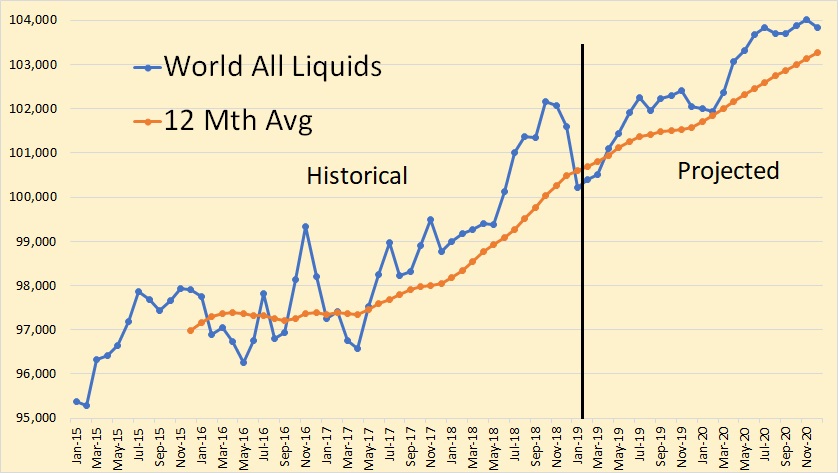

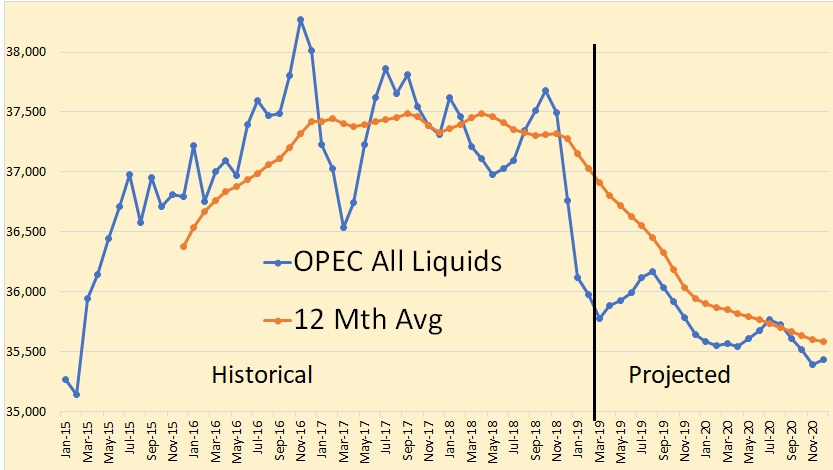

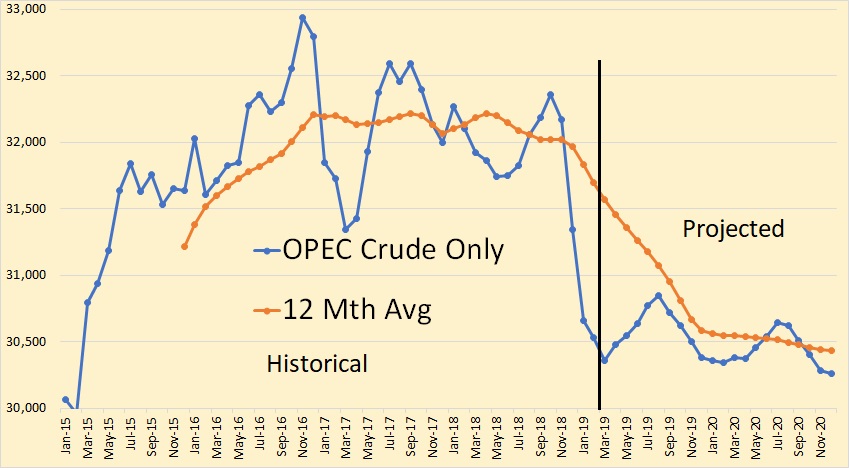

Most of the data below is taken from from the EIA’s Short-Term Energy Outlook. The data through February, 2019 is the EIA’s best estimate of past production and all data from March 2019 through December 2020 is the EIA’s best estimate of future production. However in most cases February production is highly speculative so I drew the “projection” line between January and February.

Understand the above chart is Total Liquids, not C+C as I usually post. As you can see the EIA expects world petroleum liquids to keep climbing ever upwards.

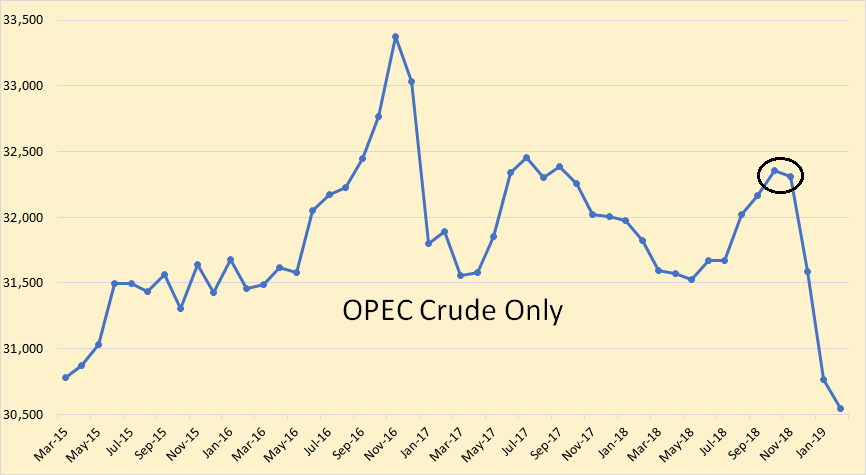

This is the EIA’s data for OPEC all liquids with Production data from April 2019 through December 2020.

Notice the EIA expects OPEC production to keep declining through December 2020. Also they expect total liquids to decline slightly faster than crude only. This is interesting since neither condensate nor other liquids are subject to OPEC quotas.

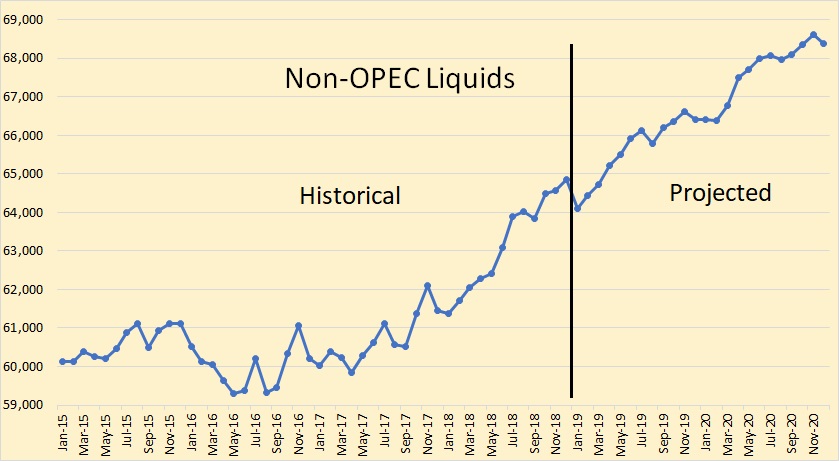

About two years ago I made note that the EIA expected Non-OPEC to plateau but they expected OPEC to keep increasing into the future. Now they have completely reversed themselves as they expect all future growth, at least for the next two years, to come from Non-OPEC countries.

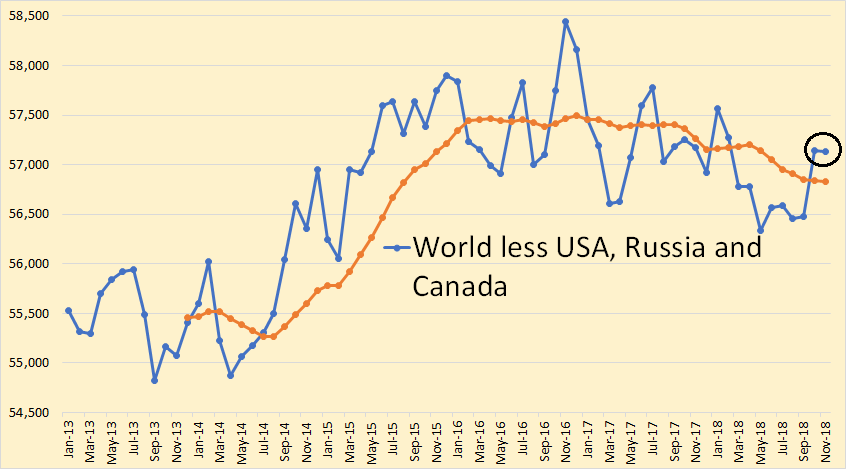

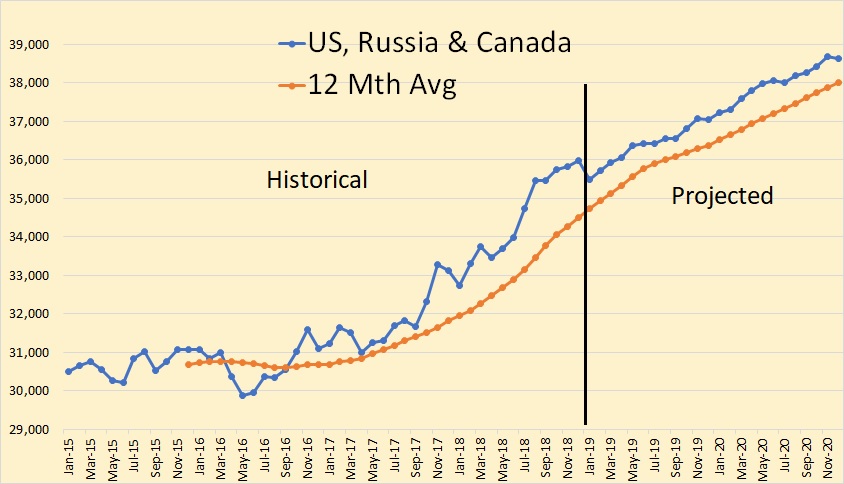

The below chart is from the EIA’a Monthly Energy review and is C+C through November 2018.

