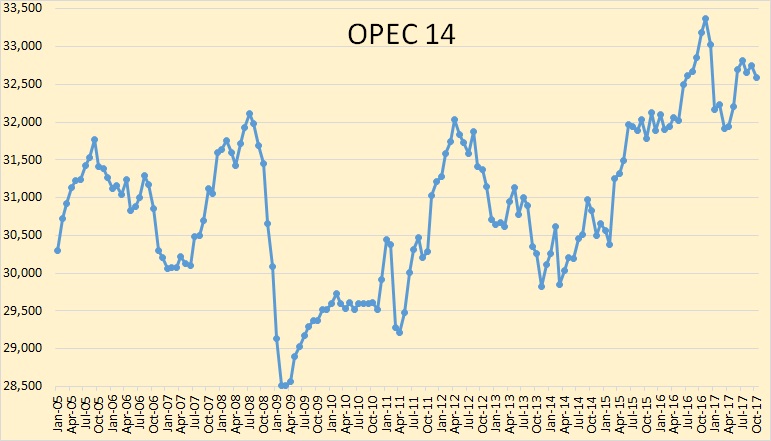

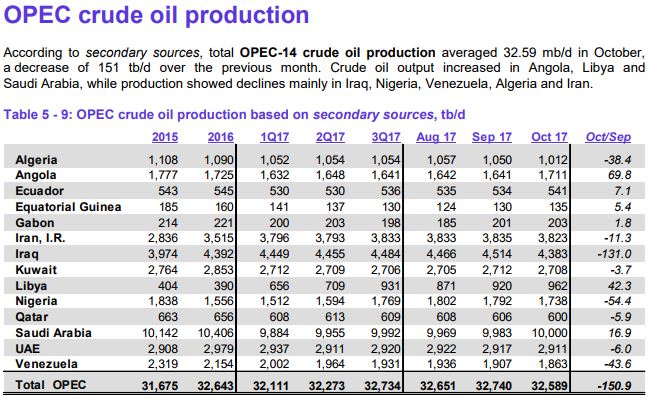

All data below is based on the latest OPEC Monthly Oil Market Report.

All data is through October 2017 and is in thousand barrels per day.

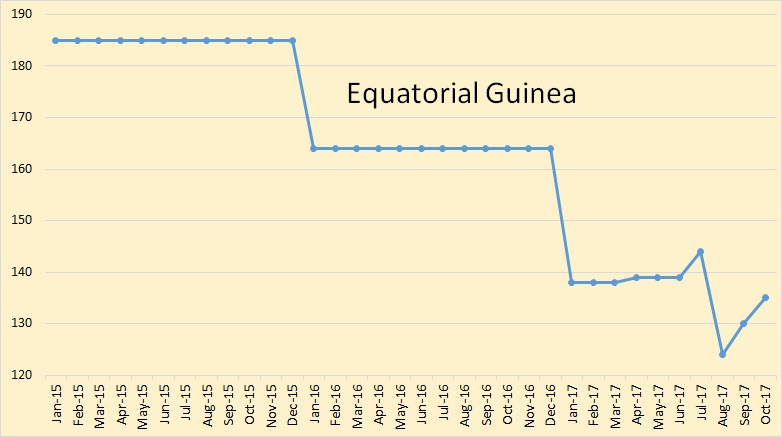

I have now included Equatorial Guneia although I only have data from January 2015 from OPEC’s secondary sources. The January 2015 E. Guneia data was extended back to January 2005. I know this is inaccurate but production from E. Guneia is so small it will make little difference.

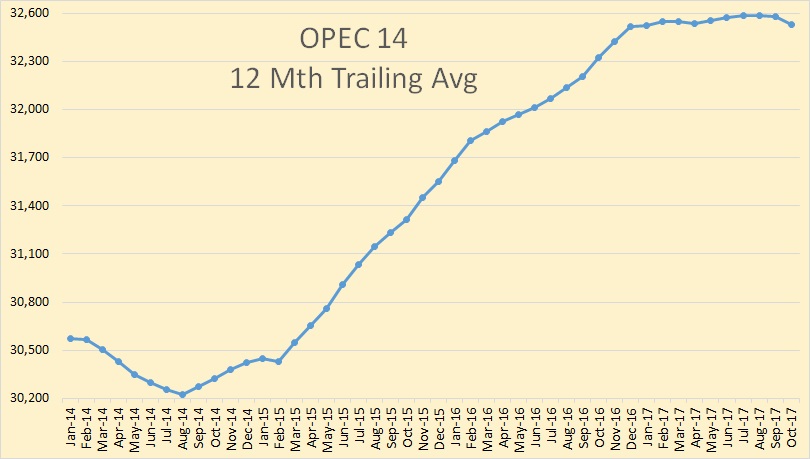

OPEC crude oil production dropped by 151,000 barrels per day in October.

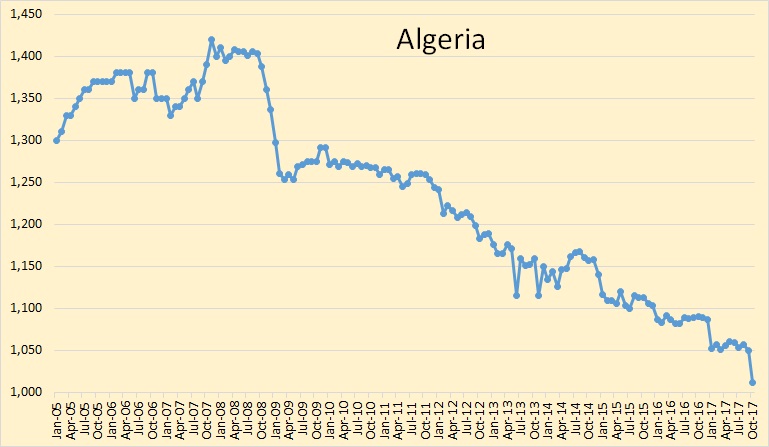

Algeria took a hit in October, down 38,400 bpd.

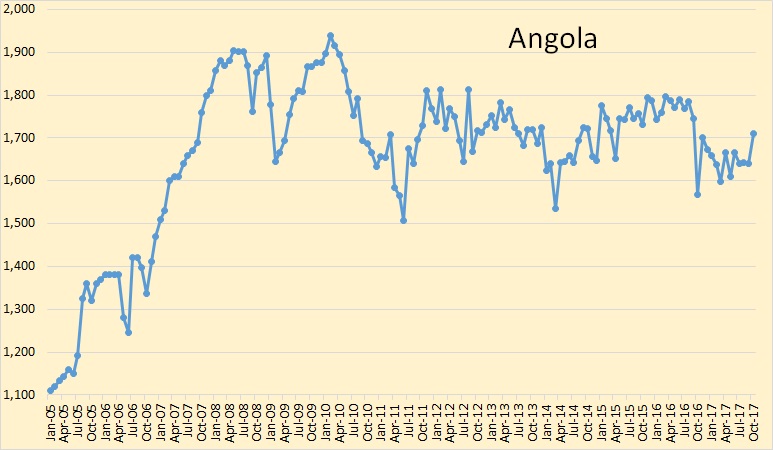

Angola was up almost 70,000 bpd in October.

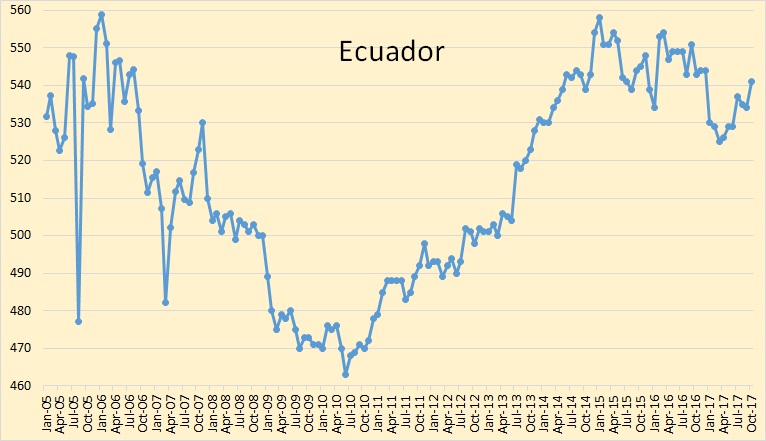

Not much is happening in Ecuador. They were up 7,100 bpd in October.

I do not have historical data for Equatorial Guinea. The OPEC MOMR gives average annual production data for 2015 and 2016 and quarterly data for the first two quarters of 2017. But now we will have monthly data from now on. However, they produce the least of all OPEC countries and their production will make little difference.

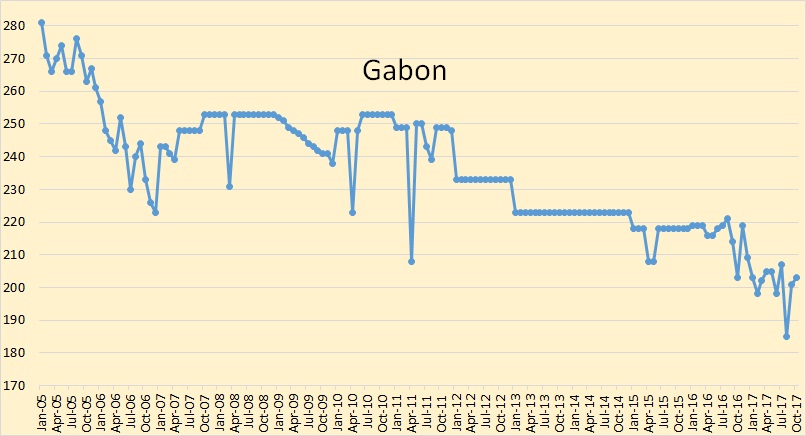

Gabon, another of the also-rans. Any change in their production will have only a small effect.

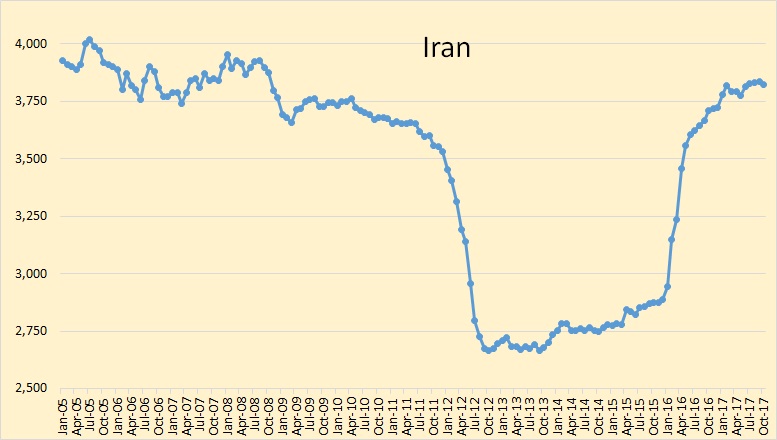

Iran has clearly reached a post-sanctions peak.

