A Guest post by:

Dr. Minqi Li, Professor

Department of Economics, University of Utah

E-mail: minqi.li@economics.utah.edu

This Annual Report evaluates the future development of world energy supply and its impact on the global economy as well as climate change. The report projects the world energy supply and gross world product (global economic output) from 2017 to 2050. It also projects carbon dioxide emissions from fossil fuels burning and the implied global average surface temperature from 2017 to 2100.

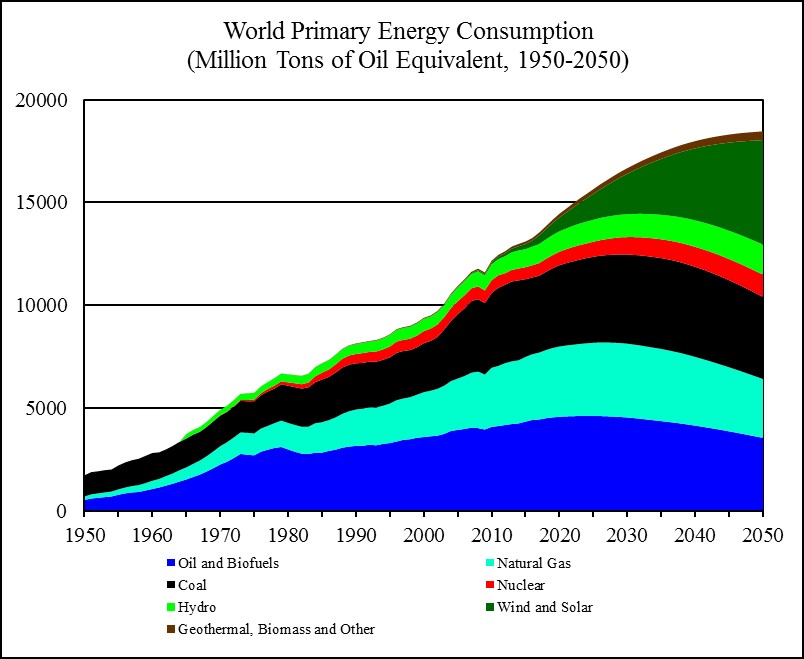

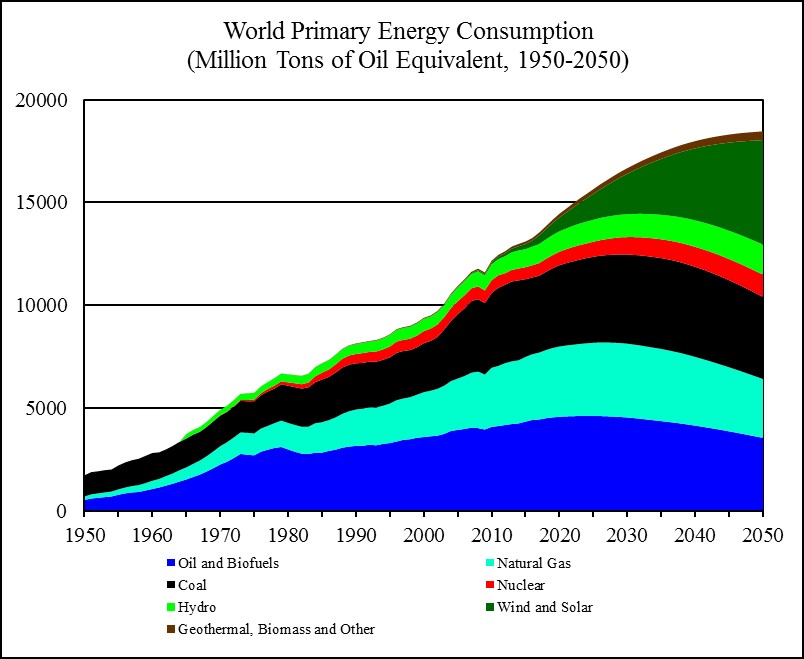

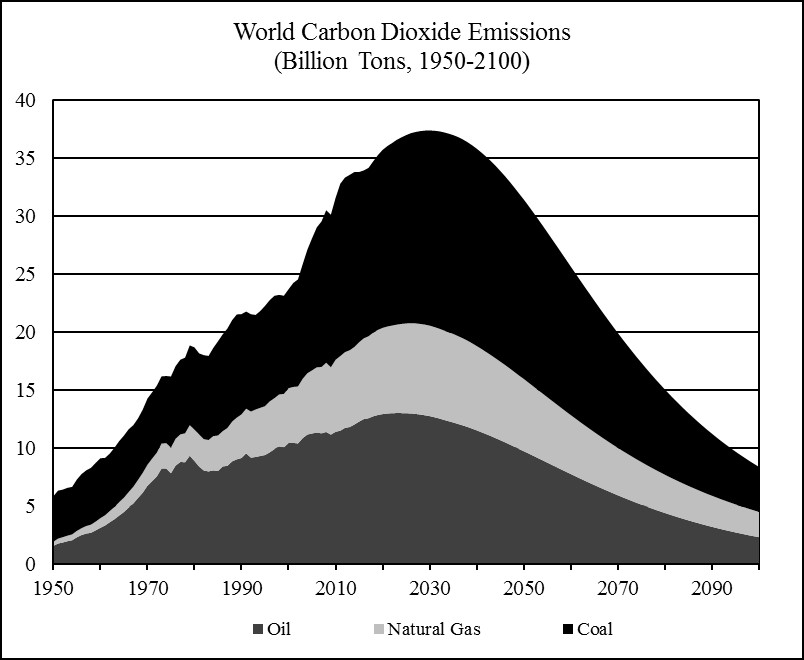

Figure 18

Sources: World historical oil, natural gas, and coal consumption from 1950 to 1964 is estimated from carbon dioxide emissions (Boden, Marland, and Andres 2017); world primary energy consumption and its composition from 1965 to 2016 is from BP (2017); world primary energy consumption and its composition from 2017 to 2050 is based on this report’s projections.

To project the future oil and natural gas production, this report uses Hubbert Linearization as the primary analytical tool. Hubbert Linearization was first proposed by American geologist M. King Hubbert (Hubbert 1982). It plots the current production to cumulative production ratio against the historical cumulative production. It uses the downward linear trend of the current production to cumulative production ratio to determine the ultimately recoverable resources.

Past experience suggests that Hubbert Linearization exercise tends to underestimate the ultimately recoverable oil and natural gas resources. Despite its limitations, Hubbert Linearization provides a useful tool helping to indicate the likely level of ultimately recoverable resources under the existing trends of technology, economics, and geopolitics. To mitigate this “pessimistic” bias, I use the US Energy Information Administration (EIA)’s official projection for the US oil and natural gas production from 2017 to 2050 (EIA 2017, Table A1), which may prove to be too optimistic.

There is a high level of uncertainty regarding the future of the world coal production that may be influenced by economics, climate stabilization requirements, as well as resources constraints. This report uses the “proved coal reserves” reported by the BP Statistical Review of World Energy (BP 2017) to evaluate the future coal production in China and India, currently the first and second largest coal producer in the world. I use EIA’s official projection for the US coal production from 2017 to 2050 (EIA 2017, Table A1). To project the rest of the world’s future coal production, I apply Hubbert Linearization to the rest of the world’s historical coal production data.

For the future wind and solar electricity consumption, I do not impose a definite limit on their future potential. However, I assume that the annual installation of wind and solar generating capacity will grow at a progressively slower rate and eventually approach a certain level of maximum.

For the future production (consumption) of biofuels, nuclear electricity, hydro electricity, geothermal electricity, biomass electricity, I use the projections made by EIA’s International Energy Outlook (EIA 2016).

The previous Annual Report, “World Energy 2016-2050”, was posted at Peak Oil Barrel (Political Economist 2016): http://peakoilbarrel.com/world-energy-2016-2050-annual-report/

Figures and tables are placed at the end of each section.

World Energy 2005-2016

According to BP’s Statistical Review of World Energy, world primary energy consumption reached 13,276 million tons of oil equivalent in 2016 (BP 2017). From 2005 to 2016, world primary energy consumption grew at an average annual rate of 1.8 percent.

World oil consumption (including biofuels) was 4,418 million tons in 2016, accounting for 33.3 percent of the world energy consumption. From 2005 to 2016, world oil consumption grew at an average annual rate of 1.1 percent.

World natural gas consumption was 3,204 million tons of oil equivalent in 2016, accounting for 24.1 percent of the world energy consumption. From 2005 to 2016, world natural gas consumption grew at an average annual rate of 2.3 percent.

World coal consumption was 3,732 million tons of oil equivalent in 2016, accounting for 28.1 percent of the world energy consumption. From 2005 to 2016, world coal consumption grew at an average annual rate of 1.6 percent.

World consumption of nuclear electricity was 592 million tons of oil equivalent in 2016, accounting for 4.5 percent of the world energy consumption. From 2005 to 2016, world consumption of nuclear electricity declined at an average annual rate of 0.5 percent.

World consumption of hydro electricity was 910 million tons of oil equivalent in 2016, accounting for 6.9 percent of the world energy consumption. From 2005 to 2016, world consumption of hydro electricity grew at an average annual rate of 3.0 percent.

World consumption of wind and solar electricity was 292 million tons of oil equivalent in 2016, accounting for 2.2 percent of the world energy consumption. From 2005 to 2016, world consumption of wind and solar electricity grew at an average annual rate of 25.3 percent.

World consumption of geothermal, biomass and other renewable electricity was 127 million tons of oil equivalent in 2016, accounting for 1.0 percent of the world energy consumption. From 2005 to 2016, world consumption of geothermal, biomass and other renewable electricity grew at an average annual rate of 7.4 percent.

According to the World Bank and IMF data, gross world product (global economic output) was 111.5 trillion dollars (in constant 2011 international dollars) in 2016 (World Bank 2017; IMF 2017). From 2005 to 2016, global economic output grew at an average annual rate of 3.5 percent.

World average energy efficiency was 8,401 dollars per ton of oil equivalent in 2016. From 2005 to 2016, world average energy efficiency grew at an average annual rate of 1.7 percent.

According to the BP Statistical Review of World Energy, world carbon dioxide emissions from fossil fuels burning reached 33.4 billion tons in 2016. From 2005 to 2016, world carbon dioxide emissions grew at an average annual rate of 1.4 percent.

World average emission intensity of primary energy consumption was 2.52 tons of carbon dioxide emissions per ton of oil equivalent. From 2005 to 2016, world average emission intensity of primary energy consumption declined at an average annual rate of 0.3 percent.

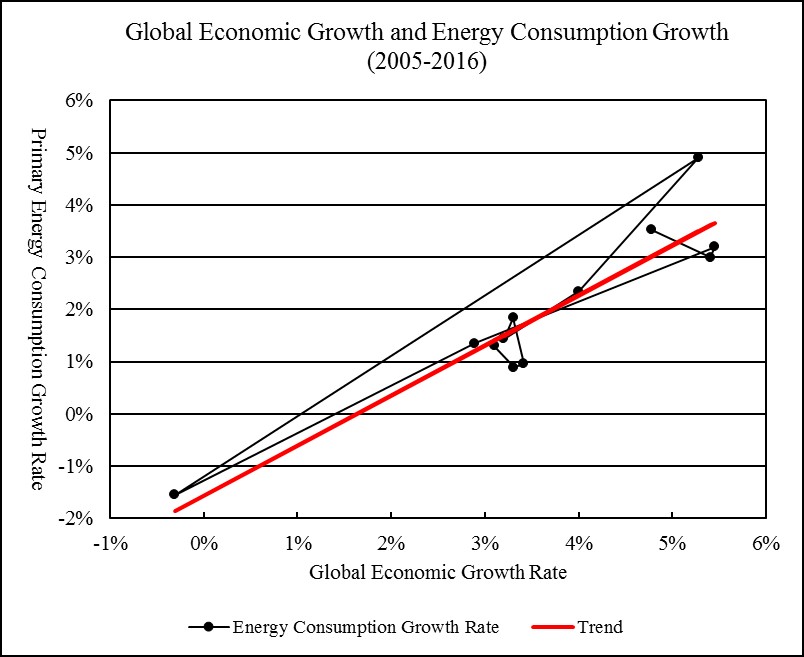

Figure 1 compares the historical world economic growth rates and the primary energy consumption growth rates from 2005 to 2016. The primary energy consumption growth rate has an intercept of -0.0157 at zero economic growth rate and a slope of 0.959. That is, primary energy consumption has an “autonomous” tendency to fall by about 1.6 percent a year when economic growth rate is zero. When economic growth rate rises above zero, an increase in economic growth rate by one percentage point is associated with an increase in primary energy consumption by 0.96 percent. R-square for the linear trend is 0.860.

Figure 1

Sources: Gross world product in constant 2011 international dollars from 2005 to 2015 is from World Bank (2017), extended to 2016 using data from IMF (2017, Statistical Appendix, Table A1); world primary energy consumption from 2005 to 2016 is from BP (2017).

