Below are a number of oil (C + C ) production charts for Non-OPEC countries created from data provided by the EIA’s International Energy Statistics and updated to October 2019. Information from other sources such as the IEA and OPEC is used to provide a short term outlook for future output and direction.

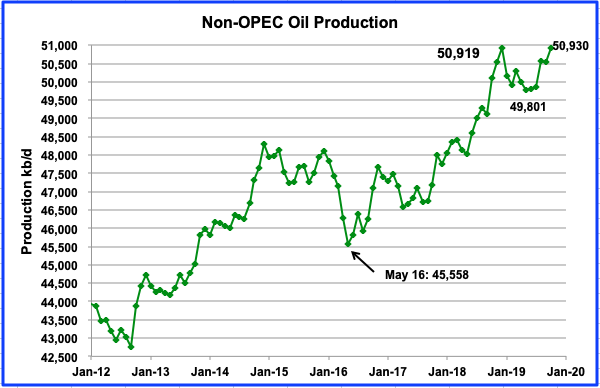

Non-OPEC production increased by 382 kb/d to 50,930 kb/d in October from 50,512 kb/d in September. This is second highest monthly increase for 2019 after the August increase of 699 kb/d.

October’s production exceeded the previous high of 50,919 kb/d reached in December 2018 by 11 kb/d. Gains from Norway, U.S, and Canada overcame declines from other countries to post the new October record.

Contrast what has happened with output in 2019 with 2018. From December 2017 to December 2018, production increased from 47,768 kb/d to 50,919 kb/d, an increase of 3,151 kb/d. Of this, the three largest contributors were U.S., Russia, and Canada. From December 2018 to October 2019, production so far has increased by 11 kb/d. How much will the next two months add?

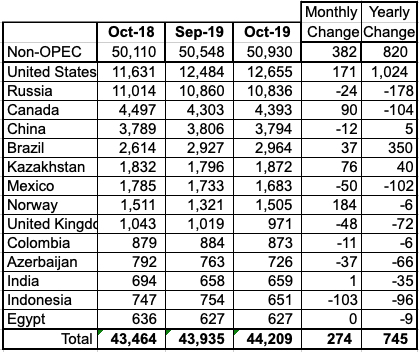

Above are listed the world’s 14th largest Non-OPEC producers. They produced 86.8% of the Non-OPEC output in October. What stands out in this table are the triple digit monthly increases from the US and Norway and the yearly increase from the US of 1,024 kb/d. Last year, world demand in Q4-19 increased by 1,450 kb/d over Q4-18, according to OPEC. US output growth covered 70% of that demand increase. There are indications that the US may not be able to sustain this level of annual production growth going forward. For Q4-20 over Q4-19, OPEC is projecting a demand increase of more than 1,500 k/d.

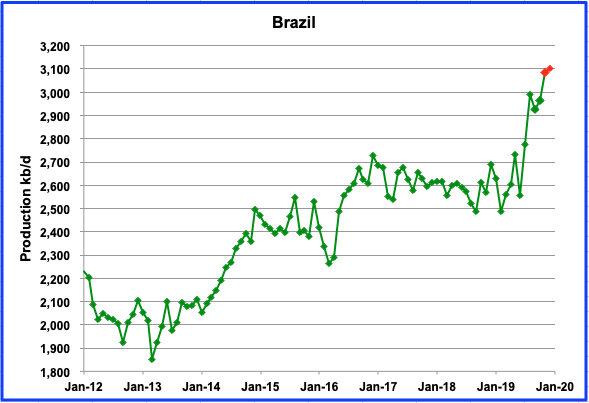

Brazil had a small output increment of 37 kb/d in October to 2,964 kb/d. This was an unexpected small increase from its deep pre-salt layer. However, larger increases are projected for November and December. The two red dots show what is expected for November and December. “In December, average production was also a record, totaling 3.1 million barrels of oil per day” as reported here.

Some earlier reports on Brazil speculated that the deep pre-salt layer could add an additional 1 Mb/d to current production. However the latest licensing round did not attract many bids and in some reports is viewed as a failure. The lack of interest will slow the increase in production and may be limited to its current level. This report, “Is this peak oil for Brazil?” notes the problem with increasing production is associated with cost.

“Recent research by consultants Rystad Energy says that many of the off shore oil projects sanctioned before 2014 generated little or no profit for investors because of higher than anticipated engineering costs.”

On February 1, Brazil’s oil workers went on strike. However Petrobras said that crude and fuel production remains stable thanks to emergency hires on their platforms.

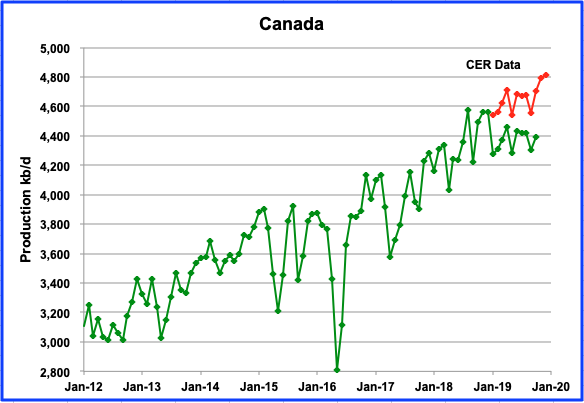

According to the EIA, Canada increased its production by 90 kb/d in October to 4,393 kb/d. However this is a much smaller increase than the 147 kb/d reported by the Canada Energy Regulator (CER). Output from Alberta continues to be limited by the curtailment rules imposed by the government. In October, rail shipments of crude to the US dropped to 270,070 b/d from 319,594 b/d in August while in November rail shipments increased to 297,476 b/d, according the CER.

With increasing rail shipments and the Keystone pipeline returning to normal operations, inventories in Western Canada have started to fall and the WCS to WTI discount has shrunk from $25/bbl in December/January to closer to $17/bbl in early February.

While shipments from Alberta are still under constraints, Alberta received two pieces of good news in early February.

As reported here, the Federal Court of Appeal ruled Tuesday that the federal government sufficiently consulted with indigenous communities before approving the Trans Mountain expansion (TMX) pipeline for a second time last year.

The decision clears an obstacle for the project, which Justin Trudeau’s government purchased in a $4.5-billion deal in 2018, and is already under construction. Once built, the pipeline will transport diluted bitumen, a heavy crude produced in Alberta’s oil sands, to tidewater.”

In Minnesota, the PUC regulators voted to approve the replacement of Enbridge’s aging Line 3 pipeline with a new route and new pipes.

Approval of these two projects will add more than one million barrels per day of export capacity possibly by late 2021 for line 3 and 2022 for TMX. This will result in a slow increase in oil production in western Canada after 2022.

China’s production continues its slow decline which started in July 2019. Since July it has declined by 41 kb/d to 3,794 kb/d. It is expected to maintain this level of production into 2020 and no significant growth is expected. China’s oil companies are increasing spending and drilling to maintain output at its current level.

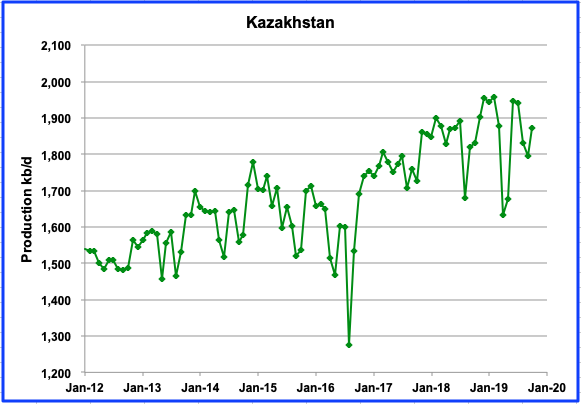

Kazakhstan output increased by 76 kb/d in October to 1,872 kb/d after completing field maintenance. It is expected that their production will rebound to between 1,900 kb/d and 2,000 kb/d in 2020 due to increasing production from the Kashagan field.

“In emailed comments, a spokeswoman for the Italian company said Kashagan crude production had reached 400,260 b/d on September 4. The increase was achieved through the conversion of an additional well to injection operations to support output, following a major maintenance shutdown earlier in the year,” according to S&P Global Platts.

Mexico increased output for four months after July 2019 to 1,733 kb/d. However in October output declined by 50 kb/d. More recent data from Pemex indicates that output will recover in November and December.

According to Reuters, “Mexican national oil company Pemex’s crude output dipped to 1.76 million barrels per day (bpd) in October, down more than 7 percent compared with the same month last year, according to company data released on Monday. Pemex officials have said that the extended output slide is due to the natural decline of its major fields as well as budget cuts in recent years that have crimped its exploration and production activities.”

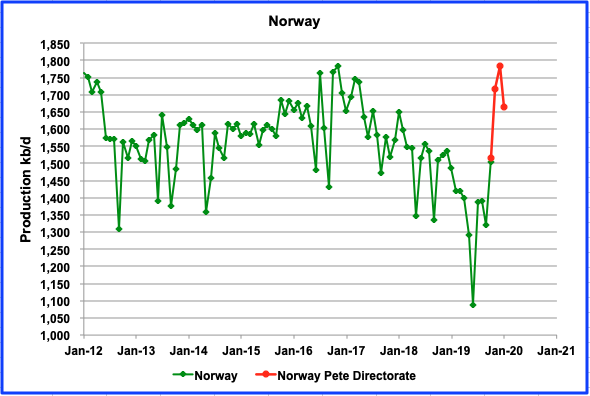

Norway’s oil output for October increased by 184 kb/d to 1,505 kb/d and reflects the addition of the first new oil from the Johan Sverdrup field. In December the JS field was producing at a rate of 350 kb/d according to Reuters. While smaller increments can be expected in 2020, according to OPEC, it is not clear from the latest data from the Norwegian Petroleum Directorate (NPD) that it will happen.

