A Guest Post by George Kaplan

Production History and Reserves

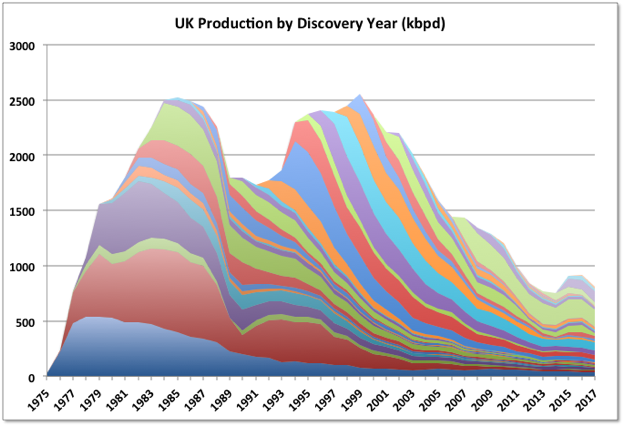

UK oil production peaked in 1999. The peak was probably pushed out a couple of years because of the major production interruptions following the Piper Alpha disaster. Production declined quickly until around 2011, then the high oil price allowed more brownfield and then greenfield developments that created a third local peak in 2016. Production is declining again this year but there are several large projects due that will create another peak in 2018 or 2019 (nearly equal to the 2016 one). After that terminal decline is likely. The chart below shows C&C production split according to the year of first production of the field.

Like all such all diagrams, this shows that the largest fields were developed first and declined the slowest.

Most data here is taken from the new UK Oil and Gas Authority (which replaced part of the disbanded Department of Energy and Climate Change), some from the Scottish Parliament and the rest from Company and Trade Paper publications (but presented without the implied “Everything is Awesome” imaginary soundtrack that accompanies and influences everything from all such sources).

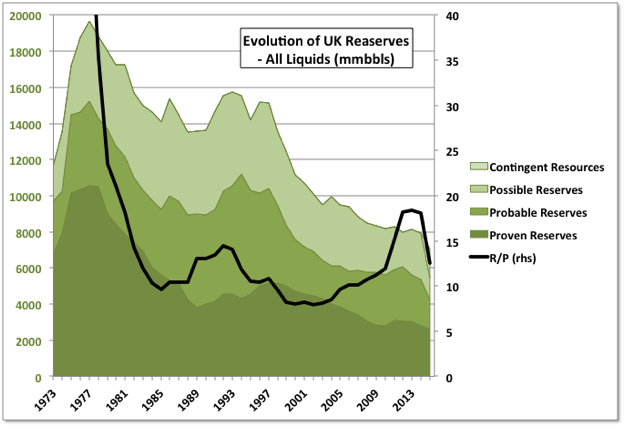

Reserves for oil and gas have been declining fairly steadily since 2000. The UK reports according to SEC rules (i.e. including only developed reserves and those with definite development plans) and, from this year, reports 3P and contingent resources. The R/P ratio given below is based on 2P numbers. The oil reserves include onshore oil (which is around 100 mmbbls) and NGLs (which are about 4 to 5% of the total).

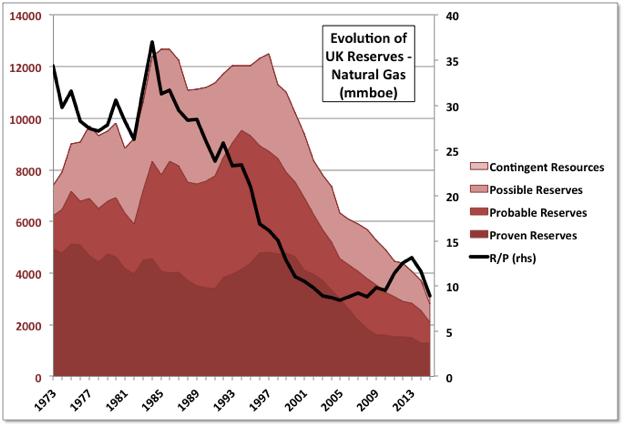

Natural gas reserves in particular are looking low and declining fast – possibly mostly gone except for some associated gas in the remaining oil reserves by 2030 without some big discoveries – but this post concentrates mostly on oil. Remaining 2P oil reserves (as of December 2015) are 4.2 Gb (so say about 3.9 C&C only) , and for gas, 2.1 Gboe. There have been studies that indicate around 5.6 Gb of undiscovered recoverable oil (and 3.6 Gboe of natural gas): UK OGA

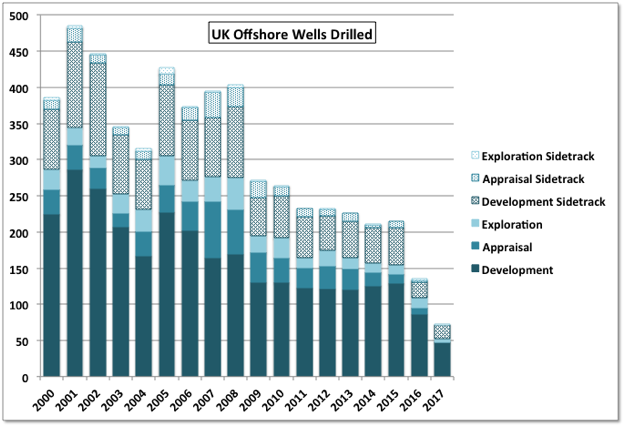

However recent activity for licensing, exploration drilling and development approvals would suggest that the E&Ps think that the putative undiscovered oil and gas is going to be difficult to find and expensive to bring to production. Recent drilling activity has mostly been for development wells with only fourteen exploration wells in 2016 (plus two sidetracks) dropping to five and one in the first half of 2017. Appraisal wells have been even fewer, only eight in 2016 and one so far this year, reflecting previous years drop in discoveries, especially any large fields. 2017 figures are through July.

Many of the development wells are predrilling for subsea completions on projects due over the next couple of years. Hence these numbers, too, will decline as those projects come on line and fewer follow. It’s also notable that drilling dropped after the short price dip in 2008, but didn’t pick up again as prices and overall E&P activity rose significantly from 2009 through 2013.

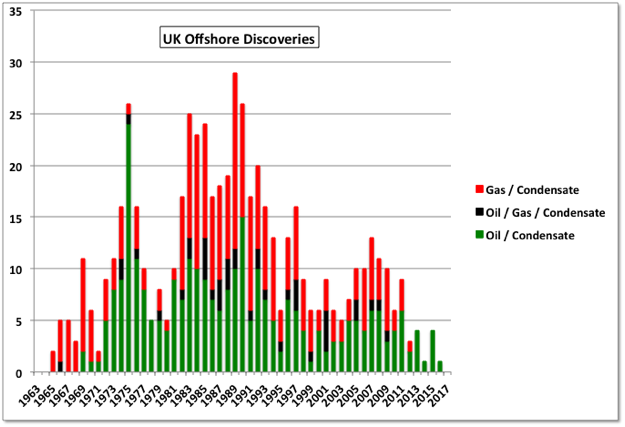

Discoveries have dropped off in line with the decline in drilling and reserves, as would be expected. UKOGA does not provide individual fields reserves that I have found so this chart only gives numbers of discoveries (only one last year and none this). The fall off would be even more marked based on size as only small fields are now being found (and no gas fields for five years).

The UK Oil and Gas Authority don’t provide easily analysed data concerning the licensed blocks, although there are a couple of Excel files they have that I haven’t been able to download which might. In the two full rounds plus one supplementary round since 2015 there have only been four firm wells bid out of 75 new licences; there are a few conditional wells but all the other bids have been for new seismic (and much of it 2D) or review of data only, followed by drill-or-drop.

Recent Production

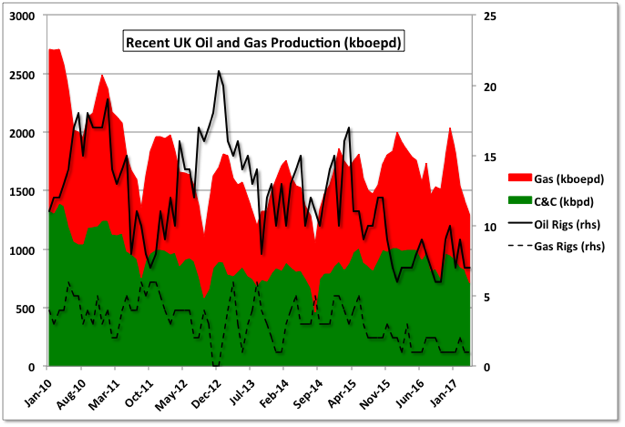

Recent monthly production numbers for C&C and Natural Gas, with drilling rig numbers (from Baker Hughes) are given below. Production is highly seasonal because maintenance turnarounds are scheduled in spring and summer when the weather is clement and gas demand is low. Installation of new facilities occur then as well which means that new production tends to ramp up mostly in the first half of the next year.