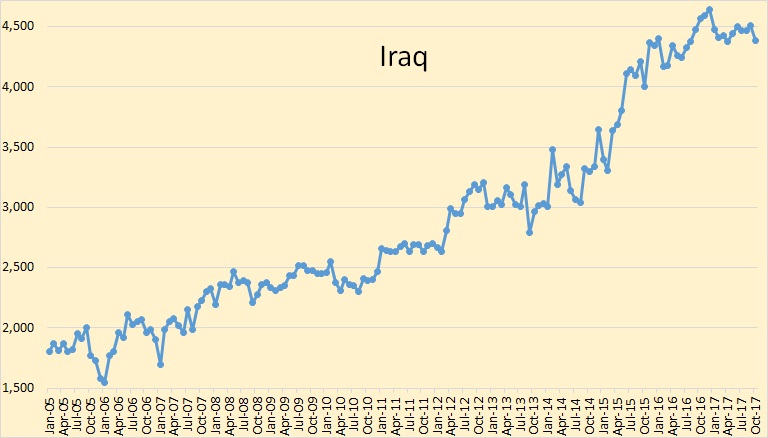

Iraq, OPEC’s second-largest producer, appears to have reached at least a temporary peak.

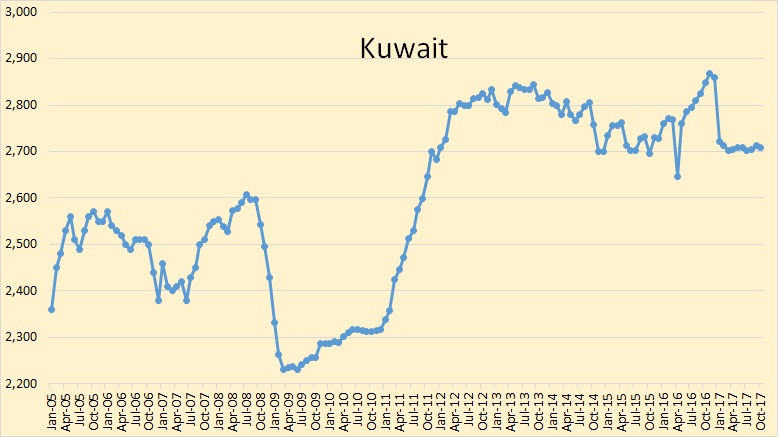

Kuwait’s crude oil production has been holding at just a tad over 2,700,000 bpd for all of 2017.

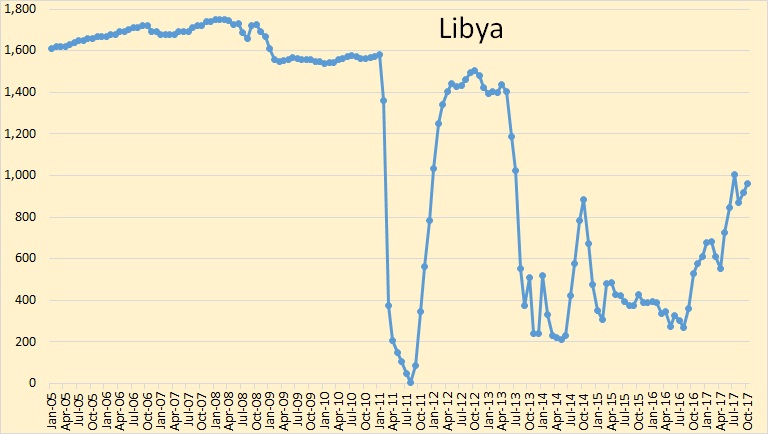

Libya has overcome most of their political problems. They should be producing a bit more than they are currently producing. Perhaps it will take them some time to repair their infrastructure.

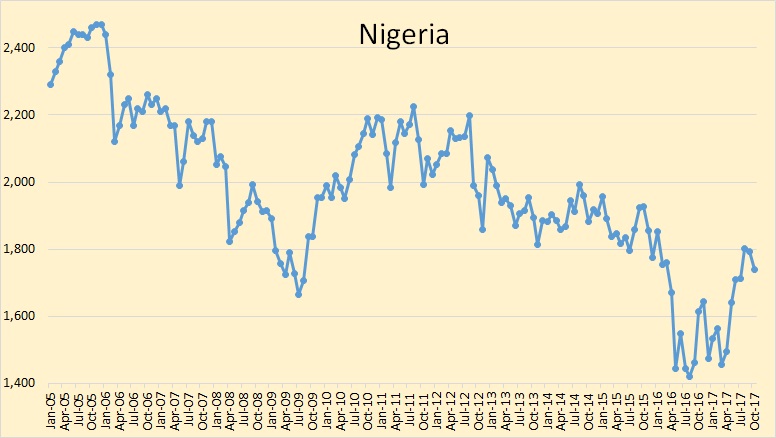

I believe Nigeria will always have serious political problems. They are dramatically overpopulated and will always have rebel factions. Don’t look for any dramatic increase in production from Nigeria.

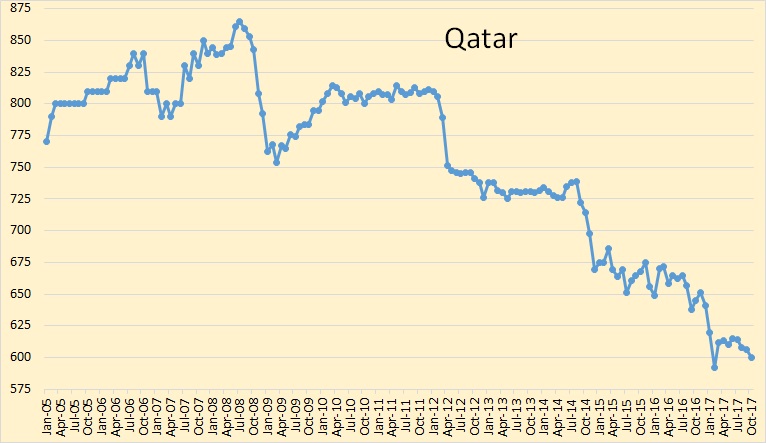

Qatar’s crude oil production peaked almost ten years ago. Their decline will continue.

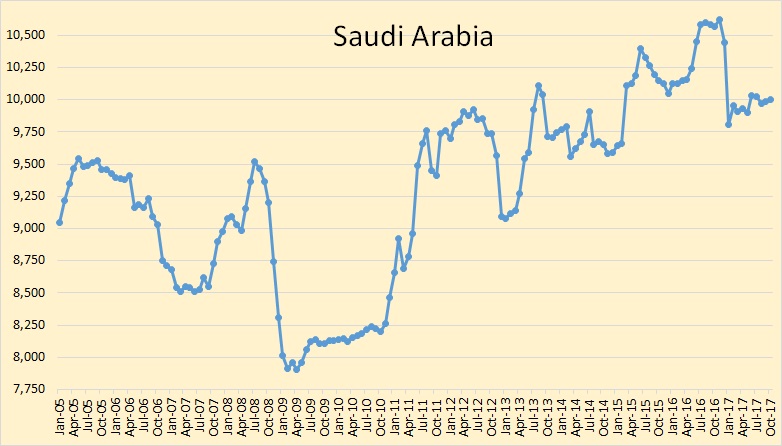

Saudi produced exactly 10,000,000 bpd in October.

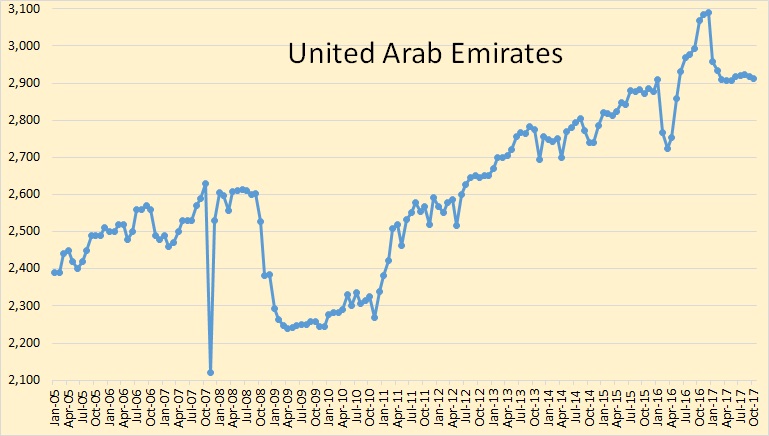

UAE’s crude oil production is holding steady at just over 2,900,000 bpd.

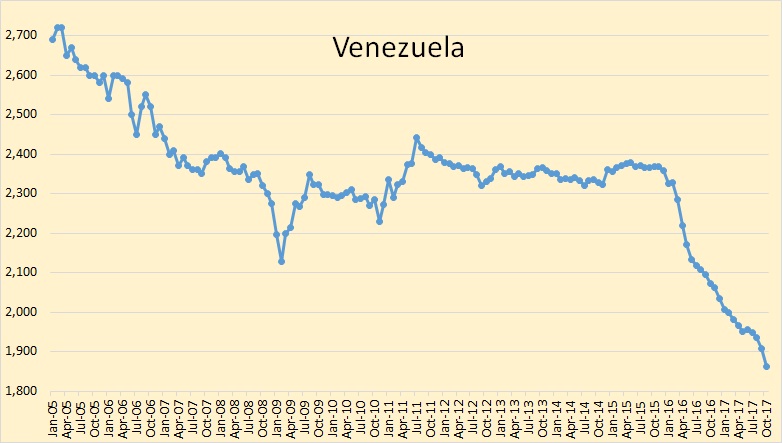

Venezuela’s crude oil production decline has accelerated in the last two months. Venezuela will very likely become a failed state in the next few years, or perhaps months. Their economy will totally collapse. This will hit their oil production even harder.

