A guest post by George Kaplan

Leasing

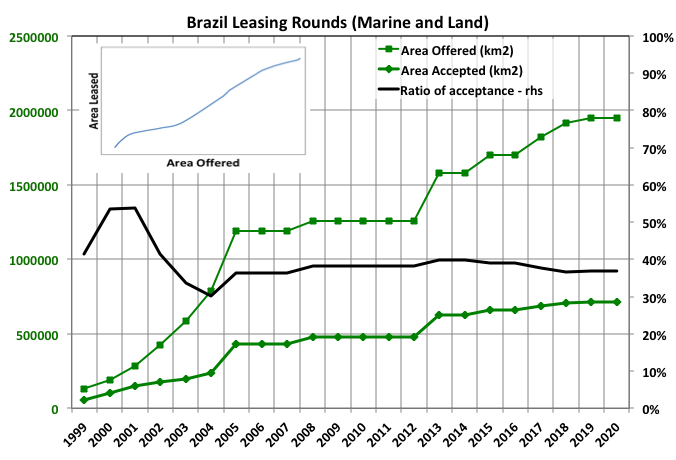

The creaming curve for lease sales in Brazil looks like it is turning towards the asymptote overall. Unfortunately there is insufficient data provided to allow land and marine leasing to be separated but I expect that the curve for land is close to the limit but that for marine areas is barely half way. The average take up of offers has remained high, which suggests APB, the Brazilian authority in charge, is discerning about what it offers.

Drilling and Exploration

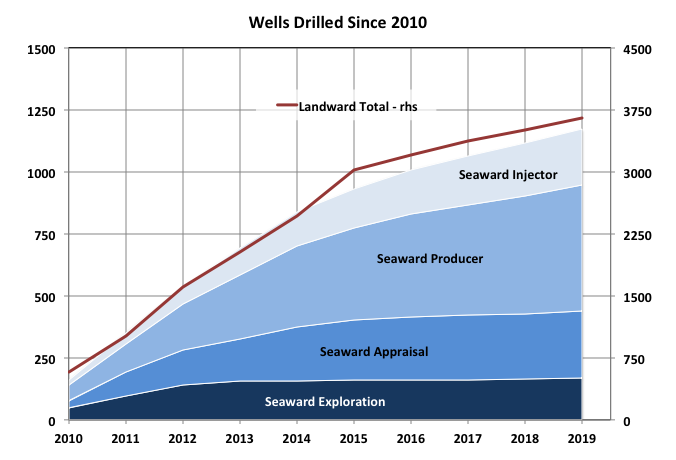

Only a handful of exploration and appraisal wells are drilled onshore nowadays, but production wells continue to be added, though I expect they are all marginal producers (there has been a notable decline since 2015).

Marine exploration and appraisal annual drilling numbers are also starting to decline. Production and injection well drilling is still healthy even with the decline in rigs (see below) and the wells are probably increasing in capacity in the Santos basin.

Note the numbers are incremental from 2010 as there is no data available before then.

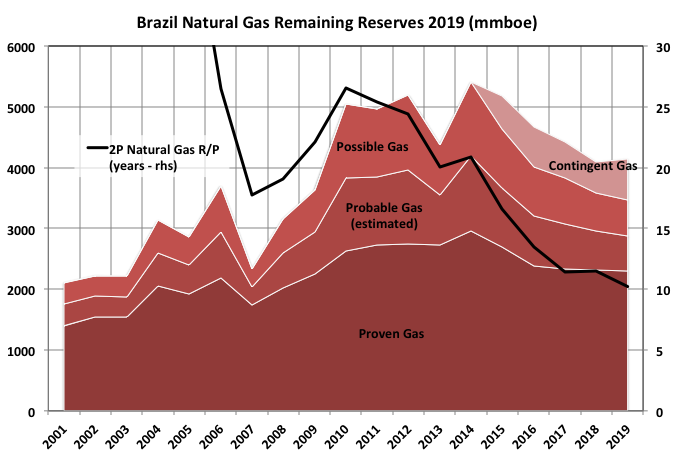

Reserves

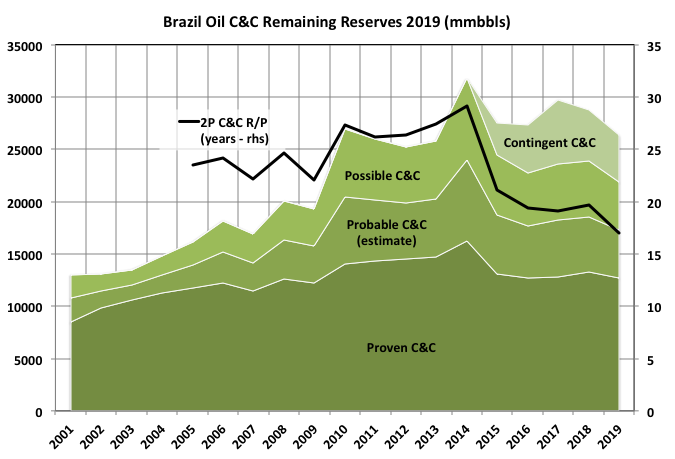

The oil and gas authority, APB, reports Brazilian reserves every year, usually in April, for the end of the previous year. Surprisingly, given the amount of exploration and development activity there, reserves have fallen overall since 2010 and, unlike OPEC countries that seem to hold reserve numbers about constant even as production declines and R/P values increase, the average remaining production period has been falling steadily and fairly rapidly. Some large markdowns in large field reserves and recent dry holes in Santos basin (notably by Shell) might explain some of this.

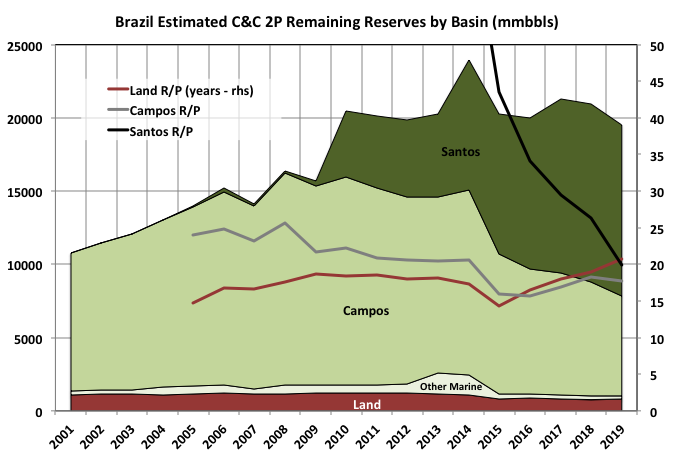

A Verhulst curve fitted to the Santos basin projects at least double the remaining reserves, and probably more, although it also shows a large reduction for Campos (see below).

APB only reports proven and possible reserve numbers, so I have estimated probable (2P) numbers, which are the most likely ultimate recovery, by splitting the difference.

Santos R/P has been declining fast and will accelerate as new FPSOs come on-line unless the apparently missing 2P reserves are added.

Natural gas production isn’t a significant consideration. Any production is used locally and Brazil has to import a bit, The usable supply may dwindle as new fields in Santos have high carbon dioxide content, which means it may have to be re-injected if transport to shore is non-commercial (I’ve seen some reports on how this may be addressed but nothing definitive).

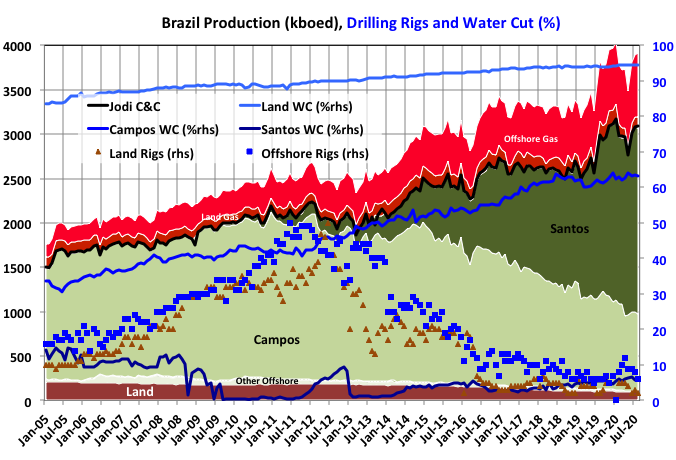

Oil Production

Production jumped in late 2019 but has struggled to maintain a plateau since then as FPSO start-ups have become sparser while the Campos basin decline continued apace.

Drilling rig numbers offshore increased in 2020 in support of the new FPSOs but land drilling virtually disappeared.

Rate of decline in the Campos basin, onshore and for small offshore basins have accelerated decline rates through 2019 and 2020, and all growth is coming from the Santos basin, which seems to be entering middle age with a rising water cut and the first developments reaching exhaustion.

