When will Peak Oil actually arrive? There has been considerable debate on that point recently. Well if you are talking about “Conventional Crude Oil” it arrived in 2005. But in many cases unconventional crude oil works just as well so I think we must count that. I will comment on that at the end of this post below.

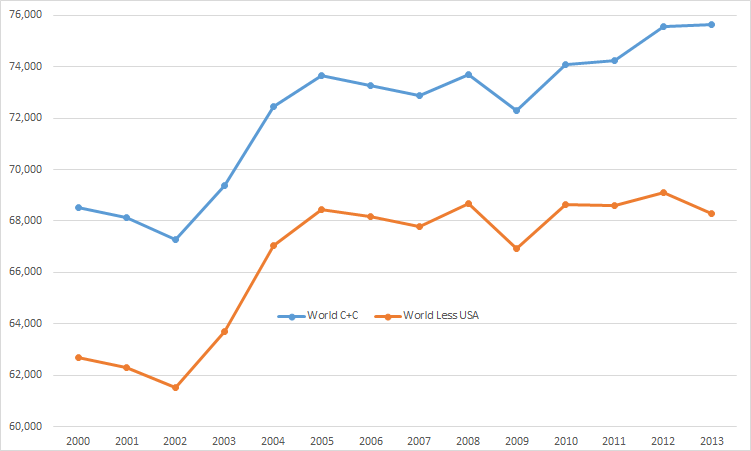

The chart below is kb/d with the last data point, 2013, is the average through October.

Averaging the first 10 months of 2013, World oil production was up only 66,000 barrels per day. And without the US LTO input, world production would have been down 807,000 barrels per day, lower than the 2005 level.

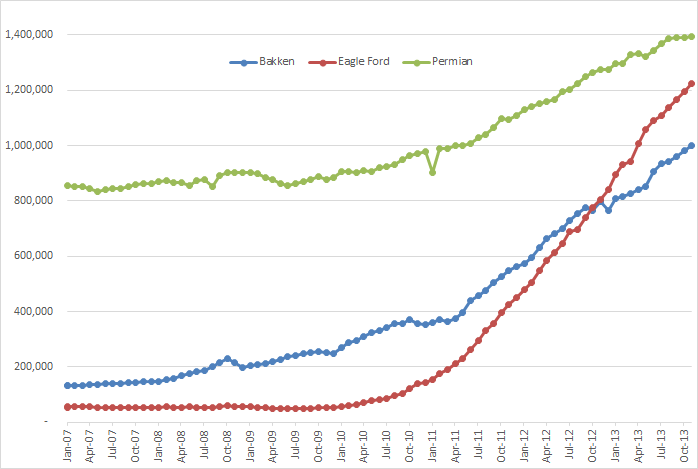

And it is all about LTO, primarily it is about three oil plays, the Bakken, Eagle Ford and the Permia.

The data for this chart was taken from the EIA’s Drilling Productivity Report. The data is through December 2013 but the last four months must be taken with a grain of salt. They are nothing but a wild guess from the EIA. For instance December production in the Bakken was down over 50,000 barrels per day but the this report has the Bakken up by over 20,000 bp/d. Not to worry however they will correct the data in three or four months.

I am not at all clear on what the Permian really is. That is, is it shale oil or is it a conventional field. The Permian Basin has been producing oil for 90 years. Now a lot of people are referring to it as “shale oil” But the Texas RRC does not use the word at all in their description of the Permian Basin. I think it is basically a conventional field. Perhaps there is a small part of it that is shale, after all, the Permian is many fields, not just one. But if some oil man could enlighten us on what the Permian really is, it would be greatly appreciated.

But many in the oil business are having second thoughts about shale oil.

Wells That Fizzle Are a ‘Potential Show Stopper’ for the Shale Boom

The average flow from a shale gas well drops by about 50 percent to 75 percent in the first year, and up to 78 percent for oil, said Pete Stark, senior research director at IHS Inc.

“The decline rate is a potential show stopper after a while,” said Stark, a geologist with almost six decades in the oil patch. “You just can’t keep up with it.”

Geologists Jeffrey Brown gives his take on all this:

The net increase in US Crude + Condensate production (C+C) from 2008 to 2013 was about 2.5 million barrels per day (mbpd), i.e., from 5.0 to 7.5 mbpd. I’m assuming that the decline rate from existing production rose from about 5%/year in 2008 to 10%/year in 2013 (as an increasing percentage of production comes from high decline rate tight/shale plays).

Let’s assume that we see another 2.5 mbpd increase in net production by 2018 (to 10.0 mbpd in 2018), and let’s work backwards from there. Let’s assume that the decline rate from existing production continues to increase at 1%/year per year, hitting 15%/year in 2018.

So the projected volumetric declines from existing wells would look like this:

2013: 7.5 x o.1 = 0.75

2014: 8.0 x 0.11 = 0.88

2015: 8.5 x 0.12 = 1.02

2016: 9.0 x 0.13 = 1.17

2017: 9.5 x 0.14 = 1.33

2018: 10.0 x 0.15 = 1.50

So, in round numbers and based on the above assumptions*, we would need about 7 mbpd of new production from 2013 to 2018, just to offset declines from existing wells. And we also need new production to show the net increase from 7.5 to 10.0 mbpd.

For example, the assumption is that we would need 0.75 mbpd from 2013 to 2014, to offset declines, plus another 0.50 for new production, for a required gross increase in production of about 1.25 mbpd from 2013 to 2014, to show a net increase of 0.50 mbpd.

So, based on all of the foregoing, in order to show a net increase of 2.5 mbpd from 2013 to 2018, I estimate that we would need on the order of 9.5 mbpd of new gross production through the end of 2018. Or, based on the foregoing, in five years we would need to basically do what it took the US oil industry decades to do, as we approached our 1970 peak rate of 9.6 mbpd.

And everyone is complaining that it costs way too much these days to produce oil. Even Oman is saying the costs are way too high.

Gail Tverberg has strong opinions on this subject and dedicated her latest post to explaining in:

Beginning of the End? Oil Companies Cut Back on Spending

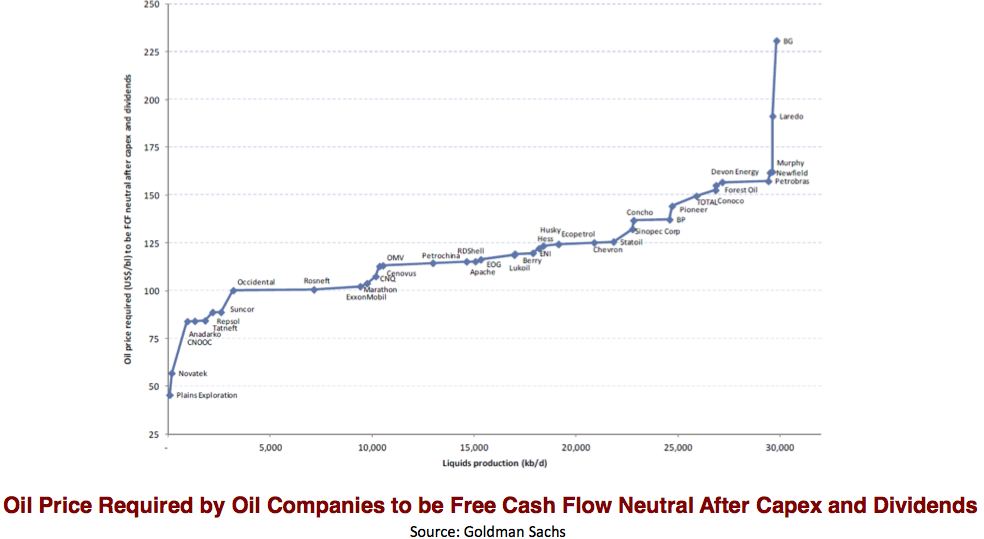

She says capex is way too high and uses data from Goldman Sachs to prove it.

With that kind of capex required how can anyone make any money? In fact a lot of companies are losing money:

World’s largest drilling company posts huge loss

And if that isn’t enough the per barrel marginal cost of non Non-OPEC oil, last May, was $104.50. It is likely over $110 per barrel today.