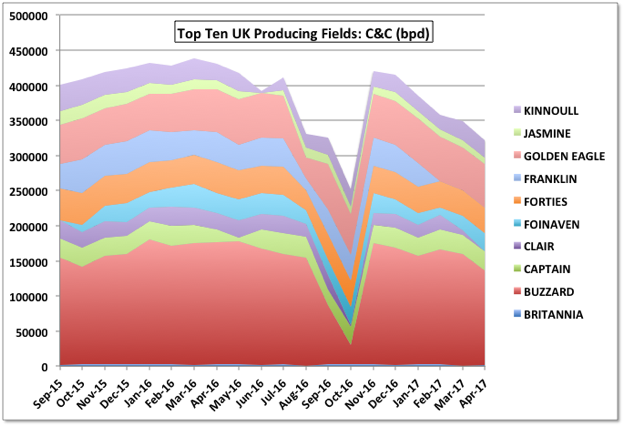

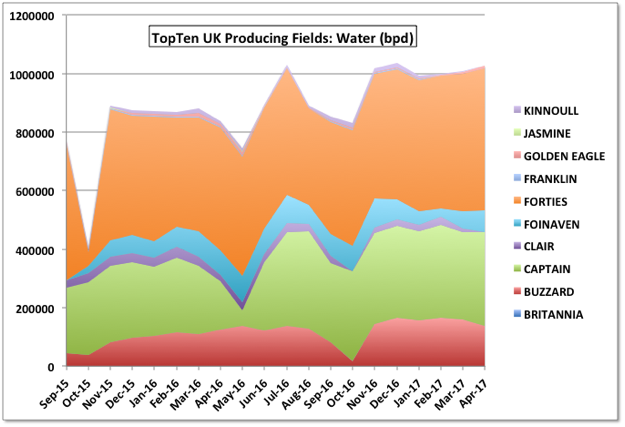

UK production comes from many small and medium sized fields; this is in contrast with Norway where most production comes from fewer large fields. The top ten fields by production in 2016 are shown below. Collectively they have peaked (note UK is a month behind in producing the data compared to most other governments that issue good data, so these numbers only go to April). Franklin and Clair are offline and all shown are in decline. Collectively they process far more water than oil, as is common in mature fields, and their water cut is still continuing to increase.

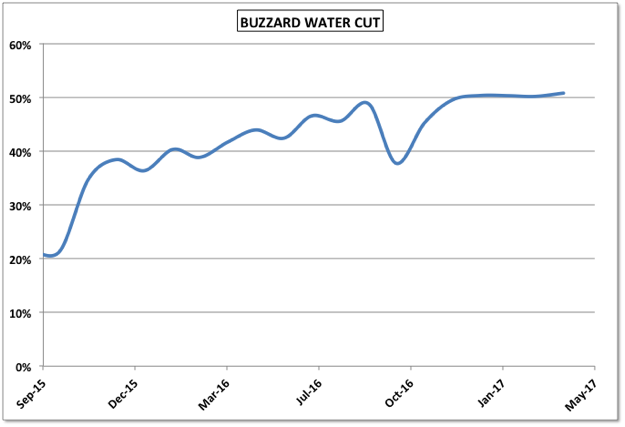

Buzzard has been the largest producing field for many years and has stayed on plateau for about three years longer than originally expected, but it now looks to be hitting high decline rates. Its water cut has passed 50%, which is often a threshold for the end of a plateau, and still increasing.

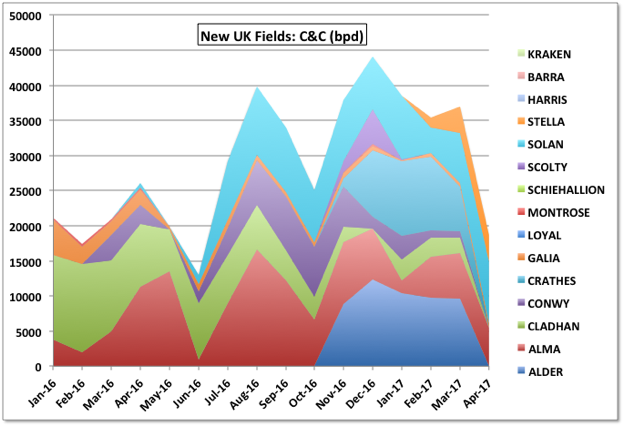

Recent fields additions have been small, and most go into almost immediate decline, for example the Cladhan field started up in December 2015 and looks to be already exhausted, (in fairness it is classed as a gas field so the production would likely but to recover a small oil deposit before starting the blow down of the gas). However the next batch of projects to come on line are much larger – some fields shown in the legend, but with no flow numbers yet are for facilities that have been, or are currently being, installed but did not show production in April.

Future Production Projection

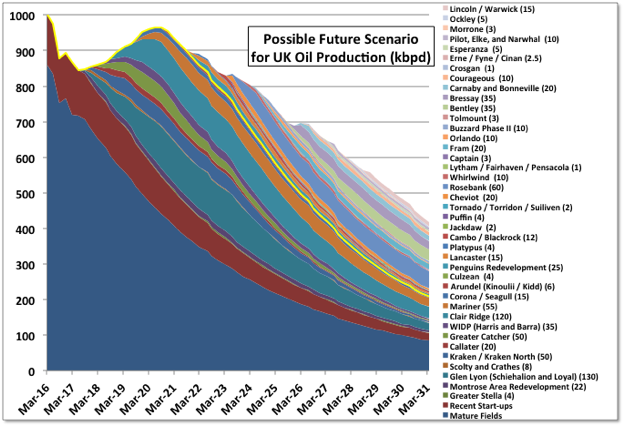

A proposed projection for production until 2030 is given below. The projects before the yellow line are now operating or being constructed. Expected start up times and nameplate capacities (in brackets after the name) have been taken from company presentations. Expected availability, ramp up times, plateau periods and decline rates have been estimated based on the type of installation and to match given 2P reserve numbers. The total recoverable oil for developed and due fields from 2016 to exhaustion, is 3.7 Gb, which matches fairly well with the estimate given above (maybe a bit low, but there may be fields included in the UK OGA numbers that have development plans but are not in construction yet. The “recent” fields are anything started in the last three years, and have slightly different assumed decline parameters than the mature fields.

The developments listed that are above the yellow line are pure guesses based on known discoveries and tentative plans discussed in company presentations and trade papers (i.e. currently in appraisal). There is another 1.2 Gb C&C in the production shown. some of this is from small gas fields which I have just given nominal condensate production numbers (a couple of these have actually had their licenses relinquished, but someone else may take them up again).

All attractive discoveries are immediately fast-tracked, even with recent low oil prices, and many of the more marginal, aged legacy discoveries were developed when oil prices rose above $100. Therefore all of the larger oil developments in these putative projects are quite unusual (read difficult), and likely to be expensive, e.g.: Rosebank has layered reservoirs between lava flows or some such; Fram is a thin oil rim with large gas cap (and has been around since the Eighties); the Hurricane operated fields are basement rock (deposits in fractures in granite which has been pushed above the source rock for the oil), Bentley is heavy oil, the previous licensee went bust, it might be developed using steam injection, which is quite marginal for offshore developments because it’s difficult to prevent excessive heat losses; the Pilot fields are similar but more advance in concept for steam injection; Bressay is marginal heavy oil and it’s development was cancelled by Statoil last year, possibly until they see the results of the Mariner development, which is similar but more commercial.

As pretty well all the forthcoming projects are now in the later development stages of construction, commissioning or installation there are few to none reasonably sized projects for the UK currently in detailed design. Most of the larger engineering design teams have broken-up and the remaining installation and start-up teams will probably soon follow. If there is another boom period it may be difficult quickly to ramp up project activity, so meeting the schedule for unapproved projects as shown is going to be increasingly problematic.

And to end on an upbeat note (as seems to be required in all MSM articles these days – we don’t seem to be considered mature enough to be able to cope with bad news) though here slightly pretentious, this is “At the Theatre” and/or “The First Outing” by Renoir, showing good things really can come from humans using oil (with a UK connection too). Renoir isn’t considered quite top tier and this might not be one of his best (or it just might be) but the young lady shown, at that time and that place, definitely did think everything was awesome; and with no post-modern irony or need to take a selfie either.

Hi George,

I found the following projection from the UK govt (from 2015)

https://www.ogauthority.co.uk/data-centre/data-downloads-and-publications/production-projections/

The UK seems to be much more conservative than the US EIA as their projection is only a little more optimistic than yours through 2026 and then from 2026 to 2030 your projection declines more steeply (which seems accurate to me because these will be smaller fields which tend to decline more rapidly).

I tried to scale the chart similar to yours.

There are also projections from Oil and Gas UK (the industry body) which are more on the higher side. They and the UKOGA present final results with a bit of a range, but I think it’s interesting to dig down a bit, for instance both their and my projections only work if the as yet unapproved and, I think, rather expensive undeveloped discoveries come on line. Also a gentle decline curve makes it look like things gradually wind down, but really the industry in the UK is coming to an end and it will be a series of sudden stops: e.g. no more detailed designs (I think the last big on is not for UK but for Johanne Sverdrup in Norway and that is well into construction phase now; no more exploration drilling; no start ups in a year; no more involvement of the multinational majors etc.

Below is one chart I didn’t include as it is a bit rough and ready and shows average time from discovery to production based on discovery year. It’s natural that this would always show decline as projects only get added once they come on line, which would then bump the line up, but I think it also shows the general move to small, short cycle projects, which will naturally be followed by … nothing at all.

(The granularity is only to the nearest year for each project so zero means a new discovery well which was immediately tied in for production.)

