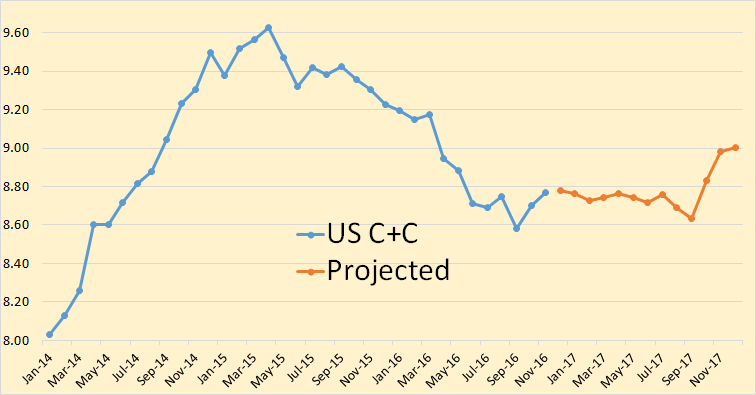

The EIA has just released its Short-Term Energy Outlook. Some of their projections should be taken with a grain of salt because they usually change every month. Nevertheless…

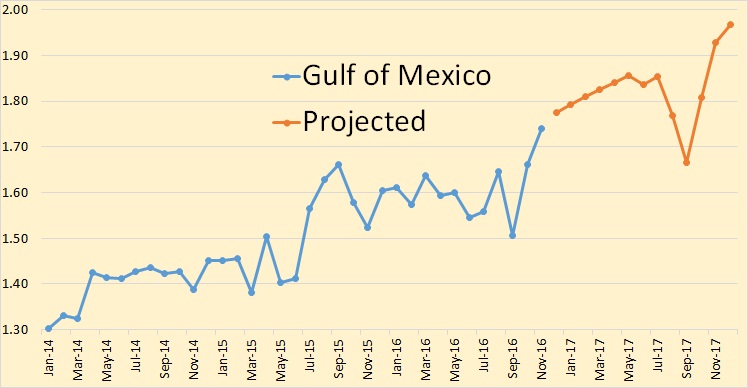

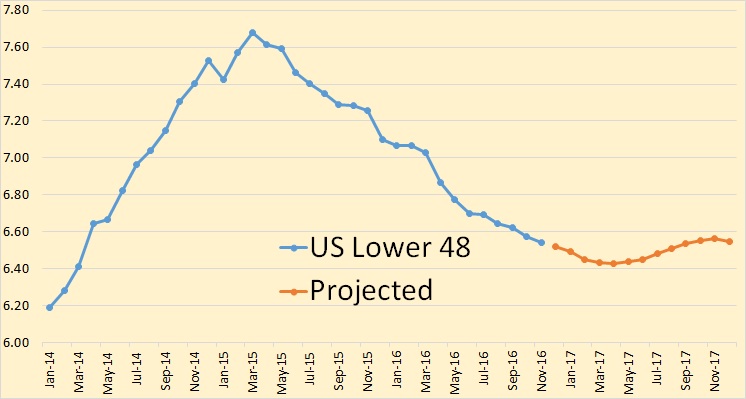

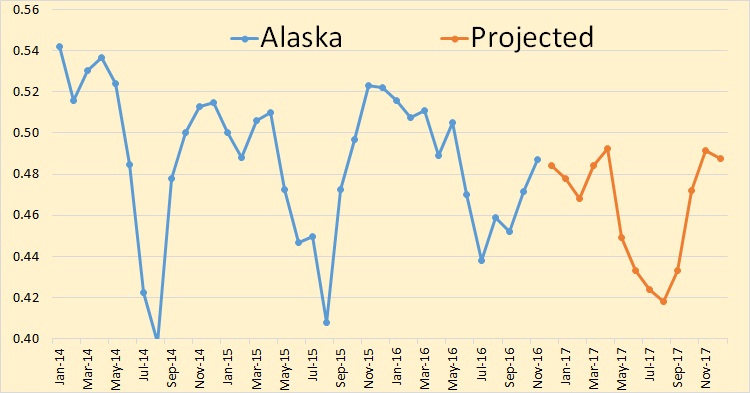

All US production is Crude + Condensate. All other production numbers are total liquids. The data is in million barrels per day.

The EIA has US production leveling out at just under 8.8 million bpd until Oct. 2017.

They have all large gains coming from the Gulf of Mexico.

The EIA sees no big gains coming from shale plays. They have production bottoming out in March and April, then increasing only slightly the rest of the year.

They have Alaska pretty much holding its own thru 2017.

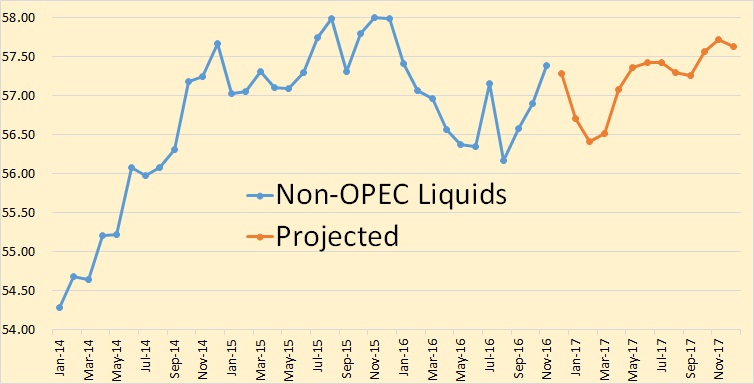

They have Non-OPEC liquids recovering in 2017 but still holding below the 2015 average.

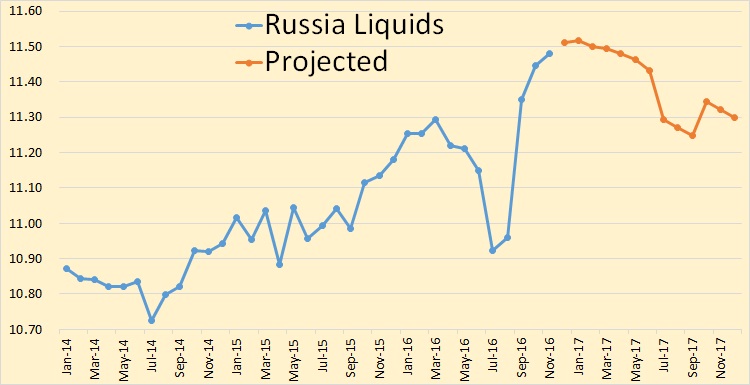

The big increase in 2017 average is supposed to come from Russia. They have Russia peaking in January then starting a slow but steady decline.

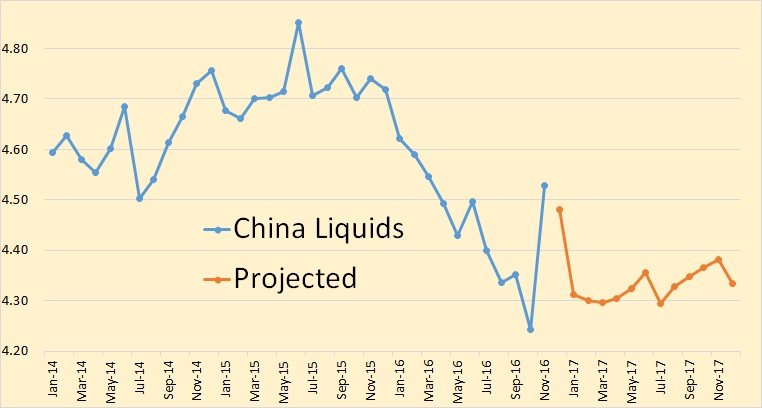

The EIA says China saw a huge increase in liquids production in November, down slightly in December before dropping again in January. I have no idea where the EIA got this November production data from. I could find nothing on the web that confirmed this data.

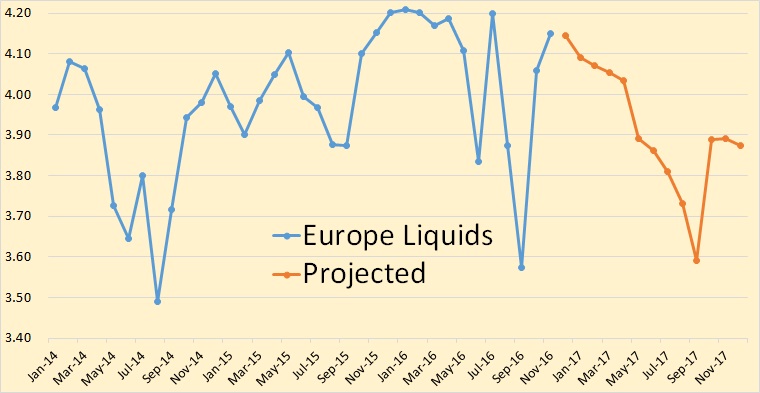

Europe consist primarily of the UK, Norway and other North Sea production. The EIA has Europe declining throughout 2017 before recovering somewhat in October.