Virtually all crude oil increase since 2016 has come from three countries, USA, Russia and Canada. The spike upward (circled) in October and November 2018 was partially due to OPEC prepping for cuts. Every OPEC country made heroic efforts to increase productio during those two months in order to increase their quota. Quotas were set in December.

Nevertheless OPEC production during these two months was still over one million barrels per day below their record set in November of 2016.

Okay, back to the EIA’s Short-Term Energy Outlook of total liquids.

Here is what the EIA expects Non-OPEC liquids to do.

And most, but not all, they expect the growth in total liquids to come from just these three countries.

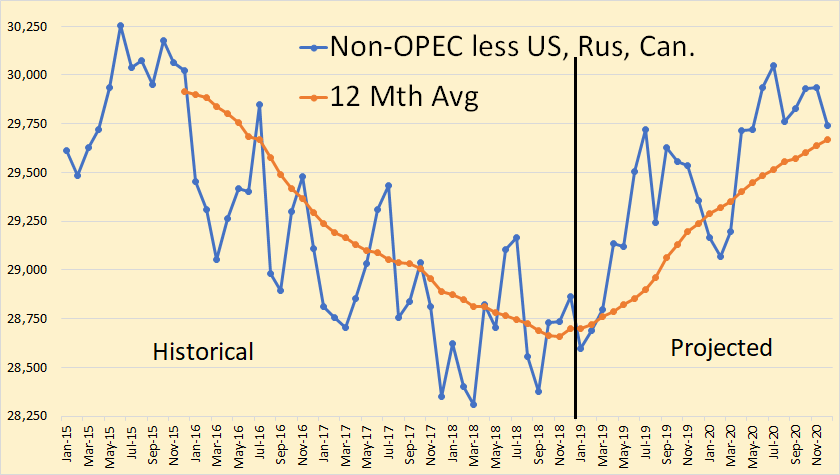

Even though Non-OPEC less US, Russia and Canada has been trending down, the EIA expcets a complete turnaround in that trend.

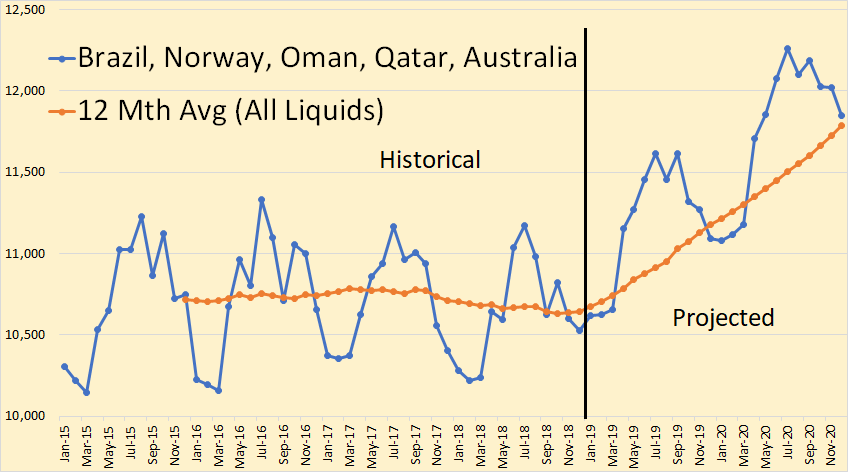

They expect about 1.2 million barrels per day of that future increase to come from five other countries, Brazil, Norway, Oman, Qatar, and Australia.The annual gyrations seen in this chart is due to Brazil’s ethanol production. It peaks in mid summer and bottoms out in mid winter.

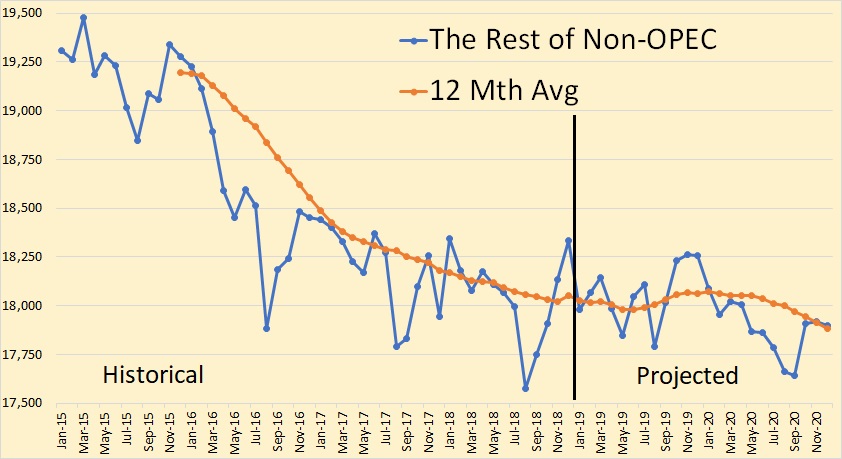

But finally we have reached the limits of the EIA’s optimism. After the USA, Russia, Canada and the five nations listed above, they only expect the rest on Non-OPEC to slightly slow their decline rate.

The bottom line: In the next decade or so, there will be countries that increase their oil production and there will be countries that will have a decrease in oil production. Peak oil will occur, or did occur, when the amount of oil from increasing countries cannot overcome the decrease in oil production from declining countries.

https://www.zerohedge.com/news/2019-03-19/bloodbath-us-shale-stocks-continues-worst-yet-come

AEO 2019

What is this? It doesn’t make any sense.

Ron,

Working from phone so messed up chart includes stuff besides crude on first chart second is a bit better.

Doesn’t look all that realistic to me. Looks like someone just drew a straight line.

agree not realistic, part of the problem for lower lines I the scale of that first chart.

AEO 2019

Better chart c+c I agree this is far too optimistic.

So if tight oil and bitumen are level and everyone besides the eight countries mentioned is declining, with USA and Canada being wholly unconventional in gains…where’s the crude coming from?

tight oil and bitumen for aeo 2019, tight oil output increases from 6.9 to 12.7 from 2018 to 2050, about a 6 Mb/d increase. OPEC production increases from 35 to 49 Mb/d or roughly 14 Mb/d from 2018 to 2050.

The cumulative World C+C output is 2440 Gb from 1870 to 2050 for the AEO 2019 reference scenario. If we assume the EIA believes 2050 will be the peak in World C+C output and also that this occurs at 50% of URR, this implies a World URR of about 4800 Gb for C+C. Optimistic does not quite cover it, ridiculous would be more apt. 🙂

Were these parts of the report written by completely different people? OPEC is declining in their near-term and its supposed to add 14 million barrels per day *escalating net* over the following three decades. Wut?

Polypro,

The short term outlook covers now to Dec 2020. The AEO is a long term forecast 2019 to 2050

I understand that but production curves simply don’t do that. Not without a major externality that’s left URR in place. See Venezuela (economic collapse, failure to exploit), Iraq (war, sanctions, civil war) and Russia (disorderly breakup).

You don’t go down while pumping flat out and then rise to better and better new highs in the same resource. Just doesn’t happen. As you say the implied URR on that curve, particularly OPEC, is absolutely ridiculous.

Polypro,

Pumping flat out simply means producing developed resources at maximum. The rate that new wells are drilled can change with the price of oil just as it did with US tight oil output from 2014 to 2018.

Have you looked at the stats? It went down then up, also world output 1979 to 1986, though that was the Iran/Iraq war mostly. An oil market glut causes changes in OPEC behavior.

The EIA has World tight oil output of 140 Gb from 2000-2050(AEO 2019 has US tight oil cumulative output of roughly 120 Gb from 2000-2050). For “rest of the World” (excluding US) this implies only 20 Gb of tight oil output which seems reasonable, note that my estimate for US tight oil output is considerably lower than the EIA estimate at about 87 Gb and would imply about 110 Gb for World cumulative tight oil output from 2000-2050.

Note also that a brief analysis I did for World demand for oil under an optimistic scenario where plugin vehicles continue to ramp up at the 2014-2018 rate. Annual sales increased at an average rate of 58% per year and we assume commercial plugin vehicle sales follow the 2014-2025 personal vehicle growth trend from 2025 to 2035. This scenario has demand peaking in 2025 and falling faster than supply under an alternative scenario where plugin sales grow more slowly. That in turn implies lower oil prices after 2025 than the AEO reference scenario where oil prices peak in 2045. A lower oil price scenario than the AEO reference scenario would reduce my estimate of tight oil URR, probably to 65 Gb or less and would imply steeper decline rates for tight oil output after 2025 than my “standard” scenario which assumes the EIA’s AEO reference oil price scenario is correct.

Where does the electricity come for all those plug in vehicles? I saw a study done for a small area in Spain, and the infrastructure investment is prohibitive. They identified bottlenecks down to the individual building parking area. The authors recommended condominium owners install the chargers and buy the KW capacity soon, to get locked without having to pay for extra infrastructure. Those who come later would have to pay over 10K euros each for the grid expansion. And that doesn’t account for the extra generation capacity, which is going to be extremely expensive if the socialists win the election, because they want to close nuclear power plants.

In conclusion I believe you should use two or three countries to understand if your figures make sense, because I just don’t see it happening.