Oil

World oil production (including crude oil and natural gas liquids) was 4,382 million tons (92.2 million barrels per day) in 2016, 0.5 percent higher than world oil production in 2015.

In 2016, Saudi Arabia was the world’s largest oil producer by energy content; Saudi Arabia produced 586 million tons of crude oil and natural gas liquids (12.3 million barrels per day), accounting for 13.4 percent of the world oil production.

The United States was the world’s largest oil producer by volume; the US produced 543 million tons of crude oil and natural gas liquids (12.4 million barrels per day), accounting for 12.4 percent of the world oil production.

The Russian Federation was the world’s second largest oil producer by energy content or the third largest oil producer by volume; Russia produced 554 million tons of crude oil and natural gas liquids (11.2 million barrels per day), accounting for 12.6 percent of the world oil production.

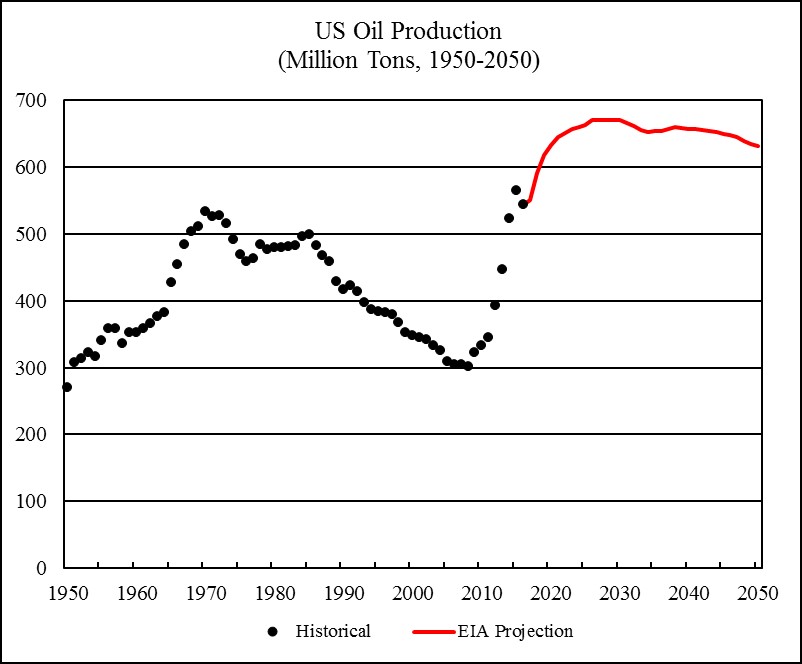

Figure 2 shows the historical and projected US oil production from 1950 to 2050. The projection is based on the US Energy Information Administration’s reference case scenario of the US oil production from 2017 to 2050 (EIA 2017, Table A1).

The US cumulative oil production up to 2016 was 33 billion tons. According to EIA’s current projection, the US oil production will peak in 2026 with a production level of 670 million tons and the US cumulative oil production will be 55 billion tons by 2050. Hubbert Linearization applied to the EIA projection from 2041 to 2050 implies that the US ultimately recoverable oil resources will be 90 billion tons.

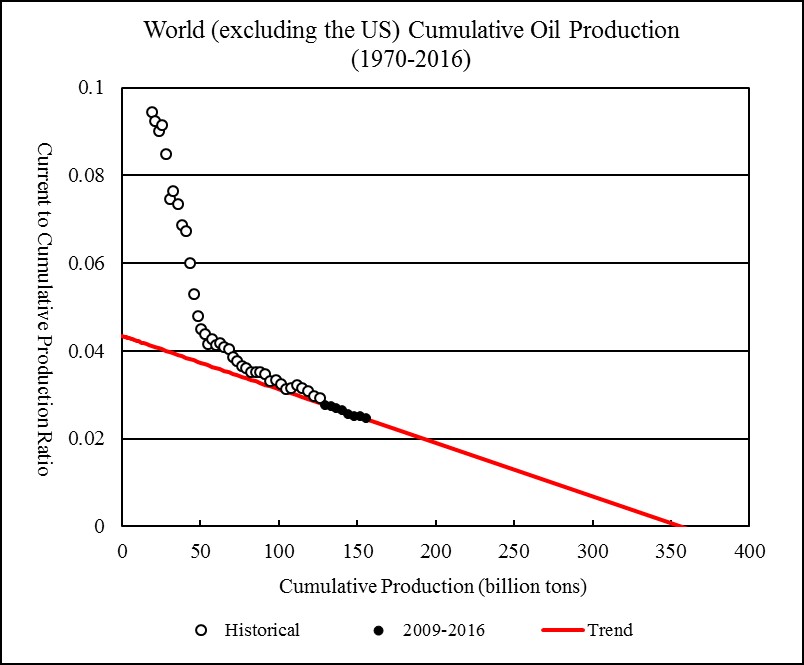

Figure 3 applies the Hubbert Linearization analysis to the world (excluding the US) oil production. The world (excluding the US) cumulative oil production up to 2016 was 156 billion tons. The linear trend from 2009 to 2015 indicates that the world (excluding the US) ultimately recoverable oil resources will be 356 billion tons. Regression R-square is 0.960. Year 2009 was the year of “Great Recession”. Other things being equal, using a recession year as the initial year in Hubbert Linearization leads to a larger amount of estimated ultimately recoverable resources than using a regular year.

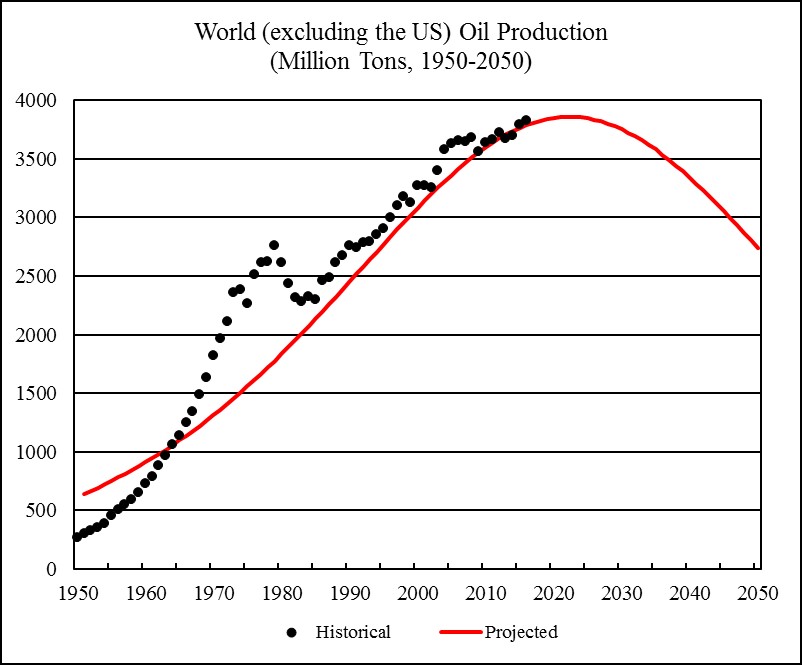

Figure 4 shows the historical and projected world (excluding the US) oil production from 1950 to 2050. The world (excluding the US) oil production is projected to peak in 2022, with a production level of 3,861 million tons.

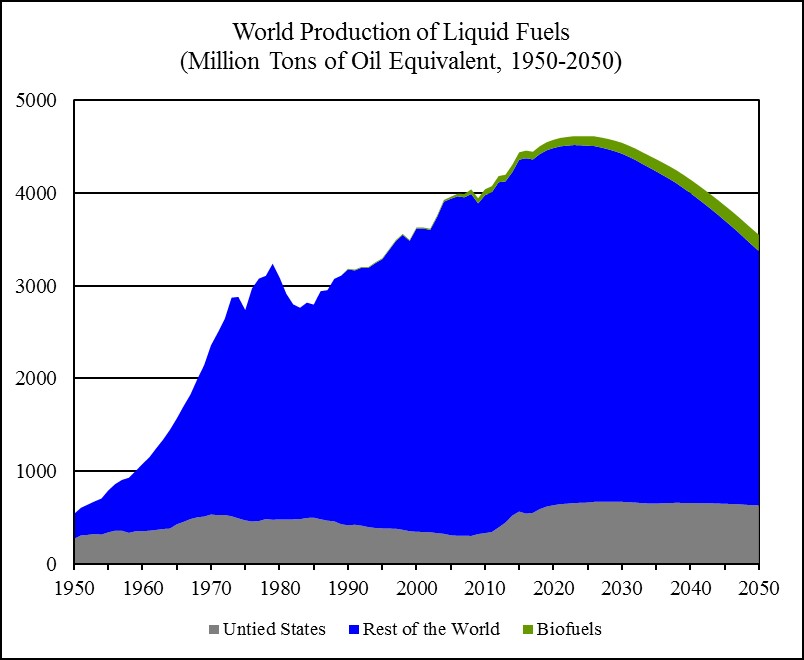

Figure 5 shows the historical and projected world production of liquid fuels. The world production of liquid fuels is the sum of the US oil production, the world (excluding the US) oil production, and the biofuels production. Projection of world biofuels production from 2017 to 2040 is from EIA (2016, Table G3), extended to 2050 based on the linear trend from 2030 to 2040. The world production of liquid fuels is projected to peak in 2024, with a production level of 4,614 million tons.

By comparison, in “World Energy 2016-2050” (the last Annual Report), world production of liquid fuels was projected to peak in 2023, with a production level of 4,540 million tons.

Figure 2

Sources: US historical oil production from 1950 to 1964 is from Rutledge (2008); US oil production from 1965 to 2016 is from BP (2017). Projected US oil production from 2017 to 2050 is from EIA (2017, Table A1).

Figure 3

Sources: World historical cumulative oil production is from Rutledge (2008); world oil production from 1965 to 2016 is from BP (2017).

Figure 4

Sources: World historical oil production from 1950 to 1964 is from Rutledge (2008); world oil production from 1965 to 2016 is from BP (2017).

Figure 5

Sources: See Figure 2 and 4 for the US and the world (excluding the US) oil production. World biofuels production from 1990 to 2016 is from BP (2017). Projection of world biofuels production from 2016 to 2040 is from EIA (2016, Table G3), extended to 2050 based on the linear trend from 2030 to 2040.

Natural Gas

World natural gas production was 3,552 billion cubic meters (3,213 million tons of oil equivalent) in 2016, 0.6 percent higher than world natural gas production in 2015.

In 2016, the United States was the world’s largest natural gas producer; the US produced 749 billion cubic meters of natural gas (691 million tons of oil equivalent), accounting for 21.1 percent of the world natural gas production.

The Russian Federation was the world’s second largest natural gas producer; Russia produced 573 billion cubic meters of natural gas (522 million tons of oil equivalent), accounting for 16.3 percent of the world natural gas production.

Iran was the world’s third largest natural gas producer; Iran produced 202 billion cubic meters of natural gas (182 million tons of oil equivalent), accounting for 5.7 percent of the world natural gas production.

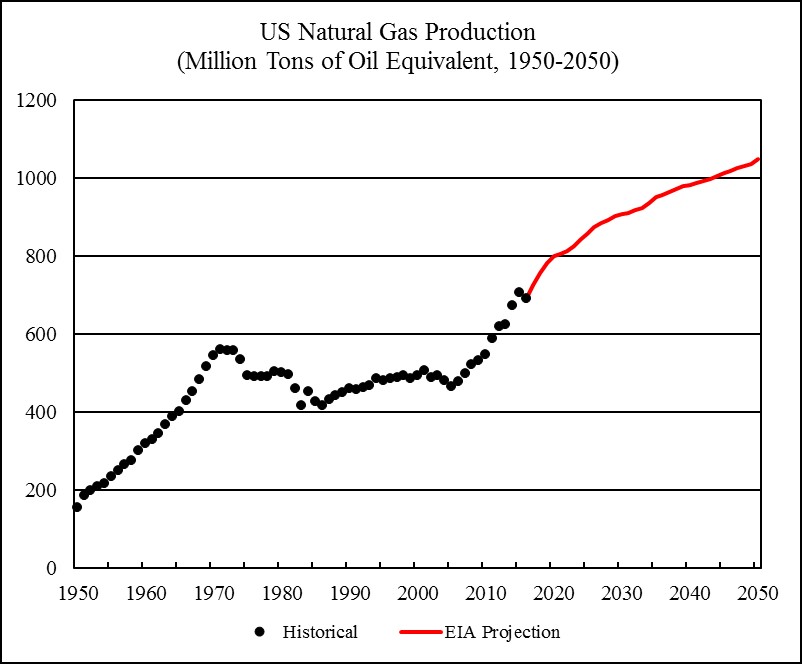

Figure 6 shows the historical and projected US natural gas production from 1950 to 2050. The projection is based on the US Energy Information Administration’s reference case scenario of the US natural gas production from 2017 to 2050 (EIA 2017, Table A1).