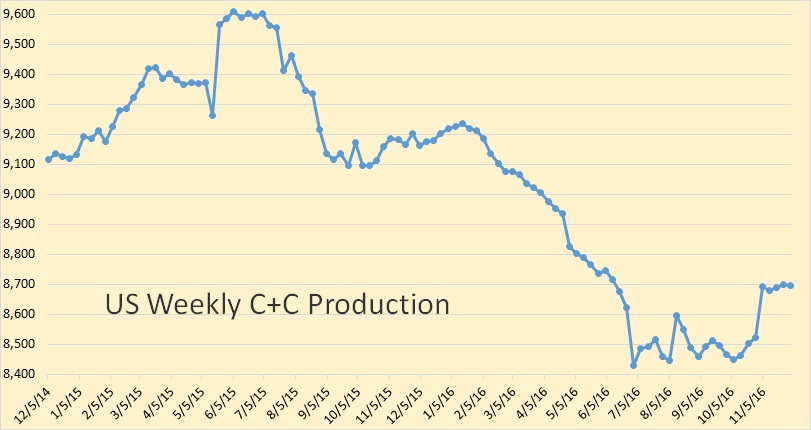

And just out, the EIA’s weekly estimate of US Weekly Petroleum Status Report with their best estimate of US C+C production as of December 2nd. This data is in thousand barrels per day.

one reason people invest in LTO

http://www.oilandgas360.com/oklahoma-attractive-place-oil-gas-investment/

economics & favorable business climate…..make America great again ??

Ron, a couple of recent posts that may interest your readers:

OPEC Production Data and the Feeble Deal

The Aramco IPO and the Black Art of Estimating Oil Reserves

Ron and/or Dennis.

I think it might be helpful to link Enno’s recent posts on Bakken, EFS and Permian in this thread. I know he has posted them all on previous threads, but maybe having all three together would be good for readers of POB.

He has some new data displays that are very worthwhile to review in my opinion. One in particular, which shows cumulative production in relation to most recent month’s production, is very helpful IMO.

Hi Shallow sand,

Enno’s most recent 3 posts. The first link has his new advanced insights format, which I believe will be offered by subscription in the future.

http://shaleprofile.com/index.php/2016/11/27/north-dakota-advanced-insights-test/

http://shaleprofile.com/index.php/2016/12/05/eagle-ford-update-through-august-2016/

http://shaleprofile.com/index.php/2016/12/07/permian-update-through-august-2016/

In the future you are welcome to post the links to Enno’s posts if you think it would be helpful.

Steve at SRS Rocco report has a new, very informative post up showing that Middle East oil exports are lower today than 40 years ago!

“According to the 2016 BP Statistical Review, the Middle East produced 30.10 mbd of oil in 2015 compared to 22.35 mbd in 1976. This was a growth of 7.75 mbd. However, Middle East domestic oil consumption increased from 1.51 mbd in 1976 to 9.57 mbd in 2015. Thus, the Middle Eastern economies devoured an additional 8.06 mbd of oil during that 40 year time-period.”

Would be great to see an update on the global export land model that Jeff Brown (westexas) used to update us on. How much C+C is available on the global markets as of today after domestic consumption?

I´m not Jeff B. but if I remember last version of BP stats. correctly, the net export market has been on a bumpy plateau between 2005-2015. It has varied between 41-44 Mb/day (approx.). 2015 set a record which was just slightly higher than 2005. It´s possible that 2016 will be slightly higher.

I like this link.

http://mazamascience.com/OilExport/

World exports have been bumpy flat for 10 years or so.

Ecuador might be an importer soon’ish.

I like this site as I take an interest in observing the changes as exporters become importers. The country charts provide some rough idea of those timings.

interesting link, I think you misread the Ecuador graph though

2015 was indeed a net export record. The increase came mainly from Canada, Iraq and Russia. Iran may boost net exports in 2016, Kazakhstan will also add some. At least to me it seems unlikely that net-exports will grow substantially above the 2015/16-level. Increase from the mentioned countries will be needed to compensate decline in Mexico, Colombia, etc (+problems in Venezuela). Seems more likely it will continue on the plateau or decline. Nigeria and Libya are wildcards.

mazamascience also use BP-data but seems to give a much higher number, ~48Mb/day. Don’t know why.

How do you calculate world total net export numbers if total global exports = total global imports?

Meanwhile, BP statistics for world oil exports (not net exports) show a rising trend.

I expect further increase in 2016, due to rising exports from Saudi Arabia, Iran, Iraq and Russia.

The IEA Oil Market Report, November 2016 on Iran’s oil production and exports:

“With gains of 810 kb/d so far this year, Iran has emerged as the world’s fastest source of supply growth. Crude oil output rose by 40 kb/d in October to reach a pre-sanctions rate of 3.72 mb/d and shipments of crude oil climbed well above 2.4 mb/d, a rate not seen in at least seven years.

For six straight months, the National Iranian Oil Co (NIOC) has been exporting more than 2 mb/d of crude – double the volume seen under sanctions.”

Iraqi oil production and exports in 2016 were also above 2015 levels

source: IEA OMR, November 2016

According to JODI, Saudi Arabia’s crude and refined product exports in January-September 2016 was about 460 kb/d higher than 2015 average.

So that says KSA domestic consumption is 2ish mbpd?

Are we comfortable with that?

3.3 mb/d in 2015

http://peakoilbarrel.com/texas-update-november-2016/#comment-587974

But that’s not what your chart says, in controvention to BP’s data.

Your chart says KSA exports at 9. Production is known or thought to be 10.5. And since consumption is all liquids, that chart’s products level is the correct number.

9 subtracted from 10.5. Leaves 1.5 consumption.

This looks bogus.

Did email BP. Waiting.

10.5 is crude only.

Total liquids (including condensate and NGLs) was 12.0 mb/d in 2015 (BP number)

BP data. Only include countires if production > consumtion. Net export = sum(production – consumption).

Compared with your figure, US, for example, is thus not included, Canada has a lower value (import light), etc.

I second the motion. JJB where are you!? I love your net export comments.

Survivalist,

Jeffrey Brown posts (as Jeffrey Brown) at OilPro.

So does Enno, and his work is having some effect. Jeffrey Brown’s work does too. It’s gratifying that both are viewed with respect on a site for O&G professionals.

Thanks a lot for her info. I’ll follow articles at that site. Are you aware of any info or links that present JJB’s net export math analysis with the most recent production and oil trade data sets? If so, or if ever so, please kindly consider posting such a link to the comments on POB. I really like his net export math. I’d love to see it applied to other resources like natural gas and food.

Survivalist,

I don’t know where else Jeffrey Brown posts. I did see in a comment somewhere that he’ll post at Econbrowser when the topic is oil related, but that’s all.

Thanks for that piece of info.

BP’s numbers for oil exports (available from 1980) and production less consumption (available from 1965) are slightly different, which may reflect changes in inventories and other balancing items.

According to BP, Middle East oil exports in 2015 was 20.6 mb/d, the record for the period from 1980.

Production less consumption was 20.5 mb/d vs. all-time high of 20.8 mb/d in 1976-1977.

But 2016 should see a new record due to ramp-up in production and exports from Saudi Arabia, Iran and Iraq.

Middle East oil exports (mb/d)

Source: BP Statistical Review of World Energy

Iran exported condensate around the sanctions. This was called oil. Probably still do.

“Iran’s total crude oil and condensates sales likely reached around 2.8 million barrels per day in September, two sources with knowledge of the matter said, nearly matching a 2011 peak in shipments before sanctions were imposed on the OPEC producer.

Iran sold 600,000 bpd of condensates for September, including about 100,000 bpd shipped from storage, to meet robust demand in Asia, the two sources said. September crude exports increased slightly from the previous month to about 2.2 million bpd, they said.”

http://financialtribune.com/articles/energy/51005/condensates-drive-iran-oil-export-pre-sanctions-high

“Iran’s condensate production has exceeded 610,000 b/d this year, with 561,000 b/d of this — or around 90% — coming from the 16 operating phases at the giant offshore South Pars gas field in the Persian Gulf, Akbary said.

The latest additions to the project were phases 17, 18 and 19, which came into operation this year, Akbary said.

In addition, eight new phases are currently being installed at the field. Phases 20 and 21 will become operational in 2017, Akbary said, while phases 13 and 22-24 are expected to begin in 2018. Iran hopes the entire development will be completed in 2021.

By then, South Pars condensate production will exceed 1 million b/d.

Smaller offshore fields under development could add another 50,000 b/d, with a further 55,000 b/d on top of this should additional projects be approved.

Onshore fields could add a further 115,000 b/d, taking total capacity to more than 1.2 million b/d.

Iran’s domestic consumption currently stands at around 260,000 b/d, leaving a surplus of more than 350,000 b/d this year. But consumption is forecast to rise to more than 700,000 b/d by 2021 with the completion of new condensate splitters, such as the 360,000 b/d Persian Gulf Star.

… as a result, Iran’s condensate exports are expected to drop to around 250,000 b/d in 2021.”

http://www.platts.com/latest-news/natural-gas/dubai/major-investment-needed-to-avoid-output-fall-26601277

Jeffrey Brown used to post here, but he got tired of some people’s response to his posts, and said he was leaving for good. It is a pity, because he was adding to the site as many commenters do.