Fernando,

Much of the charging occurs overnight when there is plenty of excess capacity. Also much less energy is required for electric transport as there are fewer thermal losses. When more solar is available charging will switch to daytime as there will be excess capacity during the day. The process will occur over decades and will be figured out.

Dennis

Demand growth is being mainly driven by aviation and chemical industry.

https://www.iata.org/pressroom/pr/Pages/2016-10-18-02.aspx

https://www.iea.org/geco/oil/

https://www.meti.go.jp/english/press/2018/1019_003.html

For oil demand to fall, electric car sales must reach 60 million per year. Electric motorbike sales must reach 50% at least.

Hugo,

Plug-in vehicle sales have been growing at 58% per year from 2014-2018, if that rate continues until 2026, plugin sales reach 78 million in 2026, I also assume commercial vehicle sales start growing at 58% per year from 2025 to 2040.

Note that I consider this an upper limit to the rate of plug-in vehicle sales growth. Chemicals use primarily natural gas and NGLs, I focus on C+C output rather than total liquids.

Also note that the airline industry is becoming more efficient over time so fuel per passenger mile is decreasing. Jet fuel growth has been about 20% of the total petroleum demand growth. As fuel costs go up this may change. I have assumed after 2025 airline and marine transport demand remain fixed in the “low demand” scenario, I expect reality will fall between the “high supply” scenario and the “low demand” scenario, where exactly actual supply and demand will balance is difficult to predict with precision.

Dennis

A great deal of oil is used in the petrochemical industry to make plastics, tyres and a hundred other things.

Consumption in the sector has doubled since 2000AD

https://www.ft.com/content/5ae88252-cb9b-11e8-b276-b9069bde0956

https://www.iea.org/newsroom/news/2018/october/petrochemicals-set-to-be-the-largest-driver-of-world-oil-demand-latest-iea-analy.html

If you think the aviation industry will be fixed after 2025 then you obviously think global GDP will stagnate also.

Globally the middle class is expanding, it has grown by a billion since the turn of the century and will grow by another billion to 2030.

These people are buying their first fridges, washing machines, computers, petrol cars and flying.

At some point probably around 2025 there will not be enough oil to meet demand. Prices will rise to constrain demand. The IEA in 2012 predicted $125 per barrel by 2030, I think we will see $125 sooner than that.

Hugo,

Most plastic uses NGL as an input, I don’t consider NGL as oil most of it (80% of the “barrels” produced) is a gas at standard temperature and pressure, more like natural gas than crude oil. Airline passenger miles can increase while efficiency also increase with total jet fuel use changing very little.

Hugo,

Keep in mind that the IEA uses a very broad definition of oil, essentially grouping together all liquid fuel and calling it “oil”. NGL output will grow to some degree as natural gas output will probably not peak until 2035 (NGL output will peak at about the same time). Also IEA has a very inflated view of the output growth that is likely from shale gas and tight oil. Their forecast for NGL output (which matches their demand forecast) is likely too high. Demand will depend on prices and as supply becomes short, prices will rise and demand will fall.

Where do you get the 60m figure? The simplest model is that demand for oil for cars will start to fall when the number of ICE cars on the road starts to fall. There are about 80m new cars a year, and a billion on the road. About 70m are scrapped each year, so the fleet grows by about 1% a year. If 10m EVs are sold, then the number of ICE vehicles on the road should be flat.

The main advantage of EVs is lower operation costs, so vehicles like taxis that are used intensively may make the switch sooner, meaning they will have an even stronger influence on demand. So I would expect demand from cars to fall when annual sales are 10m or so.

There are other considerations. For example, countries with lots of cars are aging quickly, and old people drive less. There is a serious concern in the car industry that total demand for new vehicles will soon start to fall as car sharing continues to spread. If autonomous vehicles work out, which seems likely, this trend could accelerate quickly, because driverless taxis would be very cheap.

The car industry is very nervous right now, and that does not bode well for the oil industry, although the effects won’t be felt for years.

The scenario for World output under the optimistic plugin vehicle scenario for 2025 to 2040. The “supply” line can be thought of as maximum output in a World where plugin vehicle sales grow only fast enough to keep demand at the level of World oil supply. If plugin vehicles sold meet my optimistic scenario (which can be though of as an upper bound of what might occur with maybe a 10% probability) then supply would fall to the level of the “demand line” and oil prices would drop below the level of the AEO 2019 reference case to keep expensive oil off the market (expensive producers will stop producing due to lack of profits). Note that reality is likely to be somewhere between the supply and demand lines shown and is impossible to predict.

Scale on chart above is World C+C supply or demand in millions of barrels per day (Mb/d).

Some international inventories week/week changes (million barrels)

Total Distillates: -7.14 (shown on chart)

https://pbs.twimg.com/media/D2NDNZ_WoAEFes9.png

Light Distillates: -3.16

Middle Distillates: -5.27

Heavy Distillates: +1.29

Light & Middle https://pbs.twimg.com/media/D2ND8VoWsAA6Aoq.png

Total (Crude + Products): -10.75

Crude Oil (Japan+USA): -3.61

https://pbs.twimg.com/media/D2NDhPZXcAEEtKm.png

Fujairah weekly inventory change.

Total Products: +2.29 million barrels

https://pbs.twimg.com/media/D2FxExIWwAAoKH0.png

Japanese weekly Inventory change. Total (Crude + Products) +5.86 million barrels

https://pbs.twimg.com/media/D2FzPq2WoAY9LfW.png

US inventories week/week change (million barrels)

Crude Oil: -9.6

Total Distillates: -6.6

Propane & NGPLs: +0.9 (not on chart)

SPR: flat

https://pbs.twimg.com/media/D2NEkAEWkAAxld1.png

Article out. Iran is shipping petroleum products. They seem to have some new refineries and they are shipping product rather than crude. The products apparently are not included in sanctions.

So charts showing Iranian exports of crude to have declined once again won’t mean much.

The charts are crude plus products. So not really relevant.

had nothing to do with the charts that aren’t showing Iranian exports — which do appear here sometimes. It’s new info.

“Reuters reports, quoting industry sources from Asia, that since the sanction waivers do not extend to oil products, even countries granted waivers may be buying products such as fuel oil from Iran.”

There is talk of fuel oil transfers ship to ship in territorial waters of countries not participating in the sanctions. The talk didn’t delineate the fuel oil definition, which usually includes diesel. If Iran is shipping diesel, and they should be, there will be no scarcity of customers.

And exactly how much oil products do they export? I don´t think it´s a meningsfull volume compared to lost oil export.

Iran’s oil consumption is 1.8 mbpd.

Data is available but spread out. It appears as if Iran has about 4 mbpd of refinery capacity and some of that processes NGLs from the big offshore gas field shared with Qatar. So anything beyond 1.8 is available for export.

This is good: https://www.petroleum-economist.com/articles/politics-economics/middle-east/2019/iran-hobbles-through-the-sanctions

It’s good but rather a lot of opinion. Dood says as of May crude exports will be about 1.5 mbpd. That’s crude, vectored out via Russia and China auspices. Products, as above.

Venezuela exports to the US dropped to zero. The oil is being purchased by Indians and Chinese, and some Russian traders. Production dropped a lot during the mega black out. And Maduro keeps trying to incite Trump to intervene without international backing, but this is known to be Castro’s plan to interfere in US elections by getting Trump into an occupation where Cuban agents can use terrorism to cause US casualties. Castro’s idea is to get a radical Democrat like Sanders elected, this in turn would lead to US withdrawal, and of course all sorts of concessions or even economic aid to the Castro dictatorship.

Unfortunately the Venezuelan people are caught in this struggle between US marxists aided by Castro and US Republicans. Thus Trump has to use diplomacy to get Maduro isolated even more, first at the OAS, then at the UN. And meanwhile the level of savagery by the Maduro regime climbs as it seeks to goad the US into an attack.

Unfortunately I’m not getting much traction with my suggestion to create a 20 thousand strong Venezuelan police force recruited from the 4 million in the Diaspora, who can take a small port and airport with other nations’ naval and air support, and create the conditions for massive defections from the military, who would eliminate the Cubans embedded in their units, move to the liberated area, reorganize, and gradually expand the territory controlled by Guaidó. This is the best option for the Venezuelan people to free themselves, and cut off the Cuban tentacle.

https://en.wikipedia.org/wiki/Walter_Mitty

Fernando,

I really enjoy your posts on oil production and engineering.

The idea that you are influencing the Venezuelan, Cuban or American government is absurd.

“Unfortunately I’m not getting much traction with my suggestion to create a 20 thousand strong Venezuelan police force”

Gee I wonder why you aren’t getting “much traction”…..

Ferdi’s problem is that he is not a Flat Earthist. Flat Earthism is obviously true, and only morons doubt it. Anyone who fails to promote Flat Earthism will fail to get traction, because it is the fundamental truth that all right thinking men are converging on.

Survivalist, when I lived in Venezuela I met people, but best of all I hired very smart college graduates. My budget allowed me to cherry pick the top of each class, and I made sure they received very good training, way above what multinationals do. I could justify it because these bright Venezuelans were replacing expatriates who made an incredible amount of money, had company paid apartments and other perks. Most of these Venezuelans are now living abroad, some who had engineering degrees went on to get MBAs. And as it turns out some of them are tapped to prepare the “What comes next” plans, and I serve as their informal advisor.

This gives me the idea to discuss options, they run up the line what they think makes sense, and then I get feedback. Most of what we discuss is technical or involves the type of contracts to use in the short term, as well as practical issues such as how to lure an engineer making $20K a month to return to Venezuela to work for PDVSA, or how to contract security services.

