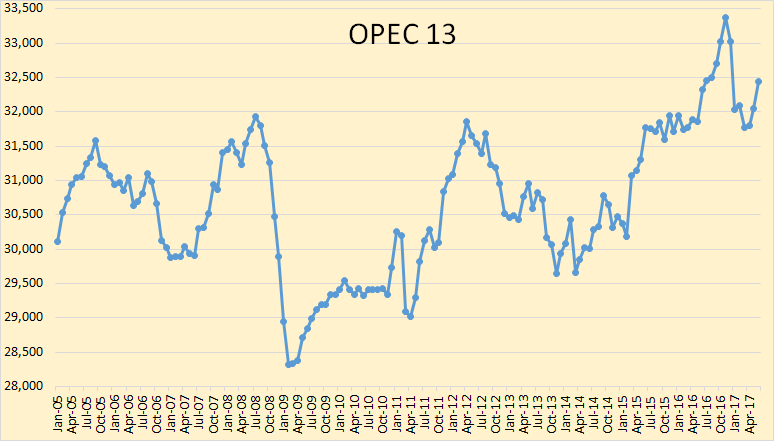

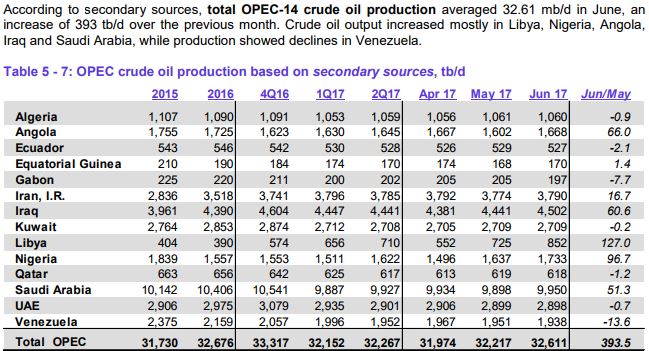

All data below is based on the latest OPEC Monthly Oil Market Report.

All data is through June 2017 and is in thousand barrels per day.

The above chart does not include the 14th member of OPEC that was just added, Equatorial Guinea. I do not have historical data for Equatorial Guinea so I may not add them at all. It doesn’t really matter since they are only a very minor producer. Also, they are in steep decline, dropping at about 10% per year.

March OPEC production was revised upward by 23,000 bpd while April production was revised upward by 72,000 bpd.

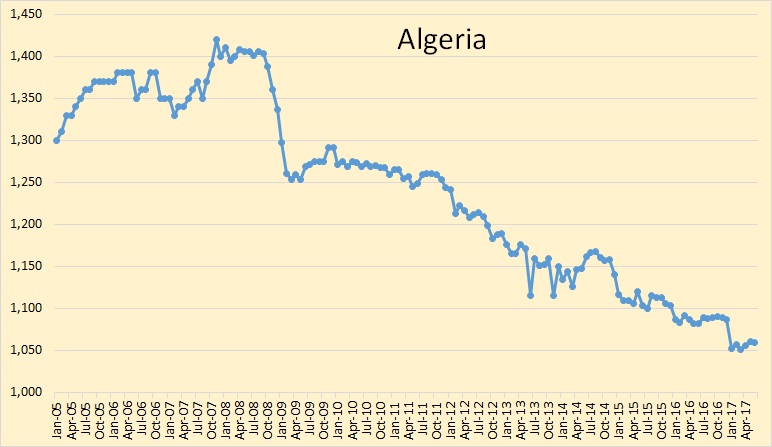

Not much is happening in Algeria. They peaked almost 10 years ago and have been in slow decline ever since.

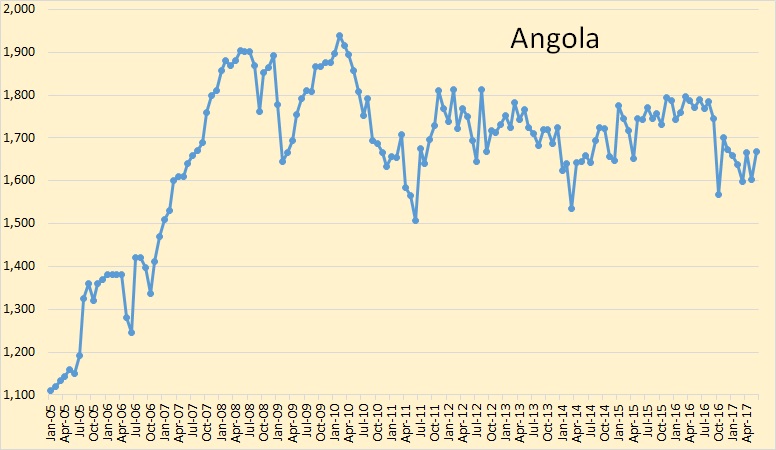

Angola peaked in 2010 but have been holding pretty steady since.

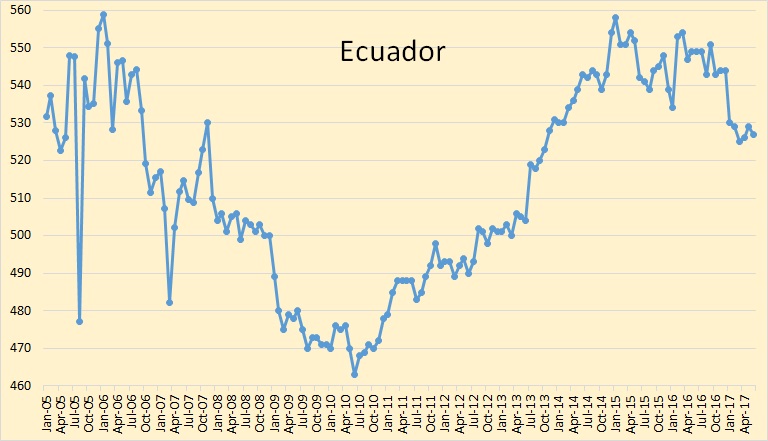

Ecuador peaked in 2015. They will be in a slow decline from now on.

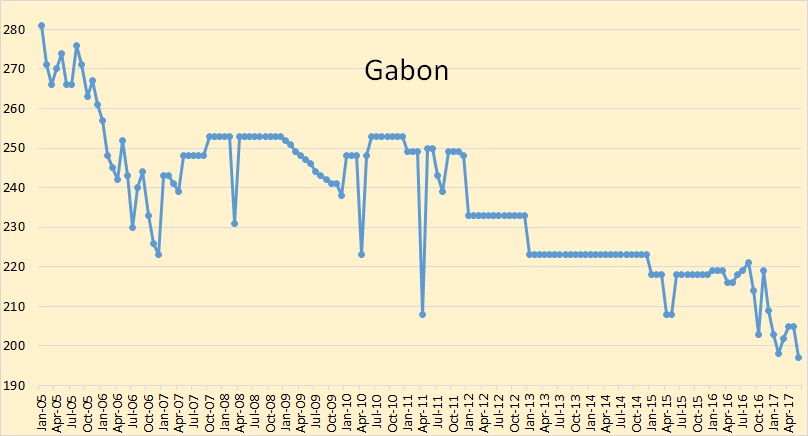

Any change in Gabon crude oil production is too small to make much difference.

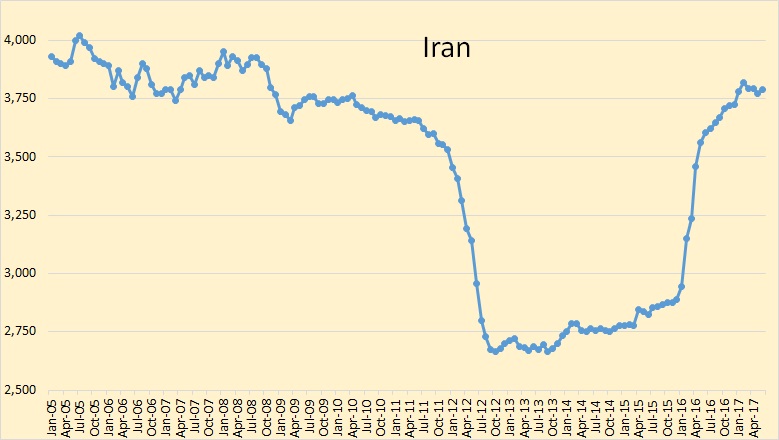

Iran’s recovery from sanctions has apparently peaked. I expect a slow decline from here.

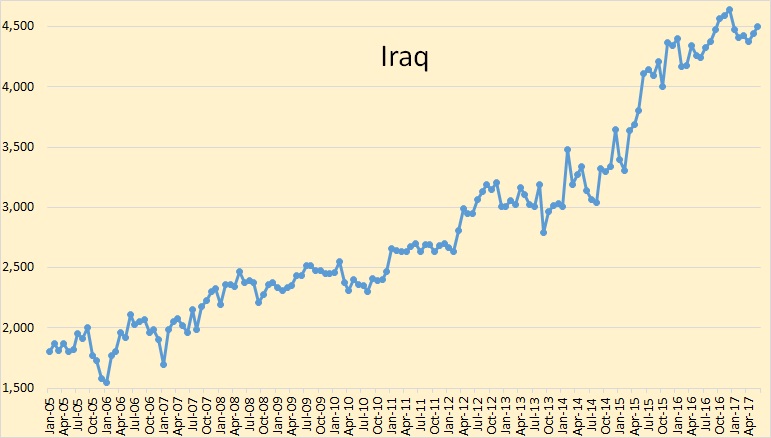

Iraq is holding steady since their December peak.