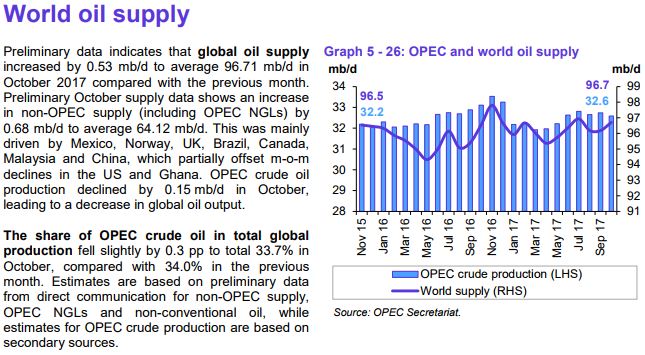

World oil supply has held steady for two years.

OPEC Head Says Oil Cuts ‘Only Viable Option’ to Stabilize Market

The Organization of Petroleum Exporting Countries should decide at its meeting later this month whether or not to extend the cuts,…

Cuts? What cuts?

U.S. SHALE OIL PRODUCTION UPDATE: Financial Carnage Continues To Gut Industry

As the Mainstream media reports about the next phase of the glorious U.S. Shale Oil Revolution, the financial carnage continues to gut the industry deep down inside the entrails of its horizontal laterals. The stench of fracking fluid must be driving shale oil advocates utterly insane as they are no longer able to see the financial wreckage taking place in these companies quarterly reports.

This weekend, one of my readers sent me the following Bloomberg 45 minute TV special titled, The Next Shale Revolution. If you are in need of a good laugh, I highly recommend watching part of the video. At the beginning of the video, it starts off with President Trump stating that the U.S. has become an energy exporter for the first time ever. Trump goes on to say, “that powered by new innovation and technology, we are now on the cusp of a new energy revolution.” While I have to applaud Trump’s efforts for putting out some positive and reassuring news, I wonder who is providing him with terribly inaccurate energy information.

I would kindly like to remind the reader; the United States is still a NET IMPORTER of oil. We still import nearly six million barrels of oil per day, but we export some finished products and a percentage of our shale oil production. Thus, we still import a net of approximately three million barrels per day of oil.

A few minutes into the Bloomberg video, both Pioneer Resources Chairman, Scott Sheffield, and Continental Resources CEO, Harold Hamm, explain how advanced technology will revolutionize the shale oil industry and bring down costs. I find that statement quite hilarious as Continental Resources and Pioneer continue to spend more money drilling for oil and gas then they make from their operations. As I stated in a previous article, Continental Resources long-term debt ballooned from $165 million in 2007 to $6.5 billion currently. So, how did advanced technology lower costs when Continental now has accumulated debt up to its eyeballs?

READ MORE: https://srsroccoreport.com/u-s-shale-oil-production-update-financial-carnage-continues-to-gut-industry/

Unfortunately, it seems as if energy investors are taking the BAIT that the U.S. Shale Oil Industry has turned around. Well, it would be nice if it were true. However, when the market finally crashes from being tremendously over-extended and over-valued, then the oil price will head down south with it. This should strike the fatal blow to the U.S. Shale Oil Industry.

steve

I agree with everything that you say up until the last paragraph.

What if Bloomberg came out with a story that said US shale oil companies are insanely over-valued because at current prices, they will all go bankrupt and US shale production in the next 3 years will decline by 2 million bbbls/day from current levels. [My summarization of your position, more or less.] There would seem to be a huge supply deficit in 3 years since many projections are counting on +2-3 million bbbls/day increase in US shale production in that time-frame.

Why does your scenario lead to the conclusion that “then the oil price will head down south?”

clueless,

As you are probably aware, well… I believe you are, the market and economy are being propped up by a massive amount of money printing, debt, and leverage. So, when the market finally crashes, it will gut employment tremendously. Thus, Fewer workers = less demand for energy.

When the markets crashed in 2008, the oil price went down along with it. This has less to do with SUPPLY & DEMAND, and more to do with deflation.

However, demand will fall as supply falls, but again, it is not the critical determining factor for the price. Unfortunately, the quality of oil has fallen so low, it really isn’t worth bidding it up.

Lastly, if the world didn’t have $270 trillion of debt and a quadrillion in derivatives, then maybe the price of oil could trend higher for years.

steve

Hi Steve,

Looking at US debt (all sectors) to GDP, it has been stable since 2009 (slight decrease of 0.2% per year) after rising at 2.4%/year from 1992-2008.

https://fred.stlouisfed.org/series/ASTDSL

https://fred.stlouisfed.org/series/GDPA

I used data from links above and did Debt/GDP then took natural log to determine growth rates (slope of trend lines) from 1992-2008 and 2009-2016.

Chart below. It is debt to GDP that matters, this has not changed much since 2008.

Dennis,

That doesn’t include the now $13+ trillion in FX and currency swaps that aren’t included in the debt figures. However, they behave like debt. That $13 trillion figure ballooned over the past 4-5 years.

steve

Hi Steve,

There are counterparties to every derivative, when one side loses the other side wins. Perhaps there will be another major Global financial crisis. In the past 100 years there have been two major financial crises (1929 and 2008), financial doomers predicted a major crisis every year from 1930 to 2008, after 78 years they got it right.

https://www.theguardian.com/business/2017/jul/10/how-healthy-global-financial-system-mohamed-el-erian

Good piece on derivative risk (Steve probably has seen this but others may not have been introduced to derivatives beyond “The Big Short”).

https://www.aol.com/2010/06/09/risk-quadrillion-derivatives-market-gdp/

There may be a financial crisis when oil and other fossil fuels peak and decline around 2030, much will depend on the price level of fossil fuels and how quickly the transition to renewables and alternative transport systems occurs.

“After 12 years shale producers still have to borrow to pay for development. After 12 years even a successful pizza parlor has accumulated its required operating capital.”

So, does having a positive cash flow even matter any more?

Energy News – From previous thread, THANKS for the Saudi Export Info!

You have to wonder how much of the world’s 96.7 mbpd ‘crude’ oil output is natural gas liquids?

Hard to get a handle on because non-oil liquids are not reported separately, (from 2014):

“Refiner Phillips 66 (PSX.N) and midstream giant Plains All American (PAA.N) have said condensate is oil with an API gravity of 45 or above. Meanwhile, Marathon Petroleum Corp’s (MPC.N) top executive said in a recent interview he believed condensate should have an API gravity of 60 and above.

Without a universal standard, production data vary wildly. The EIA’s own figures suggest that anywhere from 8 percent to 16 percent of U.S. crude oil production is condensate – a difference of more than half a million barrels a day.”

https://www.reuters.com/article/us-oil-condensate/u-s-oil-industrys-billion-dollar-question-what-is-condensate-idUSKCN0HX0BU20141008

Depletion of oil fields means increase in non-crude liquids with decreased energy content and decreasing percentage of motor fuel product, not just in the US but in other oil regions. If 10% of the 96.7 million barrels is non-oil gas liquids then actual crude oil output isn’t really increasing as OPEC secretariat seems to suggest.

I know this has been mentioned before, I’ve heard it from Art Berman and others w/ energy backgrounds, but the ‘good news’ is constantly repeated.

steve from Virginia,

Dennis was kind enough to send me an excel spreadsheet on Global NGL production. According to his data, the world produced 92.1 mbd of C+C+NGLS in 2016. Of that total, NGL’s accounted for 11.5 mbd. Thus, NGL’s represents 12.5% of the total.

And yes, not only do NGL’s contain approximately 55% of the energy in a typical barrel of oil, but it fetches about 55% of the market price for oil as well. So, the world is producing a lot of crappy liquids, which gives the impression to the BrainDead Layman, that we are producing a record amount of oil…we are not.

We are producing a record amount of LOW-QUALITY CRAPPY PETROLEUM LIQUIDS. I would imagine if we would break it down by separating oil sands, shale and NGL’s… the good quality stuff peaked a while ago.

steve

There are different ways to define “conventional oil”. If we include deepwater offshore and polar oil but exclude “extra heavy” oil (API Gravity < 10 degrees) and tight oil output in our definition of "conventional" Crude plus condensate (C+C), then in 2016 annual output of conventional C+C was at a peak (annual data through the end of 2016) at 73.2 Mb/d. The previous peak in 2005 (72.1 Mb/d) was exceeded in 2015 (72.9 Mb/d). There are other definitions of conventional oil, many (like BP) include NGL, in that case the data by mass is better than volume because it approximates energy content more closely. NGL is useful for heating and petrochemicals, but less so for land transportation.

About that Venezuelan default and all the crap from NYC banker propaganda?

http://www.zerohedge.com/news/2017-11-15/venezuela-signs-32-billion-debt-restructuring-deal-russia

$3.2B

The deal spreads the loan payments out over a decade, with “minimal” payments over the first six years, the Russian Finance Ministry said in a statement. The pact doesn’t cover obligations of state oil company Petroleos de Venezuela SA to its Russian counterpart Rosneft PJSC, however.

“The terms are flexible and very favorable for our country,” Wilmar Castro Soteldo, Venezuela’s economic vice president, told reporters in Moscow after the signing. “We will be able to return to the level of commercial relations with Russia that we had before,” he added, noting that a deal to buy Russian wheat will be signed next week.

Wheat. Oil. NYC will rage. (Particularly the NY Fed)

Then we have this from ye olde ISDA

A finance industry committee convened to discuss whether Venezuela’s state oil company has defaulted on its debts has elected to delay the decision once again, underscoring the uncertainly swirling around the country’s bond payments.

ISDA is made up of bank reps. If anyone among them has big bond holdings, they are NOT going to declare default. S&P can make whatever call they like. They are not the arbiter.

To learn what crap this is, go back and research what ISDA did when Greece could not pay their bond payments. Did they declare default? No. Hell, no. Such a declaration could have become global systemic. So no way in hell they obey their own rules and declare things according to those rules.

It’s all silliness, people. 2008/9 destroyed it all. Pretense holds the system together now.

The propaganda is amazing.

The fear of Ven gaining control of the largest reserves on the planet has the elite a bit shaken.

Venezuela doesn’t have the largest reserves in the planet. Based on what I’m seeing, Venezuela’s reserves are now less than 75 billion barrels. The figure they booked was always bogus, but now it’s more bogus than ever.

We shall see—–

http://geab.eu/en/top-10-countries-with-the-worlds-biggest-oil-reserves/

Venezuela’s oil reserves are bogus. They are estimated using unsound technical and economic methods. The heavy oil recovery factor is overstated, and all reservoirs are poorly managed. As time goes by, and nothing is done to correct the damage being done to oilfields, oil reserves must be reduced beyond the volumes being produced.

