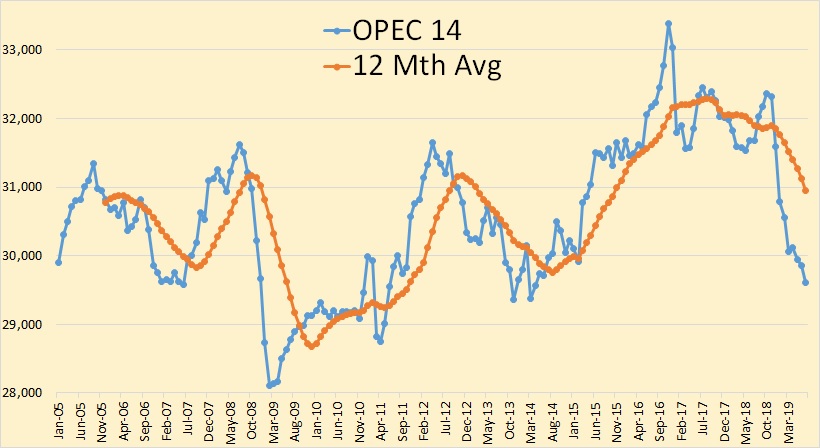

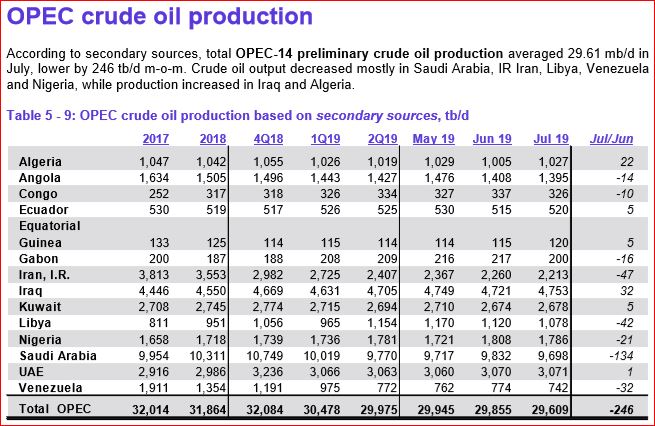

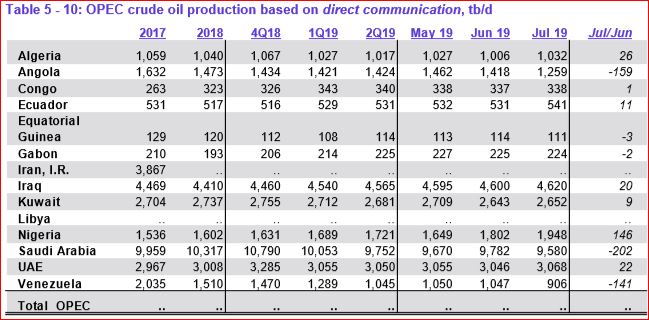

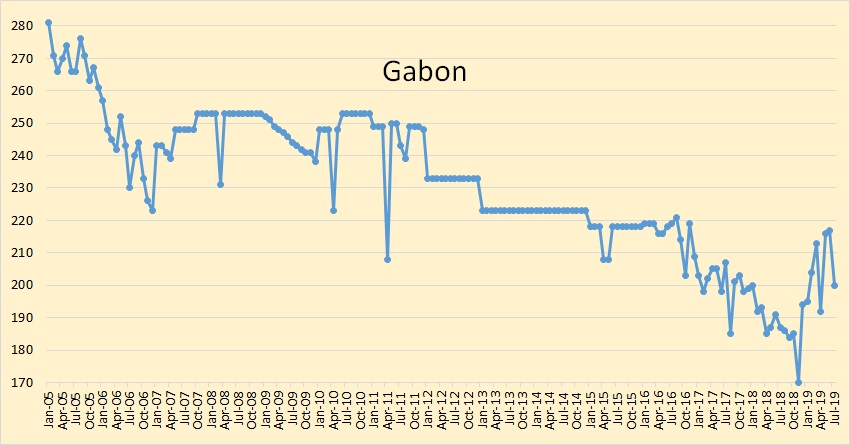

All data below, unless otherwise specified are from the latest OPEC Monthly Oil Market Report. All data is through July and is thousand barrels per day.

OPEC crude oil production was down 246,000 barrels per day in July’

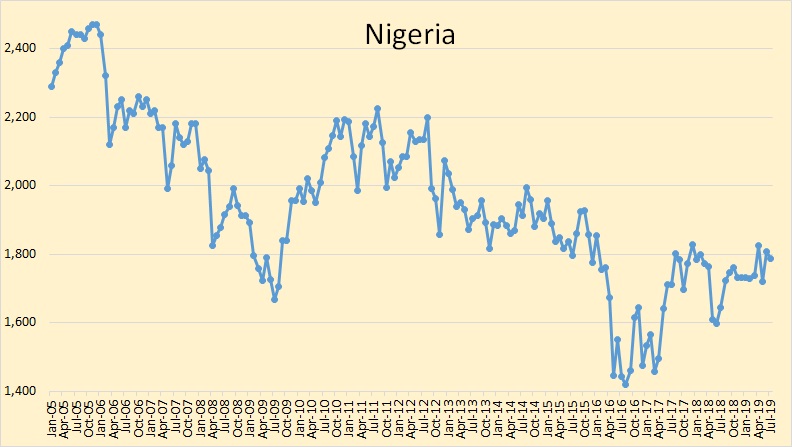

There is often a difference between what secondary sources say OPEC produces and what the countries themselves say they produced. Nigeria said they were up 146,000 bpd while secondary sources said they were down 21,000 bpd. Similar differences can be found in the Saudi and Venezuela data.

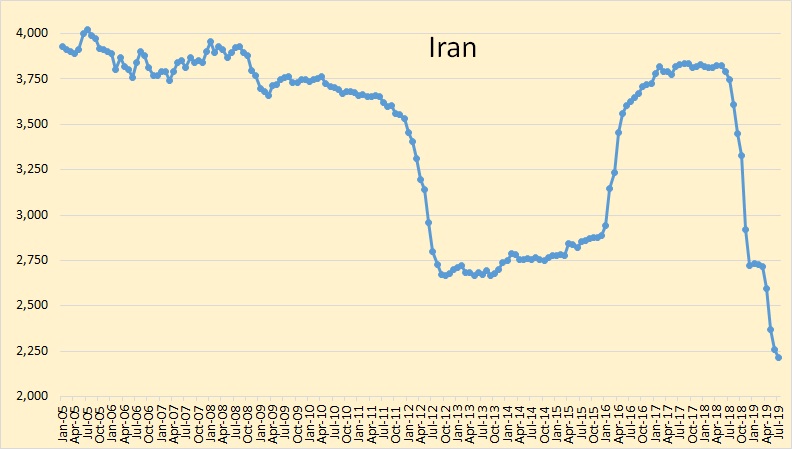

Iran’s decline, due to sanctions, has slowed slightly but they were still down 47,000 bpd in July.

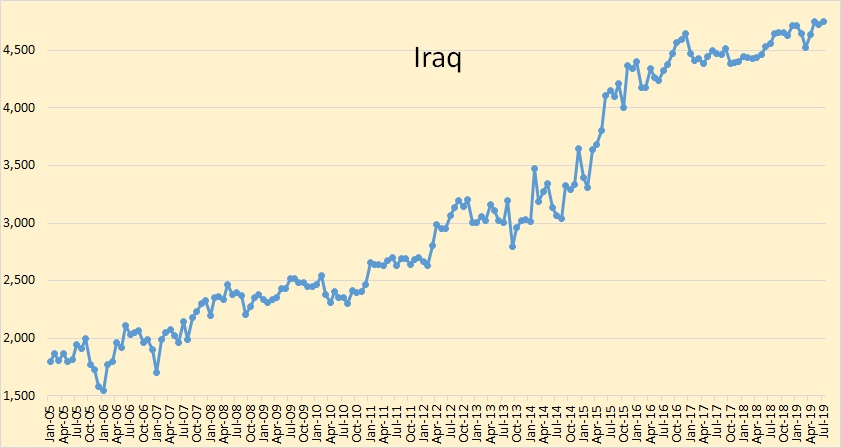

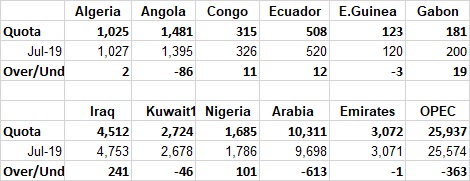

Iraq’s crude oil production was up 32,000 bpd in July. That is a new all-time high for them. They are totally ignoring their OPEC quota request.

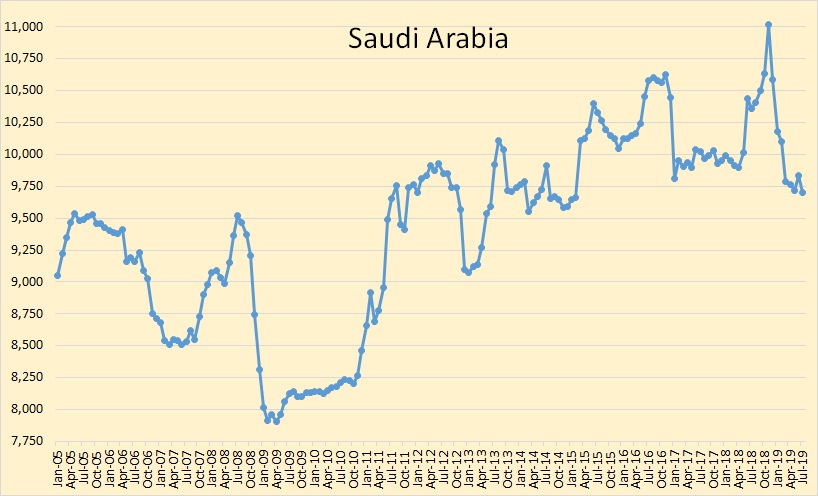

Saudi crude oil production was down 134,000 bpd in July.

