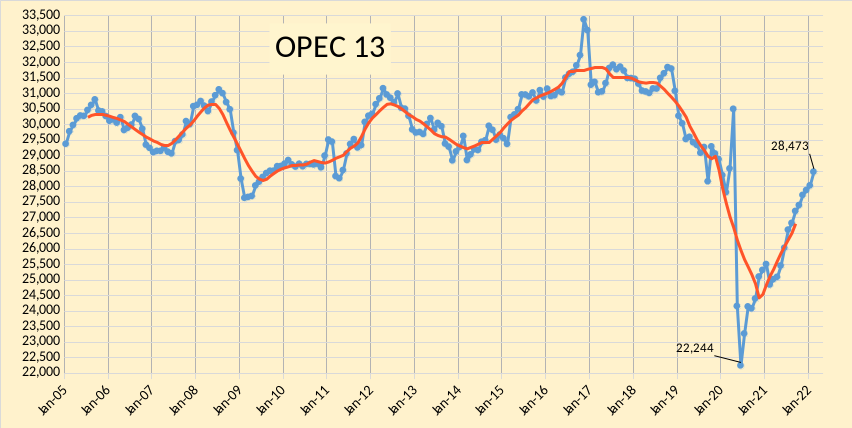

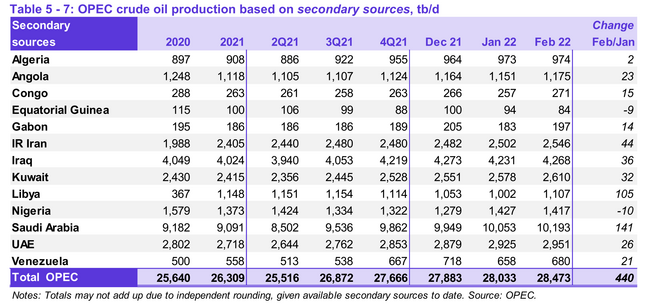

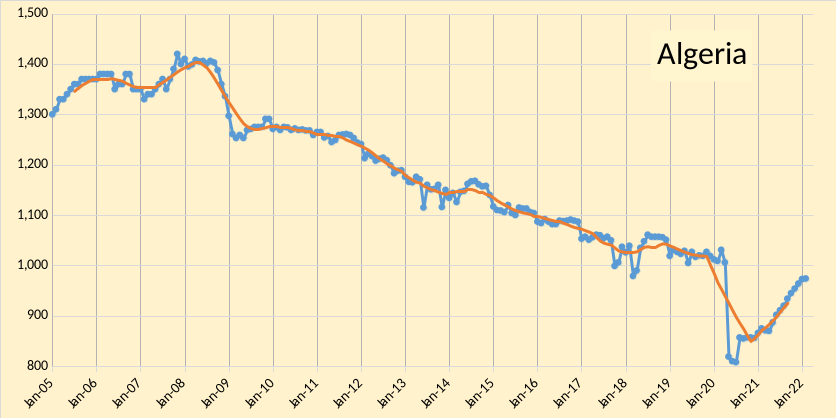

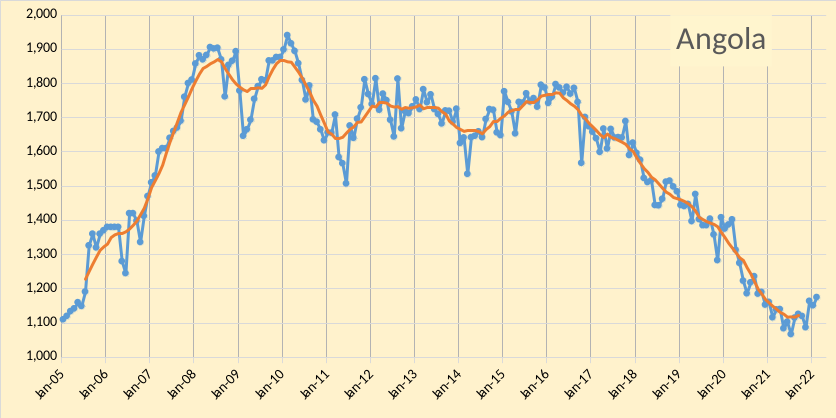

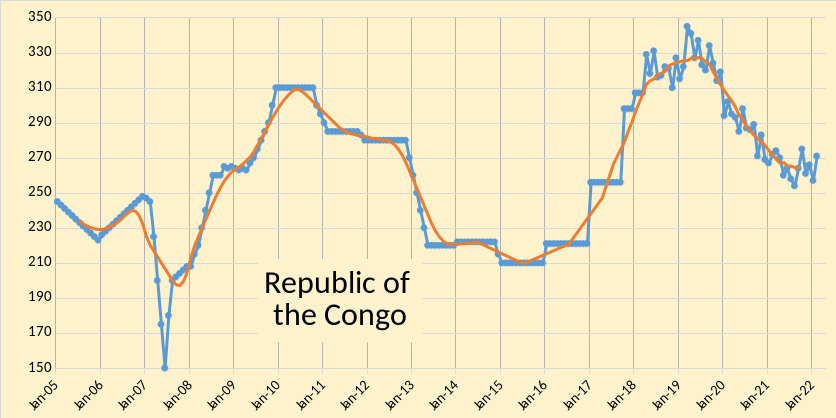

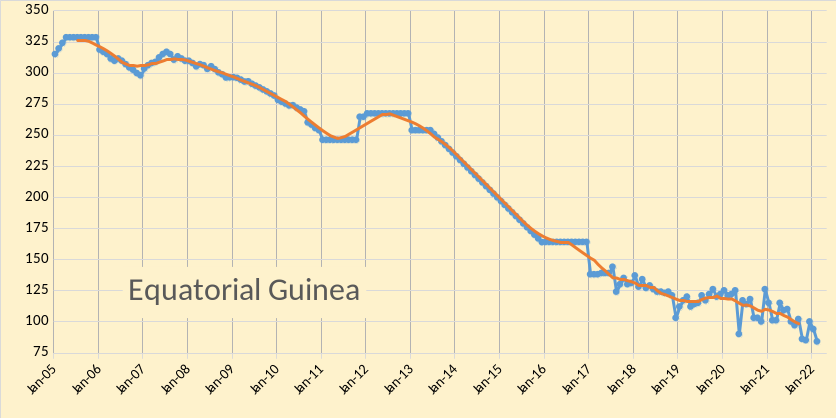

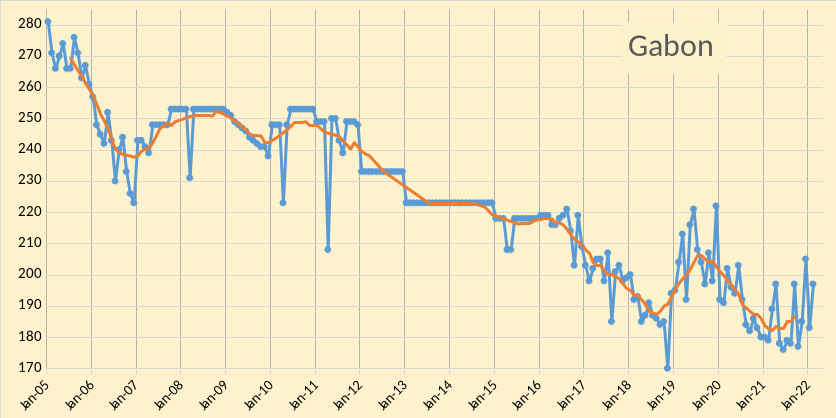

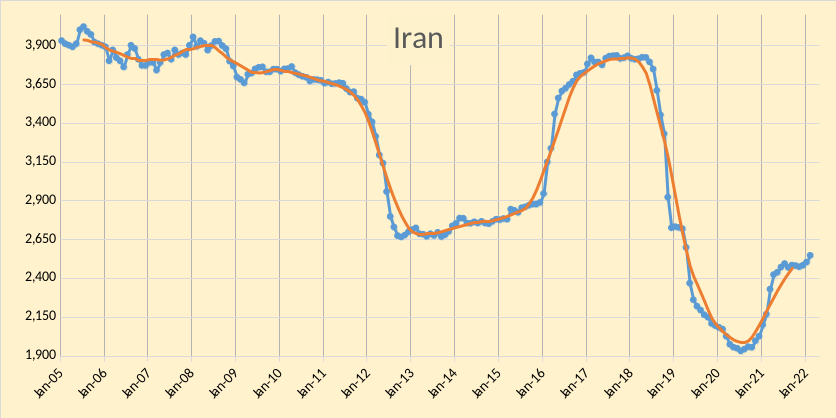

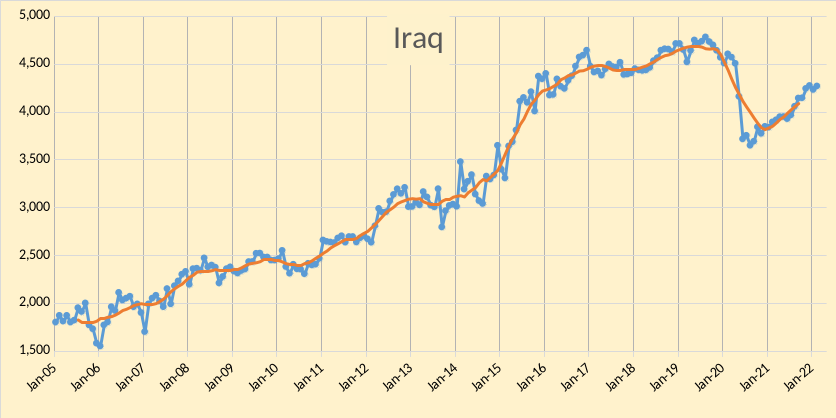

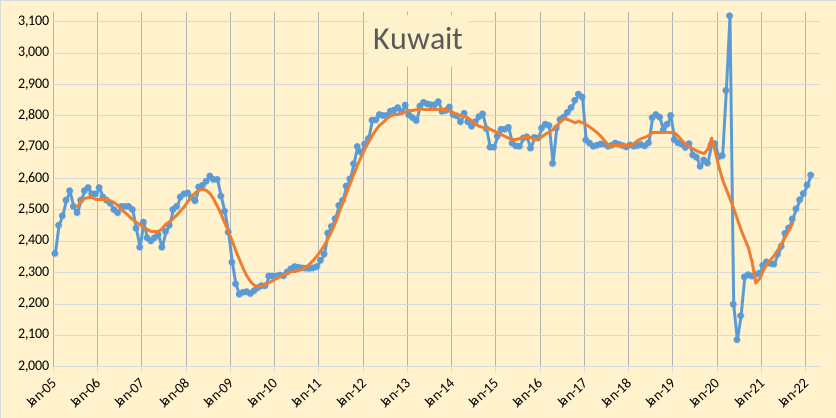

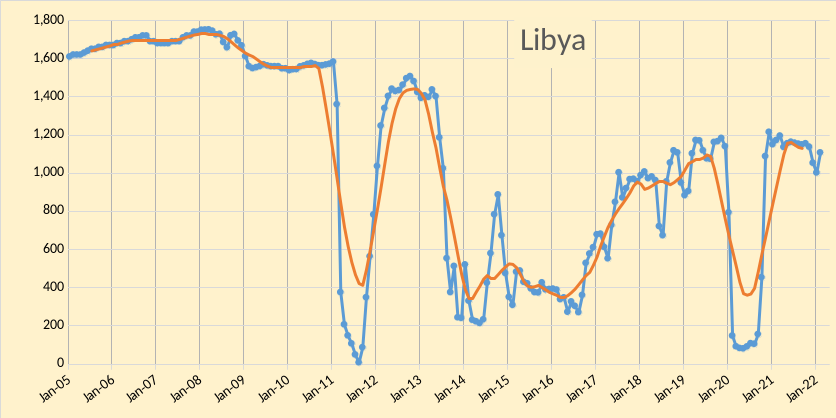

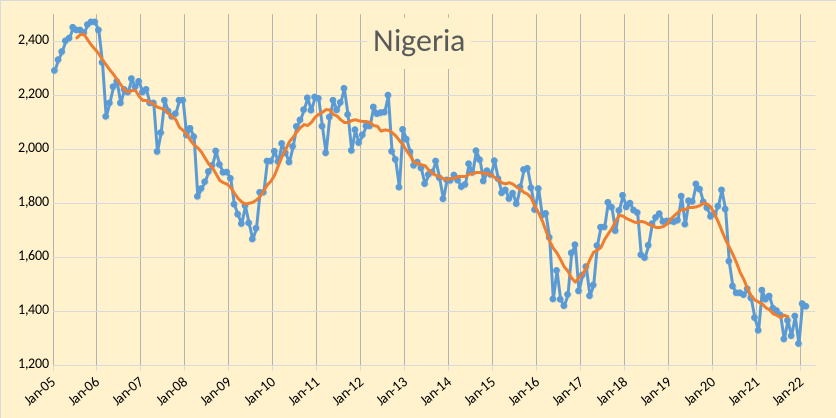

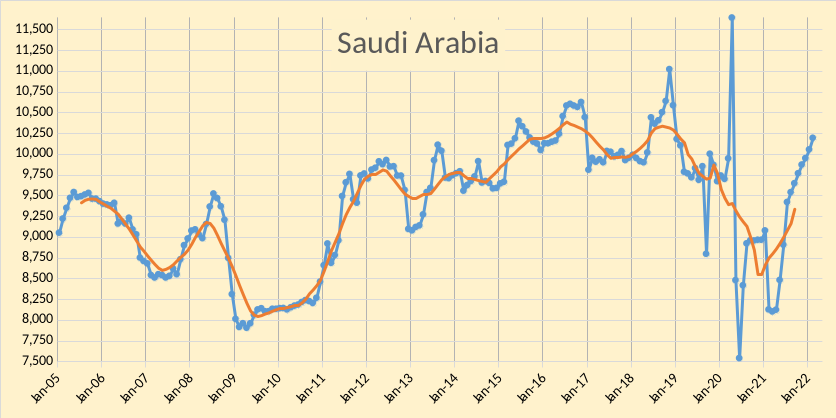

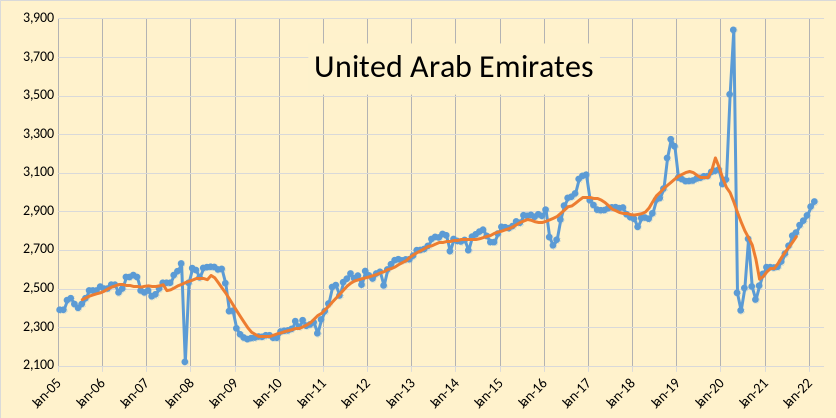

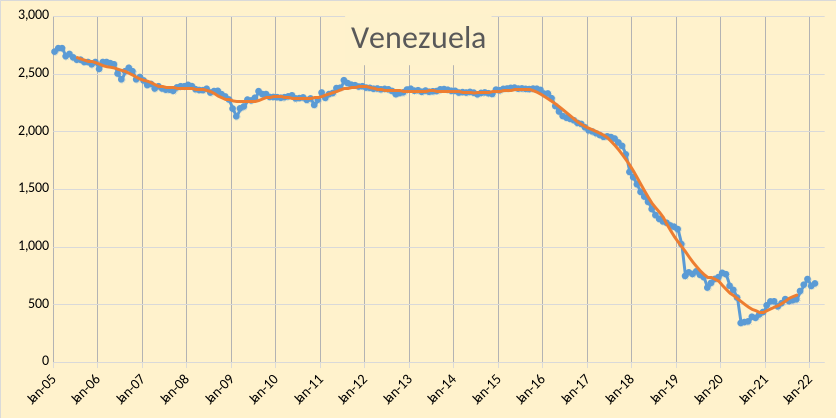

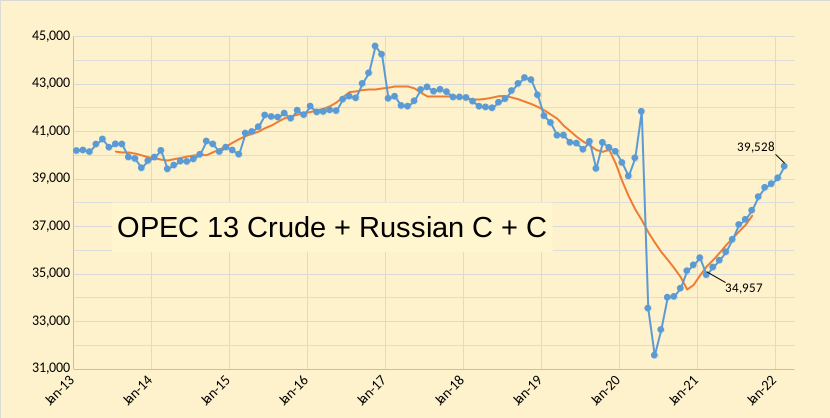

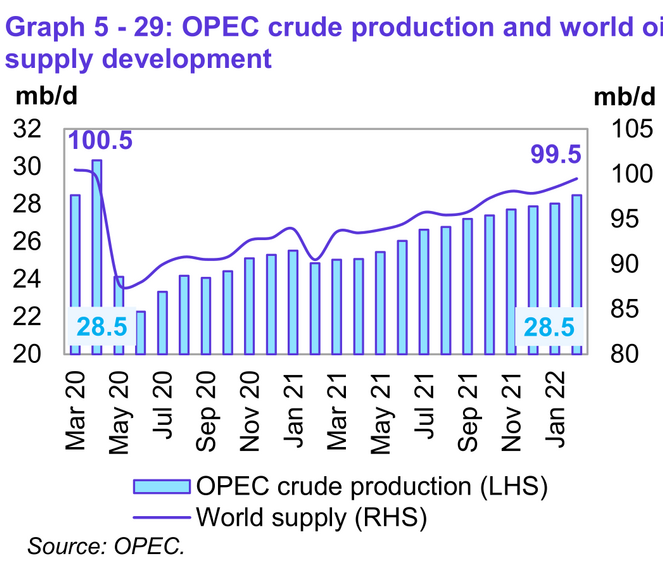

The OPEC Monthly Oil Market Report (MOMR) for March 2022 was published this week. The last month reported in each of the charts that follow is February 2022 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In most of the charts that follow the blue line is monthly output and the red line is the centered twelve month average (CTMA) output.

OPEC output increased by 440 kb/d according to secondary souces in February. January 2022 output was revised higher by 52 kb/d from what was reported last month and December 2021 output was revised lower by 35 kb/d compared to the February 2022 MOMR. Most of the increase in OPEC output was from Saudi Arabia(141 kb/d) followed by Libya (105 kb/d), Iran (44 kb/d), Iraq (36 kb/d), and Kuwait (32 kb/d). Six OPEC members saw increases of less than 27 kb/d (total of 101 kb/d for that group of 6 nations). Only two OPEC nations had lower output in February with a total decrease of 19 kb/d.