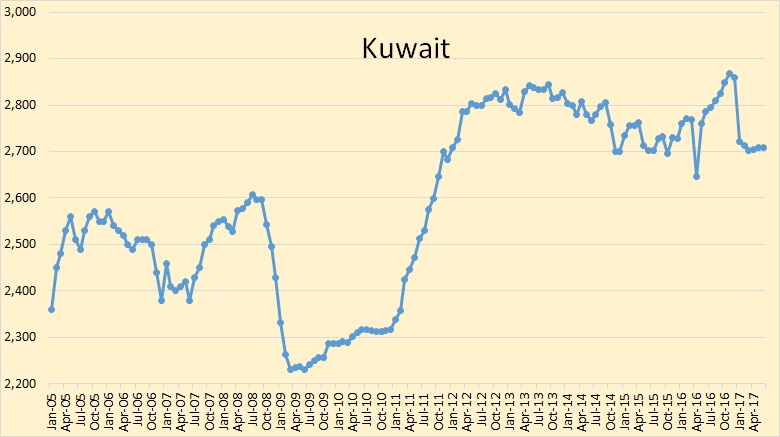

Kuwait is down 154,000 bpd from their November peak. That is about 5.4%.

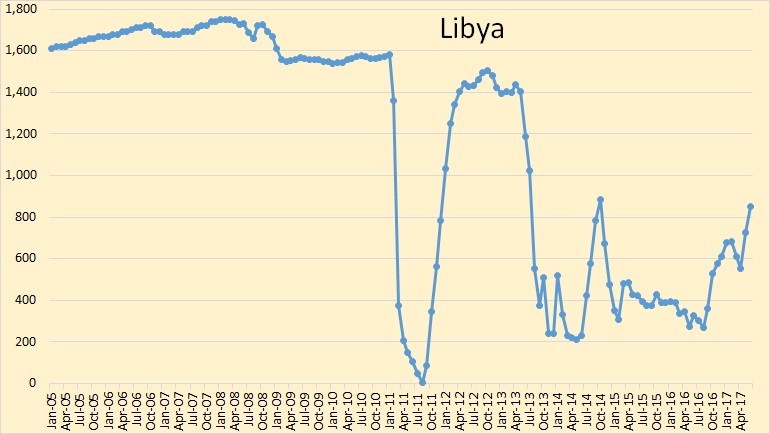

Libya was up 173,000 barrels per day in May and up another 127,000 in June but they still have a long way to go before they get back to their maximum possible production level, which is around 1.4 million bpd.

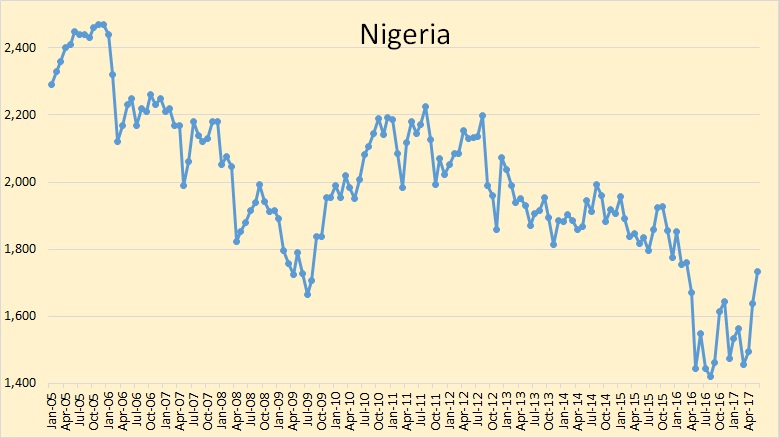

Nigeria was up 141,000 bpd in May and up another 96,000 bpd in June. It’s hard to tell what’s happening in Nigeria.

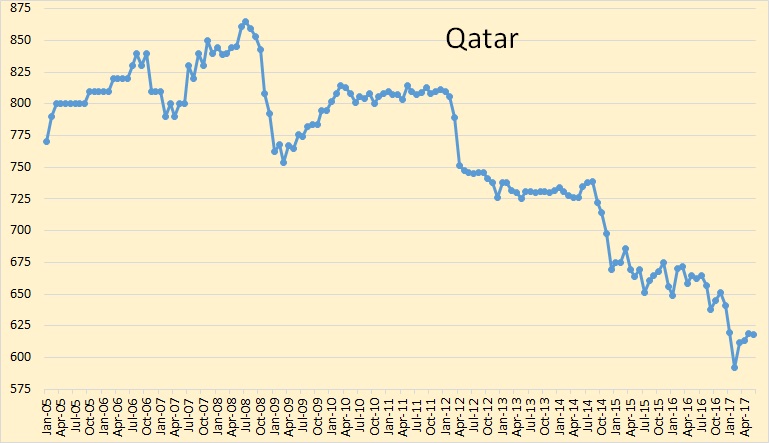

Qatar has been in decline since 2008. Her decline will continue albeit at a very slow pace.

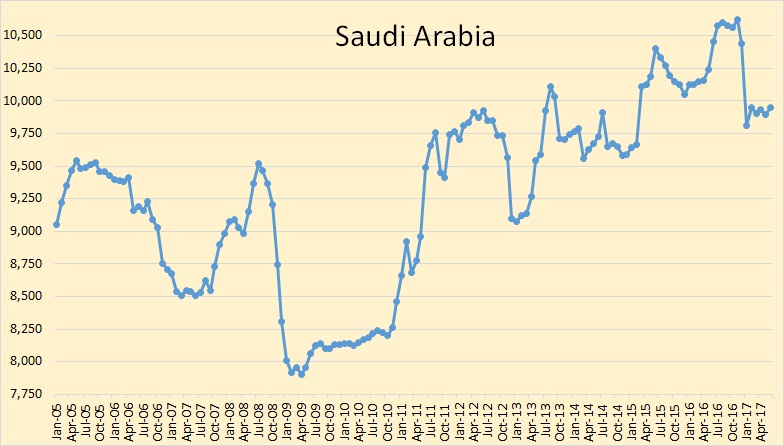

Saudi Arabia cut in January, then stopped cutting. Their production was up 51,000 bpd in January. I think this is where we will be for some time unless there is a real shake up in OPEC.

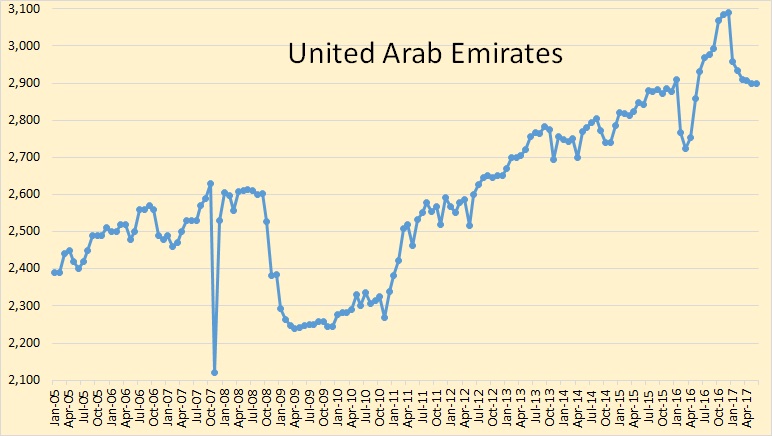

The UAE is down almost 192,000 bpd since December. This is the largest percentage cut in OPEC. I don’t think it is all voluntary.

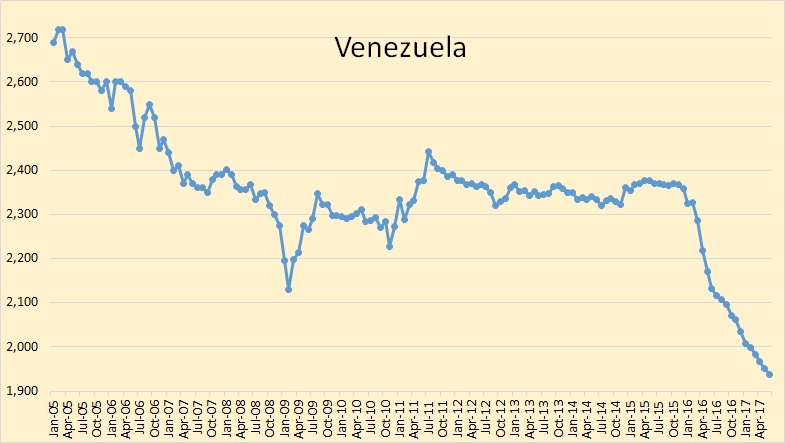

Venezuela’s problems will continue. They are now below two million barrels per day. They are at 1,938,000 bpd. They are down 430,000 bpd since November of 2015.

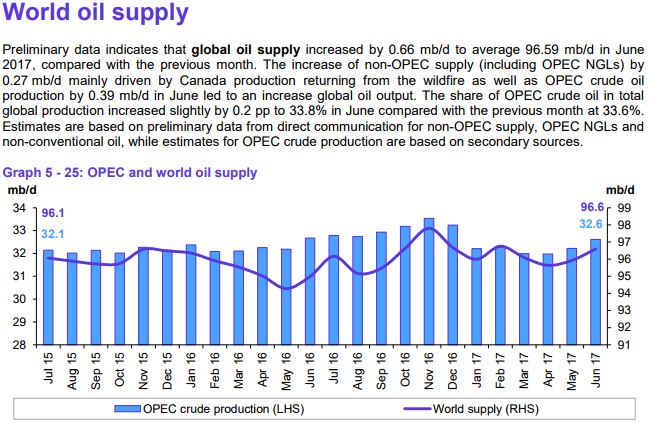

World oil supply, total liquids, was up 660,000 bpd in June. This is huge. Oil prices will continue to drop if this continues.

I thought I would add a chart of Russia’s production since they are now the world’s largest producer.

So? Peak Oil is also fake news it would appear, right or wrong?

Wrong

Well it would be fake news if oil production will never peak. And if you believe oil production will never peak than you are a goddamn fool. The peak oil folks are exactly right, they just had their timing a little off.

Their timing is not ‘off a little’ Ron, it’s off by a country mile. But what would I know? I’m a goddamn fool.

November 2016 appears to be the peak for total liquids based on the chart above. You see?

I have seen several, including those that said 2005 was the PEAK.

Figure it out Davebee. It’s not rocket surgery.

http://euanmearns.com/a-new-peak-in-conventional-crude-oil-production/

Pay attention to words like conventional, unconventional, crude, condensate, natural gas plant liquids, refinery gains, biofuels, and total liquids.