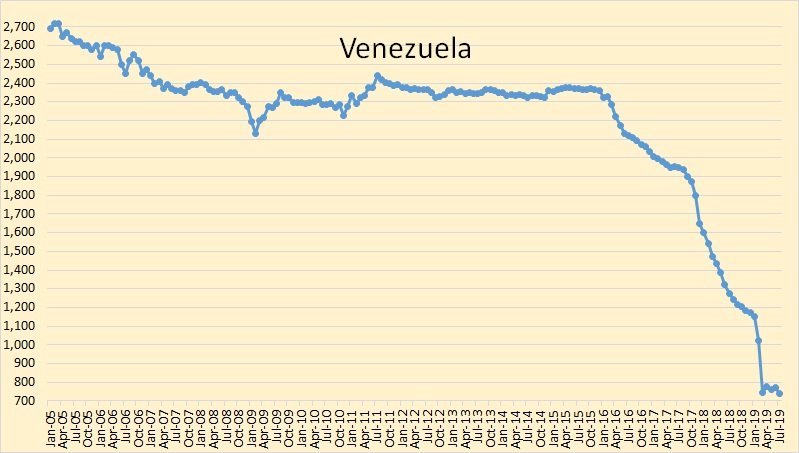

Venezuela’s crude oil production decline appears to have reached a bottom.

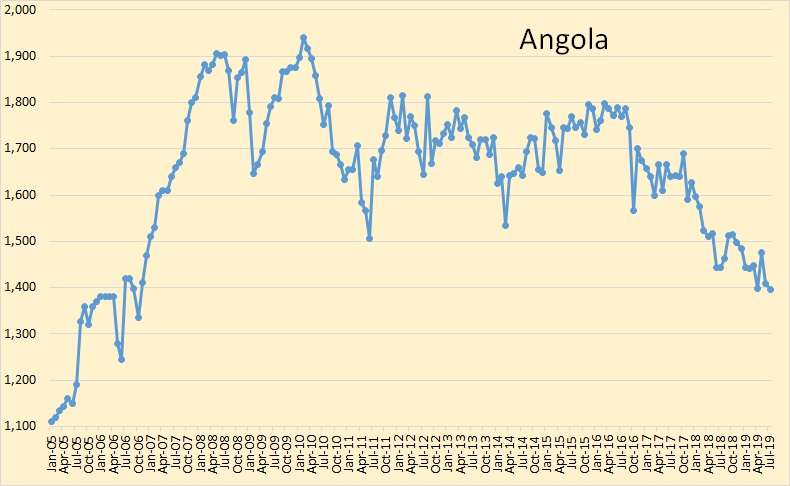

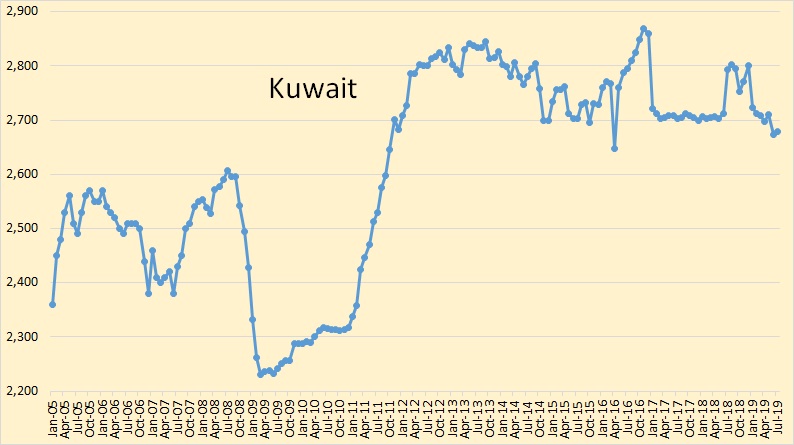

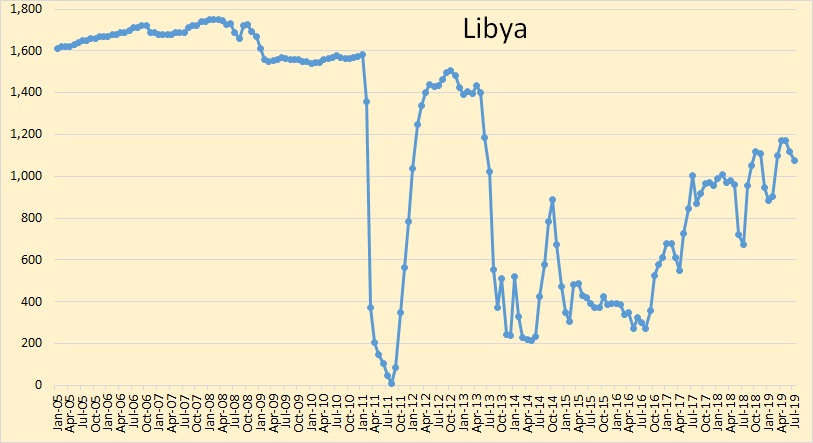

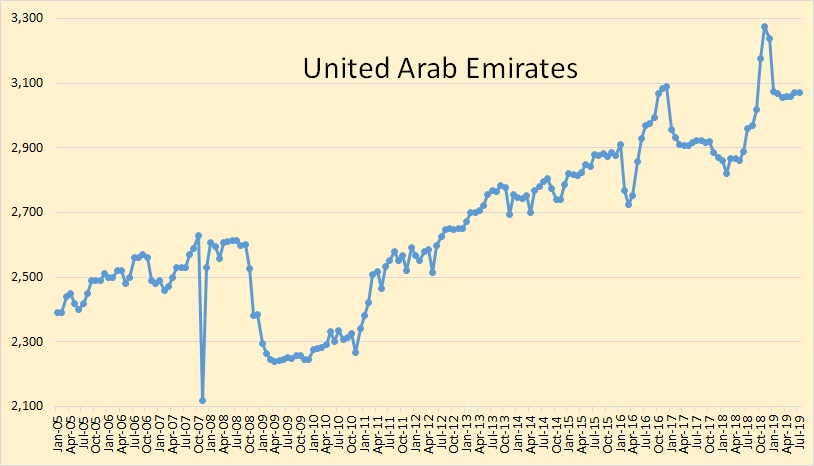

Libya, Iran, and Venezuela are exempt from OPEC quotas. Iraq is totally ignoring their quota as they are producing 241,000 barrels per day above their quota. I believe Nigeria and Angola are both producing flat out. Angola is producing 86,000 bpd below their quota while Nigeria is producing 101,000 bpd above their quota. Kuwait may be producing flat out as well as they are 46,000 bpd below their quota.

Saudi Arabia is the big question. Are they choosing to produce 613,000 barrels per day below their quota? Or perhaps there is another reason?

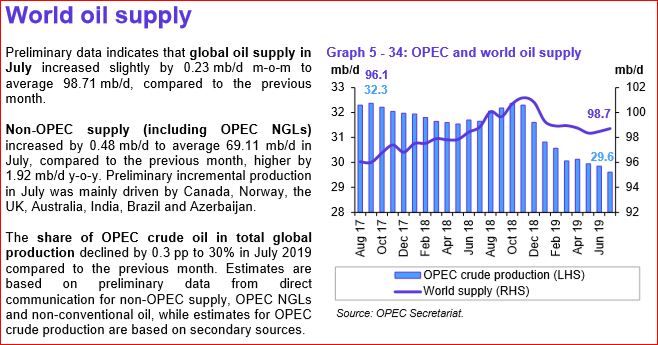

I am a bit skeptical of OPEC’s estimate of World total liquids supply of 98.7 mb/d. Also, their statement that OPEC crude share of global production is just not correct. OPEC production, crude only, has averaged 39% of world C+C. OPEC does not publish C+C data but if they did their C+C data would be well over 40% of all C+C production.

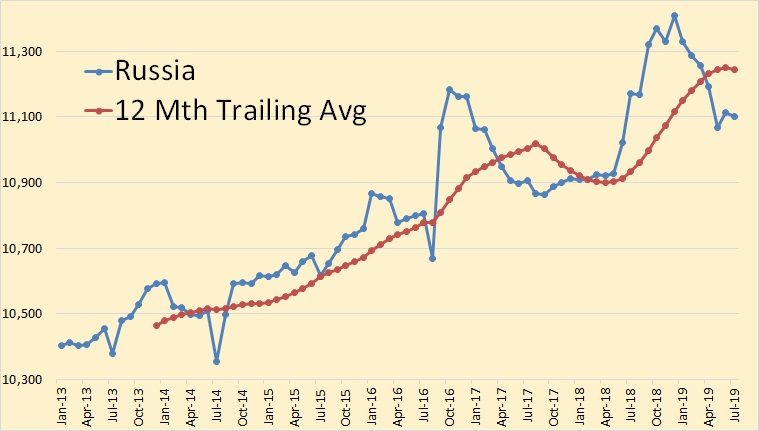

Russian C+C production was down 11,000 bpd in July according to the Russian Minister of Energy.

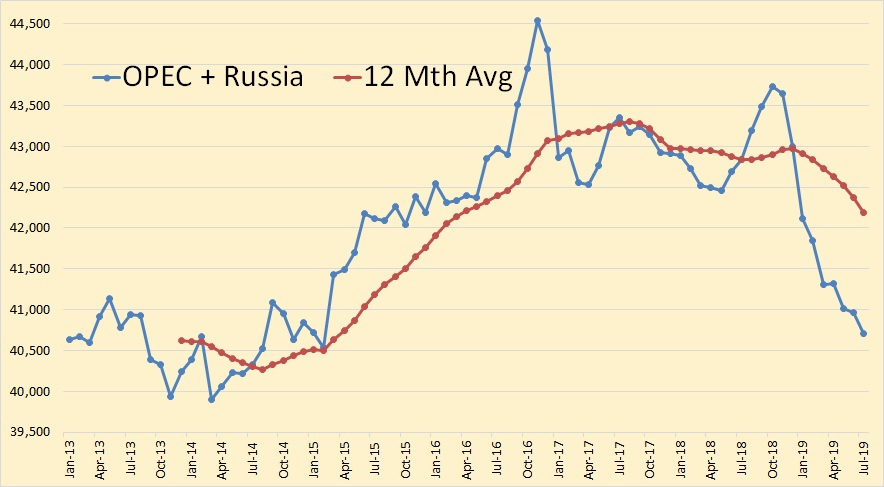

OPEC plus Russia C+C production averages over 55% of total world production.