The US cumulative natural gas production up to 2016 was 32 billion tons of oil equivalent. EIA’s current projection implies that the US cumulative natural gas production will be 64 billion tons of oil equivalent by 2050 and the US ultimately recoverable natural gas resources will be 153 billion tons of oil equivalent.

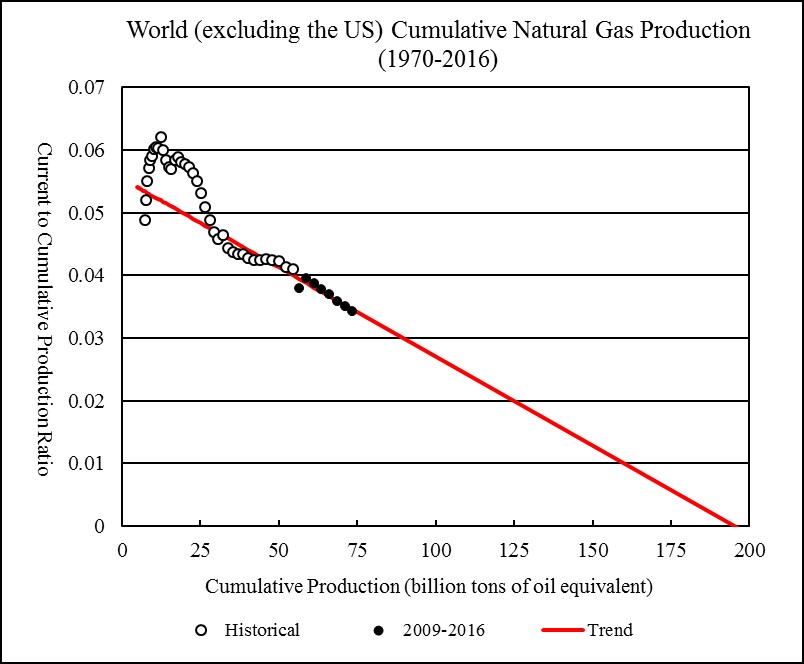

Figure 7 applies the Hubbert Linearization analysis to the world (excluding the US) natural gas production. The world (excluding the US) cumulative natural gas production up to 2016 was 74 billion tons of oil equivalent. The linear trend from 2009 to 2016 indicates that the world (excluding the US) ultimately recoverable natural gas resources will be 195 billion tons of oil equivalent. Regression R-square is 0.843.

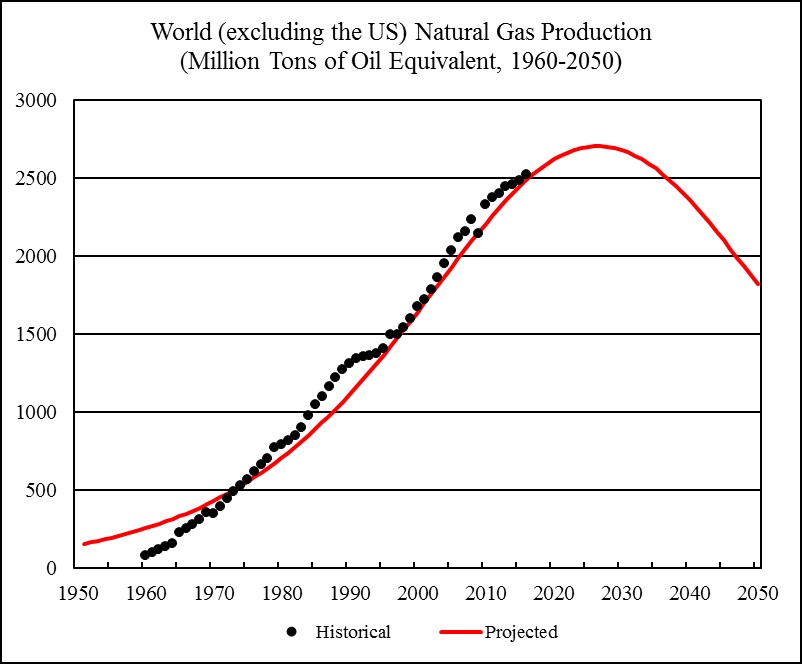

Figure 8 shows the historical and projected world (excluding the US) natural gas production from 1960 to 2050. The world (excluding the US) natural gas production is projected to peak in 2027, with a production level of 2,706 million tons of oil equivalent.

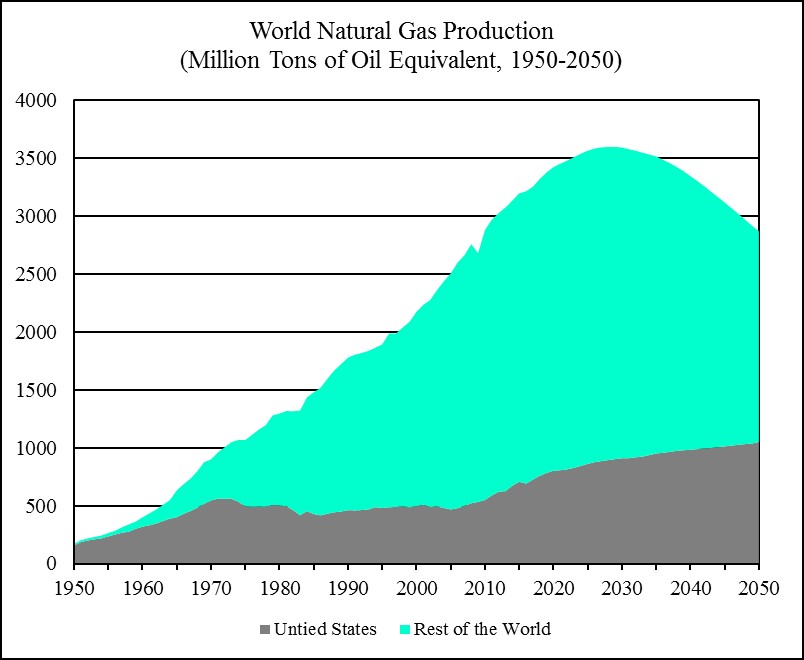

Figure 9 shows the historical and projected world natural gas production. World natural gas production is projected to peak in 2029, with a production level of 3,596 million tons of oil equivalent.

By comparison, in “World Energy 2016-2050” (the last Annual Report), world natural gas production was projected to peak in 2030, with a production level of 3,694 million tons of oil equivalent.

Figure 6

Sources: US historical natural gas production from 1950 to 1969 is from the US Energy Information Administration, Natural Gas Data, Natural Gas Gross Withdrawals and Production, “U.S. Natural Gas Marketed Production”; US natural gas production from 1970 to 2016 is from BP (2017). Projected US natural gas production from 2017 to 2050 is from EIA (2017, Table A1).

Figure 7

Sources: World historical cumulative natural gas production is from Rutledge (2008); world natural gas production from 1970 to 2016 is from BP (2017).

Figure 8

Sources: World historical natural gas production from 1960 to 1969 is from Rutledge (2008); world natural gas production from 1970 to 2016 is from BP (2017).

Figure 9

Sources: See Figure 6 and 8 for the US and the world (excluding the US) natural gas production. World historical natural gas production from 1950 to 1959 is estimated using carbon dioxide emissions from natural gas consumption (Boden, Marland, and Andres 2017).

Coal

World coal production was 7,460 million tons (3,656 million tons of oil equivalent) in 2016, 6.3 percent lower than world coal production in 2015.

In 2016, China was the world’s largest coal producer; China produced 3,411 million tons of coal (1,686 million tons of oil equivalent), accounting for 45.7 percent of the world coal production.

India was the world’s second largest coal producer by volume (but the fourth largest coal producer by energy content); India produced 692 million tons of coal (289 million tons of oil equivalent), accounting for 9.3 percent of the world coal production.

The United States was the world’s second largest coal producer by energy content and the third largest coal producer by volume; the US produced 661 million tons of coal (365 million tons of oil equivalent), accounting for 8.9 percent of the world coal production.

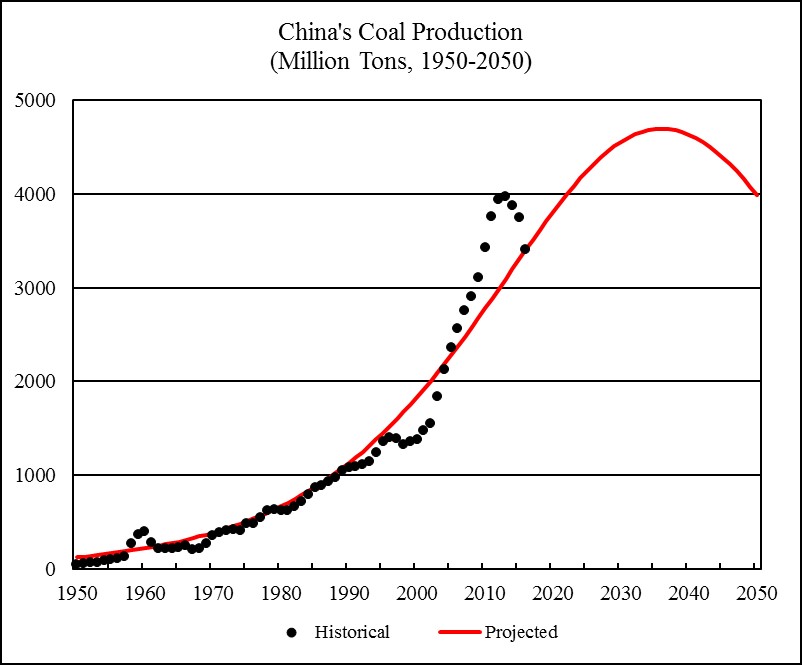

Figure 10 shows China’s historical and projected coal production from 1950 to 2050. China’s cumulative coal production up to 2016 was 79 billion tons. According to BP Statistical Review of World Energy, China’s coal reserves were 244 billion tons by the end of 2016. China’s implied ultimately recoverable coal resources are 323 billion tons. China’s coal production is projected to peak in 2036, with a production level of 4,699 million tons.

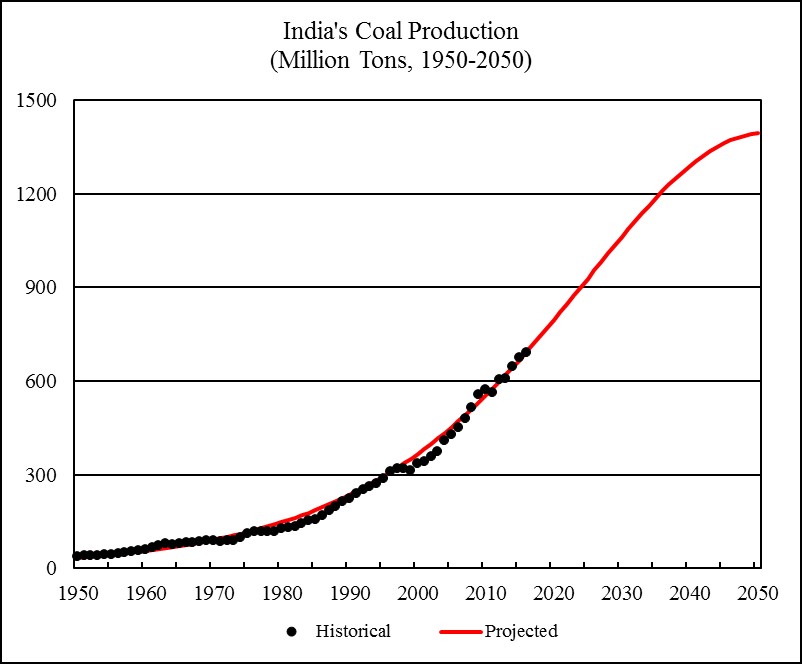

Figure 11 shows India’s historical and projected coal production from 1950 to 2050. India’s cumulative coal production up to 2016 was 16 billion tons. According to BP Statistical Review of World Energy, India’s coal reserves were 95 billion tons by the end of 2016. India’s implied ultimately recoverable coal resources are 111 billion tons. India’s coal production is projected to peak in 2051, with a production level of 1,396 million tons.

