North Dakota publishes Historical Oil Production by County. However confidential wells are not included in these totals. But they also publish a State Summary Report which does include confidential well data for the previous two months. Working with both we can get a pretty good estimate of production from each county.

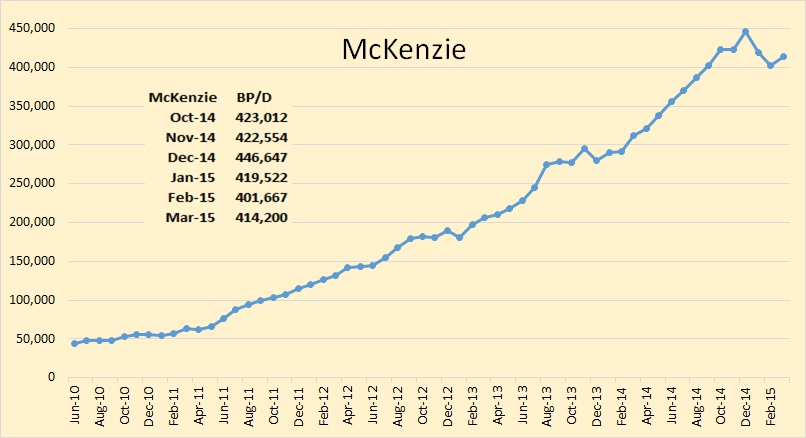

McKenzie had a 12,533 bp/d gain in March but they are still 32,447 below their December high.

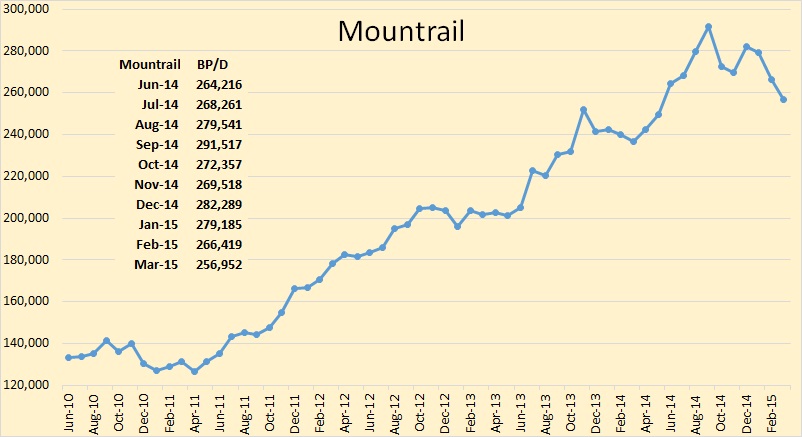

Mountrail peaked back in September 2014 and dropped another 9,467 bp/d in March. Mountrail dropped the most in October when the Bakken rig count averaged 191 and WTI averaged in the mid $80s. Once North Dakota’s largest producer, I don’t think there is any question that Mountrail has peaked.

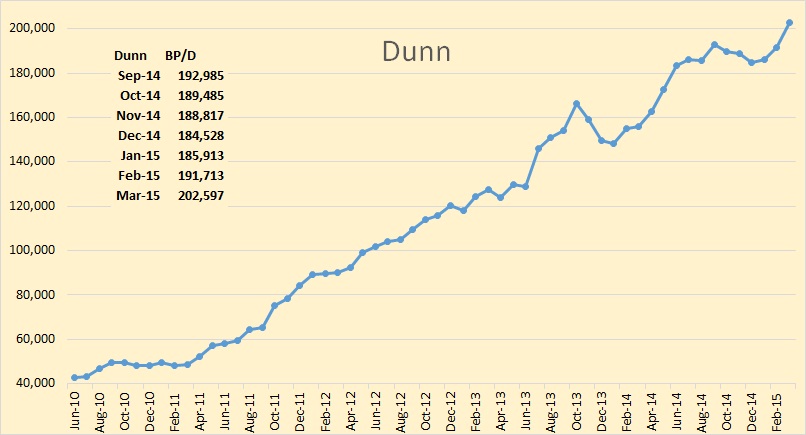

Dunn had a big increase of 10,884 bp/d in March and surpassed its previous peak in September.

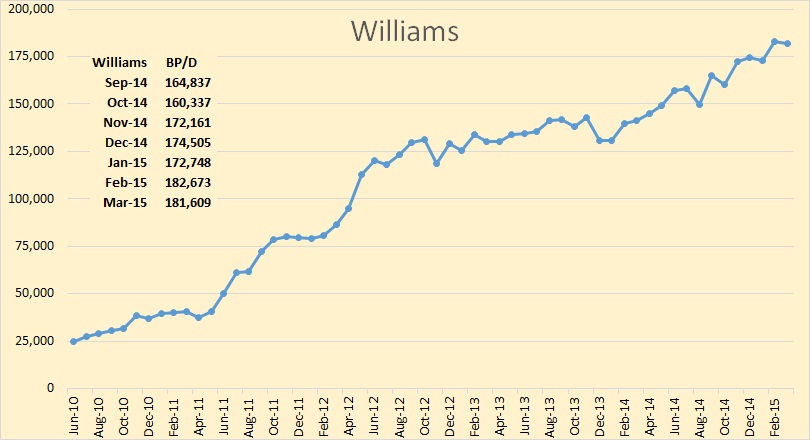

Williams was down by just over 1,000 bp/d in March.

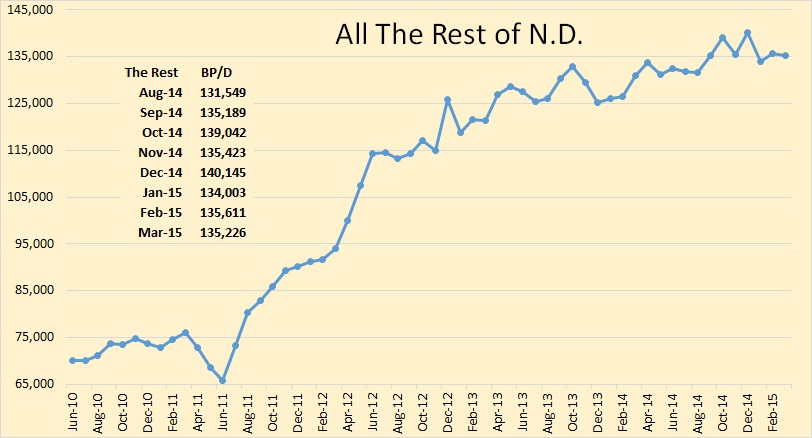

North Dakota outside the big four counties has been basically flat for about a year now.

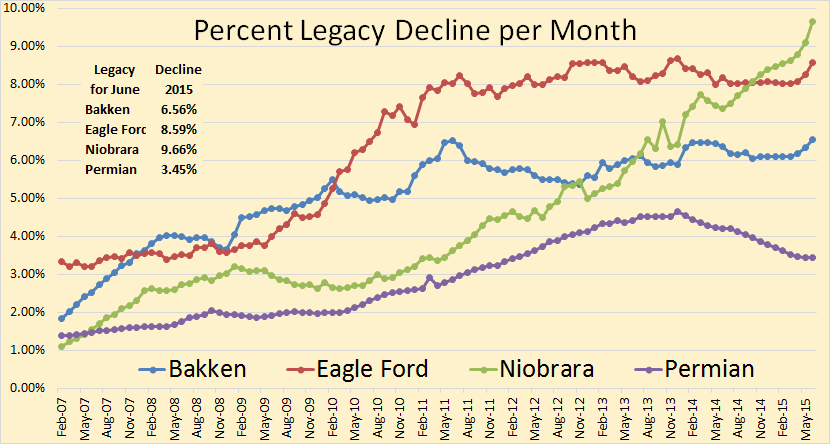

Here I have plotted the legacy decline of all four major shale plays according to the EIA’s Drilling Productivity Report. The legacy decline, in barrels per day, is the total decline all wells combined except those that came on line during the current month. So the plot above is the percentage of this months decline of the previous months production.

I don’t really believe those numbers are accurate. There is no reason that I can think of that would make the decline of previously drilled wells to increase as production of new wells brought on line declines. What the EIA has done here, I think, is to keep the legacy decline increasing every month as if production were increasing also. I cannot imagine the EIA overlooking something so obvious. However apparently they did.

That being said, I think they have the legacy decline relatively accurate before the production in three of the four plays began their decline a few months ago.

