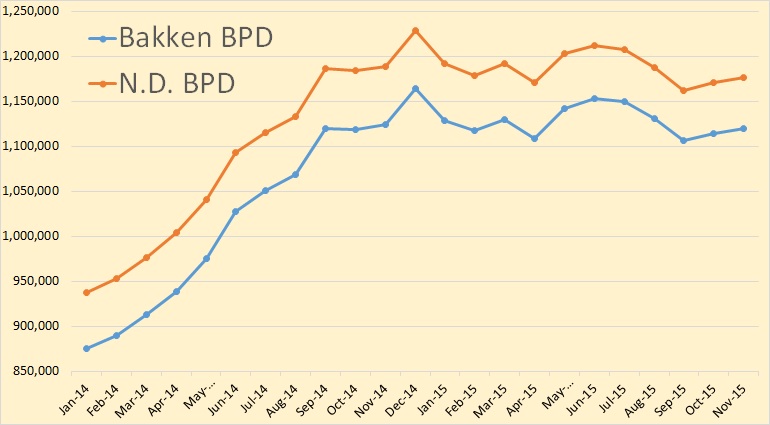

The Bakken and All North Dakota oil production data is out.

Bakken production was up by 5,166 barrels per day to 1,119,380 bpd While all North Dakt0a was up 5,195 bpd to 1,176,314 bpd.

North Dakota production has been basically flat for 14 months. Both North Dakota and Bakken production is still below their September 2014 levels.

From the Director’s cut

Producing Wells

October 13,190 (all time high)

November 13,077

10,655 wells or 81% are now unconventional Bakken – Three forks wells 2,422 wells or 19% produce from legacy conventional pools.

ND Sweet Crude Price

October $34.37/barrel

November $32.16/barrel

December $27.57/barrel

Today’s $20.00/barrel (lowest since March 2002)

(all-time high was $136.29 7/3/2008)

Rig Count

October 65

November 64

December 64

Today’s rig count is 49 (lowest since August 2009 when it was 45)(all-time high was 218 on 5/29/2012)

The statewide rig count is down 78% from the high and in the five most active counties rig count is down as follows:

Divide -77% (high was 3/2013)

Dunn -74% (high was 6/2012)

McKenzie -72% (high was 1/2014)

Mountrail -88% (high was 6/2011)

Williams -88% (high was 10/2014)

Comments: The drilling rig count decreased 1 from October to November, held steady from November to December, and decreased 15 so far this month. Operators are now committed to run fewer rigs as oil prices continue to fall. The number of well completions fell sharply from 43(final) in October to 26(preliminary) in November. Oil price weakness is now anticipated to last through this year and is the main reason for the continued slow-down. There were no significant precipitation events, 5 days with wind speeds in excess of 35 mph (too high for completion work), and no days with temperatures below -10F.

Over 97% of drilling now targets the Bakken and Three Forks formations.

At the end of November there were an estimated 969 wells waiting on completion services, only 6 less than at the end of October.

Crude oil take away capacity depends on rail deliveries to coastal refineries to remain adequate.

The drop in oil price associated with anticipation of lifting sanctions on Iran and a weaker economy in China is leading to further cuts in the drilling rig count. Utilization rate for rigs capable of 20,000+ feet is about 35% and for shallow well rigs (7,000 feet or less) about 20%.

Drilling permit activity declined October through November then fell further in December as operators continued to position themselves for low 2016 price scenarios. Operators have a significant permit inventory should a return to the drilling price point occur in the next 12 months.

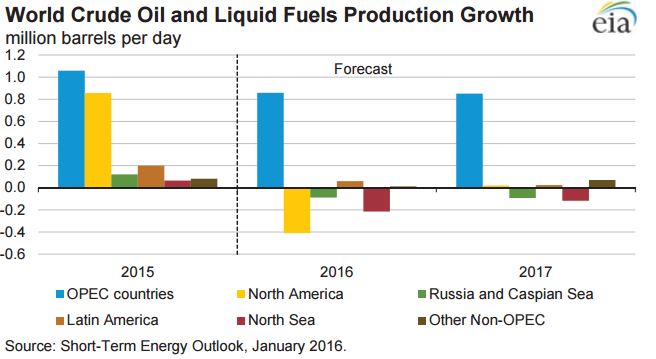

The EIA’s Short Term Energy Outlook came out a few days ago. They are expecting production growth to continue in 2016 and 2017. But all the growth plus some, they say, must come from OPEC. Non-OPEC production will be down so the “Call on OPEC” must make up the difference between supply and demand.

In other words they are saying “OPEC will save us from peak oil”.

They are expecting OPEC to continue to increase production while North America takes the largest drop followed by the North Sea then by Russia and the Caspian Sea area. The Caspian area is basically Azerbaijan and Kazakhstan.

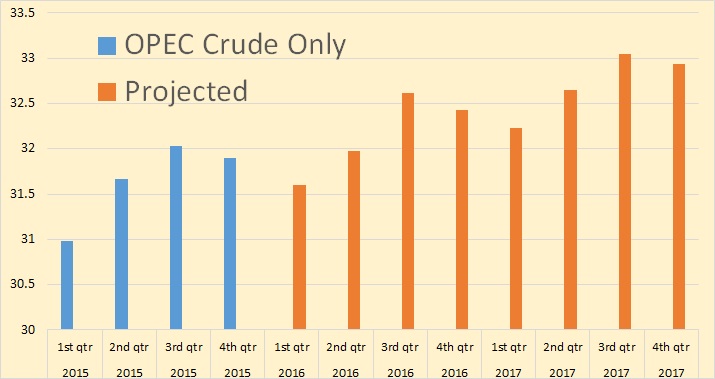

This is their quarterly expectations of OPEC. Down in the first quarter of 2016 but above the fourth quarter of 2015 for every quarter thereafter.

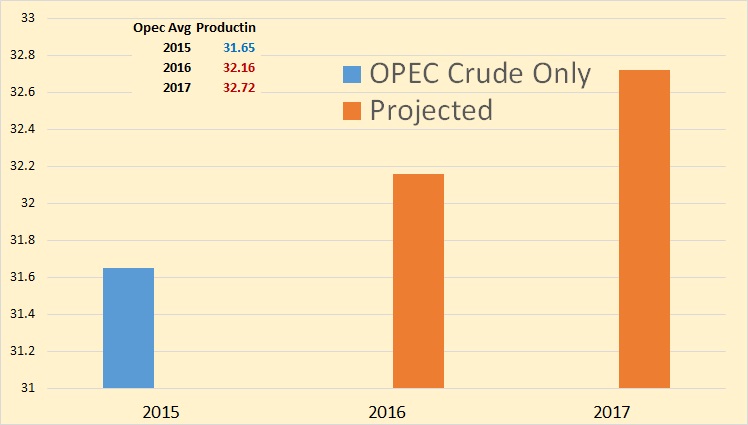

This annual chart fives a somewhat better look at what the EIA expects OPEC to do in the next two years.

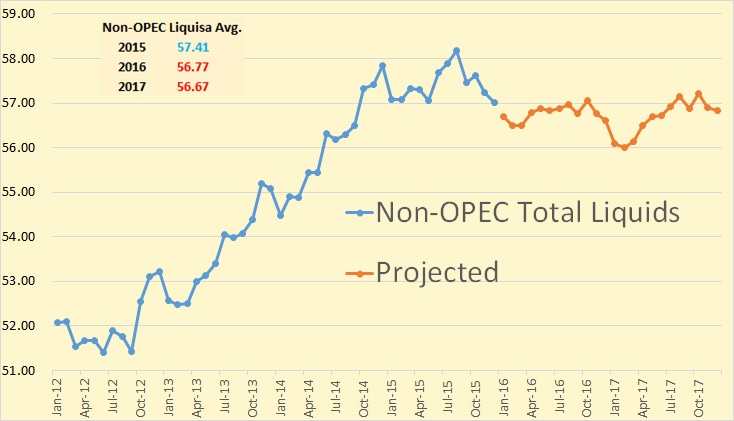

Here is what the EIA expects Non-OPEC total liquids to do in the next two years. They are expecting the Average Non-OPEC production to be down 640,000 barrels per day in 2016 and down another 100,000 bpd in 2017.

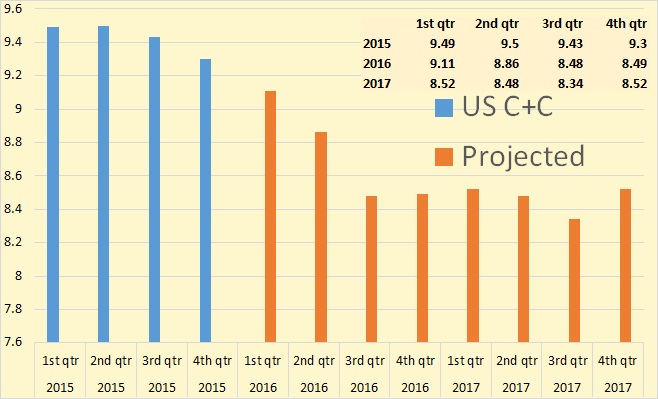

The EIA STEO gives us their Quarterly C+C numbers for the US, but not other countries. The EIA says US Crude + Condensate averaged 9.43 million bpd in 2015, and will average 8.73 million bpd in 2016 and 8.46 million bpd in 2017.