In the chart below OPEC 13 crude and Russian C+C are shown, I expect that OPEC 13 crude plus Russian C + C will likely top out at about 40500 kb/d, if sanctions are not removed from Iran and Venezuela, potential future increase for OPEC 13 and Russia is about 1000 kb/d without Iranian sanctions relief. If Russia falters due to ongoing sanctions and cannot increase output from the February 2022 level, potential OPEC capacity is reduced to about 700 kb/d.

World liquids output was about 1000 kb/d below the March 2020 level in February 2022.

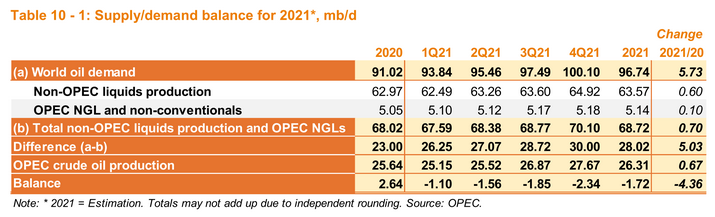

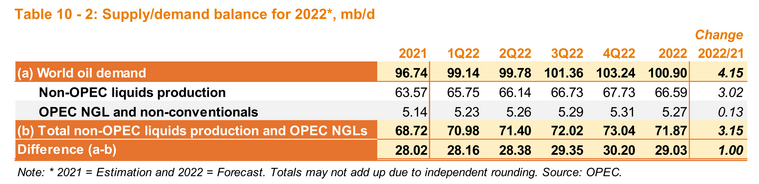

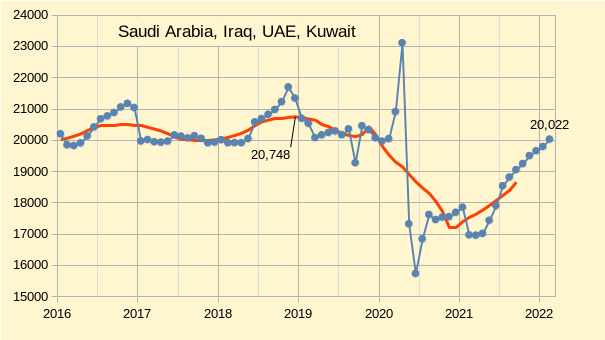

In figures 5, 6, and 7 we can see a potential future problem for oil supply if the OPEC estimates for World demand and non-OPEC output are correct. All OPEC spare capacity is essentially in the 4 nations shown in Figure 7 above, with the difference between the recent 12 month average peak and February 2022 output being only 726 kb/d. If we add this to February 2022 OPEC 13 output we get potential OPEC output of only 29199 kb/d, where we assume no further decline in other OPEC output (not likely based on recent history). We can see in figure 6 that the call on OPEC in the third and fourth quarters of 2022 will exceed the capacity of OPEC, and note that the call on OPEC is likely to be higher than in figure 6 due to lower output from Russia than OPEC has forecast (in the range of 300 to 500 kb/d less than OPEC currently expects). It is doubtful that Venezuela will be able to boost output significantly and there is strong Republican opposition to rejoining the JCPOA suggesting that a deal with Iran may not be possible (at minimum it will make negotiations difficult). My expectation is that oil prices will remain in the $100 to $150/b range, likely well into 2024, due to the turmoil caused by the Russian invasion of Ukraine. It is possible that a severe recession might keep oil demand and oil prices in check, the outlook is highly uncertain.