Hi George,

Very interesting, thanks. I agree your decline scenario is more reasonable and as you point out, even that might be too optimistic. Would higher oil prices ($100/b or more) perhaps allow some 3P reserves or contingent resources to move to the 2P category and allow a less steep decline? I expect that some time between now and 2030 that oil supply may not keep up with demand at current oil price levels and that oil prices will rise to previous high levels (2011-2014) or perhaps higher.

A question about the “discovery wells that are immediately tied in”, aren’t these discovery wells already included in 2P reserves, or are these “possible reserves” or possibly contingent resources that were believed to have a low probability of being produced? In some sense it would seem such wells might be considered “reserve growth” rather than “discovery”, in the sense that if a platform already existed nearby, then the “discovery” was made earlier (which is why there is a nearby facility), but the total size of the 2P reserves was uncertain (which is always the case until the platform is decommissioned). In my mind the time from discovery to production (when there is no pre-existing production facility) cannot be less than 5 years for offshore production in deep water.

If it’s an exploration well to a new formation then it would be a discovery. If it’s an appraisal well or development well that accesses more than was expected it would be growth. There are different planning, approval, reporting, tax etc. issues depending on the well type. Sindre (or Syndre or something like that) was a small new field drilled from Gullfaks this year. It would only have taken a few months to build the tie-in from the well bay to the manifolds and it was producing. For such small fields Norway and (I think) UK waive a lot of the development application bureaucracy. The North Sea isn’t particularly deep and there are existing platforms near anywhere prospective for gas, not all with drilling rigs though, subsea tie backs would take a lot longer.

The Baltic Sea: Europe’s Forgotten $80 Billion Oil Play?

The Baltic Sea is universally known as a pathway for oil and product transportation, but little is known of its production potential. Yet a recent flurry of activity in the Baltic offshore has stirred hopes that the best is yet to come, and similarly to the Northern and Caspian Sea nations, the Baltics could tap into their resource potential. According to the United States Geological Survey, the Baltic Depression Province, comprising of offshore Poland, Russia, Lithuania, Latvia, Estonia and Sweden with swaths of onshore territory, holds up to 1.6 billion barrels of technically recoverable oil, of which 82 percent is unconventional.

http://oilprice.com/Energy/Energy-General/The-Baltic-Sea-Europes-Forgotten-80-Billion-Oil-Play.html

So ……. that’s about enough to hold us for maybe three weeks or so, depending on how the cards fall. Consumption per capita could go both ways, up or down. And of course it will take fifty years or more to get that oil out of the ground and into trucks and cars.

Take comfort in such great good news. I had a highly amusing encounter with a self made millionaire relative a few days ago who reads a couple of business magazines and watches Fox news. He is utterly convinced that the oil fields recently in the news up Alaska way are a couple of the BIGGEST ONES EVER.

Well they are, if you limit the discussion to ones that are NEWLY discovered, and not yet developed.

Somebody tell us how many years it’s been since the discovery of a new super giant field.

1.6 Gb technically recoverable is probably only 400 to 600 mmbbls actual – so 2 or 3 projects if it is all in the same place, if it is spread out in small clumps it will never be developed without a main anchor facility. That is probably why it’s forgotten.

Thanks for these details. Huge decommissioning cost in future

https://www.ogauthority.co.uk/news-publications/publications/2017/ukcs-decommissioning-2017-cost-estimate-report/

The impact on oil revenue is in my post:

Brent Exit

http://crudeoilpeak.info/brent-exit

Will bankrupt (or nearly so) countries merely abandon rather than decommission their oil, gas and nuclear facilities?

Huge and increasing with each new report, and the North Sea is now starting to be funded by tax payers.

Libyan Oil Liberator Aims To Boost Russian Ties

http://oilprice.com/Latest-Energy-News/World-News/Libyan-Oil-Liberator-Aims-To-Boost-Russian-Ties.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+oilpricecom+(Oil+Price.com+Daily+News+Update)

Everybody is after that premium Libyan Oil.

Iran port gets first oil swap cargo in 7 years

http://www.presstv.ir/Detail/2017/08/12/531508/Iran-Caspian-oil-swap-Turkmen-crude-Dragon

The collapse of the Soviet Union has given Iran an opportunity to position itself as a major transit route for the Caspian energy. However, plans for building a pipeline to take the region’s oil and gas to the Persian Gulf have been shelved amid US opposition.

08/17/2017 at 4:33 pm

Rune, thank you. Regrettably you might have gotten cut off at the knees with another post and your excellent work will not receive the attention it deserves.

Statements such as these: “We’ve hit the bottom of defaults,” said Steven Oh, global head of credit and fixed income at PineBridge Investments. “By and large, it’s over,” are so ridiculously absurd it is incredible. The shit has not even begun to hit the windmill for the US shale oil industry yet.

Reply

Rune Likvern says:

08/17/2017 at 5:53 pm

Mike, thanks.

Would the blog owner allow linking a thread in the new post?

Kaplan has some good posts!

Some days/weeks ago I noticed on NDIC site that 61 rigs were active, today 53 and 5 MIRU. Not sure what that means.

From looking at the 10-Qs I noted that the companies outspent cash flow from operations so far in 2017.

If present prices are sustained for say another year I would keep a safe distance to windmills.

Reply

Mike says:

08/17/2017 at 6:33 pm

Yes, Mr. Kaplan does have good posts and this one is important. Unfortunately the topic always seems to turn to shale oil somehow and I think your work needs revisiting; I’ll cut and paste it if I need to, with apologies to Mr. Kaplan. I am still reeling from the implications of interest on legacy shale oil production…its like malaria that never goes away.

Roger that on windmills; it seems to me that the first big blob to hit will be WLL. Its in, or on the way, to hospice care.

@ 08:16 CDT:

Mike says:

Rune: timely, and poignant, please see this: http://oilprice.com/Energy/Oil-Prices/Are-Investors-Bailing-On-US-Shale.html…

“The third, and perhaps most glaring, problem with the growth-first shale model is that shale companies were burning through cash when oil prices were $100 per barrel, and they are still burning through cash even after the much-heralded efficiency gains achieved over the last three years. According to Bloomberg and Bloomberg Gadfly, the free cash flow after capex for a collection of 33 shale E&Ps has been profoundly negative over the past 12 months. More worrying for investors is that the cash burn in the Permian has been particularly large, and worse, it has accelerated over the past year.

As Ellen R. Wald puts it in Forbes, “when the financiers lose interest, the Shale Revolution will be over.”

As we gave discussed numerous times, the shale oil revolution would not have occurred but for abundant, low interest credit. It is hanging on now, by a thread, for the same reason.

Saw in Rune’s post an estimate of 6% interest being paid.

Spent some time recently with credit rating websites and found a listing of recent and prevailing debt from some of the producers, and despite their “less than investment grade” credit rating they were paying well under 6%. Rune if you see this maybe a quick scroll will find the links I included. Mostly Moodys.

I use 6% based on averages from several companies SEC 10-K/Qs.

I found Whitings’ effective interest rate (weighted average) for Q1-17 at 6,06% and Q2-17 at 5,86%.

Looking at their notes (from their 10Q for Q2-16) they have;

$961M maturing Mar-19 with an interest rate of 5,0%

$562M maturing Apr-20 with an interest rate of 1,25% (convertible)

$874 maturing Mar-21 with an interest rate of 5,75%

$408M maturing Apr-23 with an interest rate of 6,25%

Then add a senior subordinated note due in 2018 at 6,5%.

For large majors I found that their average interest rate is in the span of 3,5% – 4,0%.

Sounds right for Whiting, but they didn’t seem to be a representative player.

What was most surprising was the rates being paid by companies in shale with credit ratings far below Exxon, (Moodys junk ratings) but interest rates just slightly above Exxon and only . . . 1.5% (from memory) above Treasuries.

Completely insane.

”Sounds right for Whiting, but they didn’t seem to be a representative player.”

With regard to Whiting data on their loans, these are available in their SEC 10-K/Qs and the link below is to their investor relations site so anybody can check by themselves.

http://www.whiting.com/investor-relations/sec-filings/

Whiting is/has been the biggest producer in Bakken(ND).

According to Watcher this does not make Whiting a representative player.

I have provided my information in a transparent way so that anyone with an interest can check it out.

Hi Mike,

Rune can re-post his comments here.

Or I can if he would like.

Here is a link to the discussion. Well worth reading in my opinion. Maybe Rune could write a post on this and it could be cross posted here if he would like? Rune does some of the best work around, in my opinion.

http://peakoilbarrel.com/opec-july-production-data/#comment-612146

Thank you, Dennis; I hope that he will, or you. Even if one completely disregards investor presentation hype it is still often very difficult to sift thru Q’s & K’s, even SEC filings, to find out how the shale oil industry is getting away with it’s funky arithmetic. Rune is doing that now and it is VERY important. Even with what “appears” to be higher productivity rates in newer shale oil wells, those new wells must carry the financial burden of older, legacy wells whose debt has not been paid back. As Rune points out, that burden is increasing and very problematic.

I agree with you, by the way, regarding the ‘size’ of the resource in shale basins and the role that Tier 2 type shale will play in our future. It will be more expensive to exploit, even less profitable, if that is possible, and far less productive. We are already seeing that, even, perhaps, early signs in the Midland Basin. And again, where is the money going to come from to develop these reserves?