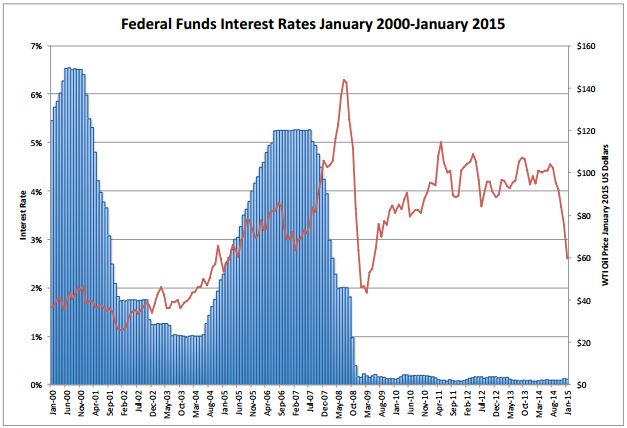

On another subject. Art Berman posted the below chart a while back.

Notice that since the crash of 2008 the Federal Funds rate has been almost zero at at time when oil prices enjoyed years of very high prices. Art argues that all this shale drilling has been done with Stupid Money. Stupid money is really stupid investors looking for a higher rate of return than they can get from the money market where returns are almost zero.

Greenlight’s Einhorn slams oil frackers at Sohn conference and Jim Cramer says Einhorn has spooked the shale oil market, making this a good time to buy them. (Video).

One more comment on stupid money, that is exactly what is driving the Chinese real estate boom. The flood of capitalism into china has created a wealthy class. Though this is still a very small percentage of the people, a small percentage of 1.4 billion people is still an awful lot of people. And they have money and no place to put it. China has a law against people investing outside China. The Chinese stock market is a roller coaster where money can be lost almost as fast as it is invested. So people invest in real estate. To create a market for all this money China is building between 12 and 24 new cities every year. Every piece of those cities has already been sold to the new Chinese middle class. And they are all empty. And they just keep building and building because the money just keeps coming and coming and coming.

That story is told in this twelve and one half minute video. Please watch it before you post below and say that there is no Chinese real estate bubble.

China’s massive real estate bubble, ghost cities

___________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

Ron,

Great article. Ya got to love Art’s graph on the Fed Funds rate vs the price of oil. Art also has a longer term graph that goes back to the 1970’s. You can clearly see how the change in interest rates trended with the price of oil… that is until 2008.

Ron, quick question. Are the companies in the Bakken still working through that backlog of unfracked wells? Do you have any idea the number or how much as been worked through?

steve

Lynn Helms said that at the end of March there were 880 wells waiting on completion. However Helm’s numbers are often off quite a bit and I really don’t believe they were quite that many. But there were, at that time, likely over 800 drilled but unfracked wells. I think they will likely reduce that number by about 50 wells per month. In other words, there will be 50 more wells per month fracked than drilled. So it will likely take them over a year to work through the backlog.

Helms also says that you have a year to complete a drilled well before the state declares it abandoned and requires you to plug it. But reading the North Dakota rulebook, he actually has the discretion to extend this period essentially indefinitely: full wording below for those having trouble sleeping.

—–

“1.The removal of production equipment or the failure to produce oil or gas, or the removal of production equipment or the failure to produce water from a source well, for one year constitutes abandonment of the well. The removal of injection equipment or the failure to use an injection well for one year constitutes abandonment of the well.The failure to plug a stratigraphic test hole within one year of reaching total depth constitutes abandonment of the well. The removal of treating plant equipment or the failure to use a treating plant for one year constitutes abandonment of the treating plant. An abandoned well must be plugged and its site must be reclaimed and an abandoned treating plant must be removed and its site must be reclaimed, pursuant to sections 43-02-03-34 and 43-02-03-34.1.

2.The director may waive for one year the requirement to plug and reclaim an abandoned well by giving the well temporarily abandoned status. This status may only be given to wells that are to be used for purposes related to the production of oil and gas. If a well is given temporarily abandoned status, the well’s perforations must be isolated, the integrity of its casing must be proven, and its casing must be sealed at the surface, all in a manner approved by the director. The director may extend a well’s temporarily abandoned status and each extension may be approved for up to one year. A fee of one hundred dollars shall be submitted for each application to extend the temporary abandonment status of any well.

3.In addition to the waiver in subsection 2, the director may also waive the duty to plug and reclaim an abandoned well for any other good cause found by the director. If the director exercises this discretion, the director shall set a date or circumstance upon which the waiver expires.”

Ron. I the previous post, I noticed that two of the wells I was analyzing had been re-fracked.

Is there indication as to how prevalent this is in the Bakken? Is this being classified as EOR? It doesn’t meet my definition, but I don’t know that my definition is correct.

Also, did you read my OPEX analysis at the end of the last post? I know 9 wells is a small sample, but I expect that OPEX per barrel is going to be higher than advertised in years 3 and beyond in all LTO plays. It is simply a function of much fewer barrels produced, with OPEX not falling at the same rate. Water cut will be a huge issue, as wells that produce significant water, with no onsite disposal, will be challenged economically.

Shallow, I have no idea how many wells in the Bakken are being re-fracked but I would guess it is not all that many. You have just a good of data on that as I do. I do not think that would be considered EOR however.

I am sorry but I have not got around to reading your OPEX analysis. I really don’t have a lot of time to read as much as I should these days. I try to follow the blogs and news stories as much as possible and I try to read most of the comments on this blog. But I have other problems. My wife has serious short term memory problems, probably the first stages of ALzheimer’s, along with other health problems and it is almost a full time job just taking care of her. She interrupts me every minute or so and breaks my concentration no matter what I am doing.

But I do what I can. I get new posts out because I enjoy doing it but deep analysis of the more technical aspects of the Bakken or Eagle Ford is something just don’t have the time to do. I do greatly appreciate the efforts of guys like you and others who do such analysis however.

Thanks.

Ron. Sorry to hear that. Having had family members with similar issues, I know that can be a challenge. Best of luck to both of you!

My best wishes, Ron, and likewise with others’ inputs hereon.

Ron, if you haven’t already. Get your wife to the doctors for a prescription of Namenda. The sooner the better. Also, daily cardio exercise and brain challenging games. Cut the sugar(simple non nutritious carbohydrates) out of her diet. Best wishes !

That is tough. I am concerned that many of my generation will be facing either Alzheimer’s themselves or taking care of someone who has it. We could use far more caregivers, and that would be a great way to put more people into jobs, and yet we treat these as low paying jobs.

Best wishes ! Daily cardio exercise and brain challenging games indeed, probably also medication.

Good luck and good strength to both you and your wife. The life of a caregiver is trying and can wear one down. Having gone through it, I highly recommend getting as much help as possible.

Hi Ron,

I most sincerely wish I could offer you more than just sympathy.

My Dad is getting in bad shape too but I expect that he will be able to look after himself for the most part for another year or two , at least to the extent of feeding himself and getting to the bathroom and so forth.

We have our hands full.

Short and Sweet. I offer my emotions and thoughts for your situation Ron.

The only way I dealt with watching my Mom go was an understanding that this is a Darwinian world.

prayers be damned.

Hey Ron, just wanted to join the others in wishing you and your wife well!

I recall reading somewhere that they are trying larger grain size sand for new wells. I wonder if the point of re fracking is to try larger sand. I can see how larger grains can give higher flow rates for new wells. On the other hand it could result in higher decline rates and I would think no extra oil.

Any indication of the date of original frack? I read an academic analysis by some local Univ professor who said refrack wasn’t at all profitable, but the year of that paper was pre 30 stage fracks.

It occurs to me just about the only way that can work is if the original well frack was 5 or 10 stages, and they choose to lengthen it out and refrack to 30.

Mr. Patterson

My sincere best wishes to you and your family in these trying times.

Shallow, if you view the API numbers of the wells and the last two digits are not zeros, then some sequential activity has occurred post original completion (don’t know the codes, but ND DMR should source the current API #).

There have been several dozen, possibly more, refracs in the Bakken alone – probably several hundred nationwide – but very little info seems readily available.

Ovi, There are many factors relating to a well’s viability to refrac, but the most prominent one seems to be the size/occasion for the original fuckup. There are MANY early wells that have large lengths of non productive zones. Most definitely a work in progress.

Mr. Likvern, The ND folks have just introduced a new well classification SI/NC denoting shut in, no completion. Whether they apply only to newly classified wells or the older ones also, I do not know.

US Shale Oil Firms Say Refracking Not The Best Path In Downturn

http://www.rigzone.com/news/article.asp?a_id=138443

Dunn 200,000 bpd

Mountrail 250,000 bpd

MacKenzie 400,000 bpd

Williams 180,000 bpd

Total: 1,030,000 bpd

Might as well stop drilling in the other counties.

The Chinese have three condos and no cars, instead of one house, two cars, a pickup truck and a boat. Looks like a wash.

Empty cities in China versus empty vehicles in America.

Those Australians like their four-wheeled transport machines at 523 vehicles per 1000 people.

I see an automobile bubble out there on the streets of America.

