Dean Fantazzini has provided his latest estimates of Texas oil and natural gas output.

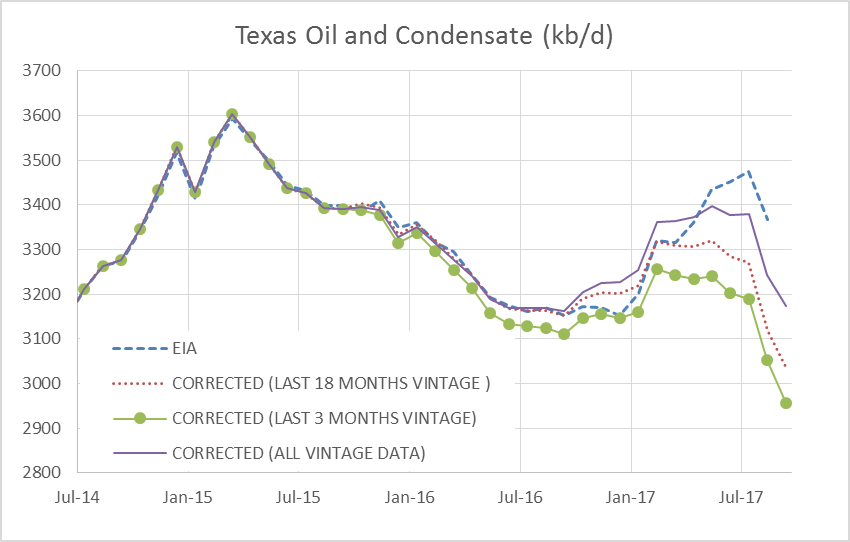

His analysis is based on RRC data only. Each RRC data set from Jan 2014 to Sept 2017 for crude and from April 2014 to Sept 2017 for condensate and natural gas are used in the “all data” estimate, the most recent 49 months of data are collected for each individual data set. After March 2016 there was a shift in the data for crude and condensate so for the C+C estimate, I include an estimate which uses all data from April 2016 to the most recent data point (“Corrected 18 month vintage”). Dean prefers to present an “all vintage data” estimate and an estimate using only the most recent 3 months “correction factors”. For Sept 2017 the all vintage data estimate is 3174 kb/d, the last 3 month vintage estimate is 2957 kb/d, and the last 18 month vintage estimate is 3039 kb/d with falls of 68, 96, and 80 kb/d respectively from the previous month.

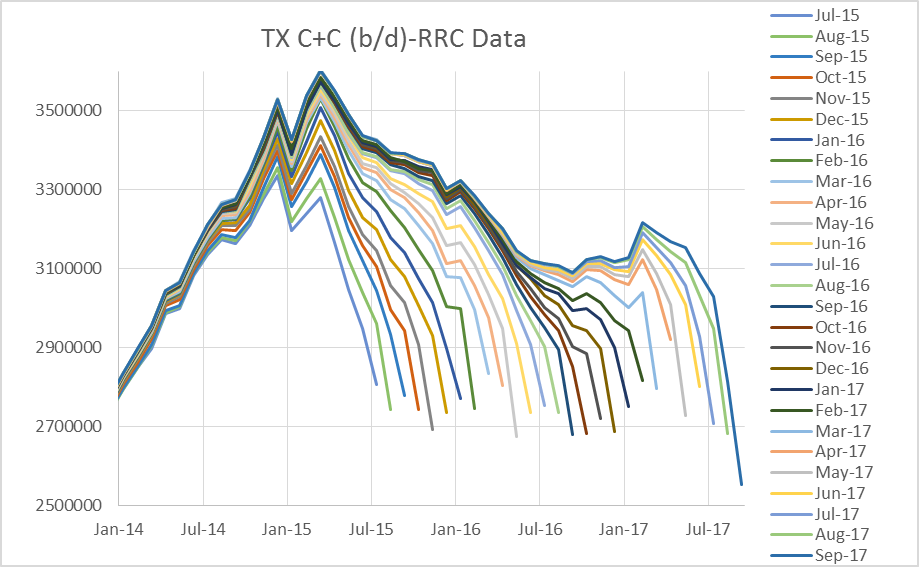

A chart I have not presented recently shows initial data reported for the past 26 months (July 2015 to Sept 2017). The change in the data around July 2016 is pretty clear. Notice how the lines start to become very closely spaced at about 6 to 8 months from most recent estimate, especially for the Sept 2016 to Feb 2017 period. This is an indication that the RRC data is improving.

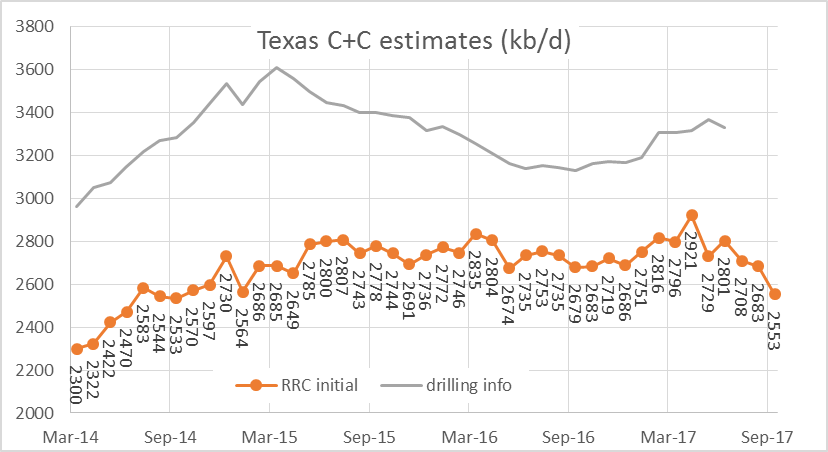

The Chart below is something new. It shows only the most recent data point from each of the data sets since March 2014 and compares with the data from drilling info which can be found at the EIA website. Notice that the RRC initial data from the RRC website’s online query does not always move in sync with the drilling info data due to fluctuations in the amount of pending lease data from month to month and other factors affecting the speed that data is reported and processed.

Note that the best data is from the Texas Railroad Commission (RRC) and is reflected in the data from drilling info. Only the most recent month has incomplete data (about 91% of the total) and I have dropped that data point (July 2017) in the chart above, the most recent drilling info data point is June 2017.

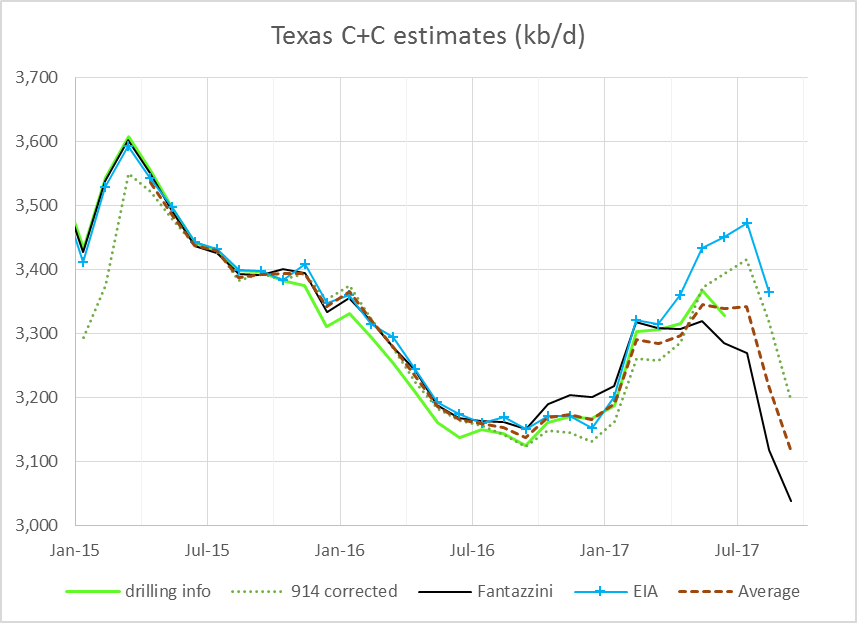

To get an estimate for the July to Sept period, we can use Dean Fantazzini’s data (I use the 18 month corrected estimate) and also a “corrected” 914 estimate. The 914 survey by the EIA surveys large producers to get a basis for an up to date estimate, this data is reported monthly by the EIA.

To correct the 914 survey report, I find the difference between the drilling info data and the 914 survey for each month from April 2015 to June 2017 and then take the average of that difference, which is 319 kb/d. This difference is then added to the 914 survey for each month and is labelled “914 corrected” on the chart below. The data for the 914 survey can be found at the EIA link earlier in the post and an explanation of the 914 survey is found at this link. The short story is that large companies that produce about 90% of Texas output respond to this survey by the EIA, which is then used to estimate output.

The “Average” of the 18 month corrected estimate from Dean Fantazzini’s analysis (“Fantazzini” on the chart) and the 914 corrected estimate is also plotted. To get an estimate for 914 corrected for September, I use the average difference between the 914 corrected estimate and the initial RRC reported data for June, July, and August (327 kb/d) and add this to the Sept 2017 RRC initial data.