This a quote from what might be one of Jeffrey J. Brown’s last posts, if not the last post:

The thread(s) surrounding the post-in-question is(/are) interesting as well.

I have not read through their entirety but am curious to know if and/or how it was resolved.

Hi Caelan,

Jeffrey does not like the way Enno Peters and I do mathematics, I guess. That is his problem, Enno does a great job, I occasionally make mistakes, but if Jeffrey Brown needs yes men he should look elsewhere and he has.

Fair enough, Dennis.

I, along with others apparently, was simply previously unaware as to why Jeffrey might have left, and exactly when and so decided to look into it.

Incidentally, with regard to Bedford W. Hill’s work, I decided to look into that as well and am reasonably satisfied, given sufficient concerns with it as well as Bedford’s own approach and/or attitude, to take it with a large grain of salt.

Hi Ron,

As we have a little in the way of hindsight, does it remain your contention that we have passed peak production, as I recall, in 2015? And/or has any particular circumstance either confirmed your view then (e.g., the dearth of capex in exploration), or has given you reason to think that global production may continue to increase?

I still think 2015 will be the peak. 2016 is already in the books at slightly below 2015 production levels. No doubt that Non-OPEC 2017 levels will be below 2015 but OPEC production will make it close. But I am still betting on 2015. After that serious depletion starts to set in. So we are currently on that bumpy plateau but that bumpy will last 5 years or less, not the couple of decades it was supposed to last.

Hi Ron. Thanks for your awesome website. The word blog doesn’t do it justice.. It is truly the best, and attracts a great group of commenters. May I ask how you might see ‘serious depletion’ playing out, roughly speaking? Do you have any predictions or wild ass guesses on the slope of the production decline or perhaps where world crude plus condensate production might be by 2020 and/or 2025? Given your wisdom and insight into human nature what are your feelings about the human response to these future conditions?

Do you have any predictions or wild ass guesses on the slope of the production decline or perhaps where world crude plus condensate production might be by 2020 and/or 2025?

Not really. We all had a pretty good idea where things were heading until shale oil raised its ugly head. No one that I know of predicted that. But now it looks like shale oil is a USA phenomenon with no appreciable production anywhere else in the world.

My strong feeling right now is that the shale oil phenomenon has given the entire world the idea that peak oil is, or was, an illusion or an idea that had no valid support in the real world.

But peak oil is as real as it ever was. The amount of recoverable oil in the ground is finite. We may have had the numbers wrong in our personifications because of shale oil. But that does not change the big picture. The peak oil phenomenon is as real as it ever was.

The real danger is that the media, as well as the general public, has been sold the idea that peak oil has now been discredited because of shale oil. It has not. And that only increases the dramatic shock effect it will have when it finally becomes obvious that peak oil has arrived.

Of course some will agree but say that “No big deal, renewables will make peak oil a non event!”

And these folks are in for an even bigger shock than the peak oil deniers…. Well, in my opinion anyway.

Ron.

Like the “US phenomenon” comment.

2016 10K will be out in late February-early March for US LTO producers.

It will be interesting to compare 2014, 2015 and 2016. In particular I am waiting to see the estimates of future cash flows to see how much more the engineering firms let them slash future estimated production costs and estimated future development costs.

In my opinion, there was a lot of hocus pocus in those particular numbers, which, of course provide the basis for proved reserves and PV10.

The amounts slashed from 2014 to 2015 were incredible, for example Mr. Hamm’s CLR dropped its estimate of future production costs by 60%.

To me, that is like a farmer saying I estimate next year and beyond that the cost of seed, chemicals, fertilizer, fuel, labor, real estate taxes, etc, will fall by 60%. I am not familiar with any commodity based business where that is reality. Yet almost ALL US LTO did the same thing, 30-60% reduction.

The point is, had they not done that, they would have basically lost ALL of their proved reserves at 2015 prices. My point is, how can a company that is losing large amounts, pre-reserve write downs, have any economic reserves? If the costs cannot all be recovered for the well at SEC prices, there are no reserves for that well.

2016 SEC prices are about $10 lower. We shall see what they come up with.

“And these folks are in for an even bigger shock than the peak oil deniers…. Well, in my opinion anyway.”

I think the odds are pretty good that Ron is right. We can hope that Dennis C and the others who think production will stay on a plateau for a while and then gradually decline rather slowly are right.

If they are, and the electric car industry does as well as hoped, then the economy national and world wide can probably adapt fast enough to avoid catastrophic economic depression brought on specifically by scarce and expensive oil.

If for some reason, any reason, oil production declines sharply and suddenly, for a long period or permanently, we are going to be in a world of hurt.

People need not starve, at least in richer and economically advanced countries, but millions of people could lose their jobs and a lot of businesses dependent on cheap travel would fail. The effects of these lost jobs would expand outward thru the economy doing Sky Daddy alone knows how much damage.

In poor countries, starvation is a real possibility.

The time frame I have in mind in making this comment is out to twenty or thirty years. After that, it’s anybody’s guess what the population will be, and what the economy will be like.Hell, it’s anybody’s guess as far as next week is concerned, so far as that goes.

The economy isn’t just about cars of course.

People are going to be in an added, as you say, ‘world of hurt’, if they maintain the line of thinking– while skewing its discourse away from other forms of transition and outright survival– that that kind of complex, multilayered, global-systems technology in the face of peak oil is going to somehow save them.

It’s about priorities.

Should farmers be talking more about food resilience than cars, and that far more people may have to become farmers?

But perhaps that’s just not as glamorous as an electric-powered self-driving nature-detached idiot-box-on-wheels or chimpmobile (with apologies in advance to the real chimps).

Of course life isn’t about cars or technology, which, far too often, humans misuse anyway in their dicking around with the planet, but about living harmoniously on it, the only home we have. If we undermine its capacity to allow us to thrive just for the sake of a job– a tax-theft opportunity for the governpimp– or a car– a consumer cash-sinkhole lock-in and cash-cow for industrial elites and governpimp licensing and registration schemes– we have nowhere else to go.

We can’t drive to the nearest Earth-like planet.

What Ron Patterson and the Peak Oil-ers in general fail to include in their calculations is the geopolitical aspect of oil, as well as Global Economics.

In order for us to understand what the imperatives are in dictating oil production levels, prices etc we should be at first able to distinguish between the different types of oil producers. To provide the most obvious contrasting example, let’s take Russia & the USA. These two major oil producers are quite dissimilar to each other, if not outright opposites. For Russia – a much poorer country – oil production is *the* core industry, as well as the core export item which is vital for the country’s success or failure. The US – a much wealthier country – despite its high production levels, is still a massive importer. This distinction makes a world of difference. For the US, the aim of oil production is to be maximized, so that imports can be minimized and also that oil exporters (such as Russia) can enjoy far less strategic or economic leverage. Hence, the expensive and risky gambit on shale oil and tar sands in North America. For Russia on the other hand, the goal is never to maximize production, their aim is to balance production levels with price levels so that the Russian economy can get the best results and the country the most leverage possible in the long-run. My point here is that when we make forecasts over future production we should always make the distinction between countries that are producers, yet importers and countries that are producers-exporters and rely to a high (or absolute) degree on oil revenues for their well-being. So, the first distinction we can make, is between oil-producing-exporters and oil-producing-importers. The first category would include: Russia, KSA, Iraq, Iran, Kuwait, UAE, Libya, Venezuela etc, while the 2nd would include the US, China, UK, India etc… But another, even more important distinction is crucially important here. Some of the oil exporters are part and parcel of the US-EU (NATO) economic-military structure while others are not. The first category would include: KSA, Kuwait, UAE, Norway, Canada etc while the second category would include: Russia, Iraq*, Iran, Libya*, Venezuela, Kazakhstan etc…

From the above, another clear conclusion arises. The US-EU Axis (NATO) has calculated that the oil exporters it doesn’t already control must be attacked until a high degree of control over them can be imposed. This has taken the form of a direct military attack as in the cases of Libya and Iraq, or the form of Hybrid Warfare methods of sabotage and subversion against all the others.

Now, how does all this relate to actual production levels? My point here is this, the dominant US-EU Axis is very much interested in suppressing the levels of oil production (or conversely, the level of prices) from places such as Russia, Iran, Iraq etc whenever this is possible (for example, when the North Sea and North Slope were being developed, or when shale/tar sands came online more recently) In fact they have been doing exactly that for decades now (pressure on Yeltsin’s Russia, sanctions on Saddam’s Iraq, sanctions on Iran and now sanctions on Russia) As you can see, the sanctions carousel shifts between these 3 oil giants that NATO does not control.

This is the point I have been periodically making on this blog but nobody seems to be picking up on it. Yes, countries such as the US, Norway, UK, Indonesia etc have peaked to various degrees and can only maintain or increase production temporarily via massive capital expenditure and technological breakthroughs. While countries that have been victims of US-EU (NATO) hostility are merely trying to navigate out of the siege laid against them until they hold enough leverage to produce closer to their real potential.

So, for the umpteenth time, Russia, Iran, Iraq, Kazakhstan and very possibly Libya and Venezuela are nowhere near the peaks and will be growing producers in the coming decades. The only question is whether this will be done under their own terms, or under NATO’s terms.