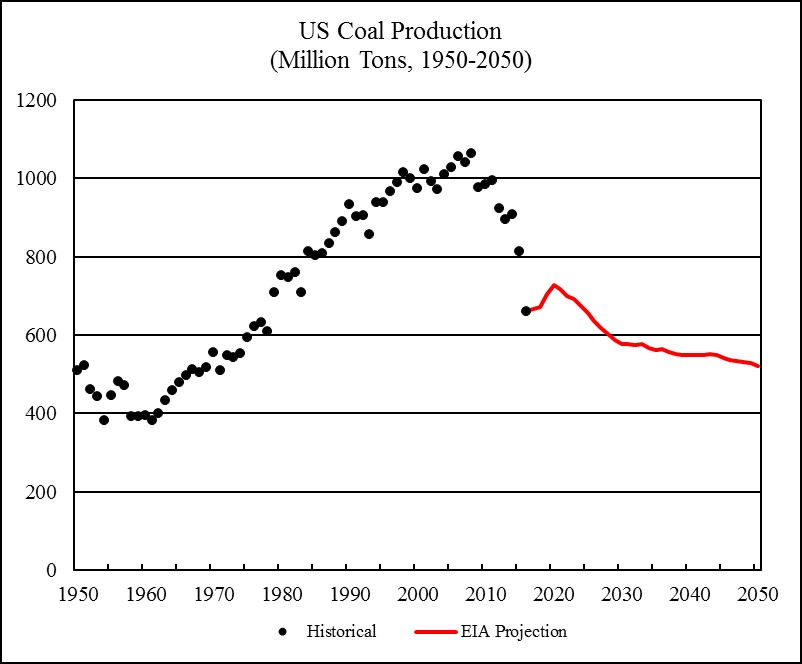

Figure 12 shows the historical and projected US coal production from 1950 to 2050. The projection is based on the US Energy Information Administration’s reference case scenario of the US coal production from 2017 to 2050 (EIA 2017, Table A1).

The US cumulative coal production up to 2016 was 76 billion tons. EIA’s current projection implies that the US cumulative coal production will be 96 billion tons by 2050 and the US ultimately recoverable coal resources will be 138 billion tons. The US coal production peaked in 2008, with a production level of 1,063 million tons.

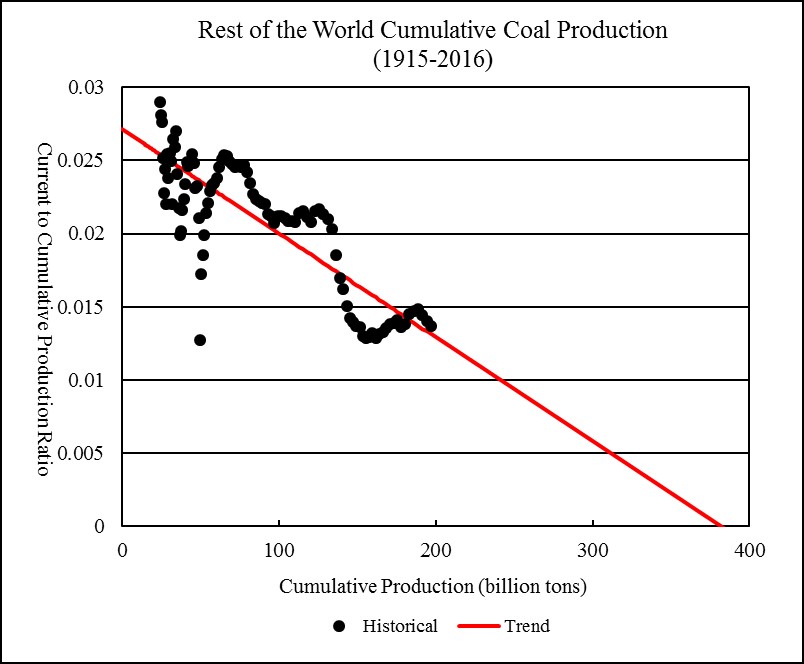

Figure 13 applies the Hubbert Linearization analysis to the rest of the world’s (world excluding China, India, and the US) coal production. Despite wide fluctuations of the current production to cumulative production ratio over the past century, a long-term downward trend can be identified. The rest of the world’s cumulative coal production up to 2016 was 197 billion tons. The linear trend from 1915 to 2016 indicates that the rest of the world’s ultimately recoverable coal resources will be 382 billion tons. Regression R-square is 0.699.

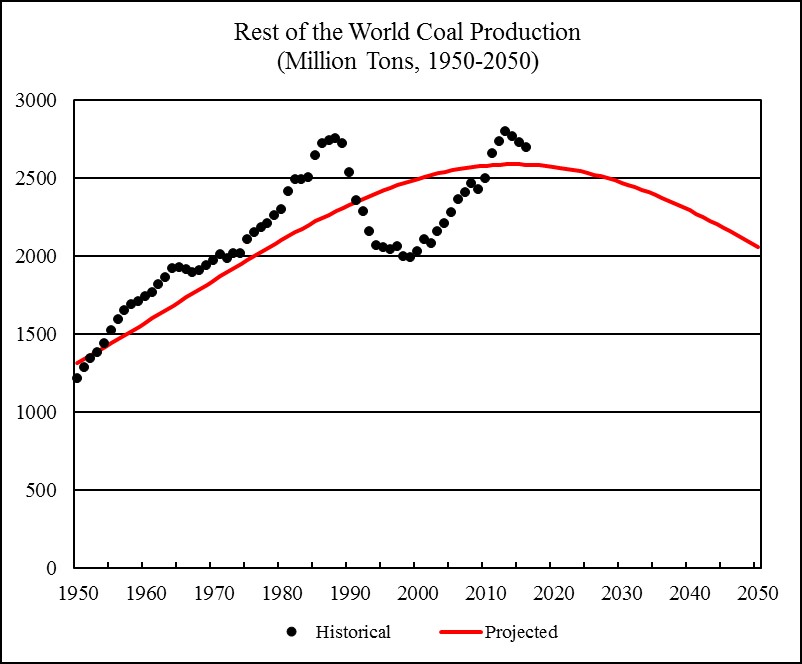

Figure 14 shows the rest of the world’s historical and projected coal production from 1950 to 2050. In 2013, the rest of the world’s coal production reached 2,798 million tons, which has been the highest level on record.

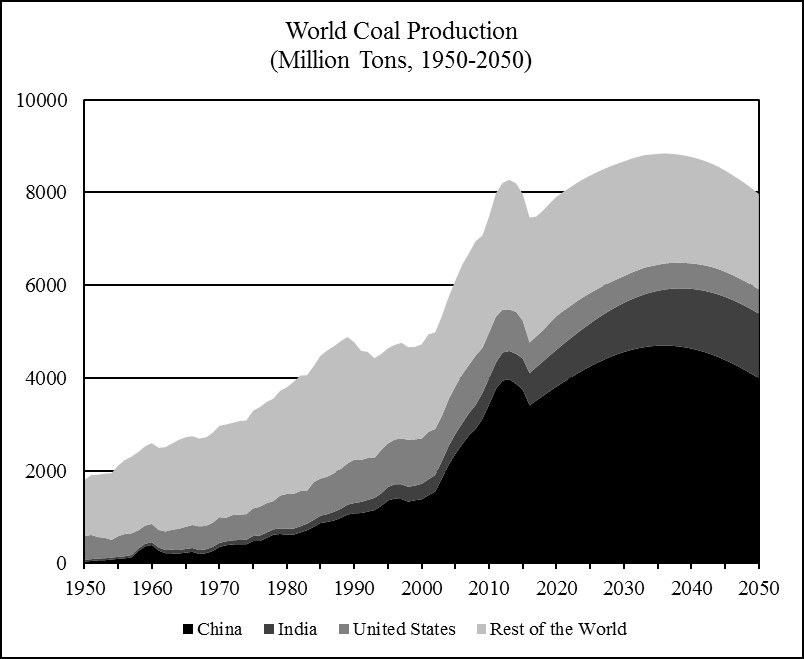

Figure 15 shows the historical and projected world coal production. World coal production is projected to peak in 2036, with a production level of 8,844 million tons.

By comparison, in “World Energy 2016-2050” (the last Annual Report), world coal production was projected to peak in 2039, with a production level of 8,695 million tons.

Figure 10

Sources: China’s historical coal production from 1950 to 1980 is from Rutledge (2011); China’s coal production from 1981 to 2016 is from BP (2017). China’s projected coal production from 2017 to 2050 is calculated by this author using the assumption that China’s ultimately recoverable coal resources equal the sum of historical cumulative production and the coal reserves reported by BP (2017).

Figure 11

Sources: South Asia’s historical coal production (used as a proxy for India’s coal production) from 1950 to 1980 is from Rutledge (2011); India’s coal production from 1981 to 2016 is from BP (2017). India’s projected coal production from 2017 to 2050 is calculated by this author using the assumption that India’s ultimately recoverable coal resources equal the sum of historical cumulative production and the coal reserves reported by BP (2017).

Figure 12

Sources: US historical coal production from 1950 to 1980 is from Rutledge (2011); US coal production from 1981 to 2016 is from BP (2017). Projected US coal production from 2017 to 2050 is from EIA (2017, Table A1).

Figure 13

Sources: The rest of the world’s coal production is the world coal production less the sum of China’s, India, and the US coal production. World historical cumulative coal production is from Rutledge (2011); world coal production from 1981 to 2016 is from BP (2017).

Figure 14

Sources: The rest of the world’s coal production is the world coal production less the sum of China’s, India, and the US coal production. World historical coal production from 1950 to 1980 is from Rutledge (2011); world coal production from 1981 to 2016 is from BP (2017).

Figure 15

Sources: See Figure 10, 11, 12, and 14 for China’s, India, the US’s, and the rest of the world’s coal production.

Wind and Solar Electricity

World consumption of wind and solar electricity was 1,293 terawatt-hours in 2016 (292 million tons of oil equivalent), 19.2 percent higher than world consumption of wind and solar electricity in 2015.

Wind and solar are renewable energy resources. However, wind and solar electricity is intermittent. Incorporation of wind and solar electricity into electric grids requires maintaining a large backup generating capacity and poses challenges to grid reliability. Curtailing of excess wind and solar electricity when surges of wind and solar generation exceed demand may impose limits on how much wind and solar electricity can be absorbed by a given system of electric grids. In the long run, wind electricity and solar electricity are also limited by the availability of land and mineral resources (Castro et al. 2011 and 2013).

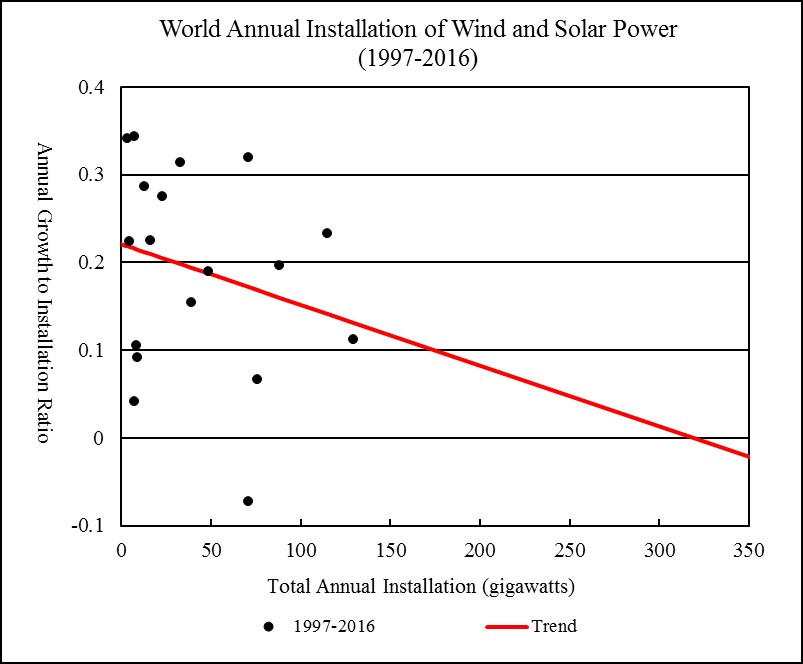

In 2016, the world installed 50 gigawatts of wind generating capacity and 75 gigawatts of solar generating capacity. Figure 16 compares the historical relationship between the annual installation of wind and solar generating capacity and the annual growth to the annual installation ratio (that is, the ratio of the growth of the annual installation to the annual installation) from 1999 to 2016. The downward linear trend indicates that the annual installation of wind and solar generating capacity should eventually approach the maximum of 282 gigawatts (where the linear trend meets the zero horizontal line).

However, the annual growth to the annual installation ratios have fluctuated widely and the R-square for the linear trend is very low (0.071). Wind and solar electricity is still in the early phase of their development. In the future, as data accumulate, one can hope that a more clear and reliable pattern may emerge that can help to illustrate the potential limits to wind and solar development.

