This is a guest post by Political Economist

World Energy 2014-2050: An Informal Annual Report

“Political Economist” June 2014

The purpose of this informal report is to provide an analytical framework to track the development of world energy supply and demand as well as their impacts on the global economy. The report projects world supply of oil, natural gas, coal, nuclear, hydro, wind, solar, biofuels, and other renewable energies from 2014 to 2050. It also projects the overall world energy consumption, gross world economic product, energy efficiency, and carbon dioxide emissions from 2014 to 2050.

The basic analytical tool is Hubbert Linearization, first proposed by American geologist M. King Hubbert. Despite its limitations, Hubbert Linearization provides a useful tool helping to indicate the likely level of ultimately recoverable resources under the existing trends of technology, economics, and geopolitics. Other statistical methods and some official projections will also be used where they are relevant.

Oil

According to BP Statistical Review of World Energy 2014, world oil consumption (including crude oil, natural gas liquids, coal-to-liquids, gas-to-liquids, and biofuels) reached 4,185 million metric tons (91.3 million barrels per day) in 2013, 1.4 percent higher than world oil consumption in 2012. In 2013, oil consumption accounted for 32.9 percent of the world primary energy consumption.

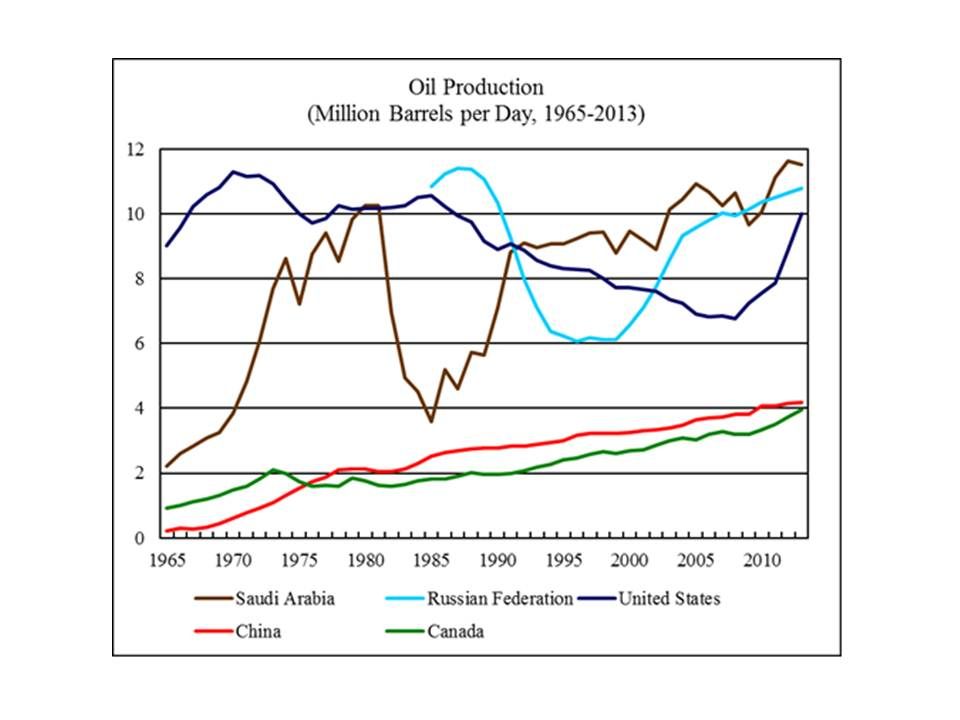

World oil production (including crude oil and natural gas liquids) reached 4,133 million metric tons (86.8 million barrels per day) in 2013, 0.6 percent higher than world oil production in 2012. Figure 1 shows oil production by the world’s five largest oil producers from 1965 to 2013.

As of 2013, world “proved” oil reserves stood at 238 billion metric tons, 1.0 percent higher than the “proved” oil reserves in 2012.

As of 2013, world “proved” oil reserves stood at 238 billion metric tons, 1.0 percent higher than the “proved” oil reserves in 2012.

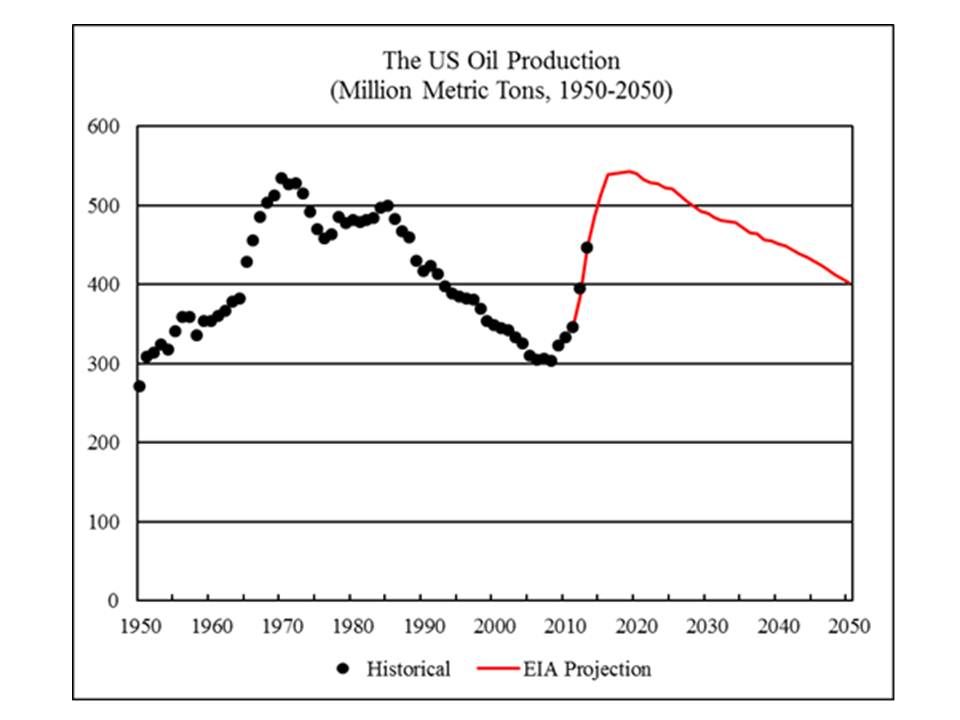

In recent years, the US oil production has surged due to the “shale oil” boom. The US accounted for all of the growth of world oil production from 2008 to 2013. Figure 2 shows the historical and projected US oil production from 1950 to 2050. The projection is based on the reference case scenario for US oil production from 2011 to 2040 projected by the US Energy Information Administration (EIA), extended to 2050 based on the trend from 2031 to 2040. The EIA reference case projects the US oil production to peak in 2019, with a production level of 543 million metric tons.

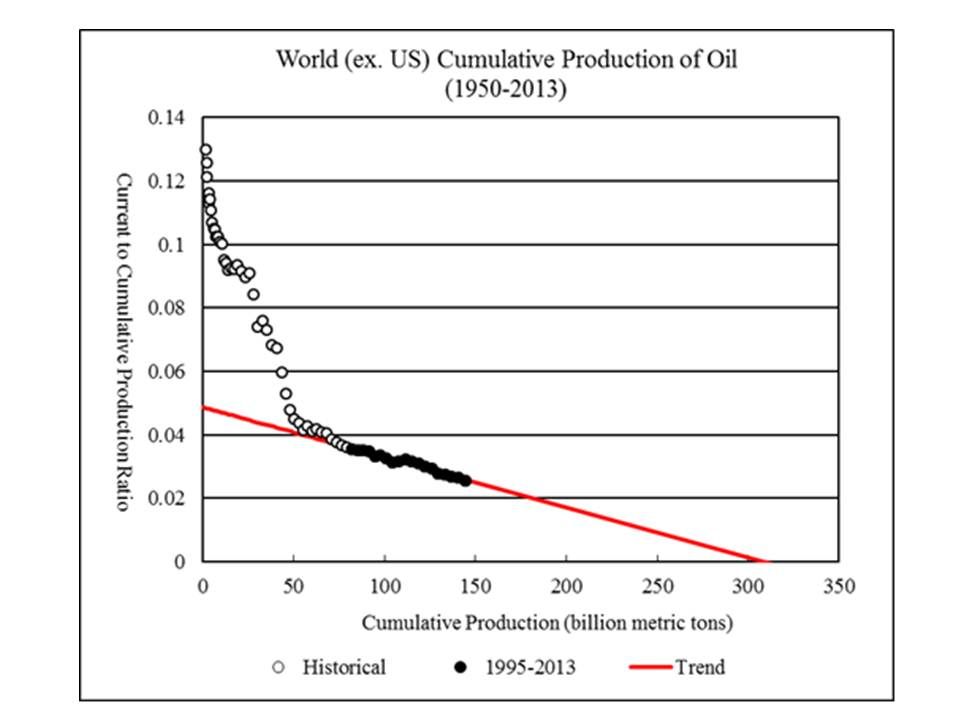

Figure 3 applies the Hubbert Linearization analysis to the world (excluding the US) oil production. As of 2013, the world (excluding the US) cumulative production of oil was 145 billion metric tons. The linear trend from 1995 to 2013 indicates the ultimately recoverable amount to be 309 billion metric tons. Regression R-square is 0.964.

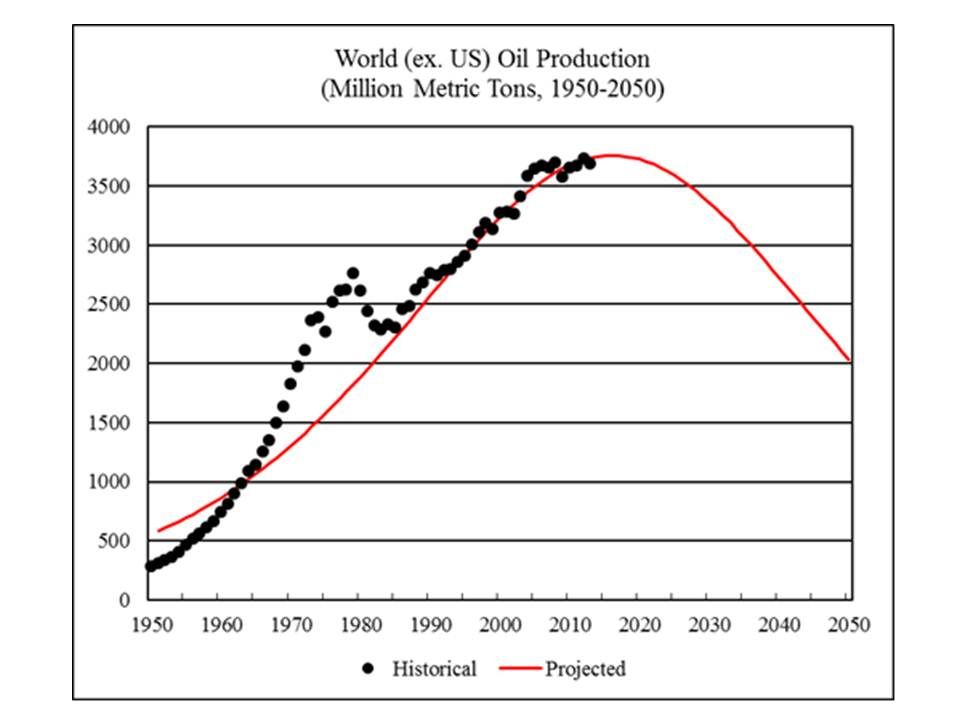

Figure 4 shows the world (excluding the US) historical and projected oil production from 1950 to 2050. The world (excluding the US) oil production is projected to peak in 2016, with a production level of 3,758 million metric tons.

