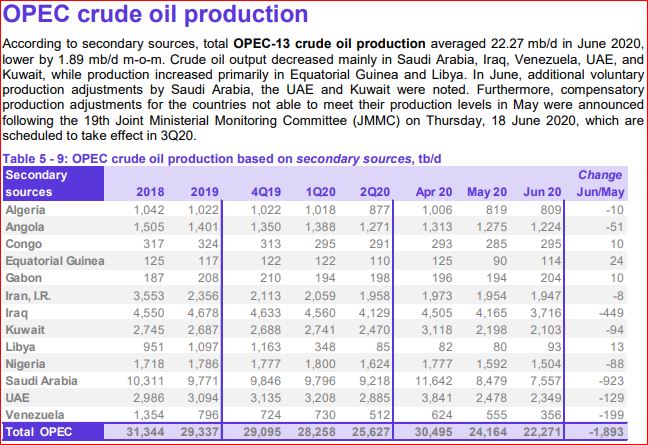

All OPEC data below is from the July 2020 OPEC Monthly Oil Market Report.

All OPEC data is through June 2020 and is in thousand barrels per day. All copied and pasted texts are in italics.

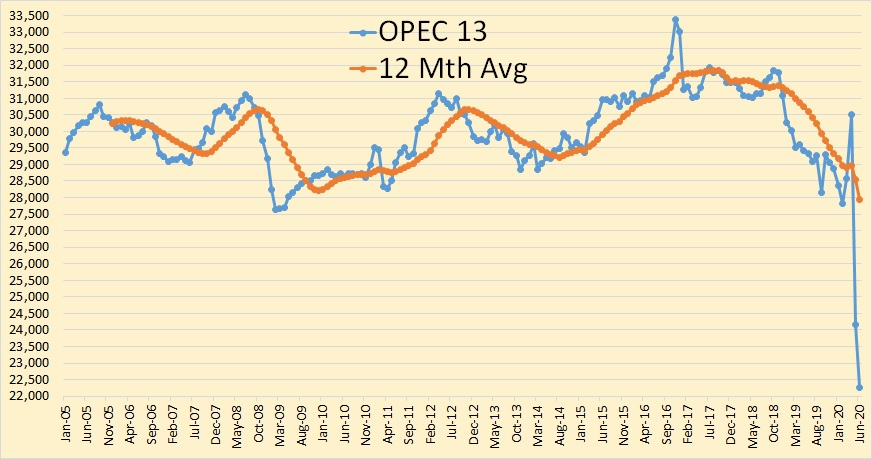

OPEC cut further in June, down almost 1.2 million barrels per day. They are down about 6.8 million barrels per day since November 2019.

All OPEC major producers cut production in June. The tiny producers didn’t seem to bother.

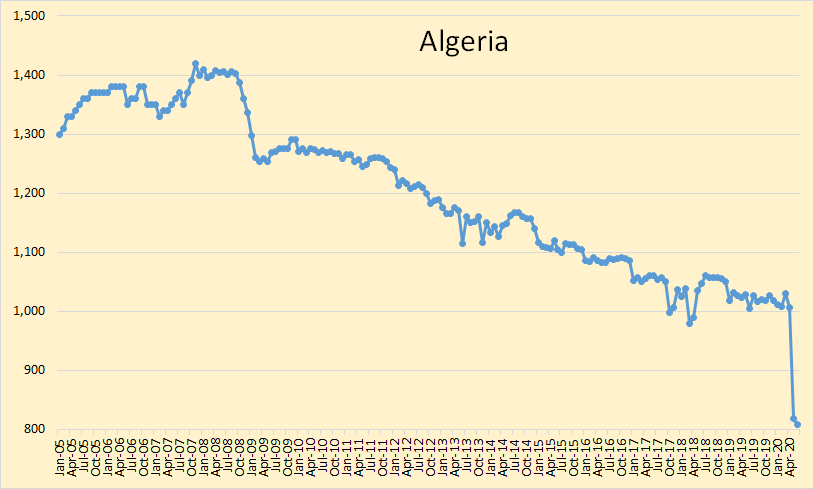

Algeria has cut about 200 Kb/d over the last two months.

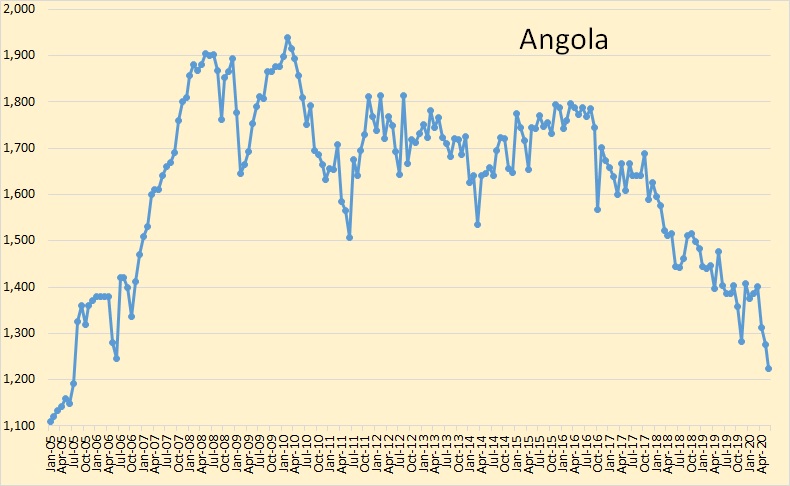

It’s hard to tell whether Angola is cutting or just declining further.

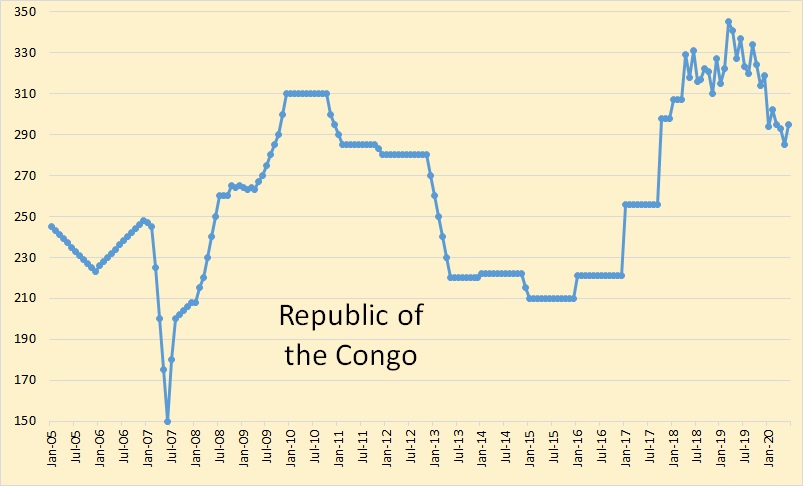

Nothing much is happening, oil-wise, in the Republic of the Congo.

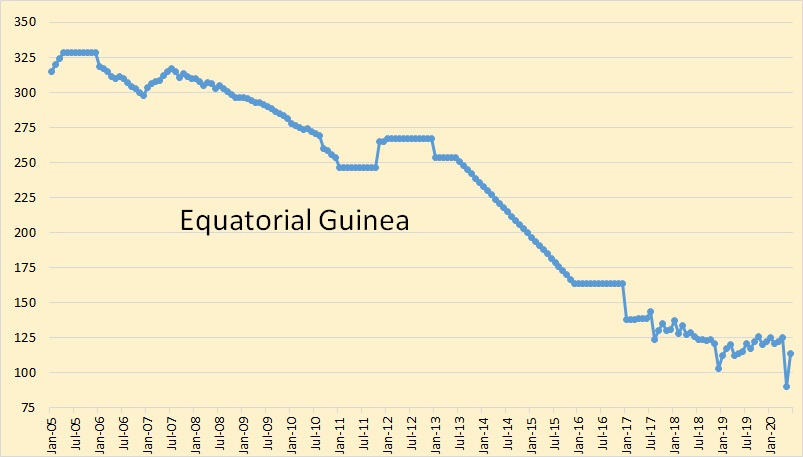

Ditto for Equatorial Guinea.

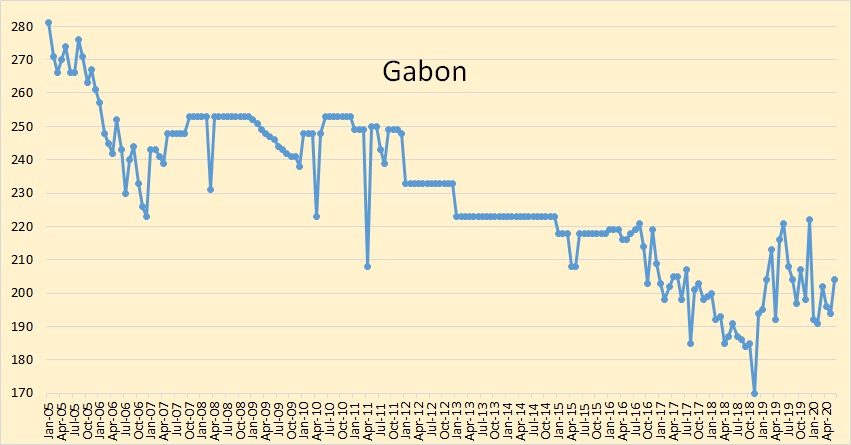

Ditto again for Gabon.

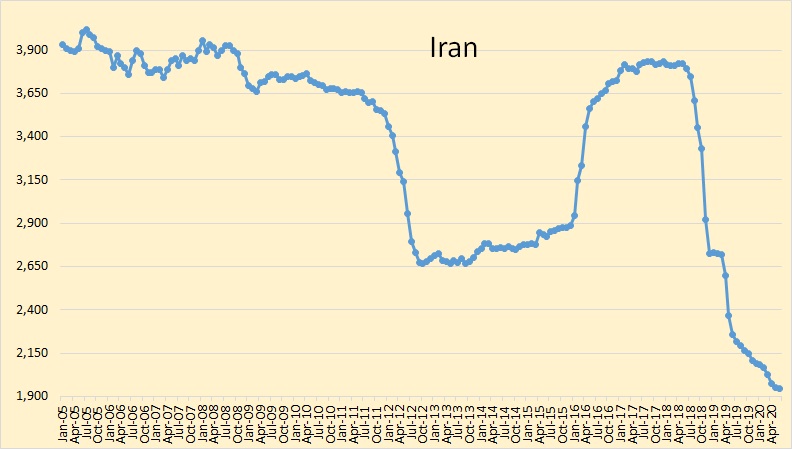

Iran is still suffering under sanctions. They say all their storage is now full and has been for some time. They now have a lot of wells shut down. It will likely take them about a year to ramp completely up when sanctions are lifted.