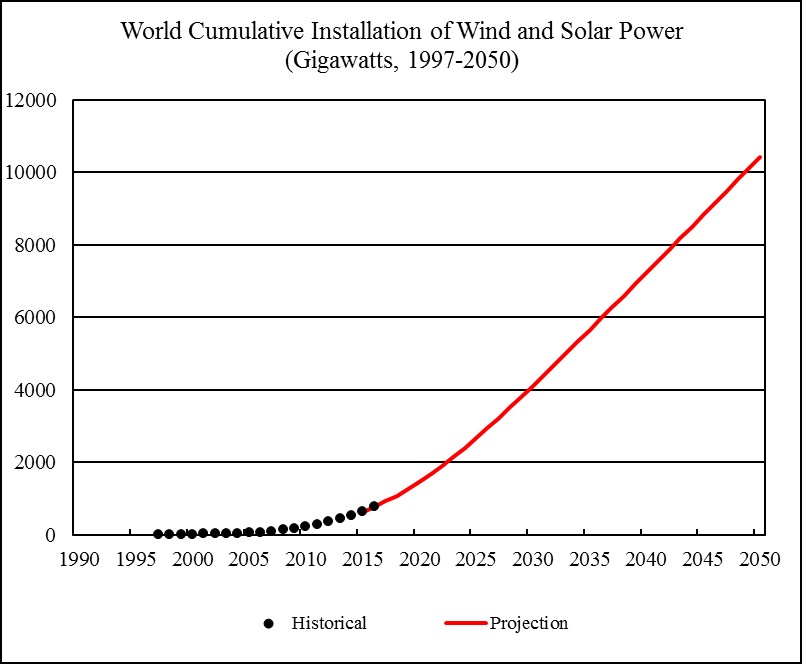

The parameters of the linear trend shown in Figure 16 can be used to project the future installation of wind and solar generating capacity. The world’s cumulative installation of wind and solar generating capacity is projected to rise to about 9,400 gigawatts by 2050 (Figure 17). By comparison, in “World Energy 2016-2050” (the last Annual Report), the world’s cumulative installation of wind and solar generating capacity was projected to rise to about 6,600 gigawatts by 2050.

The future wind and solar electricity generation can be estimated using the following formula:

Electricity Generation (current year)

= (Beginning-of-year Generating Capacity + End-of-year Generating Capacity) / 2 * 8760 Hours * Capacity Utilization Rate

In 2016, the observed world average wind electric power capacity utilization rate was 24.7 percent; the observed world average solar electric power capacity utilization rate was 14.4 percent; the observed world average wind and solar electric power capacity utilization rate was 20.8 percent. From 2005 to 2016, the world average wind and solar electric power capacity utilization rate averaged 21.6 percent. These capacity utilization rates are calculated using wind and solar electricity consumption and generating capacity data provided by BP (2017).

I assume that from 2017 to 2050, the world average wind and solar electric power capacity utilization rate will be 22 percent.

Figure 16

Sources: Annual installation of wind and solar generating capacity from 1998 to 2016 is from BP (2017).

Figure 17

Sources: Cumulative installation of wind and solar generating capacity from 1997 to 2016 is from BP (2017).

Nuclear, Hydro, Geothermal, Biomass, and Other Renewable Electricity

World consumption of nuclear electricity was 2,617 terawatt-hours in 2016, 1.6 percent higher than world nuclear electricity consumption in 2015.

To project the future nuclear electricity consumption, I use the US Energy Information Administration’s projection of net nuclear electricity generation from 2017 to 2040 (EIA 2016, Table H16), extended to 2050 based on the linear trend from 2031 to 2040. I adjusted the EIA’s projection downwards to match the projected net nuclear electricity generation in 2016 with the nuclear electricity consumption in 2016 reported by BP (2016).

World consumption of hydro electricity was 4,023 terawatt-hours in 2016, 3.1 percent higher than world hydro electricity consumption in 2015.

To project the future hydro electricity consumption, I use the US Energy Information Administration’s projection of net hydro electricity generation from 2017 to 2040 (EIA 2016, Table H18), extended to 2050 based on the linear trend from 2031 to 2040. I adjusted the EIA’s projection upwards to match the projected net hydro electricity generation in 2016 with the hydro electricity consumption in 2016 reported by BP (2016).

World consumption of geothermal, biomass, and other renewable electricity was 561.7 terawatt-hours in 2016, 4.7 percent higher than world consumption of geothermal, biomass, and other renewable electricity in 2015.

To project the future consumption of geothermal, biomass, and other renewable electricity, I use the US Energy Information Administration’s projection of net geothermal electricity generation and net other renewable electricity generation from 2017 to 2040 (EIA 2016, Table H20 and H22), extended to 2050 based on the linear trend from 2031 to 2040. I adjusted the EIA’s projection downwards to match the projected net generation of geothermal, biomass, and other renewable electricity in 2016 with the consumption of geothermal, biomass, and other renewable electricity in 2016 reported by BP (2016).

World Energy 2017-2050

Figure 18 shows the historical and projected world primary energy consumption from 1950 to 2050.

World historical consumption of oil, natural gas, and coal from 1950 to 1964 is estimated from carbon dioxide emissions from fossil fuels burning (Boden, Marland, and Andres 2017).

World primary energy consumption and its composition from 1965 to 2016 is from BP (2017).

World consumption of oil, natural gas, and coal from 2017 to 2050 is assumed to be the same as production. Oil consumption includes biofuels production. Coal production in tons is converted to coal production in tons of oil equivalent using the formula: 2.04 tons of coal = 1 ton of oil equivalent (based on the observed world average ratio in 2016).

World consumption of wind, solar, nuclear, hydro, geothermal, biomass, and other renewable electricity from 2017 to 2050 is converted to their thermal equivalent based on the formula: 4.4194 terawatt-hours = 1 million tons of oil equivalent.

World primary energy consumption is projected to rise to 17,347 million tons of oil equivalent by 2050, effectively reaching a plateau by the late 2040s.

For 2017-2050, global economic growth rate is estimated by using the linear relationship between the primary energy consumption growth rate and the economic growth rate observed for the period 2005-2016:

Economic Growth Rate = (Primary Energy Consumption Growth Rate + 0.0157) / 0.959

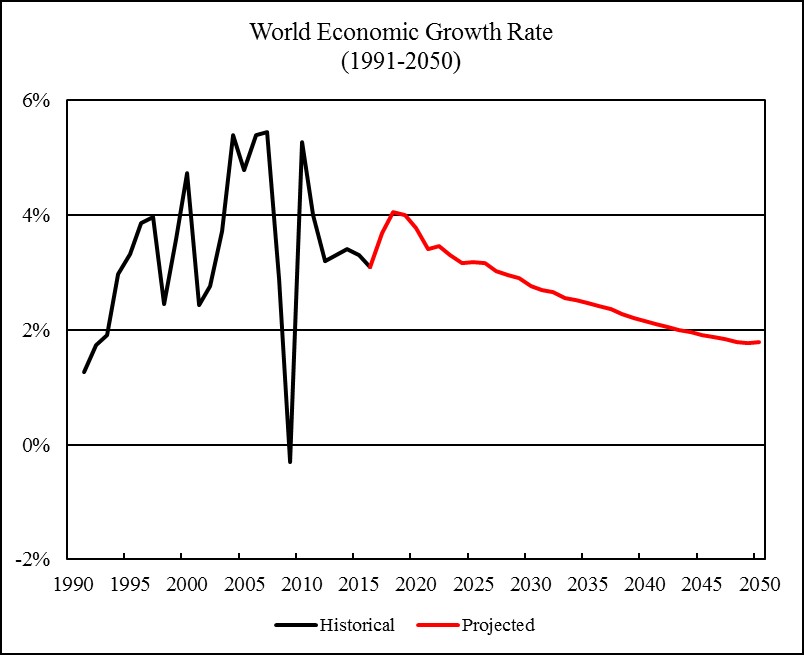

Figure 19 shows the historical and projected world economic growth rates from 1991 to 2050. World average economic growth rate is projected to fall from 3.8 percent in 2001-2010 and 3.5 percent in 2011-2020, to 3.0 percent in 2021-2030, 2.2 percent in 2031-2040, and 1.7 percent in 2041-2050.

Since the end of the Second World War, global economic growth rate has fallen below 2 percent only in several occasions. During 1913-1950, when the global capitalist system suffered from major wars, revolutions, and the Great Depression, world economy actually grew at an average annual rate of 1.8 percent (Maddison 2010). Thus, by the mid-21st century, although the global economy will continue to grow, world economic growth rate may become too low for the global capitalist system to maintain basic economic and social stability.

Nevertheless, gross world product (in constant 2011 international dollars) is projected to rise to 257 trillion dollars by 2050. By comparison, in “World Energy 2016-2050” (the last Annual Report), gross world product was projected to rise to 207 trillion dollars by 2050.

Figure 18

Sources: World historical oil, natural gas, and coal consumption from 1950 to 1964 is estimated from carbon dioxide emissions (Boden, Marland, and Andres 2017); world primary energy consumption and its composition from 1965 to 2016 is from BP (2017); world primary energy consumption and its composition from 2017 to 2050 is based on this report’s projections.

Figure 19

Sources: World economic growth rates from 1991 to 2015 are from World Bank (2017); world economic growth rates in 2016 and 2017 are from IMF (2017, Statistical Appendix, Table A1); world economic growth rates from 2018 to 2050 are based on this report’s projections.

Carbon Dioxide Emissions and Climate Change, 2017-2100

Figure 20 shows the world carbon dioxide emissions from fossil fuels burning from 1950 to 2100.

Historical carbon dioxide emissions from the burning of solid, liquid, and gaseous fuels from 1751 to 2014 are from Boden, Marland and Andres (2017). For 2015-2100, I estimate the carbon dioxide emissions from oil, natural gas, and coal consumption by assuming that each ton of oil consumption (excluding biofuels) emits 2.881 tons of carbon dioxide, each ton of oil equivalent of natural gas consumption emits 2.175 tons of carbon dioxide, and each ton of oil equivalent of coal consumption emits 3.882 tons of carbon dioxide. These conversion factors are based on the observed relationship between carbon dioxide emissions and fuel consumption in 2014.

World carbon dioxide emissions are projected to peak in 2030 at 37.1 billion tons. By comparison, in “World Energy 2016-2050” (the last Annual Report), world carbon dioxide emissions were projected to peak in 2029 at 36.0 billion tons.

Cumulative world carbon dioxide emissions from fossil fuels burning from 1751 to 2100 will be 3,584 billion tons. These are emissions from direct fossil fuels combustion only and do not include emissions from cement production and gas flaring.

According to Intergovernmental Panel on Climate Change’s Fifth Assessment Report, cumulative carbon dioxide emissions will largely determine the global mean surface warming by the late 21st century and beyond (IPCC 2013: 27-29).

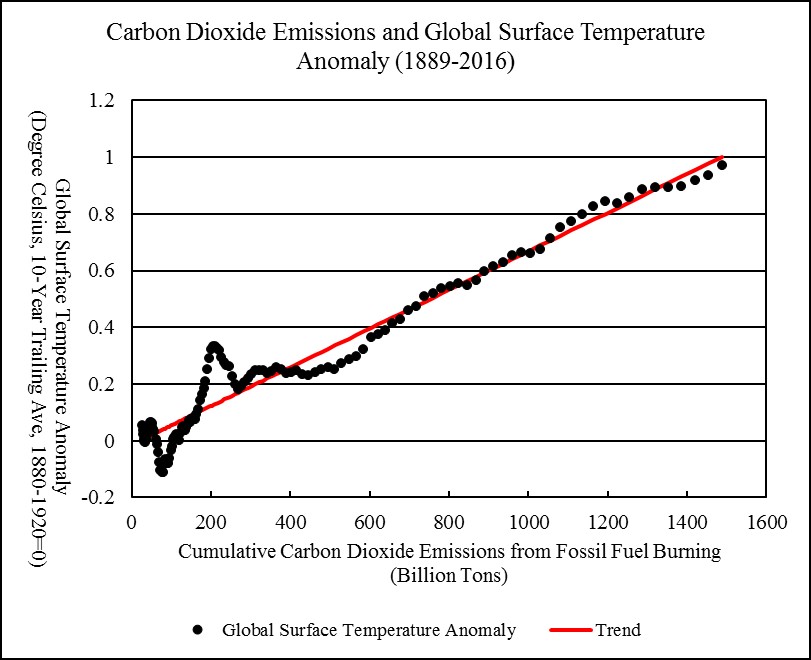

Figure 21 shows the historical relationship between the cumulative carbon dioxide emission from fossil fuels burning (not including emissions from cement production and gas flaring) and the global surface temperature anomaly. Global surface temperature anomaly is measured as the difference between the global average surface temperature and the average global surface temperature in 1880-1920. The latter is used as a proxy for the pre-industrial global temperature (Hansen and Sato 2016). Global surface temperature anomalies are shown in ten-year trailing averages to smooth out short-term effects from El Nino and solar irradiance cycles. The linear relationship between historical cumulative carbon dioxide emissions and the ten-year average global surface temperature anomalies indicate that for an increase of cumulative carbon dioxide emissions by one trillion tons, global surface temperature will rise by 0.68 degrees Celsius.

