A Guest Post by George Kaplan

Brazil

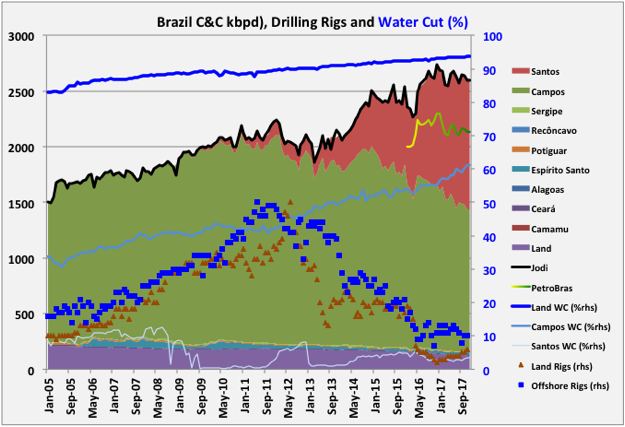

Brazil had a fairly uneventful 2017 for C&C production. Overall production was up 4.5% at 957 mmbbls (114 kbpd average), but the December exit rate was down 4.5%, or 124 kbpd, at 2612 kbpd. There were only two new platforms with significant ramp-ups, and one of those went off line for a couple of months late in the year. The Libra (now Mero) extended test FPSO came on line in November but had achieved only 11 kbpd.

Pre-salt production exceeded 50% for the first time. It was 1356 kbpd, or 52%, in December compared to 1262, or 46%, for December 2016. There were 85 pre-salt wells up from 68, but average production for each had fallen from 19 kbpd to 16, which is as expected as they were drilled mostly on producing platforms.

Petrobras owned 94% of December production, with Statoil at 2.4% (63 kbpd) and Shell, from their BG purchase at 2.1% (57 kbpd); for 2016 the numbers were 94%, 2.1% and 2.0%.

(Note that December water data wasn’t available at the time of writing so the water cut values have been assumed to be the same as November for the chart.)

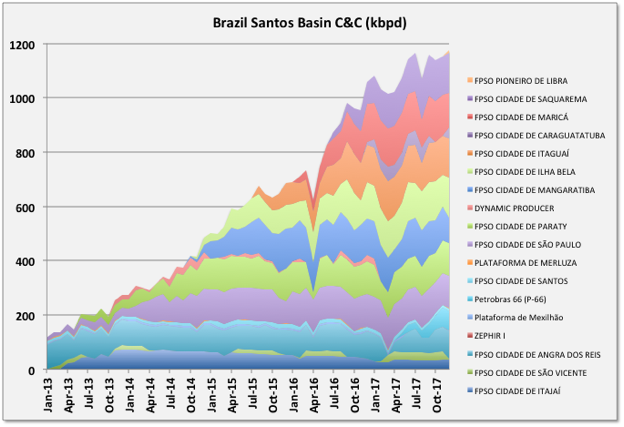

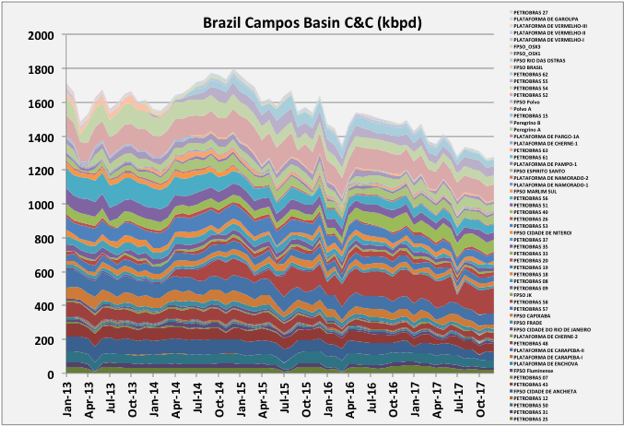

Santos platforms increased overall, but some of the older ones may be showing signs of coming off plateau. Campos platforms declined and the rate may be increasing as the water cut growth is accelerating.

This year will be a bit different as over 1 mmbpd of nameplate capacity is due to come on line, but it will be interesting to see how efficiently that amount of work is handled, and how far the ramp-up times might be limited by drill rig availability. If they add only another 20 odd wells then there is likely to be less than 400 kbpd new production. In addition reserve numbers for 2017 will come out in early April and the estimated Mero numbers will be important.

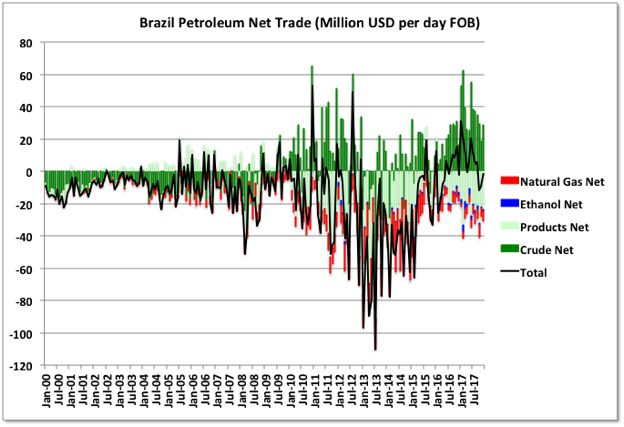

In 2016 Brazil had switched to a net exporter of petroleum in overall value as crude production grew; but in the second half of 2017 it looks like demand growth has taken over again and they are back to being a net importer.

Mexico

On the one hand, over the past five or ten years Mexico has been the prime exemplar for what post peak oil decline looks like after in-fill drilling and secondary and tertiary recovery options have all been used to accelerate production of available reserves, and discoveries dry up. On the other, last year it was one of the few countries with significant new discoveries.

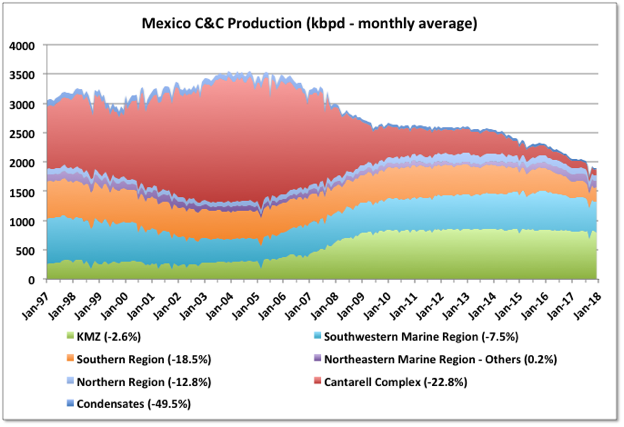

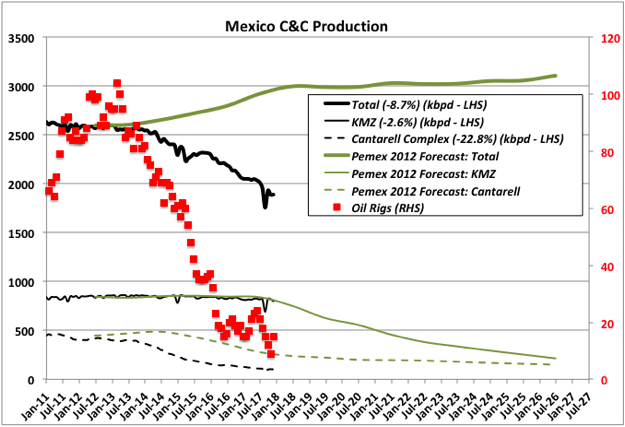

For 2017 overall C&C production dropped 18 mmbbls to 80 mmbbls (10% or 218 kbpd) and exit rate for December dropped 178 kbpd to 1890 (8.7%). Using the same average annual percentage drops would give a fall of 196 kbpd for next year, but I think that KMZ field will accelerate decline, maybe by 10%, and Pemex might be due for another major lost time incident or maintenance outage, so a drop of 250 to 300 kbpd is more likely.

The January 2018 data has been issued but only for major regions rather than individual fields so the charts below only show to December. However January was a good month with a 56 kbpd increase, split between the two maritime regions.

