The Texas RRC Data Base came out a few days ago. The data is reported through September but of course it is incomplete. The data from the field comes in very slow in Texas and the RRC only reports the data they receive. All data is through September and is in barrels per day.

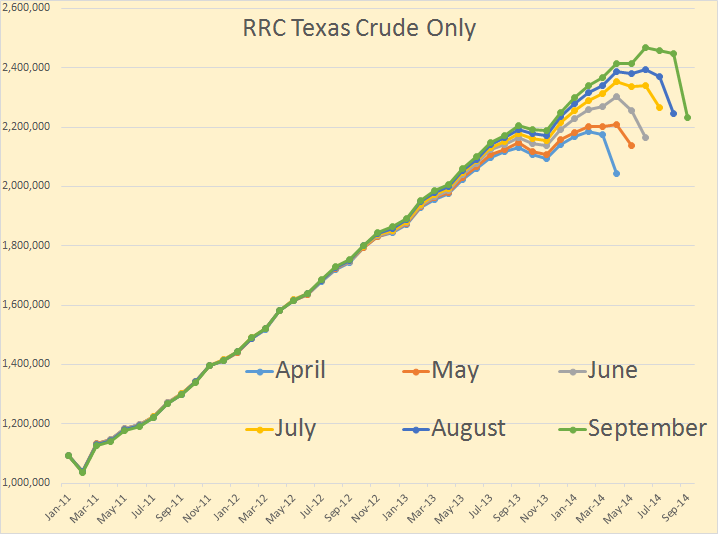

Crude only has shown a slight downward trend for the last two months. After revision, when the final data comes in, production will likely still be up slightly but if this is any indication, it will be up less than in months past.

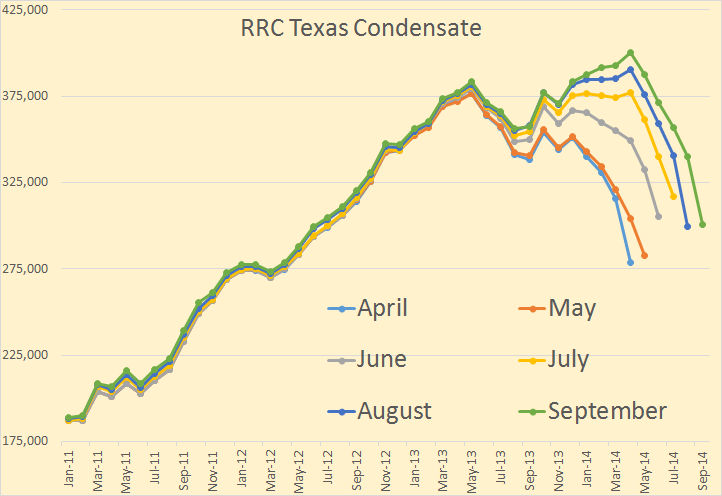

Texas condensate production started a dramatic slowdown in June of 2013. It actually declined three months in a row, June, July and August of 2013 but then started to recover. But production growth has slowed since that date.

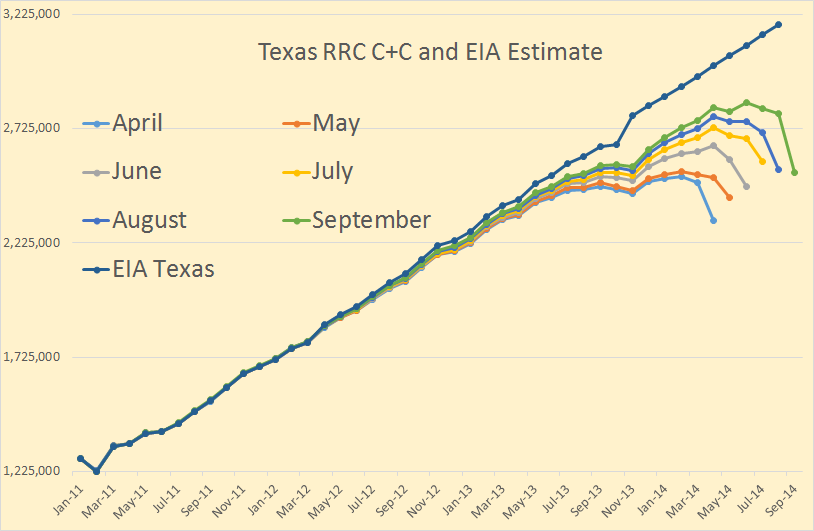

Adding the two we get what the EIA reports, Crude + Condensate. I have included the EIA’s estimate which is only through August. The EIA is just guessing here of course and this guess seems to be revised by a few barrels every month. Of course they eventually get it right as the dip in October 2013 shows.

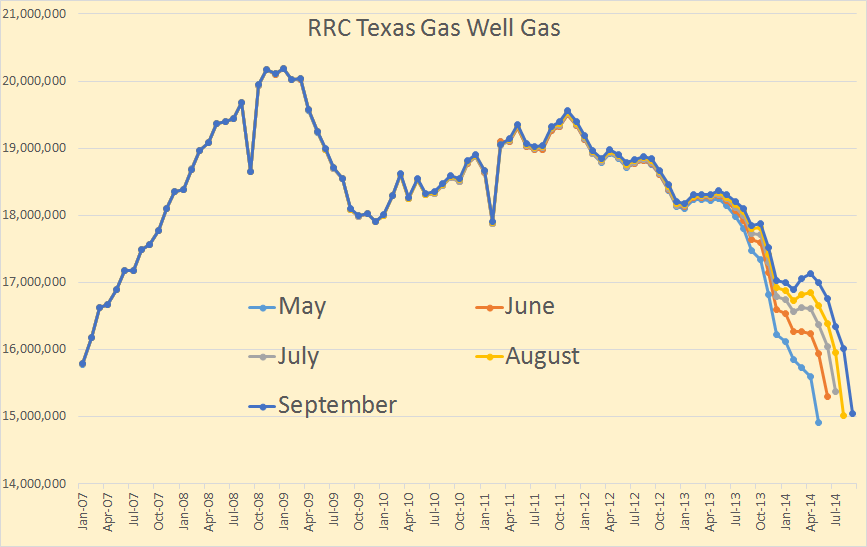

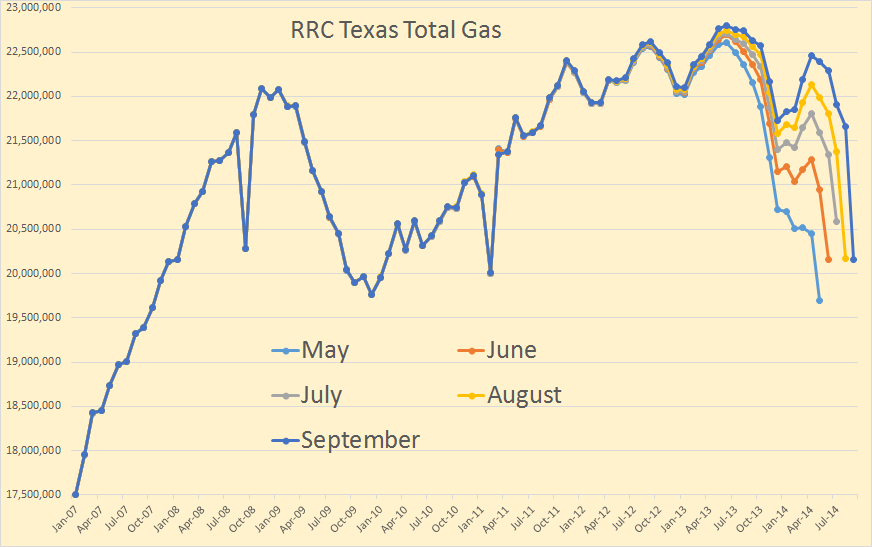

Texas gas well gas peaked back in January 2009 and reached a lower peak in November of 2011. But it appears to have peaked unless much higher prices spurs a lot more drilling.

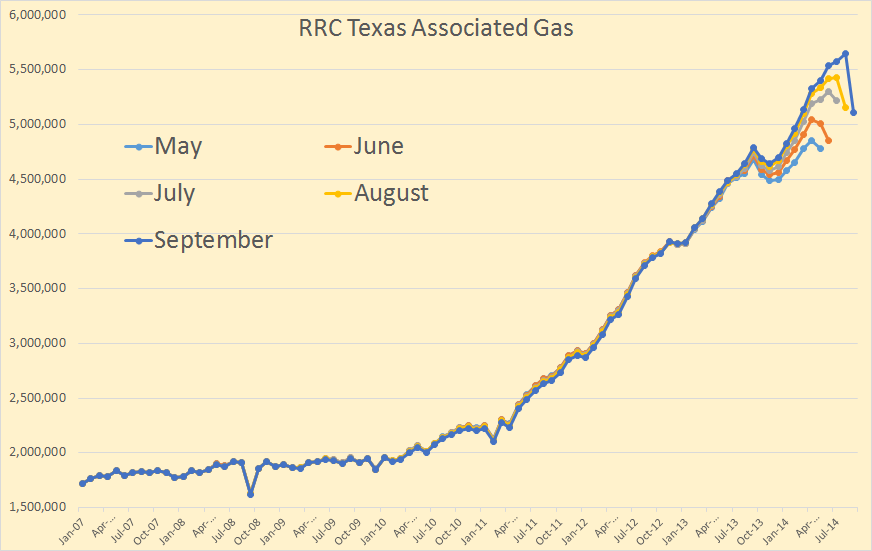

Texas associated gas is still increasing because oil drilling is still increasing. Texas associated gas accounts for about 22 percent of Texas total gas.

