By Ovi

All of the Crude plus Condensate (C + C) production data, oil, for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM which provides updated information up to February 2025.

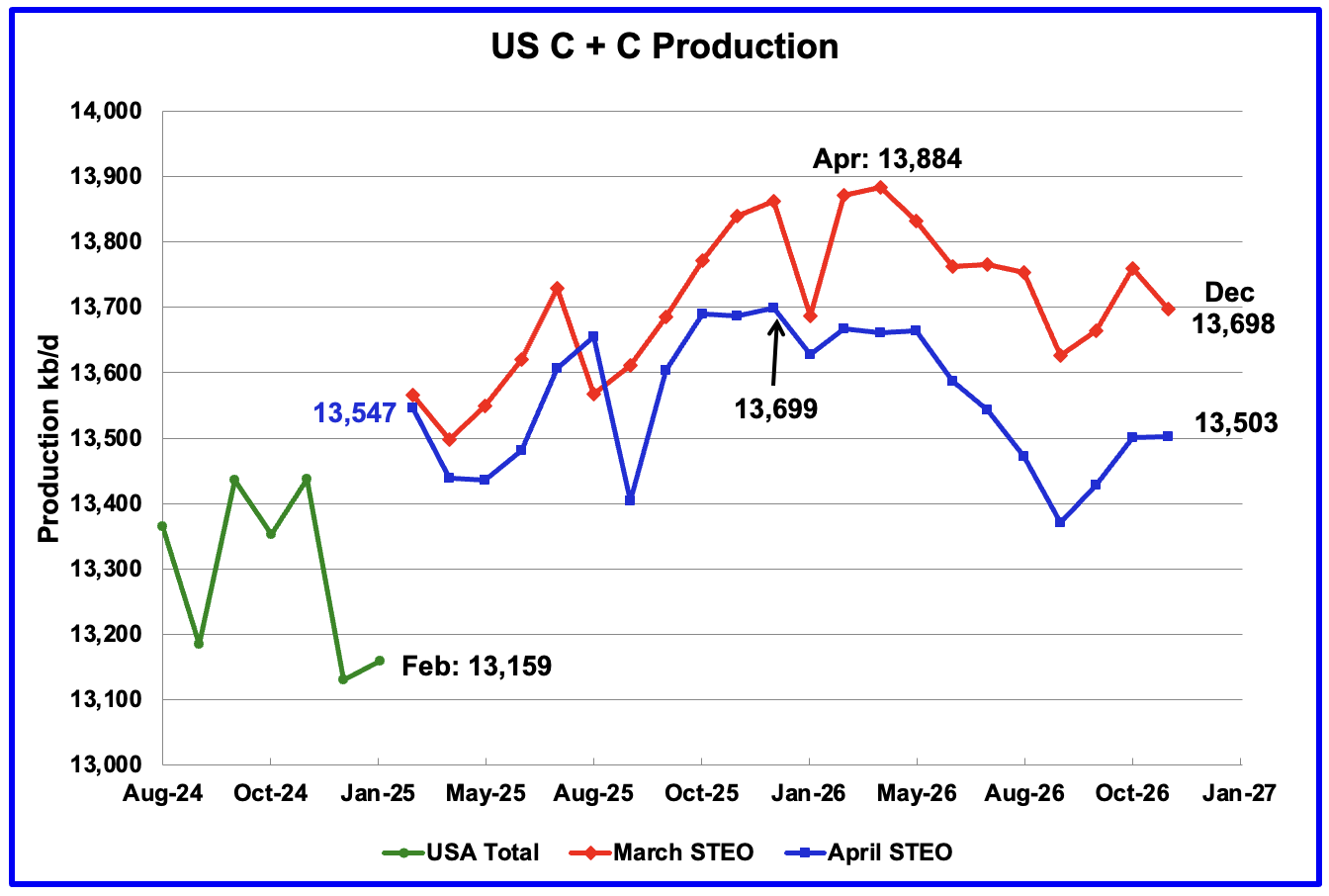

U.S. February oil production increased by 29 kb/d to 13,159 kb/d, 149 kb/d lower than December 2023’s 13,308 kb/d. The largest increases came from Texas and New Mexico. January’s production was revised down from last month’s 13,146 kb/d to 13,130 kb/d a decrease of 16 kb/d which is more than one half of February’s increase.

Production in March is expected to increase by 388 kb/d. For the last two months the STEO forecast has been really off the mark, too high by a significant amount. February was too high by 379 kb/d.

The dark blue graph, taken from the April 2025 STEO, is the U.S. oil production forecast from March 2025 to December 2026. Output for December 2026 is expected to reach 13,503 kb/d. From March 2025 to December 2026 U.S. production is expected to decline by 44 kb/d.

The light blue graph is the STEO’s projection for output to December 2026 for the Onshore L48. February Onshore L48 production rose by 24 kb/d to 10,919 kb/d. From March 2025 to December 2026, production is expected to decrease by 54 kb/d to 11,218 kb/d. December 2026 production was revised down from 11,440 kb/d by 222 kb/d from last month. Note how production starts declining in mid 2025 to December 2026.

In the previous US post, it was not clear how much of the January 305 kb/d drop was due to cold weather vs the lower completions associated with the low January Frac Spread count. A maximum drop of 90 kb/d was estimated as being related to the cold weather. The continuing low February production points to fewer completions along with possibly geology, i.e. fewer Tier 1 wells, dropping pressure and increasing GORs as being the main cause of the January and February production drop.

This is a comparison of the STEO’s March and April forecasts on an expanded scale since it would be difficult to see on the previous chart.

On April 2, the US President announced Liberation day. Under normal circumstances the April STEO would have published on April 8. However due to the impact that Liberation day tariffs would have on the World’s/US‘ economy, the STEO analysts decided to revise their original April report and delay its publication to April 10. While there was little change to March 2025, the December 2026 production forecast was lowered by 195 kb/d to 13,503 kb/d. The green and blue graphs are the same as those in the previous chart.

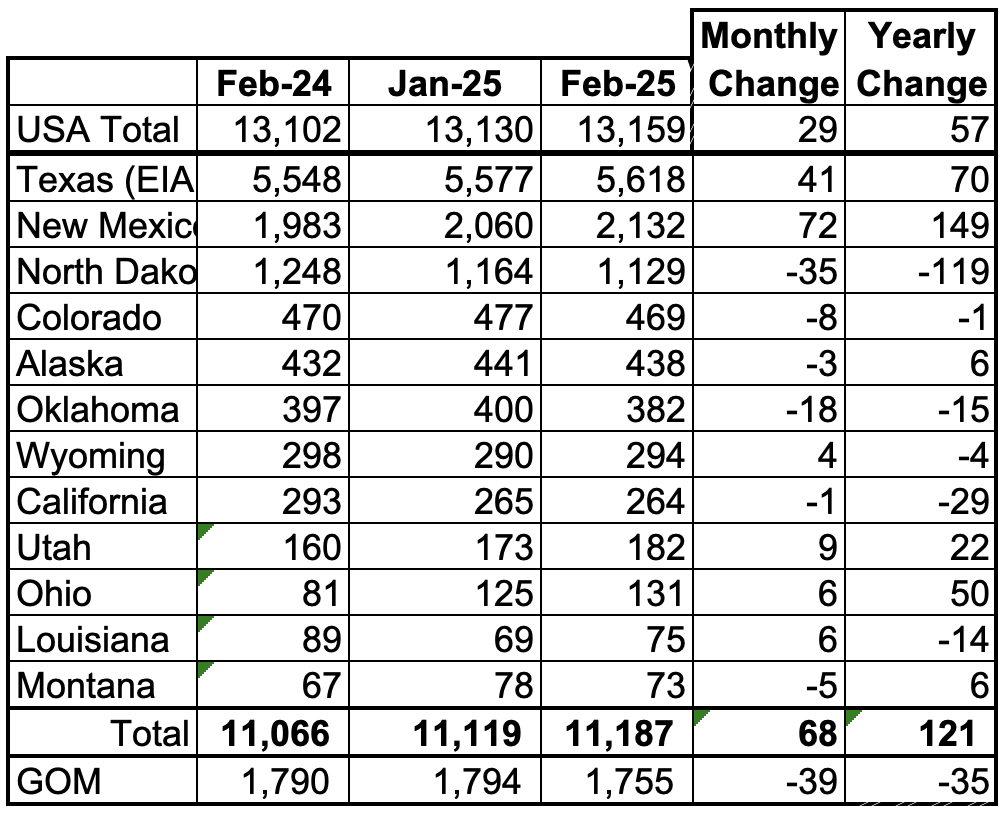

U.S. Oil Production Ranked by State

Listed above are the 12 US states with the largest oil production along with the Gulf of Mexico. Montana was added to this table a few months back since its production exceeded Louisiana’s production and we wish to keep tracking Louisiana.

These 12 states accounted for 85.0% of all U.S. oil production out of a total production of 13,159 kb/d in February 2025. On a MoM basis, February oil production in these 12 states rose by 68 kb/d. On a YoY basis, US production increased by 57 kb/d with the biggest contributors being Texas and New Mexico, offset by a North Dakota decline.

State Oil Production Charts

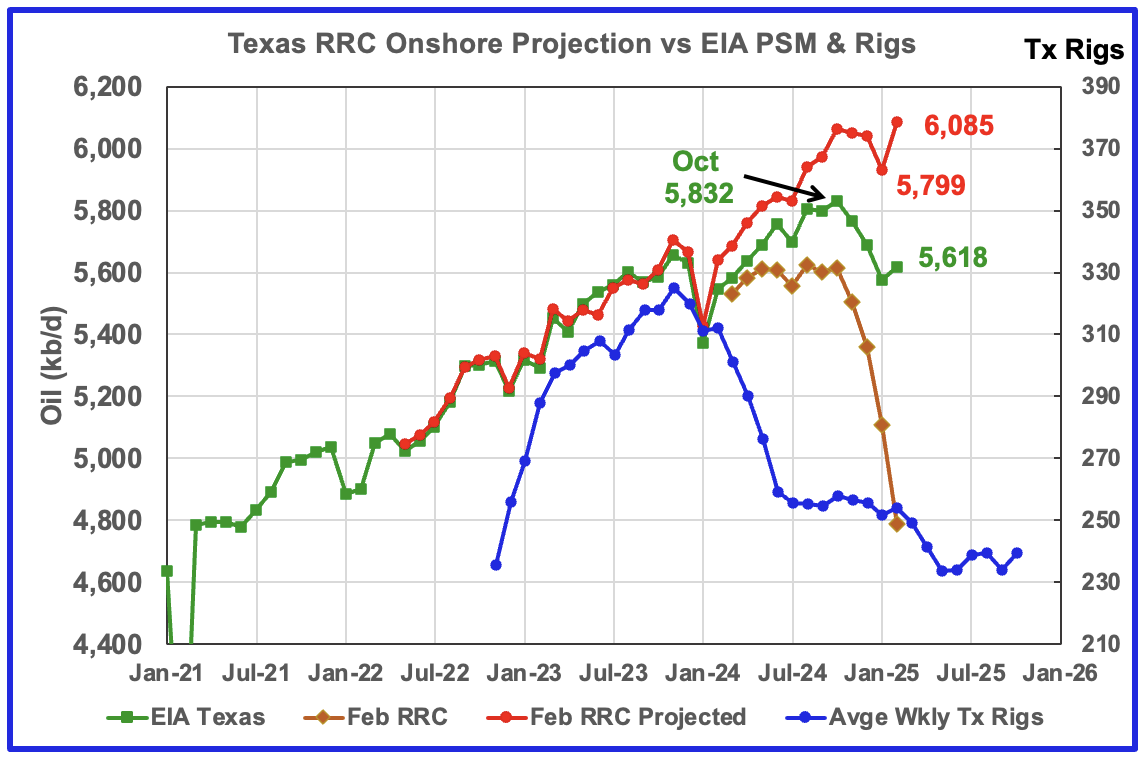

According to the EIA, Texas production increased by 41 kb/d in February to 5,618 kb/d and is 214 kb/d lower than October 2024. YoY production is up by 70 kb/d. Note that both December and January production from last month were revised down by 6 kb/d and 7 kb/d respectively.

Texas production has been dropping since October. The drop could be related to the drop in completions that started in October while the January drop could be a combination of cold weather and low completions. A few more months of data is required to see if Texas is nearing a production plateau and possible peak.

The red graph is a production projection using January and February Texas RRC data. Due to more production revisions than typical to earlier months in the February report, the projection is too optimistic by roughly 400 kb/d. However, note that both the projection and the EIA show production rolling over in October and dropping in January and increasing in February.

The blue graph shows the average number of weekly rigs reported for each month, shifted forward by 10 months. So the 276 rigs operating in July 2023 have been shifted forward to May 2024. From February 2024 to July 2024, the rig count dropped from 312 in time shifted February 2024 to 256 in July 2024. That drop of 56 rigs has had no impact on production up to August 2024 but November may be the first month when the rig drop impact on oil production is starting to show up along with fewer completions.

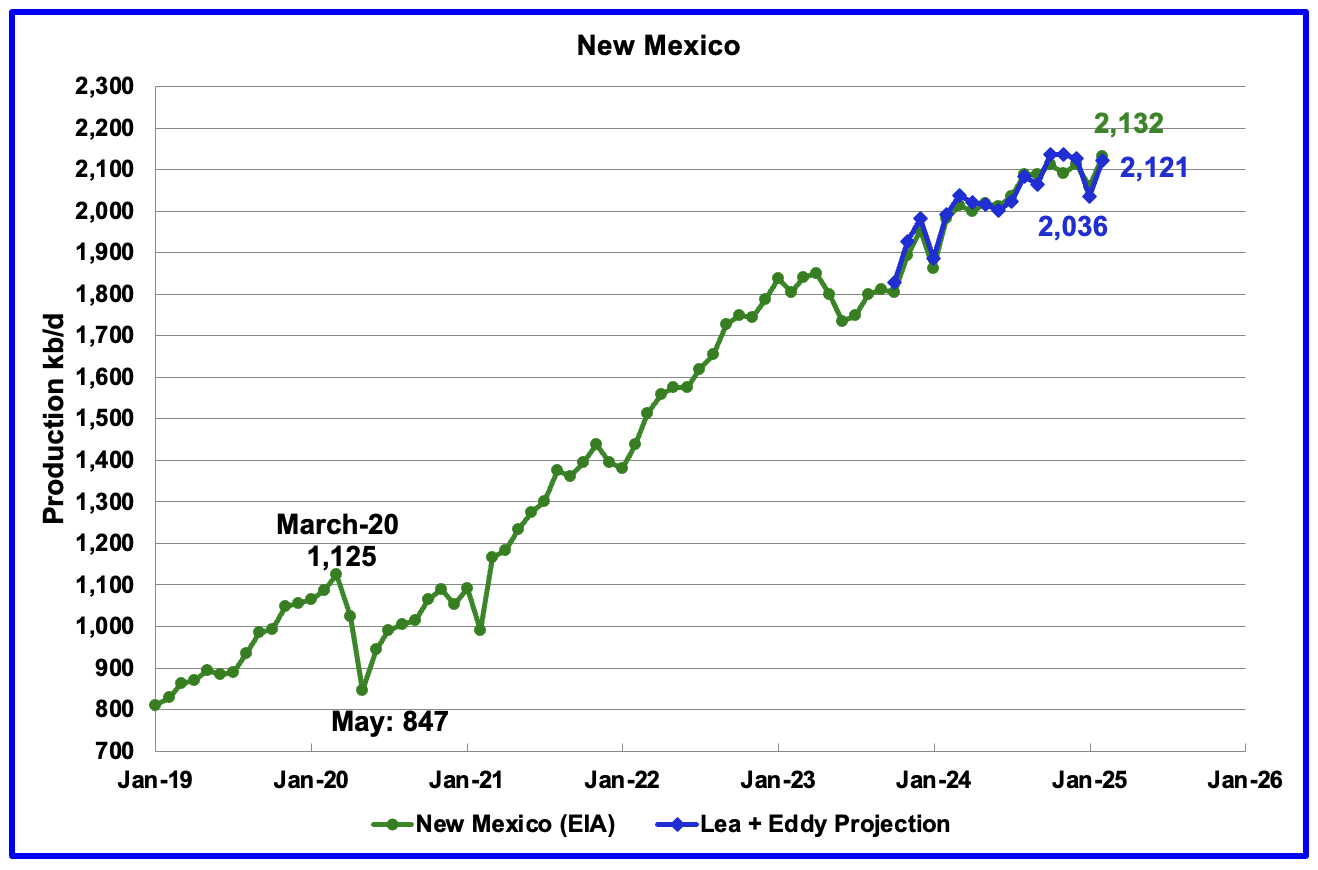

According to the EIA, New Mexico’s February production rose by 72 kb/d to 2,132 kb/d.

The blue graph is a production projection for Lea plus Eddy counties. These two counties account for close to 99% of New Mexico’s oil production. The difference between the January and February preliminary production data provided by the New Mexico Oil Conservation Division was used to make the projection. A 1% correction was added to the Lea plus Eddy production projection to account for their approximate fraction of New Mexico’s oil production. The methodology used for projecting New Mexico production is identical to that used for Texas.

The projection estimates February production was 2,121 kb/d an increase 85 kb/d over January, similar to the EIA’s report. The increase is related to February production increases in both Eddy and Lea counties and is discussed further down in the Permian section.

More oil production information for a few New Mexico and Texas counties is reviewed in the special Permian section further down.

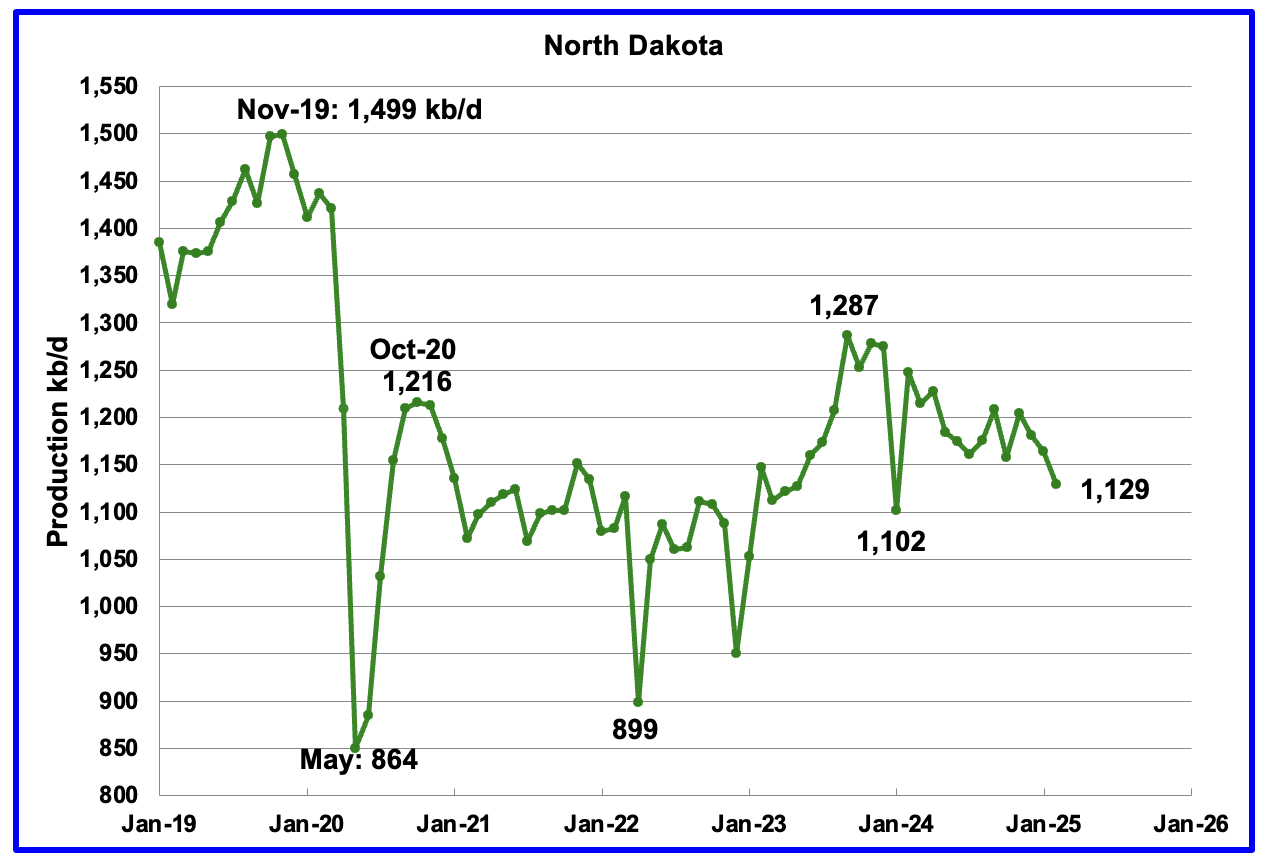

February’s output dropped by 35 kb/d to 1,129 kb/d. Production is down by 158 kb/d from the post pandemic peak of 1,287 kb/d. The North Dakota Department of Mineral resources reported February production was 1,164 kb/d.

The unusually large difference between the EIA and the ND DMR may be due to an over estimation by the EIA associated with very cold February weather in ND. During February production dropped between 120,000 and 150,000 barrels of oil per day according to this Article.

According to this Article, North Dakota oil prices are near breakeven levels. The report has a lot of information of breakeven prices. “Breakeven costs in the Permian Basin of West Texas and New Mexico range between $38 and $42 a barrel.”

Alaskaʼs February output dropped by 3 kb/d to 438 kb/d while YoY production rose by 6 kb/d. The rise in production to close to 435 kb/d over the last four months is an indication that production for the next few months will be on its regular plateau after summer maintenance. EIA’s average weekly February production for Alaska is the same at 438 kb/d.

Alaska has recently brought new fields online to consistently have YoY and monthly production gains which have broken away from the earlier dropping production trend red lines. According to this Article, first oil production begins at Nuna project in Alaska in December.

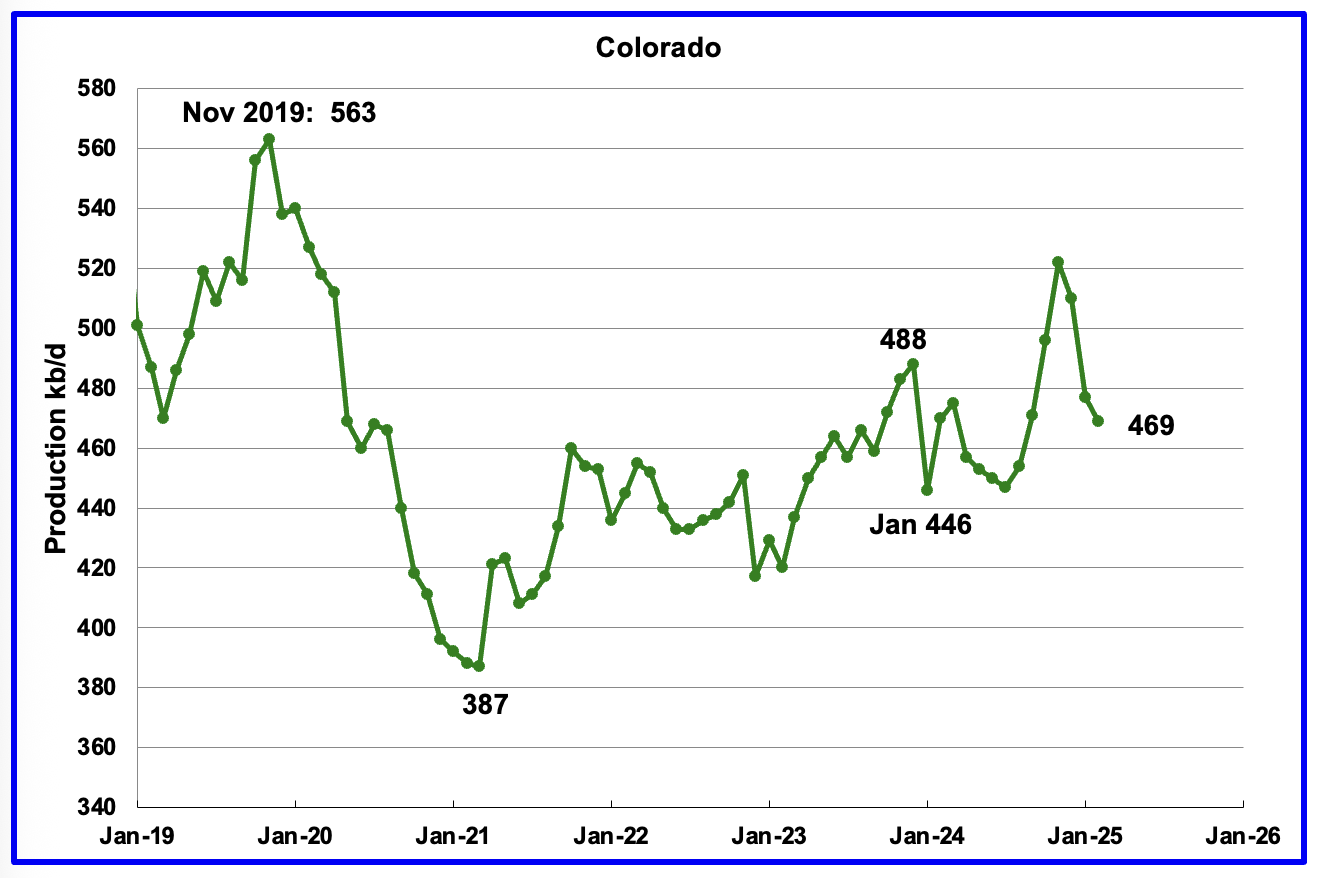

Coloradoʼs February oil production decreased by 8 kb/d to 469 kb/d.