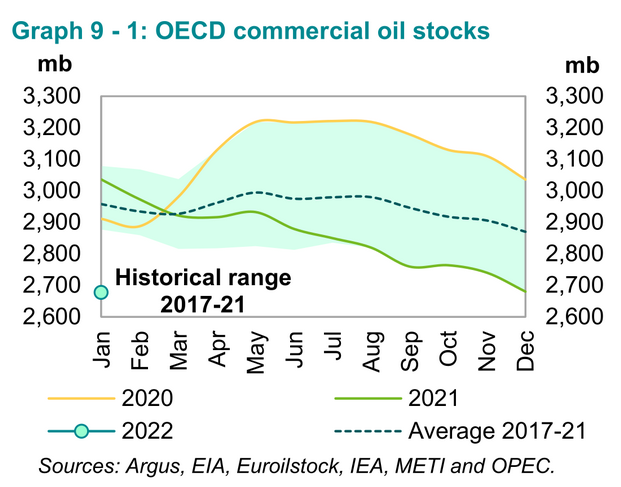

OECD commercial stocks are well below the 5 year average as seen in figure 8 above, this also suggests higher oil prices in the future.

There are a number of worst case scenarios by Rystad and Barclays suggesting oil prices might rise as high as $200/bo, if oil stops flowing from Russia to Europe due to the current Russian aggression in Ukraine as in this piece from March 8.

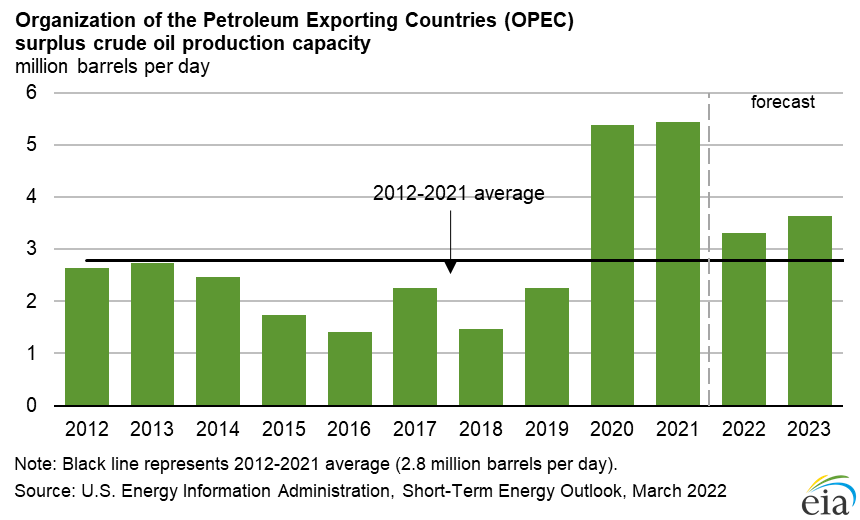

Note that many analysts seem to believe the spare capacity numbers reflected in the chart below from the EIA STEO.

The actual OPEC surplus production capacity without any removal of sanctions on Iran are likely to be about 25% or less of the 2022 level estimated by the EIA (730 kb/d in reality vs 3200 kb/d as in the chart above). I imagine if main stream analysts realized this their oil price predictions might be even higher.

Thank you for the report Dennis.

3 questions:

1) UAE, Kuwait and Saudi Arabia seem to have very similar datapoint trajectories. It is even noticeable in figure 7. Any reasons for this, or possibly a coincidence?

2) Do you expect the Russian war to extend to 2024 ? Why? Seems highly unlikely to me.

3) Do you acknowledge now, your friend Mr Powell was wrong about inflation being transitory and that stagflation is a possible scenario now? Or are you still in denial about this scenario becoming a real possibility ?

Iron Mike,

Figure 7 is the sum of all 4 nations, the reason some of the moves in output are similar is because they are at times bound by quotas that move in sync and at times when there are not quotas they ramp up output just befor quotas are imposed to increase their benchmark in advance of the quota agreement.

I expect oil prices will remain high at least until 2024, storage may be reduced to very low levels and it will take some time for Russia to recover oil output after sanctions are removed. There may also be some ill will towards Russia that remains after hostilities are concluded so that Russia may not find a market for its oil or natural gas.

So that was poorly worded as the 2024 refers mostly to oil price levels being high rather than the length of the War in Ukraine. As things stand now the war might drag on longer than expected. It may be a stalemate where neither side will back down.

I agree the US Fed was wrong on inflation being temporary, but I doubt we will see stagflation, most of the inflation is a supply chain issue due to the pandemic and in time this will ease.

Stagflation was what was seen in 1978 to 1982 in the US where we saw both high inflation and slow economic growth. Real GDP Growth from 2020Q4 to 2021Q4 was about 5.5%, hardly a stagnant economy.

In short I do not expect stagflation and the Fed may be able to reduce the economic growth rate and reduce inflation, a soft landing might be difficult to pull off given the highly uncertaim geopolitical environment.

Iron Mike,

I edited the post to make my comment about Oil prices being high until 2024 more clear, thanks for the question about that as it was very poorly written by me.

Forgot my core inflation chart for US from data at link below

https://beta.bls.gov/dataViewer/view/timeseries/CUSR0000SA0L1E

Dennis,

Do you not see a problem with this chart: CPI vs interest rates

Iron Mike,

No.

It concerns me. 1970-80s inflation was curbed by having interest rates above the CPI rate (for the majority of the period). Do you see the decoupling of interest rates and CPI after 2008, especially currently CPI is heading to 8% while interest rates are at 0.5%. Do you not see a problem with this ? How on earth are you suppose to curb 8% inflation with 0.5% interest rates?

Something has changed in the past 10 or so years. The same rules no longer apply. Probable culprit is QE maybe. Or maybe i am just delusional and debt isnt an issue in all this.

No, Iron Mike your concerns are legitimate . MMT works until doesn’t . We are approaching the “Minsky Moment ” . It is going to get rough , very rough .

No IM you are right – Fed balance sheet is a huge issue. The only question remaining is what will they do once bear market bounce ends and oil, fertilizer and therefore food stays inflated. Can’t hike that out of existence easily.

Iron Mike,

Strong unions and high inflation expectations lead to wage push inflation. Unions are no longer much of a force in the US and inflation has been relatively low for most of the past 40 years, so things are indeed very different now than in 1979.

No need for concern about inflation in the US, the Fed will raise rates, the economy will have slower growth and inflation will subside.

Twocats,

Fertilizer is mostly a product of natural gas, this is not in short supply, Russian gas can be replaced in time.

Dennis,

You believe the fed can increase the fed fund rate to ~ 7%, at the moment its at 0.5%.

You don’t think that will cause an asset market crash (real estate and stockmarket) ? Interesting if you don’t, because if interest rates rose by that amount, it will make 2008 look like firecracker from my perspective. Since the debt market will blow up with rates that high.

Let me add, I am very much open to being wrong here.

Iron Mike,

Fed does not need to raise rates to 7 % to get inflation under control.

https://www.market-ticker.org/akcs-www?post=245432

3) Very simply, the interest rate of short term federal bonds needs to be higher than the inflation rate.

To halt the inflation (not transitory) you have to raise interest rates and pull liquidity out of the system.

That is not good when you are in 30 TRILLION dollars of debt which is effectively variable rate, as it needs to be rolled over and over and over again to the current interest rate.

If you think this is a good financial situation, you are nutz

Oh…and Medicare / Medicaid is on pace for 2 trillion this year…..OOOOOPS!

Hole in head,

None of it was withdrawal from inventory.

Dennis , ok . I will take you at face value but I still wait for interjection from Seppo and Pollux . Time for me to hit the ” Sleep ” button .

Saudi Inventory

Hi Seppo,

Saudi Arabia produces around 3600 million barrels per year, your chart has a change of 150 million barrels over 4 years in Saudi stock levels out of 14400 million barrels produced over those 4 years, about 1% of total output. The way the accounting is done the change in crude stocks is production minus consumption (input to refineries plus any direct burning of crude) minus net exports of crude. So we would need to look at all this data to know what is happening. My guess is the production numbers are fairly accurate (those from secondary sources after revisions).

Peak avocado,

No the short term interest rate need not be higher than inflation to affect the economy. The rate of inflation has been low for years, most people’s long term expectation is that inflation will return to 2.5% per year or less. Raising rates will increase borrowing costs and reduce the demand for loans and this will slow economic growth. This is intro macroeconomics, not all that difficult. The international angle makes it a bit more challenging, but it is likely that other central banks will also raise rates or their currency will weaken which will tend to increase their inflation rate (due to rising cost of imports) and due toi increased dmand for their lower priced goods as exports (due to lower currency value of the domestic currency).

As the Fed hikes rates

Buckle Up!

Medicare is growing 9% per year.

Buckle Up!

WHOOPS… EIA Drilling Productivity Report January 2022 Bakken Oil Production… FUBAR

The Folks running the show at the EIA’s Drilling Productivity Report, must have given over the job to their young children… with a bunch of crayons.

According to the DEC 2021 Drilling Productivity Report, the Bakken should have added 8,000 bd of production from Dec -21 to Jan-22. Unfortunately, ShaleProfile and the North Dakota DMR (where shaleprofile get’s its data), reported a 58,308 bd decline or 5% drop for Jan-2022

Thus, ND Bakken production fell from 1,145,000 bd in Dec-21 to 1,086,692 bd in Jan-22. Bakken oil production fell 5% while Natgas fell 7%.

IRONIC… the March EIA Drilling Productivity Report shows Bakken oil production at 1,172,000 bd for March and 1,188,000 bd for April.

Maybe the ENERGY TOOTH FAIRY might provide some support to the Bakken to get production growing again?

steve

Perhaps you could give us your predictions Steve for March and April and we can see how close you get.

Predicting the future is a very low odds endeavor by nature with about a 0% success rate.

Good luck.

D COYNE,

Here is my prediction for Bakken Mar-Apr production… FLAT OR LOWER. 🙂

steve

Steve,

Note that shale profile supply projections for Williston are:

Jan 2022-1056 kb/d

Feb 2022-1157 kb/d

Mar 2022-1164 kb/d

Apr 2022- 1159 kb/d

See

https://shaleprofile.com/us-tight-oil-gas-projection/

Note also that the DPR includes conventional and unconventional oil where the supply projection at shaleprofile includes only unconventional output. To make them comparable about 25 kb/d needs to be subtracted from the DPR estimate.