For the US, the aim of oil production is to be maximized, so that imports can be minimized and also that oil exporters (such as Russia) can enjoy far less strategic or economic leverage.

Baloney! The US government does not have an aim of oil production. The US government does not produce a single barrel of oil. Oil, in the USA, is produced by private and publicly owned companies. Their aim is to make money, nothing else.

Hence, the expensive and risky gambit on shale oil and tar sands in North America.

Again, that risky gambit was not made by the US government, it was made by private and publicly owned companies. They took that risky gambit because they thought they could make a fortune. Do you really believe they had Russia in mind when they decided to drill and frack that oil bearing shale? Do you really believe they did it because they wanted Russia to enjoy less economic leverage? I doubt that any of them really gave a shit about Russia’s welfare.

The US sanctions against Russia was because of their takeover of Crimea and their invasion into Ukraine. It had nothing to do with trying to suppress their oil production. Ditto for the Iranian sanctions. Obama wanted to halt their development of nuclear weapons. Good God man, do you really believe those sanctions was about suppressing their oil production instead?

So, for the umpteenth time, Russia, Iran, Iraq, Kazakhstan and very possibly Libya and Venezuela are nowhere near the peaks and will be growing producers in the coming decades.

Libya and Venezuela peaked long ago. Russia is at her peak right now. Iran is very likely post peak. Iraq can increase production slightly but is very near her peak. Kazakhstan is at 1.75 million bpd and if they can manage to keep the toxic oil from Kashagan from corroding their pipes they may one day get to 2 million bpd. Big deal.

So you really believe that the USG has no way of influencing what the various American corporations do? There is no such thing as “free-market” in the abstract, the state is involved heavily every step of the way. Legislation, regulation, taxation, subsidies (or lack thereof) directions to financial institutions, bail-outs etc etc etc. I am not of course saying that the USG commands US corporations as would be the case under say a Stalinist system, but you can bet it can *influence* it. Several laws were passed around more than a decade ago in order to precisely encourage shale operations (Cheney was behind them) Secondly, I find it shocking that you deny the most obvious statement I made, namely that major oil importers struggle any which way they can to minimize oil imports, maximize own oil production (if they have any oil reserves that is) and also control the countries that do export oil. Just read what the CIA said about the Persian Gulf right after WWII. Control of oil-rich regions has been an absolute imperative for US FP since then. Astonishing that anyone that can doubt that. As for your claims about anti-Russian sanctions, again your ignorance about geopolitics is astonishing. The Ukraine crisis was provoked by NATO itself (see: EuroMaidan) and Russia reacted to it. NATO was long looking for an excuse as well as the right timing for imposing sanctions on Russia. The Ukraine crisis, as well as rising oil production in North America provided a perfect opportunity for those sanctions to be imposed at the time they did, otherwise they would have looked pretty pathetic. And notice what the sanctions were all about: a) no selling of oil equipment to RUS firms, b) no lending to RUS oil firms, c) no US-EU oil corporation can invest in RUS oil or cooperate with RUS oil companies. This, coupled with a crushed price was hoped that would discourage/impede the Russian oil industry. It’s so eye-popping it hurts. BTW, I am not moralizing here, I am just presenting the facts as I see them, from the prism of RealPolitik.

As for your persistent belief that every country in the world has peaked in terms of oil production. How long do you have to be proven wrong until you admit it? I am sure that you thought that Iraq under Saddam had “peaked” or that during the early years of US occupation it had also peaked. But what do we see? A war ravaged country being able to rapidly expand production. Imagine what the Iraqi oil production levels would be if the country enjoyed some relative piece and the global market called for it? My point here is that these countries are constrained by market as well as geopolitical factors, which you seem to completely ignore.

So, I hope that your blog is still around in the coming years, when all of Russia, Iran, Iraq, Libya, Venezuela & Kazakhstan boost oil production. Some of them will boost their production massively, others significantly. You will see.

I’m sure the world looks like you depict it, from where you look Stravos. But it doesn’t look like that from here.

Russia has sanctions imposed on it for acting aggressive on its borders. I’m sure it feels uncomfortable to be surrounded, and not have a good port to the south for its navy. I truly believe that USA and the rest of the modern world were hoping Russia would join in a constructive and cooperative role after the Soviet breakup, but they have failed miserably so far. Still hope though.

And Iran has sanctions imposed because they have been an extremely aggressive theocracy that no one wants to have nukes- the sanctions imposed included China and Russia as sponsors. Also, it was to Russia advantage economically, to not have Iranian oil on the market. China, Europe and USA do prefer to have Iranian oil on the market, but not at the cost of a theocracy (bizarre) with nucs.

More to say- but thats enough to chew on.

“Russia has sanctions imposed on it for acting aggressive on its borders”

What about >90% of Crimea’s population voting for re-unification with Russia?

“extremely aggressive theocracy”

What about Saudi Arabia sponsoring terrorists all around the world? Is it a perfect modern democracy?

I talk Real-Politik but you have again collapsed into the cheap hypocritical nonsense of the MSM and pseudo-experts. The mere suggestion that Iran has been “aggressive” is insulting to my intelligence. Iran can’t be aggressive regardless of their inner desires. Iran can only hope to defend itself from the US & its allies and even that would have been impossible without Russian and Chinese support from behind the scenes. I don’t see why you think that Russia & China going along with the West on imposing sanctions on Iran somehow proves that the excuse for them was truthful. No, Russia & China both make deals with the West all the time, in the hope that they can serve their own interests as best possible. If it means screwing Iran in some cases, then so be it. Every state is in this for its very own interests (no permanent allies, only permanent interests)

As for Russia. There wouldn’t be a more catastrophic scenario imaginable for the West (especially Europe) if Russia ever managed or was allowed to enter the global marketplace in anything remotely resembling “fair terms”. The reason why NATO is so obsessed with Russia is because that country possesses *all* the necessary elements (massive hydrocarbon reserves, nukes, metals, strategic location, geographic size) for a superpower, except of course the economic part. But, as NATO strategists are keenly aware, that can change, and if it does, then the Global Balance of Power changes radically and at the expense of NATO. This is why Russia is NATO’s number one target and not say China, or India or anybody else. Most people have been fooled by thinking that power in international relations is all about the size of your GDP. While this may be true for most countries, it’s definitely not true when it comes to Russia. If I were NATO I would be doing the same and more in order to bring Russia down.

Reality, Through The Real Fake News Lens (… or is that the fake real news?…)

Hickory, I wonder what some of those so-called ‘fake news’ sites and, for example, Dmitry Orlov, would say, and have have said, about NATO, Iran, US, and Ukraine, etc., vis-a-vis your comment. Do you know?

Where do you get your ‘news’ incidentally?

In any case, there are many sides to a story and, often, little is as it seems…

Especially in matters of hypercomplexity (and vested interests, etc.).

What’s New, Pussycat?

Hi Ron

I agree.

Plateau until 2019 or 2020 then some decline slow at first and gradually accelerating. Unless a recession hits in that case acceleration is more rapid.

Thanks Dennis, on the rare occasion where we agree. 😉

Hi Ron,

I also agree peak oil will be obvious before long, I think eventually (by 2020 at least unless a big recession intervenes) oil prices will rise, maybe to $100/b. Most will expect a big surge in output, but any surge will be small (1 Mb/d at most) and likely short lived (if it happens at all).

Whether oil prices spike and this leads to either Great Depression(GD) 2 or a lot of EV and plugin sales is unknown, it might be the latter at first with GD2 following between 2025 and 2030. It will depend on how quickly oil output falls, I think it might be 1% or less until 2030 if oil prices are high with faster decline rates once the depression hits.

As usual big WAGs by me. Of course nobody knows, but your insights on how things might play out would be interesting.

For some insane reason, the major oil companies are hell-bent on exploration and production, even when oil prices are so low that OPEC & non-OPEC companies are coordinating to reduce output.

That exploration and production is going to be largely unsuccessful and entirely unprofitable.

But I think it’s rather hard to predict whether the supply will dry up before or after the demand. Alternatives to oil are a very real thing now.

Nathanael,

The majors hell-bent on exploration and production? That’s just what they aren’t; E&P budgets have been cut and cut again by all and sundry (Chevron just announced another reduction, as an example), and there’s plenty of awareness in the industry that trouble lies ahead because you don’t find oil and gas if you don’t look for them.

They’re digging a hole up ahead for us to fall into in a few years, and they know it.

That’s what I am wondering. If knowledgeable fossil fuel insiders are being appointed to the Trump administration, do they use their knowledge to steer the country in a sustainable direction, do they BS energy policy to keep the country in the dark, or do they intentionally sabotage the country’s energy future (I hope not)?

A lot of what is reported here is info that the industry knows, even if the public at large and politicians do not.

I’m not a Trump fan, and I expect his energy team to look out for the one percenters, rather than the country.

Never the less, I will assume the role of devil’s advocate for the moment.

In a nutshell, the fossil fuel question boils down to depletion and the environment. What are we going to do about these two problems, which are very different, but nevertheless very much the same, since they are so tightly intertwined?