Vehicles per capita

100% of Hawaii’s electricity to be generated by renewable sources by 2045.

http://thinkprogress.org/climate/2015/05/07/3656346/hawaiis-green-grid-plans/

The islands will be a natural habitat for electric vehicles.

I wish the people of Hawaii success and tip my hat to NextEra Energy for taking on the challenge.

In order to keep the Global economy from collapsing and to potentially raise the 2 billion or so people up from starvation and poverty we need growth.

Growth by definition requires growth in energy consumption. The two are physically coupled.

Growth in “renewable energy” supports growth, and therefore the economy that is paying for them, only when added to existing energy resources so growth in “renewables” must exceed the decline in existing energy resources plus some level of additional and exponential increase.

Growth in “renewables” at that level of magnitude would require consuming massive amounts of conventional energy resources, taking more energy availability away from current uses of energy so that means “renewables” would have to grow even more in order to maintain the existing Global economy and support growth. I haven’t even mentioned that all this new energy, in order to be a benefit to the global economy needs to be economical which means cheap.

So proposing a “transition” to ”renewables” is not a transition at all but just another industrial development that guarantees that we burn up every available source of FF (and every other finite natural resource) at an increasing rate.

Don’t just say that transitioning to “renewables” will generate jobs and growth without addressing the above issues. All the proposals for “renewable energy” and EVs completely ignore the hard cold facts of a Global economy on the brink of collapse and an environment that is also on the brink.

What we need is more state violence to usher in the “transition” (I thought the more fashionable word was “transformation”) to the green Utopia.

And if you don’t believe it, just ask Joseph Stalin or Milton Friedman, two great believers in the Fichtean philosophy (we’ve got to give those romantics and idealists their due) that Utopia is possible, but to get there you first gotta knock a few heads together.

HI Glen ,Jeff

You guys would understand reality a LOT better if you focused your thoughts on biology – specifically Darwinian biology – and the physical sciences – rather than your holier than thou moralizing.

There is a collapse baked in. It is not the fault of any specific person or ideology but rather the RESULT of the biological imperative to reproduce. Fossil fuels are something we humans as a group have used to enable us to reproduce all to well- like rats in a corn crib.

When the corn is gone the rats die off. When the fossil fuel starts getting real short so will we. Dieoff will proceed faster than fossil fuel depletion in many locations due to unequally distributed resources and unequal incomes.

The process is sure as hell going to be accompanied by PLENTY of violence. At least you get that much right.

Some of us will survive. Some of us will may even continue to enjoy a more or less modern life style and society based on renewable energy. There is no guarantee of course.

But there is likewise no guarantee there WILL NOT be a successful transition to a sustainable renewables based economy- in some places at least.

It ain’t over till the fat lady sings.

There is still an unimaginable amount of wealth left in countries such as Canada and the USA – more than enough to enable such countries to make a successful transition- if they make the effort.

Yes, you and I agree on our expectations. Live will get tough, but not everyone will be effected equally and simultaneously.

The idea that there will be global collapse and that everyone in the world will experience it in the same way isn’t something I anticipate. And the reason is that some people are much more vulnerable than others. So I think they will be affected earlier and more profoundly. Others can protect themselves from the disruptions and might even be able to take advantage of the disruptions as fewer people are able to compete for the remaining resources.

Mac,

There’s a drive to have sex. There isn’t much evidence for a “biological imperative to reproduce”. If such as drive exists, it’s clearly pretty feeble.

The majority of the world’s population live in countries where the fertility rate is below replacement. 97% live in countries where the fertility rate is either below replacement or dropping very fast.

Look how your family, and those of your neighbors, has gotten less fertile in each succeeding generation!

I agree that the drive is to get laid rather than to create a baby as such.

The RESULT nevertheless has always been lots of kids- until very recently. Effective and affordable birth control is one of the very luckiest of the beneficial accidents brought about by modern technology.

Now of course I might be so wrong that I am not even in the ballpark but I THINK the doomers are MOSTLY right – that MOST of the human race is too poor and getting too late a start to manage the transition in the face of depleting resources, increasing environmental destruction and local populations that are STILL increasing – but you are right about birth rates having fallen off so much that peak population is within sight, especially in advanced countries.

I also think that the resource and environmental issues are so grave that even countries still as rich in resources and as thinly populated as the USA could easily fail to manage the transition.

If we allow ourselves to get into a bad downward economic spiral the political will and wisdom to make the necessary long term investments in renewables will not come into being.

As a matter of fact my personal estimate is that current day business as usual even in rich western countries might very well collapse due to resource , environmental, and political troubles before we can get renewables built out to the extent they can shoulder the load– UNLESS we get some sort of heart attack serious wake up bricks upside our collective heads.

I BELIEVE in the ”Mighty Mighty Market and the Invincible Invisible Hand” to a substantial degree considering my understanding of our existential difficulties. But I do not so far as I can tell have nearly the faith in technology and scientific progress that you do.

The cornucopians and technocopians might be right in the very long run but still wrong in the short to medium run – meaning that societies right across the board world wide collapse into chaos.

The cornucopian team not only has to win THE GAME. IT HAS TO WIN EVERY INNING, or nearly every inning, from here on out to keep us from chaos.

But the Market is not ALL THAT mighty and the Hand is not QUITE invincible. The market and the hand can work defacto miracles – given time enough. They have worked many such defacto miracles before.

They can work this one too – in my estimation- if we help them along with incentives and subsidies and regulations designed to speed up the deployment of renewables and slow down the burn rate of our remaining fossil fuel endowment.

There is still plenty of oil , coal , and gas to last a LONG time if we use them sparingly and eventually restrict their use to ESSENTIAL purposes.

But time is short considering the magnitude of the job.

If we don’t get a serious move on , we may not be able to make the transition successfully even in the richest and most powerful countries.

A lot of people who are smarter than I am do not believe any country will make it across the renewables goal line.

But I personally do not believe in giving up.

DON’ T GET CAUGHT IN EGYPT.

Effective and affordable birth control is one of the very luckiest of the beneficial accidents brought about by modern technology.

It’s not really an accident. It’d kind’ve inevitable that we’ll figure out how to do this kind’ve thing, as we figure out biology.

If we allow ourselves to get into a bad downward economic spiral the political will and wisdom to make the necessary long term investments in renewables will not come into being.

Farmers not only kept buying tractors in the middle of the Great Depression, they bought *more* of them to cope with low food prices.

I do not so far as I can tell have nearly the faith in technology and scientific progress that you do.

We have all the tech we need, right now. We do need good governance, and I agree that’s not guaranteed. People need to be politically active, and get out the word.

I agree with Mac, sex is just a device used to make animals reproduce. I bet fish feel really good when they put eggs in the water.

Yea, about as much as pushing your head though a birth canal.

All you need is good accounting, to internalize the costs of pollution, oil wars, etc. A good Pigovian carbon tax would do it, implemented in the form of higher levels of taxes that already exist: fuel taxes, utility taxes.

A few efficiency regulations are nice, as well, via mechanisms that already exist: CAFE, appliance standards, zoning and permit standards.

No communism required.

Oh! So making everything more expensive will make everything work out?

You are truly oblivious aren’t you?

No, for two reasons.

1: oil and other FF are already expensive, but the wrong people are paying the bill. Pollution gets paid for by health insurance and taxes of various sorts. Oil wars get paid for by taxpayers and the soldiers. Let’s have the consumers of oil & FF pay for these costs instead. Overall costs won’t go up: income taxes (or some other tax) will go down, and it will cost more to fill up the SUV, as it should.

2: we have cheaper and better alternatives. Hybrids, EVs, heat pumps, insulation. Cheaper and better.

People can and should switch from expensive FF to cheaper and better alternatives, and correct pricing will incentivize that switch.

Right on, Nick! Always good to see someone writing what I think I should but am too lazy to do.

I gave a forum this morning at the local Quaker’s meeting, saying just that and tossing in the F 35 as a nice example of how not to spend resources, and I was very pleased with all the intelligent questions and remarks, and the general enthusiasm to do something about it here and now.

The Pope says so too, so there’s three of us already.

You’ve got to admit, though, that Rex Tillerson’s carbon Utopia is hardly any more realistic than the Green’s Utopia.

Between these two competing Utopias, I’m at a loss to know which one to choose.

Your incorrect assumption is the continuation of BAU.

Your incorrect assumptions include is that there is a monumental thing called a “Green”, and that such a fictional entity is pursuing “utopia” in the area of energy, rather than something much more prosaic: just trying to reduce and then eliminate carbon emissions.

Growth by definition requires growth in energy consumption. The two are physically coupled.

That’s unrealistic. A Prius uses 20% as much fuel as a Chevy Tahoe, but gets people to work just fine. A train uses 1/3 as much fuel as a truck, but moves freight just as well.

Growth in “renewable energy” supports growth, and therefore the economy that is paying for them, only when added to existing energy resources.