In August 2024, Colorado had 10 rigs operating and ended the year with 7. Colorado began 2025 with 7 rigs in January and February and dropped to 5 in March/April. Is the dropping rig count beginning to show up in dropping oil production?

It should be noted that Colorado drillers are facing increasingly stricter environmental rules according to this Article which could be reducing drilling locations.

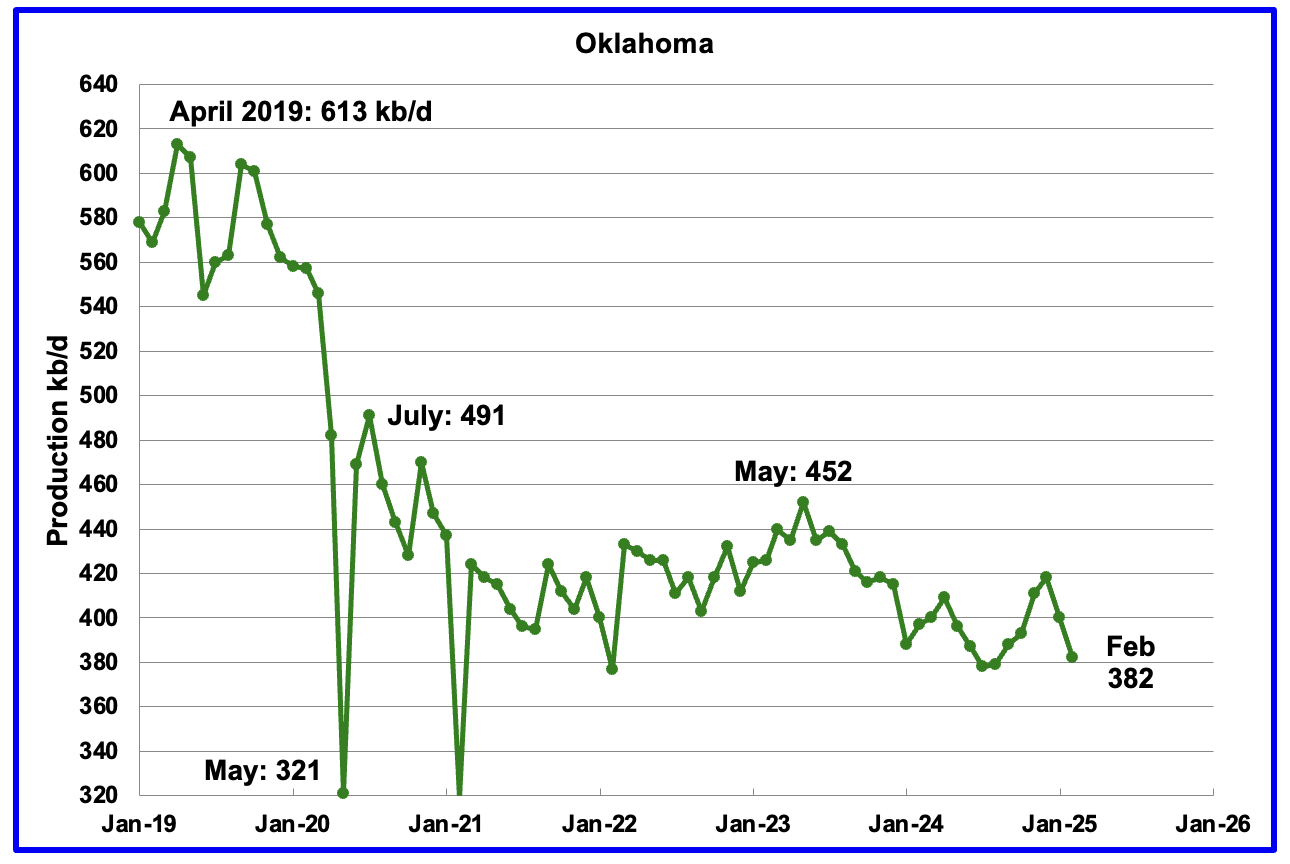

Oklahoma’s output in February dropped by 18 kb/d to 382 kb/d. Production remains below the post pandemic July 2020 high of 491 kb/d and is down by 70 kb/d since May 2023. Output entered a slow declining phase in June 2023.

At the beginning of the year, there were 40 operational rigs. In February 6 rigs were added to bring the total to 46 and an additional 4 were added in March to raise the count to 50 in March and April. Will the increase in the rig count result in increasing oil production going forward?

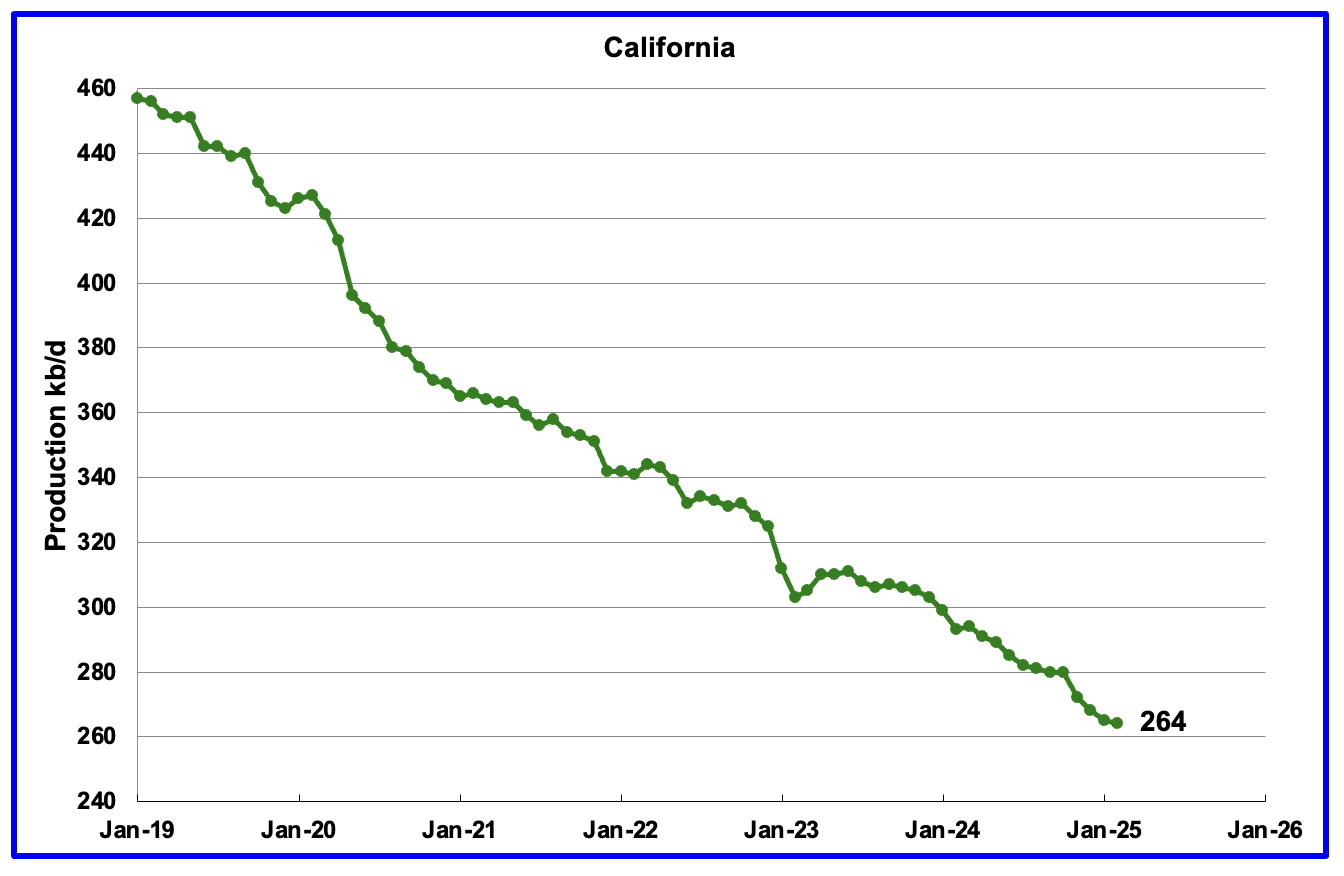

California’s declining production trend continues. February production dropped by 1 kb/d to 264 kb/d.

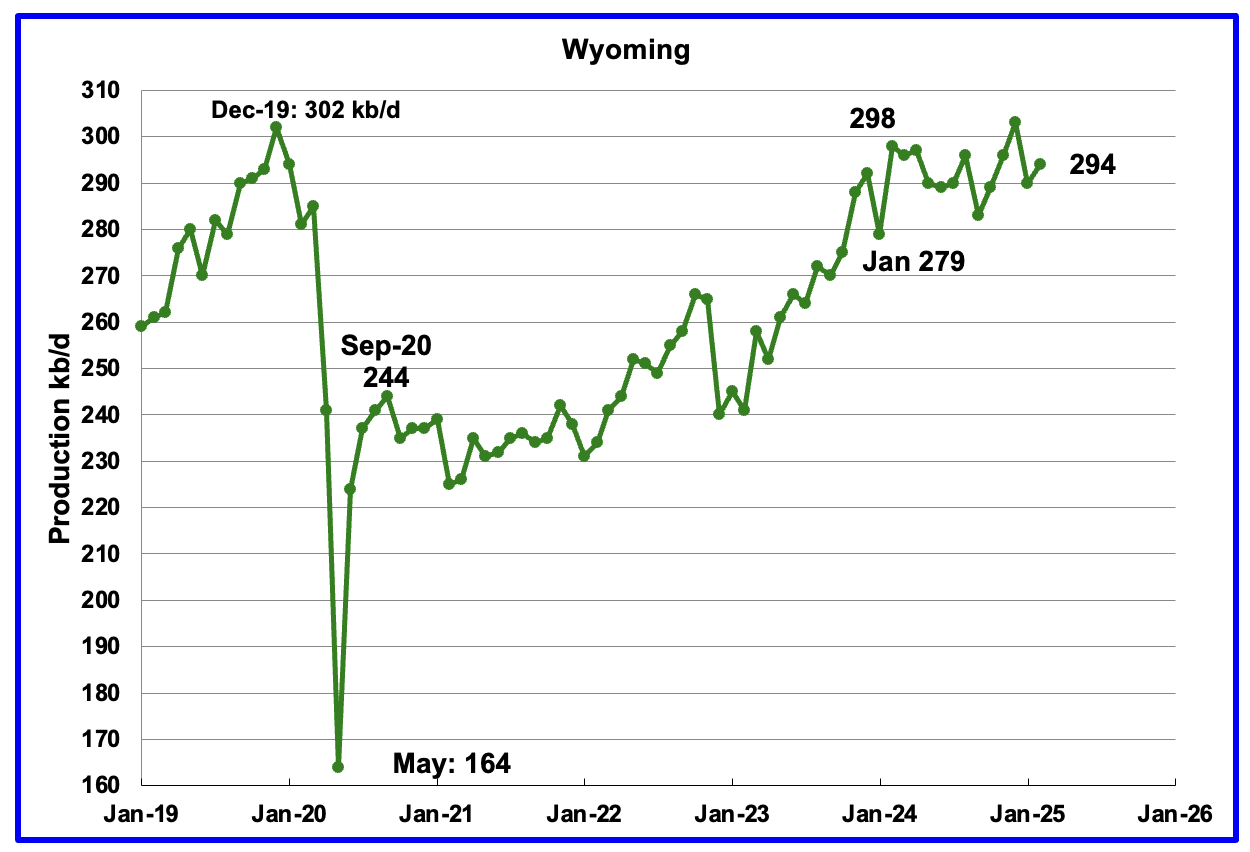

Wyoming’s oil production has been rebounding since March 2023. However the rebound was impacted by the January 2024 storm. Production peaked in February 2024 and is now showing signs of being on a plateau. February’s production rose by 4 kb/d to 294 kb/d.

In August Wyoming had 8 operational rigs. The rig count has slowly risen to 14 from November to January and to 16 in April.

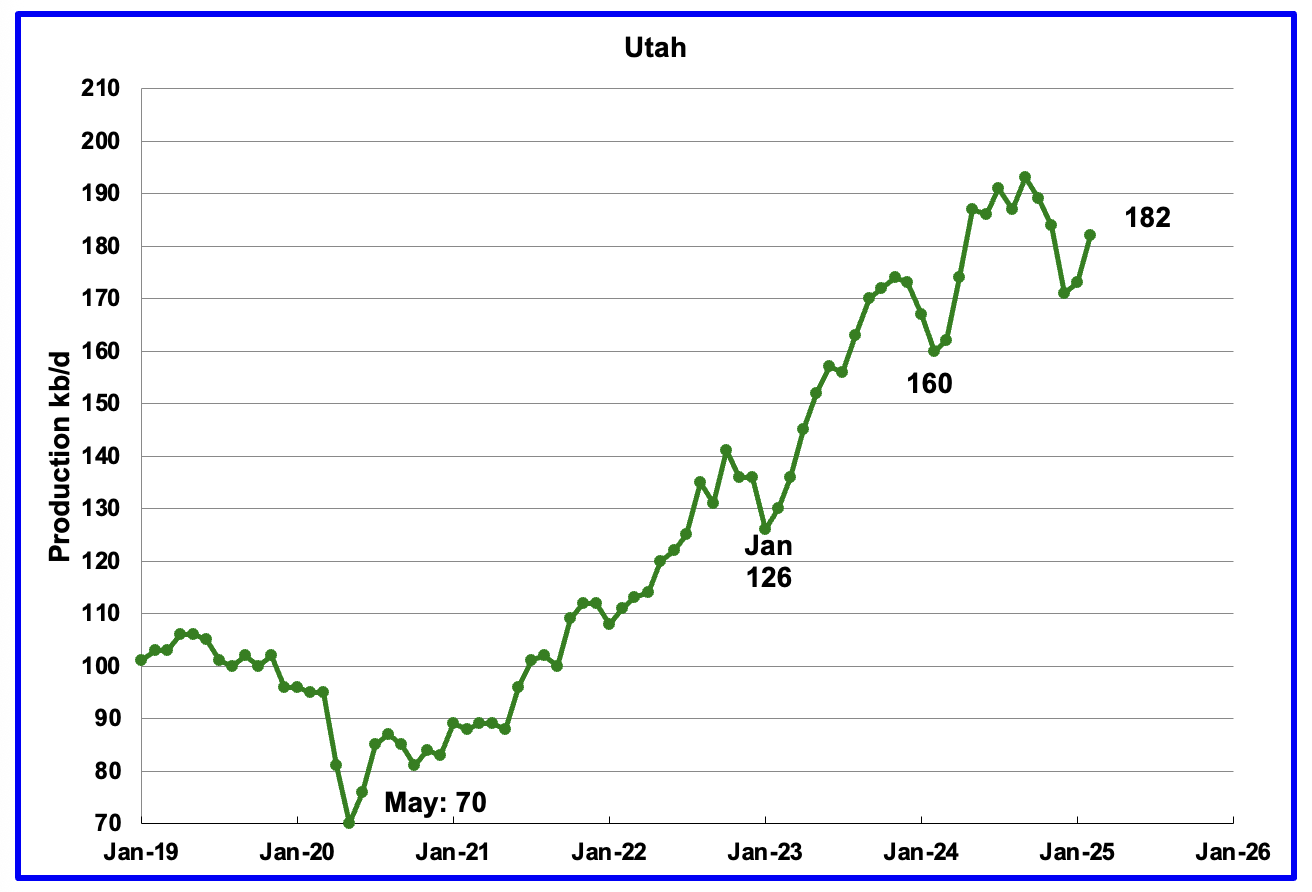

February’s production increased by 9 kb/d to 182 kb/d. Utah had 8 rigs operating from October through April.

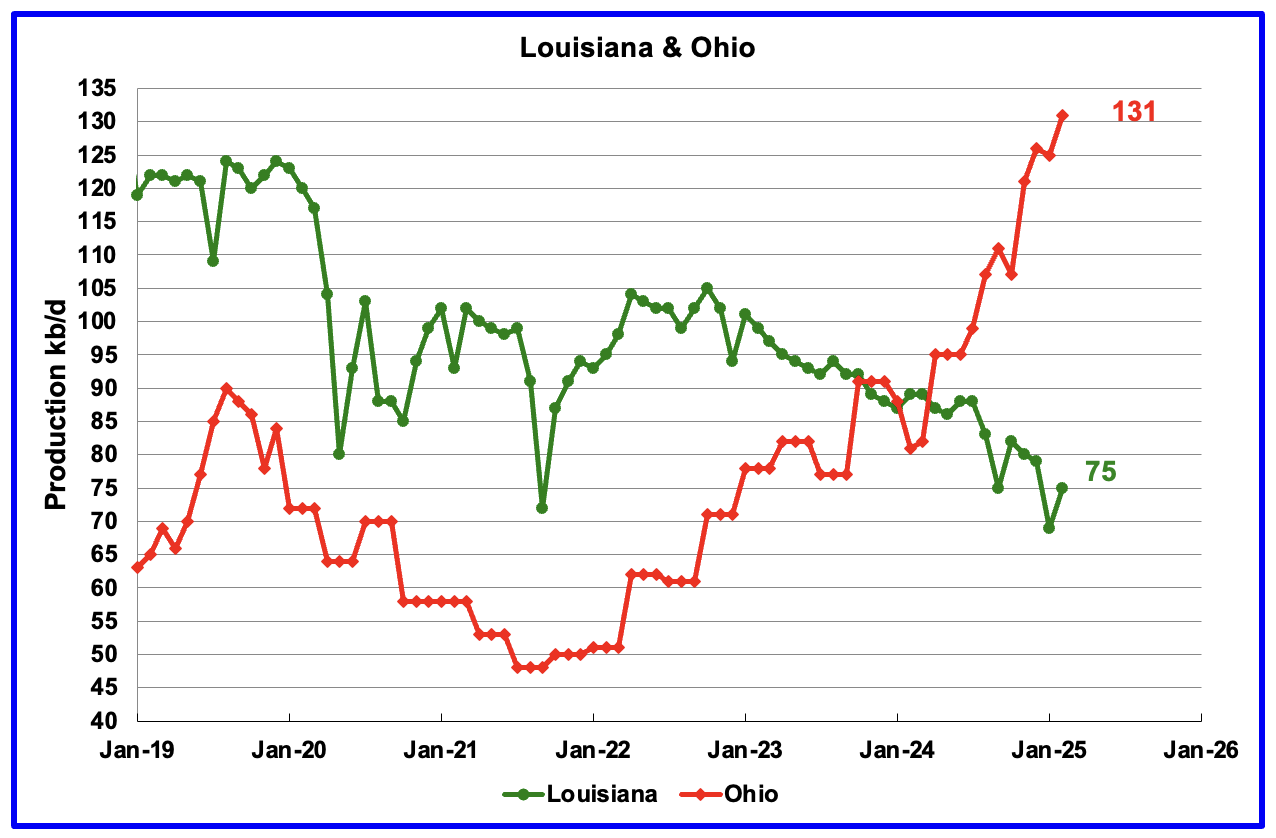

Ohio has been added to the Louisiana chart because Ohio’s production has been slowly increasing since October 2021 and passed Louisiana in November 2023.

Louisiana’s output entered a slow decline phase in October 2022 and continued to fall in January but recovered a bit in February. February’s production rose by 6 kb/d to 75 kb/d. As of all of 2025, there are no oil rigs operating in Louisiana. In November 2024, one rig was operating. Anybody have any thoughts on this and can it be confirmed?

Ohio’s February oil production increased by 6 to 131 kb/d, a new record high. The most recent Baker Hughes rig report shows 1 horizontal oil rig operating in Ohio in December and January. In April, 8 rigs were operational. Is Ohio’s crude primarily condensate recovered from NG wells?

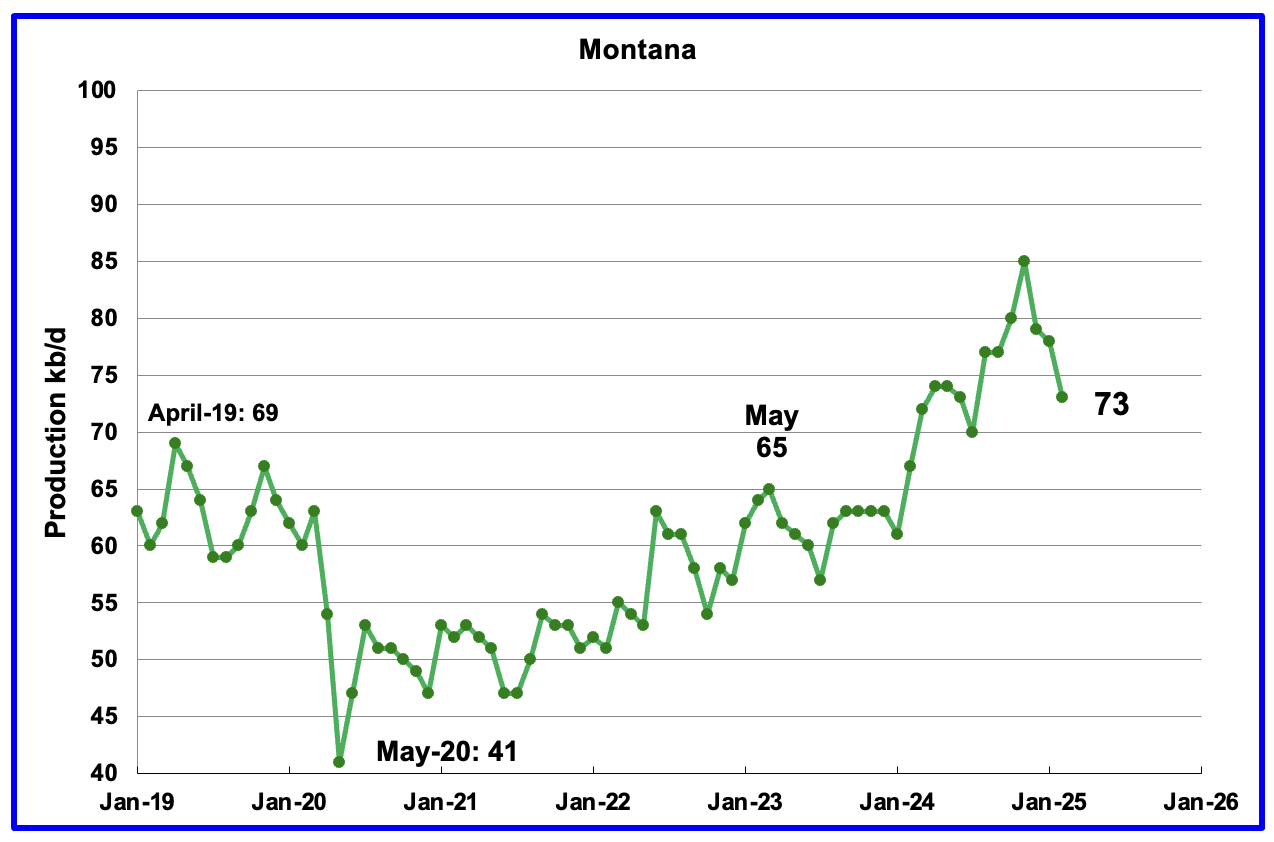

February’s oil production dropped by 5 kb/d to 73 kb/d. Montana had one oil rig operating from December through April.

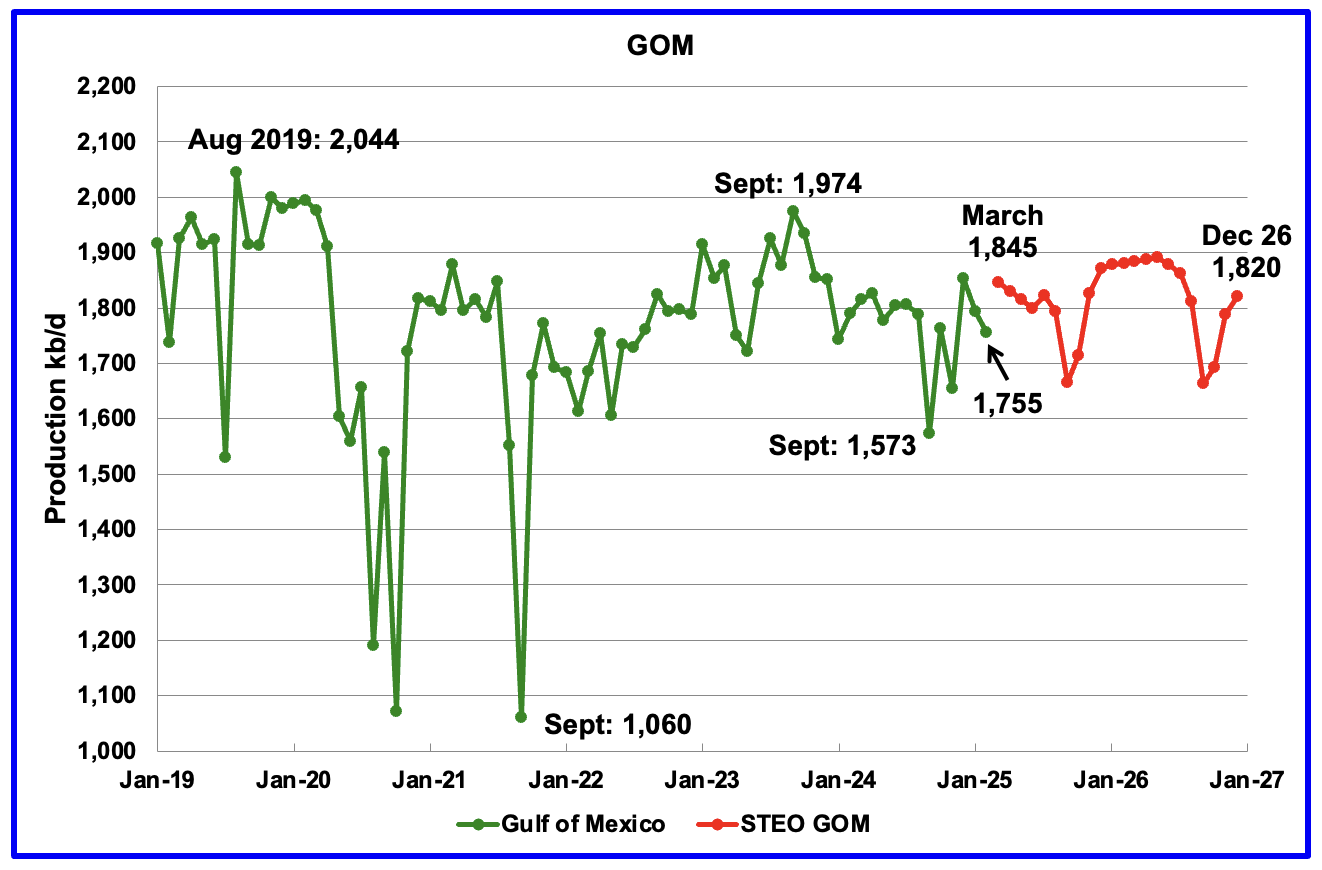

GOM production dropped by 39 kb/d in February to 1,755 kb/d vs the STEO forecast that it was expected to rise to 1,865 kb/d in February, a 110 kb/d over estimation. March production is projected to rise to 1,845 kb/d.

