A post by Ovi at peakoilbarrel

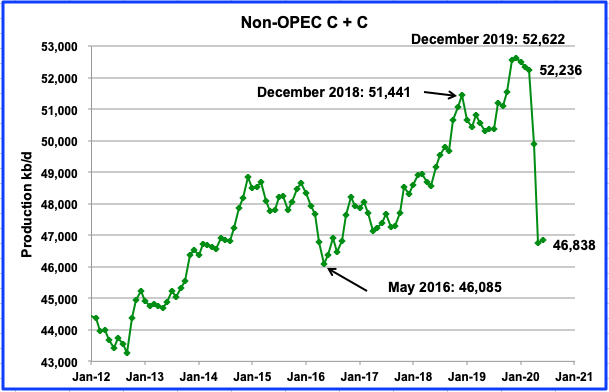

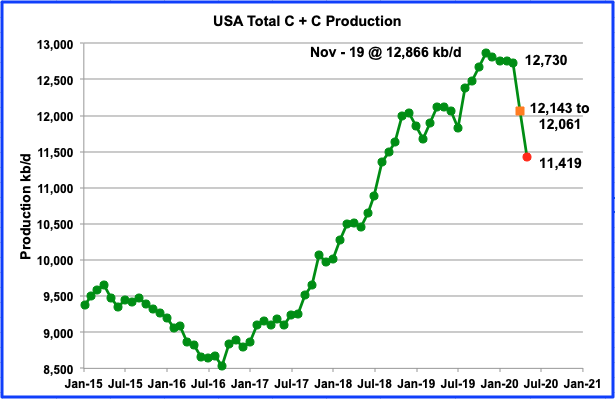

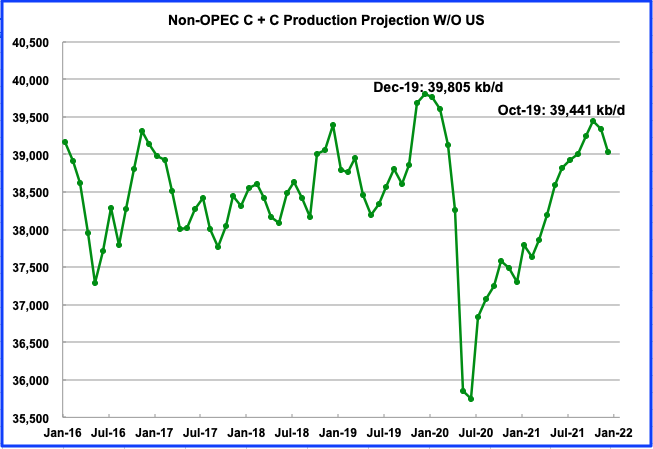

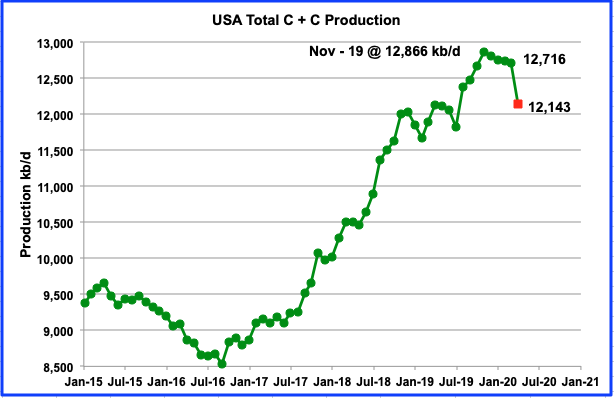

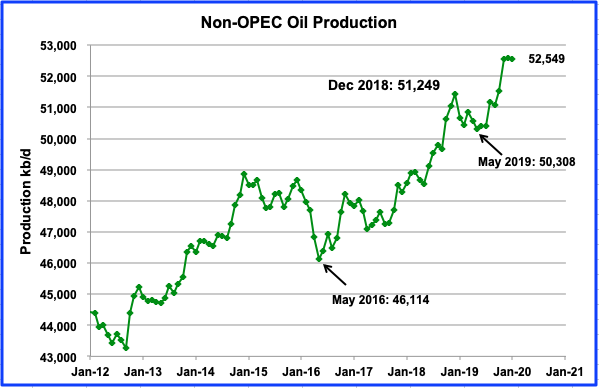

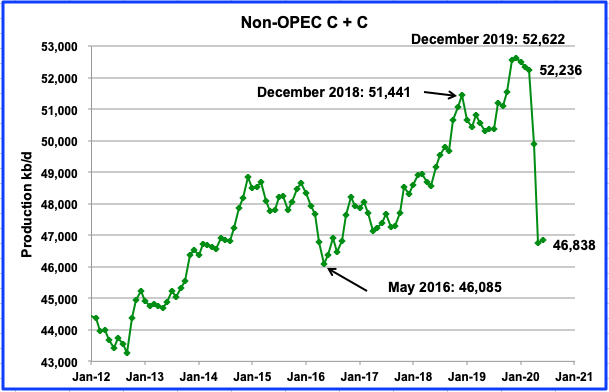

Below are a number of oil (C + C ) production charts for Non-OPEC countries created from data provided by the EIA’s International Energy Statistics and updated to March 2020. Information from other sources such as the OPEC and country specific sites is used to provide a short term outlook for future output and direction.

Near the end, there is a section comparing World oil production with World oil production W/O the US. Interestingly, World oil W/O the US peaked two years before World oil production. The last section provides a short summary of The Shift Report, where it shows the increasing difficulty oil producing countries will have in offsetting decline in old oil fields and the difficulty in getting back to pre-pandemic supply levels.

It would be appreciated if we could have some further comments on these two sections before the Covid comments start. Does the fact that world oil production W/O the US peaked two years before World oil production make it more likely that November 2018 will continue to be the date for Peak Oil? Are there any weaknesses or missing or newer information that could shift the Shift Report time frame for meeting world demand post 2025?