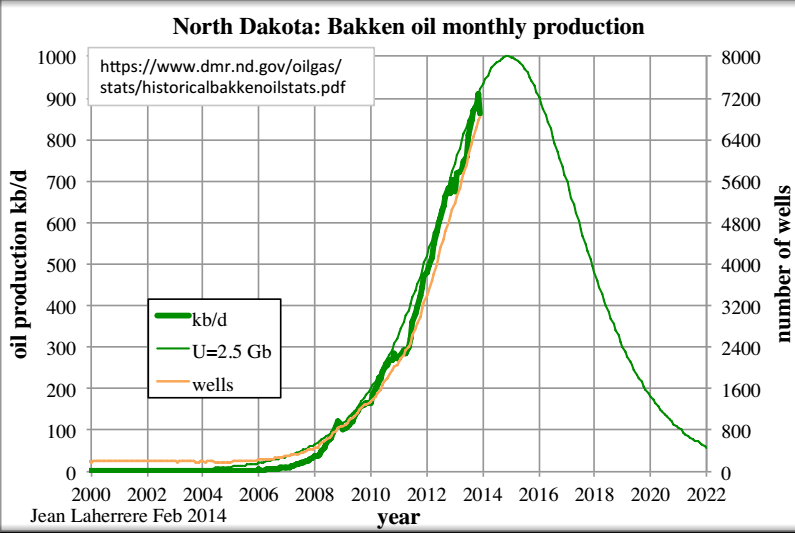

Jean Laherrere has updated his projection for Bakken Production based on the latest December data. He sees the Bakken peaking toward the end of 2014.

But when will crude oil, or C+C peak. We can only guess. It is a little like predicting the weather, like saying there is a 50% chance of rain tomorrow. I will give my peak oil prediction in the same manner but with increasing probability as we move further along the calendar. My opinion is:

There is a 10% chance that the peak was in 2013

There is a 25% chance that oil will peak in 2014 or before.

There is a 40% chance that oil will peak in 2015 or before.

There is a 70% chance that oil will peak in 2016 or before.

There is a 90% chance that oil will peak in 2017 or before.

In regard to assumptions about the decline rate from existing US oil wells (this would be the decline in production from 2013 to 2014 if no new wells were completed in 2014):

*I think that we would all agree that a higher percentage of US natural gas production comes from tight/shale plays, versus the current percentage of crude oil production that comes from tight/shale plays. I frequently reference the 2013 Citi Research report which put the estimated 2013 decline rate from existing US natural gas production at about 24%/year, which implies that the industry has to replace 100% of current natural gas production in a four year period, just to maintain current production for four years.

Hi Ron,

As Webhubbletelescope taught us long ago (around 2005 as I recall) if extraction rates can increase we might hold off the decline for quite a while. So your guess at the peak is not very different from what I would guess. Where I think I would get strong disagreement from most people at Peak Oil Barrel is that if the World Economy does not go down the drain when the peak is reached, that we might limp along on a plateau for many years. Currently extraction rates are on the order of 2.6% of mature reserves, Norway has an extraction rate close to 20 %. Below I present a scenario with a URR of 3200 Gboe (gigabarrels of oil equivalent) for C+C+NGL where extraction rates rise to only 5.2% from the current 2.6% level, if we can go to Norwegian levels the plateau might be extended further. Note that Jean Laherrere’s World Scenarios often assume about 3000 Gb URR for all liquids. This scenario is optimistic, but the URR is only a little higher (7%) than someone who knows much more than me.

Dennis, now I know where you get your optimism from. You have the “bumpy plateau” lasting for about 35 years. Really now? Do you think that is reasonable? Silly question because obviously you do.

But countries do not stay on a plateau. They peak then decline, all within a few years. If we could coordinate all countries where they would all peak sequentially, one every year for 35 years, then your scenario would be feasible. But that is not going to happen.

In fact we have been on that bumpy plateau for eight years and it cannot possibly last much longer. When oil peaks the decline will be slow at first, perhaps no more than 1% per year for two or three years. Then it will start to accelerate to between 2 and 4% per year. That’s when things will really get tough. And if some countries, like Russia, start to hoard oil, cutting exports in half or so, then the proverbial excrement will really hit the fan.

What happens when we hit peak oil? Nothing, absolutely nothing! We will not even know it until perhaps two or three years later. But to believe that after the world oil supply starts dropping at 3 to 4 percent per year, year after year, that life will only be a little harder, and we will all figure out a way to get by, is to believe in miracles.

No, no, no. That is when things starts to collapse. Civilization as we know it will be over. Sorry about that.

And I’ll just add that even if “we” (meaning the global human population) have been on an an oil production plateau since 2005, we have not been on a reproduction plateau. Whereas we were then 6.5 billion, we are now 7.2 billion. And many more of those billions – see China as exhibit A – are stepping into fossil fuel dependent lifestyles, so the ‘production’ plateau is stretched ever more thinly among more and more of us. Toss in the net energy considerations, which includes some of the ‘oil substitutes’ having lower energy density than crude, and the declining EROEI of pret apita at all – we are instead slipping down the slope. Then there’s WT’s net export thingy… When one looks at all those aspects together, I don’t see how the cornucopians sleep at night 🙂 And I didn’t even mention Gail’s debt diatribe…

And I’ll just add that even if “we” (meaning the global human population) have been on an an oil production plateau since 2005, we have not been on a reproduction plateau. Whereas we were then 6.5 billion, we are now 7.2 billion. And many more of those billions – see China as exhibit A – are stepping into fossil fuel dependent lifestyles, so the ‘production’ plateau is stretched ever more thinly among more and more of us. Toss in the net energy considerations, which includes some of the ‘oil substitutes’ having lower energy density than crude, and the declining EROEI of pretty much every liquid fuel, and we are not on a net per capita plateau at all – we are instead slipping down the slope. Then there’s WT’s net export thingy… When one looks at all those aspects together, I don’t see how the cornucopians sleep at night 🙂 And I didn’t even mention Gail’s debt diatribe…

Ron,

It is but one scenario. If prices rise and extraction rates rise, the plateau might be extended, this is not a prediction, it is a low probability scenario maybe a 1/4 chance. A slow decline could easily be in the cards, the 1 % decline that you suggest for 2-3 years before “things will really get tough”, could be extended for quite a while especially if extraction rates can rise from 2.6% to 10 % over the next 40 years. I was wrong about Norway, I was looking at an older analysis. A more up to date analysis based on data from Rune Likvern and using Webhubbletelescope’s Shock Model suggests about a 12% extraction rate for Norway. So I think the upper limit for World extraction rates 35 years from now might be about 10 %. A scenario with a 1 % decline in oil output from 2030 to 2050 can be created by raising extraction rates from the present rate of 2.6 % in 2013 linearly to 3.8 % in 2050.

See chart, note the green + are BP data for c+c+ngl up to 2011 and then a 1 % decline from 2030 to 2050. I would put the likelihood of the scenario in the chart below a little higher maybe 50%, but only if the 1% decline proves manageable for society (as in not total chaos).

Old article from Gail explaining among other things the energy content of substitute liquids compared to conventional crude. There are also EROI differences. http://ourfiniteworld.com/2012/04/09/what-the-new-2011-eia-oil-supply-data-shows/

Hi Robert,

That is why I used barrels of oil equivalent for NGL. For those who are not familiar with this concept, a barrel of NGL has about 70% of the energy content of a barrel of crude oil so we multiply a barrel of NGL by 0.7 and voila we have 0.7 boe. There are EROEI differences as well, but for those who believe that the importance of liquid fuel is of the highest order (due to its high energy density and convenience) other types of energy (natural gas, coal, wind, solar, and nuclear) can be used in the extraction process. I am not arguing this can go on forever, my contention is that the energy cliff that many people forsee may arrive later, perhaps we will attempt to make some changes in the mean time, because the cliff will arrive and the longer the plateau is extended, the steeper the decline on the downside. A gradual decline would be a much better scenario, but I do not really have a lot of control over what path society will take, hopefully prices will rise enough that people realize that something needs to change, wind, solar, and nuclear may become more competitive with fossil fuels, maybe a very difficult transition will take place. Actually a difficult transition of some sort will take place, how difficult it is depends a lot on how soon we begin, 1980 would have been a much better time to begin, hopefully we will not waste the next 34 years.

Jeff,

I was looking at the Shale Gas Production in the U.S:

2011 U.S. Shale gas production (gross) = 8,500,983 Mcf or 23.2 Bcf per day

2012 U.S. Shale gas production (gross) = 10,296,572 Mcf or 28.2 Bcf per day

2013 U.S. Shale gas production (gross) = 11,300,000 Mcf of 31.0 Bcf per day (estimate)

I believe the Marcellus was instrumental in pushing that estimated 2013 total to 31 Bcf per day. I hardly doubt the Eagle Ford, Marcellus and maybe the Utica will be able to add 16-17 Bcf to offset that 24% decline we agree upon.

I think 2014 may indeed be the year we may get the SHALE GAS ENEMA. If not 2014, probably the next year.

Dennis,

The one thing that Charles Hall (top mind on the study of the EROI) said when he retired in a recent interview, “I tried to warn you all…LOL, now it’s your problem.”

I thought that was an interesting way to put it, but that is what Charles said to James Howard Kunstler regarding the serious problem we face with the falling EROI of energy.

