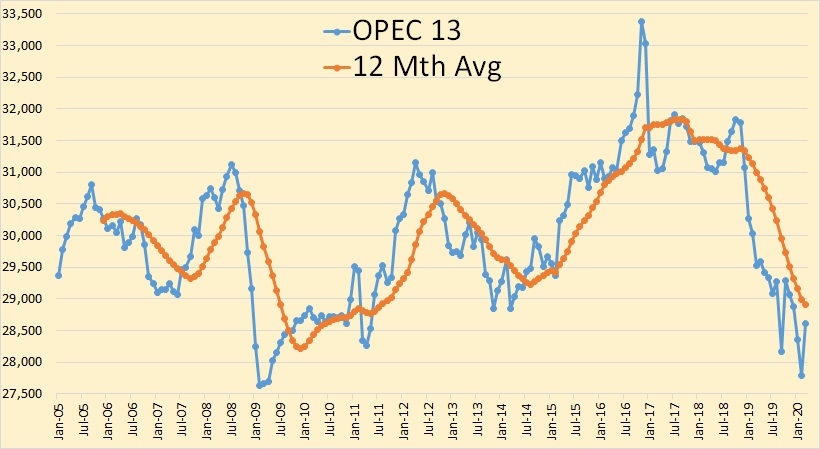

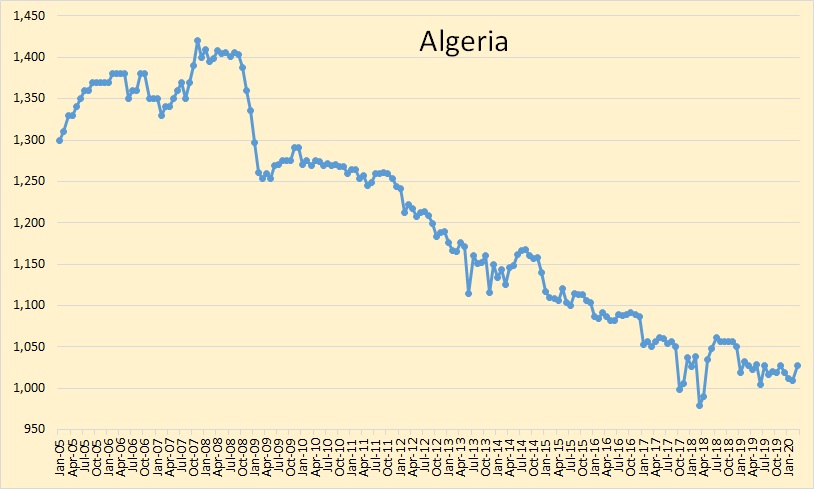

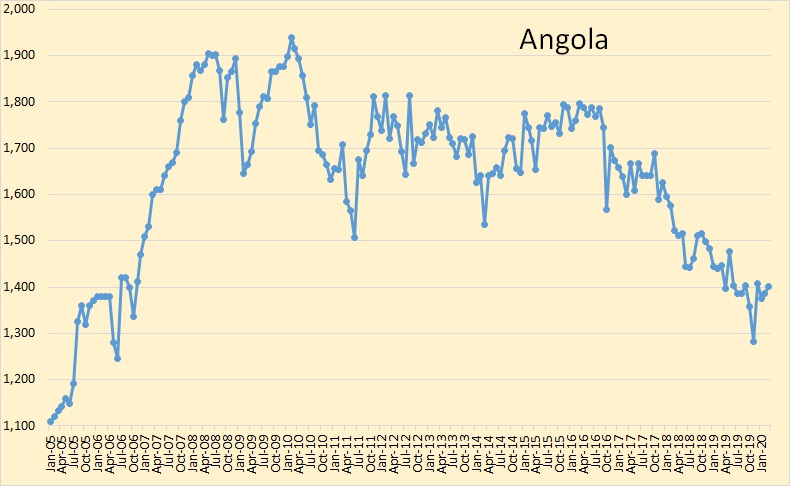

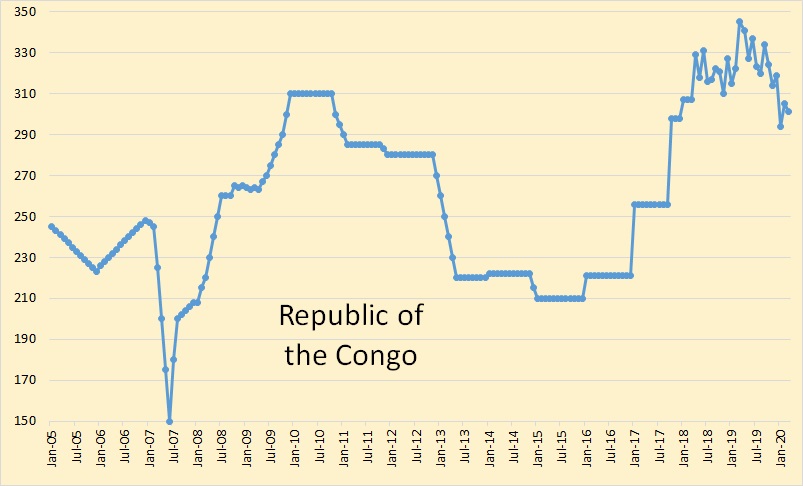

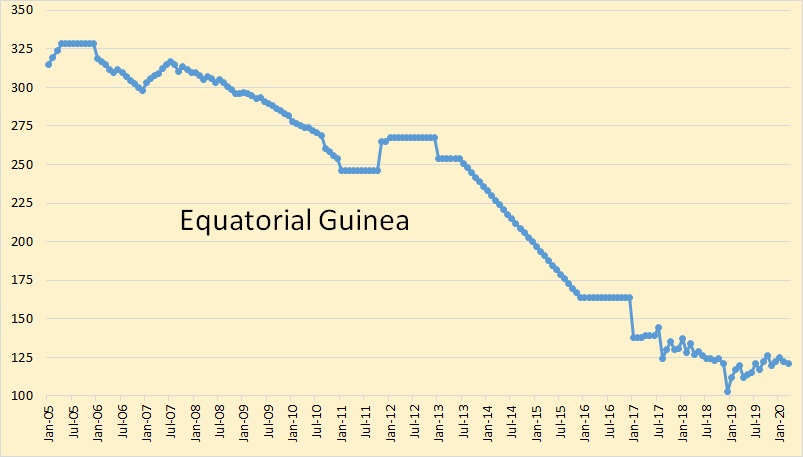

All OPEC data reflected in the charts below are from the April edition of the OPEC Monthly Oil Market Report. https://momr.opec.org/pdf-download/ The data in in thousand barrels per day and all data is through March 2020.

Though OPEC 13 was up 821,000 barrels per day in March it was still the fourth lowest month in 9 years.

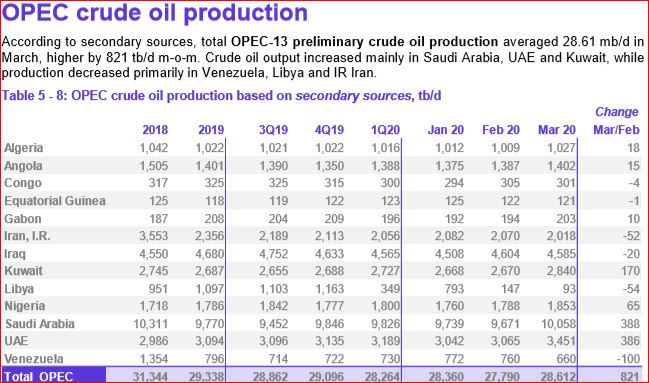

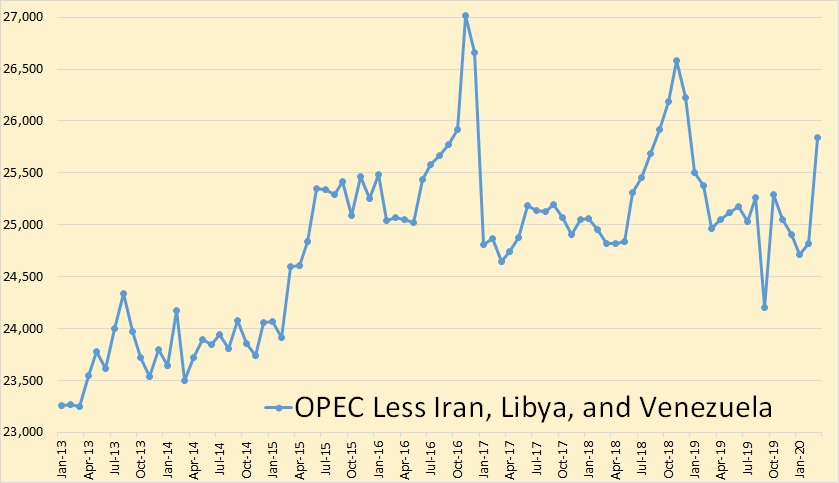

Iran, Libya, and Venezuela are exempt from the agreed on cuts. These three were down a combined 206,000 barrels per day. Those subject to cuts, were up a combined 1,026,000 barrels per day.

Untitled Spreadsheet

What you see here is OPEC members positioning themselves for the agreed upon cuts. This has happened twice before,in recent history, in 2016 and again in 2018. Everyone was producing flat out, and, no doubt, some even emptying their storage tanks. Nevertheless one can see the obvious decline since 2016.

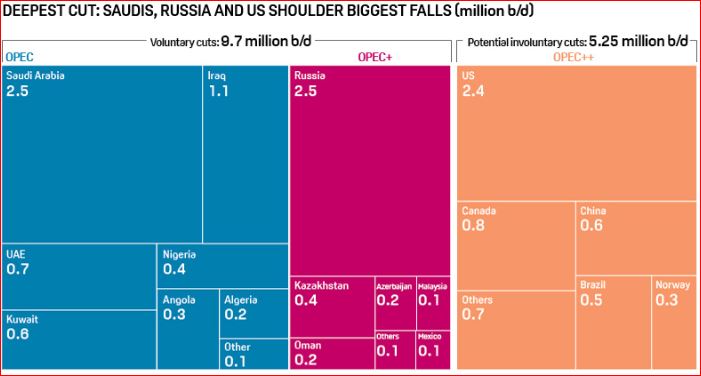

Here are the agreed upon cuts. Though I am sure not everyone agreed. Nevertheless this is the cuts, from their March production numbers that they should be making, beginning in May 2020.

Note: I cannot locate, on the web, the exact date the cuts are to start or from what point. That they start on May 1st and from their March production level is just an assumption on my part. If anyone has better information please inform me and I will make the necessary correction.