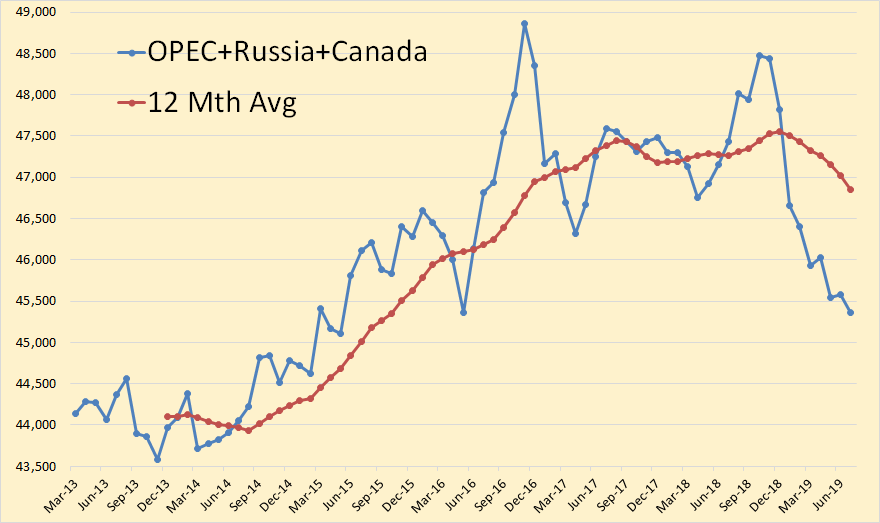

OPEC + Russia + Canada, over 58% of world oil production, through July.

About one third of the world production (non OPEC, USA, Can, Rus) entered what looks like terminal decline in late 2015. OPEC+Russia (about half of the world production) appears to have entered decline in late 2018. USA+Can cannot compensate and even appears to be peaking.

Peak Oil is here. Consumption keeps growing over 1% every year. Production grows less than 1% every year. The powers that be have only one way to handle the situation. Consumption needs to grow less and that means economical slowdown. For some countries recession is coming.

Carlos

Last year the United States alone increased production more than global demand increased. Therefore OPEC + cut production to support prices.

The United States will increase production this year by more than global demand requires. That is why prices are so low.

Oil demand and production are still increasing, so we have not hit peak oil.

Keep watching the monthly EIA 914 reports. It won’t come close. And, latest reports indicate a larger than norm hurricane season.

Year to date.

10.8 to 12.3. which is 1.5 million barrels per day increase in C&C which is more than global demand increase. This is why OPEC + are making cuts.

https://www.aljazeera.com/ajimpact/opec-oil-production-cuts-2020-190701153530944.html

Hugo, I don’t think you are looking at this correctly.

Look at the OPEC+Russia chart in this page. It is down to 40.5 kbpd, its 2014 level, with a loss of 2.5 kbpd from their peak.

Then look at the Non-(OPEC/Russia/USA/Canada) or rest of the world chart here:

http://peakoilbarrel.com/usa-and-world-oil-production-3/

It is down to 24 kbpd, a loss of over 1.5 kbpd since 2015.

Canada+USA is about 16.5 kbpd as seen here:

http://peakoilbarrel.com/world-oil-production-as-of-march-2019/

So what we have is that OPEC+Rusia and “rest of the world” have lost about 4 kbpd from their respective peaks and their combined production is now lower than it was in early 2015. That’s 80% of C+C oil world production that has peaked and is declining.

Canada+USA account for 20% C+C oil world production. The US fracking industry has lost hundreds of billions of dollars already and somehow you think they will continue expanding to cover for production loses from the rest of the 80% world production plus a >1% yearly increase. We don’t even know if that expansion is possible even if money is not an issue.

Although oil production could increase from Iran, Libya, and Venezuela if things change for the better, it is doubtful that it will happen before oil production enters terminal decline as we are hit by the effect of low capital investment in new projects. Peak Oil is an immediate reality and we will suffer its effects long before the cause is clearly identified by most people.

Peak Oil was avoided in 2005 by fracking of shale oil, and was avoided again in 2015 by the shale oil industry continuing operation despite being profoundly uneconomical, thanks to central banks zirp and monetary expansion. Third time in 2019 is probably the charm.

I mean mbpd not kbpd.

Carlos

OPEC plus have not lost oil production, they have made production cuts in order to try and prop up prices. I can assure you Saudi Arabia does not have a natural decline rate of 15% per year. It has made these cuts.

Iran could produce another 1.5mmbd, but the sanctions means it cannot sell that oil to anyone.

If we were at peak oil and China, India, Japan, Europe etc were struggling to buy the oil they needed. Then oil prices would be over $100 and more. At the moment they cannot give it away.

We are at least 3 years away from peak oil and more likely 5.

Hugo,

The cuts are imaginary. They tried the cuts in the 1980s and it was a disaster in terms of lost market share to them. So this time they have fake cuts to move the markets. The drop in production is quite similar to the drop in production from Iran and Venezuela, so it looks like they are losing production from some nations with the rest unable/unwilling to compensate and selling it as voluntary cuts.

World oil production is at the same level as a year ago

http://peakoilbarrel.com/wp-content/uploads/2019/06/World.jpg

So there hasn’t been any increase in production, while demand has increased. Curiously prices are going down and inventories up. We can’t trust the inventory data as it is an easy way to manipulate prices. The solution must be that a slowing in demand is anticipated from further economic deterioration.

In 5 years we might not be able to return to peak production even if we try. Depletion and lack of investment will play against.

Carlos

Do you believe US oil production figures?

I have no reason to doubt them.

Do you believe US production will continue to increase over the next years enough to compensate other nations decline? If not who do you think will increase its production enough to continue increasing world production?

Good, therefore you can see US production has increased more than global demand required. That is why oil prices fell under $30 at one point.

OPEC + then decided to cut production, you can see it in the graph above, from late 2018.

Anyway if you do not want to believe the obvious facts, I will not stop you believing what you want.

For first time in history heavy oil from norwegian field catches premium over Brent….the world is short of heavy oil

USA production isn’t remotely sustainable, nevermind a continuous offsetting increase of other people’s terminal decline. Besides the structural unprofitablity, its implausible that the resources in place are as large as the EIA estimates. No one on the ground believes that. They keep going back to the same almost saturated sweet spots despite the spacing issues. The supermajors don’t believe it either as their interest in buying lower tier acreage or companies that mostly have that left is nonexistent. They need new production but they don’t want this stuff.

Russia, KSA and a few others are deliberately restricting their production levels in order to support prices. Also, Iran & Iraq can massively increase from their current production levels if (when) the need arises. There is no Peak Oil and there won’t be any during the next several decades at the very least.

It appears that the US (25% of global oil consumption/waste?) has but 3 choices. 1. Become Trading partners with Russia and Iran. 2. Get serious on Energy Transition execution. 3. War, Terror and more regime change 4. Deploy the Alan Parsons Project.

https://youtu.be/Ei_GZnrr1nw?t=23

What say You?

Usually 1 and 3 are combined in the resource rich country aren’t they? Then it goes wrong some way down the road when the new regime ‘turn’, and things get worse than before

3. seems to fit the history. I don’t blame anyone not patient enough to scroll down to the bottom.

https://en.wikipedia.org/wiki/List_of_wars_involving_the_United_States

RRC data. Dennis gives no value to RRC completion data, and I don’t blame him. However, the permit info in the report is real time. Wells won’t be drilled without permits. Time from permit to completion is, usually, six to nine months. If they are lucky, five months. Problem is, the well type (horizontal vs verticals or directional) is not broken out. It can be used for trends, however.

From January to July, these are the totals for total oil, or oil and gas wells for Texas:

1035, 843, 1003, 786, 893, 853, 749

This is the same for the EF:

201, 192, 218, 150, 164, 176, 112

For the Permian:

711, 546, 612, 476, 577, 554, 479

Trend is down. Gate to new pipelines now open. If, they expected to drill more to fill it up, permits would reflect that. They don’t. As some reference, there were 183 approved vertical permits for the Permian for July. That’s a little higher than average, which the report I pulled for the year, puts them at an average of 104. Texas production will not be up much for this year. Nor, does it look promising for the first of next year.

GuyM,

Trend may be down a bit. Seems there are often an excess number of permits so there may be plenty of permits issued waiting for drilling or completion. So far tight oil production has continued to increase, though the rate of increase is slower than 2018.

Yes. Peak oil is now.

Oh for God’s sake.

Here you go, chew on this. The day there are the initial 2 mile long lines at gasoline stations, not just in the US but all over the world . . . that day we will still see announcements of record oil production globally.

This is species killing stuff. Wall Street popular saying . . . no one rings a bell at the top. Well, no one is going to give you any warning whatsoever that oil scarcity deaths start that month. You will know nothing of it. You will be told it is all from some temporary factor that will soon be fixed.

So if you see something now that looks like a warning sign, it’s probably not legit.

We had peak oil, conventionally, already. Just caused lower consumption due to the higher price. That will come first, again.

I doubt peak oil is now, I would say 2023 at the earliest and 2027 at the latest, best guess remains 2025.

Could be. Depends on the survival rate of independents. I dont think the majors would get their price, and we may wind up with some extended chapter 11s.

I doubt peak oil is now also. World oil production is about 2 million barrels per day below what it was in November 2018. Down 2 million barrels per day is definitely not a peak.

Ron, do I read some irony between your lines?

Perhaps. OPEC is producing at 2011 levels. The world is kept at bay from peak oil only by US shale production. And US shale production is on shaky legs, just trying to stay ahead of the red queen.

I just don’t see this blind optimism that US shale will continue upward for the next 5 to 6 years.

I well remember when it was said that: “When Saudi Arabia peaks, the world peaks”. That was just not correct. But now it is obvious that when the US of A peaks, the world peaks.

Ron,

I agree US peak will likely be close to World peak (perhaps one year before.)

OPEC/NOPEC has cut output to support oil prices, if they rise, the cuts will end. US output will continue to increase at least until 2024 in my opinion.

OPEC output varies based on the price of oil, this has mostly been true since 1988, and is likely to continue until 2030.

Dennis, OPEC produced more oil per day in 2005 than they are producing today. OPEC peaked in 2016. End of story.

OPEC will not save the world from peak oil.

Hi Ron,

I guess I thought we were talking about the World peak, the question is can OPEC increase output, I maintain that they can and will choose to do so when oil prices rise.

It is the combination of rising US output and the increase in OPEC output that will keep the trailing 12 month average of World C+C output rising until 2025.

Dennis, OPEC average daily production in 2016 was 32,113,000 barrels per day. In 2018 every OPEC nation was producing flat out, no cuts, no quotas. In 2018 they produced 31,857,000 barrels per day. In 2019 they are averaging 30,134,000 barrels per day. And that is still with most OPEC nations producing flat out.

Nuff said.

But 2 opec countries are under sanction. Thats 3 to 4 mbod without question. Then there is the ability of at least iran and iraq to achieve 10mbod each over time and sustain that for 20 or more years.

. Thats 3 to 4 mbod without question.

Sanctions are not affecting Venezuela’s oil production. It is collapsing for another reason. And it will take them a decade or more to recover when they finally settle their economic problems.

