A post by Ovi at peakoilbarrel

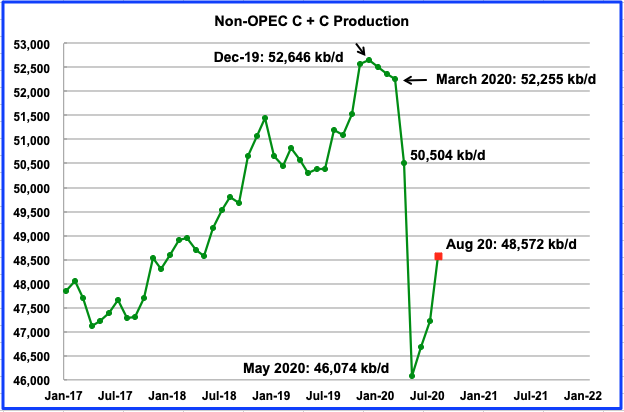

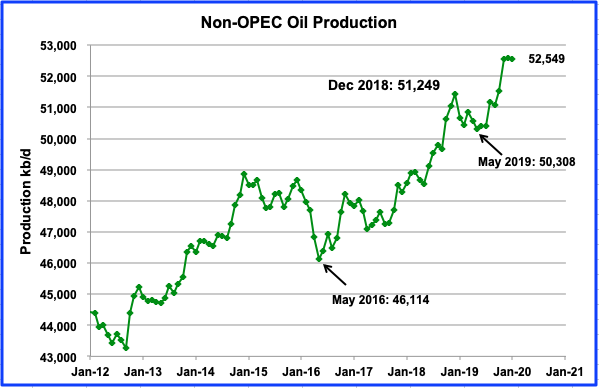

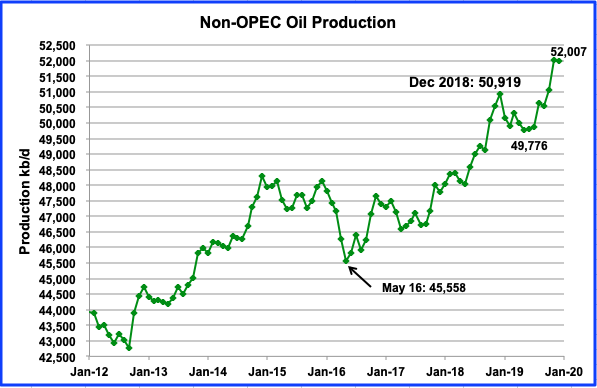

Below are a number of oil (C + C ) production charts for Non-OPEC countries created from data provided by the EIA’s International Energy Statistics and updated to June 2020. Information from other sources such as OPEC, the STEO and country specific sites is used to provide a short term outlook for future output and direction for a few countries.

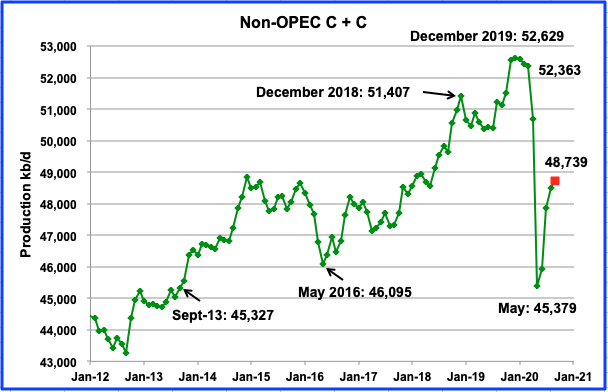

Non-OPEC production has started to rebound from the May low of 45,379 kb/d. According to the EIA, June’s output added 564 kb/d to May’s to end up 45,943 kb/d. Using data from the STEO, a projection for Non-OPEC output was made to September. September output is expected to rise to 48,739 kb/d, with the biggest increment occurring in July, close to 1,000 kb/d. Of the 1,000 kb/d, 500 kb/d will be provided by the US.

Read More