“The world outside the US and Canada does not produce much more crude oil than in 2005 The growth came from unconventional oil.”

http://crudeoilpeak.info/incremental-crude-production-update-august-2016

Does it matter? From a consumer’s point of view it doesn’t matter where oil came from only that it is available at an affordable price.

It seems like measuring tons, instead of barrels would make the conversation more meaningful. Weight seems like it would correlate better with energy content. Venezuela has lost a lot of heavy oil production and the frackers are pumping light stuff. Does anyone have data that shows how this affects total energy pumped out of the ground?

Just look at BP data in tonnes for consumption or production.

I think production is better because biofuels are not included (C+C+NGL only), but if you want to look at all liquids consumption in tonnes gives this data.

I absolutely agree that mass will be closer to energy content than volume and is a much better measure of energy output.

Glad you admit you are.

NAOM

The above graph is for OPEC. Not World Total.

Regarding “off by a mile”, World Total was predicted in the 60ies to be at year 2000, it was at year 2005 on the conventional oils that was produced at the time. Which was very spot on, since consumption patterns over several future decades are hard to predict with accuracy.

The non-conventional oils was not predicted, and extended the “oil grace”, but they will have the same fate. And make oil more expensive while we wait.

Eventually oil production will peak. But it matters whether it peaks due to supply constraints or reduced demand. In less than 10 years EVs will be cheaper than ICE vehicles. The demand for oil will drop and therefore supply will drop as well. This is not what peak oilers like me had in mind 10 years ago.

It’s possible that electric vehicle sales will grow fast enough to reduce oil demand.

It’s also possible that the combined effects of increasing population and increasing prosperity will result in demand for oil continuing to grow for quite some time, even if electric vehicles start selling in considerable numbers.

Oil is used for a lot more things than just gasoline for automobiles, lol.

It might be that we will not have batteries that are sufficiently powerful and cheap enough to run large trucks, farm equipment, construction machinery, etc, for another twenty years- or another century, for that matter.

Depletion is an iron clad fact.

It’s impossible to predict what the odds might be, but we could see the price of oil shoot way up within the next few years, high enough to bring on an economic recession.

For my part, I intend to burn all the diesel I can afford, to the extent I have the time and opportunity, on permanent improvements to my farm property, as fast as I can manage to burn it. I don’t believe diesel fuel will STAY cheap.

Remember Yogi.

Predictin’s hard, ‘specially the future.

OFM,

Tesla is revealing their electric semi later this year. It uses multiple Model 3 Motors and the Gigafactories 2170 cells.

They have Mercedes former head of their semi division leading the project. They’ve been working directly with customers to design it.

In a few more years, they will stop making ICE cars because EVs will be cheaper to manufacture, fuel and maintain. After that all new demand will be satisfied by EVs. I will be surprised if after 2025, ICE cars are manufactured and conventional automobile manufacturers are still in business. If Foxconn builds a $15,000 EV that is cheap to fuel and requires practically zero maintenance, who in his right mind will buy a gasoline car? All we need is a battery price of less than $100/KWhr and anyone will be able to make a $15,000 EV with a 200+ mile range. EVs are today where flat screen TV was 15 years ago. 10 years after they first appeared in showrooms, flat screen TVs grabbed 100% of the market share. All we needed for it to happen was for the price of LCD screens to drop below a certain threshold.

I agree, the EV is basically a flat sled giving a lot of room for creativity/body design and material use. It has high potential for modular construction and 3d printed parts. Break point is about $25,000 so if manufacturers can produce cars in the $15,000 to $30,000 range then the EV will take the market.

A smaller battery can be used if additional braking energy recovery is implemented. That should cut cost and weight.

Also EVs will lose their mechanical connection to the driver, making them easier to operate as self driving cars.

Self driving cars will be bi-directional, with four wheel steering, no “reverse gear” or other directional preference, and a motor on each wheel. Passengers will sit facing each other.

“In less than 10 years EVs will be cheaper than ICE vehicles. The demand for oil will drop and therefore supply will drop as well. This is not what peak oilers like me had in mind 10 years ago.”

LOL! No. EVs have a tiny market share. of the 17.55M cars sold in the USA during 2016, only 159K were EV (less than 1% of total sales). Americans also switched back to SUVs & pickups (63% of all vehicle sales in 2016 were SUVs and Pickups). Clearly Americans don’t want to by EVs.

That said, it appears that most people will no longer be able to afford new vehicles. in the USA the average vehicle loan duration is approaching 6 years. Much of the recent auto loans are in subprime terrority.

http://touch.latimes.com/#section/-1/article/p2p-92259365/

“Ford’s F-Series pickup remained the bestselling vehicle in America in 2016, with 820,799 trucks sold. That’s the equivalent of 93 trucks sold every hour.”

“Toyota’s U.S. sales chief, Bill Fay, said consumers’ shift from cars to SUVs is one of the most dramatic the industry has ever seen. Three years ago, trucks and SUVs represented 50% of the U.S. market. They closed 2016 at 63% of total sales, and analysts don’t see that changing anytime soon. Boomers and millennials both like the space and the higher ride that SUVs offer”

“Car buyers stretch loan payments to record lengths to get in pricier vehicles”

http://www.marketwatch.com/story/car-buyers-stretch-loan-payments-to-record-lengths-to-get-in-pricier-vehicles-2017-07-03

“Average auto-loan lengths are at nearly 70 months and payments are at the highest this year”

“The average amount that buyers financed was hit with the biggest uptick for the year last month, at $30,945, or up $631 from May. The financing trend also lead to the highest monthly payments for the year, now averaging $517, which increased from $510 in May.”

“It’s financially risky, leaving borrowers exposed to being upside down on their vehicles for a large chunk of their loans”

The demand for oil will drop and therefore supply will drop as well.

Supply will start declining soon. Simply because Oil Major companies stopped drilling for oil and start drilling for money in Wall Street. Shell, Exxon, Chevron, BP, Total, all cut CapEx in 2013 and continue to cut. For all of 2016, only 2.4B bbls were discovered. That less than 30 days of world demand. Sooner or later the Shale/Tight Oil will pop. Shale Drillers borrowed about $350B and can’t pay it back. Banks and pension plans continue to loan them more so they can remain operational, since if they stopped loaning the more money, the drillers would start defaulting. Its just smoke an mirrors, buying a few more years.

“Global oil discoveries and new projects fell to historic lows in 2016”

https://www.iea.org/newsroom/news/2017/april/global-oil-discoveries-and-new-projects-fell-to-historic-lows-in-2016.html

“Oil discoveries declined to 2.4 billion barrels in 2016, compared with an average of 9 billion barrels per year over the past 15 years. Meanwhile, the volume of conventional resources sanctioned for development last year fell to 4.7 billion barrels, 30% lower than the previous year as the number of projects that received a final investment decision dropped to the lowest level since the 1940s.”

“Shale Oil Drillers Cannibalize Themselves While Debt Bombs Loom On The Horizon”

https://seekingalpha.com/article/4081588-shale-oil-drillers-cannibalize-debt-bombs-loom-horizon

“Shale oil drillers who generally couldn’t deliver positive net income at $100/bbl oil continue drilling campaigns easily funded by debt and equity issuance. But while presentations by many of these companies show decent shale oil well rates-of-returns, or IRRs, with WTI at $50/bbl and even $40/bbl and below, these presentations typically omit such all-in costs as infrastructure build (gathering, water disposal, etc. etc) and, of course, the big one: interest payments on debt.

“But the point is that some of the shale oil companies have taken on large debt obligations in order to keep drilling. And all that drilling puts more oil on an already over-supplied market. And that pushes down the price of the commodity that they have to sell in order to service the debt. It is a vicious circle, and it will be the debt-and-equity holders that get caught holding the (empty?) bag when the music stops.”

I agree that there will be factors in play other than just EV adoption which will affect oil demand.

I think depletion, recession, global economic slowdowns, strategic commitment to use less oil, etc. will all play a role.

people had been rolling from one loan to the next, but with car prices dragging, loan terms extending, and credit weakening, this process is slowing way down. in addition, inventories have been riding historic highs.

so once the next bottom drops out there will be a huge overhang of used and unsold new cars which will take another set of years to clear out, very similar to the housing crises where foreclosure inventories took years and years to clear up.

I think this whole dynamic will be a massive blow to EV adoption. It might very well mimic New Housing Starts in the Us following the financial crises.

https://www.theatlas.com/charts/4JTYjf6U

Figure a number of years to clear out the dead-weight.

New technologies do not enter a broad market directly, but by finding early adopters in niches , and spreading from there. So the question is not whether Joe Sixpack thinks he wants an electric car. The question is which niches will be first to be filled. Taxis are good candidates. City buses are very good candidates, as are delivery vans. Large fleets of cars that travel in a fixed radius are also attractive — and given the superior performance of EVs over combustion vehicles, police cars make a lot of sense.

alimbiquated Wrote:

“New technologies do not enter a broad market directly, but by finding early adopters in niches , and spreading from there. So the question is not whether Joe Sixpack thinks he wants an electric car. The question is which niches will be first to be filled.”

Technology is been pouring into ICE vehicles for a 100 years, get the prices to own and maintain them increases almost every year. I cannot recall when new technology made a significant reduction in vehicle costs. If People are struggling to afford lower cost ICE vehicles it seems unlikely they will be able to afford EVs.

My guess is that many people will be forced to do without or hang on to their older cars until the fall apart. I believe the average vehicle age is creeping up since newer vehicles are becoming increasing more expensive. Its very likely this trend will continue and grow.

Suyog Wrote:

“EVs have a tiny market share today because batteries are still expensive and not available in sufficient quantities. ”

This is not going to change. The cost is because of the high cost of sourcing & refining the materials that go into batteries, as well as the processes need to manufacture them. People tend to corrorate Moore’s Law (electronics) to Battery develop. About every 18 monthes electronics double in performance. Batteries take more than two decades of R&D to double the performance. At it stands, Battery chemistry has reached its limit. You can only squeeze so much lemon juice from a Lemon. The only way to make any dramatic battery energy density is to abandon the standard battery chemistry and develop something completely difference. Yes there will be a few minor improvements, by using better electrolytes, and additives to the anodes, but they will only offer tiny improvements.