Here’s something I wrote about the topic a while back

https://21stcenturysocialcritic.blogspot.com.es/2015/05/venezuelas-heavy-oil-scam.html

3.2 billion US dollars is less than 3 % of the money owed by Venezuela and state owned companies. The Russians agreed to refinance because they aren’t about to get paid anyway, and this allows the maduro dictatorship to launch propaganda making believe debt holders are going to renegotiate.

Most bond holders aren’t going to negotiate with the regime because Maduro named a couple of guys under USA and Canada sanctions for drug traffic, money laundering and human rights abuses. There’s also the lack of a National Assembly approval, plus the regime has no plan whatsoever to show how it will fix the economy. Cuba has a lot of power over maduro, the Castro dictatorship foreign minister stated privately to an European diplomat that their Venezuelan colony would remain in castro’s hands because oil prices were going to go up and they had cut the cost to keep the Venezuelan people alive, they simply keep them half starved and without medicines.

While not the life expectancy of Cuba (79.55 years– US has 78.74), it is about 75, comparable with Brazil.

And the population is increasing.

How could that be?

I guess the lack of condoms and pills, lack of electric power keep the young ones having babies. As for any health or life expectancy figures, they are either old or faked. So don’t bother with that garbage.

Yea, garbage.

Somehow, I won’t take your word for it.

It doesn’t matter. The statistics you use only prove that castroism focuses on having its slaves live long miserable lives. So are you in Cuba working for the regime? You use their lines, but you lack finesse.

I have friends who are in Cuba frequently.

I’m sorry comrade, your world ended with the Bay of Pigs.

I enjoyed watching the USSR fall, and the way it looks I may see the end of the Castro dictatorship. As long as we can keep the Obamas of this world helping it survive, it’s just a matter of time. It has become heavily dependent on the oil and cash it steals from Venezuela, and it’s scared of change and loosening its grip on the people. Thus it will remain a backwards, abusive sore on the face of the planet, it won’t cure itself, and in time it will die. The key is not to allow Castro to colonize Venezuela and expand into a mini empire of evil.

Cuba is changing.

We live in a dialectical world.

The USSR was a much too conservative and a authority centric world for me.

The revolution ended in 1922.

We shall see– but things will not remain the same.

Fidel died of old age.

“3.2 billion US dollars is less than 3 % of the money owed by Venezuela and state owned companies. ”

I haven’t seen any number other than $21B for total debt. OTOH there IS a mention out there of debt/GDP of 28% and GDP is 300B. Of course one cannot know what proportion of the 100B would be external. Probably that’s the 21B, in which case this is pretty powerful stuff the Russkies just did.

As for the oil company’s debt, it doesn’t matter who the shareholders are. That’s not Venezuelan debt and is not backed by Venezuela’s govt. Imagining it is would be like declaring Nestle’s debt is backed by Norway’s Sovereign Wealth Fund just because they own shares in Nestle. Or declaring the government of Switzerland backs Apple debt because the Swiss National Bank (their central bank) buys shares of Apple.

Beyond all these details is the big picture. Russia is not going to allow regime change via “financial force” aka banking sanctions. Russia’s alternate financial network is becoming a real thing with real power, because it is based in oil and oil is all that matters.

The Wall Street Journal says it is $142 billion.

https://www.wsj.com/articles/default-in-venezuela-whats-next-1510705378

The total debt can be a moving target. Some use only sovereign bonds, others add the bonds issued by state companies. Others add several tens of billion of Chinese debt, and others add outstanding debt to nations such as Brazil, money owed to companies which delivered goods and services, money owed due to arbitration and court awards, etc.

GDP is also very hard to estimate at this time, because the economy is paralyzed and inflation seems to be way over 1000%. What we do know is that Venezuela is suffering from very serious brain drain, which impacts PDVSA and service companies, the population is suffering from hunger, lack of medicines, epidemics, lack of electricity and clean water, and very serious human rights abuses. Regime leaders are involved in cocaine traffic, and they continue to send oil and cash to Castro even though the country is borderline failed.

I posted a link to Daniel Yergin’s remarks about Venezuela in the non petroleum thread. It’s worth reading and somebody commenting on it over here in this thread.

North Dakota Director’s Cut just released for September.

Increase almost 20k bbd over August.

Bakken stats

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

active wells increased by 158 from August to Sept and output increased by 19 kb/d for the Bakken Three Forks to 1055 kb/d. Only 77 new wells were completed in the North Dakota in August 2017 and output increased that month by 23 kb/d.

Director’s cut at link below

https://www.dmr.nd.gov/oilgas/directorscut/directorscut-2017-11-15.pdf

They have added over 1,100 Bakken and/or Three Forks wells to boost production back to where it was in March, 2016.

So, conservatively $8 billion spent just to climb back up.

The amount of capital being burned on energy in the USA is truly remarkable.

Dennis, I have seen data that shows the total cost of all “shale” oil and gas wells from maybe 2003 forward, and then the gross proceeds from same. Very interesting how far from payout the USA wells are, in aggregate.

shallow,

I have mentioned this before, but SERIOUS TROUBLE will come down hard on the Bakken. Looks like someone hasn’t been honest about its production figures.

Fireworks will arrive shortly….. hehehe.

steve

Any hints?

Company or government?

shallow,

I probably said too much already. However, I just spoke with the ex-senior person from the company. He is going public before the end of the year.

If this news spreads as far and wide as I imagine… oh well, we are going to see investors FLEE the Shale Oil Ponzi.

steve

shallow,

If you get this, why don’t you respond to me at my contact info below:

SRSrocco@gmail.com.

steve

Hi Shallowsand,

Let’s say those 1,100 wells net $30/b at 200 kb per well (average 60 month cumulative) that would be $6.6 billion net income after 60 months. It will take $37/b net for these wells to pay out. Rising oil prices may allow this to happen.

Also they have been high grading so 60 month cumulative may be higher than I have estimated (I used the average 2014 well to create a hyperbolic well profile).

Also well costs may have come down as service costs have been reduced, though I doubt the average well cost has fallen to $6 million per well.

Not sure about the economics of these wells, clearly most of these companies have continued to burn cash, but higher oil prices will certainly improve the economics.

In the interest of those few oily readers you have left on POB, Dennis (I see you ran Guy, a knowledgeable royalty owner from Texas, off with that stupid comment about the Texas Railroad Commission), lets NOT say what you said.

Instead lets say that at $50 dollar hedged oil prices the net back, take home pay for a Bakken operator is actually $20 a barrel. And it is. Costs are not going down, they are going up, and longer laterals and enormous frac’s make true well costs actually closer to $9M. Such a well would therefore require 450,000 BO to payout.

Some very learned people on this site, actually knowledgeable about the oil industry, who are now also gone, have proven it will take $85 dollar plus oil prices, sustained, for the unconventional shale oil industry to pay back its debt and simply be able to replace reserves. The days of all this enormous ‘growth’ crap are over.

To render credible analysis of the future of unconventional shale resources in America one must have had actual first hand experience in the actual business of oil extraction. In other words, one must have had to write checks to drill wells, write checks to pay operating costs, write checks to the Federal government for taxes, write check after check, etc, etc., and watch their net revenue drop like a rock every month. Ignoring debt and economics to simply say there is 40GBO of recoverable shale oil in America is, forgive me, not in the least bit credible. The EIA, the IEA, almost every predictor of the future ignores the economics of shale extraction and it’s debt. Those predictions are therefore meaningless. Hoping for higher oil prices to make the future work out like you want it to is not a tactic, it is not a plan. It is a disservice to people searching for knowledge.

So, ignore the Million Dollar Way thing, and Michael Filloon, the self serving dribble in investor presentations, the “we are going to unleash America’s oil ‘might’ on the rest of the world” Perry/Trump bullshit and listen instead to Shallow Sand. He has written some checks in his day. Best not run him off.

Don’t worry, Mike. I don’t post as much, but I appreciate the oil section of this site.

I do miss the oil people that used to lurk here.

Just hoping, praying really, the shale dudes finally exercise some restraint. But not looking to promising on that end, despite being in their best interests.

Thanks shallow sand.

“Just hoping, praying really, the shale dudes finally exercise some restraint. But not looking to promising on that end, despite being in their best interests.”

The game is probably more complex than we think: it might not be in the best interests of the US financial institutions that “the shale dudes finally exercise some restraint.” And bankers rule the world. “The shale dudes” are essentially puppets of the US banks. And being a puppet means that they are incentivized to do what banks want them to do: to drill and produce even at a loss. After all, perverse incentives are common — the longer top honchos survive the more money they can grab via salary and bonuses, so you actually do not need to coerce them.

You do not need to be a “conspiracy theorist” to understand this part of the environment.

But for banks the losses on loans given for the production of shale oil can be compensated somewhere else (for example profits on derivatives; the game must be rigged, but so what), if they help to depress the oil price (in other words loans can be given without expectations that they will ever be repaid). After all the USA is the net importer of oil and for country as a whole some level of subsidy for oil production (even given to wrong people) makes perfect sense.

Also the price of oil is an important geopolitical tool. And always was. In this dimension, one popular version of the events is that in 2014 it was a gambit (accidental or planned does not matter much) to put Russia on the knees again so the movement of prices down was amplified somewhat artificially. And with the help of KSA.

Much like the USSR was put on its knees by collapse of oil prices ( also with the help of KSA) just before its dissolution (although the reasons for dissolution were mostly internal: facing economic stagnation, the USSR elite with its inept leader ( Gorbachov ) changed sides and joined neoliberal camp, effectively privatizing the assets that they controlled and putting the rest of population into misery)

See for example:

https://www.usatoday.com/story/money/business/2014/10/22/russia-oil/17716263/

The key question here is: Are big banks using derivatives to suppress oil prices? If yes (and I suspect the answer is yes), that means that some complex games around this capability, including the “Cold War II” style geopolitical games against Russia are not only possible, but quite probable.

That also means that “supply and demand dudes” are somewhat detached from reality. Looks like in oil, the tail can wag the dog for several years, I think.

Of course, there is a limit and at the end we need to face the reality. But when finance dominates the economics living in “artificial reality” can last several years, if not half of a decade.

That probably why “shale dudes” can get “evergreen” loans on reasonable conditions without any problems all the time and “Continental Resources long-term debt ballooned from $165 million in 2007 to $6.5 billion currently”

They now have more debt than equity.

https://www.gurufocus.com/term/deb2equity/CLR/Debt%252Bto%252BEquity/Continental+Resources+Inc

I think in ten years of so we will get a more clear picture about what exactly happen in mid 2014 and why this “oil price recession” lasted till, say, 2018.