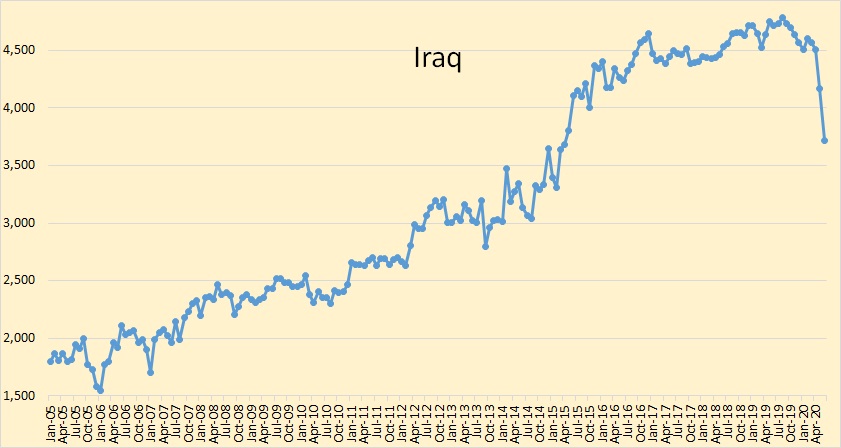

Iraq finally got the riot act read to them by Saudi Arabia. They are down almost 800 kb/d over the last two months.

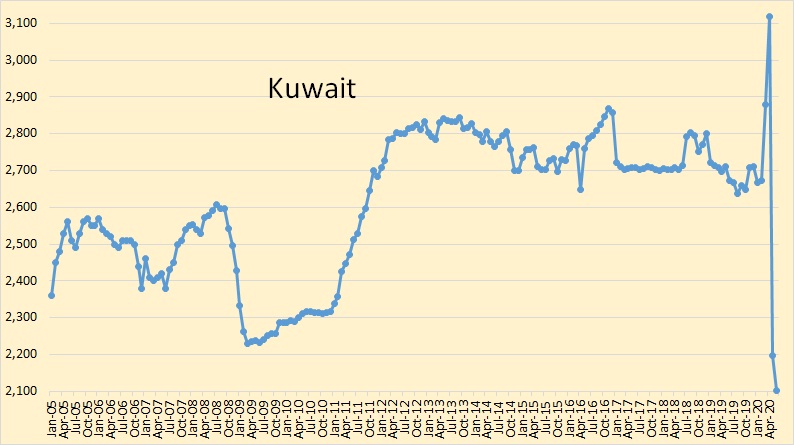

Kuwait cut a bit further in June, down 94 Kb/d in June.

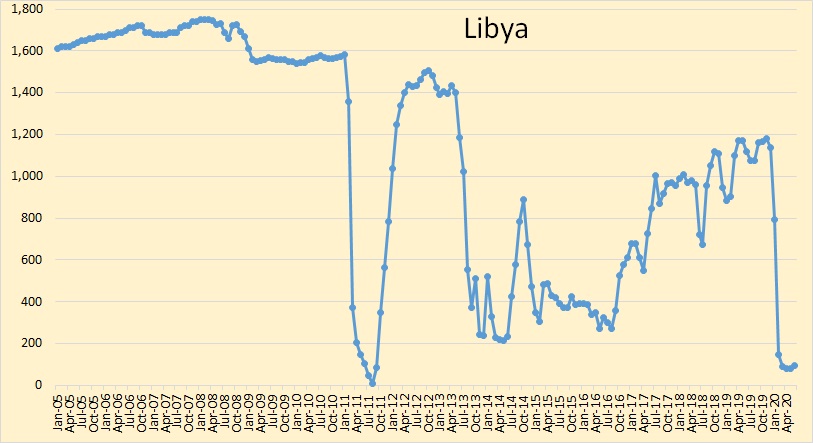

Libya says the blockade is over but the Rebels say it is not. Their production will likely be up slightly in July but they are not going to increase production very much any way soon.

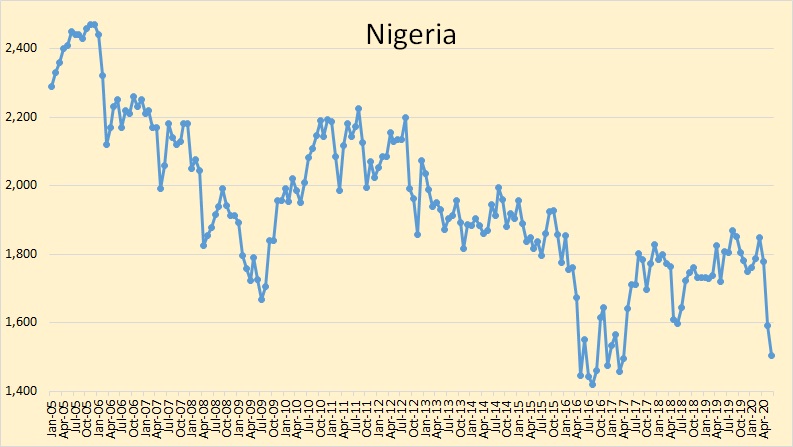

Nigeria appears to be doing their fair share of cutting.

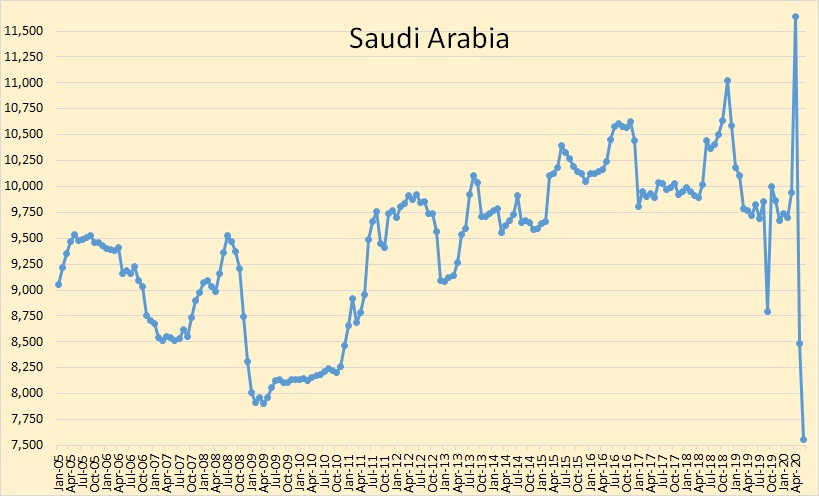

Saudi has cut more than two million bpd off their average of the recent past.

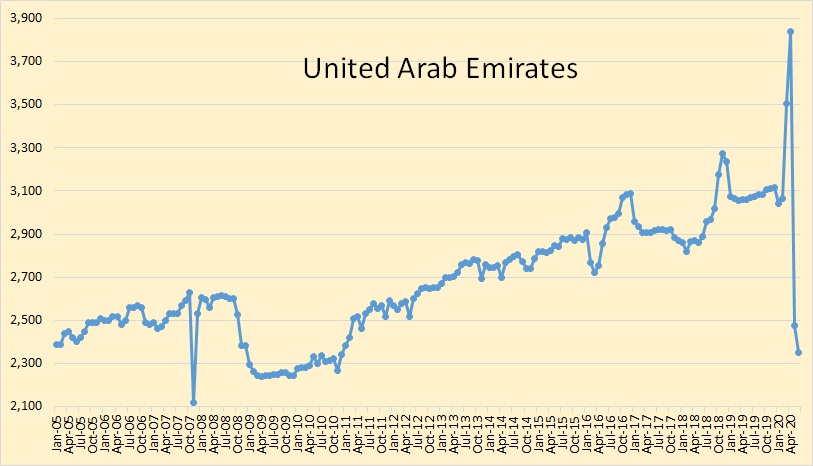

The UAE is down about 700 kb/d from their average of a few months ago.

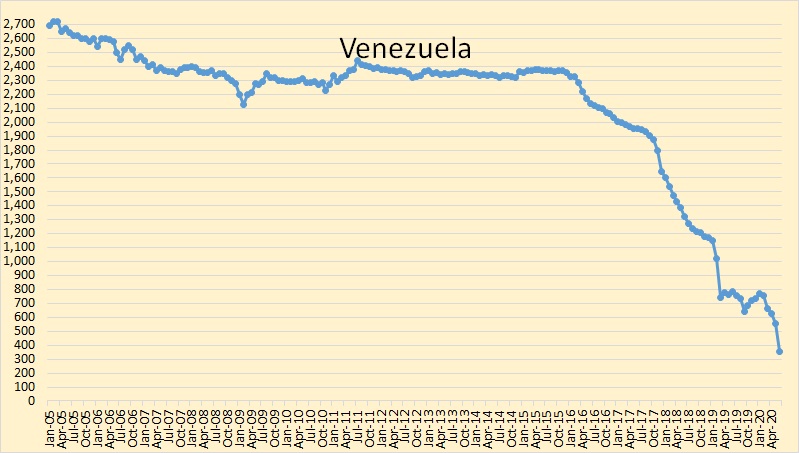

Venezuela just can’t get a break. Their economy is in shambles and their oil production is suffering, not just from sanctions but from neglect as well. Venezuela could now be considered a failed state.

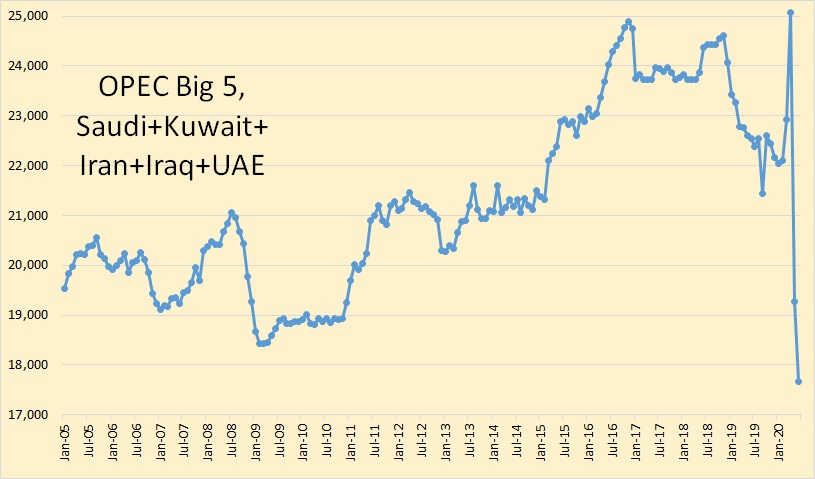

This is the where the vast majority of OPEC production comes from. They are down about 4.5 million barrels per day from their recent average.

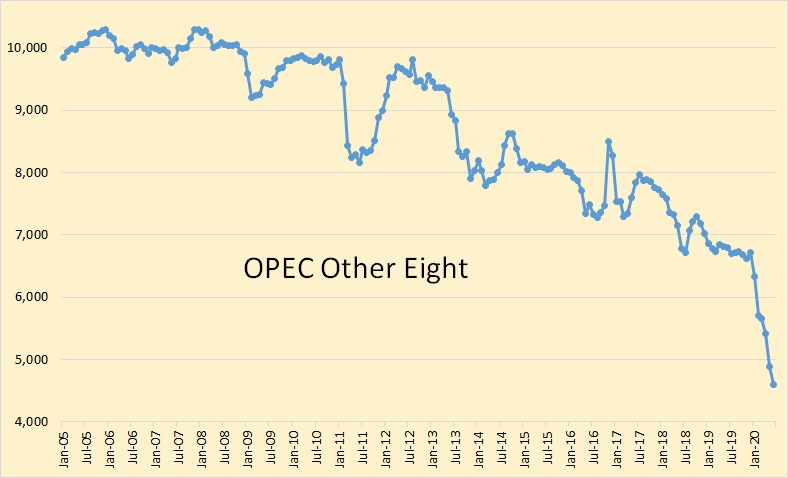

However the rest of OPEC is down about 2 million barrels per day from late 2019. Some of this is natural decline. How much? We will just have to wait to find out.