For the data I have available right now, the best estimate for Texas C+C is represented by the “drilling info” line in the chart above through June 2017, from July to Sept 2017 my best guess is the “Average” line (3119 kb/d in September) with about an 80% probability the final data will fall between the 914 corrected estimate (3199 kb/d) and the Fantazzini estimate (3039 kb/d) and about an equal 10% chance the final data will be above or below those estimates. In short, the best estimate through June 2017 is based on RRC data (including the pending file).

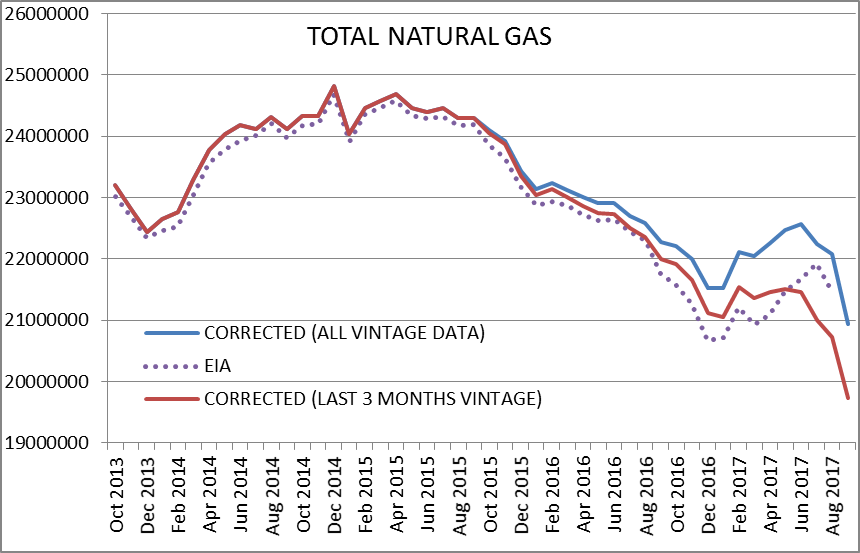

For Sept 2017 the all vintage data estimate is 20,942 MMCF/d, and the last 3 months vintage estimate is 19,736 MMCF/d, a decrease of 1145 and 988 MMCF/d respectively.

Just saw another train load of fracking sand head up into the northeastern corner of the Marcellus for gas fracking. Been getting fairly active up there these the past six months.

Map of natural gas drilling in Pennsylvania

http://stateimpact.npr.org/pennsylvania/drilling/

I see that the Penn East pipeline is under quite a bit of fire from locals and environmental groups.

https://stateimpact.npr.org/pennsylvania/2017/11/13/new-gas-pipeline-capacity-sharply-exceeds-consumption-report-says/

http://www.mcall.com/opinion/mc-hyman-penneast-pipeline-20171119-story.html

I have to sign up for an FTP access, and the first time you do that there is supposed to be a delay the first time you receive anything. So anything I could ultimately provide on pending leases will no doubt be delayed. In the interim, no doubt drilling info is the most accurate, but not timely, either. October will provide a better picture anyway, as September is screwed up by Harvey. Good analysis.

Hi Guym,

Thanks. The pending file data added to the RRC online query gives a pretty decent estimate for Texas output for all but the most recent month. For that month, we can use the 914 survey compared to the drilling info data to find a “correction factor” and then add that to the most recent 2 month’s 914 survey to get approximate output for the most recent two months. For prior months RRC data (including pending data) gives the best estimate in my opinion.

We are close. Not to the level of horseshoes, maybe hand grenades. EIA is playing the game with scud missies.

The EIA estimates could be better I agree. They are probably about 100 kb/d too high for August 2017, we will see Nov 30 what their revisions are, the monthly estimates do get better over time, drilling info data for older months (prior to the 2 most recent months seems best.

Like Mike has said on many occasions, patience is the key.

A couple of weeks ago I met former Australian Prime Minister John Howard at a seminar. In 2004-2007 I had an exchange of letters with him in which I warned peak oil might happen in his (last) term. His conclusion was “I agree to disagree”. The crude oil peak in 2005 caused high oil prices and the US recession end 2007. High Chinese demand for the Olympic Games mid 2008 caused the oil price shock and the financial crisis. I now had the opportunity to personally hand over a paper with these details, available in PDF in my downloads menu.

http://crudeoilpeak.info/downloads

We peak oilers were right and Howard was wrong. At the time of the financial crisis US shale oil was irrelevant. It came then too late.

During the seminar I asked him a question and that was the answer:

Former Prime Minister Howard assumes US shale oil will provide for China’s oil demand growth

http://crudeoilpeak.info/former-prime-minister-howard-assumes-us-shale-oil-will-provide-for-chinas-oil-demand-growth

In the meantime we have to watch out what is happening elsewhere:

The fight for Northern Iraq’s remaining oil

http://crudeoilpeak.info/the-fight-for-northern-iraqs-remaining-oil

Re China and the Olympics as mechanism for oil price spike.

Chinese oil consumption growth:

2005-2006 7.2%

2006-2007 5.1%

2007-2008 1.7%

2008-2009 4.2%

2009-2010 14%

It’s a popular theory, for God knows what reason, but there’s no evidence China spiked consumption for the Olympics. Certainly not like coming out of the financial crisis in 2009. And before you try to make a case for monthly granularity, remember this is why God created storage.

I think the 2008 spike had elements of supply and demand in it. World GDP was flat for a couple of years after the tech bubble crash and then suddenly took off until being rudely interrupted by the 2007/8 crash. But oil development also slowed down between 2003 and 2005. I remember recruitment and general rates were down and then suddenly went mad with firms paying signing on bonuses to fresh graduates and poaching becoming an issue in the years before 2007 because they had a number of delayed projects that reached FID (and often complicated mega projects like the tar sands and deep water), and they could see the price continuing to climb because the was lower than normal new production coming on stream. The 2007/8 crash actually didn’t stop that very much as Saudi made big cuts to boost the price within a few months.

Or maybe they made big cuts because they had fewer customer orders for oil. What a novel thought — producing and shipping what was ordered.

The big E&Ps make decisions on what they think the price is going to be over the life of a project, not on a particular day, and above that what the share holders are expecting from them over the next three months to a year. I’m not sure if that is what you are asking though.

George – I only worked for Mobil Oil for a couple of years after leaving school and as a grunt was never involved in economic analysis so you may be correct about “big E&P”. But for the last 38 years I’ve seen and often generated project economics for large an small companies, some public and some private including my latest (and last gig). And in every case I recall we carried the then current price forward for the life 0f the well. Sometimes a very slight increase or decrease after the first 2 or 3 years.

The only time I witnessed a company use highly inflated prices over time was when reviewing a prospect from some promoter looking for some fool to buy their deal. Didn’t bother me or my engineers: we would just use the reserve and risk that made sense to us and used our on price platform. Obviously our analysis never looked as promising.

I think you are talking about fairly near term projects. The bigger E&Ps have economic models which inlcude a forward projection of price. They are quite closely guarded secrets and it can be quite a big deal when the price projection gets updated, although in my experience they all seem pretty much the same for each company. They will run different contingencies i.e. high, low and medium price scenarios, and they are only one of several different inputs that go into a final decision, which sometimes just comes down to one of the high heijans having a feeling that $X per barrel development cost seems “about right”.

Part of the analysis also is needed so that royalty and tax projections can be made to the authorizing body (i.e. local/country government) who would need to approve any dvelopment plan and are always interested most in how much money they are going to get (which quite often doesn’t accrue entil the later part of a project and maybe covering 15 to 30 years in the future).

https://seekingalpha.com/amp/article/4127133-permian-duc-wells-surge-massive-implications-wti-oil-prices-inventories-permian-oil-producers

Do I hear an echo? Not included in their list of constraints is the lack of gas pipelines. You can bring them online, but without gas transportation, the can’t be on for long due to flaring restraints. It’s a waste of money to flair, anyway. The pipelines won’t be ready until about mid 2019. What about big balloons? It’s a big open space area. And they forgot to mention the lizards slowing down the sand mines. In all seriousness, somehow, more wells will be completed, just not as fast as was assumed.

Guy

When the land grab phase took place in the early Bakken days, much criticism was directed towards operators for the flaring that took place.

Little discussion occurred about the vast size of the area (twice New Jersey’s expanse), the high, 90%, oil to gas ratio, the 36 month ‘clock’ for HBP leasing requirements to be met, and the rapid drop in initial output that impacted the gas as well as the oil.

For these and many other reasons, state regulators allowed flaring with incrementally restrictive targets so as to allow drilling/development to take place.

Throughout those hectic years, wide eyed entrepreneurs/vendors were coming out of the woodwork in attempts to get operators to use their systems to capture, rather than flare, the associated gas.

Virtually none of these schemes were adopted, as far as I know.

However, several intriguing systems such as LNGo from Dresser (now owned by Siemens), UOP Russell (now owned by Honeywell) and others developed micro, mobile, cryogenic hardware to effectively process field gas.