But there will always be political problems. They are likely to get worse, not better.

Peak oil will be when the most oil is produced, not what could be produced if there were no political problems anywhere in the world.

Ron,

In 2019 all except Iran and Saudi Arabia look like they are producing flat out, higher oil prices in the future will likely end OPEC cuts and OPEC output will increase by 600 kb/d at minimum. If the US settles its dispute with Iran, Iranian output could increase by 1300 kb/d. I imagine high oil prices might lead Trump to change course on Iranian sanctions.

Ron Wrote:

“Peak oil will be when the most oil is produced, not what could be produced if there were no political problems anywhere in the world.”

🙂

Dennis, Maybe that’s D Trump’s strategy before the next US President election, to settle the dispute with Iran and lower the oil prices and take the credit for doing so.

Tom,

That is a possibility, hopefully many citizens will see that it is BS, Trump is full of it, but fools enough voters to get elected, he may pull it off in 2020, incumbency is surely an advantage.

Opec will not save the world and neither will USA . The problem is that all the increase in the last few years is from shale or LTO ,call it what you will . Problem is that this is mostly + 45 API so poor in middle distillates . In reality peak oil is when the^ black goo^ peaks . NGL’s ,NGPL,s ,bio fuels, LTO and the term ^all liquids^ are used as a fig leaf to hide the real peak of the ^black goo ^ . We are past peak as far as the ^black goo^ is concerned .

The nature of the liquid is a big deal.

The bigger deal is this believing of numbers that come from people with agendas.

You’re not going to get any warning. No one has any incentive to give anyone correct data.

“The problem is that all the increase in the last few years is from shale or LTO ,call it what you will . Problem is that this is mostly + 45 API so poor in middle distillates . “

In 2005 (!) on Bloomberg tv channel someone said, in other words, that the most valuable oil to make kerosene of is increasingly difficult to get. I guess that kerosene is a middle distillate.

The shale oil boom might last for many decades, for what it is worth

The shale oil boom might last for many decades, for what it is worth.

Shale production may continue for a decade, or a bit longer, but not decades. However, that is not the point. The point is, how long can shale continue to increase production.

The legacy decline for shale varies between 5% and 6% per month! The EIA’s Drilling Productivity Report says US Shale production will increase by 85,000 barrels per day in September. Probably not, but that is not the point. To get an increase of 85,000 barrels per day, they had to have new well production of 649,000 barrels per day. That is because they had 564,000 barrels per day of legacy decline. For every one barrel per day of increased production, they had to produce 7.64 barrels per day of new oil because they had 6.64 barrels per day of legacy decline.

The more they produce the more they have to produce just to stay even.

For every one barrel per day of increased production, they had to produce 7.64 barrels per day of new oil.

This is the key point regarding shale oil production. The higher the production, the more new production is needed to increase production. It’s essentially an exponential function. Shale oil production will not increase for much longer because it’s not physically possible to drill/frack at a sustained exponential rate.

This is the key

Frugal, damn, why is that so hard for some people to understand?

I don’t see this exponential problem in shale.

Shale production is not oil production, it’s mining.

You need 3 drilling teams, 4 fracking teams and get over long time a constant production. When you want to increase (say you have enough acres, as enough ore in a iron mine) you hire 2 new teams, as in mining employing a new excavator and conveyor belts.

So, like in a mine, when you fire a team production drops almost immediately.

The big ones (XON) in the Permian do Shale oil mining exactly like this – they have own drilling and fracking team, working constantly.

The same thing as mining is when you have to drill your b-class acres. As in a mine when the ore veins run out in thickness.

So either close your mine, hire more teams to maintain production or life with decreasing production at constant costs when the qulity is declining.

I’ve left out technical progress. This is just a cost reducer (need less drilling / fracking teams to do the same output).

Eulenspiegel, your mining example is not a good comparison at all. That is because new mines don’t decline in production by 6% per month.

Here is the exponential function of shale oil. They must produce new oil at the decline rate just to stay even. Growth in production is only accomplished if they produce more oil than declined that month.

But if they do produce more oil than the decline rate, then the decline will be even higher the next month. That is, if they had to produce 649,000 barrels of new oil in September to grow production by 85,000 barrels, then to grow oil by a like amount in October, they will have to produce more than 649,000 barrels. The more they increase production each month, then the more they will have to produce the next month just to stay even.

When production increases, the monthly loss through legacy decline also increases. Therefore just producing the same increase as they did last month will not do. They must always continue to increase by more than they did last month just to stay even.

As always: The greatest shortcoming of the human race is our inability to understand the exponential function

Ron, in my opinion it is a better model than conventional oil.

In conventional oil, you can pump 20 years after drilling. For 50 you’ll have to do more things like water flooding etc. So increasing production is just drilling a few more holes (and install the additional infrastructure).

In mining, you have a decline rate of 100% / day.

You send a team in, they mine 100 tons of ore in their shift, move out and production after their shift is 0.

When you want more ore, you have to send in a team next day again.

Having 1 minint team gives you constant ore / day. Firing them gives you sudden production of 0.

So with LTO you send a fracking team in to create 1 well, produce oil for a few months (I’m exaggerating) and then you have 0 production again.

So you have to send in the team again. And again.

If you use 1 team drillling constantly new holes. you’ll have nearly constant production (after the first ramp up time of overlaying declining productions, in reality a few years).

Increasing production means more teams constantly drilling new holes (as in mining: drill hole, fill with explosives, boom, carry away ore, repeat).

The big question for the peak shale oil is here: How many drilling/fracking teams can be payed and supplied with anything they need for working efficient. It’s not just hiring teams.

To employ more teams they need more road capacity, sand capacity, water transport, take away pipelines, more stuff … you know better than me.

As in deep mining: The elevator capacity / tunnel train capacity limits the maximum possible production. For increasing production, you have to increase everything, and then hire new teams.

So the question is: How much money do they invest to stretch all these capacities.

Frugal,

I model the production that will occur. An exponential increase in completion rate is not needed, a linear increase will do. In fact the completion rate can be constant and if that constant is high enough, the output will increase for quite a while (though the rate of increase will gradually slow.) A key factor is that eventually the EUR of the average completed well will decrease as sweet spots get saturated with wells. It is difficult to predict exactly when this will occur. My guess is that it will be 2020 for Eagle ford and Bakken and perhaps 2023 for the Permian Basin and Niobrara. For the Permian Basin if the completion rate matches the average completion rate for the first 6 months of 2019 from July 2019 to June 2037, then output increases from 3530 kb/d in June 2019 to 5368 kb/d in June 2029 (5200 kb/d in July 2025 and 5000 kb/d in Jan 2024). No exponential increases needed, just a constant completion rate is enough.

If oil prices increase at some point, it is likely that the completion rate will increase gradually and output is likely to increase faster than this exceedingly conservative scenario.

According to Dennis,

For the Permian Basin if the completion rate matches the average completion rate for the first 6 months of 2019 from July 2019 to June 2037, then output increases from 3530 kb/d in June 2019 to 5368 kb/d in June 2029 (5200 kb/d in July 2025 and 5000 kb/d in Jan 2024).

And according to Ron:

To get an increase of 85,000 barrels per day, they had to have new well production of 649,000 barrels per day. That is because they had 564,000 barrels per day of legacy decline.

Now if the ratios stay the same up to January 2029:

Legacy decline in 2029 = 5368/3530 x 564,000 = 858,000 barrels/day/month

But the average completion rate for the first 6 months of 2019 produces only 649,000 barrels/day/month of new oil.

This gives an initial production decline in June 2029 of 858,000 – 649,000 = 209,000 barrels/day/month.

Frugal, of course. How simple is that? If monthly production increases. Then legacy decline also increases. Therefore, assuming production per new well stays the same, then completions must increase every month to compensate for the increased legacy decline.

Ron, monthly completions can stay constant to produce at the same level, they can even slow somewhat.

When a region drills 100 holes / month (all same quality), the first year they will get much growth, the second year round about 20% ( since the wells from last year declined 80%), the third year 4% and after this it’s nearly constant. Not exactly right, but that’s the direction.

The wells from year 2 deliver exact as much in their first year than the wells from year 1. So total production is adds year 1 production 100% + year 2 production from the first batch of wells (20%).

In year 3 it’s 100% + 20% + 4% from a years production.

And so on until the wells are closed.

And they have to continue drilling theses holes, month after month or decline.

But production will never decline when drilling the same amount of same quality wells.

When they want to grow, they have to increase to for example 120/month – and stay there. So more $$$ each month, not just a growth spurt. When they go back to 100, they’ll decline after a adjusting time.

Worse quality of new holes has to be directly compensated by drilling more holes, for more $$$ and even worse cashflow.

With the same quality, you’ll never drop production while drilling the same number of new holes. Sinking production by constant drilling activity indicates other problems: Frack hits, running out of good acres, wrong length or spacing or other calamities.

That’s a warning sign to look for. And a sign that this basin has seen it best days.

Frugal,

I was looking at Permian basin only and Ron was looking at all US tight oil so you cant really use these two estimates. The fact is the legacy decline does not increase very much if the completion rate remains constant.

For July 2019 Permian legacy decline was 264 kb/d according to DPR.

The estimate from my model is in chart below with constant completion rate (no increase or decrease in completions per month) from July 2019 to July 2035.

click on chart for larger view.

Ron, monthly completions can stay constant to produce at the same level, they can even slow somewhat.

Eulenspiegel, please try to understand the argument Dennis is making. He is not talking about production staying at the level, he is talking about output increasing from 3530 kb/d in June 2019 to 5368 kb/d in June 2029…..with no increase in completion rate. That is, the completion rate remains the same.

Dennis wrote:

The fact is the legacy decline does not increase very much if the completion rate remains constant.

No, of course, it doesn’t. It doesn’t because production does not increase either.

I have posted below a chart of Permian legacy decline rate since 2013. Legacy decline rate for the Permian is currently around 6% per month.

Hi Ron,

To be clear, my model has no increase in completion rate for the Permian basin, it is held at the average rate for the first 6 months of 2019 which I estimate (based on my model and the EIA tight oil production estimate by play) at 456 completions per month on average from Jan 2019 to June 2019.

Bottom line there are a lot of completions (5472 per year on average from July 2019 to June 2029) or a total of 54,720 new wells completed over that period.

Not quite “no increase in completions”, which suggests no wells are completed after June 2019. That would be a very different scenario. 🙂

Not quite “no increase in completions”, which suggests no wells are completed after June 2019. That would be a very different scenario. ?

I thought the meaning was quite clear. At any rate I have added “rate” to the sentence to clear things up.

