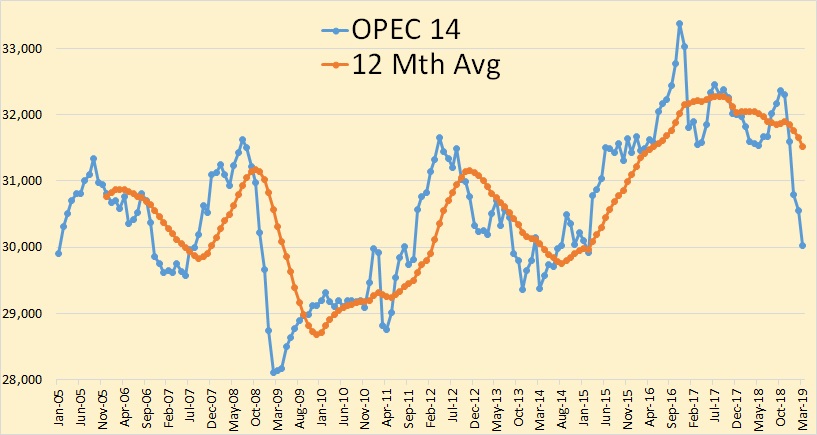

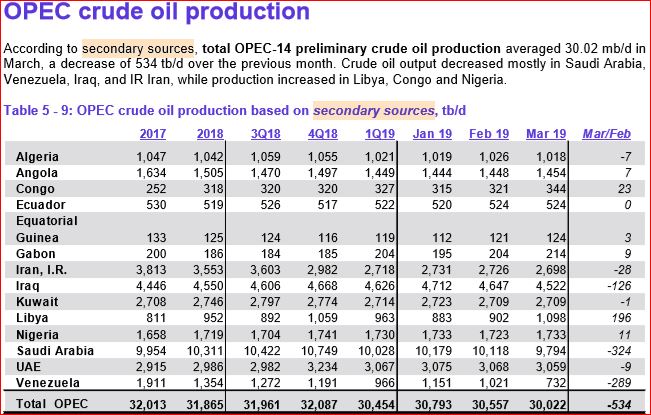

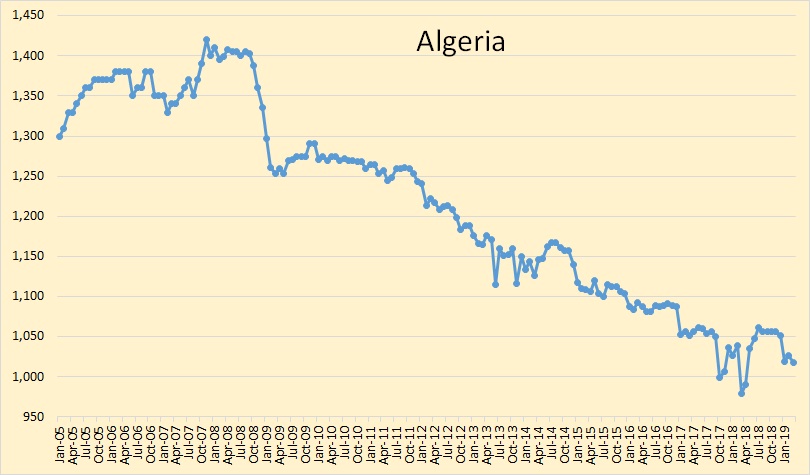

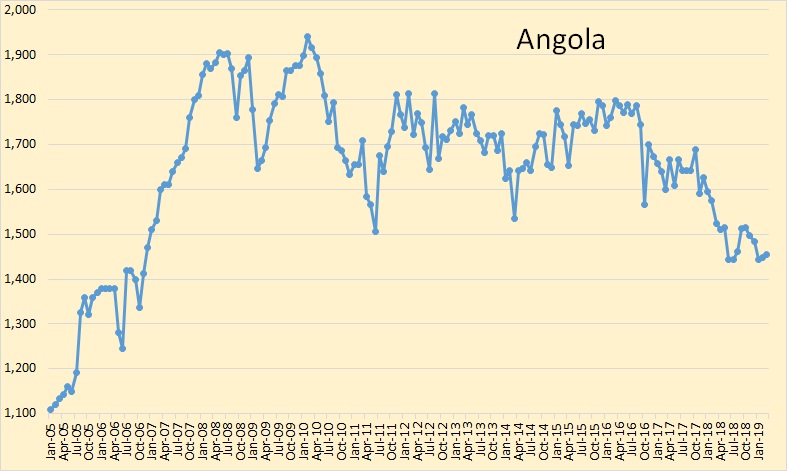

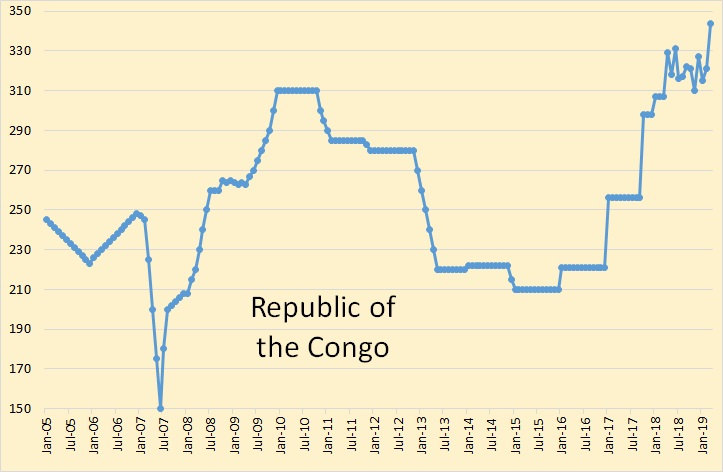

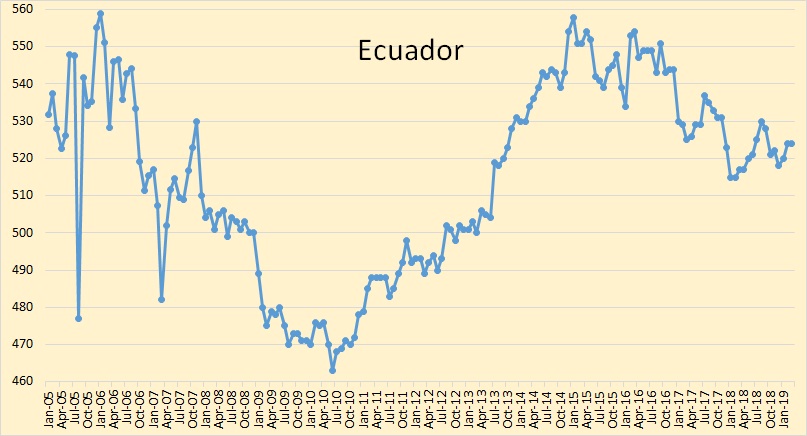

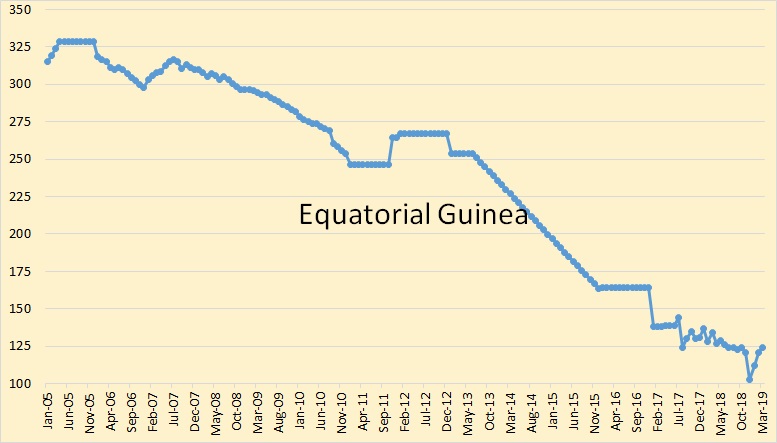

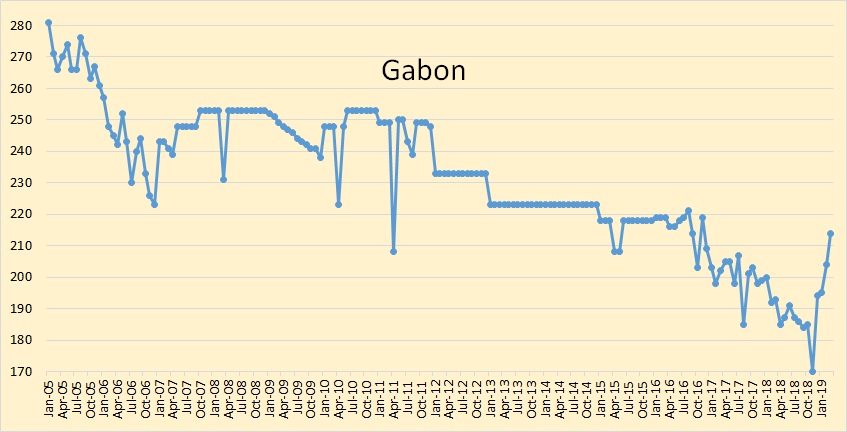

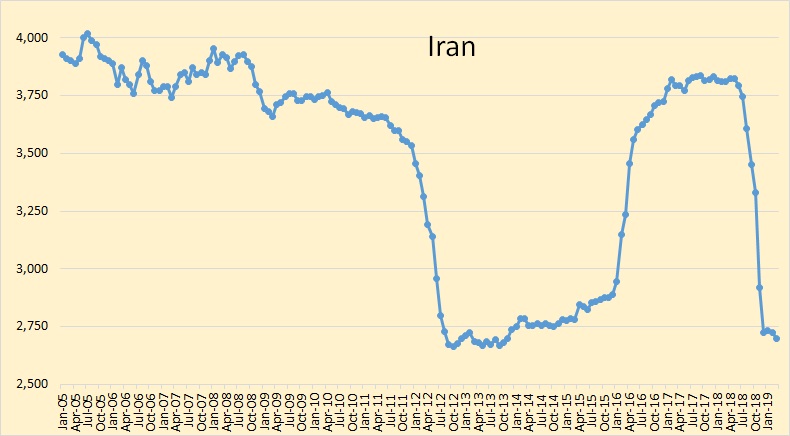

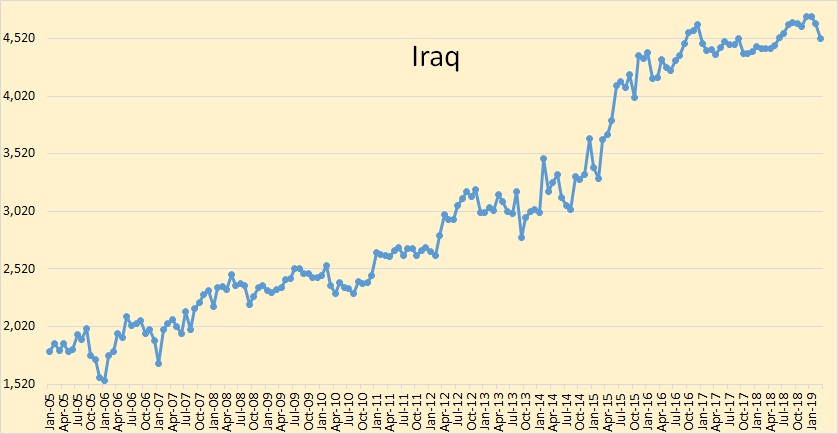

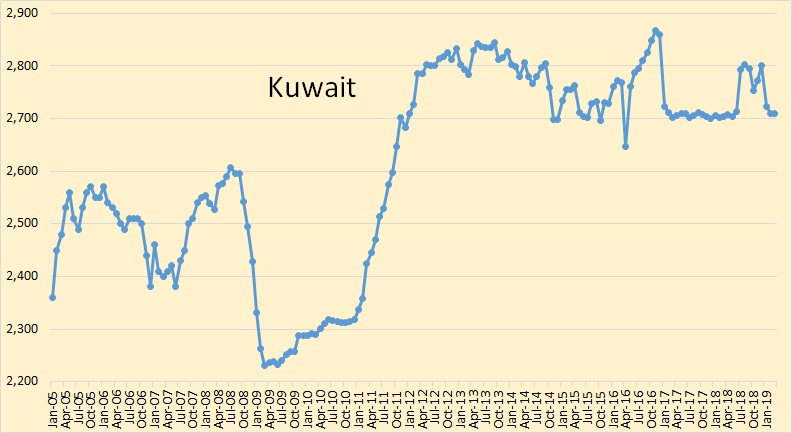

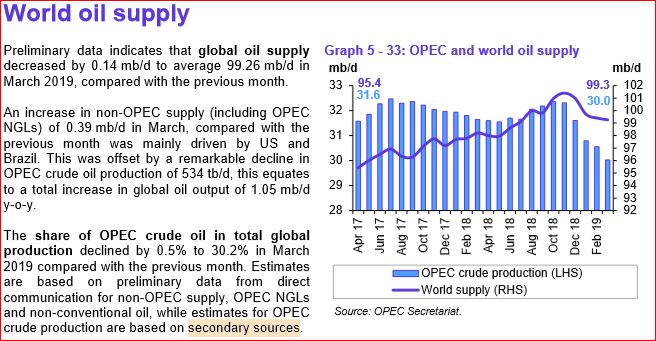

The below OPEC charts were taken from data in the OPEC Monthly Oil Market Report. All data is through March 2019 and is in thousand barrels per day.

There was another big decline in OPEC production in March, down 534,000 barrels per day.

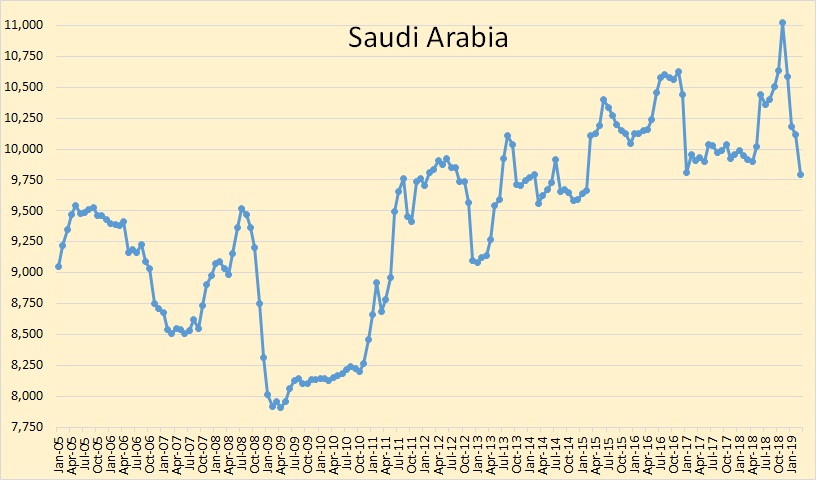

The decline was mostly Saudi Arabia, Venezuela, and Iraq.

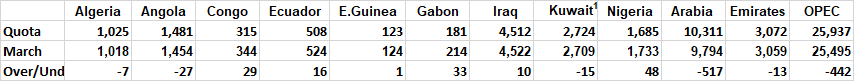

Iran, Libya and Venezuela are exempt from quotas. Everyone except Saudi Arabia are near their quota. Saudi is over half a million barrels per day below their quota.

Although Iraq was down 126,000 bpd in March they are still at their average for the last two and one-half years.

I think Kuwait is at, or very near, peak production except for their share of the neutral zone. That is shared 50/50 with Saudi Arabia. Their share would be about half a million barrels per day. It is shut down because of a political disagreement between the two countries.

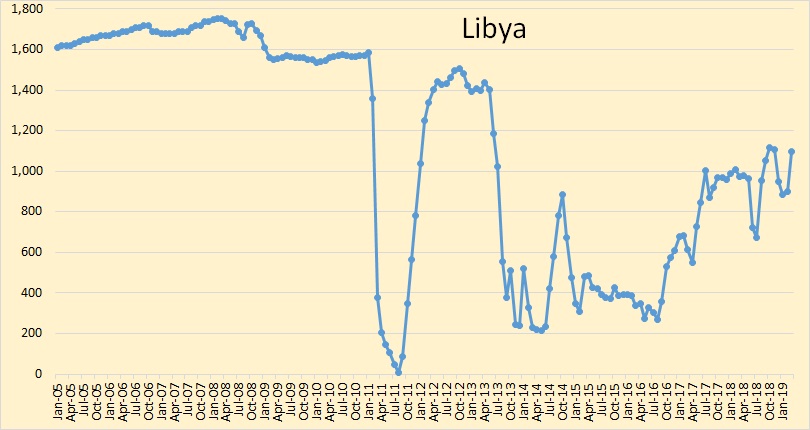