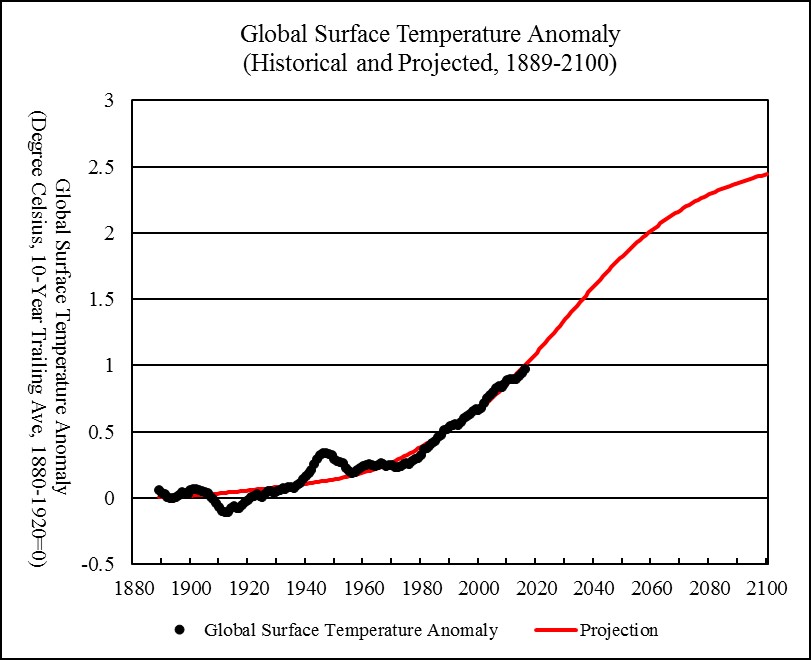

Figure 22 shows the historical and projected global surface temperature anomaly from 1889 to 2100. Global surface temperature anomalies are shown in ten-year trailing averages to smooth out short-term fluctuations. The future temperature projections are based on the future carbon dioxide emissions projected by this report and the linear relationship between cumulative carbon dioxide emissions and the global surface temperature shown in Figure 21. Under the current trend, the global surface temperature is projected to rise to 2.43 degrees Celsius above the pre-industrial level by 2100.

According to Hansen et al. (2016), global warming by more than two degrees may lead to the melting of West Antarctica ice sheets, causing sea level to rise by 5-9 meters over the next 50-200 years. Bangladesh, European lowlands, the US eastern coast, North China plains, and many coastal cities will be submerged. This will lead to the end of civilization as we know it.

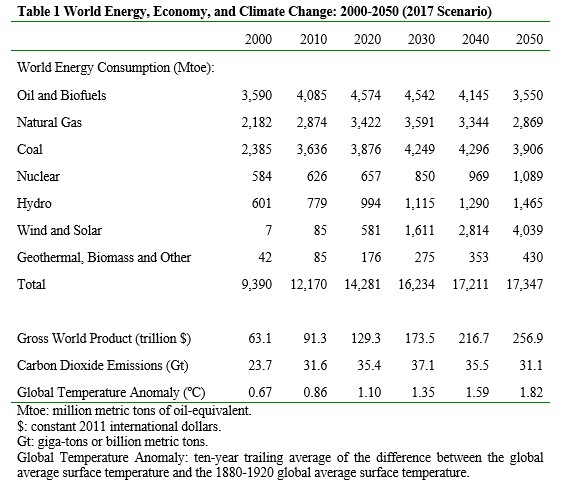

Table 1 summarizes the results of this Annual Report.

Figure 20

Sources: World carbon dioxide emissions from fossil fuels burning for 1950-2014 are from Boden, Marland, and Andres (2017); world carbon dioxide emissions from 2015 to 2100 are estimated using oil, natural gas, and coal consumption projected by this report.

Figure 21

Sources: Historical carbon dioxide emissions from 1751 to 2014 are from Boden, Marland, and Andres (2017), extended to 2016 using fossil fuels consumption data from BP (2017). Global surface temperature anomaly from 1880 to 2016 is from NASA (2017).

Figure 22

Sources: Global surface temperature anomaly from 1880 to 2016 is from NASA (2017). Future temperature projection is based on the projected future carbon dioxide emissions (see Figure 20) and the historical relationship between cumulative carbon dioxide emissions and global surface temperature (see Figure 21).

References

This is a brave effort. But…the coal, wind & solar, and “world product” projections are not useful.

Hubbert Linearization was useful for oil production in the US under price controls. It’s certainly not useful for coal forecasting. In particular, the idea that China’s coal consumption will grow until 2036 is not realistic. Nor are the growth assumptions for wind and solar useful: the idea that there are practical limits on solar electrical power generation is highly unrealistic. And, that means that the idea that “world product” will be limited by energy is unrealistic (even if the correlation of energy to production were valid….which it isn’t).

Hi Nick,

For China’s coal output probably a URR similar to the US is more realistic (around 100 Gt) and India may be less (80 Gt), so I agree that the coal estimate looks too high.

Energy has correlated pretty well with real GDP in the past (only World levels are appropriate to use), perhaps this will change in the future, but that is highly speculative.

Certainly energy efficiency can increase, but the gains are not unlimited.

Hi Dennis, a coal URR of 100 Gt for China would clearly be too low.

China’s cumulative coal production is already 79 Gt and its annual production now is about 3.5 Gt

Or do you mean RRR of 100 Gt?

Energy has correlated pretty well with real GDP in the past

Yes, as have many other things: other commodities such as metals, etc.

But, we’ve never made a sustained attempt to aggressively increase energy efficiency. To suggest that this would be impossible is also highly speculative.

Cars are a good example: US fuel efficiency has doubled in the last 40 years, to about 23MPG. It’s perfectly clear that it can be doubled again to 46MPG via hybridization, then doubled again to 92MPG by adding a plug, then doubled again by eliminating liquid fuels.

Similarly, housing can be made so efficient that it has no need for a net grid or FF energy input. Technically, it’s not zero energy, but it may as well be, given that it uses no net inputs besides solar panels on it’s roof. So, as a practical matter it’s infinitely efficient.

The Original Post makes no attempt to analyze the limits of efficiency under a policy of aggressive efficiency improvement – Business As Usual efficiency improvements are not appropriate evidence.

This article and the graph within show that the connection between GDP and energy use has been declining, both in developed and developing countries since 1990. So there is no reason to assume that economic growth (by current definitions) requires increased energy consumption.

Global energy intensity continues to decline – Today in Energy – U.S. Energy Information Administration (EIA): “Worldwide energy intensity, measured as energy consumption per unit of gross domestic product (GDP), decreased by nearly one-third between 1990 and 2015. Energy intensity has decreased in nearly all regions of the world, with reductions in energy intensity occurring both in the more developed economies of the Organization for Economic Cooperation and Development (OECD) and in the emerging nations of the non-OECD.”

Decline of energy intensity does not imply that there is no correlation between economic GROWTH and energy GROWTH

This is made clear by Figure 1

Even in OECD countries (benefiting for relocating energy intensive production to other parts of the world). Energy consumption has mostly stayed on a high plateau instead of declining.

In the rest of the world, higher economic output still requires higher energy consumption even though the two may not increase at the same rate

Decline of energy intensity does not imply that there is no correlation between economic GROWTH and energy GROWTH

Sure. But we’re not really concerned about correlation here: we’re concerned with causation, especially under conditions of scarcity that don’t exist today.

Of course, this isn’t really a very important point, given that there’s very little evidence that in the long run we’ll be faced with energy scarcity. But, the Original Post does argue that’s likely, and under those conditions…people would manage energy very differently. We know that people respond to price incentives – that’s well established.

Hi Nick,

Ok infinite efficiency and zero energy inputs.

Are you sure that is the argument you want to make?

Let’s just say I am not convinced.

Hyperbole results in people ignoring you.

Do solar panels rain down from heaven where you live? 🙂

hmm. Maybe I didn’t communicate that well.

So, you’re familiar with Passiv-Haus technology, aren’t you? Am I mistaken that the concept is that a house is so well insulated that it doesn’t need HVAC equipment like a furnace or AC; uses active air handling and heat exchangers to prevent heat loss to ventilation and outside air; and uses PV as it’s primary energy source?

My understanding is that a home built to Passive House standards would need not *net* inputs from the grid, or from an NG supply. Is that your understanding?

And, so, from the point of view of the larger society, this house would need no energy inputs at all. Energy efficiency is output divided by inputs: if the inputs are zero, then as a *practical* matter, it’s infinitely efficient.

Now, there’s no question that in this scenario there’s a need for energy, but energy efficiency is generally considered on the basis of *operating* energy inputs, not capital. As another example, I have a calculator that’s been powered by PV for decades. It needs no power from the grid – if there’s enough light for me to see the display, there’s enough light to power the calculator. My point of view is that the designers of this calculator have taken energy efficiency and improvements as far as possible, and as far as they need to go: if every device and building in our society was powered by ambient energy, we would have completely solved all of our energy problems. In other words, at the point where something is so efficient that it’s powered by ambient energy, further efficiency improvements are meaningless.

Does that make sense??

Hi Nick,

I am concerned with the total energy used by society. The solar panels need to be produced, can it be done using no net energy?

I hope your answer will be no. But you come up with some surprising logic.

Well, there are several parts to the answer:

First, no, clearly PV takes energy to produce. Not much: the energy required to produce enough PV to power a typical EV over it’s lifetime is no more than about $600 worth of energy (that assumes a conservative EROEI of 10:1, 250k kilometers over the vehicle’s lifetime, and .2 kWhs per km, and $.12/kWh in the US). A Passive House might be on the same order of magnitude. But, yes, it does take some.

Second, I thought this particular conversation was about the limits of energy efficiency.

Third, part of my comment was about how far efficiency can go. Look at the changes I discussed for both EVs and homes: 23MPG to 46, to 92, to 184….doesn’t that tell us something?? It seems to me that should change some people’s perceptions about the limits of what can be done.

4th, I was also discussing how far it makes sense to take energy efficiency. What’s the point of investing in further efficiency for my calculator, or for a Passive House that already needs no net inputs beyond panels? Isn’t that good enough? And, doesn’t that clarify how it makes little sense to think that our energy needs won’t be met in the future, when a home can be net energy neutral with the power that comes from it’s own roof?

Hi Nick,

yes it was about the fact that there are limits to energy efficiency.

You seemed to be implying that there are no such limits.

Energy efficiency can help, but there are physical limits to how efficient energy use can become.

Perhaps you disagree or would like to discuss something else.

And no it does not make sense to discuss Passivehaus design as needing no energy.

The solar panels are an energy source and without either battery or grid backup, it would require other sources of energy (or energy storage) due to intermittency.

Minqi is not arguing that energy supply will be insufficient, simply that he believes it will take more time to make the transition to non-fossil fuel than some believe.

We don’t really know how quickly it will occur.

” yes it was about the fact that there are limits to energy efficiency.

You seemed to be implying that there are no such limits.”

With a pragmatic POV the next 30 years there are indeed no limits for efficiency on a large scale. You can generate a lot GDP with saving energy.

Hi Ulenspiegel,

I agree there is the potential for large gains in efficiency by eliminating most thermal sources of power and most ICE use.

After that is accomplished over the next 30 to 40 years, further gains may be minimal.

The idea that these gains are unlimited and not subject to diminishing returns (in terms of % GWP [gross world product] spent to accomplish the increased efficiency relative to the % decrease in energy used to produce the marginal unit of GWP) is absurd in my view.

Beyond 30 or 40 years, do you still expect further efficiency gains will be unlimited?

I do not, I believe they will be marginal unless the transition to non-fossil fuel is far slower than I expect.

t there are physical limits to how efficient energy use can become

This could be beating a dead horse, but maybe it’s important.

People often get distracted by the fact there are limits to things like conversion efficiencies. But…that’s not really what we’re talking about here. We’re talking about efficiencies of energy *consumption*.

Transportation, for instance: when a vehicle moves from one place to another, physics calls that “translation”. Unless you’re going up a hill, it could be zero, except for real world losses, mostly friction. But…there is no minimum level of energy needed: it can get as close to zero as you like, if you keep working at it.

So, you can go from 12MPG to 1200MPG by reducing the various losses: drive train, suspension flexing; aerodynamics, etc. When you get to 1,200MPG (as engineers have demonstrated with prototype vehicles!) you’ve likely gone far beyond the point where anyone cares about further efficiency.

Heck, when you get to 120MPG (which is where we are now for production vehicles, with vehicles like the Tesla S or the Chevy Bolt), you may have gotten pretty much as far as is needed.

But…if there’s a shortage, or we realize that we need further efficiencies due to new evidence about pollution (perhaps GHG pollution)…then it will certainly be possible to find further efficiencies. Here are some examples:

you can reduce suspension flexing with dynamic suspensions, that adjust wheel height from the ground to sharply reduce tire and strut flexing. Or, you can use a suspension that converts kinetic energy into power, rather than simply converting it into heat, as suspension struts typically do today.

Aerodynamics can be greatly improved: the cross section that causes wind losses can be reduced; the skin interrruptions can be reduced, say by replacing side mirrors with cameras; the nose and tail can be redesigned to reduce turbulence; etc., etc., etc. The possibilities are simply endless, and today’s low hanging fruit is yesterdays obsolete basics.

Hi Nick,

So in your world friction can be eliminated?

Not in mine.

Hi Nick,

You should probably reread your physics text.

How does something go from a velocity of zero to a velocity V without expending any energy?

Even in your flat frictionless world, energy would be need to be “consumed” to get from point A to point B.

