Peak Oil from the Demand Side: A Prophetic New Model

This is a Guest post by Avery Morrow

Avery Morrow’s Internet Fancy

The most attention-grabbing attempts to predict oil futures have come from geologists and environmental activists, who tend to look solely at production. An overlooked doctoral thesis by Christophe McGlade, Uncertainties in the outlook for oil and gas, in contrast, focuses on how both supply and demand might be constrained in the coming decades. Peak oil researchers should take note of McGlade’s thesis because he predicted, in November 2013, that oil prices would sink, and that they will stay low throughout the second half of this decade. I found this paper on Google Scholar and have no connection with the author, but I appreciate his careful consideration of peak oil arguments, and his ability to distance himself from the more narrow-minded aspects of both economic and geological thinking. Here’s a representative quote from the middle of the thesis, p. 216:

The focus of much of the discussion of peak oil is on the maximum rates of conventional oil production. Apart from issues over how this term is defined, results suggest that focussing on an exclusive or narrow definition of oil belies the true complexity of oil production and can lead to somewhat misleading conclusions. The more narrow the definition of oil that is considered (e.g. by excluding certain categories of oil such as light tight oil or Arctic oil), the more likely it is that this will reach a peak and subsequent decline, but the less relevant such an event would be.

Advocates for peak oil often try to fit oil production to a curve based solely on an idealized image of production. Indeed, when nothing unusual happens on the downslope, oil production looks like a Hubbert curve, especially on micro levels. But at the macro levels, unusual things do happen: for example, the shale boom. McGlade argues that pessimists have failed to acknowledge that now that conventional oil has reached its peak, we should not expect a smooth ride down, but rather we should expect the unexpected, such as discoveries of new methods of production or adjustments in demand. Oil production is an artificial, not a geological, process, and nothing about the way oil is produced at the macro level demands that it must look like a bell curve. Of course it is impossible to actually know what factors will really affect demand at a global scale, but the IEA considers two central scenarios which McGlade aims to apply to the future of oil (p. 174). One is the “low-carbon scenario” (LCS), in which the world’s governments take immediate and unprecedented action to keep anthropogenic warming below 2°C. The other is the “new policies scenario” (NPS), where new policies are adopted, but are insufficient for capping the temperature rise. This is assumed by the IEA to be what current green energy policy is actually pointing towards. McGlade does not even bother to model the IEA’s “current policies scenario” (aka “business as usual”), where very little is done to stop carbon emissions. It is hard to know whether the NPS has actually been implemented by IEA member states, but we will see that the NPS is disastrous enough.

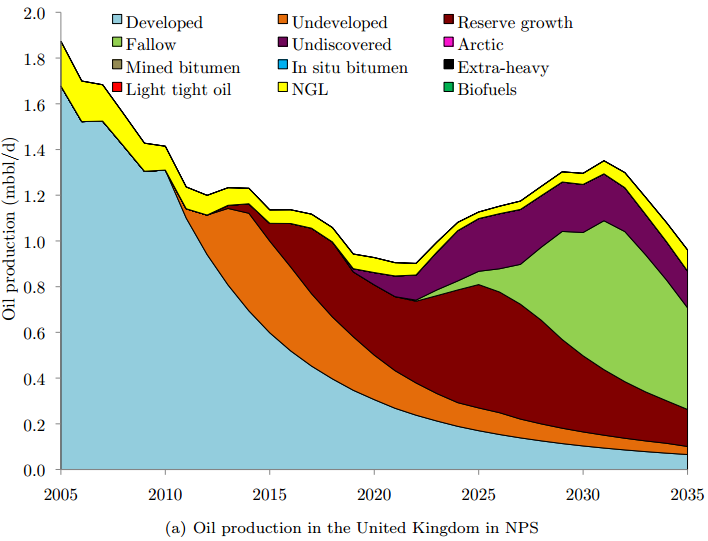

Figure 10.12: Production of oil in the United Kingdom in NPS (top) and LCS (bottom)

Here is a sample modeling of NPS and LCS, showing future production in Britain. Notice how much environmental policy can do to limit oil production. LCS looks a bit like a bumpy version of a Hubbert curve, while NPS, the “greenwashed business as usual” scenario, envisions the exploitation of currently unused “fallow” fields in order to feed higher demand. If we are concerned only with supply, we might glance at these graphs and assume naively that this shows a healthy supply meeting demand for both LCS and NPS. In fact this is not the case. The graph for NPS actually displays an insufficient supply for world needs. This is not the result of underestimation, either.

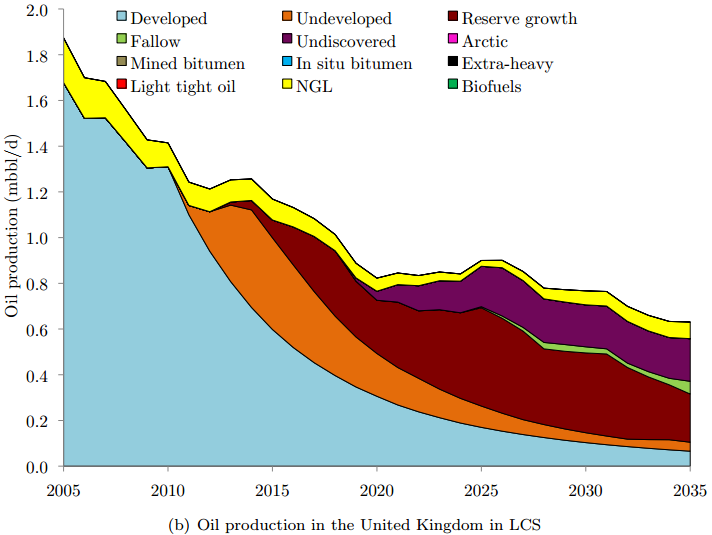

Global oil production in NPS grouped by field type and region

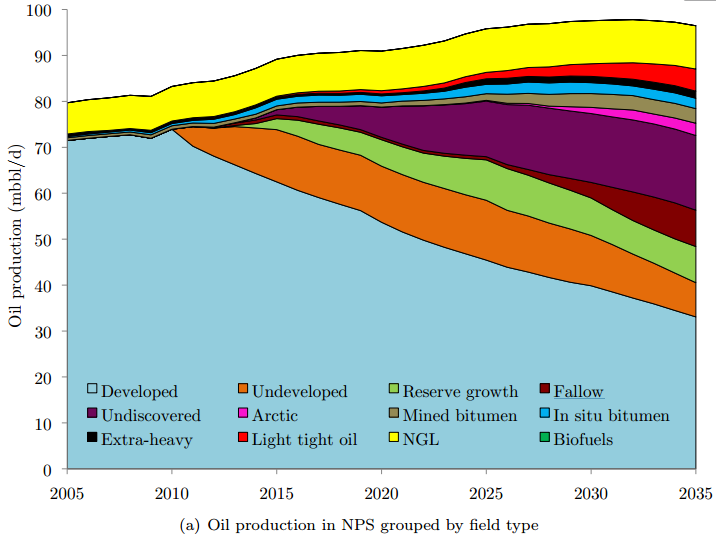

Global oil production in NPS grouped by discovery date and water depth

Here is world production for NPS. McGlade allows for very generous production increases, technological discoveries, and a long lifespan for conventional oil, which combine to produce Paul Krugman’s glorious fantasy: several decades’ worth of crude oil, biofuels, and NGL, and a gentle plateau over the years 2020-2035 with no one year that can be labeled a peak. This is the result of several upwards adjustments in McGlade’s model, including a built-in assumption that exploitation of an oil field is not a simple Hubbert curve but can be given a boost through “advanced oil recovery” (p. 232). The initial result of McGlade’s model, in both the NPS and LCS scenarios defined above, is a prediction that oil prices will actually sink in the second half of the 2010s (p. 247). I think this is quite notable as an accurate prediction made more than a year in advance; no other model seems to have accounted for the effects of shale and tar sands on supply so successfully. However, the price numbers that begin in the 2020s are not so pleasant, and would certainly upset the likes of Krugman.