Lybian production was up 196,000 in March. They will likely be down again in April as fighting there has escalated.

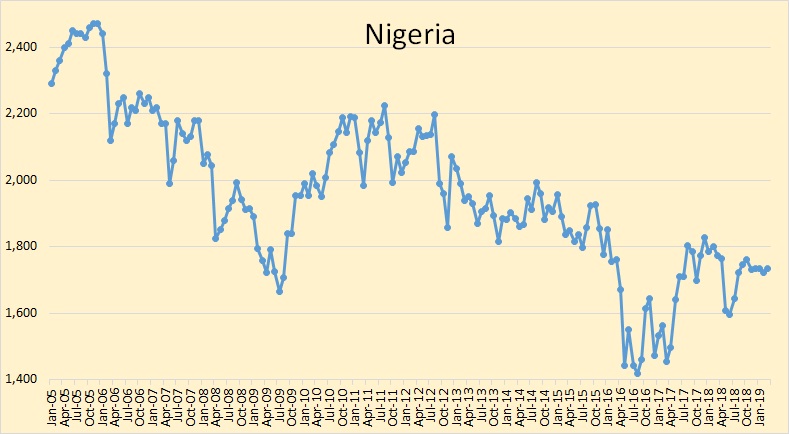

Nigeria appears to be in slow decline. They are still producing well above their quota.

Saudi Arabia is another story altogether. They are over half a million barrels per day below their quota.

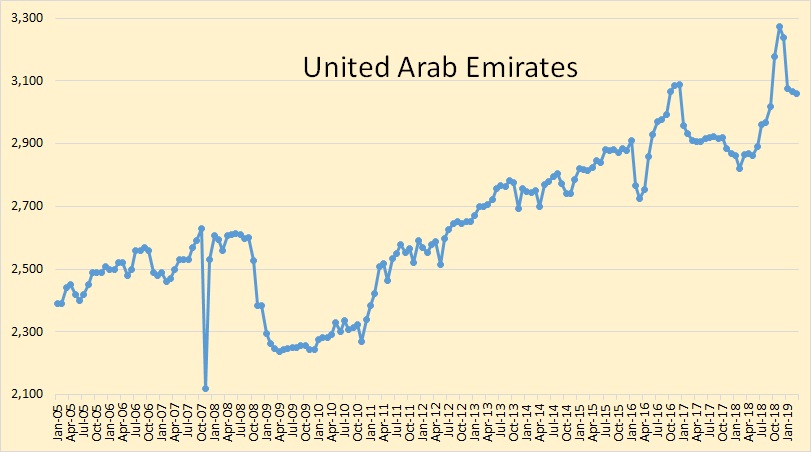

The UAE is producing slightly below their quota. The October, November, December spike in production was obviously a heroic attempt to increase their quota as they are still producing well above their average before that three month period.

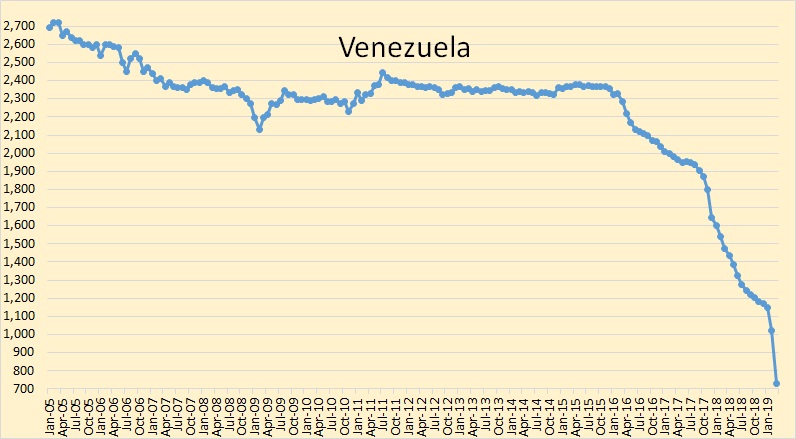

Venezuelan production was down 289,000 bpd in March. The blackouts there hit them hard. I would be afraid to even guess where they are going from here.

Concern Saudi Arabia’s Oil Reserves

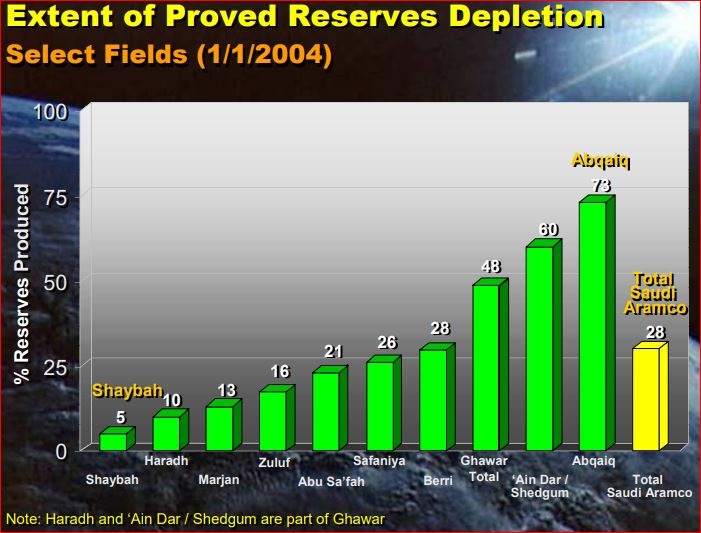

In February 2004 Saudi Arabia published a slide PDF stating, among other things, their current depletion status. But first, I want to post a bit of their history.

Crude Oil Supply Scenarios: Saudi Aramco’s Perspective

Saudi stated, fifteen years ago, that Ghawar was 48% depleted and the Ain Dar/Shedgum section of Ghawar was 60% depleted.

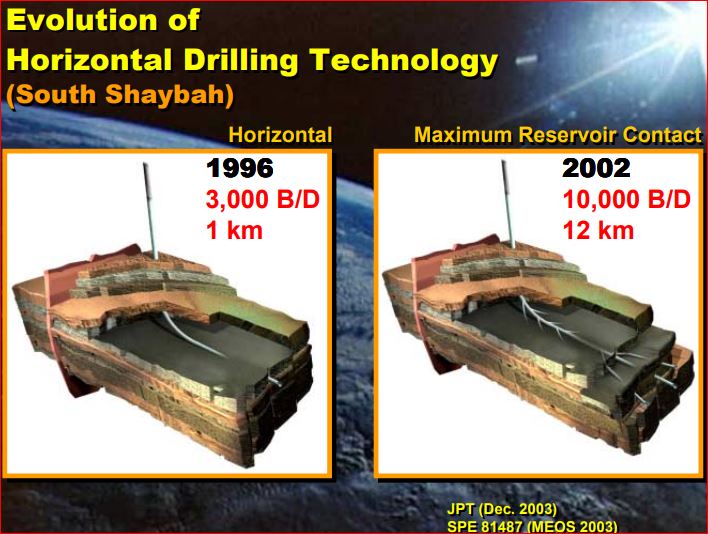

They stated, in the same PDF, that they had gotten their water cut under control. But what happened, around the year 2000, that resulted in this improvement?