I used to be a fossil fuel doomer, but over the last few years I have grown cautiously optimistic that we CAN ( at least from the technical pov ) transition to renewable energy while still maintaining an industrial civilization and the good life associated with it.The mind blowing progress made in renewable energy led me to change my mind.

The potentially killer question is this one. WILL we finish the transition before we run short enough of fossil fuels that finishing it is impossible? (Or before we muck up the environment so bad we wish we HAD run out of fossil fuels sooner? )

Once the energy and associated economic shit are well and truly in the fan, people and governments necessarily make short term decisions on the basis of short term survival. Long term problems are necessarily ignored. People won’t invest in projects that only pay off over decades, when they are hungry and cold .

Now here comes the devil’s advocate angle.

It is POSSIBLE- possible , mind you, dear reader, that we really are at risk of a sudden and economically catastrophic shark fin decline in oil production, and maybe in the production of natural gas as well. Maybe even coal, but I personally think there is coal enough to last until the renewables industries are ready to shoulder the load.

IF this is the case, then Trump’s team will know, if any body at all knows.

And IF this is the case, then whatever the Trumpsters might do to prop up the fossil fuel industries a few more years will be that many more years we have to make technical progress in renewables.

And even without today’s subsidies, the renewables industries will continue to grow, and the industrial base that supports them will continue to grow, here in the USA.

The Trumpsters won’t look favorably on renewables here in the USA, but renewables will still grow here, and the rest of the world doesn’t answer to Trump.

Breakneck technical progress will continue to be made, overseas if not domestically. We can easily import technology. The renewables industrial base will continue to grow rapidly world wide.

I think maybe that every time we double the amount of renewable energy that is produced, we may be halving the potential difficulties involved in doubling it again. And beyond that, every ton of coal we save, every cubic meter of gas we save, every barrel of oil we save, in the event that a supply crisis DOES happen, means we have those tons and cubic meters and barrels to put to CRITICAL uses.

This military analogy might be a poor one to get my point across, but many a general has left a rear guard to allow him to move the bulk of his army to a safer place. Sometimes the guard left has been to small, sometimes it was adequate. A thousand men out of fifty thousand might not be enough, but two thousand might do the trick. An additional five or ten percent of our total energy consumption coming from renewables, combined with efficiency and austerity measures, MIGHT be the difference between a successful transition and a crash that means the end of life as we know it.

Four more years of abundant fossil fuel energy might just be THE DIFFERENCE.

I am not arguing that this scenario is the case, but that it is POSSIBLE that it might be the case.

Preacher sez God works his miracles in mysterious ways. Maybe Sky Daddy sent us the Trumpsters to give another four years of cheap fossil fuels so we can continue to work on renewable tech in the meantime. 😉

Now fer Sky Daddy’s sake remember this is a devil’s advocate comment, and that there really are silver linings in black clouds – some black clouds, anyway.

You are a smart man, Dennis?

Hi Guy,

When I agree with Ron of course. LOL.

Hi Dennis,

If I am not mistaken, you have moved up your estimate of global petroleum peak, and perhaps the pace of the decline.

Just months ago, your opinion was that it would not occur until 2025. Are you moved by any specifics that you would like to share?

Thank you, and as a follower of your good work, I appreciate your insight.

Yes, that is a change of position. It used to be 2025. Another advance and we are in.

I have long said plateau from 2015 to 2020, possibly till 2025. I think it will be slow decline from 2020 or 2025 for about 5 years. Depression might start as supply falls steeply or stagnant supply and high prices might cause a depression. Yes I have become more pessimistic and think Depression may be here by 2025, though 2030 remains my best WAG.

Dennis – you are one of the few who posts that actually adapts his thinking according to the data and is prepared to discuss it, which is one reason I usually read your posts and comments even if I often disagree on some aspects.

Unfortunately the internet does the opposite of what was expected and in general promotes group thinking and immutable position taking instead of free thought and expansion of ideas.

I normally try and make my guesses for the future with such wide ranges that I can never be wrong, which of course doesn’t really contribute much of any value in the end.

Hi George Kaplan,

Thanks I enjoy your posts as well, though we often disagree.

Generally I learn much from you posts and though I don’t always agree, you definitely influence my thinking.

My position on the peak is that an undulating plateau between 79-81 Mb/d (average roughly 80 Mb/d for the 12 month moving average) is likely from 2015 to 2020 and perhaps as long as 2025. My best guess has been about 2020 for the peak for quite a while, but there are innumerable reasons why this guess could be wrong due to fluctuations in prices, global conflicts, and Worldwide recessions all of which are difficult to predict at best.

Trump Taps Oklahoma Attorney General Scott Pruitt As EPA Head

http://www.zerohedge.com/news/2016-12-07/trump-taps-oklahoma-attorney-general-scott-pruitt-epa-head

now we are cooking with peanut oil… get’r’done boys????

Awesome! Now we are truly fucked.

Are the Gulf of Mexico numbers for October and November actual figures or projections? If actual figures could you post a source and a link? Thanks!

The uptick in Gulf is primarily touted by EIA. I know most of that was based on info around the first of the year. Seems like a large part of the projection was based upon what Freeport was going to do. Since then, Freeport has sold a large part of those fields with projected increases in 2017 to Anadarko. I am sure Anadarko will do something with it, but is Capex the same?

Ron – in the charts above, are the breaks between historical data and projections noted in the EIA data, or is that a call that you make. In other words, since we are now in December, are you assuming all of the November data points are actual historical data that EIA has already received?

The reason I ask is because the latest GOM actual data that I am aware of is from September, yet the chart suggests the EIA has historical data through November?

You may have already answered this. If so, I apologize for missing the reply.

thanks

I’m not Ron, but I can say that the latest historical production data (and all other data, except prices) is for September.

The numbers for October and November are preliminary estimates.

SouthLa, if you go to Short-Term Energy Outlook, then click on “All Tables”, it will bring up the a list of all tables in Excel. Then if you click on “Table 4a” you will get oil and gas production, consumption and storage numbers from 2012 thru 2017. The numbers through November 2016 are in bold, meaning those are the best estimates of already produced oil or whatever. The remainder are not in bold meaning they are estimates.

Of course the latest numbers are just their best estimate gleaned from the data they have. (Actually in most cases the November numbers are just estimates because they have no data.) Those numbers will change next month when they get better data. Of course the November numbers will change more than the October numbers and so on because the further back the data the more accurate it is.

The below is a snip from that data.

Ron,

the latest numbers that are considered “historical” or “actual” are for September and can be seen here:

http://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_m.htm

Of course, these numbers can be revised, but in the past several months these revisions for U.S. C+C output were not substantial.

The numbers for October and November are based on weekly estimates are are much less reliable. Hence, I think these are preliminary estimates, even if they are shown in bold in the STEO.

Anadarko makes no mention of new Horn Mountain coming online, and Heidelberg has an additional 10k bbls per day coming online in 2017. LLOG says son of Bluto will probably be expanded in the future. Clearly not 2017.

http://www.eia.gov/todayinenergy/detail.php?id=25012

Where is EIA coming up with the increases from, now?

OK, lame duck.

Guy,

From what I remember, the EIA projections of GOM production increases were made about 2 years ago, and they really haven’t made any changes to those projections. I can’t say for sure, but one thing they may anchor on is published name-plate capacity for deepwater production facilities. If, for example, a facility has a published name-plate capacity of 100 kbopd, they may assume the facility will actually achieve that, given a reasonable amount of ramp-up. In actuality, the facility may only achiever 50-60 kbopd. Now this may in line with what the operator predicted, but yet the result is 40-50 kbopd from what the EIA projected.

Now the logical question may be – why would an operator design a facility with more capacity than they plan to produce? It may be they are planning for 3rd party tie-backs, or they may have a phased development. Of course, there also are the cases where the operator is actually planning for 100 kbopd of production, and only achieve half of that.

Good points. It is also because they have not adjusted their estimate based on facts they should not have overlooked as obvious as Freeport exiting oil and gas as non-core assets. The buyer, Anadarko, being firmly established in shale, and getting a bigger bang from Capex within the shale. Anadarko is part of their projection for major increase in the Gulf. They are staying active in it, but they are staying more active in West Texas. LLOG is a smaller player, and may not have the Capex to lay out. I really don’t know, as the company is private, and there is little research available. You think if they used these companies as the poster children for an upsurge in production, they would at least call them and ask if they are still in business. Ya think?

Not sure how long it will take Anadarko to capitalize on their Freeport assets, they may still be trying to get a handle on the base business associated with these assets – and they also recently announced they will take over BP’s Hopkins discovery. They were already pretty deep into new projects with Lucius and Heidelberg.

LLOG has been the most active explorer in the Gulf this year. They have had a fair bit of success drilling the small amplitude/AVO plays that have been their bread and butter over the years – that result in the 1-3 well tiebacks to existing facilities, such as Delta House.

The EIA oil production forecast for the GOM is a complete fabrication! Here is proof:

Nawar has a list of 2016 new projects that itemize the new GOM projects here:

http://www.investorvillage.com/groups.asp?mb=19176&mn=3794&pt=msg&mid=16582044

The new projects list is derived from the leading independent energy analysts, Energy Aspects!

