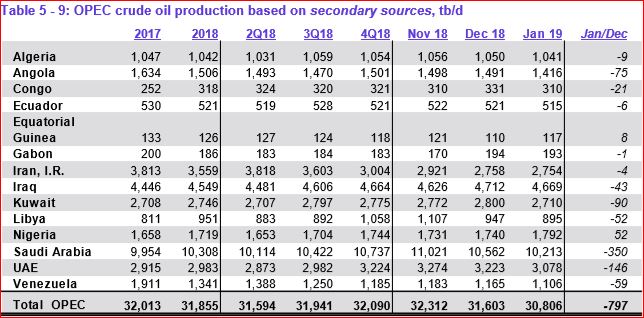

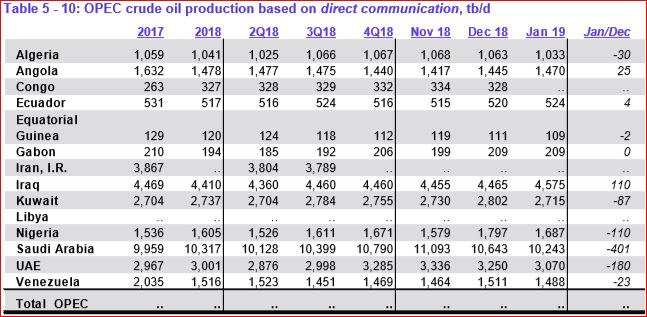

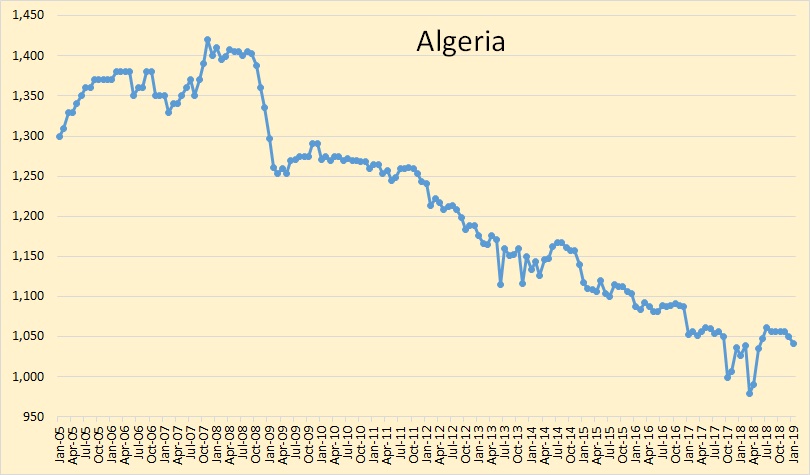

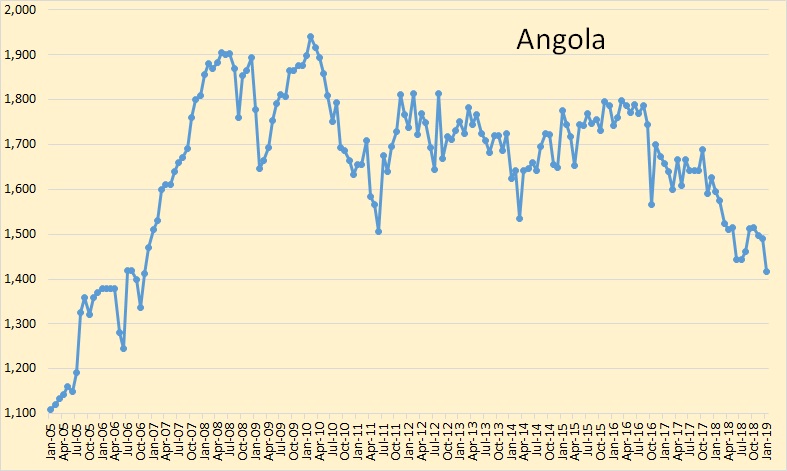

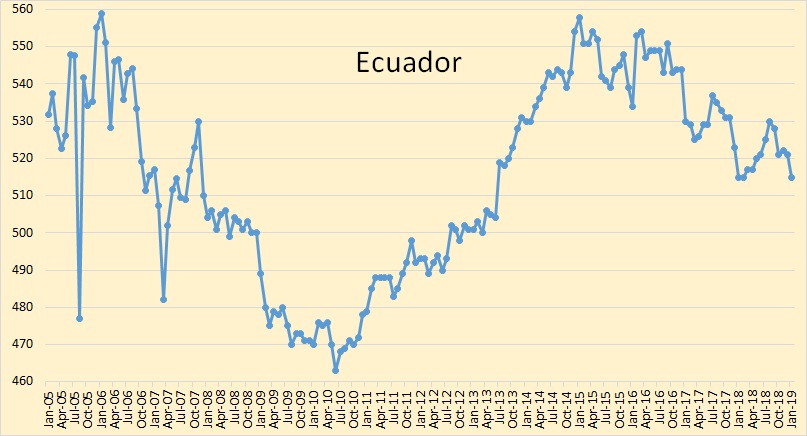

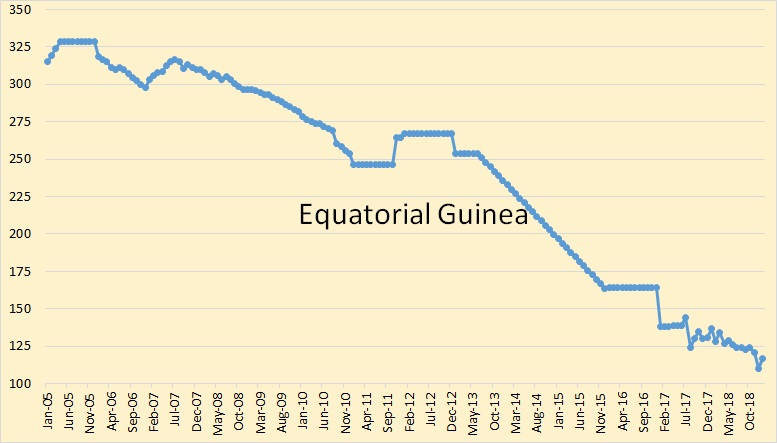

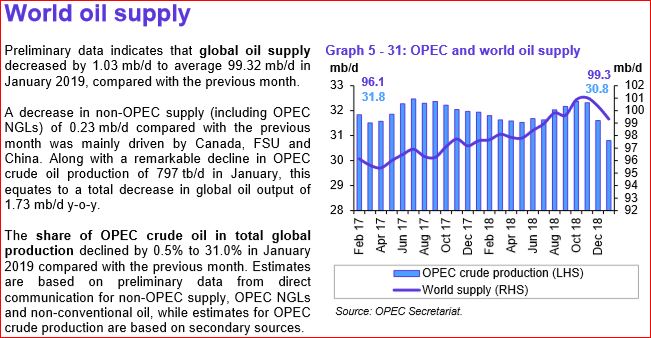

The data below is taken from the OPEC Monthly Oil Market Report. All OPEC data is through January 2019 and is in thousand barrels per day.

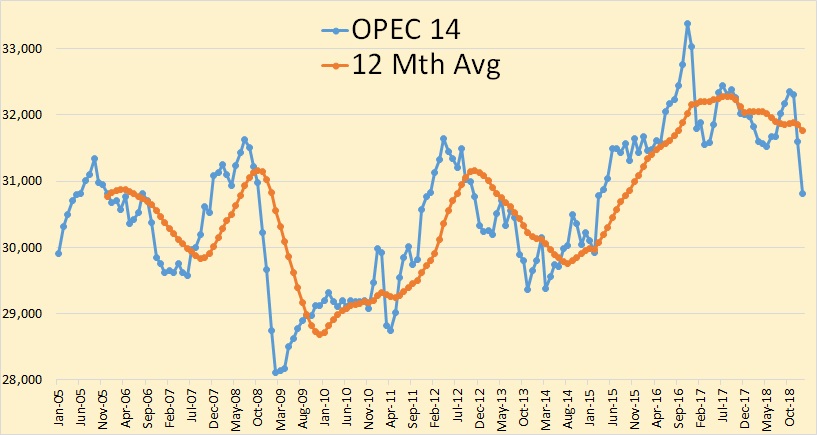

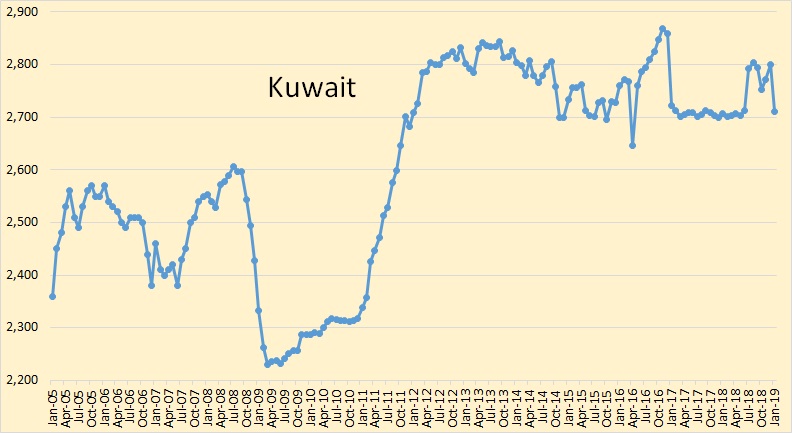

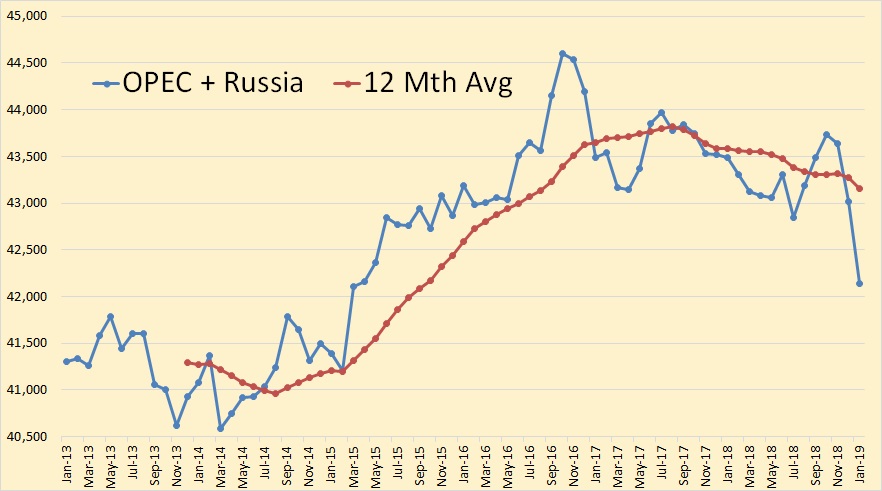

OPEC 14, crude only, was down just three thousand barrels short of 800,000 barrels per day in January.

