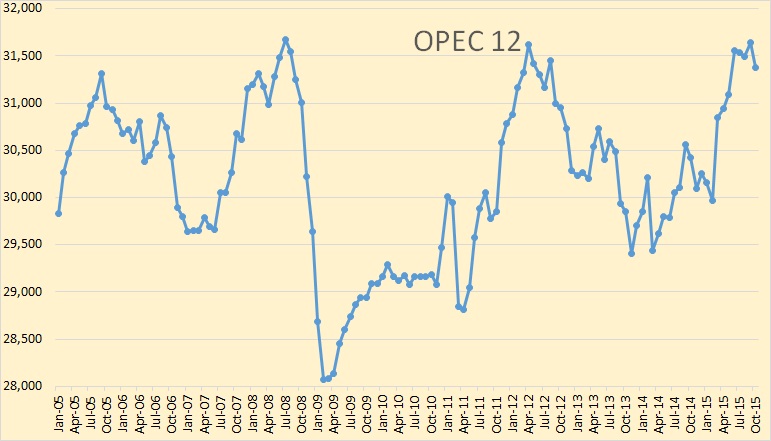

OPEC has published their OPEC Monthly Oil Market Report with crude only production numbers for October 2015. The charts are “Crude Only” production and are in thousand barrels per day.

OPEC 12 was down 256,000 bpd in October.

OPEC uses secondary sources such as Platts and other agencies to report their production numbers. I find these numbers far more useful than those reported by direct communication with the OPEC countries. Those numbers are political and usually highly inaccurate.

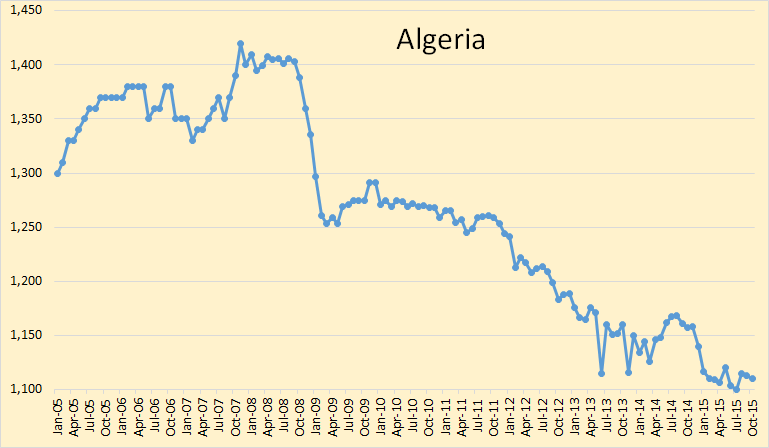

Algeria peaked in November 2007 – 2008 and has been in a steady decline since that point.

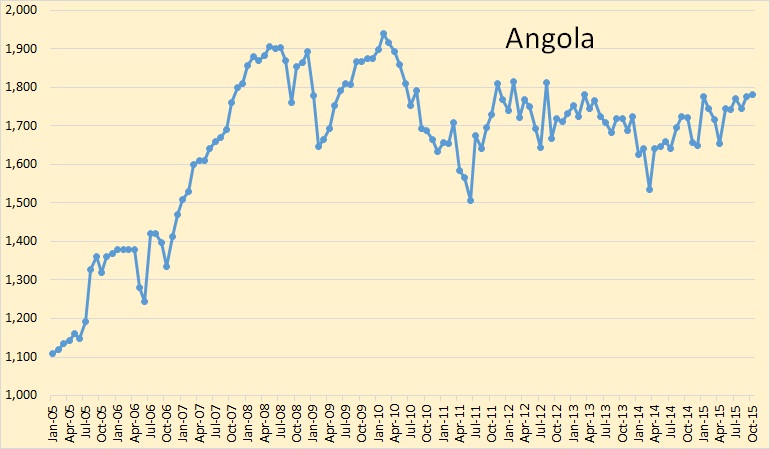

Angola has been holding steady since peaking in 2008 and 2010.

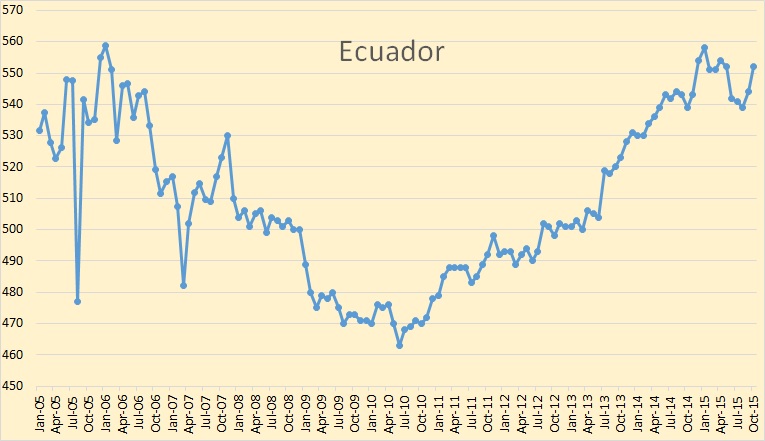

Ecuador appears to have peaked this year. It is likely production will be down, but only slightly, next year.

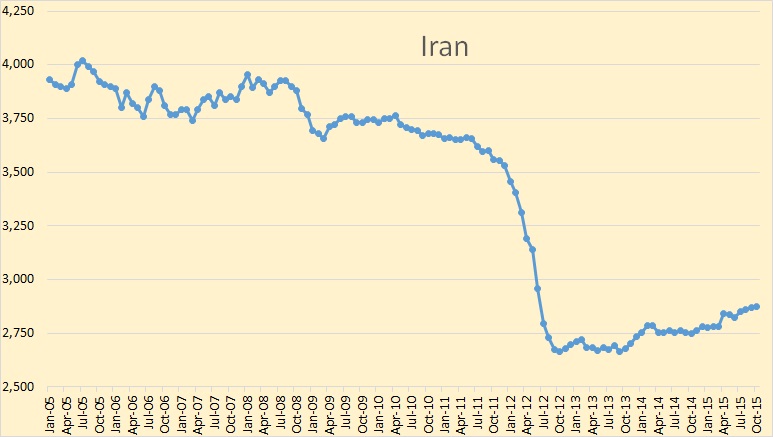

Iran appears to be poised to increase production when sanctions are lifted. But don’t expect too much very soon. After years of neglect, their infrastructure is in very bad shape.

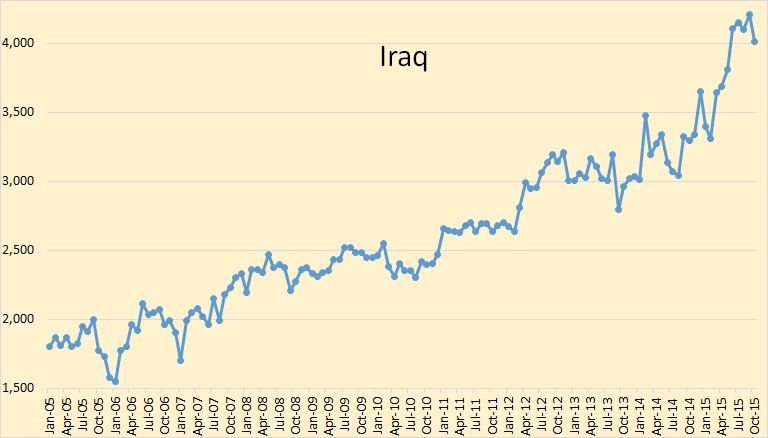

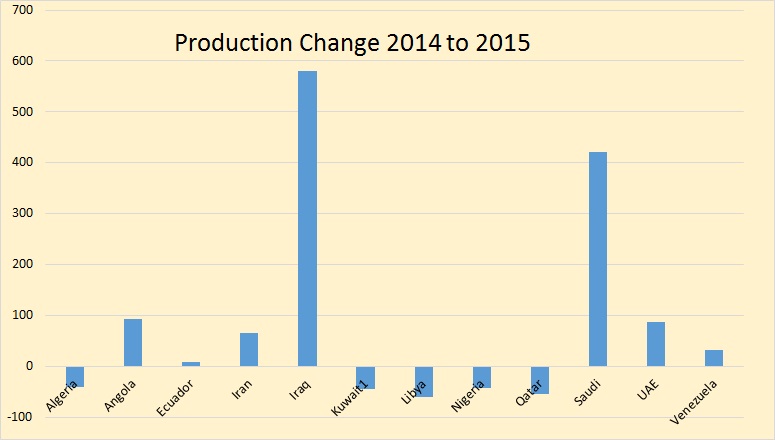

Most of the 2014 to 2015 production change has come from Iraq.

This chart shows the change in the average production from 2014 to 2015. Of course we are only averaging the first 10 months of 2015 versus all 12 months of 2014. The data is in thousand barrels per day.

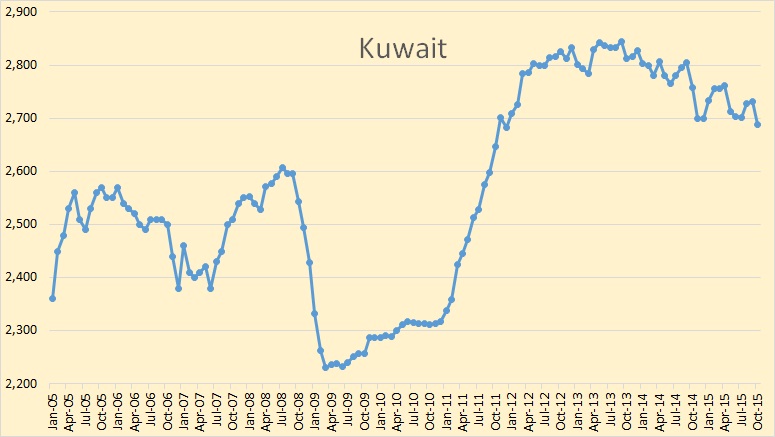

Kuwait peaked in 2013 and has declined about 150,000 bpd since then. I believe 2013 will be the all time peak for Kuwait.