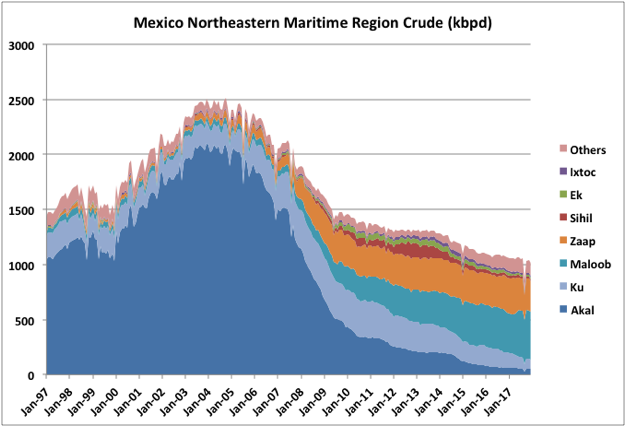

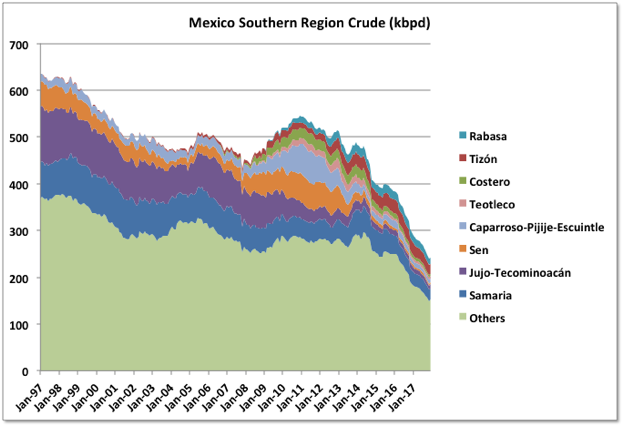

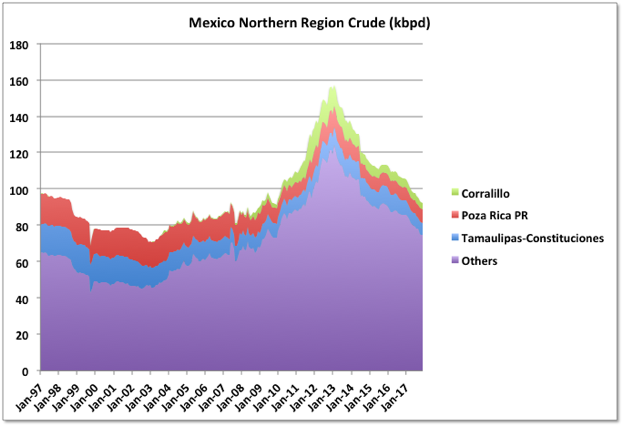

Really only the Northeastern Marine Region, which includes KMZ and Cantarell (with it’s dominant field being Akal), has been holding a modest decline rate, and that is likely to change this year as KMZ comes off plateau. The green lines in the chart show Pemex forecast for production from 2012, which hasn’t worked out too well overall – they were relying on significant new discoveries and rising production from Chicontepec, neither of which happened – but the predicted decline for Cantarell was quite close and that for KMZ looks like it is being followed now.

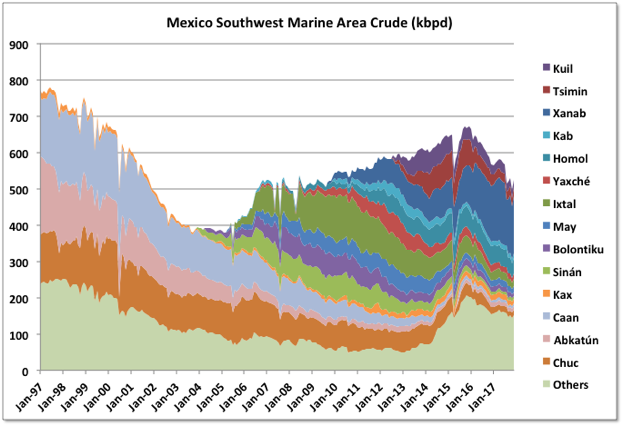

The two onshore regions and the Southwestern Marine Region are in steep decline and it seems unlikely this is going to slow down this year, though Abkatun has been offline because the previous platform was destroyed a couple of years ago, and a replacement is due in 2019.

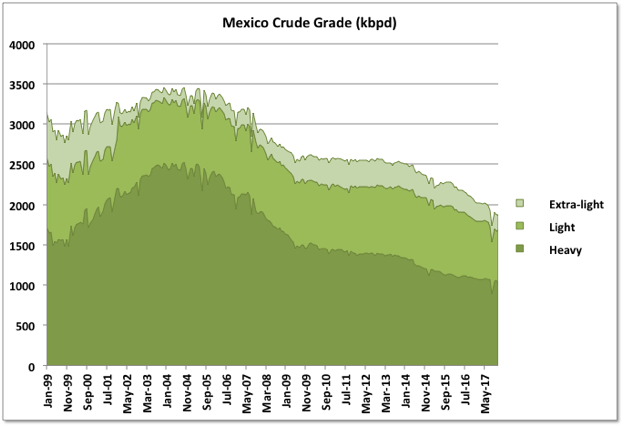

Most of Mexico’s production is heavy oil. The light and extra light (and more so condensate though it is a small stream and I have not shown it) are declining faster than the average. Recently exports of light oil ceased completely and they may soon need to start importing some to blend for the refineries.

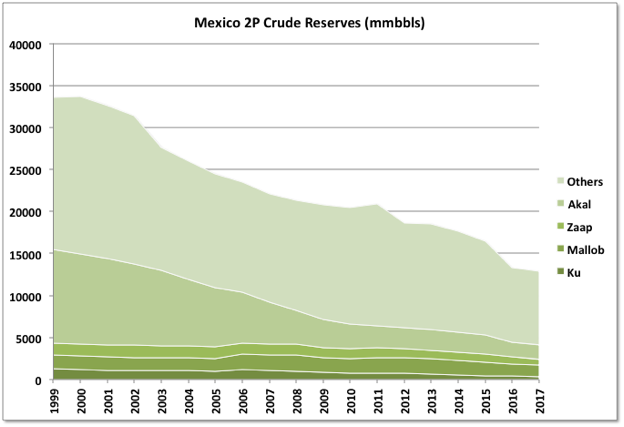

Mexico 2P reserves are declining slightly faster than their production. The four biggest fields in ultimate recovery are Ku-Maloob-Zaap and Akal (in Cantarell). These contribute almost half of production but now are down to about 30% of total reserves. KMZ overall has an R/P factor of about eight years, implying about a 12% decline rate should be expected going forward, almost all their reserves are shown as proven, so there is little upside potential. Akal is a strange field now: it has almost 2,000 mmbbls of reserves despite being at the end of a severe decline period, and with more probable than proven. The R/P is 85 years, which seems to imply a large portion of the total Mexico reserve is unavailable for faster recovery. There must also be some question on how long the existing infrastructure of wells and platforms can keep on producing before requiring extensive and expensive replacement, and whether this has been factored into the reserve estimates.

Their 2018 reserve estimates (for end of 2017) are due in April. Note that they label the reserves against the year of issue rather than the year for which the analysis is made, unlike most other regulators, so 2017 numbers are for end of 2016.

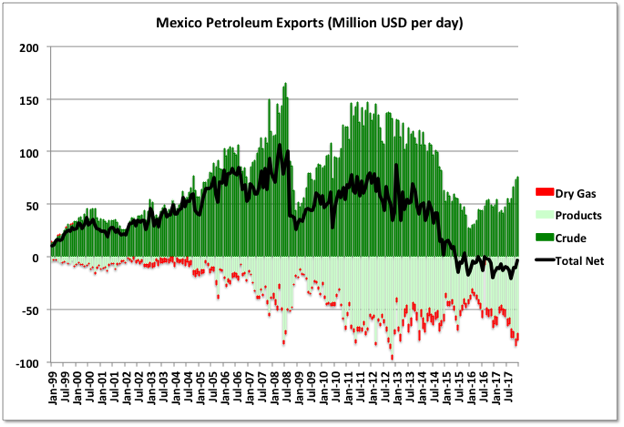

Mexico switched from a net petroleum exporter to importer a couple of years ago. Recently it has rduced its internal demand, and hence its import bill despite, falling production.

Off Topic Finish

I am a fan of cricket and cricket writers; I think, like baseball, it is a game that invites fine writing. I buy the Times, in spite of some of the awful political columnists, partly because it has Mike Atherton as it’s main cricket reporter. He was one of England’s finest players and possibly a better writer. Today, March 1st, he had a column concerning world cricket’s “slow awakening” to climate change; it and golf are probably the two summer sports most in tune with the elements. As usual a good read (and as usual the standard tedious, trite and logically flawed denier comment crap rapidly followed), but I think it missed the point: “slow” is not really good enough any more. 30% of clubs in England are prone to flooding now, some that have been badly affected have been given grants to recover – what exactly is the point of that when they face growing risk as climate change accelerates?

We have gone from denial that it’s happening to denial that it can possibly get any worse (maybe a bit of progress there). What is happening in the Arctic and Antarctic, especially as you can actually see the ice disappearing through satellite images, should surely wake people up; the fact that scientists predicted the consequential weather changes and extreme events before they happened should surely mean growing credence; but no and no.

In these circumstances analysis of oil production trends, along with a lot of other things we’d consider business as usual but that require a broadly stable and predictable environment to make sense, become small, irrelevant bits of noise on the overall signal; any future predictions are unlikely to be at all valid or really of much use. I starting looking at some of this stuff because the gushing, everything-is-awesome and often error prone reports from the MSM and the industry cheerleaders didn’t always make a lot of sense. I guess I’ll continue, but overall there are much bigger issues looming, and much faster than most people expected.

Nevertheless, despite the gathering clouds, the new English cricket season is only a few weeks away, and I’m looking forward to it like every year, so my deep-rooted denial is probably not much different to anyone else.

Thanks George.

Great job as always.

Agree. Thank you.

“Mexico switched from a net petroleum exporter to importer a couple of years ago”.

Looks like 2015.

Not too many countries left as net liquid fuel exporters.

I lived in Mexico last year.

Petro (the cost) was a issue for some of the proletariat, but always available.

Well, if Brazil is slow starting off with that one million increase, I am sure interest will pick up, fast, later in the year.

One new takeaway from the following post,is that RRC is starting to hit , at least, one company to decrease production due to excess flaring in the Permian. That is bound to become more prevalent.

https://oilprice.com/Energy/Crude-Oil/EIAs-Shocking-US-Oil-Production-Predictions.html

Good post, thanks George.

George,

Any thoughts about the impact of Mexico’s fear of foreign investment in oil E&P?