I really doubt that Algeria will cut 200,000 barrels per day.

Angola is supposed to cut 300,000 barrels per day. That would put them at about their January 2005 production level.

Congo is almost a non participant in this drama.

Ditto for Equatorial Guinea.

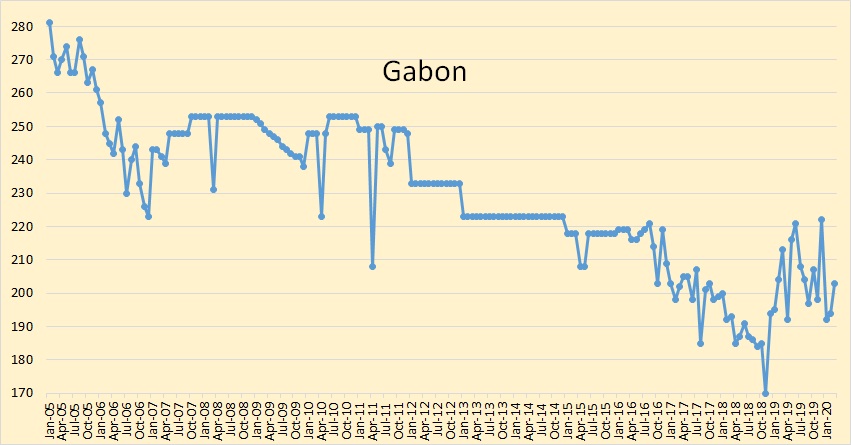

Ditto for Gabon as well.

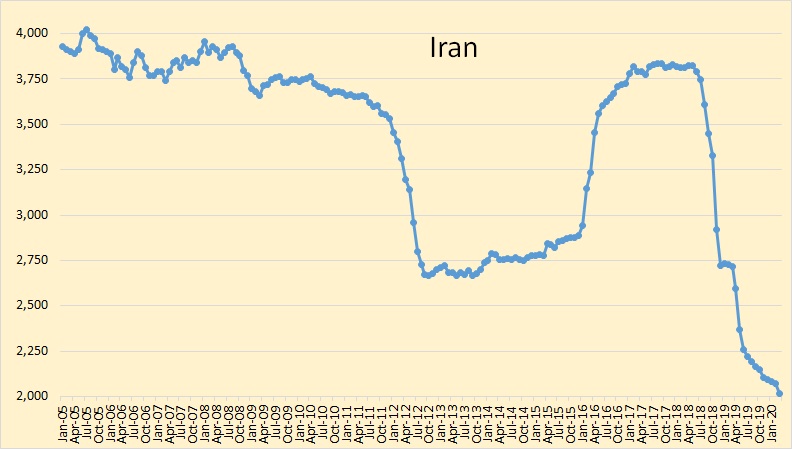

Iran, exempt from cuts, was down 52,000 barrels per day.

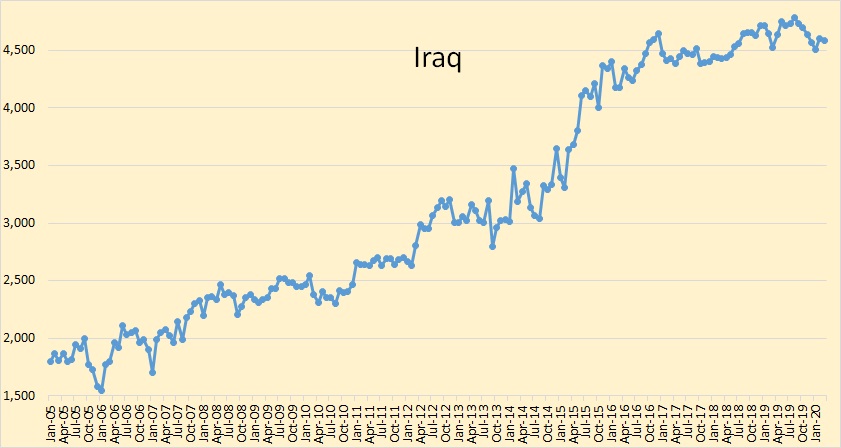

Iraq, down 20,000 barrels per day in March, has obviously been producing flat out since forever. They have always ignored quotas. But now they are supposed to produce OPEC’s second largest cut, 1,1,00,000 barrels per day. If they ignore cuts this time this will really piss Saudi Arabia off. This is about to get interesting.

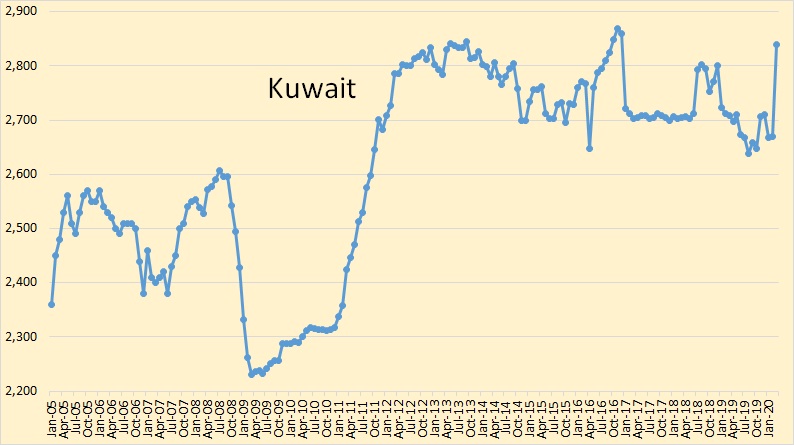

Kuwait increased production by 170,000 barrels per day in March, preparing them for a 600,000 bpd cut. That would put them at 2,240,000 bpd, near their 2009 lows.

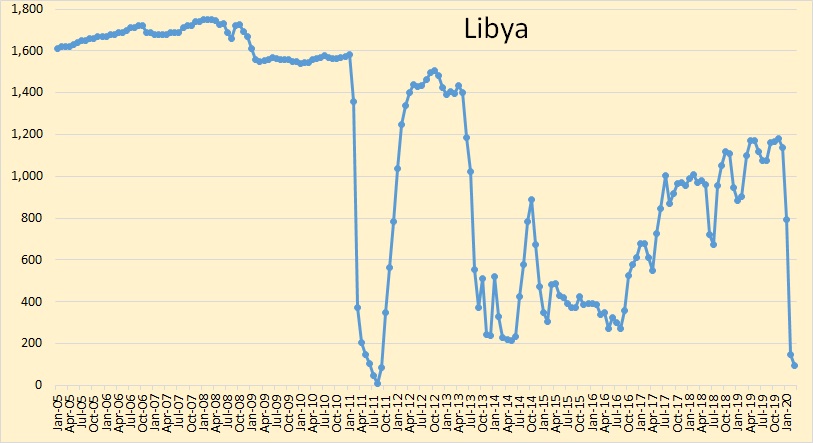

Libya was down another 54,000 barrels per day in March. Their export posts are still being blockaded.

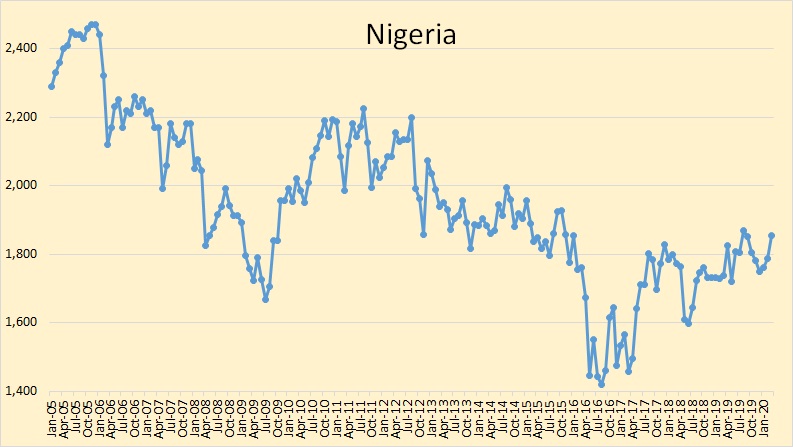

Nigeria was up 65,000 barrels per day in preparation for a 400,000 bpd cut.

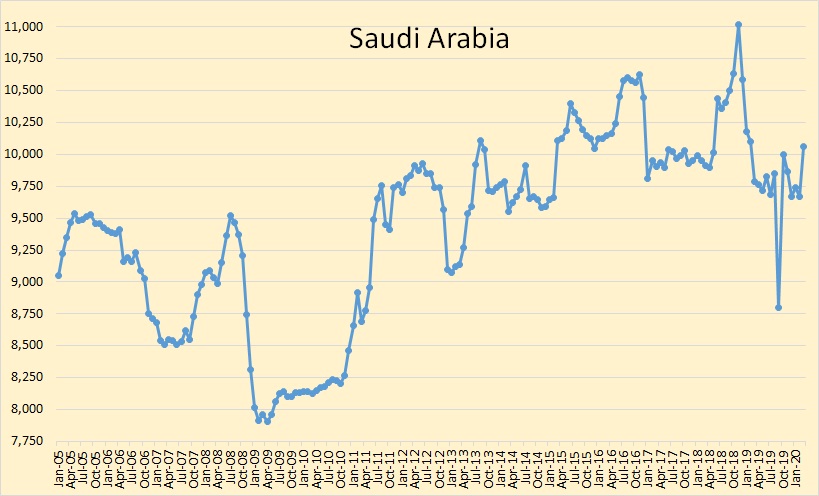

Saudi Arabia increased production by 388,000 barrels per day in preparation for a 2,500,000 bpd cut. That would put them at 7,558,000 bpd. The last time they produced at such a low level was 2002.

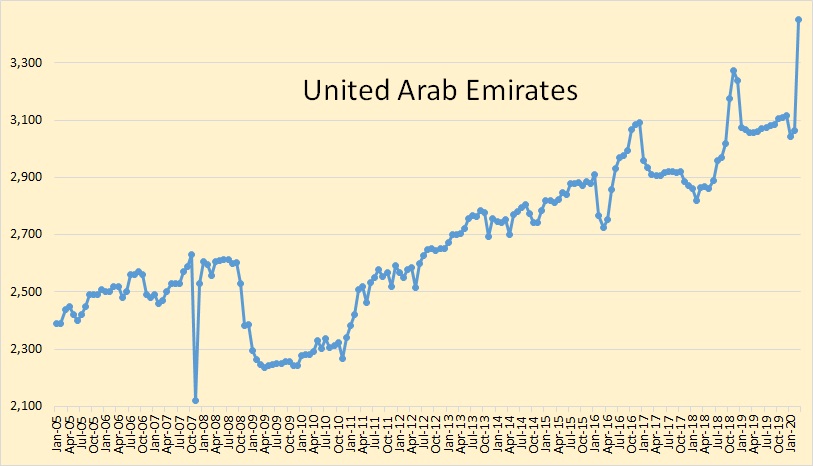

The UAE increased production by 386,000 barrels per day in preparation for a 700,000 bpd cut. That would put them at 2,751 bpd. They are capable of doing that I believe.

