A Guest Post by George Kaplan

EIA reserve estimates for USA for 2016 have been issued (a couple of months later than usual). The numbers they provide are ‘proven’ reserves of crude, condensate and natural gas.

The data is provided directly by the E&Ps with some adjustments made by EIA for missing numbers. The data show reserves for the end of a given year, plus the reasons for change over the year: basically discoveries, production, revisions and sales. Until 2015 EIA had different categories for discovery (essentially a new reservoir, although there may be new pockets in existing freservoir) and extension (an increase in the area of an existing field). Recently most of this category has been extensions to LTO fields (i.e. an increase in the expected economic drainage area of a play). This year the reporting has changed so all discoveries and extensions are reported as a single figure and I’ve shown only this sum for previous years too. I have summed revision gains and losses plus adjustments to give a net number, and similarly for sales and acquisitions.

This year the data include non-producing reserves. I don’t know for sure if this is new but I haven’t noticed it before and can’t find any history for previous years. ‘Non-producing’ may mean reserves behind wells that are offline (e.g. are uncompleted, for maintenance or because of lack of processing or transport capacity); or that have real development plans for their production (typically starting within the next five years according to SEC rules, although for large, long cycle conventional projects the time can be extended). The undeveloped values for 2016 are shown on each chart.

‘Probable’ reserves are not included but I think this contribution might now be a relatively small proportion overall. The conventional oil reserves are in mature fields and these tend to have decreasing proportion of probable as they age – see below for the GoM, where BOEM 2P numbers are actually lower than EIA 1P estimates. For LTO there are few new fields each year and production growth comes from incremental development of known fields. In theory the expected recovery should be fairly well known but there are some really large revisions both up and down each year, which might indicate the E&Ps don’t have much idea, so setting reserves as proven versus probable maybe isn’t very meaningful.

The discussion here covers mostly crude for the USA, the GoM and the main tight oil plays, plus some look at natural gas overall and in the GoM. For some of the shale plays I have made some high level guesses about future well numbers, which I’ve based on figures from Enno Peter’s excellent shaleprofile blog.

USA Total Oil

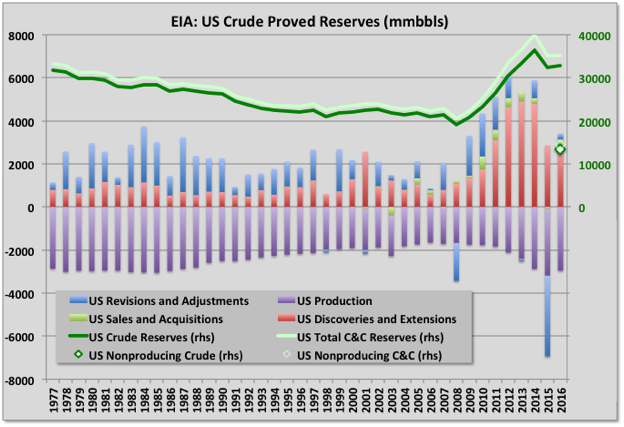

Total proven oil reserves for US in 2016 rose slightly: production was about equal to discoveries and extensions plus small net increases from acquisitions and revisions (see chart above). Although the overall net revision was small both the total increases and decreases exceeded 5 Gb, which is high relative to total reserves, for decreases this is the second highest number after last year and is likely to be a reflection of the uncertainties associated with tight oil plays as there is no history for any being run through a full life cycle. In fact the two revision numbers were almost equal and the change came from ‘adjustments’, which is a catch-all category used to make the numbers balance and might well just be a rounding error. The average price of oil fell in 2016 compared to 2015, which likely had an impact on some marginal areas.

Discoveries and extensions were about equal to 2015 and well down on 2013, which looks like the peak of a bell curve for tight oil growth that started in 2005. If so then it should drop down now through 2021, although possibly extended a year or so because the price crash in 2015 looks to have had a significant effect.

I have shown condensate for total reserves, though not the yearly adjustments, which for some reason EIA don’t give in the same format, by region, as they do for crude (neither do they do it for natural gas or NGL). Condensate reserves have been growing significantly because of shale gas but fell slightly this year.

Global conventional oil discoveries dropped to a new record low in 2015 and again in 2016. Combined with the USA tight oil numbers the drop is even more pronounced. Conventional oil saw another small drop in 2017 and that looks the most likely course for tight oil too, given the recent trend.

Non-producing reserves are shown as the green diamond and are just over a third of the total, and this a common proportion across different plays and for oil or gas. For conventional plays these would usually represent non-developed fields, but for tight oil are mostly non-drilled areas or non-completed wells in known and partially developed fields.

Crude production fell in 2016 but picked up again in 2017, which will be reflected in this years release that is due again in November.

Gulf of Mexico Oil

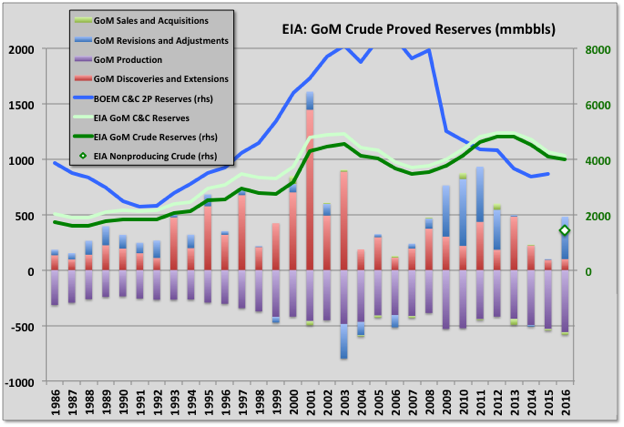

For GoM crude production is increasing through 2016, but discoveries are low and hence depletion and decline rates are high. I have included condensate reserves, but the production and adjustment figures are for crude only. Condensate production has been declining with natural gas (see below), and is now relatively insignificant. I don’t know where the big revision upgrade for 2016 came from but could be the Appomattox project, which was approved for construction, or the BP extensions to the Atlantis field. However there were significant numbers for reserve decreases exceeded by larger increases, so overall several fields have been affected.

The EIA 1P and BOEM 2P numbers are converging, the difference is probably mostly to do with which undeveloped reserves are included. The EIA non-producing reserve is about 1.4 Gb, a large part of which is in Appomattox, and probably Mad Dog. The producing reserves, at around 3.6 Gb, imply average 15 to 20% depletion rates in the on-line fields at current production rates.

Main Light Tight Oil Reserves

Eagle Ford

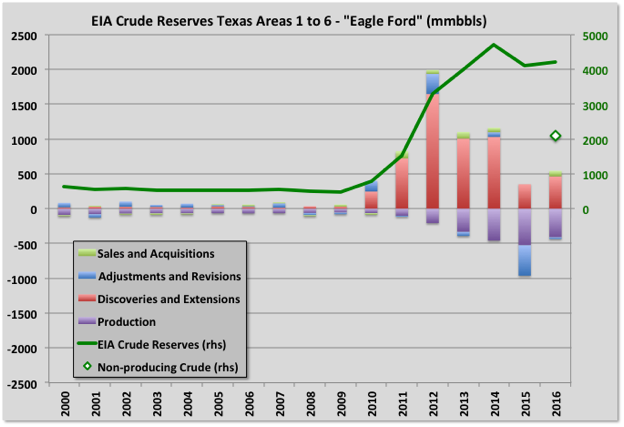

Discoveries and extensions increased slightly in 2016 compared to 2015, but are well down on the peak year of 2012. Eagle Ford has a lot of condensate production and extends over a large area including some conventional oil, so there may be a couple of logistic curves overlaying each other for the discoveries. This year the production seems to have started a slow decline and that looks about in-line with the discovery pattern. Price changes may have had some impact as well, but maybe less than would have been seen for conventional plays or in a normal interest rate environment.

Non-producing reserves, which would include DUCs, anything off-line for maintenance or because of lack of transport capacity and any areas with clear development plans, are 2.1 Gb. At 150 kbbls EUR per well that would require 14,000 wells to be completed, or 2,800 per year if they are to be developed within the five year SEC limit, which is about double this year’s number. Recently the EUR seems to be falling for new wells, which might suggest the core area is being exhausted, if so more wells would be required: something doesn’t quite add up.

Bakken

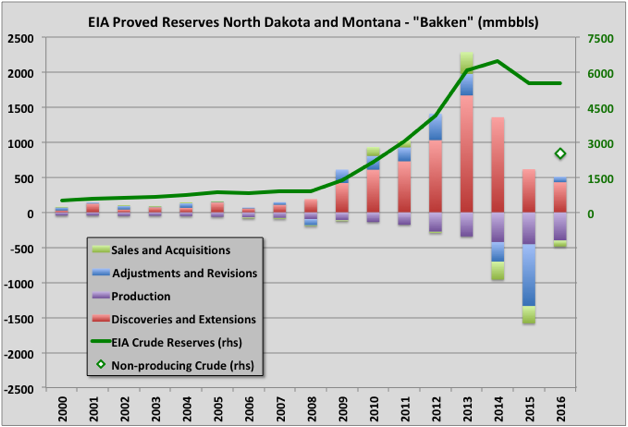

Discoveries and extensions show a pretty good bell curve, and seem likely to drop down fairly low over the next couple of years. The shape of the LTO discovery curves for different areas look somewhat similar but with the life cycle proportional to the total reserve. There have been fewer than ten Bakken wildcat discoveries reported over the last three years, so the growth must come from extensions of existing fields, which should be fairly well known now and with declining potential for further increases. A higher price may encourage more exploration and discoveries but most recent wildcats outside the core areas have come in dry.

