This is a guest post by Rune Likvern. His web site is:

FRACTIONAL FLOW

Growth in Global Total Debt sustained a High Oil Price and delayed the Bakken “Red Queen”

The saying is that hindsight (always) provides 20/20 vision.

In this post I present a retrospective look at my prediction from 2012 published on The Oil Drum (The “Red Queen” series) where I predicted that Light Tight Oil (LTO) extraction from Bakken in North Dakota would not move much above 0.7 Mb/d.

- Profitable drilling in Bakken for LTO extraction has been, is and will continue to be dependent on an oil price above a certain threshold, now about $68/Bbl at the wellhead (or around $80/Bbl [WTI]) on a point forward basis.

(The profitability threshold depends on the individual well’s productivity and companies’ return requirements.) - Complete analysis of developments to LTO extraction should encompass the resilience of the oil companies’ balance sheets and their return requirements.

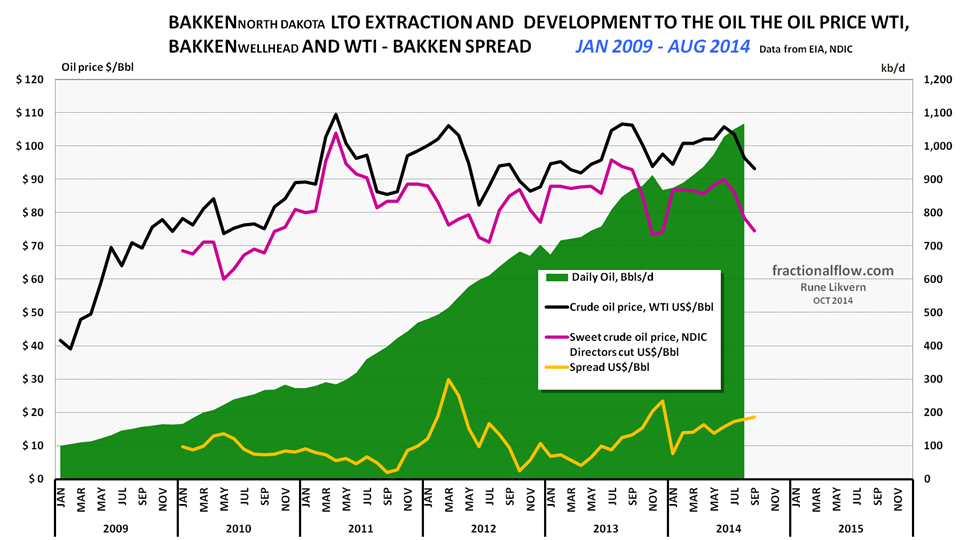

Figure 01: The chart above shows development in Light Tight Oil (LTO) extraction from January 2009 and as of August 2014 in Bakken North Dakota [green area, right hand scale]. The top black line is the price of Western Texas Intermediate (WTI), red middle line the Bakken LTO price (sweet) as published by the Director for NDIC and bottom orange line the spread between WTI and Bakken LTO wellhead all left hand scale. The spread between WTI and Bakken wellhead has widened in the recent months.

What makes extraction from source rock in Bakken attractive (as in profitable) is/was the high oil price and cheap debt (low interest rates). The Bakken formation has been known for decades and fracking is not a new technology, though it has seen and is likely to see lots of improvements.

LTO extraction in Bakken (and in other plays like Eagle Ford) happened due to a higher oil price as it involves the deployment of expensive technologies which again is at the mercy of:

- Consumers affordability, that is their ability to continue to pay for more expensive oil

- Changes in global total debt levels (credit expansion), like the recent years rapid credit expansion in emerging economies, primarily China.

- Central banks’ policies, like the recent years’ expansions of their balance sheets and low interest rate policies

- Credit/debt is a vehicle for consumers to pay (create demand) for a product/service

- Credit/debt is also used by companies to generate supplies to meet changes to demand

- What companies in reality do is to use expectations of future cash flows (from consumers’ abilities to take on more debt) as collateral to themselves go deeper into debt.

- Credit/debt, thus works both sides of the supply/demand equation

- How OPEC shapes their policies as responses to declines in the oil price

Will OPEC establish and defend a price floor for the oil price?

I have recently and repeatedly pointed out;

- Any forecasts of oil (and gas) demand/supplies and oil price trajectories are NOT very helpful if they do not incorporate forecasts for changes to total global credit/debt, interest rates and developments to consumers’/societies’ affordability.

Oil is a global commodity which price is determined in the global marketplace.

Added liquidity and low interest rates provided by the world’s dominant central bank, the Fed, has also played some role in the developments in LTO extraction from the Bakken formation in North America.

As numerous people repeatedly have said; “Never bet against the Fed!” to which I will add “…and China’s determination to expand credit”.

Let me be clear, I do not believe that the Fed’s policies have been aimed at supporting developments in Bakken (or other petroleum developments) this is in my opinion unintended consequences.

In Bakken two factors helped grow and sustain a high number of well additions (well manufacturing);

- A high(er) oil price

- Growing use of cheap external funding (primarily debt)

In the summer of 2012 I found it hard to comprehend what would sustain the oil price above $80/Bbl (WTI).

The mechanisms that supported the high oil price was well understood, what lacked was documentation from authoritative sources about the scale of the continued accommodative policies from major central banks’ (balance sheet expansions [QE] and low interest rate policies) and as important; global total credit expansion, which in recent years was driven by China and other emerging economies.

I have described more about this in my post World Crude Oil Production and the Oil Price.

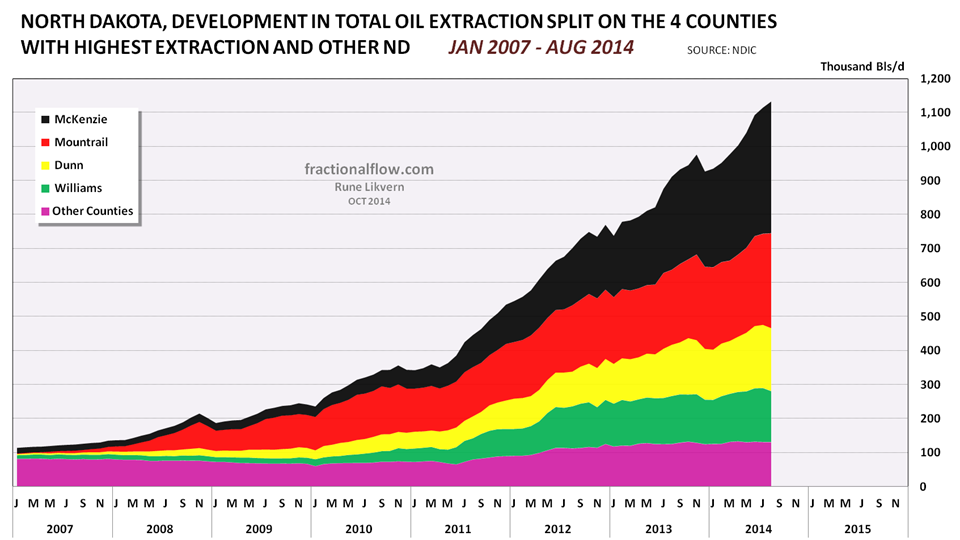

Figure 02: The chart above with the stacked areas shows developments in all oil extraction in North Dakota as of January 2007 and of August 2014 split on the 4 counties with the highest extraction and the rest of North Dakota. Growth in oil extraction in North Dakota is now primarily from McKenzie and Mountrail counties.

Summer of 2012

With oil prices at the wellhead in Bakken at $70/Bbl in the summer of 2012, the companies netted back around $45/Bbl.

In the summer of 2012 monthly LTO extraction was on its way towards 19 million barrels (Mb).

The total monthly net cash flow from the LTO extraction generated thus about $850M ($45/Bbl X 19 Mb) which could fund monthly additions of 85 – 95 wells (if the companies’ cash flows unabridged was used for well manufacturing).

This level of well manufacturing was estimated to sustain an LTO extraction level of 0.7 Mb/d in Bakken(ND).

The companies had, by then and based on a low end estimate, added a total of $14 Billion in external funding, primarily debt, refer also figure 03.

Summer of 2014

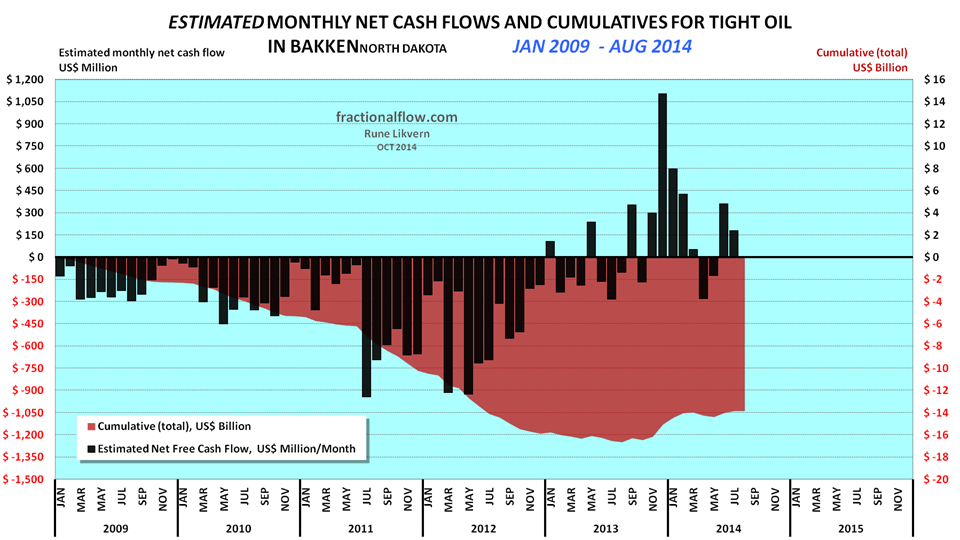

Figure 03: The chart above shows an estimate of cumulative net cash flows post CAPEX in manufacturing of LTO wells in Bakken (ND) as of January 2009 and as of August 2014 (red area and rh scale) and estimated monthly net cash flows post CAPEX (black columns and lh scale).

