the shale wells have turned out to be profitable yet. The sector as a whole is burning cash like they are flaring gas. Still 40 rigs are operational in the Bakken. In my humble opinion there is a gigantic discrepancy between drilling for oil and making money nowadays in the Bakken. So I see no need to count on the absent correlation between profitability (price) and production to make further projections about the future.

The latest NDIC data showed a large decrease in the total number of wells, for the first time in recent history. That is a new thing. It might turn out to be fatal. According to shaleprofile.com (Enno Peters) there are now more than 900 wells (and counting) producing zero! More than 600 wells (and counting) are producing on average 5 barrels per day. More than 1500 wells (and counting) are producing on average 18 barrels per day. A stunning 3200 wells (and counting) are producing on average 40 barrels per day!

According to the NDIC the average Bakken well produced 83 barrels/day in dec 2016. But the median well produced only 50 barrels/day. 2 years ago the median well produced a little over 75 barrels/day. The ND Bakken has peaked, but it is in fact the production of productive wells that has peaked. There is an enormous and fast growing portfolio of wells that produce nothing or hardly anything. That makes the decline structural, I believe. That makes operators plugging wells, discarding the production from those promised “fat tails”.

So, again, time will tell. But I think I’ll stick to my model for another while.

“the median well produced only 50 barrels/day. 2 years ago the median well produced a little over 75 barrels/day.”

Less new wells – lower average output per well

Hi Verwimp,

In this case it is a prediction for Jan 2018 ND Bakken/Three Forks output and the prediction is based on the assumption that the average well will produce approximately the well profile I have been using for the past year (which has underestimated actual output) and that the number of new wells added will average between 61 and 85 new wells per month over the Jan 2017 to Jan 2018 period and that new well EUR will start to decrease in June 2017 and reach a maximum annual rate of decrease of 4% in June 2018.

The wells that get shut in temporarily is a big part of the “seasonal effect” that you attempt to model, the other part is slower completion rate due to poor weather. George Kaplan has suggested that it is likely that many of these shut in wells will be brought on line in spring.

George has forgotten more than I will ever know about the oil business, so I am assuming his guess would be far better than mine.

Hi Verwimp,

Why do you think fewer wells were completed in 2016 (729 wells) than in 2015 (1436 wells), and in 2015 compared to 2014 (2157 wells)?

Chart below compares Brent Annual Spot price (vertical axis) with Annual ND Bakken/Three Forks well completion rate for 2014 to 2016. Lower prices means lower profits and fewer wells are completed as a result.

Mike Shellman has suggested that oil prices and profits make a difference and he knows the business (I do not). I believe that Shallow sand and Fernando Leanme would also agree that the oil price will influence output (they also know far more than me).

I’m not sure if three data points prove correlation. Given that no shale company has turned a profit in the last five years, I agree that price/profit does not seem to have as much effect on shorter term production as geology.

Hi Yaman,

Then we could use monthly data from June 2014 to Jan 2016 for Brent spot prices and then compare with well completions from Dec 2015 to July 2016 due to the 6 month lag between decision to drill and well completion. This gives us 20 data points. The R squared is 0.785 which we would expect as oil prices alone do not determine the number of wells completed, there is weather, regulation changes, and plenty of other factors which affect the number of wells completed.

Hi Yaman.

Also see Rune Likvern’s post (link below) figure 2

https://fractionalflow.com/2016/04/06/the-bakken-lto-extraction-in-retrospect-and-a-forecast-of-near-future-developments/

Figure at link below

https://fractionalflow.files.wordpress.com/2016/04/figure-2-bakken-estimated-net-cash-flow-and-cumulative.png

Note the cumulative debt (in red) did not change much from Oct 2013 to Nov 2014, the acceleration in debt after Nov 2014 was due to the fall in oil prices which increased the level of negative cash flow.

A more recent chart at

https://fractionalflow.files.wordpress.com/2016/08/fig-3-bakken-monthly-ncf-vs-cumulative.png

shows that by the middle of 2016 debt had leveled again.

If oil prices eventually rise, perhaps the debt can be paid out of positive cash flow. EIA reference case has Brent at $75/b in 2020 in 2016$ and the high oil price case has Brent at $98/b (2016$) in 2017.

Hi Dennis,

Correlation doesn’t imply causation.

You may find a much lower R² in the Permian?

You will find, for sure, lower R² at some other place on Earth.

Why I think less wells were drilled in the ND Bakken post 2014 oil price collapse?

– Because there is less oil left to drill for.

– Because the drilling companies’ expectations of earning money in the future waned.

You refer to other people who may know better. I am ready to listen to their arguments, because I’m not an oil man and I will never pretend to be one. I live in Belgium 4.400 miles away from the Bakken. So who am I to make statements about Bakken oil production?

I’m an engineer in civil construction, I have a rather solid math background, I look at numbers with an open mind, I studied oil data both globally and in depth (and coal and gas), I recognise patterns, I detect wrong arguments when they appear to be wrong.

The ND Bakken dataset prior to december 2013 followed the pattern of a Hubbert curve almost exactly. Adding a sine wave to it, to correct for seasons, just did the job to match the dataset even more exactly. Given the origin of the Hubbert curve is Lower48, given ND Bakken is lower48 too, I just dared to publish my graphs here; the result of a purely mathematical approach, completely without any technical, technological or economical concern whatsoever.

Apparently, 37 months later my model is still spot on. Because I made a good guess? Because of chance? No, because Hubbert did a wonderfull job modelling finiteness in the Lower48. All credits to Hubbert.

‘But… The world is full of examples that contradict to Hubbert!’ I know, but I recognise the unlimited passion of inhabitants of the Lower48 to go for their goal. To get things done today instead of tomorrow, especially when it’s about making money. There are no constraints in the USA, unlike anywhere else. Therefore the purely theoretical Hubbert curve shows up so nicely in the USA today again.

And you know what? The Permian is my next target. Because of this graph (see below). You see what I did? This is my ND Bakken Model on top of Enno’s data collection of the Permian, shifted 1 1/2 years or so. You see the pattern? There’s more to come, Dennis. I promise.