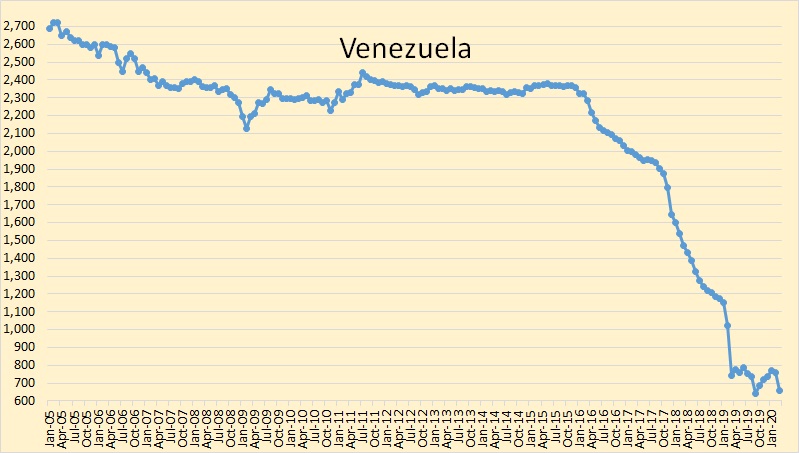

Venezuela’s political problems have increased causing their oil production to drop further. They were down by 100,000 bpd.

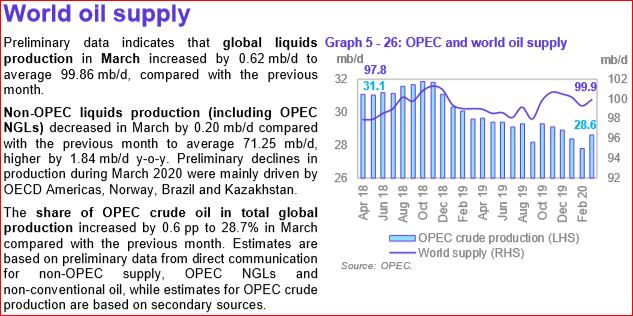

The OPEC World oil supply chart shows OPEC crude only but World supply is total liquids. Non-OPEC total liquids plus OPEC NGLs were down by 200,000 bpd in March.

Russian C+C production was 11,248,000 barrels per day in March. If they cut production by 2,500,000 bpd that would put them at 8,748,000 bpd. I doubt that will happen.

Notice: I speculate on cuts in the above post. Of course I am talking about voluntary cuts. Involuntary cuts are another matter altogether. That is cuts they had to make because their storage tanks were full and then had no option except to cut production. Such cuts could, if things get bad enough, be even greater than the voluntary cuts they have agreed on.

Ron, I think all the cuts they agreed on are basically involuntary ones. Once storage is full, they have to cut production, there isn‘t any place in the world all that oil could go to. So IMO all those fancy ageements are simply the attempt to „sell“ the inevitable.

Well there is a tremendous difference between involuntary cuts and voluntary cuts. If they could cut production below demand, they could keep prices high. But if all cuts are because the market is flooded with oil, then prices fall through the floor.

So, we shall see which market prevails.

Both markets? It looks like they are trying to give it some order.

If they can achieve stable prices, they obviously win something. Also, if they are able to distribute the losses. Because certainly – besides the lesser quantities of oil – prices won‘t go up very high. So it‘s all about managing the inevitable.

I expect that by 2021 oil prices may start to recover, though it depends on how well the World does in reopening economies in the face of covid19, hopefully testing can be ramped up, treatments are developed, and eventually a vaccine by Sept 2021, it will take another year before vaccine production is ramped up and the vaccine has been widely administered. At that point, perhaps Sept 2022, the economy will be able to recover.

All is highly uncertain, obviously.

If things get really nasty, we, the people from the developed world, will have the responsibility to keep the people in the third world from starving – we can‘t save some hundred thousand people in our countries and kill by those means millions elsewhere. That‘s ethically unsustainable and in my eyes the single mayor problem we‘re going to face in the months and years to come.

If we assume this responsibility, this might be the beginning of a better world. Otherwise everybody will be trying to save his own behind and things will turn really ugly, not only in the poor countries.

In other words, I can‘t see any return to BAS. It‘s simply not possible if we take in account human and ethic factors.

Westtexasfanclub,

I agree.

Oil’s Collapse Is Taking an Entire Service Industry Down With It

No one is feeling the pain of an oil collapse more than the shale producers. Except, perhaps, their suppliers.

Since the start of 2019, the oilfield services sector has lost almost 50,000 jobs, or about 13% of its workforce. Meanwhile, the falloff in fracking — the technology used to shake loose oil from shale — is forecast to face its worst year ever with at least half of all work expected to be ended by July 1, according to Citigroup Inc. The domino effect for workers across a wide spectrum of companies can be devastating, said Skip Locken, Pioneer’s vice president of drilling operations.

I don’t understand – why is anyone completing any wells at all right now?

Nick G,

There might be a few monster wells that might be viable at these prices, but not many in the US. I would expect completion rate will fall close to zero, not sure it will get all the way to zero, but certainly to 10% of Jan 2020 completion rates are likely to be reached, perhaps lower.

Leases have time limits on production or they are forfeited. My recall is some of them cost money up front. Drill and produce, or forfeit.

At https://shaleprofile.com there is a great tool that can be used for future supply projections for tight oil.

The projection below only includes Eagle Ford, Bakken, Permian, and Niobrara.

Tool is at https://shaleprofile.com/us-tight-oil-gas-projection/

Chart below assumes 5 month lag between changes in rig count and changes in output,

monthly rig change is -100 (or -10%) up to Dec 2021, then 40 (or 4%) from Jan 2022 to Aug 2025, then -39 (-3.9%) from Sept 2025 to Dec 2029. No changes in well productivity are assumed.

tight oil output reaches 5 Mb/d in Dec 2029, this allows US exports of tight oil to stop even without any refinery upgrades, it also allows the US to produce tight oil for a longer period, potentially maintaining tight oil output at 5 Mb/d out to 2040.

The unlabeled brown/gold area represents Niobrara output in the chart below.

The biggest casualty of Covid19 will, ironically, be the doomer theory of peak oil, something I personally subscribed to for 15 years or so but am now willing to write it’s obituary. As Dennis’ chart above shows, US shale oil, along with many other production basins, is likely to have tremendous spare capacity over the next decade to keep energy prices affordable. Covid targeted some of the most egregious offenders of global energy waste with precision: airplanes, cruise ships, business conferences, etc.

https://oilprice.com/Energy/Crude-Oil/Coronavirus-Has-Wiped-Out-A-Decade-Of-Oil-Demand-Growth.html

Peak oil production and consumption almost certainly peaked in 2018 (80% or higher probably imho). Covid is promoting a de-globablized, more nationalized world that will inhibit a return to the oil consumption levels of the late twenty teens. This is happening simultaneously with profound advancements in renewable energy production and storage, along with political pressure to combat climate disruption that will resurface after Covid is contained in the next 12-18 months. While the global economy pauses, the intense research into solar electricity and battery storage continues unabated.

Experimental concentrated solar cell efficiency is approaching 50%: https://www.nrel.gov/news/press/2020/nrel-six-junction-solar-cell-sets-two-world-records-for-efficiency.html

Battery research is just on the cusp of a major cycle of reduced costs. The price of a PV panel today from when I installed a system on my home in 2007 is down 95-98%. This same thing is about to happen with batteries over the next 8-12 years.

Flow batteries: https://cleantechnica.com/2020/04/13/how-low-can-energy-storage-go-lots-lots-lower/

My guess is oil prices will struggle to stay over $50/barrel for a month or more ever again.

I’m retired now. That’s my old group at NREL. Its really a great accomplishment but they had to publish early because they were shut down. The device is being limited by internal resistance between the individual cells. Something that is anticipated in kind of work and will eventually be solved. This limits the current density and hence the concentration that the device can effectively operate at. Since the cell’s efficiency increases as the concentration ratio increases it will easily exceed 50% efficiency once these issues are resolved. Because of the expense associated with the growth of the device it needs to be deployed in high intensity concentrator systems where the cells represent a relatively small fraction of the over-all system cost.

Thanks SW I appreciate your insight!

Yes not a silver bullet but more posted as an example of the fact that even after these tremendous efficiency gains over the last decade there is still ongoing breakthroughs.

Stephen Hren says:

“The biggest casualty of Covid19 will, ironically, be the doomer theory of peak oil”

That’s bogus because some of us have written about peak oil and oil depletion for 15 years on the blogs w/o ever referencing the term “d00mer”. All we were doing was tracking the empirical data and making educated guesses on the trajectory, and golly-jeez weren’t we SPOT ON all along!

Regardless, this is an event that seems like it will have a similar impact to the 1973 oil shock, in that it flattens the curve of oil consumption, possibly for the next five to ten years. So on the original trajectory we would have had peak oil in 2005, that shifted it to 2025 or so. Now it’s been shifted out again, possibly to 2035 due to a lower consumption curve (something like what you were talking about in your previous post right?).

That will buy the world a lot more time to transition to a renewable energy economy before the disastrous effects of a supply peak.

Just a few more massive crises and we’ll never reach peak oil. When you consider that anyone 25 and under has lived their entire conscious lives living from one world-ending catastrophe after another its any wonder the suicide/drug OD/mass shooting rates aren’t even higher. But – peak oil is only partially impoverishing them, so that’s in the plus column.

Sorry, we always will reach peak oil some day – this is basic science. If there are only catastrophes from now on, alien invastion and zombie apocalypse and everybody is building his Mad Max vehicle, 2018 was peak oil.

This is the easy crystal ball scenario – the more difficult is in a restarted economy when 2018 will be propable surpassed, but for how long and how much. That’s the more complicated one.

Eulenspiegel,

I think twocats may have been talking about peak supply (high oil prices at peak, where I will arbitrarily define “high oil price” as more than $80/b in 2020 US$) rather than peak demand where oil prices are lower than the “high oil price” defined above.

Of course there will be some peak in oil output at some point in time (I usually think in terms of centered 12 month average World C C for peak oil).