Undeveloped reserves are 2.5 Gb, which at 400 kbbls EUR per well (from Enno Peter’s data) would be 6,250 wells. I don’t think there is enough acreage in the core area to support that (by maybe 3,000 wells short from December 2016), but outside that area the EUR would drop and many more wells would be required. Last year 1071 wells were spudded, a few more completed, so it might just be possible to develop those reserves within five years as required by SEC reporting rules, but I think they’d have to get a move on, and the E&Ps definitely don’t appear to be erring on the conservative side for their estimates.

There is a tiny part of the Bakken in South Dakota, but I haven’t included that.

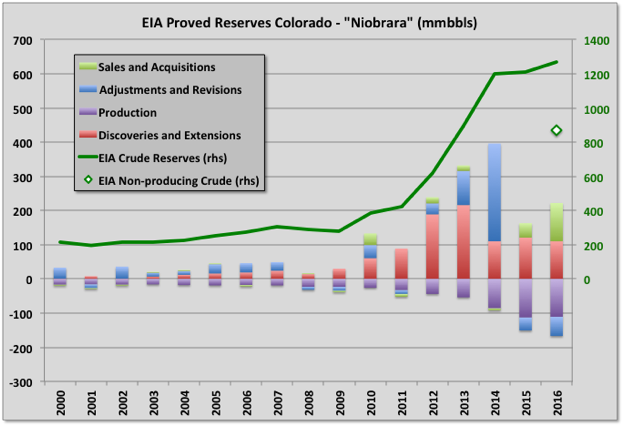

Niobrara

Niobrara reserves increased, mainly due to acquisitions. I’m not clear exactly how acquisitions can exceed sales so significantly, but it could be the E&Ps purchased land with resources that hadn’t previously been considered for development. Like Eagle Ford and Bakken the discoveries and extensions look likely to be trending significantly lower over the next couple of years, but there is a high proportion of undeveloped reserve that could allow a production increase or extended plateau.

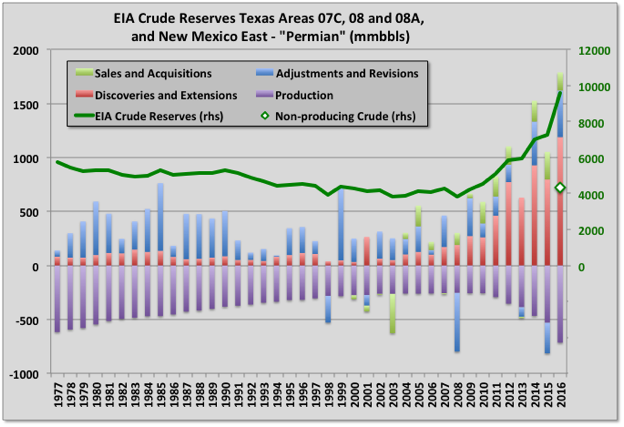

Permian

The Permian is where most of the reserve growth has occurred, in fact over half the total. The chart shows the gradual decline in conventional oil from 1979, which presumably is still continuing, and then the sudden growth in reserves and production since 2008 from LTO. I don’t understand how there can be significant acquisitions over sales every year, but there it is. The reserves for 2016 are almost a third of the total for US, and likely grew further in 2017. Similarly non-producing reserves are the largest of all areas, and too are almost a third of the US total at 4.3 Gb. It’s difficult to see what the likely average EUR for Permian tight oil, horizontal wells will be as all the wells are fairly young, but 400 to 500 kbpd seems on the cards. So that would represent be about 10,000 wells worth or 2,000 a year to meet a five year development schedule, which is about what was achieved in 2017. Therefore continued, increasing production looks likely and the repeated highlighting of the Permian as a key component of many E&Ps near term plans is understandable.

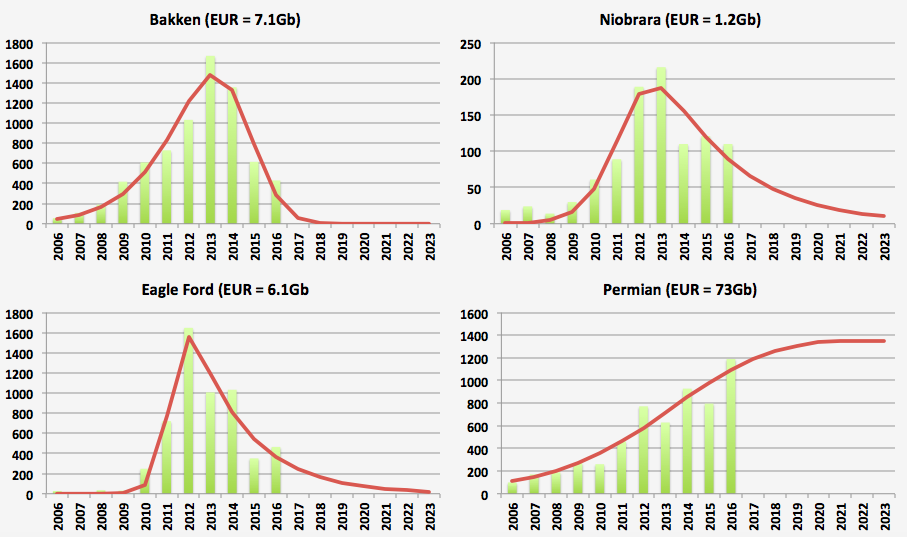

Estimated Ultimate Recovery

I fitted Verhulst equations to each of the four areas’ original discovery values. This allows estimates for the ultimate recoveries to be made as they are the areas under the curves, as shown. Note these estimates are just the conclusions from curve fitting based on the E&P stated numbers, they do not imply I think that is what will be achieved. The numbers need to be treated with a lot of caution, but the great thing in writing for a blog is you can speculate without complete scientific rigour. One problem is that revisions aren’t included – to be meaningful these would have to be backdated against the original discovery years, and that data isn’t available. In addition some of these, particularly the Permian, have more than one play involved and should be represented by a matching number of independent curves, but I don’t have the data to do that either. For the Permian especially there isn’t really enough data to fit a good curve (most of it is extrapolation): a small drop in discoveries for 2017 would more than halve the EUR for the newly fitted curve.

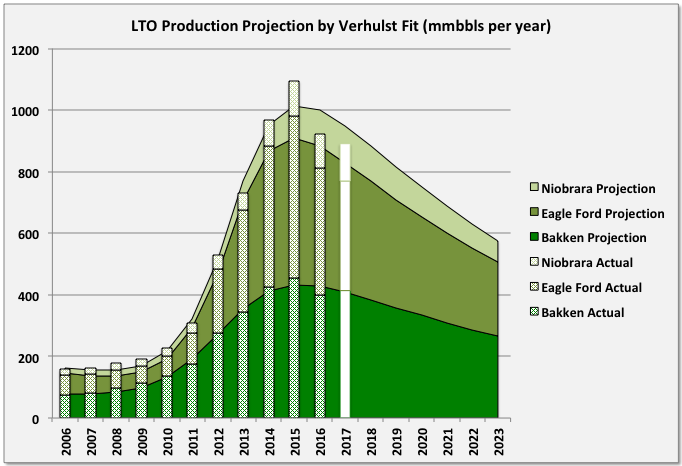

For Bakken, Eagle Ford and Niobrara I also fitted a Verhulst equation to production numbers and hence provide an estimate for future trajectory. I didn’t do this for the Permian as the error bars would swamp all other numbers, but the picture their might be clearer next year. The total production for the Verhulst curves (i.e. for post 2006 developments) is equal to the total EUR predicted from the discovery curve fitting plus any net revisions and acquisitions for the period 2006 to 2016. I assumed that reserves before 2006 would decline exponentially at the same rate as 2006. The fits are pretty good, but then there aren’t really many points to match, interestingly though all three plays break down in the same way with 2015 higher than expected and 2016 lower. It remains to be seen whether this is an artefact of changing policies in response to falling prices, or inaccurate reserve numbers, or maybe just that Verhulst isn’t the best choice. I’ve included preliminary 2017 values, but didn’t use these in the curve fit (and should emphasise again that, especially for Eagle Ford, the production isn’t from a single play or necessarily all non-conventional oil). By this method it looks like the three regions are at or around their peaks, with an overall slow decline to come

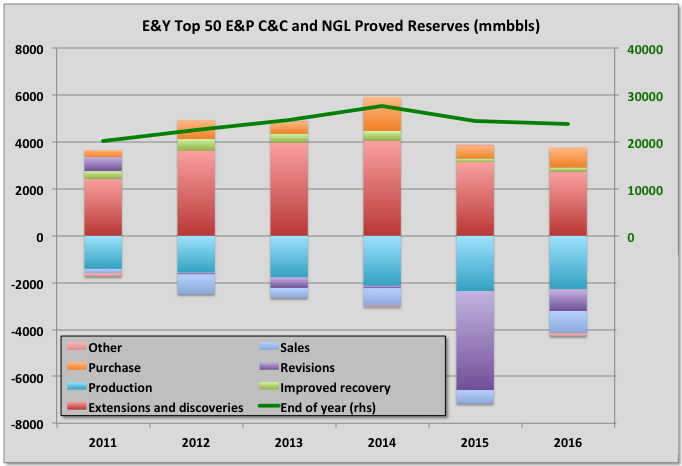

Ernst and Young

E&Y make their own estimates for US reserves for the fifty largest E&Ps. It’s main advantage is that it comes out in June, well before the EIA numbers. They also include condensate and NGLs. As shown below nothing they presented seems to be at odds with the EIA numbers, although they do show a slight decline for 2016 rather than a small uptick.