Oil (C + C) production data for Norway is published monthly by the NPD and is shown in red. In February it reported preliminary output of 1,784 kb/d for December and then an unexpected drop of 121 kb/d to 1,663 kb/d in January. No explanation was provided.

Russian production decreased by 24 kb/d from September to October to 10,836 kb/d according to the EIA. Also shown in red is a modified version of the oil output as reported by the Russian Ministry of Energy. It is higher than the EIA data because it includes condensate from NGPLs. The Russian data has been reduced by 350 kb/d to show how it parallels the EIA data.

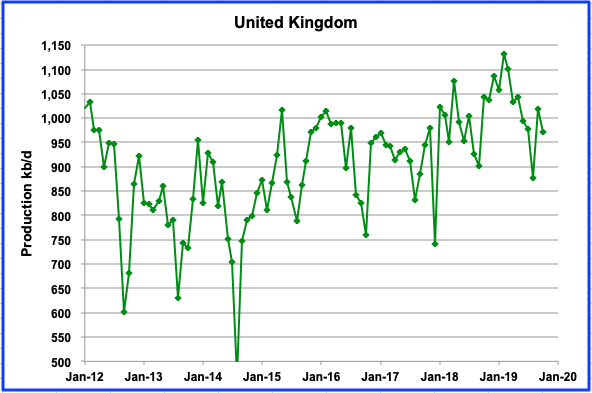

The UK output shows a drop in production of 48 kb/d to 971kb/d in October.

According to the IEA, “UK production was disrupted by a number of unplanned outages in October and at 1 mb/d was 120 kb/d below year ago levels. The largest producing field, Buzzard, was offline for most of the month while operator CNOOC made repairs to pipework.”

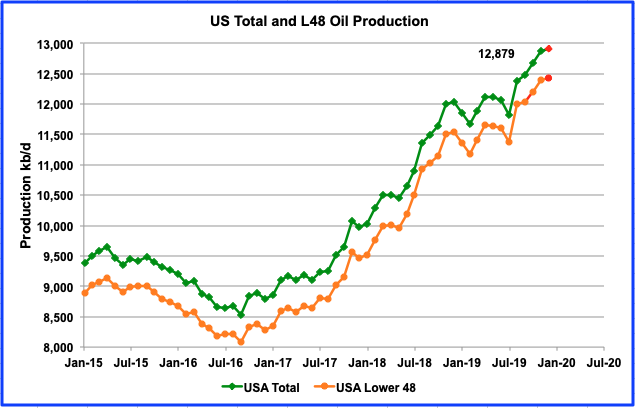

The latest data from the January EIA report shows that US production surged by 203 kb/d in November to reach a new high of 12,879 kb/d. Since June the US has increased output by an average of 164 kb/d/mth. Looking forward to December production, the February Short Term Energy Outlook (STEO) estimates US production for December to be 12,906 kb/d, an increase of 27 kb/d from November and is shown in red as the last data point.

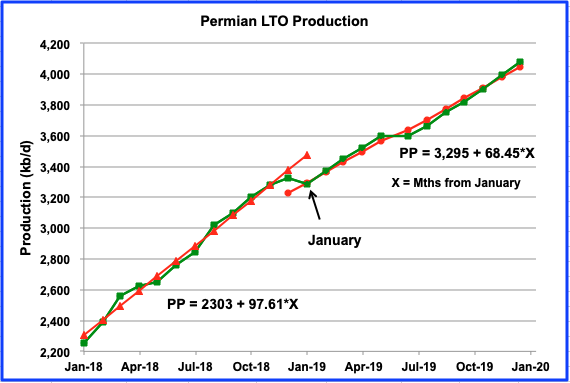

The major contributor to increasing US production has been the Permian basin. However there are indications of slowing. In 2018, Permian production grew at an average rate of 97.61 kb/d/mth. In 2019 the average rate has slowed to 68.45 kb/d/mth. Over the last three months from October to December, output growth averaged 88 kb/d/mth according to the EIA LTO report.

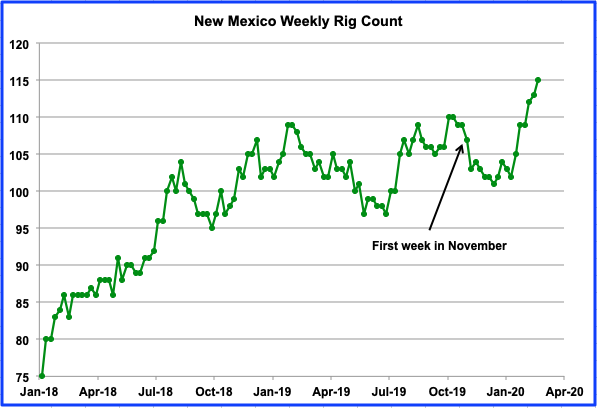

While Texas has been getting much attention regarding its production growth, New Mexico has also increased its output and recently has exceeded 1 Mb/d. Over the last four months since July, it has increased its overall output by 171 kb/d.

Above is the weekly rig count for New Mexico. While there were an average of 104 rigs operating in November and December 2019, by the third week in February 2020 (Feb 21), 115 were in operation. This is a good indicator of further growth coming from New Mexico.

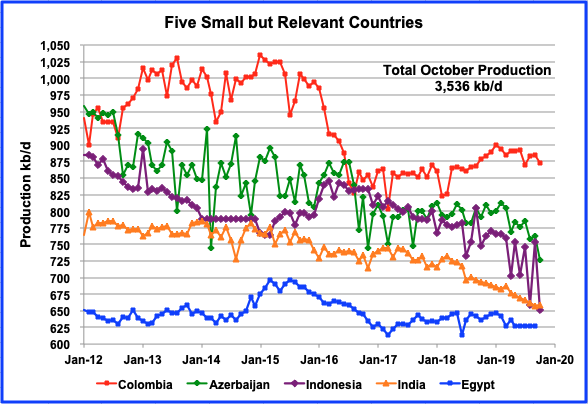

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. All five are in overall decline. Their combined October production is 3,536 kb/d down 150 kb/d from September’s output of 3,686 kb/d. Since March, Indonesian output has been very erratic and has varied each month by 50 kb/d to 100 kb/d. In October, its output dropped by 103 kb/d. Is the erratic behaviour an indicator of upcoming problems in the Indonesian oil fields?

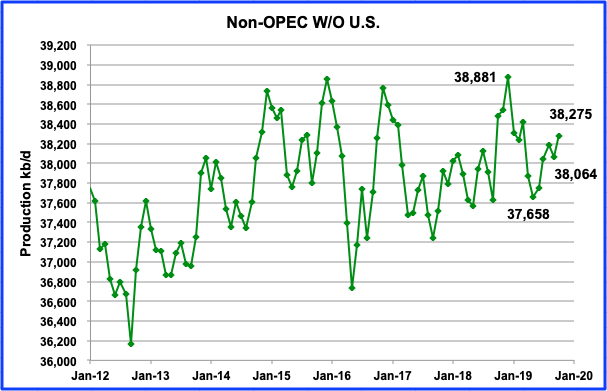

This chart shows Non-OPEC production without the US and is one of the more critical charts that bears watching in the near future. It is providing an early indication that the Non-OPEC oil producing countries, excluding the US, could currently be on a plateau. In October, the Non-OPEC countries, excluding the US, added 211 kb/d. The current October gap with December 2018 has decreased to 606 kb/d from 817 kb/d in September.

This year will be critical since Brazil and Norway have brought new fields online with new production capacity. Over the next two months, from the charts above, Norway will add 279 kb/d and Brazil will add 136 kb/d by year end, provided the EIA reports output levels as shown in the charts. Adding the additional combined production of 415 kb/d from Norway and Brazil to the 38,275 kb/d October output results in an output increase to 38,690 kb/d by year end. This would put the 2019 peak 191 kb/d lower than the December 2018 peak of 38,881 kb/d. Whether the peak will be exceeded or not exceeded, will depend on the increases and decreases from the remaining Non-OPEC countries. For instance Indonesia dropped 103 kb/d in October. How much will Indonesia recover by year end?

Of course the above estimate excludes the decline that never sleeps. Recall that in last month’s post, it was estimated that the current annual decline rate was estimated to be around 522 kb/d.

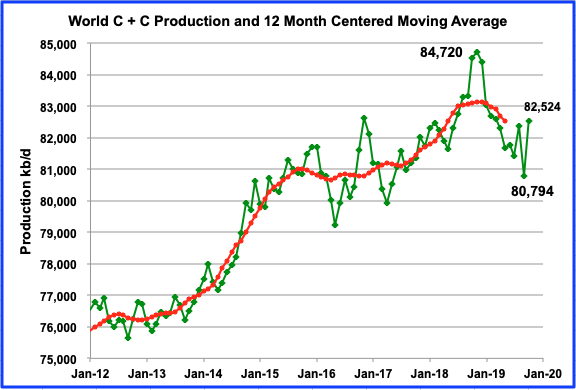

World oil production recovered by 1,730 kb/d to 82,524 kb/d in October 2019 from 80,794 kb/d in September. Of the 1,730 kb/d increase, 1,350 kb/d was contributed by Saudi Arabia after recovering from the attack on its Abqaiq processing plant, one of the world’s most important oil production facilities. In addition, two large contributions from Brazil and Norway added a combined total of 211 kb/d in October.