So the DPR etimates that are comparable to the shale profile estimates above would be

Jan 22-1129.33 kb/d

Feb 22-1139.82 kb/d

Mar 22-1147.31 kb/d

Apr 22-1163.41 kb/d

These estimates are not that different (and note that the Jan shaleprofile estimate may reflect actual data reported, the DPR came out before that data was available.

My prediction from Feb 27, 2022 is:

Jan 22-1043 kb/d

Feb 22-1044 kb/d

Mar 22-1044 kb/d

Apr 22-1044 kb/d

This includes only North Dakota Bakken/Three Forks output,

I agree with your flat to down prediction, though I often underestimate.

According to NDIC. Bakken/Three Forks output was 1047 kb/d in Jan 2022, so my guess was surprisingly good, I mention this because it is unusual that I guess correctly (or nearly correctly).

See

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

I’m not going to make estimates because they would be guesses on my part.

However, it appears only 17 wells were added in January. Normally the average is 50-60 wells per month, which makes sense with 29 rigs.

Assume winter weather was a factor.

Still, doubtful the ND Bakken grows much. Likely not going to top previous peak, and I think most agree with that, even bullish forecasts.

It’s all on the Permian as far as oil production growth, as has been stated many, many times.

The EFS and Bakken are very likely post-peak, while the remaining shale basins besides the Permian are either too small, or too gassy.

Shallow sand,

Good assessment, there might be enough growth in other basins to offset the decline in the Bakken and Eagle Ford and even grow tight oil a bit above today’s level, with $75/bo oil prices (2021$). Below I guess at US minus Permian basin tight oil output assuming a maximum oil price of $75/bo (2021$) from May 2022 to July 2035 with prices falling after that date.

Shallow-Dennis,

Part of the issue I found is that the ND DMR is showing 346 fewer wells producing in JAN 2022 vs DEC 2021. This seems to be a larger factor than the 18 Bakken wells completed in Jan 2022… mostly by Grayson Mills, Hess & Exxon (13 wells).

Will be interesting to see what the adjustment will be in FEB 2022.

Regardless… Bakken Water Production vs Oil is now 162% vs 115% back in 2016.

Thus, the Bakken is producing 1.6 barrels of water for each barrel of oil JAN-2022 versus 1.1 barrels of water for each barrel of oil JAN-2016.

steve

Steve.

Good point.

It seems like a lot of Bakken wells are listed with 0 or SI.

I have pointed this out regarding Parshall Field.

I suspect multiple factors at play. One being lack of work over rig employees. Another being wells with poor economics. There are likely other reasons wells remain shut in.

Dennis.

No doubt some smaller shale basins could add some oil, but as you state, not enough to move the needle.

Permian has to do the heavy lifting if we are going to see 1 million +/- BOPD yoy USA growth. I don’t think we will see much of that. Getting much above 13 million will be tough IMO. Just educated guesses.

Shallow sand,

I agree most of any future tight oil increase in the US will be from the Permian basin, that is why I focus on the Permian basin. In the past I have been surprised by how resiliant tight oil production has been, for ND Bakken Three Forks I expect 7.5 Gb of a mean TRR of about 11 Gb (68%). For Permian basin 68% of mean TRR is about 51 Gb. High oil prices might result in higher URR than 51 Gb (say average oil price of $100/bo from 2022 to 2030 in 2021$). Of course lower oil prices would give different results, but $75/bo(2021$) or more would easily allow 51 Gb URR for Permian basin in my opinion.

Dennis , Enno is good not only good but very good . So was Andy Hall till he was burnt . The war in Ukraine cannot be discounted, when a country that is 15/20 % of the ELM model is under pressure . Understand the quality and quantity differential ( you are intelligent ) . If all we have is WCS or all we have is LTO can the system of IC survive ? We are in trouble . The first rule ” If you are in a hole , stop digging further ” .

Hole in head,

It is not all we have, we can import what we need, Russia only exports about 12% of total World exports and no doubt this will just move around so that China and India take more of the Russian exports and other nations will pick up barrels from elsewhere. There will be some difficulties while adjusting and no doubt China and India will get discounts on their oil for their trouble. This will also reduce income for Russian producers and we may see a lack of investment and reduced Russian output. Higher oil prices due to supply shortfalls may led to faster development of existing oil resources in the Middle east, Canada, Brazil, Norway, China, US, and Guyana which may offset some of the fall in Russian output.

Enno would be the first to mention that he makes no attempt to guess at future well productivity or future rig count. He assumes rig count remains constant and well productivity remains constant in the future, a highly simplistic scenario.

Reality is that well productivity will decrease while rig count will increase so his approach may end up getting things about right, difficult to know as the future is not known.

Some of the LTO can be utilized and some can be exported, there are plenty of places that have refineries well suited to LTO. The US refineries are well set up for WCS, we just need the pipelines to ship it to the Gulf coast.

I agree Enno is beyond good or very good he does exceptional work.

SA production is interesting now. In the past they have only spiked a few months above this level – let’s see if they now can hold it, showing true reserve capacity.

Kuweit, Iraq and UAE should have some reserves left when reaching the old plateau production is the target.

Eulen , how much was it inventory withdrawal ? Seppo and Pollux because you are keeping an eye on this .

How do you check the oil inventories? This will be an interesting time for SA as they may be exposed as having little-to-no spare capacity. They’ll probably try and frame their lack of supply as them being ‘wanting to keep prices high’ in order to avoid panic I imagine.

Saudi Inventory (repeat as the previous attempt did not show up)

If you still don’t understand then you are beyond assistance and nobody can help . Simplest as can be .

http://www.dailyimpact.net/2022/03/12/the-uber-driver-and-the-fracker/

Hole in head,

At $90/bo at the wellhead, the average 2020 Permian well has an ROI of about 190% after 36 months in real dollars assuming a 2.5% inflation rate, if natural gas sells for $3.50/MCF and NGL sells for $31.50/b. Over the life of the well the ROI is 319%. In terms of DCF, where we have discounted net revenue equal to the initial well cost (10.3 million including P&A at end of life) the nominal annual discount rate would be 112.5%.

This is the reality. Here I assume the average 2020 well is shut in when output reaches 20 bopd at 169 months after first flow. EUR of the well (oil only) is 479 kbo, NG over the life of the well is 2035 MMCF and NGL over the life of the well is 169 kb.

I don’t think Putin will back down under the pressure of sanctions and isolation.

I think he’ll push on until the hard end, one way or another.

He may even do what ever it takes to draw the US into the conflict if he gets frustrated enough.

He may call NATO’s bluff soon.

The only out I see is either capitulation by Ukraine, or Putin taken out from within.

Who knows how much pounding the Ukrainians are willing to absorb.

Anyone else think Putin is willing to back away with some measure of restraint?

Although Biden and other NATO leaders are rightfully trying hard to avoid getting into an all out war with Russia, we are close to a series of tripwires.

Obviously-

“The World Could See A Record-Breaking Oil Supply Shock”

https://oilprice.com/Energy/Energy-General/The-World-Could-See-A-Record-Breaking-Oil-Supply-Shock.html

The generals must be starting to have second thoughts. If they don’t get killed trying to galvanise unwilling troops they’ll be made scapegoats by Putin. They are evidently not much cop at soldiering and I don’t think they get many big opportunities for self enrichment at present so why not try politics after a coup. A pissed off military is not a healthy state for existing rulers to live with.

I wonder if any of them are high up enough to get close.

Putin surely has his scene wrapped up tight.

A company of T-90 tanks could get pretty close.

“Rallying energy commodity prices are expected to drive up primary energy expenditures globally to a record 13 percent of world gross domestic product (GDP), comparable to the energy cost levels in the 1979-80 energy crisis,”

in 2022.

“The expected record 13-percent energy expenditure would be three times the average level of 4 percent between 1900 and 2020, and 1.3 times the 2018 levels”

https://oilprice.com/Latest-Energy-News/World-News/Energy-Spending-To-Hit-Record-13-Of-Global-GDP-In-2022.html

This is obviously spilling over to food and other base commodity prices as well.

Doesn’t leave much air in the room for other expenses like war or new upgraded energy/transport systems.

Its a big tilt towards stagflation. The only industry that high energy pricing helps is the energy producing industry. For all other economic sectors it is like dragging a dead cow uphill.

Hickory,

It’s important to distinguish between costs and prices. If the price of oil goes up, cost doesn’t rise at the same time, so net profits skyrocket. So, income and wealth are being transferred from oil consumers/importers to producers/exporters. New England sends money to Texas, Germany sends money to Russia, etc.

The US is in an unusual situation, because it has very low net energy imports. As a whole, the US has little impact, but there are shifts between entities.

These transfers will cause difficult imbalances, but that’s different from a reduced level of resources for other functions. IOW, high FF expenditures don’t necessarily mean limited resources for military, renewables, etc.

More reality!

https://twitter.com/Labamba123456/status/1504880235732516866?t=pK7HGVBMvhpGBvnHPRRyZw&s=19

Thanks Lightsout . Some time you have to use a hammer to put some sense into people .

If The Russian-Ukraine War Escalates… There Will Be Many More Losers Than Winners

I hesitated in writing this comment, but said… what the hell. I noticed these days that people are highly polarized in one aspect or another. Whether that is politics, religion, or now this war. Americans today literally HATE each other for their political views. However, this is nothing new as a brief look back in history and we find plenty of examples of Holy & Civil Wars as far as the eye can see.

I don’t spend much time watching the MSM news because it’s no longer news like it was during the Walter Cronkite period. I refrain because I do want to become one of the HATERS as I see many in my extended family. However, the major reason has to do with the failure to warn the public about our coming Energy Cliff or Energy Scarcity.

Unfortunately, it seems as if the Western Press is motivated in escalating this war to include NATO and even more forces. If that becomes a reality… the WEST IS REALLY SCREWED. I DO NOT CARE TO GET INTO A DEBATE over this because I am against the war… REGARDLESS.

However, if we look at this chart below, any Western Politician who thinks Europe can “BAN-WEAN-OFF” Russian Natural Gas, then they have to be one of the most STUPID INDIVIDUALS in the world. Why? Because 47% of Net Natgas Surpluses come from Russia & the CIS countries.

So, again… if the Powers That Be, WHOMEVER they are, want to escalate this War even Further, The ALLIES DO NOT HAVE THE SAME ENERGY RESOURCES as the United States did during WW2 by supplying 70% of the World’s Oil.

Lastly, if the EU and Germany really want to put pressure on Putin and stop importing Energy, especially Natgas… all they have to do is totally DESTROY THEIR ECONOMY to do it.

So for all the HATERS in the world that feel good at night believing they are on the RIGHT SIDE of whatever the hell that SIDE is… the real facts are in the chart below.

GOD HATH A SENSE OF HUMOR….

steve

IOW: The Psychopath has the keys to the car and the rest are bound in the trunk.