They don’t have a fear, they are now actively encouraging it, but maybe not getting as much immediate interest as they’d hoped.

George, have you ever looked at the science of global warming? How the heating effect of CO2 is logarithmic? How it is tuckered out as a greenhouse gas? How the Sun had been more active in the second half of the 20th century than it had been for the previous 8,000 years? I commend this as a starter: https://wattsupwiththat.com/2017/01/17/xkcds-cri-de-coeur/

Another evil manipulator of sketchy research is this guy.

Right, the off topic climate BS should have been placed in the non-petroleum thread rather than clogging up the more useful petroleum thread.

Well, “What is my head doing up my ass?” is a humorous source, but strays from reality with robust absurdity.

So, if you need some humor——

Go fuck yourself, it’s my post I can put what I like in it. People are free to ignore any and all of it – and I wish you in particular would. You, on the other hand, should have put your comment on the other thread, or better still just shut up completely as you are probably the biggest waste of bandwidth we have to put up with.

I want to discuss Neymar’s foot operation.

Climate change is all about whose numbers you have a greater belief in. Not much different from the mainstream media’s coverage of the oil & gas industry I suppose.

Climate change has become a political hot potato after it was coopted by the left as a means to introduce changes, taxes, and income redistribution schemes. This turns discussions about it into food fights.

For example, what ignited this particular fight was a comment about what’s happening in the high latitudes. However, I look at data all the time, and there’s nothing unusual happening. Antarctica seems to be close to a neutral ice balance, the Antarctic circumpolar current has been running colder than normal for several years, and it continues to do so. In the north we see ice mass to be a bit higher than in the last two years, but the overall trend is for less sea ice. This has led to more snow fall, which means snow cover is much higher in winter months. Greenland continues to lose ice at a very slow rate, sea level continues to rise but over the last year or so it’s running flat. It’s not exactly an earthshaking phenomenom.

coopted by the left as a means to introduce changes, taxes, and income redistribution schemes.

Sigh. Those are just talking points from the fossil fuel industry to block change. They want to create “red under the bed” fears.

A carbon tax is the main proposal from “the left” (really, just people who listen to climatologists). That’s a very simple free market solution – in fact, the main ways you’d see it are in fuel and utilities taxes which already exist. Complicated, annoying things like “cap n trade” and the Clean Power Plan were developed because the FF industry wouldn’t tolerate carbon taxes.

Carbon taxes are simply too effective (because decentralized free market price signals can be so powerful). They can’t be allowed by the defenders of the status quo.

Are you Ayn Rand’s secret child from her affair with Harold Bloomfield? Just stick to your right-wing, conservative blogs with their reverence for the wealthy, herd-conformity, and disdain for rational thinking. You make me want to vomit.

Have compassion.

He was a member of the Cuban elite under Batista and his corrupt regime, and had to flee to Spain under that Fascist Franco, and his brutal actions.

He has insight into oil, but is severely wounded.

Yes, and I’ve also read enough of you to know you haven’t got a clue on the subject. I’d recommend David Archer’s book, short and easy to read, and succinctly debunks all your “theory”, but there are plenty of other’s that do the same thing. Or just go to SkepticalScience and if you want more details follow the references and links.

https://oilprice.com/Energy/Crude-Oil/US-Sanctions-Could-Be-The-Final-Nail-In-The-Coffin-For-Venezuelan-Oil.html

More on potential actions by US on Venezuelan oil. The most interesting to me was a Columbia University report that states JV’s are cutting back production to limit exposure. Venezuela has not been keeping up with their capex requirement. I think the JVs are mostly the last pumping.

That’s a bit off. JVs are managed by Venezuela with some foreign partner advice, most of which is ignored (pdvsa management is dogmatic, stupid, and corrupt). Some foreign partners had been loaning money to the JVs to allow production to decline less, but that seems to have dried up. My guess (and it’s a guess) is that JVs produce about 50 to 60% of the current rate.

https://oilprice.com/Energy/Energy-General/US-Gasoline-Consumption-Falls-For-The-First-Time-In-Five-Years.html

This is hilarious! According to this article, gasoline consumption fell right after Trump got in. The reason being illegal immigrants drove less because of fear of being caught. Direct cause and effect, yup. Could have been the result of heavy drinking afterwards, and not wanting a DUI.

That is a great photo George, anachronistically charming with the dark storm clouds lending a sinister aspect of impending trouble.

I fully agree, the future is looking very fuzzy and foggy at this point with an anything can happen aspect. Fear and anxiety are growing though. Much like that first day on the battlefield when one hasn’t met the enemy yet but you know you will, no sense predicting the outcome, time, action and chance will tell all.

Mex refineries look well north of 1.2 mbpd throughput. Pemex owns a chunk of a US refinery, too, but not important for domestic consumption.

1.9ish mbpd Mex consumption. What is coming in probably isn’t crude.

They don’t import any crude or condensate at the moment, only petrochem., nat. gas, and refined products.

Thanks for the post George, always informative.

Funny that Mexican imports seem to mirror exports, like a reflection on a lake. Except that in the early naughts the sun was high and the net was positive where as currently the sun is lower and the net is negative. I wonder if the sun will continue down or go back up.

Something to do with refining capacity and demand changes maybe. What I should do is actually show total imports and exports, because even within each category I’ve used a net number, which, thinking about it, could be confusing (mostly for products I think, but maybe growing for crude now).

This could turn out to have some political and military significance.

“The Philippines’ government is in talks with an unnamed state Chinese oil company to discuss the opportunities for joint oil and gas exploration in the South China Sea. Earlier this month, China and the Philippines set up a panel to study ways of resolving their rival claims to parts of the South China Sea that may contain oil and gas reserves.”

https://oilprice.com/Latest-Energy-News/World-News/Manila-State-Chinese-Oil-Company-to-Explore-Disputed-Sea-Together.html

I just saw this quote on the Art Berman site. I wish more reporters and politicians were aware of this so we could have more realistic discussions about the future of energy.

“Shale is not a revolution–it’s a retirement party. Shale plays were not some great new idea. They became important only as more attractive plays were exhausted.”

Thanks for the update to George!

The most interesting thing right now is how much the projections for Brazil oil production will be stalling compared to their amboutious targets for 2018 (1 mill bpd nameplate). Just thinking out loud it would take 15-20 rigs to drill 40 new deepwater wells averaging 15 kbpd to give let us say 600 kbpd. Some rigs could probably be used to different tasks than drilling new wells in the Santos basin also e.g. in the Campos basin as well, so let’s say 15 rigs for 40 new wells in the Santos basin. Right now, there is only 8 active offshore rigs according to Baker Hughes…not enough, so we can expect this number to go up. Some of the wells connected to the new flow of FPSO’s could have been drilled well ahead of startup time, I don’t have the knowledge to estimate how many. But I do know that many FPSO’s in the past have been hampered by local content requirements that Brazilian shipyards could not deliver. So some sort of dealys would not be of surprise, even if much of the work is done in China these days. The brazilian economy is doing much better lately, 2% growth (gdp) and vehicle sales are up in the double digit percent. So as a rough estimate 600 kbpd growth will cover 200 kdpb decline, 200 kbpb domestic growth and give room to 200 kbpd export growth. And that is the most generous scenario I could think of. Petrobras is most likely not eager to invest too much before oil prices are even higher.

Some wells might have been predrilled, but not many given the few operating rigs, as you point out. I think they also use 1 water injector to about 1.5 producers, and those take as long to drill (a bit more as they are deeper). ANP has a lot of information on wells so I might take a closer look, all in Portuguese but Google Translate is pretty good. Although the FPSOs weren’t cancelled after the price fall and corruption issues there were a few drilling rigs cancelled, even some already under construction, and I haven’t seen news of them being reinstated.

I think just the training and logistics growth needed to support all those new platforms over one year is going to give potential for serious delays and maybe some lost time incidents.

IEA Oil Market Report: 13 February 2018 – available to non-subscribers

Download pdf file from this page: https://www.iea.org/oilmarketreport/omrpublic/currentreport/

IEA OECD Crude and Product Stocks – Chart: https://pbs.twimg.com/media/DXTdiRYX4AER6B5.jpg

IEA OECD Gasoline and Distillate Stocks – Chart: https://pbs.twimg.com/media/DXTeu4GXkAUc1mj.jpg

Saldanha Bay in Africa – the private storage there has been drawing down, but I’m not sure how full it was?

ClipperData – While only 1.24 million bbls left storage in Saldanha Bay in 2015, and 2.1 million bbls in 2016, total exports last year reached nearly 18 million bbls, with two-thirds leaving in the final two months of the year. And looking at the chart it’s still drawing in 2018 (Jan+Feb looks like 6 million barrels exported)

http://blog.clipperdata.com/the-och-aye-nessie-formation

Bloomberg – Although largely unknown outside the oil trading industry, Saldanha Bay is one of the world’s largest crude storage facilities, with a capacity to hold 45 million barrels in just six gigantic, partially-buried concrete tanks.

What’s interesting is trying to reconcile that the huge draws are reflected in IEA’ depiction of supply/demand balance. I know I should not inject logic into their analysis, but seems to me if supply/demand was mostly in balance the third qtr of 2017, we would not be experiencing significant draws. And even though the green line (supply) matches the yellow line, sort of, for the first half 2018, isn’t the yellow line above the green line the latter half of 2018? And that indicates oversupply? I must be chart challenged.

And I have read nothing in this analysis that reflects declines in established fields. Only increases in production, like life is stagnant. Sorry, but this analysis is so flawed, it belongs in the intensive care ward.