For your complicated scenario I expect about 2027-2029 for peak oil, and I expect oil prices to be high during and shortly after the peak (with high oil prices lasting until 2035 to 2037).

This scenario assumes a covid19 vaccine becomes available by August 2021 and that proper fiscal and monetary policy measures are taken by most national governments which will minimize the length of the depression that may result from the pandemic.

Eulenspiegel,

my points are as follows:

1) peak oil is a dynamic that has been in play since at least 2002, driving decisions, changing the nature of the economy, and creating austerity in one form or another.

2) the GFC was a civilizational “step-down” ala Kunstler’s Slow Emergency which on some levels we will never recover from. The pandemic will be the same.

2) the hope of suspending peak oil and thereby creating an energy transition through a series of massive crises like the GFC and the current pandemic is a little absurd:

a) i think part of the austerity dynamic may have facilitated the pandemic – the reduction in budgets for public health, etc.

b) the economic loss will drive millions if not billions into poverty – an energy transition would conceivably take some amount of economic input and planning – and its very difficult to plan in the aftermath of a crises.

c) the sentiment of “disaster suspends peak oil” views the “transition” as one that happens without people. 10s of millions of people lost their stored wealth in the GFC. 10s of millions if not billions of people are spending down their savings now to avoid bankruptcy, starvation, what have you. if the only thing stopping peak oil collapse is collapse then its a distinction without a difference. Like committing suicide on death row.

Now if you believe that an energy transition could both steadily reduce FF and bring billions of people into a modest standard of living (developed world reducing energy consumption, and developing world increasing) then I guess one could look at it that these sacrifices are the birth pangs of that new world. If its just BAU – then the transition will arrive just in time for a final collapse / step-down.

Twocats,

Do you feel that renewables just cannot provide the same level of energy consumption as fossil fuel?

to nick G – I definitely believe it is worth a shot to go for full renewables and use as little FF as we need to keep large grids afloat. I’d rather have electricity 14 hours a day than 0 hours a day. I can conceive of a very fulfilled life using a small fraction of the energy I personally use today. I think a lot of people feel the same way I do. few of those people have actual power.

Stephen Hren,

Doubtful the peak will be moved beyond 2030, though potentially there could be a plateau from 2027 to 2035, transition will be difficult, and perhaps impossible, but in my view the odds are low that it will not be possible and also low odds that a transition will be easily achieved. It will take hard work and sacrifice, but it can be achieved.

Dennis, stretch the plateau from 2018-2035, label it a very, very optimistic scenario and I agree with you. But I really doubt 2018 will be SUBSTANCIALLY surpassed at any moment in the future. Almost two decades of a plateau would not be the worst thing for a transition though (well, including the coming deep dip in that plateau) …

westtexasfanclub,

I agree that is an optimistic scenario, note I expect a severe dip from 2020 to 2021 with recovery by 2025 to 2018 output levels, so the plateau would be at about 83 Mb/d from 2026 to 2035, which is admittedly optimistic, more realistic would be a plateau from 2026 to 2030 with gradual decline to perhaps 78 Mb/d by 2035 followed by steeper decline as EVs and plugin hybrids gain market share for land transport, in addition high oil prices may lead to better efficiency for sea and air transport and perhaps more localized supply chains which would reduce demand for sea and air transport, improving teleconferencing may reduce business travel and reduce the level of air transport.

All speculation on my part and all impossible to foresee.

Very well explained . Thanks ,twocats .

Thanks for all the thoughtful input, everyone. I agree that the energy transition will likely be brutal and hope I wasn’t painting too pretty of a picture of it. I see the future as a choice between a dramatically lower per capita energy consumption future powered by renewables, or total earth death if powered by fossil fuels. However, I also still think we need some fossil fuels to make it to the renewable transition, as the capabilities, especially in terms of storage, are not there yet. If fossil fuels, especially the most useful one – oil, peak too early and were burned in an unproductive manner (excessive travel, wanton consumption, etc), which appeared to be the case prior to the current Covid crisis, then it seemed likely we would not have the resources to make the transition.

On the other hand, if they peaked too late and we had too much supply, especially of oil, then climate disruption would reach a level that was no longer tolerable for much of life. Covid has targeted some of the most egregious forms of oil consumption, prolonging the peak by flattening the consumption curve and making this energy available to move towards a renewable energy future. This is happening simultaneously with major advances in battery tech, the last piece of the puzzle for making intermittent renewable energy sources viable to many of civilization’s needs.

So far as economic equality is concerned, we know that the current top-down fossil fuel energy system does not create equitable wealth. A renewable energy civilization with distributed energy rather than concentrated energy will have a far greater chance of equitable wealth distribution. But of course there’s a really good chance we’ll figure out a way to fuck that up too…

HIH – thanks. to stephen – very well put and I apologize for inferring your comments were made flippantly. I did take some liberty with them.

Lots of these solar cell efficiencies are achieved by adding complexity to an already complex process. Achieving a record efficiency is more of a technical achievement than a practical achievement.

On Baez’s blog someone was nominating Keith Barnham for a $1,000,000 sustainability prize, as he was the one that first suggested using multiple quantum wells as a highly efficient solar cell. The longstanding problem is how to create multiple quantum wells at scale.

I was working with III-V materials for my thesis work and even back then there were bizarre ideas for improving efficiency. At the same time that Barnham was advocating MQWs for solar cells circa 1990, we were thinking about how to use the vicinal surface lattice staircase to more naturally generate one at scale — either “vertical” superlattices or quantum wires.

https://forum.azimuthproject.org/discussion/comment/21862/#Comment_21862

Interesting to speculate on this stuff but I veered off in a different direction

PV increase will continue to happen incrementally. Storage is what’s about to plummet in price, and that’s the missing piece of the puzzle.

I always shake my head when ideas come up that will increase efficiency by 2 or 3 times that cost 10 times as much. Lots of great ideas but they do not come near for watts for the buck. The USA seems to be lost in the idea of huge, expensive technical improvements rather than churning out lots of cheap panels, there’s a reason so many goods carry ‘Made in China’.

NAOM

The biggest casualty of Covid19 will, ironically, be the doomer theory of peak oil,

Poppycock! Renewables have been hit just as hard, if not harder, than fossil fuels by this virus. When and if we recover from this nightmare we will be back to the exact same problem, dwindling fossil fuel and a race by renewables to fill the gap while we still have liquid fossil fuel.

It is obvious that OPEC peaked in 2016, (with the exception of Iran and Venezuela). Non-OPEC has been propped up for almost a decade by shale oil.

World peak production was October and November of 2018. That was over a year before the virus killed demand. If we are very lucky and demand does come back, production will never reach that point again. Well, that’s my opinion anyway.

Hi Ron, I don’t think demand will come back quickly either, or ever perhaps – that’s exactly what’s going to give us a buffer of spare capacity in oil production that will allow a transition to occur. And yes many renewable energy jobs are going out the window right now as well. Since energy demand is collapsing it makes sense that all energy jobs are being hit. The question is what jobs will grow once the recovery in energy demand happens from its lows in a year or three. I’m betting renewable energy jobs will be much better positioned to start growing again once energy demand starts growing. But I never expect you to agree with me on that one.

I’m betting renewable energy jobs will be much better positioned to start growing again once energy demand starts growing.

You are talking jobs while I am talking energy. True, renewables can replace fossil fuel… when the sun is shining… or the wind is blowing. But there will always be a demand for liquid fuel for most of ground transportation and all of air and sea transportation… and in the cold winter dark nights.

But right now we just have to survive this nightmare.

Hi Ron,

Always is along time. 🙂 Air transportation might “always” require liquid fuel, sea transportation and ground transportation could move to other types of energy. I will define always as for the next 150 years.

I tend to agree that peak oil supply (where oil prices become high due to demand for C+C becoming higher than supply at some “low” oil price level and thereby driving oil prices higher) is likely to occur. The current downturn in oil output is mainly a combination of oil output growing faster than demand (in 2017 and 2018) and then the pandemic crushing demand for oil.

At some point the pandemic will end and eventually the economy will recover, my guess is by 2023 or 2024 we are likely to be close to 2019 in real World GDP per capita. The peak will be delayed from 2025 to 2027, oil prices will be high (over $100/bo in 2020 US$) from 2027 to 2040 and by that time transition to electric transport and perhaps autonomous driving will have reduced demand for crude for land transport to the point that oil prices start to fall. Perhaps air transport alone will be enough to keep oil resources from becoming stranded assets, but I doubt it. A lot of the more expensive oil will never be produced (oil sands, tight oil, deep water off shore and Arctic oil resources).

Well, Even though I spent my career working on solutions, I must say that I share Ron’s pessimism. I believe that what we are living through right now is just a dry run for what is eventually in store for us. Viruses are natures immune system for us. She has been tinkering for awhile now. Consider Mother Nature like a soccer mom driver her unruly kids on a long trip. They are raising hell in the back seat. She keeps saying over and over. “Don’t make me stop this car” Well, I think she stopped the car. The thing is, despite the death and dislocation, this is a relatively mild example as the morons on FOX News delight in telling us. But don’t worry Sean, Mother Nature has an endless supply waiting in the wings and the you really really don’t want to know what she’s got cooking up next. No, the planet is going to be just fine. We are the ones who aren’t going to make it. And we are catching a tiny glimpse of how it is going to end. The next time around it won’t be a cough.

I know I’m the odd man out optimist here, but… I am observing some changes in the past week where I live in Texas… Traffic is back and consistent. My sense is that gasoline demand has already started to ramp back up and will ultimately surprise to the upside. Humanity here is bubbling over and can’t be contained much longer.

On human pathogens… they are always defeated, otherwise we would all be dead and no one would be posting here. Small pox, Polio, Spanish flu, mumps, etc… all of them felt like the end of the world when they were in an outbreak, but we conquered or contained them and moved on. This situation will be the same. With trillions of dollars of enterprise value at work finding solutions currently (Gilead, Abbott, J&J, etc…) multiple pathways will be created for solutions quicker than anyone expects… the big carrot is dangling and humanity is greedy. This is why the pathogens eventually lose and humanity wins….Humanity is not linear, it creates new pathways and timelines for solutions, especially when inspired by greed.

Then we move on, forget and get lazy again.

This virus was highly transmissible but not particularly lethal. Still, look what it did to the world economy in a matter of months. There will come a virus that is just as transmissible but is five perhaps ten times as lethal. Then, it will be all over. Instead of the idiots on Fox News clamoring for us to get back to work, while they broadcast from home or “secure locations” within a matter of weeks there will be no one keeping the lights on. No one stocking the grocery stores. No one keeping the water flowing. The financial systems will collapse and it will be a matter of weeks not months before even the richest among us are reduced to savages.

gung.