Adding the two we get Texas total gas. Total gas production still appears to be increasing but only slightly.

Other News:

Water is the biggest output of U.S. oil and gas wells

The biggest product of the U.S. petroleum industry is not oil, gas or condensate but water — billions and billions of gallons containing dissolved salts, grease and even naturally occurring radioactive materials…

Argonne estimated that more than 7.5 barrels of water were produced for every barrel of crude, and 260 barrels of water for every million cubic feet of natural gas, based on state and federal records for onshore oil and gas production…

But the vast majority of water from onshore oil and gas wells, accounting for more than 92 percent of all produced water, is re-injected underground to maintain pressure in the reservoir (71 percent) or into non-producing formations for disposal (21 percent).

This is interesting since, in most shale fields, like the Bakken, they do not have injection wells where water is injected just to keep the pressure up. That just doesn’t work very well in tight oil fields. What I think they do is just drill injection wells in permeable rock solely for getting rid of water that comes up with the oil as indicated in the link below. It is from the Bakken permit list. Bold mine.

NDIC Permit List For November 14th, 2014.

#90323 – WHITE OWL ENERGY SERVICES, INC, WHITE OWL JOHNSONS CORNER SWD 1, NENE 23-150N-96W, MCKENZIE CO., 835′ FNL and 360′ FEL, SALT WATER DISPOSAL, BLUE BUTTES, ‘Tight Hole’, 2463′ Ground, API #33-053-90323.

A Different Kind of Oil Crisis

“It is increasingly clear that we have begun a new chapter in the history of the oil markets,” the IEA stated in its November oil market report, observing that the world’s oil supply is outstripping projected oil demand—the opposite of what was happening just over six years ago when oil prices peaked.

For countries whose finances are heavily or almost wholly reliant on high oil prices, it’s a tough time. At current price levels, the national budgets of Iran, Venezuela, Nigeria, Iraq, Libya, Russia and Saudi Arabia will not break even, which could force these countries to burn up precious cash reserves, as well as leading to infighting over market share, upsetting an already fragile world order.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

271 responses to “Texas RRC November Production Report”

From Newsweek’s “A Different Kind of Oil Crisis”. I read this last night after finding it on Yahoo where it was prominently displayed. I like their opening statement — “In a world that has become acclimated to sky-high oil prices…”. The reason I “like” it is because of how boldly they assert as fact a completely absurd point. I admire the pure propaganda value. From my point of view, the world has NOT acclimated to sky-high oil prices. Rather, the global economy (and national economies) have been devastated by “sky-high” oil prices and by the massive build up of debt that governments used to compensate for those unbearable oil prices. This Newsweek article fit in nicely with other major propaganda pieces that I found on Yahoo doing just one scan last night, one of which by the New York Post blatantly suggested the Peak Oil is an invention of Wall Street which is used to manipulate the price of oil higher so that Wall Street can make larger profits. With articles like these on Yahoo, is it any wonder that the “masses” of regular people are clueless about the real issues behind Peak Oil?

The following chart shows steady buildup in total global public debt (much of it financed by accommodative central banks) versus the steady decline in the Ratio of Global Net Exports of oil (GNE) to Chindia’s Net Imports (CNI) from 2002 to 2012 (the same trends continued in 2013, although there were some EIA revisions to prior years for the GNE/CNI Ratio).

Available Net Exports, the supply of GNE available to importers other than China & India, fell from 41 mbpd in 2005 to 34 mbpd in 2013.

I’d much prefer to see a similar chart with either inflation adjusted dollars, or preferably change in debt/gdp ratio. I don’t think the debt figure by itself is that instructive.

After you finish the graphs you suggested, I’d like to see them.

In any case, by definition the remaining supply of post-2005 Available CNE (the supply of Cumulative Net Exports of oil available to importers other than China & India) has declined, the question of course is by how much?

Another way to conceptualize what is going on is that we have, in my opinion, seen a massive increase in total global public debt per barrel of remaining post-2005 Available CNE.

Well I found this image in the recent geneva report, I guess this is a close enough proxy. Quite worrying.

http://www.voxeu.org/sites/default/files/image/FromMay2014/lane%20fig1%2026%20sep.png

How do you go about embedding images? I’m rubbish at html.

I think there is a google on it for wordpress.

But then I thought there was google for “Comment Editor” for wordpress, passed it along to Ron, he implemented it — and you notice we don’t have a comment editor?

A couple of points.

-One person’s debt is another person’s asset so why not rename Total Global Assets?

-Depending on the currency in which those assets / debts are denominated the graph will be different.

-Not all debt is related to oil so to use that as an assumption makes no sense.

-Is debt/assets only related to exported oil rather than to all oil produced?

One of the problems with using data instead of a thesis as a starting point is that it may lead to finding relationships which do not exist. In this case Jeff’s GNE concept makes logical sense, or at least is a very interesting and useful way of looking at oil production/imports/exports but I fail to see how this is meaningfully related to global assets / debt.

Rgds

WP

IMO, central banks, especially in developed countries, have been engaging in massive QE, trying to keep their economies going–some semblance of BAU–despite very expensive oil.

That is quite likely true but the direct connection between the amount of debt/assets and the marginal price of oil is missing.

Rgds

WP

As noted below, in my opinion we are seeing an accelerating rate of decline in the remaining supply of Global CNE (Cumulative Net Exports of oil), and especially an accelerating rate of decline in Available CNE (the supply of Global CNE available to importers other than China & India), at the same time that we continue to see a huge buildup in global debt

The mutant crony-capitalist-plutarchy-nation-state monster is going to try every trick in and outside of the book to survive. Unsure where the ventricular fibrillation kicks in or if it’s already upon us, but it’s likely not going to bode well for everything the monsters’ Captives depend on it for. Pensions? What, me worry?

One person’s debt is another person’s asset so why not rename Total Global Assets?

Exactly.

Because those debts will not be paid and the “assests” will vanish into thin air?

I have the same sentiment. Say I lent my friend $30,000 to help him in his business. For a while, I am confident he can pay me back via his business profits. A bit later, his business goes belly up. I can’t expect to get all $30,000 back. What I thought was an asset turned out to be a loss. So while times are good, the Total Global Assets value is fine, but “assets” can disappear, like my friend’s promise. Am I missing something logically? Maybe I am not factoring in the fact that my $30,000 is still in the system somewhere.

Debts are always paid, if not by the debtor, then by the creditor. Even in cases where debts are paid back with hugely inflated currencies, e.g., the German Hyperinflation, this would be an example of the creditor taking the loss.

In any case, my point is that, in my opinion, we are seeing an accelerating rate of decline in the remaining Global CNE (Cumulative Net Exports), and especially an accelerating rate of decline in Available CNE (the supply of Global CNE available to importers other than China & India), at the same time that we continue to see a huge buildup in global debt.

My contention is that most debt and equity prices are miss-priced, since they don’t begin to take into account accelerating rates of decline in Global and Available CNE.

Link to GNE/CNI Ratio graph for 2002 to 2012 follows. The EIA has revised some previous values, but the slope changed pretty much the same, from 2002 to 2013.

http://i1095.photobucket.com/albums/i475/westexas/Slide20_zps26112103.jpg

my $30,000 is still in the system somewhere.

That’s why bankers have the idea of “senior” and “junior” debt. Senior debt gets paid off.

More generally, if you have a an investment (like a bond for example) it has three numbers that determine its value: Price, risk and yield. If you know two you can theoretically calculate the third. The yield is the cash that comes out of the investment. the price is the money you pay to get this cash flow. They risk connects the two.

“…the logic behind money pretty clearly isn’t what the textbook story claims it is. That doesn’t mean that there’s no logic to it at all; what it means is that nobody wants to talk about what it is that money is actually meant to do… I can sum up the matter here in a single sentence: the point of money is that it makes intermediation easy.