I think this is what them calls a preedickament.

Mike B , a correction ” Psychopath ” should read ” Psychopaths'” . They are in Washington and Brussels .

Hole in head,

Clearly the only honest account of events comes from Russian State TV. Your name is proving to be apt.

Dennis , RT and Sputnik have been banned in the West in case you are not aware . The first amendment is now in control of the ” fact checkers ” . Sad day .

Dennis , ” Your name is proving to be apt ” . Yes , you are correct . The Zen master is in agreement .

Thirty spokes share the wheel’s hub;

It is the center hole that makes it useful.

Shape clay into a vessel;

It is the space within that makes it useful.

Cut doors and windows for a room;

It is the holes which make it useful.

Therefore profit comes from what is there;

Usefulness from what is not there.

What would you call a doughnut without the hole ?

This is in jest . Nothing serious . Take a break and be well .

I disagree with your assertion that western leaders seek to escalate the Russian invasion of Ukraine.

Only Russia can escalate or de-escalate its invasion.

Uniformly, they want Russia to roll back within its borders and leave all of the neighboring countries sovereignty intact.

Its a reasonable expectation.

[note that no bold capitals were used in this comment- I am not trying to sell a product]

The other point about energy is an undeniable quandary.

Putin would have been smarter to have begun his invasion at the beginning of winter for maximum affect.

Well… He has the s550 missiles now… s

Heh, my local utility informed me today that gas prices are increasing by 30%. That should focus minds. It certainly does mine. I’m buying a heat pump.

The little stretch of row houses where I live has about 20 families. There are now six electric cars and seven solar roofs here. The rate of change is remarkable.

Sounds like you’re in a very bougie area. I only see this in very well to do places. Everyone else suffers. The “can’t afford £1.70/litre petrol? So buy a £30k car” rallying cry of some is a little tone deaf. Know what most people over here with 50% increases in heating and power are doing? Cutting back on discretionary spending. Or eating.

And yes, I asked them if they tried not being poor. Didn’t go down well.

If you are poor in Germany you always have recourse to public transportation.

We have been cutting down on eating though. My wife tracks our expenses, and we pay €7 a day each for food. And we use a lot of fancy ingredients like expensive fish and exotic spices. We could probably get down to €4 without really “doing without”. Of course a big part of that is not eating out, thanks to the pandemic.

The “heating or eating” types tend to be those on atrocious zero hour contracts or already on benefits. I imagine a lot of business relying on eating out has been decimated by COVID, but also now with inputs going up even with a full restaurant, they may be barely scraping by on paying off any debts accrued in the last two years. That and people not being in cities or commuting and needing convenience foods too.

I’d say we have public transport here too, but… we’ll, it got wiped out in some areas due to sheer costs and limited use outside major urban areas. A bus service that was quite popular near me took just under an hour to go round a load of local villages from one major town to another. Since last year, that service now takes three hours with multiple connections and barely does half the stops somehow. Also runs half as often, naturally.

And I won’t even get into the 30p added to petrol and diesel in the last month. One friend commutes 90 minutes and may as well just never come into work soon.

Alim, I spend £2.14 per day on food and groceries (€2.57, $2.83) with one or two meals out per week. So €4 per day is very possible. Lidl helps!

Don’t forget to budget to buy a new heat pump in 10 to 15 years. In our condo development (South Carolina) built in 2007, every heat pump has been replaced. We are talking about 124 condos.

https://finance.yahoo.com/news/1-putin-says-russia-start-132501739.html

March 23 (Reuters) – Russia will seek payment in roubles for gas sales from “unfriendly” countries, President Vladimir Putin said on Wednesday, sending European gas prices soaring on concerns the move would exacerbate the region’s energy crunch.

HICK,

As for your comment in regards to Putin starting the war at the beginning of the winter, I believe China’s XI told him to wait until after the Winter Olympics. You know… all the money that was invested for the Winter Games & PR would have been in vain.

steve

yes, I’ve wondered if that may have been a factor,

but a huge mistake on his behalf if it was.

Steve , 100 % on the dot . The Ukie / Russia war is a trailer . Russia is just an excuse . China is the target . The problem for Washington is that both Moscow and Beijing know this . They have joined forces and undercut Washington .

The Xi/ Biden talks . Biden asked for help . This is how perfectly ridiculous this attempt is: Can you help me fight your friend so that I can concentrate on fighting you later?

Steve, it sounds like you and your little buddy are eager to join the fascism parade.

Moscow or Minsk are looking for eager comrades.

ORGFARM,

Thanks for your comment. I couldn’t have said it any better.

Interestingly how individuals label someone who provides an Objective or Pragmatic view.

steve

Haha 引蛇出洞 as the Chinese say, lure the snake out if its hole [so you can decapitate it].

Putin’s overreach has done the luring for us.

ORGFARM,

I also found this Tweet quite Balanced… don’t you?

LOL,

steve

Steve , Gore VIdal called USA ” United States of Amnesia ” ,because basically their lack of understanding history . A bright mind and a critical thinker .

Over half of the USA reads at less than a 6th Grade level.

It other words, they are illiterate,

Loved this one!

Your argument is events that happened nearly a century ago? Did you know Germany had fascists back then too? I know. I was shocked as Scholz was that NATO had literal Nazis in it.

Are you going to mention the Azov brigade next as some slam dunk own, or are you saving that nugget?

Well, I’ll be danged.

If that’s the case, I guess those Ukrainians deserve to die, right?

Shit talking people who are being bombed at this moment is despicable.

Orgfarm , I agree with you . I attended a pro Ukie rally in my town just for the heck of it .

I talked with the people waving flags and shouting slogans . I asked them some questions which were (1) Where is the Sea of Azov (2) name the countries that share a border with Ukraine (3) Do you know of the Minsk Accord . Answer ; Nil , nadda , nulla , shunya . They were there because of the free sausages and beer offered by the local brewery , basically a PR ballgame and virtue signalling . I am fed up with this . A local restaurant removed Russian salad from it’s menu and another changed Chicken Kiev to Chicken Kyiv . How did that change the recipe or flavor , I wonder . I am now cracking eggs ( heads) everyday to bring people back to senses . As is said ” Humans go toxic as a herd , but they have to be detoxified one at a time ” . Remember WMD in Iraq , Russiagate , Covid , vaccines . When will they learn ? Never .

Orgfarm , it is getting crazier by the day .

https://nypost.com/2022/03/19/space-conference-axes-name-of-first-man-in-space-because-he-was-russian/

POB history without the name of Ron Patterson ?

Orgfarm,

So you are claiming the Ukrainians have shelled lots of civilian areas in the Donbas matching the destruction of the Russians in Ukraine?

Could you provide some support for your assertions? From source besides Russian state media (not particularly reliable).

So you assert that all independent media throughout the World have conspired to lie?

This seems a bit far fetched.

Actually, the Maidan was created by a company of oligarchs in response to the fact that the President of Ukraine (in 2014) Yanukovych began to rob his fellow oligarchs using his power. The unemployed were hired for the Maidan.

There, on the Maidan, they paid money, fed, bio-toilets were brought, all this was financed by offended Ukrainian oligarchs and supported by Western politicians. The fascists of Ukraine also arrived on the Maidan and this movement taught support and developed.

In response to the subsequent overthrow of the government, the east of Ukraine populated mainly by Russians rose up. Due to the ban on the use of the Russian language. Then the uprisings in the east, except for Donbass and Lugansk, were suppressed and hundreds of thousands of people either fled or disappeared in the basements of the Ukrainian Gestapo. Of course, the Western media will not tell about it…

Orgfarm- “You seem to have never opened a book on the history of Ukraine”

Part of my family escaped from that region around 1900.

There is no trace of the larger extended family that didn’t emigrate.

And yeh, I would be categorized as a big reader.

I don’t just read books only approved by the state, or the Fox news list.

I am not a Tucker Carlson acolyte.

Nor do I condone any of the fascist supremacy history of any country- rather I condemn it all.

Bigger point is that I have a big bias against authoritarianism and tyranny, whatever the flavor.

And I offer no apology for for that attitude.

There is no excuse for for Russian invasion, whatsoever.

Nobody is threatening their post-Soviet territorial integrity.

The only thing that was under threat for them was the dream of a return to a greater Russian empire.

Their neighbors don’t share that dream, except perhaps the Belarus dictatorship.

I would refer you to Wikipedia on Donbas conflict.

You guys seem to believe Russian propaganda.

When a region launches a separatist movement leading to a civil war, there are bound to be civilian casulties, the separatist movement was lead by former Russian FSB and supported by Russia. Essentially this was a stealth invasion of Ukraine by Russia, now Russia is simply making its ambitions more clear. The civilian casulties are all the responsibility of the Russians and their separatist allies.

Can you pont me to the indiscrimanant bombing of civilain targets by the Ukrainians in this conflict? Nothing like the scale of the Russian targeting of civilians.

https://en.wikipedia.org/wiki/War_in_Donbas

Dennis here is Wikipedia on Mr Zelensky .

“Zelenskyy has gained worldwide recognition as the wartime leader of Ukraine during the Russian invasion; historian Andrew Roberts compared him to Winston Churchill.[172][173] Harvard Political Review said that Zelenskyy “has harnessed the power of social media to become history’s first truly online wartime leader, bypassing traditional gatekeepers as he uses the internet to reach out to the people.”[174] He has been described as a national hero or a “global hero” by many commentators, including publications such as The Hill, Deutsche Welle, Der Spiegel and USA Today.[172][175][176][177] BBC News and The Guardian have reported that his response to the invasion has received praise even from previous critics.[171][17 ”

So he is an equivalent of Winston Churchill and a global hero hiding in the basement . What happened to critical analysis ?

https://www.youtube.com/watch?v=BxZMhCtYN2k

At 1940 there has been the Stalin regime. He starved millions of Ukrainians to death a few years before so it’s clear they have been a little pissed at him.

And now Putin held his Sportspallast speech. The tone was accurate the same as the original – several old people here got memories.

>> He [Putin, March 16th?] called for Russians to distinguish true patriots from “scum and traitors”—political opponents and dissidents—and to get rid of the latter like bugs. “I am convinced that such a natural and necessary self-purification of society will only strengthen our country, our solidarity, cohesion and readiness to respond to any challenges.”

Russia specialist Anne Applebaum tweeted: “Putin’s call for a ‘self-purification’ of Russian society can have only one intention: To remind Russians of Stalin and his ‘purges.’ …

<<

~ Heather Cox Richardson, Letters from an American

John , I request that you do some research on Anne Applebaum and her husband . Both hardcore neocons in the class of Victoria Nuland , Blinkin , Helms , Rumsfeld etc . I will make it simpler for you .