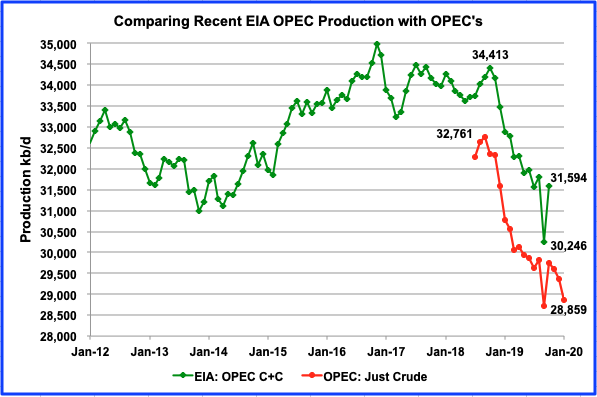

This is a comparison of the EIA’s estimate of OPEC’s C+C production vs OPEC’s crude output. The EIA’s estimate is roughly 2,000 kb/d higher, due to the inclusion of condensate. The EIA’s big production increase in October is 1,348 kb/d. However, OPEC shows a smaller increase of 1,037 kb/d. October OPEC production is now down by 3.9 Mb/d from the peak in September 2018.

Russia the Big Kahuna of non OPEC output. Got curious about Bahzenov shale, Beyond information from last spring.

Came across a November article with an interview of Vladimir Putin. There is a quote. “We will never frack for oil. We don’t need to.” He was talking in front of a audience that had a green interest.

Gazprom Neft is the focus of production near the Kara sea and they already have three horizontal rigs running. (google translate says neft is Russian for oil) Because it is Gazprom, that looks like gas emphasis, but Gazprom themselves have talked in terms of oil output. The Bahzenov is very large and extends away from the Kara sea south, east and west.

They may or may not be fracking. Probably are. And Putin probably tuned out neft in the briefing.

Watcher

Is shale oil the same as tight shale oil?

Gazprom Neft says Bazhenov shale oil output to reach viability by 2022-2023

Vladimir Soldatkin

ST PETERSBURG (Reuters) – Russia’s Gazprom Neft expects lifting costs at Bazhenov formation, the world’s largest shale oil resource, to gradually fall and reach an acceptable level for viable production by 2022-2023, a top company official said on Thursday.

Russia sits on huge reserves of shale oil, which needs more investments for developments than the conventional oil. Unlike the United States, it lacks technology and funds to produce shale oil in large volumes.

The break-even lifting costs for shale oil production at the formation stand at 8,500 rubles ($132) per tonne ($18/bbl), Alexei Vashkevich, head of geological exploration and resource base development at Gazprom Neft, told reporters.

“We are ready to get that number in 2022-2023,” he said in comments, cleared for publication on Monday.

He said the company had been working to raise its effectiveness, including via implementation of state-of-the-art technologies.

The company plans to start commercial production of oil from Bazhenov formation in 2025, Vashkevich reiterated.

The International Energy Agency describes Bazhenov as the world’s largest source rock, a bed of ancient organic matter dating back to the Jurassic period which has given rise to most of the crude oil pumped from the fields of West Siberia.

Gazprom Neft estimates that the reserves of the light, low-sulphur and of low-viscosity Bazhenov formation stand at between 18 billion and 60 billion tonnes.

Reporting by Vladimir Soldatkin; Editing by Subhranshu Sahu

Unlike the United States, it lacks technology and funds to produce shale oil in large volumes.

Really?

Other big oil companies have the funds also, so in about 10 years Russia will produce 10 mbd of shale oil, while climate continues to go to hell.

Gazprom Neft estimates that the reserves of the light, low-sulphur and of low-viscosity Bazhenov formation stand at between 18 billion and 60 billion tonnes.

That is at least 120 Gb of crude oil

Humans like to copy each other so it will be interesting to see if or how this Canadian railway blockade gets copied.

You think protestors will block rail lines in Russia? Oh sweet child.

‘Copy’, ‘blockade’ and ‘Russia’ (etc.) are rather malleable.

I suspect one thing that aids Russian lifting costs is a substantially lower cost of labor.

Labor is the #1 cost regarding most oil production.

Not saying that is a good thing, BTW.

Shale is a jobs program ?

Watcher answered my question regarding the nature of the Bazhenov shale further down.

“The geology is different from the US. There is clay content that makes the rock pliable. Fracking attempts bend the rock rather than create fractures. Last I recall studying, it’s a matter of surface area. Not all of it is clay. Some is frackable.”

Looks like KSA are going to be fracking too.

https://uk.reuters.com/article/saudi-gas-jafurah-idUKL8N2AL5X0

It’s all about natural gas. Saudi desperately needs more natural gas. They are having to burn crude oil to generate electricity and fresh water.

Could shale crude oil production from the Permian Bone Spring formation be about to enter a peak production plateau?

Bone Spring produces less oil than the Spraberry and Wolfcamp formations but EIA shows Dec 2019 Bone Spring at 670 kbd which is still significant.

https://www.eia.gov/energyexplained/oil-and-petroleum-products/data/US-tight-oil-production.xlsx

Occidental, which owns Anadarko now, appears to be on an oil production plateau since mid 2018 for Bone Spring of about 85 kbd which is 13% of total Bone Spring.

Both Bakken and Eagle Ford appear to be on a peak crude oil production plateau so growth from the Permian Spraberry and Wolfcamp formations need to offset potential Bakken and Eagle Ford declines to keep US crude oil production growing this year.

https://www.eia.gov/petroleum/drilling/pdf/bakken.pdf

https://www.eia.gov/petroleum/drilling/pdf/eagleford.pdf

Similarly, Concho Bone Spring production appears to be on an oil production plateau since mid 2015 of around 60 kbd. Both of the charts are from shaleprofile.

Bone Spring production continues its recent growth from Jul 2019 at 602 kbd to Dec 2019 at 669 kbd. I don’t know which companies are contributing to that growth 67 kbd? According to shaleprofile, Occidental and Concho are not contributing.

Shaleprofile chart on Permian production by formation. Bone Spring is the bottom dark blue and growth increased by only 15 kbd from Aug 2019 to Sep 2019. Spraberry is pink and just above is Wolfcamp, light blue.

Tony, the Bone Springs in the Delaware sub basin has literally been carpet bombed the past four years with overdrilling and well interference. 2017 GOR is upwards of 7.5 and 2018-2019 is on the express elevator up to that level and beyond. That bench represents how the Delaware is fast becoming a gas basin; the Wolfcamp, in my opinion, is not far behind. To quote a PE friend of mine working the Permian, “the Delaware has been ruined, forever.”

The Midland Basin has geographic, geological/stratigraphic restraints that will cause it to be drilled up soon enough; the Delaware has long been thought of as the promised land and THE hope for America’s oil future. That will not prove correct. Remember, please, that if half the Delaware Basin revenue stream is associated gas or NGL related, where is all the money going to come from for its development in the future? If not from net revenue, where? More credit?

Mike, as you say “the Wolfcamp, in my opinion, is not far behind” may be earlier than expected. EOG, the number 2 US shale oil crude producer at 600 kbd 2019Q3, including royalty owner production, is showing a small decline in Wolfcamp from 199 kbd in May 2019 to 186 kbd in Nov 2019. The chart below also shows Bone Spring growth stalling, according to shaleprofile.com

EOG releases their 2019Q4 results on Feb 28 and it will be interesting what is said about Permian production.

Mike,

If we look at New Mexico’s Permian output (mostly Delaware basin there), the revenue ratio is not 2 to one. More like 4 or 5 to one if we use $30/bo net for crude, $1.50/MCF net for NG, and $15/b net for NGL, I used the Texas average for barrels of NGL per MCF of NG, it was about 50 MCF gross NG to extract 1 barrel of NGL in 2018 (using EIA data).

In June 2019, for Wolfcamp and Bonespring in New Mexico Permian, oil was 708 kb/d and NG was 2503 MMCF/d, so $21.24 million in net oil revenue per day (at $30/b net), $3.7 million per day for NG revenue at $1.50/MCF, and $0.75 million per day for NGL at $15/b for 50 kb/d of NGL. Total NG+NGL net revenue of 3.7+0.75=$4.45 million per day and oil at $$21 million, so about 4.7 dollars from crude for every dollar from NG and NGL, roughly 20% rather than 50%, by my calculations. The output data is from https://shaleprofile.com

Tony,

About 94% of Permian Output is from 3 formations, Wolfcamp, Spraberry, and Bonespring roughly 70% of Permian output is from the Wolfcamp formation as of Nov 2019. Data from shaleprofile.com at link below:

https://shaleprofile.com/blog/permian-monthly-update/permian-update-through-november-2019/

Russia has its own central bank. If they want Bazhenov oil to flow and money is needed to make it flow, they can create the money — just like everyone else.

Newcomers here probably are unaware of past Bazhenov discussions. The geology is different from the US. There is clay content that makes the rock pliable. Fracking attempts bend the rock rather than create fractures. Last I recall studying, it’s a matter of surface area. Not all of it is clay. Some is frackable.

Point being, don’t use the field-wide numbers estimated. All of it won’t flow.

Russia has its own central bank. If they want Bazhenov oil to flow and money is needed to make it flow, they can create the money — just like everyone else.