In our rural area I haven’t noticed a difference in traffic except on the interstate, where semi truck traffic is heavy and auto traffic is light.

Thus gasoline is $1.27-1.55 per gallon but diesel is over $2.50 per gallon.

Our area has been very fortunate with only about 10 cases in a 40 mile radius. One death in a nearby county, a 90+ year old. All but one case has recovered and is not under quarantine.

I suspect we will get hit hard by this as the urban areas recover. Just like news travels slowly to here, so will COVID -19.

Or maybe we will largely be spared. I really have no idea.

Do you think if we have a v shaped recovery the shale knuckleheads will immediately return the rigs? Or do they finally have the fear of God injected into their brains?

shallow sand,

I would think the speed of the tight oil recovery will depend on the price of oil, at least in part. If the April 2020 Short term energy outlook price projections for WTI are correct, (oil price goes to $20/b in April and gradually recovers to about $43.50/bo in June 2021) then I expect tight oil output will fall by at least 3 Mb/d by Dec 2020 and not start to recover until 2022/2023, if we banned oil exports from the US, tight oil output might only return to 5 Mb/d. The US government is not that smart so we will continue export a precious resource for peanuts. See scenarios (there are two) down thread.

Dennis,

You’re concerned that private enterprise is not conserving our oil resources. In effect, you’re saying that’s oil is more valuable than it’s market price. In other words, there is an external cost to oil production, which is not reflected in market prices.

There is a simple, effective tool for fixing this problem: excise taxes. They internalize this cost, keep value at home, and reduce production (if high enough).

Nick,

There are not many people that support higher taxes, so although you are correct in principle, it is difficult to institute such policy in practice. I like fee and dividend for carbon taxes, but it has never caught on.

Nothing to do with nature according to Nobel prize winner.

http://thejewishvoice.com/2020/04/2008-nobel-prize-for-medicine-winning-dr-luc-montagnier-says-covid-19-was-manipulated-for-hiv-research/

In fact he says nature will make the virus less virulent.

Multiple scientists have debunked that theory.

https://www.sciencenews.org/article/coronavirus-covid-19-not-human-made-lab-genetic-analysis-nature

“That finding debunks a widely disputed analysis, posted at bioRxiv.org before peer review, that claimed to find bits of HIV in the coronavirus, Hodcroft says. Other scientists quickly pointed out flaws in the study and the authors retracted the report, but not before it fueled the notion that the virus was engineered.

Some stretches of the virus’s genetic material are similar to HIV, but that’s something that stems from those viruses sharing a common ancestor during evolution, Hodcroft says. ‘Essentially their claim was the same as me taking a copy of the Odyssey and saying, “Oh, this has the word the in it,” and then opening another book, seeing the word the in it and saying, “Oh my gosh, it’s the same word, there must be parts of the Odyssey in this other book,” she says. ‘It was a really misleading claim and really bad science.’”

Regarding the economic condition in 1-2 years, I see only one discrete reason that economic growth (and consumption) will remain hampered. This virus will have slightly accelerated deaths among those over 60 yrs old, but on the overall growth curve of humanity, the covid-19 pandemic will not be noticeable. The march on towards 9.7 B by 2050 remains unaffected.

Energy consumption will be back to ‘full steam ahead’.

The big economic hurdle I see to growth resumption is debt. Not my field of expertise, but at some point the global financial system will need to go through some form of reckoning, assuming the human universe is not completely absurd [I know it has a huge component of absurdity]. This reckoning could be extremely painful. Ask those who have lived through episodes of severe deflation, austerity, hyperinflation, or devaluation, and poverty.

How long will it take to return to the same purchasing power of citizens, as they had prior?

How long will it take city, and state budgets to get back?

How long will it take for corporations to take on new projects (risk)?

Hickory,

With proper monetary and fiscal policy decisions by national governments, the crisis can be managed. The Great Depression was such a disaster due to poor government policy informed by classical economics.

The solution is in a short book (284 pages),

https://www.amazon.com/gp/product/B07JCJXDG4/ref=dbs_a_def_rwt_hsch_vapi_tkin_p1_i0

no doubt this can be found at your local library, though at 99 cents, it is not expensive.

I am glad that you are optimistic about it all be handled well. I certainly hope that pans out.

An awful lot of budgets are severely broke, from the family and small business level, to the cities, states and corporate level. And none of these entities have a money printing, Fed backstopping capability.

Hickory,

Yes, that is why I referred to national governments who usually have the ability to control money supply and issue debt (Europe is a bit complicated as individual nations do not control money supply). The state and local governments must be supported by the Federal government and individual citizens through government stimulus for the economy and other aid.

It is a societal choice, severe depression or economic recovery. The correct choice is obvious from my perspective, people just need to get over their fear of government debt. In a severe economic crisis it is the answer.

A textbook explanation can be found in

https://www.amazon.com/Macroeconomics-William-Nordhaus-Paul-Samuelson-dp-B0086HWNS6/dp/B0086HWNS6/ref=mt_paperback?_encoding=UTF8&me=&qid=

Most any textbook by Paul Samuelson will do, most University libraries will have several copies.

Hickory,

I do not think it will be handled well, only that with good leadership it could be. In the US that is far from the case, so I am the opposite of optimistic.

I wholeheartedly agree with you on that Dennis.

It seems to me that very few entities manage their financial cards well, whether in or out of crises.

The government appears to be diverting a large amount of financial aid to large businesses, the inspector general should oversee that – oh, wait!

NAOM

What strikes me as the big financial risk is not really debt, but the effect of high debt on purchasing power. And not just debt, but the loss of income or revenue, the loss of credit worthiness, the draw-down of reserves, the decreased willingness to to take financial risk, and the sustained unemployment in many sectors.

I’m referring to families on up to corporations, and all the levels of government who don’t have direct access to magic fed money.

There will be sustained loss of purchasing power that will take a very long time to recover.

So Dennis,

You are against the free market? I always had a hunch you were a Keynesian.

Iron Mike,

Not against the free market, just not a fan of Great Depressions. The free market sometimes needs help, I tend to take the view if it’s broke then we should fix and when it isn’t we leave it alone.

Free markets may self regulate in the long run, but why wait and suffer?

Dennis,

There is always going to be some draw backs. Why should inept companies survive financial crisises and be bailed out? What that ultimately does is it encourages bad behaviour.

Even with regards to covid-19 situation which isn’t technically a financial crisis, good companies should have put away money for rainy days. Smart individuals have savings for rainy days! But that rarely if ever happens with corporations, because these big companies don’t give a shit since they know the government will bail them out. A lot of airlines companies prior to the covid-19 situation where doing share buy backs and overinflating their share prices while turning millions/billions in profit year after year.

Why should tax-payers bail them out? Did tax payers get a cent all those years when they where turning a profit? These companies should be allowed to fail so they learn from their ridiculously greedy policies. Keynesian economics hadn’t accounted for greed on steroids.

Iron Mike,

Keynesian economics is not synonymous with government bailouts of large industries.

Note that often these bailouts are simply low interest loans that are repaid in full, the reduced economic disruption means lower unemployment rates.

Note that this is far from a “rainy day” event, it is a 100 year level event, that nobody was prepared for.

So in your view a depression is a better plan, Herbert Hoover felt much the same. 🙂

It’s also possible to give no aid to any corporations, Keynes did not specify. The government could just send checks to people so they have income and perhaps do some infrastructure investment and fund state and local governments to some degree.

In the US with a Republican president and Republican control of the Senate, government bailouts of big business are likely, but I would agree it is far from the best approach.

Note also that few US citizens would make it through this crisis without government assistance, perhaps it is different in Australia. Most people do not have enough savings to get them through this crisis on their own.

Dennis,

I don’t want to drag on the dialogue but:

Keynesian economics is not synonymous with government bailouts of large industries.

Maybe, but that is how it is being used in the real world.

In my worthless opinion, people don’t have enough savings to get them through such periods because of poor economic education and in some areas of the world, over inflated asset prices and the consequent debt overload. Where i live in Australia, property prices are ridiculously inflated. Why? Because government, and central bank policies don’t allow assets to deflate as they would in a free market.

These Keynesian policies has huge ramifications for people in my generation. And just cause bigger problems further down the line. Your thinking is, make today easier for a harder tomorrow.

Austrian school and or Chicago school of economics makes much more sense. Financial crisises are seen as natural cycles and the antidote to poor business practices. With the death of some businesses comes the life of new ones, and the same mistakes would not be repeated. And the debt slate starts clean.

In your thinking debt just gets piled on more and more and more…billion, trillion, quadrillion, let the future generations pay them off kind of thinking. It is lazy and undignified in my opinion.

Iron Mike,

I would take Paul Samuelson and Walras over Friedman and von Mises any day of the week.

Just because policy makers make bad choices does not mean the theory is incorrect.

As I said, businesses can be allowed to fail, it is perfectly consistent with the neoclassical synthesis of neoclassical and Keynsian theories.

When the economy is doing well, leave it be, when it is not use fiscal and monetary policy to stimulate the economy.

When done properly, the debt is paid back during good times so that when bad times come money can be borrowed.

The lack of savings is simply a matter of income inequality, that could be solved by progressive taxation.

Again good leaders would help, we have few of those in the US.

Dennis,

Government debt to gdp ratio (U.S). There has been periods of reduction but look at the trend.

https://www.macrotrends.net/1381/debt-to-gdp-ratio-historical-chart

Surely there has been more good periods of economic growth than recessions to stabilize debt growth, but such a thing hasn’t happened at all. And this doesn’t include the 2 trillion dollar fiscal stimulus in 2020, which is a negative period of economic growth.

Lets be honest, it is just going to keep going up 🙂

Iron Mike,

US Government debt to GDP at about 110% of GDP, it should be lower I agree, the time to accomplish reduced debt is during times of prosperity.

Debt is much less of a problem than many believe. In 1947 US government debt was 87% of GDP and in 1945 debt was about 112% of US GDP. Government debt was reduced up to 1970, debt levels were also reduced during the Clinton administration, though not as much, but it was only 8 years from 1993 to 2001.

As to what the future will bring, I will be honest, I do not know, I can only speculate, just like you.

The simple reason to never allow a recession without intervention is that the country always exits it poorer than it could have been with intervention. It really doesn’t matter how many problems are kicked down the road, a wealthier country will invariably have an easier time dealing with them. Allowing a recession/depression to fix economic problems is the economic equivalent of bleeding a patient in medicine.

Mike —

Classical economics predicts that unemployment should always be low. High unemployment means labor supply is outstripping demand, and that should lead to a fall in labor costs, reducing unemployment. It is the “pure” market theory.