Intermediation… is the process by which other people insert themselves between the producer and the consumer of any good or service, and take a cut of the proceeds of the transaction. That’s very easy to do in a money economy, because… the intermediaries can simply charge fees for whatever service they claim to provide, and then cash in those fees for whatever goods and services they happen to want.” ~ John Michael Greer

“… So money goes toward those who will create even more of it. But, basically economic growth means that you have to find something that was once nature and make it into a good, or was once a gift-relationship and make it into a service. You have to find something that people once got for free or did for themselves or for each other, and then take it away and sell it back to them, somehow. By turning things into commodities, we get cut off from nature in the same ways we are cut off from community.” ~ Charles Eisenstein

“Our mainstream money system is based on competition, selfishness, greed, individual gain, instead of cooperative values, altruism, good will…

The mainstream money system destroys communities. It affects everything in our lives…

One of the biggest hurdles is people’s ignorance of how the mainstream money system works… Mainstream money is issued by banks, and those banks have an agenda… they’re giving a public service in providing a medium of exchange which we all use– we have to use– but at the same time they have a for-profit agenda. And there’s a contradiction there. In fact, if you think about it, the banks issuing money is anti-democratic…

If everybody knew the full facts about how money is issued, how it’s put into circulation, who is issuing it, how they have power and control over the economy, and over individuals’ lives, I think there’d be a lot of very unhappy people around.”

~ Francis Ayley

“Only after the last tree has been cut down,

only after the last river has been poisoned,

only after the last fish has been caught,

only then will you realize that money cannot be eaten.”

~ The Cree People

No, they would end up on the balance sheet of the borrower.

Let’s say Alice has assets worth $10 minus $5 debt to Bob. Bob has $15 in assets including the $5 Alice owes him.

Total “real” assets 20 dollars, ten each. But Alice has 5 on paper and Bob has 15 on paper because of the debt. Whatever happens to the debt the “real” assets stay the same.

Since the net value of the debt is zero on the two balance sheets put together, the fate of the debt is immaterial to the total value of the assets in the system.

So if Alice can’t pay her debt she goes bankrupt, Bob gets $5, and there are $20 of real assets in the system and no debt.

If on the other hand Alice simply doesn’t pay back (maybe the debt is forgiven) she ends up with $10 and Bob has $10. The value of debt ends up on her balance sheet.

Ilambiquated, Why can I follow quantum mechanics and the Dirac delta function but not understand the difference between a credit and a debit? Your explanation leaves me totally lost: my fault (not yours). There must have been something in my education that expunged bookkeeping and accounting neurons. Good try anyway.

Quantum mechanics, or auroral plasma fluid dynamics, are utterly trivial compared to the above discussion — that did not even reach the stage where :

And then the defaults underway threatened global stability so central banks created money and paid off the loans.

Ilambiquated,

With all due respect, that is the FUCKING STUPIDEST THING I have ever heard.

Steve

Furthermore…. 55% of those who owned US Treasuries polled didn’t realize they would lose money if rates increased… lol.

Just goes to show you how FRICKEN STUPID American investors really are.

Steve

Steve,

If rates rise, holders of T-bills lose money on paper (the market value goes down), but they lose nothing if they hold them until maturity.

Nick,

LOL… the 10 year Treasury won’t be around in ten years.

LOL… steve

Doug Leighton

If it’s any comfort to you, coming up with this stuff was a major mathematical breakthrough we owe Renaissance Italian bankers. They invented the negative number to do it.

When Alice borrows $5 from Bob, they write a big -$5 in her account, indicating she owes $5. This is offset by the +$5 extra cash she now has, so her (net) worth does not change.

Bob gets a big +$5 written on his account, but that is offset by the -$5 cash transaction that resulted from him giving $5 to Alice. His net worth doesn’t change either.

All very simple. The sums all add up to zero, so no “new money” was created. It’s the magic of negative numbers.

The only thing left is the price Alice will pay (interest) and the risk (to Bob) that Alice won’t pay back. See my comment to AugustusGloopius for more on that.

(can’t seem to answer directly)

Ilambiquated, interesting history lesson, so I guess bankers are (were) good for something. However, I think I’ll make do with imaginary numbers but, speaking of Italians, in the late 1500s Bombelli set down rules for complex number multiplication. 🙂

Yahoo is worse than most with their perpetually sunny skies headlines.

This is why ZeroHedge became big. Quite a lot of people grew intolerant of it.

Maybe most important of all — it never used to be like this. The emphasis used to be on “dirty laundry” in the media. “If it bleeds, it leads.”

Now . . . it’s sunny skies and bright horizons.

We got the bubble headed bleach blonde, comes on at five

She can tell you ’bout the plane crash with a gleam in her eye

It’s interesting when people die, give us dirty laundry

Part of a popular song of decades ago, pointing out how negative media was. See how this has all changed? THIS is part of the disquiet. A switch was flipped in 2008.

“A switch was flipped in 2008.”

Watcher, it probably isn’t unreasonable to suspect that after the Lehman collapse and multi-hundred-billion dollar bank bailouts, somebody somewhere decided that a steady stream of propaganda was needed to keep public confidence stabilized. Since the 2008 flipping of that switch that you mention, the propaganda barrage has been incessant and widespread, coming from multiple well established media and news sources. It seems almost impossible that so many media/news outlets suddenly decided on their own to begin denying the grim realities of our global energy situation (and closely associated financial system) all on their own, independently of each other. The flipping of that switch implies a single source of command and control that set off the waves of “feel good, all is well” propaganda through the multiple channels and from multiple sources. Blame Obama for flicking that switch? Oh, please…

The right wing has generally noticed it and presumed that Obama being elected is what prompted the mostly left wing media to adopt sunny skies and bright horizons as a perspective.

But they, like the left wing, can’t think deeper, because they have jobs to go to and only see headlines. They don’t have time to read further.

This was systemic. Not conspiratorial. Systemic. Negative media became the norm because that’s what the audience wanted — dirty laundry. The generalized, universal advertiser base does need their advertising outlets to have good viewership/listenership/readership ratings but the content all of a sudden became compelling. When money is scarce, negative attitude does not induce purchase. Simply that. Lots of lots of people seeing your advertising is important, but only if they buy — and post 2008 with real income accelerating downwards there suddenly ceased to be a normal inclination to do impulse buys.

And so viewership goal-seeking got trumped by a need to induce purchase inclination. The decision was made . . . imposed . . . on media to emphasize purchase inclination over viewership ratings.

” …somebody somewhere decided that a steady stream of propaganda was needed to keep public confidence stabilized.”

NWR, I don’t think that somebody somewhere decided any such thing. I used to work in the medical field and spent time with many very bright people. Nary a one of them had ever heard of peak oil or seemed to grasp the limits to exponential growth. A very intelligent friend of mine (with multiple degrees) recently bought a monster Toyota PU with a V8 engine. He lives where he works and drives the truck primarily for pleasure. I’ve talked with him a little about peak oil and it’s like I’m talking to a wall. He can’t imagine a world where energy constraints change everything about how we live.

Likewise the media has many (alleged) very bright people but how many have advanced degrees in economics or earth sciences? I think they simply report what they believe to be true.

Now with oil prices down, it’s definitely “party on” time (and, yeah, I think that low energy prices are picking up where QE left off).

This winter it will be interesting to see how the NDIC reports play out. I’m betting that these low prices quickly sort out the men from the boys in the LTO arena.

Byron

Watcher and Byron, I get your points and they are good ones. But I believe it is a little naïve to believe that there is no central control of propaganda themes being pumped through the many “news” media channels.

No doubt, much of the propaganda that we see and read originates from reporters and news producers who are short on facts and looking to cater to their respective audiences. I was just reading on the New York Times this morning internal documents (emails, memos, etc…) between oil industry geologists and financial analysts who question the “hype” surrounding shale oil plays. That hype (aka: propaganda) serves the interests of many individuals seeking financial gain, and I think probably falls under the category of systemic.

But there are many ways to influence news cycles and news content being generated, not all of which require direct marching orders from an editor or media station boss to his reporters, as in “write this, say this”.

Carl Bernstein says a lot about how the CIA influences what gets printed/disseminated through America mass media channels:

http://www.carlbernstein.com/magazine_cia_and_media.php

Wikipedia does an interesting write-up on how intelligence operatives influence America opinion by manipulating news coverage:

http://en.wikipedia.org/wiki/CIA_influence_on_public_opinion

Six corporations control 90% of the media in America, and it is naïve to assume that the CEOs or other top level individuals in these organizations do not directly influence what news gets printed and the general themes and content of what news gets published.

http://www.businessinsider.com/these-6-corporations-control-90-of-the-media-in-america-2012-6

I got my BA degree in Public Relations. I learned that there are many ways to manipulate mass media to run news and content that promotes unstated goals. These techniques can be used for good or for evil, with “good and evil” often being subjective definitions.