The only history repeating itself is the track record of IEA being consistently wrong.

Ok, someone help me out here. We have Iran, Iraq, Saudi Arabia, OECD (including US), Singapore floating storage, and the South African storage as noted above. China’s floating storage, will probably stay in China. What other huge storage places are there?

Supply/demand calculations…

I don’t know if the IEA are still counting 1 million b/day of Chinese crude imports as SPR input? And so maybe the IEA are under reporting Chinese retail fuel demand? China keeps saying that they aren’t filling their SPR at such a high rate (although they delay their SPR data by 6 months and so it’s difficult to know).

The Chinese are the only squirrels in a world filled with grasshoppers. Increasing SPR is important to them, but I believe all I have read, is that the teapots are loading up commercially.

2017-04-04 Caribbean Storage Tanks = 140 million barrels

Low taxes and the Caribbean’s proximity to U.S. and Latin America oil centers have made it into one of the world’s largest oil storage centers, holding as much as 140 million barrels. While a lack of official data can make the area invisible to some, the information is key in framing a full picture of global supply and demand at a time of market uncertainty.

Grand Bahama, Aruba, Bonaire, Curaçao, St. Eustatius and St. Lucia, mostly known for the beaches that draw sun-chasing visitors from around the world, all have significant depots to store crude and refined products.

https://www.bloomberg.com/news/articles/2017-04-03/oil-traders-said-to-drain-caribbean-hoards-as-opec-impact-hits

https://www.bloomberg.com/amp/news/articles/2017-09-20/oil-traders-empty-key-crude-storage-hub-as-global-demand-booms

Largely drawn down in Sept 2017, according to this article. Vitol should know, a lot of it was apparently theirs.

I do remember mention about 15 VLCCs around Singapore, which is roughly 30 million barrels. Less than half of what it was.

Chris from Vitol, reported about a half billion drop in the world, in a short period of time. Does that sound like we were only temporarily experiencing a half million barrel a day shortage?

Here in the US, we can’t see it, because the damn trees are blocking the view of the forest.

I am not always sure of what information to trust in the oil market. But with the relentless strong backwardation for brent and lately also wti, it is logical that all private and off the radar storages have an incentive to offload crude. And that is what makes the thesis of a strong coming bull marked more likely; there are no more private/off the radar storages to draw from together with an already low cushing storage. I believe drawing from strategic storages to keep market balances could be the story late 2018 or beginning of 2019; not many agree but some do at this forum at least.

2018-03-01 LONDON (Bloomberg) — Libyan oil is gushing again with production and exports surging to the highest in years.

Despite unresolved domestic conflicts that first erupted after the ouster of dictator Muammar Qaddafi, Libya has somehow found a way to get its crude flowing. Already this year, it’s secured commitments from some of the world’s biggest energy companies, including at least three new annual cargo-lifting contracts and a $450-million oil-field investment from France’s Total SA.

Shipments from the holder of Africa’s biggest oil reserves last month jumped to 1.19 MMbpd, the highest since Bloomberg began tracking tankers from the country in July 2014, and 22% up from January. Production jumped to the highest in 4 1/2 years.

While it’s rare, an individual country’s shipments can sometimes briefly rise above its output due to the timing of when vessels leave, or if cargoes are loaded from storage.

Chart https://pbs.twimg.com/media/DXSlmUaW0AA_Le8.jpg

http://www.worldoil.com/news/2018/3/2/libyas-oil-gushing-again-as-output-exports-hit-multi-year-highs

The UN is preparing to reopen an office in Benghazi – A sign that things are becoming more stable in Libya…

2018-03-02 – Addressing a meeting today in Benghazi with more than 60 tribal leaders and elders from Libya’s East, SRSG @GhassanSalame said: “we are preparing to reopen a @UN office in Benghazi and I promise you to continue to engage with people and residents of Barqa”

Official twitter account of the United Nations Support Mission in Libya: https://twitter.com/UNSMILibya

Trump’s decision to shrink Bears Ears monument by 85% was linked to oil concerns

https://twitter.com/i/moments/969652617533014016

“March 15 email from Senator Hatch’s office. Adopting this map would ‘resolve all known mineral conflicts,’ the email said, referring to oil and gas sites “

Baker Hughes North America rig count dropped 1 overall. US oil up 1, gas up 2. Bakken was down 2, but most interesting GoM was down 3, which might just be some noise but continues a downward trend and, at 14, the count is lowest recorded except for one month after Deep Horizon and an outlier in September 2016. I read somewhere that wells planned for GoM this year are down almost 10% from last, and the continuing outages at Delta House and Enchilada, and now it looks like Caesar/Tonga/Tahiti, might delay some of those previously planned.

Canada rigs dropped 4 and appear to be tailing off, maybe because of the pipeline issues, but weather might have an impact as well, as they’ve had extremes both ways this year, and the drop because of permafrost thaw and frost heave has been gradually getting earlier this decade.

2018-03-01 CALGARY — Oilsands giant Canadian Natural Resources Ltd. says it is moving up planned maintenance shutdowns at its heavy oil projects in northern Alberta and will slow down production from new wells to avoid selling the product at current poor prices.

On a conference call to discuss fourth-quarter earnings that beat analyst expectations, the Calgary-based company said Thursday it plans to drill only 59 net Alberta heavy oil wells in the current quarter, down from 116 drilled in the fourth quarter.

Canadian Natural production averaged a record 1.02 million barrels of oil equivalent per day in the fourth quarter, a 19 per cent increase from the year-earlier period, as it ramped up the latest expansion of its Horizon oilsands mining and upgrading project.

http://calgaryherald.com/pmn/business-pmn/canadian-naturals-fourth-quarter-adjusted-earnings-rise-but-net-profit-down/wcm/03b04c0b-d298-476e-be07-35e2813cc4af

Alberta Canada, Total Production (crude oil +condensate + bitumen) in January is 3326 kb/day down -158 kb/day month/month. But still up +143 kb/day from the average production in 2017 of 3183 kb/day

Total Production https://pbs.twimg.com/media/DXXHEhiX4AEYrql.jpg

Split Production https://pbs.twimg.com/media/DXXH1UMWsAEiS8Y.jpg

Closing stocks https://pbs.twimg.com/media/DXXInGuW4AAjoDZ.jpg

George. I read an article about the OTC tradeshow in Houston.

Attendance peaked at 108,000 in 2014 and by 2017 down to 64,000, the lowest since 2006.

Furthermore, many in attendance in 2017 were pushing their onshore services more than offshore, even though this conference is all about offshore.

In North America, at least, it seems shale is sucking up all the service providers.

It would be good if FT did another article following CERA next week like the one that had the graph below from last year. I see offshore basins in overall decline. There are a couple of new ones – Guyana and Mero – but the others are mature and not likely to make a big impact anymore, for oil at least and maybe not much for gas after East Africa gets developed. The only thing that kind of goes against that is the constant refrain from USGS, industry etc. that offshore is where the resources are, but nothing in recent lease sales, discoveries, or reserve growth seems to back that up. Current trends to me indicate almost no drilling or new developments within about ten years, and show no signs of being influenced by price change – maybe they need $100 plus, but supposedly everything has good dramatically cheaper over the last two years.

But onshore it’s only the Permian that is exciting now. Is there anywhere else remotely like it geologically? I think maybe not, I’m not a geologist but Texas seems a bit unusual – it has had huge rivers bringing stuff south for millions of years but little tectonic activity to mess up the rocks.

George,

Interesting chart thanks.

Exploration has been cut in half. Discoveries by more than half. The future will be interesting.

Fernando claims 63 per barrel shallow sand likes 60 per barrel. Others in the know like you and Mike remain silent.

I just don’t see prices under 70 per barrel by next sept unless there is a major recession in the next 5 months.

Until either a major world recession occurs or oil prices rise to 80 per barrel or more supply will not meet demand in my opinion.

I agree, it won’t. I agree prices should be higher, just based upon the extent of the draws. But, when? On one hand, we have fudamentals that indicate that even if we reach EIA, and IEA’s lofty projections, we will be short of supply. But, we obviously are now, but no one is worried, because the “estimators” have stated we may wind up with a glut. “What, me worry?’. There will be some draw down in the second quarter, but most will be trying to compare the US draws to the increase in the Permian. It won’t matter most of that increase will be shipped out of Corpus Christi. Hardly a direct relationship between world supply/demand, but betcha that’s what happens in the press. That will carry on until spot prices rise. Competition for the next barrel. How long will that take? Who knows, but I have my money on 2019, when I think spot prices will kick the idiots in the ass. Ninety percent of oil futures are just fake paper that the gamblers use. They will listen to the sirens until the ship crashes, there is only a small percent that represents oil. So, the question is how long will the walking dead influence spot prices?

As George indicates denial is part of life, and easy to partake in.

2019, because it will take them that long to find out that OPEC can not turn on the taps to produce 2.5 million more. That’s when OPEC will feel the brunt of public anger, because they are “intentionally” causing prices to rise by delaying production. Lies have a way of catching up with the fibber. However, reality could catch up earlier, Quien sabe?

https://oilprice.com/Energy/Crude-Oil/Where-Do-Oil-Markets-Go-After-The-OPEC-Deal.html

And this is exactly the crap people will be taking as gospel for as long as EIA and IEA keep singing the Permian song. Ban ICE in China by 2022? I know they considered new sales at a much later year, but this is absolute malarkey, which gets treated as fact after awhile.