Shale decline curves are hyperbolic.

Fernando said:

“Shale decline curves are hyperbolic.”

In terms of math it’s considered hyperbolic, but in terms of physics it’s diffusional. There’s a huge diffusional spike initially followed by a low-rate fat-tail, which gives it that hyperbolic (non-exponential) shape. The tail may be fat, but low enough as to be of arguable value.

If the diffusion shows any limiting factor, then the model is Ornstein-Uhlenbeck, and the fat-tail essentially disappears and it damps quickly.

Bottom-line, Dennis does indeed apply a hyperbolic model in that chart.

Hi Ron,

The scenario shows that output does indeed increase for a time, so your assumption that there is no output growth when completion rate remains fixed is incorrect.

Ron Wrote:

“When Saudi Arabia peaks, the world peaks”…But now it is obvious that when the US of A peaks, the world peaks.

So who gets to ride the camel, Me or my son?

“My father rode a camel. I drive a car. My son flies a jet airplane. His son will ride a camel.”

Well the world’s conventional oil production certainly peaked a while ago. Even if one treats Venezuela and Canada as conventional because their production was usually in forecasts, the USA fracking has to be considered a separate thing. The industry cycle is different, the grade produced is different, the economics are “different.” The tail is *very* different as without new drilling the entire patch would disappear in less than three years. Blap, gone to stripper wells.

Hi Ron,

I judge the peak by 12 month trailing averages. For the World C+C trailing 12 month average peak is April 2019 at 82925 kb/d based on EIA data. We will have to wait to see what the June 2019 12 month trailing average will be, as so far the data for May and June 2019 for the World is incomplete.

I somehow feel the truth lays somewhere between Ron and Dennis. Reality is much more chaotic than Dennis’s predictions, albeit there could be more oil in the ground than assumed by Ron: Probably some undulating chaos lies ahead of us where the peak, especially if it doesn’t refer to a 12-month-average, could appear at any place along the timeline of the next five years.

Dennis, 2018 oil production is the average for January through December production. Ditto for 2019 production. The peak year will be the peak year.

Dennis, this ain’t rocket science. And this ain’t April, it’s August.

Not so fast Ron

This is the age of Trump. I know for us simpletons it makes sense the average would be production. I’m not sure how Trump would do it, but I’ll bet the tangerine could make 2019 peak the best ever. A world depression followed by war.

Peace

Ron,

You can do as you choose, I look at rolling 12 month averages. Yes it is august, but we only have World C+C data through April 2019, so the trailing 12 month average for World C+C output in April is the maximum to date for the data we have. Yes not rocket science, quite simple.

So you can go by peak year, I will continue to focus on the peak 12 month period instead. No right answer, just a different approach.

Hi Ron,

Do you have data for World C+C output from May, June, July, and August of 2019? Latest data from the EIA is April 2019.

No, but OPEC + Russia + Canada, about 58% of world oil production, is down 667,000 barrels per day, April to July. I doubt that the other 42% of world oil production is up anywhere near that amount.

The 2019 7 month average for OPEC + Russia + Canada is 1,629,000 barrels per day below their 2018 average.

I have posted that chart up top, just below OPEC+ Russia.

US tight oil up 351 kb/d from April to July, so if condensate output from OPEC was unchanged, and the rest of the World saw no change in output the World would be down by 316 kb/d. US tight oil average output for the first 7 months of 2019 is 944 kb/d higher than the 2018 average, so 2019 is lower than 2018 so far (assuming other areas have remained at 2018 levels.) OPEC and Russian output can probably increase if oil prices rise. Currently they are trying to cut supply to raise oil prices. This may result in lower output in 2019 compared to 2018.

Yemen rebel drone attack targets remote Saudi oil field

https://www.miamiherald.com/news/business/article234108062.html

Things are getting even more interesting.

This attack was 750 miles from Houthi territory.

Round trip would be 1,500 miles.

A Predator has a published range of 1,150 miles.

My guess is they are infiltrating Saudi Arabia, attacking from much closer than 750 miles out and maybe sacrificing the drone. Sort of like the Jimmy Doolittle raid on Tokyo in WWII, for similar purpose. With a similar result. Message sent, message received.

You know more than I do.

Sounds reasonable.

It’s a one way trip. The drones used by houthis don’t fire a missile and then fly home, they are the missile. The drone is mounted with a 30kg warhead and it is flown into the target, usually in a swarm attack.

https://www.defensenews.com/unmanned/2019/05/21/how-yemens-rebels-increasingly-deploy-drones/

https://en.m.wikipedia.org/wiki/HESA_Ababil

Thats was my understanding also—

For those interested, Houthis have been using drones to attack the radar components of Patriot surface-to-air missile systems for a few years now.

‘Kamikaze’ drones used by Houthi forces to attack Coalition missile defence systems

https://www.conflictarm.com/download-file/?report_id=2465&file_id=2467

Thanks for the information. That’s fascinating. The ability of small groups to project force seems to keep growing.

Inventory draws should begin to pick up for the US soon. 1 million in pipeline from the Permian to the coast. Exports to increase, Cushing to decrease, and production mostly flat. A lot of the Permian production has been going to Cushing as an outlet. Depends on how much can be loaded on to ships, now, and how much lite oil can be sold. Pipelines are going to be losers for awhile. Additional pipelines need to take note.

There are two, sure fire, statistics and reports that will define where we are going. You can argue them, but you will lose. One is the EIA monthly 914 report, the other is the Texas RRC permits. There’s some DUCs, but by this time, I consider them as normal DUCs between drilling and completion as is norm. And the 914 May show it up a little for June, but I don’t see it going up further. Or, much more.

Guy

Attached is the latest LTO data from the monthly EIA 914 page. The main difference that I can see is the drop in the monthly production growth from 2018 to 2019. 2018 production growth averaged 153 kb/d/mth. 2019 production growth over the first seven months has dropped to an average of 97 kb/d/mth. The total July increase over June was 107 kb/d/mth. The biggest increases for July came from Sprayberry (33 kb/d) and Wolfcamp (46 kb/d).

Not sure what that is. This is what I was referring to:

https://www.eia.gov/petroleum/production/

Any estimates past this point in time are totally meaningless.

GuyM,

Tight oil is not broken out in monthly report.

Data is likely from “tight oil production estimates by play”, just search on google.

Or go to link below then click on excel file under tight oil production estimates by play

https://www.eia.gov/petroleum/data.php#crude

EIA estimate based on drilling info data is 7534 kb/d in May, 7637 kb/d in June and 7744 kb/d in July 2019.

Fairly sure this is what Ovi used.

Almost all of the tight oil increase from Dec 2018 to July 2018 is from the Permian basin, 405 kb/d for Permian vs 429 kb/d for US tight oil increased output over the past 7 months. For first 5 months of 2019 Permian output increased by 237 kb/d with US tight oil increase of only 219 kb/d.

Guy/Dennis

That is the data I used. I summed the production from all of the plays and separated the data into 2018 and 2019 to see if there was a difference in the growth. Below are the charts for the 9 plays. As you can see the two biggest growth plays are Spraberry and Wolfcamp. Bonespring and Niobrara still showing slow growth.

Second chart

Thanks Ovi,

Your second trendline on your first chart suggests a recent trend of 97 kb/d for monthly increase or an annual increase of 1164 kb/d. If the trend were followed from Feb 2019 to Dec 2019 it would suggest about an 870 kb/d increase in US tight oil output from Dec 2018 to Dec 2019. I think there might be a slowdown the last half of 2019 so would estimate something like a 650 kb/d increase over the Dec 2018 to Dec 2019 period for US tight oil output. That estimate is pretty conservative if the July EIA estimate is correct as we have already seen a 429 kb/d increase in tight oil output from Dec 2018 to July 2019, so my estimate suggests only an average monthly increase in tight oil output of only 44 kb/d for the last 5 months of the year.

Dennis

My plan is to leave the line the same and track the updated data to see if production starts to fall away and begins to roll over. Unfortunately, the latest data indicates an increasing trend. Here are a few of the latest monthly growth numbers. I wonder if the March increase was a result of info errors (missing data) in the January and February data.

Growth

March 209 kb/mth

April 60

May 81

June 103

July 107

Yeah, but it is but estimate guesses. There more likely scenario is that Bakken, EF and Okla. are already starting to go down by June/July. But, time will tell.

Guy

Bakken appears to be plateauing. However its production was up by 30.8 kb/d (Only Bakken) in June to 1.367 Mb/d.

Ok, bad choice of words, again. By down, I meant little or no growth. And, that’s what I expect from the rest of this year, net.

GuyM,

Yes so far for US LTO in 2019, if we exclude the Permian basin there has been almost no growth in output, so I agree with your guess for everything except the Permian basin, there I expect the growth is likely to continue, but at a somewhat slower rate than the first half of the year.

Thanks for valuable informstion Guy, in my mind from what I have read the shail oil have change some caracter espesialy in 2019. It have become more light that means lower quality. If quality goes down this will mean less profit if any at all to drill new wells after all exspensives, loan balones are payed. The good thing is it seems now low sulfur diesel demand increase because new IMO rules and prices, refinery margins in Asia increases. But it might be this will have minor Impact for WTI price as they demand more heavey oil , brent i.e for their marine diesel..

Is Brazil C&C production on a peak plateau?

Source EIA

Entirely possible. All their new production are high investment, high risk, high decline deepwater projects. Making that all go right on cue is difficult.

To me the interesting graph here is Saudi Arabia. Ignoring the spike in 2018 where they were likely pulling from storage to increase their rates for bargaining clout prior to the OPEC+ cuts, there is a clear trend line from middle 2017 to now of a gradual 1.5-2% decline in production. With little left to bring online and Ghawar apparently in decline, I wouldn’t be surprised if this trend line is their maximum production.

Is Saudi Arabia post peak C&C?

Source EIA

Tony, from this graph it can’t be concluded. Since the year 1997 one could have asked the same question at least seven times. The same number of small dips have occurred since then.

Time will tell what happens with world production when oilprices rise. Could be that quite some countries have spare capacity. However, depletion never sleeps: a phrase that will never lose its meaning. Maybe within 3-4 years from now more countries are past peak, which could be bad news for total oil exports.

A reason to go long on NG? US consumption rate is mind-boggling. NG is now banned for new construction in some regions.

https://www.zerohedge.com/news/2019-08-15/americas-chernobyl-three-mile-island-set-finally-close-its-doors

https://blog.ucsusa.org/mark-specht/why-berkeley-banned-natural-gas-in-new-buildings

“A reason to go long on NG? US consumption rate is mind-boggling. NG is now banned for new construction in some regions.”