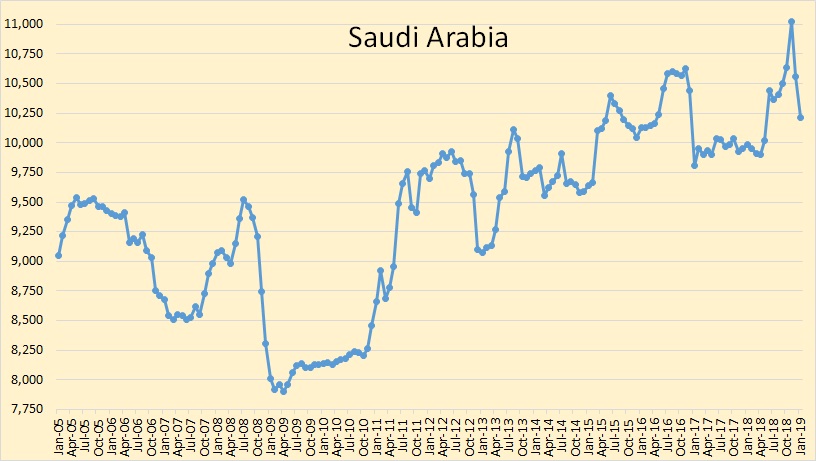

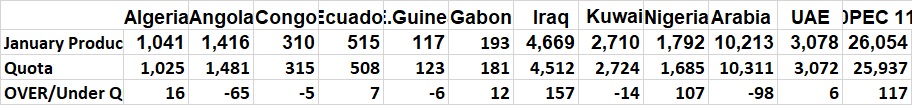

The difference between what Saudi says they produced and what secondary sources say Saudi produces is 51,000 bpd. But the difference between what Iraq says they produced and what secondary sources say is even more remarkable.

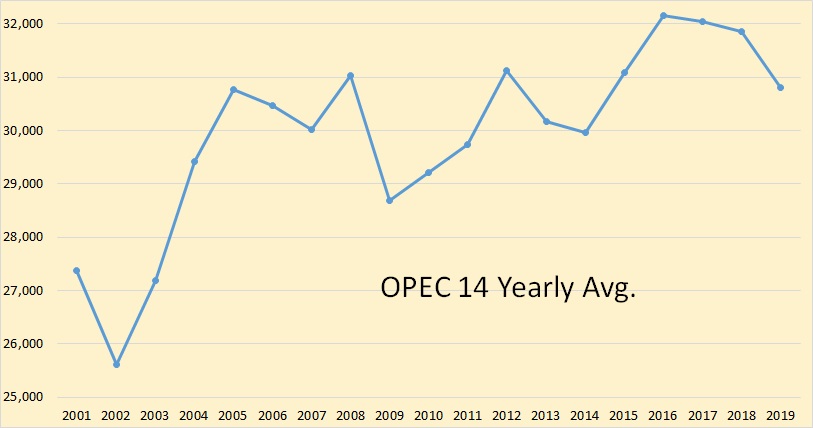

OPEC 14 peaked in 2016 and, in my opinion, have been producing flat out since then, except for January of course. The 2019 avg is January only.

Angola was down 75,000 barrels per day in January.

Ecuador peaked exactly four years ago and is down 43,000 bpd since that point.

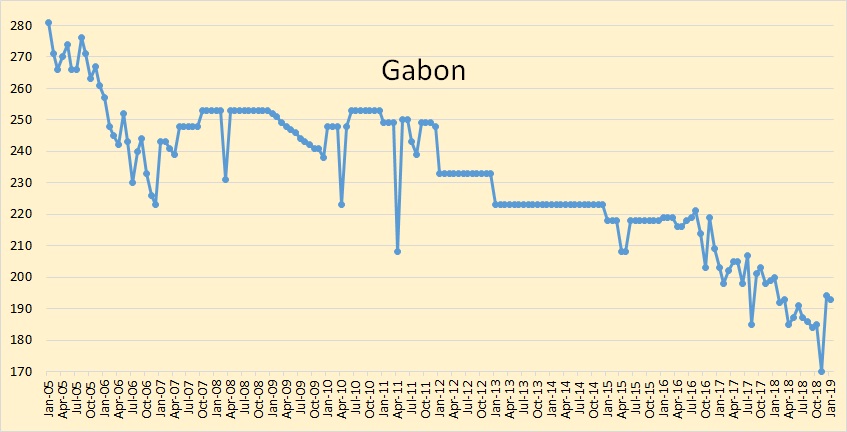

It looks like Iran has reached their post sanctions level of production.

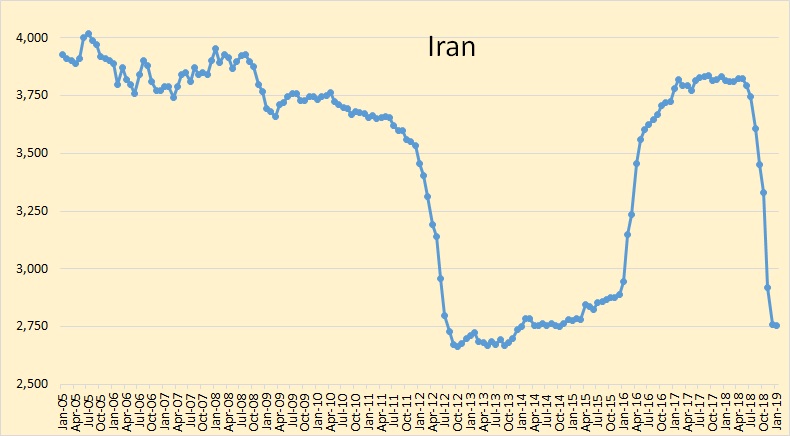

Iraq showed little interest in cutting production in January. Via direct communications, they said they were up 110,000 barrels per day though secondary sources said they were down 43,000 bpd, a 153,000 bpd difference.

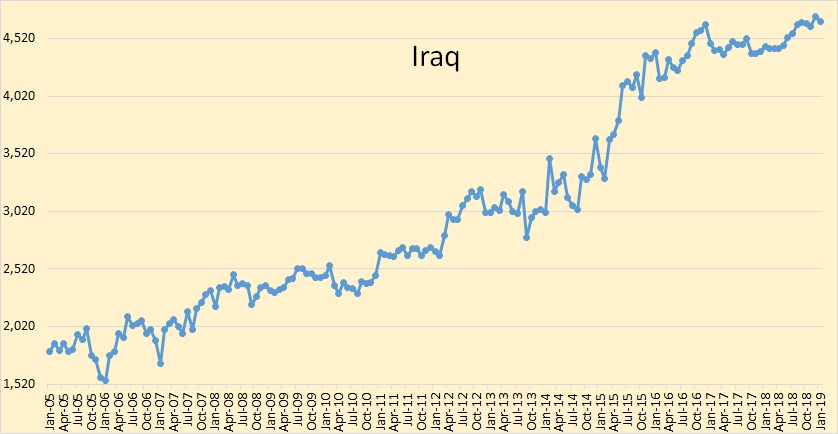

Kuwait’s monthly peak was in December 2016. Their annual peak was in 2013. They are now back to a level they have been able to hold.

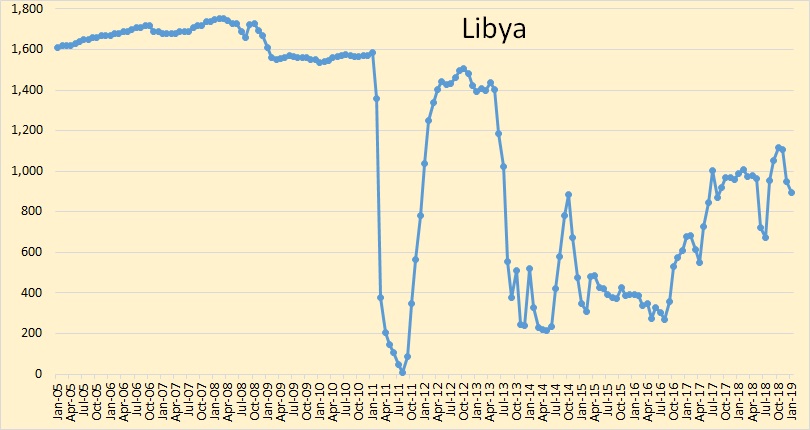

Libya, like Iran and Venezuela, is exempt from quotas.

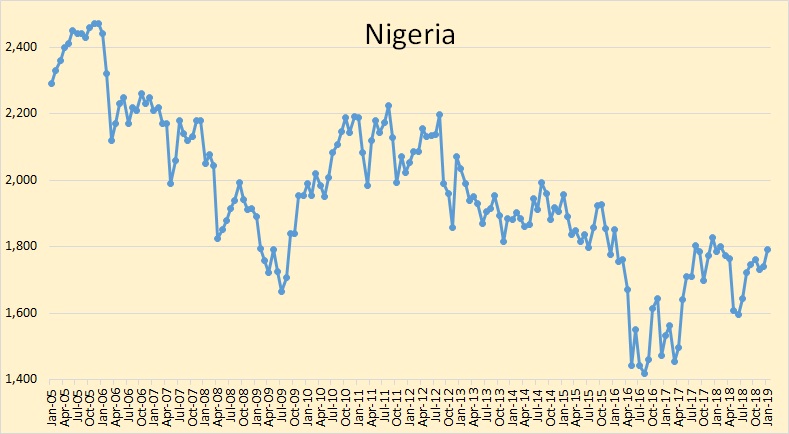

Nigeria claimed they were down 110,000 barrels per day but secondary sources says they were up 52,000 bpd. Perhaps with all the political problems they are having, they are in no mood for cutting production.

Saudi Arabia, the big dog on the block, was down 350,000 barrels per day in January, though they said they were actually down 401,000 bpd.

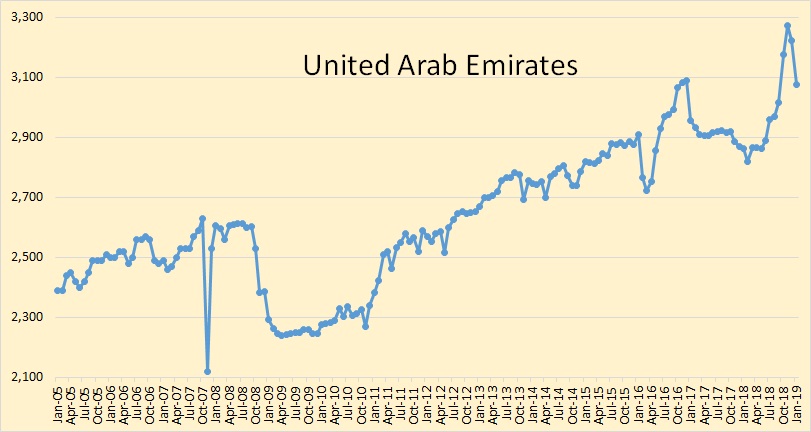

The UAE was obviously prepping for their quota cut for the last three months in 2018. They are now backs to what they can probably hold for awhile.