The ban in France was set to be in 2040. China was considering it, but set no timetable. That was on new cars sold. Not banning ICE vehicles.

Dennis. I like $60 doesn’t mean it will stay around where it is now.

I, of course, have no idea where prices go.

It does look that the world will need 100 million BOPD in 2019. Assuming this and assuming growth worldwide of 1 million plus per day annually for a few more years, one would think prices are headed up.

Funny to think we had prices in the $30s for much of 2016, and prices in the $40s for much of 2015 and 2017, even though I think we already knew where demand was headed.

Dennis Gartman, “WTI will never be above $44 in my lifetime.” I think he is still with us.

Heck, some were calling for $10 in early 2016. Have to take them seriously, given 2016 prices were flat out ridiculously low.

Pretty sure we wont see less than 25 per barrel.

Clearly the 44 per barrel guess for a high price is wrong.

Your guess for prices would be better than mine.

SS – sorry I commented below before I read your response, but I’ll leave as is.

Dennis – $60 was an aspiration not a forecast as I understood it; I am not familiar with the $63 number so don’t know when or what it was for, but haven’t most grades been above that for some time now and looking to be on a long term increasing trend (I don’t follow monthly prices much)?

Either way I’m not sure what that has to do with my comment, which, maybe to be a bit clearer, is that after the deep water surge 10 to 15 years ago offshore activity has been in steady decline, masked a bit by cost inflation, but not directly correlated with oil price (noise rather than trend), and possibly accelerating even now.

Hi George,

Your comment had a chart which I said was interesting. The fall in new field wildcats seems to roughly correlate with oil price.

Are you of the opinion that the price of oil has no affect on exploration?

I think there is a connection and the price of oil is relevant.

Others may believe otherwise. There is no doubt a bit of a lag, maybe 6 to 12 months between oil price movements and exploratory drilling, but I don’t have the exploratory drilling data.

There are at least three factors, or possibly more that affect drilling. Oil prices, economic growth, and available geological prospects.

I agree there is not a simple one to one correlation. In general there are very few phenomena where that is the case.

Dennis.

I know your comment was directed at George,but I’ll chime in.

First, $56-65 WTI is aspirational for our particular operation, plus a level that I do not think US consumers can reasonably complain about with regard to the resulting gasoline price from that level.

As to offshore, I do think price matters, but in conjunction with that, as for GOM at least, shale plus Deep Water Horizon will make a difference even if price gets back up to $90+ WTI.

I read the American Oil & Gas Reporter and have for many years. It is a trade magazine we receive.

For years and years, almost exclusively offshore was the focus, almost all in GOM, but also in all other parts of the world (highlighting exploration efforts of US companies).

Now, almost nothing about offshore. All shale focused.

Keep in mind, there are tons of ads in this publication. All advertising services for the shale industry.

I think COP, one of the world’s largest E & P’s announces awhile back that they soon will do no further offshore exploration.

Of course, the idea that shale can replace worldwide offshore is not going to be a good one, unless it turns out other parts of the world can replicate US production increases in those “foreign” shale basins.

Pretty US centric post by me, but I live in the middle of the middle of USA. That is why I greatly enjoy the posts on all other producing areas of the world, and comment little as I know little outside of USA.

US Shale production increases on this massive scale is something never seen before. Therefore, forecasts of shale’s future production have to be difficult.

I am afraid when the peak of shale is hit, absent some secondary or tertiary recovery method yet to be shown economic, the decline will be steep and there will be a price spike. This will lead to more rapid transition of other fuels, but there will be some bumpy economic times ahead.

Hi shallow sand,

I agree lto will probably decline sharply, 5% per year or more by 2030 and oil prices are likely to rise sharply 150 per barrel or more by that time, bumpy economic times are very likely 70% probability.

Exploration dropped significantly from 2009 to 2014 even as prices went to their highest, and then dropped a bit faster when the price dropped further. Development had a boost from the high prices, particularly from some old and previously unattractive projects getting to FID, but the extra production was what partly killed the price, and now there aren’t any left like that, so development now, even as prices rise, is either fast tracked new discoveries (there aren’t that many) or one or two well tie backs or extended reach wells with small production. As I said I think the trend is independent of price and driven by geology, price generates the boom and bust cycles and evens out over time, all oil is going to be developed eventually, it is just too good to let go. $60 or $63 prices don’t seem to be particularly relevant numbers either way.

A bit more: I think the ultimate limit for the size of deposits that would be explored for and developed will be from EROI, I don’t know the number because we haven’t got there yet, but maybe 5 to 10. If exploration success rates stay low then towards the higher end. The oil price won’t be the only variable but also the cost of the exploration and production wells, the grade of oil, the distance to available hubs, the perceived risk on resource ranges, maybe also availability of finance.

Related to that – the Trump steel duty is probably going to have a big impact on tubular prices and hence deep water well costs.

But Trump says tariff wars are easy to win, which stands in contrast to Bush’s 2002 steel tariff fiasco. We will never set up a Vat tax, as it is horribly regressive, so let’s just move on. State sales taxes are equivalent to a Vat, and they mostly affect those, mostly, who “have not”. It’s obviously internationally illegal for Vat to be used, simply on import. However, I don’t think it would be internally illegal for a state to impose a use tax on imports, to be offset with other Federal funds. Yeah, it gets complicated, but possible.

Trump was a good TV host.

I think that was his high point.

George,

I agree the price of oil is just one factor of many.

It certainly is true there was little increase when oil prices were high. Looking at that chart it looked like exploration dropped more steeply around the time that oil prices dropped in 2015.

The drop from 2009 to 2014 may well have been a lack of good opportunities. Agree its not just price.

At some point prices will need to rise.

I disagree that eroei matters for a single product like oil.

What is important is the society wide eroei for all energy outputs and inputs.

So you think a small field, where the wells would be a high proportion of the CAPEX, with a best case EROI of 5 assuming something is found, but maybe only one in 20 chase of finding anything, would still be drilled?

I think business decisions are based on profits and not eroei. That’s what most people in the industry say.

I agree, but the EROI issue will mean there is a hard limit after which arbitrage and efficiency aren’t going to be able to produce a profit no matter what, while allowing for exploration risk (of course there may be technology on the way that would be able to say without drilling how much oil is present, and then the EROI limit would reduce significantly).

Hi George,

Lower eroei will require higher prices. The main point is that as long as oil can be produced profitably, eroei will not matter.

That might be your main point, it wasn’t mine.

Hi George,

Do we actually have an accurate estimate of EROEI for deep water offshore?

If you are claiming that if costs are higher than revenue plus a reasonable level ROI, then we are agreeing.

I just don’t find EROEI a very useful concept.

Lots of things are produced which do not have an EROEI greater than one, because it is profitable to do so.

You don’t find it useful (which is different from saying it has no use), other people do. I think I clearly said I don’t know at what level EROI would become an issue because we are not there yet. Lot’s of things are produced EROI less than one, but ultimately from something which has one greater than one, and oil has about the best EROI of any energy delivery system around at the moment. Ultimate EROI is therefore a growing direct impact on costs; but as oil fields get smaller and wells more difficult so to is exploration risk.

Yes there must be something that provides the energy, it could be coal, natural gas, nuclear, wind, solar, geothermal. There are lots of possibilities.

I agree high cost will require high prices.

For the most part EROEI is not very well measured, nice for philosophical discussions, but not much more.

on EROEI

https://connectrandomdots.blogspot.com/2012/07/test-post.html

Rgds

WeekendPeak

EROI is a good way of framing a discussion, even if fuzzy, criticisms of it are often not of the concept but of the limitations of available data.

There are lots of possibilities to provide energy, but ultimately they have to be have higher EROI than what they are used to produce. if what they are used for is just to produce other forms of energy (i.e. really arbitrage) then there has to be a limit. Knowing that, even if not being able to quantify the exact value, is a useful concept.

UAE production dropped in January because of planned maintenance, but if they have excess capacity (they cut 120 kpbd in January 2017) why didn’t they just use some of that to make up the difference, which, in usual design practice, is the whole point of having installed spare capacity. To answer my own question it could just be an issue with oil quality (I think most initial OPEC cuts were in heavier oil), or not worth the expense of starting mothballed plant, or they just don’t have it.

UAE oil output said to drop most in year on works:

http://www.worldoil.com/news/2018/3/1/uae-oil-output-said-to-drop-most-in-year-on-works

https://mobile.reuters.com/article/amp/idUSKCN1GE2DW

GAZPROM has cut off Ukraine.

Who run Bartertown?

this of course comes as no surprise to me and other actual American energy producers

but now we have a motives of so many here:

http://www.breitbart.com/big-government/2018/03/02/house-report-russia-used-social-media-disrupt-u-s-energy-markets-promoting-pipeline-protests-climate-change-debate/

make america great again??

The upside of this info is that perhaps people on the right will believe that Russia is meddling American public opinion on many levels, not just energy. Anything to cause turmoil.

Maybe it is time for Trump to listen to his intelligence info and consider Russia to be a social and political threat.

Boomer

The Voice of America program is a decade’s old program that was spurred, in part, by the US government to wage an information war directed at the population under the sway of the USSR.

A tool of the Cold War as it was touted as being truth based.

The fact that foreign countries and foreign-based companies pour resources into the USA to influence American opinion is as old an endeavor as the USA has existed.

Definitely not a one way street, either.

Not only did Qatar help finance Josh Fox’s Gasland (the early versions listed the credits, which were subsequently removed), other hydrocarbon producing countries continue to sponsor “research”, protests, and anti-oil/gas movements throughout this country.