Should get interesting when NG prices start rising considering that Power companies have been shutting down lots of coal and nuclear plants & replacing then with NG plants. It would not surprise me to see power prices soaring to 35 to 50 cents per kwh in the US. I would imagine lots of people that use NG or Propane for heating also find it difficult to heat their homes in the winter.

My advice is to relocate someplace with moderate weather: Not too cold (heating) or not too hot (air conditioning) as energy prices rise. Either build new or retrofit your home to be extremely energy efficient. My guess is that probably 50% of US home are not going to be livable without affordable heating & cooling. During the bubble years lots of poor quality homes need cheap energy. Not sure if many of them could be retrofitted because of poor layouts & construction.

Also a good idea not to relocate near any major urban regions. I would imagine high unemployment, uncomfortable living conditions is going to make a lot of unhappy & desperate campers: ie lots of violence, riots, general despair.

Or, move to Texas. Unlimited NG and has its own energy grid.

Unless you have 25,000 gal Buried Propane tank to last you a Lifetime, I’d consider lightly populated areas of the Ozarks, IMO Need to be above 1500 feet elevation and have ancient water. I’ve been buying remote land with and without grid access for decades. If anyone wants to share strategies email me at my handle at gmail. Texas Energy much too Fragile and Centralized. Solar 2.0 will allow abundant battery-optional energy. You can light a mansion with a handful of 18650’s, so you really don’t need much in that way of eChem Storage. Note that Li Batteries are on the Sept 1st Tariff List. So if you been thinking of a BattleBorn LFP (Lithium Phosphate) Battery for your RV or UPS, now may be the best time for a while.

GuyM

“move to Texas. Unlimited NG and has its own energy grid.”

Not for me. TX is morphing into Southern California. I doubt TX has unlimited NG. I recall TX already has a few NG shortages about a decade ago when some cold snaps happened. I suspect a lot of NG is tied with Shale production. If the shale drillers go bust, NG prices will rise in TX just like everywhere else.

More recently:

“Power Blows Past $9,000 Cap in Texas as Heat Triggers Emergency”

https://www.bloomberg.com/news/articles/2019-08-13/texas-power-prices-briefly-surpass-9-000-amid-searing-heat

That’s ok. Sure we won’t miss you. Nah, only Austin is resembling SC. Rest is pretty normal.

Austin is the only place in Texas I would even consider living in and even the blues can only sustain you for so long.

Austin is at least 1/2 hour from Texas.

“It would not surprise me to see power prices soaring to 35 to 50 cents per kwh in the US.”

Over what sort of time frame? Maybe for short periods in the short term but, prices like that would result in massive surges of capacity growth for wind and solar. LCOE for solar and wind are now under 2c per kWh in some locations and I suspect at some point in the next decade they will both have an LCOE of under a cent per kWh. 35 to 50 cents? Please!

IslandBoy Wrote:

“Maybe for short periods in the short term but, prices like that would result in massive surges of capacity growth for wind and solar.”

I doubt it. Electric prices in Germany are about 35 to 40 cents per kwh, and they have a lot of solar & wind which is backed by cheap Polish Coal fired power plants. Issue with both Solar & wind is intermittent generation. Every watt produced by solar & wind in the US is backed by NG fired plants. There is no massive storage system to back Solar & wind production. The only reason why Solar & Wind works is due to the very low cost of NG prices & the fast ramp up/ramp down of NG fired turbines which can change output in just a minute or two.

US power companies are borrowing billions to replace old coal fired & nuclear plants with new NG plants. That debt isn’t going disappear even if NG prices go through the roof. The US also has an grid that is showing its age likely needing $300B to $500B in investment for updates and to replace worn out equipment and distribution lines over the next 25 years. We also have to pay a huge cost in decommission shutdown Nuclear power plants (currently shutting down between 2 & 4 Nuke plants per year).

The USA is dead broke with $23T in national debt, and about $70T in unfunded pensions & entitlements. Currently the only way the US economy can function is with ultra low interest rates so it can continue to borrow trillions to keep its doors open. Sooner or later the USA is going to run out road to kick the can, and my guess is that all comes apart in the 2020s.

The US lacks a skilled workforce for the electrical grid as there are few young workers in the industry. Most of the US power companies are in panic mode because their boomer workers are retiring & they cannot find replacements:

https://www.tdworld.com/safety-and-training/trends-report-power-companies-facing-labor-shortage-and-skills-gap

Plus NG is the #1 resource in the US for home heating and Domestic hot water. So even if somehow NG is completely eliminated (very improbable) from power generation it does nothing to solve heating needs.

I can only respond by saying I think Watcher is on to something with regards to money. US Politicians are unlikely to let a lack of money get between their voters and the voters’ energy needs. If money is what is needed, it will be borrowed or “quantitatively eased” or whatever (created out of thin air!). That applies to tight oil now and will probably apply to renewables any time they are seen as a viable substitute for FF. I follow developments in the solar PV, EV and battery space very closely. You might be surprised at some of the stuff that is coming down the pike!

Polish coal is not cheap anymore. Besides lignite, average shaft depth in Silesia (main coal region) is now 1 km (1000m!). Poland actually imports coal from Russia.

After problems with surges of German wind power, there is no direct power exchange between Poland and Germany too, the former mainly importing power from Sweden and Ukraine.

German power generation is mainly a mixture of wind, gas and lignite. They are opening new lignite places. Nuclear is on the way out there.

“The only reason why Solar & Wind works is due to the very low cost of NG prices & the fast ramp up/ramp down of NG fired turbines which can change output in just a minute or two.”

Not quite.

Wind and solar power do work in large part BECAUSE NG turbine plants can ramp up and down fast. TRUE.Fast ramping gas plants mean we don’t need to waste much fuel on so called ” hot spinning reserve” back up capacity.

BUT…….

The HIGHER NG prices and coal prices go, THE BETTER, as far as the wind and solar power industries are concerned.

And of course regardless of the prices of gas and coal, the more wind and solar power we use, the less gas and coal we have to buy to generate electricity.

Long term, that’s good for everybody except the owners of the coal and gas industries. Short term, the transition to using more wind and solar power may result in the price of electricity going up, for a while, to help pay for the new infrastructure.

If one wanted to buy a futures contract on the NYMEX for December, 2024 Henry Hub mmbtu price is $2.82.

Most expensive contract price between now and then is February, 2024 at $2.86.

(Prompt month is $2.20).

When can we expect US peak gas…? 2020? 2025? 2030?

OneofEU,

My guess is 2025 to 2030, I have not delved very deeply into US natural gas projections, I expect higher natural gas prices in the future may lead to better profits and continued drilling. In the past I have tended to underestimate, so perhaps 2030 is the better guess.

One of EU

Currently, the three state region of Pennsylvania, Ohio, and West Virginia are on track to exceed 11 Trillion cubic feet for 2019 production.

(To put 11 Tcf in context, one can scan recent years’ announcements regarding the size of ‘monster’ new finds, particularly in the eastern Mediterranean).

The US Department of Energy projects this region to continue to increase production with a ~20 Tcf annual output 30 years out … 2050.

The massive (check out USGS estimates) Mancos and Barnett plays are barely worked due, primarily, to the extraordinary abundance of both associated production as well as Appalachian Basin output.

The recent announcement of EQT’s new CEO – Toby Rice – that he is positioning his company, the largest natgas producer in the USA, to be viable at $2/mmbtu HH should be sending shock waves throughout the global energy market.

Peak US gas production is way too far out to remotely predict its timing, at this point.

Coffeeguyzz- thanks for the info.

I’m familiar with irrigation piping, but have no idea how nat gas gets from the well to the centralized processing facilities. How big are the pipes, how far do they generally run, how much flow is required to make collection and piping feasible? Seems like it would be difficult to make things work on a small scale.

Anybody have link to a site or article that explains this?, at a level that someone without industry experience would be able to digest, would be appreciated.

Hickory

Those are all great questions that I do not have ready answers to.

My understanding is that the gathering lines can run anywhere from the 4 inch all the way up to 16/20 inch size the closer they get to the processing plants. (Something like a couple dozen processing/fractionating plants on either side of, and within, the northern West Virginia panhandle).

Small independent companies along with the upstream operators are engaged in this activity.

The Appalachian Basin is an extremely difficult environment to emplace gathering lines for several reasons.

Some factors – not all – include the absence of pre set Drilling Units like most western states have.

Rugged, hilly, forested terrain.

Extreme pressure differential from Utica (5 to 8 thousand + psi) to the 2 1/2 – 4 thousand psi in the Marcellus.

(Upper Devonians are even lower).

Huge variance in “wetness” of the gas plays a role in where gas goes.

Some of the pads coming online have absolutely crazy high production numbers of well over 100 MMcfd for several months which plays a big role in the size/pressure specs of the gathering system.

It’s not sending shockwaves through the global energy market because it isn’t true.

EQT share price hasn’t been this low since 2003.

This smacks of EOG’s claim of being able to achieve attractive returns at $30 WTI, which also was not true.

When you are desperate you will say about anything.

These shale stocks won’t recover without higher oil and gas prices. 2017 hype is long gone.

I sold the two shale stocks I owned. I am strongly considering getting out of COP and XOM too. In particular XOM, which seems hell bent on losing money in the Permian Basin.

Just look at the 10Q. Terrible results.

Upstream has absolutely stunk up the place while the averages have risen to all time highs. I cannot think of a poorer managed industry than US shale. It’s embarrassing.

Shallow

If you followed the operational particulars of what Toby Rice is setting out to achieve, you might pause in your evaluation.

As I have said umpteen times over the years, a BIG problem in the upstream industry is the sheer quantity of product coming to market.

This is the main reason why, the very day AFTER EQT announced the stupendous 72 MM cf 24 Hr IP of its legendary Scotts Run, EQT’s stock DROPPED over 7%.

The awareness that, underlying the Mighty Marcellus, lurked a Big Brother of even more prodigious potential … a combined resource so vast that natgas would be available for generations to come … naturally diminished its value as a ‘scarce resource’.

If EQT cannot operate profitably at $2/mmbtu HH (a goal I think unattainable, BTW), then $2.20/$2.50 should still send shudders throughout the industry as I most definitely believe it can and will be done.

How?

As per Rice’s somewhat contrarian approach …

Hold lateral lengths to the 10k/12k range.

This faster drilling, shorter length will unleash the “cookie cutter” approach that Harold Hamm so successfully implemented in the early Bakken years.

Increase well spacing to the 1,000 horizontal range.