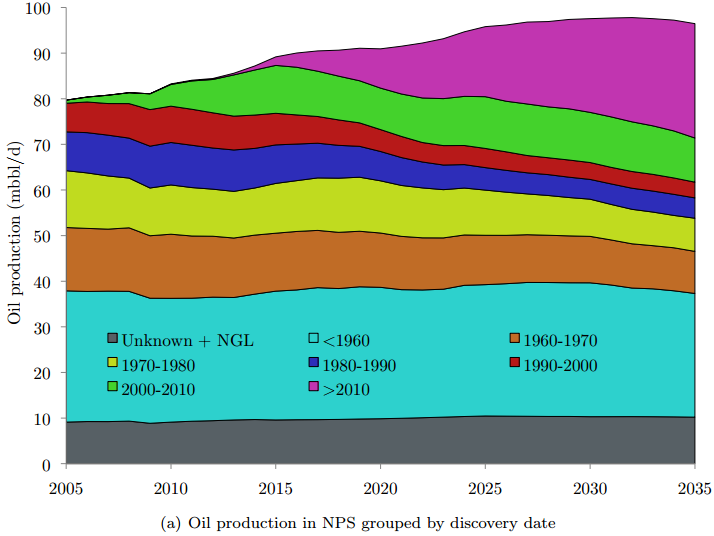

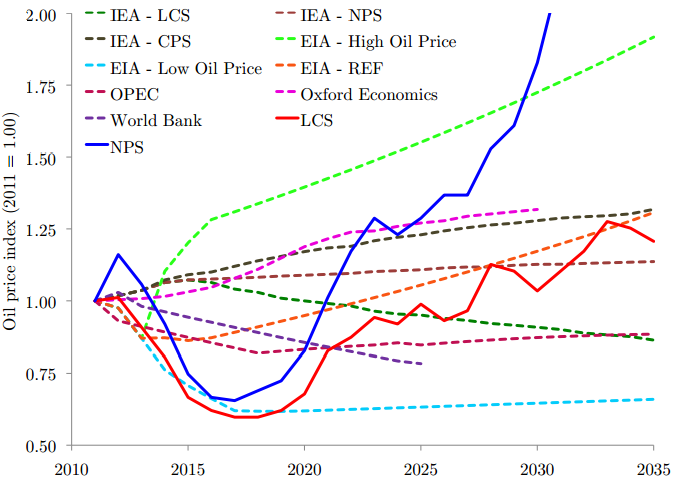

First, prices in both NPS and LCS reach a slight peak in 2012 at around $100/bbl and $90/bbl respectively before they soften throughout the remainder of the 2010s. The price in NPS drops to a minimum of $57/bbl in 2019 while a minimum of $47/bbl is achieved in LCS in the same year. This reduction in prices may well lead to a cut in production by members of OPEC, but these results suggest that there is plenty of new capacity available on a global basis to meet demand at prices well below current levels. It is important to bear in mind that this reduction occurs without light tight oil playing any major role.

Second, this period of low prices is followed by a steady, and under NPS rapid, rise in oil prices after 2020. In NPS prices more than double (rising to $160/bbl) between 2020 − 2030 and global production rises by 6 mbbl/d. After 2030, there are insufficient new projects available, even from Canadian bitumen, and so demand destruction becomes the predominant mechanism used to allow supply and demand to match, resulting in a spike in prices reaching a maximum of just under $500/bbl in the final year. Even so total production remains on a plateau. This demonstrates that while there may not be a peak in oil production prior to 2035, it does not follow that there will be sufficient capacity available to prevent a major rise in oil prices. A more restrained yet steady rise is also seen in LCS, which averages just over $100/bbl in the 2030s.

Evolution of oil price between 2010 − 2035 as modelled by BUEGO under the NPS and LCS demand scenarios

Comparison of real oil price projections in the reference and low-carbon scenario to other agencies’projections

McGlade’s NPS scenario ends with the oil price literally off the charts by 2035, as can be seen in figure 10.10 above. But he predicts that this will be avoidable if the atmospheric CO₂ concentration remains on track to be below 425 ppm through 2100, with all the emissions cuts that entails. For the record: it was at 350 ppm in 1990, and is at about 400 ppm today; so the rate of increase needs to slow significantly. In other words, the next decade of global policy, 2015-2025, will determine the difference between a comfortable energy transition in 2025-2035 and a “business as usual” that transforms rapidly into a doomsday scenario. If the news carries items about previously abandoned plays in Britain coming back online, this should be taken as a sign of desperation — it will be far better news if we have no such news. If we hit 2025 without making severe changes to our lifestyles, even the most generous scenario will allow us no more wiggle room to avoid catastrophic collapse.

___________________________________________________________

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

Awesome! This study should be bookmarked for ages. I have been following the discussions on peak oil for roughly 7 years now (from just before the $147 peak) and my thinking has evolved over the years as new evidences come online. This study seems the closest to reality atleast to me.

I think this study is on the optimistic side with its central estimate of 5100 Gb for remaining ultimately recoverable resources (RURR). If we add cumulative C+C output to 2010 (1100 Gb) to the RURR for a World URR we get 6200 Gb. This estimate includes C+C+NGL and about 1200 Gb of Kerogen oil is included in the estimate, if we deduct that we get 5000 Gb of C+C+NGL. About 1300 Gb of this total is natural bitumen and extra heavy oil from Canada and Venezuela), Jean Laherrere estimates about 500 Gb from these sources. If we deduct another 800 Gb from the URR (assuming Laherrere’s extra heavy estimate) we would have 4200 Gb, in addition if we assume 500 Gb for the URR of NGL we would have C+C less extra heavy oil(including oil sands in Canada) of 3700 Gb. This estimate is about 1200 Gb higher than the 2500 Gb estimate I use, based on discovery data from Jean Laherrere as well as Hubbert Linearization.

A conversation between Steve Mohr and Christophe McBride would be interesting as each of their doctoral theses covers similar ground.

Note that Steve Mohr’s central estimate for C+C was about 2400 Gb for World C+C less extra heavy in 2010 and about 800 Gb for oil sands from Canada and Venezuela.

Steve Mohr’s thesis also models both supply and demand, but reaches different conclusions than McBride.

Steve Mohr’s Thesis can be found at the link below:

http://ogma.newcastle.edu.au:8080/vital/access/manager/Repository/uon:6530

On rereading the Mohr thesis, I realize that he includes NGL in his oil estimates. I typically use about 300 to 400 Gb for an NGL URR estimate, if that is correct for Mohr’s estimate his conventional (excluding bitumen and extra heavy oil) C+C estimate would be between 2000 and 2100 Gb, slightly lower than recent estimates by Jean Laherrere.

So for McBride’s “conventional oil” Mohr has 2400 Gb for his central estimate and 2900 Gb for the high case, where McBride’s low case is 3200 Gb for conventional oil and 3800 Gb for the central estimate. Table below is Table 7.1 from p 155 of McBride’s thesis, and gives remaining resources (RURR), 1200 Gb of cumulative output to 2010 needs to be added to find the URR for conventional oil.

The high conventional oil case in Mohr’s thesis is 2900 Gb, if we deduct 300 to 400 Gb for NGL, the C+C estimate would be 2500 to 2600 Gb.

Hi all,

I said above,

If we deduct another 800 Gb from the URR (assuming Laherrere’s extra heavy estimate) we would have 4200 Gb, in addition if we assume 500 Gb for the URR of NGL we would have C+C less extra heavy oil(including oil sands in Canada) of 3700 Gb. This estimate is about 1200 Gb higher than the 2500 Gb estimate I use

This is not quite right, another 500 Gb of extra heavy oil and bitumen needs to be subtracted from the 3700 Gb figure to get McBride’s central estimate of C+C less XH (as Laherrere defines it) or McBride’s “conventional oil” less NGL would be 3200 Gb if we assume the URR of NGL is 500 Gb. So the McBride central estimate is about 700 Gb larger, than my estimate of 2500 Gb and 1000 Gb larger than recent estimates by Jean Laherrere.

An alternative comparison is to look at “conventional oil” which is C+C+NGL with the exclusion of natural bitumen, extra heavy oil (Orinoco belt), and kerogen oil (Green River). Mcbride’s central estimate is 3800 Gb (1200 Gb cumulative output through 2010), Laherrere’s is 2500 Gb (300 Gb of NGL), and my estimate is 2900 Gb (400 Gb of NGL).

https://iris.ucl.ac.uk/iris/browse/profile?upi=CMCGL94

I note that he has a twitter account

I got heartburn already, he declares that NGL and light tight oil are “conventional” oil.

(page 29 +/-).

Particularly since he later says shale gas is “UN-conventional”.

page 32.

I got heartburn already, he declares that NGL and light tight oil are “conventional” oil.

(page 29 +/-).

And how exactly would that make any difference to his final conclusion?!

If we hit 2025 without making severe changes to our lifestyles, even the most generous scenario will allow us no more wiggle room to avoid catastrophic collapse.

Seems to me you miss his main point by quibbling about the differences in the varieties of oak trees in a forest that is already burning to the ground.

I’m writing this post from south eastern Brazil and have been witnessing some of the consequences of climate change first hand. You may or may not agree that burning fossil fuel is one of its main underlying causes. I on the other hand am convinced that the science supporting that position is solid!

Cheers!

Fred,

Agreed. And… from my location, climate change is surely making big changes. I am sitting in a local Crab Shack here in New Orleans, and I can tell you, the crabs aren’t like they used to be. Climate change has made them smaller.