The idea to create a police force with exiles originated when I was sketching how to defend an oil field contracted by a multinational (I assume you know I worked in those settings for decades), when company policy is to use two security rings, the outer being a national guard or national police force. From a legal and public relations standpoint its preferable to have the inner ring be contract employees who are NOT armed. And an outer ring of armed national guard. This way if shooting starts, the shooting is done by the government. The problem of course is that today, the Venezuelan police force abuse human rights, have really happy fingers, and are prone to execute unruly youngsters with a shot behind the ear. And no decent company would want to be involved with people like that.

So it occurred to me there are thousands of military and police who fled, and are probably interested in a job, working in a National Police Force trained not to abuse people. So I started sketching what it would look like, and suddenly it seemed to me 20 thousand well armed police would do to take Maduro down. I suggested this to my contacts, they liked it, and passed it up the line explaining that in any case we need something reliable to protect power plants, water supply, ports and non oil field assets. But the idea seems to be on the shelf (I say this because there’s no noise about military or police being recruited in Colombia, Chile, Peru, etc).

We also know Cuban intelligence has spies in the system, therefore anything that’s discussed will get to them. And this is why I discuss it here. And of course there are other issues I don’t discuss, nor am I about to disclose detailed action plans, because there’s a chance the US thinks along the same lines I am, and I hope their system doesn’t leak as much as the one that’s full of Venezuelans.

Get it?

Well—-

It is almost April—-

And Maduro is still there with popular support.

“Random Guiado, the President who wasn’t There. The longer this goes on, the stronger the Bay of Pigs smell grows.”

Wasn’t the coup to happen months ago?

This is going to take a while—

Yeah a long while, Maduro will probably last longer than Trump.

Maduro has zero popular support. He does have paid paramilitary called colectivos, who ride motorcycles and are armed with 9 mm automatics, shotguns, and rifles. Over the last three days most of the repression is by colectivos called into action by Maduro. They shoot at protesters and that’s that. We also see a few national guard and police firing tear gas.

The regime is still decaying. For example, Jorge Rodriguez, one of the top regime brains, is hiding in a hotel in Ciudad Guayana. Power cuts are so serious I’ve lost contact with my friends in Maracaibo, who last reported heavy looting, no electricity and little water.

The water supply to Caracas us nearly zero, so we see people trying to catch sewage running down the river guaire, and huge lines at small springs located at Avila national park. So I anticipate epidemics will surge within a few days.

I’m starting to get a bit of positive feedback, and I noticed one individual with connections (can’t name the source) is working actively to have Trump endorse the police force concept.

It’s hard to predict what’s going to happen, but I’m going to continue to advocate the idea that 20 thousand Venezuelans can do the job with US naval and air support.

A guy with military experience tells me he thinks it’s better to go heavy, with two assault ships, one carrier, and miscellaneous assets. These will help escort the first entries until we take control of a port and airport. And I don’t see how Maduro’s skimpy support will withstand a force which can easily recruit and arm 100,000 highly motivated men and women to continue on towards Caracas.

Thanks again for these updates and insights Fernando.

A Deacon at our church who escaped Venezuela a couple years back is confirming everything you are saying. The blackouts, along with lack of food and water are becoming unbearable for his family members back home.

This is truly a tragedy and I pray we see swift action to help those suffering under this terrible socialist/communist regime.

Thanks for sharing your story FL, I’d guess you and I are probably on the opposite end of a lot of spectrums in this world, so perhaps talking military affairs might be interesting. No? Maduro seems to be getting economic support primarily from China (IMHO an attempt at debt-trap diplomacy that will backfire), and gestures of military support solely from Russia. I think I saw a headline recently about S-300’s, but I haven’t had a chance to read up on it. And Lavrov was making some strong statements. Anyway, you and I, and perhaps we, should follow up on this topic in the Non-P thread. I’m particularly interested in Hezbollah (likely the best light infantry in the Middle East) and IRGC operatives in Latin America, and their use of Venezuelan passports and false identity documents to enter North America. Def lots brewing in Ven. Buckle your chinstrap!

Maduro isn’t getting economic support from anybody. He also continues to ship free oil to Cuba. To make up the short fall he has allowed illegal mining in the jungle, and they are cutting down trees, stripping the soil and finding gold they ship to Turkey to be refined.

If you want to discuss this in the non oil thread I’ll try there.

Explains oil price moves of late. If inventories continue to decrease oil prices will continue to increase.

IT’s playing on the Future market. In short term they can move the market everywhere they want. As long as the storage is not completely empty.

Yes, there is plenty of play in the market, by which I mean that production costs are much lower than the value of the product in a pinch. You can see this is true because only government mandates (like CAFE in the US or the heavy taxes in Europe) are at all effective at reducing consumption. Inventories only matter in the minds of the traders, and their sentiments determine prices.

Slowing economic concerns in the market today. Short term correction riding a 3 month bull.

WTI just printed a bearish shooting star on the weekly chart at close today. NOT the daily chart the weekly chart. Which has huge implications. Price is going down from here. It’s not going to make it back to the former trendline it broke that originates off the 2016 lows.

After the initial knee jerk reaction to FED’s policy that was lower for the dollar and higher for WTI. Dollar got bought and WTI got sold.

Direction couldn’t be more clearer if your paying attention.

The 3m10y inverted today. Which isn’t good at all if you desire higher oil price. Recession is near. Seems to me FED should have known backing out of QT would flip the yield curve by sinking the long end of the curve. Doesn’t really matter why it flips. Banks can’t make money borrowing short and lending long equals recession.

Short term interest rate cuts will be back on the table in short order. To try to correct this inverted yield curve. FED doesn’t really have a choice in the matter. But the damage is already done. Recession should be here 3-4 months after the FED starts cutting interest rates again.

Baker Hughes U.S. Rig Count

Oil: -9 at 824

Nat Gas: -1 at 192

Louisiana -3

Permian -5

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-reportsother

Table https://pbs.twimg.com/media/D2R2poxWoAAI1Dj.png

I failed organic chemistry in college…so bear with me….

If you can convert Coal and Natural Gas to Oil ( hydrocarbon chains?? ).

Do those count when calculating when peak oil has arrived?

I must go now….I am getting my vasectomy in the morning.

Luke 12:33 ( Ivanka Trump 1:10)

“Sell your possessions, and give to the needy. Provide yourselves with moneybags that do not grow old, with a treasure in the heavens that does not fail, where no thief approaches and no moth destroys.”

I assume those are not likely to be enough to replace falling oil output so I focus on c+c output. Coal and natural gas will also peak, coal in 2030, and natural gas in 2035, with 2 year window around each guess.

Both coal and natural gas have lower energy densities than oil, so you would lose a bunch of energy making the conversion. Wouldn’t it make more sense to directly burn the coal and natural gas?

Do they count when calculating peak oil?

Hyrdro carbon chains are the same aren’t they?

They only count if they are actually converted from coal or natural gas to gasoline, diesel, or jet fuel. At current prices and technology that is unlikely to occur at a greater scale than today. Impossible to predict with precision future developments, but with wind, solar and evs having rapidly falling costs this makes it more likely that oil price peaks around 2025 and makes the substitution of coal or natural gas for liquid fuel highly unlikely, probability 10% or less.

DC,

(OT: What have you done with DougL? Set him free immediately.)

Doug had one of his hissy fits he has every few months, threatened to leave, and quit posting. He’s always ultimately come back, though, so the odds are in your favor if you enjoy his posts.

Dave Hillemann,

Thanks. I shall study patience.

On the other hand, coal and NG can substitute for oil: China is using coal for petrochemicals, and of course NG is used for that as well. And then there’s NG for transportation, especially heavy fleets.

As the price of oil (and the recognized cost of externalities) rises, oil demand will be a leaky barrel, suffering from a thousand cuts.

Rystad Energy claims in a newsarticle that US shale oil and shale gas will grow and become a quarter of the world’s total petroleum production in the 2030’s. The company also claims that debt is a misunderstood aspect of the shale oil production, because investing in shale oil is so attractive that the shale oil companies reinvest all their profit to grow faster. Any comments?

They’re lying. US LTO doesn’t make positive free cash flow, ergo no profits to “reinvest.” It is true that they plow whatever they make back into production but they kind of have to operating at a loss.

>investing in shale oil is so attractive that the shale oil companies reinvest all their profit to grow faster

The claim doesn’t even make sense. If all their investments come from their own profits, then they aren’t accruing debt. But they are accruing debt. What they do with their profits is irrelevant to that fact.

Has Rystad ever addressed the net operating losses that almost all shale companies have accumulated since 2014?

The GAAP profits for shale are heavily dependent upon company estimates of well productivity, and also spread much of the well cost over as much as a 50 year period.

For income tax purposes, shale companies expense all intangible drilling costs (non-equipment) and in 2018 were also able to expense almost all equipment costs too. Therefore, shale companies have been accumulating large income tax losses and have been paying little to no income taxes.

In theory, shale will someday pay income taxes, but that is dependent on well productivity plus an eventual slowdown in CAPEX. Of course, higher oil and natural gas prices would also make a tremendous difference.

I have also argued that tax law changes could really hurt shale (and our conventional company too – to a lesser extent).

Democratic Party majorities and a Democratic President could end IDC expensing. Requiring intangible drilling to be taken over the life of the well would greatly increase shale taxable income. We still haven’t drilled a new well since 2014. However, assuming prices do increase enough, we will again someday. Losing IDC expensing would affect our decision.

Of course, we are much more worried about losing the percentage depletion deduction, which is the “tax break” which helps small producers. It is limited to the first 1,000 BOEPD and limited to independent producers.

Finally, the rate at which NOL’s may be carried forward and offset future profits could greatly affect shale. Currently net operating losses may be carried forward indefinitely but can only offset up to 80% of net income, which is another change. These apply to post 2017 NOL only. 2017 and prior can only be carried forward twenty years and can offset 100% of income.