They include three US projects: all GOM:

Heidelberg 80k b/d

Stones 50kb/d

Julia 34k b/d

Hedelberg forecast directly from the operator forecasts a production rise from ~12k b/d to ~32k b/d by end of 2016:

p6 of their latest presentation:

file:///C:/Users/kopel/Downloads/Anadarko+Jefferies+Presentation.pdf

Stones: From the press release of the startup: ” September 6, 2016. Shell announces today that production has started from the Stones development in the Gulf of Mexico. Stones is expected to produce around 50,000 barrels of oil equivalent per day (boe/d) when fully ramped up at the end of 2017

That would suggest a gradual ramp all the way from Sept. 2016 through December 2017. At best a 20% initial flow in September or 10k b/d

Julia: The first well came on line in April and the 2nd one was to start a few weeks later:

ExxonMobil starts up Julia oil field in the deepwater Gulf of Mexico

04/19/2016

Offshore staff

IRVING, Texas – Exxon Mobil Corp. has started oil production at the Julia field in the deepwater Gulf of Mexico under budget and ahead of schedule. The first production well is now online and a second well will start production in the coming weeks.

The Julia development is located about 265 mi (426 km) southwest of New Orleans in water depths of more than 7,000 ft (2,134 m). The initial development phase uses subsea tiebacks to the Chevron-operated Jack/St. Malo production facility.

According to ExxonMobil, the development includes the use of subsea pumps that have one of the deepest applications and highest design pressures in the industry to date.

Neil W. Duffin, president of ExxonMobil Development Co., said: “Successful deepwater developments like Julia, located more than 30,000 ft [9,144 m] below the ocean’s surface, benefit from ExxonMobil’s disciplined project execution capabilities and commitment to developing quality resources using advanced technology.

“This initial production will provide ExxonMobil with insight into the potential future development of the reservoir.”

The Maersk Viking drillship is currently drilling a third well, which is expected to come online in early 2017.

http://www.offshore-mag.com/articles/2016/04/exxonmobil-starts-up-julia-oil-field-in-the-deepwater-gulf-of-mexico.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+offshore-latest-news+(OS+-+Latest+News)

So when you consider the start dates and the companies own reports, then there is no evidence of any material GOM oil production growth from the GOM starting October 2016. Furthermore, there is not one 2017 GOM project. So, the EIA forecasting oil production growth of 500k b/d by the end of 2017 is pure fiction. To compound the error, the EIA excludes GOM depletion of what I recall is ~22% depletion in the GOM for 2017 of ~300k b/d (1.5 million b/d of production @20%).

The EIA oil production forecast for the GOM is a complete fabrication!

Thanks, Coolreit! With 15% decline rates, I can’t imagine much of an increase, overall.

Here is the list of projected deepwater GoM field start-ups from February 18, 2016 issue of Today In Energy

http://www.eia.gov/todayinenergy/detail.php?id=25012

EIA C+C production projections for the Gulf of Mexico: STEO Dec 2016 vs. STEO January 2016

This shows production from the new leases reported to BOEM since 2015, except Hadrian South which is mainly a gas field, but including Julia which EIA missed. Also missing is Gunflint (nameplate 60 kbpd) which hasn’t reported any production although supposed to have started in early 2016. Son of Bluto 2 started early and looks to be watering out quickly. Dantzler also cut a lot of water early and is in decline. Silvertip was tied in as part of Great White (Perdido spar). West Boreas and Deimos South are considered part of Mars B (tied into Olympus spar I think) but I can’t tell if they are operating (there are two new leases that appear to have started in 2016). Stones only started operating in September. Heidelberg has a very slow ramp up. Julia has two wells on line but is only at half nameplate (I don’t know if it is limited by capacity at the Jack hub. As others I don’t see where 300 kbpd of new capacity is supposed to come from, especially given high declines in mature deep water fields.

I noticed I missed off Big Bend – that started up October last year hit an early plateau and looks to be in slight decline at 16 kbpd at the moment. (note the graph is stacked production, oil only – none of the leases reported condensate).

Thanks George,

Gunflint is probably identified by BOEM as Freedom/Gunflint – but I don’t see any reported production for that either through September.

Julia production is not limited by Jack capacity. Jack capacity is around 170 kbopd, and is currently around 120 (with Jack, St. Malo and Julia).

George,

I think what you show as Horn Mountain Deep and Holstein Deep are actually just the base production from those fields. I don’t think either Horn Mountain Deep or Holstein Deep are on production yet — I think.

Agreed probably – the numbers are given by lease number only. Sometimes there can be more than one well to a lease (they give the number of completions so sometimes you can see when something starts up then), but additional complications are that BOEM sometimes use different names from the E&P company, and there are often several leases per field. Tie backs, even if given a particular name, are listed against the main filed only. I think there is a way to apportion production to particular wells and from there to a particular tie-back, but it’s beyond may attention span at the moment. I was more interested in the overall shape of the curve – which shows a clear flattening. Horn Mountain Depp added two completions in March/April, I need to check further on Holstein, I might have screwed up there as the curve looks suspiciously similar to Horn Mountain Deep. I think there probably is another 150 kbpd ramp up nameplate capacity between Gunflint, Stones, Heidelberg and Julia and maybe 50000 extra tiebacks if they are drilled – but that would only just about cover decline over the next 15 to 18 months.

It’s also interesting that, though now in decline, Dantzler and Big Bend initially exceeded expected production capacity, and still do.

Another correction: Son of Bluto 2 didn’t cut a lot of water, I looked at the wrong column, so I don’t know why it declined so fast. I think it may have capacity for a second well there.

Interesting, that, in the Annual Energy Outlook 2016, the EIA projects further growth in the U.S. Federal offshore (ex Alaska) oil production to 1.93 mb/d in 2021.

Given high decline rates for deepwater fields, that implies new start-ups or ramp-ups.

One of these projects is BP’s Mad Dog Phase 2 . Is there anything else?

Mad Dog Phase 2 is expected to start drilling in 2021. There is no explanation for why EIA is reporting increased production, as they are.

The additional ones I can think of are Stampede and Big Foot, both in 2018, and Shell’s Appomattox, but I don’t know when that is slated to come online.

In addition, there will be a fair number of 1-3 well tiebacks to existing facilities. (Maybe 3-4 a year??)

Guy M, SouthLaGeo,

Thanks

There are Thunder Horse South tie backs next year (BP, nameplate maybe 42,000 bpd), Heidelberg Phase II might add another 30,000 in 2021, small tie backs to Delta House (Odd Job next year at 5000, maybe others), Vita (c/w Power Nap) has gone out for FEED but I don’t think it could get done before 2022 now, possibly Caesar/Tonga additions next year (20,000 ??), and I think Typhoon (or might be called Tornado now) might have started up recently at 13,000 tie back to Helix producer.

So I corrected Holstein Deep (I don’t think there have been any new tie ins and it is in gradual decline), added Big Bend, Gunflint (though it is zero flow) and Pheonix (no change in the dates shown but Tornado has started up at 20 kbpd this month and will be choked to 13 to 16 kbpd at plateau (this used to be Typhoon I think, but all these names are quite confusing) there are other tie-back options for Phoenix, which is serviced by the Helix producer, in the future, including a second Tornado well and Motormouth.

The plateau through 2016 is maintained but I think there will be a jump in October and then a steady rise at least for a few months. I don’t know the issue with Gunflint but if it has a lot of predrilled wells and is just waiting on getting the production facilities operating there could be another big increase then.

Also I had a thought on Julia and Horn Mountain Deep: it’s possible that the completions listed by BOEM include producer and injector pairs so at the moment Julia has only one producer, but two wells, and therefore with another producer to come to give full capacity (at up to 35 kbpd).

Thanks George,

Do you still think that the EIA’s projections for the GoM are unrealistic?

If so, is that because of depleted resource base, or likely project delays, high costs, etc.?

Alex – I don’t think there will be as high a peak as they say – I don’t see where the projects ramping up or in late development stages are that could achieve that (I still go for around 1.85 mmbpd sometime in mid 2017 as peak). But equally the decline might be less steep than they show and the tail fatter. Two other projects not yet approved are Shenandoah and Kaskida. I think they would both be about 150 kbpd nameplate, but they are high temperature / high pressure and Kaskida has sand issues I think (maybe they both do), and both might need relatively many wells – so very expensive. There’s also Tiber / Gila / Gibson / Guadelupe (I don’t know much about that but over 100 kbpd), Anchor (also about 100 kbpd), some fields around Tahiti for tie backs and Constellation (ex-Hopkins) which used to be considered a big find with BP but know looks like a smaller tie back (30 kbpd maybe) for Anadarko. After those only bits and pieces are left, and with not much frontier exploration going on so little prospect of big finds either. Anadarko and BP have a lot of the prospects which would tend to mean they’ll get spread out a bit. I’ve also been surprised at how long the schedules are for Appomatox and Mad Dog II (and also Trion on the Mexican side) they all are around 7 years from FID to plateau rates.

Hi Ron

How are you?

Thats* true?

*http://www.nextbigfuture.com/2016/12/microwave-oil-recovery-could-unlock.html

Trillons of barrels?

Been around a long time. Wasn’t funded at $110/b.