Most of the discoveries come from these largest companies (the condensate and NGL have some impact but it looks like the smaller companies had very low discovery rates), but there is less growth from net acquisitions (i.e. purchases minus sales) than I would have expected, e.g. compared to 2014, so maybe the smaller companies had decided to ride out the low price years or maybe they had nothing that the larger companies considered worth going further into debt to buy. E&Y break out revisions for IOR as a separate category and the numbers indicate this isn’t contributing much, for all the technology improvements, and is declining.

Natural Gas

I’ve only looked at total US gas and the GoM. Data for individual areas is available but it takes a lot more effort to download and sort by area than for crude oil.

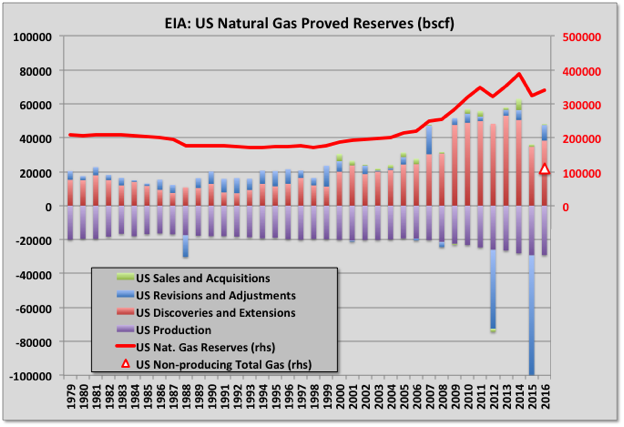

Total USA Natural Gas

Reserves dropped significantly in 2015, but rose slightly in 2016 to 341 Tcf (about 57 Gboe). Non-producing reserves are about a third of the total at 110 Tcf (18 Gboe). However discovery rates are in slight decline and may have peaked in 2013. Discoveries rose rapidly from 2007 because of the shale plays and if a something like a normal bell curve is followed may decline equally rapidly now. Production shows signs of starting to plateau over the last three years; it will be interesting to see how things evolve if prices start to rise or LNG exports quickly expand.

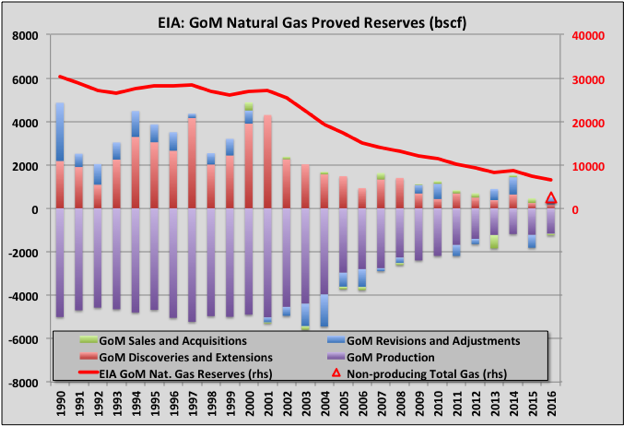

Gulf of Mexico Natural Gas

The Gulf of Mexico is at the end of its life as a significant gas producing area. The last major producing gas field is Hadrian South, which started up in early 2015 and had been supplying just over 10% of total gas, but came off plateau last July and has declined rapidly. Most of the remaining gas is associated with oil and there isn’t much undeveloped reserve remaining.

Off Topic Finish

A living coral reef in Fiji:

NEB has issued it’s estimates for 2018 Canadian production. The average annual production increases quite a bit at 260 kbpd, but not so much for the exit rate at 107. All numbers from December 2017 onwards are estimates and a couple in November.

2018-02-20 – Scotiabank – Canada’s oil patch once again finds itself with too much crude and too few pipelines, depressing the value of Canadian crude relative to US and global benchmarks.

Chart on Twitter: https://pbs.twimg.com/media/DWfFcucVwAIMNUj.jpg

pdf file: http://www.gbm.scotiabank.com/scpt/gbm/scotiaeconomics63/pipeline_approval_delays_2018-02-20.pdf

There was some excitement last week of more activity in offshore as more projects were expected to be approved:

Hail shale, but deepwater oil fights back: https://in.reuters.com/article/us-oil-deepwater-analysis/hail-shale-but-deepwater-oil-fights-back-idINKCN1FY2AI

What they failed to point out was that because the projects are smaller the actual production to be developed is about 16% down, and likely significantly more so for developed reserve as those smaller projects decline faster. A significant proportion will be gas, and I think at least three of the projects are redevelopments of existing, producing fields, including Penguins, which has been much hyped for the UK but is in fact needed only because Brent Charlie, to which it is currently tied-back, is getting shut down and decommissioned.

https://www.rigzone.com/news/shell_to_redevelop_penguins_field_in_uk_north_sea-15-jan-2018-153140-article/

I love the baloney about the market for a deep water field’s oil production being clouded by electric vehicles.

Fernando,

Yes it will take some time (10-15 years) before EVs become significant, but for the past 3 years the World wide growth rate in annual sales of “plugin” vehicles (plugin hybrids and EVs combined) has been about 43% per year. Should that rate continue as these cars become more mainstream with increasing oil prices and falling battery costs, then 50% of annual sales of light duty vehicles would be reached by 2027. By 2036 (assuming growth rate slows to 9%/year by 2036 ) about 1 billion light duty vehicles Worldwide will be plugin vehicles.

For short term projects lasting 10 years (like smaller deepwater projects) or LTO wells that produce most of their oil over the first 5 years, plugin vehicles will not be a problem.

Eventually this may be a problem for OPEC as the World could reach 2.2 billion light duty plugin vehicles by 2048 and trucks and rail may also move to electric, only air travel and ships will create much demand for oil, these could also eventually replace oil with nuclear, wind, or biofuel. Not by 2050, though perhaps by 2070.

Denis, you are great at what ifs. There’s nothing in the horizon to support such growth rates for electric vehicles. Furthermore, if the rate continues growing as you assume, it runs into supply bottlenecks. Given that deep water projects make or break over a 20 year period, and that producers will be asked to deliver 80 to 90 million BOPD for decades (something they’ll be unable to accomplish in spite of higher prices), the last of their worries will be electric vehicles. Their main worry will be where the heck can they find new oil reserves.

Hi Fernando,

The growth rate of the past three years is history.

You assume there will be supply bottlenecks, perhaps you are right, perhaps not.

I agree there will not be enough oil supply to satisfy demand through 2030 and oil prices are likely to be very high, it is unlikely that oil demand will fall below supply before 2040 or so.

The high oil prices coupled with falling prices for batteries (due to economy of scale in production along with continuing innovation) may lead to a continuation of the 40% growth rates in the sales of plugin vehicles.

Run the scenario and you will confirm that if a 40% growth rate continues for World plugin vehicle sales for 10 years and then the growth gradually slows to 10% annual sales growth rates for another 10 years (falls by 3% each year 40, 37,…, 13, 10) most light duty vehicles get replaced by plugins by 2050.

https://insideevs.com/monthly-plug-in-sales-scorecard/

Hi Denis,

In 2015 sales dropped. In 2017 it was approximately 30% growth. Am I looking at the same figures?

I am looking at Worldwide annual sales for plugin vehicles.

Take the natural log and do a least squares fit to get exponential growth rate, it is about 43.7%/year for World wide annual sales growth rate for plugin vehicles from 2014 to 2017.

I’ve started using the Excel exponential curve fit, with the chart set to show the equation.

Getting lazy…

Hi Nick,

Yes that’s easily done. It essentially does what I have done. I guess I like straight lines. 🙂

Yeah, me too. When you’ve done linear regression for a long time, it feels like a good way to show a good fit. But, a log transformation isn’t quite as intuitive for most folks, I’ve found.

The “thing” that gets overlooked with the exciting growth numbers about light Electric Vehicle sales increase rates is this pesky thing that Gail Tverberg often writes about–

low wages for non-elite workers (a large and growing part of the global working class). All the electric vehicle sales growth figures of recent years are taking place in this asset-bubble “recovery” from the Great Recession. From the cusp of when the USA dropped into the G.R, Dec. 2007, it is now 124 months elapsed time. This seems very anomalous to me, to have such a long period between cusps or Seneca Cliff moments going into recessions.

I may be wrong; there may be some way of sustaining such fast EV sales growth even with stagnant and falling real wages of our U.S. / global working classes.

I’m a Prosperity Skeptic(TM) tho.

Yours, B.G.

Gail’s not a reliable source. She’s been trashing alternatives to fossil fuels for a very long time, and predicting imminent disaster, and she’s been consistently wrong.

This has been an unusually long recovery, but historically that’s normal for recoveries after credit crunches, which is what we had. See the book “This time is different…”.

EVs are cheap to own AND operate. They’re cheap to buy used. See Edmunds.com

ICE fuel use rate with 30 percent gain per year of EV sales, plus fuel use rate if ICE efficiency gain of 3%/yr for first 25 years.

See comment http://peakoilbarrel.com/open-thread-non-petroleum-february-21-2018/#comment-631324

for the conditions and graph of ICE and EV populations over time.

Hi Fernando,

I’m eager to know your opinion or best guess as to when oil production will peak, whether you believe in the “undulating plateau” scenario wherein oil production will be roughly flat for several years, and how fast you think oil production will decline after that.

My gut feeling is that the depletion of legacy fields will wipe out production faster than electrified light transportation can wipe out demand for oil.