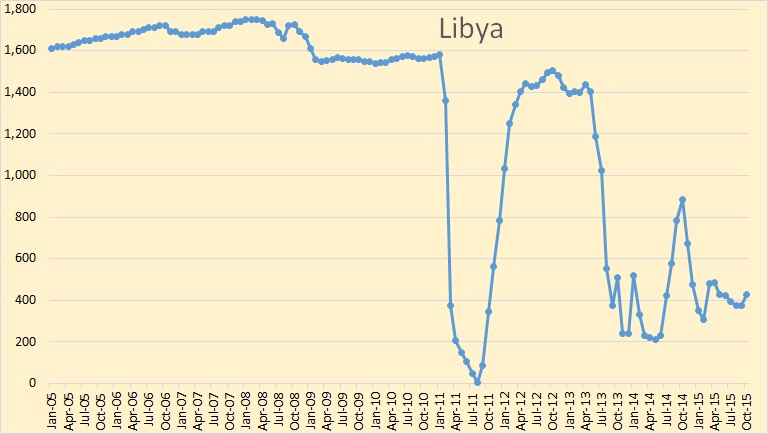

Libya is struggling with their own Arab Spring. There is no way of knowing when, if ever, peace will break out there. I think it extremely unlikely they will produce as much as 1,000,000 bpd within the next 5 years or s.

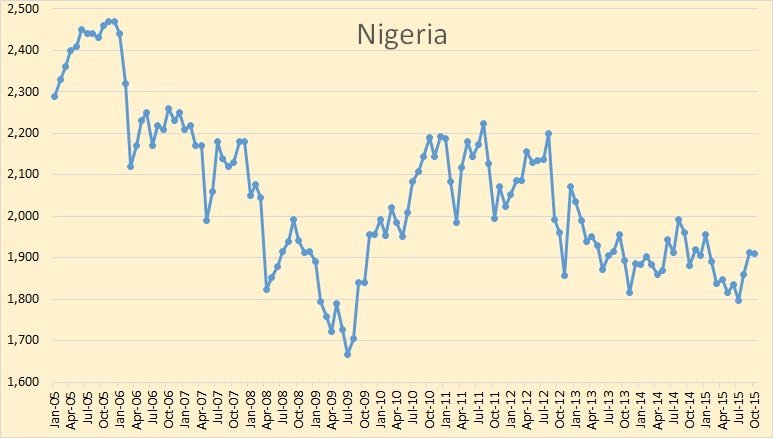

Nigeria is struggling with their own political revolution. But it appears they are in decline regardless of their political problems.

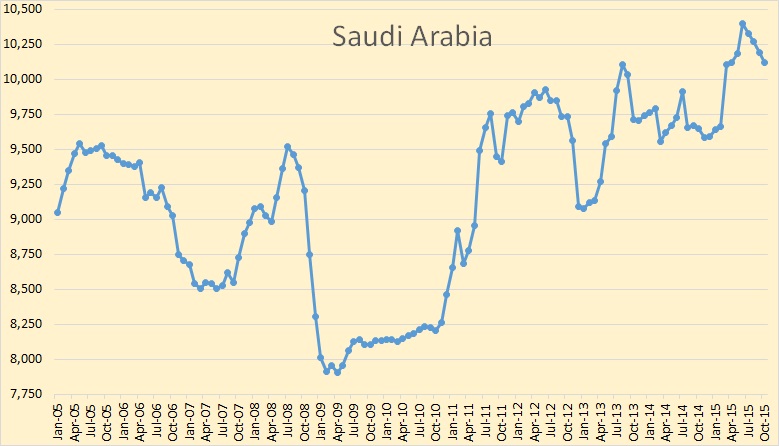

I believe Saudi is producing every barrel they possibly can. They will be lucky to hold this level for much longer.

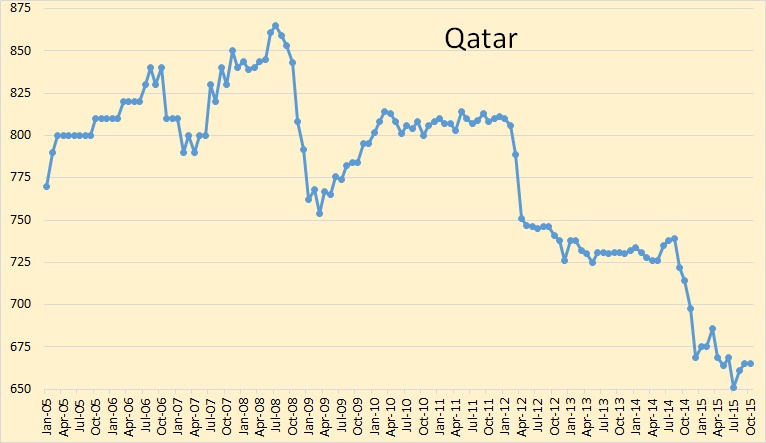

Qatar has lots of natural gas but their oil production has clearly peaked and is now in pretty steep decline.

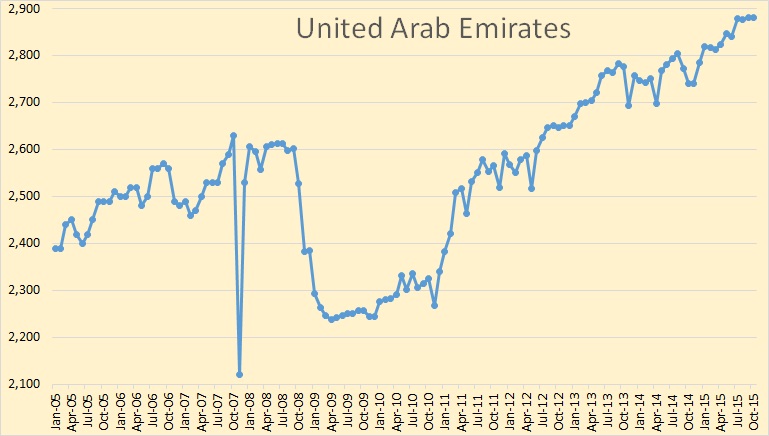

From 2005 through 2010 the oil rig count in the UAE averaged around 12. In October their oil rig count stood at 46, almost 4 times their average. They have managed to increase their production about 11% above their 2008 peak. I believe UAE production is about to follow Kuwait’s lead and rollover.

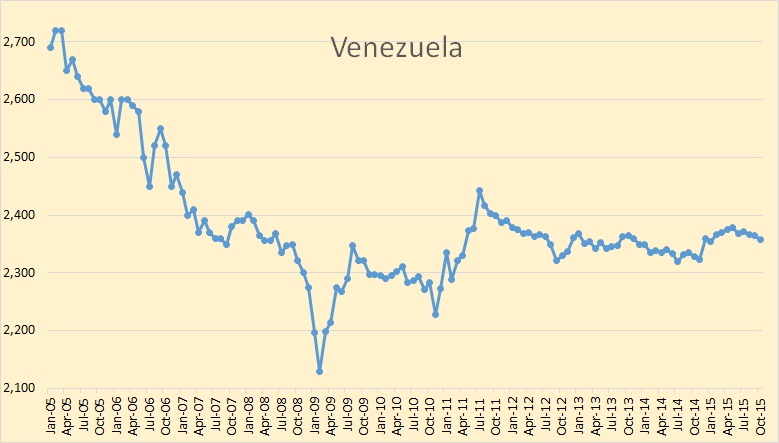

Not much can be said about Venezuela. Their conventional oil is in decline but their bitumen production is keeping production relatively flat.

OPEC has world oil supply peaking in June and July and declining by about 1 million bpd since then.

From the EIA:

Mr. Patterson,

Please take a look at our new site. It is a work in progress so we would greatly appreciate any feedback you have to offer.

Best,

Tejasvi Raghuveer

There is a five minute video of the new portal. And click on the “feedback” link to leave your feedback. I am leaving feedback that it will be extremely difficult to copy and paste the data into my spreadsheets. You can get the data in Excel format but you must copy and paste each country individually, or so it appears to me.

Hi Ron,

I have been able to download all countries for C+C, but country groups have to be done separately (I think). There are a lot of blank rows in the spreadsheet for the data not requested (Total petroleum and C+C+NGL+other liquids) so there would need to be some rows deleted to make the file more manageable). I wish they would publish the international data beyond April 2015!

Dennis, I am sure we will figure out how to extract the data to our spreadsheets without too much extra effort when they finally get it completed. And when they do I expect them to have several months data, hopefully through the summer.

So if OPEC is barely keeping its market share, and North America is starting to reduce its production, who is winning market share? Russia?

That only UAE and KSA have been up to the task of increasing production is startling. It is a demonstration that OPEC has very little production growing room.

Underrated post.

Javier,

Well, there’s been a bit of a ruckus affecting Iraq’s production, and that of Iran has been down as a result of sanctions.

I don’t disagree with your main point overall.