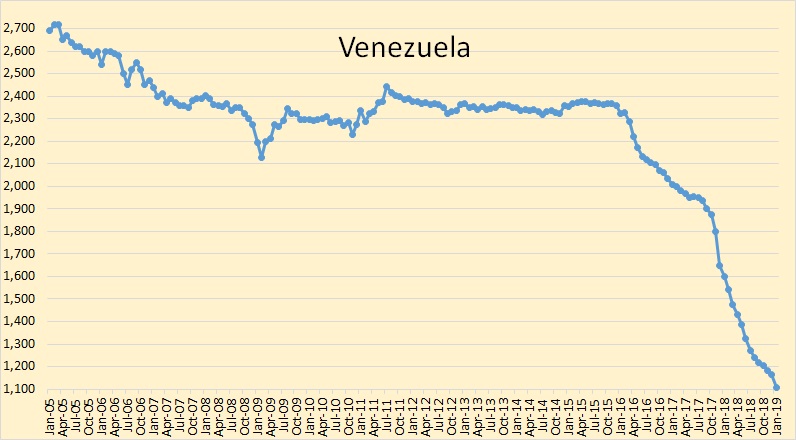

The sad story of Venezuela continues…

Eleven OPEC nation are subject to quotas. Here are their over or under stats.

OPEC + Russia, down 1,590,000 barrels per day since October, should be enough to move the market. And it does seem to be up about 1.5% this morning.

They are saying Non-OPEC liquids were down 23,000 barrels per day in January.

Thanks Ron. I always find your charts to be more informative than just the momr numbers. It seems that the chart for Angola is missing, and they are down quite a bit for the month. Is that an oversight or is there something else up with that.

Sorry about that. Angola is up now. I just missed them accidently.

Some other stuff from OPEC’s MOMR.

Forecast for Non-OPEC output increase in 2019 seems pretty high at 2.33 Mb/d from Q4 2018 to Q4 2019, I doubt it will be even half this level. Though OPEC includes NGL and processing gain in their estimates and I focus on C+C, I expect non-OPEC C+C output to increase 1 Mb/d at most from 4Q2018 to 4Q2019, my guess would be 750+/-250 kb/d.

Yeah the forecast increase is mostly from the USA with a bit from Brazil

OPEC MOMR forecast for 2019

US total supply +1.8, Oil +1.29, NGLs +0.48, Biofuel +0.03

Brazil – oil production could rise substantially in 2019 if the delayed FPSO vessels and other scheduled facilities come on line in time during the year. Liquids supply is expected to rise by 0.36 mb/d to average 3.63 mb/d in 2019.

Double checked EIA’s estimate for US C+C+NGL and it is a 1.35 Mb/d increase from Dec 2018 to Dec 2019 in the most recent STEO, 0.79 Mb/d of this is C+C. So their estimate is different from OPEC estimate if one looks at the Dec to Dec increase. However if we take the annual averages for 2018 and 2019 the difference is 2 Mb/d for the STEO, in my mind the Dec 2018 to Dec 2019 increase is the important number to focus on and the C+C number is more important than total liquids.

A question here:

The graphic states some really “big” changes like Vietnam – what’s about all the other non opec states, especially China. Are they exactly flat?

And Russia commited a cut – I think they’ll keep word as last time.

China is not flat. No one is ever exactly flat.

Russian average oil production in 2018 was 11,115,000 barrels per day. Their quota, if they keep it, is 11,191,000 barrels per day. That is a 76,000 barrels per day increase over their 2018 average production.

Their production in December was 11,408,000 bpd and 11,330,000 bpd in January.

Russia

OECD Stocks

The EIA’s STEO released today.

https://www.eia.gov/outlooks/steo/

They forecast US C+C production to increase +0.79 million barrels per day during 2019

From Dec 2018 11.93 million barrels per day

To Dec 2019 12.72 million barrels per day

The EIA’s forecast might not be too far off, but I think they expect maybe 200 kb/d higher output in the GOM and my interpretation of George Kaplan’s and SouthLaGeo’s recent comments is that flat or possibly declining GOM output is a more likely scenario.

If I have interpreted correctly and their assessments are correct (they both know way more than me) then this would imply about a 600 kb/d increase primarily from tight oil in 2019 (Dec 2018 to Dec 2019). With enough pipeline, refinery, and port capacity that is a possibility especially if WTI returns to $60/b or higher by Dec 2019. My guess is the EIA expects oil prices to be lower than that.

It is doubtful that both the STEO oil price and output predictions will be correct.

Looking more closely at the STEO, lower48 excluding GOM increases 520 kb/d from Dec 2018 to Dec 2019 (seems reasonable, this will be mostly tight oil). GOM increases by 270 kb/d from Dec 2018 to Dec 2019, I will let others more knowledgeable than me comment on that forecast. Alaskan output is supposed to be flat in 2019.

WTI is supposed to rise from $50/b in Jan 2019 to $56/b in Dec 2019, it is not clear if that is a high enough oil price to spur higher tight oil output, especially as interest rates continue to rise.

Venezuela production should take a larger drop in February. Today Interim President Guaidó announced Feb 23 would be the day a big push would be made to push humanitarian aid columns into Venezuela. Collection points for food and medicine are now available in Colombia and Brazil, and others are being prepared.

Maduro moved 700 special forces (FAES) which are usually kept serving as death squads in large cities, to cover the bridges between Ureña in Venezuela and Cucuta in Colombia, with orders to fire on the humanitarian relief trucks. Guaidó responded the border was plenty long and Maduro lacked enough FAES and Cubans to stop the relief from crossing the border. He also pointed out that if Maduro had to use death squads to patrol the border it meant he didn’t trust the Army, the National Guard or the National Police, so he asked for volunteers inside Venezuela to help overcome Maduro’s thugs with sheer numbers.

Today it became very common to see an individual scream “Maduro!” and the crowd respond “f…k you!”. It’s the way people pass the time at metro stations and while waiting in line. And the police seem to have abandoned the usurper, because they seldom do anything about it.

PDVSA can’t keep operating long with that US sanction on payments.

Yesterday the National Assembly named a new PDVSA board of directors. They also named boards for PDVSA subsidiaries, all the way to CITGO. The paperwork will be in the USA this weekend, and next week CITGO’s new management can start sending dividends to accounts controlled by Guaidó. The new PDVSA board will also notify entities doing business with PDVSA that all contracts and agreements made with the “Maduro PDVSA” are illegal, and those participating in what amounts to looting and robbery will be prosecuted to the full extent of the law.

Given that US Democrats who are interested in helping Maduro now control the House, I have proposed that 200 million USE from CITGO dividends be used to create a heavily armed police force with 20 thousand volunteers. This sidesteps the communists in the US Congress who are likely to leak plans to their Castro spy network contacts.

Fernando,

LOL. Yes it is clear that Castro rules the World.

You may not realize how ridiculous some of the political stuff you say sounds.

Castro died of old age.

I think Fernando believes Raul Castro is the new World leader, responsible for every bad thing that occurs world wide. 🙂

The Castro dictatorship has between 22000 and 40000 agents, military personnel, administrators, and specialists in torture in Venezuela. The lower figure is from a Cuban government statement informing that 22K Cubans would be voting for the new Cuban communist constitution in February.

Cuba’s ruler is Raul Castro. They set up a stooge called Diaz Canel as nominal president, but the real power is held by Raul, his son Alejandro, and Alejandro’s son Raulito.

I understand Americans, Europeans, etc who favor Marxism and may be closet communists are not about to accept these facts. I have spent my life watching your performances all over the world, and I realize you will always favor, cover up, or deny, the grossest abuses and the imposition of misery because that’s fundamental to your ideology.

In other news, Liborio Guarulla, the tribal chief and Assembly deputy who represents Amazonas tribes, announced they had successfully begun to bring food and medicine to Indian tribes using river launches which crossed the Colombian Venezuelan border using three rivers, including the Orinoco. The launches were escorted by Indian warriors, and the army border posts didn’t try to stop them.

I’m told this self declared president was elected to the National Assembly from a fairly small district in an election with a small turnout. I’m further told that his leadership of the National Assembly is a result of his being the leader of a fairly small party, and the leadership of the National Assembly rotates among the various parties. It happened to be his turn. On that schedule, the orchestration from Washington has unfolded and we see what we see.

I’m also told that the other opposition parties are about three-quarters opposed to this guy declaring himself president, largely because no one had ever heard of him prior to January, other than his friends from the Washington DC university where he was educated.

The people who live in the barrios, who are two things, poor (subsidized) and the majority, do not favor this guy, of whom they have never heard. Obviously their subsidy for decades has come from oil. One might ask, why is this wrong? The oil is under their country and the proceeds from that oil funds their subsidy.

If you want their support, outbid Maduro. No one has seemed to want to build huge apartment complexes with excellent air conditioning and fully funded electricity for those people in the barrios — because perhaps they don’t want to separate themselves from their own money. So outbidding Maduro hasn’t happened. And let’s not pretend that this isn’t the way that politics is done in the United States. It is exactly the same way. Budget is allocated for votes. Let’s not pretend otherwise.

The alternate approach, being pursued now, is to try to cut off that subsidy flow from the oil via sanctions. This was tried some years ago by getting control of the oil union workers management and orchestrating strikes to shut off the oil flow and thus the subsidy to the poor. Chavez pointed out what had been done and the populace decided that any faction who would inflict that sort of pain on the country to further their own ends must be denied power, and Chavez was re-elected over and over.

I suspect this is not going to fly. At least not until you can manufacture some evidence of al-Qaeda having control of Maduro, and maybe some alleged chemical warfare attacks. The chemical warfare card is a good one to play, when all else fails.

I don’t think it is going to fly also.

But I have no contacts in country now.

Things seem to be sputtering on the coup attempt by the US.

Maduro was to gone quite a while ago according to MSM .

Obviously they are a flawed propaganda source.

“Obviously they are a flawed propaganda source.” Yes, if only it came from a truly legitimate source such as “Moon of Alabama – Where Barflies Get Together” that you frequently link to it would be so much more believable.

Hint–

Maduro is still there—

Where the Barflies hang?

The National Assembly just approved the new PDVSA boards. The process is slow because lawyers have to make sure all the paper work will meet US Court requirements (the target is CITGO and the state bank accounts).

Yesterday I heard a recording which discloses Maduro’s murder squads, the dreaded FAES, number 1600. About half are convicts taken from penitentiaries. In addition to the FAES, Maduro counts on Cuban military personnel placed in the chain of command, the SEBIN (equivalent to the KGB), and colectivos, armed motorcycle gangs which number about 10 thousand, and the National Police. But it looks like the National police is split. The armed forces will not fight for Maduro, they are kept in check by the SEBIN, a military intelligence outfit similar to the Soviet GRU, and Cuban agents.