I read the article. Exactly how the process is supposed to work is found here:

MOVE OVER, FRACKING. THERE’S A NEW TECHNOLOGY IN TOWN

In Kearl’s playbook, you’d leave the kerogen in the ground and bring its oil to the surface. Producers would microwave oil shale formations with a beam as powerful as 500 household microwave ovens, cooking the kerogen and releasing the oil. It also would turn the water found naturally in the deposits to steam, which would help push the oil to the wellbore. “Once you remove the oil and water,” Kearl continues, “the rock basically becomes transparent” to the microwave beam, which can then penetrate outward farther and farther, up to about 80 feet from the wellbore. It doesn’t sound like much, but a single microwave-stimulated well, which would be drilled in formations on average nearly 1,000 feet thick, could pump about 800,000 barrels. Qmast plans to have its first systems deployed in the field in 2017 and start producing by the end of that year.

Sounds like a pipe dream to me. And even if the plan works, which is doubtful, only a small percentage of the Green River kerogen could be turned into oil and recovered using this method. It is not all there, spread neatly near the surface with little or no overburden.

If I had a million dollars to invest in this scheme…. I wouldn’t.

Hi Ron.

I read the article to find out what the power source for the microwaves would be. I didn’t see a general answer but there is mention that the NG that is often flared could be the power source, I guess in some cases.

That got me wondering about how variable the kerogen is in composition and whether deciding how much NG and how much oil is to be produced might lead to tunable microwave generators; the conditions that produce oil from kerogen aren’t just the same as the conditions that produce NG, and those conditions will vary as the kerogen’s composition does.

I liked the suggestion at the end that the first use of the technology could be in de-gunking oil wells; that seemed to be a sensible approach.

I wouldn’t invest that million either.

How deep can a microwave penetrate a rock?

According to this article, microvaves attenuate rapidly in rock –80 feet from the wellbore sounds like BS.

For a frequency of 2.45 GHz (e.g. WiFi or Microwave oven) that works out to a skin depth of about half a meter to a meter. That is, the field will be down by exp(-1) (8.7dB) after half a meter. So this is why the typical rule of thumb is t about 5-10 dB/meter attenuation at low microwave frequencies.

Hi Caroline,

I had read about that too. Put it this way: Sometimes if I have a really yummy dessert, I might like to lick the plate after, especially if I feel as though I didn’t have enough and there’s no more left. Microwave oil recovery sounds a little like this.

…Hey, question for you: Lemon meringue or pecan pie?

Cheapest wholesale electricity pricing available in New England (Locational Margin Pricing) spiked way above $200/Mwh a few hours ago … nearly ten times the average.

Currently over 60 bucks per.

Data is available in realtime on ISOExpress site, Charts and Graphs section.

As winter has yet to arrive, New England’s collective, purposeful shunning of future fossil fuel use may provide guidance for us all.

Coffee,

It looks like it is game on in the NE gas market.

http://www.bentekenergy.com/

Algonquin city-gates hits $9/MMBtu

Friday, December 09, 2016 – 5:56 AM

Algonquin city-gates traded at $9.35/MMBtu for gas day December 8, a $3.40/MMBtu increase over the day prior. Prices have not reached levels that high since March 2015, not surpassing $8.00/MMBtu so far for 2016. This is due to temperatures in Boston forecast to be 31 degrees F tomorrow, dropping further over the weekend to the mid-20’s F, nearly 10 degrees F below normal. Overall, the Northeast will experience a demand spike this weekend, likely to continue to spur prices higher. Total demand is forecast to rise 2 Bcf/d to 26.2 Bcf/d Friday, further increasing to reach 27.1 Bcf/d Saturday before coming back down to average 25.7 Bcf/d for the weekend. While the storage draw last week was rather low for this time of year, with DTI and TCO pulling out 1 Bcf and 4.3 Bcf, a larger draw is expected for the coming week as weather across the Northeast is forecast to average over 8 degrees F below normal and the Northeast falls into a net short supply position.

$8-$9 should be around the price where LNG is drawn into the market. But the surprising thing to me is, this is the first taste winter, with storage levels full to over flowing. What is going to happen if/when the local storage volumes are under strain? It looks like the NE are in for some very high and volatile pricing in the next few years.

Push

This is a fascinating unfolding of politics, ideolgy, economics, resource availability (scarcity) that fossil fuel haters and boosters alike can see play out in the ‘real world’.

Right now, according to that ISO Express site, coal is generating 9% of the juice – up from near zero last week. The creaking coal burners may bail them out this winter, but the 1,500 Mw Brayton Point plant (biggest in NE) is permanently going bye bye this coming spring.

That LNG stuff is also interesting as their supplier in Trinidad is running out of gas and plans are being made to import from Venezuela to liquify.

Near term crucial period may be next Wednesday through Friday as bitter cold overlaps with normal business days causing strong demand for both heat and electricity.

Those people may get both … but at a heck of a price.

Toolpush,

Despite its massive political and financial support due to its high monetary importance, shale gas has big structural weaknesses, which are revealed by a cold period. I have been pointing to this since about two years.

Besides the high concentration of shale gas in the Northeast, which entails a big challenge for distribution, there exists a high leverage towards cold winters. Below chart shows high storage growth – and collapsing prices – during mild winters, and extreme shortage of gas in cold winters.

About ten years ago at least two thirds of gas came from the South (Texas, Lousiana, GOM). This had little impact on production during cold winters. However, as today two thirds of gas production come from the North, cold winters induce not only high consumption, but also much lower production.

During the last cold period in 2013/14 estimated 142 bcf were lost due to gas well freeze offs.

http://www.platts.com/latest-news/natural-gas/houston/cold-winter-causes-gas-well-freeze-offs-to-spike-21398172.

As this time most of gas production lies within the northern part, gas well freeze offs will impact also Canadian gas, which still exports a net of 5.9 bcf per day to the US. Furthermore, shale gas seems to be very vulnerable towards gas well freeze offs due to its high water component. In addition, shale gas production in the Nort East increased substantially, which increases the potential losses due to Freeze offs manifold.

So, there is a good chance that we can see production losses of 500 – 1000 bcf during this winter – in addition to high consumption.

The market can smell and anticipates this and will be driving prices to – in my view – unseen levels.

Heinrich,

Glad you chimed in. A little issue I see, even though storage stands at a level greater than 4 tcf, half of which is classified as NE and Midwest. This gas is local to the areas of main use. The rest is in the “producing areas”. Meaning southern states. Most of the pipelines that carried this southern gas to the northern markets,in the past have since been commandeered by Marcellus /Utica gas. As long as the M/U gas region can keep these northerly pipelines full, then the it is hard to see these northern markets being able to make use of half the gas in storage. Of course the southern market will require electrical generation to keep warm, but nothing like what the NE and Mid west use. So as the numbers on the storage draw will be of some interest, it will be from which regions the draws are made will tell the bigger story.

If the NE price of gas gets separated enough from Henry Hub, it will be interesting to see if any LNG finds its way to Canada, to be flowed back into Maine and beyond. There will be plenty of Atlantic basin LNG to hijack to the US ports if the price and demand dictate.

Are you still going for your $20 mcf HH price? NE price, I can see getting there if the arctic vortex hangs around, but that is a constrained market. HH is a totally different matter.

Toolpush,

Thanks for your reply. 20 $ per mcf depends on if the winter remains cold. My point is that shale gas has significantly changed the supply structure – leading to implosion of supply when demand is extremely high – which makes the US vulnerable to huge price spikes. During the last cold winter in 2013/14 AGT prices went as high as $ 90 per mcf – albeit just for a short period.

It is not as simple as ‘flooding the market with cheap gas’. Even the small spike we have seen so far should never had happened. As the shale market share has significantly increased over the last three years, the impact on prices could be now very big. When temperatures are going very cold, gas customers will pay any price to receive gas as in many cases gas customers cannot allow their facilities to freeze off. On the other side, inventory will not go to the market as nobody knows how long the cold spell will last. LNG is an option, yet LNG is very slow. It can take weeks until supply reaches the customer and then the cold snap is probably already over.

It will not be a sustained price rise. As soon as the winter is over, prices will come down again. However, the damage to financial markets is then already done. If natgas prices are up tenfold, inflation can go up over 5%, which will be a major disruption to financial markets.

Push

I guess you are aware that the Jones Act will prevent any US LNG from being shipped directly to the Everitt terminal for the foreseeable future.

The Bahstin folks are gonna be supplied from Yemen, Trinidad, or wherever despite being a short car ride away from the largest gas supplies on the planet.

And, yes, Mr. Leopold, AGT could well exceed $20/ mmbtu next week, but HH most likely is many years away from that.

coffee,

Over the last ten years the US gas supply structure has considerably changed. Northeast contributes one third of US gas supply. Texas slipped to 12.6 bcf/d gas well gas and much less than 20 bcf/d total gas – which is a long term low. GOM gas supply precipitated during the last years. So, the center of gravity of natgas supply shifted to the Northeast. As the Northeast has an oversupply for most of the year, the rest of the US depends on the Northeast.

If the Northeast shifts into a supply deficit this will have also a massive – and growing – impact on HH. We will see soon by how much.