Charles believes we need something north of say 10/1 EROI to sustain our modern society — maybe even higher. Shale Oil and Tar sands at 5/1… won’t pay the bills.

I am not even going to include the INSANITY of OIL SHALE at 2/1 (at best) EROI.

The manufacture and printing of hundreds of Trillions of Derivatives may be a good way to DELUDE the masses of an illusion of growth, but I don’t think we have a lot of time left before the House Of Cards comes down.

steve

Steve,

If you talk to people like Rockman, the EROEI concept just is not very relevant in the energy business. Oil and natural gas producers are in business to make money not energy.

Dennis,

I realize that the Energy Industry could care less about the EROI. However, the falling EROI is killing their bottom line. Hence the new realization of selling projects and cutting back on exploration by the Oil Majors to keep their clients, the shareholders happy.

Which you correctly stated Dennis… the Oil Majors are in the business of making profits, not producing oil.

The problem with society today is the LEFT HAND could give a RAT’s AZZ of what the RIGHT HAND is doing. This is our curse. Even though we may smack ourselves on the back bragging how we took dominion over the earth and advanced technology… Mother Nature gets the last laugh.

While I do enjoy debating these issues and researching energy, mining and the precious metals… in the whole scheme of things, we are a pathetically egotistical lot.

steve

Steve,

I agree.

And while I’ve no doubt that Rockman knows his business, it is also indisputable that money has no intrinsic value, and therefore in the grand scheme is useless to us, whereas energy, of course, has great intrinsic value, so as its ROI declines it matters greatly to society, no matter what the oil industry thinks…

Hi Clifman,

What is intrinsic value? Is it the same for you as it is for me? How is it measured.

If a thing can in and of itself do something of worth. Energy can do work. Food provides sustenance. Water & air also keep us alive. Fertile soil grows food. Money can only sit there. It can feed our dreams, but in and of itself… utterly worthless.

Clifman is right about intrinsic value. It is a word used very frequently in options trading. If an option is “in the money” it has intrinsic value for the amount it is in the money. For instance if you hold a call on stock x at an exercise price of $40 and the stock is currently priced at $41 then the call has one $1 of intrinsic value. However the current price of the call may be $2.

That extra $1 of premium over the intrinsic value will dwindle as time passes. At expiration a call is worth exactly what its intrinsic value is, that is the amount it is “in the money”. If a call is “out of the money” at expiration then it is worthless because it has no intrinsic value. That would be the case if you hold a $40 call on stock X and it sits at $39 at expiration. You lost the total premium you paid for the call. You may have paid $2 for it and you lost everything. But if the stock sits at $45 at expiration then you get $5 for the call. You made 150% on your money.

Options trading is a get rich or go broke game.

Ron,

In clifman’s world options would have no intrinsic value, since they are simply pieces of paper(or information stored in a computer somewhere) assigned dollar values by the market. I think he would look at them in similar terms as money which has no intrinsic value. He did not answer the question of measurement or the subjective nature of value. What does he think of a work of art, or a piece of jewlry? Do they have intrinsic value? Which has more or less intrinsic value?

Dennis,

I get into this debate on “Intrinsic Value” with many on the subject of gold and silver. If we are going to be ABSOLUTE… nothing contains intrinsic value…. it’s all subjective So arguing the point is like a dog chasing its tail.

However, certain things have “UNDERSTOOD” intrinsic value. Gold and silver, for instance, have intrinsic value because you can go just about anywhere in the world and most people will understand their worth.. well maybe not Americans as we have be lobotomized from the neck up on the subject of money.

Regardless…the U.S. Treasury can print a new crisp $100 bill for 12.5 cents a piece. It takes the gold industry $1,250 now to produce an ounce of gold.

Thus, the Treasury can print $1,300 worth of Benjamin Franklins for a measly $1.63. This is what the Gold and Silver mining industry has to compete with…. PAPER GARBAGE.

U.S. DOLLAR = Fiat Currency

GOLD & SILVER = Money

Every time I go to the Bank I ask for a withdrawal of Fiat Currency… not money. They look at me strange, but it’s not my fault the public has been bamboozled for the past 43 years.

steve

Dennis, I am simply giving you the definition of the word “intrinsic” as it is used in everyday language. When I was options trading and a stockbroker, I used the word many times a day.

I am sure you are aware of the fact that the meaning of a word changes as the context of how you are using it changes. I can fly and a bird can fly. But when I say I can fly I do not mean I can literally fly like a bird. I require an airplane to fly.

Likewise the meaning of the word “intrinsic” changes depending on how you use it. Clifman is correct that money has no intrinsic value, meaning it is not something you can eat or use as a tool. I am also correct in saying the intrinsic value of an option depends on how far it is “in the money”.

If we both, Clifman and I, wrote the dictionary demanding that they change the meaning of the word they would tell us both we are just silly. The meaning, in this case, depends on how you are using the word.

But basically we are both using the term to mean “of actual value”. It is just that I would, in my example, regard money as having actual value where he would not. I am saying that we are both using the term correctly, he is just using it in a different context than I.

Here’s a little thought experiment to make the point: You are tasked with building some grand infrastructure project – say Hoover Dam. There are 4 unlimited ‘piles’ of resources available to you, of which you must pick 3, then use nothing else, to do the job. The 4 ‘piles’ are energy, raw material, labor and money*. Choose well…

* And yes, money could be cash, gold, options, stocks, electronic blips – any form you like. All equally worthless (except gold’s value in making things) unless traded with someone for something else… of actual use/value.

Clifman,

This is the big problem today…. way TOO MANY PAPER contracts chasing very little in the way of physical assets.

I keep bringing up gold because I think we are going to hear a lot more about the shiny yellow metal in the future.

The Chinese imported a record 247 metric tons of gold in January — ONE MONTH. That is more than the total monthly world mine supply.

The Big U.S. Dollar reset is coming. I don’t know when it will occur, but when it comes… the public will not be prepared for a 20-30% devaluation in one day.

steve

Clifman,

Interesting thought experiment. It is not the world we live in though. And you never answered my question about how intrinsic value is measured. Generally speaking in any world I can imagine there are not unlimited piles of resources that are freely available. You also side stepped works of art and what their intrinsic value is (if any). Money is both a medium of exchange and a store of value (though not a very good one unless the rate of inflation is zero). In society as it is currently constituted, an unlimited pile of money (or better yet a bank account with a 1 followed by 12 zeroes, would enable me to build a damn by buying the goods and services to do it.

Dennis,

Starting to feel like beating the proverbial dead horse, but I’ll respond since you asked. And let me first say that while it’s clear our views of the future differ widely, I very much respect your analytical ability, and all the work you’ve put in modelling the Bakken. Also appreciate your work helping Ron manage this site. So…

No, there are not resources freely available. That’s just the point. They all have costs. It takes energy to find, extract, process & utilize them. As you point out, we live in a society that has laid dollar values over everything (except, of course the env’l, social & other externalities we choose to ignore, which, as AGW is proving, have very real costs nonetheless, but that’s another topic). So we come to think of dollars as having the value of comfort, food, mobility etc. It doesn’t. Saw a cartoon once of a Wall St. type running down the street with a lion in pursuit, tossing big bills behind him in a vain effort to find the price of not being eaten. Good metaphor for the human predicament at present, IMO. We think money can ‘produce’ ever more energy & resources, provide us with an ever brighter, infinitely growing future. It can’t. The real world has real limits and cares absolutely nothing about what financial markers we make up in our heads to assign value to any of it. This is why EROEI matters, even though as Rockman pts. out, the oil patch is ignorant of it. They want dollars, so will burn up one form of energy that’s cheap to get at the one with a higher dollar value, not caring if the energy balance is horrible. Society could have used that cheap energy to better purpose – maybe not today but certainly in an even more energy scarce future, to generate electricity, run a tractor, lots of very valuable uses, but won’t be able to, ’cause it was burned to ‘make money’. Guess I strayed a bit there, but the underlying pt. is that real things matter – energy, soil, water, clean air, stable climate, mineral resources. Money is a fiction of our imaginations. When I say it has no intrinsic value, I mean you can’t eat it, can’t heat your house with it, can’t grow food with it, can’t drink it. You have to give it to someone else who shares the mental fiction that it has value in exchange for something that has its own intrinsic value, which you then make use of. Whew!

As to art… has never meant much to me, so I’ll throw the stars at night and wild places in the same bag so that I can say, yes, I get your point. These things have emotional value to us, but that of course varies widely depending on the observer, so that’s not really what I’m talking about here. Is it Maslow who developed that hierarchy of needs? So art etc. would be near the top, not really necessary for life, but nice and certainly desired for a full life. The intrinsic value I’m talking about are of those things that provide for the basis of survival. In the culture we swim in, money plays a role, yes. But in the end, I’d rather have a donut than a dollar, firewood than a Franklin, soil than a savings account…

Clifman: Art has different value to different people. Even different artists have different value to different people. But don’t you see that the situation is the same with commodities? Different segments have different indifference prices. This is the basics of how a demand curve is created and is econ 101.