The next steps are therefore for Guaidó to have full access to the CITGO dividend flow, as well as claim all the funds owed from recent oil sales. That money is needed to buy food, medicine and weapons. The idea is to try to enter Venezuela with food and medicine on February 23 via multiple entry points, and try to get army units to take sides with Guaidó. If that doesn’t work the CITGO funds will be used to buy weapons, and the next time an effort is made to take food in, if the regime has groups loyal to it blocking access, they will be dealt with.

Maduro’s FAES appears to be his main fighting element, he sent 700 to Ureña to block access from Cucuta in Colombia. But they can’t put more elsewhere because they are needed as terror and hit squads in the main cities to stop people there from revolting. And the Cubans don’t appear to be working in compact units, they are placed in individual units. So I don’t expect to see a Cuban infantry company appear anywhere, they learned the lesson in Granada.

Yesterday I saw an interesting video: a young man, dressed in military fatigues, approached Venezuelan National Guard soldiers who were on the other side of the Colombia-Venezuela barrier. He asked them to approach him and explained he was a Venezuelan who had served in the US Marines in Afghanistan, that many guys like him, Venezuelan citizens veterans of the US Middle East wars, were getting organized to escort the food into Venezuela. I have a grandson who served in the Middle East in the Rangers, and he told his mother he wouldn’t mind if they sent him to see some action, but right now he’s in some sort of program going to college to be an officer, so I doubt he’s going to be sent. My guess is the US may be organizing forces which have dual nationality so they can chat with the locals they meet, if the US does send troops in.

Remember, this effort is intended to put Maduro down in a peaceful manner. But if he doesn’t want to cooperate then he will be put down, period. And anybody who backs him is also likely to end up dead. The process is irreversible.

Watcher,

Start here:

The National Assembly is the legislature of Venezuela.

If the Speakership of the National Assembly rotates then that is the way the National Assembly operates. Whoever is rotated in is the Speaker, and that is currently Guaido.

The Venezuelan constitution allows for the Speaker to act as Interim President when there is no legally elected President.

In the last election for the National Assembly the parties supporting Maduro lost the majority. Subsequent to that loss Maduro called a special election for a Constituent Assembly that was to draft a new constitution for Venezuela. That election was declared fraudulent by the usual suspects: Most of the countries of South America, the EU, the OAS, the US, Australia and so on.

After the Constituent Assembly first convened it declared itself able to make laws that overruled any made by the National Assembly (the nation’s legislature, remember) that did not support Maduro’s policies and act in solidarity with them.

The Constituent Assembly subsequently declared that the National Assembly had no authority to make laws anyway.

The election that Maduro is said to have won was scheduled for December, as presidential elections are in Venezuela, but moved to April–by the Constituent Assembly–then to May, which is why it was called a snap election by opponents. The election had the lowest turnout in the country’s era of democratic elections. It was declared invalid by the usual suspects, for good reason.

This is why the current Speaker was able to declare himself the Interim President: because the election was re-scheduled by a body that lacks the authority to do so and the results were thus invalid. Got that so far? (Maduro had declared that parties that boycotted elections had removed themselves from legislature and couldn’t run in elections anyway.)

Now, it is correct that the poor (a couple of million of whom have left Venezuela in the last few years) were given subsidies by the governments of Chavez and Maduro. The subsidy programs were funded by using PDVSA, the national oil company that supplied 97% of export income to the country, as a piggy bank while overlooking the fact that it costs money to keep an oil industry going. Objections to the results of this led to more than 14 000 oil workers fired by Chavez and an ongoing loss of expertise and experience as oil workers have left the country for some years now. Those policies, along with Maduro’s helpful appointment of a general to lead PDVSA, have contributed to the degradation of the national oil industry that is reflected in Ron’s charts. Byproducts are poverty increasing along with malnutrition and lack of medicines and the other reasons that so many Venezuelans have left Venezuela.

It doesn’t matter where Guaido went to school.

Not an expert on the National Assembly, but I read someone’s translation of the relevant item in the Constitution as regards interim presidents. There is nothing in the Constitution that allows an individual to become the interim president because someone declares an election invalid. The relevant text only allows an interim president if the current president abandons his post, which seems to be interpreted as leaves the country.

This has not taken place. There is no valid text to allow the Speaker to take power because his party declares an election invalid. There is no law permitting this and claims to the contrary are not correct. The quoted law only permits it when the president abandons his post.

Now the reason the speakership rotating is significant is the presentation of the situation with the suggestion that the individual was elected by the National Assembly to the post of speakership. I believe this suggestion came out of Pompeo or it may have been Bolton. This elevation of the individual in question to some supposed acclaim by the National Assembly via votes is not correct. The guys small party happened to be scheduled for that position and Washington orchestrated their scheduling around that. Odds are extremely high that if the National Assembly was voting for a Speaker it would not be him. It would be someone from one of the larger parties.

The entire exercise is an external coup d’etat.

Oh, by the way, why do you think it is the poor who left? One would think it was the middle class seeking some place with more potential for themselves. Why would the poor leave those subsidies? How would the poor fund the travel?

And of course this would suggest Maduro’s majority becomes even larger, if it was the non poor leaving.

Hi Watcher.

Article 233: The reasons are absolute absence, or permanent inability to serve, for reasons of death, resignation, physical or mental incapacity, abandonment of office, or the popular revocation of his mandate.

The present situation isn’t one of getting the President out of office, though–it’s that Maduro was re-elected in an election that was fraudulent because it was convened by the Constituent Assembly, itself created in an election declared fraudulent because not done according to the constitution. Thus, Maduro’s term ended 9 January 2019 and there is no President. That’s the opposition position.

With no president in office the Speaker of the National Assembly, the current one whoever that may be, becomes Interim President.

Why do I think it’s the poor who have been leaving? Because some million of them have crossed into Colombia with some moving on to Peru and Ecuador, for a start, and others into Brasil, where indigenous people are moving humanitarian goods across the border into Venezuela past the border guards.

The subsidies aren’t for everybody poor in Venezuela either but you’ll have to ask FernandoL for details.

The poor aren’t the only ones leaving, no; there’s been a great drain of oil workers and management (?) from PDVSA. This bodes ill for restarting Venezuela’s oil industry even if, or when, the country settles down to where that would be possible.

Synapsid has it right. And Watcher is doing his best to argue in favor of a communist tyrant. We have seen plenty of this here over the years, although I notice their numbers have dropped.

One point I can make is that to get the Europeans to back Guaidó has been incredibly difficult, because they have a heavy component of hard core leftists in key positions. For example, the head of EU Foreign policy is Mogherini, an Italian communist who used to be an Arafat groupie. Even now, the EU recognized Guaidó but she’s running around with a “Contact Group” trying to organize a dialogue, which by now can only be held to lay out how the Maduro clique and Cuban forces leave Venezuela.

So are we yet willing to declare peak OPEC?

There is no way to know for sure, but I think the odds favor that not just OPEC, but the combined production of OPEC + Russia has peaked. That’s just over half the world’s crude oil production. But it will be about two years before the picture becomes clear, or a lot clearer than it is today.

Under a favorable political and managerial climate [such as no sanctions and civil wars], Libya Venezuela and Iran could combine for close to 3 Mbpd additional production, correct?

I know, fat chance.

Yeah, if only peace would break out all over the world.

With the population still rising, especially in the undeveloped world, and natural life support systems declining at an increasing rate, it is far more likely that political problems will increase rather than decrease. And that includes political problems in oil exporting countries.

I’m with Ron, peace in the undeveloped or lesser developed countries is less likely than trouble, even when the economies of such countries are growing.

And while they may skip the land line in favor of the cell phone, it’s damned unlikely, imo anyway, that they can skip the ICE in favor of electrified transportation, because conventional vehicles and machinery are going to be cheaper than electrified versions for quite some time.

So oil demand is going to grow in any lesser developed country with a growing economy for at the very least ten years. Maybe a LOT longer than ten years. And it will grow faster than it does in developed countries that will be adapting to shorter supplies by reducing per capita consumption to some extent, as the price goes up.

“Rust and depletion never sleep.” I forgot his name, but the guy who’s famous for saying it was a noted figure in the financial sector of the oil industry.

Venezuela can’t recover production for a while. I just saw the draft of a white paper on what needs to be done, gave them a harsh review, and concluded the best short term goal is to stabilize production. The lack of trained and experienced personnel is a huge bottleneck, and they are bound to make mistakes. And the situation on the ground is terrible.

Is it only missing maintainance and material defects – or do they even have damaged their oil fields by wrong pressure management?

As much as I read the big number of their oil reserves is kind of tar oil – so lifting this huge treasure would need another kind of investing like in Canada?

Eulenspiegel,

Venezuela’s Orinoco is at about 55 C vs 15 C for Canadian oil sands.

So it is easier to produce than the Canadian oil sands (less energy intensive) mostly using a process called CHOPS (Cold Heavy Oil Production with Sand)

https://en.wikipedia.org/wiki/Heavy_oil_production

Yes I was looking at that a few days ago, so in fact the extra heavy oil of Venezuela can still be produced by wells ? (with specific technologies). It is true for all of this reserve ?

And currently, do they produce any, or is all or most of their production from conventional reservoirs ?

By the way Venezuela passed its peak in 1970, with a secondary peak around 2000 :

http://mazamascience.com/OilExport/output_en/Exports_BP_2017_oil_bbl_VE_MZM_NONE_auto_M.png

Can it be said that without the extra heavy, their conventional peak is passed “whatever the management” ?

And about extra heavy, I see in below slides (11) :

http://www.oilproduction.net/files/extra-heavy-oils-in-the-world-energy-supply.pdf

“About 500 wells drilled and 2,000 additional wells

to be drilled to maintain production (up to year 2033)”

(just for Total)

So is it correct to say that extra heavy from Orinoco also requires much more wells than conventional ? (a bit like LTO but for different reasons)

Venezuela produces oil from over 100 fields. These are located from the Colombian border all the way to the Orinoco Delta, and from the Orinoco river to wells drilled near the coast in Falcon state. Today heavy oil is about 70% of the country’s production because the light and medium oil fields are depleted and have been mismanaged. There’s also a large number of shut in wells, oil spills, broken pumps, etc. Nobody really knows how bad it is.

These 70% are what is called “extra heavy” or just “heavy” ?

10 degrees API or lower. I’m trying to get some information, but my contacts are a bit pissed off because I criticized a white paper they wrote. They included BS about renewables and I told them to cut that out. The emphasis right now should be on how to use existing laws to get foreigners to put cash in to recover production. This means the existing JVs are the most useful vehicle, and that additional JVs can be created to handle other areas. The cute part is that the JV regime was suggested by the Cubans and implemented by Chavez, so the commies won’t have much to complain about.

my contacts are a bit pissed off because I criticized a white paper they wrote. They included BS about renewables and I told them to cut that out.

Well, this is where your bad judgment about renewables is coming back to bite you. There’s a good chance they know more than you about it, and they’re annoyed that you’re being obtuse or they’re losing faith in your expertise.