Future Projections

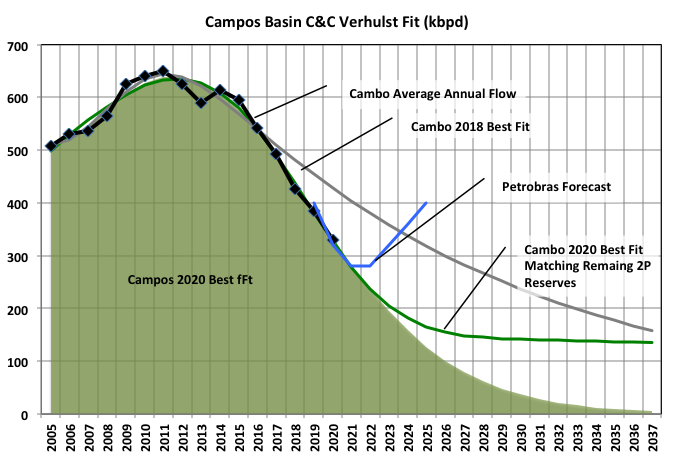

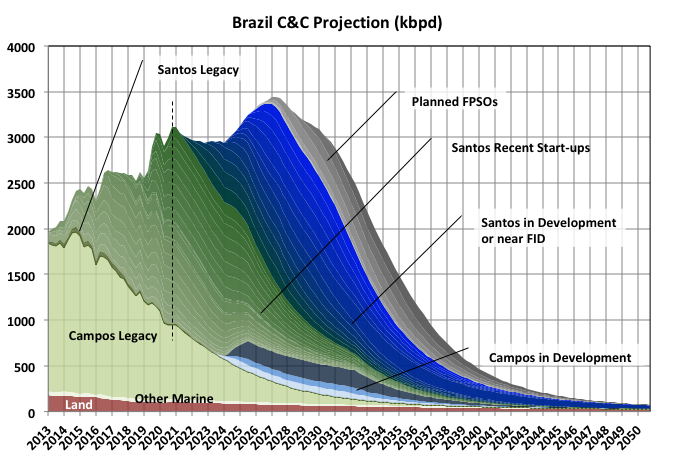

Fitting a Verhulst curves to Santos basin production is virtually impossible as it is in such an early stage of development. An attempted fit resulted in remaining reserves of 22Gb compared to the APB figure of 11 to 12Gb. The estimate is bound to increase as a number of very large FPSOs come on line before 2025. Therefore the projection is based on a bottom up on recent, developing and possible projects that have started up or been announced, using any data for throughput, reserves etc., that is available and otherwise using usual design practice (e.g. typical field size for a given design throughput, FPSO availability, ramp-up times, decline rates, plateau periods).

The Verhulst best fit including annual production through 2019 results in a much thinner tail than from 2017 because recent figures have been much lower than the fit then. 2020 production was not used in the fit but the value prorated from monthly data through September shows the declining trend is continuing. The remaining reserves calculated from the fit is only 2Gb compared to 6 to 7 Gb from APB data. Fitting the curve but constraining the reserves to this numbe produces an unrealistically thick tail. The 2017 gave a better match but more likely there is another round of developments due that would need a separate curve to match. The first three of this are currently under development and their expected additional flow over the next few years matches the prediction from Petrobras – it only shows Petrobras’ share of total equivalent production so the line shown has been prorated to total oil.

Combining the bottom up model with the top down fits for other basins gives the projection below. Note this does not include any undiscovered allowance for which I really don’t have much to go on, even to provide a range – for instance the discoveries in Guyana and Suriname may indicate more upside in the north and around the Amazon outlet.

There are forty FPSOs reported as in concept evaluation. I have shown six as near FID and six in planning phase; most of these are large producers (180 to 225kbpd of oil production). I suspect many of the others will be non-commercial or tiebacks. However, Brazil doesn’t seem to use many tieback solutions despite Campos and now Santos basins being mature enough; this may have something to do with the geology or seabed conditions.

Brazil’s latest plan for COP26 lacked any goals to cut emissions by 2030 or to stop deforestation, and why would they be expected to if the developed countries aren’t prepared to fully compensate them immediately. Humans will put correction of near term perceived unfairness and gaining status advantage above any long-term consideration of their, and still less others’ however closely related, wellbeing every time. If we did anything else we wouldn’t be where we are now, for good or bad.

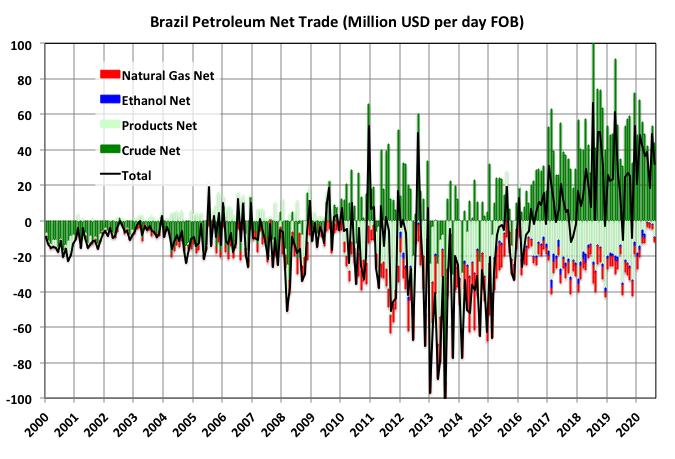

Imports and Exports

Brazil became a net petroleum exporter in 2017, from news reports I don’t see that it has made much of an improvement to its economy or society.

Off Topic Finish: Rise and Fall

There is a much-cited essay from 1976 by General Sir John Glubb, a British diplomat called The Fate of Empires and Search for Survival in which he describes repeated cycles that empires throughout history appear to share. He described how most last about 250 years, or ten generations, and follow six stages: the age of the pioneers (also called the outburst), the age of commerce, the age of conquests, the age of affluence, the age of intellect, and the age of decadence.

From my perspective, admittedly with a statistically meaningless sample size of one, we are in the latter stages of some kind of near global empire. I’m not sure what to call it, possibly the western empire or the industrial empire but the corporation empire might be most fitting (and not because we’re collectively getting paunchier). It is rather nebulous because presently there isn’t direct control by one country over many other states but there is no denying that the business world, and I’d include crime and corruption enterprises as a significant part of that, has an inordinate influence over global politics. If so then I have lived through the last part of the age of affluence, most of the age of intellect and am currently experiencing a transition to the age of decadence. From Glubb’s descriptions the age I’d choose to live would be that of intellect, so I should consider myself lucky. It is characterised by: excess wealth that allows concentration on knowledge acquisition and acquiring degrees and certificates for there own sake, rapid expansion of universities often with endowments from the elites, increased travel and spreading multiculturism.

He has a quote concerning the age of intellect that particularly encapsulates the delusions of the BAU, growth-at-all-costs, techno-copian crowd:

Perhaps the most dangerous by-product of the Age of Intellect is the unconscious growth of the idea that the human brain can solve the problems of the world. Even on the low level of practical affairs this is patently untrue. Any small human activity, the local bowls club or the ladies’ luncheon club, requires for its survival a measure of self-sacrifice and service on the part of the members.

This is not as disparaging as some opinions of John Gray, who is often thought of as the philosopher for a fading civilisation, such as:

Like Christianity in the past, the modern cult of science lives on the hope of miracles. But to think that science can transform the human lot is to believe in magic

When a more balanced world emerges, it will be after many crises, and after our present utopian faith in technology has been consigned to the rubbish heap of history.

Actually using “when” rather than “if” makes this one of his more upbeat statements’.

The age of decadence holds much less appeal, it can be described as “bread and circuses,” or for these times “drugs and internet porn/reality TV” might be more apt. It is characterised by exploding wealth disparity, excessive materialism and status signalling, overextended militaries (and these days I’d include militarised police forces in that), decline of religion (does American neo-evangelism a religion or a political movement), increased reliance on state intervention at all levels, currency debasement and overt sexual prurience.

There are other approaches to studying how societies, civilisations and empires rise, evolve and fall. Aspects of these studies have names: cliodynamics, environmental determinism, ecological overshoot analysis, etc. with proponents including Diamond, Costanza, Bardi, Lewis, Middleton, Turchin, Tainter, Homer-Dixon, Acemoglu / Robinson, etc. The various theories of collapse all seem biased, to some extent, by the political and moral standpoints or specialist fields of the proponents, not least Glubb. Recently analysis has been converging on a non-linear, dynamic system approach that, in theory, would encapsulate all the features proposed by those authors, e.g. marginal energy gains, marginal complexity costs, property rights and trustworthiness of institutions, population limits, resource depletion, environmental degradation, natural disasters, invasion, novel parasites etc.

As I understand it the system dynamics explanation goes something like as follows. The similar cyclic nature of societies might imply some common fundamental features in their systems. That they have been able to endure despite unpredictable and erratic exogenous, until suddenly they can’t, implies that it is those features that determine the life time of the society and once the resilience is lost any sufficiently large knock will cause the collapse. A key indicator that the end is nigh is excessive wealth disparity and a rising centralised hegemony, though I think these are consequences rather than causes, so artificially reversing them would not necessarily prevent a decline to collapse. I haven’t seen much on how population growth versus key resource depletion affects cycles (I’d say energy supply has been central for all civilisations and capacity for waste disposal as important for all societies, and waste disposal capacity needs to be included as a possible limiting resource). The best that I can suggest is that these limit the maximum size of a civilisation and, a little like peak oil but more asymmetric, the growth and decay rates then adjust to give a typical life span.