The assumptions for the chart are WTI oil price (realized price which is netted back to the wellhead), average well costs starting at $8 Million in January 2009 and growing to $10 Million as of January 2011 and $9 Million as of January 2013. All costs assumed to incur as the wells were reported starting to flow (this creates some backlog for cumulative costs as these are incurred continuously during the manufacturing of the wells) and the estimates do not include costs for non- flowing and dry wells, water disposal wells, exploration wells, seismic surveys, acreage acquisitions etc.

Economic assumptions; royalties of 16%, production tax of 5%, an extraction tax of 6.5%, OPEX at $4/Bbl, transport (from wellhead to refinery) $12/Bbl and interest of 5% on debt (before any corporate tax effects).

Estimates do not include the effects of hedging, dividend payouts, retained earnings and income from natural gas/NGPL sales (which now and on average grosses around $3/Bbl).

Estimates do not include investments in processing/transport facilities and externalities like road upkeep, etc. The purpose with the estimates presented in the chart is to present an approximation of net cash flows and development of total use of primarily debt for manufacturing of LTO wells.

The chart serves as an indicator of the cash flow for the aggregate of oil companies in Bakken.

Since the fall of 2012 and until the summer of 2014 oil prices at the wellhead in Bakken oscillated around $90/Bbl (ref also figures 01 and 04) which netted back around $60/Bbl to the companies.

This makes a material difference to the companies’ net cash flows from LTO extraction and they also added an estimated $2 Billion (low end estimate) in debt since the summer of 2012. The companies had thus considerably improved their abilities to fund growth for and sustain a high level of (monthly) well additions which provided for growth in LTO extraction.

In the summer of 2014 monthly LTO extraction was on its way towards 32 Mb.

The total monthly net cash flow from the LTO extraction generated thus about $1,900M ($60/Bbl X 32 Mb) which unabridged could fund monthly additions of 190 – 210 wells (no dividends paid out and/or down payments of debt). This is close to the number of monthly well additions reported by NDIC since the harsh winter loosened its grip.

Note in figures 03 and 04 how the (low end) estimates for total debt has more or less remained flat since last winter.

Now (fall 2014)

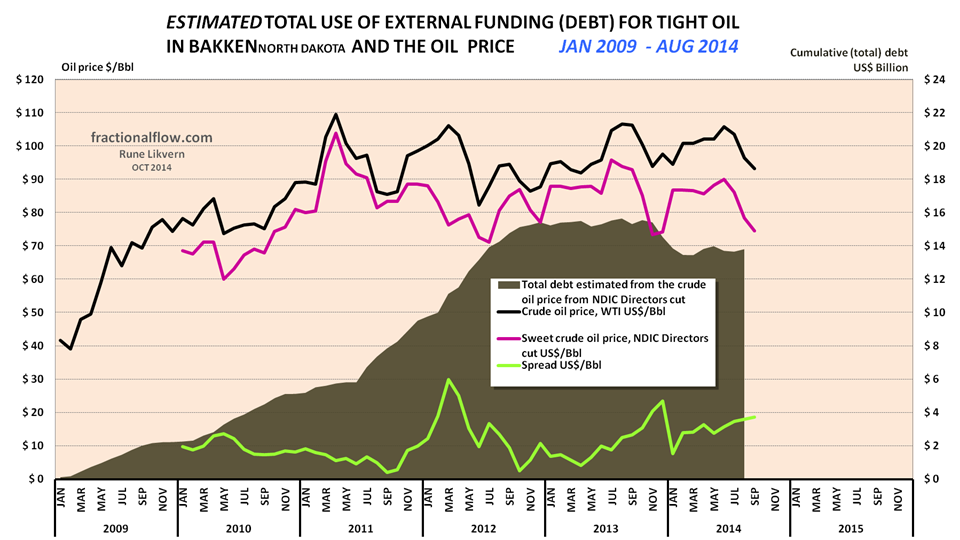

Figure 04: The chart above follows the same methodology as presented in figure 03 for estimates of changes to total debt (dark green area and right hand scale) with the difference that the wellhead price published by NDIC in their monthly reports has been applied.

In the chart is also shown the developments in the oil price WTI (black line), at the wellhead (dark red line) and the spread between WTI and the wellhead price (light green line), all left hand scale.

Since last summer world oil prices have come significantly down and I hold it likely they will remain low or decline some more if not OPEC curtails its supplies. As of writing the wellhead price in Bakken is $63/Bbl(sweet and as of Oct. 30th) and the “average” point forward breakeven is estimated at $68/Bbl (at a 7% discount rate and at the wellhead).

The effect of the low oil price causes a noticeable reduction in companies’ total netted cash flows which now is estimated below $1,400M/month.

This ($63/Bbl at the wellhead) cash flow could unabridged fund 140 – 155 wells/month.

However the world does not work as straight forward as this.

Companies in Bakken had levered up (used debt) likely under the expectations that oil prices would remain high(er). It was the expectations of sustained high cash flows that (primarily) was/is used as collateral to assume more debt. Various covenants may dictate the companies to continue to manufacture wells. A higher leverage (from declining cash flows) results in relative higher debt carrying costs.

A lower oil price shrinks the debt potential on their balance sheets and some will deleverage (reduce their total debt) as a response to the lower oil price.

Their sources of income to reduce their debt; a portion of their cash flows from their operations and/or sales of assets.

The dividend policies vary amongst public companies and oil companies have been facing mounting pressures from impatient investors who looks for yield.

For public companies, there has been an additional powerful factor at play after the Fed started QEing, key phrase: Companies’ Market Capitalisation, refer also figure 10.

Investors in companies involved in LTO extraction had no reason to complain as there was growth in LTO extraction and QE “buoyed everything” with little relation to the actual underlying fundamentals.

My model (also presented in the “Red Queen” series at The Oil Drum) estimates it now takes around 130 net well additions/month in Bakken (ND) to sustain present LTO extraction levels. This could be funded with a wellhead price around $60/Bbl, if the companies’ net cash flows unabridged were spent towards well manufacturing.

However the financial capacities of the companies becomes impaired from a sustained lower oil price and these will start deleveraging, thus reducing their capital expenditures which, and with a time lag, entail a down scaling of their well manufacturing.

This change in strategy is often presented under the euphuism of “targeting financial performance”.

If monthly net well additions drop below the “Red Queen” number (now estimated at 130 – 135 wells/month), Bakken(ND) LTO extraction is likely to decline.

A sustained lower oil price, thus:

- Impairs the companies’ abilities for well manufacturing (reduces funding from cash flows)

- Drives the need for deleveraging (which reduces the funds which otherwise could be allocated towards well manufacturing)

- May give priorities to complete wells that are drilled, but not completed as there exists a big inventory of wells drilled and not completed and funding for the completions comes from the cash flows. These wells represent “cheap” flow additions.

The LTO Break Even Price

Another parameter which is important to keep an eye on is the development to the break even price that meets the companies’ return expectations. The wells come with individual designs (costs), flow rates and EURs and the break even price is subject to a range of return requirements [my presented numbers are discounted at 7%].

I have used actual well data from North Dakota Industrial Commission (NDIC) to make estimates of what I will continue to refer to as the “reference/average well”, refer also figure 07.

Since I started following the Bakken LTO developments this “reference/average well”, and notably since 2013, has experienced some improvements to its total first 12 months cumulative LTO extraction (refer also figure 07) and the judges are still out there if the deployment of improved (and likely more expensive) technologies allows for some faster extraction and/or increased total extraction (higher EURs).

Changes in the oil price are the dominant source for changes to the financial returns of the wells.

Those who does not worry about returns (that is a discount rate at 0% of full life cycle costs) would now achieve this with around $50/Bbl at the wellhead.

Who are willing to put their money at risk for a 0% return? (Putting the money in the mattress gives the same return.)

A sustained oil price below $70/Bbl (at the wellhead) is, with a time lag, likely to slow drilling activities as this is the profitability threshold for the “average” well. Should the oil price (at the wellhead) remain below $70/Bbl the oil companies will focus on drilling those wells expected to meet their return requirements. If wells meet their expectations is not known before after it has flowed for several months.

One early indicator for changes in activity levels is to follow the development of the number of rigs drilling.

Well productivity Developments

Longer laterals, more use of proppants, more fracking stages, has with time lead to documented improvements in well productivity (here defined as total LTO extracted during the first 12 months of flow) for the “average” well in the Bakken formation in North Dakota, refer also figure 07.

More advanced wells may, however, mask the possibility of extraction growth from areas with poorer geology.

Developments as of Aug 2014

Three of the charts below have expertly been produced and provided by Enno Peters, who agreed to let me use them in this post.

Figure 05: The stacked areas in the chart above show developments in LTO extraction of the population of wells by vintage.

Chart by Enno Peters.

The strong growth in LTO extraction happened while the wellhead price in Bakken was above $70/Bbl, refer also figure 01.

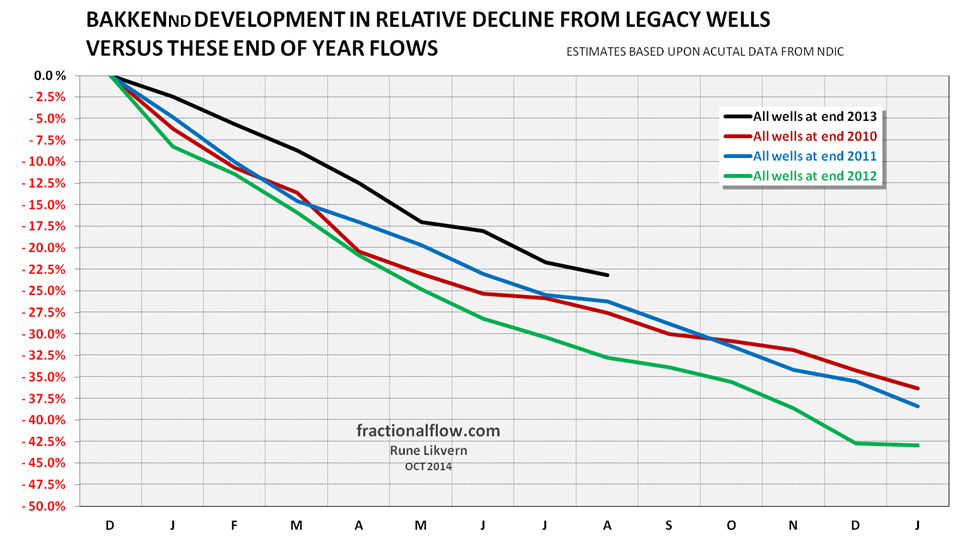

Figure 06: The chart above, based upon the NDIC data for figure 05, shows how LTO extraction in Bakken declines by vintage [end of year].