So, not only do we have to deal with huge VOLATILE swings in temperature and increased weather anomalies due to climate change, Sea Food isn’t worth eating anymore.

steve

32 degrees in Pasadena when the rose parade started yesterday, tied the record for coldest start to parade ever. Did you see all the snow out there in the mountains east of San Diego? San Diego!?! or the snow in Vegas on new year’s eve. good thing we got all this global warming huh,hate to think of how bad the cold and snow would of been without it.

http://www.usatoday.com/story/weather/2014/12/31/snow-cold-california/21109169/

Climate is not temperature. I too am rather skeptical of the modeling of this complex non-linear system. But it is a complex non-linear system and we are putting more energy into it. Take a snow globe. Those little water filled objects with a scene in it that has particles of fake snow in it and give it a shake. It swirls around creating a little snow storm. Shake it a lot harder and you create a blizzard. That is what is happening. We are shaking the globe harder by putting more energy into the system than is reflected out of it. Steadily. Now what the local consequences of this are on any given day, week or month is anybodies guess. The arctic ice melts. The jet stream goes nuts and cold air is dragged crazily south etc. Previously stable weather patterns are disrupted. Predictions become less reliable. But there is no denying that there is more over-all energy in the system. Temperature is just an unfortunate short hand measure of energy. Unfortunate because some idiot will always chime in that winter disproves the underlying mechanism.

SW,

Joey is a troll, possibly a trollbot.

Please don’t feed the troll.

Thanks for the thoughtful analysis but it is wasted on the moronic.

Joey fails to understand the resulting 4-6 times warming of the Arctic compared to the rest of the planet distorts the normal functioning of the Jet Stream. Thus, Arctic cold air heads further south than normal and warmer air moves north.

This creates a POSITIVE FEED-BACK LOOP which will continue this anomaly for quite some time. The POOR SLOBS who believe we are entering into a new mini ice age because the southern latitudes are experiencing much colder temperatures, fail to realize the Arctic is suffering from much higher temperatures.

You can’t have a new ice age if the Arctic is warming more compared to the southern latitudes…. silly people.

Unfortunately, that NITWIT George Noory on Coast-to-Coast Am doesn’t believe in Peak Oil or Climate Change…. even though he believes in space aliens. Either Noory is just plum ignorant or was bought off by the company that took over Art Bell’s old show and LOBOTMIZED it to death.

That show is complete garbage today.

steve

Google “Danish Meteorological Institute” – Arctic

They have a 58 year record of Arctic Temps (air). They plot each individual year against a 1958-2002 average graph. I do not see much difference, if any, between 58 years ago and 2014. In fact, the entire summer last year never got above average.

However, I think that there may be an increase in Arctic ocean temps during that time.

It is very hard for arctic air temperatures to rise much above zero Celsius as long as there is sea ice. The extra heat energy mostly goes into melting the ice. Average Winter temperatures have risen sharply, but are of course well below zero. Once all the sea ice has melted, you will see sharply higher summer temperatures as well. A couple of years ago, it looked likely to happen before the end of the decade, but two cool summers have allowed some increase in summer ice volume, and full melt may not be until 2025 or 2030

It’s called ambient heat. Can’t measure it with a thermometer,but it is all too real just the same . put a pot of water and ice on the stove,stick in a thermometer and turn on the heat. The water’s temp won’t rise until all the ice is melted. What melted the ice? Ambient heat energy. We’ve been turning up the heat for awhile now steadily increased in fact each and every year without a break. What conclusion can we draw from that fact,as it pertains to the fate of the genus homo and the rest of the animals requiring a habitat in which to live?

http://www.skepticalscience.com/DMI-cooling-Arctic-basic.htm – Link describing what Ralph said.

If the arctic is warming, how come there was 50% more ice this year at the minimum point in September than in 2012?

The Arctic is losing ice.

http://www.theguardian.com/environment/climate-consensus-97-per-cent/2014/oct/20/2014-arctic-sea-ice-extent-6th-lowest-in-millennia

When discussing the Arctic sea ice death spiral, contrarians also invariably change the subject to the modest increase in Antarctic sea ice extent. That increase is happening despite the warming of the Antarctic region, with a variety of contributing factors (changes in the ozone layer, winds, and ocean salinity due to precipitation and collapsing Antarctic land ice, for example). However, the Arctic has lost 10 times more ice than the Antarctic has gained.

How many people fully comprehend the headline “2014 Arctic sea ice extent – 6th lowest in millennia”? Even had to give it a bit of thought and decided to look up the data. Imagine my surprise when I found out that the ice cover was 50% greater than in 2012. Is there any hint of this in the article. NO! Is this a reporter who is just blindly quoting the official site and is too lazy to do some independent research or is it the MSM in general that is concerned with straying from the official line.

Personally I am a fence sitter and keep looking at the data. I agree that two years of data is not enough to prove anything. The first clue of a change of direction will require the ice level to move above the median line.

The reasoning that I have read was that open water absorbs more heat/energy and this is leading to warmer artic water. I presume the reverse should also be true. More ice cover will reduce energy absorption. The question I have is will it result in increasing ice at the summer minimum.

Maybe we will have a clue in 2020.

Al Gore said that the Arctic would be ice free by 2014. Maybe the science needs some tweaking.

Forgot to add my name.

Ovi

While summer sea ice has covered more of the Arctic in the last two years than in 2012’s record low summer, this is not an indication that the Arctic is returning to average conditions, Meier said. This year’s minimum extent remains in line with a downward trend; the Arctic Ocean is losing about 13 percent of its sea ice per decade.

http://www.nasa.gov/press/2014/september/2014-arctic-sea-ice-minimum-sixth-lowest-on-record/

The surface area increase belies the fact that the ice grows thinner. Sorry. Wish you were right.

Accidentally cut off the scales.

Here is the chart. Yes there is a downtrend. However 2013 and 2014 are above trend. As I said, we need at least five more years of data to see if the trend continues down or changes to either, flat, or up.

Meanwhile here in the mountains of southwest Virginia I spent a good part of the day outside working in just a long sleeved shirt. If there had been no breeze I would have worn sleeves.

I still have a couple of neighbors who butcher their own hogs. They are still waiting for weather cold enough to safely butcher since their meat houses are not refrigerated and it takes a few days for salt to work it’s preservative magic.

Wow. Just wow. Someone on here really thinks this in evidence against climate change? Beyond belief. Ever heard of Jennifer Francis?

It has been unusually cold in parts of Ventura County. Some crops lost. Helicopters kept us awake at night protecting crops near Santa Rosa Valley. My wife threw a small snow ball at me which she had gathered from frost on our car. She is still worried about a couple of our outdoor plants. Should be warmer later this week

clifman,

We are in serious trouble and folks are regurgitating either INCORRECT or WORN-OUT DATA. Methane is blowing out of the Arctic in an exponential fashion.

Regardless… I would imagine within a decade, most NITWITs who think the earth is cooling will have to eat crow.

steve

It’s kind of quaint to find somebody who’s enough of a “true believer” to still believe in the whole global warming fairy tale. Here in Kentucky I have a real hard time finding anybody who’ll admit to buying the rotten bill of goods the climate “scientists” and “experts” are trying to sell us. Probably because one needs to be a communist to fall hook, line, and sinker for their propaganda, and there just aren’t many communists in Kentucky, thank God — lol.

Anyway, since you brought it up, I would really appreciate if one of you “true believers” would be so kind as to explain the following:

Antarctic ice coverage at all-time highs.

Arctic ice coverage INCREASING for the last 3 years.

Temperatures of the deep oceans staying stable.

17 years and counting of no global temperature increase.

Drastic changes made in recent years to the weather recording stations, resulting in the artificial creation of higher temperatures within the structures themselves.

The fact that temperatures and weather being recorded today has 1000x greater accuracy than 100, 200, 500 years ago.

The plain and simple fact is, global warming is driven entirely by a left-ring redistributive economic agenda, not genuine science.

Very truly yours,

Steven Nisson

Paducah, KY

well to be fair Steve, you did say most NITWITs.

You anti-global warming people seem to troll the Internet, looking for mentions of global warming and then posting comments. You don’t participate in the group’s overall discussion. You are propaganda machines, only posting everywhere on one topic.

And the whole communist thing is pretty silly. That’s appealing to a 1950s fear.

A Koch-bot.

I’m anti global warming. I prefer temperature in today’s range to 1 degree warmer. I’m also against inaccurate terminology and push personnel to use their units, label axes, and remember some people are color blind.

Seriously? Is this satire?

Steve, the crabs might also be smaller because of population overshoot and demand exceeding the ability of the crabs to reproduce, thereby crabbers being required to “harvest” smaller crabs at higher prices.

Delectable cracked Dungeness crab on the Left Coast this holiday season was selling retail at ~$45-50/lb. The price in the shell was $5-$10/lb, which translates to $15-$30/lb to crack it oneself. I suspect that’s too high for the bottom 90%+ of households, even for a once-a-year holiday treat.