Nony- No. A BTU will provide the same amount of heat, warm my bottom the same as it will yours, regardless of any commoditization we try to lay upon it. I know I’m the outlier here and pretty much anywhere in this culture, but dollars are ultimately worthless. Energy & other resources have innate worth, ’cause they can do things of value. Some of the minds to read on this include Charles Eisenstein, Charlie Hall, Herman Daly, Steve Keen, Robert Costanza, Nate Hagens…

Hi Clifman,

You may think our points of view are more different than they actually are. I understand what you are saying about money. I was trying to get you to think about “intrinsic value” and whether it has a lot of meaning, to me it does not.

I am not quite sure if you noticed, but you never answered the measurement question, unless when you talked about BTUs you mean that energy is the proper measure of value so that we might use Joules or BTU’s to measure value.

My point is that the intrinsic value of a thing cannot be measured objectively, it depends on the person, I may think a nice pair of skis are valuable, you may not care for skiing and think that they had no value or certainly less value than the avid skier. Money is quite useful as long as others are willing to exchange something that I deem to be valuable in exchange for money so that they can exchange the money for some other thing that they think is valuable. You are certainly correct that if people were unwilling to exchange goods and services for money, then the money would have no value. On that point we are in complete agreement.

Why do I think looking for measures of “intrinsic value” are a waste of time? First because any such measure is simply a theoretical construct, one can create an “objective” value system based on labor (see Ricardo and Marx), or energy or even capital (and turn Marxian economics on its head). If you have read “The Energy Trap” blog post by Tom Murphy then you might realize why I think using energy as a measure of value might lead to less willingness to invest in renewable energy than the current paradigm. In our current way of organizing society (which I agree is far from perfect), the problem that Murphy raises of people being unwilling to invest today in technology with a high level of embedded energy (such as solar, wind, geothermal, hydro, or tidal power) because they will have less energy available tomorrow is largely hidden from view. From my perspective moving to a paradigm where we concern ourselves with EROEI, may be counterproductive if it leads to an energy trap. Under the current capitalist system there are many problems, but if externalities were valued appropriately (including carbon emissions) through taxation or fees, the system does a good job of allocating resources efficiently. Is it a perfect system? Not at all, just the best we have come up with so far (particularly in the UK and Switzerland where they have control over their money supply.)

So how does this imperfect system deal with peak oil? In Europe they institute high taxes on liquid fuels, and encourage renewable energy, they develop a robust public transit system. They also have pretty low fertility rates, though East Asia is even better on that front. The higher the price of liquid fuels (and fossil fuel in general), the more incentive there is to invest in Wind, solar, and geothermal and the HVDC transmission system needed to support them. Easy to accomplish? Absolutely not. On transport there will be be fewer and fewer cars driven by fossil fuels as prices rise and a small percentage will be replaced by hybrids and electric vehicles, most people will be priced out of the private vehicle market (cars and trucks) and will walk, bike or ride public transportation.

Also note that if the world moves towards East Asian fertility rates of 1.5 births per woman, there will be a dramatic reduction of population to 2.5 billion by 2200 see

http://www.demographic-research.org/volumes/vol28/39/28-39.pdf

Chart below with different fertility rates (0.75 to 2.5) and life expectancy of 90. (I don’t think anything below 1.5 or above 2.0 is realistic long term.)

I was just going to not bother having the basic argument. For one thing it’s somewhat philosophical. (I.e. even if you think personal indifference prices are vaporous, they still dictate results that we see in markets.) It’s just not used to having these types of discussions, especially with people not exposed (properly) to the view that they are contesting.

Even if you think a physical metric is the only important thing, why energy? I mean a cement pillar of ceramic has no energy content (in terms of combustion potential). But it has physical features (load bearing capability for instance). Actually has a complex list of physical attributes if you look at dynamic versus static, shear, compression, tension, etc. Then there is chemical resistance, hardness, temperature behavior, etc.

Even for a fuel, energy density is a difference. Or for crudes, their hydrocarbon ratios.

If you had predicted a 2016 peak back in 2005, they would have thought you a total optimist. And you seem to have moved out a year from that earlier “end of 2014” call. We’ll turn you into a cornie, yet. Come on in…the water’s great!

Kidding: thumbs up for making a prediction.

Nomy, the 2014 to 2015 thing was about the Bakken. There is a difference between the Bakken peaking and the rest of the world peaking you know. Also I am saying that there is a 10% chance that the world C+C peaked in 2013. However it is very likely that when LTO peaks in the US, the world will be at peak also. Will the rest of LTO peak at the same time the Bakken peaks? I doubt it but the two peaks will likely not be more than one year apart.

OK.

Hi Ron,

Just to clarify, you are betting that the LTO peak will be in 2016 and will coincide with the world peak (maybe at around a coin flip on the odds.) Do I have that right?

And I realize I am not quoting you and you have said none of these things, just seeing if I am understanding correctly what your opinion is.

From Ron’s statements you can indeed deduce that he expects the biggest chance of peak oil to occur in 2016 (30%) followed by 2017 (20%)

No Enno that is not right at all. I said, I believe, there is a 70% chance it will happen in or before 2016. That is not the same thing as saying there is a 30% chance it will happen exactly in 2016.

And because I say there is a 90% chance that it will happen in or before 2017 in no way implies that I think there is a 20% chance it will happen exactly in 2017.

Statistics simply do not work that way. If it has not happened by December 31st 2016 then the chances would be entirely different for 2017.

As I explained in another comment, if your life expectancy is 75 at birth, then on the day you reach 75 your life expectancy in no longer 75. It would be some figure greater. Surely you can understand that.

Ron, as Dennis also explained, these probabilities can be deduced.

Sure, as you, Dennis and I all agree, probabilities change over time, so I agree with your life expectancy example. But you make these probability statements all at this moment.

Example : if I always get my salary in the 3rd or 4th week of the month, and the chance that I get it in the 3rd week is 40%, then that means that right now (suppose we’re in week 2) I expect the chance to get my salary in week 4 is (100%-40%=)60%. Of course, once we enter/leave week 3, these probabilities will change as they are dependent. But that will only change with time, at this moment I can make definitive statements about the probability in week 4. Do you agree with this example?

I would not have argued this point, but as you seem so adamant on your position, and I am also fully convinced about mine, I don’t mind to clarify this discussion until its conclusion, until hopefully one of us has learned something.

Dennis, no I am not betting it will be in 2016 I am betting it will happen during or before 2016. That is totally different than betting it will happen exactly in 2016.

Hi Ron,

The probabilities are additive. First the life expectancy does change over time, I agree with that. For example when I was born my life expectancy might have been 65, meaning that there is a 50/50 chance I will make it to that age upon birth. The odds are very different when I am 60, at that point (depending on my health), my odds of living to 65 would have increased to 80% (I am not an actuary I am guessing).

The thing we are looking at in the present example is different. It is odds of living to 20, 30, 40,…, 60, 70 at birth. So lets say at birth the chances I will die at age:

20 or earlier -1%

30 or earlier-5%

40 or earlier-10%

50 or earlier-20%

60 or earlier-35%

65 or earlier-50%

These probabilities add up (because I can only die one time).

die 21-30 4%

31-40 5 %

41-50 10%

51-60 15%

61-65 15%

So for any age range 0 to 30, or 30-65 you just add the probabilities.

0-30 =6% or 31-65 =45%

I agree with Jean Laherrere that we will peak in late 2014 or earlier. We won’t know for sure, though because the government reported data will intentionally obscure the truth. They will include ngl’s et.al.

Ron, you have so clearly described the situation with your 2 key oil production charts: US and all else. All else has peaked long ago, 2005 to be precise. So, it all depends on shale which you have discussed here with others. My take on shale is pretty clear from the initial shale play: the Bakken. The Bakken growth rate in production is slowing. While it fell in December due to weather, the growth rate had been declining before then. I think by the end of summer, the Bakken growth rate will be close to zero:

ND ND ND

Change Change %

When the Bakken peaks in 2014, the world will peak as well.

Coolreit, if you use the HTML “pre” function then your post will look exactly like what you typed in.

That is < then pre then > and after your data < then /pre then >.

I have done that to the table in your post above.

Ron:

Thank you for fixing my format!