Chou En Lai was reportedly once asked what he thought was the historic impact of the French Revolution. After considering the question for a moment he replied:

“It’s too soon to tell. ” ;-).

I think the same is true about the historic impact of the current low price period.

One negative side effect way was that at the stage then the US population was financially spooked by high gas prices (over $4.5 per gallon, which is a common price is Europe) and started buying more economical vehicles, the process was suddenly reversed. And everybody is happily driving SUVs ever after.

Hi mike,

https://www.eia.gov/analysis/studies/drilling/pdf/upstream.pdf

link above has well costs, $6 million D+C for Bakken, land cost about $2 million

USGS tight oil undiscovered is about 36 Gb

https://energy.usgs.gov/OilGas/AssessmentsData/NationalOilGasAssessment/AssessmentUpdates.aspx

Proved tight oil reserves 11.7 Gb

https://www.eia.gov/naturalgas/crudeoilreserves/

So about 48 Gb of proved reserves plus undiscovered resources (F50).

I agree higher oil prices ($85/b or more) will be needed.

I expect by 2020 this is likely to be correct (oil prices above $85/b), but maybe there is more cheap oil out there than I realize. I expect 400-500 kb/d of tight oil increases each year over the 2017-2021 period, not enough to take care of increased oil demand, OPEC, Russia, Brazil, and Canada will probably not be able to make up the shortfall so stocks will continue to fall and oil prices will rise.

Timing unknown, but my WAG is $75/b by Sept 2018.

I based my $30 net on an example given by shallow sand, but you are correct I remembered incorrectly. His example was $45/b wellhead and $15/b net. Sorry I got it wrong.

Divide my 60 month net income by 2 so $3.3 million for a well that cost $7.3 million (in shallow sand’s example), so in the red by $4.4 billion for those 1100 wells.

Thanks for correcting me.

Hi Mike,

Using shallow sands $7.3 million well cost (8000/1100) and $15/b net, it’s 487 kb over 5 years for payout, for the average 2014 well my estimate is about 250 kb over 5 years.

So $29.20/b net is needed for payout and an increase of $14.20 per barrel in the well price (with no increase in costs) would do it. That would be about $70/b WTI, to take care of debt would require higher prices, though perhaps not another $15/b.

If your estimate of $9 million per well is correct, we would need $36/b net for payout and $77/b WTI, perhaps $8/b extra is needed to cover interest costs, but that would imply about $58 billion in debt if interest is 5% on the debt (assuming Bakken output of about 1000 kb/d).

Rune Likvern estimates cumulative debt at about $35 billion, at 5% interest and 1000 kb/d this implies an extra $5/b in interest cost so about $82/b WTI would be needed if well cost is indeed $9 million per well.

Bottom line, higher oil prices are needed for profits somewhere from $75/b to $82/b WTI, and Rune Likvern’s estimate is about $84/b, but for a point forward estimate breakeven (7% return) is as low as $63/b (for the average 2016 well).

https://fractionalflow.com/2017/10/08/a-little-on-the-profitability-of-the-bakkennd/#more-1235

Yeah, it amazes me when I see companies constantly drilling in areas where I can see they are seriously draining money. They would have to keep borrowing heavy just to drill. On the other hand, there are some companies that get it right. Take one company I know of, specifies that they will drill most of their wells in areas that will only gross them $8 million a year, at $40 oil prices. That’s a serious sweet spot definition. In the Eagleford, that returns most of your capex the first year, if not all.

Hi Guym,

Has that company actually achieved many wells that are that prolific?

What percentage of their wells have achieved what they are claiming?

You don’t have to name the company, I am just wondering if this is investor hype or real results.

It’s EOG, the number of wells and percentages are on their presentations (hype). But in this case, I tend to believe them. On well completions use operator 253162, and check out the initial productions on completions. I think in their hype, they have at least 15 years of that kind of inventory. Basically, they have the richest areas in the Eagle Ford (and the largest Eagle Ford operator), and did an acquisition last year that landed a bunch in the Permian. They did a record well in the Permian this year, and if you check out the wells drilled in Karnes, district 2, about half the wells are in the Austin Chalk sweet spot, which are, overall, outperforming everything else. The percentage is bigger this year, because they dumped a lot of the areas that would produce less than 100k barrels the first year. I know, because they miscalculated and sold part in my area that recently came in at initial production of over 1000 barrels a day. The other leases were held by production at well over 100k the first year. Can’t win em all.

But even though the undrilled part of my property would be coveted by just about any other company, EOG will not drill, because it doesn’t meet their criteria until oil is at close to $70 for a good while. Which is ok by me.

Thanks Guym.

It would be nice to know how much condensate from those nat gas wells is being added as crude. Has that contributed to the increase?

No, it wouldn’t. Don’t find any mention of wells drilled for the primary purpose of flowing gas.

Which is puzzling since there is lots of talk about how rich Bakken gas is in NGLs.

Hi Watcher,

The oil wells produce “associated gas”, this is pretty much true of nearly every oil well.

It is the associated gas that is relatively “wet” and has some NGL which can be recovered if the gas is not flared.

Somewhat not the point, but maybe obliquely.

The point is pre capture, those liquids didn’t get into the truck. Now they do.

Hi Watcher,

I think they get separated at the natural gas processing facility and then go somewhere by pipeline, but perhaps they use trucks.

My point is that there are not many natural gas wells in ND, the gas comes from oil wells and is “associated gas”. Associated with oil production from oil wells.

The associated gas is gathered, taken to a gas plant, most of the C2+ molecules are separated, put in a cold pressurized tank, and shipped by pipeline to a fractionation plant. The fractionation plant ships ethane to chemical plants by pipeline. The C3 and C4 can be shipped by rail, pipeline, barge, etc. c5 is natural gasoline, that’s sent to a refinery.

Search Results

Eyes in the sky raise questions over Saudi oil storage – Financial Times

https://www.ft.com/content/3a1626f2-c47a-11e7-b2bb-322b2cb39656

“…Orbital’s analysis of satellite imagery suggests that Saudi Arabia’s above-ground tanks — whose floating roofs allow them to see when oil inventories are rising or falling by measuring shadows cast across the top of the tanks — have seen no real change in the past 18 months…While Saudi Arabia has reported to Jodi that its oil stocks have declined by about 70m barrels since early 2016, the Orbital analysis suggests the above-ground tanks have actually seen inventories rise marginally over the same period.”

So Ron is right in regard to Saudi. Inventories in storage within Saudi Arabia itself are up. But sales ex storage in other countries keep the money flowing in even while Saudi can claim to have reduced production.

Of course, an oil sale of oil ‘borrowed’ from another country would also allow it to keep income, claim reduction, and store a buffer of oil domestically in case of a ‘geopolitical perturbation’ it is working on.

Will WTI above $50 make a difference? At least in the Tier 1 acreage (sweet spots)…

Bloomberg: Shale drillers are promising to add a new wrinkle to their world-shaking oil boom: they may finally make money.

In third-quarter earnings reports, explorers including Pioneer Natural Resources Co., EOG Resources Inc. and Anadarko Petroleum Corp. said they’re on the cusp of shrinking or even eliminating the gap between operating expenses and the cash they take in. That would mark a turning point for an industry that’s piled up losses and lived on borrowed money for years, as drillers plowed resources into developing new oil plays across the U.S.

https://www.bloomberg.com/news/articles/2017-11-15/shale-goal-in-sight-pump-with-a-profit-without-hurting-growth?

For the zillionth time, free cash flow includes net borrowing.

You can borrow your way to positive cash flow. FCFE (to equity holders) includes net debt. Wanna get really crazy? Consider the fact that it includes preferred issuance but not common issuance.

Cash flow is just another hype parameter.

Gulf of Mexico – HOUSTON (Reuters) – A combined 75,206 barrels per day (bpd) of oil and 215,122 million cubic feet per day of natural gas production are shut-in at four platforms in the wake of a Nov. 8 fire at Royal Dutch Shell’s Enchilada platform, according to U.S. government data.

http://www.reuters.com/article/us-shell-gulfmexico-shutins/about-75000-barrels-per-day-of-gulf-oil-output-still-shut-after-shell-fire-idUSKBN1DG03X

I’m not sure if this will interest anyone, just been looking at ND completions, they are said to have become more variable – whatever that means?

Director’s Cut – Lynn Helms – NDIC Department of Mineral Resources

10/10/2017 – The number of well completions has become highly variable from 95(final) in July to 63 (preliminary) in August.

11/15/2017 – The number of well completions has become highly variable from 84(final) in August to 71 (preliminary) in September.

Also those dips in the number of completions at the start of 2015, I remember reading that they were due to freezing weather. But now looking at the annual review files those dips have been revised out.

Not posting opinions, just facts:

September Texas C&C 76,578,264

Texas RRC – I don’t always remember to note down the initial number but here are the few that I’ve got. Hurricane Harvey reduced output from the Eagle Ford.

Or compare since 2015 (2014 had massive verticals) completions to Dean’s estimates based on initial, to EIA monthly numbers. Bet that would tell a tale. Yes, part of that is Harvey. Then, again, how well were the wells read August 31 during the downpour? As I said before, September will prove nothing. October will. Another month.

Chart

Wow, looks even better charted. As I thought, it really started to diverge after the first quarter.

I was just looking at this, but don’t have enough data 🙂

You can eyeball with the chart above. Predictably, a very strong correlation. October was the lowest completion month, so far. We can, obviously, up production two hundred barrels a day from wherever it finally stops with about six hundred completions a day. Which is probably maxing out current completion crews, but I don’t know that, so just sit back and look at some weird EIA numbers vs some pretty well known numbers. Be even more strange, if EIA weeklies were charted, and current predictions of where it will be by EIA. Through the Looking Glass strange.

Guym – Typos? I am always doing it, but –

“We can, obviously, up production two hundred barrels a day from wherever it finally stops with about six hundred completions a day.”

200 barrels/day??

600 completions per day??

However, you do say “obviously” so I agree with that.

Typo, 200k barrels a day, sorry. 600 completions a month. Not typos, just typing before I think.

The EIA weekly data, STEO, and DPR are not very good. Lately the monthly numbers have also not been very good (since April 2017.) At some point he EIA starts to correct their mistakes and revises their estimates, not clear when that will occur. Based on the most recent RRC data and the correction factors from last month it looks like the EIA’s August 2017 Texas C+C estimate is 240 kb/d too high and Sept Texas C+C output fell another 80 kb/d to 3045 kb/d.

It seems there are no facts, just estimates, we will know in Nov 2019 what, in fact, was output in Sept 2017. Or the way I look at it, we won’t ever know, but we will have a pretty good estimate at that point.