No. An EV, or electric train, doesn’t use any fossil fuel at all to operate, and doesn’t have to use any to be manufactured (though they do use a little now).

Renewables are totally dependant on fossil energy. Once fossil energy is gone, so will “renewable” energy. Hence renewable energy is just a fossil energy extender. It gives us extra time to either voluntarily reduce world population to the carrying capacity of the Earth as fossil energy declines or we just carry on expanding it as we have been doing, letting nature to reduce the world population in her own way. We will follow the latter course because at the end of the day, we’ll behave just like yeast in a vat of sugar, as Catton detailed in his book Overshoot.

Renewables are totally dependant on fossil energy.

Not necessarily. We had windmills and watermills before widespread use of coal and oil. You can also have thermal energy that doesn’t depend on fossil fuels. People have been taking advantage of passive solar for a very long time. We’ve had sailboats for a very long time.

Totally agree that we will continue to have low tech renewable energy capacity after we have used up all our fossil energy. However, that World will not support 10 billion people.

Why not? Wind, solar and nuclear (if you’re into that) are affordable, scalable, etc.

What’s your concern, specifically? Scale? Cost? EROEI?

Why didn’t human population grow to 10 billion before fossil energy? why didn’t it do it with all that renewable energy that we were using before?

Renewables are totally dependant on fossil energy.

This is a complex topic – it’s hard to cover it all in one argument, so let’s break it down a bit, and start with oil. Thinking about reducing oil consumption requires breaking things down a bit further:

Oil consumption can be reduced by simple conservation; demand reduction; efficiency; and substitution.

Conservation is just reducing what you do: perhaps the convenience of popping out to the store daily isn’t quite worth the gas, and you shop every other day instead. This is inconvenient, but often not a big deal: one uses gas where it produces more value than the current price, and if prices rise one drops activities of lesser value.

Demand reduction (aka a shift in the demand curve) might be caused by economic contraction. That’s painful, although the contraction isn’t necessarily caused by the oil prices.

Efficiency is cheap: more efficient cars tend to cost less, hybrids and EVs are cheaper over the life of the car.

Substitution is often also very cheap. Moving from kerosene to electricity was an improvement in every way. Moving from oil-fired generation to coal, gas and nuclear was generally an improvement and large cost reduction. Heating oil’s replacement by efficiency, NG and heat pumps are generally an improvement in quality of life.

EVs (hybrids, PHEVs, EREVs and pure EVS) have a lifecycle cost which is lower than ICE vehicles, and have much better handling and performance.

The US reduced net imports by 25% after the Great Depression, when GDP had recovered to what it was 4 years before. In general, the US economy and consumers are far better off for the 25% decrease in Net Imports:GDP.

The “big kahuna” is replacement of fuel for personal transportation with electricity, though replacement of liquid-fueled long-haul trucking by rail may have a bigger impact in the short-term (long-haul trucking uses about 1.5M bpd).

Some asphalt is being replaced by cheaper concrete: *”asphalt and road oil” consumption fell from 200 million barrels per year in 2005 to 120 million barrels per year in 2014. the stats

Home heating oil: demand fell from 540,000 bpd in 1984 to 230k bpd in 2013 according to EIA data, cut by conversions to natural gas, technological equipment advances, and homeowners winterizing their homes with insulation and new windows. This can fall further. “Maine residents slashed their heating oil use by 45 percent between 2004 and 2009, a dramatic reduction that’s highlighting the combined power of rising prices, stepped-up weatherization and new heating technologies.”

Oil-fired generation has fallen from 20% of US oil consumption to less than 1%.

Oil is simply not essential. We need to “think outside the box”, and see a world without it.

You are just substituting one form of fossil energy (oil) by others (coal and gas), all finite resources. Fossil energy is essential for keeping our carrying capacity at 7+ billion.

HI Wimbi,

I am with you and Nick all the way as a matter of principle.

The necessary technology does indeed already exist.

Unfortunately the will to use it does not, and that will probably will not come into existence in time to make for a successful transition.

The time lag between the market signal sent by high fuel prices and widespread deployment of renewable tech is too long.

There may be a more or less PERMANENT shortage of oil at any time.

Suppose the international situation were to go to hell in a hand basket and the Russians simply quit exporting and a few guys -anybodys guys – manage to sink a few tankers?

A second hand Volt or Leaf would sell overnight for fifty grand- maybe a hundred. BUT no matter HOW HARD GM and Nissan might try, they could not together manage to build five hundred thousand Volts and Leafs within the next year because the necessary capacity to supply that many additional batteries does not seem to exist. The battery factories themselves would have to be expanded.

IF the depletion of fossil fuels is slow enough , and steady enough, the price of them will probably increase gradually so that we can indeed make the transition in some countries at least by just letting the market and the hand play their usual roles.

BUT I am very firmly convinced that the technology ambulance, so to speak, might run out of gas short of the emergency room doors.

Getting renewables deployed on the scale necessary to shoulder the load now carried by fossil fuels is probably an impossibility- at least within the easily foreseeable future.

Getting renewables deployed even to the extent necessary to EXTEND the life of our current remaining one time gift of fossil fuel is in and of itself a job comparable in my estimation to fighting WWII – for a generation , not just four or five years.

The public will get behind renewables once the public does finally understand that oil and gas ( coal too ) are finite and getting to be too scarce to depend on them anymore.

I am and always will be a conservative at heart, meaning that I believe in leaving everything to the private sector that can be safely and humanely left to private enterprise and charity.

This is one of the things that cannot be managed privately and SAFELY within the time available.

Hence I am firmly in the camp of those who believe in subsidizing research and development and deployment of renewables – plus tough regulations concerning efficiency of course.

The time lag between the market signal sent by high fuel prices and widespread deployment of renewable tech is too long.

There’s such an excess of energy consumption that we have lots of leeway for dealing with the transition. The average vehicle gets only 22MPG, and only has 1.2 passengers (or a driver and .2 passengers).

Car pooling…it’s a bit convenient, but more people carpool in the US than use mass transit.

Ed ,you are right AT THIS TIME that renewables cannot support the current population of the world.

But the population is going to come down – big time – for reasons pleasant or not so pleasant.

And renewables are good enough to GRADUALLY be built up to the point that the smaller future population can rely on them for a low energy but still modern life style.

Most of the energy we use these days is actually wasted if judged on the criteria of necessity.

We must eat for instance but we can eat potatoes instead of potato chips. Potato chips are probably ten times as energy intensive as potatoes. Beer need not be hauled thousands of miles. Better beer can be brewed right in your own community.

We do not really need to fly very much at all. People can adjust to the idea that if they want to continue to visit Grandma they can’t move a thousand or five thousand miles away.

And contrary to what the naysayers claim, the energy returned on the energy invested is adequate for renewables to be self supporting. The only real problem is that not enough renewables in the form of wind, solar, geothermal etc have been deployed.

This is going to be a race between fossil fuel depletion and renewables deployment on an adequate scale.

Given that winning it is critical, I am in favor of ” cheating” by providing steroids to the renewables industries in the form of subsidies- even though as a matter of principle I am generally opposed to subsidies.

“Russians simply quit exporting”

Can you imagine, all hell would break loose. This would be tantamount to declaring war on the American people who have a god given right of access to all international resources. 🙂

On your point that renewables can in theory renew themselves. You may be correct but lets have a reality check. In the UK we produced 53.7 TWh of energy from renewables in 2013. This amounts to 2.29 kWh/day for each person. (enough to power to just over two 40W light bulbs each) It is estimated that we each consume 200 kWh/day in the UK and perhaps 250 kWh/day in the US. Therefore I totally support your stance on giving steroids to the renewable energy industry but we also need population reduction policies, and to reduce our energy consumption.

Ideally, increasing renewables so they produce 32 kWh/day each (ie 4 doublings from 2 to 4 to 8 to 16 to 32) while reducing our energy consumption to 20 kWh/day each. The excess energy could then be used to renew our renewables.

Can you imagine people in the US living on just 1/10th of their current energy consumption ? !!!

The UK has more than enough cheap wind power resource on land.

At the moment people object that it ruins the view! People can have much higher power bills with offshore wind and nuclear, they can import power from the continent, or….they can accept wind turbines in the countryside.

Choices…

Mac,

For better or worse (mostly worse), the US has more than enough coal to get through a transition. The Illinois Basin has 180 billion tons of high sulfur coal (annual consumption is less than 1 billion tons)- it’s not being used because scrubbing sulfur is a bit more expensive then strip mined low-sulfur sub-bituminous coal, but it will be used if it’s needed to keep the lights on.

All available fossil energy will be used whatever the environmental costs. Given the choice between keeping the lights on and climate change, the majority of people will vote to keep the lights on. Mankind is pre-programmed to maximise energy usage in the short term at the expense of long term survival.