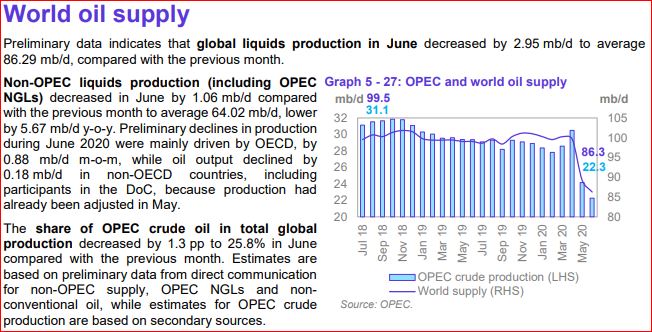

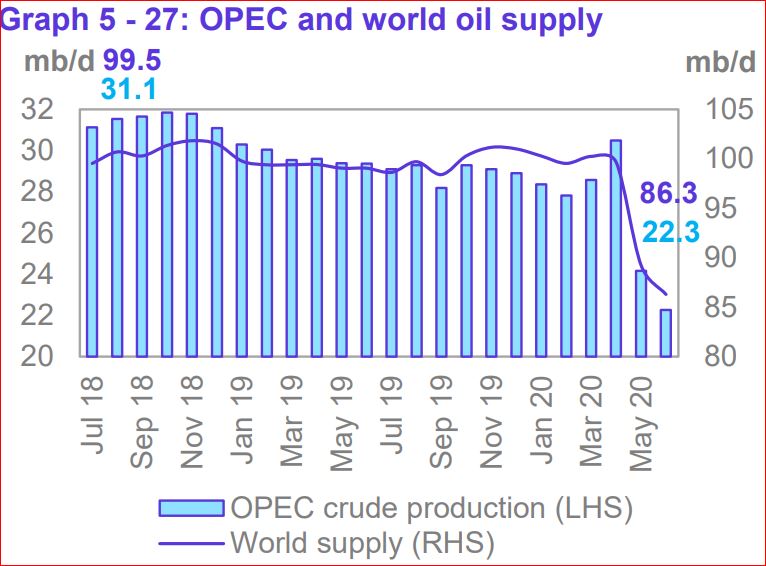

This chart, enlarged below, is very interesting.

The data here is apples and oranges. The OPEC data is crude only while the World supply data is total liquids, including condensate, NGLs, and bio-fuels. However total liquids is down about 14 million barrels per day in the last two months.

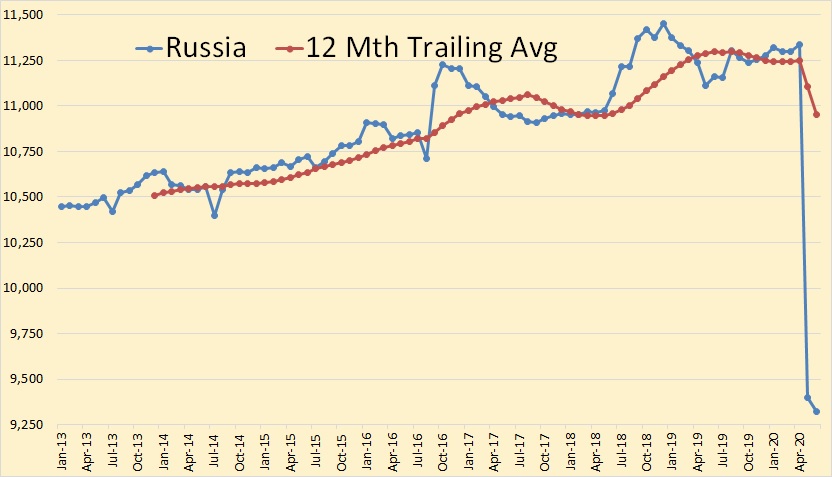

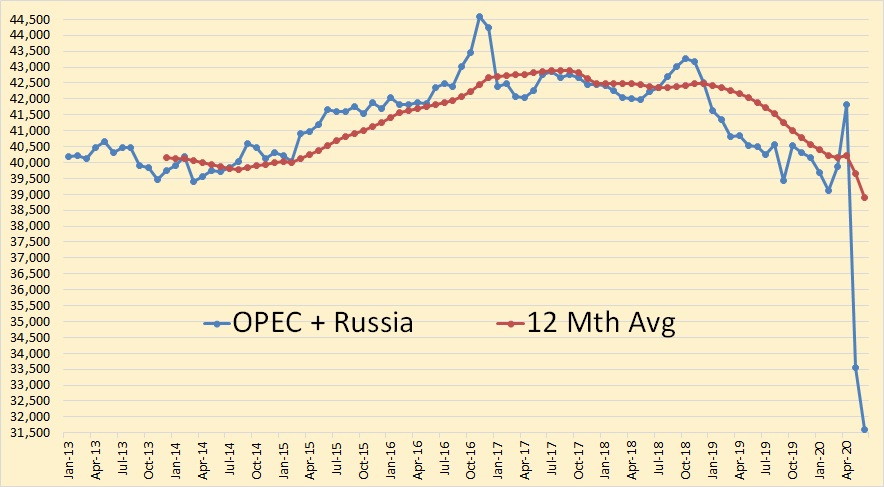

The only other nation who’s June data is available is Russia. They were down 64 Kb/d in June for a total two-month decline of 2,016 Kb/d for the last two months. Their production in June was 9,323 Kb/d.

OPEC Crude only + Russia C+C comes to 31,594 Kb/d. That is about 9 million barrels per day below their 2019 average and over 11 million barrels per day below their average high in August of 2017.

The below are two links to articles I found on the web yesterday. The first says the US has peaked, the second says the World has peaked. I agree with both. I have only copied and pasted a small part of each article.

Shale boss says US has passed peak oil, bold mine

US crude production has already peaked, according to one of the country’s leading shale executives, as producers battered by the price crash shun new output growth and start trying to become profitable.

Matt Gallagher, chief executive of Parsley Energy, one of Texas’s biggest independent oil producers, said the record output level struck earlier this year would be the high-water mark. “

I don’t think I’ll see 13m [barrels a day] again in my lifetime,” the 37-year-old Mr Gallagher told the Financial Times.

“It is really dejecting, because drilling our first well in 2009 we saw the wave of energy independence at our fingertips for the US, and it was very rewarding . . . to be a part of it.”

American oil output plunged by as much as a quarter this spring, as crude prices crashed in the wake of a Saudi-Russia price war and the coronavirus outbreak, prompting several operators, including Parsley, to shut wells and slash planned spending.

After one of the most dramatic stretches in its history, the oil industry is slowly recovering. March and April saw the toxic combination of depressed demand, excessive supply, limited storage capacity, and intense financial speculation that turned prices on one index negative. Although concerns about a second wave of coronavirus infections remain high, demand is now back on the rise, and supply is in check.

But that doesn’t mean that the industry is out of the woods. For now, though, the greatest source of uncertainty for oil producers is structural in nature, not cyclical. In fact, there is an increasing sense that peak oil—the moment when oil production reaches its point of maximum before starting a structural decline—has finally arrived. Since the 1950s, there has been plenty of speculation about an imminent shortage of crude oil. Such speculation has proved consistently wrong, as all predictions tended to underestimate both the true amount of global oil reserves and the ability of technology to overcome physical constraints.

____________________________________________________________________________

If the US has peaked, and I believe it has, then the world has peaked. True, if all sanctions were lifted and all political problems were settled, and if everyone suddenly started producing flat out. We could probably surpass the November 2018 peak. But these things are just not going to happen. And, by the time this Covid-19 demand problem is over, and with the US post-peak, the rest of the world will have declined enough that the 2018 peak will never be reached again.

I agree production has likely peaked Ron. The only question going forward is if demand will ever recover sufficiently for anyone to notice.

Lightsout,

Do you believe it likely that World demand for C+C will never return to the average 2018 level of about 83 Mb/d? Seems highly unlikely that will be a correct scenario from my perspective.

Hi Ron,

The last article on a World peak was about peak oil demand, rather than peak supply. That might happen at some point, but likely not until 2030-2035. Even with a US peak (which seems fairly likely, probably 2:1 odds in favor) it does not take much of an increase in average World extraction rates from conventional proved developed producing reserves to surpass the 2018 peak. In chart below the extraction rate in 2018 was 5.6% for conventional producing reserves and in 2027 the extraction rate is the same at 5.6%, with about the same output, in the past extraction rates have been as high as 12 % (in 1973) and for all of the period from 1950 to 2000 extraction rates have been above 5.9%. The average annual extraction rate from 1950 to 2019 for conventional producing reserves has been about 8%. Recently (2019) for the US, the extraction rate for all producing oil reserves was over 15%.

That’s the reason I disagree that a US peak necessarily means a World peak, especially if I am correct that demand may surpass the 2018 level of demand prior to 2030.

The last article on a World peak was about peak oil demand, rather than peak supply.

No, it was about peak oil. What causes that peak is open for discussion, but it really does not matter, peak oil is peak oil. Peak oil is the point of oil production that reaches a level that will never be broached again… ever. It just doesn’t matter why that peak will never be reached again.

Your charts and percentage figures are all about the past and will have very little bearing on the future. You are simply grossly underestimating what is happening right now and what it means for the future. You see total recovery from this pandemic. That is simply dreaming. The world will never be the same again. But I am not going to argue that point with you. It just seems so damn obvious to me that I am at a loss to explain, or even comprehend, your position.

I know, your world view, your belief system, has always been very Cornopopian, or perhaps Pollyannish would be a better word. But this time you seem to be off in dreamland. No, no Dennis, the world will never be the same again.

This virus Dennis, is not going away. It will never go away. We may get a vaccine. But the virus has already mutated into several different strains. It will continue to do so.

Out of fear, people will change their social behavior. They will not travel as much or even socialize as much. This will have a dramatic effect on the economy of every nation on earth, or at least every developed nation, nations that consume a lot of energy and other products. They will never consume as much again.

Ron,

I imagine things will change, as they always have done. I just think the change may be less dramatic than you foresee. I agree demand may be less than it would have been without covid19. Note that World demand for C+C has grown at an average rate of about 800 kb/d per year from 1982 to 2018, a BAU scenario would be for 91 Mb/d of World C+C consumption in 2028. My scenario calls for 83 Mb/d in 2027, about the same as 2018, in the grand scheme whether World peak output is 2018 or 2028 matters very little.

