There has been plenty of hoopla lately concerning the boom in shale (LTO) oil production. From the New York Times: Surge Seen in U.S. Oil Output, Lowering Gasoline Prices

Domestic oil production will continue to soar for years to come, the Energy Department predicted on Monday, scaling to levels not seen in nearly half a century by 2016.

The annual outlook by the department’s Energy Information Administration was cited by experts as confirmation that the United States was well on its way — far faster than anticipated even a year ago — to achieving virtual energy independence.

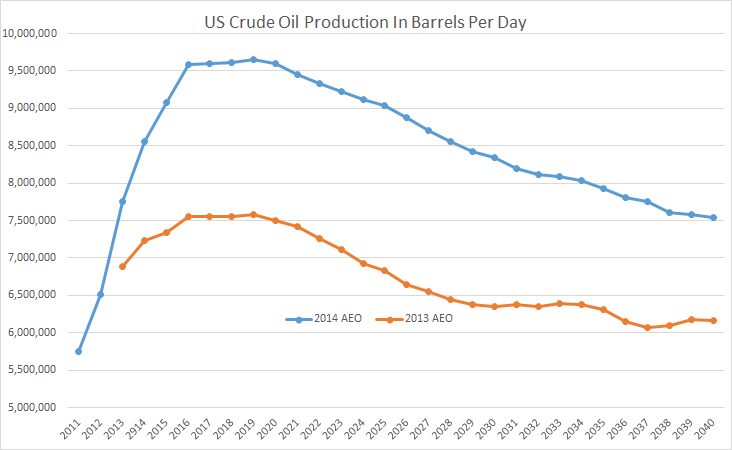

What the EIA is actually predicting: AEO2014 EARLY RELEASE OVERVIEW. The data is C+C.

The first two points were what was actually produced in 2011 and 2012 and the rest of the blue line is what they are predicting for the future. The orange line is what they predicted last year. The predicted numbers this year are a lot higher but the shape of the curve looks the same. They predict US Crude + Condensate will plateau in 2016, actually peak in 2019 and by 2021 be headed for a permanent decline.

Note the difference between AEO 2013 and AEO 2014. The difference rises to just over 2 mb/d and holds that difference util 2030 when it slowly closes down to 1.37 mb/d in 2040. And everything above about 5 mb/d is all Shale, or Light Tight Oil. They expect LTO to rise to about 4.5 mb/d by 2016, hold that level for almost 5 years and for LTO to still be above 2.5 mb/d by 2040.

Anyway here is what Saudi Arabia thinks about it all. Saudi will not be affected by shale oil output: report:

“Since we doubt that tight oil production will grow as much as most commentators surmise, and since we believe that tight oil production will keep representing only about 3% of total liquids supply, we do not believe that the growth in oil production from tight rock formations in the US, or from shale formations elsewhere, will materially affect Saudi Arabia’s long-term position in the oil industry,” Jadwa said in a study.

And questions are being raised elsewhere: Shale well depletion raises questions over US oil boom

In October, the government began issuing a monthly report on drilling productivity that charted declines in six major U.S. shale plays. The U.S. Energy Information Administration estimates that it takes seven of every 10 new barrels produced in those areas just to replace lost production.

Of course this article is quoting the EIA and their new Drilling Productivity Report.

Speaking of that report, Steve’s blog, SRSrocco Report, has this headline: Eagle Ford Shale Decline Shoots Up A Stunning 10% in One Month!

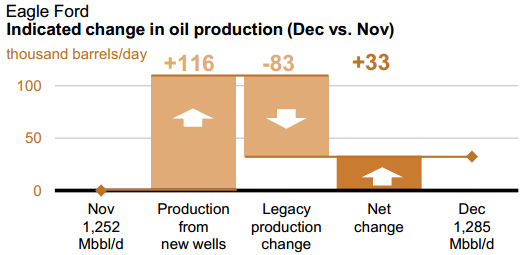

What Steve is talking about is this. First from last month’s Drilling Productivity Report:

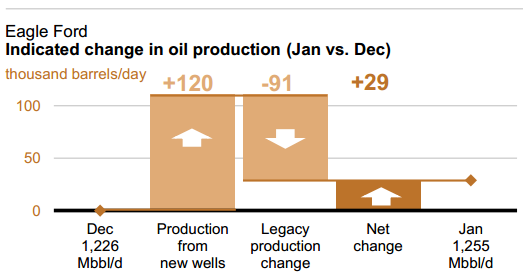

And see the difference from the latest report:

But getting back to the statement in the “Fuel Fix” article that it takes seven of every 10 new barrels produced in those areas just to replace lost production. If the EIA is correct in their latest report it takes a bit more than 7 of every 10 barrels just to make up for the declines of old wells. If their figures are correct, in Eagle Ford, it takes almost 7.6 barrels of every 10 barrels from new wells just to make up for the decline in production from old wells. And of course that number increases every month.

If the EIA’s decline rates are anywhere close then the Bakken should reach her peak at about 1.25 mb/d and Eagle Ford at about 1.6 mb/d, or at some point very close to those numbers.

Bottom line, all the hype is just hype. The US will likely never reach 4.5 million barrels per day of shale oil, the peak will not be spread out over five years as the EIA believes, and the decline will be a whole lot steeper than the chart above indicates. Shale oil may delay the peak of world oil production for one year, or two at the most.

While it is true that only the Light Tight Oil is keeping Peak Oil from being an obvious fact, that can only last for a year or two, then the US, along with almost every other nation in the world will be in decline.

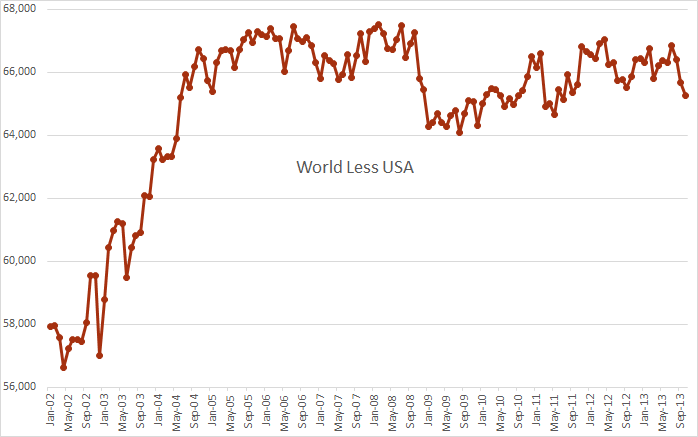

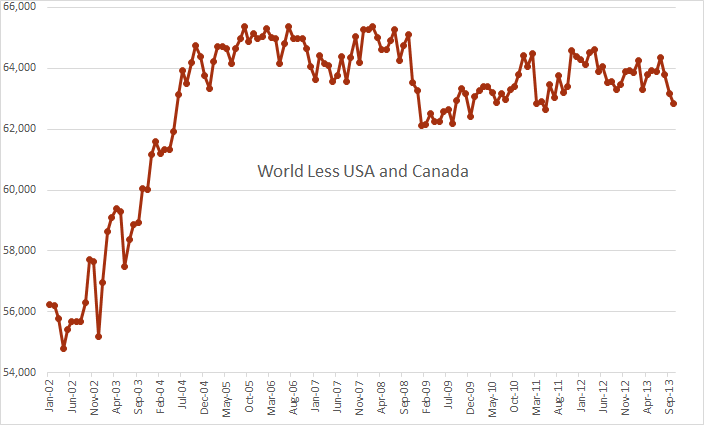

The EIA’s International Energy Statistics is about a month late already. International oil production data is a really low priority with the EIA. They are much more concerned with the price of kerosene and other such matters than they are with world crude oil, the lifeblood of every economy in the world. So we will have to do without it until they get around to posting that data, if ever. But in the meantime I have constructed the below chart using mostly JODI data, with some EIA data used for countries that do not report to Jodi. I use it just to show what the world oil supply would look like without US Light Tight Oil. The last data point is October 2013.

According to JODI, the world less USA peaked in January of 2008 and almost reached that point again in July of 2008. In October of 2013 we are down about 2.25 mb/d from that point. Interesting to note also that the world less USA has dropped some 1.5 mb/d since July. July was the last month the EIA’s International Data Statistics has data for.

Euan Mearns, below, asks that this chart be posted. The last data point is October 2013:

It doesn’t look a lot different from the “World Less USA” chart. Down 2.53 Megabytes a day from the peak of July 2006. Keep in mind this is JODI data which differs somewhat from the EIA data. The EIA however only has updates through July 2013. There has been considerable attrition in production since then.

The following charts are based on data from the EIA’s AEO 2014 Early release.