Or both.

I believe when I have asked Fernando in the past he thought even 10 years from the time Maduro is removed from office to get Venezuelan output back to 2 Mb/d was quite optimistic and that might not even be possible.

Libya and Iran might provide another 1 Mb/d combined, but I agree with Ron it is not very likely. Possibly Iraq could increase output a bit further and note that the peak in OPEC output occurred around the time of the oil glut in 2016, since that time OPEC has been purposely restricting output to bring oil prices up. When oil has returned to $80/b or higher for a year or two, that is when we will know the true potential for OPEC output, I believe they may return to the previous 12 month peak and perhaps higher in the 2020 to 2025 time frame and then might maintain a plateau for 5 years or so (2025 to 2030 would be my best guess at perhaps 33 to 34 Mb/d for OPEC 14).

peak in OPEC output occurred around the time of the oil glut in 2016, since that time OPEC has been purposely restricting output to bring oil prices up.

Errr… and just which OPEC nations has been purposely restricting output to bring prices up?

Saudi Arabia, Kuwait, Iraq and the UAE were all producing at maximum capacity during the last quarter of 2018, and OPEC still did not reach their peak of 2016. The rest of OPEC is declining faster than these nations can increase production. The decline of other OPEC nations is the problem OPEC has.

In late 2016 an agreement was reached to reduce OPEC output, sanctions on Iran has reduced output there by 1000 kb/d, those sanctions could be removed, potentially Libya might settle its civil war and output might increase by 200 to 300 kb/d if that should occur. Perhaps Iraq might be able to raise output further when oil prices rise.

When oil prices are high (over $80/b for a couple of years) and we continue to see OPEC output fall, that’s when I will believe OPEC might have passed it’s peak, until then we don’t really know what their potential is in my opinion.

The last three months of OPEC production excluding Iran, was 250,000 barrels per day lower in 2018 than the last three months of 2016. During both three months period, OPEC was at maximum production, prepping for cuts.

So evem excluding Iran, OPEC was still down a quarter of a million barrels per day during each period of maxium production, 2016 to 2018.

Iran peaked in 2005, if that is of any interest to anyone.

Iran has self – declared reserves of 120 billion barrels – much more than all this LTO wizardry in the USA even in optimistic guesses.

When this is even a bit true, they could double their output with enough investments.

I don’t know enough about conventional oil development, but even if it takes a 3-digit billion sum to develop it’s much cheaper than LTO.

Only: Who invests a 3 digit billion sum into a theocratic regime on a top position in the “Shoot em up” list of USA and Israel.

Iran has self – declared reserves of 120 billion barrels…

No, Iran has self-declared reserves of 155.6 billion barrels.

OPEC share of world crude oil reserves, 2017

Two thirds of them are mythological barrels, just like the rest of OPEC reserves.

Ron

Saudi Arabia cut production from 10.4 to 9.8 at the beginning of 2017. Also 10.4 was not their max as they produced 11 million barrels per day in Nov 2018.

December and January OPEC have cut 1.5 million barrels per day.

We do not know if Saudi Arabia cannot produce more than 11 million barrels per day, because at the moment it is not needed.

I realize that Hugo, but OPEC is 14 nations, not just Saudi Arabia. Also, during the last three months of 2016, as well as the last three months of 2018, Saudi was producing what they could, not what was needed.

Ron

How do you know they produced what they could?

If you look at the charts, every OPEC nation that could produce more oil during the final quarter of 2016 and 2018, did produce more oil, especially in November. (Quotas were set in December.) The obvious reason was they were prepping for quota cuts. Their quota cuts would be determined from what they produced during that period.

OPEC has never cut their production because of what was needed. They only ever cut when prices were very low. They cut in order to increase prices. Then when prices were high, they produced every barrel they possibly could.

OPEC is not a philanthropic organization and never have been. They don’t give a flying fuck about what is needed. They only want maximum profits from their oil and gas.

FWIW: A VZ production recovery would probably mirror Iraq’s in the sense it takes a while for a nation to recovery from anarchy. I am sure there will be groups that battle for control (like the Shia\Sunni in Iraq), even with heavy US\NATO involvement. Then it’s going to take time for oil companies willing to send in people. Generally skilled Foreign workers are reluctant to work in unstable areas (No point in making big $$$ if you get killed).

Like Iraq, anything that can be sold for scrap will. I am sure people will loot equipment & steel during the chaos during the transistion (like the did in Iraq). But I suspect that unpaid\underpaid Oil workers already started scraping equipment & steel years ago.

My guess it will probably take close to 10 years before VZ oil production recovers to its pre-Madrio\Chavez levels, once the Mo is gone.

Your vision is a bit wrong, because Venezuela isn’t at all like Iraq, and Guaidó isn’t nearly as stupid as Bush, Cheney etc al. Army units guard oil installations and they will not be fired. Venezuela has no Sunni Shiah sectarian divide, and Maduro supporters are less than 15 % of the population. Plus many are in the cities away from the key oil fields.

It’s hard to explain to foreigners who don’t understand the details, but the main reason why it will be slow to get things going very fast is the amount of damage already done, the lack of personnel and the need to dot every i to make sure there’s zero corruption or waste.

“and Maduro supporters are less than 15 % of the population.”

And you Fernando have zero credibility on any of these kind of issues. Your bias is about 900 miles out in front of your facts. So far, you can’t even realize that the rear view mirror is showing the front of your car as tiny speck.

Fernando Wrote: “Venezuela has no Sunni Shiah sectarian divide, and Maduro supporters are less than 15 % of the population. ”

I presume the remaing 85% don’t all back Guaidó. I suspect like Iraq is not necessary backing the right guy that can turn VZ around quickly. US has a habit of supporting the wrong leader. I doubt this time will be different. Also Both China & Russia have Billions of loans with VZ that will likely be defaulted with USA support. China & Russia might choose to promoted opposition to Guaidó.

Fernando Wrote:”Venezuela has no Sunni Shiah sectarian divide”

Perhaps not on a religious difference, but one of economics & political ideologies. VZ has been socialist leaning for a very long time. Once Mo is gone I suspect we’ll see plenty of new Communist\Marxist pop up. They will simply blame the Crisis as Mo being incompetent, not the failures Socialism or Marxist. I have talked with several people that fed VZ to the US and they still see the country heavily entrenched in Socialism & Marxism, They think the failures are simply the result of Mo not delivering the Promised Marxist Paradise. Most of the smart people left VZ already. What Remains is mostly Socialist Marxist supporters.

Your supposition is wrong, because Guaidó has become very popular. This led potential rivals to hitch themselves to his wagon. That means the 85% who does oppose Maduro has a very solid front. The differences of opinion are about details such as whether Guaidó is being too soft with Chavistas, whether they should lynch high level Maduro supporters, put them on trial, or just let them be. After Maduro is gone there will be a few communists who try to make trouble, turn to terrorism, etc.

You are right in the sense that most Venezuelans are used to daddy state and dependency, lack self initiative and are quite passive. But chavistas will never return. The regime stole too much, the depravity and torture have been too much, the murder squads in poor areas have killed too many young men, and the horror will be engraved. So the government that emerges will be similar to say Macron’s in France. Guaidó actually sounds like a Jesus like figure with Bill Clinton inside. Why do you think the regime hasn’t arrested him? If they do that 85% would trash the 15%. And they know it. Venezuela is on the edge of an orgy of violence, and a significant number Maduro supporters will likely come out missing their heads. Some of them are putting out videos threatening terrorism and mayhem, but that’s the typical reaction of bullies who know they are about to lose control.

Just scrolled through EIA. They’re looking for oil consumption increase this year in the US, and next year and the year after.

Magnitude looked like a few hundred K bpd for this year. Well north of 20 mbpd. Revision date Feb 2019.

IEA Febuary OMR released today for subscribers, free highlights https://www.iea.org/oilmarketreport/omrpublic/

2019-02-13 (S&P Global Platts) Unlike other oil forecasting agencies, the IEA expects global demand to grow faster this year than in 2018 due to “lower prices and the start-up of petrochemical projects in China and the US.”

The IEA raised its estimate of the US’ crude output growth this year to 1.1 million b/d, from 1 million b/d in last month’s report,

Platts -> https://www.spglobal.com/platts/en/market-insights/latest-news/oil/021319-oil-markets-may-be-able-to-adjust-to-venezuela-sanctions-iea?

(They don’t say if the demand increase from petrochemical is for LPG (ethane propane butane) or Naphtha. In other words is it natural gas or oil or flexible?)

Note the discrepancy between IEA and EIA on US crude output, this may be a matter of the IEA including NGL with C+C, not really sure. The EIA says US output will increase by 790 kb/d with 270 kb/d of this coming from offshore in the Gulf of Mexico, about 520 kb/d is forecast to come from tight oil from Dec 2018 to Dec 2019. In my view non-OPEC supply is likely to increase by about 800 kb/d (I expect GOM output to be flat, but there might be a 280 kb/d increase from Brazil that will make up the difference). I expect World demand for C+C will increase about 800 kb/d (long term average from 1982 to 2018), so the OPEC/Russia cuts will leave a /supply demand imbalance. This will become apparent by May or June 2019. At that point OPEC/Russia would be wise to let oil prices rise to $80/b before gradually raising output to balance the oil market. That point might not be reached until May 2020 with a gradual rise in Brent oil prices (3 month centered average price) from $65/b in May 2019 to $80/b in May 2020. Political instability is likely to lead to less than a steady upward trend in oil prices, they will be volatile, but this is how I see the general trend developing based on expected supply and demand.

This article is from Nawar Alsaadi. We know Bakken should peak as the NG capture is only 79% vs. state mandate of 88%. We also know EF is not the growth engine. I agree with OPEC assessment that Permian will peak in 2020. According to Enno Peters, more than 70% of the new wells drilled in US is to compensate for legacy wells decline. I am skeptical of the US growth projections if most companies say that they want to live within free cash flow.

https://oilprice.com/Energy/Crude-Oil/Fifty-Shades-Of-Shale-Oil.html

Excellent article, couldn’t agree more with the author.

Krishnan V.

Interesting article thanks. I think OPEC may underestimate US tight oil potential while the IEA tends to overestimate. Below is a high and low scenario for US LTO and a “medium” scenario that is a simpe average of the low and high cases. The Permian, Bakken, Eagle Ford, Niobrara, and other US lto scenarios are laid out at link below.

http://peakoilbarrel.com/open-thread-petroleum-february-5-2019/#comment-665896

An alternative Permian scenario is used for the “high” US LTO scenario leaving the other basins the same for both the high and low scenarios. The difference between the two Permian scenarios is simply the rate that new wells are completed, for the low scenario the peak monthly completion rate is 500 new wells per month and for the “high scenario” the peak completion rate is 727 new wells per month. For context the completion rate was about 410 new wells per month in Dec 2018 and had increased from a 184 wells/month average in 2016 to 392 wells/month average completion rate in 2018 or about an increase of 104 new wells per month each year. The high scenario reaches an annual average completion rate of 727 new wells per month in 2026 an increase of only 86 new wells/month per year on average from 2019 to 2026.