If no wells were added the total LTO extraction from Bakken would decline somewhere between 30 – 40% after 12 months. On August 2014 LTO extraction was approaching 1.1 Mb/d, which would result in a decline of 0.3 – 0.4 Mb/d after 12 months if no more wells were added.

This illustrates that LTO as a source of sustained oil supplies requires to stay on the drilling treadmill. The LTO extraction level is sensitive to the oil price, the companies’ return requirements and the strength of their balance sheets.

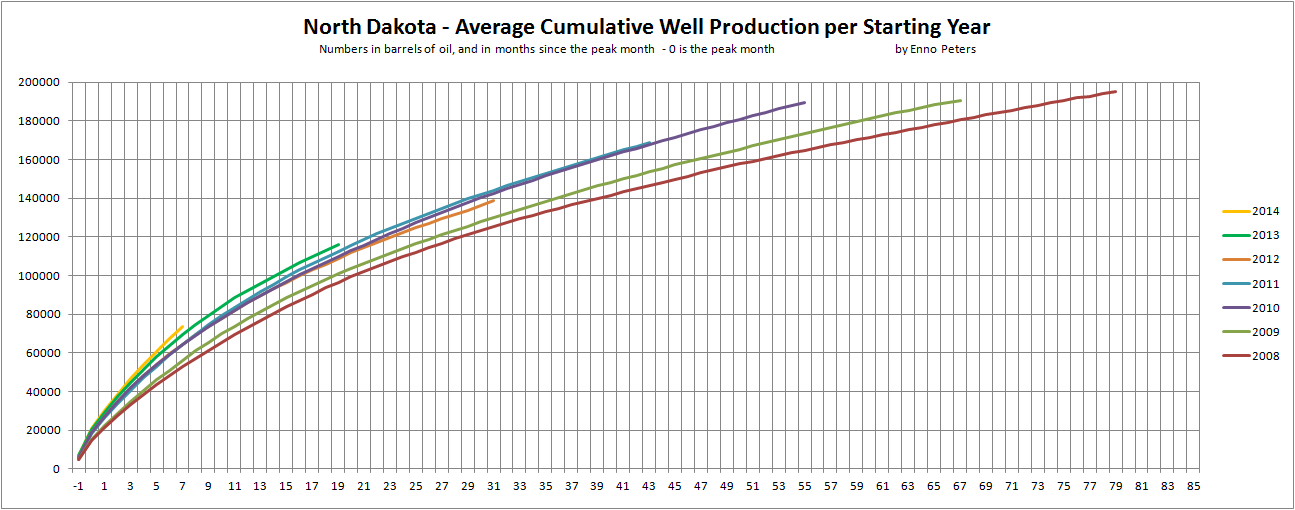

Figure 07: The chart above shows how cumulative LTO extraction for the “average” well by vintage [calendar year] develops with time.

Chart by Enno Peters.

Total LTO flow during the first months in 2013 and so far in 2014 has been higher than in the years 2010 – 2012. What remains to be seen is if this over some time results in increased total recovered oil or if the most recent and advanced wells extracts the oil faster. Note how the cumulative for the early wells from 2013 now converges towards those of the previous years.

Total Extracted Liquids from Bakken Wells has grown with time, led by Produced Water

Figure 08: The chart above shows development in the water to oil ratio for the “average” wells by vintage [calendar year] in Bakken. Produced water (brine) is separated and transported to dedicated disposal sites.

Chart by Enno Peters.

A noticeable trend from the chart above is that produced water to oil ratio has increased with time (total liquids [oil + produced water]).

Some Supplementary Information

To me what we are now witnessing is the most telegraphed correction in history. The end of Fed’s QE and higher Fed’s fund rates in the near future.

I will briefly present two macroeconomic sizes that helped sustain a high oil price.

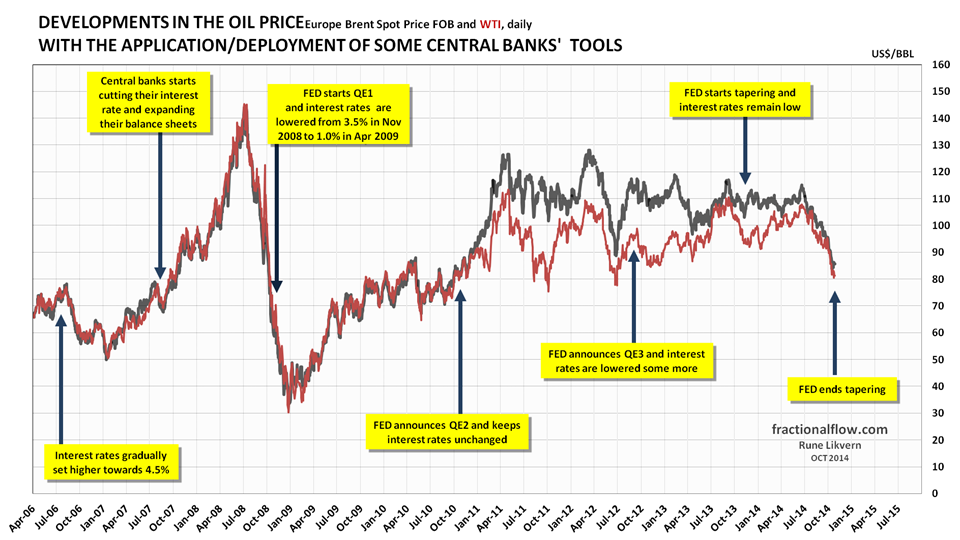

Figure 09: The chart above shows the developments in the oil price [Brent spot; black line and WTI; red line] and the time of the Fed’s announcements/deployments of available tools to support the global financial markets which the economy heavily relies upon. The financial system is virtual and thus highly responsive.

The chart suggests causation between Fed policies and movements to the oil price.

Some of the money from QE found their way as loans to emerging economies to fund economic growth and thus also supported oil demand and the oil price.

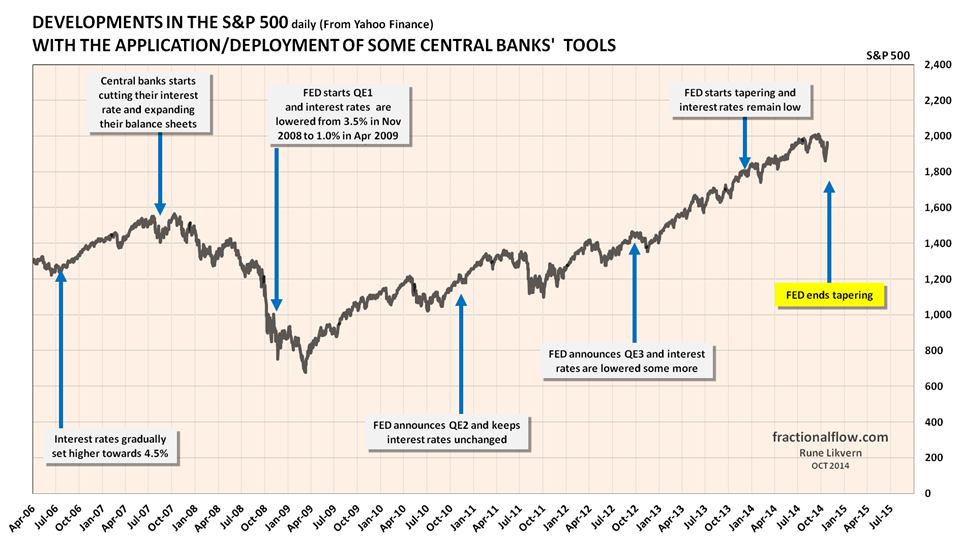

Figure 10: The chart above shows the developments in the stock index, S&P 500, and the time of the Fed’s announcements/deployments of available tools to support the global financial markets which the economy heavily relies upon.

The chart suggests causation between Fed policies and movements in the stock index.

Several of the listed companies active in LTO extraction are included in the S&P 500 index, thus these were given an uplift from the general bull market and investors in LTO saw their share prices rise.

The common features of figures 09 and 10 are that they show possible causations from Fed’s policies. Added liquidity and low interest rates also supported the oil price and the stock market.

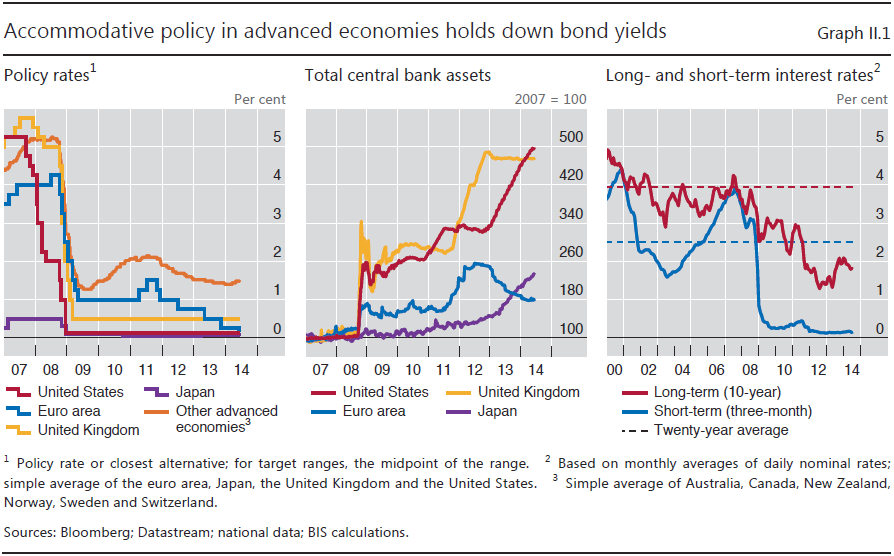

Figure 11: The chart above shows [left panel] how advanced economies’ central banks in concerted efforts lowered their interest rates following the Global Financial Crisis (GFC) in 2008.