Hi Coolreit,

Using the output data in your comment and charting output vs month where Nov 2012 is month 1 and Dec 2013 is month 14, I applied an exponential trendline which shows a 2.2 % rise in output per month (until the December drop, but all datapoints were used for the trendline). Also notice that the rate of increase was slower before June 2013 (month 8) and more rapid from June to November (month 13). So not much of a slowdown over the period you covered except for the weather related December drop. If you covered a longer period, back to 2010 or even 2008, you would see the slowdown in rate of increase. Also note that this is about a 30 % annual increase (1.022^12=1.298), earlier (2008-2011) the Bakken output was doubling about every 18 months which is about a 60 % annual rate of increase. Your basic point is correct output is not rising as fast as before and that the peak will certainly arrive soon, perhaps in 2014 or as late as 2017, my money is on 2016+/- 1 year.

Looks pretty linear. Of course the CAGR (% rate of increase) will slow down as the total gets larger (basic math). But a linear increase doesn’t seem so awful.

It’s sort of strange though. I’m more used to things being exponential up or down or maybe sigmoid. Perhaps we are at the inflection point of a sigmoid?

Nony,

I am pretty sure you nailed it, it looks we are close to an inflection point, for now we are still concave up (second derivative slightly positive), notice the exponent on the exponential fit is positive, but I think this will change over the next 12 to 24 months to concave down and the peak will likely happen 6 to 12 months after that so 18 to 36 months (roughly) to peak for the ND Bakken, though 30 months is my best guess.

Hi Ron,

The pre function only works for administrators or possibly editors, only the HTML tags below the “you may use these HTML Tags and attributes” can be used by everyone else. I would change that if I could but I have not been able to figure out how to make those features available to everyone. Can you do that in the comment box or do you have to use the editor the way you do with img tags?

Rockman is sorely missed at least by me.

He is absolutely right for now and he will continue to be right until –well , until he is wrong.

Some kinds of energy are still dirt cheap and still extremely plentiful and so long as cheap coal for instance can be utilized in the production of oil that sells for a lot more than coal per unit of energy oil companies will buy coal and sell oil.

( The coal is used indirectly and bought indirectly as electric power and embedded energy in steel and so forth. )

It really doesn’t matter from a dollars and cents pov if energy is wasted so long as the process generates some excess dollars and cents.

Sooner or later it will matter.I don’t know how long that will be, but eventually the gap in the prices between the energy in coal and the energy in oil will begin to close.

Once natural gas becomes scarce enough the it will no longer be possible to profitably burn it in the process of producing oil because we need nitrates even more than we need oil.

We will starve without synthetic nitrogen fertilizers and natural gas is the key feedstock in the manufacture of these fertilizers.

Of course there are other ways of manufacturing ammonia which is the key intermediate feedstock but the by far most economical process starts with natural gas and this will be true so long as natural gas is cheap.

At some price point we may again use electricity to make the ammonia which used to be done back when there was plenty of excess cheap hydro. So far as I can remember the last plants making ammonia this way closed up a long long time ago.

EREOI matters but just not yet.But it will matter and it is not a question of if but when.

Wind power is supposedly unaffordable according to the fossil fuel lobby but I will not be surprised to read here someday that instead of powering all those fracking pumps and drill rigs with diesel that it has become more economical to build power lines out to the oil fields and lay temporary cables the last few miles and move or extend them from well pad to well pad. Then they can frack and drill when the wind blows and the rest of the time they can do it with coal.

I may be wrong but I think I remember reading about solar power being used some places in mid east oilfields now because it is already economical to do so. The electricity made by pv panels cost less than electricity generated by burning some of the oil, making it profitable to save the oil for sale.

If the price of oil doubles again the sand country oil fields may become home to the worlds largest and fastest growing solar farms.There are a hell of a lot of electric motors in oil fields and in sand country and almost all of them are running on oil fired electricity. Theoretically oil companies there could cut their own oil consumption by close to half by using oil fired electricity only at night.

Farmer Mac Wrote:

“I may be wrong but I think I remember reading about solar power being used some places in mid east oilfields now because it is already economical to do so. The electricity made by pv panels cost less than electricity generated by burning some of the oil, making it profitable to save the oil for sale”

That depends on what they are trying to power. They are using it to power remote sensors that send data back wirelessly. These monitoring stations need less than a Kilowatt to operate. This is like using small solar panels to power calculators. I very much doubt they are using PV to power pumping stations and other machines that need dozens to hundreds of kilowatts.

PV is often used in remote locations simply because it more economical than running power lines many miles from the grid and if you really don’t need a lot of power. You would have to run all night, and on cloudy days, off the battery. However pumps are usually powered by gasoline when they are too far from the grid. Grid power is the cheapest if you are close enough that it does not cost a fortune to run the lines.

I doubt you would ever see an oil well pump run from PV. But I have noticed, in Pensacola, billboard lights powered by PV and even a few powered by wind.

Like isolated windmills pumping water

http://oldbogus.livejournal.com/121254.html

Hi Techguy

I m sure you are right about solar being used in mideast oil fields for remote sensors and so forth but that sort of use is old news and has been common place for a long time even in locations with a poor solar resource.

I think I am right in saying that solar is being used to offset some internal oil consumption in the sand country oil fields but I did a very poor job of describing how it happens.

There are some fairly large solar farms there already that feed into the grid and the grid provides electricity to the oil industry and so they are using solar in that sense and supposedly it

is more profitable to generate the juice with solar and sell the oil.

Given that the entire generating capacity, or very close to the entire capacity , of these countries is oil fired, the awesome solar resource (sunny almost every day), the dramatic recent reduction in the cost of pv, and the high price of oil, I am willing to believe that solar electricity is being substituted for oil fired electricity for no other reason than that it is now bottom line profitable to do so.

But I can’t prove it and I have so many energy related sites bookmarked I have little hope of finding this article again. If I get ambitious I may look for some proof but tonight I don’t feel very energetic.

I got ambitious enough to google it and got this very quickly indeed.

Since Saudi Arabia relies so heavily on oil for electricity production, measuring solar grid parity in Saudi Arabia is best done by comparing the cost of solar electricity generation with the opportunity cost of burning oil for electricity rather than export. According to ClearSky Advisors’ analysis, solar energy in Saudi Arabia is currently cost competitive with oil fired power plants. The analysis states that with currently available technologies and cost structures, large-scale solar PV costs less than $0.15/kWh, while the opportunity cost of burning oil for electricity costs the Kingdom between $0.127-$0.174/kWh.

Any large increase in the price of oil will definitely make it profitable for the Saudis to use solar more and sell the oil saved thereby.

This is from a company that specializes in solar investments and it may be a little on the optimistic side but there is no question about the Saudis investing heavily in solar in the near future and they have announced long term plans for solar that are extremely ambitious .

Further more solar thermal is now up and running commercially in at least a couple of places making steam to use in enhanced oil recovery.

“This is from a company that specializes in solar investments and it may be a little on the optimistic side but there is no question about the Saudis investing heavily in solar in the near future and they have announced long term plans for solar that are extremely ambitious.”

Yeah, you can pretty much never, ever believe an industry source. Panels cost money up front. They abrade in sandstorms, the get things blown into them by the wind, you have to buy replacements, the batteries die and have to be replaced blah blah blah. Hell, even on spacecraft gamma particles start to break down the lattice structure of the blah blah blah and you get negative exponential (as particles start going thru holes already made) declines in power over time.

It ain’t magic and it’s not going to solve anything. There are ballyhooed efficiency increases screamed to the world as “new records” every year or two of 30ish% and more, but if you try to go order some panels you will be lucky to get 15%, which hasn’t changed much in quite a few years.

Always beware hype.

Hi Watcher,

At Do the Math, a blog by Tom Murphy, he looks at both solar and wind

in the following piece:

http://physics.ucsd.edu/do-the-math/2011/12/wind-fights-solar/

You are correct that it isn’t magic, but the solar resource is plentiful, and the wind resource is pretty large as well (but quite a bit less than solar).

Murphy is not optimistic that we will ever transition to renewables however because of the Energy Trap:

http://physics.ucsd.edu/do-the-math/2011/10/the-energy-trap/

Part of his argument in the Energy Trap post relies on arguments related to EROEI.

As energy becomes scarce we will need upfront investments(in solar, wind, or nuclear)to provide future energy needs and these investments have a lot of embedded energy. Murphy argues that society will be unwilling to forgo current energy consumption to provide for future energy needs.

In the real world nobody really considers EROEI, and based on Dr. Murphy’s arguments this is probably a good thing (because we would fail to invest appropriately for the future.) As the real price of fossil fuel rises, solar, wind, geothermal, and nuclear all become more competitive, businesses and consumers will invest in these technologies because it makes economic sense. Nobody knows what the embedded energy of a particular product is, they look at prices (consumers) or profits (businesses).

Dr Murphy is somewhat recently Dr.