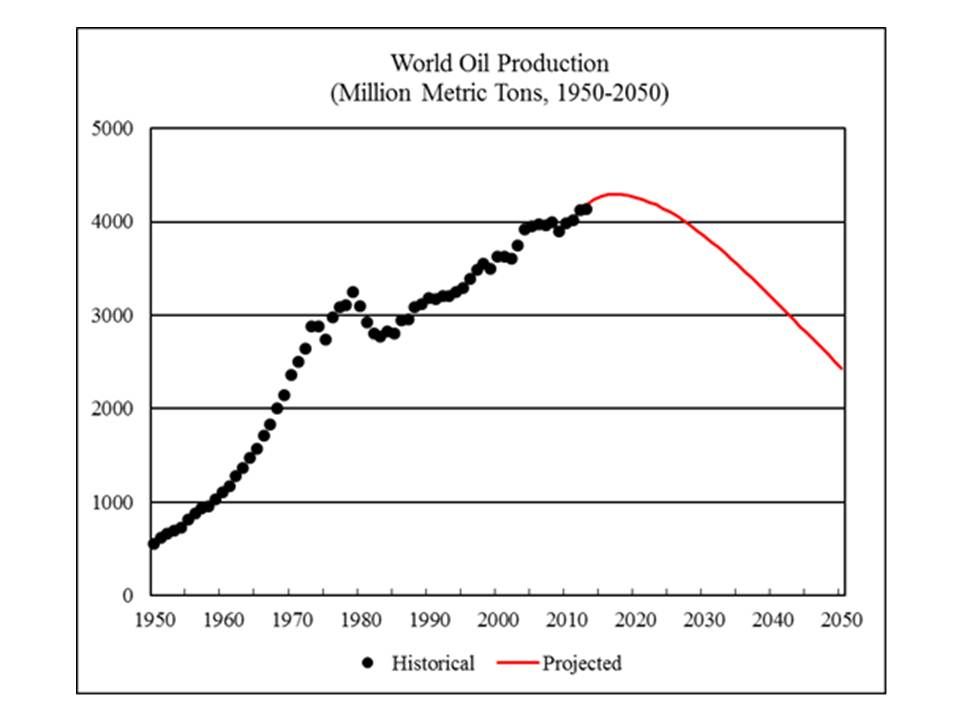

Figure 5 shows the world historical and projected oil production. The projected world oil production is the sum of the projected world (excluding the US) oil production and the projected US oil production. World oil production is projected to peak in 2016, with a production level of 4,297 million metric tons.

Natural Gas

According to BP Statistical Review of World Energy 2014, world natural gas consumption reached 3,348 billion cubic meters (3,020 million metric tons of oil-equivalent) in 2013, 1.4 percent higher than world natural gas consumption in 2012. In 2013, natural gas consumption accounted for 23.7 percent of the world primary energy consumption.

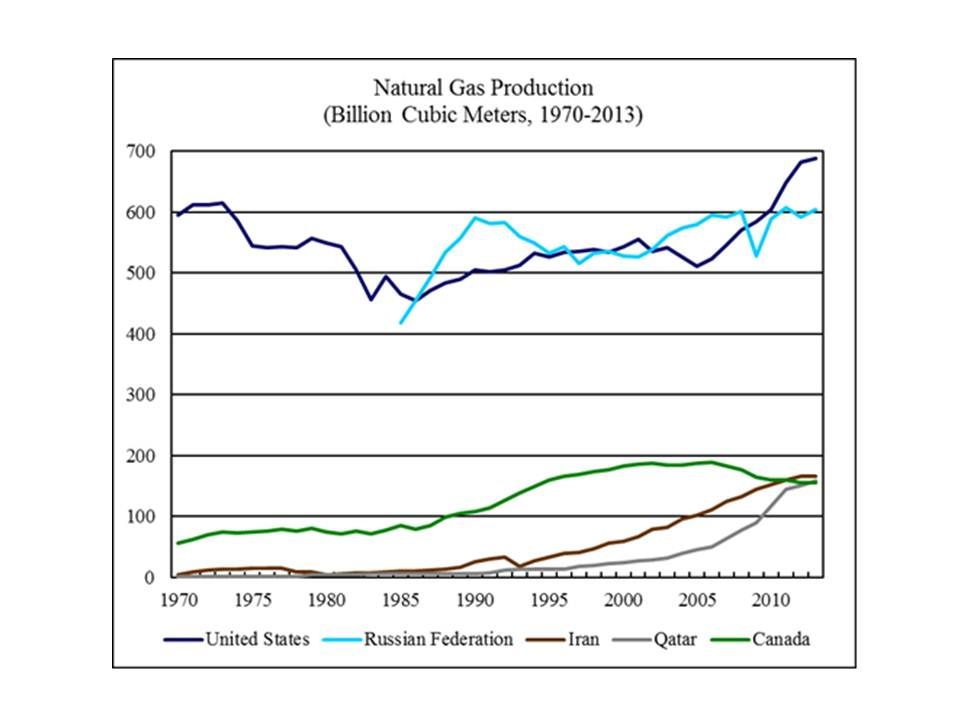

World natural gas production reached 3,391 billion cubic meters (3,060 million metric tons of oil-equivalent) in 2013, 1.1 percent higher than world natural gas production in 2012. Figure 6 shows natural gas production by the world’s five largest natural gas producers from 1970 to 2013.

As of 2013, world “proved” natural reserves stood at 186 trillion cubic meters, 0.2 percent higher than the “proved” natural gas reserves in 2012.

As of 2013, world “proved” natural reserves stood at 186 trillion cubic meters, 0.2 percent higher than the “proved” natural gas reserves in 2012.

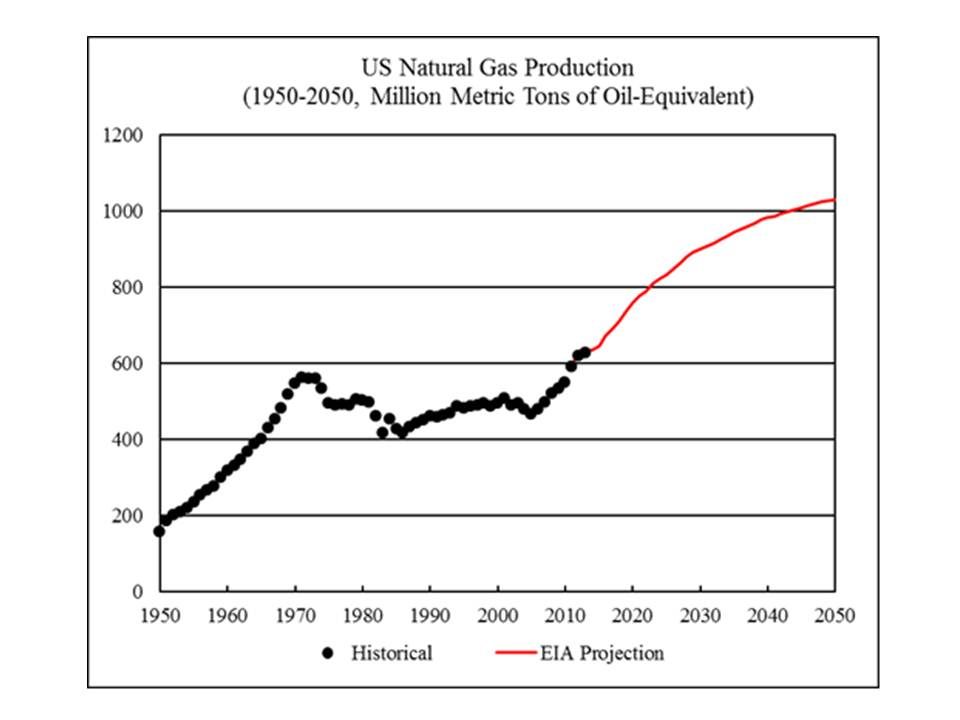

In recent years, the US natural gas production has surged due to the “shale gas” boom. The US is the world’s largest natural gas producer, accounting for 20.5 percent of the world total production. Figure 7 shows the historical and projected US natural gas production from 1950 to 2050. The projection is based on the reference case scenario for the US natural gas production from 2011 to 2040 projected by the US Energy Information Administration (EIA), extended to 2050 based on the trend from 2031 to 2040. Based on the EIA projection, the US natural gas production will not peak before 2050.

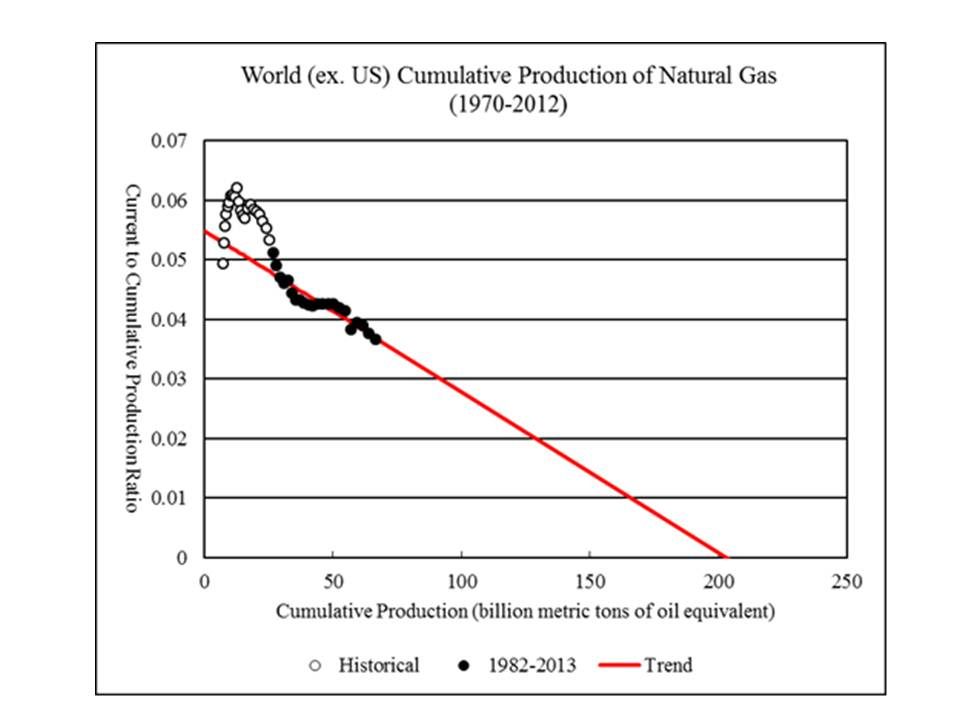

Figure 8 applies the Hubbert Linearization analysis to the world (excluding the US) natural gas production. As of 2013, the world (excluding the US) cumulative production of natural gas was 67 billion metric tons of oil-equivalent. The linear trend from 1982 to 2013 indicates the ultimately recoverable amount to be 203 billion metric tons. Regression R-square is 0.859.