Injected water was rising fast in their reservoirs. They began to plug vertical wells just below the oil line. And they began an infill drilling program with new horizontal wells, then horizontal MRC wells, that pulled the oil from the very top of the reservoir.

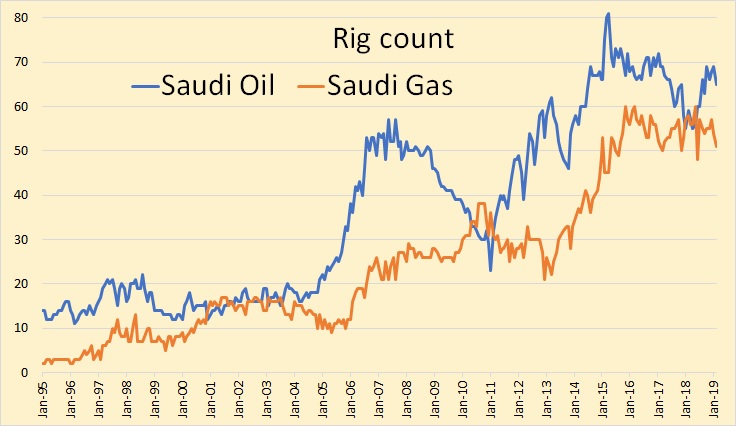

It was not until 2005 when the infill drilling program began in earnest. It slowed down in 2008/2009 when prices collapsed. But it picked up again as prices recovered and they needed more infill wells to keep production up.

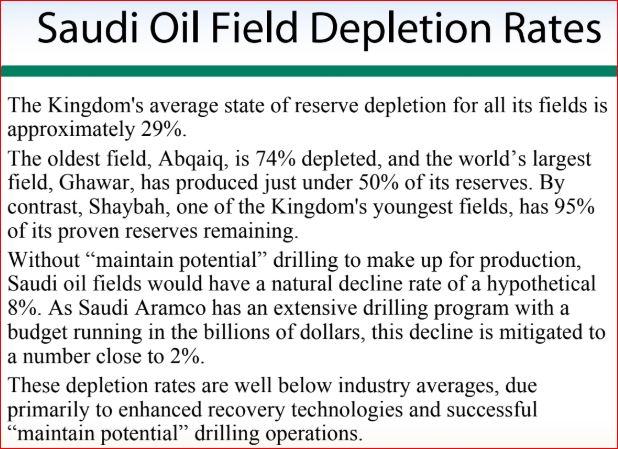

Saudi stated such in this remarkable PDF they posted in November 2006:

Saudi Arabia’s Strategic Energy Initiative: Safeguarding Against Supply Disruptions

The above statement is really astounding. One needs to read it carefully to fully understand the claims made here. They are saying that their fields have a natural decline rate of 8%. But with their massive infill drilling program, they have gotten the decline rate down to almost 2%. Their new horizontal wells are pulling the oil right off the top of the reservoir so they get less water. They are pulling the oil up a lot faster so their decline rate drops to almost 2%.

But the most astounding thing here is that last sentence: These depletion rates are well below industry averages… Now just a cotton picking minute here. We are talking decline here, not depletion. They are entirely two different things. If you suck the oil out faster, causing the decline rate to decrease, you have to be increasing the depletion rate.

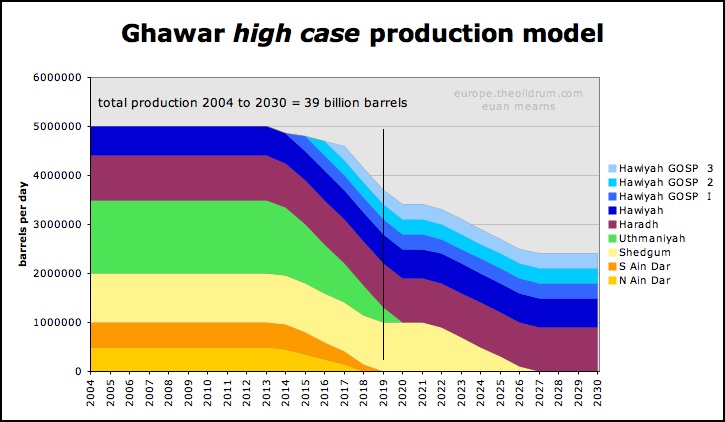

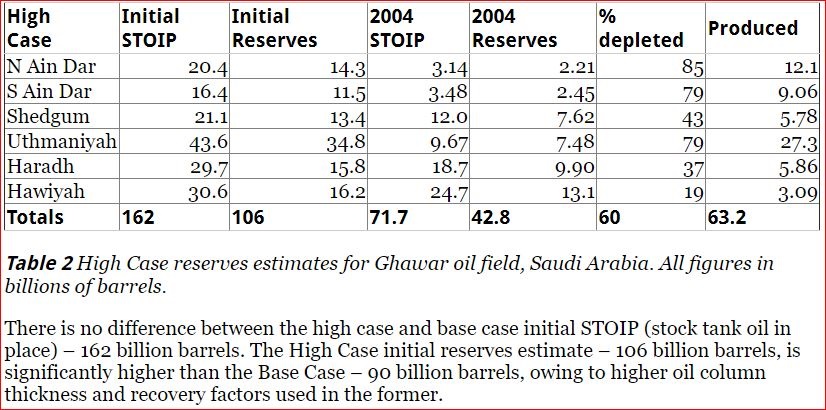

Euan Mearns posted in April 2007, using 2004 data:

GHAWAR: an estimate of remaining oil reserves and production decline

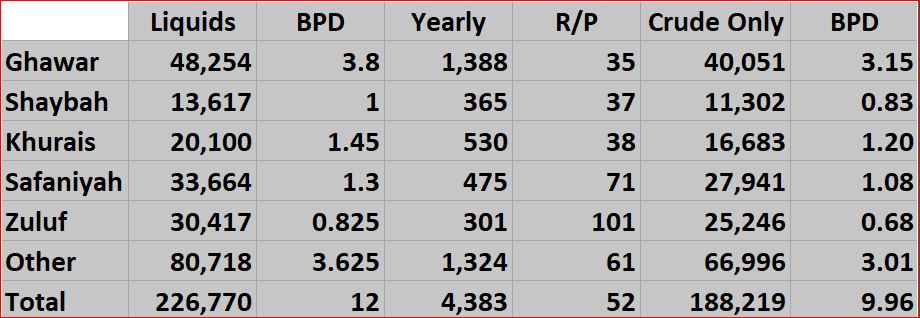

Euan posted two scenarios, base case and high case. The high case hit the nail on the head, 3.8 million barrels per day in 2019.

It is important to note that Ghawar’s older northern fields have a much higher decline rate. Also Ghawar showed no decline until around 2013. This is because they were not producing the field at full capacity. Then around 2013, the depletion caught up with them and, as they admitted, they began producing at full capacity.

Here is the data Euan used to make his assessment. He had Ghawar at 42.8 billion barrels of recoverable reserves in 2004. If Euan was correct then Ghawar likely has about 18 billion barrels of recoverable reserves left.

Ghawar’s top three fields have been producing for 70 years. Why is anyone surprised that they are now in serious decline?

A few days ago Saudi Aramco has published a bond prospectus, the first ever since the total Saudi takeover of ARAMCO in 1980. There have been several reviews of this prospectus on line:

From Bloomberg

The biggest Saudi oil field is fading faster than anyone guessed

And from OilPrice.com

Aramco’s Mythical Ghawar Field Could Be Its Weak Spot

The online version of the prospectus is quite long, 235 pages plus a 10-page introduction. But it is extremely revealing. It has generated a lot of controversies. For instance, on page 21 we find this, bold mine:

Based on the initial 40 year period and 20 year extension of the Concession, as at 31 December 2018 the Company’s reserves were 256.9 billion barrels of oil equivalent (sufficient for proved reserves life of 52 years), consisting of 201.4 billion barrels of crude oil and condensate 25.4 billion barrels of NGLs and 185.7 trillion standard cubic feet of natural gas.

Their claimed proven reserves have been downgraded by 10 billion barrels but that is not all. Those reserves are BOE. That is crude oil, plus condensate, plus other liquids, plus natural gas. Crude + Condensate is only 201.4 billion barrels. Assuming their percentage condensate is 5.5%, a very conservative estimate, that would mean, that they are claiming, their “crude only” reserves are around 191 billion barrels. So the below reserves what Saudi Arabia claims they have, in billion barrels.

BOE ———————– 256.9

Total Liquids ———– 226.8

Crude + Condensate – 201.4

Crude Only ————- 191

On page 88 we find this:

Notice the last line, MSC or maximum sustainable capacity.

MSC refers to the average maximum number of barrels per day of crude oil that can be produced for one year during any future planning period, after taking into account all planned capital expenditures and maintenance, repair and operating costs, and after being given three months to make operational adjustments….

Based on the initial 40 year period and 20-year extension of the Concession, as at 31 December 2018 the Company’s reserves were 256.9 billion barrels of oil equivalent (sufficient for proved reserves life of 52 years).

In their definition of MSC they say crude oil but in their 52-year projection they use their “combined reserves” figure, (BOE), so which are they talking about. If we multiply 12,000,000, (their MSC), times the number of days in 52 years, we get a number close to 227 billion, their “combined reserves” figure. So their MSC of 12 million barrels per day is, very likely, total liquids. However, they mix their data so often it is hard to tell.

On the same page they say:

The Company generated revenues by utilizing the spare capacity provided by MSC of SAR 133.0 billion ($35.5 billion) from 2013 to 2018.

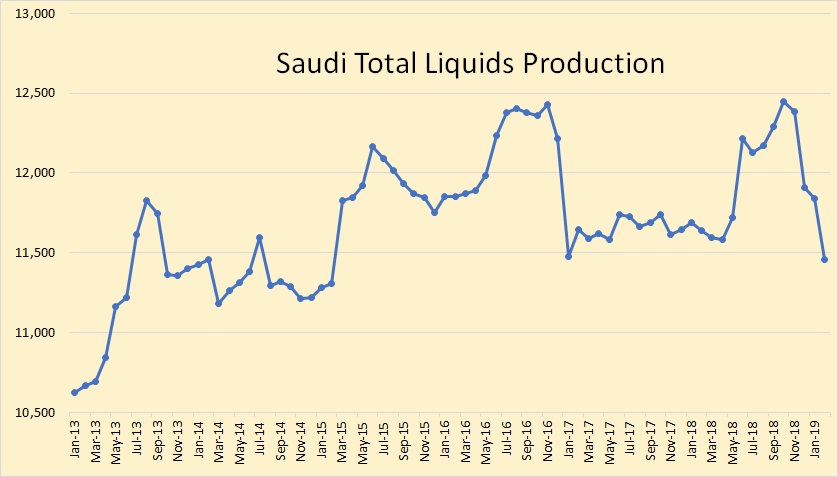

In their own words, they have been producing at maximum sustainable capacity since 2013. Let’s see what the numbers say. According to their data above, LNG is 11.72% of their reserves, and we assume, of their production. So if we assume condensate is at least 5.3% of production, (in the US it’s between 8% and 16%), then we add 17% to get Saudi total liquids production.