+1

This comes up now and then and threatens digression from oil, but it’s a big deal. The Soviets did not really have a central bank. The CB they had was limited in its ability to create money by regulations that aligned it strictly with interior Ministry five year plans.

People tend to focus on the Strategic Defense Initiative in the United States as the reason the Soviets fell, or they focus on the crash in oil prices destroying the money influx to the Soviet Union and causing it to fall.

Before Bernanke’s QE the largely arbitrary and whimsical nature of money creation was essentially invisible to the public. And so nobody really thought about what that meant the Soviets. There does not have to be a foreign exchange constraint. The Chinese peg has demonstrated that.

If the Soviets had possessed a Central Bank with the same charter as the Fed or ECB or BOJ, they probably would not have fallen.

And in that context, if they have to have oil, and money is preventing oil from flowing, then the oil can be made to flow. If the geology holds the barrels, then you can print oil.

Difference is that Russia needs profitable exports to stay afloat. The US runs massive trade deficits, yet does not run in economic issues (yet). Any Drilling in Russia needs to be profitable for it to be viable.

On a side note, It appears that Oil prices have not cratered even though about 90% of the Chinese economy is shutdown due to the Covid-19 virus. China normally imports about 9.6Mbpd. I would imagine it probably only needs to import under 2Mbpd while its quarantine is in place.

As the disease spreads is going to reduce consumption much more. S. Korea appears to have major problem brewing and probably be next to go under full quarentine. Italy & Iran seems have the beginning of an outbreak.

The global economy should start to feel the impact in the next 30 to 45 days as supply chain failures start idling a lot of production as companies cannot get the materials needed for production. All it takes is lost of a single component used in products to shutdown an entire factory. So far its hit Japan and S. Korea, but I suspect it start impacting US and the EU.

Question is: Will this pandemic trigger an global economic depression that the Central Banks cannot prop up anymore?

Central Banks will prop up asset prices. As long as banks are told not to call in loans or debt. Nothing is going to happen. This is actually just another buying opportunity before the CB’s unleash more QE than anybody ever thought possible. Matter of fact the worse it gets over the short term the larger the dose of QE. And when the virus is done working though the population there will be a massive post virus rally. As everybody gets back to doing business.

Only thing that will cause a depression that central banks can’t overcome with money printing is a physical lack of oil at any price. Even then the CB’s will be bank rolling the transition to renewables. ECB has already stated that was their intention. So the transition will be funded at no cost. The money to do it will be created at no cost. And it will never be paid back.

There is another thing already at work they can’t control.

Housing / rent prices. Good for the ones owning one already, all other will be locked out.

Even a small cockroach flat will cost 2 million $ to buy or 15.000 a month to rent. Nowhere to life, locked out from society.

Money is just a tool to distribute goods and labour – as the socialistic 5 year plan.

It’s much more efficient, but it can’t create more people working or more goods by itself. It can motivate people better than 5 year plans, but even that has it’s limits.

So throwing more printed money at getting oil is the same as a 5 year plan – funneling working power from other segments to oil drilling and everything around it. It will leave other segments understaffed – for example if you pay truck drivers 100 grands a year to drive sand, construction companies will have no drivers in that region or everything gets more expensive.

At a certain moment this money printing will spin out of control – this is the moment of the Zimbabwe dollar. The one moment they print to much and the belief in money wanes. And everybody wants to get rid of his pure money and get some goods – doesn’t matter what.

Does not matter if CB prop up assets is nobody buys and companies layoff. Companies could prop up there stocks with more buybacks and cut production\costs so there stock goes up. about 80% or more of Exec compensation comes from Stock options, and they compensation is tied to stock price not revenue.

In the Case of Russia (CB), it cannot simply print money since no one wants rubles, and it cannot afford another case of hyper-inflation. Russia has to live with in its means. Most of its economy is based upon oil exports so if Shale Oil isn’t profitable, its not going to happen. Considering Oil prices are in the low 50’s & likely to fall do to falling global demand (Covid-19) it just puts a nail in the coffin of Russian Shale drilling.

HHH Wrote:

“This is actually just another buying opportunity before the CB’s unleash more QE than anybody ever thought possible. ”

Perhaps, but along with the money printing comes debasement and currencies will decline. It also would put people to work, as companies could just implement cost cutting measures and use savings & asset sales to inflate stock prices. Every major US corporate debt is just floating above junk bond status as they simply borrowed trillions for stock buybacks with no intention of ever paying it back. This will continue as long as there are lenders and they have assets to sell off.

This pandemic is likely going to be the catalysts to trigger a global recession. In the last couple or recessions China continued to grow which help prop up the global economy. Currently its shutdown and probably will be for several months. That removes about 28% of the global manufacturing capacity and many countries rely on China for parts, assemblies, and materials they use to manufacture products.

HHH Wrote:

“ECB has already stated that was their intention. So the transition will be funded at no cost.”

That’s not likely to work. The issue in the EU is horrible demographics as Europeans birth rate crashed about 3 to 4 decades ago and all the boomers are heading into retirement. Thats why the EU tried importing all those refugees as replacement workers. Only later to discover they are an additional welfare burden on them. In order to build infrastructure, they need a young and willing labor force to do the work.

“Only later to discover they are an additional welfare burden on them. In order to build infrastructure, they need a young and willing labor force to do the work.”

You may not say this here, or you can loose your job. Pure Nazi.

They are the best Asset Europe ever has got, pure and clean, no rassism or patriachat as with us ugly whites…

A lot of the immigration is from poorly run European countries to better run ones. For example, Poland, whose economy doubled in size the first 7 years after joining the EU, is a huge magnet of immigration. For example there are more than 2 million Ukrainian citizens living in Poland, thanks to the Russians attacks on the country. Compare that to a Polish population of only 37m or so.

It is a common Republican trope to blather on about European immigration without much attention to the real numbers. It’s really just racism behind a thin veneer of eugenic “science”. In fact the situation is similar to America, where the birth rate is well below the replacement rate.

The most dramatic example is probably China, which will be a country of old men in 2050.

Anti raycism is when you pillage a neighboring country of its human resources so you can have cheap labor while depopulating both countries. If only we could have more love not hate.

And it’s not Russia that imposes IMF agreements and statges armed overthrows everytime the population votes the wrong way.

Difference is that Russia needs profitable exports to stay afloat.

Hint:

Russia is the most self sufficient of all major countries:

“Russia now has the world’s most self-sufficient and diversified … into the most self -sufficient diversified major country in the world”

Peakoil.com picked up the latest post directly from peakoilbarrel. Hopefully that will attract more participants to participate with comments on our site.

The Russian Ministry of Energy has posted their January production. It is up by 9 kb/d from 11,275 kb/d in December to 11,284 kb/d in January.

It looks likely that US shale crude oil production will be on a plateau from 2019Q4 to 2020Q2. At the end of this week the vast majority of shale oil companies would have released their 2019Q4 results and 2020 guidance, which will revise the plateau.

Tony,

What do you think will happen to the price of oil if your forecast is correct?

My expectation is that the price of oil is likely to rise. What might happen to tight oil output in 2020Q3 and 2020Q4, if the price of WTI rises to $60 to $70/bo? My guess is that the completion rate will increase and output is likely to rise, though there may be a 4 to 6 month lag between changes in the oil price and changes in output.

At the moment it looks like a 40$ WTI phase soon – then only the companies with deeper pockets can increase production through it. All others have to cut back investing for a time.

Eulenspiegel,

Future oil prices are difficult to predict, if you mean 40 to 49 per barrel, that is possible. I doubt we will see an average monthly price for WTI at $40/b unless we get a coronavirus Worldwide pandemic and/or a major financial crisis similar in severity (or worse) than the 2008/2009 GFC. The futures market has Dec 2021 WTI at $50.77/bo currently, futures markets can of course be wrong, but a tight oil market, which may be apparent in June 2020, is likely to make the futures market quote from today, wrong by $10/b and $60/bo in Dec 2021 seems more likely.

Note that I tend to always be wrong about future oil prices, like everyone else.

We have a coronavirus worldwide pandemic.

We have an outbrake in Europe, in Iran they have huge unreported numbers. With several days between infection and first symptoms it is very very difficult to contain now.

Yes, I think 40-49. Only 1.30$ until there for WTI.

Yes that is correct, we have a pandemic, I guess I was thinking of a severe pandemic. like in 1918 when about 2.6% of World Population (50 million of 1.9 billion) died from the outbreak of an H1N1 virus. A similar level of mortality at today’s World population would result in about 205 million deaths. There is much that is unclear about the present pandemic. The economic effects could be severe and might indeed reduce demand and lead to a crash in oil prices, difficult to predict in my view.

You had mentioned $40, and probably meant forties, big difference between 40/b and 49/b, so I just wanted to clarify.

Yes that is correct, we have a pandemic,…

Dennis,

No

“The WHO said it was too early to call the outbreak a pandemic but countries should be “in a phase of preparedness”.”

Source: BBC

56 mins ago

Han,

I was using the dictionary definition of pandemic rather than a precise epidemiological definition, as I am not an epidemiologist.

We know more today than in 1918, so perhaps we will do better this time, in addition this virus may be very different than before, either better or worse. There is still much to learn.

Good information, I stand corrected, I do not know if this is or will become a pandemic.

WHO doesn’t know shit.

Once a disease spreads from an epicentre (EPI…DEMIC) to an area much wider it is known as a pandemic. The virus is now global, so it is a pandemic (PAN as in wider).