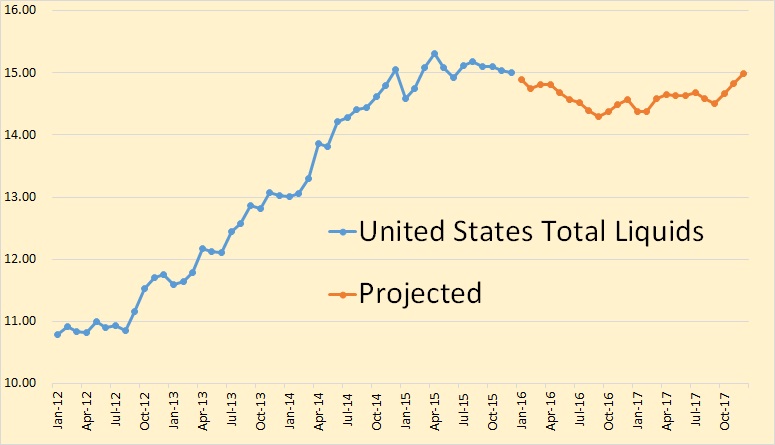

The EIA is expecting US total liquids to do a bit better than C+C. They have total liquids averaging 15.02 million bpd in 2015, 14.6 million bpd in 2016 and 14.63 million bpd in 2017. That has C+C dropping 700,000 bpd in 2016 and another 270,000 bpd in 2017. But they have total liquids dropping only 420,000 bpd in 2016 and increasing by 30,000 bpd in 2017.

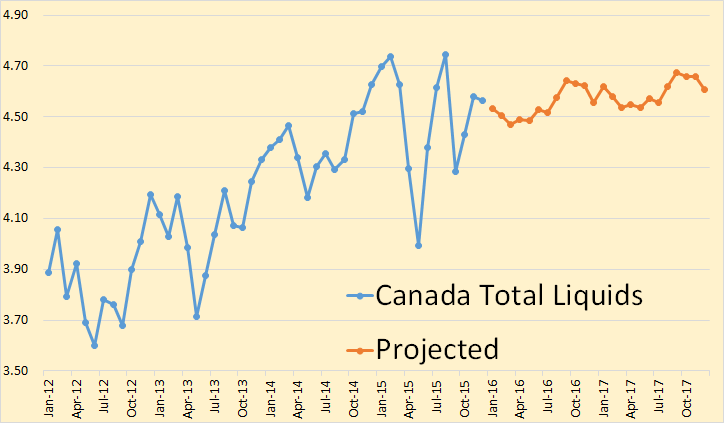

The EIA has Canada basically flat for the next two years. They have Canadian total liquids averaging 4.5 million bpd in 2015, 4.55 million bpd in 2016 and 4.6 million bpd in 2017.

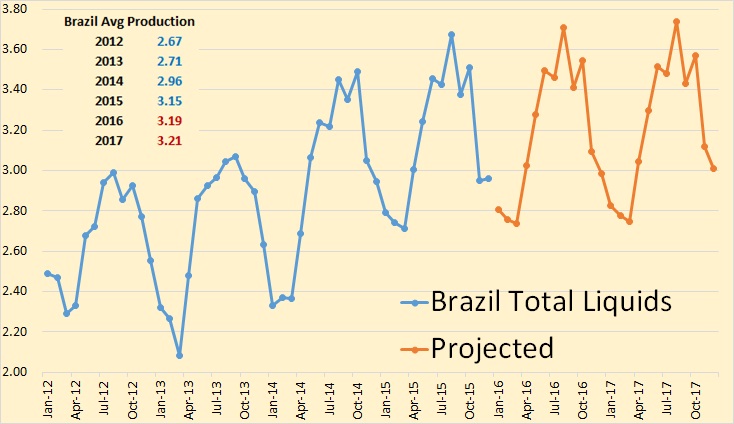

The oscillations you see in Brazil’s total liquids production is caused by their seasonal ethanol production. But basically they have Brazil almost flat but slightly up for the next two years.

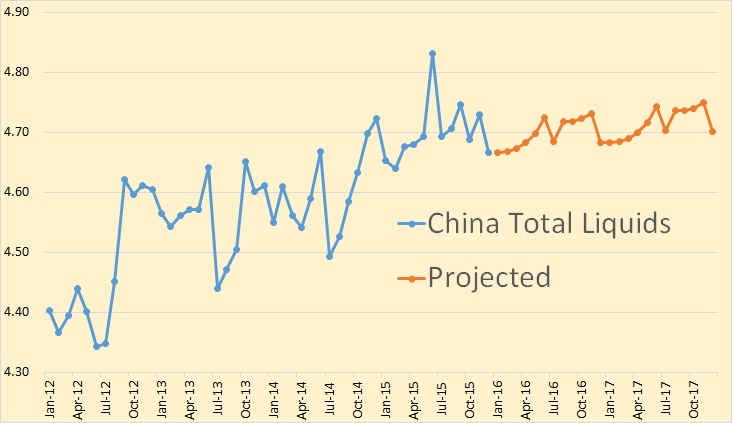

They have China total liquids almost flat for the next two years. They have them averaging 4.7 million bpd in 2015, 4.7 million bpd in 2016 and 4.72 million bpd in 2017.

And last but not least we have Russia. The EIA has Russian total liquids dropping by 100,000 bpd in 2016 and another 110,000 bpd in 2017.

Looking at these numbers it becomes obvious that the EIA is just making a wild guess at future oil production for everyone in the world except the USA. And their guess for the USA is only a slightly better educated guess than elsewhere.

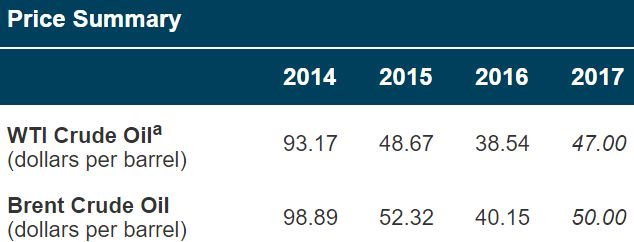

And here is what the EIA expects the price to do in the next two years.

So 113 less well. 26 new completions and production up????

This is why God gave us chokes.

You reservoir is normally not too happy though – does the same apply for shale? Seems to be very desperate approach and will hurt in the medium run

Choked ’em at $100 barrel and unchoke at $30 a barrel. Brilliant business plan.

“Looking at these numbers it becomes obvious that the EIA is just making a wild guess at future oil production for everyone in the world except the USA. And their guess for the USA is only a slightly better educated guess than elsewhere.”

Pretty much.

Yeah. Wow. I could make better wild guesses just by looking at Hubbert production curves.

If your job is to project that demand is going to continue growing and supply is going to continue meeting demand, then the “call on OPEC” is the reasonable way to proceed. After all OPEC are the ones doing their best to increase their production, growing or keeping their number of rigs and with Iran ready to start selling this month all the oil it has in tankers and increasing production.

Compared to OPEC all the rest look bleak. Nobody seems to be able to increase production significantly.

The real issue is that EIA is probably being too optimistic in judging OPEC increase and underestimating some of the rest of producers decline.

The decisive factor on oil price is the economy, whether it starts recovering from current weakness as some factors indicate or it goes down in recession as others suggest.

Javier: “If your job is to project that demand is going to continue growing and supply is going to continue meeting demand, then the “call on OPEC” is the reasonable way to proceed.”

For once, I think this is fair enough. Iran is being allowed back into the market and has the capacity to increase production. It is conceivable that Iraq will succeed in reconstructing enough of its oil industry to increase production as well. These will be sufficient to overcome depletion from existing fields – and then some.

What we need to realise is that “above ground issues” have been putting limits on production in several countries. The potential resolution of these issues does not invalidate the Peak Oil thesis.

What I’m hanging out for is to see Ghawar fail. When that happens, everyone in the market will start treating Peak Oil as a fact.

I am with Ron on this. I am of the opinion that US tight oil is going to show such reduction in 2016, that almost every producer is going to show some decline, and that Middle East OPEC is not going to be able to increase its production enough to compensate, as 2015 being the Peak Oil.

It is very possible that prices will recover, but before production recovers to a level of production above 2015 we will have a global recession sending prices, demand and production to a lower level again.

Sorry for geologists, but Peak Oil is going to be an economical event. And it is going to be misunderstood. People will be lead to believe that we still have plenty of oil, it is just that we don’t need that much anymore for a variety of reasons. Peakoilers are never going to get any recognition, and markets do not need to show any panic about it. Only the smart money will see the painting on the wall.

The stock market in the United States is in a tailspin, and the analysists at CBS news are pointing the finger at low oil prices.

Aren’t low oil prices supposed to be a boon for the aggregate economy?

You can never trust the post-hoc explanations that analysts give about what the stock market is doing.

What Javier said. Every time the market randomly fluctuates (probably due to program trading or what the traders ate that morning), analysts give a “reason” for it, but they’re incredibly post-hoc and nearly always wrong.

Sorry for geologists, but Peak Oil is going to be an economical event.

Peak oil will be, or was, an economical and a geological event. Or better yet, it will be an economical, geological and a technological event. There will always be far more oil left in the ground than can ever be recovered, given the technology and resources available to recover it.

Hi Ron,

I agree completely.