Classical economics has been observed to be false. In some cases, unemployment gets very high and stays that way.

Keynes suggested that the problem is “sticky prices”. That means that workers with jobs refuse to take wage cuts even in times on high unemployment. His remedy was to print more money, causing inflation, in times of high unemployment, which results in inflation. Inflation reduces real wages without reducing nominal wages, thus sneakily solving the sticky price problem.

Once real wages decline, the market should automatically reduce unemployment, just a classical economics predicts. Keynsianism is deeply rooted in market economics.

That is Keynesianism in a nutshell. It doesn’t really matter how the money is spent, but unemployment money is a good bet, because it is politically palatable. Keynes himself joked about digging ditches and filling them back up to improve the economy.

Republican ideologues prefer handouts to rich people, but this is less effective at moving the real economy, and result in things like the Trump tax cut resulting in the Trump stock market bubble and share buyback. In fact the economy probably would have been about the same without the tax cut.

Are there any alternative ideas around?

Milton Friedman used his “law of rational expectations” as a “Monetarist” counterargument. It basically says that workers aren’t as easy to fool as Keynes thought, so inflation won’t unstick labor costs. Italy’s scala mobile, where unions negotiated wages automatically linked to inflation, are the classic example of rational expectations.

Monetarism sounded good in the inflation-wracked 70s, but its emphasis on tracking money supply foundered on the definition of money. Remember the Thatcher government arguing about the relative significance of M0, M1, M2 etc? Also the velocity of money, which measures how often a given dollar is spent per year, further muddies the waters.

In the end Monetarism tightens the rules of Keynesianism, but doesn’t upend it. Nobody has had a better idea yet, whatever the guy trying to sell you gold online claims, so we’re stuck with Keynes.

Also, I realize this is a bit off topic, but the question recently arose on the difference between fiscal and monetary stimulus. In the current situation, is it better to lower interest rates or engage in deficit spending?

The current problem facing the world economy is not reduced money supply. The problem is the velocity of money. The money is there but not being spent because of COVID-19.

In this situation, fiscal measures like handouts to needy people, who have no choice but to spend the money immediately, are much more likely to succeed than low interest rates. Low interest rates fail to address the underlying problem of low velocity.

Bailing out companies makes more sense than cutting interest rates, but the government should focus on cases where the bailouts will result in increased spending by the company.

Alimbiquated,

Always easier to reduce interest rates, as they approach zero (or become negative), this becomes a less effective policy (much of the World has already reached that point) and then fiscal policy is the better option, particularly money put in the hands of lower income people who will immediately spend it. Fiscal stimulus aimed at the rich could simply be saved rather than spent and is an ineffective approach. That is why tax cuts for the wealthy is dumb policy.

Dennis, Mike,

Share buybacks are companies paying off debt, because shares are debt the company owes to shareholders. Companies pay interest in the form of dividends.

In the current zero interest climate buybacks make sense to companies. Tax cuts that make them possible don’t help the economy, they just transfer taxpayer funds to private companies. As Dennis says, the money is just saved (by reducing debt), and that is dumb policy.

Buybacks raise the price of the stock without increasing the value of the company by reducing the number of shares. The total value of the company is the number of shares times the price per share.

I suspect that the Trump stock market bubble was driven by people seeing the prices going up because of buybacks, assuming it meant the value of companies was increasing, and pouring even more money into the market on that belief.

This suggests that Wall street is run by sheep that can’t do basic math, but there may also be other issues including tax issues involved. It’s just speculation on my part.

Dennis,

Just because policy makers make bad choices does not mean the theory is incorrect.

When has an economic theory being sufficiently tested to see its viability? It is tough to make that statement in the economic field since it isn’t a science, in my opinion.

You know more than me on this issue. But the Fed monetary policy and government fiscal policy are all Keynesian theory. Correct me if i am wrong please. The long-term downtrend of inflation and its disappearing act is because of asset bubbles, that is where the inflation is in my opinion. I could be wrong but that is what it seems.

When done properly, the debt is paid back during good times so that when bad times come money can be borrowed.

When has this happen in modern times, or historically? Which government/president actually reduced debt during the good times? I see the opposite when one looks at public debt/gdp ratio. Again i could be wrong and correct me if i am.

Hi Alim,

Thanks for your input, good info. None of this is my field of expertise but Milton Friedman and the Chicago school of economics such as Thomas Sowell seem to make more sense to me.

I think the lack of inflation in current times is hiding in asset and equity prices (such as share buybacks which you mentioned) which isn’t counted towards inflation statistics.

100% the velocity of money is the issue now. But what about government debt from fiscal stimulus? Who is accountable for that? MMT doesn’t see any issue with the government having infinite debt. I don’t think their economic theories match with what is actually occurring in the real world. They seem to be just going along with the experiment to see what happens.

Iron Mike,

Asset bubbles have little to do with inflation rates which measure a basket of consumer goods and how the price of that basket changes over time.

The velocity of money has slowed considerably as the limits of monetary policy are reached. In 1981 in the US money velocity was 3.5, in 2019Q4 it had fallen to 1.29 for the US.

Pushing more money into the system will simply reduce the velocity of money.

I agree social science does not allow controlled experiments, so no theory can be “correct” in the way a physical theory could be easily tested in a lab.

In addition if one devised a “correct theory of economics”, one would need to keep it a secret. As soon as such a theory was known, the behavior of society would change and invalidate the underlying assumptions of the model.

Makes social science a tricky business.

Dennis,

Asset bubbles have little to do with inflation rates which measure a basket of consumer goods and how the price of that basket changes over time.

Think about it this way. When the price of a house exceeds “market value” then wages decrease relative to property prices. So if a family is spending more of their income paying off a mortgage than consumer goods, then surely that will drive down inflation. Which is what is happening now. That’s what i see. People are overloaded with debt and don’t have spare capacity to spend on consumer goods. Hence the inflation figures are anemic due to the basket of goods used to measure the statistic not taking into account assets such as property prices for e.g. What i am trying to say is that inflation in property prices (not measured) is overtaken the inflation of consumer goods (measured).

Pushing more money into the system will simply reduce the velocity of money.

Can you elaborate on what you mean please. By pushing more money into the system do you mean by fiscal policy ? Or monetary policy as in reducing rates to make credit more accessible to consumers?

And shouldn’t those policies increase the velocity of money i.e. inflation ?

Iron Mike,

I am talking about monetary policy which controls the supply of money. When the Central bank attempts to increase economic activity by increasing the supply of money, in some cases the money simply circulates more slowly (velocity of money).

Fiscal policy is government spending and/or the level of taxation. So increased government spending (on hospitals, roads, military, housing, or research) or a reduced level of taxes would both be expansionary fiscal policy with the reverse (less government spending or increased tax levels) being contractionary.

https://en.wikipedia.org/wiki/Fiscal_policy

Inflation is not the velocity of money.

Velocity of money is total money in circulation divided by total monetary transactions (in layman’s terms, how many times the average dollar changes hands in a year). Inflation is the average price level for a fixed basket of goods (representative of the average consumer) and how this price level changes over time (pretty much nothing to do with velocity of money).

Note that housing costs are included in CPI, about one third of the CPI is based on housing costs. US house prices increased at about 3.5% per year from Jan 2018 to Jan 2020.

https://fred.stlouisfed.org/series/CSUSHPISA

For velocity of money in US and definition under chart see

https://fred.stlouisfed.org/series/MZMV

discussion of CPI and housing costs at link below

https://seekingalpha.com/article/4173463-cpi-and-housing-prices

Long term (1987 to 2020) housing prices have increased by 3.62%, while the consumer price index has increased at 2.44% per year, keep in mind that for many in the US their home (if they own it) is their retirement savings, and while 1.2% (roughly) is not a great return on investment, it allows a bit of extra income in retirement, the housing cost included in the CPI is based on rent payments and does not always reflect current market conditions as rents tend to increase more when a new renter signs a lease.

Dennis,

Thank you so much for the info. I’ve noticed in the U.S house prices (depending on area of course) are much more affordable than in Australia. Sydney and Melbourne are some of the most expensive properties in the world.

Regarding your statement:

Inflation is not the velocity of money.

Inflation is the average price level for a fixed basket of goods (representative of the average consumer) and how this price level changes over time (pretty much nothing to do with velocity of money).

I have to go ahead and disagree with that. Again i could be wrong but looking at this article:

https://www.stlouisfed.org/on-the-economy/2014/september/what-does-money-velocity-tell-us-about-low-inflation-in-the-us

MV = PQ

Inflation (price of goods P) is directly correlated with the velocity of money. V~P.

You are correct in your view since monetary supply M increases velocity V has the tendency to decrease as they are inversely correlated based on that equation.

There are many websites that argue the strong relationship between velocity of money and inflation.

Iron Mike,

Generally in that very simplified MV=PQ equation, assuming any of the variables is fixed proves to be a flawed assumption.

When I started studying economics in the late 70s, it was often assumed that the velocity of money was relatively constant, if we we further assumed that Q was relatively constant, then clearly P would be proportional to M.

Problem is that neither assumption is borne out by the data, Q (total real expenditures in the economy or real GDP) is constantly increasing and over time since 1980 the velocity of money has been decreasing. Let’s assume for a moment that the velocity of money was fixed (despite reality), then if real GDP grew at say 1.5% per year on average, then we would want money supply to also grow at 1.5% per year if we want the price level to remain stable. Typically the inflation target is about 2% per year, which would imply money supply growth of 3.5% per year for an economy growing at 1.5% per year on average and that hits the 2% target for annual rate of inflation.

It only works if velocity of money is fixed.

https://fred.stlouisfed.org/series/MZMV

https://fred.stlouisfed.org/series/M1V

https://fred.stlouisfed.org/series/M2V

According to the wikipedia article on money suppy

https://en.wikipedia.org/wiki/Money_supply

MZM velocity is supposed to be a good predictor of inflation so is often followed by inflation hawks.

Actually I was trying to convey exactly the ideas presented in the piece you linked, obviously I am not stating things clearly.

I was trying to say the velocity of money is not constant, it has been decreasing over time and that breaks the link between money supply and prices, that is basically what the pieve you linked is saying, I agree with it in full.

Dennis,

Yes i understand what you are saying. The article also states:

If for some reason the money velocity declines rapidly during an expansionary monetary policy period, it can offset the increase in money supply and even lead to deflation instead of inflation.

The velocity of money can be calculated as the ratio of nominal gross domestic product (GDP) to the money supply (V=PQ/M), which can be used to gauge the economy’s strength or people’s willingness to spend money.