Source:

https://www.merriam-webster.com/dictionary/pandemic

Mike,

From “your” book:

“an outbreak of a disease that occurs over a wide geographic area and affects an exceptionally high proportion of the population : a pandemic outbreak of a disease”

What the WHO says still holds:

”It’s not enough for a cluster of disease in a country to exist and even spread (to call it a pandemic)— it has to spread in a sustained way, from person to person, time and time again, through many generations of transmission.”

“A similar level of mortality at today’s World population would result in about 205 million deaths.”

Well, that is not the scenario we currently face.

The mortality of those known to be infected is just over 2%.

This is not nearly as contagious, nor fatal as the 1918 flu-

“The pandemic mostly killed young adults. In 1918–1919, 99% of pandemic influenza deaths in the U.S. occurred in people under 65, and nearly half in young adults 20 to 40 years old.

With the current covid-19

COVID-19 Fatality Rate by AGE:

*Death Rate = (number of deaths / number of cases) = probability of dying if infected by the virus (%). This probability differs depending on the age group. The percentage shown below does NOT represent in any way the share of deaths by age group. Rather, it represents, for a person in a given age group, the risk of dying if infected with COVID-19.

AGE

DEATH RATE*

80+ years old 14.8%

70-79 years old 8.0%

60-69 years old 3.6%

50-59 years old 1.3%

40-49 years old 0.4%

30-39 years old 0.2%

20-29 years old 0.2%

10-19 years old 0.2%

0-9 years old no fatalities

But economic effects, including oil consumption, may be very heavy.

Hickory, Politicians seeking a reduction in “entitlements” such as medicare and social security must have also noticed the age stratified death rates you outlined. I wonder whether the response to the virus will be affected by the potential to reduce benefits. I can see both sides of the argument. First, it would be inhumane to do less than everything possible to save every human life. Second, nature has always sought to “reduce the herd” of the old and infirm, which this virus seems to select. Third, the elites would like to cut those transfer payments, and most 60+ folks present more cost than income to their respective governments. Just a question I have no answers to.

“Death Rate = (number of deaths / number of cases) = probability of dying if infected by the virus (%). ”

Not sure if that is going to hold, since those that get re-infected have a much higher risk of heart failure.

https://www.reddit.com/r/China_Flu/comments/f8acpe/clinical_features_of_covid19_i_am_very_very/

Its likely there won’t be possible to produce a good vaccine, because a vaccine will likely cause cytokine storm for patents that get re-infected.

Hopefully it mutates into a much less contagious virus and dies out. If its here to stay then it will become very bad.

Its also considerable more infectious than the flu with an R0 of 6 to 8, flu is less than 2.

This virus is probably wide spread since it has a very long time between initial infection and symptoms appear (up to 24 days). In the US there are about 360K chinese students attending univerity. About 30K travel home during the winter break. So its likely there are a bunch inflected in the US. To date the US has only tested 414 people for Covid-19.

Hickory,

The virus may kill 10,000 people in China over the course of a few months, but cars kill over 250,000 a year, over 20,000 a month. The virus is shutting down traffic, so it will probably mean a net decrease in China’s mortality rate.

Eulenspiegel,

There is no precise, mathematical definition of a pandemic.

Outbreaks get characterized as pandemics by epidemiologists — who are not yet using the term. That’s because they’ve yet to see sustained transmission among people who have not recently traveled to China or had close contact with someone who recently traveled to China.

It’s not enough for a cluster of disease in a country to exist and even spread — it has to spread in a sustained way, from person to person, time and time again, through many generations of transmission.

Tedros said the decision to use the word pandemic is based on ongoing assessments of the geographic spread of the virus, severity and impact of the society and for the moment they are not witnessing the uncontained global spread of this virus.

Source: 2 hr 22 min ago

Coronavirus has pandemic potential, but it’s not there yet, World Health Organization says

From CNN’s Amanda Watts

This is absolutely a pandemic. Its spreading in over a dozen countries. and probably more, since there is a severe lack of testing, especially in the third world nations.

TechGuy,

If much more people than officially known are infected, then it is a pandemic, according to the definition of the Webster dictionary:

an outbreak of a disease that occurs over a wide geographic area and affects an exceptionally high proportion of the population.

Until now most countries with registered infections have less than 10 people who tested positive.

“Its likely there won’t be possible to produce a good vaccine, because a vaccine will likely cause cytokine storm for patients that get re-infected.“

The spanish flu pandemic killed mostly young people because of overreaction of the immune system: a cytokine storm. Without those people having received a vaccine.

To prevent yearly seasonal flu some countries give a vaccine every year to people older than 65 years and risk groups. Apparently not provoking a cytokine storm.

Patients who got infected already with the novel coronavirus don’t need a vaccine anymore.

A vaccine won’t be available soon at a large scale, they expect that to take at least one year

Dennis,

I don’t know what will happen to the price of oil if my forecast is correct. If corona virus decreases demand for oil then WTI oil price could stay around $50. The prices of NGLs and gas are also relevant. Natural gas is only $1.85 which explains why so many companies flare the gas.

Tony,

Obviously nobody knows what will happen.

So we create a scenario, let’s assume oil demand continues to grow at the average annual rate of 800 kb/d each year(1982-2018 average growth rate) and your forecast is correct.

What do you expect will happen to price of oil. Note that natural gas prices have little effect on demand for liquid petroleum fuels.

Assuming a prolonged low oil price may not pan out. I would expect extreme volatility over the next 12-24 months as the virus works its way around the world, disrupting economies as it does so. Demand will plummet, but there is also the very real chance of oil-producing states descending into chaos/collapse, most vulnerable at the moment being Iran and Iraq.

Oil prices have been volatile since 1974, so nothing new there.

If demand decreases, oil prices may decrease and supply will decrease as well because few tight oil producers make money at $50/b or less, and few offshore deepwater projects are profitable at those prices, OPEC+ may be smart enough to control output to keep oil prices high, otherwise they just shoot themselves in the foot.

Difficult to predict how it goes, but volatility in oil prices is likely to continue as it has for the past 46 years.

This is price volatility associated with an ultimate global peak of production in 2018 – that’s the new part.

Stephen,

There have been other “peaks” which were thought to have been the ultimate peak. We will see if the 2018 “peak” is real when demand recovers. The “peak” in supply will be associated with high oil prices of more than $90/bo in 2020$. So far we have not seen this, when we do, I will agree that peak supply has indeed been reached. It is unclear if this will result an any greater oil price volatility than has been seen over the 1975 to 2019 period, we will know in 10 years or so.

If Iran and/or Iraq enter a collapsed state type situation similar to Libya/Venezuela, dropping their production by 80% or more, then we will be able to say peak oil has happened. My wag is that the likelihood of one of these events occurring is an order of magnitude (from say 5% to 50%) more likely now that covid19 is running rampant through the region. Both states experienced waves of protests in 2019, and faith in government is very low. People dying in the streets will not help matters.

This could lead to a dramatic rise in oil prices very quickly.

We are also looking at the likelihood of oil ships being quarantined for prolonged periods of time due to covid19 outbreaks on board. This could be a major disrupter of moving oil cargos around the world, also possibly leading to a spike in prices. Right now all the markets are looking at is demand cratering, but like we saw in China with manufacturing, the supply chains are also very likely to get disrupted quickly. Ships can get quarantined overnight.

This is the type of volatility I’m talking about, if that helps clarify it for you, Dennis.

Stephen,

Future cannot be predicted.

Plenty of volatility from 1974 to 2019, perhaps it will become worse than before. Over relatively short periods we have seen oil prices change by a factor of 3. Is your expectation that the volatility will exceed that? I would put the odds at 5:1 against.

Thanks for the comment. I hope you will publish the revised data.

Jean,

It is not very clear who you are talking to. Better to say:

“Tony,

Thanks….”

If indeed you were addressing your comment to Tony. That is a guess on my part.

Fair enough. The comment was effectively addressed to TonyEricksen. Thanks to you (Dennis Coyne) to point out this.

Jean,

I did a test and realized your reply was to Tony’s comment, unfortunately the way the blog is structured it is difficult to see that when there are many replies below the original comment, so putting the person’s name in there makes it a bit clearer (in that particular case).

I also hope Tony updates his forecast and agree with others who think his comments are excellent.

Thank you Mr. Eriksen.

Oil and the virus.

Oil consumption has a fairly high, economics independent, floor. Food has to move to shelves and into mouths whether the mouth has a job or not. Or whether the store with the shelf is profitable or not. Or if the truck driver got paid or not. Food has to move.

Various phrases above . . . no one wants rubles. The Russian oil workers do. Why would anyone else matter? CB can’t print money explosively because can’t afford hyper-inflation. Why presume those two are related? The Fed, ECB and particularly the BOJ have printed beyond explosively and can’t get the 2% inflation they want.

What does the virus mean? China got surprised. They had a very large node of infection before any measures could be taken to stop the node from growing. They will probably have 10000 deaths because that localized node will overwhelm the ICU support capabilities in that city.

The entire United States has about 95,000 ICU beds. That city in China has 12 million people and 11000 people are listed as serious/critical. If the US has 95000 beds nationwide, that single city in China won’t have 11000 beds. Absent specific treatment, it is generalized supportive measures that keep people alive long enough for their bodies to evolve a defense. So those who need a respirator and can’t get one won’t live.

That’s one city. Quarantines, masks, all sorts of various measures are being put into place in China and are already in place other countries that have various nodes that have appeared. These measures will have occasional failures and create a new node, but the measures will then be applied to that new node. Everywhere else has had warning. China had no warning and had 10000 people infected before anyone knew anything. Their infection growth rate is not likely to be equalled in the developed world.