Javier: “I am of the opinion that US tight oil is going to show such reduction in 2016, that almost every producer is going to show some decline, and that Middle East OPEC is not going to be able to increase its production enough to compensate”

Agree on the first two statements, disagree on the third. Iran can increase and so probably can Iraq. The increase will be enough to compensate for reductions elsewhere. But then they will have hit the roof and have nowhere to go but down.

We will probably be able to tell in about 6 months whether the 2015 peak in oil production is developing as “The Peak Oil” or not. By then we will see how much the Middle East is increasing with respect to the US decline.

Hi Javier,

There will be a recession in 2016? Interesting. I think 2030 is more likely.

Can you tell us how serious this recession will be? More or less severe than the GFC of 2008/2009?

I didn’t say there will be a recession in 2016. I said there could be a recession in 2016. Citigroup thinks it has a 65% chance based on historic data. I think it has a higher chance.

What is your 2030 prediction based on? 22 years without a major recession speaks of a very different economy to what we have, and of strong growth that we lack.

Hi Javier,

For the World as a whole, the only year that real economic growth was not positive was 2009, over the period from 1960 to 2014, so that is one year out of every 54.

If we look at World Real GDP per capita, there were 4 recessions, 2 from oil shocks (1974-5 and 1982) and 1991 and 2009, that is 4 recessions (not the usual way of defining them though) in 55 years or one every 13.7 years.

If we take the average of these two methods of identifying recessions we would have one recession every 35 years.

If we have another recession between 2030 and 2040 (a single year would be very difficult to get right), that would be 26 years after the last global recession. Time will tell if my guess is correct, but peak fossil fuels is likely to lead to slower economic growth and I expect that peak will be around 2030 (for combined energy production from coal, oil, and natural gas).

You’re extrapolating from the wrong period. The twentieth century is an economic anomaly for several reasons including the wealth distribution (much more equitable than usual, see Piketty) and government policy (much more Keynesian than usual, probably because of the wealth distribution).

Anti-Keynesian government policies which benefit the relative position of a small elite — the norm from the Industrial Revolution until 1945 — give you a *much much higher rate of recessions*. Look at the 19th century data.

“The twentieth century is an economic anomaly for several reasons including the wealth distribution (much more equitable than usual, see Piketty)”

Apparently that started to change in 21st century:

Richest 1% will own more than all the rest by 2016

The combined wealth of the richest 1 percent will overtake that of the other 99 percent of people next year unless the current trend of rising inequality is checked, Oxfam warned today ahead of the annual World Economic Forum meeting in Davos.

The international agency, whose executive director Winnie Byanyima will co-chair the Davos event, warned that the explosion in inequality is holding back the fight against global poverty at a time when 1 in 9 people do not have enough to eat and more than a billion people still live on less than $1.25-a-day.

Extreme inequality isn’t just a moral wrong. We know that it hampers economic growth and it threatens the private sector’s bottom line.

Winnie Byanyima

Executive Director, Oxfam International

https://www.oxfam.org/en/pressroom/pressreleases/2015-01-19/richest-1-will-own-more-all-rest-2016

I hereby forecast the average oil price in 2016 will be about $65 per barrel.

Everyday that it spends below $30 means a day that it has to spend significantly above $65 to give that average. In my humble opinion on a matter on which I am far from expertise, you are incorrect, Fernando. The economy cannot resist high oil prices right now, and I doubt the economy will improve that much in the coming months. If the global economy avoids a recession and improves, we might get an average between $40-$50. If not, it will be below $35. We will be swimming in oil that nobody can sell at the same time as production craters. A nightmarish scenario.

I do not think that oil price can reach $65 this year, not to say to average $65.

But not because “The economy cannot resist high oil prices right now”.

What is particularly wrong with the global economy, that it cannot afford $65?

Do we have a worldwide recession?

China’s economy is slowing not because of high oil prices, but because of long-term structural issues. Meanwhile, China’s oil demand continues to grow.

Empirical evidence suggests that the “oil burden” (total amount of oil consumption X price of oil) becomes unaffordable for the global economy, when it reaches 5% of global GDP. At $65 it would be only between 2 and 2.5%.

The key reason for the current glut in the oil market is excess supply, not the weakness of the global economy.

Hi AlexS,

I agree $65/b average price seems too high, my guess would be $50/b for an average oil price, but $65/b by Dec 31 2015 seems possible, though I might guess $60/b for an average monthly price in Dec 2016.

Both Fernando and you know more about the industry than me, so both your guesses would be better.

Could you give us your guess for the average in 2016, it seems to be more than $30/b and less than $65/b based on previous comments, maybe $42.5/b ?

AlexS,

What is wrong with the global economy is that it is at the brink of global recession. The global economy was being sustained by strong debt-based growth in Chindia creating huge malinvestment there, manifested in ghost town projects. Whether China stabilizes or not, it is no longer capable of sustaining previous strong growth because of high indebtment and flow of capitals outside the country. OECD is in the midst of a deflationary situation with the economies temporarily stabilized by the collapse of oil prices, while all commodity exporting countries from the developing world are entering recession.

We were going directly towards a new global recession, when oil prices collapsed delaying it. But low oil prices are not a cure, they alleviate some symptoms while creating other serious problems.

I agree with Petro below that if oil price goes above $65 in the current situation, that would directly trigger a global recession. Since a global recession is the biggest fear to the economical powers of the world, oil prices are not going to be allowed to recover unless the global economy recovers.

I suppose it makes sense now why sanctions on Iran have been lifted at a time when the world does not need more oil, and when such a decision, pushed by the US and EU, was clearly going to worsen the situation of the US oil industry.

Oil prices have to remain depressed for the foreseeable future until a time when the economy improves enough to withstand higher oil prices. That time might not come. Alternatively oil prices could rise if the economic powers lose control of the situation. We definitely don’t want that to happen.

Most people don’t realize that most of the world is immersed in a deflationary crisis. A consumer crisis if you will. Due to long term unavoidable tendencies, population growth, robotics, globalization, there has been an excess supply of labor in the world. As a consequence labor has been cheated of their part of the increased wealth, and capital has retained the lion’s share of it, giving rise to growing inequality. To compensate for their stagnated purchasing power, labor increased its debt load to saturation in many parts of the world. Japan was the first to enter the deflationary hole. Despite being a remarkable country with a lot of things in their favor, they have been unable to get out. Now most of OECD is joining and will drag the world’s economy to the hole. This crisis has no solution, and Peak Oil will make sure our civilization never recovers.

There are plenty of solutions to the general deflationary economic crisis. Keynes described most of them. Most of these solutions are referred to as “socialism” in a derogatory fashion (whether they are actually socialist or not) so the capitalists running this country (and most other countries) refuse to implement them. Even the countries run by self-described socialists usually refuse to implement them… for whatever reason.

I’ll list off the solutions, in my personal order of preference:

(1) Large taxes on the billionaires, permanent direct cash transfers to the poor & middle class (a “guaranteed basic income” such as Milton Friedman supported)

(2) Cancellation of debt held by the poor and middle class, “sucks to be you” for the bondholder

(3) Printing lots of money and giving it directly to the poor and middle class

(4) Printing lots of money and spending it on building infrastruture, paying it to the poor and middle class for work

(5) Taxing the billionaires and spending that on building infrastruture, paying it to the poor and middle class for work.

The problem is essentially a political problem. Marx predicted that it could not be solved, because the billionaires would never agree to any of it, and that the result would be bloody warfare. The Tsar seemed to prove Marx right. But Clement Atlee and FDR proved that Marx was wrong. Then Margaret Thatcher and Ronald Reagan attempted to prove that Marx was right and that Atlee & FDR were aberrations.

I’m not sure who’s right about that but I’ll fight for the FDR/Atlee solution.

Robin: “Holy sharkfins, Batman!”

Batman: “That’s correct, Robin!”

Hi Fernando,

Are you serious or just poking fun at me? Even I think and average price for 2016 of $65/b is too high (the eternal optimist). I can see maybe $65/b by August 2016 (for the monthly average), but an average for 2016 of 55 to 60/b seems more reasonable, in my opinion. Though even that seems a little high, probably $50/b for 2016 would be my guess for the average 2016 oil price (WTI).

Denis, i have an equation i use to estimate forward price. When I plug in the data it says the average price one should use to evaluate well económics is $65-70 per barrel. I guess I should have explained where it came from. It’s just the number for a price deck one uses to run budgets, do económics, things like that.

Hi Fernando,

Thanks. So that is what the price should be in a rational world.

Hi Javier,

I agree the oil price will be determined in part by oil demand which depends mostly on the World economy. It is also determined by the supply of oil which depends on how profitable it is to produce oil at the prevailing oil price. Oil prices are determined by both supply and demand, each is equally decisive. Which blade of the scissors cuts the paper? The answer is both blades, just as both supply and demand determines the price.

Rising U.S. oil production is not surprising at all. Furthermore, I would contend that as the price of West Texas moves towards $20 and the Rig Counts fall by another 100 rigs, total U.S. oil production should increase towards 10 million barrels per day.

Thus, this is a huge victory for both ” Well Efficiency” and “Cost Cutting of Shale Oil production.” I would imagine as the price of oil moves even lower towards $10, continued increases in efficiency should be good for another 1 mbd addition of U.S. domestic oil production.

Which means, Peak Oil will become a complete farces as the price moves in the single digits and total U.S. production heads over 12 mbd.

Professor MudFlap

Prof – Your sarcasm is so thick we might have to mix it with Benzene to get it to flow.