All empires are civilisations but the reverse need not be true (and not all societies are civilisations). Large societies rarely completely collapse – they tend to devolve and simplify, whereas empires can disappear completely. In either case, however, the contraction phases might be rather unpleasant for those experiencing them. A recent study by Centre for the Study of Existential (CSER) at the University of Cambridge concluded that average duration for civilisations has been just over 300 years, but with a wide distribution and fat tail. As a subset empires will have more common features than civilisations in general, and therefore more similar life cycles, which may explain the differences from Glubb’s work, but equally his study was rather sparse on quantifiable data.

Most proposed solutions to our ills strike me as treating the symptoms and not the disease; if the ultimate cause is an intrinsic property of large societies then I’m at a loss as to what can be done. The best that may be hoped for is to embrace a collapse as an opportunity for rebirth and regeneration. I’ve seen reports that this is Bardi’s approach, though I have not yet read much from him directly. That is easy to say in my newly vaccinated state, in a centrally heated home and looking forward to a pleasant meal; probably less easy to say and still less to put into practice whilst shivering with cold and in fear, and wondering where your families’ next meal is coming from.

It’s always dodgy to say, “this time it’s different”, but there are some notable features now. Firstly the earth is full, there’s nowhere with sparse population and under-exploited resources left to move to in order to leave the wreckage behind after a crash. Only in the last ten generations has there been significant, net overall growth in population, consumption, energy and waste production, GDP etc.; at the same time we are now actively reducing the land and resource available to us. Previous collapses and any subsequent recovery happened in the Holocene, a period of unusually stable climate that we may now have disrupted irreversibly in the anthropocene. Some previous collapses have been associated with over exploitation of one or two key resources; at the moment it is difficult to find one without some supply threat from depletion, geopolitical disruption, or excess costs. We do not live in harmony with nature and rely on industrial society functioning at fairly high levels to maintain the balance, for example: vaccines, insulin and antibiotics; fertilizer production; infrastructure maintenance; intensive farming and food distribution; civil and national conflict control; cross border humanitarian agencies etc.

As a footnote the CSER website has many interesting open source papers and videos that I haven’t found elsewhere, although it is heavy on AI “Terminator” or GE “Planet of the Apes” type threats, highly academic (lots of attempted points scoring in the Q&As) and often oriented towards the establishment with clear faith in progress, assumed continuation of capitalism, government structures, institutions etc., so just the types Gray and Glubb were commenting about.

Thanks George,

Informative post as always.

Our latest paper might be of some interest you:

https://link.springer.com/article/10.1007%2Fs41247-020-00081-4.

Thanks, George, fantastic post. You have Brazil declining slightly by 2024, then increasing by almost half a million barrels per day by 2027, then falling off a cliff. Interesting.

The below is the EIA’s estimate of Brazil’s C+C production through November 2020.

This is Plaats projection. Yearly increase of 100 kb/d up to 2027/28 up to approximately 3,800 kb/d and then flattening.

https://www.spglobal.com/platts/en/market-insights/latest-news/electric-power/123120-commodities-2021-brazil-eyes-more-oil-industry-reforms-to-lure-investors

The success of the pre-salt in the Santos Basin of Brazil has been perhaps the most significant new offshore oil development in the last 15 years or so. Production is approaching 2 mmbopd.

10-12 years ago alot of industry interest was placed on the African side as well, specifically in Angola, which was adjacent to the Santos Basin prior to the opening of the Atlantic. There has been very limited success in the pre-salt on the Angola side.

George, how field-specific can you get with the Brazil data? In most of your others assessments, for example the GOM and North Sea, you have alot of field specific data.

Thanks again!

SLG – there are data for fields but it’s on a well by well basis and takes more effort to extract. The number and size of files is a bit much for my Mac (it doesn’t quite glow, but the recharge wire has been dscoloured by the heat) and my patience (I do glow), especially as APB are inconsistent in how it is presented (changing units, no standard file names, sometimes missing or hidden items). I had it compiled through 2016 but it will take a bit of time to get the rest. Unlike GoM, UK and Norway the field names mean nothing to me – as far as I recall (which is getting shorter and fuzzier) I only ever participated in one three month study on a project there. Another difference is that Brazil, in Santos especially, uses many FPSOs for one field, whereas in the other basins it’s one platform to many fields.

Ron – the Campos decline was quite dramatic, I think Santos could be steeper just because of the speed with which it has been developed, but also the wells there seem to have high decline rates (though data is still a bit sparse). New discoveries will ameliorate things somewhat, typically these would dwindle in size to tie-backs but there’s not much evidence of that yet.

Schinzy

Thanks for the link, I’ll read with interest. Here are some links of my own, though probably more applicable to the other side.

These are links for CSER:

https://www.youtube.com/channel/UCoMIcy9-8QxuhhRSwc9cVQg/videos

https://www.cser.ac.uk

These are a links to recent summaries of our predicament under the “worse than expected” heading:

http://www.climatecodered.org/2021/03/zero-by-2050-or-2030-15c-or-2c.html

https://www.media.mit.edu/events/will-technology-save-us-from-climate-change/

https://mahb.stanford.edu/library-item/underestimating-the-challenges-of-avoiding-a-ghastly-future/

https://www.youtube.com/watch?v=SM8pQmA7wos&list=PLgQ8vQtnNUnXHlMFjMIAyKHqxWTJlcEC-&index=11

https://www.lse.ac.uk/lse-player?id=c490ba04-dfee-4205-aa82-01ef2a7bfb4c

This is worth a look too – a bit more upbeat, ridiculously so at times:

https://www.fhi.ox.ac.uk

Every UK university seems to be setting up similar departments future risk studies, this is from Manchester:

https://www.youtube.com/playlist?list=PLgQ8vQtnNUnXHlMFjMIAyKHqxWTJlcEC-

And this is LSE:

https://www.lse.ac.uk/granthaminstitute/

The thing I find under studied in all these centres is resource depletion. I watched a scary documentary last week about fish stock collapse, apparently 50% of all catch is not reported because it’s bycatch, for private consumption, sports fishing etc. so even the fisheries we think are doing OK aren’t, and that’s without considering climate change.

Excellent info on Brazil George.

And I really appreciate the very thoughtful comments on the Rise and Fall.

Thank you for the links George. I will go through them slowly. I have to say that I am currently more focused on selling solutions rather than looking at problems. I have been enormously influenced by my daughter (https://miss-permaculture.com) who has introduced me to permaculture and it’s proposed solutions.

Example:

My vote for the disruptive technology for the next decade is

composting. I believe that in the next decade much of the false information about composting will be dissipated and that the technology will be embraced to solve problems ranging from water pollution to global warming.

According to the EPA

(https://www.epa.gov/ghgemissions/global-greenhouse-gas-emissions-data) 24% of greenhouse gas emissions come from land use while all of transportation

represents only 14%. By changing our land use, rather than being a source of greenhouse gas, land use could become a sink. According to Wikipedia, there is 3 times more carbon in the soil than in the atmosphere (https://en.wikipedia.org/wiki/Soil_carbon). According to Paul Stamet about

1/3 of the carbon in the soil is contained in the mycelium of fungi

(https://www.youtube.com/watch?v=mPqWstVnRjQ).

Solution to global warming: grow fungi. Fungi thrives in forests and compost piles. Joseph Jenkin’s 3 rules: do not defecate in water, do not defecate on the soil (better than water but spreads disease), wash your hands. The cost effective solution to human excrement which improves the soil, helps to solve global warming, decreases water pollution is composting. See

http://humanurehandbook.com/ and http://carbonfarmingsolution.com/.

Thanks for the fantastic article George.

Schinzy- this summer I’ll be setting up a composting toilet facility at my woodlot/retreat. Thanks for the links re same.

Welcome to the revolution!

Woodstock

About Jean-Marc jancovici, he’s speaking about the reduction of oil products consumption. Very well and I agree with him about this. But a problem is the fate of the oil producer states such as Algeria which has also a galloping demographic. Jean-Marc Jancovici knows about this and, if my memory is good, he did give the example of Syria or Lybia as failed states because of oil production decline in these countries. The only problem is that he has no solutions to avoid for this kind of states a future of failed states. For me, that’s something which is lacking in the intellectual reflection. And it is perhaps here that developing technologies to give to these countries something to sell could be useful.

Then again:

Brazil’s Covid crisis is a warning to the whole world, scientists say – “The acceleration of the epidemic is leading to the collapse of public and private hospital systems”

https://desdemonadespair.net/2021/03/brazils-covid-crisis-is-a-warning-to-the-whole-world-scientists-say-the-acceleration-of-the-epidemic-is-leading-to-the-collapse-of-public-and-private-hospital-systems.html

China is targeting above 6% growth in GDP for 2021. Only one way to get there is to do things that will devalue their currency. The higher oil prices go the more they will have to do to reach above 6% growth in GDP. The higher oil prices go the more each country will have to do to reach their growth targets.