Hi Ron,

Very good post !

I suggest you remove USA production reaction to the price signal, as well as Canada.

Then it becomes really scary …

Happy Chrismas,

Michel

Something that most of our friends in the media seem to be missing is that even with the recent optimistic revisions to their outlook for US crude oil production, the EIA in effect seems to be asserting that US crude oil production (actually crude + condensate) will not materially exceed the 1970 rate of 9.6 mbpd.

It’s one of life’s little ironies that a region that is–so far at least–still a post-peak crude oil producing region is used to rebut the Peak Oil “Theory.”

It’s as if Daniel Yergin were standing on the top of a tall building and dropped a rubber ball, and after observing that the ball bounced, and was showing an upward trajectory, observed that the “Theory” of gravity is clearly wrong.

Hi Ron, I got a new post up on OECD oil production – 15 charts in total. Your World less USA is an interesting chart. You could remove Canada too. Best Euan

OECD oil production update July 2013

Euan,

Usually onshore fields level off more than the North Sea has because the regional decline rate becomes less pronounced as the field matures. Is the reason for the relatively steady decline rate (if we did a 12 month moving average) because the platforms get shut down suddenly due to higher operating costs offshore? Interesting post. Thanks.

DC

DC,

I asked Rockman that question a while back and his answer was YES.

Where can we find Rockman nowadays?

Hi Oldfarmermac,

He posts a lot at peakoil.com. It would be great if he posted here. He does have a page called locking up oil here at POB.

DC

Dennis, Don’t fully understand your question. But hope this helps. In the North Sea there has been very little decommissioning to date. But off shore, companies are much more limited in what they can do to keep production going, in particular an offshore platform has finite deck space and a finite number of functioning wells determined by the number of “slots”. A platform with 24 slots is never going to have more than 24 wells (sure someone is going to correct me here with multilaterals). And so at the start you may have 24 oil producers. Later 4 water injectors and 20 oil producers. Eventually, you want to do infill drilling – new wells drilled between the existing. To do this you need to abandon existing producers and hope that the new wells have higher production rates. Onshore, drilling activity is normally additive – everything you do gets added to what you already have. Offshore it is replacive – you replace a well with 95% water cut with one that has 90% water cut. Expect Gulf of Mexico, Angola, Brazil, deeper water bits of Nigeria etc to go the same way as the North Sea. Hope this helps. Euan

Euan,

That answered my question. The question as I posed it was not very good because of my lack of knowledge of off shore operations(and because it was badly written). In my question I asked about the platform being abandoned (which will occur eventually), but you pointed out what was not obvious to me. Individual wells are shut down when new wells are added, typically the new wells may not be as productive (from an EUR over the life of the well perspective) as the well that it replaces. That is lets assume that most wells are online for 7 years and then are shut in and replaced with a new well, when I say the new well is less productive, I mean that if the well being replaced had produced 2 million barrels over its 7 years in production that the new well will produce something less than 2 million barrels. In any case I know more than I did before, so thanks.

DC

Euan,

I suppose I will the the spoiler, but you are basically correct and I am just pointing out the exception that proves the rule.

As you stated, offshore platforms are designed with a fixed number of slots, or spaces to drill wells. Usually this is in a defined grid pattern, of say 3 x 4 or 8 x 10 slots or anything inbetween, and this normally restricts the total number of wells drilled.

I have recently come off a platform in the Congo, where a small enterprising oil company has bought oil fields from Total. They re-completed some wells, took production from 6000 to 20000 barrels per day. Now comes the tricky part. The platform was 12 slot, 3×4 and they tacked on another 4 slots to one side of the platform. Though this is not a simple job.

Just to show what else is happening, the reason for adding the slots was to reach a small pocket of oil which had been out of reach when Total was drilling, but now with rotary steerable assemblies it was in reach. We started our kick off in the 26″ hole section (shallow) drill out 10,000ft at 80 degs in 12 1/4 and dropped into much better than expected oil reservoir.

The most usual method of extending the life of a platform after all the slots have been drilled, is to side track. You cut the casing either the 13 3/8 or the 9 5/8 pump cement and kick off into a new hole, then case and complete. With the new drilling tools we use, the new side track can be used for extended reach, or maybe just to target bypassed pockets of oil, previously missed or unknown at the time.

So the moral of the story is, there is still more oil out there to be produced from old platforms, but as you all know, it is at the margins, and not ever threaten the peaks.

Thanks, I knew it would be a bit more complex. But if I understand you correctly, in a sidetrack the original well is cemented meaning that the sidetrack replaces and does not get added to existing production.

There are off course sub-sea tie backs as well, where a semi-sub or jack up can drill wells through a sub-sea template (new slots) and flow lines tie back to process facilities on neighbouring platform.

Euan,

Sorry for not replying earlier but i have been away for a couple of days.

Your correct, side tracks use the slot and conductor of an old well that has watered out or is just sub economic. The inner casing strings are cut and retrieved, the old hole is plugged with cement to seal the now non producing formation and cement plug is left at the point where you want to kick off. A new hole is then drilled, this is call a side track.

Sub sea completions and tied back to a platform is also a method of adding wells to a platform, but unless these tie backs are built into the platform at the design stage, it will also take a fair bit of engineering to achieve. The advantage of a sub sea tie back is the extended ranges that can be achieved. Where a well drilled from the platform maybe at a stretch reach 3 miles, a sub sea tie back can be drilled up around 10 miles from the platform (maybe further these days) and reach many more pockets of bypassed or previously sub economic oil.

So once again the long and the short of it all, extra wells can be added to platforms, but not easily. With the easiest “additional” wells being re-drills, which required a one well bore to be abandoned before the new well is drilled and completed. There are no stripper wells off shore, unlike on land due to the operating cost being so high.

Toolpush and Euan,

You both know a lot more than me about the oil business. I have a question about real (inflation adjusted) well costs in the LTO plays (where well cost includes both drilling and fracking.)

In my models of the Bakken and Eagle Ford I assume real well costs will decrease over time to some limiting value, so that there is a floor to well costs and that the real cost will not fall to less than $7 million per well in the Bakken or $6.2 million per well in the Eagle Ford. I know that Rockman would say “what kind of well, how long are the laterals and how many fracking stages”. My answer would be let’s assume for simplicity that the optimum lateral length and number of fracking stages for the average well has been found and that this will not change over time. If that were the case (and this clearly oversimplifies) does my floor for well costs seem high, low or about right? Jan 2013 average costs for a well in the Bakken are about $9 million and in the Eagle Ford about $8 million and the model assumes costs fall at an 8% annual rate until reaching $7 million in the Bakken and $6.5 million in the Eagle Ford . Any alternative suggestions that might be more realistic, without being impossible to model?

Thanks.

DC

Don’t forget acreage cost. And of course there is a cost to maintain the well for every year it is in production. Mark Anthony one year ago:

The Real Economy Of Bakken Shale Wells Of Continental Resources

Based on most recent CLR quarterly report, I estimate that direct well drilling cost is $11.65(M) per well. Figuring in overhead and production maintenance costs, I think a lifetime cost of $13M per well is a very conservative estimate. Let me do the calculation using $13M and $15M cost per well. Realized revenue was $65 per BOE.

And from this past May, Continental hopes to get well costs down but don’t think they will get down to 7 million per well.

Well Costs at the Bakken Are Declining

Hi Ron,

I use the point forward method that Rune Likvern uses. I think well maintenance is part of operating expenditures (OPEX) which Rune estimates at $4/barrel (I learned this method from Rune, and trust that it is approximately correct). The cost for leases in the point forward cost method is left out, which is standard practice. The reasoning is that the lease costs are a sunk cost, if you don’t drill you will be stuck with those costs anyway unless you sell the rights to someone else, or go bankrupt, so the decision to drill or not to drill on land that has been leased has little to do with the lease costs. That is my understanding. Rune can correct me if I have misunderstood.

On Continental Resources well costs in their Dec 2013 investor presentation (see slide 11 of link below), they forecast 7.5 million per well by the end of 2014. My model has well costs at 7.6 in Dec2014 and 7.0 in Feb2016:

http://investors.clr.com/phoenix.zhtml?c=197380&p=irol-presentations

click on link to December 2013 Presentation.

These forecasts may well be optimistic and even if continental gets to these levels in the ND Bakken, all companies may not be able to match these levels.

So far, the rest of the industry has been a year behind continental on well costs, if the chart above is accurate (investor presentations tend to stretch the truth).

DC

Euan, I have just posted, above, chart of World production less US and Canada as you requested.