Hi Verwimp,

I have shown before that when the Hubbert type of analysis is done too soon is severely underestimates URR. That is likely to be the case for your ND Bakken Hubbert curve which has a URR about half of proved reserves plus cumulative production (roughly 6 Gb). The USGS estimates a 95 % probability that the TRR will be more than 7.5 Gb (USGS analysis from April 2013), see

https://www.dropbox.com/s/evwtxgsuisewczk/2013_Bakken_ThreeForks_Assessment.pdf?dl=0

Note that the 7.4 Gb mean estimate is undiscovered TRR (UTRR) and is for ND and Montana, for ND Bakken/TF it is 5.8 Gb and we need to add proved reserves at the end of 2012 (3.4 Gb) and cumulative production of 0.6 Gb to find the mean TRR estimate of 9.8 Gb, for F95 UTRR=3.5 and TRR is 7.5 Gb.

Note that the USGS F95 estimate for Permian LTO resource (Wolfcamp only) is 11 Gb and the F50 estimate is 19 Gb. What is the URR of your Permian Hubbert curve, maybe 5 Gb?

See

https://www.usgs.gov/news/usgs-estimates-20-billion-barrels-oil-texas-wolfcamp-shale-formation

Oh on correlation and causation, there is a good theory (neoclassical economic theory) as to why supply will be affected by price, the correlation just supports the theory. Possibly it is coincidence just as your chosen URR for the Hubbert curve by chance coincided with oil prices dropping by a factor of 2 (or more).

I agree time will tell if your Hubbert estimate is correct, I believe your URR is too low by at least a factor of 2 and possibly 3. By 2019 it is likely to be clear, we will have to wait. If oil prices rise to $75/b by the end of 2017 as I would guess (and I never get price predictions correct), then we may know by Sept 2018.

That would be a hell of a situation with all the money that has been dumped into the Permian over the past year for it to be already at peak and be post peak within a year and a half from now.

I was an investment banker and in and around the finance industry for a decade. I know a bubble when I see one, and Permian is a bubble.

Classic indicators: zero historical economic profits financed by debt and asset sales and hyped up by bankers and media resulting in surging land prices. If this is not a bubble, I don’t know what is.

I cleaned up the graph for better insight. The ressemblance between Permian production (blue) and the Hubbert curve (red) is so unbelievably great it would be an astounding coincidence if the Permian would be following another curve.

And that would be a hell of a situation indeed.

Verwimp – How do you explain why Permian has not followed the Hubbert curve after 3Q16, which is where you ended your graph?

Permian LTO production in January 2017 was 1.6 mb/d instead of 1.05 mb/d in your chart.

Permian LTO production (mb/d)

source: EIA-Drillinginfo report

And production growth has actually re-accelerated in mid-2016 with the increase in well completions

Year-on-year growth in Permian LTO production (%)

Verwimp – How do you explain why Permian has not followed the Hubbert curve after 3Q16, which is where you cut it off in your graph?

Frenzied Betting, Sleeping Market: Something Must Give in Oil – Bloomberg: “Unfortunately for the bulls, the oil market itself has fallen asleep after an initial surge. As Standard Chartered analysts including Paul Horsnell pointed out this week, prices have been stuck around a dollar a barrel above or below $55.50 since mid-December. Meanwhile U.S. crude closed above $54 a barrel only once since OPEC’s Nov. 30 meeting, despite crossing that price level 14 times. ‘If crude prices are to break out of their recent range in the next few weeks, the risk is to the downside,’ JBC Energy GmbH in Vienna said Thursday.”

It’s going to go up to around $63.

Shale oil is called subprime oil for a reason.

We need to account for the fact that shale oil production was supported by junk bond issuance. The loss on shale oil junk bonds is not that big: the U.S. energy companies have defaulted on ~$40 billion in high-yield bonds in 2016, more then doubling the $15 billion for 2015 according to Fitch. But they do affect future junk bond issuance…

What is interesting is that MSM stopped talking about shale junk bonds in 2015 as if they got some order from above 🙂 Most warnings are from 2014, some from 2015:

http://www.econmatters.com/2014/11/subprime-crisis-in-shale-oil-junk-bonds.html

https://www.bloomberg.com/news/articles/2015-06-18/next-threat-to-u-s-shale-rising-interest-payments.

In this sense, even $ 63 might be too low, if loans became more expensive and well servicing costs continue t0 rise. Printing junk bonds is a necessary side effect of shale oil production and this is now definitely more expensive activity then before.

I think that the return to profitability for shale at oil prices below $70 bbl is very problematic.

The $63 justifies fracturing and completing DUCs, because the well drilling cost is already sunk. Waiting an extra year for $70 is a wash. Therefore if those companies have sense they will start getting contracts and permits to start completing now, in 2017. If they don’t have cash they can sell to those who do.

DUC levels are already normalized back to pre-crash levels in both bakken and eagle Ford. You can confirm using EIA duc supplement data. There is no more quality duc to complete.

The number of the DUCs is still well above 2014 levels in the Bakken, Eagle Ford and Niobrara. And rapidly rising in the Permian.

But a few years ago people saw a long future for both the Bakken and the Niobrara and look how much they have leveled off. I keep coming back to that point. If these areas have short production lives, then the great fracking miracle is going to take us only so far.

AlexS – your rhetoric in your post does not align with your graph. Bakken and Eagle Ford DUCs are clearly back to 2014 levels and largely off from their respective peaks. Permian DUCs are rising because it is uneconomical to “complete” these wells, and company debt levels are reaching their limit. The bubble is over.

The DUC numbers are rising because the more wells being drilled and completed the more DUCs are needed to maintain the same relative inventory (i.e. the time to complete all the DUCs at current completions rate is kept fairly constant), and so allow the rigs and completion crews to work independently. Nothing more complicated.

Yes, but the number of the DUCs was increasing in 2015 – early 2016 when the number of new wells was decreasing.

And despite a decline in the DUC inventory in the Bakken and Eagle Ford, the number of the DUC relative to new wells is still much higher than the “normal” levels in 2013-14.