When the constant drum beat emanating from mass media news sources is “all is well”, “American energy independence”, “the economy has recovered” — and so many other similar themes day in and day out, relentlessly, despite obvious facts that prove otherwise, I find it difficult to believe that there is not some central source driving these propaganda themes. Sure, a lot of reporters and writers who are short on facts jump on the “hype” bandwagon. But at the same time, very few reporters and writers who dig for the facts and who might present a contrary, more fact-based opinion, get nearly as much front-page top-of-the-fold exposure as the propaganda writers. Maybe it is because the advertisers don’t want to see the “bad news” as it might scare their buyers away. But then again, those corporations that run much if not most of the advertising are often under the same umbrella corporation(s) as the news media channels, and are being driven by the same small group of top level decision makers.

Conspiracy? No, I wouldn’t call it that. Concerted attempt to keep the masses calm, confident in existing financial and government institutions while those very institutions crumble around them? Yes, that is pretty much what it looks like to me.

“But then again, those corporations that run much if not most of the advertising are often under the same umbrella corporation(s) as the news media channels, and are being driven by the same small group of top level decision makers.”

Now that . . . is a good case for your position.

This is one of the relatively few times I am with Watcher (and others who hold similar beliefs) one hundred percent of the way.

“But then again, those corporations that run much if not most of the advertising are often under the same umbrella corporation(s) as the news media channels, and are being driven by the same small group of top level decision makers.”

THIS imo is worthy of being engraved in stone above the entrance to any place where public affairs are discussed.

The mass media is a twisted horror circus. Reminds me of that book/movie “Something Wicked This Way Comes”.

Haven’t the citizens figured out that very little important useful information is rendered through these outlets? When some good info is actually disseminated it is so surrounded by useless info that most people will not pay much attention.

But even good information not of much use, since the power to act has mostly been reduced or taken away from the citizenry by corporate/government edicts. Now they expect information to be acted upon by government and when it isn’t then it must not be important or true. There is a huge disconnect now between government and most citizens. News is mostly a twisted form of entertainment at this point, at least at the mass media level.

“I like their opening statement — “In a world that has become acclimated to sky-high oil prices…”. The reason I “like” it is because of how boldly they assert as fact a completely absurd point. I admire the pure propaganda value. From my point of view, the world has NOT acclimated to sky-high oil prices.”

The sad thing is when I read that line, I was giving them credit in my mind for at least acknowledging that prices have been high. Much of what I read in the media claims that oil prices are low and gets worse from there…

“The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country. We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of. This is a logical result of the way in which our democratic society is organized. Vast numbers of human beings must cooperate in this manner if they are to live together as a smoothly functioning society. …In almost every act of our daily lives, whether in the sphere of politics or business, in our social conduct or our ethical thinking, we are dominated by the relatively small number of persons who understand the mental processes and social patterns of the masses. It is they who pull the wires which control the public mind.”

Edward Bernays (the “father” of Public Relations) – 1928

What was true in 1928 is even more true today, infinitely more so.

In today’s world, the entire population is sliced and diced into specific target markets, with vast amounts of research conducted into learning just exactly what makes those target markets “tick” — their wants, their needs, their fears, their emotional “hot buttons”. We are being studied like lab rats and decisions are being made that affect us all based on the findings of those studies. In short, we are being manipulated.

The “opinions of the masses” IS a national security issue. Especially in a time where long trusted institutions are failing, where so many things long taken for granted are on the verge of being taken away.

A good Public Relations professional must always be looking into the future, studying trends, recognizing potential future crises and preparing media campaigns and other strategies to preempt negative public opinion when those things happen. Seeing a crisis approaching in time allows a PR practitioner to begin subtly laying the psychological groundwork for the more hard-hitting attitude adjusting work that might need to be done later.

In my opinion, the concentrated focus of propaganda themes that we are being barraged with today from multiple angles and from multiple sources are all derived from the recognition that the world as we know it is on the verge of radical change. And TPTB, whoever they are, have embarked upon a campaign to mold and adjust public opinion, to reset expectations, to manipulate and massage the masses through crises that have yet to unfold. Seeing and recognizing that intense propaganda messages are attempting to prepare us for something really big is pretty good evidence (imo) that something really big is heading our way.

” …In today’s world, the entire population is sliced and diced into specific target markets, with vast amounts of research conducted into learning just exactly what makes those target markets “tick” — their wants, their needs, their fears, their emotional “hot buttons”. We are being studied like lab rats and decisions are being made that affect us all based on the findings of those studies. In short, we are being manipulated….

…In my opinion, the concentrated focus of propaganda themes that we are being barraged with today from multiple angles and from multiple sources are all derived from the recognition that the world as we know it is on the verge of radical change. And TPTB, whoever they are, have embarked upon a campaign to mold and adjust public opinion, to reset expectations, to manipulate and massage the masses through crises that have yet to unfold. Seeing and recognizing that intense propaganda messages are attempting to prepare us for something really big is pretty good evidence (imo) that something really big is heading our way.”

Can’t disagree with the first paragraph. The major cable news channels manage to report (or not report) events framed in a manner that conforms to their political/economic agenda.

Maybe a year ago Fox brought on some Asian guy that was an astrophysicist (or something that sounded equally impressive). He had done high level research on climate change and his data revealed that human activity had no impact on climate. I googled the guy and found out that he did have an impressive CV. He was also well funded… by ‘big oil’, coal, and the Koch brothers. I’m not saying he was incorrect but perhaps some disclosure was called for 🙂

The country was ‘tricked’ into the Iraq war. Can’t forget how Judith Miller ended being a White House NeoCon sock puppet.

On your last comment quoted above, I think that you suggest that there is an overall voice massaging the message as TPTB are aware of some specific rouge wave headed our way. I’m not so certain that I would go that far. Media palavating has been at a rather constant drone for an extended time… through periods calm and crisis.

So what do you propose this ‘really big’ critter is that’s headed our way. I would guess that if there is a group of insiders that know something specific, we would probably know too. It’s too hard to keep secretes these days.

Personally I see it as the eventual energy crunch. Most of us have no idea how far up we’ve managed to leverage our lifestyle by the convenience of cheap energy. Hope the down side ride is slow and gentle rather than steep.

Oh, and pardon my spelling…

Byron — The eventual energy crunch is just exactly what it is. And it isn’t a secret — it is discussed here and on peakoil dot com and on other venues regularly. But it is NOT widespread knowledge, thanks in great part to the very effective propaganda of which I speak that tends to give uninformed individuals wrong information and induces them to believe things are going just fine when in fact things are most definitely not “going just fine”.

Have you read the 2010 Joint Operating Environment (JOE) created by top military strategists and declassified for common distribution? A lot of discussion in that document pertains to the security challenges (dangers) of a world experiencing energy shortages “as soon as 2015”. Those discussions include not only foreign security challenges, but internal domestic challenges as well. Subsequent to that document’s creation, President Obama issued Directive No. 3025.18, “Defense Support of Civil Authorities,” on Dec. 29, 2010, authorizing U.S. Military forces to be used “to quell civil disturbances … in accordance with applicable law or permitted under emergency authority”. Is the U.S. Military aware of and planning for domestic and foreign security issues related to energy shortages? Sure looks like it.

The fact that police forces across the country are “militarizing”, getting equipment from the military and beefing up both their defensive and offensive capabilities is I think undisputable. Homeland Security is in a class all by itself. And I guess we can rest assured that NSA is doing their part to keep tabs on potential troublemakers as well.

Everything points to authorities in the top levels of government, military and industry being well aware of severe issues heading our way and preparing for those eventualities, including but not limited to bombarding the populace with propaganda to manage and mold public opinion and perception as we slide ever closer to that “something big”.

http://www.fas.org/man/eprint/joe2010.pdf

http://www.washingtontimes.com/news/2014/may/28/inside-the-ring-directive-outlines-obamas-policy-t/?page=all

” …Have you read the 2010 Joint Operating Environment (JOE)… “

No I have not but I did just download it for later review as it looks like it will require a little more attention than usual (for a change). Thanks for the link.

I’m not sure that the coming energy crisis is the cause for the militarization of law enforcement or the creation of the Utah data farm. Those last two items stem, I believe in part, to 9/11 and the financial crisis. I am sure that TPTB do get how close we came to sinking into a financial whirlpool and that could explain the law enforcement and NSA stuff (plus good business is where you find it). But then energy was a poorly understood component of the 2008 debacle.

Anyhow if the our ‘leaders’ really do get peak oil, it would represent a massive failure of leadership to not work on mitigating the consequences through education, tax incentives (okay, some of those do exist), and policy.

BTW, I don’t know where you live in the NW but I do know that it contains spectacular scenery. In an earlier life I had the privilege to travel through Washington state and British Columbia via bicycle. These days my travels have been mostly in a kayak on the Great Lakes.

Byron — Thanks for the discussion. I appreciate your point of view. BTW, I live southwest of Portland, Oregon about 30 miles or so, in the Chehalem Valley. It is indeed beautiful here, farmland and orchards and world class vineyards everywhere with a big river flowing through it. I never visited your neck of the woods and don’t know that I ever will, but I have friends from there and they assure me it is equally beautiful — but with meaner mosquitos, much meaner… 🙂

I don’t think that world leaders believe in Peak Oil in the way it’s discussed here.

