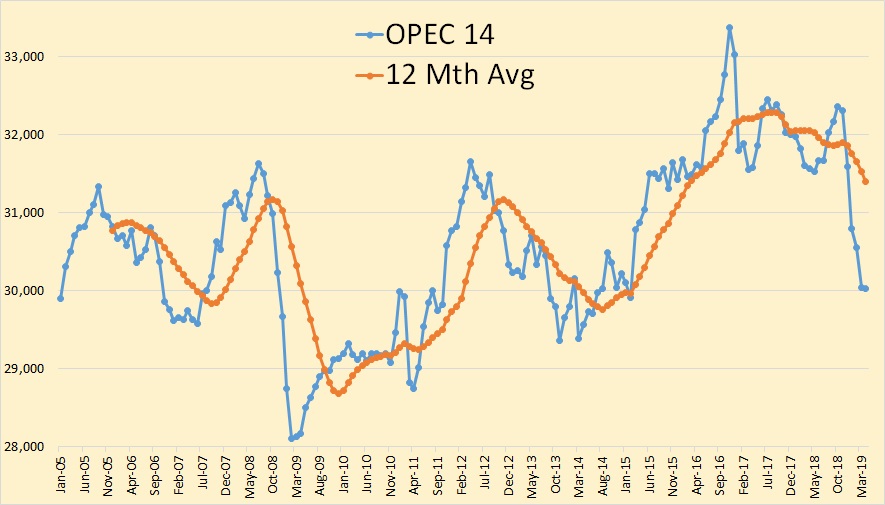

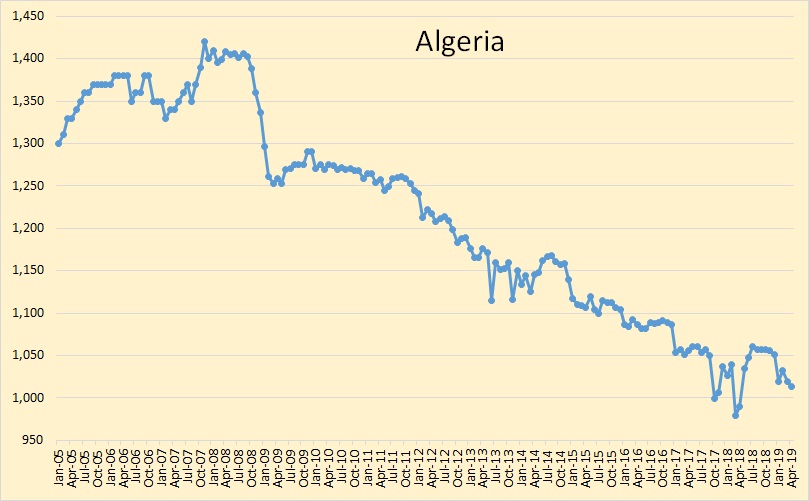

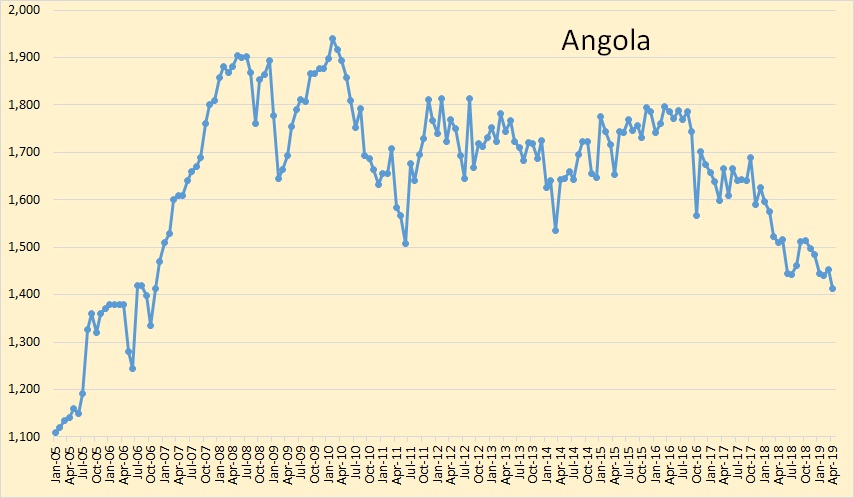

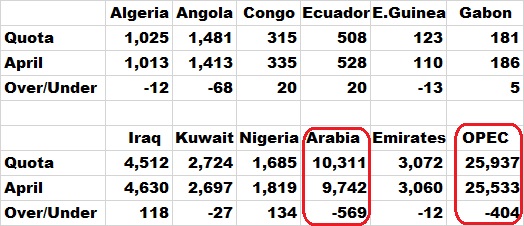

The data below was taken from the OPEC Monthly Oil Market Report. All data is through April 2019 and is in thousand barrels per day. The data is crude only, that is it does not include condensate.

Total OPEC production hardly moved in April, down a mere 3,000 barrels per day.

Algeria peaked in 2008 and has been in slow decline ever since.

Angola is also in slow decline.

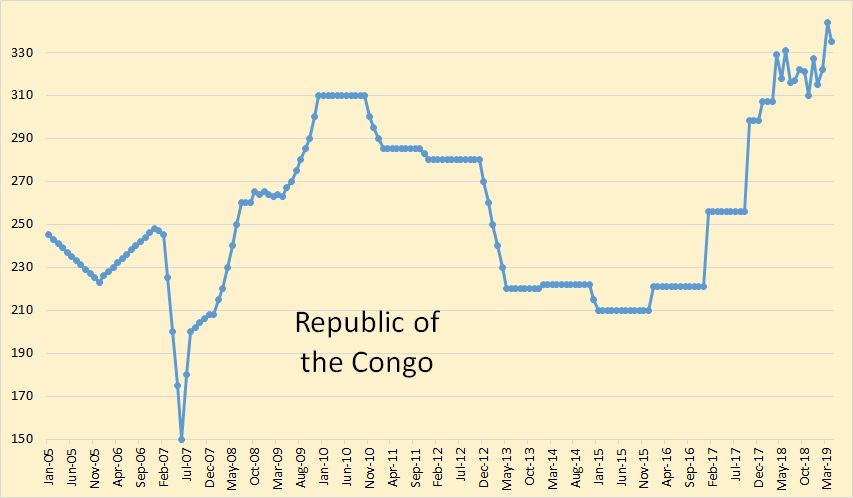

The Republic of the Congo, not the DRC, is the newest member of OPEC but they hardly produce enough to count.

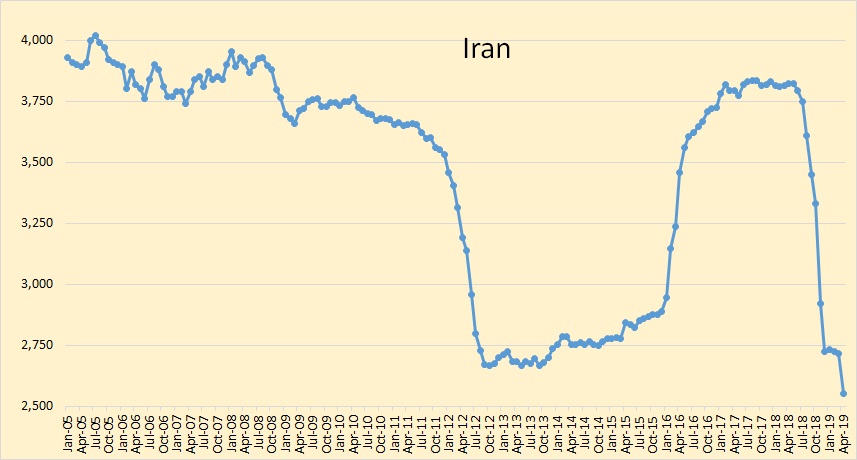

Iran took another hit in April, down 164,000 barrels per day due to Trump sanctions.

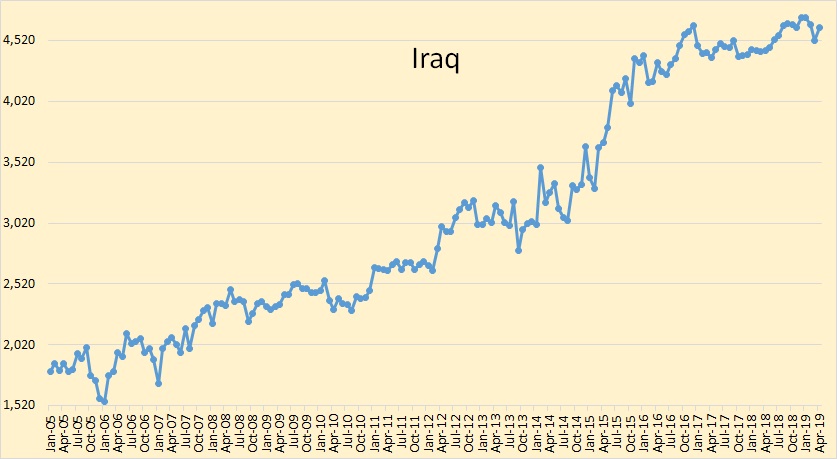

Iraq is obviously ignoring sanctions and producing every barrel they possibly can.

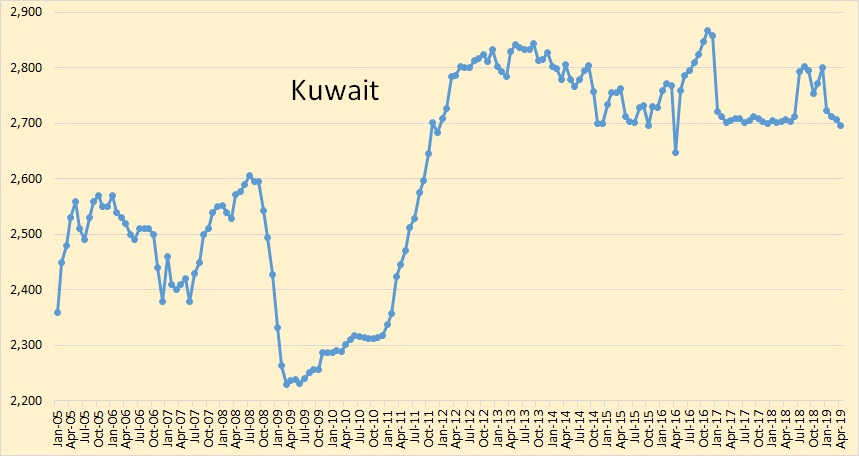

There has been little change in Kuwait’s crude production. They peaked in 2013 but have been holding steady since.