The middle panel shows the relative growth (expansion) of the balance sheets (assets) for US Federal Reserve (Fed), European Central Bank (ECB), Bank of England (BoE) and Bank of Japan (BoJ) post the GFC. Note the growth of the Fed’s balance sheet since 2012 (middle panel).

The right hand panel shows the development in long and short term interest rates together with the twenty year average.

Chart from p 24 in BIS 84th Annual Report, 29 June 2014.

The middle panel in figure 11 which has been lifted from BIS 84th Annual Report.

So what about China?

Oil is a global commodity. China has in recent years had strong economic growth, which has been facilitated by a rapid credit expansion. This has allowed China to steadily grow its oil imports and consumption (refer also figure 14), which thus supported growth in global oil demand and a higher oil price.

Figure 12: Chart above shows Chinese leverage, changes in total debt to GDP. Note the growth of this metric since 2011.

Figure 12 has been lifted from p 70 of the Geneva 16th report “Deleveraging? What Deleveraging?” made public 29 September 2014.

Note the rapid growth in Chinese debt post 2008 in figure 12 and note the growth in Chinese petroleum consumption and imports since 2008 in figure 14. China continued good economic growth post the GFC by aggressive credit expansion.

According to data from the Bank for International Settlements (BIS in Basel, Switzerland) China saw its annual growth rate in private, non financial sector debt accelerating from around 10 Trillion Yuan as of Q4 2010 to 18 Trillion Yuan (about US$3 Trillion) as of Q1 2014. (100 Yuan approximates USD 16)

The Shift in Oil Consumption

Figure 13: Chart above (areas are not stacked) shows developments in OECD total petroleum consumption (grey area), production (green area) and net imports (red area) since 1965 and as of 2013 [rh scale] together with the oil price [Brent, black dots and lh scale].

The chart shows that the higher oil price stimulated for more supplies within OECD (dominated by LTO extraction), and at the same time the high oil price and the effects of total debt loads reduced consumption.

- The oil price has in recent weeks significantly weakened and if a higher demand/consumption within OECD fails to materialize from this weakness, this strongly suggests influences from other structural forces.

Figure 14: The chart above (areas are not stacked) shows developments in China’s total petroleum consumption (grey area), production (green area), net exports (blue area) and net imports (red area) since 1965 and as of 2013 [rh scale] together with the oil price [Brent, black dots and lh scale].

Post the GFC it was primarily credit expansion in China (refer also figure 12) that saw to it that global oil demand continued to grow in the face of a higher price. China is also filling their strategic petroleum reserve.

Summary

The spectacular growth in LTO extraction in Bakken in the recent years happened because of a sustained high(er) oil price and the use of more cheap debt for funding. Now it appears this development nears a crossroads.

LTO developments are flexible and allow for rapid adaptation to changes in the oil price and each well represents limited capital requirements, as opposed to large capital intensive oil developments that takes years to bring on line.

It normally takes 4 to 6 months from a LTO well is spudded until it starts to flow.

The prices at the wellhead in North Dakota is now around $63/Bbl (sweet) and should oil prices remain low (or go lower), the future developments of LTO extraction in Bakken will move into the twilight zones between profitability (return requirements), reduced capital expenditures (from declines in cash flows which shrinks the companies’ debt capacities), deleveraging, dividend policies and OPEC policies.

It is from this twilight zone the Bakken “Red Queen”, for some time outrun by the high oil price, cheap debt funding, growth in global total debt and low interest rates will emerge and catch up.

From here it will be most interesting to follow the continued race between Bakken LTO extraction and its “Red Queen”.

Hi All,

I am not quite sure what I am doing incorrectly, but I get lower breakeven costs. Note that 5% interest on 14 billion in debt amounts to about $2/b in interest costs at a ND Bakken output level of 1 million b/d which is 365 Mb per year. If we take 5% of 14 B that is 700 million in interest per year using simple interest rates.

My breakeven cost for the current average Bakken well (see chart below) with oil prices assumed to rise over time from breakeven to $119/b in 23.5 years (life of the average well abandoned at 200 b/month output), transport cost=$12/b, OPEX=$5.5/b, other costs=$3.5/b, royalties and taxes=27.5% of wellhead revenue, and a real discount rate of 7% is $57/b at the wellhead and $69/b at the refinery gate.

If anyone is interested in finding my errors a spreadsheet with the breakeven calculations for the average north Dakota well can be found at the following link.

https://drive.google.com/file/d/0B4nArV09d398b2tILXkwUTBwWWc/view?usp=sharing

I am trying to reconcile the difference between Mr.Likvern’s breakeven of $68/b at the wellhead and my result of $57/b at the wellhead, I believe that his average well (from previous analyses that I have read) is more productive than what I use, this would tend to make his breakeven price lower than what I would get with a new well EUR of 320 kb.

“My breakeven cost for the current average Bakken well (see chart below) with oil prices assumed to rise over time from breakeven to $119/b in 23.5 years….”

What exactly does the above imply?

Should it be understood as the oil price starts at some level and over time grows to some specified level?

Hi Rune,

Yes the price starts now at the breakeven price and rises over time at an annual rate of 2.43% (o.2% per month) for 23.5 years (which is the life of the well).

If we assume the price is fixed over the life of the well (oil prices remain constant for 23.5 years) the wellhead breakeven price is $66/b, which matches your result fairly well.

Note that the EIA estimates that real oil prices will rise to $140/b in 2012$ in their reference scenario and they have tended to underestimate future oil prices.

Your method is likely the standard way that this is done, but assuming that real oil prices will remain $78/barrel for 23 years seems unrealistic so I assume they will rise over time by 2.4% per year on average, this would result in a real oil price of $130/b in 2040 if we start at $69/b in November 2014. Note that $69/b is the refinery gate breakeven price, using this method with oil prices rising over time.

For those that think real oil prices cannot rise above $120/b, I can keep real oil prices under $120/b until 2040 by reducing oil price inflation to 0.15% per month, the breakeven price (refinery gate) rises to $71/b ($59/b at the wellhead) and real oil prices are $114/b (2014$) in 2040.

Dennis,

So you have a break even price that grows with time. …..interesting, never seen that before.

There is no way to confidentially project the future oil price without accounting for global total debts, interest rates, households developments in affordability etc.

How many foresaw the recent steep decline in the oil price?….and what was their reasoning for it?

Hi Rune,

I did not expect prices to fall, I believe that you did and you were correct.

I absolutely agree that the future path of oil prices is unknown.

Note that the choice of no change in price is also an assumption, which may be proven incorrect. Do you think if oil prices fall to say $69/b that the most likely future path of oil prices is for them to remain at $69/b? If so, I guess I am just more optimistic, the assumption of an average 2%/ year rise in oil prices from $71/b to $102/b in 20 years time (2034) strikes me as pretty conservative.

Off course I am correct!

The break even price is what is required to meet certain financial assumptions. It does not foretell anything about future developments, but should be considered as a required weighted price over the economic lifetime.

Anyone trying to guess the oil price 20 years from now is in for a lot of disappointments.

Hi Rune,

I meant that you had predicted that prices would fall and you were correct on that call. You are also correct on the breakeven price, so you are correct on two counts.

You do see that the financial assumptions are simply different. The correct breakeven price assumes that real oil prices will remain at the breakeven price for the life of the well. If we make the financial assumption that the WTI oil price will remain at say $80/b in 2014$ for 20 years, and further assume that the world economy will not collapse when liquid energy output (C+C+NGL+biofuels in Mtoe) declines, then an assumption of $80/b for 20 years is as likely to prove false as an assumption of oil prices rising at 1.8% per year on average for 20 years.

Time always answers these questions.

Your main point, that oil prices are unpredictable is undoubtedly correct, it is also possible that oil prices will fall further to $70/b (or lower) and remain there indefinitely. If that happens, then the peak in liquids fuel output may be behind us.

Hi Rune,

On further thought, a single price makes the most sense, for the simple reason you gave, we do not know future prices. The breakeven price is supposed to be very conservative by its nature.

It asks the question, what constant oil price level under current cost conditions and at a given discount rate will result in the NPV of future net revenue being equal to the cost of the well?

For a $9 million well with OPEX of $6/b, other costs of $3.5/b, transport costs of $12/b, royalties and taxes of 27.5% of wellhead revenue, and a real discount rate of 7%, the answer for the average Bakken well (at and EUR of 320 kb) is $66.50 at the wellhead and $78.5 at the refinery gate, fairly close to your estimate of $68/b.

BTW sports fans, have a look at Rune’s China consumption. 11 mbpd looks likely for 2014, yes? Isn’t that exciting?

Hi Watcher,

The Chinese economy is growing rapidly, the OECD is growing anemically by comparison, one would expect that economies that are growing more rapidly will increase their oil consumption more rapidly as well.

Yes,

but also look at China’s credit expansion. Could there be a relation?

Hi Rune,

China has a tendency to oversave (by western standards), the credit expansion may just be China modernizing, as long as buying on credit is not overdone and payments can be managed, this tends to expand the economy, clearly this can be overdone. In times of recession, it makes sense for governments to run deficits, when the economy returns to health the debt can be repaid, western economies have been doing this for quite a while.

I think the debt problem is not as bad as some think.

See

http://www.economist.com/news/leaders/21625785-its-debt-will-not-drag-down-world-economy-it-risks-zombifying-countrys-financial

China has a low public debt.

There are lots of good analysis about China’s credit expansion and common for them is the total debt load is now of concern ref also reports from BIS and Geneva 16th report.

It appears as the less one knows about China’s total debt and credit expansion the less worried people tend to be.