Mr. Leopold

Yes, as you referenced with LNG getting to consumers, it may not be the actual amount of natgas that exists (substantial, actually) so much as the efficient, effective transport of same.

That may be quite a ways off into the future.

Coffee,

Yes I am fully aware that the Jones act would prevent any GOM LNG, from going to NE gas market. That does not stop GOM LNG going to Canada, and being put into the pipeline system from there. I not sure if the Canadian LNG evaporation plant is in a ready state to take short notice delivery is the only issue I see.

There is plenty of LNG on the high seas heading from the west coast of Africa to Europe, or from Qatar to Europe, sailing right past the US’s front door that would be willing to change destination on a whim for the right price. Cargos of oil have been known change buyers many times while at sea. LNG should not be any different, especially in this new era of the spot LNG market.

These EIA projections are indeed to be taken with a grain of salt, I think. Especially concerning the USA. Why would the production suddenly stabilise? There has been a -10% decrease over the course of the last 1,5 year. (= a severe decline). And now, miraculously, things will stabilise?

I think, over the course of the next 365 days, the USA will lose another million barrels per day of oil production.

Wasn’t going to be the first one to go that far. Pretty sure we have another half million to go by end of 2017. Including the Gulf. Still, that would be about a million barrels less than EIA is projecting.

Supposedly the increase in oil price should stabilize US production that has been severely affected by low prices. It remains to be seen if OPEC+Russia cuts (no article on this?) in 2017 realize and if US production can increase to compensate for the cuts. Obviously OPEC+Russia think not or they would not be cutting production, unless it is a fake cut in the first place.

New drill oil completions reported for Texas in November totaled a whopping 264 wells. Yeah, things are going wild in the oilfield now that oil is at $50 a barrel!

What effects do you foresee that breathtakingly enormous new Texas oil discovery recently announced by USGS having with regard to near/long term well completions within the state? Thanks.

Dan Goudreault,

I’m not an oil&gas professional, but here’s a start: The USGS announced “undiscovered, technically-recoverable” oil, and gave a range of possible amounts. That means that the geology would allow there to be oil there.

No oil was discovered, nor will there be unless someone drills and finds oil. There’s years of work before that stage; if oil were found there’d be more years before drilling, completion and production yielded much oil.

Now, over to someone who knows what they’re talking about.

I won’t deny there is an uptick in drilling coming, it is just that I perceive a different rationale for it, than assuming they are jumping at $50 oil to plan to go all out for that reason. Some companies are completing wells that would only be profitable at $100 a barrel. No rationale for those, other than they are simply trying to hold on to the lease, and hope. I follow EOG fairly closely, and from my own lease, I know they are trying to hold on to fairly good leases, but only drill what they have to. I think that is the reason your seeing an uptick. They are planning on what will hold the leases for 2017. They are balancing those permits for “marginal” wells at $50, with permits in the sweet spots. From a planning perspective, it makes sense on getting that over with first. Then you can concentrate on what is going to keep you alive. It is interesting to note that the Austin Chalk (Sugarcane) has become their new sweet spot in Karnes County. They have 5 or 6 now producing, and 9 more planned so far for next year. All are doing very well, and two had first month production in excess of 100k barrels a month. Less decline than the Eagle Ford, so far. Other companies are now jumping on it, too.

Mr. Minton do you have continuous drilling provisions in your lease and if so may I ask, what year did you lease to EOG?

I contend that at these oil prices the speculation about “drilling to hold leases” is vastly overblown, that most leases made in the Eagle Ford and Bakken before 2012-2013 had no continuous drilling provisions in them, and that most of the drilling still being done in those two plays, at these oil prices, are actually related to loan covenants regarding booking PDP reserves, SEC 5 year rules regarding PDNP reserves and to reduce taxable income thru IDC deductions. Most shale oil companies are looking down the barrel of loans coming due beginning 2017 and continue to do stupid things with borrowed money because they have no choice. In spite of lower costs and higher EUR’s brain washing campaign, they are all still losing money hand over fist. Even mighty EOG.

HZ Austin Chalk wells cost considerably less that shale wells because they don’t typically require frac’ing. Some of the initial IP’s and IP90’s in the Chalk have been spectacular, especially for EOG who is well know for gutting wells to create big EUR’s; take it from me, an old Chalk hand, however, the decline on Chalk wells after 12-18 months will suck the hardhat over the top of your head and I am quite certain 95% of those wells will NOT payout either. They did not in 1981, 1991, 2001 nor will they this time around the block either.

Yes it has continuous drilling clause.

Austin chalk wells by EOG are frac’ed. Who cares what happens to the decline in 12 to 18, if you recover over 300k the first year?

If EOG frac’s those Chalk wells then they cost essentially what an EF well costs. If a Chalk well makes 300,000 BO in the first year, which they don’t, then declines 80% annually after the first 12 months and every year thereafter, they’ll never reach payout. If your only interest in any of that is from the standpoint of a royalty owner, then I am sure you don’t care about profitability. I do.

Yes it has continuous drilling clause.

Austin chalk wells by EOG are frac’ed. Who cares what happens to the decline in 12 to 18, if you recover over 300k + the first year?

Mike, pls elaborate on this theory.

We have sought the reason wells are being drilled at sure loss, and lease obligation was one suggestion. Can you flesh out this other

I contend that most mineral leases made before 2013 did not contain “drill and earn provisions” in them (drilling commitments) and that one well could hold the entire lease. I can confirm that in S. Texas and I suspect less knowledgeable mineral owners in the Bakken that leased early in the play had no drilling commitment provisions in them either. Leases made later in both plays involved more sophisticated mineral owners who required drilling commitments. In W. Texas, for instance, all that now being drilled is subject to drilling commitments.

SEC rules are very clear regarding ‘proven but not producing’ reserves that were “booked” and made into assets…they must be drilled within 5 years or lost. DUC wells are PDNP reserves and they too must be completed within 5 years.

I am familiar with two new loan covenants, particularly relative to recent credit swaps, etc. that if a company gets more money in the equity swap, they must develop PDNP reserves or suffer penalties.

None of this precludes the fact that 95% of the shale oil wells being drilled in America and these oil price levels will not payout unless prices rise dramatically. Those wells ARE drilled at a sure loss. The shale oil industry is penned up now like a heard of goats; they voluntarily drill unprofitable wells with borrowed money because they need cash flow and they need to book more assets to be able to borrow more money. They are also forced to drill and complete wells that are unprofitable for reasons I have explained. The ONLY way out for them, even the biggest of them, is if oil prices rise into the 80’s and 90’s and that is not going to happen for a long time, short of some big chicken fight somewhere in the world that would have an affect on supply.

What do you suppose all the oil and gas people proposed for the Trump administration are going to do? They want to open up more federal property (including national parks) for drilling and facilitate more pipelines to bring Canadian oil into the US. I don’t understand their focus on expanding the market. How can that help all the current oil producers hampered by low prices?

Is there a chance that once they are running the various government departments they won’t actually push for any of this? Is it mostly symbolic BS?

Rosneft sells 10% stake to Qataris and Glencore. That’s a pretty big surprise to me at least.

https://www.bloomberg.com/news/articles/2016-12-07/glencore-qatar-fund-buy-russia-s-rosneft-stake-for-11-billion

(An article in the FT is better but behind a paywall – try the Google route if interested).

Chevron to cut budget another 20% in 2017. Much bigger than expected, again by me anyway.

http://www.reuters.com/article/us-chevron-outlook-idUSKBN13X01S

International rig counts are out – up five overall, mostly a bounce back to around September numbers from an unusually big dip in October, especially in the North Sea.

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-rigcountsintl

Also I took a look at some of the Bakken daily reports for this week, new permitting and completions announcements seem to have come to a stop – maybe the extra cold weather, or maybe someone on vacation and not completing the paperwork, or a sign of things to come?

Is this the news of an industry with a rosy glow of optimism following the OPEC announcements? Too early to feel the impact yet I guess.

Not really. There is not a lot of interest in drilling for $50 to $60 oil in the shale. Go back and look at what happened in 2009 when oil dropped to $60. Most places are profitable to drill at $80 to $100. Very few are profitable at $50. The press can hype all they want. It won’t change reality.

I think the press helps – if enough people buy it, silly money will give free loans to these companies to continue drilling. You can loose as much money as you like, as long as you have creative bookkeeping and a neverending roll in of money.

We had this here in Germany in the wild 2000s – film making fonds have been the red hot burner, people lost millions but continues investing until alle these companies where history. Hollywood was laughing about Germany “silly money”.

The Fallacy Of Increasing U.S. Oil Production Post-OPEC Agreement

It’s little surprise that Credit Suisse recently stated:

“With service prices, particularly pressure pumping expected to rise in 2017 on the back of increased activity, a Permian operator commented that it is already seeing greater than a 20% increase in completion costs. The biggest concern for Permian management teams has been a potential scramble for equipment and services that higher commodity pricing could introduce, and the OPEC move has the potential to drive faster service cost inflation than we would have otherwise seen, muting the impact of the oil spike on returns for US shale operators.”

In other words, the cost of drilling is likely to go up just as fast as the price of oil goes up… if there is a cut in production by OPEC.