Hi everyone, I would like to take this opportunity to introduce my new book, “China and the 21st Century Crisis”, that was just published this month:

http://www.amazon.com/gp/product/0745335381/ref=s9_simh_gw_g14_i1_r?pf_rd_m=ATVPDKIKX0DER&pf_rd_s=desktop-1&pf_rd_r=0N90KBQKCC7YD61P4623&pf_rd_t=36701&pf_rd_p=2253014322&pf_rd_i=desktop

In addition to discussing the coming economic and social crisis, the entire Chapter 6 is about peak oil and climate change. It includes my latest 2015 scenarios for “peak energy”

Introduction of the book on Amazon:

Most discussions of the global financial crisis take the United States as their focus, both for analyzing what went wrong and for making plans to avoid similar mistakes in the future. But that may not be the case next time: as Minqi Li argues convincingly in China and the Twenty-first-Century Crisis, by the time of inevitable next crisis, China will likely be at the epicenter.

Li roots his argument in an analysis of the political and economic imbalances in China that would exacerbate a crisis, and possibly even precipitate a full collapse—and he shows in detail the reasons why that collapse could happen much more quickly than anyone imagines. Writing from a Marxist and ecologically oriented perspective, Li shows unequivocally that the limits to capitalism are fast approaching, and that events in China—essentially the last great frontier for capitalist expansion—are likely to be pivotal.

Praise for The Rise of China: “Li has accomplished something different and very important. This is a book which explains much that seems a puzzle and challenges the received opinion of many analysts. It should be read by all concerned persons.”

(Immanuel Wallerstein, Yale University)

“This is a must read for anyone seeking to understand the workings of global capitalism. In a clear and concise fashion Minqi Li explains the importance of Chinese economic dynamics to contemporary global capitalist stability and why the growing class and ecological contradictions undermining Chinese capitalism likely means we are heading into a new period of sustained global crisis. The need for system change has never been clearer.”

(Martin Hart-Landsberg, Lewis and Clark College)

“At the moment that the whole world is suddenly wondering about the unsustainability of the Chinese economy and beginning to recognise that China is increasingly at the centre of the crisis of our times, Minqi Li has produced a book that argues exactly that. Moreover, he does so with a breadth that goes beyond most economic analyses, encompassing the interconnected economic and ecological crises of our time. China and the Twenty-First-Century Crisis is an important, timely, and bound to be influential work.”

(John Bellamy Foster, University of Oregon)

“Writing from a Marxist…………………. oriented perspective”

Worthless to me.

Why would such a perspective be worthless? While I have doubts about the pertinence of an exclusively Marxist world view I also have doubts about a BAU capitalist model. From my perspective I just see the global crisis and I think that both traditional Capitalism and Marxism are both obsolete world views, which is precisely why they are in crisis. I’m currently studying other, as yet unnamed, disruptive models.

Hi Fred,

When people hear Marx, they get red in the face and cannot think… 🙂

As Doug likes to say, you are spot on as usual.

LOL

I’m with Fred when it comes to having grave doubts about both Marxism ( communism ) and capitalism.

There is no doubt in my mind that capitalism is superior, taken all around, but this does not mean that capitalism may not be fatally flawed, and it does not mean Marxism is without merit.

If there is any one very short answer to the failure of communism, it is that the people who got to the top of the heap first seized power for themselves and their own families and friends and cronies, and operated communist countries as personal fiefdoms.

Quite a lot of fairly intelligent people believe that if current trends continue, capitalist countries will soon be operated as private fiefdoms by the people at the top of the capitalist heap. Some people say this has ALREADY happened.

If there is any one good reason to suppose that a communist government, which by MY definition at least is a defacto authoritarian government, is in some respects superior to a democratic government, it would be that a communist government can at least POTENTIALLY tackle a really serious problem without having to worry overmuch about the next election.

Our American government for instance is apparently just about powerless when it comes to increasing the taxes on motor fuels even though such a policy would be very good for the country long term.A communist government can simply decree how high the tax will be and thus reduce the need for imports and provide a powerful incentive for any commie land citizen able to buy a car to buy one that is very fuel efficient.

A number of the larger species of animals have survived in Europe for the last thousand years or longer, instead of being hunted to extinction, due to kings and emperors preserving them for their own hunting pleasure.

A democratic government would not likely have been able to muster the will and the resources to protect such animals in times past.

Authoritarian governments compare favorably to democratic governments under certain circumstances.

A Marxist tale of two economies

Note that the US profit rate declined during/before each major crisis (1930s, 1970s, 2008-2009)

Look at how the Chinese economy has been super profitable but how China’s profit rate has declined sharply since 2007

The book is also distributed by University of Chicago Press

http://press.uchicago.edu/ucp/books/book/distributed/C/bo22356875.html

Table of Contents

1. China and the 21st Century Crisis

2. China: Classes and Class Struggle

3. Economic Crisis: Cyclical and Structural

4. The Capitalist World System: The Limit to Spatial Fix

5. The Next Economic Crisis

6. Climate Change, Peak Oil, and the Global Crisis

7. The Unsustainability of Chinese Capitalism

8. The Transition

Bibliography

Index

Hi Political Economist,

A problem with Marxism is its reliance on the Labor Theory of Value. I am sure you are familiar with Piero Sraffa’s work and such an analysis can easily be used to create a Capital Theory of Value.

Using such a theory Marxism could be turned upside down with capitalists having surplus capital extracted by exploitative workers.

The choice of what good is “the source of value” in an objective value theory is an arbitrary one.

There are many problems with Walrasian and Keynesian theory as well, but the problems with neoclassical economic theory (of the early 1970s from the Paul Samuelson era and maybe of Paul Krugman today) pale in comparison to the problems at the foundation of Marxian theory.

Hi Dennis, thanks for bringing this up. This is definitely not about energy. But since you mentioned this here, let me give you some of my thought.

First, regarding neoclassical economics, the debate between two Cambridges pretty much destroyed the logical foundation of neoclassical economics. Because neoclassical economics cannot establish the definition/measurement of “capital” without first knowing marginal productivity of capital; but they cannot establish the definition/measurement of marginal productivity of capital without first establishing “capital”.

So neoclassical economics is involved in circular reasoning, and without a meaningful concept of capital, the rest of the system collapses.

The above is mostly theoretical. It does not necessarily undermine one’s faith in the efficiency of a market economy (ironically, it is conceivable that the entire neoclassical case for invisible hand can be reconstructed based on labor theory of value; after all, Ricardo did that)

But since then there has been lots of development among the more enlightened mainstream economists that have basically established that market failures are both devastating and universal. This is serious, because this means, in fact, in their heart, they know the invisible hand argument is invalid. Stiglitz came close to admit it in some interviews.

Why does it matter? Consider the current environmental crisis. It is conceivable that we will fail to stop climate change and the emerging climate catastrophes will bring down human civilization. From the neoclassical perspective, this is because the market prices for fossil fuels are wrong. Can this be corrected by government intervention? From the neoclassical perspective, to do this, the government needs to know the correct prices and even if the government does know the correct prices, there is still the implementation problem (principal-agent problem, people will find ways to outmaneuver government, etc). If the government does not know the correct prices or cannot implement, then we cannot correct market failures. If, on the other hand, the government does know the correct prices and can implement, why not have socialist planning?

Compare this to socialism. Of course one needs to be reminded of the Soviet environmental disasters. But the Soviet environmental failures were almost nothing compared to the contemporary Chinese environmental crisis (and I need to remind people that China’s current environmental crisis has happened after China’s capitalist transition). Whatever is/was their internal system, both the Soviet Union and China are a part of the capitalist world system and therefore both of them are obligated to pursue economic growth.

Although this has not happened in history, but it is definitely conceivable that a socialist economy can be structured to be based on zero or negative growth. But this cannot be said of capitalism.

In fact the strongest economic argument against socialism is that the socialist economies did not grow rapidly enough (even though Cuba succeeded in delivering higher life expectancy than the United States and for some years Cuba was considered the only country that met the principle of sustainable development by the living planet report). Therefore, the question is, if it turns out that capitalism cannot provide sustainability for human civilization, what social system can deliver sustainability while meeting population’s basic needs?

Now, about labor theory of value. There are two different questions here. One has to do with the labor theory of value as a theory to explain the long-term equilibrium prices in a competitive market economy and the other has to do with what Marx called the theory of surplus value.

About the theory of surplus value, it needs to be reminded that Marx’s theory of surplus value or exploitation is not moralistic but based on observed economic facts (although it could be used for moralistic purposes). All it says is no more than this: in a capitalist economy, a workers has to work longer than the social labor time embodied in the commodities consumed by the worker himself (or the worker’s family) and in this sense, the capitalist profit (surplus value) derives from the worker’s surplus labor. This is factually true.

Of course, as you said, a similar quantitative relationship can be established for other production inputs. Say, the total energy consumed in a society will have to be greater than the energy input used for energy production (people here are of course familiar with EROEI, which has to be greater than 1 for society to function). Based on this, one could argue that not only the workers are exploited but energy is also “exploited”.

But if one really wants to extend the concept of “exploitation” here (which I don’t think makes sense), what is being “exploited” is energy BUT NOT energy owners (even less the owners of capital goods consuming energy).

In any case, the concept of “exploitation” or surplus value has to be used in a context of social relations. It makes sense that the workers can take over the means of production and appropriate their own surplus value (or products of their surplus labor). But it is obviously nonsense to say that the energy input can somehow appropriate the “surplus energy” consumed in other energy consumption processes.

Finally, about the long-term equilibrium prices. It can be easily established that in “simple commodity production” (pre-capitalist market economy, where the producers own their means of production), market prices tend to fluctuate around ratios that are in proportion to the total labor embodied in commodities (including both direct labor and indirect labor embodied in means of production).