The undeveloped world may have a temperature advantage.

If you look at the cruise ship Diamond Princess in Japan, out of 691 cases, 3 are mortal so far. And it is safe to assume the passengers are affluent, get very good treatment and are likely biased towards 60+ in age. I would guess all of the passengers+crew are tested for the virus as well. It can get worse yet, but stand as an example of mortality rate in very affluent countries.

It seems to me that some sort of anti viral treatment and further out in time vaccine would help to make this a more “flu-like epidemic”. If it really can’t be contained. Still when considering that the global population increases with 70 million people annually, the epidemic would not likely even disrupt that figure with more than 1/7 in the worst case scenario.

The fear component is what could cripple the economy. If every new country panic as they get the virus going forward, and neighbouring countries also panic; we are going into a fear induced recession anyway. It would not last very long I guess. Maybe 1-2 years, and then CBs will stimulate economies back to where they were before.

When it comes to oil demand ofcourse tourism, factories, trade abroad and the service sector would suffer in impacted places. And that alone would put pressure on a lot of companies.

And while all of this is going on, very few pay attention to damage done to the supply side of oil. It is going to be very substantial going forward. I am curious when the supply problem gets physical. There is a lot of slack in the form of crude and product storage but it would not cover a deficit for too long.

Shale Profile has just posted the Eagle Ford November update. Production is down by 49.1 kb/d. Producing wells is up by 123. Considering that SP only shows an increase of 15.5 kb/d for the Permian, the US November monthly production may be less than 50 kb/d.

Ovi,

Mr Peters gives an estimate after revisions, for Permian it is 3.9 Mb/d for Nov and for EF it is over 1.3 Mb/d for Nov 2019. So for Permian that would be an increase of 189 kb/d and for EF a decline of about 30 kb/d for a net of 159 kb/d increase. The Bakken decreased by less than 1 kb/d in Nov 2019, so for these 3 basins we would have about a 158 kb/d increase in Nov. If we look at the Oct estimates we would see roughly flat output from the Oct post revision estimate and the similar estimate in Nov for the Eagle Ford and about a 100 kb/d increase for the Permian for Nov 2019 using the same method.

That is fairly similar to the EIA’s estimate for Nov overall tight oil production of 85 kb/d (that estimate would be different as it includes more than just the Bakken, Permian, and Eagle Ford basins.)

The Permian and Eagle Ford estimates always get revised higher for the most recent few months at shaleprofile over the upcoming months. Initial data is incomplete from Texas and New Mexico state agencies.

Oil production came in again at just over 1.3 million bo/d (after upcoming revisions), as it has since the start of 2019.

Quote above from

https://shaleprofile.com/blog/eagle-ford-monthly-update/eagle-ford-update-through-november-2019/

Dennis

I did not compare SP’s October number from the October update with October from the November update. The October production is up by a little over 30 kb/d in the November update. Will October be revised up again or is the second month closer to the final number?

Ovi,

I did it two ways, using Enno’s estimate after revisions compared with the October estimate in the November updates for both EF and Permian, the estimate seemed too high. So then I compared the Oct updates after revisions with the Nov estimates after revisions. October may be revised higher over time, I would say the numbers stabilize after 3 months or so.

Comparing Oct and Nov Permian updates at shale profile from March to Oct 2019. The difference between Nov and Oct estimates are (starting in March) in kb/d:

1

9

0

15

18

16

27

46

https://in.reuters.com/article/saudi-schlumberger-gas/update-3-us-shale-oil-output-growth-to-slow-in-2020-schlumberger-ceo-idINL8N2AP029

Looks like SLB hit lows not seen since 2003.

XOM hit lows today not seen since 2005.

I didn’t think XOM was very active in the EFS. To my surprise 37 of its 116 EFS wells have first production in 2018 and 2019.

Doesn’t look like much success in the EFS. Hopefully not too much invested there. Not sure why XOM is drilling there now unless it is a “use it or lose it” situation. Sometimes in those situations it is best to lose it.

Also pretty astonishing to compare TSLA’s market cap with the oil majors and large independents, such as XOM, CVX, RDS, TOT, BP, COP and EOG.

I know this isn’t an investment forum, but seems relevant to me to the PO discussion.

Someone on CNBC noted that the value of all oil stocks in the S&P 500 was less than $1T

XOM: 229.5B. In June 2014, XOM was at its high $104. Today $54.

CVX: 189.3B

COP:58.6B

SLB: 41.2B

OXY: 32.3B

For comparison

MSFT: 1.320.1B

AAPL: 1,289.7B

XOM earned more in 2000 than in 2019. I think 1999 and 2016 are the only years post Exxon Mobil merger where earnings were lower than 2019.

In 2000 debt was just $7 billion +/-

I am in error. 2001 and 2002 were also years where XOM earnings were below 2019.

A decision to be made in Canada by Trudeau as to supporting or not supporting a new oil sands project in Alberta — has gone away. Trudeau will have to make no difficult decision. The project has been pulled by the relevant company because of doubt about profitability.

The Alberta provincial government is looking into setting a government corporation to invest in oilsands projects. More details should come in the next week or 2.

Watcher

Profitability was not the issue. The high cost has been known all along. The fear was if the government turned it down, it would be more difficult to reapply and a get it approved when prices improved.

What sparked the withdrawal was the protests, by some British Columbia hereditary chiefs, across the Canada against a natural gas pipeline under construction in BC. The Climate Change supporters have joined them to make it look like there are a lot of indigenous supporters backing them. Unfortunately the indigenous chiefs in the Frontier mine area all were in favour of the project. There are now open conflicts beginning to arise within the indigenous community on how these protests are actually hurting indigenous nations by taking away economic opportunities. Below is a quote from the statement issued by Frontier

Clear climate-change policies don’t “exist here today and, unfortunately, the growing debate around this issue has placed Frontier and our company squarely at the nexus of much broader issues that need to be resolved,” reads a letter sent by CEO Don Lindsay to federal Environment Minister Jonathan Wilkinson on Sunday.

The “broader issues” are the conflict between Climate Change, Resource Development and Economic opportunities for Indigenous nations and Canada.

Now WTI is in the 40s range. Most wells coming online now with their high initial production will be money loosers until we see a sharp rebound.

For first class oil companies this won’t matter, but what is all about the smaller ones?

I am wondering when all these supposed bankruptcies will start rolling in…

The question is when companies go into survival mode and cancel all drilling.

From the forum here the ballpark costs for producing the oil from an existing well is 20$ / barrel – so you can maintain a positive, shrinking cashflow as long as you don’t have to pay back too much interrest or credits.

Bankruptcies have been rolling in: 208 from 2015-2019 according to Haynes and Boone, https://www.haynesboone.com/-/media/files/energy_bankruptcy_reports/oil_patch_bankruptcy_monitor.ashx?la=en&hash=D2114D98614039A2D2D5A43A61146B13387AA3AE.

Bankruptcies actually bring in more money to LTO production because through bankruptcy debts are canceled. A company emerges from Chapter 11 with new owners (the creditors), wells, and no debt making it a more attractive investment to the next round of hopeful energy investors.

Bankruptcies actually bring in more money to LTO production because through bankruptcy debts are canceled

So the creditors will keep crediting even at losses ad inifinitum?

Sounds like bizzaro world capitalism….

Covid19

Putting this virus into perspective.

It kills in China 0.2% of people aged between 10 and 30 and 0.4% 30 to 40 year olds. 1.2% of 40 to 50 year olds.

https://www.worldometers.info/coronavirus/coronavirus-age-sex-demographics/

This is in a country known for it’s very high water and atmospheric pollution which are well documented in killing people and also damaging immune systems.

https://www.scmp.com/news/china/science/article/2166542/air-pollution-killing-1-million-people-and-costing-chinese

China also has a very high percentage of male smokers, with 1 million dying from smoking in 2017

https://ourworldindata.org/smoking

The death rate from this virus for non smokers, who live in countries with clean water and where air pollution is not like China is probably around 1 in 800 and probably less.

Honestly if a fiction writer came up with a story of a virus which caused governments to arrest people for having a temperature, shutting down all trains, banning football matches and collapsing the world economy. The virus in question would have to kill at least 10% of those infected, for the story to be believable.

The non lethal aspect of the virus means it is impossible to contain. It will spread around the world killing large numbers of people (though a relatively small percentage). A lethal virus is much easier to contain because those who catch it die rather than spreading it.

Schinzy,

Definitely true. The scarier situation would be if the virus was to mutate again, which is a possibility. At the sametime a low percentage mortality rate will still be significant if it was to go all out pandemic.

Why presume a mutation makes it worse? Mutations of viruses are happening every day. Only the tiniest of percentages of those worsen their nature by becoming more infectious or lethal.

The vast vast majority of mutations lessen the danger of a virus. This has always been so.

Watcher,

Obviously I meant a mutation which continues to be lethal or infectious to humans. Who cares about the vast majority of the mutations which make the virus non-lethal. They are the viruses evolutionary dead ends, unless they can infect another host other than homosapiens.

Just a possible scenario . The Covind virus is in the Middle east . There it combines with the MERS virus to mutate and form a new virus . This would be a lethal combo . There are 3 million refugees living in camps at close quarters . A case for a disastrous outcome .