So yes, Saudi has been producing at maximum sustainable production, at least for the last four years. That is not to say that they are currently producing at MSC levels.

I have created the below table using 17% for Condensate + NGLs. All data except the R/P ratio is in million barrels. Understand these liquids reserve numbers are Saudi’s own figures, not my estimate. The “crude only” numbers are assuming condensate plus NGLs are approximately 17% total liquids.

Dr. Mamdouh Salameh has commented on this prospectus. I thought his comment worthy reposting here. And I might add I agree completely with his conclusions. Bold mine.

Dr Mamdouh G. Salameh is an international oil economist. He is also a visiting professor of energy economics at the ESCP Europe Business School in London. Dr. Salameh holds a PhD in Economics specializing in the economics and geopolitics of oil and energy.

There was a lot of fanfare about Saudi Arabia created by investment banks which are destined to benefit hugely from Saudi Arabia seeking to launch a major bond issuance to help finance its acquisition of 70% stake in Saudi petrochemical giant Basic Industries Corporation (SABIC).

With supposedly 266 billion barrels (bb) of proven reserves, exports of some 7 million barrels a day (mbd) providing an annualized revenue of $171.19 bn at current oil prices and production costs of $7.5 per barrel before tax, Saudi Aramco could to all appearances be confirmed as the world’s most profitable company. However, appearances could be deceptive.

To help a successful bond issuance, Saudi Aramco has for the first time since it has become a fully-owned Saudi company issued a prospectus in which it shed some light on its finances on what is being touted by investment banks like the discovery of the secret of long life.

However, the prospectus left many crucial questions unanswered. Prominent among them is the real size of Saudi proven reserves and the production levels of its very aging oilfields which underpin its current production.

Four giant oilfields Ghawar, Safaniya, Hanifa and Khafji (shared with Kuwait) all of which are more than 70 years old and which are being kept producing by a huge injection of water, have over the years accounted for more than 90% of Saudi oil production with Ghawar accounting for 50% of the total.

Now the Saudis are saying that Ghawar which is the core of Aramco’s oil production and which has been for years contributing 5 mbd to Saudi total production, can only produce 3.8 mbd. If this is the case, then the persistent reports about depletion of reserves which have been circulating for years about Ghawar must be true. It is fair to suggest that the same depletion would have also affected the other aging oilfields. This is supported by the fact that Saudi oil production peaked in 2005 at 9.6 mbd and has been declining since. In a nutshell, Ghawar could be the Achilles heel of Saudi oil production.

This also gives the lie to Saudi claims that they have a production capacity of 12 mbd meaning a spare capacity of 2 mbd.

Meanwhile, the persistent question marks about the actual size of Saudi proven reserves will continue unabated until a truly independent audit is undertaken.. Far from having proven reserves of 266 bb, I estimated the remaining Saudi proven reserves at no more than 70-74 bb. By adding Saudi production since the discovery of oil in 1938 till now (for which we have figures) and then deducting them from Saudi claimed proven reserves along with an annual depletion rate of Saudi aging fields averaging 5%-7% for the same period, my calculations came to around 70-74 bb of remaining reserves.

The fact that Saudi Arabia’s proven reserves remained virtually constant year after year despite sizeable annual production and a lack of major new discoveries since 1965 is due to the Saudis increasing the oil recovery factor (R/F) and the oil initially in place (OIIP) to offset annual production. The Saudis have been declaring an R/F of 52% or even higher when the global average is 34%-35%. They have also increased the OIIP from 700 bb to 900 bb on the basis of Saudi Aramco projecting new discoveries which are yet to be discovered.

And for a different opinion from Michael Lynch:

Declining Production At Saudi Arabia’s Largest Oil Field Is Not Cause For Concern

Why did Ghawar’s production decline? Since the field still has 48 billion barrels of proved reserves (according to Aramco’s numbers), maintaining 5 mb/d should be technically easy. However, the field is not a stand-alone operation; Aramco has a choice of investments among numerous fields, and explicitly chose to add capacity elsewhere, as proven by the fact that the national capacity is 12 mb/d, showing no signs of decline.

Got that? Ghawar is declining simply because ARAMCO chose to move production elsewhere. Lynch is right if Ghawar still has 48 billion barrels of oil. Euan Mearns estimated that Ghawar had 43 billion barrels of recoverable reserves in 2004. If that is close then Ghawar should have about 18 billion barrels of recoverable reserves left.

Michael Lynch and Robert Rapier are among a dwindling few oil people who still believe Saudi Arabia’s absurd reserve numbers. After this Saudi prospectus, it is likely that the vast majority now agree with Dr. Salameh. However, it is possible that Robert could have revised his opinion after reading the Saudi prospectus.

And another contrary opinion from climate change denier site WUWT

No… “The biggest Saudi oil field is [NOT] fading faster than anyone guessed”…

The author of this article, David Middleton, makes the absurd claim, “The MSC rate is more of a minimum rather than a maximum. That sentence just shows the absurd levels of twisted logic deniers will go to in order to deny the obvious.

There are many replies to this WUWT post, pro, and con. Many of the replies are from people who actually worked, or talked to people who worked on Ghawar. I will quote one of them, Mr. Glen Morton.

I am a geophysicist and former exploration director for a large independent oil company. At one time I had the top web page on Ghawar on the internet and have studied this field extensively. At one time, I was in charge of reservoir simulation for my company. Every seminar and meeting I went to I talked to people who had worked Ghawar doing reservoir simulations. Absolutely everyone of them said the field didn’t have the reserves people thought it did in the West. In 1996 at the SEG convention, a Saudi Aramco employee gave a paper showing the water level for northern Ghawar and it was nearly at the crest of the field. Yes, the southern part of Ghawar had less permeable and porous rocks than the north and that was developed in a drilling mania in the first decade of this century. I for one do not think you are correct about Ghawar not declining fast. One guy told me that they had drilled a well for a core below the water level to see how much residual oil was left in northern Ghawar. Because of the vugular nature of the rock, there was only about 10% residual oil saturation. I for one find the Bloomberg article consistent with everything I know about Ghawar. I think Ghawar’s problem is why the Saudi’s were unable to ramp up production fast enough to kill off shale in 2014–go look at their production and it gradually rises from something like 9.5 million a day to 10.5 a day over a period of a year or so. That is my recollection of that curve. There was no step function in Saudi production.

Conclusion:

In 2004 and again in 2006, we had hints, from Saudi officials themselves, that Saudi oil fields were beginning to have serious water cut and depletion problems. Now with this bond prospectus, we have the coup de gras. Ghawar and the majority of Saudi’s other super-giant oil fields are in serious decline.

The idea that Saudi still has 266 billion barrels of proven reserves must now be regarded as pure fiction. The Saudis themselves are no longer supporting that figure. They are now saying 256.9 billion barrels of oil equivalent. That included condensate, NGLs, and natural gas. Their oil reserves, they say, are 201.4 billion barrels of C+C. But even those numbers are absolute fiction. They have been lying for years so why should we start believing them now. Then they say they got their decline rate down to almost 2%. But then they confuse things by claiming this is also their depletion rate.

My estimate of Saudi reserves. I agree with Dr. Mamdouh Salameh, Saudi likely has between 70 and 74 billion barrels of recoverable reserves.

EIA – U.S. Petroleum Balance Sheet

A crude oil build of +7 and a gasoline draw of -7.7 (record 3rd largest draw). Finished gasoline supplied is up but also refinery outages have probably played a part as refinery crude input is lower than last year

pdf file http://ir.eia.gov/wpsr/overview.pdf

Oilytics chart summary https://pbs.twimg.com/media/D3zNFjGW4AElO-6.jpg

4 wk ave. imports https://pbs.twimg.com/media/D3zL-QkWAAE_Inj.jpg

Japanese weekly inventory change, crude oil -2.82 million barrels

https://pbs.twimg.com/media/D3xoRdfX4AABUAM.png

Fujairah weekly inventory change, total: +1,811 thousand barrels.

https://pbs.twimg.com/media/D3xpZsfWAAA4unH.png

2019-04-10 (Reuters) The battle for Tripoli is still raging, and little is certain.

Some diplomats who had met Haftar many times and lobbied their governments to overlook his hardline comments – such as that Libya was not ready for democracy – despaired when it became clear he was committed to taking the city by force.

Haftar, for his part, has been consistent in speeches and statements about his commitment to military force in his declared mission to restore order to the north African country and also dropped hints about ultimately ruling the country.

https://www.reuters.com/article/us-libya-security-haftar-insight/how-libyas-haftar-blindsided-world-powers-with-advance-on-tripoli-idUSKCN1RM0PJ

I smell Qatar funding.

RON,

Excellent post. Great job on all the Saudi data. If you believe that the Saudi’s total crude oil reserves are closer to 70-74 billion barrels, what sort of realistic annual production can they pump for an extended period? Or do you think their production will start to really fall in the next few years?

Steve

The below is Saudi Arabia’s annual average, crude only. I don’t ever expect their average to be their 2016 average. The 2019 average is the first three months only.

I do expect their production to start to decline, but not all that fast.

Steve,

We will know what MSC is for Saudi Arabia when oil prices rise to $110/b. So far the MSC for any 12 month period has been 10.46 Mb/d of C+C output (Dec 2016). If we include NGL (as BP does), the MSC in 2016 was 12.4 Mb/d, which implies NGL output in 2016 of 1.94 Mb/d.

I imagine that even if the 72 Gb proved reserve estimate is correct, KSA could probably maintain the 10.46 Mb/d output though 2025 at least. Note that US proved reserves were 42 Gb at the end of 2017. So far MSC for US (highest 12 month average output) is 11.1 Mb/d for C+C output (most recent 12 month average US C+C output).

I agree!

Ron, this is an excellent summary. Thank you for pulling it all together.

Chris M.

Hi Ron,

Generally I would go more with the estimates of a geophysicist, geologist, or petroleum engineer than an economist.

Also note that if proved reserves were 72 Gb, then 2P reserves (best estimate) are likely to be 115 Gb.

Reserve estimates change in the US, typically increasing at an average rate of 2% per year (or that was the case from 1980 to 2005). In Twilight in the Desert, the 1979 estimate from US companies for Saudi 2P reserves was 177.5 Gb and 111 Gb of C+C was produced from 1980 to 2017. That would imply 66 Gb of 2P reserves if there had been no revision of reserve estimates in the past 40 years. If we assume Saudi reserve estimates were revised at the same average rate as US reserves from 1980 to 2005 (2% per year) and then reserve growth ceased from 2006 to 2017 (unclear why this would be the case), then Saudi 2P reserves would be 167 Gb at the end of 2017. Below we have a Hubbert Linearization which suggests a Saudi URR of 277 Gb and implies remaining reserves of 166 Gb at the end of 2017. Note that Hubbert Linearization is a flawed method that in most cases underestimates remaining reserves.

See also page 98-99 of link below

https://aspofrance.files.wordpress.com/2018/08/35cooilforecast.pdf

The link above is an August 2018 estimate by Jean Laherrere and his URR estimate for Saudi Arabia is 300 to 350 Gb, if we take the average of 325 Gb, this suggests about 214 Gb of remaining C+C 2P reserves, very close to the Saudi estimate (201 Gb).

Perhaps they read Mr. Laherrere’s work. 🙂

Generally I would go more with the estimates of a geophysicist, geologist, or petroleum engineer than an economist.

Good! How about this guy?

I am a geophysicist and former exploration director for a large independent oil company.

I quote him up top. He has two other comments in the 121 replies to this post:

No… “The biggest Saudi oil field is [NOT] fading faster than anyone guessed”…

Mr. Morton has two other comments there in addition to the one I quoted up top. Here is part of the second one:

If the max rate of production today is 3.8 million per day, that is around a 25% decline from 15 years ago. Talk about micrporous saturation (most of which will never see the surface tank) really pales in comparison to the data we have on the actual number of barrels produced in the past vs what is said to be the maximum possible production today. I will stand on the schist and on my position on this issue.