As to seafood not being worth eating, I have to agree, albeit regrettably so.

“Agreed. And… from my location, climate change is surely making big changes. I am sitting in a local Crab Shack here in New Orleans, and I can tell you, the crabs aren’t like they used to be. Climate change has made them smaller.”

Law of unconsidered consequences strikes again:

Much more likely trend caused by evolution and human harvesting methods. Harvested crabs are regulated by size. Small crabs are thrown back and only the largest crabs are harvested. This trend alters the genetic profile that favors smaller crabs over large crabs. The large crabs are being genetically manipulated into extinction and favoring crabs that are genetically evolved to be smaller. There are numerous studies that humans hunting practices are altering evolution on wild game and fish.

Humans always tend to look for answers that best suites their knowledge or beliefs, not on broad observation, research and critical thinking. From my observations, its appears that human have broadly blamed climate change/global warming for the cause of everything from droughts to hair loss.

“Sea Food isn’t worth eating anymore.”

Yes, but not because of the size of crabs, but because of all the pollution. Humans have treated the worlds oceans as giant toilet. Seafood, especially predators and bottom feeders have the highest concentrations of toxins. The oceans are so polluted that eating seafood more than once per month, increases your odds for disease and lower IQ. FWIW: I stopped consumption of all seafood back in 2007 because of rising mercury levels. I don’t not trust the gov’t recommendations since they are likely manipulated by lobbyists to protect the fishing industry.

Techguy,

I was making a FUNNY. I don’t live anywhere near New Orleans.

I ger my data on climate change from ELMER FUDD.

Steve

Climate Change is being felt here in Albania as well. Our forests are severely burning every summer. Boldog új évet magyar!

Fred, “If we hit 2025 without making severe changes to our lifestyles, even the most generous scenario will allow us no more wiggle room to avoid catastrophic collapse.”

Ten years. OK, counting relatives, I know say 100 people reasonably well. These mainly include folk living in Western NA, Europe (especially Norway, Italy and the UK), Africa (mainly Uganda) plus China (all regions) and northern Vietnam. The economic status of these people runs the full spectrum: dirt poor to wealthy, and educations range from about none to Full Professors. Not one of these people (or families) has lifestyle-change plans beyond generally improving their lot: No electric cars, no rooftop turbines, no moves to greener climes. Everyone I know wants: 1) kids in a good school, 2) to take the odd trip, 3) money in the bank to cover a downturn. Business as per usual you might say. My question: who exactly is leading this severe-lifestyle-change charge? Am I totally blind?

Doug, no one is leading any kind of severe-lifestyle-change charge. And no one ever will. People will change when they are forced by events to change and not one day before.

Arguments never produce changes in the population as a whole. Only events force people to modify their life style.

People never hear arguments of coming disasters and act, they always wait until the disaster actually happens then react.

People were leaving the city of Güssing Austria in the early 1990’s because there were no jobs. The city’s leaders decided to stimulate the local economy by switching to renewable energy sources for heating and electricity generation. Güssing succeded both in transforming its energy sources and stimulating the local economy in 2001. In the 1990’s fossil fuels were cheap and there was no carbon tax. The first thing Güssing did was to reduce energy consumption by 50%.

By the end of the 21’st century everyone will be using renewable energy sources. Güssing is ahead of the game. Anticipating future trends has its rewards.

Ovi The surface area increase belies the fact that the ice grows thinner. Sorry. Wish you were right.

I would modify that to say, “most people”. As usual,however, point well taken. And even if they react to disasters, they often react in stupid ways. Response to Hurricane Sandy. Build bigger and better along the coast. Let taxpayers take it in the toocus next time too. We had a major flood here in Colorado last year. Response in my home town was to build even more houses along the local creek which caused major damage last year. Talked to a guy whose house took major damage. I asked him if he was going to get flood insurance. He said, “of course not, I don’t live in a flood plain.” Okie dokie. After all, it’s a thousand year flood.

Ron is dead center in the bullseye as usual when he comments on human nature.

The only hope we have for the people of the world in general taking the problems of climate, environment, and resource depletion seriously is that Mother Nature will smack us upside our collective head with a WHOLE SERIES of Pearl Harbor magnitude wake up bricks.

It is going to take a lot of them and they will have to come pretty fast and on a pretty regular basis and be well distributed in order to provoke a large enough and long lasting enough response to save our self absorbed present tense only asses from collapse.

The odds of Mother cooperating to this extent world wide are just about ZERO. What will happen is that she is will wallop us with a few broadsides that restore the population of humans into balance with whatever is left of the environment in terms of the big picture all over the globe. Saudi Arabia will have one person per many many square miles. Egypt will have about as many MAX as can be fed with locally grown food.IF New York remains a super city the residents are going to have to export something other than banking and advertising and high fashion to pay for their imported food and raw materials.

But some countries are very favorably situated in terms of geography, military power, population and resources. The people of such a country MIGHT realize that desperate troubles require desperate measures and that their survival depend on getting with the desperate measures.

The United States and Canada are countries that imo have a shot at making it thru the bottleneck more or less whole.Times will undoubtedly be very tough but maybe not so tough that very many people in North America die of starvation disease exposure or civil disorder.

But our only hope is that we suffer that series of wakeup bricks upside our collective head – soon enough, fast enough and often enough to force us to act but not so many and so hard that we are UNABLE to act.

The odds don’t look too favorable but in my estimation they are a long ways from hopeless.We will unless I am badly fooled be closing our southern border within a decade or less and not too many people are going to migrate in thru Canada- to the contrary a lot of us will be moving north if Canada will have us.Hardly anybody is going to arrive by water either here or in Canada- the oceans are too wide for refugee boats.

With a flat out effort made on the conservation and efficiency fronts -meaning drastic lifestyle changes – and the population leveling off and declining we MIGHT make it ok for another century or two. Nobody is going to invade North America for the foreseeable future unless they release an incurable disease that kills yankees fast and efficiently leaves their own people untouched.

And somebody does that- well we will probably nuke EVERYBODY unaffected to be sure we get the right ones.

Yogi sez predictin’ is hard. ‘Specially the future.

SOMETHING will get us sooner or later. But later may with a good shot of luck can mean a LOT later in human terms.

With a flat out effort made on the conservation and efficiency fronts -meaning drastic lifestyle changes – and the population leveling off and declining we MIGHT make it ok for another century or two.

That’s why I keep pointing out that although some conservatives many not consider themselves conservationists, if they support policies that decimate everyone but the top 1%, then they are doing their bit to slow down consumption.

If people are too broke to buy much gas, to live in big houses, to buy stuff, and to fly on airplanes, they aren’t going to be using as much per capita fossil fuels.

And I think the way the wealth is concentrated in the world right now, a good chunk of the world’s population could die off and not affect the lifestyles of the wealthy. In fact, it might be better for the wealthy because there would be less competition for the remaining resources. I think that’s the economic reality of the world right now. Much of the world’s population isn’t really essential for farming, manufacturing, or resource generation. Machines have increased efficiency so much that the number of people whose labor is needed to support the wealthy is much smaller than it used to be.

Boomer,

As far as pessimism goes, ask yourself: 10 years ago 2004 with oil prices at $20, what would you have predicted to happen to the aviation industry if prices went up by five times, to $100?

Many unemployed immigrants to industrialised EU are returning to their more rural country of origin. This will lower fossil fuels use. 100,000 albanians have returned from Greece in these 5 years since the economic (peak oil and financial) crisis began

Rita,

Rita, “Many unemployed immigrants to industrialized EU are returning to their more rural country of origin………….”

I wasn’t aware of that but Italy receives many “illegal” immigrants from Africa (and used to have Albanians coming in). In the past these people could normally find work but the Italian economy is so bad now many of them simply move on to France etc. It’s pretty hard to believe many Africans would return to their home countries voluntarily.

Hi Doug,

You are most likely correct.

It seems Wimbi has made some changes, I have made modest changes, but not nearly enough, just hybrid vehicles, a passive solar house in my case and will probably get an EV for my next car. Higher fossil fuel prices will be needed for there to be any significant changes, very possibly too little too late.

A crisis will be the only thing that might get the ball rolling in the right direction.

Goddam it, I changed all right, went all PV, and everything GOT BETTER. What sacrifice? I spent some free cash I happened to have, got a lot of PV, and now coast along all cosy and happy while my neighbors worry about the next power outage, which is mighty sure to happen soon as it always does this neck of the dead end road.

My wife tools around in her Leaf, with all her ladies’ clubs who are SLOWLY getting the idea that it actually is a real car, and really does car-like things, and by some sort of incomprehensible miracle, runs on the sun! Costs NOTHING above the initial not-all -that-high investment.