The April 2025 STEO projection for the GOM output has been added to this chart. It projects production in December 2026 will be 25 kb/d lower than March 2025 at 1,820 kb/d.

According to the OPEC MOMR, in the coming months, output is expected to be supported by project ramp-ups and several new projects, such as the deepwater Whale platform that started production in January.

A Different Perspective on US Oil Production

Combined oil output for the Big Two states Texas and New Mexico.

February’s production in the Big Two states increased by a combined 113 kb/d to 7,750 kb/d and is 194 kb/d lower than October 2024. Clearly these two states were the drivers of US oil production growth up to October 2024. Has the trend flipped?

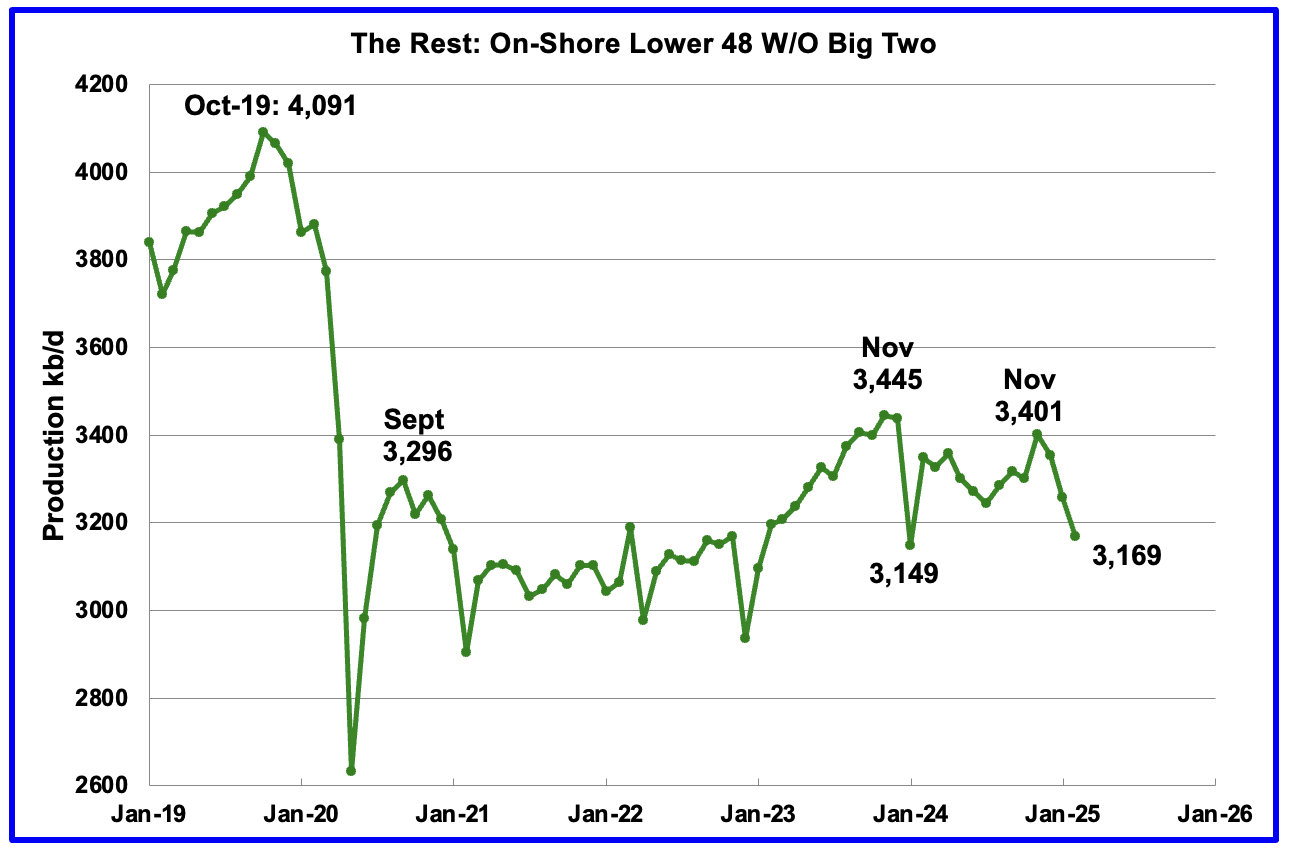

Oil Production by The Rest

February’s oil production by The Rest dropped by 89 kb/d to 3,169 kb/d and is 232 kb/d lower than November 2023.

Permian Basin Report for Main Counties and Districts

This special monthly Permian section was added to the US report because of a range of views on whether Permian production will continue to grow or will peak over the next year or two. The issue was brought into focus recently by two Goehring and Rozencwajg Report and Report2 which indicated that a few of the biggest Permian oil producing counties were close to peaking or past peak. Also comments by posters on this site have similar beliefs from hands on experience.

This section will focus on the four largest oil producing counties in the Permian, Lea, Eddy, Midland and Martin. It will track the oil and natural gas production and the associated Gas Oil Ratio (GOR) on a monthly basis. The data is taken from the state’s government agencies for Texas and New Mexico. Typically the data for the latest two or three months is not complete and is revised upward as companies submit their updated information. Note the natural gas production shown in the charts that is used to calculate the GOR is the gas coming from both the gas and oil wells.

Of particular interest will be the charts which plot oil production vs GOR for a county to see if a particular characteristic develops that indicates the field is close to entering or in the bubble point phase. While the GOR metric is best suited for characterizing individual wells, counties with closely spaced horizontal wells may display a behaviour similar to individual wells due to pressure cross talking . For further information on the bubble point and GOR, there are a few good thoughts on the intricacies of the GOR in an earlier POB comment and here. Also check this EIA topic on GOR.

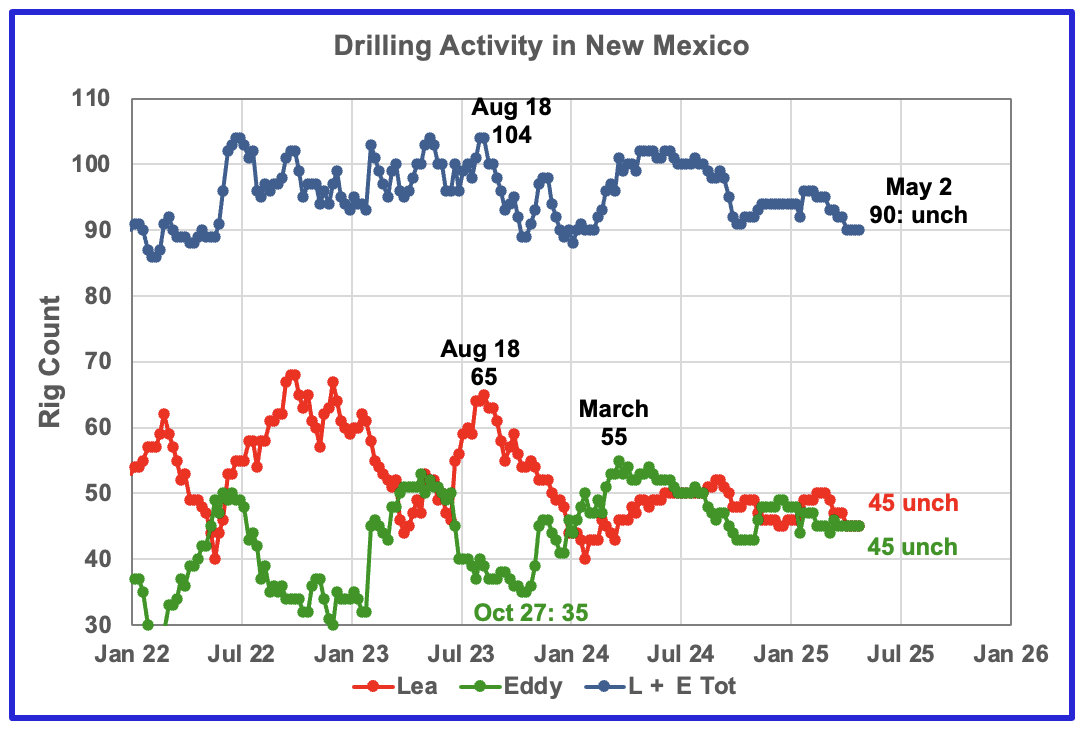

New Mexico Permian

The total rig count in Lea and Eddy counties in the week ending May 2 was 90 and is down 10 from the July 2024 count of 100. The total rig count has held steady at 90 for the last four weeks.

Lea and Eddy county rigs have both stabilized around 45 over the last few months but are hinting at a slow decline.

Lea County’s oil production appears to have entered a plateau phase in May 2024 at 1,240 kb/d. February’s projected output saw an increase of 41 kb/d to 1,216 kb/d after the January drop to 1,175 kb/d. Preliminary February data from New Mexico’s Oil Conservation Division (OCD) indicates Lea County’s oil production increased by 30 kb/d to 1,170 kb/d.

Production has been essentially flat to slightly down since May 2024 as the rig count fell. February’s large production increase could be related to a production rebound associated with January’s cold weather.

The blue graph shows the average number of weekly rigs operating during a given month as taken from the weekly rig chart. The rig graph has been shifted forward by 8 months. So the 64 Rigs/wk operating in August 2023 have been time shifted forward to April 2024 to show the possible correlation and time delay between rig count, completion and oil production.

Comparing the flattening oil production since May with the dropping time shifted rig count, indicates/implies the newer wells drilled since June had higher IPs to offset the decline associated with the fewer wells drilled by the declining rig count. The rising rig count starting in November 2024 may be able to slow the declining/flattening production in Lea County but the writing on the wall is saying that Lea County is close to peak production.

Note that rig counts are being used to project production as opposed to completions because very few extra DUCs are being completed at this time.

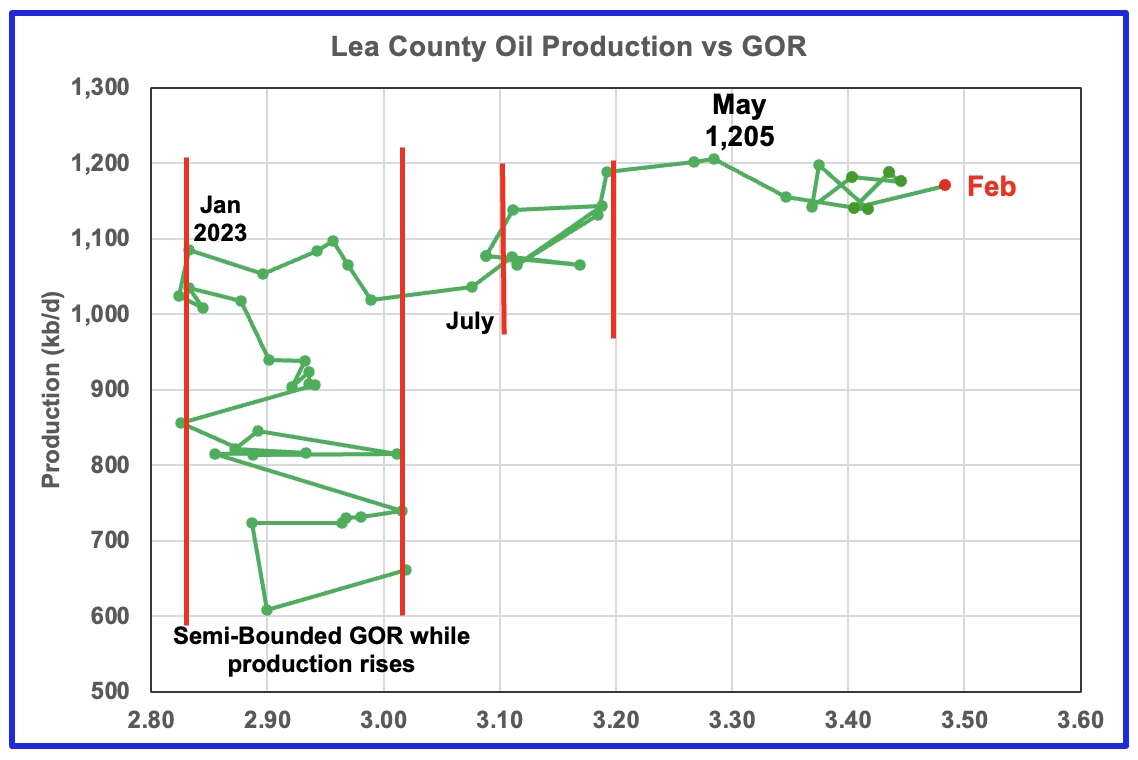

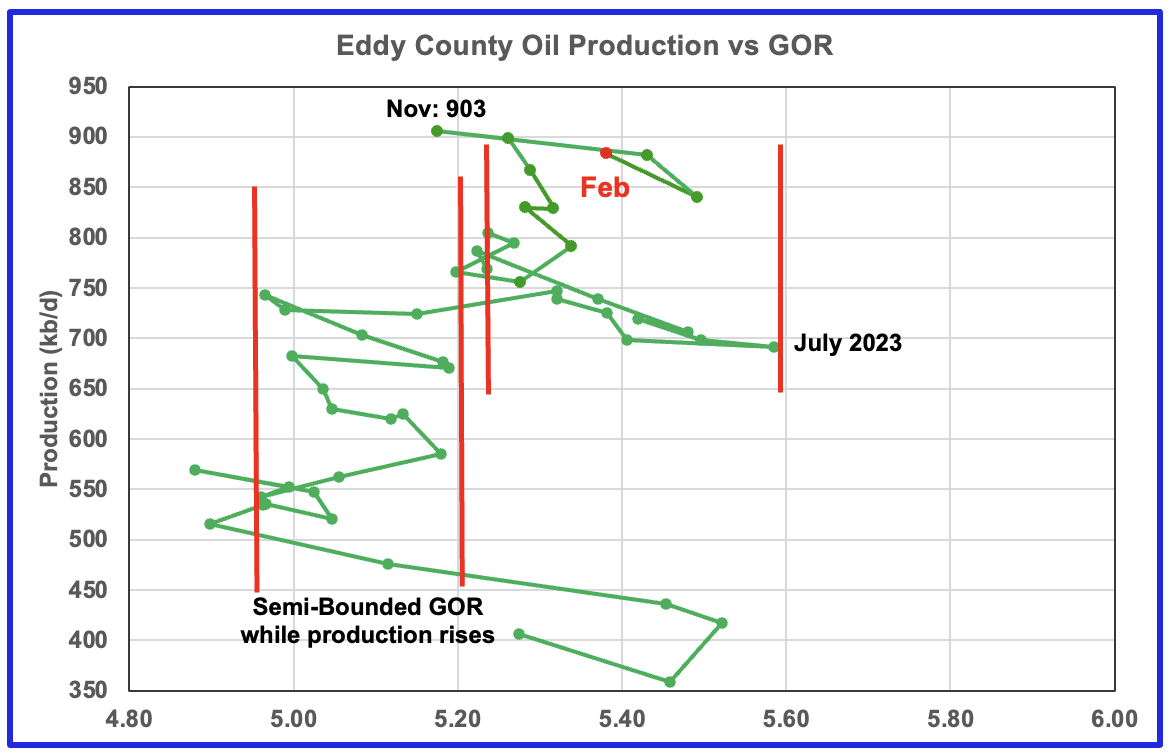

After much zigging and zagging, oil production in Lea county stabilized just below 1,100 kb/d in early 2023. Once production reached a new high in January 2023, production appeared to be on a plateau while the GOR started to increase rapidly to the right and entered the bubble point phase in July 2023.

Since July 2023 the Lea County production has continued to increase as the GOR remained within a second semi-bounded region. This may indicate the recent additional production is coming from a new field/area since the GOR’s behaviour since August 2023 to March 2024 time frame appears once again to be in a semi bounded GOR phase accompanied with rising production.

The GOR moved out of the second semi-bounded GOR region in April and hit a new high in May. Since July the GOR has bounced around 3.4. February saw a production rise as the GOR increased to a new high of 3.48.

This zigging and zagging GOR pattern within a semi-bounded GOR while oil production increases to some stable level and then moves out to a higher GOR to the right has shown up in a number of counties. See a few additional cases below.

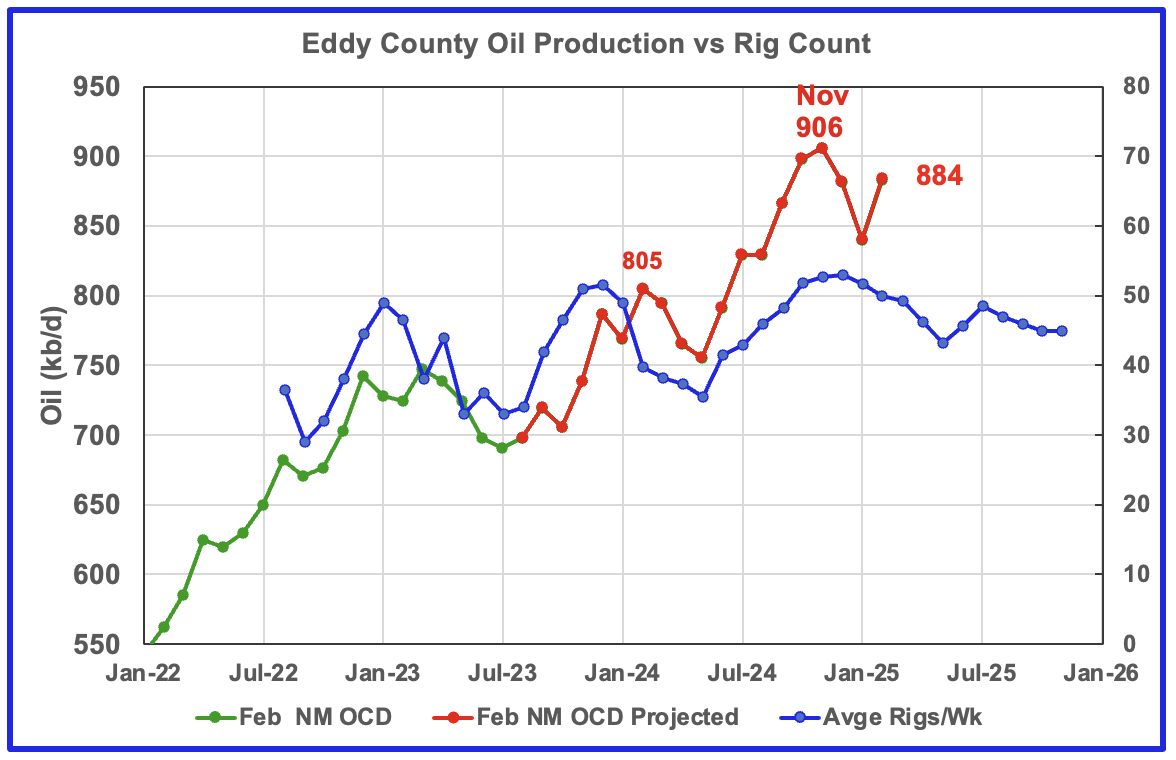

February’s projected oil production increased by 44 kb/d to 884 kb/d. Similar to Lea County, the production increase could be due to a rebound from January’s bad weather.

Eddy County’s oil production first peaked in February 2024 at 805 kb/d. After dropping for three months, the number of rigs and associated wells increased and so did oil production. From May to November, production rose from 755 kb/d to 906 kb/d, an increase of 151 kb/d, while essentially paralleling the increasing rig count. Over that same time shifted rig period, 14 to 15 rigs were added to Eddy County as production rose. Was a new Tier 1 region/area discovered to attract such a large increase in the rig count?

In November 2024 the projected oil production increased by 8 kb/d to a new high of 906 kb/d. This smaller increase relative to previous months also appears to reflect the production impact associated with the slowing increase in the rig count.

The blue graph shows the average number of weekly rigs operating during a given month as taken from the above weekly drilling chart. The rig graph has been shifted forward by 7 months to roughly coincide with the increase in the production graph starting in November 2023.

Clearly the production rise up to November 2024 is closely associated with the rise in the rig count and associated well completions delayed by roughly seven months. The smaller November increase is the second clue that the production rise associated with increasing rigs is about to end. The dropping rig count starting in January 2025 implies that production in Eddy county may be heading into a short term plateau phase between 850 kb/d and 900 kb/d.

The Eddy county GOR pattern is similar to Lea county except that Eddy broke out from the semi bounded range earlier and for a longer time and then added a second semi bounded GOR phase. For February New Mexico’s Oil Conservation Division (OCD) reported oil production increased by 43 kb/d to 883 kb/d and stayed within the second semi-bounded region.

Note the big increase in the GOR from November to January. The February drop in GOR along with rising oil production implies the new wells are being drilled in a region/area with a much lower GOR.