The problem has to do with “prices of production” or the equilibrium prices in capitalism (you are probably aware that this is known as the “transformation problem” in the Marxist literature). All the difficulty comes from the fact that in capitalism, the direct labor time (“live labor”) is further divided into necessary labor (the labor time it takes for the worker to replace his value of labor power) and surplus labor. In fact, knowing the production coefficients, a unique set of equilibrium prices and the equilibrium profit rate can be solved from a set of past labor (indirect labor), necessary labor, and surplus labor for each commodity. Thus, a definite set of mathematical relations can be established between the prices and the labor variables (although it’s no longer simple proportionality; but I think it does not matter)

Of course the Neo-Sraffians would like to emphasize that you can take any other important input (say, energy) and establish a similar set of relationship between prices and say, past energy, necessary energy, and surplus energy. But, as I said, energy cannot be a player in social relations.

In any case, labor theory of value plays an insignificant role in modern Marxist economics (I personally still think labor theory of value is valid but it no longer provides important insights).

You will not find labor theory of value in my book. But I hope you will still find it intellectually interesting (and a little provocative).

Hi Dennis, I wrote a long reply to your question on labor theory of value. But somehow after I posted it, it appears to have disappeared.

I attempted to re-post it. But each time it was marked as a SPAM

So please find my reply saved here:

http://redchinacn.net/portal.php?mod=view&aid=28599#comment

Hi Mac,

I had to laugh when I read is part –

“If there is any one very short answer to the failure of communism, it is that the people who got to the top of the heap first seized power for themselves and their own families and friends and cronies, and operated communist countries as personal fiefdoms.”

You could change the word “communism” with “capitalism” and it would still be true.

Chief,

Did you read past the first paragraph?

😉

Quite a lot of fairly intelligent people believe that if current trends continue, capitalist countries will soon be operated as private fiefdoms by the people at the top of the capitalist heap. Some people say this has ALREADY happened.

I no longer believe that to be the case. What I am finding is that quite a lot of fairly intelligent people are seriously thinking outside the box. I know the last time I posted a link from the DIF you commented that it was mostly pie in the sky, maybe, but if nothing else Google what these people are involved in. Michel Bauwens, Neal Gorenflo & April Rinne

The Sharing Economy Redefined

12 Nov 2015 17:00 – 18:00 GMT

https://www.thinkdif.co/headliners/april-rinne

Also check out:

Denmark: Ahead of the Game?

06 Nov 2015 10:00 – 10:30 GMT

https://www.thinkdif.co/emf-stage/circular-economy-the-danish-approach

Yes, the Danes are a rather ‘Socialist’ bunch… I’ve been to Denmark and I liked what I saw! US policy makers could learn a lot from how the Danes run their country.

If anyone still believes the US political system is working then I don’t have a whole lot to say to those people. As for total insanity I give you the current crop of GOP presidential candidates… and Hillary isn’t much better. Of course there are islands of sanity in the US, Colorado is going to have Universal Health Care on their ballot in 2016. At least they are starting the conversation.

And last but not least I’m currently in one of the least sustainable and most dysfunctional cities in the world, Sao Paulo, Brazil. I’m learning a lot about the future here, it is quite an eye opener!

Cheers!

Fred, it has been a long time since I read the book The Gulag Archipelago by Aleksandr Solzhenitsyn, I don’t remember much of it anymore. One memory I have is when each morning came along, prisoners in the camp would exit from their plush digs and have one boot in their hands full of urine. When one of the prisoners would die, the other inmates would wait for a couple of weeks to notify the camp officials of the death so they could have the daily rations of their fellow dead inmate. Fun times in Siberia during Uncle Joe’s tenure as the leader of the Soviet Union.

Didn’t Joe spend a couple of years there himself?

Seems as though I read that some where.

Eric Allen Blair said it best, imagine a jackboot on your throat forever, a bleak future, not what you want to see. George Orwell was his pen name, nom de plume. He also wrote an essay on how the British treated the people of India. The title of the essay is quite offensive, so it is unwise to provide a link to George’s thoughts on what the people of India had to endure under British rule.

George didn’t have good words to say about socialists either.

The English were not too kind to the native population of India, Mahatma Ghandi went to the ocean and started to make salt to protest the salt tax imposed by the British. Ahimsa was his stock-in-trade, non-violent, peaceful protest. He would have been at odds with Mr. Marx.

Ghandi was a lawyer, traveled to Britain to practice, so Ghandi was fairly astute at knowing if people were being treated fairly or not.

Ghandi’s great grandson was in Kentucky maybe 15 years ago now to help the downtrodden in that state.

Compassion is what is needed in this world, not stupid money that has words that say ‘In God We Trust’. Yeah, right. What a bunch of crap.

Just a little encouragement goes a long ways.

Ghandi had the right idea, get to work. Karl would have benefitted had he gone to India to help Mahatma make salt.

Everything you do is work, so it cannot be avoided.

Have a nice day. har

Ghandi had the right idea, get to work. Karl would have benefitted had he gone to India to help Mahatma make salt.

Exactly! I don’t really give a crap about Karl’s or Adam’s personal views, philosophies or ideologies. What I care about is the people in the trenches who are helping to make that salt. No bullshit Gods, just ordinary people caring about people and helping each other. Encouragement and compassion, yes! Oppression and greed, not so much.

Hi Fred,

I did not mean to badmouth futurists to the extent of calling their ideas and dreams pie in the sky.

Mostly I was trying to point out that while a some portion of the stuff at the link would become reality, hardly any of it is likely to scale up fast enough to help us out of the current deep overshoot hole we are in.

But I hope I am wrong about that!

I always look forward to your comments, they deepen my insights into places I have never had the opportunity to see, and probably never will.

Sky Daddy alone knows what will happen to the people in a place such as Sao Paulo when the shit really and truly hits the fan, for any number of reasons, but my armchair study of history augmented by my ag background leads me to believe the suffering is going to be beyond comprehension.

So far as I can see, there is only one place all those people can realistically be expected to go, and that is whatever afterworld they believe in, if any.

They are not going to go back out in the country side on short notice and take up life as subsistence farmers, there are too many of them, and they wouldn’t have a clue as to how to get started.

Ditto Sand Country ( my personal pet name for the source of most of the oil ) people living on imported food paid for with oil money, and having babies right and left.

It is hard to see other countries admitting immigrants by the millions, annually, for more than a very short period of time. Western European countries for example are already having problems providing for their own native born citizens.

MAYBE collapse due to overshoot will manifest slowly and countries such as Brazil will have time enough to make and execute plans to avoid the worst case disasters, but I fear collapse is apt to arrive suddenly, in some places, like a hurricane or an earthquake, with little warning.

IF Brazil were to devote every cent and every available man and machine to building a pipeline system and pumping stations to bring new reliable water however far is necessary to Sao Paulo, on a war time basis, starting tomorrow, it would probably take two or more years, on a war footing, to finish it- assuming the country could pay for it, and other cities weren’t in as bad or worse need.

Hi Old Farmer Mac,

Yes if the dictator is a benevolent one, then authoritarian government might be superior, but these are relatively rare so I would take my chances with democratic government and try to get some “benevolent dictators” elected. 🙂

Comrade Li is loyal to Mao thought as re-expressed by Chairman Hu when he said “let some of the people be rich following market socialism! Long live chairman Deng!”

However, I am sure that, in the future, he will write a book explaining why Marx was a mental midget who failed to visualize a dynamic system.

Karl Marx the genius:

http://pubs.socialistreviewindex.org.uk/isj85/morgan.htm

Karl Marx the idiot:

http://redicecreations.com/article.php?id=29612

If anything, the chief revolutionary was disruptive.

Japan is buying a metric ton of oil for ¥35,250, $289, 39.60 per barrel.

Maybe they will start converting their nuclear power plants to oil powered.

No, TEPCO is building new coal-fired power plants.

So you (Political Economist) are Minqi Li? Google came up with this little gem:

Peak Energy and the Limits to Global Economic Growth Annual Report 2011

World oil production will peak before 2020; world coal production will peak before 2030; and world natural gas production will peak around 2040. World total energy supply will peak in the mid-2030s. As rising energy efficiency fails to offset declining energy supply, gross world output peaks around 2050 and declines over the second half of the 21st century. While the carbon dioxide emissions from fossil fuels consumption are projected to peak before 2030, the cumulative carbon dioxide emissions over the century imply a long-term global warming of 3.5-7°C, with potentially catastrophic consequences for the humanity …

I wonder where you came up with these particular dates & figures for the various commodity peaks?

That’s my 2011 scenario for future world energy

Last year I posted my 2014 scenario on this site:

http://peakoilbarrel.com/world-energy-2014-2050-part-1-2/

If you’re interested in 2015 scenario, then please read Chapter 6 of the new book

Thank you, Ron. I wonder if we are looking at a fairly substantial fall in production at the start of next year bringing it into balance with demand and reducing or eliminating more going into storage.

The combination of OPEC stalling, even without any cutback after their December meeting, and falling overall rig count starting a year ago may get 1-2 mmb/d off the market pretty soon. Although only slowly, consumption is rising too.

Figure 6.19 from the book

World Energy Consumption, 1950-2050

I would guess that you read “50 Shades of Grey.”

You’re indeed clueless

Hi Minqi Li,

At $100 for a hardback. You could probably charge an additional $50 and get it accredited as a college text book in an American college. Then you could retire somewhere in the Bahamas (or Iceland) with an umbrella in your drink.

Seriously, that’s a pretty scary chart showing an extremely lot more fossil fuel consumed in the future. Does Chapter 6 predict when earth becomes uninhabitable for man ? Or is that why your chart stops at 2050 ?

I guess smoking fossil fuel isn’t much different than cigarettes. Just the time frame and damage.

Chief, thank you for your friendly suggestion. I have to concede that despite being a economist, I haven’t succeeded in marketing myself.