Dollar has already turned against all the other major currencies. Which means dollars will now be following back out of China and pretty much everywhere else in the world. Global reflation trade is over. Eurodollar shortage #4 just started. Meaning as dollars leave countries outside US there is a dollar shortage. Not enough dollars for everybody to service their debts and it’s like a game of musical chairs.

What will be interesting to me is if price of oil can continue higher in the face of dollars leaving the rest of the world. Maybe it can for awhile. With OPEC continuing cuts. And money not flowing into US shale like it once did. Maybe $100 oil makes money flow into US shale again later on this year or in 2022.

Then again if yields on long-term US debt continue to go higher. Or if yields on short-terms debt fall into negative territory. And FED’s hands just happen to be tied this time. and stock market gets sacrificed. Which all are currently on the table at the moment. Oil prices will fall sharp.

HHH , from what I am reading and latest from Yellen the more likely course of action is going to be a no increase in interest rates and QE to infinity . The reason is that the Fed has stopped targeting inflation rate and indicated it will look at average inflation . Basically the Fed thinks it’s Ok for a short term spike in inflation and it can/will make a move when inflation gets high enough for its distaste . The only problem is that by the time inflation gets high enough for it’s distaste it will also be high enough for it to control . My scenario is high inflation and high oil prices pushing the world into a deeper hole . Raising interest rates is not an option as that would immediately crash the financial system while the outcome of QE infinity will be similar to slowly boiling the frog over the long term . The Fed is in a tight spot .

>Like Christianity in the past, the modern cult of science lives on the hope of miracles. But to think that science can transform the human lot is to believe in magic

That’s fine, but eschatology is also a key element of Christianity. Christians have been expecting that the end of the the world is just around the corner since the cult was founded. It’s part of what Nietzsche called the slave mentality, a feeling of helplessness compensated by blind faith that the real world is temporary, or an illusion.

So this kind of argument can go either way.

My feeling is that societies more heavily influenced by Christianity tend to more obsessed with the idea of the world coming to an end.

For example, the last secretary of state, Mike Pompeo, for example, based US foreign policy towards Iran on his reading of the Book of Esther, and many Americans like him believe that a war between Iran and Israel will herald the Second Coming of their Savior. Reagan’s Secretary of the Interior believed it was Divine Will that we burn oil as quickly as possible, before the world came to an end. These people draw explicit parallels between their “Holy Books” and reality.

In the end it’s just name calling, a game anyone can play. Prophets of Doom calling trust in scientific progress believing in miracles does seem like delusional projection though.

It’s also worth mentioning that many improvements can be made to the world based on existing technology. For example, planting trees, combatting erosion and taxing carbon are probably the solution to the global warming threat, and they require no new tech at all.This does not require any leap of faith.

The word science can mean a lot of different things. When we say the word science people will have a lot of different associations; some people think it’s a field of experimentation, a mode of learning, a fashion of testing hypothesis; and have then the ability to change the relationship between people and people, and people and nature, by way of technology and understanding.

Latest climate models show more intense droughts to come

https://phys.org/news/2020-06-latest-climate-intense-droughts.html

That dismal forecast was brought to you by ‘science’.

I’m not really interested in the level of “trust in scientific progress” that the cornucopians and their objectors may have or have not. That seems like a foolish proxy. I’m interested in risk & probabilities; what are the perceived probabilities that the scientific community will come up with a solution so we can keep the consumer orgy going, or maybe not die in famine and famine related violence? 100%? That seems ridiculous; right up there the with the Book of Mormon, although they are big on a fully stocked pantry.

Some might not like discussing perceived probabilities, because it’s not an all of nothing morale virtue, like “trust in scientific progress” (you either got it or you don’t).

Surviving Progress

https://youtu.be/fGyU6MEstjU

Saudi Arabia disagrees with Dennis.

Saudis Bet Against Return of USA Shale Glory Days

(Bloomberg) — Saudi Arabia just made a high-stakes wager that the glory days of U.S. shale, which transformed the global energy map in the last decade, are never coming back.

By keeping a tight grip on supply at Thursday’s meeting of the OPEC+ alliance of oil producers, Saudi Energy Minister Prince Abdulaziz bin Salman showed he’s focused on boosting prices — and confident that this time around it won’t encourage American producers to surge back and steal market share.

“‘Drill, baby, drill’ is gone for ever,” said Prince Abdulaziz, who’s orchestrated the revival of the oil market after last year’s catastrophic collapse.

His swagger comes mixed with a good dose of diplomatic tension: Russia, Saudi Arabia’s most important OPEC+ partner, has tried to convince Riyadh for several months to increase output, fearing that rising oil prices would ultimately awaken rival shale producers. The Saudis are certain the American industry has reformed itself.

Ron,

I mostly base my scenarios on what has happened in the recent past. Below we have a “low completion rate” tight oil scenario which I call the low scenario where it is different this time than the past and tight oil producers are very disciplined. I compare this with a “high scenario” where tight oil producers increase completion rates at rates similar to the past (2017 to 2019 rates of increase in tight oil completion rates in change in number of new wells completed per month). I also show the average of the two scenarios.

The future is unknown by both the Saudis and me. These are three of an infinite number of possible future scenarios, the probability of being correct is zero.

Low scenario URR is 84 Gb and high scenario is 93 Gb.

If I may. Is it pertinent to take into account the ban of granting new concessions of federal lands for oil shale? If so, will the oil shale production decrease more rapidly than in your scenarios?

Jean-Francois,

That has not been taken into account, the low completion scenario might be consistent with that, note also I have not taken into account falling demand which might occur in 2035 to 2040 and lead to lower oil prices, such a scenario would lead to lower oil prices than I have used for these scenarios after 2040 and also lead to lower completion rates and less need for oil from federal lands.

Also the ban on new leases is being looked at, the ban is a temporary hold at present and will likely be held up in court as oil companies sue to overturn the Biden administration’s policy. At present oil companies loaded up on drilling permits before Biden took office and those permits remain valid for 4 years.

See

https://www.reuters.com/article/us-usa-biden-drilling/big-u-s-oil-drillers-have-federal-permits-to-mute-effect-of-any-biden-ban-idUSKBN29Q1S5

Jean-Francois (cedilla to be supplied by the reader) Fleury,

Not oil shale–that’s a different critter. Note that DC uses “Tight oil”, a short form of light tight oil (LTO), on his chart. Media use of “shale oil” opens the way to this point of confusion.

“LTO” is easy to use.

(Hmm…still too early for Port.)

Never too early for port.

Isn’t Port for people who don’t like wine?

I did study wine at UC, but Port never made it on the curriculum.

Maybe those good Reds from living in Sonoma County jaded my taste.

DC,

Wisdom! And just in time.

I feel swayed, and just as soon as I finish this fresh mug of Assam I shall return to the road you point out, from which I’d strayed.

Tugging of forelock in appreciation for the mildness of the reminder.

For Hightrekker:

There is some truth in what you say but it doesn’t apply to all Port aficionadi (italics to be supplied by the reader.)

My own case, though, stems in part from having been living in the Bay Area the year that California wines won the blind tasting against French wines. Suddenly living was swamped by all things wine-related. You couldn’t go into a gas station and not encounter a wine and cheese layout; there were wine and cheese parties wherever you looked; public lectures on wines and wine culture; wine on offer in any home you might visit. This went on for a year or more, and I sampled and learned (I’d always paid attention to the cultural history of wines, and later on to the archaeology), and discussed, and after moving to Connecticut to begin graduate study and encountering different takes on wines finally I was in an informed position to say that I don’t care for wine. Champagne is OK, I guess. In January 1991 I was treated to a glass of a Rothschild burgundy ($13 dollars a glass in 1991) in an old hotel in Portland, Oregon, and after a few sips I said “Yeah, that’s pretty good”. No palate, I fear; none at all.

Ports are fortified wines (19% or 20% alcohol), as are Madeiras and Sherries. Traditionally it was brandy that was added to the wine to stop the fermentation and in the case of Port it’s added before all the sugars have been used up, hence the relative sweetness though I don’t find most to be sweet myself but then my palate… For whoops, try a Madeira. With a Port or Sherry you have a week or two to finish a bottle once it’s opened, but with Madeira just remember to put the cork back in the bottle. Madeiras are so brutalized in the making that nothing can hurt them.

I think the shale attitude change is at least in part the result of the Presidential election.

It is very hard to find left wing management and boardrooms among the shale players and majors.

For several years we have dealt with the attitude that oil producers are pariahs, evil people damaging the environment.

Living in rural USA, I don’t find many who feel this way. However, even where I live, there are liberal MSNBC watchers. People I have known for decades. They have watched enough MSNBC to now be espousing these views, despite that the end of oil would destroy our local economy. They aren’t brainwashed as bad as the Fox viewers, but I see the same TV opinion news influencing them too.

There are posters here who attack Mike and me, while continuing to use many petroleum based products. This post will probably bring them back out.

So, for quite awhile, a part of me thinks, ok, let’s see how things go by winding down US oil production. Part of that is self interest, we aren’t drill baby drill. Oil price is the big thing for us as we are going to produce about the same amount of oil every year. So self interest for us is higher oil prices. But not so high as to hurt the economy. Still would like $55-65 WTI with less volatility.