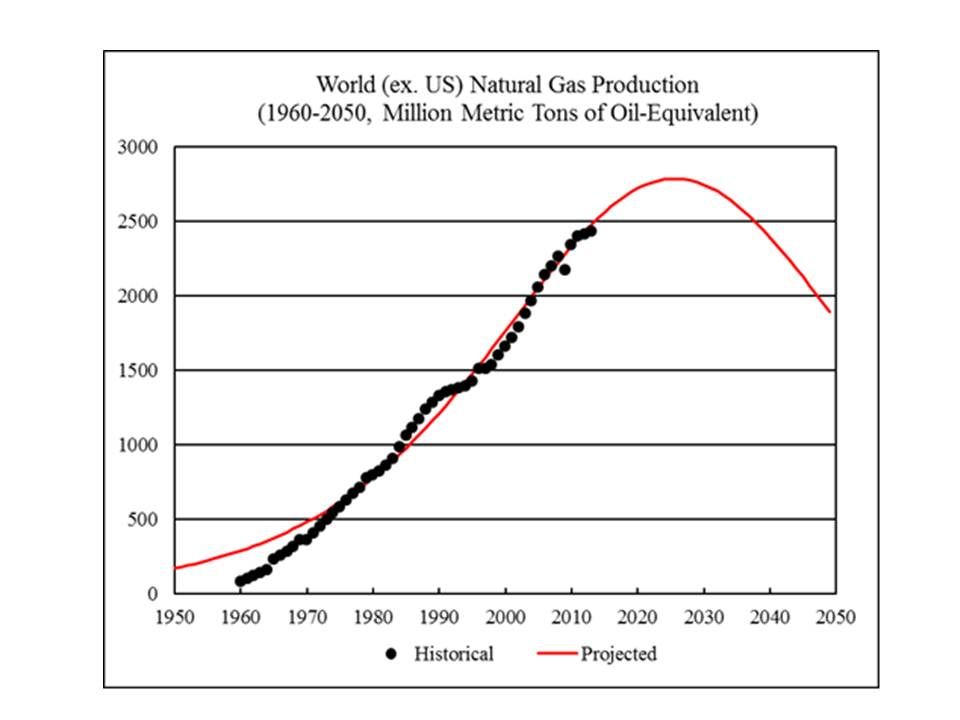

Figure 9 shows the world (excluding the US) historical and projected natural gas production from 1960 to 2050. The world (excluding the US) natural gas production is projected to peak in 2027, with a production level of 2,786 million metric tons of oil-equivalent.

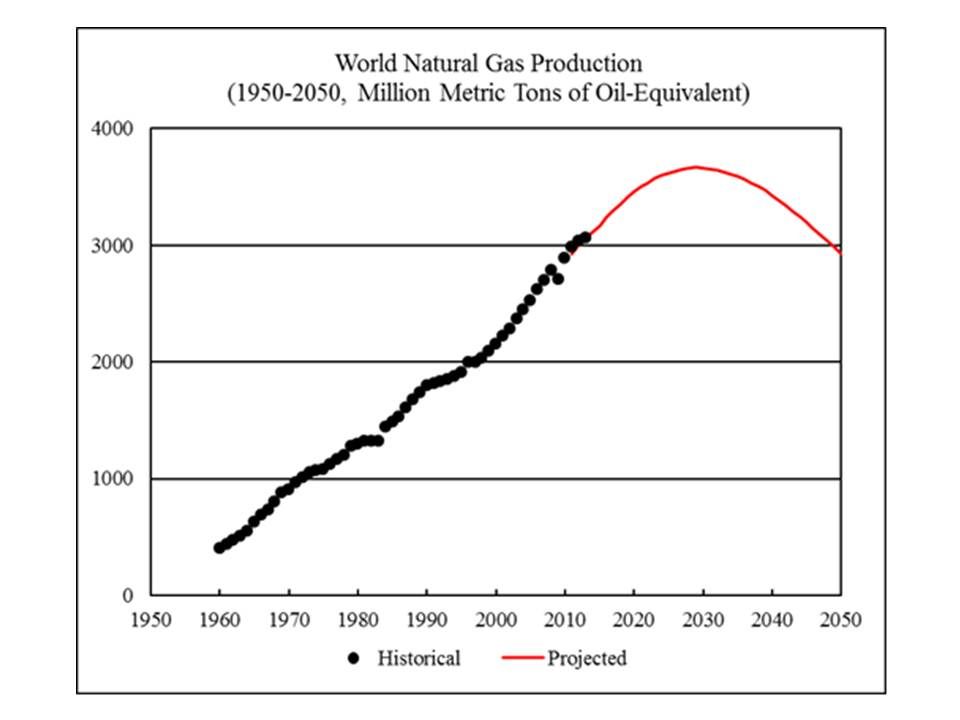

Figure 10 shows the world historical and projected natural gas production. The projected world natural gas production is the sum of the projected world (excluding the US) natural gas production and the projected US natural gas production. World natural gas production is projected to peak in 2029, with a production level of 3,667 million metric tons of oil-equivalent.

Coal

According to BP Statistical Review of World Energy 2014, world coal consumption reached 3,827 million metric tons of oil-equivalent in 2013, 3.0 percent higher than world coal consumption in 2012. In 2013, coal consumption accounted for 30.1 percent of the world primary energy consumption.

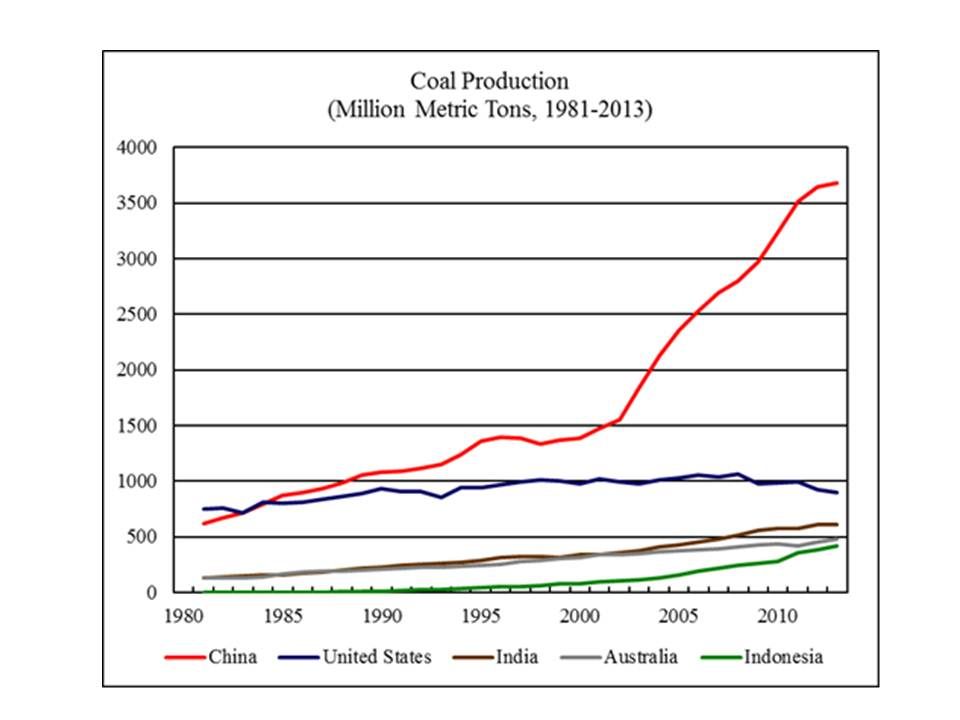

World coal production reached 7,896 million metric tons (3,881 million metric tons of oil-equivalent) in 2013, 0.8 percent higher than world coal production in 2012. Figure 11 shows coal production by the world’s five largest coal producers from 1981 to 2013.

As of 2013, world coal reserves stood at 892 billion metric tons, 3.6 percent higher than the coal reserves in 2012. The total increase in coal reserves by about 31 billion metric tons can be accounted for by the upward adjustment of reserves by Indonesia (an increase by 22 billion metric tons), Turkey (an increase by 6 billion metric tons), and Brazil (an increase by 2 billion metric tons).

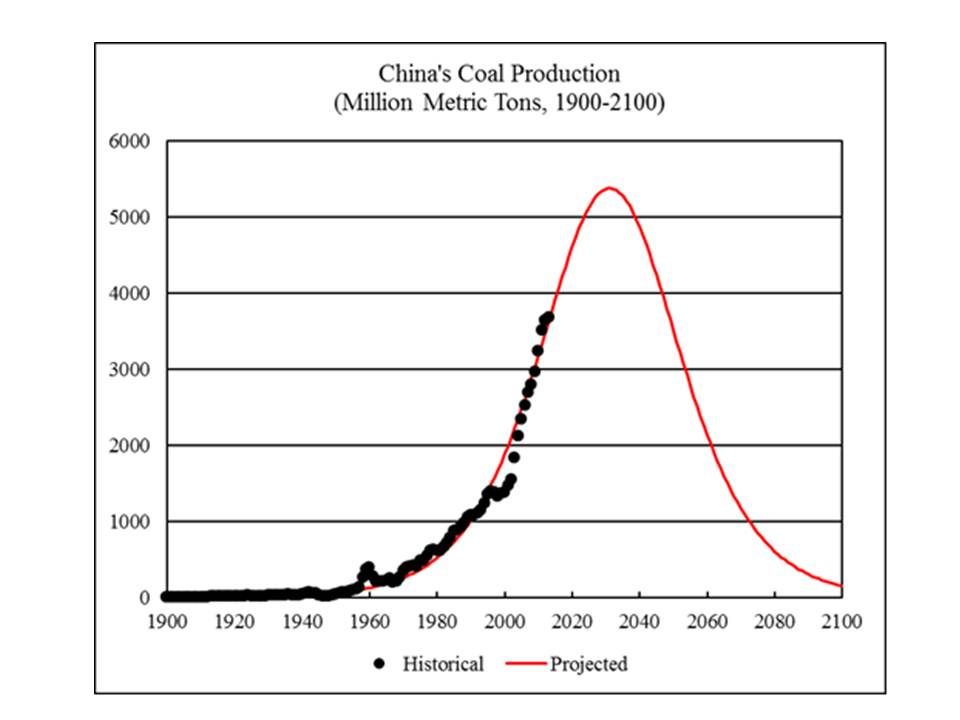

China is the world’s largest coal producer, accounting for 47.4 percent of the world total production. For many years, the BP Statistical Review of World Energy has reported China’s coal reserves to be 114.5 billion metric tons without update. According to China’s Ministry of Land and Natural Resources, China’s coal “reserve base” was 230 billion metric tons as of 2012. China’s cumulative coal production from 1896 to 2013 was 66 billion metric tons. I assume that China’s ultimately recoverable coal resources will be 300 billion metric tons.

Figure 12 shows China’s historical and projected coal production from 1900 to 2100. China’s coal production is projected to peak in 2031, with a production level of 5,383 million metric tons.

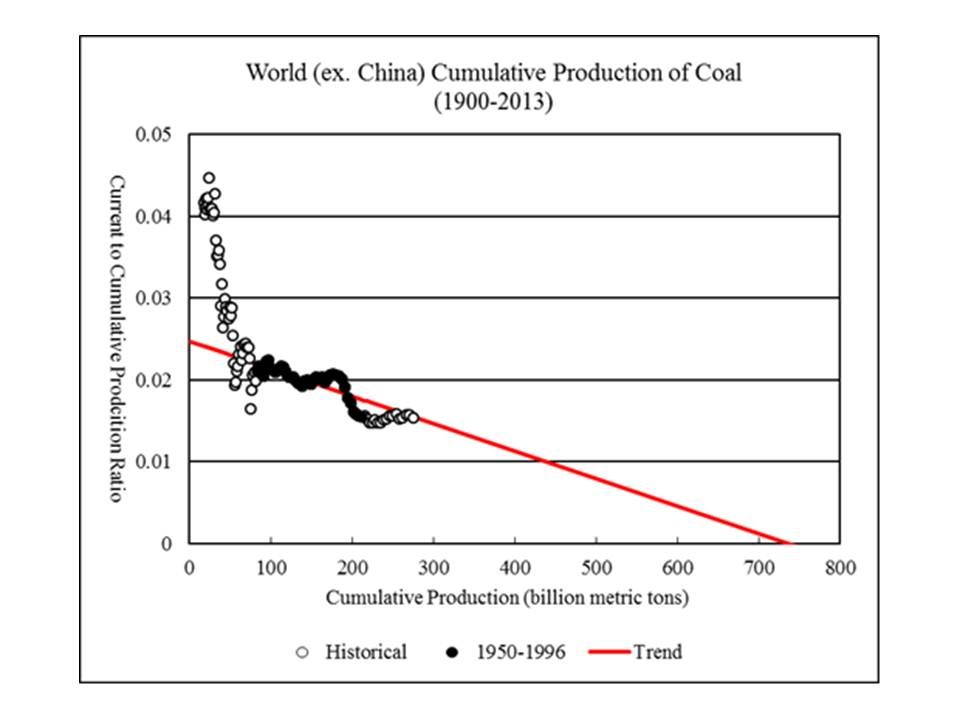

Figure 13 applies the Hubbert Linearization analysis to the world (excluding China) coal production. The historical trajectory of the world (excluding China) coal production was complicated by the collapse of the Soviet Union, which led to drastic declines of coal production in the 1990s. A direct application of linear trend from 1950 to 2013 results in projected production levels significantly lower than the observed production levels for recent years. A linear trend from 1950 to 1996 is used instead, yielding projected production levels similar to observed production levels for recent years.