“Applebaum is a member of the Council on Foreign Relations.[71] She is on the board of the National Endowment for Democracy and Renew Democracy Initiative.[72][73] She was a member of the Institute for War and Peace Reporting’s International Board of Directors.[74] She was a Senior Adjunct Fellow at the Center for European Policy Analysis (CEPA) where she co-led a major initiative aimed at countering Russian disinformation in Central and Eastern Europe (CEE).[75] She was on the editorial board for The American Interest[76] and the Journal of Democracy.[77]

You are mistaken in the Russian Federation, they are not persecuted for political views, unlike Ukraine. For example, several popular authors have disappeared from YouTube, suspicion of sympathy for Russia, about those who lived in Ukraine, we will never hear or find out, well, one from Latvia has only been detained so far.

Putin wanted to reconquer Ukraine and Moldova before the 100th anniversary of the founding of the Soviet Union, which comes in December 2022. His “mission accomplished” rally was planned for last Friday, but didn’t pan out. Now the Chinese, who were promised a two-week “special operation”, and have Biden pushing them hard, are edging away from the whole mess.

Let’s find that “Mission Accomplished” banner (maybe Dubya still has it around) and post it to the Kremlin. We can all pretend he managed this task and have cake and champagne and then go out merry ways. One to reality, the other cloud cuckoo land.

I believe the operation will be delayed. The military do not understand its meaning and ask for the mobilization of those liable for military service. 200,000 military men will not be able to control such a large territory.

I don’t understand either. The fact is that a new administration is not introduced in the occupied territory, but remains basically (with rare exceptions)

Ukrainian.

The people understand that the former government can return and punish for

cooperation with Russia.

Perhaps Putin does not want to control the entire territory? but he just wants to destroy the military infrastructure and knock out military equipment.

I’m confused…

George , totally disagree . Understand Putin was a spy and head of FSB . He reads Sun Tzu and Karl Von Clausewitz . Putin is no imbecile . Putin knows the value of spies . Sun Tzu said so .

I personally don’t think much of Sun Tzu aka captain obvious. By modern standards, The Art of War is essentially common knowledge. It focuses almost solely on tactical ability to the detriment of long-term social and political objectives that actually underlay the cause of goals of warfare. As well, Sun Tzu doesn’t actually cover the proper way to build, maintain and secure lines of communication and logistics: the true nuts-and-bolts of warfare. MBAs sure like him though lol.

“He will win who knows when to fight and when not to fight.”

“In the midst of chaos, there is also opportunity.”

“The greatest victory is that which requires no battle.”

“The wise warrior avoids the battle.”

Duh! Thanks for coming out Tips.

Clausewitz has a much better grasp on the importance of logistics, supply and proper composition of the army, and provides a more professional approach on the topic.

“There is nothing more common than to find considerations of supply affecting the strategic lines of a campaign and a war.”

– Carl von Clausevitz

Survivalist, yes logistics is important .

Hilarious that this eludes the Russian Army more than their ability to find welcoming Ukrainians.

The confirmed kill ratio between BLUEFOR and REDFOR here is so horribly skewed, one would think Russia just didn’t want to fight at all. And that may indeed be the case with throwing VDV wave after wave into the proverbial meat grinder, using conscripts with barely any food and fuel, and spending all their money on vanity hardware rather than, say, non-shit radios or tyres.

The “corruption is a feature, not a bug” aspect of the Russian military has fucked them. Hard.

Jomini is quite good too if you like that kind of thing. On a related note; “Jomini of the West” is on Twitter and posts good info on Russian military status in Ukraine.

https://mobile.twitter.com/jominiw

[Sunzi] focuses almost solely on tactical ability to the detriment of long-term social and political objective

The acme of military achievement is not to fight a hundred battles and win them all, but rather to win without a fight.

-Sunzi

Alim , correct . Survivalist underestimates SunTzu but that is his personal assessment . For Sun Tzu one spy was better than a battalion .

Intelligence reports, provided by spies and other means, are often contradictory and many of them are wrong.

OPEC’s Production Commitment Improves in February

Attached is a table which compares the February output, according to secondary sources, for the OPEC 10 countries with their required February commitment. The overall monthly deficit is 668 kb/d, 80 kb/d lower/improved than the January deficit of 748 kb/d. The main reason for the improvement is Saudi Arabia’s reduced gap from 123 kb/d in January to 34 kb/d in February.

As can be seen, the biggest February deficiencies were in Angola and Nigeria. Also noted at the bottom for SA is their February output according to the “official communications” which indicates they are essentially on target.

Ovi ” The overall deficit is 668 kb/d, ”’ . Missing the woods for the trees . Adios.

🤣🤣🤣🤣🤣🤣

Dennis

This is the second look at the Saudi Arabia “production/stock change” discussion started in the previous OPEC post. JODI updated their Stock data to January 2022 and there were no revisions.

The first chart shows that stocks went down by 920 kb or 30 kb/d in January.

The second chart looks at three pieces of info. Two are info from the OPEC reports, production according to secondary sources and direct communication.

The red graph shows production according to secondary sources. The production shown is the three-month revised final number shown in the OPEC report. January is only two months revised production.

The green graph is production according to direct communication. Note that Direct communication output is always higher.

The blue graph assumes the secondary sources production numbers are missing some stock data since those numbers have been lower than direct communications for the last twelve months.

For January 2021, secondary sources estimate production to be 10,053 kb/d. (Note this is two months revised production from the March OPEC report). Since stocks decreased by 920 kb or 30 kb/d in January, that would imply a lower actual production of 10,023 kb/d, which by fluke is the same as December. Interestingly this is the production level shown during 2017 in your Saudi Arabia chart in the post above.

The data collected/graphed is shown in a table below. Only six months of data is used in the chart because an expanded Y scale was required to show the small differences.

Chart 2

Chart 3.

Ovi,

The stock change is production minus consumption minus net exports of crude, in order to evaluate stock change we need all of this information. The production is production, and note the difference between direct communication and secondary sources is not large once all revisions from secondary sources are in ( see Jan 2021 to Oct 2021 with only a 288 kb/d difference over 10 months or about 29 kb/d per month.) Yes direct communication seems to be higher (perhaps an overestimate, though a minor one). The secondary plus stock change tells us nothing without consumption and net export data.

Dennis

There is an implied assumption in my estimate that internal consumption is not changing much and that the stock numbers are also true.

I still think there is something strange that Direct communication output is always higher. The other thing I am looking at is SA output has to increase by 105 kb/d each month. This will begin to stress SA production capability. For April SA has to produce 10,436 kb/d. Looking at the SA chart, the only time they were able to do this for a six month period was in Q2-16.

To add more complexity to the situation, SA just announced their production has been affected by Houthi rebels.

“Saudi Arabia says it “won’t bear any responsibility for any shortage in oil supplies to global markets” after attacks by Yemen’s Iran-backed Houthi rebels have affected the kingdom’s production.”

Let’s keep checking the stocks to see if they can provide a clue as to what is happening with SA production.

Ovi,

The stock numbers can be accurate, but the explantion for changing levels likely comes from changes in either consumption or net exports. The production is production, stocks are a separate matter.

Based on BP data (which includes condensate and NGL), Saudia stocks should have decreased by about 111 million barrels is 2019 and by 159 million in 2020. Consumption and exports are not constant.

Note that the secondary source information may not be accurate or Saudi information might not be accurate, sometimes there are simple explanations for this, such as the secondary sources assume a different ratio of crude to condensate output than the Saudis, the difference is fairly small once the revisions are in. Also not that you use Saudi stock numbers so for consistency you should use either the Sausi direct communication or Jodi numbers for Saudi output in my opinion.

Dennis

I use both use both sources in an attempt to find a discrepancy. Secondary sources do not have separate stock info. There is only one source for stock info, JODI. They are also the direct communication source for Saudi production.

According to the JODI stock chart above, SA Crude stocks dropped by 45,000 kb in 2019.

Ovi,

That can easily be explained by changing levels of exports or consumption. So stocks decreased by 123 kb/d in 2019 or about 1.3% of production levels (assuming 9500 kb/d for year). Does Jodi give consumption and export data? That would give us a clearer picture.

I would like to hear the opinions, or guesses, of some of the regulars here, as to how long it might take for the oil business to settle down and stabilize once the shooting in Ukraine is over.

I’m not asking about prices, as such, but more so about how long it might be until the price of oil is more or less stable again, from one month to the next, or one year to the next.

( I do expect the price of oil to stay pretty high for quite some time to come and maybe indefinitely, considering depletion and a growing world population. )

Thanks in advance.

I would guess Putin has better information about the condition of Saudi Arabia, etc than anyone on this site.

And I think this site is great!

Putin is not dumb and he is surrounded by oil men and spies that have infiltrated ARAMCO and these organisations.

He is moving cause its what he has wanted all his life and he is 70. So he had to move at first opportunity.

He wants to experience the feeling of controlling his enemies thru energy.

He wants his legacy to be the guy that rebuilt Soviet Union, and destroyed the West.

He will be the leader who destroyed Russia.

I am not predicting success by Putin. I think he has miscalculated Ukrainian resolve.

I think Putin is a horrifying human.

That being said.

1) Does anyone doubt a Saudia Arabian Oil Elite could have been caught in a RUSSIAN HONEY TRAP?

2) Does anyone doubt the Mike Shellman is wrong about the Shale disaster in America? And Putin’s oilmen haven’t figured out the obvious.

If 1 & 2 is true….Putin has put world in a dangerous position if he can keep his own people from killing him.

thanks!

Peak we will leave the putin stuff behind and will go to your bullet points .

1. Honey trap does not work in KSA . Islam allows you to have 4 wives anyway , so why be coy about it . All one has to do is get a Maulvi (priest) and say ” Nikah Qabool ” and you are married . I had a Kuwaiti friend who said that after the noon prayers on Friday all men went directly to the airport to catch flights for Bahrain and Dubai . Further very few women work in KSA and are depending on their spouse . The ‘ other woman” is tolerated . Doesn’t become a scam like in the West .

2. Yes , I am sure that Mr Putin knows about peak oil . He also knows ” peak everything ” . Maybe he visits POB ? 🙂

I expect the coming recession will bring prices down considerably. And will likely outweigh what is happening as a result of Ukraine.

Banks are going to stop lending. With the yield curve inverted. And I’m going to take a guess and say FED continues hiking rate in the face of an inverted yield curve. Because prices won’t react to rate hikes but the yield curve will react to rate hikes. And credit markets blow up within a year or less. Maybe much less. Bringing the price of everything down.

I don’t see stable prices being in the cards. Wild swings in both directions is what I think will happen.

OFM,

Oil prices have not been stable on a regular basis since 1974, they might become stable again in 2074, when oil is no longer of much importance.

Hi Mac.

I don’t think the price will stabilize.

I see the Saudis as the linchpin here. They have had 10 years of low prices and volatility not working in their favour. They are now being asked to use their supposed spare capacity to lower the oil price and/or replace Russian oil. This leads to two potential scenarios:

1) The Saudis can produce 12 million barrels a month when pressed, without cheating and drawing down storage. It is worth showing this limitless supply to push the price on their stock offerings.

2) The Saudis can’t even produce 10 million barrels a day as their fields are peaking, so it is in their interests to keep prices high. I think that volatility works in their favour under this scenario, as volatility works against shale oil financing and production.