I guess I am a bit surprised that yall think a 75 year old field wouldn’t have problems producing at earlier rates. Anyway, as I said, I will stand on the my schist.

Also there are six replies there by “brianjohn” who states:

I was the lead production engineer for several pilot projects. They were in 2 offshore fields (Abu Sa’fah and Berri) and in “production challenged” areas of the Ghawar field (in Uthmaniyah and Haradh)

Okay, he was the lead production engineer who actually worked in the Ghawar field. Would you value his opinion? I would suggest you read his comments along with those of Mr. Morton.

Ron did these guys give an estimate for proved reserves for Saudi Arabia or for Ghawar?

I do not doubt that production is lower today in Ghawar, I doubt the 72 Gb reserve estimate by an economist.

Did these guys give estimates? I didn’t find any.

Most of the discussion was about MSC, I agree that would be a maximum rather than a minimum.

For crude alone it looks like about 10.4 Mb/d, and for C+C+NGL roughly 12 Mb/d based on the data. Perhaps KSA has peaked, we will know for sure when oil prices rise to over $90/b.

No, they did not. They just showed that Ghawar, and the rest of Saudi Arabia has suffered tremendous depletion over the past 75 years or so. However, there is nothing alarming about that. It is only what one would expect. Except for those who believe Saudi has “Magic Oil”. That is when a barrel of oil is produced another barrel magically appear to take its place.

In the US we have the same magic oil I guess. Without revised reserve estimates US oil reserves would be negative. 🙂

Laherrere estimates URR of 325 Gb (300 to 350 Gb), cumulative production through 2017 was 111 Gb, this suggests 214 Gb of remaining reserves, fairly close to the Saudi 201 Gb estimate for C+C.

Dennis, I am curious. What do you think caused the decline in Ghawar production? Do you agree with Michael Lynch, that there was really no decline, they just decided to cut Ghawar production for some other reason. And they could easily ramp back up to 5 million barrels per day if they wished to do so?

Ron,

I imagine the Northern end of the field probably is spent, or nearly so. We don’t really know what has been happening to output in the fields of Ghawar, or I don’t.

Let’s say output was 5 Mb/d in 2005 and that in 2018 it was 3.8 Mb/d, that would be about 2% decline per year from 2005 to 2018, exactly the number the Saudi’s have given for the decline rate target with infill drilling.

Generally I don’t agree with much that Michael Lynch has to say. My expectation is that Ghawar will continue to decline at 2% per year. In 13 years (2031) output may be down to 2.89 Mb/d.

Well, no, Ghawar is not declining at 2% per year. Ghawar did not start declining in 2004. And the southern two fields are not declining at all. The northern three fields reached their Seneca Cliff somewhere around 2010 and began declining at several times 2%. They will decline to near nothing in the next few years. Then Ghawar will have level production at somewhere around 2 million barrels per day and hold that level for a decade or two.

Ghawar cannot possibly be adequately described as one field. It is five different fields with five different decline and depletion rates.

When Saudi said, in 2006, that their average decline rate was down to almost 2%, that was the average for all their fields. Some fields were declining at a much faster rate and some fields were not declining at all. Khurais and Manifa were still to be ramped up. Those fields had been in mothballs and would be brought back on line. Now they are likely not declining at all but other fields are declining at a much faster rate than 2%.

But here is the important point. The depletion rate is another matter altogether. That figure is likely above 8% per year.

Hi Ron,

Do you have production data for the various fields from 2006 to 2018? Seems we have very limited information on output from these fields for the past 12-14 years, so your description may be correct, but it seems there is not a lot of data to back it up since Euan’s post in 2004, the model looks interesting, but whether it is in fact correct is unknown. In other words his total output for Ghawar proved a good guess and it seems likely that Ain Dar and Uthmaniyah would have very low output (perhaps zero) by now as they were about 80% depleted in 2004. Euan’s model has output decreasing to 2.4 Mb/d by 2030 or at an average rate of 4% per year over the next 11 years. So far his model has been excellent and it might prove correct through 2030. It is not clear if other fields can ramp up output, clearly somewhere in Saudi Arabia took up the slack of the 1.2 Mb/d decline in Ghawar output, plus a little extra compared to 2004 output. It may be difficult to repeat that feat as there are not a lot of great prospects, but perhaps they can speed development n other fields by faster completion rates.

Of course I realize this increases the rate of depletion, the faster you pump, the more quickly remaining reserves are reduced.

Do you have production data for the various fields from 2006 to 2018?

Dennis, you know better than ask such a silly question. Saudi production of individual fields is a closely guarded secret.

Dennis, have you ever wondered why the Saudis keep all this data such a secret? Why don’t they just let the actual data known to the world? What was the production data from Safaniya in 2018? Or what was the production data from Manifa in 2018? Or what was the production data from Khurais in 2018, or from Berri, or from all their other fields? And how did that compare to the production in 2017, or 2016?

Dennis, we don’t know shit about any of this. We don’t know because it is a closely guarded secret. Why, Dennis, Why?

They know Dennis, they know and they don’t want you to know. Why?

I know why Dennis. Because what they actually report, which is almost nothing, is a lie. You simply choose to believe it. I do not. I choose to believe the analysis who try to figure out why they are lying. You choose to simply believe the Saudis.

Dennis, the idea that Saudi Arabia has 266 billion barrels of reserves is preposterous beyond belief. Even the Saudis realize that now are trying to slowly reduce that figure. Yet some people, like you, Robert Rapier and Michael Lynch, seemed perfectly ready to believe such an absurd figure. That just floored me. Goddammit, have some people gone insane?

Okay, I have said my peace here and showed my ignorance as to what Saudi Arabia actually can produce for the next 50 years. But you know, it is what they say they can produce.

You believe them. I don’t. And neither of us can prove our case. And there it must rest until the actual production data comes in… next year and next year and…..

Hi Ron,

Michael Lynch is also an economist, so I don’t put a lot of stock in what he says. Robert Rapier is an engineer who has worked in the oil industry and is pretty knowledgeable, Jean Laherrere also knows a lot. The Saudis say their proved reserves are 201 Gb for C+C, that is probably too high (this would be 320 2P reserves and I think that is likely to be too high).

The likely reason the Saudi reserves are not revealed is that all the OPEC nations lie about their reserves to get bigger quotas, as you well know.

In 1979 American companies estimated Saudi proved reserves at 110 Gb and 2P reserves at 177.5 Gb (data from Twilight in the Desert). In 2018 Laherrere estimated URR for KSA at about 325 Gb, so at the end of 2017 2P reserves would be 325-111=214 Gb and proved reserves would be about 133 Gb. As Laherrere often says the 2P estimates are the best estimates, so I pay attention to those.

So I tend to believe Laherrere’s 2P estimate of 214 Gb rather than the Saudi 2P estimate of 320 Gb. Sometimes HL can underestimate so potentially remaining 2P reserves might be 260 Gb for C+C (average of Saudi and Laherrere estimate).

Unfortunately it looks like those comments have been removed from that site Ron.

Nope, I just checked and they are still there. Try again.

No… “The biggest Saudi oil field is [NOT] fading faster than anyone guessed”…

The WUWT moderators are being put in their place by Glenn Morton and brianjohn, who actually worked on Ghawar.

Helium decline is also a news item again:

https://physicstoday.scitation.org/doi/10.1063/PT.3.4181

Error in my chart above, cumulative production was 149 Gb so remaining reserves would be 128 Gb for 2P reserves and proved reserves would be about 80 Gb, not that far from the 74 Gb proved reserve estimate of Salemah.

Good work Ron

Good work Ron.

When this is true, that’s the reason China is pushing electric travel as hard as they can.

They have more possibilites to know the truth (secret service) than we reading reports. And with SA and Russia having only round about 80 GB left, and producing each round about 10 mbpd, there are not many years left before a major oil incident.

I wonder why oil prices are that stable at the moment. Oil production fell hard this year so far, down everywhere except USA. And there the growth is decelerated.

And demand is still climbing, it will use up all the US growth projected by the optimistic EIA.

A 500 kbpd decline from OPEC is not included here, they still calculate with an increase from opec.

Last question: Where is Russia standing at the moment?

Ron,

I’m wondering if you can help solve a mystery.

In the bond prospectus SA revelaed their financials. Puzzling to me was the claim of revenue of $356 billion.

Why puzzling?

Because Brent averaged ~$75/bbl in 2018. Divide $356 by $75 and you come up with 4.75 Gbbl, which when we divide by 365 days in a year, we get 13 million barrels per day production.

???

I can’t get their numbers to work. Even with a 10% premium on their grades of crude (generous), that leaves 11.7 mbd of production…. I can’t get anything to line up here.

Any ideas?

Chris,

They also produce NGL and natural gas, in 2016 it was about 1.94 Mb/d or 708 MMb of NGL, I have no idea what the average selling price is for NGL on World markets, it would depend on the mix of NGL of course.

Saudi Arabia, in 2018 produced approximately 3.76 billion barrels of crude only. Their BOE produced was approximately 4.75 billion barrels. That would account for the revenue is they sold every barrel of it. But they consumed a lot themselves. So other than that I have no explanation. Do they count their own consumption as revenue?

EIA has about 4.5 Gb of total liquids produced by KSA in 2018, that would imply $79/boe average selling price.

I suppose in accounting terms the Saudi Government could pay Aramco for the subsidized oil and the 4.75 Gbo would give us the $75/boe selling price.

Aramco produces oil and gas and sells it to foreign and domestic users.

Saudi power companies that buy oil and gas are separate companies.

Saudi Arabia has the perfect situation to develop solar power, lots of sun and the reward of being able to sell another 3.5 million barrels of oil per day.

What is stopping them?

They intend to produce only 10% from solar by 2023

“Saudi Arabia has the perfect situation to develop solar power, lots of sun and the reward of being able to sell another 3.5 million barrels of oil per day.

What is stopping them?

They intend to produce only 10% from solar by 2023”

I’ve been wondering myself why they aren’t going solar faster, thus saving millions of barrels that could pull in billions in cash…. obviously more cash than the oil itself will ever bring in.

I don’t know why they are so slow about it, but here are my semi educated guesses.

One the royal family has been undergoing a generational and cultural transition, and it’s altogether possible that because of internal political considerations, that it has been difficult to impossible to change things around very much, in terms of their overall management plan. There are probably tons of people with power and influence who want things to stay the way they are now, because change would hurt them personally in terms of power and money.

Maybe the entire country IS a pressure cooker about to explode, as I have read in various places, and the government aka the royal family has been unwilling to rock the boat by way of making any serious new changes for fear of losing control of the country. I do know, or at least believe, that in spite of the incredible amount of money oil exports bring in, the national budget is pretty tight, and that the royal family has managed to stay in power mainly by buying the loyalty of the people as a whole, and that most of the money that isn’t siphoned off, maybe ALL of it, is spent as fast as it comes in.

And last but not least, maybe they’re holding of going solar on the grand scale for the same reason I’m holding off at the personal scale. Maybe they believe that every year they delay the investment, they will get so much MORE for their money that they’re simply watching the prices of solar farms fall from one year to the next, and holding out for more capacity for less money.

The real answer is likely some combination of these and maybe some other explanations.

ofm

There certainly are power struggles going on in Saudi Arabia.

https://oilprice.com/Geopolitics/Middle-East/Is-A-New-Crisis-Brewing-In-The-Saudi-Royal-Family.html

They are so busy trying a hold on to power, remove people from power, fighting a war in Yemen that constructive planning becomes very difficult.