As of 2013, the world (excluding China) cumulative production of coal was 275 billion metric tons. The linear trend from 1950 to 1996 indicates the ultimately recoverable amount to be 736 billion metric tons. Regression R-square is 0.626.

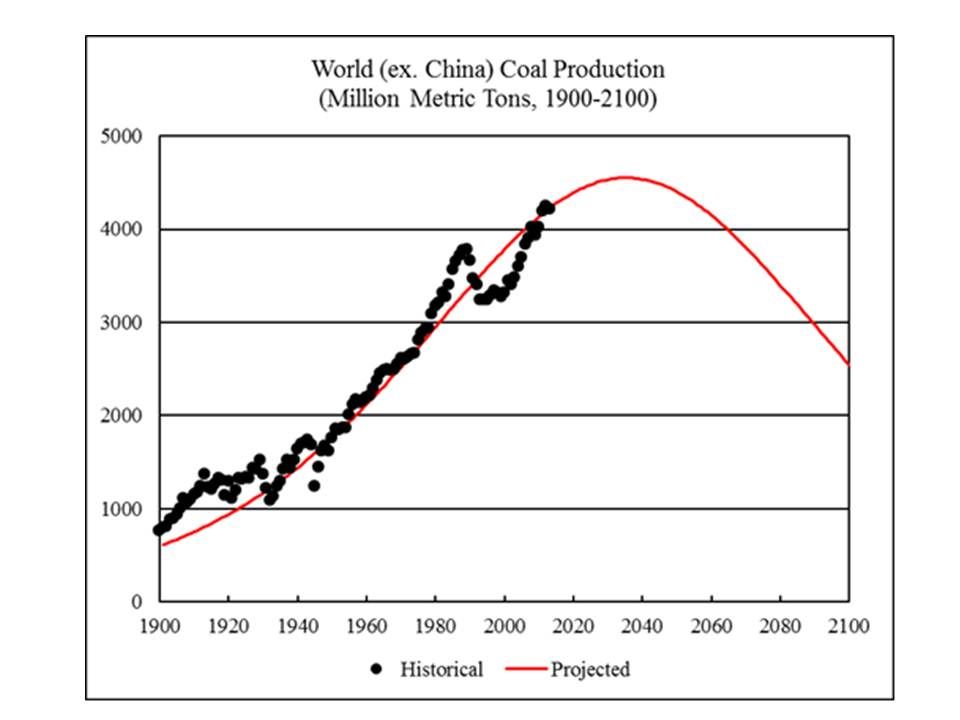

Figure 14 shows the world (excluding China) historical and projected coal production from 1900 to 2100. The world (excluding China) coal production is projected to peak in 2035, with a production level of 4,551 million metric tons.

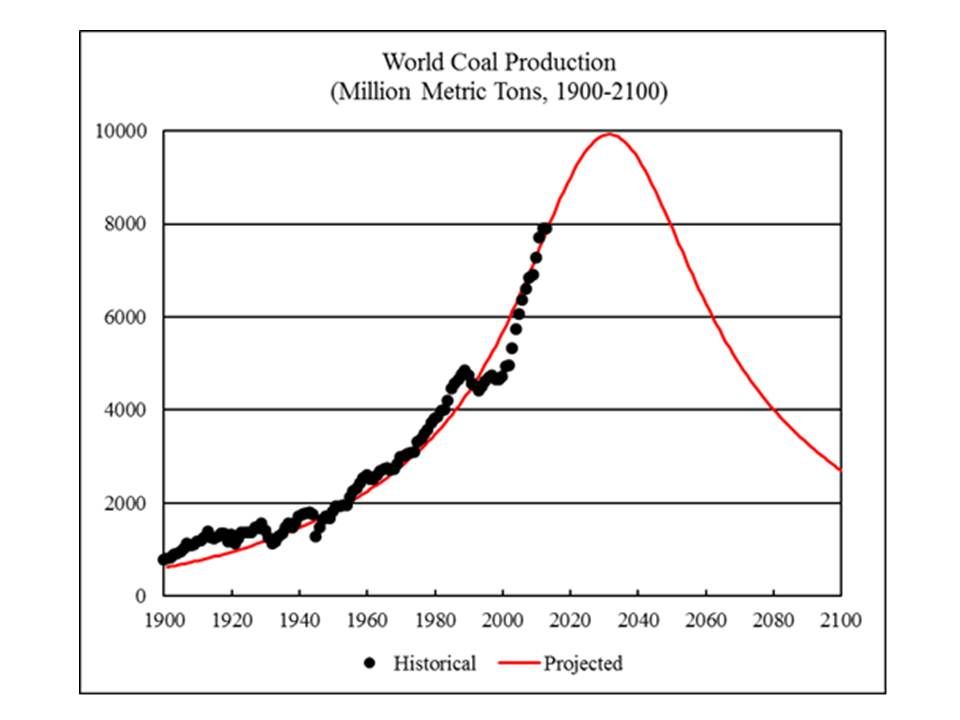

Figure 15 shows the world historical and projected coal production. The projected world coal production is the sum of the projected world (excluding China) coal production and China’s projected coal production. World coal production is projected to peak in 2031, with a production level of 9,922 million metric tons.

That graph of coal production and China’s line is just staggering. I knew they were producing a lot of coal but that graph really puts it clearly.

I guess that peak “fossil fuel” should be around 2026. So we have only about 10 years to prepare the society to completely change energy production and consumption. I think we are not prepared for peak oil (in maximum 5 years). What if gaz and coal production are decreasing as well? The change will not be progressive anymore.

I suspect that oil cannot be substituted fast enough with other energy sources on a global scale to offset the decline rate from global peak production for long. Therefore the global economy will be constrained by the global oil supply, and as supply declines, so does demand, and therefore supply of NG and especially coal.

Also I suspect that what we have seen in Libya and Iraq is a foretaste for peak oil – that decline will not be a smooth Hubbert curve (or any other curve). It will be a chaotic stair step down.

We don’t have 5 years to plan a transition to alternate fuels – we have max 5 years to build our resilience and mentally prepare for rapid decline of all energy.

“I guess that peak “fossil fuel” should be around 2026. So we have only about 10 years to prepare the society to completely change energy production and consumption.”

Coal production is dependent on Liquid fuels, specifically diesel. Without ample Diesel to supply demand, Coal production will decline. Also consider that LTO, the only supply that is increasing, and it doesn’t contain any diesel (or barely any)

Take a quick look at this page from the EIA:

http://www.eia.gov/forecasts/steo/report/us_oil.cfm

See chart “U.S. Gasoline and Distillate Inventories”

While it doesn’t show a smoking gun for diesel, it shows that refining stocks have remained low for the past several years and gasoline stocks remain at the highs. I think this shows that refineries are able to produce ample gasoline, but are probably having difficultly with diesel.

I haven’t been able to dig up any graphs that show long term diesel production relative to crude oil, but it think it make show a disturbing trend.

FWIW: I think we are already out of time to prepare. Peak liquid fuels is likely around the corner, perhaps in the next 18 to 32 months, unless there is a major discovery that can bring cheap oil to the market. The odds are the LTO (Shale) was the last ditch effort to keep global production from declining. We should have started preparing back in the 1980s or the 1990s to avoid a crisis.

“Also consider that LTO, the only supply that is increasing, and it doesn’t contain any diesel (or barely any)”

We’ve addressed this. It’s not Libya quality diesel content, but it’s not zero or even nearly zero. It’s hard to get good, consistent data on this, but zero is just not correct.

It is likely this mini-meme got started when Eagle Ford output was mostly condensate. That has changed.

http://www.tititudorancea.com/z/us_diesel_onhighway_retail_prices_graphs_history.htm

Says diesel’s price is down the last 3 months. Never quite understood seasonal formula changes for gasoline, maybe it’s done for diesel too, because for damn sure WTI isn’t down over that timeframe.

TechGuy,

The US exports a lot of diesel to Europe and Latin America; west and North Africa too, and Japan and…

We are refiner to the world, so our diesel exports are not necessarily based on domestic crude–we import crude, refine it, and export the products. Sweet, huh?

Personally I think coal production will grow as oil declines and that a good bit of coal will be converted to synthetic gasoline and diesel fuel.

It is true that this synthetic fuel will be considerably more expensive that conventional diesel fuel but in my opinion we will cut back elsewhere enough to pay for it.

Keep in mind that the population is still growing and that most of the world can get a lot more economic bang out of a gallon than countries such as the US.

We burn a lot of diesel in frivolous ways that no doubt contribute to gross national product. But a gallon burnt in a giant pickup commuting doesn’t compare to a gallon burnt delivering food to stores and materials to factories.

We need to remember that fuel efficiency is going to improve fast once the price of it really begins to bite hard on people who are still earning relatively good incomes.I expect that fifty mpg new cars will be the norm in a decade- which is a hell of a lot sooner than most people expect- but then I expect an oil crunch and permanent price spike within the next few years.

Maybe the economy will shrink enough to reduce oil demand but I just can’t see things working out that way over the longer haul unless the economy actually collapses- which will happen eventually when fossil fuels are really scarce unless runaway climate change brings collapse on sooner.

But oil that costs twice as much- or synthetic coal based liquid fuel- will still be utterly indispensable to the day to day economy. We can adapt faster than most people think once the crunch hits.An oil price spike will bring on a recession no doubt but it need not be permanent.

I have a different perspective about oil prices being a person who uses it in relatively small amounts to generate a lot of income.It doesn’t take very many gallons of diesel to raise a hundred thousand bushels of apples or corn compared to what it sells for.

Transportation will shift away from trucks to electrified rail and from gas hog cars to buses and street cars and zoning will catch up with the times and businesses and housing will be built in the same neighborhoods. Businesses will be allowed to move into former residential neighborhoods.

I would gladly pay twenty bucks a gallon to run our little farm before I would even think about getting a draft animal.As I see it the less oil is produced the higher the price will get until it gets somewhere up into the stratosphere.The price will never come down because there is not enough of it to support business as usual.Business as usual will contract much faster than demand for oil as I see things.

But in the end it all depends on how fast oil peaks and declines. If it happens fast the pessimists are right;there will not be enough time to adapt.

Mac,

The most likely form of synthetic fuel in the short term is Gas to Liquid (GTL). It’s competitive with $100 oil right now, in the US and some other places.

In the longer term, I’d say using electricity (from wind, solar and nuclear) to electrolyze hydrogen from seawater (as well as pull carbon from seawater) is likely. That can be done for between $5-$10/gallon, which caps the price of oil at no more than about $250, and probably more like $150.