2018 was a decent year for most stripper producers (unless they have a lot of debt). However stripper producers likely didn’t grow much, more than likely saw production decline at a low rate as vertical well drilling is at multi-decade lows.

Shale companies registered very high net operating losses as they spent greatly over cash flow to grow US production by around 2 million BOPD.

NOL’s are reported on company 1120 Federal Income Tax Returns. I say look at tax return figures whenever possible when analyzing any company, especially US E & P’s.

SS you may or may not have ever encountered this, but for personal income taxes capital loss carryforwards have no time limit.

Some smart folks harvested capital losses during the financial crisis in 2008 and these still exist. They can be used to offset $3,000 of income where that income is of the ordinary sort, meaning not capital gains, each year until the loss is used up. Or if capital gains are achieved in a given year, the past carried forward capital loss can reduce that capital gain until the loss is used up.

A bit similar to operating loss carryforwards. Thus there is precedent.

Watcher.

I am aware of capital losses being offset against ordinary income as you have described.

What I am pointing out is nothing new, although the NOL carryforward rules were recently modified by the new tax law which was most noteworthy for lowering corporate rates and also for greatly limiting the SALT deduction on Schedule A for individuals.

I went back and looked at some older 10K for US E & P pre shale boom. There were NOL sometimes, but nothing even close to the magnitude of what has been incurred the past four years.

US E & P corporate taxes are complex. When you compare the tax accounting to GAAP accounting, there are major differences.

Incurring NOLs in E & P doesn’t necessarily mean the business is not making money if it is growing quickly. It will be interesting to see how this shakes out in future years.

Net operating losses aren’t just being incurred by shale. They are present in coal, wind and solar. Tesla has something like $7 billion of NOL carryforwards as of 12/31/2018.

For a variety of reasons, energy producers are incurring net operating losses.

Good for consumers, but they cannot go on forever.

Was wondering if anyone had seen this development… apparently a sizable quantity of oil was reportedly discovered in the Golan Heights region. This fellow Martin Armstrong alleges that there is more oil in the Golan Heights than all of Saudi Arabia…(?)

https://www.armstrongeconomics.com/international-news/middle_east/is-there-really-more-oil-in-the-golan-heights-than-is-saudi-arabia/

I find this very hard to believe…

Sometimes it’s hard to believe charlatans…

Or, probably, the reference is to olive oil.

http://www.zimmer.co.il/c/en/default.asp?siteID=2797

Mike-

“I find this very hard to believe…”

Thats good, trust your instinct.

Its just high ground. Good place for artillery aimed towards the farms below. Drops 300o ft in 7 miles.

Thanks! Rystad Energy also claims that the “2016 wells” gave super profit. Is it possible they have an agenda if their comments are all wrong?

It’s called “talking your book.” As an industry service company collecting fees, they benefit directly from more capital sloshing around in the industry. So talk it up to make it look like a better investment.

Wall Street at large is seeing this quite differently. See terrible stock price & performance vs. the supermajor oil companies and the recent crackdown on lending/placement. Market says “this is a bad industry with no hope of profitablity.”

Thanks! I always get good answers in here!

Baker Hughes rig count still shows Kansas with zero rigs running. December oil production in Kansas was down to 91K BOPD per EIA, a low not seen since the aftermath of the 1998 price crash.

Interesting view related the EIA short term production forcast. They predict Norway will increase production, well the truth is some new fields will come in production , but the decline from exsisting fields is also significant becausea long period with limited investment think production will much be the same. The exsploration rate is increasing and that is good as last year only 15% of resourses pumped up was added with new resourses. The shale oil production acc. to Rystad will continue to increase as it have done for years , and they predict oil majours like Shevron , Exoon will make that happen. Well first off all there is a majour change, so far this increase have been done by depth. All loss carried forward have been borrowed money and thoose investors have lost confidence in shale. In such environment and with climat focus interest of capital will increase that in addition will reduce free capital for exspansion. I believe what we see.now WTI 50-60 usd / bbl is what wil be the situation in 2019 , 2020 as the world economy is weak caused by trade war , lack of growth in emerging economies. A good sign is Baker Huges rig count , this shows active oil riggs in shale is continue to go down, soon the best DUC are taken, compleated than there will be decline in US shale oil, if it recover will be related to oil price that CEO Mark Papa told need to be 75 USD WTI or above.

Thanks for the analysis Freddy, I find it quite interesting.

On another point, this post has been up over two days and you are the first to comment on it. There has to be a message somewhere in that, I am just not sure what it is.

Ron,

Good post. My comments on longer term EIA forecast in AEO were intended to simply add to your analysis which was excellent. Often when others agree with what you have said there is not much that needs to be said.

Or that’s how I interpret it.

Ron and Dennis,

Thanks very much for keeping up the website. For what it is worth I appreciate seeing the charts. It might end up being more interesting to keep this EIA forecast (March 2019) and evaluate how close the actual production they report ends up being over the next year? Regards,

Regarding Norway and short time increase, its as simple as johan sverdrup coming online this year and as it looks a bit ahead of original plan. First phase will ramp up to 440.000 boepd and second to 660.000 boepd witch for sure will be faster than underlaying decline in old and current producing assets.

In other Norwegian news looks like Equinor have struck hydrocarbons in an exploration well close to russian border. This is a mayor structure and a major find needs to happen if it should be viable for developing imo.

They have not really announced it yet, operation has been prolonged from original schedule with an extra month while already at TD.

EIA projections are profoundly flawed, being the only question if they are aware of it or if they actually believe their own shit.

Increased production is driven by relatively high or increasing oil prices that signal increased demand, OR by the need of producers to maintain income at the expense of other producers when prices fall as it happened between mid-2014 to late 2015.

The second case is difficult to take place when oil prices are relatively low, as now, and when there are agreements between producers to limit production to sustain prices, as now. Therefore EIA is projecting an oil price increase amid general economic weakness, a trade war, Chinese ongoing slowdown, and so on. The economy is not signaling any urgency about oil supply after the Iran sanctions have taken place without much effect. Prices are not going to sustain an increase in oil production unless something unforeseen takes place, and such event cannot be included in EIA forecast.

According to Art Berman presentation about the 2018 price collapse the markets are signalling $60/b oil for 2019-2020 with $10 price excursions. If he is correct we will not see an increase in oil production, and might even see a slight decrease as Venezuela continues its fast descent to near zero oil production. Everybody knows that a country that came to depend almost exclusively on oil will implode when its oil production collapses, the only question being how the implosion will look and what will be the final death toll.

Not sure which markets Art is referring to when he said markets are signalling $60/B oil for 2019-2020 with $10 price ecrusions. But nothing trades in a complete vacuum. If you really want to know where prices are headed you have to look at a bunch of different markets and price charts to determine which way markets are headed.

https://tradingeconomics.com/ndx:ind

Useful little tool for anybody that doesn’t trade and have up to date access on price on anything and everything but would like to.

Check out the NASDAQ-100. Which is Banks, insurances firms,brokerage houses and mortgage companies. Pull up the weekly candlestick chart and you’ll find are very large bearish shooting star at the close of last week. This is very,very i could say very a thousand times, bearish for US stock markets.

Check out WTI oil and everything else while you are there. Bearish shooting star there as well.

US treasuries, the Dollar and Japanese Yen will be the so called safe havens. Yen will gain on everything including the dollar as this plays out. Dollar will gain on everything besides the Yen.

MR. market is pointing towards a not so bright immediate future. This isn’t months away it’s now.

I could make the case a extended period of sub $20 oil is coming.

But will leave it as i believe $20 oil will be visited. So i don’t upset the crowd who believes otherwise. 🙂

One more thing i’d be more than ecstatic if things were going the other direction. They just aren’t.

Good spot. Definite a shooting star on the NAS100 weekly chart. But i think you need to get the confirmation next week maybe ?

It’s a shooting star sitting right on top of one of the greatest run ups your ever going to see over a 3 month period. 3m-10year just inverted. I’ve been doing this a long time 20+ years. Chances of it not confirming are next to zero.

Are you shorting the market? If you are right, lots of money to be made.

Iron Mike,

This isn’t a trading website so i’m not going to discuss what i may or may not be doing trading wise.

I just wanted to give a different point of view of price from a traders point of view. Just share what i’m seeing. Because assumptions on price are everything when your projecting Peak Oil

I think my internet must be broken, but I thought I saw oil with a slight gain today. The chances of this were next to zero! When you say “next to” do you mean, like within the same galaxy?

So with sub $20 oil you are assuming demand decreases like it did in 2008-09 time frame, only more significantly?

So we are headed for a worldwide economic depression?

For producers sub $20 is extreme, especially for an extended period, as you are predicting. There were will a tremendous shock in the US high yield market as well as the US stock market.

Shallow,

We could very well find ourselves over supplied even at $20.

HHH,

Yes this is not a trading site. Using charts to predict the future simply doesn’t work, if it did the market would quickly eliminate any gains.

$20/b might occur in 2050, not before for any 12 month period unless there is a Worldwide depression similar in magnitude to the Great Depression.

If governments worldwide follow the nonsensical policies followed by the European Union in response to the GFC (where fiscal austerity ruled the day), then we could indeed see a catastrophic economic result similar to the US economic response when Herbert Hoover followed similar policies. Those who believe a market economy is self correcting are correct in the long run, but as Keynes famously said, “In the long run, we are all dead…”

Government intervention in the economy is not a socialist plot, on the contrary, Keynes believed it was necessary for capitalism to survive and would prevent a socialist revolution.

Dennis,

Do you care to wager that charts can’t tell you where price is going? I know for a fact they can and people who know how to do it do it all the time.