Hi hole in head,

I just looked up MERS virus, it has a mortality rate of ~ 30%. That is extremely high. If hypothetically by a very small probability a new virus was to mutation between MERS-CoV and Covid-19, it could be a hell of a virus as you said. Especially if it has an extremely long incubation period of covid-19 and it hold a similar mortality rate of the mers.

Schinzy

That is right, many people who have tested positive have shown no symptoms at all.

People can have it and not have a temperature, but spread disease to others.

https://www.thelocal.it/20200225/latest-deaths-coronavirus-italy

Those in Italy who have died were old or in poor health.

Seasonal flu kills up to 646,000 in a year.

I doubt it will kill the 7 million people that smoking kills each year.

Seasonal flu kills up to 646,000 in a year.

I doubt it will kill the 7 million people that smoking kills each year.

Well hell, I doubt seriously that it will kill as many people, worldwide, as cancer, or heart attack or die from automobile accidents. It is absurdly silly to point out that other things cause more death and conclude from that that this disease is nothing to worry about.

So not to worry because a lot more people die of other things. Really now, how stupid is that?

FYI- for those interested.

N95 masks, the disposable ones, sold out pretty fast in my area.

I have a 3M 6500QL series 1/2 mask for various reasons.

I use the 3M #2091 P100 ‘pink pancake’ filters (100 is better than 95).

Even when disposable N95’s are sold out the P100’s are still available…. and they’re better/higher filtration. You just need the 1/2 mask to attach them to.

If it gets nasty I’ll prob go remote camping at the doomstead for 6 months.

Ron

It is not stupid to point out the disproportionate response and hysteria that this virus is causing.

Smoking kills 7,000,000 people per year and causes over a trillion dollars worth of other illnesses to hundreds of millions more people.

https://www.fctc.org/resource-hub/global-economic-cost-of-smoking-attributable-diseases/

Smoking could easily be banned and prevent millions crippled by heart disease, lung disease and lung and throat cancers.

Only a fool cannot see how all this fear is being used to manipulate people into accepting draconian measures being imposed upon them.

A virus that does not show ANY symptoms in over half who carry it cannot be controlled.

If health services were properly funded there would be sufficient resources to treat properly all those who became seriously ill.

In the UK the rich have had their income tax cut in half over the last 40 years and hospital beds reduced by half.

https://www.kingsfund.org.uk/publications/nhs-hospital-bed-numbers

Previously there would have been huge scope for isolation wings for such an outbreak. Now there is only fear and mistrust.

I know who the stupid is.

Wayne, the subject is the Coronavirus. It is causing the stock market to crash. Oil is down and producers are going bankrupt. Hotels, restaurants, theme parks, and hundreds of other types of businesses are suffering huge losses and many will go bankrupt. Airlines are cancelling thousands of flights and millions of people are losing their jobs. The economy of the world will very likely suffer dramatically.

But smoking kills 7,000,000 people per year. Of course this is true. But it has not one fucking thing to do with the subject at hand.

Ron

You really have not a clue how to see this do you.

The coronavirus is infecting people just like the flu does.

It is killing only a tiny fraction of a percent of health working people.

It is mainly the Stalinist Chinese government who have created this mass hysteria by locking down entire cities.

At this rate every food processing plant will close, every school, every university. For what?

To prevent sick 80 year olds from doing what they will do anyway.

Lets all starve to death, great plan

Wayne, I agree with you. The hysteria will be far more damaging than the virus economically. But governments can’t be seen to be doing nothing, it’s just not politically possible to let the virus run rampant, even though it will and all we are doing is prolonging the economic torture. Even China’s victory at containing the virus will be short lived and for naught if all its neighbors are suffering from it.

We should consider quarantining the elderly at home and letting the virus run its course as quickly as possible through the population. As soon as younger folks are immune from exposure with most likely just cold-like symptoms, they can help take care of the elderly without worry about infecting them. Right now we are pulling the band aid off as slowly as possible.

Hi Stephen,

Am I not reading people can get infected more than once? And that the second time, you are more likely to die since you are weakened from the first infection and from the drug treatments used to fight it.

You heard right songster. And Stephen’s idea would be disastrous. Those young people who had already had the virus would just spread it further.

What is known about this virus is almost nothing. We just found out that having it once does not give you immunity.

We just do not know. And pretending we know something we do not know may be the most dangerous thing of all.

Hi Songster, yes I’m seeing some of that. I’m also hearing from China that they are using plasma from recovered patients to help those who are currently sick. Just thinking out loud as it were…I have elderly parents and a brother who just started chemo so I would like to think there is a way I could take care of them if need be, maybe by getting the virus early, recovering, and then being immune. That may not be possible however.

EIA’s tight oil estimates by play have been published, a big adjustment for change in tight oil output for Dec from 80 kb/d to 30 kb/d. Current estimate has rate of increase dropping from 16%/year from March to Oct 2019, to only 7%/year over the Oct 2019 to Jan 2020 period. If the recent rate of increase continues (probably not due to low prices) through Dec 2020, output would increase by about 587 kb/d from Dec 2019 to Dec 2020. Probably something lower like 400 to 500 kb/d over the Dec 2019 to Dec 2020 period is more reasonable, as always much depends on the price of oil over the next 10 months.

Data at link below

https://www.eia.gov/energyexplained/oil-and-petroleum-products/data/US-tight-oil-production.xlsx

Chart below has tight oil data for most recent 25 months.

Big change in the tight oil estimates for 4 of the past 5 months from Aug to Dec 2019. Chart below has the Jan 2020 estimate for tight oil minus the Dec 2019 tight oil estimate from Jan 2019 to Dec 2019.

The difference was particularly big in Dec 2019, but also large in Aug, Sept, and Nov 2019.

Note that 81 kb/d too high for Dec may seem very large, but the current Dec 2019 estimate is 8171 kb/d so 81/8171=1%, not a very big relative error. All other months are considerably less with the 2nd biggest under 0.7%.

If we focus on the Permian basin, the past 12 month trend has been an average annual increase of 775 kb/d. This increase may be offset by decreasing output in other tight oil basins during the remainder of 2020.

Dennis

Attached is the chart for the DPR difference from February to March. The trend is generally the same with a peak positive change in August and moving into the negative range for the last three months.

Also attached is a chart that compares the change in monthly production according to the DPR and LTO. They are very similar, now that both have been updated, and it makes me think that they are now using the same source of information updated to their different publishing dates.

Second chart

Ovi,

The differences in your first chart look different to me.

Chart below compares LTO and DPR changes in output from March 2019 to Jan 2020, they are similar from May 2019 to Sept 2019, not sure why you left off the Jan 2020 point for LTO.

Dennis

Just forgot to increase the range out to February on the LTO data.

As for the first chart, it compares the changes in the DPR report from February to March. Your chart compares the LTO change.

My comment above is “The trend is generally the same”, meaning the trend in the changes to the DPR and LTO data are generally the same.

Ovi,

Yes I realize your first chart compares the two most recent DPR reports’ revisions. As to “sameness”, I would simply disagree, the two charts look quite different to my eye, but this is simply different opinions.

Thank you, Dennis, for the EIA tight oil link.

BOOM

https://www.zerohedge.com/commodities/explosion-rocks-largest-oil-refinery-plant-west-coast

Oil trending lower, WTI Closed under $50 today. The next question is: Will it dip below $40? A lot of factories are starting to idle due to lack of parts or materials. More and more urban regions are falling under quarantine.

China wants desperately to restart its factories, but I suspect if they do it, Covid-19 will flare in a horrible way, presuming the workers decide to go back to work.

I think we may see some more shale bankruptcies in the next 3 to 4 months.

https://finance.yahoo.com/news/2020-crucial-oil-000000681.html

“Around 200 North American oil and gas companies have declared bankruptcy since 2015, but the mountain of debt taken out a few years ago is finally coming due. Roughly $41 billion in debt matures in 2020, which ensures more bankruptcies will be announced this year. The wave of debt may also force the industry to slam on the breaks as companies scramble to come up with cash to pay off creditors.”

So we have collapsing oil prices and a lot of debt coming due. What could possible go right to save the day for shale?

Not to worry, central banks will proceed to QE infinity.

Yep. It is a matter of National (energy) security. It is something that can be argued with conviction. Perhaps some people do well in the process. Others, not so much.

Just an FYI. The government of Hong Kong is going to have its Central Bank create the equivalent of $1,400 per person and hand it out to every adult in Hong Kong. Stimulus.

EIA MER just released.

https://www.eia.gov/totalenergy/data/monthly/pdf/sec3.pdf

Table 3.1 shows estimated US crude oil production to Dec 2019

Nov 2019 at 12.879 mbd is the peak as Dec 2019 12.861 mbd. These are just estimates and have to wait for further revisions.

Tony

They also show a big jump of 110 kb/d to 12,971 kb/d for January. The January output appears to be close to the average for January as taken from the weekly data. The November and December numbers are also close in the weekly data and that may be why the MER is showing a drop of 18 kb/d in December. As you say these are just early estimates.

If we compare 12 month least squares trend for MER L48 and LTO from Feb 2019 to Jan 2020. the annual rate of increase for MER L48 is 1385 kb/d and for LTO (official estimate) is 1131 kb/d. The MER L48 includes GOM output which is highly variable and might account for the 254 kb/d difference in the two estimates. There has been a notable slowdown in the rate of increase in LTO output for the past 4 months or so, low oil prices are likely, in my opinion, to result in an even slower rate of increase over the Feb 2020 to Dec 2020 period, perhaps an annual rate of increase of 200 to 400 kb/d for US tight oil.