Aviation, long-distance passenger travel, seasonal agriculture and long-haul water transportation are the primary high value uses of liquid fuel: that’s maybe about 25% of current oil consumption in the US. More than half of oil consumption is passenger vehicles, and 90% of that is easily eliminated with plug-ins. Most freight can go by rail.

So, probably 75% of fuel consumption would just go away with $200 oil, replaced by cheaper and better alternatives. If oil went above $250, pretty much all of liquid fuel consumption would be provided by synthetic fuel.

What sort of quantities of GTL output could we expect should oil go to $250 over the course of a month? How much of that output can we see that month?

Well, that’s extreme. How about over two months?

Good point. GTL (or CTL, for that matter), won’t come quickly.

Really fast responses include carpooling (which even now is bigger in the US than mass transit) and carsharing.

Slightly slower responses include switching from low MPG vehicles to more efficient vehicles: the average US vehicle only gets 22MPG, and the average household has more than 2 cars to choose from.

Then people can switch vehicles: on average US vehicles change ownership every 3-4 years.

Then people can buy new cars that get 100 or 200 MPG (or infinite). 50% of vehicle miles travelled come from vehicles less than 6 years old, so that will make a difference faster than you might think.

Why ask the US to do anything? Why not ask China and India to not buy 30 million gasoline vehicles per year?

In fact, all of these things are contortions of expected human behavior. Why not expect that which is likely — that no one asks anything at all?

Population decline is Occam’s Razor.

Well, you asked about response time to high oil prices. Most people do respond to price signals.

But what does that mean?

You’re India. You have more people elderly than the entire US population and none of them have an income. You have more people out of work and indigent than the entire US population.

They are striving to achieve the sort of GDP that can fund those people rather than have them die of tuberculosis.

The price goes up, and the response is supposed to be . . . give up? Don’t burn oil priced in whimsically printed dollars? Let your people starve and die so that the rich countries can still burn it?

India’s not that far from the Middle East. Why not just go take the oil?

And, of course, there is also the producer psychology at $250/barrel.

“This is crazy. This stuff is utterly precious. Sorry, it’s not for sale anymore. We’ll just keep it. If we are low on food, we’ll trade with food producers for food, but no more using money as an incentive to persuade us to ship something so precious that our grandchildren will want.”

The price goes up, and the response is supposed to be . . . give up?

No, India has lots of good options. First, they need to decontrol the price of diesel. They’ve already decontrolled gasoline, but they can’t afford to keep on subsidizing diesel. That will encourage proper usage and efficiency. Fuel subsidies can be replaced by ration cards that would be far cheaper, as the middle class consumption (which is the majority of consumption) would be cut out.

2nd, they can do what China is doing, and encourage electric bikes: e-bikes sell in larger quantities than either gas bikes or gas cars, in China.

3rd, they can actually fix their grid: a very big portion of diesel in India is burned in generators, which is an incredibly bad use.

“This is crazy. This stuff is utterly precious. Sorry, it’s not for sale anymore. We’ll just keep it. If we are low on food, we’ll trade with food producers for food, but no more using money as an incentive to persuade us to ship something so precious that our grandchildren will want.”

Oil will be mostly obsolete in a couple of generations. They should sell it as fast as they can, and invest the money into other kinds of industries.

Given 2008’s ongoing recession beginning @ about $147, could the uneconomy sustain itself @ $200?

A lot of people will start switching to substitutes at lower prices, so we’re unlikely to see such prices without a major supply disruption.

Ok, cool, thanks.

Hi Mac,

My family is moving to a “golf cart” community in FL. Most of my wife’s daily commuting (shopping, bringing my son to school etc) will be done on the golf cart. I plan on putting solar PV on the cart’s roof. We may not have to charge it very often. I currently drive a smart car for my commute. Eventually we will buy a house and I will put PV on the roof of the house and purchase an electric car for my commute. It will be relatively easy to significantly reduce my family’s FF use.

Best,

Tom

Lotsa golf carts are gas powered.

High ground in Florida I hope?

Looking forward to analysis of premium adjustments on FL homeowners’ insurance to cover solar panels in a hurricane zone.

“We should have started preparing back in the 1980s or the 1990s to avoid a crisis.”

Nothing the 2005 Hirsch report didn’t advise, which oddly also appears to have been the peak production of oil year. Therefore, according to that report, urgent migration efforts should have begun in 1995, or more leisurely moves in 1985. Ah well, time to reboot the total market failure that is the electric car on our way back down to the ostler.

Oooh market failure.

Nissan Leaf 2014 $27K price Sales total 100,000 units . . . since launch in 2010. That’s global and a grand total of 25K units / year for a design in its 4th year.

Equivalent priced proper, conventional car, hard to find them without going into the luxury space (and in case you’re wondering, Lexus ES entry level car does about 90,000 units/year, and that’s $5K more expensive):

Let’s just use the generic Camry

Toyota Camry approx 350,000 units PER YEAR.

And before folks wave hands in the air about tax subsidies to bring the Leaf price down, keep in mind if you do that then you’re comparing sales to cheaper cars that sell one HELL of a lot more than a Lexus.

“Market failure”. Well put.

These expected positive noises over electric cars ignore other studies that point to renewables as costing an order of magnitude more than more productive sources, and ignore the poor record of nuclear, which was promised to deliver energy too cheap to meter (optimism well recorded by James E. Akins in “The Oil Crisis”). Nuclear regardless uses a finite fuel source, so is no long-term solution. Nuclear may well be attempted as a glowing Hail Mary play; the Chinese do seem to be having a go. Whether their experience merely repeats the faltered steps of Western powers remains to be seen. Other criticisms of electric cars, well, any time spent slumped out over a wheel well is a lost opportunity to exercise, and I do wonder how the roads will be maintained, given the poor road quality I observe (Seattle has not funded non-arterial road repair since the mid-1990s, and the gas tax likewise languishes), and one might also read of dire reports from U.S. engineering groups after this or that bridge failure points to a lack of basic road maintenance (why?). Ecological destruction from the existence of the road network, manufacture, use, and etc. of vehicles might also be a concern: “Where man goes, trees die; or, to paraphrase Tacitus, we make a desert and call it progress.” — Ursula K. Le Guin, “Lavinia”. Regardless, my nose and ears tell me that battery electric vehicles remain utterly irrelevant (a finding strongly backed by the sales numbers—0.62%), as consumers continue to double down on Carbon. Shifting to electric vehicles might well improve urban air quality, but that’s just hiding the burning coal under some other rug, and really does not address the root cause: the need to consume far less energy. Cute little golf-cart micro-vehicles may indeed have some role to play in the Carbon endgame, but given the high costs of non-Carbon energy sources, the high costs of road maintenance, the high ecological costs, and the various other costs and limitations of electric vehicles—already once a total market failure back in the 1920s—a more credible analysis might point to a future of hardship and sacrifice—try walking everywhere you need to go—and certainly not to easy wheeling in some electric vehicle of hypothetical affordability on hypothetically maintained roads. Better steps might be to skip the whole fuss over such expensive vehicles—my transportation budget for 2013 was $60 for new shoes, and is $0 to date in 2014. What is yours? What instead could you do with the money thus saved? Perhaps support the uncommercial lodgepole pine, to help better preserve the dwindling U.S. snowpack, and help better maintain the water supply? Many other such opportunities beckon.

studies that point to renewables as costing an order of magnitude more than more productive sources

That’s not realistic. It may have been true decades ago, but not now. If you’re unconvinced, post the sources for those studies, and I’ll go through them with you.

Chinese proverb:

‘best time to plant a tree: 50 years ago, second best time: today’.

As of 2013, world “proved” oil reserves stood at 238 billion metric tons, 1.0 percent higher than the “proved” oil reserves in 2012.

The above numbers go directly against these:

Western analysts. Last year, the global oil industry discovered just 13,000m barrels of oil, a third less than in 2012 and the lowest discovery rate in 62 years. I know 13,000m barrels still sounds a lot, but consider that 2013 global consumption was almost 33,500m.

Turmoil in Iraq could engulf global oil market

Which one’s are correct?

Hi Frugal,

This is a definition thing which perhaps Doug Leighton could explain, he has actually done work in this area and I have not. I believe it has something to do with resources, reserves and the difference between the two. What gets discovered initially is a resource, as oil companies gain more knowledge about the resources and become convinced that they can be produced profitably, those resources become reserves.

Bottom line, it often takes many years before a discovered resource (or a portion of same) becomes a proved reserve.

Frugal, the answer is very simple. The world does not have 338 billion metric tons of proven reserves. That would be over 1700 billion barrels. The world has nowhere close to that amount. The world has about half that amount. That is counting OPEC with about 1200 billion barrels. They have about one third that amount or about 400 billion barrels… or less. They have about the same, or slightly less than, non-OPEC.

About six weeks or so ago I read an article that helps me understand why. To my regret I did not save the link. But the article quoted an OPEC or Saudi official, I don’t remember which, as saying they planned on getting 75% recovery rate from all their fields. That’s how they plan on recovering another 1200 billion barrels.

BP reports reserves both in tons and barrels. According to BP, the world’s “proved” oil reserves in 2013 were 1,689 billion barrels or 238 billion tonnes. BP’s “proved” reserves include Canadian and Venezuela heavy oils, for which 1 tonne correponds to about 6 barrels (instead of 7.3 barrels for average crude oil).

Yes and BP reports what OPEC nations tell them they have, or very close to it. BP would not offend the OPEC national oil companies by telling them their reserves are a lot of wishful thinking. BP has a lot of contacts in OPEC countries.

I think “proved oil reserves” also include profitability. So higher the oil price higher the reserves. There are also the OPEC reserve increases in the late 80s. Saudi Arabia has about 254 billion barrels of reserves since 1988 while there was no major new discovery and they produced about 90 billion barrels. As of today, their total production is about 150 billion barrels and we can see the difficulty they have just to maintain their production level. So their real reserve should be of 150 billion barrels at maximum and probably less.

Hi Ron,

There are about 800 Gb of conventional proved plus probable reserves based on Jean Laherrere’s estimates, there are also about 500 Gb of extra heavy reserves in the Canadian oil sands and Orinoco basin (when we add these two together).

So the grand total is 1300 Gb, Jean Laherrere expects the URR for C+C less extra heavy oil to be 2200 Gb and through Dec 2013 about 1200 Gb of C+C had been produced so about 200 Gb are expected to be added to reserves to get to the 1000 Gb.

So for World C+C URR Jean Laherrere’s most recent estimate is 2700 Gb with about 1500 Gb left to produce (about 220 metric tons of oil, the extra heavy is more dense at 6 Gb per metric ton vs 7.33 Gb/ton for regular crude).

Note that Jean Laherrere’s estimates are conservative, based on a hubbert linearization of world C+C less extra heavy the World C+C URR may be 3000 Gb rather than 2700 Gb (assuming extra heavy URR is 500 Gb).

Hi PE,

Nice job.

Chinese growth on coal output seems to be slowing down lately. David Rutledge of Caltech has estimated about 140 Gt for a Chinese coal ultimate using data through 2009. I have updated Professor Rutledge’s spreadsheet with the latest BP coal data for China and the ultimate increases to 230 Gt. To reach a 300 Gt ultimate for Chinese coal I assumed Chinese coal output would grow about 1.8% each year to 2016 and then updated the model as if we had 2014 to 2015 Chinese coal data.

The model predicts a somewhat lower and later peak than your Hubbert model for China. Peak output is 4650 million metric tons in 2033 with a URR of 295 Gt.

Hi Dennis, this is interesting. I am also using Rutledge’s spreadsheet but have got a different URR for China coal. As I promised, I’ll post it below.