How about your Tesla? Against a couple of hundred grand?

Or maybe something friendlier like maybe you just admitting that your were wrong and got schooled.

You’d have to come up with some new charts though to fit what low price will mean for oil production.

I’m actually trying to help you get the story right about peak oil. By helping you get price right.

Guess we will see what happens over next couple of years.

In my opinion 20$ oil is a trigger for 200$ oil – at least if it’s longer than a few weeks before rocketing up again.

20$ oil will take out shale (there are less class A++ fields left than last down turn), and during changing the owner of the companies no one will invest.

20$ oil will “regime change” some other producing oil countries, in Venezuela style. Perhaps Iraq -5mb/day in short time.

And 20$ oil will let consumption high, even in a strong economic down turn. Simply by being too cheap.

And it will kill off any investing in offshore oil, and questioning existing fields.

Do you care to wager that charts can’t tell you where price is going? I know for a fact they can and people who know how to do it do it all the time.

Really now? If they can do it all the time then they can, very quickly, become multimillionaires playing the oil futures market. Trying to guess which way oil prices are going are what traders do. And they use charts and every other tool at their disposal. Some of them make a little money and some of them lose money. But none of them are becoming multimillionaires by playing the oil futures market.

Ron,

It’s not a guess when you wait on the market to tell you what it’s going to do. And it always does if your patient enough to wait on it to tell you and also know where to look and why. Day traders tend to lose more often than not. Because they have the need to make money right away.

NASDAQ-100 is going to lead the way this go around. It’s not as obvious elsewhere yet. In order to be successful trading oil futures. You got to know how to trade every other asset class out there. Trading doesn’t happen in a vacuum. You can’t just be an oil futures trader and be successful. Not successful long term at least.

Go look at WTI, gasoline, heating oil, charts. They are all somewhat similar. Yet different. How do i know all three are headed south. If you looked just at gasoline and the run up it’s been on. You probably think that will continue if you look a certain data sets that pertain just to the price of gasoline. But you’d be wrong because you’re basically looking through a microscope when you should be looking through a telescope.

Your not seeing the asteroid that is coming that is going to screw up what you believed to be true if inventories and production are the only things an oil trader is looking at.

Day traders tend to lose more often than not. Because they have the need to make money right away.

HHH, Who brought up day traders? Obviously, charts can never tell you what is going to happen today, or in the next few hours. Charts can only indicate the long-term trend, if anything.

But they cannot even do that. Most oil traders trade longer term, they are not day traders. They look at the charts and try to guess where oil will be next week, next month, the next few months or next year. And if they could do that, they would all be multimillionaires. Traders who use charts are right about half the time. The other half they are dead wrong.

Charts cannot tell you the future of oil prices. End of story.

Ron,

they don’t simply trade only against other traders – they are the counterpart for oil hedging, too. They hold the other side when shale companies try to hedge.

And most traders trade for big banks. They are making billions, as you said. For example Goldman Sachs alone 10 billions last year. Most is earned trading the stock / bonds / commodities markets. Futures are one tool to trade these markets.

Eulenspiegel, I know all that. I was a stock and commodities broker for all of about six months. But the word “stockbroker” is just another word for “salesman”. I was not much of a salesman so I left the business and got back into computer hardware.

If you think banks are making millions trading oil futures, you are dead wrong. Banks hedge their bets just like oil producers or oil consumers do.

Yes, banks earn big bucks. But they do not earn billion trading oil futures. If you believe that then you are dead wrong. Banks try never to be gamblers. Though the real estate loans they make are always somewhat of a gamble. But trading naked futures is always a gamble. Hedging is a different story.

Banks earn their money by lending money at a higher interest rate than they pay depositors. They loan other people’s money and pocket the difference.

Some banks do computer trading. I have explained how that works but I will go over it once again. Computer programs watch for a difference between stock futures and the physical stocks. When the gap gets great enough, that triggers a buy of the one that is high and a selling program of the one that is low. That is, they either buy or sell a basket of stocks representing the futures programs they buy or sell. Then as soon as the gap closes, they unload both positions. It sometimes happens in a matter of seconds or minutes.

But banks only do this with equities because the exchanges trade both the physical equinity and futures of that equinity. Physical commodities are not traded on any exchange, only the futures are traded.

Banks do not make very much money betting on which way the market will move, whether that be stocks or commodity futures.

Ron,

Sorry but you have no idea what trading is if you believe people can’t use a chart to tell you where price is going. I’ve been doing it for 20+ years and making a really good living doing it. I only trade major turns in markets.

I can also tell you every principle that make ‘s trading what it is works today just like i did 20 years ago or so. CB’s didn’t change a damn thing when it comes to reading a chart. And neither did HFT machines.

Charts are saying US stock markets including the dow, s@p500 and NASDAQ-100 and multiple other stock index’s are at very least going to put in a 35%-40% correction starting next week when the NASDAQ-100 technically runs out of room to run any higher than it is. PERIOD!

Which implies a 35% to 40% correction for the Dow and S&P 500.

Go long on CL futures be all means if you believe oil can rally. While the most important stock index in the world is having a 35%-40% correction.

One more thing you need to consider. Dow is project a move back to 18,500-18,000 currently. Could be lower depending on where the neckline of the head and shoulders is broken. My best guess is it will technically break the neckline in NOV or DEC of this year as we are at the peak of the right shoulder at the moment. It could be next year. If i’m shorting the DOW that is exactly where i’m taking profit. Based on a measured move lower from the current head and shoulders it’s trading in.

How on earth does that happen when CB’s are all in with monetary policy? Charts aren’t wrong and neither are my technical breakdowns of them.

HHH,

You can simply bet against all the other chart readers, let me know when you get to a billion. 🙂

Should be easy money. I will keep mine, I am not a gambler.

HHH,

You can tell me I have been schooled if Brent trades at a 12 month trailing average price of $20.00/b or less in 2018 US$ before December 31, 2030. Is that the bet you are willing to make? Might be some easy money in it for me. 🙂

$20 oil will CRUSH any exploration and development and NOBODY will spend a dollar on CAPEX.

No Questions Asked.

A short-term high for consumers but a worse cataclysm than 2015…

I am in Central TX, (Bryan/College Station) and remember well the 1980’s crash and of course 2015-18.

The offshore oil exploration company I work for here was saved by a TGS contract during that sh+t show.

We are now so swamped with jobs it is stupid.

Not enough boats or people worldwide- (NEW , unused fleets were cut up for scrap) and honestly a dozen people I personally know ( some family members) either retired or went to other technical fields.

They have all refused offers to come back….

Please remember, we are already 3 years behind on Explorati0n and Development and we are just starting to see the ramifications of that 3 year worldwide “vacation”.

Oh, and IMO 2020 is rolling in. Not a problem for us as we have to use .5ppm diesel anyway….

Plus all the other Producer Countries with their own personal problems….

Yessir, gonna be a wild show.

I was /am no fan of Jimmy Carter but the world should have listened to him back in 1977.

That old grasshopper/ant fable comes to mind…

A lot of lost years since then, would have been nice to develop alternates before it got scary.

But that is what Humans do…

Silly creatures….

Interesting how the service firms are all swamped yet are mostly on the brink of BK, based on how the shares are trading.

I started to pay attention to oil during the Carter years. We could have had a very manageable transition to alternative options to oil if we had used those decades to plan for it.

Instead, we’re going to have significantly more disruption when we can’t keep our petroleum consumption at current levels.

Re shale financing . . . Folks should go and read financial articles from Wednesday afternoon of this week.

The Fed basically took a sledgehammer to their dot charts. In the ongoing desire on their part to be transparent they have, until Wed., projected their expectations for increases to short-term rates over the next two years to be 4 increases this year and 4 next year.

As of Wednesday, that’s all gone. The new dot chart says zero increases this year and at most 1 next year. The 10-year treasury immediately cratered its yield to 2.5something percent. Still falling. Overseas we see Germany tracking, and Japan, and more and more maturities on their yield curves return to negative. Not just real negative. Outright nominal negative. This is something that Financial media does not talk about. Negative nominal interest rates from major country government bonds. How could they talk about it? It is utterly obvious that this specific reality demonstrates that the entirety of all analyses has no meaning. Their only defense is silence. Shale would prefer that it stay that way.

The Fed also announced an end to balance sheet normalization, which is euphemism for trying to get rid of all of those bonds and MBS that were purchased as part of QE. They are ending their purchases late this year. They dare not continue the move towards normal. I believe that leaves their balance sheet still holding in excess of 3 trillion. That’s not normalization, sports fans. And it has been TEN YEARS.They havent been able to get to “normal” in ten years, and as of Wed, they will stop trying.

The Treasury notes are the underlying basis for what shale companies have to pay to borrow money. Thoughts by folks here that the monetary gravy train will shut off shale drilling need rethinking. Bernanke changed everything. Forever. These Fed actions are indistinguishable from whimsy. Imagining that Powell is Peak Oil cognizant and is focused on shale is a tad extreme, but only a tad. I recall a Bernanke quote during the crisis that made clear he knew what Peak would mean — at any price.

When US Equities are well on their way south US treasury yields will also join the negative club. But oil will also be $20. Not saying that oil can’t keep coming out of shale but there will new owners. Entirely new owners. As all the debt gets wiped out.

EEK!

Probably true.

My suspicion is if oil keeps pumping at $20 the owners will be the US Gov….

I would sure hate to lose our Royalties if the Feds nationalize oil at the “Request and Convenience of the Government”.

Had that personally happen to one of my enlistments back in the day…

I sure like our monthly minerals’ check…..

“When US Equities are well on their way south US treasury yields will also join the negative club. But oil will also be $20”

I don’t believe Oil will fall much anymore. Oil prices were kept in check by the rising dollar. Now that the Fed is no longer hiking, and probably will be cutting rates soon, its likely Oil prices will start rising again. I think we probably will see some short dips in energy and Stocks, but once the Fed cuts or does more QE, prices will climb back.

I’ve also noticed that prices for everything are going up. We are back in stagflation with falling labor demand, but rising costs: materials, Food, imports, etc. My wild ass guess is that WTI will be higher in Dec 2019 than it is today.

Its possible that the Fed is now trapped: Rising inflation, but failing labor demand. Prices will likely increase as unemployment increases. My guess is Fed will let Inflation go unchecked in order to avoid another major recession. If this assessment turns out to be correct, Holding cash in USD is going to losing strategy.

FWIW: I don’t believe the number of job offerings reflect the real labor market. I think companies are keeping a lot of filled jobs posted due to extreme employee turn over rates. For instance retail job turnover rates are as high as 81% per year. Often worker quit after a few months or weeks. Thus it just makes sense for employers to keep the same jobs permanently listed, even if they have the position currently filled.

Nobody will be willing to drill new wells in tight oil plays at $20/b and all the investors who have lost money due to bankruptcies will scare away other investors. Supply decreases more than any demand increase and oil prices increase. If oil prices reach $20/b which is doubtful it will be very short lived.

In June 2015 China was, according to EIA charts a few articles back ( http://peakoilbarrel.com/eias-data-for-world-and-non-opec-oil-production/ ), producing about 4.4 million barrels a day. By October 2016 they had dropped to about 3.8 million and have been holding fairly steady ever since. I’m curious if those here might think that China is a good case study, so to speak, and that a relatively sudden drop is possible in other oil producing regions. To put it mildly, I’m not a petroleum geologist. I’m curious if OPEC Middle East, for example, might experience a decline of similar proportions over a similar time frame, that is a decline of 13% or so, over a year and a bit? Do any post peak production profiles give insight into the potential post peak production profiles for OPEC Middle East?

FWIW I really liked these stacked graphs.

http://crudeoilpeak.info/latest-graphs

Perhaps a new one will be out soon. In the first graph the top six in the stack are USA Iraq Canada Russia Brazil & KSA. To Ron’s point, it seems to me that once increases from that group of 6 can no longer offset declines from everyone else in the world, then the oil peaks.

Interesting observation Survivalist.

Dittmar https://link.springer.com/article/10.1007/s41247-016-0007-7

noticed a 3% per year decline for 5 years followed by a 6% per year decline

in Indonesia, Mexico, and the North Sea. The decline in North Sea production

ceased around 2013.

I think that oil production is an economic phenomenon, so I do not think

this is a question for petroleum engineers, it is a question for investors.

I think that the reason we have not seen peak oil yet is because so much

money has been created to invest in oil production (when we speak of

investment, we are speaking about money

creation) https://truthout.org/articles/global-banks-invested-1-9-trillion-in-fossil-fuels-since-paris-climate-pact/.

Investors are under the false impression that a shortage of a commodity

which is vital to the economy leads to higher prices. Empirically this is

not true. I have been reading Graeber’s book on the history of debt. Each

time there is a famine, farmers cease making money.

I will tell you what the end looks like: either investors pull their money

because they lose confidence, or we continue money creation to produce oil

until inflation causes the workers to quit. That is the end of any resource

extraction industry, that’s why there are 60,000 abandoned mines in

Australia. Both phenomena can be observed in Venezuela. Oil production

crashing because investors have pulled out and workers quitting because their

salaries can no longer feed the family.

Thanks for the Reply and the insight, I appreciate it.

Schinzy,

Inflation is caused by excess aggregate demand with properly managed money supply.

So far there is very little evidence of inflation in the OECD (and most other nations).

Most of the expansion of debt at the World level has been in emerging and other non-OECD nations as there has been better access to credit markets.

Colombia is going to try fracking

2019-03-08 (Reuters) Fracking could nearly triple Colombia oil and gas reserves: minister

Exxon Mobil, Conoco Phillips, Parex and state-run oil company Ecopetrol are among those seeking to operate in the six blocs, Mines and Energy Minister Maria Fernanda Suarez said in an interview late on Thursday, without identifying the fifth company.

“We have 5.7 years of crude reserves and 11 years of gas reserves. Our estimates say that with unconventional deposits we could have 30 years of gas and 15 years of crude.”

https://www.reuters.com/article/us-colombia-energy/fracking-could-nearly-triple-colombia-oil-and-gas-reserves-minister-idUSKCN1QP1OO

MinEnergy Bogotá DC March 19, 2019. The average crude production during the month of February was 892,530 barrels average day

Buying or selling oil futures, or can you predict the future price.

I am putting this here because it deals with the future of oil prices, though it could be applied to any commodity. Some folks seem to think that “the experts” by looking at charts, can predict the future of oil prices. They cannot.

As I have posted before I was once a commodities broker. I bought and sold commodity futures for other people. I never made them very much money however. No one ever makes much money trading naked futures. I have listed below 11 professional futures trading advisors. Eleven of the very best. Only one of them has averaged over 1% per year before commissions. One could do far better buying CDs.

Trading naked futures, that is unhedged futures positions, is a pure gamble, nothing more. Those who are very good at this can make millions. However, I have never heard of any such person or organization that was successful in doing this.

Commodity Trading Advisors

Jack Bogle was not just right, he was broadly right. This is the first time I’ve seen active management trashed outside equities. Good data.

Watcher, I am not sure what you are driving at. John Bogle was an investment manager, not a gambler. He founded Vanguard, a mutual funds management company. He was also the first to champion index investment. That is buy funds that reflect the stock market index. He was the furthest thing from a naked futures gambler.

Missed the point. Bogle’s index approach was far more powerful than the marketing brochures.

If an active manager tries to pick stocks and outperform an index, he has to pick stocks not just better than the index, but better than the index PLUS his salary.

And Bogle wanted the world to invest via index funds, absent active (paid) management.

Per your comment, active picking of commodities didn’t work, either.

But what most people do not dig into is the concept of variance capture. The larger the active manager’s portfolio, the more variance of the underlying index he will capture. This is further drag on his attempt to outperform. He faces not just his costs, but also variance capture. The sigma of the index will be tapped into by whatever he chooses. It will constantly be a mathematical drag on his pursuit of alpha.

2019-03-25 (Schlumberger) Kibsgaard Speaks at Scotia Howard Weil 2019 Energy Conference

… in North America land, higher cost of capital, lower borrowing capacity, and investors looking for capital discipline and increased returns suggest that future E&P investments will likely be at levels dictated by free cash flow. Based on this, we expect E&P investment levels in North America land to be down more than 10% in 2019 versus 2018.

In addition to the impact of lower investments, US shale production is also facing increasing technical challenges; as infill drilling creates interference between parent and child wells, as drilling steadily steps out from the core Tier 1 acreage, as the growth in lateral length and proppant per stage is starting to plateau, and as increased light oil production impacts domestic refining capacity.

All these factors point to a more a moderate production growth from US shale in the coming years.

https://www.slb.com/news/presentations/2019/2019-03-25-kibsgaard-howard-weil.aspx

US LTO production growth forecast by Goldman Sachs

GS chart: https://pbs.twimg.com/media/D2a_dE1UYAA1Iqe.jpg

Oil Majors US LTO production forecast (XOM, CVX, RDS, BP)

HSBC chart: https://pbs.twimg.com/media/D2gt9yJXcAAU1k3.jpg

The Goldman Sachs estimate is a bit too optimistic, they predict about a 5.8 Mb/d increase in US tight oil output from 2019 to 2025 with a maximum annual output of 12.3 Mb/d in 2025, in 2018 average annual US tight oil output was 6465 kb/d, I expect the peak will be about 10.9 Mb/d in 2025, an increase of about 4.4 Mb/d from 2019 to 2025.

It is possible the majors will increase output, but they will mostly just take market share from the weaker independent tight oil producers.

2019-03-19 (S&P Platts Global) Libya’s crude oil production has recovered to 1.2 million b/d but the OPEC producer has the ability to increase output to 1.4 million b/d this year “if the security situation remains stable” the chairman of state-owned National Oil Corporation told S&P Global Platts Tuesday.

NOC’s focus will also be on recommissioning all essential oil service companies, drilling and workover contractors in order to restore all existing shut-in wells and rehabilitate surface facilities. NOC has over 400 shut-in wells that require minor and major works.

“Bringing these wells back online and enhancing existing production through infill drilling will significantly add to our production outlook,” Sanalla added.

https://www.spglobal.com/platts/en/market-insights/latest-news/oil/031919-interview-libyan-oil-output-could-reach-14-million-b-d-if-security-holds-sanalla

Libya’s crude oil production was 0.9 million b/d in February

Chart https://pbs.twimg.com/media/D2g1bPlWkAAlxt4.png

March 15, 2019 (Rystad Energy) Offshore decline rates started to increase in 2016, and have continued to increase over the last two years. And reached almost 10% last year. A key reason for the increased decline rates, is the lower infill activity. Since 2015 the infill activity has dropped ~33%.

Bar chart https://pbs.twimg.com/media/D1r7v2HWsAAd6rj.jpg

Rystad Energy on Twitter: https://twitter.com/RystadEnergy

The STEO production forecast – this does make me think that it’s easy to forecast production additions, just by reading the press releases. But it must be much more difficult to forecast declines, all oil fields will come off plateau sometime but when? So knowing the net change in a year or two is difficult?

EIA STEO Table 3b. Non-OPEC Petroleum and Other Liquids Supply

Forecast for production change over two years from Dec2018 to Dec2020

United States +2.48

Brazil +0.6 (new FPSOs?)

Norway +0.3 (Johan Sverdrup?)

Australia +0.13 (probably NGLs?)

Qatar +0.13 (probably NGLs?)

Indonesia -0.11

The big shocker here is Russia. Up 70,000 barrels per day over two years. That’s six tenths of one percent over December 2018 production. It could just as easily be down that much. They are basically saying that Russia has peaked.

And they have the US up two and a half million barrels per day. That has to be a best case scenario. Anyway I have very serious doubts about that one. Ditto for Brazil. Everything must go just perfect for brazil to be up 600,000 barrels per day in two years. OPEC expects Brazilian production to grow by 360,000 bpd.

I think they probably have Canada pretty close.

Re above, oil and the Golan Heights

http://cdn.intechopen.com/pdfs/24550/InTech-Late_proterozoic_paleozoic_geology_of_the_golan_heights_and_its_relation_to_the_surrounding_arabian_platform.pdf

This is dated long before any recent attempts at hype or rumor. It doesn’t suggest any oil, and it’s pretty thorough.

Watcher,

It’s a good descriptive piece. It will tell an E&P company what’s down there in general terms with ages and thicknesses of the units and the kinds of deformation they’ve undergone. The maps and cross sections would go on the lab wall for reference along with similar work for the surrounding region, to give context.

What the company will need next is detailed lithologies. Drilling and seismic is in order, more of it and in detail.

My humble opinion.

I think the focus of the paper is the degree to which the geology is similar to northern Jordan and Israel. Where presumably exploratories were already drilled.

Watcher,

Yes, the paper draws on data from drilling in Jordan and I think Israel. You try to extrapolate from surrounding areas when you can, to help you know where to aim, but the oil that counts is what you find with the drill bit.

It isn’t an oil-oriented paper, just a straight report on the regional geology.

2019-03-26 The IEA’s Global Energy and CO2 Status report

Global energy consumption in 2018 increased at nearly twice the average rate of growth since 2010, driven by a robust global economy and higher heating and cooling needs in some parts of the world. Demand for all fuels increased, led by natural gas, even as solar and wind posted double digit growth. Higher electricity demand was responsible for over half of the growth in energy needs.

The full report is online: https://www.iea.org/k3k0/

This is a clip from an article at Bloomberg

A Flood of U.S. Oil Exports Is Coming

Javier BlasMarch 26, 2019, 12:01 AM EDT

Oil trader Paul Vega is at the vanguard of shale’s next revolution.

Driving his pick-up truck through the heartland of the Permian basin — the vast tract of west Texas scrub where one of history’s greatest oil booms means miles-long traffic jams — Vega says there’s more crude being pumped than America’s refineries can absorb. Today, the primary task of trading houses like his is getting the stuff overseas.

“We buy it, we truck it, we put it on a pipeline, and there it goes to the port — and from there to the world,” said Vega, who heads the office of global commodities trader Trafigura Group in Midland, the region’s oil industry hub.

What started as an American phenomenon is now being felt around the world as U.S. oil exports surge to levels unthinkable only a few years ago. The flow of crude will keep growing over the next few years with huge consequences for the oil industry, global politics and even whole economies. OPEC, for example, will face challenges keeping oil prices high, while Washington has a new, and potent, diplomatic weapon.

American oil exports stepped up a gear last year, jumping more than 70 percent to just over 2 million barrels a day, according to government data. Over the past four weeks, U.S. oil exports have averaged more than 3 million barrels a day — more than what Middle East petro-state Kuwait sells.

Ovi

That referenced article could be a sobering, highly informative read for anyone following the hydrocarbon world.

The amount of oil yet to be unleashed via fracturing/horizontal drilling is simply vast.

A few years on, the even larger amounts of natgas to be extracted, consumed, exported by way of ‘unconventional’ methods will transform the world as we now know it.

Coffeeguyzz,

The amount of oil will depend on the price of oil, if the EIA’s AEO 2018 reference oil price scenario proves correct and the USGS mean TRR estimate for US tight oil also proves correct, then US tight oil output will be about 90 Gb, this is a drop in the bucket of World resources of about 1800 Gb (about 5% of the total resource). Perhaps the NGLs from shale gas will be “vast”, but that doesn’t really help much with transportation and will be expensive to implement widely for the vehicle fleet.

Eventually natural gas will stop growing very quickly and prices may increase. As natural gas prices rise and wind and solar costs continue to fall natural gas may no longer be able to compete in the electric power business.

Do any of the shale gas focused companies actually have positive GAAP earnings?

Cabot net income -431 million for past 3 years

Chesapeake net income -3327 million for past 3 years

Range Resources -1940 million for past 3 years

These were the top 3 producers in the Marcellus in 2018

EQT net income was -1525 million for past 3 years

Southwestern Energy net income was -1401 million for past 3 years

These were producers 4 and 5 in the Marcellus.

Combined net income for the top 5 Marcellus producers for the past 3 years was

-8624 million so not a lot of profit at least for the largest producers.

Eventually these companies will need to turn a profit or they will find nobody is willing to lend them more money, higher natural gas prices would help.

EIA Monthly Energy Review statistics updated to December

https://www.eia.gov/totalenergy/data/monthly/index.php

World crude oil production

Chart https://pbs.twimg.com/media/D2mLcheXcAAWNcJ.png

The change in crude oil production over the last 10 years

(from the 2010 full year average to December 2018

Bar chart: https://pbs.twimg.com/media/D2mML1FX4AEaTBz.png

10 year change for OPEC countries, these statistics include gas condensate which is not included in the OPEC MOMR reports (without LPG)

Bar chart: https://pbs.twimg.com/media/D2mOIGoWwAIP7RK.png

Non-OPEC +7,42 kb/day

OPEC +1,714 kb/day

World +9,056 kb/day

EIA MER Table 11.2 Petroleum Consumption in OECD Countries

Average 2018: +307 kb/day increase from average 2017

December 2018: -1196 kb/day decrease from December 2017

Chart https://pbs.twimg.com/media/D2majLzXcAAqCAq.png

EIA MER Table 11.3 Petroleum Ending Stocks in OECD Countries

Chart: https://pbs.twimg.com/media/D2mbVp3XQAEzLRD.png

EIA MER annual data, 1982-2018. Average annual output increase of 810 kb/d each year.

What might help in not brokers but a graph of giants going offline due to lack of 150/barrel investment opportunities to keep pumping…aka CO2 injection?

https://www.rigzone.com/news/wire/shales_growing_pains_could_curb_us_oil_production-26-mar-2019-158457-article/

Seems now big Shale Companies is implemented decline rates of child wells and other cost related to well spacing in their budgets. WTI seems to have stabilaced at 50 usd range. Could it be a peak in 2019…?

Freddy,

From that article you linked:

Too close, and the child wells can turn out to be less prolific than their parent. But too far apart, and drillers can end up leaving oil in the ground.

Over time companies will figure out the optimal spacing so that it is “just right” and will maximize output per dollar spent on the well’s D+C. I assume this optimum has been determined for most plays and that maximum average EUR per well has been reached in most plays by 2018. I expect sweet spots will run out of room and EUR will gradually decrease in 2019 for the Bakken and Eagle Ford and in 2023-2024 in most other US shale plays with new well EUR averages remaining constant in the “newer” plays from 2018-2023. Clearly this is only a guess, but if it is correct US tight oil will continue to increase from 2019 to 2025 and may enough to keep World C+C output from peaking until that time, much depends on oil prices which I expect will gradually rise to $87/b in 2018 $ by 2025, beyond that it will depend on the speed that the transition to EVs and other plugin vehicles occurs which could potentially limit demand by 2025 to 2030 if it occurs rapidly and might keep oil prices from rising beyond $87/b in 2018$ over the 2025-2035 period. After that we might see oil prices fall as oil demand might fall more quickly than oil supply, difficult to predict.

Dennis, what seems quite clear is so far shale revolution have been driven by increased depth , acc. to a studdy that was done among 40 Companies they had average 30.billion dollars in depth. Some of this is losses carried forward that mostely is borrowed. Now it seems reality have changed, Investors , banks dont want any more to borrow out capital or invest in exspansion. It means as the pioneer Mark Papa have told there is a growing consern. The other issue is related to geological constraints, they might get some more knowledge but at least todsy tjis is not solved. I agree 85 or 75 USD might give increase production and again more active riggs as huge number off wells need to be drilled to offset decline. Guess they are compleated lots of Ducs now since oilproduction seems stabile with some increase?. Hopefully banks and investors will fund new wells when the Ducs are used as acc. to Mark Papa a 50 usd WTI world gives no profit for exspansion. Offcourse it could be different but at the moment it seems riigs are shut down, Companies sending home staf, workers and wall street is not happy…

Freddy,

I agree $50/b at the refinery gate does not work, about $65/b is needed for breakeven, typically refinery gate prices track LLS or Brent in the US and exported oil can probably fetch the Brent price. So Brent is the proper benchmark rather than WTI. Given petroleum stock levels we are likely to see higher prices from May to Sept 2019. If we consider days of forward consumption for the OECD, in 4Q2018 it was about 92 days, similar to 2011 to 2014 levels when oil prices averaged about $114/b in 2017$ ($102/b to $121/b in 2017$ was the annual average price range over those 4 years.) Eventually the oil market will come to this realization, though it may take days of forward consumption reaching 90 days (perhaps in 2Q2019) before traders wake up.

Council on Foreign Relations (CFR)

The New Oil Darwinism

https://www.cfr.org/blog/new-oil-darwinism

Now they are producing permian oil for 15 $ / barrel – let’s see when the first company claims it can be done for 10 or 5.