I am feeling sorta guilty about making all those dreaded life style changes and getting nothing but cushy deals out of all of it. Have I sold my soul to Mephistopheles?

To boot, had fun with all those wires and gadgets.

Or, who knows, maybe I’m on to something?

Wimbi – would like to ask you some DIY solar questions. E-mail adkdan@hotmail.com if you’re willing to entertain them. Thanks. Or we could do it on here if Ron’s OK with such for helping spread such info.

Africans probably not, but East and South Europeans have more choices to return. Albanians are returning form Italy as well. Even more italians are living in Albania now.

A couple of thoughts.

1st, I live in a walkable neighborhood, commute to work in an electric train, improved the windows (with lami glass) so that no heat is needed down to about 2C. Life is far better: I can relax in the train, walk to fun things, and the house is far more comfy.

2nd, that doesn’t matter. Individual voluntary efforts won’t do it, and we shouldn’t expect them to. This is something that needs to be done on a society-wide basis, with planning, standards, regulations, and carbon taxes. Societal plans are far more efficient, far fairer, and far more workable.

You don’t expect basketball players to follow imaginary, voluntary rules, right? They follow the rules as promulgated by the league, and enforced by the refs.

That’s the way society works.

As Fernando says, NGL as crude is just wrong, it’s plastics and propane, not the source of gasoline and diesel.

The composition of light tight oil is crude-oil like, but the economics and production “reservoir” dynamics are totally different. It’s stuff stuck in the source rock, so it kept cooking, so is much lighter than conventional crude, and contains a lot of NGLs, witness the severe fireballs when the trains crash. Because it deplete so rapidly, and is so costly, it’s a less reliable source to continue BAU.

What really concerns me is that he waffles on peak oil, saying essentially “he said, she said, oh well, I guess there’s disagreement”. If one takes LTO out of the conventional picture, then it’s obvious there’s a bumpy plateau since 2005.

See the 2nd picture at:

http://euanmearns.com/broken-energy-markets-and-the-downside-of-hubberts-peak/

Now of course the cornucopians will say “arbitrary/unfair”, “infinite fungibility”, …,

but the point is that if conventional oil has peaked, so will unconventional.

So, if we accept reality (that conventional oil has plateaued), we’re not going to be misled that the smoke from the burning forest is just alarmism, indeed things are possibly worse than they look, so we had better get sustainable asap. (and oh, btw, the sustainable cures for peak oil are the same cures for AGW).

He says (bottom of 216) “The more narrow the definition of oil that is considered (e.g. by excluding certain categories of oil such as light tight oil or Arctic oil), the more likely it is that this will reach a peak and subsequent decline, but the less relevant such an event would be.”

But never justifies why it’s “less relevant”. I’m smelling “I don’t want to psychologically accept peak anything, so … oh look, shiny!”.

In fact, refineries are built and tuned to different crude oils, and the economics go haywire if fed something different than their optimum. So, for example, condensate is being exported (as “crude oil”) rather than used so much in the US, and has low prices due to low demand in the US.

The “… by 2025 … to avoid catastrophic collapse” is Avery Morrow’s conclusion, not Christophe McGlade’s.

McGlade’s model says prices peaked in 2012, but they actually ran for two more years at high levels before crashing rather more abruptly than his model. If his model doesn’t show reality, what good is it?

He claims OPEC may curtail production (they aren’t), and they have “plenty of additional spare capacity” (pg 247). If they did/do, why didn’t the Saudis jump into the market with more than just 1 million bpd back in 2010 when prices leapt back to $100? Ummm – maybe that’s all the “spare capacity” they had???

Maybe if they can kill 1 million bpd of LTO/tar sands, that’s all it takes to get oil back to $100.

If one takes LTO out of the conventional picture, then it’s obvious there’s a bumpy plateau since 2005.

See the 2nd picture at:

http://euanmearns.com/broken-energy-markets-and-the-downside-of-hubberts-peak/

Now of course the cornucopians will say “arbitrary/unfair”, “infinite fungibility”, …,

Or they could say that oil peaked 10 years ago, and no one noticed. No gas lines, no shortages, no die off, no resource wars.

The Doomer books and tapes were wrong.

George Duuuuh-byuh’s little misadventure in Iraq wasn’t a resource war?

Nobody noticed that prices started climbing in 2003, culminating in $147/bbl in 2008, nor that little financial difficulty exacerbated by those high oil prices?

Now I grant you that very few outside of the peak oil community (and perhaps not so many even in it) noticed that E&P (exploration and production) capex quadrupled over the last decade, while all liquids only increased 12%. Care to explain that any other way than nearing/at the peak of conventional oil?

Ya, the fast crash doomers have proven themselves wrong.

But happy days forever don’t seem to be really and truly here.

Ya, the fast crash doomers have proven themselves wrong.

Now just tell me sunnnv, just how can a prediction about the future be proven wrong years before it is supposed to happen?

Impn this universal continuum, oil prices started climbing in 1999.

Actually, many noticed the effects via higher prices at the pump. It’s just that they did not know that it was caused by peak oil.

John B., this is the way I see it: oil ranges from extra heavy (around 7 degrees API) to very light oil (say 45 degrees API). Condensate is a gas at the reservoir and turns liquid at the surface. NGL is butane, propane, and ethane. Natural gas is methane. The industry has found and exploited most of the easy to get oil, a lot of condensate. NGL isn’t oil.

As we exploit these resources we “move up the degree of difficulty”. So today a lot of the new oil and condensate is either very heavy, in very deep water, or in really crappy rocks.

As we move up the degree of difficulty we need a higher price to justify the higher costs we face. There comes a time when the higher prices allow other sources to compete.

And as far as I can see, when it comes to oil we are at the end of the party. There isn’t much beyond a certain water depth, the “shales” aren’t everywhere (they aren’t real shales), and extra heavy oil requires a huge amount of steel and steam to extract and process. Thomas Gold is a charlatan. And that leaves us standing out on a plank. After the oil gets really expensive we can use coal to oil. And after coal gets too expensive then what? Natural gas to liquids? That has a limit. Everything you can think of I have looked at for years. And so the end will come. It’s unavoidable.

If you were right, then production wouldn’t be increasing. And the price would be going up instead of down.

Reality is quite a different thing than the “End of Suburbia” nonsense doomer books and tapes that have been published so profusely.

I’m right. Production increased because prices went up sixfold in 15 years (check oil prices from mid 1999 to mid 2014).

I don’t read end of suburbia doomer books. I’ve been in the oil business for almost four decades. and if you allow me I can pass on some knowledge before I get too old. It’s your choice.

Gracias. Your knowledge is greatly appreciated.

Again, EVs are better and cheaper than ICEs.

So, why “the end”?

Because electric vehicles aren’t really cheaper. They have to be mandated and heavily subsidized. This issue seems to be somewhat ignored by advocates. If they were competitive they would take over the market. The only thing which uses a battery and is very competitive is the golf cart. A hybrid makes sense. Beyond that you get into make believe green economic mucus. It just doesn’t hold its shape when you try to grab it.

The reason you think fossil fuel vehicles are cheaper is that many of the costs of fossil fuel have not been factored into their prices. Pollution costs, for example.

You mean CO2.?.? Thats correct. Now we need to discuss your carbon tax proposal, and the parallel commitment to end all subsidies given to renewables?

You mean CO2.?.? Thats correct. Now we need to discuss your carbon tax proposal, and the parallel commitment to end all subsidies given to renewables?

I was thinking more about water pollution, air pollution, health costs, land destruction, and so on. Fossil fuels aren’t especially clean.

I haven’t brought a carbon tax proposal. You must have me confused with someone else.

Fernando,

I agree – it would be great to have stiff carbon taxes, and eliminate all subsidies.

EVs would replace ICEs very, very quickly. Coal would be eliminated pretty darn quickly too.

Because electric vehicles aren’t really cheaper.

That’s just flat out not true.

Have you looked at Edmunds.com’s 5 year total cost of ownership? The Nissan Leaf is the cheapest thing around, even without the tax credit/subsidy. With the credit, it’s insanely cheap. At least, in the US – I don’t know about Spain, which probably taxes the heck out of new cars, like most of Europe.

If they were competitive they would take over the market.

The Tesla is taking over the market. Other EVs, like hybrids and low end EVs like the Leaf, take much longer because they’re only somewhat better than the competition overall, and people take a while to get used to new things.

The Tesla shows the truth of the principle that a new thing has to be dramatically better than the old thing to displace the old thing (at least quickly).

Right. Musk is very clever. He wants to push the industry toward the EV, and he put out one that nobody could possibly say was anything but a great car. So what if it cost a lot. People who buy those huge muscle things don’t count cost anyhow.

The leaf on the other hand gives the impression ” just like any other car, except can’t hear the engine”.