At earth surface the solar constant is about 1 kilowatt/square meter averaging out cloudy areas of the planet vs sunny. That’s with 100% efficiency.

A lousy 110 horsepower Camry is (745 watts/hp) 82 Kw required to do the same thing as a proper gasoline powered one on an instantaneous basis. That Camry will take you 500 miles on a tank of proper gasoline.

So you want to get that 82 KW? That’s 82 square meters on the roof with 100% efficient cells. With actually existing panels you can buy it’s 7X that. Good luck with that. You want to go 500 miles? Haul a $100K Tesla class battery behind you, and plan on an overnight recharge every 120 miles.

You get rather better miles per watt on a spacecraft in orbit. Doesn’t haul much food, tho.

That 82 KW is peak power output (not energy input) . In normal driving a sane (ie European ) car needs about 10KW average at the wheels. My car holds 45 litres of diesel (at about 10KWh a litre) and will cover over 700 miles at moderate speeds. That is about 35KW at an average speed of 55mph, but the engine is only about 25 % efficient. A Nissan Leaf uses about 20KWh to do about 80 miles. The motor is nearer 90% efficient, so it uses about 14KW out of the batteries.

We do not drive 24 hours a day. To recharge a 20 KWh battery over 10 hours at 15% efficiency would need 14 Sq Metres. A lot, but most houses cover a larger area.

Hi Ralph,

Thanks. Note that not everyone drives 80 miles each day. Is the 15% efficiency for the PV, I am guessing that there are losses as well in the charging process (I have no idea how large they are).

Lets say someone works for 8 hours and commutes 1/2 hour and maybe spends an hour on errands on work days. That would leave 14 hours for charging and using your numbers I think the area needed would be reduced to 10 m^2, if only 14 kWh are needed per day, a 4 KW system should be close to taking care of the car.

Also I drive about 20k miles per year which is about 55 miles per day so I would only need about 10 kWh per day.

if I were to do a system for my home (I use about 300 kWh per month) an 6 kW system would be enough for the car and home use in a grid tied system.

Which means you’re using the grid as your battery.

And I carefully said “to do the same thing”. A Camry might not haul one light guy at 55 mph. It might be called on to haul 5 people, in a Montana winter at -20 degrees F at the Montana speed limit, which is north of 80 mph and some places unlimited.

If Europe doesn’t like that kind of driving, they are entitled to like what they like. They are not entitled to dictate what others like, unless the EU wants to do that by force, aka, military suppression of US consumption. If the EU can do that by force then they gain that entitlement. Good luck on that. I don’t think the EU has a military.

The idea of probability of peak increasing going forward seems to me a very rational way to predict that point in time when there are so many variables. The exact moment of peak means nothing except perhaps academically. The financial interactions with production or the lessening thereof are what will cause and have seemed to already have caused economic havoc. I tend to put my faith in math more than in magic so barring a miracle of Biblical proportions I guess that the peak of LTO means the peak of oil and all that it may imply. LTO may have bought a bit of time but it would seem that like the Alaskan finds it was time merely wasted as far as transitioning from FFs is concerned. Maybe it is for the best that the public indulges in the conveniently provided bread and circuses as when circumstances make it apparent that our “leaders” were guilty of lies of omission at the very least they may become a bit …irritated and …emotional.

Yup. If only the public understood what they are about to be angry about.

There are some new regs out today involving the transport of crude by rail.

http://online.wsj.com/news/articles/SB10001424052702303880604579405412862500426?mg=reno64-wsj&url=http%3A%2F%2Fonline.wsj.com%2Farticle%2FSB10001424052702303880604579405412862500426.html

I suppose people in Japan have a little better handle on peak oil and fossil fuel supplies in general than most other people.

Even after Fukushima they are going to restart their nukes pretty soon and I will not be at all surprised to hear that they are building new nukes five years from now.

http://news.yahoo.com/japan-plan-keeps-nuclear-key-energy-source-053009295.html

Japan is a compact country and already gets by with relatively little oil considering the size of the country”s economy .

If battery prices come down as much as most industry analysts think they will over the next few years the Japanese can cut their consumption of oil even further.

Japan is a compact country and already gets by with relatively little oil considering the size of the country”s economy .

Japan uses less per capita than the USA but about 3 times as much as the average citizen of the world. That could hardly be considered as “relatively little”.

Per capita consumption in gallons per day

Bingo.

It’s nice to realize others understand. US oil consumption is 24ish% of the global annual total and has 4% of the population and that’s where the GDP comes from, boys and girls.

You want that GDP, you burn oil. You don’t burn oil, you don’t get the GDP.

Japan burns something like what, 4 mbpd? And produces nada.

Good old China and India are coming. They are coming fast. And they are NOT going to allow the US to maintain that 24:4 ratio. There is no reason for them to tolerate such subordination in perpetuity. They MUST act to suppress US consumption.

Once down the road with shale, can society ever turn back until it collapses in a heap. Drill/price rise/drill

faster/price rise/drill still faster. More and more resources. Fewer and fewer rents left over to support

governments and social systems.

Keep drilling faster. 🙂

I’m actually not kidding. Replacing decline has been an issue from the first well drilled. There was some cornie who used to cite a book from 1919 talking about the problem of replacing decline. Given no new wells, the world’s oil production will drop (has always been so, will always be so). The key is drilling faster, drilling better, squeezing the towel.

And I’m saying this will work (maybe it will, maybe not). Nature does not have to favor us, just because we want oil. The prolonged high price of oil is a very disturbing factor compared to the 84-2004 low price regime. Then again, the futures curve trends down (but not radically down).

What to make of it? I donno.

Heck, I don’t know how to calculate if OPEC (or SA) is acting to control prices or is pumping full out. If they are pumping full out, it’s actually a worse situation for us than if they are exercising market power.

There is something to this perspective.

The most dangerous thing Quantitative Easing has done is expose the whimsical nature of money. If the system is at risk and needs more, then you print more, whether there is any basis for it or not.

And in that context, if you will have people starving for lack of food transport unless companies drill for oil, even at a loss, then you will print up money — in complete cooperation with other central banks, which prevents currency collapse, and hand the money to the drillers.

Which is why I don’t watch particularly the economics of oil production. If you need oil and it’s not economical, you can just make it economical by decree.

While EROEI is ignored by the industry in decision making, in the end it is all that matters.

“While EROEI is ignored by the industry in decision making, in the end it is all that matters.”

Thank you for saying this.

“Even after Fukushima they are going to restart their nukes pretty soon and I will not be at all surprised to hear that they are building new nukes five years from now.”

I think they just built themselves a doomsday machine with all these nuke power plants. Sooner or later there is going to be a issue that causes one of the spent fuel pools to catch fire, than its “sayonara” for Japan and probably a large region in Asia. Humanity can survive without electricity, however it can’t survive a nuclear wasteland. There is no difference running these plants as giving a five year old a gallon of gasoline and a book of matches and not expecting a tragedy. Fukushima has already damaged a third of the pacific ocean and its by no means anywhere near controlled.

Sorry Farmer, but I don’t subscribe to the idea of using nuclear power. Its the death of the planet, Mutual assured destruction. FWIW: I believe a nuclear war would be survivable, without the nuke plants. I don’t believe humanity or any vertebrates will survive if the worlds nuclear reactors (~440) meltdowns. Even a loss of less than hundred will probably end humanity.

“If battery prices come down as much as most industry analysts think they will over the next few years the Japanese can cut their consumption of oil even further.”

Japan is bankrupt. It has the highest Debt to GDP in the entire industrialize world, and the only way it still functions, is by printing Trillions. It would not surprise me if Japan endures an economic collapses in a few years. I can’t see how Japan can safety manage its Nuclear program with an unsustainable economy.

Japan’s government debts are largely to its own people. The Japanese people reached peak consumerism 25 years ago, and have been saving their earnings ever since. The government uses these savings to build huge infrastructure projects in a forlorn attempt to boost GDP. So when the people realise that their retirement savings have been thrown away they will be angry, but how they show that anger will depend on their national character. They may simply throw their leaders in jail and go back to a poorer way of life.

Japan reached peak consumption in 1996 at 5.739 million barrels per day. In 2012 they consumed 4.726 million barrels per day. The EIA does not give their 2013 consumption.

Always useful to note that GDP has the implicit price deflator in it to yield the Real number and so whilst Japan may report 0% of 0.5%, they are lying — much as the US does. All you gotta do is gin up the inflation adjustment and you can make the real report be whatever you want.

And that’s where the Japanese oil consumption went.

Ralph Wrote:

“So when the people realise that their retirement savings have been thrown away they will be angry, but how they show that anger will depend on their national character. They may simply throw their leaders in jail and go back to a poorer way of life.”