Past human experience with pandemics suggests that changes may be less dramatic than you envision.

The virus won’t go away, people will develop immunity and trea tments will be developed that lessen its impact.

Many people distinguish between peak supply (peak occurs in a high oil price environment) and peak demand (where the peak occurs in a low price environment).

Generally the peak demand argument has been considered Cornucopian from an oil perspective and the article is all about peak demand, which is your argument as well.

We will see in 5 years that the World economy is growing again and perhaps will have reached the 2019 level for real GDP at market exchange rates. Oil demand may require a few more years as more work from home and less business travel and perhaps sourcing more goods locally all will tend to reduce oil demand. In addition there might be a transition to electric transport which also reduces demand.

In my opinion all of these factors combine to allow C+C consumption to be 83 Mb/d in 2027 rather than 90 Mb/d (in the BAU case).

Yes, Dennis, things will change: The virus comes along with other structural changes and problems: Digitalization has gone a long way and is now entering a moment where it can really replace travel, be it the daily commute to the working place or all those business meetings, maybe it will even replace tourism to a certain extent. The structural change is mostly based on debt: IMO there would have been a recession anyway and things had to change (you just can’t paper it over again and again). And then there’s what Ron calls “fear”. The behavior has changed on a large scale, people stick to their safe areas, their homes, and their families. So, all in all, there is less consumption of fossil energy sources which is going to be compensated to a certain extent by electricity. This latter point is decisive: Even with a complete recovery, the energy mix will be different and oil will be used less. Things and behaviors will or rather HAVE already changed and therefore we crossed peak oil 19 months ago.

Westtexasfanclub,

I agree that there will be less oil use for all of the reasons you suggest, my estimate is that the difference will be less than 9% of 2018 World C+C demand by 2027 (about 7 Mb/d). Keep in mind that from 2000 to 2019 more than 100% of the increase in World demand for energy from C+C+NGL came from non-OECD nations (see chart downthread).

Also on passing peak 19 months ago, that is roughly correct for the trailing 12 month average, though if you are taking annual averages from BP and consider oil consumption (C+C+NGL is what BP uses) measured in joules, the peak was 2019 at 193 exajoules. The C+C production peak was 2018 according to both EIA and BP data, perhaps it will not be surpassed due to lack of demand for oil.

I just am not as optimistic as you and Ron that demand for oil will peak before supply does. I expect we will see high oil prices as supply may not keep up with demand after 2024 or 2025, so some demand destruction due to high oil prices will be needed to balance the oil market, oil supply will continue to increase until 2026-2028 (the precise year is impossible to predict, that’s my best guess for the 3 year window). Oil prices will continue to rise in order to destroy enough demand to balance the oil market, but by 2035, I expect transition to electric transport, telecommuting, more online shopping, less travel, better energy efficiency, etc. to reduce oil demand to less than supply at prevailing oil prices (somewhere above $90/bo in 2020$). Then we see oil prices decrease and more expensive oil will become stranded as it will not be able to compete with cheaper OPEC and Russian oil. Much of the 400 Gb of unconventional oil resources (perhaps half, maybe more) may never be extracted as the World gradually moves to other types of energy (natural gas, coal, renewable, and nuclear.)

Dennis, I do not expect supply to ever be able to surpass the November 2018 peak even if demand were there. However, there is no denying that this virus thing has put a tremendous hold on demand. I expect this problem with demand to continue for several years, not several months to a couple of years as you seem to believe.

Things are just so uncertain with this virus problem and the effect it is having on the economy that I am afraid to make any prediction whatsoever for the distant future. But there is going to be hell to pay for the next three or four years… or that is my opinion.

When things get back to an even keel, (they will never get back to pre virus conditions), I expect demand will slowly return. But, by then, there will be enough decline that we will never get production back to pre virus levels. I expect prices to rise but not nearly as high as you seem to think they will.

In short, it is my humble opinion that we are post-peak supply as well as post-peak demand.

Ron,

The scenarios I have presented have oil demand returning to the 2018 level in 2027. You seem to think we will have a prolonged Depression, that is certainly possible, I just think it unlikely. There may be a number of social changes that lead to decreases in oil demand, but I am not so optimistic to think that this will be enough to keep oil demand to less than the 2018 level of demand over the long term. I do expect a peak in supply in 2026 to 2028 and oil prices will need to rise to match demand with supply as output peaks and then declines.

Also you focus on a single month peak in November 2018, I look at centered or trailing 12 month averages, the trailing 12 month peak, based on EIA data is May 2019, the centered 12 month peak would be Oct/Nov 2018. That 12 month average peak is about 83 Mb/d for World C C, I expect we will reach that level, and perhaps surpass it in the next 10 years or so, best guess is 2027, but it is impossible to predict accurately.

Also you focus on a single month peak in November 2018, I look at centered or trailing 12 month averages, the trailing 12 month peak, based on EIA data is May 2019, the centered 12 month peak would be Oct/Nov 2018

Hey, it really doesn’t matter. Use the monthly peak, the yearly peak, or the trailing 12-month average peak. None of them will be surpassed…. ever again. Or at least that is my humble opinion.

Ron,

I agree it does not matter, the peak is either past or soon will be (next 10 years), whether World C+C reaches 82 or 84 Mb/d, between now and 2030 will be of little significance, we just are on different sides of the fence as to whether future World C+C output will be more or less than 83 Mb/d in the future for any single year average.

Mentime, what happens if another new virus happens along in the next few years? Is covid 19 just a one off? Perhaps we have entered an era of repeated major pandemic events that necessitate worldwide lockdowns. Perhaps in 2025, just as the world economy has near recovered from the Covid 19 event, Covid 20 develops in badgers, foxes, mice, whatever, and sweeps the world. Perhaps the new virus especially affects young people, or whites, in contrast to the effect on people of colour or older generations, as is the case with civid 19. Rember that the Spanish flu back at the end of WW1 especially carried away fit young men. Remember that the Black Death that ravaged Asia and Europe in 1348 to 1349 was followed by another plague, almost as virulent, in 1361. Think that perhaps with global warming, and environmental degradation, and bleak monoculture, and globalisastion, humankind is marching into a future more uncertain, an environment more unstable, ecosystems more liable to impact on humanity with ever more frequent and unmanageable infection events. Covid 19 has shattered the world economy, profoundly affecting the hydrocarbon producing system; more pandemics in the future can surely only effect ever more damage.

Perhaps in 2025, just as the world economy has near recovered from the Covid 19 event, Covid 20 develops in badgers, foxes, mice, whatever, and sweeps the world.

Mike, Covid-19 is 19 because it was first detected in 2019. If another springs up in 2025, it will be Covid-25, not Cocid-20.

well said Westexasfanclup, I agree with your characterization entirely.

The biggest pitfall to this scenario is the possibility of growth of the international economy picking up steam in the next few years faster than any of us now foresee.

The collective human economy is a bulldozer with weak brakes, with population projected to reach 8.5 billion people by the end of this decade.

This supports the line of thought put forth by Dennis- non-OECD growth trend.

This chart of Asian oil consumption is telling. Over 80% imported.

credit Matt -http://crudeoilpeak.info/peak-oil-in-asia-update-june-2020-part-1

That can’t be and that won’t be because, de facto, the production of currently exploited oilfields is going to decline (-30% till 2030) and the implementation of new oilfields is going to be more complicated than in past years. Geologically speaking, the oil companies have spent hundred of billions dollars to look for new oil fields and in recent years, they were only able to discover the half of what would be necessary to supply the world oil demand. Above ground, the oil compagnies are facing a wave of retirements among their engineers and they have difficulties to recruit new ones, due to the decrease of reputation of oil industrie in the public view and that means loss of knowledges, competences and skills and then less effectiveness in the implementation of oil research and extraction. The investors are beginning to see the oil extraction sector as a risky one due to the appearance of legal disputes about global warming and have more reluctance to invest in oil companies. And with the problems of economic recovery associated with oil supply problems in the next months, the economies are going to be shaky. In return, this will not encourage oil products consommation and will not increase the profits of oil industrie and the working capitals necessary for investments in research and implementation of new oilfields. Therefore, I have some doubts about the capacity of oil market to provide enough oil for everyone and the growth of oil demand/supply. And Chinese do see that in that way as they have decided to implement more coal powered electric plants in order to supply enough electricity for electric cars.

Mr. Fleury,

The chart for Asia is historical output, so it already is.

I agree it may not continue at the same rate, though I expect Europe, North American, and Australian consumption will decrease while Asia, S. America, and African consumption will increase, at some point (probably 2025-2050) World consumption will decrease in my opinion due to lack of supply at an affordable oil price.

I mistyped in comment above, I meant 2025-2030, will be the point that consumption will decrease due to lack of output and rising oil prices.

Ron,

Since 2000 the C+C+NGL consumption of energy (measured in exajoules) by the OECD has been decreasing, I expect that trend to continue. Growth in consumption of oil has come from non-OECD nations over the 2000-2019 period. Data from BP Statistical Review of World Energy.

People will not be able to take on as much debt for questionable consumption, (too big houses, vacations, complicated cars, extravagant weddings, etc). Airlines down, what? 95%?

Tomorrow a town run for my wife and I and we may get a takeout meal for lunch to eat at the beach, the first in 2 months? And we have just 2 active Covid cases on Vancouver Island the last few weeks. (None in hospital). People are traveling and camping, but few dine out and bars remain closed. The point is, our curve is on the zero line, but behaviour has changed for many. I don’t think it will ever go back to the way it was.

Paulo,

Yes things change. So imagine 3 years in the future and there may be good treatments for covid19 and only very rare cases of it because eventually herd immunity might be reached (so that only the very vulnerable are likely to be affected). Do you think under those imagined circumstances people will no longer go to bars and restaurants? I agree there may be a drop in business, but eventually the fear will subside.

I hope so. 🙂

Funny thing is, we are starting to live with it. It doesn’t feel so earth shattering depressing. Of course my glass of spiced rum helps.

Paulo,

Yes many of us are adjusting, humans are pretty resilient.

I do enjoy a meal out once in a while and expect when things are under control (probably in 2-3 years) we will return to restaurants.

This will not be the case for everyone of course.

According to countrymeters.info the world population increased by an estimated 51,000,000 so far this year. This is more than Texas and Florida combined. I have to ask, how many parents would rather not use wood or cow dung to cook the meals for their babies? I would think that most wish for a cheap reliable alternative. That’s not wind and it’s not solar either.

most wish for a cheap reliable alternative. That’s not wind and it’s not solar either.

Nothing is perfectly reliable. Nuclear plants can “trip” in a matter of minutes. Coal and NG generation can fail. Grids can fail. Oil exports can be interrupted, pipelines can break, trains can derail. Fossil fuels deplete and new wells, mines and fields must be found.

In very important ways, wind and solar are much more reliable. They are (or can be) domestic supplies that can’t be blocked. Wind and especially solar are available almost everywhere, unlike fossil fuels, and they don’t deplete.

Wood, cow dung, kerosene…they all pollute. Their indoor pollution kills many people. And if you live in a low-lying coastal area, like billions around the world, you’ll be very happy to slow down sea level rise.