Ron, thanks for that. It’s not as dramatic as I might have guessed – that’s why its good to have the pictures. Canada a much smaller producer with steady production gains since at least 94, doesn’t have the same impact as the U turn in big brother to the South.

Ron,

What data did you use for Canada, JODI or EIA? As we have discussed before the JODI data, may give us some idea, but there is a lot of bad data in the JODI database and it is a huge amount of work to clean it up. A useful exercise, to convince those who may tend to discount JODI data altogether, might be to put the EIA data on the same chart as the JODI data, if it matches up pretty well through July 2013, that would give one more confidence in the JODI data.

DC

The British Government can tell me the exact individual responsible for reporting UK data to JODI but they do not know where the EIA, IEA or BP get their data from – a lot of it goes via IHS.

There are some huge discrepancies between EIA and IEA for some countries. I’m using EIA at present cos it’s user friendly XL spread sheet, but so far behind the curve at present I’m thinking of migrating to JODI.

If you add up the forecasted levels of LTO in the AEO2014 early release over the 2011 to 2040 period they expect 44 Gb of LTO production. Recent USGS estimates put the ND Bakken at 11.4 Gb at the 5 % probability level. If we add about 4 Gb for 2011 proven reserves in Bakken, Eagle Ford and Permian Basin(most recent EIA estimate is 2011) and undiscovered LTO resources at about 6 Gb, and we triple this estimate to 18 Gb (to be exceedingly optimistic) then we could come up with 33.4 Gb(11.4+4+18) for US LTO. This still falls 11 Gb short of the EIA estimate. Of course the EIA estimate is unlikely to drop to zero in 2041 for US LTO output, so a realistic guess for the TRR behind their model is likely to be 54 Gb (44Gb+10Gb output 2041-2073).

Bottom line, the EIA’s AEO 2014 early release took an already overly optimistic AEO 2013 LTO forecast and made it 21 Gb higher raising it from about 33 Gb (AEO2013) to 54 Gb (AEO2014 early release).

It would be interesting if the USGS reassessed the other LTO plays in the US, remember that the April 2013 assessment approximately doubled the undiscovered TRR from 3.65 Gb to 7.4 Gb (mean estimate). I used the F5 (5% probability that there will be more than this and 95% probability that there will be less) case of 11.4 Gb for the Bakken/Three Forks, which is about 3 times the previous estimate. Doing the same (tripling) for the rest of US LTO brings us to 29.4 Gb and adding proven LTO reserves and output before 2011 gets us to 33 Gb. It is likely that there is a 95% probability that US LTO will be less than 33 Gb, but the EIA forecast is at least 44 Gb and probably 54 Gb when output after 2040 is included.

DC

It is likely that there is a 95% probability that US LTO will be less than 33 Gb, but the EIA forecast is at least 44 Gb and probably 54 Gb when output after 2040 is included.

Dennis, do you have any idea how the EIA, IEA, BP, etc. come up with their URR numbers? Do they simply estimate the volume of the oil bearing strata and multiply this number by an assumed average percentage of oil within this strata? Of course they would also have to estimate the volume of oil withing this strata that will be recovered. So it looks like three guesses multiplied by each other.

Frugal,

The short answer is no, I don’t know where they get their numbers.

It is definitely a lot of estimation. To get a feel for how the USGS did their most recent estimate there are two good papers at the links below (kind of heavy reading though.)

http://pubs.usgs.gov/fs/2013/3013/fs2013-3013.pdf

http://pubs.usgs.gov/of/2013/1109/OF13-1109.pdf

DC

Ron, your first chart is quite fantastic. Someone needs to crunch the numbers. You guys used to have about 2000 rigs (mainly land rigs). Having drilled the sh*t out of shale gas, a couple of years ago most migrated to drill shale oil. Are 2000 rigs enough to produce chart 1? Are you building more rigs? Is the plan to go to 3000, then 5000? Teachers leave school chasing high wages in The Bakken?

And so what happens to gas production and price in the interim? Once the fracking crews and pipelines catch up and then suddenly there’s no new wells to hook into the system.

At some point drilling technology improvements will peak out, and the quality of resource drilled will begin to decline.

Hi Euan,

Quite a lot of the LTO increase has been from the Eagle Ford and North Dakota(ND) Bakken/Three Forks where there is a total (in the two plays together) of between 400 and 450 oil rigs according to Baker Hughes, my models suggest the ND Bakken and Eagle Ford will peak at around 2.8 million bpd in 2016+/- 1 year. The rest of the LTO in the EIA forecast in the near term is from the Permian Basin, which if it can maintain present levels of output adds about 1.3 MMbpd, that gets us to 4.1 MMb/d if Permian output is maintained until the ND Bakken and Eagle Ford peak. Other plays such as the Montana Bakken, Niobrara, and others will contribute in total maybe 0.5 MMb/d by 2016, which would get us to 4.6 MMb/d by 2016 (the EIA has US LTO at 4.5 MMb/d in 2016), beyond that I question if other LTO plays will be able to fill the gap left by the rapid decline we will see in ND Bakken and Eagle Ford output in the 2016 to 2020 time frame.

To finish the rig part of the comment there are another 450 oil rigs in the Permian Basin (about 75% of these rigs are vertical rigs) so about 1000 oil rigs running in the LTO sector (450+450+100 from Niobrara). Also the economics could work out so that the Bakken and Eagle Ford rigs move to other areas after the peak, the question in my mind is, “will they find significant amounts of oil in the other tight oil plays?” Time will tell, but I do not think it will be as much as the EIA believes.

DC

More great stuff Ron and Steve!

Thanks!

Here is Bakken (really ND) data:

Sorry for misalignment!

EF only increased by 3mmbl/d (1255-1252) from November to January (2 months). Bakken only increased by 8k MOM in October. My guess is US shale oil peaks in fall 2014 at the latest as Bakken and EF are the two primary US shale plays and they are both peaking now..

Coolreit, the [pre] -[/pre] function works. Just replace the brackets with chevrons..(<)

Nov 2013 and Dec 2013 corrected to Nov 2012 and Dec 2012.

Thanks clifman!

DC

Note that the months listed are reporting months — for 2 months prior. So July’s report is for May.

I’d suggest this matters because of the on site tanks and the trucks that ship the tank contents. Those tanks fill during bad weather and an arriving truck can drain that tank faster than the well flows. If the tank were empty or partly empty, the filling of the truck is slower . . . waiting for flow from the well itself.

So without question the fracking trucks are hit by weather because we can see the additional well count take a hit in bad weather. But flow from already producing wells also is hit, and surges when good weather arrives.

Watcher,

I think you are incorrect. When the NDIC reports data for July output, it is their estimate for July output, it gets revised every month at the statistics link as better estimates come in. See

https://www.dmr.nd.gov/oilgas/stats/historicaloilprodstats.pdf

At the link above we get oil production statistics for all of ND, if we want Bakken/Three Forks oil production data we use:

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

Oh my bad, the data does explicitly label for 2 months before the announcement. So the label is right.

Coolreit,

Why use ND data instead of ND Bakken data when the ND Bakken data can be found at

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

Also remember that the Eagle Ford “data” in the DPR is an estimate after May 2013, the EIA estimates may be correct, or not and the Bakken and Eagle Ford may peak in 2014 or not, Ron thinks 2015, I can see 2016 as my best guess, but I don’t think anybody really knows. It depends on the extent of the sweet spots and how successful the attempt is to increase well density in the sweet spots. I could easily see a peak in 2015(as Ron predicts) followed by a short plateau, but I will be surprised if it lasts for 5 or 6 years, it depends a lot on how productive the “other LTO” plays are in the US. If we mostly get our LTO from the Bakken/Three Forks, Eagle Ford, and Permian basin and the rest of the US LTO is a bust, we will see a pretty short peak and decline in the 2014-2016 time frame. That is the pessimistic forecast, these types of forecasts have often been wrong in the past. They are bold, just as the EIA forecast in the AEO 2014 early release is bold (on the optimistic side), reality is often boring.

DC

DC:

Thanks. I did not know about that better data.

This is confusing. Are the Nov & Dec shown from 2012, rather than ’12? Given the prod.sequence, that would make a lot more sense…

Meant, of course, rather than ’13…

Clifman,

Thanks you are correct. So I corrected the table to 2012 rather than 2013 for Nov and Dec.

DC

Euan,

We just saw the all time record high weekly natural gas (NG) storage decline in the US, down 285 BCF in one week.

Note that the decline rate from existing wells is much higher now than at the start of the shale gas/oil boom, because such a high percentage of NG production is coming from high decline rate tight/shale plays, and we are also declining from a higher production base. So, the industry has to drill more wells now than they did in the early stages of the shale gas boom, in order to offset declines from existing wells, at the same time that the rigs are in demand for wet gas and oil plays.