Repdo may be getting there act together and are releasing tenders this year.

https://www.pv-magazine.com/2019/01/10/saudi-arabia-to-tender-2-22-gw-of-solar-in-2019-and-wants-40-gw-in-2030/

We will only know in 3/4 years if they have any chance of reaching the 40GW of installed capacity they now plan by 2030.

The most compelling point in this is how it undercuts the narrative of KSA being under pressure because of domestic spending. This is enormous money flow into the kingdom. They have no particular problems.

There is then the question of . . . why borrow money at all? Mostly . . . to establish themselves in that market. With rates so low, it’s a favorable cost of capital matter.

hubbert linearization generally has three regions… first is limited drilling, second is horizontal drilling, third is ‘crash’… given time with horizontal drilling be long due to under producing… third region should be entered soon..

Cameron,

I guess we will see, Mr. Laherrere has been doing this for a while, his HL estimate for KSA is 350 Gb.

The last 10% of EROIR oil is uneconomical to produce… and crashes. Unless some form of terary recover is pursued?

Dennis,

Can you please send me a link regarding Laherrere estimates of Saudi Arabia. I couldn’t find the specific figure of 350Gb.

Thanks

see pages 98-99 of paper linked below

https://aspofrance.files.wordpress.com/2018/08/35cooilforecast.pdf

Quote below is from page 98:

HL of past production (2005-2017) trends towards an ultimate of 350 Gb, meaning a peak in 2016 and a decline after 2020. OD is useless. This 350 Gb ultimate is confirmed by the creaming curve using discoveries estimated in 2004

HL KSA using 2005-2017 data as Laherrere does (data from EIA for C+C). Cumulative output to the end of 1972 is 16.99 Gb. Using the equation for the line, the URR is 357 Gb.

Thanks Dennis appreciate it.

Iron Mike,

You’re welcome.

I seriously doubt the 350 B bbl EUR.

Note the SA rig count plot above (in the article) … the drilling steps up in ~2005 — about the time data used in the above HL begins. I suspect this is infill drilling. That is, mere acceleration of existing reserves (i.e., keeping deliverability up, not adding reserves). If so, extrapolating it to get an EUR is very misleading.

For what it’s worth, I’m a petroleum engineer with 30 years experience…but, the above observation requires no knowledge of engineering…it should be obvious.

Good point Roger. That is the point in time when they reduced their decline rate from 8% to almost 2%. And of course, that increased their depletion rate. Yes, yes, that would make the HL estimate very misleading.

Damn! Why didn’t I think of that?

Actually a Hubbert Curve would be consistent with maximum depletion rates, that is why it gave pretty good results for the US L48. So let’s look at Saudi Arabia’s output Curve, doesn’t look like a hubbert curve, especially 1981 to 1991.

Plot below shows a 1998-2018 Hubbert Curve estimate. Note how the 1991-1997 data is far from the line, the actual data follows a curve rather than a line as a logistic is a very poor estimate of the output curve.

Dennis, don’t reply to me, reply to Roger, the petroleum engineer with 30 years experience. He made the argument, I just agreed with him…. and I still do.

The 91 to 97 line gives a recovery rate of about half the later line gives. But even that line must be shortened by the fact that infill drilling only decreases the decline rate while dramatically increasing the depletion rate.

You have not addressed that point! Why?,

Hi Ron,

Nobody has drilled faster than the US. When there was a drilling frenzy in the US during the 1973 to 1983 period of rising oil prices, the HL plot became steeper, not flatter. So a period of higher depletion rates would tend to have the reverse effect on the Hubbert plot as you seem to believe.

Roger may be thinking about individual well profiles, the characteristics of an entire field when all well output is aggregated has different behavior.

Yes the 91-97 HL plot points to about 150 Gb for the URR, do you believe that is accurate? Cumulative production is 153 Gb, so that would suggest 2P reserves would be negative 3 Gb. 🙂

“Shortening” the 91-97 estimate would make remaining reserves more negative.

If you believe proved reserves are 70 Gb then using the 1978 2P/1P reserve ratio of 177.5/110=1.6, we would have 2P reserves at 112 Gb, cumulative production to the end of 2018 is 153 Gb so URR=153+112=265 Gb, this would be the minimum we would expect.

Mr Laherrere expects URR for KSA will be 35 to 85 Gb more than this, I think he is correct and my expectation is the higher estimate of 350 Gb is more likely to be correct.

The HL method has plenty of problems as Robert Rapier pointed out long ago on the Oil Drum.

It works only if output follows a logistic function which is rarely the case. Worked pretty well for the US L48 onshore conventional C+C, but that is an exception to the general rule which is a tendency to underestimate URR especially for early estimates when annual production divided by cumulative production is more than 5%.

Early HL estimates for US production prior to 1950 also tended to result in URR estimates that were too low. A 1920-1950 US HL plot points to about an 80 Gb URR, low by more than a factor of 2. A plot on 1935 to 1950 does a bit better pointing to a URR of 140 Gb (note that in each case the estimate is too low).

US L48 onshore conventional plot which excludes Alaskan, GOM, and tight oil output is below, the flat part is 1965-1970 and the steeper section following is 1971 to 1980.

Chart is small, click on it for larger view.

Announcement this morning of “bipartisan” bill being floated to cut oil consumption via EV subsidy expansion/extension.

Two Republican Senators, both green types and of little influence when votes are not close. No GOP House members mentioned as being on board. Bill probably dies in committee.

Budget stuff and the debt ceiling are coming. This other stuff will be off the radar screen. The Mueller event has eroded agenda defining power of the left. Tesla may not have years remaining they can wait, either.

There was a blurb out the past few days . . . somewhere. About how the pie chart of transportation dominating oil consumption was reorganizing towards plastic. Seems doubtful. We need a new pie chart.

interesting how you choose to frame/spin this-

“bipartisan” bill being floated to [cut oil consumption] via EV subsidy expansion/extension”

you could have just as easily said something like-

continue current levels of support to GM and Tesla for their EV sales, or

support the nations early phase efforts to keep up with the Chinese and European auto industry, or

continue with the early phase efforts to reduce carbon emissions.

I point out here that the slower the US innovates on energy, the less of a fraction of the worlds market will be open to its products in this huge economic space.

Don’t insulate your house, it just a green plot to kill the coal industry.

Don’t quit smoking, its just a movement to put surgeons out of business.

Don’t buy a model T, it just a scheme to replace horses.

dood, there’s no agenda. Just an evaluation of probabilities. “bipartisan” in quotes because the relevant Senators don’t move GOP policy particularly. The sponsors needed “bipartisan” to have any chance of passage. Won’t fly.

And it was worded in oil consumption context because it’s an oil blog. Why would it be different?

why would it be different-? you ask.

Well for just one reason- being straightforward about the issue.

Watcher. I wouldn’t be too worried about all those ‘green types and of little influence’.

Electrification of the vehicle fleet is going to happen slowly, even with the subsidy level being extended indefinitely, and in the mean time global demand for crude just keeps growing. Here is a fact-based discussion to consider-

https://www.nanalyze.com/2018/12/electric-cars-impact-oil-industry/

IT doesn’t seem any more fact based than any other argument. It’shard to base a report on facts that haven’t happened yet It’s just another model done by a ” 240-person agency”. Others have come to other conclusions.

The agency in question is the IEA. The IEA has been consistently wrong about the changes coming to the energy markets, as discussed here:

https://www.quora.com/profile/Paul-Mainwood/Flotsam/A-modest-proposal-to-the-International-Energy-Authority

To which the IEA responds:

The World Energy Outlook (WEO) does not aim to forecast the future, but provides a way of exploring different possible futures, the levers that could bring them about, and the interactions that arise across a complex energy system.

So, which fact or projection do you dispute, and on what grounds.

“Electrification of the vehicle fleet is going to happen slowly”

So the market share for EV did not triple in three years? (2014 to 2017)

Sales rate of plug in vehicles rose 61 percent in 2018.

“We will probably see the peak of combustion engine car sales in 2018 based on global sales through October, plus estimates for November and December,” Felipe Munoz, global automotive analyst for Jato Dynamics, told Financial Times.

As of January 2018, predictions were that the demand for ICE-powered cars will continue to grow until its peak in 2022. It turns out that the major drop in overall new car deliveries in the three largest regions in terms of sales, Europe, the U.S., and China, might have significantly changed the forecast.

“When you look at 2018 since the summer, new car sales in all of the important markets are going down. Selling combustion engine cars to customers – this will not grow in the future,” commented Axel Schmidt, global automotive lead for Accenture.

In 2019, global vehicle sales aren’t expected to decline as electric vehicles are expected to quadruple their market share to about 1.6 percent. Even if overall sales increase through the next 12 months, deliveries of ICE-powered vehicles will likely fall, say specialists.

https://insideevs.com/combustion-engines-peaked-2018-ev-rise/

Probably very few new vehicles produced without batteries in 2025 to 2030 time period. After that, almost none. ICEV’s will become stranded assets as producers of parts and repair facilities diminish.

At some point the Seneca Cliff will be hit. If they are doing all this advanced recovery to to keep flow rates up then fields will probably hit a wall and crash rather than slow decline. Is my thinking correct on that?

Karen

There are lots of places oil can be made to flow as long as there is no requirement for profit — and when that steep decline arrives, there will be no requirement for profit.

But it will only lessen steepness of the decline in a marginal way.

Karen,

There are many wells, they may not all water out at the same time. Take a look at US production before the tight oil revolution. Do you see a crash in output? Me neither. The Seneca cliff for World output requires heroic assumptions which are unlikely to be true in practice. There are many oil field throughout the World in varying states of depletion. Scenario below assumes a constant rate of extraction from conventional producing reserves from 2017 to 2065, the usual tight oil and extra heavy oil scenarios are used to estimate World C+C output (2800 Gb conventional, 86 Gb tight oil, 190 Gb extra heavy oil produced from 1870 to 2300).

Dennis,

I’ve been meaning to ask you for a while now, what program do you use to plot the data? It’s definitely not Matlab right?

It is just Microsoft Excel. In some cases the models are in a spreadsheet, in others I created a simple python program that outputs to a csv file which I then use excel to create charts.

Cheers Dennis.

Hi Dennis,

I fully agree that there is only a vanishingly small chance that world oil production will hit a Seneca Cliff, for the same reasons that I argue that the world will not likely suffer a sudden global ecological collapse.

The world is probably too big and too diversified a place for the end game to play out in a sudden collapse, unless we pass some particular environmental tipping point that knocks the legs out from under the global environment. Ditto the oil industry, it’s too big and too diversified, globally, to suffer a Seneca Cliff crash.

It’s far more likely imo at least that collapse will be piece meal and regional over time and that some countries have a decent shot at pulling thru the coming bottleneck more or less whole.

But any wide scale collapse, ecological or economic, could bring on really TOUGH consequences, such as say WWIII.

Personally I think that if any of the five to ten biggest oil producers suffers a really major decline in exportable production, the effect will be to put the price of oil back above a hundred bucks, and that might throw the whole world into a new deep recession. Hot war is a real possibility.

Are there any countries that currently export a lot of oil that are likely to turn into net importers within the next few years, other than maybe Venezuela?

OFM,

I don’t follow net exports, as I assume markets will take care of this, too many moving parts for me, I prefer the big picture.

As far as oil prices at $100/b in 2017$, this is not likely to be a problem, perhaps $160/b in 2017$ might cause an economic slowdown. Keep in mind that in 2011 to 2014 when World oil prices averaged around $115/b in 2017$ the World economy was growing by 3.3% in real (constant $) GDP at market exchange rates(IMF data). In 1981 the percentage of World GDP spent on crude oil was about 8% of the World economy. The World economy will be at 95 trillion in 2025 if we assume 3% economic growth and C+C output will be about 32 Gb and if 8% of GDP is spent on this oil output that would imply a price of $237/b in nominal dollars and a price of $194/b in 2017$ (assuming 2.5% annual inflation on average from 2017 to 2025). Prices up to $160/b may have little effect on the World economy and it will speed the transition to EVs, light rail, rail, electric buses, car pooling, biking, walking, freight by rail and water.

