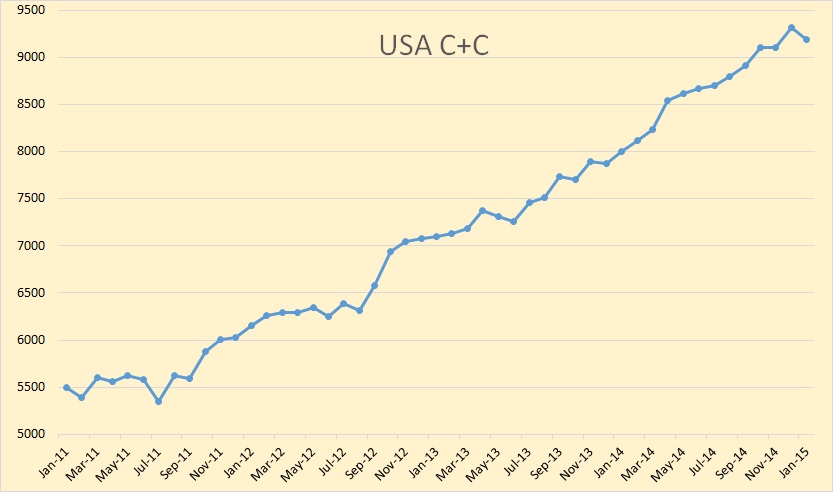

The latest Petroleum Supply Monthly is out with the USA production numbers for January 2015. The data is thousand barrels per day with the last data point January 2015.

US C+C production was down 135,000 barrels per day in January. That is the biggest monthly decline since July of 2011.

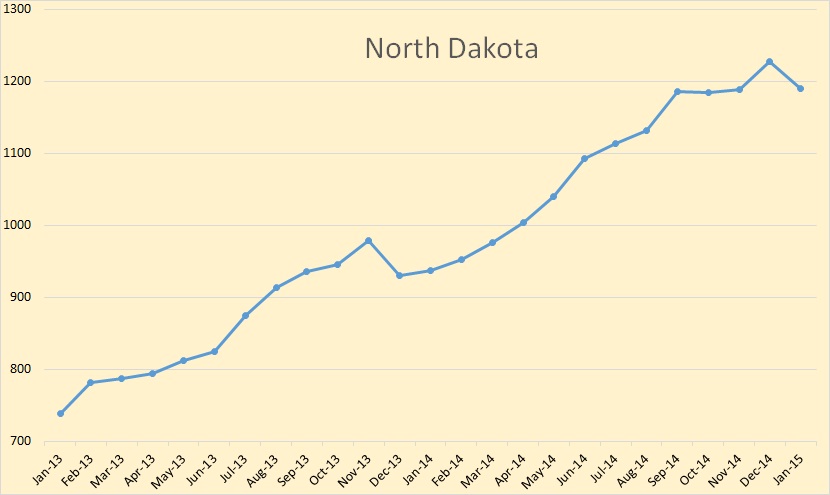

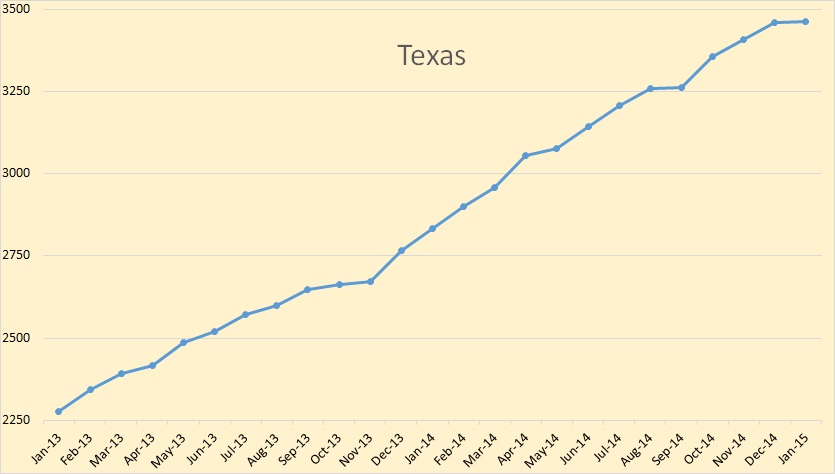

I have shortened the states data to 25 months in order to give more emphasis on the January 2015 data.

North Dakota was down 37,000 barrels per day, exactly what the NDIC reported. That is because the EIA gets their data from the states.

Texas was almost unchanged, up 3,000 bpd. The EIA gets the same data as we do from the Texas RRC so we know the data is incomplete and this is just an estimate. I believe this estimate is too high. I believe Texas should show a decline in January.

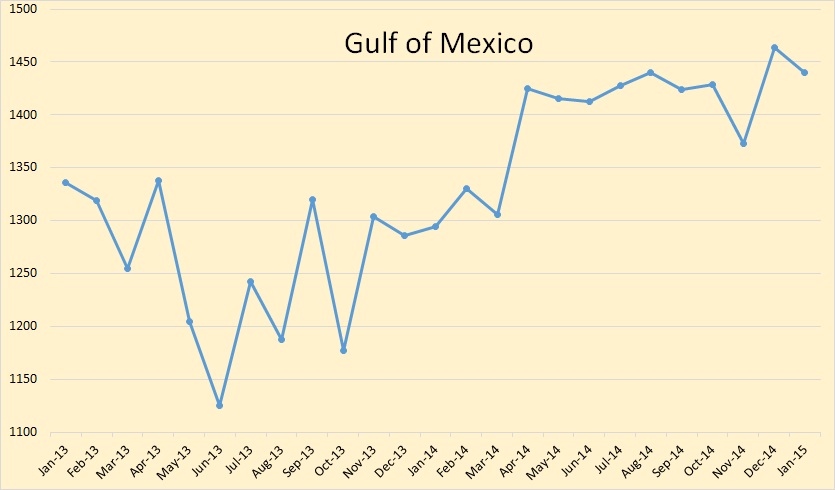

Production in the Gulf of Mexico was down 24,000 barrels per day. This could just be normal variation however, as such variation is common in the GOM.

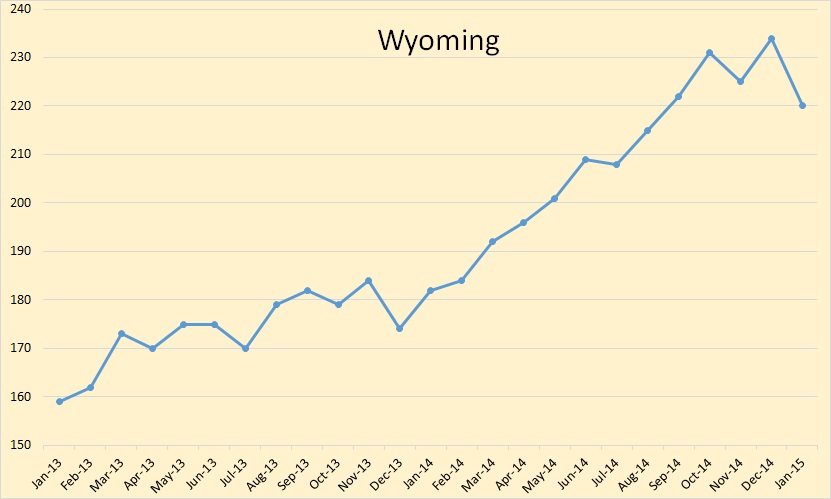

Wyoming was down 14,000 barrels per day. A huge drop for such a small producer.

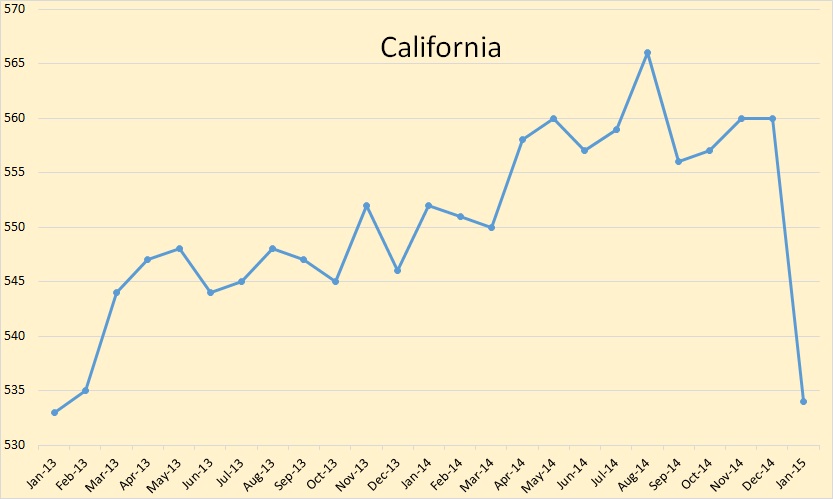

I don’t know what happened to California but they took a real hit, down 26,000 bpd or almost 5 percent of their production.

