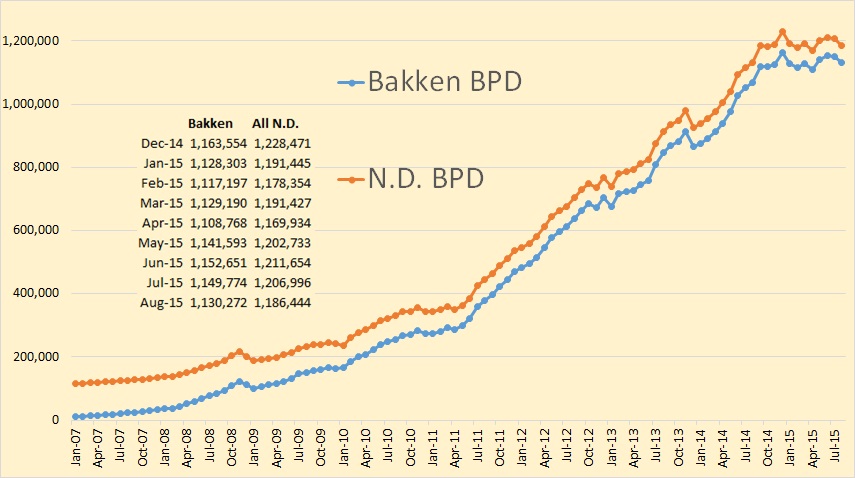

The Bakken and North Dakota production data is in.

Bakken production was down 19,502 bpd in August while all North Dakota was down 20,552 bpd.

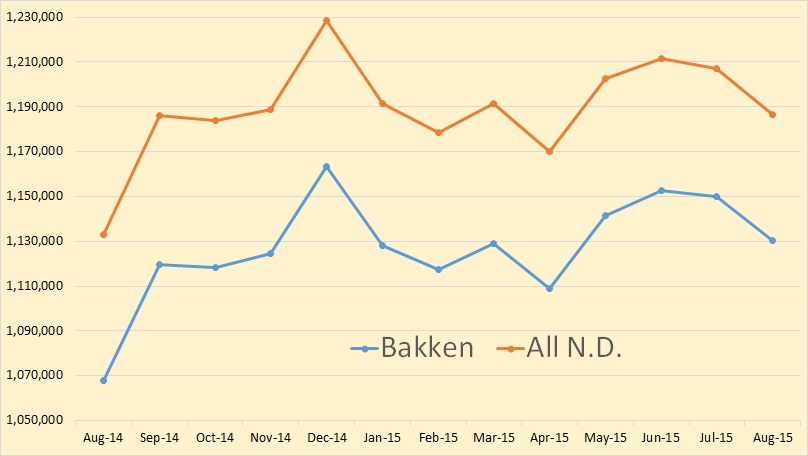

Here is an amplified chart of Bakken and all North Dakota production.

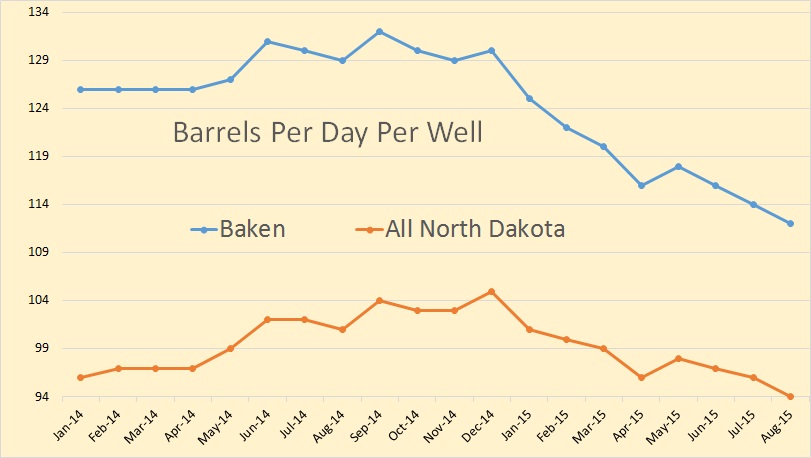

Bakken barrels per well per day is now 112 while all North Dakota gets 94 barrels per well per day.

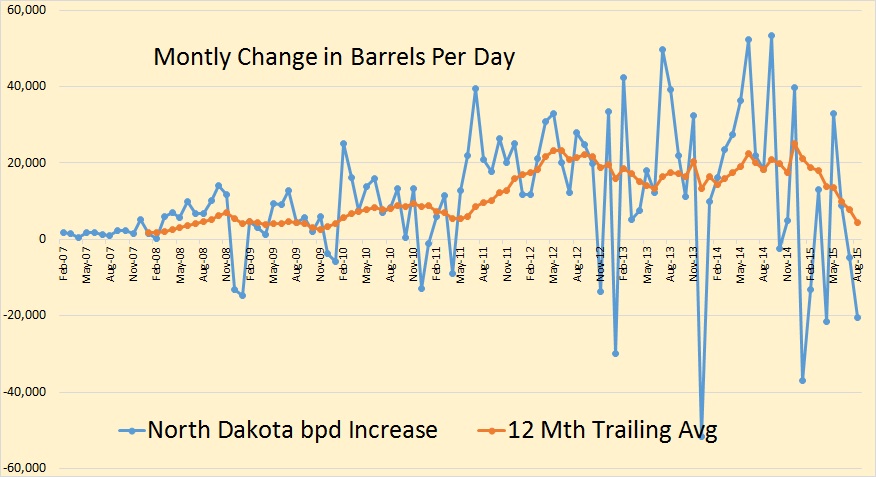

This chart shows the monthly change in North Dakota production. It is likely that by next month the 12 month average change in production will be negative.

Bakken wells producing increased by 69 and ND wells producing increased by 65.

From the Director’s Cut

July Permitting: 233 drilling and 0 seismic

Aug Permitting: 153 drilling and 1 seismic

Sep Permitting: 154 drilling and 1 seismic

July Sweet Crude Price1 = $39.41/barrel

Aug Sweet Crude Price = $29.52/barrel

Sep Sweet Crude Price = $31.17/barrel

Today’s Sweet Crude Price = $35.00/barrel

(low-point since Bakken play began was $22.00 in Dec 2008)

(all-time high was $136.29 7/3/2008)

July rig count 73

Aug rig count 74

Sep rig count 71

Today’s rig count is 67

(in November 2009 it was 63)(all-time high was 218 on 5/29/2012)

Comments: The drilling rig count increased 1 from July to August, decreased 3 from August to September, and dropped 4 more this month. Operators are now committed to running fewer rigs than their planned 2015 minimum as drill times and efficiencies continue to improve and oil prices continue to fall. This has resulted in a current active drilling rig count of 10 to 15 rigs below what operators indicated would be their 2015 average if oil price remained below $65/barrel. The number of well completions fell from 119(final) in July to 115(preliminary) in August. Oil price weakness now anticipated to last well into next year is the main reason for the continued slow-down. There was one significant precipitation event in the Minot area, 6 days with wind speeds in excess of 35 mph (too high for completion work), and no days with temperatures below -10F.

Over 98% of drilling now targets the Bakken and Three Forks formations. At the end of August there were an estimated 993 wells2 waiting on completion services, 79 more than at the end of July.

The drop in oil price associated with anticipation of lifting sanctions on Iran and a weaker economy in China is leading to further cuts in the drilling rig count. Utilization rate for rigs capable of 20,000+ feet is about 40% and for shallow well rigs (7,000 feet or less) about 20%.

Drilling permit activity decreased sharply from July to August but stabilized from August to September as operators continued to position themselves for low 2016 price scenarios. Operators already have a significant permit inventory should a return to the drilling price point occur in the next 12 months.

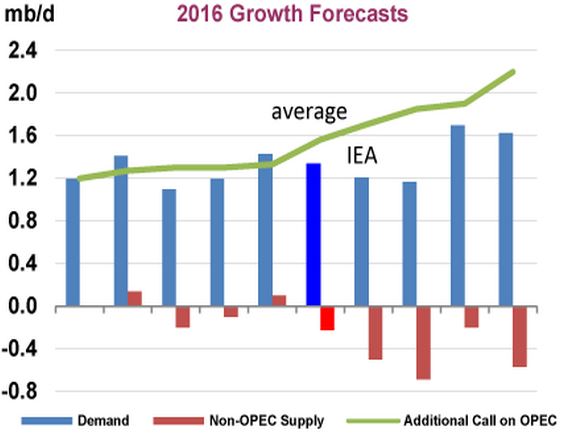

Highlights of IEA Oil Market Report had an interesting chart this month.

This is a chart of nine different demand growth and production forecasts, sorted left to right on the amount of shortfall in Non-OPEC production. Or, to put it another way, it is sorted on the amount OPEC will have to increase production to keep supply and demand in balance.