Again i know these equations are simplified, but wouldn’t the increase in money supply M decrease the velocity of money V ? (I believe you stated this 2 replies ago)

Following along they stated a few reasons as to why the velocity of money is slow:

And why then would people suddenly decide to hoard money instead of spend it? A possible answer lies in the combination of two issues:

* A glooming economy after the financial crisis

* The dramatic decrease in interest rates that has forced investors to readjust their portfolios toward liquid money and away from interest-bearing assets such as government bonds

Do you agree with this reason? And in your opinion how would you increase the velocity of money, what policies would you use? (Forgetting covid-19, but prior to that event velocity of money was declining sharply eitherway).

The velocity of money will simply depend on Money supply and nominal GDP. V=GDP/M, so if we want higher V we could reduce the supply of money or increase GDP (or both).

I agree either of those reasons could be part of the explanation, but note that only the second reason would have still applied in the US until the pandemic hit.

In my mind the logical explanation is that monetary policy just is not effective when interest rates approach zero. The extra (or excess) money supply, just sits in the accounts of the wealthy and is not spent.

When the money does not circulate (I spend money to buy a car, jobs are created, which leads to spending by the auto workers, etc (this is called the multiplier effect) when we have most of economic growth going to the wealthy who save much more of their income than they spend, there will be a tendency for velocity of money to fall, part of the explanation is income inequality. Address income inequality through a more progressive income tax code which eliminates all tax loopholes for the wealthy and the velocity of money is likely to increase.

Dennis,

I agree with with income inequality as a possible cause of reduction in the velocity of money.

Wouldn’t a government fiscal policy to for example raise the amount of money given in welfare cheques for the unemployed help increase the velocity? Even policies such as helicopter money?

It seems in both our countries, raising taxes for the rich almost never happens.

Iron Mike,

Yes anything which puts more money in the hands of low income citizens will tend to increase the velocity of money as nearly every dollar is spent rather than saved. Likewise tax cuts for low and middle income citizens will have a similar effect. Handouts for the wealthy (whether tax cuts, loans, or outright grants to big business or financial companies) are far less stimulative, though they help a bit if they reduce the number of people who lose their jobs.

Income inequality is a big problem, but wealthy Senators and representatives do not see it as such, many are what I call free market fundamentalists, I have a more balanced view. Free markets are great when they work, but there are many instances where government intervention is necessary.

“Try that with your coal mine…”

A line worth remembering.

NAOM

Write an obituary for the airlines:

How the first phase of peak oil brought Virgin Australia into minus

after 2008

http://crudeoilpeak.info/how-the-first-phase-of-peak-oil-brought-virgin-australia-into-minus-after-2008

U.S. Corn Ethanol Production Fell 45% along with Gasoline Product Supplied

U.S. Corn Ethanol Plant production for April 10th fell to 570,000 b/d versus 1,035,000 b/d on March 13th. Thus, corn ethanol production declined by 45% since March 13th, while gasoline product supplied fell 47%.

Farmers and Ethanol producers must be taking a beating from a near 50% decline in production.

Total U.S. Petroleum Product supplied fell to 13.8 mbd on April 10th versus 21.4 mbd on March 13th. I am sticking with my forecast that total petroleum products will likely fall to the 12 mbd level.

Steve

Steve,

This is not surprising as the ethanol is blended with most gasoline at 10% so if gasoline output falls by 45%, we would expect ethanol output to also fall by 45%, ethanol does not store very well so they only produce what is necessary to blend with gasoline. I doubt products supplied will fall much further, perhaps to 13 Mb/d, but 12 Mb/d seems too low. Pretty much everything in the US is shut down, doubt it will get much worse in terms of liquid fuel demand.

Dennis,

Yes, ethanol falling in parallel with gasoline product supplies is a NO-BRAINER. However, while everything is shut down, a percentage of the gasoline product supplied is heading to INVENTORIES and not in gas tanks of cars, trucks, and SUVs.

Easily, 70-75% of auto-traffic in the U.S. has disappeared. Thus, the gasoline product supplied isn’t taking into account all the LOCKDOWN of American Driving.

Over the next 3-4 weeks, it’s highly likely that total products supplied will reach 12 mbd or less. But, this isn’t really the IMPORTANT ISSUE even though you and I can have fun playing TIT for TAT.

I am more concerned about the LONG-TERM demand destruction that takes place towards the end of 2020 and onwards.

As I stated in my article: FIRST STAGE OF OIL DEMAND DESTRUCTION: U.S. Supply Of Petroleum Products Down 7 Million Barrels Per day

https://srsroccoreport.com/first-stage-of-oil-demand-destruction-u-s-supply-of-petroleum-products-down-7-million-barrels-per-day/

There will be 3 STAGES of Demand Destruction.

STAGE 1) Initial Collapse to 12-13 mbd total products by early May

STAGE 2) Rebound of U.S. oil demand as Americans go back to feed their Restaurant, Bar, Starbucks and Shopping addiction.

STAGE 3) U.S. Oil demand Declines again in 2H 2020 as the Lousy Economic Fundamentals really start to kick in along with the 2-Wave of COVID-19

steve

Srocco,

While not impossible, I tend to think your Stage 3 estimates, as you call them, are way too dire and a highly unlikely scenario outcome. Specifically, that the US economy will never return to pre Corona levels is an extreme and unlikely future. Good for drama and discussion, but not really something I would plan on financially.

Who knows what life will be like in five years, but of course it’s going to be different, it always is, with or without COVID…. but populations will be larger and economic activity will eventually be greater than pre-COVID. Not a strait line, but greater. Heck, we may have a little population surge in ~9 months with everyone cooped up in their homes! We could call them COVID Boomers… kidding, kidding…

For thousands of years, humanity has grown and expanded, crashing through challenges that dwarf today’s COVID. We are the virus of the globe. Changing to a new norm creates amazing opportunities. An abrupt negative change or challenge such as pandemics, natural disasters or global wars can eventually evolve into a positive stage and reenergize and redirect old pathways into new and fresh directions. And…our world today can adapt and redirect much quicker than in the past…. and in the future, it will be quicker than today. The velocity of change is staggering today vs just one generation ago.

^ Specifically, that the US economy will never return to pre Corona levels is an extreme and unlikely future. Good for drama and discussion, but not really something I would plan on financially.^

Disagree . First the economy will never return to pre Corona levels ,you can take that to the bank . Second the system does not work at 50-60-70% capacity and that is what our current economic setup is ,a big system composed of smaller subsystems . An analogy would be the human body which is a complete system composed of smaller subsystems ,the digestive system,the nervous system,the circulatory system etc . All must work in synchronisation for the body to function .It is not possible that a system say ,the renal system or the pulmonary system is not working and you will be able to report to work . You may be alive with the failure of a subsystem but definitely you are ^functionally^ dead . The virus has knocked out a lot of subsystems in our way of living or you may say lifestyle . The financial system is just an example ,as it is kept alive with an overdose of money printing ,just like you can keep a ^functionally^ dead alive with doses of antibiotics. This time what has happened is a Synchronised System Failure with too many subsytems going kaput and there will be no recovery from this .Get ready for what JHK termed ^ The Long Emergency ^ . The golden rule for the way our current system is structured has an Achilles heel that is ^ The end of growth is the beginning of collapse ^ . Understand the fine line ^the end ^ even ^ zero growth ^ will lead to collapse leave alone negative growth where, we are today .

HiH,

I respectfully disagree. The human body is merely a series of static subsystems that cannot adapt or change, other than through long-term evolution. Our financial system and economy comprises many overlapping subsystems that are too numerous to inventory here. These systems, most importantly, are dynamic and can adapt, redirect, restructure and redesign on the fly as headwinds are encountered. The human body simply dies at failure as it cannot adapt. In other words… our financial systems can change the rules in response to a crisis and move on…. If we get a knockout blow to a portion of our financial system, we simply recreate it and a new norm is formed. I’m not saying it’s glamorous or perfect… some are hurt along the way as the whole is preserved. A small example of this adapt and change was the simultaneous 1980’s meltdown of the S&L Crisis, oil industry and real estate…. The rescue plan took a while to gain momentum, but was ultimately successful and GDP growth grinded through. I really don’t think there was a down GDP year during this crisis other than the slight dip in the 1991 recession. And that period sucked! I remember walking in on my dad sitting in the dark in our living room listening to the 1812 Overture trying to clear his head (he was a great engineer). Our financial system survived and thrived because we could change the structure and rules… the result is that nominal GDP has grown ~300% since then. Why is the COVID 19 situation any different from the S&L era crisis cluster other than COVID is the fear of the day… which always feels like it’s the worst because it’s active and in our face. End game Doom prognosticating is easy to dish but hard to support. Never has it come to pass other than temporary pauses.

Never underestimate the resiliency of humans. We are relentless ants of greed. In this current natural disaster style crisis, we are changing the rules and will continue to do so until effective medical solutions are available, then humanity will roll back into its old habits of ravenous consumption over time as our memories fade from fear into greed and new GDP heights will be achieved. It always has and always will… until the big asteroid comes.

^The human body simply dies at failure as it cannot adapt.^

Incorrect . It is the combination of both adaption and resilience ability of the human body that evolved over hundred-thousands of years ,that bought homo sapiens (human beings) to be where we are ,or else we would still be somewhere lower in the evolutionary cycle . Of course the human body or any animal will eventually die . Death is the great equalizer .

The experience of the past handling of the economic crisis are invalid today . The world was not 7 billion people ,$329 trillion in debt , climate change breathing down the neck ,the main source of energy which is oil in depletion and decline ,terrible EROEI for all FF ,a pandemic ,a locust epidemic ,etc etc all converging at the same time . A perfect storm . The difference between 0 Celsius and 1 Celsius is not 1. The difference is at 0 you have ice,a solid and at 1 you have water ,a liquid . This is phase change . The virus is the catalyst that has triggered the phase change,if not the virus it could be something else . When you burn petrol in the car ,you get smoke , you cannot capture the smoke and turn it back into petrol . In phase change most of what we have learnt or experienced is invalid . So now the FED is doing what it did in 2008 ,throw money left ,right and centre ,in 2008 it was $ 875 billion , now it is already $ 2.6 Trillion and counting . Result , nulla ,nada ,zero . Trying to solve a health crisis by monetary and fiscal methods is not going to work . They have taken the kitchen sink,the bathtub and thrown everything,even buying junk bonds . Understand there is no such thing as a ^ zero growth^ economy , I have already pointed out that ^zero growth ^ is leading to a collapse . After this what ? The world has changed . Just one example , if ^social distancing ^ is the new normal ,then instead of 5 in a row ,there will be 2 in a row in airplanes, sit down restaurants are over ,sports events,carnivals,music festivals are over .Can airlines,restaurants,movie theaters etc survive operating at 50% capacity ?No . They are not coming back . We are now in uncharted territory , but one thing I can assure you ,it is all downhill from here ,the speed at what this will occur will be learnt shortly . Don’t depend on a vaccine in the short term ,we are still waiting for one, for SARS,HIV and many other diseases . The virus is in the driver’s seat and we are just bozo’s on the same bus . Be well .