Hi Energy News,

Data below is monthly for Texas C+C in kb/d from Dean’s estimate starting with Nov 2015. Hopefully you can copy and paste for your completion chart for Texas.

3397

3337

3360

3324

3283

3246

3193

3173

3170

3169

3159

3199

3213

3211

3230

3329

3319

3315

3319

3279

3257

3176

Data charted

Looking at Dennis’s chart, and comparing it to EN’s chart does raise some real question as to the number of completions it will take to seriously increase production. If going from 300 to 600 a month, we can only raise it about 200k barrels a month from where it stopped last, how many completions per month will it take to increase it 500k a month? How long will it take to build up frac crews? Or, the next time we get to 600, will it just keep production from falling? I really don’t think anyone can answer these questions. We are lost in the quagmire of the calculations of over a hundred thousand well depletions, drilled at different times in different EUR locations.

Or, we can sit back and just enjoy playing house with EIA and IEA, and pretend we are net exporters with play oil.

Hi GuyM,

Many of the older wells decline at a pretty steady rate (especially when averaged over a large number) maybe 8% to 9%. The field (Permian basin) can be roughly modelled (assuming a fixed, increasing or decreasing well profile) if we have the number of horizontal completions, we can get that at shaleprofile along with an approximate well profile.

On problem that confound the analysis is we must distinguish between Eagle Ford and Permian completions. The Permian recent wells (from 2017) have peak output of about 639 kb/d on average in month 2. Eagle Ford average wells in 2017 have output in month 2 of 594 kb/d. After 12 months cumulative output of recent (2016) Permian wells is 25% higher than Eagle Ford wells. Over time better profitability in the Permian basin may result in a movement of frac crews to the Permian basin from the Eagle Ford. In May 2017, 339 horizontal wells were completed in the Eagle Ford and Permian basin (TX only) based on data at shaleprofile.com. The peak rate was in 2014 at about 600 horizontal wells completed.

I am not sure how accurate the completion data is.

Basically you are correct that changing well profiles and changing completion rates in several different plays makes any analysis a challenge.

Out of curiosity guym, how do you read a well? Are many of them automated in sending data? Any?

Thanks enjoy your posts

Others would be better to ask for Bakken info, but for Texas the well info is posted on the Texas Railroad Commission site. Most of the information can be obtained on the Online Research Queries section. They have completions, permits, and various other queries. Within that section, there is a GIS map section that has all of the producing oil and gas wells in Texas. You have to keep enlarging the map before a well is visible. You can click a drop down to select info per well, unfortunately, production is given per lease, except when there is only one well per lease.

There is more valuable information in the oil and gas section under research and statistics. I would say, start with a completion report to begin with. Has more information on it than I can answer, but there are those here that can. All this is free, but confusing, at first.

To get an example of a completion report, select district 1 or 2 for Eagle Ford, Distrct 7C, 8, or 8A for Permian on the completion query.

Hope I am getting close to answering some of your question. My background is accounting, not a petroleum engineer.

Using Dean’s correction factor from last month the corrected output would be 3046 kb/d for Sept 2017 for Texas. That would be a fall in output of 130 kb/d from the August 2017 corrected estimate from Dean Fantazzini’s methodology (using April 2016 to August 2017 data sets).

Using last month’s correction factors for the August 2017 output data from the RRC gives a somewhat lower estimate than last month of 3123 kb/d, suggesting output fell by 77 kb/d from August to Sept in Texas. Note that this estimate for August 2017 is 243 kb/d lower than the EIA’s August 2017 C+C output estimate for Texas.

Guym – Glad to see you back.

Thanks, just had to take some midol.

Bloomberg Gadfly is saying that the wide Brent-WTI spread is due to a lack of pipelines?

Enterprise Products Partners LP and Energy Transfer Partners LP have new pipelines coming in the next few months that should enable another 550,000 barrels a day of Permian output to reach coastal refineries and ports. These, and other projects, should narrow the gap between WTI and Brent to a more normal level below $4 next year.

https://www.bloomberg.com/news/articles/2017-11-07/wti-crude-prices-aren-t-going-with-the-global-oil-flow

The EIA estimate the Brent-WTI spread needed for exports from Cushing at $3.5/b ($4/b if exporting to Asia)

~$3.50/b from Cushing to U.S. Gulf Coast (I guess this will drop with the new pipelines)

+$0.50/b more expensive to move WTI to Asia than Brent

https://www.eia.gov/petroleum/weekly/archive/2017/171108/includes/analysis_print.php

Hi,

Here are my Bakken updates. The production graph looks strange this month. Production for most years increased a bit and the ones that did not increase declined less than expected. So something is happening. Number of production days did not change much compared to previous month, so that is not the reason.

Looking at the GOR graph we can see that GOR decreased for all years except 2007 and 2009. The increased oil production suggests that they pumped up the oil faster. But then I would have expected increasing GOR. Instead we se decreasing GOR. So what is going on?

Freddy, this graph in particular. There are frequent items of hype about new technique this and new technique that. We could only assess that from the segment chopped off at the top of the graph.

This has come up before and there was a reason, but I don’t remember it. It would be late 2016 and onwards.

Arghh, comment put below the wrong graph. I meant the yearly production.

Yes up until 2015 we have not seen much improvements. Higher initial production has been followed by higher decline rates. However 2016 looks quite a lot better so far. But I think high grading plays a big role there.

Depletion is what is going on. GOR increases, then decreases, in gas expansion driven shale containers (this term in lieu of ‘reservoirs,’ which I do believe they are). There are some good articles out now suggesting shale containers may actually be ‘oil expansion’ driven. Nothing lasts forever; declining GOR is an example of that. We are beginning to see the fallacy in doing DCA on a shale well within the first year of production; those long tails won’t end up being very long after all.

This stupid ‘halo’ thing is meaningless. Think of a new frac creating a brief water flood affect to nearby, shut in wells, or that induced energy from the new frac creates a sort of pressure wave that travels toward a pressure sink created by nearby older wells. This so called halo BS does nothing more than speed up the rate of withdrawal in offsetting wells; it is not increasing UR. Drilling $9M wells that communicate with each other is really economically stupid.

There are no production ESTIMATES in Texas. The day that barrel or MCF leaves the lease premise it is accounted for and reported to the TRRC, by both the seller and the buyer. Hundreds of billions of dollars are exchanged by this process, each month, for the previous month’s production. Rarely, almost never, do people give money back and it is distributed to someone else based on estimates. This argument is ridiculous. The EIA surveys a handful of large companies in Texas but no operator in Texas reports production to the EIA. The delayed data that gets a few peoples panties in a bunch is very real, very accurate, including deductions for BS&W and pipeline shrinkage and can be found under ‘pending,’ filed under drilling permit numbers. Once the completion data is processed on a new well that production is moved lease ID numbers and made public. In the mean time the folks in Texas who need to know what there production is, do know. Enno Peters pretty much has this all figured out now for those that so desperately need to know and can’t do the research themselves. I have been an oil operator for a half century; the TRRC regulates the snot out of my industry and has taught the entire rest of the world how to regulate the oil and gas industry. There is nothing embarrassing about the TRRC.

Oil and gas extraction in America is undertaken by private enterprise. It is not a video/internet game, it is a BUSINESS. Increased productivity does not equate to profitability. Now the US LTO industry, trapped like goats in a pen with massive amounts of debt, will never, short of much, much higher oil prices, sustained, be profitable ENOUGH.

The American shale oil phenomena is a financial disaster. Ignore that at your own peril.

Hi Mike,

Yes the RRC is great. I am referring to the online research query that is straightforward to use, I do not have the programming skills of Enno Peters and to get easy access to the pending file, I believe a subscription is needed.

Even if the pending file is included we don’t have accurate final data (in terms of final output numbers).

I guess we are talking past each other. Every barrel reported by the RRC has been produced, that is not in question. Currently do we know the total crude plus condensate that was produced in September in Texas?

If the answer is yes can you tell us, please?

I would report the actual number if I knew what it was, otherwise I would need to estimate what the final complete output number would be.

It is all good, we will know what the output is in about 4 months (using the data reported by Drilling info, which adds the online data query with the pending file).

The EIA has data from drilling info at

https://www.eia.gov/petroleum/production/

Chart below shows 914 survey data, EIA, RRC, Drilling info and Dean Fantazzini’s estimate. The 914 survey covers about 89% to 92% of total Texas output, on average, we can get a rough estimate by assuming the 914 survey is about 90% of final output for the most recent 4 months and use the drilling info data for other earlier months.

The RRC does a great job regulating the industry and Enno Peters does a great job with the data on that we might agree.

That rough estimate of 914 survey divided by 0.9 (assumed that 914 survey covers 90% of Texas output) is compared with drilling info and Dean Fantazzini’s estimate in chart below (data only through August 2017).

Duh! Missed that all along, although I have used that query many times. I wonder how Eno does them all? Only thing I can think of is to do a wild card search. Pending is not included in initial production. Makes sense now. I could not imagine royalty owners missing payments for 18 months. I am sure there are some independent producers that make up the small difference, especially if they own the mineral rights. Overall, I agree, unless prices go up, the majority of independent producers don’t have enough to high grade at these prices.

Ok, I see, he probably pays $10 for it with the RRC (pending leases). I hadn’t seen all these data dumps before. Probably not the only thing I have missed. Next month it will be in csv format, instead of Oracle. Not that expensive.

http://www.rrc.state.tx.us/about-us/resource-center/research/data-sets-available-for-purchase/production-data/

Hi Guym,

I am a cheapskate, so I will just use the EIA information when it gets released, I think the drilling info data includes the pending leases, or that is what I have been told. I imagine shallow sand or Mike or someone subscribes to drilling info and could fill us in with the latest data from Texas, or if you get the pending lease data maybe you could tell us.

Not sure what I will get, and when, but I will try. Unless, Eno feels like donating that number. Not even going to try with September.

Hi guym,

http://www.rrc.state.tx.us/media/42749/own423_20171110_rrc180_sep2017.pdf

Aug 2017 output 2534 kb/d (“final statement”) at link above, compare to 3336 kb/d assuming 914 survey covers 90% of output, that’s only 76% of the higher number. A similar comparison of final statement for Aug 2016 (in Sept 2016 link) and comparing to drilling info data shows about 81% of drilling info data in RRC final statement.