Its at bit more complex than that, as Japan has demographic issues with too many young people to support its economy. The majority of its labor force is approaching near retirement age. While these people could continue to work into thier 60’s and 70’s it difficult to see them working in labor intensive (industrial) jobs which has been the backbone of Japanese exports. Japan depends on food imports, and imports 60% of its food (Source USDA: http://www.ers.usda.gov/topics/international-markets-trade/countries-regions/japan/trade.aspx)

Nice post Ron. I much enjoy the fact-based discussions.

I also take away from this that you say the peak is in 2016 (30%), or the year before/after (2/3). 🙂

In general I don’t care so much for predictions, as I belief some things are not knowable. There seems to be a human craving to want to know the unknowable. I am in rural China at the moment where a favored occupation of the elderly (besides playing cards/mahyong) is to make predictions about people’s lives based on their birthdates/times.

The exact peak oil date is indeed not so important. To me it doesn’t matter whether the peak will be in 2016, or 2025. Much more important is an understanding of the forces at work to get a feel how things could turn out. A lot of good information has been presented on this site that reveals some of those forces.

I think it is rational to expect that the main period of what Rockman has called the Peak Oil Dynamic will play out in the coming several decades, and that the first effects are already here for some time.

To me it doesn’t make sense when people try to debunk peak oil or the dynamic. Consuming a finite resource will lead to a maximum extraction rate at a certain moment. You can even predict that that moment will happen after some time of rising prices of extraction compared with the capacity to pay for it. How could you possibly argue with such a truism. All kinds of consequences can be deduced from this. The first effects are of course that average extraction costs even rise faster than prices, and it is quite hard to ignore seeing that already happening for at least some producers. They will start by paying more dividends, buying back shares, and selling pieces of their business, which is all an acknowledgement that they don’t see enough profitable opportunities. At a certain moment we will need to make the transition to other energy sources, and that is an incredibly massive task, but there is just no other way.

I am not a doomer like some here to expect the collapse of civilization because of it. Not necessarily because I belief in the good of people, but I do think incentives are the main motivator of behavior. Very few people will be incentiviced by a collapse of civilization. Not much fun becoming a billionaire if people are not interested in your cash anymore. Another reason for my optimism is the rise of humankind over the last million years , which is incredibly amazing to me. I think few people understand the forces behind this rise. It’s not that people are/were so very smart, unfortunately, but there has been a great desire to communicate and improve the lives of your close ones. I have not the impression that the peak oil dynamic is going to be one of the major issues for humanity during the last million years. Throughout history some part of the population always felt doom was close ahead, and many very severe challenges were overcome. I don’t think that view is blind optimism as some may here.

But it could well be one of the main challenges during our lifetimes, as are some of the other real issues like the overuse of other resources. It is also my impression that this dynamic is not highlighted sufficiently by the media or governments and the consequences could be/are already nasty for many, which is for me why I started to visit this and related sites. I think spreading good information about these issues is the best way to start dealing with them. So, Ron, even if you don’t, I also belief you are contributing to the solution 🙂

So, keep up the good discussions. I am also happy to see that different views are spoken out as how could you possible get a better understanding of the relevant factors if don’t try to argue both ways.

I also take away from this that you say the peak is in 2016 (30%), or the year before/after (2/3). 🙂

No, that’s not quite right. I said there is a 70% chance that the peak will be in or before 2016. That could be any year before including 2013.

If there is a 40% chance of something to occur before 2016(excl), and 70% chance of the same thing to occur before 2017(excl), as you say, and assuming it can’t happen more than once, then there is no other way than to conclude that there is a (70-40=)30% chance that it occurs exactly in 2016. Right?

Similarly, given your statements, there is a (90-25=) 65% (= roughly 2/3) chance of peakoil to occur within 2015 – 2017.

Not that’s it that important, but I can’t see how it is not right.

Okay, I am not going to argue the point further but that is definitely not right at all. Just because there is a 70% chance that an event will occur before 2017 in absolutely no way implies that there is a 30% chance it will happen in 2016.

If the weatherman says there is a 50% chance of rain on Tuesday and a 50% chance of rain on Wednesday, that in no way implies that there is a 100% chance of rain during those two days.

If, at birth, there is a 50% chance you will live to the age of 75 then if you reach the age of 74 then the odds change. There would then be a far greater than a 50-50 chance of you reaching 75. The average life expectancy at birth is not the same as the life expectancy at 74. If the life expectancy at birth is 75 then the life expectancy at 74 could very well be 85 or more.

Statistics is not an easy thing to understand I know, but you have it completely wrong.

Hi Ron and Enno,

In Ron’s opinion:

“There is a 10% chance that the peak was in 2013

There is a 25% chance that oil will peak in 2014 or before.

There is a 40% chance that oil will peak in 2015 or before.

There is a 70% chance that oil will peak in 2016 or before.

There is a 90% chance that oil will peak in 2017 or before.”

2013= 10 %

2014=15 %, 2013 to 2014 is 25%=10%+15%

2015=15 %,2013 to 2015 is 40%=10%+15%+15%

2016=30%,2013 to 2016 is 70%=10%+15%+15%+30%

2017=20%,2013 to 2017 is 90%=70%+20%

2018 or later-10%, 2013 or later=100%=90%+10%

I agree with Enno.

But you are both correct that it is not worth an argument.

Also the weather forecast for two different days is about two events rain Tuesday or rain Wed, we are unlikely to have peak oil in 2013 and in 2015, we are assuming there will be a single year where a peak can be defined.

The life expectancy argument is also not relevant, the odds change as you age, just as the odds that you would give on the peak would be different in 2005, 2014, or 2020, we are talking about what you think the odds are at present, just as we would look at life expectancy at birth and look at odds of living to 50, 60, 70, or 80.

I agree with Enno and DC. Please don’t ban me. 😉

Dennis, and here I thought you were a math major. The only parts you got right was the first and last. I believe there is a 10% chance the peak happened in 2013 and a 10% chance it will happen after 2017.

The term by a certain date does not imply on a certain date.

Again, statistics simply do not work like that.

Hi Enno,

Actually its physics and economics, my math only goes up to linear algebra and multivariable calculus.

Ron

Lets say I tell you that I think the peak will be before 2017 and I think the odds are 40% that this will happen. What would you deduce about what I think the odds are that the peak will happen in 2017 or later?

Hi Ron,

“There is a 10% chance that the peak was in 2013

There is a 25% chance that oil will peak in 2014 or before.”

Let’s try it this way, what do you mean when you say 2014 or before? I am assuming that you think output in 2013 will be more than 2012, so it does not mean that the peak will be in 2012 or any earlier years. I would interpret “2014 or before” as either 2014 or 2013, I am assuming that you think the peak will be in one of these two years, if it happens “in 2014 or before.” Now let’s think about the odds of rolling a 1 or 2 on a roll of the die. There is a 1/6 chance of a 1 and a 1/6 chance of a 2 so the odds of rolling a 1 or a 2 is 1/3=1/6+1/6. Likewise since you think the chances of a peak in 2013 or 2014 is 25% and you also think the chances of a 2013 peak are 10%, then you must also think that the probability of a peak in 2014 is 15%. To deny this would be like the following statement, I believe the chances of rolling a 3 or a 4 is 1/3 and that the chances of rolling a 3 are 1/6, but that doesn’t mean you can say anything about the probability of rolling a 4 (oh yes I can, it’s clearly 1/6.)

http://en.wikipedia.org/wiki/Probability#Summary_of_probabilities

If two events are mutually exclusive the probabilities are additive.

So event A is peak oil in 2013, probability=10 %

and event B is peak oil in 2014, probability=15 %

Event A or Event B (peak oil 2014 or before)=10 %+15%=25%

And I am done.

LOL! This is too funny! You guys remind me of the the CNBC hosts that debate and over-analyze an economic statistical figure.

Its not possible to really estimate when production will peak as there is way too many variables that have not to do with geology will influence production. We have the middle East destabilized, a massive debt ponzi scheme in the industrial world. A potentional geopolitical crisis in Asia (Japan-China, or North Korea). A major economic downturn could cut production for an extended period resulting in a plateau or demand destruction. We could have a War that cuts exports in the middle east or some other region.

We are already pass the peak! Since about 2005 the price of oil has risen considerably high and that it was the higher price that permitted soaring CapEx spending by Oil producers to increase production. Peak conventional oil happened in 2005 an I believe in time, historians will refer to 2005 as the peak year since past that date, prices soared and the western economies began their permanent downturn. Peak Oil is really about future economic growth, fueled by cheap and abundant oil. I doubt think anyone can argue that we will ever see energy as cheap as we did prior to 2005, which is really the only thing that matters. The battle is over, the war is lost, you guys are just watching to see which crippled soldiers limp away from the battlefield, count causalities and bodies.