Solar is far cheaper as a household energy supply, compared to wood, cow dung or kerosene. It’s taking off dramatically in Africa. And utility-scale wind and solar are cheaper than fossil fuel or nuclear in many places, and only getting cheaper fast.

The writing is on the wall: fossil fuels should be eliminated (by efficiency, redesign and substitution) as soon as possible: they’re expensive, unreliable, risky and polluting.

Nick

In your perfect world the sun is always shining and the wind is always blowing.

How much it cost that poor mother to walk the pastures collecting dried cow patties? Today on the PJM web page it showed a peak demand of 131,000 MW and the best 10,000 MW of installed win capacity could do was 1400 MW. At one point last week with a similar load wind was contributing 69 MW. The customers of PJM power System have to pay to maintain a coal, gas and nuclear infrastructure no mater how large the wind power build out to provide for hot summer and cold winter days when there is no wind blowing.

You’re focusing on wind, only. That makes no sense. Any sensible grid planner will use a diverse set of power sources. In particular, wind and solar power fit nicely together: wind is higher in winter, solar is higher in summer; wind is higher at night, solar is higher during the day.

See the comment below.

Ervin, even with all that backup factored in, renewables are able to compete. The question is not IF but WHEN they are going to replace fossil energy sources. Even if renewables would not be economically feasible, there would be the same outcome: There isn’t any other energy source once fossil energy is gone. At least not in the next two or three decades. So there will come the day renewables will represent close to 100% of our energy mix, be it in a humming new world or in a dystopian nightmare. It doesn’t matter (though yes, it matters!).

Ervin,

I live in the real world.

I have two trucks, on that’s up to sixteen tons gross, one that’s an ordinary Ford F150 four by four, and one car.

Now WHY should I keep three vehicles?

The bigger truck pays it’s own way, by hauling the occasional big load, that would take six or eight trips in the F150.

The F150 is my go to vehicle when I have to haul any ordinary sized load.

And if I don’t have to haul anything much, well, I drive my old car, a Buick LeSabre. I used to drive a compact or subcompact, but the LeSabre came my way free when the previous car died.

The LeSabre uses half as much gasoline as the F150, which uses half as much as the F700.

My low cost solution is to own all three.

We don’t have to depend on wind and solar power one hundred percent of the time to save a HELL of a lot of money. If you can cook and light your house and run your refrigerator fifty to seventy five percent of the time on wind and solar juice, that saves having to buy a hell of a lot of kerosene, or natural gas, or coal.

The cheapest NEW electricity we have these days comes our way via wind and solar farms.

Yep.

It’s going to be a while before we have to worry about how to get rid of the last 10 to 25% of fossil fuels. Until then it’s a little like arguing about how many angels can dance on the head of a pin…

Fuck you, Nick. You will always need good, hard working men like me much longer than we, and our great country, will need limp dick cry babies like you. You live in a pimple, dude. And you and others here in need of politicizing everything in life, out of fear, have ruined this blog. There is no meaningful discussion here anymore about oil. It’s no wonder that anyone with any common sense, has left, and the traffic to this site is at an all time…low.

Quit railing on hydrocarbons and get a life. Go mow some grass, take up golf, get a dog. Grow some.

Mike Shellman

My guess is Nick doesn’t do well in the famine.

Mike your posts says everything about you and nothing about Nick

lol says the guy who thinks downloading the UberEats app is gonna save him from the famine… I’m not putting favorable odds on you either lol

It definitely does and I like it!

One only has to look at this graph of atmospheric CO2 levels to see that fossil fuel burning is alive and well. Supporting and building the world, including all those pesky wind and solar farms, lithium batteries, mining minerals, building roads, EVs, making concrete, etc., etc.

Covid-19 doesn’t seem to have made a dent in it, at least yet. I wonder if renewable electricity even manages to keep up with energy demand from the added world population each year?

https://www.esrl.noaa.gov/gmd/webdata/ccgg/trends/co2_trend_mlo.pdf

See response on the non-oil thread, since this statement/question regards non-oil issues.

Thank you Hickory.

I agree Mr. Madden’s comment should be under the Electric Power Monthly post (where all non-Petroleum comments should be).

Hi Ervin,

This is the way I explained having multiple sources of transportation to my eighth grade students, in discussing farm management.

I owned a compact car that got thirty plus mpg, and I drove it whenever I could.

I owned a four by four pickup truck that I drove whenever the car failed me, due to being too small or in the shop, or when I had a pickup sized load to haul.

And I also owned a big truck that required a cdl, which I used only on days I had to haul large loads.

The combination of three vehicles was BY FAR the cheapest solution to my transportation problems.

Wind and solar power are now our go to cheapest options for electricity, and we should be using them any time we can, because this saves DEPLETING fossil fuels for the day when there won’t be ENOUGH for our grandchildren.

And FURTHERMORE, although it may never have occurred to you, when we use LESS coal and gas, the price of BOTH of the falls off somewhat, meaning people who heat their homes or make steel or manufacture fertilizers can do it cheaper……… and cheaper fertilizer means cheaper bread and cheaper meat.

I betcha never thought of it this way, lol.

Every dollar spent on wind and solar power NOW will return us a nice fat profit in the future in terms of CHEAPER coal, cheaper natural gas, and BETTER public health out comes.

There will be MORE local jobs, MORE local tax collections, and greater LOCAL control over the community electricity supply.

We will need FEWER soldiers, fewer tanks, fewer ships, fewer aircraft, to make sure we have access to IMPORTED oil and gas…. and yes, we still use a good bit of imported oil, the last time I checked, lol.

Did you know that a typical tight oil well produces only about four hundred barrels per day the first year, half that the second year, half THAT again the third or fourth year, and only a TRICKLE after ten years?

It’s true we have plenty of gas, FOR NOW, but guess what? EVERY oil and gas well eventually declines to the point it’s not worth maintaining it any more.

Ervin and everyone who responded to this comment,

In the future it would be better to discuss wind and solar under the non-Petroleum thread (this week, the EPM post is the non-petroleum thread as its focus is renewable energy rather than petroleum).

Thanks.

I frequently use the sun to cook rather than burning something. I very much appreciate not having to heat the house on a hot day. Solar cooking is under utilized and will grow, see for example https://www.solarcookers.org/.

Schinzy,

Did you read my comment?

EPM thread would be appropriate, this thread not really.

Sorry Dennis, I’ll try to stay on topic.

I do have one on topic question: how much will world extraction capacity fall by the end of 2020 due to lack of investment?

Schinzy,

That depends upon the future price of oil and future economic activity levels, a rough guess would be 7 to 10%, using World Bank estimates for future World GDP (in 2021) and EIA STEO oil price estimates (assuming typical WTI/Brent spreads).

This article https://www.energyvoice.com/oilandgas/252347/oil-and-gas-drilling-set-for-staggering-20-year-low-rystad/ states that, according to Rystad:

Assuming this to be true, about how much will extraction capacity fall by the end of the year?

Schinzy,

I do not know what the average new well produces for all wells Worldwide. I only have that information for US tight oil due to the excellent work of Enno Peters at http://www.shaleprofile.com. Note that most wells in the world do not see the very steep decline rates that are witnessed in tight oil.

Note that the Rystad estimate says Global drilling onshore and offshore, but does not break out oil from gas, looking at Baker hughes rig counts for International plus North America, oil rig counts have fallen to half of the level of Dec 2019.

If we assume the drilling rate in Dec 2019 was enough to maintain a plateau in output and that no drilling would result in a 20% annual rate of decline and further assume the completions per rig is unchanged from Dec 2019 to June 2020 and that rig count remains at the current level for the next 12 months, then perhaps we see about 10% decrease in output over the next 12 months from the current level. Note that the rig counts may well increase as oil supplies become short and prices rise, so the assumption of constant rig count level from June 2020 to June 2021 may be very conservative.

Much depends on unknown factors such as better treatments for covid19 and better government responses to the crisis in nations like the US, and a number of other nations.

Thanks Dennis.

Interesting that it may have happened and not with a bang but a whimper.

All ears are tuned to other things….

30/6/2020

Peak oil in Asia Update June 2020 (part 1)

http://crudeoilpeak.info/peak-oil-in-asia-update-june-2020-part-1

That’s one of those “Can’t believe my eyes” charts. Like watching daily virus infections mount up.

How can it go on?

Matt, just went to the toilet after reading your post ,the alternative was to wet my pants . Someday all of us are going to say ^ what were they thinking ^ .

The curve will now be dented with Corona.

India did everything to shoot itself into both feet, and for security in both knees, too.

Doing a total lockdown in a poor country without social system and with no carity to feed the poor, so they’ll have all kind of political unrest and a severe economic crisis.

This is a political statement, but it affects oil. India is the second biggest consumer in Asia. When their consumption halves, it will affect oil economy – inclusive shoving some shale companies into bancruptcy.

Eulen ,your study of the situation in India is correct except for the political unrest . Some info that members will find interesting .Out of a population of 1.3 billion as of this date 800 million are living on free ration . What is the free ration ? 5Kg of wheat and 1Kg of chickpeas PER MONTH for a family of 4 PERSONS . Works to about 2-3 pcs of bread per day . This free ration is available only till November after that stops . So you are correct that starvation and malnutrition is baked into the future . Where you have it wrong is the political unrest . Too many divisions on caste,religion,region,cultural issues and basis ,to bring the people together for a cause is not possible . I have always wondered how did Gandhi do it ,still waiting for an answer after so many years . On the whole your assessment is justified .

Even with the division: It’s no revolution then.

But the Hindus can get at the throat of the Moslems, or the Moslems burn down a temple – and then shit happens. There is no big revolution since there is a common goal missing – but you can burn down a quarter or two.

A bit like in USA, when two bouncers of the same club settle their problems on the street…

Here’s an example of seasonal variation from Islandboy’s EIA post – we see that a combination of wind and solar provides fairly flat output over the year. Increasing the solar component would raise the summer output:

Nick,

This is the Petroleum Thread, the EPM is the non-Petroleum thread.

Please keep the discussion of petroleum in the Petroleum thread and non-petroleum in that thread.

When someone makes a comment in the wrong thread, the only appropriate comment from someone familiar with this blog should be, “I will respond to you in the appropriate thread”.

You can copy and paste their comment (or link to it) and then respond in the appropriate place.

Thanks.

Dennis,

Or the appropriate response by say a moderator would be to use that delete button to send a message. Its no “misstake” these posts is in this thread and to be frank you yourself kinda condone it. I guess you will have to pick a road,.

Baggen,

The delete option is one I would prefer not to use. I cannot be reading the blog every minute. When one comment gets deleted, all replies to that comment get deleted. Your option might leave very few comments to read here.

You can moderate any blog you run in in way you choose.

Dennis,

Replied to your original comment below but seems you changed it meanwhile.

Yes that is the idea, you get the bs-derail attempt out of the oil thread. The other option is to keep it like it is..

One other option would also be to simply disable useraccounts of people doing it then you can have your thread intact if that is priority.