This is pretty basic stuff. See Newton’s Laws of Motion.

https://en.wikipedia.org/wiki/Newton%27s_laws_of_motion

No, friction can’t be eliminated. But, it can be reduced, and those reductions have no *theoretical* floor except zero. There is a large industry of mechanical and materials engineers working to reduce those losses, and they’re very good at their jobs…

2) when you accelerate something, you convert one form of energy (probably chemical) to kinetic energy. When you decelerate, you may convert that to heat via friction in the brake pads, or…you may recover it and convert it back to chemical energy (in a battery) with regenerative braking! And, of course, there is no theoretical limit to the efficiency of that recovery: each generation of regenerative braking is in fact significantly more efficient…

Hi Nick,

Well I believe the laws of thermodynamics preclude the ability to recover all of the energy with regenerative braking and such.

So assumptions that all of it can be recovered are a bit optimistic.

In addition the following statement by you seems contradictory:

No, friction can’t be eliminated. But, it can be reduced, and those reductions have no *theoretical* floor except zero.

Either friction can’t be eliminated (the “theoretical floor” is greater than zero) or it can be eliminated (there is no “theoretical floor”.)

Logic dictates that both parts of your statement cannot be true.

Hi Nick,

You said:

Transportation, for instance: when a vehicle moves from one place to another, physics calls that “translation”. Unless you’re going up a hill, it could be zero, except for real world losses, mostly friction. But…there is no minimum level of energy needed: it can get as close to zero as you like, if you keep working at it.

Objects at rest remain at rest. So although a moving object has inertia and will keep moving in a frictionless World forever unless a force is applied to slow it down.

How does the object start moving without any energy?

The laws of thermodynamics also apply here as perpetual motion breaks those rules, so you cannot just say we will recover the energy 100%. It cannot be done.

Have you ever actually taken a physics course? 🙂

Dennis,

Why are you being touchy? I know it’s frustrating when someone’s arguments don’t make sense to you, but jeez.

Okay. What I’m saying is that the laws of thermodynamics tell us that nothing is perfect when it comes to energy conversions, losses, etc. But…they don’t tell us how close we can get to perfect. In theory we can go from .1 gallons per mile to .01 gallons per mile to .001, etc.

Now, will we try to get to .001 gallons per mile? Very likely not. We know it’s possible – demonstration vehicles exist even now. But, there’s no need to make the investments and compromises necessary to get there. But…as long as energy is expensive, or in short supply, you can rely on those improvements in efficiency to continue in a robust fashion, for all of the various systems that use significant amounts of energy.

Does that make sense?

————————————–

As for the energy used for acceleration…I don’t understand why we’re disagreeing here. It seems obvious to me that the same logic applies that I discussed above. There is no limit to how much waste we can squeeze out of vehicle performance. And, if we manage to capture 95% of the energy of braking with a regenerative system, that makes an enormous difference: you’ve reduced the energy used to go through a round-trip cycle of acceleration and braking by 95%. That means that the remaining 5% is really pretty insignificant – by far the primary problem now is aerodynamics, which also have multiple opportunities for reduction. If we reduce aero losses enough to push braking losses back into the forefront…we’ll develop better systems there (e.g., super-capacitors).

Does that make sense?

Nick, you are being way too hopeful in your analysis, again.

Sure there are methods to build new places with great energy efficiency status, but we are not starting with a clean slate. The vast majority of people in the world will continue to live and work in older less efficient buildings for a very long time to come.

Last week I saw a home listed at 1.4Mill that still had a coal furnace, and single pane windows in very leaky frames. Sure, that is pretty rare here, but the turnover/renovation of older buildings is very slow, even more so in less economically vibrant areas.

Well, I think you’re talking about the pace of change, and I agree – it can be frustratingly slow.

But…I was talking more about theoretical limits: the Original Post seems to argue that Fossil Fuel is in basic some way essential to powering society. I disagree.

On the other hand: the pace of change is dependent on politics, and social consensus. It’s my understanding that all new construction in some places, like Germany and a few spots in California, are required to be net neutral. If we as a society understand the true costs of energy, we will push much harder to improve standards for new buildings and retrofit older ones.

I am with you Nick. We have all the tools needed to move away from fossil fuels and produce a low energy civilization. However, like the overworked husband, society never seems to get to those projects that should be done, only some of the ones that need to be done.

Hi Nick,

Let’s assume for a moment that all houses and buildings are demolished and rebuilt to Passivhaus standards.

Where will further efficiency improvements come from?

This is where the idea of a limit to efficiency improvements comes from.

Well, if all housing were rebuilt as you suggest, it would no longer require any net energy inputs from the grid, or from the NG system. It’s power would come from rooftop PV that as a practical matter lasts forever, and needs little maintenance.

So…as a practical matter, it would use no more energy. There would be no need for efficiency improvements in this sector of the economy. We could concentrate our attention on other sectors, like transportation, farming or industry.

And…the same logic applies elsewhere. Energy consumption by much of transportation can be reduced to the point where it’s powered by ambient energy: trains can be powered by panels on the roofs of containers; personal vehicles can be powered by panels on the roofs of the homes of their owners – that’s Tesla’s vision.

My sister is one of those crazy Californians: her Chevy Volt is powered by her home’s PV.

And our German readers can add their stories of factories powered by rooftop PV, like the Gigafactory.

Actually, I suppose the logical next step is net energy exports: energy efficiency of components inside those homes and industrial buildings would indeed continue to advance; and rooftop PV would expand beyond the needs of the buildings and it’s occupants, and those building would start to power the rest of society.

Trains could cover their own energy needs, then those of other trains, then start to export outside their network. They could start to cover much of their built area with panels (stations, sheds, even tracks and other parts of their Right of Way areas), and start to be a major force, competing with traditional utilities.

Hmmm. Inspiring thought.

Hi Nick,

Solar panels do not last forever. Nor do wind turbines, or batteries, or fuel cells, or cars.

The equipment needs to be replaced over time as it wears out and as the economy continues to grow.

Your expectation is for unlimited economic growth, I believe. (I have no such expectation.)

I noticed you did not explain where the unlimited gains in energy efficiency will come from?

Have you walked that back?

You seem to be changing the subject.

Solar panels do not last forever. Nor do wind turbines, or batteries, or fuel cells, or cars.

Well, solar panels actually do seem to last a remarkably long time. Panels that were installed 50 years ago are still going strong. They don’t stop working at the end of the 25 year warranty period: they keep on going, with losses per year of well below 1%.

But, that was an aside.

Let me try to summarize, because I think we’ve gotten lost in the weeds:

1st, I think that there’s no danger that wind and solar (and nuclear, hydro, biomass, tidal, etc) won’t be able to supply enough energy for humanity’s needs. This argument about efficiency is a secondary thing.

2nd, I do think that energy efficiency can continue to grow essentially forever, asymptotically approaching a limit, but continuing to grow. In the example of a Passiv-Haus, there are endless candidates for improvement: insulation of windows, roofs, foundations; air handling equipment; lighting, water handling, etc., etc. Here’s a concrete example: you might think that lighting has gone as far as it can go. But, even if LEDs emitted no waste heat (which is very far from the reality), the next step for offices which are primarily used in the daytime might be “day-lighting”, in which artificial lighting is mostly simply eliminated and replaced by light wells, light tubes, windows, etc. (Most people don’t realize that the standard lighting levels in offices are much, much lower than the ambient light levels outside). The possibilities are literally endless.

3rd, I do think there will be practical limits due to diminishing returns. Not diminishing growth rates of efficiency, but diminishing absolute value to that growth, as the absolute amounts get smaller.

I’ve been trying to say exactly that: In particular, I was trying to say that the point of diminishing returns might hit around the time when the needed power can be gathered from ambient energy: solar panels on roofs of houses, factories and trains.

But, of course efficiency will hit a point where it’s no longer worth the investment of time (and energy). Unless…there’s some kind of shortage of energy, energy prices rise, and more efficiency is needed. Efficiency will become moot at the point where reducing energy consumption is no longer an important issue for society and/or individuals.

Does that make sense?

Nick, all these things you are pointing out are theoretically good and possible, but I don’t think any of it changes the graph projections in this Presentation by Prof. Li in any appreciable way. My personal view.

Well, sure – this discussion of efficiency is about the demand side, and his charts are primarily about supply. This stuff would be more likely to be relevant if we, as a society, decided to aggressively reduce energy consumption.

That’s not happening nearly as much as we would all like.

We can see notable successes in California and Germany to incentivize efficiency by raising retail electricity rates, (even though it confuses some observers).

It would work better if it included industrial/commercial rates, but regulators were afraid of businesses leaving.

The US CAFE program has been enormously successful – oil consumption would be 10M bpd higher without it! Of course, we’d have hit $200 oil first…

Hi Nick G,

Your second to last comment is getting pretty close to reality with the exception that efficiency improvements will continue at a constant exponential rate essentially forever.

They will reach a point that they are no longer economically feasible or sensible and the growth will stop.

I agree that it might be possible to provide all energy needs without fossil fuel at some point in the future.

When that will be, we can only guess, but I think a guess of 2080 is more reasonable than 2050 or earlier.

A also agree that it is not highly likely that there will be a “shortage” of energy as long as prices are not artificially fixed at some low level by government intervention.

Nice straw man, but there is an interesting point you are missing: The energy industry is a big chunk of the economy today, but that proportion could fall dramatically in the next few decades.

So even though we will continue producing and using energy, the industry may be nearly zero.

Quick anecdote:

A co-worker moved into a newly built house last year.

Her electric bill dropped by 2/3… And the new house has twice the square footage of her previous home.

My bill this month was more than double her bill, but my house is almost half the size of hers.

We live in FL; a state not known for having progressive regulations on the energy efficiency of new construction.

Hi Brian,

I agree there is potential for significant gains in energy efficiency.

The argument that there is no limit to efficiency gains I do not buy.

This seems to be the story Nick G is trying to sell.

He points to prototype vehicles which get efficiency 500x the average US vehicle.

Maybe some engineers could point to to the likelihood that such a prototype efficiency would match the fleet average in 50 years.

Well, please re-read my comments. What I’m saying is that there is no *theoretical* limit to efficiency gains.

There is certainly a practical limit, but I think it’s farther out than your intuition is telling you.

I remember a high level auto executive (with solid engineering training and extensive design and manufacturing experience) telling me back in about 1980 that 40MPG was flatly impossible – it would never happen…

China’s future coal production is not estimated from Hubbert Linearization (because of the large fluctuations in recent years, it’s now premature to apply HL to China’s coal production), it is estimated by using China’s coal reserves reported by BP. BP finally updated its reported coal reserves this year and made some large upward adjustments.

China’s coal production declined quite substantially from 2014 to 2016. But now there is a high probability China’s coal production will resume growth this year. For the first five months, China’s coal production increased by 4% compared to the same period last year and in May, it increased by 12% compared to the same month last year.

About wind/solar, I do think they are also subject to ultimate ecological limits unless you think they do not have ecological impacts.

However, in the current projection, I am not assuming any ultimate limit to their long run growth. All I have assumed is that their annual installation will eventually reach a plateau.

This has already happened in Europe. I think it will happen to the world too.

Hi Minqi,

Europe may have plateaued during a period of low fossil fuel prices. Peak fossil fuel may change the dynamic.

US and China have a similar level of reported reserves and similar cumulative output.

I believe China has plans to scale back coal output, 100 Gt may be too low, but I believe your estimate is too high.

Eventually world installations will reach a plateau, but your basis for predicting that plateau is quite low.

For China I think the URR may be similar to your US estimate. I believe India will be under 100 Gt. This assumes wind and solar become cheaper than fossil fuels as costs for renewables will fall as the cost of fossil fuel rises with depletion. I assume demand for energy will continue to grow as population and real GDP continue to rise, though at a somewhat lower rate due to falling energy intensity of GDP.

Hi Dennis,

Most of my report is simply to indicate what the existing data/trend indicate. In the Chinese case, HL cannot be applied to coal yet. So for the moment, the best available data about China’s remaining recoverable coal resources are simply the reported reserves. It’s actually not “my” estimate but BP estimate.

On the other hand, it’s possible that my estimate of US/ROW coal URR prove to be too low. For the ROW, HL analysis under-predicts the current production levels. For the US, the EIA projection was prepared last year with the clean power plan included. Next year they may produce a more “optimistic” scenario for coal.

I am glad that we agree on a eventual future plateau of renewable installation. While I admit all the weaknesses my projections have, please note that they still stay above all the mainstream projections (IEA, EIA, BP) through 2050.

I am glad that we agree on a eventual future plateau of renewable installation.

If I understand your arguments, you and Dennis do not agree. Your projections seem to assume that renewables will plateau at a level that is insufficient to supply demand. Dennis’ projection does not: it assumes that it grows as needed to supply demand.

Hi Nick,

We agree that exponential growth will not continue forever.

We disagree on the level at which the crossover from exponential to linear will occur. In my scenario annual installation for wind and solar increases to 1250 GW per year (in 2046) and then levels off and gradually declining after 2054(as demand is met by 2054 by non-fossil fuel).