Although the DUC numbers may be fairly staic the wells making up the numbers are not. A well is first a permit, then a spud, then a DUC (or, very occasionally now, a dry hole) then is completed. The time from spud to completion can be several months. All the wells on a pad are drilled, then the rig moves off, the completion crew moves in and they are all completed in turn. I don’t think there are any ‘bad’ DUCs. If they are known to be dry they are just P&A’d to avoid paying rental or minimum royalty charges. Some might be found not to be as good as expected once completed, but not man these days because drilling is only in the core areas and the good prospective zones have been fully delimited by previous wildcats and development wells.

Drilled but uncompleted (DUC) infers something positive awaiting a proper time, or price to complete. That is hardly the case. I venture to guess that half the drilled but uncompleted wells are actually drilled and temporarily abandoned (TA’d) wells . Reasons to TA a well could range from mechanical downhole problems, logging and lithology analysis of the lateral suggesting completion is not warranted, poor offsetting well results, faulting, well communication issues, deferring P&A costs, leasehold issues, turning bad looking wells into disposal wells, or injection wells, and wells awaiting sidetracks and/or plugbacks. Bad or sick Three Forks wells have Bakken behind pipe, Wolfcamp D wells have B and C behind pipe, even Eagle Ford wells have Austin Chalk behind pipe. Lots of TA’d wells in the Permian are awaiting sidetracks or deepening, I’ll betcha. There are actually all kinds of “bad” DUC’s. If they were good DUC’s they would have been completed and brought to bare; for those that think spending $4M dollars to drill a well, with borrowed money, then sitting on it for three years hoping for higher oil prices before completing it is smart business, I suggest tippy toeing thru some 10Q’s and K’s coming out right now. The newest being Whitting. These shale guys need every penny they can get their hands on and would sell their mothers for the right price.

Why drill and not complete a well? You can book the same PUD reserves based on SEC proximity rules without spending the $4M. Was it a good idea in 2013 and 2014, before the crash? Drilling costs went down 25-30% in 2015 and 2016 so, guess not.

No – temporary abandoned wells in ND are designated TA. No well can be NC for longer than two years and very few are longer than one year. Most are around 6 month.

Two years then, whatever. It is a mistake to assume all drilled but uncompleted wells are capable of being completed (in their current state) or that if completed they will be good wells. Min. royalty payments or rentals would apply to leases, not individual wells on a lease (ie slot/pad drilling). An operator is going to do everything it can to defer P&A in this price climate or to prematurely plug the vertical section of a HZ well where potential might exist within reach of that vertical well in another zone. There are ways to do that, even in N. Dakota. That from an operator; take it or leave it.

Hmmm whom to listen to someone who is almost never right or a billionaire.

mike VS Sam Zell…my money is on Zell, of course I was in 5 years before he was.

http://www.worldoil.com/news/2017/2/22/billionaire-sam-zell-joins-slew-of-investors-in-awesome-stack-shale-play

SS check out the May unit production in the out today CLR report. You may want to revisit your no oil meme in SCOOP. (page 31-32)

http://investors.clr.com/phoenix.zhtml?c=197380&p=irol-irhome

Alexs, you may recall i said two years ago the stats out of Okla are going to change. Like Trump said we are just gonna get tried of winning?

Wish I had more time but someone got work around here??

Seems like whatever increases oil production will just keep prices low. So it’s not going to be a good scenario for companies.

Never said no oil. Said oil seems to drop to near nothing in 12-24 months, except for Springer formation.

I looked up the May wells. I have production thru 10/31/16. Two wells with first production 3/16 are under 100 barrels of oil per day in 10/16. The remaining five have first production in August or September, so only 1-2 months where I am looking.

Lets look in a few months, see how they hold up.

Boomer, thanks for your comment; you don’t seem to get caught up in the data obsession and appear to be able to see the forest for the trees. In spite of a draw down this week, C+C inventory levels in the US are at an all time high and growing. There are issues with the quality of LTO in America that is not allowing significant drainage (use) from Cushing, for instance, south to the Gulf Coast for refining, and imports of heavier foreign crudes (for blending) into the US are rising. LTO is just not very good stuff; that is something seldom recognized by the general public. The production cuts that OPEC have promised and that have given the US LTO industry a 6-7 dollar per barrel pay raise recently are precarious, at best, and many OPEC countries have already said they will not renew those cuts.

If you are actually IN the business of producing oil in America, and paying bills associated with that production, whether a conventional producer, even an unconventional producer (with a square centimeter of cranial capacity*), you are deeply concerned about the near term price of oil. More production, lower prices. Trump Almighty can’t fix oil prices; its a world oil market, not an American oil market. The US LTO industry is out of control, again, and on a path of self-destruction. It cannot make itself aware of market conditions and self regulate itself. If there is money to borrow, it will borrow it.

Production is growing in the Permian and as you have already determined, so much so that takeaway is problematic. More so than people are aware. Permian production and the feeding frenzy there will stifle, or hurt the price of oil. What happens in the STACK/SCOOP play in OK will not. It is primarily a gas play, as Shallow points out, and a perfect example of how the BOE slight of hand the shale industry uses so effectively, confuses people (*with no cranial capacity).

STACK won’t help Marathon, who lost $2.14B in 2016 nor will it help Continental who reduced its losses in 2016 to a paltry $400M. OK shale plays are just like all shale plays. Ultimately they will prove grossly uneconomical to produce, particularly when borrowed money is necessary to develop the play. NATGAS prices have tanked nearly 30% or more in just the past few weeks.

There is no reason to be crowing about anything going on in the unconventional shale business at the moment.

Texas tea,

Oil production in Oklahoma peaked in March 2015 (like in Lower 48 states onshore in general).

Unconventional output from the SCOOP, STACK and Woodford shale has been slowly increasing, but is still below 90 kb/d. Two years ago it was about 70 kb/d. These are mainly gassy plays with some oily zones. It’s not a new Bakken, Eagle Ford or Permian in terms of C+C production potential.

Oil production in Oklahoma and Woodford shale (incl. SCOOP and STACK), kb/d

Source: EIA

CLR is a big player in SCOOP and STACK. Its oil production there was close to 23 kb/d in 2016, but more than 72% of total hydrocarbon output is natural gas.