Disclaimer :- I am not a pessimist , just a ^disappointed^ optimist . They are also called realist . 😉

I suspect there will always be a random movement week to week due to production moving in and out of storage. For example, residual oil supply jumped 11 fold this week and other oils supply increased too. So it will be very difficult to pin the absolute low of the products supplied on a weekly basis. It can be 11, 12 or 13.

It will be perhaps far more instructive to look at a 4 week moving average as it will cut off the noise and give a much better picture closer to the true value. It was above 21.5 million BPD pre corona. Let us see where the trough forms. It can be at 13 or 12 or somewhere in between. But the fact of the matter is that 8-9 million BPD of demand has vanished. And when it recovers, we are not going to get the whole 8-9 MBPD back. Not this year, not next year.. maybe never.

How much storage is available for the ethanol corn feedstock , wonders I?

And will less corn for ethanol be planted this year?

Last year it was over 40% of all corn acreage, almost as much prime farmland as Illinois and Iowa have combined.

Hickory,

You bring up an excellent question in regards to how much corn will be planted this year for ethanol production. The typical planting time for corn is late April, early May. So, I imagine farmers are watching the corn market very closely to see how much they are going to plant.

Sure, it’s 3-4 months before harvest, but who knows how much gasoline demand will have declined by August-September.

Lastly, another SECONDARY IMPACT on the huge decline in ethanol production is the loss of distiller grains as a by-product that is fed to cattle, pigs, and chickens. So, with 45-50% of ethanol production OFFLINE, that is one hell of a lot less FEEDSTOCK for the U.S. cattle, pig, and chicken industry.

Americans still have no clue just bad the supply chain disruptions have taken place and will continue to THUNDER through the economy over the next 1-2 months.

steve

If their is demand for corn livestock feed, but not ethanol production, there is plenty of production capacity from all the land that has been recently planted to corn for ethanol.

On the bright side, the United States is officially energy independence for the first time in our lifetime.

Only Trump can fix it !

Russia’s Oil Revenues Tank Despite Historic OPEC Deal

Due to the monthly recalculation of Russia’s oil export duty based on the average price of its key export grade, Urals, for the previous month, Russia’s oil export duty in May is about to be 87 percent lower than in April, Bloomberg reported on Thursday.

According to Bloomberg estimates on data from the Russian finance ministry, Moscow would be getting less than US$1 out of each barrel of Urals it exports.

This may be of some interest…

With Western Canadian Select now trading at $4.47 a barrel, it’s cheaper than buying a 12-pack of Coke at Walmart for $5.08.

Crazy Times indeed.

steve

It’s now $10. I suspect it has something to do with expiry of May and start of June series. Is my guess correct? WTI too has jumped from 20 to 25. (Source: oilprice)

WCS at close on Friday April 17.

Big move. Up 53.6% from yesterday’s close of 7.24. Nice gain for those who risked buying yesterday. What changed?

I am not 100% sure but I am reasonably confident that it’s the changeover from May to June contracts. Oil price is right now in super contango. I read somewhere that the november contracts are trading in the 40’s. So if u have storage space, buy spot at 18, sell futures for end of the year and pocket the profit.

Someone can correct if I am wrong.

Uups … at least it’s just a gallon of Coke – a barrel would be a serious health risk ?

Asian futures WTI sub $19.

I would guess there are very few oil wells in the United States that can flow at a profit at that price. None of them in shale. A handful in Texas. A handful of California. Nothing in the Gulf of Mexico. Nothing in Alaska. Maybe a few wells onshore Louisiana and in Oklahoma.

Less than 2 million bpd? Minimum consumption for food transport and military operations and law enforcement and lawn mowing? 10 mbpd?

We’re headed towards the nationalization exit and the off ramp doesn’t have to be steep. The industry is not going to be allowed a backstop via fiscal bailout. The companies will have to borrow money from the Fed and I don’t think they want to do that because they’ve already borrowed money from other unelected folks.

I would guess government would seize the assets as the companies fold and the workers become civil servants. And if consumption increases, guess what? The price won’t go up. It’s an election year.

Western Canadian Select this morning…$2.74… Basically free. One wonders, of course, how much longer major operations like Suncor, Syncrude, Conoco Phillips et al can continue like this.

Funny how it is almost completely unreported by Canadian news outlets, as far as I can tell. I guess they don’t want to rehash the Liberal government’s historic screw up on TMX, and the subsequent fantastic level of economic devastation wrought to Western Canada, to become another lightning rod of public discontent.

All along I mostly blamed the US shale fiasco for Western Canada’s (read: Alberta’s) economic collapse over the past decade. Turns out, however, that we provided plenty o’ rope to hang ourselves with, shale or no shale. As always, the mind boggles and my jaw continues to grind along the ground.

Starting to see week over week improvement in global flights per day. Not a trend but possibly building one…

April 9th: 68,623

April 16th: 75,216

Mostly freight. The flightradar apps are filled with Fedex and UPS jets.

Agreed, but I will take it. More flights, more jet fuel demand. Total flights had been on a persistent downtrend since late Feb, but now appear to be flattening out and perhaps beginning a recovery.

I was eyeballing various chemistry & emissions over China, on earth nullschool and others. Domestic burn appears to be picking back up.

Mike Shellman has never liked the fact that the export ban on crude was lifted in Sept 2015. From a national security standpoint he is correct and there are many instances where “free trade” is not allowed for national security, we don’t sell our military hardware to our enemies as a general rule.

So I have changed my free trade viewpoint on crude oil and note that from 1975 to 2015 this was the policy of the US, no crude exports.

From 2014 to 2019 US crude exports rose from 350 kb/d to 2980 kb/d, most of this increase in exports was tight oil exports which cannot be utilized in US refineries. One solution is to refit refineries to process the lighter crude, but this is expensive and refiners have been unwilling to do so for the most part.

An alternative is to reduce tight oil output to about 5 Mb/d for the long term and reimpose the crude export ban.

The scenario below uses prices from the EIA’s April STEO and AEO 2020 reference oil price scenario along with the models I developed using data from shaleprofile.com to develop well profiles and for past completion rate data.

I have left my Bakken, Eagle Ford, Niobrara, and other US tight oil models as they were and simply adjusted Permian basin completion rates to achieve roughly 5 Mb/d of US tight oil output after recovery from the current downturn, tight oil output can be maintained at 5 Mb/d until at least Aug 2051 under the assumptions of my model (which ends in Aug 2051, no new wells are completed beyond that date in the models).

This is not necessarily what I expect will occur, it is a “what if” exercise to see how long 5 Mb/d output for tight oil could be maintained if no new US refinery capacity for tight oil was developed from now until August 2051. The aim would be to conserve US tight oil resources and utilize them in the United States.

Dennis

I agree. If the long term thinkers in the US believed in Peak Oil, the best thing to have done would have been to limit US production and import what was necessary. Also work with Canada which has massive reserves of heavy crude/bitumen. This keeps the Texas refiners supplied with heavy crude. The syncrude, (Syncrude Sweet Blend) produced from bitumen is biased toward making diesel and gasoline. Also it is has a higher quality than WTI (Sweet) and has no bottoms. This would make North America close to self sufficient.

Chins’s big push to EVs is driven by the knowledge that they had to import over 10 Mb/d of oil up to January 2020. They know this is their achilles heal. They have been going around the world buying up oil assets. They bought companies in Canada. They learned too late that it cannot be exported back to China,

On a related note to try to make North America self sufficient see below.

“BILLINGS, Mont. — A U.S. judge canceled a key permit Wednesday for the Keystone XL oil pipeline that’s expected to stretch from Canada to Nebraska, another setback for the disputed project that got underway less than two weeks ago following years of delays.

Judge Brian Morris said the U.S. Army Corps of Engineers failed to adequately consider effects on endangered species such as pallid sturgeon, a massive, dinosaur-like fish that lives in rivers the pipeline would cross.

https://www.usnews.com/news/business/articles/2020-04-15/judge-cancels-permit-for-keystone-xl-oil-pipeline

Ovi,

Maybe the raw bitumen could just be shipped by rail to the US? Then build a facility near existing pipelines (maybe in Oklahoma) to create the syncrude and ship to Gulf coast refineries. I have not really looked at the problem, but it seems the Keystone XL was poorly conceived, as a better project would have gotten around the various obstacles and be moving oil.

Dennis

In January 2020, Canada exported 400,000 bbls/d by rail. On any given day we export a around 3.8 M/d to the US. So rail accounts for around 10% of Canada exports. Cost is one issue. Roughly $15/b by rail vs $5/pipeline. The other issue is that the rail companies want a long term commitment because they have to buy rail cars, locomotives and train crews and build transfer points.

The companies have made a commitment to add rail shipments and spread the costs over all shipments.

Keystone XL was conceived more than 10 yrs ago as an expansion of the Keystone pipeline that was commissioned in 2010. Keystone went through without difficulty. For Keystone XL, they picked s shorter route through more environmentally sensitive areas. In retrospect, they should have chosen to parallel the same route.

Part of the plan was to have a spur line from the Bakken connect to it. Because of the delays some other company built the Dakota Access pipeline. It ran into protests while being built but few court challenges.

Alberta is building a refinery to convert bitumen to syncrude sweet. It is about 3 years late and the cost has doubled to $9.6 B for a refinery with a capacity to make 50,000 b/d of diesel. You can see why the preferred route is to ship the bitumen to Texas refineries designed to crack it.

HEY OVI, DENNIS

WESTERN CANADIAN SELECT IS TRADING FOR $0.28 TONIGHT. HOW DOES THAT FACTOR INTO YOUR PONTIFICATING ECONOMIC DISCUSSIONS REGARDING RAIL TRANSPORTATION, AND POSSIBLE FUTURE SUPPLY???? YES THE ALL CAPS MEANS THAT I AM SHOUTING RIGHT NOW WITH EVERY FIBER OF MY BEING

Michael,

A long term discussion on future tight oil and oil sands output for US and Canada.

The low price suggests Canadian oil that has no pipeline access, should not be produced at present. I doubt the economic down turn will last forever, but I pontificate. 🙂