I am now thinking maybe the majors and large shale independents are thinking the same as a part of me thinks. They no longer have pressure from Trump to keep growing. The left absolutely hates them. Want to sue them out of business. All while continuing to use petroleum themselves.

Add on that likely most leases are finally HBP. Maybe many of the continuous development clauses have been renegotiated? Or have been satisfied?

I also think the right wing thinks they can win back Congress with $4 gasoline. That could be the unsaid plan also. Let’s keep a lid on production, which is what the left wants anyway. We will finally make some money, get oil to $80+, and then see the Republicans take back Congress.

Who knows. Many people, many factors.

Shallow Sand, don’t forget that the big majority of the Democratic inclined voters are not ‘left’ wing.

They are center.

So are some of the republican inclined voters.

This would all be more clearly evident if partisan gerrymandering was extinguished.

The voting reform bill that just passed the house would – “require states to establish a bipartisan independent commission to redraw their congressional districts every 10 years.”

https://www.npr.org/2021/03/03/972568115/house-approves-major-election-and-campaign-finance-reform-bill

Hint:

There is no “left” in the mainstream US.

We have a one party State, not even a Labor Party like the capitalists of Europe.

Pepsi

Pepsi Lite

I agree.

How else would of Biden, a man who twice barely got 1% in Democratic Presidential primaries, have swept through the D primary and then beat Trump.

The USA is right center. But the far left and far right are very loud.

AOC said she was going to hold Biden accountable before he was even sworn in.

So Biden has to immediately move to the left, to keep the far left from attacking him. Keystone was an obvious placating of the left. There will be others oil related.

I’d like to see an open primary with a top 2 runoff. There are drawbacks, but I think that would force candidates to be more balanced.

I’d rather have elected officials who don’t have to pass purity tests and can keep an open mind.

For example, there is almost zero nuance when it comes to FF politically. It’s pretty much “drill baby drill” or “keep it in the ground.”

My personal opinion to ff is additional to enviromental problems – the easy stuff will mostly be gone in 20-30 years. In gas, too, since consumptions will grow here before shrinking.

So there will be only complicated stuff left and lots of strippers – not something to build the energy supply on the world on.

Here enviromentalists are getting lots of air time in official TV, too. They’re speaking of continuing of lockdowns for CO2 reasons for all future and more crazy stuff. Forbidding 1 family homes – only allowing flats in big towns to concentrate people.

I’m going to have to raise a differing viewpoint on this Shallow Sand-

you say that ‘the USA is center-right’.

Perhaps a on a few issues, but on very many more the country is more center-left,

such as on a womens right to freedom on reproductive choice, the desire to ban military style armaments from citizen ownership, the desire to maintain the socialist programs of social security and medicare, the desire to maintain international agreements and engagement, the desire to embrace science rather than 2000 yr old ‘belief’ systems, the desire to regulate capitalism so that people with net-worth over 50 million dollars get taxed heavily, the strong belief that people of various races, colors, religions, and sexes all deserve equal treatment by the judiciary , equal protection under the law, and equal opportunity, the desire for a free and accurate press.

These are majority positions of the country populace, and are represented politically by the democratic party.

Houthis say drones, missiles fired at Saudi oil, military sites

Yemen’s Houthi rebels fired 14 drones and eight ballistic missiles at facilities of oil firm Saudi Aramco in Ras Tanura and at military targets in the Saudi cities of Dammam, Asir and Jazan, the Houthi military spokesman has said.

Thank you for the post and the informations. What I observe is that Brazil will not be able, in the best case, to add on international market more than 500 kbpd in the future. The future is not going to be glorious with the lack of simple and easy-to-implement alternative solutions to go with.

So with OPEC+ unwillingness to raise production and the obvious state of the US, anyone willing to predict if we see shortages this year? Art Berman predicted it for this summer, and he doesn’t strike me as a unreasonable guy.

An interesting and fact based article on the Texas Power Crisis.

“There is no one party in the electrical power generation chain on which to lay the blame, and we

should quit trying”

https://www.mrt.com/business/oil/article/Texas-power-death-spiral-was-16005919.php

Power lines are shown Tuesday, Feb. 16, 2021, in Houston. More than 4 million people in Texas still

had no power a full day after historic snowfall and single-digit temperatures created a surge of

demand for electricity to warm up homes unaccustomed to such extreme lows, buckling the state’s

power grid and causing widespread blackouts.

In 1882, Thomas Edison formed the Edison Electric Illuminating Co., which brought electric light to

Manhattan but most Americans still lit their homes with gas light and candles for another 50 years.

Only in 1925 did half of all homes in the U.S. have electric power. It has been many years since

the US has been fully electrified, but in 2015, 1 billion people (three times the US population) in

the world had no access to electricity. Access to electricity is a key metric to determining a

nation’s affluence; as late as 2001, the entire county of Afghanistan was virtually without

electricity. Afghani GDP

3/7/

ath spiral’ was unavoidable; it is that simple – Midland…

https://www.mrt.com/business/oil/article/Texas-power-deat

was $500 per person in 2019 while the United States GDP was $65,000 per person.

We have come to expect that we should have electric power 100 percent of the time, and when that

doesn’t happen, then it must be someone else’s fault (Oncor, ERCOT, power generators, retail

electric providers like Griddy, employees and/or board members of any and all of the above, etc.).

There are very few who know how electric power is generated and even fewer who understand the vast

number of both mechanical and human factors that must operate seamlessly (and do operate seamlessly

99.9 percent of the time) to provide this modern miracle. We should really consider ourselves quite

fortunate to have electricity at all, but of course we, as Americans, are smarter, better looking

and more talented than everyone else and expect to have our every wish granted immediately; “Vanity

of vanities, and all is vanity” spoke Ecclesiastes. Not a few have observed that this event

occurred at the beginning of Lent, forcing involuntary penance on a people who refuse even the

slightest voluntary inconveniences.

Within ERCOT, natural gas burned in gas turbines provides about 50 percent of the generating

capacity in Texas, with wind/solar at about 30 percent, coal about 15 percent and nuclear about 5

percent. Since natural gas provides such a large percentage of electric power, and in an effort to

find the appropriate scapegoat to Texas’ woes, we first need to understand what a typical oil and

gas production facility contains. A three-phase stream (oil, salt water and natural gas) is

produced from the wellhead and flows to a separator, where the gas leaves the top of the separator

in the vapor phase and the oil-salt water mixture leaves the bottom of the separator in the liquid

phase and goes to a (gas-fired) heater-treater, which applies heat to break the oil-water emulsion

and separate the oil from the saltwater. Oil then goes to storage tanks or pipelines, while water

is either sent to a disposal well (via electric pump) or trucked off the lease.

Let’s examine what really happened during the 221 consecutive hours with temperatures below the

freezing point of water (32 degrees Fahrenheit). The natural gas in the vapor phase leaving the

separator is saturated with water vapor, and since all the functions listed above occur above

ground in steel pipes and vessels, the gas quickly drops in temperature, and the water vapor can

freeze in the pipeline creating an ice block (a hydrate). If the gas cannot leave the lease then,

unless the gas is flared, the well must be shut in. Even if the gas does not freeze in the line, if

the paved roads and dirt lease roads are too hazardous for 18-wheeled truck transports to pick up

the oil

3/7/

ath spiral’ was unavoidable; it is that simple – Midland…

https://www.mrt.com/business/oil/article/Texas-power-deat

and water from the lease, then as soon as the on-lease storage is filled, the well must be shut in.

Most leases have some level of electric power for pumps, lighting, heat tracing or similar uses,

and when the electric provider ceases to provide that power, then any efforts to restore production

and unfreeze equipment are hampered. The combination of freezing within on-lease flowlines,

hazardous conditions preventing company employees from getting to the lease, lack of crude and

water truck hauling, and the loss of electricity results in a complete wellhead shut in.

The graph below illustrates actual field production data from a Reagan County producer who battled

all the issues above:

Virtually 100 percent of the gas produced in the Permian Basin must be processed in a gas

processing plant for the removal of water, hydrogen sulfide, carbon dioxide and valuable natural

gas liquids (NGLs, which are ethane, propane, butanes and heavier), with the remaining molecules

consisting almost entirely of methane (called residue gas) delivered into large-diameter pipelines

at the plant outlet. As producers struggled to keep wells on, gas processors also struggled as

volumes to their plants steadily decreased (making it more difficult to operate), and they faced

similar issues of employee safety, in-plant freezes and loss of electricity to key pieces of

equipment like NGL pumps (if the NGLs cannot be pipelined from the plant on a continuous basis, the

3/7/

ath spiral’ was unavoidable; it is that simple – Midland…

https://www.mrt.com/business/oil/article/Texas-power-deat

plant is forced to shut down). All plants have a minimum volume of gas required to run the plant,

and many plants hit this wall; Navitas’ processing complex east of Midland dropped from 750,000 Mcf

per day to zero Mcf per day) while Cogent in Reagan County dropped from 460,000 Mcf per day to

40,000 Mcf per day.