For Watcher: I had written a fairly well received article on Oilpro several months ago, which of course is now gone, about bond ratings and the possibility of increasing interest rates, etc., in part based on this paper from Columbia: http://energypolicy.columbia.edu/sites/default/files/energy/Reserve_Base_Lending_Outlook_For_Shale_Oil_Gas_Finance_May2017.pdf It is interesting to me how many, and how far below investment grade, the ratings are for the shale industry.

Mike,

Applying an average interest of 6% for all Bakken(ND) and now, the interest expenses/costs is now about 25% of all costs and specific interest costs is steadily growing. The specific interest is related to the flow, the higher the flow the lower the specific interest and vice versa.

Already now, and as interest rates come up, it becomes a challenge to just roll over debt.

There are other aspects to this as well as most companies now are simply recirculating borrowed money for manufacturing new wells and as I illustrated in the chart in the previous post (and which Dennis now linked to) these wells on average, and despite considerable initial flow improvements, are on a trajectory to take losses spanning $2M – $4M each.

One way to look at this is; instead of paying down principal, the companies keep manufacturing wells and pays interest and risks leaving a big portion of the principal in the ground.

http://cdn.theatlantic.com/static/mt/assets/business/10yr%20Treas%202011-09-21.png

The obvious rebuttal to “as interest rates come up”.

But be that as it may be, there is no way in hell these junk companies should be placing bonds at such absurdly narrow spreads over XOM paper.

Watcher,

It is not much helpful to link to a chart showing movements in US10 year Treasury as of 2012? in an effort to document interest rates paid by Bakken players.

As you are the (only?) one that questions the interest rates I presented I would expect that you gave references/links to data that supported your claims so that everyone could see by themselves.

While we await I can inform that I found that Oasis had an effective interest of 6,30% in Q1-17 and 6,24% in Q2-17.

Link to Oasis SEC filings

http://oasispetroleum.investorroom.com/sec-filings

For both Oasis and Whiting the effective interest rate has been on a general upward trajectory since 2013.

Well sorry about that, the chart looked like it extended 3 or 4 yrs past the 2010 point, given distance between 2007 and 2010 on it.

Better? http://static1.businessinsider.com/image/561674b4bd86effb5b8b527c-1200-900/10-year-treasury-10-8-15.png

That’s out to 2016ish. You see a 32 year trend reversal in that? I know the narrative is higher rates because of central bank success in achieving booming GDP growth, but . . . you see a 32 year trend reversal in that? The US 10 yr instrument closed 2.19% Friday.

Now then, two posts ago (the GOM post) I splashed examination of shale players and their Moody’s rating and a sampling of Morningstar interest rates on their loans. It’s a lot of text. Pretty easy to pop back there to get it.

OAS and WLL are shale players and you sampled them, but EOG is larger revs, Diamondback is not tiny maybe similar revs, Devon is larger revs, Pioneer (PXD) similar size, Apache larger. Diamondback and PXD were being discussed so I got their numbers particularly, but also others.

I’m scrolling thru that comment thread to get what I told you is there, but not pasting it all. Here are the highlights

Diamondback Moodys rates it B1 as PDR (Probability of Default Rating)

As mentioned before the big 3 have different letter nomenclature

Moodys rates Chevron Aa2 (3rd highest rating)

In case anyone cares, for Moody’s nomenclature, it goes as Aaa the highest. AaX where X is 1, 2, or 3, as a division within the preceding letter. So Aa2 means it needs to get to Aa1 as one step and then one more step would be up to Aaa, the absolute highest.

From Moody’s text explaining what the letters mean

B Obligations rated B are considered speculative and are subject to high credit risk.

Below Baa is junk bonds. That’s the threshold for investment grade vs speculative aka junk

This is just Moodys.

So Diamondback at B1 means it’s on the threshold of Ba, then would need 3 more upgrades to get to Baa, and then one more level would lift it out of junk status.

Reviews are not weekly, they gotta do the whole universe, but pretty much everyone goes in their spreadsheets about quarterly, so here are some ratings from moodys

CVX as I said is Aa2 (and that was a recent downgrade)

BP A1 (bumped up June 2017, first upgrade for BP in 19 yrs, mostly cuz there is now litigation clarity)

XOM Aaa max

Apache Baa1 negative outlook (year old)

Conoco Baa2 negative outlook

Devon Ba2 negative outlook

EOG Baa1 stable outlook

Marathon Ba1 negative outlook

outlooks mean credit worthiness trend suggests the next review will hold, upgrade or downgrade depending on outlook

Now then, Devon:

Devon debt

http://quicktake.morningstar.com/StockNet/bonds.aspx?symbol=DVN

This is a Ba2 company paying only 4.83% for 30 year paper. That’s a junk bond company paying 2 lousy % above the 30 year US Treasury instrument? WTF

XOM 30 yr paper 3.7%

Somebody is subsiding this rate. This is bizarre.

Then more:

http://quicktake.morningstar.com/StockNet/bonds.aspx?symbol=pxd

This is Pioneer’s debt. Morningstar rates them BBB-. Moodys Baa2 as of March this year.

finance.yahoo.com’s balance sheet for them lists 2.7 Billion LT debt. Another half billion short term. (these numbers are 7 months old)

But back to the morningstar link above. First debt item 600 million bux due 2022. It was issued 2015 so it is long term. Rate . . . for a friggin Baa2 company . . . 2.75% traded. The US Treasury 5 yr note is at 1.8%.

That’s less than 1% over Treasury, for a Baa2 company.

I got no problem with sampling OAS and WLL, but it’s a bit cherry pickingish. Tack on other shale players like those from the Moody’s list above — which are also (like OAS and WLL) less than investment grade. They are borrowing at absurdly low rates.

(I just hit the morningstar links, they are slow for some reason but it did load, patience, don’t know why those pages on the morningstar site are always so slow. Morningstar is a major equity rater, you would think they could afford bandwidth)

Watcher,

first of all what I presented was related to the Bakken (which was clearly stated in the charts and in the text) therefore and so far I showed WLL and OAS.

Looking at Halcon (also in Bakken) latest 10/Q Q-2-17 I found an effective interest rate of 7,20%.

Many of the smaller companies have a high interest rate. Some of the bigger a lower, I wanted the average because what I presented was estimates of the average well in the Bakken by vintage.

With regard to PXD (Morningstar link) would have found that its weighted average interest is about 5,1%, for Devon 4,9%.

I have not found that Devon and PXD are active in Bakken!

Watcher wrote;

”I got no problem with sampling OAS and WLL, but it’s a bit cherry pickingish.”

Watcher, the problem is that you do not take the time to understand what is being discussed and so far you have not provided any documentation that gives reasons for me to revise the average interest rate I am using for the Bakken.

I was not referring to US 10 Year Treasuries and with respect to that below is a link that gives you very recent data on US 10YT.

https://fred.stlouisfed.org/graph/?chart_type=line&recession_bars=on&log_scales=&bgcolor=%23e1e9f0&graph_bgcolor=%23ffffff&fo=verdana&ts=12&tts=12&txtcolor=%23444444&show_legend=yes&show_axis_titles=yes&drp=0&cosd=2005-02-09%2C2005-02-09&coed=2015-02-09%2C2015-02-09&width=670&height=445&stacking=&range=10yrs&mode=fred&id=DGS10%2CDCOILWTICO&transformation=lin&nd=&ost=-99999&oet=99999&scale=left&line_color=%234572a7&line_style=solid&lw=2&mark_type=none&mw=1&mma=0&fml=a&fgst=lin&fgsnd=2007-12-01&fq=Daily&fam=avg&vintage_date=&revision_date=#0

Companies are also subject to risks evaluations and debt assumed under better financial conditions may be rolled over into higher interest debt, which some companies already has experienced.

Gargantuan link didn’t load. Familiar with the St Louis Fed site. I’m sure they have a graph of the 10 yr historical — which will look like what I just gave you and end at 2.19% Friday.

Your phrasing was as interest rates rise. The US T is the floor below even Aaa and thus also under Baa. “As interest rates rise” starts with the riskless rate of return.

If you were suggesting spread expansion, well, I am on your side then because the spread compression in these shale companies paying nearly nothing above Exxon’s rate is hard to accept.

As for Bakken only, there was CLR text I remember typing. Didn’t paste it. Their Moodys was also weak and paying not much premium over Aaa. Just relooked at their HY paper. 4.9%.

As for changing what rate you use for whatever, maybe a good idea to use the current as traded yields rather than a profile of the company’s entire issuance outstanding, especially since some of that paper was placed years ago at higher prevailing macro rates. If you are trying to speculate on rollover potential and at what rate, that would be more meaningful.

Beyond these intricate details, do you have a feel for sensitivity? If we’re quibbling over maybe delta 2%, what’s the impact? Small or large?

I use what the companies actually paid in cash for interests by quarter/year (I referred to this as an effective rate) on what they listed as an outstanding financial debt at that period. Admittedly, not perfect either as the weighted average debt also changes within a reporting period.

It is this interest rate that I found (and documented) has been on an upward trajectory. This may also reflect spread expansion.

I also briefly looked at COP and Hess an their interest rate is about 6%.

The other thing is that the total flow is constituted of flow from several companies which has different effective interest rates over time, portions of the flow so the effective interest rate (for Bakken) itself is subject to some fluctuations from one month to another.

Of course I do sensitivities to check how sensitive the results are to variations to one or several parameters.