Yes, we all have to select a path.

I don’t follow traffic on websites. Normally. But of late traffic on all websites and all YouTube videos is down. The virus is distracting.

To restart shale will likely require government intervention. A Trump re-election could generate that. There has probably not been a more oil production focused president. Ever.

There is likely no other way because accumulated debt is so high. It will require an entity that does not care about accumulated debt in order to lend more.

China signed an agreement with Iran this week. Big money. And my recall is Iran has a newly discovered field along the Iraqi border to develop. Let me go look at what China’s tanker fleet looks like.

Huge. I would expect it to start carrying oil from US sanctioned. countries

Last item. Nord stream 2. Russia has sent a ship to finish the last short distance to completion.

Watcher,

Even some oil men such as Mr. Shellman, think that restarting the tight oil industry by piling on more debt is a bad idea. It seems clear that Mike does not think the way tight oil producers have racked up huge piles of debt (maybe 300 to 400 billion dollars) is a good thing for the oil industry. In addition, producing all that oil while burning lots of cash and flaring lots of natural gas (which is a big waste of energy resources) and then exporting about 3 million barrels per day seems just plain stupid.

The tight oil industry would probably be healthier with lower output while they wait for oil prices to rise to levels where they can make money producing oil. In the Permian basin the average well would require about $60 to $65 per barrel for WTI to barely make a profit (where the discounted net revenue over the life of the well in 2020$ is equal to the full cycle cost of the well in 2020$, discount rate assumed at 10%). To make a decent profit (considering the considerable risk involved) a discount rate of 15% would be more prudent and and might require $65 to $70 per barrel assuming $1 per MCF for natural gas and NGL selling at 25% of the WTI price.

Speaking of which, Rystadt data suggest that Iran is post oil production peak and Russia gets its oil production peak in 2019.

Dakota Access pipeline can keep running amid legal fight -U.S. court

NEW YORK — The Dakota Access oil pipeline can continue to operate amid an ongoing court battle, a U.S. Appeals Court said on Tuesday, setting aside for now a lower court’s order earlier this month to shut and empty the line.

The U.S. Court of Appeals for the District of Columbia granted Dakota Access, controlled by Energy Transfer LP, an administrative stay while it considers whether the line, long opposed by local tribes and environmental activists, should be shut due to permitting issues dating to 2017.

https://financialpost.com/pmn/business-pmn/dakota-access-pipeline-can-keep-running-amid-legal-fight-u-s-court

Doesn’t really matter what anyone thinks as regards the oil industry. Texas tax revenue will have to be restored and anything that looks like it can contribute to that will get legislative and gubernatorial support.

There’ll be no trucks in the oil fields if the roads can’t get repaired because there’s no money to repair them. Conventional or shale.

Note that Texas tax revenue is not overwhelmingly dependent on oil royalties. But other revenue sectors are smashed by the virus and can’t be relied on. Texas is very well run fiscally and does not face anywhere near the pressures other states do, but Texas is going to feel this event. Restoring shale will be a priority.

Watcher,

Generally Texans seem to prefer free markets and minimal government intervention. There have been plenty of booms and busts in the Texas oil industry over the past 5 decades or so, not sure how many bailouts there have been of the oil industry in Texas, maybe none.

I can hit the delete button a few times if you like and see if that changes anything. The issue with that is ofc that i will delete according to my own preference and perhaps use the hammer a bit more frequently in the start just to send the message.

What im trying to say is i think its easier for you also and would save you a lot of time to hit the delete button then trying to get people to reply in the correct manner to post that are put on the wrong side of the fence intentionally.

I really appreciate this blog and all the hard work you and the other contributors put in, i just agree with Mike i would like it to be about oil in the oil thread and i dont think reasoning with certain individuals will get it there.

If im moderating i will ban users who dont get the message when i delete a post if it keeps happening. If that is ok with you..

Thanks. I apoligize to the community, save the recipient, for the other night. Its 120 F in Texas, the price of oil sucks and I got home after 12 hours to hear more anti oil shit from Nick G, whoever TF that is, about how badly the world needs to move away from hydrcarbons and that those of us left will just be “dancing on a pin head.” It pissed me off. If you are going to say that about my industry, and the people that work in it, who have families to feed…use your full name, at least. Its cowardly not to. I’d like to comment here more than I do, and help, but getting railed on for my political idealogy, or for what I do to make a living, is awfully damn poor and indicatve of how angry, and bored, America has become. No one political party is better than the other in THAT regard. Shallow got hosed last week for the same sort of thing…its stupid, divisive and not productive.

Sorry, again.

Mike Shellman

I don’t condone Mike’s language, but please keep in mind just how rough it has been for the thousands of small businesses in the stripper oil well industry.

We lost over $100K in June. No oil sales in May due to the 4/20/20 fiasco. We also lost money in April and May. July will be a little above or below break even. August shaping up about the same.

I assume many here are celebrating that.

No, no one’s celebrating your misfortune. And boom and bust doesn’t really help us get to a sensible future – it’s just a waste and a lot of personal tragedies.

I think we’d have a lot less misery with a little planning, but instead we’re embroiled in a long and painful fight over what to do with energy.

Sigh.

Shallow sand and Mike,

I am sorry things are not going well for you guys.

I am not celebrating at all for you or Mike doing poorly at present. It certainly seems from a distance to be a very challenging business.

At some point the World needs to move to other sources of energy as fossil fuel resources deplete. So what to do in response ends up being intertwined with oil depletion ( and peak oil is what this blog is about.)

I agree the way Nick G puts things is not nice.

So no apology needed, often I say things I would like to unsay.

Stay safe.

Dennis,

I disagree with you. I have re-read Nicks comment again and I just don’t see his comment as being “not nice”. For more than 5 years that I can remember. Nick has been on the forefront here of what the alternative energy future can have in store for all of us and has been right more than wrong. In doing so, Nick has taken a lot of incoming and I will bet you. You can’t find an equal negative response.

Maybe your confused with me, because I’m not as diplomatic.

Huntingtonbeach,

It is an empathy thing, some don’t get it.

A Trump supporter looking for empathy, I’m not buying it. Have you read Mary Trumps book? Donald is a sociopath.

Huntingtonbeach,

Not looking for, it is just common courtesy to consider the feelings of others.

Dennis,

Are you sure that we’ve offended Mike? He says “ You don’t need to apologize for me either, Dennis, or make excuses for me. I am not having a “hard time,” not at all. I was prepared for all this.”. He also says: “ Oil men, with real money on the line, cuss all the time. When they are attacked, they fight back.”

I think maybe he’s saying that he’s not “fighting back” bacause he’s offended, or because he’s stressed out because life is hard. It’s more basic: he’s defending his industry and his livelihood. In other words, he’s fighting back against the basic idea that we need to transition away from oil. He said he finds my apologies “hollow”. Perhaps that’s because I’ve been apologizing for having unintentionally offended him, but I haven’t taken back the basic argument about a transition. And…it’s the transition he objects to.

Perhaps we have a fundamental disagreement here, not a superficial issue about offending someone.

I suspect he is only defending his industry because it’s all he knows for his livelihood. Clearly he is experiencing financial difficulties and doesn’t understand or what to do about it. So he lashes out like a child.

The behavior doesn’t seem much different than what helped get Trump elected. Which has only made matters worse. I will bet you he is not better off today than 4 years ago.

Nick g, Huntingtonbeach,

Mike has been very clear right along that he’s against the shale botch–$350 billion dollars of debt sitting waiting and growing, CEOs not suffering but families losing their livelihood, and this in the name of flooding the oil market for quick money when there’ll be a time when that oil is needed here in the US. You only have to pay attention to his posts.

His company is prepared for what the oil patch is facing, in the best way: no debt. That’s a result his policy of drilling only on cash flow not on what’s called OPM–other people’s money. If you can’t afford to drill the well you don’t drill. His company has done well for several decades now and can hang on, and he has most of the crew he started with. He knows we need to get away from fossil fuels; he certainly doesn’t agree that the way to do that is to produce every bit of it until there’s none left.

If the shale bozos had run their business the way Mike has run his the transition from fossil fuels to other energy sources could have got going in a way that would have given time to avoid the suffering we’re seeing in the oil patch and the huge waste of money and energy that cause it.

Synapsid,

Your understanding is similar to mine.

Shallow, you don’t have to make excuses for me, or apologize for me; I am who I am. I was working in the oilfield when you were still going to grade school. My language is an extension of the life I have led. Your need for “acceptance” would come across better if you did not tolerate the anti-oil shit that goes on here. I mean, you ARE in the oil business, right? Oil men, with real money on the line, cuss all the time. When they are attacked, they fight back.

Dennis, you and Patterson allow the shit that goes on here for political reasons, to advance an anti-oil agenda, pro liberal message you need to deliver. One man, 1/3rd of the legislative branch of our government, scares you both to death. I will NEVER be that afraid of any one man, ever.

You don’t need to apologize for me either, Dennis, or make excuses for me. I am not having a “hard time,” not at all. I was prepared for all this.

Nick is a dick. He knows exactly what he is doing and why. His apologies are hollow. Dennis, you NEVER reprimand him, ever; he is essentially doing your work, for you.

I am done, I promise.

Speaking of hollow, why do you say “oil prices suck” and than say “not having a hard time not at all” ?

Mike,

My agenda is to address the looming peak and decline in oil output.

I don’t mind the colorful language, generally I leave that for other places, but that is me. I have two brothers in the construction industry and worked there in high school and college as well as having friends in the industry.

I am sorry you are so offended by a different political point of view.

That’s life.

I think Trump is an idiot, it is too bad so many were fooled by him.

Dennis,

“I am sorry you are so offended by a different political point of view.

That’s life.

I think Trump is an idiot, it is too bad so many were fooled by him.”

Speaking for myself i dont think anyone is offended with a different political point of view, there are probably millions of blogs dedicated into competing about how stupid trump is or if that isnt enough there is always twitter for more of the same. (perhaps this one should just be about oil?)

For me personally its just annoying and im not even an american, would it be so hard to keep “i hate trump” out of an oil thread when it dont add anything to the discussion?

You personally used to keep it out before i think that was more professional and sets the tone also since you are now the owner of this blog, if you do it its sort of green light to everybody to do the same.

Speaking for myself again i would prefer that the oil thread on POB was about you know oil and less of trump/robotaxis/whatever that isnt really related.

If we flip the coin i cant remember i have seen anyone preaching about how great trump is, perhaps nobody thinks so here, or they do but are just polite and keeps discussion towards oil, would be nice if both sides did the same thing probably gives more incentive to some people to participate in oil related discussions.

I mean why should people spend their time contribute and educate you, me and the rest here while they get nothing back and on top of that gets attitude and have to read a lot of political stuff they might not agree with that arnt related to topic at all?

Baggen,

Some of the political comments were in response to political comments by Mr. Shellman.

If an oil man is going to bring up politics, the proper response is to ignore that? Seems to me a response is warranted.

In addition, Shallow sand sometimes asks questions about EVs etc.

The discussion of what to do in response to peak oil seems pretty relevant to a peak oil blog, no?