Assuming a total loss of wind/solar and a 50 percent loss in coal, natural gas’ share of the

remaining generating capacity rose to about 80 percent; when wellhead freezes dramatically reduced

gas flow to the processing plants, and when plants were having their own freeze issues, electric

providers then cut power to these plants, eliminating what little gas supply was left available,

effectively creating a “death spiral.”

So, irrespective if (a) power generators were properly winterized, or (b) we had more gas-fired

powered generation, or (c) Texas was not deregulated, the fuel supply simply was not available,

“not even for ready money” (in Oscar Wilde’s “The Importance of Being Earnest,” Algernon expresses

his dismay to the butler regarding why there were no cucumber sandwiches, to which the butler

replies “There were no cucumbers in the market this morning, sir, not even for ready money”; after

you read this comedy you should read his equally compelling but more somber tale, “The Picture of

Dorian Gray”).

As gas supply dwindled, and power demand increased, the price of gas “for ready money” jumped from

its normal price of $3/MMBtu to $100-$200/MMBtu, and as the price of gas surged, and the demand for

power increased while its availability decreased, the price of power also surged from $.03 per

kilowatt-hour to $9 per kilowatt-hour. The typical consumer reaction was that there was “price

gouging” simply because the price increased; what we witnessed was the classic supply- demand-price

dynamic of the free market, which that same consumer enjoys on a regular basis when shopping for

virtually any product. Griddy customers enjoyed the rewards of supply-demand-price when power was

plentiful and cheap, but they knew full well that they were susceptible to price spikes; Griddy

updated open-market prices every five minutes and sent alerts when the price was increasing or

decreasing, so those customers had the tools available on their “smart” phones and could elect to

cease or continue to use power at a known cost.

Force majeure is a French term that literally means “greater force” and is related to an act of

God, an event for which no party can be held accountable, such as a hurricane or a tornado (or 221

consecutive hours below 32 degrees). Try as we might, there is no

3/7/

ath spiral’ was unavoidable; it is that simple – Midland…

https://www.mrt.com/business/oil/article/Texas-power-deat

one party in the electrical power generation chain on which to lay the blame, and we should quit

trying. Will all the entities in the chain expend the money to protect against an event that

happens once in a hundred years? Will you expend the money to buy and maintain a gas- or

diesel-powered generator and beef up the insulation in your house to protect against an event that

happens once in a hundred years? Do you expect the answers to both questions to be the same?

It is very unfortunate that lives were lost as an indirect consequence to the temporary loss of

electricity. In another segment of our lives where man and machine interact, let’s look at deaths

on Texas roadways, which run about 3,500 per year. For the last 20 consecutive years, at least one

person has died every single day in a vehicle accident; are we filing lawsuits or calling for the

resignation of employees of TxDOT, DPS or vehicle manufacturers? If we were serious about reducing

deaths to zero (TxDOT’s 2050 goal) would we drop the speed limit to 30 miles per hour on all

roadways and post officers every 10 miles to issue mandatory citations? Or would we appeal to

taking personal responsibility for safe driving habits every time we turned the key in the

ignition?

Switching gears, what should oil and gas producers be prepared for in late March when they are paid

for gas delivered in February? Just because natural gas traded for

$100-$200/MMBtu for a few days does not mean you will receive that price; it depends on what your

gas contract stipulates and whether the plant to which you are connected sold any gas during that

period. In an effort to be equitable, gas processors who did sell some high-priced gas could

possibly allocate that value to only those producers who actually delivered gas to them during that

period, rather than compute an average monthly price and applying that price to all deliveries

during February. If your gas processor passes through your share of its electricity bill, you could

be in for a shock on high pass-through power costs. You may get inquiries from royalty owners

wondering why they are not seeing the effects of $100/MMBtu gas and whether you exercised a

fiduciary responsibility to obtain that price.

This is only a partial list; the storm outside is over, but the financial and legal storm could

only be beginning.

John.

Thank you very much for this post.

JohnS , excellent post and explanations . Just confirms :

1. The chain is as strong as it’s weakest link .

2. A small hole can sink a big ship .

The small coal plant that was near me was closed almost ten years ago and dismantled. It was built after WW2. Two large plants built near me in the late 1970s-early 1980s are slated for closure this decade.

Hate to see the jobs leave the area. Had relatives that worked at them (now all retired). Current operators making about $100K, union jobs with good healthcare, defined benefit pensions and 401(k) matches.

A solar farm is being built at both of the newer coal plants. I assume one reason solar and wind compete is the lack of labor required to operate them.

I need to read more about careers in renewables. Seems like they are more construction type jobs, which can be very good.

I think if I were looking for a trade, I’d look into being an electrician or plumber. So hard to find. Had a new water heater installed, hourly charge was $125. That’s a very good rate.

To tie back to oil, this is why I see a shortage coming. Who here would recommend to a high school senior to look into a job as a coal miner, coal plant operator, oil lease pumper, rig operator, geologist or petroleum engineer.

Just look at how the mining schools, such as Colorado School of Mines, are revamping. Less than 10% majoring in a fossil fuel program such as petroleum engineering.

SS

I think that carpenters are also in good demand, along with all type of repair personnel. I have a friend whose son installs windmills and is doing quite well. He also passes along that windmills need semi-annual maintenance.

Just wondering if anyone knows how much maintenance is required for large fields of solar panels.

Ovi,

Probably not a lot of maintenance for solar, sometimes there might be inverter breakdowns and occasional wiring problems with age, but not a lot of moving parts so likely little high skill maintenance required. Panels might require cleaning in dry dusty areas, but that is relatively low skilled labor.

Dennis

That is about what I would have guessed. Cleaning the panels must be an ongoing issue.

In the summer at our place, I clean our patio table almost every day and the paper towel always cleans away a lot of black residue. Not sure how that would reduce the panel efficiency after a week or two.

Cleaning utility scale photovoltaic is an industry- even with robotic service. Good mechanical engineering innovation under way.

Want to see another aspect of the industry- an installation company my engineering friend recently went live with-

https://www.ojjo.com/

“Meet Ojjo’s all-in-one precision Truss Driver™. With industry-first automation software, soil-specific attachments, and the ability to perform simultaneous drill and drive operations, the Truss Driver dramatically reduces installation time and complexity.”

There’s a stripper well operator with a youtube channel https://www.youtube.com/channel/UCrCEQVqXtX1OT7eRPrsDPRw

‘Ohio oil man’ who appears quite young.

Thanks for posting this.

The video with the service rig is an example of what we call a “rod job.” The rods are pulled in order to change a worn out pump.

The well is a “super shallow” well, much shallower than even ours. They state on the video they ran it back in in just 12 minutes. The rig is the size I see in the shallow 300’-400’ fields near us. Basically mounted on the back of a heavy duty pickup truck. I skimmed thru another video of them pulling a well. They said there are 12-15 25’ rods in their wells, so these are 300’-400’ wells. Really cool.

The down hole pump is also tiny.

One thing I hope this video shows is how small of footprint stripper wells can be.

It also seems these young guys own the wells, based on comments. I think one could see how this is a pretty neat business (operating shallow stripper wells) from watching these guys.

When I get time I will watch the plugging videos. They appear to be a lot longer in duration.

Cheers ShallowSand, I appreciate the content that you and Mike (especially with his website) contribute.

Ohio oil man gives a brief history of the field here:

https://www.youtube.com/watch?v=lYNwlL6eZYU

including antique pumping schemes.

Ian H.

I was able to watch some more of the videos posted by this young man.

He says he is a fourth generation oil producer and that the company was founded in 1937. I was able to piece together who this is, and they are legit. Says operate about 400 wells, and from my subscription service, that is the case. Operate wells 300′-800′, then some 3,000′ and some 5,000′.

I plan on watching all of his videos. What he shows is a very accurate description of a small operator that operates shallow wells.

There are differences between what they operate and what we do. Looks like they have a lot of gas wells, and we do not have any.

Looks like the shallow oil wells are located (at least some of them anyway) in the Chatham Field in Medina Co., OH. As wells were drilled there in the 1890’s, it could be that they are operating some wells that are over 120 years old, which would beat our 115 year old wells.

I think this is really cool and I am glad that you posted the link, Ian H!

Shallow Sand —

The primary arguments for solar are fuel costs, price stability, labor savings and reduced political risk. The fact that the American coal fleet is mostly outdated as companies avoid investment to maximize short term profits has also played a big role in the recent wave of shutdowns.

Also, traditional coal plants are designed to be cheap and reliable, but not to be flexible. The arrival of cheap intermittent energy is a vicious circle for coal plants — the more renewables there are, the less viable the traditional designs. The perceived weakness of renewables is poison to its rivals.

As you mention, Wind and solar in particular have much lower maintenance costs than coal and gas. The same applies to electric vehicles compared to internal combustion engines. Machines that handle fluids under pressure are inherently maintenance intensive. In current car design that includes oil, fuel, water, brake fluid, power steering fluid, transmission fluid and air. Coal plants have separate systems for water intake, high pressure steam, low pressure steam and hot water disposal/ heat exchange. The idea that “green jobs” will replace existing fossil fuel jobs is a myth.