The fossil fuels scenario is scary but it’s actully relatively “modest” compared to some of the IPCC scenarios. The cumulative emissions between 2011 and 2100 implied are 2.4 trillion tons of carbon dioxide, just short of RCP 4.5

More spam. Why are you pimping things here.

Political Economist is a frequent contributor to this list and the book does deal with energy. I see no problem with letting him plug his book. I would allow you to do the same thing,

Yes Watcher,

How about a book explaining how markets really work.

Ron, thanks

Every body please remember, don’t respond to Banned and Censored.

He may actually seriously believe that climate science is all a joke and a conspiracy on the part of leftists and democrats, but more likely he is just a Koch brothers inspired troll.

PRETENDING there is a controversy when it comes to cutting edge science is an old trick used by businessmen and preachers ever since the Enlightenment and maybe before.If his sort is allowed into a discusson, pretty soon we would be debating vaccinating children, where the edge of the earth is, and divine creation.

The whole idea behind such people posting such comments is to create the impression among the scientifically illiterate public that there IS a genuine controversy, so as to enable business men benefitting from the status quo to continue polluting the environmental commons.

Ron has already had to ban him a couple of times using other handles.

Well he’s gone again. To get back he not only has to change his handle but also his email address and his IP address as well. I am sure he can do that because he has done that before. But it must require considerable effort on his part.

He has to be a dedicated right wing conspiracy theory nut case to go through all that trouble just to have his rant posted for a couple of hours.

OFM,

I rather think it is better if we stick to oil and economy in oil posts and leave climate science for climate posts, but if you think that there is no controversy in climate science you are thoroughly wrong. Sufficient to point you in the direction of the hundreds of articles on “climate sensitivity” (the response of climate to a doubling of atmospheric CO2) that it is hotly debated between low (harmless) and high (dangerous) values in the literature. Or the hundreds of articles hotly debating over if the pause/hiatus/reduced warming is real or not and what could be its cause.

We are seeing now and likely to continue seeing in the next years a lot more crucial developments for humankind coming from the oil fields than from the climate field. It appears that it is the human nature that when a danger is coming from one direction, most people will be looking in another. We have to be thankful to the media and politicians for keeping people interested in the climate circus so they don’t freak out with the fossil fuels reality, that is being downplayed and discredited.

Latest BP report claims that the dangers of Peak Oil have disappeared. That is a very serious signal that Peak Oil is upon us. First rule in politics: never believe anything until it’s officially denied.

I call it the “Assume the opposite” rule.

In any case, a corollary is that when you meet someone for the first time in regard to a possible business deal, and they start off by asserting how honest they are, it’s almost always a sign that the opposite is true.

Javier, the overwhelming consensus among climate scientists is that global warming and climate change is real and is caused by human activity. The overwhelming consensus among oil executives and republican politicians is that global warming and climate change is not real and even if it is, it is not caused by human activity.

I will go with science.

Ron, as explained by the scientific disagreement about climate sensitivity and the pause, science does not say that global warming is dangerous. Some scientists defend a high climate sensitivity and the inexistence of a pause, while others defend a low climate sensitivity and a real pause. You are not going with science on that one, but just with your choice of scientists.

Anybody younger than 25 has not experienced global warming first hand. They’ve just been told about that. The rest should consider that global warming for the last 150 years has been a blessing and that pre-industrial climate sucked. LIA killed 30% of the population in Finland and 15% in Scotland (with additional death toll in many other countries) between 1695-1700. That was a climate black plague.

Hi Javier,

The uncertainty is a reason to be cautious.

If the experts don’t know what the climate sensitivity is (is it 2 C, 3C or 4C?), why should we assume that the low estimate is correct? If you are concerned about cold temperatures, wouldn’t it be better to save the easy to extract fossil fuel resources so that atmospheric CO2 could be raised later if the low estimates of ECS that you believe are correct should result in the climate being too cool in the future(which I think is unlikely, but clearly you do not.)

It is mostly non-scientists that concern themselves with the so-called hiatus, climate experts expect natural variability in the climate which is superimposed on the upeard trend in temperature due to increased atmospheric CO2.

The differences in ECS in various climate models is due to the incomplete understanding of how cloud cover (low clouds in particular) will change in a warming climate, an area of active research in climate science.

Hi Dennis,

Sigh, I rather discuss about oil market share changes taking place now, but it seems nobody is interested in that.

Uncertainty is never a reason to act now. The cautionary principle applies only if the course of action is harmless, but reduction of emissions can have a poisonous effect on the economy and people’s lifes. I can tell you that pro-renewable policies in Spain have had the secondary effect of increasing greatly electricity prices, and that has harmed a lot of people while global warming has not. And one of the weakest points is that nobody has demonstrated that a significant reduction in CO2 emissions is going to have a significant effect on temperature reduction. In fact the evidence points that the effect is likely to be undetectable. See Bjorn Lomborg “Impact of Current Climate Proposals” http://onlinelibrary.wiley.com/doi/10.1111/1758-5899.12295/full

Saving fossil fuels for later sounds good on principle. But we should discuss it on its own merits not because we are scared for no good reason about climate change. I guess most people is against saving for later but that does not justify deceiving them “for their own good”. It is incompatible with democracy to deceive the citizens.

Curious then that there is literally dozens of scientific articles on the hiatus.

That is a problem only for climate model estimated ECS. Observation-based estimates of ECS, that give lower values, do not have that problem.

Hi Javier,

Didn’t you get the memo ? It’s over. You’ve been conned.

ExxonMobil, the world’s biggest oil company, knew as early as 1981 of climate change – seven years before it became a public issue, according to a newly discovered email from one of the firm’s own scientists. Despite this the firm spent millions over the next 27 years to promote climate denial.

http://www.theguardian.com/environment/2015/jul/08/exxon-climate-change-1981-climate-denier-funding

Hi Javier,

Well we don’t really have observation estimates of what will happen in the future and it has been a long time since atmospheric CO2 was 400 ppm or higher.

You are aware that it takes some time to warm the ocean yes? So one would not expect the warming from increased atmospheric CO2 to be immediate. Are you also aware that the atmospheric CO2 levels do not fall very quickly, it would take about 30,000 years for the atmospheric CO2 to fall from 560 ppm back to the Holocene average (prior to 1750) of about 280 ppm? So the observational ECS would need to wait 400 years for the ocean to warm and if we don’t like the result we would be waiting 29,600 years for things to return to normal.

I suppose one could argue that we are wasting resources by building a bridge or building a little too strong when the resources could be used to feed the hungry.

The cost benefit analysis for most people is to build things safely.

You claim there is no problem, but there are many climate scientists who know far more than you or I who believe that you are mistaken. I think those who think climate change is not an issue and are also climate science experts are very much in the minority.

Lomborg, seriously?

Why ChiefEngineer,

Climate change and global warming were already old news then. You only had to read the newspapers in 1947.

http://trove.nla.gov.au/ndp/del/article/187576882

Surprising how little the world has changed despite climate alarmism being over 70 years old.

Hi Dennis,

Most of what you say are nothing else than conjectures. Since CO2 levels are artificially high we have no idea how long they will last once we stop putting CO2 in the atmosphere. We also have no idea how much warm the oceans are going to get. Considering that they are huge, their average temperature is very cold (3.9°C), and they are warming very, very slowly, I see no reason to worry about it. Ocean temperatures are terribly cold due to the 2.6 million years Quaternary Ice Age cooling. They don’t get to warm much during short interglacials, just the top few hundred meters. All this warming is just a drop in the ocean.

And I certainly don’t give a damn about what some scientists believe or not. As If they have not been completely wrong in the past as everybody else. Let them get some evidence and some predictions right before freaking out.

The cautionary principle applies only if the course of action is harmless, but reduction of emissions can have a poisonous effect on the economy and people’s lifes.

Ah, there’s a key mistake. In fact, FF emissions: sulfur, mercury, NOX, particulates, etc., etc., etc., have an enormously poisonous effect on the economy and people’s lives. Literally.

Transitioning away from Fossil Fuels ASAP will save millions of lives, as well as make us safer and more prosperous.

Nick G,

No key mistake since we are talking CO2 which is not only harmless but beneficial. If we are going to talk contamination, then we are all going to agree.

We are likely to find out soon as I believe Peak Oil is upon us. My bet is that you are wrong and it is going to cost us millions of lives, as well as make us unsafer and poorer.

Hi Javier,

I agree that climate science is quite controversial, at the detail level but in general terms the basic question is settled.

Burning fossil fuels in the amounts we burn them is mucking up the climate. Period.

Now as far as restricting the forum to oil and economics only, that is ultimately a question for Ron to decide, it’s his forum.

Personally I am in favor of a far ranging discussion so long as it meets his basic criteria, which include overshoot and so forth.

I think you may be right about peak oil in particular and peak resources in general being super critical problems that will have to be dealt with sooner than climate change.

I look at resources and climate as two separate battles, or two separate games. We must “win” both in order to stay in the playoffs of the “life as we know it” league.

Unfortunately for humanity as a whole, the battles or games overlap in time to a large extent. And any general will tell you that a two front war is to be avoided if at all possible.

We are compelled to fight both these “enemies” simultaneously, meaning winning is going to be very hard.