It’s very unlikely that we will have much in the way of electrically driven construction equipment, aircraft, ocean going boats, or farm machinery anytime soon, certainly not within the next ten to fifteen years.

It’s one thing to make a go of building cars that are used an hour or so most days… cars which require very little power to maintain cruising speeds once accelerated from a stop. It’s something else to build a battery powerful enough to run a tractor or other machine that requires a lot of power most or nearly all the time it’s in use, especially when it is used only intermittently, a few days a month or a few months per year.

It will be MUCH easier to profitably build electrically driven commercial trucks that are in near constant use, sometimes as much as twenty hours a day for weeks on end, but more typically four to six hours of actual driving time per day, the rest being stationary loading and unloading time. Chargers are easily installed along major highways and at large industrial facilities, because such places are usually close enough to larger grid lines to operate powerful chargers without running a lot of new transmission lines, and such trucks can get a partial or even complete charge while being loaded and unloaded. Not every load goes on and off in a matter of minutes with forklifts. Some plants now partially eliminate warehousing by putting the truck at EITHER end of an assembly nine.

If bottlenecks do happen, and the raw materials needed to build batteries are in short supply, the batteries will go into the machines that can be easily charged, and the ones that can use relatively small batteries. This means cars and light trucks almost all together, with larger trucks coming next.

There’s very little likelihood that serious farming using electrically driven tractors, trucks, combines and other equipment will come to pass.

The grid in rural areas would have to be rebuilt to several times it’s current capacity, to deal with peak seasonal demand, and the cost of this expansion recouped in just a couple or three months per year for the most part. It will almost for dead sure be a lot cheaper to run agricultural equipment on moonshine, diesel or bio diesel for the foreseeable future, ditto heavy construction equipment.

I’m not going to deny the possibility that affordable and durable batteries can eventually be built that are several times as powerful as the best ones available today.

But I’m willing to bet against such batteries being available in large numbers anytime soon, say within twenty years.

The price of oil is apt to go up and stay up for decades to come as I see it.

I think there’s no need to electrify farm and aviation soon – there 2 fields that, as you described, would be most complicated to electrify.

But aviation / farming / oil chemistry together are only about a quarter of oil demand. That could be supplied by stripping existing sources for the next 100 years, or a new solution is found.

Everything else can be replaced more easy, either by electric or liquid gas.

Or scale back farming equipment to bio fuel – horse powered.

Hi Eulenspiegel,

I agree that if the worst comes to the worst, the food industry, from plow to the table, can run on biofuels. This would result in a substantial increase in the price of staple foods at the wholesale level though.

In richer, urbanized societies, this wouldn’t be as big a problem as it would be in poor countries. A bag of grain that sells for four or five bucks can be ground into flour locally at very low cost.

The bread we richer people buy in super markets ………. well, there’s a Yankee nickel’s worth of wheat in a three or four dollar loaf of sliced bread. Richer people will be able to handle the increased cost, no problem.

If you are economically borderline, living on staples and buying them in as nearly unprocessed form as possible, then you will be in one hell of bad spot. I don’t have good figures, but a ball park guess is that the price of grain would double at least. The price of a large bag of flour at the mill would almost double as well.

Mac,

Don’t forget the millions of ways that fuel can be conserved that fall short of complete substitution (like EVs). One good example: ocean shipping reduced fuel consumption sharply by reducing speed. Ocean shipping has a lot of different ways to reduce fuel, like better ship design, bigger ships, wind power, etc., etc.

BioFools? crops @ 2% effciency.. PV is 20+

https://en.wikipedia.org/wiki/Photosynthetic_efficiency

Even bigger when one considers all the inputs (driven by external energy such as FF) that go into biofuels. Ethanol from corn is pretty much a wash if not an energy sink.

Mac,

I think you’re thinking about farming in developed countries. Most staples eaten in developing countries are produced there, by small local farmers. Seems like they would use small tractors, that could be electric.

Yair . . .

It is interesting to compare the world production of wheat and rice . . . the value . . . the numbers who RELY on the two staples . . . and the average size of the farms.

Wood Mackenzie’s forecast for Russian oil production in 2018 and 2019. Looks like they think that Russia has the potential to increase production by +200 kb/day in H2 2019

https://pbs.twimg.com/media/DWjJRbAXUAAFv11.jpg

2018-02-20 Financial Post – The Keystone system is still operating under a corrective action order and shipping a restricted number of barrels out of Canada, TransCanada spokesperson Terry Cunha said in an email Tuesday.

http://business.financialpost.com/commodities/energy/a-self-inflicted-wound-pipeline-delays-to-cost-canadian-economy-15-6b-in-2018-says-scotiabank

? Someone on Twitter was saying that more diluent is being added which means that the fluid flows faster, hence the reduced operating pressure hasn’t cut volumes that much, but it costs more.

The EIA’s Weekly U.S. Imports from Canada isn’t showing an on going decrease in volumes.

Moscow (Platts)–21 Feb 2018 – Kazakhstan aims to increase crude and gas condensate production by nearly 25% to 2.155 million b/d by 2025, according to the country’s development strategy released Tuesday.

Kashagan is expected to grow to 370,000 b/d by the middle of 2018, up from around 250,000 b/d at the end of 2017, the energy ministry said earlier.

https://www.platts.com/latest-news/oil/moscow/kazakhstan-to-pump-over-2-million-bd-crude-oil-26895552

Eagle Ford- most is held by production, and the main players are concentrating on their holdings in the Permian. Upstarts with OPM are drilling what I see as nonprofitable wells from bigger companies castaway leases. But, where did you get a 150k barrel EUR????

Hi Guym,

That estimate may be based on Enno Peter’s estimate for 2012 Eagle Ford wells.

See https://shaleprofile.com/index.php/2018/02/02/eagle-ford-update-through-october-2017/

Quoting Enno Peters:

Wells that started in 2012 have now reached a production rate of about 20 barrels of oil per day, and are just shy of 150 thousand barrels cumulative production, on average.

Also from the post linked above it looks like 2014 and 2015 vintage wells may have an EUR of 200 kb and 2016 wells potentially 250 kb, chart from Enno Peters post below, I simply used a straight edge estimate for EUR.

Notice that the “lines” are concave down, so a straight line estimate, as I have done will tend to overestimate EUR, probably 220 kb is a better estimate for 2016 wells as the will probably follow the slope of the 2014-2015 curves going forward.

Something like Dennis said but I just looked at the 2016 and 2017 quarterly numbers: they seem to be tending to smaller EURs to my eye. One of the issues ith LTO is there is no history to end of life to be able to make good judgements, so I’d say my guess is as good as the E&Ps when they determine reserves.

I don’t know how retention by production is relevant, to be able to claim undrilled areas as reserves there should be a clear plan for exploitation within five years.

Hi George

On a different note it looks like the Weald shale oil myth has been put to bed this week.

George Kaplan,

Agree on Eagle Ford, that 200 to 250 kb EUR seems reasonable.

Using David Hughes roughly 9000 square mile estimate for prospective drilling area and 4 wells per square mile on average and 225 EUR average would be 9000*4*.225/1000=8.1 Gb for Eagle Ford at 36,000 wells. If we assume 3 wells per square mile on average we get 27,000 wells and about a 6 Gb URR (close to your estimate.) My guess would be 7 Gb, but clearly that is a very speculative guess.

I used 150 not 200 to 250, I was using the number to estimate how many wells will be needed to meet the non-productive reserve number, i.e. drilling in the future, and therefore took the most recent approximate numbers and I think they are declining with time. I stated my assumption, you are perfectly at liberty to disagree: ‘For some of the shale plays I have made some high level guesses about future well numbers, which I’ve based on figures from Enno Peter’s excellent shaleprofile blog.”

The URR estimate of 7.1 Gb seems reasonable, David Hughes estimate in Drilling Deeper was 7.9 Gb, he estimated about 36,000 total wells might be drilled, which implies an average EUR of 220 kb.

Using your 17,500 well estimate and the 18,600 wells completed through Dec 2016 (from shaleprofile.com) we have about 36,100 total wells (very similar to David Hughes’ estimate.) At 7.1 Gb, this implies about a 197 kb average EUR for Eagle Ford wells, fairly close to the estimate of Hughes.

I really can’t explain the data. It looks pretty funky. If a well only derives 50k barrels within a year, it is really a bad, bad well. I haven’t seen too many of those, even in Atascosa County, which I follow pretty closely. Atascosa doesn’t have the best of wells compared to some of the other Counties, so quien sabe? It just does not look right.

The wells produce far more than that in the first year, actually more than earlier wells though that might have reached a limit, it is the extrapolation to the EUR that looks like it is falling to me.

Price is restricting a lot of drilling in the Eagle Ford. Then again, there are a lot of wannabe upstarts using OPM, who are drilling in insane areas discarded by the big players, who are obviously losing money. There are huge areas held by production, that have a lot of production left. I am sitting on a 3200 acre area that has 5 wells on it. They are not going to drill on it much, until price improves. One well had a 175,000 bbl first year production, and one 150,000 first year production. The other three were in the 120,000 bbl range. The bigger ones are well over 200,000 bbls, within the first two years. But, these are not “prime” drilling areas for EOG, they want 200k the first year. When price gets in the $80 range, I imagine it will look better to them, but the area will still have to compete with many better areas. I don’t think the “numbers and charts” paint an accurate picture.

It only measures the Eagle Ford, and it doesn’t say anything about the drilling in the Eagle Ford leases within the Austin Chalk in Karnes County. It’s a freebee. Why drill in your prime Eagle Ford area, when the Austin Chalk gives you 5000 bbls a day initial production.