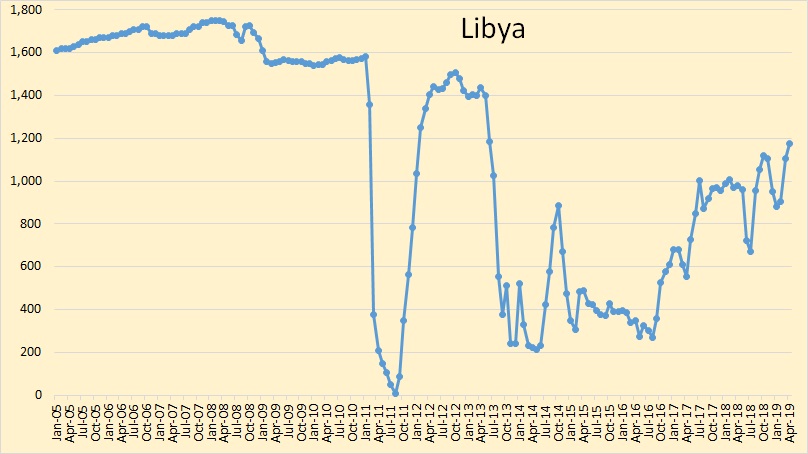

Libya seems to be making some progress against its rebel insurgents.

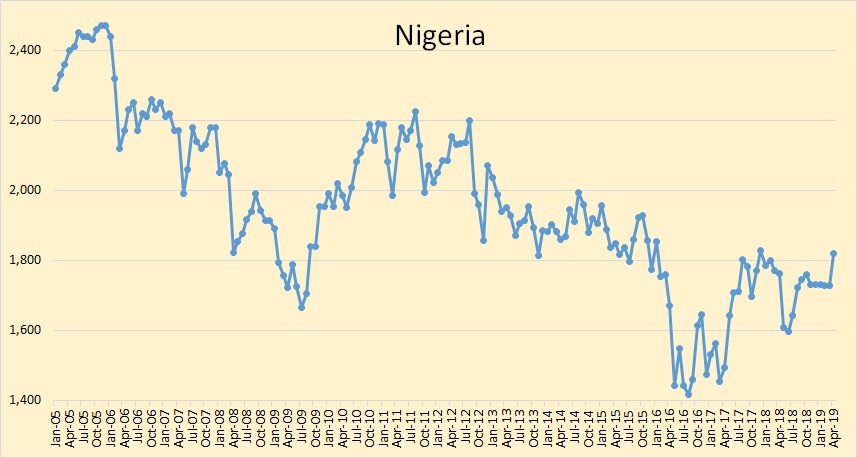

Nigeria had a nice uptick of 92,000 barrels per day in April.

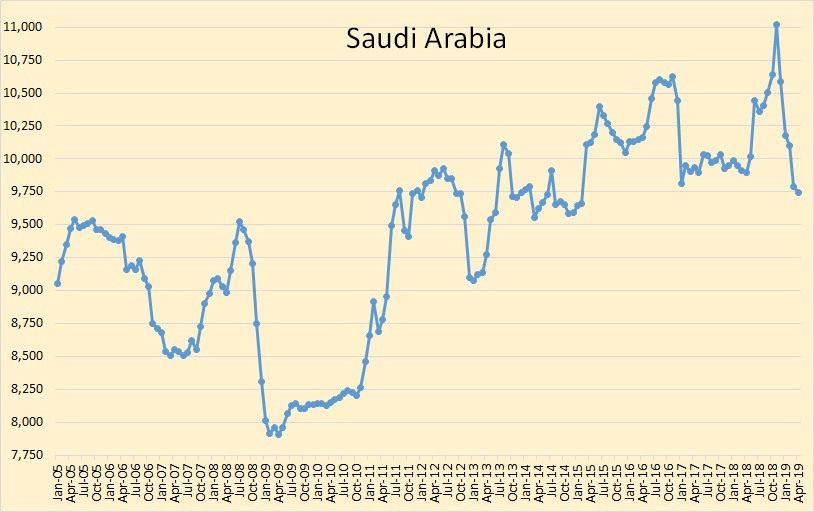

Saudi Arabia dropped another 45,000 barrels per day in April.

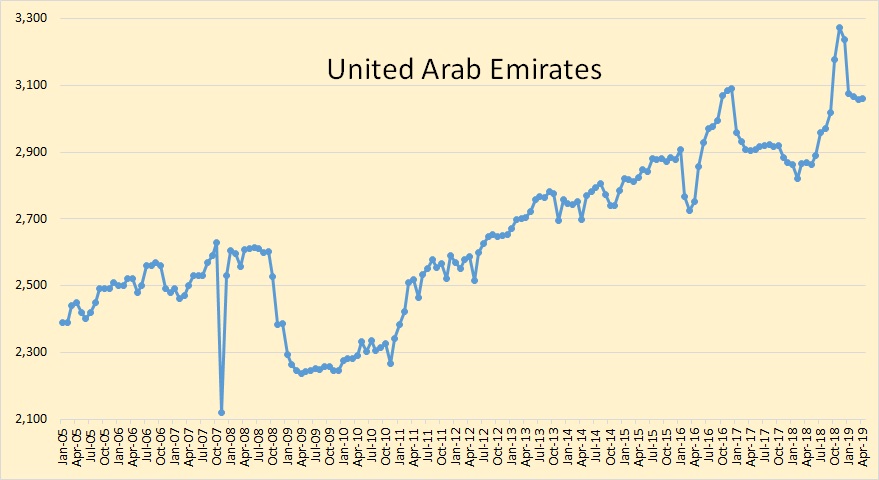

I think the UAE is at maximum production. The three-month peak in the last quarter of 2018 was extraordinary efforts just to get a high quota.

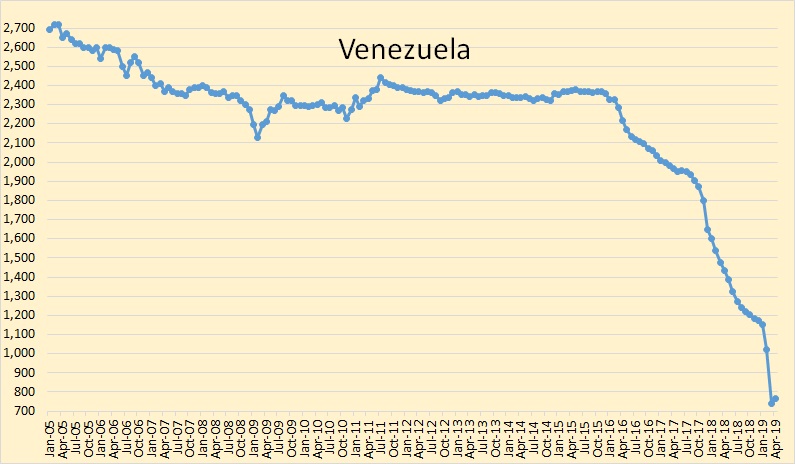

Venezuela showed a slight uptick in April.

This shows which countries are sticking to quotas and who is not. Iran, Libya, and Venezuela are exempt from quotas so the total OPEC leaves them out. Saudi Arabia is producing 569,000 barrels per day below their quota. Why?

The statement that OPEC’s crude oil share in total global production is 30.4% is a bit misleading. They are comparing OPEC crude only to world total liquids. I did a calculation based on the EIA’s data and OPEC’s share of total C+C has averaged about 41.5% over the last three years though it is down to about 39% now.

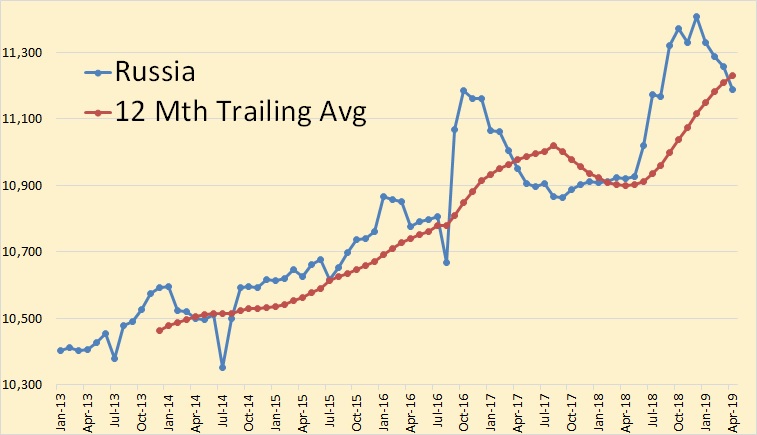

Russian April C+C production down 221,000 barrels per day from their December peak. That is according to the Russian Minister of Energy. Their data is in tons so I used 7.33 barrels per ton.

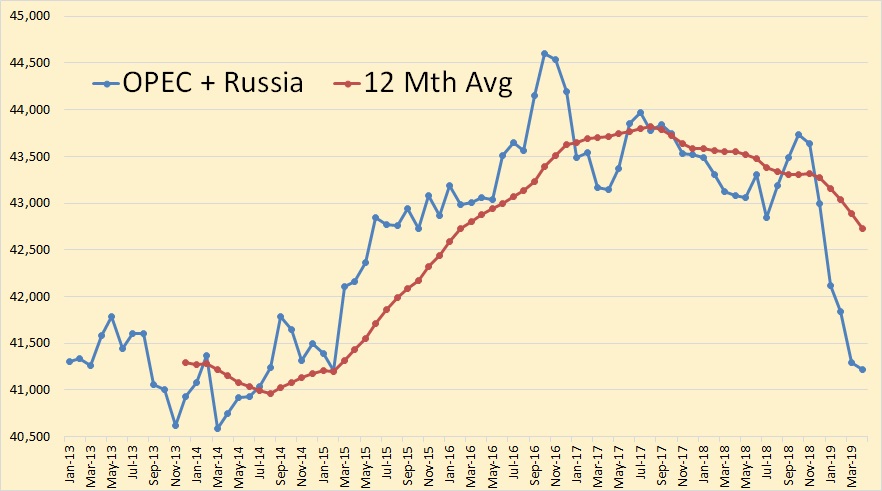

OPEC + Russia, about 52% of world oil production, down from about 55% just a few months ago. This is why 2019 world oil production will be below that of 2018. I expect OPEC + Russia to hold close to this level for the rest of the year. The rest of non-OPEC will not make up the difference.

Note: This graph adds OPEC crude only to Russian C+C.

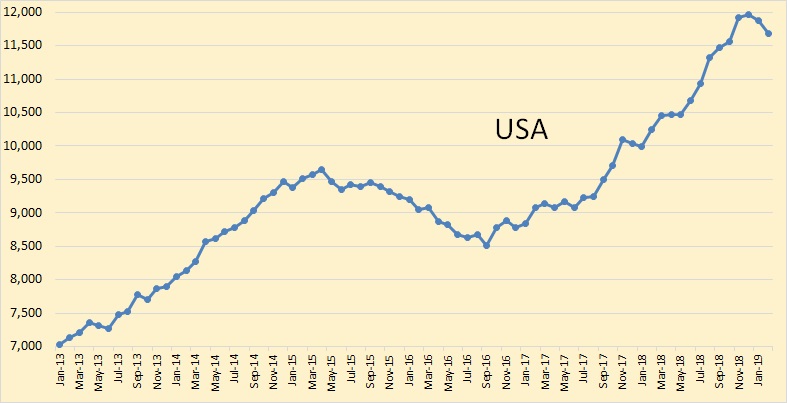

US C+C production through February 2019. The US took a hit in February primarily to a drop in the Gulf of Mexico. US production is down 280,000 barrels per day from its December high.