And, certainly, if American anti fossil fuel folks – either knowingly or not – utilize these resources, many would welcome it as fighting against a common ‘enemy’.

Hell, Boomer, just read the comments on these threads and one can see the intensity of visciousness, the extreme hatred for “The Other”.

Just months before he died, Wimbi openly called for the execution of my children, my grandchildren for the high egregiousness of not agreeing with his views on a current, controversial topic. He did so on this very site and you can look it up.

No, Boomer, we are all of us – ‘people on the right’, progressives, independents, middle of the roaders assaulted incessantly with data that is skewed, incomplete, false, devious, self-promoting, and on and on.

One constant seems to hold that readers are CERTAIN that THEIR sources are impeccable in both accuracy and righteousness.

Freedom of the Press was given the highest priority by the American Founding Fathers as those wise men knew that an informed citizenry was an existential necessity for an enduring Republic.

…and here we are.

I understand that. I have seen people on the left accept false info.

However, as you point out, misinformation is essentially a “war” tactic. So for Trump not to take action against Russian manipulation of social media is a strategic mistake.

He’s so focused on military hardware and building walls and keeping out immigrants he is overlooking how other countries can invade us digitally.

Trump’s idea of winning is expensive and not necessarily effective.

Probably the most I get off this site is when poster’s like Energy News posts stuff regarding primary data. Primary data comes from the source of the information, which will later be construed to be something different as a secondary source, or an idiotic article presuming self importance, as I am won’t to do. Schools don’t teach that anymore, apparently. We have a population who reaches for the tabloids at the store. It has nothing to do with freedom of the press, and all about education.

Guy

…all about education.

Just so.

I’ll not slide/hijack this thread to the detriment of Mr. Kaplan’s efforts.

However, as a SERIOUS, multi-decade long student of all things related to espionage, intelligence, counterintelligence, counter intelligence (two words), I cannot more emphatically stress the importance of being able to evaluate the sources, reliability, motivations, etc. of all that we read/see/hear in this Information Age.

The commonality that exists amongst the 8 billion of humans is being shredded by the constant, purposeful disinformation/misinformation that bombards us daily.

Education and self-education (coupled with a dose of humbleness) may go a long way to a better tomorrow for us all.

Fernando, I have a question, for my own clarity. According to what I have read, PVDSA has stopped providing meals to the workers, and salaries are insufficient to provide for food at home. Consequently, workers have stopped showing up, so they can provide food from alternative sources to provide for for their families. Safety is supposed to be a real issue.

Accordingly, it appears all of the oil output in Venezuela is in jeopardy. That really sounds inhuman to just speculate on the oil, as all Venezuela is in jeopardy first.

Would you please correct where I am wrong from the information I have read?

For clarity, the question is: is all oil from Venezuela in jeopardy, because the situation there is so acute?

Brazil ANP January (Petróleo óleo e condensado) production at 2615 kb/day up +3 kb/day month/month

Up is good. But EIA is looking at around 200k for the year.

https://seekingalpha.com/amp/article/4138151-impending-oil-shortage-2018-part-1-2

https://seekingalpha.com/amp/article/4138291-impending-oil-shortage-2018-part-2-2

Another look at what a lot of us here see. It’s beginning to look more than a little scary.

https://seekingalpha.com/amp/article/4139485-saudi-arabias-ongoing-oil-supply-shortage

More about the above, from the same company. Although, I know there have been some questions by others, about the actual level of Saudi oil inventory.

IEA Oil 2018

http://www.iea.org/Textbase/npsum/oil2018MRSsum.pdf

and: https://www.bloomberg.com/news/articles/2018-03-05/iea-sees-american-energy-dominance-squeezing-opec-into-2020s

In short: US LTO is expected to keep the market balanced for the next 5y. New supply is front loaded (tight market in 2023). Most new supply is light or NGL. Some grade mismatches (medium grades are short). Decline is about 3mb/d.

I don’t get the numbers to add up.

Yeah, as I posted when Energy News posted the “details” on EIA’s projection, the analysis is so weak, and broken, it belongs in an intensive care unit.

Vitol states that world inventories have dropped half a billion barrels in a short period of time. During that time US production had been increasing. So, we are balanced now? Going forward, we have new demand, declines, and drops in Venezuela. US supply is going to cover the negative by 80%? These guys need to, at least, utilize their fingers and toes, so they remember where the last count was.

I haven’t read the IEA report, but it does break down growth in US oil v US NGL?

Headlines read increase from 13 to almost 17 BOPD for US, so I guess that means about 3 million BOPD of NGL production currently?

I also note IEA predicts large US growth in 2018 and 2019, and much smaller increases 2020-2023.

I am reminded of Alfred E. Neumann from Mad Magazine, “What, me worry?”

With these projections, the signal is there is little to no reason to pursue offshore projects, US shale will meet demand?

SS: With these projections, the signal is there is little to no reason to pursue offshore projects, US shale will meet demand?

I guess that depends on your time horizon (and how credible you find the forecast to be). Much smaller supply growth in 2020 and beyond implies prices are likely to increase (US LTO is inadequate in the long term). I have no idea of IEA’s price assumption though. There is also the issue of low demand (economic) growth, that can delay a potential supply issue a year or two.

Yeah, I like the depiction of Mike’s “estimators” on his site for the cartoon characters of EIA and IEA, now we can add Alfred from Mad Magazine as the press, and daily gamblers on the fake oil contracts. I believe it is like a cartoon in what’s happening, but it won’t be so funny, later. I’ll probably profit from it later, but would probably be Ok, at a fair price like $80, to promote future growth. But, the estimators want to keep the price down, so “What, me worry?” is going to be the analysis for awhile. Until….

But I think the way the IOCs are behaving would indicate there really is a lot of oil in the Permian and it can be extracted without a long dead time between investment and return. It might be relatively expensive oil, but so is everywhere else that is left now. You can argue that offshore activity is adversely affected by the shale development, but to me the offshore has run out of prospects with acceptable risks and options for profit. I don’t know if there is a price that some more exploration for smaller fields would be favoured, but if so it would be a business environment which none of the upper management in the IOCs have any familiarity with. I think they’d all like to retire befoire being asked to make any such out of the box decisions.

All oil companies, with majors leading the pack, that focus on Permian are increasing capex targets by 20-30% in that segment for 2018. And most are showing effects of tax breaks in large graphs in their end of year presentations. I think the IOCs are playing along, tax breaks against increased capex budget, not a bad deal (cooperate with authorities, why not?). The question is will they increase capex like they promise (I don’t know, given the market situation they probably will), and does it matter really for the global balance when demand season starts to pick up in April? I don’t think so, the oil market can only be manipulated to a limited extent before realities count wanted or not.

It seems really desperate with tax cuts and with EIA and IEA working full time to try to hold oil prices down. What we need is higher oil prices, so that a transition to renewables can have an incentive. Electrification of transportation based on renewables is very doable, but the power and prosperity gained by access to an aboundance of fossil fuels are too valuable for political leaders, and therefore they try something unobtainable. Low oil prices, higher oil production, safe environment and steady gdp growth. (these last sentences probably belong in the non-oil topic)

I wanted to see higher oil prices to encourage a transition to renewables, but now fear higher prices will encourage environmental destruction to get more gas and oil out.

The Trump administration seems to say, “We have unlimited oil, so we want to open up even more areas to drilling, to get even more oil, which we will then export, because we’ll have more than we need.”

The Trump administration will have an oil nightmare I suspect, just because they got the oil industry bust-boom syclus against them and can not do enough to prevent the coming boom (too high oil prices). The new developments are too many years away. I think Trump realises the problem, he is intelligent and got Tillerson near to him. Just speculating like most others on this this subject.

There’s also this issue: selling leases that the government controls which don’t appear to be going for much. So the US government gets little for its assets, and won’t likely spur lots of development in those areas, either (not that I want to see it).

It’d be interesting to see where they think the growth for Canada would come from. They don’t have a year to year country chart in the summary but I think they must be assuming some big project FIDs and the increase is back loaded. Similarly for Norway, they will decline before Johan Sverdrup ramps up from 2020 onwards. Brazil is the opposite, their rise is front loaded in 2018 and 2019; to get the net growth shown to 2023, given their high decline rates, will need a few FIDs soon, and probably some exploration success.

Not so long ago Iran and Iraq were going to fill the gap (I think almost 10 mmbbls above where they are, combined, now), but I think every projection gets a bit lower now.

I’ve skimmed through the report. Non-OPEC crude has peaked, LTO and NGL make up most of the growth (OPEC crude, biofuels and non-conventional make up the rest). Supply growth is higher than demand in 2018 and 2019 but lower in 2020-23, i.e. there is a supply shortage 2020 assuming the economy is healthy and LTO expands as forecasted. I guess they assume stocks will build in 2018/19 and make up for the shortfall in 2020. If LTO do not grow as expected the shortage will occur in 2019.

I see more risk down than up: GOM is forecasted to hold stead over the entire period and Mexico will supply just under 2mb/d – they don’t manage to convince me why decline will stop at this level. Their analysis and projection of decline rate is flawed, they expect decline rate will continue to decrease but I find this unlikely given the size of projects that have come on stream in recent years as well as effort that was done to prevent decline in the past will be difficult to replicate with the same success. I don’t know enough about LTO to evaluate of their LTO-forecast. Permian is probably the least dirty shirt around.