Texas Permian

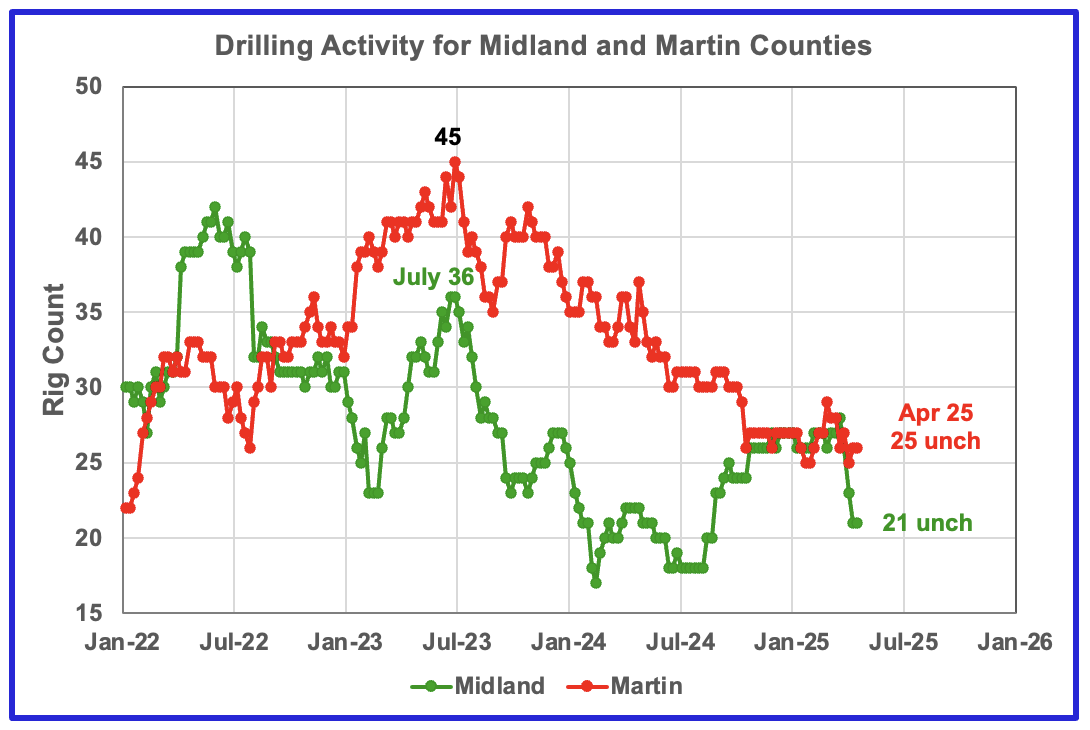

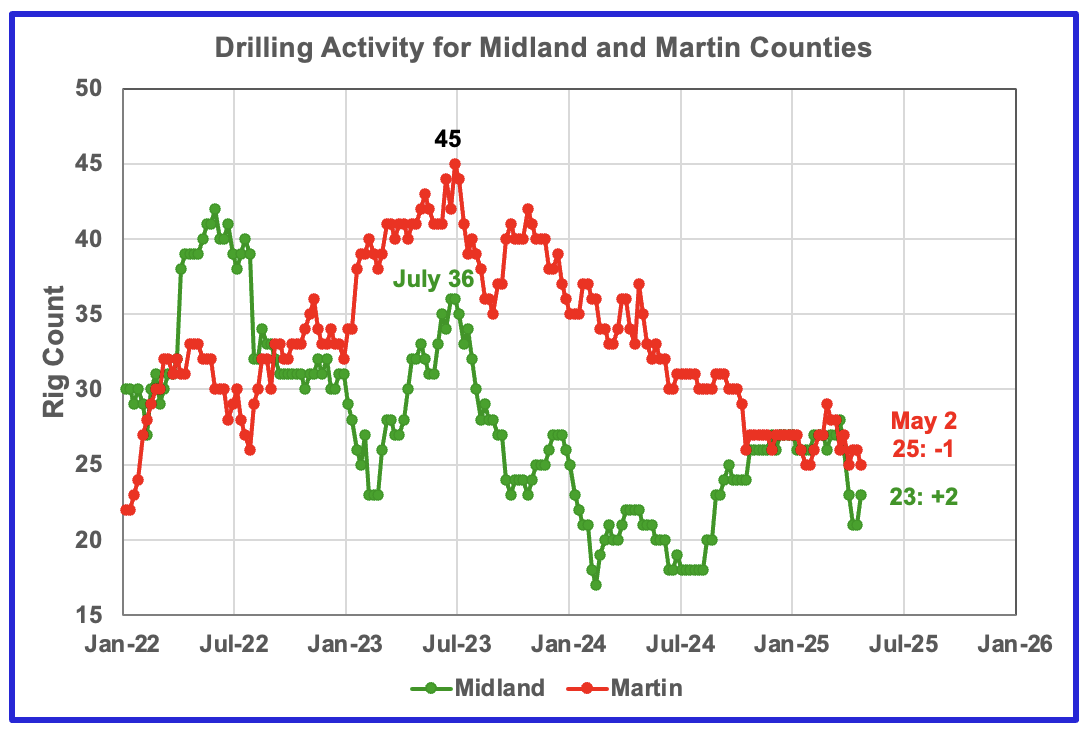

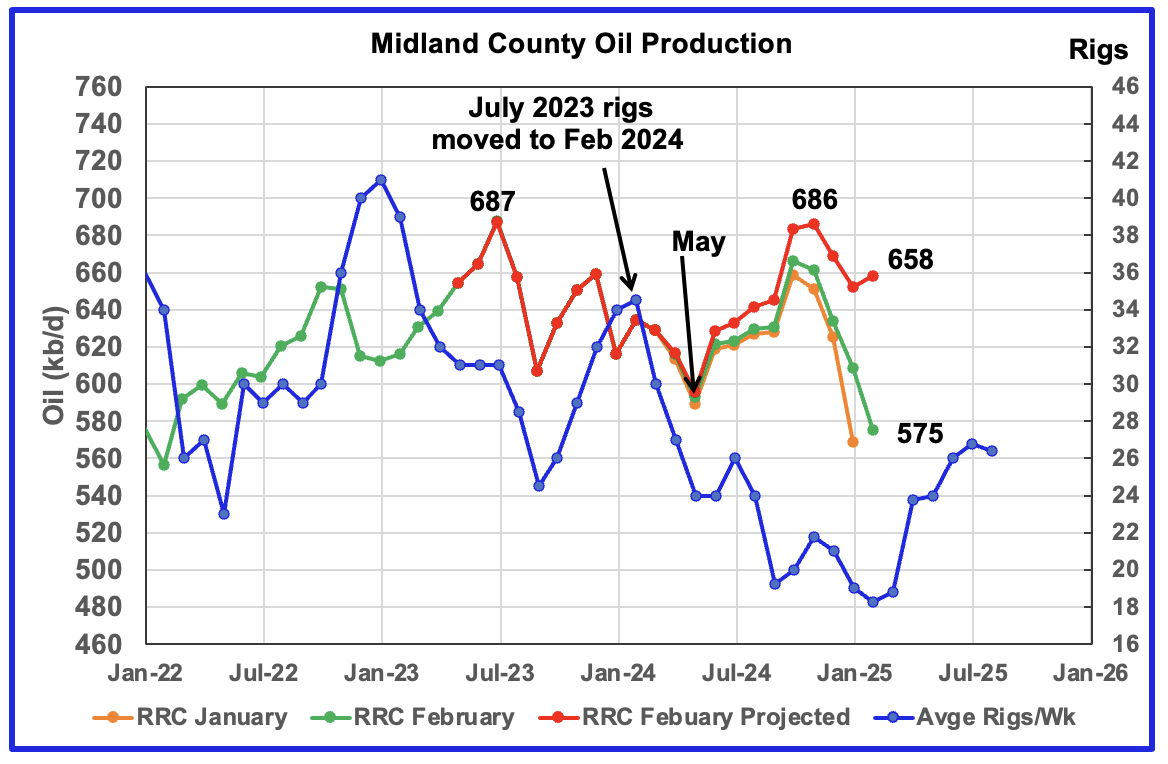

The Midland county rig count has been rising since July 2024 and was up 10 to 28 at the end of March 2025. However it dropped by 7 rigs to 21 by the end of April has rebounded by 2 to 23 in the first week of May.

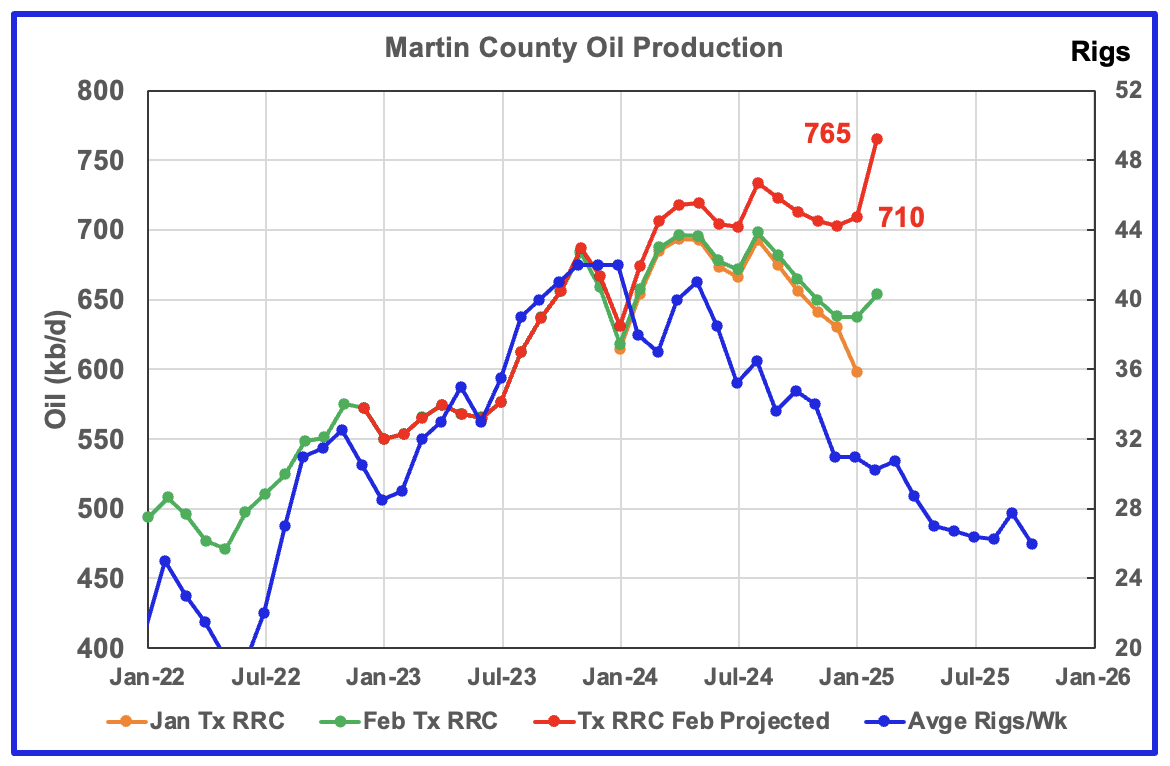

The opposite is true for Martin county. In the week ending May 2, 25 rigs were operational, down 19 from 45 in July 2023. Since the end of October Martin’s rig count has been fairly steady around 26.

Oil Production in Texas Counties

February’s projected production added 6 kb/d to 658 kb/d. Both the December and January projected production reported in the previous post have been revised lower as expected because large updates to earlier months did not occur. December dropped by 15 kb/d to 669 kb/d and January dropped by 10 kb/d to 652 kb/d.

The orange and green graphs show the oil production for Midland County as reported by the Texas RRC for January and February. The red graph uses the January and February data to project production as it would look after being updated over many months.

Even though the rig count is dropping, I think the increase in the projected production after May 2024 is real based on the increasing preliminary production shown from June to October in the latest February RRC report. Flat October and November production and December dropping is signalling an imminent production peak/plateau.

The blue graph shows the average number of weekly rigs operating during a given month as taken from the weekly drilling chart. The rig graph has been shifted forward by seven months. So the average 34.5 Rigs/wk operating in July 2023 have been moved forward to February 2024 to show the possible correlation and time delay between rig count, completions and oil production. If the seven month shift in the rig count is approximately correct in that oil production can be tied to the rig count, oil production in Midland county should increase starting in April for a month or two before resuming its decline.

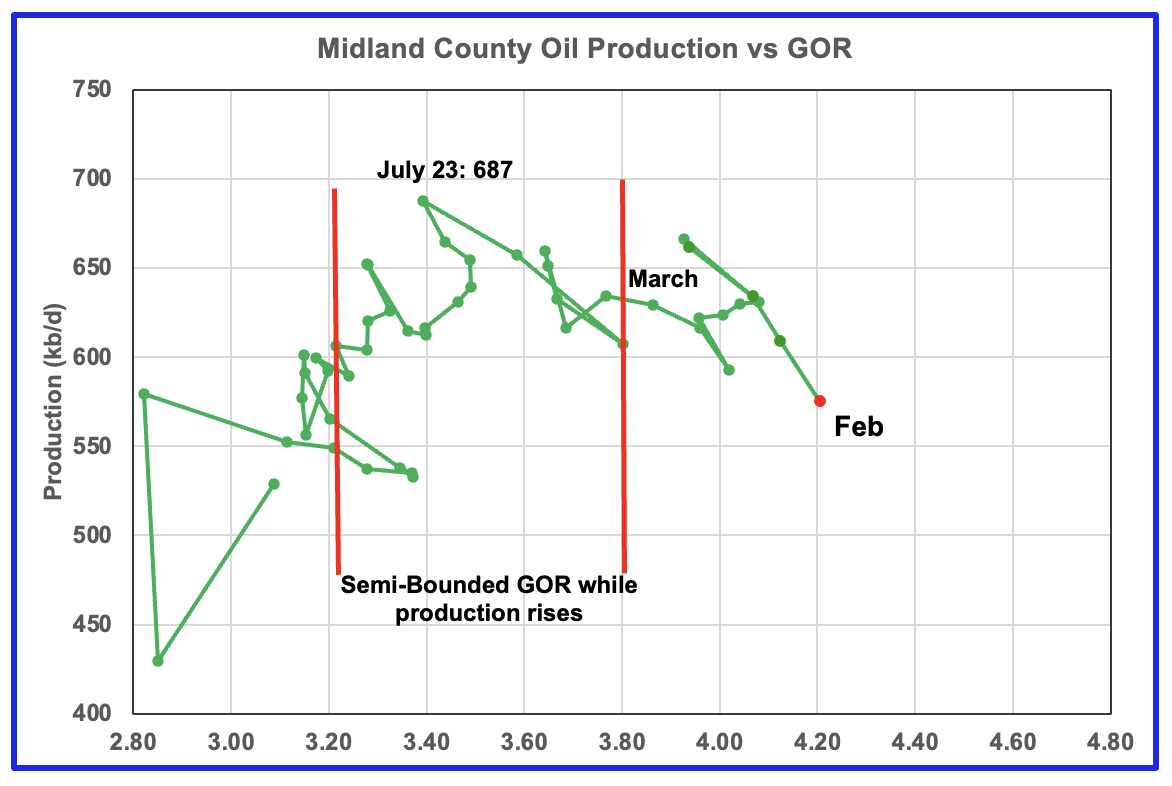

For February the GOR ratio increased to 4.21 from January’s 4.13 while reported preliminary oil production dropped.

With Midland county into the bubble point phase, oil production and the GOR have stayed within a narrow range outside of the initial Semi-Bounded GOR region since March. February GOR increased over January while production came in at a new low since the July 2023 production high.

The oil production and GOR shown in this chart are based on the RRC’s February production report. Note that while the last few months are subject to revisions, the July 2023 to May 2024 production data has been steady for a number of months.

Martin county’s projected February oil production increased by 55 kb/d to 765 kb/d. The February projection is an over correction due to production being too low in January due to bad weather. The trend from May 2024 to January 2025 is a more realistic production projection for Martin county, it’s on a plateau. For example, January production reported in the previous post has been revised down by 42 kb/d from 752 kb/d to 710 kb/d.

The orange and green graphs show the production for Martin County as reported by the Texas RRC for January and February. The blue chart shifts the rig count ahead by 6 months.

The red graph is a projection for oil production as it would look after being updated over many months. This projection is based on a methodology that uses preliminary January and February production data. The green graph shows oil production reported by the Texas RRC for February and it is higher than January’s. Note how production has dropped from September 2024 to January 2025, green graph.

My best guess for Martin County production is that it is on a plateau closer to 725 kb/d and on the verge of starting to decline as indicated by the production from August to January.

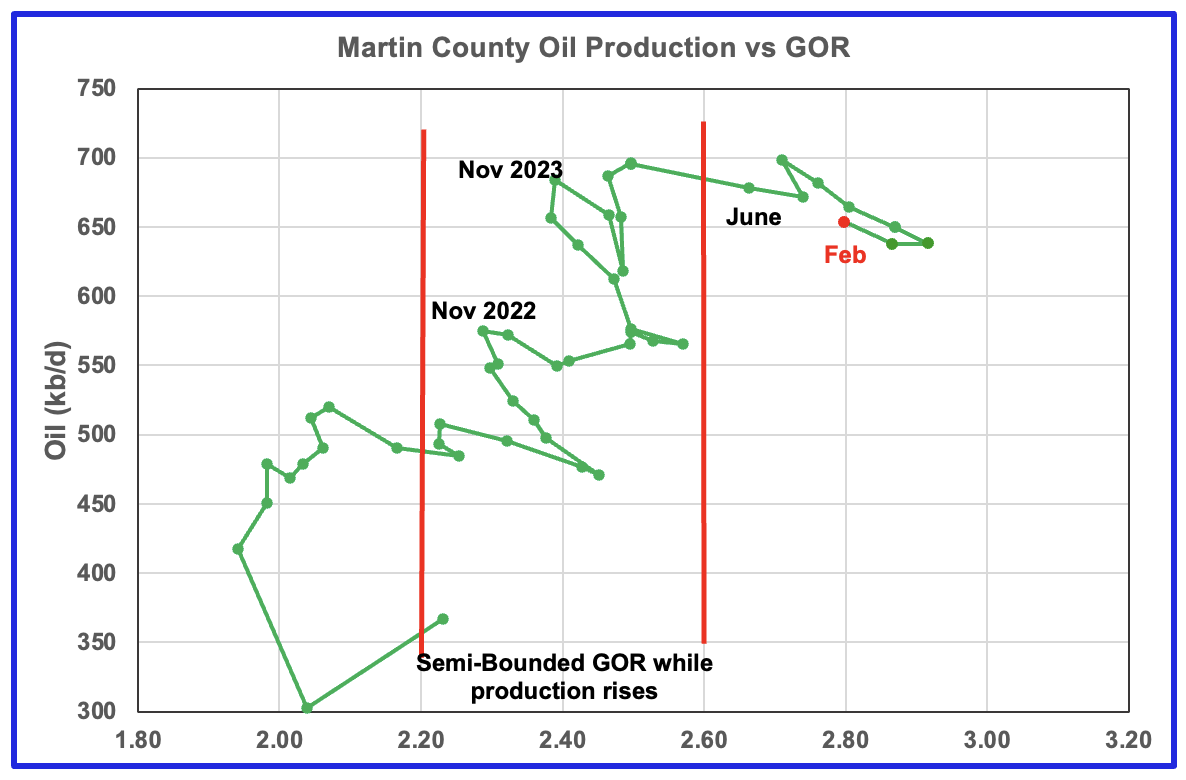

Martin county’s oil production after November 2022 increased and at the same time drifted to slightly higher GORs within the semi bounded range. However the June 2024 GOR saw its first move out of the semi bounded region. The preliminary Texas RRC’s February production for Martin county shows a decrease in the GOR accompanied by an increase in oil production.

Martin county has the lowest semi-bounded GOR boundary of the four counties at a GOR of close to 2.60. In February the GOR dropped from 2.87 in December to 2.80. Nevertheless, it is clearly out of the semi-bounded region. Martin County has now entered the bubble point phase that should result in oil production entering a plateau phase.

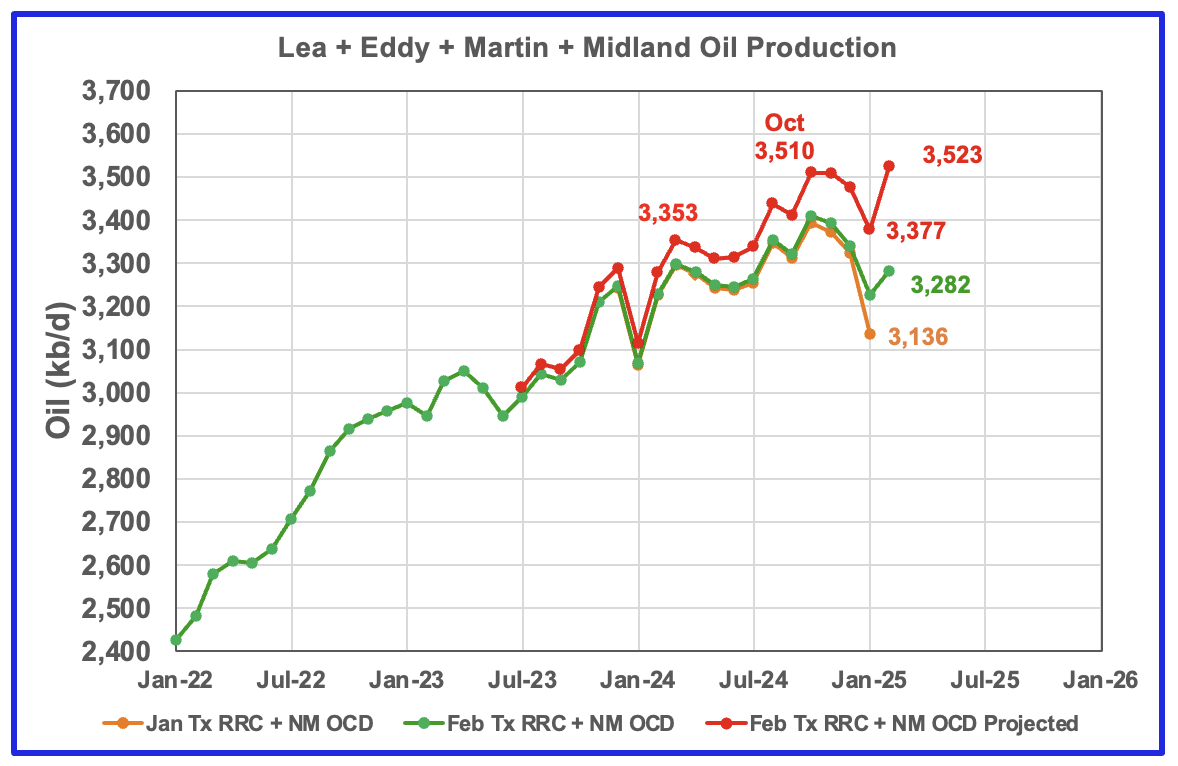

This chart shows the total oil production from the four largest Permian counties. Assuming that current February Permian production is close to 6,400 kb/d, these four counties account for close to 54% of the total. The projection for February production is overly optimistic primarily because Martin’s January production was too low which resulted in an optimistic projection for February. Also the February rise is related to smaller production increases in the other three counties. A more realistic projection would be closer to a plateau between 3,400 kb/d and 3,500 kb/d, possibly showing up next month.

The January and February initial production data is shown in the orange and green graphs respectively. The red graph uses the January and February data to project an estimate for the final February production. The large February rise is related to the production rise in all four counties.

The projection indicates that February production from these four counties increased by 146 kb/d to 3,523 kb/d. The combined preliminary February production data is higher than January’s by 146 kb/d to 3,282 kb/d.

This Article reports that: “When Exxon Mobil and Chevron report first-quarter results this week, investors will be focused on how falling oil prices have increased the risk to dividends and share repurchases for the rest of 2025.”

It further notes that: “Chevron may reduce buybacks if weak oil prices persist, said analysts from four firms. The second-largest U.S. oil company previously guided annual share repurchases between $10 billion and $20 billion.

The company is in the process of cutting up to $3 billion in costs and laying off up to 8,000 employees.”

Rystad has Lowered its production outlook for the US onshore L48 states.

“Expansion of oil production in the lower 48 US states is expected to be less than 150,000 barrels a day, as measured from the end of last year to the end of 2025, Rystad said Monday in a report. That’s down from a previous growth estimate of about 300,000 barrels a day. The consultant expects oil output in the region next year to decline based on current prices.

“We expect activity declines to be most concentrated in the Permian, as other basins already are in maintenance mode,” said Amber McCullagh, senior vice president at Rystad, referring the Permian Basin, the world’s biggest shale patch, which is located in West Texas and New Mexico.”

Findings

– The February production data was in general good and most of the projections are reasonable with only a few Texas counties being optimistic. In general all of the four largest county production charts are in a plateau phase. Taking into consideration that the price of WTI is stuck close to $60/b, the rig count is holding steady around 445, the continuing lower frac spread count and the plateauing of the four biggest counties, taken all together all point to peak production in the onshore lower 48 within the next six months.

– Lea county entered a plateau phase in May 2024. While oil production is not following the rig count graph directly, the dropping rig count is resulting in Lea production currently being on a plateau. The February projected production rise could be a rebound from the low January production associated with the January cold weather.

– Eddy County’s oil production initially peaked in February 2024. It started a new increasing phase in June as it followed the uptrend in the rig count and exceeded its previous February peak. Production peaked in November 2024 and is now in decline and possibly heading into a lower production plateau phase.

– Midland county peaked in July 2023 and has roughly followed the declining rig count graph up to May 2024. It appears to have started a new increasing phase in June 2024 and peaked in November 2024. November could be the beginning of its plateau phase.

– Martin County may have peaked in August 2024 and may have entered a plateau phase. The February projected production rise is due to the lower reported production for January which results in a too optimistic production for February. Regardless Martin county has been on a plateau closer to 725 kb/d for the last six months.

– All four of the largest Permian oil producing counties are now in their plateau phase with all four hinting that the decline phase is close at hand. Need a few more months of data to clarify the future growth/decline trend of these four counties.

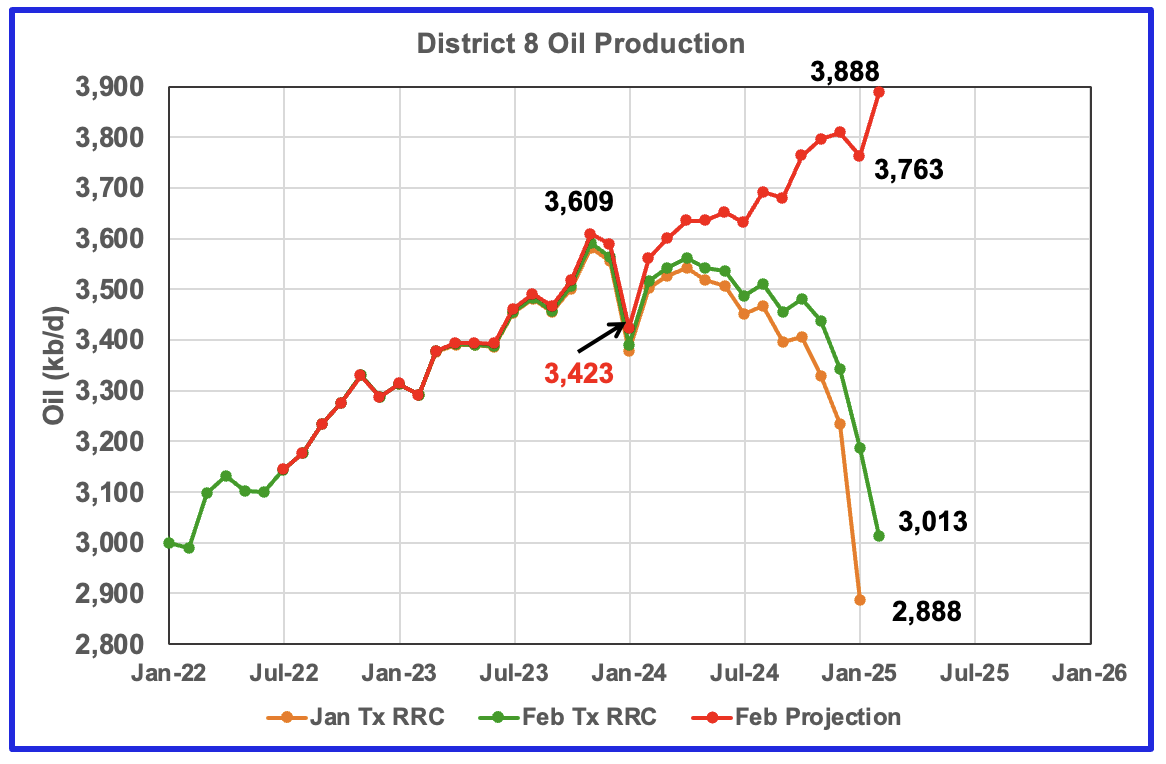

Texas District 8

The large number of small revisions to the previous months in the February report has made the February production increase of 125 kb/d in District 8 optimistic. The major contributors being Martin and Loving. This optimistic increase will hopefully be corrected in the next report. Regardless the portion of the increase up to July 2024 is real and the January drop is more than likely real.