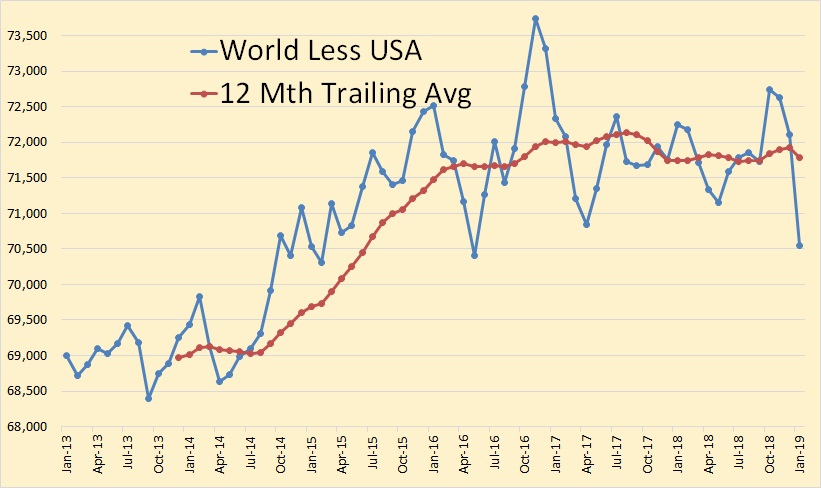

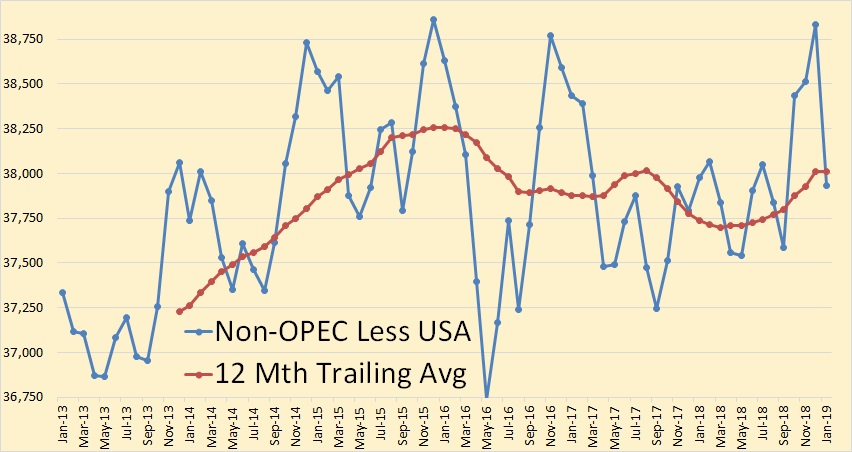

The above data is through January 2019. Only USA production is holding off world peak oil.

This chart is also through January 2019. Russia will not hold off peak oil, Canada will not hold off peak oil and certainly, Brazil will not hold off peak oil. OPEC peaked in 2016 so they will not hold off peak oil. It’s all up to the good old US of A. Are we up to the task?

Found this at the link below link about a Permian trucking company closing. Not sure what it means.

In the middle of the hot Permian oil and gas play, a trucking company is closing some operations

Mexico will not hold off peak. With the new administration in charge their bonds are on the verge of junk status. Such a downgrade would be crippling.

https://www.reuters.com/article/us-mexico-pemex-insight/mexicos-rising-oil-nationalism-faces-debt-rating-crisis-idUSKCN1SK1TE

Over the next four years we will get to read comments written by the usual suspects explaining why Mexico’s Lopez Obrador is such a great political figure fighting for social justice and blah blah. My advice to Mexicans is to sell everything and get ready to flee before it heads too far down the chavista path.

A a recent resident of Mexico, I was not surprised he buried the opposition.

Love the country,

Mexico’s collapse is certainly opening up opportunities for America’s enemies.

Why is Hezbollah involved in Mexico’s Drug War?

https://medium.com/@johnruehl/why-is-hezbollah-involved-in-mexicos-drug-war-ee64e6c902b9

Venezuela too.

Hezbollah Is in Venezuela to Stay

https://foreignpolicy.com/2019/02/09/hezbollah-is-in-venezuela-to-stay/

“We are closer to you than you think” ~ Quds Force commander Gen. Soleimani rebuking Trump for threatening Iran.

Mexico is very complicated socially.

Less oil will politically benefit a large social class.

Here’s two articles that might be of interest:

LOUSY SHALE ECONOMICS: Financial Troubles Continue At ExxonMobil: https://srsroccoreport.com/lousy-shale-economics-financial-troubles-continue-at-exxonmobil/

Global Economic Growth In Serious Trouble When U.S. Shale Oil Peaks & Declines: https://srsroccoreport.com/global-economic-growth-in-serious-trouble-when-u-s-shale-oil-peaks-declines/

Steve

Steve.

I wish XOM broke out US upstream shale and non-shale.

I suspect we would then see that US shale lost money while US GOM and US conventional onshore made more than $96 million.

I suspect the GOM and onshore conventional masks how terrible shale was for XOM in Q1.

Further, comparing XOM US to CVX US shows just how important CVX’s shale mineral ownership is.

CVX might be better off just being a mineral owner and collecting royalties.

Shallow,

Agreed. I believe XOM’s large investors, at some point, are going to get the ear of the CEO & Management and tell them to GET THE F-BOMB out of Shale, just like Pioneer Investors told its CEO, which has decided to cut shale growth projections by 15-20%, to provide investors what they want:

1) More Dividends

2) Stock Buybacks

Exxon, like BHP Billiton, will likely become DISENFRANCHISED with Shale, but will probably lose $10-$20+ billion before doing so.

steve

Well they aren’t talking about getting out of shale yet.

https://www.businesswire.com/news/home/20190517005081/en/ExxonMobil-Permian-Development-Provide-64-Billion-Benefits

Shallow: CVX’s mineral/royalty position in Anadarko’s Delaware Basin block is not insignificant. Not only did it walk with $1.2bn in breakup fees (I never got a nickel whenever I went thru a breakup!)…it is now assured of Oxy having to drill the snot out that crap while they get mail box money from it. CVX can now focus on its nearly 1.6MM acres of 0.95000 NRI’s in both basins, as it sees fit, under no stress of drilling commitments or SEC 5 year PUD rules. As I have said before, the additional 20% revenue in shaley carbonate economics is enormous. It has a no flaring policy, Chevron, and if it can secure its own pipe and its own downstream use it will be the ONLY company in American history to truly kick ass in unconventional resource plays. Everybody else essentially got theirs kicked for them.

Mike,

I know it is not intended as such, but it sounds like a good stock tip.

Oxy had more than ten times the production area (it almost has the same production area as Exxon and Chevron combined) yet ranked only about 15 or 16 out of total production in Texas. Anadarko’s area production is more likely to go down than up. Especially, after laying out all this cash. I think Oxy is setting the bait for acquisition, or it is already planned down the line. JMO

Occidental CEO Hollub is completely insane for even considering the acquisition of Anadarko. Anadarko has $16 billion in debt and is paying $947 million a year, nearly $1 billion, to service its debt.

Occidental has $10.2 billion in long-term debt and pays nearly $400 million a year to service it’s debt. If these companies merge, then they will be paying something like $1.3 billion a year in interest expense… LOL.

So, knowing this, OXY is going to acquire Anadarko for $38 billion??? You got to be kidding. This sort of debt-based acquisition insanity in the pharmaceutical industry is what drove up the cost of many drugs.

I have to tell you, there isn’t much WISDOM taking place in the oil industry. However, Chevron deciding not to acquire Anadarko is the exception.

Lastly, it will be interesting to see how the energy analysts deal with the realization that there has been a great deal of fraud taking place in the U.S. Shale Industry.

If energy analysts aren’t questioning the production or financial data of many of these shale companies, then it’s going to be A LOT OF FUN when the FAN hits the SHYTE.

Steve

You have to look at the companies to garner if their really making a profit (real) or not. Regardless of the constant negative allegations, profit is there under the right circumstances, it DOES actually exist. If profit is a higher measure than growing th, it can be a reality. I reassure myself of that with simple excel sheets. Oxy is one of those exceptions Do I think Oxy is planning on ruining their current efforts by buying s company that is operating outside of its guidelines? Duh. No, methinks it is part of a larger acquisition plan, either being currently pursued, or anticipated by Oxy. Shale is NOT forever, it has a limited lifespan. Any CEO of a large independent, who is not entertaining the economics of being bought out is incredibly stupid.

The majors can handle this a lot better than the independents.

GuyM,

Except the case of Chevron which owns a lot of land in the tight oil plays and thus has lower royalty payments, for the other majors it does not really seem that there is a good reason that they would be any more profitable than a well run independent company, perhaps their bigger size might get them some discounts, but will this really be enough to make tight oil profitable? I am not so sure, they do indeed have deep pockets, but the aim is to make money, if they bleed cash they will sell out. Perhaps they’ll figure out some magic formula, but so far only higher oil prices gets it done, so maybe their plan is to slow things down and let oil prices rise to a point where the profits can roll in. They may have better discipline than some of the independents.

Yes, a more conventional business approach would make a significant difference. The independent CEOs are mainly rewarded in the past on production increases, which is hardly a MBA approach, at least within the past 50 years. The concept of profit and return on equity, including dividends, should have been part of the reward determination. But, they are paying the piper, now.

GuyM,

Got it. Essentially many of the independent oil companies are not well run, I am thinking, will XOM do a better job than EOG? I am using EOG as my gold standard and I think of them as an example of a well run large independent oil company.

Do you think the majors (except for Chevron which has a royalty advantage) will be more profitable in the tight oil space than EOG?

I am skeptical.

No, not really. But, even EOG is a good bet for a takeover. Look at their presentations. They always put, we have x amount of good locations for x years. X is never too big, so that HAS to weigh on their minds for extinction.

“Occidental CEO Hollub is completely insane for even considering the acquisition of Anadarko. Anadarko has $16 billion in debt and is paying $947 million a year, nearly $1 billion, to service its debt.”

Sounds like Hollub is man driven to make a small fortune from a very large fortune. Its the easiest way 🙂

Mike:

Can you believe someone is giving Floyd Wilson money to start another company after he got kicked out of Halcon (with a multi million dollar separation payment of course)? The same Halcon that went BK once under his leadership and is now trading at about 30 cents a share.

I wonder what Ben Hulburt is doing these days? He was CEO of Rex Energy, it went BK. He was CEO of Eclipse, it did a 1-15 reverse split, merged with another company, and he was terminated (with a multi million dollar separation agreement, of course).

Mike we are the dolts apparently? We use our own money, not OPM.

I remember coffee going on about Eclipse Resources record setting Purple Haze well, which I assume contributed to that wonderful 1-15 reverse split.

Someone someday will write a novel about all the capital burned up in smoke by shale.

Unreal.

Shallow i stated that here long ago & many times. The business model has always been a legal ponzi scheme. Perhaps you’ve see the move the “Producers”. Promise your investors the moon, while running an assured to fail business will collecting salary and bonus. When the money all gone you walk away leaving the investors holding the bag, and yet not have commited a fraud.