It is not clear why the RRC doesn’t use its own pending lease file when making these final statements. For example they report 2630 kb/d for July 2017 on Oct 17, 2017 and the EIA reports drilling info data of 3083 kb/d on Oct 31, 2017, a 453 kb/d discrepancy. I just don’t understand, but I guess I am impatient. In any case the RRC does a great job and it’s not my state or my industry.

Hi Mike,

On the lack of estimates by the RRC, I found this:

* Preliminary Crude Oil & Gas Well Gas Monthly Production Total – Significant changes to the preliminary production figures will occur in decreasing amounts for approximately six to eight months due to the filing of corrected and late reports by industry. Commission staff anticipates that the production totals following that period are substantially complete, although continued minor changes occur thereafter. There is no point beyond which an operator may not file corrected production reports.

http://www.rrc.state.tx.us/oil-gas/research-and-statistics/production-data/texas-monthly-oil-gas-production/

To my mind the number reported on that page for the most recent month (currently August 2017) would be an “estimate” of final output. You may call it something different. I don’t speak Texan. 🙂

For August 2017 they list 2683 kb/d for Texas crude plus condensate output (I divided the number listed by 31,000 to convert from barrels per month to kilobarrels per day.)

Dennis, you may call it “estimates” if you must; hell, you can make dumb, snarky remarks about the Texas Railroad Commission all you want. I don’t care and I assure you, neither does the rest of Texas. As I have said, the people that need to know in Texas, do know. People like yourself ultimately get to know, but it is on our time frame, not yours. A few months here, a few months there, is nothing in the great scheme of life. You’ll be alright, I promise.

I think for you to accomplish want it appears you need to accomplish, that being some sort of successful prediction, you should not worry so much about a few months of confusing production data in Texas and instead focus on oil prices and the financial plight of the shale oil industry. For it, the shale industry, to deliver on your predictions it must start doing something significantly different than it has done in the past. That is, it must pay back its debt and become profitable.

If the shale oil industry borrows money to drill a stinking well that declines 75% in the first 60 months of its life time, it needs to pay that money back in 60 months. It hasn’t. Now it is so far behind it can never catch up. It baffles me plum to death that people don’t get that.

I simply wish to remind everyone that our hydrocarbon industry in America is in the hands of private enterprise; it’s a business and for business to work, it must be profitable. Not a quarter every four years, depending on how gracious OPEC feels, but consistently profitable, year after year. The shale oil industry has never been profitable, not even at higher prices. You are an economist, Dennis; you of all people should understand that.

Mike,

Always appreciate the CANDID & REALISTIC comments. I wanted to share something with you, but can’t do it in the public realm. If you are interested, please email me at:

SRSrocco@gmail.com

thanks,

steve

Hi Mike,

Yes I don’t worry about the RRC, they do a fine job.

Many people are interested in the latest data, but for Texas C+C output, we have to be patient as you have mentioned on many occasions.

I imagine there are a number of people who have access to drilling info data or the Texas C+C pending leases file.

If there is anyone willing to share that information anonymously they can email it to peakoilbarrel.com.

That is probably the best data we have.

On the economics, Rune Likvern does the best job in my opinion and I agree with his assessment.

His blog is called Fractional Flow and a recent analysis of the Bakken can be found below.

https://fractionalflow.com/2017/10/08/a-little-on-the-profitability-of-the-bakkennd/

I think I have been pretty consistent in saying that it is a mystery to me why wells continue to be completed by tight oil focused companies.

I also think I have consistently said that higher oil prices will be needed for tight oil to be profitable.

In short I agree with you.

I apologize for saying anything negative about the RRC, I will reserve negative comments for the EIA (hopefully that’s ok even though a Texan now runs the DOE 🙂 ).

I think we don’t agree on future prices, I think most of the predictions of low oil prices forever will be incorrect. Oil output will grow more slowly than demand for oil at low oil prices, supply will become short and oil prices will increase.

In my opinion, this is likely (greater than 66% chance) to occur within a year with oil prices rising to $75/b (monthly average) or higher by Oct 2018. At that point many tight oil producers may be profitable on a point forward basis, about $85/b average prices might be needed over a 5 year period to pay off debts (and cover interest payments).

This price level also seems pretty likely from 2019-2024 as supply will have difficulty meeting demand even at $85 to $90/b in my opinion.

Note that the USGS undiscovered F95 estimate plus 2P reserves is about 38 Gb. If my guesses for future oil prices are correct, this is the minimum we can expect to be produced imo.

Mike,

Yes maybe it´s depletion and wells are running out of gas. I was considering that. If GOR is high then gas suppresses oil production. So at least logically there could be a temporary boost in oil production as GOR goes down and there is less and less suppression. But it seems to happen everywhere at the same time. I would have though the more mature areas would be affected first. But Mountrail, which I consider the most mature area, appears to be the least affected. So I’m not sure…

Freddy W – could the GOR issue just be a result of the increased flaring (i.e. gas not recorded as sales)?

I use produced gas, so it shouldnt. In the flared gas graph I use gas produced and gas sold and assume that the gas which is not sold is flared.

I suggest you check for slope (derivative) changes associated with the weather. I’ve worked in areas where GOR dropped when we had very cold fronts, flowlines and separators cooled down, and sales contracts allowed us to ship fizzy oil by pipeline. But this gas comes out at the central plant where the oil has to meet vapor pressure specifications. So the question is whether the regulators change gas accounting properly.

But then it should go down every winter and it doesn´t do that.

Here we can see that GOR decreased mostly in McKenzie, Dunn and Williams. But also slightly in Mountrail.

Freddy

Your graphs are showing the impact on older wells – by definition, located in the core of the core – of the newer, nearby wells that have indisputably been drilled in these best areas for the last 24 months or so.

That is to say, operators in the Bakken are now normally completing 2 to 3 wells at a time on a pad with at least one older well already in production.

The terms being used are frequently ‘parent/child’ wells.

These operators are familiar with competitors techniques, but regularly stay silent on specific, detailed procedures.

I say all that because the entire downspacing protocols are enormously influential on how much hydrocarbon will ultimately be extracted.

As you are aware, I’ve done ‘halo hunting’ on approximately 130 wells with dramatic uptick in production in about 110 when nearby wells were frac’d.

If you want to check this for yourself, the procedure is straightforward.

Get the DMR basic subscription.

Scan the Gis map for any random energy corridor (preferably in the core).

Pick out older wells by their permit # that have a few newer wells adjacent.

Check the production history.

You should find – both via oil/gas output as well as produced water – that these older wells increase production (as your above graphs show) coincident when the new wells are frac’d.

I guess the main issue is if the adopted techniques/practices increase the recovery rate or mainly shift production in time (more now but higher decline rate in the future). I guess it is some combination but it will take several years before we know (or those of us not working in the shale plays will know – some people probably already know the answer).

Also, the flipside of “high grading” is that remaining projects are inferior. Price needs to rise or technologies improve (how?) to make reaming projects attractive.

The whole matter of accelerated production versus increasing ultimate, overall recovery has been a contentious issue for several years now.

The phrase ‘pulling production forward’ has been used by some who feel hydrocarbon recovery has not increased, but simply taken place sooner rather than later.

All the operators claim vastly higher EURs from newer wells in general.

I do not know the answer, and rather focus on proven, displayed production numbers alongside ever evolving procedures that might indicate future trends.

Many factors, naturally, play into this with the permeability of the rock being highly significant.

A commentator on Filloon’s latest post used Enno’s data to get the 10 highest oil cums from horizontals in wells started in 2016/2017.

His numbers ranged from almost half million barrels to over 800,000, mostly from EF and AC formations which, I believe, are relatively permeable compared to marble-like lower Bakken.

(Interestingly, one well was from the Powder River Basin).

So, now the ever-present components of economics looms large.

If enormous amounts of oil are recovered early in a well’s life, is it worthwhile to do so?

Apparently EOG, and others, think so.

In a related aside, Core Lab’s CEO has stated that the effective use of micro proppants (still in the early stages of use and evaluation) will extend the productive ‘tail’ of wells due to the added distance the liquids must travel to get to the wellbore as the fractures have become WAY more complex. (Notably, this is NOT an increase in frac half length).

This, in addition to these newly-propped pathways are even WAY tinier than earlier wells.

FWIW, this CEO is on record with a number of other researchers to claim that the Stimulated Reservoir Volume -SVR – can be increase ten fold via successful use of microproppants.

Your final question regarding current high grading/remaining areas has great relevance for many reasons.

When operators can now drill from spud to TD in 4 to 14 days – which is occurring all over – when completing 3,6,30 wells at a time (Rice and Encana being the leaders here), when high, early recovery rates provide upfront revenue … all these and more expand potential development areas both in existing plays and lesser known trends such as the PRB, Unita, TMS, Rogersville and more.

There is another topic that is just starting to appear which may or may not pan out, that is, smaller operators in Colorado, Ohio, and elsewhere are trying ‘big boy’ techniques in shallower, less expensive formations.

Early times in evaluating effectiveness, but so called unconventional hydrocarbon production is actually expanding, not in its twilight.

Hi Coffeguyzz,

It is the productivity of the average well that matters,

for the average 2016 US well it is about 185 kb cumulative through 60 months. Assume an $8 million well and $20/b net at $55/b WTI and that payout by 60 months is needed for profitability, in this case we need $43.25/b net for a profitable well. So assuming fixed costs (these go up usually with higher field activity), for profitable average wells, we would need $78.25/b WTI, if we ignore the high debt load and interest payments of the industry.

This is the straightforward explanation for why most of these tight oil focused companies lose money almost every quarter.

It is also the reason that over the long run, either oil prices will go up or many of these companies will go bankrupt.

Meant to add chart below. Slightly bigger chart by clicking, quality not good sorry.

https://shaleprofile.com/index.php/2017/11/09/us-update-through-july-2017/

From Directors cut:

“The percentage of gas flared increased to 17% primarily due to six force majeure events.”

Not sure what those force majeur events were. In bellow graph we can see that precentage of flared gas increased mostly in Dunn but also in McKenzie and Williams. It did not change much in Mountrail.

Maybe we cannot trust the gas production numbers because of the force majeure events. At least that is the only explaination I can think of right now.

I did notice one thing now. Even though average number of production days did not change much, the percentage of producing wells did. So perhaps those wells that were put back on production has a relatively high oil production and low gas production.

If there were older shut in wells put back on, likely a flush of production in the first few weeks, that will tail off.

I have wondered if this accounts for the “halo” effect, at least in part.

My best example from personal experience was a well we owned at one time. It had been shut in for 3 years or so.

Made over 50 BO first 24 hours, by the end of one production week it pumped off. We pumped it one day on and three days off thereafter. Averaged 2-3 BO on days pumped.