To me it appears as you Dennis is in the camp that believes that everything will be fine (let us consume more hopium) because there are only small fissures appearing that will be fixed.

And all will be fine…until it is not!

Hi Rune,

Usually the analysis by the Economist is pretty good, but they make mistakes. There are many respected economists that think the debt worries are overblown, but you can always find other economists who think the opposite.

The World was only able to escape the Great Depression by an expansion of credit to fund World War 2. A credit expansion in response to the Great Recession is the correct response as well.

If one prefers less economic growth then tight fiscal policy and tight monetary policy is the way forward. That way there will be less credit expansion, less real investment and more unemployment.

Oh I don’t care why China’s oil consumption is rising. I just notice that it is.

Often. By much. They should seek a per capita consumption equal to the US.

Then we’ll get the curtains up on this show.

Hi Watcher,

The Chinese will try to expand their oil consumption as much as they possibly can. The Chinese are less apt to be fooled by the idea that fossil fuels will never deplete.

They may pivot to nuclear, wind, and solar in a big way and in so doing will in the future leave the OECD in the dust (or at least those OECD countries like the US that refuse to prepare for the coming peak.) I hope I am wrong, but it will be great for the poor in China who may be lifted out of poverty. That is of course unless World War 3 starts because someone thinks the proper response to poor economic policy, is not to change your economic policy, but to use nuclear weapons to wipe out the competition.

People who think in those terms have not really considered carefully the notion of unintended consequences.

Yes, the consequence would be that there’s more oil to burn for the winners. The unintended consequence would be that the manufacturing China was doing will now have to return to America.

Hi Watcher,

Only in your world is that the likely outcome.

Very simple math here…if per capita oil consumption in China grew to that of America, China would consume every single drop of oil on Earth at current production rates. I think you are correct and China does not believe that it is even remotely possible to achieve this.

Hi CaveBio,

Clearly China’s per capita consumption cannot rise to US levels. They will try to increase consumption as much as possible until they transition to other forms of energy.

My guess is that they realize that coal resources are not unlimited and will begin to slow down the growth of coal fired power plants as well.

Hi.

Good analysis, and important to run.

Two things, the first of which is that the cost of capital as of Oct 2014 for energy companies was ~ 7% but it’s been moving up smartly of late. It could go back down or it might rocket higher. You might want to re-run the break-even under a variety of interest rate assumptions to check the sensitivity, as usually this is among the most sensitive of factors.

Second, I think the EUR needs to be fiddled with mainly on the basis of OXY seeking just $3b for 335,000 core Williston acres. Assuming just one well per 160 acre spacing, and an average of $20 in net profits per barrel (from your analysis and $77 oil) this measn OXY was seeking to sell $12.5 billion in potential profits for $3 billion.

Either I have to assume OXY is full of idiots (which it is not) or they know something about that acreage which does not square up an an EUR as high as is generally modeled and assumed.

Chris,

Hello and thanks!

I have run through a range of assumptions (well profiles and other variables), but one parameter has been, is and will continue to be dominant: THE OIL PRICE.

I went through the financial statements of several companies, and I take it that your reference of about 7% is typical for medium/smaller companies (may be even higher for smaller with low equity). Companies (big integrated) with good credit rating (AA or similar) I found had a weighted interest just shy of 5% (economics of scale).

I have checked for several interest rates, but there is one additional important issue, and that is when debts are due to be retired (debt redemption profile). I opted to use a conservative approach (for the public domain), assuming debts were retired as fast the revenues allowed and low interest rates.

Your point is valid and important.

We need to dig deeper into OXY’s numbers to understand their asking price. How much of that acreage is developed? What is the quality of remaining acreage? What is present production and how is this projected to develop?

There is no way to make a value assessment of the numbers you present.

OXY is in reality selling a projected future net cash flow profile.

The question to ask is not to focus on the price, but why are they selling their acreage. (There may of course be several reasons for this.)

Gentlemen, it seems I recall this Oxy sale included an estimated 80 million BOE of “developed” reserves, proven, I believe, with 16,000 BOEPD of existing production on the acreage being offered. For the record, at the time of the announcement of the sale WTI was still trading above 90 dollars. The very next day prices starting sliding.

In the Eagle Ford here in Texas I have seen much smaller trades made based on dollars per net acre, which I never quite understood. That price per acre could be anywhere from 10,000 to 40,000 dollars an acre, I guess based on the production that came with it and how sweet, or unsweet the area was.

At 90 dollar WTI there use to be an 85,000 – 100,000 dollar per net barrel of oil number floating around for buying shale oil production; I reckon that number has now gone adios.

It will be very interesting to see how a now very wobbly shale oil industry starts dumping assets; for how much and to whom.

Mike

Mike, Thanks!

80 MBOE of developed, proven reserves gives us a number and let us assume it is all LTO.

Further that LTO on average fetches $70/bbl at the wellhead, which after taxes, royalties, OPEX, financial costs nets back roughly $43/bbl.

That would have an undiscounted value of $3.4 Billion. Tight oil wells decline, so most of this production comes early and the discount effect will reduce the Net Present Value (NPV) and the higher the discount rate the more the undiscounted value “shrinks” (lowers the NPV).

Then add the value of undeveloped reserves +/- uncertainties to proven, developed, which may be hard as this is very much related to future developments in the oil price and how these reserves are developed over time.

Normally any remaining depreciation remains on the books of the Seller.

It is not about the stock, but the (cash) flow!

If the numbers for developed reserves (80 MBOE) and the asking price ($3 Billion) is close (based on media I presume), I would say the asking price is too high.

Has the company in question completed a transaction for its acreage?

Rune

Rune, here ya’ go: http://bakkenshale.com/tag/oxy/; I was close anyway. I would guess 80% of the estimate would be liquids.

No sale yet that I have heard. It won’t be me, I assure you.

Mike

Mike, I posted below before I had read the link you provided.

From NDIC data there is about 1 Mcf of gas per barrel of LTO. 1 Mcf approximates 0.17 BOE.

Based upon the numbers in the article linked to there is about 75 Mb with LTO and 12 MBOE with gas. Gas fetches around 5 – 7 % on a BOE basis. So sticking to 80 Mb with LTO gives a slight positive bias as well as using 6 Mb/a (It should be a and not d as presented) of LTO to the estimates I provided.

Sorry,

on a BOE basis gas fetches around 30 – 35 % of LTO.

ADDENDUM

As Mike kindly provided numbers on developed proven reserves of 80 MBOE (still assuming all of it, LTO) and a flow of 16,000 BOE/D which roughly is 6 MBOE/a.

The number tells something interesting as this translates into a Reserves over Production ratio (R/P) of about 13 -14 (which theoretically means that an extraction level of 6 MBOE/a could be sustained for 13 to 14 years (a rectangular profile). Further, it tells that the production has come some way down along its decline profile (getting long in its tooth).

In the real world, it does not work that way so what follows is a simplified estimate based upon a triangular production profile starting at 6 MBOE/d and declining to about 0 after 25 years. This should be a close approximation to what should be expected.

@ $70/bbl at the wellhead

Net Present Value (NPV) at 7%: $2,0 Billion

Net Present Value (NPV) at 10%: $1.7 Billion

@ $90/bbl at the wellhead

Net Present Value (NPV) at 7%: $2,6 Billion

Net Present Value (NPV) at 10%: $2.2 Billion

Mr. Likvern, from your Oxy evaluation I have learned something once again, thanks.

I am a little perplexed by Mr. Martensen’s comments, actually. I believe he is assuming that all 335,000 net acres in the Oxy sale is productive at typical Bakken EUR; correct me if I am wrong but that would imply all the acreage is proven, developed. One of my favorite shaleisms is the term “de-risked;” drill a shale well in an acreage block and the entire block magically becomes proven, developed reserves based on projected well inventory. Its an accounting principle that separates the real oil industry from the shale oil industry, IMO.

In any case, you suggest the NPV10 of the Oxy production included in the sale is $1.7 billion at 70 dollar oil. Personally, I would not buy it for that if you gave me the money but I agree with the evaluation. Regardless, it further suggests the value of remaining acreage for sale not already allocated to a well(s) is $1.3 billion. Mr. Wald suggests that acreage may be goat pasture. I’ll eat my hard hat if Oxy gets $3 billion dollars for that.

Why this is all important, at least to me is that, as you have pointed out, it is a long standing tradition in the oil business to kick the cost of plugging and decommission down the road by selling production to smaller companies who think there may be some magical “upside” to the purchase. I am not so sure that is going to work in this shale stuff. Also, how shale oil production is bought and sold is going to give us an insight into it’s real value, as opposed to ‘booked” value, and may cause a lot of financial institutions footing the bill for shale development great angst. Or should I say, greater angst. I always like to remind people that the E in EUR stands for estimated; tinker with it all you want, its still a guess, especially in tight shale with nano darcies of permeability. Just from a practical standpoint I never bought into all those long, fat tails; no, sir.

Lastly, in any large production sale, there must be a willing buyer, generally with a very willing banker ready to finance it. The shale oil industry desperately needs to de-leveraging its massive debt; if selling assets is one of the ways to accomplish that it is going to require even more borrowed dollars, in my opinion. I am not so sure that’s going to work, either. I think the folks funding this shale stuff are already getting the heebie jeebies. There will be some big “losses” in shale oil production deals and really big tax write downs.

Its going to be fun to watch how this mess sorts itself out.

Mike

Hi Mike,

It will be interesting. If prices remain under $80/b it will be a mess. If oil prices rise over time by 1 to 2% per year from current levels, the mess will come later (2017 to 2019) in the North Dakota Bakken/Three Forks.

I imagine the entire oil industry in the US is suffering at $80/b, though you would know better than me.

Mike,

Your comment should be put in bold red letters and be designated as required reading before anyone is allowed to comment on LTO. Next, the following two sentences should be inscribed in blood: “…drill a shale well in an acreage block and the entire block magically becomes proven, developed reserves based on projected well inventory. Its an accounting principle that separates the real oil industry from the shale oil…”

I know absolutely nothing about LTO but, based on years of work on conventional plays, I’m continually amazed at the way terms “reserves and proven reserves” are tossed around in the shale industry.