CLR oil and natural gas production in SCOOP and STACK plays

BP Oil production and consumption

We have now graphed the whole of BP oil production and consumption and calculated the net export balance which is not in decline but it has been flat since 2005.

Nice, Thanks!

The net exports available on the global oil markets are some 60% of the total production. In the case of dropping global oil production it will take a while for the markets to dry out. If you make this same exercise on coal and gas, you get different numbers. Only a tiny fraction of global coal and gas production is available on the global markets. Dwindling global production will result in disappearing global markets in a very short time frame.

Verwimp – What is the best way to reach you?

A big contributor to the legacy oil decline is the unrelenting physics of fluid phase behavior, with gas becoming more prevalent in the production stream. Statewide GOR increased from 1200 to 1500:1 cuft/bo in 2015. The legacy wells will be worse (i.e. the newer wells dampen the effect, which have an initial GOR of ~ 1000:1). For reference, generally a GOR> 2000:1 is considered a “gas” well or field.

Most of these LTO fields will eventually be abandoned as gas fields.

note – I tried to post a *.png graph, but the reply tool failed.

Probably too big – convert to gif or jpeg below 45 KB.

the original was 54kb. here is a 25 kb *.gif. Well count is on the right-hand y-axis, all others on the left.

Seems like this would be a very important chart when it comes to predicting the future of the Bakken.

I would think that the rising GOR at the field level may be due in part to the fact that the completion rate has fallen from about 1800 new wells per year in 2014 to about 750 new wells per year in 2016, the newer wells tend to have lower GOR, so as their proportion decreases the average GOR for the field increases.

”…has fallen from about 1800 new wells per year in 2014 to about 750 new wells per year in 2016, the newer wells tend to have lower GOR,..”

Interesting, as this is exactly the opposite of what actual data shows.

FreddyW posted a chart on Bakken GOR in the previous oil thread:

http://peakoilbarrel.com/opec-january-production-data/#comment-595923

Hi,

I missed to take into account the number of days in the month for total producing days in my last post. I wanted to investigate this more. So I did a bit of programing and adjusted each individual well for the number of days it was in production in December to see what the production would have been if it produced as many days as it did in November (adjusted for number of days in that month). I looked at wells that started production in 2014 and wells that started production in 2010. In short, both groups looked very similar and it turned out that about 86% of the increase in decline rate, for both 2014 and 2010, were because of fewer producing days and the rest for other reasons. However there is more to it than that. First of all, adjusted for number of producing days, the decline rate should stay the same or decrease a little every month, not increase. Secondly wells that are of the same age as the 2014 wells have historically had a monthly decline rate of around 3%. The decline rate in November (days adjusted) was 6,9% and in December 8,1. For the 2010 wells, monthly decline rates should have been around 1,5% but were 5,6% in November and 6,9% in December. So the decline rates are currently very very high. The huge drop in December could not have been that huge if the underlying decline rates would not have been that large.

I think the decline in GOR has something to do with it. If the reason for the increase in decline rates are that they are choking the wells, then I expect these high decline rates to be rather temporary, because I would guess that they adjust the choke only once per well. It may take some time to adjust all wells they have planned to adjust, but when that is done then decline rates should normalize. So if that is the reason then maybe it will take a few months to normalize. If the decline rates are still very high in a few months, then it doesn´t look good for Bakken..

I found a bug in my code. For 2014 about 100% of the increase in decline rates from November to December was because of fewer production days and decline rate in November was 6,43% and December 6,35% (a bit conservative). For 2010 the numbers are 86%, 4,16% and 5,16%. So lower underlying decline rates, but still very high. Sorry about that.

Try plotting real oil rate (what the well produced when it was turned on) versus (cumulative oil production plus cumulative gas in BOE) and see if that sort of normalizes everything.

If you plot the natural log of the oil rate I described above the decline curve straightens out, but in this type of well it will remain concave upwards. Take a dimensionless form (rate as a function of peak rate) and that gives you a decent type curve.

If you plot those type curves over the years you will probably see that recovery per well isn’t that different as long as they have similar reservoir contact.

So you want to see if initial oil production is correlated to cumulative oil plus gas production? Not sure though what is has to do with decline rate.

Hi FreddyW,

Are the GOR charts ok though?

The bug was that I missed to handle the scenario were there was zero production in the “after” month. It looked like this (for each well):

afterprod_adjusted = adjustmentfactor * afterprod

So afterprod_adjusted would in this case still be zero.

I don´t adjust the production for number of production days in any of my other graphs. So they should be ok.

I did some more investigation to find out if choking the wells is behind some of the decline in production. I took my data where number of producing days were adjusted to match previous month in order to remove the effect of fewer producing days. Then I grouped them into two groups, one were GOR increased and one were GOR decreased compared to previous month. Here is a summary of the results (wells with no oil or gas production have been excluded):

2014 wells in 2016, Oct to Nov:

Nbr of wells inc GOR: 1220 60,5%

Nbr of wells dec GOR: 798 39,5%

Increase for wells with increased GOR (%): -8,1

Increase for wells with decreased GOR (%): -3,7

Total production before 178465

Total production after 166997

Total decline (%) 6,43

2014 wells in 2016, Nov to Dec

Nbr of wells inc GOR: 863 43,1%

Nbr of wells dec GOR: 1139 56,9%

Increase for wells with increased GOR (%): -9,2

Increase for wells with decreased GOR (%): -4,5

Total production before 171216

Total production after 160341

Total decline 6,35

First of all, I was surprised to see that here and also historically, the group with declining GOR has a lower decline rate than the group with increasing GOR. I can only guess why that is. For wells that are 2 years old the group with declining GOR typically declines with 0-2% and the group with increasing GOR typically declines with 3-7%. So both groups for the 2014 wells declined more than usual. We can see in the data above that there was a massive movement of wells from the increasing GOR to the declining GOR group from November to December (Nbr of wells dec GOR went from 39,5% to 56,9%). We can also see that the decline rate for that group increased a bit from 3,7% to 4,5%. However total decline rate remained about the same (6,43% to 6,35%). So it did not have any affect on decline rate. It looks more like wells with higher decline rate in the increasing GOR group were just moved to the decreasing GOR group. Or in other words, they may be cheating with gas production data (flared gas) which I also suspected a few months ago.