Texas District 8 contains 20 counties. Of the 20, eight are reviewed in this post, Midland, Martin, Loving, Reeves, Howard, Upton, Reagan and Glasscock. From January 2024 to January 2025, production in District 8 increased by 340 kb/d. Of the 340 kb/d increase, those eight counties accounted for 288 kb/d or 84.7% of the increase.

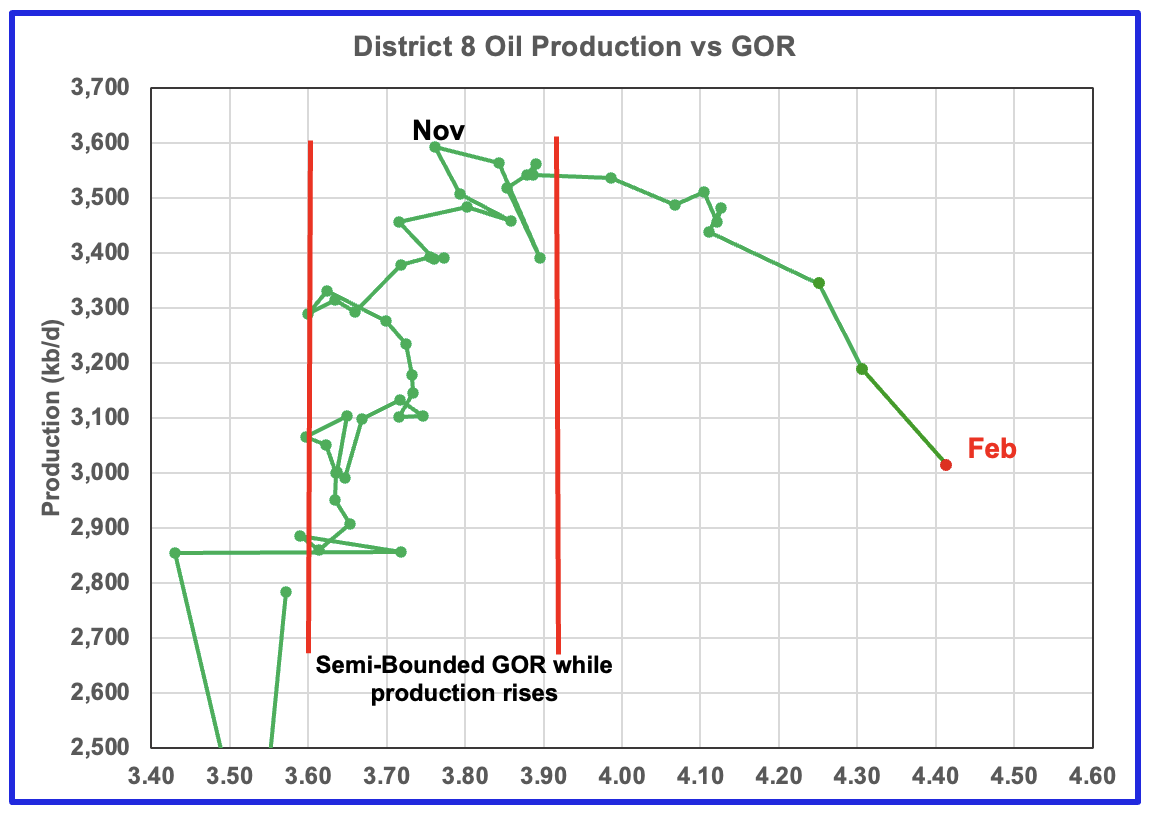

While the revisions in the production chart affect the projection, it does not affect the GOR.

Plotting an oil production vs GOR graph for a district may be a bit of a stretch. Regardless here it is and it seems to indicate many District 8 counties may well be into the bubble point phase. The GOR continued to increase in February to 4.41. This is another indicator that implies District 8 may be on a production plateau even though the projected production chart says otherwise.

Oil Production and GOR Charts for a number of Larger Texas Oil Producing Counties

Below are the next six top oil producing counties in Texas.

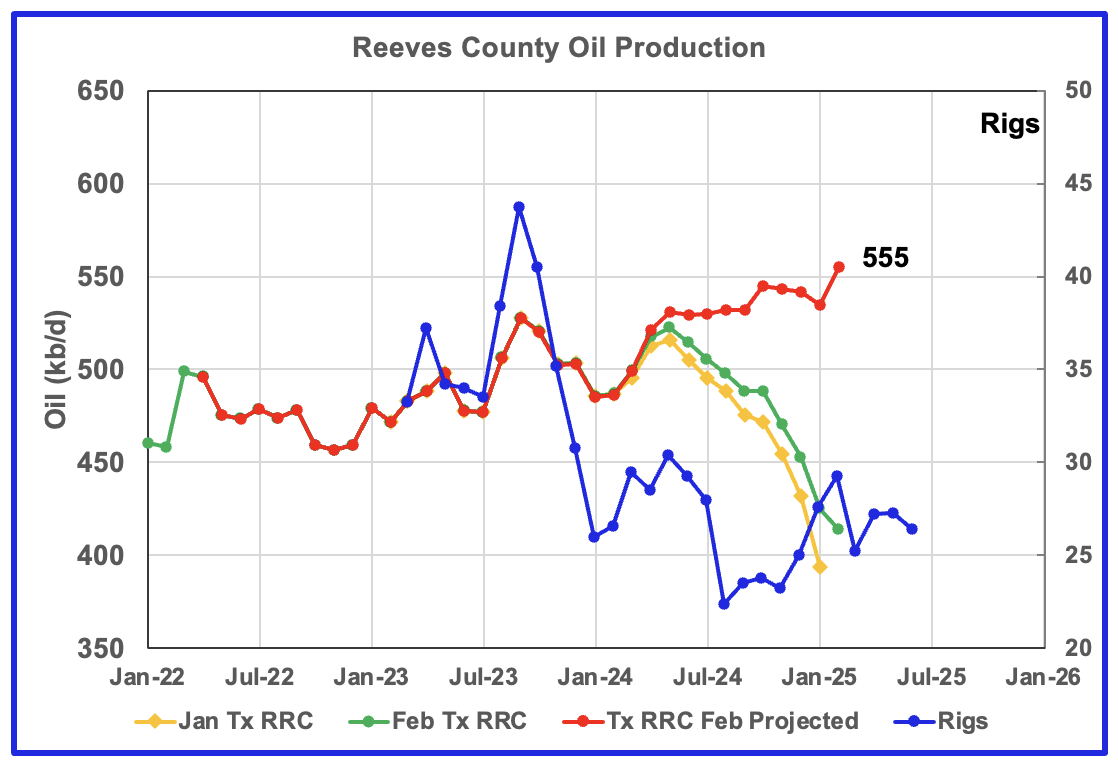

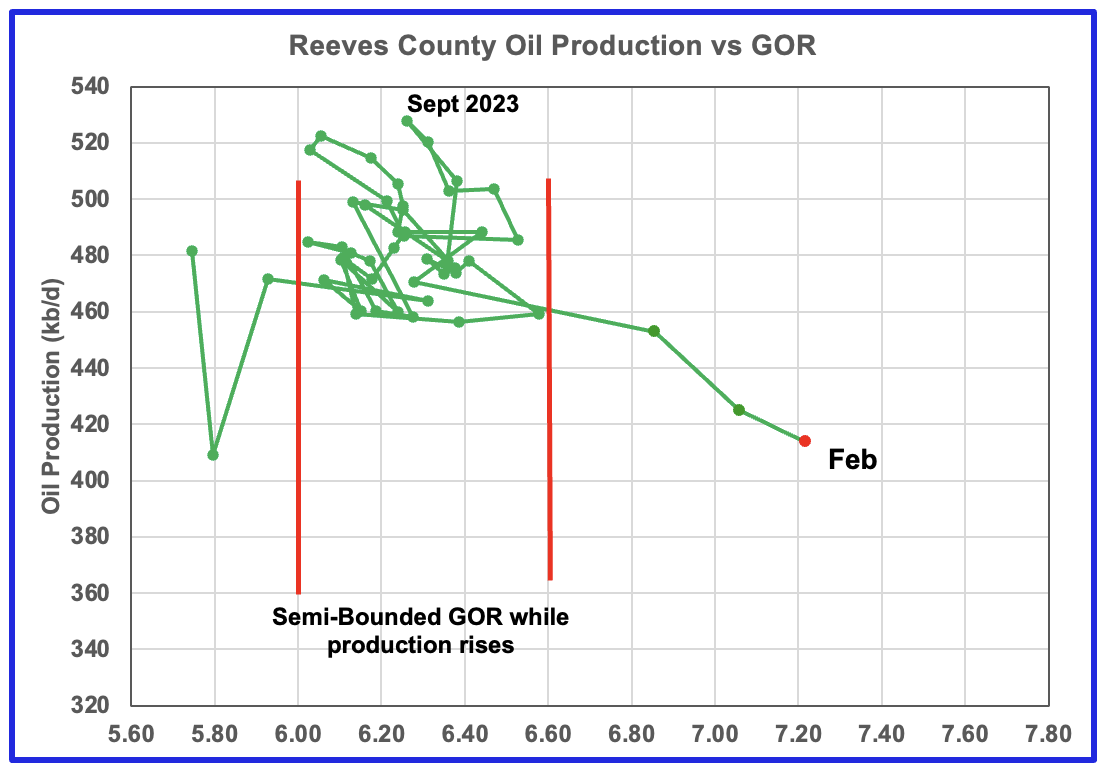

February’s projected oil production for Reeves county rose largely because the under production in January affects the February projection methodology. Production up to January is a better indicator of what to expect for oil production going forward. The GOR chart indicates that Reeves County entered the bubble point phase in December and production is entering a plateau phase before beginning to fall.

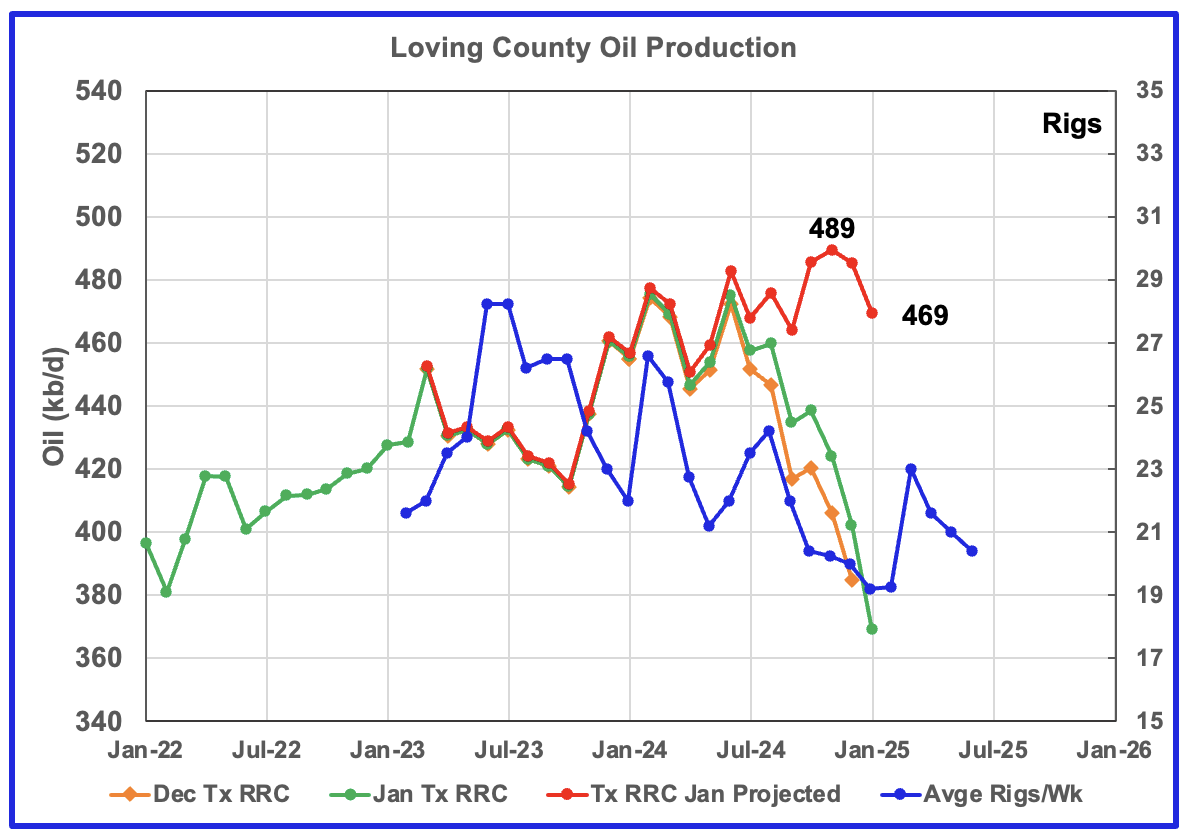

For Comparison: Loving’s January oil production chart posted in the April report.

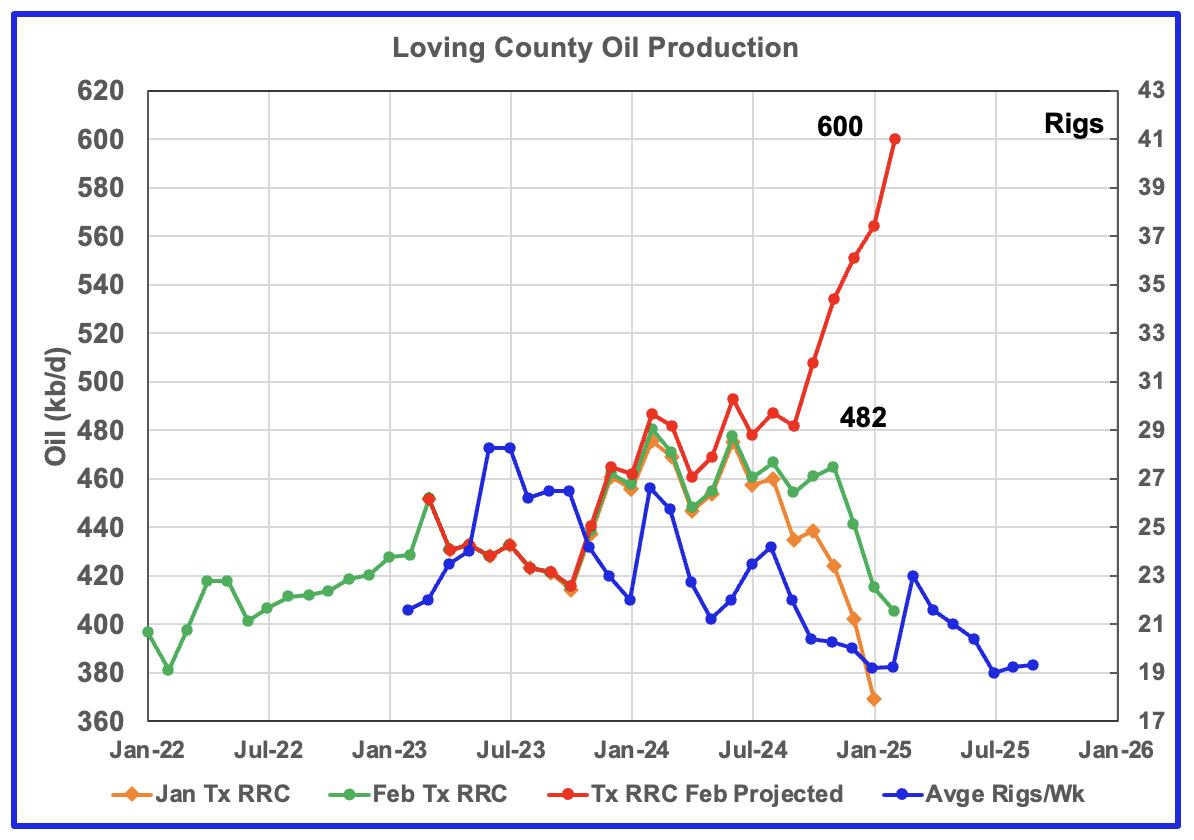

As can be seen by comparing the January and February production projection charts, Loving’s county production is very volatile. July 2024 to September 2024 are the last reasonable production points. Revisions to past months has made the post September projections questionable. However it is important to note that there was jump in the March rig count in the time shifted rig count graph.

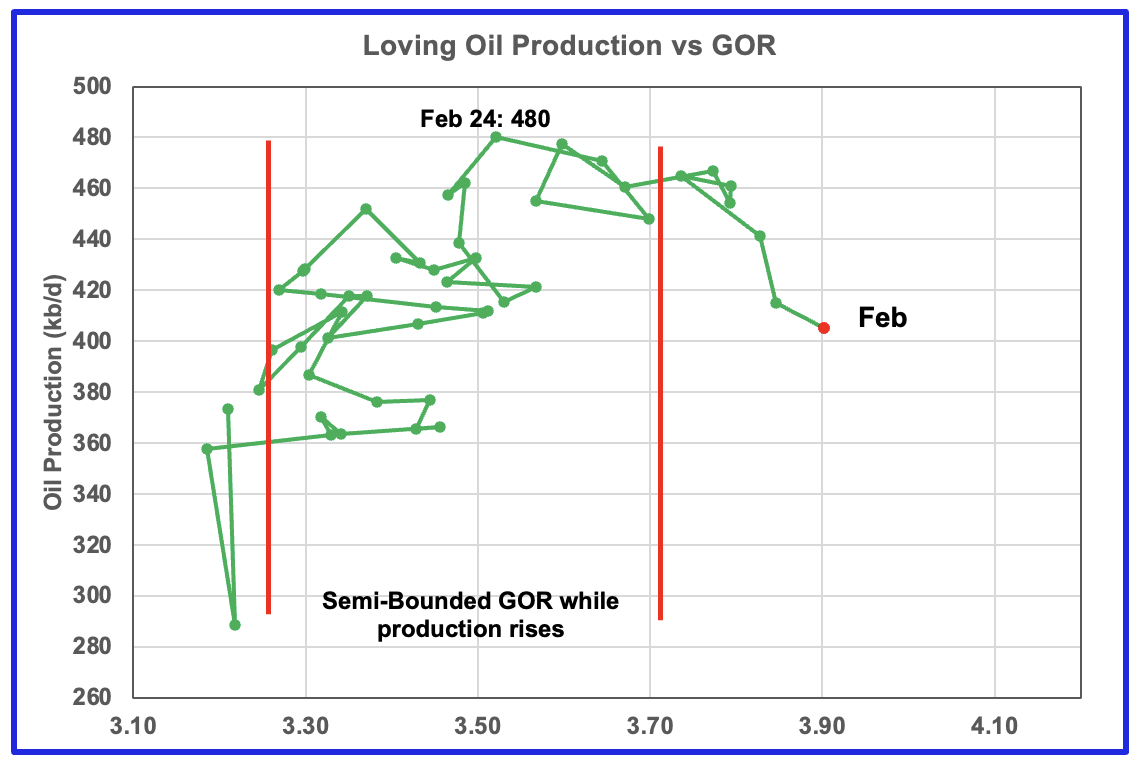

We will have to wait for the March data to make a more realistic assessment of oil production in Loving county. The GOR has moved into the bubble point which is an indication that production growth should be slowing.

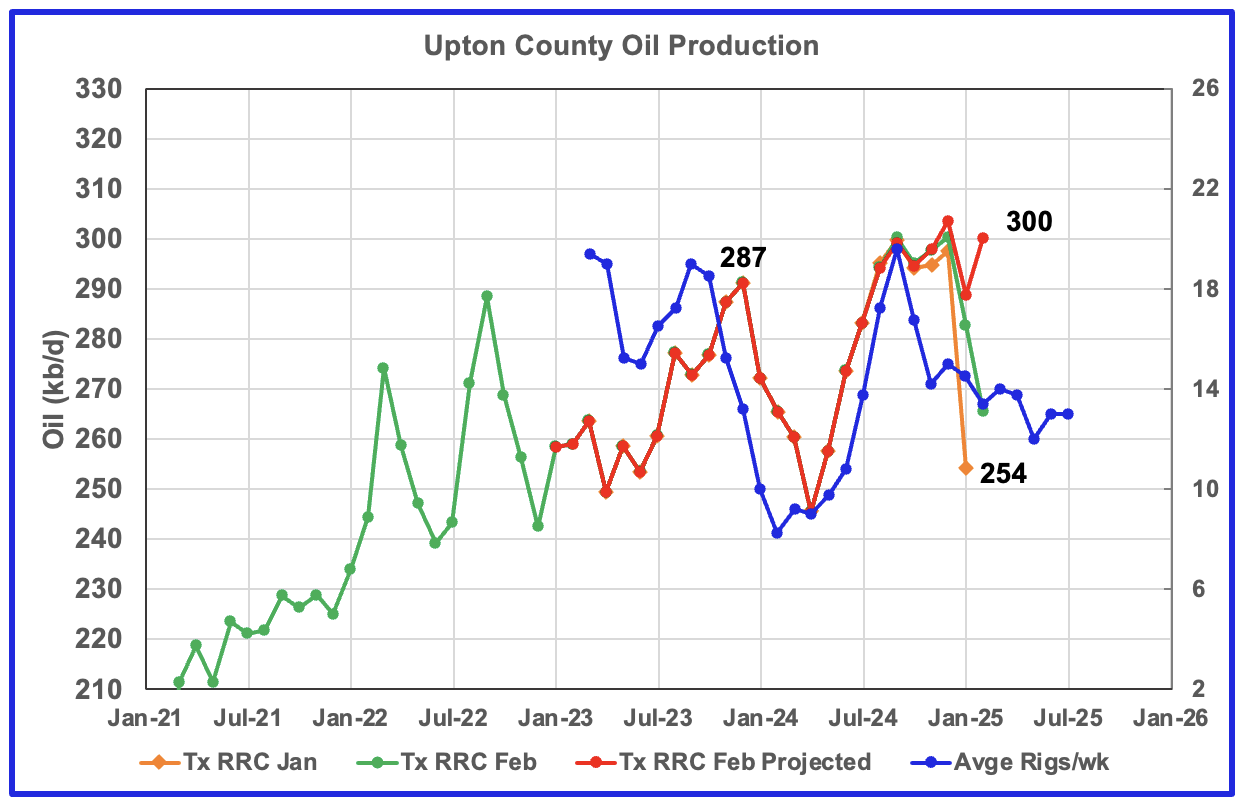

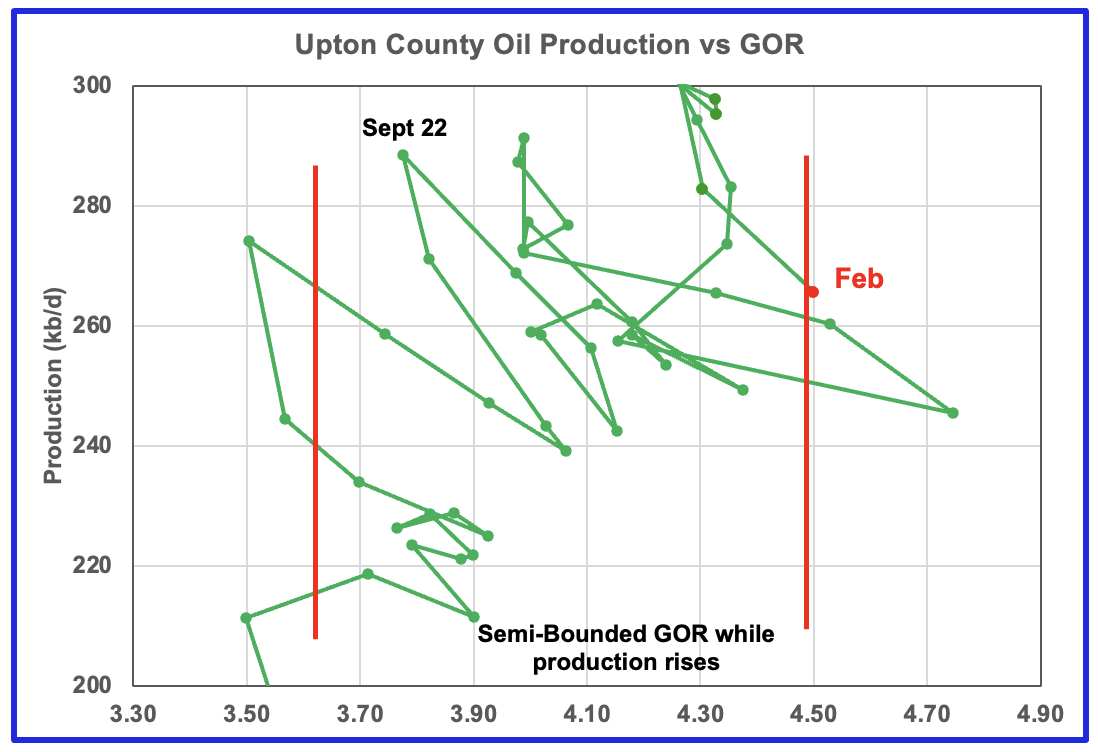

Upton county production has followed the rig count graph since January 2024 and may have peaked in December. February saw a rebound in both the preliminary production and the production projection. The GOR may be on the verge of moving out to the semi-bounded region.