In short there are many ways the World will be able to adapt. In fact the bigger problem by 2040 will be a lack of demand for fossil fuel, but that is a good problem to have and mostly a problem for fossil fuel producers who will not see it coming until it is too late. The workers will need to retrain to seal air leaks in homes and commercial buildings, install insulation, install heat pumps, as well as manufacture them, install PV panels for utilities and homes and businesses, install and manufacture wind turbines, build railroads and light rail, manufacture EV buses, trucks, cars, rail cars, you get the idea. There is much to be done, we just need to giturdun.

Dennis

Oil consumption has been increasing in all sectors and the growing global economy will require more oil in industry. You seem to think oil is just used in transportation. NOT true.

https://www.statista.com/statistics/307194/top-oil-consuming-sectors-worldwide/

Imagine oil production peaked today.

In order for aviation to continue to grow, along with other industries that use oil. How many of the 98 million vehicles sold this year would need to be electric cars?

How many electric motorcycles would have to be sold?

https://motorcyclesdata.com/2019/03/25/world-motorcycles-market/

Knowing these answers gives us a real understanding of what needs to happen.

Hugo,

First, oil will not peak today, it will peak in 2025.

Take the 2 million plugin vehicles sold in 2018 (with about 58% average growth rate in sales from 2014 to 2018), if that rate of growth continues to 2025 then sales are 49 million in 2025 and increase to 78 million in 2026, cumulative light vehicles that are plugin increases to 94% by 2025. For simplicity I assume plugin vehicles use no fuel (eventually as the share of BEVs increases over time this will become true, here it is a simplifying assumption). If we assume the average ICEV travels 30 miles per US gallon consumed and drives an average of 12,000 miles per year, then with the replacement of ICEVs with plugins (rate of growth in plugins slows to 1.5% per year after 2026 ) we get consumption of oil by light vehicles falling from a peak of 26,3 Mb/d in 2021 to 2.03 Mb/d in 2045. I have not included heavy trucks and buses or motorcycles, those will also be replaced with BEVs and add to the decrease in demand.

I realize oil is used in sectors besides land transportation (about half is used in other sectors). As oil prices increase, demand in all sectors may be reduced through greater efficiency and substitution.

Dennis

Surely you can see the unrealistic assumption of taking very low numbers with high percentage increase and extrapolating into the future. It simply never happens.

Can you really imagine that the car manufacturers build 50 million diesel and petrol cars one year and the very next year rip out half of that production and build an additional 30 million electric vehicles. That is simply ridiculous.

Not only do companies need to get rid of machines building diesel and petrol engines they have to order and install the new machinery that will build the new electric vehicles. They also need to retrain their workers.

Look at Mercedes, these are all new cars, being built with new machines.

https://www.mercedes-benz.co.uk/passengercars.html?csref=WEB1602080002_ppc_180216&s_kwcid=AL!160!3!292554137222!e!!g!!mercedes&gclid=EAIaIQobChMI5eiPtO_J4QIV6rDtCh1kLg6gEAAYASAAEgKJH_D_BwE

and half a dozen new diesel and petrol models are coming out in the next couple of years.

This is a far more realistic projection.

https://www.jpmorgan.com/global/research/electric-vehicles

and another

https://bnef.turtl.co/story/evo2018?teaser=true

11 million sales in 2025 and 30 million in 2030 is what the manufacturers are planning.

You cannot buy what is not made and retooling and retraining will be a costly process.

Also in many areas house have no front drive. Every single parking space will need a charging point. People will come home, park on the road and will need to be able to charge their car for the next day.

To think this will happen in 5 or even 10 years is beyond hope. There is one charging point within 3/4 mile of my house and probably around 10,000 cars owners in this area.

The scene below is typical all over England.

https://commons.wikimedia.org/wiki/File:Nowhere_to_park%5E_-_geograph.org.uk_-_272993.jpg

Fixing this chaos will take political will at government and local level.

It took our council 2 years to paint a double yellow line on a hump back bridge to stop accidents.

Hugo,

Pretty sure I said the projection was not realistic. So I agree.

Note that in this unrealistic scenario it takes 7 years for this to occur. In reality it will take longer. Most mainstream estimates will be too low as they do not anticipate peak oil.

The higher price of oil that may occur with a slower ramp in EVs will tend to accelerate the rate of sales.

Once people start driving Teslas more widely and as charging infrastructure gets built out, many will consider the ICEV the horse of today. An interesting mode of transport that their parents use. 😉

The Tesla model 3 is far superior to most other cars in its price range. About 33k for the standard rnge (220 miles) up to June 30 in the US.

33k? That is just over 45k AUD! Not including importation and tax costs. No one in their right mind would pay that in Australia for a model 3 (And it isn’t available here either, not sure why).

The cheapest tesla in Australia is:

2016 Tesla Model S 60D Auto

Around 70k AUD. (according to carsales.com.au)

Hi Dennis.

RE: The Tesla model 3 is far superior to most other cars in its price range. About 33k for the standard rnge (220 miles) up to June 30 in the US.

I know you recently purchased your Tesla, you can put an end to the controversy by posting a copy of your invoice, just leave off the address and any particulars.

dclonghorn,

My Tesla was more than that, and I got a $7500 rebate so my cost before sales tax was about 52,500. It has AWD, long range battery, and enhanced autopilot.

Tesla recently eliminated the lowest cost Model 3, so in the US it is $36,950 until June 30, 2019, this “Standard plus” has autopilot (used to be a $3000 option) and a longer range battery than the “Standard version” (240 miles vs 220 miles).

This was a recent change, supposedly one can call Tesla or visit a store to order the lower cost model.

Not really a big difference between the lower cost model and mine aside from difference in range and options.

https://www.tesla.com/model3/design#battery

Hi Dennis, At $52,500 plus sales tax, most folks can’t afford a Tesla. Tesla has a reputation of using bait and switch marketing, and the $33k Tesla seems to be somewhat an illusion.

There is certainly a market for electric cars today, but outside of China, that seems to be a subset of the luxury auto market. I would agree that someday electric cars will be common, but that will probably be a while.

DCLonghorn,

I agree most people cannot afford a 52K car (note that in some US states there is no sales tax and rates vary from state to state.

Yes the low price Tesla seems to be an illusion, though most people don’t buy the lowest price vehicle available, it could be that most people thought the standard plus was worth the extra few thousand and maybe most customers were getting the autopilot option so they decided to make it standard, not sure. So the extra $4000, may be a deal breaker for many, a lot of vehicles are sold in the US that cost 37k or more.

A nicely equipped F150 retail price is about 54,000, the best selling vehicle in the US. Even the bottom of the Line 4WD super cab F150 with 3.5 l V6 retails for $37,620, so clearly a lot of people are willing to spend 37k for a vehicle as the F150 has been the best selling vehicle in the US for quite a while, the nicer versions of the truck (Lariat) with more technical features and leather seats etc is similar in price to my more expensive Model 3, it seems a lot of the trucks that I see are these nicer versions.

I strongly disagree with that assessment. I believe the probability of a

Seneca cliff is increasing. I think oil extraction is an economic

phenomena, not a geological phenomena. During economic expansion, a

positive feedback loop is in place: oil extraction produces economic growth

which encourages investment in oil extraction producing more economic

growth. Once peak oil occurs, I anticipate that this feedback loop will go

into reverse: decreased oil production will produce economic contraction

which will discourage investment in oil extraction reducing extraction rates

leading to economic collapse.

Without investment the IEA estimates that production would fall by 50% in

2025 and by 80% in 2040.

I actually think economic collapse is a great opportunity to introduce a new

economic system. The one we have is not only unfair, it encourages

environmental devastation.

David Graebner asks rhetorically how a theory such as neoclassic economics

based on false hypotheses perdures. His answer is that you teach the biggest

lies in the first year. That’s why false preconceptions about the economy

are so common. I think neoclassical economics chose the wrong mathematical

tool to analyse the economy, they chose optimisation. I don’t see anything

optimal in the economy, I think differential systems would be a much more

appropriate mathematical tool with which to analyse the economy, keeping

track of money flows.

Our assessment of how the oil cycle will play out can be found here:

https://www.tse-fr.eu/publications/oil-cycle-dynamics-and-future-oil-price-scenarios.

Schinzy,

Thanks for the input. Assuming the Seneca cliff scenario occurs, wouldn’t war be a likely outcome as a result? That’s the most likely scenario in my worthless opinion. There will be little to no chance to create a new economic model you suggest.

What are your thoughts about a break out of war in the Seneca cliff scenario?

Cheers

A war? Between which countries? I know the question was not directed to me but I don’t think war is likely at all. I mean a major world war between powerful nations. Of course there will be civil wars all over, just like there are today.

Hi Ron,

I assume a Seneca cliff scenario would imply rapid economic collapse, as a result i think there will be war over resources. Between which countries i don’t know, but i assume U.S will go to war with Russia and or China, via direct war or proxy wars in regions were the countries national security depends on specific resources. So the middle east would as usual be a key area of conflict.

I believe a Seneca cliff scenario would be a catastrophic one hence the reaction to such a scenario would also be catastrophic.

U.S will go to war with Russia and or China, via direct war or proxy wars in regions were the countries national security depends on specific resources.

Perhaps! However modern warfare tends to be very energy intensive. It seems to me a rather safe bet that in a post peak oil world, mostly running on renewables, it might be more likely that societies will be trying to conserve their energy resources and not waste it on war.

But the verdict is not yet in, on whether or not humans are smarter than yeast!

In the past countries that have gone to war with one another usually shared a border or a littoral zone. There was not a lot of energy for power projection. I feel it’s likely that any future resource wars will be fought between opponents in regional areas. China vs Vietnam/India/Taiwan, Iran et al vs KSA et al, USA/Columbia et al vs Venezuela, Egypt vs Libya, Iran/Syria/Lebanon/Hez vs Israel, China vs Russia for Siberia. Maybe a 3rd Congo War. They’re usually a god damned mess. Perhaps USA will fight China in an inter-regional conflict, but I doubt it, because there wouldn’t be much profit in it, and both have more profitable opportunities closer to home. Recent news has Turkey pivoting to Russia for high end weapons contracts, which usually means some level of accompanying security guarantees. Russia showcased really nicely in Syria and sales are hot.

The idea that he US will go to war over oil with the Chinese and Russians is unlikely (IMO) because war is energy intensive, and combating credible foes on other continents is oil intensive, and therefore counter-productive.

There are much better options for the US: (assuming a bond-villain level madman (as opposed to the “In Like Flint” level madman you have now). Annex Canada, go full-on protectionist with your economy, institute renewables and limit oil use.

Voila! The US is able to go about a reduced version of it’s business while those who will be it’s real geopolitical foes (Russia, China, the Common Market) have to fight amongst themselves for the scraps. This is how I think the future will play out: globalism dies, old allies are let go or subsumed, and China and the Europeans try to get what’s left of the middle east and Russia’s oil.

Among the possibilities that will never happen are to encourage the Northern Tier of oil using states to join up with Canada – esp when they are blue (from the cold) states such as Washington and Wisconsin.

That will stretch out the oil that is left without extra political problems.

Even post-peak, there will be plenty of oil on-hand among the major militaries to wage a full-scale war over remaining resources. The energy-intensive nature of such a conflict argument does not hold much weight. It seems like wishful thinking to me. Indeed, if it were a serious factor, it could actually trigger wars before the economic dislocation that is likely to result after an actual Peak Oil event–to take care of things before oil supply became a real problem.