Just a quick look at the 2010 wells:

2010 wells in 2016, Oct to Nov

Nbr of wells inc GOR: 413 58,0%

Nbr of wells dec GOR: 299 42,0%

Increase for wells with increased GOR (%): -7,1

Increase for wells with decreased GOR (%): 0,7

Total production before 33307

Total production after 31923

Total decline 4,16

2010 wells in 2016, Nov to Dec

Nbr of wells inc GOR: 318 45,5%

Nbr of wells dec GOR: 381 54,5%

Increase for wells with increased GOR (%): -9,6

Increase for wells with decreased GOR (%): -1,0

Total production before 32864

Total production after 31169

Total decline 5,16

They look similar to the 2014 well data. The group with declining GOR also increased a lot (Nbr of wells dec GOR went from 42% to 54,5%) and both total decline rate and the decreasing GOR group decline rate increased a bit. But the decline in the declining GOR group was much lower than the decline in the increaseing GOR group (1% compared to 9,6%). So if there are any wells that are choked, then they didn´t contribute much to total decline.

Why are wells with increasing GOR declining so fast? It could be that GOR is so high that gas supresses oil production. This would result in pressure being depleted quickly and eventually cause a lot of oil to be left behind as I understand it. Or any other ideas?

FreddyW, thanks for sharing!

Hi FreddyW,

Thanks. I would also love to hear from the pros what this may mean.

Hi FreddyW,

I would think the higher GOR might be due to too much fracking such that the pressure levels in the reservoir gets depleted too quickly and doesn’t give the oil time to migrate to the well so more gas is produced relative oil and the reduced pressure needed to drive the oil to the well results in less oil produced per day.

The geophysicists, geologists, and engineers can correct this as I would love to learn.

I have never had anything to do with an LTO well, or in fact with a well on solution gas drive, but a falling GOR ratio will happen only with older wells: those close to exhaustion, with low flows, and probably entirely reliant on artificial lift (possibly with some mixed drive from water as well, but I wouldn’t swear to that). In the early operation the gas comes out of solution of all the oil in the formation and is more labile than the oil so moves easily to the well bore, and the GOR rises as the pressure declines. The easy gas gets exhausted – i.e. the methane and ethane goes first, then the propane, then butane etc. At some point a condition is reached where the gas won’t be evolved unless the pressure declines, effectively the oil is ‘dead’ at the reservoir pressure. The oil has to be pumped out with, for example, an ESP but the more you pump, and the lower the pressure, the less gas you actually produce as the oil gets continuously heavier.

Freddy, this should fix you up; it is a good explanation of gas to oil ratio behavior before and after bubble point in pressure depletion environments like unconventional shale: http://petrowiki.org/Solution_gas_drive_reservoirs. Increasing GOR is indicative of depletion. Combine this with your produced water work and you can decide for yourself what is happening in the Bakken.

Thanks Mike. I will take a look.

Thats interesting. So GOR should not start to decline until it reaches 6 mcf/barrel or so the earliest and the well may reach the economic limit before that. So declining GOR should not be expected for some time then (unless they are cheating with flared gas reporting).

Thank you George and Mike.

Just two more tables. It looks like oil and gas production goes up and down a bit for a well. When gas production drops then oil production goes up and vice versa. This could explain some of the big difference in decline rate for the decreasing GOR and increasing GOR groups above. Using a longer time period should remove this effect, which I have done in the tables bellow. They show 6 months differences instead of 1 month. I have also excluded wells with < 5 days of production to improve data.

2014 wells in 2016, Jun to dec

Nbr of wells inc GOR: 987 51,3%

Nbr of wells dec GOR: 936 48,7%

Increase for wells with increased GOR (%): -22,02

Increase for wells with decreased GOR (%): -17,39

Total before 187216

Total after 150277

Total decline (%) 19,73

2011 wells in 2013, Jun to dec

Nbr of wells inc GOR: 511 46,2%

Nbr of wells dec GOR: 595 53,8%

Increase for wells with increased GOR (%): -18,33

Increase for wells with decreased GOR (%): -13,48

Total before 115051

Total after 97109

Total decline (%) 15,59

We can see that there difference in decline rate between declining and decreasing GOR is now much lower. But wells with increasing GOR still decline faster. The average per well production is about the same in each group for both tables, but that is not visible in the tables above. The 2014 wells decline faster than 2011 wells did in 2013, however much less difference than in the 1 month tables. The decline rate has increased a lot the last few months. It will be interesting to see the coming months if it was only temporary or if this will continue.

Try this if you have $10 to spare:

https://www.onepetro.org/journal-paper/SPE-184397-PA

From the abstract it looks like tight oil behaviour is very different from conventional wells, especially if there is a lot of dynamic changes (i.e. non steady state behaviour), which would certainly have been the case in December with a lot of wells going off line and then coming back on again. I doubt if looking at the GOR in anything but large aggregates of wells will indicate much.

Mr. Kaplan

I thank you for that link and plan on reading the whole paper.

From just the abstract, however, one might glimpse how different characteristics are from conventional and unconventional sources, most specifically regarding bottomhole pressure and conductivity.

As these Bakken wells have been relatively ‘confined’ to the core areas these past several months, they have ALL been drilled on existing pads with older, producing wells closely offset to the new ones.

It is the lengthy shut in period, combined with elevated bottomhole pressure from frac fluids (hundreds of thousands of barrels per new completion), that is promoting both non linear oil/gas production as well as varying GOR in these older wells.

For all

Should anyone glance at the link from Mr. Kaplan and skim through the summary, one might see the incredible amount of brainpower that is being applied to this field.

Additionally, the 17 listed references display, line by line, how extensive the commitment of resources are being put forth by the O&G industry.

Thank you George. There is a lot of information in the summary. 2008 could fit into the stages explained in the summary. However all years started to see increasing GOR in 2014 and all years has seen it level out in 2016. So it doesn´t quite make sence.