As for Canada, It’s front loaded. Each year has net growth but it’s highest in 2018 (Fort hills, Horizon ph3, etc.) some in 2019 and then much lower. 3 new pipelines could probably result in higher supply in 2022/23 than forecasted.

Thanks. NEB had only about 260 kbpd average increase for Canada in 2018, and an exit rate only 100 or so higher (I think they’d know better than IEA), and I don’t know where much else would come from in 2019 as drilling is being cut back.

I guess NGL making up a larger proportion is OK, as they are predicting higher proportional petrochem. demand increase.

I think Mexico is going down this year and next; they have almost no drilling except in the SW region and they are already under 1950 for C&C, and with gas (and therefore NGL) declining faster than oil. It depends how fast the new discoveries get developed but so far it doesn’t look likely for FIDs before mid 2019 as they are only now planning appraisal wells.

GoM has a lot of production offline, and taking a long time to come back. Four of the wells this year were to extend Delta House plateau, but with the extended outage there it may not have spare capacity until next year now. There are very few undeveloped leases and drilling is being cut back. I don’t see how production can be maintained, but the BOEM reserve numbers will be interesting.

I agree on the decline rate: small projects and/or deep water, and reduction in in-fill wells, brownfield developments and planned maintenance all mean faster decline.

Please keep commenting.

Interesting

Hidden Pitfalls Could Hamstring America’s Hottest Oilfield

Rising costs and pipeline bottlenecks may limit Permian return

Higher number of wells may reduce pressure and production

Shale Revolution: The Big Oil Test

The world’s hottest oil field, the Permian Basin of West Texas and New Mexico, isn’t without its risks.

Drillers are pumping billions of dollars into the region, plumbing reserves that rival Saudi Arabia’s biggest field. And with production expected to almost double by 2022, the rewards are expected to be vast. But as costs rise and pipeline capacity fails to keep pace with production, the Permian can still pose a challenge.

IEA – 5 March 2018 – Oil 2018 – Forecasts to 2023

The free summary (pdf file) doesn’t contain charts, but there are some free charts at the bottom of this page

IEA: http://www.iea.org/newsroom/news/2018/march/record-oil-output-from-us-brazil-canada-and-norway-to-keep-global-markets-well-.html

Figure 2.12 US total oil supply and US supply growth

https://pbs.twimg.com/media/DXhUiJJVAAAF_Kr.jpg

Figure 2.9 Observed global decline rates for post peak conventional oil fields

https://pbs.twimg.com/media/DXhi1c4VMAAyNP8.jpg

The IEA continues to say new investment is needed, but I haven’t seen where it suggests who will make that investment.

Why should companies do it if it doesn’t look profitable? Why should investors do it if there are better places to put their money?

Maybe governments should do it for strategic reasons, but if their citizens won’t get the benefit, why use public funds for this?

So the world will end up with more demand than oil, but what entity has a financial obligation to produce more oil? Maybe none.

Seems like the IEA is saying peak oil without saying it that way.

2018-03-05 Rystad Energy estimates that liquid resources from mature assets grew 151 billion barrels over the last four years, which is almost 17% more than the amount produced in those years.

For conventional onshore, a large part of the growth is driven by Saudi Arabia. Increased infill drilling and better investment terms have lifted the estimate for the remaining resources in the country.

https://www.rystadenergy.com/newsevents/news/press-releases/Mature-fields-grew-151-billion-barrels/

That is a pretty bad article. Taking the small difference of two large numbers, both with significant errors means the error on the difference can be hundreds of percent. Then apportioning values to the difference to three significant figures is meaningless. You could just as easily write something saying the previous estimate was wrong and low or the latest one is wrong and high. The 22 Gb discovery over 4 years is eye catching number there.

Yes that’s a good point

I am assuming the Permian productivity estimates of IEA and EIA are assuming lots of tightly spaced wells.

Wonder if they are considering Encana production profiles, given they appear to be cramming more Wells per drilling unit than the rest.

I took a quick look at Encana wells with first production 1/1/16-6/30/17. Current month production is for 12/17, so these are wells ranging from 6-24 months old.

133 wells.

56 produced under 100 BOPD in 12/17.

53 produced 100-200 BOPD in 12/17.

24 produced 200+ BOPD in 12/17.

Furthermore, just 6 of 65 wells completed in 2016 made 200+ BOPD 12/31/17.

11 of these wells have made at least 200K BO cumulative.

57 of these wells have made between 100K BO and 200K BO cumulative.

65 of these wells have made less than 100K BO cumulative.

Encana boasts lower well costs than others in PB due to manufacturing approach, but tight spacing may not be the best approach to maximize recovery?

Parent – child well performance issues seem to be supported by a very cursory look at Encana well data.

What spacing is the norm, here?

Ok, I got it. As little as 10 acres a well, with 385 feet in between, which would include vertical distance. On the surface they could be very close, and overall pushing the nickel.

2018-03-05 – WSJ – Shale Trailblazer Turns Skeptic on Soaring U.S. Oil Production

Former EOG CEO questions growth forecasts, says U.S. oil isn’t ‘big bad wolf’ disrupting energy markets

U.S. oil production won’t keep growing as fast as the market seems to think

In a January speech, Mr. Papa told executives and investors that most of the best drilling locations in North Dakota and South Texas have already been tapped.

WSJ https://www.wsj.com/articles/shale-trailblazer-turns-skeptic-on-soaring-u-s-oil-production-1520257595

He, and others can question it all we want. It will change nothing. That is the perceived reality. The only thing that will override this perception, is if traders have to start bidding higher for the next barrel of oil. Even that will not change the lyrics of the Permian song, until oil is over $100, and inventories are circling the drain. Reality is set until then. You either drink their kool

aide, or something else. Don’t complain about the kool aide, it only has one flavor.

We can try different types of analysis to sing along with the Permian song. Like, ain’t it great, Permian wells will become more expensive with the new 25% increase in steel. Add that to rising completion costs, and we should have a well so expensive, it can coax any amount of oil out of the shale.

2000 years from now, they may come across a “cube” drilled with 64 wells, and put it into their new 7th wonder of the world listing. 180 miles of expensive steel tubing to reach what? Surely not oil, as the product of steel is too expensive. Maybe, they were trying to communicate with the underworld gods?

The “unlimited oil” argument makes little sense to me unless you are trying to head off more EV and renewable expansion and are trying to keep the public complacent.

It keeps oil prices down (not good for producers), it discourages investment in long-term projects, and undercuts any reason to sell leases in national parks and undeveloped coastal areas.

That’s what puzzles me. Environmental reasons aside, this is not good business policy.

I suppose if you are the president, you can brag about the country’s strength, while the reality is going the other direction. The Wizard of Oz.

2018-03-05 Plains All American Pipeline CEO talking at CERAWeek2018 in Huston

It costs $12/b to truck Permian crude to Cushing and a lot of “No-Doz” for truckers

One project they are building is a 26” pipe. That’s made in 3 places — none of them in the US

They can give up the no-doze Dec 19th. They will then be subject to the new Fed ELD law at that point. Only limited number of hours allowed for even intrastate. Better get the pipelines going by then. Won’t be enough truckers. Same goes for anything hauled, including sand. There is hardly anything they are not running up against some logistic wall in the near future. For instance, you can drive to Corpus from Midland, but you can’t drive back the same day. Same distance to Cushing. Eleven hour continuous in a fourteen hour window, then nothing for ten hours. Required to be electronically monitored, which is more cost. Two drivers needed in one truck to get it back the same day.

Let me see if I can put that into Permian lyrics. The Permian is creating more driving jobs, which much higher pay. Yea, for the Permian.

But Midland to Cushing is interstate, so they were subject to the rules Dec 31, 2017. So, what’s a silly rule to worry about. Besides Midland to Cushing is only 484 miles, so maybe only a couple of years, at over $3 billion? For a pipeline that may see the most service for only a few more years? In the meantime, that $12 a barrel could climb to $16 or more.

January 2018 – Oil & Gas Journal – Epic Midstream Holdings LP has received sufficient customer interest to sanction its proposed 730-mile crude pipeline between the Permian basin and Corpus Christi based on volume commitments and acreage dedications.

The pipeline crosses Texas between Orla and the Port of Corpus Christi with capacity up to 590,000 b/d. It includes terminals in Orla, Pecos, Crane, Wink, Midland, Helena, and Gardendale.

Epic is laying the crude pipeline, expected to be in service in 2019

https://www.ogj.com/articles/2018/01/permian-corpus-christi-crude-line-advances.html

https://btuanalytics.com/quality-matters-api-gravities-of-major-us-fields/

Old. Powerful. This was the time frame Bakken ppl said API for Bakken oil was 39, which at the time was WTI’s API. Not possible from the bar chart. Never was possible. Lies were being told.

A look at the Permian bar is similarly interesting.

http://www.argusmedia.com/pages/NewsBody.aspx?id=1254610&menu=yes

Houston, 8 June (Argus) — Permian crude is getting lighter: Analyst

Crude from the Permian basin is getting increasingly lighter, which could cause major headaches for US refiners, said Ponderosa Advisors analyst Sarp Ozkan.

About 50pc of crude from the Permian is now 42°API gravity or higher, he said at the Argus North American Crude Transportation Summit this week. The number reflects the quality of the oil at the wellhead.

“If the Permian gets much lighter, there could be some trouble blending it to spec,” he said, referring to the blending needed for the crude to meet specifications required by pipeline companies for shipping.

that was mid 2016

It ain’t like it’s getting more diesel rich.