Dennis, you are right; whenever it happens it is still a mess. I don’t think very many people know how big a mess it actually is.

I would say, from someone who produced a great deal of oil at $9.00 a barrel, the conventional oil business is still very healthy at 80 dollars. To maintain fairly predictable decline rates of existing conventional resources thru EOR and infield development, etc. we need for rig rates, labor, services, all costs to go down. The LTO business has had an easy time of it the past 5 years; let them eat fish heads for awhile and maybe costs will go down.

Mr. Leighton, well said; it is essentially two entirely different business… the young, over- leveraged LTO business that everyone is now so enamored with, and the old, traditional conventional resource business that is still reliably providing the majority of hydrocarbons the world relies on.

Mike

Hi Mike,

I guess time will tell. I am sure oil will continue to be produced at $80/b, but in the US at least at $80/b not many new conventional wells will be drilled (nor many new LTO wells). So my expectation is that overall US output will be flat to declining by 2016 if oil prices don’t rise.

My guess is that at $9/b you would be abandoning a lot of wells. At $80/b there are probably some wells you might shut in that are profitable at $90/b.

I am not suggesting that no oil will be produced, just that at lower oil prices there would be less oil produced.

Mike, thanks!

The OXY estimate/evaluation is, call it a “back of the envelope” estimate, based upon the data from the linked article.

The magic word today is GROWTH!

A couple of years back (just after my first “Red Queen” piece at The Oil Drum) I was involved in discussions (with industry professionals and petroleum specialists (like professors) from academia) about understanding the connections between the LTO production curve (cumulative versus time) and cumulative Net Present Value (NPV) for call it the “average” LTO well.

Now view it from two participants,

A) Seller who got in early and tries to sell at some optimum point (maximizing profits/earnings or NPV).

B) Potential Buyer

What is important to understand is how the time value of money works (NPV) with the geometry of the extraction curve for the LTO well.

The Seller A will by his number crunchers (oil companies of some size have very good number crunchers in their staff) find out that the optimum time to sell is some 5 to 8 years after they got started.

What A sees is that the NPV additions (to the cumulative) with time hits an optimum.

Remember B starts out at time 0 (or 1 whatever preference, there is in the timeline) which for B may be some 5 – 8 years after A got going.

This may be illustrated that for the well (it goes for a conventional field as well) used to illustrate this is that after 8 years an estimated 60% of the wells EUR had physically been recovered while cumulative NPV was 75% – 85%.

The point is the connection or disconnection between physically recovered and financially recovered.

This is something few are aware of.

So if this observation had anything going for it, this would mean that some 5 – 8 years after the LTO activities really got started some companies aware of this effect would start to look for buyers for their LTO assets.

Remember this is also much influenced by the oil price and how the production profile develops, but it gives some idea of the financial dynamics involved.

Look around now and see how many companies (preferably of some size) that has been looking to find buyers for their LTO assets.

Needless to say, the potential Buyer has less financial muscles than the Seller.

Oh and there is more, transactions of LTO acreage involves the finance industry and the dynamics described above (due to the NPV thing) requires growth in total debt.

OXY consistently drills some of the worst wells in the Bakken. Completion techniques and well management have been implicated as potential problems, but the bigger issue is probably that the company simply doesn’t have very good acreage, geologically or economically. The announcement of wanting to get out of the Bakken wasn’t much of a shock.

Earlier this week came the announcement that MDU Resources d/b/a Fidelity Exploration & Production is looking to sell all its acreage in the Bakken as well. MDU Resources is essentially a local company (headquartered in Bismarck) but never really seemed comfortable drilling in the Bakken, plus, as a relatively late entrant, was unable to secure much prime acreage. Management has indicated that there is more money to be made in the midstream sector of the Bakken, so that is where more of the company’s resources are to be concentrated. To that end, the company is involved in the new 20,000 bpd refinery in Dickinson expected to open next month. Construction of another 20,000 bpd refinery somewhere else in the Bakken is also being studied (it would be tenth [10th] such refinery proposed for the region; the Dickinson refinery is the only one to date that has actually gone to the construction phase).

Hello,

I will now do something I seldom do, because Chris Martenson’s comment demonstrates poor understanding of petroleum economics, shale developments and some pompousness.

”Two things, the first of which is that the cost of capital as of Oct 2014 for energy companies was ~ 7% but it’s been moving up smartly of late. It could go back down or it might rocket higher. You might want to re-run the break-even under a variety of interest rate assumptions to check the sensitivity, as usually this is among the most sensitive of factors.”

Note how Mr Martensen tries to suggest that I did not check out several interest levels (for debt) when preparing the article.

And then subtly wants me (for free!!!) to check out the break even price for different interest rates.

First Mr Martensen gets access to work for free and then follows on and asks for more freebees (where I come from we call these kind of people for >freeloaders), which he then likely turns around and tries to commercialize.

And no, interest rates is not a dominant factor, THE OIL PRICE is.

Second, I think the EUR needs to be fiddled with mainly on the basis of OXY seeking just $3b for 335,000 core Williston acres. Assuming just one well per 160 acre spacing, and an average of $20 in net profits per barrel (from your analysis and $77 oil) this measn OXY was seeking to sell $12.5 billion in potential profits for $3 billion.

Note how Mr Martenson suggests to fiddle around around with the EUR (which likely is a favorite for some of his background).

EUR means Estimated Ultimate Recoverable.

Mr Martenson: What kind of EUR number are you wishing for?

Further the data used are actual data (from every flowing well) from NDIC (which was stated in the article, so perhaps Mr Martenson should take his time to read and digest the article before suggesting anything).

Mr Martenson continues to demonstrate his lack of insights into petroleum economics.

Either I have to assume OXY is full of idiots (which it is not) or they know something about that acreage which does not square up an an EUR as high as is generally modeled and assumed.

As for what I have presented in the article and in the comments in this thread OXY clearly is not full of idiots.

The idiot has willingly and voluntarily presented himself to the public.

As for Mr Martenson he might find it useful to read

Lessons from Dunning-Kruger

Lessons from Dunning-Kruger

“What’s curious is that, in many cases, incompetence does not leave people disoriented, perplexed, or cautious. Instead, the incompetent are often blessed with an inappropriate confidence, buoyed by something that feels to them like knowledge.”

With the best of intentions

Rune Likvern

Hey Chris, thanks for the freebie.

Feel free to take some time out from your busy schedule and drop in once and awhile, won’t ya? ^u^

Well done, Mr. Likvern. I trust this will receive the media attention it deserves.

I assure you the Eagle Ford Red Queen race is well under way also. We are awash in LTO at the moment; prices have declined and price volatility has returned. The shale “revolution” is likely little more than an uprising. T. Boone is correct, the shale oil industry shot itself in the foot.

Thanks again for your good work, sir.

Mike

Mike,

Thank you!

Honestly I think what we are witnessing is sad as it may be a precursor to something …call it difficult.

I understand consumers relief from a lower oil price, but on the other hand you need healthy oil companies that can bring oil to the market, even if that increasingly becomes more expensive.

RUNE,

Great work. I especially enjoyed the graph showing the relationship between the OIL PRICE & the FED QE POLICY. This has to be one of the most important graphs in the article. Very few people have put together the realization that without the FED MONETARY STIMULUS, the market as a whole cannot afford this expensive unconventional oil.

Japan has just embarked on the same kind of Hyperinflation monetary policy as the German Weimar Republic back in 1920’s. They only difference, the Japanese aren’t printing actual notes, rather they just add trillions of more yen digits. This is the last stage before the once great Japanese Business empire goes down the toilet.

Right now, the U.S. Dollar is enjoying strength due to the death of the Japanese Yen, but this won’t last long. If the FED doesn’t continue with QE4 & QE infinity, then we head into a deflationary collapse. So, I doubt the Bankers & Elite will allow this to happen.

Again, without the FED & MEMBER BANKS propping up the entire market with monetary stimulus from hell, the United States and most of the world would have never come out of the collapse of 2008-2009. Also, I believe we would have seen a peak of unconventional SOONER rather than LATER.

steve

Wall Street is in deep in the Bakken and for that reason alone, it is not going to shut down.

Cash flow to them won’t stop.

The TF is a conventional oil reservoir under the impervious lower Bakken Shale that contains fissures and cracks that leaks out the Bakken oil and deposits into the Three Forks, it contains Bakken oil. The Middle Bakken is the source rock, the hydrocarbon system, and if you read Leigh Price’s paper, you will read that as oil is extracted from the Middle Bakken Shale, the kerogen begins to form new oil.

Wall Street analysts are well aware of what is going on and the development of the Bakken will continue well into the future.

Suffice it to say that the development of the Bakken will be funded and financed until the cows come home.

You do realize that if this were true no one would be hauling an entire train load of sand to drill a single TF well? They would just drill a much cheaper, conventional, non horizontal and non fracked well to access TF?

There is no company or organization called “Wall Street”. There are Wall Street bankers, oil company investors, ETFs and other types of funds, brokers, brokerage houses, speculators, hedgers, insurance companies, stock exchanges and… that’s all I can think of right now but I am sure I left some out.

You need to be more specific. Which of the above named organizations will keep the Bakken up and running full steam ahead?

Goldman Sachs

http://oilandgas-investments.com/2013/energy-services/bakken-oil-three-forks-formation/

Lines of credit:

http://www.bizjournals.com/denver/blog/earth_to_power/2014/07/sm-energy-to-acquire-61-000-acres-in-bakken-for.html

Five of the continuous AUs and one conventional AU are in the Bakken formation, and one continuous and one conventional AU are in the Three Forks formation (Figs. 3 and 4). The Bakken AUs are similar to those defined for the 2008 assessment; modifications reflect geologic insights gained during the past 5 years of drilling activity.

http://www.ogj.com/articles/print/volume-112/issue-1/exploration-development/bakken-three-forks-largest-continuous-us.html

dood, where have you been the last 3 months. You realize all those links were from the time of $110/b oil?

I heard Lynn Helms say himself that breakeven is at 30 to 40 dollars per barrel.