Hi Freddy W,

I can’t tell on your GOR chart which line is which between 2012 and 2014, one rises to the level of the 2015 GOR and the other is lower, but the color is similar and they come together and then separate and it is hard to figure, in the future if you change the y axis to a scale of 0.5 to 2.0, it might be a little easier to read, dashed lines when two curves are the same color and are near each other also helps (so either 2012 or 2014 could be a dashed line). Thanks.

Dennis,

Gas-to-oil ratio in North Dakota, the Bakken and by 4 key oil-producting ND counties (kcf per barrel), 2007-2016

Similar chart for 2010-2016

As I understand, FreddyW’s charts show GOR for the wells that started production in a particular year.

My charts show GOR for total production.

GOR is different in different parts of North Dakota. So changing share of different counties, as well as increasing share of sweet spots in total production may also affect GOR numbers.

This is an explanation given by Lynn Helms in 2016:

“Helms attributes the increasing gas production as oil production drops to the fact that low prices have forced producers to focus only on the Bakken core area or sweet spot for all 27 rigs still operating.

“That area has the highest gas-to-oil ratio,” Helms said. “The wells there also are the most productive [3,000 b/d], and the gas-to-oil ratios are two to four times what they are in other areas.”

http://www.naturalgasintel.com/articles/106414-bakkens-1-million-bd-production-unlikely-to-hold

Though I think this can’t fully explain increasing GOR in the Bakken, as it is rising in all parts of ND.

2012 and 2014 have different colors. So not sure what you mean. 2014 and 2015 have the highest GOR.

Here it is zoomed in.

Ok now I see. I had to reduce number of colors to fit into 50kB. 2012 has red dots in it.

Hi Freddy W,

Thanks my old eyes cannot make out the red dots, question answered, 2014 and 2015 are highest and 2016 is probably lower because the wells are so new. I still think the greater number of frack stages has something to do with it, maybe there was a change in the average number of frack stages from 2012 to 2013.

Is the 2000 GOR a North Dakota convention? There’s no reservoir engineering reason to designate a depleted well as a gas well when GOR increases to 2000 scf/bo. Depleted oil wells under depletion drive do experience very high GORs, but they remain oil wells.

Here’s a link that says in Texas there are tax advantages in reclassifying an oil well as a gas well.

http://fuelfix.com/blog/2016/11/22/pioneer-denied-request-to-reclassify-oil-wells/

My recall is there’s a regulation in Texas that classifies liquids from a gas well as condensate vs oil from an oil well. Almost certainly has some tax consequence.

Hi Fernando,

What are typical values for GOR when a well reaches its economic limit, assume the volume of produced water is equal to the volume of oil produced at the economic limit (or if that is not realistic please let me know what the “average well” might be would the ratio be 2:1 (water:oil), I have no idea what is typical and I realize every well is different.

Can any of you professional fellows explain the upsurge in “Legacy Oil Well” production shown in the monthly EIA Drilling Productivity Reports? The major fields, except. Permian, show that the legacy wells are rising after having been on seemingly steady downslopes for the years leading up to about early 2015. Are they reworking old wells? What’s the industry practice that has reversed the declines.

for example, this page–

http://www.eia.gov/petroleum/drilling/pdf/eagleford.pdf

The legacy well production graph represents the monthly expected change in production.

In the example you referenced monthly legacy decline was about 140,000 bopd at the beginning of 2015. This legacy decline represents the decline of wells producing in the prior month. This decline was large because there were many recently drilled legacy wells, and the recently drilled wells decline more than wells which have produced for a longer period.

By the beginning of 2017 the legacy decline had decreased to about 80,000 bopd per month because there hadn’t been as many wells drilled recently.

To dclonghorn:

Right. Another point is that more and more wells became idle so they aren’t calculated in the legacy well production.

Thanks. That helps clarify things for me.

Some of y’all are newishcomers and cannot remember how very many times monthly production reports would report completely inconsistent with new completions totals and weather and more or less 15 gazillion other factors we’d throw in.

Point being, don’t think you have why the big recent increase or why this big decrease understood. Your odds on this are poor.

Reminder from last thread:. That Enno chart color coded by year — look at how shallow the post Peak descent slope 2010, 2011, 2012 is vs 2014. Damn near vertical. That would be the last non price smash year.

This speaks to EUR, but not loudly because of . . . Wait, do we have proof these recompletions are happening? Or is this presumption.

Also suggest a read thru of the new rule making paras of the directors cut.

I can remember months when new completions and new wells operating numbers completely failed to explain a change in quoted oil production that month . . . and I embarked on chasing down traffic reports and stop light failures at intersections because trucks hauling oil having been slowed down could conceivably have been the explanation for the numbers. Nada.

What we DID conclude was negative — zero explanation for oil output quotes from the number of wells completed in a month. Number of days of bad weather preventing completions also failed to explain. Bad weather slowing down trucks remained a maybe, but for trucks hauling oil, not trucks hauling proppant.

A blast from those early days:

http://static1.businessinsider.com/image/4f5681fd69bedd0f60000048-1200/here-is-a-load-of-proppant-from-china-used-to-frac-a-well-sitting-at-the-rail-head.jpg

Ceramic proppant for Bakken. From China. Soon after this it was magically discovered that special sand from the US was “superior” (meaning cheaper, but didn’t hold the fractures open as well).

This has been my philosophy for decades. Preserve our own resources and use up everyone else’s until they run out.

Berkshire's Charlie Munger Has A Much Different Energy Plan For America Than Donald Trump | Seeking Alpha: “Munger believes that the United States should have an energy strategy that involves preserving these shale resources until some point in the future when they are much more valuable. This would be a point in time after the OPEC nations have exhausted their oil and gas reserves.

Munger would have us import oil and gas now from OPEC so that we can save our oil and gas for the future when the world is going to have major shortages.”

Sigh.

People Are Not Stupid.

The day comes when a firebrand is in control and dares to rock the societal systemic boat by declaring the price of oil will be non monetary. You want oil from Russia, America? Disarm. You want oil from KSA, America? Convert to Islam.