That was just about the time a few US refinery revamps were approved to allow them to handle light oil, including the biggest at Beaumont, which might be on line now as they can usually be turned around in a couple of years, though I don’t remember seeing an announcement.

Chinese crude oil + products ending stocks – Seasonal

(crude+gasoline+diesel+kerosene)

I’m guessing that this is just the state owned oil companies storage. And doesn’t include the independents (Teapot Tanks)

Chart on Twitter: https://pbs.twimg.com/media/DXmqa1YW4AITYpB.jpg

Probably so. Last I heard total inventory was around 850, of which about 275 was in SPR. Then again, there are no clear numbers, yet, from China.

https://seekingalpha.com/amp/news/3336519-oil-prices-pop-cushing-inventories-reportedly-tighten

Inventories are declining, and will continue to do so for the rest of the year, from analyst at Raymond James. Actually, the wording was until towards the end of the year. Is that when the Permian catches up supply/demand, or when inventory draws, globally, slow down for awhile?

http://mobile.reuters.com/article/amp/idUSKBN1GH3CU

Houston probably smells worse than a cattle pen holding a lot of cattle after this conference.

2018-03-06 – Platts – OPEC crude oil output in February falls to 32.39 mil b/d, latest @PlattsOil OPEC survey finds

Libya https://pbs.twimg.com/media/DXmx6oFWAAELjrp.jpg

Venezuela https://pbs.twimg.com/media/DXmxcjZXUAATLw0.jpg

Platts (free read) https://www.platts.com/news-feature/2017/oil/opec-guide/index

But, but, Maduro said it was increasing! Must be leaking into his crypto currency.

More than any time in history, mankind now faces a crossroads. One path leads to despair and utter hopelessness, the other to total extinction. Let us pray that we have the wisdom to choose correctly.

— Woody Allen

I like that one!

Interesting comments on Shell’s recent bidding in the late January-2018 Mexico bid round below. They used insights from their Whale discovery, in U.S. waters of the Perdido Fold Belt, to inform their aggressive bidding strategy in Mexican waters.

Also, this is the first time I’ve seen a resource estimate of Shell’s Whale discovery – “two industry sources close to the exploration efforts told Reuters that recoverable resources could be up to 700 million barrels of oil.” If truly this big, it would be one of the biggest U.S. GOM fields.

https://oilprice.com/Energy/Crude-Oil/Shell-Outsmarts-Competition-In-The-Gulf-Of-Mexico.html

Sounds pretty good for Shell, though “up to” is usually code for a 3P estimate, which at this stage could be about twice the 2P. Even at a lower number I guess that would be a new floater rather than a tie back. Shell needed something as they have had some big exploration failures recently and haven’t replaced production for some years I think. I wonder how this, and the other one in GoM, Ballymore, fits for Chevron, they seemed to be edging away from deep water the last couple of years.

Halliburtons fracturing fleet has grown from 3 million horsepower to beyond 4

March 6, 2018 – Rystad Energy estimates the market as a whole to have added 3.3 million horsepower during the course of 2017 and expects another 3.3 million in 2018. This comprises 1.3 million more in newbuilds and 2 million via refurbishments of non-working equipment, providing much needed relief to the tightening pressure pumping market.

.

Rystad Energy expects pressure pumping spot prices to increase 10-25% through the second quarter of 2018, as utilization rates approach the vital 80-85% threshold.

https://www.rystadenergy.com/newsevents/news/press-releases/Halliburtons-pressure-pumping/

EIA STEO US oil production highlights

EIA estimates that U.S. crude oil production averaged 10.3 million barrels per day (b/d) in February, up 230,000 b/d from the January level, when there were some well freeze-offs in the Permian and Bakken.

U.S. crude oil production will average 10.7 million b/d in 2018, which would mark the highest annual average U.S. crude oil production level, surpassing the previous record of 9.6 million b/d set in 1970.

EIA forecasts that 2019 crude oil production will average 11.3 million b/d.

https://www.eia.gov/outlooks/steo/

https://www.eia.gov/outlooks/steo/marketreview/crude.php

DAPL gauging interest in expanding oil shipments

By Amy Dalrymple / Bismarck Tribune on Mar 5, 2018 at 5:00 p.m.

http://www.inforum.com/business/energy-and-mining/4413182-dapl-gauging-interest-expanding-oil-shipments

The company that built the Dakota Access Pipeline is gauging the oil industry’s interest in shipping additional oil from the Bakken to the Gulf Coast.

Energy Transfer Partners recently announced it is soliciting commitments from the industry to expand the capacity of the four-state Dakota Access Pipeline and the Energy Transfer Crude Oil Pipeline, which transports oil from Illinois to Nederland, Texas.

In June, Energy Transfer Partners said in a news release the Dakota Access Pipeline from North Dakota to Illinois had a capacity of 520,000 barrels per day and could be expanded up to 570,000 barrels per day.

The announcement about a potential expansion did not specify a capacity figure. A news release said the pipeline companies anticipate that incremental capacity on the two pipelines, known as the Bakken Pipeline System, will be determined based on commitments from shippers.

Justin Kringstad, director of the North Dakota Pipeline Authority, estimates Dakota Access was 86 percent full at the end of 2017.

North Dakota produced about 1.18 million barrels of oil per day in December, the most recent figure available. Production is soon expected to exceed the state’s record of more than 1.2 million barrels a day and continue growing.

Baker Hughes international rig count or February is out. Total up 19 to 979, the highest since March 2016. Oil up 14, gas up 6; offshore down 2, onshore up 21. There were gains in ME, Africa and Latin America, but Asia Pacific dropped.

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-rigcountsintl

For offshore gas there has been a steady and quite fast decline since 2014, which doesn’t appear to be stopping. Could have something to do with a previous LNG glut, but that is suppossed to have been a bit of a myth by recent Shell report. There were big relative drops in North Sea and GoM where they’ve stopped finding much in the way of commercial gas volumes. (Ignore the label in the middle from screen capture).

Offshore oil dropped quickly after the 2015 crash, but hasn’t recovered much, with only Asia-Pacific growing steadily recently, probably in response to the expected decline for most producers there and with China especially active, but also without much to show for the activity in recent discoveries or significant production increases.

Saudi has slow decline in oil rigs, a bit of an increase in gas.

Barrels not counted in IEA, nor OPEC decreases in inventory.

https://www.hellenicshippingnews.com/wp-content/uploads/2018/02/2018-SMO1-T-VLCC-floating-storage-activity.jpg

Each VLCC contains about 2 million barrels of oil. The drop actually started occurring before the OPEC “cut”. Why does that not surprise me? EIA concentrates only on what they have “firm” figures on. So, add about 60 million barrels to what the EIA show as dropped inventory just for 2017. More may be able to be added from Mena drops, South Africa, or more that I don’t know of. Apparently, those last 15 VLCCs in the Philippines represent the majority of floating storage.

Vitol rep stated 500 million drop, but that can’t be supported by anything I found. I can only get to about half of that, but I won’t count that as a wrong statement. Just that I can’t identify it. OPECs latest report indicated about a 171 million barrel shortage in supply, which from the tankers looks a bit low.

The EIA refinery maintenance report came out a couple of weeks ago and indicated this wasn’t going to be a particularly heavy year, so US crude oil storage might not rise as much as it would have otherwise this month, though I don’t know how you can pick out any one effect from all the others.

On the VLCCs – the hurricanes look to have put some offshore that hasn’t been worked through yet, but other than that it’s only SE Asia. It would be interesting to know the grade. I think that area might be the only one left for heavy bunker oil, mostly for marine, and that is gradually reducing as the shippers move to meet low sulphur IMO requirements by 2020 (USA and Europe are already ultra-low areas – ECAS or some such acronym). But I’m not sure if that is the reason.

ExxonMobil outlines aggressive growth plans to more than double earnings

“In the upstream, the company expects to significantly increase earnings through a number of growth initiatives involving low-cost-of-supply investments in U.S. Tight Oil, deepwater and liquefied natural gas (LNG). Growth coming online from new and existing projects is expected to increase production from 4 MMboed to about 5 MMboed.

The Company Plans To Increase Tight-Oil Production Five-Fold From The U.S. Permian Basin and start up 25 projects worldwide. Those startups will add volumes of more than 1 MMboed. In LNG, the company expects to bring on new production to meet a projected increase in global demand.”

http://www.worldoil.com/news/2018/3/70/exxonmobil-outlines-aggressive-growth-plans-to-more-than-double-earnings

Another piece of news to play up supply and suppress the price of gas and oil.

And Wall Street’s response was to drop the price of Exxon stock.

“Despite the ambitious plan to woo Wall Street, Exxon shares slid 3.1 percent to their lowest level in more than two years.”

https://www.reuters.com/article/us-exxon-mobil-meeting/exxon-unveils-bold-capital-spending-plan-to-boost-profit-shares-drop-idUSKCN1GJ1TP

US ending stocks March 2nd

Crude oil up approx +2.4 million barrels

Oil products up +0.7

Overall total, up +3.1 (shown on chart)

Natural Gas: Propane & NGPLs down -3.1

https://pbs.twimg.com/media/DXtjZlSX4AIImPh.jpg

https://pbs.twimg.com/media/DXtjnUFWkAExiZj.jpg

EIA STEO Forecast https://pbs.twimg.com/media/DXtkisNX4AETNsT.jpg

Saxo charts https://pbs.twimg.com/media/DXsjmUtWAAAdOqm.jpg

EIA https://www.eia.gov/petroleum/supply/weekly/