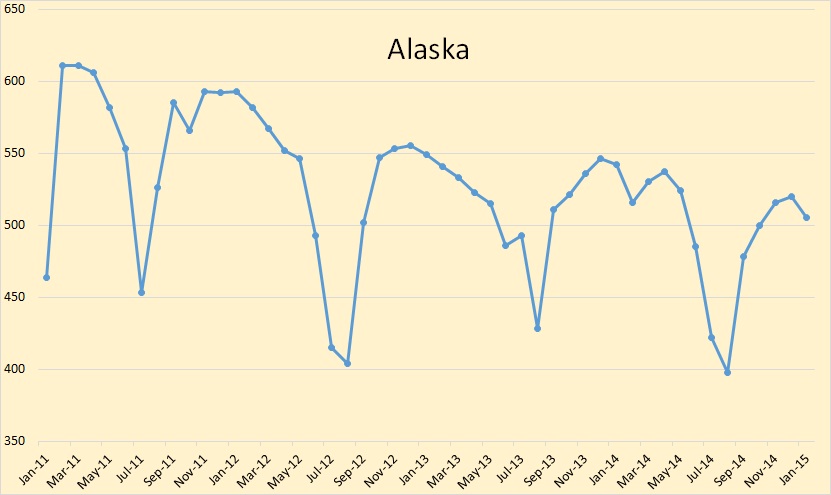

I am back to a 4 year chart with Alaska. Alaska was down 15,000 bpd. December is usually the peak month for Alaska and they do their maintenance in the summer.

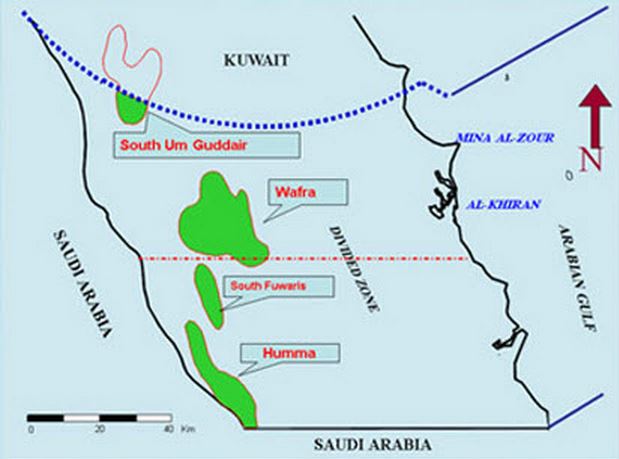

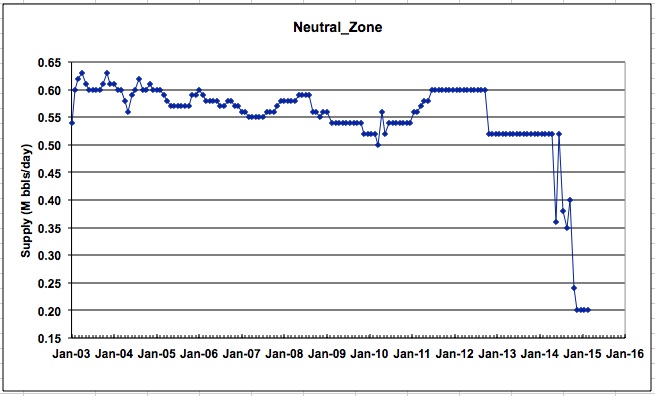

Will the Kuwait-Saudi Neutral Zone be the first area to go over the Seneca Cliff.

The Neutral Zone consist of four fields and part of a fifth. Not shown here is the Khafji field which is offshore.

Chevron – Aramco – KOC validate Wafra Steamflooding

In 2009, Chevron decided to test the thermal “EOR” enhanced oil recovery techniques with steam injection through the Large-scale Steamflood Pilot (LSP) project.

Since then the results of the steam flooding process enabled Chevron and its partners Saudi Aramco and its partners to envisage the development of Wafra in phases.

For the Wafra Phase-1 project, the operator KGOC is planning to invest $5 billion capital expenditure to produce 80,000 barrels per day (b/d).

The whole area is down from 600,000 barrels per day in 2011 to 200,000 barrels per day today. Apparently Wafra is down to almost nothing. But there is no doubt that part of the huge drop in Neutral Zone production is due to the shutdown of the Khafji field.

Kuwaiti production slid 60 kb/d to 2.76 mb/d in November due to the extended closure of the Khafji oil field in the Neutral Zone, run jointly with Saudi Arabia. The offshore field had been pumping about 300 kb/d before Riyadh shut it down on technical and environmental grounds. The Wafra oil field, in the onshore portion of the Neutral Zone, continues to produce about 200 kb/d. It is still not clear when Khafji will return to full production. For Kuwait, the Neutral Zone, which accounts for nearly 10% of its overall capacity, is vital to meeting output goals. In terms of Saudi capacity, however, the Neutral Zone accounts for only 2%.

In other news: Rosneft’s Vankor oil output may start declining next year

“(Vankor’s) oil production will stay at the plateau of 22 million tonnes this year, while next year it may decline slightly,” said Alexander Cherepanov, the chief engineer of Vankorneft, a Rosneft subsidiary which is developing the field.

The latest giant, or almost giant, to come on line in several years may be not what it was originally cracked up to be.

EDIT: Texas natural gas, oil production down in latest reporting periods: regulator

In the commission’s final production estimate for January, the state produced 81 million barrels of oil and 536.3 Bcf of natural gas. The commission’s final production estimate for December was 83.7 million barrels of oil and 553.2 Bcf of natural gas. The commission’s final January 2014 production estimate was 69.9 million barrels of oil and 566.5 Bcf of natural gas.

This works out to be 2,700,000 barrels of oil in December and 2,613,000 barrels of oil in January, a decline of 87,000 barrels per day. This does not include condensate.

_______________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne@gmail.com

What happened in July 2011 to do the downtick?

Oh and I think I remember noticing a sharp smack to Calif’s drill rig count.

Hi all,

The edit function will be disabled for and hour or so.

Test it is working again, sorry if I messed anybody up.

Hi Ron,

I may have missed it because I skimmed quickly. The Dec estimate for C+C output was revised up by about 100 kb/d, so one wonders if next month the January output may be revised higher, the January estimate for the Monthly energy review and the Petroleum Supply Monthly are almost identical, but the Petroleum Supply Monthly(PSM) has Dec 2014 output about 100 kb higher than last month’s PSM and the most recent(March) Monthly Energy Review.

For the last 5 months from Petroleum Supply Monthly we have in millions of barrel per day

Sep 8.9

Oct 9.1

Nov 9.1

Dec 9.3

Jan 9.2

In Jan 2014 output was 8 million barrels per day so output has increased 15% in the last 12 months.

This may be the beginning of a sharp decline or the start of a plateau at 9.2 to 9.3 Mb/d, next month’s data will help us decide, I expect about 9 Mb/d in a month or 2, but a rebound in oil prices will keep output at that level or maybe a slight rise back to 9.3 Mb/d by 4th quarter, that depends on the oil price ($80/b or more will likely get us back to Dec 2014 levels).

I agree with Ron that when the dust settles Texas will be down from 12/14 to 1/15.

I also think absent an oil price spike, numbers will continue to trend lower throughout the year.

Just not nearly as many brand new 1000+ IP wells being put online as in 2014, and that has to show up at some point.

One further note, notice MRO down to two rigs running in Bakken, with one listed to stack. MOC is a conservative company, they have a tremendously strong employee safety culture, for example. They are not the type of company to throw money down a hole.

Dennis, I think it is just as likely that the revision next month will be down as up. Every month was revised this month back to January 2013 with the average revision up about 23 kb/d. But other months in the past the revisions have been just as strong in the downward direction.

As revisions come in from the states, the EIA revises their data and the biggest revisions likely come from Texas. That is why I think this January number will be revised downward.

Hi Ron,

You are probably right, I don’t follow this as closely month to month. I doubt it will fall below 9 Mb/d before June and if prices recover to $70/b or more by Sept, I think output will stabilize or increase slightly by years end. Oil price is the big wild card, if they stay under $60/b long term, then the output might fall to 8.5 Mb/d by Jan 2016 (this scenario is unlikely imo).

I guessing the drought in California wouldn’t really have any effect on oil production. There not any massive infilling projects out there are there?

Ron, the note says the Saudis shut in a 300,000 BOPd field for technical reasons. I suppose it’s technical and they increased production elsewhere to make up this loss?

Only half of that drop, or 150 kbd was Saudi’s. Their production was down 90 kbd from October to December and the other 60 kbd could be anywhere.

Ok, so they take a 150kbd net cut, increase 60 kbd somewhere else, and have an effective 90 kbd reduction. They may not have the spare capacity to make up the full 150 kbd loss?

Some interesting stats on Oklahoma earthquakes in the following Bloomberg article:

http://www.bloomberg.com/news/articles/2015-03-30/big-oil-pressured-scientists-over-fracking-wastewater-s-link-to-quakes

Interesting moral question. Is it more important to have $20 million diabetes centers than it is to not have a bunch of largely imperceptible quakes.

Study: Oklahoma’s daily small quakes increase risk of big ones

http://www.pressherald.com/2015/02/15/study-oklahomas-daily-small-quakes-increase-risk-of-big-ones/

There was a 5.6 earthquake in Oklahoma in 2011:

http://en.wikipedia.org/wiki/2011_Oklahoma_earthquake

1:2500 vs diabetes center.

Boren btw is the real deal. Moderate GOP Senator for many years who left some time ago to take that univ prez job, and obviously decided to keep it — 20 yrs. Michael Price, of “Mutual Shares” fame, also left Wall Street for Oklahoma Univ and brought his money with him. That place does have brains and bux.

Boren is, and always has been a democrat.

Yup, my bad.

Laughable — Americans have no idea how yawn-inducing they are or how childish they sound in substituting the clichés of partisan politics for thoughtful discussion

Interesting moral question?