Price stability is often overlooked. It’s anyone’s guess what the prices of oil, or gas, or coal will be in 5-10 years. But the costs of an existing solar plant are well known. Bankers hate risk, so solar is more attractive even if it is more expensive.

John,

There is lots of natural gas in storage, so the processing of NGLs and natural gas is not really a short term issue for electric power, just pipe the stored methane to the power plant.

If ERCOT cannot reliably ensure delivery of power, maybe Texas should connect to the rest of the US grid so they can rely on power from other regions in an emergency.

Or they could choose to do a better job regulating their power industry to ensure reliability.

In December 2020 Texas had 429 billion cubic feet of natural gas in storage (working volume), and 727 billion cubic feet total, the base volume that remains in pipes and minimum storage levels is 300 billion cubic feet. Texas used about 355 billion cubic feet per month in Dec 2020 and 357 billion cubic feet in January 2020, so storage levels were likely adequate in February/March. Typical net withdrawals from natural gas storage are 27 billion cubic feet in February with a high of 107 billion cubic feet in Jan 2018 for Texas.

Dennis,

From the MRT article, “ . . . we, as Americans, are smarter, better looking and more talented than everyone else and expect to have our every wish granted immediately”

I have known the author, Mike Banschbach, for about 40 years. Mike is a recognized natural gas expert, a graduate of the Colorado School of Mines, an adjunct professor at the local college, former manager for ARCO. He markets oil, gas and power to earn a living for many companies in Texas and New Mexico.

Does the name “Mike” trigger an involuntary Pavlovian response in you? You don’t have to listen to real experts. That is your choice. But don’t expect the experts to listen to you. And stop telling them how to run their businesses and their State. It’s not a good look for you.

https://www.youtube.com/watch?v=IgAsNtmlQJU&t=2s

John S,

Much of what you focused on was natural gas and NGL production. Couldn’t the natural gas power plants use natural gas in storage?

Texans can run their state as they wish, I agree, and they will.

If I lived there, I would prefer a working electric power grid, but it is not my problem.

Dennis,

Here is another quote from Banschbach’s article that is worth pointing out:

“There are very few who know how electric power is generated and even fewer who understand the vast number of both mechanical and human factors that must operate seamlessly (and do operate seamlessly 99.9 percent of the time) to provide this modern miracle.”

When electricity fails EVERYTHING fails. It takes energy to move gas from storage. Not knowing the specifics, gas in storage probably has picked up various contaminates that have to removed before the gas can be “re-inserted” into the system. That process will also require energy/electricity. The system broke down. It happens. Be thankful the power grid is compartmentalizations and is not national. What if the Texas problem had cascaded across the entire country?

I think that Banschbach’s point is that the energy power grid or process in this country involve tens of thousands of individual and mechanical factors to operate seamlessly EVERY DAY to deliver electricity to MILLIONS

Of individuals and businesses and government offices each day 99.9 % of the time is a MIRACLE!

A miracle unrecognized by 99.9 % of the people in this country. Including you. The winter storm was “An Act of God”. Every county in the State of Texas had temperatures below freezing. When I consider just where the southern tip of Texas is located the magnitude of this storm is unbelievable.

Without electricity, the USA will turn into Somalia in less than a week.

John S,

I understand there are a lot of moving parts to the production of electricity and also understand, that when the system fails it can be catastrophic, thus the reason for a solid system operator.

My point was simply that the electricity failed due to inadequate natural gas, it seems gas in storage would take care of the gas supply which would have prevented the system from crashing.

Another take on Texas power debacle

https://www.cnbc.com/2021/02/17/how-the-texas-power-grid-failed-and-what-could-stop-it-from-happening-again.html

> In another segment of our lives where man and machine interact, let’s look at deaths

on Texas roadways, which run about 3,500 per year.

It’s noteworthy that Germany, with nearly three times the population as Texas, had about 2,700 traffic deaths last year. The number have been falling steadily for years. Poorly designed Texas roads are the primary problem, not speed per se, as Germans drive a lot faster than Texans on highways at least. Pedestrians are at particular risk in Texas thank to the miserable pedestrian infrastructure and lack of safety testing on vehicles.

John S, you capitalized ‘State.’ Well done.

Remember, bashing Texas is a national past time and on POB, the HOME for anti-conservatism, anti-oil, anti-natural gas, anti-guns, anti-God and anti-brain matter, if you wish to offer real life experience in the hope of enlightening someone, you will get railed on personally and/or receive unlimited free advice as to how to fix it, and yourself for believing the way you do. You are only allowed to post here if you swim with the bait ball; this is not a venue for “rational” debate nor “civil” discourse. Imagine, for instance, telling a guy who has operated in the Illinois Basin for 30 years how to dress warmly in the winter and hire pumpers?

Nice try though; I too know Mike Banschbach, a smart gas guy and worth “trying” to understand even if you don’t want to, or can’t.

Mike, though I am a liberal, I am not anti-conservative. We need a conservative party but unfortunately, we do not have one. The Trump party is everything but conservative, increasing the deficit with their massive tax cut for the rich, by two trillion dollars.

I am not anti-oil. Virtually everything we manufacture today contains oil in one form or another. We would be in one damn predicament without in. Ditto for natural gas.

I am not anti-gun, I own one, a small 32 automatic that I inherited from my wife. I am, however, anti-AK47 and anti-AR15. These are weapons of war. They were designed for killing people in mass numbers and for no other reason. They belong in the Army, not in the streets.

I am not anti-God, I am anti-religion. Organized.. religion is the biggest grift ever dreamed up by the mind of man. Preachers will demand the last dollar from the poor while living in luxury. Religion poisons everything. Note: I do believe the universe was created by some kind of conscious entity. But that conscious entity does not resemble any god ever created by the mind of man. And all gods of religion were dreamed up by some religious shaman in order to enhance his own power, prestige, and wealth.

Anti-brain matter? You will have to explain that one. I have no idea how one would be anti-brain matter.

Yes, a lot of people on this site will tell you how to fix everything, but not me. There is no fix for this damn predicament we find ourselves in.

“Note: I do believe the universe was created by some kind of conscious entity. “

On that we agree. However, the real question is did this entity create us…or are we a “random” event within this created universe?

Roger, according to many cosmologists, there are 1,000,000,000,000,000,000,000,000 stars in the known universe. So if only one in every 1 billion stars had an earth-like planet, capable of life to evolve, then there would be1,000,000,000,000,000 planets capable of supporting life. However, even if we are way too liberal here and only one in every 100 billion stars had a rocky planet capable of allowing life to evolve, then there would still be 10,000,000,000,000, or 10 trillion stars capable of allowing life to evolve.

So no, I do not believe we were designed, we were just left alone and evolved on our own. However, that is just my opinion. There is no way of proving that hypothesis.

Roger/Ron

Here is my crazy theory. As Ron notes there are 10 to some X power of stars out there. I also believe that the probability of the formation of life as we know it is the inverse of 10 to some X power of stars out there, the product of which is 1. That’s it, we are unique.

Now there is another idea out there that theorizes that our universe is one of many Multiverses that comprises something we don’t understand yet.

This could be slightly off topic. ?

Ovi, the debate is not about the chances of life forming on a planet where the evolution of life is possible. It is usually taken that it would. RNA, organic matter, has been found on many meteorites from space. But Earth-like planets, with a temperature that allows liquid water, with gravity in the right range, an atmosphere, etc, are no doubt rare. My point was, with that many stars, at least one out of every hundred billion would have such a planet.

The real debate is about the fine-tuned universe. There are about 30 or so parameters that must be exactly what it is in our universe, for stars, galaxies, rocky planets, the periodic table of elements, etc., to form. The argument from a majority of cosmologists and physicists is that there is an infinite number of universes. Therefore it can be expected that one of them will have all these fine-tuned parameters we find in this universe.

At least 90% of all cosmologists and physicists agree that the universe is extremely fine-tuned. Most of them posit the multiverse to explain it. A few just say it is just a brute fact. And still, a few others, like the late Fred Hoyle, believe it is “a put-up job.”

Brute Fact—A contingent state of affairs for which no explanation exists to be discovered.

“I do not believe that that any physicist who examined the evidence could fail to draw the inference that the laws of nuclear physics have been deliberately designed with regard to the consequences they produce inside stars.”

Fred Hoyle

An infinite number of universes is preposterous.

Ron Patterson 😉

Ron Patterson, thank you for your comment. I am conservative but not anti-liberal and I do not berate or chastise others for their political idealism, or for where they live, their “place” in life.

You have many friends that are Texan, some of them are mutual friends; Texans are a proud lot. We don’t take kindly to stupid statements implying there are no “cross walks” in Texas or that we can’t manage our own power affairs and need help from internet desk jockeys from Maine. We don’t. If you can’t move gas from the well head in a 100 year freeze event, you can’t move it from underground storage either. If people are getting run over on Texas highways its now illegal immigrants, thousands of them, with their shoes full of water, fleeing north to further suck what’s left of our nation’s economy, plum dry.