The particulars surrounding the Permian versus the Bakken – huge size, higher gas ratio, length of time for pipeline build out, amongst other factors – may well incentivize adoption of some of these systems.

http://www.rrc.state.tx.us/about-us/resource-center/faqs/oil-gas-faqs/faq-flaring-regulation/

No questions asked for flaring at well completion for ten days. Permits for extended flaring issued for 45 day periods which must be renewed for a maximum of 180 days if a well is put in where pipelines are not available. As I read it, that is it. However, I am not an experienced well operator, and there may well be ways around it. It would seem more economical to delay the well, or find some other method as you suggest above. If it were up to me, the cost of adopting another form of capture, rather than flaring would probably save some money. So, that would involve some sort of truck transportation, and drivers are what they have s major scarcity of. So, it sits there, instead of being flared.

Then again, I am parroting other writers, instead of having a primary source to draw on. So, I don’t know for sure if they are running out of pipeline capacity. If they do, short term does not look rosey.

Ok, not so sure of that article that says pipelines are filling up, see article below, which is probably a much better source:

https://rbnenergy.com/witchy-waha-permian-gas-prices-get-spooked-as-pipelines-to-gulf-coast-fill

Means they get less money, it can still get to other places, just at a lower price. I hate it when writers do that.

That comment uphole is a nonsensical, very non-operator “excuse” for poor operations and poor planning. Flaring occurs at the great financial detriment to royalty owners, shareholders, prudent reservoir management and America’s hydrocarbon future. This excuse sounds like it was spit out of an IPAA press release. Its bullshit. Flaring went on in the Bakken for nearly six years before the NDIC, not operators, started putting its foot down.

If a shale oil company touts 5,000 drillable locations over its acreage block, what is it doing drilling wells before gas infrastructure is in place?

The shale oil industry, in its infinite wisdom, now has itself painted into a corner; with debt, with lack of infrastructure, with too much gas coming from the Permian Basin (that is getting gassier), and with light tight oil that is getting lighter and no market except to export at big discounts to WTI.

Flaring America’s hydrocarbon resources away is a waste. Its stupid. There WAS no excuse for it and there IS absolutely no excuse for it now.

https://www.oilystuffblog.com/single-post/2017/11/15/Wasting-Away

your world view is what is nonsensical. no company build pipelines BEFORE they know how much reserves are there. In your world view, should a offshore player build a pipeline BEFORE moving in a rig, before drilling additional evaluation wells, BEFORE evaluation the reservoir characteristics. Hell NO none one does.

With respect to waste, that is between the mineral owners and the oil company comrade!

I suppose you always bought your lease(s), built your pipeline, installed tanks and other surface equipment BEFORE you drilled a well, perhaps that explains your bitterness?

https://oilprice.com/Latest-Energy-News/World-News/Federal-Judge-Grants-Go-Ahead-On-Keystone-XL-Lawsuit.html

more nonsense!

Tee, tee, the current flaring discussion here is related to unconventional resource plays where mass manufacturing of wells occur, more often that not in isolated sweet spots with wells drilled very close together, where almost no dry holes occur, ALL wells make associated gas, and ALL gas is used in BOE calculations for the benefit of booking phony reserves. Even if its flared. That is a far cry from offshore ‘exploration’ where success ratios are often less than 10% and delineation of a structure is required.

If hydrocarbon waste should only be between the mineral owner and the mineral developer, then regulatory agencies would not have to exist at all and there would not have to be any flaring regulations.

You shale guys, if you actually are one (with a checkbook, I mean), are drilling yourselves out of business. You can’t make any money, can’t get out of debt, aren’t smart enough to cooperate with the rest of the world to keep oil prices propped up, https://oilprice.com/Energy/Energy-General/40-WTI-Is-Now-More-Realistic-Than-60.html , are now saturating the domestic market with gas that can’t even be sold and sooner, rather than later, you are going to be all out of locations to scam, even on 330 foot spacing rules. THATS making America great again alrighty.

I am not bitter, just not stupid. And I am hardly your “comrade.”

Funny how some people manage to get on the wrong side of folks, both in the petroleum related and non petroleum threads!

Hi Mike,

It seems Texas Tea thinks all regulations are bad, or some such nonsense.

Your position makes sense. It would seem to be that some minimal regulation is needed, the RRC probably gets it about right.

When Wall Street and Shale CEO’s, at least temporarily, finally put financial discipline above growth at all costs, low and behold, WTI has now risen to above $58.

What is the financial reason for drilling and completing more and more wells, other than to establish HBP acreage, when there is not sufficient pipeline capacity to move the oil and or gas out of the field?

One would think some lessons had been learned from historical overproduction events like Spindletop and the East Texas field. Guess not.

I, for one, did not invest in oil wells to see how high I could get production. The goal is to make money. I am sure we could hire ten rigs and drill up our remaining locations this year. Wonder why we don’t do that?

It has been proven the vast majority of shale oil is not profitable sub $50 WTI. I sure hope these guys have finally decided to quit spinning otherwise.

Dennis, my industry whines about regulations constantly; its what we do. We are always looking for relief, but seldom get it. Trump was suppose to have set us free, so to speak, but could not even get methane emissions standards (VOC) relaxed. He is “unleashing America’s new energy might on the rest of the world” by printing more low interest stimulus money and by encouraging exports of America’s LTO, instead of adapting refineries to the nature of the ‘new’ product. All of those hydrocarbons we are selling overseas, even LNG, we’ll have to buy back someday from foreign sources for 3 times the cost. Its short-sighted, driven by politics and/or greed.

Waste thru flaring, pissing away our water resources, protecting the correlative rights of Lessors and Lessees, regulating the spacing and density of wells in America for reservoir preservation purposes, protecting our water and our air is necessary. Regulations are necessary and so are regulators. So, my industry accepts them and we adapt. Regulatory compliance costs per incremental BOE in America is not very much at the moment. In 3 years and 60 some odd days I fear those regulatory compliance costs are going to rock our oily world.

Guys like the commenter you reference, Dennis, can’t think past next week. They are in it all for the money, the here and the now. Not all of the oil and natural gas industry is like that, I wish to assure people of that. Some of us care about the future and feel an obligation to the public to tell the truth about what it is we do and what our oily, gassy future might look like.

Thanks Mike,

What happens in 3 years and 60 days?

I agree that regulations are necessary and that they can be over done.

In general terms, export bans can lead to inefficiency.

For example, if output levels are not regulated, it might be inefficient to rework refineries to handle light tight oil as the resource is not very large so exporting the excess while importing oil that is better suited to our refinery setup may make sense.

It is the Fed that determines interest rates and money supply. Trump has chosen a new Fed Chair, so he has done what he can on monetary policy, the Fed is, in theory, independent of the executive branch so aside from who is nominated, the president has little control over monetary policy.

No doubt you already know this, but others might not.

What happens in 3 years and 60 days?

Inauguration Day- 2021

In 3 years and 60 some odd days the political landscape in America will change to the extreme once again and the regulatory climate for my industry will go very negative; Survivalist is correct.

If export “bans” create inefficiencies, whatever that means, it is because there is too much light tight oil in America. We therefore should regulate the densities of shale oil wells per productive acre of land, and well spacing, to slow the shale oil industry down. In other words, keep it in the ground, dole it out…for America, not give it away now, to China. The resource, as you say, is not very large.

It is actually smaller than you, and others seem to think it is. The shale phenomena has hardly been profitable since its inception, even during a period of the highest, most stable oil prices in history. Productivity per well has peaked, Tier 1 sweet spots are being drained at an alarming rate, debt maturities are looming, water is going become a huge issue in Texas and there is no guarantee that prices will rise to the level you and others are counting on, or demand will stay high. Mox nix; the next level of unconventional shale development in America is going to be less productive, even more expensive, and far LESS profitable. Money does not grow on trees.

Exporting America’s hydrocarbon resources is dumb, period.

Hi Mike free trade makes sense, that is why there should be no export ban.

See

https://en.wikipedia.org/wiki/Comparative_advantage

US light tight proved reserves were about 11.6 Gb at the end of 2015.

https://www.eia.gov/naturalgas/crudeoilreserves/

excel file with reserves at link below

https://www.eia.gov/naturalgas/crudeoilreserves/excel/table_2.xlsx

Typically 2P reserves would be about 70% higher for conventional resources, we will use half that for tight oil (35%) so 2P reserves about 15.7 Gb.

The USGS estimates about 20 Gb of undiscovered tight oil at the F95 level (95% probability the undiscovered TRR is more than this).

So at minimum I would expect about 35 Gb of tight oil to be produced after December 2015. (about a 95 % probability it will be more than 31 Gb and maybe an 85% probability it will be more than 35 GB, the probability it will be more than 48 Gb is about 50%).

You are absolutely correct that we do not know what future oil prices will be.

Based on the forecasts of the World Bank and IMF for economic growth and past trends in increased efficiency in the use of oil and natural gas for the past 35 years and likely oil resources (less than 3500 Gb URR for C+C including unconventional oil) I expect the oil supply increase will not match the oil demand increase over the next 15 to 20 years.