Continental, the biggest Bakken producer, just released their 2019Q4 results

http://investors.clr.com/2020-02-26-Continental-Resources-Announces-Full-Year-2019-And-4Q19-Results-2020-Capital-Budget-And-Guidance

2019Q4 production was shale crude oil 206 kbd and guidance for average 2020 is 198-201 kbd. If this is representative of most of the Bakken then the Bakken is about to enter a peak plateau.

On Feb 4, “the Bakken field in North Dakota where Hess is a major producer will hit its peak production levels within the next two years, said Hess, who spoke Tuesday in Houston at the Argus Americas Crude Summit.”

https://www.reuters.com/article/us-usa-shale-hess-idUSKBN1ZY2GL

Tony. Check out CLR pre market. Down almost 25% to $15. Hasn’t been this low since midst of GFC in early 2009.

Harold Hamm’s paper net worth has been taking a major hit.

Just an FYI for oil workers and what might shut down production.

During the Ebola scare, the price of a quarantine patient was about $18,000 per day. Much of that was loss of use of the adjacent beds. That number is 6 years old.

A month’s stay would be about $500K. Now’s a good time to go look at your policy’s small print.

Apache also just released its 2019Q4 results and 2019Q4 Permian shale crude oil production was 103 kbd.

http://investor.apachecorp.com/financial-information/quarterly-results

Guidance for Permian oil production was also released and shows a small increase from 2019 to 2020, of between 0 to 4%.

Tony

Interesting that they are showing a reduction of 1 to 2 rigs for 2020 but expect a small increase in output.

Ovi,

Note that rigs decreased from 10 in 2017 to 7 in 2019 while output increased from 78 to 97 kb/d, so it seems they believe 5 rigs is enough to keep them at 97 kb/d, perhaps their average rig currently running is more efficient than the 10 rigs running in 2017 and the least efficient rigs have been stacked over time. It is also possible that the average well completed is more productive today than the average well in 2017, I checked this at shale profile and in fact the average well productivity decreased from 2017 to 2019 for Apache in the Permian Basin, so it must be that their rigs have become more efficient or the forecast may be too optimistic, also possible that the shale profile estimates may change as the data becomes more complete.

For completions per rig from 2017 to 2019 we have:

14.5

23.3

24.1

If we assume the 2020 rigs also can result in 24 completions per rig we would have 120 completions in 2020 with 5 rigs running, which they seem to believe will be enough to keep output flat.

Dennis

I looked at the Permian average wells and felt that there isn’t much improvement happening in the cumulative profile even though the peak production for 2019 has gone up by 77 bbls/day. I can’t see much improvement beyond 2019. So maybe their objective is to minimize expenses while maintaining level production, as you indicated.

Ovi,

I agree, Permian average productivity has been steady since 2018 and if normalized for lateral length it has been on a plateau since 2016 (that is any increase in productivity fro 2016 to 2018 was due to an increase in average lateral length for horizontal oil wells in the Permian basin.)

Possibly the number of well completions planned is close to operating cash flow so little additional credit will be needed.

Now WTI is under 48$. If it remains there for longer, my crystall ball guess is we will see shrinking US production this year.

Even the big, dividend paying multis will be hit hard by collapsing stock price and deep red cash flow after all their stock buybacks.

Eulenspiegel,

If WTI remains $48/bo or lower for the rest of 2020 (which seems doubtful to me), then I would also expect a small decrease in US output.

The simple reason that such a price forecast is not realistic is that the decrease in US output would likely lead to higher oil prices, unless OPEC+ decides to increase output to take back market share, that seems unlikely, but did happen in 2015/2016, so it remains a possibility.

Dennis, two things. If WTI remains $48 or lower, you will see a large decrease in US production, not a small one. The second thing is, there is only one thing that would keep oil that low. That is the same reason that WTI is $46.50 as I write this. That is the coronavirus outbreak. It is likely to get worse, in the USA and around the world. That will play holy hell with the oil market as well as the equities market. And the damage will be lasting.

This is what one would call a Black Swan. No one has counted on anything like this. All past predictions are out the window. No one has a clue as to what comes next except… it is not likely to be good news.

WTI Might drop below $40 on Friday or perhaps early next week.

Ron Wrote:

“This is what one would call a Black Swan. No one has counted on anything like this. All past predictions are out the window.”

On the Bright side (Polly Anna) This might temporary bring world peace as all nations focus on addressing the global pandemic and less on fighting. This certainty reduces in the chances of a global war happening soon.

Ron,

Depends on what happens with coronavirus, currently we have panic in markets, eventually this panic will subside, my guess is within 6+/-3 months.

I doubt oil prices will remain low for long, unless OPEC+ decides that overproducing is a good strategy and that they would prefer to sell their oil at a lower price. They have made dumb decisions in the past, the future may be no different.

At $48/bo, output may not drop by much. Right now Cruse futures for April 2020 are at about $46.60/bo and Dec 2020 futures are at $47.60/b0.

I cannot predict how severe the COVID-19 outbreak will be worldwide, it may be more or less severe than either of us believe.

Dennis,

Oil prices started falling sharply after the Iraq base attack by Iran which Trump decided the U.S wouldn’t retalitate.

The sharp drop was due to the subsiding of tensions and with the geopolitics aspect of oil curtailing, the economic factor took centre stage. The global economy is weak which is reflected on the sharp drop in oil prices.

COVID-19 just made the global economy weaker. It’s exact impacts on the global economy is different country to country, sector to sector but you can almost guarantee negative growth for atleast one quarter of some OECD countries. Oil prices will continue to decline in my opinion. Once COVID-19 is contained, oil prices will rise but to their previous levels of Brent 55-70ish. Can’t see them going any higher based on the demand side. If OPEC+ decides to cut production prices may rise, but $90+/barrel is extremely questionable to me, unless geopolitical factors come in again in the near-medium term.

I am probably wrong though!

Iron Mike,

I am mostly in agreement, it is unclear what prompted oil prices to fall initially, but it may have been the reduction in tensions between the US and Iran. I agree oil prices will probably only rise to $70/bo after the COVID-19 scare, but when the World peak arrives (2025/2026) I expect oil prices will rise to over $100/b, with likely a gradual rise from $70/b to $100/b over the 2022 to 2026 period as growth in World C+C output gradually falls to zero (delta C+C output).

Dennis,

I might be mistaken, but I think one needs to look at the concept of peak oil both from an economical perspective and a geological one. Ones models might different based on how much weight they give these two main factors.

Correct me if i am wrong but your world peak scenario of ~2025 is mainly from a geological perspective. From an economical perspective you would need to justify why you think the demand side will consume that much oil to cause prices to reach ~ $100/b.

I think if one was to look at the price chart of palladium. We’d probably expect oil price after peak oil to look something like that (In theory). But since oil plays such a huge role in the global economy there are underlying factors which will probably remain hidden until supply constraints begin to bite.

From the demand side prior to COVID-19, I would be interested in your view Dennis of why all OECD central banks around the world have decreased interest rates. I mean there is an absolute clear historical pattern of interest rates continuously on a downtrend from major central banks. What do you think is the reason for this?

I think some satisfactory explanation and incorporation of this phenomenon is needed to be injected into peak oil models. Until then i think peak oil models will continue to be in discord with reality.

Iron Mike,

I think that several persons have started to look into the issue and connections between CB policy/QE/interest rates, (affordable) oil price and demand. Ian Schindler (Schinzy) who writes here from time to time is one example, Rune Likvern another.

Btw. Palladium is a bit different not just b/o its low cost share in the final product (part of the explanation for the demand elasticity) but also that it is produced as a by-product from nickel and platinum. By-products tend to have low supply elasticity.

Hi Jeff,

Thanks for commenting. Can you elaborate on why you think palladium is elastic both in demand and supply.

It seems to be inelastic since from the little reading i’ve done, there seems to be an undersupply of palladium in the market and no substitute for using palladium in gasoline vehicle catalytic converters. Hence the incredibly high prices.

That is why i said we’d expect a similar situation, since oil is inelastic. And an increase in demand which outstrips supply would increase prices like palladium. And since there really isn’t any substitute for oil people would still need to consume.

Pd supply and demand respond to price increases, just not much. Main substitute for PD in catalyst is Pt. Pt was used first in auto-catalyst but prices went up and so the industry replaced some with Pd. But then the relative price changed. I’m not sure why, perhaps due to the oversupply of Pt that occurred two years ago or so? Pt is still used a lot in diesel catalyst (it performs better than Pd) but sales of diesel cars went down after diesel-gate and Pt demand followed.

Best info I found on PGEs substitution is: http://doi.org/10.1039/c4gc02197e I think institutional access is required though (university).

Jeff,

Thanks for the info and the link.

Cheers

Palladium demand will drop off in a very large way in this decade, since the sale of ICE engines will drop off. Check back in 2027 to see the trend more clearly.

Dennis Wrote:

“I cannot predict how severe the COVID-19 outbreak will be worldwide”

Is spreading very fast & will be difficult to contain with an R0 around 6. China has been shutdown for nearly a month now, and it not any closer to resolving the outbreak.

The US is grossly under prepared for this & the outbreak will likely be just as bad if not worse than in China. China as a Totalitarian state has the means to initial draconian measures to maintain quarantines.

I suspect WTI will drop to $40 or below with in the next week to 2 weeks. Currently (Friday Feb-28) is bouncing around $44. If we have an major out break in the US & EU, I think we could see WTI in the $20’s by the end of march.

techguy,

My crystal ball is broken, no doubt yours is flawless. 🙂