The IEA says demand will increase by 1.2 mb/d while Non-OPEC supply falls by .5 mb/d meaning the “call on OPEC” will be to increase production by 1.7 mb/d. The most optimistic prediction says the “call on OPEC” will be only 1.2 mb/d while the most pessimistic prediction says the “call on OPEC” will be 2.3 mb/d.

If the article below has any validity then the decline in Non-OPEC production will be a whole lot more than any of the nine prognosticators are predicting.

Offshore oil output to plunge as producers scrap field upgrades

(Reuters) – Global offshore oil production in ageing fields will fall by 10 percent next year as producers abandon field upgrades at the fastest rate in 30 years, in the first clear sign of output cuts outside the U.S. shale industry, exclusive data shows.

A drop in oil prices to half the level of a year ago has forced producers to slash spending and scrap mega projects that can take up to a decade to develop, but they are also taking less visible steps to cut investment in existing fields that will have an immediate impact on global supplies.

There have been few signs of how cost cuts of around $180 billion will impact near-term production until now. They could erode the glut that has forced down prices, and help balance global production and demand by the middle of next year or earlier, Oslo-based oil consultancy Rystad Energy said.

Data provided exclusively to Reuters by Rystad show a sharp decline in investment to upgrade mature offshore oil fields in order to arrest their natural decline, in what is known as infill drilling.

In three major offshore basins — the Gulf of Mexico, Southeast Asia and Brazil — infill drilling dropped by 60 percent between January and July this year compared with the same period last year, according to the Rystad Oil Market Trend Report, whose data is based on company data and regulatory filings.

The drop dramatically exceeds previous downturns in infill drilling going back to 1986, the data shows.

For example, according to the data, in the Gulf of Mexico, infill drilling on mature wells dropped from 149 wells between January and July 2014 to a total of 61 wells during the same period this year.

Based on this trend, Rystad Energy estimates that global offshore oil production in mature field will decline next year by 1.5 million barrels per day (bpd), or 10 percent, to 13.5 million bpd from 15 million bpd in 2015.

_________________________________________________________

If you would like to be notified when a new post is published then please email me at DarwinianOne at gmail.com

Last Week Tonight with John Oliver: North Dakota

https://www.youtube.com/watch?v=jYusNNldesc

So you think you know what’s been going on in North Dakota. Well listen up, John Oliver gives a funny yet very informative show on North Dakota and oil production.

This is just another one of the typical liberal smear and lie campaigns to try and push an anti-fossil fuel agenda on us all.

https://sayanythingblog.com/entry/a-rebuttal-for-that-john-oliver-skit-about-the-north-dakota-oil-boom/

Where leftists like Oliver and Democrats here in North Dakota see a too-cozy relationship between the state’s Republican leadership and the oil and gas industry, I think a majority of North Dakota voters see a common sense relationship that’s based more on getting the right outcome than exercising ideological vendettas.

If North Dakotans, who actually live here amid the oil and gas activity, saw things the way Oliver does then Democrat Ryan Taylor would be governor right now and Democrats would likely control the state Legislature. But they don’t, because they do actually live here, and they aren’t seeing oil and gas activity in the state through the lens of the New York Times.

I thought Oliver went pretty easy on them.

This is just another one of the typical liberal smear and lie campaigns to try and push an anti-fossil fuel agenda on us all.

Don’t you have geology working against you?

You know very well there’s a 100+ year supply of oil in the Bakken. The state’s own projections show a minimum of 100,000 bpd still being produced by the year 2100.

Bruce Oksol stated this well earlier today.

Wonder what oil prices and OPEX is projected to be in 2100?

Looks like that will be somewhere between 1-5 bopd per well. From a 20,000+ well bore, will need an incredibly high price to make that work. LOL/sarc.

On a serious note, Bakken was a large factor in one of the most trying times in the history of the US oil industry. No offense to those still working on new wells, but from Enno’s chart below, it would have been helpful had well completions ceased entirely in 2015.

You know very well there’s a 100+ year supply of oil in the Bakken. The state’s own projections show a minimum of 100,000 bpd still being produced by the year 2100.

No, I don’t know that.

And ironically, if that is the message you want to send, then that probably reinforces the idea that there is a glut of oil, now and in the future, which will keep prices low, which will make it harder for gas and oil companies to make a profit.

David Hughes in his Drilling Deeper report projected a near term peak for the Bakken and production dropping below 100,000 bpd around 2033.

The term “100 year supply” is incorrect. You could say “the Bakken/Three Forks” will be producing oil 100 years from now”.

Question: how many wells do you think will be required to produce 100,000 BOPD in 2115?

Hi Fernando,

Probably the average well output will be about 25 b/d at that point (maybe less) so about 4000 wells if that guess is correct, if it’s an average of 10 b/d, it would be 10,000 wells. Of course 100 kb/d is a drop in the bucket if demand remains at 18,000 kb/d as it is at present in the US.

This is just another one of the typical liberal smear and lie campaigns to try and push an anti-fossil fuel agenda on us all.

Paul, Oliver is an entertainer and what he does, is known comedy or political satire… Though to be honest, I sometimes laugh harder when I watch FAUX News. Compared to them, Oliver is just a rank amateur.

Now, from a purely business perspective, how’s that pro-fossil fuel agenda working out for North Dakotans? You want to read something funny? Check this out from Forbes!

Oil Bust? Bah — North Dakota Is Still Poised To Thrive

http://www.forbes.com/sites/joelkotkin/2015/10/13/oil-bust-bah-north-dakota-is-still-poised-to-thrive/

In the coming years, other industries may help pick up the slack from energy. One prime candidate is aerospace, where North Dakota is touting itself as the “Silicon Valley of drones,” an outgrowth of the conversion of the Grand Forks Airforce Base from launching bombers and tankers to drones. The country’s first drone-only business park is being built on an unused portion of the base. Other industries on the upswing include biomedicine and wind turbine parts.

Now that’s what I would normally call funny but building the country’s first drone-only business park is something I’d be willing to actually invest in. Though not for surveillance or military usage… That’s not where the future lies! The fossil fueled BAU paradigm has outlived it’s usefulness we have to get beyond it.

No, seriously, I really like disruptive technologies like this! BTW, Big Data is about to become HUGE DATA. You might consider investing in that as well. If you want to frame all of this as an anti-fossil fuel agenda, I’d say you are stuck in the past. Of course we still need oil and will continue extracting for a very long time to come but not in the same way as we have done till now. A culture that promotes ICE Pickups and guns is a stupid culture and I say good riddance! Disclaimer: I am not affiliated with any political party either on the right or the left and I think that is a completely useless framing.

https://www.ted.com/talks/vijay_kumar_the_future_of_flying_robots

At his lab at the University of Pennsylvania, Vijay Kumar and his team have created autonomous aerial robots inspired by honeybees. Their latest breakthrough: Precision Farming, in which swarms of robots map, reconstruct and analyze every plant and piece of fruit in an orchard, providing vital information to farmers that can help improve yields and make water management smarter.

Fred,

I was born and raised in Midland, Texas, in the heart of the Permian Basin. So I have suffered through any number of boom and bust cycles associated with the upstream oil and gas industry.

What I saw was that the Permian Basin was unable to escape the ravages of the Dutch Disease, and I suspect North Dakota will fare no better.

Yes Fred, you brought up a topic I have been thinking about for a long time. Robotic farming. Run it on solar energy.

Actually that is something I was wondering about. Set up solar powered charging stations with battery back up for the robots and have them fly there to recharge themselves as needed. I don’t think that would be too hard to do given what those swarming robots can already do. All they have to do now is figure a way for them to make honey 🙂

Actually, I’m looking forward to a version of your self charging, autonomous drones configured with motion sensors in the field and high res cameras, to do security duty at my homestead out in the rural parts of my island. It would be nice to be able to just take a bunch of pictures or, better yet, videos to the local police station when stuff (produce) goes missing!

I was thinking more of ground based robots. Have the larger ones carry smaller ones to disperse out to work areas. Fixed solar charging stations and have the bots come back their for energy. Of course flying ones would be great too for pollination and survey work as well as pest reduction.

We already have these flying robots in Texas.

We call them “birds”.

Around here we call them bees, but I guess everything is bigger in Texas.

Hi Ron,

As always it is difficult to predict the future changes in oil output. Output will decrease, but both OPEC and the article you cite at the end of the posts suggest mid-2016 when supply and demand will balance (assuming level OPEC output).

The cuts in megaprojects will have the following effect (from your post):

They could erode the glut that has forced down prices, and help balance global production and demand by the middle of next year or earlier, Oslo-based oil consultancy Rystad Energy said.

If it is earlier than mid-2016 as suggested above, then oil prices start to rise earlier, maybe during the second quarter of 2016. There might be a temporary dip in output and then LTO output will ramp up in response to higher oil prices.

By 2020, China’s annual oil demand is likely to reach 608 million tons. China’s need for natural gas will possibly climb to 300 billion metric tons per year by 2020. This is according to an unnamed Chinese official at the 2015 China Petroleum and Chemical International Conference today.

In 2014, China’s oil consumption was 516 million tons (growth of 3.3 % from the previous year) according to a report published by the CNPC Economic and Technology Research Institute. According to the think tank of China National Petroleum Corp, the nation’s top oil and gas producer, oil demand will grow 3 percent year-on-year to 534 million metric tons in 2015.

FACTBOX-Loan resets at U.S. shale oil and gas companies

http://uk.reuters.com/article/2015/10/13/oil-usa-banking-idUKL1N12D0E820151013

Oct 13. U.S. energy companies that hold nearly a third of the industry’s total reserve-based loans have so far reported only a 1.4 percent net fall in credit lines.

This could be a sign that banks are relaxing covenants to avoid technical defaults, while underscoring the successful steps taken by the energy companies to keep credit lines secure.

Banks typically review credit lines twice a year for smaller oil and gas companies with loans tied to reserves.

Mainly small independents are subject to semi-annual redeterminations. Big companies with investment grade ratings, such as EOG Resources and Apache Corp, do not normally face redeterminations as they have longer-term credits unsecured by reserves, according to filings.

Queue Watcher, and his moving the goal posts to keep everyone solvent!

Most news continues to be very bearish IMO. Will be a very long slog for all oil producers.

Again, only near term relief (prior to 2017) IMO is OPEC cut. Everyone convinced it will not happen. Hard to say. KSA 2015 projected budget deficit on proportional basis equivalent to US having an annual deficit of $3.5 trillion, which is pretty bad. But, KSA sees this a life and death, so hard to say. OTOH, OPEC has not waited over 18 months to cut from beginning of collapse, re 1986, 1999 and 2008.

Zombie shalers continue to drill and had a huge share price spike, despite no real oil price recovery. Very interesting. Most will have long term debt of more than 65% of SEC PDP PV10 at year end.

Counted the text:

5 of the 6 upward resets of loans were pre 1 Oct announcements

Of the 10 down resets there were 5 that were post 1 Oct announcements.

Of the 15 NoChange resets there were all 15 Pre 1 Oct (there was one that was exactly 1 Oct.)

These guys may have asked banks to redo their resets pre Oct. Or post 1 Oct resets just haven’t been reported yet.

Eighty or ninety percent of shale oil guys revenue going towards debt or maybe even just interest on the debt. WSJ article saying shale oil guys have cut all budget areas and are now eyeing across the board payroll cuts instead of more layoffs. And their loan ratios are left as is? Seriously?

This is sure looking like yet another bankster scam. Everything they touch turns to shit.

Not really the read.

When you have to have it, and you do have to have it, you’ll do anything to get it.

I didn’t explain it well, maybe the banksters are doing this at the behest of their partners, the federales. Which is the worst possible scenario for us.

No, too many people in on a big secret. There is none. The banks probably agreed to reset pre Oct 1 revaluation of reserves, to buy time.

HR, rarely has there been a bubble in history without banks jumping in and lending at an unsustainable rate to GDP that inevitably and mathematically results in debt and debt service exceeding profits, wages, and gov’t receipts, prompting a credit market/banking/financial crisis that results in a recession and bear markets for equities and corporate bonds.

US banks’ growth of commercial and industrial loans to the energy and energy-related transport sectors is similar to that which occurred for the unreal estate bubble in 2004-07.

But now there are bubbles in stocks, corporate bonds, unreal estate, trophy properties, collectibles, vintage and high-end vanity vehicles, sports franchises, margin debt, derivatives leverage, debt to GDP, rents to income, CEO compensation, film budgets, population, immigration, resource consumption per capita, and who knows what else.

The larger the credit/debt/lending bubble as a share of wages and GDP, the larger the bust and financial and economic dislocation that follows.

To that point, current US total debt and non-financial corporate debt to wages and GDP is at the level of 1929-30 and Japan in 1989-94.

The scale and scope of the emerging potential global debt-deflationary wipeout and collapse is unprecedented in world history.

BC. Sure do not like to read the end of your post.

Never get out of my mind grandparents talking about the Great Depression. One thing that stuck with me was a quote, something like, “There just was not any money, no one had any, just like all the money disappeared.”.

Was doing some reading this weekend and noted that during the Great Depression, the discovery of the East Texas oilfield crashed oil prices to extreme lows.

Is it possible that the discovery of the East Texas field exacerbated the effects of the Great Depression by driving oil prices so low it sucked even more money out of the system?

Have read that a quick switch over from fossil fuels to alternatives could crash the world economy due to the large part of same fossil fuels make up.

Kind of a chicken and egg issue, but does the over supply of commodities cause deflation? For example, the 70 million retirees who will see no COLA this year, directly due to the oil price crash.

Sorry for my naive comments. Seems like the low oil prices should have helped world economies. Not seeing that.

“One way to promote local [‘glocal/trans-local’] spending is to introduce a local [‘glocal/trans-local’/ethics-based?] currency… Eventually, in a period of sufficient upheaval, a money monopoly may be impossible to sustain, then local currencies would be freer to operate… Any initiative which reduces our dependence on national currency in circulation is going to be useful in this regard… Holmgren points out that holding cash under one’s own control, outside of the banking system can greatly increase resilience by reducing dependency on the solvency of middle men. This is very much in accordance with our position at TAE [The Automatic Earth], as cash is king in a period of deflation…” ~ Nicole Foss (my parentheses/emphasis)

“Alternative currencies and economies can insulate their users from currency-manipulations and bad economies and their economic fluctuations, and help influence, facilitate and encourage transitions to new particular forms and locales of ethical trade, economic associations and ways-of-life, and provide hedges, forms of resilience, solidarity and resistance…” ~ Me, from the Permaea Manifesto

As a producer who has accepted local currency at times, the problem is I can’t pay any of my main expenses with it. Not my mortgage or equipment payments, not my lease payments, not my main inputs cost, not my utilities…

I presume you don’t live in an ecovillage, and even if you did, the dystem would still have you sort of by the balls, yes? I mean, we’re not just talking about currency, Jef.

Part of the idea behind Permaea, incidentally, is to create a completely new society, kind of like a cancer of the state that grows slowly from within it, creates its own safety-nets from it and leverages its operations until it just dies, without violence or bloodshed, simply from the little participation that’s left in it.

One catch is how do we get Permaea to go ‘viral’? The main proposal, aside from an advertising/marketing campaign (one of the first/main ones of which I already have in mind, and you can get a hint of it in the graphics of people holding Pangaea) is we do it by leveraging ‘off the shelf parts’– groups that are already averse to the state, and there are plenty, obviously. I argue that Permaea already exists, just that those groups are simply not working together. Which really annoys me. LOL

The main proposal, aside from an advertising/marketing campaign (one of the first/main ones of which I already have in mind, and you can get a hint of it in the graphics of people holding Pangaea) is we do it by leveraging ‘off the shelf parts’– groups that are already averse to the state, and there are plenty, obviously

This is the plan behind the Transition Town movement.

Transition (TT) and permaculture are part of Permaea but both movements don’t seem to be moving fast enough/making sufficient headway or making an outright effort at getting other groups together. Maybe Transition has changed strategy since I looked, but last I did it seems it’s strategy was to transition towns(/cities), rather than to achieve solidarity and cooperation (in a permaculture/TT capacity) with state-averse people/groups.

And to quote the Permaea manifesto:

“Obviously it’s past time for a rapid paradigm-shift, an inflection point, but of the right kind(s). Question is, when, how? Transition Towns is all but crickets over here in Ottawa and Halifax, respectively, and apparently in the USA as well; Occupy has fizzled, fragmented and/or gone underground; we have yet to hear of any Deep Green Resistance resistance; David Holmgren, in writing about the consideration of a kind of ‘crash on demand’, mentions in that article that, ‘I am more than ready to acknowledge that ‘our’ collective efforts at positive environmentalism during and since the 1970s have so far failed to catalyse the necessary changes in society…’; and Michael C. Ruppert, of the 2009 documentary, Collapse and formerly the host of the Progressive Radio Network show, The Lifeboat Hour, recently fatally shot himself. (Could he have, instead, created an ecovillage with some of his engaged audience, I wonder, or did he see anything like that as a pointless endeavor, given what he knew? In any case, he often remarked that, if you don’t change how money works, you change nothing… And of course, how money works is encoded and enforced by this dystem’s own ‘proprietary black-boxed rulebook’.)”

The likes of Petro, BC or Watcher may have managed to, say, crack and peer into some or much of this ‘proprietary black-boxed rulebook’, but the problem is that it’s essentially ‘proprietary black-boxed’ and yet paid for by the ‘relatively-ignorant-about-it public-hostages-cum-parasite-hosts’.

Kid: “Hey Dad, what’s the velocity of money?”

Cae-Dad: “Go ask your mother.”

Kid: ” 🙁 ”

Cae-Dad: “Ya; 🙁 “

shallow sand (SS): “Seems like the low oil prices should have helped world economies. Not seeing that.”

Peak Oil; population overshoot and resource depletion per capita; too much debt to wages, GDP, and gov’t receipts; falling available net oil exports (oil producers consumer more of their production); demographic drag effects; extreme inequality; soaring health care costs (twice the rate of GDP) and rents in the US; asset bubble (some of which are bursting) causing disproportionate flows from firms, households, and gov’ts to the financial sector (“hyper-financialization”); a record low for labor share of GDP, regressive payroll taxes, and weak wage growth are restraining investment and productivity; high energy cost of energy extraction and increasing energy consumption to produce lower-quality, costlier crude substitutes; and fiscal constraints/”austerity” in most countries.

These factors are combining for a cumulative global drag effect that is manifesting secular stagnation, a liquidity trap, and deflation.

There is no way out but debt forgiveness and an increase in labor share of GDP. But hyper-financialization, QEternity, and unprecedented asset bubbles have resulted in the asset markets becoming “the economy”. Another bear market in equities, bonds, and unreal estate will hit the economy as in 2007-10, which is why US central banksters are so terrified to raise the reserve rate.

And globalization of the labor market and accelerating automation of paid employment (Big Data analytics, AI, robotics, bioinformatics, biometrics, nano-electronic sensors, telepresence, etc.) and elimination of purchasing power, including increasingly in the service sector hereafter, will likely cause labor share to continue to persist at the lows of the Great Depression.

I am leisurely-mulling over your comment (the issues surrounding it) here at a Starbucks coffeehouse in downtown Halifax at Queen and Spring Garden over a smuggled-in home-cold-milk-brewed green-tea ‘latte’ and purchased 2-cookie package of Walker’s Scottish shortbread cookies.

I used to have their green tea lattes with extra Japan-sourced pre-sweetened matcha green tea powder until Fukushima blew up.

The green tea I am drinking now is sourced from China, but am unsure about its safety either. So I guess if the radiation doesn’t get me, other toxins will.

Of course there are some plants in our local forests that one can make teas with, and I have done this myself. The link is to my very first and simple attempt with wintergreen, and I have experimented with other plants, including sumac, sweetfern, mint, barberry, and even spruce… Hopefully nothing nuclear blows up nearby, (as if we need the energy.)

I am waiting for a friend and if she shows, I will reward her with one of the cookies. She has until 10pm, after which time as her cookie will become mine again. In fact, I’ll email her after I send this along to let her know that this is the case.

If you go on Google Street View to view our location, just wave into your web-/phone-cam so we know it’s you and we’ll wave back.

“Be well” ~ Petro

But now there are bubbles in stocks, corporate bonds, unreal estate, trophy properties, collectibles, vintage and high-end vanity vehicles, sports franchises, margin debt, derivatives leverage, debt to GDP, rents to income, CEO compensation, film budgets, population, immigration, resource consumption per capita, and who knows what else.

So, we’re saying the FED has rigged the system. But do all the wealthy who are buying the real estate, stocks, art, etc. know everything could collapse?

Surely there are people who are benefiting now who are also aware that they are in bubble territory. Or is everyone clueless, including the FED?

Boomer,

I think most know, but the uncertainty of timing and the drive for perpetual growth in wealth requires investing in something, so they keep on, hoping to game the system.

It is all they know to do. Besides, what else can you do with electronic wealth? Other than the obvious strategy of converting it into something physical…

Jim

They know, but maybe just have yet to pass through all the 5 Stages of Grief until they get to ‘Acceptance’.

The research behind the 5 Stages of Grief, however, may not have taken account of the possible skew toward higher levels of ‘sociopsychopathology’ within certain populations. So, for example, we may, as a culture, be in more trouble than even some of us here suspect if the last stage, Acceptance, simply doesn’t arrive for some.

Boomer II, not clueless but captive to a kind of self-satisfied inertia of affluence and decadence. The top 0.001-1% have never had it so good in the history of the world. To them, the system is working perfectly and they are deserving of it because of their merit. If it ain’t broke, don’t fix it; and if it does break, as it did in 1929-33, 1937-41, and 2008-09, print trillions in reserves and net financial flows to the top 0.001-1% to fix it. No problem.

The Fed’s job is to run political cover for the TBTE banks’ license to steal. So, the Fedsters are there to maintain the credibility and legitimacy of the rentier-socialist bankster oligarchic caste’s desires, and the wealth, status, privilege, and power of the top 0.001% Power Elite benefactors.

Financial bubbles since the 2000s are a kind of de facto monetary policy of the hyper-financialized rentier-socialist corporate-state, which for the top 0.001-1% is like a gov’t-sponsored and -protected slush fund and money for nothing (but the chicks are never free).

Bravo gentlemen, I applaud and accept your observations. I always expect the worst from the east coast cartel as they will do anything to maintain their wealth and power.

WTI price is still some major miserable shit though.

BC, glad to see that someone else sees all the bubbles that have been blown up instead of allowing the economy to run its natural course back in 08. I still say that the bond market is on the brink and all of the massive government debt is at the edge of the precipice.

HR, thanks, but had the economy been permitted to run its deflationary course with the MASSIVE debt to wages and GDP, assuming the Fed had not printed to permit primary dealers to fund the US Treasury, the US nominal GDP would be about 20-25% smaller and the U rate at a similar level.

But what we will get (are getting) instead is a slow-motion depression that will reduce growth in real terms per capita that otherwise would have occurred about the same as the 1929-33 and 1937-41 deflationary episodes, and the cumulative loss of real GDP per capita in Japan since 1989 to date.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2705

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=28c6

If anyone is curious why the price of oil and commodities crashed beginning about a year ago, the recession-like contraction in the US$-adjusted acceleration of “money” velocity tells the tale.

https://app.box.com/s/ys8ijadj4b57nb95ka0b3ilph38ga7fm

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=27sX

And the tale is confirmed by the data at the links above.

http://www.zerohedge.com/news/2015-10-13/metric-we-are-already-global-recession-hsbc-warns

https://app.box.com/s/rekvofiqj1hptrqv45ipy5crzcfphoky

https://app.box.com/s/xt8fhcxp62igds328g7q6mzorpytq9pw

The world is experiencing the onset of another deflationary recession, and the acceleration of “money” velocity is contracting YoY as occurred in 2008, 2001, and the early 1980s.

The historical parallels are Japan in the early 2000s, the US in the late 1930s, and the US and world in the 1890s.

Economic history, i.e., the Long Wave, is rhyming yet again . . .

BC,

Using the REAR VIEW MIRROR to forecast future cycles works right up until the point the U.S. Dollar and U.S. Treasury Market go down the toilet and into the cesspool. I don’t believe it will take 5-10 years to flush these turds down the JOHNNY, rather it’s more like 1-3 years.

The Fed never planned on selling or liquidating its $4.5 trillion portfolio of MBS or Treasuries. This was stated in their recently released 2009 Fed Minutes. John Titus explains this in excellent detail in his new video: THE FED AUDIT SHOCKER: They Came From Planet Klepto

https://youtu.be/jt377DV2BKs

Titus shows that the FED paid the banks top Dollar for their worthless MBS – Mortgage Backed Securities. In many cases the Fed paid the banks $1.05 per dollar of MBS. Before the Fed started buying MBS, Morgan Stanley was dumping their MBS for 5 cents on the Dollar in 2008.

Regardless, the Banks can thank the Fed for $1.7 trillion of their excess reserves as it purchased $1.7 trillion of the Banks’ worthless MBS.

Titus says the real corruption is in the UNDER-REPORTED AMOUNT OF TREASURIES on the Fed’s balance sheet. He says it’s much more than the $2.4 trillion they have reported. He plans on doing another video showing how much U.S. Treasuries the Fed really should have on their balance sheet.

The collapse of the U.S. Dollar and U.S. Treasury market will wake up the 95% of Americans who continue to believe the propaganda put out by the MSM. This should also do wonders for the U.S. Shale Oil Industry.

Steve

“…The world is experiencing the onset of another deflationary recession, and the acceleration of “money” velocity is contracting YoY as occurred in 2008, 2001, and the early 1980s….”

BC,

A): money velocity ITSELF is contracting – not its “acceleration” (to use your words).

B): velocity deceleration in 2001 and 2008 is very different from that of early ’80s. That one happend as consequence of “crushing” interest rates Volker’s FED implemented to control inflation/stagflation.

The recent one (and we still have not recovered (and will not recover!) from the 2008-2009 one….yet!) is a debt/deflation story (akin to 1930s) A war is coming to “correct” this one.

And, for we are have reached limits/peaks on everything: from energy to debt; from fantasy football to trump/hillary – not even war will correct the current debt/deflation/death spiral.

be well,

Petro

Petro,

I’m throwing my hat in with you on this one.

There seems to be a consensus in Washington that the world capitalist system can be given a new lease on life with another round of events similar to the Great Depression and WWII. As you put it in your comment below: “The great ’50 and ’60s came after the 1930s and the WWII.” But as you conclude, “not this time! This time is indeed different!”

The world capitalist system requires at least two things to continue functioning:

1) Abundant and cheap-to-produce natural resources, and

2) A metropole and a perifery.

The natural resources required for another round of growth, like that which followed WWII, are simply not existent this time around, neither in the metropole nor in the perfiery.

The Green Utopians believe they have found salvation in renewables. I find the liklihood of this extremely small.

I suppose, however, that there’s always the possiblity of a “black swan” on the upside. Humanity, after all, could win the Mega Millions!

Well said, Glenn!

Be well,

Petro

Well said, Glenn!

Be well.

Yep!

For some reason my comment is not posting…

“I suppose, however, that there’s always the possiblity of a “black swan” on the upside. Humanity, after all, could win the Mega Millions!”

Thanks Glenn and I HOPE you are right and I’m wrong!

I am still young (if only at heart) and have kids.

….but, I know numbers like few others and ….well, they do not look good!

Be well,

Petro

My comments went “nuts”….

…forgive me….

be well,

Petro

Money velocity to private GDP is declining. Acceleration is contracting coincident with the emergence of price deflation.

The implication is that the Fed will have to print at least another $2.5-$3 trillion in reserves during the next recession (not counting bailouts or “stimulus”) to prevent nominal GDP from contracting with emerging deflation.

Velocity is indeed “different this time” from the early 1980s. We were at the end of the inflation/stagflationary regime of the Long Wave, and today we are in the debt-deflationary (with not much debt deflation yet) regime of the Long Wave Trough.

Corporate revenues and profits are contracting YoY and wage growth is weak, whereas growth of purchasing power is negative for the bottom 80-90% after increases in rents and health care costs, and after debt service.

Central bank (CB) expansion of bank reserves/base money with wages and nominal GDP trending at ~2% and bank net margin below 3% causes the multiplier and velocity to decline further, which in turn reflects the conditions of a liquidity trap of secular stagnation of the debt-deflationary regime of the Long Wave Trough.

Hey bc

Always interesting comments. Who do you read on these topics ?

BC,

That zerohedge link reference is really silly. “Measured in USD the world is in recession”. Yeah right…How about measured in Gold the world was in recession from 2001-2010, or that idiot running the shadowstats website which shows inflation at 20% and zero economic growth for the last 30 years. Measuring GDP in USD is worthless exercise, but funnily the people that bring it up, don’t do so when it does not suit them. Like did you find anyone showing world gdp was booming in USD terms in 2007?

Steve, he’s quite correct about the Fed’s primary role, which I describe as running political cover for the TBTF/TBTE/TBTJ criminal int’l banking syndicate’s license to steal all of us bloody, bleeping blind.

After all, the TBTE banks’ owners own the Fed and the largest primary dealer banks, including foreign banks.

The Fed, “money”, and the fractional reserve banking/financial system is utterly misunderstood by the vast majority of the US population, but it’s not an accident that it is so. What we think we “know” to be true is a result of a century of propaganda, misinformation, disinformation, and, yes, outright fraud and theft of labor product, profits, and gov’t receipts for social goods by an infinitesimally small share of the US, Canadian, UK, Aussie, and European populations (and by extension and to a lesser extent Japanese, Mexican, South American, and oil emirates).

But note that the US$ in terms of gold and M2 crashed 75-80% already from 2000-02 to 2012, as it did in 1973 to 1981-82.

World real GDP per capita and capital and trade flows between the three major trading blocs imply that growth of trade and real GDP per capita is done and all major fiat currencies will trend toward parity with one another in the long run.

Huck, you missed the point.

Also, gold needs to be adjusted for the US$ and the differential rate of M2 to industrial production (and two more metrics I choose not to disclose).

If one does not understand the fiat digital reserve currency effects and money velocity and acceleration, as the overwhelming majority of us do not, then one will miss what is actually happening and the implications.

“…If one does not understand the fiat digital reserve currency effects and money velocity and acceleration…

BC,

there is no such thing as “money acceleration”.

-The velocity of money can accelerate, or (as it’s happening now) decelerate.

Total GDP is measured as: Quantity of Money (M1+M2+M3….) * Money Velocity.

Fed controls the Quantity – we (the people/market) controls Velocity (that is why our happiness -aka: consumer sentiment – is SOoooooo important for the FED!).

For reasons that go way beyond the scope of this respected forum – therefore I shall not go into – we are not spending (aka: velocity deceleration!).

It is quite a complicated (indeed intriguing and beautiful!) topic, but I hope I was simple enough.

Be well,

Petro

Is there a single textbook that *accurately* explains this federal reserve banking system in detail? I don’t care about the difficulty of the math, just am not interested in academic texts that are wrong.

“Is there a single textbook that *accurately* explains this federal reserve banking system in detail?…”

Nope!

They make it up as they go….

-The reason I “corrected” BC was not to be an inconsiderate, disrespectful smartypants….,but to ( as much as I can and when I can) kindly suggest (to BC and others in open forums akin to this one) that the fractional reserve system does NOT operate the way R. Paul, Chris Martenson (and others) understand it and present it to be operating.

-It used to, not anymore!

Why is this important (to you, I and others)?

For we have passed the tipping point and, no matter what one thinks about the FEDand co. and what “they” have done to bring about this dire situation, right now one should pray “they” keep holding the system up and running by ANY means…no matter how absurd they seem to an Austrian economist akin to R. Paul, Mike Malloney and Chris Martenson.

Indeed, pray that Yellen.and co. goes to the microphones every day and bullshits us with “stuff”….for that means the lights are on…

We live in “bonus time” my friend and who tells you that we can fix this by being fiscally responsible and/or re-instituting the “hard money”/honest money” system we used to have – knows nothing about modern money creation/mechanics (i.e.: Jim Sinclair; Chris Martenson, etc.. despite their good intentions!!!) – OR, knows it in detail, but wants to sell books (i.e. Jim Rickards).

So, it should matter to you and I for it alters our optics of the future and points it in the correct direction/understanding – no matter how dire and obscure that might be.

We have entered the “tunnel” and this one my friend has no “light” at the end …

The great ’50 and ’60s came after the 1930s and the WWII…not this time!

This time is indeed different!

And that is why you should care, and that is why i suggested to BC a somewhat “different” view from the classic fractional reserve banking and “honest money” view prevalent out there.

Be well,

Petro

The public is not supposed to understand how the Fed and the banking system works, i.e., the gov’t-enabled and -protected license to steal; otherwise, we might be compelled en masse to burn down the Fed, Wall St, the Capitol, and the White House.

Kid: ‘Daddy? Why are there rich people?’

“Cae-Dad: ‘What do you mean by rich? You mean like in spirit?’

Kid: ‘No-o-o-o-o… Like they have lots of big houses and cars and money!’

Cae-Dad: ‘Ohhh, you mean those kinds. Well, you see, sweetie, our society allows some people to make more money than other people, working no harder that anyone else. Society then allows those with more money to acquire more land than others. Over time, this creates the dynamic for most, if not all, problems we have in society today, from landlessness, homelessness and poverty, to social unrest, war and civilizational collapse.’

Kid: ‘Why does society allow that?!’

Cae-Dad: ‘Corruption. Society uses force to uphold the laws that say that one person with more money can have more land than another with less money.’

Kid: ‘Why can’t we stop that!?’

Cae-Dad: ‘Corruption again: This setup is upheld by people with guns and weapons, or access to them, like cops, security guards and military people– people who often don’t understand this basic and very simple immoral core of our society.’

Kid: ‘ 🙁 ‘

Cae-Dad: ‘Ya; 🙁 ‘

… …

James Howard Kunstler: “I voted for Obama twice.”

Kid: “F__k you, James Howard Kunstler!”

Cae-Dad: “Now-now, be nice… He just doesn’t know any better.”

Kid: “Why not!?”

Cae-Dad: “I don’t know. He should, but reality just doesn’t work like that.”

Kid: ” 🙁 ”

Cae-Dad: “Ya; 🙁 “

Always cheerful and amusing, Caelan!

…don’t forget though:

whether you agree with him or not, J H Kunstler is a great intellectual and independent thinker!

His writing style is always intriguing and ambitious.

We need people akin to him today more than ever….

Be well,

Petro

Good points taken, Petro, and I agree for the most part with regard to JHK, which is what makes his ‘state capitulation’ more confounding.

Speaking of the public not being allowed to understand the Fed, banking/financial system, “money”, etc.:

https://app.box.com/s/rvlhbckx959xahjysa30zwyallimx0qb

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=29JG

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=29JK

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=29Jl

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=29Kh

https://app.box.com/s/cik3teki4u11tj7erkxqh1t1lw0eayvj

https://app.box.com/s/t01wkzn5j1jz9kjmlqv5gwmy92pgvrzd

What have the TBTE banksters been doing as they instructed the Yellen Fed to incessantly talk up a hike for the reserve rate?

The TBTE banks anticipated another global deflationary recession as long as a year ago and began acting on it.

IOW, they have been instructing the Fed to talk rate hike in order to keep Treasury and agency rates higher and prices lower than otherwise so they can buy at a discount and later sell to the Fed at a premium when the Fed resumes QEternity and NIRP during the next recession (having already begun) in order to fund larger deficits to prevent nominal GDP from contracting with deflation.

Moreover, they have begun to increase C&I loan charge-offs as delinquencies rise, primarily in the energy and energy-related transport sectors, but that will spread to commercial RE loans, sub-prime auto loans, etc.

The Fed’s job is to run political cover for the TBTE banks’ license to steal, and in the process fool the vast majority of the people all of the time.

A resumption of QEternity is imminent as the global economy rolls over into another deflationary recession, only this time with a side order of NIRP as the hair-of-the-dog prescription for the debt hangover of secular stagnation and liquidity trap, following faithfully Japan since 1998 and the US after 1929-33 and 1937.

“…we are not spending (aka: velocity deceleration!).”

Petro – for the sake of accuracy I think you mean we are not borrowing. Big difference.

“Petro – for the sake of accuracy I think you mean we are not borrowing. Big difference.”

JEFF:

Incorrect, my dear friend!

-Although debt/borrowing is the source of currency ( well, 97% of it anyway. 1%-3% is direct govt/treasury creation), to contribute to GDP and economic growth it MUST complete the circle which is done ONLY by public/market spending it!

Otherwise is considered “hoarded” and does NOT contribute to the “quantity” that circulates and therefore is not counted in the GDP= Q*V equation (Q=quantity, V=velocity).

Money is not as simple to comprehend as reading somebody’s post (i.e. C. Martenson) on the internet, ok.

Is not wise to be “expertly” assertive in things you may not fully understand!

Be well,

Petro

“Petro – for the sake of accuracy I think you mean we are not borrowing. Big difference”

JEF:

Incorrect, my dear friend!

-Although debt/borrowing is the source of currency ( well, 97% of it anyway. 1%-3% is direct govt/treasury creation), to contribute to GDP and economic growth it MUST complete the circle which is done ONLY by public/market spending it!

Otherwise is considered “hoarded” and does NOT contribute to the “quantity” that circulates and therefore is not counted in the GDP= Q*V equation (Q=quantity, V=velocity).

Money is not as simple to comprehend as reading somebody’s post (i.e. C. Martenson) on the internet, ok.

Is not wise to be “expertly” assertive in things you may not fully understand!

Be well,

Petro

No, I think Petro got it right.

Think of it like Newton’s second law of motion, and the equation

F = ma

Where

F = force

m = mass

a = acceleration

The Fed, with various implements in its policy-making took kit, can pretty much control m, or the mass or quantity of money.

Controlling F, however, or the forces that compel human behavior, is a much more complex and difficult problem.

“Petro – for the sake of accuracy I think you mean we are not borrowing. Big difference.”

JEF:

Incorrect, my dear friend!

-Although debt/borrowing is the source of currency ( well, 97% of it anyway. 1%-3% is direct govt/treasury creation), to contribute to GDP and economic growth it MUST complete the circle which is done ONLY by public/market spending it!

Otherwise is considered “hoarded” and does NOT contribute to the “quantity” that circulates and therefore is not counted in the GDP= Q*V equation (Q=quantity, V=velocity).

Money is not as simple to comprehend as reading somebody’s post (i.e. C. Martenson) on the internet, ok.

Is not wise to be “expertly” assertive in things you may not fully understand!

Be well,

Petro

Jef, you wrote:

“Petro – for the sake of accuracy I think you mean we are not borrowing. Big difference.”

Incorrect, my dear friend!

-Although debt/borrowing is the source of currency ( well, 97% of it anyway. 1%-3% is direct govt/treasury creation), to contribute to GDP and economic growth it MUST complete the circle which is done ONLY by public/market spending it!

Otherwise is considered “hoarded” and does NOT contribute to the “quantity” that circulates and therefore is not counted in the GDP= Q*V equation (Q=quantity, V=velocity).

Money is not as simple to comprehend as reading somebody’s post (i.e. C. Martenson) on the internet, ok.

Is not wise to be “expertly” assertive in things you may not fully understand!

Be well,

Petro

My comments went “nuts”….

I have no idea what happened!

…forgive me….

be well,

Petro

Maybe it’s because you don’t comment here nearly as much as I’d like. So vex spell cast on your comments! ^u’

Be well, despite an unwell world,

~ Cae

Yes, acceleration/deceleration of the “velocity of money”. Thanks.

Watcher is correct, in that the kerogen/tar bubble is an existential national/regional/civilizational imperative for survival. Therefore, the Fed, banks, and gov’t owned by the top 0.001% owners of the banks and Fed will print, lend, bail, and tax whatever is required to keep the lower-quality, costlier, unprofitable kerogen/tar “oil” flowing, even if it means pumping unprofitably indefinitely at declining production and price.

That is, the energy debt, kerogen/tar, and blood will flow, even if it means the latter flowing in increasingly disproportionate share domestically and around the world to secure the former and the ongoing log-linear decline per capita of the US “oil” depletion regime since 1970-85.

“Early last month, Citi “exposed” what it said was shale’s “dirty little secret.”

” when rates are at zero and when the hunt for yield generates a perpetual bid for anything the provides investors with any semblance of income, the market never gets to punish uneconomic business models by putting them out of business” “Therefore, these same producers just produce, and produce, and produce some more, driving prices ever lower”

Sure what is obvious is obvious .. but why would an investment bank crow this out?

http://www.zerohedge.com/news/2015-10-13/theres-no-more-fat-be-cut-desperate-oil-producers-cut-salaries-save-mission-critical

The story below documents the ripple effects from the slowdown in E&P activity in the Bakken. If you haven’t looked at the sand that comes out of the western WI sand mines, it is of exceptionally high quality. Unfortunately, we are still waiting to see what a reclaimed frac sand mining site looks like.

http://www.startribune.com/wisconsin-sand-mining-operations-to-cut-jobs/332262632/

Local 332262632

Falling oil prices mean layoffs for Wisconsin sand mining companies

LA CROSSE, Wis. — Low oil prices are claiming more Wisconsin sand mining jobs.

U.S. Silica Co. plans to lay off an additional 16 workers at its Sparta processing plant, while Hi Crush Services plans to idle 27 workers at its plant in Augusta. That’s according to notices posted Monday by the Wisconsin Department of Workforce Development.

U.S. Silica is an exciting company to keep track of…

Unit train delivering U.S. Silica frac sand breaks record

U.S. Silica Holdings Inc. announced earlier this week the delivery of a record-breaking 150-car unit train carrying more than 16,500 tons of U.S. Silica White frac sand from its plant in Ottawa, Ill., to a transload facility serving the Permian Basin.

Delivered by BNSF Railway Co., the unit train of sand was the longest ever delivered to a single destination on a Class I railroad, U.S. Silica officials said in a press release.

“Delivery of sand by unit train is the most cost-effective means of transport, which is extremely important in today’s highly competitive marketplace,” said Don Weinheimer, U.S. Silica’s vice president and general manager of oil and gas.

U.S. Silica has plants served by all Class I railroads.

Although the U.S. land rig count is down due to lower oil prices, large volumes of sand continue to be required as current completion designs for wells demand increased volumes of sand per stage and more stages per well, according to U.S. Silica.

Company officials cited a recent report by PacWest Consulting Partners that estimated sand usage per well rose 26 percent between third-quarter 2014 and second-quarter 2015.

http://www.progressiverailroading.com/bnsf_railway/news/Unit-train-delivering-US-Silica-frac-sand-breaks-record–46083

I wonder why they use the words “upgrade mature oil fields”? It’s drilling, sidetracking or recompletions.

Meanwhile, on the weather front, it looks like the California drought is going to become the California floods

http://thehill.com/policy/energy-environment/256780-researchers-drought-busting-el-nino-increasingly-likely

And the Arctic ice seems to be recovering in spite of “record high temperatures”

http://ocean.dmi.dk/arctic/old_icecover.uk.php

Arctic sea ice extent is increasing a little faster this autumn than it has in recent autumns, but it is a minor weather based fluctuation. It is increasing from the 4th lowest extent on record, sharply down from last September’s minimum. Sea ice volume also fell sharply to below last year’s minimum, just above the 2013 minimum. Total ice volume melt (from winter maximum to September minimum) was the third largest on record.

In the Antarctic the ice area has seen the above average values of the last 2 years disappear, and area is now tracking back close to long term average. This meant that earlier this year global sea ice area briefly came very close to an all time record negative anomaly.

There is NO recovery in sea ice. The reversion to the mean of the last 2 years is over. The long term melting trend has returned. (except it cannot continue long term, as there will be no more Arctic ice to melt at minimum, probably within a decade)

http://nsidc.org/arcticseaicenews/

Arctic sea ice volume is about one half of it’s 1980 value. Some recovery. Only a few years to go to zero volumepoint.

Like I wrote, it’s mostly weather. But the current weather is really nice. The total ice area was96 % of the median on October 12th.

http://neptune.gsfc.nasa.gov/csb/index.php?section=234

The ocean around Antarctica is nicely covered with ice, plus it has an abnormally cold water ring around it. For example, here you can see the temperature anomaly for yesterday. Brrr!

http://earth.nullschool.net/#2015/10/13/0000Z/ocean/surface/currents/overlay=sea_surface_temp_anomaly/orthographic=134.72,-76.17,430

Meanwhile the sun is weakening as predicted by NASA

http://solarscience.msfc.nasa.gov/images/Zurich_Color_Small.jpg

Where does this add up? I don’t think global warming is really as bad as touted by Obama. I’m still saying the temperature increase will probably be a rather nice 0.6 degrees C by 2060-70. And that’s probably beneficial for the world economy.

…..

Interesting points. I never thought of those.

As usual, this is an absurd projection outside the bounds of what is possible from the evidence.

Meanwhile, on the weather front, it looks like the California drought is going to become the California floods

Well, that’s just dandy, ain’t it? I mean, floods are sooo much better than droughts… /Sarc

http://thehill.com/policy/energy-environment/256780-researchers-drought-busting-el-nino-increasingly-likely

“If it downpours heavily over a short period of time, it’s going to be dangerous, not just a welcome relief they perceive to be helping the drought,” Kelly Huston, deputy director of the state’s Office of Emergency Services, told the AP.

As for this: And the Arctic ice seems to be recovering in spite of “record high temperatures”

BTW, Why do you even keep posting this climate related stuff here? Please post it over at Real Climate where they will be more than happy to rebutt your nonsense.

I’ll try to ignore your climate related posts in the future.

Then I suggest you limit your learning to items which reinforce your beliefs

“1] Satellite observations reveal a greening of the globe over recent decades. The role in this greening of the “CO2 fertilization” effect—the enhancement of photosynthesis due to rising CO2 levels—is yet to be established. The direct CO2 effect on vegetation should be most clearly expressed in warm, arid environments where water is the dominant limit to vegetation growth. Using gas exchange theory, we predict that the 14% increase in atmospheric CO2 (1982–2010) led to a 5 to 10% increase in green foliage cover in warm, arid environments. Satellite observations, analyzed to remove the effect of variations in precipitation, show that cover across these environments has increased by 11%. Our results confirm that the anticipated CO2 fertilization effect is occurring alongside ongoing anthropogenic perturbations to the carbon cycle and that the fertilization effect is now a significant land surface process.”

http://onlinelibrary.wiley.com/doi/10.1002/grl.50563/full

Hi Fred,

Fernando is a poster boy of a sort that we all need to keep in mind- a professional with a lot of brains, very well educated in certain fields, who believes what he pleases outside that field.

It does not matter if you agree with him about the overlord Cubans and the Venezuelans being latter day commie dictators, or more as you put it just dictators. There is some reason for him to continue to talk about communism in this context. The historical fingerprints are clear enough in my estimation.

Most people no matter how well educated or trained (never liked that word , trained, we TRAIN dumb animals to pull plows) in the hard sciences most directly related to engineering work are abysmally ignorant of the life sciences.

We all need to be reminded constantly that we all have blind spots. A man can be a world class authority in his own line of work and as lost as a child outside his own line.

Eeverybody needs to be literate in math , physics/chemistry, biology, and history, both kinds of history- geological and historical.

It is depressing as hell when you face up to the fact that most university graduates these days are not even INTRODUCED PROPERLY to more than one or at most two of these fields.The only ones who really get a proper grounding in two are the scientific types, they get mathematics along with their specialty.

You can graduate from an Ivy League university these days and know no more about history, math, or science than I knew when I got out of high school. I know this is hard to believe, but anybody who wishes to do so can check the course requirements for getting various degrees. The catalogs are usually online and free access.

NOW HEAR THIS.

Anybody contemplating a move to away from the big city needs to hear this.

Even though I went to a backwoods rural county high school back in the dark ages, there was an advanced placement or academic track for the doctor, lawyer, Indian Chief and teacher’s kids – but not enough of them to fill the classroom properly so some other kids were shifted in, based on our test scores. I took a science and math course every year starting in the eighth grade, for five years, all advanced placement, and some years I got two science courses. In what would have been ” study hall” I took ag- which had its OWN A P class. Out of twelve of us in my ag class eight got our degree- which considering the time and place was extraordinary.

Incidentally even today your kid can most likely get a pretty decent education at a rural area high school if you make sure he is in these select classes- assuming of course he is either BRIGHT or willing to work his tail off.

The actual EXISTENCE of these classes is not much publicized .Sometimes the school district will deny they even exist, but they are almost ALWAYS there never the less. If you go to the typical open house and follow the lawyers ,doctors and elementary school teachers ( with older kids ) around and make note of WHICH classes, specifically, are taught in WHICH classrooms, at particular hours, by PARTICULAR teachers, you can identify them easily. ( Most of the teachers involved will also have to teach some “b” and “c” level classes too, maybe as many as four out of five. )

We are toast as far as average academic achievement goes these days, compared to the rest of the world.

Our high schools are tasked with maintaining attendance rather than teaching. Passing out diplomas is more politically expedient than passing out educated kids. Teachers have next to nothing in the way of real power to insist that students actually WORK at learning.Learning can be fun , but real learning is actually WORK for the most part. The average parent pays hardly any attention to what goes on at his kids school anymore, and never did, actually, except maybe for sports.

The NEA is a trade union, rather than an organization primarily concerned about kids and education. I know, I was a member of it for years.

Most universities are MUCH more interested in tuition money than in their end of the bargain- delivering the educational goods. Adjunct professors and grad students are poorly paid, but you don’t see much about hard up professors anymore- because most of them are actually paid quite well considering the work they do- work they WANT to do, generally as it suits them, when it suits them, with very little supervision. If I had my life to live over, I would be a professor of some kind in some obscure little college writing a paper about something important to me occasionally, and teaching a couple of small classes.

A typical degree earned these days is about as useful as a pig saddle in terms of really understanding what is going on in the world. Earned is perhaps too kind a word, half the degrees are simply SOLD in exchange for a four year vacation in hormone land.

God help us, almost all of our leaders these days are lawyers and know next to nothing about anything that really matters, except the law.

Venezuelans aren’t “later day commie dictators”. The Venezuelans are the victims of a newfangled type of communist. Venezuela’s president, Maduro, travels on at least a monthly basis to meet with and receive instructions from Raúl Castro.

https://www.hrw.org/americas/venezuela

A typical degree earned these days is about as useful as a pig saddle in terms of really understanding what is going on in the world. Earned is perhaps too kind a word, half the degrees are simply SOLD in exchange for a four year vacation in hormone land.

Yep, and that is putting it mildly!

https://goo.gl/p1XspW

When I was in high school, during chemistry class one day towards the end of the school year I overheard the chemistry instructor mutter the words, “I don’t know why we try to teach them anything when they’re at an age when they don’t want to learn a thing.”

You can lead a bull to the whatchamacallit, but you can’t make him stampede.

When I was in college one of my courses in chemistry required instruction in the use of a DU2 spectrophotometer. I asked a chemistry professor if it was possible to tear down the instrument to practice troubleshooting. There was nothing wrong with the spectrophotometer, I just wanted to see what was inside. Of course the professor thought I was off my rocker and the spectrophotometer wasn’t ripped apart by some idiot who had no clue.

If it ain’t broke, don’t fix it.

I asked a chemistry professor if it was possible to tear down the instrument to practice troubleshooting.

I guess you didn’t have Google back then? 🙂 If you do a Google image search for spectrophotometer today you get everything you could possible want. Diagrams, specs, parts lists, etc… you name it.

You were just born before your time…

Fred Magyar said:

So we’re calling out the censors, are we? And as always when it comes to authoritarian solutions, there’s more than just a bit of a double standard at work.

Maybe the reason why you and the others who claim to speak in the name of “science” are losing so badly in the marketplace of ideas and public opinion (as is evidenced by the graph I have attached below) is not so much because of the content of your arguments, but because of their form?

While I certainly don’t agree with much of what Fernando says, I nevertheless defend his right to say it.

I don’t go by polling to formulate my opinions. If I did I wouldn’t write anti Netanyahu content like this

http://21stcenturysocialcritic.blogspot.com.es/2015/04/netanyahus-two-state-solution.html

Glenn, he can post whatever he wants! This is Ron’s site. I just got tired of reading his nonsense and am suggesting he post it on a site where they have experts in that field to rebut him. As I said, it is my own fault for responding to his posts,I should know better and I will just try a lot harder not to do that in the future.

Glenn, He can post whatever he want’s this is Ron’s site not mine.

I just wish he would post that kind of stuff elsewhere and that was a suggestion on my part certainly not a demand. I find his posts on most things climate related to be nonsense.

He is known over at realclimate.org and they do not have a very high opinion of him there. I mean imagine that. A climate science site, run by climate scientists who say he is wrong!

OK, I admit it is my own damn fault for responding to him. Which is why I said I would try to do a better job of ignoring his climate related posts in the future.

Fred,

I was in Bolivia a couple of years ago, and we rented a car and went up into the foothills above La Paz for a couple of days.

The driver was in his late 50s or 60s. He told me that, as a child, the snow line on the Andes was much lower than it is now. I believed him, and I suppose that my belief that global warming is happening has much more to do with what my own senses tell me than the mathetmatical models the scientists create.

It might be interesting to take some old photos of the Andes and compare the snow line then to now.

This sort of goes back to something Daniel Kahneman said in the article you linked the other day:

You’re not thinking of saving two hundred thousand birds. You are thinking of saving a bird. The emotion is associated with the idea of saving a bird from drowning. The quantity is completely separate. Basically you’re representing the whole set by a prototype incident, and you evaluate the prototype incident….

There is even research showing that when you show pictures of ten children, it is less effective than when you show the picture of a single child. When you describe their stories, the single instance is more emotional than the several instances and it translates into the size of contributions.

People are almost completely insensitive to amount in system one. Once you involve system two and systematic thinking, then they’ll act differently. But emotionally we are geared to respond to images and to instances, and when we do that we get what I call “extension neglect.” Duration neglect is an example of, you have a set of moments and you ignore how many moments there are. You have a set of birds and you ignore how many birds there are. …

http://edge.org/event/edge-master-class-2007-daniel-kahneman-a-short-course-in-thinking-about-thinking

So sometimes less is more?

The take-away from what Kahneman and others are saying is that science communicaiton is a very, very complex undertaking.

Do people equate (and maybe correctly so) global warming with taking the punch bowl away?

And if so, does this explain why an entire array of escape mechanisms — denial, avoidance, procrastination, wishful thinking, mental laziness, etc. — are triggered?

Does the tone of the debate, in which science communication all to often boils down to charging that those who do not accept the scientific consensus are “stupid,” “ignorant,” “anti-science,” and driven by money, religion and politics, cause resentment and blowback? Are these charges true?

Now granted, we do live in an era whose tone was set by Ronald Reagan, and an entire industry has grown up to engender and appeal to the escape mechanisms. But nevertheless, more and more people are opting for myth over reality. Why?

At what point do we wake up, as the arbitristas did after the Spanish Empire had peaked and an atmosphere of desengaño had set in, and begin to “attempt to discover at what point reality had been exchanged for illusion,” as Cervantes and many others of his era did?

I believed him, and I suppose that my belief that global warming is happening has much more to do with what my own senses tell me than the mathetmatical models the scientists create.

Sure, that’s fine and the actual scientific data back up those observations. Pictures are not hard to find either. Google Images has plenty.

https://en.ird.fr/the-media-centre/scientific-newssheets/424-the-dramatic-retreat-of-the-andean-glaciers-over-the-last-30-years

The dramatic retreat of the Andean glaciers over the last 30 years

February 2013 Scientific newssheets

Print

© IRD / P. Blanchon

The glaciers in the tropical Andes shrunk between 30 and 50% in 30 years, which represents the highest rate observed over the last three centuries. IRD researchers and their partners( 1) recently published a summary which chronicles the history of these glaciers since their maximum extension, reached between 1650 and 1730 of our era, in the middle of the Little Ice Age*. The faster melting is due to the rapid climate change which has occurred in the tropics since the 1950s, and in particular since the end of the 1970s, leading to an average temperature rise of 0.7°C in this part of the Andes. At the current pace of their retreat, small glaciers could disappear within the next 10 to 15 years, affecting water supply for the populations.

Life without oil may be hard but life without adequate supplies of drinking water is one heck of a lot harder…

Bolivia, I am told, is one of the countries like Mexico which will be devastated by the changes brought about by global warming.

It is my understanding that much of Bolivia’s fresh water supply comes from the glaciers. And once they are gone, then what?

I recommend reading Glaciers: The Politics of Ice, covers a lot of the problems and actions in South America concerning water supplies from glaciers.

Bolivia is overpopulated. They need to use family planning.

” The TFRs for indigenous and nonindigenous women were 4.3 and 3.1, respectively. The wanted fertility rate for indigenous women was nearly the same as that for nonindigenous women (1.5 and 1.7, respectively);” https://www.guttmacher.org/pubs/journals/3516609.html

They want fewer children, but something is getting in the way – religious barriers to contraception?

I suspect it’s a combination of religious barriers with ignorance and a bit of social breakdown (teenage pregnancy).

We used to finance an anthropologist who worked on this topic as part of a program we had to reduce poverty. She advised us the key was to keep young girls from getting pregnant, in school.

I tried an experiment with my cook’s family. Offered a scholarship to one of her daughters. She stayed in school, never got pregnant that I know of. She has a law degree now. The question now is whether she’ll find an educated guy she will want to have children with.

You did good.

Your cook was also a good mother. Many fathers are not, and many Latin American countries don’t protect young women from bad fathers, relatives, boyfriends, etc.

“This appalling case highlights several of Latin America’s abiding ills. The first is child abuse. While the plight of street children and child prostitutes has received a lot of attention, most abuse occurs in the home. Although there is little data, there is no reason to believe it is less prevalent than elsewhere in the world. It may be more so. Bolivia’s ombudsman reported that 34% of girls suffered sexual abuse before age 18. Studies suggest that up to 36% of Latin American adult women suffer domestic or sexual violence.

The second affliction is teen pregnancy, which is extraordinarily common given the region’s level of development. In Latin America 69 in every thousand girls aged 15-19 gave birth in 2012, according to the UN, a rate that is exceeded only in sub-Saharan Africa. The rate is higher than 80 per thousand in six countries in the region: Nicaragua, the Dominican Republic, Guatemala, Guyana, Honduras and Venezuela.

For very young girls the problem may be worsening. According to the UN Population Fund, over the past 15 years or so six of eleven countries in Latin America for which it has data saw a rise in pregnancies among girls aged 10-14. This is almost always the result of abuse. In Paraguay, whose population is 7m, there were 680 births to mothers under 15 last year”

http://www.economist.com/news/americas/21652331-latin-america-fails-protect-rights-and-lives-its-teenage-girls-suffer-children

Let me see if I can get the pope to approve family planning sermons.

But, this article is about abuse. Seems like a tough sell to get abusers to wear condoms.

The data is HERE when it comes to the ice mass trend over the last ten years.

http://psc.apl.washington.edu/research/projects/arctic-sea-ice-volume-anomaly/

And this is the Antarctic ice report, the one the media “forgets” to mention.

http://nsidc.org/arcticseaicenews/

And for an update, it looks like Arctic ice is reaching a very nice extent at this point in time. Check this out.

http://ocean.dmi.dk/arctic/old_icecover.uk.php

Again GW is quantum physics…

In anticipation of The Great Electrical Revolution and turning away from FFs, I have turned back the clock here in the UK and increased our electricity consumption, vs. natural gas, in a marginally innovative way.

The colder winter weather also brings shorter days so come October we swap low Wattage light bulbs for traditional incandescents. These simple devices, much cheaper than fluorescents and LEDs (we bought 50 years’ supply before they went off the market in Europe), give out 90% heat in a most pleasing manner. They dim to a warm orange colour, make no noise, are long-lasting and are pleasingly low-tech. All switched on we get about 2.5kW heat – perfect for a cold winter’s day!

Jonathan, what temperature do you mean when talking about a cold winter day?

.oops, sorry…

It’s 12 degrees in England, going down to 9-10 degrees C. Barcelona has 19 degrees, going down to 12 C. But I have my windows open. My thermometer says its 23 degrees C ?

It’s been getting down to 3 to 5 C here at night. 40 degrees N latitude.Supposed to hit zero C here by Saturday. Don’t have that Gulf Stream effect. Lowest winter temps here are about -30 C.

Fernando, while you are denying that global warming will have much effect, it has been 100 F (38 C) this week near Austin, Texas. Not only have we been breaking temperature records every day, but this has broken the all-time record for how late in the year it has been this hot by 10 days.

Techsan, I guess you don’t have the reading comprehension skills required to follow what I write. Global warming is a secondary problem. As of this year, 2015, the warming we have experienced is positive. It will probably remain a positive impact on humanity until 2060 to 2070. We will see peak oil and peak gas before 2060. Therefore a low cost energy shortage is a much larger problem. So are overpopulation and the way the American political elite is degenerating into a bunch of imbeciles (figuratively speaking, of course).

Down to -5C. The house is 18th C, but pretty well insulated. With 2.5 kW or so it can maintain a 25 degree C difference with outside ambient temp. It’s not very large, though, by US standards. But it does get some extra from cooking, kettle, and appliances – say 3.5 kW in all.

When it gets up to -5C around here in the winter I think that spring is coming. That would be a high temperature in the winter. For several weeks last winter the highs were hitting -15C or lower.

Wood is a decent alternative here since it is free at times. Otherwise it’s about 10 dollars per million BTU split and dried.

Jonathan, 2.5 kw to heat in the winter is not much. Around here the typical house needs 7 to 10 kw on the coldest days ( minus 10 to minus 20 Fahrenheit).

Here are my local energy costs per million BTU

Fuel Oil $12.54