I favour scenario #2, and think that the volatility is baked in. My guess is that a graph of the global per-barrel price running from 2022 to 2032 would look like a variation of the 2012 to 2022 oil price graph- but turned upside down. Start at $100, climbing to $170, drop back to $100 and then up to $200 by 2030.

The oil will keep on flowing .

https://oilprice.com/Energy/Energy-General/Oilfield-Service-Majors-Arent-Pulling-Out-Of-Russia.html

If you like your service provider , you can keep your service provider . 🙂

Hint:

In the 3 weeks since invasion started, Europe has paid Russia €16 billion for oil & Gas imports

Hightrekker,

Source and what did it look like the 3 weeks befor the invasion. The number is likely to decrease, India and China may become dependent on Russian energy instead, good luck to them.

“In 2021, the EU imported $108 billion (€99bn) worth of energy from Russia”

High trekker,

Where is the quote from?

https://www.weforum.org/agenda/2022/03/eu-energy-russia-oil-gas-import/

“Europe is heavily dependent on Russia for its oil and gas. In 2021, two-fifths of the gas Europeans burned came from Russia. And over a quarter of the EU’s imported crude oil comes from Russia.”

Does anyone know how Russia is selling oil outside the swift system?

Europe isn’t blocking it, as it would be suicide.

China, India, Mexico, etc have not gone along with it also.

Russia is holding off restricting supply (natural gas in Europe is key) .

Having 10% of world production in Russia makes the situation uncomfortable for us.

Russia imports very little for a major player.

Sean,

Even when U.S. and Western countries put SWIFT sanctions on Russia during the 2014 Crimea annexation, they still were in the CHIPS system. Thus, the CHIPS system is the true Dollar Settlement system, not SWIFT. Payments can still be cleared through CHIPS via Banks, by-passing SWIFT.

SWIFT, headquartered out of Belgium is becoming less relevant as China, Russia, and other countries use the Chinese CIPS payments system.

Furthermore, as the United States continues to print money by issuing Treasuries to fund its deficits ($2.8 trillion in 2021), more countries will transition away from the DOLLAR & SWIFT. But, this will take some time as the United States still carries the BIGGEST MILITARY STICK and has the World’s Reserve Printing Press.

The coming ENERGY CLIFF should speed up this process.

GOD HATH A SENSE OF HUMOR…

steve

There is more dollar denominated debt that resides outside the US than inside the US. FED isn’t even central to the dollar. Nor does it print the world reserve currency. FED prints bank reserves that are denominated in dollars which aren’t even money since those reserves never leave the FED.

Eurodollar system of banks print real dollars that are actually the world reserves currency. World has no way to leave Eurodollar system without defaulting on a truly enormous amount of dollar debt. Not in other countries best interest to be cut off of dollar funding. As their local currency would implode against the dollar.

Yield curve is starting to invert. FED will eventually change course and cut rates to fix this problem. Eventually we get negative nominal interest rates in the US.

I see can see now everyone saying the dollar is crashing. No it’s more like everyone is borrowing all the dollars they can at negative yield and investing in anything with positive yield.

Thanks Steve, very helpful.👍

Amazing fetes of mental gymnastics performed before your eyes,

allowing people to justify the invasion of Ukraine by a dictatorship bent on territorial expansion, with millions driven from their homes.

He is proud of the manipulators, getting their job done.

Good practice for the next western election cycles.

Democracy in the rear view mirror will look like paradise lost.

Fox News clean up on aisle POB

I’m not here to read this. Stay strong Hickory. Total respect for you.

Orgfarm, I loved your Collapse essay, but you are totally off base on Ukraine. And I mean way, way off base. However, I don’t think you are a troll, just totally misinformed about Putin, Russia, and Ukraine.

I think the best descriptions on what lead to Ukraine are to be found by professors John Mearsheimer, Uchicago, and Noam Chomski, MIT.

These people are hardly apologists for Russia. Both have well-reasoned, publicly available histories of scholarship stretching back decades on their predictions of this current crisis.

The mainstream case is propaganda and blame need not be laid on only one party.

https://www.youtube.com/watch?v=ppD_bhWODDc&t=26s

https://www.youtube.com/watch?v=Uctni3030zg

These represent the best alternative views from liberal sources.

Thanks—

Reality is refreshing over ideology

My respect for Dennis and Hickory continues to grow.

Orgfarm …….

You’re sounding more like Rudy Guiliana from one comment to the next.

Hickory, I agree. Mental gymnastics and slurs = trained in propaganda techniques? Easy to imagine this orgfarm guy being paid to write this stuff and maybe even his “collapse” series?

Great article on OPEC’s spare capacity, or rather their lack of spare capacity.

OPEC’s Best Kept Secret Will Soon Be Revealed

Now, with Russia in crisis and an oil shortage looming, Saudi Arabia, the UAE, and other members will need to put their money where their mouth is. If they fail to act now, rumors about a lack of spare production capacity will become increasingly believable. Current analysis already indicates that most OPEC producers are incapable of increasing production. Saudi Arabia and the UAE are believed to have higher capacity, but the current silence from both players is not going to instill confidence in observers.

Hey, I really don’t care what reports you have read, one word can explain what is happening right now in Ukraine. That word is “Genocide”. There is no excuse for genocide, ever. I have seen the films of the bombings of schools, hospitals, apartment buildings, and columns of people. Putin and the Russian army are targeting people, civilians, not only military targets. They just want to kill innocent people, women, children, and babies.

Deliberately targeting innocent civilians is a war crime. Putin is a war criminal. If you think anything different then you are woefully misinformed, not just about this war but about moral human behavior in general.

And if you believe those pictures and films are just false propaganda, then you are a lot worse off than I orginally believed.

It’s worth recalling the babies supposedly being killed in Kuwait. Not defending Russia but there seems to have been instances of misreporting. I hope the Russian’s are less murderous than presented.

So just tell me how someone can be less murderous than the videos showing the bodies of men, women, and children killed in the Russian bombings of schools, hospitals, and civilian apartment buildings. Perhaps you think people should not believe their lying eyes.

In 2014, fascists from all over Ukraine came to Odessa and defeated the uprising of the Russians in the house of more than 140 corpses. Documentary footage: https://www.youtube.com/watch?v=tAUDG5NVETc

I couldn’t help but notice that you totally ignored Putin’s genocide program. I don’t blame you. If I were a Putin cheerleader, I would ignore it too.

Ron Patterson.You are mistaken. The Russian army does not strike at civilian targets, and even more so at people. On the contrary, the Ukrainian Army does not release people into humanitarian corridors. You should not believe your media ..

Here is a video documentary about the Russian uprising in Mariupol against the Ukrainian government in 2014 :https://www.youtube.com/watch?v=Mm6VRyXheGw

“I don’t care what reports you have read…” – ron patterson

A disappointing response. Clearly we disagree on this issue.

But I loved your “Free Will” essay.

Orgfarm you have your head up your ass. Period.

Every time you touch your keyboard, you come out sounding more and more like a trumptard…… defending the indefensible.

You have a zero chance of getting an apology from me….. but you sure as hell owe readership of this forum a blanket apology, and you owe Dennis and Hickory in particular.

Org farm,

You seem to not really read or think carefully. I have looked through the information on casulties in eastern Ukraine at the UN. There have been over 3000 civilian casulaties reported, but note that Eastern Ukraine is a war zone with shelling occurring from Russian backed separatists and from Ukrainian government forces. We don’t know, or cannot tell who has been targeting civilians, but note that reports come from both sides and it is far from clear which side has done this more.

I would note that the Russians have a history of this behavior in Grozny and Aleppo, and the Russian government lies constantly.

In short the situation is far from clear. Lots of reports of human rights violations and torture, no doubt it is happening on both sides. The Wikipedia article suggests the separtist movement in the Donbas was instigated by the Russians who have supported the movement. Pretty much all civilian deaths in eastern Ukraine are ultimately Russia’s responsibility in my view.

Org farm,

Yes I read news in English, perhaps you have read every report in every language all over the World. There are many different news organizations in the US and UK, I also have a close friend from Germany and it seems the reports from there are much the same as english news reports, perhaps Seppo and Schinzy can report from Finnsh and French perspectives if the Russian point of view seems accurate.

Another consideration is the Donbas separatisy movement has been going on for 7 years and the Russian invasion of Ukraine has been gong on for under 4 weeks, so the rate of civilian deaths is about 225 per week in Russia’s invasion (and these numbers are likely under reported). Compare to Donbas conflict with 3400 civilians dead in 364 weeks or about 9.3 per week on average (roughly 25 times lower). And note that the civilian deaths are the result of both Russian back separatists and Ukrainian government forces, the UN does not detail which is which.

https://www.ohchr.org/en/press-releases/2018/09/human-rights-council-discusses-human-rights-situation-ukraine-and-democratic

For UN report see link below

https://ukraine.un.org/sites/default/files/2021-10/Conflict-related%20civilian%20casualties%20as%20of%2030%20September%202021%20%28rev%208%20Oct%202021%29%20EN.pdf

nice chart on page 3, most deaths from 2014 including civilian jet shot down by separatists (298 deaths) not including airliner about two thirds of civilian deaths occurred in 2014.

See also section 6 of UN report

from link below

https://www.ohchr.org/sites/default/files/Documents/Countries/UA/9thOHCHRreportUkraine.pdf

From executive summary section 1 (first quote) and section 6 (second quote).

The report covers the period from 1 December 2014 to 15 February 2015.

snip

Heavy civilian tolls of dead and wounded have resulted from indiscriminate shelling of residential areas in both Government-controlled areas, such as in Avdiivka, Debaltseve, Popasna, Shchastia and Stanychno Luhanske, as well as cities controlled by the armed groups, including Donetsk, Luhansk and Horlivka.

Orgfarm , wondering why Hih is not saying anything ? I came across a saying that told me to avoid the issue . “There’s none so blind as those who will not see ”

Proverb . You will never be able to make some understand or accept something if they are too stubborn or unwilling to learn or notice.

You can present facts and try to reason with him all you want, but his mind is made up. There’s none so blind as those who will not see.

Parents like them simply won’t accept that their children might need to be disciplined, and there’s none so blind as those who won’t see.

I know your head and heart are in the right place but —- ??? . Helpless . May your day be well and good .

Orgfarm,

That information is from

https://en.wikipedia.org/wiki/Malaysia_Airlines_Flight_17

The responsibility for investigation was delegated to the Dutch Safety Board (DSB) and the Dutch-led joint investigation team (JIT), who concluded that the airliner was downed by a Buk surface-to-air missile launched from pro-Russian separatist-controlled territory in Ukraine.[6][7] According to the JIT, the Buk that was used originated from the 53rd Anti-Aircraft Missile Brigade of the Russian Federation[8][9] and had been transported from Russia on the day of the crash, fired from a field in a rebel-controlled area and the launch system returned to Russia afterwards.[1][2][8] The findings by the DSB and JIT are consistent with the earlier claims by American and German intelligence sources[10][11] and claims by the Ukrainian government.[12] On the basis of the JIT’s conclusions, the governments of the Netherlands and Australia held Russia responsible for the deployment of the Buk installation and were pursuing legal routes as of May 2018.[13][14] The Russian government denied involvement in the shooting down of the airplane,[9][15][16] and its account of how the aircraft was shot down has varied over time.[17] Coverage in Russian media has also differed from that in other countries.