My read on the situation is that WW-III is most certainly being planned for among the major powers. This does not mean that it will happen, but it is certainly is in the direction of such. World wars do not just happen overnight–they require decades of carful orchestration beforehand, as was the case for both WW-I and WW-II. This includes everything from finding financing to building capital equipment (aircraft carriers are not built in a day) to the propaganda engines required to garner popular support for such battles. My suspicion is that this conflict is being planned for the 2030s, and it looks like it will involve the US, Russia and possibly China, among other players. This war could happen a bit earlier, though error in the forecast timing is more likely to be later.

Why fight such a war? Difficult to explain in a few words. To put it simply: Those in power do not like to share power, and they will do whatever it takes to preserve what power they have though the Peak Oil crisis. If this requires a major conflict to ensure that x-amount of wealth flows in y direction, then that conflict is likely (but not certain) to occur. In as much as WW-II ended up with a major redistribution of wealth and power, WW-III could also result in the same for the victor, and if the odds are favourable to the right interests, a major conflict could certainly happen.

Just my $0.02.

-best

Historically, according to Turchin and Nefedov, resource scarcity first led

to inter-elite competition and then to civil war. The civil war might weaken

the country and make it prey to invasion by foreign armies. There have been

cases in which an autocratic ruler has attacked a neighboring country to

avoid insurrection within their own country. There are already conflicts in

the Middle East which one might relate to financial stress caused by peak

oil.

I am actually optimistic that a large scale war can be avoided. See my

comment in response to Dennis below.

Schinzy,

Interesting paper, I would need to delve into several papers to understand fully. Neoclassical economic theory has plenty of problems, especially when it tries to explain macroeconomics, for an individual business I think it works pretty well, for the macro economy ridiculous conventions such as the auctioneer need to be invented to arrive at an optimal set of prices. Clearly there is no such method which determines an optimal set of prices in the real world.

As to your conclusion that a shortage of exergy will lead to falling prices for exergy, this seems unlikely. Keep in mind that a shortage only exists if their is more ability for consumption (with both the desire and the money to fulfill those desires) than available product.

So when one gets a counterintuitive result, one needs to look very carefully at the underlying theory. No doubt you have done so.

Can you explain how a “shortage” of exergy might lead to falling prices for exergy?

From page 3 of your paper:

It is tempting to believe that in the case of shortage of an essential item in the economy the price of that item will rise. This is disputed in Illig and Schindler (2017) and Schindler and Schindler (2018) where it is clearly not indicated by the dynamic production function equations. Indeed the authors speculate that as exergy goes into decline,

∂p/ ∂E ≥ 0, (2.1)

so that price actually declines with production.

A problem might be how you have defined exergy (this is not well measured so undoubtedly you chose something as a proxy).

There is a huge amount of waste in current energy systems, but over time the exergy per unit energy consumed has been increasing and will continue to do so as the percentage of fossil fuel utilized falls.

Email me if you are interested in discussing. You may not want to pursue in a public forum.

Another thought. Oil is not the only source of exergy, there is coal, natural gas, nuclear, hydro, geothermal, wind, solar, and biofuels.

So there might not be a peak in exergy per capita as wind, solar, hydro, geothermal, and biofuels substitute for fossil fuels, it seems a mistake to reduce exergy to fossil fuel use.

I absolutely agree that fossil fuel production is an economic phenomenon and especially in might tight oil model only consider that a barrel of oil will be produced if it is profitable to do so.

For my conventional and extra heavy oil shock models there is no economic input to the models, it is assumed in those models that there is always adequate demand such that oil prices rise to a level where the marginal barrel is profitable to produce. That is certainly a valid criticism of the oil shock model. One that I should address.

I also wonder if you assume that exergy causes the economic growth, you may have the causation arrow reversed. In any case when two things are correlated causation could go either way or both ways or neither way (spurious correlation).

Dennis

We could have a deflationary cycle such as in the Great Depression.

https://www.frbsf.org/economic-research/publications/economic-letter/2009/march/risk-deflation/#2

As an example food prices started falling because there were so many unemployed. Farmers could not sell their goods, so stopped producing.

Even though supply of food diminished, prices continued to fall.

http://ramwebs.wcupa.edu/jones/his480/reports/dep-food.htm

Peak oil could cause very high oil prices which in turn causes a recessionary and deflationary spiral.

When money can be printed with no account of something tangible, anything can happen.

Hugo,

If nobody has money to buy food then in economic terms that is a lack of demand. Classical Economics taught that there could be no lack of demand and that markets would be self correcting, Keynes master work showed that the classical economics was a special case of a more General Theory of Macroeconomics. As long as economists understand this theory another Great Depression is not very likely. Friedman and Swartz’s work on Monetary theory will also help, there needs to be adequate money supply and when there is a lack of aggregate demand the government needs to step in with fiscal stimulus.

This knowledge is the reason the Great Financial Crisis did not become Great Depression 2, though European fiscal policy prolonged the crisis in Europe as much of Europe seems to be unfamiliar with Keynesian Theory or chose to ignore it in favor of neoclassical macroeconomic nonsense.

If all nations in the World follow the European response to another financial crisis then a deflationary death spiral may be assured.

We can only hope Europe and the World has learned from the European catastrophe that was the economic policy response to the GFC.

Dennis

All economic theory has it’s limits, they all work up to a point or in certain situations.

Including your economic belief system.

Your belief that limitless money supply will prevent another financial disaster is wrong.

The reason being, finances are reliant on goods and this is a finite world. If raw materials were unlimited then your beliefs would hold true. Unlimited money meets unlimited raw materials. BINGO

How will unlimited money repair this?

https://www.weforum.org/agenda/2018/07/fish-stocks-are-used-up-fisheries-subsidies-must-stop/

It is actually too much money that is destroying all the fish in the world.

How will unlimited money fix this?

https://www.theguardian.com/environment/2017/sep/12/third-of-earths-soil-acutely-degraded-due-to-agriculture-study

Perhaps you think that the money another billion people will make will fix soil erosion?

https://news.nationalgeographic.com/2016/12/groundwater-depletion-global-food-supply/

Our fish are trawled to extinction for money, our forests destroyed for money. Vast amounts or chemicals are poured onto crops to make more money.

And you really think money will fix what it has destroyed.

https://www.theguardian.com/australia-news/2019/jan/24/darling-river-crisis-the-farms-without-safe-drinking-or-washing-water

When limitless money meets limited natural world.

I have absolutely no doubt which will win out.

Economics will be seen for what it is, the exploiter of our natural world.

Hugo,

Yes monetary policy has limits, that is why fiscal policy is needed as well in an economic crisis.

Where did I say limitless money solves any problem?

In some cases a lack of money does indeed cause problems, that is why a deflationary spiral is so damaging. Any debts become larger in this situation and many loans are defaulted on, this causes an unwillingness to lend as well as a lack of demand because all financing dries up.

With an inadequate supply of money the wheels of commerce grind to a halt as a barter economy is not very efficient (which is the reason money exists). You may not have studied a lot of economics, but this is all pretty standard stuff.

Economics is just the study of how humans allocate scarce resources to provide for human needs. It is humans that exploit the natural world, economics is just the study of how we do it.

Don’t blame economics, blame humans. Capitalism should be regulated properly to reduce negative externalities. The problems you point to is a failure of governments to properly regulate those negative externalities.

Capitalism is far from perfect, but when properly regulated and with a tax structure that is highly progressive, including high estate taxes with all loopholes closed (this might include a 50% tax on money moved to offshore accounts in tax havens), it is a better system than any other devised so far.

(I am thinking of the progressive nations in Europe, rather than the poor implementation of capitalism in the US where the wealthy have managed to capture government to increase their share of income and wealth.)

Dennis

You cannot regulate over consumption.

People are inherently greedy, rich people build big houses that use up huge amounts of limited resources.

Rich progressive Europe uses 3 times as much oil as India.

Plentiful energy and money has enabled farmers to plough vast areas of land and deplete the aquifers.

There are no regulations which will feed another billion people and prevent ecological destruction. 8 billion poor people could live on earth. 8 billion middle class people will destroy it.

You can tax consumption and that will reduce it. For the wealthy we can tax income at 50% they will accumulate less and consume less. Regulations can be put in place to require businesses to take back worn out goods and pay for their recycling or disposal. This will change the way things are made so there is less cheap throwaway items. There can also be regulations on farming and other economic activity to reduce environmental impact.

Note also that middle and higher income nations have lower total fertility ratios and as the world develops birth rates will fall and population will decline. That will probably be the biggest factor that will reduce environmental impact.

Dennis,

Let me first say first that my world view has been fundamentally modified in the

last 14 years. The first tremors began when I started following the peak oil

debate in 2005. The second major tremor began when my daughter introduced me

to the culture of permaculture in 2009.

I was astonished to learn in 2009 that many neoclassical economists

discounted the importance of energy in economic production because of the so

called “Cost Share Theorem” from neoclassical economics. Richard Feynman

said: “If your theory is not compatible with empirical results, it’s wrong.

It doesn’t matter who you are nor how smart you are.”

In the above referenced paper, I am aiming at posthumous fame by assuming

that exergy production, more commonly called energy production produces

economic growth rather than the contrary. We make that assumption and reason

from there. Our conclusions are different from those of neoclassical

economists. We will see what happens, if we are wrong, well then we are

wrong and our theory can be thrown out. If we are right, we might attain

posthumous fame one day. That’s exciting!

Take Venezuela as an example. There is a lot of oil in Venezuela, but

production is crashing. Venezuela neglected its oil infrastructure for

almost 20 years. Nationalisations lost money for foreign investors so they

stopped investing. Inflation is very high. Workers in the oil industry are

quitting because their salaries are too low to feed their families. Without

foreign help, the feedback cycle has gone into reverse. The economy is

collapsing with oil production. Could this happen elsewhere? I think so. I

have a list of countries which I consider candidates to be the next

Venezuela. I look for neglect of oil producing infrastructure and things

that can scare away foreign investors: wars, corruption, theft, lawlessness,

sanctions, etc.

The reason I think large scale war can be avoided is ecoagriculture.

Ecoagriculture is a strict subset of organic agriculture. Most organic

agriculture is not ecoagriculture. Industrial agriculture fights against

nature. Ecoagricultural techniques are like surfing the waves while

industrial agriculture is riding a jet ski against the current. The more one

learns about how plants grow naturally, the more one wonders how industrial

agriculture works at all. In fact, the reason industrial agriculture works

is cheap oil (and gas). That’s why between 3 and 5% of North Korea’s

population starved to death in the 1990s after the Soviet Union halted

deliveries of subsidised oil to the country. The Soviet Union also halted

deliveries to Cuba. The Cubans did not starve because they brought in

Australian experts in ecoagricultural techniques to show them how to grow

food without oil.

Ecoagriculture produces more food per hectare than industrial agriculture

but labor inputs are higher. After peak oil, we will be obliged to switch to

ecoagricultural techniques if we are to feed the world. If we switch to

ecoagricultural techniques before peak oil, there are big advantages with

respect to climate change. Ecoagriculture improves soil quality. The best

indicator of good soil is its carbon content. There is 3 to 4 times as much

carbon in the soil as there is in the atmosphere. Industrial agriculture

vents this carbon into the atmosphere. That’s why agriculture is responsible

for 24% of global greenhouse gas emissions while all of transportation

produces only 17%. That’s why Toensmeier wrote The Carbon Farming Solution.

The amount of carbon we can sequester in the soil by improving its quality

through different land use can be found

here: http://carbonfarmingsolution.com/carbon-sequestration-rates-and-stocks.