Jef,

While I appreciate the witty comment… I want you to know I spend a lot of time looking over the charts. I take this analysis seriously.

That being said… I am very bullish on Chesapeake. I hear they have new Alien technology that can produce NatGas for free. I am taking all my kids college money and riding all on CHK’ s glorious return.

Prof. MudFlap

That’s nuthin!. NorthDakota sour was fetching -50c a barrel on Friday according to Flint Hills domestic price Bulletin. What they loose per barrel they will make up for in volume, thanks to new tech!:

https://www.fhr.com/refining/domestic.aspx

Hi Professor,

What we really need is for the price of oil to fall to zero because then we would have an infinite amount of oil. Yeah, we should just set the oil price to zero, that’s the ticket. 🙂

For the sarcastically impaired, the above was not meant to be taken seriously.

Mudflap,

Do u really think usa production will get to 12 mbd with oil prices dropping to 10 dollars.

This contradicts everything I have learned about the economics of oil production.

Are u serious?

Just when I thought I was starting to understand.

Where is Rockman, Mike or ShallowSand to comment? For the benefit of an honest bloke that just wants to learn…lol!

Lol! I missed the alien comment!

The EIA outlook for electricity generation is kinda interesting:

A decline in power generation from fossil fuels in the forecast period is offset by an increase from renewable sources. The share of generation from natural gas falls from 33% in 2015 to 31% in 2017, and coal falls from 34% to 33%. For renewables, the forecast share of total generation supplied by hydropower rises from 6% in 2015 to 7% in 2017, and the forecast share for other renewables increases from 7% in 2015 to 9% in 2017.

So in summary, they expect NG prices to rise relative to coal, more rain in 2016 and 2017 (more hydropower) and modest, continued growth in wind, solar and biomass.

The Baker Hughes Rig Count is out. US rigs down 14 but oil rigs down only 1, gas rigs down 13. Permian down 7, Williston down 2.

The Baker Hughes Rig count I believe misrepresents the rigs that were dropped. The vast majority of the rigs operating in the Permian, Eagle Ford, Colorado DJ Niobrara and Williston are drilling for oil not gas. This would be a total of 15 oil rigs layed down last week, not 1.

In addition, the rig count in ND should be at or below 15 by the end of March of this year. This is based upon rigs still drilling, but current contracts will not be extended.

“63 of the 89 analyzed NNRs (Non-renewable Natural Resources – essential to growing/maintaining industrial societies) were scarce globally in 2008.” “All indications are that we will attempt to reestablish and maintain or exceed pre-recession economic output (GDP) levels and growth rates, both domestically (US) and globally. We will soon discover, however, that ever-increasing NNR scarcity has rendered these goals physically impossible, and that the implications and consequences for human societal wellbeing associated with this reality are catastrophic.” Source – Scarcity, Humanity’s Final Chapter? Christopher Clugston

It is quite reasonable to assume a hard human population crash is baked in.

But with a MUCH reduced population, and the harsh task master of necessity constantly and forcibly inserting a steel toed boot into the REMAINDER of humanity’s backside, it is also reasonable to assume that some people in some places can at least POTENTIALLY adapt to shortages of non renewable resources WITHOUT giving up all or most of the truly good parts of modern life.

Sometimes we can recycle, sometimes we can substitute, and sometimes we can simply do without.

Just ONE invention- the PILL- along with other related technologies – has the potential to EVENTUALLY reduce demand for most resources by an order of magnitude. Nobody actually knows, but women with a modest education and access to birth control appear to be not only satisfied but even DETERMINED to have less than two kids on average.

The mouth pieces of the fossil fuel camp will continue to insist otherwise, but renewable energy CAN potentially at least support a new generation ” business as usual”. Call it bau lite or greenwashed bau, if you are being sarcastic, but it can at least POTENTIALLY come to pass.

Call it a religion if you please.

Now here is a truth about religions that is at the same time pie simple and yet over the heads of people who do not understand religion.

“Prayer changes people. People change things.”

If faith in technology and human enterprise together comprise a religion, that is ok, because people who believe are motivated and encouraged to ACT.

ACTIONS lead to change.

Is success assured? Absolutely NOT.

But a failure to act GUARANTEES failure.

http://blogs.scientificamerican.com/plugged-in/texas-sets-new-all-time-wind-energy-record/

Those of us who believe renewables can never shoulder the load ought to read it and THINK a little.

Nobody who is HONEST ,and knowledgeable, in advocating renewables says that going renewable means we can continue to live the way we do today.

But that does not mean that some of us cannot eventually live quite well while also living sustainably.

If I were building a new house today, it would need so little energy to heat and cool it that supplying it renewably would be a cakewalk. AND it would last, barring fire or tornado, for at LEAST a couple of hundred years. The old house I live in will last a couple of hundred years, and was built in a hurry out of oak lumber and masonry, with nothing even remotely high tech used, unless you consider steel roofing, fiberglass insulation, aluminum window frames, and glass high tech.

( The steel roof needs a new coat of paint every twenty years, instead of REPLACEMENT, and the aluminum windows were switched out for double glazed vinyl some years ago. )

I will have more to say about this link, and what it PROVES, in a later comment.

Hi I have some update graphs for Bakken. First average production profile. Confidential wells are not included, so that’s why the first 5 months of data may look strange. It´s a bit hard to see the lines but it’s just for reference for my other graphs that show gas to oil ratio and water cut. The production profiles for the different years are quite similar.

Here are the gas to oil ratio profiles. You can see that it started to increase about 8-10 months ago for all years. From 2013 and later the angle is very steep.

Either I don’t understand what the vertical axis of this graph is saying or it is just wrong. It is labeled “GOR (mcf/barrel).” 6,000 cf of gas has the energy content of a barrel of oil. The high end points of lines on the graph are around 1.5 which would represent 1,500,000 cubic feet of gas. This suggests that the gas energy content is 25 times the energy content of the oil. That is extremely unlikely, in my opinion.

Hi. mcf/barrel (of oil) is correct. It is not intended to show the energy equivalent. From what I understand, GOR is defined as mcf/barrel. I could be wrong, but anyway, the intention here is to show how the ratio changes over time and from year to year.

GOR units have to be spelled out. We engineers use SCF per BSTO when we are being picky.

The units in that graph are mcf per barrel. So if it’s 1.2 mcf/bbl then we can also say it’s 1200 cubic feet per barrel. Or 1.2 mmbtu (more or less). A barrel of oil has anywhere between say 4.8 to 6.5 mmbtu. I’m a bit tired, but I think I got it right.

The fact that 1000 cubic feet of natural gas is nearly a million BTU means that somewhat confusing terms can be used for the same commodity (1000 cf = 1 mmbtu).

1200 cubic feet per barrel would be a very reasonable 20% of the energy content of the oil.

If the m represents 1,000 in the oil patch what does it stand for? The metric system typically uses k for 1000 (kilo) and m for a million (mega)?

Don, m and mm is Roman. About 6000 cf has the energy equivalent of one barrel of oil. So if you divide the y-axis by 6, you will get the energy equivalent.

Thanks. It’s good to know what is happening with this notation.

In the oil patch, m is a thousand and mm is a million.

This is very interesting. It suggests that the quality of prospects are declining by year into rocks that have a more gas-prone source, perhaps. Gas molecules, being smaller, flow faster than oil molecules. The drive in these rocks is overpressuring caused by maturation. The more the pressure drops, the greater the preferential flow of gas relative to oil. Perhaps all the Bakken wells are going to die at once.

I found a very interesting paper called “BUBBLE POINT SUPPRESSION IN UNCONVENTIONAL LIQUIDS RICH

RESERVOIRS AND ITS IMPACT ON OIL PRODUCTION”

Link: http://petroleum.mines.edu/research/urep/thesis/2.Tuba%20Firincioglu%20PhD%20Dissertation%20Final.pdf

It´s more that 100 pages long and very technical, so I only looked through it quickly. But I found some really interesting information. First

“Capillary discontinuities and surface forces in confinement of the nano-pores of

liquids-rich reservoirs cause significant deviation from the conventional phase

behavior. The bubble-point pressure is suppressed in nano-scale pores and the

suppression amount is a function of the bubble radius and the interfacial tension.

Higher capillary pressure values (that is, the smaller the bubble radius) result in

higher bubble-point-pressure suppression. ”

So you can pump harder in an unconventional reservoir before it reaches the bubble point.

Now look at page 92:

“Predicting the GOR behavior of a well is very important from an operational perspective.

Most of the pumps that are used in unconventional oil fields are not capable of lifting fluids with

GOR values higher than 5000 scf/stb. So the GOR level in the well determines the lifespan of the

well. When a well’s GOR is low and steady like in Well_5, the life of the well is longer than a

well like Well_3 in which the GOR increases rapidly. Figure 6.18 compares the cumulative

production of the two wells in the model. With a GOR limit of 5000 scf/stb, Well_3 would be

abandoned due to pump limits after 4 years of production while Well_5 would continue

producing for 10 years. This would increase the cumulative production difference between the

wells even further. ”

Wow, so if you pump too hard the lifespan can decrease from 10 years to just 4 years! Looking at cumulative production in figure 6.17, it has decreased from about 2 million barrels to 1,3 million barrels. But of course if they can use better pumps, then I suppose they can get more oil out?