Org farm,

The people killed in the Donbas region were killed by both Ukrainian and separatist shelling on both sides . The responsibility for the conflict lies mostly with the Russians in my opinion, I would not use the term genocide in this case.

Org Farm,

Someone else claimed something about propaganda and slur.

I don’t really care, I am not going to parse every word written by everyone on this blog.

Go elsewhere if you are looking for a very tightly controlled conversation.

When Alan Watts was criticized for not being strict enough in his zazen practice, he said, “Like a cat, when I’m tired I sit, and when I’m done, I walk away.”

I actually had Watts as a “teacher” once a week for an entire semester.

One never knew what would emerge.

That is so far in the past, it would not be remotely possible now.

Org Farm,

Don’t take things out of context. The civilian casualties in Donbas are not very clear, though by pulling up UN reports it is pretty clear that most of the casulties occurred in early 2015 due to indiscriminant shelling of civilian areas by both sides. There is no excuse for this in either case.

I will refer back to the russian history of repeatedly using this tactic, potentially the Ukrainians were responding in kind. Also note the Russians started the war, and in my view shoulder the majority of the responsibility for all civilian deaths in the conflict.

You seem to see it differently, or that is the impression of your comments.

By taking one sentence from a long post, you take the statement out of context.

Things not being clear referred to who caused the civilian casulties, the Ukrainian forces or the russian backed separatists.

So yes indeed, you took my words out of context.

It is clear to me that all of the civilian casulties are the fault of the Russians because they caused the conflict in the first place and really don’t seem to care who gets killed, or that is how it looks from here.

Org farm,

I change my thinking all the time.

People can reach different conclusions when looking at a set of facts. You seem to believe or at least insinuate that the Russians were justified in instigating the Donbas conflict. If that is you view, I would strongly disagree. It seems to be a power grab by Russia, pure and simple.

I agree skepticism is good and and I am skeptical of the conclusions you seem to have reached.

Org Farm,

I do not agree on a single sentence pulled from a longer post not being without context.

You seem to think every person reads every post carefully and then remembers every detail.

A small snippet pulled from a larger post can create any story you wish. That is what taking something out of context means. You play that game very well, I find it rather tiresome.

Vladimir Putin instructed to convert payments for gas supplies to unfriendly countries into rubles

March 23/ 16:33

Moscow. Russia will refuse to accept payment for natural gas supplies in currencies that have compromised themselves, including dollars and euros, and will switch to payments in rubles. This was stated by Russian President Vladimir Putin.

“I have decided to implement a set of measures to transfer payments – let’s start with this – for our natural gas supplied to the so-called unfriendly countries, for Russian rubles as soon as possible,” he said at a meeting with the government.

That is, Putin explained, it is planned to abandon all compromised currencies in such calculations.

At the same time, the head of state stressed that Russia would continue to supply natural gas “in accordance with the volumes and prices, according to the pricing principles fixed in the contracts concluded earlier.” “Unlike some colleagues, we value our business reputation as a reliable partner and supplier,” TASS quoted Putin as saying.

He again clarified that the changes will affect only the payment currency, it will be changed to the Russian ruble. The President instructed the Cabinet of Ministers to issue a corresponding directive to Gazprom on amending existing contracts.

“At the same time, all foreign consumers should be given the opportunity to make the necessary transactions, and it is necessary to create for them an understandable, transparent procedure for making payments, including the purchase of Russian rubles in our domestic foreign exchange market. I ask the Bank of Russia, together with the government, to determine the procedure for making such transactions within a week “, Putin ordered.

According to the president, the West has shown everyone that obligations in euros and dollars may not be fulfilled.

Alexander , I fail to understand the decision . yes , it will increase the demand for roubles in the international market and make the rouble stronger . However the buyer of the roubles has to sell a currency (USD, Euro, GBP etc) to the Russian central bank to get hold of the roubles , What changed ? The Russian central bank would still be stuck with the Euro’s and USD because of the sanctions . Nothing much I would say . Any explanations ?

Good evening! Hole in Head I think that this was done so that the ruble was a more popular currency. Some countries will have to keep some kind of reserve in rubles. And even after the event on 24.02.2022

the ruble has become highly volatile, which means it adds a moment of unpredictability and there will be a need to insure risks. + This will be a certain inconvenience. I think that if the conflict subsides, everything can return. This is not certain.

Alexander , this is what Martin Armstrong has to say .

What I would do if I were Putin is to create a two-tier monetary system like South Africa once had with the Financial Rand and Domestic Rand. What I would do to put Biden in Checkmate would be to back ONLY the domestic Ruble with gold to restore confidence among the Russian people, but leave the Ruble float for international transactions – the opposite of what FDR did in 1934.

https://www.armstrongeconomics.com/markets-by-sector/foreign-exchange/usd/putin-puts-bidens-king-in-check/

Hole in Head.I don’t know the government’s plans. There are a lot of incomprehensible things for me. The fact is that very few troops entered Ukraine, about 200,000. These troops cannot control such territory. Local administrations of Ukraine continue to manage cities. And the war continues. It seems Vladimir Putin wants to negotiate , after he destroys the war machine of the Ukrainian fascists. Putin has a high rating in Russia. The pro-Western opposition and communists opposed him. Many IT specialists left the country.

Alexander , this is a borrowed thought ,but a reasonable method of settling the account under new rules . Advantages :-

1. Instead of worthless paper Russia will get hard goods ,real stuff (Volkswagon) .

2. RCB will not have to print roubles . This will control the money supply and inflation . The roubles float in and out of the banking system in Russia and Germany (example ) .

Read ;

Volkwagen sells cars in Russia, they get rubles in their account at a Russian bank, then they sell these rubles to Uniper, who receive them in their account at another Russian bank, Uniper uses the rubles to pay Gazprom Export for the natural gas. Volkswagen transferring rubles to Uniper within the Russian banking system will be paralleled by Uniper transferring euros to Volkswagen with the European banking system.

Checkmate ??

Hole in Head.Yes, of course you are right. This is a natural development of events.

That move by Putin hurt real fast .Only 48 hrs and the buyers are in pain .

https://www.reuters.com/business/energy/german-gas-buyers-raise-alarm-over-russias-rouble-demand-2022-03-24/

Oil prices ‘not our fault’

Saudi Arabia says it’s not responsible for high oil prices as rebel attacks reduce production

In other words, we have no more spare capacity.

Que: “We must level Yemen to the ground or you will not have your oil, If you´re not with us, you´re against us”

Btw, in my view Yemen is much worse than Ukraine in terms of human suffering, and has been going on for about as long, but no-one gives a fxxx…

Another question to Hicks and Ron, have you read 1984?

And also, regarding Germany and Quatari NG, I guess Syria will be a re-emerging hot spot in short order.

Hi Laplander . Tks for bringing up the double standards . Syria as a hotspot ? When Ukraine is over , so will be Syria . RF had simulated trials of it’s Kinzhal and Kaliber hypersonic missiles . Well they have now fired 4 missiles and bingo they hit the bullseye in actual battle . It was the Kinzhal that destroyed the base 20 miles from the Polish border and destroyed the NATO training centre and killed 250 of the ” Soy boys ” who came from overseas to join the battle . Those who survived are now back home . Some people learn the hard way . The next application of Kinzhal and Kaliber will be Syria . Germany has to stand up to Biden or it is going to have an unhappy ending . As to Qatari gas , sorry Bro they are maxed out . The question now is who is willing or can pay the higher price for the LNG ? Europe or Asia ? Germany vs China , Japan, South Korea and India . Take a pick . Let the games begin . 🙂

Hole in head,

Are you familiar with WW2. How did appeasement work in that case? My understanding is that it did not go well, unfortunately humans do not seem to learn from past mistakes.

Yemen may be worse than Ukraine, there are many wars and much suffering. So we should probably ignore the plight of the Ukrainians and focus on Yemen.

https://news.un.org/en/story/2020/12/1078972

Ukraine maybe 13k before Russian invasion of last 4 weeks, so yes less death.

Also

https://www.commondreams.org/news/2022/02/10/civilian-casualties-yemen-nearly-doubled-saudis-backed-ouster-outside-monitor

Appeasement was a policy of one-sided concessions. Meaningful negotiations involve concessions by both parties. Hitler also had a stated goal of global conquest since 1933. Russia has stated straightforward and limited goals in Ukraine which have gone ignored since at least 2006, if not earlier.

“Peace in our time”, HOH?

Yes , it will be tested Ron . In the meanwhile . As Steve signs off ” God hath a sense of humour ” .

The mule party has been a light year out front in helping us transition to renewable energy, while the elephant party has mostly sabotaged the transition any way it could.

I WONDER if that might have anything to do with who owns the fossil fuel industry, sarc.

We used to have two Russians, inside Russia, who posted here regularly. We haven’t heard from them in a while. Wonder why? Of course, that was a rhetorical question, we all know why.

Ron,

Same thing is happening to Russians living in the United States. Maybe we should burn all Russian books next?

While I am totally Against this current Russian-Ukraine War, I think it would be a good idea for Russia to totally cut all ENERGY EXPORTS for 3 months.

This will solve TWO ISSUES: 1) Western Hypocrites will be forced to PUT UP or SHUT UP and not get the energy it is already importing from Russia while beating the War drum, 2) Russian War Bear won’t have the extra funds to continue the war effort.

Both will destroy the European & Russian Economy.

GOD HATH A SENSE OF HUMOR…

steve

When this invasion was planned to push back the NATO influence area, this backfired no matter who wins.

Here in Europe NATO was in a vegetative state before – less and less countries kept their military forces up to date, so the danger for russia was complete ZERO. They could barely defend, and no capacity for any invasion.

Now they are all in a shopping frency, buying new shiny military toys and repairing and upgrading their stuff.

When the Russians had only done the usual stuff – giving their rebels some more weapons, doing some secret service manipulation, some boycotts, bribing some politicans, the NATO slumber would have continued.

Hi Ron. I was sick, rheumatoid arthritis. And yes, I am also against the war ….

Alexander,

Glad you are well.

Try to keep a clear mind of the big picture folks, and recall that this is not some kind of pissing match.

No matter what your views were on Russia and Ukraine in January and before,

Everything changed as of Feb 24th when Russia invaded Ukraine.

Started an optional war, and has displaced roughly 10 million Ukrainians from their homes.

They outright lied about their intentions up to the last minute, and are still lying to their people up this to current moment.

Violated international agreements on sovereignty.

And if you don’t think that is a core massive problem here, then you and I are likely to find ourselves on different sides of a battle line if war comes to our area some day. We just see the world in a massively different way. Sad to say, but so it.

I’ve got no patience for fascism apologists, and so I will attempt to restrain myself from further ‘discussions’ on this topic.

There are some of you whom I do respect (whether we specifically agree on particular issues or not).

Wish it was easier to extend that further, but it is not.

Hickory,