Dennis,

I was not talking about a specific comment in this post i was talking in general about the trend here and i think you understood that as well but i guess i got my answer, thanks.

Baggen,

I guess the problem is that everything ties together, oil production is tied to politics to some extent. As an example see

https://www.oilystuffblog.com/single-post/2020/04/21/Breaking-News

Dennis,

Yes Dennis i have hardly questioned that and that is not at all what my post was about, i think you know what my intention was speaking about the trend here and how it has changed and deflecting to adress that is also an answer.

As i said i got my answer the subject is done for me.

Dennis, you and Patterson allow the shit that goes on here for political reasons, to advance an anti-oil agenda, pro liberal message you need to deliver.

Mike, I do not have any anti-oil agenda. I have been preaching from day one here on this blog that I do not believe oil will disappear one day before it is all gone. Or at least before the affordable oil is all gone. The no-oil agenda is nothing but wishful thinking by a few folks who are really not fully aware of the big picture.

I am however pro-liberal and virulently anti-Trump. Trump is doing Putin’s bidding. He is dividing America with his racial hatred rhetoric. He is alienating our allies and embracing our enemies, primarily Russia. His pulling our troops out of Germany because he is pissed off at Merkel is shameful, but not as shameful as pulling out of Syria and turning the country over to Putin and his buddies. We cannot survive another four years of Trump. And that opinion has not one goddamn thing to do with oil.

I have been following the peak oil story for almost two decades now. Not because I am rooting for it or against it but because I simply think it is happening and the results will be devastating.

We live in a globalized world, a world that cannot survive without cheap liquid transportation fuel as well as without all the myriad other things we get from petroleum. The drastic decline and eventual disappearance of oil will mean the end of civilization as we know it.

Ron,

Could you explain me why you consider Russia as an enemy of the USA?

I know this is an oil thead and sorry for that but you mentioned this.

I lived half of my life in USSR and half in the western world.

Have you seen The untold history of the United States by Oliver Stone?

Thank you

Sergey, Russia is definitely an adversary of the USA. Enemy might be too strong a word, but close enough.

Russia opposes our policy in the Middle East. They have, until very recently, actively supported Bashar Hafez al-Assad and his brutal regime. They meddle in our domestic policy including our elections. Putin is trying to regain the former empire by annexing Crimea and trying to take back Ukraine. And I could go on and on but…

No, I haven’t read the Oliver Stone book.

Mike. I guess I needed to read this.

I do not work in the oilfield. (I did work in the oil field in the summers during college).

Your language is yours and mine is mine. Where I work no one should ever drop F bombs. Never. You would probably agree with that. But in the 25 plus years I have worked there, it has went from almost never to routine. Much more so since about 2016. So my tolerance for that isn’t very high anymore. I have sent several people “across the street” for that.

So we work in different places. I use some of those words at times when I go out in the field. Maybe this is a place for that, oh well.

I am not asking for acceptance here. I figure it is better to poke holes in others’ extreme positions than yelling at them. I get yelled at a lot anymore, and believe me it only hurts the person yelling at me. Yelling at me never works. So I don’t yell at others if I want to change their views.

More importantly, I am attempting to educate the people here the upstream industry isn’t just “evil ExxonMobil”. I think I have had success with the ones who aren’t radical. We are going to need petroleum for a long time yet in the USA. But the radical left doesn’t see it that way. Also, the radical left has little nuance, and will destroy small producers first with “one size fits all” regulation.

As you also know, we are on the line for over 300 wells and several employees. So it’s no game.

For example, with Nick g, we debated methane regulations as related to stripper oil wells. I think I made some pretty good points in that debate. I won’t convince him maybe, but maybe will convince many here who had never considered the issue. Keep in mind, in my line of work we can argue with each other for hours, treat each other like crap, and then go have a beer together when it’s all over. Few understand how we can do that.

I’ll not criticize anyone’s language anymore. I probably should lay off posting here, as it seems oil prices have mostly stunk since I showed up here. I’m not very superstitious, but it gets to the point where one has to wonder.

Shallow sand,

I agree it seems there would be a reasonable position between no methane emissions and reasonable levels of emissions, I do not know enough to offer a reasonable proposal, but I imagine you could. I do not think your position is no regulation, but reasonable regulation.

I enjoy your comments and Mike’s as well. I appreciate all of the knowledge that both of you have shared here.

Shallow Sand,

You made a point about the radical left aiming to destroy the oil industry with regulations.

Perhaps true to some degree, more or less.

Yet it brings up a very important point for people who relate themselves to either party.

I do not think the radical left currently dominates the Democratic party policy, by and large, as much as the Republicans media and leaders would like to portray it as such. And yet it is a constant battle to have pragmatic and level headed people with world experience to maintain positions of power within the party.

It looks to me like the Republican party has been losing that battle badly over the last 30 years., or longer- perhaps starting with McCarthy.

Partisanship (both sides) is gradually chipping away at the ability of this democracy to function with any measure of effectiveness.

Do what you can to prevent the radical or extreme elements of your party from dominating the discussion and the policy making.

Work to get news and commentary from non-Partisan sources to round-out and reality test your beliefs.

Partisan and Fact rating of media sources-

The chart is at the bottom of the page.

We should each aim to get our news from the top center- [reputable and less partisan]

https://www.adfontesmedia.com/the-chart-version-3-0-what-exactly-are-we-reading/

shallow sand,

I come here to learn. You and Mike Shellman are the ones I learn the most from. I’ll bet I’m far from being the only one to say that.

What you’re doing here, both of you, is valuable and needs to continue because what you offer needs to be known, widely. Lousy behavior by others, intentional or not, is annoying and ought to be called out but please don’t consider leaving. You’re needed here.

Mike, shit happens. We have all let it fly at times. It’s human nature.

I think it’s a mistake for you to feel those here that want to see a transition away from fossil fuel are blaming you. If they are, it’s their mistake. Your just a small cog doing what you know what to do. We are all to blame for the damage being done to the mother ship. If there is a finger to point, it’s at those who have lied to the public for decades for self interest about global warming.

The world needs to transition away from fossil fuel. If you don’t keep yourself aware of the big picture. Your going to get yourself ground up in the system with your pants down and needless stranded assets. The over production in shale is a good example what can happen to you. The world is in a different place than it was just a decade ago of supply shortages. You need to manage your business accordingly.

The last 4 months has seen 40 million Americans added to the unemployment pool. California Resource Corporations filed chapter 11 two days ago. I feel your pain. This reset that’s coming is not about you or I. It’s about all of us.

As an example, a big mistake here is that this site has separated itself into two separate topics because both are related. Those hard working oil field workers with their nose in the oil patch are going to get their ass handed to them again if they don’t watch the big picture.

It’s not personal

Mike,

No disrespect was meant. And in particular, the comment about “angels” wasn’t meant to be disrespectful. It referred to an old metaphor about pointless arguments*, and was intended to mean that it wasn’t very productive to argue about how we’d solve problems that are decades away.

*”In modern usage, the term has lost its theological context and is used as a metaphor for wasting time debating topics of no practical value..”

https://en.wikipedia.org/wiki/How_many_angels_can_dance_on_the_head_of_a_pin%3F

Nick,

My guess it was mostly the comment at 2:23 PM, that Mike might have found offensive, it was not about angels dancing on heads of pins at all.

Well, Baggen. They way I remember it you are Norwegian (I could be wrong of course).

The oil market was headed towards a deficit. Low investements and somehow manipulation from a price level of comfort to a price level of discomfort (too low) before the pandemic. The shift in demand pattern after february is obvious and all of a sudden the major powers try to keep oil prices up to a reasonable level. The huge levels of inventory flexibilty and market place intervention is always going to influence prices. So what new to take from what is going on?

The most interesting thing happening in Europe right now is how they see a “recovery” and where the stimulus money are going. Great to shield the service sector, but what about the energy sector? Focus on hydrogen as a solution means that the problem (not enough cheap energy to import) has been acknowledged a long time ago, and that cheap financing can speed up the desired direction. The consequences for the financial system is not so important than to overinvest in renewable energy when the chance is still there. Overinvestment into everything is what happens when interest rates approach 0 and credit is available no matter what. And it is very apparent that governments in Europe prepare for a situation with less favorable imports of cheap energy. Who cares about fair and free markets anyway?

kolbeinh,

The fair and free markets philosophy is a nice idea, but it mostly exists only in microeconomics textbooks. Many large firms have quite a bit of market power and most government regulatory agencies have been captured by those large firms which have undue influence on policy.

When those who have wielded extraordinary influence over government policy lose their special place, the fall back position is that “others” (not them) should not influence government policy, only they should receive special treatment. 🙂

Markets are neither free or fair, they never have been and never will be.

kolbeinh,

close enough im fron sweden, but i suspect your message was not directed towards me as i just replied to Dennis original message where he asked me if i offered service as a volunteer moderator.

Peak oil demand is happening because of peak oil supply, or to be more precise, the rising energy cost of energy within the economy as a whole. Demand and supply are intricately intertwined, given that one cannot exist without the other.

For over a decade, all major industrial nations have kept interest rates beneath inflation, in a desperate attempt to stimulate their economies out of stagnation. The problem is that the people running these countries have lost sight of what the economy really is. They think they can stimulate it by manipulating money. The human economy is a thermodynamic machine, that produces wealth through the action of energy on matter. What this means is that there is a finite amount of cash that people can afford to spend on oil, because it takes a certain amount of oil based energy to generate a certain amount of real wealth (I.e the utility of goods and services). Less abundant energy leads to stagnation of the economy and it won’t necessarily generate high energy prices because it destroys the wealth base of the economy and undermines what customers (refineries) can afford to pay producers for their product.

Gail Tverberg has pointed out, supply shortages do not necessarily result in longterm high prices, because they tend to undermine the productivity of the economy. The Peak Oil Demand meme is a propaganda ploy by desperate people who want to pretend that geological depletion doesn’t matter, because as if by magic, suddenly we don’t need as much anyway. They like to sell the idea that demand is declining because we are oh so clever that we don’t need as much anymore because the world is ‘decarbonising’. It is a way for people who originally refused to accept the idea of geological limits on oil supply to avoid facing up to being wrong. But the Peak Oil Demand meme is nonsense.

It isn’t as if the world has suddenly developed an alternative transport system that can run without oil products. Air transport is diesel powered. Ships are diesel powered. So are most railways. So is road based goods transport. Electric cars are a small fraction of the personal transport market, which is itself only a modest part of total oil demand. They are so far having a negligible impact on oil demand. The petrochemical industries consume oil and natural gas as feedstock. From memory, this accounts for about a third of all oil demand. The only way that oil demand can fall, is if humanity as a whole consumes less of the things that oil provides, such as transportation and petrochemical products. That means getting poorer. Exactly what has been happening in OECD countries since the turn of the century. And the root cause is declining EROI of the whole energy supply chain. In other words, geological depletion of fossil fuels.