In the meantime, EOG is putting most of its capex into the Permian. It may make equal to the Eagle Ford, but they need to get wells drilled to hold more production. Meanwhile, they are finding out which areas are not so good so they can sell it to the shyster companies with OPM to drill more unprofitable wells.

Guym, yes something doesn’t look right (in fact that is what I said in the post) – you maybe think it’s the production data, I think it’s more likely the E&Ps are overestimating their undeveloped reserves, or at least their ability to bring them online within five years (something for which some of them have been warned in the past by the SEC, though I think only informally so far).

You seemed to provide examples of why there could be low producing wells in poorer areas as well as high producers so maybe the average as shown is explained.

Yeah, it’s probably a combination of factors, as discussed, with E&P overestimation being the greatest factor. There is a lot of good area that has a significant amount of area to drill, yet. The counties within and just north of the Karnes fault, far southeastern Atascosa County, northeastern LaSalle County, and northwestern McMullen, all have the capability of EUR above 300. Below that, and it’s high condensate/gas, causing companies like Pioneer and Devon to want to divest. Hence, from many wags, the Eagle Ford is dying, but a lot of good area is held by production. Outside of those areas, there be dragons. There are fewer areas like mine with 250-300k EUR well capability. More with 150 and below. Most of the good areas are held by EOG. There are many other players, but EOG holding the greatest area. By 2016, most of the area they wanted to keep was held by production. Of course, with continued drilling clauses, they have to keep drilling some. EOG may create another factor in determining what EUR comes out of an Eagle Ford with their enhanced oil recovery program. Over a 140 well test area, they have been able to increase recovery by 30 to 70% with gas injection.

http://www.artberman.com/bad-actors-hurt-eagle-ford-shale-well-performace/

This article more depicts my view of Eagle Ford EUR, but bad actors can make a difference. Not as many wells being drilled, because most leases are held by production. In the meantime, senseless wells are being drilled to appease OPM, and voila, you have average crummy wells.

Note that he limited wells selected to those with only one per lease, because Texas reports production by lease vs by well. Which raises a question how others are measuring individual EUR per well, when there is no place to get that data? That means he had to overlook most production. If you have a good well on a lease, you usually have more than one.

Hi Guym,

That is a problem with Texas RRC data. Enno Peters has figured out some way to estimate output from multi well leases, I am not sure how he accomplishes this. A good programmer could probably figure out an algorithm, I never attempted this.

I constantly use the same method to find out production in general areas. I come up with similar numbers to the charts indicated in Art’s article. Single wells on a lease should be a clue that they are not producing, in general, to where there are multiple wells on a lease. I also compare the initial rates on multiple wells with the single wells, to get another guess how an area is doing. Production on wells has gotten better, not worse. Compare the EURs in Art’s charts to the potential EURs on Enno’s, and remember Art’s wells depict mostly an earlier time in drilling. It ain’t right.

http://www.worldoil.com/news/2016/8/3/eagle-ford-shale-still-shows-promise-of-greatness-in-variations

Then again, what price are we talking about.

https://stratasadvisors.com/~/media/Files/PDF/Upstream/2015/Garrison_Jessica_WhatDoEURsandWellCostsNeedtoBe_2015.pdf?la=en

Or, who is measuring EURs.

Enno’s chart really had me going. For just EOG, who I have the operator number memorized, from 02/01/2018 to current, I pulled the completions from district 1 an 2. There were 18 in District one, where the highest IP rate was 3566, the lowest was 1815, and the average was 2500 bbls a day. District two had eight, with the highest of 3480, lowest 1638, and an average of 2774 bbls a day IP. Going further, I pulled all completions for district one, and sampled them. There were only a few wannabes that had ridiculously low IP rates like 28 and 48, but most were name players who produced probably an average IP rate of around 1000. EOG’s rates, from my previous research would yield EURs well north of 400k. The majority would yield north of 225k, and the losers would not pull it down that much. Not very scientific, but probably within reason, in my opinion.

Even using the drilling productivity report, which I don’t like, the average well approximates 1,300 bbls a day initial. That’s closer to a 300k EUR, than a 150k EUR. As the well should make close to 150k the first year with an IP rate of 1300k. Mine do.

Hi Guym,

I think Enno’s data is pretty good.

Note that I believe George’s estimate is the average EUR for the entire life of the field.

He assumes, correctly I believe, that eventually the tier one areas will become saturated with wells and then the new well EUR will start decreasing.

My estimate for 2014-2015 Eagle Ford average wells (based on Enno Peters data through April 2016 downloaded almost two years ago) is about 203 kb, if the wells are shut in when they reach 10 b/d due to economics. It is certainly possible that the average well profile improved in 2016 as wells were high graded (sweet spot only drilling.) Eventually EUR will fall as closely spaced wells in the sweet spots may not have as high EURs as older wells that may have been spaced appropriately.

Using more recent data (from Feb 26,2018 from Shaleprofile.com), the 2016 average Eagle Ford EUR is about 217 kb, cumulative output is 122 kb for the first 18 months, the best hyperbolic fit has qi=25,771, b=0.8377, and Di=0.355 (see Arps hyperbolic).

http://www.petrocenter.com/reservoir/DCA_theory.htm

For Mike and Shallow sand’s payout calculations, 60 month cumulative is 181.3 kb and 36 month cumulative is 156.8 kb, the well reaches 10 b/d output after 136 months (11.3 years).

Hi Guym,

In 2016 the average EF well made about 537 b/d in month 2, (which tends to be the highest month, because on average most wells don’t produce for 30 days in the first calendar month that they produce). The average well’s 12 month cumulative output was 100.7 kb for wells that started producing in 2016 (based on data from 1411 EF wells in Enno Peters database for 2016.

https://shaleprofile.com/index.php/2018/02/02/eagle-ford-update-through-october-2017/

After 10 months cumulative output for the 2017 wells is about 7 kb higher than 2016 wells, but most of this is from the first 5 months of output, after that the 2016 and 2017 well profiles look very similar for data so far (based on 770 wells starting production in 2017 with at least 5 months of data.)

Based on Enno Peter’s data the cumulative for the average EOG well in 2016 was 151 kb after 12 months (data from 207 wells) compared to 101 kb cumulative output for all EF wells in 2016 (1411 wells) after 12 months.

EOG does gave very good wells, peak output (month 2) is 956 kb/d for average 2016 EOG wells (224 wells total), compared to 536 b/d in month 2 for the average EF well in 2016.

To get an idea of a field’s potential, all wells both good and bad need to be counted in my opinion.

The increase in well productivity comes with a higher cost tag and whether it is 225 or 250K BO EUR, at a gross WH price of $60 per barrel and a net back price of $30, those kinds of estimated UR’s are barely (in)sufficient to pay out $7.5M well costs. One cannot replace reserve inventories that are declining precipitously, much less grow reserves, by breaking even. It is, in my opinion, a mistake to assume the future of unconventional shale oil resources in our country is strictly price dependent. It is very much money dependent.

I think one of the primary reasons there are any rigs still running in the EF is to comply with SEC, 5 year, drill-it-or-lose-it rules for proximity related PUD reserves. If you have borrowed money on PUD reserves and are about ready to have to impair, again, because you are running out of time, you are up Shit Creek. Or further up Shit Creek than you already were. Otherwise, I don’t know why anyone is drilling Eagle Ford wells anymore…unless they know, guaranteed, the price of oil is going to $85 and will STAY there.

Just thinking about all these stripper horizontal wells gives me LOE nightmares.

A major expense being downhole failures, doesn’t it make practical sense that these wells will be very high cost? Over 10,000’ of rods rubbing up and down against 10,000’ of tubing, and in particular in beginning of the “curve” where the down hole pump apparently must sit in order to keep from pumping off.

We have wells that haven’t been pulled in years, but those are slow pumping verticals that are very shallow. Many drilled with a cable tool. Straight holes, little rod wear.

I just cannot imagine getting a long run without a failure on these hz wells with a 640 Lufkin pounding away 24/7/365.

I drove by 33 Eagle Ford shale oil wells today, Shallow; did a little windshield poll. Twenty one of them were down. Or on pump-off controls. Either way, they weren’t making money. Might be they were all WOR; everybody has fled S. Texas for points West. Hauling frac sand can now make you upper middle class in less than 6 months.

Rod lifting those kinds of wells you describe… been there, done that. It sucks. Steal one in a garage sale, or off eBay and for a while you think you hit a big lick. Then along comes a $135K well intervention that takes 2 years to payout and you wish you’d become a landscape engineer (lawnmower) instead.

So it looks like shale oil is all about getting as much as you can in the first 3 years – the rest is pure luck before equipment breaks down?

All wells on rod lift eventually will have down hole failures. When wells fail often, or are low oil volume, they may become uneconomic to produce.

From what I have seen from actual joint interest statements to non-operated working interest owners, it costs between $3,000-$20,000 per month to operate a shale oil well. Much of the expense depends upon how much water is produced with the oil. Almost all produced water is truck hauled. Water disposal systems are being constructed, but those are very expensive.

The $$ figure I cite does not include repairs of down hole failures such as pump failures or tubing leaks. About the cheapest downhole repair I have seen for one of these wells was $15,000. The highest I have seen was almost $500,000.

EUR estimates for these wells are for a 40-50 year well life. Much of that life the well will produce under 25 BOPD. Most of the wells in TX are burdened with a 1/4 royalty.