The other issue is that EV are still fossil fuel vehicles since the power grid is 68% fossil fuel plants. In the US the only significant change is construction of more NatGas power plants, but at the cost of shutting down coal and nuclear power plants. To switch US transportation over to EV is has some challenges since the Grid would need major investments to handle the extra capacity. About every joule currently provided by ICE will need supplied on the Grid instead. Another issue is that there is going to be a severe shorted of GRID workers as the boomer retire. Few workers in Gen-X or the millennials pursued careers in the power industry.

Odds are that EV will never take off and consumers will drive much less than they do today. Due to a combination of higher vehicle costs, lack of employment as automation replaces about 1/3 of all workers, higher energy costs, and technology that allows workers to work from home.

That said, Its seems likely that the demographic and debt problems will be coming home to roost in the near future. Worldwide Debt is about $220T which is more than double worldwide GDP (about $107T). Plus industrialize world has a mountain of unfunded entitlements and pensions that are beginning to hit gov’ts and companies. We are on track for a dystopian future as all these problems become more present.

Actually, the cost of a *comparable* car has been falling steadily for years. Think of a 1968 Beetle for $2k – it was about 30HP, with no AC, no nothing. The same vehicle now would cost much less, adjusted for inflation which has risen by about 5x. Heck, you could probably still make it for $5k, which is half the price.

Car prices have risen because cars have been adding various features, and lately “cars” have become, more and more, SUVs which are larger and more profitable.

“Actually, the cost of a *comparable* car has been falling steadily for years.”

Nope. In the 1960s and 1970s Americans largely purchased their vehicles without auto loans. if what you stated applied, then the majority of americans would not be using car loans an the size and duration would not be increasing if cars were become more affordable.

Growth of Auto loans in the US:

https://2.bp.blogspot.com/-lmfS9nJmemI/Vs-RMaS4s2I/AAAAAAAAUe4/m5DfKm-ZLxY/s1600/Screen%2BShot%2B2016-02-25%2Bat%2B7.05.24%2BPM.png

It does not matter that newer vehicles have more stuff, the cost of vehicles compared to take home pay is making them unaffordable. Regardless of what you believe, the fact is that very few Americans buy vehicles with cash (no debt) and the size of the loans and loan duration is increasing. Presuming this trend continues over the next 10 years, very few Americans will be able to afford new vehicles. Its likely that Americans with long duration loans make be stuck paying off their old auto loan after their vehicle kicks the bucket.

Trying to spin to state this is incorrect, is just plain wrong. Math does not lie.

Of course math can lie, if you use it wrong.

Please note: I said “comparable”. The very cheapest car on the road, a Nissan Versa, costs about $12k. Adjusted for inflation that’s about the $2k you would have paid in 1968 for a VW Beetle. The Versa is far better than the Beetle – faster, heavier, more powerful, safer, longer lived, with many more features.

The average new car costs about $34k. That’s about 3x as expensive as the cheapest car on the road. We can see that most people don’t buy the cheapest car on the road.

Affordability isn’t the problem, it’s people’s willingness to borrow money when they shouldn’t, to buy stuff they shouldn’t. They have more credit than sense.

>If People are struggling to afford lower cost ICE vehicles it seems unlikely they will be able to afford EVs.

An EV is a significantly simpler vehicle. Not ICE, no transmission, simple drive train, tiny cooling system, etc. The only question is the price of the batteries, and it is falling quickly.

EVs have a tiny market share today because batteries are still expensive and not available in sufficient quantities. I was talking about the future. I think the tipping point will be around 2022 when EVs will be cheaper to manufacture than ICEs. By then you may also have new entrants such as Mahindra, Foxconn, BYD, etc.

If Americans cannot afford new cars, that will make transition to EVs faster. In a few years they will be cheaper to make, cheaper to fuel, and have low total cost of maintenance. That is exactly the kind of vehicle someone who doesn’t have a lot of money will buy.

Rather than just throwing out the “fake news” buzzwords, why don’t you provide a factually supported argument as to why worldwide crude oil production will never peak?

Further, what is “off by a country mile?” Pretty vague statement.

Hey shallow Sand

I thought you lived in the “country”.

where I live a country mile is slightly more than a mile. ?

Lol. True Dennis.

I guess the poster was using the phrase to describe time, whereas I am more familiar with it being used to describe other measures, primarily distance.

You and Ron both tend toward posting sourced data, so I am just wondering about the reference to fake news.

I suppose $2 gasoline today means the chance of a supply crunch in future is zero = fake news?

Hi shallow sand,

That went right over my head (time vs distance).

I don’t get the fake news either.

Ron thought the peak might be in 2015, he has admitted he missed that (for trailing 12 month average), but I think he nailed it if we look at the centered 12 month average (which is the correct measure imo).

I think that previous peak will probably be surpassed, but I don’t know Ron’s current opinion. My opinion is a peak between 2020 and 2030 for the 12 month centered average of World C+C output.

“Ron thought the peak might be in 2015, he has admitted he missed that (for trailing 12 month average), but I think he nailed it if we look at the centered 12 month average (which is the correct measure imo).”

FWIW: a delayed peak likely just means a steeper decline in the future. Better technology has just make it possible to extract a finite supply faster. My guess is that if a recession is avoided, that Oil prices will start increasing and working back up above $80/bbl in the next 12 months which cut demand. That said I think we are teetering on the edge of another major recession, which would drive demand down and lower prices.

It really depends one what the Worlds Central banks do. The world is 100% dependent on cheap debt and liquidity. Take away the punchbowl and it starts to collapse. refill with a bigger punchbowl and the party goes on.

Regardless, CB can’t print energy, and even if CBs let the party continue for the next few years, eventually physics will force a crisis.

I believe the CBs collectivity printed about $1T for 2017. But with the Fed raising rates and planning to start selling its MBS holdings its seems that are going to start draining the punchbowl.

My guess is that either 2016 will be the peak (recession begins this year and cuts demand and shale drillers go bust) or very latest 2019 when lack of reserve replacement begins to impact supply. Also I am not entirely sure that the statistics for world production are accurate. It could be that real peak has already happened and we just don’t know it yet.

Hi Tech guy,

You are correct that statistics could be revised either higher or lower. It is possible the peak might be before 2020 especially if your recession prediction is correct.

I also agree that the later the peak the steeper decline rates will be.

My best guess is 2025 with 2% decline by 2030.

Perhaps by 2035 demand falls due to high prices and more EVs sold worldwide.

We will see what happens when the model 3 has greater volume in 2018.

EVs can be SUVs.

It’s off topic , but I think it’s justified to mention here at this time that those of us ( I’m aiming this at YOU in particular NICK) who habitually present the case for renewables by way of rose tinted comments and articles, etc, should speak in more measured, sober tones.

Otherwise, we help set the stage for political backlash against the environmental movement.

In particular, what I have in mind at the moment is that just about all of us at the old TOD, and here now, and environmentalists in general, ridiculed the right wing “drill baby drill ” argument on a daily basis for years.

Well, Baby got busy drilling HERE in Yankee Land.

And peace broke out, in practical terms, in Sand Country,at least to the extent that just about everybody over there could get back to pumping oil.

And them there free market,awesomely stupid, flag waving, right wing trumpster types turned out to be RIGHT.

We have two dollar gasoline again, and anybody who thinks the average or typical guy or girl on the street doesn’t know this is a goddamned fool, to borrow Ron’s latest description of those who think peak oil is a joke.

The country as a whole tends to be simple minded, when it comes to politics, and the first and often the ONLY thing that many voters have on their mind when they enter the voting booth is the state of the economy.

Right wing websites are LOADED with old quotes made by people like us- like me- who ridiculed the idea of a growing oil supply a few years ago. Such quotes are powerful weapons in the hands of the fossil fuel industry, and the bau establishment.

So THESE DAYS I for one try to talk about renewable energy, peak oil, and related topics in measured tones, so as not to see my words thrown back at me as foolish jokes a few years down the road.

Mac,

I think you’d have to look quite hard to find the kind of quote you’re thinking of in my comments here or on TOD (not that it would be impossible….just rare, I think). I don’t remember ever suggesting that the return of $2 oil was impossible, though I did think it was unlikely. I was one of the very first people on TOD to ask about the Bakken, much to the skepticism of most (“Westexas” did provide the kind of quote you’re thinking of, when he answered my question about the Bakken with the comment that the US would never surpass it’s 1970’s peak).

You’ve misinterpreted several of my comments in the past as meaning something they didn’t, to make this kind of argument, about such things as the continuing use of FF, or the economics of EVs. I’ve tried to correct those comments several times. Uhmm…isn’t poking people for their reaction called “trolling”, and isn’t that considered somewhat impolite in online society?

I try, in fact, to not make predictions, optimistic or otherwise – I try to stick to statements of cold hard fact, such as that EVs with medium range are currently cheaper to own and operate than otherwise comparable ICE’s (without subsidies, and even without considering the considerable external costs of oil); that renewables are cheaper than FFs when *all* costs are considered; that FFs are not irreplaceable for any functions of modern society; and that FF’s *could* be replaced relatively quickly and that would be an optimal economic path for society, even from a pretty conservative approach to inclusion of external costs. That’s not a prediction, it’s just a statement of what I consider sober reality – the tech currently exists to transition away from FF – that transition depends more on human choices than geology or physics.

Finally, the idea that progress should be limited in order to prevent “backlash” is entirely unrealistic. The FF industry and it’s allies are ruthless about fighting for their narrow, short term benefit. They are manipulating those who are uncomfortable with social change to maximize their resistance, and reducing the pressure for change either in the area of energy, or the area of civil rights would never, ever, ever, ever be rewarded by greater progress. The sad thing is that it’s just a game to them – if advocates for change were to give up on a hot button topic, these manipulators would simply move on to another. If guns were made mandatory for every child and adult, then abortion would be the thing. If abortion were made illegal in every corner of the land, then drugs, or communism, or gay marriage, or reckless dog walking would become the trigger topic.

I do agree that respect, careful listening and civil discussion is always a good idea.

Let me say that again – respect, compassion, dialogue and understanding are always a good idea. Any mediator or negotiator of conflict will tell you that.

Y’all do realize peak is not required for widespread death and war?