As far as the investors: “A fool & his money so part ways”

This suggests that at the next US/world recession, when investments stop supporting shale for a significant time, that will likely mark peak oil? Any subsequent ramp up will not be able to offset the ongoing declines elsewhere

Robert,

A recession like the Great Financial Crisis can be recovered from fairly quickly in the oil industry, if proper economic policies are followed in response to the economic crisis. So depending upon the timing a new peak might happen after the crisis. For example if GFC2 started today, output would decrease as demand fell, but a fairly rapid recovery by 2021, might lead to a new peak. If the GFC2 occurred in 2022 to 2025, then I would agree, the peak in World output would be 2021 or 2022 in that case (depending on which month in 2022 the crisis started).

Dennis,

So, you say, “that a recession like the Great Financial Crisis can be recovered fairly quickly, if ‘proper’ economic policies are followed.”

By “Proper” economic policies, are you referring to the $30 trillion of debt the Chinese Govt added since the 2007 Financial Crisis? Also, when the markets were tanking OCT-DEC 2018, one of the reasons we had a nice rally was due to the Chinese Govt pumping 4 trillion Yuan into the economy in JAN… one month.

Then we had the about face by the Federal Reserve to stop raising interest rates as well as capping the Fed’s assets sales to the $4 trillion level instead of $3.5 trillion.

So, with the Central Banks in the world going ALL IN, I gather that is what you are referring to by “Proper” economic policies.

Oh, by the way, the Japanese Govt owns 50% of the entire Japanese Bond market and 80% of all Stock ETFs.

LOL,

steve

Steve,

Generally monetary policy loses traction as real interest rates approach zero as far as being a good economic stimulus. A better approach is to use fiscal policy. A call to reduce government deficits during an economic crisis, is an example of poor economic policy.

I would agree the debt must eventually be reduced, after the economy has recovered, this is why the corporate tax giveaway was an example of bad economic policy, now would be a good time to try to balance the budget (if we had a more sane approach to trade policy in the US). With a clown in the White House one does not expect sound economic policy.

Not sure the answer to Japan’s economic problems, much of that is a demographic problem that will require innovative policy. No idea what that is however.

Mostly by “proper” economic policy, I mean using government fiscal stimulus to recover from a severe economic downturn, like FDR’s New Deal or a similar level of government spending as the military buildup for WW2 (preferably on something besides war, such as infrastructure or renewable energy).

The European response to the GFC is an example of poor economic policy, as was the Hoover administration’s response to the Great Depression.

Dennis,

Things have changed dramatically since 2008, in regards to “Govt Stimulus” to remedy economic downturns. Since 2008, the top central governments have GONE ALL IN. This is well beyond lowering interest rates or providing some liquidty.

Governments are now PRINTING MONEY and buying ASSETS. Thus, they “ARE THE MARKETS TODAY”, as I tried to provide examples in my previous comment.

Stocks Values are now 145% of U.S. GDP. When stocks were 60% of U.S. GDP, 1960-1990’s, then we could have bear markets and recessions. NO LONGER.

Why? Because STOCKS are now the economy. Which is precisely why Govt’s are now ALL IN THE MARKETS.

steve

That’s why I think many voters/citizens are politically and economically screwed. They no longer have much leverage. Whether they work or not and whether they buy or not is increasingly irrelevant to the wealthy. It’s about paper value.

Boomer II,

Paper value will go down in an economic crisis and people do get to vote, maybe they will vote for people that will represent their interests.

They’re irrelevant until things start getting violent. I remember how the late 60s made the status quo sit up and react, and that was just over one little SE Asian war. Today, we’re sitting on a virtual powder keg. Just like the Chinese walking away from Trade talks, there are always consequences, some more serious than others, and most unintended. Today, China called it a Peoples War and urged citizens to stop buying anything US made. We’ve been doing that in Canada ever since the steel and aluminum tariffs. I would suspect most of the World is now rooting against the US until this period of division and bluster fades into a distant memory.

We’ll see what happens around Hormuz, I guess. That would make everything else, irrelevant.

The Fed is in the bond market, both Treasuries and Mortgage backed securities, they were gradually reducing the assets held by paying off the securities as they mature a process called unwinding the balance sheet. Perhaps other central banks are involved in the stock market, in the US it is bond markets only.

Currently the Fed balance sheet is at 3.892 T$ from a high of around 4.5 T$. Before the crisis it was about 900 B $. So just 3 T to go. 🙂

“I would agree the debt must eventually be reduced, after the economy has recovered” ….and how pray tell does the economy do that, as all the cheap conventional oil peaked in November 2005?

When has debt ever been reduced, even in a good economy? NEVER EVER

“We must pay back our debt when the economy recovers….” SAID NO GOVERNMENT EVER

“clown in the Whitehouse”…well, what would you know of it? The alternative at the time was far worse.

BTW Dennis, those charts that Ron posted are clearly indicative of PEAK OIL, which is happening NOW and not 2022-2026.

“clown in the Whitehouse”…well, what would you know of it? The alternative at the time was far worse.

Mike, I agree with you on almost everything. But not in this case. Nothing, absolutely nothing, could possibly be worse than Trump. A lot of people had an intense dislike for Hillary, but she would have made a far, far, better president than that idiot, narcissist, nut job we have in there now.

Otherwise, thanks for the vote of confidence on my charts.

Nothing, absolutely nothing, could possibly be worse than Trump

Oh, I dunno, how bout Trump Clown and Circus version 2.0 in 2020…

.

Hillary, or as she was named, Killary Clinton.

Perhaps for the USA she would have been better, but for the rest of the world?

She would have started already 1 or 2 new proxy wars. Trump has done many dump things and is an idiot – but not started a new war. And he is not very eager to intensify current running wars.

So far – that can change any minute. It is settled at the end.

“Trump has done many dump things and is an idiot – but not started a new war. And he is not very eager to intensify current running wars.”

Sorry you must be living under a rock. Shortly after he took over office, He taunted NK to start a nuclear war. Including B-52 over flights of the Korean DMZ.

Then there is Syria, launching Cruise missiles in retaliation for fake Chemical Weapons attack staged by the Rebels, White hats. US still has forces in Syria that has been bombing Syrian army forces that were trying to take control back of its southern territory where the US & Israel are planning to build a pipleline.

Now there is Iran. Hes order the US Navy to mobilize for a conflict with Iran, and working on moving more than 120K US troops to Iranian borders.

No action against KSA secret war in Yemen, that has killed at least 100K and another 5M to 10M Yemen are facing a long duration Famine.

Then there was MBS caught red handed ordering the murder of a KSA dissident.

That said Clinton would have been just as bad or worse. Only a Psychopath would go on TV and joke about the brutal murder, as well ask joke about the millions who died or became refugees in the Syrian Proxy war she started while at the US state Dept.

Bottom line, Gov’t power always attracts the worse that humanity has to offer.

And her statement: We came, we saw, he died.

Hillary. What a lovely lady.

Are not Americans getting seriously fed up of the all the f… wars and all the killing of civilians? I think most other nationalities are . The wars are camouflaged as we are the great Saints rescuing the world. Are Americans not able to see through their government’s propaganda?

Become a democracy or we will bomb you back to the stone age! Your choice. Good luck.

American global politics. So sincere.

https://peakoil.com/publicpolicy/that-time-john-bolton-said-its-good-to-lie-about-war

Check out what Patrick Clawson is saying.

Who be behind the Curtain? https://www.transcend.org/tms/wp-content/uploads/2018/02/wikileaks-media-council-foreign-relations-usa3.png

Hi Mike,

The highest trailing 12 month output for World C+C was Jan 2019 (the last data point available from the EIA.) I judge peak by the 12 month averages not based on a single month. So until I see a 12 month output that is lower than the previous month, I won’t call a peak. Typically Ron calls this in a similar way, so it seems his 2018 peak has moved to 2019. Also note that my “low scenario”, consistent with Mr. Laherrere’s World URR estimate (2800 Gb) suggests a 2020-2024 peak, with a best guess of 2022 and maybe a 60% probability it will fall in that 5 year interval, if the low URR estimate is correct. I believe my medium scenario with a URR of 3100 Gb is more likely, that peak will be between 2022 and 2025 with a best guess of 2023 or 2024, perhaps a 55% probability the peak falls within these 4 years and a 20% probability it falls before this period and a 25% probability it occurs later than 2025.

And as always I could be wrong for either of these cases and in fact I have a high case with URR of 3400 Gb where peak would be later in 2025 or 2026 and a range of 2023 to 2028 for the likely peak, perhaps a 65% chance it would occur in this interval, with perhaps a 15% chance the peak occurs before 2023 and a 20% chance it occurs after 2028. Low, medium and high scenarios compared in following chart, extraction rate held constant at 2019 level from 2019 to 2050.

>“We must pay back our debt when the economy recovers….” SAID NO GOVERNMENT EVER

That’s complete bullshit. For example the German government has been paying off debt for years.

You’re so blinded by Republican propaganda that you don’t even bother to do a basic check of the lies you spread for them.

“A call to reduce government deficits during an economic crisis, is an example of poor economic policy.”

Except deficits continue to grow even during the boom times. Current and growing debt levels are assured mutual destruction. No way the world it get out of this with the worse crisis since the collapse of the Western Roman empire.

Techguy,

Yes currently we have poor economic policy where we are decreasing taxes and increasing deficits (in the US) when we should be doing the reverse. During Clinton’s presidency we got pretty close to a balanced budget after the increasing deficits seen during the Reagan era. A balanced budget may be enough because inflation tends to reduce debt to GDP under those circumstances. Most politicians are not comfortable using a budget surplus to pay down the national debt, but in a high employment situation that would be fine with me.

Agree this is not very likely, best we can do is to raise taxes and cut spending to approach a balanced budget, and even that is highly unlikely with the lack of many moderates in either political party in the US.

Debt based monetary system either expands or contracts.

Paying down debt in debt based monetary system is never going to happen Dennis.

Money disappears when debt is paid down. Which means there would be less money in the system to service debts.

Debt has to expand in a debt based monetary system. Or system will collapse. People just don’t seem to understand that fact.

10-15 years from now US government debt will be $35-40 trillion. It has to be. Otherwise we’ve had a debt crisis and instead of inflation we got debt deflation beyond anything that anybody can really comprehend.

It has been said that when the system contracts “money. goes to money heaven”.

HHH,

There can be more private debt and less public debt.

I am not suggesting pay off all debt, just reducing Government debt to GDP ratio during times of low unemployment. This is macroeconomics 101.

Where do bubbles factor into this? You seem to be suggesting that our system has to keep growing or terrible things happen.

But don’t we always reach a point where people realize they won’t get their money back and it is a race to be the first to get it out before it isn’t there anymore?

Garrett Hardin on growth, interest, and debt. https://www.garretthardinsociety.org/docs/hardin_living_within_limits_ch_8.pdf

The picture at the bottom is of Garrett Hardin with L F Buz Ivanhoe and Walter Youngquist (author of GeoDestinies). https://www.garretthardinsociety.org/gh/gh_pictures2.html

Boomer II,

Sometimes debts are defaulted on, a physical asset such as a house is difficult to unload, or a factory, or an oil well, any physical capital will be difficult to sell in a severely down market and usually people just hold the asset.