Maybe true or maybe not, it remains to be seen.

Where have you been?

Helms said that? Or Kudlow?

BTW with horizontals and fracking 20 yr old technology, why would it take til 2008 to start going after NoDak oil if breakeven is $30?

What you will find is people say “some of our wells are profitable at $30. True, if they are already drilled.

What you will find is people say “some of our wells are profitable at $30.

They me be cash flow positive, but not necessarily profitable.

“With oil prices at the wellhead in Bakken at $70/Bbl in the summer of 2012, the companies netted back around $45/Bbl.”

70 minus 45 equals 25. The breakeven is at 25 dollars according to what is in Rune’s analysis right here in the today’s post.

http://www.resilience.org/stories/2014-01-09/red-queen-update-in-bakken-nd-it-is-now-mostly-about-mckenzie-county

Here is what it says at the link:

For what it is worth the model estimated that total production from the producing wells (Bakken (ND)) as of October 2013 to October 2014 (year over year) would decline by 318 kb/d or 37%.

Doesn’t look like that happened at all.

It doesn’t seem reasonable that with horizontal drilling and fracking 20 year old technology that it took til 2008’s $147/barrel to get NoDak underway– if they could have made money at $25/b.

Additionally, with that alleged profit margin CLR and EOG would be funding new drilling from cash flow, not 6% high yield bonds. And further, CLR and EOG would not have their bonds rated less than investment grade (aka junk) by Moody’s – which they are — if those margins were there.

Hi Village idiot,

Rune’s analysis suggested that if no more wells were drilled after Oct 2013, that the decline would be 37%, this was to get a handle on how many new wells would be needed to keep output flat at Oct 2013 levels.

Also note that the netback is the net revenue a company receives after paying royalties and taxes, transport costs, and all operating expenses (including interest and overhead).

The company still has to pay back the principle on any loans and have funds to drill new wells and has to earn a 7% real rate of return on money invested. The breakeven price is the oil price needed to make this happen.

Today the breakeven price is between $66.5/b (my estimate) and $68/b(Rune’s estimate which may be the better estimate).

Mike from S. Texas, who knows much more than I about the real oil business suggests that my estimates probably underestimate many of the real costs of producing oil, so I think he would like Rune’s higher estimate of $68/b and might even add a couple of dollars for stuff that Mr. Likvern (who also knows more than I do about the oil business) may have left out.

A big problem with many of the analyses by investment firms like Goldman Sachs, is that they take the well profile presented in investor presentations as their starting point. That “average well” produces 450 kb over a 60 year lifetime.

When you look at the actual well data from the NDIC and consider that rising water disposal costs for older wells will result in abandonment when the well produces less than 7 barrels per day, then a “real well” will produce only 320 kb over about 24 years. This raises the breakeven oil price.

Also note that if we assume the well is not abandoned until 30 years (at an output of 3b/d) the EUR only rises to 330 kb and the breakeven oil price falls to $66/b at the well head, not that this is equivalent to a WTI oil price of $78/b.

Yesterday the Dec 2014 futures contract for WTI closed at $78.54 on the NYMEX exchange and my “realistic” estimate suggests $78.50 is the breakeven oil price, with Mr. Likvern’s estimate at $80/b (prices at the refinery gate which is equivalent to the WTI.)

http://www.marketwatch.com/investing/future/crude%20oil%20-%20electronic

breakeven $30-$40?

ahahahhha

AHHHAHAHHAHAHA!

maybe on 10-20% of wells

if you read Leigh Price’s paper, you will read that as oil is extracted from the Middle Bakken Shale, the kerogen begins to form new oil.

That’s crap. Kerogen forms oil if cooked at “coffee pot” temperatures for a few million years, or in just a few hours if cooked at about 650 degrees F.

The Middle Bakken is at “coffee pot” temperatures. The kerogen there may still be turning into oil and gas but it is an extremely slow process, one would not be able to notice any change over the course of one human lifetime.

Capitalists aren’t going to fund anything at a loss. They’ll cannibalize current cash flows to stay afloat, sure, but no one is investing in something with an expected negative return.

Now, we’ve established that bankers will lie straight-up about the return and the risks (see housing) but that just means that when the investments fail – and a lot of them will fail at these prices, because they were marginal-to-Ponzi to start with – interest in these investments plunges and you can’t give them away.

This has happened to the oil industry before.

Idiot,

I actually agree with you. The system is driven by MONETARY HEROIN, if you pull the drug, the entire system crashes.. with possible death. So, yes… the FED & Wall Street will continue to prop up the Bakken and Shale Oil & Gas market because a continued ENERGY SUPPLY is necessary to keep the Fiat Monetary Dollar system alive.

Death of one, is Death of the other.

Who knows how long before the system finally cracks, but when it does… I wouldn’t want to be anywhere near a major city or metropolis.

steve

Hi Steve,

I will reply here for the interest on the debt comment below, for the field is very crowded down there…

Fed has been buying the majority of longer maturity treasuries, because the interest on the $18T debt is not a LINEAR, simple math one, otherwise we wouldn’t be able to pay it even now. If you would like me to expand on the details of that (the steepening, or widening of the yield curve and what those concepts mean) I’ll do it on your site, for it takes a long time. Most of the national debt now is under 5Years (actually mostly under 2years maturity) with a much lower interest and it will stay that way until the whole thing goes “kaboom”. There will be NO interest rate increases (actually the yeild on treasuriesWILL go lower – contrary to common sense belief!) Fed will not let it! When that happens (rate increase), that means they lost control and is time to run for the hills (literally!) and pray. Also, the low interest payments on the NATIONAL debt are NOT the principal reason(as you say in your comment, Steve) why the fed keeps rates low, they are a cool bonus …Rates are kept low to keep the total outstanding consumer/corporate credit/debt (which FAR exceeds the national one) from collapsing and MOST importantly: for enabling more borrowing! In order for our system to continue, we need more borrowing more than we need air to breathe…really!

2. And this is for Dennis Coyne as well as you:

going to gold standard is extremely DEFLETIONARY not inflationary (again, details to explain far exceed the space on this blog’s comments, so I won’t go there) If we go to gold standard (hypothetically speaking) we WILL have the mother of all margin calls and enter a deflationary death spiral …and Dark Ages …in very, very short order…and it will not be like the one following the fall of Rome, for they did not have nukes!

Whoever truly believes that (gold standard) in today’s environment i.e. Jim Sinclair, Richard Russell, etc., knows nothing of the modern economics and money. The very few ones who really know, i.e. J. Rickards, say it for OTHER reasons.

After the fall of Breton Woods in 1971, the ONLY chance we had to go back to gold standard (and afterwords undo the ills we’d done to make us go off of it in ’71 and do things right – which we would have never done anyway and makes the point an oxymoron and mute!) was when gold reached $800+ in 1980, or so.

We have crossed the Rubicon…strange and bizarre as it may sound, today we should pray that ol’ grammy Yellen is able to stretch this longer, for it is bonus time for ALL of us and we should enjoy!

hard to fathom, but true. Indeed!

Be well,

Petro

P.S. : very good post Rune. Thank you!

Hi Petro,

Thanks for correcting me. That makes perfect sense, gold would be in short supply which be like a contraction of the money supply, this would drive interest rates up, but would lead to a deflationary spiral like 1929 to 1933 (in the US) along with economic collapse a la the Great Depression.

Essentially a gold standard would cause credit to dry up and would be like throwing sand (or super glue) into the gears of commerce.

…in a nutshell: bingo…but in over, over, over …………drive.

-Great depression is a kindergarten spooky Halloween brunch compared to what’s coming. Very few people know the details of this, and I am lucky (damned…) to be one of them…but seriously: at this stage of the world economy and credit markets, pray that gramy Yellen is able to go to the mics every month and speak what all of your fellow commentators here and most of pundits out there call bullshit, for that means They are still in control…still.

-Bizarre, ain’t it!

The die has been cast! No matter who is president or fed chairman or…(you put the name here..) even Ron Paul (who truly does NOT understand that, the hole we’re in is inescapable! He should have been president after Kennedy and most definitely BEFORE Reagan…that way we might have had a small chance today…) The difference between one, or another will be ONLY timing – NOT the outcome. Peak energy is closer at hand and might be mingled (or instigator of) with the financial calamity, but for most of us the climate catastrophe might be the Thing we will not see…of course the ones of us who are going to be “lucky” to be alive afterwards will have to deal with the wrath of Mother Nature….so consider writing and reading at this site, or wherever just fun and do not take it seriously. It got me nowhere eventhough I know financial and economics matters like a handfull few and profited handsomely for it…

So, whoever tells you that we are going to have money backed by gold/silver (or any hard, “unprintable” commodity for that matter!) after it all collapses, is a dummy (99%), or a liar (1%).

Pray for yellen, kuroda, draghi and co. to give all of us more time….I am, every day!

What I told you is NOT representation of “Stockholm Syndrome” and hope it helps! With the risk of being a presumptuous prick, I dare to say is the best advice you will ever get and I was generous enough to give it to you for free..I need to redeem my past sins…some anyway…You are welcome!

Go to Europe, smoke that old Cuban you been hiding, crack that Chateau Margaux open, cash that 401k and Be happy and well.

Petro

P.S.: next stop: negative iterests rates (NIRP vs. ZIRP))and cashless society…interesting times! Ha, Ha, Ha…

Meanwhile, over in Asia, following his latest election shellacking delivered by a minority of lost souls who bothered to vote, the formerly most powerful leader in the world, Barack Obama, will star in a thriller this weekend, appearing in the same room with Xi Jinping, Shinzo Abe and, drum roll please – Russia’s Vladimir Putin.

Yair . . .

Brisbane is in Asia?

Cheers.

The whole capitulation to the governpimps is in a sense one glorified Stockholm Syndrome.

Petro,

Thanks for the explanation. Yes, I realize the FED has been sucking up the long dated Treasuries, and a result is a lowering of the annual debt payment. I do realize this is a BONUS, and not the stated goal of the FED.