So, just for illustrative purposes, let’s say a 5 year old EFS in TX is now producing 6,000 net BO to the working interest owners. At $50 WTI it is providing gross income of $300,000. By the time we subtract LOE, G & A, and severance taxes, there is likely less than $100,000 left.

Then, realize many shale companies, to raise money, have sold their gathering systems, something which kind of astonished me at first. Therefore, the working interest owners are also paying to use those systems. Even less $$ to the bottom line.

So, as Mike says, it just becomes a gamble on how many down hole failures occur. If you luck out and have none in the year, you might make a little at $50 oil, more than one per year and you have likely lost $$.

There will be several hundred thousand of these wells onshore US before it is over. Each with a plugging and abandonment cost of around $250K estimated.

But, at $100+ oil, these might work. Just a big risk.

Hi Shallow sand,

My EUR estimates assume the well is shut in permanently when flow gets to 7 b/d or less. The model EF well I use has an EUR of 213 kb over 155 months (12.9 years), cumulative output is 177 kb over first 60 months and 154 kb over the first 36 months. This well profile is based on data from 2014-2015 wells pulled from shaleprofile.com in April 2016, I have not updated the well profile since then. Chart with hyperbolic coefficients in chart below, a least squares routine was used to fit the hyperbolic to the data (21 months of data at that time).

Assuming $30 total cost per barrel a 60 month payout would require about $72/b. A 36 month payout would require $79/b where a $7.5 million dollar well cost is assumed in both cases.

The rod has to go all the way down the horizontal? I didn’t know that

As a corralary, has anybody ever drilled a horizontal “uphill”? og to the bottom or below the zone such that the fluids later flow don to the vertical part of the well?

Wake,

I think that is how it is done, the pump goes in the vertical section of the well which may be as deep as 10,000 feet, then another 10,000 feet of horizontal lateral for a total length of the well of about 20,000 feet. The bend in the pipe (the heel) is usually lower than the toe (the far end of the horizontal well).

No, the pump is set in the radius and the approximate maximum deviation from vertical is 10-12 degrees. That still creates mechanical problems, as does highly deviated wells drilled with speed records in mind. Drilling efficiencies (faster is better) are eaten plum up when turned over to the production department. Yes, depending on dip rates of the sediment(s), lots of wells are drilled heel down, toe up.

Its still early in the leaning curve but there are thousands of shale oil wells making less than 20 BOPD; at $60, economic limits I believe are closer to 10-12 BOPD and there are also lots of those. Water production and OWR is the deciding factors in economic limits.

Thanks for the correction Mike. The radius makes sense.

If the economic limit is 11 b/d the EUR falls to 201 kb,

time to payout is unchanged. It is doubtful that oil will remain at $60/b in my opinion.

The average EF well (as in the profile I show) reaches 11 b/d 9 years after starting production. The earliest EF wells (from 2011) will get to that point in 2020 (for the average well), some of the more poorly performing wells (bottom 25%) may be at that point about now.

Many wells may be temporarily abandoned when oil prices are low, not sure if it is practical to bring them back on line as I don’t know the industry, it may depend in part on the price of oil.

I suspect the optimum is to push the kickoff point as low as possible, and place the pump right above the kickoff. But I’m not sure about the GOR, which can gas block and overheat the pump if it’s placed too high. In theory, these wells will make a lot of gas, and this makes pumping a real hassle.

Gas lift isn’t much good if a well is low rate and has a 1500 scf/bbl liquid ratio. So gas lift may only make sense for wells making a lot of water. When I had teams designing wells I emphasized they lay out strict guidelines for drillers regarding the directional design. This was even considered in pad design and layout, because it can define the horizontal leg length. It’s even useful to have well drilling performance graded in part using the final directional survey.

I suspect these companies were a bit greenhorn when they started drilling these wells 10-12 years ago, neglected these issues, and now the have a limited well life. Maybe their design was better anyway, or maybe the better option is to let the wells die, put in a gas lift string, and use it to kick off the well at regular intervals? It all depends on the particular well. There must be a ton of money to be made optimizing lift.

Mike, I don’t know much about gas lift, but am reading an article that it is best for these highly deviated hz wells. I guess produced gas is reinjected with large compressors?

Article states these shale wells have gas slugs that are hard to handle on rod lift, and that submersibles also have a tough time handling the gas slugs.

Seems that gas lift might not be so cheap, when I read about large compressors, I see $$$$$$$. A lot of power expense, high compressor rental rates, or spend big $$$ for one and spend big $$$ when it breaks down.

Also, looking at some Bakken well photos. Are those pump jacks 4 or 5 stories high? We use some 10’s and 13’s, and you can fit one of them in the back of a pickup truck.

20 BOPD shale well or 1 BOPD 1,000’ stripper? Hmmmm, seems like an easy decision to me.

Mornin’ Shallow. Work starts early in the oilfield. Again, rod lifting any deep HZ well is a nightmare, particularly shale oil wells that if not pumped properly, do indeed slug, or u-tube gas causing POC’s to kick in and shut the well down for fluid buildup. They also sand up frequently, make scale (many wells in the EF have an increasing H2S component to them), and shale wells make paraffin, to boot. Interventions are very nasty and very expensive. The whole thing requires actually getting dirt under one’s pedicured fingernails, if you can imagine that.

Those are big 640 units you are looking at in N. Dakota, an enormous upfront CAPEX that later becomes overkill in the life of a shale oil well and are expensive to fix, yes. If you want some I suggest you wait a few years and you’ll be able to buy all you want on eBay for little of nothing.

Gas lift can be more economical, depending on fluid conductivity. As wells deplete GOR goes back up (before it goes back down) and a lot of wells are taken off rod lift and put back on gas lift, then they will go back on rod lift when they reach hospice care.

For one’s assets to be “liquid” there always has to be buyer on the other side of the deal. The shale oil industry is selling assets like crazy right now to increased dividends and appease angry shareholders but most of those “assets” are undeveloped Tier 2 type acreage blocks. The wells on those blocks are marginal and getting more marginal and when undeveloped acreage is all gone there will be less and less acquisitions and mergers, etc. because buying marginal stripper shale oil wells, with high incremental lift costs, that are subject to plugging and decommissioning costs, won’t happen. Major integrated oil companies do not want to operate 4,000, 12 BOPD wells that are declining 10% per year. Lots of big shale producers will be forced to ride those horses plum in the ground and when the dust all settles, and UR’s are half of SEC booked EUR’s, folks are going to finally “get” what a scam this has all been.

Sand problems, by the way, in the Permian are nothing compared to water problems that are coming. We have a mutual friend attending a Permian Basin water conference going on right now in Midland and he is appalled at all the lying going on about water in West Texas. Everybody’s “predictions” for the future are all now on the back of the Permian and water problems out there, in the desert, is going to slow that party down and raise costs big time.

Are you participating in the oil price contest? I’ve never seen so many experts so absolutely certain that the price of WTI is going to be $79.87 on November 27, 2018. Is there a trophy or something if you get it right?

For the shale oil industry to get thru the less it made for itself prices are going to have to get much higher, and STAY there. Like they haven’t done in the past.

Hi Mike,

Call it $110+/-10 $/b at the end of 2018, if the annual rate of increase from the last half of 2017 continues. As you well know we don’t know the future price of oil, and you never make any prediction, so I guess you are correct. 🙂

Rystad Energy – Oil and gas production from the Southeast and East Asia region is estimated to decline by nearly 20% (3 million boe/d) from 2017 until 2025, as new projects are not able to compensate for the natural decline in production of mature fields. However, China’s production is expected to decrease the least, supported by the stable output from the giant Changqing field and several ramping up projects, including Longmaxi Shale.

https://www.rystadenergy.com/newsevents/news/newsletters/EandP/eandp-newsletter-february-2018/

Hi George Kaplan,

There are about 11,337 wells that have been completed in the North Dakota Bakken/Three Forks through Dec 2016 (9300 from Jan 2011 to Dec 2016), probably the average EUR of wells drilled so far is about 325 kb, so with no further drilling this suggests about 3.7 Gb. Another 2.5 Gb added to this would be 6.2 Gb, fairly close to your 7.1 Gb estimate. I would guess that there may be some probable reserves, proved are 4.8 Gb for ND Bakken/TF, at the end of 2016 about 2 Gb of cumulative C+C had been produced from ND Bakken Three Forks, so for North Dakota about 6.8 Gb of proved reserves plus cumulative output at the end of 2016.

A conservative estimate of 30% of proved reserves for probable reserves (about half the rate of UK North Sea) would be another 1.4 Gb for 2P plus cumulative output at 8.2 Gb. Potentially reserve growth might increase URR a bit more to 9 or 10 Gb for URR, especially as oil prices rise.

I set up a scenario with about 40,000 completed wells with EUR decreasing after 2020 enough to give the mean USGS TRR (about 10 Gb) with 120 new wells added per month through 2034 with decline after to no more wells added after 2039. Then economic assumptions applies with oil prices increasing from $55 to 120/b (2017 $) linearly over 9 years, then falls from 2032 (again in straight line to $99/b in Dec 2040).

This price scenario (a pretty conservative one) reduces URR to 9.1 Gb. EUR falls from 370 kb (2018 to Dec 2019) in Jan 2020 to 121 kb in 2032, total wells completed is 31,400 (fairly similar to David Hughes estimate). Peak output about 1300 kb/d in 2020 for this scenario (prices only reach $73/b by mid 2020 in this scenario). Higher oil prices could potentially result in a higher completion rate than this scenario.

As always, the scenario could be changed to higher or lower completion rates, and different oil price scenarios.