For financial assets bought at the top of the bubble, people can try to sell on the way down, but at some point it makes more sense to hold the asset as it becomes undervalued, it is pretty difficult to call tops and bottoms effectively, this is only known looking backwards.

Generally macroeconomics ignores these bubbles except in considering utilization rates of available labor and physical capital. In a crisis these rates will be low and government spending can help to boost employment and capital spending.

Also the demographic transition will lead to lower labor availability and economic growth may slow as population peaks and falls, real GDP per capita may continue to grow at 1970-2017 average rates (about 1.5% per year) or they may slow down as the World becomes more developed, difficult to say, but as we try to move to a more sustainable World, lower growth rates would be preferred. Though human impact can be reduced by more recycling, cradle to grave manufacturing, building more durable and repairable products, and just consuming less throw away products.

These kinds of changes can be accomplished, but the biggest factor will be people choosing 1 child families so that World population can fall precipitously.

People will have to save more as social insurance is not likely to be adequate as population declines. In any case education is the key to smaller family size, it should be a focus especially for girls.

Hi Ron,

If your assumptions are correct, (no change in OPEC+ Russian output levels from April 2019 to Dec 2019), then C+C output will be lower in 2019 than in 2018. My guess is that the oil market will be short and oil prices will go up. OPEC members will either increase the quotas in June or they will cheat on their quotas, Russia may leave the deal in June unless quotas go up. I think it likely we will see a moderate increase in OPEC plus Russian output, enough to make World C+C output for the 12 months ending in 2019 somewhat higher than 2018. Even if my guess proves incorrect for 2019, I expect higher oil prices will result in year end 2020 average output being higher than 2018, with a likely peak between 2022 and 2026.

I think those are pretty good guesses if all remains as it is. It depends on how much Exxon, Chevron, and maybe Shell? will gobble up. They are interested in how much they can get out of it to be refined, not for how much they can export. That leaves the estimate any where close to your prediction to, well…flat.

Dennis, it’s just my estimate, nothing more. However it is based on the output of every nation in the last five years, what they have produced and what I think they can produce. Yes, the price will affect production, but only as much as it can affect production. I don’t think OPEC can produce much more than it is producing today. And non-OPEC, less USA peaked three years ago. And even the EIA has Russian production at a near standstill for the next two years.

Yes, yes, there will still be some nations with a slight increase in production. But the declining nations decline more than the others increase.

As I said, it’s all up to the USA. Hey, just look at the charts. It has been all up to the USA for the last few years. And now it is even more so. More so right when shale oil production is looking iffy.

The main place where we disagree is OPEC, I think they can produce another 500 to 750 kb/d, that will offset Iranian reductions and the US will increase a little, maybe 500 kb/d for the year, and that might be enough to result in an increase.

Hey I may be wrong, just a difference in what we see for future output from OPEC, with the exception of Saudi Arabia, and Iran OPEC is probably at close to maximum output, but I think Saudi Arabia will be able to get back to 10.4 Mb/d if needed, US output may get to 12.5 Mb/d by the end of the year, we just don’t know.

The main place where we disagree is OPEC, I think they can produce another 500 to 750 kb/d, that will offset Iranian reductions…

Goodness, I hope they can. OPEC April production is down 2,327,000 barrels per day below their October 2018 level. That was when everyone was straining to produce every possible barrel they could in order to get a good quota number. So I am sure they could very easily increase production by 750 kb/d from April production.

Their strained October 2018 peak was still over one million barrels per day below their peak of November 2016.

No, OPEC is close to maximum output except for Iran and Venezuela. Iran could possibly ramp up in a couple of months if sanctions were lifted but it would take Venezuela a decade to get back to pre-collapse levels.

Yes, Saudi may get back to 10.4 million barrels, but even so, that would still be well below their previous peak. Hell, their quota is 10,311,000 bpd.

Why do you think they are producing 569,000 barrels per day below their quota? I think it is quite possible that Saudi has peaked and is now in deep trouble.

As far as the US getting to 12.5 million bp/d by the end of the year… I seriously doubt it. It could happen but it would shock me if it did.

Ron,

Much will depend on oil prices and pipeline construction in Permian basin. GOM output might rebound (after drops early in the year) and tight oil may go up by 750 kb/d, if the Dec to March rate of increase continues for the rest of the year. This id much less than OPEC forecasts for US output where crude is expected to increase by about 1.5 Mb/d in 2019, my scenario has a YOY (2018 avg to 2019 avg) increase of 1.13 Mb/d and average output for 2019 at 12.1 Mb/d and about 12.4 Mb/d for Dec 2019.

So yes Probably not 12.5 Mb/d at the end of 2019 and much less for the 12 month average (12.1 Mb/d). Guesses as always (the OPEC guess is close to 12.5 Mb/d for the 2019 average output, I agree that is too optimistic).

Lots of possible reasons for Saudi to produce below quota, so they can raise prices, so they can fill the gap when the sanction waivers are removed. Note that I ignore monthly peaks and only pay attention to sustainable capacity which I define as lasting for 12 months, so I look at recent 12 month peaks instead of monthly peaks. The extra Saudi output can fill the gap left by Iranian drops in output and other OPEC producers might be able to produce a few hundred kb/d more (combination of other OPEC producers).

This leaves the World’s spare capacity critically low so I expect this will push oil prices higher as it becomes evident how low OPEC spare capacity is, the sustainable capacity may be close to zero if Iranian exports fall by 750 kb/d, but expectation is for 500 kb/d or less.

I now follow your argument for “producing all they can”, at the recent monthly peak, that is probably correct, it is doubtful that OPEC minus Venezuela and Iran could sustain production at the Nov 2018 rate of 28,219 kb/d for longer than 2 or 3 months. That would be an increase of 1510 kb/d from the April 2019 level, but as I suggested only half that level (750 kb/d) is sustainable in my view.

Ron,

Looking more closely at my medium tight oil scenario, I would expect average 2019 output to be about 12 Mb/d for the US (trailing 12 month output in Dec 2019) vs 11 Mb/d for the 2018 TTM avg. I expect the December 2019 monthly output to be roughly 12.5 Mb/d, about 820 kb/d higher than Feb 2019 output and 537 kb/d higher than Dec 2018 output.

“So I am sure they could very easily increase production by 750 kb/d from April production.”

Just water it down with some condensate. Shh. I won’t tell if you don’t /sarc

Tech guy,

Condensate has been included in EIA estimates since at least 2005 (around the time I started following this closely), some of this condensate increases propane supplies which is very useful in rural areas with limited access to natural gas infrastructure (tends to be no local distribution system.)

The percentage of US output from 2015 to 2019 (where EIA data is available) with API gravity of 45.0 or lower has been pretty steady at 77 to 80% (for 12 month running averages). So the high condensate claims are not really a significant issue. We simply export the higher API liquids that refineries cannot utilize in the US, most of the US refinery capacity is designed for heavier blends of crude.

Hi Dennis,

It was a Joke. I did include the “/sarc” tag.

Look Dennis, Russia has peaked and Russia’s only chance to hide it is to hang together with OPEC, so Russia has ‘quota’ to follow.

Russia said that her oil ouptut will start to go down after 2022, and expects to produce only 5mbd in 2030. That, however, means only 1,5 mbd for export then (if at all).

Perhaps Russia has peaked, we will know more when OPEC quotas are lifted.

Data from Russian Oil Ministry was used to produce the chart below, I used 7.3 barrels per tonne and the chart has the trailing 12 month (TTM) average C+C output in kb/d.

The peak is not apparent from this chart, my guess is that they will maintain a plateau for some time after reaching peak output, perhaps it is 10.4 Mb/d (the most recent trailing 12 month average). We will know more in the future.

Also see (from July 25, 2018)

https://www.reuters.com/article/us-oil-opec-russia-idUSKBN1KF20Y

MOSCOW (Reuters) – Russia’s oil production this year will increase to 551 million tonnes (11.02 million barrels per day), a new 30-year high and up by around 3.5 million tonnes from previous expectations, Energy Minister Alexander Novak said on Wednesday.

He said Russia would further raise production to 555 million tonnes in 2019 after the Organization of the Petroleum Exporting Countries and other oil producers led by Russia agreed last month to ease production curbs.

On a monthly basis you are correct, Russia peaked in Dec 2018, but I focus on 12 month average output. Also I noticed that the 7.3 barrel per tonne estimate gives very different results from EIA data, using a conversion factor of 7.0365 b/tonne gives a result consistent with the EIA estimate for Russian C+C from Jan 2013 to Jan 2019. Chart below uses 7.3 b/tonne.

This chart uses the 7.0365 b/tonne conversion.

In a perfect world, Denni’s prediction might be the most accurate. The question is: How perfect is this world?

Westexasfanclup,

Not perfect at all. The scenario is just a guess assuming things roll along as they have. Unfortunately I cannot predict future shocks. Possibly the world will adapt to higher oil prices and transition to alternatives, won’t be easy, but probably won’t require a perfect World, just one that does not fall apart completely. It will be interesting.

Dennis,

“It will be interesting”. Definitely. My guess, as we are approaching higher probabilities of war and economic downturn, is, that the peak of the idealized curbs of your graphs could well be hidden in the ups and downs we might be facing. So 2018 could indeed be the all-time high if recovery doesn’t set in as fast as you are guessing (well, this is, in fact, a guess IN a guess, so not really worth to discuss that point, I just wanted to hint toward that possibility just as Robert did).

Westexasfanclup,

War in the Persian Gulf would be a huge shock, look at 1979-1985 for an idea of what that looks like, recessions are minor bumps, even GFC is a small bump.

Of course the real world output will not be perfectly smooth like my models, where I often hold extraction rate fixed after 2018. This is just a simplification, it will no doubt fluctuate randomly, superimposed with political and economic shocks to the system which cannot be predicted.

In any case peak might be 2018, it might be 2025 and if your point is that the natural ups and downs of any plateau will make the peak difficult to pick. I agree, we won’t know until 5 to 10 years after it has occurred that we are past the peak (or peak plateau).

Totally agree, but I dare to claim the – once again very bumpy – plateau is reached.

Hickory has also pointed this out, perhaps based on your hints.

It may be the case that a bumpy plateau started in 2015 that wont end until 2035, it is just a matter of how wide one makes the band around the plateau, is it +/-5%, of so for 83 Mb/d of C+C output we would have 79 to 87 Mb/d for the range of the plateau, and for my 3100 Gb URR guess the model output fits nicely in that range from 2015 to 2034, a more conservative model (2800 Gb) would have a shorter plateau from 2015 to 2028 and would be likely to peak in the 2020 to 2023 time frame at about 84 Mb/d. The higher URR model peaks in the 2022 to 2025 time frame at about 86 Mb/d. The bumps and randomness of a real world output curve would mean these estimate may be off by a few years and 1 Mb/d higher or lower, the URR guesses are also problematic and could be off by +/-100 Gb or more.

War in the Persian Gulf would be a huge shock, look at 1979-1985 for an idea of what that looks like

Hmm…not so much. 1979 was indeed an oil shock, but it was also the beginning of the Paul Volcker era at the Federal Reserve. He reversed the easy money and low interest rates of the previous 10-15 years or so in order to eliminate high inflation expectations.