People that maximise their energy usage have a competitive advantage over those that don’t. The former conquer and exploit the latter.

No other energy source (apart from nuclear) can match the energy density of fossil energy. We are totally and utterly dependant on it. If you decide to leave it in the ground unused then you can be assured that your competitors wont and they will wipe you out.

Mankind likes the products of energy, like light, transportation, etc. Wind and solar powered EVs are faster and more fun than “gassers”. Mankind doesn’t care a hoot about actual levels of energy consumption, and neither do our genes.

Our genes especially don’t care what powers our vehicles, or our lights: FF, wind, solar…they don’t care. They just want to get around, shop, have well lit and warm houses, etc. If we have really good insulation and no furnace, they don’t care.

US coal consumption has fallen quite sharply, due to greater efficiency and the growth of alternatives. Wind is cheaper than coal, even if you don’t take climate change into account.

Wind, solar (and perhaps nuclear) will continue to grow, and fossil fuels will decline and disappear. 100 years from now kids will be baffled that we ever used fossil fuels.

1st, are we agreed that oil can be replaced?

2nd, no, EVs can be powered by wind, solar, nuclear, etc. There’s a very nice synergy, because EVs buffer renewable variance, and can absorb wind & nuclear excess night time production.

Using my figures from earlier and that EVs give you a range of 100km on 15kWh of energy. This means renewables in the UK in 2013 would have allowed us to travel 9.5miles each per day by EV providing we only used this energy for this purpose and nothing else. Two people traveling together = 19 miles per day.

Again:

The UK has more than enough cheap wind power resource on land.

At the moment people object that it ruins the view! People can have much higher power bills with offshore wind and nuclear, they can import power from the continent, or….they can accept wind turbines in the countryside.

Choices…

Ron, thanks.

Looking deeper into the NDIC data it turns out several wells in Dunn has revived (chart did not load).

The growth in Dunn comes from a combination of added wells and revived vintage wells.

Rune, two of the nine wells I looked at in Dunn had been re-fracked. Will be interesting to see decline rate of those.

I have a time series chart of the 3 (Dunn, Middle Bakken) wells listed below

KUPPER 34-10H (revived in late summer -14)

VIHON 44-8H (revived in early summer -14)

HOUGHTON 34-25H (revived in fall of -12)

Their production wobbles around at a higher level, too early to make any calls on decline rates.

Hi Rune,

If you can save your chart in gif format or reduce the number of pixels by resizing to get the file below 50 kilobytes in size it should post. There seems to be a size limitation on the charts.

Let us see if it works below 50 kB.

It worked and thanks Dennis!

Revived is the result of refrcking… so refracking returns the dead to life?

But for how long?

/

As I had no confirmation (as of yet) that the wells were refracked I opted to use the word “revive”.

For how long …we will just have to wait and see.

My point by drawing attention to this is that there is a lot of moving parts out there….which makes modeling long term developments a very, very comprehensive task.

Rune: this is mere speculation: the Middle Bakken has a depletion drive, during a well’s early life the hydraulic fractures drain the (naturally) fractured reservoir rock and set up a pressure field with the pressure gradually increasing from the well itself, to the hydraulic fracture plane, and then away from the fracture. Somewhere along the path from the rock matrix to the well the pressure drops below the bubble point, but the well gas to oil ratio doesn’t seem to increase much.

I think some of the natural fractures may be so small they don’t allow the gas bubbles to coalesce and form channels (we observe something like this in viscous heavy oil, but in those systems the oil viscosity is what slows down gas bubble formation).

When a well is shut in the reservoir fluids continue flowing towards the well (this is what causes the long pressure buildup period). But these reservoirs may have fractured matrix full of supersaturated oil, with tiny micro bubbles trapped by the narrow confines of the fracture network.

As the pressure builds the gas may re dissolve in the liquid, which returns to being a very low viscosity highly swollen fluid. This in a sense returns the well to an earlier time in its life.

An additional effect which needs to be factored is scaling in the hydraulic fracture network. I haven’t run the water chemistry simulations, but if I were running field ops producing a reservoir with a very salty water in a high temperature environment reservoir, I would check carefully if it will deposit scale and salt when the system ph increases, or there’s a slight temperature change, or there are nucleation particles for the scale. This is a pretty tricky issue, but it can damage the wells. If it happens then the solution is a pain in the behind, but a treatment is available.

Maybe these wells benefited from the shut in plus they injected a fluid to wash the wells and reduce the scale/salt damage.

Previous Ronpost graph made clear that certain things are not changing yet — namely more than 50% of this production is from new wells, less than 15 months old.

Helms listed the four companies doing the vast majority of these wells and 3 of the 4 likely didn’t borrow. XTO/Exxon would finance via internal cost of capital — which at first glance faces no restrictive covenants — but at second glance they are going to have at least a bi-annual review and maybe quarterly. Exxon’s internal cost of capital is pretty likely to be quoted well south of high yield paper.

But even that chicken comes home to roost eventually because HY paper didn’t get to be high yield because it is funding a high probability project. It’s high yield because it’s funding huge risk.

Exxons internal cost of capital includes the target return on shareholder equity. Because a company like Exxon has a really high return for shareholders, the internal cost figure they are probably using should be between 8 and 12 %. In other words, a business unit manager is told to make that amount or face the choppers. However, the business unit is judged on the longer term performance using an internal price deck. And that price deck isn’t the futures market prices.

Ron has presented developments by county.

Another way is by company (operator).

The chart below shows developments in Whiting operated wells (WI interest varies, but on average Whiting holds about 60%) in Bakken/TF as from Jan- 08 and as of March 2015.

Whiting added 84 producing wells (of 480 – 500) for the period Jan-15 to Mar-15 (Q1-15).

Total LTO production for Q1-15, about 13 Mb.

The total decline of the wells started during 2014 was 28% from Dec-14 to Mar-15.

Rune,

Do you believe refracked or revived wells could make much of a difference in offsetting peak production? And would refracking be economic on a large scale? I know Art Berman tends to think addotional fracking at low oil prices is a silly thing to do.

Steve

Chart below shows development in Continental operated wells in MB/TF (ND) as from Jan-08 and Mar-15. (NOTE; the equity volumes may differ due to Working Interest may vary between wells).

In the chart is also shown the development in the oil price (WTI) left hand scale.

LTO extraction in Bakken took off as the oil price moved above $80/b.

Continental’s wells are on average poorer (first 12 months totals for 2014 vintage about 80 kb) than Whiting’s (first 12 months totals for 2014 vintage about 90 kb), which makes the decline slower.

Continental added 79 new producing wells during Q1-15.

Whiting may find it challenging to offset the higher decline rates from their 2014 and 2015 wells.

At $80/b (WTI) wells that averages first 12 months total of about 75 kb (LTO) would make it.

At $60/b (WTI) wells that averages first 12 months total of about 100 kb (LTO) would make it.

(This is based upon a pro forma well and is for guidance.)

A general observation from the “Red Queen” series was that the higher the first 12 months totals were, the higher the decline from year 1 to year 2 became. This is still valid.

I showed that in the post

http://www.theoildrum.com/node/10102

ref figure SD5.

Steve, good and important question.

I have it in my blood to look for profitability. A lot of things are possible if you do not have to consider the profitability issue. A refrack by itself may be profitable, and I would like to see the full life cycle costs/profitability.

Refracks also costs money, therefore I do not see refracking becoming a major issue, if so then something else has to give, like manufacturing of new wells. There is something called financial constraints.

If oil prices goes way up, that allows for different considerations.

Got stuck waiting a long time this afternoon so went back to the nine wells in Dunn Co., ND lease operating statements and did some elementary school math. I analyzed the 12 month period from 3/14 to 2/15. Note all wells are within about a 15 mile radius. I did not include gas, the figures below are per barrel of oil.

The seven wells showing first production from 9/08 to 6/10 averaged 28.75 barrels of oil per day per well during the preceding year. OPEX was $34.13 per barrel for these 7 wells during the previous year, ranging from a low of $17.01 to a high of $59.66.

The two wells showing first production in 3/13 averaged 140.10 barrels of oil per day per well during the preceding year. OPEX was $10.67 per barrel during the preceding year, with one at $9.62 and the other at $12.02.

There were 13 tubing leaks or pump changes during the year for the nine wells, and those were included in OPEX for purposes of my per barrel calculations.

I do realize this is a very small sample, but it does support my notion that older wells producing significantly less oil will have a much higher OPEX, and modeling does need to account for that.

Also, as would be expected, the well with the most down hole failures in the year had the $59.66 OPEX, and the $17.01 OPEX had none. As it is where I am from, down hole failure rates greatly affect economics. The lease operating statements I reviewed all list down hole repairs as AFE CAPEX, so this also needs to be considered in modeling as I am not sure the companies show these in OPEX/LOE calculations. Looks like a pump change runs in the $30K range and tubing hole in the $65-70K range. Probably figure one or two per well per year.