To me a more interesting question is that all if this surplus energy hadn’t been spent on creating a society where people sit all day in front of screens for work and entertainment while munching french fries and fat burgers and processed chicken nuggets and drinking oversized cups of carbonated corn syrup, is it possible the we might not even need those $20 million diabetes centers at all. Gotta wonder what might happen if we learned how to walk, ride bicycles, eat healthy and at least occasionally turned off our electronic communications devices and actually had face to face conversations now and again? Nah, that would probably be a really bad idea…

I won’t be sorry if the scarcity/price of oil reduces the amount of corn grown for corn syrup.

Fred, you are probably very right. Lifestyle is a big factor in diabetes and cardiac epidemic in this country. Personally, I dropped TV years ago, because content was mostly valueless to me and the few shows I used to like I could get on my computer. Now I have little or no interest in TV shows at all.

However, the whole TV/Cable thing is changing. TV will be on most computers and other devices and on demand. So I doubt if the problem will go away soon.

As far as food goes, just eating food that doesn’t need a list of ingredients label would benefit a lot of people. You know, real foods that you have to cook at home (not just heat in the microwave). I was already eating a fairly healthy diet when the final straw happened. I like fruit pies, oftentimes make them myself, but went to buy one in a supermarket. The list of chemical ingredients was amazingly long. I put it down and now don’t eat commercially prepared food if at all possible. Who knows what that stuff really does to you.

How we could convince a large population to convert away from sugar/starch/ chemical garbage I do not know. We live in an age where most people want everything done for them and they want to spend as little time as possible on the mundane things in life (like cooking) and spend their time watching mindless entertainment or playing computer games, or texting incessantly.

Just to diferentiate re: diabetes (apologies for those who know this already)

My wife developed Type 1 diabetes at age 13. It is an auto-immune disease similar in origins to lupus, rheumetoid arthritis, etc…where an over-active immune system goes on to attack a part of the body. In a diabetic’s case, the immune system destroys the pancreatic islet cells that produce insulin. It may have started with a cold? No one knows how it starts. It didn’t start at 7-11, that much is for sure.

What is often disparingly referred to as ‘diabetes’ is actually type 2, where your body produces insulin but has trouble absorbing it (usually due to poor diet and being overweight, but not always), thus resulting in higher blood sugar levels.

In my wife’s case, who is in excellent physical condition at age 55, if she strays from a healthy life style and screws up her regimen, she will die in short order, either in a diabetic coma (first recognized as almost drunk-like behaviour, followed by a sweating convulsion) or will soon destroy her body much like a type 2.

Her excellent health is due to the great insulin now available, and blood testing kits (than you micro-electronic sensors and the people who made invented them). Also, I attribute this to her good character and determination, + the excellent medical care she receives from BC Medical Services (single payer).

I always like this next part….besides his sharing credit and noble prize winnings with fellow researcher Banting gave away the rights to ‘insulin’:

“Banting, Macleod, and the rest of the team patented their insulin extract but gave away all their rights to the University of Toronto, which would later use the income from insulin to fund new research.

Very soon after the discovery of insulin, the medical firm Eli Lilly started large-scale production of the extract. As soon as 1923, the firm was producing enough insulin to supply the entire North American continent.”

Imagine….giving the rights away to the university. It is a different world, these days.

My point being, I am a little sensitive about the term diabetes tossed around as if it is all a result of chunking up treats at the table and no exercise, or a lack of character. I have also met very fit people who have gone on to develop type 2 diabetes and need insulin. May it never happen to you good folks.

I have also read doomers who believe that folks who develop diseases such as dibetes should just be allowed to die….as if they deserved to get sick. It is not that simple. My wife has made huge contributions to her family, community, and career. The world would be poorer for her not having lived.

We are heading out in 20 minutes to go buy some kayaks!! Have to run.

regards

Paulo

From New England Journal of Medicine -2001

“A total of 91 percent of the cases of diabetes in this cohort (95 percent confidence interval, 83 to 95) could be attributed to habits and forms of behavior that did not conform to the low-risk pattern.

CONCLUSIONS:

Our findings support the hypothesis that the vast majority of cases of type 2 diabetes could be prevented by the adoption of a healthier lifestyle.”

http://www.ncbi.nlm.nih.gov/pubmed/11556298

The food industry is very much to blame, filling everything with sugars and pushing starches, as well as adding a long list of chemicals to our diets. About 60 percent of people cannot handle sugar surges well, causing diabetes and cardiovascular problems, also eye problems. If society would really push the info hard at people as to the risks, maybe more would eat and act sensibly.

There are so many great medical advances out there now. A friend of mine works for a company that made a device using modified EEG to detect eye problems in infants so that many can be saved from blindness before it is too late.

Good luck to you and your wife, a tough road to follow but enjoy life as much as you can. I lost my wife last year after a nightmarish decade long struggle with multiple cancers. We used to love whitewater kayaking and rafting together.

All the best to you too, Allan. This life business is tough for us all at one time or another. Thank you for your reply.

Hi Paulo,

Yes I am aware of the difference between Type 1 and type 2 diabetes. I was indeed referring to Type 2 diabetes which in our society is the overwhelming majority of the cases and it is generally exacerbated by poor diet, lack of adequate exercise and consequent obesity. And as I’m sure you are well aware there is very little incentive for preventive health care in this country. So we end up with a perverse system where 20 million dollar diabetes clinics are seen as the best solution to the problem.

I certainly wish you and your wife the absolute best! I myself gave up watching TV back in 2006 with all its mostly contentless programming. Haven’t really missed it. I do spend time on line but at least I get to access information that interests me personally. Perhaps I am deluding myself somewhat that this is a better use of my time but at least I feel that I have a little bit of control.

I have also been an avid ocean kayaker since 2000 and use my kayak as a diving platform out on the coral refs near my home. So I can highly recommend that activity, may you and your wife spend many many hours enjoying being out on whatever bodies of water that you may wish to explore!

Cheers!

Fred

Are the earthquakes taking place in the same horizontal plane where they fracture to produce natural gas?

Most researchers are attributing the increase in earthquakes to wastewater injection wells.

The epicenter depth generally is a few to many thousand feet below the frac depths (horizontal plane) of productive zones. Water injectors may be diverted below the production zones though, to keep from circulating water back to producers.

3.0+ Earthquakes in Oklahoma (2015 on track for 875):

Jeffrey: It would be great to have graph of barrels injected to compare to that.

I had the same thought – but can’t find anything as of yet.

There is the grand-daddy of injection wells and earthquakes,

the Rocky Mountain Arsenal injection well.

http://earthquake.usgs.gov/research/induced/pdf/Healy-et-al-1968-Science-%28New-York-NY%29.pdf

Right hand side of figure 1 shows good correlation between volumes of fluid and number of earthquakes.

Most of the wastewater is due to the rise of dewatering wells, and is being injected near okc and a bit north, where there have been a few 4+’s the past few months (the 5’s were near Prague on a different fault system). There really needs to be better regulation about the injection pressures that are allowed to limit the incidence of eq’s. Hamm’s tactics are a pure attempt at strong arming and it would be nice if there were some way to impose penalties for such behavior. Hopefully the drop in oil prices shuts in some of these dewatering wells down too and that exacts some punishment on Hamm.

Watcher,

Look up a term called the b value. Basically it shows that as lower magnitude eq’s increase, large eq’s scale with them (albeit logarithmically). I have to check the data (at home now), but I think the latest b values are showing that 5’s are likely to occur every 2-3 years, 6’s around 50, and 7’s every few hundred (maybe 700 if memory serves). Of course these are just estimates, but the risk only rises as fluid injection continues in the same formations that are already overpressured. One magnitude 6 or 7 could easily do billions of damage, not to mention possible loss of life, so I’d say it is important to limit the eq’s so they don’t wreck the $20 million diabetes center, plus lots more.

Hillson: Am not in earthquake prediction business but very intersted in the science and graduated before hearing of “b” values.

Was there at one time a thought process that small quakes were regional stress releasers that would actually lesson the chance of bigger magnitude, or at least divert the stress to another area down the fault? I also have been curious that in pulling up maps of epicenters they appear very scattered as opposed to lining up along one fault. Could we be looking at more of a regionally stressed area fracturing when friction is reduced by the injectors?

Not exactly. Injecting fluids at the pressures and rates they have been has changed the stress state in the subsurface dramatically. Easiest way to think about it is more small eq’s means more big ones too.

MBP, where for out thou?

Reverse faults, normal faults, thrust faults, whatever kinds of faults they might be, sometimes grow with depth (get bigger) and sometimes fizzle completely out with depth. They don’t often exist from surface to CE. Injecting waste water at 10,000 feet need not cause Mother Earth to burp at 7000 feet. She is always moving, doing Her thing, earth; I have had 30 year old production casing part, break in two, in a fault plane before. Its not like natural things stop occurring just because humans are around for a brief moment in geological time.

I often believe these shivers (we get them a lot in S. Texas too) are from massive amounts of produced water withdrawal along fault systems and pressure depletion. Injection wells are typically found in areas of production, and in areas of very high WOR. Just a thought.

Mike

Mike: Do you know if any injection wells were shut down in the Barnett earthquake swarm area?

No, sir, I do not believe so. I recall the TRC stating there did not appear to be any correlation but was going to “study” it some more.

Thou has been out looking at some moldic crinoid dolopackstone and wackestone cores. I am not a structural geologist, so though I took structure classes in undergrad its not something that I have focused on since then. There are probably people who have more knowledge on the subject than I do. That being said, I could see the small earthquake related to larger ones both ways, either by reducing overall stress or creating a situation where a major fault is more prone to slip. If anyone has any papers on the subject I’d like to read them.

I don’t think frac’ing a well will cause an earthquake that could be felt, I’ve looked at our microseismic and the propagations are not very far and there just isn’t that much water being put into individual producing wells. I’m sure it is technically possible but I just have yet to see the evidence for it. I do think that SWD wells could cause problems in the right tectonic environment, but the biggest issue to me is injection pressure. Many SWD wells inject above fracture pressure, which is dumb, and I think if they reduced the rates on those wells the earthquakes would reduce in frequency.

MBP, we inject above frac pressure because the disposal wells get the crap picked up by vacuum trucks, flow back, and mud. It’s not something I decided, but that’s just how it was done. Bottom line is I have seen wells take 10,000 bwpd year after year , all above frac pressure gradient. The disposal fall off shows the pressure builds. When I was supervising these things I made sure we didn’t have losses to through the upper seal at the well (ran temperature logs in offset producers). But I’ve always felt we didn’t do it 100 % right. By it I mean the water handling, and the way we had allowed the vacuum trucks to dump into the main water disposal tank. I assume it’s the same all over.

Do they do any Cutting re-injection in the lower 48?

In Sakhalin, they loved their re-injection well. All things went down, invert mud, cuttings and even cement, nicely sweetened with ample sugar.

These wells were definitely above fracture point, and also we were in a very seismic area. I haven’t heard of a big one there yet unless you count the 9.0 off Japan in 2011? smiles!

I went back and checked the data just to make sure I reported the right info. Using a simple b-value analysis, the frequency of EQ’s related to the current injections (2009-2015) are:

Mag 5 – every 5-6 years

Mag 6 – every 150-200 years

Mag 7 – every 4500-6500 years

whereas for the time period of 1970-2008, the frequencies were much lower:

Mag 5 – every 100-110 years

Mag 6 – every 900-1000 years

Mag 7 – every 7500-8000 years

The trends converge around Mag 7.2, indicating there is little effect of fluid injection on the very big EQ’s of Mag 7 or greater.

So my memory was way off for the 7’s, but the 5’s to 6’s are still very much a possibility in the near future, especially if fluid injection continues.

Image below (sort of) shows how these estimates were made.

Real Estate Fiesta in the Dallas/Fort Worth Area

Bloomberg: It’s almost impossible to buy a house in Dallas:

http://www.bloomberg.com/news/articles/2015-03-27/it-s-almost-impossible-to-buy-a-house-in-dallas

Down here in Houston, where we’re more tied to the oil industry, it’s a similar story. Housing inventories were at historic lows. There was a huge boom in detached single family, townhome, and apartment construction over the last few years. Now that the economy is slowing, there’s a developing glut of apartments and townhomes while SF housing development never caught up to demand.

One of the interesting aspects of the oil crash is the statistic that for every oil-related job in Houston lost, there are potentially 4 non-oil-related job losses. Government and business leaders down here are still optimistic, however, that this won’t be like the 80s because Houston has diversified into meds and IT. That 4-to-1 job dependency number doesn’t seem to reflect that hope. They also are counting on growth in the refining and chemical sectors to offset the upstream slowdown. But as I understand it, the success of the upstream sectors relies heavily on the Brent/WTI spread which narrowed as demand receded (until lately, when domestic oil stocks have been filling up).

I think Houston is in for a world of hurt that everyone is ignoring. Houston’s boom has been directly related to high oil prices. In effect, Houston has been living off of the massive wealth transfer from suburban America to the oil companies to go find that hard-to-reach oil. I don’t think demand will recover enough to rekindle the speculation necessary to keep the shale boom going again. So remember that next time you hear Rick Perry talk about the Texas Miracle.

Houston, you have a problem. Face it. The fundamentals of your existence are breaking down.

I was utterly stupified when I saw this Space Shuttle on the parking lot of the Nasa Space Center. It’s just corroding until it has disappeared, while you are looking at it.

My friends do not believe this. “Is this America?”

You could maybe adaptively-reuse that for a home with some architectural intrigue and panache… Imagine those thermal tiles on the kitchen floor or those engine exhaust cones on top of a trullo-like roof!

But if we had pure democracy, we’d be on Titan (etc.) by now, with truly robust, reusable spacecraft; liquid methane lake beachfront property and Earth-origin genetically-modified life swimming around; a terraformed Mars with a new moon, from a knockup of Phobos & Diemos and a few asteroids, circling it for some Earthlike tidal forces; Lunar cottage-country & low-grav sportsplexes; and Jacque Frescoworld (He’s 99 years old!) here on Earth, with Nick G ‘Can Do!’ EV valet-parking and PV-cleaning/polishing clones.

These could be where the clones sleep. It’s possible! Don’t let peak oil get you down! Everything will be fine! You’ll see!

Now some people might exclaim, ‘How can you let those poor clones sleep in those things?’. But then, BAU has built a world around us and expected us to ‘live’ in it whether we like it or not, so why not?

Keep up the good work, Caelan.

Your cover is secure.

[as usual, destroy this message upon reading]

——————-:END TRANSMISSION:——————–

Hey, still beats sleeping in a shack with a tin roof!

Or you could try micro dwellings >;-)

http://n55.dk/MANUALS/MICRO_DWELLINGS/micro_dwellings.html

Cheers!

They must be those things from where people do podcasts. (I always wondered about that. Now I know.)

Incidentally, is that your bamboo bike? I like, except for the yellow rims. I’d have gone with a neutral color, that way they are accentuating as opposed to overriding the bamboo’s natural color. Aside from that, how’s the ride? I imagine the bamboo naturally dampens some of the vibes?

Apparently, bamboo is a type of grass, so it’s a grass bike.

By the way, the fashion with men’s shorts seems to have gone back up over the knee and are generally tighter, less loose.

Thanks to your inspiration– ‘shack with a tin roof’ (which I think would be a fun project to renovate)– I found this cool site that I’ve bookmarked. It is one of those sites that, if you keep scrolling down, more pops up, and at a cursory glance, there’re some very nice shacks.

Speaking of podcasts, I’m listening to Ecoshock Radio.

Aside from that, how’s the ride? I imagine the bamboo naturally dampens some of the vibes?

Apparently, bamboo is a type of grass, so it’s a grass bike.

Roger that sir!

I’ve taken that bike on some pretty grueling trails and it has performed way better than I would ever have suspected. Given that it is designed to be a very simple bike and it has no mechanical shock absorbers it takes the rocks, roots and bumps remarkably well. Bamboo has the tensile strength of steel and because it is a grass it has the flex of materials such as carbon fiber. I love it!

I happen to like the yellow wheels it’s bright and cheery! As for my out of style shorts, I only wear my short tight ones on very special occasions BIG GRIN!

BTW, I have a friend in Brazil who is an agronomist and he owns a business called Bambu Carbono Zero he is a specialist in reclaiming depleted soils by planting bamboo, he tells me it is a great carbon sink too. The bamboo grows to commercial size much faster than any tree.

Fred,

Using bamboo for soil building is different! Here in central Florida, bamboos are invasive exotic plants and hard to kill. How does he get rid of the bamboo so he can grow something else once the soil is enriched?

Jim

hey Cracker,

Brazil has about 200 native species of bamboo so he is definitely not working with invasive species.

How does he get rid of the bamboo so he can grow something else once the soil is enriched?

I’d have to ask him about the specifics but I believe he harvests different tracts of it at different times. I also believe it is used as a means to prevent erosion so some of it is allowed to remain in place permanently. I think he also grows bamboo side by side with other plants, similar to what is done with Permaculture. So there is really quite a lot to it.

Next time I talk to him I’ll ask him.

Cheers!

Great stuff! As a kid I loved to burn it for the noise and flying shards as the joints steamed up and exploded.

I have been trying to make a logical fit of my automatic transmission to it, but hard to beat cost and simplicity of single speed chain.

Maybe should try bamboo in my pyrolyzer stove- turns it into gas and carbon. Carbon back to ground- negative carbon energy.

Interesting moral question?

To me a more interesting question is that all if this surplus energy hadn’t been spent on creating a society where people sit all day in front of screens for work and entertainment while munching french fries and fat burgers and processed chicken nuggets and drinking oversized cups of carbonated corn syrup, is it possible the we might not even need those $20 million diabetes centers at all, Gotta wonder what might happen if we learned how to walk, ride bicycles, eat healthy and at least occasionally turned off our electronic communications devices and actually had face to face conversations now and again? Nah, that would probably be a really bad idea…

I believe that one was a mockup, but still.

The oil crash should be short lived. As far as I can see production growth in the USA has stalled. We know it’s decining continuously elsewhere, and the low price encourages demand. Houston will be fine within 2 years.

Dallas. Wierd city. It looks like someone pulled the plug sometime early 1980’s. Still some 1920’s boomtime buildings last, others are replaced by 1970’s highrise. Others are replaced by… nothing. By parking lots in fact.

Nowadays, just like in the rest of the US, people flee the surrounding countryside and end up in suburbs of megacities, dreaming of big city life. Working at Subway’s or Wendy’s after all.

Cities boom because they boom. They grow because they grow. No significant economical activity sustains these cities, unless the fact that they are growing. (Phoenix AZ being the ultimate example.)

I write this from my average Belgian home. A house that was built in 1872, when Dallas was founded. I have everything available in walking distance.

https://www.youtube.com/watch?v=o_8b6ej0U3g&index=3&list=WL

23 minute video from Tom Murphy – A physicist explains the limits to growth. This presentation is very succinct, but may be a bit long term for some – the short term view starts around 20 minutes in.

Edit – you may have seen this 6 months ago.

Yeah, that video is quite succinct!

I’ve posted on this site a few times myself, I highly recommend watching more than once >;-)

Not playing for me. Can you post a link? Thx!

It was originally posted here:

http://library.fora.tv/2011/10/26/Growth_Has_an_Expiration_Date

But I want my pony!!!

Here ya go, you can keep it in a gerbil cage… there are times when I really hate humans!

It’s a strawman: no one is arguing that physical growth will continue forever, or that it needs to. Economies consist of Goods and Services, and the physical quantity of Goods can plateau, while their value grows (due to rising speed, quality etc. – think 2015 phone or computer vs 1980 phone/computer), and the value of services grows as well.

For instance, US sales of cars, homes, appliances etc., plateaued decades ago.

It’s a strawman: no one is arguing that physical growth will continue forever, or that it needs to.

Really? Where and in what context do you hear anyone openly discussing the downsides of economic growth? Not to mention that it is physically impossible to continue growth and it is not possible to completely decouple a value and services based economy from the constraints imposed by energy needs. As you well know, there is no free lunch!

BTW, Did a Google search on ‘The Benefits of Economic Growth”

About 56,700,000 results (0.53 seconds)

This sums up the mainstream view:

The benefits of economic growth include: Higher Incomes. This enables consumers to enjoy more goods and services and enjoy better standards of living. Lower unemployment With higher output firms tend to employ more workers creating more employment.

Benefits of Economic Growth | Economics Help

http://www.economicshelp.org/macroeconomics/economic-growth/benefits-growth/

anyone openly discussing the downsides of economic growth?

Economic growth isn’t the same thing as physical growth. Again, US sales of cars, homes, appliances etc., plateaued decades ago, while GDP is 2.5x larger.

it is not possible to completely decouple a value and services based economy from the constraints imposed by energy needs.

And, yet, US GDP is 2.5x larger than it was in 1979, while oil consumption is lower. Computers are 1,000 faster, but they weigh much less. Cars use half as much fuel per km, but they’re much faster, safer and more reliable. Doctors, lawyers and engineers use less paper. X-rays and photography don’t use silver film anymore.

Oil and other fossil fuels are expensive, dirty and risky. We don’t need them for a good life – the oil and coal companies would love us to think that they’re the only thing protecting us from disaster, but it ain’t so. We should kick the habit ASAP – we’ll be better off in many ways.

You do realize GDP dollars are not the same dollars now as then?

It’s adjusted for inflation.

The inflation adjustment includes speed, quality, etc. So, GDP growth is literally and officially defined as including those things. It’s very possible to have growth based on nothing but those “intangibles”.

It’s very possible to have growth based on nothing but those “intangibles”.

No, I’m afraid it is not!

Economic growth isn’t the same thing as physical growth.

Nick, you can’t possibly be serious! This is no economic growth without physical growth. At the end of the day it is impossible to completely decouple the economy from the physical world and therefore the laws of thermodynamics apply. Tom Murphy explains precisely why that is the case and let’s not forget, he is physicist, not an economist.

Tom appears to be a good physicist. And, as an amateur economist…not so much.

Tom is good at demolishing strawmen, like this.

Again, people have enough cars, and houses, phones and computers. They need improved versions, and they need better and more services: healthcare, eldercare, childcare, entertainment.

How? By better design, higher labor productivity, etc. Better ways of doing things, not brute force growth of “stuff”.

“How? By better design, higher labor productivity, etc. Better ways of doing things, not brute force growth of ‘stuff’. ~ Nick G

Don’t forget real democracy, freedom, ethics, where the ‘brute-force plutarchs and their henchmen’ don’t get to tell people what they have enough of, what they need and how to have it. That requires a fundamental rewiring of ‘economy’. Real and true economy means real and true democratic control over the means of production.

As for higher labor productivity; why, in what sense, for whom and for what? Corporate CEO’s? Governtheft-as-taxation? Minority/elite benefit?

You want growth? Let happiness, stability, real community, security, a resilient ecosystem, diversity, peace and leisure, etc., and time for all those grow.

BRAVO! That’s what I am preaching in my op-eds here and they are well received.

I am also having fun by shocking people by my somewhat luxurious living entirely on solar.

They simply can’t believe it. Doesn’t solar mean slim and simple?

My maternal grandparents were farmers. They used to tell me about the long hours they put in. My grandma used to work all day, but sometimes she would go catch crabs on a nearby beach. My paternal grandparents were mountain folk, from Eastern Cuba. Grandma was descended from French settlers, grandfather from northern Spain. My great grandparents had worked to send a grandson to school, he returned and built a small hydro dam, connected a generator to it, and they bought a fridge for their small country store. I don’t have anybody in my family who ever stopped doing something to get ahead. Some people work three hours a day and seem to enjoy that life. In my family we don’t. I guess that’s one reason why we don’t like communism, we don’t like freeloaders.

What is that statistic again about the US? 5% of the world’s population using 25% of the world’s energy?

There are some ‘conquistadors’ that install foreign puppet regimes that ‘their aides’ then make a petroleum career out of in aiding that level/scale of freeloading. Olé.

Maybe you and your family are not somehow related, but Spain and France, etc., sent a lot of ‘entrepreneurs’ to the ‘new worlds’ to help ‘develop’ them and ‘get ahead’ in part through African slavery and Native land-grabs and genocide.

Ya, we don’t like freeloaders over here either. The ones that matter.

“To accumulate wealth, power, or land beyond one’s needs in a limited world is to be truly immoral, be it as an individual, an institution, or a nation-state.”

~ Bill Mollison, from Permaculture: A Designer’s Manual, second ed.

Incidentally, we’ve apparently been doing agriculture ‘wrong’ for the past 7000 years.

Permaculture agro techniques appear less labor intensive and more self-perpetuating.

“The Special Period’s malnutrition created epidemics, but it had positive effects too. Manuel Franco describes the Special Period as ‘the first, and probably the only, natural experiment, born of unfortunate circumstances, where large effects on diabetes, cardiovascular disease and all-cause mortality have been related to sustained population-wide weight loss as a result of increased physical activity and reduced caloric intake’.

A paper in the American Journal of Epidemiology, says that ‘during 1997-2002, there were declines in deaths attributed to diabetes (51%), coronary heart disease (35%), stroke (20%), and all causes (18%)…

‘The famine in Cuba during the Special Period was caused by political and economic factors similar to the ones that caused a famine in North Korea in the mid-1990s. Both countries were run by authoritarian regimes that denied ordinary people the food to which they were entitled when the public food distribution collapsed; priority was given to the elite classes and the military.” ~ Wikipedia

The big mooches. The ones that matter.

Che Guevara ‘u^

Che Guevara was a mass murderer. That’s some hero you have. My great grandparents were born after the end of slavery in Cuba. From what I gather they were typical inmigrants: dirt poor, but with the ability to work pretty hard.

Yes, I heard about that, but you might be relieved to know that the tune, if recalled, has little to do with Che other than as a metaphor for something else. My intent there was more just for conceptual fun. I have little idea about the real activities of Che.

As for you, just because we share the same blog doesn’t mean your propaganda about Cuba et al. isn’t any less propagandistic. While I live in Halifax, I know very little about what goes on in the local official, etc. circuits, even if I think I might, such as just because I might glance at a free weekly rag on the bus.

But in any case, alas, murder and torture happen everywhere and in every system. Your communist bemoans, though understandable, are, in a sense, absurd reductions, perhaps like your notions of freeloading and the like. If we could travel into the past along each of our lineages, it is imagined that we’d likely run into more than a few murderers and rapists along the way.

Looking at one of my ex-girlfriends with Mongol heritage, I couldn’t help but sometimes feel as though I was staring at Ghengis Khan in the face, especially when she was angry at me.

BTW, hopefully, your great grandparents’ fridges or their grandson’s hydro dam didn’t interfere with other people’s lands, farming and general quality-of-life; hydrological cycles or wild species migration patterns, etc..

I don’t do “propaganda”. The Castro family dictatorship is a horrible thing. But I’m pretty sure it will disappear. Evil things end sooner or later.

They come and go like bad cramps…

BTW, does Cuba grow coffee, is it any good, and do you ever go back?

Whether growth can continue indefinitely long – as in forever in a closed space or system is not it question in terms of physics.

It can’t and case closed if you use the usual definition of growth meaning more stuff and more consumption of resources and more people on an ever increasing basis.

But Nick does have a valid point if you are willing to accept a different definition of growth – one that measures quality of life more so than quantity of consumption.

I would not argue that growth according to this alternate definition can continue INDEFINITELY or forever but I can’t see any real reason it cannot continue for quite a while – assuming good luck and stability.

I agree.

And, that’s ok. The idea that growth has to continue forever is also a “strawman”. The economy can grow until everyone has what they want, and then plateau. The economy won’t collapse at that point. Instead, the amount of time people work would start to fall, like France in the last 50 years.

But Nick does have a valid point if you are willing to accept a different definition of growth – one that measures quality of life more so than quantity of consumption.

Perhaps if you are talking mostly about some form of spiritual growth I might consider the point, however I think that arguments that hold that it is possible to continue anything like the current BAU model of growth, which by definition depends almost exclusively on growing consumption of goods and resources, then I obviously will have to strongly disagree that such is possible.

Just came across this review of:

“Collision Course”

Endless Growth on a Finite Planet

By Kerryn Higgs

https://mitpress.mit.edu/books/collision-course

Overview

The notion of ever-expanding economic growth has been promoted so relentlessly that “growth” is now entrenched as the natural objective of collective human effort. The public has been convinced that growth is the natural solution to virtually all social problems—poverty, debt, unemployment, and even the environmental degradation caused by the determined pursuit of growth. Meanwhile, warnings by scientists that we live on a finite planet that cannot sustain infinite economic expansion are ignored or even scorned. In Collision Course, Kerryn Higgs examines how society’s commitment to growth has marginalized scientific findings on the limits of growth, casting them as bogus predictions of imminent doom.

The more I hear people talking about growth being at all possible or that it is good in anyway, the more I am forced to reject the premise. It is simply absurd to believe that! The planet is already too full of humans and we have hit the resource wall. We are in deep ecological overshoot! The only reasonable future course of action is degrowth, a contraction of the economy and a world where we must do more with much less and learn how to be happier doing so. Anything other than that is doing the same thing over and over again, which happens to be the definition of insanity. >;-)

Cheers!

Fred

It’s just a matter of definitions.

The fact is that the official US government definition of growth includes quality improvement in both goods and services. Period. Full stop.

No increase in physical quantities of resources required.

It’s just a matter of definitions.

From Wikipedia:

“Because it is based on value added, GDP also increases when an enterprise reduces its use of materials or other resources (‘intermediate consumption’) to produce the same output.”

So, as Nick points out, “growth” can occur using fewer resources.

The only reasonable future course of action is degrowth, a contraction of the economy and a world where we must do more with much less and learn how to be happier doing so.

That’s just not how most Humans think.

I suspect growth will continue beyond our earthly boundaries.

http://www.space.com/29004-manned-mars-missions-planetary-society.html

We’ve already covered this ‘metagrowth’ on The Oil Drum.

But the invocation into a dialogue of any ‘official government definition’, and along a soulless ‘products and services’ tangent (as if one’s existence is reducible to government definitions and the consumption of products and services) seems both insidious and specious, especially when (said) government(s) doesn’t (don’t) even follow the letter of its (their) own definitions.

In any case, if the universe is infinite, then maybe ‘growth’ fundamentally is too… hopefully outside of the empty vapid officiousness of government/bureaucratic definitions.

If you consider having eight buttons instead of seven on whatever the latest Chinese coal to American landfill gizmo is, there might be growth. Hedonics, I believe is what they call such, ah, adjustments to the Grossly Damaged Planet numbers. An example throwaway:

http://techcrunch.com/2015/03/31/amazons-new-dash-button-hardware-offers-instant-orders-for-staple-products/

Well, that only has one button, but still has landfill written all over it. How are wages faring, by the way? Have those gone up by 2.5 or whatever the quoted number for progress is these days?

Nope, wages are still stagnant.

The Kochs are fighting hard to keep that going, too.

“Don’t let the pessimism in TOD and other PO websites get you down…

Too Funny:

“California is a net importer of oil. It produces only about 37.2 percent of the petroleum it uses. In 2007, the state spent nearly $50 billion for gasoline and $9.7 billion for diesel.

Petroleum-based fuels account for 96 percent of the state’s transportation needs. The dependence on a single type of transportation makes Californians vulnerable to petroleum price spikes. Transportation is the largest emitter of greenhouse gases.

The state is now at work developing flexible strategies to reduce petroleum use. It is developing alternative transportation fuels to reduce air pollution and greenhouse gas emissions.

Meantime, the demand for gasoline and diesel fuel will continue to rise because of population growth, the lack of mass transit, and the number of sports utility vehicles on California’s roads.

Also, jobs and housing continue to become farther apart, increasing the miles traveled by the work force.”

And we wonder why it is all going to hell in a handbasket.

It’s the blind leading the dumb.

You know, I found out why it’s so common to see higher density housing here where I live: real estate taxes are biased to charge per square meter of surface area within the lot, not the market value. The way to get around it is to build a complex with several buildings, put the tennis courts on top of the parking garage, build a single pool used by 240 apartments placed in 8 tall buildings, and have an area for small businesses which service the 500 people living in the complex. This is pretty common around here, in part because land is really expensive but also because a house with a large yard pays a really high tax.

That’s fascinating. So they charge based on land, not improvements (buildings, etc)?

How do they decide how much to charge per hectare?

Excellent question. They have a complex set of equations into which they plug in the property’s characteristics. What I’m told is that it values the land much more than the “value added” construction. It’s also limited to 50 % of the real market value.

I live in a fairly expensive area, the land is quite expensive. But I noticed there are large open areas to the north, about 500 meters from the beach. It would seem the land could be use for large houses on large tracts, but that’s not what we see. Most construction is condos.

But the whole layout here is quite different. We have an electric tram, bus lines, 300 kmph high speed rail to Madrid, and traffic tends to flow smoothly because all the lights are timed to turn green as long as you drive the speed limit (the max in town is 50 kmph).

It will all work fine as soon as you default on the loans that built it.

There’s no defaulting around here. I don’t know anybody with a mortgage. The debt seems to be at the local government level, and above. It’s a mix of really lavish spending (this place is spotless, it’s like Disney world), and too much welfare state. Around here the right wing is somewhat socialist, and they take bureaucracy as something God decided was good for us. But I don’t think personal debt is that high simply because credit just doesn’t get issued in large amounts. I do hear there are people in swanky dwellings around the golf course who have mortgages above the property’s value.

Fuel prices in California have to be the biggest farce on the planet, no maybe the second biggest behind manmade climate change science. But anyway consider this, with gas at $42.00 per barrel a few month back, in Orange County we were paying an average of $2.30 a gallon, now the price per barrel is $48.00 a barrel and the fuel prices are at $2.50 a gallon…yes the summer blend costs about 15 cent more that’s still over a dollar per gallon… lets put that in perspective

16 gallons – 16 buck$ to much

20,500,000(rounded) autos in CA lets say once a week fill her up (I fill up 2-3 times a week, but I am in sales and have to drive alot)

$328 million dollars per every 2 months

$656 million per month

$7.872 billion a year just because of price gouging

Notice how they NEVER find any criminal activity involved with the gasoline prices (manipulation) in California? Somehow I’m starting to think maybe federal Government and the State of California are involved in the manipulation???

It’s not just California that gouges – it’s nationwide. In Maryland I paid $2.099 on 1/23/15 and $2.449 on 3/23/15 – the last time I filled up my 31+ mpg 2013 Honda Fit. I keep mileage records for fuelly.com and fueleconomy.gov (where they’re publicly available), so I’ve got all the data at hand right now.

Prices rising from Jan through Mar-Apr aren’t new and are “supposedly” due to refineries being changed over from winter to summer blends. Last year, I paid a short-term low of $3.259 on 2/5/14, and $3.539 on 3/31/14 and it rose to $3.599 by 4/25/14 where it pretty much stayed until dropping slightly when summer began. In 2013 it was $3.299 on 1/17/13, and it bounced between $3.579-$3.799 between 2/22/13 – 3/29/13 before dropping a little in later spring.

All the prices mentioned are at the same lower-than-avg-price gas station.

Summer and winter blend my @$$. The bureaucrats got an excuse for everything. So just where and when and for how long is this price increase suppose to be? Where I live the frickin price has gone up .52 cents in less than a month. It always goes up like a rocket and comes down like a balloon. People’s driving habits do not change from one week to the next drastically. Everyone basically has the same similar schedule. Going to work, shopping, school, etc. I’ll bet the average person’s routine when it comes to driving their vehicle doesn’t change from week to week by more than 1/100 of 1 percent. So how do all the gas companies know to raise the pump price by a dime or more in one day? If I had invested in petroleum jelly 50 years ago I might be rich today because the energy producers have been sticking it to us all that time and laughing their way to the bank.

If the evil oil companies are ripping you off you should be buying their stock or – even better – open up a gas station yourself!

rgds

WP

WP,

Do you think the 3 above posters are human flesh, or purely electrons? Funny how 3 new poster arrive and bounce off each other on one of America’s most famous conspiracy theory, on how the oil companies rip of the US population.

Also funny how the US has some of the cheapest fuel in the world, baring countries that directly subsidize gasoline and diesel, yet everyone seems to want to complain how expensive fuel is, while driving their F-250

Toolpush. Kind of odd. In any event, before anyone blames gas stations and refiners, look at RBOB. Traded just like all other commodities. It can be irrational too. We live in a low gas price state, but we are .70 off the January lows, but so is RBOB, even though oil is the same as January, maybe somewhat worse. Brent spread to blame?

Tool:

Unfortunately they are probably human. It is very easy to look for scapegoats in pretty much any part of life for anything which isn’t going quite your way. (which means” more, cheaper, faster, easier”).

Also, if you think something is too expensive the simplest solution is to not buy it. Gas too expensive? Screw ’em – drive by and don’t buy gas!

But seriously, in general I have difficulty dealing with people who don’t think and once in a while I don’t take the usual course of action – ignoring them – but actually say (write) something. Fortunately on Ron’s site there aren’t that many of those people and even when they pop up they tend to leave somewhat quickly. Most of the regulars seem to understand that the best way of dealing with idiots is to ignore them.

rgds

WP

How can you speak about them as if they are not there?! That is so rude! ‘u^

Isn’t that what Harold Hamm did? Started his career as a grease monkey pumping gas?

A sly dog, Harold must be.

Actually, I completely changed my mind about what I wrote previously. What was I thinking!

Hm, yeah, me too. I got word back that Evan feels the same way. So, apologies to the rest of the blog for our little digression.

Yep. And, hey, guys, let’s take our meds before we post next time, shall we?

G’day Fellas,

Great to see y’all drop in again. You must have all been watching at the same time according to your time stamps.

Good to see y’all have a good sense of humour.

You also remind me of a little critter we had here recently. He is like a Chameleons. Keeps changing his colours.

Saw on my way to work local gas prices were raised less than 24 hours ago out of speculations on the effects of the rebellion in Yemen. Now they’re going to have to make a far greater rollback in light of the Iranian negotiations. But when do you suppose the greedy oil cos. are going to implement a rollback? Probably after they are done fleecing those of us planning on traveling for Easter.

Fortunately, I drive a Nissan Leaf, so none of that really affects me anyway haha.

No Flat Earth Wingnut with the lead?

Javier, where are you?

From Forbes and sorry if posted earlier;

http://www.forbes.com/sites/christopherhelman/2015/03/26/stop-propping-up-zombie-oil-companies/

” The thing is, much of the debt taken on by smaller shale oil producers will never be paid back unless oil prices go significantly higher than $100 — because even at $100 oil they weren’t generating any free cashflow.”

..

”A director of oil and gas financing at a big bank in Houston told me last week that he and his peers are currently in the throes of some ugly borrowing base redeterminations. Obviously, how much money an oil company can borrow against reserves depends upon the value of those reserves. With prices collapsed, a lot of tight oil now isn’t worth drilling at all — it’s worthless. Companies are busting the terms of their bonds and bank loans left and right — it’s common for borrowing covenants to require a company to keep their total indebtedness to within four times their annual EBITDA. But banks are waiving that requirement, for now. “We don’t know how to run an oil company; we don’t want to run an oil company,” says the banker. “Hopefully oil prices come back up this summer.” If not, by the time the next set of borrowing base determinations come around in October, there will be blood in the streets as many zombie companies will finally have no choice but to give up.”

A lot of upcoming writedowns in proven undeveloped reserves.

Thanks for the link Rune. It is true that banks do not want to operate oil assets, but I am surprised they would keep forking over more money knowing it likely won’t be paid back.

Even if we are lucky enough to get back to $65 WTI, I don’t see how that rights the ship for many of the shale companies. They need $100-$300, depending on how bad of shape they are in.

My, my. Imagine that. Covenant busting.

And he was fibbing. He doesn’t have to run the oil company. He can just take the reserves and hold them. They’re not going anywhere and he wasn’t going to get repaid anyway.

These bozos are walking into the workout session and saying “YOU!! YOU will be responsible for the destruction of US energy independence, and don’t you DARE believe for 1 microsecond that we won’t go public with this and name banker names, and maybe even where your kids go to school. Okay, I apologize for that one. But . . . you get the picture.”

This will work for a while. Maybe long enough to try that on the Fed.

Watcher, you deserve an Oscar: Stand-Up-Comedy. Now, if I understood 0.01% of your financial stuff I might be able to hold my head high around here. Alas, ‘twil never be.

Doug, hold your head high. Diverse knowledge makes this blog go, and believe me, you know a lot more stuff that I do not, than vise versa.

Watcher, the banks don’t want to, but can operate the assets until they are sold. Most of the production staff will stay on and work, they want a job and most oilfield personnel have a lot of pride. They pumpers live it, they are not going to walk away unless the pay just stops. Further, having a good group operating the leases enhances their value. We have leases adjoining us where the operators went broke, but the pumper didn’t go anywhere, unless the lease was just shut down.

The shale wells will generate a lot of cash, and as the banks have the first lien, they should be able to foreclose, have a receiver appointed, and keep the production going until sold. They don’t want to do this, but they will and have for over 100 years.

Alternatively, they will sell the mortgage for a discount to a third party (private equity) and be done with it. I have seen that up close too.

What banks will not do is drill more wells. I have never seen that. That is why I am surprised they are going to throw more money down the rat hole.

I guess this is where the long quoted oil field saying comes in, and I think the quote originated from HL Hunt, “Owe the bank a hundred thousand and it is your problem, owe the bank a hundred million and it is their problem.”

There is an old novel. Hmmmm Tom Wolfe. The Man Is Full. Something like that.

In it there is a scene that he researched. It’s what a bank does when someone thinks that if he owes 100 million then the bank has a problem. Banks have been doing this for a long time. There are procedures in the company manual for guys who think if he owes a lot the bank has a problem.

It ain’t pretty. It goes back to where money came from. The bank is fractional reserve and it can get its ratio tweaked. The borrower, has nothing.

So having read this latest Ronpost, I think to myself, “This is news! Let’s see if it’s being carried elsewhere.” So, I pop “us oil production” into the search box of my browser and select “news” from the results. The top news headline was “American Oil Production Grew by the Most in Recorded History Last Year” and apparently that bit of information is what the MSM chose to report. Gotta keep the happy stories going! Shame on Ron for not reporting that news!

More disturbing than Ron ignoring the news that US “crude oil” production has never grown by as much as 1.2 million barrels in a single year before now, is the fact that rather than report this drop in production, USA Today chose to report “US oil storage crunch might cut crude prices”.

It seems that the public must never be provided with any news that might suggest that all is not well in the state of “happy motoring”. Welcome to the Twilight Zone!

Alan from the islands

I think it is just generic reporters regurgitating things they have already read. Digging for new relevant info is hard work and requires a lot of effort.

There’s a tendency for the news to flow with the current. When I moved here I thought it would be different, but I see a pretty uniform coverage. This morning they are all serving exactly the same pablum to justify a Saudi invasion of Yemen using Pakistani mercs. A few weeks ago they all sang the same tune about Russia getting ready to invade us. I thought that was so ridiculous I decided to write about the threat posed by Finland (my two Finnish friends seemed to think it was funny).

DIRECT EVIDENCE FOR A POSITIVE FEEDBACK IN CLIMATE CHANGE: GLOBAL WARMING ITSELF WILL LIKELY ACCELERATE WARMING

http://www.sciencedaily.com/releases/2015/03/150330122439.htm

“A new study has confirmed the existence of a positive feedback operating in climate change whereby warming itself may amplify a rise in greenhouse gases resulting in additional warming.”

This implies the system is unstable. The temperature cannot rise forever. At some point equilibrium must be established between energy coming in and energy going back out into space.

It’s unstable, and equilibrium is very difficult.

It will eventually reach equilibrium, but algae may be the dominate life form.

….and/or cockroaches…

Petro

My vote goes to the Cyanobacteria they seem to like warm oceans with lots of CO2. Cytochrome C and his cousins are going to be busy >;-)

http://www.cop.noaa.gov/stressors/extremeevents/hab/current/cc_habs.aspx

Evidence also indicates that climate warming may benefit some species of harmful cyanobacteria (both freshwater and marine) by providing more optimal conditions for their growth (reviewed by Paerl and Huisman 2008 and 2009). Increasing temperature and CO2 either alone or in combination with nutrient availability may determine the growth and relative abundance of HAB species (Fu et al. 2008). Historical evidence from long term phytoplankton monitoring data and fossil records suggests that future climate warming could impact HABs through the alteration of their geographic range and shifts toward relatively more and earlier blooms (reviewed by Dale et al. 2006).

Interesting critters.

http://www.biofuelsdigest.com/bdigest/2015/03/23/joule-says-will-go-commercial-in-2017-solar-fuels-on-the-way/

Fred,

Have you ever seen the stromatolite fossils by Grinnell Glacier in Glacier National Park? – 6,693′ above sea level. Gives one an appreciation of time and change

The article doesn’t really contribute anything new. It’s a rehash of the old controversy over whether CO2 leads or lags large climate swings. The way the ice ages come and go make it clear the system is delicately balanced and the main driver is the orbital variations.

The feedback mechanisms are the clouds as well as the isostatic rebound of continental land masses previously under the giant ice caps in North America, Europe and Asia.

Actually there are many feedback mechanisms that can either amplify or diminish the effects of a change in climate besides the ones you mention. Another is the melting of permafrost resulting in the release of methane. And you should consider the release of carbon from ecosystems due to changing climatic conditions such as the die-back of high-carbon ecosystems (i.e., the Amazon). One that especially concerns me is Atmospheric Vapour because as the atmosphere warms its concentration of water vapour increases, further intensifying the greenhouse effect which in turn causes more warming, which cause an additional increase in water vapour — a self-reinforcing cycle. My understanding is that water vapour feedback may be strong enough to double the increase in the greenhouse effect due to the added CO2 alone. In any case, I think these discussions are best left to scientists who have the data and are trained in the interpretation a critical factors.

Oh, and respecting glacial isostasy, typical uplift rates are of the order of one cm/year (or less) and it mainly affects northern Europe, Siberia, and Canada. This certainly influences permafrost melting and methane release in a significant way but it would take a specialist to calculate the effect(s).

I did the calculations. It’s not that complicated. The rate is variable, when you remove the ice load the sucker starts bobbing up real fast, and the decline can be approximated with a simple exponential.

We had a lengthy discussion at Lucia’s last summer about the subject, feel free to go look it up. After the discussion I sat down and studied the subject and have developed a pretty good understanding of how this works. By the way, the movement of mass back and forth between the continents and the oceans influences volcanism. Think about it.

“By the way, the movement of mass back and forth between the continents and the oceans influences volcanism. Think about it.”

Well, I’m an engineer, geologist and geophysicist; I’ve thought about it and I don’t have the faintest idea what you’re talking about. You “did the calculations.” What the calculations did you do?

Work out the stress field change on top of a mid ocean ridge, with a magma chamber in near perfect equilibrium. Remove 100 meters of water worth of pressure, and you will see the pressure reduction causes magma to liquefy and allow gases to migrate, creating the conditions for eruptions. As far as I can see volcanic activity has to accelerate at the spreading centers whenever the ice caps are being formed. Neat, isn’t it?

In my case I think the scientists need engineers to supervise and review their work.

Three people were going to the guillotine, and the first was the lawyer, who was led to the platform and blindfolded and put his head on the block. The executioner pulled the lanyard and nothing happened. So, out of mercy, the authorities allowed him to go free. The next man to the guillotine was a physician, and he lay his head on the block, and they pulled the lanyard … nothing. The blade didn’t come down. So, to be fair, they let him go too. The third man to the guillotine was an engineer. They led him to the guillotine and he laid his head on the block and then he said, “Hey, wait. I think I see your problem.”

http://www.angelo.edu/faculty/kboudrea/cheap/cheap4_engineers.htm

Fernando you may well be right about this study adding little, though my guess is that extracting pattern from time series data is beginning to yield explanatory results for glacial oscillations.

Re climate feedbacks. You mention net albedo from clouds, ice and snow – sure they add to the fun.

But having non-condensing gases in the atmosphere is key to the temperature at equilibrium during oscillating orbital cycles. Without CO2 et al, and CO2 having a longish life in the atmosphere, the default condition would be “Snowball Earth”, (happened a long time ago), with the main greenhouse gas, water vapour condensed out.

I read that the direct heat-retaining effect of non-condensing gases is about 25% of total heat retention. The hotter the atmosphere gets the more H2O is carried in air (positive feedback), but the cycling of CO2 concentration between glacial min 180ppm to interglacial max 300ppm over the last million years interacted with hydrological cycle and H2O vapour concentration in a complex way. Despite complexity, the direct heat retention by recent CO2 400+ppm will drive positive feedback from water vapour via higher temperature. Additionally, the exchange equilibrium for CO2 between the ocean (plus terrestrial) carbon store(s) will change with temperature, as it did during previous glacial oscillation. Eventually though – following Peak Oil and etc. – whatever our ‘burn’, we should see a ‘Peak CO2’ followed by a much longer period of gradual net carbon sequestration, despite the by then prevailing higher global surface and ocean temperature. I should add as caveat; if the draw-down capacity of the ocean and vegetation fails catastrophically at any point then of course ‘we’ are into something else entirely – something akin to the PETM 55ma.

best

phil

Phil, I’m familiar with the process. I happen to think papers like this are like beating a dead dog. I suspect a lot of this is researchers trying to establish their careers and names producing papers which become quotable material for the media and of course the political machine. Nature publications serves very little that appears to be original thinking, it has become a political machine.

Doug L,

Another site for new papers is EurekAlert! It’s hosted by AAAS and supported by DOE, NSF, and NIH.

Thanks Synapsid, I’ll monitor it for awhile and perhaps add it to my already crowded tool bar.

Doug L,

Go to the home page and scroll down a bit until you see, in blue in the central column, View all science news; click on that. You’ll see a sidebar on the right that lists the categories, such as Chemistry & physics, or Earth science.

I find it a useful site and quick to scroll through. There’s lots of overlap between the categories so scrolling speeds up as you go.

CLIMATE-RELATED DISRUPTIONS OF MARINE ECOSYSTEMS: DECADES TO DESTROY, MILLENNIA TO RECOVER

http://www.sciencedaily.com/releases/2015/03/150330163347.htm

“A new study reports that marine ecosystems can take thousands, rather than hundreds, of years to recover from climate-related upheavals. The study’s authors analyzed thousands of invertebrate fossils to show that ecosystem recovery from climate change and seawater deoxygenation might take place on a millennial scale.”

I guess there are still Flat Landers:

Javier, where are you?

We need to know why a 19 year old paper on Philippine Volcanism is going to override 100 years of physics and climate science.

Yeah but think of all the new coral reefs growing in downtown Miami and Disney World there has to be at least a bit of poetic justice in that.

It might look like this again a few million years from now

https://www.youtube.com/watch?v=EMwxwRA9Xr8

…I duno about corals, man.

Acidity from prozac, nexium and viagra might be tough on their “bones”

I join you in a “glass half full” toast though…cheers!!!

Be well,

Petro

Hi Doug,

here’s some more “good” news:

http://thinkprogress.org/climate/2015/03/12/3632373/carbon-sinks-climate-action/

…and this from that lovely “free”, “beacon” of truth called NYTimes, of all places:

http://www.nytimes.com/2015/03/24/science/earth/amazon-forest-becoming-less-of-a-climate-change-safety-net.html

…even cockroaches shall have it tough!

Be well,

Petro

P.S.: thanks for the update, Ron!

Important: I posted this up top in the text of the post. But I will put it down here also because I think it is important.

Texas natural gas, oil production down in latest reporting periods: regulator

In the commission’s final production estimate for January, the state produced 81 million barrels of oil and 536.3 Bcf of natural gas. The commission’s final production estimate for December was 83.7 million barrels of oil and 553.2 Bcf of natural gas. The commission’s final January 2014 production estimate was 69.9 million barrels of oil and 566.5 Bcf of natural gas.

This works out to be 2,700,000 barrels of oil in December and 2,613,000 barrels of oil in January, a decline of 87,000 barrels per day. This does not include condensate.

I think we are learning Ron is good at this production prediction stuff. Unfortunately, the traders have their own agenda, so can’t make any money on the predictions, LOL.

Shallow, I did not predict anything, I just read the numbers from North Dakota and from Texas and it was obvious to any damn fool that production was way down in January. The EIA Drilling Productivity Report was the one saying “Production is still soaring through March.

Oil prices crashed, but US output is still rising. How long can that last?

What’s surprising, though, is that US oil output has kept growing even though oil prices have fallen by half since last summer. On March 25, the US Energy Information Administration announced that US crude production rose yet again to 9.42 million barrels per day — the highest level since 1973:

This is insane. The EIA Petroleum Supply Monthly just said January production was 9.185 million barrels per day. they are saying it is 235,000 barrels per day higher!

And that 9.185 figure is counting Texas as increasing 3,000 barrels per day higher while Texas is telling them that they declined by 87,000 barrels per day. You would think that people who write these articles would be a little more aware of what’s actually going on.

What are traders going to do when they find out they have been snookered?

I guess that we can all make money because there is only one thing that they will do.

Ron, February was a short month; when THAT production data comes out lots of folks are going to be having an OMG moment.

Mike

Hi Mike,

As long as we look at it in barrels per day, a short month does not really matter. Lower output would be good as oil prices will increase eventually, probably in August or Sept. Based on RRC data, there were a lot fewer wells completed in the Eagle Ford in Feb vs Jan or December. I don’t have data on the Permian basin (TX side), but they have seen a big rig decline there (mostly the vertical rigs) so I would think output should be lower unless they have a big backlog of wells waiting to be fracked. I am not sure if the Permian might pick up some of the slack from the Eagle Ford.

Also the adjustment factor for Jan is 1.175 which when applied to C+C in Texas leads to an increase in Jan output rather than a decrease.

Texas output of C+C in Jan increased by 143 kb/d from Dec when the adjustment factor is applied to crude plus condensate. Link for adjustment factor below:

http://www.rrc.state.tx.us/oil-gas/research-and-statistics/production-data/production-adjustment-factor/

The adjustment factor is not supposed to be applied to condensate, but some adjustment factor is needed as the preliminary number almost always is revised higher the following month.

Dennis, shouldn’t the Texas Jan production be down MoM after applying Dean’s correction?

Hi Candid,

There are many different estimates. The EIA’s estimate shows output was flat from Dec to Jan. The Texas estimate shows C+C output was up and Dean’s estimate shows it was down.

Depending upon what you would like to see you could get different results. In the past the EIA’s petroleum monthly data has been the best estimate, though Dean’s eastimates have been very good as well. The RRC estimates for the most recent few months are usually too low. Probably the best guess (imo) would be an average of Dean’s and the EIA’s petroleum supply monthly estimate. All of these estimates get revised over time and recent estimates tend to have the largest errors.

Dennis, I think the Platts data I provided Ron last night regarding actual oil production declines from December to January in Texas is the real deal, not guesses. Get with him on that. Dean’s got it down to the gnat’s ass. As you know, I don’t much care about guessing when all anyone has to do is wait a couple of months to get the full skinny. In Texas we rely on what Texas says about production, not the stinking EIA.

I own and operate lots of oil wells, Dennis. February was a “short” month and will reflect a disproportionate decline in production to days in the month. That will have to do with EOM sales, balancing reported production to actual barrels sold, on location storage, sagging prices and other operational considerations. That’s just the way it is.

You may only look at these production numbers on a BOPD basis, not me. I am looking for big headlines, like “US PRODUCTION IN FEBRUARY TUMBLES.” The shorts have got complete control of the oil market right now; I want their hair on fire by May and going long again.

Mike

I second that one Mike. I know we’re in a high lifting cost area. However, I feel better after scanning through several US 10K and seeing how much it is costing the big boys to fight the decline.

I wonder if we add in CAPEX just to keep production flat to LOE, taxes and G & A, how much of the world’s production is under water, in the red? I bet it is pretty darn high when all the costs are figured in.