So…the 1979-1985 era was less an oil shock and more a high interest rate and low inflation rate policy shock.

And even so, GDP rose over the 1979-1985 period. It even rose over the 1979-1982 period, where oil consumption fell by 18%!

Now is very different: the Fed explicitly excludes the impact of oil price increases from their considerations for rate policy, and we’re already in an era of low inflation. So, that’s a shock that’s very unlikely to be repeated.

Nick,

Growth was not very good from 1980 to 1982 using IMF data for World real GDP growth rates at market exchange rates

https://www.imf.org/external/pubs/ft/weo/2019/01/weodata/weorept.aspx?sy=1980&ey=2000&scsm=1&ssd=1&sort=country&ds=.&br=1&c=001&s=NGDP_RPCHMK%2CNGDPD&grp=1&a=1&pr.x=58&pr.y=7

The chart is incorrect for the years used for the average it was 1985 to 2000. If I had used 1983 to 2000 the average growth rate would be slightly higher (3.26% vs 3.19%).

Ref Venezuela production, the report is off by about 70 kbopd. The corrected numbers should have march higher by 70, April lower by 70. Dennis, if you send me the link to the venezuelan oil data you use in that excel file, i can give you an annotated version with political events posted since say 2012, the year Chavez got cancer and Maduro got control.

Fernando,

Ron has the data through April, I use the EIA data, I think Ron has a spreadsheet with OPEC data going back many years.

It would be also interesting to separate Venezuelan oil production in conventional and bitumen and then relate both to the oil price.

I don’t have great information on the split between extra heavy oil from Orinoco and conventional crude, though we could take the OPEC figures and subtract from the EIA figures, we would only get about 100 kb/d of extra heavy oil for Jan 2019, that seems too low. Elsewhere I have read that half of Venezuela’s output is from Orinoco.

Fernando probably knows.

I guess that Venezuela’s crude oil exports must be low at the moment but I’ve not seen any recent numbers…

2019-05-14 (Argus) Venezuela’s crude production has dropped to around 500,000 b/d as sluggish export loadings and replete storage force state-owned PdV to shut in wells, four company officials tell Argus.

The decline is most pronounced in the Orinoco heavy oil belt, where production has dwindled to less than 200,000 b/d in recent days, compared with more than 700,000 b/d in early May.

“All production that is transported as DCO is shut in,” a senior PdV official said, referring to the Orinoco crude that is diluted with naphtha for pipeline transport to the Jose upgraders and blending facility.

PdV has been forced to store more of its crude because exports are not keeping pace with production, even at the reduced level.

https://www2.argusmedia.com/en/news/1902787-venezuelan-crude-production-sinks-to-500000-bd

Platts version https://www.spglobal.com/platts/en/market-insights/latest-news/oil/051419-venezuelas-orinoco-belt-crude-production-falls-to-169800-b-d

Venezuela major basins https://pbs.twimg.com/media/D2xSEWBWsAAhoOG.jpg

Hello Energy News

Interesting, that – referring to your sources of information – export is Venezuela’s bottleneck. That’s quite contrary to the common narrative that sluggish socialism is to be blamed for it.

Not really. A longtime admirer of EN. He only reports facts, and they are damned inclusive. Rarely, have I seen him naming causes, like I am prone to imagine what they are. Hence, he can never be “incorrect”. He can always be regarded as the provider of the latest information, not putting forth anything that is questionable as to any one belief. A true champion of journalism.

I thought the marxists who back the Cubazuelan regime narrative and continue to defend socialism were giving up writing in defense of the regime.

Production is down for several reasons.

1. The well and reservoir decline

2. the lack of maintenance and investment,

3. really bad investment decisions by a PDVSA management and staff gutted since the regime named General Quevedo as President of PDVSA in the second semester of 2017

4. the impact on wells and facilities of the large blackouts experienced after two of the Guri generators were damaged

5. Brain drain as qualified Venezuelans flee.

6. Work slowdowns taking place in recent weeks after oil union workers met President Guaidó, and he assured them his policy would allow those who are employed now to remain.

7. US sanctions are having a minor impact, but they arent really that effective. For example, Maduro is still giving away oil to the Castro dictatorship, the Russians help handle oil payments, and oil is still moving to China, and India. And because production is so low, there’s very little to export anyway.

I would also add that Faja production has a much higher water cut, because PDVSA didn’t know how to drill and complete wells to avoid water, and breached shale barriers which served as containment layers to avoid getting water to the wells. The higher water content can’t be handled properly by surface equipment because water requires more heat to raise temperature, and this in turn is used to break up emulsions and separate crude from water. The net effect is that crude has out of spec water, excessive salt, and they have no option but to cut fluid rates.

Thanks Fernando,

Do you have a rough estimate of Faja output say in March 2018 and March 2019 (or any two months from 2018 and 2019 that are 12 months apart)? The comment by Energy News suggests 200 kb/d in the past week vs 700 kb/d early in May. In other places I have read about half of Venezuelan output from Faja (maybe 1000 to 1200 kb/d). My guess is you know where to find the data.

Fernando,

Another quick question, with someone running the show for Venezuelan Oil industry with your expertise and the ability to call the shots (say the head of a National Oil Company) and willing investors (say a new stable government was in place that was not socialist) would it take maybe 10 years to get Venezuelan output back to 2.5 Mb/d, or is that too optimistic? This is 10 years after the stable government is established (probably a 5 year process at best).

Dennis, it depends on what happens after the Maduro regime falls. Venezuela has a missing generation running government and companies properly, and I’m not impressed by the quality of the people around Guaidó, who lack experience and have never been tested in a real tough situation like this. Based on what I’m seeing it’s going to be touch and go, but it’s possible to take it back to 2.5 in 10 years, if they get their act together.

Production seems to be holding up better in Maracaibo than the Faja and Furrial. I too heard the 500 KBOPD, so my guess is the Faja is down to say 150. The question is whether they can restart de upgraders, and handle the labor problems. Maduro, I hear, has very little support inside PDVSA, and I suspect they are simply letting things fall apart to drive him out.

Thanks Fernando.

Always interesting to get your perspective.

If they can refine it they can burn it.

From Platts piece:

The Orinoco production decline, if extended, will pull Venezuelan output lower. One field operator said an “optimistic scenario” would put Venezuelan output at 400,000 b/d to 500,000 b/d.

Also this chart from the Platts piece, which forecasts 600-700 kb/d (reading off chart).

The EU-15 inventory numbers from the OPEC MOMR to March. With the April number from Euroilstock. And the US monthly inventories to February with lastest weekly number from the EIA.

My latest graph on crude and condensate (EIA data up to December 2018) showing that production excluding US and Iraq is flat since 2005:

http://crudeoilpeak.info/latest-graphs

The Australian government continues to be complacent. Its recent liquid fuels security review claims that oil supply disruptions are unlikely. I have done the following analysis. China peak oil in 2015 and rising oil imports constitute a pre-existing condition which will exacerbate any oil supply issues.

2/5/2019

Australian fuel security review ignores peak oil in China 2015 (part3)

http://crudeoilpeak.info/australian-fuel-security-review-ignores-peak-oil-in-china-2015-part-3

30/4/2019

Australian fuel security review ignores peak oil in China 2015 (part2)

http://crudeoilpeak.info/australian-fuel-security-review-ignores-peak-oil-in-china-2015-part-2

29/4/2019

Australian fuel security review ignores peak oil in China 2015 (part1)

http://crudeoilpeak.info/australian-fuel-security-review-ignores-peak-oil-in-china-2015-part-1

Thanks, Matt, I just can’t stop looking at your graph. Peak oil really happened in 2005 were it not for the USA and Iraq. And notice that the price of oil did not really affect production. The rest of the world started to decline after 2005 in spite of spikes in oil prices. High oil prices did not really increase production.

Matt, your chart is priceless. Thanks.

Hi Ron,

Supply is limited by demand, so the impression that Iraq and US were what caused supply to increase is just a matter of how the chart was stacked. In a nation that has peaked, high oil prices don’t cause production to increase, but it likely slows the rate of decline vs a scenario with lower oil prices. This fact is easily seen by looking at US tight oil output and the effect of the crash in oil prices. Also the fact that oil prices were so high from 2011 to 2014 is the reason that US tight oil output increased by 3.88 Mb/d from 1 Mb/d to 4.89 Mb/d over the Jan 2011 to March 2015 period, a 389% increase in output.

If we consider World C+C less US tight oil less Canadian oil sands we get the chart below.

Yes, there are many ways to stack graphs. From bottom to top I usually start with countries having flat production (if any). Then the declining group with a peak. Then a growing group offsetting that decline in the order of growth rates. That’s why the US is on top – the big mover. Iraq is there because of it’s special role. Bush and Cheney – who knew about the approaching peak – invaded Iraq to shift the predicted peak a couple of years into the future (which took longer than anticipated)

I wrote this post:

16/3/2013

Iraq war and its aftermath failed to stop the beginning of peak oil in 2005

http://crudeoilpeak.info/iraq-war-and-its-aftermath-failed-to-stop-the-beginning-of-peak-oil-in-2005

That’s why I call the Iraq war the first peak oil war.

We may also remember that the Iran oil expert Dr. Ali Samsam Bakhtiari (who did a presentation to the Australian Senate in 2006 – which I attended) always spoke of geo-political feed back loops when oil gets scarce.

Matt,

Your analysis and chart are excellent, just another take on how one might divide things up.

In this case we compare non-continuous (aka conventional oil) with continuous oil (aka unconventional). I leave out Orinoco because I do not have a good data set on Orinoco output.

Very interesting chart. See the effects of Libya in 2011. One country can move the whole thing. Some countries lose production, like Libya in 2011, and US is flat??? If it increases (US) after 2019 as Dennis predicts, the it is up to flat. But, if the US remains flat, or not much increase, it’s all down.

GuyM,

Output is either above or below my predictions 100% of the time, its roughly a coin flip. 🙂

Well, I’d say that places you squarely within the human range? Drifting around with the rest of us wanna be Vulcans.

Iraq was a political outage, coming back online.

Today we have political outages, too:

– Canada with green movements refusing to build more pipelines – 1- 2 mb/day more possible

– Venezuela, can come back after regime change – 2 mb/day more possible

– Iran, can come back with a new US president or China running blockade breakers – 2 mb/day more possible

– Lybia can come back with one side winning the civil war – 0.5-1 mb/day more possible

Venezuela is a wild card, if someone taps the tar oil there lot of production is possible, and bye bye enviroment.

So it’s still a political and not a geolocical peak, even without USA.

There have always been political problems and there always will be. If it were a perfect world we might hold off peak oil another five to ten years. But the world is not perfect and never will be. Peak oil will be peak oil, regardless of the cause.

Exactly. It doesn’t matter for max production if an easier geopolitical issue, say Libya getting back close to post-civil war max, is overrun by other people’s natural decline rates in the meantime. This is particularly the case re: Venezuela where it would take many years of large foreign investments to restore production if it started tomorrow. By the time that happens, Russia and China (aging fields only held up by EOR blitz) will be down by much more.