Earlier this year, Citi Research estimated that the decline rate for existing US NG production* is about 24%/year, and they estimate that we need about 17 BCF/day per year of new production (from all sources) just to maintain the current NG production rate. To put this in perspective, the EIA shows combined dry NG production from the UK + Norway to be about 15 BCF/day in 2012.

*This would be the year over year decline from 2013 to 2014 if no new wells were completed in 2014.

Jeff, its a fascinating story to follow. But very time consuming to follow LTO, shale gas, rigs etc. I gather you guys are pressing ahead with building LNG export facilities. Dave Hughes’ production stack for US shale gas already shows signs of topping out. As far as I can tell from afar, US has enough rigs to keep either oil or gas increasing, but not both. Rigs will not migrate back to gas until the price dictates that they do so.

Probably been posted before but worth repeating:

http://static.cdn-seekingalpha.com/uploads/2012/9/30/121744-1349015645052574-Mark-Anthony.jpg

Ed,

Thanks, I had not seen that chart before, once the Marcellus levels off, Natural Gas may begin to decline. Though as Euan suggested, a rise in natural gas prices may change things. It is difficult to tell how much a rise in prices will effect the ratio of gas rigs to oil rigs, from a business perspective I would think it would depend on the relative profitability between oil and nat gas drilling at forecasted prices for oil and natural gas. At some point, prices of oil and natural gas rise to a level that people begin to switch to fuel cells, ground source heat pumps and maybe even district level combined heat and power units to increase energy efficiency, as well as using more wind and solar where appropriate.

DC

Ed, this is the killer chart. I think Cabot have drilled something that resembles more a conventional gas field in Marcellus than genuine shale gas. Fracked it and got gushers. And some are extrapolating that across the USA. But the drilling fleet has gone, and won’t return until nat gas prices / shale gas economics converge with that for the liquids plays.

How Jeffrey Brown’s oil export model is working in Venezuela:

Desperate to Boost Oil Production, Venezuela Moves to Devalue Currency

Oilprice – December 21, 2013

This article was written by Oilprice.com, the leading provider of energy news in the world.

On December 16, 2013, Venezuelan President Nicolas Maduro outlined plans to use a weaker exchange rate in order to lift the prospects of its ailing oil sector and deal with a worsening economic crisis. Venezuela’s foreign exchange reserves have depleted to their lowest levels since 2004. The weaker exchange rate allows the government to earn more Bolivars for every barrel of oil sold, which is priced in dollars on the international market.

The measure appears to apply only to oil transactions. The official exchange rate in Venezuela is 6.3 Bolivars per dollar, while the alternative exchange rate used for oil sales hovers near 12 Bolivars per dollar, according to the Wall Street Journal. Unofficially, exchange rates on the black market often mean people pay as much as 60 Bolivars for every dollar.

The de facto currency devaluation comes as the economy continues to deteriorate. Yields on Venezuela’s sovereign debt reached 15% in early December. Standard & Poor’s and Moody’s Investors Service, two credit rating agencies, both downgraded Venezuela’s credit rating in mid-December, citing “growing radicalization of the economy.”

The battered economy has also pushed President Maduro to consider raising gasoline prices. Heavy government subsidies result in Venezuelans paying some of the lowest prices at the pump in the world – around 5 cents per gallon. Subsidies are not only expensive for the government, but they also discourage efficiency, and higher domestic consumption eats into potential exports. Slashing subsidies will reduce this enormous fiscal burden, which can cost the government around $12.5 billion per year.

However, Maduro is in a bind because raising gasoline prices and devaluing the currency will only exacerbate inflation, already running at around 54% per year. Stoking inflation will squeeze the Venezuelan people further, already reeling from unemployment and shortages of food.

President Maduro has sought to maintain a grip on all powers of government, following in the footsteps of the late Hugo Chavez. On November 19, the Congress passed, and Maduro signed, a law that grants the President power to rule by decree for the next year. He argues the powers are needed to clean out corruption and reduce the harmful influence of capitalist forces. Buoyed by the populist maneuver, Maduro’s party won municipal elections on December 8, which has given him enough political capital to pursue risky maneuvers to head off a worsening economic crisis.

The Maduro government is entirely dependent on its flagging oil industry. Venezuela holds the second largest oil reserves in the world at 211 billion barrels. Oil represents 95% of export earnings and about half of budget revenues. Yet Venezuela’s oil exports have declined by nearly half since peaking at 3 million barrels per day in 1997. Natural decline of the nation’s oil fields is a contributing factor, but the mismanagement of Petróleos de Venezuela (PDVSA), the state-owned oil company, is the greater reason for decline.

Venezuela Net Petroleum Exports

Source: EIA

In late November, Citigroup published a report concluding that Venezuela presents, “probably the biggest bull risk to the oil market in 2014 outside of the MENA [Middle East and north Africa] region.” Venezuela is struggling to pay its debts, and the government is pillaging PDVSA’s coffers as it searches for cash. Without money to invest in its oil fields, even if Venezuela can avoid a more acute crisis, such as debt default or a coup, its oil output will decline over the long-term.

http://m.fool.com/investing/general/2013/12/21/desperate-to-boost-oil-production-venezuela-moves

Robert Rapier who will be familiar to just about everybody here as a regular at now dormant The Oil Drum has a very good article up at Energy Trends Insider about the transportation of oil to market dealing mostly with Canadian oil sands – but it touches on some US production too.

http://www.energytrendsinsider.com/2013/12/16/how-bitumen-gets-to-market/

I think all the regulars here will find it useful in gaining insight into the future of both Canadian and US production.

My layman’s take away is that if the Keystone Xl doesn’t get built – and right now it looks as if it won’t, ever- A lot of US production will be permanently dependent on trains since our own production is expected to peak and decline to soon to support building a pipeline.

Hi Old Farmer Mac,

I understood RR’s post a little differently, I think he spent a lot of time discussing how other pipelines besides the Keystone XL will be built, and that trains will be used in the mean time. You are correct that the remote shale plays (ND Bakken) will be dependent on trains for transporting oil. The oil sands, will be longer lasting and pipelines will be built.

DC

I fully agree.

Folks… I actually think we are going to see much different overall production figures from these Shale Fields than many have forecasted. As Euan states, the U.S. doesn’t have the drilling rigs to increase both Oil & Gas production. Furthermore, I believe as these companies add new wells further away from the sweet spots, production will turn out to be much lower than expected.

While I realize this is a Peak Oil Blog, I have been looking at some very interesting CLIMATE DATA that has been recently released. I am one who believes there is climate change taking place, however I thought it was HYPED and severely over-rated.

After looking at the Data coming from NASA’s CARVE project as well as some of the data being released from the two Russian scientists (Shakhova–Semiletov) on the Siberian Ice Shelf, methane release is increasing significantly in the Arctic regions in just the past several years.

Nasa’s CARVE project just released data this summer showing huge methane plumes coming from the Arctic Ocean at over 150 km wide.

From many of the scientists now looking at better data and more sophisticated modeling, there is a real threat that methane gas release could go exponential. The real threat of increased global warming is no longer from Carbon emissions, but rather Methane.

Well, anyhow… thought I’d share that. Probably most have already come across this data, but I found it quite alarming to say the least.

steve

Hi Steve,

There is a great deal of uncertainty about aerosol emissions and their effect on global warming. The effect of the CO2 is well understood, there is also variability from PDO (the Pacific Decadal Oscillation) which is hard to predict and effects global temperatures.

The short story here is that depending on whether we are in an El Nino or La Nina stage, in some cases a lot of the excess warming is stored in the ocean and in others it shows up in the atmosphere as a measured temperature increase.

See http://www.realclimate.org/index.php/archives/2013/12/the-global-temperature-jigsaw/

for a much clearer explanation from a climate expert.

Back to aerosols. The huge increase in aerosols released by Chinese coal use may be masking some of the expected warming, but the size of the contribution of aerosols in cooling the atmosphere, is not well understood. It is very difficult to reduce the amount of CO2 in the atmosphere once it is there, so the question is do we assume the aerosol contribution is at the low end of the range of estimates or at the high end.

Back in the day, when a civil engineer was uncertain about how the dynamic forces might effect the safety of those travelling over a bridge, they would over build the bridge by a factor of 2 or 3, just to be safe. It seems to me that in the face of uncertainty about exactly how large the effect of global warming may be, it would be better to err on the side of caution.

http://www.realclimate.org/index.php/archives/2013/11/arctic-and-american-methane-in-context/

The link above covers the Methane issue, bottom line, it is not likely to be a problem. The thing we need to worry about is carbon dioxide emissions, they need to be reduced as quickly as is feasible.