As I said 7.1 isn’t my estimate – it comes from extrapolating a curve fit to the E&P estimates. It’s just another wy of looking at it, I make no claims for it being better or worse than any other, for me it’s more interesting as a base line to see how things change as the core area get’s exhausted

George,

Just comparing the estimate that isn’t yours with an alternative, higher prices may lead to more well completions as lower EUR wells may still be profitable, as prices go up reserves may increase for that reason.

It seems likely that as oil supply becomes tight, oil prices will rise.

Norway production numbers for January out. Crude up 77 kbpd, mainly with Goliat coming back on-stream. They’ve stopped breaking out condensate from the total liquids, but it was fairly small. They are down 7 kbpd y-o-y and 23 from prediction. In other news a small dog fell asleep at the local shopping mall.

http://www.npd.no/en/news/Production-figures/2018/January-2018/

Well, as they say, let sleeping dogs lie. Great post. You da man!

Norway’s 2018 production forecast for C+C, average 1.585 million b/day.

I got a large spreadsheet with estimates on field level for 2018. I got to 1598 million b/d as I summarised all the fields. Accounting for outages that normally may affect production some places the number I got is pretty much in line with OD forecasts or somewhat lower. I suspect reality might be even lower and at least the 1.7% decline last year. I am doing this to get a feel for production forecasting offshore when detailed information is available, and in this country it is fortunately also very reliable.

The bigger Norway story might be gas – I think it is going to start dropping, which might come as a surprise to some customers.

https://oilprice.com/Latest-Energy-News/World-News/Surprise-Crude-Draw-Lifts-Hope-For-Oil

And oil price is down. Interest rates are up because traders are confused on what did the Fed really say? And so forth, another day ends. Confused, but it ends.

https://www.reuters.com/article/us-global-swf-kazakhstan-analysis/kazakhstans-frozen-billions-sound-alarm-for-sovereign-funds-idUSKCN1G40MI

Synopsis, Kazakhstan’s SWF has been semi-sued in European court. Assets frozen. SWFs are usually fed by oil. Norway the largest.

In the past SWFs were considered sovereign assets and immune to seizure by other governments (absent debt owed to the govt itself). This situation is a private businessman with investments in K’stan. So he’s grabbing for the SWF money outside K’stan. Court ruled for him and all other SWFs have gotten concerned.

From the previous OPEC thread: one area I forgot that there may be spare capacity is the neutral zone, shared by Kuwait and Saudi. It has a couple of major fields, one operated by Chevron, and has been shut down due to some sort of dispute for a couple of years but could add 400 kbpd I think.

Not entirely surprised

http://peakoil.com/forums/aspo-usa-implodes-t74037.html

ASPO instead of sticking to the facts about oil depletion and providing sober and rational predictions allowed itself to be steered by a few extremist doom mongers.

The likes of Jeff Brown, Ace, Patzek and others were given air time their knowledge never warrented.

http://www.theoildrum.com/node/5154

A typical example of the kind of illiterate research that gained traction between 2005 and 2012.

http://europe.theoildrum.com/node/4202

Just another example of someone putting themselves forward as an expert.

Sam Foucher was another figure fiddler who only got air time, because the people who gave him air time knew even less.

http://www.theoildrum.com/node/3626

I said years ago that unless a calmer and better informed message was put across, the real threat of Peak Oil would be done a great disservice.

This is exactly what has happened.

Peter,

It’s quite nice of you to come in here and ridicule individuals on the timing of Peak Oil. So what that some of the Peak Oil analysts got the timing off by a few years in the whole scheme of things. The negative predicament of peak oil today is far worse than it was in 2005.

Furthermore, it’s interesting to see someone bickering over the timing of the peak oil collapse when the real issue has always been the negative consequences of the collapse.

Peter, you remind of a wife who is pissed off at the Doctors who gave her husband two years to live. Thus, the death of her piece of garbage husband was something she looked forward to due to the $5 million life insurance policy. Unfortunately, the Doctors got the timing wrong, so she had to live with the wretched slob for another ten years.

Regardless…. you have no idea how bad the situation is in the U.S. Shale Oil Industry. Just because peak oil was postponed due in part to a massive increase in debt, money printing, zero interest rates and the swindling of hundreds of billions of dollars from investors to continue the U.S. Shale Ponzi Scheme, doesn’t mean the negative consequences of peak oil aren’t still going to be awful.

Lastly, the market has no idea the tremendous amount of FRAUD, CORRUPTION and CRIMINAL ACTIVITY that is taking place in the Shale Oil Industry. However, in a few years, it will become quite apparent.

I saw a recent comment that Mexico could tap into its Shale Oil Deposits and grow its production tremendously just as quickly as the U.S. Shale Industry. If Mexico and Mexican investors are stupid enough to start another Shale Oil Ponzi Scheme, then they would deserve to lose billions of dollars.

If the market thought ENRON was the biggest Energy Ponzi Scheme in history, they are in for a rude awakening.

steve

Peak Oil collapse?

What in particular are you worried about? Do you feel that civilization will collapse without cheap oil?

“the market has no idea the tremendous amount of FRAUD, CORRUPTION and CRIMINAL ACTIVITY that is taking place in the Shale Oil Industry”

I haven’t heard this much fear mongering since the last time you were pushing your silver and gold sales. Have you tried Tverberg’s, she had her readers all whipped up on the end of civilization that never happened years back. I’m sure there’s still a few doomers hanging out over there. Good luck !

Maybe an investment in an EV is a better idea for you SRSrocco

Our civilization is more addicted to oil, than ever. Oil in nonrenewable, and most of production comes from fields discovered many decades ago. The fact that collapse didn’t happen so far, means that it will only be worse, because every day 200k addicted to oil people show up on this planet.

Are you worried about the oil industry collapsing, or civilization?

If it’s civilization, are you worried about the short term, or the long term effects?

Good gravy Nick, are you serious? Civilization will eventually collapse, and peak oil will only be one of the causes. There are so many other causes. The destruction of the environment will be one of the primary causes.

are you worried about the short term, or the long term effects?

When civilization as we know it collapses, all effects will be long term.

“because every day 200k addicted to oil people show up on this planet”.

Let’s at least defined the problem correctly. A reduction of available transportation isn’t going to be the cause of collapse. Actually, less transportation would slow down the destruction of the environment.

The answer to mass shootings isn’t more guns

A reduction of available transportation isn’t going to be the cause of collapse.

Well, it’s not only transportation we are talking about. A declining oil supply will make everything more expensive. Oil is used in farming and delivering the food supply around the world.

We live in a globalized and mechanized world. And there is no going back. The collapse of globalization and mechanization will cause a dramatic die-off of the population. That will cause political chaos and more destruction of human life. And hoards of hungry people will eat anything with meat on its bones.

The collapse of globalization and mechanization will cause a dramatic die-off of the population.

So, Ktos…is this what you’re worried about??

“The collapse of globalization and mechanization will cause a dramatic die-off of the population.”

The sooner we’re knocked down a few billion the better off the other forms of life that we share the planet with will be.

I’m optimistic for myself. Everyone else is fucked.

because every day 200k addicted to oil people show up on this planet.

Right: • 360,000 births per day—————– • 151,600 people die each day

The root of the problem is the daily growth rate of 200k humans per day that is destroying the environment or mother earth that supports all of us. There are many resources that are being consumed at unsustainable rates, not just oil. We live in an age of an unbelievable buffet of conveniences and riches. We are just spoiled. We waste more resources than we need. In addition, basic economics teaches us we will substitute an expensive resource with a less expensive one. Running out of oil isn’t going to be the focal point of our demise.

Steve

Some of the so called experts publishing their expertise on theoildrum deserve nothing but ridicule.

Jeff Brown in one of his presentations predicted Russia would be a net oil importer by 2022.

Oil is vital for certain things such as pesticides, herbicides, plastics, aviation and marine travel. The main consumer of oil are cars. Cars are not vital, they are a luxury. Obviously some people living in remote areas need cars but electric cars are already an alternative although rather expensive.

Most people live in cities and it is absolutely possible to live your entire life in a city and never get into a car.

https://jalopnik.com/these-ten-cities-have-the-best-public-transit-in-the-wo-1610824583

Indeed London and other cities had excellent electric trams and light railways until idiots like ford had them ripped up.

http://www.tundria.com/trams/GBR/London-1934.shtml

An electric tram can remove hundreds of cars off the roads, if they could build them in the 1910 and 20s they sure can today. Infact trolley buses do not require digging up roads, route could be up and running in a few months.

http://www.geoffbannister.com/tod/two_routes_657.html

Since farming and food transportation only takes up about 15% of oil consumption I do not have a worry about oil.

The five greatest threats we face are soil erosion, deforestation, water depletion, fish stock destruction and antibiotic resistance. I see little attempt to deal with any of these issues.

Then everyone dies. Does it really matter what you die of?

The peak oil “experts” deserve to be ridiculed. I don’t know how to predict when oil production will peak but then I never pretended to have that ability. A lot of people pretended to have that ability and mislead the rest of us (“Nosedive in the desert” anyone? Where is Stuart Staniford?) Maybe peak oil will eventually happen, but it will happen because of demand peak. In a couple of years there will be lots of electric cars and in another 10 years they will cheap. When batteries become cheap there is no reason why trucks, farm machinery, etc cannot run on electricity.

Suyog

Steve, as best as I can recall, a few blogs back you mentioned that some big news was going to released regarding Bakken production. Was the news ever released?