That has been said, a wide range of China’s coal URR could be legitimate. According to the Chinese official sources, China has more than 5 trillion tons of coal resources, out of which 1.4 trillion tons are considered to be “identified”. On the other hand, just a few years ago, China reported the coal reserve base to be 340 billion tons. It has been adjusted down to 230 billion tons.

A lot will depend on climate policy and environmental constraints.

Hi PE,

I was using the data you gave to aim for about 300 Gt for a Chinese URR for Coal. Then put the BP data from 1981 to 2013 in Rutledge’ spreadsheet and ran the macro to get 230 Gt, that was too low. So I guestimated that Chinese output would increase at about 2% per year from 2014 to 2016 and put that in Rutledge’s spreadsheet and that gave a URR of 295 GtI then created a smooth curve to fit between actual data and Rutledge’s model output over the 2014 to 2020 period and the chart I show above is the result.

The premise was that Chinese coal output looks like it may be slowing down, time always answers these questions.

Letter to the Financial Times, reproduced in its entirety. Requires Registration Bold mine.

It would seem premature to declare that Peak Oil is dead

From Dr John Howard Wilhelm.

Sir, Your assertion that Peak Oil is dead and that US output of liquid petroleum has regained its previous peak reached in 1970 should not go unchallenged (“Looking past the death of Peak Oil”, Editorial, June 17). According to data from the US Energy Information Administration, US field production of crude oil in 1970 was 9.6m barrels a day. For 2013 it was 7.4m b/d. That is, in 2013 US crude oil production stood at 77 per cent of its annual 1970 peak.

If one looks at the facts, the situation is far more fraught than implied by your analysis later in the piece. Earlier data from the Bakken oilfield indicated that annual production per well averaged 85,000 barrels a year initially with a decline rate of 40 per cent a year, which implies on a compounded basis 856 barrels a year or 2.35 b/d in 10 years, surely a level at which a stripper well would be shut down.

Later data I was sent by a prominent geologist indicate an initial annual rate per well of 133,955 in the Bakken with an annual decline rate of 63 per cent,* which implies that in seven years the daily production rate of the average well could well be even lower than the 2.35 b/d.

From everything I know, this situation broadly applies to all US and world shale oil and gas developments. Given this and given the reality cited in your piece that “it is a striking fact that since 2005, all the increase in the world’s crude oil production has come from the US”, it would seem premature to regulate the Peakists’ argument to the “dustbin of history”.

* This statement is a little confusing. That would indeed be the annual production if it were held for an entire year. But that rate only for the first month. That works out to be 367 barrels per day for the first month. That is a decline from a report I got in mid 2012 which stated that the average production per new well was 400 barrels per day.

Hi Ron,

The person who wrote this letter does not seem to realize that the decline rate does not remain 63% every year, (I know that you know this.)

Using the data that Enno Peters collects, the annual decline rate of the average North Dakota Bakken well from 2008 to 2013 is shown in the chart below. Also shown is the output of the average well in barrels per month (right axis), output falls to 16 b/d after 15 years and the decline rate is about 6 % at that point. Even at 30 years this well would be producing 6 barrels per day, not a lot of oil but more than 2 barrels per day.

If the data start in 2008, how do you know what decline rates will be in 30 years? Are you just curve fitting the decline rate with an exponential? That’s what it looks like from the graph. But I’m sure there’s a fair amount of uncertainty in the data, so we’ll have to wait and see before an assertion like this can be proven valid.

One of those duh moments.

Yes that is correct we have 6 years of data, the NDIC suggests that the decline rate in the out years is exponential at 6 to 7 %, this is what past Bakken wells (which have been around since 1953) have shown.

Ahhh but therein lies the rub. Those old wells were all conventional wells drilled in the anticline where enough oil left the reservoir rock to settle in the source rock. The shale wells are fracked directly in the source rock, their decline rate is likely to be a lot higher.

Hi Ron,

That is possible, the USGS and NDIC disagree, but both could be wrong. The USGS estimates about 360 kb for the EUR of the average Bakken well, same as me, the NDIC typical well has a terminal decline rate similar to what I use (around 6.5%).

Whether the tail of these well profiles decline at 10% or 6% will make very little difference, most of the oil is produced over the first 10 years anyway. See Rune Likvern’s well profile below.

Caption from chart is:

“Figure 05: The chart above shows the well profile and cumulative for oil from the “2011 average” well that was derived from 230 wells that started to produce as from June 2011 and through December 2011.”

See http://www.theoildrum.com/node/9954

Note that much of my analysis is based on the pioneering work done by Rune Likvern on the North Dakota Bakken.

Comment from Jean Laherrere. He chooses to send his comments to me rather than post directly. I have also posted two charts he included in his post.

———————————————————-

IEA definition for condensate is either classified with x crude oil when sold with it , either with NGL if not IEA follows Norway definition by NPD condensate is confused with oil depending the sale for Kristin field from Oct 2005 to Sept 2006 no oil only condenste, but since Oct 2006 no condensate only oil NGL is reported separately.

I have compared NPD production data reporting oil, condensate, gas and NGL with IHS data reporting only oil, condenste and gas.

It is obvious that IHS forgets NGL. IEA definition of condensate is confusing and explains the discrepancy with NGL with EIA which reports crude and condensate and separately NGPL.

Condensate definition is a mess for the world.

Best regards,

Jean

Comparisons Kristin, Mikkel & Asgard production

And so, if you want more oil production, you can get more oil production — without drilling a single additional well or doing anything else. Just call something else oil.

The news seems to have gone quiet on the Baiji oil refinery. On the 21st both sides claimed to have full control, and since then silence in the MSM that I can find.

Clearly the refinery is still off line and likely to remain so as ISIS controls all surrounding territory, including pipelines.

My guess is a stand-off with troops reinforcing the refinery by helicopter, but all road access blocked.

Ralph W,

This is the latest:

ISIS takes over Iraq’s main oil refinery at Baiji – reports http://t.co/eFPEmK8Uox

This will disrupt the Iraq gas market, as long as the fields are safe… everything is allright

Reliable data is scarce. Numbers suggest 40ish% of Iraq gasoline comes from there.

I guess those nifty 50 caliber equipped white Toyota pickup trucks have a fuel source (provided someone ships some crude to the refinery — that will be cool, ISIS already flowing money to the Kurd oil field as payment).

These ISIS guys are doing an outnumbered Blitzkrieg that is pretty much astonishing.

I am never confident about Gaussian prediction curves, especially concerning mining and drilling operations. Since the production rate is dependent upon geology, technology changes, economics, and disruptive technologies; I don’t see how the downside could look anything like a smooth Gaussian prediction. Just look at the US production curve, Russia’s, Saudi, Texas. Not at all Gaussian in nature.

Any publically available studies on this?

Hi Allen,

These are logistic curves and nobody really expects the curve to be smooth on the way down, it can be thought of as a trendline that might apply if there are no severe shocks to the system. A big war, political upheaval, radical technological changes, natural disasters, and economic recessions will all act as shocks to the system causing output to fall below or rise above the trendline.

Nobody can possibly predict when these shocks will occur and how large they will be.

According to Ivanhoe – World Oil 1996 and Hubbert Center Newsletter 1997; Hubbert never claimed that production would be Gaussian, http://hubbert.mines.edu/news/Ivanhoe_97-1.pdf

This is in response to Dennis’s comment on China’s URR.

It is still difficult to apply HL to China’s coal production due to the economic restructuring in the 1990s (which reduced coal production) and the surge of coal production in the first decade of the century. For HL to be applied, you need to have a downward trend for current production to cumulative production ratio. This leaves the analyst with a difficult choice.

One could use every observation from 1970 to 2013. That would give you a downward trend (as shown below). But obviously it is not very accurate. The trend indicates the URR to be 376 billiion tons (bigger than the 300 billion tons assumed in the main post). As the trend line is still below the observed ratio, in the next few years, the observed ratio will keep pulling the trend line up, implying somewhat bigger URR.

Alternatively, observing that the current to cumulative production ratio finally started to turn down after 2011, one could use the observations from 2011 to 2013. That would give a URR of about 160 billion tons. But that is based on only three data points.

Dennis, since both you and I used Rutledge data, can you tell why our results are different. I’ve China’s cumulative production up to 1970 being 5.26 billion tons and up to 2013 being 66.1 billion tons.

I’ll later post some comments showing what if one applies HL to the world oil, world gas, and (possibly) world coal as a whole.

Hi PE,

I did not do an HL for China.

I plugged the BP numbers into Professor Rutledge’s spreadsheet, when using only data through 2013 the spreadsheet gives about 230 Gb URR for China. Based on your analysis I thought this might be too low and the production levels were also lower than actual data for the model.

Looking at actual data a growth rate of about 2% for coal output looked reasonable so I tried putting “data” in the spreadsheet for 2014 to 2016 where China’s coal output increased by 1.8% over the 2014 to 2016 period and then recalculated the China spreadsheet and got a URR of 295 Gb, similar to your analysis. The curve I showed is the model output from Professor Rutledge’s spreadsheet from 2021 to 2098 and I filled in from 2014 to 2020 by just linearly increasing output (by 35 million tons each year).

So the difference is that I did not use any Hubbert Linearization, Professor Rutledge’s model works differently.

I adjusted the model slightly using the 35 Mt output increase up to 2018 in Rutledge’s model (with BP data from 1981 to 2013 and all other data left as in original spreadsheet), when recalculated the URR is 320 Gt. In chart below the model output is 2019 to 2098 and 2014 to 2018 “data” is the 2013 data point plus 35 million tons for each year up to 2018. All data up to 2018 was fed into the model to get the 320 URR. Chart below is more similar to your Hubbert model as far as peak output. Peak output is 5.1 Gt in 2035.5 and URR is 320 Gb.

Hi PE,

I have the same cumulative output China’s coal output for 1970 and 2013 as you do.

I am just using Rutledge’s model for China.

One consideration is that Chinese reserves could easily grow. So 320 billion tons is a possibility. I like the 295 Gt model better.

This is what you will have if applying HL to 2011-2013 only

mazama says China’s coal consumption is ramping steeply and has outstripped production.

You have to admire those folks. You want GDP? You burn the hell out of everything. People worry about climate? Tell them to stop burning anything at all so there is more for you.

But in general, you gotta admit . . . these guys may just ramp coal consumption to the moon, cut back on their production and “burn everyone else’s first”. We’ve heard this before, yes?

Hey guys, check out Steve’s post.

Decline of U.S. Shale Energy & The End Of Precious Metal Manipulation

Now I don’t really pay much attention to precious metals, but Steve takes the EIA’s own data on shale decline rates and makes them look rather alarming. You should check it out.

Fascinating graphics – one thing that I have a question about though – surely if we are now at legacy decline rates of 80% or thereabouts (and increasing) for the Bakken and Eagle Ford we should be seeing the EIA actual monthly production curves for those fields starting to ‘top out’? Shouldn’t the upward trends in the relevant graphs be showing at least a declining gradient?

The increase in barrels per day is declining. The new wells in the Bakken, in December, produced 89,000 bpd to gain 26,000 bpd in total production. In July, they are predicted to produce 92,000 bp/d, 3,000 bp/d more to produce 20,000 bp/d or 6,000 bp/d less.

New wells in Eagle ford, in December, produced 116,000 bp/d to gain 33,000 bp/d in total production. In July they are predicted to produce 138,000 bp/d or 22,000 bo/d more than in December but total production will increase 24,000 barrels per day or 9,000 bp/d less than they produced in December.

They have to produce more and more to gain less and less. The Red Queen is running faster and faster but gaining less and less. Soon she will have to run as fast as she can just to stay in the same place.