High Permian scenario used in high US LTO scenario in chart below.

This is really interesting stuff. Thank you Dennis.

I went to shaleprofile and did a little “eye balling” and some calculations based on his October update for the Permian. It looks like the decline for 2017 will probably end up a little above 60% by the end of December. It’s currently 52.8% for the ten months to the end of October. Assuming declines don’t get better on 2018 wells which seems a safe bet, that means the decline from 2018 wells alone will be a little over a million barrels a day in 2019. My complete “guesstimate” on the declines from 2017 and earlier vintage wells is that will be somewhere around 350k barrels per day? That would mean that total decline to be “made up” before there is growth for 2019 at about a little over 1.35 million barrels per day. That would imply that to get 650 thousand barrels per day growth, 2019 wells would need to deliver about 2mm barrels in production by December of next year. I think I did that right?

It gets more pronounced in 2020. Again using 60% decline on the 2019 would mean 1.2mm decline from 2019 vintage wells, and likely more like 500k plus for 2018 and earlier vintage wells which would suggest that the first 1.7mm barrels produced in 2020 would be just to make up for decline rates? Does that seem right to you?

Yes I guess that’s why someone called it the “treadmill” as frackers have to run just to standstill

Energy News,

Good point that someone’s work can be found at link below

http://peakoilbarrel.com/debt-oil-price-bakken-red-queen/

also

http://www.theoildrum.com/node/10119

Energy news Wrote:

“Yes I guess that’s why someone called it the “treadmill” as frackers have to run just to standstill”

Also referenced as the “Red Queen” From Alice in Wonderland.

Mario Vachon,

Thanks. Everyone else seems to ignore this stuff.

For the entire Permian Basin if no wells were completed after Dec 2019, the entire Permian tight oil output would decline at an annual rate of 56% from Dec 2019 to Dec 2020. The annual decline rate in this “shutdown” scenario would accelerate to 89% from Dec 2024 to Dec 2025 and remains at about 90% until 2039 before moderating a bit.

I don’t really use decline rates in my models, I fit a hyperbolic well profile to the data for the average well and assume all completed wells are average wells (for simplicity). This is essentially based on the “Red Queen model” presented long ago at the oil drum, (these same ideas were developed about the same time by James Mason and Paul Pukite).

In the past my work has been reviewed by Paul Pukite and Jean Laherrere, though this specific model has not been checked by anyone but me, the author of the Red Queen series is in no way associated with any of my work, any errors are mine alone.

Enno Peters at http://www.shaleprofile.com has presented very interesting data lately suggesting terminal decline rates are quite a bit steeper than I have usually assumed (my typical assumption has been 10% per year terminal decline rates). I have revised this to 14% based on data from all wells in the Permian basin using a different methodology than Enno Peters (who focuses on the wells at the bottom of the rate distribution).

The model below assumes $10 million well cost in 2017 $, royalties and taxes of 32%, LOE of $2.3/b plus fixed monthly cost of $15000 until well is shut in at end of life, and transport cost of $5/b, all costs in real 2017$. Real oil prices are assumed to follow the AEO 2018 reference oil price scenario for real Brent oil prices in 2017$, the annual discount rate is 10% (inflation rate assumed at 3%/year, so real annual discount rate is 7%.) It is assumed wells are completed if their NPV, based on assumptions is greater than or equal to $10 million in 2017$.

Cumulative net revenue is not discounted and reaches a maximum negative value of $179 billion in 2027 (annual interest rate is assumed to be 7.9%in nominal terms), the debt is paid off by 2028 and cumulative net revenue (cumulative profits) reach $732 billion in 2017$ by Dec 2050. Peak tight oil output of the scenario is 7450 kb/d in 2028, economically recoverable resources are about 59 Gb and about 176,000 total wells are completed from Jan 2010 to June 2054.

Wow. Thank you very much for that Dennis. I’ll try to digest that a little bit but I have a few questions that come to mind right away. First of all, what is an “average” well, and does it change with time? For example, it seems that newer wells have higher peaks and “likely” higher EUR than older wells, so do you change the model continuously to fit most recent wells? I also wonder if wells start to deteriorate somewhat (Parent/child wells, sweet spot exhaustion and other things I don’t really understand too well but have heard may hurt future wells?) Another question that comes to mind is how you determine when wells are drilled because I don’t know if there are any physical limits to how many can be drilled in any particular year and whether that would be a consideration?

Anyways, that you very much for the detailed and interesting response. I’m going to chew on this some more and try to think it through.

Mario.

Hi Mario,

I use 6 separate well profiles to match historical data at shale profile as the well profiles have changed over time.

After 2017 I assume the well profile is unchanged until Jan 2023, at which point I assume new well EUR starts to decrease. I assume the shape of the well profile (b and Di parameters for a hyperbolic) and that the Qi parameter decreases in proportion to the number of wells drilled. I assume a total of 250,000 wells would be drilled at very high oil prices (a TRR limiting scenario) and set the amount that each well completed will decrease the EUR so that with the maximum of 250,000 wells completed the URR would be the mean USGS TRR estimate for the Permian (75 Gb). The economic assumptions result in fewer wells being drilled (176,000) for my “medium scenario”.

The 250,000 number was chosen because the Permian is roughly 6 times larger than the Bakken for mean TRR and typically the Bakken scenarios have about 42,000 wells for a medium TRR scenario, 42,000 times 6 is about 250,000 (the EUR of Bakken and Permian wells is similar so that is the basis of this approximation).

Also note that after Dec 2022, tis scenario uses a slightly smaller well profile for Each future month until no more wells are completed after 2054.

For the chart below I show the well profiles from 2010 to 2017, wellpro1 is used from Jan 2010 to Dec 2012, wellpro2 from Jan 2013 to June 2014, wellpro3 from July 2014 to Dec 2014, wellpro4 from Jan 2015 to Dec 2015, wellpro5 from Jan 2016 to Dec 2016, and wellpro6 from Jan 2017 to Dec 2022 for the medium scenario.

As to how many wells can be drilled per month (it is simply a guess), I look at older basins to see their experience as well as what has occurred in the Permian basin so far. There may be future limitations due too lack of workers, water, or deteriorating roads, I have assumed here that well completion rates roughly double over 9 years (2019 to 2027), this might be too optimistic. The EUR ranges from 146 kb for wellpro1 to 413 kb for wellpro6. (146, 165, 221, 306, 396, and 413 kb respectively).

Consider that the Eagle Ford (with a total mean TRR of about 11 Gb from USGS estimates, so a 6.8 times lower mean TRR than Permian basin at 75 Gb) had a maximum competion rate over 300 new wells per month in early 2015.

For the Permian basin at 6 times the size this suggests a maximum completion rate of 2000 new wells per month to match the Eagle Ford rate relative to TRR. My scenario has a maximum completion rate of 727 new wells per month ( the number was chosen to get a curved function with a peak around 2027 and about 250,000 total wells completed, the method was not very scientific, it was chosen arbitrarily, clearly the future completion rate cannot be predicted.)

Think of this as a “what if” exercise, if this many wells are completed, then output looks like this, if all the other economic assumptions are also correct, the new well EUR starts to decrease as I have predicted and the rate of decrease in new well EUR falls at the rate the model predicts and that the USGS mean estimate for TRR is accurate.

The likelihood that this scenario will match the future is pretty close to zero as there are an infinite number of future possibilities and this is but one of that number.

Mario,

Chart below has well completion rate in wells completed per month on right axis.

I always invite others to suggest alternative scenarios that they believe are more realistic and I can easily run them in my model. All I need is a list of numbers and I can copy and paste into model. The scenario has 410 wells completed in Dec 2018, a list of numbers say 120 numbers for the next 10 years (120 months) or one could give me annual average completion rates and I can interprolate. Happy to do it.

Wow. Just wow. That is some incredible work. I had no idea it was such a complex model. All the assumptions seem reasonable, although as you say will undoubtedly be wrong just because the possibilities are almost limitless and new information and circumstances will alter today’s best guesses.

Thank you very much Dennis.

You’re welcome Mario.

Chevron’s Permian production plan

https://pbs.twimg.com/media/DzUA_NtWkAIRGI_.jpg

A chart with MBOE is useless IMO.

I wish they would ignore the natural gas and NGL, it is only the C+C that generates any net revenue, that is why they flare as much natural gas as will be allowed in the Permian basin.

It is useful in the following sense though. If we assume the ratio of natural gas and NGL output to C+C output remains constant from 2018 to 2022, then Chevron is forecasting an increase in their output of roughly a factor of 3. For the basin as a whole (if the same assumption were applied basin wide,) that implies an increase from 3000 kb/d to 9000 kb/d from 2018 to 2022.

I doubt that will happen, I expect an increase from 3000 kb/d at the end of 2018 to about 6000 kb/d at the end of 2022, so a factor of 2 rather than a factor of 3 is my high completion rate scenario. In that scenario the average monthly completion rate increases from 392 new wells per month in 2018 to 639 new wells per month in 2022 an increase in the monthly rate of about 62 new wells per month each year (in the 2016 to 2018 period the rate of increase was about 104 new wells per month each year.)

There’s a comment below about Laredo. Their gas and gas liquids production are rising disproportionately fast and oil – not so much. The oil portion of their Permian production is forecast to decline 5% while BOEs continue to rise because the GOR keeps rising.

What is not discussed here are the rate limiting steps. Are there pipelines to carry NG and NGL? Mike Shellman said that there is a lot of flaring of NG in Permian.

Krishnan Viswnathan,

There is not enough pipeline capacity especially for natural gas and yes there is a lot of natural gas being wasted by flaring, it is up to the Texas RRC or DEP or perhaps the EIA to enforce any existing regulations.

Up to the people of Texas and New Mexico and the owners of the resources to make sure this is done.

I am not an oil guy, can the natural gas be reinjected into the formation?

Perhaps it is too expensive.

I’ve not got any insight into Permian production limitations. I don’t subscribe to anything and so I only know what’s in the news.

EIA – U.S. commercial crude oil imports last week fell to the lowest since Jan 1997 (might be partly due to fog?) Crude oil imports from Venezuela were 117 kb/day

U.S. Petroleum Balance Sheet

http://ir.eia.gov/wpsr/overview.pdf

EU & USA monthly chart plus US weekly inventory Feb 8th (yellow dot on chart)

US total (crude oil + distillates) 924 million barrels

Total = crude oil: 451 + distillates (light+middle+heavy): 473

Chart https://pbs.twimg.com/media/DzT_sfNX0AAMxpW.png

US weekly inventory change (million barrels)

Crude oil +3.6

Light +0.4

Middle +1.4

Heavy +1.5

Total +7.0

SPR no change

Propane & NGPLs +0.25 (not included)

Chart https://pbs.twimg.com/media/DzUAPwaWsAY3IxZ.png

https://flowcharts.llnl.gov/content/assets/images/charts/Energy/Energy_2017_United-States.png

It would be educational if there were an oil flow diagram for the oil producers which contrasted internal usage and export.