Hurling insults on POB, anonymously, is now the norm; that does not require proper use of brain matter and in fact, is a no brain matter, matter. Its mean, divisive and unproductive. When its personal, its cowardly. Its gotten worse under current management and the “price” of admission for wanting to contribute to a debate on POB, or perhaps enlightened someone with real life experience is a “lecture,” or a chart, that more often than not does not even make sense. Trump’s level of narcissism pails in comparison.

Neither you nor I are afraid of calling the kettle black. Take care, sir.

Hi Mike,

See

https://en.wikipedia.org/wiki/2021_Texas_power_crisis

In previous cases, (1989 and 2011) the problems of the Texas grid in winter have been analyzed and experts have made suggestions for improved system reliability. Those suggestions have been ignored.

Texas of course will run things as they see fit, good luck.

This article is also a good summary.

https://www.washingtonpost.com/business/2021/02/18/texas-electric-grid-failure/

Oil Jumps Above $71 After Key Saudi Crude Terminal Attacked

Brent oil surged above $71 a barrel after Saudi Arabia said the world’s largest crude terminal was attacked, although output appeared to be unaffected after the missiles and drones were intercepted.

How Fracking Became America’s Money Pit

For most any nation, let alone a superpower, energy independence is considered the geopolitical holy grail. So when fracking lured in American investors, everyone had high hopes the country would finally break free of OPEC. But oil is a complex game, and 2020 saw sharp declines in demand caused by the cartel’s maneuvering, shale oil’s oversupply, and now the devastating effects of the coronavirus. What’s worse, the startup mentality of the U.S. fracking industry promised investors mythical growth and nonexistent returns. In the end, it burned a $340 billion hole in Wall Street’s pocket.

Used to hear more about Ceraweek. The Argentinians did a presentation.

Vaca Muerta shut down most of 2020, but restarted in December at 125K bpd. Hyped big NGL flow. No numbers quoted.

Some Jose is pushing for a long gas pipeline to Brazil. Financing don’t look cheap.

Preferred to building LNG export facilities to send elsewhere, though maybe not because the government may write the check. Behind the IMF’s back.

STEO is out for March.

https://www.eia.gov/outlooks/steo/

Chart below is most recent EIA short term estimate for L48 C plus C excluding GOM.

Their price scenario expects oil prices to fall in last half of 2021 and to level off at $55/bo for WTI for the last half of 2022.

Dennis

Dec-22 at 10.21 Mb/d is 170 kb/d lower than the Nov-19 peak which was 10.38 Mb/d. It’s also 0.43 Mb/d higher than the Feb STEO projection which was 9.78 Mb/d. It’s amazing what the price increase to $55 does to the projections. Will the drillers really respond?

Also note the output drop in Feb to 8.27 Mb/d, a drop of 530 kb/d.

Ovi,

The February drop may be due to the Texas shutdown due to the Arctic weather. Note also the quick rebound expected in March. I am somewhat skeptical of their oil price scenario, but I rarely/never get future oil prices right, my guess is flat prices at about $60/bo for WTI from now until Dec 2022 with prices bouncing between $58 and $62/bo over most of the period.

https://oilprice.com/Energy/Crude-Oil/How-Oil-Could-Go-To-100-Per-Barrel.html

Some believe oil will go to $75/bo, others think $100/bo, so my $60/bo for WTI is fairly conservative.

They expect that the oil barrel price will fall at the end of this year and will stay at 55$ for 2022. And during this time, they expect to see the production to rise steadily? That’s incoherent as the main growing component is going to be the LTO (you see, I learn the lesson!). And I observe that the production is supposed to skyrocket immediately after the Texas cold event. Spectacular! Is the STEO the result of a modelisation or is the publication of this STEO an incentive for the LTO producers to produce more?

Jean-Francois,

The model is based mostly on economics, so the shut down in February due to the Texas weather crisis, drops production that month, then the weather warms and production continues at close to the January rate. The higher prices at present drive higher completion rates, the prices falling to $55/bo may still allow continued increases in output, unless completion rate falls. There models are no doubt imperfect, a property shared by all models. 🙂

Their modelled output does not look unreasonable based on their oil price scenario, though I think they may be low on their estimate for oil prices in 2022, $60/bo would be a better estimate imo.

I have considered US L48 output excluding GOM and tight oil from Jan 2000 to Dec 2020 and estimated the trend in L48 onshore conventional oil (excludes tight oil), this was combined with the STEO March estimate to find an approximation for the STEO tight oil estimate shown in chart below, this is compared with my medium and high tight oil scenarios (from chart posted earlier (link below).

http://peakoilbarrel.com/brazil-summary/#comment-714874

The DC medium scenario is the same as “average high/low” scenario from chart at link above.

It would seem the EIA disagrees with KSA on US tight oil. My scenarios perhaps fall between these other estimates (note there is also a DC low scenario not shown on chart below).

Senator Cory Booker has introduced legislation that will require the US Treasury to determine methane emissions on a basin by basin basis, and then tax all upstream producers based upon a formula which factors in the basin wide methane emissions and then divides it amongst producers based upon production volumes.

OTOH, the US EPA will be releasing new existing source methane rules on upstream production that will are supposed to be much more stringent than the Obama administration rules.

Haven’t seen any language yet. So cannot really pass judgment until then.

Not sure the methane tax will even pass. Doubt Manchin will be a yes vote.

I paid $2.99 per gallon yesterday, which is the highest I have paid since 2014. I haven’t been to Alaska or CA since 2014.

I foresee $4 gasoline in 2022 if the majors and large US independents stick to CAPEX plans.

Can the Democrats hold the US House and Senate with $4+ gasoline?

Shallow sand,

The highest US average city retail price for gasoline since Jan 2009 was in May 2011 at $3.93/gallon (nominal price). In April 2011 the average monthly spot price for WTI was $109/bo. The highest level ever since Jan 1976 was July 2008 at $4.09/gallon for the average US city gasoline price for unleaded regular, when WTI average monthly nominal spot price was $133/bo.

Do you expect WTI will be over $109/bo (or $133/bo) by November 2022?

I am skeptical. It might reach $80/bo at most imo. I still like $55 to $75/bo as a best guess range with a 50/50 chance it will be higher or lower than $65/bo within this range for average monthly WTI spot price.

Note that the last time average monthly WTI spot price was over $70/bo was October 2018 and the average nominal city gasoline price (regular unleaded) was $2.89/gallon that month. When Obama was reelected in 2012, the October 2012 gasoline price was $3.79/bo. I doubt that the Democrats hold the house and Senate in the mid term elections in 2022 in any case.

Dennis. Many states raised gasoline taxes since 2014.

The refinery closures caused large products draws. Those likely won’t be caught up easily.

Refineries won’t be able to easily ramp to full utilization after shut downs and delayed maintenance in 2020.

Stimulus will result in higher demand.

I think $90s oil would now result in national average of $4 IMO.

Shallow sand,

Agree 100% on stimulus increasing demand.

Average state excise tax on retail gasoline (weighted by gasoline sales) has increased by 6 cents per gallon since 2008. As to how quickly refineries can ramp output, I will defer to your expertise.

You said $4/gallon, if US oil producers stick with current CAPEX plans. The problem is that the current plans are based on $60/bo for WTI (or less). At $90/bo for WTI, those CAPEX plans get adjusted higher, imo.

In order to get $4/gal gasoline, you would need to assume that OPEC will not increase output at $75/bo and tight oil producers will not increase output at $75/bo. Seems far fetched to me. If I am correct, oil prices never get to the $90/bo for WTI need to reach $4/gallon before 2023.

As you well know, I never get future prices right, so perhaps you are correct. I think we could see $3.50/gallon, I doubt we will see $4/gallon before October 2022 (though we might get there by 2024).

Dennis.

Federal government policy matters.

Obama admin didn’t want high gasoline prices and didn’t do much to stifle US supply.

Trump admin definitely wanted low gasoline prices and encouraged supply.

Biden Administration has thus far been silent about gasoline prices, despite a $1 increase since the election. Further is taking actions to reduce supply.

US public companies are complying with administration wishes. API now supports a carbon tax.

There appears to be less supply long term. It should help the transition away from oil.

Question the short term political implications.

I am sure you will have an answer for this, you do when it comes to EV.

I have heard from several living in Gulf Coast states they will never go fully EV. The reason is the need to escape quickly in the event a category 4-5 hurricane on the way.

Is this a legit concern?

Shallow sand,

Consider getting gas at the gas station when everyone else is doing the same, often this means long lines. Many EVs can go about 300 miles on a charge, that will typically be enough to get one out of danger, so it would not be a concern for me. I would watch the weather and have my EV plugged in and fully charged, ready to go.

The ones I talk to keep a vehicle full of gasoline during hurricane season.

SS,

When Katrina hit, there were many people who ran out of gas on the freeway: traffic jams caused very long periods of idling. EVs don’t have that problem. I imagine A/C could be a problem for both ICEs and EVs – you might have to go without AC to ensure getting out.

Personally, I think a plugin hybrid is the best compromise. Something with about 45 miles of electric range and 300 miles of gas range would give the ability to run on either electric or gas, depending on availability, and also mitigate the highway idling problem.