So it takes a while for it to soak into people’s head that this thing is not just like any other car–it’s almost free to run it down the road. When that does finally get in, I think these things will really take off.

And the guy who cares for his own car will stop being puzzled that he has near nothing to do- and he will quit worrying that he can’t hear whether the engine is right because he can’t hear any engine.

Nissan might not see the Leaf as the absolute success story you do. They are increasing the range, presumably to increase the popularity. The price is expected to rise from $29,000 to $33,000. “Cheapest thing around” is getting a lot more expensive. Five years of data may not be sufficient to judge. The batteries are noted to deplete in range over time. As we can see from the increase in price, batteries are very expensive.

http://www.thestreet.com/story/12554189/1/nissan-to-extend-electric-car-leadership-with-135-mile-leaf.html

I would expect increases in range, and price to be a logical progression. No big news there.

Anonymous,

That article about the Leaf appears to be speculation and is kind’ve out of date – can you find anything else on the topic?

Let’s put it this way: electric vehicles aren’t really cheaper FOR SOCIETY. They thrive due to mandates and subsidies. They are social parasites. The rational answer FOR SOCIETY is very high road taxes and mass transit. But since most of you enviromental types are Americans used to a cushy lifestyle you can’t look very far outside the fence. Remember, I’m not worried about a solution for you guys. I’m worried about billions of chinese, indians, Pakistanis, people like that.

Yair . . . Here again Fernando Leanme I have to disagree with your conclusions.

I see EVs being adopted by third world countries in the form of electric bicycles, tuk tuks and the likes, this despite the fact that gasoline and diesel is used far more efficiently than it is in socalled “developed” countries . . . witness a family on a 125cc scooter or 35 people (including those on the roof) in what we would call a 15 pax 2.7 litre turbo diesel bus.

I just post my views to demonstrate my alternate way of thinking and really appreciate your comments and insight into oil related matters

Cheers.

I suspect there would still be a number of electric vehicle sales, even without the subsidies.

One thing your are never going to see is the rest of the world all driving F150s. There’s never going to be enough oil production for that.

However, electric vehicle use around the world is a real possibility.

http://cleantechnica.com/2012/10/05/electric-scooters-in-asia-pacific-will-increase-nearly-tenfold-from-2012-to-2018/

Why keep repeating the same incorrect ideas? Have you looked at Edmunds.com? It includes all costs over 5 years, like depreciation, insurance, maintenance, repairs and fuel costs.

EXCLUDING TAX CREDITS OR SUBSIDIES, the Nissan Leaf is cheapest.

The Prius C is next cheapest.

————————

As for mass transit, Europeans use only 18% as much fuel per capita as Americans, but they still only use mass transit for 11% of travel miles. I like trains – I use them every day. But their not the answer to everything, even in Europe or Cairo. Especially not Cairo…

I agree that very high fuel taxes are the answer. That won’t move people to mass transit, though. It’ll move them to EVs.

Take a look at official chinese government statements on ev’s. Why would they go to the trouble if ev’s were just parasites, huh?

The chinese business guys I know are real smart.

Scrub puller, a tuk tuk is like an electric toothbrush.

Better and cheaper? Nonesense. EVs have been subsidized for five years now in Washington State, um, apparently to the tune of a $7500 federal tax credit and a $500 rebate on some wall thingy and an exemption from the sales/use tax and motor vehicles sales/use tax and remain, well, a “niche like the Corvette” and otherwise a rounding error of the total fleet numbers. Some question the need for such discounts, given that the rich are well able to pony out such cash. And then there’s the little road maintenance problem, in addition to the Bertha boondongle, on top of the piss poor public transportation. A nixed fancy vehicle tax being a major cause of metro funding issues, along with the trying to spread metro out over unservable sprawl. Somehow replace all those ICE with EV in a glorious orgy of well-oiled consumption and you’d still have folks stuck in traffic on unmaintained roads and crammed into crush-load busses. That’s neither better nor cheaper.

I spent $29 on transportation last year, and car sat twice. Got no tax breaks like the carists do for the trouble. What would $29 get me in your car world?

Back on the insane infrastructure side of things, as Charles Marohn of Strong Towns points out, Ferguson has $300,000 in bog-standard roads, no shade trees, and a sidewalk two cannot walk abreast on. What, do we give the police EV so they can feel all green before shooting the consequent jaywalkers? Or, we could build more than mostly survivable communities, ones that do not virtually mandate the purchase of hilariously expensive vehicles? Yeah, right! There have been signs of sanity, though, with some areas actually *gasp* reallowing kids to walk or bicycle to school, instead of wasting limited school funds on vehicles to drag tham hither and yon. More money for teachers, exercise, and no money wasted on cars. Now that’s better and cheaper.

There have been signs of sanity, though, with some areas actually *gasp* reallowing kids to walk or bicycle to school, instead of wasting limited school funds on vehicles to drag tham hither and yon. More money for teachers, exercise, and no money wasted on cars. Now that’s better and cheaper.

I think having people walk and ride bikes is a better option than any sort of vehicle use. It’s healthier and requires less road maintenance.

The EV subsidy doesn’t bother me because the number of EV vehicles on the road is still small, so it isn’t like the subsidies are costing the taxpayers a lot of money. Now, if we could get rid of all subsidies, including tax benefits to home owners, that would probably be a good thing. The entire tax structure could be reworked, but no one knows how to tackle it.

I guess I am just a pessimistic old farmer but my bet is on old men and old mules getting ” older faster” once they have hit middle age.

As a theoretical matter these charts and arguments are great. As a purely practical matter the contest is not always to the strong nor the race to the swift but that is the way to bet.A very, very few old men and mules remain hale and hearty and as productive as ever well into old age but that is not the way to bet.

Now as to the demand side argument I am a long term optimist but a short term pessimist. I do argue in favor of pure electric and plugin hybrid vehicles as being superb technology that can go a LONG way to freeing us from oil addiction. I occasionally point out that the French are on track to have an oil free rail system pretty soon.Ditto some other technologies and adaptations.

But while I believe that plug in hybrids and pure electric cars, etc, are going to sell like ice water in hell a LOT sooner than most people expect or would even believe I do not believe they are going to sell fast enough soon enough to allow us to get the oil habit under control before the oil habit takes a huge and potentially fatal bite out of the economy’s backside.

The key point that I agree with is that we should not be TOO SURE we know what is going to happen.My excellent personal doc has been right to my knowledge about ninety percent of the time when he tells somebody they have a few weeks or months to live. But maybe one time in ten the patient rallies and lives a good long while.

My bet is that the price scenario he predicts is in the ball park except that the low price scenario he predicts for the rest of this calendar decade is just too good to be true from the Joe Sixpack pov.

But things could work out that way if the economy remains in the doldrums and the market ( with a swift hard kick in the butt from politicians to help keep the market on the job!!) delivers more efficient autos, trucks, planes, construction machinery soon enough and fast enough.

Folks up in Connecticut who make plenty of money are going to replace old oil furnaces with nice new heat pumps when the furnace croaks even if oil is relatively cheap and economic managers in countries that import oil are going to continue to do as much as they can do to keep consumption down to help with balance of trade issues.

But I just don’t see production being so good that prices can stay well below a hundred bucks very long with so much of the world economy just now getting to the point it can really make good use of lots more oil than ever before.

I strongly suspect that all those millions of new cars in China are not being driven very many miles per year per car yet due to cars being sold faster than the streets and highways can be upgraded and or built to accommodate the traffic. But if oil stays cheap they WILL BE driven because cheap oil is probably the one biggest thing that will help them continue to build and pave new streets and roads at their usual smoking hot pace. This applies to India and just about any other country as well which has not yet built out a truly extensive modern street and highway network.

I am not a pinko commie by any means but neither am I blinded by the thinking of deflationists. REAL CAPITAL exists in the form of people with skills and three dimensional natural resources.MONEY is just a way of keeping track and deciding who gets what.

MONEY as such is not going to stop the continued development of the world economy so long as the actual resources needed are available in sufficient quantity. Ways will be found to renege on old debts even as loans are made.

Oil seems to be the KEY limiting resource these days.And while I am not trying to horn in on our court jester’s turf the cheaper it gets the more expensive it gets.

Anybody who appreciates a little zen in his English will get it immediately.

OFM,

Whole-heartedly agree with every word you wrote.

This young buck when from fast-approaching-collapse-doomer (2005-2011) to a cautious it-won’t-be-easy-but-we-may-make-it optimist.

I could easily foresee a scenario where the shale peak creates another 2008 type event. Prices rocket to $200, severe recession, financial panic. In that period, if it comes, and my bet is it will (but I’ve been wrong about countless things in my life) we could face a complete collapse scenario. We don’t have to, but depending on policy decisions and timing it could fall apart.