Superficial observers will quickly suspect lost interwell recovery. In actuality, while employing the latest targeting/completion techniques (especially Extreme Limited Entry), MORE hydrocarbon recovery will be had using FEWER wells.

Biggest tactic will be the successful implementation of massive, choreographed drilling/fracturing of thousands of wells located relatively close by … which was the primary reason the Rice’s sold to EQT in the first place.

At <$800/1,000 foot drill/completion cost, a 12,000 foot lateral will cost under $10 million.

At 20 Billion cubic feet EUR , @$2/mmbtu, $40 million gross revenue will be generated … a significant amount in the first 3 years.

The ripple effect of inexpensive hydrocarbons in gaseous form is still in the early stages of global impact.

When tiny Benin and New Caledonia are setting up electricity generation using LNG available via FSRUs, when the massive

Sergipe project in Brazil (the first of 3 Brazilian plants) is coming online, when BHGE is committed to providing 60 mtpa in modular LNG hardware (within shouting distance of Qatar's current production), it should be apparent that a huge shift is underway in the global energy world.

Coffee. It’s all talk and we all know that until gas prices rise, these companies aren’t worth investing in.

I don’t know what your motives are, but it seems that every company you tout in this space winds up broke.

I recall you making a big deal about a well called Purple Hayes drilled by Eclipse a couple years ago and how the technique would revolutionize the industry.

Care to let us know what happened to Eclipse?

I can’t think of an industry that has performed worse financially in my lifetime than US shale.

I defy you to go over every single post I’ve made on this site over several years and identify a single one where I have “touted” a single company.

Ever.

Conversely, should you care to check, you would find how I’ve always stressed my keen interest in the operational aspects of this industry … most especially cutting edge efforts.

The Purple Hayes well?

The one with the then-world-record of ~20,000 foot lateral, drilled in one trip in (IIRC) 13 days?

It had only been Ohio’s best oil producing oil well for several quarters running last I checked.

It has since been exceeded by a few others (Outlaw and Crawford).

Speaking of the now defunct Eclipse, their Painter 2H well in Tioga county is absolutely tearing up at almost 6 Bcf in less than 9 months online … targeting the Utica, no less.

Eclipse is gone … bye bye … folded into a new privately owned outfit called Montage which itself is the latest iteration of the long gone Magnum Hunter.

You are in the business end of hydrocarbon production, severely impacted by both the glut in supply and low price.

If you want some supporting “Those SOB shale guys” tripe you’ll not get it from me.

Continued, high US hydrocarbon production is Gar. Own. Teed. for several decades to come.

Natgas … a century’s worth.

Whether people wish for it or not … that’s the way it is.

coffeeguyzzzzzzz sezzzz:

Didn’t realize that Ohio was the new Bakken LOL

How can the fact that the shale companies are financial failures not be relevant?

I hope you aren’t one of these far left socialists that have recently come on the scene in the US.

I doubt you are, but yet, you do seem to be very capable of completely ignoring the financial aspects of the shale business.

Also, I do think the company that Eclipse merged into is a public company, with a stock price after a reverse stock split of under $3.

A $10,000 investment in Eclipse IPO is worth $77 today, just 5 years later.

How can that not be relevant to the discussion on this board??

The only way for producing companies to make profit in a commodity sector that is ‘oversupplied’ [as reflected in low price], be it potatoes, nat gas, or crude oil, is to restrict the supply so that price rises to a level where an efficient, low cost producer can be in the black financially.

In this economic scenario, you can buck the market forces in several ways- unsustainably low interest rates or other direct subsidies to the producers, artificial price support, or some sort of tariff/rebate/ tax scheme targeted to the industry.

Short of those kind of government interventionist measures, it is the business failure of the producers that will reduce the supply until the product is able to garner a higher price in the market.

The only other pathway to higher prices is depletion of the product, which it seems many in the oil producing business are hoping for.

Understandable.

But coffeguyzz point about abundant nat gas is clear. And the ramifications are huge, especially for coal producers. Nat gas has taken coal to the woodshed and the battle is over, just a matter of time til its all played out. First round knockout.

But also a big effect for wind and solar industry. These domestic generators would be booming much faster if not for the low nat gas prices. Very stiff competition for power purchase agreement prices.

Its become a very tough sector for everyone selling energy.

For the moment, its a buyers market.

All from fracturing.

Coffeeguyzz,

EIA estimates for both tight oil and shale gas tend to be too optimistic especially after 2030. Associated gas output will fall as LTO reaches peak in 2022-2025 (depending upon oil and natural gas prices.) Perhaps higher natural gas prices might delay the natural gas peak to 2035, I have not looked closely at USGS estimates for shale gas lately. The estimates from investor presentations are often very optimistic and the EIA seems to base their analysis on these types of estimates, leading to poor estimates.

Coffeeguyzz,

He asked about conventional natural gas.

Dennis

I do not too closely track conventional gas, but I try to keep an eye out for what is considered noteworthy developments.

To that end, the ~180 Trillion cubic foot resource off Mozambique along with the ongoing eastern Mediterranean and Siberian discoveries may offer some interesting perspectives.

Mozambique will host one of the anticipated 4 new FLNG structures planned in the coming years. (There are currently 4 FLNGs operating globally).

While the targeted resource sizes for some of these floaters may not be especially large, it is significant that new, proven technology and hardware has expanded viable hydrocarbon recovery into areas heretofore deemed not feasible.

The numbers out of Russia/Mediterranean are particularly relevant, perhaps, to both your reference to conventionals and my initial comments about Toby Rice’s ambitious goals of operating at extraordinarily low gas prices.

Specifically, 17 Tcf recoverable just touted off Yamal, the 50 Tcf range for Zohr and Leviathan is only a few years’ output from the Appalachian Basin (current annual production ~11 Tcf and rising).

Multi decade output of cheap, unconventional gas will strongly affect global energy markets.

Nowhere is this impact more apt to arise than in other shale plays around the world.

China, Mexico, Argentina, the UK, Australia, Russia contain HUGE amounts of gas in shale with topside factors (political, logistical, economic, ideological), being the main brakes for more robust development.

The arcane fact that Argentina is now slated to get 2 so called Super spec rigs is one example of this.

These rigs will now reduce the cost per well in the Dead Cow, although many, many other constraints remain.

As the pace setting US unconventional industry steams ahead with ongoing improvements, global players will benefit from the ever improving operating templates as EQT is poised to show.

Somewhat related to this abundant, cheap fuel – natgas – is the evolving hardware relating to LNG.

If people do not learn of the mid scale, small scale, even micro scale LNG universe of events, they will be stunned at what is to be 5 years out.

Right this very moment, there is Argentinian hardware liquefying NEPA natgas and having it trucked to a Rhode Island utility.

New world rapidly dawning.

Coffeeguyzz,

Two problems for natural gas. At low prices (as in US today), nobody makes money and the losses will not continue forever because investors don’t really like losing money. At high natural gas prices where producers make a decent return on investment, solar and wind are cheaper and demand for natural gas will not be robust.

In addition there is a lot of associated gas from tight oil production and that is likely to wane as producers are forced by geology to move to tier 2 and higher leases where again lack of profits will shut down most producers.

Perhaps natural gas doesn’t peak until 2040, but it may suffer the same problem that coal has before long as cheaper wind and solar reduce demand for natural gas.

Grace 1

https://www.marinetraffic.com/fi/ais/home/shipid:416354/zoom:14

moving

Goes very slowly. Maybe undecided.

Tries to stay in international waters. Could be boarded near Lampedusa (ironically, since it does not want to stay there unlike many others) by Italians. Narrow pass there.

Lebanon, Turkey, could be destinations.

Lebanon does not have much to lose from US sanctions.

Entering Sicilian Strait. An Empty area around the ship. No escort.

https://www.zerohedge.com/news/2019-08-16/report-bankruptcy-filings-rise-among-us-energy-producers

“Natural Gas Intelligence believes a bankruptcy wave for the upstream sector could be nearing. This is because operators across the country have been scaling back since oil crashed -44% in 4Q18. Producers have been faced with margin compression, high debt loads, and oversupplied markets so far this year.

Haynes and Boone recorded 192 E&P bankruptcies since 2015 totaling $106.8 billion in debt and recorded 185 OFS bankruptcies involving $65 billion of debt over the same time.

And with SocGen’s Albert Edwards warning about a deflationary bust, it seems that the inflation downturn could force commodity prices much lower, could kick off the tidal wave of energy bankruptcies during the 2020 election year.”

[Seems likely the Shale Revolution is about to come to an abrupt end].

“[Seems likely the Shale Revolution is about to come to an abrupt end].”

OPEC: Yes we can

All it needs is a batch of new investors buying the companies after filing.

With new money then there is a new round – until this money is consumed again.

A blurb of note. India’s oil imports have not grown at the same rate they did last year.

There are all sorts of explanations floating around, and none of them seem to point at a lowered desire to consume.

The first seems to be some disruption among refiners as replacement for Iranian oil proved to be a scramble. Refineries cannot accept just any oil. It would need to be oil closely approximating Iran’s oil. And so, an explanation.

Another explanation notes that import of coal also has been weak, and so fingers are pointed at weak GDP growth.

Lastly, there is contradictory talk about India’s fields surprising to the upside. Obviously if you get domestic production, you don’t have to import.

Watcher , India is FUBAR . Some interesting facts . 500000 cars in factory inventories , 375000 two wheeler’s lying at the factories . No buyers .218 car dealerships closed . 350000 workers fired . Almost all showrooms have fired the sales staff . There is no traffic . Next in line are the mechanics and tech staff . Tata trucks that were priced at about $ 50000 a piece are NOT selling at $39ooo . There is no trust between traders in all field because of a liquidity crisis bought about by demonetisation in late 2016 . The govt has used all the pool of domestic savings and now pondering on overseas borrowing. The present administration touched 52 % of the budgeted deficit in the first 4 mths (Apr -Jul) . How will they meet the expenditure for the next 8 mths only heaven knows . No there is no increase in output due to ^ reserve growth^ . The fields are old and tired . Iranian oil was a disruption and was taken care off since they had advance notice . The India growth story is over so to expect an increase unwarranted . The situation is not bad , it is a disaster which is on the road to a catastrophe coupled with climate change . The trio of India, Bangladesh , Sri Lanka are second on the list for problems relating to climate change after Australia .

By the way in India the financial year is April –March . This was designed keeping in view the monsoon season on which Indian agriculture is 70% dependent .

I suppose this means oil consumption growth will be 4% rather than 5.9%.