But….there’s no question that the US and OECD are badly vulnerable to something like a war between KSA and Iraq. Everyone knows the problem, and our lack of preparation is almost treasonous.

But, it’s not stupidity. It’s control of elected leaders and media by corporations, and especially by the fossil fuel industry. Look at the Republican Party – it’s almost impossible for somebody to be a Republican politician without agreeing that Climate Change is a hoax. Look at the new leader of the Senate energy committee: Inhofe!!!

Fuel prices *are* low – at least in the US (and for commercial uses in Europe). They’re *way* low in many places like Venezuela.

Fuel should be much more heavily taxed to internalize the cost of pollution, supply risk, and military costs of oil.

Our lives are a fraud, Northwest Resident.

Even Kunstler doesn’t seem to catch the fundamental seed of the coercive/embedded-violence-based nature of the crony-capitalist governpimp state setups. And now, the mere flapping of butterfly’s wings is approaching hurricane-force, while we all throw our children and grandchildren under the bus for padding/air-bags/shock-absorbers.

This site amounts to (attempts at) peering at specific angles into the Black Box.

That it’s about ff/energy/etc. gives it a wider, more concrete perspective than most, perhaps.

Mike just posted on the GOM post, an explanation of what the term “break even” means. He is talking about break even in the oil patch and I think his argument hits the nail on the head. I would invite everyone to read his post, or to have him re-post it here as it will get more exposure on a new post.

I will yield to him about what “break even” means in the oil patch but I hope everyone understands that “break even” means something entirely different to crude oil exporting nations as indicated in the last link in the above post, “A Different Kind of Oil Crisis”. Break even to exporting nations simply means that above a certain oil price the government has a budget surplus and below that price they have a budget deficit.

It’s as simple as that.

Yup. Deficits can be funded by your central bank. You don’t even have to borrow it from the public if you don’t want to. I will have to look into this for Muslim countries. Their religion disallows interest on debt.

Further, you can always cut spending. Or raise taxes. You don’t have to just sit there and have oil price decide fiscal budgets. It’s a use of “breakeven” that has no meaning.

Directly from Mike’s text:

“I can make money producing existing wells with oil prices at 30 dollars a barrel; for lots of conventional guys with better stuff it’s even lower than that. Those kinds of wells will not get shut in and lots of that kind of conventional stuff, for instance infield development wells, will still get drilled even at 50 dollar oil. ”

But.

The thing is . . . shale happened because there is no more growth in US conventional. The graphs were all in decline pre shale.

The Bakken is the poster child of shale. If they get sledgehammered, that destroys the boom narrative. Mike’s conventional fields will percolate along . . . in decline . . . and his people will have jobs, but the US population will grow and oil production will not.

The narrative being destroyed accelerates the death of shale as people exit the region. Already existing wells do not grow output.

I would argue that shale happened only because of high, stable oil prices, cheap money, and an incredibly successful public relations campaign. It, LTO, has “grown” domestic output the past 6 years, but the “costs” are staggering; money in versus money out, the shale oil industry has yet to make a dime. If it stopped completely, tomorrow, I do not believe it could pay all its debt; inside a year the 3-3 1/2 million barrels it spits out would be down to half of that, the next year, half of that again. That is not something Americans should hang their hats on. Shale oil was never going to keep growing output, not ever. It has it’s merits, LTO, but in the big scheme of things it is just a medium size fart in a big north wind.

The shale oil industry, I suspect, is feeling a little puny with 75 dollar oil prices. It has had the sniffles for what, 6-7 weeks? You have already pronounced the patient dead and the virus airborne, spreading to the rest of the oil industry. I don’t think so.

Well you’re right, badly phrased by me re Shale “happened because conventional couldn’t grow.” Shale happened because scarcity driven deflation is like entropy and dragged down interest rates relentlessly, perpetually and the price was high — but were there cheaper conventional alternatives existing, shale would not have happened even with the high price and low interest rates. The effort would have tapped the cheaper conventional.

“The shale oil industry, I suspect, is feeling a little puny with 75 dollar oil prices. It has had the sniffles for what, 6-7 weeks? You have already pronounced the patient dead and the virus airborne, spreading to the rest of the oil industry. I don’t think so.”

Well . . . except that you laid out in the para before this one estimates of losing 50% of shale output in a year — and that’s exactly the amount I suggested in my scenario. 50% down, and then another 50% . . . that IS death. You’re suggesting that without embracing my “death” perspective. That number sequence would crash the employment base. The state revenues. And, yes, the “Boom Narrative”. That’s death.

The only part of this whole thing that seems questionable to me is permanence. Would the Fed backstop the next array of lenders so that they’d be willing to fund drilling at $85/barrel? If the Fed doesn’t, I suspect the lenders will be scarce — and presto, the death is then permanent.

If the shale oil industry were to shut down tomorrow, that would be instant death, you are correct, sir. But that is not going to happen, not just based on a few weeks of slumping oil prices.

My only point in all this was to remind people that “break even” oil prices is really a meaningless term, in my opinion. The oil industry acts, and reacts, based on what it thinks is going to happen tomorrow, not too much on what happened yesterday. You raise a very good point, however, who is going to fund the 2nd quarter of the shale oil game?

Gawd, I have muddled thru nine dollar oil, OPEC production increases, 300% increases in costs, increases in taxes and every regulatory authority in the country wanting to run me plumb in to the ground. I never dreamed of asking the government get off my back or to loan me money. If the Federal government ends up having to fund the shale oil industry, I for one am going to be a mad son of a bitch.

Hell, Mike. They’ve Already Done It With Other Industries!! Banking would not exist if they had not done it.

Neither would GM.

But when the time comes, the obfuscation and camouflage will be so deep that they’ll be able to mouth babble that undercuts your confidence in what you think . . . what you KNOW . . . is happening. They’ll redefine things. Rephrase things.

Oh, and the Fed is not part of the Federal government. That will be step one in throwing curve balls at your outrage.

Governpimps own/control the overwhelming majority of the Earth’s oil already, yes?

So what about shale. Penny ante

The Feds fund the SPR (other countries don’t fund oil storage), and military protection for oil imports.

And the industry doesn’t pay the cost of pollution (CO2, sulfur, particulates, etc).

“other countries don’t fund oil storage” Of course they do. China, for example, has 7o odd “storages” in a “3-level system” including state strategic oil reserves, commercial oil bases and regional oil “storages”: Providing a 100 day buffer in case of supply disruptions. Japan, India, South Korea, Italy, Spain, France, etc. all hold reserves. In fact, about 4.1 billion barrels of oil are held in strategic reserves; 1.4 billion is government-controlled.

In fact, according to a 2001 agreement, all 28 members of the IEA must have a strategic oil reserve equal to 90 days of prior year’s net oil imports for their respective country and several countries also have agreements to share stockpiles in the event of an emergency.

Is that an IEA thing? Hmm. They have no enforcement arm. I know the EU has such a regulation. Did you mistype?

Watcher, Its kind of laid out below: Level of strategic reserves set by the IEA No idea about enforcement.

http://www.sagess.fr/en/commitment/obligations-and-guarantees/aiming-to-be-energy-independent

Yes, there are widespread SPRs, but my understanding is that in the EU, at least, they’re paid for by the oil industry. I’m not sure about China – that would be interesting to verify.

Here’s info from the link you provided:

“Every member of the IEA must maintain permanent oil reserves. Each country decides on the ways and management of its reserves. Three principal systems exist:

• private reserves: strategic reserve obligations are held entirely by private operators.

• state reserves: strategic reserve obligations are handled entirely by the state.

• reserve agencies: the strategic reserve obligation is handled by an agency which receives payments from operators to cover its costs.

France handles its reserves through a combination of operators and an agency (CPSSP/SAGESS).”

So, in the example of France: their reserves are entirely paid for by “operators” (directly, or through an agency paid for by the operators), which I understand to mean the oil industry.

More detail from the same source:

“France obliges oil operators who carry out their activities on French territory to ensure a supply of strategic oil reserves equivalent to a percentage of the quantities released for inland consumption in the previous calendar year (28.5% as of July 1, 2011 and 29.5% as of July 1, 2012 in accordance with the European directive, effective January 1, 2013). These reserves for civilian use are distributed throughout,metropolittan France in accordance with an annual plan of storage, as approved by an administrative commission (Commission Interministérielle des Dépôts d’Hydrocarbures) on hydrocarbon deposits (commission interministérielle des dépôts d’hydrocarbures or CIDH).