I was just fixing to ask which countries are expected to become net importers, rather than exporters, over the next five or ten years.

OFM,

Difficult to predict because it depends on oil price policies and how consumption responds to the oil price that results. My guess is that nations that subsidize oil internally will gradually reduce those subsidies as oil prices rise. They could give poor people a free gas card that grants them a fixed number of gallons of fuel and people would be allowed to trade those to others on the market, this would encourage people to conserve fuel as the traded price will rise to the price people are actually willing to pay, this “market” price could be used to set the price of gasoline for those who choose to use more than their allotted number of gallons.

Such a policy might reduce riots especially if the allotted number of gallons was close to median usage by the middle class.

The subject of Tradable Energy Quotas (TEQs) was widely discussed here in the UK a few years ago. It’s not a thing that is getting much attention at the moment though.

https://en.wikipedia.org/wiki/Tradable_Energy_Quotas

Back atcha Dennis,

Thanks for your ideas.

They may actually be put into effect in a couple of the more advanced countries that are oil producers, but my guess is that the lesser developed countries that produce oil are more likely to take the easy short term route, and continue to provide gasoline and diesel to their own people, at less than market prices, in most cases.

The end game is that at some point it will be impossible to avoid allowing the prices of oil products to go up very sharply. Riots may follow.

And when this happens, depending on how many other things are going wrong at the same time….. governments may fall.

It is often said the consequences of revolutions are worse than the conditions that brought them on.

OFM,

The smart nations will use the tradeable energy quota idea and thereby encourage their citizens to conserve scarce resources. The others will fall to revolution as you assume, then the quotas will be used by the government that replaces the foolish ones that came before.

There are few things more profound than that box marked “Rejected Energy,” representing over 2/3 of all energy extracted.

I’m not really sure of the significance of that. Using fossil fuel products as combustible fuel limits the efficiency at which one can obtain useful work from the fuel. That efficiency number is really only useful when comparing one source to another and the ffs pretty much will operate in the 40%=/- range for most stationary applications. For motor vehicle type uses the efficiency is just terrible compared to electric and I doubt much improvement is likely there. That rejected energy is just a fixture of the way energy is extracted through combustion so I doubt it has any meaning except for how much you are overheating a river near a coal or NG power plant.

“Using fossil fuel products as combustible fuel limits the efficiency at which one can obtain useful work from the fuel.”

Yes, that’s what I mean. We’ve wasted that endowment on trips to the package store. That’s profound.

I am not so sure. It looks like hybrid cars are very competitive with the EV.

The efficiency of Tesla and similar EV is grossly overrated. You have losses in the transmission line, losses in the charger, losses in the battery. Plus if the mechanical transmission is used (for example 10:1 fixed gearbox like in Tesla), you have losses in transmission and motor during driving (say 10%). So total efficiency of electricity usage would be around 70%, which is high, by not that high. Atkinson-cycle ICE engines used in hybrids have ~40% efficiency.

The ~56kwh Roadster battery takes ~70kwh to charge. (approx) So ~20% of the electricity you pay for is lost to heat. How much is the charger and cabling, and how much the batteries, I have no idea.

Here is a very simple calculation. Tesla with the air conditioner on auto 73F and external temperature 60F (minimal use of the air conditioner) consumes around 300 watts/mile. Double this for temperatures below freezing point or temperatures above 90F.

The cost per mile at 15 cents per Kwh and 20% loss is 5.4 cent.

Hybrid SUV like RAV4 hybrid (which is a much better and safer car, especially in winter) with an average of 35 miles per gallon and the price of gas at $2.5 per gallon has cost 7.1 cents per mile.

That means that Tesla provides just 24% economy, which is completely eaten by the higher cost of Tesla (say $44K vs. $29K ).

Assuming mileage 200K at the end of the life of each car, this $15K difference adds 7.5 cents per mile.

Which means that at those price levels Tesla is competitive only if electricity is free.

likbez

Your calculations are probably correct, but there are other considerations.

For instance, UK oil production peaked in 1999 at around 3 million barrels per day, it has now fallen to 1 million. At $50 oil, it costs us $25 million per day to import the oil we consume over our production. Our wealth is draining away in a trade deficit that has increased with declining oil and gas production.

If we install enough wind turbines.

https://www.theguardian.com/environment/2018/nov/30/windy-weather-carries-britain-to-renewable-energy-record

We can power electric cars, trains and trams and reduce our energy insecurity.

Also global warming is a major concern also

Likbez,

The Tesla Model 3 is perfectly safe in winter, and is a far nicer car than a RAV4 hybrid. The appropriate comparison would be to Volvo XC60

https://www.edmunds.com/volvo/xc60/2018/hybrid/

Let’s compare apples to apples

https://www.edmunds.com/bmw/3-series/2018/hybrid/

Seems the model 3 is working for you.

Great!

Dennis,

Dennis,

I know people enjoy opening Telsa 3 “suicide handles” at -5F . The joke is that “Now you know what Elon’s flamethrower is for.” 😉

https://www.youtube.com/watch?v=–pD42h0VK4

What about road clearances? What about the ability to lock differential when driving on steep ice-covered incline ?

There are also “known unknown” related to lithium battery use (Panasonic cells) at low and very low temperatures. As no Tesla 3 is 8 years old yet, it difficult to say whether the battery can last till the end of the warranty period in continental climate weather conditions (very cold in winter, very hot in summer).

Looks like if you cool a lithium battery below zero F and try to drive before it warmed to 70F the longevity of battery decreases. Higher temperatures also have negative effect (https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4526891/ )

There is also another proven negative factor at winter temperuture for cars with lithium batteries — the dramatic loss of range. https://www.cnbc.com/2019/02/06/aaa-confirms-what-tesla-bmw-nissan-ev-owners-suspected-of-cold-weather.html

See also

https://www.hybridcars.com/tesla-model-s-could-lose-up-to-40-percent-range-in-cold-weather/

At low temperatures lithium battery can’t be charged so if in normal conditions Tesla recaptures energy for the battery during regenerative braking (regen) this is not the case anymore. That further decreases range.

If you run out of energy at -5F, the car needs to be tolled.

If you try to keep battery warm your battery will be drained during parking, unless you are connected to the charger.

At low temperatures (especially with front wind) and during initial warm up of the cabin the heater consumes around 5KWH further draining the battery.

At 90F loss of range is less then in winter — about 20%, but at 100F it is similar and the effect of battery longevity are also similar and negative.

So in areas with continental climate EVs make much less sense then say in California.

Likbez,

As I have suggested, works fine in winter. As long as one doesn’t ride in the car naked during the winter, losses from using the heater are not that great. So far the lowest temperatures the car has seen parked overnight outside have been about minus 15 F for a low with an average of about minus 10 F, battery lost about 250 Wh each hour on average. Battery capacity is about 78,000 Wh. Average temperature where I live is about 19 F in Jan. In Jan I drove about 1500 miles and averaged about 300 Wh per mile vs 245 Wh/mile in October (1600 miles). That is my experience in average winter weather where temperature averaged 19 F in Jan 2019. Range decreased by about 22%. My experience is that range also decreases in a hybrid during winter( I have been driving Toyota hybrids since 2004).

Have driven plenty in snow and ice with the Model 3 this winter, take it to a ski area almost every weekend, the more snow the better. 🙂

Dennis

Judging from people experiences there are some undeniable problem with driving Tesla 3 in winter.

The construction of door handles in Tesla3 is a problematic for winter. Frameless windows also represent a problem. Some pretty educational videos:

1. People are running of energy with Tesla 3 parked at airport for a week or so at cold weather. You need to leave at least 15 km per day in battery in cold weather, or you are in trouble. 30 if weather is very cold. Looks like Tesla 3 tries to heat battery all the time to avoid damage from low temperatures.

https://www.youtube.com/watch?v=0mfs9amXhs8

2. To drive Tesla 3 in cold weather you need to “preheat” the car until battery reaches “working temperature” range:

https://www.youtube.com/watch?v=D2gmphV8IZQ

3. ~52 miles commute to work in cold weather is all that can be made safely. In video below only 43 miles left at the end (the car was not connected to the charger during the working day):

https://www.youtube.com/watch?v=Uvybhb8P894

4. A very short round trip with a preheated car, which was parked outside) reveals problems some problems with handling.

https://www.youtube.com/watch?v=E2Qjt0obVfI

Ample supply of heat from ICE engine helps steering. Tesla does not have it and it looks like it became very stiff.

It is actually amazing that lithium batteries (which are electrolyte based) work that well at such low temperatures. So in way Tesla experiment opens new frontier for lithium batteries.

FYI: The biggest issue is that Tesla does not make any money selling cars. Its estimated that it looses about $5900 for every car sold:

https://www.investopedia.com/articles/markets/070116/tesla-losing-money-each-time-it-sells-car-tsla.asp

When you have heavy weights like Stanley Druckenmiller & Ray Dalio shorting Tesla its likely that company will go bankrupt in about 2 years.

GM has announced it ending production of its Volt in March.

Most electric vehicles have very high deprecation rates, Losing about 70% of its value in about 5 years.

https://www.denverpost.com/2018/10/11/electric-car-depreciation/

Meaning its a very niche market, since almost no one wants used EV’s. I see a lot of people buying used EV’s, taking the battery pack for off-grid homes & sell the rest of the vehicle for scrap.

My guess is electric cars will follow the same path as Edison’s DC grid, that was replaced by AC power. Only Hybrids will be economical. Its just one of those experiments that just does pan out over the long term.

TechGuy

You are quoting old “news” from 20 Oct 2018 about Tesla. The news were from year 2016 , probably after they invested for Model X line of production. After Oct 20 Tesla reported 2 quarters of positive earnings, with surprising good margins for Model 3 , over 20% in Q4 , even after a price cut in the quarter. By the way, total Tesla sales increase from 7B$ to 21B$ in just 2 years, from 2016 to 2018.

Your second quoting is mainly about Nissan Leaf EV cars. Hard to jump to conclusions from this about Tesla.

Beside this, most car makers plan a lot of EV in the immediate future. Give them some credit they know something on this matter.

Alex Palti: “You are quoting old “news” from 20 Oct 2018 about Tesla”

October 2018 isn’t old news. Nothing has changed since then except that Telsa is laying off about 10% of its workforce. As far has it profit, I think its just fiction & fraud. Most of Tesla Executives are leaving. Its CFO quit just a few weeks ago which should be a very large waving red flag.

Tech Guy says:

My guess is electric cars will follow the same path as Edison’s DC grid, that was replaced by AC power. Only Hybrids will be economical. Its just one of those experiments that just does pan out over the long term.