Up to 2030 the World economy might be able to adjust as oil prices increase, but around 2030 (+/-2 years) I expect another economic crisis and oil prices may crash as a result.

Much depends on policy experts understanding Keynes General Theory as to how bad the ensuing recession becomes.

If we tighten out belts (Hoover policy) things will be really bad, if we use fiscal stimulus (ala World War 2 minus the destruction of war) to expand public infrastructure and provide business incentives (through tax breaks) the recession might be mild.

I’m with Mike. I would absolutely ban all fossil fuel exports, unless we get to the point where we have trivial longterm domestic demand.

We just have too much internal demand for this critical resource.

Hi Hickory,

Interesting, oil might make sense, and perhaps even natural gas, coal does from an environmental standpoint.

If I were a fossil fuel producer, I would want the freedom to sell my product where the price is highest.

If the US government wants to ban exports, they should guarantee producers they will get the best price for their product or be able to take a tax deduction for lost revenue due to export restrictions.

Hi Dennis- “If the US government wants to ban exports, they should guarantee producers they will get the best price for their product or be able to take a tax deduction for lost revenue due to export restrictions.”

That is big policy decision worthy of debate. I’m not in agreement. The government picks winners and losers all the time, without giving compensation to the losers. But the whole country loses when we have a shortage of energy.

Exporting fuel is short-sighted. China wouldn’t be so foolish.

Silly me- I believe in planning, like a national energy plan. And export of fuel wouldn’t be in my 5, or 10 yr, plan. A national longterm plan can and should buck free markets when it has dramatic benefit for the common good. That is how China pulled hundreds of million out of severe poverty over the last 30 yrs. Planning.

Hi Hickory,

Yes the government does pick winners and losers at times.

How did economic planning work out for the Soviet Union?

China exports rare earth elements and other energy products (solar panels).

I think David Ricardo got the labor theory of value (LTV) wrong, but he was correct on comparative advantage.

The choice of labor as the source of value in the LTV is arbitrary, one could easily choose capital or any other good.

Government interference in the economy should be minimized as much as possible as it often creates as many problems as it solves.

Hi Hickory,

I am not really concerned about an export ban one way or the other, if it makes sense to restrict exports and the producers aren’t complaining about it, that works for me. Whether there is an export ban or not really makes little difference as long as the oil supply is adequate.

If one wants to argue that we should keep the oil in the ground and save it for later, that would be an argument for shutting down all US production (or maybe all new drilling as it makes sense to produce those wells that have been drilled).

I doubt many in the oil industry would be happy with that solution.

Regulating output would make sense and I believe the RRC has the power to do that (unless the laws have been changed since 1970 in Texas).

That is up to Texas, I think it is a good idea but I am not a citizen of Texas.

So I guess I agree with Mike that oil output should be regulated, and if he likes the idea of an export ban, that works for me as well, but output regulation would be more efficient so is a better option.

I would like to see a coherent longterm national energy policy, but it is just a fantasy I have. Won’t happen, we will continue to just drift and flop around. Failure to plan, to learn from mistakes, to adapt to current conditions. Broken government.

Hi Mike,

What did the Obama administration do tht was bad for the O+G industry?

You guys are talking like it’s your oil to regulate. Go ahead. No production for a while, lease expires. Mineral right owners get tired of playing grab ass with goverment, and don’t lease again. Oil stays in the ground, and when your car runs out of gas, you can bring it over to the old well heads, and let it sniff the oil. Pissoff. Personally, rather than get a pittance, because some socialist wants to regulate it, I’d rather it Rest In Peace with the other dead reptiles, rather than have the live reptiles regulate how much, and when it can be take out.

What about regulating the refineries, so that exports won’t be needed? So that for a five to ten year period, we won’t have to do as much importing as we do. Try addressing the real problem concerning exports.

Hi Guym,

I believe that by law in Texas, the RRC does have the power to regulate oil output.

No it is not my oil to regulate, that is correct.

What do you think of the export ban?

Should the government have the power to decide who you can sell your oil to?

The question really is where to draw the line on regulation, I imagine your view is not that there should be no regulation of the oil industry, there should be just the right amount.

The question is how much is too much.

Mike – I agree that what you say wasting NG resources happens SOMETIMES. But an operator may be forced to flare NG to produce oil before a gathering system is in place to generate an acceptable rate of return. While that doesn’t benefit the mineral owner (unless they are desperate for cash flow at the time) it might be a deciding factor in whether a well gets drilled or not. IOW if the mineral owner doesn’t get a well drilled at all then they are not only losing the revenue from any NG that might have been flared but also the oil revenue.

I’m currently redeveloping a shallow oil field in Texas with horizontal wells. The field was producing 12 bopd TOTAL from 6 wells before I started drilling. The lease I drilled on was producing NO OIL. It did have 8 plugged and abandoned wells on it that had been depleted in the reservoir. Or so everyone thought. It took me 10 years to convince an operator that there was enough residual oil worth drilling for. And for good reason: I discovered a reservoir dynamic that was virtually unknown throughout the industry. Took me that long to find a billionaire who didn’t think I was nuts and was willing to risk a couple of $million to prove I wasn’t. LOL.

My first well came in at 200 bopd. The second well did similar. Water cut did increase quickly…as I had predicted. But the results were very economic. And I’ll drill a third well early next year for my new owner since the project is still economic at current prices. But the reservoir still contains a small amount of NG in the oil. And the nearest pipeline was many miles away. Had the mineral owner (who bought the property to just run cattle on) insisted on us not flaring my wells would never have been drilled. And certainly would have never been drilled since others that have tried the technique had done it wrong and thus convinced industry it could never be done profitably.

Bottom line:had the land owner insisted in not flaring he would have missed out on over $2 million of royalty payments. He paid $60,000 for the land and gets $12,000/year for the grazing rights: it’s still scrub land because he didn’t want to spend money planting improved grasses. The money he “lost” from flaring: about $35,000. Made $2+ million and still getting $160,000/year. And I’ll drill another well on his lease next year.

I’m pretty sure he’s still OK with us flaring that NG.

That’s a nice story, Rockman; I have similar ones that involve the short term necessity of flaring gas delineating a structure, or a new idea. The issue of flaring in unconventional resource plays, however, the obvious point in my comment, is different. Its a damn waste. The shale industry should have the financial wherewithal (its OPM anyway), it certainly claims the “technology,” to reduce and ultimately prevent all waste. As shale plays get gassier and more waste occurs, for instance due to overproduction and lack of takeaway capacity, should we turn our back on one phase of the production stream to the benefit of only the other? No, its America, not Libya. Having just come from the Delaware Basin there are parts of it that look like Libya for the flaring. And for what? To shove that LTO down to Corpus ASAP, then on to China?

I think we are fast approaching the point that perhaps we should rethink the role that several hundred thousand mineral owners have under our nations shale plays, out of a population of 324 million, to control our hydrocarbon destiny by being “OK” with flaring in the name of monthly royalty checks. We use to have folks that were willing to regulate our industry, in the name of conservation, now its about tax dollars and votes.

Its an unusual statement for an oily fella to make, perhaps, but its not the same world we operated in 40 years ago. We’re going to need that gas, and that oil, in the good ‘ol US of A someday.

Mike – If adding the pipeline cost makes a project uneconomic a well won’t get drilled. There’s no technology out there that changes those numbers. Had my mineral owner not agreed to flaring my operator would not have funded my first well. The pipeline would have cost more then the well. And it was a very expensive well. Do you really think a Bakken operator would flare NG he could sell at a profit? Why would he do that? OTOH if he lost $500,000 laying a pipeline and selling the NG why would he do that if regulations didn’t require him to do so?

Rockman, I think Bakken operators did flare gas that they could have sold for a profit, actually for over six years before the NDIC stepped in to regulate flaring. Why would an operator do that? Because it could do that. Because $85 dollar ND Sweet oil was worth more than $2 associated gas and our industry has always considered associated gas a ‘byproduct’ of oil. Because flaring $2 gas added greatly to the BOE BS that created EUR’s that helped Bakken operators engage in reserve base lending practices that were based on falsehoods. Converting gas to oil equivalents on a BTU basis, for the benefit of economic projections, when that gas is going up a flare stack, is a lie where I come from.

Fortunately Lessors don’t call the shots on flaring, they don’t get to chose what is more important anymore. The TRRC does. Again, my beef is with resource plays with laterals throughout them that look like a game of pixie sticks and in sweet spots laced with gas gathering systems. Fortunately, most of that gas is now getting gathered in the Bakken and EF; not the Permian, however, and not for remote, delineation reasons either. They tout ‘drillable’ locations and PUD reserve potential but are six to ten months behind building gathering systems to those areas. And now, of course, there is so much of the stuff they have no place to put it, so they flare it. And still have over 300 rigs going wide open.