The rig graph in the oil production chart has been shifted forward by six months.

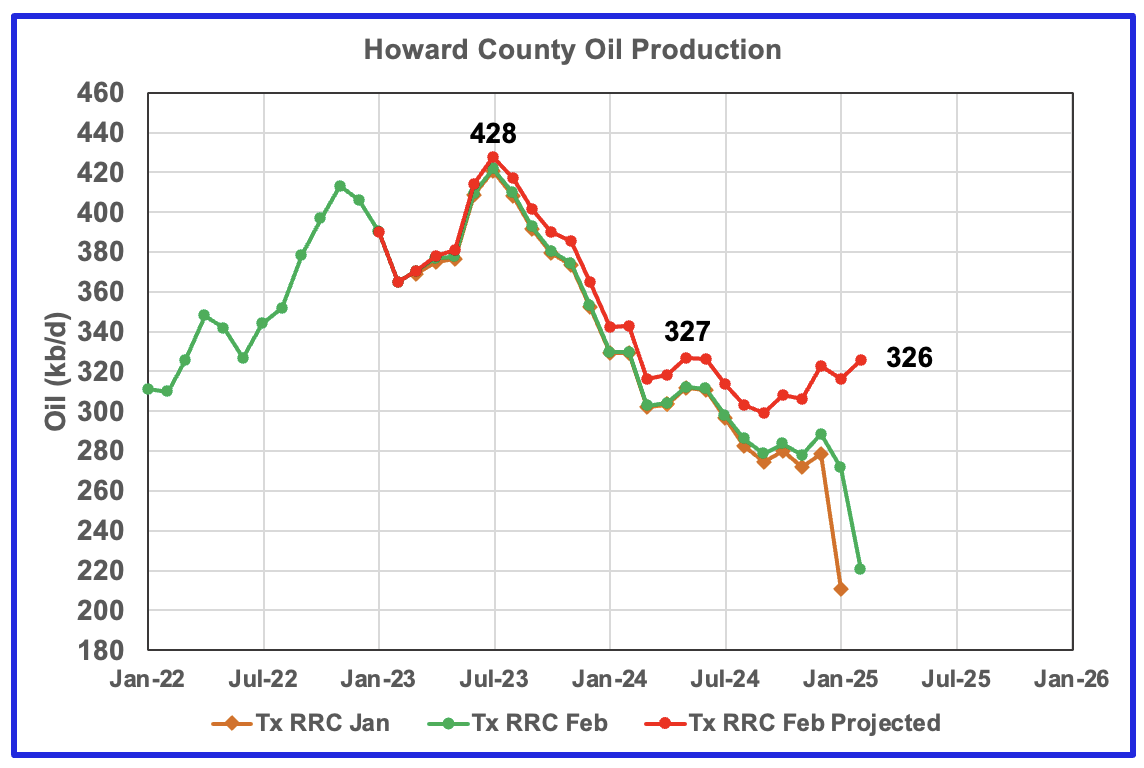

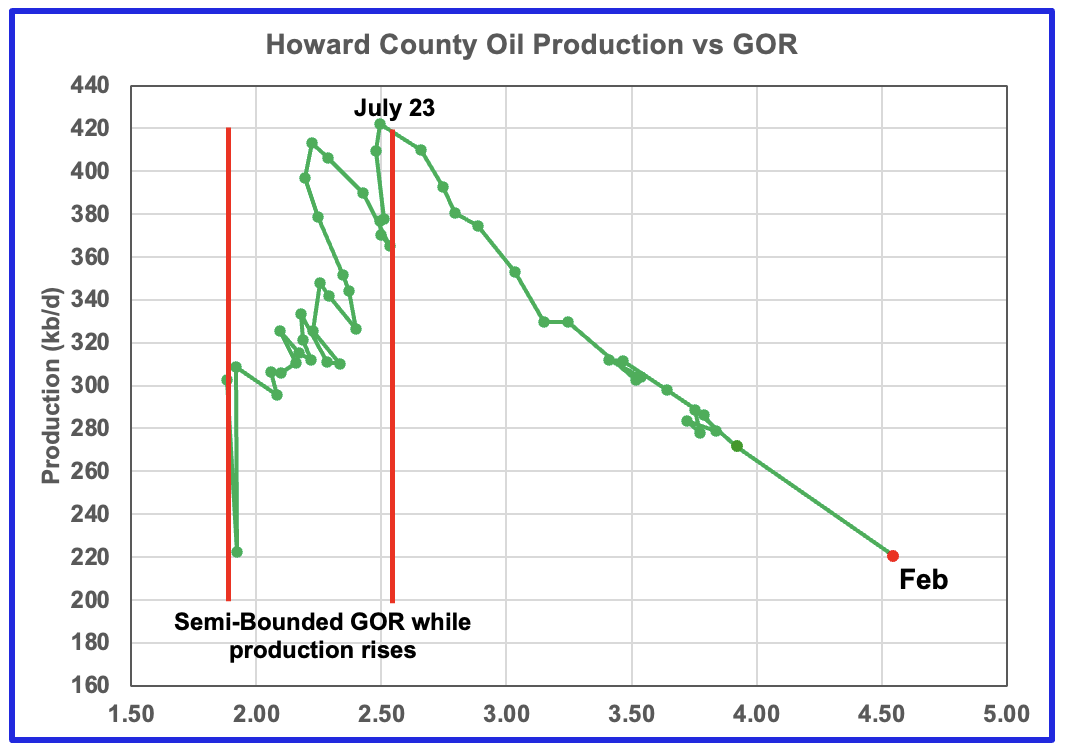

Howard county peaked in July 2023 at 428 kb/d. Note the rapid movement of the GOR to higher ratios once it broke out of the Semi-Bounded GOR range. While the GOR has risen to new highs, preliminary production has kept on falling. However the projected production rise shown after July 2024 may be an indication that production has moved into new and lower plateau zone.

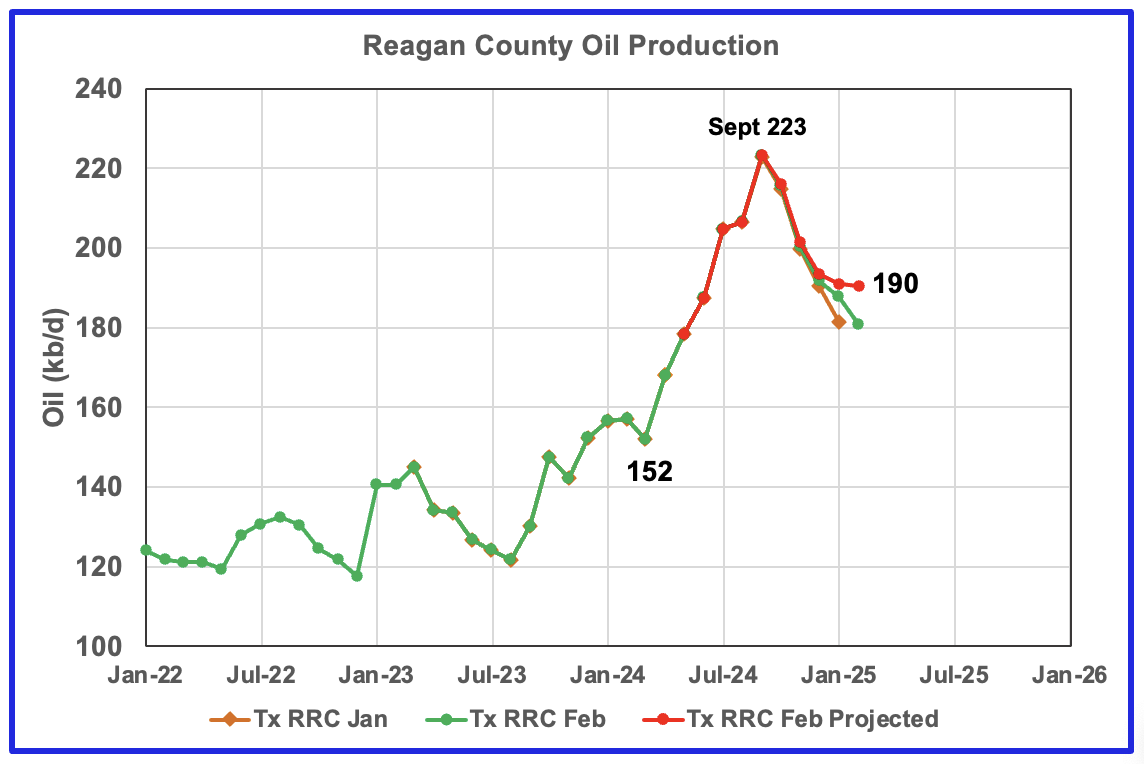

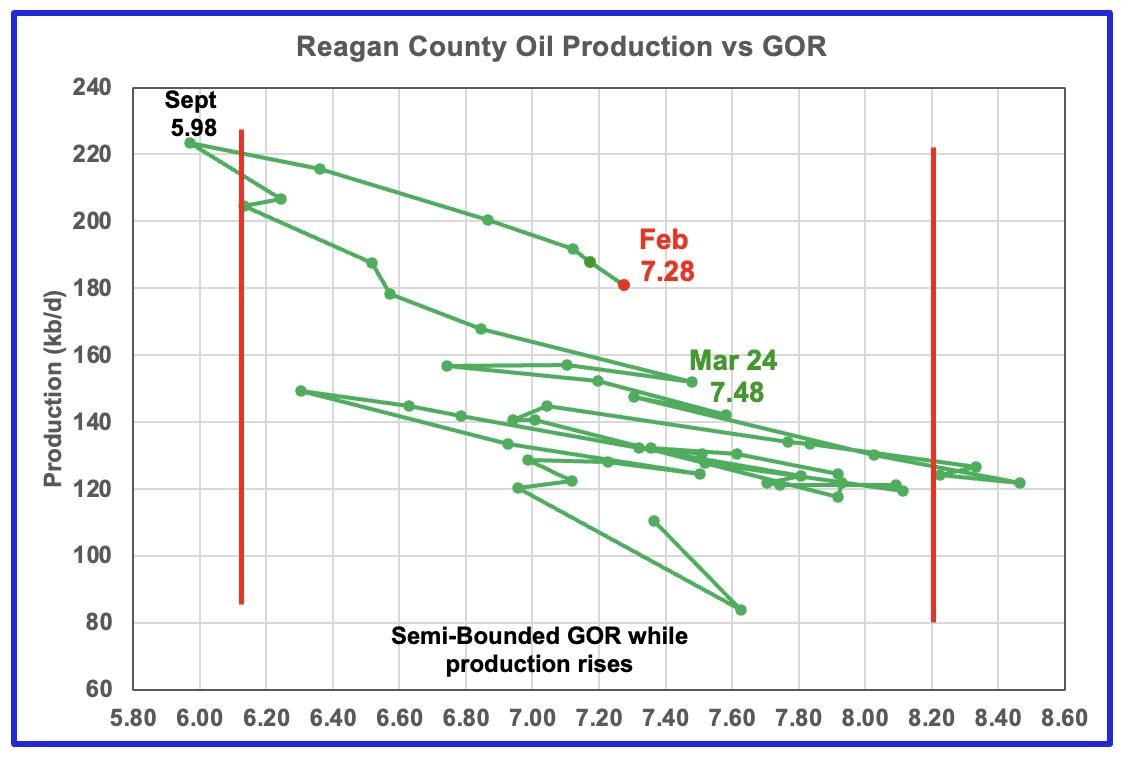

Reagan county oil wells have a very high GOR. The production chart indicate that oil production has been falling since September along with an increasing GOR.

Starting in March 2024, output increased by 72 kb/d to a peak of 226 kb/d in September 2024. At the same time the GOR fell to a new low of 5.98. These new wells must have had a very low GOR to drop the average GOR from 7.48 to 5.98. After the September production peak, the GOR began to rapidly increase to the current level as production fell.

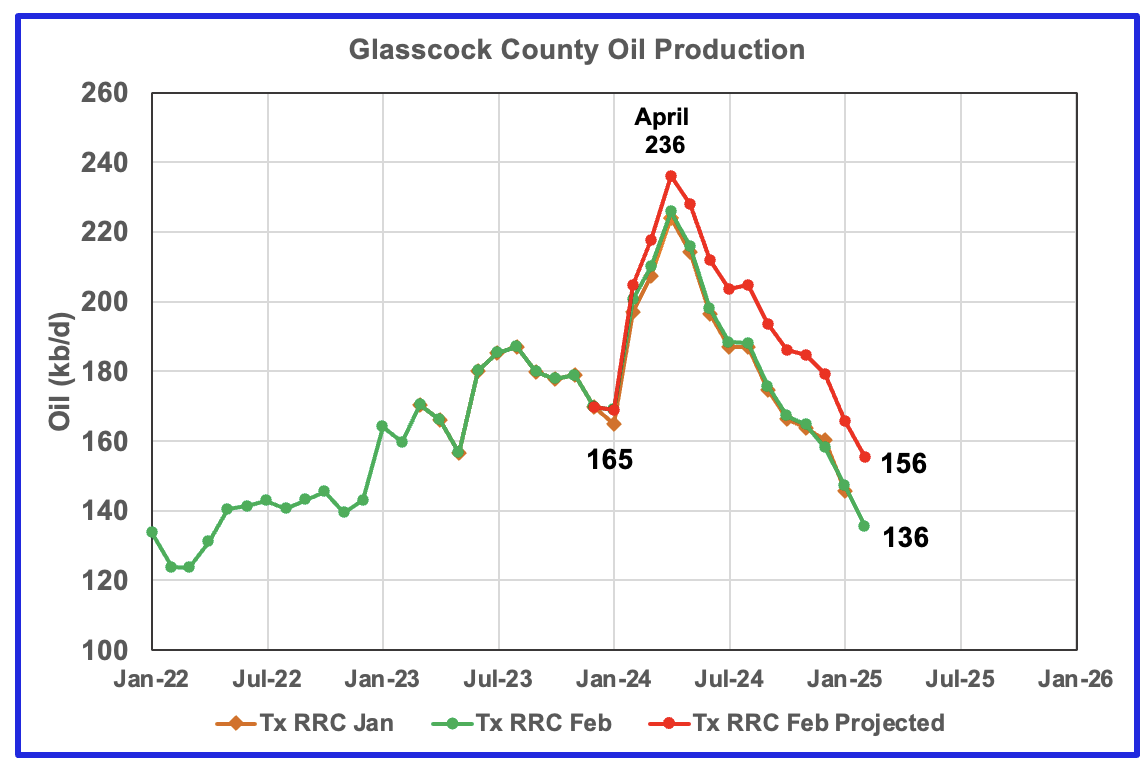

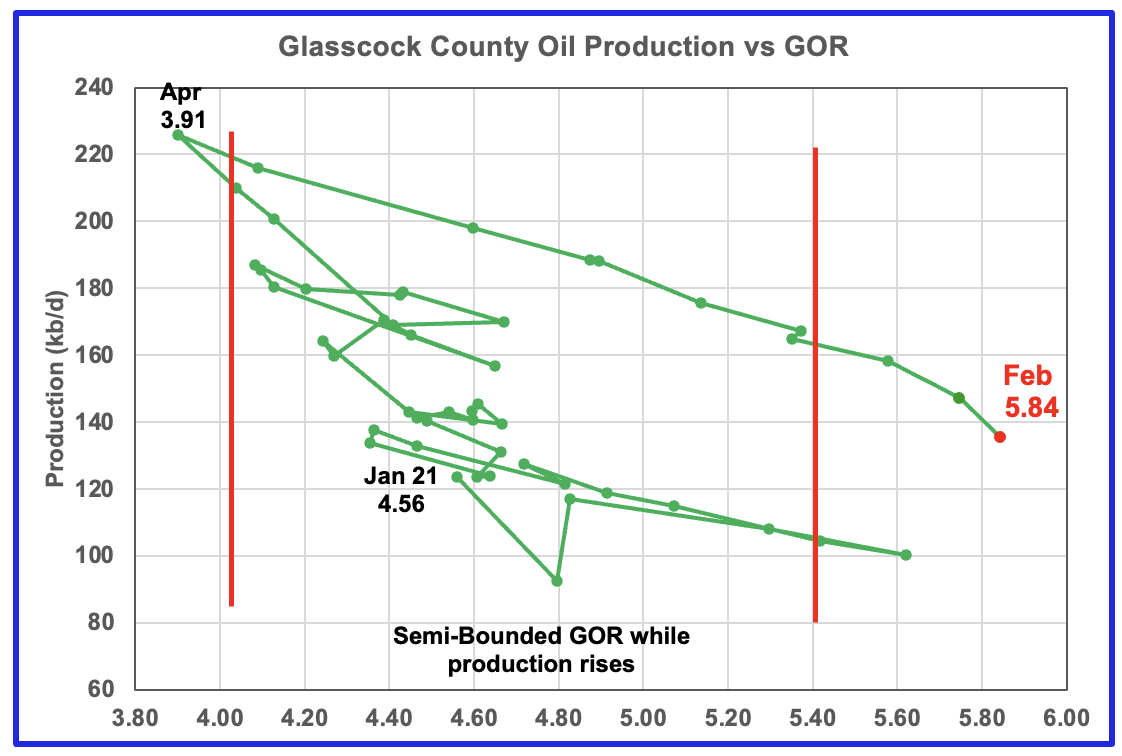

Glasscock production has been falling since April 2024 and does not show any sign of slowing. The GOR moved out of a very wide Semi-Bounded region to a new high of 5.84 in February. Note the rapid increase in the GOR starting from 3.91 in April 2024.

Frac Spread Count

This table summarizes the Frac Spread count for these Permian Counties for the week ending April 11. These counties are the main ones reviewed above. As I have noted before this data base is a bit difficult to work with and is not fully up to date. For instance there is no information for Martin County for the week ending April 11. The latest data for Martin county is for the week ending March 27. During that week, there were 19 Frac Spreads in operation, assuming the data base was up to date.

Since the company collecting this data is private, the information may be supplied on a voluntary basis by the Frac Spread companies.

As can be seen the greatest activity is occurring in the top 3 counties. For Eddy, Lea and Midland counties, the Frac Spread count to Rig count ratio is 0.51, 0.44 and 0.52 respectively. Interesting that the ratios are so close.

Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The new DPR report in the STEO provides production up to March 2025. The report also projects output to December 2026 for a number of basins. The DUC charts and Drilled Wells charts are also updated to March 2025.

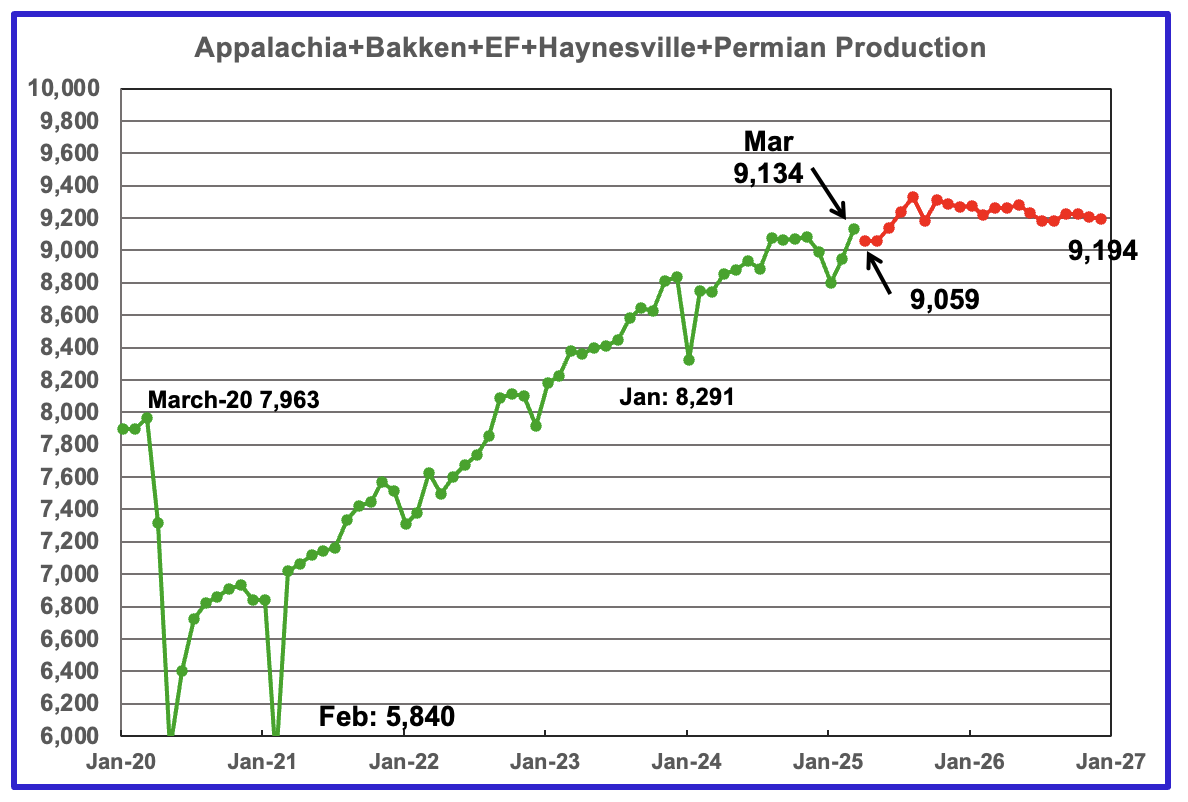

The oil production for the 5 DPR regions tracked by the EIA’s STEO is shown above up to March 2025. Also the March 2025 STEO projects production out to December 2026, red markers. Note DPR production includes both LTO oil and oil from conventional wells. DPR oil production for the Anadarko and Niobrara regions is no longer available.

The March oil output in the five DPR regions increased by 187 kb/d to 9,334 kb/d. Production is expected to drop by 75 kb/d in April to 9,059 kb/d. Note the sharp production rise of 269 kb/d from April 2025 to August 2025. After that, production growth becomes production decline. Considering the flat rig count and low completion rate, it is not clear why production should rise over this period.

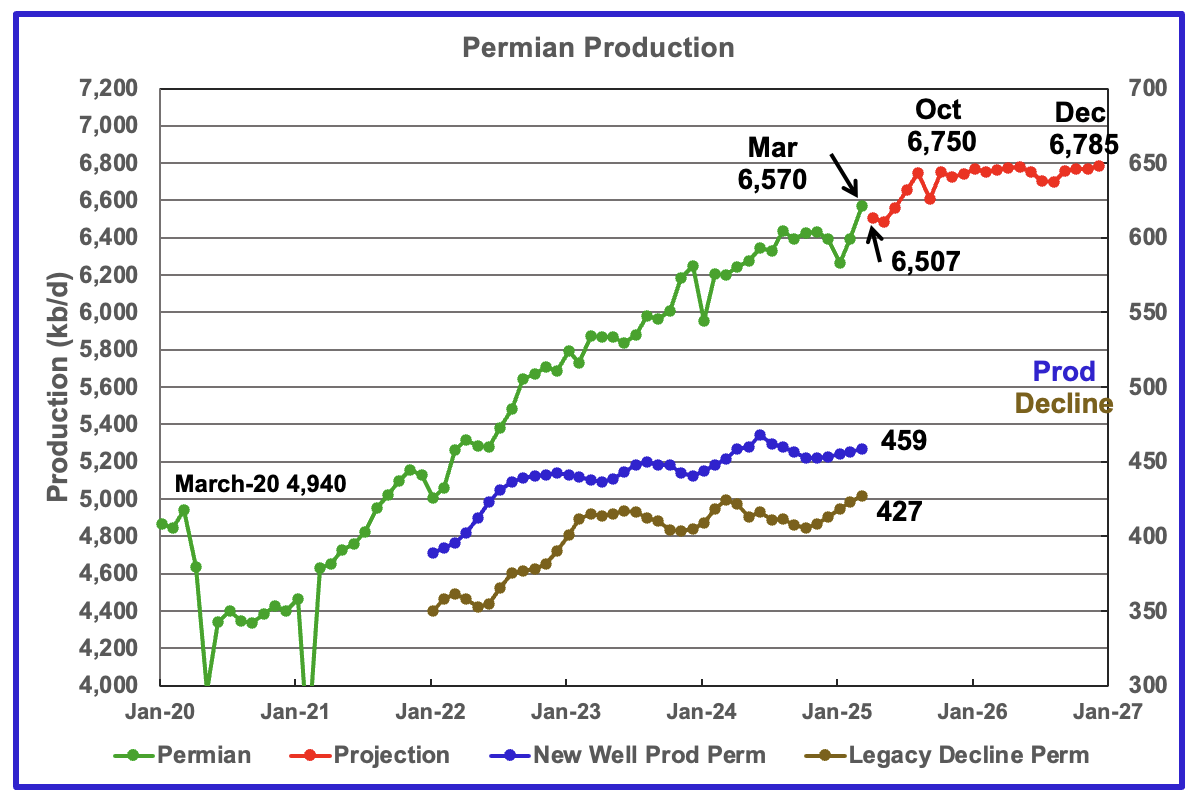

The EIA’s April STEO/DPR report shows Permian March output rose by 175 kb/d to 6,570 kb/d. From April 2025 to December 2026 output is expected to rise by 278 kb/d to 6,785 kb/d. Also note how production rises by 243 kb/d from April to October 2025 followed by production being essentially flat.

Production from new wells and legacy decline, right scale, have been added to this chart to show the difference between new production and legacy decline. Note how the decline rate is growing faster than production rate.

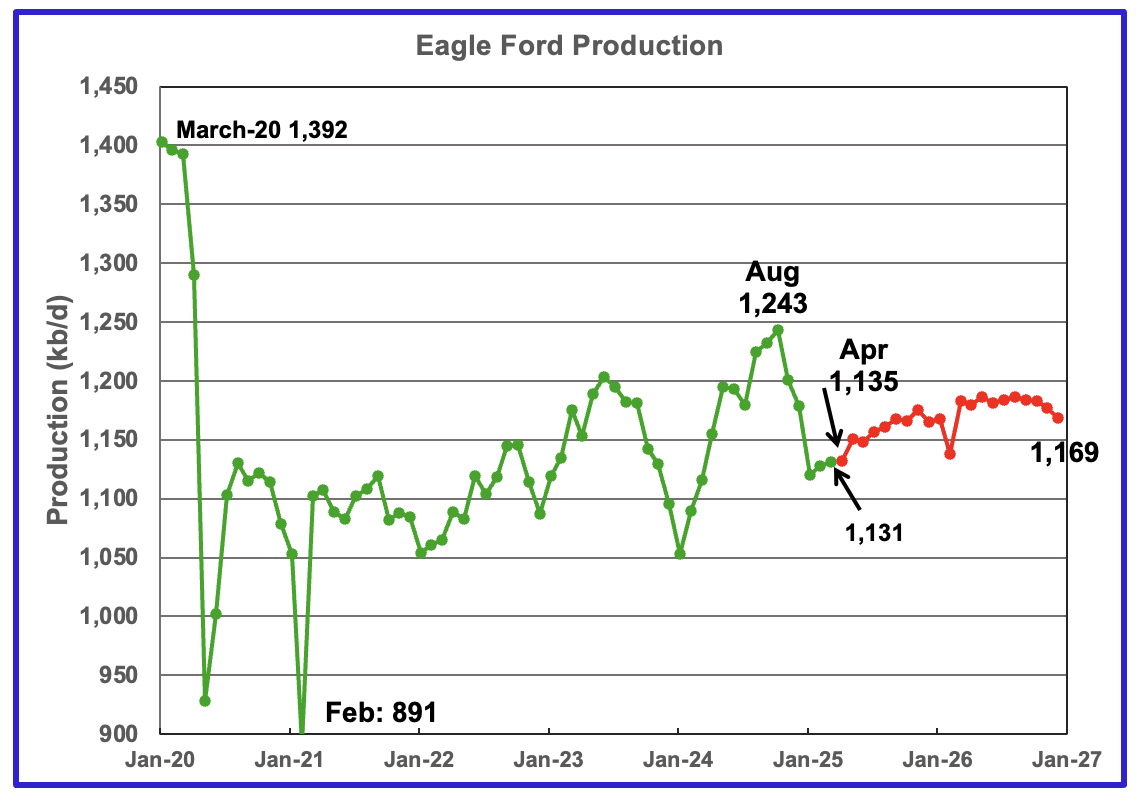

Output in the Eagle Ford basin had been increasing since January 2024 and appears to have peaked in August 2024 and then dropped every month until January 2025. March production increased by 3 kb/d to 1,131 kb/d. April 2025 production is forecast to increase by 4 kb/d to 1,135 kb/d.

Production over the next two years is expected to peak in the later half of 2026 at close to 1,180 kb/d. Output in December 2026 expected to be 1,169 kb/d.

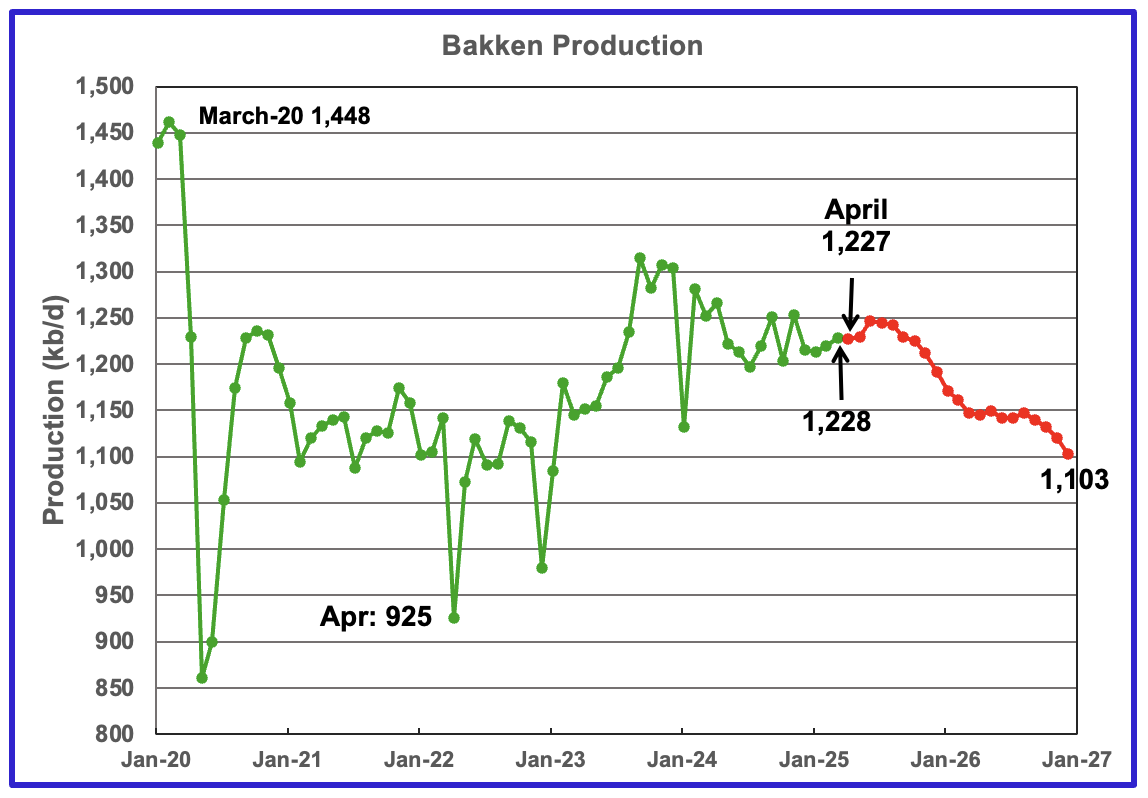

The DPR/STEO reported that Bakken output in March rose by 8 kb/d to 1,228 kb/d. The STEO/DPR projection, red markers, shows output to be essentially in decline after July 2025, dropping to 1,103 kb/d in December 2026.

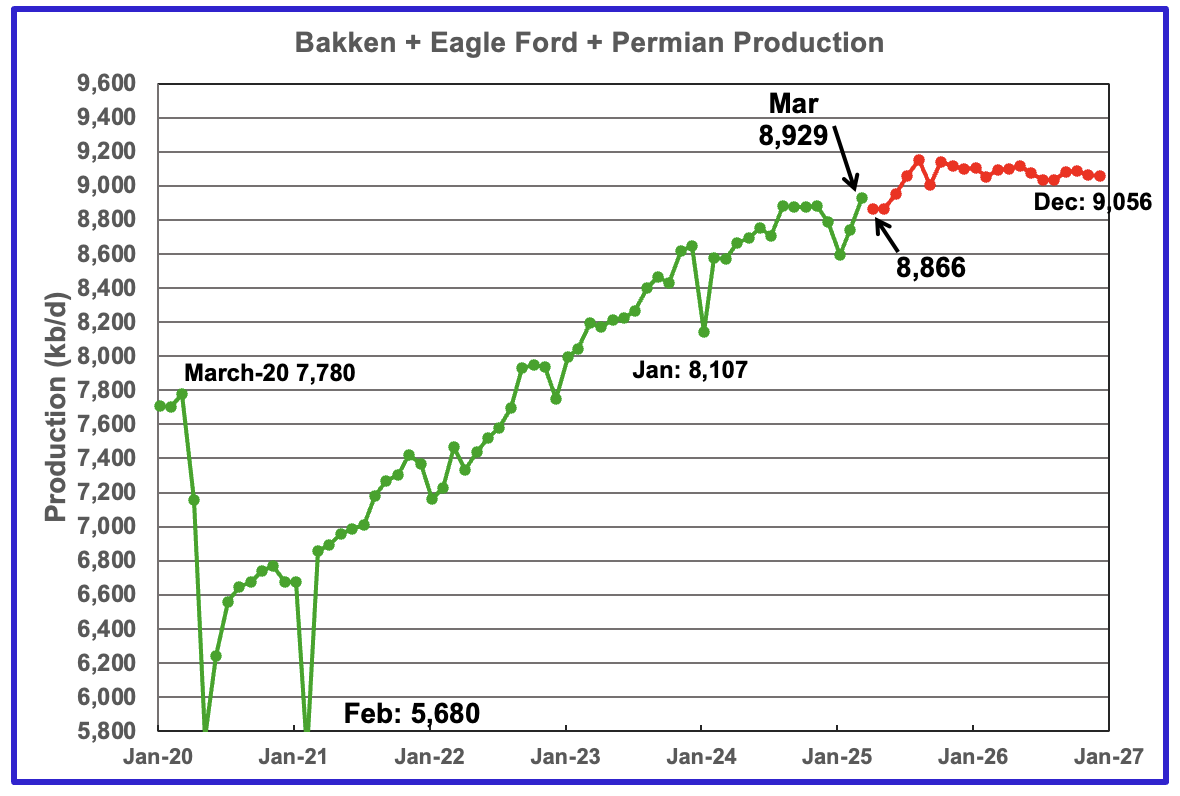

This chart plots the combined production from the three main LTO regions. For March output rose by 186 kb/d to 8,929 kb/d. Production for December 2026 is forecast to be 9,056 kb/d, a downward revision of 145 kb/d. Production declines after August 2025.

DUCs and Drilled Wells

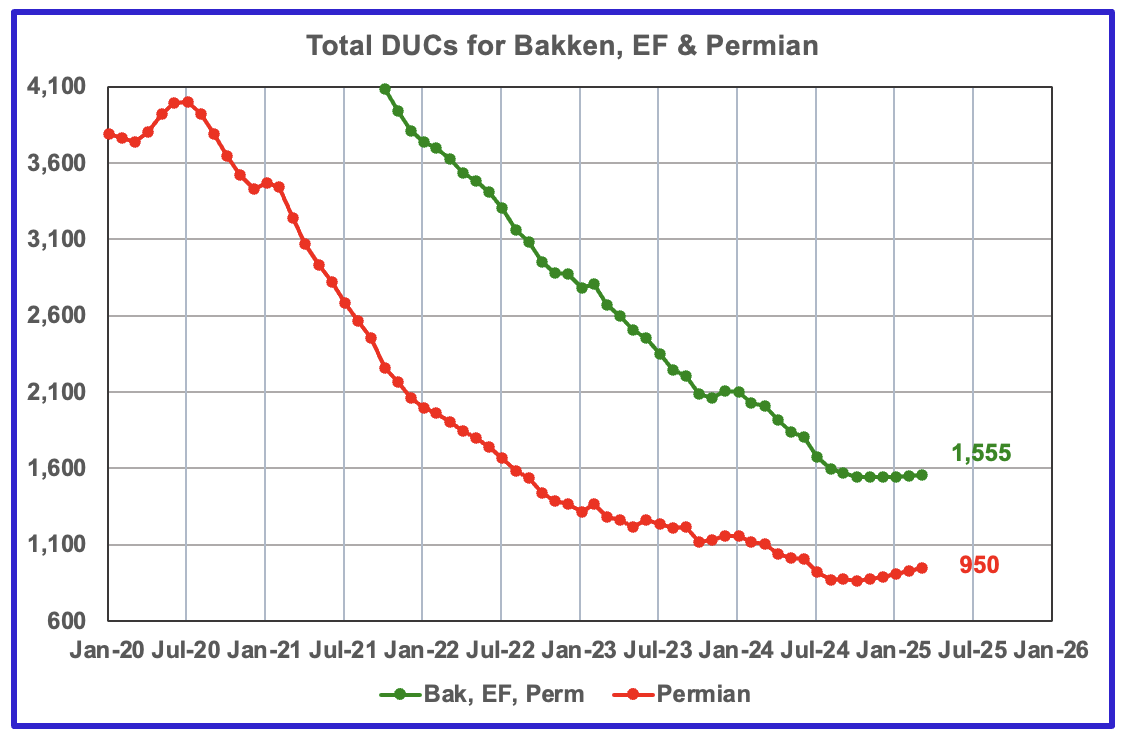

The number of DUCs available for completion in the Permian and the three major DPR regions has fallen every month since July 2020 to December 2024. March DUCs rose by 6 to 1,555. In the Permian, the DUC count increased by 20 to 950.

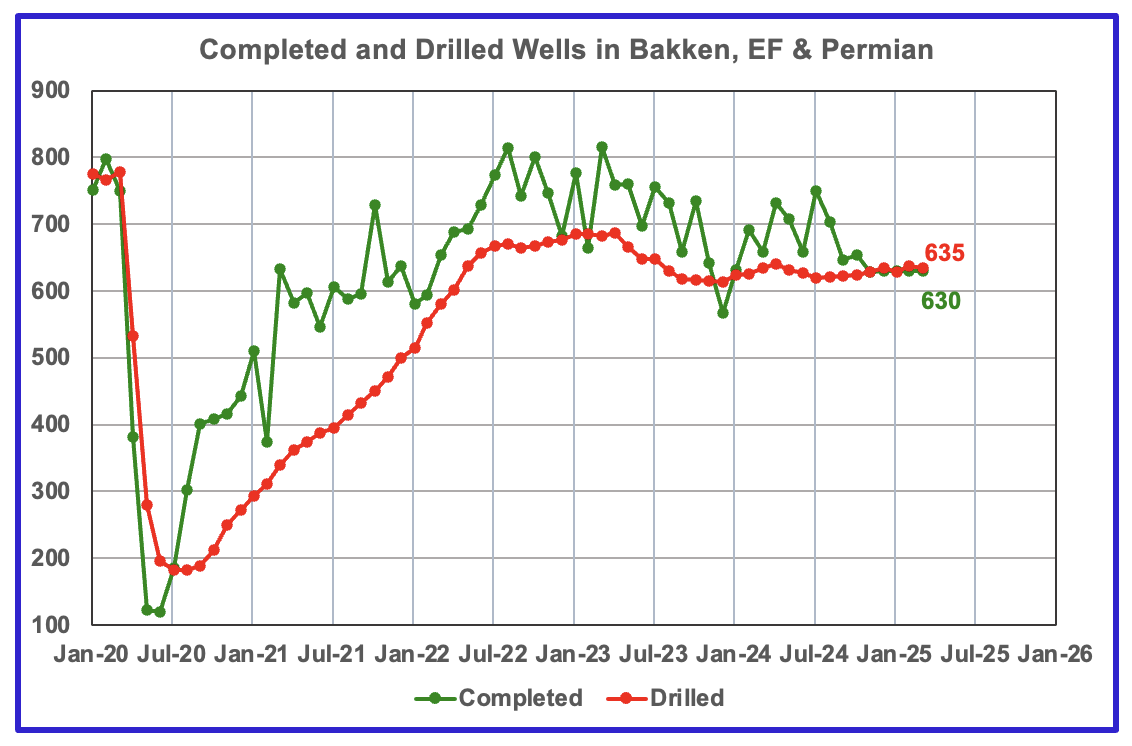

In the three primary regions, 630 wells were completed and 635 were drilled.

In the Permian, the monthly completion and drilling rates have been both stabilizing in the 440 to 460 range over the last 6 months.

In March 2024, 443 wells were completed while 463 new wells were drilled. This is the sixth month in a row in which the number of wells drilled exceeded the number of completed wells.

Rig Report for the Week Ending May 2

This week’s rig count is the first sign that low oil prices are affecting the count. However the combined rig count of the 4 big Permian counties was up by 1. Eagle Ford and Ohio were the biggest losers by dropping 3 each. NG was up.

– US Hz oil rigs were down 6 to 437.

– New Mexico rigs were unchanged at 90 while Texas dropped 4 rigs to 228. Texas Permian was down 2 to 184.

– In New Mexico, both Eddy and Lea were unchanged at 45 and have held there for 4 weeks.

– In Texas, Midland added 2 to 23 while Martin dropped 1 rid to 25. Midland is down 4 rigs over the last 6 weeks.

– Eagle Ford dropped 3 to 38.

– NG Hz rigs added 3 to 85.

Frac Spread Report for the Week Ending May 2

The frac spread count dropped by 4 to 201. It is also down 51 from one year ago and down by 40 spreads since October 11.

https://x.com/MrGlobal2025/status/1918708456992682420

“Oil Markets to Collapse Monday” ???

https://youtu.be/Fzefz-_ywqg

https://www.zerohedge.com/commodities/we-are-tipping-point-shale-giant-diamonback-says-us-oil-output-has-peaked-slashes-capex

Low prices have bad consequences… on the industry…

Almost 400kbarrels/day under the projection and no serious increase in price…?

Svaya,

Oil prices are determined on the World Market which seems to be oversupplied,especially with recent OPEC announcements to increase output and a possible Worldwide Recession that many expect due to Trump Tariffs which will reduce World Oil consumption.

Also keep in mind that most oil analysts realize the EIA STEO is often wrong. It will be interesting to see the EIA revisions in May to the STEO, though in a Trump executive branch one wonders if these will only become worse in the future as pressure may come from the White House to alter forecasts to their wishes. The independence of agencies from political pressure seems to be at a low point.

Something to watch.

DC

Of course numbers are fake or messaged at the very least for political or economic gain. Biden’s jobs being created in an election year overstated by some 815,000 jobs is a prime example.

This type of shit goes on everywhere under every politician. China’s GDP is fake and to a certain extent so are the GDP numbers in the US.

Which is why using GDP numbers to calculate or forecast anything is meaningless. Because the numbers aren’t real to begin with.

Oil producers overstating their reserves is another prime example of what is happening for political and economic gain.

Corruption is widespread. We don’t have any honest folks in power anywhere.

HHH

Only the gullibles believe the numbers.

>Also keep in mind that most oil analysts realize the EIA STEO is often wrong.

Ok but that doesn’t change the fact that it’s >300Kbarrels/day under the December 2024 peak. But then the markets are chaotic anyway so I wouldn’t be surprised if it increases next weeks and month.

Svaya,

The price of oil is screaming recession. The economic background doesn’t support higher oil prices.

OPEC gave up on their supply cuts because they didn’t work to keep prices higher. Contrary to popular belief OPEC isn’t in the driver’s seat controlling oil prices. Though they can send prices even lower by increasing production during a global recession.

What we are going to get is interest rates cuts and back to QE everywhere. Not that either of those things matter but that’s the direction we are heading. The fact that they will be doing both is just an acknowledgement of how bad the economic background actually is.

Low to no growth environment.

Remember that the dollar denominated debt that exists outside the US in the Eurodollar market isn’t owed to the US. The banks outside the US created all that dollar denominated debt. The rest of the world owes those dollars to themselves collectively.

Got dollars? Because absolutely everyone outside the US needs dollars to repay the debt. They don’t need gold or bitcoin or their own local currencies. They need dollars.

What’s it going to look like outside the US if the banks in Japan lending the dollars into China get defaulted on?

The world can’t leave the dollar system without defaulting on themselves.

The scramble for dollars outside the US will continue. And sometimes that scramble for dollars will involve the selling of US dollar denominated assets.

De-dollarization implies the value of the dollar going through the roof.

Re-dollarization implies the dollar going back to 2008 lows.

If you pull out a long term chart of both WTI, Brent and DXY you’ll see that oil prices at their all time highs coincided with the dollar being at an all time low.

It was because credit in the Eurodollar market was flowing freely prior to 2008. Not so freely ever since 2008. Credit is still flowing but the cost of obtaining credit has gone much higher since 2008. Not talking about just interest rates. Talking about collateral and what it cost to actually borrow money. And a lot of the time collateral is borrowed in order to obtain credit in REPO.

Dollars are just more expensive to obtain now than they were in 2008.

HHH, I don’t understand since the banks originated the loans, why can’t they just tell their customers that they will accept a different currency instead of us dollars in repayment (a kind of bank-customer currency swap deal at rates both parties can live with), and at least circumvent a scramble for dollars?

Phil S,

You can go into the FX market and sell Yen or Euro’s or whatever currency you have in order to buy dollars. It’s more costly to do than just borrowing. But banks will generally do it. At least for most of the major currencies that aren’t the dollar.

And since all those other currencies are in fact loaned into existence instead of printed. It will create a shortage of their local currencies which will create problems in their local economy’s. Because they are creating bank liabilities in their own currencies that have to be repaid in their own currencies. But are buying dollars.

Banks want to be repaid in a currency that is accepted everywhere as money. The Chinese yuan isn’t money globally. Eurodollars are money globally.

If banks accepted other currencies for dollars denominated debt directly it’s no different Then selling Yen or Euros or whatever and buying dollars.

It will create Yen and Euro and whatever currencies shortages. Because of the liabilities of bank balance sheets when money is loaned into existence.

The idea of a free lunch by just printing money to repay debts is a false idea.

Government debts aren’t really ever paid back. They are just expanded. Rolled over with new debt at maturity.

However private debts are repaid every month. Which shrinks the actual money supply. So we need economic growth in order to repay debt and energy in order to grow.

Without private growth tax receipts fall. And government’s income get cut.

Government debts are financed through money created on the balance sheets of commercial banks. There is a bank liability somewhere on some banks balance sheet that has been used to purchase those government treasury securities.

All loans are liabilities on one bank balance sheet and deposits on another banks balance sheet.

People think money is free and clear from any debt because they went and earned it. No! There is a bank liability on some banks balance sheet where the money used to for your paycheck is owed to a bank by someone.

It might indeed be free and clear for you to use but it’s still owed to some bank somewhere because it was loaned into existence.

I subscribe to a relatively fast collapse of BAU as we know it because the debts aren’t payable in a energy contracting world.

It doesn’t matter if we still have a lot of oil, coal and natural gas. It doesn’t matter if we can build solar panels and windmills to produce electricity.

What matters is can we grow or not. And governments are hiding issues by overstating GDP numbers and job numbers and so on.

In a true energy transition. Solar and wind energy would have to repay all the debts incurred during the time before the energy transition took place when FF were what was used.

I’m not buying that idea.

There will be no growing our way out from under our debt. Mass insolvency and hyper-deflation is the future.

Banks can do that but that doesn’t change anything. The dollar deposits were created when the bank made a loan and the only way to “uncreate” the deposits is to pay off the loan. So it doesn’t really matter who holds the deposit – it exists and there is no other way to get rid of it except for repayment.

rgds

WP

HHH

Government debts aren’t really ever paid back. They are just expanded. Rolled over with new debt at maturity.

Interesting claim. What happened to the surpluses the German government ran from 2010 to 2020?

Great job Ovi,

I would note that the claims that breakeven prices in the Permian are around $40/b are very different from my own estimates for average Permian wells. If we assume the average Permian well has full capital cost of $12 million (includes plugging at end of life, overhead, and land cost), at a nominal discount rate of 12.5% per year the discounted net revenue over the life of the well is about 10 million at $60/b at wellhead , NGL at 35% of crude price at wellhead and NG at $3.20/MCF at wellhead (this is a very optimistic price for Permian where WAHA spot prices have been under $2/MCF).

In short breakeven prices are not $40/bo, that might be LOE for a flowing well, but nobody makes money in the Permian at that price for their entire portfolio of wells. There might be 5% of all Permian wells drilled to date that might have been profitable at $40/b and $3/MCF, maybe only 1%.

Hmmmm,

“If we assume the average Permian well has full capital cost of $12 million”

Yesterday I posted this link from Reuters-

“Exxon is the largest producer in the Permian basin, the top U.S. oilfield, and operates the lucrative Stabroek block off the coast of Guyana. Cost of supply in the Permian is less than $35 per barrel, the company has previously said, allowing it to make money even at lower oil prices.”

Not sure both of you are talking about the same costs. But, one thing for sure Dennis is that you don’t know what Exxon’s costs are. If you are using numbers on the cost of pipe for example from guys like Shellman or Shallow Sand. I can tell you for sure that’s not the cost Exxon is paying for it. That would be like comparing GM’s productions cost to build a car to yourself in your garage or your local convenience store costs to Costco.

I wouldn’t be suprised if Exxon’s average capital costs to complete and cap a well in the Permian is less than $8 million.

Huntingtonbeach,

You can look at 10Q to get an idea of capital cost for a well. You may believe XOM’s costs are lower, but I would say there is a lot of hype in investor presentations, including those by XOM. You are correct that I don’t know what XOM’s costs are, but only a fool would believe the numbers that are in an investor presentation, read the fine print which says in a nutshell, don’t believe these numbers.

Also my analysis is based on the basinwide average, it is possible that XOM only drills above average wells, and has costs that are 66% of the average producer. If you believe that, I have a bridge in Brooklyn I can sell you.

ExxonMobil And Nabors Test Fully Automated Drilling Rig In Permian

As the U.S. rig count continues a slow rise in a somewhat muted response to higher prices for crude oil and natural gas, two giants of the industry announced last week that they are partnering in an effort to make the drilling process safer and more efficient through automation. In an industry first for a land drilling rig, ExxonMobilXOM subsidiary XTO Energy and Nabors Drilling have reached total depth on the first of a planned three horizontal wells in the Permian Basin using an innovative Nabors drilling rig with a fully-automated, unmanned rig floor.