Theoretical peak based on believed URR and actual peak are not the same thing. To say nothing about how suspect some URR claims are (anything from the Gulf state NOCs, lazy extrapolations of US fracking).

My overall URR is essentially an average of Laherrere’s work and the work of the USGS for conventional oil, is based on Laherrere’s work for extra heavy oil and I use mostly USGS mean TRR estimates and my own analysis to estimate tight oil output.

I presented a poster on Permian output at the AGU Fall Meeting last December (poster can be downloaded at link below (about 75% works pretty well for viewing PDF). Note that the poster was finished just before new estimates for the Permian Delaware Basin were published so an updated analysis has been done (mean case is similar to earlier high case for URR with revised TRR estimates).

https://agu.confex.com/agu/fm18/meetingapp.cgi/Paper/446221

I have also done a Bakken Analysis (updated since post below)

http://peakoilbarrel.com/oil-field-models-decline-rates-convolution/

The type of analysis above combined with the economic analysis presented in the AGU poster and work in Mathematical Geoenergy (link below) on the Bakken, has been completed for all major shale basins in the US.

https://www.amazon.com/Mathematical-Geoenergy-Discovery-Depletion-Geophysical/dp/1119434297

The resulting model ( see below) might be considered lazy analysis by some and of course is far from perfect, chances that it will be a correct depiction of future output are infinitesimally small as this is one of an infinite number of possible future scenarios.

Chart below shows annual EIA tight oil data. In 2018 the model underestimated actual annual average tight oil output by about 175 kb/d, in 2019 the model predicts 12 month average tight oil output at 7410 kb/d, in March 2019 output had already surpassed this level, with average output for the first 3 months of 2019 at 7331 kb/d, so the model may again underestimate output in 2019. In short, the model is fairly conservative, if anything it may underestimate future tight oil output. Well profiles used in the analysis are based on the free data available at shaleprofile.com. Hyperbolic well profiles are fit to the data and a 15% terminal exponential decline is assumed when the hyperbolic decline rate flattens to 15 % (typically at about 12 years after initial output for best fit hyperbolic using OLS).

If average US tight oil output for the April 2019 to Dec 2019 period (9 months) rises by 146 barrels per day above the March 2019 level of 7,419,000 barrels per day, then my model estimate for 2019 average US tight oil output will be correct. My guess is the model will underestimate US tight oil output.

I agree that regardless of how you stack it, peak was 2005 if not for USA shale and Iraq coming back online after being invaded.

The constraints to production are far from just geologic. Technical, military, political, environmental decisions, energy conservation or alternatives, economic policy, all play their role.

Hickory,

Alternatively one might claim that it was expected that Iraq would come back online once the security situation improved. The biggest surprise was how quickly tight oil ramped up and I was relatively surprised that Canadian Oil sands ramped as quickly as they did. Though looking back at the 2008 Canadian Association of Petroleum Producers (CAPP) forecast, they did predict such growth in oil sands output, but I was skeptical at the time.

The 2018 CAPP forecast predicts 4.38 Mb/d of oil sands output in 2035, about 1.3 Mb/d above Dec 2018 oil sands output. This is a fairly slow pace of increase about a 76 kb/d average annual increase from 2019 to 2035.

Agree Dennis.

I’m watching the maneuvering and story telling of the trump team in regards to Iran. Seems they are just itching for a reason to attack Iran.

I’m no fan of the Iranian goals and operations beyond their own borders.

But another fabricated war (like Iraq) will be an even bigger disaster.

Careful what you wish (vote) for folks.

Hickory,

Agree War with Iraq was dumb, and war with Iran would be dumber. I am surprised how good George W is looking at this point, I was not a big fan when he was president, but he is looking better and better compared to the moron in chief.

Eulenspiegel,

CAPP forecast from 2018 has Canadian output increasing by 1.4 Mb/d by 2035, for Venezuela an Optimistic forecast would have them at 2500 kb/d by perhaps 2035 so about 1.8 Mb/d above current output. For the more relevant point in time in 2025 when the peak is likely to arrive, CAPP has Canadian output at 694 kb/d above 2018 average Canadian output and Venezuelan political problems are unlikely to be resolved by that time, a very optimistic scenario (even for me) would have Venezuelan output perhaps at 1.6 Mb/d or about 800 kb/d above April 2019 output. An Iranian solution to political conflict with the US and Sunni Persian Gulf producers might indeed allow another 2 Mb/d, for Libya 300 to 600 kb/d is a reasonable estimate. The chances that all problems in Venezuela, Libya, and Iran will be resolved by 2025 are near zero. Canada at a 700 kb/d increase is probably reasonable and even solving the Iran puzzle is possible with a reasonable US President, which could give us 2.7 Mb/d by 2025, this might be adequate to offset declines elsewhere or lessen the rate of decline after 2025. Libya might be able to recover before 2025 (I am not tuned into the civil war there, perhaps it will be a stalemate), Venezuela is unlikely to make much progress before 2030 in my view, though Fernando might have some insight there.

Norway is to add 0,5 mb from a new field at the end of the year.

US is planing to take control of Iran & Venezuela to insure its fair share. One problem with the US – Iran war. Iran has nukes. Iran sort of let that slip out a few days ago, when it stated Iran can take out the entire US naval flotilla stationed in the straight with a single missile.

That armada just sent to the Gulf should be considered a floating Gulf of Tonkin.

The USA should be able to take out a single or a few medium range missiles. Something nearing the fleet with high velocity will be taken out.

I don’t think Iran has access to the newest russian hypersonic technology. Instead it’s propably a variation of the old Scud missles.

A reason for a war it will be even when shot down anyway.

Khalij Fars is an Iranian single-stage solid-propellant, supersonic anti-ship quasi ballistic missile with a range of 300 km. It is based on the Fateh-110, which itself can do about mach 3.5. KH 35 is a pretty good anti ship missile, although subsonic. A large volley would likely overwhelm fleet defenses.

China and Russia are probably looking at research opportunities to be conducted in the next Middle East weapons lab, er I mean war, courtesy of the American taxpayer. Iraq during the 2003 to 2010 time frame was mostly an anti-armor lab. Iran war will likely feature more anti naval technology, which China is quite interested in these days.

Iran has its own missile program & also been sharing missile & nuke tech with North Korea.

A nuke assault on a Naval group would like be multiple missiles, all but one decoys. The Nuke would be detonated as air burst to cover a large area and does not need to be close to its target.

In the case of the Iraqi Scuds, they had chemical warheads and need to be very close range to do any damage. a Nuke can be air busted high above its target and cause widespread destruction.

I would imagine Iran would be launching dozens of missiles nearly at the same time, in order to overwelm defensive systems. One tactic with nukes is high alt. airbust which causes localized EMP knocking out radar and other electronic systems, thus rendering them in operative or blind for a period, & enough time to reach their targets.

War is a terrible thing. No one wins, except perhaps the Arms merchants.

As the fabricated events from the Gulf of Tonkin showed, attacks don’t need to be real to be used as an instigation for war-

https://www.usni.org/magazines/naval-history-magazine/2008/february/truth-about-tonkin

All it takes these days is a press release and bit of ‘news’.

Who Pays the Pro War Pundits?

https://youtu.be/PuVFeeFJ1X0

“Journalists for Hire : How the CIA Buys the News”

https://gosint.wordpress.com/2019/05/07/two-years-ago-journalists-for-hire-how-the-cia-buys-the-news/

I’m late to the party. As regards Occidental versus Chevron and the pursuit of Anadarko, which then evolved into discussion of the 2009 events in the crisis, which maybe should not have because there’s a lot of inaccurate information that went back and forth but it doesn’t matter. I’ll just toss out some data that either you have or should already have. I didn’t work through the entirety of the scroll, and that doesn’t matter either.

Perhaps the most important item and OXY –> CVX thing is Warren Buffett. He is funding the OXY bid. He is buying 10 billion in preferred. You can go and find a wiki or something on preferred stock in general but in this case he is purchasing preferred in OXY that’s going to yield 8%.

Just consider that repeated. And think about that number. And then go and look up Bank of America and its preferred held by Warren Buffett.

The reason this is a big deal his Buffett was approached during the crisis and essentially was begged to participate in the attempts to prevent global annihilation. He agreed to bail out BOA and his instrument was preferred.

I can assure you he doesn’t want a position in shale. The odds look higher that someone approached him to make this happen.

Oh and by the way the Fed in January when they announce the suspension of rate increases also put a date of sometime this year for suspending the unwind as well. And yes the BOJ owns one hell of a lot of the Japanese stock market. I’ve mentioned this before in the context of the silliness of presuming that there are free markets. Probably best to realize that they will be less and less free as oil scarcity asserts itself.

About a month-and-a-half ago a conference was held how’s the follow-on to a Davos discussion some months earlier. The conference publicized it’s subject matter as being an expansion of the Fed’s toolkit. It turned out that the majority of the conversation focused on one tool proposed. That tool will be the Fed’s purchase of equities. Buffett won’t always be around.

I don’t think W. Buffett would spend a dime on the shale companies if it wasn’t for the expectation of a good return. That fact that he got 8% preferred is just the kind of outstanding bargain you can get when you are a huge player with resources (money) to deploy, and you are smart.

Buffett is not compelled to bail them out. How I see it anyway.

Buffett was approached to do the Occidental deal. He was approached by Bank of America.

https://www.bloomberg.com/news/articles/2019-05-03/buffett-says-bofa-s-moynihan-was-matchmaker-on-occidental-deal

https://readsludge.com/2019/05/02/bank-of-america-is-set-to-profit-from-the-biggest-oil-industry-merger-in-years/

“By the end of 2018, Berkshire owned 918.9 million Bank of America shares worth $22.6 billion, its largest common stock investment other than Apple, and sat on an $11 billion profit.”

https://uk.reuters.com/article/us-anadarko-petrol-m-a-occidental-buffet/frothy-markets-turn-dealmaker-warren-buffett-into-a-bankroller-idUKKCN1S62GN

The headline is deceptive, but that’s a good find. A few 10s of millions of advisory fees is not the motivation.

Read within. It’s the 107B in shale loans they made.

Buffett is a large holder of BAC common BECAUSE OF THE BAILOUT he did. The preferreds were convertible preferreds. They had a conversion price that evolved to be well below the price of the common in 2017. The mechanism involved warrants but that doesn’t matter. He put up $5B to bailout BAC and got 6% preferreds that were convertible into a big chunk of common.

(For amusement folks should go back and look at the story of BAC during the crisis from about 2006 to 2011. Odds are at least 50/50 a murder took place to keep the CEO from talking.)

Someone needs to scope out his $10B 8% preferreds in OXY. Are they convertible?

And make no mistake here, BAC needed another bailout — from the devastation unfolding in shale debt.

U.S. Petroleum Balance Sheet

EIA pdf file http://ir.eia.gov/wpsr/overview.pdf

Oilytics chart summaries

https://pbs.twimg.com/media/D6nZBGLXsAAfGk8.jpg

https://pbs.twimg.com/media/D6nafnnWAAA0HqQ.jpg

Global fossil fuel subsidies hit record $5.2 trillion –

https://desdemonadespair.net/2019/05/global-fossil-fuel-subsidies-hit-record-5-2-trillion.html

The Free Market in action.