DC

2013 marks the 17th year of no warming on the planet. Almost everything that could go wrong did go wrong for the cause of global warming. 2013 was the best of years for climate skeptics; the worst of years for climate change enthusiasts for whom any change – or absence of change — in the weather served as irrefutable proof of climate change. That governments and the public would abandon the duty to stop climate change was in their minds no more thinkable than Hell freezing over. Which the way things are going for them, may happen in 2014. –Lawrence Solomon, Financial Post, 20 December 2013

http://i.dailymail.co.uk/i/pix/2013/09/28/article-0-185ABB0700000578-394_634x325.jpg

As the Anthropogenic Global Warming boondoggle continues to collapse, the Greens and others complicit in the warming alarmist industry are busily looking for reasons for their failure to convince people of the validity of their message. It’s called crying Wolf, repeatedly, the Greens simply don’t comprehend that after decades of failed predictions of looming environmental holocaust, people are bored of the CO2 wolf that never comes. Like all good scams and totalitarian ideologies the suppression of dissent and discussion was of a paramount importance to keep the public with the Green message. The Greens and warmists always knew that their story would never stand up to public scrutiny and debate which is why they worked so hard to suppress dissent and smear the opponents with labels like “Denier”. –Tory Aardvark, 17 December 2013

Global sea ice area is the second highest on record for Dec 16th, and the highest since 1988. For most of this year, it has been above the 1979-2008 mean. –Paul Homewood, Not A Lot Of People Know That, 19 December 2013

http://notalotofpeopleknowthat.files.wordpress.com/2013/12/image_thumb47.png?w=520&h=314

OK, this is probably going to be the most boring interview I’ve ever done. And I probably shouldn’t even do it because it’s kind of a losing proposition, but I will because I think this issue of climate change is truly important, and that it is a major tragedy how poorly it’s been handled. The boredom [is] so purified and crystalized it’s in an unadulterated form that could make even a robot want to commit suicide. –Randy Olson, Spiegel Online, 20 December 2013

Last month we told you about John Beale, the Environmental Protection Agency employee who bilked taxpayers out of almost $900,000 by pretending to be a secret agent. Telling EPA colleagues that he was a CIA operative, Beale was paid for long absences while on imaginary missions for “Langley.” Now there is a disturbing new question about John Beale that goes to the heart of the EPA’s mission. Are we now supposed to believe that in contrast to his other lies, the work Beale chose to perform at EPA is the product of careful and honest analysis? What Congress needs to examine is whether the policies that the head of EPA says were shaped to a large degree by Beale were also based on fraud. –The Wall Street Journal, 19 December 2013

Surprise! The media still doesn’t want to discuss climate change that much. A new FAIR survey looking at top national news networks found that while reports of extreme weather dominated the media in 2013, networks failed to include hardly any mention of human influence. A study in August revealed that the more time viewers spend consuming conservative news, the more likely they are to become skeptical of climate science. –Catherine Taibi, Huffington Post, 18 December 2013

Critics are slamming Reddit over a single moderator’s decision to ban climate-change skeptics from contributing to its science forum, attacking the move as “political censorship.” In an op-ed titled “Reddit’s science forum banned climate deniers. Why don’t all newspapers do the same?” Nathan Allen explained his decision to wipe comments from some users he dismissed as “problematic.” Allen called for other news outlets to follow his example, asking “if a half-dozen volunteers can keep a page with more than 4 million users from being a microphone for the antiscientific, is it too much to ask for newspapers to police their own editorial pages as proficiently?” –Adam Shaw, Fox News, 19 December 2013

http://wattsupwiththat.com/2013/12/20/newsbytes-for-global-warming-campaigners-2013-was-the-year-from-hell/#more-99655

As before Anthony Watts is not a particularly “untainted” source for information on climate change. Try realclimate or context earth for better information.

http://www.realclimate.org/

http://contextearth.com/

I am not convinced.

Do you realize that the sea ice in the arctic refreezes in the winter? And that the melting in the Antarctic likely does not reach its minimum until mid-March, so the amount of sea ice on Dec 16 means relatively little? The other stuff is of very little interest, to the global warming argument.

http://en.wikipedia.org/wiki/Anthony_Watts_(blogger)

DC

DC: With all of your sophisticated models and knowledge, you prefer to label people who disagree with you as “not a particularly “untainted” source for information”.

Hi Coolreit,

In an earlier conversation you had mentioned “tainted” data, so that was in reference to your previous use of that term. I do not take the stuff on Watts blog seriously. If you do, that is your prerogative, we can simply agree to disagree. You are unconvinced by preferred blogs covering the subject such as real climate and context earth. Our individual understanding of science may well be different, the many skeptical talking points have been debunked to my satisfaction. I will leave it at that.

DC

Coolreit,

While you bring up the typical response from the other side of the climate change debate, the real issues are worse than ever. Even though land-surface temperatures have not increased since 1998, the warming has gone into the oceans. This is not a good thing as warmer water is making its way up to the Arctic Sea and melting the ice and releasing the methane hydrates.

Secondly, as climate change goes into hyper-drive, the Jetstream breaks down and becomes increasingly volatile. Thus, the reason for the record cold temperatures and snow in places that it shouldn’t be.

There will be more record cold temperatures as well as higher temperatures during climate change. 100 year old citrus trees in Tucson died because it got too cold in the past few years. This is due to climate change.

Lastly, as more methane hydrates breakup and release methane in the atmosphere, the more the oceans will heat up…. rinse and repeat.

steve

Dennis,

While the consensus has been that CO2 is the overwhelming factor in the increase of global temperatures since 1850, the new understanding is in the forecasted rapid release of Methane in the future by studying releases in the past. I am not going to link the video’s or articles here, but the earth has seen a rapid 6-8 C increase in just a few decades.

They have recorded the rapid increase of global temperatures going back millions of years and found that the increase of Methane emissions not Carbon paralleled the temperature rise more closely.

According to Guy McPherson’s recent presentation which he gave at DePauw University in Indiana on Oct 3, 2013, (okay just one link found below), there have now been 24 positive climate feedback loops since 2010.

2010 = 1

2011 = 4

2012 = 6

2013 = 13

Guy McPherson’s presentation: http://guymcpherson.com/recent-video/ – TOP VIDEO

The two Russian scientists that I mentioned are very concerned at what they see taking place at the Siberian Ice Shelf. Basically, everything taking place there in the past 2-3 years is quite anomalous.

This goes above and beyond forecasts of 1-2 C global warming by 2100. Again, these scientists who are studying the Arctic are quite alarmed at the rapid increase of methane emissions from the permafrost and methane hydrates in the arctic ocean and Siberian Ice Shelf.

I will leave it at that as I plan on exploring this in detail at my SRSroccoReport.com website in the future.

steve

Hi Steve,

The guys at real climate are experts on climate change. Guy McPherson may be a smart guy, but climate change is not really his area of expertise. Did you read the article I linked?

http://www.realclimate.org/index.php/archives/2004/12/stefan-rahmstorf/

If you compare the credentials of Dr McPherson with Dr Ramsdorf with regard to climate change, you would want to pay attention or at least listen to the views of Dr. Ramsdorf.

http://en.wikipedia.org/wiki/Stefan_Rahmstorf

Alas no Wikipedia page for Dr McPherson, but I checked his publications at his blog, climate change is not really his field.

DC

Dennis,

Yes, I have checked out that link and have read many articles on the RealClimate.com site. They tend to be a bit more conservative. While it is true that McPherson is not a climate scientist, his specialty is taking the scientific publications on climate change and putting it all together.

That being said, I believe there are a good number of excellent scientists at the AMEG – Arctic Methane Emergency Group site that are very concerned at the “Real Data” and “Actual Evidence” that is coming from the areas that THEY are doing the research.

Here is the listing of scientists at AMEG that DO study climate and weather:

Ed Dlugokencky, PhD, National Oceanic and Atmospheric Administration (NOAA), US

Michel Halbwachs, Professor of Physics, University of Savoie, France

Veli Albert Kallio, Chairman of the Frozen Isthmuses Protection Campaign, UK/Finland

Jon Egill Kristjansson, Professor of Meteorology, Oslo University, Norway

Mike MacCracken, PhD, Chief Scientist for Climate Change, Climate Institute, Washington, US

David Mitchell, Associate Research Professor, Division of Atmospheric Sciences, DRI, US

Brian Orr, PhD, former Principle Scientific Officer, Department of the Environment, UK

Stephen Salter, Emeritus Professor of Engineering Design, Edinburgh University, UK

Natalia Shakhova, PhD, International Arctic Research Center, University of Alaska, US

Igor Semiletov, PhD, International Arctic Research Center, University of Alaska, US

Peter Wadhams, Professor of Ocean Physics, Cambridge University, UK;

Leonid Yurganov, PhD, Department of Physics, University of Toronto, Canada

steve

Yep,

You are correct, all experts. You would admit they are kind of out of the mainstream? I guess I am a conservative in this regard, overstate the case and you are not taken seriously.