The only thing supporting production is the debt ponzi scheme. I will make a prediction and I am certain it will be correct: The year global production peaks in Mb/d is the year the Debt Ponzi pops. Once the Debt ponzi crutch is gone CapEx for non-conventional production will disappear overnight. The same with the massive amounts of investments in maintain existing conventional production.

Exactly Dennis, thank you.

You honor your math major 🙂

I PREDICT…. 100% PEAK OIL after 2014.

steve

That doesn’t work Steve, I need 2 statements to make a deduction. How much chance of having peak oil after 2018?

Enno,

LOL.. I like my original forecast. I think there is a 100% chance we peak sometime after 2014.

steve

Steve, that is quite bold. I will go further the chances are 200% 😉

Dennis,

I will match and double your bet… 400%.

steve

Hi Ron,

there is a 0% chance that the peak was in 2012 or before

“There is a 10% chance that the peak was in 2013

There is a 25% chance that oil will peak in 2014 or before.

There is a 40% chance that oil will peak in 2015 or before.

There is a 70% chance that oil will peak in 2016 or before.

There is a 90% chance that oil will peak in 2017 or before.”

There is a 100% chance that oil will peak after 2012

I believe the following is equivalent:

10 % chance peak is in 2013

25% chance peak is in 2013 or 2014

40% chance peak is in 2013 or 2014 or 2015

70% chance peak is in 2013 or 2014 or 2015 0r 2016

90% chance peak is in 2013 or 2014 or 2015 or 2016 or 2017

100 % chance peak is in 2013 or 2014 or 2015 or 2016 or 2017 or later

Lets compare to the following when rolling a single die (cubic):

10% chance of rolling a 1

25% chance of rolling a 1 or 2

40% chance of rolling a 1 or 2 or 3

70% chance of rolling a 1 or 2 or 3 or 4

90% chance of rolling a 1 or 2 or 3 or 4 or 5

100 % chance of rolling a 1 or 2 or 3 or 4 or 5 or 6

We have an unusual die.

A fair die would have been 1/6, 1/3, 1/2, 2/3, 5/6, 1.

But as in the case of a fair die where we could find the probability of a 2 by 1/3 minus 1/6 which is 1/6, our unusual die has a 25%-10%=15% probability of a 2, likewise the 3 has 40%-25%=15% probability, next 70%-40%=30% is the probability of a 4, the 5 has 20 % probability (90%-70%), and the 6 has a 10% probability (100%-90%)

These ideas are the basis for

2013=10%

2014=15%

2015=15%

2016=30%

2017=20%

2018 or later=10%

Peak Oil is fascinating and I can’t tear my eyes away. I’ve been following the data for many years now would say that I am addicted to any news in regards to energy, always waiting with baited breath for a production decline which may or may not represent the start of the down-slope. Why? I don’t really know. I guess it stems from wondering about what changes will happen once the down-slope starts and the trend becomes clear.

Will we continue to fumble on attempting BAU?

What will happen to world economies?

Will governments come together and implement sensible policies or rationing?

Will we have eventual social chaos or war?

Will life go on largely as normal and peak oil be a non-event?

Will the cornucopians or doomers be right? Or will a middle-ground occur.

So many questions! Given that I thought the peak would be earlier 2010’s I now had to revise my own original estimation and would not be entirely surprised if the peak if further off than some think. Maybe I need to forget about peak oil for a while and focus on other things! The anticipation is killing me 🙂

Leslie Corrice is an excellent source of news and information about Fukushima and other nuclear issues including radiation hysteria http://www.hiroshimasyndrome.com/fukushima-commentary.html

Ron made a reference to this article (Wells That Fizzle Are a ‘Potential Show Stopper’ for the Shale Boom) which contains the new meme for the LTO companies — software! Yes, software to the rescue. Here are some choice tidbits.

“The oil patch needs more brain for its brawn.” Hmmm…I see, the problem all along has been too many bulked up geologists who spend their time at the gym instead of studying.

“The reason is enough to give pause to anyone enjoying the benefits of cheap, abundant energy produced in the U.S. “ Oh, man, have I ever been enjoying that cheap abundant energy. Just had a cheap, abundant energy party down in my man cave last week. Woo hoo.

“New wells are fizzling out in their first year, threatening the 3-year-old oil boom.” Dude, did you have to bring me down? Is there an answer? There must be some really really smart people working on this problem.

“The challenge is forging alliances between two groups who previously rarely needed to work eyeball to eyeball — the people who know rocks and the people who poke holes in rocks.” Huh? What the hell are you talking about man? Are you talking about drillers and geologists? WOW! And all this time I thought the drillers and geologists worked together. How could they have missed such an obvious opportunity?

“Halliburton engineer Ron Dusterhoft, who was charged with marshaling a SWAT team of experts to tackle the problem, can now see a solution using artificial intelligence software dubbed Cypher. One Texas well that the team studied for months should have been drilled deeper, at a different slope, to really hit the sweet spot for oil.” Yeah Baby! I love SWAT teams. So these dudes flew in on black helicopters and used artificial intelligence (the best kind of intelligence I’m told) and they hit a sweet spot on one well. Go SWAT, Go SWAT!

“A lot of these wells aren’t performing well because they just haven’t been put in the right place,” he said. So THAT’S why they aren’t performing! Guys, come on! Put down the barbells and start putting the wells in the right spots!

“Just when the nation is hastening its march toward energy independence, the industry is concerned about crummy rock causing shale wells to sputter, some dropping as much as three-quarters of their output in the first year. That forces drillers onto a hamster wheel: They have to drill more wells, faster, to keep production up and satisfy investors, who in turn see costs rising and profits suffering.” Much as I would pay to see drillers forced onto a hamster wheel, I wouldn’t want to do it if it means investors not being satisfied.

The industry has so far been able to live with the decline curve problem because operators have been able to scratch out better initial production in wells, Stark said. “If you don’t have that improvement, then you get stuck after a while and have to drill more and more wells just to stay even,” Stark said. OK, OK, I know this is the big build up. Things are looking bad but there’s an answer, right?

Now, energy companies including Halliburton and Schlumberger Ltd. are realizing they need to buttress their efforts with brains before brawn.

Dusterhoft was charged with assembling a SWAT team of engineers and geologists at Halliburton — something new in shale drilling where the two disciplines traditionally minded their own tasks: geologists found the oil, and engineers figured out how to drill the well.

Understanding the peculiarities of shale rock requires bringing both into the same room for the first time. Yeah, let’s get those geologists and drillers into the same room. Sounds like a start. Why the heck didn’t they think of that before?

Before the hunger for more science and technology, the industry was essentially drilling wells blindly, said Peter Duncan, a former geophysicist at Royal Dutch Shell Plc who founded Microseismic Inc. Operators originally viewed shale rock in the “layer cake” model, thinking all of the rock was the same. Real-world experience showed that’s not the case, he said. Silly operators. I’m getting hungry for more science and technology, how about you?

Commingling the expertise of their scientists through a software program Schlumberger calls “U-ROC” has led to an almost 30 percent increase in production in some wells in the Eagle Ford, Cordes said. U-ROC! I love it! It has a cute name! I want in on some of that U-ROC magic, where do I send my money?

They’re starting to figure it out. Laredo Petroleum Inc. shares doubled in the five months after it talked on a call with investors in May about working with Halliburton on well-spacing and by using a “science-based approach” in West Texas’ Permian basin. Oh Baby, do they ever have it figured out. Shares double after a call to investors? It’s like printing money. It’s better than printing money!

By August, Laredo said it had its best-ever results in the Permian and that it was “among the best” of all peers working there. The well’s success was attributed partly to Laredo’s own internal efforts to pump more time and money into the science of drilling and production, said Ron Hagood, a spokesman at Laredo. And oil company executives never lie or exaggerate, so it must be true. But exactly what does “among the best” mean? And what does “of all the peers working there” mean? And what does “attributed partly” mean? Could you please be a little more specific? No? No way in hell you say? Shut up you say?

THE BIG FINISH

Ultimately, Dave Dunlap, chief executive officer at Superior Energy Services Inc., said he doesn’t ever see the decline curve challenge going away entirely.

“We’ve drilled all the good stuff,” he said. “These are very poor quality formations that I don’t believe God intended for us to produce from the source rock.” Man, and I was just starting to feel good. You’re a bummer. And if God didn’t intend us to produce from that rock how come we’re doing it? Are you saying God is wrong?

Awesome post, man. “Come on guys, put down the barbells!” 😀

I think the high decline rate was pretty well known. We’ve put thousands of holes into the Bakken and have data based on current development scheme going back to 2008. This pitch seems more aimed at companies that haven’t been drilling in the shale than those that have.

Hilarious…

I re-posted it over at the Hedge….