Perhaps figure 6.21 is closer to normal wells. In that case cumulative production is decreased from more than 2,6 million barrels to 2 million barrels.

Figure 6.20 is also interesting. Higher GOR gives a smal increase in oil production at first, but when GOR reaches around 2 (mcf/barrel) then oil production start to get lower than the reference.

Freddy

Now you are coming full circle back to the importance of pressurization/repressurizatin of these formations in unconventional development.

The blowout that Oasis experienced in the Bakken a few months back happened due to the increased pressure from a nearby, in progress frac.

As these laterals are placed closer together, as the amount of water used is increasing due to slickwater procedures, nearby wells are having elevated formation pressures which is increasing their output.

And here are the water cut profiles. It is also increasing for all years, but more slowly than the gas to oil ratio.

One problem with the above three graphs is that even in the last datapoint, the average input data is half a year old as they only contain complete data. So bellow graphs better show whats happening on a monthly basis.

First oil, gas and water production for wells that are 6 months old. As before oil production continue to stay rather flat compaired to gas and water production which are increasing. Oil plus water is a bit lower the last 3 months though.

And finally same as above but for wells that are 24 months old. Here we can see that oil production is actually leaning slightly downwards since 2010. This even though initial production for the wells in 2013 where higher than earlier years because of completion improvements.

Well, I got my answer. The posted price on Flint Hills Resources Crude Price Bulletin for 1/15/16 for ND sour crude oil is -$0.50.

Does this mean if you call them to haul a tank they will require payment up front, or will they send you a bill? LOL!!

Seriously, can someone explain this and if they have ever seen this before? Maybe in 1998-99??

I do think it very noteworthy that the OPEC basket is below $25 and that many crude oils both in North America and around the world are selling for under $20 per barrel, with some selling under $10 per barrel.

I suspect heavy crude in the Rockies, of which there is quite a bit in places like CO, WY and MT, is selling under $15.

“Seriously, can someone explain this and if they have ever seen this before? Maybe in 1998-99??”

Hey Shallow…

…oh, I CAN and indeed, I HAVE explained THIS to you…and you (et al.) have chosen (so far anyway…) NOT to listen…..

-There are many (including in this respected forum) ……oh, what one calls them….:

“Monday morning quarterback”, I guess….who are calling for $10 oil now, but… If you go back and read the comments (some in reply to you directly!!!!) on this forum 6, 8, 10….even 12-14 months ago, you will know the handful (…and I am being VERY GENEROUS by saying: “…a handful….”!!!!) of commentators who REALLY knew what they were talking about…

…perhaps you have learned and shall know better WHO to listen to next time….

perhaps…,…one can only hope…

Be well,

Petro

Petro, Errrr, you really didn’t say anything here, just… “I told you months ago.” Perhaps you did but I am skeptical unless you can post the link to those comments. One thing for sure, you explained absolutely nothing in your post above. Which leads me to doubt that you ever did answer the question Shallow is asking.

Perhaps I am wrong but it would behoove you to prove what you are saying.

I was just asking for an explanation about why a grade of crude would go negative, rather than just be zero $.

Petro, I had typed a long whiny response to you, but deleted it. Not worth it. So I’ll do a shorter one.

All I will say is I think an oil price of under $30 (or $50 for that matter) is contrived, the same as I felt the 2008 run up was contrived.

I care about a lot of people. I saw many lose their jobs as a result of the 2008 meltdown, which I believe was helped along by $120-140 oil spike. Most of them were not in oil. We helped keep one family from losing their home. To this day, they are grateful, but yet I am sure embarrassed to have had to ask. Hard working family, but both got canned the same month. They should not have had to be in that position in the USA.

I also have many friends now who are out of a job, and maybe a way of life, due to this crash. The ones who own leases currently have assets worth less than zero.

It’s is not a game, or something to be cryptic about. It is F’ ing real.

Have you had to fire a good worker due to circumstances out of your control? Answer that one with some cryptic BS.

Dear Shallow,

I misunderstood the question/comment. I apologize!

I was not being “cryptic” and or insensitive.

Unfortunately, when I realized, the comment was posted.

I know very well the pain is real.

I am connected to oil/energy in my line of work.

Again, I misunderstood and I apologize!

Be well,

Petro

Apology accepted.

Thank you, Shallow!

And thank you for not posting your “long, whiny response”.

It was indeed not worth it!

And I feel bad, for I had a detailed, technical answer to/for your question…but we are beyond it now, I guess…

Be well,

Petro

I don’t have any problem with reading an answer to my question as to why a price for a grade of crude would go negative, instead of zero.

Find my answer below OFM comment…

Be well,

Petro

Ron,

you are correct!

My bad.

Be well,

Petro

Ron,

my reply to Dennis’ comment below did not show up yet.

I was wondering if you can help.

It was comment-555927 , I think.

Thank you.

Be well,

Petro

Ron,

Thank you for helping with my “in limbo” comment/reply to Dennis!

Be well,

Petro

Hi Petro,

Can you remind us what you were predicting 12 months ago?

My expectation was totally wrong, I thought US output would decline quite rapidly and it did not, keep in mind, most of us focus on WTI or Brent, many other grades of oil have always traded at a discount because they are more difficult to refine.

So let’s focus on WTI, what were you saying exactly 12 months ago for prices in Jan 2016 (or the end of 2015). Did you say the oil price would be $30/b?

That is excellent, can you give us your prediction for Jan 2017? Maybe you will be lucky two times.

You should be a very wealthy man with such good foresight. 🙂

Hi Petro,

As far as I can tell you have not said anything about oil prices, as Ron said your comments are cryptic, not clear what you are saying.

Dennis,

my reply (comment-555927 i think it was) did not show up…yet…

I am going to ask Ron about it and see if he can help.

Be well,

Petro

Ah, these pesky computers, dear Dennis….

they have the naughty habit of “remembering” things…..(that is why NSAlikes to “pick” inside them!)

-So let’s see if the computers remember…

too many comments of mine on the topic, but let us start with your favorite timing, shall we:

” So let’s focus on WTI, what were you saying exactly 12 months ago for prices in Jan 2016 (or the end of 2015). Did you say the oil price would be $30/b?” ~Dennis Coyne

Well, as a matter of act I did:

http://peakoilbarrel.com/opec-crude-oil-production/#comment-485300

I suggest you scroll down to the part of the comment where I write …

“Prices are headed in the direction of 1999 again…..”

This baffled nNgass, who in response to my comment, wrote:

http://peakoilbarrel.com/opec-crude-oil-production/#comment-485461

nNgass wrote that, for my comment was indeed bizarre to him back then (January, 2015);

I was the only one on the site saying that.

You and others were busy “narrating” about the demand/supply bs and when the drop in the rig count would take prices at $100 again….and the SAD part dear Dennis, is that you are still doing that ….but this time is January 2016…

-What nNgass (and obviously you) did not know is that I had a few other comennts like that dating back in July and August of 2014 (imagine that ….right when this whole thing started and oil was at >$100/brl)

As a matter of fact -and let us see if the computer “remembers” again -I was schooling/lecturing you (and that is the correct wording, no arrogance there. You shall understand when you read the comments how truly uninitiated were you on the topic of deflation and what that meant to/for commodities – specifically oil!)….as it turns out, clearly fruitlessly:

http://peakoilbarrel.com/debt-oil-price-bakken-red-queen/#comment-418791

http://peakoilbarrel.com/debt-oil-price-bakken-red-queen/#comment-419619

…and then more recently there’s this:

http://peakoilbarrel.com/peak-oil-open-thread/#comment-545553

…and then this:

http://peakoilbarrel.com/international-rig-counts-2/#comment-555175

I have plenty more, but I think I was simple enough for you to understand my point….

You wrote:

“You should be a very wealthy man with such good foresight”.

-I worked in energy investment banking with the best in the business Dennis and was rewarded very handsomely for it (still am…).

…oh, and dear Dennis – IT IS NOT LUCK!

Be well,

Petro

Hi Petro,

Well I hope you continue to predict markets correctly. It is possible that oil could hit $10/b some day. Probably in 2060 or later when the economy has moved to other energy sources and oil has gone the way of the buggy whip,

You think you understand economics better than everyone, my guess is you are mistaken.

-Wow…quite a tone/tune change from your previous comment, ain’t it!

Those darn facts are indeed mean, stubborn sons of Bs, aren’t they?!?!

“You think you understand economics better than everyone, my guess is you are mistaken.” ~ Dennis Coyne

Boy, you have no idea how dearly I do agree with you there, and how MUCH I hope you are right….for the sake of all of us and our children!!!

Be well,

Petro

P.S.:

let us not question each others morality, integrity and intentions from now on, shall we Dennis?

Not a good idea!

Let’s debate in a healthy way and question our knowledge and input, but not our intentions and morality. This way we ALL learn from eachother.

Hi Petro,

I just couldn’t find your oil price predictions, which were that we were headed to 1999 oil prices (at some time in the future), you did not say when this would occur, so not much of a prediction really.

Anyway I am not paid handsomely for market predictions (and a good thing because I am not correct on oil prices often).

I could make a very nebulous prediction that oil prices are headed to $100/b. No doubt at some point in the future I could claim to have made a correct prediction. 🙂

Yep!

Right on brother, you got me there!

G’nite and be well Dennis.

Petro

Hi Petro,

I couldn’t find your comments, giving oil prices.