I also do realize the FED will never raise rates or the whole system would collapse. However, the borrowing you are talking about is mainly by the large corporations and banks… not JOHN Q PUBLIC.

Lastly, as to your reply to Dennis, I do realize the collapse of the Fiat Monetary System and the FED could push us into a new Dark Age. Unfortunately, with the Nitwits running the show now, I don’t see an alternative.

So, I really don’t give a rats azz if the world went back on a Gold Standard, I just like to discuss it for the sake of argument. However, when the Great Paper Ponzi Scheme comes down, I would much rather be holding onto precious metals than just about all of the paper garbage masquerading as ASSETS.

Basically, its how to protect oneself after the collapse and not how to try to fix the system that can’t be fixed.

steve

Hi Steve,

Wouldn’t we see very high inflation rates if there was a gold standard?

Would that be a positive attribute of such a system?

Has real GDP grown at the same rate as the growth of gold supply over time?

Dennis,

Yes, the market would experience relatively high interest rates compared to the near zero interest rates today… artificially manipulated of course. However, the U.S. Govt cannot afford high interest rates as it would push the $350 billion in annual interest payment on the debt to probably over $1 trillion.

Which is the reason interest rates CAN NEVER RISE until the entire system collapses.

Dennis, if we were on a real gold standard, I do not believe it would allow the production of most unconventional oil sources. Nate Hagens also believes this to be true. Under a true gold standard, the kind of debts we are experiencing today would not be allowed.

Thus, debt has allowed us to steal oil production from the future that we really can’t afford today. Sounds strange… but that’s the common sense of it all.

If the world backed their fiat currencies with gold, the price per ounce would be north of $10,000 and more like $15,000-$20,000. The price of silver would rise to $200 or more.

Which is the very reason the FED & MEMBER BANKS have been destroying the paper price of gold and silver over the past 3 years and especially the last week to put negative pressure on the Swiss Nov 30th referendum vote to back the Franc 20% with gold.

The SNB and the Swiss Govt do not want this vote to pass, but the polls say the public has a 45% YES and 39% NO. I would imagine if the fiat monetary authorities can push gold down to say, $1050-1,100 by the end of November, this might be enough to get a NO VOTE.

Lastly, I don’t believe the U.S. has had real GDP growth since 2007. We consumed 101 Quad BTUs of energy in 2007 (at the peak) and now we are at 97 Quads currently. How does GDP Grow if energy consumption falls?

How? You get the Magicians at the U.S. Govt to under-report inflation which over reports GDP Growth.

steve

Hi Steve,

I will try to be more clear.

You think a gold standard is a good idea. You also seem to think debt is a bad idea. I disagree. Too much debt is a bad idea, no debt would mean economic collapse.

Let’s do a thought experiment and imagine the Bretton Woods system had remained in place. Ignore interest rates for the moment and focus on inflation rates. What do you think would have happened to inflation rates if we had not dumped the Gold standard? Either economic growth would have been much slower or inflation would have been much higher?

So by advocating a gold standard either you would like to see slower economic growth or higher inflation, or some combination.

Note that I am talking about the World economy and the assumption is that all major economies ad never left the Gold standard.

Dennis,

Let me see if I can explain this way. The Western Roman Empire collapsed due to a falling EROI which was experienced via their debasement of their Silver Denarius. However, the Eastern Roman Empire lasted for another 1,000 years as it did not debase its gold coin… the Byzantine.

Even though the Western Roman Empire collapsed in a huge part by debasing their currency… they had relatively little debt.

The U.S. System not only debased its currency, the U.S. Dollar, we are up our eyeballs in debt… which we must remember as peak oilers… are nothing more than ENERGY IOU’s.

Dennis, the Bretton Wood’s gold standard died in the 1960’s when the western countries joined a GOLD POOL to dump gold and the market to suppress the price. This is why Nixon dropped the Gold-Dollar peg in 1971 and a great deal of our gold went overseas.

However, if we were on a real gold standard, ACCOUNT DEFICITS would not occur. Gold is the ultimate distinguisher of debt. So, even though we may have had some debts, it would be a fraction of what they are today… this goes for the rest of the world.

And.. you must remember, all the BONDS and Govt’s balance sheets aren’t ASSETS, but also future ENERGY IOU’s.

Lastly, Peak Gold production would have occurred back in the early 2000’s if we were on a real gold standard. Which means Global GDP growth would have also peaked.

steve

Hi Steve,

So you think economic growth is a bad thing?

So you think economic growth is a bad thing?

Good or bad isn’t even the right question anymore, it is simply physically impossible going forward!

However for what it’s worth, I do think it is a bad thing as it is currently destroying every single ecosystem on the planet. Now my question to you is, do you think destroying every ecosystem is a good thing?

And before you answer that question go climb a tall tree and sit on a large branch and saw off the branch between yourself and the trunk of the tree… let me know what happens!

Over at The Oil Drum, perhaps you, too, recall some discussion about economic growth and how an economy could still ‘grow’ but it would be growth of a different kind, like maybe how plants grow; growth modeled on natural growth.

Yes, I do recall those conversations, however all growth, even so called natural growth is eventually limited by the laws of thermodynamics. Tom Murphy of Do The Math blog, has a great presentation on this topic called ‘Growth has an Expiration Date’.

Cheers!

Rings a bell. I’ll check it out.

About Tom Murphy, I don’t think he is actually predicting the end of economic growth. He is predicting the end of growth in energy consumption only.

Um, try that again — he is predicting the end of growth, but he is assuming growth requires energy and not providing much evidence that it is true, except correlations from past economic growth.

he is assuming growth requires energy and not providing much evidence that it is true,

Actually, he isn’t assuming anything! He is unequivocally stating, based on the laws of physics, that there no way in hell that growth, of any kind, can exist without energy!!!

To me at least, this is so obvious that I have a very difficult time wrapping my mind around anyone’s arguments to the contrary. Basically we are both staring at a black square and you are telling me it is white! Sorry to disappoint you but the damn square really is BLACK!

How does GDP grow as energy use falls? First it has to be looked at on a world basis because embedded energy flows with the flow of goods. When looked at on a world basis, increasing energy efficiency can lead to a higher rate of growth of GDP than the rate of growth of energy consumption.

Chart below shows a very slight improvement in energy efficiency around 1990,

as fossil fuels deplete, wind, solar, and nuclear will need to be ramped up or economic growth will have to slow. Reduced population growth and an eventual peak in World population between 2050 and 2100 will allow economic growth to slow down with continued increases in GDP per capita.

Not without a lot of bumps in the road.

Dennis,

Here’s the chart that says it all by Gail Tverberg. You can’t have REAL GDP growth if the energy supply growth goes negative. It’s really that simple. And, I never said you had to believe Shadowstats.

However, only an IDIOT would not consider the $4+ trillion of monetary stimulus sitting on the Fed Balance sheet as not INFLATIONARY. Instead of allowing this inflation to go into the precious metal and commodity markets, it was siphoned into the Bond and Stock Markets

Which is a DIRECT IMPACT on why the Total U.S. Retirement Market increased to $24 trillion in Q2 2014 from $23.1 trillion Q4 2014.

Unfortunately, Americans have been brainwashed into thinking DEBT & MONETARY PRINTING is good. Which is why they continue to contribute into the biggest paper Ponzi scheme in history.

REPEAT… we have had no NET GDP GROWTH since 2007. It’s all been Accounting Smoke and Mirrors. I am not saying you should believe… I am just saying… wait around a few years and it will proven true.

steve

CORRECTION: According to the ICI – Investment Company Institute, the total U.S. Retirement Market increased from $23.1 trillion in Q2 2013 to $24 trillion in Q2 2014.

Also, this is up from a lousy $14.s trillion in 2008. Americans are sitting on the biggest stinking pile of paper garbage.. and they have no fricken idea.

steve

Fer Chrips sakes….LOL

That’s $23.1 trillion Q4 2013 to $24 trillion Q2 2014.

RON WHERE THE HELL IS THE EDIT FUNCTION….LOLOL

Hi Steve,

http://krugman.blogs.nytimes.com/2014/11/09/keynes-derangement-syndrome/

One of my favorite quotes in economics comes from Frank Graham, who wrote that disorder is the sole substitute in social science for the controlled experiments of the natural sciences. What he meant was that drastic events, outside the normal run of experience, offer a much better way to test competing theories than day-to-day events, which aren’t too hard to shoehorn into various dogmas.

So it was with the global economic crisis, and especially the monetary policy response. Broadly speaking there were two views about what would happen when central banks hugely expanded the monetary base. On one side, those with a more or less Keynesian viewpoint saw this action as harmless at worst, possibly somewhat helpful, because they expected most of the new bank reserves to just sit there given near-zero interest rates. After all, that is what happened during Japan’s attempt at quantitative easing after 2001:

see chart below from the Krugman piece

On the other side, many people were quite sure that explosive inflation was just around the corner.

Steve:

Again, great analysis, info and commentary putting the whole puzzle together!

Hi Steve,

I do not agree on the under reporting of inflation, the BLS statistics are good, the Shadowstats stuff, not very credible.

Lastly, I don’t believe the U.S. has had real GDP growth since 2007. We consumed 101 Quad BTUs of energy in 2007 (at the peak) and now we are at 97 Quads currently. How does GDP Grow if energy consumption falls?

This is completely nonsensical. You have you own private definition of what the economy is, but you shouldn’t expect anyone else to be on board. energy is less than 10% of the economy.

There is no connection between physics and economics, just as there is no connection between ethics and cosmology (God rested on the seventh day, so go to church). You are simply muddled in your head, trying to equate two very different things.

What you need to do is ask yourself where the value of things comes from. For example, an IBM XT personal computer consumes a lot more energy than a iPad tablet. Does that mean that it has a greater economic value? Obviously not. In fact, one of the economic benefits of tablets is that they consume less energy. Not consuming energy makes things more valuable.

You get the Magicians at the U.S. Govt to under-report inflation

Lemme see, the price of oil fell from $115 to $78, you think energy controls the entire economy and you’re still complaining about inflation? Shouldn’t you be claiming we are experiencing massive deflation? You are not thinking this through very carefully.