All that needs to happen is consumption overwhelm output, regardless of if it is still rising.

Considering how much is wasted, market prices should deal with this pretty easily.

Saudi Aramco’s Manifa oilfield production hit by technical issue: report

KHOBAR, Saudi Arabia (Reuters) – Output from Saudi Aramco’s massive Manifa oilfield has been hit by a technical problem, the International Oil Daily reported on Tuesday, citing unnamed sources.

Manifa is one of state-run Aramco’s biggest oilfields and latest expansions, with a production capacity of 900,000 barrels per day. Aramco brought the field online in two phases.

The industry publication reported that it was unclear how much production was removed as a result of corrosion of the water injection system used to maintain pressure in the reservoir.

It added, quoting sources, that the losses were likely to be in the “millions of dollars”.

Saudi Aramco did not immediately respond to an emailed request for comment.

The offshore oilfield – made of rigs on manmade islands linked by 41 km (25 miles) of causeways and bridges over the Gulf – was discovered in the 1950s.

“Corrosion control in the water injection system is not a technical challenge but it can be expensive to repair the water injection lines. They will probably have to shut down the field for maintenance,” said Sadad al-Husseini, a former executive vice president at Saudi Aramco.

“It may have an impact on maximum sustainable capacity but will not affect Aramco’s share of exports,” said Husseini, now an energy consultant.

Reporting by Reem Shamseddine; Editing by Dale Hudson

Wonder what LOE per barrel is for Manifa? Does it produce heavy crude?

Sounds like maybe they have to spend a lot of money on both chemicals and repairs due to corrosion. That doesn’t sound like low cost oil to me, especially when one includes offshore and man made islands.

Everyone seems to assume all OPEC oil is very low cost in terms of both CAPEX and OPEX. I suspect that is not the case.

The Manifa oil field was discovered in 1957. Development of the reservoir was executed under the Manifa Arabian Heavy Crude Programme from 1964 until it was stopped in 1984 because of the heavy nature of the crude. The programme was restarted in 2006 to offset the 6-8 per cent annual decline in output from some of Saudi Arabia’s older fields, equivalent to 700,000 barrels a day (b/d).

The Manifa field is about 45 kilometres long and lies partly onshore. Its production capacity is 900,000 b/d of oil, 90 million cubic feet a day of gas and 65,000 b/d of condensate.

Copied from the net.

Read some about this field online

Says estimated cost $10 billion.

Very rough estimate of money spent on Bakken wells would be $100 billion?

Manifa produces 900,000 BOPD, with no private royalty owners. Inject 1.35 million BWPD for water flood project.

Bakken wells produce just shy of 1 million BOPD, with rough estimate of 20% of oil being the property of private royalty owners, so operators get about 800,000 BOPD. Also, need to spend over $10 billion per year in CAPEX and OPEX to maintain that production level, again very rough estimates on my part.

Haven’t seen OPEX information for Manifa.

Heavy oil which is refined and goes primarily to US.

If it’s just a question of getting the chemical dosing right, or maybe fixing deaerator operations, then it will be fairly simple. If they’ve got the wrong reservoir chemistry or wrong metallurgy for the piping, or the reservoir has started to sour they are in big trouble.

It’s manageable, I’ve seen a large field go sour, we had to overhaul the oil treating system, put in h2s removal, and overhaul the water injection system. But I believe Manifa was already somewhat sour anyway?

So world production is up 660.000 bpd. But OPEC is just up about 400.000 bpd and Russia is roughly flat. Where do those 260.00 bpd come from? US fracking? Canadian tar sands? China? Brasil? India?

Mostly US some Brazil. India and China are in decline.

Hi,

I have not posted any Bakken graphs for a couple of months. But today I have quite a lot of graphs to share. You usually don´t have separate Bakken posts anymore, so I´ll put them here.

First production grouped by year. Most notable is the increase in production the last few months for the 2007-2009 curves. Also 2010 production has been flat since the beginning of the year. This happens at the same time there has been a relatively high increase in water cut for most years which I will show later. So something is going on. It´s propably because of the “halo effect”, where communication with newly fracked wells cause increase in water and oil production for nearby older wells (or possibly refracking).

Here is the water cut grouped by year graph. A bit hard to see around 50% as it is quite crowded there. But the curves appears see higher increases lately. It´s more noticeable for the 2007 to 2009 curves except that 2008 started increasing already late 2015. I have included 2017 for the first time in this graph. Water cut is a bit higher than previous years, but be aware that the data is incomplete and a lot of confidential wells are not included. The data is best from 18 months and later.

So what can cause this general increase in water cut?

Freddy

Thanks, as always, for your posts.

Although actual refrac activity is taking place in the Bakken, it is still not very widespread and gets very little publicity.

In addition to the hydraulic communication between wells during new fracturing (halo effect), there are increasing number of operators actually pumping water down into existing wells (pressurizing) prior to original fracturing of new, nearby wells so as to prevent damaging frac ‘hits’ that emplace unwanted proppant into the older wellbore.

Marathon is doing a lot – relatively speaking – of Bakken refracs and they put online (can’t find it at the moment) a paper describing different steps they take to protect older wells when new ones are frac’d.

The vintage that tends to show this – 2007 to 2010 – correlates to the early sweet spot wells that are now the area of recent development.

Quick edit:

Paper is 13 page pdf ” Ben Ackley Marathon Frac Operations WBPC 2014″ brings up the quick, wonky info.

Thanks coffeeguyzz. I think the halo effect theory is more likely as it also explains why older wells see increased production and why the new wells are so productive. But if the increased water cut is because of water being pumped down then it should only be temporary. So we will know within a few months if water cut goes back to previous levels or not.

Thanks for the graph Freddy. Notice the trend for new wells that begins in 2010 wells. Every year, the first year’s water cut gets progressively higher. In 2010 it was about 32 percent. In 2011 it was about 35 percent. In 2012 it was over 40 percent. In 2016 it looks to be around 47 percent. This is a clear trend, it is not something temporary.

There can be only one reason for this trend. As the average new well gets further and further away from the sweet spot, the water cut just gets higher and higher.

Yes more wells further away from the sweet spots is one reason for the increase in water cut historically. That is probably a big contributor for the high water cut and low oil production for the 2012 wells. Other reasons for the increase is more wells in three forks which contains more water and as I said more proppants when fracking causing longer cracks reaching deeper where there is more water. If you look at 2014 to 2015 they have similar water cut. It increases in 2016 and even more so far in 2017. There are fewer wells in three forks in 2016 and 2017 than in 2014 to 2015 , so that is not the reason for the increase. Most of the new wells now come from McKensey. I had a look in my data for Grail and water cut there has increased from around 25% to around 45% for the 2012 wells for example. The 2016 wells also has a water cut of 45% now. The increase seems to mainly have happened in 2016. Grail is one of the very best areas and also quite small. So something seems to have happend there.

Activity in the Bakken has coalesced around the sweet spots as the years have passed since the first modern horizontal wells were drilled there. This has been particularly true since the price crash in 2015. Almost all drilling since then has been in the sweet spots, not farther and farther away from them, as that would make little economic sense. In light of that, perhaps the better thing to say is that the sweet spots are becoming less and less sweet for one reason or another.

Here is the production profile. Here we can see that the 2016 wells has much higher production than before and 2017 even higher so far. But how can they be that much higher? Well, increasing water cut for older wells and much higher production for new wells suggests to me that they must be using much more proppants and water when fracking than before. This will cause longer cracks which both reach longer down to lower Three forks (and possibly bellow) where there is more water and also reach older wells causing increased communication between wells.

Freddy

The single biggest factor in increased output, as all the operators are saying this, is the implementation of diversion material in the proppant mix.

The ‘near wellbore’ diversion material temporarily plugs larger fissures, thus enabling pressure buildup and prompting many new fissures to form.

The ‘far field’ diversion material limits the unwanted extent – vertical as well as lateral – of the fractures giving operators far more control of the process.

Historically, only 60% of the perforation clusters would be productive.

Now, it is claimed to approach 100%.

In addition, the reduction of ‘stress shadowing’, ie., interference between stages during fracturing, is allowing an increase in both number of stages as well as perf clusters.

All this causes a big increase in the stimulation of the reservoir.

Final note … the recent introduction of VERY small (200/400 mesh) proppant is expected to significantly boost production further.

Better proppants could explain some of the increases in production. But I dont think all of it as the increases have been quite large.

200/400 mesh proppant is some more internet dribble being used to imply the shale oil industry has yet a “new”handle on things. I am quite certain that nobody repeating this shale propaganda even knows what it looks like and does not even have a clue the practical aspects of its use in frac technology (its like talcum powder). The short term productivity gains observed have more to do with longer laterals and just stuffing more sand into shale wells, not proppant size. The proppant stuff is just more techno wizardry for those that need a hobby. As I have said before, its causing immense production problems and horrendous increases in incremental lift costs per BO and we have not even seen the effects of overburden, frac closure and proppant embedment yet.

GOR increases then decreases in various stages of depletion of a tight shale. Think about a nearby well getting frac’ed with 300K BW and creating something similar to a water flood front for other nearby wells. That’s the stupid ‘halo’ effect that makes people want to have sex with themselves over the wonders of shale. It speeds up the rate of withdrawal (depletion) in nearby wells; that’s it. It does not increase UR.

Indeed, where is all this water coming from? Well, its not good, wherever its coming from, and high grading is taking its toll, IMO. Who in the Bakken has turned the corner and started making money?

I didn’t think so.

Thanks, Freddy; that’s some big work you’ve done there.

Yes, the CEO of Core Lab is completely clueless about this ceramic material that has been used primarily as additives in lacquers and industrial coatings until some bright individual decided to try it in fracturing.

The scouring/sandblasting effect as the fissures form enable this tiny material to open more of the formation for the larger size proppant.

Naturally, know nothings such as the engineers at Haliburton spew non stop dribble because … well, because that’s what they do, I suppose.

Anyone with the least familiarity with the Bakken knows that 2 mile long lateral have been the norm for many years, now.

Likewise, all the sand going downhole must be going somewhere.

And it is.

It’s going into the vastly expanded network of complex fissures.