No, I will not be able to pin point the (effective/paid) interest rate anytime down to two decimal points for several reasons (one being several companies are not public), but if it is (for the average well) within +/- 0,3% (like now moves in the band of 5,7% – 6,3%) that is likely the best one can hope to do with data from public sources.

With sustained low oil prices (present levels) a 1% (in either direction from 6%) has a marked effect on how fast the well recovers the outstanding employed capital (money). This is why I put a lot of effort and attention into this part and I change the interest rate as it actually changed over time.

Doing a full cycle analysis reveals that the (Bakken) wells started after the price collapse are very sensitive to the interest rate and of course the sales price for primarily oil.

This approach illustrates that all the production (despite a small portion with profitable wells) started since 2014 is very, very likely to produce huge financial losses. For now this flows under the radar as the companies report in BOE and further spreads the interest expenses over all production whereby the legacy wells (pre 2014) subsidizes the newer wells.

Using Jan-2009 as a baseline I have estimated that in total in Bakken(ND) some $37B – $40B has been spent above net cash flow as per Jun-2017. This is primarily debt and proceeds from assets and equity sales.

During the period Jan-Jun 2017 gross interest expenses amounted to an estimated $1,100M.

CAPEX out spent net cash flow with an estimated $740M during the same period.

Without this infusion of external capital the completed wells would have been lowered with about 100 during Jan-Jun/17 and lowered the flow.

This would have brought the specific costs up.

Another way to look at this is that the companies financed all their interest expenses in this period with borrowed money and assets/equity sales.

Sounds like a major bubble. Wall Street and the financial community have got to get out before they are left holding the bag.

Or, as Watcher assumes, the government will just keep funneling money that way until there isn’t any more oil to pump, and then everything collapses. I guess by that time the smart rich will have bought lots of land in the safest places they can find.

From what I observe there are now some cracks in this bubble, some companies have already been through Chapter 11 restructuring and some like Whiting is now selling assets likely to pay down debt.

I for one doubt the government will step in and save the day, IMO this becomes like imposing a tax on people to ensure they can continue to get cheap oil/gas.

Almost all US oil is in Republican states. Republicans presently control the govt.

It could happen.

Dennis,

I am pondering on collecting all the pieces around for a post and I am for cross posting it at POB.

Just have to find the time for it and further I will have to update the production profiles as I have verified that the average wells I used for the 2014, 2015 and 2016 vintages have had steeper declines than what I used. This produces a result with a positive bias.

Rune, outspending revenue by $40B in the first half of 2017 in my estimate puts the US upstream LTO industry back over $300B in current long term debt, NOT including the $80B it has already walked the check on.

I actually snow skied in Dubai once, on a pass thru; just to say I did. I bring that up only to suggest that if one throws enough money at something, anything, the end result might appear, on face value, to have worked. To be real.

The shale oil industry is no different; the fact that production continues to grow has absolutely nothing whatsoever to do with it’s success, new technology, higher productivity rates, or lower incremental costs …none of the above.

It’s just not paying its debt back. And its borrowing more money on top of all that old debt. Take away its liberal, low interest CAPEX source and the shale industry is far from “resilient.”

I look forward to your post, sir. Thank you.

Mike, thanks.

I played around with the numbers for Bakken when I came to realize that in a scenario, there no wells were added and all net cash flow was directed towards reducing the principal, the specific interest costs would grow fast because the production would decline faster than the reduction of the principal.

It is well known among mountaineers that it is not the way up that poses the greatest dangers, it is the way down.

I start to sense that managers in some companies have become aware of this.

Then other cost elements could likely follow, G&A, LOE, transport.

It will take me some time to develop the post.

Would it be fair to say that the shale industry is now in overshot territory.

That is an interesting perspective.

For the Bakken a future oil price sustained above $130/bo is what could bail them out.

Just about everybody seems to believe that oil at a hundred bucks or more means a world wide economic depression. I won’t argue with that, but on the other hand, I also believe that the world can adjust to oil prices in the hundred dollar plus range, if the price of oil goes up gradually and STAYS up, so that we don’t backslide, giving up fuel efficiency for hot rod performance and convenience.

Personally considering the FACT of depletion, I’m convinced that oil will be back in hundred dollar plus territory within a decade or so, unless the electric car industry grows as fast as it’s biggest boosters think it will, and batteries or fuel cells get to be cheap enough within the same time frame to use them in real trucks, farm and construction machinery, etc.

Hi Rune,

You forgot your smiley face. I assume you were joking because in the past I think you have said you believe it is unlikely we will see oil prices as high as $130/b for any sustained period as it is likely to result in a worldwide recession.

Your position also may have changed, so I will not presume to know your current opinion on future oil prices.

Dennis,

My understanding of the oil price formation is that there are several nonlinear and complex processes with positive and negative feedback loops where also fiscal and monetary policies needs to be included.

A more granular, full cycle analysis of what oil prices will bail out the 2014, 2015 and 2016 vintages are that these need a sustained oil price above $100/bo (at the WH) to reach payout and higher to earn some return, as from NOW!

Given how far down the decline/depletion curve these vintages are and how such a price shock would affect the global economy, I hold that NOT very likely.

Not sure if that entails a smiley face for consumers or a tragedy for those who will have to take the huge losses.

Hi Rune

That would be great email me at peakoilbarrel@gmail.com when you get a chance.

In the other thread in response to Rune’s comment below

http://peakoilbarrel.com/opec-july-production-data/#comment-612159

I said:

Thanks Rune,

I guess I would do the accounting differently and only apply the LOE,G&A, and interest expense to the oil produced and then add in the net revenue (post tax) from NG and NGL to the net revenue stream.

To make sure I understand properly, when analyzing oil (and ignoring NG and NGL) for Whiting in 2017Q2 , did you use $16.21/bo for the combined LOE, G&A, and interest expense? Or did this number increase because you ignored the BOE from NG and NGL so the barrels in the denominator was smaller.

As a simple example, say we had $20/BOE in expenses for 100 BOE that includes 20 BOE of NG and NGL combined, if we ignore the NG and NGL (assume the price was zero for both), I would now put the expenses at $2000/80 bo=$25/bo and then I would add the post tax revenue from the NG and NGL back into the analysis.

Dennis Coyne

Ignored says:

08/17/2017 AT 12:40 PM

Hi Texas Tea,

Perhaps, but if tight oil output is as prolific as some people believe, then oil prices will fall below $40/b and the worst may not be over, especially if service costs start to rise further. What is your expectation for future oil prices?

Dennis my best “guess” is that oil prices remain range bound for another 6-12 months, below $60 above $40. Regardless of what others say, NEW LTO oil is some of the cheapest NEW oil that can be brought to the market. Since most people, including those making the $$ decision in the board rooms of the large integrated companies know this, they will continue to elect NOT to spend the money necessary to bring the required more expensive, less economic large scale projects to market in the out years, 5 years and longer. There is a oil pig in the pipeline and until it clears new money will not be put to work (in the amounts required) out side of LTO until LTO has peaked.

This will lead to a couple of investable ideas. One there will be a period, my guess is starting in a 1-2 year window and lasting 7-10 years where the LTO companies will increase their production substantially and will be profitable. Domestic upstream, mid stream and service companies should do very well. As for prices, I think the market will be cleared of the overhanging inventory sometime next year and prices will rise steadily to the upper upper $60 lower $70. Is that enough to “flood” the market again, I just do not think so, but I do not know. The work that you guys do here that has value to me seems to indicate at best the world has 2- 3 million BBL/D spare capacity in a 100 million BBL/D market which is slim to offset the built in depletion and any potential geopolitical crises that could eliminate that spare capacity over night. I might also make the point that Robert Rapier made, oil demand is still increasing, so new production will need to meet the depletion as well as the new demand. The lowering of Cap ex over the last 3 years has set us up of a wild ride in the future. The first to profit will be US upstream LTO and then service companies and pipe lines.

On this note:

” Hofmeister cited three independent studies that came to similar conclusions about the penetration of electric vehicles. Bloomberg, Goldman Sachs and the IEA agreed that by 2050, there will be four billion automobiles on the road worldwide. Two billion will be battery driven and the other two billion will be internal combustion driven, fueled either by gasoline or ethanol or natural gas.

“The demand for mobility will drive power-source,” Hofmeister said. “A sudden takeover by public policy that says leave it in the ground—it’s not going to happen.”

https://www.oilandgas360.com/heard-at-the-2017-enercom-conference-and-oilfield-tech-innovation-day/

How odd – they seem to be assuming that there are pure EVs on one side, and pure ICE’s on the other. That’s mighty unrealistic: there are hybrid-electrics, plugin hybrids, and extended range EVs like the Chevy Volt, that use only 10% as much fuel as the average US vehicle. You could have 4x as many vehicles and use half as much fuel as we use today, and still not use pure EVs at all.

And, of course, the true cost of fossil fuel (including oil) is much higher than the market price. Particulates that cause asthma, NOX, SOX, oil wars, etc, etc – oil is too expensive even if you don’t include the real costs of climate change.

I have noticed Total, Sinopec, PetroChina, Lukoil, Saudi Aramco, PetroBras, Chevron and rather a lot of other oil companies have managed to not buy shale companies and make them wholly owned subsidiaries.

Isn’t that odd? I think XTO was the only major acquisition and they were a natgas company then.