Let’s say they are correct, the solution is the same, reduce global warming as rapidly as possible, so far methane levels have not risen much. Let’s focus on a problem that can be fixed (CO2 emissions).

What is the alternative?

DC

DC,

If an individual watched McPherson’s presentation, they would have heard he state from a scientific publication that the carbon level in the atmosphere today, will likely stay at this level for the next 1,000 years.

Basically, there is no way to lower this amount for quite a long time. The only place we have a chance, is to mitigate future carbon & methane emissions by massive geo-engineering projects.

However, it seems as if it is too late for anything to be done to stop what seems to be the beginning stages of a runaway event.

Here is one short video interview of Prof Natalia Shakhova on the Rapid Release of Methane Hydrates from the East Siberian Arctic Shelf:

http://www.youtube.com/watch?v=kx1Jxk6kjbQ

steve

Steve,

I must not be stating my position clearly. 400 PPM of CO2 is a problem, 450 PPM is more of a problem. What do the people who think catastrophic methane release is likely, propose as a solution?

Do they think reducing carbon emissions will make matters worse?

Isn’t part of the solution to methane, to keep warming as small as possible? Would 3 C be better than 2 C? There are some things that would help absorb CO2, there is a concrete that takes up CO2, there are land use changes which could help. The main thing is to reduce our consumption of fossil fuels, it may not be enough, but it will help and the more quickly we do it the better.

What does the AMEG propose as a course of action?

DC

DC,

I encourage anyone to check out the AMEG website. They propose huge geo-engineering projects that make the Manhattan project seem like a high-school science fair.

Again, new research shows that it will be difficult to lower Carbon concentrations in the atmosphere to make a difference. The only chance we have now is to stop further releases by these massive geo-engineering.

To some, it looks we have run out the clock. The rapid destabilization of the East Siberian Arctic Shelf as well as the forecasted ice free Arctic Ocean by Summer of 2015 points to a system that is no longer controllable.

Basically….. Nature Bats Last as McPherson calls his site.

steve

Hi Steve,

Ok, I definitely disagree with massive geoengineering projects to solve the problem. In many cases human solutions to problems create bigger unforeseen problems.

Attempting to hold the line (or reduce gradually) the present greenhouse gas levels is the best approach in my opinion, and in the opinion of the majority of climate scientists.

I also think that if the case for global warming is overstated (runaway methane release), the public reaction is either oh well there is nothing we can do so don’t worry, or those smart guys will come up with some technofix in the future and everything will be ok.

Neither gets us to do what needs to be done, which is to reduce fossil fuel use as quickly as possible. If more needs to be done, then CO2 could be captured and converted to calcium carbonate, though this would be expensive, or pumped under ground(also expensive). Changes in farming methods and less clearing of forests would also help to take up CO2, if those types of geoengineering are what you mean, that would be fine. All of this is pretty unlikely, as we cannot get many people to think that there is any global warming problem at all(because the excess energy is being stored in the ocean). I guess I am more conservative than I realized. Again, I will just have to agree to disagree.

I think your position may be, that the time for half measures is gone, we have to act decisively.

My position, we have to act.

US Population position, those scientists don’t know the answer let’s wait until we have proof.

DC

DC,

I agree with you 100%. I don’t think geo-engineering projects would help.. probably cause more harm.

There is a great interview by someone who is probably one of the best minds on the Methane-Arctic issue. Paul Beckwith did a recent interview where he explains how the warming Arctic will impact weather and climate.

http://www.ecoshock.info/2013/12/why-is-weather-so-crazy.html

It is the very top interview link. As for me, I believe that we have run out the clock. The climate system is now in a runaway mode.

steve

Steve,

Agreed.

Dennis

From the methane hydrate video:

“Everything looks anomalous….That makes me think the worst thing might happen…We do not like what we see there. Absolutely. Do. Not. Like.”

I listened to the talk. She said, “There is a POTENTIAL RISK that IF WARMING CONTINUES, the larger ??? massive amount of methane could be released” She continues, ” It MIGHT POTENTIALLY happen”..”might happen”.

Well, that sure sounds like scientific wisdom! It has not even warmed for 17 years, but we have to worry IF IT WARMS as we enter solar cycle 24.

Have you listened to the four esteemed scientists who just presented the contemporary science at the American geophysical Union? They said we are entering solar cycle 24 which corresponds to a cycle that occurred 100 years ago (hint snow in the mideast a week ago – that last happened 100 years ago). You should listen to that. It’s going to much colder for a dozen years!

For what it is worth, here is the latest data we have on actual global climate. For those interested you can find my post on the “Dixie cup world”.

Global Analysis – November 2013

• The combined average temperature over global land and ocean surfaces for November 2013 was record highest for the 134-year period of record, at 0.78°C (1.40°F) above the 20th century average of 12.9°C (55.2°F).

I apparently did not type in the hyperlink correctly. I won’t try to put in the hyperlink a second time. Here is the web address:

http://www.ncdc.noaa.gov/sotc/global/2013/11/

To allow more levels of commenting people may want to reply one level up. so in this case if there are no intervening comments to cause confusion I click the reply link to CaveBio’s previous comment but it appears below his reply to himself so the conversation remains readable. Call it “conservation of reply levels”.

In general on a wordpress blog if you have an {//http:} the blog adds the needed html to create the link. It seems if you attempt to add the appropriate tags the link does not work.

DC

Steve:

I am so impressed with your contributions on your blog and elsewhere, but you demean critics by suggesting they are not of the consensus opinion on global warming or now what is called called climate change.

The ice isn’t melting beyond the norms:

http://wattsupwiththat.com/2013/12/20/newsbytes-for-global-warming-campaigners-2013-was-the-year-from-hell/#more-99655

The global temperatures have been flat for the last 17 years:

http://i.dailymail.co.uk/i/pix/2013/09/28/article-0-185ABB0700000578-394_634x325.jpg

Coolreit,

I have gone back on my word here by continuing with this topic. However, I am not demeaning critics… I am just stating that the trend is much worse when we look at ALL the Data.

The huge increase of ice in the Arctic Ocean in 2013 over 2012 is not a success story for the deniers, it is an attempt at rebalancing by the system. Unfortunately, that huge increase of ice y.o.y does not describe the age of the ice. A good portion of the Arctic Ice used to be over 5 years old. Now the majority of it is only 1 year old.

You keep bringing up the peak of Land Surface temperatures since 1998 as another reason why global warming is not occurring. I told you that it has moved into the oceans (especially deep ocean) since 1998. The planet did not stop warming… it just went into the oceans for the past 17 years…. and that’s not a good thing.

Why? Because that is where methane hydrates are stored. There are recent charts showing some of the most extreme high temperatures in the Arctic, it would shock you. While land surface temperatures have not risen on the planet as a whole since 1998, the Arctic is getting very hot (for the Arctic)… and this is where the problematic store of methane hydrates are located.

I will be discussing this on my blog in the beginning of the year. I don’t want to continue anymore on this subject as its not in line with the subject of Ron’s site.

steve

Cool Reit,

You seem to be in the habit of considering disagreement as “demeaning”. Steve was quite respectful, unless

“While you bring up the typical response from the other side of the climate change debate…” is considered demeaning?

DC:

Maybe, it was a poor choice of words. If so, I apologize to Steve.

However, it is ever so frustrating when you and Steve choose omnipresent words from the global warming disciples such as “deniers”, “consensus” etc. to determine fact.

Would the 31,487 scientists including who doubt the existence of global warming be called consensus? In any case, science is not determined by consensus, but truth.

Coolreit, you can put me firmly in the camp with DC and Steve, there is a large consensus that global warming and climate change is caused by human activity. Also, that crap about 31,487 scientist doubting global warming is sheer nonsense.

Is there a scientific consensus on global warming?

The signers of that petition were just people. The petition claims that over 9,000 of them actually had a PhD. But there is not one word about how many were actually climate scientists. I worked with PhDs all my life and the vast majority of them knew from little to nothing about anything outside their discipline. That paper Global Warming Petition Project is the perfect example of the kind of nonsense that climate change deniers are spreading. It is pure crap!

Anyway as my first link spells out 97% of climate papers stating a position on human-caused global warming agree global warming is happening and we are the cause.