(Last two months production from ND still over 1 MMbld?) Hmmm.

Maybe just more unknowing bluster.

coffee. Is all this technology going to make ND work at sub $50 WTI?

I am beginning to think 2005-2014 was just an aberration, like the late 1970s-early 1980s. Combination of Middle Eastern war and explosive Chinese demand. Extraordinarily high CAPEX spent in response, resulting in oversupply.

I am wondering if we will be sub $50, on average for another decade?

Shallow

Very short answer, most probably not.

For many reasons, contractual supply for pipelines being but one, new production continues up there.

But, ss, VERY minimal new drilling is occurring, which is the big ‘tell’ – to me – of how the operators up there respond to $36 ATW.

With very few exceptions, the only economically justifiable new shale production is in the heart of the Permian.

At $60 WTI, perhaps $55 range, an acceptable, if not optimal revenue stream might exist.

BTW, Rockman started an informative thread on the other peak oil site about the real world bankruptcy situation with the shale companies.

Enlightening stuff.

Biggest, yet underrated factor in the hydrocarbon world, IMHO, is the precarious political and financial status of KSA.

There are increasing signs of instability in both actions and strategies.

Fallout could be huge,

I suppose some think money can still be made in the Bakken, as private equity is buying HK’s 29,000 BOEPD in the Bakken, plus undrilled acreage, for $1.4 billion.

I suspect this is a bet on higher oil prices in the future, plus starting out without debt? HK has had some decent wells over the years on Fort Berthold.

NASDAQ earnings calendar shows HK is expected to earn .06 per share in Q2. So after Chapter 11 they appear to be getting by.

coffeeguyzz,

The Luddites believed that technolgical progress could, and should, be held back.

The central planners believed that the business cycle could be tamed if only there were more, and then some more, and then even more, government intervention.

These may sound like fantastical creeds, and so they are.

But what is even more fantastical is that, after 400 years of evidence to the contrary, these creeds are still widely believed.

Hi Glenn,

You have posted on several occasions that government intervention is necessary.

Very few here suggest there should be no technological progress, but people who know how oil is produced (shallow sand, Mike, and Fernando) point out that technology is not magic and will not lead to unending growth in oil production which is often implied by you and Coffeguyzz.

Every oil field that has ever started producing increases output at first, eventually reaches a peak and then declines.

Often technology enables us to produce oil faster and sometimes results in a marginal increase in the percentage of oil in place that is recovered (considered on a Worldwide average basis).

The US is likely to produce no more than 50 Gb of LTO output (total URR) based on USGS experts, the rest of the World perhaps 100 Gb (Russia is not likely to produce LTO until their considerable conventional reserves deplete), other nations (China and Brazil) may not have the success that the US has had.

In any case even 200 Gb of World LTO (an optimistic estimate in my view), is not very significant compared to World conventional reserves of 1700 Gb. These unconventional reserves (extra heavy oil and LTO) may reduce the decline rate of World oil output after 2030, but they will not be enough to stop the decline in oil output.

••••Dennis Coyne said:

Where have I posted that “government intervention is necessary”?

What I have posted is that the government intervention you and Mike advocate — that allowables be resurected and imposed on shale producers, reducing supply and driving up oil, natural gas, gasoline and electricity prices — is completely outside the realm of political possibilities.

••••Dennis Coyne said:

Sure they do, at least when it comes to the shale industry. Many here frequently cast dispersions upon the remarkable technological innovations that have unleashed the shale revolution. Case in point: Mike’s comment above.

••••Dennis Coyne said:

But technology is magic when it comes to renewables?

And can you point to exactly where I said or implied that “technology will lead to unending growth in oil production”? Is it possible for you to make an argument without alleging absurd absolutes?

••••Dennis Coyne said:

Is stating the obvious supposed to be some great new insight?

••••Dennis Coyne said:

Sometimes new technology unlocks oil that was not economical to produce before, and the increase in reserves is completely new and is far from “marginal.”

The rest of your comment is nothing more than speculation about the future, and who can argue with that? As Hannah Arendt observed in The Origins of Totalitarianism, “demagogically speaking, there is hardly a better way to avoid discussion than by releasing an argument from the control of the present and by saying only the future can reveal its merits.”

Glenne said:

What is this guy, some character from the Bowery Boys or the Three Stooges? Or Archie Bunker, LOL

FYI, we are actually doing some very interesting applied mathematics in applying dispersional probability profiles to the models of fossil fuel discovery.

BTW, Dennis this would be a great insert comment for the book, if it wasn’t for the fact that they want to keep it straight and narrow on the technical path.

Glenne says:

So, what do you call people that apply advanced stochastic analysis techniques to quantify the dispersional 🙂 properties of wind speed? Are these people Luddites because they are using their math brains to best understand how to harness wind energy?

Glenne is nothing but a blow-hard windbag. setup#punchline#lol

@whut,

By all means, if you can’t attack the message, then attack the messenger.

Glenne, I am confused now. Are you the Luddite, because you refuse to believe in rather obvious scientific facts?

@whut

So just exaclty what are those “rather obvious scientific facts” that I refuse to “believe in”?

Your comment sounds much more like something a preacher would say than a scientist, but please enlighten us as to what those “rather obvious scientific facts” are.

Umm, like the scientific fact that crude oil is a finite and non-renewable resource? Luddites like yourself are oblivious to such knowledge.

@whut,

So I’ll ask you the same question I asked Dennis: Is it possible for you to make an argument without accusing your opponent of absurd absolutes?

Everyone recognizes the existence of certain analytic truths, that is, truths in which the predicate can be be derived from an analysis of the subject. Such truths — such as “crude oil is a finite and non-renewable resource” — are a priori, because they do not require recourse to experience.

Everyone also recognizes the existence of empirical truths, or truths in which the predicate can be known through perception. These are a posteriori truths.

Science, however, depends on the possibility of synthetic truths a priori, that is, truths which the predicate cannot be logically deduced from the subject but which also do not depend on the testimony of the senses. Empiricists (e.g., Hume) believe that there are no such truths.

Synthetic truths a priori include statements such as, “The US is likely to produce no more than 50 Gb of LTO” and “the rest of the World perhaps 100 Gb.” The fact that these synthetic truths are predicted to occur in a highly complex and chaotic global system does nothing to improve their chances of actually coming true.

Glenne, Is it possible for you to make a comment w/o calling them Luddites, etc?

Hi Glenn,

Ok.

You seem to imply now that you do not believe that oil will never peak.

Some progress, I guess.

Would you like to narrow it down to the nearest 20 years.

I have suggested 2020 to 2030.

Dennis,

Oh, I think I’ll leave the job of manufacturing synthetic truths a priori up to you.

Go for it. Knock yourself out.

Glennee said

“Go for it. Knock yourself out.”

I think we are knocking other people out by actually doing the math.

You are that variation of former-high-school-debate-loser who refers to philosophers such as Hume instead of a real physicist and mathematician such as Laplace. A couple of days ago I wrote this pieces about Laplace:

http://contextEarth.com/2017/07/18/deterministic-and-stochastic-applied-physics/

@whut,

Well aren’t you the fan of reductio scientiae ad mathematicam? It’s not difficult to see why you would want to crown Laplace philosopher king.

However, as this article originally published by the Mathematical Association of America notes, Laplace couldn’t even convince his fellow determinists, like Leo Tolstoy, of math’s ability to predict the future

“An issue for Tolstoy is unknowability and uncertainty.”

Tolstoy concluded that the future “is deterministic and determined precisely, but practically and possibly in principle unknowable by humans.”

“[T]o the imperfect human mind not all information can be available in a snapshot and so it is reduced to ignorance or at best probabilistic reasoning.”

https://www.sciencenews.org/article/tolstoys-calculus

Hi Glenn

I am simply agreeing with peer reviewed research on a peak in conventional oil between 2020 and 2030.

CAPP estimates only a 2 Mb/d increase by 2030.

Using data, models and USGS estimates I have shown no more than a 3 Mb/d increase in LTO output is likely in the US or 7.7 Mb/d by 2025.

It is easy to criticize when you make no predictions of your own.

How likely do you think the EIA’s high technology and high resource case is?

I would put the probability at less than 1%.

No doubt you will say this is speculative.

Absolutely correct. Most predictions are speculative, though the future mass of a carbon atom with 6 protons and 6 neutrons

and 6 electrons can be predicted fairly accurately.

Dennis said:

“It is easy to criticize when you make no predictions of your own.”

Ain’t that the truth!

One thing poor Glenne doesn’t understand is the difference between stochastic projections and deterministic predictions. That is the problem statement that Laplace thought a lot about and pioneered the math for. He didn’t necessarily get everything right, but established many of the foundations.

OTOH, Glenne thinks I care what Tolstoy had to rhetoricize about the topic. Fat chance.

So, as a summary:

1. An oil production analysis is a stochastic projection

2. An ocean tidal analysis is a deterministic prediction

Can we go further with deterministic projections for seemingly random or chaotic phenomena? Sure, in the case of something like ENSO, which is responsible for El Nino, it is highly likely that it is caused by the same mechanism as ocean tides, and therefore amenable to Laplace’s tidal equations:

http://contextearth.com/2017/06/23/ensoqbo-elevator-pitch/

Dennis,

The reason I don’t make predictions about when peak oil will occur is because it is extremely hard, to the point that it is a fool’s errand.

You are aware, are you not, that reserve estimates are based on 1) the price of oil at the moment the reserve estimate is made, 2) the technology that exists at the moment the reserve estimate is made, and 3) the amount of geological knowledge that exists at the moment the reserve estimate is made?

These are factors that are constantly changing. Therefore peak oil will take place in a highly complex system where making predictions about future events is exceedingly difficult, and not some highly reductionist mathematical model that omits most of the important factors. Predicting future oil reserves, and peak oil, is far more complicated than merely calculating the known amount of oil in place in the world and applying the percentage of that oil that has been economically recoverable up to that moment. With a high enough price of oil, and enough technological breakthrougs, there are vast amounts of oil out there that can, and will, be recovered.