Buying an existing up and running shale company means being on the hook for the debts that company owes, to a greater or lesser extent, depending on how sharp your lawyers are.

AND on top of that, there’s the possibility that the federal government will decide to change the xxxxing rules in the middle of the game, and do as it pleases in distributing assets and holding debtors accountable. It’s happened before, at least a couple of times, on the grand scale, in recent years. GM and bank bailouts.

If I were a top executive at an oil major, I wouldn’t really want to run that risk.

They can buy physical assets from bankruptcy judges safer and easier.

Dennis, I think the view outlined in the short video is reasonable and coincides with what I attempted to lay out in answering your question as to the future price of oil.

https://www.woodmac.com/analysis/when-will-tight-oil-make-money

Hi Texas Tea,

The LTO oil is probably cheaper than offshore deep water and oil sands development, and I agree that at $70/b it can be profitable, but the resource may not be as large as some believe and eventually new well EUR will decrease as sweet spots are drilled up and LTO will become more expensive. The total recovered in the US is likely to be about half of what the EIA predicts (maybe 40 Gb and possibly 50 Gb if oil prices go to $120/b and remain that high until 2040, which is unlikely).

So you seem to be bullish on LTO and less so on the rest of the World. My position is that if the rest of the World has enough oil to keep oil prices under $60/b for the next 10 years, LTO producers in the US will not make much money.

Dennis says:

“So you seem to be bullish on LTO and less so on the rest of the World. My position is that if the rest of the World has enough oil to keep oil prices under $60/b for the next 10 years, LTO producers in the US will not make much money.”

without getting into your argument if memory serves that seems to be completely contrary to what your most recent “courageous” predictions were just a few weeks back.

Hi tt,

I make many predictions are you talking about World output?

In this case I am simply saying if oil supply is plentiful and prices remain low there won’t be high profits.

Notice the “if” means if my high scenarios are correct, I cannot predict exact future output, just present reasonable high and low scenarios.

Dennis says ” My position is that if the rest of the World has enough oil to keep oil prices under $60/b for the next 10 years, LTO producers in the US will not make much money.” I suppose the KEY word is IF. because a month ago your position was:

Dennis Coyne

Ignored says:

07/27/2017 AT 5:59 PM

Hi shallow sand,

“I used to think $55-65 would not be high enough to increase LTO output, but clearly I was wrong. Whether World output will continue to meet demand at $55-65 per barrel remains the question. Currently stocks are falling and if OPEC continues its cuts along with the 10 non-OPEC countries, eventually the lack of new projects in the pipeline will begin to hit World output, probably by 2019 or 2020.

At that point even if OPEC and LTO producers produce as much as possible profitably, output is unlikely to satisfy demand.

It is for this reason that I expect by 2020, $65/b will be too low an oil price to keep the oil market in balance.”

Dennis is that still your position?

Hi TT,

So yes that is still my position.

I do not expect there will be enough oil produced at $60/b to meet demand, but IF I am wrong, then LTO producers may not make much money at $60/b, they may have positive earnings, but I doubt they will be doing very well price earnings ratios will still be quite high.

Hi Texas Tea,

Also on re-reading your comment about oil prices, I mostly agree with your position, even the part about a “substantial” increase in US LTO output, I believe this might rise to as much as 6.5 Mb/d if oil prices rise over $90/b, but it will be short lived and the peak will be reached in 5 or 6 years (2022 or 2023) and by 2030 decline will be rapid (maybe 8% per year or more at the fastest point around 2030).

So the only minor point of disagreement is the level of LTO output, you may believe the EIA’s reference scenario with 90-100 Gb of US LTO output is conservative where my opinion is that it is wildly optimistic, we may both be incorrect, time will tell.

Thanks for the excellent work George.

George

Do you beleive the claims being made for the volumes of oil held in the Weald basin?

Really the high claims come from the media trying to sell copy and a bit less from companies trying to sell shares (more hints and nudges than claims, the one obvious con man has now left I think). But I don’t think in the end any real claims are going to be made and validated unless/until a lot of wells are drilled – as is 100% the case for all oil plays. If you look at the Bakken they drilled out wildcats for about five years until they started hitting about 50% dry wells – so obviously they didn’t know what was there before then (and they still hit an occasional duster).

If you are referring to DL the ozzy then no he is still very much involved.

Don’t think it was posted in the previous thread, new Jodi data: https://www.jodidata.org

Sorry if if continue to bring this up but I think it deserves attention: “Saudi crude oil stock level fell to a 65 month low of 257 MBBL in June” (export was down too, their production this year has been about the same as their 5y average).

Chinese oil production was up in June but it looks like it is seasonal.

I think this is very significant and cannot believe that it is so ignored by the media. I am wondering, what the minimum practical storage number is (it can obviously not be zero) and if their export decreases are a direct result of this

Re: George’s topic

July 2014, back when Scottish independence was on the radar screen and future oil tax revs were the focus of how an independent Scotland could fund itself.

http://www.bbc.com/news/uk-scotland-scotland-politics-28260475

They put the likely total between £2.9bn and £7.8bn [oil tax revs] in 2016-17, which could be the first full year of independence under its timetable.

A spokesman for Scottish Energy Minister Fergus Ewing said the respected economist, Prof Sir Donald MacKay, had described Mr Alexander’s oil figures as missing “a mountain of black gold”.

“North Sea oil is a huge asset and will be for many decades to come – and the OBR’s forecasts rest on estimates of future production which are well below those used by the industry, by leading experts and by the UK government,” said the spokesman.

. . .

“It depends on the price of oil in the next 20-30 years, it depends on new technology being developed, it depends on the fiscal regime, it depends on the way the regulator behaves, it depends on our ability to attract inward investment into the UK and to Scotland against very significant investment.”

Lesson: Oil assessment JUST ABOUT EVERYWHERE seems to place geology roughly in last place in the list of important factors in analysis. How can one not be cynical?

It is still popular in Britain to say that we still have a lot of coal if we need it!

We actually need gas and lots of it. See here

https://www.britishgas.co.uk/the-source/our-world-of-energy/energys-grand-journey/where-does-uk-gas-come-from

Thanks George – I will keep a note of this post and your case that the end will come in sudden steps down. And thanks for the lovely Renoir – I did not remember seeing this one.

Gas supply is definitely a problem, I didn’t post the history for gas but see below – that gives kboed based on discovery year (like for the oil). There is only UK data for gas fields (versus associated gas) from 2000. There aren’t many new offshore gas projects, maybe fewer than for oil, although there was one started last week, so additions will be minor from new oil fields associated gas.

I think also the Norwegian fields are about to go into decline, we gat a lot from Orman Lange which is going down fast, they do have couple due this year, but with the Dutch field declining we are competing with Europe for supply.

The Renoir’s in the National Gallery, quite small.

Don’t worry George.

We are going to frak our way out of trouble.

https://www.ft.com/content/f68508f0-8346-11e7-a4ce-15b2513cb3ff

My first thought, when I saw this graph and the oil graph above was it’s time to transfer the British transportation system over to renewable electric

A reality check on renewable energy.

https://www.youtube.com/watch?v=E0W1ZZYIV8o&t=102s

Thanks for the link. I have always believed there is no single one change to fix the problem, but it will take thousands of changes and some technological ones that haven’t been discovered yet. Conservation and efficiency are also going to be a major must to get ourselves off our fossil fuel addiction.

The LA basin will be a much better and healthier place to live. When transportation has been converted to solar and non fossil fueled powered EV’s.

Drill Our Way to Lower Gasoline Prices, President Obama? Yes We Can.

https://www.youtube.com/watch?time_continue=8&v=jCFtE9vlWts

I don’t generally agree with much that GS has to say, but THIS time he has a POINT, one which those of us who believe in renewable energy should take to heart, when talking about renewables.

Overselling our arguments makes us look like damned fools in the eyes of the general public, which as a general rule doesn’t know shit from apple butter about the geological realities of the oil industry, and hardly any more about the realities of population growth and economic growth world wide, implying ever greater consumption of an ever smaller resource in the ground.

We would do well indeed to insert a few QUALIFIERS into our remarks, so as to prevent them from being used as bats, in the bau press and bau blogs, to knock us right out of the ball park.

Bartenders don’t talk about hangovers. It’s our job to be realistic about the easy times, FOR NOW, while being at the same time realistic about what the future MUST hold, and might hold.

At the same time, I want to point out the utter idiocy and or hypocrisy of the right wing political camp which in the same breath celebrates free market ingenuity and results, while simultaneously spouting partisan bullshit about the Democrats waging war on the energy industries, etc.

“Overselling our arguments makes us look like damned fools in the eyes of the general public”

OldMacDonald aka KGB Trumpster, no one should know better than you.

Actually, the oil market and current pricing hasn’t gotten to were it is today by only drilling ourselves to this oil glut. Conservation, efficiency, substitutes and the expectation of more substitutes have also played a major roll. Don’t forget the Saudi’s flooded the market 2 years ago to maintain market share.

I give credit where it’s due, and old HB has a point about conservation, efficiency, and dumping when it comes to the oil biz.

But he STILL managed to miss my POINT, because he is so utterly determined to prove I really am a Trumpster.