On another note, got to thinking about the hype regarding decreasing time to drill the hole. We hire a contractor who takes his time and does it right. Last thing we want is a crooked or otherwise deficient hole that results in much future expense. Maybe the LTO drilling equipment is so good that rushing does not affect well bore quality?

I’ve mentioned this before, but when I had lots of well data I found it was better to derive OPEX using a fixed plus variable formula. One possible equation:

OPEX= 10000. + Qoil x 5 + Qwtr x 5 + Qgas x 0,5

Q= barrels per month for oil and water, mcf per month for gas.

Please don’t hold me to the actual figures. The use of constant dollars per barrel can lead to overestimating the amount of reserves to the economic limit.

“BEIRUT (AP) — In a rare ground attack deep into Syria, U.S. Army commandos killed a man described as the Islamic State’s head of oil operations”

“IS has made major inroads at Iraq’s Beiji oil refinery complex in recent days. Reports vary, but U.S. officials have said IS is largely in control of the refinery, as well as the nearby town of Beiji. It’s on the main route from Baghdad to Mosul, the main IS stronghold in northern Iraq.”

http://hosted.ap.org/dynamic/stories/M/ML_SYRIA?SITE=AP&SECTION=HOME&TEMPLATE=DEFAULT&CTIME=2015-05-16-08-39-42

Shallow: you are doing good work and I don’t want the fact that my owning interest in shale wells to interfere with your work. I mean that. Previously I have said this, directed to you:

“It is difficult to generalize about operating costs; your post down hole would suggest that. Water hauling runs the gamut, from 1.50 to 5.00 a barrel. I am aware of two rod jobs on shale wells in the past 10 days, unfortunately; one was 28K and went like silk, the other well the rods were parted and engaged with an overshot, DHP pump would not come off seat, the rods were backed off, the TAC was stuck, which had to be shot off and fished, all that pulled wet and under pressure that made an enormous mess, tubing hydrostatically tested, rods replaced, new DHP…that “rod job” was 167,000 dollars. Its pretty hard to make assumptions about OPEX; I always allow two down hole maintenance events per year, one easy, one not, and a certain allowance for surface maintenance, like the two heater treaters I saw this morning on fire. OPEX is kind of all over the board.”

Down hole maintenance is NOT CAPEX. If shale oil companies are doing that it is contrary to 100 years of oilfield accounting practices. If they are doing that, what is the surprise? They look for ways to distort the facts. What can you say about a company like Pioneer who claims 1.3 BOE EUR of shale wells in the EF where the data suggests 350K? Remember please, at the moment, are pretty soon thereafter, ever stinking shale well in the country is going to be for sale. They are going to want to put new paint on all that, anyway they can.

Older wells do indeed have higher operating costs. Most of that is, of course, related to tubular fatigue, increased issues with DH emulsions requiring higher production chemical costs, corrosion, depletion, higher WOR, all kinds of things. As we get older we have a harder time getting out of bed in the mornings, yes? Yes. So it is with shale wells. All wells.

Sometimes however, problem wells are NOT just related to old age, as you have implied. Take for instance the deviation profile of a horizontal well that was in a hurry to be finished; 17 days instead of 24 days. Those wells are being crammed down the hole at lots of expenses, including lost circulation, cement integrity and down the road production maintenance. A well that has tubing holes is crooked as hell and was blown down using big pumps with no regard for deviation. There are engineers with EOG whose only job is to discern rod wear and where to put rod guides. So the answer is, OF COURSE, the time to drill a well effects it’s quality. Drilling practices also greatly effect EUR, in my roughneck opinion.

From the shale get-go the mission was high IP’s and the ability to book reserves. The quality of the well bore did not mean squat. As the play progressed, and the economics appeared to be failing, the shale companies stated trying, desperately, to cut costs and the big deal was drilling days vs. rig day rates. LTO equipment is the same horizontal drilling equipment, and practices we were using 40 years ago. If you try and blow them down, you’ve got problems down the road to deal with. I have seen some deviation profiles on 17 day wells that are horrible.

I know that you and many others want hard, instant facts about costs. I would share with you what I know but it would not help; they are all over the board. It is simply the nature of what we do. Rune, Shallow, MBP, Fernando and Mike will be able to operate the same stinking shale wells for an array of different costs that will boggle your mind. I’ll be the cheapest, however, LOL.

Lastly, if I may, re-fracing shale wells was something the industry came up with years ago as soon as economics started to fail. They love to claim that is an ace in the hole they have to increase recovery factors and make the well more economical. I am personally familiar with very few re-frac’s that have worked in the EF. By working, I mean economically working. Initially a typical 20-26 stage 4,000,000 pound frac in the EF cost something in the order of 4M. Now, of course the shale guys are boasting, big time, about reaching out and touching someone with 35 stage, 6,000,000 million pound fracs. Those wells have reached the cliff and will not be re-frac’ed. Rune speaks of financial constraints, there are also engineering constraints on what can be done with a frac. Remember, please, re-fracing adds, minimum 3M ADDITIONAL costs to the well, and at the moment, at current oil prices, that requires another 100,000 BO of recovery just to pay the re-frac out. No way, Jose. Anytime anybody has to “re-do” something in the oilfield it is generally no bueno por nada.

Mike

Mike, no problem. Always appreciate your posts!

I know that costs are all over the map because all kinds of stuff can either go right or wrong.

The only reason I posted what I did is I have been very suspicious about $6 per barrel LOE, and even more so when I see future projections that barely increase it or hold it constant. I’ll bet they are really fudging those numbers in the SEC reserve reports, and bet true PV10 is even worse than what they will show at the end of the year.

I’m pretty much done analyzing the shale stuff. I like looking over financials of oil production, may be a crazy thing to like to do.

This site has helped me, I think, deal with our investment going from great guns to pretty much zilch in the income producing category. I figure it will come back again sometime, just have to get through it

like in other downturns.

Of course earlier this year when our oil price in the field had a 3 handle I claimed I was going to take a break from posting here, and I think that held for like 27 hours! LOL!!!

I guess I’m just having fun trying to see from how many different angles I can call BS on these shale guys as they continue to make their dubious claims.

I still like HH talking about CLR exercising financial discipline in the most recent conference call, after his company had just borrowed over $1 Billion dollars to drill shale wells in the worst four months of oil prices in years.

That were still 26 hours too many..

Mike,

If money and profitability is of NO concern, there is NO engineering constraints. 😉

“What can you say about a company like Pioneer who claims 1.3 BOE EUR of shale wells in the EF where the data suggests 350K?”

Mike – I think you left out a “million” before BOE (barrels of oil equivalent) .

From the net, it seems TAC is tubing anchor – correct?

The crooked well thing is interesting – since the Bakken wells go on pump real fast, 6 months to a year or so.

Do you know if the same is true in the EagleFord and the LTO (light tight oil) part of the Permian?

Seems penny wise and pound foolish to make wildly crooked hole when you know some kind of pump is going in there soon.

I’m guessing that the LTO world uses a traditional downhole pump hung off some tubing,

(due to the deep holes), and that when a pump rod wears a hole in the tubing that leak back around the pump body means production stops – correct?

While poking around I saw some wheeled rod guides.

I only knew about the old plastic ones.

Are the wheeled units in wide use, or just for really crooked holes?

FYI – for the other curious amateurs – near all I know about oil well pumps is in:

http://infohost.nmt.edu/~petro/faculty/Kelly/424/ROD%20PM.pdf

Sunny, I did leave out the M for Pioneers EUR predictions, sorry. TAC does stand for tubing anchor, there are wheeled rod guides, yes and rods part (break) and tubing holes occur quite often; tubing holes cause the fluid to not reach the surface, yes. EF wells can go on gas lift, or rod lift sometimes pretty quickly; not always. Some wells will flow for a year or more. I am in no position to offer an opinion on the performance of PB shale wells.

Indeed, Rune; you are absolutely correct. Shallow, I kinda like picking on those shale guys too. Somebody’s gotta do it. Lots of smart people around here do a good job of it. It is hard to accurately predict the future of a business that is in constant flux. Oil and gas extraction is a fluid situation, you might say, always changing, no two problems the same. If you think you’ve got it figured out, wait awhile and you don’t.

Mike

Awesome posts guys, thanks for sharing so many insights.

Drilling practices do have a large impact on well performance. Sometimes the directional plan is neglected or set by engineers who are rewarded for the wrong results (days to TD, initial rate, total well cost).

CAPEX does have a huge impact on well economics, but the operating costs do have to be considered. Horizontal wells can be really hard to optimize, because there’s a conflict between the well bore directional “smoothness” and the need to drain a given area and layer.