Anyone who has ever worked in the oil patch proper knows that the floor of an active drilling rig has long been one of the most dangerous places in the business. Whether drilling downhole, changing out drill bits or pulling strings of drill pipe out of the hole, the labor intensive activities necessary to drill these deep holes into the earth have always accounted for a significant percentage of reportable, lost-time accidents that companies incur every year.

In its Oct. 7 press release, Nabors announced that the technology now exists to drill these horizontal wells in the Permian Basin – and presumably any other oil and gas producing region – with no employees having to be present on the rig floor, where the action takes place.

https://www.forbes.com/sites/davidblackmon/2021/10/11/exxonmobil-and-nabors-test-fully-automated-drilling-rig-in-permian/

Nabors Announces World’s First Fully Automated Land Rig Has Successfully Drilled Its First Well

The PACE®-R801 concept rig has safety and efficiency at the core of its design, purpose-built to showcase Nabors technology and to push the boundaries of industry performance and possibilities

Nabors Industries Ltd. (NYSE: NBR), a leading provider of advanced technology for the global energy industry, today announced its PACE®-R801 – the world’s first fully automated land drilling rig – has reached total depth on its first well, a horizontal well for ExxonMobil in the Permian Basin.

Combining Nabors proprietary Smart Suite of automated drilling software with Canrig® robotics on the PACE®-R801 creates an unmanned rig floor that removes crews from red zone areas and delivers consistent, predictable drilling performance.

https://www.nabors.com/nabors-announces-worlds-first-fully-automated-lan/

Oil Drilling Automation: Revolutionizing the Industry for Efficiency and Safety

Overview

Oil Drilling Automation: Revolutionizing the Industry for Efficiency and Safety

Drilling automation has become increasingly relevant in the oil industry. The integration of advanced technologies and computer-controlled systems has led to more efficient, safer, and cost-effective drilling operations. With the rise of automation, companies are able to maximize performance while minimizing human exposure and environmental impact.

The adoption of automation technologies in drilling operations includes the use of machine learning, robotic systems, and real-time data analysis. These technologies enable the drilling process to be optimized, improving the overall productivity of oil extraction. The growth and improvements in drilling automation also have the potential to enhance worker safety by reducing the need for manual labour in hazardous environments.

As the industry looks to the future, continuous research and development will be crucial in pushing the boundaries of drilling automation technologies.

Key Takeaways

Automation leads to more efficient and safer oil drilling operations

Advanced technologies such as machine learning and robotics play a key role in drilling automation

Addressing challenges and staying ahead through research and development are crucial for the future growth of the industry

Overview of Oil Drilling Automation

Evolution of Drilling Automation

In the past, drilling operations were manually intensive, requiring significant human intervention and expertise. With time, the oil and gas industry has witnessed a shift towards the adoption of automated solutions to enhance safety, efficiency, and data-driven decision-making. The development of drilling automation technologies has been driven by advancements in AI, control systems, and digital transformation, enabling companies to optimize drilling processes and reduce human error.

Key Benefits of Automation in Drilling Operations

Performance improvement: Drilling automation can maximize drilling operations and improve overall consistency. Automation technologies help ensure consistency in performance, regardless of operator skill level or environmental challenges.

Enhanced safety: The integration of autonomous systems reduces the need for manual operations in high-risk environments, minimizing the potential for accidents and injuries. Advanced visualization and monitoring tools enable real-time supervision, fostering a safer workplace for drilling personnel.

Data-driven decision-making: Modern drilling automation solutions are equipped with sensors and data collectors, enabling efficient data processing and analytics. These data insights, combined with AI-powered algorithms, allow drilling operators to make informed adjustments and optimize drilling performance.

Cost-effectiveness: Automation systems reduce manual processes that have a high level of variability so that crews can more effectively run the drilling operation. Moreover, optimized drilling practices can reduce wear and tear on equipment, contributing to lower maintenance expenses.

Environmental impact: Drilling automation promotes sustainable practices by limiting resource consumption, reducing waste, and enhancing overall efficiency. Improved precision and consistency can lead to a reduction in days on location.

https://www.helmerichpayne.com/resources/product-highlights/oil-drilling-automation-revolutionizing-the-industry-for-efficiency-and-safety

Like you said Dennis, you don’t know the cost.

Huntingtonbeach,

For people in the industry, they are very dubious of the XOM claims, but you are right I don’t know, I rely on others in the business that know far more than me.

Whenever this wank from California uses my name in his comments I feel the incessant need to go outside and rinse off with a garden hose.

Last I looked there was only one Nabors R801 IN the entire Permian and I have no idea if its working anymore; its day rate was 2 times a normal 2000 HP, semi-automated rig working in the Permian. Rig automation is not helping Exxon one ioda.

Exxon is a poor tight oil operator. It uses its “power” to bully service providers into lowering costs, which in turn hurts other smaller operators in the play and RAISES costs for everyone else. That hurts America.

Exxon has $40B of long term debt and pays almost a $B a year in interest. Its 1Q25 profits are lower and going way lower 2Q25 when <$60 oil kicks in. Trump was in office only 2/3rds of the entire quarter and the price of oil did not get near $60 until THE BEGINNING OF THE 2ND QUARTER! Everybody waiting for rigs to fall after 30 days of $60 oil is nuts!

Its amazing a far left, progressive socialist like this guy from Californy is defending Exxon earnings; that must be about…let me guess…personal dividends. I thought you folks were anti-oil?

Nony, I got the reference. I am flattered. I am too smart to have operated tight oil wells, but too dumb to never have had working interest in them. It was the only time in 65 years I ever lost money in an oil play. Have you ever even seen one?

Your hero, Permian Resources, drills horrible wells. 55% gas in their Delaware production stream? In 2024 it GROSSED 80 cents an MCF for its gas, AFTER hedge protection.

It has 4.2 billion dollars in long term debt and only 312,641 MM BO of PDP reserves GROSS of royalty (SEC 10K). Net of royalty it therefore has to have an additional $18 per BO breakeven price, just to pay off its long term debt. Then there is retirement costs, or don't you have the ability to understand that.. oil extracted from a well is burdened by all the costs and liability of the company that extracts that oil?

You don't seem to understand well economics at all. That the U.S shale sector keeps drilling wells that don't make sense to us "peak oilers" is the exact same reason it has lost $400B already in the 14 years of its existence, with another $200B yet to be paid off. Plus the cost of plugging its wells and cleaning up its mess. Everything the shale sector does going forward is based on…more indebtedness.

I don't like this place anymore. If y'all are going to continue to rag on me, get your shit straight, at least.

I am trying to help my country understand the oil and gas business better, to be better prepared for the future, in the face of qazillions of people who will lie to, to your face, for the sake of a lousy dollar. Or because they falsely believe they have the intellectual, and moral, highground over you, They don't.

I like you, actually. The Red Adair history is fascinating.

Thanks Mike,

I realize now where you get the 12 to 13 million cost for the average Permian well from reading your blog, I appreciate the lesson. It is land cost and plugging cost (mostly land cost) that adds another 2.5 million to D and C cost, other overhead (tank farms, gathering lines and electric power lines, and 1000 things I don’t know about) might add another 0.25 million per well on average.

To add to Mike’s comment – XOM in 2024 spent 19.3bn of stock, paid 16.7bn in dividends for a total of 36bn – just in 2024. Pretty close to the 40bn in debt. It’s a game of pushing up the stockprice by reducing the float and increasing the dividend.

rgds

WP

The above is so true. I have drilled many many many wells in the Permian and I will not drill there again at these prices. Investors are just trading dollars. I can tell you it is an uneconomic venture. The Majors do get services cheaper as they can prepay for services which vendors love. I have drilled with the Majors and their well costs are over $11 million dollars per well.

Thanks LTO Survivor. Am I correct in assuming the $11 million is just D & C or is that full cycle costs, including land cost?

LTO, I hope you are well. I appreciate these comments; I otherwise get so much shit from people who try so hard to make giants out of nothing but piss ants; I appreciate the positive, real life feed back. Thanks WP. Thanks DC.

Look, debt is debt, man. You can change defintions, move the goal posts, say stupid things like “sunk” costs don’t count….OK then, pay the debt back. That is all I care about. I mean really, you have to be really sorta fucked up to admire, and defend a business model that was created on, and feeds on, debt. All these giant, monster wells in this place or that…so what?

When people tout big IP’s and new, phony technology, 10/40 tail ends and 18,000 foot laterals with dissolvable frac plugs, landmen with ORRI’s who tout the “wonder” of drilling HPHT wells (been done for 70 years !) and ignore economics, and debt, I envision bored people in the basement looking at something so important as American shale oil and gas as….entertainment. I see them sitting on the couch playing shale oil like a video game. Then going to the mailbox every 25th.

The shale oil phenomena would not exist but for debt. Nobody in their right mind that cares about their kids, or their country, could see it any other way.

I haven’t been giving Dennis the cost of steel or anything else for a long time.

I’ve maybe given him what our costs are in the past few years? I don’t really remember.

I haven’t studied 10k and 10q for upstream companies for a long time either.

Huntingtonbeach,

XOM capital and exploration expenditures for US upstream in 2024 were $11.252 B and about 546 net wells were completed in the US in 2024, so upstream capital spending was over $20 million per well, based on the 10k for 2024. In 2022 when there were fewer aquisitions, US capital spending per well was 13.32 million for XOM. This pretty close to the oilystuff.com estimate of 12 to 13 million per well for full cycle costs in the Permian.

Thanks Dennis, but I really don’t think 20 million is a good number from the 10K. To many other expenses could be in there distorting the well cost. I did ask the question to Google AI and got this:

what is the break even point for the cost of oil in the permian basin

The break-even point for oil production costs in the Permian Basin varies depending on several factors, including the specific sub-basin (Midland vs. Delaware), the type of well (existing vs. new), and the individual producer’s operational efficiency.

Here’s a general overview:

1. Existing Wells vs. New Wells:

Existing Wells: The Permian Basin boasts some of the lowest break-even prices in the United States for existing wells, often below $50 per barrel.

New Wells: Break-even costs for new wells are typically higher, reflecting the initial investment in drilling and completion.

2. Midland vs. Delaware Basins:

Midland Basin:

Existing Wells: Reportedly around $38 per barrel.

New Wells: Reportedly around $62 per barrel.

Delaware Basin:

Existing Wells: Reportedly around $31 per barrel.

New Wells: Reportedly around $64 per barrel.

3. Average Break-Even for New Wells:

Average across Permian Basin: Data from a Dallas Fed Energy survey indicates an average break-even price of $65 per barrel for drilling new wells in the Permian Basin.

Regional Average for New Wells: Another source suggests the average break-even price for drilling new wells in the Permian Basin is around $62 per barrel.

Important Considerations:

Fluctuating Costs: Break-even prices can change over time due to factors like technological advancements, operational efficiency improvements, and fluctuations in service costs.

Company-Specific Costs: Individual companies may have different break-even points depending on their specific circumstances, drilling techniques, and asset quality.

Full-Cycle Costs: Full-cycle costs, which include exploration, drilling, completion, and operating expenses, can be significantly higher than just operating expenses for existing wells.

Oil Price Volatility: The break-even point is highly sensitive to changes in oil prices, and companies may adjust their production plans based on current market conditions.

In conclusion, while the Permian Basin is known for its low break-even costs, especially for existing wells, it’s crucial to consider the specific factors influencing these costs when analyzing the profitability of oil production in the region.

*****

Existing wells must mean workovers. This is probably were the $35 number from Exxon is coming from. I noticed AI goes behind paywalls to get some of it’s information. Might be useful. Also, I thought it was interesting that Shellman responds to me and I think he is a policial ****** ****. But you, really go overboard trying to be nice and work with him. Yet he still calls you just as bad as thing as me and won’t respond to you. Maybe you’re using the wrong approach. Anyway, look out below because I used his name again. I really don’t care anymore, my life is to short for that. That’s the next generation problem. I live in Trumpland and see it everyday I visit the club. The business guys are starting to figure it out and are getting pissed at Trump. On the other hand, the religious idiots I don’t think will ever come around. Last week a guy wore a t-shirt that said – “Transsexual are just retarded gays”. One more thing, I guess we have a local election coming up here soon. When you drive around town there are signs that say – “Protect our children from pron Vote No on A & B”. I guess now the parents are having to explain what porn is to their young kids and not happy about it. Can you imagine. Their trying ban books for children like “Everybody poops” because it’s pornographic. God help us, we’re going to need it. LOL

A general ballpark number for breakeven is all that is really important anyway.

Dennis

Thanks.

I was surprised to read those low cost Permian production numbers. Two things to note.

The New Mexico rig count has been very steady at slightly over 90 rigs/wk since October. Also Midland and Martin seem to be settling in close to 25 rigs/wk each since October. If this continues then that lower breakeven price may have some credibility.

On the other hand if your numbers are closer to the truth, then the companies face the question of not drilling and having their quarterly report show a production drop, which share holders won’t like. On the other hand they could drill and report a smaller profit/loss but show steady production.

I was wondering if you could run your Permian model and then suddenly in early 2025 drop the number of monthly completions by 10% for say 6 months and then back up to the original number, I am assuming prices rebound back to $70 six months later. I ask this because I am wondering whether the production drop that occurs with the drop in completions ever gets recovered in three or 4 years.

Attached is an article which shows the cost pressures Chevron is facing.

“The Permian Basin, a key area for Chevron, will see a reduced budget of $4.5bn–5bn as the company shifts its focus from production growth to enhancing free cash flow.”

This statement lends more credence to your breakeven oil price and possibly slower growth in US production. We will have to keep watching the weekly rig count and Frac spread for the next few months to get a better idea of how the oil price affects rigs and fracs,

https://finance.yahoo.com/news/chevron-plans-reduce-2025-capex-102326434.html

Ovi,

This is the scenario you requested. I simply modified my scenario in the way you requested.

Dennis

Thanks

What was the completion rate pre-drop?

There is a production drop but not as big as I expected and it recovers much more quickly than I expected.

In Dec 2024 it was 487 completions, it falls to 438 completions from Jan to June 2025, then increases to 482 in July 2025 (as that was my initial scenario rate).

Here is anothet article that mention 60 usd/bbl WTI. Think the tarrifs will inctease cost level for imported equipment and spare parts.

https://finance.yahoo.com/news/cheap-crude-tests-u-shale-220000404.html

Actual I had exspected about 75 – 80 usd/bbl. Think there have been a positive impact on cost by use of simultaneously

fracking. I read that they frack 3 wells simultaneously fracking. This might also they do with drilling horizontal wells. Higher utilization of equipment and pepole, reduced transport cost reduce cost each foot well. But I believe productivity improvement goes slower now.

Freddy,

Productivity is decreasing when normalized for lateral length, this has been the case since 2016 in the Permian Basin. I am convinced that $60/b or lower will be a problem for tight oil producers in the US.

There is also several other issues that is a growing challange in shale buisiness. The higher utilization of a field means more chield well interference. Beside that it seems more wells became gasier. There is also a growing water production. Thoose 3 elements together with the fact that geology are getting more challenging as the best area is already drilled Tier 1 Area. Think now they operate Tiere 2 and 3 area. If it had not been for improved drilling, fracking processes break even price would have been much higher. But this tecnology requires huge capital and Area and the smaller Company have significant higher break even price than Exoon.

some of the lowered EUR/ft numbers are delayed because the decline tail is 3 years behind, the IP/ft might be just as good or looks slightly higher with longer laterals and more proppant/liquid loading.

The EUR estimates or EIA/USGS reserve estimates all might be over estimating for shale oil by 30~>50% based on higher IP and a slower decline curve; while underestimate shale gas, especially in Marcellus, where the decline tail also scales up with longer lateral, higher IP.

Ovi,

Slight variation with DPR completion rates for Jan 2024 to Feb 2025 used, then 10% drop (from 443 to 399) from March to August 2025, then back to 443 wells in Sept 2025, I assume an annual rate of decrease in new well productivity (EUR) of 2% starting in Jan 2025 for this scenario. I also assume the completion rate is 443 wells per month from Sept 2025 to Dec 2028 and then completion rate decreases falling to zero by August 2035.

On the rigs in Louisiana, my guess is that most of the oil is condensate from gas wells. Chart with C+C and wet natural gas for Louisiana from 1997 to 2025 below.

Lousiana Horizontal Oil and Gas Rigs, HOR=horizontal oil rigs, HGR=horizontal gas rigs

Dennis

Thanks. Looks like Louisiana is mostly condensate.

Ovi:

TLDR: Most OH reported oil would be considered “lease condensate”. Most LA reported oil would not.

EIA used to report crude gravity by state, at every ten API points (LT30, 30-40, 40-50, GT50). I could not find data more recent than FEB2024, but as of that time, ~80% of OH crude was higher than 50 API gravity, a threshold that almost anyone would consider marketing as “condensate”. In contrast, only about 20% of LA oil was above 50 API gravity.

Basically, I think the story of LA oil is that it is mostly legacy (declining) conventional crude from onshore and state GOM waters. It’s not like nobody will ever drill another oil well in LA, but mostly what is going on now is drilling of the Haynesville (which is very dry gas, with almost zero condensate, often not even processed for NGLs…but placed directly into dry gas long haul pipes!). So, overall the state is more of a mix of active drilling for dry gas (almost zero associated crude/condensate) and just declining conventional crude oil (with negligible drilling) and occasional up/down from weather, especially hurricanes.

Ohio is a different story. Almost all the drilling is going after the Utica or Marcellus and, in OH, these wells produce significant amounts of BOTH gas and associated lease condensate. They are truly “in betweener” wells. In contrast, LA where it is more a story of different populations.

But even in OH, it’s not as simple as “gas was growing and oil (lease condensate) grew with it”. This is because if you look at the changes over time, oil has been growing FASTER than gas in OH.

In general, you can expect gas to oil ratios to grow over time, because oil decline curves are steeper than gas decline curves. So, for a prospect like ND, where they drill enough to essentially keep crude production flat, they see gas grow. But in OH, it has been the opposite, gas production has been essentially flat, while oil quixotically grew!

Consider that in SEP2021, OH oil production was only 48,000 bopd. And it has almost tripled since then. Meanwhile, over the same time frame, gas production slightly declined (from 6.1 to 5.5 BCF/d). So…yes, there really is sort of a little “oil play” within OH. I wouldn’t overdramatize it. It’s not NM. But it is not just EOG spin machine either. It’s happening.

As for the BH data on “oil directed” or “gas directed” rig count, I would maybe not read too much into it. First of all, BH data is not perfect (not to slam it, very happy we have something). Second for OH, I suspect these wells need both oil and gas revenue to be NPV+. So, it’s really kind of arbitrary what you call the rig–it is actually drilling for both. I suspect there’s more than one rig in the “oil play” of OH. I think EOG has one and so does Encino. They just don’t care what they call the “directed” field on the BH data.

Nony

TLDR: I try to let the charts tell the story.

Thanks for the detailed info on OH and LA.

As for BH data, maybe the numbers themselves are not as important as the trend. While the numbers are dropping, there is no info on how to compare today’s rigs with those in January 2023. Do the new rigs have double or triple the power of the January 2023 rigs. If so, not as many are required to drill the same number of wells. Difficult to interpret those number without more info.

Bottom line. we really need to know how many wells are being drilled every month. Novi Labs used to provide that info but it is not available for free now. In 2023, the last year of significant rising US production, Novi Labs was reporting an average of 460 new wells per month. Production and Rig counts have been flat since the end of 2024 to today. What has changed?

Agreed. And cool, man. Yes, per rig productivity has gone up. Even leaving out lateral length increase (which helps by spreading setup and vertical), you just have an aspect of speed. They have gotten faster over the years, even within the lateral.

There is also an issue of high/low grading. This happens not only with the land, but with the crews and equipment. So, the best crews/rigs tend to be concentrated more during a bust. (Conversely of course, when we have a boom, then more marginal equipment and greenhorn drilling crews are mobilized.)

Also, of course there can be an effect of cost deflation. If very few rigs are drilling, the rig rates tend to be low. (During a bust.) During a boom, they rise rapidly. Can be a 2x difference across the cycle. (And yes, there are many inflationary aspects also: tarrifs, inflation itself, etc. But during a bust, you will see capital costs to drill a well go down…this happens every cycle.)

One small note: if you want to look at number of wells, than the relevant metric is per well production, not normalized by length. If you decide to look at normalized (by foot) productivity, than you also have to know how many feet were drilled, not how many wells!

Oh…and if you just want a “chart story” for LA and OH crude density comparison, here is the relevant data:

https://www.eia.gov/dnav/pet/PET_CRD_API_ADC_MBBLPD_M.htm

I would do a double column 100% comparison, for FEB2024. Not a time series.

https://d2mvzyuse3lwjc.cloudfront.net/doc/en/UserGuide/images/100_Stack_Column_Graph/100_Stack_Column.png?v=38773

here is a chart from EIA (https://www.eia.gov/petroleum/production/#ng-tab) of gross gas from WV, PA and OH, and I combine the WV PA together to show a 4th plot.

Details: most gas from WV and PA are from Marcellus, and Utica only has about ~0.8 and ~0.5 BCFPD for PA and WV respectively. Therefore, one could see the total Marcellus gas is still increasing and clearly not peaking yet, e.g. from ~24BCFPD Feb2020 to ~29BCFPD in Feb 2025; while the PA Marcellus has been flat since Feb2020 mainly due to wellhead prices way lower than HH. And total production to date for Marcellus only is already ~100TCF since 2010.

OH gas is mainly from Utica, and because lower GOR ratio and drilling targeting only condensate to oil, the gas production has been falling.

Marketed natural gas production from PA, WV, and Ohio. The OLS trend from March 2022 to Feb 2025 (36 months) is an annual increase of about 0.51 BCF/d. Unless pipelines are built to NE or to Gulf Coast or a new LNG facility is built in Maryland we are not likely to see a big increase in Appalachian Natural Gas output (includes both Marcellus and Utica Formations).

Dennis,

Nony’s comment down below about ‘trying to at least know what you don’t know’ may be particularly apt when it comes to the Gas World … specifically App Basin future production.

As you have focused primarily on oil these past many years, it is understandable that you have limited familiarity with all things gas.

The possibility of more pipe to serve NYS and New England is growing stronger, but it is the data center build out that will greatly boost App Basin natgas output.

The Homer City operation alone will consume close to a Billion cubic feet (~800) when it is fully online in a few years’ time.

The current backlog from Siemens, Mitsubishi and GE Venova for large natgas turbines is approaching 5 years, despite a ramping up of production capacity.

It would not be surprising to see App Basin increase output of natty by 5 to 10 Bcfd in a decade’s time if current plans come to fruition.

Coffeeguyzz,

Perhaps output will increase, depends on prices and demand. The future is difficult to predict.

I would caution talking about normalized per foot production in the context of well go nogo investment decisions. When you are deciding to drill or not, you look at the capital cost versus the production. At the well level.

Yes…for a peak oiler, it may be interesting that rock productivity is down. But for an investment decision, it is not the relevant metric. Even if you just think of it as a capital efficiency increase, longer wells can help. Essentially more feet for the same 12 million or whatever initial capex.

The benefit of a longer well is the vertical and the move setup cost being spread over a longer lateral.

Of course there are tradeoffs. We have very few 4 mile wells for instance. But we have very few 1 milers any more either. It’s been a gradual evolution of capability to allow economic drilling at longer lengths. Steering. Lease boundary trading. Etc.

Nony,

I only look at productivity per foot to get an idea of utilizing the productive area of each formation, so for example if an operator claims they have 30000 locations left to drill, it makes a difference if they are talking about 10k wells or 15k wells. For my models I just use well productivity that is not normalized for lateral length, future productivity is a guess, but I simply assume lateral lengths will remain what they were for the most recent well that I have the data to do a decent well profile estimate (currently for 2022 wells) and assume productivity may decline at a rate similar to the rate we have seen normalized productivity decline in the Permian since 2016 (about 2% per year). The guess is likely to be incorrect, but I don’t have any new data at the average well level.

I think with capital budgeting, it’s important to know that you don’t know. I don’t place too much stock in either a flashy press release or the industry veterans that habituate this blog comment section (very few in number and not shale operators).

I looked for a public pure play Permian operator to estimate average capital costs and got this:

https://permianres.com/operations/

They are Delaware focused, so probably a bit deeper (more expensive) than a Midland subbasin operator.

If you look at their 2025 capital budget it is $2B (1.9-2.1B), to drill 214 net wells (285 gross, 75% WI). So that implies 9.4 MM/well. Their expected average lateral length is 10,000 feet (i.e. “two miles”).

They actually say that only 80% of the $2B is for well-level D&C, the other 20% is for central facilities and workovers, but I’ve been conservative and just allocated 100% of the total capex to the overall (net) well count.

See: https://permianres.com/permian-resources-announces-strong-fourth-quarter-2024-results-and-provides-full-year-2025-plan-with-increased-capital-efficiency/

Of course, you could look at more companies or even interview someone from Halliburton or the like.

But…if you see a bunch of wells getting drilled that don’t make sense to you, but the industry continues to do so…I would at least consider that your model (or the assumptions within it) are at issue. Not that all these operators are just trying to make peak oil blogs look bad by wasting their money.

Nony,

Thanks.

Based on 10k for 2024 for Permian Resources the average capital cost per well was about 10 million. If we assume this is average cost for all producers in the Permian Basin, and use their average sales price in 2024 for crude, NGL and NG then the well pays out in 37 months and would be profitable. If we assume prices drop to current level for Oil and NG and NGL sells at about 30% of crude, then the average well pays out at about 90 months. Also keep in mind that with tariffs, pipe will become more expensive which will tend to increase costs. This might be offset with lower costs for rigs and frac spreads due to lower levels of activity.