The cluster of associated ideas whose co-occurrence establishes some common

intellectual terrain among researchers who study complexity — “system”, “interactions”, “emergence”, “selforganization”,

“learning and adaptation”, “evolution and coevolution”, “positive feedbacks”,

“networks”, “distributed control” — is notably, and quite astonishingly, absent from the peak oilers’ theories and predictions.

Glenne says:

“.. the amount of geological knowledge that exists at the moment the reserve estimate is made? These are factors that are constantly changing. “

That’s basically all amateurish double-talk when somebody says “don’t do the analysis because geological knowledge is always changing”

It’s like saying “don’t do computer science because technological knowledge is always changing”. LOL

@whut,

No, it’s like saying it’s hard to predict the future of “computer science because technological knowledge is always changing”

So tell me, can you show me where you predicted the cell phone revolution back in the early 1980s? The shale revolution back in 2000 or 2005?

If not, what with your your flawless command of physics and math, why not?

With your infallible crystal ball, by now you should be the richest man on earth. If not, what’s the problem? What possibly could have gone wrong?

Glenne, You’re just plain weird with your Luddite-like anti-math attitude. Go look up the math of the Oil Shock Model, Dispersive Discovery, and Dispersive Diffusion. They all predict the production of oil and explain the historical flow better than anything since the heuristic Hubbert curve.

Hi Glenn,

For an empiricist, I suppose the future does not exist. And of course you believe all predictions of the future are speculative, and I think in most cases you are correct (physics and chemistry would in some cases allow pretty good predictions of the future in controlled experiments).

My “scenarios” make a set of assumptions about the future based on the knowledge of what has happened in the past.

The assumptions are indeed speculative, but I always invite people to provide alternative assumptions, but few have the courage to offer any.

Clearly nobody knows the exact path future production will take.

We can only speculate or we can sit on the sidelines and critique the guesses of others.

One could suggest that it is absurd to expect absolute precision about when peak oil might occur.

When the peak does arrive it will be both peak supply and peak demand as they tend to match if the market determines prices.

Hi Glenn

Yes I am aware oil reserves depend on prices, technology.

, and geology and that these change over time.

The experts who have studied this expect conventional oil resources to be between 2000 and 4000 Gb (C+C+NGL).

Unconventional resources will be between 400 and 1000 Gb (LTO and extra heavy oil with API gravity of 10 or less.)

Peak oil is likely to be between 2020 and 2030, where likely means a probability of more than 84%.

Dood, they are all losing money.

Proppant isn”t free. If you use more of it, it costs more. If you add a different kind it costs more.

And the executive bonuses are production based, not profit based. If they can get other people to fund via loans those bonuses then of course they will do it.

You want evidence the proppant pays for itself in production? You can find it. It appears in the earnings per share number. If it doesn’t then there is no evidence.

This is no different than drilling holes to recover pores of oil amounting to 20 barrels, total. At $45/b you get $900 from that. If someone else pays the $7 million for the hole, why not drill?

http://wolfstreet.com/2017/07/17/2-billion-private-equity-fund-collapses-to-almost-zero/

“Investors who’d plowed $2 billion four years ago into a private equity fund that had also borrowed $1.3 billion to lever up may receive “at most, pennies for every dollar they invested,” people familiar with the matter told the Wall Street Journal.”

It is the same WSJ that last 4 years were writing about “resilience of shale” like parrots, every day. Of course it is resilient with Gran Ma and Gran Pa money if you look that it was mostly pension funds that are invested.

From the WSJ article.

“Only seven private-equity funds larger than $1 billion have ever lost money for investors, according to investment firm Cambridge Associates LLC. Among those of any size to end in the red, losses greater than 25% or so are almost unheard of, though there are several energy-focused funds in danger of doing so, according to public pension records.”

Ves,

So now those evil shale people are screwing Grand Pa and Grand Ma out of their hard-earned savings?

After all, we have it straight from WolfStreet. Wolf Richter blasts the unscrupulous shale industry when he writes:

“The renewed hype about shale oil – which is curiously similar to the prior hype about shale oil that ended in the oil bust – and the new drilling boom it has engendered, with tens of billions of dollars being once again thrown at it by institutional investors, has skillfully covered up the other reality: The damage from the oil bust is far from over, losses continue to percolate through portfolios and retirement savings, and in many cases – as with pensions funds – the ultimate losers, whose money this is, are blissfully unaware of it.”

There’s a problem, however, with using EnerVest to bash the shale industry. And the problem is very easy to spot for anyone who has even the most rudimentary knowledge of the oil and gas industry (which of course leaves Richter out): EnerVest’s portfolio has very few shale assets.

• EnerVest is the largest conventional oil and natural gas operator in Ohio

• EnerVest is the largest producer in the Austin Chalk, another conventional field.

• EnerVest is the fifth largest producer in the Barnett Shale, which is the only shale holding listed in the company’s list of core areas.

• EnerVest has spent $1.5 billion purchasing assets in the Anadarko Basin since 2013, again in conventional fields.

• EnerVest is a top 20 producer in the San Juan Basin, again a conventional field.

https://www.enervest.net/operations/locations-map.html

So Richter uses the implosion of EnerVest, a company that is predominately a conventonal oil and gas producer, to bash shale? That really makes a lot of sense. ?

Glenn,

shale/no shale, they lost every single penny. and btw wsj lied to you every single day for the last 4 years about milk & honey in oil patch. how do you feel about it?

Ves,

For me it is has been “milk and honey in the oil patch.” So here’s how I feel about it….

https://m.popkey.co/e975d7/JmXzE.gif

Hi Mike.

Another update on the HRZ shale well Alaska.

Icewine#2 Operations Update

The Icewine#2 well was shut-in on the 10th July for a six week period to allow for imbibition and pressure build up to occur. Prior to shut-in, 16% of the stimulation fluid had been recovered from the reservoir under natural flowback, with trace hydrocarbons returned at surface.

Imbibition, or “soaking”, allows for absorption of frac water into the formation, which may displace reservoir water molecules that are restricting hydrocarbon molecules from flowing into the created fractures. The pressure build up data will provide insights into the permeability created by the stimulation. Ultimately, the post shut-in well performance will determine the next steps required, such as continuing to flowback naturally or the introduction of artificial lift (eg swabbing).

The HRZ shale shares several characteristics with other successful shales in the Lower 48; however, there is no blueprint or benchmark against which it is meaningful to measure performance as there are also many differences. At this juncture, the Joint Venture is of the view that further analyses are required to determine what impact the performance of the well to date has on the probability of success for the play. These analyses include, but are not limited to;

comparison of the flowback rate against the expected flowback rate based on reservoir parameters and the successful execution of the fracture stimulation;

reconciliation of the petrophysical model, and the apparent in-situ hydrocarbons, with the hydrocarbons recovered to surface to date.

These analyses are ongoing and will be communicated once complete.

Further updates will be made as and when appropriate throughout the testing program.

I had a deeper look into individual well data for the 2016 well. It turns out that the vast majority of the very best wells are in Bear Den, Croff, Spotted Horn, Pershing, Blue Buttes, Westberg, Twin Valley, Banks and eastern part of Camp. Those areas are the sweet spot areas of McKensey and many of those areas still have a relatively low well density. Grail also still has some good wells, but not as good as the very best ones. The well density in Grail is now about 4,9 wells per section. So it looks like the high well density start to affect the productivity of the wells. Hughes, in his report, assumes the average drill density in Bakken will be 2 to 3 wells per section with of course a higher density in the core areas. Middle Bakken and Three Forks are both productive in Grail and there are about the same amount of wells in both formations in that area. It should allow for a higher well density than for example Parshall which is very productive in Middle Bakken but not very productive in Three Forks.

So we will probably continue to see very good wells coming from those areas untill the well density has increased some more.

The GOR graph shows that GOR has started to increase again after being flattish for some time. 2014 to 2016 see very high increases and should now be in the territory where gas suppresses oil production (around 2,2). I wonder for how much longer they can increase this fast.

The older wells from 2007 to 2009 continue to look flattish. Are they running out of gas?

I have included 2017 for the first time here too. It has started off around the same level as 2016. It´s too early to say anything more than that and also remember that it the data is incomplete with many confidential wells not included.

Here is graph I made last months showing how GOR distribution has changed over time. It doesn´t happen much from one month to the next, so I didn´t bother creating a new one for this month. It shows three dates; 6/2014 just before GOR started to increase a lot, 8/2016 just before GOR entered the flattish phase and the latest date when the graph was created 4/2017. From 8/2016 to 4/2017 the groups 0,0 to 0,7 has increased, 0,7 to 1,3 has decreased, 1,3 to 2,3 has increased and unclear for 2,3 and higher. So there are possibly 3 groups of wells, one group where GOR is decreasing, one group where GOR is increasing and possibly one group where GOR doesn´t change much.

And my final graph showing production over time for wells that are 6 months old. It essentially shows what we have seen in the other graphs. Water cut has increased and the wells now start to produce more water than oil, the wells are flowing much much more liquids than before and gas production has increased much more than oil production. The gas production curve actually has an exponential look to it. Again, I wonder for how much longer it can increase like that.

Anyone have info on average Bakken water disposal costs?

They are all losing money, but beyond that water costs usually determine the production level below which cap and abandon.

Freddy, I doubt you can get this data, but a gassy geology flows liquid that isn’t oil. The relentless march upward of API speaks of NGLs rather than oil. If people just ignore API degrees and flow liquid that is API 47 or even 51, but still call it oil, the numbers will all be corrupted and no one will know.

I gotta go research NoDak’s taxation regulation on liquids that are not crude.

No sorry, I don´t know of any such data. They just call it oil and gas.

Nigeria:

“LONDON, July 14 (Reuters) – Nigerian trade was limited with tender awards coming out and force majeure declared on Bonny Light exports while the market was also looking ahead to September schedules due to emerge next week.

* Total declared force majeure on exports of Djeno crude oil in the Republic of Congo, traders said on Friday, after a collision.

* Traders said exports went down after a ship collided with a single point mooring. One said the vessel was the DHT Sundarbans chartered by Vitol.