He TOTALLY missed my unqualified statement that the tight oil boom, and the gas boom, which is not altogether one and the same, are pretty much OBAMA’s legacy, lol. My point was that the R’s who are foaming at the mouth about D obstructionism of the energy industry, overall, are either deluded, or partisan hypocrites.

API: US petroleum demand highest for July since 2007

http://www.ogj.com/articles/2017/08/api-us-petroleum-demand-highest-for-july-since-2007.html?utm_content=bufferf06cc&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

• Total US petroleum deliveries, a measure of US petroleum demand, moved up 4.9% in July from a year ago to average nearly 20.7 million b/d, the highest July deliveries in 10 years.

• “Strong demand for petroleum is a good sign for the economy, which grew for the 98th consecutive month,” said API Director of Statistics Hazem Arafa. “American workers and consumer continue to benefit from these positive economic signs along with relatively low fuel prices.”

• Domestic crude oil production…reach[ed] its highest July output level in 45 years. Domestic crude production…was up by 8.6% from July 2016 to average 9.4 million b/d in July.

• NGL production in July averaged nearly 3.7 million b/d… This was the highest July output level on record.

Not everybody back before the 2014 oil price crash was drunk on the peak oil Kool Aid. There were people who got it right and saw the oil glut and price crash coming. From a 2012 article in Rigzone:

Harvard Study Refutes Concerns over Oil Becoming a Scarce Commodity

http://www.rigzone.com/news/article.asp?hpf=1&a_id=119949

And you gotta love this rebuttal from the comments section. The biggest howler of all is when Weiss asserts that the “rise of unconventional production such as US shale oil…is moot.”

The aggressiveness with which Weiss attacks Maugeri’s forecast is also quite striking. Maugeri was certainly right in pointing out the “psychological factors” and the “still deep-rooted belief that oil is about to become a scarce commodity” that are in play.

Rick Weiss | Aug. 13, 2012

111 mbpd is Magueri’s call and 3 yrs to get there.

Per the bible, last year’s total was a bit over 92 million bpd. It rose only slightly last year, from OPEC and Russia since the US was down last year.

So if 111 is the call by 2020, he has 3 yrs to go from 92 to 111.

Shake doesn’t really change much in the big picture.

https://aleklett.wordpress.com/2017/04/16/fracking-tight-oil-forskjuter-peak-oil-med-nagra-ar/

texas tea,

It looks like you guys are doing all the good up in Oklahoma.

Evolving Oklahoma STACK play continues to draw interest as E&P operators seek sweet spots, IHS Markit says

http://www.businesswire.com/news/home/20170817005283/en/Evolving-Oklahoma-STACK-Play-Continues-Draw-Interest

Glenn,

you ain’t seen nothin yet…The Scoop and Stack Plays are in the first inning. With at least 3 currently economic horizons in scoop (15-20 wells per unit), with the dry gas, wet gas, condensate and oil windows being clearly defined and now largely all HPB, an operator can make decisions where they want to spend $$$ for what product mix they think will be most profitable. I think what is lost on many here, is what the short video I posted up thread attempts to explain, the cost of the land and initial well and other infrastructure does look expensive (uneconomic) when compared to ONLY the 1st well or 2 production. What they seem to miss (willfully ignore) is +90% of the total value sits waiting to be exploited. This is truly an oil man’s wet dream. I am very happy to be a very small part of it all.

“The value of that pipe in the ground, most often as long as you’re in the right areas, isn’t decreasing in value — that’s increasing in value every day,” Conklin said Thursday in a phone interview. “We’re certainly in the early innings when it comes to pricing the space efficiently.”

http://www.worldoil.com/news/2017/8/18/blackstone-bets-on-shale-boom-lasting-with-harvest-deal

TT

While the Scoop/Stack operations are in the first inning, it might be instructive to look to the Bakken, which is slightly farther along, to get a sense of future developments.

A quick glance at Enno’s well profiles shows a big uptick in 2008 wells output.

Slightly more focused, Dunn county shows the most dramatic increase.

I’ve not been following Bakken events too closely, but the increase may be linked to refrac’s or halo effect, or both.

Whatever the reason, this is but one example to look for as operators continue to leave no oil behind.

Glenn you may have noticed;

EIA’s Drilling Productivity Report initiates coverage of the Anadarko Basinhttps://www.eia.gov/petroleum/weekly/archive/2017/170816/includes/analysis_print.php

come a long way since all the geniuses here did not even know about it when I began posting?

will the free market win again?

https://www.extremetech.com/extreme/253842-mazdas-2019-efficiency-breakthrough-diesel-engine-runs-gasoline

http://market-ticker.org/akcs-www?post=232310

The free market guided by government regulation to average 54.5 miles per gallon by 2025. Just like how this post should have been guided to the non oil post section.

Fifty four. five in ‘ 25 is technically possible, and might even have been politically possible, had the Democrats gained decisive control of the federal government.

It’s damned unlikely now.

Let’s just wait until the fat lady sings before we count our chickens. Trumpster is the ODD small hand boy out in the world.

I have some hopes that the D’s will regain control of the government in 2020, but they are no more than tenative hopes.

For now, Old HB as usual manages to ignore key facts if they don’t suit his own personal religion, one of these facts being that the R’s are FIRMLY in control of government at all levels on a national basis.

Hey guys, how many of you know that HRC wants to be a preacher?

It looks like ICE vehicles are fixin’ to show EVs how the cow ate the cabbage.

But how does this square with all the predictions afoot of “peak oil demand”?

It doesn’t square, of course. Somebody’s predictions are going to be wrong.

Why Would Oil Demand Peak, Contrary to Peak Oil Supply?

http://www.rigzone.com/news/oil_gas/a/151442/Why_Would_Oil_Demand_Peak_Contrary_to_Peak_Oil_Supply

The general concept of peak oil is that crude oil is a finite and non-renewable resource. That’s all there is to it, contrary to this guy’s constant belly-aching that the concept has somehow been disproved.

I think it’s more like how humans are learning how to eat Lean Cuisine frozen meals

how does this square with all the predictions afoot of “peak oil demand”? It doesn’t square, of course.

I’d say it’s perfectly consistent: ICEs are competing with EVs to see which can reduce fuel consumption faster. That’s a recipe for falling oil consumption.

“That’s a recipe for falling oil consumption”…. WELL if you ignore population growth perhaps. What it is a recipe for is slowing the rate of growth of NEW demand.

Let’s just wait until the fat lady sings before we count our chickens. It’s still in the first quarter of the EV’s vs. ICE game.

except this is like a Harlem Globe Trotters game, all the adults know who is going to win,it just the children that do not and if they did not give away tickets and pay the other team to show up…. they could not even fill the stands… ?

Hi Texas Tea,

When output stops growing whether it is due to geological and technological constraints or because high oil prices reduce demand does not really matter (and it will be both effects in combination), there will be a peak and it is likely to occur between 2017 and 2030 an exact date cannot be foretold. In the mean time output is likely to increase until it doesn’t. High oil prices will change the game as will the falling price of EVs. The future is unknown, you seem to be sure oil output will increase for the next 20 years or more, I am highly skeptical that will be the case.

Dennis says..”you seem to be sure oil output will increase for the next 20 years or more, I am highly skeptical that will be the case.”

No Dennis, what I am sure of is that the free market is in a much better position to address the needs of the future then a bunch of bureaucrats and bloggers.

A person as intelligent as your self should now be aware why freakin models NEVER work, models show one possible outcome, in many cases a per-conceived outcome. only fools trust models, the intelligent folks always ask what are the known unknowns and what are the unknown unknowns, and then present a model that has the following disclaimer: “This model aint worth a shit” but here is something to think about and call it a day, NOT MAKE FREAKIN PUBLIC POLICY BASED ON IT.

The model is simply that crude oil is a finite and non-renewable resource. It works perfectly fine for an individual well or for the set of all wells on earth.

No wonder you have such mistrust. You have been under the impression that oil is infinite.

Seems like the marketplace is saying oil isn’t worth that much even if it is expensive to produce. And therefore it isn’t a good investment.

And the marketplace seems to be saying that even if the government makes more leases available, there aren’t a lot of bidders.

Hi Texas Tea,

I agree well regulated markets do a good job providing efficient outcomes when externalities and public goods are taken into account. I always state the assumptions of my model with the understanding that the assumptions may be incorrect. I also usually give several cases high low and middle where typically the high and low cases bound about 80% of the probability with about a 10% chance higher or lower scenarios would match reality better, the middle case is typically meant to be representative of the infinite number of scenarios that could be created between the high and low cases.

Yes models are simplifications which are unlikely to be precisely correct in any case but simply give a sense of what might happen under different possible cases.

I often invite people to make suggestions on how the scenarios might be improved, different price or cost assumptions for example, but usually no suggestions are offered.

What should public policy be based on?

Hopes and prayers? I think rational analysis is a better way forward.

Oil resources are limited, we should plan accordingly or we will find ourselves short of energy.

You sound like a free market fundamentalist, markets are not perfect there are a number of problems that often need to be addressed. See

https://en.wikipedia.org/wiki/Market_failure

If markets were perfect there would never be a need for government intervention in markets. We do not live in a perfect World with perfect markets.