In some cases it’s better to drill a very straight hole as far down as possible, kick off the directional section to reach horizontal without putting much constraint on the deviated hole, because the pump will be kept in the straight hole to avoid the rod on tubing wear problems. In other cases we choose to use gas lift or jet pumps, but those require very skilled wireline operators and special tools. Another option is to demand a very smooth curve, use a tubing rotator, coated tubing, special rod centralizes, and live with a larger OPEX budget.

Lately I’ve been leaning towards keeping the holes as straight as possible, kick off with a fast build, and place the pump above the kick off point. Later, when the well loses pressure it can be jet pumped if it makes a lot of water, placing the jet pump just above the liner top.

The key to all of it is to balance the need to keep the well costs down with the objective to keep OPEX down by avoiding well interventions.

“Later, when the well loses pressure it can be jet pumped if it makes a lot of water, placing the jet pump just above the liner top.”

That will be the procedure, sir, IF, as you say, these shale wells make water. That is the key to the long fat tail theory… formation water. I struggle with that, at least in the Eagle Ford where I am familiar with the depositional environment in which this organic enriched shale slid into the basin. There is no connate water that will move up to fill hydrocarbon depleted pore spaces, in my opinion and where is the vertical permeability in this dense shale to allow that, even if there was?

I wish someone could explain that to me because it is paramount to recovering remaining reserves in these shale beds once natural and induced energy is depleted. For these wells to recover their EUR from year 5 out, there better be lots of natural formation water involved, yes?

Mike

Mike, good point about produced water.

My novice geology view of the shale wells is they are like a formation in our area, big IP, produced water volume decreases with produced oil volume very quickly, you end up with a well that makes about a barrel of oil and a barrel of water per day, no ability to water flood, just install your stove pipe size gun barrel, shut in when it freezes and hope for no down hole failures. Those are about 2,700′.

There are guys that make a good living operating those wells when oil prices are strong. Of course, they do not have large office building, nor jets, nor corporate suites at all the pro sports venues. They work in the field themselves, drive a pick up truck with all their tools in it and have a small office in their home or shop, which shop is typically a pole building. No upper management bringing home 7 figures.

It looks to me that vertical Bakken wells from earlier times leveled out to average about 8-9 barrels per day. Assuming the horizontals do the same, I do not know how those will support the big buildings, etc. or pay back the billions of dollars borrowed.

I also see Enno’s work about number of shut in wells already. Yikes. I suppose when they are officially shut in that is for a reason other than temporary due to drilling on the same pad, or does ND require paperwork on those. I assumed wells with 0 production for a month were either waiting on a rig or down due to work on a nearby well, and SI wells were intended to be longer term?

Mike, these wells seem to make fair amounts of water from the first day. As far as I know these are depletion drive reservoirs with 5 to 10 % recovery factor. The natural pressure will never be fully depleted, simply because they’ll reach a very low rate and there will be some pressure left in the reservoir volume located away from the hydraulic fractures.

However, in a naturally fractured reservoir with fractured wells it won’t be unusual for a well to see a surge in water production (it’s just plumbed to some sort of water layer, for example in the Three Forks). The key is to pull the water together with enough oil. I’ve found that jet pumps can do a fair job in reducing well costs. But they don’t like too much gas. Jet pumps also require occasional acid pills to wash scale and inhibited plus filtered water, if that’s your power fluid. I prefer water but that depends on the surface equipment set up.

Fernando, initial water production in shale wells I suspect would be induced frac water, wouldn’t you think? Depletion drive with 3% recovery factors and as I said, that you must have missed, was there was NO such source for outlying water in the Eagle Ford. I was wondering about bound water that is going to allow shale wells to produce economic OWR on artificial lift for 18 more years.

As to your 95% efficiency comment (meaning, I assume, you had 95% of your wells, or your company’s wells, going at one time, all the time); its a little different oilfield these days and everyone is, or was, stretched to the limits of availability. I am trying to give folks an idea of what reality is today for mid-size shale companies struggling to keep wells fixed with limited workover rig availability, CT and pumping services otherwise dedicated to completions and frac’ing, weather problems (particularly 5 months a year in the Bakken) and not a large pool of on- location consulting skills to draw from, etc. etc.

You should consider coming out of retirement and moving to North Dakota as soon as possible.

Mike, a lot of experienced people went to the Bakken to make big bucks. I know one that was offered over $200K in 2011. They had to offer a lot of $ given the location and weather, I assume.

The guy I refer to didn’t go. As you have also alluded, many of the experienced people are 55 or older. In addition to not wanting to pull up stakes at that point, he said he didn’t think he could take the winters.

Mike, initial water production is a mix of frac fluid and a small amount of connate (formation) water. After three to four months the water being produced tends to be formation water.

Don’t forget the pore space and the micro fractures are filled with water and oil (or water and gas in the Eagle Ford). These fluids expand as the pressure drops, which implies the fraction of water in the rock exceeds the threshold it requires to be mobile.

Mobile water moves towards the hydraulic fracture plane, as it does so the water saturation increases. And as the water saturation around the hydraulic fracture plane increases the water moves easier. Looking at the well curves water to oil ratio seems very steady, water rate drops over time.

But the water to oil ratio we see is an average, some wells may be making more water. Those wells are potential jet pump candidates. Jet pumps hate gas, it makes the pump work as a gas compressor, but water in the mix helps keep the pump relatively cool. Formation temperature is really high, this means a pump installed low, close to the reservoir, has to deal with the heat. Water seems to really help keep the pump temperature down. You use water as the power fluid and it cools the well much better than oil. Add formation water and that pump temperature is going to drop below 200 F. But you really have to watch the water chemistry. Those brines are famous for dropping scale.

Ron P said” There is no reason that I can think of that would make the decline of previously drilled wells to increase as production of new wells brought on line declines”

Consider this, since low producing wells have a higher operating expense per barrel they are more likely to get shut in than higher producing wells during an economic downturn, due to low prices. That would leave a higher percentage of “younger” wells with their naturally higher decline rates, thus increasing the decline rate overall.

Sound reasonable?

Sounds reasonable but the greatest increase in the legacy decline rate comes in May and June. It is a projection not an actual measurement. I kinda doubt that that was what the EIA was thinking about when they projected a higher decline rate for those two months.

Chris Nelder on the latest Greentech Media Podcast.

http://www.greentechmedia.com/articles/read/peak-oil-in-an-era-of-fossil-fuel-abundance

” Over the last few years, analysts and academics worried about peak oil have been on the defensive.

The fracking revolution has brought an abundance of oil and gas that no one thought possible a decade ago. So we can declare peak oil dead, right?

Chris Nelder, an energy analyst who’s written extensively on the subject, has a simple answer: no.”

Texas data are out:

http://webapps.rrc.state.tx.us/PDQ/changeViewReportAction.do?viewType=Monthly%20Totals

plateau confirmed. Waiting for you Ron 🙂

I didn’t expect the data to come out on the weekend, I checked late Friday evening and it was not there. It will be sometime tomorrow before I can get anything out.

I sent you an email but I will tell you here because I don’t know how often you check it. If you would post me your charts I would be glad to put them in the post. I could perhaps make them a bit clearer.

I have reworked my water/oil ratio analysis. In the past I may have mixed some confidential production with non-confidential production. However, for confidential production the water production is not revealed, and therefore that skewed the results. In this chart, I only included well production months that were not confidential, and should give a much better reflection of reality. This shows the overall water/oil ratio of North Dakota wells per vintage. The total average WOR in the whole of ND is just over 1, but this is because there are some older wells that have a far larger amount of water production.

I hope it is visible (little tough to stay within the 50 kb image limit..)

Question for coffeeguy : I didn’t see any API’s in ND where the last 2 numbers were increased, indicating a major work over. Do you have an example where this happened?

I also updated an analysis regarding wells shut in, based on their reported status, per vintage, for the whole of ND. I guess that the recent development of pad drilling may have caused a somewhat faster initial increase of percentage of wells being shut in.

Based on this it looks like wells from the past 6 years have about a 10% chance of being shut in during the first 6 years, but that for more recent wells this % could get higher.

Enno,

Great chart that should nicely tie in to the discussions about maintenance costs (where Shallow, Mike, toolpush, Fernando and many others share great insights and data) as the wells ages.

This illustrates an important part of the dynamics of LTO extraction.

Prior to 2011 there were about 2,000 wells in MB/TF. Now (Mar-15) there were close to 9,500 wells in MB/TF. These 7,500 wells (and counting) added since 2011 are “youngsters” (4 years and younger!) and as the wells ages the guys in the fields will experience the effects from that ……and find that Murphy brought his huge family over as well.

This may become a big issue in the near future and a potential big business opportunity for those specializing in well maintenance. Just like handling produced water is.

Maintenance requires the insights from highly skilled and seasoned professionals.

Will the required number of these professionals be around as the need arises?

I think an issue that most analysts are underestimating is the time lag necessary for service companies to get anywhere close to their drilling and completion capacity this time last year–given the time necessary to repair and service neglected equipment, to hire laid off workers (most of whom have probably gone on to other jobs, and who may not want to come back), to retrain laid off workers and to hire and train new workers.

Underlying this is the ongoing “Shift change” as Oil Patch personnel who entered the business in the late Seventies and early Eighties are retiring in ever greater numbers.

When I look at well performance of a well on artificial lift for a given year, for instance in an effort to find some consistency in OPEX per incremental barrel, I always use 340 producing days, allowing 3 weeks for a well to be down, waiting on services, etc. It has been much more than that in the EF. The general rule of thumb for any operator is that 15-20% of it’s well inventory is generally down at any given time awaiting workover. Some completion rigs will of course move over to the work over side of operations in the shale biz but I don’t know if that will improve matters.

I agree with Rune. The issue of personnel is one to be very concerned about, IMO. Lots of new engineers coming out of school want to become drilling and completion engineers because that is where the romance is. Production is boring, as someone said a while back. Its not, really, as optimizing artificial lift design, treatment of fluids, water disposal, DH issues, etc. once wells go of artificial lift is very, very complex. I have to do it all but my specialty, if I have one, is production problem solving and optimization. The only way I came by that is thousands upon thousands of hours of experience and learning from my mistakes. I don’t see a lot of kids coming up behind old farts like myself that will be able to do what I do. I don’t wish for that to sound self serving.

http://info.drillinginfo.com/doubling-down-on-the-great-crew-change/

Mike

I have asked before about automation.

High paying jobs cry out to be automated. Low paying jobs do not.

Recall The Atlantic’s article — “The Robot Will See You Now”. Robots were doing primary care physician tasks. The docs were informed of this and a study was done on which patients had more accurate diagnoses and treatments.

The docs gathered and discussed how to beat the robots. They decided that the robot would not be able to discern issues in the patients’ tone of voice and what is normal for that area and what is not.

So the docs went out and did their diagnoses and treatments using test results but emphasizing these other factors.

They underperformed the robots who relied only on test results.

So there is no job out there too complex for automation. It is the ultimate address of personnel and the ultimate source of low income tax revenue.

Mike, I’ve worked in field operations which targeted 95 % efficiency for the year. We had months with 97 % efficiency. But we had a much lower system breakdown, holes in the tubing were quite rare, and we worked constantly to avoid things like excessive rod stress and esp shut downs. It’s also extremely important to have the pulling unit contract and the personnel to get after a sick well in a hurry. I think a big difference is our well concentration and the overall number of wells in a given area. We never operated if we had to take care of wells that were too far from the operation centers.

Hi Enno,

For your April Data set for 2007 I only get 3% well mortality. I would define well mortality as no production for the most recent 12 months, sometimes wells are shut in for longer than this and then the well is brought back to life. For 2008 I get about 3.6% well mortality where the most recent 12 months of production are less than 5 b/month for all 12 months.

I don’t think a temporary shut in for maintenance should be included as well mortality.

These look like 80% water / oil numbers for new wells (where the production comes from). That would mean 800,000 barrels of water per day.

Tanker trucks seem to be quoted 5000-11000 gallons for “large trucks” and all such probably

can’t get to all sites. Here is an article on overweight trucks in the Bakken

http://www.startribune.com/bakken-truckers-often-haul-heavy/282092631/

Regardless, 800,000 barrels of water per day is 276 million pounds of water disposed per day (8.2 lbs/gallon, probably low given the impurities). Typical empty truck hauling the 85K pound road max is 18,000 pounds.

So 85K – 18K = 67000 lbs. The article says the water workers limit them to 150 barrels (X 42 X 8.2 =) or 52000 pounds.

276 million / 52,000 = 5308 truck trips per day in the 4 counties.

That’s a lot. More than double that added to haul oil (though some small number of wells probably have pipelines to the site).

The legend says water/oil. To get the percent water you would need to divide the water by water + oil. If you had 800 barrels of water and 1000 barrels of oil that would give you .8 water divided by oil. That would give you 44.44% water.

I hope my figures are correct.

Indeed, the overal WO ratio in ND is just over 1, meaning that a bit more than 1.2 bpd of water is currently produced. Some companies are specialized in handling very high water cut wells (eg search for Citation oil & gas).

Enno. Citation operates leases near us. I think they got their start in the 1980s buying onshore lower 48 leases from the majors. I think they produce about 35,000 BOE per day, mostly oil. From what I know, they have stuck to operating conventional production, and have not gotten into LTO despite having operations all around it. It is a privately owned company.

Thanks for the info Shallow, I see they own a couple of very high water cut wells (WORs far over 10 if I remember correctly) in ND; indeed older conventional wells.

Do you know if water handling is any different between conventional and LTO wells?

Enno. I do not know in ND. However, everything Citation operates near us is under water flood. I suspect their high water cut wells in ND would be also, as I cannot see how the economics would work otherwise, but that is a guess.

Light oil is easier to separate from water. If the water is separated as soon as well fluids reach the surface it’s possible to use a very simple separation system (no need to use heaters, but the water does have some hydrocarbons).

I wouldn’t assume all the water gets trucked. I’ve worked in fields where 95 % of the water was handled via flow lines. As they move to use multiwell pads they may find that it’s fairly easy to knock out and filter and dispose of the bulk of the water at the pad.

To be honest, I find the way they do things in ND to be really bizarre. It’s as if they were in the 1930’s.

Fernando, I read an article about a company named Liberty Resources Managemt which is developing about 9000 acres in the Bakken in an organized manner, with central tank battery and water disposal wells. The article read like this was a novel idea for the Bakken, so I think you are correct. Has been developed kind of like Spindletop?

Shallow,

Having to drilling such spacing units before they can lay longer term claim to the lease, to me, would make it difficult to have a well laid out plan, as the first priority was to secure the lease, and then concern themselves about maximizing production, afterwards.

Toolpush. Good point. The EFS and Bakken shale plays are both like that, while Permian would have more HBP acres, I assume.

Also, if I recall correctly, one disposal well price tag for the Liberty project was $3.7 million and the lines were over $16 million.

Push,

Exactly.

Take, roughly, 12,000 square miles of actual or perceived valuable, hydrocarbons bearing land … divvy it up into 2 sq. mile Drilling Spacing Units … the approx. 6,000 retention wells need to be drilled within 36 months of the time JohnnyWhiteShoes Landman hands bewildered Mr/Mrs Rancher/Farmer a big fat check or ALL the time and effort spent goes bye bye … and you have the overall conditions the Bakken operators struggled with from years 2008 to, roughly, 2012 … the so-called Land Grab Phase.

This is once again occurring right this moment with the Rogers ville shale in Eastern Kentucky. The first public unveiling of Cimarex’s test results are a few months off and already the fever-pitch rumors are driving land leasing values sky high.

The Marcellus guys had five years to fulfill their lease agreements and, due to the vast acreage involved (20 million sq acres+ in PA alone) many operators are falling short. Since everyone now recognizes the value of the underlying resource, whoever cuts the check next time around will have to add a bunch more zeroes.

Coffee,

With all the borrowed money that the shale players have used up, in their mad land grab, where money was no object, believing in the longer term all would turn up roses, they are going to have to pull a major rabbit out of their hat, not only to make a profit at lower oil prices than expected, but to pay off their debt as well.

I am sure if larger drilling units had been laid out, then a lot of these issues would not have arose. At least not to the same extent. We all know Watcher loves his trucks, but with a well planned and thought out development, water, oil and gas would all be travelling via pipelines, whether they be permanent high pressure steel or more temporary low pressure plastic/synthetic.

Push

No doubt.

The frantic pace, coupled with the far flung, extensive acreage … the mind-numbing technological improvements … the financial machinations involved to bring it all about …

Whodda thunk in only 6/8 years time there would be formations such as the Niobrara, the Utica, the shales of the Permian, the Bakken, the Eagle Ford, the Marcellus producing several millions of barrels oil daily, several tens of billions of cubic feet of natgas daily … with several more formations waiting in the wings.

Cowboyistan.

toolpush, the state should have passed unitization rules to allow for a more organized development. As you know, this is done in other states, it works, and it saves a bunch of money.

I think the government folk in ND were just unprepared to deal with the Bakken, they didn’t think things through and fell into a rut. They could have done a much better job. The companies too could have done better, but I think their management lacked vision, or were too used to small and medium size projects. Developing a 1 mm bopd field is something very few people get to practice. I worked on three 600,000 bopd plus projects, and it sure gets painful.

‘After OPEC’ article in the current issue of The Economist:

http://www.economist.com/news/business/21651267-american-shale-firms-are-now-oil-markets-swing-producers-after-opec

From the article: