North Dakota just released the Bakken September Production Data as well as the September Production data for all North Dakota.

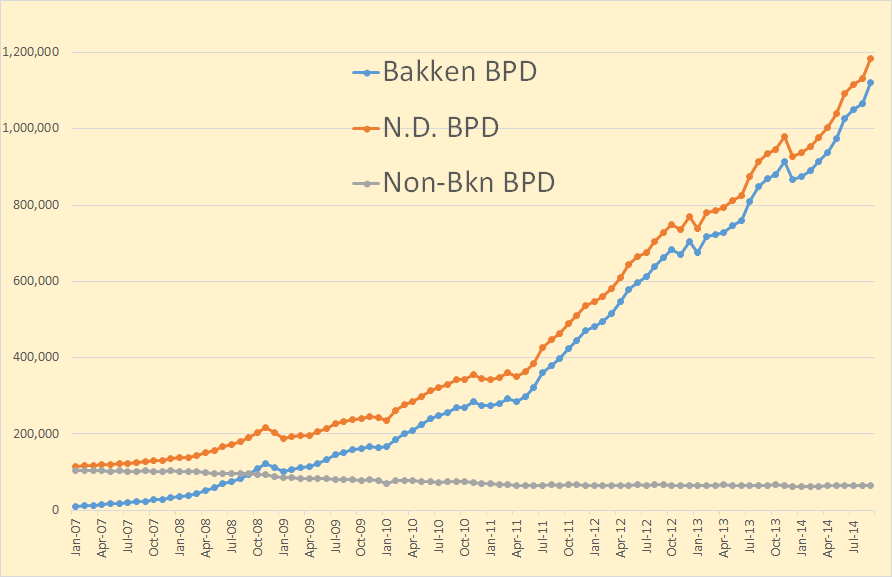

There was a suprisingly hefty increase in Bakken production in September, up 52,568 bpd to 1,120,031 bpd.

North Dakota production was up slightly less, 52,394 bpd to 1,184,693 bpd. This means production outside the Bakken was down slightly.

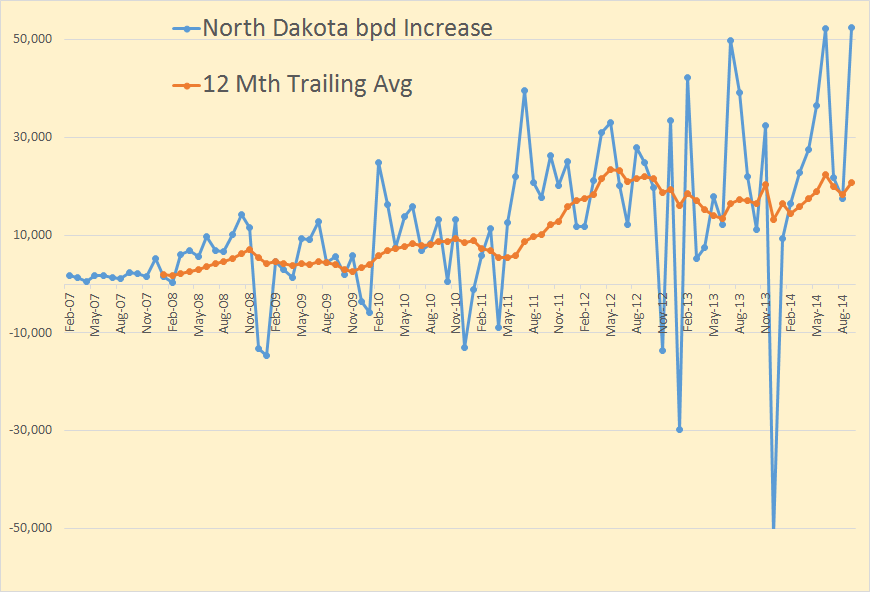

These big increases happen ever so often and are usually followed by a not so large increase for a few months. I think there is some kind of reporting anomaly here. But as you can see the 12 month average increase gives a better indication of what is really going on.

From the Director’s Cut:

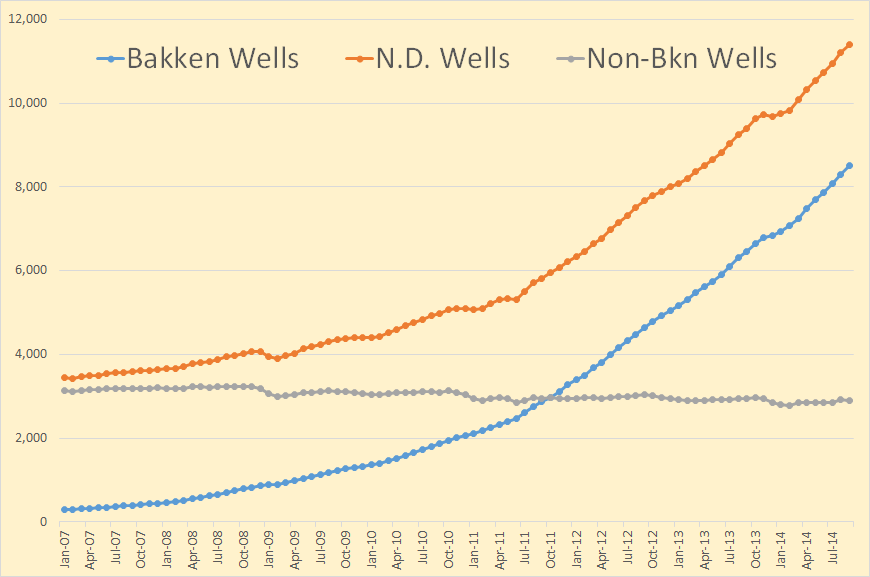

Aug Producing Wells = 11,565

Sep Producing Wells = 11,741 (preliminary)(NEW all-time high)

8,238 wells or 70% are now unconventional Bakken – Three forks wells

3,503 wells or 30% produce from legacy conventional pools

Aug Sweet Crude Price = $78.46/barrel

Sep Sweet Crude Price = $74.50/barrel

Oct Sweet Crude Price = $68.94/barrel

Today Sweet Crude Price = $58.75/barrel (all-time high was $136.29 7/3/2008)

WTI Trigger price is at $77.18 today. The 2014 calendar year extraction tax trigger price

is $52.06. Extraction tax exemptions are triggered after 5 months below that price.

Aug rig count 193

Sep rig count 195

Oct rig count 191

Today’s rig count is 186 (all-time high was 218 on 5/29/2012)

The drilling rig count was up two from August to September, then dropped four

September to October and has since fallen five more from October to today. The number of well completions decreased from 272 in August to 176 in September. The primary

cause is the focus on flaring reduction. Several operators have reported postponing

completion work to achieve the NDIC gas capture goals. There were no major

precipitation events, but there were 5 days with wind speeds in excess of 35 mph (too

high for completion work).

The drillers and completion crews pretty much kept pace in September. At the end of

September there were about 610 wells waiting on completion services, an increase of 10.

This makes no sense at all. Well completions were down by 94 from August yet production increased three times the August increase.

All North Dakota producing wells stand at 11,406, up 196 by the North Dakota published stats. That is considerably different from Lynn Helms’ count of 176. I cannot explain that discrepancy.

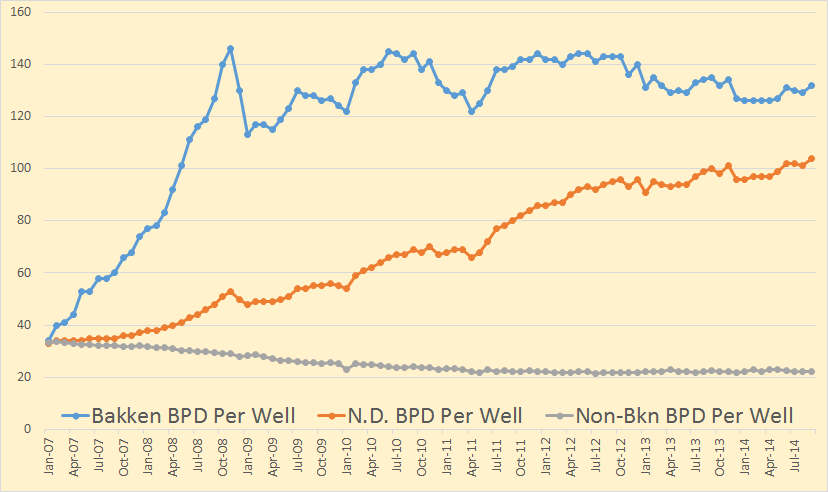

Bakken barrels per day per well was up by 3, from 129 t0 132.

I know this is a short post but there is just nothing more to report. I hope we have some theories in the comments section on the strange production reports coming out of North Dakota. Why was production up by a multiple of three while well completions were down by one third? Will someone please explain that?

I will have a much longer post coming out Monday, or perhaps Sunday depending on the comment traffic. It will be a guest post by Jean Laherrere on the Gulf of Mexico production. He has 16 charts in his post.

I have done 2 posts on the impact of US tight oil:

6/11/2014

US oil dependency on Middle East has hardly changed since 2007

http://crudeoilpeak.info/?p=6576

5/11/2014

US oil consumption did not increase as result of US tight oil boom

http://crudeoilpeak.info/?p=6554

Ron, (no answer to your September data question, but a question from my side trying to estimate upcoming October numbers) I understand lots of wells await completion. How long can these wells wait without suffering any kind of degradation? Or: to ask the same question the other way around: Wouldn’t it be in the interest of the shale companies to postpone completion, seeing the oil prices plummet? Because the very first month after completion generates such a high production, it would be a waste to get that oil at low prices.

‘We’ are counting drilling rigs, but shouldn’t we count completion efforts?

The wells, as I understand in, are awaiting fracking crews. And I doubt that there is any technical reason that they could not wait for years. There may be political and/or economic reasons they could not wait that long however.

Basically these drilling companies are working with borrowed money and they need to get income from the sale of oil in order to service their loans and keep their busing from going bankrupt. I doubt that they could afford to wait very long indeed.

The rule you gotta drill to hold a lease I think extends to “you gotta produce oil” to hold a lease — so there would be a time limit.

No, there would be no time limit in the absence of an actual drilling commitment in the leasehold provisions and that is highly unlikely except in the most sophisticated of leases on enormous ranches, or farms. Most of these guys are drilling well # 18 H in one pooled unit, that acreage is all held by production. No time requirements. None of your other posts make any sense to me whatsoever.

Watcher,

You are correct in you hold a lease by production, but I remember there was a court case in New York. where the No fracking law was in place. The oil companies were claiming they should have been released from there obligations to some degree, to retain their leases due to uncertainty of the no fracking laws. I believe the courts ruled that to retain the leases and comply with the lease terms, they needed to be drilled, even though they could not complete them in a economical fashion.

Not sure what the fine detail is there, but just drilling a well, will/can retain releases for some time if not for a long time, but hold by production will hold the lease why production lasts

New York law tends to favor “strict construction” of contracts (this has been important in making New York a financial center). So if you write a contract in New York which requires you to do something to maintain a lease, you don’t get to claim excuses for why you didn’t do it — if you didn’t do it for *whatever reason*, you’re out of luck and you lose the lease. In particular, the oil companies knew what the law was (fracking moratorium) when they signed the lease agreement, so they have no legal case.

Other states are much more generous in allowing excuses and “soft interpretation” of contracts. I don’t know enough of the law in other states — but the sort of argument they made in New York is worthless in a New York court, but might work in another state.

How do they know when oil prices will rise, or how much? If they *really* knew prices were going to rise, they’d be better off just playing the futures market.

Which I’m thinking about…

This makes no sense at all. Well completions were down by 94 from August yet production increased three times the August increase.

. . .

Why was production up by a multiple of three while well completions were down by one third? Will someone please explain that?

Rampant bogosity, and growing pressure to generate more of it. Nobody’s under oath.

This sort of thing attacks the very core raison d’etre of data hounds. Not a lot else can evoke the same anger as changing definitions, holding back numbers, juggling timeframes and just outright refusal to report some things.

Heads up, the disclaimer that was at the end of previous director’s cuts is gone.

Today’s price $58!!!!! That would be with WTI at about 74. $16 discount!!! These doods are toast.

and catch this from the DC:

“Crude oil take away capacity is expected to remain adequate as long as rail deliveries to

coastal refineries keep growing.”

I’m inclined to stay signed on to most of the $16 discount being that it’s thin oil, but if more and more of it is going to the coast, then THAT is where that $16 discount is coming from. Ship it farther, pay more.

Hi. Here are the updated production profiles. Not much has changed really from August. But it´s interesting to see that the 2014 curve seem to drop quite fast. However we have to wait for at least a couple of more months before we can draw any conclusions as we have not got that much data for 2014 yet.

Not bad odds geology came to town. I note the DC has stuff in it about animal species declared endangered as well as talk about flaring restrictions having an impact.

It smells like they are getting their excuses polished up and ready to fly.

Ya know what else that light blue line looks like? Open choke. Big IP and faster ramp down. In 6 mos they are under producing 2013 wells that had a lower starting point.

This has “we don’t give a damn about the out years” written all over it.

The production profiles for Mountrail is even more interesting. Not visible here, but the production for the first 3 months have decreased about 10 bopd since august. That means that the production late this year has been lower than earlier this year. You can also see that right now, the first months of production is about the same or even lower than 2010-2013. But since the total production for ND has not changed in that much for the first 3 months, it should mean that there has been increased production elsewhere late this year.

Mountrail is the county with the highest well density. So any effects from down spacing should be visible here first.

Naaaaah, don’t think so. They are hyper good instrumented. They will know if they’re cannibalizing adjacent wells long before county wide stats get published. They’ll stop downspacing long before the overall monthly’s drop.

I think in fact that is exactly what you are seeing as wells get further down the decline curve faster, to many wells drilled on too close of spacing. These guys are still in the learning curve on how close they can drill this junk, in the mean time the idea they won’t do anything to speed up the rate of income is a little absurd. They’ve got loans to pay. They have dedicated rigs and dedicated frac crews working 24/7 whereby if they snooze they loose. So up until early September they were just going wide open, skidding rigs from well to well and not looking back.

I get the heebie jeebies looking at the OWR’s. Seems very early for that to be happening. Produced water will kill those guys at 60 dollar net oil.

There would be no “degradation” occur to the lateral that has been cased; it could sit there forever awaiting completion.

Mr. Patterson, I don’t know the answer to your question but I would guess it is little else than reporting issues with the State. Perhaps there was a deadline of production balancing reports or something. In any case there would be no practical, field related reason that I could think of.

Good luck sorting it out.

Hi Mike,

The NDIC reports the number of producing wells in the Bakken, if we assume that most of the change in producing wells is due to new wells being brought online and keep in mind that the well can be producing for only a few days and be a “producing” well, then we could have August being an odd month where most of the new wells started producing near the end of August and Sept could be an odd month where most of the new wells started producing towards the beginning of September. That and month to month variation in the productivity of new wells could account for the high increase in output in September relative to August.

You are correct about New York but this is North Dakota and if it does not move up there, they frac it. The are drilling only the sweetest of sweet spots at the moment and all that was HBP years ago. In reading the link to ND data there has not been a new lease taken up there in big 5 counties in a long time.

Has anyone here computed PV10 for Bakken using the current WTI forward strip, discounted to Williston light sweet, taking into account severance and extraction taxes and an average of LOE as reported by the public companies operating there? The same should be done for the Eagle Ford now that there is a lot of public well data available.

I suspicion the results would be revealing in that further debt could not be advanced to fund most of these projects at the current strip without lenders/debt issuers violating standard industry lending practices.

Would be interested to see if I am wrong. I would do myself but don’t have the software.

Bakken about $78/b results in breakeven using a real discount rate of 7%, which would be similar to PV10 assuming 3% inflation, for the Eagle Ford which has a lot of condensate (40% or so), and would receive $5/b less than WTI at the refinery gate breakeven is higher, around $80/b.

This includes estimates of royalties and taxes, LOE, transport costs, and associated natural gas sales. Well cost assumed at $9 million in Bakken and 8 Million in eagle Ford.

Dennis Coyne: Thank you for the response. Is Bakken breakeven of $78 WTI or well head?

Hi shallowsand,

It is at the refinery gate so wti or brent would be closest. At the well head it would be $66/b, just subtract the $12/b transport cost (which is what I assume for the Bakken).

Sorry I missed this.

Great stuff Freddy, thanks!

Hi Freddy,

In my judgement 2014 doesn’t look significantly different from 2010 to 2013 wells, I expect the 2014 curve will flatten out and match the other curves, time will tell.

I am referring the Bakken all formations chart rather than the Mountrail chart.

Thanks. Yes that is for sure a possibility. The last data point for each curve contains the average for wells completed January and February that year (I have not included the data point for January only as the data tend to diverge too much with only one month of data). The data point before that March, February and January and so on. The last data point for 2014 seem to follow the 2012 curve. So yes, it seems as if the production for those months were just a bit lower. Well will see the coming months.

For Montrail it looks like March was a really good month. It´s visible both in the production and water cut graphs. The data points to the right in the graph should move downwards in the production graph as they get updated with production data for wells completed the last couple of months. Then we of course have 3 more month of data we dont know anything about yet.

Nice work Freddy.

I recommend also looking at the Middle Bakken and Three Forks formations separately : The number of new wells in the Middle Bakken peaked in 2012, and I expect that the number of new wells in the Three Forks formation overtakes the number of new wells in the Middle Bakken in 2015/2016. My impression is that Three Forks wells on average produce 15-20% less than Middle Bakken wells. That means that already there are local areas where sweet spots are running out.

Hi Enno,

Last time you checked, what was the ratio of Three Forks to middle Bakken wells (say new wells over the last 3 months)?

If your prediction is correct (and the well profiles for the middle Bakken and Three Forks are unchanged) we should see the average Bakken/Three Forks well EUR decrease by 7 to 10 % by 2015/2016.

It will be interesting to see how it unfolds. Thanks.

Thank you Enno. I did look at Middle Bakken and Three Forks seperately for the August data. I also found that Three Forks produced someting like 15-20% less. But Lower Bakken which separate them is only about 50 feet thick and Three Forks 250 feet. A well can extract oil from someting like 600 feet away. Studies you can find on the internet indeed confirms that there is communication between Middle Bakken and Three Forks wells. How much depends on how good barrier Lower Bakken is, which varies. It makes it more difficult to try to analyse the data. So I thought it was better to look at them together. Less graphs also also :).

Here is the water cut profiles. First month water cut for 2014 has increased 1 percentage. I don´t think much has changed since August besides that.

The water cut for Mountrail has increased about 2 percentage for the first 3 month compared to August data.

Freddy, these charts are really the first pretty solid indication of geology taking hold. There have been excuses and maneuvers always available before this, but these squiggly lines are suggesting dollars may stop mattering.

Though of course if they manufacture headlines, we’ll never know.

Hi Ron,

I don’t think the completion counts that Helms gives in the Director’s cut are accurate.

There is variation from month to month in the output of wells that are completed, so that accounts for a lot of the differences, also we get numbers for the producing wells each month, but some of these wells might have been newer wells (say 12 months old) just brought back online after being down for maintenance while some older wells(say 48 months old) may have been taken offline for maintenance for the month of September, a combination of these effects can cause the data to jump around.

Or North Dakota could be lying about the production data (this seems less likely).

I think it is just statistical variation.

Also if you look at the changes in the number of producing wells in the Bakken and ignore the completion numbers in the director’s cut, in Aug the producing wells increased by 210 and in September by 213.

One would have expected the increases to be about the same.

A further source of statistical variation is that if a well produces for 1 day in September then it is counted as a producing well. So as an extreme example if all 210 wells in August were new wells that were brought online on August 31, there would not be that much output from those wells in August, if 213 new wells were all completed on September 1, then those wells would be flowing for 30 days and produce much more output. Clearly this example is not realistic, but the idea is that one month more of the new wells might have come online early in the month and the previous month more of the new wells were brought online towards the end of the month and this could cause a lot of month to month variation in oil output.

One less day.

Hi Watcher,

Yes one less day, but that doesn’t matter much if we do it in barrels per day.

Maybe we could think of it this way take the average number of producing days for all new wells (we don’t know what this is but I bet Freddy or Enno could dig it out of the data for wells that are not confidential.) My guess is that for August this might have been 10 days, but for September maybe 20 days.

Or to create a factor of 3, August 8 days average output from new wells and September 24 days of output from new wells.

Ya that’s where I was going. Mid month online has one less day to percolate.

In general this report is just flat out weird. There were two consecutive poor months prior to it and with better weather. Something is amiss.

Note they spiked the permitting upwards too. That was supposed to slow because of permits requiring a flaring management plan, starting 1 June. No evidence of it.

Hi Watcher,

Just statistical variation, the previous 2 months increases were weird low and this month weird high, it all averages out.

Remember not all wells start producing on the first day of the month, on average the mean number of days of production would be expected at around 14 to 16 days, but there is month to month variation, some months (like July and August) the mean might be 8 days, other months (such as September) it might be 24days.

In addition not all wells are “average”, some months the average new well might have higher output over 15 days than in other months.

None of this is unexpected.

Several producers, in their 3rd quarter reports, said that an unusually wet August in western North Dakota negatively impacted their operations. When there’s a lot of rain, the ground gets soft, counties place weight limits on paved roads, the dirt roads to the wells get rutted, etc. In short, trucks can’t run, and, as you know, Bakken production depends on trucks in the region being able to operate.

Rainfall data for August confirms it was a wet month. September weather was much drier and nicer, especially for Dunn, McKenzie and Mountrail Counties.

http://www.reuters.com/article/2014/11/14/us-iea-oil-idUSKCN0IY0ZN20141114

Supply and demand are imo adequate to explain the drop in oil prices assuming weak demand and strong supply of course.NO PROBLEM at all understanding this.

BUT I have yet to see any honestly understandable argument about oil prices and a strong dollar that really makes sense. Dollars are convertible into other currencies at will and if the dollar goes from let us say one dollar per yugarian peso to ninety yankee cents per yugarian peso then if the yugarians are selling oil for yankee dollars they do indeed get less dollars.

BUT THEN THEY ARE GOING TO EXCHANGE THE DAMNED DOLLARS FOR SOMETHING>>>

If they spend the dollars on ”anything” priced in dollars outside the US -anything priced in a currency that has fallen agains the dollar —they will get MORE of that ”anything”.

Just what is it that foreign oil sellers are compelled to buy from yankees that they can’t buy someplace else except maybe protection mafia style ? (Meaning that if you pay one of Uncle’s goons weekly he will not send a different one to break your figurative leg by imposing some sort of sanction on your country? )

Dollars are sort of like virginity in an old fashioned society- perhaps valuable if kept locked away in some sense but worth a hell of a lot more if actually spent.

Holding dollars when the value of them is going up in relation to other currencies might be profitable but on the other hand there are some wrinkled up old virgins around who would have a hard time finding a hard man after saving ”it” too long.

And if the yugarians convert their oil dollars into their own currency then they get MORE of that to spend domestically.

I would truly truly like to hear a PLAIN ENGLISH non techno speak explanation of why the transaction is resulting in any particular loss to the sellers of oil beyond whatever the banksters rake of after the mode of the money changers Jesus threw out of the temple.

I am not saying it does not happen that exporting sellers lose but only that the explanation of the loss just seems to be sort of shall I say opaque?

Now if the sellers have to use the proceeds of their sales to pay off dollar denominated debt in that case their loss would be perfectly obvious and transparent. But to the best of my knowledge FOREIGN oil exporters are not that deep in dollar debt doo doo. I might be wrong about that of course.

I am generally inclined to throw rocks at banksters first and find a reason for doing so later as a matter of personal prejudice. 😉

Yes, they are going to exchange the dollars for something. Oil. The dollar gets more valuable, and the underlying vehicle redenominates.

Got no interest in copper. But it has been redenominating downwards since July, too. You can make a case for copper price being economic contraction derived (with oil), but gold has no function in society and it has been redenominating downwards along with oil and copper since July.

Besides which this has been a huge dollar move. HUGE. You don’t see stuff like this unless someone is getting conquered.

Too much coincidence.

Maybe it’s easier to understand if you consider Boeing vs Airbus. Boeing is about to face serious problems because the dollar has made purchase of their aircraft more difficult for international customers.

Airbus pays their headquarters staff in Euros and the Euro to . . . say Thai Baht conversion looks a lot more gentle than to USD. If Thai Airways wants airplanes, the Airbus is going to be cheaper. The airplane redenominated.

Your reply explains Boeing having a problem with a strong dollar.

I didn’t ask about the problems that exporting American sellers have due to a strong dollar.

I asked about the supposed loss of purchasing power supposedly afflicting FOREIGN oil producing countries selling their oil for dollars.

So if the Thais sell us some oil for dollars and the dollar is up compared to the euro they can convert to euros and get more euros since the euro is down and buy an Airbus plane rather than a Boeing plane and thus not suffer any significant loss of purchasing power.

So far as I know there is not much anybody needs in this world that is not manufactured or produced in other countries.

We do seem to have a near monopoly on the export of democracy in recent times but it is not selling too well on the international market recently.Nevertheless I would not be too surprised to hear we are exporting some down Venezuela way within the next decade or so.

So far as gold is concerned I personally believe the price of it is controlled basically by fear. People buy it when it looks as if inflation and hard times are in the cards and sell it when things look to be safe and stable.

It is basically useless except for filling teeth and making electrical switches for top quality electronic gear and maybe a couple of other minor uses.And of course for convincing people that if you have it you are solvent.

AND so long as sellers are willing to accept it you are indeed solvent.

If the shit hits the fan I would rather trade a barrel of my apples for a few boxes of ammo or some diesel fuel than for a gold coin although my dentist might prefer the coin.So I will try to put my hands on a little more physical gold if I get to thinking collapse is imminent..I have a little already…

I asked about the supposed loss of purchasing power supposedly afflicting FOREIGN oil producing countries selling their oil for dollars.

That’s not what I thought you were asking. I thought you were trying to imagine the scenario that defines a price of oil as a result of dollar value change vs other currency. The answer is like the airplane. Redenomination. That word usually refers to a currency, but in this case it can apply to another asset form, like an airplane or a barrel of oil.

To go to your particular issue, there would be reason to think Russia isn’t hit very hard by oil price change (excluding for the moment the reality of Renminbi swaps) because lots of their customers are in Europe, who . . . not pay with Euros, but buy with Euros. The Euro/Ruble cross then becomes operative rather than the USD/Ruble ratio. The Euro hasn’t risen the way the USD did.

The overall point being, oil could be money, copper could be money, gold could be, and they could be envisioned as constant in value. The dollar could float against them.

I give an example. If a barrel of costs 100 euros to extract (+profit). With dollar at 1.5 for one euro, the cost is $150. With dollar at 1.25, the cost is $125. From my “euro” point of view, the price is the same. From a dollar point of view the price decreased by 8.3%. So as stated or implied by Watcher, it is possible that only US (shale oil producers) will be hit by so low oil prices.

Historically, there is a factor 2 to 3 between dollar value increase (or decreases) and oil prices. Dollar variations are amplified in oil.

Oil exporters may be selling their oil for either euros or dollars in international markets.

But with the exception of north sea oil produced by the Brits and Norway and a little bit by a couple of other countries maybe there does not appear to be any oil produced for export by countries that use the euro.

My argument is basically this. We hear about the strong dollar causing the Russians and Iranians and other exporters financial pain.

But I just can’t see that the strong dollar is costing these oil exporters any significant loss of actual purchasing power unless they are using oil dollars to pay off dollar denominated debt.

I conclude that the claim that the strong dollar is really hurting the Russians and Iranians in any direct sense to any significant extent is bullshit.They can convert such dollars as they get into other currencies at very little cost.

My belief is that the price of oil in any currency or all currencies ( take your pick) is down because of supply and demand.

If the Iranians want bulldozers at a time the American dollar is strong and the Japanese yen is weak they can buy Komatsus instead of Catepillars. They are just as good or better machines.

I will not dispute that our dollar being the dominant currency and our military and economic power being so great that Uncle Sam is not throwing up barriers to his enemies doing business freely with the rest of the world.But I expect the Iranians can put their hands on very nice Japanese cars without too much trouble and top quality German industrial machinery even though we are pretty tight with both the Germans and the Japanese.

About the only things that in my estimation that we have that is noticeably better than the stuff manufactured by other countries is military hardware and maybe oil drilling equipment since we have a huge oil industry and cutting edge domestic oil technology.Everybody else is behind to some extent – probably- in these two areas.

We have food to export but food is highly fungible and freely traded and food from any country can be easily substituted for food from another.

Barter is a clumsy and highly inefficient way of doing business especially on the small scale due to the bother of getting buyer and seller together with the right quantity in the right place.

But when a country has let us say fish for sale and wants to buy oil from a country with oil but no fish- I don’t see any real impediment to them coming to an agreement that so many barrels of oil will be swapped directly for so many tons of fish.Shiploads at a time of course.

Once delivered fish and oil can be distributed thru the existing domestic channels using domestic money.Very little or no actual money needs to change hands between these two hypothetical countries.

Not bad.

But I just can’t see that the strong dollar is costing these oil exporters any significant loss of actual purchasing power unless they are using oil dollars to pay off dollar denominated debt.

The problem you have with this phrasing is purchasing power has a different definition than what you’re saying. An implication that the exporter’s currency is eroding in terms of what food it can buy or what transport it can buy blah blah.

But in general yup, if your customer is a country whose currency did not run up, then you shrug.

It too me a long time to realize reporters didn’t go to Hopkins and Wharton. They don’t understand anything and the people they call for quotes were the only ones in the office with nothing better to do than answer the phone from a reporter.

Youdaman, Chris, but I don’t usually sign onto history of this or that sort of multiplicative correlation, because all history ended in 2008 and multivariate regression gets dicey when there are a lot of variates.

Don’t mean it’s wrong, tho.

I think what we are seeing is the increasing effects of complexity spiraling increasingly into Chaoslaland or Wonderlalaland if you will, where up is half-down, left is kinda-right, and I’m not sure if it’s in is don’t know maybe out maybe not, something like that, what are you talking about, you are wrong, but that you are wrong is based on EIA data, so that’s what this stats/graph/pie plate thinks/says from boardFox.org news comments they will go soon sexypundithalfwitwft…

David Hughes created the below graph with data published in the IEA’s World Energy Outlook 2014. This is their “New Policies Scenario”.

Hughes comment: I bit the bullet and bought WEO2014. The following is a chart I put together of “Total Primary Energy Demand” for its “New Policies Scenario”. Still digging through its 700+ pages! Dave

And exactly what “The New Policies Scenario” is:

The New Policies Scenario. This is used as a reference case. It assumes that governments will follow through on the (non-binding) pledges that they have made to reduce emissions and deploy renewable energy sources.

The IEA is saying Gas consumption will increase 53%, oil up 12.5% and coal will increace 13.5% by 2040 if governments follow through on their pledges to reduce emissions and deploy renewable energy.

Ron,

Does Hughes have a blog or something? If so would you mind linking me to the source of the image

David Hughes posts his reports at the Post Carbon Institute. A list of all his published reports can be found at David Hughes, Post Carbon Institute

However the above chart is not yet posted at the PCI web site yet. It was posted by David Hughes himself on peakoildiscussion at googlegroups.com. I joined, by invitation, when the group was first being formed. I have no idea if they are accepting new subscribers or not.

New Policies Scenario?! You are kidding right? That is not a new policy it is BAU pure and simple! That chart is pure fiction! It won’t happen because it simply can’t.

“Interestingly over the forty years since 1970, the real world has followed scenario number 1 in Limits To Growth. This is the so called business-as-usual scenario (the World Model Standard Run). Population and economy has continued to grow as they did in the decades before 1970 and as a consequence THE WORLD MOVED INTO OVERSHOOT this apparently occured IN THE 1980s.IN THE 1980s.”

We are almost in 2015 and Wiley Coyote may not have looked down yet but he has run out past the edge of the cliff… Just curious what part of ‘LIMITS TO GROWTH’ and ‘OVERSHOOT do people not understand?

Grow Grow Grow your bloat

sucking down the cream

Merrily, merrily, merrily, merrily,

Life is but a dream.

Cheers!

See my previous comment.

Trying to connect energy (or other resource) consumption with GDP is a chump’s game. Economic growth is about adding information to the system. Expanding energy is a side show.

As Werner Löwenstein put it:

If there were something like a guidebook for living creatures, I think the first line would read like a biblical commandment: Make thy information larger. And next would come the guidelines for colonizing, in good imperialist fashion, the biggest chunk of negative entropy around.

The biggest chunk of negative entropy we’ve had access to is fossil fuels. They are running out, and their use is undesirable for various other reasons. So we’ll have to be less flagrant, and look to other chunks of negative entropy, like uranium or the sun.

Both ideas are important. It is silly to compare the current situation on how we used energy in the 19th century because it is about information, not energy. We are awful at converting energy to information now, and were ludicrous then.

Trying to connect energy (or other resource) consumption with GDP is a chump’s game. Economic growth is about adding information to the system. Expanding energy is a side show.

You can’t possibly be serious!

From http://ourfiniteworld.com/2013/01/24/how-high-oil-prices-lead-to-recession/

Figure 3. World growth in energy use, oil use, and GDP (three-year averages). Oil and energy use based on BP’s 2012 Statistical Review of World Energy. GDP growth based on USDA Economic Research data.

yes strong correlations. Especially to energy, what will have to happen, and is even observable in your chart, is the declining degree to which energy is dominated by oil.

The current energy transition is way from oil and to everything else. Of course the problem is that everything else has lower energy density, so this is very unlike the last transition, to oil, and must involve much less waste.

What we we see, and are seeing, is the end of the wasteful world built by oil. Auto-dependent suburbia and all the other indulgences of the cheap oil age are unsustainable, and will not last. Either places will be intensified to become more efficient or will be abandoned.

This will be ‘doom’ for some places and boon for others.

It was Stuart Staniford, I think, who said ‘peak oil will not be synchronous’ and he’s clearly right; in time as well as in place. It’s effects, which are already upon us, are unevenly distributed.

This recent price drop is really interesting, especially for the U.S., as it is clearly stimulatory for the consumption side but depressive for domestic producers, and however much of the economy is dependent on them. Texas, and NoDak in particular. Importing nations with no domestic oil industry clearly get a straight boost.

Depending on how long it lasts.

Which is simply to say we can expect to see an increasing divergence of the relationship between oil consumption and economic performance this century. This will be more marked in the places that by luck or design are more ‘fit’ for the realities of our age. Hint; these will not by any means be the same ones that prospered in the great cheap oil age.

the problem is that everything else has lower energy density

What does this mean? Electricity is very dense, and EVs work just fine.

Auto-dependent suburbia and all the other indulgences of the cheap oil age are unsustainable

Why? EVs are cheaper than ICE autos.

Nick, electricity is not an energy source.

Well, think kilowatt/hour.

No, it’s true that electricity is typically generated from other forms of energy, like the chemical energy in coal, or the mechanical energy of wind.

But, they are all equivalent when they arrive at your outlet.

Nick, “Electricity is very dense.” What does this mean? To my mind, electricity is considered either statically as an accumulation of charge or dynamically as a current with carriers (of electrical charge) being electrons or protons: density doesn’t come into it. The only way I’ve seen energy density used is relative to reactor fuel as in how much fuel you have to burn in a plant to power the same size city. Alternately, with normal fuels (gas, coal, oil, peat and wood), you could ask how much energy could be extracted with perfect thermal efficiency and total burn-up and somehow define that as energy density, I suppose.

It’s an answer to the silly idea that wind or solar power aren’t “dense”. Electrons are mighty small, and they carry a lot of energy per cubic whatever.

I think the energy density thing comes up when you are designing a vehicle. There you have the issue that batteries are a lot bulkier and heavier than liquid fuels like diesel.

Sure. But battery volumetric density is only a minor problem for vehicles. We can see that in the Tesla, where the electric motor and battery free up so much space they have both a back and front trunk (aka frunk).

The Volt loses room for a 5th passenger because GM used an obsolete battery design in order to get the 1st generation Volt out the door quickly (the battery was originally designed for the Volt’s 2-door, all electric predecessor).

Hi Fred,

There is a definite feedback between energy and real GDP, note that fossil fuel energy can be replaced with wind, solar, and nuclear over time. I will not be easy, maybe it is not possible, but that proposition is far from certain. Fossil fuel scarcity will increase prices and other forms of energy will be substituted.

Also the correlation is there but the causation arrow goes from GDP to energy more than the other direction.

Also the correlation is there but the causation arrow goes from GDP to energy more than the other direction.

In every known natural system the causation arrow goes from more available energy to more growth. What makes you think it is the other way around for growth in GDP?

Because there is far more available energy than is used by the economy. This is extrasomatic energy, which is different from almost all biological systems, and it’s not a limit on economic activity.

Fred,

Good point, I agree on the energy being necessary for GDP, there are two points, energy can be used more efficiently so that more GDP could be produced per unit of energy consumed with greater efficiency.

Also the Chart looked at both oil and energy, I was thinking in terms of fossil fuel energy, other types of energy exist (wind, solar, nuclear, geothermal,etc) so I misspoke on the second point where I said energy and should have said fossil fuel energy.

Also the point was that an increase in GDP leads to more energy usage, I don’t think either can be thought of as the cause of the other, it is a bit of a chicken egg problem, they move together with neither being cause or effect.

Ilambiquated,

Negative entropy was originally defined in order to provide a scale-invariant thermodynamic representation of dynamic order; there are mathematical uses to this in information theory and statistics.

It’s true that a biologist or two throw this term around (incorrectly) while attempting to do things like creating a unified theory of biology and physics. But the sentence in your comment: “The biggest chunk of negative entropy we’ve had access to is fossil fuels.” is utter nonsense.

It’s true that a biologist or two throw this term around (incorrectly) while attempting to do things like creating a unified theory of biology and physics.

As for a unified theory of biology and physics I’ll let Richard Feynman express it better that I ever could…

http://www.goodreads.com/quotes/78268-a-poet-once-said-the-whole-universe-is-in-a

“A poet once said, ‘The whole universe is in a glass of wine.’…

…If our small minds, for some convenience, divide this glass of wine, this universe, into parts — physics, biology, geology, astronomy, psychology, and so on — remember that nature does not know it! So let us put it all back together, not forgetting ultimately what it is for. Let it give us one more final pleasure; drink it and forget it all!”

However most modern biologists are not generally ignorant of the basic laws of physics, without which you can’t understand chemistry, let alone biochemistry! Though for the sake of convenience they usually think in terms of exergy instead of entropy.

Exergy is the available (or: usable) energy of a system

and hence a measure of energy quality: The higher the

quality of the energy, the smaller the energy loss (e. g.

as waste heat) when it is used.

Ecosystem Thermodynamics

An Illustration connecting Energy, Exergy, and Entropy

The toothpaste tube (energy) is used by squeezing out

the paste (exergy). When all paste (exergy) is used up,

the tube (energy) is still there, but its usefulness

(quality) has diminished. In the picture, the depression

in the tube (entropy) increases as the amount of paste

diminishes—but the depression is not a negative paste

as one cannot use it to unbrush one’s teeth.

So yeah, negative entropy is utter nonsense, even a biologist could tell you that much >;-)

The concept of “negative energy” is common in quantum mechanical problems since it has to do with the inherent fluctuations that exists in energy fields (Dirac equation). But, like negative mass, used in a number of speculative theories, such as on the construction of wormholes, I doubt Ron’s Blog will benefit from this information. And introducing “negative entropy” is analogous to finding answers from the latest Star Wars episode. Time to move on?

Using the term “negative entropy” for “free energy” when talking about biology is certainly not something I invented.

I think the biological perspective is that free energy is something biological systems hoard to stave off entropy, and that’s why they prefer the term.

Negative entropy is just a term invented my Schrödinger to mean free energy in biological systems, as far as I know.

As I have remarked in other threads, the correlation between increased energy consumption and economic output indicated that in the past, increasing energy consumption was the easiest way to make the economy grow. It does nothing to prove it is the only way in the future.

We live in a world of obvious and rampant inefficiency. There is no reason to assume that this is the only possible state of things. Wherever inefficiency has had short term disadvantages, it has been dealt with. I see no reason why that should not continue.

Exactly. The oil age is in fact defined by waste, because it was so cheap, so dense, so portable and so abundant. The current transition away from oil as the primary energetic basis of the economy is centred on the reversing this habit. Parts of the economy and society that cannot become considerably more efficient and utilise other, mainly electric, sources of energy will not survive.

Yes this means the electrification of transport through electric vehicles, but also the reduction in low value trips or their replacement, where possible, by Active and Transit modes. -> there will many EVs, but many fewer Vs in total. The private car is in overshoot, it is already being replaced by shared cars in cities which will greatly reduce their numbers….

Correlation is not causation.

You’ll see a very similar chart for GPD vs copper, GDP vs concrete, GDP vs iron. GDP vs lots of things…

Negative entropy? What planet are you from? There is no such thing as negative entropy in the context of fuels such as oil or uranium. Do you even know what entropy means!? Have you ever taken a course in thermodynamics?

Have you ever taken a course in thermodynamics?

He probably hasn’t, I tried starting a discussion with him about the second law of thermodynamics and how it relates to information.

There are people who go on about economic theory and don’t connect the dots to basic physics, let alone ecosystem thermodynamics. Hint both economics and ecology have the same Greek root. However the economy is just a subsidiary of Ecosystems Inc. and Ecosystems are subject to the laws of thermodynamics.

Here is a good primer on this subject and it very clearly explains what entropy is:

http://www.uni-kiel.de/ecology/users/fmueller/salzau2006/ea_presentations/Data/2006-07-05_-_Thermodynamics_II.pdf

But there are always some people who just don’t want to accept reality as it is and there is nothing that anyone can do to change their minds…

“I wouldn’t want my child

growing up in a world

headed for total heat death

and dissolution into a

vacuum. No decent parent

would want that.”

Kansas state senator Will Blanchard

Not sure if you read my last comment in the conversation you mention, but the point is that we are nowhere near the theoretical conversion rate of energy to information.

That is why the energy to GDP discussions are irrelevant.

There is a certain asymmetry here: adding energy, capital and other resources to an efficient but resource-poor economy can make it boom. Look at East Asia.

But making resources scarce in an inefficient economy is only problematic if the economy does not have the technology or political will to react in an appropriate way.

In fact by spurring investment growth, resource scarcity can actually strengthen an inefficient economy. The best example of this is the american industrial boom. It was driven by rich resources, but also by labor scarcity that forced companies to invest in labor productivity.

Another great example of how scarcity strengthens the economy is the Toyota Production System. It was created to deal with shortages of labor, capital and even factory floor space at Toyota. Once in place, it completely upended the car business and a lot of other manufacturing as well.

Excess resources, on the other hand, cause what’s often know as the Dutch Disease or the Curse of Oil. The hopelessly incompetent and venal Saudi regime, for example, will never be turfed out as long as they have oil money to buy off their enemies.

The biggest chunk of negative entropy we’ve had access to is fossil fuels

Not really. All of human burning of fossil fuels over the last century is probably 3 months of sunshine on earth.

3 months!!

Fossil Fuel accumulation in the Earth was incredibly inefficient. It’s far more useful to use it directly. 100,000 terawatts of power, every second of every day, of every year. Humans only use about 10 terawatts right now.

Wind, solar and nuclear are far more powerful than fossil fuels.

Check this one out: Is U.S. Oil Production Set To Plummet?

Chris Theal of Kootenay Capital says American oil production is set for a fast pullback.

He expects such a quick turndown in US oil production because most producers receive a discount to WTI, meaning they’re receiving even less cash flow.

.

“We do think shale will rollover in output and it will be much sooner than most people think,” says Theal. “We could very well see negative week over week contraction in output in the US before the OPEC meeting” on November 27…

The oil rig count in the US has gone down four weeks in a row. It will be interesting to see how this shows up in the Wednesday EIA report on overall US production. Only 13 of the 42 weeks in 2014 so far have shown drops in US production.

Theal and his team went back through weekly production data in the US starting after 2011 – when tight oil production really took off.

He says the data is more conclusive in the three instances when WTI fell below $85 a barrel; US output fell up to 200,000 barrels a day in literally a span of eight weeks from a much lower production base than now…

Producers in almost all the major oil basins in the US receive a discount to WTI. So they are receiving even less cash flow than many investors might think.

I’m reminded of Stephen King’s novel and movie “Thinner.” The main character, after being cursed, can only minimize his weight loss by eating vast quantities of food every day. If his calorie intake fell off only slightly, his weight loss accelerated tremendously.

Globally, the industry has only been able to keep us on an “Undulating crude* oil” plateau by consuming vast quantities of capital.

*45 and lower API gravity crude oil

Jeffrey, I corrected your post.

Three cheers for this guy being smart enough to restrict analysis post 2011. Bozos would have done all of history and found less.

The thing is, industry destruction is only 1/3 the bad news. It truly looks probable that 2/3 of the bad news is permanence. When this industry is wiped out, it’s not coming back when oil price rises. There is a hysteresis. The lenders are going to be burned and another request for money from them is not going to be well received. Then the clean up burdens on the state etc should generate some legislative obstacles to another industry try. The people having left the state will matter, but as Farmerguy says if the salaries are there and tempting, they’ll come back.

Another subtle thing is how technology didn’t create the industry. Technology was already there. The price made the industry so there was no magic still being implemented that can lower the breakeven bar further.

And lastly will be the broken long term contracts for rail and sand and whatever. The sand industry will have to shut down and get in line to sue. They aren’t going to leap to get involved again.

Hysteresis. The oil price that destroys the industry is not a threshold. Once the industry is smashed, the price has to be a LOT higher than the price that smashed it if restart is to happen.

Unless someone in gubmint has something on the ball and intercedes fast. Then . . . you have a new jobs program, GOP approved.

If the dollar is being driven up intentionally that same someone might engage in a different theatre of battle.

It seems safe to say that the bigger any organization is the slower it will react to changes in circumstances. This may not be a natural law but it is certainly the case the vast majority of the time.

Big government and big companies aren’t ABLE to change course quickly.

But as the oil industry goes the people doing a whole lot of the drilling it the tight oil fields are basically one horse hand to mouth operators. Some of them are no doubt trying to figure out a way to make this weeks payroll even as I type this comment by delaying paying one or more of their suppliers.

I have no personal knowledge of this industry but a very fast drop off in drilling by the smallest operators – those with very limited working capital- does seem very likely.

I have seen numerous construction jobs shut down with hardly any notice at all when the builder ran out of cash. These were invariably the smaller jobs going up at the time.I was once hired on a Thursday and laid off on a Friday in an unexpected job shutdown.

If the smallest operator run out of cash then their assets will be shortly redistributed to other larger companies that have money enough to buy them up of course.

But profit margins shrink a lot faster than wholesale prices and it is likely that most of the people in the tight oil fields aren’t making much if any profit right now. So they won’t be in any hurry to assume ownership of leases that must be drilled and produced in order to hold onto them. Nor will they be interested in immediately renewing the leases on rented equipment or in renewing contracts with truckers until the price of oil goes up again.

I am not a number cruncher but my guess is that daily production needs to fall off only a million or so barrels a day to push prices up noticeably.But maybe the annual production rate decline of legacy fields is not as high as we have been lead to believe and conventional production is holding up better than expected.

Or maybe the world economy is so sick that even a couple of million barrels less produced a day would not stop the price from falling even farther.

Very few things are as simple as they appear to be at first glance.

If a good many tight oil drillers give up and quit it will probably take a month or two ( another wild ass guess ) for the loss of production to work it’s way thru the supply chain and show up as a price increase- or at least as a more stable price rather than a falling price.

Ya, makes sense. However. The small fry are legion. If they shut down, overall production falls and the big fry lose infrastructure economies of scale. Their costs rise.

Or costs fall due to slack demand.

Like sand? Can’t be. Long term contracts in place. There’s no escaping that sort of thing.

Hi Watcher,

What happens when a company goes bankrupt? The long term contract is out the window. What about wages for truck drivers and fracking crews?

Do you expect a lot of upward pressure on wages as drilling starts to decrease. Same story with rigs, companies that are not doing well break their lease, now rigs are freed up and can be found at lower prices.

There’s a lot more to it than sand.

“There’s a lot more to it than sand.” ~ Dennis Coyne

PEAK OIL BARREL:

Walking You Through the Quicksand-Floored, Funhouse-Mirrored Glass Maze, One Energy Unit At A Time

^u^

We stopped talking about the same thing.

The issue was higher costs for the industry as a consequence of loss of economies of scale, because of widespread failure of small fry. Small fry always hop onto infrastructure or bulk pricing defined by purchases of the industry in total. The water disposal wells are used by big and small fry, e.g. The small fry die, their production disappears (because they stop drilling, not their already existing wells, remember 70% of production is less than 20 months old), the success narrative fails and big fry see an interest rate increase req’d to do private or public placement of their next issuance.

But after small fry die, the long term contracts in question refer to those held by the big fry, who have not yet failed, and can’t reduce their costs because those contracts are locked.

Hi Watcher,

Contracts do not last forever and they can be renegotiated.

As power is concentrated in the hands of larger players who may have survived because they are more efficient and have lower overall costs, they will push costs lower.

If there is reduced demand for the inputs to the drilling process, including labor, due to a slowdown in drilling those input costs will tend to decrease.

Do you think there are long term contracts for every input into the oil production process? There may be some costs that cannot be reduced, but it is highly unlikely that there will be no reduction in input costs as the boom goes bust.

Perhaps Mike can correct me here, I think he may have seen a few booms and busts in his career and would have much more insight.

Jeff,

Great analogy. The world has been on a bumpy plateau of 73 mbd of conventional crude ever since 2005. If we go by a conservative 5% annual decline rate, the world had to add nearly 4 mbd of new production each year to remain flat.

I would imagine part of this new production wasn’t just new fields, but also EOR. How long can the world add 4 mbd each year??

Seems to me that we start to see a decline within the next few years and then more of a SHARK FIN drop off after 2020.

steve

One small clarification, you are talking about conventional crude + condensate.

My contention is that the global industry has spent trillions of dollars on upstream expenditures, just keeping actual global crude oil production (from all sources), in my estimation, at an average post-2005 production rate of about 66 mbpd.