Flaring gas is like eventually throwing half your Thanksgiving turkey in the garbage; its the American way. Its the way our industry has always done it, we can’t change, so lets carry on. The BCF’s of gas that have been pissed away in America because of this run-amuck shale phenomena is criminal. You will forgive me, of course, for not being so quick to defend poor planning and intentional deception from my industry. I’d like to see that change.

https://www.dallasfed.org/-/media/Documents/research/econdata/energycharts.pdf

Texas Tea,

Very interesting link. It confirms that oil and especially gas ( down from the peak of 25 bcf/ d to 18 bcf/d) production slowed down in Texas. This is actually a good thing as prices recovered and the industry can be healthy again.

Hi Heinrich,

Natural gas estimates from drilling info at link below

https://www.eia.gov/petroleum/production/xls/comp-stat-gas.xlsx

Texas natural gas was at about 21.64 BCF/d in June 2017 based on drilling info data.

Point logic has TX nat gas at 21.5 BCF/d in June. The EIA natural gas estimate looks pretty conservative (based on 914 survey covering about 90% of output from selected large producers).

Mistake above, point logic had 21.5 BCF/d in July 2017 rather than june as I stated earlier, sorry.

The chart is correct, I just typed the wrong month.

Dennis,

I know your approach very well, yet I was referring to the charts of the Dallas Fed on page 23 where Texas natgas production is unmistakenly indicated between 17and 18 bcf/d.. This is more than 7 bcf/d below its peak. Production numbers of oil and gas are vastly overstated by the EIA. There is growing evidence on this. Furthermore, the ratio of stock vs oil price is sharply declining for most of shale companies, which indicates companies have much less cash for new production. So, we will be seeing a much reduced production in the future.

Hi Heinrich,

The Fed report is based on EIA marketed production, my charts are gross withdrawals, you need to compare apples to apples. For Texas the maximum for Marketed production was about 21.9 BCF/d in March 2015. Output has fallen as low as 18 BCF/d in Feb 2017, but in August it was 18.5 BCF/d due to a hurricane lowering output in the Eagle Ford. In July output was 18.9 BCF/d.

Your 25 BCF/d peak output number is based on gross withdrawals.

Marketed production for Texas

https://www.eia.gov/dnav/ng/hist/n9050tx2m.htm

Gross withdrawals for Texas

https://www.eia.gov/dnav/ng/hist/ngm_epg0_fgw_stx_mmcfdm.htm

24.6 BCF/d in April 2015 (peak) and 21.4 BCF/d in August 2017.

Not a difference of 8 BCF/d, a difference of 3.2 BCF/d.

Hi Heinrich,

As the chart from the presentation below shows, the peak was 22.5 BCF/d in Oct 2014, and in August 2017 TX Natural gas output was 18.5 BCF/d (for marketed natural gas as it says in the note). So the decrease in marketed production is only about 3 BCF/d from recent peak (from 1989 to 2017) to August 2017, rather than your claim of 7 BCF/d.

Sorry for posting this out of sequence, but questions Dennis had above, left no reply available.

Dennis, this is probably more than you ever wanted to know about a history of Texas oil production:

https://tshaonline.org/handbook/online/articles/doogz

Obviously, the laws pertaining to allowances were put into effect long before we became an importing country in 1948.

Since we have been an importing country, why should we regulate oil production?

We are not fully utilizing the LTO produced in the US due to decisions of the refineries to not switch to using it in favor of using heavier oils. Hence, no matter what we produce, we import oil. If, you feel we are potentially putting the US at risk, then regulate the damn refineries, not the producers. At this point, at least the exports are helping to offset trade deficits. What do I think? Leave it alone. If refineries made this decision, it will fall on them eventually. Regulating production makes less sense than changing the Jones Act, building more pipelines to the East and West coast refineries where they can use LTO, or “assisting” gulf coast refineries in converting to LTO.

As I recall, the major price movements downward were due to panicked response from Cushing builds. The market would have healed by now, without an OPEC “cut”.

I think OPEC finally realizes that a 9 month extension is a major over correction:

http://mobile.reuters.com/article/amp/idUSKBN1DS14Z

Hi Guym,

We would regulate production for the same reason that the RRC continued to regulate output from 1948 to 1970. Basically to keep prices up.

I guess we can just let the market figure it out. Pipelines probably will not be built because the resource isn’t large enough, and refineries won’t retool for the same reason, so we might as well export the oil to wherever there are refineries that can process the light oil.

It really makes no difference to me, but there are some who feel strongly we should conserve our resources. I tend to agree that exporting oil at a low price now so we can import oil at a higher price in the future seems a bad idea.

It’s not 1950, and prices are far from 2.60 a barrel. How do you explain to the public that you are regulating production, so the will have to pay a higher price at the pump.

Do you know when prices will equalize to make those that want to conserve somebody else’s oil happy? It’s not their fzzzing oil.

Who’s oil is it- the Comanche?

Its a question of the common good for the long-run, vs those few who would like to profit in the short-run and sell the resources of America off-shore.

What about selling logs from the national forests to Japan or China?

What about letting foreign fishing fleets sweep ‘our’ territorial waters?

Does the equation change when you are in an ownership position?

As long as your are netto importing oil, it doesn’t matter. You aren’t really exporting oil – exporting 2 mb light oil, importing 2 mb other oil in replacement.

Otherwise the raffineries would have to retool.

The other question is: Just import more oil and let it wait in the ground, while pumping other peoples oil reserves ( as Europe does due to the lack of oil) and finance more Jihad?

And how long goes the firework, is Permian like Ghawar or just a smaller field exploited rapidly?

Of course it does, unless you want to nationalize the land like other countries. Good luck with that. You want to give it back to the Comanche, good luck with that. Natural resources are a different definition than national resources in America. Rancher x, drills oil himself, it his oil. Rancher y, decides never to drill oil, puts that statement into his trust, and it remains in the ground forever. Even oil from a lease allows the royalty holder to collect his oil at the wellhead in almost all leases. It’s his oil, originally. The oil in a national forest is both a natural resource and a national resource.

And you, and Mike below, are missing the most important fact. Not all the oil is coming out of the shale, at this point. Less than 8%. Thirty years ago, they were not using the technology to get that 8%. Technology on enhanced recovery is still moving forward. Russia claims to be able to remove 50%, and so do some other articles on enhanced, I have read. Even EOG is increasing production in selected areas by 50% more (to equal 12-15%), now, with capex less than drilling. The era of cheap oil has long since passed. The oil era is not over, if they pump out that 8% that they can easily get to. Most keep selling US capacity for oil far short. Technology is advancing, still. They are basically ignoring some shale areas, because it is not cost effective at 50 to $60 oil price. Neither is oil sands, which are not all in Canada.

Hi Guym,

In your opinion, it seems the USGS LTO estimates are far too low (talking about US only here) at a median estimate of about 50 Gb for recoverable resources at the end of 2015.

Is that correct?

In some sweet spot areas recovery factors may be above 8%, but in the non-sweet spots it may be far below this (0 % in many cases unless oil prices rise to $200/b).

Do you expect average recovery factors for all shale wells to rise to 20%? I am skeptical that the average shale well will rise to above 10% for recovery factor.

Note from the World perspective, the US treatment of oil resources is strange, and the legal treatment of resources in most of the World may result in very little light tight oil being produced outside the US. Maybe some in China, Argentina, and Canada and probably less than 50 Gb for total LTO produced outside of the US.

https://oilprice.com/Energy/Crude-Oil/Russia-Claims-To-Have-Invented-Alternative-To-Fracking.html

Look at previous presentations by EOG. Also, if you want to spend some time, research other articles on enhanced recovery. You might also peruse some enhanced recovery joint efforts with the Colorado School of Mining. In 1980, they told my grandfather that he was crazy to hold on to his mineral rights and pass it on to his kids. They would never get the good oil he found out of the shale. In ten years, we can revisit this conversation, but I say the writing is already clearly on the wall. I would say limiting it to only 8% is clearly short sighted.

Hi Guym,

It seems the owners of refineries and pipelines think your point of view is incorrect.

In any case you seem to be a free market guy, fine to let the market work it out.

A smart royalty owner would push for limits on output as it puts money in their pocket.

If it were my oil I would prefer to sell at a high price rather than a low price, but maybe it’s different in Texas. 🙂

America is unique in all the world. Less than 1/50th of 1% of the American public own America’s hydrocarbon resources under “their” land. Therefore it is “their” fizzing oil to do what they want with. Lessors want money, now, and many don’t mind draining all of the water under “their” land to get “their’ oil and “their” money. Lessees want money, taxing authorities want money, everybody wants money. Now. Nobody wants to think past next week, what the future might look like when all of America’s hydrocarbons are gone. Its beyond comprehension, apparently.

The explanation for regulating the rate of future shale oil extraction in America is to conserve for our future. For our children. That’s what you tell people. Its either slightly higher gasoline prices now, or $8 gasoline later, and forever, or no gasoline at all.

As to making a few royalty owners in our nation angry about controlling the number of wells that can be drilled on “their” land at any give time? Tough titty. Put a lid on it and feel privileged you even have minerals that can be exploited. Most don’t. I am a royalty owner and am plenty good with regulating the rate of hydrocarbon growth on my land, and in America.