The US would not be producing oil from tight oil wells, with their massive annual decline rate, if there were sufficient onshore conventional oil resources to meet consumer demand. The shale industry only exists because the more promising plays of yesteryear are now depleted. The British North Sea, produces a fraction of what it once did. This has nothing to do with peak demand. It is a direct result of depletion in giant oil fields and an absence of new discoveries capable of taking up the slack. The stagnation in Chinese oil production is due to depletion. The same is true for large parts of OPEC. The world did not exit the stone age due to lack of stones. But the world is exiting the oil age as we speak, precisely because high EROI conventional oil deposits are increasingly depleted. We are literally running out of stones.

“supply shortages do not necessarily result in long term high prices, because they tend to undermine the productivity of the economy”

“The term ‘shortage’ can be easily confused with scarcity, which is one of the underlying basic problems of economics. The easiest way to distinguish between the two is that scarcity is a naturally occurring limitation on the resource that cannot be replenished. A shortage is a market condition of a particular good at a particular price. Over time, the good will be replenished and the shortage condition resolved.”

https://study.com/academy/lesson/scarcity-in-economics-definition-causes-examples.html

“Definition: Scarcity refers to resources being finite and limited. Scarcity means we have to decide how and what to produce from these limited resources. It means there is a constant opportunity cost involved in making economic decisions. Scarcity is one of the fundamental issues in economics.

How does the free market solve the problem of scarcity?

If we take a good like oil. The reserves of oil are limited; there is a scarcity of the raw material. As we use up oil reserves, the supply of oil will start to fall.

If there is a scarcity of a good the supply will be falling, and this causes the price to rise. In a free market, this rising price acts as a signal and therefore demand for the good falls (movement along the demand curve). Also, the higher price of the good provides incentives for firms to:

Look for alternative sources of the good e.g. new supplies of oil from the Antarctic.

Look for alternatives to oil, e.g. solar panel cars.

If we were unable to find alternatives to oil, then we would have to respond by using less transport. People would cut back on transatlantic flights and make fewer trips.

In the short-term, demand is price inelastic. People with petrol cars, need to keep buying petrol. However, over time, people may buy electric cars or bicycles, therefore, the demand for petrol falls. Demand is more price elastic over time.

Therefore, in a free market, there are incentives for the market mechanisms to deal with the issue of scarcity.

With scarcity, there is a potential for market failure. For example, firms may not think about the future until it is too late. Therefore, when the good becomes scarce, there might not be any practical alternative that has been developed.

Another problem with the free market is that since goods are rationed by price, there may be a danger that some people cannot afford to buy certain goods; they have limited income. Therefore, economics is also concerned with the redistribution of income to help everyone be able to afford necessities.

Another potential market failure is a scarcity of environmental resources. Decisions we take in this present generation may affect the future availability of resources for future generations. For example, the production of CO2 emissions lead to global warming, rising sea levels, and therefore, future generations will face less available land and a shortage of drinking water.

The problem is that the free market is not factoring in this impact on future resource availability. Production of CO2 has negative externalities, which worsen future scarcity.

The tragedy of the commons occurs when there is over-grazing of a particular land/field. It can occur in areas such as deep-sea fishing which cause loss of fish stocks. Again the free-market may fail to adequately deal with this scarce resource.”

https://www.economicshelp.org/blog/586/markets/scarcity-in-economics/

“…personal transport market, which is itself only a modest part of total oil demand.”

Uhhh – until the Covid-19 thing hit, U.S. was using 9 million bpd of gasoline out of 20 million bpd of all liquids. That’s 45% of U.S. “oil” (all liquids) demand.

https://www.eia.gov/dnav/pet/pet_cons_psup_dc_nus_mbblpd_m.htm

While the EIA world data only go to 2017, the amount of gasoline and diesel is about the same.

26 vs 28 million bpd out of 98 million bpd all liquids. Hardly “modest”.

n.b. in Europe diesel cars/suvs are still fairly popular.

https://www.eia.gov/international/data/world/petroleum-and-other-liquids/annual-refined-petroleum-products-consumption?pd=5&p=0000001001vg0000000000000000000000000000000000g&u=0&f=A&v=mapbubble&a=-&i=none&vo=value&&t=C&g=00000000000000000000000000000000000000000000000001&l=249-ruvvvvvfvtvnvv1vrvvvvfvvvvvvfvvvou20evvvvvvvvvvvvvvs&s=315532800000&e=1483228800000

TonyH,

I agree peak demand is unlikely for oil. The average rate of growth for the OECD from 2000 to 2019 for real GDP at market exchange rates was 1.66% per year on average. This was a considerable slow down from the 1980 to 1999 rate of growth in real GDP (2.89% over that period). Note that we also need to take account of population growth as the rate of growth in OECD population may have been different in the two periods.

On a real GDP per capita basis growth has also slowed with 1.6%/year growth in the 1980-1999 period vs 1%/year growth in the 2000-2019 period. The long term rate of growth in real GDP per capita from 1975-2019 has been 1.7%/year with the rate of growth gradually slowing over time (with the exception of the GFC). Data used was from World Bank.

https://data.worldbank.org/indicator/NY.GDP.PCAP.KD?view=chart

As economies become wealthier it seems they grow more slowly.

Higher prices do not necessarily indicate a supply shortage, but simply reflect the higher cost of the product.

Generally the World economy has found ways to utilize oil more efficiently as the cost has increased. I would agree that efficiency only takes us so far, but the combination of substitution (electricity and natural gas for transportation) and efficiency is likely to allow the World to adjust to depletion of oil, as coal and natural gas deplete other types of energy are likely to be substituted (nuclear, wind, solar, hydro, geothermal, and tidal power.)

Hi Dennis,

“Generally the World economy has found ways to utilize oil more efficiently as the cost has increased. I would agree that efficiency only takes us so far, but the combination of substitution (electricity and natural gas for transportation) and efficiency is likely to allow the World to adjust to depletion of oil, as coal and natural gas deplete other types of energy are likely to be substituted (nuclear, wind, solar, hydro, geothermal, and tidal power.)”

You’re basically correct, in terms of applying economic theory,as best I can see, and mostly things do work out the way you say, long term.

But peak oil has the potential to not only upset the apple cart, it has the potential to smash it to bits.

Given that oil truly is the life blood of industrial civilization, if production drops off fast, due to depletion of legacy fields, or for any reason…………….

It could be game over, for life as we know it, because discovering or inventing substitute technologies may well take place WAY too long for deployment at scale. A collapsing world economy can’t invest enough in alternative energy technologies to offset a fast decline in oil supplies, in my opinion.

I’m basically a pessimist, but not an outright doomer. I think people like Ron and Doug are closer to right in describing the mid term future than Nick.

I hope like hell you are right in your belief that oil supplies won’t peak for a few more years yet, and then decline only gradually. We can do things politically to stop civilization from falling apart, if the decline in daily supply occurs slowly.

If it comes about swiftly, I can’t see anything LESS disastrous than hot oil wars that could escalate into something approaching WWIII.

Maybe industrial civilization is a dead man walking. Maybe we will be smart enough to deal with peak oil when it happens. Maybe we will put a fifty thousand dollar tax on fifty thousand dollar six thousand pound trucks used for nothing more important than fetching home beer.

If we don’t, it may well be game over.

The oil guys here have my respect and my sympathy. I’ve been driven out of business myself, by changing times. Had to retire, unable to compete on the necessary scale to stay in. But they don’t seem to acknowledge that sometime pretty soon, we are going to HAVE to get by on a hell of a lot less oil per capita, world wide, and quite possibly a hell of a lot less per capita even here in Yankee land.

Nick and company have my respect too. But that faction never seems to fully acknowledge that the alternatives they propose may not scale up fast enough to prevent us all going to hell in a hand basket. ALL of us maybe.

OFM,

If we assume society falls apart as soon as peak oil is reached, then we have assumed what we are trying to prove.

The decline in output of crude plus condensate is likely to be gradual about 2.8% per year from 2040 to 2100, I believe the World economy will be able to adjust. Note that the decline rate in C C output is lower from 2030 to 2040, the average annual decline rate is 1.25% over that period after a peak in 2028 for the scenario shown below.

I think many of us do acknowledge that without good policy, that the ramp up of alternatives to fossil fuel will not occur fast enough to reduce environmental and economic damage. That is the reason we advocate for better government policy to avoid a potential crisis.

I also acknowledge that a crisis is indeed possible and perhaps likely, I just don’t think we should give up without a fight.

I also acknowledge that the process of trying to mitigate the damage done by overconsumption might do more harm than good. Careful study of potential consequences by ecologists and other scientists of any action taken to reduce the social and and environmental impacts of an energy transition must be undertaken in my humble opinion.

Dennis,

We have to grow debt exponentially from where we are or debt deflation happens immediately. Global debt has to double about every 10 years or so. That is the rate of debt expansion we have to have or we get a crisis. We go into permanent crisis when the energy base that supports all this debt can no longer grow. Making all cars electric doesn’t change the outcome.

HHH- “We go into permanent crisis when the energy base that supports all this debt can no longer grow”

Financial market are said to attempt to price the conditions approx 6 months out. In your opinion, what are the financial indications that the ‘smart money’ acknowledges the coming shortage of energy- What are the leading indicators that people should look for?

The dept will be paid back the next few years I think.

There is now a stimulus package, financed with FED money. The same round about the world.

And there will be the next one, financed with more fresh money. This was done in history several times, and it always ended the same.

With fresh new money, and the old one (and all the dept in this money) was worth nothing.

It’s the same now as losing a war – an economy in trouble, and lots of dept.

Germany had this 2 times last century – WW1 ended 1918, 1923 was pay back year, and WW2 was lost 1945, payback in 1949. This time without hyper inflation, but the country was still on war economics and ration cards, money was kind of worthless.

So that’s my take – new money. And to get the curve to oil – the end of the petro dollar, and lot’s of chaos through this. Countries will have problems to buy their oil, USA will restart fracking no matter the cost.

We have a bumpy road before us. Just my viel into the crystall ball, no warranties.

HHH,

Oil is not the only energy used by society, I don’t believe I said that “making all cars electric” would solve all problems, it is just one part of a multifaceted solution which includes improve fuel efficiency with hybrid and plugin hybrid vehicles, lighter vehicle construction, less powerful engines, as well as battery electric vehicles. The energy for batteries used in transportation can come from natural gas, coal, nuclear, hydro, wind, solar, geothermal, and tidal power, the solution can occur gradually over the next 20 to 50 years as oil output will decrease gradually. As far as natural gas output, that may not peak until 2040 to 2050, coal output has already peaked, though that peak may be surpassed in the future, but probably the final peak will be before 2035 for coal output. I agree debt will expand as real GDP grows, just as it always has (for past 200 years at least).

Well said, Dennis!

I pray you are right about the available daily supply of oil dropping off slowly and gradually.

I’m not too worried about your projections in terms of GEOLOGY. We’re probably on safe ground in that respect.

But a million things can and might go wrong politically and economically……. wrong to such an extent that things will snowball on us, collectively,world wide, with Sky Daddy alone knowing how things would work out in the end in such cases.

But I’m unlikely to live long enough to see the end game.