That scenario assumes demand for electric power continues to grow at 3% per year, possibly improved efficiency will reduce this rate of growth, but such efficiency increase will be offset by increased demand from transportation and space and water heating, eventually the rate of growth of electricity demand will fall as population growth is reduced (by 2070-2100, maybe 2085 for best guess of population peak).

If electricity demand growth falls below 3% per year before 2046 then less capacity will be needed.

Hi Dennis,

In your scenario, what explains the “slow down” from about 2027 to 2040?

Hi Minqi,

I assume eventually the capacity factor for wind and solar will reach 33%. I assumed a capacity factor of 20% (same as 2016) for the early part of the scenario and had it ramp up from 20% to 33% over the 2027 to 2040 period.

Not all that realistic probably, a better model would have a more gradual change that topped out at a 27% capacity factor (33% seems too high and 23% too low so I picked a number in between).

This would result in a smoother curve.

The 27% assumption would increase the capacity installed from 18,800 GW to 23,200 GW in 2050.

We agree that exponential growth will not continue forever.

I guess my question is about the underlying fundamentals. The Original Post seems to assume that non Fossil sources (wind/solar/nuclear, etc) will meet some sort of resource limit, which will cause problems for economic growth. As best I can tell, you do not make that assumption.

Hi Nick,

I did not get that implication, can you point to the part of the post where Minqi says that, I may have missed it.

There are several places. First, in the Original Post: … wind and solar electricity is intermittent. Incorporation of wind and solar electricity into electric grids requires maintaining a large backup generating capacity and poses challenges to grid reliability. Curtailing of excess wind and solar electricity when surges of wind and solar generation exceed demand may impose limits on how much wind and solar electricity can be absorbed by a given system of electric grids. In the long run, wind electricity and solar electricity are also limited by the availability of land and mineral resources (Castro et al. 2011 and 2013).

He’s said the same thing in comments about “ecological limits”, and also referred to Evan Mearns several times as a source for the idea that a 100% renewable grid is not possible.

And for the economics he said: Thus, by the mid-21st century, although the global economy will continue to grow, world economic growth rate may become too low for the global capitalist system to maintain basic economic and social stability.

He’s not talking about a temporary, transitional problem. He’s saying that energy supplies can’t grow fast enough to supply enough energy to allow the world economy to grow. That only makes sense if you think that there is some kind of natural limit to energy supplies in the reasonably near future (because of course, if you extrapolate far enough anything hits a limit, even 100,000TW of solar power).

I suppose it’s conceivable that he’s sufficiently economically illiterate that he believes that rising energy prices would not cause energy supplies to ramp up in response. I think that’s what you’re thinking that he’s thinking, and it’s true that’s a common (if puzzling) idea.

But, I think it’s clear that the Original Poster is instead thinking about physical limits due to intermittency, as we see in his later comment about Mearns analysis.

Hi Nick,

He says wind and solar may be limited, there are other non-fossil fuel sources.

On the economy there are several reasons Minqi might think the growth rate of the economy may slow.

A very simple reason is that the real GDP per capita has been relatively steady from 1960 to 2016 (about 1.4% per year). The population growth rate is likely to slow based on most population models.

So we would expect the rate of GDP growth would fall over time.

Another reason that the economic growth rate is likely to slow is that more of the World will become developed and generally more developed economies grow more slowly.

You seem to believe that exponential growth can continue without limit.

I do not agree that is possible and I am fairly sure Minqi does not think infinite growth is possible.

Ecological limits are a given. Though no doubt you would disagree.

Wind/solar…not assuming any ultimate limit to their long run growth. All I have assumed is that their annual installation will eventually reach a plateau.

The article implies that world production will be limited by energy supplies. If we expect demand for additional energy, and also project that solar & wind do not grow to meet that demand, then we must assume some kind of hard resource limit to wind/solar. The total solar resource is on the scale of 100,000 terawatts, while human energy production is roughly around 15 terawatts, a ratio of roughly 7,000 to one. To conclude that this presents a practical limit, one must assume that only a tiny, tiny fraction of the solar resource is usable – this is highly unrealistic.

It takes time/effort to “grow” anything, especially if you believe solar resources are virtually unlimited

I’m not sure what you’re arguing.

Yes, wind and solar installations require labor and costs to install. Of course, those costs are below the cost of coal in many areas even now, and are continuing to decline quickly. So, I’m not clear what the problem might be.

First, in many parts of the world, solar is still more expensive than coal/gas; in the US, wind is still more expensive than gas

Second, cost is not the only factor that limits wind/solar; there is the problem of intermittency/curtailment

Thirdly, it simply takes time+engineers+workers to install anything. The US now normally installs just 20-30 GW of any type of capacity each year. Unless you turn the US into a Soviet-style planned economy, things won’t be much different in the future.

Hi Minqi Li,

I imagine if prices change that things could be very different in the future.

In areas with good wind resources (Texas, Iowa and other plains states) wind is cheaper for power generation than natural gas (new build). In areas with good solar resources (US south west) solar is cheaper than natural gas.

In addition the price of natural gas will rise while the pride of wind and solar will fall so natural gas and coal will lose to wind and solar over a wider area.

The intermittency is not a problem.

http://www.sciencedirect.com/science/article/pii/S0378775312014759

Abstract

We model many combinations of renewable electricity sources (inland wind, offshore wind, and photovoltaics) with electrochemical storage (batteries and fuel cells), incorporated into a large grid system (72 GW). The purpose is twofold: 1) although a single renewable generator at one site produces intermittent power, we seek combinations of diverse renewables at diverse sites, with storage, that are not intermittent and satisfy need a given fraction of hours. And 2) we seek minimal cost, calculating true cost of electricity without subsidies and with inclusion of external costs. Our model evaluated over 28 billion combinations of renewables and storage, each tested over 35,040 h (four years) of load and weather data. We find that the least cost solutions yield seemingly-excessive generation capacity—at times, almost three times the electricity needed to meet electrical load. This is because diverse renewable generation and the excess capacity together meet electric load with less storage, lowering total system cost. At 2030 technology costs and with excess electricity displacing natural gas, we find that the electric system can be powered 90%–99.9% of hours entirely on renewable electricity, at costs comparable to today’s—but only if we optimize the mix of generation and storage technologies.

Highlights

► We modeled wind, solar, and storage to meet demand for 1/5 of the USA electric grid. ► 28 billion combinations of wind, solar and storage were run, seeking least-cost. ► Least-cost combinations have excess generation (3× load), thus require less storage. ► 99.9% of hours of load can be met by renewables with only 9–72 h of storage. ► At 2030 technology costs, 90% of load hours are met at electric costs below today’s.

Graphical abstract below

Thirdly, it simply takes time+engineers+workers to install anything. The US now normally installs just 20-30 GW of any type of capacity each year. Unless you turn the US into a Soviet-style planned economy, things won’t be much different in the future.

Electricity consumption in the US has essentially stopped growing. So, the US is actually doing pretty well to be installing that much – it’s more than is needed to handle demand, and appears to be driven more by a desire to reduce costs and clean up the grid.

On the other hand, US installation rates have been much higher in the past.

If, as a society, we decide to be more aggressive about installing clean power, we can certainly substantially increase installation rates. That’s what utilities do: they respond to what they’re asked to do by their customers, and by the commissions that regulate them. That’s not Soviet style central planning, that’s just Business as Usual for the US.

Don’t give some of these guys ideas about copying a soviet style economy. They actually believe in Marxism.

If long distance extra high voltage ( meaning HVDC lines ) transmission costs continue to come down as the technology advances, and the industry that manufactures the specialized equipment needed scales up, there is no reason to believe there is any PRACTICAL limit on the amount of solar electricity that we can produce, at least not for the next few decades, other than the costs of building solar farms and transmission lines. There are tens of thousands of square miles of more or less undeveloped land that gets full sun as much as ninety percent or more days per year.

Only a very minor fraction of all this land would need to be under solar farms to generate as much solar electricity as we can use.I don’t personally believe land is a limiting factor, so long as the grid is managed sensibly, and so long as long distance transmission is implemented efficiently.

The actual installations of lines on towers is a mature technology, and the price of running lines from a to b probably won’t fall much if at all, and might go up as the supply of raw materials needed, such as steel and aluminum, become more expensive. But it’s my understanding that the real money is spent at each end of a hvdc line, on the super expensive equipment needed to tie it into the existing ac grid at each end. I could be wrong about that, and hope somebody here knows enough to set me straight if I am wrong.

I guess we could run cables to Russia, and from there swing them down via China to Vietnam and Cambodia and Thailand and Malaysia and Indonesia and cross the ocean to Australia?

Hi Fernando,

I think we can realistically expect to run power lines from the American Southwest and Midwest to our major Yankee population centers, once the cost of HVDC equipment comes down as the industry scales up.

And if the political problems can be solved, it’s very likely it will be possible and practical to run lines from your part of the super sunny Med area to European population centers.

For sure such long lines are going to cost a hell of a lot, but once they’re built…….. they last just about forever with good maintenance.

And I for one am not much worried about when we can transition entirely away from using fossil fuels. If we can get eighty or ninety percent of the way there, things ought to work out ok in my opinion, for quite a long time, a century or more at least.

If a country such as Spain or the UK can cut down on the use of imported energy by just half, this would save such a country an enormous amount of hard to come by foreign exchange earnings.

Hi OFM,

Climate change may be a problem if we don’t get close to zero fossil fuel use by 2075 or so (say to 1% of today’s level of fossil fuel carbon emissions by that time).

The quest for rapid reduction in fossil fuel use is less about energy scarcity and more about tackling climate change. If we burn all the easily available fossil fuel there is a higher risk of damaging climate change.

Winter days are quite short in sunny southern Spain. And some days we get dust from the Sahara. Although I read that global warming may bring more rain to the desert, so the dust storms may not be as much of a problem.

Hmmm. You seem to be discussing production, but if China is planning to reduce coal consumption (so that they never hit production limits at all), then wouldn’t consumption be the more important factor?

China’s coal consumption data for 2017 of course are not yet available.

If coal imports have grown even more rapidly than coal production over the first half of this year. So it should not be difficult to guess what has happened to coal consumption.

Well, do we have good numbers for China’s annual or monthly coal consumption for the last few years?

This link has BP data for China coal. Consumption and imports.

http://mazamascience.com/OilExport/

Their chart seems to show China’s coal consumption dropping for the last 3-4 years.

Minqi Li said:

Ecological limits are fine, but what about economic limits?

Germany, for instance, has set what is perhaps the most ambitious agenda for wind and solar in the world. Nevertheless, wind and solar penetration, as a total of Germany’s total power production, is plateauing at about 18%.

But here’s the question: Will households and small businesses in other nations of the world be willing to pay the economic cost they paid in Germany to achieve Germany’s high level of wind and solar penetration?

Here’s a recent article by an economist from the University of Houston that recaps the enormous economic cost that households and small businesses, and now Germany’s electric companies, have paid, and continue to pay, to finance Germany’s super ambitious goals for renewables.

https://www.forbes.com/sites/uhenergy/2017/03/31/100-renewables-by-2050-germany-pays-the-price-for-its-ambition/#635209ba1e98

“Nevertheless, wind and solar penetration, as a total of Germany’s total power production, is plateauing at about 18%.”

Nonsense, please get correct data for more than two years.

Because 2016 had much lower average wind speed in comparison to 2015, you have a 2 year “plateau”. In 2017 we will see a drastic increase (one has only check data for the first 6 months) and for the next two years we will see additional 8 GW wind power, i.e. each year 2% more of the net electrcity demand is provided by wind, this with decreasing costs of offshore wind.

The realistic differential costs between BAU and energiewende are less than 17 billion EUR per year (EE sucharge – saved primary energy) , 0.5% of GDP, hardly a gamebreaker and mainly a legacy of early years with expensive PV.

To claim that these numbers are relevant for other countries is stupid propaganda.

P.S. If you want to argue with primary energy demand then keep in mind that the data are not temperature corrected.

Well my lying eyes.

It sure looks to me like that curve of Germany’s installed wind and solar capacity has flattened out.

Yes, do not present a graph you do not understand. 🙂

2017 is only 6 months old and we have a continuation of the trend of the last few years, you only have to check the data on Fraunhofer ISE energy charts.

While net addition of capacity (GW) is reduced, the capacity factor of the installed turbines have increased, the output too. Minor mistake, you also forget the effect of replacement of old turbines. Net addition is zero, but 100% gain of CF.

Then you claim a plateau when there is a net addition and an increasing generation? That is a contradiction even within your limited understanding of German renewable landscape.

Ulenspiegel says:

Nah. That dog don’t hunt either.

The growth in power production from renewables not only stalled out in Germany in 2016, but in all of Europe & Eurasia as well.

Again, y-o-y data depend on weather, that is my point. 2016 had a very low average wind speed, 2015 was above average, therefore, bad weather compensated for record addition of wind turbines.