Based on the Rockman comment, one wonders how much oil is coming out of the Bakken were the Texas standards defining it.

Basically, what he said was based on well designation condensate coming out of the ground can be called oil. We already know some NGL type liquids are getting into the railcars. Seems hard to imagine that NGL trucks are offloading into those railcars.

The much more credible scenario is the truck loads up at the well with whatever is coming up that is separated from water. Then that is quoted as production and hauled to the railcar. Done. 1 million bpd declared.

The refineries know. The transport costs can conceal their refusal to pay WTI prices.

Dennis suggested I do HL to the world oil, natural gas, and coal as a whole. For oil, it works. HL analysis for 1995-2013 indicates the world’s ultimately recoverable oil resources to be 388 billion tons. Cumulative production up to 2013 was 176 billion tons. The implied world oil production peak happens in 2018.

By comparison, the HL analysis applied to world (ex. US) gives a URR of 309 billion tons. EIA projection implies the US URR to be 67 billion tons. The implied world total URR is 376 billion tons and the projected peak year is 2016.

For natural gas, HL applied to world total leads to significantly different result. The trend from 1995 to 2013 indicates the ultimately recoverable natural gas resources to be 432 billion toe. The predicted peak year will be 2044.

By comparison, in the main post, world (ex US) URR is 203 billion toe. The EIA projection implies a very large US URR of 138 billion toe. The total URR is 341 billion toe. The predicted peak year for the world total is 2029.

No reasonable HL can be applied to world total coal production at this point. If one uses all observations from 1930 to 2013, it produces an incredibly large URR of 5 trillion tons. If one just uses the last three data points (2011-2013, made possible by China’s slow down after 2011), the implied URR is 1,015 billion tons.

In the main post, world (ex China)’s URR is estimated to be 736 billion tons and China’s URR is assumed to be 300 billion tons, adding up to 1,036 billion tons.

The world coal reserves reported by BP were 892 billion tons. The world cumulative production up to 2013 was 341 billion tons. The implied URR is 1,233 billion tons.

If the world coal URR is about 1 trillion tons, long-term global warming is likely to be about 3C (forget 2C). Anything beyond 1 trillion tons (or if oil and gas peak much later than is predicted here) is likely to produce run away global warming. This will be shown in Part 3 of this report.

I agree.

There could be 1T tons of coal in Alaska and Alberta, each.

We have to make a choice to solve Climate Change – geology won’t do it for us.

Thanks PE,

It seems that HL does not work that well for natural gas and coal, the way that you did the analysis originally seems best(especially coal).

The problem is that the choices seem to be made to get the HL to give the result we expected to start with and then are justified because of the collapse of the soviet union for coal or increasing output in the US due to shale gas. Note that in looking at coal data for the former Soviet Union it seems the coal output slowed in 1992, so if that is the justification for limiting the selected data for World Coal ex China the period should possibly be 1950 to 1992 rather than 1950 to 1996. Interestingly, this gives almost the same result as an HL for 1981 to 1992 as for 1981 to 2013 which is about 500 Gt. If we take China at 300 Gt, this would be about 800 Gt for World coal which is not far from Rutledge’s estimate of about 840 Gt if we bump up the original estimate by 160 Gt due to the higher Chinese estimate. I am hopeful that less coal will be produced and that rising prices for all fossil fuels will cause a transition to other energy sources such as wind, solar, geothermal, and nuclear.

A comparison of your Natural Gas URR estimates with those of Jean Laherrere would be interesting

see http://aspofrance.viabloga.com/files/JL_2013_30Mai_Clarmix.pdf

Figure 22 in that pdf has the world ultimate at 13,000 TCF or 2200 GBoe or 300 GToe.

So the method used in your main post agrees pretty well with Jean Laherrere for Natural Gas, your estimate is a little higher, but Laherrere’s estimates tend to be on the conservative side (and in time may be proven correct).

Laherrere’s C+C+NGL URR estimate is about 425 Gt, your estimate for World C+C+NGL at 376 Gt or 388 Gt is a little on the conservative side. Remember that Laherrere has World C+C at 2700 Gb, but then estimates another 300 Gboe of NGL (I believe he adjusts for the lower energy content of NGL) so for World C+C+NGL he estimates URR=3000 Gboe. I used 7.33 b/t for 2500 Gb and 6 b/t for the 500 Gb of extra heavy oil to get URR=425 Gt.

Dennis, thanks for the comparison between my result and Laherre’s.

For coal (ex China), I tried 1950-1990 before I did 1950-1996. The trouble is, in addition to producing a large URR (more than 1 trillion tons ex China), the predicted current to cumulative ratios for the last few years are too high (implied projected production levels too high relative to observed production levels).

For 1981-2013, URR is about 530 billion tons. In this case, the trouble is the predicted current to cumulative production ratios are too low for recent years. If you keep adding years before 1981, it start to look better. For 1950-2013, you get the best R-square (about 0.82) and URR is 630 billion tons. But the predicted current to cumulative production ratios are still low.

For 1930-2013, it looks pretty nice on graph. R-square is 0.74. URR is 678 billion tons.

See below.

Sorry, I’ve the wrong graph attached above. Here is the 1930-2013 HL graph.

That looks pretty nice. But the current to cumulative production ratio is still too low. It’s not obvious from the HL graph. But look at the historicla and projected production graph:

My main interest is to add up all individual energy types and project the total primary energy consumption. If there is a too large gap between the projected production level and the observed level for 2013 (either in plus or minus side), it would cause a huge gap for between 2013 and 2014, making the growth rate for 2014 looking pretty wierd.

Saudi Arabia’s Ability to Plug Oil Gap May Be Limited

Spare Oil Capacity May Be Lower Than Expected

http://online.wsj.com/articles/saudi-arabias-ability-to-plug-oil-gap-may-be-limited-1403517159

Since I had the following chart prepared, the EIA has slightly revised some of the Saudi values, but production remained at about 104% to 105% of the 2005 value (total petroleum liquids + other liquids). Based on BP consumption data, Saudi net exports in 2013 (8.5 mbpd) were 93% of the 2005 level (9.1 mbpd). The Saudi ECI ratio (ratio of production to consumption) in 2013 was down to 67% of the 2005 level, and remaining estimated post-2005 Saudi CNE (Cumulative Net Exports) fell to 57%.

Based on the 2005 to 2012 rate of decline in the Saudi ECI Ratio, I estimate that their post-2013 CNE are down to about 31 Gb. At the 2013 net export rate of 8.5 mbpd, remaining Saudi CNE would be depleted in about 10 years, but of course the expectation is for declining net exports, so it will take longer than 10 years to approach zero net exports.

If one extrapolates to 2014, Saudi CNE would be around 51%.

So, can we say that in 9 years (2005 to present) Saudi has exported half of all they will ever export post-2005 ?

It seems a lot more likely the world will continue on as it is for another 20 years with no big changes.

Wow, this is from Wall Street Journal

The main stream media is finally picking up on this story, perhaps. If it hasn’t been posted already, an article last week from the NYT, citing research from Citigroup and Chatham House that Saudi Arabia could become a net oil importer as early as 2022:

http://www.nytimes.com/2014/06/18/business/energy-environment/18iht-ren-saudi18.html?_r=0

To be clear, Chatham House doesn’t think this will happen until 2038..

Based on the current ECI data, my ballpark guess for Saudi Arabia approaching zero net exports is around 2040, but of course if we see a significant decline in production, in could happen much sooner.

But in any case, a focus on when a major net oil exporter might approach zero net exports is really misplaced, since the biggest volumetric depletion rates are in the early portion of the net export decline phase.

For the Six Country Case history, it took them 12 years to collectively hit zero net exports, but only four years, or one-third, of the way into the net export decline period, they had shipped 54% of post-1995 CNE.

William Cohen, former US Secretary of Defense, was just on CNBC discussing his concerns about ISIS triggered sectarian unrest spreading to Jordan and Saudi Arabia, and he called for a crash program to immediately militarily bolster defenses in Jordan and Saudi Arabia. He explicitly views ISIS as a threat to Saudi Arabia, and I’m a little puzzled since ISIS and Saudi Arabia royal family are both Sunnis, but perhaps ISIS regards the Saudi royal family as hopelessly corrupt.

I had thought that the primary threat to Saudi Arabia was a revolt among the Shiite populace, combined with possible problems with which member of which branch of the very large royal family will become king.

Logistics.

You have to have neighborhoods willing to feed people that may get their house bombed.

With 20+% of the KSA populace not even citizens (and a goodly chunk of those Catholic Filipinos), it’s hard to see where an ISIS invading force can maintain supply lines.

I don’t see this happening. ISIS will get themselves some more oil wells and sell some oil and get rich. Those slideshows they create for their donors that show how many actions they took in the last fiscal quarter become less important . . . when they no longer need the donors. But, they WILL hate Shiites and continually shoot them up. If that Basra oil is funding Shiite government in Baghdad, then it will get shot up, too.

Destabilization risk greater than Iraq: Expert

http://video.cnbc.com/gallery/?video=3000286417&play=1

Tuesday, 24 June 2014 9:15 AM ET

Bill Cohen is a Maine lawyer with a Bachelors degree in Latin. Never did think he knew much.

The kneejerk is to strengthen the military of anywhere bordering Iraq, excepting Iran, though Northrop Grumman used to make serious money selling F-14s to Iran back in the day.

Regardless, you will get strong statements from people about shoring up defenses until the moment any money you send them buys Sukhois instead of F-16s. Then it’s not clear there’s any reason to help them build up their military.

ISIS considers the Saudi family to be willful kaffirs i.e. hypocrites on Sunni Islam. Death penalty.

I wonder if Cohen was acting at the Saudi’s behest, in regard to advocating for immediate reinforcements for Saudi Arabia and Jordan?

I don’t think he has a history with them.

There would be much better vehicles. Panetta or Perry had connections there. Aspin for sure but I think he’s dead.

There is the question of who it would be . . . which of the 100s of brothers etc.

A former US ambassador to Saudi Arabia joined the Cohen Group in October, 2013:

http://cohengroup.net/news/current_news/news10152013.cfm

Good find.

This one is also interesting from a peak oil perspective, about how the oil majors are ditching any efforts at continued production and essentially giving in to the fact that there are pretty much no more profitable projects out there even with oil at $100+

http://www.nytimes.com/2014/06/18/business/energy-environment/18iht-ren-oil18.html?rref=business/energy-environment&module=Ribbon&version=context®ion=Header&action=click&contentCollection=Energy%20%26%20Environment&pgtype=article

No, Northern Gateway Is Not a Nation Builder

On the contrary, its legacy will be a momentous clash of civilizations. Unless it is stopped.

By Andrew Nikiforuk, Yesterday, TheTyee.ca

“Grandson?”

“Yes?”

“Are you on Warren’s payroll?”

“You don’t need to trouble yourself with such things, Grandfather.”

“My dear, we never had a democracy to begin with.”

Rafe Mair: Why I’m for Massive Civil Disobedience

Gateway approved, now ‘British Columbians will learn the stuff they’re made of.’

By Rafe Mair, 21 Jun 2014, TheTyee.ca

We agree on that for sure, AWS. Northern gateway is dead in the water as far as I’m concerned.

I heard an interesting theory a couple of days ago. The big push is on for Gateway and new plants because of a fear the ‘Greens’ will limit Oil Sands development as the realization of Climate Change sinks in. As for what I believe, I think it is simply short sighted greed going for it all and not husbanding for the future.

regards..Paulo

haha

When the shale rolls over in the US, you think Canada is kick in with the husbanding strategy?

haha

As for what I believe, I think it is simply short sighted greed going for it all and not husbanding for the future.

Something between ignorance and reckless madness is the foundation of what might be called energy policy in Canada.

Our energy illiteracy will be our undoing.

cheers, aws.

It looks like Flanagan South/Seaway Twin pipelines will start up this year.

future pipelines

That is about 500,000 bbl/day of bitumen from Alberta to Texas. With trains taking about 1.1 Mbbl/day now from Canada, this could drop to 600,000 bbl/day, but will then increase by 200,000 bbl/day per year.

Kinder Morgan pipeline will take another 600,000 in 2016, likely. So, that will push rail traffic down to 400,000 for one year, before the inevitable increase again. By 2020, we will be back at 1.2 Mbbl/day by rail, and hopefully by then Energy East (1.1 Mbbl/day), Keystone XL (800,000 bbl/day) or Northern Gateway (500,000 bbl/day) will be operational.

By 2020, we will be back at 1.2 Mbbl/day by rail, and hopefully by then Energy East (1.1 Mbbl/day),

Enbridge warns Ottawa councillors that Energy East pipeline could lead to winter gas shortages

By Vito Pilieci, OTTAWA CITIZEN September 10, 2013 7:04 AM

TCP is reworking things to bring in Marcellus gas via the soon-to-be reversed Iroquois gas pipeline.

Anyone here confident that the Marcellus Red Queen will be able to fill that 25% demand void?

I was given to understand the US reqmts were going to be difficult to meet.

But the rebuttal would be the absence of price increase in the futures. If it’s going to happen, no one is seeing it coming as of now.

Hello everyone,

A little off topic from this thread but:

“Hormone-disrupting activity of fracking chemicals worse than initially found”

Many chemicals used in hydraulic fracturing, or fracking, can disrupt not only the human body’s reproductive hormones but also the glucocorticoid and thyroid hormone receptors, which are necessary to maintain good health, a new study finds.

http://www.sciencedaily.com/releases/2014/06/140623103939.htm

Meh. Who needs a world where men are men and women are women anyways? We all know that women are the fairer, gentler, kinder and better sex, so we might as well all be women. Right?

Just a little snark to go with your coffee on a Tuesday morning! 🙂

Ron, per your graphs showing peak coal not occurring until 2031, the following link has information about the climate impact of using much of the remaining coal reserves.

http://news.bbc.co.uk/2/mobile/science/nature/7789249.stm

Climate outcome ‘hangs on coal’

“Clearly, to address the climate issue we have to address the coal issue,” Professor Caldeira told BBC News.

A new analysis presented here puts the total available global coal reserves at 662 billion tonnes.

“There is far more than enough currently useable coal and other fossil fuels to push us past the threshold beyond which we would not want to go with the climate,” Dr Kharecha said.

What are the chances you’ll ever hear in a global warming fundraiser . . . a guy get up and say

“We’re already past the point of no return and human extinction from global warming is inevitable regardless of any action taken.”

Kingsnorth does that.

However he is not asking for money.

I spend most of my free time these days poking into such subjects as climate and the future of humanity and I cannot find any good reasons to think that humanity will become extinct as the DIRECT result of climate change or scraping the bottom of the fossil fuel barrel in terms of current consumption levels.

We are incredibly adaptable and the world is a very large place.Some parts of it will still support us even with a runaway greenhouse climate.These places may be pretty far north or south or maybe in the highest mountains in more lower latitudes and small in extent.

But ten thousand individuals are enough to eventually repopulate the world.And that ten thousand will have an unbelievable treasure trove of stuff the rest of us leave behind to help them along.

Synthetic fabrics are generally very resistant to rot and will last indefinitely if out of the sun.Clothing made out of such fabric would be easily found for at least a century after a collapse.

Just one stainless steel dinner knife that could be sharpened on a stone and thus made into a spear point would have been worth a couple of virgin brides in the ancient world.Axes and other basic wood working tools are still very common and can last for centuries.

Survivors of collapse are not going to have to face a non technological future naked and without tools or shelter. A well built house with metal or slate roof will stand for a century even if totally unoccupied with zero maintenance and there are a lot of such houses all over these days.Ditto industrial buildings that are all metal and masonry.

Now indirect or secondary effects are a different matter altogether.WWIII nuclear or biological or both COULD finish us off without a doubt.

Even a fast spreading and generally fatal man made plague would probably burn itself out before reaching every corner of the world.

But there won’t be very many of us around (compared to now) a couple of centuries down the road barring some incredibly good luck.

WWIII is in my estimation eventually inevitable and will inevitably be nuclear and most likely biological as well.

Countries that find themselves existentially threatened will arm themselves as best they can given their resources and the life sciences are marching right along.

In a couple more decades any good sized university will probably have enough people on the payroll to create a bioweapon as easily as a bunch of engineers can build a newly designed power plant or ship.

Even after considering the down side possibilities I think the odds of our survival as a species are at least better than even to good simply because we are so widely dispersed and adaptable.

Well, coal is the issue. Best evidence is that oil consumption is going to get a much harsher cap than anything that has been seriously proposed dropped on it by geology and mathematics.

If you advanced that world transportation fuel consumption needed to be capped by 2016 and subsequently reduced several % per year, even most of the far out there greens would laugh out of the room. Brutal and infeasible.

That said, well, all growth from 2008-present has been US shale and US shale isn’t going to keep running that much longer…

Earl, they are not my graphs. This is a guest post by Political Economist. They are his graphs.

I stand corrected.

~ Yearbook ~

Pictures of pasts

Fading with time

Like promises

Of hopeful futures

Where have we gone…

Look us up

If only in our thoughts

In memories reborn of

Paper and ink

What have we become…

Questions for ourselves

Answers worn with age

Like the dusty old annuals

Whose stories dissolve

As faculties fail

With each passing term

Look us up

If only in our thoughts

In memories reborn of

Paper and ink

~ CM, 1991

Downeast LNG Gets Back Up With Bidirectional Project

Joe Fisher, Natural Gas Intelligence, June 20, 2014 (free 7 day trial)

100 years of supply… now down to 20 years?

One doesn’t make a re-gasification investment, for import, with an expectation of only starting to see revenue in twenty years… do they?

U.S. Ruling Loosens Four-Decade Ban On Oil Exports (from Wall Street Journal; for non-subscriber access, Google the headline and follow the link to the article)

In separate rulings that haven’t been announced, the Commerce Department gave Pioneer Natural Resources Co. and Enterprise Products Partners LP permission to ship a type of ultralight oil known as condensate to foreign buyers. The buyers could turn the oil into gasoline, jet fuel and diesel.

The shipments could begin as soon as August and are likely to be small, people familiar with the matter said. It isn’t clear how much oil the two companies are allowed to export under the rulings, which were issued since the start of this year. The Commerce Department’s Bureau of Industry and Security approved the moves using a process known as a private ruling.

For now, the rulings apply narrowly to the two companies, which said they sought permission to export processed condensate from south Texas’ Eagle Ford Shale formation. The government’s approval is likely to encourage similar requests from other companies, and the Commerce Department is working on industrywide guidelines that could make it even easier for companies to sell U.S. oil abroad….

The private rulings by the Commerce Department define some ultralight oil as fuel after it has been minimally processed, making the oil eligible for sale outside the U.S. The Brookings Institution estimates that as much as 700,000 barrels of ultralight oil per day could be exported starting next year.

Eventually, the exemption could grow to a substantial portion of the three million barrels a day of oil that energy companies are pumping from shale, industry experts say. From 2011 to 2013, U.S. oil output soared by 1.8 million barrels a day, with 96% of new production in the form of light or ultralight oil, according to the Energy Information Administration.

Oil From U.S. Fracking Is More Volatile Than Expected (The backstory from the Wall Street Journal. This is something Watcher could have probably written.)

Oil from North Dakota’s Bakken Shale field has already been identified as combustible by investigators looking into explosions that followed train derailments in the past year.

But high gas levels also are affecting oil pumped from the Niobrara Shale in Colorado and the Eagle Ford Shale and Permian Basin in Texas, energy executives and experts say.

Even the refineries reaping big profits from the new oil, which is known as ultralight, are starting to complain about how hard it is to handle with existing equipment. Some of what is being pumped isn’t even crude, but condensate: gas trapped underground that becomes a liquid on the surface.

The federal government says 96% of the growth in production since 2011 is of light and ultralight oil and that is where growth will continue.

The huge volume of this gassy new oil has created a glut, pushing prices to $10 or more below the level of traditional crude. Energy companies think they could get higher prices by sending the new oil abroad, which explains some of the push to lift a U.S. ban on exporting crude. Federal officials recently gave two companies permission to export condensate under certain circumstances.

This new crude can act like a popped bottle of Champagne, says Sandy Fielden, an analyst with consulting firm RBN Energy. “If it’s very light, it froths over the top” of refinery units, he says. Many refiners “can’t manage that in their existing equipment.”…

Refining executives complain that some ultralight liquid is getting mixed in with higher-price traditional crudes. Greg Garland, the chief executive of Phillips 66, told analysts recently that there was no question that “people are blending condensate” into West Texas Intermediate, the U.S. benchmark, to try to pass it off as regular crude and get more money for it.

That’s not to say that light crude isn’t worthwhile—as long refiners are prepared for it. Gulf Coast refiners used to import light crude but today they have replaced most of it with oil from U.S. shale. Some experts warn that without new equipment, refineries will soon run out of capacity for ultralight oil pumped in the U.S.

Consultants at Bentek Energy forecast that without a change to U.S. export policy that allows oil to be exported, an oversupply of ultralight oil will drag the price of West Texas Intermediate to $80 a barrel by 2019 from $106 today—a level that would cause some companies to stop drilling.

“Greg Garland, the chief executive of Phillips 66, told analysts recently that there was no question that “people are blending condensate” into West Texas Intermediate, the U.S. benchmark, to try to pass it off as regular crude and get more money for it.”

That’s not some fringe blogger. That’s the CEO of Phillips 66 said that.

What’s not laid out in that statement is potential impact on quoted production. We clearly don’t have any idea how much oil is coming out of the ground.

Commerce Dept spoke up late today to deny this story.

If the export of condensate is allowed, but oil is not, then I can see the “recorded” amount of condensate rising rapidly, as all that borderline oil/condensate, suddenly gets the condensate label, rather than the oil label. All those light fractions in the those Bakken oil tank cars may just disappear. As Deep Throat said a long time ago, follow the money.

‘.as much as 700,000 barrels of ultralight oil per day could be exported starting next year.

Eventually, the exemption could grow to a substantial portion of the three million barrels a day of oil that energy companies are pumping from shale,’

In a finite world all that means is the poor old US of A has to IMPORT three million barrels a day more to sustain it’s internal consumption. Dumb, but not surprising.

The chances of Iraq increasing its oil production in the near future seem to be increasingly remote.

Iraq’s Oil Ministry announced last Wednesday that it has postponed indefinitely the bidding round for the 300,000 barrel per day (bpd) Nassiriya oil field and refinery project, which was set to take place on Thursday.

If you look at the map you will that Nassiriya is in the supposedly safe Southern zone of Iraq.

Also the Baiji refinery may finally have fallen, But perhaps not see http://www.iraqoilreport.com/security/energy-sector/baiji-refinery-nearly-falls-insurgents-12569/

The image I tried to upload is http://blogs.platts.com/wp-content/uploads/2014/06/iraq-oil-and-gas-map.jpg

ISIS, Iraq, Kurdistan and Oil

and Kunstler writes:

All mothers and fathers ought to also have their teenage girls vaccinated to prevent

HPV. Dermatitis, or pores and skin illness, is 1 of the most typical issues that people have.

To talk about intercourse is a taboo in the culture.

Check out my web-site; does insurance cover std testing