“We have enough of your dollars created from thin air. Let’s have something of real value to us before we send you oil. The price is described above.”

But if we haven’t wasted our own oil, we’ll still have it. And then if other countries want to give us terms we won’t accept, then we don’t use their oil.

Of course, without imports, we won’t have enough to run our country business as usual. But we’re going to head that way anyway, as global supplies become more scarce and/or expensive.

When the shit is well and truly in the fan, in terms of oil available for import to the USA, which will probably come to pass within the next couple of decades, barring the technocopians being right in predicting electricity displacing oil, well……

We have both economic and military muscle enough , assuming we wise up about globalization , and don’t export the rest of our industrial base, to INSIST on oil being sold to us , although getting it for dollars will be harder from year to year.

Saudia Arabia will never be self sufficient in food until the population there falls by what, eighty percent or better? If anybody will have the capacity to export food on the grand scale, it will be the USA.

And if anybody has a military umbrella under which smaller and less powerful countries can shelter at relatively low risk of the people there being treated like convicts, it will be the USA.

This is not to say we have been or are altogether NICE about the way we treat our allies, but compared to other countries, we stack up pretty well in this respect.

Nothing will move on the world ocean for quite some time if Uncle Sam finds himself in a corner where in his own interests indicate that nothing moves.

Of course considering that ninety percent of the leadership in China consists of engineers and scientists, where as ninety percent plus of western leadership consists of lawyers and other mostly parasitic types, it ‘s only a question of WHEN, rather than IF China will be a military superpower, and maybe the SOLE super power.

Maybe you should look up the numbers on USA food exports and imports. We’re not really the agricultural export powerhouse most people think we are.

Jimmy Carter said exactly that when he was President. Smart, but the industry didn’t like it.

And that is exactly when I started to think about this. During Jimmy Carter’s term. Had we done something starting then, we would have had decades to prepare for a time of declining oil supplies and higher prices. We could have had a relatively smooth transition. But we did nothing, so it is likely that when oil gets really expensive, it’s going to be an economic shock and we will have to make a rapid transition.

Sir Ronnie The Lessor continued the mythology (however, he tripled the national debt).

He perfected the Electronic Nuremberg Rally, and the Charge and Loot profit model.

It was a New Time in ‘Merika!

The North Slope was flowing, and SA had oil, as I remember, at $10 a barrel.

The Stock Market was depressed, and had nowhere to go but up, the Casino was open and they could make the rules, interest rates were 16% with nowhere to go but down,.

None of these are in place for Cheeto Boy.

The Soviets were being bled to death.

They are currently doing quite well.

California Resources Corporation (NYSE:CRC), an independent California-based oil and gas exploration and production company, today reported a net loss of $77 million or $1.83 per diluted share for the fourth quarter of 2016.

Highlights Include:

Received sixth bank amendment removing capital investment limitations and allowing additional joint ventures, among other changes

Initial 2017 capital investment plan of $300 million

2016 capital investment of $75 million with only $31 million of drilling and workover capital

Quarterly production of 135,000 BOE per day

A 2.2% sequential decline

A 10% year-over-year decline, excluding PSC effects

Annual production of 140,000 BOE per day

Annual production costs down 16% from prior year

Annual operating cash flow of $130 million

2016 Annual free cash flow2 after working capital of $49 million

2016 Organic reserve replacement ratio of 71% with minimal drilling and workover capital

2016 Adjusted Organic F&D costs of $3.42 per BOE3 excluding price adjustments

“Our planned 2017 capital budget of about $300 million should allow us to increase activity, enhance margins and return to a growth profile beginning in the second half of the year. Additionally, we expect to further expand our actionable inventory. We are pleased to have received our sixth bank amendment which removed capital investment limitations. We will continue to align our investments with our cash flow.”

CRC expects to align our capital investment with our operational cash flow, and adjust our capital plan accordingly. Based on the current market conditions, CRC will begin the year with a capital investment plan of $300 million, consisting of approximately $150 million for drilling and completions, $50 million for capital work-overs, $50 million for facilities, $25 million for exploration and $25 million primarily for mechanical integrity projects.

http://www.businesswire.com/news/home/20170216006267/en/California-Resources-Corporation-Announces-Fourth-Quarter-2016

CRC has been bleeding red ink for over 2 years. I don’t see anything less than $60 per barrel stopping that. Do they know something about the future price of oil most don’t ??

RRC production numbers for December and drilling numbers for January are out today. Production is steeply down and this will not change very soon as more wells are shut then permit in January (see below chart).

I just went looking for more info about this online and don’t see any. I can find info about the number of permits issued, but no one is mentioning plugged wells or net wells. Are people overlooking this or just choosing not to write about it?

boomerII,

To get the newest production (also individual wells ) from RRC Texas go to:

http://webapps.rrc.state.tx.us/PDQ/changePageViewAction.do?pager.offset=20

– click on: general production query

– you get a new site : general query criteria

– in the open form click on: initial view: lease

– choose the data range

– choose one : both

– district : statewide

– all other four : none selected

– click submit: you get a new site

– click on monthly totals and you get the production data for the months you have selected the data range; it is important to note that the latest four months get revised substantially; so a frequent check is necessary

for data on drilling go to:

http://www.rrc.state.tx.us/oil-gas/research-and-statistics/well-information/monthly-drilling-completion-and-plugging-summaries/

The RRC data is incomplete for at least 12 months, so a better estimate is the EIA data.

Baker Hughes rig count is out, US overall up 6 oil, 4 gas; but the drop in offshore rigs of 3 would likely have a bigger impact than the increase in onshore rigs.

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-rigcountsoverview

Canada has started the spring decline and is down 21. See below.

Canada has to reduce rig count once the thaw sets in because there are restrictions to moving heavy loads on some roads, as they can get damaged when not solid. It looks like the thaw week might be getting gradually earlier in the year. Even this year when there has been some cold weather pushed south by the hotter air in the Arctic it is pretty early to start, but the prevailing weather pattern has just reversed with the Arctic now cold and warmer air moving to lower latitudes.