And do you mean then that you do not think oil output is likely to increase for the next 20 years or are you one of those who have no idea, you surely talk a big game, but I guess revealing what you believe about future output is a little too scary. So what do you think? Higher output or lower in 2025 than in 2016 (annual average C+C output) and what about 2030, 2035, and 2040 relative to 2025? Maybe you expect an undulating plateau between 80 and 82 Mb/d from now until 2040.

models NEVER work

That’s unrealistic. We know models work well enough to rely on for everyday planning decisions.

There’s a whole industry based on models, that all of us rely on for risk management for both personal and business insurance. It’s called the insurance industry. And, there’s a well respected profession that develops those models, known as actuaries.

The interests of Little Oil (non-integrated US domestic oil companies and royalty owners) and Big Oil (integrated international or transnational oil companies) have come into conflict one more time.

For my own personal self-interest, I would like to see Venezuelan oil taken off the market, because that would drive up the price of oil. That would be great for my pocketbook, and it would be a shot in the arm for US shale, as well as other domestic oil producers. However, it would not be good for the integrated globalist oil companies.

Big Oil Urges Trump Not to Levy Economic Sanctions on Venezuela

http://www.texasmonthly.com/energy/big-oil-urges-trump-not-levy-economic-sanctions-venezuela/

The law of supply and demand works the same when it comes to sanctions against Russia. Stunting Russia’s ability to produce and export oil and gas makes for higher prices.

However, Russian sanctions (both those of 2014 and the more extensive sanctions passed by the Senate in June, 2017) would have hurt the interests of the globalist oil companies:

Steve Bannon’s economic nationalism squared off against Rex Tillerson’s globalism and neoliberalism in Trump’s White House, and Bannon lost:

“) would have hurt the interests of the globalist oil companies:”

what’s a globalist oil company.

who would you have them sell to

Since October of 2016 almost every oil producing country in the world has attempted to voluntarily reduce its oil production to raise the worldwide price of oil…EXCEPT the goddamn America shale oil industry. It has exhibited no cooperation with the rest of the world whatsoever and, if fact, has taken great advantage of those that did by borrowing MORE money and and INCREASING its production. Now the price of oil is back below October 16 pre-cut levels, the entire N. American conventional oil industry including Canada and (gasp!) MEXICO (isn’t that where you live, Mr. Stehle, Mexico?), and entire world economies are back on their financial heels, again. In the mean time the shale oil industry is deeper in debt, still filing bankruptcies and still unable to make a stinking nickel of profit. It needs a shot in the arm alright.

The people of Venezuela don’t actually get to vote for who governs them and things are SO bad down there right now they are literally eating house cats. But to hell with that. America needs to teach them a lesson in democracy. Lets sanction their oil exports and finish them off completely. A nice coup would do, and the death of what, 25,000 people; is that enough? Why don’t we just invade Venezuela; now there’s an idea. It’ll help the US shale oil industry and Mr. Stehle’s pocketbook. The same guy, by the way, who is always telling me the shale oil industry is raining on my parade, now thinks Venezuela is raining on his parade.

I think I am going to hurl.

A couple of companies did report some small profit last quarter. GAAP.

But they are pretty much all still showing a ttm loss. ttm is almost as standard as GAAP now. (Trailing Twelve Months).

PXD for example posted a small quarterly profit but finance.yahoo.com (and others) show EPS -$1.97 (TTM)

Sanctions on Ven are pretty complex. The GOM refineries process that heavy oil at a profit. They don’t want sanctions. But deeper down, the Russian(Rosneft)/Goldman funded big refinery being built inside Ven is due to come online in less than 12 months. That will cut off the US GOM refiners from that profit source.

••••Mike said:

That is undoubtedly true of some world economies, but it is certainly not true of the United States’ economy.

US shale, by bringing about lower oil prices and diminished volumes of imported oil, has worked wonders for the United States’ trade deficit.

••••Mike said:

US shale makes it possible for the US to de-militarize its energy policy, to disengage from its far flung resource wars around the world. That argues against military intervention in Venezuela, not for it.

The US should just tax gas at the pump. Then it would become a net exporter of liquid fuel. Until it gets serious about that, it will remain a net importer.

California gas tax increase is now law. What it costs you and what it fixes

Nov. 1, 2017: The base excise tax will increase to 30 cents a gallon.

July 1, 2019: The price-based excise tax will reset to 17.3 cents a gallon, about half-a-cent more than the rate the Brown administration projects will be in effect by then anyway.

The 47.3-cent combined excise tax in effect July 1, 2019 will be adjusted for inflation beginning July 1, 2020.

http://www.sacbee.com/news/politics-government/capitol-alert/article147437054.html

This is no gas tax, this is a joke.

We here in Europe are above 30 cens A LITRE – and this the last 50 years. You can live with it. Even at the farm, use your pickup truck only to transport things and buy a small car to drive your children to the baseball team.

At the moment we are at 1.3 € / litre – that’s cheap. It’s about 5.8$ / gallon. Diesel is cheaper, it has reduced tax to help truckers and farmers. Btw, farmers get a small contingent of tax free diesel.

Well surely by now Eulenspiegel you have realized Americans like to take baby steps. When it comes to doing the correct thing regarding tax policy. The only thing the right cherish’s more than their religion is their dollar. Health and a livable environment won’t be valued until it’s lost and an opportunity to make a buck trying to recover it.

Only in America

“The only thing the right cherish’s more than their religion is their dollar.”

Coming from a hypocrite who has bragged about making a killing in the oil biz, here in this forum, at the expense of the consumer, lol.

There’s not really all that much difference between a Republican Lite congress critter or president aka Clinton wing D and a real Republican, lol.

Mike says: “America needs to teach them a lesson in democracy. Lets sanction their oil exports and finish them off completely. ”

Mike, you know more about the oil industry than most people on this site, including especially me, will ever know. I believe that your comment is [sarcastically] saying what I believe. If we sanctioned their oil, that could lead to abnormally low oil prices, even if there were a shortage. That is because investors would then “know” that Venezuela will fail, and that a new government might be able to increase production back to historical levels.

There have been countless stocks that have declined in value because they paid a 6% dividend because of a low price. They keep paying it, and the price drops another 33%. Now it is an 8% dividend. The price drops another 25%, and now it is a 10% dividend. Finally, they cut the dividend to zero, and the stock rises significantly. Why? Because the investors knew that they could not keep it up without going bankrupt. Now that they took bankruptcy off the table, the company is investable.

After a government failure [morally correct in my view], oil will likely come under increased pressure because production projections will lead to thinking similar to what we are now dealing with in Libya, and to what has been dealt with in both Iran and Iraq.

Clueless, thank you, that is precisely what I meant regarding Venezuela, which is dear to me for many reasons, and you have speculated properly. Venezuela has tremendous reserve potential in the Orinoco region, oil that America needs now, and will need desperately in the future. It is the height of American arrogance to want to harm its people, to sanction its oil export ability, to cause more chaos than already exists in that country and to wish to destroy what might be left of potential investment in Venezuela, regardless of who is in charge of its government. You have given three very good examples of just how that works, thank you.

Its a world oil market, not an American oil market. The US shale oil industry has NO “hammer” over anybody in the world; without low interest stimulus money to borrow it can’t stand on its own two feet, BOTH of which now have self inflicted bullet holes in them anyway from overleveraged oversupply. Thank you again, sir.

Glenn,

With all due respect, you are one hell of a self-absorbed individual.

Do you actually post that many comments because you believe people are interested, or rather because you need to continue reassuring yourself that you are correct in your own mind?

Steve

I notice that his posts aren’t triggering many replies anymore. I think more people are hiding him and not seeing his posts. People seem to be skipping over him now and not trying to have a conversation.

That’s what happens when a troll floods too hard. It’s a fine art.

Javier Part 2

A lot of similarities in their rhetorical technique- ad hominem, argument by assertion, cherry picking, opposing facts with normative arguments etc etc.

Both frequently comment at Juddith Curry’s site. They’re probably cubicle buddies at the Koch brother sock puppet brigade office.

Glenn was over at OFW (which has degenerated into a alt right boys club) for a while– it wasn’t working.

I guess the main requirement is not being capable of being embarrassed, and a aversion of reality.

That, and being a sociopath.

Normative is almost being polite, it’s like a succession of delusional, bullshit just-so stories masquerading as deep scientific analysis, and the ad-hominems are just a part of standard passive aggressive narcissist/gaslighter make up.

Mike said:

Nah.

There’s Iran.

There’s Nigeria.

And there’s Libya.

I have always found that part of Mike’s argument to be the most ridiculous. Ron has shown for years now with his charts that OPEC went to great lengths to flood the market, over producing and even selling reserves into a flooded market to force a slowdown in LTO. But Mike always focuses on his fellow countrymen, his neighbors, and co workers in the industry to lay blame on. The US producers are doing what free market business men do. His values and condemnation are misplaced from where i sit.

I think Mike and Maduro must be related, perhaps separated at birth or perhaps he just fell asleep during his one hour economics class, after roughnecking all day I can’t hold it against him?

What does overproducing mean?

Does that mean KSA produced oil for which they had no customer?

I would suggest that to Texas Tea ‘over production’ means pushing the price of oil is so low that shale oil producers can’t make any money. Then again they weren’t making any at $100/barrel either. It’s an investment scam. Wall Street has to pump and dump something. It appears to be the only thing many people in Texas have going for them.

Chatting about finances in 2007 with Americans who thought ‘investment diversification’ meant buying another house, but in a different neighbourhood, had a similar droning quality and repetitive pattern.