Even if Tesla does go belly up ICE and Hybrids are already dead! You really need to have a conversation with my son’s generation. They will not own cars as you think of them. They will use EVs such as this when they need them.

https://www.youtube.com/watch?v=wLZKdkgB85k&t=7s

They will also change the economic model that supports private car ownership. As for Hybrids, oil and ICE vehicles They are so last century!

Likbez,

I will say it again, not really any significant problems, occasionally doors freeze shut during thaw freeze cycle (rain or very wet snow followed a severe temperature drop. Heating the car solves the problem, which can be done using smartphone app remotely.

Dennis,

I agree that Tesla 3 is OK luxury car. It is not a lemon but it is overhyped. Being cutting edge technology entails problems with reliability, while the price is very steep. I guess you paid around $50K for it. For this price you can by XC60 or UX 250h LUXURY. A couple of my friends are driving Tesla 3 and so far none has any significant problems. Both are enthusiasms highly recommending it.

It might well be connected with how much money they spend for a Corolla size luxury car 😉

https://www.consumerreports.org/car-reliability-owner-satisfaction/tesla-model-3-loses-cr-recommendation-over-reliability-issues/

Consumer Reports has now pulled its recommendation of the Model 3 based on reliability issues. “Members say they’ve identified a number of problems with their cars, including issues with its body, hardware, as well as paint and trim,” Consumer Reports said.

Likbez,

Like I said, no problems for me, it is possible the earliest vehicles might have had problems. I received my car in October 2018.

Consumer reports also rates the Tesla Model 3 as having the best consumer satisfaction of any of the cars it has evaluated. The size is comparable to the Mercedes C class and BMW Series 3.

I live in a place where the average temperature was 19 F (-7 C) in January 2019. I drive the car to a ski area almost every weekend, no matter the amount of snow on the road (the more the better as I prefer more snow at the ski area).

The car is parked outside, not plugged in, often with temperature at -20 C for an overnight low temperature. The car is charged at the base area while I ski (no charger at condo complex).

At some point I hope to convince my condo association to install a charger as it would be more convenient.

I used two pieces of recent info to estimate the percenatge range drop associated with EVs in cold weather.

Recently the AAA issued a report in which they stated that at 20F, the average percentage range drop of the four EVs they tested at 20F was 40%. A few weeks ago in our local paper, a reporter tested a Chevy Bolt at 14F and reported that the range drop was 47%.

The range of a vehicle is determined in a test lab at 68F. So a temp drop of 48F reduces the range by 40%, based on the AAA tests. Assuming the efficiency drop is linear, that translates into 0.833% drop for each 1 degF drop.

So the percentage range loss for the Bolt, which is 54 degs below the test temp, should be approximately 0.833*54=45%. Reasonably close to the 47% reported.

A 40% to 47% range loss is major and I am now beginning to think that the Canadian/US govt/Automakers should be providing this info to customers on the fuel economy label. A good bogie cold temp would be 32F. I can hear the howls from the EV crowd. “Automakers in Canada/US discouraging consumers from buying EVs.”

Maybe Consumers Report might start doing cold weather tests on EVs and plug in hybrids after the recent cold snap in US and Canada this winter. As noted above, some plug-in hybrids turn on the gasoline engine to provide cabin heat in winter. Not sure what they do at 95F. Does the engine drive the AC compressor?

Ovi,

The drop in range depends on the length of the trip.

In cold temperatures such as 14F the battery energy is used to warm the battery over the first few miles and range is not very good if calculated over a 5 mile trip. Over the course of a longer trip such as 100 miles the range loss is not as great.

It also depends how high one heats their car. I dress warmly when it is 14F outside rather than my typical clothing inside my house.

If I didn’t dress properly, my range would be lower.

Average temperature where I live was about 19 F in January (average monthly temperature in 2019), the range was about 24% lower over about 1500 miles driven compared to October 2018 results (1600 miles driven in October 2018).

There is a loss of range, but it is not as large as 47% based on my experience in a Tesla Model 3.

In October the average was 241 Wh/mi and in January it was 300 Wh/mi.

Recent 500 mile trip mostly highway miles at about 0 C, I averaged about 270 Wh/mi, mostly drove at about 65 MPH (104 kph). At 270 Wh/mile that’s is about 285 miles (455 km) of range.

The integrated oil companies usually avoid trouble during periods of low oil prices because of steady refinery profits. This could be an issue?

2019-02-13 (EIA TWinP) Low gasoline crack spreads and high crude oil feedstock costs reduce U.S. Gulf Coast refinery margins

The U.S. Energy Information Administration (EIA) estimates that margins for U.S. Gulf Coast refiners have declined to the lowest levels since late 2014, based on recent price trends in certain grades of crude oil and petroleum products.

https://www.eia.gov/petroleum/weekly/

World gasoline margins (Platts & MS) chart https://pbs.twimg.com/media/DzMyUtVW0AEqE_D.jpg

Reuters longer term version from last month https://pbs.twimg.com/media/DyJc-NbWkAIirak.jpg

(EIA STEO Feb 2019) U.S. Gulf Coast refinery margin—reached $5.89/b on January 29, the lowest price since December 2014

OPEC spare capacity is now around 2 million barrels per day.

OPEC has cut production by 1.5 million barrels per day in the last 2 months.

Besides that Saudi Arabia and Kuwait have ended their dispute over the neutral zone, which will add another 500,000 of spare capacity.

https://oilprice.com/Energy/Crude-Oil/Saudi-Arabia-Kuwait-Discuss-New-Oil-Production-In-Neutral-Zone.html

IN the longer term Saudi Arabia will add another 1mmbd to it’s capacity over the next few years.

https://www.reuters.com/article/us-oil-opec-falih-investment/saudi-arabia-to-invest-20-billion-in-spare-oil-production-capacity-idUSKCN1ME111

As Ron Patterson explained several times here, OPEC members cheat. They cut from the elevated, unsustainable level, achieved specifically to accommodate cuts.

So “after cut” level is often not that different from a reasonable “normal,” sustainable production level in their current production conditions, plus some, related to previously delayed maintenance, shutdowns.

Four years of capital underinvestment bite production both in OPEC and non-OPEC. So talking about excess capacity is somewhat problematic and we now need to distinguish between “prime oil” and “subprime oil.”

Most people who talk about “excess capacity” are interested in lower oil price (the list includes the USA and the EU governments ) That’s why condensate and other “subprime oil” is counted in total oil output. Supply of “prime oil” now is stressed.

In other words, everything connected with oil is now politically charged. That means that it is not wise to take IEA data and their forecasts at face value. It should be viewed as an opinion of the agencies deeply (institutionally) interested in the low oil price.

You need the ability to read between the lines, much like readers of the press in the USSR. And as several experts here do. You need the acute ability to cut through “official bullsh*t”.

And neutral expert opinion is very difficult to come by. That’s why this blog has so much value.

Likbez

You mean like the expert opinion that claims peak oil has arrived every single year since 2008?

I cannot be bothered to find the quote from the oil drum, but a more recent comment by Ron.

“Bottom line, it is obvious that we are on the cusp of peak oil and only the seemingly ever-increasing barrels from US shale oil production is keeping it at bay. But it now looks like that party is about to be over. I think it is very likely that peak oil has already arrived, if not this year then 2015 for sure.”

https://oilprice.com/Energy/Crude-Oil/Did-Peak-Oil-Arrive-in-2014.html

OPEC which peaked in 2014 at 30 million barrels per day, produced 33 million barrels per day last year before cutting production. OOPPPS

You are correct expert opinion is hard to come by.

Dennis, with his calculation of a peak in 2025 + or – 3 years is about right.

Hugo Wrote:

“Dennis, with his calculation of a peak in 2025 + or – 3 years is about right.”

That really depends on how much debt the Shale Drillers can take on, and presumes there is not another global recession before 2025. Next three years for Shale Drillers may be a problem. I believe something like $150B in debt comes due between now and 2023. That’s a lot of debt to roll over, as well as take on more debt to fund CapEx. Without constant US Shale production increases, world production peaks.

TechGuy

It is a massive amount of debt. It all depends on the price of oil over the next couple of years. A price over $70 will probably see them though, if an economic downturn causes prices to fall to $40-$50 then some will go out of business.

This in turn would probably causes oil prices to rise sufficiently to save less indebted companies.

Hi Tech Guy,

As log as the recession is mild, oil output is likely to recover above 2018 levels (highest 12 month average of C+C output to date).

If there is another GFC, possibly the peak will be 2018. I cannot predic t future financial crises with any accuracy, my expectation is the next severe recession will be 2030+/-3, with peak oil being a possible cause (with a lag of 3 to 7 years).

I am also likely to be incorrect.

Heads up. Some scroll upwards there is a quoted article from oilprice.com.

The writer is Nawar Alsaadi. I suspect we fell victim of presumption. He has an Arabic sounding name, and that leads us to suspect he knows something about oil.

Look into this guy. There’s nothing ugly or horrible about his background, but there is nothing in it that shouts out expert. He is a writer. Including publishing fiction.

He’s also “with” some investment firm. Turns out he’s president and CEO of the firm and conveniently an employee count is not easily found.

What this got to do with the content of the article? I doubled checked the data and its spot on, you are free to take his data and come up with a different conclusion, but I don’t get this personal spin.

Don’t you check credentials of people you hire?

I know Nawar quite well from Energy Investing board. He started a board for long term investing there. I consider him quite knowledgeable in energy area. He has an issue with the board and quit the site. I would say your comments are off base.

Watcher likes to experiment with others. I believe it’s called trulling.

Yeah, and he probably has brown skin also. And you know what that means. /Sarc

Ron,

That he is highly intelligent no doubt, like many other non-white people. 🙂

I’m curious – does anybody know, by the data trends, which OPEC country is likely to run so low on oil that they become a net importer, next? I do understand this event may take some time to occur.

If you take a look at PXD announcements, I reach the conclusion that Permian is slowing. Like Dennis Coyne, I look at growth after fourth quarter 2018. Oil production in fourth quarter is 199.2 Kilo barrels/day. The guidance for 2019 is between 203 to 213 Kilo barrels/day. PXD is spending 300 MM dollars for gas processing and water treatment infrastructure.

Hi guys,

Long time lurker, but first time commentor. I would like to get Mr Patterson’s take on Robert Rapiers latest report on KSA’s reserves.

Thanks.

I had to google the link, but it was not hard to find.

How Much Oil Does Saudi Arabia Really Have?

Okay, you will have to read the article to see how Robert arrived at his conclusion. But his conclusion is:

So, I have no good reason to doubt Saudi Arabia’s official numbers. They probably do have 270 billion barrels of proved oil reserves.

I find his logic horribly flawed. Robert compares Saudi’s growing reserve estimates with those of the USA.

First, the US Securities and Exchange Commission have the strictest oil reporting laws in the world, or did have in 1982. Also, better technology has greatly improved reserve estimates. And third, the advent of shale oil has dramatically added to US reserve estimates.

Saudi has no laws that govern their reserve reporting estimates.