FF make our world look different than 18th century, so I don’t get the subsidy thing. Unless you are a moron (hi Dennis), and think, that our civilization can be powered by “renewable” energy.

Have the cajones to state your name, “name,” especially if you’re going to insult our moderator. Otherwise, stfu.

Well, there’s an argument in that post, somewhere, but damned if I can figure it out.

I don’t think Dennis coined the terminology “renewable energy”, which would make most scientist cringe. Alternate is a much more acceptable term. Can it replace FF uses? Surely, not in the near term. At least all of the uses. But, it’s much better than nothing. Nothing is the end result of relying on FF. In the end, we will adapt to alternate, or wind up with the nothing end of the spectrum. I vote adapt, but I am only one vote out of billions.

GuyM- “Can it replace FF uses? Surely, not in the near term. At least all of the uses. But, it’s much better than nothing. Nothing is the end result of relying on FF. In the end, we will adapt to alternate, or wind up with the nothing end of the spectrum. I vote adapt, ”

I agree with you entirely here. Question is- Timing, how fast should we get to it?-

How long will affordable oil and gas last, how quickly can we deploy alternatives ‘at massive scale’, how much incentive for adaptation should we apply.

I think it is unlikely we will achieve a transition with enough energy available for normal function of the economy as we know it. Not at this pace.

I hope to be wrong on this.

My view is that we must first have a major crisis to get the focus right and also adjust to the reality, that is; what is common knowledge? Second, there will be a time frame with faltering oil output and increased focus on natural gas, that will allow for more focus on a transition. The following up question is if we will have an environment with room for adjustment like now with plenty of capital and low interest rates to once again allow for a transition. The governments around the world are the ones that can plan, or else short term is the norm – and short term planning is often unfortunately to be expected I guess. Some governments have been making incentives for renewables now for a while because it is easier now when you have overabundance in some nations (my guess). I am just reading the policy in etc. Norway between the lines; that is where I live, so also easier to pick up signals here as opposed to elsewhere.

kolbeinh wrote:

“My view is that we must first have a major crisis to get the focus right and also adjust to the reality, that is; what is common knowledge? ”

We already did back in 2008. Its pretty much back to BAU at this point. No investment in Public train transport. People are buying big SUVs again. More big McMansions with no attentions to energy efficiency.

Nothing is going to change until the world is forced into Change. Lots of unable consumers lead to global wars. USA started early with wars in the Middle East targeting Oil Exporters. Only VZ and Iran remain, Both will end up with war with the US either very soon, or before 2023.

Yes, it is grim. The peak oil theme was not present too a large degree in 2008 though? The war drums are approaching Iran it seems. That is going to be 5x worse than Iraq if it happens. Total chaos with oil supplies lacking and the country itself too big to be easily invaded. If it is an economic blockade it is still going to be disruptions in oil supplies with no end in sight. Venezuela is going to be a piece of a cake compared to that one. Question is if the Trump administration has time enough and goodwill enough to do this quickly enough. I am in the camp that things tend to take time (both in this instance and also for example in the climate change question).

I don’t think the future will look like the present in terms of energy no matter what we do or don’t do. We can either shoot for as smooth a transition as is possible, or wait until we hit crisis mode and let economic failures happen as they may.

Boomer II,

I agree with your assessment. If I ruled the World, I would choose option one, I don’t, so option 2 looks more likely.

The crisis might prompt policy changes to help attempt a smoother transition, at this point most people think we have hundreds of years of fossil fuel, what many fail to realize is that once half of the resource has been produced, declining output is likely to follow soon. Continued output at the peak level doesn’t continue until 100% of the resource has been produced, we all know this, but most people do not get this fact.

Cumulative C+C output at the end of 2018 was 1365 Gb, if my medium URR estimate is correct (3100 Gb) then thr midpoint is 1550 Gb, about 185 Gb more than the year end 2018 level, output was 30.2 Gb in 2018, so in just over 6 years we would be past peak if output doesn’t increase after 2018. My guess is that output over the next 6 years will average about 31.2 Gb each year, so the peak would be a little less than 6 years in 2024. A lower URR estimate would move the peak to 2022 and a higher estimate to 2026, the changed URR estimates would also result in a lower or higher peak output level from 84 to 88 Mb/d, with the best guess at 86 Mb/d.

In any case, the peak will become evident over the next 5 to 10 years, at that point things may change.

Dennis,

I suppose the peak will be evident when China won’t be able to get those additional hundreds of thousand of barrels it needs to keep its economy on a stable path of growth (or when fracking can’t provide the US-illusion of plentifulness anymore). Then everything will break loose.

The problem will be gradual decline will make people miss the peak thinking it is a repeat of 2005 to 2010 where there was a plateau followed by an increase. After 2025 an increase in output is not likely.

“The problem will be gradual decline will make people miss the peak thinking it is a repeat of 2005 to 2010”

not so sure it will be gradual. It could become a whipsaw event where prices become very chaotic, rising & falling in response to economic instabilities.

I am sure your aware of system stability & tipping points. Systems can be stable right up to the tipping point, then suddenly & rapidly become verychaotic.

If we look at the summer of 2008, that seemed to be the tipping Point. Oil prices peaked out at $147\bbl and soon after the global economy collapsed into a rapid collapse as the tipping point was breached. The change was global as it affected all nations as over extended companies, consumers an gov’ts suddenly had their feet knocked under them (metaphorically speaking)

If you look at the global economy today, its slowly creeping toward the tipping point as debt growth & demographics (Boomers beginning to retire putting pressure on underfunded pensions forcing many local & state gov’t to raise taxes). Its possible that rapid rising of energy price could once again be the trigger for the next financial crisis.

Oil prices are essentially global. when they change in prices they impact the entire global economy rather than a local\regional economic changes. It has the power to trigger tipping points in many locations unlike a localized recession, natural\manmade disaster. So if oil prices are low and only country falls into a recession it usually does not trigger the rest of the world into a recession, but when Oil prices are, usually a lot more nations fall into recession.

When worldwide recessions hit they have a much more powerful impact on all nations as everyone feels the pinch which tends to global change peoples spending & employment.

Techguy,

Yes I am aware the system can become unstable. Japan is a case where the demographics are not good, and so far a tipping point has not been reached, the economy has been remarkably stable considering the very high debt levels.

The GFC was due to poor regulation of the financial industry (see The Big Short) rather than high oil prices. Oil prices were quite high from 2011 to 2014 (an average for Brent of $107/b over that period) while Global GDP growth remained strong. The volatility in oil prices from 2015 to 2018 has also not affected World GDP very much.

So though it is possible there might be a GFC 2 or major war, it is by no means highly likely (I would guess 50/50 odds that decline in World C+C output will or will not be more than 2% per year from 2019 to 2030. My best guess is about 1%/year on average from 2025 to 2030, the World can likely adjust to the $130/b oil prices that are likely to result and the high price to keep demand in line with supply.

Dennis Wrote:

“il prices were quite high from 2011 to 2014 (an average for Brent of $107/b over that period) while Global GDP growth remained strong.”

Not really, The economy was largely floating on a lot of QE, stock buyback, and cheap & easy credit. Since then Companies have been burying themselves deep in Debt to support stock buybacks & buying up competitors. Ditto for consumers, doubling down on their debt load because lower interest rates made it possible to borrow even more.

So with all this additional debt, we are creeping back up into the default territory as consumers & business may start to find it difficult to service there debt. No doubt gov’t will unleash the QE kracken to avoid another financial crisis, but its hard to drop interest rates below zero for consumers & businesses without major repercussions.

Tech Guy,

Note that the fact remains that real GDP growth was relatively strong and has remained so since 2010, eventually there will be another recession, but it is not likely that any near term (next 5 years) recession will be severe. The 2009 recession was the worst since 1933. Not likely to repeat until 2030 in my opinion.

See

https://www.bis.org/statistics/totcredit.htm?m=6%7C380%7C669

For BIS debt to GDP

Hickory,

I believe you are correct, if you are assuming the economy will continue in the future as it has in the past. This will not be possible and that should be a catalyst for change, which is probably a good thing in that the present path is not a good one, we need to change course. The future path that is chosen is difficult to predict, all we can be nearly certain of is that the path is likely to change.

Dennis,

I believe CTL is very economic when oil rises roughly above $75/bbl in current dollars. But…economies of scale require very large projects, and so they’re very risky.

12 years ago it started to become economic when prices rose above around $50 (not adjusted for inflation since then), but the Feds sent strong signals that they would not provide policy support (loan guarantees, etc) because of how dirty CTL is. And…investors dropped the idea.

CTL has only gotten riskier – I’d be very surprised if it had a future outside some limited projects in China.

Thanks Nick

The original discussion of subsidies here had to do with a faction who believed that price could restrain consumption. It is probably not a perspective that qualifies as absurd, but almost.

Note parenthetically that the same relative absurdity applies to production as well. Argentina.

I may disagree with Dennis (strongly), but he is anything but a moron. I doubt you are even capable of understanding the math behind the models he is producing.

Niko,

I forget your point of view, perhaps you believe the C+C URR is far lower than say Mr Laherrere’s estimate and no transition is possible.

Not many agree with my positions, but there a variety of reasons. I think a transition to other sources of energy will be necessary, but I doubt BAU will continue, the necessity of transitioning to non-fossil fuel will lead to social change. I am unsure what form that will take, I am hoping it will be one that attempts to minimize human impact on the environment, perhaps by encouraging smaller family sizes, better stewardship of the planet, etc.

Note that I see no reason why this would be likely, except that eventually it will become clear that it is necessary for anyone who opens their eyes. It is already crystal clear to me.

Is it possible that coal to oil could postpone the peak a few years?

Tom,

I imagine it would take quite a bit of time to install needed equipment and I am not sure the price would be competitive. I think at best it would reduce decline rates a bit, doubt it would be of much significance. Good data on coal to liquids cost is hard to find.

North Dakota Director’s Cut: March +54 kb/day to 1,390 kb/day

pdf file on this page: https://www.dmr.nd.gov/oilgas/informationcenter.asp

completions chart

https://pbs.twimg.com/media/D6oXmoZX4AIUApn.png

US inventories week/week change (1000 barrels)

Crude Oil: +5,431

7 oil products: +737

Total (crude oil + 7 products) +6,168

Propane & Natural Gas Plant Liquids: +8,480

SPR: -1,764

Line 13 Adjustment +5,845

Chart https://pbs.twimg.com/media/D6rpeDgWsAEeASx.png

US Crude Oil & Distillates

+6.6 million barrels week/week

+40 million barrels year/year (from May 11th 2018)

Chart https://pbs.twimg.com/media/D6rprWOXYAAQqWz.png

Fujairah weekly inventory change (1000 barrels)

Total Distillates +111 week/week

Total Distillates +6,383 year/year

https://pbs.twimg.com/media/D6l8763X4AAN5dd.png

Japanese weekly inventory change (million barrels)

Crude Oil +8.93 w/w

Total (Crude + Distillates) +10.82 w/w

Total (Crude + Distillates) +3.08 year/year