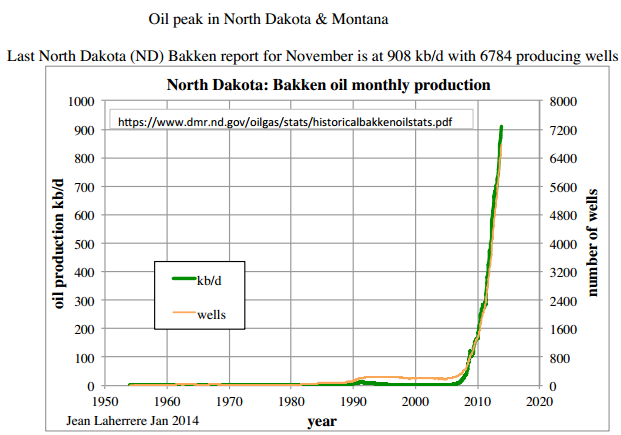

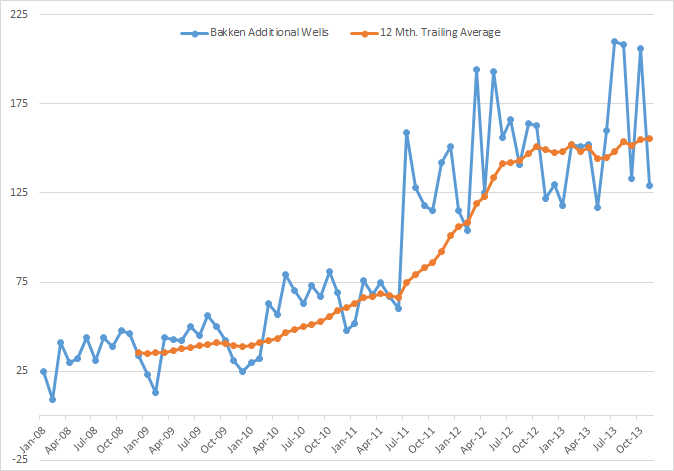

Figure 1

Edit(2/10/2014) For anyone interested a spreadsheet with the TRR scenario can be downloaded here just click on down arrow near the upper left to download spreadsheet.

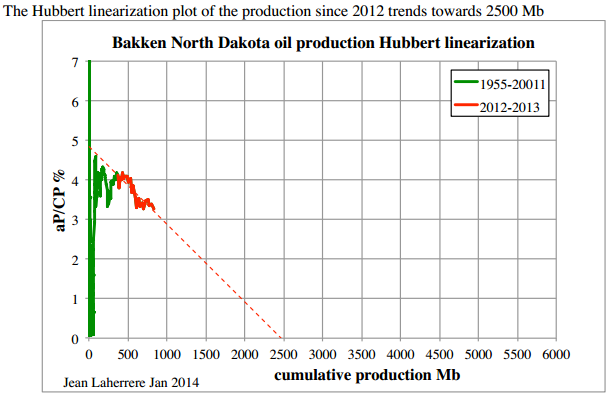

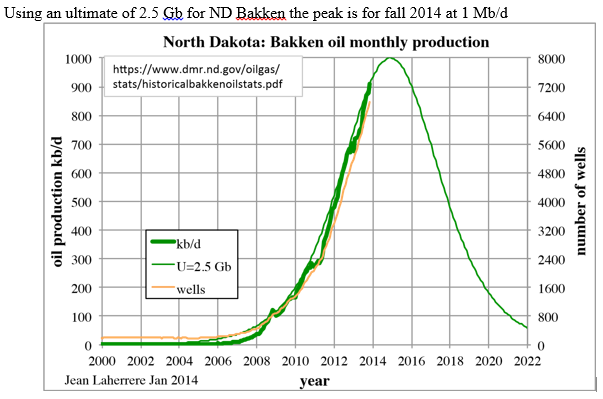

A recent post at Peak Oil Barrel by Jean Laherrere suggested an ultimate recoverable resource(URR) for the North Dakota Bakken/Three Forks of about 2.5 Gb based on Hubbert Linearization. This conflicts with a recent (April 2013) USGS mean (F50) TRR estimate of 8.4 Gb. (See my earlier blog post.)

I decided to update my scenarios based on the range of USGS TRR estimates from F95=6 Gb to F5=11.3 Gb for the North Dakota(ND) Bakken/ Three Forks. Note that at year end 2011 there were 2.6 Gb of crude proven reserves in ND and at the end of 2007 about 0.5 Gb, I will assume all of this reserve increase came from the Bakken/ Three Forks, so 2.1 Gb of proven reserves added to 0.35 Gb of oil produced from the Bakken/ Three Forks gives us 2.45 Gb for a minimum URR. The Hubbert Linearization points to about 0.05 Gb of undiscovered oil whereas the USGS suggests 3.5 to 8.9 Gb of undiscovered technically recoverable resource(TRR) in the North Dakota Bakken/Three Forks.

Note that Mr. Laherrere has forgotten more about geology than I know. He may have information that I don’t have access to or has read the USGS April 2013 Bakken/Three Forks assessment and found that the report was not credible. I have assumed in my analysis that the USGS analysis is correct, if it is not then my analysis will also be flawed. I would love to hear from Mr. Laherrere about the specific problems he sees with the USGS analysis, I no doubt would learn much.