Qualifications of Signers

Signatories are approved for inclusion in the Petition Project list if they have obtained formal educational degrees at the level of Bachelor of Science or higher in appropriate scientific fields. The petition has been circulated only in the United States.

The current list of petition signers includes 9,029 PhD; 7,157 MS; 2,586 MD and DVM; and 12,715 BS or equivalent academic degrees. Most of the MD and DVM signers also have underlying degrees in basic science.

All of the listed signers have formal educations in fields of specialization that suitably qualify them to evaluate the research data related to the petition statement. Many of the signers currently work in climatological, meteorological, atmospheric, environmental, geophysical, astronomical, and biological fields directly involved in the climate change controversy.

The Petition Project classifies petition signers on the basis of their formal academic training, as summarized below. Scientists often pursue specialized fields of endeavor that are different from their formal education, but their underlying training can be applied to any scientific field in which they become interested.

Outlined below are the numbers of Petition Project signatories, subdivided by educational specialties. These have been combined, as indicated, into seven categories.

1. Atmospheric, environmental, and Earth sciences includes 3,805 scientists trained in specialties directly related to the physical environment of the Earth and the past and current phenomena that affect that environment.

2. Computer and mathematical sciences includes 935 scientists trained in computer and mathematical methods. Since the human-caused global warming hypothesis rests entirely upon mathematical computer projections and not upon experimental observations, these sciences are especially important in evaluating this hypothesis.

3. Physics and aerospace sciences include 5,812 scientists trained in the fundamental physical and molecular properties of gases, liquids, and solids, which are essential to understanding the physical properties of the atmosphere and Earth.

4. Chemistry includes 4,822 scientists trained in the molecular interactions and behaviors of the substances of which the atmosphere and Earth are composed.

5. Biology and agriculture includes 2,965 scientists trained in the functional and environmental requirements of living things on the Earth.

6. Medicine includes 3,046 scientists trained in the functional and environmental requirements of human beings on the Earth.

7. Engineering and general science includes 10,102 scientists trained primarily in the many engineering specialties required to maintain modern civilization and the prosperity required for all human actions, including environmental programs.

The following outline gives a more detailed analysis of the signers’ educations.

Atmosphere, Earth, & Environment (3,805)

1. Atmosphere (579)

I) Atmospheric Science (112)

II) Climatology (39)

III) Meteorology (343)

IV) Astronomy (59)

V) Astrophysics (26)

2. Earth (2,240)

I) Earth Science (94)

II) Geochemistry (63)

III) Geology (1,684)

IV) Geophysics (341)

V) Geoscience (36)

VI) Hydrology (22)

3. Environment (986)

I) Environmental Engineering (487)

II) Environmental Science (253)

III) Forestry (163)

IV) Oceanography (83)

Computers & Math (935)

1. Computer Science (242)

2. Math (693)

I) Mathematics (581)

II) Statistics (112)

Physics & Aerospace (5,812)

1. Physics (5,225)

I) Physics (2,365)

II) Nuclear Engineering (223)

III) Mechanical Engineering (2,637)

2. Aerospace Engineering (587)

Chemistry (4,822)

1. Chemistry (3,129)

2. Chemical Engineering (1,693)

Biochemistry, Biology, & Agriculture (2,965)

1. Biochemistry (744)

I) Biochemistry (676)

II) Biophysics (68)

2. Biology (1,438)

I) Biology (1,049)

II) Ecology (76)

III) Entomology (59)

IV) Zoology (149)

V) Animal Science (105)

3. Agriculture (783)

I) Agricultural Science (296)

II) Agricultural Engineering (114)

III) Plant Science (292)

IV) Food Science (81)

Medicine (3,046)

1. Medical Science (719)

2. Medicine (2,327)

General Engineering & General Science (10,102)

1. General Engineering (9,833)

I) Engineering (7,280)

II) Electrical Engineering (2,169)

III) Metallurgy (384)

2. General Science (269)

http://www.petitionproject.org/qualifications_of_signers.php

Good God, what a load of crap! The only ones on that list that study climate change would be “II) Climatology (39)”. Atmospheric Science, marginally but Meteorologists are weather men and women. And Astronomy! Do you have any idea what an astronomer does? They study other planets, black holes, other galaxies, comets and such.

And the rest of the list is not even remotely connected to climate science. Math, Metallurgy, and Medicine… 2,327 medical doctors, nurses and pharmacists in that group. And the list goes on, Zoology, Food Science, Animal Science… and the absurdity goes on and on. These disciplines have absolutely nothing to do with climate science or climate change.

And the list of names does not give any title or educational degree, just names. Were I a climate change denier I would be truly ashamed of that list.

I also don’t think you can question Professor Seitz’s qualifications:

Letter From Frederick Seitz

This letter from Professor Frederick Seitz is circulated with the petition. Physicist Frederick Seitz was President of the US National Academy of Sciences and of Rockefeller University. He received the National Medal of Science, the Compton Award, the Franklin Medal, and numerous other awards, including honorary doctorates from 32 Universities around the world. In August 2007, Dr. Seitz reviewed and approved the article by Robinson, Robinson, and Soon that is circulated with the petition and gave his enthusiastic approval to the continuation of the Petition Project. A vigorous supporter of the Petition Project since its inception in 1998, Professor Seitz died on March 2nd, 2008.

Also, did you see who started the petition? Edwin Teller:

http://www.petitionproject.org/index.php

From Wiki: Edward Teller (Hungarian: Teller Ede; January 15, 1908 – September 9, 2003) was a Hungarian-born American theoretical physicist[1][2][3] who, although he claimed he did not care for the title,[4] is known colloquially as “the father of the hydrogen bomb”.

Teller was truly a great man, a great theoretical physicist who died over ten years ago. His discipline had nothing to do with climate science and even if it did he just might have a different opinion if he were alive today. But the fact that this petition was started by a man who was not a climate scientists, and started well over a decade ago, speaks volumes about the list itself.

As Ron stated, having a degree in the sciences does not make yon expert on global warming, MD’s, vetrinarians, anyone with just a BS or MS, does not qualify as an expert in my opinion, PhDs in geophysics, mathematics, geochemistry are likely to be the only relevant degrees and in addition, those fields are very specialized and the degree itself does not make someone an expert. The petition is a smokescreen. The experts are the people with publications in relevant peer reviewed journals, that is where “the truth” is found.

DC

I guess you ignored this:

The following outline gives a more detailed analysis of the signers’ educations.

Atmosphere, Earth, & Environment (3,805)

1. Atmosphere (579)

I) Atmospheric Science (112)

II) Climatology (39)

III) Meteorology (343)

IV) Astronomy (59)

V) Astrophysics (26)

2. Earth (2,240)

The following outline gives a more detailed analysis of the signers’ educations.

I) Earth Science (94)

II) Geochemistry (63)

III) Geology (1,684)

IV) Geophysics (341)

V) Geoscience (36)

VI) Hydrology (22)

I feel like a heretic here now, but I am not alone. My friend and neighbor runs the NJ Aids testing program while he also teaches pathology at Robert Wood Johnson Medical Center. He is also both friends and patient of my cardiologist. That cardiologist is the grandson of one of the former leaders of the World Health Organization. Count him in as a heretic too!

As anecdote to this debate on alleged global warming, my friend worked for the Czech society of scientists for a number of years with his cardiologist. A few years back, then President of both the Czech Republic and simultaneously the rotating President of the European Union, Vaclav Klaus came to NY. Key Czech leaders came and dined at my favorite NY restaurant, Carmines at my recommendation. While dining, everyone was talking Czech, but my friend and the deputy defense minister were talking in English. After some time, Vaclav Klaus asked my friend what he and the defense minister were talking about. My friend said to Vaclav that his friend (me) doesn’t believe in global warming. Vaclav smiled and then directed his secretary to reach down and get his book. He signed it and gave it to my friend for me. In the first page of the book is a picture of Vaclav tied to a stake with firewood at the base. The gentleman holding a match next to him says to Vaclav, “Now do you believe in global warming!”

Vaclav Klaus speaks on alleged global warming:

http://www.firstthings.com/blogs/firstthoughts/2009/11/16/vaclev-klaus-vs-al-gore/

Vaclev Klaus, president of the Czech Republic, is a politician. That qualifies him as a climate scientist? My cousin Clem has opinions on climate science also. He is just as qualified as President Klaus on the subject, should I quote him?

So we should ignore 31, 487 scientists with 9,000 PhD’s in the widest variety of fields, a former President of the Rockefeller Institute, the father of the atom bomb, an MIT professor in climatology, a former IPCC lead scientist and everyone else who doubts the existence of anthropormorphic global warming!