Watcher ,the answer is I don’t know . There is so much of wastage . A month or so ago the city of Chennai ran out of drinking water. That means zero,nada ,null ,nulla . The water suppliers were trucking water from deep groundwater wells as far as 150 Km away from Chennai . A round trip of 300 Km . At peak summer 32000 vehicles which includes trucks, light trucks ,tuck tuck ,two wheeler etc were running around the clock to fill in the demand . They have now started a ^water express^ which brings 10 million litres of water per day from a reservoir 350-400 km away . Of course it runs on diesel . So 10 million litres per day for a city with a population of 9 million . That is 1.1 lit per person per day . Holy lord , I waste that while I shave .

150 km water pipeline should be not such a great problem to build?!

Trucking it all is horrible inefficiency. Maybe even moving population would be more efficient.

But if situation is so dire, India has nothing to lose by buying Iranian oil.

It is only a matter of time when someone will realize that he has more to lose than to gain by refusing to buy Iranian oil.

Amigo ,it is evident you are ignorant about India . The issue is not technical but legal ,political and financial . I could write a thesis on this ,but that would be a waste of cyberspace . Just to inform you that a super fast train between Mumbai and Ahmadabad with Japanese know how and virtually 0% interest loan funding was inaugurated in 2014 . The project is stalled because the railways cannot acquire the land for the rail lines . Things are very complicated .

As to moving 10 million people idea , what brand of pot are you smoking ? That is the total population of Belgium . Chennai is a city more than 200 years old . Where do you replicate all that was an incremental increase in infrastructure over the 200 years . A terrible idea . Can you build a new Rome or London or Amsterdam which are as old as Chennai ?

As to Iranian oil , it was a small disruption but taken care off since there was a six month advance warning on the sanctions . India cannot afford to be on the wrong side of USA . It’s credit rating is one notch above junk . It will take a call from the treasury or White House to the rating agencies to push it junk . Don’t believe this can happen ,then see what happened to Turkey because they purchased the missile system from Russia .

I am an European in Europe, have never visited India, so may be a bit ignorant about Dekkan, yes. What problems I heard of India had, looked like typical problems of a loose federal country.

Didn’t know Chennai is 10 milion people. However, my ignorance pales in the comparision to the ignorance of the goverment of that city, who certainly knows the number. And did nothing. In a normal country it would be a case for riots. Indians must be very docile.

India has a pro-Soviet past (it was Pakistan that was always pro-US), so it could join Russia now. Started to buy Russian oil already. But Russia is far away, and Iran is close.

India is a direct competitor of China, the relations have never been really good, so it is interest of China to weaken India, unfortunately for Indians.

If US wants to weaken China, it may want to prop up India.

The Indian advantege is a relatively positive picture in the West: a land of colourful spirituality housing China-persecuted Tibetans. Nothing of threatening efficiency of the Chinese ant-like society.

Kashmir.

You have a point, but Pakistan is more disliked than India.

China has a stake in Kashmir too, so maybe the recent Indian action is indirectly directed at China.

https://thediplomat.com/2019/08/what-the-bifurcation-of-jammu-kashmir-tells-us-about-indias-china-strategy/

Maybe a crucial statement of the article:

‘By displaying the political will to change existing paradigms, could there be more hawkish engagement with China as well?’

I can understand that you are not fully informed about the conditions on the ground . Yes, Indians are very docile and too god fearing . It is their belief that everything is predestined that is keeping the riots away . As to being China’s competitor ,it is no match .The US tried to prop it as a counterweight to China but failed . India’s economy is $ 2.7 trillion,China is $ 15.5 trillion . China’s armed forces are twice as large as India . The US has now given up and only pays lip service . As to Kashmir ,the move was done to win upcoming elections in some states . The new buzzword is ^nationalism^ . Kashmir is the new Palestine ,Kurdistan . The only difference is that where in Palestine all of the middle east was subdued by US thru military or financial bribes here Pakistan and China are not going to be subdued . Trump is on the verge of moving out of Afghanistan . The Taliban and the Jihadi’s will move to Kashmir . This sore will bleed New Delhi . This at a time when the economy is on the verge of collapse . As to India’s advantage as a peace loving, spiritual country in the West ,well that is not important in geopolitics . What is important is whether you are a financial power or a military power . Unfortunately India is neither .

OPEC prediction

https://www.bloomberg.com/news/articles/2019-07-11/opec-sees-new-oil-surplus-in-2020-as-u-s-shale-keeps-surging

I guess you have to decide who knows more about what oil production will be next year.

Hundreds of researchers and geologists who have access to the best data and expensive research sites.. or Ron who claimed peak oil in 2015 and every year since.

https://oilprice.com/Energy/Crude-Oil/2015-Could-Be-The-Year-Of-Peak-Oil.html

Has Ron’s knowledge or pattern of thinking changed?

I would say not. It is not reasonable to think that all good production news is false or hyped up. It is not reasonable to think that everything that can go wrong will.

nor is it reasonable to think everything will go right.

That is why, when you look at every country and exploration potentials, it is reasonable to take a middle ground.

If every country suddenly had no corruption, there was peace in Libya, Nigeria, Sudan. Free democratic governments in Iran, Iraq, Venezuela, Russia etc. Then oil production could increase up to 2035.

However this is as unreasonable as those who claimed peak in 2008 of 2015. Neither of which proved correct.

Taking into account political factors in every country, which is very difficult. A peak in oil production between 2022 and 2026 is reasonable.

Hugo, let’s hear your prediction. When is Peak Oil going to happen?

Frugal

I just wrote 2022 to 2026

Hugo,

You’re dreaming and guessing. Build your own model and make your own predictions. Also, state your assumptions.

I’m not sure that you have the mathematical skills to build your own model. However, you do have skills to criticize others, including Ron who tirelessly volunteers his time to inform others about the world’s energy situation. Ron also provides a forum for open communication including your critical useless statements.

Tony

Tony

What mathematical model do you suggest to determine if sanctions continue against Iran in 2022 or 2023?

What mathematical formula can you suggest as to how stable Iraq will be over the next 10 years.

What mathematical calculation could have predicted Muammar Gaddafi being overthrown. and if Libya is stable enough to achieve this?

https://oilprice.com/Energy/Crude-Oil/Libyas-60-Billion-Push-To-Double-Oil-Production.html

Once you have answered these questions, answer another.

https://oilprice.com/Energy/Crude-Oil/2015-Could-Be-The-Year-Of-Peak-Oil.html#

What information did Ron Provide here that was informative?

Hugo, you are a bullshit artist. Hundreds of researchers and geologists disagree just as much as the folks on this blog. Have you read Robert Rapier’s predictions lately? To my knowledge he has made no world peak predictions but he has published several articles stating that US shale production is toast. And I have not predicted peak oil every year.

If every country suddenly had no corruption, there was peace in Libya, Nigeria, Sudan. Free democratic governments in Iran, Iraq, Venezuela, Russia etc. Then oil production could increase up to 2035.

My dad used to say: “If every man was honest, wouldn’t it be a wonderful world.” But “if” is not an option. The world is what it is and we must live in the world as is, not postulate “if” at every bad turn of events.

So if you have a prediction, not an “if”, then make your prediction, or quote your favorite predictor. Else shut the fuck up.

What can you do to predict the future?

You only can do models – and here it’s super complicated.

Not only oil price, technic, available capital – but also politics.

And politics plays the main role – Trump just executing 2mbd in Iran. Perhaps Democrats enabling them again and paying Iran compensations to boost further production. Not predictable.

Ron

You said Quote

“I am betting that when the June data finally comes in that it will show crude oil production in the US has seriously declined since December 2014. ”

“I am now more convinced than ever that 2015 will see the peak in world crude oil production. I have very closely studied the charts of every producing nation and my prognosis is based on that study.”

“I see many nations in steep decline and most every other nation peaking now, or in the last couple of years, or very near their peak today. These include the world’s three largest producers, Russia, Saudi Arabia and the USA.”

Ron all of these statements were wrong in 2015 and wrong today. United States is production 3 million barrels per day more and is not near peak and prices have been crushed by over production.

https://www.iea.org/newsroom/news/2019/january/could-tight-oil-go-global.html

Russia is producing a million barrels per day more and has large potential and if Europe needed the oil enough they will break sanctions to help Russia get that oil.

https://www.chathamhouse.org/expert/comment/russia-s-untapped-arctic-potential#

Saudi Arabia is not near peak and are increasing potential by 1 million barrels per day.

Saudi Arabia have produced what they said they would despite all the naysayers.

Hugo, say what you wish about Saudi or Russia, or any country and their oil production, just leave my name out of it. I will not continue to put up with this constant harassment from you.

Ron

Are you seriously saying people are not allowed to provide evidence which shows you have been wrong in the past and why they feel you are wrong now.

Hugo, Hugo (sigh)! I disagree sometimes with many, Ron and Dennis can attest to that. However, I do try to do it in a respectful way. Almost all posters on this board deserve that. If you think your comments were respectful, then what can I say?

I remember the time that he posted that. Prior to the Permian. He did not call it peak. He raised the question that many of us were thinking at the time. And, Peak may not be yet, but the assumptions are not out of bounds either in Ron’s or Dennis guesses. Either guess has its bias. Dennis in math, and Ron’s is it’s gotta happen sometime soon. I’m biased close to Ron’s. But bias usually does not have close accuracy. So, who knows, but if you can’t keep a level discussion, then no one wins.

Hugo I find your comments useful and insightful and are not disrespectful at all. Peak has been called too often, especially by Ron. You and Dennis have a good chance of being right that peak is still maybe five years out. But also like you said there are many things we can’t know or predict, especially political ones. Many people like the Saudis and shale oil folks have an incentive to lie and obfuscate. I think there’s a good chance there’s a black swan out there that will bring peak forward but it is likely to be economic or politically in nature.

I’ve been reading this for many years, and I have not seen Ron call it once during these years since recently. On the cusp a couple of times, but he argued with me when I first called it for 2018. He and I may still be wrong, but yours is not an argument, it is an attack. You give the impression that he is flakey, and that is far from my impression. Guy hosts an open forum, and you guys roast him, while he pays for your rights to speech. There was nothing respectful in the attack. And, attack is the only way you could consider it. The guy has more oil experience than anyone currently posting. Yuk!

Stephen,

People don’t like to be called on it when they have been incorrect, a better approach might be to have a link to the post and simply quote the post.

There is not much that has been written in the past about future oil output that has been correct years later. Oil output will peak, nobody knows when, I guess 2025, but scenarios can be created with peaks from 2018 to 2040 with the average of 27 scenarios with a plateau from 2021 to 2026, see chart below from earlier Oil Shock Scenarios post.