In 1999 the average oil price in 2014$ was about $25/b, and although we are not there, we have certainly headed in that direction and your guess was certainly better than mine.

Note that at the time you did not say when this would occur (the future covers a lot of ground).

So can you tell us what your expectation for the oil price (WTI) in Dec 2016 is (monthly average)? A range would be fine, say $20-30/b or whatever range you are comfortable with.

Petro.

I hope you realize this all is not just some game. I really don’t know what you are driving at. I don’t really care if you are insulting me, I cannot tell. But you seem to be trying to tell others besides me something. I think you are telling “us” that we are idiots and mocking us?

Try telling that to all the people who have been fired in the industry in the last 12-15 months.

Try telling that to my friends who have shut down their wells and are looking for any job. Guys who have been their own bosses for 20+ years, who survived 1998-99 but cannot keep things going now. They work every day of the year, and much of what they own is currently worth less than zero.

Try telling that to all the retired people who own royalties, who are seeing a part of their meager income shrink or disappear altogether.

Try telling that to the kids in college who are in petroleum engineering, who went from looking forward to high paying jobs to no job and having to change majors/go to school longer/incur more student debt.

Maybe oil is finished, will be below $30 forever, or whatever you are driving at.

All I know if there seems to be more and more economic suffering going on in this country. Boom and bust is not good for the vast majority of this country.

Most people would like to have job stability, a decent house, be able to provide for their families. My grandfathers both had 8th grade educations. But they worked hard. They had that stuff, house, food, able to provide for kids, etc. They worked the same stable jobs their whole lives. My father and uncles have done the same. You may think constant jov upheaval is a good thing. I do not. It hurts our country.

I know this post is whiny, but I don’t care. I care about people. There is a lot of lack of respect for people these days. Making fun of misery. I’m sick of it.

I have kids. They are smart, don’t get in trouble, respect others and themselves. I worry about them every day.

Dear Shallow,

if this is your “long, whiny answer”, (probably “got stuck” akin to my reply for Dennis and is showing after my apology above) – I still accept it and apologize.

I do, indeed!

Let’s get past this…

Thank you for understanding.

Be well,

Petro

I thought I has deleted that. Oh well I am over it. Hope I was not too whiny.

Since you know a lot about where oil prices are headed, any chance you can give us some insight from here?

Dear Shallow,

I will have an answer for your original question…

…after my first answer to it (mistakenly, as we established already!), I owe you one!!!!!!

One thing, though…:

if you would like to know where we are (very likely) headed, do your self a favor and “drop” your emotions with regard to the topic….

Although truly and utterly justified on a human/social level, they “cloud” your view…scientifically speaking.

M. Simmons taught me that……….

Be well,

Petro

No problem. We know pretty closely what it will cost to plug and abandon. We also know it will take quite awhile, and that we will start with the worst, first, in the event things change. That is pretty much the worst case for the oil. I’m worried about everything else if we are entering a deflationary spiral.

No emotion here on this discussion from this point, both ways, works just fine for me.

I read your previous posts.

You do not think OPEC will cut, or do you think that will not matter?

I assume you think oil demand is not increasing from this point forward?

I would note the Fed did raise interest rates, contrary to what you thought. However, it appears maybe this was a mistake, so I am not holding that one against you at all.

I agree that worldwide debt is a problem, but it has been for awhile and at many other times throughout history.

“I would note the Fed did raise interest rates, contrary to what you thought”

No, they did not!

Do not get caught on headlines…they increased overnight fed fund rates for the dealer banks in hopes of them making more loans, so that the REAL interest rates (i.e. your mortgage rates and inflation rates) increase, for pension plans and insurance companies are imploding. Fed fund rates are very different fro REAL interest rates (which are negative….still….and in perpetuity….)

-But if you have noticed since the Fed “increased rates a month ago, everything is shaking and having a seizure and MOST importantly, the 10 year treasury note (upon which every loan, or APR is based) is LOWER today than December 17.

It is a very complicated process….I wish I could be more helpful in simpler terms.

…and believe me: Fed rates (even though they will “increase” a bit more in the coming months) will FIRST go to 0% BEFORE they reach 1%

Again, do not get caught in headlines…

We are headed for NIRP (and if you read my posts, I used that term BEFORE anybody here even knew what that meant….) and “helicopter money”….

Be well,

Petro

You guys are a riot…

(Petro, where are you located?)

Chuckling aside, as a layperson here (and a good lay’ at that– nothing arrogant, mind you ;), I imagine that it’s as simple– and I know Petro has mentioned the exponential function for example– as the uneconomic machine sucking ever-harder through an ever-narrowing straw at ever-thickening dregs to power its ever-weakening sucks, yes? Well, if so, this smacks of a feedback loop. And, if so, my intuition is telling me we are in bigger trouble than what some people may realize.

‘…Now if ‘we’ could only thin out the Middle East populations a little… and take more fuller control of the oil infrastructure and area…’

I also seem to recall BC ‘forecasting’, maybe a few months to a year ago, oil around the price that it is, with a qualification, something to the effect that they thought that most on here would think they were crazy.

Of course then there’s shortonoil (apparently, AKA BW Hill) and Futilistist’s aforementioned fast-collapse contention, ostensibly through their ‘fog’ of psychological difficulties.

Just for the record, I have not kept up-to-date with Guy McPherson and whether he has revised his human extinction forecast time-frame or not.

“…my intuition is telling me we are in bigger trouble than what some people may realize…”.

Your intuition “tells” you well (as unfortunate as that may be…), dear Caelan.

I am glad you read me correctly and I am envious of your “light” and humorous understanding of things…

be well,

Petro

What’s Dennis’ (Coyne) backup plan, if you might know, if you are correct?

My ‘lightness’ seems to be tempered or balanced with some extreme seriousness. Perhaps it’s because we need balance for a healthy psyche.

Hi Caelan,

Are you asking your question to me or Petro?

I have no plan. Nobody knows what the future will bring, only that it is very likely to be different than the present.

I envision a future with lower population using energy and resources in general much more efficiently due to scarcity. Fossil fuels will peak and decline and will become more expensive, alternatives such as wind and solar will decrease in cost relative to today’s costs and become more competitive with fossil fuels and gradually will replace fossil fuels.

The transition will be difficult, perhaps impossible, there is no backup plan, society will have to adjust to the resources that are available, as it has always done.

That is unlikely to change.

So the plan is that there is no plan.

“What’s Dennis’ (Coyne) backup plan, if you might know, if you are correct?”

Caelan,

If I am correct (and I truly and dearly pray to God I am not – and Dennis is!

I have children and hopefully a few good years and grandchildren ahead of me…), but if numbers do not lie and I read them correctly…which again, I hope I don’t…

…I, or you, or Dennis, or anybody/ everybody will NOT need a back up plan.

-We shall need our family close by and pray that IT (whatever IT maybe) is quick and not too painful…

Be well,

Petro

Thanks, guys… So the small consensus between you two seems to be that no plan is good to go, yes? Why’s that?

So maintain business-as-usual? Keep shopping and driving (to work)? Let the (pseudo)government take care of the rest? Forget relocalization, resilience and related; the ‘Peak Oil 101’ stuff?

How? Is there a ‘Be Well’ plan that I am unaware?

“So the small consensus between you two seems to be that no plan is good to go, yes? ”

Yes Caelan, but Dennis and I come to that “consensus” from very DIFFERENT points of view….

…and yes, you can be well!

Try a good vintage Bordeaux and a well aged Cuban or Nicaraguan….

Petro

Hi SS,

First off, I want you and your friends and family in the oil biz to know that while I am a big advocate of electrification of the personal auto, etc, I don’t expect the world to go renewable fast enough to do much if any harm to the oil biz for the remainder of your working life. Depletion and hard times on the part of consumers might put you out of work, depending on how old you are , but it will be a LONG time before electric automobiles displace gasoline burners.

I know almost nothing about oil from a hands on pov , but being a small businessman, and one who reads a hell of a lot, I do know a little about how businessmen behave when they are short of cash and running at a loss.

Sometimes, quite often actually, you lose LESS by staying open, than you do by shutting down. A restaurant operator with a ten thousand dollar a month lease has to pay the ten grand even if he closes the doors. He can maybe stay open, and make enough on sales to reduce his overall loss for the month to less than the ten grand, maybe a lot less.

But if staying open doesn’t generate any cash, he NEEDS to close asap.

An oil producer operating as a BUSINESSMAN can be expected to shut in any production that costs him more on a day to day basis than it sells for.

So – you have shut in some wells, as is reasonable, but I am willing to bet you are still producing some, on a losing day to day basis, so long as the loss is small, in order to keep your crew together, and maybe in the hope that keeping the wells up will cost LESS than putting them back on line later, when the price goes up.

Let us suppose you are NOT a businessman, in the usual sense, but a NATIONALIZED oil company manager.

Now what are your priorities? You still need to make a profit, long term you are more or less compelled to make a profit, even if you get it in the form of a subsidy. You still balance your books, one way or another , or you WILL shut down, eventually.

But what about the short term? The government may make it impossible, or nearly impossible, for you to do what you really ought to be doing, as the manager. The fear of labor unrest, the loss of national prestige, the question of what happens next election, etc etc, may result in higher ups in the government TELLING you what you are going to do, whether it makes sense or not.

I can’t see any reason why a company with good management would sell oil for ten or fifteen bucks that COST more, in direct immediate day to day expenses to produce, except if legally trapped into doing so, as for instance to hold a lease, hoping for a higher price. MAYBE management would know in some cases that shutting in temporarily means shutting in PERMANENTLY ? and so gambles the day to day loss against possible future profits?

I think maybe the real problem is that ENOUGH GOVERNMENTS are involved in producing oil to temporarily trump the ordinary rules of the business world.

Maybe the government of country X would rather eat not only a long term loss, but also even a SHORT TERM day to day loss, rather than suffer the loss of face involved in just shutting in production. Country Y observes what X does, and follows suit.

Pride and politics might be bringing about a race to the bottom.

These remarks are intended as snack foods for thought. Maybe you or somebody else can add to them.

OFM:

This is almost word-for-word what I have been telling friends and family about oil production for about the last year.

Dear Shallow

as I said, I owe you an answer ….

I will try to avoid too much technicality and be as concise as possible, but will still be long – sorry…

I am dividing my answer in 2 parts:

-Macro-view, or overall “picture” if you will and,

-Micro-view, or more practical and directly related to your question (why crude or specific densities of it sell for -$?).

Macro-view:

First, do not get emotional. As dark and as difficult the situation you and your colleagues find yourself in is right now, it is very likely going to get worse (and, I am afraid, much worse. This is my personal view, please do not “quote” me on that).

Secondly, set aside everything you read here, or on every/any other forum/site/media/book/paper/publication/presentation etc., etc., etc., they confuse and make you “foggy”.

Now, I am NOT suggesting to not read and/or comment on this respected forum and/or others – I do it myself (and today, maybe a bit much…). I am saying to do it in a more “relaxed” manner and to enrich your overall understanding of things, rather than seek solutions.

There aren’t any!

Most importantly (and here comes the “technicality”), get OUT of your mind and forget about (literally!) concepts such as: supply/demand, market fundamentals, well-head cost, first year per well production, heavy crude cost, IEA/EIA projections, number of rigs….blah, blah, blah…..

Economic laws and fundamentals as you and I (and everybody else) have learned and known them to work before, do NOT work anymore. It sounds crazy and idiotic, but in the environment we are in, is true (hint: up-streamers are paying mid/down-streamers to “take” their stuff and everybody – and I mean: everybody in the world – is producing full capacity as prices go to $0. Is that how demand/supply works? I do not think so…but I digress).

The ONLY thing you need to know about fundamentals is this (I am going to use rough numbers here, so don’t “fight” me with the decimal points – so to speak):

-Oil above $60-$70/brl kills the economy; Oil below $50-$60/brl kills your business. Pick your poison!

Demand/supply and market fundamentals worked flawlessly before, for the above numbers were far apart. We had plenty of sub $10/brl oil in the ground up until…..oh, pick a number: 10-15 years ago let’s say.

Not so much anymore!

We burned most of the “poke a hole in the desert and gushes out” type of oil, “Ghawar, or Texas in the 1930s” type of oil. Today we are left with “Bakken and 10-mile-under-sea-Horizon” type of oil. That works only with high yield (aka: junk bonds) paper financing which is crushing as we speak…and that is why you see the paradoxes you see in the price/ production figures you see today. That is why you see shale/tar and other expensive production going exponential ONLY after 2008-2010 (hint: TARP1, TARP2, QE1…QE99…) even though fracking is a 50-60 year old technology (here’s another fun trivia for you: a lot of “prolific” commentators on this forum and others akin to it think that fracking is a new tech thingie…ha, ha, ha..).

We did never use and/or improve it before, for it did not make economic and financial sense. We had plenty of cheap conventional oil…or so we thought…

A lot of that money (QE99…ZIRP…) was used to finance Chesapeake, Occidental and a lot of other “lovely” names you hear frequently in the news nowadays.

Contrary to what most (and I think this includes you) believe, Peak Oil will not come as the consequence of physical constraints (i.e no more oil in the ground. We will NEVER run out of oil!!!). Peak Oil shall follow (I personally believe we are post-factum here, actually…but I could be and I hope I am wrong!) financial collapse (already in progress) in very short order.

And that, dear Shallow, is in short why you and I shall never see $100-$150/brl oil under NORMAL market conditions. Our problem is a demand/affordability/debt collapse problem – NOT a oversupply/glut problem.

Oversupply/glut/all-time-high production is consequence of the guys in charge who, fully aware of the predicament we are in and which I explained above (or tried to, anyhow), want to be the “last man standing” while crushing the “higher cost guy” as they produce full capacity into oblivion and as the price per barrel goes >$0 – contrary to every and any sound economic and financial logic.

Sounds familiar? It does, for it is exactly what is happening today.

On an earlier comment to you (a few posts back), while I was teasing you with Dr. Sh. Cooper, PHD (indirectly and kindly reminding you that: I indeed “…informed you thusly…”; but now that you did read my earlier comments/replies here – I know I have your attention!), I suggested to you not to worry about prices going lower, for they shall!

That is baked in – so to speak, therefore I suggest you try to make peace ( as difficult and as painful as that maybe) with that reality. Worry and run for the hills (literally!) when the prices SPIKE higher, for they will.

Caution: I did not say rise gradually, I said “spike”, because this time is going to be different. This time supply/demand and other normal market forces shall have nothing to do with it.

This time prices will go higher as the result of financial-economic-political collapse, and/or war, and/or natural-climate calamity, and/or all of the above. And when that happens, oil prices and the well-being of your family business will be the last thing you have to worry about…

Sounds a bit dramatic and dark…well let’s see:

we are now entering a deflationary wormhole (death spiral, if you will) the likes of which human kind has NEVER seen, EVER.

The closest and only one that is remotely similar (key word is ‘remotely” here, for they did not have nukes and they had vast, vast amounts of cheap resources available – you know…the ones we burned, destroyed and consumed 1500 years later- those resources; and there were far less than 1 billion of us back then !!!) to the one we are entering in, is Roman Empire during 4-5 century AD. We all know what followed afterwards, but for the uninitiated here (historically speaking): 1000 years of what we call Dark Ages. Rome (the city) which had enjoyed public baths and aqueducts (that put to shame many in parts of the world today); Rome which is the basis of every modern form of government in the world today and had more than 1.500.000 inhabitants back then , reached that glory again only at the beginning of the 20th century, more than 15 centuries later…

Draw your own conclusions….

So, dear Shallow, that is your macro view …presented in short detail and extremely simplistically

The micro-view that directly answers your question with regard to sour crude going negative, is coming tomorrow…is too late and I wrote enough today

Be well,

Petro

.

That is a difficult to read post. Try indenting and using simple and easy to read paragraphs with appropriate spacing.

If u don’t do this, no one will read it or get your message anyway.

…and that is what you have to say after what I wrote?!?!

In that case, my advice to you is: do not read it!

Clearly is not simple enough for you.

Be well,

Petro

Lol! I am an idiot but trying to learn.

I had a job one time where I thought I wrote the best sales pitch.

It was very long, well researched, and compelling arguments.

It was thrown in the trash and I never got to do another one.

I’ve never forgot that lesson. Short and sweet is the only way to have a chance to sell your ideas.

Most humans won’t strain their eyes to give a damn about ur opinion.

Thanks for your feedback petro.

Hi Petro,

I don’t have any argument with you about the world being headed to hell in a hand basket. From my own professional pov, everything you have said fits in nicely as component parts of human overshoot.

The QUESTION is not if but WHEN.

HOW MUCH LONGER do you think Old Man Business As Usual will stumble along before he collapses ?

A year or two? Five years, ten years or longer?

I am figuratively praying for five years, that would allow me to get my ducks lined up the way I want them.

Thanks OFM.

I do not have a crystal ball, so 1 day/1 month/1 year…I do not know.

But as you read above, I think everything will follow financial/economic downfall…and I believe we clearly are seeing its progression.

Will other “things” happen at the same time or will there be a lag period, so to speak – who knows.

I do not want to “disappoint” you as I did disappoint Dennis by not stating the exact amount of dollars and cents per barrel of oil 12-14 months ago and, 1 year from now – I do not want him to quote me and point out that I was wrong….just joking…

-On a serious note though, although NO ONE shall be ready for what’s coming, I believe that you are one of the most prepared (so to speak) ones. From what you write, your knowledge and practical know-how far surpasses that of 99% of populace.

I truly and sincerely mean that!

I wish my family and I were remotely close…

..and I wish I am dead wrong on what I write….

Be well and keep writing, for I indeed enjoy your cautious and well grounded optimism.

Be well,

Petro

Summerized as

his answer is in 2 parts:

-Macro-view, or overall “picture” and,

-Micro-view, or why crude or specific densities of it sell for -$?).

Macro-view:

1, going to get worse, much worse. please do not “quote” me on that

2, every/any other forum/site/media/book/paper/publication/presentation etc.,

etc., etc., they confuse and make you “foggy”.

3,Don’t seek solutions.There aren’t any

4,forget about supply/demand, market fundamentals.

5, Normal economic and fundamentals do NOT work anymore.

6, Everybody in the world is producing full capacity as prices go to $0.

7, Oil above $60-$70/brl kills the economy; Oil below $50-$60/brl kills your business.

8, Demand/supply and market fundamentals worked before, when we had plenty of sub $10/brl oil

up until 10-15 years ago but not anymore

9, Because we are left with “Bakken and 10-mile-under-sea-Horizon” type of oil. That

works only with high yield (aka: junk bonds) paper financing

10, That is why you see shale/tar and other production going exponential ONLY after 2008-2010 (hint: TARP1,

TARP2, QE1…QE99…) even though fracking is a 50-60 year old technology

11, Was never use and/or improved before because it did not make economic and financial sense

12, QE99…ZIRP… was used to finance Chesapeake, Occidental and a lot of others

13, Peak Oil will not come as the consequence of physical constraints (i.e no more oil in the ground.).

14, Peak Oil shall follow financial collapse (already in progress) in very short order.

15, (we) will never see $100-$150/brl oil under NORMAL market conditions because the problem is a

demand/affordability/debt collapse problem – NOT a oversupply/glut problem.

16, Over supply production is consequence of the “last man standing” to take out the higher cost oil

by producing at full capacity so the price per barrel goes >$0

Therefor prices will go lower

17, The prices will then spike as the result of financial-economic-political collapse, and/or war,

and/or natural-climate calamity, and/or all of the above.

18, we are now entering a deflationary wormhole (death spiral )remotely similar is Roman Empire

during 4-5 century AD.

and as Petro stated

…presented in short of detail and extremely simplistically

Still wtg on micro view I guess

Corrections anyone ?

Forbin

Thank you for enumerating my sentences and inserting spaces between them!

Very synthetic and concise of you…

Be well,

Petro

Hi Petro,

I do not agree with your analysis.

On point 6, everyone always produces at full capacity in the oil business, CAPEX has been cut back and supply will fall as output declines, nothing new there.

One difference is that OPEC is not regulating the oil market, that is the main difference, move along these aren’t the droids your looking for 🙂

On point 7 there is very little evidence that oil above 60-70 per barrel kills the economy. From 2011 to 2014 with average oil prices over that period above $100/b (Brent) the World economy was doing fine. Europe not so much as they seemed to have forgotten the lessons of Keynes.

On point 10, yes the fracking and horizontal drilling are not new technology, output went up because oil prices were high and because interest rates were low. If interest rates had been at more “normal levels” (10 year treasury at about 5%), the LTO boom might not have gotten out of hand.

On point 13 anybody that has passed an introductory economics course understands that peak oil will depend on both supply and demand for oil.

On point 4, I strongly disagree, in the short term markets can become unbalanced, but in the long run businesses go bankrupt and supply and demand balance.

On point 18, there does seem to be a downward trend in World inflation levels (based on IMF data), the 1996 to 2014 trend in inflation rates goes to zero in 2044 if extrapolated. Not sure why there would be a permanent lack of aggregate demand Worldwide. A few things have changed in the past 1500 years so the Roman Empire collapse seems a bad comparison. That was a local event in Europe, not a World wide event.

Dear Dennis,

you have to address this to Forbin.

He made the numbers/point trying to “simplify” my comment to which he (Forbin) replied…how nice of him, don’t you think?!

Be well,

Petro

Total oil production is up in ND from 1171 kbo/d (Oct) to 1176 kbo/d (Nov). There were 77 new wells producing (72 in Sep), while 93 new wells were spud (122 in Oct). These newly producing wells do seem to have had a good first month on average.

Still, the biggest surprise is that the decline in older wells (> 2 months) was not more – they should typically decline by about 50 kbo/d per month (for the front month), but in November they just declined by 25 kbo/d. I suspect that the reason is, as Lynn Helms mentioned during the webcast last month, that operators tried to produce as much as possible before the feared OPEC meeting early December. There was a similar low decline in older wells the month before (Oct), while the decline was above 50 kbo/d in every earlier month this year, except in May (30 kbo/d).

Below a graph that shows this. The difference between the green and red line represents the total growth/decline of oil production in ND.

If this interpretation is correct, we may see bigger declines in the following months.

Overall production in ND

50% of the oil is from wells < 2 yrs old.

Note that some of the 2013 wells are also less than 2 years old, those that started producing in December 2013. So for wells 23 months old or less, it is 50% of output, which is exactly what you said <2 years is the same as <=23 months.

Note that your statement has been true for at least 7 years (which makes it a very good statement!)

There is a sense that this should be a more powerful reality than it seems to be.

Any chance you know what the typical equivalent is for a conventional field?

If I understand you correctly Enno, you believe that shale production in the US will begin to decline shortly (in the coming months) due to inherent depletion of existing wells. What will that do to the surplus in world petroleum production and to prices?

LJ,

In my posts, I like to focus as much as possible on the data, instead of making projections. I do think the data from ND & the Niobrara shows sufficiently clear that both plays are on a downward path. Even with the excellent data from especially ND, it is already clear how difficult it is to make accurate projections just a year out. That should make everybody humble about the capability to make accurate projections about supply from larger regions, inventory, and prices (assuming that demand can be more easily predicted, which is also doubtful).

I guess I am not the only one who is highly surprised that just a relatively (in % terms) small surplus was capable of creating such a huge price drop. I do think a large part of the price action can be attributed to market participants who do not have a stake in the production or processing of the oil. They’re just good at front running everybody else. I therefore expect to keep seeing extreme price volatility.

Although I have considerable contempt for the economics profession as practiced by individuals, because most economists seem to be scientifically illiterate, the basic theory of supply and demand holds up as well as an anvil in my estimation.

All the way back in the sixties, in the FIRST introductory courses taught in econ, at my university , the text, which was HUGE, and the professor, who expected you to read EVERY line, twice, VERY carefully, both covered the concept of price elasticity in great detail, with plenty of examples.

It is not at all unusual for the price of a commodity to crash by half or more if the producers keep bringing it to market in quantities greater than the market “desires”.

The typical user of oil, be that user a commuter, or an airline, can find a use for only a LITTLE MORE oil, at any price, in the short term.

So the price crashes.

We aspiring PROFESSIONALLY trained farmers learned that in the VERY first “ag econ” course, first quarter. Incidentally that course was taught by a professor in the business school, in the same hour, in the same classroom, as the business and econ majors took it. But the ones of us who grew up on farms learned it the hard way, seeing our GROSS revenues CRASH in years we made bumper crops, and our gross revenue SOAR when we made a short crop, nationally.

The three or four best years we ever had, we had only half a crop or less, but got triple or even quadruple the usual price, wholesale.

The ONLY difference is their transcripts say “Econ 201” whereas mine says “Ag Econ 201”.

Bottom line, supply and demand theory is amply SUFFICIENT to explain the price of oil. Supply has outrun the end users immediate needs, end users are mostly unwilling to store oil products, and even if willing, UNABLE in ninety nine percent of all cases. A price crash has resulted.

Being a farmer, I am the ONE out of hundred people able to store a significant amount of oil.

The recurring situation in farming is actually tragic: very small overproduction can cause complete collapses in price — AND it’s very hard to store the stuff for later because it rots! This is a market failure, and the damage to the farming industry is a bad thing.

The same situation in oil is socially beneficial, as the damage to the oil industry is a good thing!

(P.S. The kings of ancient Egypt managed grain farming as a centrally planned economy, storing excess production for lean years, while paying the workers the same rate every year — and they managed farming far better, from a social utility point of view, than any of our “market” economies do today. Which is absolute proof that central planning can be superior to “free markets”…. for some things.)

I see that the increase in oil production came mainly from the 2015 wells. Pre 2015 wells together decline a little.

Thank you Enno,

Do your stats show that the number of DUCs in North Dakota is declining? Maybe this is one of the factors contributing to the resilience of ND Bakken production?

Also, how the operators were able to reduce the decline rate of the old wells?

Alex,

“Also, how the operators were able to reduce the decline rate of the old wells?”

In the following overview you can see the monthly change in daily output, by wells that started producing in a certain year. What this shows is that in Nov, the growth from 2015 wells was quite large, while the declines from wells from earlier years was quite low. How they do this, I don’t know – maybe with chokes, and producing older wells for more days?

Thank you, Enno.

Would be very interesting to know what they are actually doing.

Maybe refracs also help to maintaing production at the old wells.

The chart below from Rystas shows that there were about 110 refractured wells in the Bakken in 2014 and ~70 wells in January-August 2015, more than in any other shale play.

source: http://www.ogfj.com/articles/print/volume-13/issue-1/features/refracking-the-shale-plays.html

Very interesting article, thanks!

This is what I got with my recent analysis (see graph below). It shows that, as I mentioned at the time, I was being conservative (underestimating refracks), to make sure I didn’t overestimate the effect from the refracks on the decline of the average well.

It also means in my opinion:

1) that I slightly overestimated the gain from refracking, as I took the wells with the best gains as having been refracked.

2) that I slightly underestimated the decline of wells in the far tails (after 7-8 years). Including refracked wells into the average well performance has an out-sized effect, especially at the far end of the tails where the typical daily output is low.

3) that the mentioned “halo-effect” from Coffeeguy, although it probably exists in certain cases, has a very minor effect on the overall well performance & decline.

Therefore, I strongly belief that in order to analyze the well decline correctly, one has to take into account these refracked wells. Currently, about 6% of the completions in 2015 are refracks, compared with about 4.1% in 2014.

Producing days are actually down slightly from the month before. GOR did not increase much either. So don´t know either how they did it. The new wells in October and November where quite good though.

Thank you, Freddy

The webinar is available. Helms mentioned that many marginal wells were shut in (which explains the drop in producing wells), while a number of MB+TF wells that were shut in started to produce again.