For the last time, these are not all scientists. It is dishonest for you to imply that they are all scientists. Only a tiny fraction of them are actually scientists and an even smaller fraction of the scientists on the list are actually climate scientists.

And yes you can ignore all of them that are not climate scientists. Those that actually are climate scientists make up about 1% of all the climate scientists. And the vast, vast, majority of climate scientist do believe that climate change is caused by human activity.

Coolreit, you cannot just post a list of people from unrelated disciplines and imply that their opinions prove a point or. What an astronomer or a physician thinks about climate change carries no weight whatsoever in this scientific debate even though they can post Md, or PhD, after their names.

The very fact that they posted a list of names of people in a hundred totally unrelated disciplines and implied that these people’s opinions carried weight in this debate proves that the list is just pure junk.

Coolreit,

I know a lot of physicians, they are smart people who know very little about the science of global warming.

Also there are about 16.5 million US citizens with science, math or engineering degrees at the Bachelors, Masters, or Doctoral level, so about 0.24% of US science and engineering degree holders have signed the petition.

DC

On McPherson: Anyone who would speak at a “March against Monsanto” rally is not worth one’s time.

Coolreit,

Give it up dude. Take the rant to your hamsters. This is a wonderful blog about peak oil – can we please keep it on that subject? Please? You seem to have very intelligent things to say about oil, more than I do, which is why I’m a lurker and not a poster. But you are rapidly losing your credibility with your long rants denying global climate disruption. It makes you look silly and ridiculous, just so you know.

Hi Stephen,

Please, no name calling. I don’t agree with Coolreit’s position on climate change.

And I have probably not been as polite as I should be.

However everyone has a right to express their opinion. I would much prefer an open intelligent discussion where opposing views can be presented.

If we all agreed about everything, there would be little to discuss.

There are several different datasets on global temperature and there have been several problems in the past with the satellite data, but when these problems were corrected, good agreement between surface temperature data and satellite data is achieved.

http://nsstc.uah.edu/climate/2013/november/nov2013GTR.pdf

At the link above is the most recent report on satellite data from UAH where Spencer and Christy work. The temperature trend from Nov 16, 1978 (when the satellite temperature record begins) to the present is 0.14 C/decade, it has been 35 years or 3.5 decades since 1978, so over this 35 year period global temperature has risen 0.49 C. Other data sets show warming from 1880 to 1978 of 0.25 C, so total warming since 1880 is 0.74 C, pretty close to other data sets.

http://data.giss.nasa.gov/gistemp/graphs_v3/Fig.A2.txt

Data from the link above shows that the decadal temperature change for the GISS data from 1978 to 2012 was 0.16 C/decade which is pretty close to the UAH result.

If we smooth the annual data using an 11 year centered moving average and a 21 year centered moving average we see that when we look at the long term trend over the 11 year time frame suggested by Ben Santer, the “no warming for 15 years” goes away.

DC

Dealing with peak oil and global climate disruption is the most gigantic challenge humanity, and the world, has ever faced. Citing nitpicking reports funded by the most dubious of sources (Exxon and the Koch brothers for the most part, as we all know if you look just a tiny bit under the surface; see this SciAm article: http://www.scientificamerican.com/article.cfm?id=dark-money-funds-climate-change-denial-effort) to try and obfuscate the science that overwhelming proves that climate disruption is anthropogenic saps our will as a species to deal with this most pressing of all problems. The science behind climate change is at least as strong as the science supporting the causes and treatment of cancer, for instance, and I’d bet heavily that if any climate disruption denier was diagnosed with cancer you would find them at the closest hospital post-haste. To further the analogy, undermining the diagnosis with dubious science so that the cancer patient becomes more terminally ill would be immediately seen in the case of an individual patient to be a morally corrupt activity. When the patient is our entire planet, the only known refuge for life in the universe, this undermining of the science behind the diagnosis becomes that much more morally corrupt.

Stephen,

I agree that climate science is sound. I would also like to convince others that the science is sound. I also share your frustration that more people are not convinced that the science is legitimate.

The question is: Would you be convinced by an argument that included insults? My son often points out that I argue in ways that offend others, and I notice when I re-read my posts, that he is correct. I am trying to improve.

People who are not convinced by climate science [and there are a lot of people ] will not be convinced by using pejoratives such as “denier” or by questioning who funds the researcher. Logical arguments refuting some of the assertions, such as “global land-ocean temperatures have not increased for 17 years” as I tried to do above, may be more effective.

Anyway please try to be polite, I will try to do the same.

Dennis

Dennis,

Thank you for trying to appeal to my better nature, and all the time you’ve spent refuting Coolreit’s dubious arguments. Let me suggest, however, that it is just such accommodating engagement that allows climate deniers to win, because they have a different goal than those who believe in actual science. Their goal is to undermine the consensus that exists around anthropogenic climate disruption and delay any real sustained action to transition to a renewable energy economy, so that they can continue to make fabulous quantities of money engaging in the status quo of a fossil fuel-centered economy. So simply by taking them seriously and engaging in these arguments when all of the data from the opposing side comes from obviously manipulated paid-off sources means that we lose and they win, because they don’t have any desire to win the argument, only delay as long as possible.

Furthermore, anonymity is bullshit, and arguing with someone on the internet when they refuse to use their real name is like having a fist fight with a ghost. Who is Coolreit? He/She will raise hell and try his/her damnedest to confuse the situation, then retreat into the shadows to pop up as someone else tomorrow. It’s likely he/she is a paid staff member of a climate denier group whose sole purpose is to troll the internet and sow seeds of doubt about climate disruption. If you want to have a real discussion about these issues, come out of the shadows: state your name and who you work for.

Stephen Hren

stephenhren@gmail.com

Who am I? Read my books, check out my comments on theoildrum.com (member for 6+ years as themudranch, always signed my name), read my huffpo blogs

Hi Stephan,

I doubt that Coolreit is anything more than a person who is convinced that climate change is not occurring, or that if it is it is because of solar cycles, or some other explanation but that is a natural process that humans cannot effect.

I think that there are people who are trying to delay action on global warming by creating confusion. Unfortunately the science is complex and when faced with two sets of apparently competent scientists with opposing views, people think the science is not very solid.

It would be interesting if a list of worldwide experts was created (say 3 or more papers in peer reviewed journals whose subject is relevant to climate change) and the views of those experts were reviewed. I think it would be very clear that there is a very small percentage of experts who think that climate science is incorrect.

Most people who disagree with climate science are not part of a big conspiracy, they just don’t understand the science.

DC

Dennis/Stephen,

Just wanted to chime in here with a single point. First, disclosure, my name is Dan Combs and I know Stephen personally, ‘though we’ve been out of touch a few years. I’d say my response to Coolreit falls midway between your positions. But I just want to point out, Dennis, that unfortunately, humans almost never make decisions based on logic/rationality/information. I used to think that was the case, and tried vainly to convice folks of PO/AGW etc with facts & data. But folks respond emotionally to these and pretty much all other issues. George Lakoff, among others, would be one to read about this, although even he speaks of just getting things framed correctly, with the right language & trigger words, to ‘win the argument’. People don’t change their mind based on evidence. They change their mind based on how a thing directly affects them – like a kick in the gut. That’s why we’re not going to prepare for PO or ameliorate AGW. They’re going to overtake us before enough of us grok that we needed to change our way of liviing generations ago. Oops, we’re toast. Now who to blame. Scapegoating will be much more rampant than will be sustainable behavior. Just a li’l Christmans cheer for all to ponder…

Clifman, of course we will do nothing. I have been trying to tell folks that for over ten years now. Sometimes they get really mad just because I try to tell them that they cannot change the world. They actually believe that they can make a difference. So I just gave up and left them with their delusions.

We are but observers of this tragedy. Sometimes we become small bit players but never making any difference in the final outcome.

Hi Ron,

I think a blog can make more of a difference than you realize. Matt Simmons book “Twilight in the Desert” got me interested in peak oil.

The choices that people make matter. Maybe you would argue that there are not any choices in reality, that the world is on autopilot and nothing that anyone does makes any difference. In most cases you may well be correct. But it makes one wonder, “If you are convinced that nothing that any individual does make a difference, why write this blog?”

DC

Really Dennis, you are one in 7.1 billion and you really believe your efforts will change the course of humanity?

Why do I do it. The same reason I am drinking bourbon right now, I just love to do it. And, I must admit, I do get some satisfaction in telling all those folks they really have no idea what is going on.

However there will be survivors. So perhaps I could have some influence, convincing some folks to make preparations, to increase their chances of being among the survivors.