We were hours away from collapse in 2008. With the political brinksmanship present today, it is possible a TARP type package would be delayed until it was too late. Even if the U.S. holds their system together there is the very real and much more likely scenario of Europe’s financial and monetary system coming apart during the next crisis. As growth collapses deficits would soar, and PIIGS countries would find themselves with no hope of bringing debt/GDP in line with what Germany wants. As they bicker with meetings and summits banks would collapse.

In 2008 countries bailed out their own banks, but this put Ireland and Spain on the precipice of monetary collapse and sparked the EU sovereign debt crisis. Banks in Europe can only be saved by pooled funds next time around, which means Germany would have to be willing to create and basically fund a new mechanism for saving banks in other countries. if events most swiftly like in 2008 this could be the epicenter of a genuine global collapse scenario.

However, if we make it past that critical period with humpty dumpty cracked, but not broken, we’ll be well into a world where PV, wind, and electric cars are powering a healthy base of societies activities. Self driving cars and services like Uber/Lyft will create the possibility of a new model of transport where you don’t even need to own a vehicle. If we only needed 1 vehicle for every 6 people in the U.S. it would save a lot of resources.

My guess is people will be forced into this new mode of transport because the current system will become unaffordable for many. It seems technology will progress, but we will become much poorer, which is simply a continuation of what has unfolded over the last 30 years.

Meat will eventually be grown in petri dishes as that tech gets cheaper and our current means (feeding crops to cattle) gets ever costlier due to demand growth and climate change.

In my “optimistic” view, the technologies on our doorstep, technologies that already exist, and need only economies of scale, will allow us to successfully make oil a smaller and smaller part of our lives to the point where by 2035 a spike in prices, although impactful, would not create the economic meltdowns it currently does.

At the same time, I believe the U.S., Europe, and Japan’s people will be, on the average, much poorer. Millennials struggle more than Gen X, and Gen X struggles more than Baby Boomers. Gen Z will have it worse than Millennials. College debt and ever lower wages for jobs requiring a college degree will sap the middle class dream from many in the next decades. Many will make it through by not having kids as well as a transition toward a more multi-generational home structure in the U.S. The U.S. is unique in that children, parents, and grandparents rarely live under one roof. This will change, and likely quite rapidly in the recession that follows the next oil price spike.

Anyone have any thoughts on this? I enjoy any opportunity to adapt my thinking, and become more aware of my own blind spots.

My view is similar. I think most people will become poorer, forcing them to consume less, which reduces the need for fossil fuels. And as the price of those goes up, consumption goes down even more.

I don’t foresee everyone being wiped out, so I think some people will continue to do better than others. And the harder it gets for most people, the more resources there are left for those few who can afford them and have access to them.

For the planet’s health, global depression is probably a good thing. For the people affected, probably not so much (though I think a simpler life with less consumption is not, in itself, a bad thing). However, I’d say individual people or cultures matter little when it comes to the future of Earth. If some people survive well enough, humans can continue. If no humans survive (which I think would mean most Earth would have become uninhabitable to most life), then Earth continues on, perhaps reinventing itself anew again, a process that continues until the Sun no longer supports it.

On a geologic timeline I see humans simply as a catalyst for releasing the stored entropy of fossil fuels. A sort of “entropy finds a way” kind of view.

The Carbon Cycle as described in textbooks focuses on primarily seasonal and yearly cycles, and, before human influence, is correct in positing that carbon sequestration is mostly a one way street.

In a similar vein, before the existence of photosynthesis an intelligent observer would presume low entropy EM waves hitting the Earth were a one way street. Who could possibly conceive that a complex process would come about that utilizes that entropy to do work (photosynthesis) instead of being naturally “wasted” as it experiences heat death.

At some juncture there will be a 4th Law of Thermodynamics that states “Any low entropy system that cannot attain equilibrium by current processes will, if sustained long enough, utilize free energy (low entropy) to develop processes that bring the system into equilibrium”. Those new processes are, by definition, complexity.

The most accessible form of this is the formation of a star. Heat death alone cannot bring the system to equilibrium. The reaction rate (which itself is simply “entropy finding a way”) is so slow that disequilibrium builds – entropy is bottlenecked, like water behind a dam.

Fusion reactions break the bottleneck. Entropy can now flow higher, but only after a highly complex series of processes develop. We need look to the stars for evidence that highly complex, self-sustaining processes are a natural consequence of entropy build. What we call life will one day be thought of as no different than the complex processes unfolding in a star, a hurricane, or any other complex system that results from entropy build and disequilibrium.

Entropy built up in this planet’s crust, and to me it was all but inevitable that some process would come along to release that entropy. An intelligent observer could no more predict humans would be that mechanism than one could predict photosynthesis before it came about.

Science can predict the half life of a block of uranium, but cannot predict what specific molecule will undergo decay or when. Similarly, we can surely predict that a constant building of low entropy in disequilibrium will develop a process (complexity) to bring about equilibrium, but we cannot predict how or when.

Hopefully that all makes sense. I feel as though this broader view of life, energy, and complexity will not take root until we have evidence of life else where. I think that will spark a healthy debate that invariable leads to a single conclusion – life isn’t a unique process separate from the “natural” complexity we behold every day; it is simply a different category of entropic process no less or more important than the complex entropic process of stars, storms, or ocean currents.

Even when I was a doomer I was quite content. Do we weep for the dinosaurs struck by an asteroid? No, because that event pathed the path for us. Would a creature living 65 million years from now weep for us? No, we were but a step in the continuous march of cosmic time.

There is already such a Fourth Law of Thermodynamics formulated by the late Nicholas Georgescu-Roegen

Brian,

I thought I had a handle on entropy before reading your comment; now I’m not so sure. Actually, when I hear the word “entropy” my first thought involves old steam engines puffing down the tracks; next comes change in entropy as in thermodynamically reversible process followed by statistical stuff per Boltzmann. Finally the mind shifts to phase transitions, information theory, Second Law and lastly arrives at quantum mechanics as in wave function collapse.

But, when you say: “low entropy EM waves hitting the Earth” I have no idea what that means. Wave energy is determined by amplitude isn’t it? The only time I’ve heard of entropy relative to EM radiation is in terms of wave function collapse. “Entropy is bottlenecked, like water behind a dam” Really? “Fusion reactions break the bottleneck.”

I’ve always thought fusion corresponded to an increase in entropy (as melting ice cube) where order is decreasing in a closed system. “Entropy built up in this planet’s crust.” I think you mean entropy DECREASED in the planet’s crust, at least if you’re referring to the accumulation of fossil fuels. I won’t go on but when you ask: “Hopefully that all makes sense?” No, it doesn’t, not to me anyway.

Solar fusion is not entropy in the sense of things breaking apart and never being put back together, but spreading of (total) disorder in space. We get sunlight on Earth because of entropy as the sun’s fusion spreads energy into the solar neighborhood. At least that’s the way I see it.

You got it right. Now we got to figure out where the initial high entropy level came from.

Doug,

It was truly a messy comment I made. More of a cathartic act where I just rolled with the thought stream to see where it led. Internet trolls the world over would be proud!

I internally debated whether to post it, or just delete it since it was a very (euphemism alert) “creative” rambling. I apologize.

That being said, I will defend my non-sense cause this is the internet after all.

I was using the concept of entropy interchangeably with equilibrium. EM waves are on a fundamental level a low entropy form of energy; any system with a net influx of EM energy is a system that is accumulating (relatively) low entropy energy. Photosynthesis guides its journey to higher entropy, and captures a percentage in chemical bonds.

To me it’s all about fundamentals. If an EM wave can be use to do work, whether in a solar panel, photosynthesis, or making water evaporate, then it is by definition a low entropy form of energy.

I was sloppy in my wording when saying “entropy build” as what I was trying to convey was a building concentration of low entropy. Interchanging that sloppy term with “disequilibrium” was an attempt to marry the two seemingly separate concepts. In modern thermodynamics rising entropy is equivalent to approaching equilibrium, a low entropy system is = to being far from equilibrium.

“Entropy is defined as a thermodynamic property which serves as a measure of how close a system is to equilibrium, as well as a measure of the disorder in the system.”

In relation to fusion reactions we are in complete agreement; I just didn’t explain it very eloquently. I was referring to the moments before a star is born. Fusion is the new process that allows the low entropy gas cloud to more quickly reach equilibrium i.e. higher entropy.

A brown dwarf, although it is far from equilibrium, never gets far enough from equilibrium for the activation energy required to overcome the Coulomb force to happen spontaneously at its gravitational center.

I, um, hope that makes more sense. You are far more knowledgeable on this subject than I.

No problem Brian, ramble on to heart’s content. And, sorry if I came across as a prima donna. This isn’t a physics blog so I really should keep my trap shut sometimes. Blame my wife who, as a mathematical physicist, is extremely exacting and a bit brutal when I cross the line with my unwarranted generalizations — which I’m ALWAYS making.