Canadian Oil Sands – Wall Street Journal – 2017-02-17

Oil sands projects can require billions of dollars in upfront investment and seven to 10 years, or more, to bring returns. Instead, companies are increasingly focusing on new sources of crude oil, such as shale, that don’t require the same massive investment and that can get from development to production much more quickly.

To be sure, oil output isn’t expected to fall in Canada as it has in the U.S., and some projects for which money has already been spent may go forward, a sign of the resilience of oil sands investments once money has been spent. That is because the cash cost of producing barrels once projects are up and running is low.

https://www.wsj.com/articles/energy-companies-face-crude-reality-better-to-leave-it-in-the-ground-1487327406

And what does that mean for pipeline construction?

I can’t see the original article since it is behind a paywall.

But this appears to be the text of the article without the above graph.

Energy Companies Face Crude Reality: Better to Leave It in the Ground | Fox Business: “Once considered a safe bet, Canada’s vast deposits are emerging as among the first and most visible reserves at risk of being stranded by a combination of high costs, low prices and tough new environmental rules.”

Hi all,

The sharp downturn puts Bakken output closer to my model based on average new well output profile (based on data shared by Enno Peters) and the number of completed wells each month (also based on data from Enno Peters). The model output has been lower than actual output for about a year, with this month’s data point the model is fairly close to actual output (model is 1.6% too low) . This “uncanny accuracy” is likely a matter of chance as the actual new well output varies from month to month.

Three future scenarios are presented with a constant number of new wells completed each month from Aug 2016 to Jan 2022 of 85 wells, and 125 wells, the 61 well model has 61 wells from Jan 2017 to Jan 2022.

Note that the most recent 12 months the average was 61 new wells per month and in Dec 2017 82 new wells were added. Also from April 2012 to Nov 2015 there were more than 125 new wells per month for the trailing 12 month average, the peak was about 186 new wells per month for the 12 months ending in March 2015.

We have no idea how many new wells will be added in the future.

Dennis, one thing you are forgetting…. geology. Your model looks very accurate if wells of the future are as productive as wells of the past. They will not be. Wells of the future will not be nearly as productive as wells of the past. All the sweet spots have already been drilled. We are now drilling the fringes, more and more water with less and less oil.

Hi Ron,

Model assumes new well EUR decreases over time.

Hi Ron,

The 61 well model would have about a 7.7 Gb URR if 61 new wells per month were added until March 2040 (28,500 total wells in Bakken/Three Forks from 1951 to 2040).

This assumes about a 4% annual decrease in new well EUR from June 2019, note that the USGS estimates a 95% probability that 2P reserves will be more than 7.7 Gb and 2P reserves at the end of 2012 were about 5.7 Gb. At the end of 2015, 2P reserves were about 7.2 Gb in the North Dakota Bakken/Three Forks. My guess is that the 61 well model is pretty conservative and the USGS F95 estimate (from April 2013) is likely to be the minimum output from the ND Bakken/Three Forks.

This assumes about a 4% annual decrease in new well EUR from June 2019,

Really now? 4% annual decrease in EUR? Dennis! Oh my God, Dennis, surely you see the absurdity in such an absurd estimate of annual decrease in EUR! And what about the period the period between now and June 2019? Are you assuming 0% decrease between now and then?

note that the USGS estimates a 95% probability that 2P reserves will be more than 7.7 Gb and 2P reserves at the end of 2012 were about 5.7 Gb.

Dennis, the EIA has lost all credibility with their prediction that the Backken will be producing 2 million barrels per day in 2040. That number is absurd beyond belief. If you are going to make some prediction about Bakken future production you need to find some source of data other than the EIA.

Hi Ron,

The USGS is not the EIA. It is the United States Geological Survey (USGS).

So far the EUR has been stable (or increasing) from 2008 to 2016, perhaps it will decrease before June 2018. My model has a gradual decrease in new well EUR from June 2018 to June 2019 from 0% per year in June 2018 to 4% per year in June 2019 if the rate that new wells are added is only 61 new wells per month.

If the rate that new wells are added is higher then new well EUR will decrease more rapidly.

The rate is consistent with the USGS estimate which is also consistent with proved reserves.

My estimates are based on the data.

Dennis, the EIA gets their “proven reserves” data from the USGS. The USGS does not, to my knowledge, make predictions about the future production of oil. They leave that chore up to the EIA.

It does not make one whit of difference where the data comes from. The idea that the Bakken will be producing 2 million barrels per day in 2040 is just downright stupid, stupid beyond belief. And whether that very stupid prediction is based on the USGS estimate of Bakken reserves or the EIA’s estimate of future Bakken production makes not one whit of difference.

Question: Do you believe that the Bakken will be producing 2 million barrels per day in 2040.

Hi Ron,

No I don’t think the EIA’s output estimates are very good.

Short answer is 125 well model would have 250 kb/d in 2040.

I use the USGS TRR estimate (10 Gb at least) as well as the past well profiles to model future output. My EUR for the average Bakken well is about 320 kb over a 22 year life and the rate of decrease in new well EUR depends on the rate that new wells are drilled. If we assume 40,000 total wells are drilled, a 5% annual EUR decrease with 125 new wells per month added results in a 10 Gb URR, but profitability issues would result in only 33,000 wells and a URR of 9.2 Gb. Output in June 2040 would be about 200 kb/d and the secondary peak would be 1090 kb/d in 2020.

Well I must say 200,000 bpd sounds a lot closer to what the Bakken will be producing in 2040 than does the 2,000,000 that the EIA is predicting.

But we will just have to wait and see. After all I will only be 102 in 2040. No problem, I’ll make it. 😉

Hi Ron,

I hope so. 🙂 Of course my prediction will be wrong, but I think it will be closer to reality than the EIAs prediction a more realistic guess would be 200 kb/d+/-200 kb/d (0 to 400 kb/d for ND Bakken/Three Forks output in 2040).

“This assumes about a 4% annual decrease in new well EUR from June 2019”

I agree with Ron, 2019 is not realistic. I think 2012 or maybe even earlier. No later than 2013 at least. Later production profiles may look similar now, but they have higher GOR and water cut and also higher decline rates.