Keep a lid on it? No thanks, freedom of speech still exists. So, if I decide my sick wife deserves our oil more than your your kids, I can still say so. Even sick, my wife will probably outlast me by thirty more years. If making sure she has enough to live on is greed, then I am guilty. Sue me. And if you think you have the political ability to help regulate oil production, go for it. Its a free country, more or less.

And if you have problems in having oil regulated, and want it for your kids, do your own regulation. Rather than take the percentage marketed from your lease, use that clause in your lease that allows you to get your portion at the well head. Buy tanks and hoard it for later. That way your kids will have the only oil on the block, while the other kids only have their EVs.

Hi Guym,

So you think the Texas RRC should not regulate oil output even though it is legal (as far as I know) for them to do so.

Consider this.

No regulation, oil price = $30/b

Output restricted by the RRC by 33% so that oil prices go to $100/b.

Say the wells on your land produce 100 b/d on average and you keep 25% of the barrels produced.

So without regulation you get $750/d or $270k per year and with regulation you get $1675/d (16.75b/d*$100/b) or $611k/year.

It is unclear why you think this is a bad idea.

Do you prefer low oil prices? 🙂

No I don’t think they should regulate it, because I never see it getting to under $30 again. If it gets close to $30, again, we can revisit this conversation. Otherwise, it seems a waste of time. If the RRC thought it was necessary, they could regulate it. They don’t. I don’t. Go argue with the RRC. In the meantime, you can read Mr. Kaplan’s new post. Production is going down, big time. Starting to regulate Texas production now, would really hurt in the near future.

Hi Guym,

They would only regulate to keep prices up.

You may be right maybe there will never be a glut of oil in the future.

Time will tell.

Note that we could just as well do the example with $50/b oil and $100/b oil.

In that case it’s $611k per year with regulation and $456k per year without.

Maybe the RRC should aim for price stability around $85/b (in constant $2016) and follow OPEC’s lead. It would probably be better for the industry if prices were stable.

Just a thought.

I did a search on the last two oil threads and could not find this article, posted on Seeking Alpha three days ago, so here it is.

WTI Oil Price To Surge On Correction To Overstatement Of EIA Production Estimates Per DEPA?

At an EIA Webinar November 16th, industry group DEPA claims the EIA is overstating America shale oil producer’s production by at least 6.6MM barrels of oil per month.

DEPA claims the EIA’s overstatement of U.S. shale oil production is depressing the WTI (versus Brent) oil prices and costing U.S. producers $4B in 2017 revenues.

DEPA claims WTI oil prices would be $4.00 to $5.00 per barrel higher (vis-à-vis Brent) if EIA’s estimates accurately reflected current U.S. shale oil production.

With America’s energy resurgence, the EIA’s forecasts have significant market impact and need to be more timely and sophisticated in response to industry dynamics.

Per DEPA, WTI oil prices will narrow the gap with Brent as EIA’s “Monthly Crude Oil and Natural Gas Production” reports demonstrate actual production is lower than EIA’s weekly estimates.

Click on the link to read the rest of the article. It is very interesting.

Hi Ron,

Weekly production estimates and forecasts by the EIA are not very good, but the monthly output estimates are pretty good. Accurate forecasts are difficult as it is difficult to forecast future well completion rates and future new well productivity. It would be interesting to go back and look at older DPR forecasts and compare to actual tight oil output. Comparison is difficult because the DPR does a regional forecast, where the tight oil production estimates strip out the conventional output.

Hi Ron,

I used to make disparaging remarks about the DPR, but I checked the Nov DPR against the April DPR and they match pretty well. I also compared the tight oil estimate with the DPR and through Sept 2017 the match is good. By deducting 566 kb/d from the DPR estimate for Oct to Dec 2017 (to account for conventional oil included in the DPR regions), I did not include Anadarko or Appalachia in the estimate so it is for Bakken, Eagle Ford, Permian, Niobrara, and Haynesville oil production. Adding the other regions would increase the estimate by 590 kb/d to 5600 kb/d in Dec 2017. The DPR fits with the Dec 2017 to Sept 2017 trend line fairly well (not sure what Anadarko and Appalachia regions represent so I dropped them for now.)

Note that not all of the 590 kb/d from the Anadarko and Appalachian regions is tight oil, that is simple the regional estimate for Dec 2017.

Hi all,

The comment above had a couple of errors.

The “tight oil” shown is all tight oil output, the DPR forecast is also incorrect.

In short the chart is wrong. Sorry.

In the chart below I take all tight oil output and deduct that from all output reported by the DPR to get an estimate of “conventional” oil produced in the DPR regions, in Sept 2017 this was 1132 kb/d. This conventional output is deducted from the DPR forecast for Oct 2017 to Dec 2017 (where I have assumed the September level will not change for conventional over the next 3 months). The trend line for the tight oil estimate from Dec 2016 to Sept 2017 is also shown, the DPR forecast is above this trend line.

Note that the Sept tight oil estimate may be a little high (based on Texas output in Sept).

I suspect the DPR forecast may be 100 to 200 kb/d too high in Dec 2017 even if the linear trend continues, I would also expect that restrictions on Permian basin output due to a lack of natural gas pipeline capacity may lead to even slower growth than a linear trend so that the 800 kb/d annual growth rate may slow to 500 kb/d. If my guess is correct then the DPR forecast may be up to 300 kb/d too high for Dec 2017 (this assumes the tight oil estimate in Sept is too high by about 100 kb/d).

You get there a different manner than I do, but we’re getting closer to diverging. Close enough that I couldn’t say which one of us will be correct.

Hi Guym,

I would say our estimates may be converging. Though you may think the opposite.

I meant converging, sorry.

Ron, I am beginning to think that there is no such thing as oil and gas “information.” Just guesses.

Re the EIA, Bloomberg has an article up today about several guru’s who are currently advising OPEC as they approach their meeting. One of them is Andy Hall, a very long-time successful and famous trader who shut down his energy fund this year. Article says that Andy is advising OPEC that EIA is way understating current shale oil production.

Hi Clueless,

Interesting they either are over estimating or underestimating or have it just right.

My guess is they have it pretty close (within 100 kb/d) for the monthly estimates (about 99% correct) and are probably overestimating by 1% or so for the most recent months.

Difficult to measure anything precisely, eventually the number is known fairly well, but it takes a few months, patience is required.

Yeah, by 300k barrels a day per Andy Hall. He should get out of the business.

At least OPEC had Morgan Stanley to listen to, which partially offsets the other malarkey.

We (energy news and I) posted a link to the actual EIA webinar, which is included in your link on the last thread. That has a lot of goodies. The article on DEPA that is.

That DEPA presentation is hilarious coming from the shale guys.

A statement asking the EIA to take action to make sure the shale guys do not oversupply the market.

I will tell you, I for one feel vindicated. These shale guys all throughout 2015 and even in 2016 made ridiculous claims. Those claims, I believe, resulted in a horrific crash in the price of oil. Such a horrific crash that we shut in some production and tried to figure out what the heck to do in order to survive.

Not only did the crash of WTI into the $20s and $30s hurt the little conventional like Mike and us, it caused widespread BK in all US oil sectors. I am sure Mr Hamm, et al were sweating bullets.

The DEPA presentation Hamm made basically reads like something pulled directly from us “peak oilers” on this site. EUR’s overstated and the whole 9 yards.

Wow!! Just wow!!

It sure as heck doesn’t look like we are going to be hearing about ridiculous sub $40 WTI breakevens anymore from these guys!

My only complaint on the argument is that their major complaint rested in the spread. We need a good spread for export purposes. It’s not affecting just WTI, but oil in total. A 4 to 5 dollar spread should be sufficient to move exports, I would guess. It looks like we are there, right now.

Hi shallow sand,

If Hamm’s view represents the consensus, maybe the tight oil guys have learned something.

https://oilprice.com/Geopolitics/South-America/Venezuela-To-Try-US-Citizens-Former-Citgo-Executives-As-Traitors.html

talk about needing to stop digging the hole any deeper. I hope the pain and suffering for the average Venezuelan serves as a example to the left leaning world, just how tenuous any political system is and what happens when you tell business’s and entrepreneurs they and their ideas are no longer welcome. some folks just are incapable of learning.

Hi Texas Tea,

When leaders thwart democracy, people suffer whether those leaders are from the right or the left.

Hopefully they will get back to democratic governance in Venezuela, sooner rather than later.

Even if the current regime is ousted and a more democratic one put in place, Venezuela is thoroughly f***ed for years to come.

And the lesson to be learned is that Chavez and Maduro got there by democratic means. Democracy is about promising things to get elected, exactly as Trump demonstrated. Once elected you do as you please. Even in advanced countries people will believe and vote what they want to believe. Democracies have a hard time defending from internal takeover by populist radicals be them from the left or the right. Some Muslim countries (Egypt, and Algeria, for example) responded by shutting down democracy when radicals reached power by democratic means. Hitler’s example is still painful to remember but could be more painful if forgotten.

Democracies are by no mean safe in any country. They require strong defense if needed.

Hi Javier,

Representative democracy is not perfect, just the best system of government devised so far.

Economic catastrophe can lead to poor leadership choices by a Democracy as was seen in response to the Great Depression.

Hopefully the lessons of history will not be forgotten, nor Keynesian economic theory (to get us out of an economic crisis through deficit spending.)

https://www.bloomberg.com/news/articles/2017-11-23/venezuela-s-state-oil-producer-tells-staff-to-cut-costs-by-50

I am sure that no Citco VP’s will be traveling to Venezuela in the near future, so that should help costs.

https://oilprice.com/Energy/Energy-General/Venezuelas-PDVSA-Orders-50-Cost-Cuts.html

PDVSA employees are being ordered to cut spending by 50% while painting production, probably with implied threats of similar punishment. I’d say that is impossible but also that the risk to operating personnel will increase by a couple of orders of magnitude, and when there are major accidents the associated production will be gone for good.

North Dakota – Natural Gas Produced & Flared, MCF/day, updated to September – I was just having a look and thought I would share the chart for anyone who is interested.

That’s as much flaring as selling. What a waste.

Different scales.

Oops! Still a lot.

Out of interest what happens if you plot average GOR against average flared ratio?

North Dakota – Natural gas / Crude oil production ratio – along with vol N.Gas flared.

Ratio of flared n.gas to oil production

Thanks – What is the R-squared from a trend line if you plot one against the other, especially since 2013 – it looks to me like there is some decent inverse correlation there (or maybe better to plot GOR against 1/flared ratio)? The flared ratio should ideally be amount flared over total gas produced so GOR is only on one side of the correlation.

Hi George,

I don’t see the correlation. In some periods there is a negative correlation and in other periods it looks positive.

This question is as much about domestic Yankee politics as it is about the production and sale of oil in and of itself, but it’s obvious that politics has a hell of a lot to do with the production and price of oil, domestically and internationally as well.

So……..It’s as obvious as the noonday sun that the Trump administration is making whoopee with the coal industry around the clock, and that it’s very friendly to oil and gas interests too.

But Trump types are all about making money, or stealing it, or avoiding paying it in taxes.

Now it seems to me that while banksters are banksters, and generally about as ethical as the proverbial biblical snake, they DO nevertheless know how to count money. They wouldn’t have been loaning money to an industry that arguably won’t ever be able to pay it back……. unless ONE, they were (and remain convinced ) utterly convinced that the price of oil will be going up substantially, thereby enabling the tight oil industry to pay up, OR , TWO,that they (the banksters) have been putting big profits into their right hand profit, as the result of losing smaller amounts out of their left hand pocket by way of bad loans made to the tight oil industry.

It’s not at all hard to see why the Obama administration and congress, regardless of which party controlled congress at any given time, would have been be perfectly willing to overlook and even quietly encourage such reckless lending, because cheap energy is a powerful economic stimulant, and incumbents are just about dead sure to be reelected when times are good.

But DT is so erratic it’s hard to believe ANYBODY with money enough to matter trusts him and his administration to stay any given course.

Who’s going to wind up owning all these bad loans? How will the current administration and congress deal with this issue of it once it becomes impossible to look the other way?

It sure as hell isn’t going to go over too well with the Trump base to try offloading this bill onto the ordinary tax payer, when it’s finally necessary to deal with it.

How much longer will it be until it’s impossible to ignore it any longer, assuming of course that the price of oil doesn’t go up substantially?

I have been a CPA for ove thirty years, and several years of that time I was a bank auditor with a responsibility of reviewing loans.

I assume you are referring to upstream companies in the shale business. Which are primarily producing companies, and not start up exploration entities.

You start by identifying the primary asset that provides the collateral, the producing wells. If you were first in line to take over this collateral as income, what would be your expenses? If you look at the income statement, most would go away. Unpaid unsecured creditors get money after you recoup the loan. Your loss is limited by the wells’ income, and the marketing, royalty holders, lowest employee cost to get the job done, and transportation costs. In other words, you would make a profit before you dumped it. Better than many other industries to loan to. So assuming there is always a nefarious action by the banker/bondholder to lend the money just isn’t reality. And many of the losses of the companies you may be looking at, are paper losses. The cash flow may not be there, primarily because of the cost of new wells drilled. Others may have cash flow problems because of bad management, but the banker is fairly secure on those loans.

The shale business is here to stay for awhile.

But as for politics, that’s a story of a different horse.

At some point, aren’t all the companies’ assets all tied up with secured loans so that if these producers want more money, they have nothing left to offer?

Seems like the bankers who got in early and can claim those assets if the companies default feel secure. But why would anyone else lend unsecured money other than at a high rate of return?

Aren’t producers going to hit a lending wall if they haven’t already?

Hi Boomer,

Your one twenty three am hits dead center. WHY, if the risks are so high, do I keep hearing that the tight oil industry can still borrow at very low interest rates ???

Thank you ,Guy!

I better say that TWICE, THANKS AGAIN!

Now please allow me to make sure I understand your reply. I do know about as much as the next person on the street about the way banks loan money, although I have zero specific training in this area.

Are you telling me that the people who have loaned out all the money we hear so much about here in this forum which supposedly CANNOT BE REPAID are actually not worried about these loans ?

You seem to be saying, clearly enough, that if the payments on such loans are NOT made, and the balances paid off as contracted, that they the LENDERS are reasonably confident that they can foreclose and that the cash flow generated by the assets will be adequate to make the lenders whole ?

I have said from time to time that I know virtually nothing about the oil biz except for reading a few books and what I have learned in forums such as this one, and none of the books and not very much of the discussion of the financial side of the industry in blogs like this one goes into any real detail.

What , typically, is the order of seniority of the secured parties in terms of loans or any money in the tight oil biz? Will the owner of the land who sells a lease get his share before the bank gets paid ?

Will the contractors who have done work get paid ahead of the bank? This can be the case in such contracting work as I have done. Put a car in a garage and run up a good sized repair bill, and even the bank that has a first lein on that car can twiddle it’s thumbs until the bill is paid, or else the car can rust away in a secure storage lot.

Now here’s another aspect of the whole entire question of these loans. Sometimes the people IN an industry are ALL wrong, and simply follow each the other in conducting their business, and collectively dig themselves a very deep hole.

I have talked to low level people in the banking business who have told me they knew they were passing up good customers, and making loans to bad ones, because of guidelines coming down from higher management. If they try to finesse these guidelines, and be more conservative in making loans, they lose out, for lack of productivity, where as if they make lots of them, they can’t lose. They’re either due for a pat on the back, or else they’re covered, they did their work as directed.

If they make a loan to a person who has always paid ok, except for a period a while back when laid up by an accident, and it goes sour, their ass is on the line, for violating the guidelines, EVEN THOUGH there is no reason to think the borrower will have ANOTHER accident and be out of work a second time. Etc.

My attorney who specializes in real estate and bankruptcy tells me at times that he can’t borrow a dime to invest in a house he can get for a BARGAIN price, with the appraisal being as much as twenty or thirty percent above the purchase price…. whereas on the same day, he could if he wanted to, buy a brand new Mercedes that cost more than the house in question, within forty eight hours, and that they would just let him bring it home for a test drive for the first couple of days.

And the kicker is that the same bank that wouldn’t loan him seventy five for a house that would generate free cash as a rental will loan him the a hundred grand for the car, with him filling out the loan application in the same branch office.

The car of course will depreciate ten grand on the spot.

And for what it’s worth, I mention Obama because he was in office at the time. The R’s were always numerous enough and part of the time in CONTROL of congress, so I’m not knocking Obama any more or less than the R’s.

I want to be RIGHT, on the facts, above all else. If the money loaned to the tight oil industry is at risk, I’m going to say so. If it’s NOT, I’m going to say so.

I DO know the difference between personally owning stock in a company that’s bankrupt and owning that company as security after foreclosure has wiped out any obligations junior to my own.

It’s a very common thing for people who actually work in a business or industry to be mistaken about, or ignorant of , some critical key aspects of their own line of work.

Maybe the guys in this forum who say the industry is losing money and will continue to lose money, are dead on, I’m willing to go along with that.

Maybe they’re wrong about whether the LENDERS are at risk, or maybe they’re only thinking about the OWNERS of the industry when they post comments , and failing to say so.

There is always risk in a loan, except those that are made with offsetting cash security made for fixing credit scores. Can a bank lose money on an oil well? Of course, but the question is always how much is the risk, compared to the interest rate charged. When an oil company is loaned up, the ones mainly at risk are the shareholders, because they are last in line. Are there bad loans for the banks? There always are, it’s just a question of percentages to loan balance. That’s always reviewed internally by banks, by the external CPAs, and by regulators. Why is a mortgage tougher than a car or business loan? Two reasons, interest rates and what happened in 2008. Regulations regarding mortgages have been killing the housing industry since they were put into effect. It’s not so much the banker would not be willing to loan on the mortgage, it’s all the crap he has to deal with. I really don’t think that lending to upstream companies is putting the US economy at risk. Then again, I was one of those who expected houses to always increase in value?

Yes, the royalty holders always have to be paid, they didn’t sign the note. Just the operators did.

OFM – ALL farmers steal money!! ALL farmers cheat on their taxes.!! There is not an HONEST farmer living in the United States.

They all suck off the government teat – i.e., non-farmers. There is no more corrupt group of people in the entire world, including the Mafia. F— Off with Trump types – you are the Trump types.

Hi Clueless,

I’ll copy your comment over to the non petroleum thread and deal with it there. This one is for oil. Read my eleven twenty five seven thirty four am and you will see that I am not taking sides as a political partisan.

https://oilprice.com/Energy/Crude-Oil/Oil-Major-70-Of-Crude-Can-Be-Left-In-The-Ground.html

I thought the concepts were all over the place when oil was going down in price. Now that it is going up, it’s complete madness. Somehow, I think the concept of leaving 70% of the proven reserves in the ground after two years will not be a widely accepted notion.

Mexico had a big drop in September production because of hurricanes, which has mostly been recovered but they still continue on a general decline, losing an average of about 15 kbpd C&C+NGL per month from August to October (10% y-o-y drop from October 2016), and with KMZ still showing signs that it might be coming off plateau this may accelerate.

October: All liquids – 2163, Crude only – 1902 bpd.

A chart for anyone who is interested – Mexican crude oil production bouncing back after the maintenance work that followed Hurricane Harvey

Mexican crude oil exports up in Oct due to refinery outage

15th October, Pemex – The Rehabilitation Process of the Refinery in Salina Cruz Continues After the Earthquake and Multiple Aftershocks

– the electricity generators, suffered a lateral displacement that affected their proper operation.

http://www.pemex.com/en/press_room/press_releases/Paginas/2017-087-national.aspx

(The refinery was also closed between mid June and August)

chart on Twitter: https://pbs.twimg.com/media/DPjaoWVX4AANuwn.jpg

I thought that I’d have a look at this, Dennis pointed it out a couple of months ago…

EIA, International petroleum, world crude oil production:

Updated to August, up +706 kb/day or +0.88% year/year

The average for the 1st 8 months of the year: up +544 kb/day year/year

Web page: https://www.eia.gov/totalenergy/data/monthly/

Thanks Energy News.

I usually focus on the 12 month centered average, the most recent 12 months is current peak in World output, the previous peak was surpassed 3 months ago and each month since has been a new peak.

The first 8 months of 2017, average output has been 80.7 Mb/d and if that rate continues for the remainder of the year, then next month may see a near term peak at 80.97 Mb/d, the current trailing 12 month average World C+C output is 80.93 Mb/d.

What’s your guess, Dennis. Is there developing a new plateau around 81 Mb/d or are we going to see substantial growth over the next months and years?

Hi Westtexasfanclub,

It will depend in part on the price of oil which I believe will increase to $100/b or more by 2020. If that guess is correct (let’s say a linear increase from $60/b now to $100/b by June 2020 ($1.30 per month average increase from Dec 2017 to June 2020), I think World output could potentially increase to 85 Mb/d by 2022 (at the earliest) or more likely around 2025, then there might be a short plateau (2 to 3 years) and then decline. If we remain on an undulating plateau between 81 and 82 Mb/d, the plateau might be extended to 2030 before a decline below 80 Mb/d.

Much will depend on actual prices and World demand for oil, which in turn will depend on how rapidly the transition to EVs and plugin hybrids occurs worldwide.

I don’t want to bring up that discussion again why I think $100/b is unsustainable in the long run, but I must underline that both of your scenarios look positive for a former doomer like me. The decade and a half that we won coupled with technological advances really seem to make a difference: That between a possible future and none. Just sad that peak oilers are still deemed crazy while the world at the same times is not really pushing to exploit this new window of opportunity. But maybe all the small steps finally sum up to something worthwhile.

Hi Westtexasfanclub,

I agree that oil at $100/b or more will not be sustainable for more than 10 years, probably a transition to other types of energy for transport will occur over those 10 years and eventually demand may fall to a point that the oil price decreases. Note that oil prices were above $100/b (trailing 12 month average Brent oil price) from August 2011 to Nov 2014 (a little more than 3 years). The World economy was not doing terribly (considering it was recovering from the worst financial crisis since 1929) over that period. Now the World economy is larger so nominal $100/b oil will be less of a problem. Note that my scenario has us getting there in June 2020 (still 2.5 years away). I expect there may be another economic crisis around 2030 and oil prices may fall if this guess is correct.

Note that I hope there will be no economic crisis, but I expect the transition to EVs and plugins will be slow and oil prices may spike to $200/b as the decline gains momentum after 2025 and the lack of transportation energy will lead to an economic crisis.

I forget your specific argument for why $100/b won’t fly, but a high price is needed to change people’s transportation choices.

Hi Dennis,

it was not specifically my argument. It’s the (here) common sawtooth-argument: High prices bring down the economy and therefore demand, then there will be the next recovery and so on. The limit may be above $100/b but not for much I think. Altogether inertia seems to be in favor of PO and its effects. The world moves slower than our mind, probably also towards the solutions. But it’s certainly moving on!

Got it.

I agree there is likely to be some oscillation of prices around some equilibrium and there are always new shocks to the system so equilibrium is never really reached.

I think some stable region around $100-$120/b might be approached from 2020 to 2025, once the peak is reached (say in 2025, just for kicks), I expect oil prices will continue to rise maybe to as much as $150/b and there may be a new stable band of $120-$150/b from 2025 to 2030.

As the World economic growth rate starts to slow due to difficulty with a transition away from oil in transport, and a mainstream realization that peak oil has indeed arrived (I expect this will take 5 years at least for this to occur), oil prices may spike to $200/b and then we may see a financial crisis and depression. This will then reduce demand for oil and bring them back to $100/b or lower.

That’s my WAG.

USA, the backlog of barrels waiting offshore, updated to Friday Nov 24th

The total is down 7 million barrels from last Friday, Nov 17th. But is still up approx 23 million barrels above normal level. Charts on Twitter

Split, Anchorages & Ports: https://pbs.twimg.com/media/DPedZkNX0AAvkPM.jpg

Total: https://pbs.twimg.com/media/DPeeKPyXcAAggU8.jpg

TankerTrackers –> http://tankertrackers.com

Wonder at what point they get included in inventories? Traditional is to decrease inventory at year end for tax purposes.

Hi Guym,

When the ships are unloaded at the dock, the oil is added to US stocks.

Big increase in Chinese offshore rig count, not sure why?

Bloomberg September 2016: “China’s crude output won’t see an apparent rebound unless Brent recovers to $60 a barrel level, as most of China’s aging oilfields can’t make a profit below this price,” Tian said.

http://www.bloomberg.com/news/articles/2016-09-13/china-oil-output-drops-to-6-year-low-as-state-giants-shut-fields

South China Seas dispute with Vietnam reconciled? Or maybe the opposite and they want to get in first before Malaysia, Vietnam, Philippines.

Obviously, their perceived potential for future oil shortages is more than others. That is, buildup in inventories, and more drilling offshore. All politics aside, they are pretty smart dudes. They are investing all over, including substantial investments in US oil and gas.

? Official ?

” “Putin is now the world’s energy czar,” said Helima Croft, an analyst who directs global commodity strategy at New York-based RBC Capital Markets, as quoted by the media.”

Concerns of old man Ghawar vitality ? 5 Million+ for 3+ decades ?

ELM in Action and/or Fracking Magic in Russia?

https://www.rt.com/business/410836-putin-oil-tsar-analyst-saudi/

Hi Longtimber,

Your mention of Ghawar sent me off to google depletion.

I remember being dead sure back in the old TOD days that Ghawar would soon be history, and that we would soon be in one hell of a fix for oil.

Well, I’m still waiting. 😉

But if I live long enough, I’ll see another day when we’re going to be in one hell of a fix for oil, because depletion is almost sure to outrun the transition to renewable energy for transportation.

Hanging around with the experts who hang on just one side of a question is generally a big mistake, and believing along with all the old TOD crowd about the crisis being at hand was a mistake on my part, although it’s not one I regret. Timing is everything, when it comes to predicting problems, lol. In the long run, we old TOD types will be proven right, barring miracles on the renewables front. TIMING , again!

Sometimes being wrong in evaluating data results in making the right decision! I’m happy with all the decisions I made as the result of thinking we would be in a permanent bind for oil. The most important one of those decisions was to get seriously engaged in the environmental debate, and to actually do some serious writing…….. this blog being a damned convenient free training site for me!

( Serious writing, meaning properly organized and edited is in the works.Comments I post here are mostly off the cuff. )

SOMETIMES, maybe even most of the time, the conventional thinkers, the BAU guys, the banksters, and all those other unsavory types, Republicans and the like, turn out to be CORRECT in their arguments and analysis when it comes to the way things will play out over coming years. The R types have been right about there actually BEING plenty of oil ……. so far.