Hi Steve

sharkfin only happens if there is a crisis, if decline is slow and the economy adapts decline could be 2% or less per year. I think of a shark fin as 4%/year or higher decline rates.

The economy could adapt to nationalization of shale production, too, yes? Because capitalism and all that.

Hi Watcher,

I was thinking more in neoclassical economics terms. Oil prices rise, people find ways to reduce oil demand through substitution. Nationalization of the LTO industry seems pretty far fetched. More public transportation, tax incentives for rail expansion, consumers choosing deathtraps for transportation because M1 tanks are not very fuel efficient, all of these seem likely as gasoline prices rise to $6/gallon ($1.58/liter).

The price is $58 now. You see all those transition measures funded through a GOP Congress within the next few weeks? Or months? Or years?

Someone smacked the dollar down beginning end of European close Friday. The battle may be underway. But don’t delude yourself. If $58 stays on the table, this is going to be a sledgehammer and it isn’t going to swing slowly.

Hi Watcher,

What do you think the oil price will be when the peak arrives?

There does not need to be government policies, but if there are price increases there will be consumer preference changes, and eventually a demand for better public transportation, some of these could be through local governments independent of the federal government. On the coasts where population density is higher, local governments and private industry can provide this.

The WTI price is the benchmark, on November 11, 2014 the spot price closed at $77.85. As drilling slows in the Bakken, Eagle Ford, and Permian basin supply will decrease and oil prices will rise. By 2018 when World supply reaches a peak, oil prices will be $100/b (2014$) at minimum and will likely rise at 3%/year or more from there, by 2028 the real oil price will be at least $134/b (2014$), gasoline would be close to $5/gal. If real oil prices rose 5%/year, oil would be $162/b and gasoline about $6/gallon(US gallon).

Dennis,

I actually disagree. I think we have SUCKED oil from the future to fill in the gaps today. I have stated here and on my website… (http://srsroccoreport.com/), that the world really can’t afford Tar Sands or Shale Oil. The only reason we have done so is due to the massive propping up of the Markets by the Fed and Central Banks.

I am not going to debate this issue, but can tell you many Central Banks have now become net buyers of gold since the U.S. Investment and Housing Collapse in 2008. I realize many here still think gold is just a stupid piece of metal.

Well, if that is the case than the Chinese, Indians and Russians must be some really STUPID PEOPLE as they have been buying gold hand over fist. And I would kindly like to remind those who hold this BARBAROUS RELIC mentality, that those three countries hold more than half of the world’s population.

From 2003-2009 the Central Banks dumped nearly 3,000 metric tons of gold on the market which helped to suppress the price as well as artificially prop up their fiat currencies. From 2010-2014, Central Banks became NET BUYERS of nearly 2,000 mt. And this official data does not include Chinese Govt Demand in which they remain perfectly silent. This figure is likely more than double.

Anyhow, the reason I keep bringing up gold is due to the fact the world has finally had enough of the FED and U.S. Dollar being printed into complete madness which is severely impacting oil and commodity producing nations.

http://www.zerohedge.com/news/2014-11-15/oil-producing-countries-currencies-are-getting-crushed

Once the Fed and U.S. Treasury are no longer able to prop up the markets, I believe we see a SHARK FIN decline because the world won’t be able to afford this expensive oil. The collapse of Capital is coming.

Using monetary printing and massive debt to steal oil from the future is exactly the mechanism that will give us our SHARK FIN decline.

steve

Well, if that is the case than the Chinese, Indians and Russians must be some really STUPID PEOPLE as they have been buying gold hand over fist. And I would kindly like to remind those who hold this BARBAROUS RELIC mentality, that those three countries hold more than half of the world’s population.

Would you care to tell us what percentage of those 3.5 billion people actually hold that gold? Let alone use it for their daily commercial transactions? The vast majority of the Russian, Indian and Chinese PEOPLEare definitely not buying gold, gold is useless as a means of exchange for basic goods. Drop me a line when the governments of those countries start minting gold coins and putting them into circulation.

Fred,

Elmer Fudd told me I don’t need to explain myself. If its good enough for Mr. FUDD, it should plenty good for everyone else.

Regardless… I say, it’s a horrible EROI to waste time on this. I just like to provide data and lets see how smug the PAPER MACHE INVESTORS will behave after the first US DOLLAR devaluation.

Whord….

Steve

A lot of the gold that is brought in Asia goes into jewelry, and is not intended for barter. Gold is traditionally viewed as valuable so having gold jewelry is like driving a Ferrari — it shows you can. So it is better seen as consumption than investment.

LOL… what a siily notion. Anyhow… Chinese physical gold bar and coin denand was 410 metric tons in 2013, according to the World Gold Council. Howver, the China Gold Council states actual demand was double.

We have proof by the number of Shangha Exchange gold imports.

Steve

A metric ton is a million grams. So if there were 410 million Chinese, that would be one gram per person. But there are three times as many Chinese, so it’s a third of a gram per person.

You can buy a 1.54 gram 22 carat ring for 4546 rupees on line. Call that 4/3 of a gram, including purity (carats).

http://www.grtjewels.com/well-crafted-leaf-design-gold-casting-ring

That’s like $72. It’s probably too expensive, otherwise they wouldn’t be advertising on line. $60 might be more realistic.

I doubt there’s much India/China arbitrage leeway, so let’s use that as a proxy. Your average Chinese may earn $7,000 a year, say $7,200.

If one Chinese in 4 bought a ring like that it would explain all Chinese gold purchases. If one in 10 bought 2 1/2 it would be the same.

It’s apparently 1% if GDP, which is an awful lot.

Bummer. ‘u^

Hi Steve,

No doubt you expect a financial crisis by 2020.

If you are incorrect and the financial system muddles along until 2030, what causes oil companies to stop investment in 2020? They may not be able to manage 4 mb/d maybe only 3 mb/d.

Hi Steve,

The economy is real goods. Money is necessary, but less important than you think.

LTO is a drop in the bucket, 20gb or so of 3000 gb of c+c. If no extra heavy oil then. URR is 2500 gb.

Still no sharkfin, see my reply to Laherrere

Dennis,

You say money is less important than I think. Of course you would say that. The Universities teach Keynesian Fiat monetary science. Why would I think you would state otherwise. Gold is a joke in business college.

Do you have any idea that Gold and the Real Bills Doctrine was the fundamental system of trade up until 1913 when the Federal Reserve was created and then especially after the last nail in the coffin…. WW1?

The producers of the world financed Fast Moving Goods to the market without the banks. This was the Real Bills Doctrine. Basically gold was the ultimate extinguisher of debt and these Real Bills.

Today, we do not have a mechanism to Extinguish debt… which is why it grows like a cancer.

So, Dennis while I understand your LESS IMPORTANT OPINION of MONEY, it doesn’t mean your are correct.

steve

Hi Steve,

I know that you know more than all the economists, I will just have to disagree. Money is not to be ignored, a financial crisis can inflict real pain on the real economy as it did in 1929 and 2008.

Using gold as money or backing paper money with gold only makes the situation worse as it leads to deflation and higher debt burden in real terms.

Note that the green curve in the chart above leaves out tar sands and Orinoco belt oil, LTO would be an insignificant 20 Gb (at most) of 2500 Gb of C+C output. The financial collapse that you are certain will occur (and that I think unlikely) could cause a shark fin decline in oil output, an asteroid strike would do it as well.

I do not try to model low probability events.

Dennis, when you’re referring to Venezuela remember they reportedly have over 200 billion barrels of conventional oil as well as the stuff in the Orinoco Belt, estimates of which range from 100 to 270 billion barrels. In 2009, the USGS updated this to over 500 billion barrels.

The reason I mention this is in case you are lumping all this oil under one roof. Of course the Orinoco oil is down pretty deep and may never be extracted (mined) but the conventional reserves are viable, indeed they are an attractive resource to many oil companies and will be extracted once (if) the politics get sorted out.

Hi Doug,

My scenarios treat Orinoco oil separately from Venezuelan conventional. For extra heavy there are two pieces, Canadian oil sands and Orinoco belt oil. I am following Jean Laherrere’s estimate that there will be 250 Gb of extra heavy oil from each of these areas for a total of 500 Gb of extra heavy oil.

If Steve is correct that the extra heavy oil is too expensive and the URR from these sources will be much less than 500 Gb, then output would follow the green line (roughly) in my chart. I do not think Steve is correct and if there are no above ground problems, output could follow the red line.

In reality, there will be wars, recessions, and possibly an economic collapse, any of these will cause actual output to deviate from the scenario I outline. Such events cannot be predicted in advance, nor can the speed with which the economy may be able to adapt to the decline in fossil fuels which are likely to peak between 2020 and 2030.