I guess this means that private tank farms & floating storage have been emptying quickly. This is interesting although it is just conference chatter with no details…

2018-02-22 FT – Vitol, world’s biggest independent oil trader, sees “fairly strong” demand for crude this year, leading to a further drawdown in global stockpiles later in 2018.

Speaking at International Petroleum Week conference “Half a billion barrels of oil has been drawn down in a short period of time”

Stockpiles at important oil storage hubs such as Saldanha Bay in South Africa have been “emptied” and crude stored on tankers at sea, such as off the coast of Iran and Singapore, is “all gone.”

(one free read) https://www.ft.com/content/3d812528-17b6-11e8-9376-4a6390addb44

What do you think a “short period of time” is? One year would be 1.4 mmbpd short, or 1.6% negative balance – that would seem to be the biggest oil news of 2017 if true (or maybe second after record lowest discoveries).

He must mean 12 months, and he’s including everything OECD stocks and floating etc

US storage (crude+products) topped in February 2017 and have fallen by 152 million barrels to November. US monthly chart https://pbs.twimg.com/media/DVN7mH3WkAAtWVf.jpg

The floating storage statistics that were available (for free) topped out February 10th 2017 (sadly no longer available)

What’s going to stop stocks keeping on falling? Doesn’t it indicate we are under supplied – there should be a signal to price, but it only seems to be triggered by US crude stocks, which are mostly influenced by refinery outages at the moment, not global numbers.

Yeah, the stocks have been dropping faster than US supply has been increasing, and it has increased a bunch since the first of last year. So, how’s the increase in US shale supposed to keep up with the increase in demand, and the shortage already apparent? I am talking 2018, not 2022.

This is why I expect Brent may be at $107/b by the end of 2018.

See comment further down.

Hi Dennis,

If Brent is trading at $107 ten months from now. California Resource Corporation (CRC) will be trading north of $50 per share, which you can buy today for less than $20. If you want to leverage that trade, you can buy January 2019 $35 calls for less than $3. You can make money with your knowledge if you put it to work. It could make the difference between you buying model S instead of a model 3. It’s why the weekly EIA balance sheet Energy News posted a link to below is so important.

You snooze you lose

Huntingtonbeach,

Trends can change, I am not a gambler.

The “if the current trend continues” is a very speculative “if”.

You are welcome to make that bet, I’ll keep my money.

“I expect Brent may be at $107/b by the end of 2018”

That’s a lot of “if”‘s from such a bold statement from someone who discounts the EIA balance sheet for uncertainty. There is a difference in random chance gambling and risk management. I’m with Goldman Sachs seeing Brent reaching $80 plus in the next 6 months. Remember this opportunity you are pasting on. Because I’m going to remind you of it later this year.

Safe minimum risk 10 year T notes pays less than 3% before inflation. Warren Buffett manages risk and doesn’t gamble.

To each is own.

Snort—-

HighCocaine, you might want to take notes before autonomous driving takes your day job

Job?

You must be kidding!

You can’t acquire wealth working–

Huntington beach,

Place your bet.

My guess is 85/b in 6 months simular to goldman’s guess.

The guess could be right or wrong.

You see the “may” in that bold guess, I assume.

The output estimates in the weekly petroleum update is not very good.

I have never suggested the entire report should be ignored. Import, export, and stock levels are useful. Output data not so much.

Dennis, I already have more than enough CRC to buy a model 3 and bought a whole lot of it for less than $10. If it’s 6 months or 2 years, oil is going up in price. Every time a drill bit enters mother earth, there is a risk of it being a dry hole. I’m just not into getting dirt under my finger nails. If your really that risk adverse, how about a little XOM and a sunroof on your 3?

There are doers and there are talkers, but when the Tesla meets the road. What’s your tombstone going to say ?

Huntingtonbeach,

I could buy a Model S tomorrow, I choose not to and will wait for the Model 3, you may not be aware, but there is a long line for the Tesla Model 3, those who own a Tesla get to jump the line, I am not one of those people.

I choose not to be.

As you have said it’s a free country, thank goodness for that.

OK Dennis, I’m going to stop trying to push your button for now. I wouldn’t buy an S either. I thought the quality of the interior was more inline with a 50K vehicle with a few modern designs to take ones attention away from that fact. The performance is amazing, but I’m not 20 years old anymore. So that doesn’t register that important with me anymore either.

Besides, 100K for a car just doesn’t really make sense. The moment you take ownership, it’s worth 20% less and the idiot parked next to you will slam his door into it, if he doesn’t rear end you. It’s only a means of transportation.

My bike is fossil free and I have electric gardening equipment. They are both good examples that we can live well with less fossil fuel.

Huntingtonbeach,

Agree 100k is too much, every car depreciates rather quickly, but it’s hard to find a used Tesla with the features I want, I’ll buy new and run it into the ground. Bicycles are nice for local transport in nice weather.

To go 100 miles in a couple of hours, not so much and I would rather reduce my carbon emissions when making such trips, I will also get PV to power the car, in the mean time I support low carbon electricity production by buying green tags.

It takes one person at a time to make positive changes.

If he refers to the last 8 months (incl. february) that would mean a deficit of more than 2 mill barrels/d, storage reductions of 60 million barrels a month. Really big numbers, difficult to check them though.

If this was true, we’re in big trouble with demand growing nearer to 2mb/d than 1 adding to the demand.

So we would need 3.5 mb/d new capacity end of the year – with all these frack sand shortages and OPM companies stuffing the scare frack sand in unproductive holes this will get difficult, especially when OPEC doesn’t has much real spare capacities fast. Just 3 month peak capacities won’t do the trick, a fast opening of field in Iraque and Saudi spare fields would be necessary to prevent 150$ oil.

I also have big problems figuring out how the deficit is going to stop. The strange thing is as G.Kaplan commented above, that the market seems unaware of where all this is heading. Stock prices for E&P companies for example are lagging hard compared to other sectors.

“The strange thing is as G.Kaplan commented above, that the market seems unaware of where all this is heading. ”

Can’t blame them for that… There are so many uncertainties and counter-intuitive signals going on that it’s quite a gamble to make a forecast.

The price of oil is pushed down by the prospect of increased LTO production, while the the tax cut from Trump could raise inflation and push the price up… But this could also increase interest rate much quicker, which could harm LTO financials and investments, so push the price higher. But then, consumption could be harmed. And we don’t exactly know what OPEC will (or could) do if the price rise above $70. And the incredible growth seen in 2017 may have some bubble composition that could deflate soon, reducing also the demand.

2018 is a tough year to decipher for analysts.

Ves,

This concept is referred to as Say’s Law. In short, supply creates its own demand.

This “Law” has been discarded by economists to the “dustbin of history”.

See

https://en.wikipedia.org/wiki/Say%27s_law

Today, most mainstream economists reject Say’s law.

Global Offshore Prospects – Westwood Group, from 25th January, but can’t remember if it was posted.

https://www.sut.org/wp-content/uploads/2018/01/Global-Offshore-Prospects-SUT-25th-January-2018-1.pdf

They actually predict continued fairly low investment and offshore drilling for the next few years. They also have a list of new production which I think has a number of errors – e.g. Bonga SW next year and Rosebank in 2020 (I don’t think either has gone through FID yet), Zama in 2020 (appraisal drilling is not even due until early 2019 but I guess production could be fast tracked if successful), Sepia and Horseshoe in 2019 when I think both are scheduled for 2021/2022 (and they can’t spell Egina which you’d have thought they would given the amount of money they charge).

Talking at the same conference

UAE energy minister: People talking about “oversupply”, but “my worry is an undersupply”, as the effects of years of investment cuts into future oil production take effect.

The data on global oil stocks has never been very clear, there may be some proprietary data out there that gives the industry a better idea of what actual stocks are.

People may pay the most attention to US stocks because LTO caused the oversupply in 2014 so if that occurs again it may show up there, also US net import levels should give some clue as to how much US is pulling from the World market.

Prices also give us a clue as to how tight the market is. Brent has been rising at an annual rate of increase of about $40/b, at the end of 2017 it was about $67/b, should this rate of increase continue for another 12 months we might reach $107/b by the end of 2018. Lately the increase has slowed, it is impossible to predict forward prices and futures contracts do a poor job of predicting oil prices 12 months ahead.

The model continues to say $63.

Thank you George for yet another great post.

I’m not sure if I interpret the Westood presentation correctly. Do I miss something or have they forgotten how decline affect supply-demand balance? Page 15 (and 18) seems to only include new projects (another issue I would add to yours: Sverdrup is expected to ramp up instantaneous, but it is scheduled to come online at the end of the year).

Agreed on Westwood – I think a presentation by an economist or management consultant rather than a petroleum engineer; not so sure about the post, from the comments evidently too long and not as readable as it might have been, but thanks anyway. I thought there’d be someone commenting on Permian – the resource looks much higher than I had expected – rather than nitpicking over the smaller areas.

George,

You seemed to throw out the Permian estimate. The USGS estimate (F50) is about 29 Gb of undiscovered TRR for Wolfcamp and Spraberry combined, Delaware maybe another 5 Gb for 34 Gb, plus proved reserves of 4 Gb (at time of USGS estimates) for a total of about 38 Gb.

Verlhulst does not give a very good estimate in general and especially early in the life of a field can give strange results.

If we assume average EUR for Permian basin horizontal wells of 250 kb, the 38 Gb estimate suggests 152,000 total wells might be drilled. (Note that the 250 kb EUR average assumes that new well EUR will decline after sweet spots are fully drilled.)

The average 2015-2016 Permian well has an EUR of about 290 kb (based on data through April 2017).