I understand most older LTO wells are not pumped continuously. By older, I mean 5+ years.

Shallow

The length of time these older wells are offline seems to average about 3 months.

In the past year, though, many wells are down for 6 months.

When they are turned back online, it is common for production to equal (sometimes exceed) the very original production numbers.

These guys – in the Bakken, at least – have been doing a lot of innovative work as these wells are getting closer together, but they rarely discuss in detail what is going on.

In 2017, in the Bakken, something different is definitely occurring as the produced water coming from parent wells is regularly double initial produced water numbers after being offline for 3 to 6 months.

Oil/gas stays elevated for 8 months or so.

coffeeguyzz and shallow sand,

I am well aware of the “halo effect”. I think it was I who first discovered the phenomena a long time ago. However I have not seen it affecting all years at the same time before. Of course, the wells are getting closer and closer so more and more wells should be affected. But still… It could be one of several reasons and old wells where pressure has been built up is being put back on production is another. I would need to look into the data more deeply. But that would require a lot of work, so I´ll see if I get time to do some more investigations.

I believe the force majeure was due to a gas processing plant having problems.

The oil and associated gas production continued with the excess gas being flared.

Ok thanks. Does Mountrail use another gas processing plant as it was not affected?

I did some more investigations. I looked at average oil and gas production from wells that restarted production the same month or restarted production previous month (as on average they only produce for half the month during the first month so most of the increase will be visible the month after). They may have restarted production either because they were shut in while nearby wells were fracked (halo effect) or perhaps were refacked or they have been shut in for some time for other reasons. So here are my findings for a few of the years:

2010:

The restarted wells did have a positive effect production, but the effect was not that much more than what it has been before. I calculated that it could only explain maybe 50% of the increase. GOR was also lower for those wells but can only explain a small part of the GOR decrease.

2011:

Here the production increase was only small and the restarted wells can explain all of that increase. The GOR decrease was also small but the restarted wells could not really explain all of that decrease.

2014:

Similar to 2010. The restarted wells contributed more than usual to production, but could not really explain why it was as high as it was. For GOR they could only explain a small part of the decrease.

So to conclude. The restarted wells only contributed to some of the production increases and only a small part of the GOR decreases. So it´s still a mystery whats going on. Maybe it´s depetion related after all as discussed with Mike.

I looked a bit more into it and I found examples of wells where production ramped up slowly over several months after being suspended for some months and wells that were producing most of the month or even the whole month while there was apparent fracking going on nearby. So the method I used will not find all those wells I was looking for which means the halo effect or restarting of suspended wells can still be the reason for the increases.

For GOR something similar happened last winter when there were also gas capturing problems. Then GOR dropped and then increased again after the problems were solved. So I don´t think we can trust the GOR numbers. We have to wait one or two months and see what happens.

A Long Time Coming: Offshore Project Sanctioning

I can’t recall this being posted, but it’s from August (the text and chart don’t necessarily agree with the headline, depending on how you read it). Offshore investment continues to decline, especially in the larger projects. Since it was issued I can’t remember anything else large being approved except Johan Castberg, which seems pretty close if not quite at FID. For large to mega projects gas numbers are beating oil by two or three to one.

https://clarksonsresearch.wordpress.com/2017/08/03/a-long-time-coming-offshore-project-sanctioning/

More pipeline drama, coming after the spill.

Dakota Access Pipeline Company Paid Mercenaries to Build Conspiracy Lawsuit Against Environmentalists

https://theintercept.com/2017/11/15/dakota-access-pipeline-dapl-tigerswan-energy-transfer-partners-rico-lawsuit/

New developments with Venezuela and their oil company.

“Several intellectuals, such as former Minister for Basic Industries and Mining Victor Alvarez, have urged the government to default on its debt in favor of investing in national production.

This position found an unexpected advocate last week when opposition head of the National Assembly and First Justice leader Julio Borges also called on the government to default and restructure its debt repayments. ”

This does not mean the opposition is joining with Maduro. This guy has written to Goldman all year long demanding that they lend no more money and told Goldman that a future opposition government would default on any loans provided the Maduro govt, and so they better not lend any. This would seem to be pre-emptive punishment.

But it does mean Ven thinkers are outside the box and may have come to understand that oil is rather more important than money.

And this before the restructuring mtg of this past Monday;

“The top-level consultation took place despite warnings from the US Treasury to creditors last week that it would be extremely “problematic” for US financial institutions to attend. Any agencies thought to be breaking US economic sanctions against Venezuela could face heavy corporate fines and jail time of up to ten years. ”

They not only want payments obstructed, they are threatening bondholders with jail if a way to take payments is found.

“Last Friday international press reported that Venezuela’s state-owned energy utility CORPOLEC had defaulted on a bond interest payment worth more than USD$650 million. Venezuelan authorities later responded that the payment had been made but arrived late.

The Venezuelan government has since reiterated its commitment to making foreign debt repayments, while state oil company PDVSA confirmed Wednesday that it had made payments on a string of its bonds.”

Though China has reportedly made no offer of debt relief to Venezuela, Foreign Ministry spokesperson Geng Shuang reiterated to press Thursday that his government believed Venezuela was “capable of adequately managing the debt problem”.

“We hope that the parties involved can settle the matter through consultation. At present, financial cooperation between China and Venezuela continues as normal,” he added.

Ven’s oil company owes about 9B to Rosneft and some other entity owes 23B to China. Neither Russia nor China seems to care what S&P or ISDA says.

“The South American country now has 10 years to pay its debt to Russia, although it is expected to make “minimal” payments within the first six years, the Kremlin said.”

That’s 10 yrs. The first 6 yrs will have token payments. They are not going to allow regime change by financial force.

Some of the past debt to Russia, it should be noted, was to buy Russian weapons. This is normal stuff. The US has various programs ongoing where they loan money to a country, which then buys US weapons. Greece was required to buy European weapons with some of its ECB bailout money. All normal stuff. The point being a failure to repay such loans doesn’t bother the lender much because they made a profit on the weapons sale, and money is created from thin air anyway.

https://oilprice.com/Energy/Crude-Oil/Chinese-Crude-Inventories-Fall-For-First-Time-In-12-Months.html

China not having trouble using oil.

About Venezuelan debt, the size of a debt means doesn’t mean a whole lot, except when you also ask about the ability of the debtor to pay.

It appears to me that the Maduro regime is just about out of repayment options.

So, it isn’t the size that is important, but what you do with it is important? Sorry, couldn’t contain myself.

https://www.marketwatch.com/story/oil-climbs-in-electronic-trade-as-isda-rules-that-pdvsa-and-venezuela-defaulted-on-debts-2017-11-16

The credit debt swaps were only 1.5 billion of the total.

Goldman Sucks is probably sucking wind.

Another item important to understand . . . repayment of loans is the last thing the NY banks want.

Not in the context of influence. In the context of earning interest. The problem with Venezuela all along is they don’t borrow much money. 28% of GDP contrasted with over 100% of GDP for the US (25% of which has its own central bank as the lender). The NY banks are being denied income by this refusal to borrow.

And worse . . . what borrowing there is has shifted to Russia and China and won’t require the US banking network for flow. Venezuela has the ultimate collateral underground and refuse to involve NYC.

THIS is the source of the demonization.

So NY banks should be quaking in their boots, because Ven won’t borrow from them?

It’s ok, I am sure they would have to pay a premium, but I heard Goldman Sucks has billions the NY banks could still buy up.

There is a bit of that. Maybe more so the evolution of Russia and China’s alternate payment networks that eliminates US banking power.

Hell, Bitcoin does that. However, you have to be able to fund it.

Mac–

Not really.

What they do lack are the paths to pay those debts with US sanctions.

They have very little government debt.

Maybe Maduro has cash enough to pay GOVERNMENT debt as such.

The country is sure as hell busted, economically and politically.

The people there are in one hell of a fix, even if they happen to be Maduro supporters.

It’s my firm opinion that Maduro and company are about as low as the proverbial snake’s belly, as low as it is possible to be.

YMMV.

Guys, “Hightrekker”‘s baloney parallels regime propaganda so closely I have to conclude he’s plugged in to their talking points, may even be on the regime payroll. The maduro regime can’t pay because it lacks cash flow. It lacks cash flow because it destroyed the Venezuelan economy.

It’s useful to see how government social media propaganda gets distributed, and the level of sophistication of their scriptwriters. Hightrekker isn’t a professional, but hee/she does seem to be getting official talking points.

Hightrekker has been on my ignore list for quite awhile. I don’t remember why I chose to hide his posts, but I never see what he posts.

On this date: (Nov 20th)

1975 — Spain: The Beloved & Respected Comrade Leader Fascist Dictator Francisco Franco (for 36 years) dies (& he’s still dead!) He is replaced by another General — General Rejoicing (!!).

https://oilprice.com/Energy/Energy-General/Oil-Tycoon-Hamm-Slams-EIAs-Overoptimistic-Shale-Forecasts.html

Can’t believe Perry is not listening to him. However, waiting until after OPEC makes a move is probably wise.

Guym.

Have you seen the calculation of how much CLR lost by cashing in their oil hedges in late 2014?

I could figure it, but I have gotten a little lazy in looking at the 10K’s

Lol, forgot about that one. I will look, but I doubt they calculated it. Should have been. Hamm said, something to the effect that he was so confident that the price would go up, he was going to sell all his hedges for a profit. The price then went dowwwnnn, and then dowwnn some more!

https://seekingalpha.com/amp/article/3294555-continental-resources-billion-dollar-blunder

Not written well, years are off in article, but roughly one billion, less the $400 million gain on it.

Net loss in 2015 was about 350 million, and the profit via hedge would have made it a net profit of over 400 million.

The leading contenders for the EIA were Hamm and Perry. Proves Trump has a sense of humor. Sick sense of humor, but humor.

https://oilprice.com/Alternative-Energy/Renewable-Energy/Teslas-Surprise-Unveiling-Reveals-Fastest-Production-Car-Ever.html

Ok, I could definitely live with this one.

Unlikely it’ll corner at all well. Massive battery bricks at speed prefer continuing in a straight line, as per Mr Newton!

It also has a $200,000 price tag. Every action, has a reaction, equal in force, and in the opposite direction. Which is exactly the direction I will go in with that price tag.

http://market-ticker.org

Is Tesla On The Verge of Bankruptcy?

[Comments enabled]

If you want one of their alleged “Super-Roadsters” you need to ante up $5,000 now plus $245,000 more within 10 days by wire transfer.