* Shell’s Nigerian subsidiary declared force majeure on Bonny Light crude oil exports effective on Thursday, the company said in a statement on Friday, after the Nembe Creek Trunk Line was shut down, one of two pipelines transporting the grade. “

Financial Times 4/2/15-

“Not only do oil and gas account for more than 90 per cent of Nigeria’s export revenues, which have roughly halved in the past six to eight months, the government relies on them for 70 per cent of fiscal revenues.”

Hi all,

Below is a chart with updated ND Bakken/Three Forks data through May 2017 (985 kb/d), also a model roughly matching the data through May 2017 (80 new wells assumed for May 2017) and two future scenarios through Jan 2020. The lower scenario assumes 80 new wells per month and no change in future well profiles through 2020 and a higher scenario assumes an increase of 5 new wells per month (80,85,90, … , 135, 140) until 140 new wells per month are reached (May 2018) and then 140 new wells per month until Jan 2020.

My expectation that actual output will fall between these two scenarios.

Hi all,

Enno Peters has a new post up

https://shaleprofile.com/index.php/2017/07/17/north-dakota-update-through-may-2017/

He reports that 87 new wells were added in the North Dakota Bakken/Three Forks in May 2017.

I adjusted my low scenario to 87 new wells per month (7 higher than the scenario in the chart above.)

The high scenario mostly has changed in May 2017 from 80 new wells to 87 new wells and then goes (90, 95, …. , 135, 140) and remains at 140 new wells per month until Oct 2026. The high scenario is about an 11 Gb URR.

Texas Drilling Permits and Completions Statistics for June 2017 released July 11th 2017

Total well completions processed for 2017 year to date are 3,872; down from 6,429 recorded during the same period in 2016.

Texas RRC News: http://www.rrc.state.tx.us/all-news/071117a/

coffee: Thanks for the heads up on Rockman BK discussion on PeakOil.com. I had quit looking at that site because it seemed to have become very radical. Rockman is a good poster, however, lots of knowledge, and a down to earth guy too.

What he describes there is why this is probably going to play out like 1986-1999. Takes years for US onshore upstream to be placed in the category of “not investible”. So $40s or lower, on average, until mid-2020’s, unless there is a prolonged major supply disruption, which necessarily means a major Middle Eastern war lasting for years.

The possibility of $90 WTI has to be erased from memory, just like $30 WTI had to be erased from memory from 1986-1998.

Over the course of the history of mankind, more assets have changed hands at a price completely absent any effect of supply and demand than those that might have cared about such things. Vastly more. Let’s count a few.

1) Every single inheritance. In the history of mankind, every single inheritance.

2) All gifts.

3) All conquests.

4) All manifestations of economic predation. Predatory pricing established those levels.

5) All monopolies

6) All thefts

7) All taxation

8) All govt decreed excise or tarrif

Want more proof? How about the ultimate:

The purchase of about 2 Trillion dollars of mortgage backed securities by the Federal Reserve from 2009 to 2015. The pricing of those securities was 0 at mark to market, so mark to market was disallowed, but even with that, the Fed specified the price to be whatever they wished, and the sellers didn’t have any reason to complain. The price paid was far above supply and demand (aka 0). $2 Trillion. That probably exceeds amounts for assets from all history that someone imagined was taking place at a free market price. Not to mention the ongoing buys from the ECB in progress today.

So the price of oil will be what the lowest priced large sellers want it to be, and they have no reason to imagine that their victory should be measured in a whimsically created substance.

There is nothing anyone can do about it.

Shallow

The upside potential might be stronger than appears at present for many reasons.

Although the Enervest situation has been conflated with the shale industry, the exact opposite reality might prove to your (smaller operators) collective benefit as you ride out this current storm.

Time was, ss, that some camel upwind in the desert somewhere would fart and global oil markets would reverberate for days.

Now, in hydrocarbon producing countries from Nigeria to the Philippines, including Iraq, Libya, Yemen, Syria, KSA and others there is conflict raging from low level to all out warfare. Heck, there were reports the other day of a thwarted attack on a Saudi offshore facility.

Qatar is virtually quarantined.

Russia is battling international sanctions.

And … $46 WTI???

You kidding me???

We ain’t in Denmark (most of us), but something’s sure is rotten,

SS – It has been my experience that concerning financial matters, nothing “plays out” like the past. Consider the period 1986-1999: No one was concerned that the world was near peak oil. OPEC spare capacity was at least 4 times what it is today, [ask Ron], at a time when final demand was much less. Iraq invaded Kuwait, and then we went to war to get them out – remember the oil well fires. Russia collapsed. The “BRIC” countries [Brazil, Russia, India and China] were inconsequential. The Dow Jones was down 22.6% in ONE DAY in 1987. The International Monetary system almost collapsed in 1997. The world was transitioning from a period of high inflation to much lower inflation. Japan was booming [until 1990].

You can probably add a dozen significant happenings to the list without thinking too hard. The point is, so many variables have changed that something as significant as oil is going to “play out” based upon today’s factors, not “like” 1986-1999. Some people are still trying to analog to the 1930’s in order to predict the next great depression in the stock market – do not listen to them.

I know things never play out exactly as in the past.

However, one has to prepare for the worst, and prices will be low for awhile IMO.

The Rockman BK discussion helped put it in focus for me. The wells will be drilled, and only when it is clear all large US shale oil basins have hit their limit, will prices begin to rise. That might not take 12 years, but I think at least 5 is likely.

The only intervenor would be a supply shock from the Middle East.

Another poster on another site also has given me some clarity. He states there has not been enough suffering experienced yet in the US oil patch by those responsible for the production boom.

We just went through two bad years of prices in 2015-2016, and at the first sign of light, the industry was able to raise a ton of cash and go back with guns a blazing. There were no consequences to the powers that be from the 2015-2016 low prices. Heck, the strip was higher this time last year, yet we are still adding rigs.

It will take a minimum of five years, until it is universally believed that prices will be low forever, that supply will be abundant forever, and that the sector is a bad investment.

Once that happens, look out, price could rocket. But it will be awhile IMO.

Shallow,

good paper by mr ray dalio “deleveraging” – worth the time to read …….

as you say – history doesn’t repeat ……

rgds

simon

Some difference between now and 86-99: i) decline rates are higher, ii) Spare capacity is _much_ lower (oil stocks are high which apparently is what traders observe) – back in 86 KSA could flood the market, iii) not much new big projects in the pipe after 2019 and North Sea is declining this time while it was increasing back then.

Rebalancing should go faster this time if (!) demand continues to increase.

Will there be a north dakota post? Seems interesting, considering the drop in oil production vs increase in gas production and number of producing wells. Or does anybody already have some thoughts?

Initial Texas production for May available on statewide search query today. Usually, it is posted close to the seventeenth. Last month was the 24th.

Oil 76,381,908 and condensate 8,209,446.

June completions down from May. Completed mwd reports through June 30, 2016 equals almost 2620.Mwd reports through June 2017 equals close to 4050. Where’s the beef?

EIA – Drilling Productivity Report – Release Date: July 17, 2017

https://www.eia.gov/petroleum/drilling/#tabs-summary-2

Permian – New-well oil production per rig

chart: https://pbs.twimg.com/media/DE9UOizUMAAjbhn.jpg

The DUC Count is growing larger

EIA numbers are basically worthless, as far as the Permian goes. To analyze it like they are trying to do, you would have to separate conventional production from horizontal production. Take more gathering tools than they are using to accomplish that. Until 2015, they were still drilling 800 a month or so vertical wells, which dropped down to 100 to 150 a month since then. Looking at district 8A, that production is dropping like a rock. Combining the two, production appears to be pretty flat for Texas since the first of the year.

Rig count is high, but it appears there must be a lot of down time in between drills.

The EIA drilling report came out yesterday revealing the tragedy, which unfolds now in the shale industry.

Below chart depicts new production (blue line) and depletion rate (red line ‘legacy decline’) and resulting net growth (yellow bars).

As the massive 5 mill bbl/d of new production looks like topping out due to financial exhaustion of shale companies, the depletion rate of equally staggering dimensions of 4.3 mill bbl/d follows the new production rate like a shadow leaving the net growth at a mere 0.5 mill bbl/d. As the depletion rate soared to 91% of total production – much faster than new production – over the latest months from 2.5 mill bbl/d to 4.3 mill bbl/d, the red line will soon cross the blue line and net production will decline steeply towards the end of the year.

As this will bring down share prices of shale companies even further in the near term, the consequences of lower US production, increasing US trade deficit and a much lower dollar will be a steep rise of the oil and gas prices in the mid term.

Again, using simplistic models to project how a complex animal like Texas production will behave crosses the border of stupidity. The Permian until 2014 was primarily a dying conventional field, propped up by a massive number of vertical wells. Yes, there was some horizontal drilling being performed, but the mass of production was conventional. Which is not profitable to bolster now with million dollar wells. You can’t use conventional numbers and horizontal numbers, with no separation, to project the future. Texas producing oil is not just Eagle Ford and several fields in the Permian. If you look at the other districts outside of 1,2, 7c, 8, and 8A, they are declining. Actually, 8a (Permian) is declining, too. It was, and still is, primarily conventional. Just as stupid is their projection of what the GOM will produce. US production will probably be close to flat by the end of this year, and whatever the price of oil will be, it will struggle to increase next year.

Conventional production should have a yearly decline rate of about 6% if everyone stops investing – not this steep one.

But mixing up conventional / fracking production in Permian doen’t make it easy to analyce it.

The big days of permian tight oil still will come – it’s a very new field, and the sweetspots are almost untapped so there’s a lot space for growth.

How many money is made there is another thing with low oil prices and sky high land costs – owning a few hundred acres there is definitly no mistake.

I am pretty sure it is greater than 6%. Look at district 8A production around July of 2014. It was about 284,500 a day. Despite the fact that they continued to drill horizontal and vertical wells there, it is now only about 248,000 a day ( in preliminary figures). Most wells had a fairly low EUR. They just needed enough EUR to make a profit on a million dollar well at $100 a barrel, or thereabouts. That doesn’t require too much. Agree about the future of the Permian, but it won’t lift Texas production as quick as their stupid models project.

http://www.newsbusters.org/blogs/business/aly-nielsen/2017/07/18/soros-gave-207-million-alleged-russia-funded-climate-groups-us

From the article: