A guest post by George Kaplan

There’s not much revelatory here, more a completist’s list showing reserve changes for seven IOCs, with more to come over the next months, but it gives me an excuse for a rant at the end.

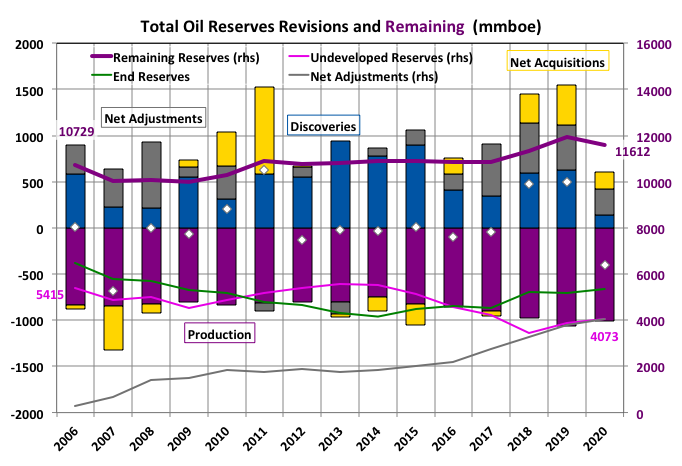

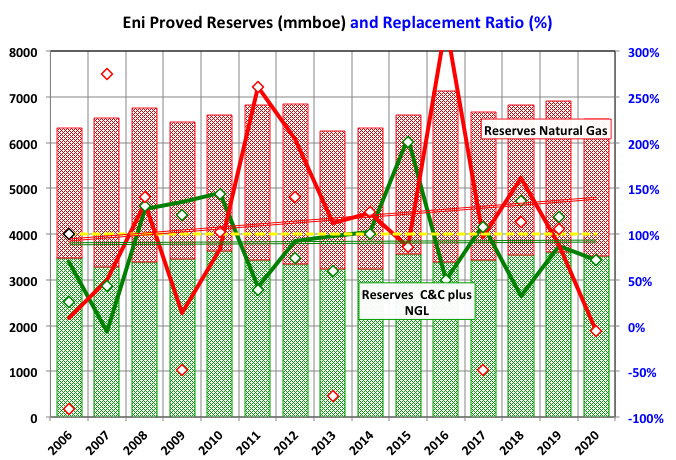

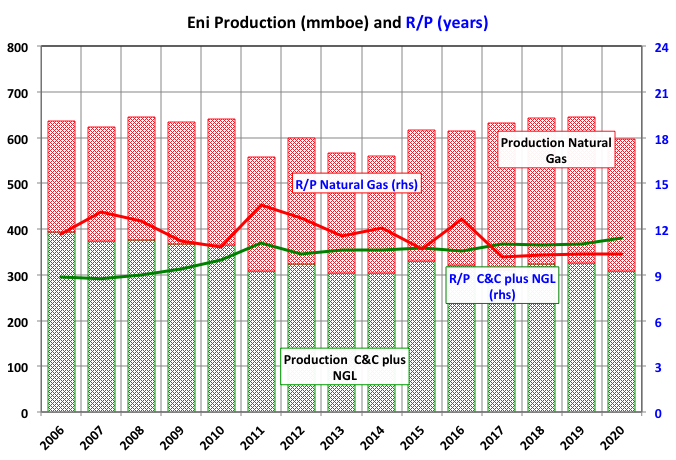

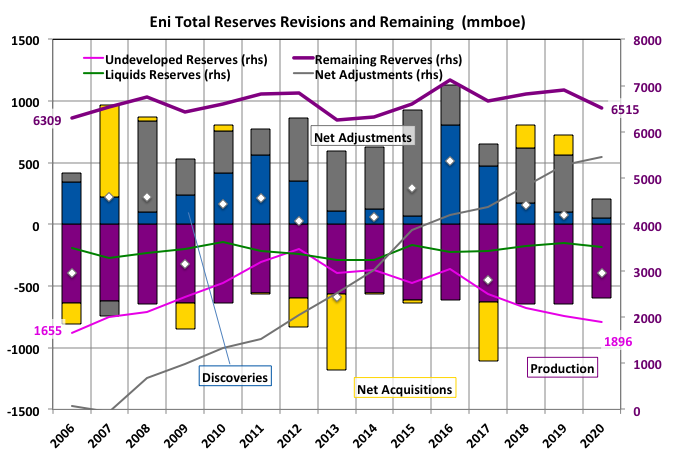

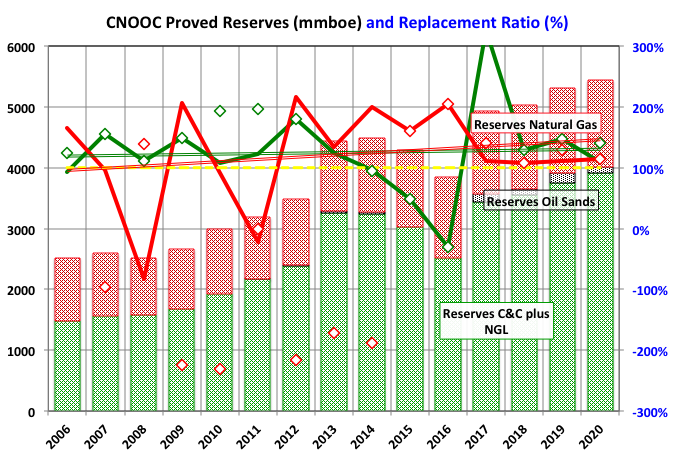

There are a few general trends but exceptions to each one. As discoveries have dropped production has been maintained, presumably through in-fill drilling and other brownfield activities – this can’t be construed from the data shown, although deeper analysis of the annual reports such as looking at drilling activities and financial details might be able to give further insight. Therefore remaining reserves have fallen as have reserve to production (R/P) ratios. Replacement ratios have been at or just below 100% and seem to be dropping faster – i.e. depletion is accelerating and actually seems to be particularly pronounced in recent years (acceleration of acceleration is called jerk or jounce I think). Looking at individual companies doesn’t give the full picture because of purchases and sales, but there is less of that than I expected for the companies shown here. A fuller picture might come when combining all the larger companies but even then it will not be complete. The recovery ratios are show for the organic numbers (i.e. without the net trades) as solid lines and trend lines with overall ratios shown as marker points.

The cumulative net revisions plus adjustments (i.e. the results of technical, economic and human – aka cock-up – factors) from year to year are shown. Generally these are a similar magnitude to discoveries and about half the cumulative production. This can be compared to unconventional results, to be shown in future, where they are often zero or negative indicating that the original URR estimates where too high, as most observers suspected.

For this group of companies the oil side has been doing better than the gas side, which is similar to what was seen for the super majors in the previous post, and is the reverse of what I expected.

The 2014/2015 price crash had a bigger effect than the 2008 financial crisis and marked a change in trends that has not been recovered from (this may mean that the 2020 crash has less of an effect than it would otherwise).

Looking at individual companies only gives a part picture but these smaller major may give a sign of what to expect in the supermajors.

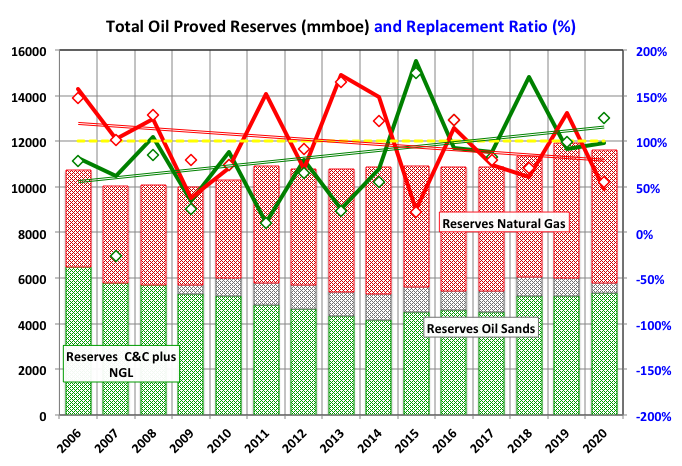

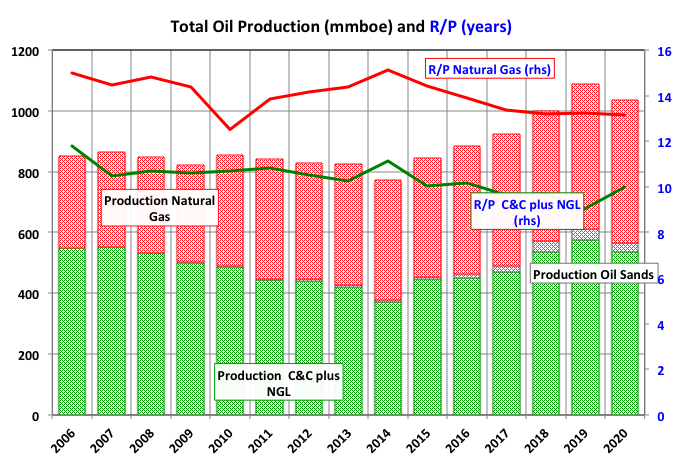

Total Oil (France)

Total Oil has done better than most in increasing reserves and production, more so in oil than gas, but at the cost of a continuing fall in R/P for C&C – I think at around 6 to 8 years it’ll enter a treadmill where the dearth of discoveries will be impossible to cover up by maintaining production. Its proportion of undeveloped reserves has also been dropping, which must mean something for its future production costs, but I’m not sure exactly what. It has a small interest in oil sands – I haven’t separated out R/P or R-R for the bitumen as they shoot up and down with huge jumps depending on prices and just confuse things.

Total is at the forefront of putative switch over to non-fossil fuels among the majors and larger independents, and is changing its name to TotalEnergies, which isn’t much of a jump really.

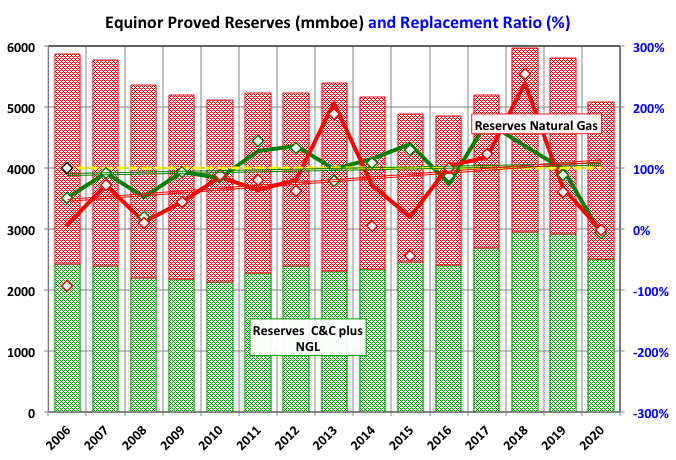

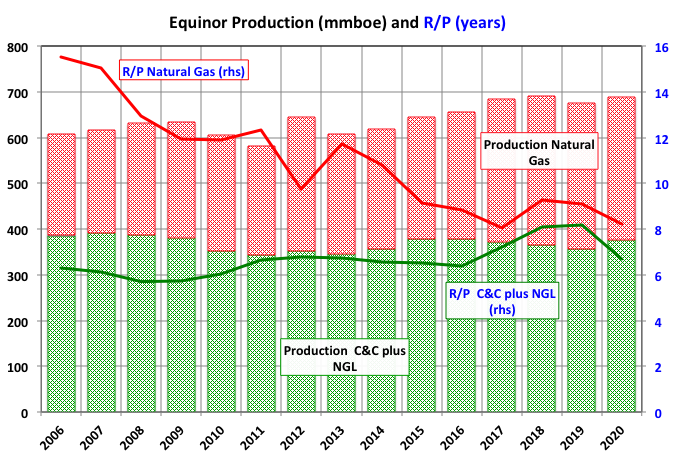

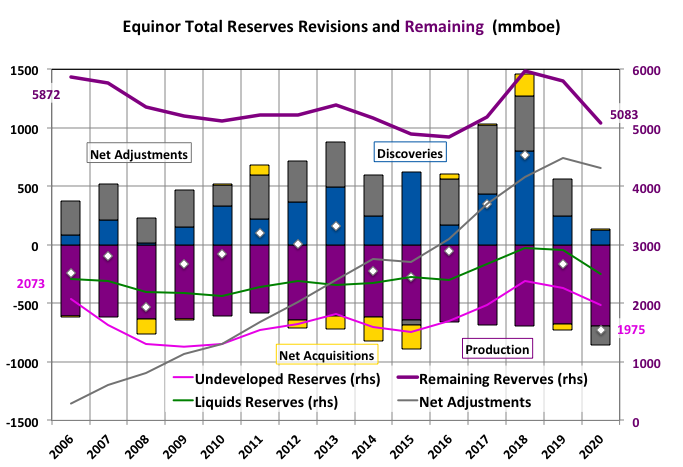

Equinor (Norway)

Equinor has a particularly pronounced drop in natural gas R/P, which is possibly bad news for European gas importers, especially the UK, though the rest of Europe has its own problems with Russia.

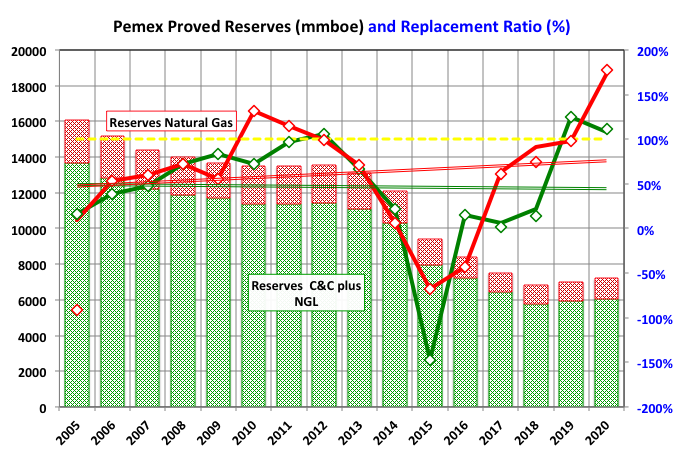

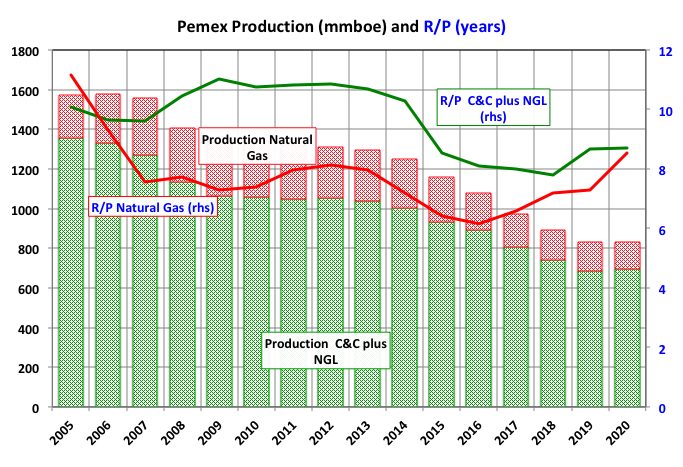

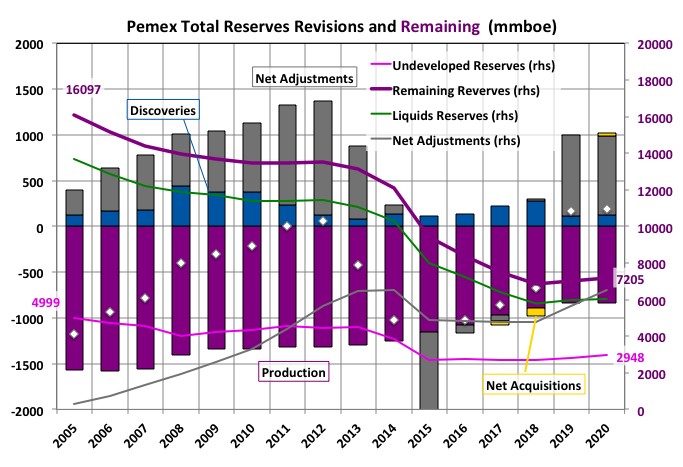

Pemex (Mexico)

Pemex is in a bad state and rarely achieves a 100% replacement ratio. Discoveries have been miserly with most additions coming from revisions and adjustments, presumably mostly upgrading from probable to proved as FIDs are approved. There was a plan to sell off some assets to pay down data but there’s little evidence of that and it seems to have faded away under new President ‘Acronym’.

Pemex makes up most of Mexico’s resources and the state has an excellent energy agency with detailed data including field-by-field production and reserve data including probable and possible values. I keep trying to get round to updating a post on these but its still someway off.

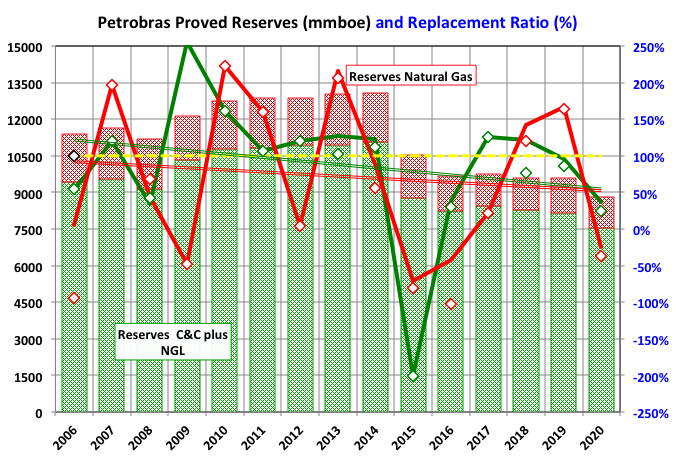

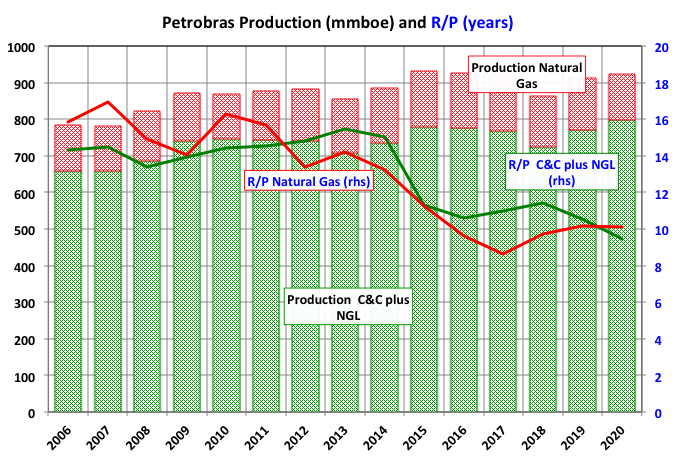

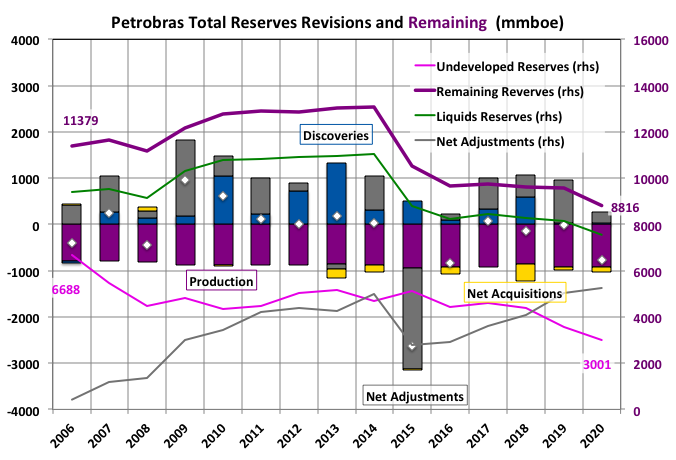

Petrobras (Brazil)

Given all the excitement about growth in pre-salt basins Petrobras has not been showing many signs of expansion. Like Mexico, Brazil has a pretty good energy agency, which gives more detailed data (I have done a post on that but it’s several months old – it updates reserve data at the end of March so it too is due a revision. Also like Pemex it has a plan to sell assets and there is evidence of that proceeding. Deep-water, especially pre- or sub-salt basins, seem, like other non-conventional assets in shale and oil sands, to be especially vulnerable to price volatility.

Eni (Italy)

Eni has been successful at maintaining reserves and production and to achieve this appears to use sales and purchases more than others.

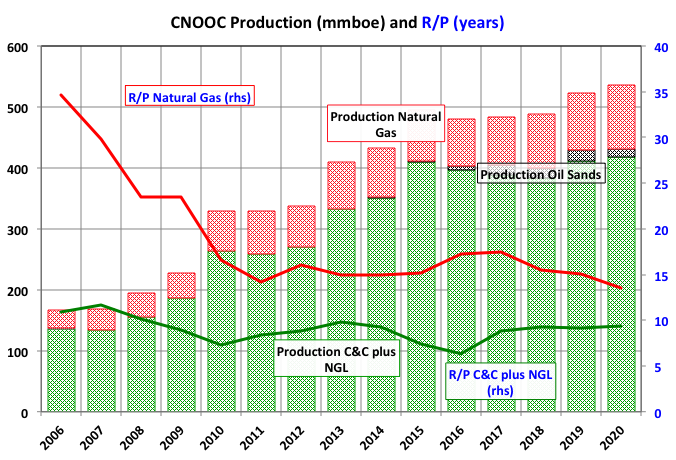

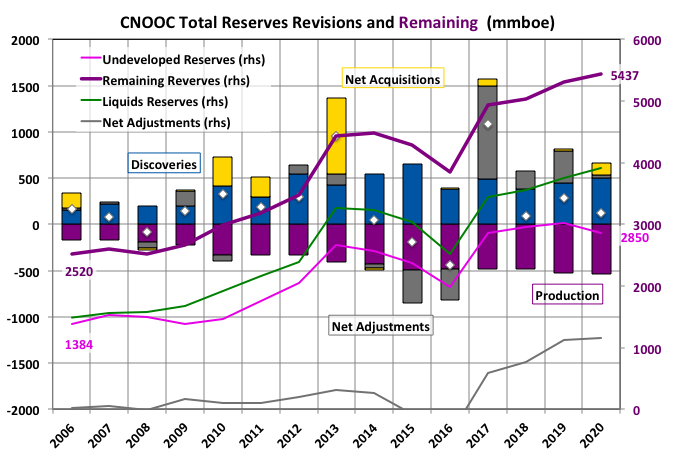

CNOOC (China)

CNOOC has had aggressive growth over the last fifteen years in both reserves and production, mostly from discoveries rather than acquisitions. It has a small interest in the oil sands as legacy of its purchase of Nexen in 2013. It needs a name change, ‘offshore’ it is not.

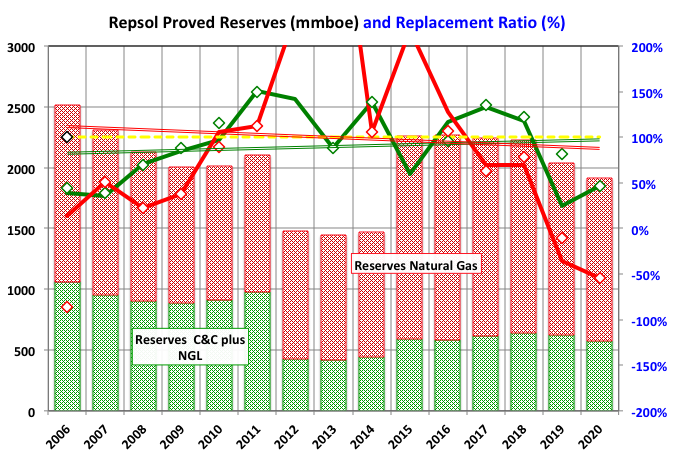

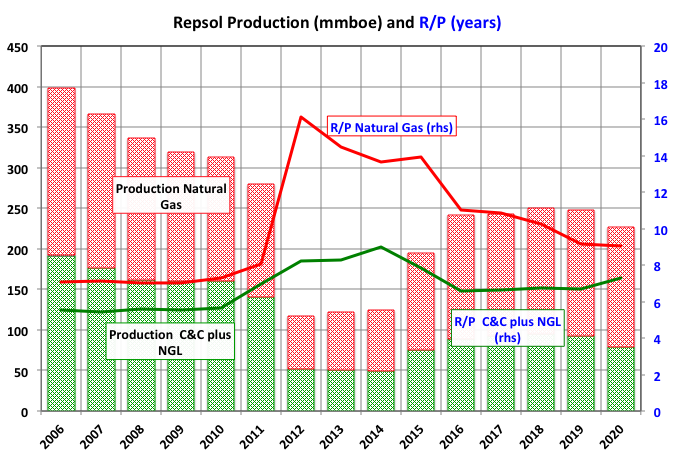

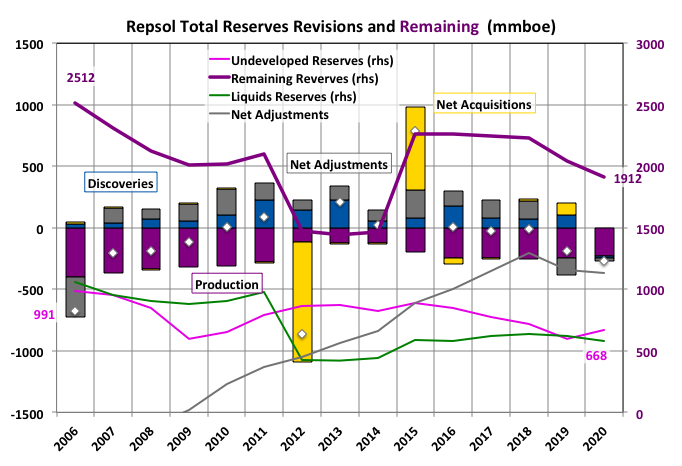

Repsol (Spain)

Repsol is a relatively minor player amongst this group and looked like it might be giving up when it had its assets seized in Argentina in April 2012, but then changed its mind in 2015 and bought Talisman, maybe taking advantage of some cheap assets at the time, though it might think better of it since.

Off Topic Finish: Dive! Dive! Dive!

I have reached the conclusion that a major collapse in the next fifty years is inevitable and the least bad future would be an early, rapid event where the inevitable undershoot stops a bit short of extinction over the coming millenia, if not for humanity then for a good few of the remaining charismatic flora and fauna. I don’t know how to quantify ‘least bad’, maybe something to do with minimizing global suffering, however going down that road leads to concluding it’s better to have no humans (e.g. see ‘Better Never to Have Been’ by David Benatar). There’s a question of the repugnant conclusion that modern philosophers circle endlessly, which is related but goes in the opposite direction, allowing for the far from certain assumption that I understand it correctly, i.e. that it is better to have a huge population leading lives just above misery. Optimising a linear system (e.g. one with weighting actors applied to different parameters) will always end up at some limit such as zero or as many as possible. In order to get some intermediate population the objective function, the thing being maximized, has to be non-linear such as a parabola (or its multi-dimensional equivalent) but I wouldn’t know how to define it (square of life expectancy, power factor or environmental damage, exponential of GINI factor – take your pick, but to get non-linearity there needs to be a function that captures human interactions, either directly or via affects on the ecosystem, as a benefit or handicap to wellbeing).

If I had to choose a period to live in it would be that which I have experienced, so it can’t be too disappointing, for me anyway, if it ends prematurely and relatively unpleasantly. In fact I could not choose anytime earlier as without, at the time, the latest medical discoveries, neither my mother nor I would have lived through my birth and, even had I done so, from the age of two I would probably have been condemned to a short and miserable life in a wheelchair. I have experienced a period and location that has almost uniquely not been ‘nasty, brutish, short and solitary’ for the majority, with liberty and comfort that would be unbelievable to past generations. And I appreciate my good luck has been at the expense of others, present or in the future. I don’t believe our descendants will look at as with anger or condemnation and if there is disbelieve at what we have ‘chosen’ to do it will be more of the ‘Wow!’ kind. There will be historical scapegoats vilified and it would be nice if Trump became the principle one, but I doubt that life will be that fair.

Either just before or just after university I read something that may have been ‘Limits to Growth’, but since I have had trouble seeing how things would continue after 2025, but for most of the time was prepared to believe that something would come along. Originally I thought resource limits would be the weak link, then climate change, but now it is any of up to ten planetary boundaries – and in the tiny chance we overcome them something else, it’s inevitable in an evolutionary environment. It would be nice to think this influenced my decision not to have children but I doubt it. I wonder how many others who state they’ve made rational decisions to go childless against their real wishes have entirely binary reasons. We have a group imperative to multiply; otherwise we wouldn’t be here. People can argue that basic education of women will bring the birth rate down but part of that is because families can choose to spend more resources on ensuring more offspring survive to reproductive age, and therefore overall consumption of the resultant smaller population would increase. More importantly, women are only half of the equation, certain men (and more so in times of hardship) will choose the easy option of having as many descendants as possible and even if fewer overall survive as a result then its OK as long as their proportion in the remaining population is increased. Denial of women’s rights, however covert and tacit, fits right in with this strategy.

I go with John Gray on most collapse related things so in response to what’s coming I think you just have to shrug your shoulders and get on with things; the earth isn’t going to care still less the universe(s) as a whole. It’s a pity what we are doing to our fellow creatures and losing so much beauty but the biome will likely recover and mostly they would do far worse to each other given the chance and the reproductive advantage it might provide, and beauty is subjective towards things from our evolution the have given us benefits. This is not an excuse for us all to turn into slavering, fascist barbarians – morality and decency are absolute good things in themselves but also provide a more pleasant and composed way to live.

Any species that achieves our level of cognition is going to follow somewhere like the path we have; it’s impossible to separate our worhy achievements from all the bad stuff that accompanies them. Any species that finds itself happy with its lot is going to be out competed by those that are not, and quickly disappear. There is no route to evolve towards contentment as a group.

Inherently steady state civilisations (including fully circular circular industrial economies) are impossible – any individual choosing growth would immediately gain an advantage and therefore everyone must also so do to keep up. They might be achievable for some time through set hierarchies and strict authoritarianism if that’s your thing (was the Samurai era in Japan something like that?). In hunter gather groups getting bonked on the head by your peers if you get a bit too far above yourself seems acceptable, in a civilized society it’s a police state. Over wide areal and temporal regions dynamic equilibrium may be possible but locally it would be, and has been for most of agricultural civilisation, ever changing, possibly close to turmoil at times, and rather fragile, fraught and frightening for the populations (and would be more so in our full world than for historical, putative steady-state civilisations).

If the only way to survive is for civilisation to exactly follow narrow prescribed behaviours that maximise our efficiency for using available resources (as laid out by some sort of technocopian Star Council) with no margin for messiness, uncertainty and self expression, which is how I see most of the current proposed ‘it’s easy, the problem is you’re just doing it all wrong’ solutions from various parties, then I’m not interested. It may preserve a civilisation but it wouldn’t be a human one – better to die on your feet than live on your knees with a yoke around, or USB port in the back of, your neck. Recent histories from many autocratic regimes suggest that having scientists and engineers directly running things isn’t necessarily a good idea, they may be good at what they do, but in politics what they do is often not good. I think a technocracy would be close to hell. Just imagine taking the supercilious proselytisings of Musk, Zuckerberg, Page/Brin, Seba and the other happy shiny people of their ilk to their desired conclusions (which might include supercilious proselytizing from happy shiny AI entities – I’d rather choose Judgment Day and face the HKs.

Our brain is a pretty awesome thing (although the continued existence of clownish climate deniers and rabid MAGA-men or, more so, MAGA-women might cast some doubts) but maybe no more evolutionarily extraordinary than a cheetah’s speed, a bacteria’s biochemistry, a yew’s longevity, a frog’s ability to survive six months frozen solid, quantum effects in the sense of smell or bird’s direction finding, the mammalian immune system, regenerative abilities of jelly fish, the Calvin cycle etc., including innumerable things that we aren’t aware of yet and may never be). Is the complete extinction of one of these any worse than of the others and, if so, who sets the precedence? Definitely not Musk or his AI proxy I’d suggest.

Of course it is easy for me to condescend with these rants from my superannuated (smug?) comfort zone, not least because a near term fast collapse is not going to happen. We humans, and especially the well off (I’d say that includes 80-90% of the West,) are going to do everything we can to avoid it and in the process will push us further into overshoot, trash everything trash-able and maximisis subsequent suffering while minimising the chances of having something worthwhile survive. Notwithstanding that, as things degenerate, I find it increasingly annoying to be preached at by proponents of the EV powered continuation of happy motoring BAU bliss as if that’s the only view point anyone can possibly have; and if you propose an alternative then it must be just a trolling wind-up or whistling past the graveyard and deep inside you must really want the shiny EV.

Top ten recent scary ‘it’s worse than we thought’ reports.

- The 2020 Report Of The Lancet Countdown On Health And Climate Change: Responding To Converging Crises

- The Historical Impact Of Anthropogenic Climate Change On Global Agricultural Productivity

- Global Warming Is Causing A More Pronounced Dip In Marine Species Richness Around The Equator

- Underwater Robot Reveals How Warm Water Is Melting Thwaites Glacier

- Future Of The Human Climate Niche

- Global Groundwater Wells at Risk of Running Dry (behind a pay wall but the abstract gives the gist and other science round up blogs like phys.org or even Bloomberg.com, if you have free articles left, have more information see, also Competition for Shrinking Groundwater).

- Global changes in oceanic mesoscale currents over the satellite altimetry record (also behind a pay wall but try the local library or Desdemona Despair).

- Blip: Humanity’s 300 Year Self-Terminating Experiment With Industrialism by Christopher O. Clugston (Published in 2019 but recent for me).

- Bright Green Lies: How the Environmental Movement Lost Its Way and What We Can Do about It by Derrick Jensen et. al. (recently published, also has an accompanying documentary film – lots of good stuff but also interesting to me as evidence of growing disillusionment or resignation in radical ecologists – see also Paul Kingsnorth, Jeff Gibbs, Deb Ozarko, Jem Bendell, Mick Green.

- Seaspiracy has caused a kerfuffle with some participants claiming they were misrepresented but there have been several more sober documentaries about overfishing with a similar message that pre-date it: An Ocean Mystery: The Missing Catch; Chasing Coral; Our Planet: High Seas; The Price of Fish; The Race To Save Our Marine Fisheries; The End of the Line; Racing Extinction (Seaspiracy and the last two cost money – judging by the number the high seas must be particularly attractive to film makers).

This has been written in mid to late April. My guess is that there will be another ten such items that would make up the list at the time it is posted; we live in an exponential world.

Mr Kaplan , usually I say ” I am a fan of your off topic ” , but this time you hit the ball out of the park in the post in entirety . Kudos . Muchos Gracias , Bedankt , Merci , thanks in English .

HOLE IN HEAD

I second that. Thanks George.

Thanks, at least food for thought perhaps, if nothing else.

Mr. Kaplan

Thank you for your rant. Food for thought is an understatement and very much appreciated. Please accept this feeble attempt at gratitude and encouragement.

While I may not agree with all of your thoughts, you have expressed angst or lack of contentment, to say the least, which is where growth comes from. It appeared to me that you spoke of what you were aware of less than what you knew as absolutes. Thus, you advanced humanity in the greater argument or confusion, if you will. There are no easy answers and there never were any. No human is qualified to drive this ship and to proffer such, as many do, wreaks of arrogance and ignorance of man’s finite understanding and capabilities.

This world has an expiration date that none of us have the privilege or burden of knowing. Our job is to love each other which is manifest in many, many ways, not the least of which is being good stewards of what we were given for the benefit of all mankind. I have been woeful in that endeavor but have realized since early adulthood that we could not continue on a growth always paradigm without hitting an asymptote. Contentment is a theological goal yet existentially threatening in so many ways in the process of correction of the growth always paradigm. Human nature defies contentment.

Thanks for your expression and for the forum that allows it to be told. All that has been discussed here over time is a part of a conundrum and energy, environmental and humanity issues are all intimately interwoven.

Thanks for the thoughtful reply, more so than my stream of consciousness stuff I suspect. Nothing I write on our condition should be taken as absolute and unwavering. I don’t think there can be such a thing (e.g. to me absolute morality is rather hubristic and colonial – there’s probably a better word). In an evolving world everything has to be relative, to be otherwise implies knowing the ultimate destination, which effectively is no different from religious belief in a creators plan.

You wrote a good read, Mr Kaplan. Thanks. I never felt the urge to say you’re hitting the ball out of the park.

It felt like a personal and emotional scream of dispair to me, that is. I hope you’re not feeling that bad all the time??

Today, since AD2006 or something, in the West a new generation is growing up without the notion of growth. Because they live in a society without growth. Their entire frame of reference is built nowadays. It will differ fundamentally from ours (I’m 44yo) who grew up in times of unlimited and ever increasing possibilities.

We must, as a society, allways trust on the power and the ingenuity of our yougsters, cause they will steer us (then the elderly) thrue the challenges of the times ahead.

They face a difficult path, but I’m confident they will find their way forward.

Nice way to avoid all blame and abdicate responsibility eo another generation, still if it helps you sleep at night, but I’d suggest passive aggression isn’t a good stance to take, it makes you look a bit pathetic and wearisome and leaves a bad taste in others mouths.

Jensen and Kingsnorth—

Never had anyone on the blog even mention them- interesting.

Excellent!

Thanks George. Always stimulating.

“There is no route to evolve towards contentment as a group.”

Interesting point. I guess we’ll just have continue to savor the part that pertains to the individual, with no false expectation of advantage passed to the offspring.

Put me on the list of those who think the best path for the coming time of global petrol depletion is to come up with no replacement. Just let the collective human factory and farm fade, and the population with it.

Easy for me to say, I’m over 50.

However, there are about 6 billion people under 50 who might feel differently about it and may refuse to simply fade without a fight for alternative sources of energy production.

Note- severe petrol rationing by the global authorities (readers choice), if instituted soon, could extend the petrol age for many many decades- If that was a goal. Of course this won’t happen [voluntarily], but severe level of de facto petrol rationing will come in a haphazard manner without any input from any authority, based solely upon depletion and the uneven distributive forces of the market and armed conflict.

Eni has always been a curious company and its stock’s behavior amplifies that.

The share price is below half what it was in 2007, but this generates a P/E under 5.

And their dividend yield is only about three and a half percent.

So what’s wrong with the company? Nothing. Never has been. This doesn’t mean the stock is about to go up because nothing was wrong with the company the past 10 years, and it still didn’t go up.

Nigeria’s oil exports drop

“The drop in Nigerian supply is part of a wider development in which exports from African OPEC members – among them Algeria, Angola and Libya – has fallen by 650,000 bpd in May, Kpler said. The decline so far is unexpected, since OPEC had agreed to raise output from May.”

I’m probably going to do a post on sub-saharan Africa as it’s the only place where there are audited reserve numbers from IOCs of nominal OPEC stated reserves. I don’t expect Nigeria especially to come out well. All its large fpsos except Egina are well through their lifecycles and the three or four new ones on the cards have their fids continually pushed back – I think the deep water reservoirs remaining are quite complex and require high oil prices (and the share holders increasingly seem to want guarantees of stable high values before committing). Also the western companies are still trying to et out of onshore contracts and unrest is spreading – and likely to get worse as the true bill for the epidemic becomes known, food prices continue upwards and government oil revenues continue to shrink. Good luck convincing a country in that state that they need to stop new fossil fuel developments in order to save the rest of the planet and particularly western lifestyles. Post unlikely before October as there are three others waiting : independents, shale companies, Canada, and Ngerian nnpc don’t issue yearly data until late summer.

In answer to Georges Kaplan, I think we are going to face a more modest style of life. Perhaps some gadgets and some wastes, such as the fast-fashion, will disappear, but we will have enough margin to keep in place some other things, for example medicine. For example, I think we will go back to sailing ships for maritime fret. Ok, more than this modest schooner-brig. It will involve a complete change of mental attitude towards the current race for speed in the economy and it is going to be extremely dramatic for some people.

https://www.youtube.com/watch?v=Y_x2WOkQNW8

A consolidated post :

ENI : Italy has had zero growth from the last 10/12 years , so ENI is just following the pattern . As per Mr Kaplan ENI is more of a trading company than an extraction company . One of the reasons is that they were dependent on Libya ( former colony ) for their crude and that is in turmoil . I travel over Europe by car and seldom see a ENI pump .

Africa : Not surprised . All these countries are members of OPEC . I have said that OPEC should be OPEC 5 (KSA, Iran, Iraq , Kuwait , UAE ) the rest are in permanent decline or have political problems that are not going to be solved . This will continue .

JFF : Modest lifestyle is not possible . Our economic system is ” The landfill economy ” basically it means ” Your waste is my income ” . No, there is no margin . Our current economic/ financial system is meant to work at 90/95 % capacity or else it will crash . There is no such thing as a ” steady state economy ” . It is a pipedream .

No refinery , electric plant ( the drivers of IC ) can survive at 75 % capacity . I have posted earlier ” I am a little bit pregnant ” or ” Is the prostitute a virgin ?” . Sorry , but ” You can’t jump the gorge in two jumps ” . Basic ” The end of growth is the beginning of a collapse ” . Regret to disappoint ( I deem you to be a logical commentator)

but you have the problem misdiagnosed .

P.S : Mr Kaplan, just to qualify my earlier comment . We always hear what the whales ( XOM, BP, Shell , CP, Chevron) are doing but never what the minnows are doing . You have shed a light on this for the first time as far as I know . Thanks for this info .

”Our current economic/ financial system is meant to work at 90/95 % capacity or else it will crash .” I didn’t tell that this economic system will survive… It is obvious that some activities will disappear with the disappearance of the oil economy. This is where the margins will be found. For example, management of the pension system / decrease in economic activity with decrease in oil supply. If we convert the 40 million individual vehicles in France with an electric motor, it will cost 200 billion euros. Manageable on 10 years. This will allow the vehicle owners to have an economy of 1000 euros more or less per year and per vehicle. And 40 millions x 1000 = 40 billions euros/year. This sum could be used to fund the retirement system. Beyond this, it will be necessary to find a job for the people concerned and that will be a problem.

Manageable, but we dont have the metal to make that many batteries 🙂

JFF,” If we convert the 40 million individual vehicles in France with an electric motor, it will cost 200 billion euros. Manageable on 10 years. This will allow the vehicle owners to have an economy of 1000 euros more or less per year and per vehicle. And 40 millions x 1000 = 40 billions euros/year. This sum could be used to fund the retirement system. Beyond this, it will be necessary to find a job for the people concerned and that will be a problem.”

The keyword is “If” . In India we quote “If my great grandfather and his progeny was alive , we would be an army ” . Unfortunately my great grandfather and his progeny are not alive and there is no army of my clan . Second you say ” necessary to find a job ” .Are you kidding ? There are no jobs . Period . India lost 50% of the jobs in the organized sector . 80 % jobs in the unorganized sector . Thailand , Indonesia lost 30% jobs . USA and Europe are having disguised unemployment with the unofficial UBI and forbearance programs . I have earlier posted , unemployment is going to be the biggest headache for the governments . Governments have no solution because there is none . There is no nett surplus energy to kickstart . What I agree with you is ” I didn’t tell that this economic system will survive…” . Be well .

1) Escape negroes.

2) Get physically fit.

3) Make as much money as possible.

4) Reduce spending as much as possible.

Rinse and repeat.

5) Get banned from POB

+1

George Kaplan,

Dolph9 is gone.

“Dolph9 is gone.”

Thank you.

>near term fast collapse is not going to happen

I don’t know if near term has an exact definition but I’m convinced that our way of life is much more fragile than most people realize. David Korowicz explores the topic in his superb study called ‘Trade Off’. You can find it here:

https://www.feasta.org/2012/06/17/trade-off-financial-system-supply-chain-cross-contagion-a-study-in-global-systemic-collapse/

Growth as a function of cheap energy is in obvious decline and we face degrowth sooner or later. And yet governments, businesses and citizens rack up debt (a call on future cheap energy) like there is no tomorrow. I simply can’t see a way how this would end well and that’s only the financial aspect with so many more.

We have lived so well for long on cheap oil. When I look back and see the OPEC/NOPEC price manipulations and destruction the oil futures market has brought to the oil industry it makes me weep. The world has treated this precious and depleting commodity as “just in time inventory”. This not like corn or crops with a one year growing cycle. Most projects and more specifically the larger projects takes years of lead time just to bring to production. One of my trusted advisors told me several years ago that the oil and gas industry is univestable. I resisted his view but he is right. No one in their right mind can invest in a project and with little degree of certainty in predicting revenue and and survive the volatility The Majors are all reeling and jumping to the next shiny penny of green alternatives.

I would love to see an energy transition to green and sustainable energy but we are so far away from replacing our total energy needs.

M The regular guy on the street has no concept of how hard it is to find oil and hard to produce as well. I would love to pose this question: Would you rather take your chances with inaccurate and immature climate models or live in a world without affordable and abundant energy? We have suffered from the embarrassment of riches with excess oil supply for decades and now we are going quickly of a cliff with no parachute. I have predicted that taking a year off from replacing reserves will have devastating effects not only on short term supply but for the longer term. The economy and our way of life as we know it is going to be very challenged in years to come. We as a global community have been profligate and irresponsible in our development of alternatives and use of hydrocarbons. The piper will collect.

“Would you rather take your chances with inaccurate and immature climate models or live in a world without affordable and abundant energy?”

I think that’s a false dichotomy at best and really just comparing apples and oranges. The accuracy of the models (they are actually directionally pretty good and always have been since Arrhenias’s time, which is not immature) doesn’t set the price of fuel. Very few policy decisions affecting oil prices have so far been made based on the real findings of the models. If they had oil would be at least twice as expensive, all new developments would be banned from about ten years ago. It is possible to drop fuel prices again if you find you’ve made a mistake, it is not possible to pump the Atlantic ocean out of Miami once it has flooded in, or undesertify the US southwest once it has become uninhabitable.

The models directionally have been atrocious.

You bandy about cutting off the legs and feet of modern agriculture like a knob we can turn without starving billions. It makes you hard to take seriously in all honesty.

All indications are that sea level rise has been steady for the last 10,000 years since meltwater pulse 1A.

People naturally want to figure who to blame for the lack of investment in oil E & P, looking to wall street or OPEC or green environmental policies, for example.

The consistent low price for oil is why the E & P budgets of the major companies have been cut back. It is not for lack of capital available for good projects. The second problem is lack of good new projects- good meaning production costs low enough to give a decent and reliable return on the investment. Anybody with capital, be it a teachers retirement fund or the banks in Houston or a silicon valley venture fund, wants a decent risk-adjusted return on investment. Otherwise better to put the money under the mattress [so to speak].

Why has the price been low for oil? It is the very success of LTO production that has brought so much oil so fast to the market that supplies have been flush. Simply, the frenzied pace of drilling and production in the USA came too much too fast. No coordination to match market requirements (demand).

Some may want to blame the electric vehicle industry (and those who are advocates of alternative energy development) for lack of oil demand growth. In reality, we haven’t seen that competition much at all yet. But we will start to it as this decade rolls on, and that future outlook does indeed affect those who might consider funding a big future project.

If you (whoever you are) are deploying a billion dollars of funding to new energy project development you ask yourself- What is most likely to give some return and least likely to go belly up? Its an entirely rational question to ask, and industry players such as Equinor and BP are coming up with their own answers that guide their corporate funding priorities.

These swings of under and over investment in future projects is nothing new in the history of markets- especially ones so dysfunctional as the global oil market.

This is true except oil is harder to find and produce and the lead times to meet demand will be longer plus there is a lot less of it to find. I am stunned at the lack of replacement of reserves everywhere

Inherently steady state civilizations (including fully circular circular industrial economies)

A circular economy doesn’t have to be steady state if if continues to improve the value it adds to the materials available to it. That process can’t continue forever, but we are far away from optimal use of available resources.

For example, commercially available chips already pack a hundred million transistors into a square millimeter. This provides lots of latitude for optimization without increasing material consumption. Furthermore the numbers continue to rise quickly as the technology improves.

There is plenty of room at the bottom, as Richard Feymann put it.

I would say, in your example of semiconductors, we’re very much at the point of diminishing returns using silicon with little in the way of revolutionary architecture designs on the horizon. The processes are also that much more energy and money intensive now, with our present predicament being fab houses able to keep pace with demand right now (and check out TSMC’s water issue).

There’s probably more to be gained by optimisation, such as Apple moving to ARM for their laptops and desktops now and absolutely nailing it with TDP values that make Intel look wholly incompetent and arrogant (regarding Intel, to paraphrase Batman villain Bane: market dominance has cost you your innovation. Victory has defeated you!). But that is still just a variation on better performing silicon reaching the physical limits of the transistor gate size. Photonic computing, anyone?

Great read as usual George. Thanks for putting in the work.

I decided to forego city life for the last 2 waves of COVID, and have been at the woodlot enjoying a meditative sabbatical aka chopping wood and walking the trails. It’s been a beautiful spring!

I hope you’re doing well (I would hate to see your writing dry up haha). Hang in there!

Wasn’t there a recent fad for a book about how good chopping wood can make you feel – I can believe it.

From Oil price

https://oilprice.com/Energy/Crude-Oil/US-Shale-Is-Finally-Giving-Shareholders-A-Payday.html

Record Free Cash Flows

Many U.S. shale producers generated record free cash flows in the first quarter, and the sector as a whole is expected to continue generating more free cash flow than at any given point in the past, according to a Bloomberg Intelligence analysis of 31 independent firms.

EOG Resources, for example, generated a quarterly record $1.1 billion of free cash flow and earned $1.62 per share of adjusted net income, the second-highest quarterly earnings in company history, chairman and CEO Bill Thomas said on the earnings call.

Dennis

In the meantime the STEO is projecting oil output to start increasing in July at approximately 75 kb/d/mth. At the same time the STEO has WTI at $55 in June. Difficult to rationalize increasing production and dropping WTI.

The DPR output is flat till June so we might get a clue there when the June report comes out. It will be interesting to see if the STEO changes its tune or if they have some info we are not aware of. Current Permian increases are being offset by decreases in the other basins.

Ovi , I am being repetitive . The red queen effect is in motion and the treadmill is churning faster . To add ,depletion , rust and aging never sleep .

HH

I am wondering why the STEO doesn’t know this.

Ovi, being repetitive once again .

” “It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

― Upton Sinclair, I, Candidate for Governor: And How I Got Licked

🙂

HH

Got it.

?

This is folly. You cannot grow reserves and pay dividends as an E&P company unless the price $150 per barrel. The MLPs of the 2000’s proved that it is impossible ie Enervest, Linn Energy. It is not sustainable in the United States. Unfortunately the Wall Street green analysts are too inexperienced and too young to know and understand this is an impossibility. The silver lining in this is that their short term greedy demands ensure shortages in the future and much higher prices.

This may be of interest. EOG look like a company with its best days (in terms of growth and absolute performance) or three or four years in the past. (red is natural gas, green is C&C and ngl.)

There have been very few successful wild cats since 2013 so the reserve growth is really just extensions, especially additions as fids are made.

Production has been as below. Most of the shale specialist companies have a similar shape. Some are a bit behind and are peaking now or next year (smaller ones than EOG), some were ahed and have gone bust (Chesapeake/Whiting) or been sold (Concho/Noble/Anadarko)).

Mr Shellman has an explanation for the cashflow of EOG and other shale plays . Looks like the ” girls ” are not as pretty as they seem in their photographs . Good lighting and camera does wonders for past expiry date actresses and so do good CPA ‘s and blind investors for the shale players . 🙂

https://www.oilystuffblog.com/single-post/for-shale-oil-cash-flow-ain-t-free?postId=0ca8fc66-fdc5-4916-b60c-ca39bf8fedba

I will continue that the outlook for oil has never been worse since I started paying attention in 1997. One would think that $60s WTI would help, but it hasn’t. No drilling going on here at all. Still a lot of wells that were SI due to negative oil price that continue to be SI. There are no workers. Almost no workover rigs are even available, almost all are still stacked. We have been waiting on a rig for weeks, there are literally less than ten workover rigs running in a field with over 3,000 active production and injection wells.

The people that own leases here are almost all age 50+. Oil is going to die due to the negative sentiment. I sure hope the alternatives will pan out.

Shallow sand,

Have costs increased by more than the price of oil (which has roughly doubled based on monthly averages)?

Tight oil companies are claiming a very good Q1, was that not the case for conventional?

Dennis.

Of course financially things are much better than in 2020 (after February, 2020 anyway). Costs haven’t doubled. But they are up. Electricity prices are up 15%, due to higher natural gas prices. Steel tubing is up 22% over last year. Chemicals haven’t went up yet.

Rig rates aren’t up yet, but finding a rig is difficult. There aren’t workers to operate them at this time.

What I am referring to is sentiment. I cannot remember a time when sentiment for the future among oil producers here has been lower, which is strange given the substantial improvement in oil prices. I think the sentiment is that these wells have an expiration date that is just around the corner.

We are currently of the opinion we won’t be able to sell our wells for much of anything. We aren’t yet ready to accept 24 months net at $60 WTI (although maybe we should). So we are preparing financially to have the funds to P & A them in the future.

Maybe this sentiment is confined to our tiny, old, shallow, depleted corner of the Lower 48 onshore?

Shallow sand,

Thanks, I imagine there is money to be made, despite the poor long term outlook. Oil will be needed while the transition occurs and it is unlikely to result in demand falling faster than supply before 2030 (and perhaps not until 2035). To me that suggests oil prices that will mostly be $70/bo or higher from 2022 to 2030 (WTI in 2020 US$) and perhaps until 2035. As always, my oil price predictions are very likely wrong ( about a 100% probability.)

The May MER is out and March and April output are shown in Red. Still trending down.

As forecasted.

Oasis Petroleum Inc. Announces Strategic Sale of Its Permian Assets and Updates 2021 Outlook

https://www.prnewswire.com/news-releases/oasis-petroleum-inc-announces-strategic-sale-of-its-permian-assets-and-updates-2021-outlook-301296501.html

Oasis is one of the shale specialist companies that peaked before EOG (see above) and is selling up rather than going bust.

Production:

OAS went through a Chapter 11 bankruptcy in 2020. It recently announced the purchase of assets in the Bakken from Diamondback. Diamondback has acquired the assets in the Bakken as a result of buying QEP, which was about to go bankrupt. QEP at one time had among the best acreage in the Bakken.

OAS says it is selling the Permian assets to help pay for the Bakken asset purchase and in order for it to be focused solely on the Bakken. It had orginally been a Bakken company, but bought Permian assets when the Permian was all the rage a few years ago.

Thanks – if it has gone bust already that fits in even clearer with the shape of the reserve and production curves and being among the group of companies with the earliest peaks in reserve holdings that have disappeared one way or another (if only temporarily for some of them, at least for the time being).

GEORGE+KAPLAN,

Excellent job on the reserves and I really appreciate your insights about the future of our economy-markets-society. I have watched the Seaspiracies documentary and agree the world can’t continue at this level of exploitation.

best regards,

steve

Shallow,

Yes, indeed. I have been following Oasis for quite some time. The last price it traded on the NYSE before it went bankrupt was 12 cents a share. However, after bankruptcy, Oasis was listed on NASDAQ it started trading at $20.

Today, the current price of Oasis is $83.

This is the kind of insanity taking place on Wall Street.

steve

Raymond James analyst Marshall Adkins…..

https://www.hartenergy.com/exclusives/global-oil-prices-could-surge-70-year-end-194275

“Global oil inventories have already neared “normal” levels—7.6 billion barrels—and will drop well below that from January 2022 to October 2023, according to the firm’s research. Even if OPEC+ output recovers to pre-COVID levels by 2021, inventories will still fall roughly 2 MMbbl/d, Adkins noted.

On the other side of the equation, the consensus among analysts is that demand will surge 5.5 MMbbl/d in the next six months. If this comes to fruition, Adkins said OPEC will have to back off all cuts and increase by an additional 2 MMbbl/d to balance the market by year-end 2021.

“To get to a balanced market, OPEC+ has to get back to where they were pre-COVID by the fourth quarter and go well above that by early 2022,” he said.”

A hiccup for Shell .

https://www.reuters.com/business/sustainable-business/dutch-court-orders-shell-set-tougher-climate-targets-2021-05-26/

They will appeal this in the higher court .

Exxon got the odd problem too.

https://www.ft.com/content/da6dec6a-6c58-427f-a012-9c1efb71fddf

Meanwhile, when there is need to be pragmatic.

Canada’s top pension funds boost investments in oilsands amid promises to green portfolios.

Canada’s biggest pension managers boosted their investments in the country’s major oilsands companies in the first quarter of 2021, raising questions about the funds’ recent commitments to greening their portfolios.

The cumulative investment by the country’s top five pension funds into the U.S.-listed shares of Canada’s top four oilsands producers jumped to US$2.4 billion in the first quarter of 2021, up 147% from a year ago, a Reuters analysis of U.S. 13-F filings show. Much of that increase, which bucked a declining trend since 2018, came from rising prices of shares already owned, but the funds also purchased more shares.

It should be noted that while the IEA recently said that oil companies need to stop exploring for new oil, these companies only have to mine it. The four companies mentioned are Canadian Natural Resources Ltd., Suncor Energy, Cenovus Energy and Imperial Oil. These companies will be the last ones standing as oil runs out.

https://financialpost.com/commodities/energy/oil-gas/canadas-top-pension-funds-boost-investments-in-oilsands-amid-promises-to-green-portfolios

Ovi,

What is the cost per barrel for oil sands producers? I would think it would not be lower than middle east OPEC producers.

Recent article below

https://yaleclimateconnections.org/2021/03/canadas-oil-sands-industry-is-taking-a-big-hit/

In the article above they cite costs at about $45/bo, with transport costs for rail to US at $20/bo, so that would imply a breakeven for oil sands exported by rail at over $65/bo. It is unclear if an increase in export capacity by pipeline will occur, so oil sands remains a less profitable business than most other types of oil production, if oil prices start to fall after 2030 due to demand falling faster than supply, oil sands production may become unprofitable and may cease.

Dennis

Attached is part of an analysts report that answers your question. I have emailed you the full report in case someone can help with the analysis .

The first case refers to syncrude. It is a mining operation and they upgrade the bitumen to Syncrude sweet blend. Their operating cost is $Cdn 26.64 and the net back is $35.48. I do not know what goes into the cost. Clearly wages are in there. What else, energy? Does maintenance come out of the netback or is it in the cost. Maybe somebody can explain

Fort Hills is a SAGD operation and I think their output is Western Canada Select which has a roughly $15 to $20 discount to Syncrude output. Syncrude cost plus netback is $62.12 while Fort hills is $41.70.

East coast is off Newfoundland and is deep water oil.

The whole range of costs are there. Note these are average oil price (the sum) over the quarter. They will be higher for Q2.

I would imagine there is a high cost for natural gas in oil sands production, there’s an argument for saying they are mostly just arbitrage projects that convert gas to liquid based energy.

Newfoundland is not deep water, it is 80 to 120m. Two of the platforms there are GBS’s and sit on the sea bed (with another currently in development limbo). It does have its own unique issues though, because of the risk of icebergs, so the other two operations use FPSOs to allow quick disconnect even though the shallowness is not ideal for the flexible risers. As a basin it is now past middle age, Its not a big producer and probably hasn’t really lived up to its early promise.

George

I never was clear on Newfoundland oil since I kept reading about difficulties and I just assumed it was deeper than 120 m, thought maybe 500 m.

As for that old saw that Syncrude Sweet Blend (SSB) was just NG converted to oil, It is a bit of an overblown tale. There used to be a company called Canadian Oil Sands, (COS) which ultimately was bought out by Suncor. As an aside, Sunoco was deeply involved in developing the oil sands and Suncor was an off shoot.

COS was a bit sensitive to that NG story and their quarterly reports were very detailed. Stuff I don’t see these days. Below is a table that shows what happens to the bitumen to the SSB process.

The bottom line in the table shows an average of 1.2GJs of NG to produce a barrel of Synthetic crude. in other words, 20% of the energy in SSB was NG.

The other interesting tidbit is the ratio of synthetic crude to bitumen, close to 0.84. COS used cokers to extract the carbon and recovered the hydrogen to upgrade the remaining oil to SSB.

My understanding of SSB is that it has a higher quality than WTI because it is low in sulphur content and is more biased toward making diesel than gasoline. Depending on demand there was a time when it commanded a $5 premium to WTI and at other times it would go to a $3 discount. Today it is at a $1 discount.

Double click chart to enlarge,

Tks for the info. I think the biggest use for gas is to provide heating for steam used in SAGD operations, then other heating for topsides separation processes and then providing hydrogen for the upgraders. SAGD has been the bigger growth area rather than mining recently. Is this use covered in your figures? I can vaguely remember something like 20 to 25% of Canadian gas being used in the oil sands but I wouldn’t put money on my memory being even directionally correct.

George

COS/Syncrude, in this and the previous table are mining operations. The NG is used to provide heat to the cokers, three of them. The cokers were designed and provided by EXXON and were new in the sense that they used a continuous process as opposed to previous batch processes. You would have a much better understanding of how it works than I do. I do recall the cokers didn’t work as efficiently as planned at first but mods finally made them work.

They had to be shut down, I think every one or two years to change the catalysts and remove carbon.

Exxon was and is a 25% owner of Syncrude and provided their knowledge, senior staff and operations management to maintain the operation. Sometime later this year, SU will take over the management of Syncrude.

Note that Syncrude is multi-company partnership and is a subsidiary of SU. Imperial Oil is the Cdn subsidiary of XOM.

Actuallly a google search gives that the oil sands uses 30% of the canadian gas. Including other energy uses in the upgraders etc and that required to produce that amount of gas is why the EROI for the SCO is given as only 2.5 to 3, which is barely enough for civilization to tick over according to Hall.

When taking into account the cost of gas and all the other costs of production, anyone have a notion as to what breakeven price for COS end product is?

Dennis

There is a troubling, but reasonably accurate, statement in the article that really turned the heat on the oil sands.

“One study found the extraction and processing of oil sands produces more than twice the greenhouse gasses compared to other North American crude oils.”

The original press release by an eviro group stated that the process to make synthetic crude produced three times more CO2 than regular WTI. The press in Canada and possibly US did not get the subtlety associated with production. The headlines that the public saw was: “Oil sands produce three times more CO2 than conventional oil”.

At that time, the oil industry just ignored the comment but eventually they came to the party and explained that the majority of CO2 came from burning the oil and that the production portion was closer to 25% of the total and not that much different than the average US barrel. I think the Canadian Petroleum institute hired IHS CERA to do a study. Chart attached.

Thats good info Ovi. Thanks.

A new study commissioned by the French military by The Shift Project is out for French speakers:

https://theshiftproject.org/article/nouveau-rapport-approvisionnement-petrolier-europe/

The study is based on Rystad’s UCube data but the data has been reviewed by professionals from the oil industry (engineers or former engineers from Total). The study concerns the 16 countries that are the largest suppliers of oil to Europe. The general gist is that Rystad underestimates the cost of developing a significant portion of the reserves they have listed because Rystad ignores the quality of the rock along with associated gas and water production in their reserve data.

I don’t also understand why they don’t take into account the current level of production of KSA : have they increased their production? Have they been able to do it? In April 2021, they were at 8 Mb/d, voluntarily or not.

Remember that they are using Rystad’s data. The analysis is only as good as Rystad’s data. Many of the remaining reserves were discovered in the 1960s. It was remarked during the oral presentation that had these reserves been easy to produce, they would have already been produced. The reason they weren’t was because there was some sort of geological challenge in extracting the oil.

I attended a presentation by a Rystad representative in 2017. Their estimates with respect to U.S. LTO were spectacularly high. I asked whether or not they took into account industry finances and the answer was a resounding “Yes!”.

If the concern is availability of oil to EU and France shouldn’t the internal use of the exporting countries be a major concern? If the internal use just stays constant then the available exports fall faster than the decline in production but given the demographic and economic changes in some of those countries the internal use could be rising. Is it assumed that there would be no change in export destinations – e.g. Brazil, Guyana/Suriname, Canada might have available oil that EU could compete for.

I think gas supply might be a bigger issue, no petrol for cars is one thing, 24 hour rolling blackouts in an industrialised country in the middle of winter or during a heat wave would be something else again. Is anything similar planned?

The study was commissioned by the French military. The military is very energy intensive and in particular oil intensive. The French air force uses 50% of military oil, then comes the navy, and finally ground forces. The military is trying to think of less oil intensive ways of killing people. A Leclerc tank needs 300 liters of fuel to travel 100 Km on a road. However the armor is considered flimsy. An M1 Abrams tank has excellent armor but requires over 400 liters to travel 100 Km. Off road it’s almost double. Which tank is more effective in an oil constrained war?

Seriously….the answer is obviously a Toyota pick up truck.

If you ask the Norwegian armed forces the answer would be – we would just do more simulations. And they plan on doing exactly just that. Have the military play computer games; good for reducing fuel consumption. At least during peace time.

Kolbeinih , bullseye . That is what the governments do worldwide , play computer games . 🙂

P.S : On a personnel note , in India we go a step ahead , godmen , astrologers and quacks rule the day .

” shouldn’t the internal use of the exporting countries be a major concern? ”

Yes indeed. I’ve said it before- the global production number for oil isn’t the important measure in the arena of peak oil.

It is the falling ‘oil available for export’ (net oil export) that will shake the global order to the core.

There are very few oil exporting countries left.

The countries with the highest oil consumption/capita (that are not oil producers) are Germany, Japan and South Korea.

Oil Production to Consumption ratio by country- page 28

https://www.eni.com/assets/documents/documents-en/WORLD-OIL-REVIEW-2019-Volume-1.pdf

It is a really hard sell to a petroleum exporting country to reduce oil consumption. Norway may be best in class trying to reduce oil consumption through for electrification of transport as of now. At the same time price of petrol is still reasonable and some people are going back to especially diesel cars due to reliability and longevity. I came to understand that this issue is even more profound in California. So, as of now it is really the government promoting reduced fossil consumption with a growing opposition both politically and among the people. Saudi Arabia, UAE and other oil producing countries aligned with the west try to implement policies to reduce oil consumption, but it is mostly government driven. Most common people don’t see a problem with consuming fossil fuels like before. The whole idea of keeping oil prices down because we voluntarily want to reduce consumption is artificial at best.

And fossil fuel consumption is not going down significantly in Norway. But that has to do with insane construction activity with getting up electric railways, energy efficient homes and upgrading all kind of infrastructure. Not unlike many other places in the world for the time being.

Here is a graph of the exporters based on BP Statistical Review.

JFF

Please be on lookout for the english version of this report, just like you did for the original one.

Ovi, I use Google chrome and when I visit the French version a window appears asking if I want it translated into English . Works fine and the English translation is perfect . The report is 181 pages and the summary 30 pages in Pdf for download. On reading the preface it is clear Europe is going to be in trouble on the supply side . They say 2030 assuming increased LTO supply , which is an incorrect hypothesis . I would presume much earlier if growth comes back pre covid which I doubt much , otherwise Europe will just keep floundering . Example , in April UK ( Brexit) replaced Germany as the largest import source to China from the continent .

Ah, thank you for mentioning this new report. Nothing new under the sun, I would say. The forecast of oil supply for UE is a little bit more disagreable to read than with the first report of last year.

UE? Had to look it up. La union européenne. Or, the EU to us anglos…

I forwarded your request to the people concerned. But basically this report was commissioned by the administration of the French Ministry of Defense and was written in French. And the team is overbooked. So, you will have perhaps to wait a little bit.

Here is a summary of the report. https://theshiftproject.org/en/article/oil-what-are-the-risks-for-the-future-of-europes-supply-the-new-shifts-report-about-peak-oil/

JFF

Thanks

From your link, bold theirs:

Based on a critical assessment of the data from the Norwegian company Rystad Energy, a strong reference in the fossil-fuel industry, the results show that:

All 16 countries show a declining trend in new reserve discoveries, and the size of new fields in operation also tends to decrease overtime.

14 out of the 16 examined countries demonstrate a decline in production or a level lower than the maximum level observed in the past.

The depletion rate of the accumulated discoveries to this date in the 16 countries is close to 70%, and the time lag between identification and development is increasing is all countries. This is due to the scarcity, over the last ten to thirty years, of significant new oil fields with a quality level or geographical location that would justify development within the timeframe previously in force in the industry.

I’m surprised how optimistic their conclusion is-

“Carried out by France’s leading oil experts and commissioned by the French Defense Ministry, the analysis concludes that total oil supplies to the EU are likely to drop by 10 to 20% over the 2030s, as compared to its current 2019 level.”

I think they risk underestimating the combination of depletion, unplanned ‘human’ disruption of oil production and trade, and the increasing competition among buyers of oil. Regarding the last point, the EU may have trouble competing with China for oil available on the market, for example.

They would be wise to plan for a greater decline in available imports, I believe.

Oh, don’t worry for that. Check the website of the shift project. It’s full of analysis concerning the adaptation of different aspects of the economic system of France with a decreasing oil supply. I agree with you that the analysis is probably to much optimistic about the oil supply of Europe over the next decade.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WRPUPUS2&f=W

I suppose folks have seen this. Consumption is floating along about 2 mbpd below 2020’s early top. With production at 11 mbpd, hard to see how this doesn’t translate to imports.

Which can be purchased with bitcoin.

Bitcoin USD (BTC-USD)

CCC – CoinMarketCap. Currency in USD

37,094.16-3,058.2617 (-7.6166%)

Iran: Nationwide Protests By Oil Workers And Employees In Oil Centers In 9 Cities

“On Wednesday morning, May 27, 2021, official employees of Iran’s oil company held rallies in different oil centers in Tehran, Assaluyeh, Abadan, Ahvaz, Gachsaran, Mahshahr, Bandar Deylam, Khark, and Lavan Island, protesting their low salaries and harsh livelihood condition due to skyrocketing prices.”

Protests in Oman over economy, jobs continue for third day

“Groups of Omani protesters demanding jobs have gathered in several cities for the third consecutive day in the biggest challenge yet for the Gulf state’s new ruler.

The economy of Oman, a relatively small energy producer with high levels of debt, is vulnerable to swings in oil prices and external shocks such as the coronavirus pandemic.”

A new thread on March US oil Production has been posted.

http://peakoilbarrel.com/us-march-oil-production-rebounds-strongly-from-winter-storm-low

A new Open thread Non-Petroleum has been posted.

http://peakoilbarrel.com/open-thread-non-petroleum-may-29-2021/