Oh, Brian, one word of warning, talk about Brown Dwarfs all you want but don’t get onto pulsars; I’ve been following pulsar physics for over 40 years and can go on forever about them. 😉

You must be old. Do you remember when popular mechanics had articles about atomic powered cars? I used to lap that stuff up, and wanted to study at MIT to design miniature atomic engines for lawnmower sand things like that.

Life is a self-organized energy-dissipative structure?

http://www.salon.com/2015/01/03/god_is_on_the_ropes_the_brilliant_new_science_that_has_creationists_and_the_christian_right_terrified/

shuffling, that’s a way to visualize it. When you get down to it we living things absorb high energy photons and give up low energy photons. We are entropy reduction machinery.

A bit of perspective: the process of fossil fuel accumulation is astonishingly inefficient. The total fossil fuel burned by humanity in the last two years (accumulated over many millions of years) probably is equal to about a month of Earth’s solar insolation.

The whole idea that we have a one-time surplus of energy is unrealistic: the current solar flow is 10,000x as large as human FF energy dissipation.

The whole idea that we have a one-time surplus of energy is unrealistic:

Nick, I know you are solar power’s most enthusiastic cheerleader. But I do believe you are overselling it just a bit. The conversion to solar power, such as it will be, will be very expensive and rife with problems. And it is will not be even close to the panacea you expect it to be.

The point is that there’s an enormous surplus of affordable energy available to us.

Does that mean there’s no work involved in using it? No. Every energy source has required a lot of human ingenuity to access, from water power, to Dutch & Spanish windmills, to Dutch peat, to charcoal, to coal, to oil, etc.

Expensive?

No. PV is already cheaper than the grid in many places, and it’s cost continues to plunge. It’s far cheaper than oil/diesel generated power (which may be as much as 10% of current oil consumption).

Solar power doesn’t fall equally everywhere, but it’s far more generally distributed than fossil fuels.

Panacea?

I wouldn’t suggest we try to use solar power for everything. That would be far sub-optimal, though doable if necessary. A diverse supply of energy sources is clearly cheaper, more reliable, more accessible, etc. Wind & hydropower (which are indirectly powered by solar power) have a very nice synergy with PV/CSP. Nuclear will work, if needed.

Does that address your concerns? It’s short, because instead of covering various possibilities, I think I should stop and ask – what would you think might be the main showstopper?

Sunset?

Nope.

Now, the fact that sunshine only shines in the day means that the optimal mix of solar is probably not more than roughly 1/3 of kWhs – more than that probably means increasing storage or increasing consumption during the day, which might be a bit inconvenient.

But, as I mentioned above, a diverse supply mix is definitely best.

Seems to me winter time sunset in Beijing is one hell of a show stopper. Cold, short daylight, lots of chinese huddled and cursing the communist party leadership in the dark because they forgot to order batteries when they bought the solar panels.

oops. That should be “The total fossil fuel burned by humanity in the last two hundred years (accumulated over many millions of years) probably is equal to about a month of Earth’s solar insolation.”

I think some of the metrics are 1 year of solar insolation is more energy than all fossil fuel resources combined. Or 1 hour of solar insolation is equivalent to 1 year of human energy consumption.

Some more practical metrics are from an NREL study that estimated 7% of a city’s surface are could provide 100% of it’s power if covered with PV. Or 1/3 of the Mojave Desert could power the entire US. Or an area the size of Spain could power the whole world.

So obviously, the potential resource is there.

Does that work if Spain is covered by clouds in late December?

Yes. I suggest you pickup a panel just to check it out. They work fine on cloudy days, even if it’s raining. Of course they don’t work at night, but there’s plenty of batteries around to fix that. Cheap lead/acid batteries work fine for PV.

BTW, didn’t you write an excellent article about oil companies colluding to quash renewable energy, and electric cars?

No it doesn’t really work. We have solar plants and the local papers carry lots of information about what goes on. Low sunlight, panels break, they have to use water to wash them because we get Sahara dust. Many of them were expecting huge subsidies, went broke when the government realized the whole thing was a scam. In real life, here, they have a lousy reputation. Same in Germany. Wind power does much better here, we read less complaints. What solar did was hurt renewables overall, because the money spent subsidizing it could be used to pay for the gas turbines and small hydro w need to offset wind intermittency. Solar is bogus once we get away from the equator and have longish winter nights.

My guess is that literal factory grown meat is a LONG way off at best but your general views match up more or less with mine. I think there is a very good chance countries such as the US can pull thru peak oil more or less whole but no doubt there will be some severe economic consequences and average living standards are going to fall.

This will not because technology cannot EVENTUALLY make up for oil and most other resource shortages but rather because technology imo cannot move so fast from gleam in the eye to verified experiment to small demonstration to high priced early adapter niches to general economic dominance.

Don’t get caught in Egypt!!!

( I always use Egypt as an example of a country with a huge fast growing population that imo will not be able to pay for imported food and energy.)

U.S., Europe, and Japan’s people will be, on the average, much poorer. Millennials struggle more than Gen X, and Gen X struggles more than Baby Boomers.

Median wages haven’t grown in the last 30 years, but they haven’t fallen. Household incomes have risen, due to women working more. Per capita GDP, and average incomes have risen significantly.

So, why have median wages stagnated? Because income gains over the last 30 years have to gone to the top 20% of earners, with much of them to the top 1%.

It’s not a problem of Peak Oil – it’s that the rich are getting richer, and the rest of us aren’t.

In some cases it’s caused by technology. In others it could be illegal immigration. Putting a few extra million low skill individuals in the labor pool doesn’t help the lower skill labor to get leverage and higher wages. And now I will wait with my helmet on.

No, I agree, it’s a complex thing that’s influenced by a lot of factors. For instance, information technology makes it easier to have a “winner takes all” economy.

A very big factor is unionization – a lot of people have been brainwashed into thinking they’re “too good” for unions, and they’re much poorer for it.

No helmet required.

Importing more people, especially low-skill people, does not help the situation in the U.S. going forward. No racial or ethno-sociaological profiling here, just the cold hard reality of finite resources with increasing extraction/production costs, divided by more and more ‘consumers’.

Automation certainly has a lot to do with reduced opportunities for decent employment as well.

As does Outsourcing.

As does consumer/societal satiation.

I think that these four factors (Automation, Outsourcing, continuing immigration/too high of a population, and Satiation) probably account for the shortfall in good employment opportunities in the U.S.

But what evidence is there for finite resources creating a problem? Inflation is low, and commodity prices are falling (not just oil).

Demand for many manufactured goods has plateaued, but we certainly need a lot of new infrastructure, including things related to energy. There’s enormous unmet demand for services, including childcare, healthcare, eldercare, education, entertainment, etc.

A large part of the problem is too much income going to the wealthy, who have a lower “propensity to consume”. They put their money into paper investments, and the economy stagnates.

I guess I could invest in a restaurant instead of mutual funds. Spaniards don’t know how to make a decent sandwich.

I am one hundred percent with Fernando in this respect. My own people were greeted with ” No irish need apply” signs and worse when they came over and I have understanding and sympathy for refugees economic , political , or religious.

But facts are very stubborn things and the demand for ordinary low skill or semiskilled labor is far short of the supply and every new immigrant adds to the problem.

If I am short of help sometimes I have paid twenty five dollars an hour if the need is critical- for help such as harvesting in front of an incoming hurricane.

But when there are five or six applicants for a farm labor position then I can get a good man for eight bucks. If there are a dozen applicants I can if I choose get the youngest and toughest of the lot and work him like a machine.

If there are twenty applicants some of them will gladly work for less than minimum wage and often do.

I used to know tons of liberals very well and used to spend most of my time around them.A very few of them paid casual laborers maybe a dollar more than the local going rate. The rest put their own wallets well above their rants about living wages.I have yet to meet one personally who pays a so called ” living wage”.

When I was doing handy work it the university district in Richmond Va and asked how much I was owed for some small job I usually found the best answer was to just say whatever you think is fair.This had a good bit to do with getting paid in cash and not having a half a dozen different kinds of licenses and permits of course.

Not once was I ever paid anything close to local union scale or the going rate for a contractor to have done the same work.For example for replacing a faucet and a couple of light switches and rehanging a sticky door a real liberal loud mouth professor known for bitching about local companies not being willing to pay fair wages gave me forty bucks for four hours which did not include my road time. I will say that his wife looked distressed and slipped me another twenty on my way out.

The reason I happened to know all these people well was that my sweet pea at the time was a grad student getting her masters in ed and we lived in the immediate neighborhood and our social life revolved mostly around the university.

A plumber with a number in the phone book at that time would have charged forty bucks just to swap out the faucet.

The rest put their own wallets well above their rants about living wages.

They weren’t ranting about people not volunteering to pay more, they were ranting about the need for a general rule to pay more.