Part of this obligation is ensured by the oil operators. The other part is entrusted to the Comité Professionnel des Stocks Stratégiques Pétroliers (CPSSP), whose exclusive mission is to stockpile and maintain these strategic stocks. The CPSSP delegates the operational management of its mission to SAGESS. The CPSSP and SAGESS, together, are considered the national oil reserve agency. It is for this reason, in the adoption of the new European directive on strategic oil reserves, that SAGESS has been officially nominated the Central Storage Entity (CSE) for France (decree N° 2012-1544, dated December 28, 2012). SAGESS, a privately-held and tightly structured company thus concerns public interest.”

scarcity driven deflation

Scarcity of what? Money? Because scarcity of goods drives prices up as the same money chases fewer goods.

What happened in 2007 /2008 was that trillions of dollars disappeared when the housing market in the US crashed and the paper assets the banks had been allowed to build on that market disappeared, causing a panic.

scarcity of oil drags everything down

Mike,

In the post that ron linked to, you mentioned that the bakken first started to be developed when oil fell to $40, which is true and a good point. However I’d argue that the more important thing would be the oil price at the time that the rigs were contracted to start the drilling there. I’d wager it was a little higher than $40 at the time. How many wells were then drilled, but not fracked until oil prices rose again?

Secondly, it’s not only the shale industry that has the sniffles. I was at petex in the UK yesterday, and many of the speakers presenting there were much less optimistic than I’ve seen in the last few years. Many companies now seem to need $100+ oil to grow supply, or even maintain old fields at current levels. Forties in the north sea has only been sustained thanks to heroic drilling by Apache, for example, but that seems under threat now. I think a supply crunch in a year or two and an accompanying price spike seems likely.

Good input.

Oil hit $147 summer of 2008 and Mike’s comment was decisions were made to GO at North Dakota that month. Then when price crashed, a lot of money had already been borrowed and contracts signed. They just proceeded and hoped like hell for a reversal.

The Fed somewhat engineered precisely that via monetary stimulus, not to mention $800 billion in Bush’s TARP legislation.

I will note that now, with elevated production numbers in NoDak, months of momentum just may not exist anymore at this level of debt. If you don’t drill a solid month of wells, you go into decline instantly. Decline is deadly — because it speaks to the lenders who will be asked to fund the next well.

Should probably have phrased that if you don’t frack a solid number of wells, because there is a queue.

Hi Watcher,

Once the company has invested in drilling a well it will be fracked. If we assume prices remain in the 75 to 80/b range (WTI price) for 6 months or more.

The drilling will slow down to 100 wells per month or less and we will see Bakken output decline, same story for Eagle Ford. The decline will only be very steep (20 to 30% per year) if drilling stops completely in the LTO plays. I don’t know if that is likely at the assumed price level, we might see a 5 or 10% decline and 75 new wells per month, time will tell.

You always presume functionality nominal and results become mono variate dependent.

Very unlikely. If gov’t doesn’t step in to provide lenders confidence, it doesn’t have to unfold with a decrease in wells. When one bond issue defaults, they are ALL in default from that company. By law. They are all due in full immediately. So they will have to borrow to meet bond redemption cash reqmts, in addition to fund drilling. This sort of thing can avalanche.

And this doesn’t even address the ramifications of the boom narrative being hit. In addition to workforce problems, you have rational suppliers looking at things and demanding COD terms for pipe and proppant.

Their religion disallows interest on debt.

So does Christianity.

Christianity has such an edict? I know Islam does. There are special Islamic banks that redefine this or that, but in general they can never pay interest on savings and may never charge interest on loans. “Riba” is absolutely forbidden.

So an array of Sharia compliant banks now do exist and they are growing.

https://en.wikipedia.org/wiki/Islamic_banking

My observation is a standard method is the bank buys an item and sells it to the customer who was planning to finance the item. They let the customer pay in installments, interest free, but the resell to the customer is priced at a profit. Default is prevented by some side collateral.

Christianity DID until the Italian bankers worked out a deal with the Pope. Once upon a time usury was punishable by death. Now you see why.

Notice that the gold bugs are predicting Apocalypse because the Fed is lending money in a non-usurious way — with no interest. How the world has changed.

It’s also worth noting that the Rhein Main region — Southern Hessia and Eastern Rhineland Palatinate — was a European business hub in the High Middle Ages, with towns like Frankfurt, Speyer, Mainz Worms etc because there were Jews there, who didn’t mind charging interest.

https://www.dmr.nd.gov/oilgas/dailyindex.asp

When the barrels per day are anywhere between 1000 and 2500, you’ll have drillers drilling for oil, especially in McKenzie County. The recovery of drilling costs will be shortened, more wells will be drilled, the rig count in McKenzie County will remain constant. Not all of the wells, but a good number anyhow.

365x500bpd=182,500 barrels per year.

182,500×50 dollars per barrel= 9,125,000 dollars after one year of production at 50 dollars per barrel.

At 1000 bpd, half of the number of days to reach nine million dollars.

The drilling in McKenzie County will continue at a very high rate even at 50 dollars per barrel… even more at 80 dollars per barrel.

The thing is you do seem to know how to do math.

But you didn’t deduct state production tax, extraction tax, royalty to the land owner (that’s 15+%), salary to the truckers, fees to the water disposal people, gasoline for the equipment, diesel for the trucks . . . all this stuff comes off the oil flow revenue. And then there is interest on the loan that paid to drill the well.

If the price is $50/barrel, they don’t get to collect all $50.

Never mind those other numbers, they don’t make it look good.

Just pay attention to the raw data and raw numbers, makes better graphs.

All expenses just lengthen the time for realized profits, but those profits are still going to happen in the long haul.

You forgot the accountants, pollutants, CO2 emissions, land degradation. More hidden costs yet to be counted. So never mind those upfront costs. it’s already money down the drain.

I know they’re all there, the taxes, the royalties, interest expense, along with the drilling costs, but it is too easy to ignore them. The results you have are then poor, but better than nothing at all.

Give us clean laundry.

“All expenses just lengthen the time for realized profits, but those profits are still going to happen in the long haul.” Is there lonh haul in shale oil production? Obviously not since production declines 90% in 3 years.

Ronald, the production numbers you read at the link you posted are for the first 24 hours of production. They in no way resemble the one year average. I don’t think there is any way you can even get an idea of first year averages from those numbers but I would guess it would be around .25% or .30% of that number.

Ronald,

About 30% of each barrel sold goes to royalties and taxes, there is also about $12/b of transport costs to get the oil to a refinery, $7/b of OPEX (including $3/b for water disposal). The 30% is on wellhead revenue.

Let’s take your $50/b oil price (we will assume this is the Brent price). With transport cost it is reduced to $38/b, then pay 30% of that for royalties and taxes, and you are left with $26.60/b, then deduct operating costs and you are left with $19.60 per barrel. The average Bakken well produces 87.5 kb in year 1, that would be a net income of $1.7 million for the first year, each year the revenue needs to be discounted by the required rate of return for the oil company.

Not a lot of new wells will be drilled at an oil price of $50/b, a few might be drilled at $75/b in the sweetest of sweet spots, but if prices remain at $75/b there will be a big slowdown within 3 or 4 months as the already drilled wells (about 600 or so in the Bakken) get fracked, but very few new wells get drilled, we will see this hit in February or March unless oil prices increase by then.

Hey guys ,

Some of you may have read Twain’s essay on the true identity of Shakespeare.In it he says that he absolutely can tell if somebody writing about the gold fields and the American west is telling it from experience or making it up as he goes- BECAUSE he spent time there himself and was able to catch all the little mistakes make by writers without actual on the ground experience.

It is Twain’s judgement that the guy the literary world accepts as Shakespeare found not possibly have written the plays- because who ever wrote them knew a hell of a lot of stuff somebody from Shakespeare’s station in life simply could not have known.

I find this to be an extraordinarily powerful argument but the identity of Shakespeare is not what I have on my mind. In his day there was often a person to be found in the Royal Court known as the JESTER. His job in life was to entertain the Court first and foremost but he also possessed a certain amount of freedom that allowed him to make fun of people and institutions and customs rather freely. Talk of that sort would have gotten anybody else thrown into a dungeon more or less on the spot and the keys tossed into the moat.

The jester often times knew a great deal about what was what and was usually a rather intelligent man. So he was listened to even though he was the jester-ESPECIALLY because he was the jester.Most of the time whatever he had to say was nonsense good for a laugh and every body knew it.But OCCASIONALLY he had something very important to say.

Ronald is our court jester unless I am a much bigger fool than I think I am and I would bet he is laughing his ass of most of the time while he is composing his comments.But here and there -just as the real jesters of old did- he says something important.

Read him as the Jester and also as a pundit talking sarcastically about certain realities and you will read him with pleasure and maybe even gain a useful insight here and there.

NOW GO BACK and read his last two comments again the one at 11:49 am and 12:21pm and think about Jay Leno talking about the follies of the president and congress.

Ronald is making fun of the establishment and actually doing a damned good job of it considering he is not getting paid.

Take this one sentence.

”Never mind those other numbers, they don’t make it look good.”

Ronald is poking some fun at the whole industry and the people here who are too dead serious earnest to recognize a joke.

That line is no more and no less than a comedians sarcastic summary of the entire business case that has make millionaires and billionaires out of some people in the tight oil industry even though the industry itself has probably lost money so far and may continue to lose money in the future.

Though it is a bit off topic, I have read just about everything there is to read on the Shakespeare authorship, and to me it seems pretty easy to see that Oxford is the most likely author behind the Shakespeare pen name, by a long shot. If he didn’t write it all, he sponsored it all. I enjoy thinking about it and talking about it, though no one else I know does.

To bring it slightly closer to topic, though those in charge of English departments will make you seem crazy if you don’t buy into the orthodox view, the evidence is clear.

Those in charge of religions, or at least the ones I grew up in, same thing. Very smart people included who never question a core assumption.

And I think the same for exponential growth in general and peak recourses in particular. I just think many people cannot or do not let new information touch their core assumptions.

Although maybe I’m just attracted to conspiracies is another explanation….

The question of who is mad and who is not , the inmate or the keeper of the asylum is one that is always relevant.The establishment has constantly and continuously pictured environmentalists and peak oilers and others possessed of similar convictions and beliefs as suffering from various delusions that they find amusing so long as we are not getting much attention but dangerous if we manage to get out from under the rocks and into the sun..

The professional literary establishment has it’s head so far up it’s ass it will never ever see daylight in respect to Shakespeare.All the people who have power and status in that establishment have gotten it by playing along in the status quo game and gradually working their way up from undergrad to professor.So they are now all on record as believing Shakespeare – a man without the necessary background living at a time without the media we have today – could have written the plays attributed to him.

This is about as absurd on the face of it as somebody without any training in shall we say physics either formal or hands on writing a paper on the mechanics of wind turbines and getting it right. Now I could write such a paper -a very simple one of interest to laymen but not to engineers- without any such specific training- if i put a hell of a lot of time into it- because I have the internet and the resources of a vast library system of actual books and periodicals available..

A historian who wanted to could spend his entire life productively writing about disasters brought about by delusional thinking on the part of the establishment.

Never mind those other numbers folks they don’t make it look good.And never mind the fact that the only thing we have that for damned sure was written by Shakespeare is a couple of lines that could easily have been written by any literate street urchin…

They don’t make him look good so just ignore them.

Don’t pay any attention to the little fat man behind the curtain!

Listen to the MIGHTY WIZARD!

I just think

manyThe Vast Majority of people cannot or do not let new information touch their core assumptions.There fixed that fer ya! That’s just the way humans are wired and science has know this for a quite a while now. There is plenty of peer reviewed research on this topic.

Cheers!

What if the new info kind of creeps in slowly, almost imperceptibly?

It would seem that drilling would slow but I wonder if somehow the shale drillers will be able to float even more debt, despite the lower prices. Although their stock prices have fallen, I am surprised the “pure shale play” companies haven’t fallen more. It is also interesting how they have been able to float 20-30 year bonds with production which declines so quickly. Apparently they have just scratched the surface in terms of developing the number of total locations that are out there, and all that undrilled acreage is the long term collateral?

I have noticed several of the companies have shed most, if not all of their conventional production. That has surprised me as I have watched this develop. I am pretty much in agreement with what Mike posted above.

Dennis Coyne. Thank you for all of the statistics you provide. You cited a figure above for “average” Bakken production for year one. Do you have those figures for years 2-5? Likewise do you have the same for Eagle Ford? It is interesting how drilling these areas is described as a “manufacturing process”, yet just simply reviewing the state websites shows that there are some very prolific wells and some real duds. That seems more similar to conventional drilling than “manufacturing” to me.

Two items.

About 2 weeks ago the sprint to the microphones started from various shills announcing lower and lower and lower breakeven analysis for the shale producers. Unfortunately for them, they spoke too soon — because the price kept falling right through their analysis and left them unable to credibly lower it further and keep a floor under those stock prices.

Second item is I looked at least cursorily at EOG and Continental junk issuance and I don’t recall seeing any 30 year paper.

The majority of CLR per matures in 6-10 years. The most recent quarterly financials do show $700,000,000 maturing in 2044. Still think makes it pretty iffy given steep declines. Will be difficult to pay that debt if this turns out to be a long term price decline like 1986-1998. Still think market cap of $20 billion seems high for 182,000 boepd, with debt levels, steep decline at current oil and Nat gas prices. Maybe because most are convinced price not going lower and maybe headed back up soon. I wonder what oil price will be used to calculate PV10 at year end? Could that choke off more debt issuance? Seems like maybe they can use average for calendar 2014. That will be beneficial to them.

I looked on Moodys. There was no 30 yr issuance listed, but I only did page 1 for both clr and eog.

They list 5.9 B in total debt so that 700M would be 12% of total debt. To get an overall average of 6-10 yrs, the other 88% is going to have to mature sooner, and most of what I saw was 5-7 yrs — which makes sense.

The ugly part of all this is this is not a bank. They are issuing bonds to the public via an underwriter, who would hype the paper. So a rational lending pool might say no, but compensated advisors might put some of their clients into this paper, even if it’s crapola.

Most debt issued by corporations is not repaid but rolled (so yes, technically it is repaid, but it’s repaid with the proceeds of another bond issue).

What will be interesting is what yield investors will demand for those bond issues which replace the current debt.

Rgds

WP

Hi Shallow sand,

For the Bakken we only have real data out to about 6 years for “modern” Bakken wells (multistage fracks and horizontal wells). Chart below for 2008 to 2014 average Bakken well.

For the Eagle Ford I only have real data out to 28 months, I can use a hyperbolic well profile beyond this, but I am less confident than my Bakken data (where we have real data out to 6 or 7 years).

In fact the well profile has improved over the 2.5 years I have data for (August 2010 to Aug 2012). The data shows for 75 wells drilled from may to August 2012 the EUR was higher than earlier wells, for these wells I only have 15 months of data and the sample size is small. I believe that these well probably reflect current wells best. Chart below based on only 75 wells which started producing in the Eagle Ford between May 2012 and August 2012 (data collected in October 2013).

Note that the 87.5 kb in year 1 was a mistake(I remembered incorrectly), current data suggests the average Bakken/Three Forks well produces about 81 kb in the first 12 months and about 270 kb after 10 years, and about 340 kb after 20 years, the well gets shut in at 25 years at about 7 b/d with a final EUR of roughly 360 kb.

So, only about 22% gets produced in the first first year, but probably 70% of expenses are in the first year.

It makes sense that they’d be cashflow negative, but that’s not as bad as it sounds.

Dennis Coyne: Again for all of the information! The shale plays have many proponents and detractors. Having the information you provide greatly helps with the facts regarding production rates and economics. I assume associated gas helps somewhat, and more in Eagle Ford than Bakken?

Yes Rune Likvern has estimated about $3/b net income from associated gas sales per barrel of oil produced in the Bakken. For the Eagle Ford, I would have expected it to be somewhat higher, but when I actually estimated it, the result was similar.

And about 30% of that is flared, so that could go up.

I’ve never seen a discussion of the economics of setting up a gathering & distribution network to prevent flaring…

Using the latest RRC data up to T and the previous data up to T-1, I computed the amount of corrections that each month should undergo to be close to the real data. In doing this, I consider only the last 24 months (older months have only negligible corrections): what I did was to sum for each month the corrections which took place in the previous “h” months, where I put h=24 for computational simplicity.

For example, the correction for the last month (which is one subject to the highest degree of corrections over time) were equal to 624134 bbl/day (only oil , no condensate).

By doing this for all the past 24 months, I reconstructed the supposed “real” Texas oil production data. The result is the figure attached to this comment.

A small warning: after 8 months of these monthly corrections, I want to say that the correction factors have quite a high volatility. For example, the correction for the last month ranged between 350000 bbl/day to 650000 bbl/day. In the next days, time permitting, I will try to use some “average” correction factors and see whether there are some major differences.

here is the corrected data for condensate, which seems to have reached a plateau,

total gas is slowing down its growth,

finally, my corrected C+C vs the EIA (kb/day)

Thanks Dean

Thanks Dean from me as well. Ron’s graphs contain good information, but I find it difficult to pick a trend, and need to rely others for interpretation. Your graphs make everything clear, though I do recognize they may not be exact but are a good approximation.

Thanks everyone!

Great work Dean. Very clever. Perhaps if you make an average in monthly production for more than 2 series of data you can get an even better aproximation? As you can see in Ron´s graphs, the monthly increase for a certain month can vary quite a bit between the series of data.

Something like this:

production(t+1)=production(t)*(z(t+1)/y(t)*y(t+1)/x(t)*….)^(1/(number of series))

number of series -1

That’s a good procedure. It provides an instantaneous measure of a parameter that would otherwise force months of delay.

And Sept looks like the sharpest decline you’ve posted.

Thanks!