Many have very little faith that the capitalist system will be able to adapt to less fossil fuel, I am somewhat agnostic on this point.

There are those that have great faith in their conviction that collapse is inevitable, others have faith that things will be fine. I can see both sides of this divide and do not know which way things will go. Humans can do both wonderful and terrible things when faced with crises.

We live in interesting times.

Venezuela has about 30 billion barrels of conventional oil reserves, or less. Very likely less. Venezuela increased their oil reserves the same way the rest of OPEC nations did, with a pencil. Look at their conventional reserves they had before the “OPEC proven reserves war” of the 1980s. That tells you how much conventional oil they really have, minus what they have produed since then.

They do have a lot of bitumen however. But that is a long way from being conventional oil. The stuff is so thick they must mix naphtha with it in order to pump it through the pipeline. And they are having a lot of trouble getting enough naphtha.

OK, Venezuela’s CLAIMED reserves. I guess my point to Dennis was Venezuela has conventional reserves that are currently viable plus Orinoco which may turn out to be fantasy oil in the greand scheme of things and when making projections the two should be considered separately.

Hi Doug,

Agreed. They are treated separately in my analysis which is why I refer to Orinoco belt oil as extra heavy, the rest of the Venezuelan oil (the conventional oil) is included in the C+C minus extra heavy(XH) category.

OTOH if they happen, they weren’t low probability.

Hmmm.

If I buy a megabucks ticket and I win, that does not mean that before the event it did not have a low probability of occurring.

Probabilities are estimated in advance of the event.

Inflation extinguishes debt rather nicely as a matter of fact.

One of the sources of central bank terror at that thought of deflation.

I seem to recall a ‘maybe-more-of-an-Orca-fin’ qualification some time ago on The Oil Drum.

I understand that although gold has very few actual good uses beyond filling teeth and making top quality electrical switches that it does have an extraordinarily powerful hold on the imagination of mankind and that it has historically been accepted in exchange for goods and services when nothing else was acceptable to sellers.

But what happens in ten or twenty years if Yougaristan has gold and wants oil and the Saudis have the oil but are having problems with their imported food supply? And with controlling their borders? Uncle Sam is going to have the food and the military to help them out but little or no gold. A shipload of grain and meat is going to be worth a lot more than a vault full of gold.

Let’s face up to reality. There simply is not enough mined gold in existence to use it as money given the size of the world economy these days. And pegging any currency to gold means that anytime the actual value of that currency declines whoever has it will insist on exchanging it for the gold that backs it.All the gold in vaults in any country anywhere that has a big international trade would vanish in a heartbeat as soon as the politicians and bankers start depreciating the currency.

So far as I know there is no example of any currency not losing value over any long span of time once the economy of the issuing country expands to the point that there is a lot more currency out there than gold to back it.

Cokes were a nickel when I was a kid and gasoline was thirty cents and sometimes less.Gold was thirty or thirty five ? bucks..If Uncle Sam had kept the gold backing the dollar instead of going off the gold standard all the gold in Ft Knox would have lasted only a few months if that long.

Money has value these days because people have faith in the government that issues it.I don”t think any country will ever again have a gold standard that lasts very long.This would require a stable currency and so far as I can see there aren’t any politicians or bankers or business men who really want a stable currency. They all want a constant but controlled and predictable inflation.That way they can borrow and borrow some more and repay with depreciated money.

The ultimate lenders are the people who are dumb enough to hold long term paper no matter who issues it if it has an interest rate on it that is less than the true inflation rate- and by true inflation rate I mean the cost of the things people actually buy from food to housing to energy to police protection to entertainment.All the really important things I have ever bought in my life have gone up faster in price than the supposed rate of inflation on average.Fortunately most folks incomes have gone up too but not so fast as prices of a lot of critical goods and services.

Also gold is too valuable per cc for barter. Despite everything gold bugs might claim, gold has almost never been used* as currency for doing your daily shopping. Silver and copper are prefered and always have been.

*In the real world that is. In World of Warcraft and other fantasy games gold is commonly used as currency.

Yes I recall the nickel coke. One could also get ice cream, coffee, gum. hershey bars and many other items for a nickel. During the late 30’s one could get long black licorice sticks for a penny. But my favorite example is the penny post card. The cost of the postcard and the stamp totaled one cent. Money wears many hats. It can be a store of value, a standard of value, a medium of exchange and may have additional esoteric functions related to time. What is currently available to satisfy all of these functions?

Farmer mac,

You bring up some great points, but all this debate and opinion making will become totally meaningless the day the US Dolar suffers its first devaluation.

Steve

Hi Steve,

You mean beyond the typical 3% per year due to inflation?

Or are you talking about moves in international exchange rates, which happen all the time?

Boeing would love a weaker dollar.

Dennis,

LOL… you have no idea how ugly this will get.

Steve

Steve,

It may get ugly, but if so it will not be for the reasons you think. And it is by no means certain that collapse is imminent. There will be bumps along the way, recessions for sure, possibly severe. A lot depends on people realizing that a fossil fuel peak is likely (in total fossil energy consumed) within 10 years, if everyone realizes this too late, (like in 10 years) adjustment will be difficult at best and severe recession or depression becomes more likely.

This is more likely to be the cause of a sharkfin decline, a depression around 2025 or so, maybe it will happen in 2029 (it would make for interesting historical symmetry.

Hopefully economists will remember their Keynesian economics.

Why are experts

Securities valuation 101.

There is not very much to be learned from long term observation of a largely random process. Ask Jack Bogle.

After testing 284 experts in political science, economics, history and journalism in a staggering 82,361 predictions about the future, Tetlock concluded that they did little better than ‘a dart-throwing chimpanzee’.”

I find that experts in some fields (e.g., economics) are particularly not helpful because they base their predictions on predictable patterns they don’t expect to change significantly from year to year.

But I think the inability to make predictions can be seen in the discussions here, too. When we confine ourselves to discussing what is happening in oil fields, we have some concrete evidence to mull over. But when we try to take that information and predict its impact for the future, we are all over the map. We’ve got people predicting the collapse of the world economy, the extinction of homo sapiens, etc.

I think Nassim Taleb had a similar story in his book The Black Swan. Then again, we are, all of us, pretty close to our dart throwing chimpanzee cousins… >;-)

A lot depends on people realizing that a fossil fuel peak is likely (in total fossil energy consumed) within 10 years, if everyone realizes this too late, (like in 10 years) adjustment will be difficult at best and severe recession or depression becomes more likely.

Realization is not the issue. The issue is how do various parties maneuver to achieve advantage over their fierce competitors and crush them as the peak event unfolds, before they get crushed themselves.

This tag stuff is complex.

Crush it!

Realizing the situation (by a large number of people) or maneuvering are not mutually exclusive; they can happen simultaneously and be done by the same people.

I’m good with that, provided it is understood that realization leads to fierce competition as an utterly inevitable thing.

A screen grab highlighting the evolution of the Ontario FiT (feed in tariff) and the decline in the cost of installing solar.

It’s from a video that the Ottawa Renewable Energy Co-operative put together.

Here’s a short webinar explaining the co-operative and how it finances projects. It’s in the process of it’s third share offering to finance $3 million in projects this coming year. The shares can be applied to an RRSP (like a 401K), and they likely will pay an annual dividend of 5% because of the 20 year Fit price guarantee. The video points out that there are now 70 renewable energy cooperatives in Ontario.

I don’t think we fully grasp how disruptive, in a really good way, solar will be.

I wonder to what extent the Kochs will use their money and political influence to do whatever they can to prevent alternative energy from making more gains in the US.

I saw this the other day. The Americans for Prosperity is funded by the Koch brothers.

“Tim Phillips, the president of Americans for Prosperity, has said that his group intends to aggressively attack any Republican candidate in the 2016 primaries who endorses carbon regulations.”

http://www.nytimes.com/2014/11/13/world/asia/in-climate-deal-with-china-obama-may-set-theme-for-2016.html?partner=rss&emc=rss

The political use of “global warming” for fear-mongering scarey stories is going to have a huge detrimental cost to society by causing electricity prices to skyrocket. They already have in Germany where 600,000 families had their electricity turned off last year for non-payment. Ontario Canada is going broke with wind and solar as well.

By 5th grade I knew Arithmetic, but evidently government planners skipped it. New policies will eliminate reasonably priced energy, and substitute voltage with more costly energy. Anyone who predicts this will cost more is deemed reactionary, and is ridiculed by the “green” lobby. Their goal is to confuse voters, every time.