OFM,

I have read so many of your post as to make for a book, and I agree with you on most issues. I wish I could somehow easy your worries about climate. I have looked to the evidence through published scientific literature in great detail and dedicated a lot of time to the issue. It is very clear that we are responsible for over 95% of the increase in CO2 of the atmosphere mainly from fossil fuels burning. I have studied evidence that convinces me that this CO2 does have a warming effect on the climate, meaning it causes climatic changes that cannot be explained within natural variability. However the basic question remains unanswered: Is climate change now governed by man-made causes or by natural variability? or in other words: Do we know if natural variability has been overwhelmed by the greenhouse gas effect? The answer is we don’t know. The “Anthropogenic Global Warming” formulated per IPCC as “There is very high confidence that industrial-era natural forcing is a small fraction of the anthropogenic forcing except for brief periods following large volcanic eruptions. The natural forcing over the last 15 years has likely offset a substantial fraction (at least 30%) of the anthropogenic forcing.”, besides contradicting itself in the same paragraph (>30% is not a small fraction), remains an hypothesis. “Anthropogenic Global Warming” remains an hypothesis because the evidence is contradictory, some of its theoretical signatures are nowhere to be seen, and lacks predictive capabilities. Despite a continuous increase of the radiative forcing from CO2 of more than 20% in the last 15 years, climate hasn’t changed much. The popularity of the AGW hypothesis between scientists is due more to the lack of alternative explanations than to its solidity, but this only speaks of our ignorance about the climate, that is defined as a “wicked problem.”

In essence AGW hypothesis is telling us that in the figure below the left part is essentially all natural variability, and the right part is essentially all man-made variability (at the same scale, courtesy of Euan Mearns). This is clearly absurd and only people that suspend their independent reasoning can believe it. If natural variability is capable of offsetting >30% of the anthropogenic forcing, as IPCC recognises, then it is capable of contributing >30% to the warming, and in that case the conclusion is inescapable: Global warming is not going to be dangerous because natural variability has not been overwhelmed by the greenhouse gas effect, and natural variability wants to cool the planet, not warm it. The AGW hypothesis, as formulated by the IPCC, appears false. The GHG effect forcing looks overestimated and natural forcings underestimated in all current models.

Why not have such posts labeled as ads and get paid for them.

Watcher, this blog is about energy and primarily about oil. If anyone writes a book about energy and especially about oil, they are welcome to post about that book on this blog.

That’s what this blog is all about Watcher. I thought you knew that. So why are you raising such a stink about someone who talks about their energy/oil book?

I hope more people write such books and posts about them here.

Figure 7.5 from the book

China’s and the US Oil Imports as % of World Oil Production

Everyone,

This should offer some insight as to where the price of oil is heading…. Something Very Strange Is Taking Place Off The Coast Of Galveston, TX:

Having exposed the world yesterday to the 2-mile long line of tankers-full’o’crude heading from Iraq to the US, several weeks after reporting that China has run out of oil storage space we can now confirm that the global crude “in transit” glut is becoming gargantuan and is starting to have adverse consequences on the price of oil.

While the crude oil tanker backlog in Houston reaches an almost unprecedented 39 (with combined capacity of 28.4 million barrels), as The FT reports that from China to the Gulf of Mexico, the growing flotilla of stationary supertankers is evidence that the oil price crash may still have further to run, as more than 100m barrels of crude oil and heavy fuels are being held on ships at sea (as the year-long supply glut fills up available storage on land). The storage problems are so severe in fact, that traders asking ships to go slow, and that is where we see something very strange occurring off the coast near Galveston, TX.

http://www.zerohedge.com/news/2015-11-12/something-very-strange-taking-place-coast-galveston

—————

I believe the U.S. and world oil industries are heading for serious trouble. I saw a figure thrown around either here or somewhere else that the Oil Industry will lose half a $trillion this year.

If we consider that the glut is actually much worse than it is and China is close to filling their expanded Strategic Oil Reserve, this should do wonders for price going forward.

If the oil price remains below $40 (or thereabouts) in 2016, I wouldn’t be surprised to see U.S. oil production below 8 mbd.

Maybe we can switch to running electric cars as we have 100 years worth of natural gas and coal reserves. 🙂

All the best,

steve

wow.

quick question…long answer?

Is the oil that is in these tankers already sold?

Is oil shipped before it is bought?

I would guess that almost all of it has been sold at least once. From the producer to someone. Now, let’s suppose that there is an interesting chess game going on. I do not know how many of the VLCC ships exist in total. But, suppose an investor or a group of investors, have enough money to store enough crude to fill up most of those ships [and of course, they have sold all the oil forward – say for delivery in 2 years]. The Saudi’s may not “want” to cut production, but what do they do if at some point there are no ships available to ship their production? I would guess that would force them to cut production.

Just thinking out loud here (or, maybe not thinking). There are already comments that the demand for the ships has caused the price of the ships to skyrocket. Which has not affected the price of the crude – yet.

If you actually click on each ship you will find that the majority of these vessels had their last port of call as Houston. None of those vessels are carrying crude. In addition, many/most of these vessels are not even VLCCs. They are product/chemical tankers who are waiting for refineries to get them product or simply bulk carriers not carrying crude. This is hardly an unusual phenomenon. So this in no way represents a stock pile of floating crude or anything close to it. Funny how the zerohedge hype machine works. Doesn’t take much time to do get to the actual facts, but why get in the way of a good doomsday story.

Excellent point, Anon. Had a tanker expert tell me the exact same thing when this article came out yesterday. Appears you will both be ignored by the zerohedge crowd though. That’s actually probably a pretty good place to be.

good catch. thanks for posting

marine tracker..

http://www.marinetraffic.com/

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2015/11/line%20tankers_0.jpg

These are old small ships. This oil is not transported across the Atlantic. 2 vessels are empty.

These are not silhouettes of oil tankers.

https://en.wikipedia.org/wiki/Globtik_Tokyo

Are there any numbers crunchers among us that have estimated or can generate an estimate as to what percentage of oil production world wide is “under water” ?

My current impression is that virtually all deep water oil is under water pun intended, financially, and that at any price under about fifty bucks or so, a good bit of deep water oil is not only in the hole but even worse, cash flow negative.

But it seems to be the case that older dry land legacy fields are almost all cash flow positive and maybe most of them are profitable at forty to fifty bucks.

Now it seems pretty obvious that an independent oil company, even a super major, would shut in any cash flow negative production unless compelled to keep it producing due to lease terms or union labor issues or something of that nature. Some cash flow negative wells might be kept in production due to the high cost of closing them on the one hand and the hope of higher prices before too long on the other.

BUT- and this is a big old but- a national oil company might be in a position due to political considerations whereby it is difficult to impossible to shut in cash flow negative production.

I were a brand X national oil company manager, and wanted to shut in cash flow negative wells, I might have real problems with the labor force and with the rest of the government bureaucracy.

Any remarks along these lines by people who crunch numbers, or have experience working with national oil companies, will be greatly appreciated. My comment is only intended to set the stage.

Hi Old Farmer Mac,

Most of us have limited access to the proprietary data needed to answer the question. Crunching the numbers is not difficult, access to the data is more of a problem, or too much work to go through all the oil company reports to get a limited picture. I don’t think anyone has access to National oil company data for OPEC members so a big piece of the puzzle would be missing.

Hi Dennis,

Thanks, I see that I posed my question too broadly.

But one of the hands on guys might be able to throw some light on the topic, in respect to some given oil fields or maybe even some countries.

It seems reasonable to presume that independent companies can keep costs as low or lower than government run companies, so if it costs independent company X twenty forty bucks in variable costs to get a barrel out of the ground in an old badly depleted field, a national company operating in a similar oil field probably can’t do it any cheaper.

Old Farmer Mac,

I agree private companies are usually more efficient. I am not a hands on guy. Shallow sand and others would be far better than me on this question.

OFM. OPEC member Ecuador would be an example.

On 8/26/15 their president announced that their cost per barrel countrywide was $39.

Fernando mentioned, and I agree, that this was not just the lifting costs, or OPEX, but was an amount that was contracted between the government and private operating companies.

If the $39 figure is accurate, Ecuador has been losing money on a per barrel basis since July as their oil sells for several dollars below Brent. I think when Brent hit lows in August, Ecuador was selling oil for $30, or a loss of $9 per barrel.

Doesn’t have to be that way. Argentina’s price is $77/barrel. No reason Ecuador can’t specify something above $39 and consume that amount internally.

HI watcher

In a free market that is open to international trade the oil price will be the same everywhere. Clearly not the case for Argentina.

A characteristic of a “free market” is the ability to set prices as you wish. If there is one global price for oil, that is not a “free market.” Is my thinking wrong?

Yes.

In a free market that’s “frictionless” (i.e., no transportation costs) and with “perfect information”, you can set any price you want, but if it’s higher than the “clearing price” no one will buy from you. And if you set it lower, you’ll sell out instantly.

In a free market, a country like Saudi Arabia would be able to sell their oil for say $20 per barrel which would allow them to take market share from all their competitors. Also, a country like Ecuador should be able to charge $50 for their barrel of oil if it costs them $39.

The comment Javier posted earlier is perhaps relevant here – if Saudi Arabia is pumping all out to increase market share, and yet their production remains fairly flat, how do they intend to increase their market share?

Watcher,

I don’t know if you have seen but by the end of last thread there was person from Argentina explained that “$77” price. It is actually more $55 in US dollars or $77 payable in pesos. So it is not $77 but $55 and that is more or less what was Brent price until this most recent collapse of oil price in the last week. There is really nothing in that story of $77 per barrel in Argentina.

How is it $55 but $77 if paid in pesos . . . and the country uses pesos so $55 should be the focus? The country uses pesos, which was Bloomberg’s point. That’s how royalties are computed.

Because when you sell a barrel of oil to refinery in pesos and go to exchange office to exchange it for $US you cannot exchange it for official exchange peso-dollar rate. So in reality you get only $55 US.

This deal is just stop gap measure to keep things going and employees employed instead rigs rotting in the yard and it works over there because probably Opex/Capex is less than $55. And that is not the case with shale or oil sands and I would very much doubt GoM. Plus you have to take into the account of the scale of how much Argentina produce versus consume. If it s not much difference between the two there is not much of net loss. That is clearly not the case in US on one extreme (significant imports) and Canada on the other extreme (significant exports). Someone has to pay that net loss.

Hi Watcher,

We could do the same in the US I suppose. Just declare the oil price to be $77/b, the oil companies would love it. They could import oil at $45/b and just mark up the price. Not sure any government officials supporting such a policy would be re-elected, but hey we would have lots of expensive oil.

Now when World oil prices rise above $77/b, will we then subsidize the oil consumers?

Mac,

There is no straight answer. It all depends. If you compare other industries like health care between private and government run entities around the world the government wins hands down in terms of cost and delivered value. It is all about check and balances.

Obviously enough a precise answer would be out of the question.

But people doing comparable work under comparable circumstances in different places or companies are , broadly speaking, probably going to be doing it at roughly the same cost.

So if one of the regulars here says the operating cost, variable cost or lifting cost of oil at a given field they know about is x dollars per barrel, the figure at a similar field operated by a different company, government owned or privately owned, will probably be fairly close.

The one BIG exception to this observation could be or might be that corruption and gross mismanagement are more likely in a government owned company, as for instance PEMEX and in Venezuela. The actual hands on managers, the engineers, the mechanics, etc, in both cases are probably competent, but in impossible situations due to outside interference from politicians determined to loot the industry.

There is a big difference between running at a long term loss, but collecting some desperately needed cash on a daily basis, and actually being in the hole not only long term but on a daily cash flow basis as well.

UNLESS political considerations prevent it, cash flow negative wells, maybe whole oil fields, would normally be shut in, and as quickly as possible, except for one thing.

It seems that shutting in some wells damages them, and that getting them restarted is very costly, or maybe even impossible, according to what I have read here in this forum. And it might be easier to just run a well at a moderate negative cash flow in hopes of the price going up, than it is to pay the cost of permanently closing the well.

Any amount of light on such a shadowy subject is better than none.

OFM. One example would be Teapot dome in WY. The federal government owned until this year. A lot of research and testing done there by the Federal government over the years.

It was sold by the federal government for a reported $45 million. The new buyer believes there is a lot of upside, particularly with regard to improving operating costs. The new buyer’s prime motivation is profit. The federal government’s was not. This is not an apples to apples comparison to OPEC and other exporting nations, of course.

Look at how many industry people have lost their jobs in this oil and gas bust. That amount of job loss doesn’t happen if federal or state government is operating exploration and production. The job losses were almost strictly to cut costs, and large cost cuts have been realized.

I know little about OPEX outside the US, but I suspect government operation tends to drive up costs, as the profit motivation is not at the level it is for private enterprise.

It should also be noted that governments typically hire private corporations to operate production. There is a built in profit for the operator many times, with the government taking all the price risk. I think these types of contracts are really hurting countries like Iraq and Ecuador, from what I have read.

Of course, there are all different types of contracts. However, it appears many governments are loath to allow the private companies a share of the oil. Therefore, in times of high oil prices, governments profit, in times of low prices, they can even lose money.

I think in Iraq, companies are paid a fixed amount for every barrel they produce, plus costs. Therefore, production has spiked. However, this is pressuring the Iraqi government financially. I have read Iraq is in serious arrears to the private companies with regard to reimbursing costs, despite having very cheap costs of production.

A real life example. We have one lease where we own a minority of the working interest, but operate it. The non-operated working interest owners are barely breaking even, but we are doing a little better due to making a small profit on operating the lease, in addition to our interest in the lease.

Many times it depends on the deal negotiated. With Brent going from $120 to below $45, many governments are trying to renegotiate. Now they want to be royalty owners. When prices were higher, the wanted to take the risk and be working interest owners.

Disclaimer. Before the politically bent get out of whack, this comment is not meant to be political and states my opinion as to oil and gas only, hopefully bringing up some points that might be helpful.

Another real world example. Have a friend who tests tubing and has a few oil wells he owns and operates.

Testing tubing is not an easy job. He goes out at 6 am and runs his wells and by 8-9 am he and his hands are out testing.

Oil prices got so high, he thought about selling his testing business as he was making much more off his few oil wells, and pumping those was not as hard or time consuming.

However, he has lived through price crashes before, and he is now very happy he didn’t sell the testing business.

Hi Shallow sand,

Are you able to reveal to us what your average cost per barrel is? Or to put it another way, at what price of oil (over the long term) would you be able to keep your business running long term? In some sense that is your “real cost”, your most expensive barrel would be the one where you make a penny on the barrel, otherwise why produce it?

Hi Old Farmer Mac,

From someone with very limited knowledge like me, it would seem that there are many different types of fields all over the World and that each is unique. A simplification often used is to use the World wide average costs, but this is notoriously difficult to pin down and it changes over time with improved technology and as the “cheaper resources” deplete over time. These opposing forces of depletion and technology, might balance over time so that costs are unchanged. The pessimists (and I count my self as one) believe that depletion wins this battle over time and the optimists think that technology will either keep costs constant or even decrease the cost of oil over time. Over the long term when the oil market is in better balance, the cost of the marginal barrel (highest cost barrels) should be about 90% of the price of oil (which enables the producers to earn a 10% profit).

Based on this and the fact that before the current glut, the oil price had been relatively stable at around $100 to $110 per barrel over several years, my guess is the cost of the marginal barrel is 90% of $105 or about $95/b and will continue to rise as oil resources deplete. Once the market clears the excess oil inventory (I don’t know how much oil is in storage) oil prices will quickly rise to $105/b or higher, probably in 2017.

As a simple exercise let’s say supply falls short of demand by 1 Mb/d and excess inventories are 365 Million barrels, in that case it takes a year to clear the excess inventory (the numbers are obviously created so I can do the arithmetic.) If we assume in this simple example that on average in 2016 that supply is 1 MB/d less than demand, then in 2017 the oil price begins its rise.

In reality the price would gradually rise as the excess inventory is reduced. The OPEC oil market report looks at storage numbers pretty closely so it is a good place to start.

Hi Old Farmer Mac,

In the case of cash flow negative wells, I believe there is a choice of flow rates depending on the size of the choke. So I imagine they might choose to reduce the flow rate to the lowest possible level that will not damage the well.

Also keep in mind that when shallow sand talks about a company being cash flow negative this is not at the individual well level, it is at the company level. For most wells that have already been completed (unless the well is 10 years old or more) the operating costs of producing the oil for an individual well will be less than the price of oil. So the question is not so much about shutting in old wells, it is whether to complete wells that have been drilled (about half the total cost of the well) or whether to spud new wells.

Calm down this is about to be turned upside down with Winter, $2.00 gas, Rig count drop kicking in, and I believe a falling USD. There is always a lot of chatter around the shoulder month going into heating season. If you guys thing oil prices are still set by supply and demand than you need to go a lot further down the rabbit hole. This is an attempt at QE 4 except that like QE123 it’s not working. ZIRP is choking the economy but that is what the Fed wants because they CAN NOT let interest rates go up. The Fed does not care about the economy but only the Zombie banks and the level of crime and “Deep Capture” going on at the highest levels of finance and government is stunning. God help us (we are going to need it).

Hi Dr. Don (or Dr. Doom which ever you prefer),

The American economy currently is closer to a state of deflation than inflation. Plus a totally dysfunctional congress that doesn’t have the ability to address economic issues. A near zero interest rate by the Fed is the appropriate policy under our current situation.

Now tell me the truth, have you been studying Tverberg economics over at Our Finite World ? I would recommend attending your local college and taking an economics 100 level course.

Best Wishes

Thanks Chief for the economics 100 level tip.

Do you understand the inverse relationship between a bonds yield and price? You see by keeping interest rates at zero we cause the liquidating value of the debt to grow to a level where it crushes the economy. The USA is using the Gibson’s Paradox playbook laid out by Robert Rubin and Larry Summers. Keep interest rates at zero, keep a lid on gold and you can print all the money you want. The FOMC controls oil gold silver bond yields by using HFT with money they create out of thin air and an army of 75 traders. You really should get out more.

Hi Don,

Do you understand the United States is pretty much the strongest economy in the world since the financial collapse of 2008. Monetary policy is the only reason with the current dysfunctional congress that the country is not in a depression. Seven years ago the country was lead by a 8 year Republican compassionate conservative and losing 750,000 jobs per month. Get back to me when the Republicans take responsibility.

You will get your rise in interest rates in do time.

Due time Chief.

It looks more and more like Venezuela is going down the toilet.

How much longer the Maduro regime can hold out is anybody’s guess.

What this will mean for Venezuelan oil production is also anybody’s guess. Mine is that the industry will pretty much grind to a halt for a few months to a year or maybe longer once the pressure cooker finally explodes.

http://www.cnn.com/2015/11/11/americas/venezuela-president-family-members-arrested/

Concho Bids To Acquire Clayton Williams Oil and Gas

http://www.mrt.com/business/oil/top_stories/article_ff545ee0-8997-11e5-96aa-4b7aa0c550e6.html

Worth a few minutes in case anybody is interested in the FACTS associated with the issue. LOTS of facts in this link.

http://blogs.scientificamerican.com/plugged-in/getting-to-no-the-facts-behind-obama-s-decision-to-reject-keystone-xl/

OFM, the Keystone Pipeline moves oil across southern Canada through Manitoba then turns South into the US.

The Keystone XL would just shorten the route.

Canada imports Bakken crude, the Canadian Pacific hauls it into Canada. The amount is 478,000 barrels per day. Ethane from Bakken crude goes to the tar sands to be used to extract the oil.

Here’s a link to the map:

https://www.google.com/search?q=keystone+pipeline+map&oq=keystone+pipe&aqs=chrome.2.69i59j0l2j69i60j69i57j69i60.10757j0j4&client=tablet-android-samsung&sourceid=chrome-mobile&ie=UTF-8#imgrc=Q_dPHm-2U1kxBM%3A

The article didn’t mention at all the campaign within Nebraska to stop the pipeline. That was what I was following.

The Nebraskans weren’t basing their objections on global environmental issues. They just didn’t want the pipeline across their property.

I think Obama said no because with the price of gasoline so low at the moment, the country didn’t need it. It was a good time to kill a project that had grassroots objections and was touted by rich people hoping to make more even money.

Revealed: Saudi Arabia’s manifesto for change in the face of rumours of coup plots

http://www.telegraph.co.uk/news/worldnews/middleeast/saudiarabia/11989106/Revealed-Saudi-Arabias-manifesto-for-change-in-the-face-of-rumours-of-coup-plots.html

Of course, from the point of view of the disenfranchised princes, they see an attempt to consolidate power in one family line.

It is high time for more mainstream movies to deal with peak oil and peak everything. Are there any writers here to write a script? Surely we have movie heavyweights visiting this site. We have plenty of non-fiction factual books but the general public and politicians will only begin to understand when top movies lay out the scenarios ahead.

Here’s a novel by Kurt Cobb:

http://preludethenovel.com/

Not gonna have movies made that show human extinction.

When growth stops and meds transport stops and universities shut because the effort of walking behind a plow doesn’t generate surplus calories to feed researchers, extinction is a few centuries away.

FWIW: Lots of politicians know. However public discussions about PO does not win them votes. Roscoe Bartlett use to give detailed presentations to the House of Reps when he was in office on Peak Oil and debt, I believe as early as 2002 or 2003. I believe he did updates every year on the topic, until his retirement.

It probably going to be quite a while before PO becomes a household topic. Currently gov’ts around the world are struggling with Peak Debt, global destabilization, and aging populations. Since Oil prices are at 10 year lows, there is no chance of PO gaining traction. FWIW, we are likely to see further global destabilization as the Emerging Markets (ie China, Brazil, India) face a credit crunch.

As far as the Public: Zombies are hot, and so are the Kardashians. Unless your show has human mutants in it, you can forget about getting the attention of the public.

FYI: The Mad Max series was about Peak Oil. Earlier this year another Mad Max Movie was released, but I didn’t see it.

It was about no water. Seemed to be lots of already refined gasoline around that had not gone bad.

Watch wrote: “It was about no water.”

https://en.wikipedia.org/wiki/Mad_Max

“George and I wrote the [Mad Max] script based on the thesis that people would do almost anything to keep vehicles moving and the assumption that nations would not consider the huge costs of providing infrastructure for alternative energy until it was too late.”

[I believe the second film has an intro that the world collapsed was caused by Oil depletion. ]

Hi Chief Engineer,

Thanks for the insult I appreciate your thoughts.

Do you even know what causes inflation or are you trapped in your Keynesian mind.

Good luck with your Bob Rubin Larry Summers world and the end of our 44 year Keynesian experiment.

Dr. Don

Hello again Don,

When I use the word inflation to mean a rise in the price level and you uses it to mean more money printed by those irresponsible fellows in Washington, it’s no wonder we don’t succeed in talking sensibly about it. Socrates said, “If you want to argue with me, first define your terms.”

Inflation means a rise in the average price of all currently produced goods and services. It does not include rising wages and money. Inflation is merely a rise in the price level of currently produced goods and services.

The fundamental cause of inflation is excessive growth in aggregate demand or nominal GDP. In long-run equilibrium, when actual inflation turns out to be exactly what people anticipate. The pace of that inflation depends only on the growth rate of aggregate demand adjusted for the trend growth of natural output. Zero adjusted demand growth is necessary for the economy to be in long run equilibrium with zero inflation.

Because a high rate of demand growth is sustainable only if it is fueled by a continuous increase in the nominal money supply, in the long run inflation is a monetary phenomenon. In the short run actual inflation may be higher or lower than expected and unemployment can differ from the long-run equilibrium natural unemployment rate.

“…The fundamental cause of inflation is excessive growth in aggregate demand or nominal GDP…”

Chief…if so, can you be kind enough to explain the 1973-1983 to me/us please?

(Spoiler alert:

No you cannot!

‘Cause you think that inflation is an increase in prices…

….ha, ha, ha!)

Be well,

Petro

P.S.: so you learn…price increase is a CONSEQUENCE of inflation not the cause of it!

And Dr. Don – even though he has a better understanding of the matter than you do, he is incorrect in what he writes as well.

President Johnson failed to recommend tax increase to finance the upsurge of government expenditure during the Vietnam War. A rule requiring a balanced budget would have forced Johnson to recommend the tax increase he resisted in the 1966 political season. The economy was allowed to reach too low unemployment rate though 66-69, partly because of the Federal Reserve accommodation and the tax cuts of 64-65. The Nixon’s reelection campaign activist economist continued undesirable acceleration in monetary growth.

There can be no final victor in the monetarist/non-monetarist debate. Because the non-monetarists must stake their confidence on the willingness of politicians to do what is needed to stabilize the economy. Rather than what is politically expedient.

Again, inflation is a general increase in prices and fall in the purchasing value of money.

“…Again, inflation is a general increase in prices and fall in the purchasing value of money….”

Again, the general increase in prices and the fall in the purchasing power of money (there is no such thing as: “the purchasing VALUE of money”) are consequences of inflation – they are NOT the inflation.

You got that backwards.

Be well,

Petro

Hello Petro,

I have come to the conclusion that you are explaining to me the Trump and Carson phenomenon by example.

I will be voting for Hillary.

Best wishes in your circle of words and you might want to enroll at your local college in an economic 100 level course.

“…I have come to the conclusion that you are explaining to me the Trump and Carson phenomenon by example…”

-You “conclude” too much!

Trump, Carson and Hillary know nothing about what we are narrating here….and obviously, so do you!

Be well,

Petro

P.S.: you have yet to account for this:

“…The fundamental cause of inflation is excessive growth in aggregate demand or nominal GDP…”

Chief…if so, can you be kind enough to explain the 1973-1983 to me/us please?

“… in the long run inflation is a monetary phenomenon…”

-Not just in the long run – inflation is always a monetary phenomenon:

whether sought and justified (as in a genuine economics expansion: i.e. ’50s and ’60s), or as a consequence of bad policy (i.e.: ’70s and ’80s), or as a weapon to “combat” deflation and/or wage war (i.e.: as in now)!

Logical explanation (i.e.: supply/demand/labour) works only in times of genuine economic expansion and plentiful resources….not NOW.

And that is why your logic is flawed and Ms. Tverberg’s is correct ( her “foggy” understanding of credit/debt/money notwithstanding!)

Mises, Hayek and co. as well as Keynes, Friedman, Krugman and co. are ALL wrong!

As the situation is now however (i.e.: passed the tipping point) I take Keynes/Krugman anytime…for it extends what we have right now: good days.

What comes next….haven help us all!

Be well,

Petro

Economics is the study of how the goods and services we want get produced and how they are distributed among us. Another slightly different definition favored by many economists is the study of how our SCARCE productive resources are used and to satisfy human wants. This definition emphasizes two central points. First, productive resources(oil) are SCARCE in the sense that we are not able to produce all of everything that wants for free. Second, human wants if not infinite, go far beyond the ability of our productive resources to satisfy them.

Petro says- “Logical explanation (i.e.: supply/demand/labour) works only in times of genuine economic expansion and plentiful resources….not NOW.”

Your phrase – “Plentiful resources” is simply a value judgment dreamed up in Tverberg economics and you agree with.

LNG suppliers selected – Power plant in operation by 2018

Head of the Electricity Sector Enterprise Team (ESET) Dr Vin Lawrence says there was a vast number of credible bids that were put forward for the supply of natural gas to the new power plant to be built by Jamaica Public Service Company (JPS).

New Fortress Energy, the same entity which won the bid to supply gas to the Bogue power plant in Montego Bay, has been selected as the entity to supply LNG to the new plant, on which construction is expected to begin by the second quarter of next year. The arrangement will see New Fortress installing the facilities to receive, store and re-gas the fuel for use at the new 190-megawatt gas-fired plant at Old Harbour.

“Six entities submitted 16 variations of proposals and we were quite delighted at this because we have gone through 15-20 years of attempting to get LNG to Jamaica without much success, and on this RFP, we have had six credible entities submitting 16 variations of supply proposals,” Lawrence said.

The ESET chair, who was addressing a Jamaica House press briefing at the Office of the Prime Minister yesterday, also announced that the JPS has selected Spanish firm Abengoa to construct the new plant.

Lawrence said the agreement is for New Fortress Energy to build a terminal and supply the JPS with 200,000 metric tonnes of LNG per annum. New Fortress Energy will build, own and operate the plant which Lawrence said must be expandable.

Further down in the article, it addresses the timeline. The LNG importation and distribution facilities will be in place by the end of 2017 with the power plant to come online in early 2018. Does anybody here think that LNG prices will still be relatively low in early 2018? Will suppliers be willing to enter into long term contracts, fixing prices at relatively low levels for the long haul?

Another thing I noticed was the selection of “Spanish firm Abengoa to construct the new plant”. Abengoa is big on “sustainability” and one arm of the group Abengoa Solar is involved in several cutting edge CSP (solar thermal) projects outside of Spain, in the US (Solana and Mojave Solar Project), South Africa, Chile, United Arab Emirates (Shams-1) and Algeria. Am I reading too much into this or is the selection of Abengoa to construct the plant a good indicator that the new plant will not be a run of the mill NG power plant? They could have selected hundreds of other companies to build a run of the mill plant. Why Abengoa?