I’m seeing a new narrative from the small OPEC countries. It goes like this:

“Look, if we come out of that meeting next week with no production cut at all, the markets are expecting SOMETHING from us and the price will crash. So we HAVE to announce something, anything. Not just walk out with no change.”

This is what the world has become. Supply and demand matter less than headline reading algorithmic trading response. So call the algorithm writers, find out what they want in a headline, and give it to them — true or not.

Anyone doubt those oil ministers can trade this in their personal portfolios?

Oil at 75 dollars, 117 yen to the dollar, 75×117=8775 yen for 42 gallons of oil.

Oil at 100, 88 yen to the dollar, back about a year ago or so in January of 2013, 8800 yen for a barrel of oil. At the moment, it is a wash.

The yen was at 76 in Oct of 2011, October of 2011 had oil prices at 98. A barrel of oil was on sale in Japanese yen, 7448 yen, in 2011.

http://www.oanda.com/currency/historical-rates/

http://www.macrotrends.net/1369/crude-oil-price-history-chart

I used Mr. Peabody’s Wayback Machine.

A possible scenario:

If the yen makes its way to 80 of them for a dollar and oil regains some to 80 from the current shellacking, the yen count will be 6400 for a barrel of oil.

A stronger yen in the future could cause lower oil prices.

February 2009 had prices under 44 usd and drilling activity was at the nascent stage. It did not come to a screeching halt, the armature was not damaged, it still is spinning nonstop.

The leases to expire will guarantee drilling activity; the rigs are next door.

I doubt that the current price of oil is going to be a kill switch this time around.

The die is cast.

Had not the price of oil became all foam and froth at 147, a price stability action, an act of Congress, to prevent wild speculation, ‘you can’t do that’, the Bakken would not have had so much attention paid to actual drilling, prospecting, finding oil, production increases that were not projected/expected would have never become a real deal, the play would never had been. When diesel was over 5 dollars per gallon in Tennessee, the farmers went back to mules.

The oil industry has only itself to blame for increased production from non-conventional plays due to increasing skepticism of the reliability of conventional fields, which are obviously at the end of their rope, looks like from Jean Laherrere’s post. A ‘how’d he do that?’ post. Tough to dig it all out, but it seems to me the that is what I got out of it the most of all. The entire pla(y)net has been mapped for oil reservoirs, it is a known and the projected amounts end up short. Enter the Bakken because the price was high enough to make a buck and a yen too.

The Bakken’s increased contribution to the supply side represents about 1/77th of the total daily worldwide production, about 1.3 percent, an efficient distribution system became enough to place a checkmate on the price limit. Gotta get that Bakken ethane shipped up to the Athabasca tar sands pronto. You can thank the Burlington Northern and the Canadian Pacific for their efforts.

Bakken oil products are in the Athabasca tar sands bitumen before it reaches the pipeline, for cryin’ out loud.

The success of the Bakken play is taking its toll at the moment. The amount of oil in place, yet to be harvested, is more important than the current torrent of monetary mayhem.

The long term has far more promise.

“The amount of oil in place, yet to be harvested, is more important than the current torrent of monetary mayhem. ”

There is an aspect of “the oil is there, we know it’s there, we just have to go get it”.

But.

Without 0% interest rates, without a boom narrative in place, it may cost WTI $250 minus transport costs to get it. That has government subsidy or nationalized industry written all over it.

You can have the oil provided you have no expectation of profit getting it. Gov’ts WILL do that when starvation threatens. They would have no choice. It will be quite the challenge to see them do it while maintaining a facade of normalcy.

So true, Watcher. And then, there’s always that little physical reality hurdle of how much energy is required to get an equivalent unit of energy out of the ground. That’s the little inconvenient issue that it will be “interesting” to see (future) nationalized oil companies struggle with. Best of luck to them!

The EROEI calculations I’ve seen are always a guaranteed trip into amorphous spiral. Inevitably the calculation doesn’t know where to stop. Yes a truck carries oil, but shall we include the calories burned by the driver, the joules burned making his shoes holding the pedal down, the manufacturing joules for the truck factory, the calories burned by the guys building the truck — it all just goes insane.

The economists wave their hands at physics and say . . . forget that stuff, just track the money. Money has built into it all all those things you don’t know how deeply to calculate (even if we print it from thin air and it changes its value from day to day).

So it’s flat out hard to get a handle on EROEI.

Um. Has anybody noticed that energy return -solar is way better than energy return -yet more gobbled-up fossil fuel?

And about those scientists. They say we gotta leave the ff’s where they are, regardless of anything else, or the biosphere goes up in smoke. How’s that for an energy return?

Fossil burning people are sinners. Sinners should be burned at the focal point.

Energy return from volcano lava is probably pretty good, too.

Haven’t seen any 400 horsepower John Deeres harvesting cornfields with lava fuel, either.

Those tractors ar a tiny percentage of total energy consumption.

Somewhat irrelevant in that it is consumption that MUST take place and there is no alternative fuel methodology.

As is true of jet aircraft. There is no alternative to liquid fuel and there isn’t going to be one. Total consumption, 5-6 mbpd.

Oh, and I have been remiss. I note often the silliness of waving hands over heads about US oil consumption when it is China’s consumption graph that is a 45 degree angle upwards, but hey, let’s be proper in this. Let’s look at cruise ships and their role in getting Chinese and Indian per capita oil consumption up at US levels where it belongs.

“China is planning to build its first cruise ship, targeting the nation’s huge aspirational middle class as it looks for new ways of spending its money and vacation time.

To venture into new waters, Chinese shipping officials have secured the help of Carnival Corp., the world’s largest cruise-ship operator. The Miami-based juggernaut of cruising said on Wednesday it had signed a memorandum of understanding with the China State Shipbuilding Corporation to help design its maiden cruise vessel.”

Now that’s exciting!

You people are not facing facts.

Burn the ff’s and the planet cooks.

True or not true?

The rest of all this jabber is hot air, and real thin at that. dam poor return on investment.

PS, Sure there is a substitute for jet fuel. Don’t fly, I haven’t for a decade, and am happier for it.

So you saved some jet fuel for a Chinese adventurer to burn.

PS, Sure there is a substitute for jet fuel. Don’t fly, I haven’t for a decade, and am happier for it.

That’s what I think, too. I don’t accept that humanity as a whole has to keep driving into a wall. Whether people change lifestyles because of global warming, because the fuel runs out, or because they don’t have the money, they adjust. It may be a painful adjustment, but they will do what they have to do with whatever they have to work with.

And if the planet becomes uninhabitable, so be it, but unless something catastrophic happens suddenly, life won’t disappear immediately and whatever life remains will keep going for as long as it can keep going.

The first time I flew in a jet plane was 42 years ago. The second time I flew in a jet aircraft to carry passengers to point b from point a was about two years ago. I thought I was never going to fly in an airplane ever again, but I did. I once thought that flying was for the birds, but I changed my mind.

You think that the jet is the only one in the air until another jet in flight crosses the flight path probably less than 1000 feet above where the jet is. It is then when you know that it is a sophisticated form of travel. There are no ox carts up there getting in the way.

It was in an embraer, a jet manufactured in Brazil. If it’s not Boeing, I’m not going, but I made an exception, might as well, I can’t get to point b unless I board the aircraft. A great airplane, the embraer, it didn’t crash and the landing was the greatest thrill in the world. You make it out of there in one piece, a relief, pure joy. Flying is alright, but landing is better.

You are not going to beat 550 mph and be there in less than an hour what takes two days of hard driving.

It is the safest form of transportation. It would be foolish to provide all of those passengers with a car and point them in the direction they have to drive when they prefer to fly. They’ll be causing accidents right and left when all they had to do was fly to New York from Boston instead of trying to drive. Why try to drive through all of that traffic when flying is the way to go?

The airline industry is not going to go broke. It saves lives.

The automobile industry has done its job too, not that they have been doing nothing at all. If the number of highway deaths would have continued at the pace it was at in 1968, there would be over 120,000 highway fatalities each year. Improved highway systems, improved safety standards, improved driving techniques have all contributed to decreased traffic fatalities by a factor of three over a 46 year time span.

If jets crashing and burning would cause 33,000 passengers to lose their lives in a year’s time, nobody would fly. The business would nose dive as well. Airplane crashes with a loss rate of a hundred per day would become a disaster.

To believe that alternative energy is going to be a solution to the oil dilemma is a flight of fancy, a pipe dream, taking leave of your senses, it is not going to happen. You have Munchhausen by proxy.

Solar is for space vehicles with solar panels, not for the earth. Just kidding, solar to make electricity is the next big step, imo. Where the age of oil ends and the energy age begins.

If the oil is gone, can’t find any, coal will be the hydrocarbon of choice and it will be used. Steam engines to pull trains, feedstock for power plants, steam shovels, the beat will go on. You’ll be able to do some coal gasification, an cook the coal to make jet fuel, even. Coal is the greatest fuel ever, really. It can make electricity by the ton.